Third Quarter 2013 Financial Results November 6, 2013 Building Momentum By Accelerating Value Realization, Optimizing Transparency and Growing Net Asset Value

Notice To Investors This presentation contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are typically identified by words or phrases such as “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,” and other words and terms of similar meaning. These statements reflect management’s current views with respect to future events and are subject to risk and uncertainties. We note that a variety of factors and uncertainties could cause our actual results to differ significantly from the results discussed in the forward-looking statements, including but not limited to: general economic, market, or business conditions; changes in commodity prices; opportunities (or lack thereof) that may be presented to us and that we may pursue; fluctuations in costs and expenses including development costs; demand for new housing, including impacts from mortgage credit availability; lengthy and uncertain entitlement processes; cyclicality of our businesses; accuracy of accounting assumptions; competitive actions by other companies; changes in laws or regulations; and other factors, many of which are beyond our control. Except as required by law, we expressly disclaim any obligation to publicly revise any forward-looking statements contained in this presentation to reflect the occurrence of events after the date of this presentation. This presentation includes Non-GAAP financial measures. The required reconciliation to GAAP financial measures can be found as an exhibit to this presentation and on our website at www.forestargroup.com. 2

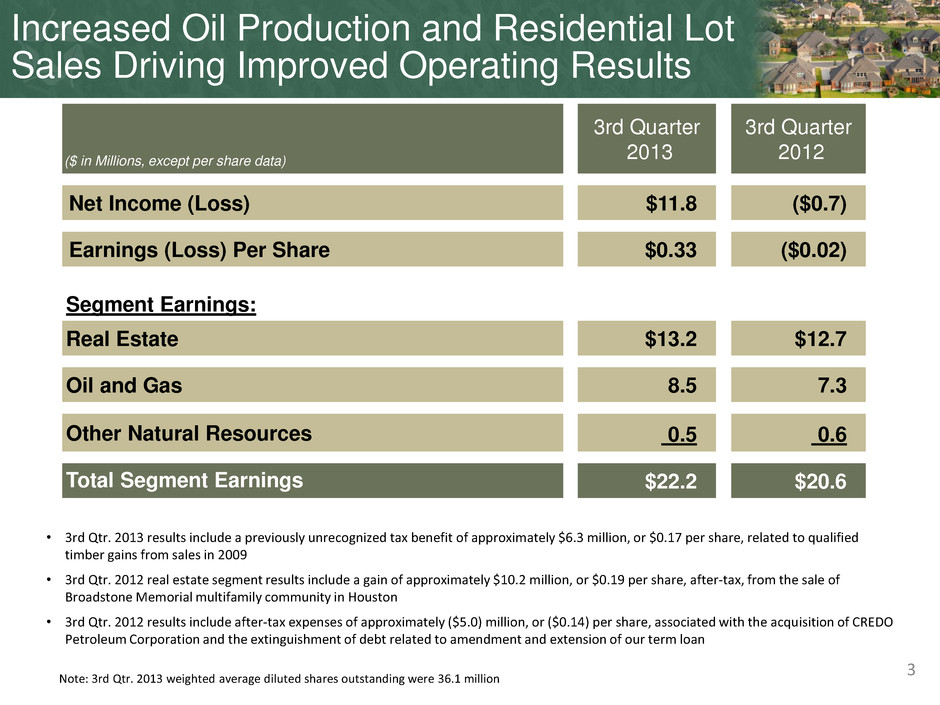

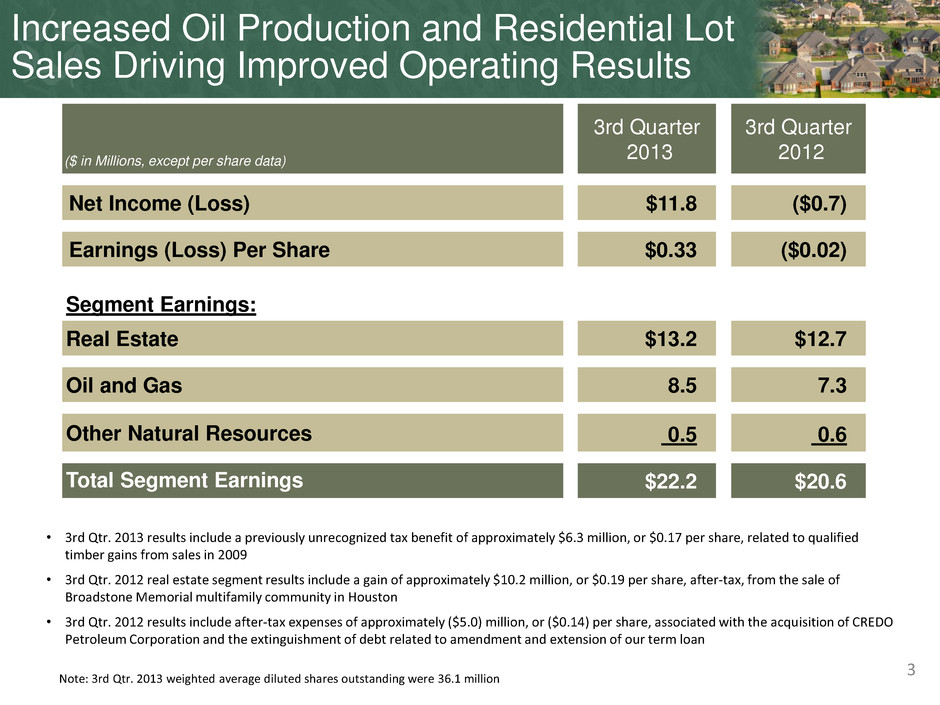

Increased Oil Production and Residential Lot Sales Driving Improved Operating Results 3 • 3rd Qtr. 2013 results include a previously unrecognized tax benefit of approximately $6.3 million, or $0.17 per share, related to qualified timber gains from sales in 2009 • 3rd Qtr. 2012 real estate segment results include a gain of approximately $10.2 million, or $0.19 per share, after-tax, from the sale of Broadstone Memorial multifamily community in Houston • 3rd Qtr. 2012 results include after-tax expenses of approximately ($5.0) million, or ($0.14) per share, associated with the acquisition of CREDO Petroleum Corporation and the extinguishment of debt related to amendment and extension of our term loan Note: 3rd Qtr. 2013 weighted average diluted shares outstanding were 36.1 million ($ in Millions, except per share data) 3rd Quarter 2013 3rd Quarter 2012 Net Income (Loss) $11.8 ($0.7) Earnings (Loss) Per Share $0.33 ($0.02) Segment Earnings: Real Estate $13.2 $12.7 Oil and Gas 8.5 7.3 Other Natural Resources 0.5 0.6 Total Segment Earnings $22.2 $20.6

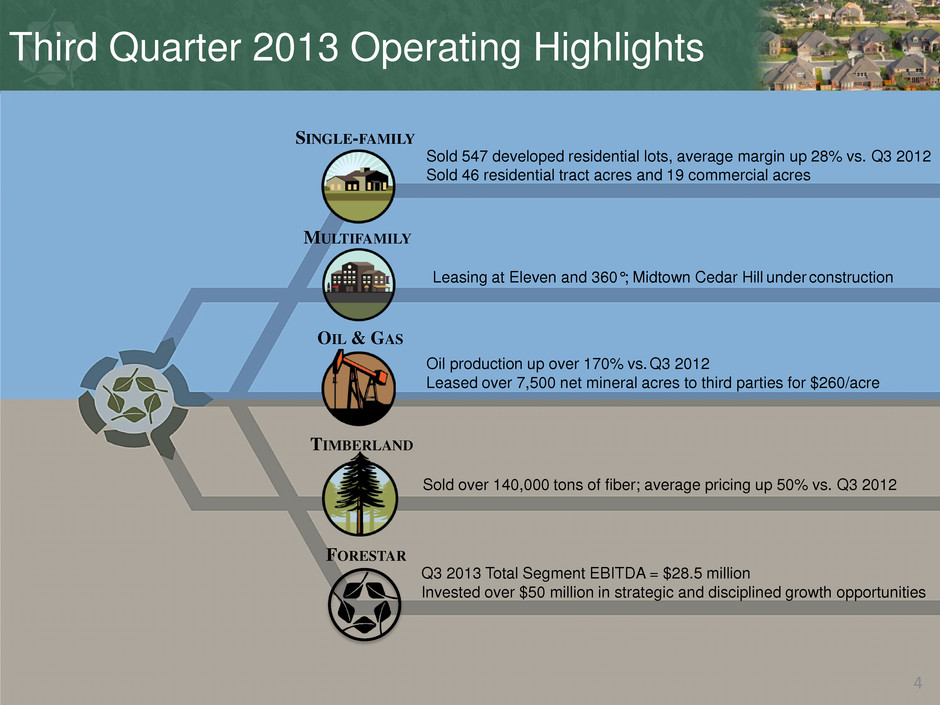

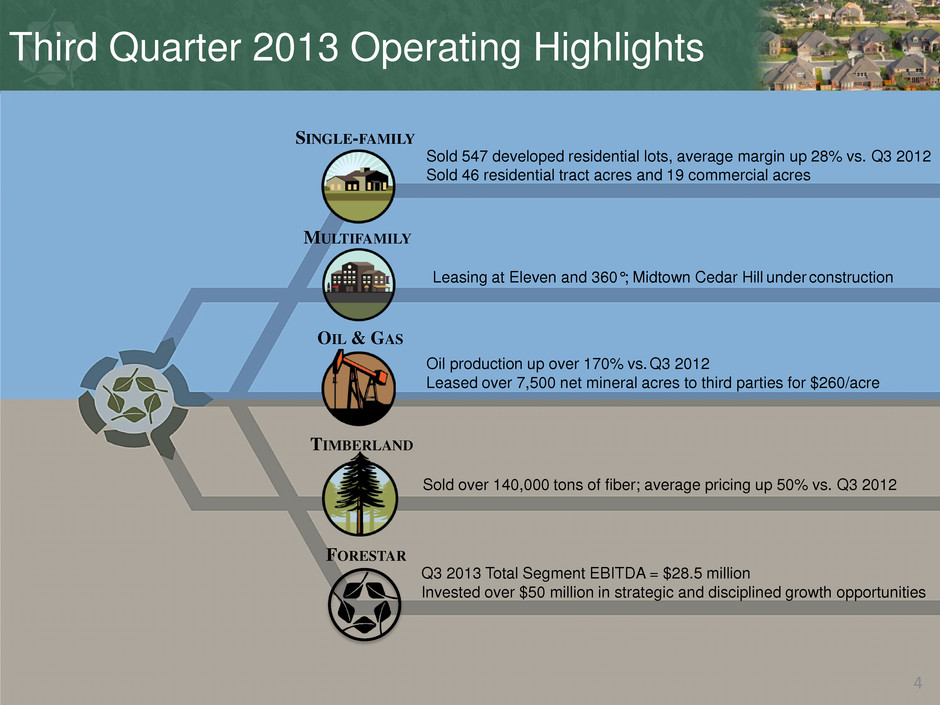

Third Quarter 2013 Operating Highlights Q3 2013 Total Segment EBITDA = $28.5 million Invested over $50 million in strategic and disciplined growth opportunities Leasing at Eleven and 360°; Midtown Cedar Hill under construction Sold 547 developed residential lots, average margin up 28% vs. Q3 2012 Sold 46 residential tract acres and 19 commercial acres Sold over 140,000 tons of fiber; average pricing up 50% vs. Q3 2012 OIL & GAS SINGLE-FAMILY FORESTAR TIMBERLAND MULTIFAMILY Oil production up over 170% vs. Q3 2012 Leased over 7,500 net mineral acres to third parties for $260/acre 4

Real Estate Third Quarter 2013 Highlights Building Momentum By Accelerating Real Estate Sales and Building a Solid Multifamily Pipeline 5

