Information on Execution of Key Initiatives and Second Quarter 2016 Financial Results July 29, 2016 Exhibit 99.2

Notice to Investors This presentation contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are typically identified by words or phrases such as “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,” and other words and terms of similar meaning. These statements reflect management’s current views with respect to future events and are subject to risk and uncertainties. We note that a variety of factors and uncertainties could cause our actual results to differ significantly from the results discussed in the forward-looking statements, including but not limited to: general economic, market, or business conditions; market demand for our non-core assets;changes in commodity prices; opportunities (or lack thereof) that may be presented to us and that we may pursue; fluctuations in costs and expenses including development costs; demand for new housing, including impacts from mortgage credit rates or availability; lengthy and uncertain entitlement processes; cyclicality of our businesses; accuracy of accounting assumptions; competitive actions by other companies; changes in laws or regulations; and other factors, many of which are beyond our control. Except as required by law, we expressly disclaim any obligation to publicly revise any forward- looking statements contained in this presentation to reflect the occurrence of events after the date of this presentation. This presentation includes Non-GAAP financial measures. The required reconciliation to GAAP financial measures can be found as an exhibit to this presentation and on our website at www.forestargroup.com. 2

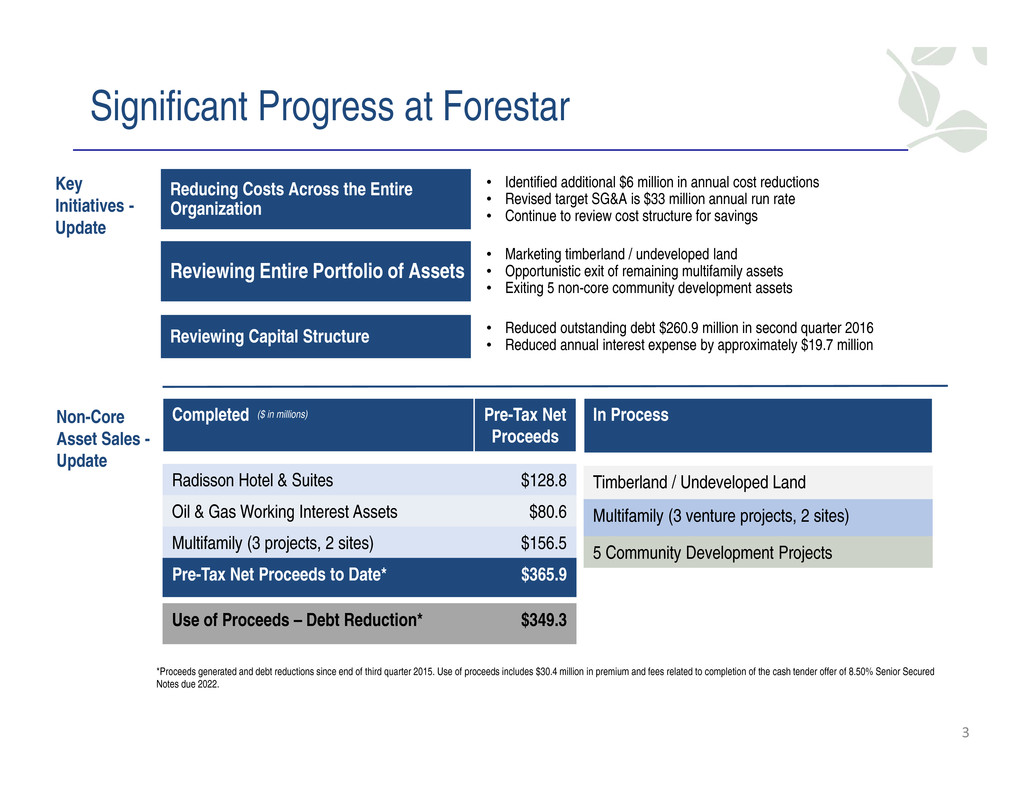

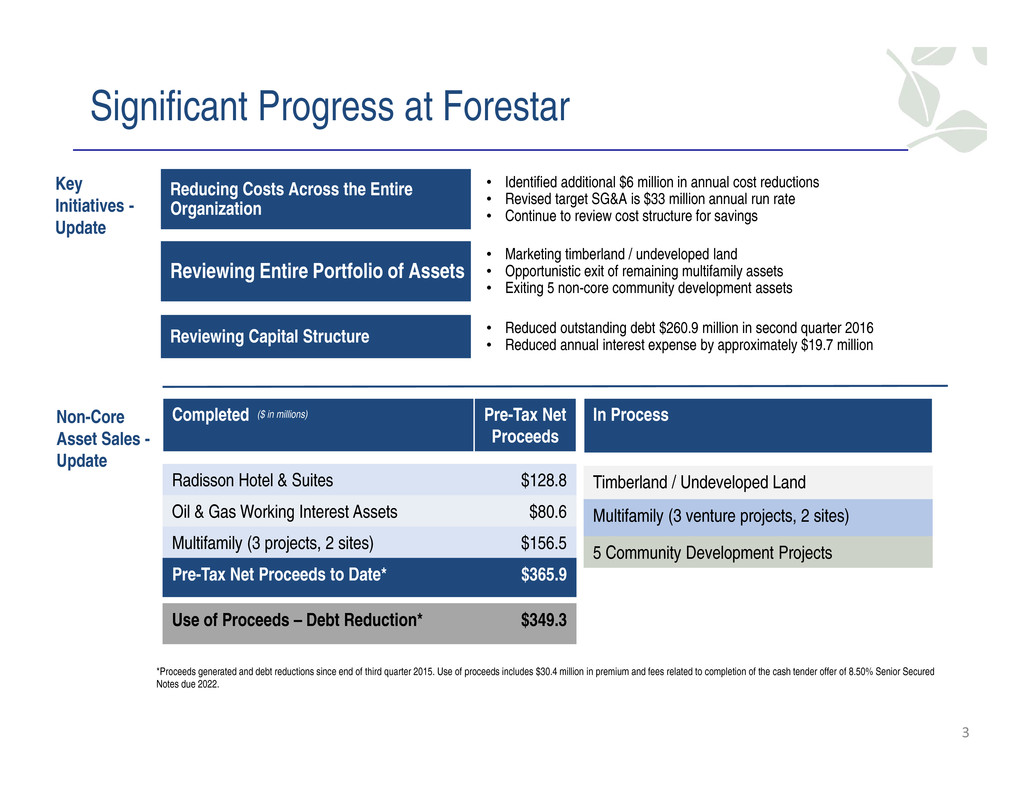

Significant Progress at Forestar Completed Pre-Tax Net Proceeds Radisson Hotel & Suites $128.8 Oil & Gas Working Interest Assets $80.6 Multifamily (3 projects, 2 sites) $156.5 Pre-Tax Net Proceeds to Date* $365.9 ($ in millions) In Process Timberland / Undeveloped Land Multifamily (3 venture projects, 2 sites) 5 Community Development Projects Non-Core Asset Sales - Update Reducing Costs Across the Entire Organization • Identified additional $6 million in annual cost reductions • Revised target SG&A is $33 million annual run rate • Continue to review cost structure for savings Reviewing Entire Portfolio of Assets • Marketing timberland / undeveloped land • Opportunistic exit of remaining multifamily assets • Exiting 5 non-core community development assets Reviewing Capital Structure • Reduced outstanding debt $260.9 million in second quarter 2016• Reduced annual interest expense by approximately $19.7 million Use of Proceeds – Debt Reduction* $349.3 Key Initiatives - Update *Proceeds generated and debt reductions since end of third quarter 2015. Use of proceeds includes $30.4 million in premium and fees related to completion of the cash tender offer of 8.50% Senior Secured Notes due 2022. 3

