Forestar Investor Presentation September 2013 Building Momentum By Accelerating Value Realization, Optimizing Transparency and Growing Net Asset Value

Notice To Investors This presentation contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are typically identified by words or phrases such as “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,” and other words and terms of similar meaning. These statements reflect management’s current views with respect to future events and are subject to risk and uncertainties. We note that a variety of factors and uncertainties could cause our actual results to differ significantly from the results discussed in the forward-looking statements, including our ability to achieve synergies and value creation contemplated by the merger with Credo. Other factors and uncertainties that might cause such differences include, but are not limited to: general economic, market, or business conditions; changes in commodity prices; opportunities (or lack thereof) that may be presented to us and that we may pursue; fluctuations in costs and expenses including development costs; demand for new housing, including impacts from mortgage credit availability; lengthy and uncertain entitlement processes; cyclicality of our businesses; accuracy of accounting assumptions; competitive actions by other companies; changes in laws or regulations; and other factors, many of which are beyond our control. Except as required by law, we expressly disclaim any obligation to publicly revise any forward-looking statements contained in this presentation to reflect the occurrence of events after the date of this presentation. This presentation includes Non-GAAP financial measures. The required reconciliation to GAAP financial measures can be found as an exhibit to this presentation and on our website at www.forestargroup.com. 2

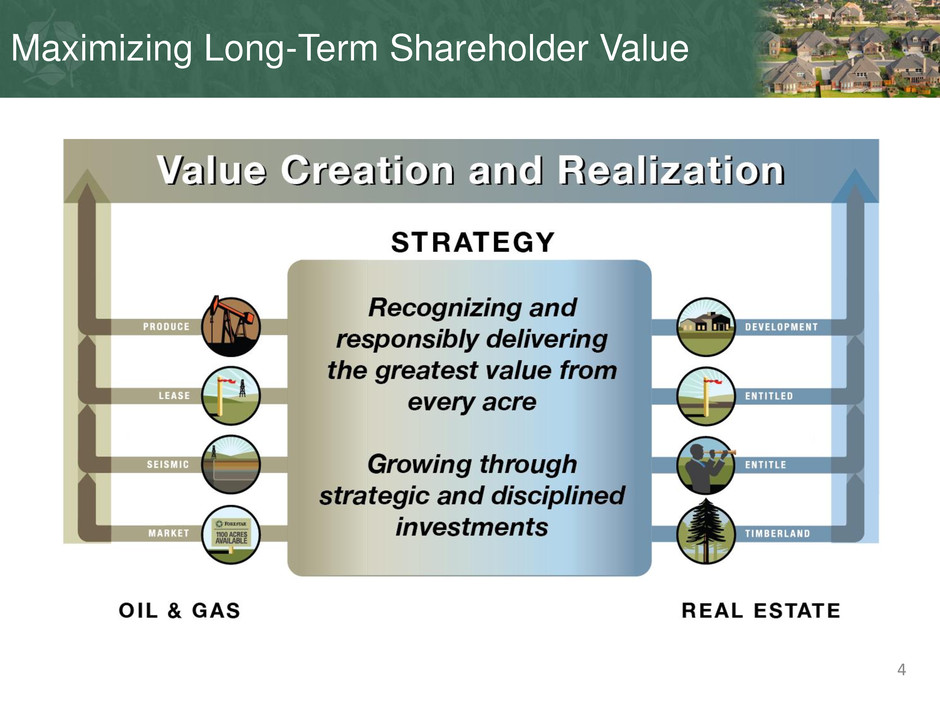

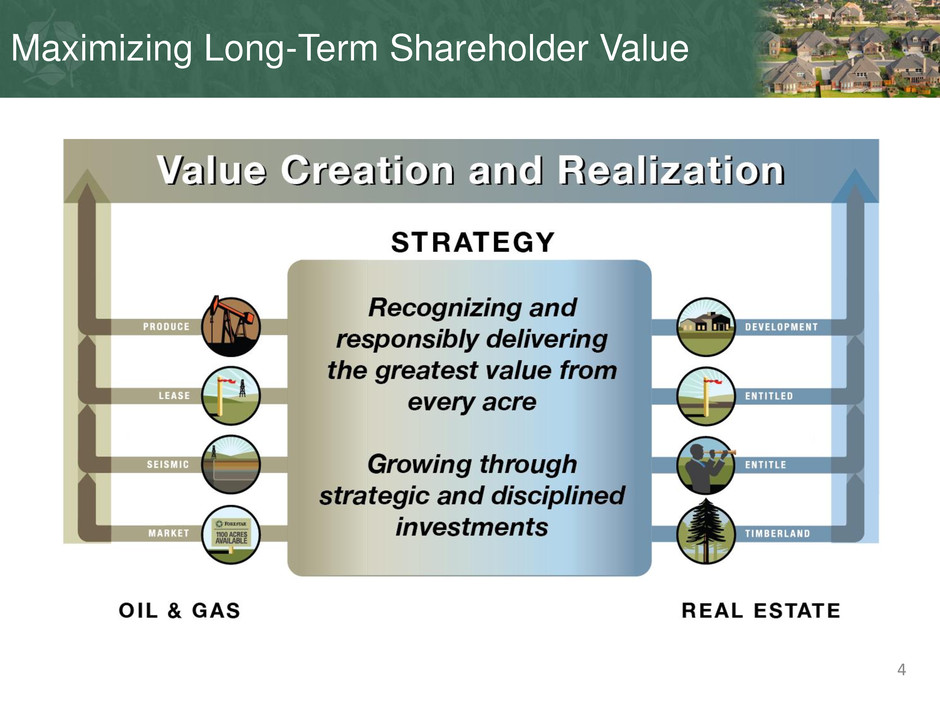

Maximizing Long-Term Shareholder Value Through the Development of Best of Class Oil and Gas and Real Estate Businesses 3

Maximizing Long-Term Shareholder Value 4

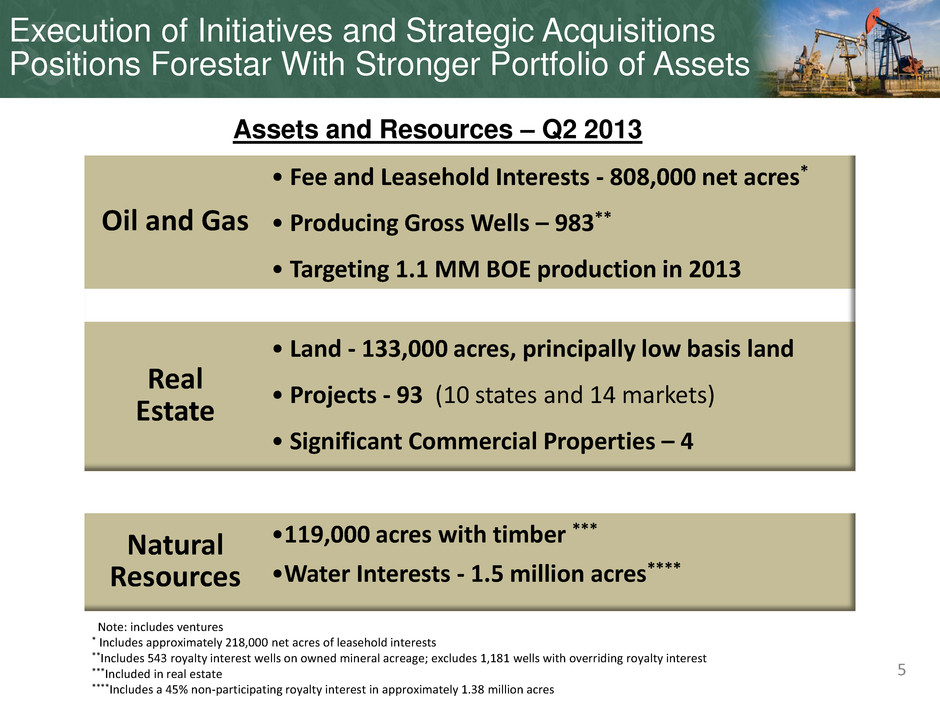

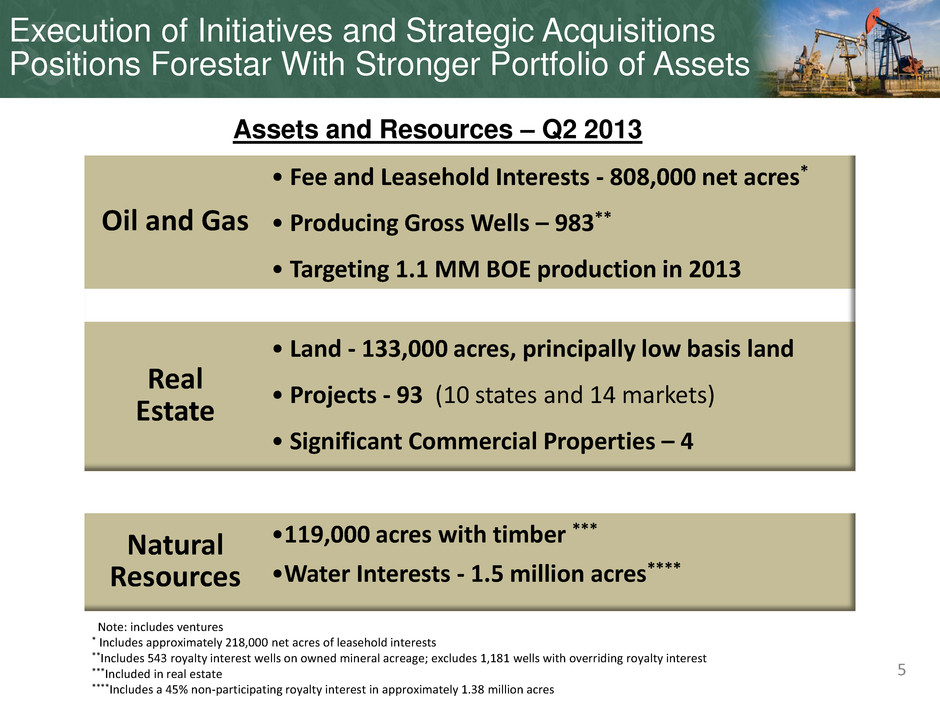

Execution of Initiatives and Strategic Acquisitions Positions Forestar With Stronger Portfolio of Assets Assets and Resources – Q2 2013 Oil and Gas • Fee and Leasehold Interests - 808,000 net acres* • Producing Gross Wells – 983** • Targeting 1.1 MM BOE production in 2013 Real Estate • Land - 133,000 acres, principally low basis land • Projects - 93 (10 states and 14 markets) • Significant Commercial Properties – 4 Natural Resources •119,000 acres with timber *** •Water Interests - 1.5 million acres**** Note: includes ventures * Includes approximately 218,000 net acres of leasehold interests **Includes 543 royalty interest wells on owned mineral acreage; excludes 1,181 wells with overriding royalty interest ***Included in real estate ****Includes a 45% non-participating royalty interest in approximately 1.38 million acres 5

Oil and Gas Building Momentum By Driving Leasing and Exploration to Increase Production and Reserves 6