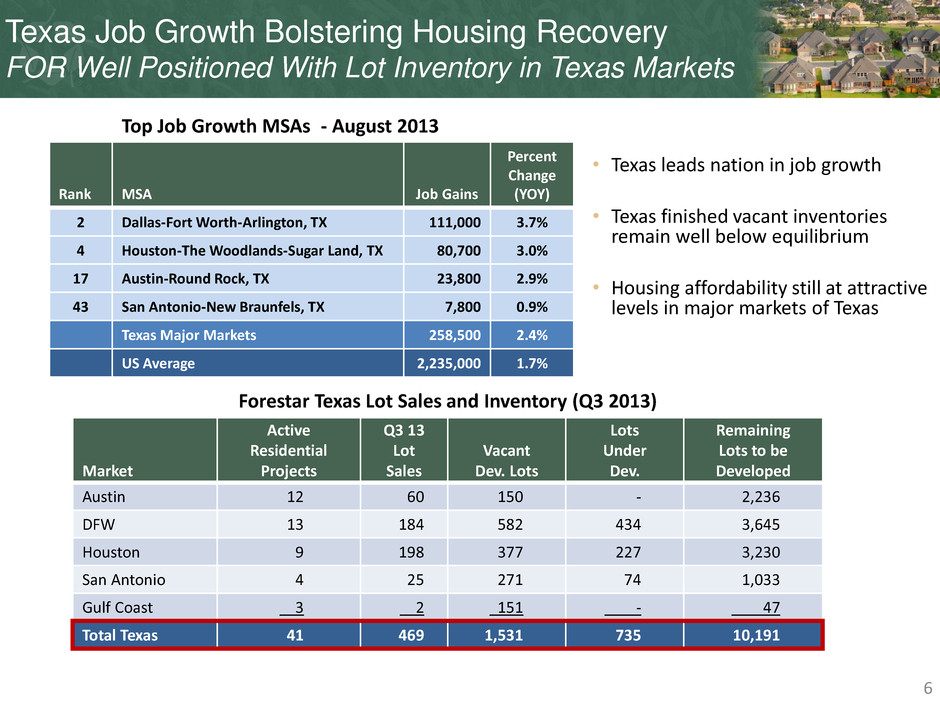

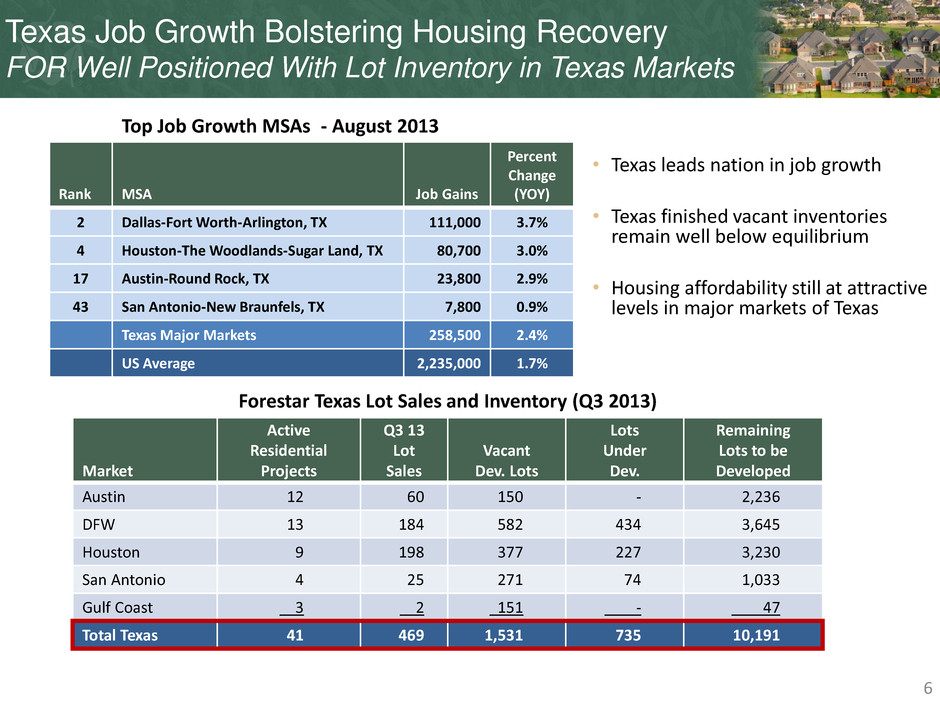

Texas Job Growth Bolstering Housing Recovery FOR Well Positioned With Lot Inventory in Texas Markets Source: Metrostudy. Not seasonally adjusted. 6 Market Active Residential Projects Q3 13 Lot Sales Vacant Dev. Lots Lots Under Dev. Remaining Lots to be Developed Austin 12 60 150 - 2,236 DFW 13 184 582 434 3,645 Houston 9 198 377 227 3,230 San Antonio 4 25 271 74 1,033 Gulf Coast 3 2 151 - 47 Total Texas 41 469 1,531 735 10,191 Forestar Texas Lot Sales and Inventory (Q3 2013) • Texas leads nation in job growth • Texas finished vacant inventories remain well below equilibrium • Housing affordability still at attractive levels in major markets of Texas Rank MSA Job Gains Percent Change (YOY) 2 Dallas-Fort Worth-Arlington, TX 111,000 3.7% 4 Houston-The Woodlands-Sugar Land, TX 80,700 3.0% 17 Austin-Round Rock, TX 23,800 2.9% 43 San Antonio-New Braunfels, TX 7,800 0.9% Texas Major Markets 258,500 2.4% US Average 2,235,000 1.7% Top Job Growth MSAs - August 2013

$12.7 $10.6 $2.4 ($10.2) ($2.3) $13.2 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 Q3 2012 Residential & Commercial Sales Undeveloped Land Sales Gain on Sale of Multifamily Assets Commercial & Income Producing Properties Q3 2013 Real Estate – Results Reflect Improving Demand and Forestar’s Ability to Deliver Q3 2013 Real Estate Sales • Residential lot sales – 547 • Up over 103% vs. Q3 2012 • Margins up over 28% vs. Q3 2012 • Residential tracts - 46 acres • Average $109,000 per acre • Equates to 171 paper lots • Commercial tracts - 19 acres • Nearly $258,000 per acre • Undeveloped land - 1,300 acres • Over $4,950 per acre Segment Earnings Reconciliation Q3 2012 vs. Q3 2013 ($ in millions) 7 Note: Includes ventures 3rd Qtr. 2012 real estate segment results include a gain of approximately $10.2 million from the sale of Broadstone Memorial multifamily community in Houston

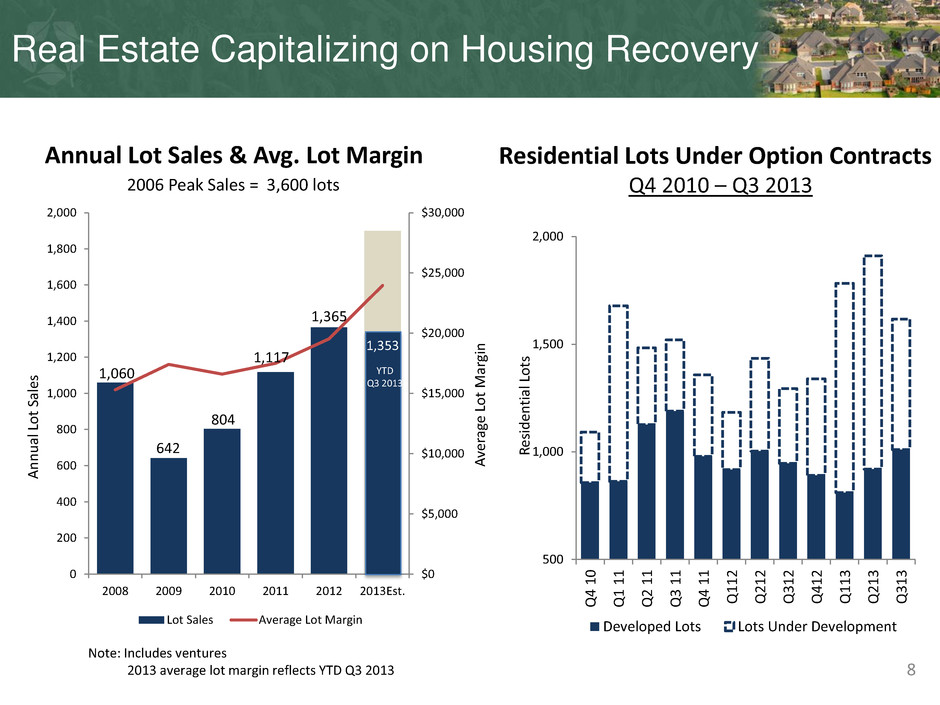

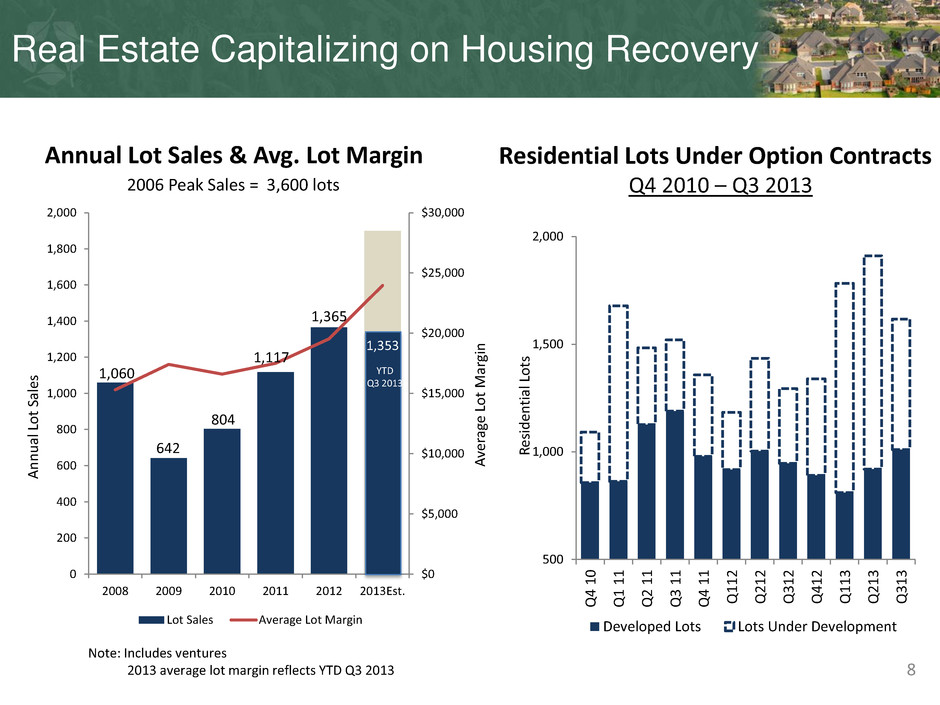

8 Note: Includes ventures 2013 average lot margin reflects YTD Q3 2013 A n n u al Lo t Sal e s 500 1,000 1,500 2,000 Q 4 1 0 Q1 1 1 Q 2 1 1 Q3 1 1 Q4 1 1 Q1 1 2 Q2 1 2 Q3 1 2 Q4 1 2 Q1 1 3 Q2 1 3 Q3 1 3 R esi d en tial Lo ts Developed Lots Lots Under Development 2006 Peak Sales = 3,600 lots Residential Lots Under Option Contracts Q4 2010 – Q3 2013 Annual Lot Sales & Avg. Lot Margin 8 Real Estate Capitalizing on Housing Recovery $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2008 2009 2010 2011 2012 2013Est. Lot Sales Average Lot Margin 1,365 804 642 A ve ra ge Lo t M ar gi n YTD Q3 2013 1,353 1,060 1,117

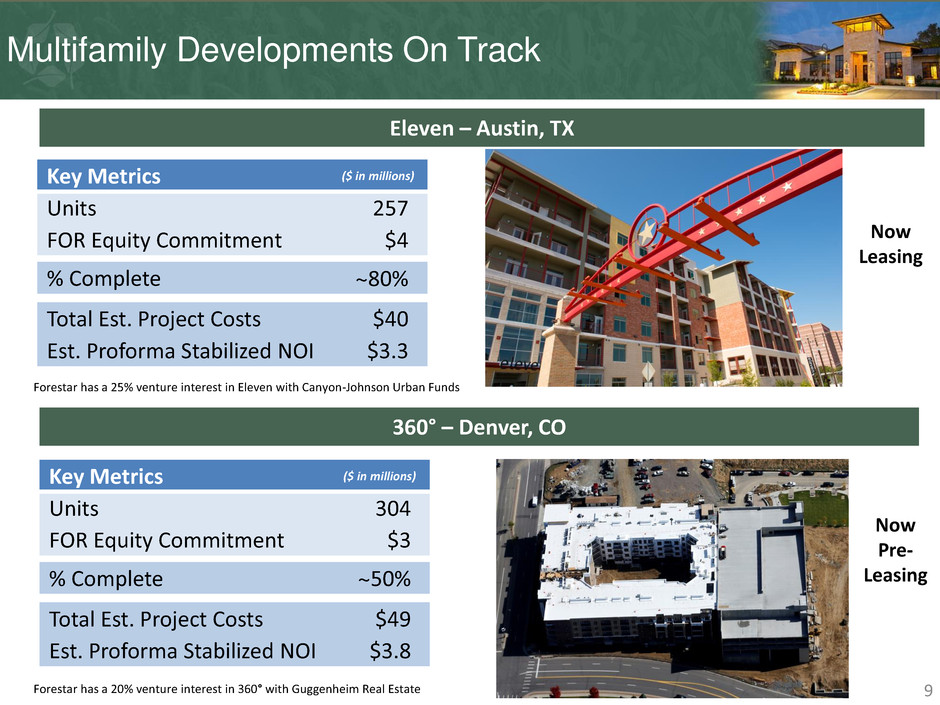

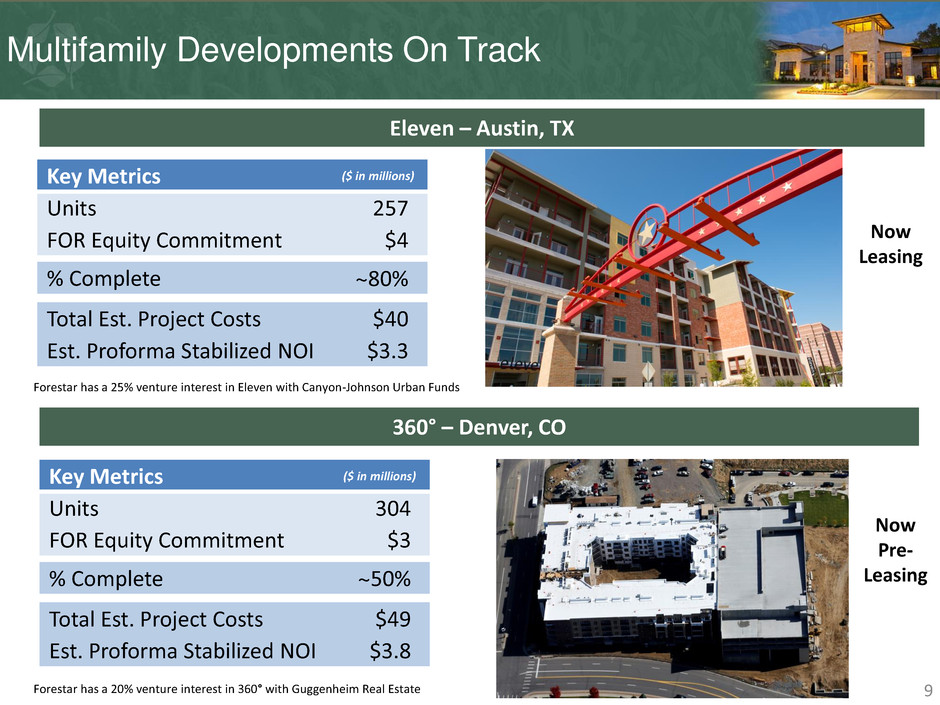

Multifamily Developments On Track 9 Now Pre- Leasing Key Metrics ($ in millions) Units 304 FOR Equity Commitment $3 % Complete ~50% Total Est. Project Costs $49 Est. Proforma Stabilized NOI $3.8 360° – Denver, CO Eleven – Austin, TX Key Metrics ($ in millions) Units 257 FOR Equity Commitment $4 % Complete ~80% Total Est. Project Costs $40 Est. Proforma Stabilized NOI $3.3 Forestar has a 20% venture interest in 360° with Guggenheim Real Estate Forestar has a 25% venture interest in Eleven with Canyon-Johnson Urban Funds Now Leasing

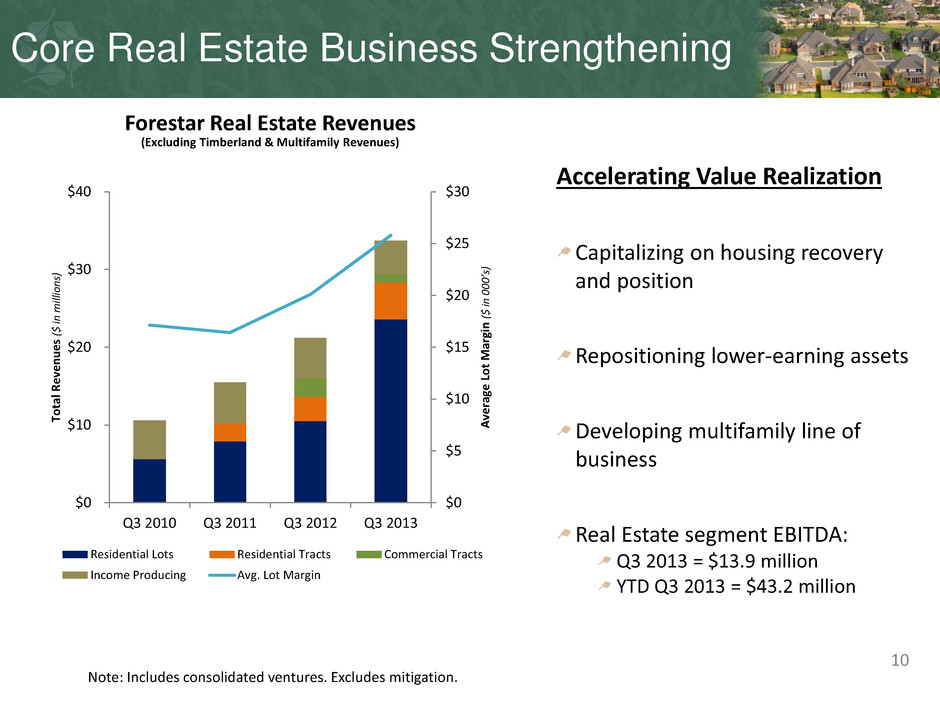

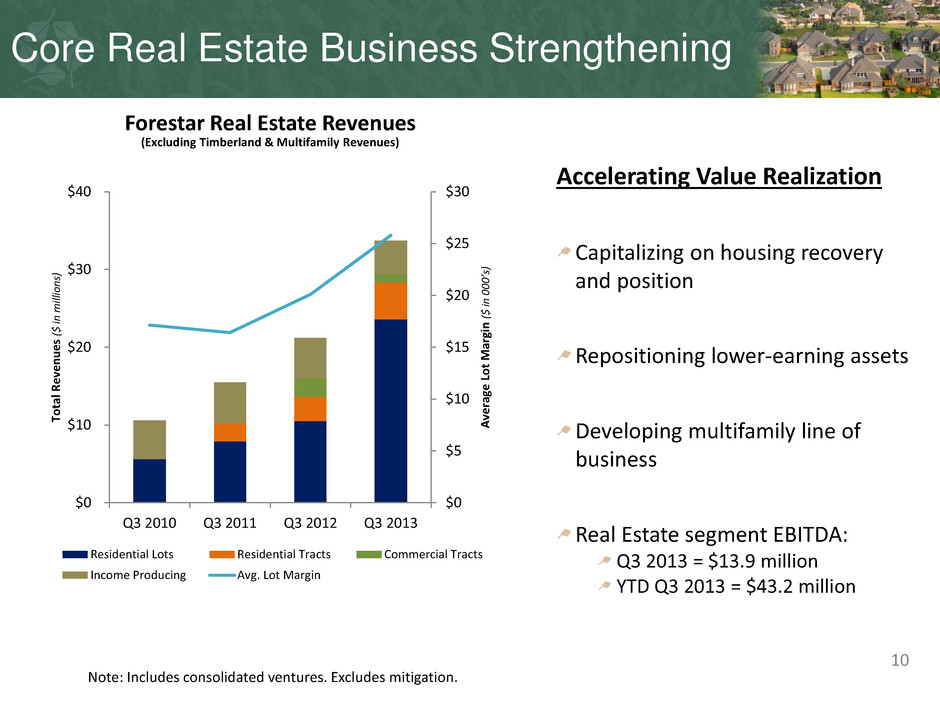

Note: Includes consolidated ventures. Excludes mitigation. Forestar Real Estate Revenues (Excluding Timberland & Multifamily Revenues) Core Real Estate Business Strengthening 10 Capitalizing on housing recovery and position Repositioning lower-earning assets Developing multifamily line of business Real Estate segment EBITDA: Q3 2013 = $13.9 million YTD Q3 2013 = $43.2 million Accelerating Value Realization $0 $5 $10 $15 $20 $25 $30 $0 $10 $20 $30 $40 Q3 2010 Q3 2011 Q3 2012 Q3 2013 A ve ra ge Lo t M ar gi n ( $ in 000’ s) To tal R e ve n u e s ($ in m ill io n s) Residential Lots Residential Tracts Commercial Tracts Income Producing Avg. Lot Margin

Oil and Gas Third Quarter 2013 Highlights Building Momentum By Driving Leasing and Exploration to Increase Production and Reserves 11

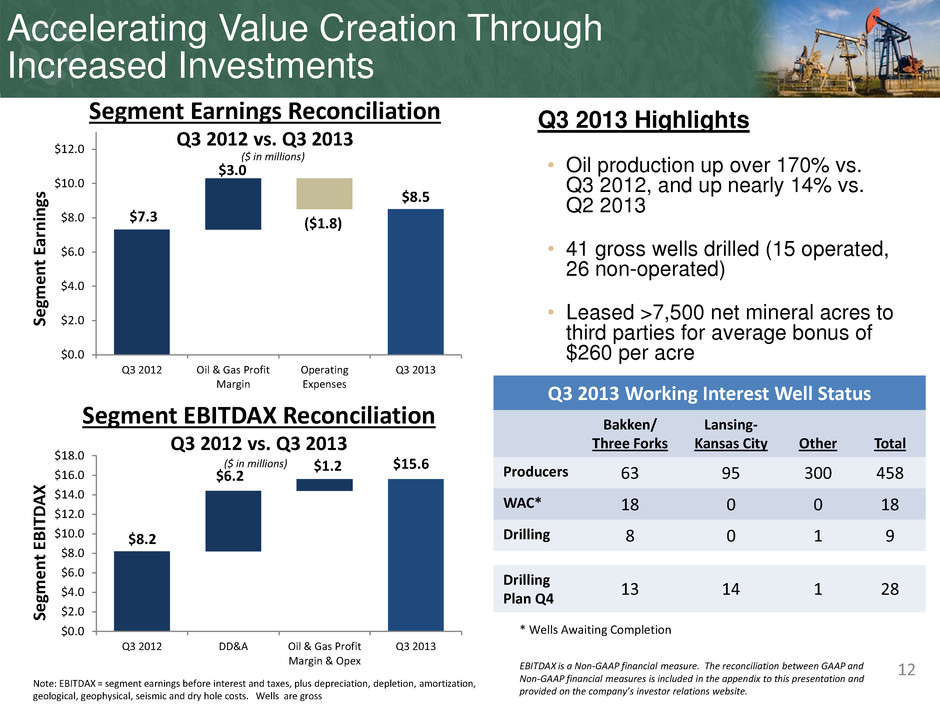

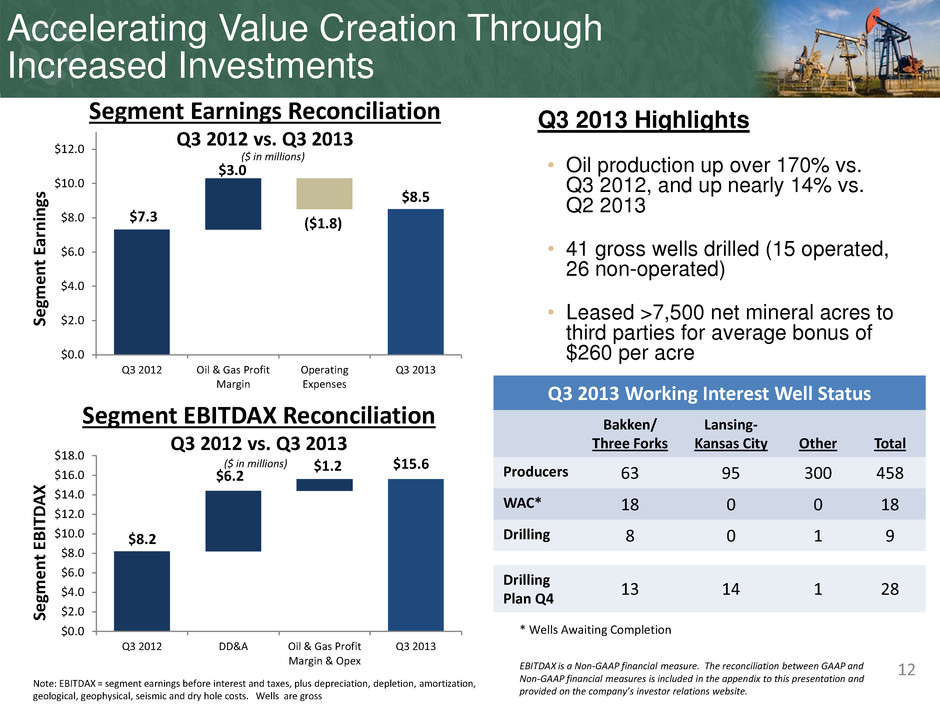

Accelerating Value Creation Through Increased Investments $7.3 $3.0 ($1.8) $8.5 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 Q3 2012 Oil & Gas Profit Margin Operating Expenses Q3 2013 Se gme n t Ea rn ing s Q3 2013 Highlights • Oil production up over 170% vs. Q3 2012, and up nearly 14% vs. Q2 2013 • 41 gross wells drilled (15 operated, 26 non-operated) • Leased >7,500 net mineral acres to third parties for average bonus of $260 per acre ($ in millions) 12 Segment Earnings Reconciliation Q3 2012 vs. Q3 2013 $8.2 $6.2 $1.2 $15.6 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 Q3 2012 DD&A Oil & Gas Profit Margin & Opex Q3 2013 Se gme n t EBIT D A X Segment EBITDAX Reconciliation Q3 2012 vs. Q3 2013 ($ in millions) Note: EBITDAX = segment earnings before interest and taxes, plus depreciation, depletion, amortization, geological, geophysical, seismic and dry hole costs. Wells are gross EBITDAX is a Non-GAAP financial measure. The reconciliation between GAAP and Non-GAAP financial measures is included in the appendix to this presentation and provided on the company’s investor relations website. Q3 2013 Working Interest Well Status Bakken/ Three Forks Lansing- Kansas City Other Total Producers 63 95 300 458 WAC* 18 0 0 18 Drilling 8 0 1 9 Drilling Plan Q4 13 14 1 28 * Wells Awaiting Completion

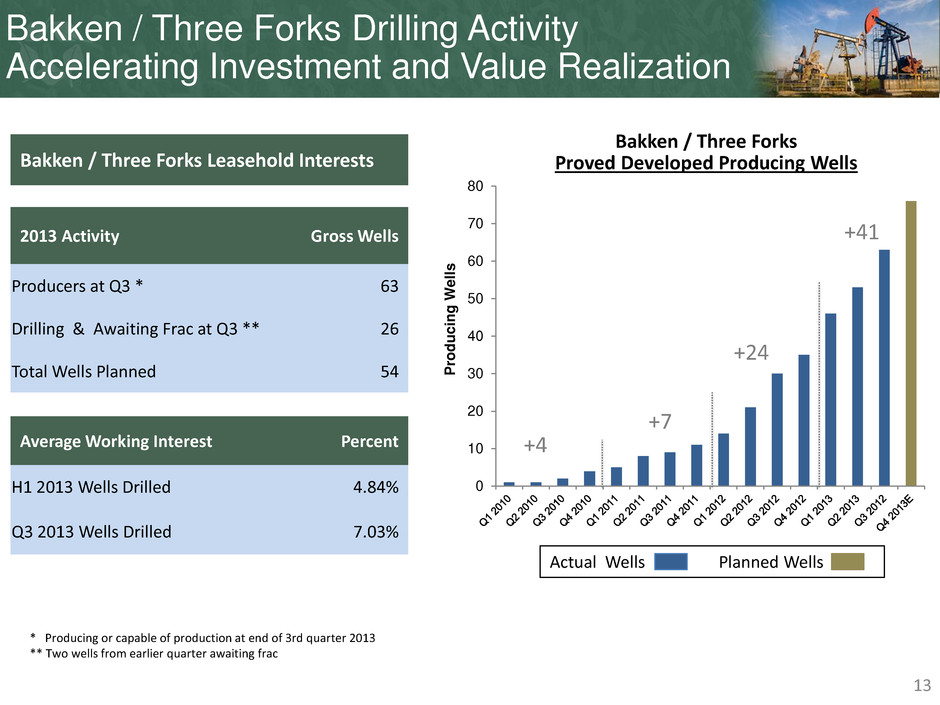

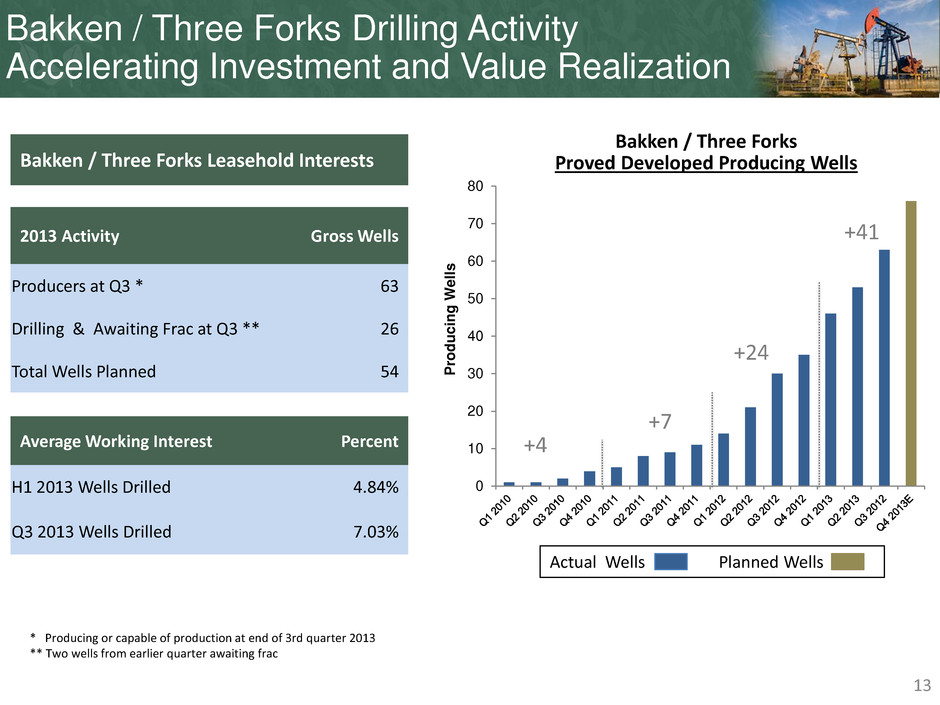

0 10 20 30 40 50 60 70 80 P rod u cing We ll s Bakken / Three Forks Drilling Activity Accelerating Investment and Value Realization Bakken / Three Forks Leasehold Interests 2013 Activity Gross Wells Producers at Q3 * 63 Drilling & Awaiting Frac at Q3 ** 26 Total Wells Planned 54 Average Working Interest Percent H1 2013 Wells Drilled 4.84% Q3 2013 Wells Drilled 7.03% 13 13 13 Bakken / Three Forks Proved Developed Producing Wells +4 +7 +24 +41 Actual Wells Planned Wells * Producing or capable of production at end of 3rd quarter 2013 ** Two wells from earlier quarter awaiting frac

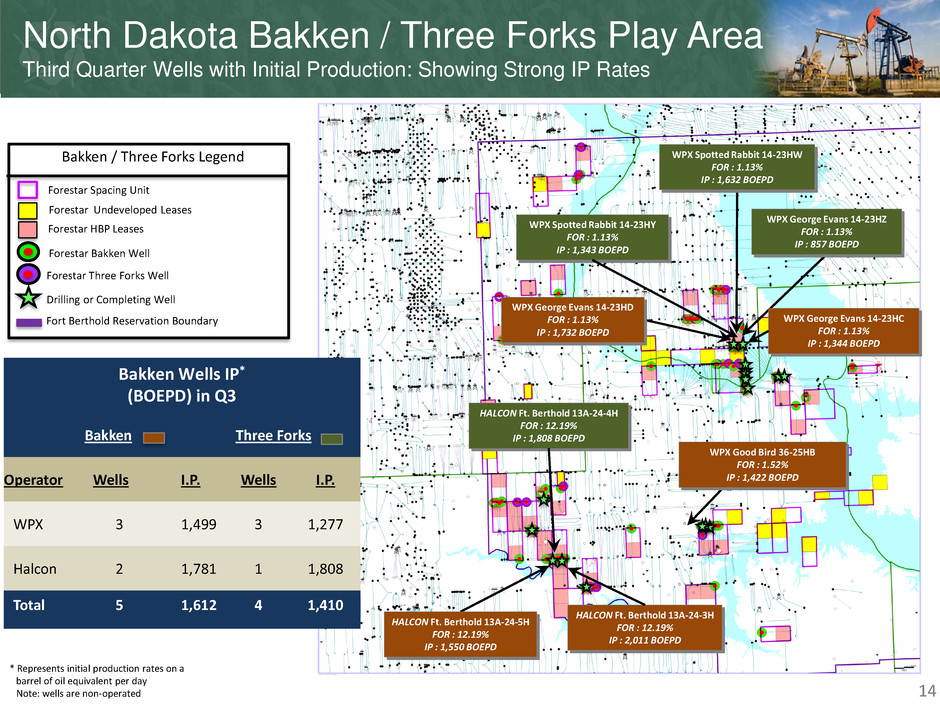

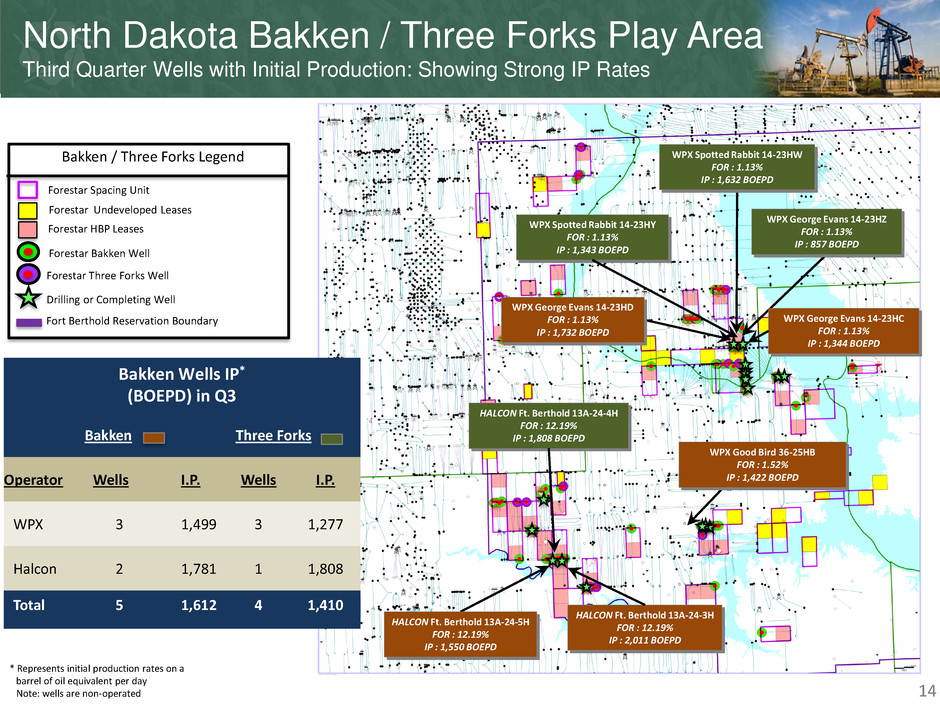

HALCON Ft. Berthold 13A-24-4H FOR : 12.19% IP : 1,808 BOEPD WPX George Evans 14-23HZ FOR : 1.13% IP : 857 BOEPD WPX George Evans 14-23HD FOR : 1.13% IP : 1,732 BOEPD WPX Good Bird 36-25HB FOR : 1.52% IP : 1,422 BOEPD WPX Spotted Rabbit 14-23HW FOR : 1.13% IP : 1,632 BOEPD North Dakota Bakken / Three Forks Play Area Third Quarter Wells with Initial Production: Showing Strong IP Rates 14 * Represents initial production rates on a barrel of oil equivalent per day Note: wells are non-operated Bakken Wells IP* (BOEPD) in Q3 Bakken Three Forks Operator Wells I.P. Wells I.P. WPX 3 1,499 3 1,277 Halcon 2 1,781 1 1,808 Total 5 1,612 4 1,410 Bakken / Three Forks Legend Forestar Bakken Well Forestar Three Forks Well Drilling or Completing Well Fort Berthold Reservation Boundary Forestar HBP Leases Forestar Undeveloped Leases Forestar Spacing Unit WPX Spotted Rabbit 14-23HY FOR : 1.13% IP : 1,343 BOEPD WPX George Evans 14-23HC FOR : 1.13% IP : 1,344 BOEPD HALCON Ft. Berthold 13A-24-3H FOR : 12.19% IP : 2,011 BOEPD HALCON Ft. Berthold 13A-24-5H FOR : 12.19% IP : 1,550 BOEPD

