Table of Contents

As filed with the Securities and Exchange Commission June 30, 2008

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the fiscal year ended December 31, 2007

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-33632

BROOKFIELD INFRASTRUCTURE PARTNERS L.P.

(Exact name of Registrant as specified in its charter)

Bermuda

(Jurisdiction of incorporation or organization)

Cannon’s Court

22 Victoria Street,

Hamilton, HM 12, Bermuda

(Address of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Title of class | Name of each exchange on which registered | |

| Limited Partnership Units | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

23,341,850 Limited Partnership Units as of June 27, 2008

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Table of Contents

Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days

Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

x U.S. GAAP ¨ International Financial Reporting Standards as issued by the International Accounting Standards Board

¨ Other

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

Table of Contents

| INTRODUCTION AND USE OF CERTAIN TERMS | 1 | |||||||

| FORWARD-LOOKING STATEMENTS | 2 | |||||||

| 3 | ||||||||

Item | 1 | 3 | ||||||

Item | 2 | 3 | ||||||

Item | 3 | 4 | ||||||

| 3.A | 4 | |||||||

| 3.B | 5 | |||||||

| 3.C | 5 | |||||||

| 3.D | 5 | |||||||

Item | 4 | 25 | ||||||

| 4.A | 25 | |||||||

| 4.B | 26 | |||||||

| 4.C | 33 | |||||||

| 4.D | 34 | |||||||

Item | 4.E | 35 | ||||||

Item | 5 | 35 | ||||||

Item | 6 | 47 | ||||||

| 6.A | 47 | |||||||

| 6.B | 52 | |||||||

| 6.C | 53 | |||||||

| 6.D | 56 | |||||||

| 6.E | 56 | |||||||

Item | 7 | 56 | ||||||

| 7.A | 56 | |||||||

| 7.B | 56 | |||||||

| 7.C | 63 | |||||||

Item | 8 | 63 | ||||||

| 8.A | 63 | |||||||

| 8.B | 64 | |||||||

Item | 9 | 64 | ||||||

| 9.A | 64 | |||||||

| 9.B | 64 | |||||||

| 9.C | 64 | |||||||

| 9.D | 64 | |||||||

| 9.E | 64 | |||||||

| 9.F | 64 | |||||||

Item | 10 | 64 | ||||||

| 10.A | 64 | |||||||

| 10.B | 64 | |||||||

| 10.C | 80 | |||||||

| 10.D | 81 | |||||||

| 10.E | 81 | |||||||

| 10.F | 98 | |||||||

| 10.G | 98 | |||||||

| 10.H | 98 | |||||||

| 10.I | 98 | |||||||

Item | 11 | Quantitative and Qualitative Disclosures about Non-Product-Related Market Risk | 99 | |||||

Item | 12 | 99 | ||||||

| 99 | ||||||||

Item | 13 | 99 | ||||||

Item | 14 | Material Modifications to the Rights of Security Holders and Use of Proceeds | 99 | |||||

Item | 15 | 99 | ||||||

Item | 16.A | 99 | ||||||

Item | 16.B | 99 | ||||||

Item | 16.C | 100 | ||||||

Item | 16.D | 100 | ||||||

Item | 16.E | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 100 | |||||

Table of Contents

| 100 | ||||||||

Item | 17 | 100 | ||||||

Item | 18 | 100 | ||||||

Item | 19 | 101 | ||||||

Table of Contents

INTRODUCTION AND USE OF CERTAIN TERMS

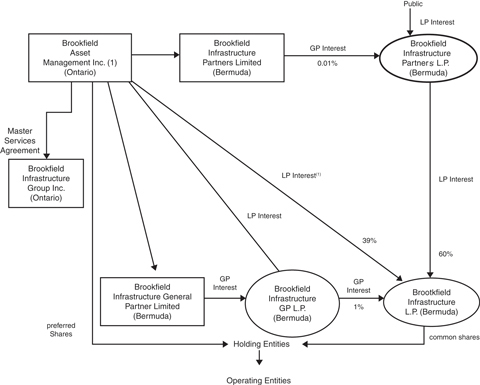

Unless the context requires otherwise, when used in this annual report on Form 20-F, the terms “BIP”, “we”, “us” and “our” refer to Brookfield Infrastructure Partners L.P., Brookfield Infrastructure, the Holding Entities and the operating entities, each as defined below, taken together. In addition, unless the context suggests otherwise, references to:

| • | an “affiliate” of any person are to any other person that, directly or indirectly through one or more intermediaries, controls, is controlled by or is under common control with such person; |

| • | “Brookfield” are to Brookfield Asset Management and any affiliate of Brookfield Asset Management, other than us; |

| • | “Brookfield Asset Management” are to Brookfield Asset Management Inc.; |

| • | “Brookfield Infrastructure” are to Brookfield Infrastructure L.P.; |

| • | the “current operations” are to the businesses in which we hold an interest in as set out in Item 4.B “Business Overview”; |

| • | our “electricity transmission operations” refer to our interest in Transelec Chile S.A., or Transelec, our Chilean transmission operations, our investments in the Transmissions Brasilerias De Energica companies, or TBE, our Brazilian transmission investments, which were transferred to us by Brookfield as described in Item 4.B “Business Overview – Current Operations – Electricity Transmission – Overview” and Great Lakes Power Transmission L.P., which holds our Ontario transmission operations as described in Item 4.B “Business Overview – Current Operations – Electricity Transmission – Overview”; |

| • | “Holding Entities” are to the subsidiaries of Brookfield Infrastructure, from time-to-time, through which it indirectly holds all of our interests in the operating entities; |

| • | the “infrastructure division” are to the portion of Brookfield’s infrastructure operations owned during the periods prior to November 27, 2007 that were contributed to us as part of the spin-off; |

| • | the “Infrastructure General Partner” are to Brookfield Infrastructure General Partner Limited, which serves as the general partner of the Infrastructure GP LP; |

| • | the “Infrastructure GP LP” are to Brookfield Infrastructure GP L.P., which serves as the general partner of Brookfield Infrastructure; |

| • | “our limited partnership agreement” are to the amended and restated limited partnership agreement of our partnership; |

| • | the “Manager” are to Brookfield Infrastructure Group Inc. and, unless the context otherwise requires, include any other affiliate of Brookfield that provides services to us pursuant to the Master Services Agreement or any other service agreement or arrangement; |

| • | “our Managing General Partner” are to Brookfield Infrastructure Partners Limited, which serves as our partnership’s general partner; |

| • | “Master Services Agreement” are to the master management and administration agreement dated as of December 4, 2007, among the Service Recipients, Brookfield Infrastructure Group Inc. and certain other affiliates of Brookfield Asset Management who are party thereto; |

| • | “operating entities” are to the entities which directly or indirectly hold our current operations and assets that we may acquire in the future, including any assets held through joint ventures, partnerships and consortium arrangements; |

| • | “our partnership” are to Brookfield Infrastructure Partners L.P.; |

| • | the “Redemption-Exchange Mechanism” are to the mechanism by which Brookfield may request redemption of its limited partnership interests in Brookfield Infrastructure in whole or in part in exchange for cash, subject to the right of our partnership to acquire such interests (in lieu of such redemption) in exchange for limited partnership units of our partnership, as more fully set forth in Item 10.B “Memorandum and Articles of Association – Description of Brookfield Infrastructure’s Limited Partnership Agreement – Redemption-Exchange Mechanism”; |

| • | “Redemption-Exchange Unit” is a unit of Brookfield Infrastructure that has the rights of the Redemption-Exchange Mechanism. See Item 10.B “Memorandum and Articles of Association - Description of Brookfield Infrastructure’s Limited Partnership Agreement - Units”; |

| • | “Service Recipients” are to our partnership, Brookfield Infrastructure and the Holding Entities; |

| • | “spin-off” are to the issuance of the special dividend by Brookfield Asset Management to its shareholders of 23,344,508 of our units on January 31, 2008; |

