Exhibit 99.1

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON MONDAY, MARCH 30, 2015

NOTICE OF SPECIAL MEETING AND

MANAGEMENT PROXY AND INFORMATION CIRCULAR

RELATING TO, AMONG OTHER THINGS, THE PROPOSED ARRANGEMENT INVOLVING TAHOE RESOURCES INC.

THIS NOTICE OF MEETING AND MANAGEMENT INFORMATION CIRCULAR IS FURNISHED IN CONNECTION WITH THE SOLICITATION BY THE MANAGEMENT OF RIO ALTO MINING LIMITED OF PROXIES TO BE VOTED AT THE SPECIAL MEETING OF SHAREHOLDERS OF RIO ALTO MINING LIMITED TO BE HELD ON MONDAY, MARCH 30, 2015.

|

RECOMMENDATION TO SHAREHOLDERS On the recommendation of a special committee of independent directors, the board of directors of Rio Alto Mining Limited has, after careful consideration, unanimously determined that the Arrangement is fair to the shareholders of Rio Alto Mining Limited and is in the best interests of Rio Alto Mining Limited. The board of directors unanimously recommends that the shareholders of Rio Alto Mining Limited vote FOR the special resolution approving the Arrangement. |

TO BE HELD AT:

THE OFFICES OF DAVIS LLP

Suite 2800, Park Place

666, Burrard Street

Vancouver, BC V6C 2Z7

At 9:00 a.m.

|

| These materials are important and require your immediate attention. They require the shareholders of Rio Alto Mining Limited to make important decisions. If you are in doubt as to how to make such decisions, please consult our proxy solicitors, Kingsdale Shareholder Services, by telephone at 1-866-581-1479 toll-free in North America or call collect at 416-867-2272 outside of North America, or by email at contactus@kingsdaleshareholder.com. |

THE ARRANGEMENT AND THE RELATED SECURITIES DESCRIBED HEREIN HAVE NOT BEEN APPROVED OR DISAPPROVED BY ANY SECURITIES REGULATORY AUTHORITY, INCLUDING WITHOUT LIMITATION ANY SECURITIES REGULATORY AUTHORITY OF ANY CANADIAN PROVINCE OR TERRITORY, THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION, OR THE SECURITIES REGULATORY AUTHORITY OF ANY U.S. STATE, NOR HAS ANY OF THEM PASSED UPON THE ACCURACY OR ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

February 27, 2015

Dear Rio Alto Shareholders,

The board of directors (the “Board”) of Rio Alto Mining Limited (“Rio Alto” or the “Company”) cordially invites you to attend the special meeting (the “Meeting”) of shareholders of Rio Alto to be held at the offices of Davis LLP at Suite 2800, Park Place, 666, Burrard Street, Vancouver, BC V6C 2Z7 on Monday, March 30, 2015 at 9:00 a.m. (Vancouver time).

At the Meeting, you will be asked to consider and, if deemed advisable, approve, with or without amendment, a special resolution (the “Rio Alto Arrangement Resolution”) approving a statutory plan of arrangement pursuant to section 193 of theBusiness Corporations Act(Alberta) (the “ABCA”) and related matters. The full text of the resolution and a more detailed description of the Arrangement are included in the management information circular (the “Rio Alto Circular”) that accompanies this letter.

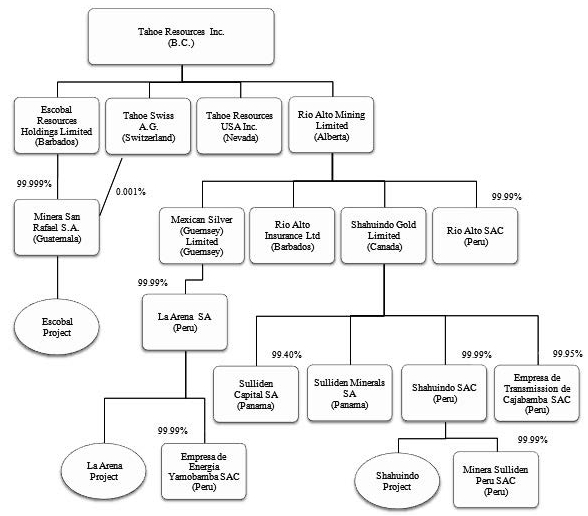

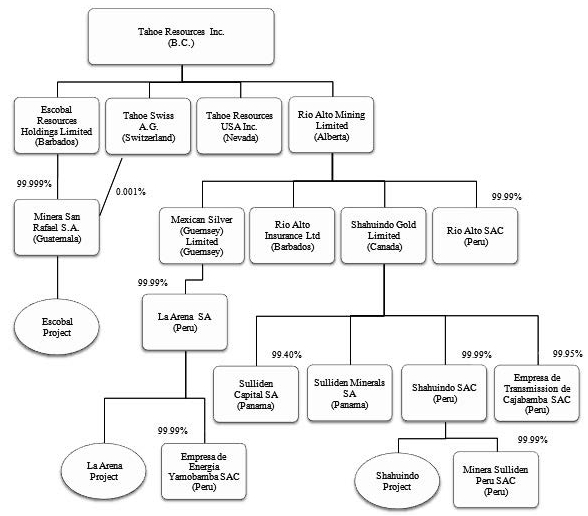

The Rio Alto Arrangement Resolution is in respect of a proposed plan of arrangement (the “Arrangement”) involving Rio Alto, Tahoe Resources Inc. (“Tahoe”) and a newly incorporated company, which is wholly owned by Tahoe, 1860927 Alberta Ltd. (“Subco”). Pursuant to the Arrangement, Tahoe will acquire all of the issued and outstanding common shares of Rio Alto (the “Rio Alto Shares”) from the shareholders of Rio Alto (“Rio Alto Shareholders”) in exchange for common shares of Tahoe (“Tahoe Shares”) on the basis of 0.227 of a Tahoe Share and $0.001 in cash for each Rio Alto Share. Each Rio Alto Share held by Tahoe will thereafter be transferred to Subco in consideration of the issuance by Subco of one common share of Subco (each, a “Subco Share”) for each Rio Alto Share so transferred, following which Rio Alto will amalgamate with Subco. The Arrangement will result in Rio Alto becoming a wholly owned subsidiary of Tahoe. In order to complete the Arrangement and the amalgamation under the ABCA, Rio Alto Shareholder approval must be obtained in respect of the Rio Alto Arrangement Resolution.

To be effective, the Rio Alto Share Arrangement Resolution must be approved by an affirmative vote of at least two-thirds of the votes cast at the Meeting by the Rio Alto Shareholders present in person or by proxy. The Rio Alto Arrangement Resolution must also be approved by a simple majority of the votes cast at the Meeting by Rio Alto Shareholders present in person or by proxy (after excluding votes cast in respect of Rio Alto Shares over which Alex Black, President and Chief Executive Officer of Rio Alto and his joint actors, exercise control or direction, and whose votes may not be included in determining minority approval pursuant to Multilateral Instrument 61-101 –Protection of Minority Security Holders in Special Transactions). The completion of the Arrangement is also subject to certain other conditions, including receipt of the approval of the Arrangement by the Court of Queen’s Bench of Alberta and the approval by the shareholders of Tahoe of the issuance of the Tahoe Shares in connection with the Arrangement.

Upon completion of the Arrangement, the combined company will be led by a new management team comprised of members of the current management teams of both Rio Alto and Tahoe and the new Board of Directors will consist of six of the existing members of the Tahoe Board and three nominees from Rio Alto.

The Board has unanimously determined that the Arrangement is fair to Rio Alto Shareholders and is in the best interests of Rio Alto. The Board has received the opinions of GMP Securities L.P., the financial advisor to the Board, and Scotia Capital Inc., the independent financial advisor to the special committee

If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com

- ii -

of the Board, which concluded that, based upon and subject to the scope of review and the assumptions and limitations contained in the opinions, as of February 8, 2015, the date the Arrangement was initially agreed to between the parties, the consideration to be received by the Rio Alto Shareholders pursuant to the Arrangement is fair, from a financial point of view, to the Rio Alto Shareholders.