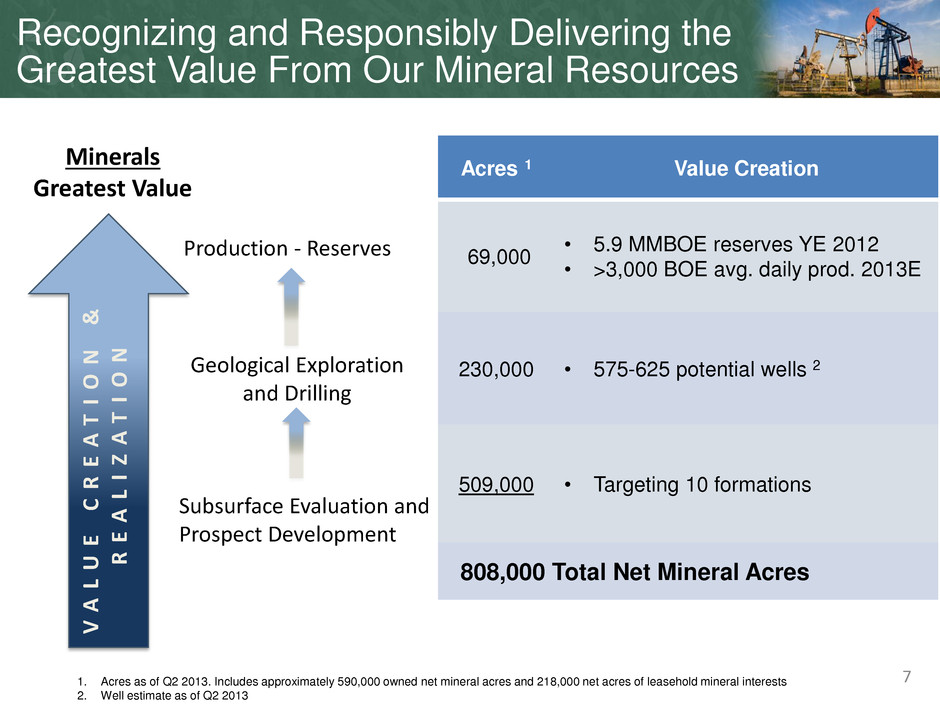

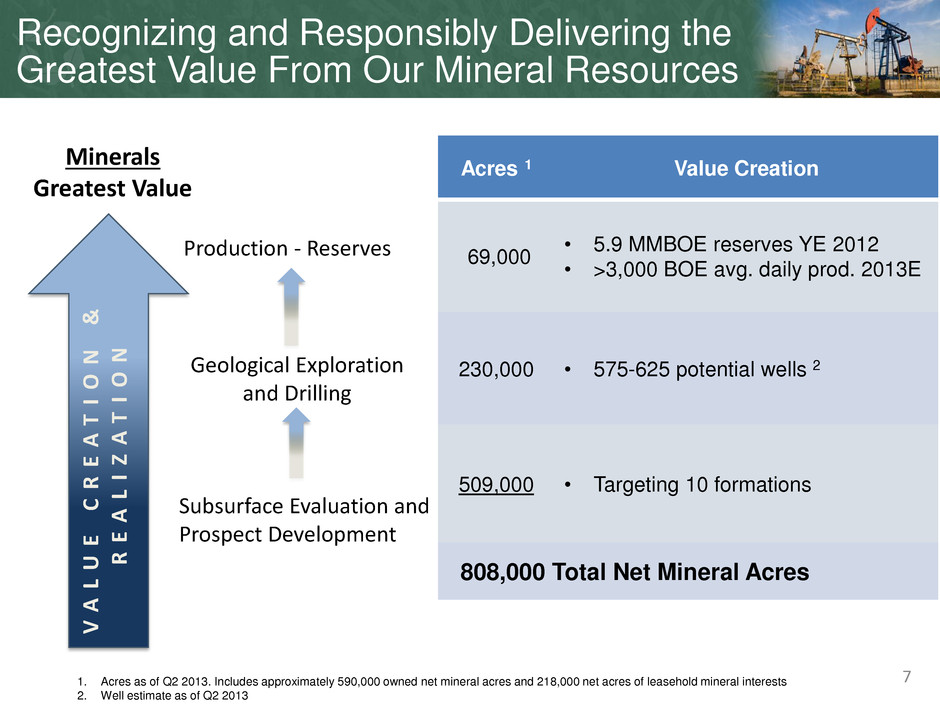

Recognizing and Responsibly Delivering the Greatest Value From Our Mineral Resources 1. Acres as of Q2 2013. Includes approximately 590,000 owned net mineral acres and 218,000 net acres of leasehold mineral interests 2. Well estimate as of Q2 2013 7 V A L U E C R E A T I O N & R E A L I Z A T I O N Minerals Greatest Value Acres 1 Value Creation 69,000 • 5.9 MMBOE reserves YE 2012 • >3,000 BOE avg. daily prod. 2013E 230,000 • 575-625 potential wells 2 509,000 • Targeting 10 formations 808,000 Total Net Mineral Acres Production - Reserves Geological Exploration and Drilling Subsurface Evaluation and Prospect Development

8 Mineral Interests Located In Prolific Oil & Gas Basins 8 Net Mineral Interests* State Owned Leasehold Total Texas 252,000 11,000 263,000 Louisiana 144,000 2,000 146,000 Nebraska / Kansas - 164,000 164,000 North Dakota - 7,000 7,000 Georgia / Alabama 192,000 11,000 203,000 Other** 2,000 23,000 25,000 Total 590,000 218,000 808,000 * Note: As of Q2 2013; includes both fee and leasehold interests ** Excludes approximately 8,000 net mineral acres located in various states related to overriding royalty interests 8 Over 800,000 net mineral acres • 590,000 net acres of fee ownership • Significant recurring cash flows from royalty interests • 218,000 net acres of leasehold interests • Bakken / Three Forks (7,000 net mineral acres) • Central Kansas Uplift (164,000 net mineral acres) Basins / Formations Williston (Bakken / Three Forks) Denver – Julesburg Basin Central Uplift Appalachian Basin Black Warrior Anadarko Basin Fort Worth Basin East Texas Basin Gulf Coast Basin Texas, Louisiana, Mississippi Salt Basin South Extension Appalachian Basin

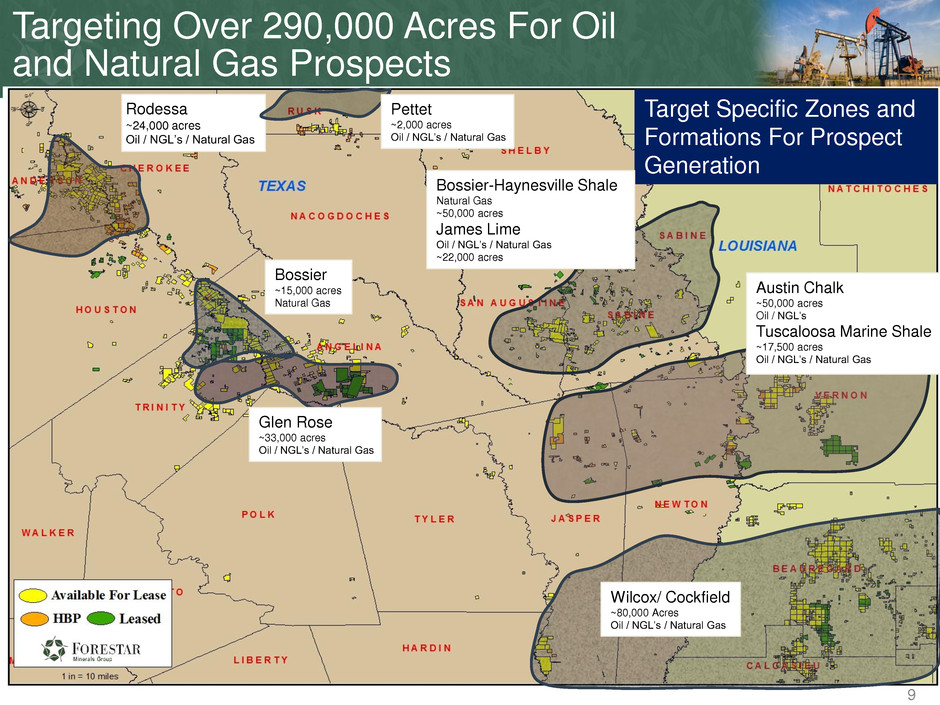

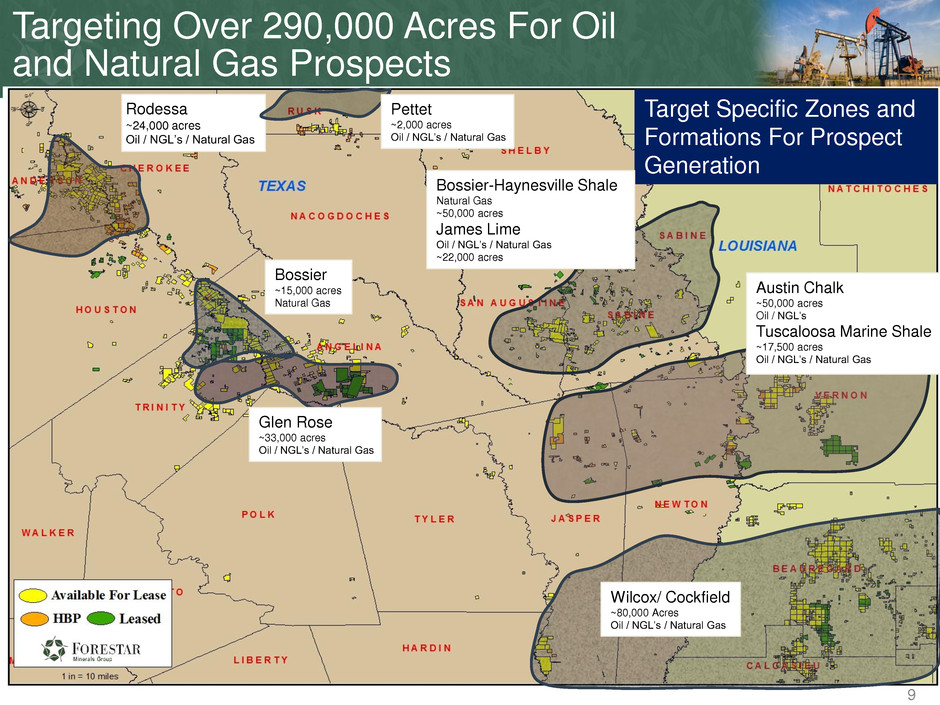

Rodessa ~24,000 acres Oil / NGL’s / Natural Gas Target Specific Zones and Formations For Prospect Generation Pettet ~2,000 acres Oil / NGL’s / Natural Gas Glen Rose ~33,000 acres Oil / NGL’s / Natural Gas Bossier ~15,000 acres Natural Gas Austin Chalk ~50,000 acres Oil / NGL’s Tuscaloosa Marine Shale ~17,500 acres Oil / NGL’s / Natural Gas Wilcox/ Cockfield ~80,000 Acres Oil / NGL’s / Natural Gas Targeting Over 290,000 Acres For Oil and Natural Gas Prospects Bossier-Haynesville Shale Natural Gas ~50,000 acres James Lime Oil / NGL’s / Natural Gas ~22,000 acres 9

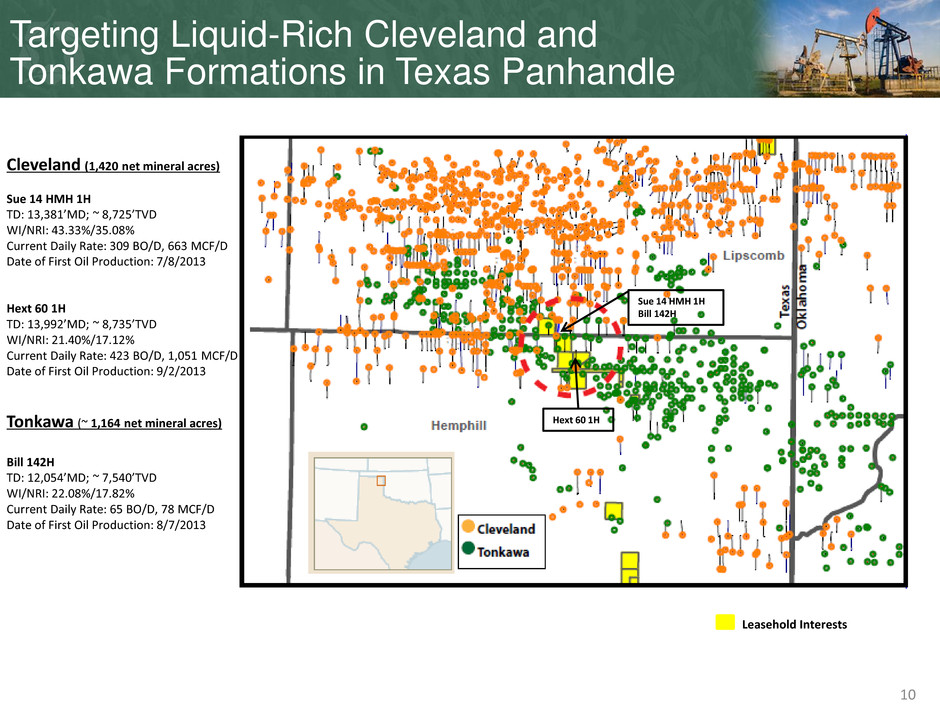

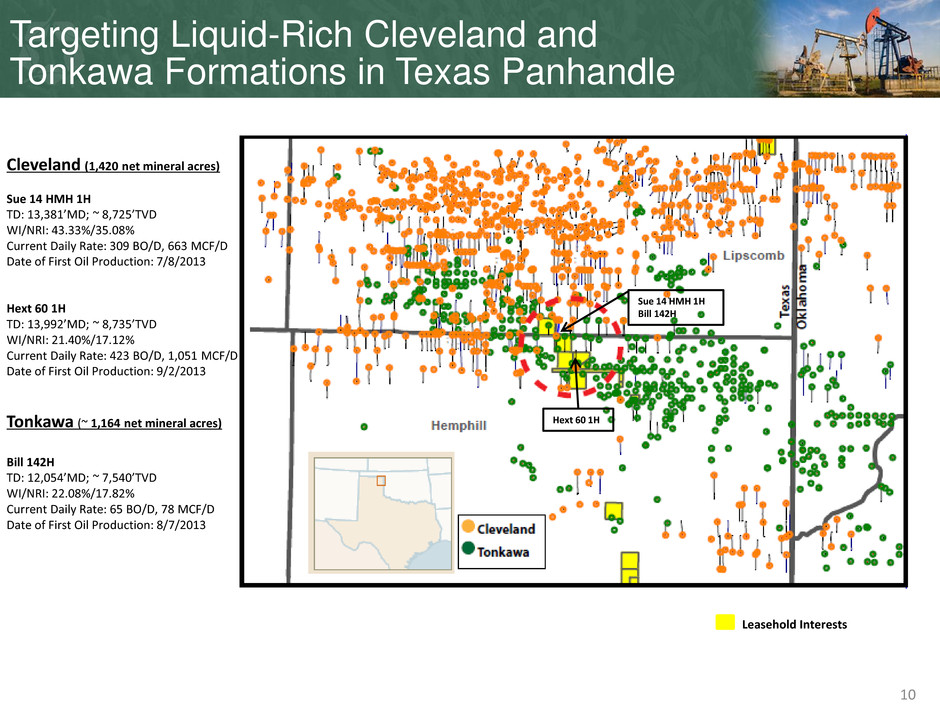

Targeting Liquid-Rich Cleveland and Tonkawa Formations in Texas Panhandle Cleveland (1,420 net mineral acres) Sue 14 HMH 1H TD: 13,381’MD; ~ 8,725’TVD WI/NRI: 43.33%/35.08% Current Daily Rate: 309 BO/D, 663 MCF/D Date of First Oil Production: 7/8/2013 Hext 60 1H TD: 13,992’MD; ~ 8,735’TVD WI/NRI: 21.40%/17.12% Current Daily Rate: 423 BO/D, 1,051 MCF/D Date of First Oil Production: 9/2/2013 Tonkawa (~ 1,164 net mineral acres) Bill 142H TD: 12,054’MD; ~ 7,540’TVD WI/NRI: 22.08%/17.82% Current Daily Rate: 65 BO/D, 78 MCF/D Date of First Oil Production: 8/7/2013 10 Hext 60 1H Sue 14 HMH 1H Bill 142H Leasehold Interests

