Exhibit 99.2

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

La Arena Project, Peru

Rio Alto Mining Limited

Technical Report (NI 43-101)

Prepared by Mining Plus Peru S.A.C. on behalf of Rio Alto Mining Limited

Effective Date: 31stDecember 2014

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 1 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

DATE AND SIGNATURE PAGE

The “qualified persons” (within the meaning of NI 43-101) for the purposes of this report are as listed below. The effective date of this report is 31st December 2014. The report was completed and signed on the 27 February 2015.

| | |

| [signed] | | |

| | | |

| Mr. Enrique Garay | M Sc. (MAIG) | |

| Vice President Geology | | |

| Rio Alto Mining Limited. | | |

| Signed on the 27 February 2015 | | |

| | | |

| [signed] | | |

| | | |

| Mr. Ian Dreyer | B.App. Sc, MAusIMM(CP) | |

| Corporate Development Geologist | |

| Rio Alto Mining Limited. | | |

| Signed on the 27 February 2015 | | |

| | | |

| [signed] | | |

| | | |

| Mr. Tim Williams, | FAusIMM | |

| Vice-President Operation | | |

| Rio Alto Mining Limited. | | |

| Signed on the 27 February 2015 | | |

| | | |

| [signed] | | |

| | | |

| Mr. Greg Lane, | FAusIMM | |

| Chief Technical Officer, | | |

| Ausenco | | |

| Signed on the 27 February 2015 | | |

| | | |

| [signed] | | |

| | | |

| Mr. Scott Elfen, | P.E, | |

| Global Lead Geotechnical Services | |

| Ausenco | | |

| Signed on the 27 February 2015 | | |

| | | |

| [signed] | | |

| | | |

| Mr. Fernando Angeles, | M.Eng (Min), P.Eng | |

| Senior Mining Consultant | | |

| Mining Plus Peru SAC. | | |

| Signed on the 27 February 2015 | | |

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 2 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

| | | | |

| 1 | EXECUTIVE SUMMARY | 9 |

| | 1.1 | Introduction | 9 |

| | 1.2 | Property Description and Location | 9 |

| | 1.3 | Ownership | 9 |

| | 1.4 | Geology and Mineralization | 10 |

| | 1.5 | Exploration | 10 |

| | 1.6 | Production | 10 |

| | 1.7 | Mineral Resource Estimate | 11 |

| | 1.8 | Mineral Reserve Estimate | 13 |

| | | 1.8.1 | Oxide Mineral Reserves | 13 |

| | | 1.8.2 | Sulfide Mineral Reserves | 15 |

| | 1.9 | Capital and Operating Costs | 16 |

| | | 1.9.1 | Oxide Gold Project | 16 |

| | | 1.9.2 | Sulfide Copper Project | 17 |

| | | 1.10 | Interpretation and Conclusions | 18 |

| | | 1.11 | Recommendations | 19 |

| | | |

| 2 | ISSUER AND TERMS OF REFERENCE | 20 |

| | 2.1 | Sources of Information | 20 |

| | 2.2 | Site Visits | 20 |

| | 2.3 | Report Responsibilities | 21 |

| | 2.4 | Units of Measurements | 21 |

| | 2.5 | Other Abbreviations | 21 |

| | |

| 3 | RELIANCE ON OTHER EXPERTS | 22 |

| | | | |

| 4 | PROPERTY, DESCRIPTION AND LOCATION | 23 |

| | 4.1 | Property Location | 23 |

| | 4.2 | Mineral Tenure and Status | 23 |

| | 4.3 | Environmental Liabilities | 26 |

| | 4.4 | Permitting | 26 |

| | 4.5 | Annual Fees and Obligations | 27 |

| | | 4.5.1 | Maintenance Fees | 27 |

| | | 4.5.2 | Minimum Production Obligation | 27 |

| | | 4.5.3 | Royalties, OEFA Contribution and OSINERGMIN Contribution | 28 |

| | | 4.5.4 | Ownership of Mining Rights | 30 |

| | | 4.5.5 | Taxation and Foreign Exchange Controls | 30 |

| | | 4.5.6 | Environmental Laws | 31 |

| | | 4.5.7 | Mine Development, Exploitation and Processing Activities | 32 |

| | | 4.5.8 | Mine Closure and Site Remediation | 32 |

| | | 4.5.9 | Worker Participation | 32 |

| | | 4.5.10 | Regulatory and Supervisory Bodies | 33 |

| | 4.6 | Risks that may affect access, title, or the right or ability to perform work | 33 |

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 3 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

| | | |

| 5 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY | 35 |

| | 5.1 | Project Access | 35 |

| | 5.2 | Physiography and Climate | 35 |

| | 5.3 | Hydrology | 35 |

| | 5.4 | Population Centres | 37 |

| | 5.5 | Surface Rights | 37 |

| | 5.6 | Local Infrastructure and Services | 37 |

| | 5.7 | Seismicity | 39 |

| | | | |

| 6 | HISTORY | 40 |

| | 6.1 | Ownership History | 40 |

| | 6.2 | Previous Mineral Resources | 40 |

| | | 6.2.1 | Coffey Mining 2010 | 40 |

| | | 6.2.2 | Andes Mining Services (AMS) 2011 | 41 |

| | | 6.2.3 | Andes Mining Services (AMS) 2013 | 41 |

| | | 6.2.4 | Mineros Consultores SAC (MICSAC) 2014 | 42 |

| | 6.3 | Previous Mineral Reserves | 43 |

| | | 6.3.1 | Coffey Mining 2010 | 43 |

| | | 6.3.2 | Kirk Mining 2013 | 44 |

| | | 6.3.3 | Mining Plus 2014 | 45 |

| | 6.4 | Production | 47 |

| | | |

| 7 | GEOLOGICAL SETTING AND MINERALISATION | 49 |

| | 7.1 | Regional Geology | 49 |

| | 7.2 | Project Geology | 52 |

| | 7.3 | Mineralization | 60 |

| | 7.4 | Structural Geology | 60 |

| | 7.5 | Hydrothermal Alteration | 61 |

| | | |

| 8 | DEPOSIT TYPES | 65 |

| | 8.1 | Introduction | 65 |

| | 8.2 | Deposit Types and Mineralization | 65 |

| | 8.3 | High-Sulfidation Epithermal Au | 65 |

| | 8.4 | Porphyry Cu-Au (Mo) Deposits | 66 |

| | | |

| 9 | EXPLORATION | 68 |

| | 9.1 | La Arena Deposit | 68 |

| | 9.2 | Major and Regional Exploration Target | 68 |

| | | | |

| 10 | DRILLING | 71 |

| 10.1 | Introduction | 71 |

| 10.2 | Drilling Procedures | 72 |

| 10.3 | Drilling Orientation | 72 |

| 10.4 | Surveying Procedures | 72 |

| | 10.4.1 | Accuracy of Drillhole Collar Locations | 72 |

| | 10.4.2 | Down-hole Surveying Procedures | 72 |

| 10.5 | Sterilization Drilling | 73 |

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 4 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

| | |

| 11 | SAMPLE PREPARATION, ANALYSES AND SECURITY | 74 |

| | | |

| | 11.1 | Sampling Method and Approach | 74 |

| | | |

| | 11.1.1 | Diamond Core Sampling | 74 |

| | 11.1.2 | Reverse Circulation Sampling | 74 |

| | 11.1.3 | Logging | 74 |

| | | |

| | 11.2 | Sample Security | 75 |

| | 11.3 | Sample Preparation and Analysis | 75 |

| | | |

| | 12.1 | Introduction | 77 |

| | 12.2 | Analytical Quality Control | 77 |

| | | |

| | 12.2.1 | 2014 Quality Control | 77 |

| | | |

| | 12.3 | Bulk Densities | 81 |

| | 12.4 | Drillhole Database | 81 |

| | 12.5 | Data Type Comparisons | 81 |

| | 12.6 | Adequacy of Data | 85 |

| | |

| 13 | MINERAL PROCESSING AND METALLURGICAL TESTING | 86 |

| | | |

| | 13.1 | Introduction | 86 |

| | 13.2 | Oxide Deposit | 86 |

| | | |

| | 13.2.1 | Mineralogy | 86 |

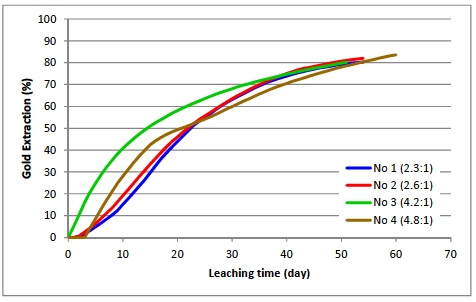

| | 13.2.2 | Leaching Performance of Sandstone Rock | 87 |

| | 13.2.3 | Pre-Operations Test Program | 87 |

| | 13.2.4 | Evaluation of Oxide Intrusive Leaching Properties | 89 |

| | 13.2.4.1 | Test Work Description | 89 |

| | 13.2.4.2 | Sampling | 90 |

| | 13.2.4.3 | Oxide Intrusive Test Work Programs | 91 |

| | 13.2.4.4 | 2013 Oxide Intrusive Program | 92 |

| | 13.2.4.5 | Early 2014 Oxide Intrusive Program | 94 |

| | 13.2.4.6 | Late 2014 Oxide Intrusive program | 96 |

| | 13.2.5 | Dump Leach Results for Economic Modelling | 97 |

| | | |

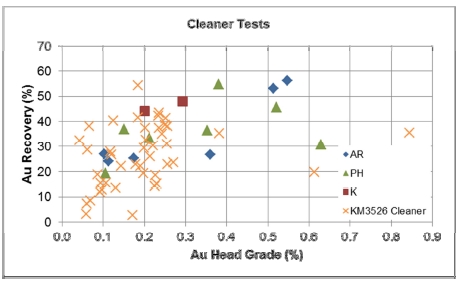

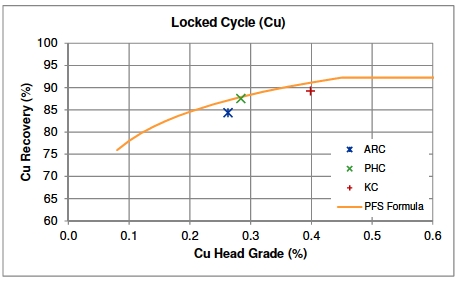

| | 13.3.1 | Historical Test Programs | 99 |

| | 13.3.1.1 | Stage 1 Testing | 99 |

| | 13.3.1.2 | Stage 2 Testing | 100 |

| | 13.3.1.3 | Stage 3 Testing | 101 |

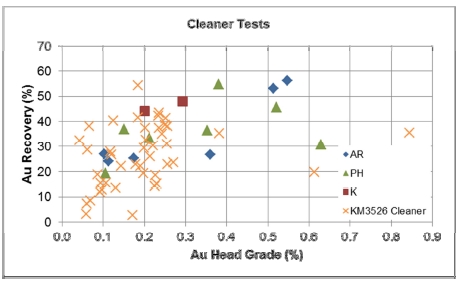

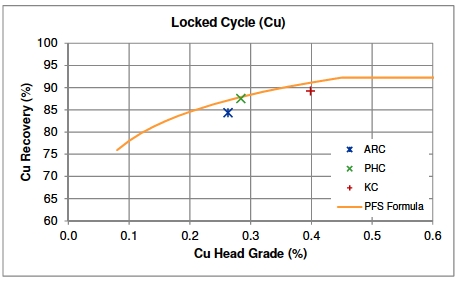

| | 13.3.1.4 | Stage 4 Testing | 102 |

| | 13.3.1.5 | Stage 5 Testing | 102 |

| | 13.3.1.6 | Stage 6 Test Work Description | 103 |

| | 13.3.1.7 | Mineralogy | 103 |

| | 13.3.1.8 | Metallurgical Sampling | 104 |

| | 13.3.1.9 | Comminution Test Program | 107 |

| | |

| 14 | MINERAL RESOURCE ESTIMATES | 115 |

| | | |

| | 14.1 | Introduction | 115 |

| | 14.2 | Database | 117 |

| | 14.3 | Geological Modelling | 118 |

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 5 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