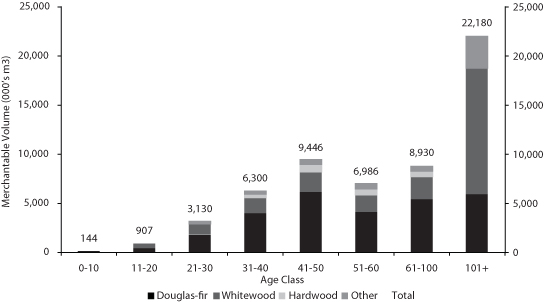

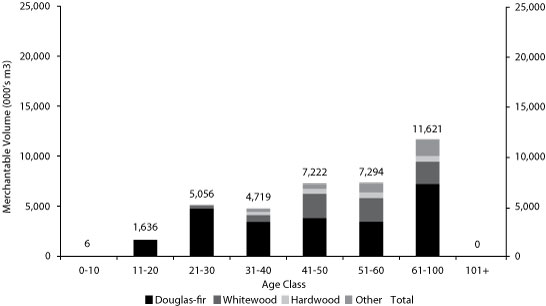

| • | our “timber operations” are to our interest in Island Timberlands Limited Partnership, or Island Timberlands, our Canadian timber operations and our interest in Longview Timber Holdings, Corp., or Longview, our U.S. timber operations; and |

| • | “our units” are to the limited partnership units in our partnership and references to “our unitholders” are to the holders of our units. |

1

Table of Contents

This annual report on Form 20-F contains certain forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will” and “would” or the negative of those terms or other comparable terminology.

The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us or are within our control. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward looking statements. The following factors, among others, that could cause our actual results to vary from our forward looking statements:

| • | our partnership’s limited separate operating history; |

| • | our financial statements may not present our financial results in the most meaningful manner; |

| • | our assets are or may become highly leveraged and we intend to incur indebtedness above the asset-level; |

| • | foreign currency risk and risk management activities; |

| • | our partnership is not regulated as an investment company under the U.S. Investment Company Act; |

| • | we are not subject to the same disclosure requirements as a U.S. domestic public company; |

| • | we are exempt from certain requirements of Canadian securities laws; |

| • | general economic conditions and government regulation; |

| • | exposure to uninsurable losses; |

| • | contingent liabilities; |

| • | labor disruptions and economically unfavorable collective bargaining agreements; |

| • | the competitive market for acquisition opportunities; |

| • | our ability to execute our growth strategy, including completion of acquisitions, and to achieve desired results from acquisitions; |

| • | some of our current operations are held in the form of joint ventures or partnerships or through consortium arrangements; |

| • | electricity transmission may require substantial capital expenditures; |

| • | electricity transmission development projects may expose us to construction risks; |

| • | electricity transmission clients may default on their obligations; |

| • | changes in tolls or regulated rates for electricity transmission; |

| • | potential adverse claims to lands used in our electricity transmission operations; |

| • | weather conditions, industry practice and regulations associated with forestry may adversely affect our timber operations; |

| • | the competitive business environment for our timber operations; |

| • | aboriginal claims to lands may adversely affect our timber operations; |

| • | Canadian export regulations applicable to timber; |

| • | Brookfield’s influence over our partnership; |

| • | the lack of an obligation of Brookfield to source acquisition opportunities for us; |

| • | our dependence on Brookfield and its professionals; |

| • | interests in our Managing General Partner may be transferred to a third party without unitholder consent; |

| • | Brookfield may increase its ownership of our partnership; |

| • | Brookfield does not owe our unitholders any fiduciary duties; |

2

Table of Contents

| • | conflicts of interest between our partnership and our unitholders, on the one hand, and Brookfield, on the other hand; |

| • | our arrangements with Brookfield may contain terms that are less favorable than those which otherwise might have been obtained from unrelated parties; |

| • | our Managing General Partner may be unable or unwilling to terminate the Master Services Agreement; |

| • | the limited liability of, and our indemnification of, the Manager; |

| • | changes in tax law and practice; and |

| • | other factors described in this Form 20-F, including, but not limited to, those described under Item 3.D “Risk Factors” and elsewhere in this Form 20-F. |

Except as required by applicable law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the events described by our forward-looking statements might not occur. We qualify any and all of our forward-looking statements by these cautionary factors. Please keep this cautionary note in mind as you read this Form 20-F.

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

3

Table of Contents

| ITEM 3. | KEY INFORMATION |

| 3.A | SELECTED FINANCIAL DATA |

The following table presents financial data for the infrastructure division as at and for the periods indicated:

| As of and for the period from January 1 to November 26, | As of and for Year Ended December 31, | |||||||||||

MILLIONS | 2007 | 2006 | 2005 | |||||||||

Revenue | $ | 537.1 | $ | 307.8 | $ | 102.8 | ||||||

Direct operating costs | (245.1 | ) | (163.0 | ) | (77.9 | ) | ||||||

| 292.0 | 144.8 | 24.9 | ||||||||||

Net loss (income) | $ | (64.3 | ) | $ | (4.9 | ) | $ | 1.0 | ||||

Total assets | $ | 7,521.3 | $ | 4,627.8 | $ | 973.4 | ||||||

Divisional equity | $ | 1,527.1 | $ | 349.8 | $ | 266.8 | ||||||

The following is non-GAAP financial information for the infrastructure division for the periods indicated:

|

| |||||||||||

| As of and for the period from January 1 to November 26, | As of and for Year Ended December 31, | |||||||||||

| 2007 | 2006 | 2005 | ||||||||||

Adjusted net operating income(1) | $ | 15.6 | $ | 32.9 | $ | 7.3 | ||||||

| (1) | Adjusted net operating income is defined as net income adding back depreciation and amortization, deferred income taxes and a performance fee accrued, net of minority interest related to those items, which are either directly on the statement of income or are a component of the equity earnings of an underlying investee company. Adjusted net operating income is a measure of operating performance that is not calculated in accordance with U.S. GAAP. Please see “Managements Discussion and Analysis of Financial Condition and Results of Operations— Non-GAAP Financial Measure” for a discussion of adjusted net operating income and its limitations as a measure of our operating performance. The following table presents a reconciliation of adjusted net operating income to net income: |

| As of and for the period from January 1 to November 26, | As of and for Year Ended December 31, | |||||||||||

| 2007 | 2006 | 2005 | ||||||||||

Net (loss) income | $ | (64.3 | ) | $ | (4.9 | ) | $ | 1.0 | ||||

Depreciation and amortization | 134.9 | 49.7 | 12.7 | |||||||||

Deferred income taxes | (25.6 | ) | (2.3 | ) | — | |||||||

Performance fee payable | — | 40.0 | — | |||||||||

Minority interests in the foregoing items | (29.4 | ) | (49.6 | ) | (6.4 | ) | ||||||

