Goldman Sachs

Small/Mid Cap Financial Services Symposium

February 11-12, 2008

Focused on Maximizing Value for Shareholders

Forward Looking Statements

This presentation contains “forward-looking statements” within the meaning of the federal securities laws. These forward-looking

statements are identified by their use of terms and phrases such as “believe,” “anticipate,” “could,” “estimate,” “likely,” “intend,” “may,”

“plan,” “expect,” and similar expressions, including references to assumptions or our plans and goals. These statements reflect our current

views with respect to future events and are subject to risk and uncertainties. We note that a variety of factors and uncertainties could cause

our actual results to differ significantly from the results discussed in the forward-looking statements. Factors and uncertainties that might

cause such differences include, but are not limited to: general economic, market, or business conditions; demand for new housing;

competitive actions by other companies; changes in laws or regulations and actions or restrictions of regulatory agencies; deposit attrition,

customer loss, or revenue loss in the ordinary course of business; costs or difficulties related to becoming a stand-alone public company;

the inability to realize elements of our strategic plans; changes in the interest rate environment that expand or reduce margins or adversely

affect critical estimates and projected returns on investments; economic conditions affecting real estate values and oil and gas prices and

changes in market and/or general economic conditions, either nationally or regionally, that are less favorable than expected; natural

disasters in primary market areas that may result in prolonged business disruption or materially impair the value of collateral securing

loans; assumptions and estimates underlying critical accounting policies, particularly allowance for credit losses, may prove to be

materially incorrect or may not be borne out by subsequent events; current or future litigation, regulatory investigations, proceedings or

inquiries; strategies to manage interest rate risk may yield results other than those anticipated; a significant change in the rate of inflation or

deflation; changes in the securities markets; the ability to complete merger, acquisition or divestiture plans; regulatory or other limitations

imposed as a result of a merger, acquisition or divestiture; and the success of our business following a merger, acquisition or divestiture;

the final resolutions or outcomes with respect to our contingent and other corporate liabilities related to our business and any related

actions for indemnification made pursuant to the separation and distribution agreement between us and Temple-Inland Inc.; and other risks

as set out in the reports we have filed with the Securities and Exchange Commission, which you may view at www.sec.gov.

New factors emerge from time to time and it is not possible for us to predict all such factors, nor can we assess the impact of any such

factor on our business or the extent to which any factor, or combination of factors, may cause results to differ materially from those

contained in any forward-looking statement.

Any forward-looking statement speaks only as of the date on which such statement is made, and, except as required by law, we expressly

disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement to reflect events or

circumstances after the date of this presentation.

2

Over $16 billion in assets

2nd largest publicly-traded depository institution

headquartered in Texas

158 branches

Texas - 102

California - 56

Insurance agency – 9th largest bank-owned agency in U.S.