| | | |

| | 14.3.2 | Gold Estimation Domains | 119 |

| | 14.3.3 | Copper Estimation Domains | 121 |

| | 14.3.4 | Other Elements | 121 |

| | | |

| | 14.4 | Sample Selection and Compositing | 121 |

| | 14.5 | Basic Statistics | 121 |

| | 14.6 | Variography | 124 |

| | 14.7 | Block Modelling | 126 |

| | 14.8 | Grade Estimation | 127 |

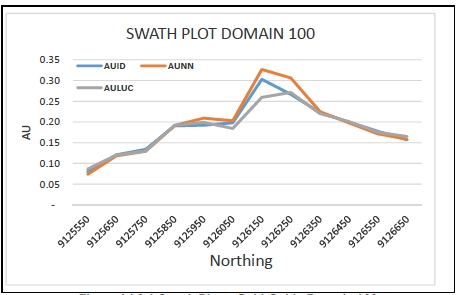

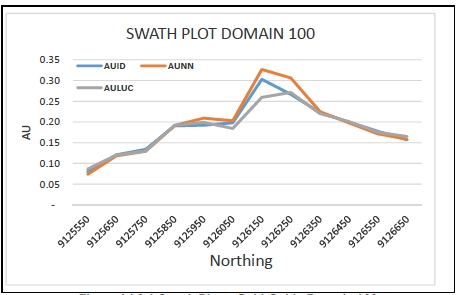

| | 14.9 | Model Validation | 130 |

| | 14.10 | Ancillary Fields | 132 |

| | 14.11 | Resource Classification | 133 |

| | 14.12 | Mineral Resource | 134 |

| | |

| 15 | MINERAL RESERVE ESTIMATES | 136 |

| | | |

| | 15.1 | Types of Materials | 136 |

| | | |

| | 15.1.1 | Oxide Material: | 136 |

| | 15.1.2 | Sulfide Material: | 136 |

| | | |

| | 15.2 | Assumptions and Parameters | 137 |

| | 15.3 | Pit optimization | 139 |

| | 15.4 | Cut-off Grades | 140 |

| | 15.5 | Mineral Reserve Statement | 141 |

| | | |

| | 15.5.1 | Oxide Mineral Reserves: | 142 |

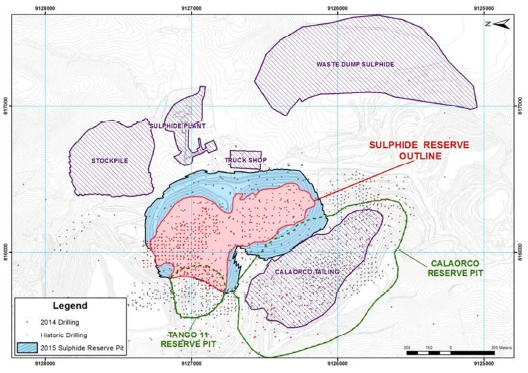

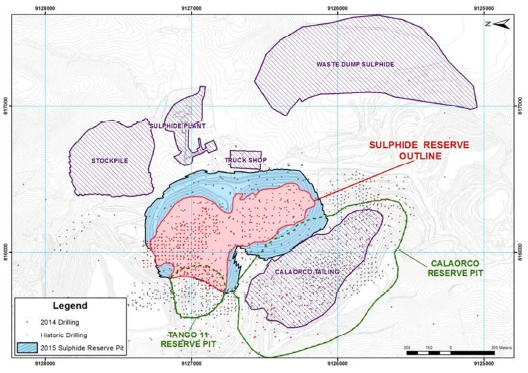

| | 15.5.2 | Sulfide Mineral Reserves | 143 |

| | | |

| | 16.1 | Geotechnical | 144 |

| | 16.2 | Hydrogeology and Hydrology | 147 |

| | 16.3 | Oxide Project Mine Layout | 148 |

| | 16.4 | Sulfide Project Mine Layout | 151 |

| | 16.5 | Mining | 152 |

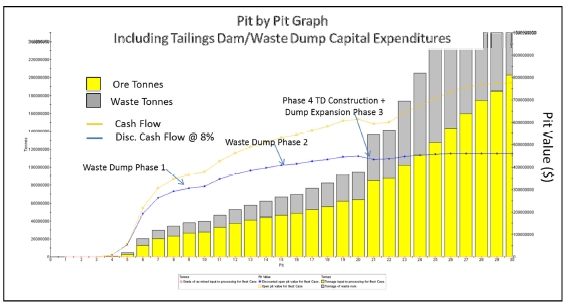

| | 16.6 | Mine Production Schedule | 153 |

| | 16.7 | Mining Equipment | 155 |

| | | |

| | 17.1 | Oxide Process Plant | 157 |

| | | |

| | 17.1.1 | Processing Flow Sheet – Dump Leach | 157 |

| | 17.1.2 | Dump Leach Process | 157 |

| | 17.1.3 | Process plant | 158 |

| | | |

| | 17.2 | Sulfide Process Plant | 160 |

| | | |

| | 17.2.1 | General | 160 |

| | 17.2.2 | Design Criteria Summary | 162 |

| | 17.2.3 | Plant Design Basis | 162 |

| | 17.2.4 | Unit Process Selection | 165 |

| | 17.2.5 | Comminution Circuit Sizing | 166 |

| | 17.2.6 | Flotation Circuit Design | 168 |

| | 17.2.7 | Concentrate Regrind | 169 |

| | 17.2.8 | Concentrate Thickening and Filtration | 169 |

| | 17.2.9 | Concentrate Storage and Load Out | 170 |

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 6 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

| | | |

| | 17.2.10 | Tailings Thickening Disposal and Water Recovery | 170 |

| | 17.2.11 | Reagents and Consumables | 171 |

| | 17.2.12 | Water Services | 172 |

| | 17.2.13 | Air Services | 174 |

| | |

| 18 | PROJECT INFRASTRUCTURE | 175 |

| | | |

| | 18.1 | Roads | 175 |

| | 18.2 | Accommodation | 175 |

| | 18.3 | Offices, Workshops and Storage | 175 |

| | 18.4 | Laboratories | 176 |

| | 18.5 | Fuel and Lubrication | 176 |

| | 18.6 | Power Supply | 176 |

| | 18.7 | Water Supply | 176 |

| | 18.8 | Explosives | 177 |

| | 18.9 | Leach Pad Design | 178 |

| | | |

| | 18.9.1 | Drainage and Geomembrane Liner System | 179 |

| | 18.9.2 | Pregnant Solution Collection System | 180 |

| | 18.9.3 | Operational requirements | 180 |

| | 18.9.4 | Geotechnical Investigation | 180 |

| | 18.9.5 | Dump Leach Stability | 181 |

| | 18.9.6 | Access Road and Perimeter Diversion Channel | 182 |

| | | |

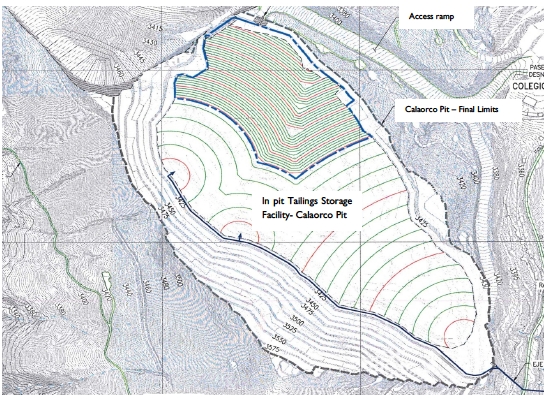

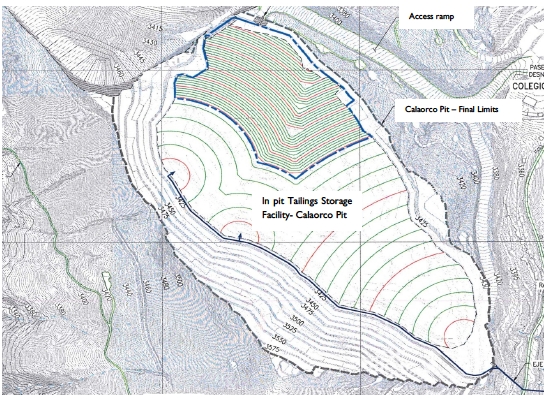

| | 18.10.1 | Calaorco Pit Tailings Storage Facility | 182 |

| | | |

| | 18.11 | Sulfide Waste Rock Storage Facility | 186 |

| | | |

| | 18.11.1 | Waste Rock Production | 186 |

| | 18.11.2 | Waste Rock Storage Facility Design | 186 |

| | 18.11.3 | Waste Rock Disposal Sequence | 188 |

| | | |

| | 18.12 | Site Infrastructure for the Sulfide Project | 189 |

| | | |

| | 18.12.1 | Design Criteria | 189 |

| | 18.12.2 | Utilities | 189 |

| | 18.12.3 | Sewage Treatment | 189 |

| | 18.12.4 | Emergency Generator | 189 |

| | 18.12.5 | On site Infrastructure | 190 |

| | 18.12.5.1 | General | 190 |

| | 18.12.5.2 | Off plot Facilities | 190 |

| | | |

| 19 | MARKET STUDIES AND CONTRACTS | 192 |

| | 19.1 | Gold Sales | 192 |

| | 19.2 | Gold Market | 192 |

| | 19.3 | Copper Supply and Demand | 194 |

| | 19.4 | Contracts | 195 |

| | | |

| 20 | ENVIRONMENTAL STUDIES, PERMITTING AND SOCIAL OR COMMUNITY IMPACT | 197 |

| | 20.1 | Environmental Risk | 197 |

| | 20.2 | Social | 198 |

| | 20.3 | Mine Closure | 198 |

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 7 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