Adjusted net operating income | $ | 15.6 | $ | 32.9 | $ | 7.3 | ||||||

| We consider adjusted net operating income to be a measure of operating performance. The elimination of cash items from a non-GAAP liquidity measure would be prohibited by U.S. rules promulgated by the Securities and Exchange Commission. However, in accordance with policies of Canadian securities regulators, notwithstanding that we consider adjusted net operation income to be a measure of operating performance, as supplemental information we set forth below a reconciliation of adjusted net operating income to cash flow from operating activities for the infrastructure division: |

| As of and for the period from January 1 to November 26, | As of and for Year Ended December 31, | |||||||||

| 2007 | 2006 | 2005 | ||||||||

Adjusted net operating income | $ | 15.6 | $ | 32.9 | $ | 7.3 | ||||

Accrued interest on debt | — | 60.6 | — | |||||||

Other changes in non-cash working capital | 42.4 | (2.2 | ) | 13.0 | ||||||

Minority interest | 22.6 | 30.8 | 7.4 | |||||||

Cash flow from operating activities | $ | 80.6 | $ | 122.1 | $ | 27.7 | ||||

4

Table of Contents

The following table presents summary financial data for Brookfield Infrastructure as of December 31, 2007 and for the period from November 27, 2007 to December 31, 2007:

Loss from equity accounted investments | $ | (7.8 | ) | |

Net income | $ | 1.1 | ||

Total assets | $ | 932.4 | ||

Partnership equity | $ | 907.8 |

The following is non-GAAP information for Brookfield Infrastructure for the period from November 27, 2007 to December 31, 2007:

Adjusted net operating loss(1) | $ | (2.5 | ) |

| (1) | Adjusted net operating income is defined as net income back depreciation and amortization, deferred income taxes and a performance fee accrued, which are either directly on the statement of income or are a component of the equity earnings of an underlying investee company. Adjusted net operating income is a measure of operating performance that is not calculated in accordance with U.S. GAAP. Please see “Managements Discussion and Analysis of Financial Condition and Results of Operations— Non—GAAP Financial Measure” for a discussion of adjusted net operating income and its limitations as a measure of our operating performance. The following table presents a reconciliation of adjusted net operating income to net income: |

Net income | $ | 1.1 | ||

Depreciation and amortization | 2.6 | |||

Deferred income taxes | (6.2 | ) | ||

Adjusted net operating loss | $ | (2.5 | ) | |

| We consider adjusted net operating income to be a measure of operating performance. The elimination of cash items from a non-GAAP liquidity measure would be prohibited by U.S. rules promulgated by the Securities and Exchange Commission. However, in accordance with the policies of Canadian securities regulators, notwithstanding that we consider adjusted net operating income to be a measure of operating performance, as supplemental information we set forth below a reconciliation of adjusted net operating income to cash flow from operating activities for Brookfield Infrastructure: |

| Period from November 27, 2007 to December 31, 2007 | ||||

MILLIONS | ||||

Adjusted net operating loss | $ | (2.5 | ) | |

Changes in non-cash working capital | 2.5 | |||

Cash flow from operating activities | $ | — | ||

Because our partnership holds a 60% limited partnership interest in Brookfield Infrastructure, distributions to our partnership will be based on our 60% interest.

The following table presents summary financial data for our partnership as of December 31, 2007 and for the period from November 27, 2007 to December 31, 2007:

Equity accounted earnings | $ | 0.7 | |

Net income | $ | 0.7 | |

Total assets | $ | 544.7 | |

Partnership equity | $ | 544.7 |

| 3.B | CAPITALIZATION AND INDEBTEDNESS |

Not applicable.

| 3.C | REASONS FOR THE OFFER AND USE OF PROCEEDS |

Not applicable.

| 3.D | RISK FACTORS |

You should carefully consider the following factors in addition to the other information set forth in this Form 20-F. Additional risks and uncertainties that we do not presently know about or that we currently believe are immaterial may also adversely impact our business, financial condition, results of operations or the value of our unitholders’ units. If any of the following risks actually occur, our business, financial condition and results of operations and the value of our unitholders’ units would likely suffer.

Risks Relating to Us and Our Partnership

Our partnership is a recently formed partnership with limited separate operating history and the historical financial information included herein for periods prior to November 27, 2007 does not reflect the financial condition or operating results we would have achieved during the periods presented, and therefore may not be a reliable indicator of our future financial performance.

5

Table of Contents

Our partnership was formed on May 21, 2007 and commenced its activities on November 27, 2007. Our limited operating history will make it difficult to assess our ability to operate profitably and make distributions to unitholders. Although most of our current operations have been under Brookfield’s control prior to the formation of our partnership, their combined results have only recently been reported on a stand-alone basis and the historical financial statements included in this Form 20-F cover periods during which some of our current operations were not under Brookfield’s control or management and, therefore, may not be indicative of our future financial condition or operating results. Moreover, historical results for all of our current operations will not be reported for any full fiscal period prior to the second quarter of 2008. You should carefully consider the basis on which the historical financial information included herein was prepared and presented.

Our partnership’s and Brookfield Infrastructure’s financial statements may not present our partnership’s financial results in the most meaningful manner.

Our partnership’s sole material asset is its 60% limited partnership interest in Brookfield Infrastructure, which our partnership accounts for using equity accounting because our partnership does not control Brookfield Infrastructure; the general partner of which is controlled by Brookfield. Furthermore, as most of our current operations are accounted for using equity or cost accounting, Brookfield Infrastructure’s financial statements do not include a detailed breakdown of the components of net income, cash flows or unitholders’ equity for most of our current operations. The only operations that are currently consolidated into Brookfield Infrastructure’s financial statements are our Ontario transmission operations. Although we provide certain income statement and balance sheet line items for our current operations on a segmented basis in a note to Brookfield Infrastructure’s financial statements, such information does not include the level of detail and note discussion that would be provided if such operations were consolidated into our partnership’s and Brookfield Infrastructure’s financial statements. While separate audited financial statements for most of our current operations are included in this Form 20-F, our obligation to provide similar disclosure in the future will depend on the significance of each of the current operations at each year end relative to our overall assets and income. Accordingly, we may not continue to provide separate audited financial statements for each or any of our operations on an ongoing basis.

In addition, we do not expect to be able to provide investors with audited financial statements containing meaningful year-to-year comparisons of financial performance for several years because our partnership’s results only reflect results for our current operations from and after the date we or, in some cases, Brookfield acquired them.

Our assets are or may become highly leveraged and we may incur indebtedness in addition to asset-level indebtedness under our new credit facility, which contains certain restrictive covenants, or otherwise.

Our operating entities have a significant degree of leverage on their assets, including acquisition-related leverage, which is not reflected in our partnership’s historical financial statements. In addition, we may increase the leverage on our assets. Highly leveraged assets are inherently more sensitive to declines in revenues, increases in expenses and interest rates and adverse economic, market and industry developments. A leveraged company’s income and net assets also tend to increase or decrease at a greater rate than would otherwise be the case if money had not been borrowed. As a result, the risk of loss associated with a leveraged company is generally greater than for companies with comparatively less debt. In addition, the use of indebtedness in connection with an acquisition may give rise to negative tax consequences to certain investors.