Top 11 officers have been with the bank an average

11 years and in the industry an average 27 years

Spin-off from Temple-Inland completed Dec. 28, 2007

Company Profile

Guaranty is focused on creating significant value for

shareholders, customers, employees and communities

3

Investment Highlights

Branches Located in High-Growth Texas and California

Markets

Loan Growth Driven by Geographic and Product

Diversification

Lowering Costs and Improving Financial Performance

Strong Credit Culture

Controlled Interest Rate Risk

Experienced Management Team

We believe Guaranty is uniquely

positioned to maximize shareholder value

4

Grow commercial lending franchise

Grow retail franchise in TX and CA

Increase fee income

Provide distinctive customer service

Improve operating efficiency

Maintain strong credit and risk standards

Strategy

We believe the combination of our strategy, expertise,

growing markets and financial strength positions Guaranty to

create significant value for shareholders

5

Loan Portfolio

Dec. 31, 2007

Maintain diversified loan portfolio

Overview

$10 billion total

Strong middle market

focus

Strong energy lending

with focus on E&P

Significant commercial

real estate experience

Lower risk single family

mortgage portfolio

Single-family

mortgage

Single-family

construction

Commercial and

business

Energy

Consumer and

other 1%

Multifamily and

senior housing

Single-family mortgage

warehouse

Commercial

real estate

7%

15%

17%

13%

15%

17%

6

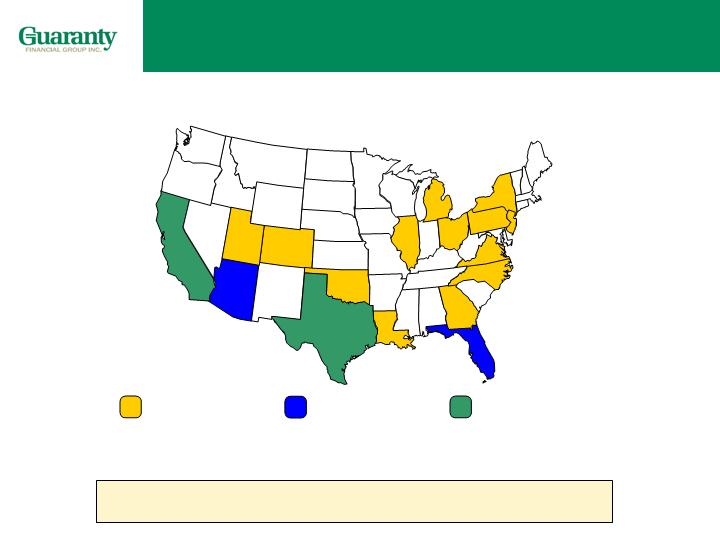

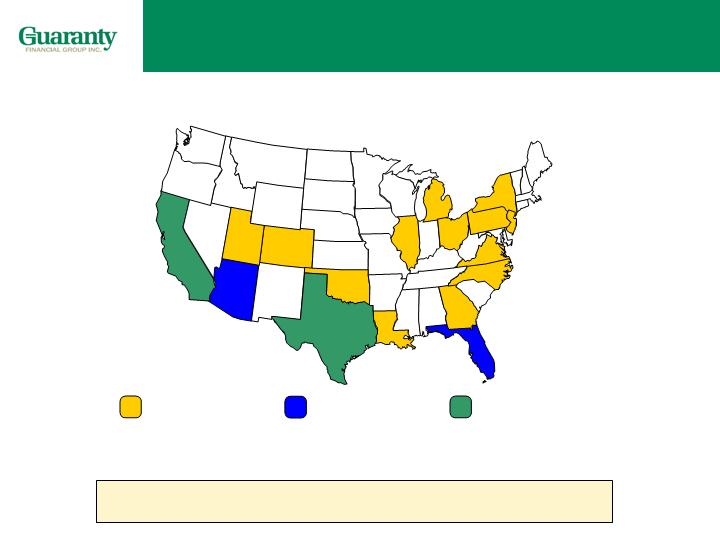

1% to 5% of

loan portfolio

5% to 10% of

loan portfolio

Greater than 10%

of loan portfolio

Grow Commercial Lending Franchise

Nationwide targeted markets

As of Dec. 31, 2007

7

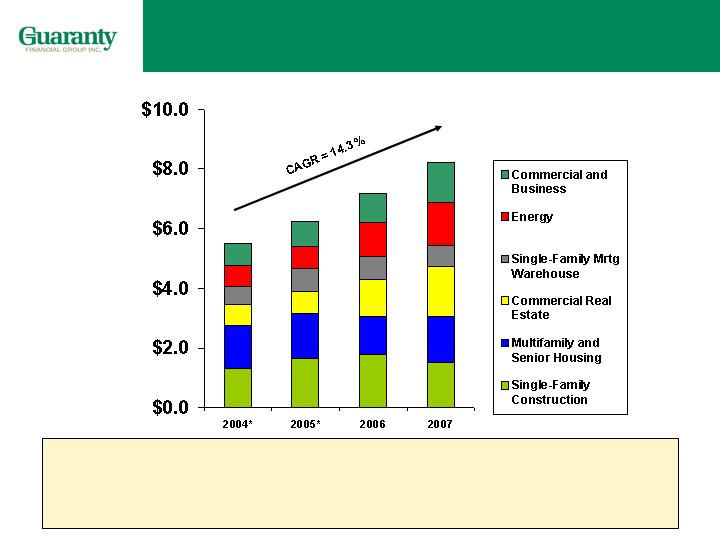

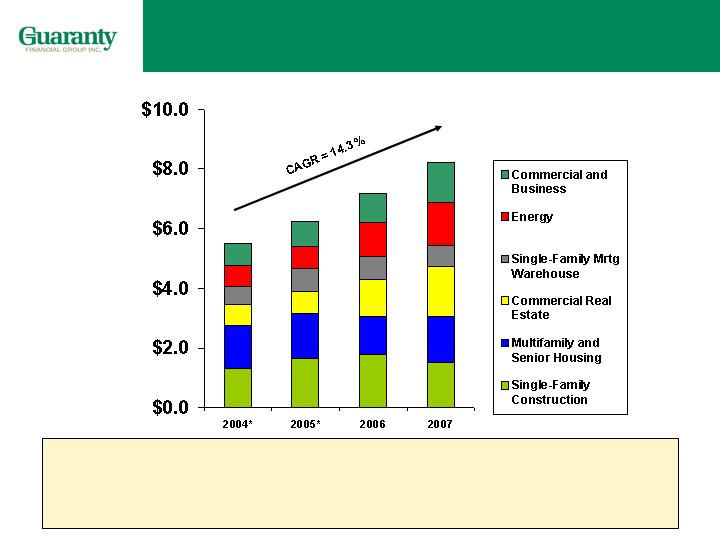

($ in Billions)

Continue strong growth in diversified commercial loan

portfolio focusing on business, commercial RE,

energy, middle market and senior housing

$5.5

$7.2

$6.2

$8.2

Commercial Loan Balances

*Excludes asset

based lending,

which was exited in

2006.

8

Grow commercial lending franchise

Grow retail franchise in TX and CA

Increase fee income

Provide distinctive customer service

Improve operating efficiency

Maintain strong credit and risk standards

Strategy

We believe the combination of our strategy, management

expertise, growing markets and financial strength positions

Guaranty to create significant value for shareholders

9

Texas Demographics

2nd largest state in U.S. (pop. 23 million)

3 of the 10 largest cities in the U.S.

Houston # 4

San Antonio # 8

Dallas # 9

2nd fastest growing state population

4 of the 25 fastest growing MSAs:

Dallas area # 2

Houston area # 3

Austin area # 18

San Antonio area # 25

- 102 branches

- $6.4 billion in retail deposits at 12/31/07

- 8th largest in Texas by total deposits

- Top 10 in 3 major markets

Texas Retail Operation

Grow Retail Franchise in TX and CA

Significant opportunity in Texas

Source: Claritas Incorporated

Houston

Dallas/Ft. Worth

Austin

San Antonio

10

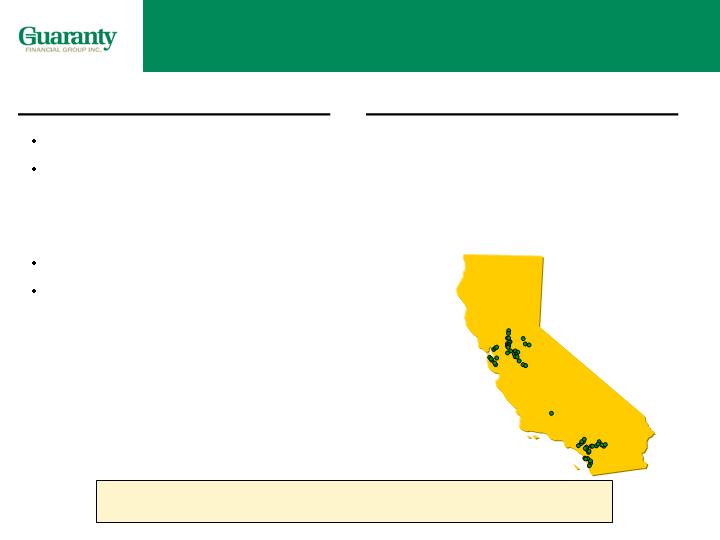

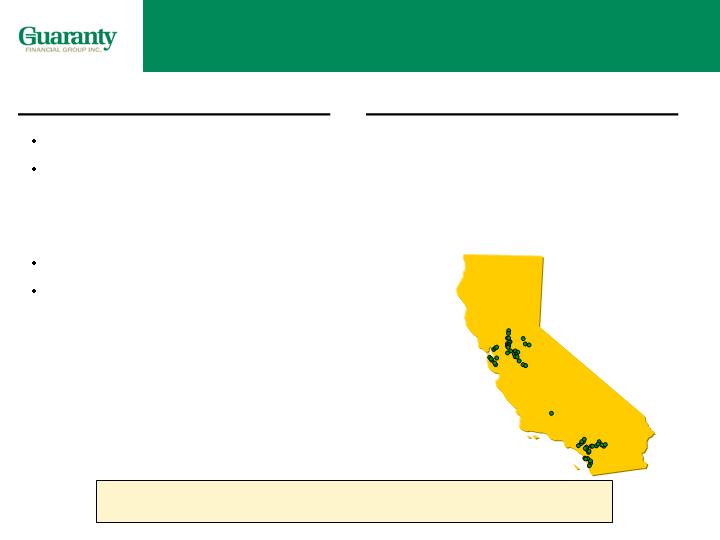

California Demographics

- 56 branches

- $2.4 billion in retail deposits at 12/31/08

- 31st largest in California by total deposits

- Significant presence in Central

Valley and the Inland Empire

California Retail Operation

Largest state in U.S. (pop. 36 million)

3 of the 10 largest cities in the U.S.

