Filed Pursuant to Rule 424(b)(3)

Registration Nos. 333-233934 and 333-233934-01

PROSPECTUS DATED MARCH 12, 2020

BROOKFIELD INFRASTRUCTURE CORPORATION

Class A Exchangeable Subordinate Voting Shares of

Brookfield Infrastructure Corporation

Limited Partnership Units of Brookfield Infrastructure Partners L.P.

(issuable or deliverable upon exchange, redemption or acquisition of Class A Exchangeable Subordinate Voting Shares)

This prospectus is being furnished to you as a unitholder of Brookfield Infrastructure Partners L.P., or the partnership, in connection with the planned special distribution, or the special distribution, by the partnership to the holders of itsnon-voting limited partnership units, or units, of approximately 32.8 million class A exchangeable subordinate voting shares, or exchangeable shares, of Brookfield Infrastructure Corporation, or our company, a corporation incorporated under, and governed by, the laws of British Columbia. Each exchangeable share will be structured with the intention of providing an economic return equivalent to one unit (subject to adjustment to reflect certain capital events). Each exchangeable share will be exchangeable at the option of the holder for one unit (subject to adjustment to reflect certain capital events) or its cash equivalent (the form of payment to be determined at the election of our company). The partnership may elect to satisfy our exchange obligation by acquiring such tendered exchangeable shares for an equivalent number of units (subject to adjustment to reflect certain capital events) or its cash equivalent (the form of payment to be determined at the election of the partnership). See “Description of Our Share Capital — Exchange by Holder — Adjustments to Reflect Certain Capital Events.” Our company and the partnership currently intend to satisfy any exchange requests on the exchangeable shares through the delivery of units rather than cash. It is expected that following completion of the special distribution each exchangeable share will receive identical dividends to the distributions paid on each unit, as more fully described in this prospectus. We therefore expect that the market price of our exchangeable shares will be significantly impacted by the market price of the units and the combined business performance of the partnership, our company and our respective subsidiaries as a whole, which we refer to throughout this prospectus as our group.Prior to the special distribution, our company will acquire our operating subsidiaries from certain of the partnership’s subsidiaries. Following completion of the special distribution, our company will own and operate high-quality, long-life infrastructure assets that generate stable cash flows, require relatively minimal maintenance capital expenditures and, by virtue of barriers to entry and other characteristics, tend to appreciate in value over time. Our initial operations will consist of utilities businesses in Europe and South America.

This prospectus also relates to (i) the delivery of up to approximately 46.5 million units to holders of exchangeable shares if our company or the partnership elects to satisfy any exchange, redemption or acquisition of exchangeable shares by delivering units pursuant to this prospectus (including in connection with any liquidation, dissolution or winding up of our company) and (ii) the delivery by Brookfield Asset Management Inc., as selling unitholder, of up to approximately 46.5 million units to holders of exchangeable shares, pursuant to the rights agreement between Brookfield Asset Management Inc. and Wilmington Trust, National Association. Brookfield has agreed that, until the fifth anniversary of the distribution date, in the event that our company or the partnership has not satisfied an exchange, redemption or acquisition of exchangeable shares in cash or by delivering units, then Brookfield, as selling unitholder, will satisfy or cause to be satisfied such exchange, redemption or purchase by paying such cash amount or delivering such units pursuant to this prospectus. The partnership and Brookfield currently intend to satisfy any exchange, redemption or acquisition of exchangeable shares through the delivery of units rather than cash.