AFTER CAREFUL CONSIDERATION OF THE ARRANGEMENT, THE RIO ALTO BOARD HAS UNANIMOUSLY RECOMMENDED THAT RIO ALTO SHAREHOLDERS VOTEIN FAVOUROF THE RIO ALTO ARRANGEMENT RESOLUTION.

Each of the directors and senior officers of Rio Alto intends to vote his or her Rio Alto Shares FOR the approval of the Rio Alto Arrangement Resolution. In this regard, the directors and senior officers of Rio Alto, who, as of the date hereof, in the aggregate beneficially own, directly or indirectly, 9,880,416 Rio Alto Shares, representing approximately 2.96% of the issued and outstanding Rio Alto Shares, have agreed with Tahoe to vote their Rio Alto Shares (and any Rio Alto Shares issued or acquired by them) for the Rio Alto Arrangement Resolution.

It is very important that your Rio Alto Shares be represented at the Meeting.Whether or not you are able to attend the Meeting in person, we urge you to complete the enclosed form of proxy and return it as soon as possible in the envelope provided for that purpose or by fax to 1-866-249-7775 for North America and (416) 263-9524 for international faxes.

All proxies, to be valid, must be received by Computershare Investor Services Inc. (“Computershare”), 100 University Ave., 8th floor, North Tower Toronto, Ontario M5J 2Y1 at least 48 hours, excluding Saturdays, Sundays and holidays, before the Meeting or any adjournment thereof. Late proxies may be accepted or rejected by the Chairman of the Meeting in his discretion, and the Chairman is under no obligation to accept or reject any particular late proxy. Voting by proxy will ensure that your vote will be counted if you are unable to attend the Meeting in person. The time limit for deposit of proxies may be waived or extended by the Chairman of the Meeting at his or her discretion, without notice.

If you are a non-registered holder of Rio Alto Shares and have received these materials from your broker or another intermediary, please complete and return the form of proxy or other authorization form provided to you by your broker or intermediary in accordance with the instructions provided. Failure to do so may result in your Rio Alto Shares not being eligible to be voted at the Meeting. See “Voting Information - Voting for non-registered holders” in the Rio Alto Circular.

If you require any assistance in completing your proxy, please call our proxy solicitors, Kingsdale. Rio Alto Shareholders residing in North America may call Kingsdale toll-free at 1-866-581-1479. Rio Alto Shareholders residing outside of North America may call collect at 416-867-2272. Rio Alto Shareholders may also email Kingsdale atcontactus@kingsdaleshareholder.com. Electronic copies of the enclosed Rio Alto Circular and the accompanying management information circular supplement (the “Supplement”) which forms part of the circular (together, the “Circular”) are available on Rio Alto’s website atwww.rioaltomining.comand on SEDAR atwww.sedar.comand on the U.S. Securities and Exchange Commission's website atwww.sec.gov.

Included with this letter, in addition to the Rio Alto Circular and the form of proxy, is a notice of the Meeting, the Supplement and a letter of transmittal (the “Letter of Transmittal”). The Supplement contains a detailed description of the Arrangement, including the arrangement agreement dated February 9, 2015 between Rio Alto, Tahoe and Subco governing the terms of the Arrangement. We have provided a brief description of the Arrangement in this letter to assist you in making your decision, but you should carefully consider all of the information in, and incorporated by reference in, the Rio Alto Circular, including the Supplement and the schedules attached thereto. If you require assistance, consult your financial, legal or other professional advisors.

If you are a registered Rio Alto Shareholder holding certificated shares or through the Direct Registration System (“DRS”), you should complete the enclosed Letter of Transmittal in accordance with the instructions in it, sign it and return it to Computershare, which acts as the Depositary under the Arrangement, in the envelope provided, together with the certificates representing your Rio Alto Shares (unless held in the DRS). The Letter of Transmittal contains complete instructions on how to exchange

If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com

- iii -

the certificate(s) representing your Rio Alto Shares and receive your Tahoe Shares under the Arrangement. You will not receive any DRS Advice for Tahoe Shares until after the Arrangement is completed and you have returned your properly completed documents, including the Letter of Transmittal and the certificate(s) (unless held in the DRS) representing your Rio Alto Shares to Computershare.

If you hold Rio Alto Shares through a broker, investment dealer, bank, trust company or other intermediary, you should follow the instructions provided by Computershare and your intermediary to ensure your vote is counted at the Meeting. You will not receive a Letter of Transmittal. Your intermediary will complete the necessary transmittal procedures to ensure that you receive payment for your Rio Alto Shares if the proposed Arrangement is completed.

If the Rio Alto Shareholders approve the Rio Alto Arrangement Resolution and all of the conditions to the Arrangement are satisfied or, where permitted, waived, it is anticipated that the Arrangement will be completed on or about April 1, 2015.

On behalf of the Rio Alto Board, I would like to express our gratitude for the support our shareholders have demonstrated with respect to our decision to move forward with the proposed Arrangement with Tahoe. We look forward to seeing you at the Meeting.

Yours very truly,

(Signed) “Alex Black”

Alex Black

President and Chief Executive Officer

If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS OF

RIO ALTO MINING LIMITED (“RIO ALTO” OR THE “COMPANY”)

| |

| WHEN: | Monday, March 30, 2015 at 9:00 a.m. (Vancouver Time) |

| | |

| WHERE: | The offices of Davis LLP, Suite 2800, Park Place, 666, Burrard Street, Vancouver, BC V6C 2Z7 |

| | |

| PURPOSE: | To discuss and, if it thought fit, approve the following items of business: |

| 1. | To consider and, if deemed advisable, approve, with or without amendment, a special resolution (the “Rio Alto Arrangement Resolution”) approving a plan of arrangement (the “Arrangement”) involving Rio Alto, Tahoe Resources Inc. (“Tahoe”) and 1860927 Alberta Ltd. pursuant to Section 193 of theBusiness Corporations Act(Alberta) (the “ABCA”) and related matters, the full text of which resolution is set forth inAppendix “A”to the accompanying management information circular (the “Rio Alto Circular”), whereby, among other things, Tahoe will acquire all of the issued and outstanding common shares of Rio Alto (the “Rio Alto Shares”) and the shareholders of Rio Alto (the “Rio Alto Shareholders”) will receive 0.227 of a common share of Tahoe and $0.001 in cash, for each Rio Alto Share held, all as more particularly described in the Rio Alto Circular and the management information circular supplement attached thereto (the “Supplement”); and |

| | |

| | 2. | to transact such other business as may be properly brought before the Meeting or any adjournment thereof. |

To be effective, the Rio Alto Arrangement Resolution must be approved by a special resolution, which is a resolution passed by at least two-thirds of the votes cast at the Meeting by Rio Alto Shareholders present in person or by proxy. The Rio Alto Arrangement Resolution must also be approved by a simple majority of the votes cast at the Meeting by Rio Alto Shareholders present in person or by proxy (after excluding votes cast in respect of Rio Alto Shares over which Alex Black, President and Chief Executive Officer of Rio Alto and his joint actors exercise control or direction and whose votes may not be included in determining minority approval pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions).

Registered Rio Alto Shareholders have the right to dissent to the Rio Alto Arrangement Resolution under the ABCA. Following completion of the Arrangement, registered Rio Alto Shareholders who properly exercise their dissent rights will be entitled to be paid fair value for their Rio Alto Shares. Failure to comply strictly with the dissent procedures in the ABCA, as modified by the Interim Order of the Court, may result in the loss or unavailability of the right to dissent.

This Notice of Special Meeting is accompanied by the Rio Alto Circular, a form of proxy, a letter of transmittal and the Supplement, which provides additional information relating to the matters to be considered at the Meeting.

If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com

- ii -

The board of directors of the Company (the “Board”) has fixed the close of business on February 25, 2015 as the record date (the “Record Date”), being the date for the determination of the registered holders of securities entitled to receive notice of the Meeting. Only shareholders whose names have been entered in the register of Rio Alto Shareholders as of the close of business on the Record Date will be entitled to receive notice of and to vote their Rio Alto Shares at the Meeting.

