EXHIBIT 99.1

December 14, 2007

Dear Temple-Inland Stockholder:

February 25, 2007, the Board of Directors of Temple-Inland Inc. approved a transformation plan to separate Temple-Inland into three focused, stand-alone, public companies and sell our strategic timberland. The plan included:

| | |

| | • | Temple-Inland retaining its manufacturing operations — corrugated packaging and building products, |

| |

| | • | Spinning off our financial services group — Guaranty Financial Group, |

| |

| | • | Spinning off our real estate group — Forestar Real Estate Group, and |

| |

| | • | Selling our strategic timberland. |

Each of the three public companies — Temple-Inland, Guaranty, and Forestar — will benefit from greater strategic focus, have appropriate capital structures to ensure financial flexibility, and be well positioned to maximize stockholder value. The majority of proceeds from the sale of strategic timberland will be returned to stockholders through a special dividend of approximately $1.1 billion, or $10.25 per share. The remaining proceeds were used to pay down debt.

We will effect the spin-off of Guaranty and Forestar by distributing common stock on a pro rata basis through a dividend to stockholders. The dividend will represent 100% of the outstanding common stock of Guaranty and Forestar at the time of the spin-off. We anticipate distributing shares of Guaranty and Forestar on or about December 28, 2007 to stockholders of record as of December 14, 2007.

Stockholder approval for the spin-off is not required, and you are not obligated to take any action to participate in the spin-off. You do not need to pay any consideration or surrender or exchange your shares of Temple-Inland common stock. Following the spin-off, Temple-Inland common stock will continue to trade on the New York Stock Exchange under the symbol “TIN,” Guaranty common stock will trade on the New York Stock Exchange under the symbol “GFG,” and Forestar common stock will trade on the New York Stock Exchange under the symbol “FOR.”

We have received a ruling from the Internal Revenue Service indicating the spin-off of each of Guaranty and Forestar will be tax free to stockholders for U.S. federal income tax purposes.

The enclosed information statement, provided to all Temple-Inland stockholders, describes the spin-off of Forestar. A separate information statement describing the spin-off of Guaranty will also be provided to all Temple-Inland stockholders.

Sincerely,

Kenneth M. Jastrow, II

Chairman and Chief Executive Officer

December 14, 2007

Dear Forestar Real Estate Group Stockholder:

It is our pleasure to welcome you as a stockholder of our new company. Our management team is excited about our spin-off from Temple-Inland Inc., and is committed to realizing the potential that exists for us as an independent company. Our vision is to be the most admired and respected real estate company.

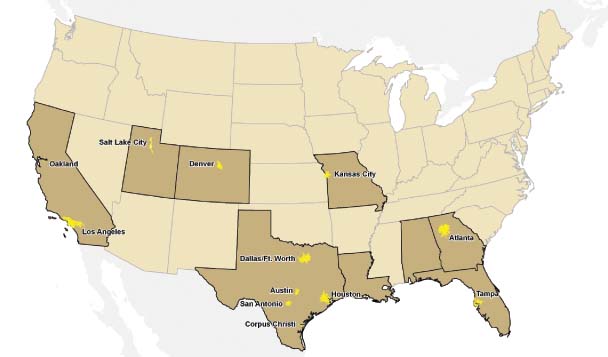

Forestar Real Estate Group is focused on maximizing and growing long-term stockholder value through entitlement and development of real estate, realization of value from natural resources, and accelerated growth through strategic and disciplined investment in real estate. We currently have real estate in nine states and twelve markets encompassing about 374,000 acres located primarily in growth corridors in the southern half of the United States. We also own oil and gas mineral interests in about 622,000 net acres in Texas, Louisiana, Alabama and Georgia.

Our common shares will be listed on the New York Stock Exchange under the symbol “FOR” in connection with the distribution of our shares by Temple-Inland Inc.

We invite you to learn more about our company by reading the enclosed information statement. You may also visit our website, www.forestargroup.com, to learn more about our company and our current development projects. We would like to thank you in advance for your support as a stockholder in Forestar.

Sincerely,

| | | |

| |  |

| James M. DeCosmo | | Kenneth M. Jastrow, II |

President and Chief Executive Officer | | Chairman |

INFORMATION STATEMENT

December 14, 2007

Common Stock

(par value $1.00 per share)

We are sending this information statement to you to describe the spin-off of Forestar Real Estate Group Inc. from Temple-Inland Inc. We are currently a wholly-owned subsidiary of Temple-Inland that holds the assets and liabilities primarily related to Temple-Inland’s real estate development and minerals operations. On November 29, 2007, the board of directors of Temple-Inland approved the final terms of a plan to separate Temple-Inland into three focused, stand-alone, public companies: one for its real estate business (Forestar Real Estate Group Inc.), one for its financial services business (Guaranty Financial Group Inc.), and one for its manufacturing operations in corrugated packaging and building products (Temple-Inland). Temple-Inland intends to accomplish this separation by distributing the shares of common stock in Forestar and Guaranty to Temple-Inland stockholders. Immediately following the separation of Forestar and Guaranty, Temple-Inland’s stockholders will own all of the outstanding shares in each of the three companies. Temple-Inland has received a private letter ruling from the Internal Revenue Service that the distributions qualify for tax-free treatment by stockholders for U.S. federal income tax purposes, except for cash received in lieu of any fractional share interests.

The distribution of our shares is expected to occur on December 28, 2007, by way of a pro rata dividend to Temple-Inland stockholders. You, as a Temple-Inland stockholder, will be entitled to receive one share of Forestar common stock for each three shares of Temple-Inland common stock that you hold at the close of business on December 14, 2007, the record date of the distribution. In anticipation of the spin-off, we recently converted from a Delaware limited liability company to a Delaware corporation. Upon completion of the distribution, we will be an independent, publicly-traded company.

On the distribution date, the distribution agent will distribute shares of our common stock to each eligible holder of Temple-Inland common stock by crediting book-entry accounts with that holder’s proportionate number of whole shares of our common stock. The shares will be issued in book-entry form only, which means that no physical stock certificates will be issued. No fractional shares of our common stock will be issued. You will receive the net cash value of any fractional share to which you would otherwise have been entitled.

No stockholder action is necessary to receive the shares of common stock to which you are entitled in the distribution, which means that:

| | |

| | • | you do not need to make any payment for the shares, and |

| |

| | • | you do not need to surrender any shares of Temple-Inland common stock to receive your shares of our common stock. |

No vote of Temple-Inland stockholders is required in connection with this distribution. We are not asking you for a proxy and you are not requested to send us a proxy.

All of the outstanding shares of our common stock are currently owned by Temple-Inland. Accordingly, there currently is no public trading market for our common stock. Our common stock has been approved for listing on the New York Stock Exchange under the ticker symbol “FOR.” A limited market, commonly known as a “when-issued” trading market, for our common stock developed shortly before the record date for the distribution and will continue up to and through the distribution date. We anticipate that “regular-way” trading of our common stock will begin on the first trading day following the distribution date.

In reviewing this information statement, you should carefully consider the matters described under the section entitled “Risk Factors” beginning on page 11.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

This information statement was first mailed to

Temple-Inland stockholders on or about December 18, 2007

TABLE OF CONTENTS

| | | |

| | | Page |

| |

| | 1 |

| | 11 |

| | 18 |

| | 20 |

| | 30 |

| | 31 |

| | 46 |

| | 47 |

| | 48 |

| | 54 |

| | 68 |

| | 97 |

| | 100 |

| | 106 |

| | 112 |

| | 112 |

| | 113 |

| | 114 |

| | F-1 |

This information statement is being furnished solely to provide information to Temple-Inland stockholders who will receive shares of our common stock in the distribution. It is not and is not to be construed as an inducement or encouragement to buy or sell any of our securities or any securities of Temple-Inland. This information statement describes our business, the relationship between Temple-Inland and us, and how the spin-off affects Temple-Inland and its stockholders, and provides other information to assist you in evaluating the benefits and risks of holding or disposing of our common stock that you will receive in the distribution. You should be aware of certain risks relating to the spin-off, our business and ownership of our common stock, which are described under the heading “Risk Factors” beginning on page 11 of this information statement.