Los Angeles # 2

San Diego # 7

San Jose # 10

Fastest growing state population

4 of the 25 fastest growing MSAs in

the country:

Los Angeles area # 7

Riverside area # 8

Sacramento area # 15

San Diego # 20

Grow Retail Franchise in TX and CA

Significant opportunity in California

Source: Claritas Incorporated

San Diego

San Francisco

Sacramento

Central Valley

Los Angeles

Inland Empire

11

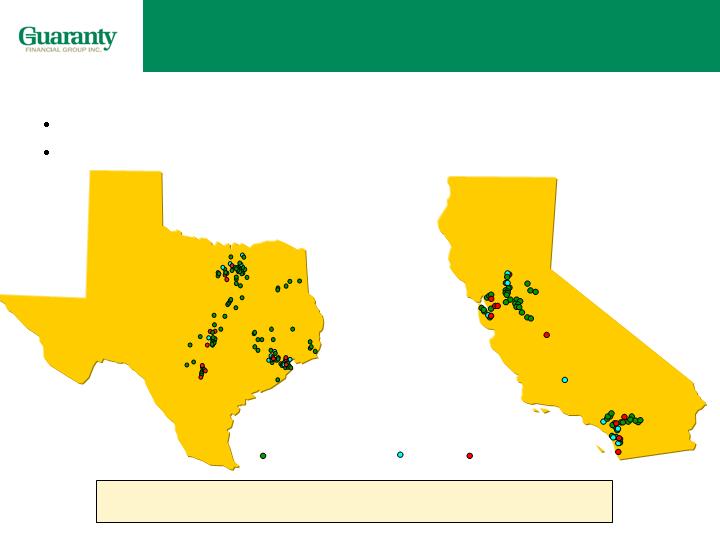

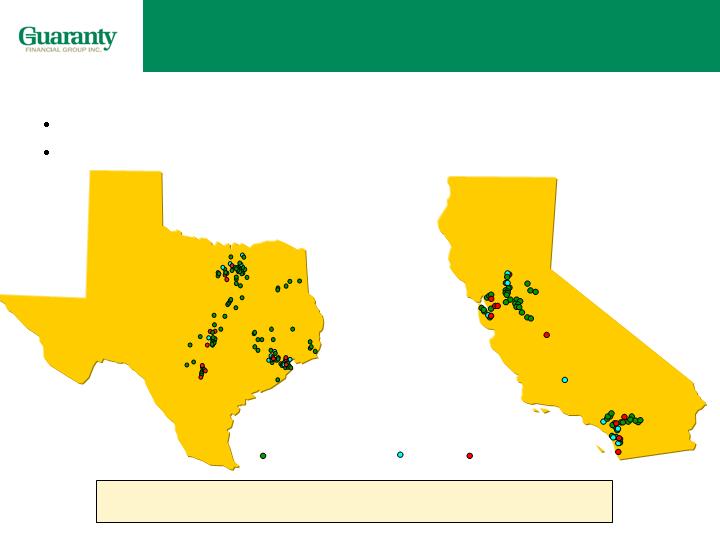

Launched program to open 42 de novo branches.

18 de novo branches opened through year end 2007.

Grow Retail Franchise in TX and CA

Growing branch network in targeted areas

De Novo Branching

Previously Existing (140)

New (18)

To be opened (24)

San Diego

San Francisco

Sacramento

Central Valley

Los Angeles

Inland Empire

Houston

Dallas/Ft. Worth

Austin

San Antonio

12

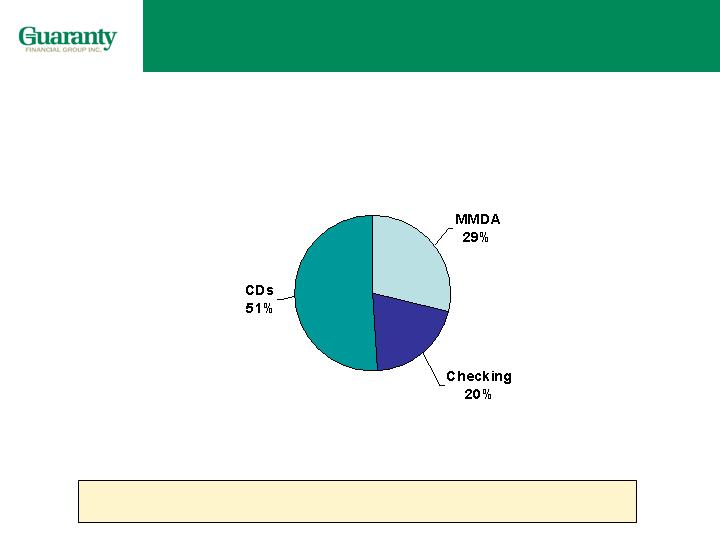

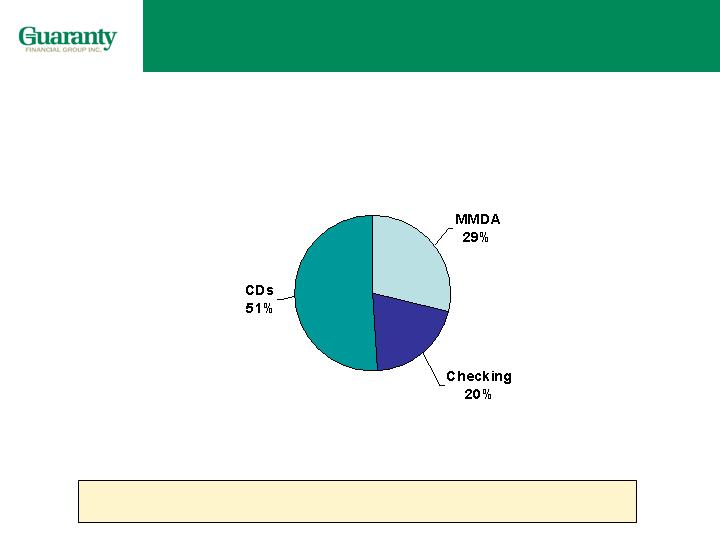

Diversified deposit base

Total Deposits (Dec 31, 2007)

Deposits

Total: $9.4 billion

13

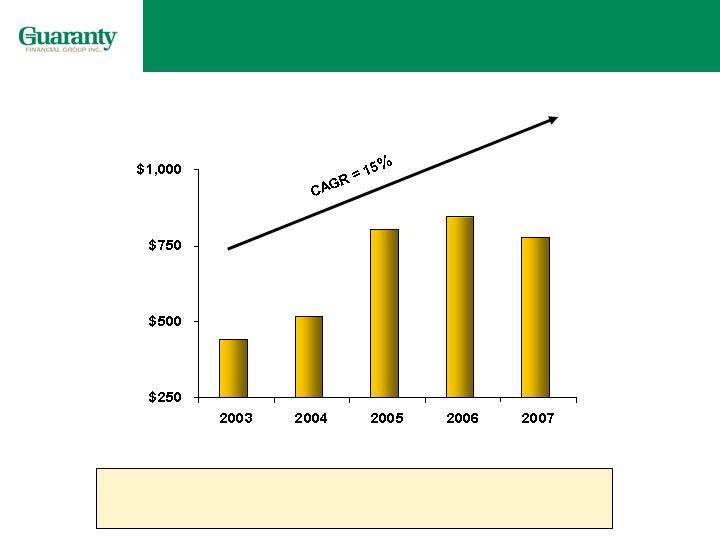

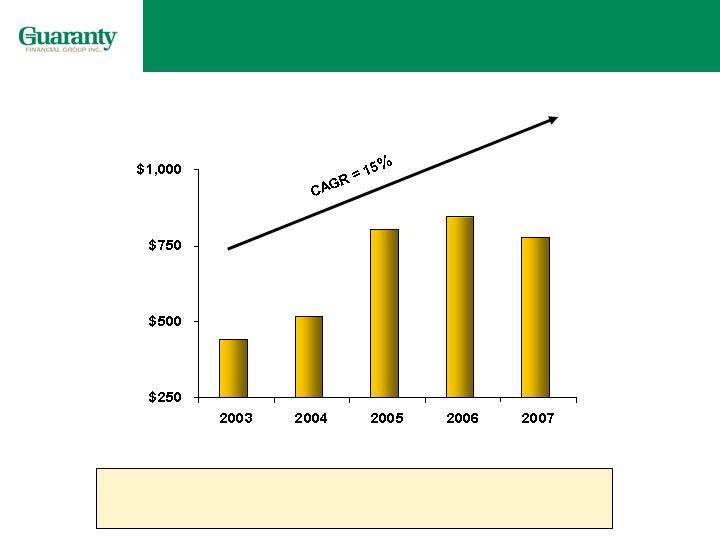

($ in Millions)