Rio Alto Shareholders who are unable to attend the Meeting are requested to complete, date, sign and return the enclosed form of proxy so that as large a representation as possible may be had at the Meeting.

Duly completed and executed proxies must be received by the Company’s transfer agent at the address indicated on the enclosed envelope, by fax at the toll-free number set out on the enclosed proxy,no later than 9:00 a.m. (Vancouver Time) on March 26, 2015, or no later than 48 hours (excluding Saturdays, Sundays and holidays) before the time of any adjourned or postponed Meeting. Proxies received after such time may be accepted or rejected by the Chairman of the Meeting in the Chairman’s discretion. The time limit for deposit of proxies may be waived or extended by the Chairman of the Meeting at his or her discretion, without notice.

By Order of the Board,

(Signed)“Alex Black”

Alex Black

President and Chief Executive Officer

Vancouver, British Columbia

February 27, 2015

It is desirable that as many shares of the Company as possible be represented at the Meeting. If you do not expect to attend and would like your shares represented, please complete the enclosed form of proxy and return it as soon as possible in the envelope provided for that purpose or fax to 1-866-249-7775 for North America and (416) 263-9524 for international faxes. All proxies, to be valid, must be received by Computershare Investor Services Inc., 100 University Ave., 8th floor, North Tower Toronto, Ontario M5J 2Y1, at least 48 hours, excluding Saturdays, Sundays and holidays, before the Meeting or any adjournment or postponement thereof. Late proxies may be accepted or rejected by the Chairman of the Meeting in his discretion, and the Chairman is under no obligation to accept or reject any particular late proxy.

If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com

- 1 -

MANAGEMENT INFORMATION CIRCULAR

Capitalized terms in this section that are not otherwise defined herein have the meanings ascribed thereto under “Glossary of Terms” in the Supplement. Certain information pertaining to Tahoe and the Combined Company in this Circular and in the Supplement, including forward-looking information and forward-looking statements made by Tahoe, included or incorporated by reference herein has been provided by Tahoe or is based on publicly available documents and records on file with the Canadian securities authorities and other public sources. Although Rio Alto does not have any knowledge that would indicate that any such information is untrue or incomplete, Rio Alto assumes no responsibility for the accuracy or completeness of such information, nor for the failure by such other persons to disclose events that may have occurred or which may affect the completeness or accuracy of such information but which is unknown to Rio Alto. This section may contain forward-looking statements and forward-looking information and you should refer to the “Cautionary Note Regarding Forward-Looking Information” at page S-2 in the Supplement.

Solicitation of proxies

This management information circular (“Rio Alto Circular”) and accompanying management information circular supplement dated February 27, 2015 ( the “Supplement”, and collectively with the Rio Alto Circular, the “Circular”) is provided in connection with the solicitation by management and the directors of Rio Alto Mining Limited (the “Company” or “Rio Alto”) of proxies from the holders of common shares of the Company (the “Rio Alto Shares”) for the special meeting of shareholders of the Company (the “Meeting”) to be held on Monday, March 30, 2015 at 9:00 a.m. (Vancouver Time) at the offices of Davis LLP, located at Suite 2800, Park Place, 666, Burrard Street, Vancouver, BC V6C 2Z7, or at any adjournment or postponement(s) thereof for the purposes set out in the accompanying notice of Meeting (“Notice of Meeting”).

The Company has engaged Kingsdale Shareholder Services (“Kingsdale”) as proxy solicitation agent for the Meeting and to, among other things, solicit proxies for the Meeting. Any solicitation costs will be borne by the Company. If you have any questions about information contained in this Circular or require assistance in completing your proxy, please consult Kingsdale by telephone at 1-866-581-1479 toll free in North America or call collect at 416-867-2272 outside of North America or by email at contactus@kingsdaleshareholder.com.

Request for Printed Meeting Materials

Shareholders can request that printed copies of the Meeting materials be sent to them by postal delivery at no cost to them by contacting Rio Alto’s corporate office as follows:

Rio Alto Mining Limited

Attention: Alejandra Gomez

Suite 1950, 400 Burrard Street

Vancouver BC V6C 3A6

Tel: 1 604 628 1401

Email:info@rioaltomining.com

If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com

- 2 -

Effective Date of this Circular:

Unless otherwise stated, the information contained in this circular is effective as at February 27, 2015.

Currency:

Unless otherwise stated, all dollar amounts are in Canadian dollars. United States dollars are referred to as “US$.”

VOTING INFORMATION

The following are some questions that you, as a holder of Rio Alto Shares (a “Rio Alto Shareholder”), may have relating to the Arrangement and the Meeting, and the answers to such questions. These questions and answers do not provide all of the information relating to the Meeting or the matters to be considered at the Meeting and are qualified in their entirety by the more detailed information contained elsewhere in this Circular. You are urged to read this Circular in its entirety before making a decision related to your Rio Alto Shares. Terms not otherwise defined in this section shall have the meaning ascribed thereto under “Glossary of Terms” of the attached Supplement.

Why am I receiving this proxy and information circular?

One of the benefits of being a shareholder of a corporation is the right to vote on certain corporate matters. This Circular provides the information that you need to vote at the Meeting. Since some Rio Alto Shareholders cannot or do not want to personally attend the special meeting at which the voting occurs, Rio Alto provides Rio Alto Shareholders with the option to cast a proxy vote, that is to say to provide authority to the persons selected by the board of directors of the Company (the “Management Designees”) to represent them at the Meeting,or to designate a person (who need not be a Rio Alto Shareholder) other than the Management Designees to represent him or her at the Meeting. Such right may be exercised by inserting in the space provided for that purpose on the form of proxy the name of the person to be designated and by deleting therefrom the names of the Management Designees, or by completing another proper form of proxy and delivering the same to the transfer agent of the Company. Such Rio Alto Shareholder should notify the nominee of the appointment, obtain the nominee’s consent to act as proxy and should provide instructions on how the Rio Alto Shareholder’s shares are to be voted. The nominee should bring personal identification with him or her to the Meeting. In any case, the form of proxy should be dated and executed by the Rio Alto Shareholder or an attorney authorized in writing, with proof of such authorization attached (where an attorney executed the proxy form). In addition, a proxy may be revoked by a Rio Alto Shareholder personally attending at the Meeting and voting his shares.

What will I be voting on?

Rio Alto Shareholders are being asked to vote to approve a special resolution (the “Rio Alto Arrangement Resolution”) approving a plan of arrangement (the “Arrangement”) pursuant to Section 193 of theBusiness Corporations Act(Alberta) (the “ABCA”), the full text of which resolution is set forth in Appendix “A” to this Rio Alto Circular whereby, among other things, Tahoe Resources Inc. (“Tahoe”) will acquire all the issued and outstanding Rio Alto Shares and the Rio Alto Shareholders will receive 0.227 of a Tahoe Share and $0.001 in cash, for each Rio Alto Share held.

If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com

- 3 -

You are also being asked to approve the transaction of any other business that may properly come before the Meeting or any adjournments or postponements of the Meeting.

What is the recommendation of the Board?

The Board of Directors of Rio Alto (the “Board” or “Board of Directors”), after consulting with its financial and legal advisors, and upon the recommendation of a special committee of the Board, has unanimously determined that the Arrangement is fair to the Rio Alto Shareholders, is in the best interests of Rio Alto, andrecommends that Rio Alto shareholders vote FOR the Rio Alto Arrangement Resolution to be considered at the Meeting, as discussed in more detail below. See “The Arrangement –Recommendation of the Board and Reasons for the Recommendation” for more details. In addition, the directors and executive officers of Rio Alto have entered into the Rio Alto Support Agreements, pursuant to which they have agreed to vote their Rio Alto Shares FOR the Rio Alto Arrangement Resolution. As of the date hereof, approximately 9,876,066 Rio Alto Shares, representing approximately 2.96% of the issued and outstanding Rio Alto Shares, were held by the aforementioned persons.

Why does the Board recommend that Rio Alto Shareholders vote FOR the Rio Alto Arrangement Resolution?