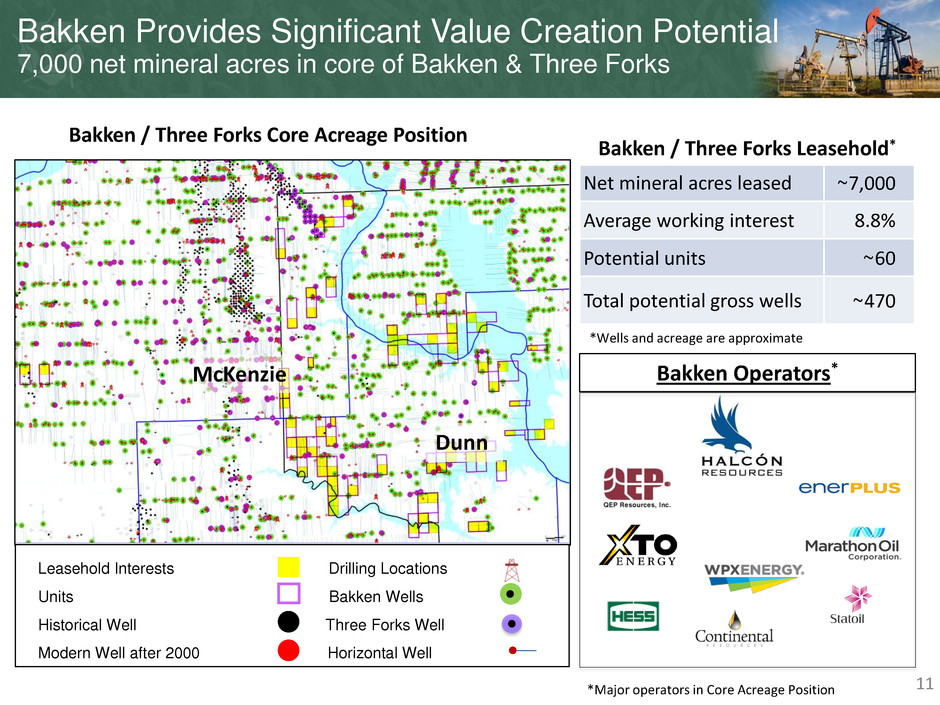

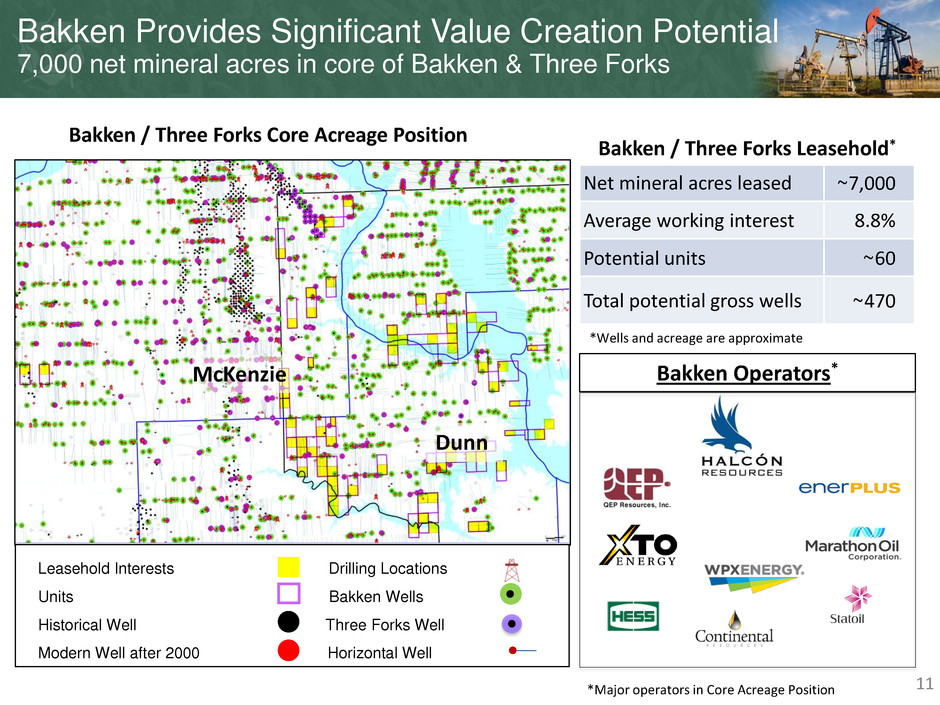

Leasehold Interests Drilling Locations Units Bakken Wells Historical Well Three Forks Well Modern Well after 2000 Horizontal Well Bakken / Three Forks Core Acreage Position Bakken Provides Significant Value Creation Potential 7,000 net mineral acres in core of Bakken & Three Forks Bakken / Three Forks Leasehold* Net mineral acres leased ~7,000 Average working interest 8.8% Potential units ~60 Total potential gross wells ~470 *Major operators in Core Acreage Position 11 Dunn McKenzie Bakken Operators* *Wells and acreage are approximate

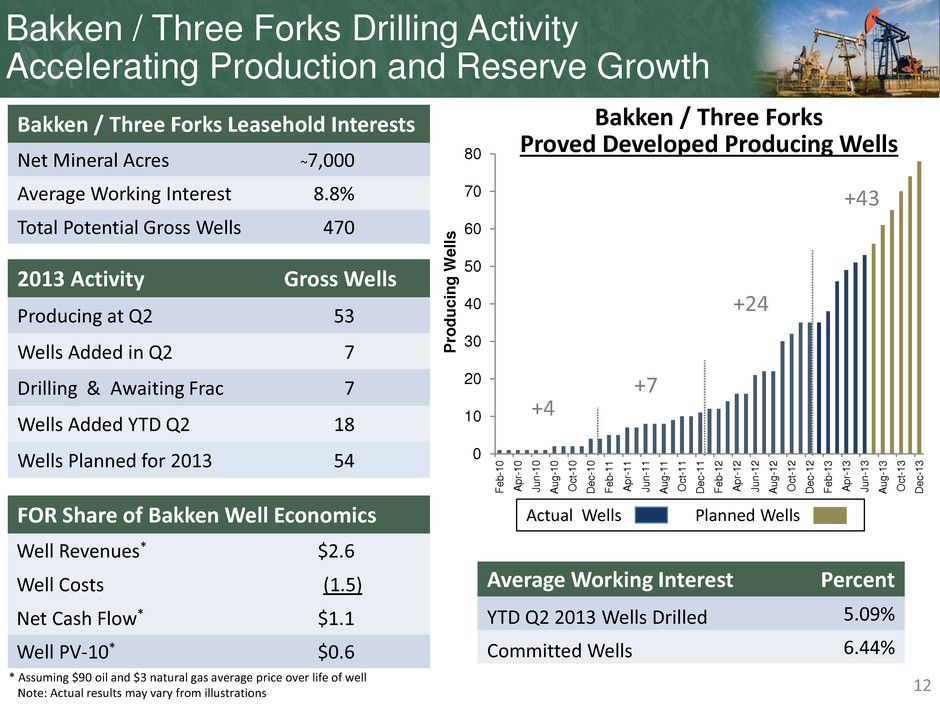

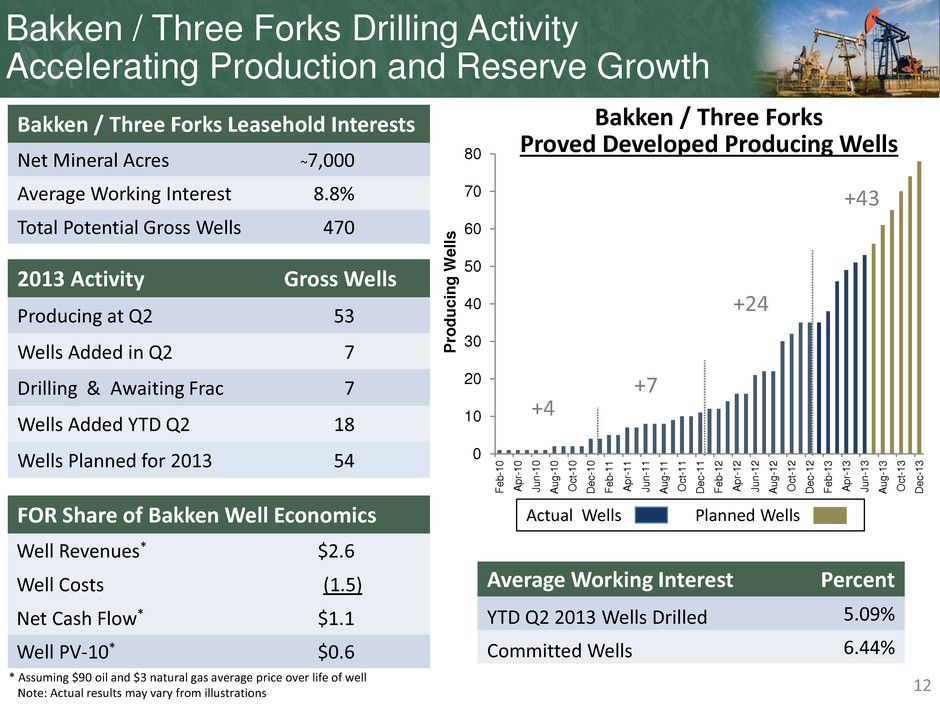

Bakken / Three Forks Drilling Activity Accelerating Production and Reserve Growth Bakken / Three Forks Leasehold Interests Net Mineral Acres ~7,000 Average Working Interest 8.8% Total Potential Gross Wells 470 2013 Activity Gross Wells Producing at Q2 53 Wells Added in Q2 7 Drilling & Awaiting Frac 7 Wells Added YTD Q2 18 Wells Planned for 2013 54 FOR Share of Bakken Well Economics Well Revenues* $2.6 Well Costs (1.5) Net Cash Flow* $1.1 Well PV-10* $0.6 12 12 12 Bakken / Three Forks Proved Developed Producing Wells +4 +7 +24 +43 Actual Wells Planned Wells 0 10 20 30 40 50 60 70 80 Fe b -1 0 A p r- 1 0 J u n -1 0 A u g -1 0 O c t- 1 0 D e c -1 0 Fe b -1 1 A p r- 1 1 J u n -1 1 A u g -1 1 O c t- 1 1 D e c -1 1 Fe b -1 2 A p r- 1 2 J u n -1 2 A u g -1 2 O c t- 1 2 D e c -1 2 Fe b -1 3 A p r- 1 3 J u n -1 3 A u g -1 3 O c t- 1 3 D e c -1 3 P roduc ing W e ll s Average Working Interest Percent YTD Q2 2013 Wells Drilled 5.09% Committed Wells 6.44% * Assuming $90 oil and $3 natural gas average price over life of well Note: Actual results may vary from illustrations