You should not assume that the information contained in this information statement is accurate as of any date other than the date on the cover. Changes to the information contained in this information statement may occur after that date, and we undertake no obligation to update the information, except in the normal course of our public disclosure obligations and practices.

We own or have rights to use certain trademarks, trade names and logos in conjunction with our business, including our distinctive “leaf-star” logo. Certain other trademarks, trade names and logos of third parties may appear in this information statement, including specifically PGA Tour® and Tournament Players Club®, each of which are trademarks of PGA Tour, Inc. The display of such third parties’ trademarks, trade names and logos is for informational purposes only, and is not intended for marketing or promotional purposes or as an endorsement of their business or of any of their products or services.

The following is a summary of material information discussed in this information statement. This summary may not contain all the details concerning the spin-off, our business, our common stock or other information that may be important to you. You should carefully review this entire information statement, including the risk factors, to better understand the spin-off and our business and financial position.

Except as otherwise indicated or unless the context otherwise requires, the information included in this information statement assumes the completion of the spin-off and all of the other related transactions referred to in this information statement. Unless the context otherwise requires, references in this information statement to “Forestar,” “we,” “our” and “us” refer to the real estate and natural resources business that will be separated from Temple-Inland Inc. in the spin-off under the name Forestar Real Estate Group Inc., a Delaware corporation, and its subsidiaries. “Guaranty” refers to Guaranty Financial Group Inc. and its subsidiaries, the financial services business of Temple-Inland, also to be separated, and “Temple-Inland” refers to Temple-Inland Inc., a Delaware corporation, and its subsidiaries, unless the context otherwise requires. Unless otherwise indicated, information is presented as of September 29, 2007, and references to acreage owned includes all acres owned by ventures regardless of our ownership interest in a venture.

OUR COMPANY

Forestar Real Estate Group is a growth company committed to maximizing long-term stockholder value. We own directly or through ventures about 374,000 acres of real estate located in nine states and twelve markets and about 622,000 net acres of oil and gas mineral interests. We invest in strategic growth corridors, which we define as markets with significant growth characteristics for population, employment and household formation. In 2006, we generated revenues of $225 million and net income of $52 million.

We operate two business segments:

| | |

| | • | Real estate, and |

| |

| | • | Natural resources. |

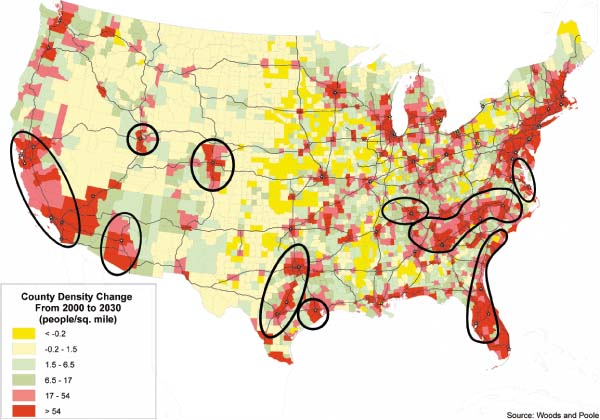

Our real estate segment secures entitlements and develops infrastructure on our lands, primarily for single-family residential and mixed-use communities. We own approximately 304,000 acres located in a broad area around Atlanta, Georgia, with the balance located primarily in Texas. We also actively invest in new projects in our strategic growth corridors, regions of accelerated growth across the southern half of the United States that possess key demographic and growth characteristics that we believe make them attractive for long-term real estate investment.

Our real estate projects are located among the fastest growing markets in the United States. We have 24 real estate projects representing about 27,000 acres currently in the entitlement process and 75 active development projects in seven states and 11 markets encompassing approximately 17,000 remaining acres, comprised of about 30,000 residential lots and about 1,900 commercial acres. We sell land for commercial uses to national retailers and local commercial developers. We own and manage projects both directly and through ventures. By using ventures, we achieve various business objectives including more efficient capital deployment, risk management, and leveraging a partner’s local market contacts and expertise. Real estate segment revenues for 2006 were $180 million.

Our natural resources segment is focused on maximizing the value from royalties and other lease revenues from our oil and gas mineral interests located in Texas, Louisiana, Alabama and Georgia. These operations have historically required low capital investment, and we intend to use the cash flow generated by our mineral interests to accelerate real estate value creation. In addition, we sell wood fiber from our land, primarily in Georgia, and lease land for recreational uses. Natural resources segment revenues for 2006 were $45 million.

Our origins date back to the 1955 incorporation of Lumbermen’s Investment Corporation, which in 2006 changed its name to Forestar (USA) Real Estate Group Inc. We have a decades-long legacy of residential and commercial real estate development operations, primarily in Texas. In 1991, we and Cousins Properties

1

Incorporated formed Temco Associates, LLC as a venture to develop residential sites in Paulding County, Georgia, and in 2002 we and Cousins formed CL Realty, L.L.C. as a venture to develop residential and mixed-use communities in Texas and across the southeastern U.S. Those ventures continue today. In 2001, we opened an office in the Atlanta area to manage nearby land with a focus on its long-term real estate development potential. In 2006, Temple-Inland began reporting Forestar Real Estate Group as a separate business segment. We believe our management team brings extensive knowledge, experience and expertise to position us to maximize long-term value for stockholders.

Our Strengths

Forestar has a strong competitive position attributable to a number of factors, including:

| | |

| | • | Geographically diversified real estate portfolio with about 374,000 acres located in nine states and twelve markets, which are among the fastest growing markets in the United States, |

| |

| | • | Stable and significant cash flow from natural resources, which will accelerate real estate value creation activities, |

| |

| | • | Financial strength, with a balance sheet well positioned for growth, and |

| |

| | • | Management team with significant experience in entitlement, development and acquisition of real estate, and management of natural resources. |

Our Strategy

Our strategy is to maximize and grow long-term stockholder value through:

| | |

| | • | Entitlement and development of real estate, |

| |

| | • | Realization of value from natural resources, and |

| |

| | • | Accelerated growth through strategic and disciplined investment in real estate. |

We are focused on maximizing real estate values through the entitlement and development of well-located residential and mixed-use communities. We secure entitlements on our lands by delivering thoughtful plans and balanced solutions that meet the needs of the communities where we operate. Moving land through the entitlement and development process creates significant real estate value. Residential development activities target lot sales to national and regional home builders who build quality products and have strong and effective marketing and sales programs. The lots we deliver in the majority of our communities are for mid-priced homes, predominantly in the first and second move-up categories, the largest segments of the new home market. Commercial tracts are either sold to or ventured with a commercial developer that specializes in the construction and operation of income-producing properties.

We intend to maximize value from our oil and gas mineral interests located in Texas, Louisiana, Alabama and Georgia by increasing the acreage leased, lease rates and royalty interests. These operations have historically required low capital investment and we intend to use the cash flow generated by our mineral interests to accelerate real estate value creation activities. In addition, we realize value from our undeveloped land by selling fiber and by managing it for future real estate development and conservation uses. We also intend to generate cash flow and create additional value through recreational leases and water rights.