| | |

| 21 | CAPITAL AND OPERATING COSTS | 199 |

| | | |

| | 21.1 | Oxide Gold Project - Operating Expenditures | 199 |

| | 21.2 | Oxide Gold Project - Capital Expenditures | 200 |

| | 21.3 | Sulfide Copper Project - Operating Expenditures | 201 |

| | | |

| | 21.3.1 | Mining Cost | 201 |

| | 21.3.2 | Processing Cost | 202 |

| | 21.3.3 | General and Administration Costs | 202 |

| | 21.3.4 | Total Operating Cost | 202 |

| | | |

| | 21.4 | Sulfide Copper Project - Capital Expenditures | 204 |

| | | |

| | 22.1 | Peruvian Mining Taxes and Royalty | 205 |

| | 22.2 | Oxide Gold Project | 206 |

| | 22.3 | Sulfide Copper Project | 207 |

| | |

| 24 | OTHER RELEVANT DATA AND INFORMATION | 210 |

| | | |

| | 24.1 | Oxide Project Development | 210 |

| | 24.2 | Other | 210 |

| | |

| 25 | INTERPRETATION AND CONCLUSIONS | 211 |

| | | |

| | 25.1 | Mineral Resources | 211 |

| | 25.2 | Mining and Mineral Reserves | 211 |

| | 25.3 | Oxide Treatment | 211 |

| | 25.4 | Sulfide Treatment | 212 |

| | 25.5 | Project Infrastructure | 212 |

| | | |

| | 25.5.1 | General | 212 |

| | 25.5.2 | Waste Dump Facilities | 212 |

| | | |

| | 25.6 | Contracts | 213 |

| | 25.7 | Overall | 213 |

| | | |

| | 26.1 | Geology and Resources | 214 |

| | 26.2 | Mining | 214 |

| | 26.3 | Oxide Mineral Metallurgy | 214 |

| | 26.4 | Sulfide Mineral Metallurgy | 215 |

| | 26.5 | Sulfide Process Plant | 215 |

| | 26.6 | Infrastructure | 216 |

| | 26.7 | Social | 216 |

| | 26.8 | Environmental | 217 |

| | |

| 27 | REFERENCES | 218 |

| | | |

| 28 | CERTIFICATES | 219 |

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 8 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

1.1 Introduction

Mining Plus Peru S.A.C. was commissioned by Rio Alto Mining Limited (Rio Alto), a reporting issuer in the Provinces of Alberta, British Columbia and Ontario whose common shares are listed for trading on the Toronto Stock Exchange (TSX), the New York Stock Exchange (NYSE), the Lima Stock Exchange (BVL) to prepare a NI 43-101 Technical Report (Report) of the La Arena gold-copper project (La Arena Project) in Peru.

The following two events have triggered an updated NI 43-101 report for La Arena Project.

| 1. | Updated gold oxide reserve and resource estimates for the oxide project is available as a result of additional data obtained from the 2014 reverse circulation infill drill program. Gold inventory has been updated as a result of the in-fill drilling program completed with updated cost estimates. |

| | |

| 2. | The completion of a Pre-Feasibility Study on the sulfide Cu-Au deposit, also known as La Arena Phase II Project, has been finalized. A Pre-Feasibility Study was completed in January 2015 by Ausenco on the Cu-Au sulfide material located on the East side of the current oxide pit. There have been no changes in the mineral resources on the sulfide deposit. |

This report has been completed having the effective date on December 31st, 2014. All monetary dollars expressed in this report are in United States dollars ("$").

1.2 Property Description and Location

The La Arena Project is located in northern Peru, 480 km NNW of Lima, Peru, in the Huamachuco District. The project is situated in the eastern slope of the Western Cordillera, close to the Continental Divide at an average altitude of 3,400 metres above sea level. The region displays a particularly rich endowment of metals (Cu-Au-Ag) occurring in porphyry and epithermal settings, including the Lagunas Norte mine at Alto Chicama, the Comarsa mine, La Virgen mine, Shahuindo exploration project and Tres Cruces development project.

1.3 Ownership

The mineral concessions pertaining to the La Arena Project have a total available area of 33,140 hectares. They are fully owned and registered in the name of La Arena S.A. The mining concessions are in good standing. Based on publicly available information, no litigation or legal issues related to the mining concessions comprising the project are pending.

The mineral resource identified so far in the La Arena deposit is completely contained within the mining concession “Maria Angola 18”. This mining concession is free of any underlying agreements and/or royalties payable to previous private owners. However, the Ferrol N°5019, Ferrol N°5026 and Ferrol N°5027 mining concessions, which are partially overlapped by Maria Angola 18 (as detailed in

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 9 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

section 4) are subject to a 2% Net Smelter Return (NSR) royalty, payable to their previous owners. Mining concessions Florida I, Florida IA, Florida II, Florida IIA, Florida III and Florida IIIA are subject to a 1.6% NSR royalty. Mining concessions Peña Colorada, Peña Colorada I, Peña Colorada II and Peña Colorada III are subject to a 1.4% NSR royalty.

1.4 Geology and Mineralization

The La Arena (Au, and Cu-Au) project is located in a prolific metallogenic province that contains many precious and polymetallic mines and projects such as; Lagunas Norte (Au-Ag), Santa Rosa (Au), La Virgen (Au), Quiruvilca (Ag-Base Metals), Tres Cruces (Au), Shahuindo (Au-Ag) and Igor (Au-Cu).

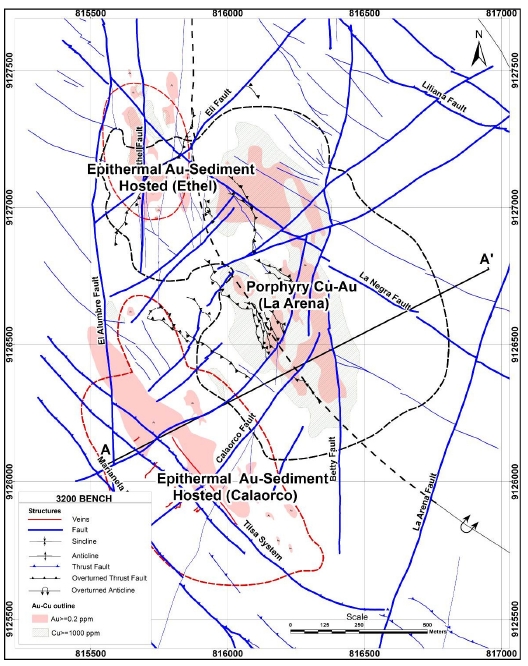

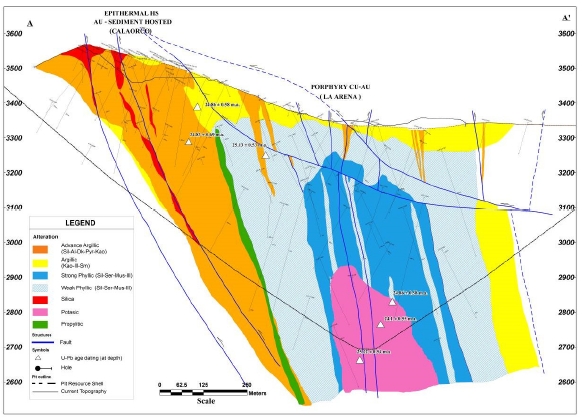

The La Arena oxide project consists of gold containing oxide mineralization which is predominantly of an Epithermal High Sulfidation style, hosted in oxidized sandstone-breccia within the Chimu Formation.

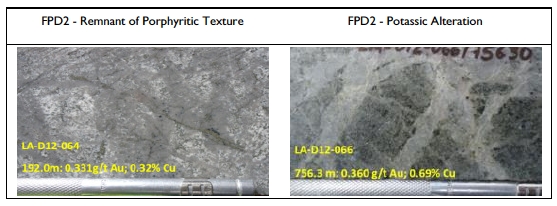

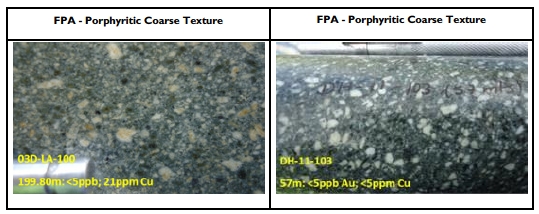

The Cu-Au-(Mo) sulfide mineralization is a porphyry type, which is hosted in a multi-stage porphyry intrusion. The La Arena Porphyry Cu-Au-(Mo) outcrops to the east from Calaorco and Ethel zones. The style of mineralization is typically porphyritic with at least four intrusive events identified. The intrusive rocks vary from dacitic to andesitic; they are differentiated by texture and composition.

1.5 Exploration

Until the effective day of this report, total drilled meters at La Arena are 284,782m. These meters are evenly split between reverse circulation (RC), at 141,591m (49.7% of the total), and core drilling (DC) at 143,191m (51.3% of the total).

The oxide domain has 19,733 m of DC drilling and 114,281 m of RC drilling which makes a total of 134,014 meters drilled in this domain. The sulfide domain has 121,858 m of DC drilling and 28,910 m of RC drilling.

During the period 2014, 22,087m of RC drilling was completed into the oxide domain, and 4,487m was completed into the sulfide domain as part of the sterilization drilling program near the Cu-Au sulfide project.

1.6 Production

Operations on site are currently exploiting the oxide gold reserve and are called the gold oxide Project. Oxide ore has been mined from Calaorco and Ethel pits, with the Ethel now being exhausted. Ore is being truck dumped in 8 m lifts onto the dump leach pad, with no crushing or agglomeration required prior to irrigation. The open pits are mined by conventional drill and blast, load and haul methods in 8 m high benches. Loading is with 170 t face shovels and a fleet of predominantly 92 t dump trucks. The Table 1.6-1 shows the historical ore and waste production since the operations began in 2011.

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 10 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

Table 1.6-1 Historical Mine Production (as Mined)

| | | | | |

| | Ore Mined | Waste | Total Tonnes |

| Year | tonnes | Au (g/t) | Oz | tonnes | tonnes |

| 2011 | 3,663,752 | 0.88 | 103,547 | 4,182,371 | 7,846,123 |

| 2012 | 8,266,964 | 0.82 | 217,128 | 12,953,447 | 21,220,411 |

| 2013 | 13,811,137 | 0.60 | 268,223 | 22,997,357 | 36,808,494 |

| 2014 | 15,274,666 | 0.52 | 256,375 | 17,332,132 | 32,606,798 |

| Total | 41,016,519 | 0.64 | 845,273 | 57,465,307 | 98,481,826 |

Cyanide leach solution is sprayed onto each leach pad cell for a nominal period of 60 days. The pregnant solution flows onto the geomembrane underlying the pad to a central collection point and into the pregnant solution pond. Pontoon mounted pumps in this pond are used to pump the solution to the adsorption, desorption and refining (ADR) plant located approximately 300 m north of the leach pad. The plant currently has the capacity to treat 36,000 t/d of ore. The process includes absorption onto carbon pellets and desorption in high caustic/high temperature leach columns. The carbon is sent to regeneration and the enriched solution is sent to electrowinning cells where a cathode is used to produce a fine-grained precipitate. The precipitate is filtered and dried at approximately 420oC, which also evaporates the mercury, which is then captured for later disposal. This dried precipitate is smelted to produce doré bars of approximately 80% Au.

A summary of processing for the project to date is presented in Table 1.6-2. Ore dumped in the leach pad may differ from actual mined ore tonnes due to the ore rehandle from the stockpile to the leach pad.

Table 1.6-2 Leach Pad Statistics

| | | | | |

| Year | Ore Dumped

(tonnes) | Head Au

Grade

(g/t) | Ounces Au

Dumped

(oz) | Ounces Au

Poured

(oz) | Recovery

(%) |

|

|

|

| 2011 | 2,466,882 | 1.01 | 80,452 | 51,145 | 77.0% |

| 2012 | 7,964,954 | 0.84 | 214,090 | 201,733 | 86.8% |

| 2013 | 13,148,713 | 0.62 | 261,232 | 215,395 | 85.6% |

| 2014 | 16,232,916 | 0.50 | 263,940 | 222,492 | 86.1% |

| Sub-Total 2012-2014 | 37,346,583 | 0.62 | 739,262 | 639,620 | 86.1% |

| Total 2011 - 2014 | 39,813,465 | 0.64 | 819,714 | 690,765 | 85.2% |

1.7 Mineral Resource Estimate

An updated model for the oxide resource was created in September 2014. The sulfide resource quoted in this report is the pre-existing January 2013 model. A small drilling program was completed in 2014 testing the sulfide breccia at the top of the sulfide domain. However, this was completed after the sulfide Cu-Au project study was commenced, and subsequent analysis shows that any changes to the sulfide model are not material to the economic viability of the Cu-Au sulfide project.

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 11 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

There have been additions to the oxide resource during 2014 due to additional data received from the RC infill drill program undertaken in the Calaorco area. The major changes to the oxide resource model for 2014, are:

The addition of a moderate amount of oxide resource on the western side of the Calaorco deposit and at depth in Calaorco due to a large infill RC drill program.

The deepening of the indicated oxide resource by between 20 and 100 m due to the additional data received from the drill program, and

The inclusion of more high-grade, Tilsa Style domains in the Calaorco area due to acquiring additional resource data in 2014.

Estimation methods for Au oxide domains have not changed since 2013, being Localised Uniform Conditioning (LUC) for low grade oxide mineralized domains and Ordinary Kriging (OK) for the oxide background material and Tilsa structures.

A summary of mine production reconciliation is presented in Table 1.7-1.

Table 1.7-1 Reconciliation of 2014 Resource Model – Oxide Total

| | | | | | | | | |

| | Resource Model (2014) | As-Mined | Variance to As-Mined |

| Year | Mt | Au (g/t) | Au (koz) | Mt | Au (g/t) | Au (koz) | Mt | Au (g/t) | Au (koz) |

| 2011 | 4.6 | 0.77 | 112.7 | 3.7 | 0.88 | 103.5 | -20% | 15% | -8% |

| 2012 | 10.0 | 0.71 | 230.0 | 8.3 | 0.82 | 217.1 | -18% | 15% | -6% |

| 2013 | 13.2 | 0.57 | 240.8 | 14.5 | 0.59 | 273.1 | 10% | 3% | 13% |

| 2014 | 13.2 | 0.51 | 217.4 | 15.3 | 0.52 | 256.4 | 15% | 3% | 18% |

| Project to Date | 41.1 | 0.61 | 800.8 | 41.7 | 0.63 | 850.1 | 1% | 5% | 6% |

The oxide resource is reported within an optimized undiscounted cash flow pit shell using metal prices of $1,400 / oz for Au and updated cost parameters. The resource in Table 1.7-2 is quoted at a 0.07 g/t Au cut-off grade with no constraints on copper, as high Cu grades can be blended and diluted in the open pit operation.

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 12 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

Table 1.7-2 Mineral Resource – Oxide Total (In Situ as at December 31st 2014)

| | | | | | | |

| La Arena - Oxide Gold Mineral Resources |

| (In Situ as at December 31st, 2014) |

| Within Optimized Pit Shell @ $ 1,400 /oz, cut-off grade 0.07 g/t Au |

| Classification | Material

Type | Tonnes

(‘000,000 t) | Au

g/t | Cu

% | Ag

g/t | Mo

ppm | Au

(´000 oz) |

| Measured | Sediments | 1.1 | 0.23 | 0.07 | 0.3 | 32.6 | 8 |

| Intrusive | 9.4 | 0.28 | 0.15 | 0.4 | 61.6 | 86 |

| Colluvium | - | - | - | - | - | - |

| Total | 10.5 | 0.28 | 0.15 | 0.3 | 58.5 | 94 |

| Indicated | Sediments | 100.8 | 0.38 | 0.01 | 0.5 | 4.1 | 1,234 |

| Intrusive | 19.7 | 0.22 | 0.06 | 0.7 | 9.7 | 137 |

| Colluvium | 2.6 | 0.34 | 0.01 | 0.2 | 2.5 | 28 |

| Total | 123.1 | 0.35 | 0.02 | 0.5 | 5 | 1,399 |

Measured

and

Indicated | Sediments | 102.0 | 0.38 | 0.01 | 0.5 | 4.5 | 1,243 |

| Intrusive | 29.1 | 0.24 | 0.09 | 0.6 | 26.5 | 223 |

| Colluvium | 2.6 | 0.34 | 0.01 | 0.2 | 2.5 | 28 |

| Total | 133.6 | 0.35 | 0.03 | 0.5 | 9.2 | 1,494 |

| Inferred | Sediments | 2.2 | 0.34 | 0.01 | 0.4 | 2.9 | 24 |

| Intrusive | 0.3 | 0.14 | 0.01 | 0.1 | 2.1 | 1 |

| Colluvium | - | - | - | - | - | - |

| Total | 2.5 | 0.31 | 0.01 | 0.4 | 2.8 | 25 |

The sulfide resource is reported within an optimized undiscounted cash flow pit shell using metal prices of $1,400 / oz for Au and $3.50 / lb Cu and updated cost parameters. The resource in Table 1.7-3 is quoted at a 0.12% g/t Cu cut-off grade.

Table 1.7-3 Mineral Resources - Sulfide Total (In Situ as at December 31st 2014)

| | | | | | | |

| La Arena – Sulfide Copper/Gold Mineral Resources |

| (In Situ as at December 31st, 2014) |

| Within Optimized Pit Shell ($ 1,400 /oz Au, $3.5 /lb Cu), Cut-Off Grade 0.12 %Cu |

| Classification | Tonnes

(‘000 000 t) | Au

g/t | Cu

% | Ag

g/t | Mo

Ppm | Au

(´000 oz) | Cu

(‘000 lbs) |

| Measured | - | - | - | - | - | - | - |

| Indicated | 274.0 | 0.24 | 0.33 | 0.4 | 38.5 | 2,124 | 2,013,930 |

| Measured and Indicated | 274.0 | 0.24 | 0.33 | 0.4 | 38.5 | 2,124 | 2,013,930 |

| Inferred | 5.4 | 0.10 | 0.19 | 0.4 | 40.7 | 18 | 22,074 |

1.8 Mineral Reserve Estimate

1.8.1 Oxide Mineral Reserves

Oxide mineral reserves have been updated as a result of material changes in the mineral resources and updated estimating inputs. The reasons for those changes are:

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 13 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

An updated resource estimate based on the new drilling campaign.

A new set of inputs for the sulfide Cu-Au pit which were taken from the latest Pre- Feasibility Study report from January 2015.

The cost and operating information gained from an additional year of commercial production of the oxide gold dump leach mine.

Oxide mineral reserves have been constrained to the final pit design based on an optimized pit shell. The mineral reserve has been estimated with measured and indicated oxide mineral resources only. The pit optimization input parameters used are listed in Table 1.8-1.

Table 1.8-1 Pit optimization input parameters for Oxide Mineral Reserves

| | | | |

| | Pit Optimization Parameters for Oxide Mineral Reserves | |

| Mining Parameters | Units | Value | |

| Mining Dilution Factor | factor | 1.05 | |

| Mining Recovery Factor | factor | 0.98 | |

| Mining Cost Sediments (direct & indirect) | $/t mined | 2.08 | |

| Processing Parameters | | | |

| Ore processing rate | Mt/y | 13 | |

| Processing Cost Sediments | $/t leached | 1.55 | |

| Processing Cost Intrusive | $/t leached | 1.55 | |

| General & Administration Cost | $/t leached | 1.22 | |

| Gold leaching recovery intrusive | % | 83 | |

| Gold leaching recovery sediments | % | 86 | |

| Economics Assumptions | | | |

| Gold price | $/oz | 1,200 | |

| Payable proportion of gold produced | % | 99.9 | |

| Gold Sell Cost | $/oz | 12.37 | |

| Royalties | % | 1 | |

The oxide mineral reserve, based on the December 31st 2014 Measured and Indicated Resource only, is summarized in Table 1.8-2. The Inferred resource and material below the cut-off grade of 0.1 g/t Au was reported as waste rock. The mineral reserves are reported as in-situ dry million tonnes and include 5% mining dilution and 98% mining recovery.