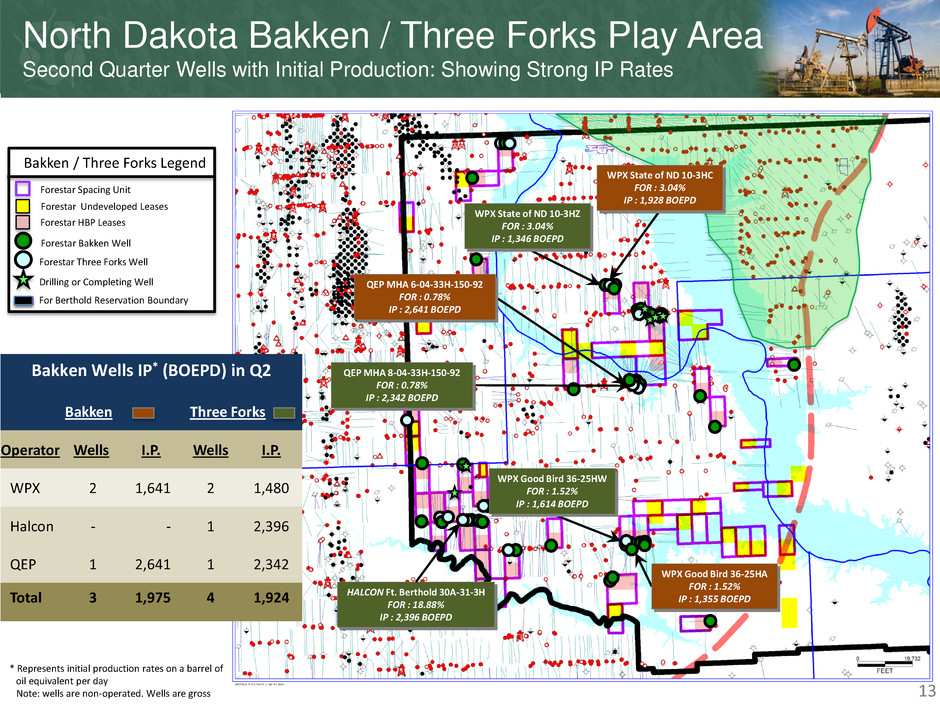

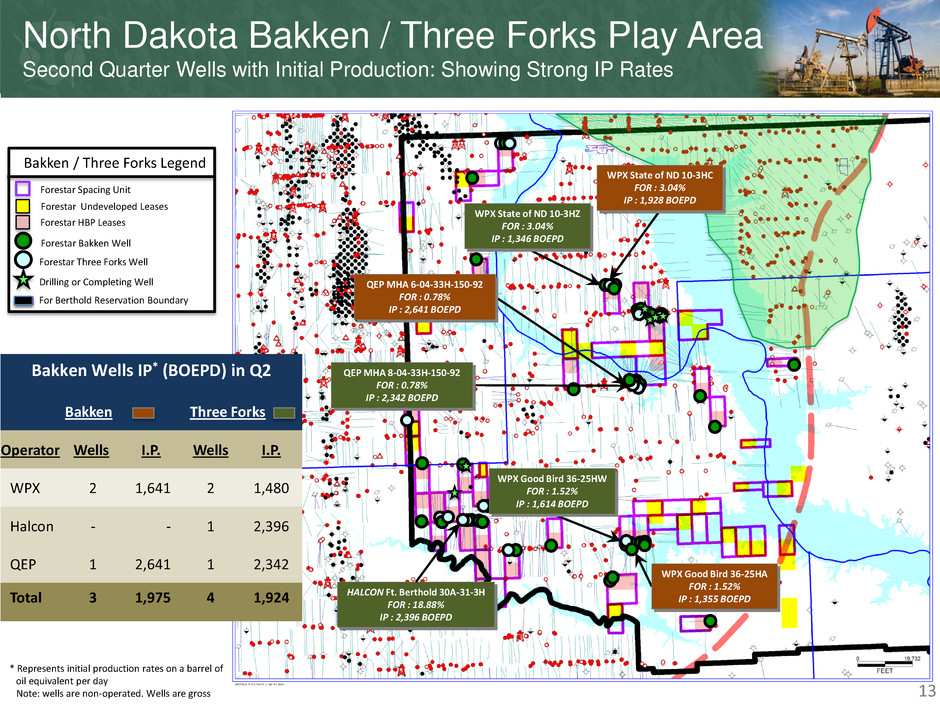

Bakken / Three Forks Legend Forestar Bakken Well Forestar Three Forks Well Drilling or Completing Well For Berthold Reservation Boundary Forestar HBP Leases Forestar Undeveloped Leases Forestar Spacing Unit HALCON Ft. Berthold 30A-31-3H FOR : 18.88% IP : 2,396 BOEPD WPX Good Bird 36-25HA FOR : 1.52% IP : 1,355 BOEPD WPX State of ND 10-3HC FOR : 3.04% IP : 1,928 BOEPD WPX State of ND 10-3HZ FOR : 3.04% IP : 1,346 BOEPD WPX Good Bird 36-25HW FOR : 1.52% IP : 1,614 BOEPD QEP MHA 6-04-33H-150-92 FOR : 0.78% IP : 2,641 BOEPD QEP MHA 8-04-33H-150-92 FOR : 0.78% IP : 2,342 BOEPD North Dakota Bakken / Three Forks Play Area Second Quarter Wells with Initial Production: Showing Strong IP Rates 13 * Represents initial production rates on a barrel of oil equivalent per day Note: wells are non-operated. Wells are gross Bakken Wells IP* (BOEPD) in Q2 Bakken Three Forks Operator Wells I.P. Wells I.P. WPX 2 1,641 2 1,480 Halcon - - 1 2,396 QEP 1 2,641 1 2,342 Total 3 1,975 4 1,924

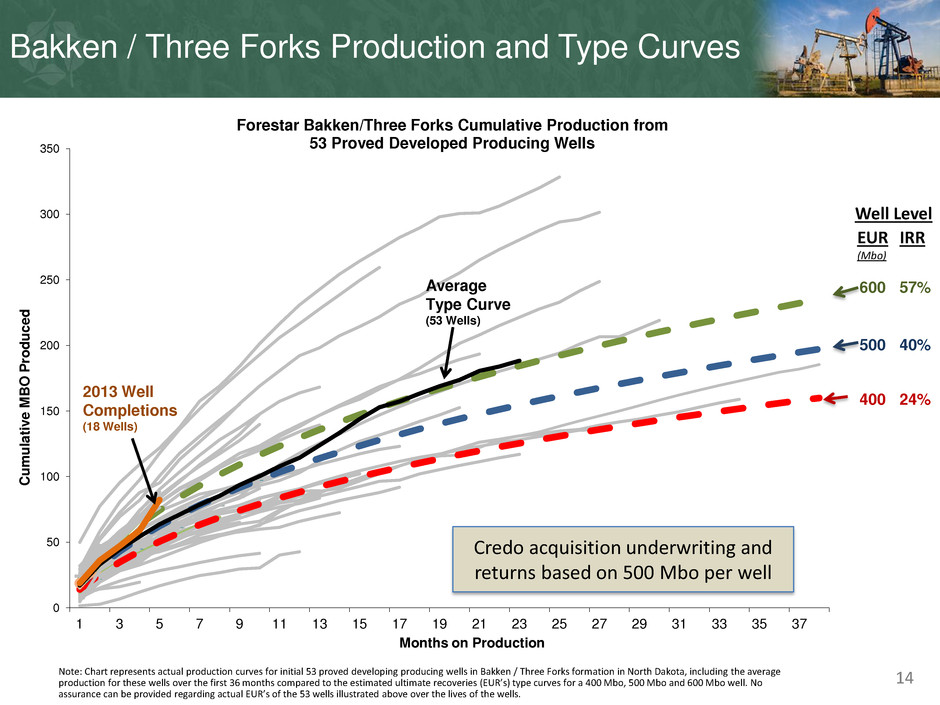

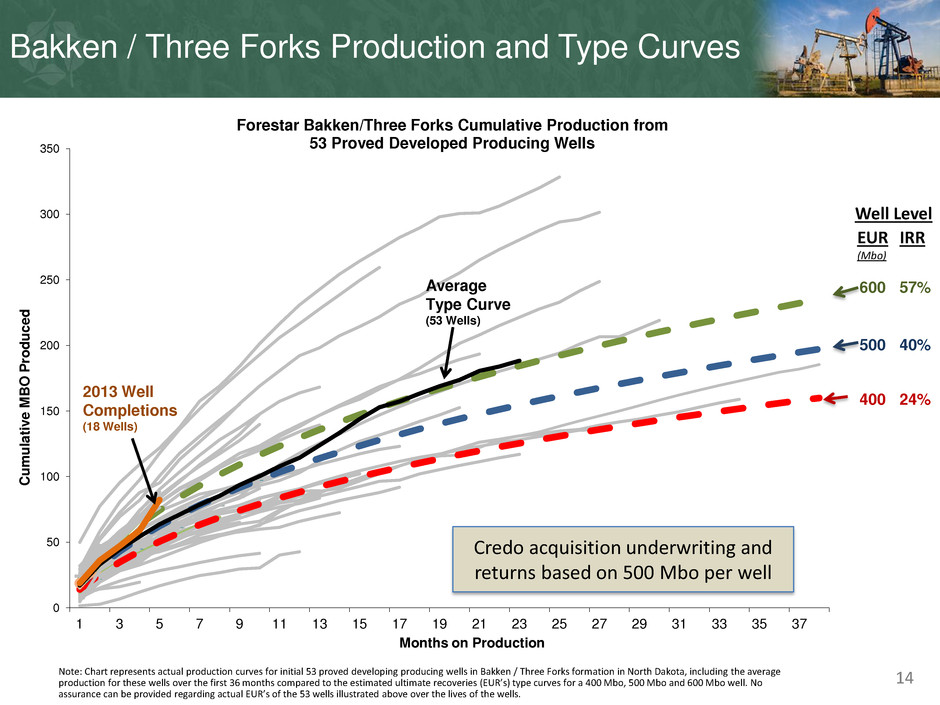

14 0 50 100 150 200 250 300 350 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 C umula ti v e M B O P rod u ce d Months on Production Forestar Bakken/Three Forks Cumulative Production from 53 Proved Developed Producing Wells Average Type Curve (53 Wells) 2013 Well Completions (18 Wells) Credo acquisition underwriting and returns based on 500 Mbo per well EUR (Mbo) IRR 600 500 400 57% 40% 24% Note: Chart represents actual production curves for initial 53 proved developing producing wells in Bakken / Three Forks formation in North Dakota, including the average production for these wells over the first 36 months compared to the estimated ultimate recoveries (EUR’s) type curves for a 400 Mbo, 500 Mbo and 600 Mbo well. No assurance can be provided regarding actual EUR’s of the 53 wells illustrated above over the lives of the wells. Bakken / Three Forks Production and Type Curves Well Level