We are committed to growing our business and will continue to reinvest our capital primarily in ten strategic growth corridors through disciplined investment in real estate opportunities that meet our investment criteria. In 2006, we invested $74 million in ten new projects, representing over 2,400 acres located in three of our strategic growth corridors.

Our real estate and natural resources assets in combination with our strategy, financial strength, management expertise, stewardship and continuous reinvestment in our business, position Forestar to maximize long-term value for stockholders.

2

SUMMARY REAL ESTATE PORTFOLIO AND ACTIVITY

The following table sets forth our real estate portfolio at September 29, 2007, and our 2006 sales and entitlement activity (including ventures).

| | | | | | | | | | | | | | | | | |

| | | September 29, 2007 | | | For the Year 2006 | |

Value Chain | | Acres | | | Lots | | | Sales & Entitlement Activity | | | Average Sales Price | |

| |

| Developed & Under | | | | | | | | | | | | | | | | |

| Development | | | | | | | | | | | | | | | | |

| Commercial | | | 624 | | | | | | | | Sold 278 acres | | | | $204,800 / acre | |

| Residential | | | 1,817 | | | | 5,195 | | | | Sold 3,539 lots | | | | $48,200 / lot | |

| Entitled | | | 14,254 | (a) | | | 24,721 | | | | Entitled 2,151 acres - 5 projects | | | | | |

| In Entitlement | | | 26,750 | | | | | | | | Moved 4,890 acres into entitlement | | | | | |

| Undeveloped Land | | | 330,706 | | | | | | | | Sold 3,652 acres | | | | $8,100 / acre | |

| | | | | | | | | | | | | | | | | |

Total | | | 374,151 | | | | 29,916 | | | | | | | | | |

| | |

| (a) | | Includes 1,266 commercial acres and 12,988 residential acres. |

SUMMARY FINANCIAL INFORMATION

The following table sets forth summary historical financial data as of and for the periods indicated.

| | | | | | | | | | | | | | | | | |

| | | First

| | | | |

| | | Nine Months | | | Year-End | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| | | (In thousands, except number of employees) | |

| |

For the period ended | | | | | | | | | | | | | | | | |

| Revenue | | $ | 142,373 | | | $ | 225,560 | | | $ | 155,487 | | | $ | 169,301 | |

| Net income | | $ | 24,689 | | | $ | 51,844 | | | $ | 34,897 | | | $ | 28,436 | |

At end of period | | | | | | | | | | | | | | | | |

| Total assets | | $ | 692,963 | | | $ | 620,174 | | | $ | 543,944 | | | $ | 517,700 | |

| Note payable to Temple-Inland and other debt | | $ | 219,453 | | | $ | 161,117 | | | $ | 121,948 | | | $ | 110,997 | |

Temple-Inland’s net investment(a) | | $ | 433,656 | | | $ | 418,052 | | | $ | 381,290 | | | $ | 368,659 | |

| Number of employees | | | 82 | | | | 62 | | | | 48 | | | | 49 | |

| | |

| (a) | | Our operations are conducted within separate legal entities and their subsidiaries or within segments or components of segments of Temple-Inland. As a result of the different forms of Temple-Inland’s ownership in these operations, Temple-Inland’s net investment is shown instead of stockholder’s equity. |

Other Information

We are a Delaware corporation. Our principal executive offices are located at 1300 MoPac Expressway South, Suite 3S, Austin, Texas 78746. Our telephone number is512-433-5200. Our web site iswww.forestargroup.com. Information contained on our web site does not constitute a part of this information statement or the registration statement on Form 10 of which it is a part.

3

SUMMARY RISK FACTORS

An investment in our common stock involves risks associated with our business, the spin-off and ownership of our common stock. The following list of risk factors is not exhaustive. Please read carefully the risks relating to these and other matters described under the section entitled “Risk Factors” beginning on page 11.

Risks Relating to Our Business

| | |

| | • | A decrease in demand for new housing in the market regions where we operate could decrease our profitability. |

| |

| | • | Both our real estate and natural resources businesses are cyclical in nature. |

| |

| | • | Development of real estate entails a lengthy, uncertain, and costly entitlement process. |

| |

| | • | The real estate and natural resource industries are highly competitive and a number of entities with which we compete are larger and have greater resources, and competitive conditions may adversely affect our results of operations. |

| |

| | • | Our activities are subject to environmental regulations and liabilities that could have a negative effect on our operating results. |

| |

| | • | Our real estate operations are currently concentrated in Georgia and Texas, and our oil and gas leases are currently concentrated in Texas and Louisiana. As a result, our financial results are dependent on the economic growth and strength of those areas. |

| |

| | • | If we are unable to retain or attract experienced real estate development or natural resources management personnel, our business may be adversely affected. |

| |

| | • | Our real estate development operations are increasingly dependent upon national, regional, and local homebuilders, as well as other strategic partners, who may have interests that differ from ours and may take actions that adversely affect us. |

Risks Relating to the Spin-off

| | |

| | • | We may be unable to achieve some or all of the benefits that we expect to achieve from our spin-off from Temple-Inland. |

| |

| | • | We have no operating history as an independent, publicly-traded company upon which you can evaluate our performance, and accordingly, our prospects must be considered in light of the risks that any newly independent company encounters. |

| |

| | • | Our agreements with Temple-Inland and Guaranty may not reflect terms that would have resulted from arm’s-length negotiations among unaffiliated third parties. |

| |

| | • | Our historical and pro forma financial information are not necessarily indicative of our results as a separate company and, therefore, may not be reliable as an indicator of our future financial results. |

| |

| | • | If the spin-off is determined to be taxable for U.S. federal income tax purposes, we, our stockholders, and Temple-Inland could incur significant U.S. federal income tax liabilities. |

| |

| | • | We must abide by certain restrictions to preserve the tax-free treatment of the spin-off and may not be able to engage in desirable acquisitions and other strategic transactions following the spin-off. |

| |

| | • | The ownership by our chairman, our executive officers and some of our other directors of common stock, options or other equity awards of Temple-Inland or Guaranty may create, or may create the appearance of, conflicts of interest. |

4

| | |

| | • | We may be unable to make, on a timely or cost-effective basis, the changes necessary to operate as an independent, publicly-traded company, and we may experience increased costs after the spin-off or as a result of the spin-off. |

| |

| | • | Until the distribution occurs Temple-Inland has the sole discretion to change the terms of the spin-off in ways that may be unfavorable to us. |

Risks Relating to Our Common Stock

| | |

| | • | There is no existing market for our common stock and a trading market that will provide adequate liquidity may not develop for our common stock. In addition, once our common stock begins trading, the market price of our shares may fluctuate widely. |

| |

| | • | Substantial sales of our common stock may occur following the spin-off, which could cause our stock price to decline. |

| |

| | • | Your percentage ownership in our common stock may be diluted in the future. |

| |

| | • | The terms of our spin-off from Temple-Inland, anti-takeover provisions of our charter and bylaws, as well as Delaware law and our stockholder rights agreement, may reduce the likelihood of any potential change of control or unsolicited acquisition proposal that you might consider favorable. |

| |

| | • | We currently do not intend to pay any dividends on our common stock. Accordingly, investors in our common stock must rely upon subsequent sales after price appreciation as the sole method to realize a gain on an investment in our common stock. |

THE TRANSFORMATION PLAN

On February 25, 2007, the board of directors of Temple-Inland unanimously authorized management of Temple-Inland to pursue a transformation plan to spin off its real estate business and its financial services business from Temple-Inland, and on November 29, 2007 the board of directors approved the final terms of the spin-offs. The spin-offs will occur through distributions to Temple-Inland’s stockholders of all of the shares of common stock of Forestar, which will hold all of the assets and liabilities of the real estate business of Temple-Inland, and Guaranty, which will hold all of the assets and liabilities of the financial services business of Temple-Inland. In addition, Temple-Inland sold its strategic timberland on October 31, 2007 as part of the transformation plan.