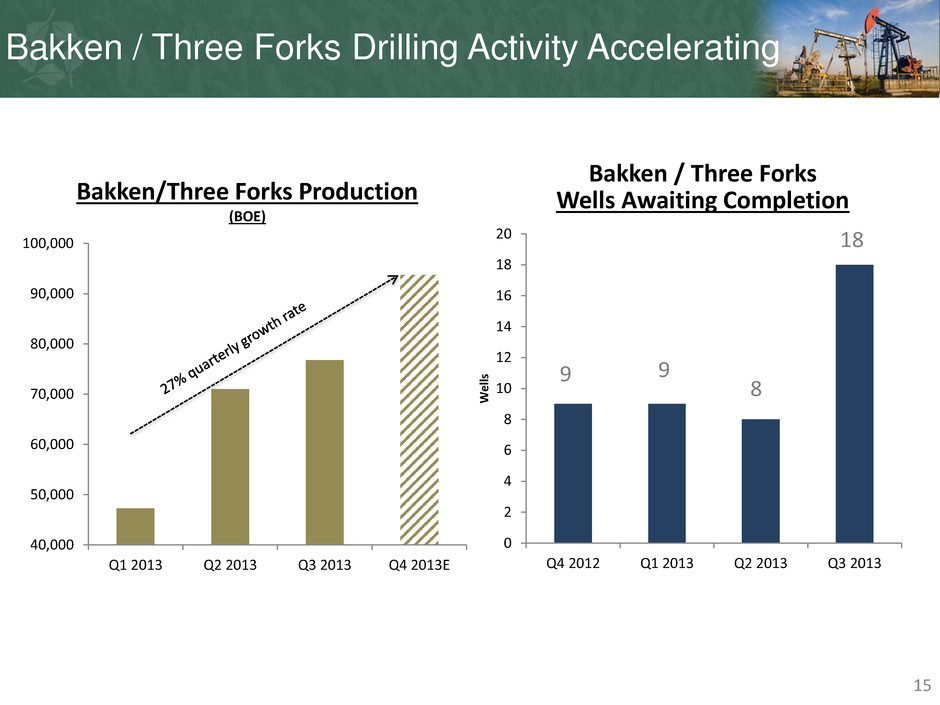

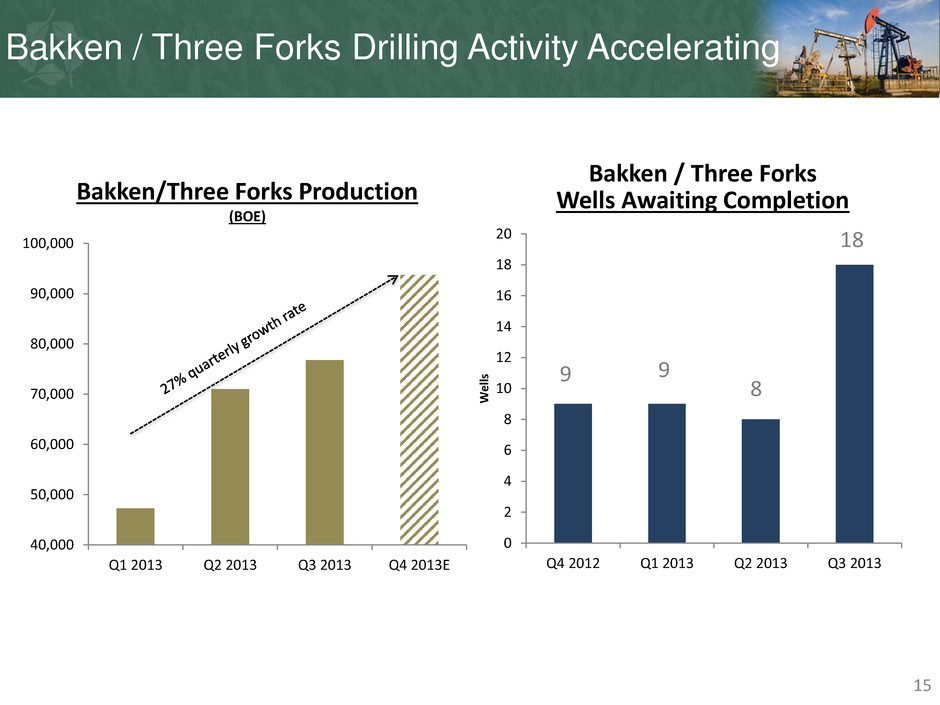

0 2 4 6 8 10 12 14 16 18 20 Q4 2012 Q1 2013 Q2 2013 Q3 2013 We lls 18 Bakken / Three Forks Drilling Activity Accelerating 15 15 15 Bakken / Three Forks Wells Awaiting Completion 9 8 9 40,000 50,000 60,000 70,000 80,000 90,000 100,000 Q1 2013 Q2 2013 Q3 2013 Q4 2013E Bakken/Three Forks Production (BOE)

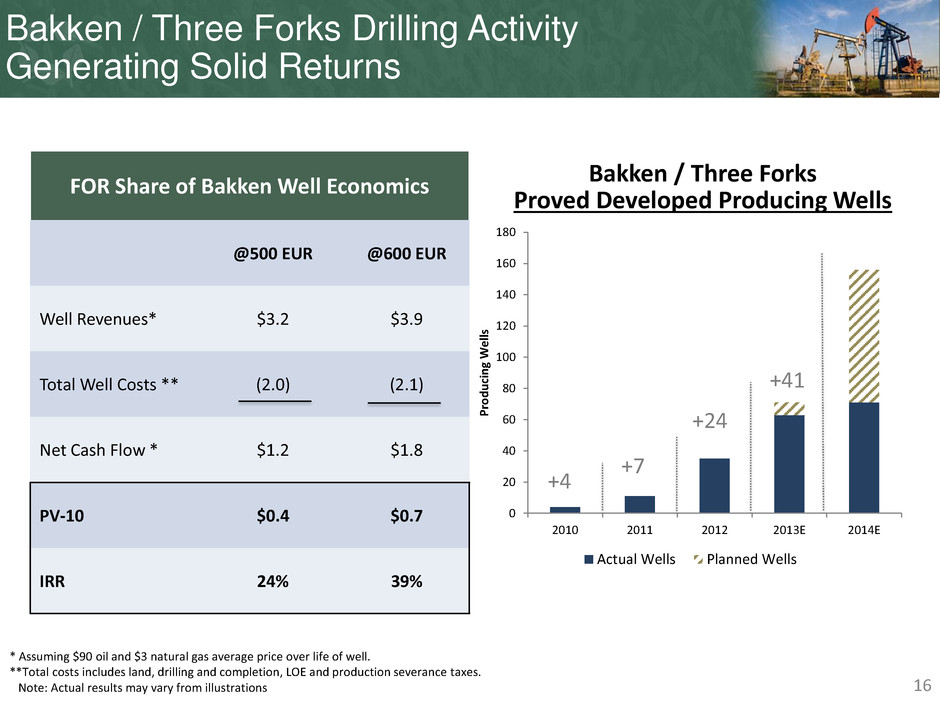

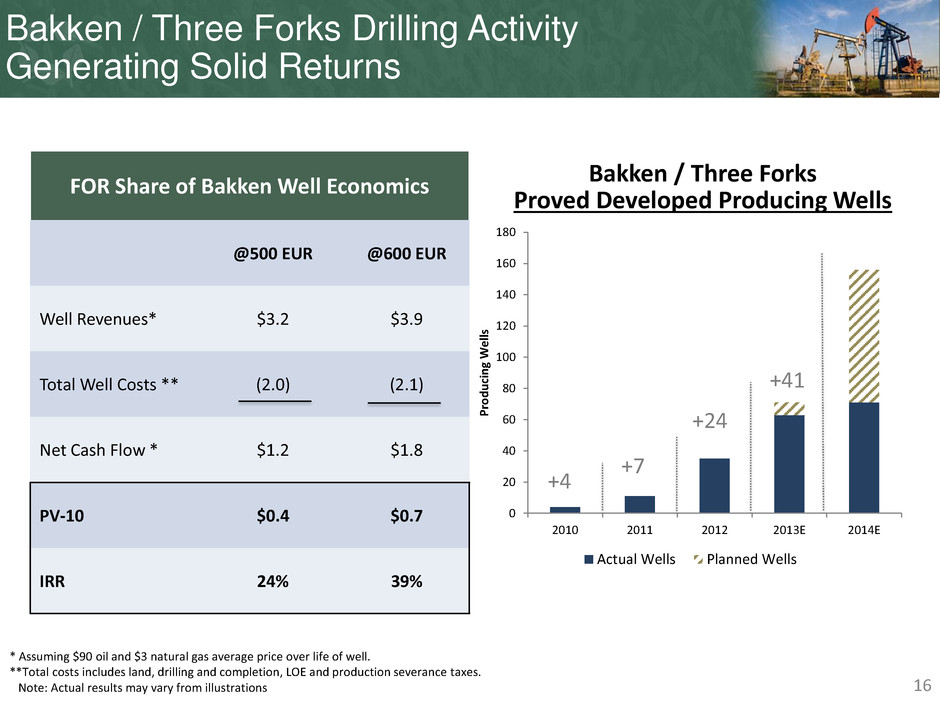

0 20 40 60 80 100 120 140 160 180 2010 2011 2012 2013E 2014E P ro d u ci n g W e lls Actual Wells Planned Wells +41 Bakken / Three Forks Drilling Activity Generating Solid Returns 16 16 16 Bakken / Three Forks Proved Developed Producing Wells +4 +7 +24 * Assuming $90 oil and $3 natural gas average price over life of well. **Total costs includes land, drilling and completion, LOE and production severance taxes. Note: Actual results may vary from illustrations FOR Share of Bakken Well Economics @500 EUR @600 EUR Well Revenues* $3.2 $3.9 Total Well Costs ** (2.0) (2.1) Net Cash Flow * $1.2 $1.8 PV-10 $0.4 $0.7 IRR 24% 39%