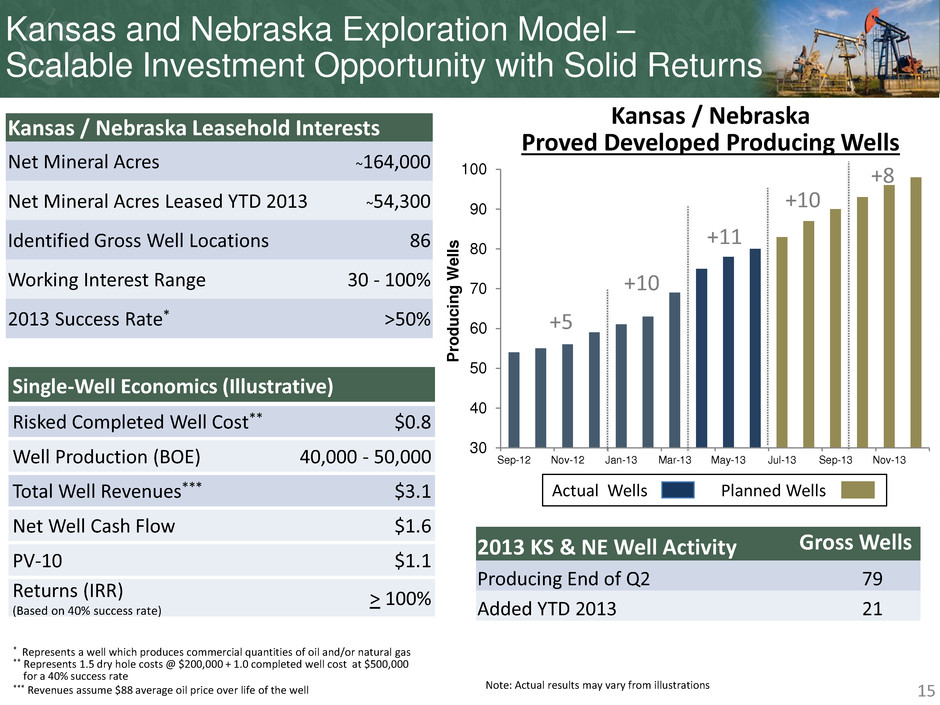

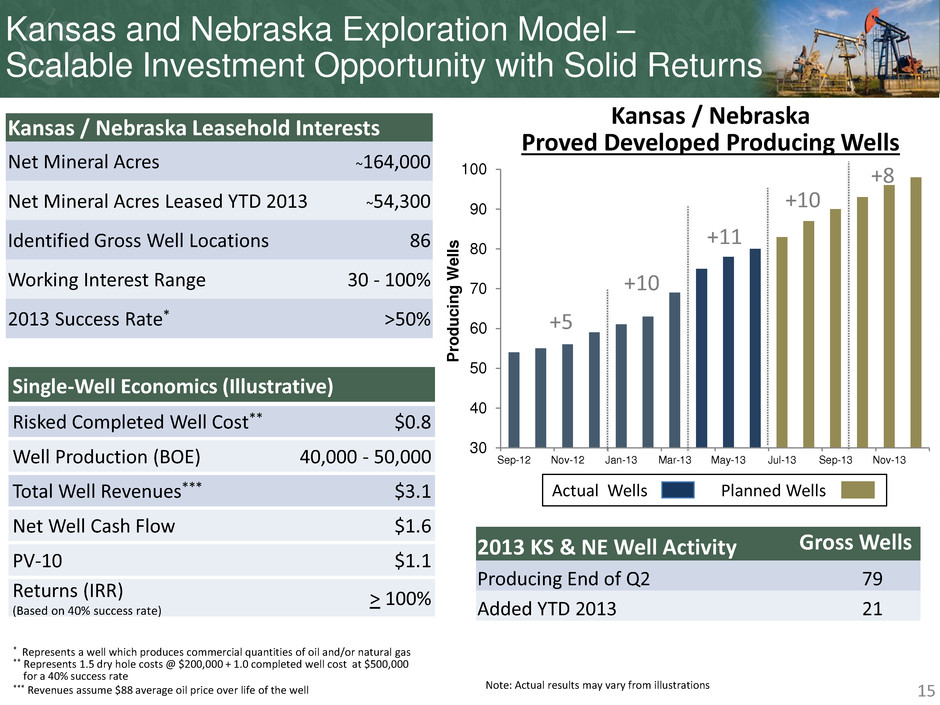

Kansas and Nebraska Exploration Model – Scalable Investment Opportunity with Solid Returns Kansas / Nebraska Leasehold Interests Net Mineral Acres ~164,000 Net Mineral Acres Leased YTD 2013 ~54,300 Identified Gross Well Locations 86 Working Interest Range 30 - 100% 2013 Success Rate* >50% 15 15 15 Kansas / Nebraska Proved Developed Producing Wells 30 40 50 60 70 80 90 100 Sep-12 Nov-12 Jan-13 Mar-13 May-13 Jul-13 Sep-13 Nov-13 P roduc ing W e ll s +5 +10 +11 +10 +8 Actual Wells Planned Wells Single-Well Economics (Illustrative) Risked Completed Well Cost** $0.8 Well Production (BOE) 40,000 - 50,000 Total Well Revenues*** $3.1 Net Well Cash Flow $1.6 PV-10 $1.1 Returns (IRR) (Based on 40% success rate) > 100% 2013 KS & NE Well Activity Producing End of Q2 79 Added YTD 2013 21 * Represents a well which produces commercial quantities of oil and/or natural gas ** Represents 1.5 dry hole costs @ $200,000 + 1.0 completed well cost at $500,000 for a 40% success rate *** Revenues assume $88 average oil price over life of the well Note: Actual results may vary from illustrations Gross Wells

2013 Capital Investment –Drilling & Completion ($ in millions) State Formation Operation Capital Exploration & Drilling ND Bakken / Three Forks Non-Operated $43.7 KS & NE Lansing – Kansas City Operated & Non-Operated 14.5 TX Cleveland/Rodessa/ Glen Rose/James Lime Operated & Non-operated 23.1 OK Deese Sand Non-Operated 3.8 Total Drilling & Completion 2013 Estimate $85.1 Generating Production and Reserve Growth By Accelerating Investment in Bakken Wells 16 Note: Drilling and completion investment excludes lease acquisition and geological and geophysical expenses

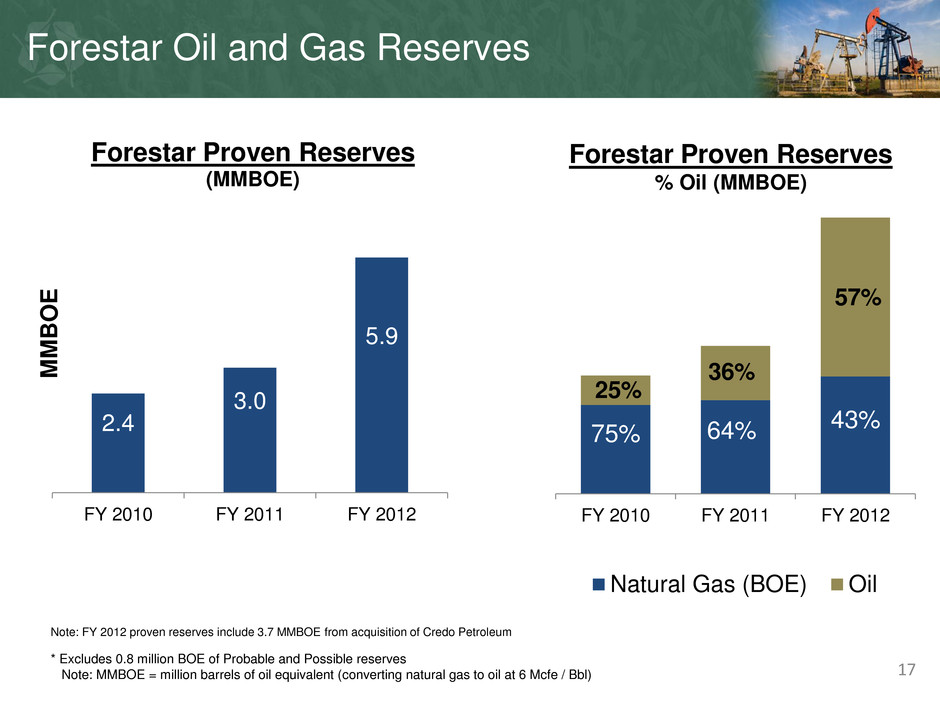

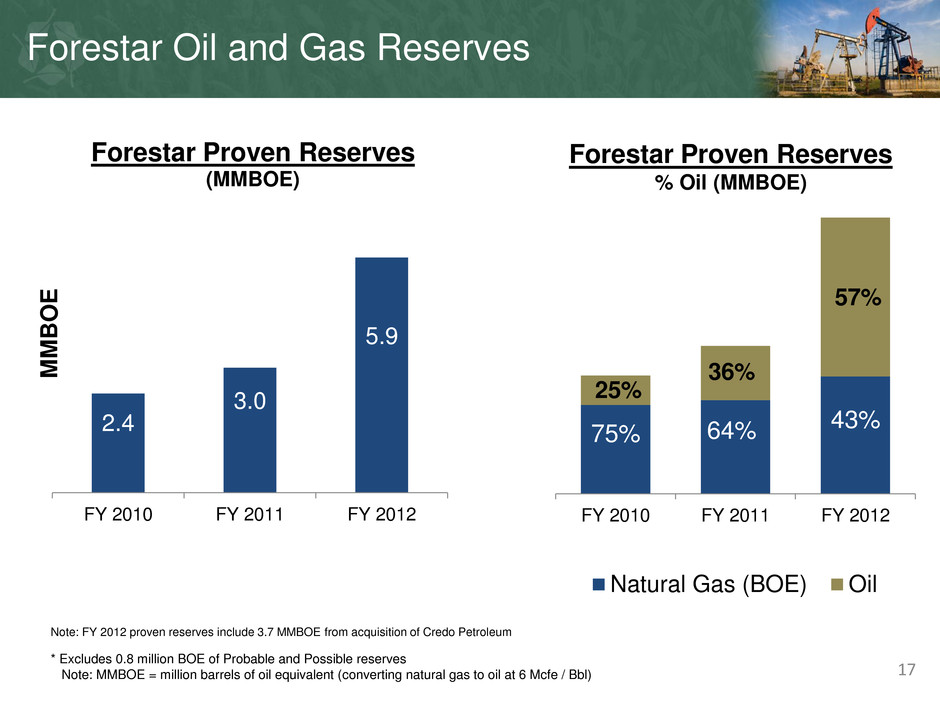

1 7 17 17 2.4 3.0 5.9 FY 2010 FY 2011 FY 2012 MMBO E Forestar Proven Reserves (MMBOE) 25% 36% 57% 75% 64% 43% FY 2010 FY 2011 FY 2012 Natural Gas (BOE) Oil Forestar Proven Reserves % Oil (MMBOE) * Excludes 0.8 million BOE of Probable and Possible reserves Note: MMBOE = million barrels of oil equivalent (converting natural gas to oil at 6 Mcfe / Bbl) Forestar Oil and Gas Reserves Note: FY 2012 proven reserves include 3.7 MMBOE from acquisition of Credo Petroleum

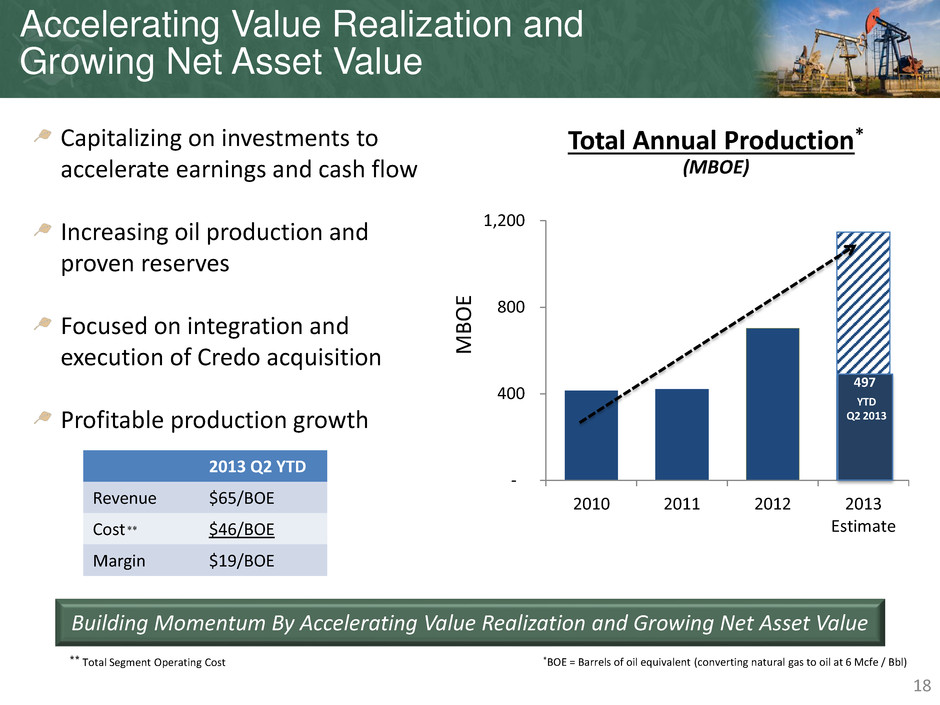

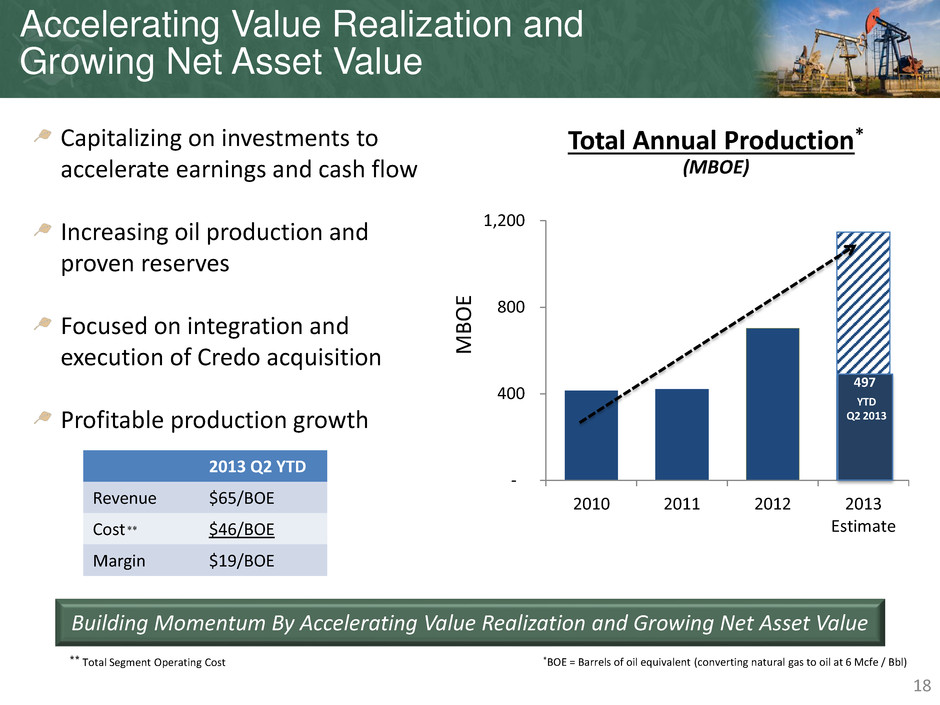

Accelerating Value Realization and Growing Net Asset Value Building Momentum By Accelerating Value Realization and Growing Net Asset Value Capitalizing on investments to accelerate earnings and cash flow Increasing oil production and proven reserves Focused on integration and execution of Credo acquisition Profitable production growth 18 - 400 800 1,200 2010 2011 2012 2013 Estimate MBO E Total Annual Production* (MBOE) YTD Q2 2013 497 *BOE = Barrels of oil equivalent (converting natural gas to oil at 6 Mcfe / Bbl) 2013 Q2 YTD Revenue $65/BOE Cost ⃰ ⃰ $46/BOE Margin $19/BOE ⃰ ⃰ Total Segment Operating Cost

Real Estate Building Momentum By Accelerating Lot Sales and Growing Net Asset Value through Strategic and Disciplined Investments 19