On a proportionate basis, the debt balance of all of our current operations was approximately $680 million as of December 31, 2007, with an annual debt service obligation of approximately $41 million. We may also incur indebtedness under one or more credit facilities, in addition to any asset-level indebtedness. On June 13, 2008, we entered into a $450 million senior secured credit facility which is available to fund acquisitions. For example, we may incur indebtedness under this credit facility in order to acquire an additional indirect interest in Longview in the event that Brookfield contributes its remaining interest in Longview to a timberlands focused partnership with institutional investors. We have made a commitment of up to $600 million to Brookfield to make such a purchase, subject to conditions, including a financing condition, described under Item 7.B “Related Party Transactions – Longview Purchase Agreement.” Although we intend to complete any acquisition, including this indirect acquisition of Longview, with an appropriate mix of debt and equity financing for our capital structure, we may finance all or a portion of this or any other acquisition and other investments with debt.

The terms of our senior secured credit facility subjects us to financial and operating covenants which restrict our ability to engage in certain types of activities and make distributions in respect of equity. For example, the facility contains negative covenants that significantly restrict Brookfield Infrastructure including, among others, limitations on debt, liens, investments, mergers and operating activities, and restrictions from making any distributions on its equity unless immediately prior to, and after giving pro forma effect to, such distribution, no default has occurred and is continuing and Brookfield Infrastructure meets a minimum interest coverage ratio. If we fail to satisfy any debt service obligations under the facility or breach any financial or operating covenants thereunder, we will be prohibited from making any distributions until such breach is cured or the lenders could declare all advances outstanding under the senior secured credit facility to be immediately due and payable and could foreclose on our assets pledged as collateral.

6

Table of Contents

We are subject to foreign currency risk and our risk management activities may adversely affect the performance of our operations.

Some of our current operations are in countries where the U.S. dollar is not the functional currency. These operations pay distributions in currencies other than the U.S. dollar which we must convert to U.S. dollars prior to making distributions and certain of our operations have revenues denominated in currencies different than our expense structure, thus exposing us to currency risk. Fluctuations in currency exchange rates could make it more expensive for our customers to purchase our services and consequently reduce the demand for our services. In addition, a significant depreciation in the value of such foreign currencies may have a material adverse effect on our results of operations and financial position.

When managing our exposure to such market risks, we may use forward contracts, options, swaps, caps, collars and floors or pursue other strategies or use other forms of derivative instruments. The success of any hedging or other derivative transactions that we enter into generally will depend on our ability to structure contracts that appropriately offset our risk position. As a result, while we may enter into such transactions in order to reduce our exposure to market risks, unanticipated market changes may result in poorer overall investment performance than if the transaction had not been executed. Such transactions may also limit the opportunity for gain if the value of a hedged position increases.

The combined financial statements of Brookfield’s infrastructure division reflect net losses for the year ended December 31, 2006 and the period from January 1 to November 26, 2007.

The infrastructure division operated at a net loss in 2006, primarily as a result of the accrual of a performance fee payable by our Canadian timber operations to Brookfield during such year relating to the increased appraised value of timber and HBU lands, which increased value is not reflected in our combined financial statements. Our partnership may incur significant losses in the future as a result of such type of expenses. The infrastructure division operated at a net loss in the period from January 1 to November 26, 2007 primarily as a result of weak results in our timber operations which were impacted by the downturn in the U.S. housing market and a strike at our Canadian operations that has since been resolved. In addition, as a publicly reporting issuer, our partnership expects to incur significant legal, accounting and other expenses that are not reflected in the combined financial statements of Brookfield’s infrastructure division. Performance fee payments and public company costs could hinder our partnership from achieving or maintaining profitability. We may incur additional losses in the future which may limit our ability to pay distributions and adversely affect the trading price of our units.

Our partnership is not, and does not intend to become, regulated as an investment company under the U.S. Investment Company Act (and similar legislation in other jurisdictions) and if our partnership was deemed an “investment company” under the U.S. Investment Company Act, applicable restrictions could make it impractical for us to operate as contemplated.

The U.S. Investment Company Act and the rules thereunder (and similar legislation in other jurisdictions) provide certain protections to investors and impose certain restrictions on companies that are registered as investment companies. Among other things, such rules limit or prohibit transactions with affiliates, impose limitations on the issuance of debt and equity securities and impose certain governance requirements. Our partnership has not been and does not intend to become regulated as an investment company and our partnership intends to conduct its activities so it will not be deemed to be an investment company under the U.S. Investment Company Act (and similar legislation in other jurisdictions). In order to ensure that we are not deemed to be an investment company, we may be required to materially restrict or limit the scope of our operations or plans, we will be limited in the types of acquisitions that we may make and we may need to modify our organizational structure or dispose of assets of which we would not otherwise dispose. Moreover, if anything were to happen which would potentially cause our partnership to be deemed an investment company under the U.S. Investment Company Act, it would be impractical for us to operate as intended. Agreements and arrangements between and among us and Brookfield would be impaired, the type and amount of acquisitions that we would be able to make as a principal would be limited and our business, financial condition and results of operations would be materially adversely affected. Accordingly, we would be required to take extraordinary steps to address the situation, such as the amendment or termination of the Master Services Agreement, restructuring our partnership and the Holding Entities, amendment of our limited partnership agreement or the termination of our partnership, any of which could materially adversely affect the value of our units. In addition, if our partnership were deemed to be an investment company under the U.S. Investment Company Act, it would be taxable as a corporation for U.S. federal income tax purposes, and such treatment could materially adversely affect the value of our units.

7

Table of Contents

Our partnership is a “foreign private issuer” under U.S. securities laws and as a result is subject to disclosure obligations different from requirements applicable to U.S. domestic issuers listed on the NYSE.

Although our partnership is subject to the periodic reporting requirement of the U.S. Securities Exchange Act, as amended, or the Exchange Act, the periodic disclosure required of foreign private issuers under the Exchange Act is different from periodic disclosure required of U.S. domestic issuers. Therefore, there may be less publicly available information about our partnership than is regularly published by or about other public limited partnerships in the United States and our partnership is exempt from certain other sections of the Exchange Act that U.S. domestic issuers would otherwise be subject to, including the requirement to provide our unitholders with information statements or proxy statements that comply with the Exchange Act. In addition, insiders and large unitholders of our partnership are not obligated to file reports under Section 16 of the Exchange Act and certain of the governance rules imposed by the NYSE are inapplicable to our partnership.

Our partnership is an “SEC foreign issuer” under Canadian securities regulations and is exempt from certain requirements of Canadian securities laws.

Although our partnership is a reporting issuer in Canada, it is an “SEC foreign issuer” and is exempt from certain Canadian securities laws relating to continuous disclosure obligations and proxy solicitation if our partnership complies with certain reporting requirements applicable in the United States, provided that the relevant documents filed with the U.S. Securities and Exchange Commission, or the SEC, are filed in Canada and sent to our partnership’s securityholders in Canada to the extent and in the manner and within the time required by applicable U.S. requirements. Therefore, there may be less publicly available information in Canada about our partnership than would be available if we were a typical Canadian reporting issuer.

Risks Relating to Our Operations and the Infrastructure Industry

Risks Relating to Our Current Operations and Infrastructure Generally

All of our operating entities are subject to general economic conditions and government regulation.