On December 11, 2007, we entered into a separation and distribution agreement and several other related agreements with Temple-Inland and Guaranty to effect the separation and provide a framework for our relationships with Temple-Inland and Guaranty after the spin-off. These agreements will govern the relationships among us, Guaranty, and Temple-Inland subsequent to the completion of the spin-off and provide for the allocation among us, Guaranty, and Temple-Inland of Temple-Inland’s assets, liabilities and obligations (including employee benefits and tax-related assets and liabilities) attributable to periods prior to, at and after our spin-off from Temple-Inland. For more information on the separation and distribution agreement and related agreements, see the section entitled “Certain Relationships and Related Party Transactions — Agreements with Temple-Inland and Guaranty” beginning on page 100 of this information statement.

Temple-Inland’s board of directors believes that creating three independent companies, each focused on its core business, is the best way to manage these businesses for the benefit of the stockholders and each of the companies, in both the short and long term. Temple-Inland believes that the separation of the businesses should not only enhance the strength of each business, but should also improve the strategic, operational and financial flexibility of each company. Although there can be no assurance, Temple-Inland believes that, over time, the common stock of Temple-Inland, Forestar and Guaranty should have a greater aggregate market value, assuming the same market conditions, than Temple-Inland common stock has in its current configuration (adjusting for the sale of its strategic timberland).

5

QUESTIONS AND ANSWERS RELATING TO THE SPIN-OFF

The following are some of the questions that you may have about the spin-off and answers to those questions. These questions and answers are not meant to be a substitute for the information contained in the remainder of this information statement, including the section entitled “The Spin-off” beginning on page 20. This information is qualified in its entirety by the more detailed descriptions and explanations contained elsewhere in this information statement. We urge you to read this information statement carefully and in its entirety.

| | |

| Q: | | What is the spin-off? |

| |

| A: | | The spin-off is the method by which Temple-Inland will separate its existing business segments into three focused, stand-alone, public companies. Following the spin-off, we will be a separate company from Temple-Inland, and Temple-Inland will not retain any ownership interest in us. The number of shares of Temple-Inland common stock you own will not change as a result of the spin-off, although the value of shares of Temple-Inland common stock may initially decline as a result of the spin-off of our company, the spin-off of Guaranty, and the sale of Temple-Inland’s strategic timberlands because the value of those businesses will no longer be part of the value of Temple-Inland common stock. |

| |

| Q: | | Why is the separation of Forestar from Temple-Inland structured as a spin-off distribution? |

| |

| A: | | Temple-Inland believes that a spin-off distribution of shares of Forestar and Guaranty to its stockholders is a tax-efficient way to separate the businesses. Temple-Inland has received a private letter ruling from the Internal Revenue Service that the distribution qualifies for tax-tree treatment both to Temple-Inland and to you, as a Temple-Inland stockholder, other than with respect to any cash paid in lieu of fractional shares as discussed below. |

| |

| Q: | | What is being distributed in the spin-off? |

| | |

| A: | | Approximately 35.5 million shares of our common stock will be distributed in the spin-off, based upon the number of shares of Temple-Inland common stock outstanding on November 30, 2007. Approximately 35.5 million shares of Guaranty common stock will also be distributed in a separate spin-off. The shares of our common stock to be distributed by Temple-Inland will constitute all of the issued and outstanding shares of our common stock immediately after the spin-off. Each share of our common stock will have attached to it one preferred stock purchase right created under a stockholder rights agreement adopted by our board prior to the spin-off. For more information on the shares being distributed in the spin-off and the stockholder rights agreement, see the sections entitled “Description of Our Capital Stock — Common Stock” beginning on page 106 of this information statement and “Description of Our Capital Stock — Anti-takeover Effects of Our Stockholder Rights Agreement, Our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws, and Delaware Law — Stockholder Rights Agreement” beginning on page 110 of this information statement. |

| | |

| Q: | | What will I receive in the spin-off? |

| |

| A: | | As a holder of Temple-Inland common stock, you will receive a pro rata dividend of one share of our common stock (and a related preferred stock purchase right) for every three shares of Temple-Inland common stock that you hold on the record date and do not subsequently sell in the “regular way” market prior to the distribution date. For more information on the spin-off distribution, see the section entitled “The Spin-off — Distribution of the Shares” beginning on page 24 of this information statement. You will also receive shares of Guaranty common stock in its separate spin-off. |

| |

| Q: | | When will the distribution occur? |

| |

| A: | | We expect that the distribution agent will distribute shares of our common stock, on behalf of Temple-Inland, on or about December 28, 2007, which we refer to as the distribution date. |

6

| | |

| Q: | | Can Temple-Inland decide to cancel the distribution of the shares of Forestar common stock even if all the conditions to the spin-off have been satisfied? |

| |

| A: | | Yes. The distribution is subject to the satisfaction or waiver of certain conditions. See the section entitled “The Spin-off — Conditions to the Spin-off” beginning on page 29 of this information statement. Temple-Inland has the right to terminate the distribution, even if all of the conditions are satisfied, if at any time the board of directors of Temple-Inland determines that the distribution is not in the best interests of Temple-Inland and its stockholders or that market conditions are such that it is not advisable to separate the real estate business from Temple-Inland. |

| |

| Q: | | What do I have to do to participate in the spin-off? |

| | |

| A: | | Nothing, but we urge you to read this entire document carefully. If you are a holder of record of Temple-Inland common stock on December 14, 2007, the record date for the spin-off, you will not be required to pay any cash or deliver any other consideration, including any shares of Temple-Inland common stock, in order to receive shares of our common stock in the spin-off. As discussed under the section entitled “The Spin-off — Trading of Temple-Inland Common Stock Between the Record Date and Distribution Date” beginning on page 28 of this information statement, if you sell your shares of Temple-Inland common stock in the “regular way” market after the record date and on or before the distribution date, you also will be selling your right to receive shares of our common stock in connection with the spin-off. You are not being asked to provide a proxy with respect to any of your shares of Temple-Inland common stock in connection with the spin-off. |

| | |

| Q: | | How will Temple-Inland distribute shares of Forestar common stock to me? |

| |

| A: | | Holders of shares of Temple-Inland common stock on the record date that do not subsequently sell their shares in the “regular way” market on or before the distribution date will receive shares of our common stock through the transfer agent’s book-entry registration system. These shares will not be in certificated form. Instead of certificates representing shares of our common stock, if you are a registered holder of Temple-Inland common stock, the distribution agent will mail to you an account statement that indicates the number of shares of our common stock that have been registered in book-entry form in your name and the method by which you may access your account. If you hold your Temple-Inland common stock in “street name” through a bank or brokerage firm, your bank or brokerage firm will credit your account for the number of shares of our common stock that you are entitled to receive in the distribution. For more information, see the section entitled “The Spin-off — Distribution of the Shares” beginning on page 24 of this information statement. |

| |

| Q: | | If I sell, on or before the distribution date, shares of Temple-Inland common stock that I held on the record date, am I still entitled to receive shares of Forestar common stock distributable with respect to the shares of Temple-Inland common stock I sold? |

| | |

| A: | | Beginning shortly before the record date and continuing through the distribution date for the spin-off, Temple-Inland’s common stock will trade in two markets on the NYSE: a “regular way” market and an “ex-distribution” market. If you are a holder of record of shares of Temple-Inland common stock as of the record date for the spin-off and sell those shares in the “regular way” market after the record date for the spin-off and before the distribution date, you also will be selling the right to receive the shares of our common stock in connection with the spin-off. However, if you are a holder of record of shares of Temple-Inland common stock as of the record date for the spin-off and sell those shares in the “ex-distribution” market after the record date for the spin-off and before the distribution date, you will still receive the shares of our common stock in the spin-off. For more information, see the section entitled “The Spin-off — Trading of Temple-Inland Common Stock Between the Record Date and Distribution Date” beginning on page 28 of this information statement. |

| | |

| Q: | | How will fractional shares be treated in the spin-off? |

| |

| A: | | We will not issue fractional shares of our common stock in the spin-off. The distribution agent will aggregate all of the fractional shares and sell them in the open market over several trading days at then |

