UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SB-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Forte Metals, Inc.

(“Forte Metals” or the “Company”)

Nevada | 1000 | 98-0501477 |

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (IRS Employer Identification No.) |

Forte Metals Inc., 502 East John Street, Carson City, Nevada, 89706

Diane D. Dalmy, Attorney at Law

8965 W. Cornell Place, Lakewood, Colorado 80227

Telephone 303.985.9324 Facsimile 303.988.6954

Copies of all communication to:

Forte Metals, Inc.

502 East John Street, Carson City, Nevada, 89706

Approximate date of proposed sale to the public: As soon as practicable after the effective date of the Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | Dollar Amount to be registered | Number of Shares to be registered | Proposed maximum offering price per unit | Amount of registration fee |

| Common Stock | $25,000 | 2,500,000 | $0.01 | $2.18 |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Disclosure alternative used (check one): Alternative 1 __ Alternative 2 X

Subject to Completion, Dated July 11, 2007

PROSPECTUS

Forte Metals , Inc.

2,500,000 Shares of Common Stock

The selling shareholder named in this prospectus is offering 2,500,000 shares of common stock of Forte Metals, Inc. at a fixed price of $0.01 per common share. We will not receive any of the proceeds from the sale of these shares. The shares were acquired by the selling shareholder directly from us in a private offering of our common stock that was exempt from registration under the securities laws. The selling shareholder has set an offering price for these securities of $0.01 per common share and an offering period of four months from the date of this prospectus. This is a fixed price for the duration of the offering. See “Security Ownership of Selling Shareholder and Management” for more information about the selling shareholder.

Our common stock is presently not traded on any market or securities exchange. The offering price of $0.01 per common share may not reflect the market price of our shares after the offering.

This investment involves a high degree of risk. You should purchase shares only if you can afford a complete loss. See “Risk Factors” beginning on page 7.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Shares Offered by Selling Shareholder | Price To Public | Selling Agent Commissions | Proceeds to Selling Shareholder |

| Per Share | $0.01 | Not applicable | $0.01 |

| Minimum Purchase | Not applicable | Not applicable | Not applicable |

| Total Offering | $25,000 | Not applicable | $25,000 |

Proceeds to the selling shareholder do not include offering costs, including filing fees, printing costs, legal fees, accounting fees, and transfer agent fees estimated at $10,000. Forte Metals will pay these expenses.

This Prospectus is dated July 11, 2007

TABLE OF CONTENTS

PART I | | | 6 | |

PROSPECTUS SUMMARY | | | 6 | |

| THE OFFERING | | | 6 | |

RISK FACTORS | | | 7 | |

| RISKS RELATED TO OUR COMPANY AND OUR INDUSTRY | | | 7 | |

| RISKS RELATED TO OUR FINANCIAL CONDITION AND BUSINESS MODEL | | | 11 | |

| RISKS RELATED TO THIS OFFERING AND OUR STOCK | | | 12 | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | | | 14 | |

DILUTION | | | 14 | |

PLAN OF DISTRIBUTION | | | 14 | |

USE OF PROCEEDS TO ISSUER | | | 16 | |

BUSINESS OF THE ISSUER | | | 16 | |

| GLOSSARY OF MINING TERMS | | | 16 | |

| PYRITE | | | 17 | |

| GENERAL OVERVIEW | | | 18 | |

Property Acquisitions Details | | | 18 | |

Land Status, Topography, Location and Access | | | 19 | |

Mining Claims | | | 19 | |

Geology of the Mineral Claims | | | 19 | |

Exploration History and Previous Operations | | | 20 | |

Proposed Work Program | | | 20 | |

Cost Estimates of Exploration Programs | | | 20 | |

| COMPLIANCE WITH GOVERNMENT REGULATION | | | 21 | |

| EMPLOYEES | | | 23 | |

MANAGEMENT DISCUSSION AND ANALYSIS OR PLAN OF OPERATION | | | 23 | |

| RESULTS OF OPERATIONS | | | 24 | |

| LIQUIDITY AND CAPITAL RESOURCES | | | 24 | |

DIRECTORS, EXECUTIVE OFFICERS AND SIGNIFICANT EMPLOYEES | | | 25 | |

REMUNERATION OF DIRECTORS AND OFFICERS | | | 26 | |

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITY HOLDERS | | | 27 | |

INTEREST OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS | | | 28 | |

SECURITIES BEING OFFERED | | | 28 | |

TRANSFER AGENT AND REGISTRAR | | | 28 | |

SEC POSITION ON INDEMNIFICATION | | | 28 | |

EXPERTS | | | 29 | |

AVAILABLE INFORMATION | | | 29 | |

REPORTS TO STOCKHOLDERS | | | 29 | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | | |

FINANCIAL STATEMENTS AND FOOTNOTES TO THE FINANCIAL STATEMENTS | | | 32 | |

PART II - INFORMATION NOT REQUIRED IN PROSPECTUS | | | 41 | |

ITEM 1. INDEMNIFICATION OF DIRECTORS AND OFFICERS. | | | 41 | |

ITEM 2. OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION. | | | 41 | |

ITEM 3. UNDERTAKINGS. | | | 41 | |

ITEM 4. UNREGISTERED SECURITIES ISSUED OR SOLD WITHIN ONE YEAR. | | | 43 | |

ITEM 5. INDEX TO EXHIBITS. | | | 43 | |

ITEM 6. DESCRIPTION OF EXHIBITS. | | | 44 | |

SIGNATURES | | | 45 | |

PART I

PROSPECTUS SUMMARY

Forte Metals, Inc.

Forte Metals, Inc. was organized under the laws of the State of Nevada on March 16, 2007 to explore mineral properties in North America.

Forte Metals was formed to engage in the exploration for molybdenum. The Company’s exploration property comprises one MTO mineral claim that contains nine cell claim units totaling 186.506 hectares. The Company refers to this mineral claim as the Jervis Moly Property (“Jervis Moly”).

We are an exploration stage company and we have not realized any revenues to date. We do not have sufficient capital to enable us to commence and complete our exploration program. We will require financing in order to conduct the exploration program described in the section entitled, "Business of the Issuer." Our auditors have issued a going concern opinion, raising substantial doubt about Forte Metal Inc.’s financial prospects and the Company’s ability to continue as a going concern.

We are not a "blank check company," as we do not intend to participate in a reverse acquisition or merger transaction. Securities laws define a “blank check company” as a development stage company that has no specific business plan or purpose or has indicated that its business plan is to engage in a merger or acquisition with an unidentified company or companies, or other entity or person.

Our offices are located at 502 East John Street, Carson City, Nevada, 89706

THE OFFERING

| Securities offered | 2,500,000 shares of common stock |

| Selling shareholder(s) | Chris Lori |

| Offering price | $0.01 per share |

| Shares outstanding prior to the offering | 10,000,000 shares of common stock |

| Shares to be outstanding after the offering | 10,000,000 shares of common stock |

| Use of proceeds | We will not receive any proceeds from the sale of the common stock by the selling shareholder. |

RISK FACTORS

Investing in our securities involves a high degree of risk. In addition to the other information contained in this registration statement, prospective purchasers of the securities offered herby should consider carefully the following factors in evaluating the Company and its business.

The securities we are offering through this registration statement are speculative by nature and involve an extremely high degree of risk and should be purchased only by persons who can afford to lose their entire investment. We also caution prospective investors that the following risk factors could cause our actual future operating results to differ materially from those expressed in any forward looking statements, oral, written, made by or on behalf of us. In assessing these risks, we suggest that you also refer to other information contained in this registration statement, including our financial statements and related notes.

RISKS Related to Our Company and Our Industry

The Company has never earned a profit and we are currently operating under a net loss. There is no guarantee that we will ever earn a profit.

From our inception on March 16, 2007 to the audited period ended on May 31, 2007, the Company has not generated any revenue. Rather, the Company operates under a net loss, and has an accumulated deficit of $26,700 as of the audited period ended May 31, 2007. The Company does not currently have any revenue producing operations. The Company is not currently operating profitably, and it should be anticipated that it will operate at a loss at least until such time when the production stage is achieved, if production is, in fact, ever achieved.

If we do not obtain additional financing, our business will fail.

We will need to obtain additional financing in order to complete our business plan. We currently do not have any operations and we have no income. We are an exploration stage company and we have not realized any revenues to date. We do not have sufficient capital to enable us to commence and complete our exploration program and based on our current operating plan, we do not expect to generate revenue that is sufficient to cover our expenses for at least the next twelve months.. We will require financing in order to conduct the exploration program described in the section entitled, "Business of the Issuer.” We need to raise $44,149.13 to complete the first phase of our exploration program and $230,000 to complete the second phase, for a total of $274,149.13 to complete both phases of our program. We do not have any arrangements for financing and we may not be able to find such financing if required. We will need to obtain additional financing to operate our business for the next twelve months, and if we do not our business will fail. We will raise the capital necessary to fund our business through a Prospectus and public offering of our common stock. Obtaining additional financing would be subject to a number of factors, including investor acceptance of mineral claims and investor sentiment. These factors may adversely affect the timing, amount, terms, or conditions of any financing that we may obtain or make any additional financing unavailable to us.

Our company was recently formed, and we have not proven that we can generate a profit. If we fail to generate income and achieve profitability and investment in our securities may be worthless.

We have no operating history and have not proved we can operate successfully. We face all of the risks inherent in a new business. If we fail, your investment in our common stock will become worthless. From inception of March 16, 2007 to the audited period ended on May 31, 2007, we incurred a net loss of ($26,700) and did not earn any revenue. The Company does not currently have any revenue producing operations.

We have no operating history. There can be no assurance that we will be successful in our molybdenum mineral exploration activities.

The Company has no history of operations. As a result of our brief operating history, there can be no assurance that that we will be successful exploring for molybdenum. Our future performance will depend upon our management and its ability to locate and negotiate additional exploration opportunities in which we can participate. There can be no assurance that we will be successful in these efforts. Our inability to locate additional opportunities, to hire additional management and other personnel, or to enhance our management systems, could have a material adverse effect on our results of operations. There can be no assurance that the Company's operations will be profitable.

There is a higher risk our business will fail because Mr. Chris Lori, our sole Executive Officer and Director, does not have formal training specific to the technicalities of mineral exploration.

Mr. Chris Lori, our President and a Director of the Company, does not have formal training as a geologist or in the technical aspects of management of a mineral exploration company. Mr. Lori lacks technical training and experience with exploring for, starting, and operating a mine. With no direct training or experience in these areas, he may not be fully aware of the specific requirements related to working within this industry. Mr. Lori’s decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to management's lack of experience in this industry.

We are controlled by Mr. Chris Lori, our sole Executive Officer and Director, and, as such, you may have no effective voice in our management.

Upon the completion of this offering, Mr. Chris Lori, our sole Executive Officer and Director, will beneficially own approximately 75% of our issued and outstanding common stock. Mr. Lori will exercise control over all matters requiring shareholder approval, including the possible election of additional directors and approval of significant corporate transactions. If you purchase shares of our common stock, you may have no effective voice in our management.

We are solely governed by Mr. Chris Lori, our sole Executive Officer and Director, and, as such, there may be significant risk to the Company of a conflict of interest.

Mr. Chris Lori, our sole Executive Officer and Director makes decisions such as the approval of related party transactions, the compensation of Executive Officers, and the oversight of the accounting function. There will be no segregation of executive duties and there may not be effective disclosure and accounting controls to comply with applicable laws and regulations, which could result in fines, penalties and assessments against us. Accordingly, the inherent controls that arise from the segregation of executive duties may not prevail. In addition, Mr. Lori will exercise full control over all matters that typically require the approval of a Board of Directors. Mr. Lori’s actions are not subject to the review and approval of a Board of Directors and, as such, there may be significant risk to the Company of a conflict of interest.

Mr. Chris Lori, our sole Executive Officer and Director, exercises control over all matters requiring shareholder approval including the election of Directors and the approval of significant corporate transactions. Insofar as Mr. Lori makes all decisions as to which projects the Company undertakes, there is a risk of a conflict of interest arising between the duties of Mr. Lori in his role as our sole Executive Officer and his own personal financial and business interests in other business ventures distinct and separate from the interests of

the Company. His personal interests may not, during the ordinary course of business, coincide with the interests of the shareholders and, in the absence of effective segregation of duties, there is a risk of a conflict of interest. We have not voluntarily implemented various corporate governance measures, in the absence of which, shareholders may have more limited protections against the transactions implemented by Mr. Lori, conflicts of interest and similar matters.

We have not adopted corporate governance measures such as an audit or other independent committees as we presently only have one independent director. Shareholders should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

We are controlled by Mr. Chris Lori, our sole Executive Officer and Director, and the Company may lack the ability to successfully implement its growth plans.

Mr. Chris Lori, our sole Executive Officer and Director, has no career experience related to mining and mineral exploration. Accordingly, Mr. Lori may be unable to successfully operate and develop our business. We cannot guarantee that we will overcome this obstacle. There may be additional risk to the Company in that Mr. Lori may lack the ability to successfully implement growth plans given that the absence of an executive management team, and that all plans rely exclusively on the ability and management of Mr. Lori, our Executive Officer and Director.

Since Mr. Chris Lori, our sole Executive Officer and Director, is not a resident of the United States, it may be difficult to enforce any liabilities against him.

Shareholders may have difficulty enforcing any claims against the Company because Mr. Lori, our sole Executive Officer and Director, resides in Canada and outside the United States. If a shareholder desired to sue, shareholders would have to serve a summons and complaint. Even though our Director does have significant assets in the Unites States, and even if personal service is accomplished and a judgment is entered against our Director, the shareholder would then have to locate the assets of our director, and register the judgment in the foreign jurisdiction where the assets are located.

Because Mr. Chris Lori, our sole Executive Officer and Director, has other business interests, he may not be able or willing to devote a sufficient amount of time to our business operations, which may cause our business to fail.

It is possible that the demands on Mr. Chris Lori, our sole Executive Officer and Director, from other obligations could increase with the result that he would no longer be able to devote sufficient time to the management of our business. Mr. Lori will devote fewer than 12-15 hours per month or 3-4 per week to the affairs of the Company. In addition, Mr. Lori may not possess sufficient time to manage our business if the demands of managing our business increased substantially.

The imprecision of mineral deposit estimates may prove any resource calculations that we make to be unreliable.

Mineral deposit estimates and related databases are expressions of judgment based on knowledge, mining experience, and analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. By their nature, mineral deposit estimates are imprecise and depend upon statistical inferences, which may ultimately prove unreliable. Mineral deposit estimates included here, if any, have not been adjusted in consideration of these risks and, therefore, no assurances can be given that any mineral deposit estimate will ultimately be reclassified as reserves. If the Company's exploration program locates a mineral deposit, there can be no assurances that any of such deposits will ever be classified as reserves.

We are sensitive to fluctuations in the price of molybdenum, which is beyond our control. The price of molybdenum is volatile and price changes are beyond our control.

The price of molybdenum can fluctuate. The prices of molybdenum have been and will continue to be affected by numerous factors beyond the Company's control. Factors that affect the price of molybdenum include the demand from consumers for products that use molybdenum, economic conditions, over supply from secondary sources and costs of production. Price volatility and downward price pressure, which can lead to lower prices, could have a material adverse effect on the costs or the viability of our projects.

Mineral exploration and prospecting is highly competitive and speculative business and we may not be successful in seeking available opportunities.

The process of mineral exploration and prospecting is a highly competitive and speculative business. Individuals are not subject to onerous accreditation and licensing requirements prior to beginning mineral exploration and prospecting activities, and as such the company, in seeking available opportunities, will compete with a numerous individuals and companies, including established, multi-national companies that have more experience and resources than the Company. The exact number of active competitors at any one time is heavily dependant on current economic conditions; however, statistics provided by the AEBC (The Association for Mineral Exploration, British Columbia), state that approximately 1000 mining companies operate in BC. Each one of these companies can be considered to be in competition with Forte Metals for mineral resources in British Columbia. Moreover, The Government of Canada at, http://mmsd1.mms.nrcan.gc.ca/mmsd/exploration/default_e.asp, reports that in 2006, $140.6 billion was spent in mineral exploration activities in British Columbia.

Because we may not have the financial and managerial resources to compete with other companies, we may not be successful in our efforts to acquire projects of value, which, ultimately, become productive. However, while we compete with other exploration companies for the rights to explore other claims, there is no competition for the exploration or removal of mineral from our claims from other companies, as we have no agreements or obligations that limit our right to explore or remove minerals from our claims.

Compliance with environmental considerations and permitting could have a material adverse effect on the costs or the viability of our projects. The historical trend toward stricter environmental regulation may continue, and, as such, represents an unknown factor in our planning processes.

All mining is regulated by the government agencies at the Federal and Provincial levels of government in Canada. Compliance with such regulation has a material effect on the economics of our operations and the timing of project development. Our primary regulatory costs have been related to obtaining licenses and permits from government agencies before the commencement of mining activities. An environmental impact study that must be obtained on each property in order to obtain governmental approval to mine on the properties is also a part of the overall operating costs of a mining company.

The possibility of more stringent regulations exists in the areas of worker health and safety, the dispositions of wastes, the decommissioning and reclamation of mining and milling sites and other environmental matters, each of which could have an adverse material effect on the costs or the viability of a particular project. Compliance with environmental considerations and permitting could have a material adverse effect on the costs or the viability of our projects.

Mining and exploration activities are subject to extensive regulation by federal and provincial governments. Future changes in governments, regulations and policies, could adversely affect the Company's results of operations for a particular period and its long-term business prospects.

Mining and exploration activities are subject to extensive regulation by government. Such regulation relates to production, development, exploration, exports, taxes and royalties, labor standards, occupational health, waste disposal, protection and remediation of the environment, mine and mill reclamation, mine and mill safety, toxic substances and other matters. Compliance with such laws and regulations has increased the costs of exploring, drilling, developing, constructing, operating mines and other facilities. Furthermore, future changes in governments, regulations and policies, could adversely affect the Company's results of operations in a particular period and its long-term business prospects.

The development of mines and related facilities is contingent upon governmental approvals, which are complex and time consuming to obtain and which, depending upon the location of the project, involve various governmental agencies. The duration and success of such approvals are subject to many variables outside the Company’s control.

RISKS RELATED TO OUR FINANCIAL CONDITION AND BUSINESS MODEL

The Company has not paid any cash dividends on its shares of Common Stock and does not anticipate paying any such dividends in the foreseeable future. Accordingly, investors will only see a return on their investments if the value of the shares appreciates.

Payment of future dividends, if any, will depend on earnings and capital requirements of the Company, the Company’s debt facilities and other factors considered appropriate by the Company’s Board of Directors. To date, the Company has not paid any cash dividends on the Company’s Common Stock and does not anticipate paying any such dividends in the foreseeable future. Accordingly, investors will only see a return on their investments if the value of the shares appreciates.

If we do not conduct mineral exploration on our mineral claims and keep the claims in good standing, then our right to the mineral claims will lapse and we will lose everything that we have invested and expended towards these claims.

We must complete mineral exploration work on our mineral claims and keep the claims in good standing. If we do not fulfill our work commitment requirements on our claims or pay the fee to keep the claims in good standing, then our right to the claims will lapse and we will lose all interest that we have in these mineral claims. We are obligated to pay $746.02 in lieu of work to the British Columbia Provincial government on an annual basis to keep our claims valid. The fee is calculated at a rate of $4.00 CDN per hectare plus a 10% submission fee: Forte Metals has 186.506 hectares which is multiplied by $4.00 CDN to equal $746.02, to which the submission fee of $74.60 is added for a total of $820.62 CDN.

Because of our limited resources and the speculative nature of our business, there is a substantial doubt as to our ability to operate as a going concern.

The report of our independent auditors, on our audited financial statements for the audited period ended May 31,2007 indicates that there are a number of factors that raise substantial doubt about our ability to continue as a going concern. Our continued operations are dependent on our ability to obtain financing and upon our ability to achieve future profitable operations from the development of our mineral properties. If we are not able to continue as a going concern, it is likely investors will lose their investment.

RISKS RELATED TO THIS OFFERING AND Our Stock

We will need to raise additional capital, in addition to the financing as reported in this registration statement. In so doing, we will further dilute the total number of shares issued and outstanding. There can be no assurance that this additional capital will be available or accessible by us.

Forte Metals will need to raise additional capital, in addition to the financing as reported in this registration statement, by issuing additional shares of common stock and will, thereby, increase the number of common shares outstanding. There can be no assurance that this additional capital will be available to meet these continuing exploration and development costs or, if the capital is available, that it will be available on terms acceptable to the Company. If the Company is unable to obtain financing in the amounts and on terms deemed acceptable, the business and future success of the Company will almost certainly be adversely affected. If we are able to raise additional capital, we cannot be assured that it will be on terms that enhance the value of our common shares.

If we complete a financing through the sale of additional shares of our common stock in the future, then our shareholders will experience dilution.

The most likely source of future financing presently available to us is through the sale of shares of our common stock. Any sale of common stock will result in dilution of equity ownership to existing shareholders. This means that if we sell shares of our common stock, more shares will be outstanding and each existing shareholder will own a smaller percentage of the shares then outstanding. To raise additional capital we may have to issue additional shares, which may substantially dilute the interests of existing shareholders. Alternatively, we may have to borrow large sums, and assume debt obligations that require us to make substantial interest and capital payments.

There is no market for our Common Stock, which limits our shareholders ability to resell their shares or pledge them as collateral.

There is currently no public market for our shares, and we cannot assure you that a market for our stock will develop. Consequently, investors may not be able to use their shares for collateral or loans and may not be able to liquidate at a suitable price in the event of an emergency. In addition, investors may not be able to resell their shares at or above the price they paid for them or may not be able to sell their shares at all.

If a public market for our stock is developed, future sales of shares could negatively affect the market price of our common stock.

If a public market for our stock is developed, then sales of Common Stock in the public market could adversely affect the market price of our Common Stock. There are at present 10,000,000 shares of Common Stock issued and outstanding.

Our stock is a penny stock. Trading of our stock may be restricted by the SEC's penny stock regulations and the NASD’s sales practice requirements, which may limit a stockholder's ability to buy and sell our stock.

The Company’s common shares may be deemed to be “penny stock” as that term is defined in Regulation Section “240.3a51-1” of the Securities and Exchange Commission (the “SEC”). Penny stocks are stocks: (a) with a price of less than U.S. $5.00 per share; (b) that are not traded on a “recognized” national exchange; (c) whose prices are not quoted on the NASDAQ automated quotation system (NASDAQ - where listed stocks must still meet requirement (a) above); or (d) in issuers with net tangible assets of less than U.S. $2,000,000 (if the issuer has been in continuous operation for at least three years) or U.S. $5,000,000 (if in continuous operation for less than three years), or with average revenues of less than U.S. $6,000,000 for the last three years.

Section “15(g)” of the United States Securities Exchange Act of 1934, as amended, and Regulation Section “240.15g(c)2” of the SEC require broker dealers dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the document before effecting any transaction in a penny stock for the investor’s account. Potential investors in the Company’s common shares are urged to obtain and read such disclosure carefully before purchasing any common shares that are deemed to be “penny stock”.

Moreover, Regulation Section “240.15g-9” of the SEC requires broker dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker dealer to: (a) obtain from the investor information concerning his or her financial situation, investment experience and investment objectives; (b) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions; (c) provide the investor with a written statement setting forth the basis on which the broker dealer made the determination in (ii) above; and (d) receive a signed and dated copy of such statement from the investor confirming that it accurately reflects the investor’s financial situation, investment experience and investment objectives. Compliance with these requirements may make it more difficult for investors in the Company’s common shares to resell their common shares to third parties or to otherwise dispose of them. Stockholders should be aware that, according to Securities and Exchange Commission Release No. 34-29093, dated April 17, 1991, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include:

(i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer

(ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases

(iii) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons

(iv) excessive and undisclosed bid-ask differential and markups by selling broker-dealers

(v) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses

Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve risks and uncertainties. Forward-looking statements in this prospectus include, among others, statements regarding our capital needs, business plans and expectations. Such forward-looking statements involve assumptions, risks and uncertainties regarding, among others, the success of our business plan, availability of funds, government regulations, operating costs, our ability to achieve significant revenues, our business model and products and other factors. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may", "will", "should", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict", "potential" or "continue", the negative of such terms or other comparable terminology. These forward-looking statements address, among others, such issues as:

| | Ø | the amount and nature of future exploration, development and other capital expenditures, |

| | Ø | mining claims to be drilled, |

| | Ø | future earnings and cash flow, |

| | Ø | development and drilling potential, |

| | Ø | expansion and growth of our business and operations, and |

| | Ø | our estimated financial information. |

In evaluating these statements, you should consider various factors, including the assumptions, risks and uncertainties outlined in this prospectus under "Risk Factors". These factors or any of them may cause our actual results to differ materially from any forward-looking statement made in this prospectus. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding future events, our actual results will likely vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. The forward-looking statements in this prospectus are made as of the date of this prospectus and we do not intend or undertake to update any of the forward-looking statements to conform these statements to actual results, except as required by applicable law, including the securities laws of the United States.

DILUTION

The common stock to be sold by the selling shareholder is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing shareholders.

PLAN OF DISTRIBUTION

The selling shareholder or their donees, pledges, transferees or other successors-in-interest selling shares received after the date of this prospectus from a selling shareholder as a gift, pledge, distribution or otherwise, may, from time to time, sell any or all of their shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These sales will be at a fixed price of $0.01. The selling shareholder may use any one or more of the following methods when selling shares:

| | Ø | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| | Ø | block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| | Ø | purchases by a broker-dealer as principal and resale by the broker-dealer for its own account; |

| | Ø | an exchange distribution following the rules of the applicable exchange; |

| | Ø | privately negotiated transactions; |

| | Ø | short sales that are not violations of the laws and regulations of any state of the United States; |

| | Ø | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| | Ø | broker-dealers may agree with the selling shareholders to sell a specified number of such shares at a fixed price of $0.008144; and |

| | Ø | a combination of any such methods of sale or any other lawful method. |

The selling shareholder may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of selling shareholder to include the pledgee, transferee or other successors-in-interest as selling shareholder under this prospectus. The selling shareholder also may transfer the shares of common stock in other circumstances, in which case the transferees, pledgees or other successors-in-interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of our common stock or interests therein, the selling shareholder may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling shareholder also may sell shares of our common stock short and deliver these securities to close out their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling shareholder also may enter into option or other transactions with broker-dealers or other financial institutions for the creation of one or more derivative securities which require the delivery to the broker-dealer or other financial institution of shares offered by this prospectus, which shares the broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect the transaction).

The aggregate proceeds to the selling shareholder from the sale of the common stock offered by them will be the purchase price of the common stock less discounts or commissions, if any. A selling shareholder reserves the right to accept and, together with its agents from time to time, to reject, in whole or in part, any proposed purchase of common stock to be made directly or through agents. We will not receive any of the proceeds from this offering.

The selling shareholder and any underwriters, broker-dealers or agents that participate in the sale of the common stock or interests therein may be "underwriters" within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the shares may be underwriting discounts and commissions under the Securities Act. A selling shareholder that is an "underwriter" within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act.

To the extent required, the shares of our common stock to be sold, the names of the selling shareholder, the respective purchase prices and public offering prices, the names of any agents, dealers or underwriters, and any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

Sales Pursuant to Rule 144

Any shares of common stock covered by this prospectus, which qualify for sale pursuant to Rule 144 under the Securities Act, as amended, may be sold under Rule 144 rather than pursuant to this prospectus.

Regulation M

We plan to advise the selling shareholder that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities of the selling security holders and their affiliates. Regulation M under the Exchange Act prohibits, with certain exceptions, participants in a distribution from bidding for, or purchasing for an account in which the participant has a beneficial interest, any of the securities that are the subject of the distribution. Accordingly, the selling shareholder is not permitted to cover short sales by purchasing shares while the distribution it taking place. Regulation M also governs bids and purchases made in order to stabilize the price of a security in connection with a distribution of the security. In addition, we will make copies of this prospectus available to the selling security holder for the purpose of satisfying the prospectus delivery requirements of the Securities Act.

State Securities Laws

Under the securities laws of some states, the shares may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the common shares may not be sold unless the shares have been registered or qualified for sale in the state or an exemption from registration or qualification is available and is complied with.

Expenses of Registration

We are bearing substantially all costs relating to the registration of the shares of common stock offered hereby. These expenses are estimated to be $10,000, including, but not limited to, legal, accounting, printing and mailing fees. The selling shareholder, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of such shares common stock.

USE OF PROCEEDS TO ISSUER

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling shareholder.

BUSINESS OF THE ISSUER

GLOSSARY OF MINING TERMS

Archean | | Of or belonging to the earlier of the two divisions of Precambrian time, from approximately 3.8 to 2.5 billion years ago, marked by an atmosphere with little free oxygen, the formation of the first rocks and oceans, and the development of unicellular life. Of or relating to the oldest known rocks, those of the Precambrian Eon, that are predominantly igneous in composition. |

| | | |

Assaying | | Laboratory examination that determines the content or proportion of a specific metal (ie: gold) contained within a sample. Technique usually involves firing/smelting. |

| | | |

Conglomerate | | A coarse-grained clastic sedimentary rock, composed of rounded to subangular fragments larger than 2 mm in diameter (granules, pebbles, cobbles, boulders) set in a fine-grained matrix of sand or silt, and commonly cemented by calcium carbonate, iron oxide, silica, or hardened clay; the consolidated equivalent of gravel. The rock or mineral fragments may be of varied composition and range widely in size, and are usually rounded and smoothed from transportation by water or from wave action. |

| | | |

Cratons | | Parts of the Earth's crust that have attained stability, and have been little deformed for a prolonged period. |

| | | |

Development Stage | | A “development stage” project is one which is undergoing preparation of an established commercially mineable deposit for its extraction but which is not yet in production. This stage occurs after completion of a feasibility study. |

| | | |

Dolomite Beds | | Dolomite beds are associated and interbedded with limestone, commonly representing postdepositional replacement of limestone. |

| | | |

Doré | | Unrefined gold bullion bars containing various impurities such as silver, copper and mercury, which will be further refined to near pure gold. |

| | | |

Dyke or Dike | | A tabular igneous intrusion that cuts across the bedding or foliation of the country rock. |

| | | |

Exploration Stage | | An “exploration stage” prospect is one which is not in either the development or production stage. |

| | | |

Fault | | A break in the continuity of a body of rock. It is accompanied by a movement on one side of the break or the other so that what were once parts of one continuous rock stratum or vein are now separated. The amount of displacement of the parts may range from a few inches to thousands of feet. |

| | | |

Feldspathic | | Said of a rock or other mineral aggregate containing feldspar. |

| | | |

Fold | | A curve or bend of a planar structure such as rock strata, bedding planes, foliation, or cleavage |

| | | |

Foliation | | A general term for a planar arrangement of textural or structural features in any type of rock; esp., the planar structure that results from flattening of the constituent grains of a metamorphic rock. |

| | | |

Formation | | A distinct layer of sedimentary rock of similar composition. |

| | | |

Gabbro | | A group of dark-colored, basic intrusive igneous rocks composed principally of basic plagioclase (commonly labradorite or bytownite) and clinopyroxene (augite), with or without olivine and orthopyroxene; also, any member of that group. It is the approximate intrusive equivalent of basalt. Apatite and magnetite or ilmenite are common accessory minerals. |

| | | |

Geochemistry | | The study of the distribution and amounts of the chemical elements in minerals, ores, rocks, solids, water, and the atmosphere. |

| | | |

Geophysicist | | One who studies the earth; in particular the physics of the solid earth, the atmosphere and the earth’s magnetosphere. |

| | | |

Geotechnical | | The study of ground stability. |

| | | |

Gneiss | | A foliated rock formed by regional metamorphism, in which bands or lens-shaped strata or bodies of rock of granular minerals alternate with bands or lens-shaped strata or bodies or rock in which minerals having flaky or elongate prismatic habits predominate. |

| | | |

Granitic | | Pertaining to or composed of granite. |

| | | |

Heap Leach | | A mineral processing method involving the crushing and stacking of an ore on an impermeable liner upon which solutions are sprayed that dissolve metals such as gold and copper; the solutions containing the metals are then collected and treated to recover the metals. |

| | | |

Intrusions | | Masses of igneous rock that, while molten, were forced into or between other rocks. |

| | | |

Kimberlite | | A blue/gray igneous rock that contains olivine, serpentine, calcite and silica and is the principal original environment of diamonds. |

| | | |

Lamproite | | Dark-colored igneous rocks rich in potassium and magnesium. |

| | | |

Lithospere | | The solid outer portion of the Earth. |

| | | |

Mantle | | The zone of the Earth below the crust and above the core. |

| | | |

Mapped or Geological | | The recording of geologic information such as the distribution and nature of rock |

| | | |

Mapping | | Units and the occurrence of structural features, mineral deposits, and fossil localities. |

| | | |

Metavolcanic | | Said of partly metamorphosed volcanic rock. |

| | | |

Migmatite | | A composite rock composed of igneous or igneous-appearing and/or metamorphic materials that are generally distinguishable megascopically. |

| | | |

Mineral | | A naturally formed chemical element or compound having a definite chemical composition and, usually, a characteristic crystal form. |

| | | |

Mineralization | | A natural occurrence in rocks or soil of one or more metal yielding minerals. |

| | | |

Mineralized Material | | The term “mineralized material” refers to material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction. |

| | | |

Mining | | Mining is the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. Exploration continues during the mining process and, in many cases, mineral reserves are expanded during the life of the mine operations as the exploration potential of the deposit is realized. |

| | | |

Outcrop | | That part of a geologic formation or structure that appears at the surface of the earth. |

| | | |

Pipes | | Vertical conduits. |

| | | |

Plagioclase | | Any of a group of feldspars containing a mixture of sodium and calcium feldspars, distinguished by their extinction angles. |

| | | |

Probable Reserve | | The term “probable reserve” refers to reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation. |

| | | |

Production Stage | | A “production stage” project is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. |

| | | |

Proterozoic | | Of or relating to the later of the two divisions of Precambrian time, from approximately 2.5 billion to 570 million years ago, marked by the buildup of oxygen and the appearance of the first multicellular eukaryotic life forms. |

| | | |

Reserve | | The term “reserve” refers to that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves must be supported by a feasibility study done to bankable standards that demonstrates the economic extraction. (“Bankable standards” implies that the confidence attached to the costs and achievements developed in the study is sufficient for the project to be eligible for external debt financing.) A reserve includes adjustments to the in-situ tonnes and grade to include diluting materials and allowances for losses that might occur when the material is mined. |

| | | |

Sedimentary | | Formed by the deposition of sediment. |

| | | |

Shear | | A form of strain resulting from stresses that cause or tend to cause contiguous parts of a body of rock to slide relatively to each other in a direction parallel to their plane of contact. |

| | | |

Sill | | A concordant sheet of igneous rock lying nearly horizontal. A sill may become a dike or vice versa. |

| | | |

Strike | | The direction or trend that a structural surface, e.g. a bedding or fault plane, takes as it intersects the horizontal. |

| | | |

Strip | | To remove overburden in order to expose ore. |

| | | |

Till | | Generally unconsolidated matter, deposited directly by and underneath a glacier without subsequent reworking by meltwater, and consisting of a mixture of clay, silt, sand, gravel, and boulders ranging widely in size and shape. |

| | | |

Unconformably | | Not succeeding the underlying rocks in immediate order of age or not fitting together with them as parts of a continuous whole. |

| | | |

Vein | | A thin, sheet like crosscutting body of hydrothermal mineralization, principally quartz. |

| | | |

Wall Rock | | The rock adjacent to a vein. |

GENERAL OVERVIEW

Forte Metals was organized under the laws of the State of Nevada on March 16, 2007 to explore mineral properties in North America.

Forte Metals was formed to engage in the exploration of mineral properties for molybdenum. The Company’s Jervis Moly Property comprises one MTO mineral claim containing nine cell claim units totaling 186.506 hectares.

The Jervis Moly Property is located near McCannel Lake, at the head of Jervis Inlet, about 110 km northwest of Vancouver, BC, and 75 km north of Sechelt, BC. The area is presently accessible by helicopter or float plane from Sechelt or Powell River. Access is by helicopter or float plane from Vancouver or Sechelt, or by boat from Egmont or Pender Harbour on the Sechelt Peninsula. A recently built hydro power plant brings local road access up to the eastern end of McCannel Lake. Suitable campsite locations with good water supplies can be found on the Jervis Moly Property. Supplies and services are available in Egmont or Pender Harbour.

The report on the Jervis Moly Property was prepared by Gregory R. Thomson P. Geo and James W. Laird, of Laird Exploration Ltd. a Professional Geoscientist registered in the Province of British Columbia. Gregory R. Thomson is a graduate Geologist from the University of British Columbia (1970) and has over 25 years of mineral exploration experience in the Province of British Columbia.

James (Jim) Laird is a prospector and mining exploration contractor and has been for more than 25 years. Mr. Laird has completed the BC EMPR course “Advanced Mineral Exploration for Prospectors, 1980”. Mr. Laird is familiar with the geology of the Jervis Moly Property project area and has extensively researched the regional geology of the Lausmann Creek area.

We are an exploration stage company and we cannot provide assurance to investors that our mineral claims contains a commercially exploitable mineral deposit, or reserve, until appropriate exploratory work is conducted and an evaluation by a professional geologist of the exploration program concludes economic feasibility.

Property Acquisitions Details

On March 20th, 2007, Forte Metals purchased the Jervis Moly Property for USD $20,000. The mineral claims are currently being held for the Company by a licenced prospecting agent. After numerous meetings with Gregory Thompson, B.Sc., P.Geo., a co- author of the property report on the Jervis Moly Property, management decided to purchase the Jervis Moly Property from James Laird. Mr Laird was the co-author of the property report on the Jervis Moly Property. The decision to purchase the property was based entirely upon management’s assessment and opinion of the geological merit of the property as outlined in the report.

Land Status, Topography, Location and Access

The Jervis Moly Property is located near the head of Jervis Inlet, about 120 km northwest of Vancouver, BC. Access is by floatplane from Vancouver or Sechelt, or by boat from Egmont or Pender Harbour on the Sechelt Peninsula.

The topography along Jervis Inlet extents from sea level to mountain tops in excess of 2000 metres elevation. Supplies and services are available in Egmont or Pender Harbour. In the vicinity of the Jervis Moly Property, topography is moderate with some deep canyons along Lausmann Creek. Elevation on the property varies from sea level and above, up to 480 metres.

The climate is typical of the West Coast of BC, mild and wet overall with some snowfall in the winter months. The summers are usually warm with less rainfall. Year-round work is possible on the property. Vegetation is a dense growth of coniferous forest, with cedar, fir, spruce, alder and maple trees. Alpine groundcover in the vicinity is usually salal and various berry bushes.

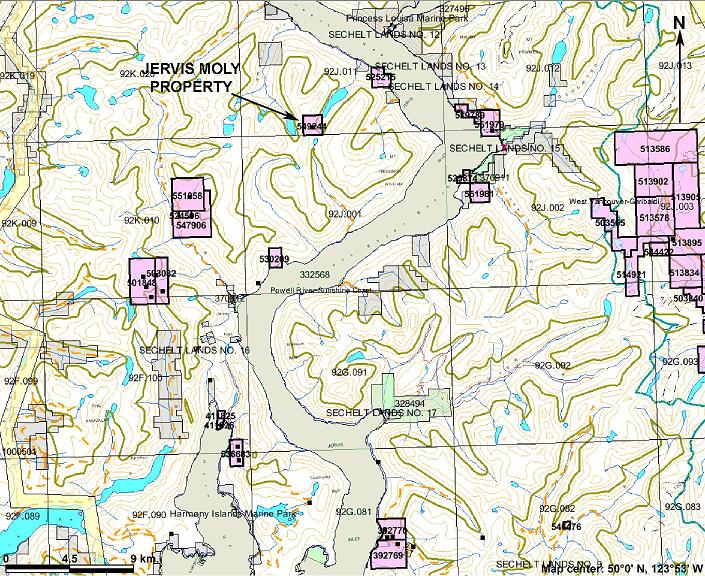

Fig. 1

JERVIS MOLY PROPERTY REGIONAL LOCATION MAP

Mining Claims

The Jervis Moly Property comprises one MTO mineral claim containing 9 cell claim units totaling 186.06 hectares. The property was originally staked in January of 2005.

BC Tenure # | Work Due Date | Staking Date | Total Area (Ha.) |

| 549244 | Jan. 13, 2008 | Jan 13 2005 | 186.506 |

| | | | |

As of January 12, 2005, British Columbia replaced its traditional claim staking method with an Internet System. To “stake” a mineral claim, a registered miner can login to the Provincial Government website at “Mineral Titles Online” at the URL http://www.mtonline.gov.bc.ca/ and electronically make a claim to an available area. Registered holders of a mining claim are then required to work their claim or make an annual payment in lieu of such work. This annual payment is calculated by multiplying the number of hectares in the claim by $4.00 plus a 10% administration fee. This is the method Forte Metals has elected to use with its Jervis Moly Property. Payment of this annual fee ensures that our claim to the Jervis Moly Property can be held in perpetuity.

Regional Geology

The Upper Jervis Inlet area is underlain by a variety of Jurassic to Tertiary granitic intrusives of the Coast Plutonic Complex. The granitic rocks intrude and metamorphose Jurassic to Lower Cretaceous argillaceous sediments and andesitic to felsic volcanics of the Gambier Group. The Gambier Group hosts the 60 MT Britannia copper, zinc, lead, silver, gold deposit on Howe Sound about 80 km to the southeast. The granitic rocks host several prospective porphyry copper-molybdenum showings at Gambier Island in Howe Sound, the Don Property at Britain River on Jervis Inlet, and the OK property near Powell River.

Geology of the Mineral Claims

The prospective porphyry copper-molybdenum showings are hosted by massive, coarse-grained biotite granodiorite of the Tertiary to Cretaceous Coast Plutonic Complex. Associated porphyritic and pegmatitic dikes cut the granodiorite.

Mineralization occurs in the granodiorite and pegmatite principally as "spots" of coarse grained molybdenite and rusty feldspar, which range in size from 1 to 30 centimetres. The proportion of molybdenite in these clots varies up to 50 per cent. Minor molybdenite also occurs with quartz as fracture-fillings in granodiorite.

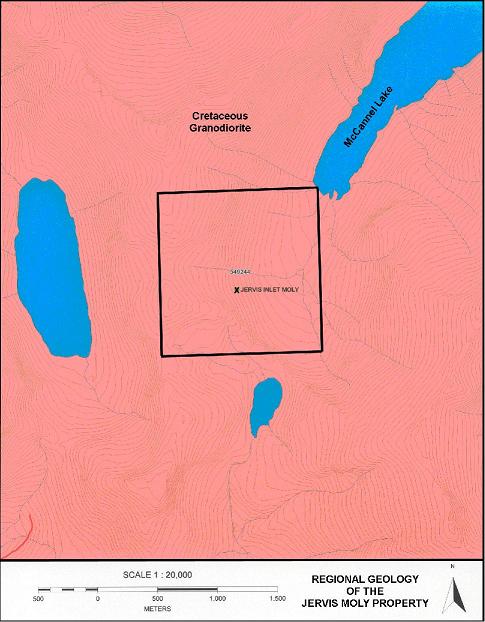

Fig. 2

REGIONAL GEOLOGY OF THE JERVIS MOLY PROPERTY

Exploration History and Previous Operations

The original showings were discovered and sampled by a Major Thompson in 1910, but the claims were allowed to lapse due to a non-existent molybdenum market at the time. A BC government geologist, C.O. Swanson first examined the property in 1936. In 1937, BC Dept. of Mines geologist J.S. Stevenson visited the property. Stevenson took two selected rock samples that assayed 2.6% and 2.7% molybdenite. He stated that the “molybdenite occurred in talus fragments as 1/8th inch flakes that range from 2 inches to 4 inches in diameter scattered in quartz diorite, and as similar flakes associated with 2-inch clots of pegmatitic quartz, feldspar and mica, widely scattered in the quartz diorite.”

Private company files of Newmont Exploration Ltd. recorded that in 1956 exploration on the property indicated that mineralization occurred as disseminations and scattered high-grade molybdenite clusters within a light-coloured granodiorite and related quartz-feldspar pegmatite dikes, intruding an older quartz diorite phase. Approximate dimensions of the mineralized intrusive stock were estimated as “1500 feet wide by three miles in length”. Sampling is reported to have averaged “+2% MoS2 across 1000 feet at the foot of a large bluff”.

In 1968, Newmont Exploration Ltd. funded a 2-week exploration program to re-examine and trench the mineralized areas. Three trenches totaling 94 metres in length were blasted in the mineralized areas. Several soil and stream sediment samples were taken as well. The present property area was first examined by co-author James Laird during 1984 while employed by Newmont Exploration Ltd.

Proposed Work Program

A proposed work program includes GPS-controlled geological mapping, rock sampling of surface showings and trench workings, construction of a control grid, and a stream silt geochemical sampling program. Based on a compilation of these results, a diamond drill program will be designed to explore and define the potential resources.

Cost Estimates of Exploration Programs

The anticipated costs of this development are presented in two results-contingent stages.

Phase 1

Reconnaissance geological mapping, prospecting, rock and silt sampling. Five days on site, two days travel, three days report preparation.

| Geologist -10 days @ $450/day | | $ | 4500.00 | |

| Consultant/Project Manager - 10 days @ $450/day | | $ | 4500.00 | |

| Sampler/Geological Assistant - 7 days @ $250/day | | $ | 1750.00 | |

| Helicopter - A-Star 7 hours at $1500.00 per hour | | $ | 10,500.00 | |

| Truck rental - 1000 km @ 0.75/km inclusive | | $ | 750.00 | |

| Rock samples - 50 @ $50.00 per sample | | $ | 2500.00 | |

| Silt samples - 100 @ $30.00 per sample | | $ | 3000.00 | |

| BC Ferries | | $ | 300.00 | |

| Per Diem (with camp rental) - 21 man-days @ $125.00/day | | $ | 2625.00 | |

| Misc. sampling and field supplies | | $ | 500.00 | |

| Report and reproduction costs | | $ | 2000.00 | |

Subtotal | | $ | 32,925.00 | |

| | | | | |

| Management Fee @ 15% | | $ | 4938.75 | |

| Contingency @ 10% | | $ | 3786.38 | |

| | | | | |

Total | | $ | 41,650.13 | |

| GST@ 6% | | $ | 2499.00 | |

NET TOTAL | | $ | 44,149.13 | |

| Phase 2 1000 metres of diamond drilling @ 100.00 per metre, plus geological supervision, camp and supplies, transportation, assays, report and other ancillary costs. | | $ | 230,000.00 | |

| TOTAL | | $ | 274,149.13 | |

COMPLIANCE WITH GOVERNMENT REGULATION

We will be required to conduct all mineral exploration activities in accordance with the federal and provincial regulations in Canada. Such operations are subject to various laws governing land use, the protection of the environment, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, well safety and other matters. Mining in Canada is governed by three acts particular to each province.

In British Columbia There are three statutes dealing with surface rights and access relating to the mining industry in British Columbia and these are the Mineral Tenure Act (MTA), the Mining Right of Way Act (MRWA) and the Mining Rights Amendment Act (MRAA)

Mining Right of Way Act

Access is generally dealt with under the Mining Right of Way Act.

Section 2 of the MRWA concerns the power of a recorded holder to secure a right of way to cross over or under or through private land for the purpose of constructing, maintaining and operating facilities necessary for exploration, development and operation of mineral title and ancillary uses.

Under Section 2(3) where private land is taken without the consent of the owner, the Expropriation Act applies.

Section 4 of the Act requires written approval of the Minister before the power to take or use land for a right of way is exercised.

Section 6 of the Act deals with the industrial use of access road and it should be noted that there is an entitlement to use the road pursuant to subsection (1) and there is a requirement to make reasonable payment pursuant to subsection (2).

The provision for a reasonable payment is designed to reimburse the owner for actual capital costs incurred by him in order to accommodate any special needs of the user and where there is a significant capital expenditure a reasonable payment for such capital expenditure shall be made.

Section 7 deals with the non-industrial use of an access road and it allows access roads to be used by any person who has a specific legal interest in the land or resources whether this interest was acquired before or after the road was constructed.

There is authority to use an existing road (as set out in Section 10) and in accordance with subsection (2) a free miner can use an existing road to locate a claim and s/he does not have to serve notice on the owner of the road of his intention to use the road or pay compensation for its use, but s/he must comply with any lawful conditions that might govern its use.

Pursuant to Section 10(3) a recorded holder who wishes to use an existing road shall serve notice of his intention to use the road and pay compensation to the owner in an amount to be agreed upon or as settled by the mediation and arbitration board and further that he be bound by all lawful conditions governing the use of the road.

Mining Rights Amendment Act

This Act establishes the right of a tenure holder to a special use permit under the Forest Practices Code for the construction of appropriate access to the area of the mineral tenure provided the title holder has a permit under the Mines Act for the exploration, the holder receives written approval from the Chief Inspector of Mines and applies for a special use permit under the Forest Practices Code. There are currently no regulations.

Mineral Tenure Act

The provisions with respect to surface rights under the Mineral Tenure Act in Section 11 state that "no person shall carry out exploration or development or extract minerals from mineral lands, locate, record or acquire mineral title, perform or use work for assessment unless he and the agent are both free miners".

In accordance with Section 11 a free miner may enter on any land provided that the right of entry does not extend to:

a. land occupied by a building,

b. curtilage of a dwelling house,

c. orchard land,

d. land under cultivation,

e. land lawfully occupied for mining purposes,

f. park land,

g. recreation lands.

In accordance with Section 14 a recorded holder may use, enter and occupy the surface of a claim for the exploration and development or production of minerals related to the business of mining. There also exists the right to use the timber and there are differences whether the property is in production or not in production. The disposition of surface rights under the Land Act is set out in Section 15 of the Act and there are certain priorities on Crown land as set out in Section 16 of the Act.

The Minister has the right to restrict the use of surface rights where s/he considers that the surface area should be used for purposes other than mining in accordance with the provisions of Section 17. The right of entry on private land and compensation therefore is set out in Section 19 of the Act. Under Section 20 a free miner must not obstruct or interfere with an operation or activity or the construction or maintenance of a building structure, improvement or work on private land. Before a person commences exploration and development of minerals (which involves a surface disturbance by mechanical means) s/he must give notice to the owner of the surface area on which s/he intends to work or utilize a right of entry for that purpose. The free miner is liable to compensate the recorded holder of the land for the entry, occupation and use of the land for his/her mining purposes.

Provision is made in Section 19 that disputes will be settled by the mediation and arbitration board as established under the Petroleum Natural Gas Act (PNGA).

The mining industry is also subject to federal environmental laws and regulations as described in the Federal Ministry of Environment Act.

Investors may view a complete description of all Federal and provincial regulation by visiting Natural Resources Canada’s website at http://www.nrcan.gc.ca/ms/busi-entre/mlr_e.htm

Unfavorable amendments to current laws, regulations and permits governing operations and activities of resource exploration companies, or more stringent implementation thereof, could have a materially adverse impact and cause increases in capital expenditures which could result in a cessation of operations. We are not aware of any current pending or forthcoming amendments to current laws, regulations and permits governing operations and activities of resource exploration companies.

EMPLOYEES

At present, Mr. Chris Lori is the sole Director and Officer for the Company. There are presently no other employee(s). We anticipate that we will be conducting most of our business through agreements with consultants and third parties.

MANAGEMENT DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

The following discussion of our financial condition and results of operations should be read in conjunction with our consolidated financial statements and the notes to those statements included elsewhere in this prospectus. In addition to the historical consolidated financial information, the following discussion and analysis contains forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of certain factors, including those set forth under "Risk Factors" and elsewhere in this prospectus.

Our business plan is to proceed with the exploration of the Jervis Moly Property to determine whether there is a potential for molybdenum located on the properties that comprise the mineral claims. We have decided to proceed with the exploration program recommended by the geological report. We anticipate that the two phases of the recommended geological exploration program will cost approximately $44,149.13 and $230,000.00 respectively. We had $0 in cash reserves as of the audited period ended May 31, 2007. The lack of cash has kept us from conducting any exploration work on the property.

We anticipate that we will incur the following expenses over the next twelve months:

| | Ø | $820.62 to be paid to the British Columbia Provincial government to keep the claim valid; |

| | Ø | $44,149.13 in connection with the completion of Phase 1 of our recommended geological work program; |

| | Ø | $230,000.00 in connection with the completion of Phase 2 of our recommended geological work program; |

| | Ø | $10,000.00 for operating expenses, including professional legal and accounting expenses associated with compliance with the periodic reporting requirements after we become a reporting issuer under the Securities Exchange Act of 1934, but excluding expenses of the offering. |

If we determine not to proceed with further exploration of our mineral claims due to a determination that the results of our initial geological program do not warrant further exploration or due to an inability to finance further exploration, we plan to pursue the acquisition of an interest in other mineral claims. We anticipate that any future acquisition would involve the acquisition of an option to earn an interest in a mineral claim as we anticipate that we would not have sufficient cash to purchase a mineral claim of sufficient merit to warrant exploration. This means that we might offer shares of our stock to obtain an option on a property. Once we obtain an option, we would then pursue finding the funds necessary to explore the mineral claim by one or more of the following means: engaging in an offering of our stock; engaging in borrowing; or locating a joint venture partner or partners.

RESULTS OF OPERATIONS

We have not yet earned any revenues. We anticipate that we will not earn revenues until such time as we have entered into commercial production, if any, of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on our properties, or if such resources are discovered, that we will enter into commercial production of our mineral properties.

Moreover, The Company since inception on March 16, 2007, and has yet to establish proven or probable mining reserves and has no quantities of proved mineral reserves or probable mineral reserves. Moreover, the Company has not purchased or sold proved or probable minerals reserves since inception. Due to the fact that we have no proven or probable mining reserves the Company will record our exploration and development costs within operating expenses, as opposed to capitalizing those costs.

LIQUIDITY AND CAPITAL RESOURCES

Our cash at the end of the audited period on May 31, 2007 was $0. Our accounts payable of $6700 on May 31, 2007 was related to incorporation costs. Since our inception on March 16, 2007 to the end of the audited period on May 31, 2007, we have incurred a loss of ($26,700). At May 31, 2007, we had an accumulated deficit of $26,700.

For the audited period ended May 31, 2007, net cash provided by operating activities was $20,000. Our financial activities for the audited period ended May 31, 2007 included the issuance of common shares for $20,000. For the audited period ended May 31, 2007, net cash used by investing activities in the purchase of the Jervis Moly Property was $20,000.

The Company has determined that its Jervis Moly Property is to be held and used for impairment, as per SFAS 144: “Accounting for the Impairment of Long-Live Assets.” Impairment is the condition that exists when the carrying amount of a long-lived asset (asset group) exceeds its fair value. An impairment loss shall be recognized only if the carrying amount of a long- lived asset (asset group) is not recoverable and exceeds its fair value. The carrying amount of a long-lived asset (asset group) is not recoverable if it exceeds the sum of the undisclosed cash flows expected to result from the use and eventual disposition of the asset (asset group). Our determination of impairment is based on the Company’s current period operating loss combined with the Company’s history of operating losses and our projection that demonstrates continuing losses associated with the Jervis Moly Property.

In accordance with FASB 144, 25., “An impairment loss recognized for a long-lived asset (asset group) to be held and used shall be included in income from continuing operations before income taxes in the income statement of a business enterprise and in income from continuing operations in the statement of activities of a not-for-profit organization. If a subtotal such as “income from operations” is presented, it shall include the amount of that loss.” The Company has recognized the impairment of a long-lived asset by declaring that amount as a loss in income from operations in accordance with an interpretation of FASB 144.

Based on our current operating plan, we do not expect to generate revenue that is sufficient to cover our expenses for at least the next twelve months. In addition, we do not have sufficient cash and cash equivalents to execute our operations for at least the next twelve months. We will need to obtain additional financing to operate our business for the next twelve months. We will raise the capital necessary to fund our business through a private placement and public offering of our common stock. Additional financing, whether through public or private equity or debt financing, arrangements with stockholders or other sources to fund operations, may not be available, or if available, may be on terms unacceptable to us. Our ability to maintain sufficient liquidity is dependent on our ability to raise additional capital. If we issue additional equity securities to raise funds, the ownership percentage of our existing stockholders would be reduced. New investors may demand rights, preferences or privileges senior to those of existing holders of our common stock. Debt incurred by us would be senior to equity in the ability of debt holders to make claims on our assets. The terms of any debt issued could impose restrictions on our operations. If adequate funds are not available to satisfy either short or long-term capital requirements, our operations and liquidity could be materially adversely affected and we could be forced to cease operations.