All of our operating entities depend on the financial health of their customers who may be sensitive to the overall performance of the economy. Adverse local, regional or worldwide economic trends that affect each respective economy could have a material adverse effect on our financial condition and results of operations. Our financial condition and results of operations could also be affected by changes in economic or other government policies or other political or economic developments in each country or region, as well as regulatory changes or administrative practices over which we have no control such as: the regulatory environment related to our business operations and concession agreements; interest rates; currency fluctuations; exchange controls and restrictions; inflation; liquidity of domestic financial and capital markets; tax policies; and other political, social and economic developments that may occur in or affect the countries in which our operating entities operate or the countries in which the customers of our operating entities operate or both.

We may be exposed to uninsurable losses.

The assets of infrastructure businesses are exposed to unplanned interruptions caused by significant catastrophic events such as floods, earthquakes, fires, major plant breakdowns, pipeline or electricity line ruptures or other disasters. Operational disruption, as well as supply disruption, could adversely affect the cash flows available from these assets. In addition, the cost of repairing or replacing damaged assets could be considerable. Repeated or prolonged interruption may result in a permanent loss of customers, substantial litigation or penalties or regulatory or contractual non-compliance. Moreover, any loss from such events may not be recoverable under relevant insurance policies.

Given the nature of the assets operated by our operating entities, we may be more exposed to risks in the insurance market that lead to limitations on coverage and/or increases in premium. For example, our timber operations are not insured against losses from fires and many components of our Chilean transmission operations are not insured against losses from earthquakes. Even if such insurance were available, the cost would be prohibitive. While not a risk borne directly by our partnership, the ability of the operating entities to obtain the required insurance coverage at a competitive price may have an impact on the returns generated by them and accordingly the returns received by our partnership.

8

Table of Contents

The acquisition of our current operations may give rise to contingent liabilities and the integration of our current operations may not be successful.

Most of our current operations were recently acquired from third parties and have only been operated by us and Brookfield for a short period of time. We are subject to any contingent liabilities that are attached to our current operations, such as claims for failure to comply with government regulations or other past activities. Accordingly, there is risk regarding any undisclosed or unknown liabilities or issues concerning the current operations. The representations, warranties and indemnities of Brookfield to us in connection with our acquisition of the current operations are limited and for the most part do not protect us against these liabilities or guarantee the value of the current operations. Although the sellers of such operations made various representations to Brookfield in connection with the acquisitions, certain of the indemnification obligations are limited in duration and amount and may have already expired. In addition, even if we could make a claim against the seller of the interest for the amount that is required to be contributed, there can be no assurance that the seller would be willing or able to satisfy any claim that may be brought or that any claim would be successful. We also may not successfully integrate the business and operations of our current operations or realize any of the anticipated benefits of their acquisition and accordingly our results of operations and financial condition could be adversely affected.

Performance of our operating entities may be harmed by future labor disruptions and economically unfavorable collective bargaining agreements.

Several of our current operations have workforces that are unionized and, as a result, they are required to negotiate the wages, benefits and other terms with many of their employees collectively. If an operating entity were unable to negotiate acceptable contracts with any of its unions as existing agreements expire, it could experience a significant disruption of its operations, higher ongoing labor costs and restrictions of its ability to maximize the efficiency of its operations, which could have a material adverse effect on its operations and financial results.

Our operating entities may be exposed to higher levels of regulation than in other sectors and breaches of such regulations could expose our operating entities to claims for financial compensation and adverse regulatory consequences.

In many instances, ownership and operation of infrastructure assets involves an ongoing commitment to a governmental agency. The nature of these commitments exposes the owners of infrastructure assets to a higher level of regulatory control than typically imposed on other businesses. For example, our timber operations are subject to provincial, state and federal government regulations relating to forestry practices and the export of logs and our electricity transmission operations are subject to government regulation of their rates and revenues. The risk that a governmental agency will repeal, amend, enact or promulgate a new law or regulation or that a governmental authority will issue a new interpretation of the law or regulations, could affect our operating entities substantially.

In addition, our operating entities are subject to laws and regulations relating to pollution and the protection of the environment. They are also subject to laws and regulations governing health and safety matters, protecting both the public and their employees. Any breach of these obligations, or even incidents relating to the environment or health and safety that do not amount to a breach, could adversely affect the results of our operating entities and their reputations and expose them to claims for financial compensation or adverse regulatory consequences. There is also the risk that our operating entities do not have, or might not obtain, permits necessary for their operations. Permits or special rulings may be required on taxation, financial and regulatory related issues. Even though most permits and licences are obtained before the commencement of operations, many of these licences and permits have to be renewed or maintained over the life of the business.

We will operate in a highly competitive market for acquisition opportunities.

Our acquisition strategy is dependent to a significant extent on the ability of Brookfield to identify acquisition opportunities that are suitable for us. We face competition for acquisitions primarily from investment funds, operating companies acting as strategic buyers, construction companies, commercial and investment banks and commercial finance companies. Many of these competitors are substantially larger and have considerably greater financial, technical and marketing resources than are available to us. Some of these competitors may also have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of acquisitions. Due to the capital intensive nature of infrastructure acquisitions, in order to finance acquisitions we will need to compete for equity capital from institutional investors and other equity providers, including Brookfield, and our ability to consummate acquisitions will be dependent on such capital continuing to be available. Increases in interest rates could also make it more difficult to consummate acquisitions because our competitors may have a lower cost of capital which may enable them to bid higher prices for assets. In addition, because of our affiliation with Brookfield, there is a higher risk that when we participate with Brookfield and others in joint ventures, partnerships and consortiums on acquisitions we may become subject to anti-trust or competition laws that we would not be subject to if we were acting alone. These factors may create competitive disadvantages for us with respect to acquisition opportunities.

9

Table of Contents

We cannot assure you that the competitive pressures we face will not have a material adverse effect on our business, financial condition and results of operations or that Brookfield will be able to identify and make acquisitions on our behalf that are consistent with our objectives or that generate attractive returns for our unitholders. We may lose acquisition opportunities in the future if we do not match prices, structures and terms offered by competitors, if we are unable to access sources of equity or obtain indebtedness at attractive rates or if we become subject to anti-trust or competition laws. Alternatively, we may experience decreased rates of return and increased risks of loss if we match prices, structures and terms offered by competitors.

Future acquisitions may subject us to additional risks.

Future acquisitions will likely involve some or all of the following risks, which could materially and adversely affect our business, results of operations or financial condition: the difficulty of integrating the acquired operations and personnel into our current operations; potential disruption of our current operations; diversion of resources, including Brookfield’s time and attention; the difficulty of managing the growth of a larger organization; the risk of entering markets in which we have little experience; the risk of becoming involved in labor, commercial or regulatory disputes or litigation related to the new enterprise; and the risk of environmental or other liabilities associated with the acquired business.

Brookfield has structured some of our current operations as joint ventures, partnerships and consortium arrangements, and we will do so in the future, which will reduce Brookfield’s and our control over our operations and may subject us to additional obligations.

Brookfield has structured some of our current operations as joint ventures, partnerships and consortium arrangements. An integral part of our strategy is to participate with institutional investors in Brookfield sponsored or co-sponsored consortiums for single asset acquisitions and as a partner in or alongside Brookfield sponsored or co-sponsored partnerships that target acquisitions that suit our profile. These arrangements are driven by the magnitude of capital required to complete acquisitions of infrastructure assets and other industry-wide trends that we believe will continue. Such arrangements involve risks not present where a third party is not involved, including the possibility that partners or co-venturers might become bankrupt or otherwise fail to fund their share of required capital contributions. Additionally, partners or co-venturers might at any time have economic or other business interests or goals different from us and Brookfield.