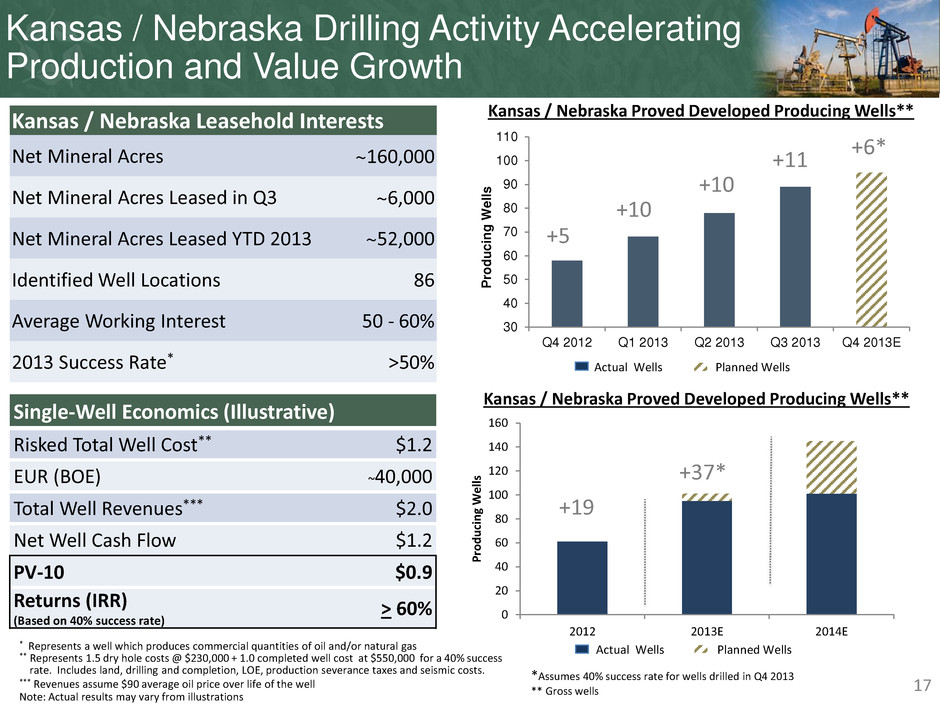

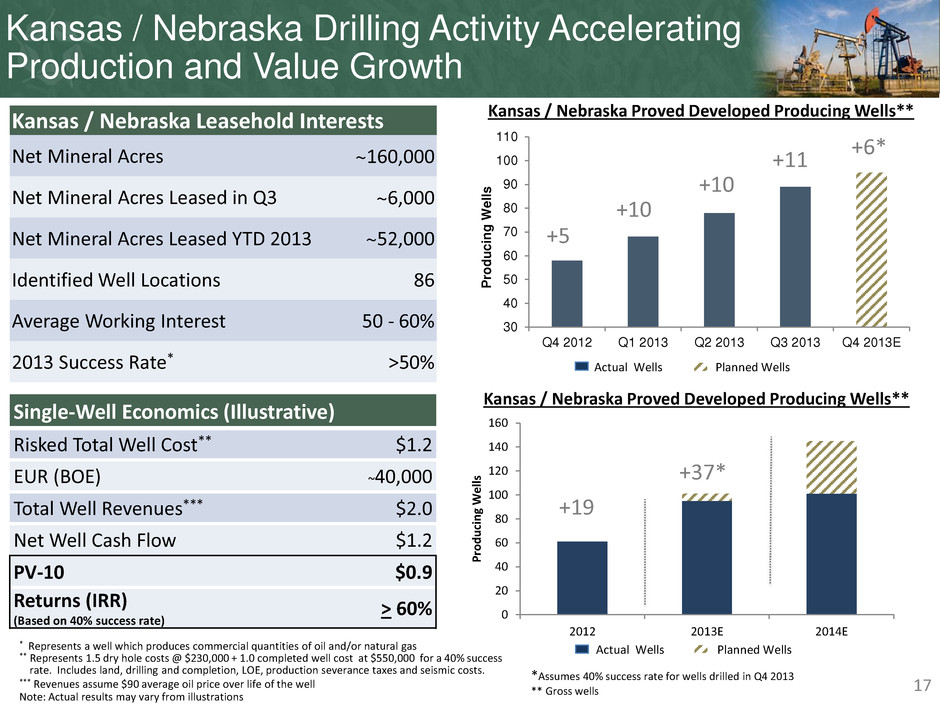

0 20 40 60 80 100 120 140 160 2012 2013E 2014E P ro d u ci n g W e lls +37* Kansas / Nebraska Drilling Activity Accelerating Production and Value Growth 17 17 17 +19 Single-Well Economics (Illustrative) Risked Total Well Cost** $1.2 EUR (BOE) ~40,000 Total Well Revenues*** $2.0 Net Well Cash Flow $1.2 PV-10 $0.9 Returns (IRR) (Based on 40% success rate) > 60% * Represents a well which produces commercial quantities of oil and/or natural gas ** Represents 1.5 dry hole costs @ $230,000 + 1.0 completed well cost at $550,000 for a 40% success rate. Includes land, drilling and completion, LOE, production severance taxes and seismic costs. *** Revenues assume $90 average oil price over life of the well Kansas / Nebraska Leasehold Interests Net Mineral Acres ~160,000 Net Mineral Acres Leased in Q3 ~6,000 Net Mineral Acres Leased YTD 2013 ~52,000 Identified Well Locations 86 Average Working Interest 50 - 60% 2013 Success Rate* >50% Kansas / Nebraska Proved Developed Producing Wells** Note: Actual results may vary from illustrations 30 40 50 60 70 80 90 100 110 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013E P ro d u cin g W el ls Kansas / Nebraska Proved Developed Producing Wells** +5 +10 +10 +11 +6* *Assumes 40% success rate for wells drilled in Q4 2013 ** Gross wells Actual Wells Planned Wells Actual Wells Planned Wells

Accelerating Contribution from Acquisitions and Oil and Gas Investments 18 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 $9.0 Q1 2013 Q2 2013 Q3 2013 Q4 2013E EBI TDAX ($ m ill io n s) E ar n in gs ($ m ill io n s) Earnings EBITDAX Investment and Production Growth Driving Earnings Momentum 40,000 60,000 80,000 100,000 120,000 140,000 160,000 180,000 200,000 220,000 240,000 Q1 2013 Q2 2013 Q3 2013 Q4 2013E Net BOE Production From Investments* Earnings Contribution from Oil and Gas Investments* *Investments include Credo Acquisition and investment in working interests

2013 Oil & Gas Capital Investment Generating Production and Reserve Growth By Accelerating Capital Investments 19 $14 $21 $25 Q1 2013 Q2 2013 Q3 2013 Est. Q4 2013 Investment in Exploration, Drilling and Lease Acquisition ($ in millions)

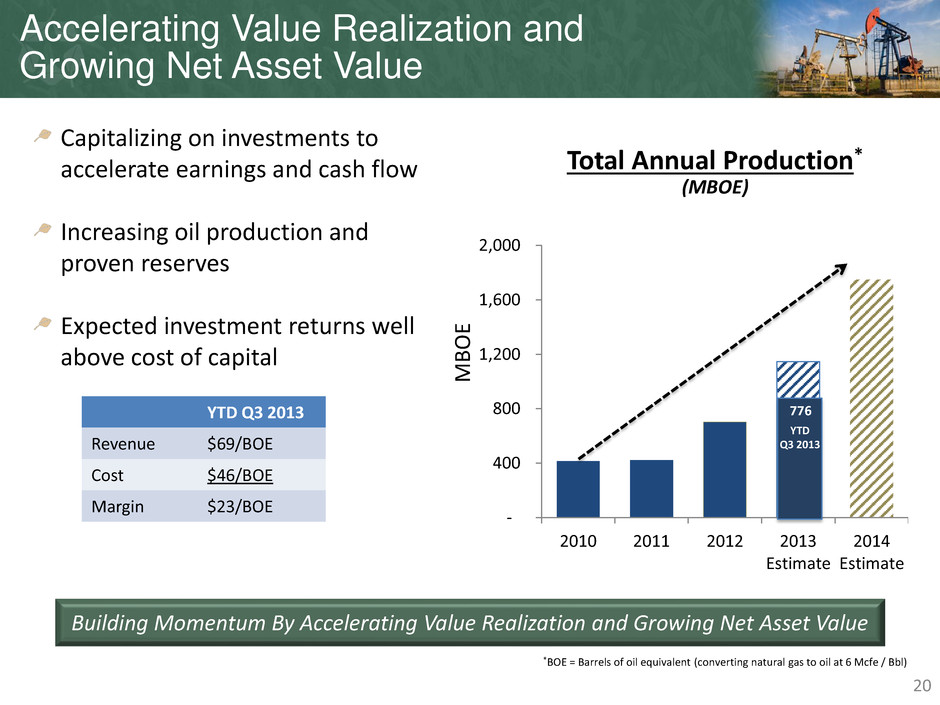

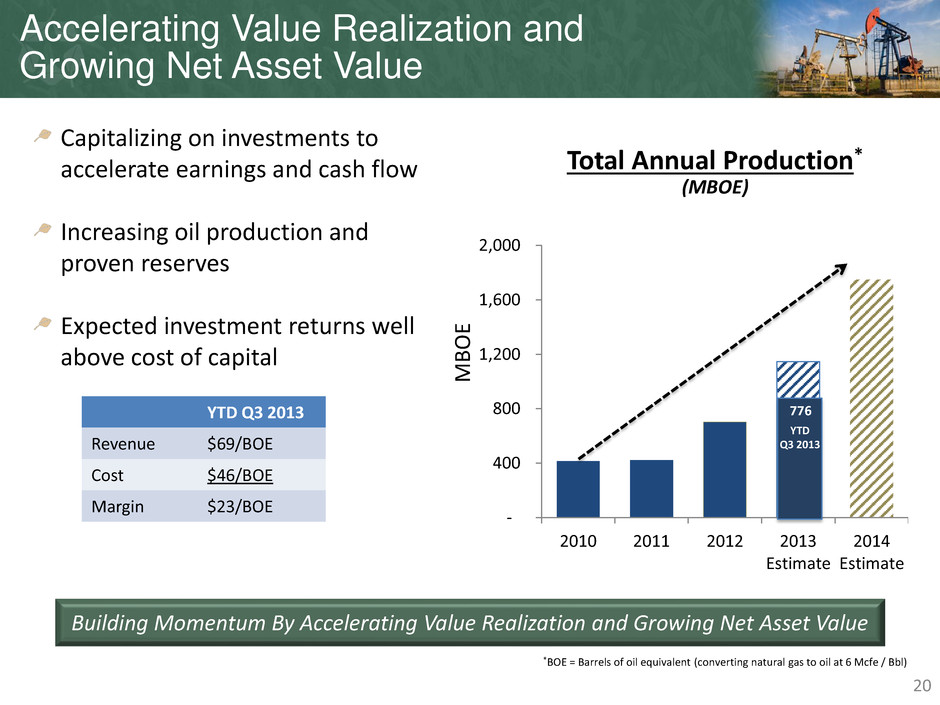

Accelerating Value Realization and Growing Net Asset Value Building Momentum By Accelerating Value Realization and Growing Net Asset Value Capitalizing on investments to accelerate earnings and cash flow Increasing oil production and proven reserves Expected investment returns well above cost of capital 20 - 400 800 1,200 1,600 2,000 2010 2011 2012 2013 Estimate 2014 Estimate MBO E Total Annual Production* (MBOE) YTD Q3 2013 776 *BOE = Barrels of oil equivalent (converting natural gas to oil at 6 Mcfe / Bbl) YTD Q3 2013 Revenue $69/BOE Cost $46/BOE Margin $23/BOE

Other Natural Resources Third Quarter 2013 Highlights Building Momentum Through Sustainable Harvests and Maximizing Recreational Lease Activity 21