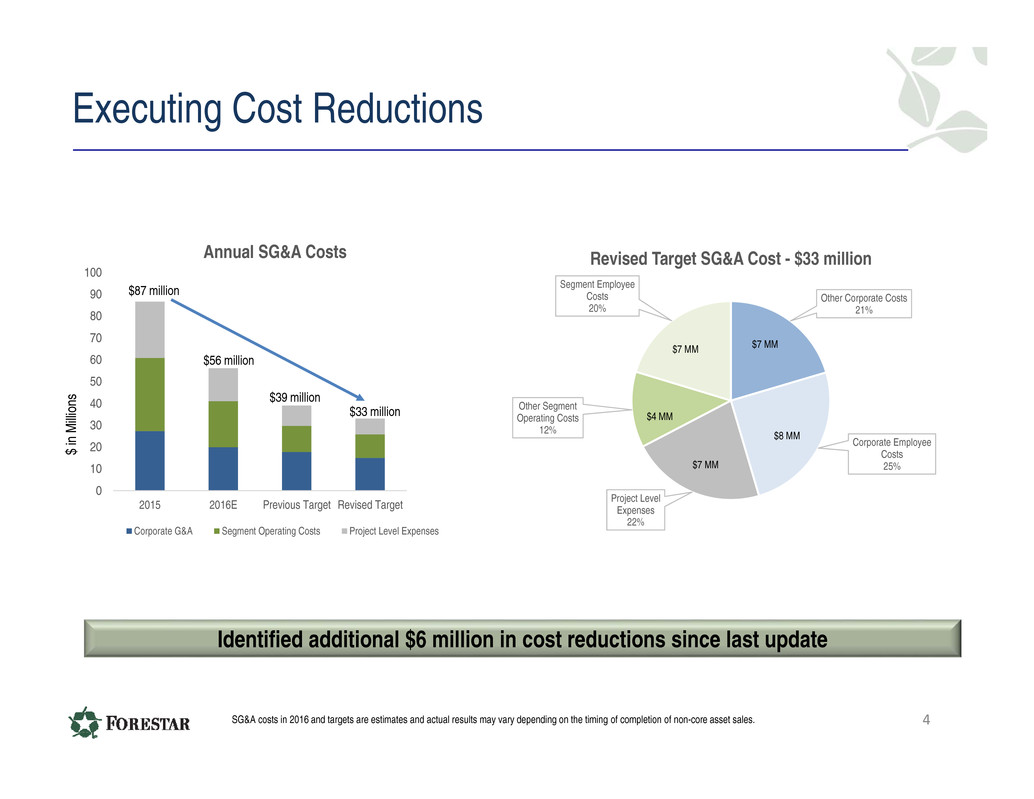

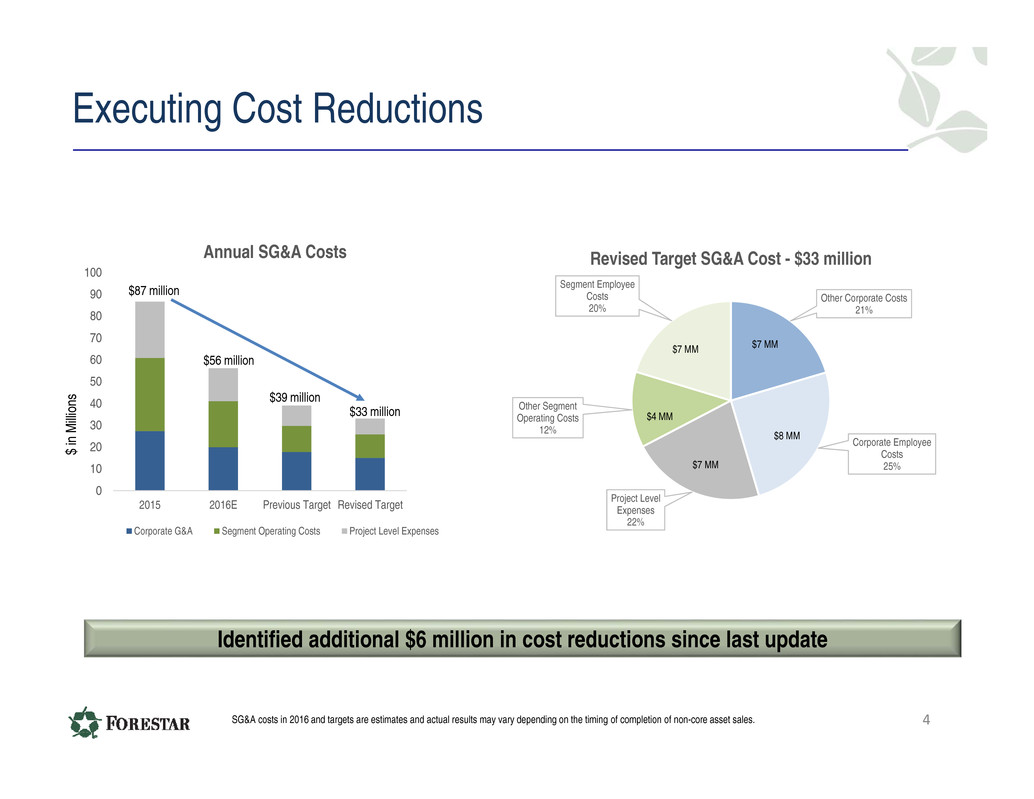

Executing Cost Reductions 4 0 10 20 30 40 50 60 70 80 90 100 2015 2016E Previous Target Revised Target Annual SG&A Costs Corporate G&A Segment Operating Costs Project Level Expenses $39 million SG&A costs in 2016 and targets are estimates and actual results may vary depending on the timing of completion of non-core asset sales. $87 million $ i n M i l l i o n s $56 million Other Corporate Costs 21% Corporate Employee Costs 25% Project Level Expenses 22% Other Segment Operating Costs 12% Segment Employee Costs 20% Revised Target SG&A Cost - $33 million $7 MM $8 MM $7 MM$7 MM $4 MM Identified additional $6 million in cost reductions since last update $33 million