Joint ventures, partnerships and consortium investments generally provide for a reduced level of control over an acquired company because governance rights are shared with others. Accordingly, decisions relating to the underlying operations, including decisions relating to the management and operation and the timing and nature of any exit, are often made by a majority vote of the investors or by separate agreements that are reached with respect to individual decisions. In addition, such operations may be subject to the risk that the company may make business, financial or management decisions with which we do not agree or the management of the company may take risks or otherwise act in a manner that does not serve our interests. Because we may not have the ability to exercise control over such operations, we may not be able to realize some or all of the benefits that we believe will be created from our and Brookfield’s involvement. If any of the foregoing were to occur, our financial condition and results of operations could suffer as a result.

In addition, because some of our current operations are structured as joint ventures, partnerships or consortium arrangements, the sale or transfer of interests in some of our operations are subject to rights of first refusal or first offer, tag along rights or drag along rights and some agreements provide for buy-sell or similar arrangements. For example, our Chilean transmission operations are subject to a shareholders’ agreement which allows for an en bloc sale of the assets without our consent and our Brazilian transmission investments are subject to put/call agreements with third parties. Such rights may be triggered at a time when we may not want them to be exercised and such rights may inhibit our ability to sell our interest in an entity within our desired time frame or on any other desired basis.

Risks Relating to Our Electricity Transmission Operations

Our electricity transmission operations may require substantial capital expenditures in the future.

In some of the jurisdictions in which we have electricity transmission operations, such as Brazil and Chile, certain maintenance capital expenditures may not be covered by the regulatory framework. If our electricity transmission operations in these jurisdictions require significant capital expenditures to maintain our asset base, we will not be able to cover such costs through the regulatory framework. In addition, we may be exposed to disallowance risk in other jurisdictions to the extent that capital expenditures and costs are not fully recovered through the regulatory framework.

10

Table of Contents

Our electricity transmission operations may engage in development projects which may expose us to various risks associated with construction.

Our electricity transmission operations may engage in development projects. If such development projects enter the construction phase, we are likely to retain some risk that the project will not be completed within budget, within the agreed timeframe and to the agreed specifications. During the construction phase, the major risks include a delay in the projected completion of the project and a resultant delay in the commencement of cash flows, an increase in the capital needed to complete construction and the insolvency of the head contractor, a major subcontractor and/or key equipment supplier. Although frequently the main risks of any delay in completion of the construction or any “overrun” in the costs of construction will typically have been passed on by us contractually to a subcontractor, there is some risk that the anticipated returns of the relevant project may be adversely affected as a result. Unexpected increases in costs may also result in increased debt service costs and in funds being insufficient to complete construction. In addition, due to any of the aforementioned delays or cost overruns, regulatory changes or other external influences, we may decide to abandon construction or development of any given project resulting in a write-off of any cost recovery we may have received for costs to the point of abandonment. This would negatively impact our income and cash flow.

Clients of our electricity transmission operations may default on their obligations under the relevant contractual arrangements.

Some of our electricity transmission operations have customer contracts as well as concession agreements in place with public and private sector clients. On the public sector side this may include central government departments, local government bodies and quasi-government agencies. Since it cannot be assumed that a central government will in all cases assume liability for the obligation of quasi-government agencies or those central government departments will themselves not default on their obligations, the possibility of a default remains. Our electricity transmission operations also have contracts with private sector clients. There is an increased risk of default by private sector clients compared with public sector clients. For example, we have an agreement with a single customer which represented 72.9% of revenues of our Chilean transmission operations in 2007. As this agreement accounts for a majority of its cash flow, our Chilean transmission operations could be materially adversely affected by any material change in the assets, financial condition or results of operations of that customer.

Our electricity transmission operations may be adversely affected by changes in tolls or regulated rates.

Some of our electricity transmission operations are regulated with respect to revenues and they recover their investment in transmission assets through tolls or regulated rates which are charged to third parties (including generating companies). In general, our electricity transmission operations are entitled to earn revenue that represents a rate of return on the regulated investment value of assets and to collect provisions for operating, maintenance and administrative costs. If any of the respective regulators in the jurisdictions in which we operate decide to change the tolls or rates we are allowed to charge or the amounts of the provisions we are allowed to collect, we may not be able to earn a rate of return on our businesses that we had planned or we may not be able to recover our initial investment cost.

The lands used in our electricity transmission operations may be subject to adverse claims.

Although we believe that we have valid rights to all easements, licences and rights of way necessary for our electricity transmission operations, not all of our easements, licences and rights of way are registered against the lands to which they relate and may not bind subsequent owners. In addition, our rights may be adversely affected by rights of governments or aboriginal groups.

Risks Relating to Our Timber Operations

The financial performance of our timber operations may be affected by economic recessions or downturns.

The vast majority of the products from our timber operations are sensitive to macro-economic conditions in North America and Japan and are thus susceptible to economic recessions or downturns in these markets. Decreases in the level of residential construction, repair and remodeling activity generally reduce demand for logs and wood products, resulting in lower revenues, profits and cash flows for lumber mills who are important customers to our timber operations. Depressed commodity prices in lumber, pulp or paper may also cause mill operators to temporarily or permanently shut down their mills if their product prices fall to a level where mill operation would be uneconomic. Moreover, these operators may be required to temporarily suspend operations at one or more of their mills to bring production in line with market demand or in response to market irregularities. Any of these circumstances could significantly reduce the prices that we realize for our timber. In addition to impacting our timber operations’ sales, cash flows and earnings, weakness in the market prices of timber products will also have an effect on our ability to attract additional capital, the cost of that capital and the value of our timberland assets.

11

Table of Contents

A variety of factors may limit or prevent harvesting by our timber operations.

Weather conditions, industry practices and federal, state and provincial laws and regulations associated with forestry practices, sale of logs and environmental matters, including wildlife and water resources, may limit or prevent harvesting, road building and other activities on the timberlands owned by our timber operations. In the case of restrictions arising from regulatory requirements, the size of the area subject to restriction will vary depending on the protected species at issue, the time of year and other factors. In addition, if regulations become more restrictive, the amount of the timberlands subject to harvest restrictions could increase. The timberlands owned by our timber operations may also suffer damage by fire, insect infestation, wind, disease, prolonged drought and other natural and man-made disasters. There can be no assurance that our timber operations will achieve harvest levels in the future necessary to maintain or increase revenues, earnings and cash flows. There can be no assurance that the forest management planning by our timber operations, including silviculture, will have the intended result of ensuring that their asset base appreciates over time.

Our timber operations operate in a highly competitive industry, subject to price fluctuations.

Timberland companies operate in a highly competitive business environment in which companies compete, to a large degree, on the basis of price and also on the basis of service and ability to provide a steady supply of products over the long-term. The prime competitors to our timber operations are governments, other large forestland owners and small private forestland owners. In addition, wood and paper products are subject to increasing competition from a variety of substitute products, including non-wood and engineered wood products and electronic media. The competitive position of our timber operations and the price realized for our products is also influenced by a number of other factors including: the ability to attract and maintain long-term customer relationships; the quality of our products; the health of the regional converting industry; the costs of timber production; the availability, quality and cost of labor; the cost of fuel; shipping and transportation costs; changes in global timber supply; technological advances that increase yield in other regions; and the price and availability of substitute wood and non-wood products.