In the course of its evaluation of the Arrangement, the Board consulted with Rio Alto’s senior management, legal counsel and financial advisers, considered the strategic alternatives available to the Company, reviewed a significant amount of information, including information derived from Rio Alto’s due diligence review of Tahoe, and considered a number of factors. Certain of the expected benefits to the Rio Alto Shareholders and reasons for the Arrangement, among others, are listed as follows (see “The Arrangement – Recommendation of the Board and Reasons for the Recommendation”, “The Arrangement – Fairness Opinion of GMP Securities L.P.” and “The Arrangement – Fairness Opinion of Scotia Capital Inc.” for a more comprehensive discussion of the reasons why the Board is recommending that Rio Alto Shareholders vote FOR the Rio Alto Arrangement Resolution):

Creation of a Leading Precious Metals Producer.The Arrangement combines Rio Alto’s currently producing, low-cost La Arena Gold Oxide Mine and the low-cost, scalable Shahuindo Project located in Peru with Tahoe’s producing Escobal Mine in Guatemala, one of the world’s largest and highest grade silver mines, providing the Combined Company with a high quality asset base and a strong growth platform.

Immediate Premium. Under the Arrangement, Rio Alto Shareholders have been offered a consideration equivalent to $4.00 per Rio Alto Share based on the closing price of Tahoe Shares on the TSX of $17.64 on February 6, 2015, which represents a premium of 22.1% to the closing price of Rio Alto Shares of $3.28 on the TSX on February 6, 2015 and a premium of 20.3% based on the volume weighted average prices of each respective company on the TSX for the 20-day period ending on February 6, 2015.

Equity Ownership in a High-Margin and High-Growth Producer with an Attractive Dividend. The Arrangement is expected to provide Rio Alto Shareholders with meaningful participation in a larger company with an enhanced market presence, including a market capitalization of over $3.2 billion, a strong balance sheet with zero net debt, strong and growing operating margins, and attractive dividends to provide increased returns during the construction of the Shahuindo Project. Rio Alto Shareholders are expected to hold approximately 35% of the issued and outstanding Tahoe Shares after completion of the Arrangement.

Superior Financial Returns.The Combined Company is expected to experience strong financial returns in the future and enhanced free cash flow generation, which may improve Rio Alto’s

If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com

- 4 -

future financial position and provide the financial flexibility to fund the Company’s growth initiatives, including the construction of the Shahuindo Project in 2015 and the potential future development of La Arena Phase II.

Continuity at the Board and Management Levels of the Combined Company.After the Effective Date, it is expected that the Board of Directors of the Combined Company will consist of nine directors, of whom three would be nominees of Rio Alto. Alex Black, the current President and Chief Executive Officer of Rio Alto, is expected to assume the role as Chief Executive Officer of the Combined Company, and several other members of Rio Alto’s management and technical team are expected to continue in their current positions with Rio Alto in the Combined Company.

Expanded Operational Capabilities.The Arrangement adds proven experience in the construction and operation of underground mines, complementing Rio Alto’s current expertise in open-pit mining.

Extensive Due Diligence Completed.Rio Alto’s management and technical teams have completed a detailed due diligence review of Tahoe, which included a site visit, geological analysis and country risk assessment.

Fairness Opinions.In the opinion of GMP Securities L.P. (“GMP”), the financial advisor to Rio Alto, and Scotia Capital Inc. (“Scotia”), the financial advisor to the Special Committee, as at the date of the fairness opinion provided by GMP and the fairness opinion provided by Scotia, and subject to the assumptions, limitations and qualifications set out therein, the Consideration to be received by Rio Alto Shareholders under the Arrangement was fair, from a financial point of view, to the Rio Alto Shareholders.

Tahoe Shareholder Approval.The Share Issuance Resolution must be approved by a majority of the votes cast in respect thereof by Tahoe shareholders present in person or represented by proxy at the Tahoe Meeting or by written consent. Goldcorp and the directors and officers of Tahoe, who collectively hold approximately 43% of the Tahoe Shares as of the date hereof, each entered into Tahoe Support Agreements pursuant to which they agreed, among other things, to vote FOR the Arrangement. On February 25, 2015, Tahoe announced that it had obtained written consent from Tahoe Shareholders with ownership, control or direction over more than 50 percent of Tahoe Shares for the Tahoe Share Issuance Resolution in accordance with the policies of the TSX.

Likelihood of the Arrangement Being Completed. The likelihood of the Arrangement being completed is considered by the Board to be high, in light of the experience, reputation and financial capability of Tahoe and the absence of significant closing conditions outside the control of Rio Alto, other than the Rio Alto Shareholder Approval, the approval by the Court of the Arrangement and other regulatory approvals.

Superior Proposals. The Arrangement Agreement allows the Board, in the exercise of its fiduciary duties, to respond to certain unsolicited Acquisition Proposals which may be superior to the Arrangement. The Board received advice from its financial and legal advisors that the deal protection terms, including the Termination Fee, and circumstances for payment of the Termination Fee, are within the ranges typical in the market for similar transactions and are not a significant deterrent to potential Superior Proposals.

Dissent Rights. Any Registered Rio Alto Shareholder who opposes the Arrangement may, on strict compliance with certain conditions, exercise his or her Dissent Rights and receive the fair value for his or her Rio Alto Shares in accordance with the Arrangement.

If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com

- 5 -

Rio Alto Support Agreements. The directors and executive officers of Rio Alto, holding an aggregate of approximately 2.96% of the Rio Alto Shares as of the date hereof, each entered into a Rio Alto Support Agreement pursuant to which they agreed, among other things, to vote FOR the Arrangement.

Rio Alto Shareholder and Court Approvals. The Arrangement is subject to the following Rio Alto Shareholder and Court approvals, which protect Rio Alto Shareholders:

| a) | the Rio Alto Arrangement Resolution must be approved by an affirmative vote of (a) at least two-thirds of the votes cast at the Meeting by the Rio Alto Shareholders in person or by proxy, and (b) a simple majority of the votes cast at the Meeting by Rio Alto Shareholders present in person or by proxy (after excluding votes cast in respect of Rio Alto Shares over which Alex Black, President and Chief Executive Officer of Rio Alto, and his joint actors exercise control or direction, and whose votes may not be included in determining minority approval pursuant to MI 61-101); and |

| | |

| | b) | the Arrangement must be approved by the Court, which will consider, among other things, the fairness of the Arrangement to Rio Alto Shareholders. |

Review of Possible Alternatives.The Rio Alto Board reviewed possible alternatives of the Arrangement (including the possibility of continuing to operate Rio Alto as an independent entity), and the perceived risks thereof, the range of possible benefits to Rio Alto Shareholders of such alternatives, and the timing and uncertainty of successfully accomplishing any such alternatives.

Do any directors or executive officers of Rio Alto have any interests in the Arrangement that are different from, or in addition to, those of the Rio Alto Shareholders?

In considering the recommendation of the Board to vote FOR the Rio Alto Arrangement Resolution, Rio Alto Shareholders should be aware that some of the directors and executive officers of Rio Alto have interests in the Arrangement that are different from, or in addition to, the interests of Rio Alto Shareholders generally. See “The Arrangement – Interests of Certain Persons in the Arrangement – Rio Alto Directors and Executive Officers” and “Securities Laws Considerations – Canadian Securities Laws –MI 61-101 – Protection of Minority Security Holders in Special Transactions” in the Supplement.

All of the Rio Alto Shares, Rio Alto Options, SGC Options and Rio Alto Warrants held by the directors and officers of Rio Alto will be treated in the same fashion under the Arrangement as Rio Alto Shares, Rio Alto Options, SGC Options and Rio Alto Warrants held by every other Rio Alto Shareholder, Rio Alto option-holder, SGC option-holder and Rio Alto warrant-holder, respectively.

How is the Arrangement to be achieved?

The Arrangement will be carried out pursuant to the provisions of the ABCA. An arrangement is a statutory corporate reorganization that is supervised and approved by a court. If the Arrangement is approved at the Meeting, the issuance of Tahoe Shares pursuant to the Arrangement is approved at a special meeting of shareholders of Tahoe (the “Tahoe Meeting”) or in writing in the form of written Tahoe Shareholders consent in accordance with the policies of the TSX, and the other conditions specified in the Arrangement are satisfied or waived (for a summary of such conditions, see “The Arrangement Agreement - Conditions Precedent” in the Supplement). Rio Alto will apply to the Court of Queen’s Bench of Alberta (the “Court”) for a final order approving the Arrangement. If the final order is granted by the Court, Tahoe and Rio Alto will complete the Arrangement shortly thereafter.