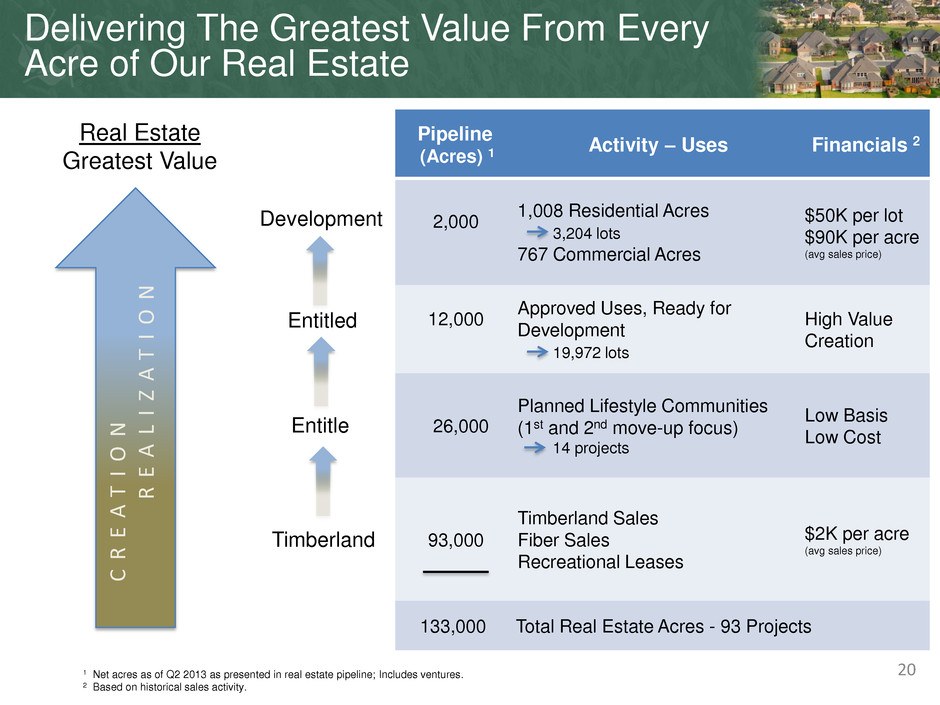

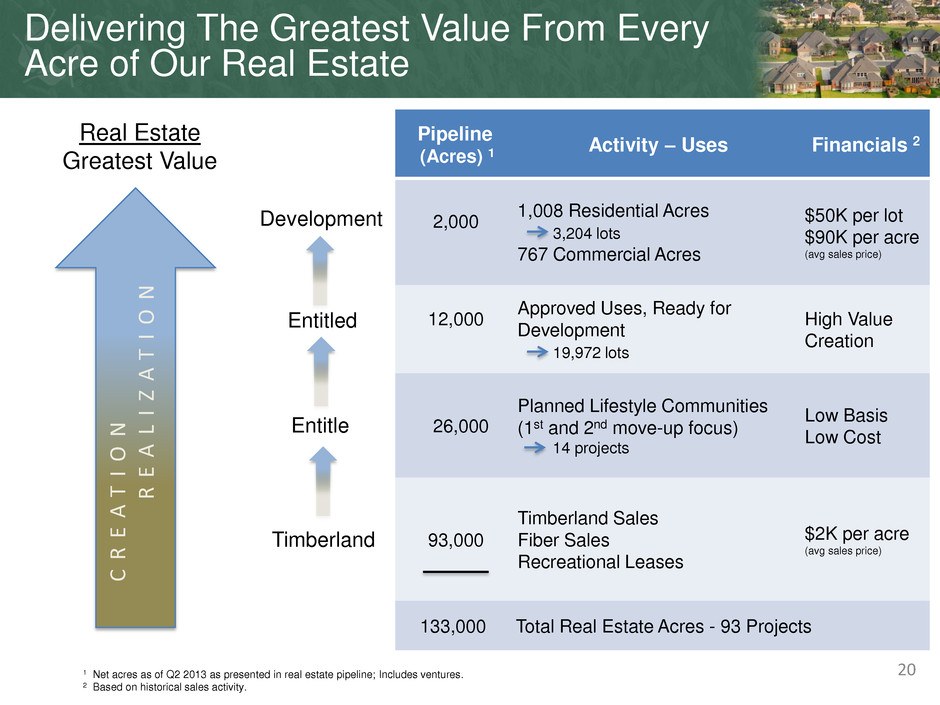

C R E A T I O N R E A L I Z A T I O N Real Estate Greatest Value Development Entitled Entitle Timberland Pipeline (Acres) 1 Activity – Uses Financials 2 2,000 1,008 Residential Acres 3,204 lots 767 Commercial Acres $50K per lot $90K per acre (avg sales price) 12,000 Approved Uses, Ready for Development 19,972 lots High Value Creation 26,000 Planned Lifestyle Communities (1st and 2nd move-up focus) 14 projects Low Basis Low Cost 93,000 Timberland Sales Fiber Sales Recreational Leases $2K per acre (avg sales price) 133,000 Total Real Estate Acres - 93 Projects 1 Net acres as of Q2 2013 as presented in real estate pipeline; Includes ventures. 2 Based on historical sales activity. Delivering The Greatest Value From Every Acre of Our Real Estate 20

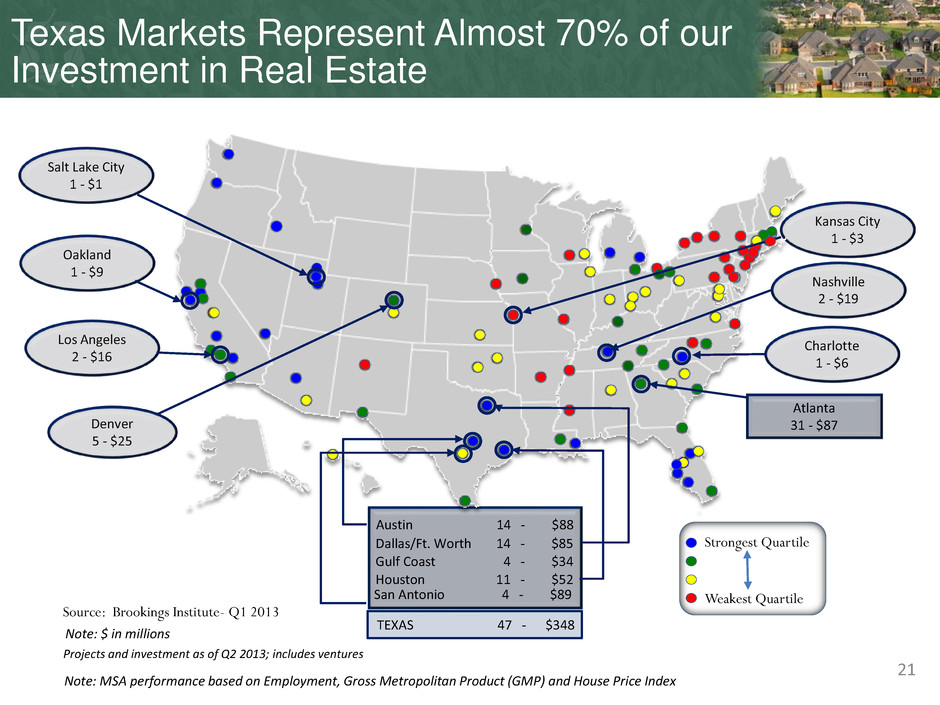

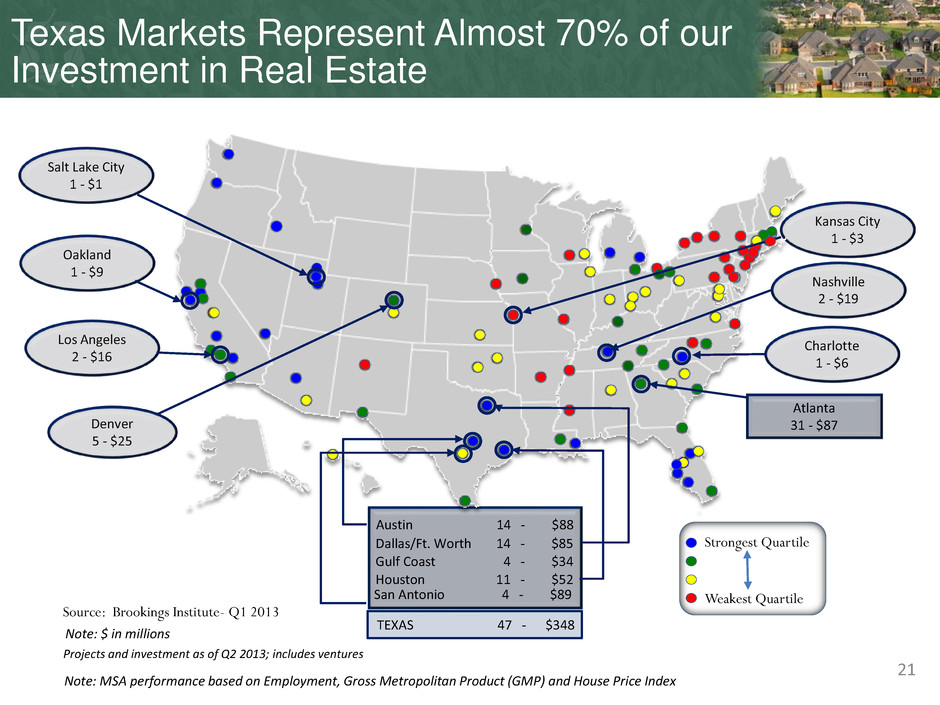

Note: MSA performance based on Employment, Gross Metropolitan Product (GMP) and House Price Index Source: Brookings Institute- Q1 2013 Salt Lake City 1 - $1 Oakland 1 - $9 Strongest Quartile Weakest Quartile Los Angeles 2 - $16 Kansas City 1 - $3 Atlanta 31 - $87 San Antonio 4 - $89 Projects and investment as of Q2 2013; includes ventures TEXAS 47 - $348 Denver 5 - $25 Austin 14 - $88 Dallas/Ft. Worth 14 - $85 Gulf Coast 4 - $34 Houston 11 - $52 Nashville 2 - $19 Note: $ in millions Charlotte 1 - $6 21 Texas Markets Represent Almost 70% of our Investment in Real Estate