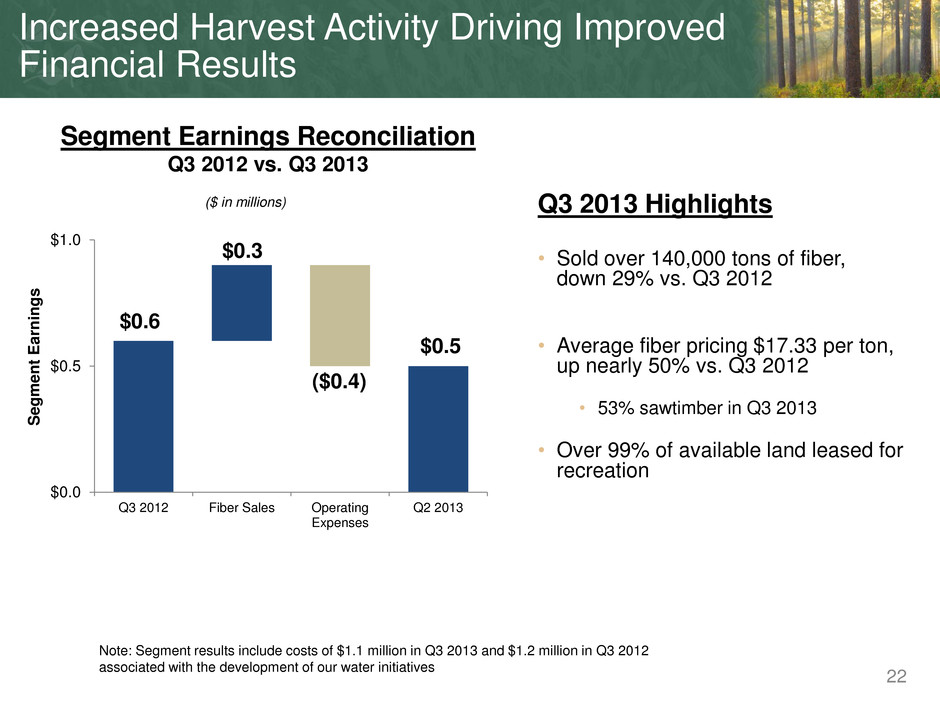

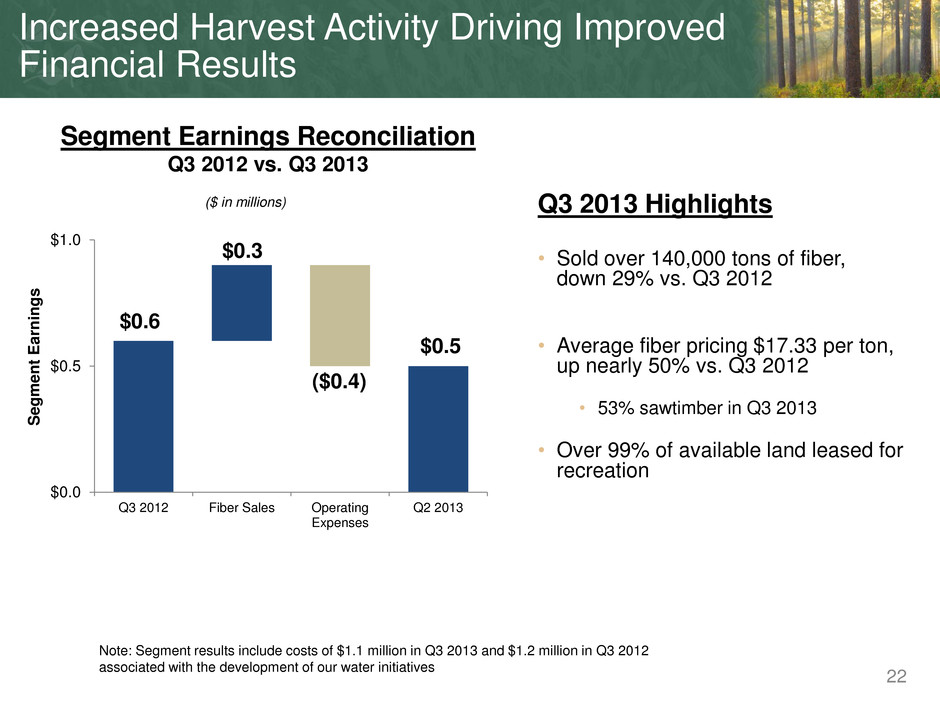

Increased Harvest Activity Driving Improved Financial Results $0.5 $0.3 $0.6 ($0.4) $0.0 $0.5 $1.0 Q3 2012 Fiber Sales Operating Expenses Q2 2013 S e gm e n t E a rning s Q3 2013 Highlights • Sold over 140,000 tons of fiber, down 29% vs. Q3 2012 • Average fiber pricing $17.33 per ton, up nearly 50% vs. Q3 2012 • 53% sawtimber in Q3 2013 • Over 99% of available land leased for recreation ($ in millions) 22 Segment Earnings Reconciliation Q3 2012 vs. Q3 2013 Note: Segment results include costs of $1.1 million in Q3 2013 and $1.2 million in Q3 2012 associated with the development of our water initiatives

Third Quarter 2013 Triple in FOR Initiatives Building Momentum By Accelerating Value Realization, Optimizing Transparency and Growing Net Asset Value 23

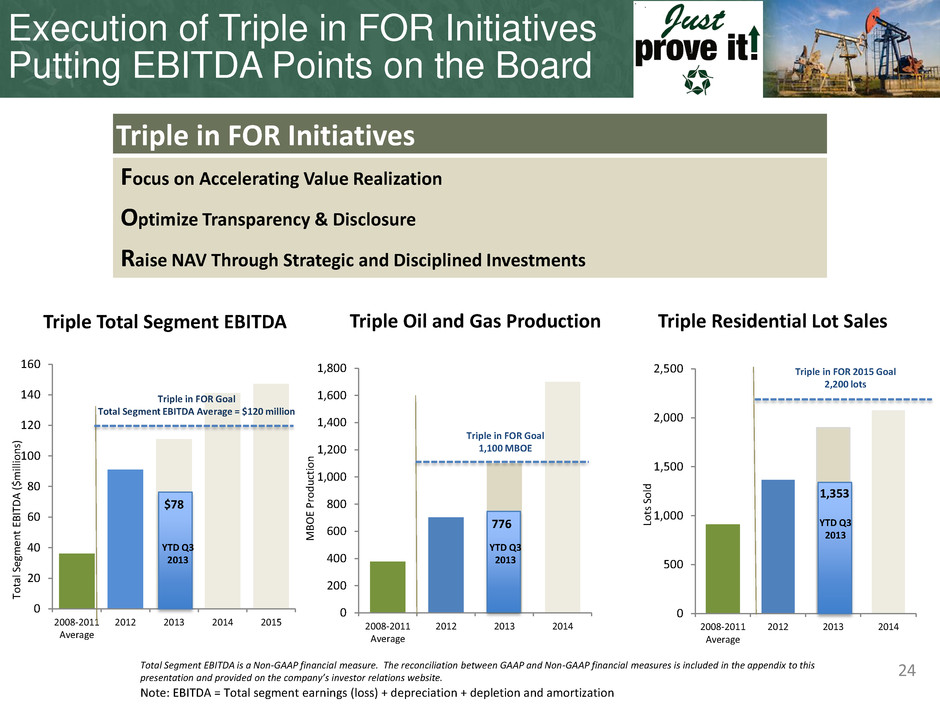

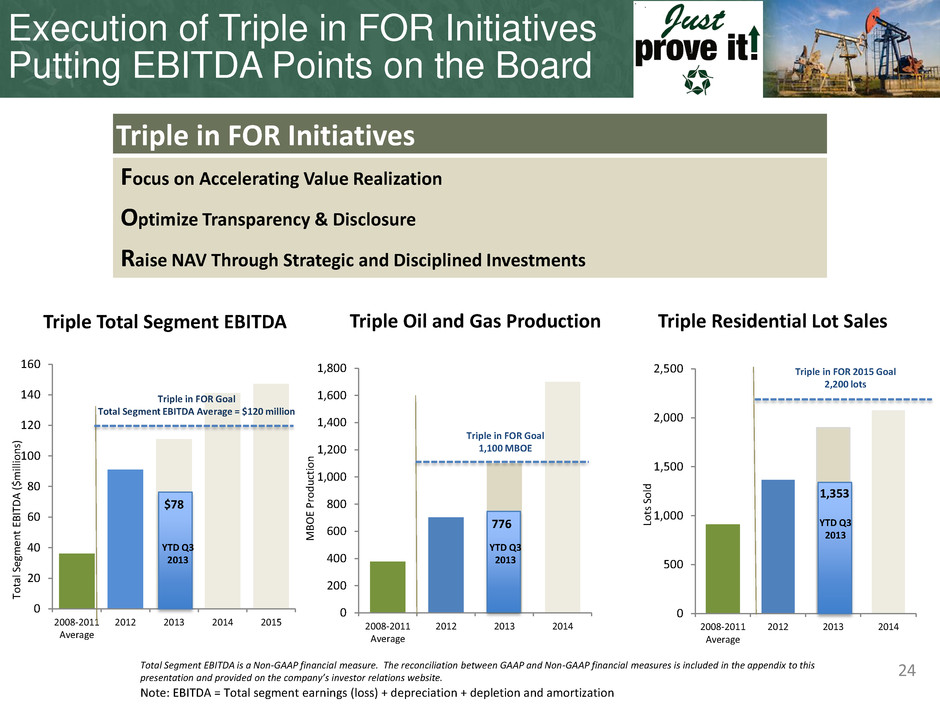

Triple in FOR Initiatives Focus on Accelerating Value Realization Optimize Transparency & Disclosure Raise NAV Through Strategic and Disciplined Investments 24 Triple Residential Lot Sales Triple Oil and Gas Production 0 500 1,000 1,500 2,000 2,500 2008-2011 Average 2012 2013 2014 Lo ts S o ld Triple in FOR 2015 Goal 2,200 lots 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2008-2011 Average 2012 2013 2014 Triple in FOR Goal 1,100 MBOE 0 20 40 60 80 100 120 140 160 2008-2011 Average 2012 2013 2014 2015 Triple in FOR Goal Total Segment EBITDA Average = $120 million Triple Total Segment EBITDA YTD Q3 2013 Note: EBITDA = Total segment earnings (loss) + depreciation + depletion and amortization Total Segment EBITDA is a Non-GAAP financial measure. The reconciliation between GAAP and Non-GAAP financial measures is included in the appendix to this presentation and provided on the company’s investor relations website. Execution of Triple in FOR Initiatives Putting EBITDA Points on the Board To ta l S eg m en t EB IT D A ( $mi lli o n s) MB O E Pr o d u ct io n 1,353 776 $78 YTD Q3 2013 YTD Q3 2013

Raising NAV Through Strategic and Disciplined Investments Investment Returns Expected to Exceed Cost of Capital Accelerating oil and gas investments Driving production, reserves and returns Real estate investments increasing with housing demand Forestar markets – tight inventories, solid job growth 25

For questions, please contact: Building Momentum By Accelerating Value Realization, Optimizing Transparency and Growing Net Asset Value 26 Anna Torma SVP Corporate Affairs Forestar Group Inc. 6300 Bee Cave Road Building Two, Suite 500 Austin, TX 78746 512-433-5312 annatorma@forestargroup.com

Third Quarter 2013 Appendix - Segment KPI’s - Reconciliation of Non-GAAP Financial Measures Building Momentum By Accelerating Value Realization, Optimizing Transparency and Growing Net Asset Value 27

Q3 2013 Q3 2012 YTD Q3 2013 YTD Q3 2012 Residential Lot Sales Lots Sold 547 269 1,353 981 Average Price / Lot $56,500 $54,100 $55,300 $49,700 Gross Profit / Lot $25,800 $20,100 $24,000 $18,000 Commercial Tract Sales Acres Sold 19 18 56 56 Average Price / Acre $257,500 $133,900 $169,700 $75,100 Land Sales Acres Sold 1,340 564 3,301 1,952 Average Price / Acre $5,000 $2,800 $3,600 $2,700 Segment Revenues ($ in Millions) $50.4 $27.1 $170.3 $71.7 Segment Earnings ($ in Millions) $13.2 $12.7 $40.8 $31.9 *Q3 2012 and YTD 2012 real estate segment results include a pre-tax gain of $10.2 million associated with the sale of Broadstone Memorial, a multifamily community in Houston. YTD 2012 real estate segment results also include a gain of $11.7 million associated with the sale of our 25% partnership interest in a commercial office project in Austin ** YTD 2013 real estate segment results include revenues of $41 million and earnings of $10.9 million associated with the sale of Promesa multifamily community we developed in Austin. Note: Includes ventures 28 28 28 Real Estate Segment KPI’s ** * ** *