Continue to emphasize non-interest

bearing checking deposits

Non-Interest Bearing Deposits

Grow Retail Franchise in TX and CA

$443

$519

$803

$845

$779

14

Grow Retail Franchise in TX and CA

Additional Product Expansion Opportunities:

Expand consumer lending

Grow small business banking

Expand banking services to title insurance agencies

and related transactions

Offer expanded banking products to professionals

Leverage branch network

15

Grow commercial lending franchise

Grow retail franchise in TX and CA

Increase fee income

Provide distinctive customer service

Improved operating efficiency

Maintain strong credit and risk standards

Strategy

We believe the combination of our strategy, management

expertise, growing markets and financial strength positions

Guaranty to create significant value for shareholders

16

Increase Fee Income

*Excludes fee income from exited mortgage banking business.

Fee Income*

($ in Millions)

Diversified and growing fee income

$136

$158

Loan and Other Fees

Deposit Fees and

Non-Deposit Investment

Fees

Insurance

Commission and Fees

$166

**Unaudited.

$157

17

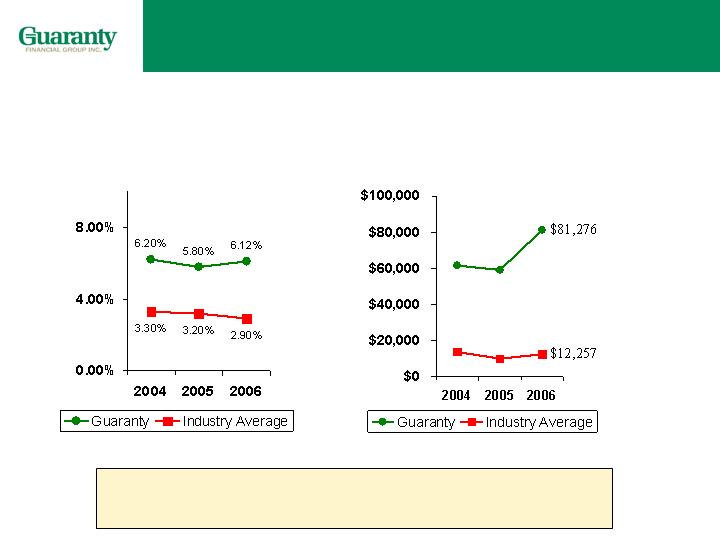

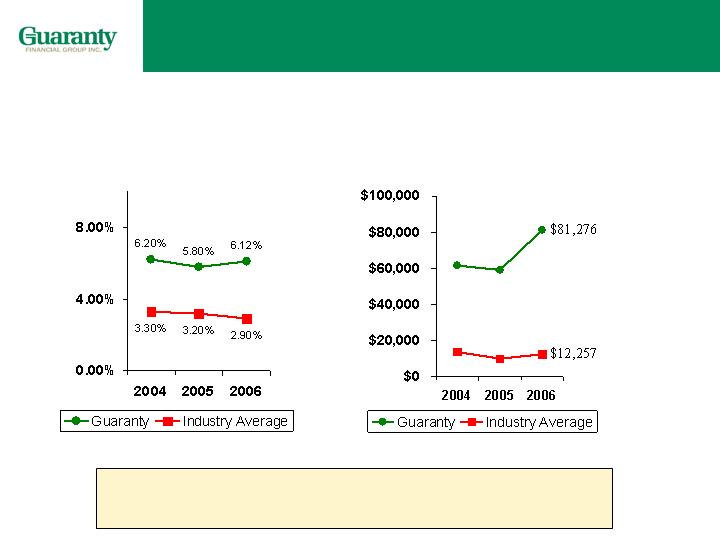

Increase Fee Income

Annuities and Mutual Funds

Deposit Account Penetration

Revenue per Licensed Banker

Our non-deposit investment

program has been very successful

Source of Industry Average Data: 2006 Kehrer-ENSI Financial Institution Investment Program Benchmarking Study

18

Los Angeles

Dallas/Ft. Worth

9th largest bank-owned insurance agency in US

The largest bank-owned agency based in TX

In operation for over 50 years

Products:

Property and Casualty

Group Benefits

Risk Management

Increase Fee Income

Guaranty Insurance is an important

source for growing fee income

Guaranty Insurance Services, Inc.