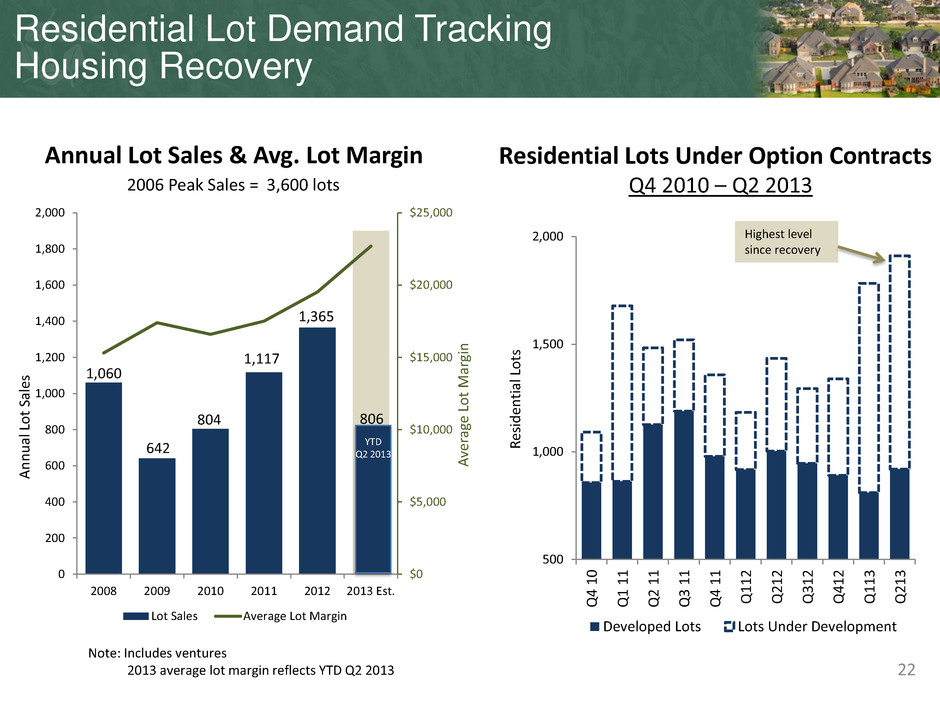

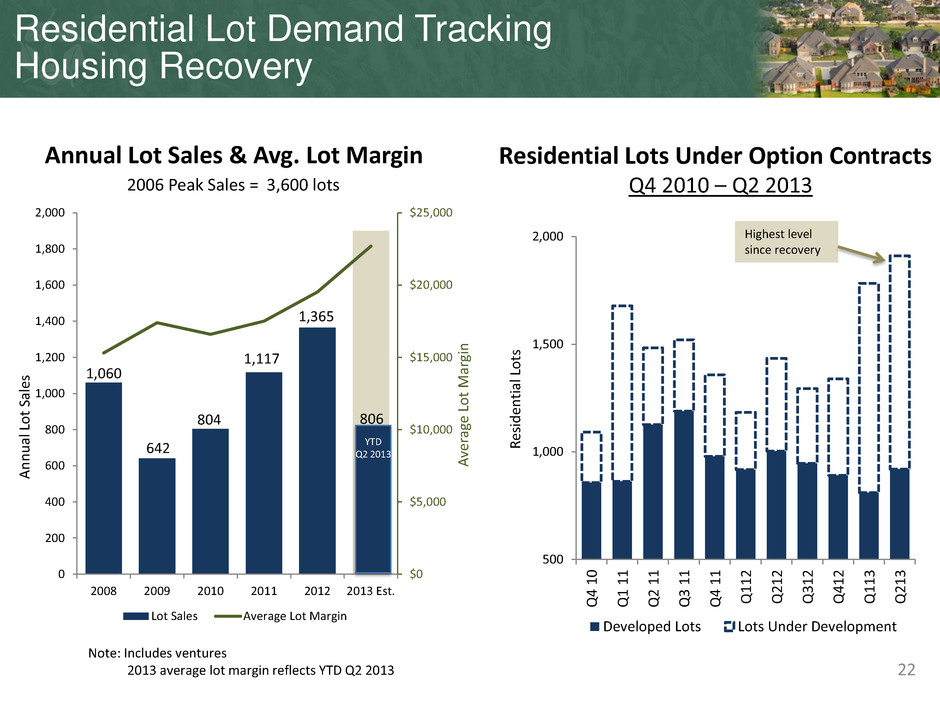

$0 $5,000 $10,000 $15,000 $20,000 $25,000 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2008 2009 2010 2011 2012 2013 Est. Lot Sales Average Lot Margin 22 Note: Includes ventures 2013 average lot margin reflects YTD Q2 2013 A n n u al Lo t Sal e s 500 1,000 1,500 2,000 Q 4 1 0 Q1 1 1 Q2 1 1 Q3 1 1 Q4 1 1 Q1 1 2 Q2 1 2 Q3 1 2 Q4 1 2 Q1 1 3 Q2 1 3 R esi d en tial Lo ts Developed Lots Lots Under Development 2006 Peak Sales = 3,600 lots Residential Lots Under Option Contracts Q4 2010 – Q2 2013 Annual Lot Sales & Avg. Lot Margin 22 Residential Lot Demand Tracking Housing Recovery 1,365 804 642 A ve ra ge Lo t M ar gi n YTD Q2 2013 Highest level since recovery 806 1,060 1,117

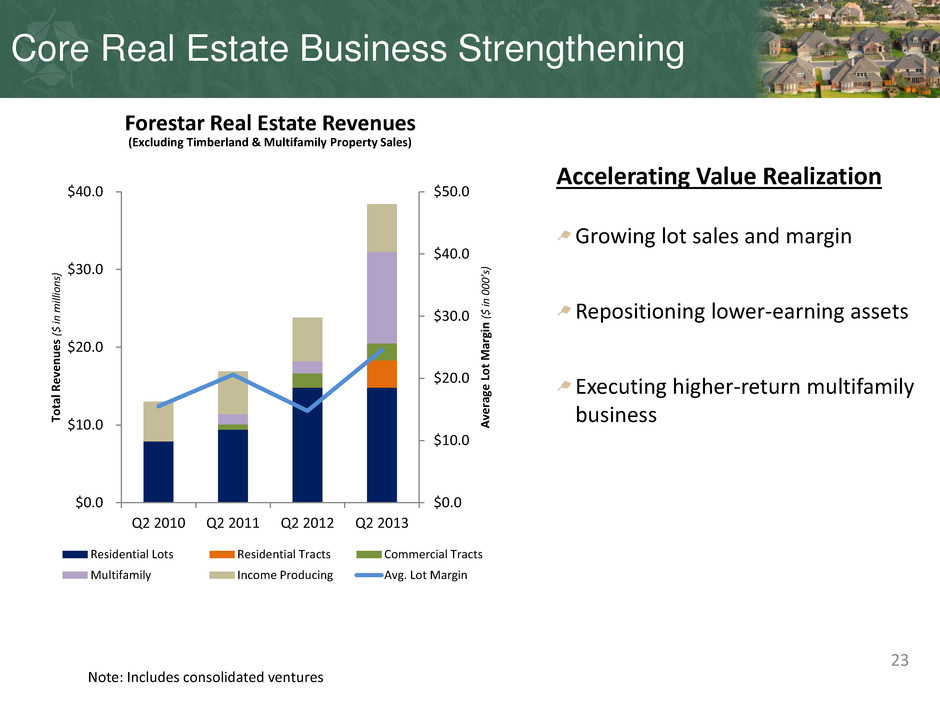

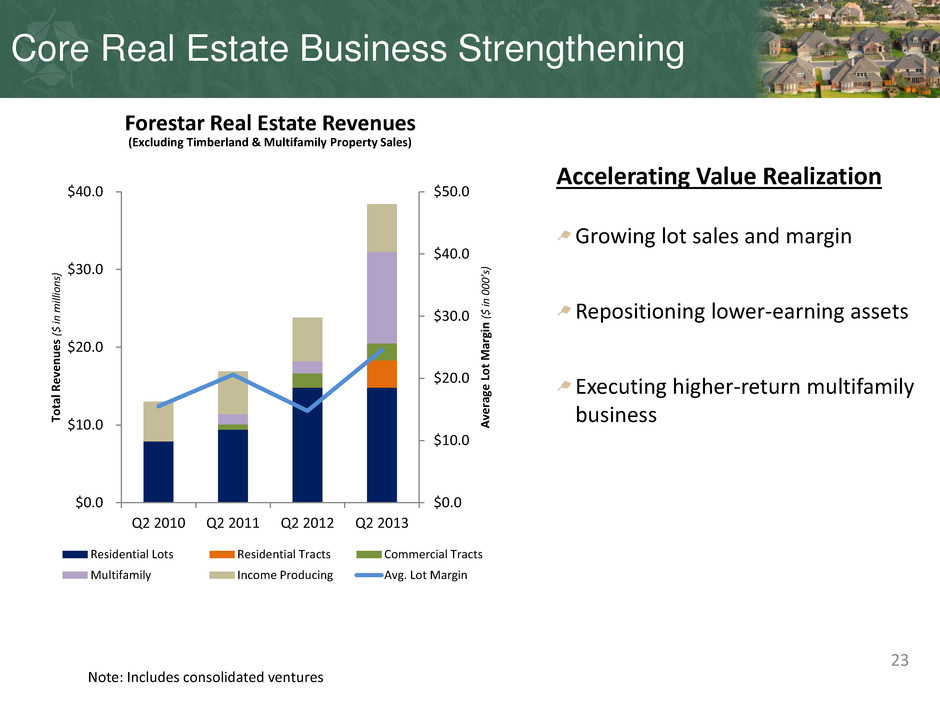

Note: Includes consolidated ventures Forestar Real Estate Revenues (Excluding Timberland & Multifamily Property Sales) Core Real Estate Business Strengthening 23 Growing lot sales and margin Repositioning lower-earning assets Executing higher-return multifamily business Accelerating Value Realization $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $0.0 $10.0 $20.0 $30.0 $40.0 Q2 2010 Q2 2011 Q2 2012 Q2 2013 A ve ra ge Lo t M ar gi n ( $ in 000’ s) To tal R e ve n u e s ($ in m ill io n s) Residential Lots Residential Tracts Commercial Tracts Multifamily Income Producing Avg. Lot Margin

Triple in FOR Initiatives Building Momentum By Accelerating Value Realization, Optimizing Transparency and Growing Net Asset Value 24

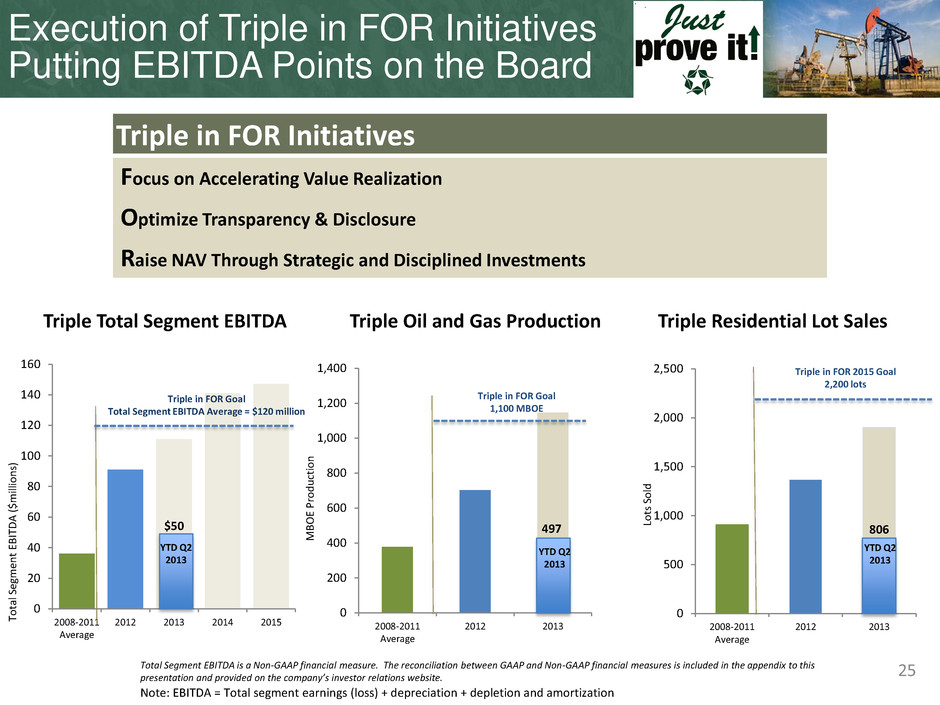

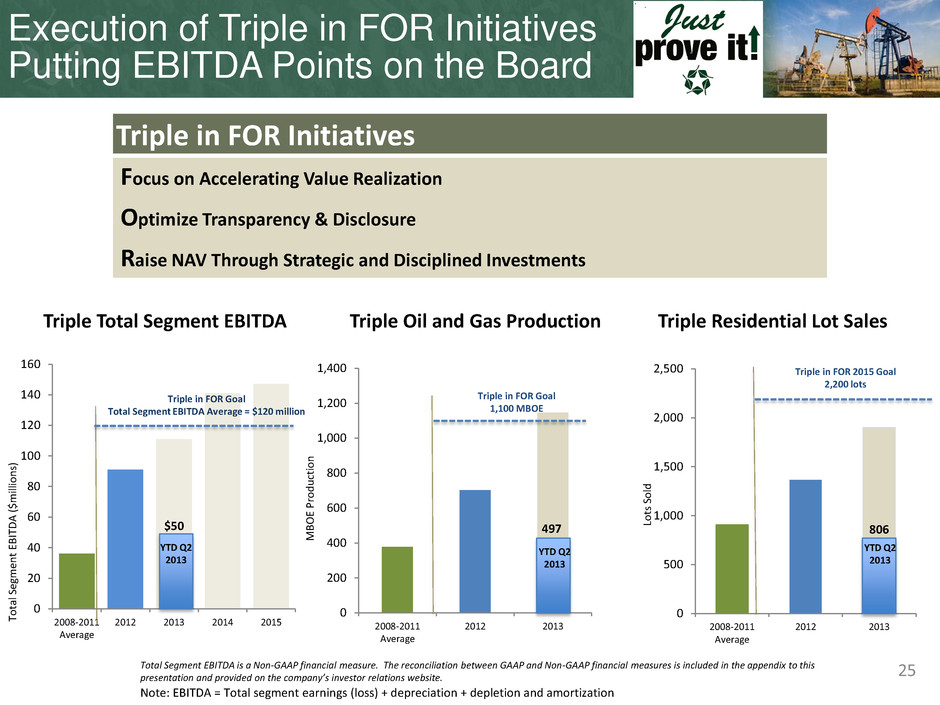

Triple in FOR Initiatives Focus on Accelerating Value Realization Optimize Transparency & Disclosure Raise NAV Through Strategic and Disciplined Investments 25 Triple Residential Lot Sales Triple Oil and Gas Production 0 500 1,000 1,500 2,000 2,500 2008-2011 Average 2012 2013 Lo ts S o ld Triple in FOR 2015 Goal 2,200 lots 0 200 400 600 800 1,000 1,200 1,400 2008-2011 Average 2012 2013 Triple in FOR Goal 1,100 MBOE 0 20 40 60 80 100 120 140 160 2008-2011 Average 2012 2013 2014 2015 Triple in FOR Goal Total Segment EBITDA Average = $120 million Triple Total Segment EBITDA YTD Q2 2013 Note: EBITDA = Total segment earnings (loss) + depreciation + depletion and amortization Total Segment EBITDA is a Non-GAAP financial measure. The reconciliation between GAAP and Non-GAAP financial measures is included in the appendix to this presentation and provided on the company’s investor relations website. Execution of Triple in FOR Initiatives Putting EBITDA Points on the Board To ta l S eg m en t EB IT D A ( $mi lli o n s) MB O E Pr o d u ct io n 806 497 $50 YTD Q2 2013 YTD Q2 2013

Forestar Investor Presentation Forestar Group Inc. 6300 Bee Cave Road Building Two, Suite 500 Austin, TX 78746 512-433-5312 annatorma@forestargroup.com Anna Torma SVP Corporate Affairs For Questions Please Contact: 26