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 14 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

Table 1.8-2 La Arena - Mineral Reserve Statement for Oxide Ore

| | | | | | |

| Classification | Material | Tonnage | Au | Cu | Ag | Au |

| Type | (‘000 000 t) | g/t | % | g/t | (´000 oz) |

| Proven | Sediments | 1.2 | 0.22 | 0.07 | 0.32 | 8.6 |

| Intrusive | 8.7 | 0.28 | 0.15 | 0.33 | 77.7 |

| Proven Stockpiled | LG stockpile | 0.3 | 0.24 | 0.14 | 0.33 | 2.3 |

| Total Proven | Total | 10.2 | 0.27 | 0.14 | 0.33 | 88.6 |

| Probable | Sediments | 80.9 | 0.42 | 0.01 | 0.42 | 1,085.2 |

| Intrusive | 12.3 | 0.27 | 0.06 | 0.84 | 105.7 |

| Total Probable | Total | 93.1 | 0.40 | 0.02 | 0.48 | 1,190.9 |

| Proven and Probable | Sediments | 82.1 | 0.41 | 0.01 | 0.42 | 1,093.8 |

| Intrusive | 21.0 | 0.27 | 0.10 | 0.63 | 183.4 |

| Proven Stockpile | LG stockpile | 0.3 | 0.24 | 0.14 | 0.33 | 2.3 |

| Total Proven and Probable | Total | 103.3 | 0.39 | 0.03 | 0.47 | 1,279.5 |

Intrusive ore hosted within the oxides cannot be separated as a different ore type for processing, as it needs to be blended with sediments in order to be leached effectively. The colluvium deposit was not included in the mineral reserve due to cost of moving the national highway at this time. However, the colluvium material inside the Calaorco Pit was included in the mineral reserves as sediments. The colluvium deposit is a small shallow unconsolidated deposit of approximately 2.0 million tonnes grading 0.34 g/t gold and it is located immediately South-East of the main Calaorco Pit.

1.8.2 Sulfide Mineral Reserves

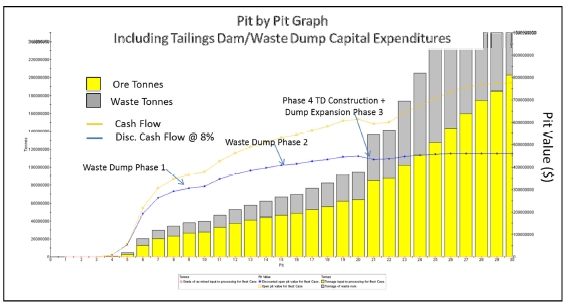

When calculating the reserve for the sulfide resource a small CAPEX constrained project was considered with strict financial hurdles. The resulting reserve at this stage is only a small portion of the total resource. The main economic assumptions used in the sulfide pit optimisation are presented in the Table 1.8-3.

The sulfide pit will be operated as an extension of the current gold mine operation. As Rio Alto operates the oxide project, the assumptions used for the sulfide project were adapted to represent the operation of the porphyry pit.

Mineral resources classified as Measured and Indicated are reported as Proven and Probable mineral reserves respectively. There were no resources classified as Measured Resources within the sulfide pit limits. Table 1.8-4 presents the Reserves Statement as of 31st of December 2014.

The tonnage and grades reported as in-situ dry tonnes and using 98% mining recovery and 5% dilution.

The cut-off grade is 0.18% Cu.

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 15 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

Table 1.8-3 Pit optimization input parameters for Sulfide Mineral Reserves

| | | | |

| | Pit Optimization Parameters for Sulfide Mineral Reserves | |

| | Mining Parameters | Units | Value | |

| | Mining Dilution Factor | factor | 1.05 | |

| | Mining Recovery Factor | factor | 0.98 | |

| | Mining Cost | $/t mined | 1.92 | |

| | Processing Parameters | | | |

| | Ore processing rate | Mt/y | 6.57 | |

| | Processing Cost | $/t milled | 4.61 | |

| | Process Copper Recovery | % | Avg. 91.1%, Range 75.9 - 92.0 | |

| | Process Gold Recovery | % | Avg. 38.9% Range 29.5 – 45.5 | |

| | General & Administration Cost | M$/y | 22.6 | |

| | Economics Assumptions | | | |

| | Copper price | $/lb | 3.0 | |

| | Payable proportion of copper produced | % | 96.5 | |

| | Copper Sell Cost | $/lb | 0.37 | |

| | Gold price | $/oz | 1,200 | |

| | Payable proportion of gold produced | % | 88.6 | |

| | Gold Sell Cost | $/oz | 8.0 | |

| | Royalties | % | 1.0 | |

Table 1.8-4 La Arena - Mineral Reserve Statement for Sulfide

| | | | | |

| Category | Tonnage | Au Grade | Cu Grade | Cu Content | Au Content |

| ('000 000 t) | g/t | % | '000 lb | (‘000 Oz) |

| Probable | 63.1 | 0.312 | 0.430 | 579,407 | 633.2 |

1.9 Capital and Operating Costs

1.9.1 Oxide Gold Project

The capital cost of the oxide project has been estimated by Rio Alto based on current operations.

Annual capital cost estimates are detailed in Table 1.9-1.

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 16 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

Table 1.9-1 Annual Capital Cost for Oxide Gold Project (in ‘000 $)

| | | | | | | |

| | | Capex Additions for Oxide Gold Project (‘000 dollars) | |

| | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | Total |

| Construction | 17,259 | 24,712 | 2,300 | 12,600 | - | - | 56,871 |

| Plant | 2,166 | 8,012 | - | - | - | - | 10,178 |

| Community Relations | 2,560 | | - | - | - | - | 2,560 |

| Permits & Engineering | 1,396 | - | - | - | - | - | 1,396 |

| Other Capex | 2,103 | 2,000 | - | - | - | - | 4,103 |

| Road Diversion | - | - | 7,000 | 8,000 | - | - | 15,000 |

| Land Purchases | 14,548 | - | - | - | - | - | 14,548 |

| Total Capex | 40,032 | 34,723 | 9,300 | 20,600 | - | - | 104,656 |

Annual Operating cost estimates for the oxide gold project, broken down by major element, are detailed in Table 1.9-2.

Table 1.9-2 Annual Operating Cost for Oxide Gold Project (in ‘000 $)

| | | | | | | |

| | | Total Operating Costs and Operating Profit (‘000 $) | |

| | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | Total |

| Net Revenue | 257,284 | 222,737 | 212,365 | 187,506 | 181,111 | 171,881 | 1,232,884 |

| Total Operating Expenses | 117,967 | 137,879 | 141,303 | 127,538 | 126,869 | 98,758 | 750,314 |

| Closure Expenditures | 1,500 | 1,500 | 1,500 | 1,500 | 1,500 | 1,500 | 9,000 |

| Operating Profit (EBITDA) | 137,817 | 83,358 | 69,562 | 58,467 | 52,743 | 71,624 | 473,570 |

| Operating Profit Margin | 53.57% | 37.42% | 32.76% | 31.18% | 29.12% | 41.67% | 38.41% |

1.9.2 Sulfide Copper Project

An overall summary of operating costs for the sulfide project is presented in Table 1.9-3.

Table 1.9-3 Total Operating Cost Summary

| | | |

| | | Units Cost | |

| | MINING | | |

| | Mining Direct Cost ($ / t mined) | 1.32 | |

| | Mining Maintenance ($/mined) | 0.02 | |

| | Mining Indirects ($/mined) | 0.60 | |

| | PROCESSING | | |

| | Power | 1.73 | |

| | Reagents, Consumables | 1.30 | |

| | Labour | 0.66 | |

| | Maintenance, Mob, Equipment | 0.93 | |

| | Total Processing Cost ($ / t milled) | 4.61 | |

| | GENERAL AND ADMINISTRATION | $22.6 M/y | |

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 17 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

Ausenco has estimated an initial CAPEX of $314 million for the processing plant and all associated infrastructure such as camp relocation, power, drainage system, tailings facilities and contingency. An additional $61.2 million has been allocated for sustaining capital during the 10 year mine life, which totals an estimated CAPEX of $415.5 million (including $ 40 million Mine Closure), for the 63Mt starter project.

The sensitivity analysis on the NPV and IRR for different Cu prices is shown in the Table 1.9-4:

Table 1.9-4 Sensitivity Analysis for the Sulfide Project

| | | | | | | | | | | |

| | | | | | After Tax NPV | | | | | |

| Interest Rate | | 2.5/lb Cu | | 2.75/lb Cu | | 3.0/lb Cu | | 3.5/lb Cu | | 4/lb Cu | |

| 0% | $ | 115,931,418 | $ | 202,256,504 | $ | 285,492,823 | $ | 448,325,631 | $ | 606,298,959 | |

| 4% | $ | 57,148,889 | $ | 124,695,433 | $ | 189,213,692 | $ | 314,925,219 | $ | 436,670,624 | |

| 6% | $ | 34,108,807 | $ | 94,249,838 | $ | 151,479,447 | $ | 262,807,486 | $ | 370,539,024 | |

| 8% | $ | 14,441,544 | $ | 68,205,343 | $ | 119,203,512 | $ | 218,270,395 | $ | 314,068,574 | |

| 10% | $ | (2,366,623) | $ | 45,879,743 | $ | 91,521,670 | $ | 180,078,151 | $ | 265,657,574 | |

| | | | | | After Tax IRR | | | | | |

| | | 2.5/lb Cu | | 2.75/lb Cu | | 3.0/lb Cu | | 3.5/lb Cu | | 4/lb Cu | |

| IRR | | 9.70% | | 15.41% | | 20.15% | | 28.22% | | 35.16% | |

1.10 Interpretation and Conclusions

The increase in the gold oxide Resource is primarily due to the definition of extra resource to the west and at depth in Calaorco, as a direct result of the 2014 drilling program.

Oxide Mineral Reserves have increased due to the physical extension of the mineralization of the oxide deposit reflected in the new Mineral Resource estimates. The gold price of $ 1,200 per ounce was not changed from the previous estimates and only costs were updated based on the performance of the year 2014.

The La Arena oxide mine continues to exceed budget expectations due to positive grade variances between resource models and mining, and the definition of additional resources at the mine.

The sulfide project reserve pit at 63 Mt is the starter pit which provides 10 years of steady mill feed at 18,000 t/d to the processing plant. A trade-off analysis conducted in Section 15 shows that this pit size represents the best discounted value for the project with lowest CAPEX. However, this pit is only a portion of a potentially larger pit from the 274 Mt resource.

The La Arena mine site has been connected to the Peru grid power supply since September 2014.

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 18 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

1.11 Recommendations

Define the northern strike extensions to the current gold oxide Resource through ongoing RC infill and extensional drilling.

Review the mine production plan for the sulfide project and smooth the total rock moved per period. An opportunity to reduce the peaks and lows on the mine production schedule was identified which allow better equipment utilization.

An opportunity to reduce the size of the low grade stockpile exists with a detailed mine schedule.

Carry out additional leaching test on both blended and unblended material.

Carry out carbon adsorption tests with pregnant liquor in order to determine carbon loading capacity when high soluble copper samples are being leached.