If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com

- 6 -

On February 25, 2015, Tahoe announced that it had obtained written consent from Tahoe Shareholders with ownership, control or direction over more than 50 percent of Tahoe Shares for the issuance of Tahoe Shares to Rio Alto Shareholders pursuant to the Arrangement in accordance with the policies of the TSX.

What will the composition of the board of directors and the management team of the Combined Company be if the Arrangement is approved?

It is expected that immediately after the Arrangement becomes effective, the board of directors of the Combined Company will consist of nine directors, with six existing directors of Tahoe continuing as directors of the Combined Company and three directors nominated by Rio Alto. Subject to the approval of the Arrangement by the Rio Alto Shareholders and the satisfaction of the other conditions for the completion of the Arrangement, the directors of the Combined Company are anticipated to be: Kevin McArthur, Alex Black, Tanya Jakusconek, A. Dan Rovig, Paul B. Sweeney, James B. Voorhees, Drago Kisic Wagner, Kenneth F. Williamson and Dr. Klaus Zeitler.

The senior management team of the Combined Company will consist of five nominees of Tahoe and three nominees of Rio Alto. Kevin McArthur, the current Vice Chairman and Chief Executive Officer of Tahoe will act as the Executive Chairman of the board of the Combined Company and Alex Black, the current President and Chief Executive Officer of Rio Alto, will act as the Chief Executive Officer of the Combined Company. The senior management team of the Combined Company will also include Ron Clayton as President and Chief Operating Officer, Mark Sadler as Vice President and Chief Financial Officer, Eduardo Loret de Mola as Chief Operating Officer - Peru Operations, Tim Williams as Vice President - Operations, Brian Brodsky as Vice President - Exploration and Edie Hofmeister as Vice President - Corporate Affairs.

Will the Rio Alto Shares continue to be listed on the TSX, the New York Stock Exchange (the “NYSE”), the Frankfurt Stock Exchange or the Bolsa de Valores de Lima S.A. (the“BVL”), the Lima stock exchange?

No. The Rio Alto Shares will be de-listed from the TSX, the NYSE, the Frankfurt Stock Exchange and the BVL when the Arrangement is completed and Rio Alto will become a wholly-owned subsidiary of Tahoe. When the Arrangement is complete, former Rio Alto Shareholders will hold Tahoe Shares, which are listed on the TSX and the NYSE and Tahoe has agreed to use its commercial reasonable efforts to obtain a listing of the Tahoe Shares on the BVL following the completion of the Arrangement, which may not occur concurrently with the completion of the Arrangement.

When is the Arrangement expected to close?

The Arrangement is expected to close on or about April 1, 2015, assuming that the required shareholder approvals of Rio Alto and Tahoe, Court approval and regulatory approvals have been received by such time and subject to the other terms and conditions set out in the Arrangement Agreement.

Should I send my Rio Alto Share certificates now?

You are not required to send your certificates representing Rio Alto Shares to validly cast your vote in respect of the Rio Alto Arrangement Resolution. We encourage registered Rio Alto Shareholders to complete, sign, date and return the enclosed letter of transmittal (the “Letter of Transmittal”), together with their Rio Alto Share certificate(s) (unless held in the DRS), at least two Business Days prior to the Effective Date which will assist in arranging for the prompt exchange of their Rio Alto Shares if the Arrangement is completed.

If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com

- 7 -

When can I expect to receive the Consideration for my Rio Alto Shares?

Assuming completion of the Arrangement, if you hold your Rio Alto Shares through an intermediary, then you are not required to take any action and the Tahoe Shares and the net cash payment will be delivered to your intermediary through the procedures in place for such purposes between CDS Clearing and Depository Services Inc. (“CDS”) or similar entities and such intermediaries. If you hold your Rio Alto Shares through an intermediary, you should contact your intermediary if you have questions regarding this process.

In the case of registered Rio Alto Shareholders (“Registered Rio Alto Shareholders”), within five Business Days after the Effective Date or as soon as practicable after the Effective Date, assuming due delivery of the required documentation, including the applicable Rio Alto Share certificates (unless held in the DRS) and a duly and properly completed Letter of Transmittal, Tahoe will cause the Depositary to forward DRS Advices representing the Tahoe Shares and a cheque representing the net cash payment to which the Registered Rio Alto Shareholder is entitled by first class mail to the address of the Registered Rio Alto Shareholder as shown on the register maintained by Computershare or at the address set out in the Letter of Transmittal, unless the Registered Rio Alto Shareholder indicates in the Letter of Transmittal that it wishes to pick up the DRS Advices representing the Rio Alto Shares and the cheque representing the net cash payment.

Registered Rio Alto Shareholders who do not deliver their Rio Alto Share certificates (unless held in the DRS) and all other required documents to the Depositary on or before the date which is six years after the Effective Date will lose their right to receive Tahoe Shares and net cash payment.

See “The Arrangement – Procedure for Exchange of Rio Alto Shares” in the Circular.

Do I have a right of dissent in respect of any of the matters to be considered at the meeting?

Yes. Registered Rio Alto Shareholders are entitled to Dissent Rights in connection with the adoption of the Rio Alto Arrangement Resolution. Those Rio Alto Shareholders who properly exercise their Dissent Rights will be entitled to be paid fair value for their Rio Alto Shares. If you wish to dissent from the Rio Alto Arrangement Resolution, you must provide a dissent notice to Rio Alto, care of Davis LLP, 1000, 250 2ndStreet S.W., Calgary, Alberta T2P 0C1 Attention: Daniel Kenney, and that notice must be received not later than 9 a.m. (Vancouver Time) on March 30, 2015 or 9:00 a.m. (Vancouver time) on the date which the Rio Alto Meeting may be postponed or adjourned.

It is important that you strictly comply with the dissent requirements, which are summarized in the Circular, otherwise your Dissent Rights may not be recognized.

How many votes do I have?

You will have one vote for each common share of the Company you own at the close of business on February 25, 2015, the record date (the “Record Date”) for the Meeting.

How many shares are eligible to vote?

The Company is authorized to issue an unlimited number of Rio Alto Shares and an unlimited number of Preferred Shares. There are no other shares authorized, issued or outstanding of any class. As at the date hereof, the Company has 334,166,939 Rio Alto Shares and no Preferred Shares outstanding. The Rio Alto Shares are the only shares entitled to be voted at the Meeting, and holders of Rio Alto Shares are entitled to one vote for each Rio Alto Share held.

If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com

- 8 -

As of the date hereof, to the knowledge of the directors and senior officers of the Company, no person beneficially owned, directly or indirectly, or exercised control or direction over Rio Alto Shares carrying more than 10% of the voting rights of the Company except for Van Eck Associates Corporation (“VEAC”), an investment manager which has investment authority over accounts that hold Rio Alto Shares and which has reported in an Alternative Monthly Report dated February 4, 2015, a copy of which being available on Rio Alto’s SEDAR profile atwww.sedar.comthat based on the accounts over which it has investment authority, it has control or direction over a total of 59,293,079 Rio Alto Shares representing approximately 17.74% of the issued and outstanding Rio Alto Shares as of the date thereof.

How many votes are required to approve the Rio Alto Arrangement Resolution?

The Rio Alto Arrangement Resolution must be passed by (i) an affirmative vote of no less than two-thirds of the votes cast FOR the resolution by the Rio Alto Shareholders present in person or by proxy at the Meeting; and (ii) a simple majority of the votes cast at the Meeting by Rio Alto Shareholders present in person or by proxy, other than votes cast in respect of Rio Alto Shares over which Alex Black, President and Chief Executive Officer of Rio Alto and his joint actors exercise control or direction, representing 1.46% of the issued and outstanding Rio Alto Shares (as of February 27, 2015).

How do I vote?