San Diego

Austin

San Antonio

Houston

Sacramento

San Francisco

Insurance locations

19

Increase Fee Income

Treasury Management

Remote Deposit

Capital Markets

Wealth Management

We believe we have significant

additional cross sell opportunities

20

Grow commercial lending franchise

Grow retail franchise in TX and CA

Increase fee income

Provide distinctive customer service

Improve operating efficiency

Maintain strong credit and risk standards

Strategy

We believe the combination of our strategy, management

expertise, growing markets and financial strength positions

Guaranty to create significant value for shareholders

21

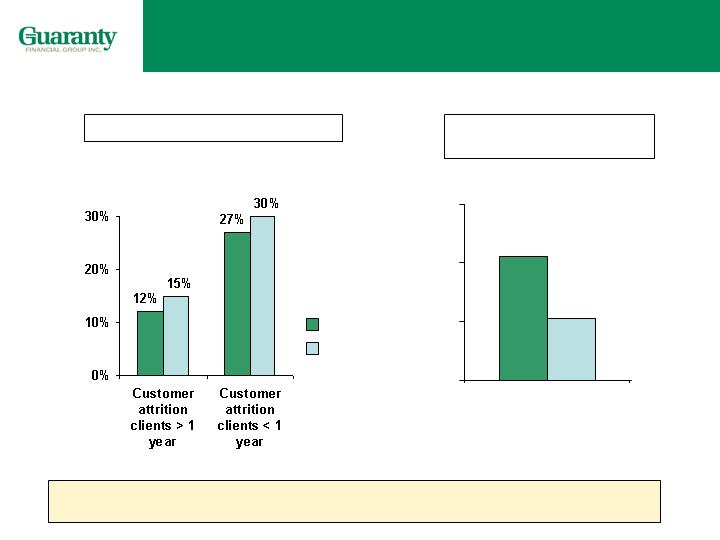

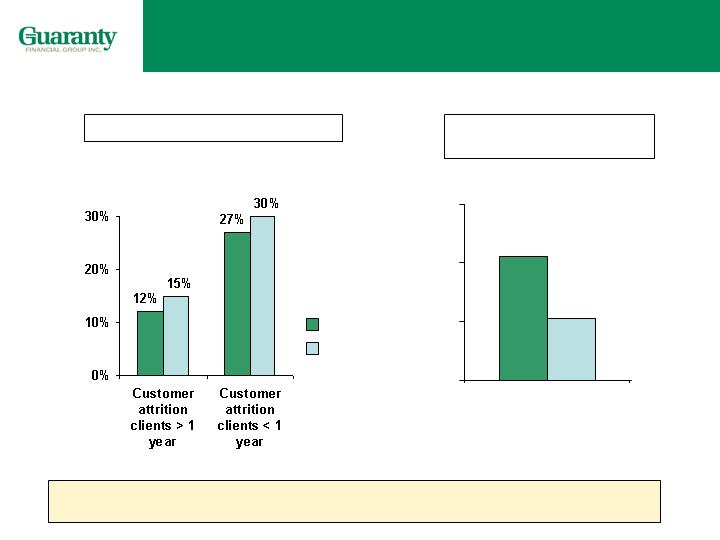

Provide Distinctive Customer Service

Successful in satisfying the needs of our customers

Retail Customer Attrition Rates

Guaranty Bank

Industry

Source of Industry Data: Council for Financial Competition

Retail Customer Tenure

(years)

10.2

8.1

6

8

10

12

22

Grow commercial lending franchise

Grow retail franchise in TX and CA

Increase fee income

Provide distinctive customer service

Improve operating efficiency

Maintain strong credit and risk standards

Strategy

We believe the combination of our strategy, management

expertise, growing markets and financial strength positions

Guaranty to create significant value for shareholders

23

Improve Operating Efficiency

Remain focused on expense management

372

388

384

534

149

151

154

184

Other

--

11

5

34

Charges related to asset impairments and severance

68%

65%

66%

74%

Efficiency ratio (excluding charges related to asset

impairments and severance charges)