Additional variability flotation tests at optimized conditions should be conducted with new samples from drill holes samples inside the current pit design.

Conduct leaching tests of pyrite concentrate and cleaner scavenger tailings using a regrinding stage to determine if economic recovery of gold from these streams is feasible.

Future plant investigations may include gravity gold recovery tests on the cleaner scavenger tailings to determine if gold losses in tailings can be reduced and to produce a gravity concentrate that can be combined with the final copper concentrate.

Perform additional testing on the sulfide waste rock facilities to better refine their physical and mechanical properties to further develop the stacking and the PAG waste rock encapsulation and leachate collection strategy;

A revision to the Calaorco tailings feasibility study is required to incorporate the changes in Calaorco pit geometry.

Complete purchasing the land required for the gold oxide project, for the public road deviation, and continued land purchases for the sulfide project.

The site closure plan needs to be updated with the new details of the proposed Sulfide operation.

Revise the detailed re-logging of the sulfide deposit, in 2015, and determine if a more selective model can be constructed with sufficient geological confidence to potentially lift grade and therefore advance the project further.

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 19 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

| |

| 2 | ISSUER AND TERMS OF REFERENCE |

Mining Plus Peru S.A.C. has been commissioned by Rio Alto Mining Limited (Rio Alto), a reporting issuer in the Provinces of Alberta, British Columbia and Ontario whose common shares are listed for trading on the Toronto Stock Exchange (TSX), the New York Stock Exchange (NYSE), the Lima Stock Exchange (BVL) to prepare an Technical Report (Report) of the La Arena gold-copper projects (La Arena Project) in Peru.

This report complies with the disclosure and reporting requirements set forth in the Toronto Stock Exchange Manual, National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101), Companion Policy 43-101CP to NI 43-101, and Form 43-101F1 of NI 43-101.

The report is also consistent with the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ of 2012 (the Code) as prepared by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia (JORC).

Furthermore, this report has been prepared in accordance with the Code for the Technical Assessment and Valuation of Mineral and Petroleum Assets and Securities for Independent Experts Reports (the “VALMIN Code”) as adopted by the Australasian Institute of Mining and Metallurgy (“AusIMM”). The satisfaction of requirements under both the JORC and VALMIN Codes is binding on the authors as Members of the AusIMM.

Rio Alto, a producing issuer, nominated three of its employees to assist in the preparation of this report: Mr Tim Williams - Vice-President Operations, Mr Enrique Garay - Vice President Geology, and Ian Dreyer, Corporate Development Geologist. Each is a qualified person under NI 43-101 rules. Messrs Williams and Garay are both shareholders in Rio Alto; however Ian Dreyer does not hold any shares of Rio Alto.

The relationship of Mining Plus and Rio Alto is solely one of professional association between client and independent consultants. Mining Plus does not have any material interest in Rio Alto or related entities or interests.

2.1 Sources of Information

The authors have made all reasonable enquiries to establish the completeness and authenticity of the information provided and identified, and a final draft of this report was provided to Rio Alto along with a written request to identify any material errors or omissions prior to final submission.

2.2 Site Visits

Rio Alto’s employees visit the mine site in a regularly basis. Mr. Fernando Angeles from Mining Plus has visited La Arena mine from 08thto 11thof September 2014. Greg Lane from Ausenco has visited La Arena mine in December 2014. Scott Elfen from Ausenco visited site in August 2014.

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 20 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

2.3 Report Responsibilities

Specific sections of the report that the Qualified Persons are responsible for are provided in Table 2.3-1 and are detailed further in the attached Qualified Persons certificates.

Table 2.3-1 Qualified Persons-Report Responsibilities

| | | | |

| | Who | Section | |

| | Enrique Garay | (Rio Alto) | Section 7, 8, 9, 10 | |

| | Ian Dreyer | (Rio Alto) | Section 11, 12, 14 | |

| | Tim Williams | (Rio Alto) | Section 4, 5, 15, 16, 17.1, 18 (except 18.10 and 18.11), 19, 20, 21, 22 | |

| | Fernando Angeles | (Mining Plus) | Section 2, 3, 6, 23, 24 | |

| | Greg Lane | (Ausenco) | Section 13, 17.2 | |

| | Scott Elfen | (Ausenco) | Section 18.10 18.11 | |

| | Combined (All) | | Section 1, 25, 26 | |

2.4 Units of Measurements

All monetary dollars expressed in this report are in United States dollars (“$”). Quantities are generally stated in the International System Units. Metal content is expressed in troy ounces (Au) and pounds (Cu).

2.5 Other Abbreviations

A listing of other abbreviations used in this report is provided in Table 2.5-1 below.

Table 2.5-1 List of Abbreviations

| | | |

| Abbr. | Description | Abbr. | Description |

| $ | United States of America dollars | koz | Thousands of troy ounces |

| “ | Inches | kW | kilowatt |

| | microns | lb | pound (weight) |

| AAS | atomic absorption spectrometry | M | million |

| ADR | adsorption, desorption and refining | Moz | million troy ounces |

| ARD | acid rock drainage | Mt | millions of dry metric tonnes |

| Au | gold | Mt/y | million tonnes |

| bcm | bank cubic metres | MW | Megawatt |

| CaO | calcium oxide | NI | National Instrument |

| Cu | copper | NPV | net present value |

| DMT | dry metric ton | NSR | net smelter return |

| EIA | environmental impact assessment | oz | troy ounce |

| g/t | grams per tonne | ppm | parts per million |

| ha | Hectare | QA/QC | quality assurance quality control |

| hp | horse power | t | metric tonnes |

| IRR | internal rate of return | t/y | tonnes per year |

| k | Thousand | t/d | tonnes per day |

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 21 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

| |

| 3 | RELIANCE ON OTHER EXPERTS |

This report has been prepared by Mining Plus Peru SAC (Mining Plus) for Rio Alto Mining Limited (Rio Alto) based on a high level assessment conducted on La Arena gold-copper Project in Peru. The information, conclusions, opinions, and estimates contained herein are based on:

Information available to Mining Plus at the time of preparation of this report;

Assumptions, conditions, and qualifications as set forth in this report; and

Data, reports, and other information supplied by Rio Alto and others sign-off parties.

For the purpose of this report, Mining Plus has relied on ownership information provided by Rio Alto. Mining Plus has not researched property title or a mineral rights for the property and expresses no opinion as to the ownership status of the property.

Mining Plus has relied on Tim Williams - Vice President Operations of Rio Alto, Ian Dreyer - Corporate Development Geologist of Rio Alto and Enrique Garay - Vice President Geology of Rio Alto, for the information regarding Mineral Resources and Mineral Reserves Estimates. It has also relied on the information provided by Ausenco on mineral processing aspects for the sulfide project and the leaching processing aspect for the oxide project.

Mining Plus has relied on the outputs resulting from Rio Alto financial model of La Arena Project and the application of taxes, royalties, and other government levies or interests, applicable to revenue or income from La Arena Project.

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 22 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

| |

| 4 | PROPERTY, DESCRIPTION AND LOCATION |

4.1 Property Location

The La Arena Project is located in Northern Peru. It is 480 km NNW of Lima, the capital of Peru, see Figure 4.2-1. Access to La Arena is 710 km on paved highways or upgraded roads from Lima. Politically, La Arena falls within the Huamachuco district, Sánchez Carrión province and Region of the La Libertad. The average altitude is 3,400 meters above sea level (m.a.s.l.) and the project is located in the eastern slope of the Western Cordillera, close to the Continental Divide with local rivers flowing towards the Atlantic Ocean.

The geographic and UTM coordinates of the gold and copper mineralization are as Table 4.1-1:

Table 4.1-1 Project Coordinates

| | | |

| Geographic | UTM (PSAD 56) |

| Latitude | 07 ° 50’ S | North | 9,126,360 |

| Longitude | 78 ° 08’ W | Este | 816,237 |

4.2 Mineral Tenure and Status

The mineral concessions of the La Arena Project fall within a total area of 33,140 hectares. The concessions are 100% owned by and registered in the name of La Arena S.A.

The mining concessions are in good standing. Based on publicly available information, no litigation or legal issues related to the mining concessions comprising the project are pending. See section 4.5 below for the fees and activities required to keep these concessions active.

The mineral resource identified so far in the La Arena deposit is completely contained within the mining concession “Maria Angola 18”. This mining concession is free of any underlying agreements and/or royalties payable to previous private owners. However, the Ferrol N°5019, Ferrol N°5026 and Ferrol N°5027 mining concessions, which are partially overlapped by Maria Angola 18 (as detailed in Figure 4.2-2) are subject to a 2% Net Smelter Return (NSR) royalty, payable to their previous owners.

Mining concessions Florida I, Florida IA, Florida II, Florida IIA, Florida III and Florida IIIA are subject to a 1.6% NSR royalty. Mining concessions Peña Colorada, Peña Colorada I, Peña Colorada II and Peña Colorada III are subject to a 1.4% NSR royalty.

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 23 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

Figure 4.2-1 Project Location Map

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 24 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

Figure 4.2-2 La Arena Project Mining Concessions

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 25 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

4.3 Environmental Liabilities

By means of Ministerial Resolution No. 096-2010-MEM/DM, dated March 4, 2009, the General Mining Bureau of the Ministry of Energy and Mines has updated the “Preliminary Roster of Mining Environmental Liabilities (2006)” (“Roster”). From the legal review of the publicly available version of the above mentioned document, it has been identified that the following Mining Environmental Liability has been included in the Roster (see Table 4.3-1).

Table 4.3-1 Mining Environmental Liability

| | | | | |

| Name | Type | Coordinates | Mineral

Right | Titleholder of the Mineral Right |

| UTM PSAD 56 |

| East | North |

La

Florida I | Mining

labour | 823,378 | 9,124,708 | Florida I | - Calcáreos Industriales Perú E.I.R.L. - IAMGOLD PERU S.A.

- La Arena S.A.

- Sociedad Minera Cambior Perú S.A. |

Additionally, the following environmental damage was identified during the field work conducted for the 2006 Pre-Feasibility Study:

In the vicinity there is an old mine called Tambo Chiquito Mine (the former Florida Mine), which drains from a coal mine on the left bank of the Yamobamba river. This is an old underground mine located 10km South East from La Arena which was abandoned approximately 50 years ago. There are still ruins from the plant, abandoned camps and offices, as well as three small waste dumps with a total of 6000m3of tailings which are not confined.

Drainage of residual acidity and mine water (pH 3.5) is occurring to the Tambo Chiquito Creek, which is a tributary to the Yamobamba River. However the creek is now stabilized and does not represent a significant environmental risk to the Yamobamba River at present.