If you are eligible to vote and your shares are registered in your name, you can vote your shares in person at the Meeting or by Proxy, as explained below. If your shares are registered in the name of an Intermediary (as hereinafter defined), please see the instructions below under the heading “Voting for non-registered holders.”

Voting by proxy for registered holders

You are a Registered Rio Alto Shareholder if your Rio Alto Shares are held in your name or if you have a certificate for Rio Alto Shares. As a Registered Rio Alto Shareholder you can vote in the following ways:

| |

| In Person | Attend the Meeting and register with the transfer agent, Computershare, upon your arrival. Do not fill out and return your proxy if you intend to vote in person at the Meeting. |

| Mail | Enter voting instruction, sign the form of proxy and send your completed form in the accompanied pre-paid envelope to: Computershare Investor Services Inc.

Attention: Proxy Department

8th Floor, 100 University Avenue,

Toronto, ON M5J 2Y1 |

| Telephone | North America: 1-866-732-VOTE (8683) Outside of North America: (312) 588-4290 |

| Fax | North America: 1-866-249-7775 or International: (416) 263-9524 – Please scan and fax both pages of your completed, signed form of proxy. |

| Internet | Go to www.investorvote.com. Enter your 15 digit control number printed on the form of proxy and follow the instructions on the website to vote your Rio Alto Shares. |

If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com

- 9 -

| |

| Questions? | Call Kingsdale Shareholder Services at 1-866-581-1479 (toll-free within North America) or 416-867-2272 (collect call outside North America). |

Your vote must be received at least 48 hours, excluding Saturdays, Sundays and holidays, before the Meeting or any adjournment thereof. Late proxies may be accepted or rejected by the Chairman of the Meeting in his discretion, and the Chairman is under no obligation to accept or reject any particular late proxy. The time limit for deposit of proxies may be waived or extended by the Chairman of the Meeting at his or her discretion, without notice.

If you vote by telephone or via the Internet, do not complete or return the form of proxy.

Voting for non-registered holders

If your Rio Alto Shares are not registered under your name, they will likely be registered under the name of your broker or an agent of that broker (the “Intermediary”).Each Intermediary has its own procedures; please follow them carefully to ensure that your shares are voted at the Meeting according to your instructions.

Without specific instructions, brokers and their agents and nominees are prohibited from voting shares for the broker’s clients. Your Intermediary should have sent you this Circular, together with either (a) the Voting Instruction Form (“VIF”) to be completed and signed by you and returned to them as required, or (b) a form of proxy, which has already been signed by the Intermediary and is restricted as to the number of shares beneficially owned by you, to be completed by you and returned to Computershare or Kingsdale no later than 48 hours, excluding Saturdays, Sundays and holidays, prior the commencement of the Meeting. To vote in person at the Meeting, a non-registered shareholder should, in the case of a VIF, follow the instructions set out on the VIF and, in the case of a form of proxy, insert his or her name in the blank space provided and return the form of proxy to Computershare no later than 48 hours, excluding Saturdays, Sundays and holidays, prior to the commencement of the Meeting.

Late proxies from non-registered holders may be accepted or rejected by the Chairman of the Meeting in his discretion, and the Chairman is under no obligation to accept or reject any particular late proxy. The time limit for deposit of proxies may be waived or extended by the Chairman of the Meeting at his or her discretion, without notice.

If you have any questions or need assistance completing your proxy or VIF, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com.

How will my proxy be voted?

On the form of proxy, you can indicate how you would like your proxy holder to vote your shares for any matter put to a vote at the meeting and on any ballot, and your shares will be voted accordingly. If you do not indicate how you want your shares to be voted, the Management Designees (whose names appear on the form of proxy) intend to vote your sharesFOR the Rio Alto Arrangement Resolution.

How can I revoke my proxy?

If you are a Registered Rio Alto Shareholder, you may revoke your proxy by taking one of the following steps:

If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com

- 10 -

You may submit a new proxy to Computershare before 9:00 a.m. (Vancouver time) of March 26, 2015 or 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting; or

You (or your attorney, if authorized in writing) may sign a written notice of revocation addressed to the Corporate Secretary and deposited at the registered office of the Company: Suite 1950- 400 Burrard Street, Vancouver, BC V6C 3A6 at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof, at which the proxy is to be used; or

You (or your attorney, if authorized in writing) may sign a written notice of revocation and deliver it to the Chairman of the Meeting on the day of the Meeting, or in any other manner permitted by law.

If you are a non-registered shareholder, you should contact your Intermediary through which you hold Shares and obtain instructions regarding the procedure for the revocation of any voting or proxyholder instructions that you have previously provided to your Intermediary.

How are proxies solicited?

The Company’s management and directors have engaged Kingsdale to solicit your proxy and the costs of doing so are being borne by the Company. The Company expects to pay fees of approximately $175,000 to Kingsdale for its proxy solicitation services in addition to certain out-of-pocket expenses. In addition to soliciting proxies by mail or telephone, Kingsdale or the Company’s directors, officers and employees of the Company may also, without additional compensation, solicit proxies in person or by phone, fax or other form of electronic communication.

Who counts the votes?

The Company’s transfer agent, Computershare, counts and tabulates the proxies. This is done independently of the Company to preserve confidentiality in the voting process. Proxies are referred to the Company only in cases where a shareholder clearly intends to communicate with management or when it is necessary to do so to meet legal requirements.

Who do I contact if I have questions?

If you have any inquiries, you can contact Kingsdale, the Company's information and solicitation agent, as follows:

Kingsdale Shareholder Services

130 King Street West, Suite 2950

P.O. Box 361, Toronto, Ontario M5X 1E2

Toll free in North America: 1-866-581-1479

Collect outside of North America: 416-867-2272

Email: contactus@kingsdaleshareholder.com

If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com

- 11 -

BUSINESS OF THE MEETING

Record Date

The Board has fixed the close of business on February 25, 2015 as the record date (previously defined as the “Record Date”), being the date for the determination of the registered holders of securities entitled to receive notice of the Meeting.

Appointment and Revocation of Proxies

The persons named in the enclosed form of proxy are officers or directors of the Company.A Rio Alto Shareholder has the right to appoint a person or entity (who need not be a Rio Alto Shareholder) to attend and act for him/her on his/her behalf at the Meeting other than the persons named in the enclosed instrument of proxy. He/She may do so by inserting such person’s name in the blank space provided in the enclosed form of proxyor by completing another proper form of proxy and, in either case, depositing the completed and executed proxy at Company’s transfer agent at the address indicated on the enclosed envelope, by fax at the toll-free number set out on the enclosed proxy or voting instruction form,no later than 9:00 a.m. (Vancouver Time) on March 26, 2015, or no later than 48 hours (excluding Saturdays, Sundays and holidays) before the time of any adjourned or postponed Meeting. Proxies received after such time may be accepted or rejected by the Chairman of the Meeting in the Chairman’s discretion. The time limit for deposit of proxies may be waived or extended by the Chairman of the Meeting at his or her discretion, without notice.

A Rio Alto Shareholder forwarding the enclosed proxy may indicate the manner in which the appointee is to vote with respect to any specific item by checking the appropriate space. If the Rio Alto Shareholder giving the proxy wishes to confer a discretionary authority with respect to any item of business, then the space opposite the item should be left blank. The shares represented by the proxy submitted by a Rio Alto Shareholder will be voted or withheld from voting in accordance with the directions, if any, given in the proxy.

Unless a Rio Alto Shareholder who has granted a proxy has agreed that it shall be irrevocable, a Rio Alto Shareholder is entitled to revoke a proxy at any time prior to the exercise thereof at the Meeting:

| (a) | You may submit a new proxy to Computershare before 9:00 a.m. (Vancouver time) of March 26, 2015 or 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting; or |

| | |

| (b) | You (or your attorney, if authorized in writing) may sign a written notice of revocation addressed to the Company and deposited at the corporate office of the Company: Suite 1950-400 Burrard Street, Vancouver, BC V6C 3A6 at any time up to and including the last Business Day preceding the day of the Meeting, or any adjournment thereof, at which the proxy is to be used; or |

| | |

| | (c) | You (or your attorney, if authorized in writing) may sign a written notice of revocation and deliver it to the Chairman of the Meeting on the day of the Meeting, or in any other manner permitted by law. |

If you are a non-registered shareholder, you should contact your Intermediary through which you hold Rio Alto Shares and obtain instructions regarding the procedure for the revocation of any voting or proxyholder instructions that you have previously provided to your Intermediary.