7

| | |

| | prevailing prices. You will then receive a cash payment in the amount of your proportionate share of the net sale proceeds, based on the average gross selling price per share of our common stock after making appropriate deductions for any required tax withholdings. For more information on fractional shares, see the section entitled “The Spin-off — Treatment of Fractional Shares” beginning on page 24 of this information statement. |

| | |

| Q: | | What if I hold shares of Temple-Inland common stock in the Temple-Inland 401(k) plan? |

| |

| A: | | In connection with the spin-off, Forestar will establish a 401(k) plan for its employees. The Forestar plan will be generally comparable to the Temple-Inland 401(k) plan, except it will not have a company stock fund. Participants who hold Temple-Inland common stock in their Temple-Inland 401(k) plan on the date of the spin-off will receive shares of Forestar and Guaranty common stock in their 401(k) plan account. The Forestar and Guaranty shares will be allocated to these 401(k) plan accounts in accordance with the spin-off distribution ratio. The 401(k) plan accounts for Forestar employees will be transferred to the new Forestar 401(k) plan after the spin-off, but their company stock fund account will remain in the Temple-Inland 401(k) plan for a period of time that will allow participants to elect when to divest these shares. |

| |

| Q: | | What are the U.S. federal income tax consequences of the spin-off to Temple-Inland stockholders? |

| |

| A: | | The spin-off is conditioned upon Temple-Inland’s receipt of a private letter ruling from the Internal Revenue Service, and an opinion of tax counsel to the effect that the spin-off, together with certain related transactions, will qualify as a tax-free distribution for U.S. federal income tax purposes under Sections 355 and 368(a)(1)(D) of the Internal Revenue Code of 1986, as amended, which we refer to as the Code.Temple-Inland has received the private letter ruling and the opinion. Assuming the spin-off so qualifies under the Code, you will recognize no gain or loss for U.S. federal income tax purposes, and no amount will be included in your income upon the receipt of shares of our common stock pursuant to the spin-off. You will generally recognize gain or loss with respect to cash received in lieu of a fractional share of our common stock. For more information regarding the private letter ruling, the tax opinion, and the potential tax consequences to you of the spin-off, see the section entitled “The Spin-off — Certain U.S. Federal Income Tax Consequences of the Spin-off” beginning on page 25 of this information statement. |

| |

| Q: | | Does Forestar intend to pay cash dividends? |

| |

| A: | | After the spin-off, we do not intend to pay a cash dividend on our common stock for the foreseeable future. Instead, we intend to reinvest our available cash flow into our business. Our board of directors is free to change our dividend policy at any time, including to establish, increase, decrease or eliminate any dividend. For more information about our expected dividend policy, see the section entitled “Dividend Policy” beginning on page 30 of this information statement. |

| |

| Q: | | What will the relationship be among Forestar, Guaranty, and Temple-Inland following the spin-off? |

| | |

| A: | | After the spin-off, Forestar, Guaranty, and Temple-Inland will be independent, publicly-traded companies, and Temple-Inland will no longer have any ownership interest in us. We will, however, be parties to agreements that will define our ongoing relationships after the spin-off. For example, under the terms of a transition services agreement that we entered into with Temple-Inland and Guaranty on December 11, 2007, Temple-Inland will provide, generally at cost, for a period up to 24 months after the spin-off, specified support services primarily related to information technology. We also lease office space from Guaranty. In addition, Kenneth M. Jastrow, II will be our Chairman and the Chairman of Guaranty. For more information on our relationships with Temple-Inland and Guaranty after the spin-off, see the section entitled “Certain Relationships and Related Party Transactions” beginning on page 100 of this information statement. |

| | |

| Q: | | Who is the distribution agent for the spin-off? Who is the transfer agent for Forestar common stock? |

| |

| A: | | Computershare Trust Company, N.A. is the distribution agent for the spin-off and will be the transfer agent for our common stock. |

8

| | |

| Q: | | Where will Forestar common stock trade? |

| | |

| A: | | Our common stock has been approved for listing on the New York Stock Exchange under the symbol “FOR.” |

| | |

| Q: | | When will Forestar common stock trade? |

| | |

| A: | | Trading in our common stock began on a when-issued basis shortly before the record date. When-issued trading refers to trading in our stock before the record date for the distribution and made conditionally because the securities of the spun-off entity have not yet been distributed. When-issued trades generally settle within four trading days after the distribution date. On the first trading day following the distribution date, any when-issued trading in our common stock will end and regular way trading will begin. Regular way trading refers to trading after our stock has been distributed and typically involves a trade that settles on the third full trading day following the date of distribution. Shares of our common stock generally will be freely tradable after the spin-off. We cannot predict the trading prices for our common stock before or after the distribution date. For more information on the trading market for our shares, see the section entitled “The Spin-off — Listing and Trading of Our Common Stock” beginning on page 28 of this information statement. |

| | |

| Q: | | How will I determine my tax basis in the Forestar common stock I receive in the spin-off? |

| |

| A: | | Shortly after the spin-off is completed, Temple-Inland will provide you with information that will enable you to compute your tax basis in each of Temple-Inland, Forestar, and Guaranty common stock. Generally, your aggregate basis in the Temple-Inland, Forestar, and Guaranty common stock after the spin-offs will equal the aggregate basis of Temple-Inland common stock held by you immediately before the spin-off, allocated between your Temple-Inland common stock and the Forestar, and Guaranty common stock you receive in the spin-offs in proportion to the relative fair market value of each on the date of the spin-offs. |

| | |

| | You should consult your tax advisor about the particular consequences of the spin-off to you, including the application of U.S. federal, state, and local tax laws and foreign tax laws. |

| | |

| Q: | | Do I have appraisal rights? |

| |

| A: | | No. Holders of Temple-Inland common stock do not have appraisal rights in connection with the spin-off. |

| |

| Q: | | Will Forestar incur any debt in the spin-off? |

| | |

| A: | | Yes. We expect to enter into a $440 million credit facility arranged by KeyBanc Capital Markets. Borrowings will be secured by about 250,000 acres of our land and other assets and, at our election, will bear interest calculated by reference to either (a) the higher of KeyBanc’s base rate or the federal funds effective rate plus half a percent, plus two percent, or (b) the London Interbank Offered Rate, or LIBOR, plus four percent. Prior to the spin-off, we will draw under this credit facility to repay our credit facility with Temple-Inland. For more information on our credit facility and our debt, see the sections entitled “Description of Material Indebtedness,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Capitalization,” “Pro Forma Financial Information,” and “Certain Relationships and Related Party Transactions.” |

| | |

| Q: | | Where can I get more information? |

| |

| A: | | If you have questions relating to the mechanics of the distribution of Forestar shares, you should contact the distribution agent: |

| | |

| | Computershare Trust Company, N.A. |

250 Royall Street

Canton, MA 02021

781-575-2879

| | |

| | If your shares are held by a broker, bank, or other nominee, you may call the information agent, D. F. King & Co., Inc., toll free at 1-888-567-1626. |

9

Before the spin-off, if you have questions relating to the spin-off, you should contact:

Temple-Inland Inc.