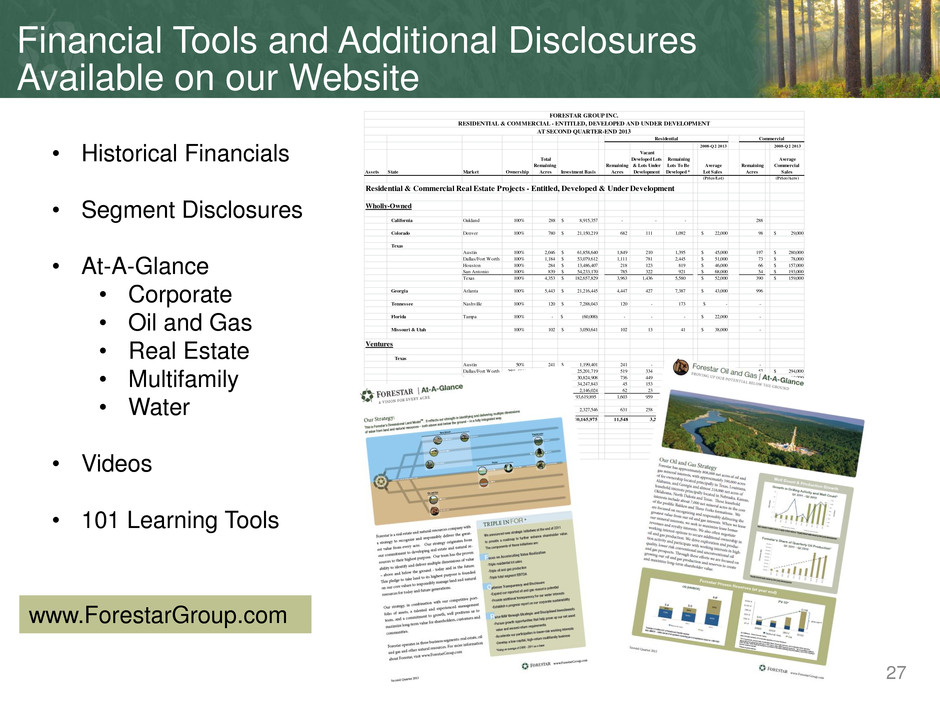

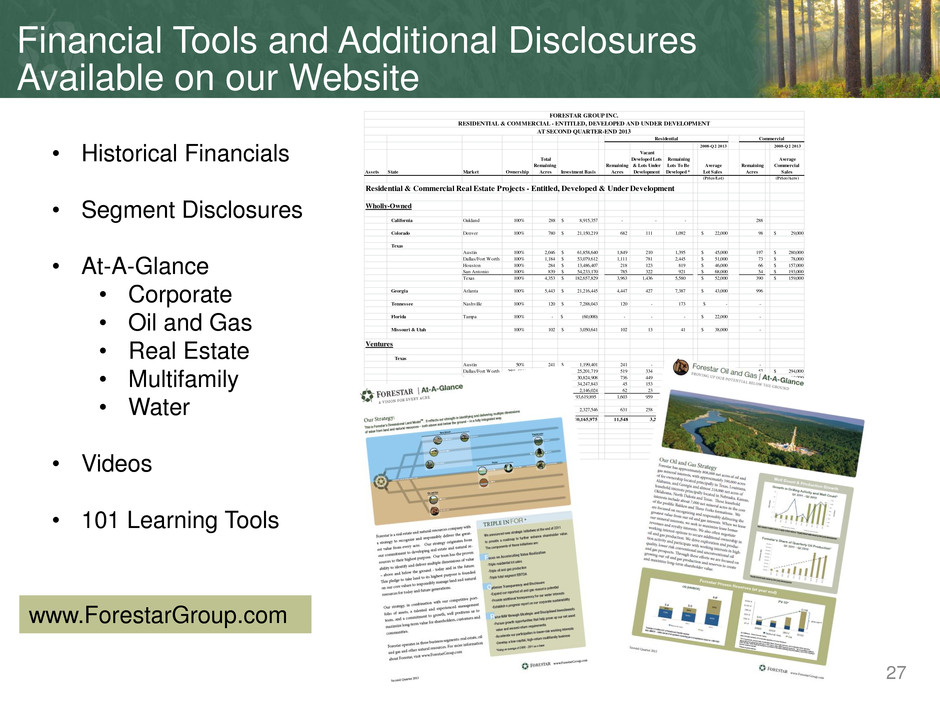

27 Financial Tools and Additional Disclosures Available on our Website • Historical Financials • Segment Disclosures • At-A-Glance • Corporate • Oil and Gas • Real Estate • Multifamily • Water • Videos • 101 Learning Tools 2008-Q 2 2013 2008-Q 2 2013 Assets State Market Ownership Total Remaining Acres Investment Basis Remaining Acres Vacant Developed Lots & Lots Under Development Remaining Lots To Be Developed * Average Lot Sales Remaining Acres Average Commercial Sales (Price/Lot) (Price/Acre) Residential & Commercial Real Estate Projects - Entitled, Developed & Under Development Wholly-Owned California Oakland 100% 288 $ 8,915,357 - - - 288 Colorado Denver 100% 780 $ 21,150,219 682 111 1,092 $ 22,000 98 $ 29,000 Texas Austin 100% 2,046 $ 61,858,640 1,849 210 1,395 $ 45,000 197 $ 280,000 Dallas/Fort Worth 100% 1,184 $ 53,079,612 1,111 781 2,445 $ 51,000 73 $ 78,000 Houston 100% 284 $ 13,486,407 218 123 819 $ 46,000 66 $ 157,000 San Antonio 100% 839 $ 54,233,170 785 322 921 $ 68,000 54 $ 193,000 Texas 100% 4,353 $ 182,657,829 3,963 1,436 5,580 $ 52,000 390 $ 159,000 Georgia Atlanta 100% 5,443 $ 21,216,445 4,447 427 7,387 $ 43,000 996 Tennessee Nashville 100% 120 $ 7,288,043 120 - 173 $ - - Florida Tampa 100% - $ (60,000) - - - $ 22,000 - Missouri & Utah 100% 102 $ 3,050,641 102 13 41 $ 38,000 - Ventures Texas Austin 50% 241 $ 1,199,401 241 - 821 - Dallas/Fort Worth 25%-88% 576 $ 25,201,719 519 334 1,680 $ 74,000 57 $ 294,000 Houston 37%-90% 1,088 $ 30,824,908 736 449 2,311 $ 42,000 352 $ 210,000 Gulf Coast 50%-75% 189 $ 34,247,843 45 153 47 $ 243,000 144 San Antonio 50% 62 $ 2,146,024 62 23 46 $ 85,000 - 25%-90% 2,156 93,619,895 1,603 959 4,905 $ 57,000 553 $ 227,000 Georgia Atlanta 75% 631 $ 2,327,546 631 258 794 $ 53,000 - Total 13,873 $ 340,165,975 11,548 3,204 19,972 $ 53,000 2,325 $ 180,000 * Includes Lots that we plan to sell as residential tracts. Date: August 7, 2013 Residential Commercial FORESTAR GROUP INC. RESIDENTIAL & COMMERCIAL - ENTITLED, DEVELOPED AND UNDER DEVELOPMENT AT SECOND QUARTER-END 2013 www.ForestarGroup.com

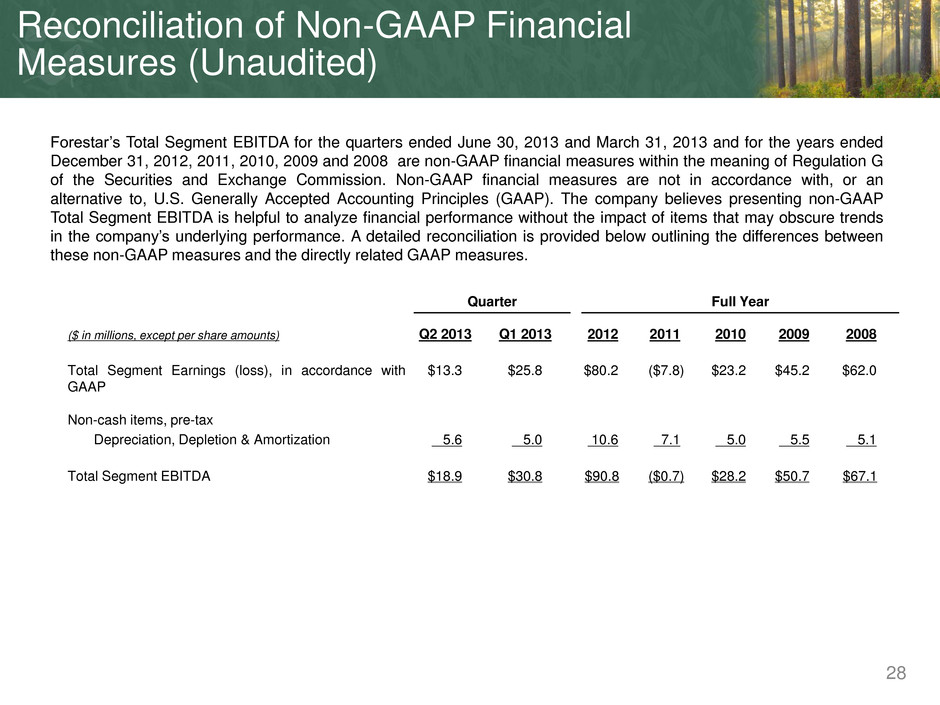

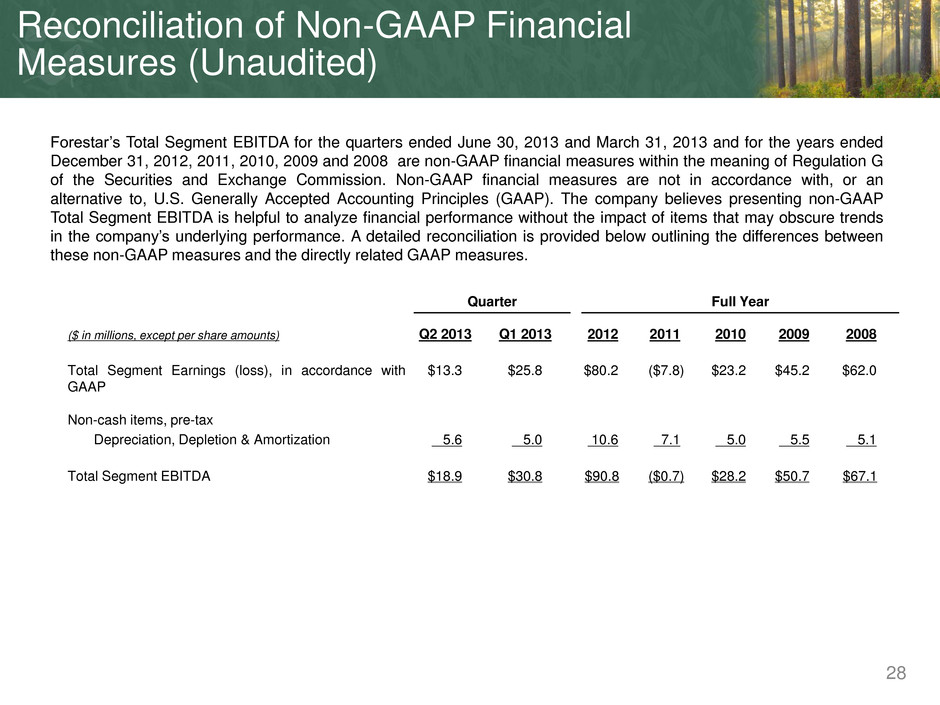

28 Forestar’s Total Segment EBITDA for the quarters ended June 30, 2013 and March 31, 2013 and for the years ended December 31, 2012, 2011, 2010, 2009 and 2008 are non-GAAP financial measures within the meaning of Regulation G of the Securities and Exchange Commission. Non-GAAP financial measures are not in accordance with, or an alternative to, U.S. Generally Accepted Accounting Principles (GAAP). The company believes presenting non-GAAP Total Segment EBITDA is helpful to analyze financial performance without the impact of items that may obscure trends in the company’s underlying performance. A detailed reconciliation is provided below outlining the differences between these non-GAAP measures and the directly related GAAP measures. Quarter Full Year ($ in millions, except per share amounts) Q2 2013 Q1 2013 2012 2011 2010 2009 2008 Total Segment Earnings (loss), in accordance with GAAP $13.3 $25.8 $80.2 ($7.8) $23.2 $45.2 $62.0 Non-cash items, pre-tax Depreciation, Depletion & Amortization 5.6 5.0 10.6 7.1 5.0 5.5 5.1 Total Segment EBITDA $18.9 $30.8 $90.8 ($0.7) $28.2 $50.7 $67.1 Reconciliation of Non-GAAP Financial Measures (Unaudited)

Forestar Investor Presentation Forestar Group Inc. 6300 Bee Cave Road Building Two, Suite 500 Austin, TX 78746 512-433-5312 annatorma@forestargroup.com Anna Torma SVP Corporate Affairs For Questions Please Contact: 29