If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com

- 12 -

Exercise of Discretion by Proxies

The persons named in the enclosed form of proxy will vote the shares in respect of which they are appointed in accordance with the direction of the shareholders appointing them and on any ballot that may be called for. In the absence of such direction, such shares will be voted FOR the passing of all the resolutions described herein. The enclosed form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the Notice of Meeting and with respect to other matters which may properly come before the Meeting. At the time of printing of this Circular, management knows of no such amendments, variations or other matters to come before the Meeting. However, if any other matters which are not now known to management should properly come before the Meeting or any adjournment thereof, the shares will be voted on such matters in accordance with the best judgment of the person named as proxy therein.

Voting by Non-Registered Rio Alto Shareholders

Only Registered Rio Alto Shareholders or the persons they appoint as their proxies are permitted to vote at the Meeting. Registered Rio Alto Shareholders are holders whose names appear on the share register of the Company and are not held in the name of a brokerage firm, bank or trust company through which they purchased shares. Whether or not you are able to attend the meeting, all Rio Alto Shareholders are requested to vote their proxy in accordance with the instructions stated on the proxy.

Most Rio Alto Shareholders are “non-registered” shareholders (“Non-Registered Rio Alto Shareholders”) because the shares they own are not registered in their names but are instead registered in the name of the brokerage firm, bank or trust company through which they purchased the shares. Shares beneficially owned by a Non-Registered Rio Alto Shareholder are registered either: (i) in the name of an Intermediary that the Non-Registered Rio Alto Shareholder deals with in respect of the shares of the Company (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans); or (ii) in the name of a clearing agency (such as CDS) of which the Intermediary is a participant.

There are two kinds of Non-Registered Rio Alto Shareholders: those who object to their name being made known to the issuers of securities which they own (called Objecting Beneficial Owners or “OBOs”) and those who do not object (called Non-Objecting Beneficial Owners or “NOBOs”).

Issuers can request and obtain a list of their NOBOs from Intermediaries via their transfer agents, pursuant to National Instrument 54-101 – Communication with Beneficial Owners of Securities of Reporting Issuers (“NI 54-101”) and issuers can use this NOBO list for distribution of proxy-related materials directly to NOBOs. Rio Alto has decided to take advantage of those provisions of NI 54-101 that allow it to directly deliver proxy-related materials to its NOBOs. As a result, NOBOs can expect to receive a voting instruction form from the Company’s transfer agent, Computershare. These voting instruction forms are to be completed and returned to Computershare in the postage paid envelope provided or by facsimile. Computershare will tabulate the results of the voting instruction forms received from NOBOs and will provide appropriate instructions at the Meeting with respect to the shares represented by voting instruction forms they receive. Alternatively, NOBOs may vote following the instructions on the voting instruction form, via the internet or by e-mail.

With respect to OBOs, in accordance with applicable securities law requirements, the Company will have distributed copies of the Notice of Meeting, this Circular, the form of proxy and the Letter of Transmittal (collectively, the “Meeting Materials”) to the clearing agencies and Intermediaries for distribution to OBOs. Management of the Company intends to pay for Intermediaries to forward the Meeting Materials to OBOs and OBOs will receive a copy of the Meeting Materials.

If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com

- 13 -

Intermediaries are required to forward the Meeting Materials to Non-Registered Rio Alto Shareholders unless a Non-Registered Rio Alto Shareholder has waived the right to receive them. Intermediaries often use service companies to forward the Meeting Materials to Non-Registered Rio Alto Shareholders. Generally, Non-Registered Rio Alto Shareholders who have not waived the right to receive Meeting Materials will either:

| (a) | be given a voting instruction form which is not signed by the Intermediary and which, when properly completed and signed by the Non-Registered Rio Alto Shareholder and returned to the Intermediary or its service company, will constitute voting instructions (often called a “voting instruction form”) which the Intermediary must follow; or |

| | |

| | (b) | be given a form of proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted as to the number of shares beneficially owned by the Non-Registered Rio Alto Shareholder but which is otherwise not completed by the Intermediary. Because the Intermediary has already signed the form of proxy, this form of proxy is not required to be signed by the Non-Registered Rio Alto Shareholder when submitting the proxy. In this case, the Non-Registered Rio Alto Shareholder who wishes to submit a proxy should properly complete the form of proxy and deposit it with Computershare at 100 University Ave., 8th floor, North Tower Toronto, Ontario M5J 2Y1 by mail, or via fax to 1-866-249-7775 for North America and (416) 263-9524 for international faxes, at least 48 hours, excluding Saturdays, Sundays and holidays, before the Meeting or any adjournment thereof. |

In either case, the purpose of these procedures is to permit Non-Registered Rio Alto Shareholders to direct the voting of the shares of the Company they beneficially own. Should a Non-Registered Rio Alto Shareholder who receives one of the above forms wish to vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Rio Alto Shareholder), the Non-Registered Rio Alto Shareholder should strike out the persons named in the form of proxy and insert the Non-Registered Rio Alto Shareholder or such other person’s name in the blank space provided. In either case, Non-Registered Rio Alto Shareholders should carefully follow the instructions of their Intermediary, including those regarding when and where the proxy or voting instruction form is to be delivered.

A Non-Registered Rio Alto Shareholder may revoke a voting instruction form or a waiver of the right to receive Meeting Materials and to vote which has been given to an Intermediary at any time by written notice to the Intermediary provided that an Intermediary is not required to act on a revocation of a voting instruction form or of a waiver of the right to receive Meeting Materials and to vote which is not received by the Intermediary at least seven days prior to the Meeting.

Voting Securities and Principal Holders Thereof

The authorized capital of the Company consists of an unlimited number of Rio Alto Shares. As of the date hereof, 334,166,939 Rio Alto Shares are issued and outstanding. Each Rio Alto Share entitles the holder thereof to one vote on all matters to be acted upon at the Meeting. All such holders of record of Rio Alto Shares as of the Record Date are entitled either to attend and vote thereat in person the Rio Alto Shares held by them or, provided a completed and executed proxy shall have been delivered to the Company’s transfer agent within the time specified in the attached Notice of Meeting, to attend and vote thereat by proxy the Rio Alto Shares held by them.

To the knowledge of the directors and executive officers of the Company, as of the date hereof, the directors and senior officers of Rio Alto beneficially own, or control or direct, directly or indirectly, 9,880,416 Rio Alto Shares, representing approximately 2.96%of the issued and outstanding Rio Alto Shares in the aggregate. The directors and officers of Rio Alto have entered into the Rio Alto Support Agreements, pursuant to which they have agreed to vote their Rio Alto Shares FOR the Rio Alto Arrangement Resolution.

If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com

- 14 -

To the knowledge of the directors and executive officers of the Company, as of the date hereof, no one person or company beneficially owns, or controls or directs, directly or indirectly, voting securities of the Company carrying more than 10% of the voting rights attached to any class of voting securities of the Company entitled to be voted at the Meeting except as follows:

| | |

| Name | Number of Rio Alto Shares

Owned or Controlled | Percent of Outstanding Rio Alto

Shares(1) |

Van Eck Associates

Corporation | 59,293,079(2) | 17.74%(2) |

Notes:

| (1) | Assumes 334,166,939 Rio Alto Shares issued and outstanding. |

| | |

| (2) | Represents the collective holdings of all accounts over which VEAC has investment authority in its capacity as Investment Manager (as such term is defined in National Instrument 62-103The Early Warning System and Related Take-Over Bid and Insider Reporting Issues). Please refer to the Alternative Monthly Report filed by VEAC dated February 4, 2015, a copy of which being available on Rio Alto’s SEDAR profile at www.sedar.com |

The Arrangement

At the Meeting, Rio Alto Shareholders will be asked to consider and, if deemed advisable, to pass, with or without variation, the Rio Alto Arrangement Resolution, the full text of which is set forth in Appendix “A” attached hereto. Among other things, pursuant to the Arrangement, Tahoe will acquire all of the Rio Alto Shares and the Rio Alto Shareholders will receive 0.227 of a Tahoe Share and $0.001 in cash for each Rio Alto Share held.