Investor Relations

1300 MoPac Expressway South

Austin, Texas 78746

Tel:512-434-5587

Fax:512-434-3750

After the spin-off, if you have questions relating to Forestar, you should contact:

Forestar Real Estate Group Inc.

Investor Relations

1300 MoPac Expressway South, Suite 3S

Austin, Texas 78746

Tel: 512-433-5210

Fax: 512-433-5203

10

You should carefully consider each of the following risk factors and all of the other information set forth in this information statement. The risk factors generally have been separated into three groups: (1) risks relating to our business, (2) risks relating to the spin-off, and (3) risks relating to ownership of our common stock. Based on the information currently known to us, we believe that the following information identifies the most significant risk factors affecting our company in each of these categories. In addition, past financial performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods.

If any of the following risks and uncertainties develops into actual events, these events could have a material adverse effect on our business, financial condition, or results of operations. In such case, the trading price of our common stock could decline.

Risks Relating to Our Business

A decrease in demand for new housing in the markets where we operate could decrease our profitability.

The residential development industry is cyclical and is significantly affected by changes in general and local economic conditions, such as employment levels, availability of financing for home buyers, interest rates, consumer confidence and housing demand. Adverse changes in these conditions generally, or in the markets where we operate, could decrease demand for lots for new homes in these areas. Thewell-publicized current market conditions include a general over-supply of housing, significant tightening of mortgage credit (especially sub-prime and non-conforming loans), decreased sales volumes for both new and existing homes, and flat to declining home prices. A further decline in housing demand could negatively affect our real estate development activities, which could result in a decrease in our revenues and earnings.

Furthermore, the market value of undeveloped land and buildable lots held by us can fluctuate significantly as a result of changing economic and real estate market conditions. If there are significant adverse changes in economic or real estate market conditions, we may have to hold land in inventory longer than planned. Inventory carrying costs can be significant and can result in losses in a poorly performing project or market.

Both our real estate and natural resources businesses are cyclical in nature.

The operating results of our business segments reflect the general cyclical pattern of each segment. While the cycles of each industry do not necessarily coincide, demand and prices in each may drop substantially in an economic downturn. Real estate development of residential lots is further influenced by new home construction activity. Natural resources may be further influenced by national and international commodity prices, principally for oil and gas. Cyclical downturns may materially and adversely affect our results of operations.

Development of real estate entails a lengthy, uncertain, and costly entitlement process.

Approval to develop real property entails an extensive entitlement process involving multiple and overlapping regulatory jurisdictions and often requiring discretionary action by local governments. This process is often political, uncertain and may require significant exactions in order to secure approvals. Real estate projects must generally comply with local land development regulations and may need to comply with state and federal regulations. The process to comply with these regulations is usually lengthy and costly and can be expected to materially affect our real estate development activities.

The real estate and natural resource industries are highly competitive and a number of entities with which we will compete are larger and have greater resources, and competitive conditions may adversely affect our results of operations.

The real estate and natural resource industries in which we will operate are highly competitive and are affected to varying degrees by supply and demand factors and economic conditions, including changes in

11

interest rates, new housing starts, home repair and remodeling activities, credit availability, and housing affordability. No single company is dominant in any of our industries.

We compete with numerous regional and local developers for the acquisition, entitlement, and development of land suitable for development. We also compete with some of our national and regional home builder customers who develop real estate for their own use in homebuilding operations, many of which are larger and have greater resources, including greater marketing and technology budgets. Any improvement in the cost structure or service of our competitors will increase the competition we face.

The competitive conditions in the real estate and natural resource industries result in:

| | |

| | • | difficulties in acquiring suitable land at acceptable prices; |

| |

| | • | lower sales volumes; |

| |

| | • | lower sale prices; |

| |

| | • | increased development costs; and |

| |

| | • | delays in construction. |

Our business and results of operations are negatively affected by the existence of these conditions.

Our activities are subject to environmental regulations and liabilities that could have a negative effect on our operating results.

Our operations are subject to federal, state, and local provisions regulating the discharge of materials into the environment and otherwise related to the protection of the environment. Compliance with these provisions may result in delays, may cause us to invest substantial funds to ensure compliance with applicable environmental regulations and can prohibit or severely restrict homebuilding activity in environmentally sensitive regions or areas.

Our real estate operations are currently concentrated in Georgia and Texas, and our oil and gas leases are currently concentrated in Texas and Louisiana. As a result, our financial results are dependent on the economic growth and strength of those areas.

The economic growth and strength of Georgia and Texas, where the majority of our real estate development activity is located, and of Texas and Louisiana, where our oil and gas leases are located, are important factors in sustaining demand for our activities. As a result, any adverse change to the economic growth and health of those areas could materially adversely affect our financial results. The future economic growth in certain portions of Georgia in particular may be adversely affected if its infrastructure, such as roads, utilities, and schools, are not improved to meet increased demand. There can be no assurance that these improvements will occur.

If we are unable to retain or attract experienced real estate development or natural resources management personnel, our business may be adversely affected.

Our future success depends on our ability to retain and attract experienced real estate development and natural resources management personnel. The market for these employees is highly competitive. If we cannot continue to retain and attract quality personnel, our ability to effectively operate our business may be significantly limited.

Our real estate development operations are increasingly dependent upon national, regional, and local homebuilders, as well as other strategic partners, who may have interests that differ from ours and may take actions that adversely affect us.

We are highly dependent upon our relationships with national, regional, and local homebuilders to purchase lots in our residential developments. If homebuilders do not view our developments as desirable locations for homebuilding operations, our business will be adversely affected. Also, a national homebuilder

12

could decide to delay purchases of lots in one of our developments due to adverse real estate conditions wholly unrelated to our areas of operations.

We are also involved in strategic alliances or venture relationships as part of our overall strategy for particular developments or regions. These venture partners may bring development experience, industry expertise, financing capabilities, and local credibility or other competitive assets. Strategic partners, however, may have economic or business interests or goals that are inconsistent with ours or that are influenced by factors unrelated to our business. We may also be subject to adverse business consequences if the market reputation of a strategic partner deteriorates.

A formal agreement with a venture partner may also involve special risks such as:

| | |

| | • | we may not have voting control over the venture; |

| |

| | • | the venture partner may take actions contrary to our instructions or requests, or contrary to our policies or objectives with respect to the real estate investments; |

| |

| | • | the venture partner could experience financial difficulties; and |

| |

| | • | actions by a venture partner may subject property owned by the venture to liabilities greater than those contemplated by the venture agreement or have other adverse consequences. |

Risks Relating to the Spin-off

We may be unable to achieve some or all of the benefits that we expect to achieve from our spin-off from Temple-Inland.

We may not be able to achieve the full strategic and financial benefits that we expect will result from our spin-off from Temple-Inland or such benefits may be delayed or may not occur at all. For example, there can be no assurance that analysts and investors will regard our corporate structure as clearer and simpler than the current Temple-Inland corporate structure or place a greater value on our company as a stand-alone company than on our businesses being a part of Temple-Inland. As a result, in the future the aggregate market price of Temple-Inland’s common stock and Forestar and Guaranty common stock as separate companies, assuming the same market conditions, may be less than the market price per share of Temple-Inland’s common stock (adjusted for the sale of its strategic timberland) had the spin-offs not occurred.