14

14

16

19

Information systems and technology

28

28

27

31

Occupancy

$181

$184

$182

$266

Compensation and benefits

2007

2006

2005

2004

Noninterest Expenses

24

Grow commercial lending franchise

Grow retail franchise in TX and CA

Increase fee income

Provide distinctive customer service

Improve operating efficiency

Maintain strong credit and risk standards

Strategy

We believe the combination of our strategy, management

expertise, growing markets and financial strength positions

Guaranty to create significant value for shareholders

25

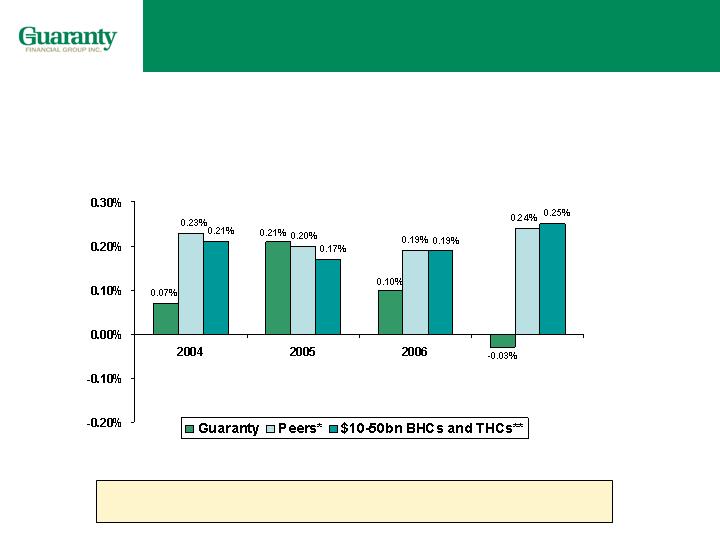

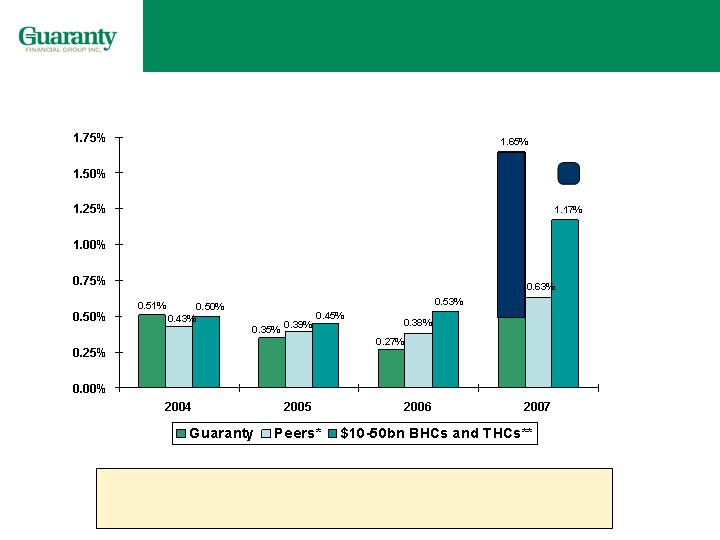

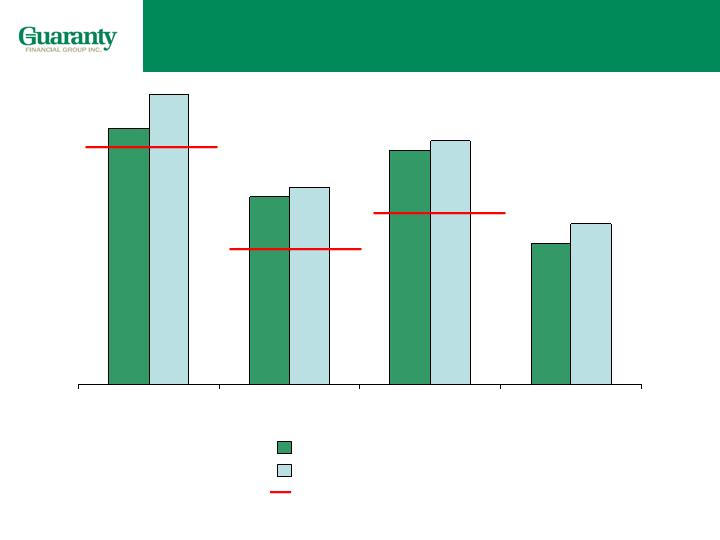

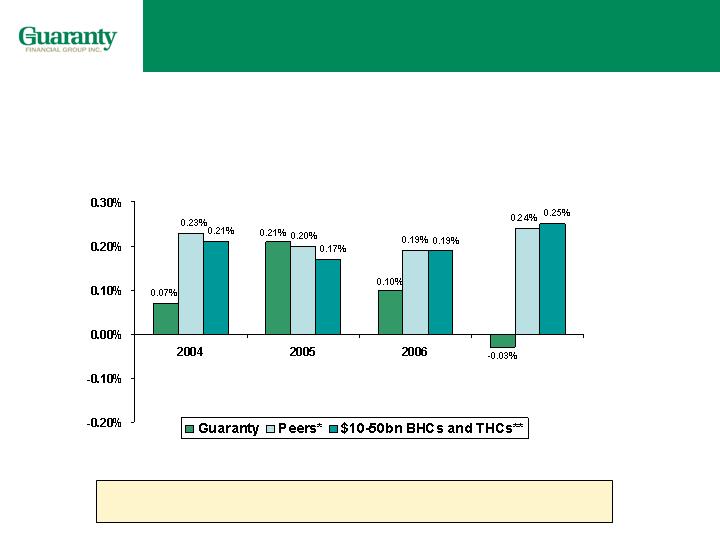

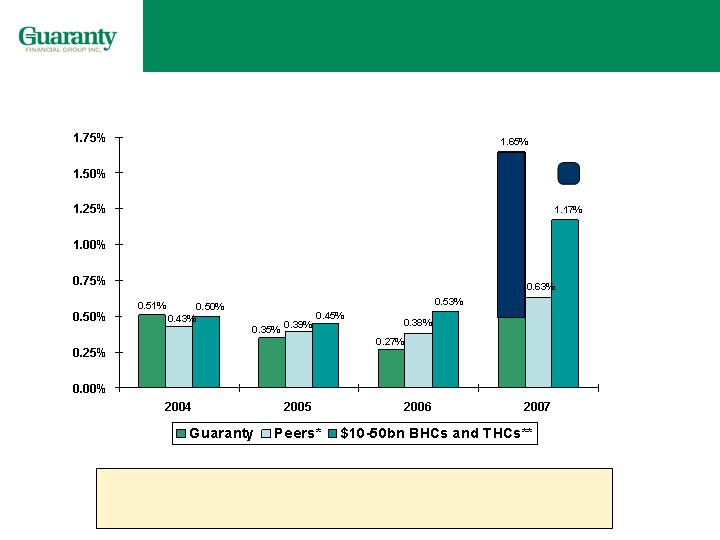

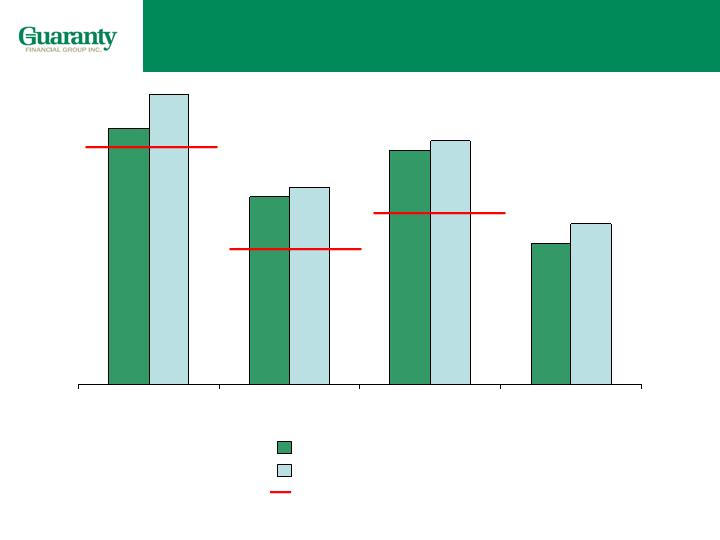

Maintain Strong Credit and Risk Standards

Average charge-off rate (2004 thru 2007):

Guaranty = .09% Peers* = .22% $10-50bn BHCs and THCs** = .21%

Net charge-offs lower than our peers

Net charge-offs as a percentage of average loans outstanding

2007

*Peers: ASBC, BOH, BOKF, BXS, CBSH, CFR, CNB, CYN, FCNCA, FMER, FULT, STSA, SUSQ, TCB, TSFG, VLY, WBS, and WTNY (IBOC 2007 information unavailable on 2/7/08).

**2007 Information unavailable for 5 institutions on 2/7/08.

Data source: SNL data

26

Maintain Strong Credit and Risk Standards

Non Performing loans as a percentage of total loans

Recent increase in historically low non-

performing loans due to market conditions

*Peers: ASBC, BOH, BOKF, BXS, CBSH, CFR, CNB, CYN, FCNCA, FMER, FULT, STSA, SUSQ, TCB, TSFG, WBS, and WTNY (IBOC and VLY 2007 information unavailable on 2/7/08).

.85%

.48%

1.17%

Homebuilder loans

**2007 Information unavailable for 8 institutions on 2/7/08.

Data source: SNL data

27

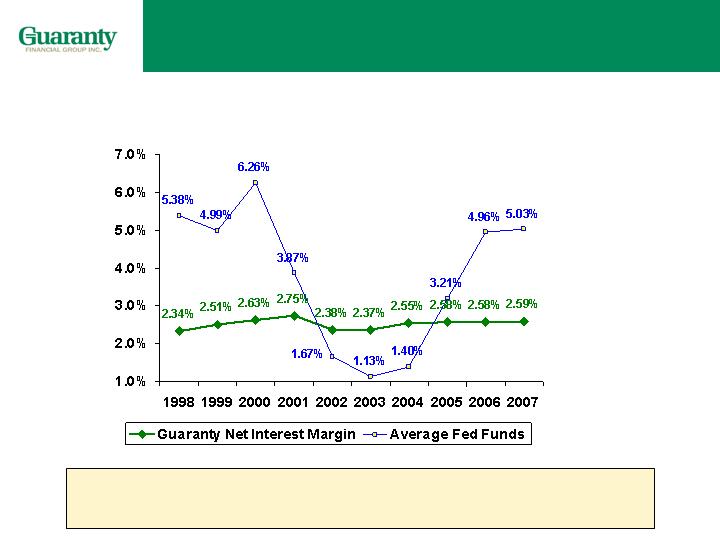

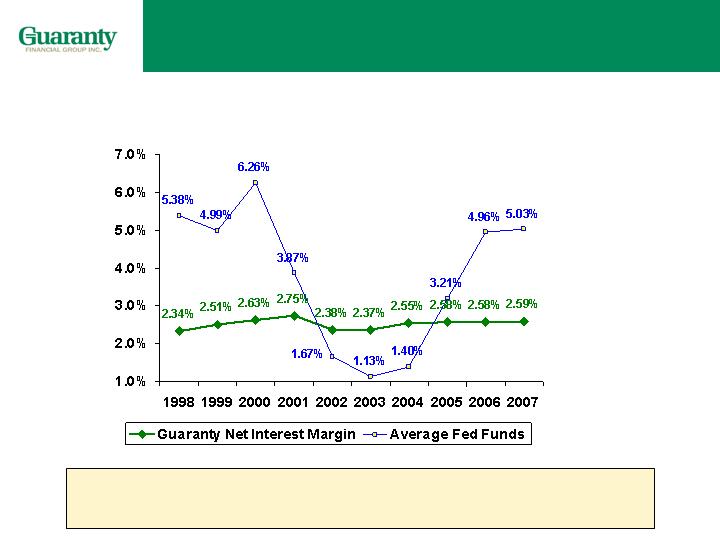

Maintain Strong Credit and Risk Standards

Net Interest Margin

Despite volatility in interest rates, successfully

maintained stable net interest margin

28

Financial Overview

29

$2.20

N/A

N/A

N/A

Diluted Earnings Per Share

7.52%

11.67%

11.97%

10.00%

Return on Average Equity

.49%

.72%

.71%

.56%

Return on Average Assets

78

121

116

95

Net Income

(48)