For additional information concerning the Arrangement, the Arrangement Agreement, a summary of certain of the tax consequences of the Arrangement to the Rio Alto Shareholders, the material risk factors associated with the Arrangement, Tahoe and the Combined Company following the Arrangement and other relevant information, please refer to “The Arrangement” and “The Arrangement Agreement” in the Supplement, as well as the Arrangement Agreement, available on Rio Alto’s profile atwww.sedar.com, and the Plan of Arrangement attached as Schedule “A” to the Supplement.

Principal Steps relating to the Arrangement

Under the Plan of Arrangement, commencing at the Effective Time, the following principal steps shall occur and shall be deemed to occur without any further act or formality, but in the order and with the timing set out in the Plan of Arrangement:

| |

| 1. | Rio Alto Shareholder Rights Plan |

The rights issued under the Rio Alto Shareholder Rights Plan shall be cancelled, without any payment or other consideration to the Rio Alto Shareholders, and the Rio Alto Shareholder Rights Plan shall terminate and cease to have any further force or effect.

Each Rio Alto Share held by a Dissenting Rio Alto Shareholder (as defined herein below) shall be deemed to be transferred by the holder thereof, without any further act or formality on its part, free and clear of all Liens, to Tahoe and Tahoe shall thereupon be obliged to pay the amount therefor determined

If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com

- 15 -

and payable in accordance with Article 5 of the Plan of Arrangement; and (i) such Dissenting Rio Alto Shareholders shall cease to be the holders of such Rio Alto Shares and to have any rights as Rio Alto Shareholders other than the right to be paid the fair value for such Rio Alto Shares; and (ii) the name of each such Dissenting Rio Alto Shareholder shall be removed from the central securities register of Rio Alto as a holder of Rio Alto Shares and Tahoe shall be recorded as the registered holder of the Rio Alto Shares so transferred and shall be deemed to be the legal owner of such Rio Alto Shares.

| |

| 3. | Transfer of Rio Alto Shares to Tahoe |

Each outstanding Rio Alto Share will, without further act or formality by or on behalf of a holder of the Rio Alto Shares, be irrevocably transferred by the holder thereof to Tahoe (free and clear of all Liens) in exchange for 0.227 of one Tahoe Share and $0.001 in cash for each Rio Alto Share held (the “Consideration”), and the holders of such Rio Alto Shares shall cease to be the holders thereof and to have any rights as holders of such Rio Alto Shares other than the right to receive the Consideration in accordance with the Plan of Arrangement. Such holder’s name shall be removed from the central securities register of Rio Alto as a holder of Rio Alto Shares legal and beneficial title to such Rio Alto Shares will vest in Tahoe and Tahoe will be and be deemed to be the transferee and legal and beneficial owner of such Rio Alto Shares (free and clear of any Liens) and will be entered in the central securities register of Rio Alto as the sole holder thereof.

| |

| 4. | Exchange of Rio Alto Options |

All Rio Alto Options shall vest and in accordance with the terms of the Rio Alto Options, each Rio Alto Option shall, without any further action on the part of any holder of a Rio Alto Option, be deemed to have been exchanged for an option entitling the holder to receive, upon the due exercise of such a Rio Alto Option (including without limitation, payment of the exercise price thereof), in lieu of Rio Alto Shares to which such holder was theretofore entitled upon such exercise, the number of Tahoe Shares equal to the product of: (A) the number of Rio Alto Shares subject to the Rio Alto Option immediately before the Effective Time, and (B) 0.227 plus the portion of a Tahoe Share that, immediately prior to the Effective Time, has a fair market value equal to $0.001 cash.

The exercise price per Tahoe Share subject to any such Rio Alto Option shall be an amount equal to the quotient of: (A) the exercise price per Rio Alto Share subject to such Rio Alto Option immediately prior to the Effective Time divided by (B) 0.227 plus such portion of a Tahoe Share that, immediately prior to the Effective Time, has a fair market value equal to $0.001 cash (provided that the aggregate exercise price payable on any particular exercise of Rio Alto Options shall be rounded up to the nearest whole cent).

Subject to the foregoing, each Rio Alto Option shall continue to be governed by and be subject to the terms of the Rio Alto Option Plan, subject to any supplemental exercise documents issued by Tahoe to holders of Rio Alto Options to facilitate the exercise of the Rio Alto Option and the payment of the corresponding portion of the exercise price with each of them. Each Rio Alto Option will remain exercisable for a period of one year from the date on which the holder of such options with Rio Alto is terminated in connection with the Arrangement, being the exercise period provided for in the Rio Alto Option Plan.

In the event that the Tahoe Option In-The-Money Amount in respect of a Rio Alto Option exceeds Rio Alto Option In-The-Money Amount in respect of the Rio Alto Option, the number of Tahoe Shares which may be acquired on exercise of the Rio Alto Option at and after the Effective Time will be adjusted accordingly with effect at and from the Effective Time to ensure that the Tahoe Option In-The-Money Amount in respect of the Rio Alto Option does not exceed Rio Alto Option In-The-Money Amount in respect of the Rio Alto Option and the ratio of the amount payable to acquire such shares to the value of such shares to be acquired shall be unchanged.

If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-581-1479 toll-free in North America, collect at 416-867-2272 outside of North America or email contactus@kingsdaleshareholder.com

- 16 -

| |

| 5. | Exchange of SGC Options |

Each outstanding SGC Option shall, without any further action on the part of any holder of an SGC Option, be deemed to have been exchanged for an option entitling the holder to receive, upon the due exercise of such a SGC Option (including without limitation, payment of the exercise price thereof), in lieu of Rio Alto Shares to which such holder was theretofore entitled upon such exercise, the number of Tahoe Shares equal to the product of: (A) the number of Rio Alto Shares subject to the SGC Option immediately before the Effective Time, and (B) 0.227 plus the portion of a Tahoe Share that, immediately prior to the Effective Time, has a fair market value equal to $0.001 cash.

The exercise price per Tahoe Share subject to any such SGC Option shall be an amount equal to the quotient of: (A) the exercise price per Rio Alto Share subject to such SGC Option immediately prior to the Effective Time divided by (B) 0.227 plus such portion of a Tahoe Share that, immediately prior to the Effective Time, has a fair market value equal to $0.001 cash (provided that the aggregate exercise price payable on any particular exercise of SGC Options shall be rounded up to the nearest whole cent).

Subject to the foregoing, each SGC Option shall continue to be governed by and be subject to the terms of the SGC Option Plan, subject to any supplemental exercise documents issued by Tahoe to holders of SGC Options to facilitate the exercise of the SGC Option and the payment of the corresponding portion of the exercise price with each of them.

In the event that the Tahoe Option In-The-Money Amount in respect of a SGC Option exceeds SGC Option In-The-Money Amount in respect of the SGC Option, the number of Tahoe Shares which may be acquired on exercise of the SGC Option at and after the Effective Time will be adjusted accordingly with effect at and from the Effective Time to ensure that the Tahoe Option In-The-Money Amount in respect of the SGC Option does not exceed SGC Option In-The-Money Amount in respect of the SGC Option and the ratio of the amount payable to acquire such shares to the value of such shares to be acquired shall be unchanged.

| |

| 6. | Transfer of Rio Alto Shares to Subco |

Each Rio Alto Share held by Tahoe will be transferred to Subco in consideration of the issue by Subco to Tahoe of one common share of Subco for each Rio Alto Share so transferred, the stated capital in respect of the Rio Alto Shares will be reduced to $1.00 without any repayment of capital in respect thereof. Rio Alto will file an election with the CRA to cease to be a public corporation for the purposes of the Tax Act.

Subco and Rio Alto shall amalgamate to continue as one corporation under Section 184(1) of the ABCA.

| |

| 8. | Treatment of Rio Alto Warrants |