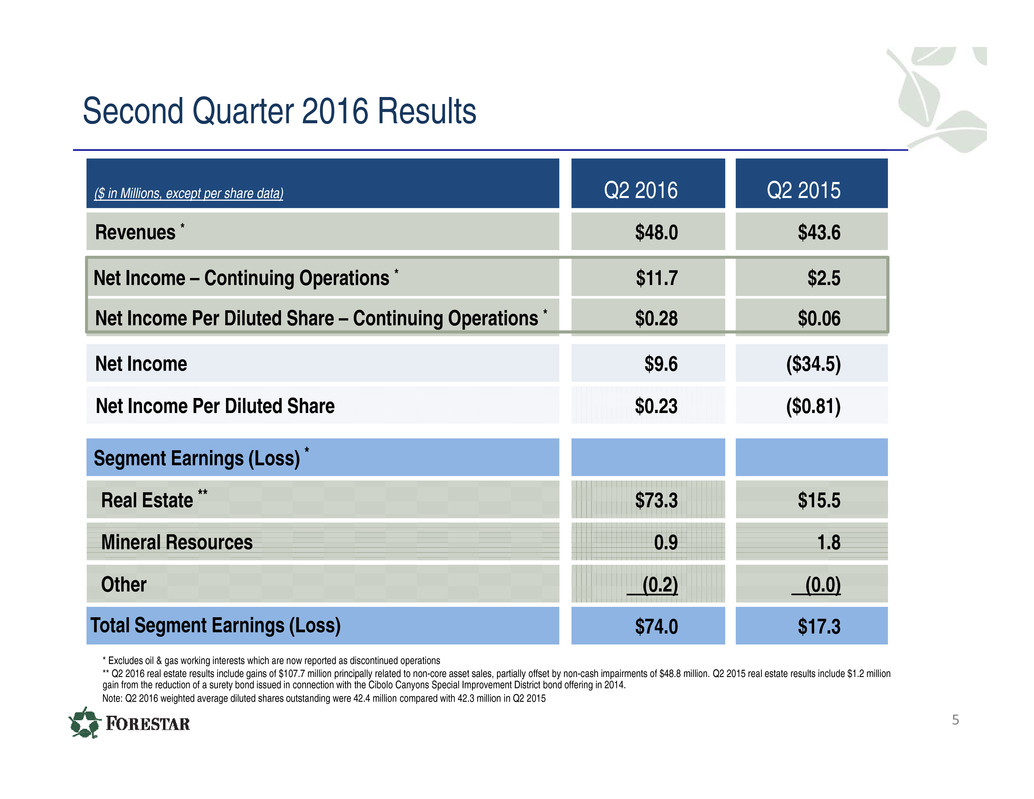

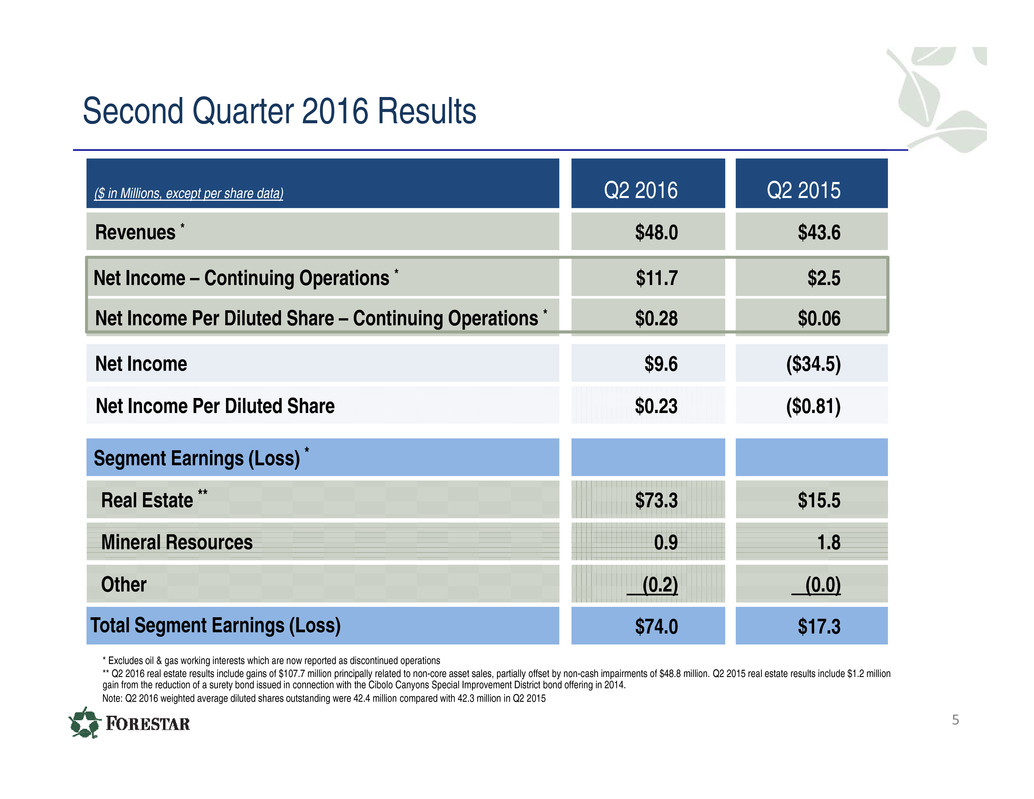

Second Quarter 2016 Results 5 ($ in Millions, except per share data) Q2 2016 Q2 2015 Revenues * $48.0 $43.6 Net Income – Continuing Operations * $11.7 $2.5 Net Income Per Diluted Share – Continuing Operations * $0.28 $0.06 Net Income $9.6 ($34.5) Net Income Per Diluted Share $0.23 ($0.81) Segment Earnings (Loss) * Real Estate ** $73.3 $15.5 Mineral Resources 0.9 1.8 Other (0.2) (0.0) Total Segment Earnings (Loss) $74.0 $17.3 ** Q2 2016 real estate results include gains of $107.7 million principally related to non-core asset sales, partially offset by non-cash impairments of $48.8 million. Q2 2015 real estate results include $1.2 million gain from the reduction of a surety bond issued in connection with the Cibolo Canyons Special Improvement District bond offering in 2014. Note: Q2 2016 weighted average diluted shares outstanding were 42.4 million compared with 42.3 million in Q2 2015 * Excludes oil & gas working interests which are now reported as discontinued operations

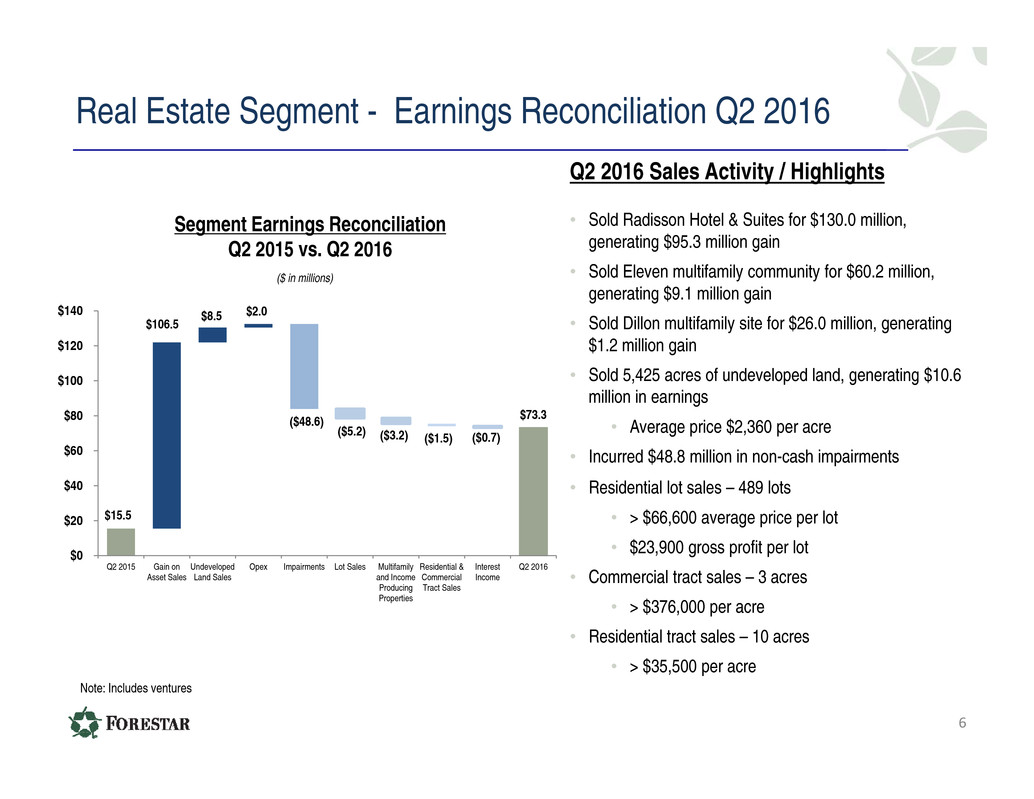

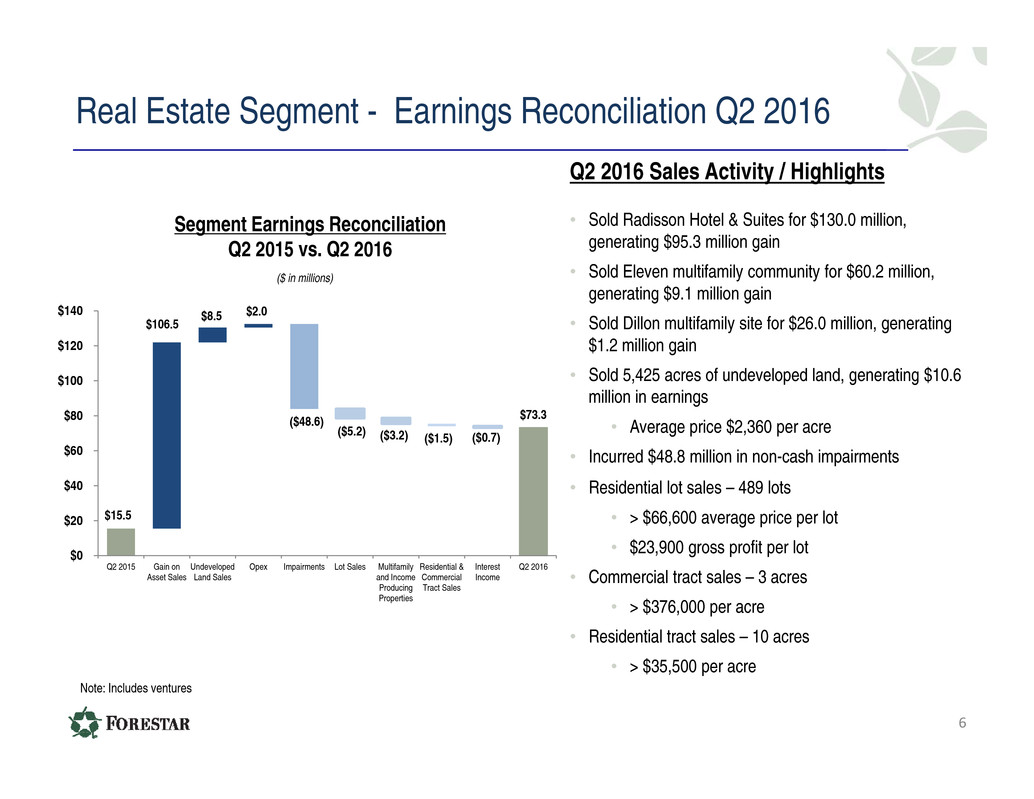

Real Estate Segment - Earnings Reconciliation Q2 2016 ($48.6) ($5.2) $15.5 $106.5 $8.5 $2.0 ($3.2) ($1.5) ($0.7) $73.3 $0 $20 $40 $60 $80 $100 $120 $140 Q2 2015 Gain on Asset Sales Undeveloped Land Sales Opex Impairments Lot Sales Multifamily and Income Producing Properties Residential & Commercial Tract Sales Interest Income Q2 2016 Segment Earnings Reconciliation Q2 2015 vs. Q2 2016 ($ in millions) Q2 2016 Sales Activity / Highlights • Sold Radisson Hotel & Suites for $130.0 million, generating $95.3 million gain • Sold Eleven multifamily community for $60.2 million, generating $9.1 million gain • Sold Dillon multifamily site for $26.0 million, generating $1.2 million gain • Sold 5,425 acres of undeveloped land, generating $10.6 million in earnings • Average price $2,360 per acre • Incurred $48.8 million in non-cash impairments • Residential lot sales – 489 lots • > $66,600 average price per lot • $23,900 gross profit per lot • Commercial tract sales – 3 acres • > $376,000 per acre • Residential tract sales – 10 acres • > $35,500 per acre 6 Note: Includes ventures

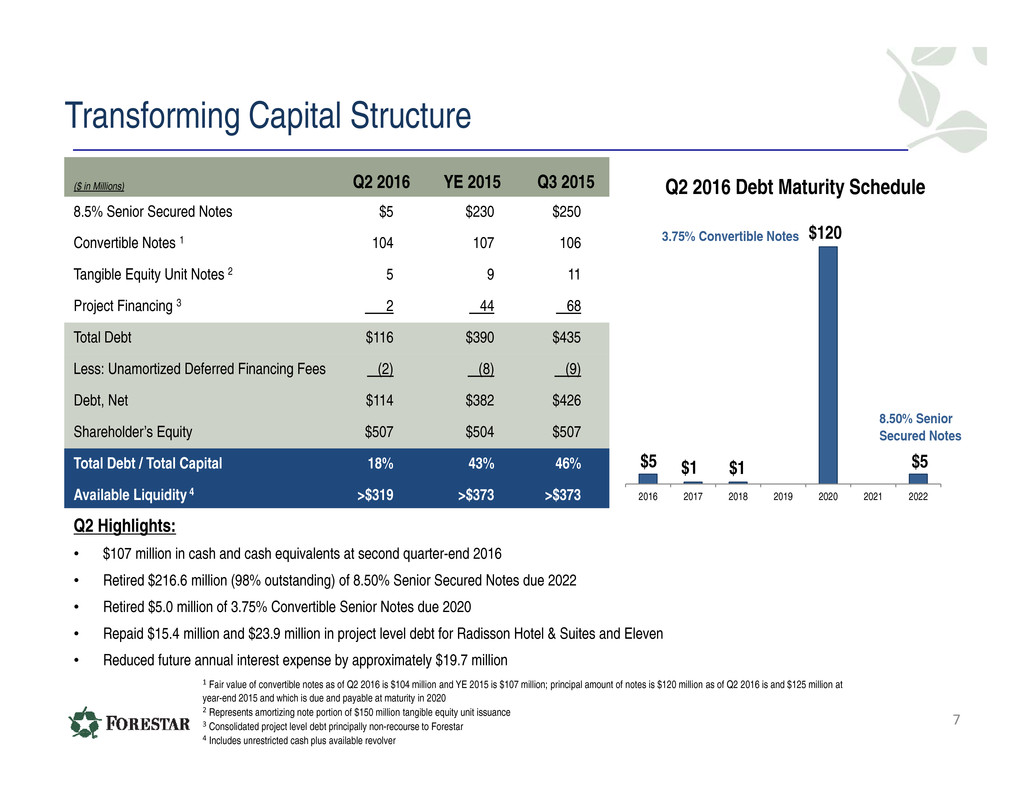

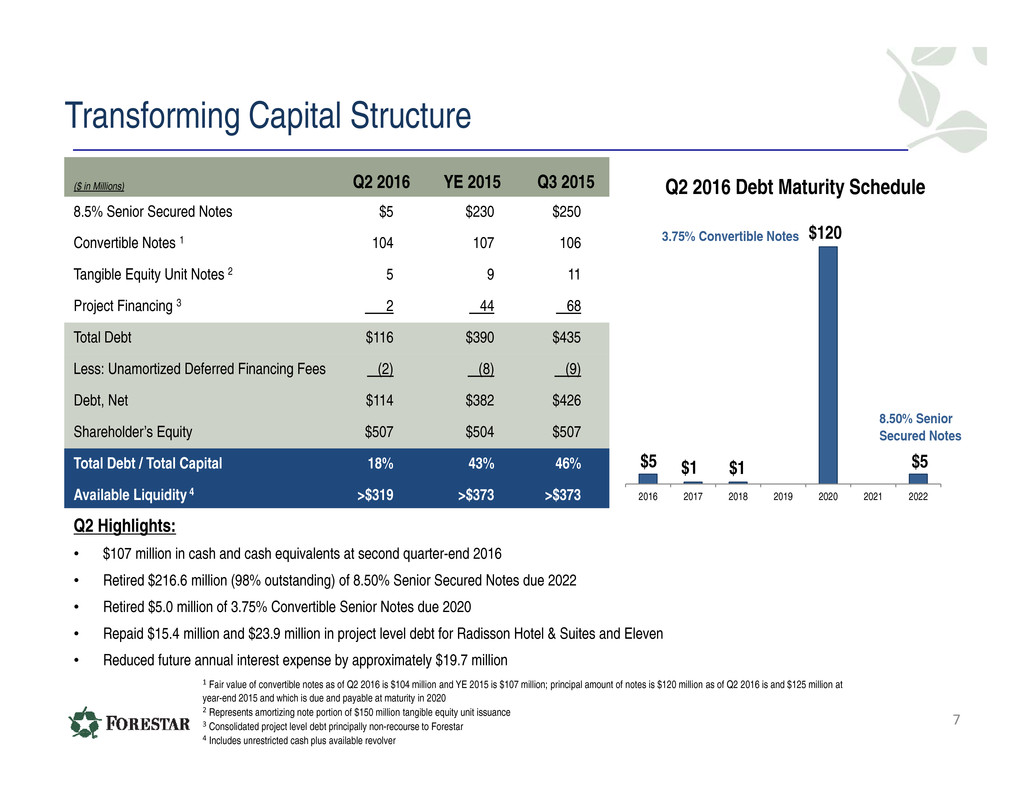

Q2 Highlights: • $107 million in cash and cash equivalents at second quarter-end 2016 • Retired $216.6 million (98% outstanding) of 8.50% Senior Secured Notes due 2022 • Retired $5.0 million of 3.75% Convertible Senior Notes due 2020 • Repaid $15.4 million and $23.9 million in project level debt for Radisson Hotel & Suites and Eleven • Reduced future annual interest expense by approximately $19.7 million Transforming Capital Structure 7 ($ in Millions) Q2 2016 YE 2015 Q3 2015 8.5% Senior Secured Notes $5 $230 $250 Convertible Notes 1 104 107 106 Tangible Equity Unit Notes 2 5 9 11 Project Financing 3 2 44 68 Total Debt $116 $390 $435 Less: Unamortized Deferred Financing Fees (2) (8) (9) Debt, Net $114 $382 $426 Shareholder’s Equity $507 $504 $507 Total Debt / Total Capital 18% 43% 46% Available Liquidity 4 >$319 >$373 >$373 $5$1 $1$5 $120 2016 2017 2018 2019 2020 2021 2022 Q2 2016 Debt Maturity Schedule 3.75% Convertible Notes 8.50% Senior Secured Notes 1 Fair value of convertible notes as of Q2 2016 is $104 million and YE 2015 is $107 million; principal amount of notes is $120 million as of Q2 2016 is and $125 million at year-end 2015 and which is due and payable at maturity in 2020 2 Represents amortizing note portion of $150 million tangible equity unit issuance 3 Consolidated project level debt principally non-recourse to Forestar 4 Includes unrestricted cash plus available revolver

8

9 Appendix

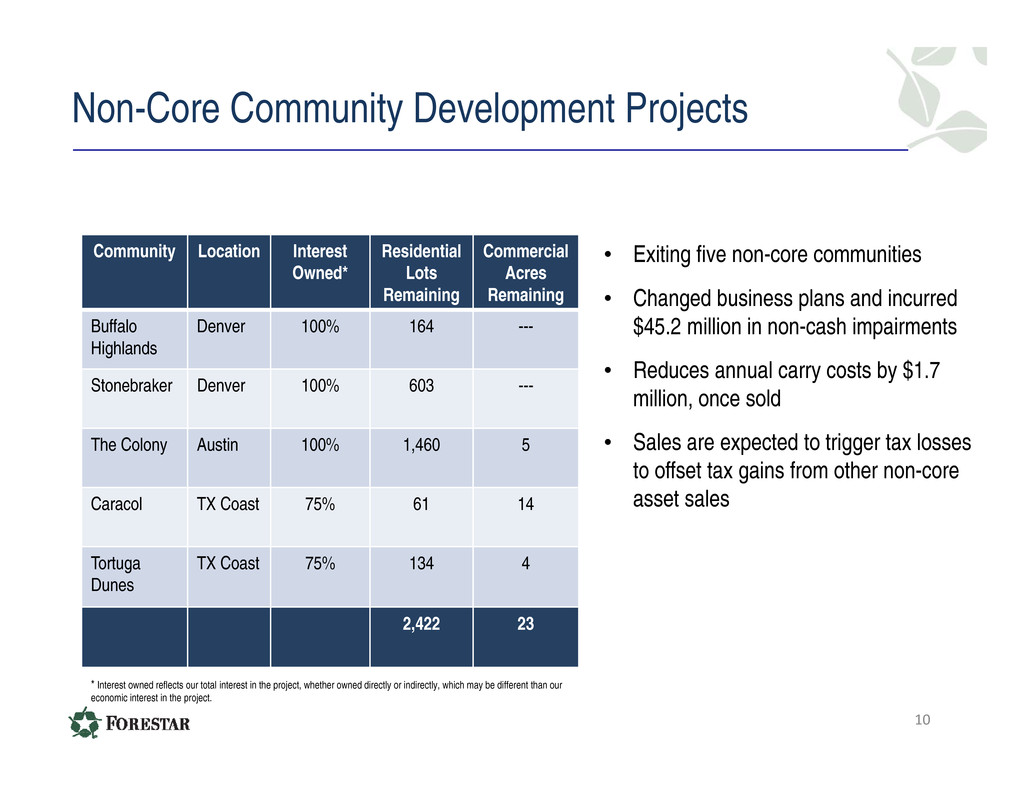

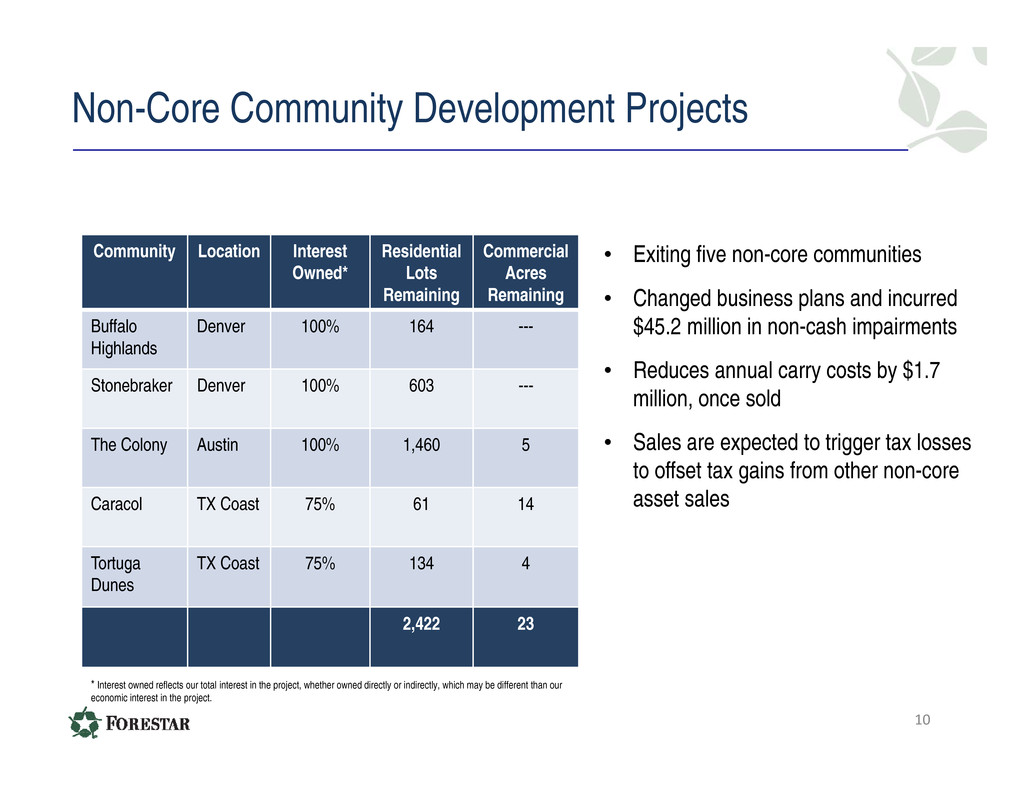

Non-Core Community Development Projects 10 • Exiting five non-core communities • Changed business plans and incurred $45.2 million in non-cash impairments • Reduces annual carry costs by $1.7 million, once sold • Sales are expected to trigger tax losses to offset tax gains from other non-core asset sales Community Location Interest Owned* Residential Lots Remaining Commercial Acres Remaining Buffalo Highlands Denver 100% 164 --- Stonebraker Denver 100% 603 --- The Colony Austin 100% 1,460 5 Caracol TX Coast 75% 61 14 Tortuga Dunes TX Coast 75% 134 4 2,422 23 * Interest owned reflects our total interest in the project, whether owned directly or indirectly, which may be different than our economic interest in the project.