We have no operating history as an independent, publicly-traded company upon which you can evaluate our performance, and accordingly, our prospects must be considered in light of the risks that any newly independent company encounters.

We have no experience operating as an independent, publicly-traded company and performing various corporate functions, including human resources, tax administration, legal (including compliance with the Sarbanes-Oxley Act of 2002 and with the periodic reporting obligations of the Securities Exchange Act of 1934), treasury administration, investor relations, internal audit, insurance, information technology and telecommunications services, as well as the accounting for items such as equity compensation and income taxes. We may be unable to make, on a timely or cost-effective basis, the changes necessary to operate as an independent, publicly-traded company, and we may experience increased costs after the spin-off or as a result of the spin-off. Our prospects must be considered in light of the risks, expenses and difficulties encountered by companies in the early stages of independent business operations, particularly companies such as ours in highly competitive markets.

Our agreements with Temple-Inland and Guaranty may not reflect terms that would have resulted from arm’s-length negotiations among unaffiliated third parties.

The agreements that we have entered into related to our spin-off from Temple-Inland, including the separation and distribution agreement, employee matters agreement, tax matters agreement and transition services agreement, were prepared in the context of our spin-off from Temple-Inland while we are still part of Temple-Inland and, accordingly, may not reflect terms that would have resulted from arm’s-length negotiations

13

among unaffiliated third parties. These agreements relate to, among other things, the allocation of assets, liabilities, rights, indemnifications and other obligations between Temple-Inland, Guaranty, and us. For more information about these agreements see the section entitled “Certain Relationships and Related Party Transactions — Agreements with Temple-Inland and Guaranty” beginning on page 100 of this information statement.

Our historical and pro forma financial information are not necessarily indicative of our results as a separate company and, therefore, may not be reliable as an indicator of our future financial results.

Our historical and pro forma financial information have been created using our historical results of operations and historical bases of assets and liabilities as part of Temple-Inland. This historical financial information is not necessarily indicative of what our results of operations, financial position and cash flows would have been if we had been a separate, stand-alone entity during the periods presented.

It is also not necessarily indicative of what our results of operations, financial position, and cash flows will be in the future and does not reflect many significant changes that will occur in our capital structure, funding, and operations as a result of the spin-off. While our historical results of operations include all costs of Temple-Inland’s real estate development and minerals operations, our historical costs and expenses do not include all of the costs that would have been or will be incurred by us as an independent, publicly-traded company. In addition, our historical financial information does not reflect changes, many of which are significant, that will occur in our cost structure, financing and operations as a result of the spin-off. These changes include potentially increased costs associated with reduced economies of scale and purchasing power.

Our effective income tax rate as reflected in our historical financial information also may not be indicative of our future effective income tax rate. Among other things, the rate may be materially affected by:

| | |

| | • | changes in the mix of our earnings from the various jurisdictions in which we operate; |

| |

| | • | the tax characteristics of our earnings; and |

| |

| | • | the timing and results of any reviews of our income tax filing positions in the jurisdictions in which we transact business. |

If the spin-off is determined to be taxable for U.S. federal income tax purposes, we, our stockholders, and Temple-Inland could incur significant U.S. federal income tax liabilities.

Temple-Inland has received a private letter ruling from the Internal Revenue Service, or IRS, that the spin-off will qualify for tax-free treatment under applicable sections of the Code. In addition, Temple-Inland has received an opinion from tax counsel that the spin-off so qualifies. The IRS ruling and the opinion rely on certain representations, assumptions, and undertakings, including those relating to the past and future conduct of our business, and neither the IRS ruling nor the opinion would be valid if such representations, assumptions, and undertakings were incorrect. Moreover, the IRS private letter ruling does not address all the issues that are relevant to determining whether the spin-off will qualify for tax-free treatment. Notwithstanding the IRS private letter ruling and opinion, the IRS could determine that the spin-off should be treated as a taxable transaction if it determines that any of the representations, assumptions, or undertakings that were included in the request for the private letter ruling are false or have been violated or if it disagrees with the conclusions in the opinion that are not covered by the IRS ruling. For more information regarding the tax opinion and the private letter ruling, see the section entitled “The Spin-Off — Certain U.S. Federal Income Tax Consequences of theSpin-off ” beginning on page 25 of this information statement.

If the spin-off fails to qualify for tax-free treatment, Temple-Inland would be subject to tax as if it had sold the common stock of our company in a taxable sale for its fair market value, and our initial public stockholders would be subject to tax as if they had received a taxable distribution equal to the fair market value of our common stock that was distributed to them. Under the tax matters agreement between Temple-Inland and us, we would generally be required to indemnify Temple-Inland against any tax resulting from the distribution to the extent that such tax resulted from (1) an issuance of our equity securities, a redemption of our equity securities, or our involvement in other acquisitions of our equity securities, (2) other actions or

14

failures to act by us, or (3) any of our representations or undertakings being incorrect or violated. For a more detailed discussion, see the section entitled “Certain Relationships and Related Party Transactions — Agreements with Temple-Inland and Guaranty — Tax Matters Agreement,” beginning on page 104 of this information statement. Our indemnification obligations to Temple-Inland and its subsidiaries, officers, and directors are not limited by any maximum amount. If we are required to indemnify Temple-Inland or such other persons under the circumstances set forth in the tax matters agreement, we may be subject to substantial liabilities.

We must abide by certain restrictions to preserve the tax-free treatment of the spin-off and may not be able to engage in desirable acquisitions and other strategic transactions following the spin-off.

To preserve the tax-free treatment of the spin-off to Temple-Inland, under a tax matters agreement that we will enter into with Temple-Inland and Guaranty, for the two-year period following the distribution, we may be prohibited, except in specified circumstances, from:

| | |

| | • | issuing equity securities to satisfy financing needs, |

| |

| | • | acquiring businesses or assets with equity securities, or |

| |

| | • | engaging in mergers or asset transfers that could jeopardize the tax-free status of the distribution. |

These restrictions may limit our ability to pursue strategic transactions or engage in new business or other transactions that may maximize the value of our business. For more information, see the sections entitled “The Spin-off — Certain U.S. Federal Income Tax Consequences of the Spin-off” and “Certain Relationships and Related Party Transactions — Agreements with Temple-Inland and Guaranty — Tax Matters Agreement” beginning on pages 25 and 104, respectively, of this information statement.

The ownership by our chairman, our executive officers, and some of our other directors of common stock, options, or other equity awards of Temple-Inland or Guaranty may create actual or apparent conflicts of interest.

Because of their current or former positions with Temple-Inland, our chairman, substantially all of our executive officers, including our Chief Executive Officer and our Chief Financial Officer, and some of our non-employee directors, own shares of common stock of Temple-Inland, options to purchase shares of common stock of Temple-Inland, or other Temple-Inland equity awards. Following Temple-Inland’s distribution of shares of Guaranty to its stockholders, these officers and non-employee directors will also own shares of common stock, options to purchase shares of common stock, and other equity awards in Guaranty. The individual holdings of shares of common stock, options to purchase shares of common stock, or other equity awards of Temple-Inland and Guaranty may be significant for some of these persons compared with their total assets. In light of our continuing relationships with Temple-Inland and Guaranty, these equity interests may create actual or apparent conflicts of interest when these directors and officers are faced with decisions that could benefit or affect the equity holders of Temple-Inland or Guaranty in ways that do not benefit or affect us in the same manner.

We may be unable to make, on a timely or cost-effective basis, the changes necessary to operate as an independent, publicly-traded company, and we may experience increased costs after the spin-off or as a result of the spin-off.