(70)

(66)

(56)

Income Tax Expense

126

191

182

151

Income Before Taxes

(372)

(388)

(384)

(534)

Non-Interest Expense

157

168

180

267

Non-Interest Income

341

411

386

418

Net Interest Income After Provision

(50)

(1)

(10)

12

(Provision) Credit for Credit Losses

$391

$412

$396

$406

Net Interest Income before LLP

2007

2006

2005

2004

($ in millions, except per share data)

Earnings Highlights

30

32.16

N/A

N/A

N/A

Book Equity Per Share

27.36

N/A

N/A

N/A

Tangible Equity Per Share

1.1

1.0

1.0

0.9

Stockholders’ Equity

5.7

5.1

6.9

4.7

FHLB Borrowings

9.4

9.5

9.2

9.0

Deposits

15.7

15.2

16.7

15.2

Total Liabilities

5.5

5.4

6.2

4.7

Securities

9.9

9.6

9.8

9.6

Loans, net of allowance

$16.8

$16.2

$17.7

$16.1

Total Assets

2007

2006

2005

2004

($ in billions, except per share data)

Balance Sheet Highlights

31

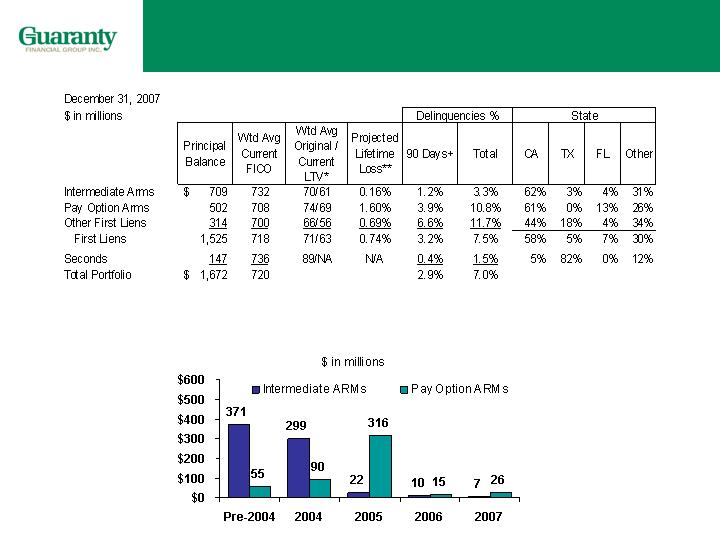

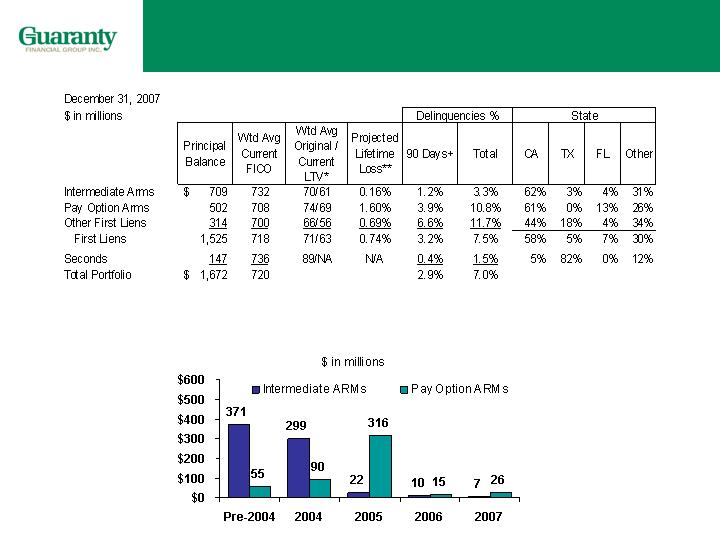

Single-Family Mortgages Detail

*Current loan to value reflects changes in loan balance and changes in property value since loan origination (with changes in value estimated using Office of Federal Housing Enterprise Oversight

data from September 2007).

**Lifetime loss projection from S&P Levels ® model (version 6.2, January 2008, midpoint of ‘B’ loss projection)

Vintage of Origination

32

Mortgage Backed Securities

As of Dec. 31, 2007 ($ Billions)

Amortized Cost Fair Value

Available for Sale:

Agency $0.57 $0.57

Private $1.37 $1.31

Held to Maturity:

Agency $1.23 $1.23

Private $2.41 $2.20

Total: $5.58 $5.31

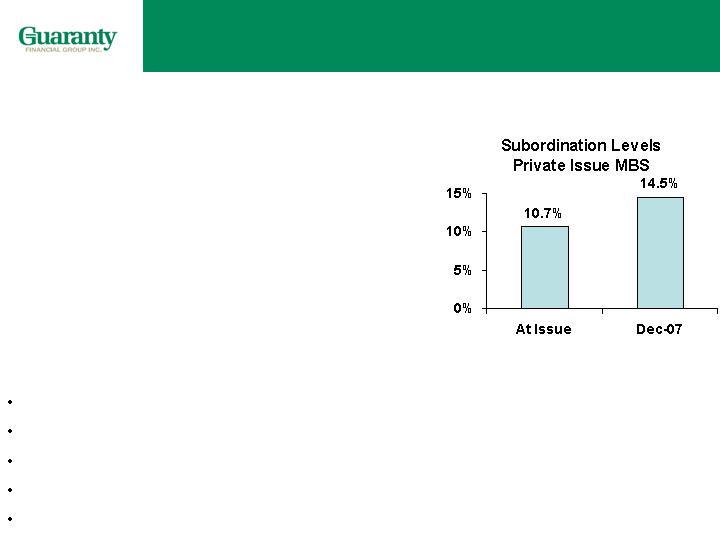

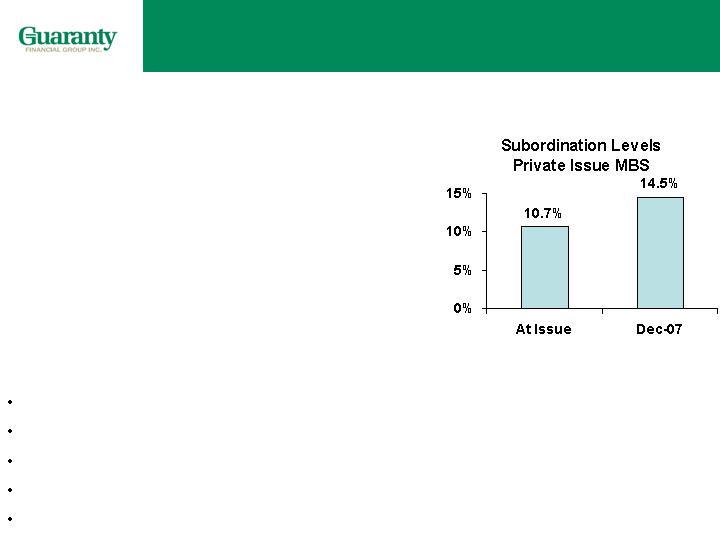

Private Issue MBS

Adjustable rate

All AAA rated

Underlying collateral delinquency rate: 11%

Weighted average current LTV: 78% (current loan balance/original appraised value)