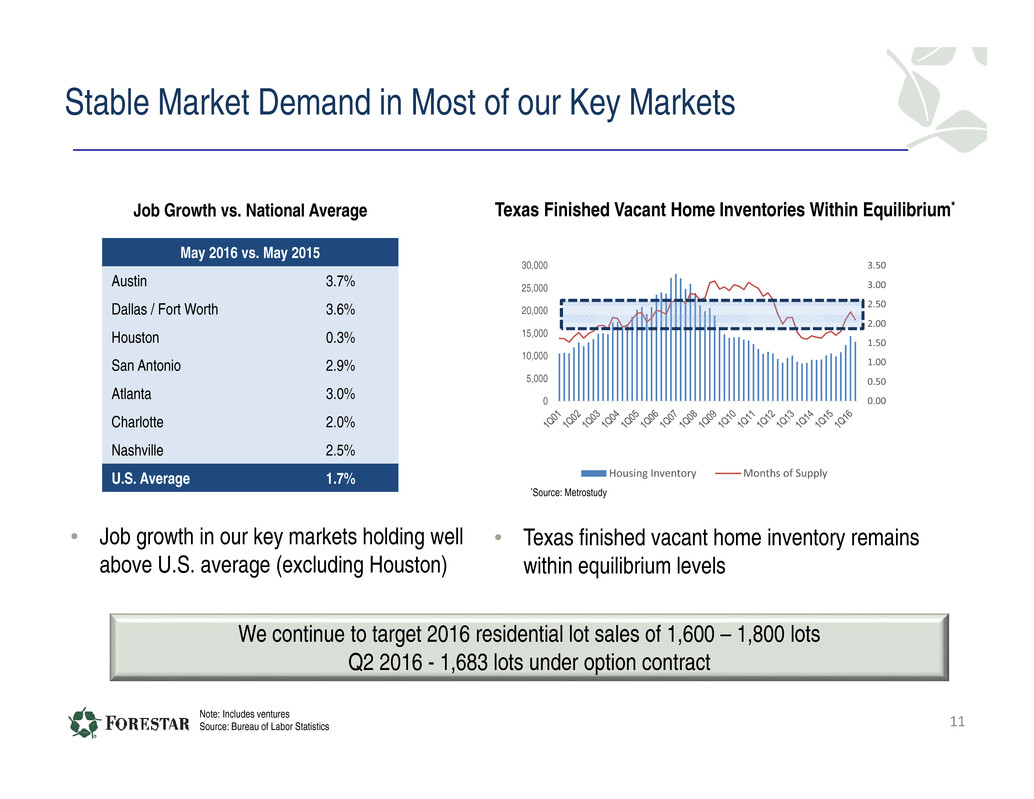

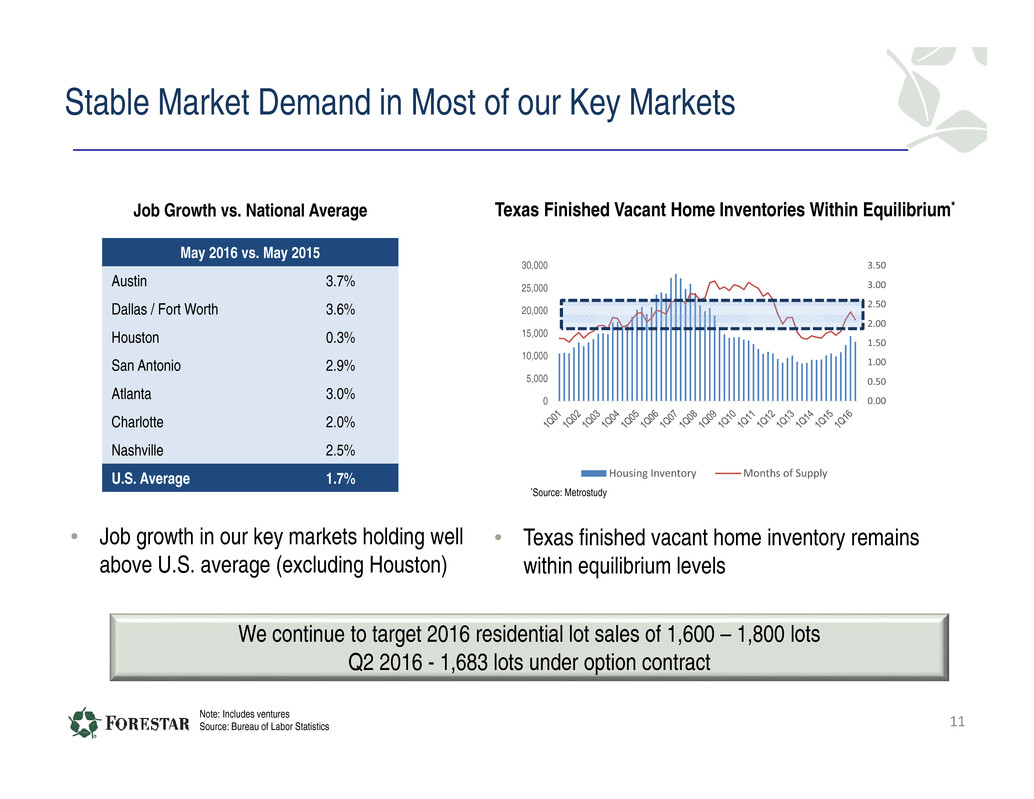

Stable Market Demand in Most of our Key Markets 11 Note: Includes ventures Source: Bureau of Labor Statistics May 2016 vs. May 2015 Austin 3.7% Dallas / Fort Worth 3.6% Houston 0.3% San Antonio 2.9% Atlanta 3.0% Charlotte 2.0% Nashville 2.5% U.S. Average 1.7% Job Growth vs. National Average • Job growth in our key markets holding well above U.S. average (excluding Houston) We continue to target 2016 residential lot sales of 1,600 – 1,800 lots Q2 2016 - 1,683 lots under option contract Texas Finished Vacant Home Inventories Within Equilibrium* 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 0 5,000 10,000 15,000 20,000 25,000 30,000 Housing Inventory Months of Supply *Source: Metrostudy • Texas finished vacant home inventory remains within equilibrium levels