Our ability to harvest timber may be adversely affected by aboriginal claims.

Aboriginal claims could adversely affect our ability to harvest timber in our Canadian (and to a lesser degree, U.S.) timber operations. Canadian courts have recognized that aboriginal peoples may possess rights at law in respect of land used or occupied by their ancestors where treaties have not been concluded to deal with these rights. In Canada, aboriginal groups have made claims in respect of land governed by Canadian authorities, which could affect a portion of our timber operations. Any settlements in respect of these claims could lower the volume of timber managed by our Canadian timber operations and could increase the cost to harvest timber on such lands.

Our Canadian timber operations are subject to federal restrictions which may require them to decrease their planned export of logs.

Currently, logs from most private timberlands in Canada are not subject to provincial export regulations, but are subject to federal export regulations. As a result, all export logs must be advertised for local consumption and may be exported only if there is a surplus of domestic supply as indicated by the absence of fair market value offers (based on current domestic prices) from domestic lumber mills. Accordingly, an increase in domestic demand could result in our Canadian timber operations being required to decrease their planned export of logs. The provincial government in British Columbia is currently reviewing its log export policy, and may recommend that the federal government impose a policy that may further restrict the export of logs from private lands in British Columbia. As export market pricing is generally at a premium to the domestic market pricing, any reduction in log exports could have an adverse effect on our Canadian timber operations.

Risks Relating to our Relationship with Brookfield

Brookfield exercises substantial influence over our partnership and we are highly dependent on the Manager.

Brookfield is the sole shareholder of our Managing General Partner. As a result of its ownership of our Managing General Partner, Brookfield is able to control the appointment and removal of our Managing General Partner’s directors and, accordingly, exercise substantial influence over our partnership. In addition, our partnership holds its interest in the operating entities indirectly and will hold any future acquisitions indirectly through Brookfield Infrastructure, the general partner of which is controlled by Brookfield. As our partnership’s only substantial asset is the limited partnership interests that it holds in Brookfield Infrastructure, our partnership does not have a right to participate directly in the management or activities of Brookfield Infrastructure or the Holding Entities, including with respect to the making of decisions.

12

Table of Contents

Our partnership and Brookfield Infrastructure do not have any employees and depend on the management and administration services provided by the Manager. Brookfield personnel and support staff that provide services to us are not required to have as their primary responsibility the management and administration of our partnership or Brookfield Infrastructure or to act exclusively for either of us. Any failure to effectively manage our current operations or to implement our strategy could have a material adverse effect on our business, financial condition and results of operations.

Brookfield has no obligation to source acquisition opportunities for us and we may not have access to all infrastructure acquisitions that Brookfield identifies.

Our ability to grow depends on Brookfield’s ability to identify and present us with acquisition opportunities. Brookfield has stated that we are its primary vehicle to own and operate certain infrastructure assets on a global basis. However, Brookfield has no obligation to source acquisition opportunities for us. In addition, Brookfield has not agreed to commit to us any minimum level of dedicated resources for the pursuit of infrastructure related acquisitions. There are a number of factors which could materially and adversely impact the extent to which suitable acquisition opportunities are made available from Brookfield, for example:

| • | there is no accepted industry standard for what constitutes an infrastructure asset. Brookfield may consider certain assets that have both real-estate related characteristics and infrastructure related characteristics to be real estate and not infrastructure; |

| • | it is an integral part of Brookfield’s (and our) strategy to pursue the acquisition of infrastructure assets through consortium arrangements with institutional investors, strategic partners or financial sponsors and to form partnerships to pursue such acquisitions on a specialized or global basis. Although Brookfield has agreed with us that it will not enter any such arrangements that are suitable for us without giving us an opportunity to participate in them, there is no minimum level of participation to which we will be entitled; |

| • | the same professionals within Brookfield’s organization that are involved in acquisitions that are suitable for us are responsible for the consortiums and partnerships referred to above, as well as having other responsibilities within Brookfield’s broader asset management business. Limits on the availability of such individuals will likewise result in a limitation on the availability of acquisition opportunities for us; |

| • | Brookfield will only recommend acquisition opportunities that it believes are suitable for us. Our focus is on assets where we believe that our operations-oriented approach can be deployed to create value. Accordingly, opportunities where Brookfield cannot play an active role in influencing the underlying operating company or managing the underlying assets may not be suitable for us, even though they may be attractive from a purely financial perspective. Legal, regulatory, tax and other commercial considerations will likewise be an important consideration in determining whether an opportunity is suitable and will limit our ability to participate in these more passive investments and may limit our ability to have more than 50% of our assets concentrated in a single jurisdiction; and |

| • | in addition to structural limitations, the question of whether a particular acquisition is suitable is highly subjective and is dependent on a number of factors including our liquidity position at the time, the risk profile of the opportunity, its fit with the balance of our then current operations and other factors. If Brookfield determines that an opportunity is not suitable for us, it may still pursue such opportunity on its own behalf, or on behalf of a Brookfield sponsored partnership or consortium. |

In making these determinations, Brookfield may be influenced by factors that result in a mis-alignment or conflict of interest. See Item 7.B “Related Party Transactions – Conflicts of Interest and Fiduciary Duties.”

The departure of some or all of Brookfield’s professionals could prevent us from achieving our objectives.

We depend on the diligence, skill and business contacts of Brookfield’s professionals and the information and opportunities they generate during the normal course of their activities. Our future success will depend on the continued service of these individuals, who are not obligated to remain employed with Brookfield. Brookfield has experienced departures of key professionals in the past and may do so in the future, and we cannot predict the impact that any such departures will have on our ability to achieve our objectives. The departure of a significant number of Brookfield’s professionals for any reason, or the failure to appoint qualified or effective successors in the event of such departures, could have a material adverse effect on our ability to achieve our objectives. Our limited partnership agreement and our Master Services Agreement do not require Brookfield to maintain the employment of any of its professionals or to cause any particular professionals to provide services to us or on our behalf.

13

Table of Contents

The control of our Managing General Partner may be transferred to a third party without unitholder consent.

Our Managing General Partner may transfer its general partnership interest to a third party in a merger or consolidation or in a transfer of all or substantially all of its assets without the consent of our unitholders. Furthermore, at any time, the shareholder of our Managing General Partner may sell or transfer all or part of its shares in our Managing General Partner without the approval of our unitholders. If a new owner were to acquire ownership of our Managing General Partner and to appoint new directors or officers of its own choosing, it would be able to exercise substantial influence over our partnership’s policies and procedures and exercise substantial influence over our management and the types of acquisitions that we make. Such changes could result in our partnership’s capital being used to make acquisitions in which Brookfield has no involvement or in making acquisitions that are substantially different from our targeted acquisitions. Additionally, our partnership cannot predict with any certainty the effect that any transfer in the ownership of our Managing General Partner would have on the trading price of our units or our partnership’s ability to raise capital or make investments in the future, because such matters would depend to a large extent on the identity of the new owner and the new owner’s intentions with regard to our partnership. As a result, the future of our partnership would be uncertain and our partnership’s financial condition and results of operations may suffer.