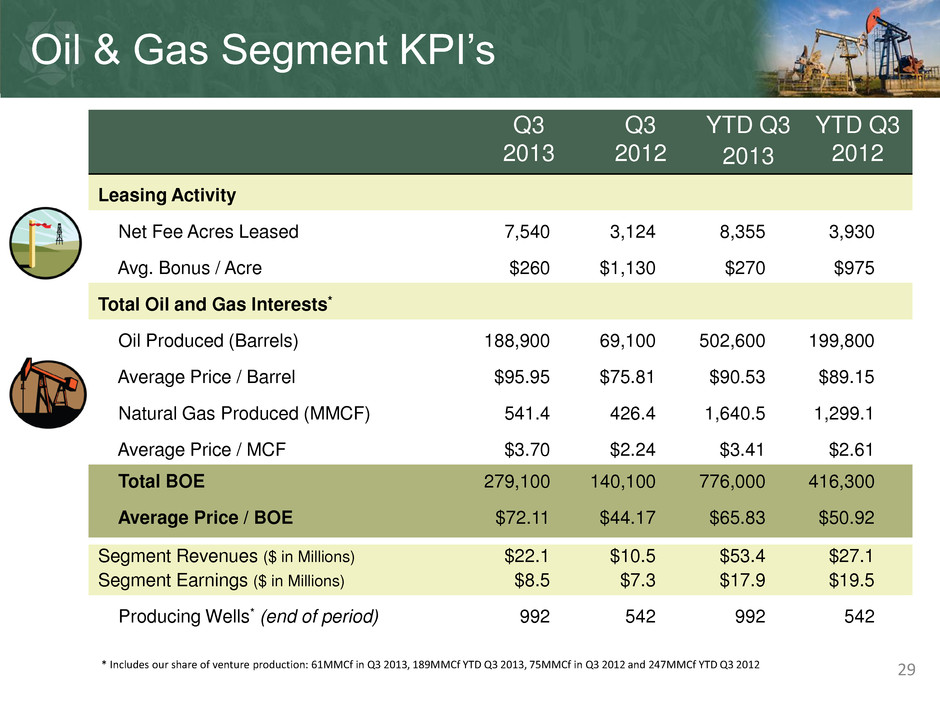

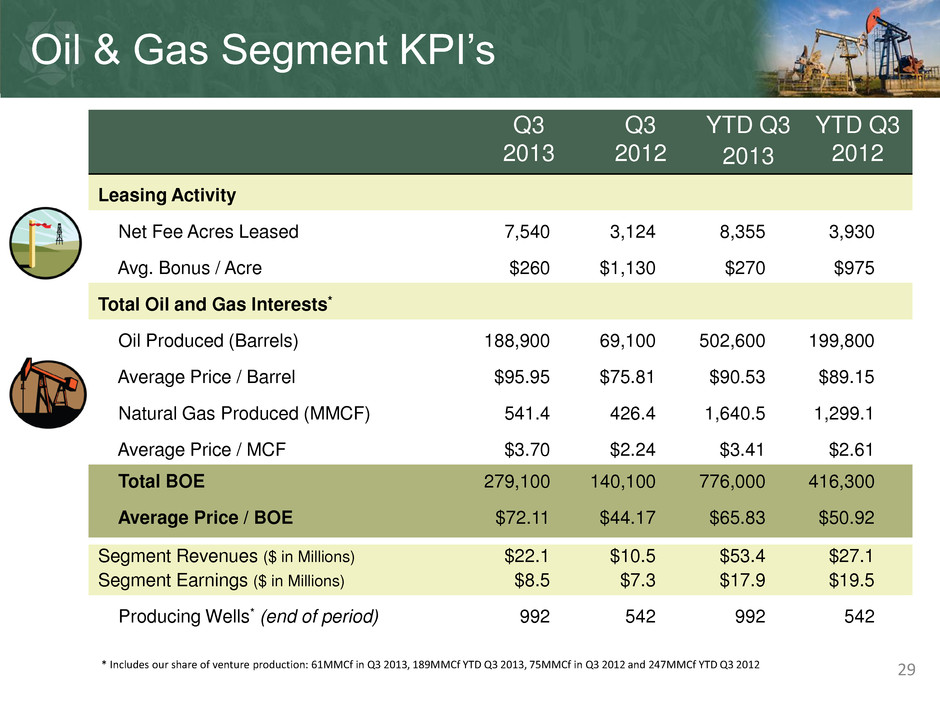

Q3 2013 Q3 2012 YTD Q3 2013 YTD Q3 2012 Leasing Activity Net Fee Acres Leased 7,540 3,124 8,355 3,930 Avg. Bonus / Acre $260 $1,130 $270 $975 Total Oil and Gas Interests* Oil Produced (Barrels) 188,900 69,100 502,600 199,800 Average Price / Barrel $95.95 $75.81 $90.53 $89.15 Natural Gas Produced (MMCF) 541.4 426.4 1,640.5 1,299.1 Average Price / MCF $3.70 $2.24 $3.41 $2.61 Total BOE 279,100 140,100 776,000 416,300 Average Price / BOE $72.11 $44.17 $65.83 $50.92 Segment Revenues ($ in Millions) $22.1 $10.5 $53.4 $27.1 Segment Earnings ($ in Millions) $8.5 $7.3 $17.9 $19.5 Producing Wells* (end of period) 992 542 992 542 * Includes our share of venture production: 61MMCf in Q3 2013, 189MMCf YTD Q3 2013, 75MMCf in Q3 2012 and 247MMCf YTD Q3 2012 29 29 Oil & Gas Segment KPI’s

30 Q3 2013 Q3 2012 YTD Q3 2013 YTD Q3 2012 Fiber Sales Pulpwood Tons Sold 65,700 160,000 314,400 265,200 Average Pulpwood Price / Ton $12.56 $9.54 $11.53 $9.51 Sawtimber Tons Sold 74,900 37,400 202,700 66,700 Average Sawtimber Price / Ton $21.52 $20.21 $22.47 $19.88 Total Tons Sold 140,600 197,400 517,100 331,900 Average Price / Ton $17.33 $11.56 $15.82 $11.59 Recreational Leases Average Acres Leased 118,700 129,200 120,900 130,500 Average Lease Rate / Acre $8.63 $8.84 $9.08 $8.84 Segment Revenues ($ in Millions) $2.7 $3.0 $9.0 $5.3 Segment Earnings (Loss) ($ in Millions) * $0.5 $0.6 $2.8 ($0.8) 30 30 Other Natural Resources Segment KPI’s * Note: Segment results include costs of $1.1 million in Q3 2013 , $3.0 million YTD Q3 2013, $1.2 million in Q3 2012 and $3.6 million YTD Q3 2012 associated with the development of our water initiatives

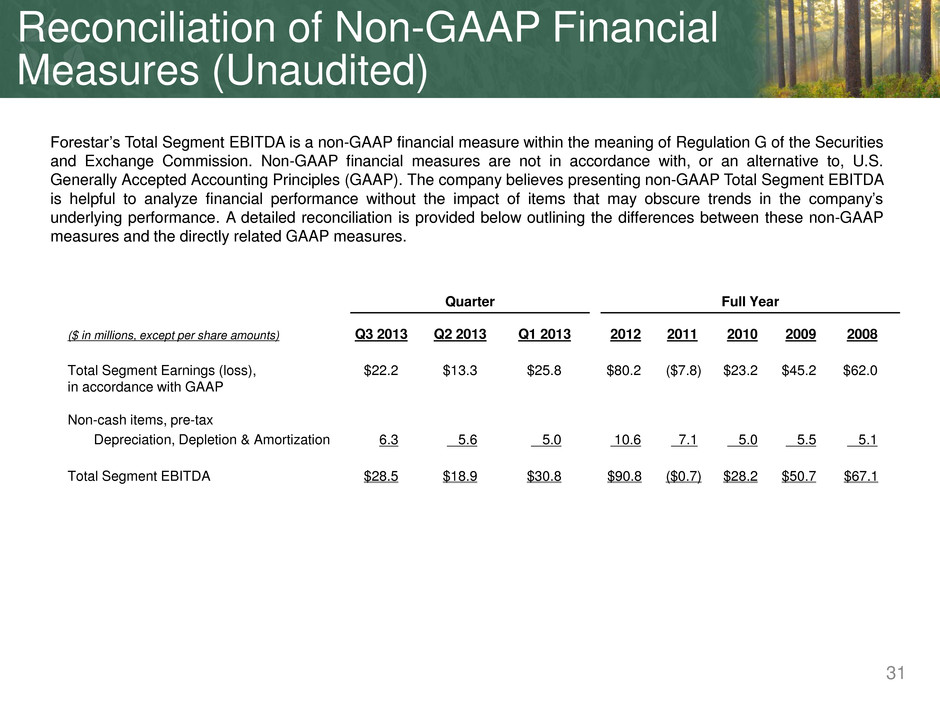

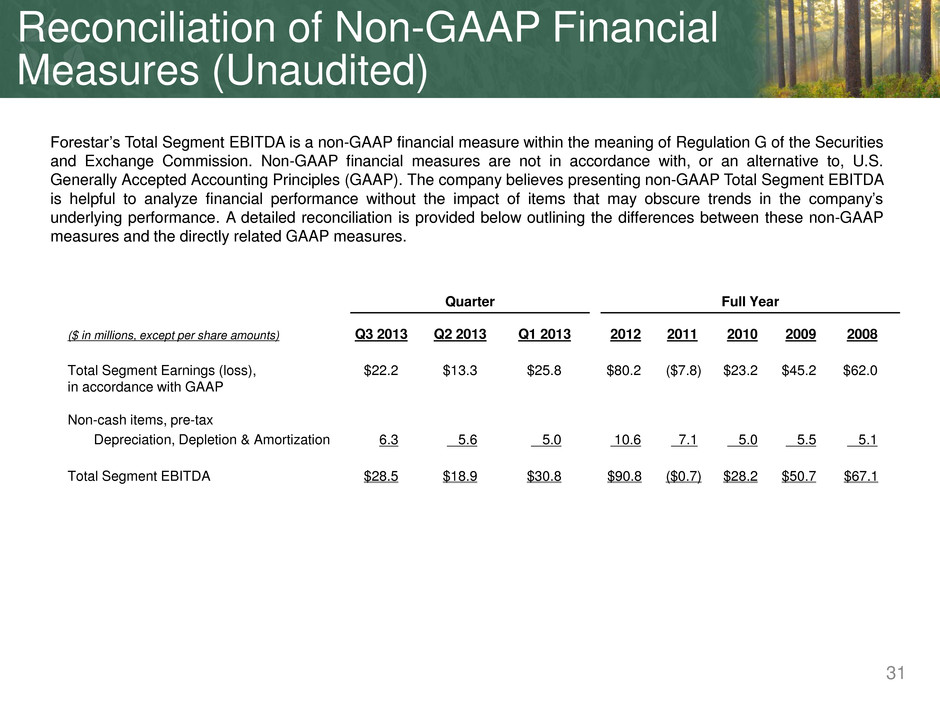

31 Forestar’s Total Segment EBITDA is a non-GAAP financial measure within the meaning of Regulation G of the Securities and Exchange Commission. Non-GAAP financial measures are not in accordance with, or an alternative to, U.S. Generally Accepted Accounting Principles (GAAP). The company believes presenting non-GAAP Total Segment EBITDA is helpful to analyze financial performance without the impact of items that may obscure trends in the company’s underlying performance. A detailed reconciliation is provided below outlining the differences between these non-GAAP measures and the directly related GAAP measures. Quarter Full Year ($ in millions, except per share amounts) Q3 2013 Q2 2013 Q1 2013 2012 2011 2010 2009 2008 Total Segment Earnings (loss), in accordance with GAAP $22.2 $13.3 $25.8 $80.2 ($7.8) $23.2 $45.2 $62.0 Non-cash items, pre-tax Depreciation, Depletion & Amortization 6.3 5.6 5.0 10.6 7.1 5.0 5.5 5.1 Total Segment EBITDA $28.5 $18.9 $30.8 $90.8 ($0.7) $28.2 $50.7 $67.1 Reconciliation of Non-GAAP Financial Measures (Unaudited)

32 Forestar’s Oil and Gas Segment EBITDAX is a non-GAAP financial measure within the meaning of Regulation G of the Securities and Exchange Commission. Non-GAAP financial measures are not in accordance with, or an alternative to, U.S. Generally Accepted Accounting Principles (GAAP). The company believes presenting non-GAAP Oil and Gas Segment EBITDAX is helpful to analyze financial performance without the impact of items that may obscure trends in the company’s underlying performance. A detailed reconciliation is provided below outlining the differences between these non-GAAP measures and the directly related GAAP measures. Quarter ($ in millions, except per share amounts) Q3 2013 Q3 2012 Oil and Gas Segment Earnings, in accordance with GAAP $8.5 $7.3 EBITDAX adjustments, pre-tax Depreciation, Depletion & Amortization 5.4 0.9 Geological, Geophysical, Seismic and Dry Hole Costs 1.7 0.0 Total Oil and Gas Segment EBITDAX $15.6 $8.2 Reconciliation of Non-GAAP Financial Measures (Unaudited)

For questions, please contact: Building Momentum By Accelerating Value Realization, Optimizing Transparency and Growing Net Asset Value Anna Torma SVP Corporate Affairs Forestar Group Inc. 6300 Bee Cave Road Building Two, Suite 500 Austin, TX 78746 512-433-5312 annatorma@forestargroup.com 33