Weighted average current credit score: 708

_____________________

Significant, and growing

subordination levels

provide protection from

credit losses

_____________________

33

Nonperforming Assets

34

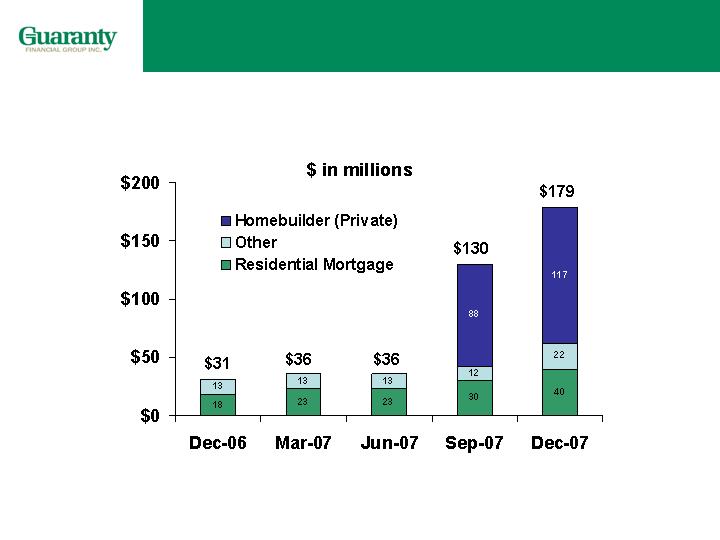

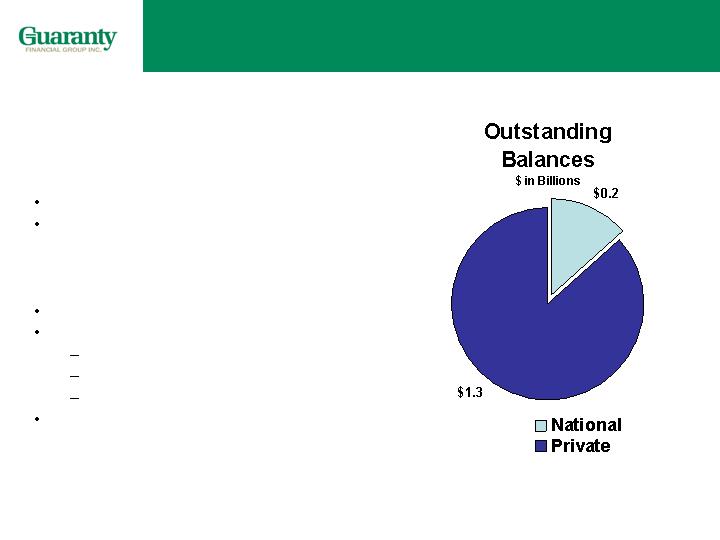

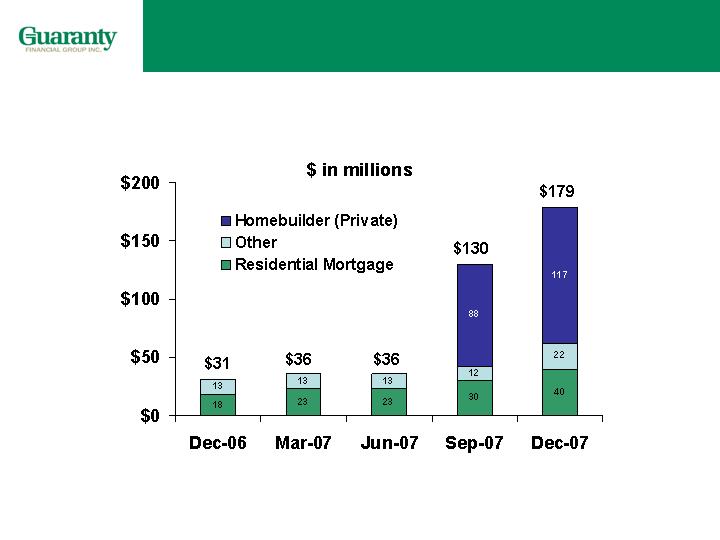

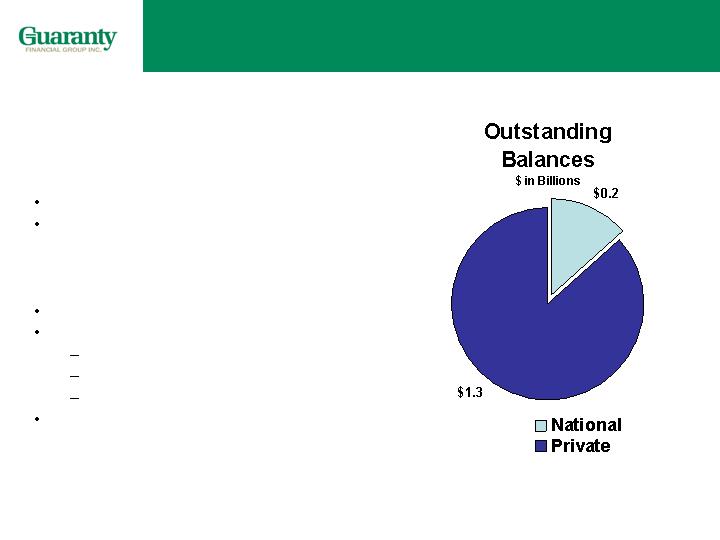

Homebuilder Portfolios

As of Dec 31, 2007

National (mostly public builders)

Approximately half secured

Borrowing base

Regional (all private builders)

Over 90% secured

Policy limits

Land Max. 50% Original LTV

Lots Max. 75% Original LTV

Houses Max. 80% Original LTV

Guarantees

35

Regional Homebuilder Loans

*Represents approx. 3% of total loans.

7%

85

34

51

Colorado

589

163

30

52

105

94

94

Houses

100%

1264

675

31%

382

219

Other

5%

66

36

Arizona

9%

119

67

Florida

10%

132

27

Texas

18%

222

128

Other California

20%

258*

164

Northern & Central California

% of Total

Total

Land/Lots &

Other

As of December 31, 2007 ($ in millions)

36

Capital

Guaranty as of December 31, 2007

Peers* as of September 30, 2007

OTS Well Capitalized Standard

Total Risk-Based Capital

Tier 1 Risk-Based Capital

Tier 1 (Core) Capital (Leverage)

10%

6.0%

5.0%

10.5%

11.9%

7.7%

8.1%

9.6%

10.0%

5.8%

6.6%

TCE/TA

*Peers: ASBC, BOH, BOKF, BXS, CBSH, CFR, CNB, CYN, FCNCA, FMER, FULT, IBOC, STSA, SUSQ, TCB, TSFG, VLY, WBS, and WTNY.

(Bank Level)

(Bank Level)

(Bank Level)

(Holding Company Level)

Data source: SNL data

37

Creating Value For Shareholders

Summary

Long, Successful Track Record in Commercial Lending

Great Markets

Experienced, Cohesive Management Team

It’s a New Day

We believe Guaranty is uniquely

positioned to maximize shareholder value

38