The environmental liability that may have been generated by previous exploration activities at La Arena is not significant, and is being managed in an environmentally efficient way, in close coordination with the community and/or individual owners who may also have been involved in such activities. La Arena has completed a survey to update and identify the existence of any other environmental liabilities. The results of the study were reported to the Ministry of Energy and Mines. No significant environmental liabilities were found.

4.4 Permitting

The La Arena Project is subject to various Peruvian mining laws, regulations and procedures. Mining activities in Peru are subject to the provisions of the Uniform Code of the General Mining Law (“General Mining Law”), which was approved by Supreme Decree No. 14-92-EM, on June 4, 1992 and

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 26 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

its subsequent amendments and regulations, as well as other related laws. Under Peruvian law, the Peruvian State is the owner of all mineral resources in the ground. The rights to explore for and develop these mineral resources are granted by means of the “Concession System”.

Mining concessions are considered immovable assets and are therefore subject to being transferred, optioned, leased and/or granted as collateral (mortgaged) and, in general, may be subject to any transaction or contract not specifically forbidden by law. Mining concessions may be privately owned and the participation in the ownership of the Peruvian State is not required. Buildings and other permanent structures used in a mining operation are considered real property accessories to the concession on which they are situated.

4.5 Annual Fees and Obligations

4.5.1 Maintenance Fees

Pursuant to article 39 of the General Mining Law, titleholders of mining concessions pay an annual Maintenance Fee (Derecho de Vigencia). It is due on June 30 and is effective for the following year The fee is $ 3.00 per hectare. The failure to make Validity Fee payments for two consecutive years causes the termination (caducidad) of the mining concession. However, according to article 59 of the General Mining Law, the payment for one year may be delayed with penalty and the mining concessions remain in good standing. The outstanding payment for the past year can be paid on the following June 30 along with the future year.

4.5.2 Minimum Production Obligation

Legislative Decree 1010, dated May 9, 2008 and Legislative Decree 1054, dated June 27, 2008 amended several articles of the General Mining Law regarding the Minimum Production Obligation, establishing a new regime for compliance (“New MPO Regime”).

According to the New MPO Regime, titleholders of metallic mining concessions must reach a minimum level of annual production (“Minimum Production”) of at least one (1) Tax Unit1or “UIT” per hectare,1 within a period of ten years. The ten periods begins on January 1st of the year following granting of the concession.

In the case of mining concessions that were granted on or before October 10, 2008 (as is the case of the mining concessions of La Arena), until the ten (10) year term for reaching Minimum Production established by the New MPO Regime elapses (on January 1st, 2019), these mining concessions will be subject to the former provisions of the General Mining Law.

___________________________

1Pursuant to Supreme Decree 304-2013-EF, dated December 11, 2013, the Tax Unit for the year 2014 was set at S/.3,800 (approximately $1,360)

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 27 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

Once the deadline to comply with the minimum production of the New MPO Regime has passed, if the company fails with compliance of production, it will be obligated to pay the Penalty of the New MPO Regime, and will be subject to the termination of the mining concession.

4.5.3 Royalties, OEFA Contribution and OSINERGMIN Contribution

In June 2004, Peru’s Congress approved royalties to be charged on mining operations. By Law Nº 29788, has modified the mining royalty regime starting on October 1st, 2011.

These new mining royalties are going to be determined quarterly and shall be applied to the quarterly operational profit. This rate shall be determined according to the quarterly operating margin, according to the following chart:

Table 4.5-1 Royalties: Cumulative progressive scale

| | | |

| a | b | | c |

| N° | Operative

Lower Limit | Operative

Upper Limit | Marginal Rate |

| 1 | 0 | 10% | 1.00% |

| 2 | 10% | 15% | 1.75% |

| 3 | 15% | 20% | 2.50% |

| 4 | 20% | 25% | 3.25% |

| 5 | 25% | 30% | 4.00% |

| 6 | 30% | 35% | 4.75% |

| 7 | 35% | 40% | 5.50% |

| 8 | 40% | 45% | 6.25% |

| 9 | 45% | 50% | 7.00% |

| 10 | 50% | 55% | 7.75% |

| 11 | 55% | 60% | 8.50% |

| 12 | 60% | 65% | 9.25% |

| 13 | 65% | 70% | 10.00% |

| 14 | 70% | 75% | 10.75% |

| 15 | 75% | 80% | 11.50% |

| 16 | More than 80% | | 12.00% |

To calculate the royalty in function to the operating margin will proceed as follows:

And, Royalty = OP * EF

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 28 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

Where:

OP : Operation Profit

EF : Effective Rate

Tmgj : Marginal Rate

MgO : Marginal Operative of column b

Ul : Upper Limit of column b

Li : Lower Limit of column b

j: Sections from 1 and n-1

n: Number of the section where is the Marginal Operative

The operating margin is the result of the division of the quarterly operating profit with the income generated by the quarterly sales of the mining agent. The amount to be paid for mining royalties will be the major amount from the comparison between the rate applied to the quarterly operation profit, and the 1% of the revenues generated by quarterly sales. In the case of the small scale mining titleholders, the mining royalty would be of 0%.The payment of the mining royalty is considered an expense when determining the corporate Income Tax.

OSINERGMIN is the government agency of record to inspect and audit the compliance with safety, job-related health and mine development matters.

The Supreme Decree 128-2013-EF, published on December 19th, 2013, the government established the rate applicable for the OSINERGMIN contribution. This payment will be made by all large and medium scale mining titleholders and it is calculated on the value of the monthly operating costs, corresponding to all their activities directly related to OSINERGMIN minus the Valued Added Tax and the Municipal Promotion Tax.

Rates by year:

2014: 0.21%

2015: 0.19%

2016: 0.16%

OEFA is the government agency of record that inspects and audits mining projects operations in order to secure compliance with environmental obligations and related commitments.

The Supreme Decree 130-2013-EF, published on December 19th, 2013, the government established the rate applicable for the OEFA Contribution. This payment will be made by all large and medium scale mining titleholders and it is calculated on the value of the monthly costs corresponding to all their activities directly related to OEFA minus the Valued Added Tax and the Municipal Promotion Tax.

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 29 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

Rates by year:

2014: 0.15%

2015: 0.15%

2016: 0.13%

4.5.4 Ownership of Mining Rights

Pursuant to the General Mining Law:

Mining rights may be forfeited only due to a number of enumerated circumstances provided by law (i.e. non-payment of the maintenance fees and/or noncompliance with the Minimum Production Obligation);

The right of concession holders to sell mine production freely in world markets is established. Peru has become party to agreements with the World Bank’s Multilateral Investment Guarantee Agency and with the Overseas Private Investment Corporation.

4.5.5 Taxation and Foreign Exchange Controls

A recent modification on the tax law approved by the government reduces the cooperate taxes starting in year 2015. The law progressively decreases the tax from 30% (applied until 2014) to 26% (2016 onward). The new law reduces the rate of corporate income tax and increase the tax rate on dividends as shown in the following Table 4.5-2:

Table 4.5-2 Corporate Income Tax

| | |

| Fiscal Years | Corporate Income Tax | Dividends |

| 2015 – 2016 | 28% | 6.8% |

| 2017 – 2018 | 27% | 8% |

| 2019 – forward | 26% | 9.3% |

There are currently no restrictions on the ability of a company operating in Peru to transfer dividends, interest, royalties or foreign currency in to or out of Peru or to convert Peruvian currency into foreign currency.

Congress has approved a Temporary Net Assets Tax, which applies to companies subject to the General Income Tax Regime. Net assets are taxed at a rate of 0.4% on the value exceeding one million Peruvian soles (approximately $345,000). Taxpayers must file a tax return during the first 12 days of April and the amounts paid can be used as a credit against Income Tax. Companies which have not started productive operations or those that are in their first year of operation are exempt from the tax.

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 30 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

The Tax Administration Superintendent is the entity empowered under the Peruvian Tax Code to collect federal government taxes. The Tax Administration Superintendent can enforce tax sanctions, which can result in fines, the confiscation of goods and vehicles, and the closing of a taxpayer’s offices.

4.5.6 Environmental Laws

Under Legislative Decree 1013, approved on May 14, 2008, the government created the Ministry of the Environment to coordinate all environmental matters at the executive level. Currently, the Ministry of the Environment is still being implemented and its areas of responsibility are being defined, but it has already assumed, and is likely to continue to assume further responsibilities currently held by other ministries and supervisory agencies.

Environmental Legal Framework Applied to Mining Activities

The “Environmental Regulations for the activities of Exploitation, Processing, Transport, Anciliary Works and Development of Mining and Metallurgic Activities”, are the controlling regulatory acts that establish, among others, the environmental requirements to conduct mining activities within the Peruvian territory.

Under this legal framework, the General Bureau of Environmental Affairs (“DGAAM”) of the Ministry of Energy and Mines (“MEM”) is the responsible governmental agency to approve the environmental studies required to undertake mining activities in Peru, while the Environmental Inspections and Auditing Bureau (OEFA) of the Ministry of the Environment is currently the agency responsible for the inspection and auditing of mining projects and operations in order to confirm compliance with environmental obligations and related commitments.

Mining Exploration Activities

In connection with the environmental aspects specifically related to the development of mining exploration projects, currently these are governed by the Regulations on Environmental Protection for the development of Mining Exploration Activities.

Pursuant to these regulations, depending on the scale and impact of the exploration activities to be conducted, mining exploration projects are classified into the following two categories:

Category I: Before conducting exploration activities under this category, title holders will submit a DIA and have it approved by the DGAAM.

Category II: In order to conduct exploration activities under this category, title holders will have an EIAsd approved by the DGAAM of the MEM plus the permits outlined below.

Notwithstanding the above, it should be noted that the approval of the corresponding environmental certificate does not grant the titleholder the right to start conducting exploration

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 31 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

activities, given that, titleholders of mining concessions are also required to obtain all governmental consents and permits legally required and the right granted by the landowner to use the surface land required.

4.5.7 Mine Development, Exploitation and Processing Activities

Pursuant to the “Environmental Regulations for the activities of Exploitation, Processing, Transport, Anciliary Works and Development of Mining and Metallurgic Activities”, prior to conducting mining and processing activities, titleholders of mining concessions must have an EIA approved.

A titleholder with an existing EIA that has executed mining activities such as exploration, exploitation, processing, closing or related activities or related to, and / or built components or modifications made without modifying its EIA , must report it to the DGAAM and OEFA within 60 business days from the entry into force of the Decree Supreme 040-2014-EM.