Brookfield may increase its ownership of our partnership and Brookfield Infrastructure relative to other unitholders.

Brookfield holds approximately 40% of the issued and outstanding interests in Brookfield Infrastructure. The limited partnership interests held by Brookfield are redeemable for cash or exchangeable for our units in accordance with the Redemption-Exchange Mechanism, which could result in Brookfield eventually owning 39% of our issued and outstanding units. See Item 10.B “Memorandum and Articles of Association – Description of Brookfield Infrastructure’s Limited Partnership Agreement – Redemption-Exchange Mechanism.” Brookfield also acquired 0.2% of our units in connection with the satisfaction of Canadian federal and U.S. “backup” withholding tax requirements upon the spin-off. Brookfield may also acquire additional units of Brookfield Infrastructure pursuant to an equity commitment provided by Brookfield. See Item 7.B “Related Party Transactions – Equity Commitment and Other Financing.” Infrastructure GP LP may also reinvest incentive distributions in exchange for units of Brookfield Infrastructure. See Item 7.B “Related Party Transactions – Incentive Distributions.” In addition, Brookfield has advised our partnership that it may from time-to-time reinvest distributions it receives from Brookfield Infrastructure in Brookfield Infrastructure’s distribution reinvestment plan, with the result that Brookfield will receive additional units of Brookfield Infrastructure. Additional units of Brookfield Infrastructure acquired, directly or indirectly, by Brookfield are redeemable for cash or exchangeable for our units in accordance with the Redemption-Exchange Mechanism. See Item 10.B “Memorandum and Articles of Association – Description of Brookfield Infrastructure’s Limited Partnership Agreement – Redemption-Exchange Mechanism.” Brookfield may also purchase additional units of our partnership in the market. Any of these events may result in Brookfield increasing its ownership of our partnership and Brookfield Infrastructure above 50%.

Brookfield does not owe our unitholders any fiduciary duties under the Master Services Agreement or our other arrangements with Brookfield.

The obligations of Brookfield under the Master Services Agreement and our other arrangements with them are contractual rather than fiduciary in nature. As a result, our Managing General Partner, which is an affiliate of Brookfield, in its capacity as our partnership’s general partner, has sole authority and discretion to enforce the terms of such agreements and to consent to any waiver, modification or amendment of their provisions.

Our limited partnership agreement and Brookfield Infrastructure’s limited partnership agreement contain various provisions that modify the fiduciary duties that might otherwise be owed to our partnership and our unitholders, including when such conflicts of interest arise. These modifications may be important to our unitholders because they restrict the remedies available for actions that might otherwise constitute a breach of fiduciary duty and permit our Managing General Partner and the Infrastructure General Partner to take into account the interests of third parties, including Brookfield, when resolving conflicts of interest. See Item 7.B “Related Party Transactions — Conflicts of Interest and Fiduciary Duties.” It is possible that conflicts of interest may be resolved in a manner that is not in the best interests of our partnership or the best interests of our unitholders.

Our organizational and ownership structure may create significant conflicts of interest that may be resolved in a manner that is not in the best interests of our partnership or the best interests of our unitholders.

Our organizational and ownership structure involves a number of relationships that may give rise to conflicts of interest between our partnership and our unitholders, on the one hand, and Brookfield, on the other hand. In certain instances, the interests of Brookfield may differ from the interests of our partnership and our unitholders, including with respect to the types of acquisitions made, the timing and amount of distributions by our partnership, the reinvestment of returns generated by our operations, the use of leverage when making acquisitions and the appointment of outside advisors and service providers, including as a result of the reasons described under Item 7.B “Related Party Transactions.”

14

Table of Contents

Our arrangements with Brookfield were negotiated in the context of an affiliated relationship and may contain terms that are less favorable than those which otherwise might have been obtained from unrelated parties.

The terms of our arrangements with Brookfield were effectively determined by Brookfield in the context of the spin-off. While our Managing General Partner’s independent directors are aware of the terms of these arrangements and have approved the arrangements on our behalf, they did not negotiate the terms. These terms, including terms relating to compensation, contractual or fiduciary duties, conflicts of interest and Brookfield’s ability to engage in outside activities, including activities that compete with us, our activities and limitations on liability and indemnification, may be less favorable than otherwise might have resulted if the negotiations had involved unrelated parties. Under our limited partnership agreement, persons who acquire our units and their transferees will be deemed to have agreed that none of those arrangements constitutes a breach of any duty that may be owed to them under our limited partnership agreement or any duty stated or implied by law or equity.

Our Managing General Partner may be unable or unwilling to terminate the Master Services Agreement.

The Master Services Agreement provides that the Service Recipients may terminate the agreement only if the Manager defaults in the performance or observance of any material term, condition or covenant contained in the agreement in a manner that results in material harm to us and the default continues unremedied for a period of 30 days after written notice of the breach is given to the Manager; the Manager engages in any act of fraud, misappropriation of funds or embezzlement against any Service Recipient that results in material harm to us; the Manager is grossly negligent in the performance of its duties under the agreement and such negligence results in material harm to the Service Recipients; or upon the happening of certain events relating to the bankruptcy or insolvency of the Manager. Our Managing General Partner cannot terminate the agreement for any other reason, including if the Manager or Brookfield experiences a change of control, and there is no fixed term to the agreement. In addition, because our Managing General Partner is an affiliate of Brookfield, it may be unwilling to terminate the Master Services Agreement, even in the case of a default. If the Manager’s performance does not meet the expectations of investors, and our Managing General Partner is unable or unwilling to terminate the Master Services Agreement, the market price of our units could suffer. Furthermore, the termination of the Master Services Agreement would terminate our partnership’s rights under the Relationship Agreement and the licensing agreement. See Item 7.B “Related Party Transactions – Relationship Agreement” and Item 7.B “Related Party Transactions – Licensing Agreement.”

The liability of the Manager is limited under our arrangements with it and we have agreed to indemnify the Manager against claims that it may face in connection with such arrangements, which may lead it to assume greater risks when making decisions relating to us than it otherwise would if acting solely for its own account.

Under the Master Services Agreement, the Manager has not assumed any responsibility other than to provide or arrange for the provision of the services described in the Master Services Agreement in good faith and will not be responsible for any action that our Managing General Partner takes in following or declining to follow its advice or recommendations. In addition, under our limited partnership agreement, the liability of the Managing General Partner and its affiliates, including the Manager, is limited to the fullest extent permitted by law to conduct involving bad faith, fraud or willful misconduct or, in the case of a criminal matter, action that was known to have been unlawful. The liability of the Manager under the Master Services Agreement is similarly limited, except that the Manager is also liable for liabilities arising from gross negligence. In addition, our partnership has agreed to indemnify the Manager to the fullest extent permitted by law from and against any claims, liabilities, losses, damages, costs or expenses incurred by an indemnified person or threatened in connection with our operations, investments and activities or in respect of or arising from the Master Services Agreement or the services provided by the Manager, except to the extent that the claims, liabilities, losses, damages, costs or expenses are determined to have resulted from the conduct in respect of which such persons have liability as described above. These protections may result in the Manager tolerating greater risks when making decisions than otherwise would be the case, including when determining whether to use leverage in connection with acquisitions. The indemnification arrangements to which the Manager is a party may also give rise to legal claims for indemnification that are adverse to our partnership and our unitholders.

Risks Relating to our Units