None of British Columbia corporate law, the Master Services Agreement and our other arrangements with Brookfield impose on Brookfield any fiduciary duties to act in the best interests of our shareholders or the partnership’s unitholders.

None of British Columbia corporate law, the Master Services Agreement and our other arrangements with Brookfield impose on Brookfield any duty (statutory or otherwise) to act in the best interests of the Service Recipients, nor do they impose other duties that are fiduciary in nature.

Our organizational and ownership structure may create significant conflicts of interest that may be resolved in a manner that is not in the best interests of our company or the best interests of our shareholders.

Our organizational and ownership structure involves a number of relationships that may give rise to conflicts of interest between our company and our shareholders, on the one hand, and Brookfield and Brookfield Infrastructure, on the other hand. For example, we expect that our board will mirror the board of the general partner of the partnership, except that prior to the completion of the special distribution, we will add one additional non-overlapping board member to assist us with, among other things, resolving any conflicts of interest that may arise from our relationship with Brookfield Infrastructure. In certain instances, the interests of Brookfield or Brookfield Infrastructure may differ from the interests of our company and our shareholders, including with respect to the types of acquisitions made, the timing and amount of dividends by our company, the reinvestment of returns generated by our operations, the use of leverage when making acquisitions and the appointment of outside advisors and service providers. Further, Brookfield may make decisions, including with respect to tax or other reporting positions, from time to time that may be more beneficial to one type of investor or beneficiary than another, or to Brookfield rather than to our company and our shareholders.

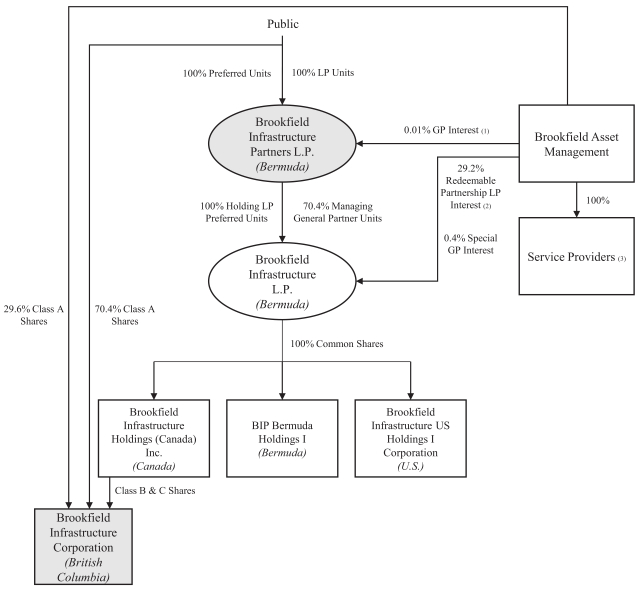

It is expected that Brookfield will, directly and indirectly, hold approximately 29.6% of our class A shares immediately upon completion of the special distribution. In addition, Brookfield Infrastructure, which itself is controlled by Brookfield, holds all of our issued and outstanding class B shares and class C shares, having a 75% voting interest and approximate 20% economic interest in our company, respectively. As a result, Brookfield is able to control the election and removal of our directors and the directors of the partnership’s general partner and, accordingly, exercises substantial influence over our group.

In addition, the Service Providers, being wholly-owned subsidiaries of Brookfield, will provide management services to us pursuant to the Master Services Agreement. Pursuant to the Master Services Agreement, on a quarterly basis, Brookfield Infrastructure will pay a quarterly base management fee to the Service Providers equal to 0.3125% (1.25% annually) of the market value of Brookfield Infrastructure. We will reimburse Brookfield Infrastructure for our proportionate share of such fee. For purposes of calculating the base management fee, the market value of Brookfield Infrastructure is equal to the aggregate value of all outstanding units on a fully-diluted basis, preferred units and securities of the other Service Recipients (including our class A shares and the exchangeable limited partnership units issued by Exchange LP in connection with Brookfield Infrastructure’s acquisition of an effective 30% interest in Enercare) that are not held by Brookfield Infrastructure, plus all outstanding third party debt with recourse to a Service Recipient, less all cash held by such entities. Brookfield Infrastructure Special GP, a subsidiary of Brookfield, also receives incentive distributions based on the amount by which quarterly distributions on Holding LP units (other than Holding LP Class A Preferred Units) as well as economically equivalent securities, such as the class A shares, of the other Service Recipients exceed specified target levels as set forth in Holding LP’s limited partnership agreement. This relationship may give rise to conflicts of interest between our company and our shareholders, on the one hand, and Brookfield, on the other, as Brookfield’s interests may differ from the interests of Brookfield Infrastructure, our company or our shareholders.

Brookfield Infrastructure’s arrangements with Brookfield, which will apply to our company, were negotiated in the context of an affiliated relationship and may contain terms that are less favorable than those which otherwise might have been obtained from unrelated parties.

The terms of Brookfield Infrastructure’s arrangements with Brookfield, that will apply to our company, were effectively determined by Brookfield. These terms, including terms relating to compensation, contractual or fiduciary duties, conflicts of interest and Brookfield’s ability to engage in outside activities, including activities that compete with us, our activities and limitations on liability and indemnification, may be less favorable than otherwise might have resulted if the negotiations had involved unrelated parties.

The liability of the Service Providers is limited under our arrangements with them and we and the other Service Recipients, including Brookfield Infrastructure, have agreed to indemnify the Service Providers against claims that they may face in connection with such arrangements, which may lead them to assume greater risks when making decisions relating to us than they otherwise would if acting solely for their own account.

Under the Master Services Agreement, the Service Providers have not assumed any responsibility other than to provide or arrange for the provision of the services described in the Master Services Agreement in good faith and will not be responsible for any action that our company takes in following or declining to follow their advice or recommendations. The liability of the Service Providers under the Master Services Agreement is limited to the fullest extent permitted by law to conduct involving bad faith, fraud or willful misconduct or, in the case of a criminal matter, action that was known to have been unlawful, except that the Service Providers are also liable for liabilities arising from gross negligence. In addition, our company and the other Service Recipients, including Brookfield Infrastructure, have agreed to indemnify the Service Providers to the fullest extent permitted by law from and against any claims, liabilities, losses, damages, costs or expenses incurred by an indemnified person or threatened in connection with our operations, investments and activities or in respect of or arising from the Master Services Agreement or the services provided by the Service Providers, except to the extent that the claims, liabilities, losses, damages, costs or expenses are determined to have resulted from the conduct in respect of which such persons have liability as described above. These protections may result in the Service Providers tolerating greater risks when making decisions than otherwise would be the case, including when determining whether to use leverage in connection with acquisitions. The indemnification arrangements to which the Service Providers are a party may also give rise to legal claims for indemnification that are adverse to our company and our shareholders.

- 35 -