4.5.8 Mine Closure and Site Remediation

Exploration Activities

Regarding environmental remediation of areas affected by mining exploration activities, the “Regulations on Environmental Protection for the Development of Mining Exploration Activities”, establishes that titleholders of mining exploration projects will do “progressive closure”, “final closure” and “post closure” programs as outlined in the corresponding environmental study. Any amendment of the closure measures or its terms requires the prior approval of the DGAAM of the MEM.

Mining Development, Exploitation and Processing

Prior to the start-up of mining activities, including mine development, exploitation and processing, titleholders are required to have a Mine Closure Plan, duly approved by the DGAAM of the MEM in order to be authorized to carry out such activities.

Peruvian legal framework covering Mine Closure Plans includes a number of financial and legal requirements intended to ensure the completion of the closure obligations by the titleholders of mining projects. In case of non-compliance, these financial and legal requirements allow the mining authority to seize the financial guarantees from titleholders and complete the Mine Closure Plans as approved, preventing mining environmental liabilities.

4.5.9 Worker Participation

Under Peruvian law, every company that generates income and has more than twenty employees on its payroll is obligated to grant a share of its profits to its workers. For mining companies, the percentage of this profit-sharing benefit is 8% of taxable income. This profit-sharing amount made

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 32 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

available to each worker is limited to 18 times the worker’s monthly salary, based upon their salary at the close of the previous tax year.

4.5.10 Regulatory and Supervisory Bodies

The five primary agencies in Peru that regulate and supervise mining companies are the Ministry of Energy and Mines (“MEM”), the National Institute of Concessions and Mining Cadastral (“INGEMMET”), the Supervisory Entity for the Investment in Energy and Mining (“OSINERGMIN”), the Labour Ministry (“MINTRA”) and, as previously described, the recently created Environmental Inspections and Auditing Bureau (“OEFA”) of the Ministry of the Environment.

The MEM promotes the integral and sustainable development of mining activities, as well as regulates all the activities in the Energy and Mines sector.

The INGEMMET is the Government Entity in charge of granting mining concessions, which entitles the concession holder the right to explore and exploit the area in which boundaries such concessions are located.

OSINERGMIN and MINTRA oversee regulatory compliance with safety, job-related health, contractors, and mine development matters, while OEFA oversees regulatory compliance with environmental regulation, investigating and sanctioning the breach of any environmental obligation.

4.6 Risks that may affect access, title, or the right or ability to perform work

Natural resources exploration, development, production and processing involve a number of risks, many of which are beyond the Company's control. Project and business risk factors and discussion on these are included in the Company’s quarterly Management Discussion and Analysis and the Annual Information Forms that are filed on SEDAR, the following list is a summary of those. Without limiting the foregoing, such risks include:

Changes in the market price for mineral products, which have fluctuated widely in the past, affecting the future profitability of the Company’s operations and financial condition.

Community groups or non-governmental organizations may initiate or undertake actions that could delay or interrupt the Company’s activities. See Social and Community Issues below.

The Company has limited operating history and there can be no assurance of its continued ability to operate its projects profitably.

Mining is inherently dangerous and subject to conditions or elements beyond the Company’s control, which could have a material adverse effect on the Company’s business.

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 33 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

Actual exploration, development, construction and other costs and economic returns may differ significantly from those the Company has anticipated and there are no assurances that any future development activities will result in profitable mining operations.

Increased competition could adversely affect the Company’s ability to attract necessary capital funding or acquire suitable producing properties or prospects for mineral exploration and development in the future.

The Company’s insurance coverage does not cover all of its potential losses, liabilities and damage related to its business and certain risks are uninsured or uninsurable.

The Company depends heavily on limited mineral properties, and there can be no guarantee that the Company will successfully acquire other commercially mineable properties.

The Company’s activities are subject to environmental laws and regulations that may increase the cost of doing business or restrict operations.

The Company requires numerous permits in order to conduct exploration, development or mining activities and delays in obtaining, or a failure to obtain, such permits or failure to comply with the terms of any such permits that have been obtained could have a material adverse effect on the Company.

Exploration, development and mining activities on land within Peru generally require both ownership of mining concessions and ownership of or a leasehold interest over surface lands (“surface rights”).

The Company constantly seeks to expand its activities and may experience delays in obtaining surface rights or may not be able to acquire surface rights because of unwillingness by the owner of such rights to transfer ownership or the right to use at a reasonable cost or in a timely manner.

The Company may experience difficulty in attracting and retaining qualified management to meet the needs of its anticipated growth, and the failure to manage the Company’s growth effectively could have a material adverse effect on its business and financial condition.

Insofar as certain directors and officers of the Company hold similar positions with other mineral resource companies, conflicts may arise between the obligations of these directors and officers to the Company and to such other mineral resource companies.

Title to the Company’s mineral properties may be subject to prior unregistered agreements, transfers or claims or defects.

The Company’s business is subject to potential political, social and economic instability in the countries in which it operates.

Changes in taxation legislation or regulations in the countries in which the Company operates could have a material adverse effect on the Company’s business and financial condition.

The Company has no dividend payment policy and does not intend to pay any dividends in the foreseeable future.

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 34 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

| |

5 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY |

5.1 Project Access

The project can be accessed via a 165 km national roadway from the coastal city of Trujillo directly east towards Huamachuco, passing through Chiran, Shorey/Quiruvilca and the Lagunas Norte project (Barrick Gold Corporation). The road is paved / sealed all the way. An air strip is also present at Huamachuco, a town of approximately 35,000 people located 21 km from La Arena that accommodates small airplanes. A private airstrip is also present at the nearby Lagunas Norte Mine operated by Barrick Gold Corporation.

5.2 Physiography and Climate

The topography in the project area is relatively smooth with undulating hills. Elevations vary between 3,000 and 3,600 meters above sea level. In general, the slopes are stable with grades varying between 16º and 27º, and the land is covered with vegetation typical of the area.

On the northern and southern flanks of the deposit, localized unstable areas exist where landslides have occurred during previous rainy seasons.

In Peru, the temperature normally varies according to the elevation, approximately 0.8°C per 100 m of elevation change. Average annual temperature data recorded from the La Arena meteorological station in 2013 is 10.6ºC. The maximum recorded temperature is 22.6°C and the minimum is 0.4ºC.

Historically, total average annual rainfall has been estimated in 1124 mm/annum and the average total annual evaporation rate in 733 mm/a. The average relative humidity varies monthly between 77 and 88%.

Maximum precipitation usually occurs during the months of October through to March while the months of June to September are the driest. The maximum daily precipitation recorded to date at the La Arena site is 245.6 mm and occurred in February 2012 while minimum precipitation was recorded in July 1998 with a total of 0 mm.

5.3 Hydrology

In September 2012 Golder Associates completed a hydrological study for the proposed new tailings site area that could be applied at the La Arena site. The study included the review and analysis of 13 regional meteorological stations located near the site. Regionally there is no hydrometric station data that can be used to determine surface water flows and calibrate the information obtained from the

| |

| INNOVATIVE AND PRACTICAL MINING CONSULTANTS | 35 |

| | |

| | MP PERU SAC | Technical Report NI 43-101, La Arena Project, Peru |

meteorological stations. Flow measurements have only been taken periodically as part of the environmental baseline studies for the sulfide project.

The climatological conditions of the La Arena site corresponds to typical climatic conditions found in the northern Sierra of Peru, where the weather is mainly controlled by the ground elevation as well as the geographical location on the eastern side of the western cordillera; the precipitation annual regime, and local specific climatic conditions.

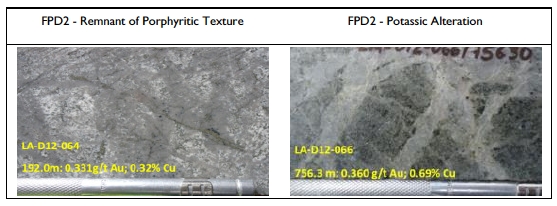

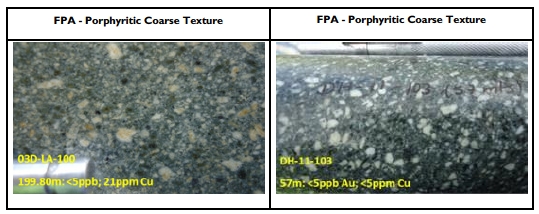

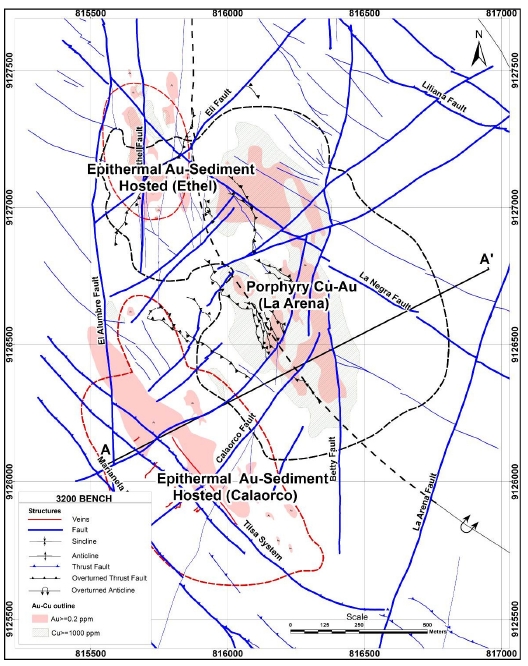

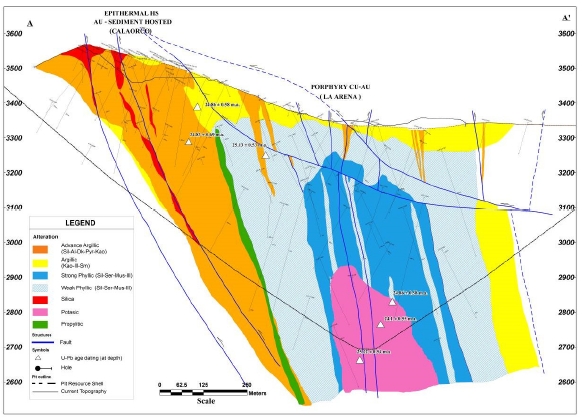

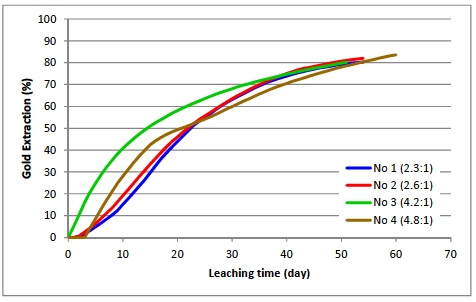

Wind speed and direction varies according to the season. From June to September the monthly average wind speed is 4.5 m/s with east direction. From October to May, monthly average wind speeds are in the order of 3.7 m/s and from east to west direction.