Following the completion of our spin-off, Temple-Inland will be obligated contractually to provide to us only those transition services specified in the transition services agreement we have entered into with Temple-Inland and Guaranty. We may be unable to replace in a timely manner or on comparable terms the services or other benefits that Temple-Inland previously provided to us that are not specified in any transition services agreement. After the expiration of the transition services agreement, we may be unable to replace in a timely manner or on comparable terms the services specified in the agreement. Upon expiration of the transition services agreement, many of the services that are covered in the agreement will have to be provided internally or by unaffiliated third parties. We may incur higher costs to obtain these services than we incurred previously.

15

In addition, if Temple-Inland does not continue to perform the services that are called for under the transition services agreement, we may not be able to operate our business as effectively and our profitability may decline.

Until the distribution occurs Temple-Inland has the sole discretion to change the terms of the spin-off in ways that may be unfavorable to us.

Until the distribution occurs Temple-Inland will have the sole and absolute discretion to determine and change the terms of, and whether to proceed with, the distribution, including the establishment of the record date and distribution date. These changes could be unfavorable to us. In addition, Temple-Inland may decide at any time not to proceed with the spin-off.

Risks Relating to Our Common Stock

There is no existing market for our common stock, and a trading market that will provide adequate liquidity may not develop for our common stock. In addition, once our common stock begins trading, the market price of our shares may fluctuate widely.

There is currently no public market for our common stock. Shortly before the record date for the distribution, trading of shares of our common stock began on a “when-issued” basis and will continue up and through the distribution date. However, there can be no assurance that an active trading market for our common stock will develop as a result of the distribution or be sustained in the future.

We cannot predict the prices at which our common stock may trade after the distribution. The market price of our common stock may fluctuate widely, depending upon many factors, some of which may be beyond our control, including:

| | |

| | • | a shift in our investor base; |

| |

| | • | actual or anticipated fluctuations in our operating results due to the seasonality of our business and other factors related to our business; |

| |

| | • | announcements by us or our competitors of significant acquisitions or dispositions; |

| |

| | • | the failure of securities analysts to cover our common stock after the distribution; |

| |

| | • | the operating and stock price performance of other comparable companies; |

| |

| | • | overall market fluctuations; and |

| |

| | • | general economic conditions. |

Stock markets in general have experienced volatility that has often been unrelated to the operating or financial performance of a particular company. These broad market fluctuations may adversely affect the trading price of our common stock.

Substantial sales of our common stock may occur following the spin-off, which could cause our stock price to decline.

The shares of our common stock that Temple-Inland distributes to its stockholders generally may be sold immediately in the public market. Although we have no actual knowledge of any plan or intention on the part of any stockholder to sell our common stock following the spin-off, it is possible that some Temple-Inland stockholders, including possibly some of our largest stockholders, may sell our common stock received in the distribution for various reasons, including that our business profile or market capitalization as an independent, publicly-traded company does not fit their investment objectives. Moreover, index funds tied to the Standard & Poor’s 500 Index, the Russell 1000 Index, and other indices hold shares of Temple-Inland common stock. To the extent our common stock is not included in these indices after the distribution, certain of these index funds may likely be required to sell the shares of our common stock that they receive in the distribution. Also, some employees of Temple-Inland and Guaranty may be unwilling to continue to hold our common

16

stock in their 401(k) plan accounts because they will not be employed by us. In addition, participants in the Temple-Inland 401(k) Plan who retain the shares of Forestar common stock that they receive in their Temple-Inland 401(k) Plan account will be required to liquidate those shares within three years after the distribution date. The sales of significant amounts of our common stock or the perception in the market that this will occur may result in the lowering of the market price of our common stock.

Your percentage ownership in our common stock may be diluted in the future.

Your percentage ownership in our common stock may be diluted in the future because of equity awards that have already been granted and that we expect will be granted to our directors and officers in the future. In addition, equity awards held by Temple-Inland employees at the time of the spin-off will be adjusted to include options to purchase our common stock. Immediately after the spin-off, options to purchase approximately 2,000,000 shares of our common stock will be outstanding, and we will be obligated to settle other outstanding equity awards with approximately 350,000 shares of our common stock, each in accordance with the vesting and other conditions applicable to such options and other awards. Prior to the record date for the distribution, Temple-Inland approved the Forestar Stock Incentive Plan, which provides for the grant of equity-based awards, including restricted stock, restricted stock units, stock options, stock appreciation rights, phantom equity awards and other equity-based awards to our directors, officers and other employees. In the future, we may issue additional equity securities, subject to limitations imposed by the tax matters agreement, in order to fund working capital needs, capital expenditures and product development, or to make acquisitions and other investments, which may dilute your ownership interest.

The terms of our spin-off from Temple-Inland, anti-takeover provisions of our charter and bylaws, as well as Delaware law and our stockholder rights agreement, may reduce the likelihood of any potential change of control or unsolicited acquisition proposal that you might consider favorable.

The terms of our spin off from Temple-Inland could delay or prevent a change of control that you may favor. An acquisition or issuance of our common stock could trigger the application of Section 355(e) of the Code. For a discussion of Section 355(e) of the Code, please see the section entitled “The Spin Off — Certain U.S. Federal Income Tax Consequences of the Spin-off” beginning on page 25 of this information statement. Under the tax matters agreement we have entered into with Temple-Inland and Guaranty, we would be required to indemnify Temple-Inland and Guaranty for the resulting tax in connection with such an acquisition or issuance and this indemnity obligation might discourage, delay or prevent a change of control that you may consider favorable. For a more detailed description of the tax matters agreement, see the section entitled “Certain Relationships and Related Party Transactions — Agreements with Temple-Inland and Guaranty — Tax Matters Agreement” beginning on page 104 of this information statement.

In addition, our certificate of incorporation and bylaws and Delaware law contain provisions that could make it more difficult for a third party to acquire us without the consent of our board of directors. Our board of directors may classify or reclassify any unissued shares of common stock or preferred stock and may set the preferences, conversion, or other rights, voting powers, and other terms of the classified or reclassified shares. Our board of directors could establish a series of preferred stock that could have the effect of delaying, deferring, or preventing a transaction or a change in control that might involve a premium price for our common stock or otherwise be considered favorably by our stockholders. Our certificate of incorporation and bylaws also provide for a classified board structure.

Our bylaws provide that nominations of persons for election to our board of directors and the proposal of business to be considered at a stockholders’ meeting may be made only in the notice of the meeting, by our board of directors or by a stockholder who is entitled to vote at the meeting and has complied with the advance notice procedures of our bylaws. Also, under Delaware law, business combinations, including issuances of equity securities, between us and any person who beneficially owns 15 percent or more of our common stock or an affiliate of such person, are prohibited for a three-year period unless exempted by the statute. After this three-year period, a combination of this type must be approved by a super-majority stockholder vote, unless specific conditions are met or the business combination is exempted by our board of directors.

17

In addition, we have entered into a stockholder rights agreement with a rights agent that provides that in the event of an acquisition of or tender offer for 20 percent or more of our outstanding common stock, our stockholders shall be granted rights to purchase our common stock at a significant discount. The stockholder rights agreement could have the effect of significantly diluting the percentage interest of a potential acquirer and make it more difficult to acquire a controlling interest in our common stock without the approval of our board of directors to redeem the rights or amend the stockholder rights agreement to permit the acquisition.

For a more detailed description of these effects, see the section entitled “Description of Our Capital Stock — Anti-takeover Effects of Our Stockholder Rights Agreement, Our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws, and Delaware Law” beginning on page 107 of this information statement.

We currently do not intend to pay any dividends on our common stock. Accordingly, investors in our common stock must rely upon subsequent sales after price appreciation as the sole method to realize a gain on an investment in our common stock.