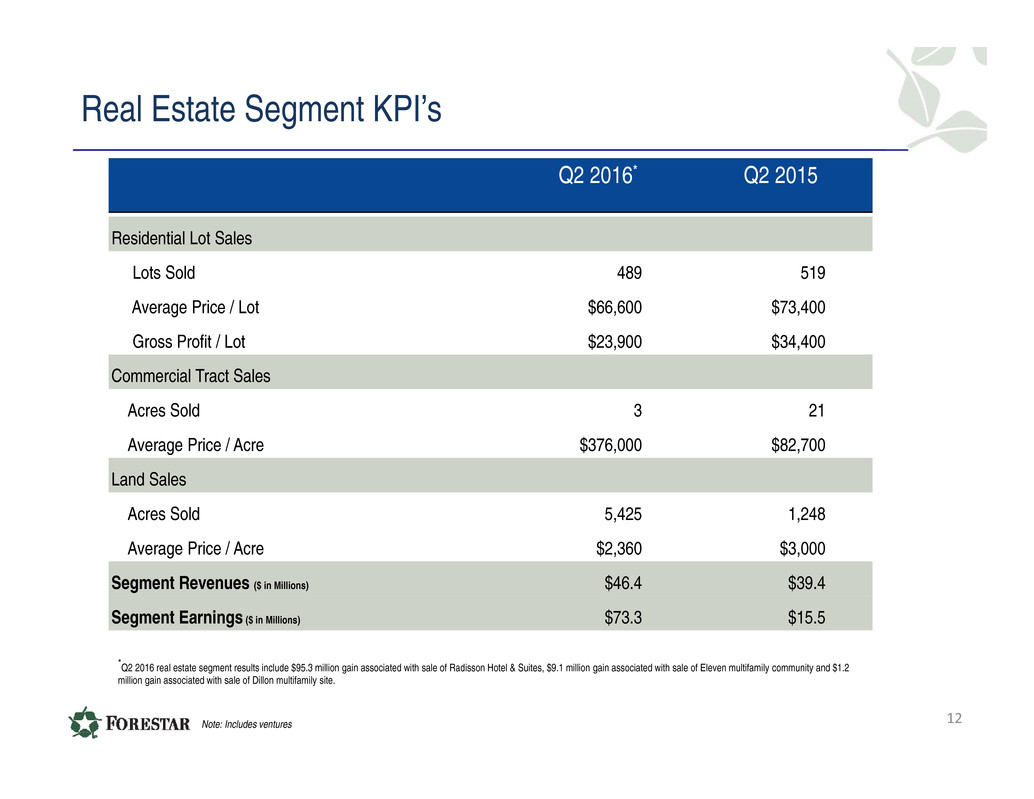

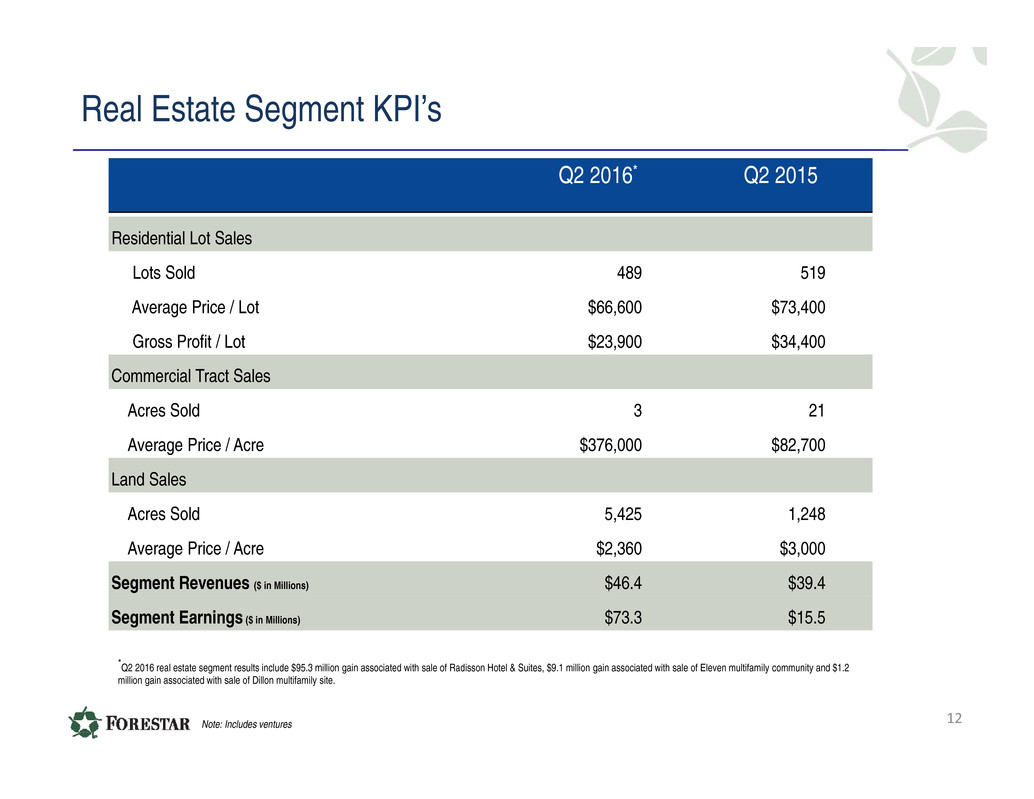

Real Estate Segment KPI’s Q2 2016* Q2 2015 Residential Lot Sales Lots Sold 489 519 Average Price / Lot $66,600 $73,400 Gross Profit / Lot $23,900 $34,400 Commercial Tract Sales Acres Sold 3 21 Average Price / Acre $376,000 $82,700 Land Sales Acres Sold 5,425 1,248 Average Price / Acre $2,360 $3,000 Segment Revenues ($ in Millions) $46.4 $39.4 Segment Earnings ($ in Millions) $73.3 $15.5 *Q2 2016 real estate segment results include $95.3 million gain associated with sale of Radisson Hotel & Suites, $9.1 million gain associated with sale of Eleven multifamily community and $1.2 million gain associated with sale of Dillon multifamily site. Note: Includes ventures 12

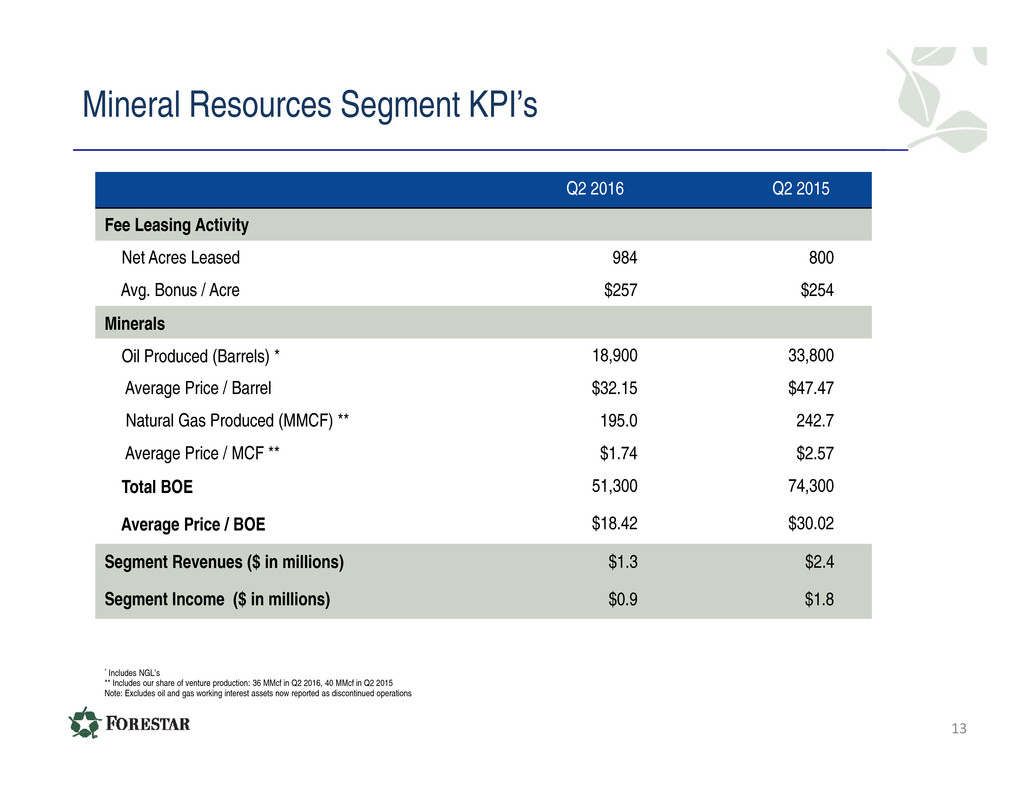

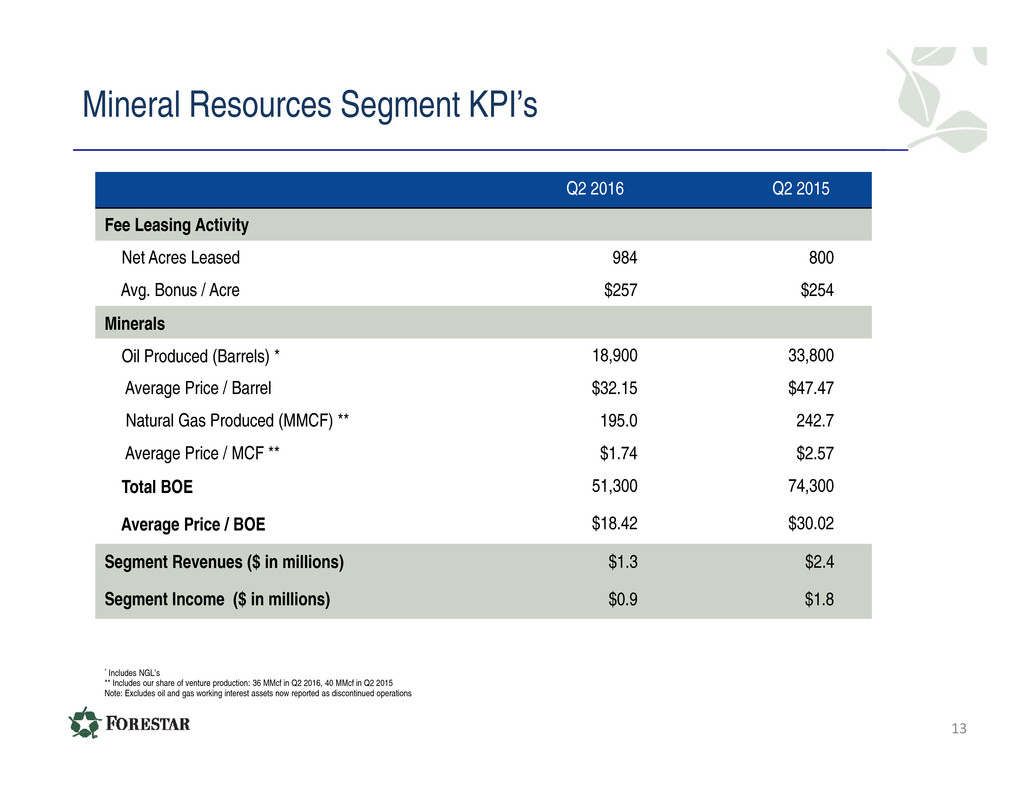

Mineral Resources Segment KPI’s Q2 2016 Q2 2015 Fee Leasing Activity Net Acres Leased 984 800 Avg. Bonus / Acre $257 $254 Minerals Oil Produced (Barrels) * 18,900 33,800 Average Price / Barrel $32.15 $47.47 Natural Gas Produced (MMCF) ** 195.0 242.7 Average Price / MCF ** $1.74 $2.57 Total BOE 51,300 74,300 Average Price / BOE $18.42 $30.02 Segment Revenues ($ in millions) $1.3 $2.4 Segment Income ($ in millions) $0.9 $1.8 * Includes NGL’s ** Includes our share of venture production: 36 MMcf in Q2 2016, 40 MMcf in Q2 2015 13 Note: Excludes oil and gas working interest assets now reported as discontinued operations

14