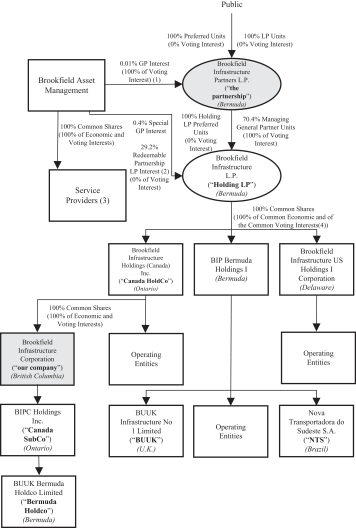

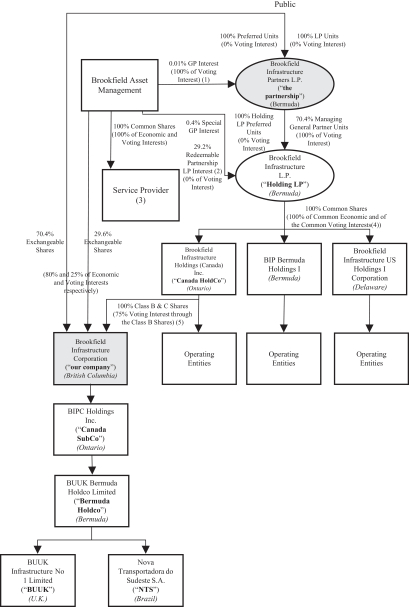

The partnership is a holding entity and its sole material asset is its managing general partnership interest and preferred limited partnership interest in Brookfield Infrastructure L.P., or Holding LP. Immediately prior to the special distribution, the partnership will receive our exchangeable shares through a distribution in specie by Holding LP, or the Holding LP Distribution, of the exchangeable shares to all the holders of its equity units (which does not include preferred partnership units). As a result of the Holding LP Distribution, (i) Brookfield Asset Management Inc. and its subsidiaries (other than entities within our group), or Brookfield, who has a current approximate 29.6% economic interest in the partnership on a fully-exchanged basis, as indirect holder of redeemable partnership units of Holding LP and special general partner units in Brookfield Infrastructure Special LP, or Infrastructure Special LP, will receive approximately 13.7 million exchangeable shares and (ii) the partnership will receive approximately 32.8 million exchangeable shares, which it will subsequently distribute to unitholders pursuant to the special distribution. Immediately following the special distribution, our company’s sole direct investment will be an interest in the common equity of BIPC Holdings Inc., or Canada SubCo. It is currently anticipated that immediately following the special distribution, (i) holders of units will hold approximately 70.4% of the issued and outstanding exchangeable shares of our company, (ii) Brookfield and its affiliates will hold approximately 29.6% of the issued and outstanding exchangeable shares, and (iii) a subsidiary of the partnership will own all of the issued and outstanding class B multiple voting shares, or class B shares, which represent a 75% voting interest, and all of the issued and outstanding class C non-voting shares, or class C shares, of our company, which entitle the partnership to all of the residual value in our company after payment in full of the amount due to holders of exchangeable shares and class B shares and subject to the prior rights of holders of preferred shares. Holders of exchangeable shares are expected to hold an aggregate 25% voting interest in our company. Brookfield, through its ownership of exchangeable shares, will initially hold an approximate 7.4% voting interest in our company. Holders of exchangeable shares, excluding Brookfield, will initially hold an approximate 17.6% aggregate voting interest in our company. Together, Brookfield and Brookfield Infrastructure will hold an approximate 82% voting interest in our company. The holders of the exchangeable shares will be entitled to one vote for each exchangeable share held at all meetings of our shareholders, except for meetings at which only holders of another specified class or series of shares of our company are entitled to vote separately as a class or series. The holders of the class B shares will be entitled to cast, in the aggregate, a number of votes equal to three times the number of votes attached to the exchangeable shares. Except as otherwise expressly provided in the articles or as required by law, the holders of exchangeable shares and class B shares will vote together and not as separate classes. Holders of class C shares will have no voting rights.

Pursuant to the special distribution, holders of units as of March 20, 2020, the record date for the special distribution, or the record date, will be entitled to receive one (1) exchangeable share for every nine (9) units held as of the record date, provided that the special distribution will be subject to any applicable withholding tax and no holder will be entitled to receive any fractional interests in the exchangeable shares. The distribution date for the special distribution is expected to be on or about March 31, 2020, or the distribution date. Holders of units who would otherwise be entitled to a fractional exchangeable share will receive a cash payment.

Holders of units will not be required to pay for the exchangeable shares to be received upon completion of the special distribution or tender or surrender units or take any other action in connection with the special distribution. Holders of units are not being asked for a proxy and are requested not to send a proxy. See “Questions and Answers Regarding the Special Distribution” for further details.

Our company may, at any time and in our sole discretion, upon sixty (60) days’ prior written notice to holders of exchangeable shares, redeem all of the outstanding exchangeable shares for one unit per exchangeable share held (subject to adjustment to reflect certain capital events as described in more detail in this prospectus) or its cash equivalent. See “Description of Our Share Capital”.

In addition, wholly-owned subsidiaries of Brookfield will provide management services to us pursuant to the partnership’s existing master services agreement, or the Master Services Agreement, which will be amended in connection with the completion of the special distribution. There will be no increase to the base management fee and incentive distribution fees currently paid by the partnership to the Service Providers, though following completion of the special distribution, our company will be responsible for reimbursing the partnership or its subsidiaries, as the case may be, for our proportionate share of the base management fee. See also “Relationship with Brookfield – Incentive Distributions”.

There is currently no public market for our exchangeable shares. We have applied to have our exchangeable shares listed on the New York Stock Exchange, or the NYSE, and the Toronto Stock Exchange, or the TSX, under the symbol “BIPC” and we anticipate that trading in our exchangeable shares will begin on a “when-issued” basis as early as one (1) trading day prior to the record date and will continue up to and including the distribution date. “When-issued” trades generally settle within two (2) trading days after the distribution date. On the first trading day following the distribution date, any “when-issued” trading of our exchangeable shares will end and “regular-way” trading will begin. The NYSE has conditionally authorized our company to list on the NYSE and the TSX has conditionally approved the listing of these securities. Listing on the NYSE is subject to our company fulfilling all of the requirements of the NYSE, and listing on the TSX is subject to our company fulfilling all of the requirements of the TSX on or before May 5, 2020, including distribution of our exchangeable shares to a minimum number of public shareholders.

In reviewing this prospectus, you should carefully consider the matters described in the section entitled “Risk Factors” beginning on page 33.

NEITHER THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS INFORMATION IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities.