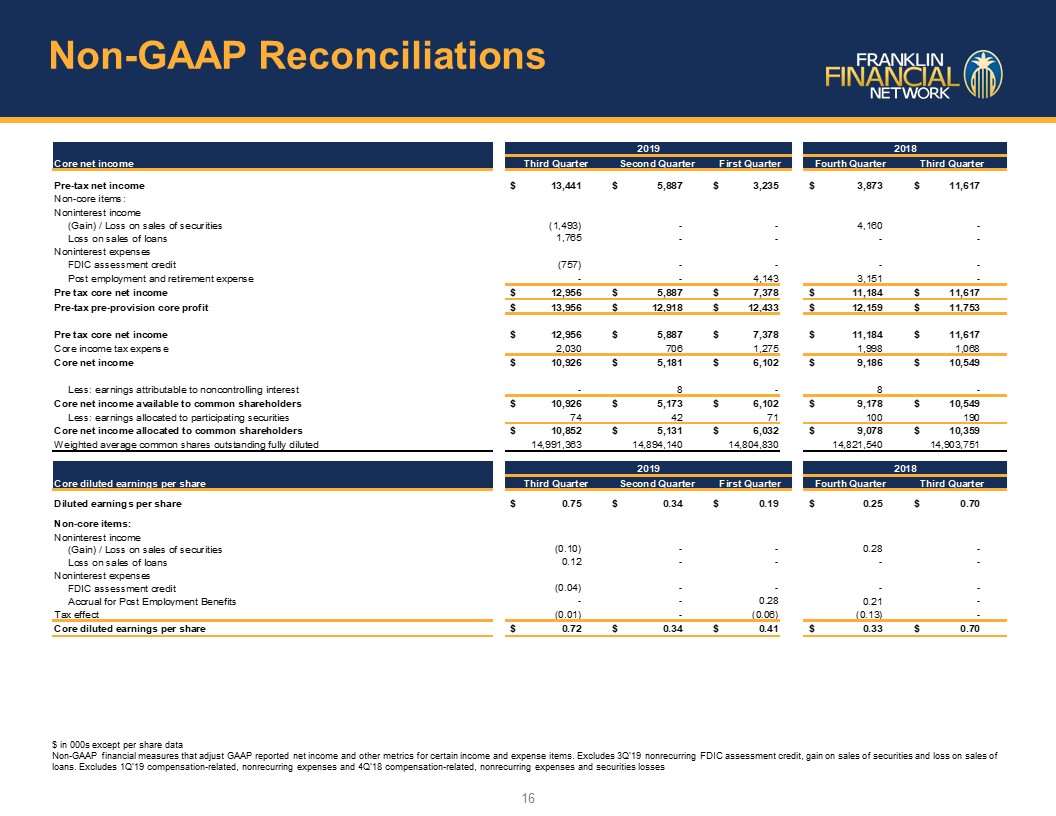

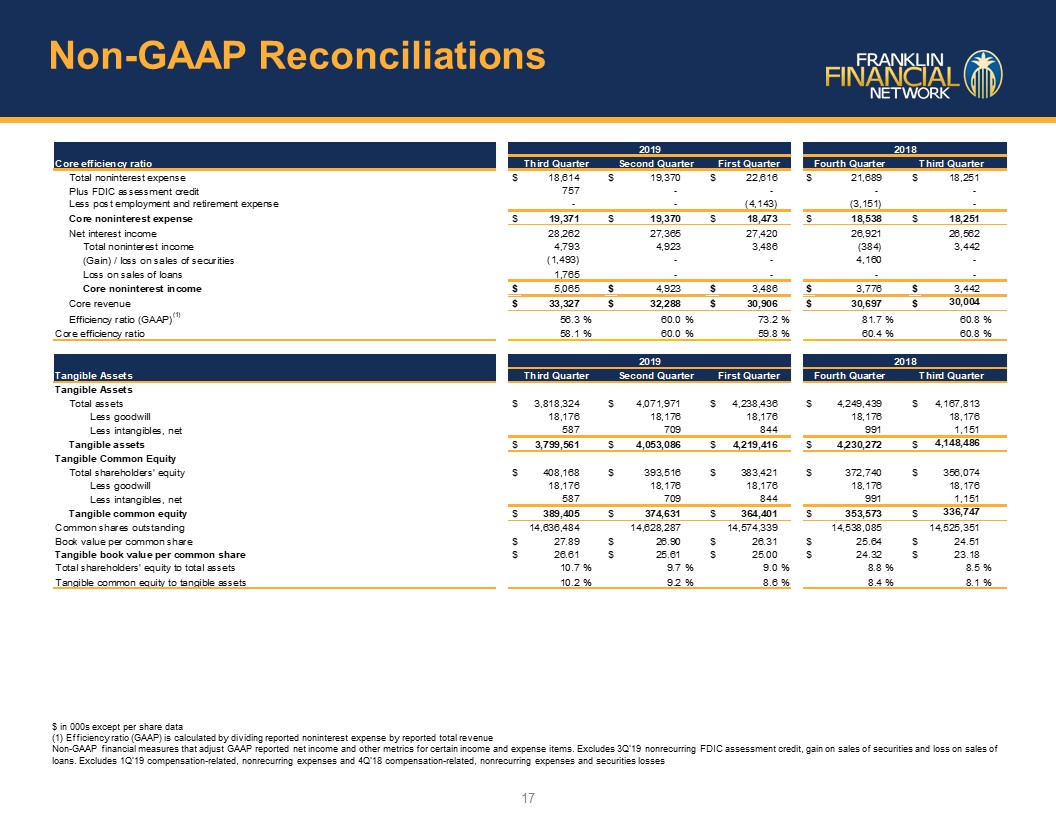

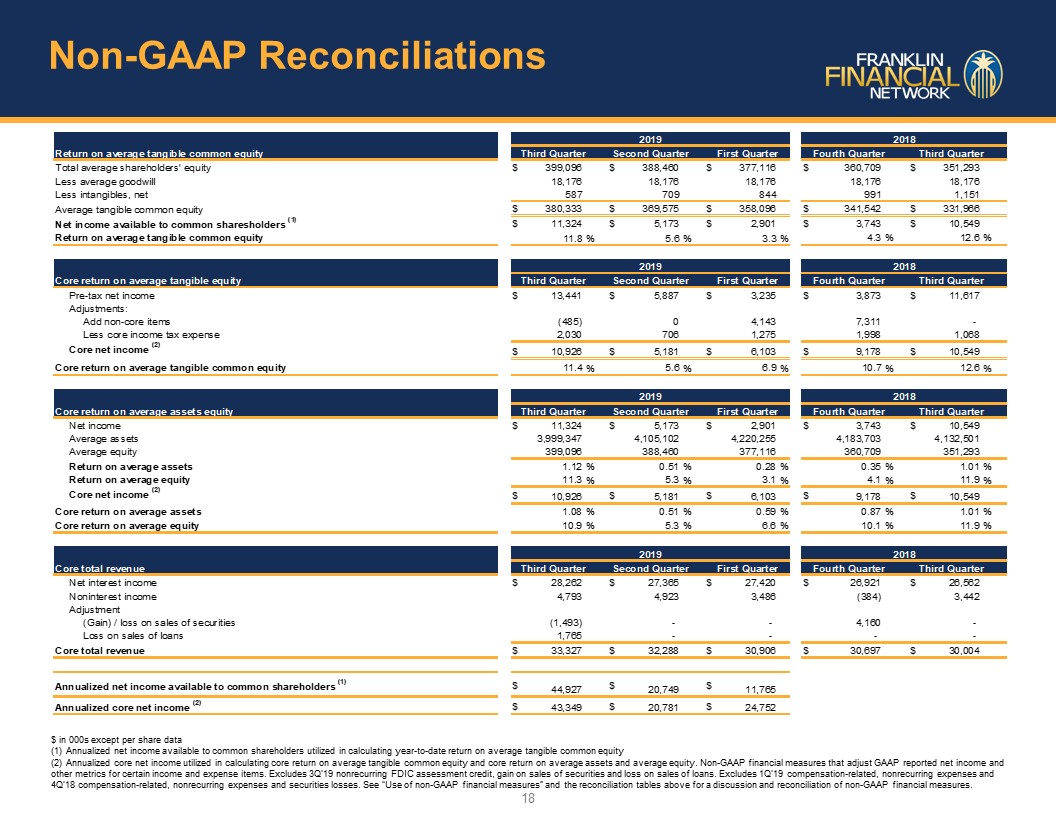

Forward-Looking Statements Except for the historical information contained herein, this presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The forward-looking statements include, among other things, statements regarding intent, belief or expectations of the Company and can be identified by the use of words such as "may," "will," "should," "would," "assume," "outlook," "seek," "plan," "believe," "expect," "anticipate," "intend," "estimate," "forecast," and other comparable terms. The Company intends that all such statements be subject to the “safe harbor” provisions of those Acts. Because forward-looking statements involve risks and uncertainties, actual results may differ materially from those expressed or implied. Investors are cautioned not to place undue reliance on these forward-looking statements and are advised to carefully review the discussion of forward-looking statements and risk factors in documents the Company files with the Securities and Exchange Commission. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless otherwise required by law.Use of non-GAAP Financial MeasuresSome of the financial data included in this presentation and our selected historical consolidated financial information are not measures of financial performance recognized by GAAP. Our management uses these non-GAAP financial measures in its analysis of our performance:"Common equity” is defined as total shareholders’ equity at end of period less the liquidation preference value of the preferred stock;“Tangible common equity” is common equity less goodwill and other intangible assets;“Total tangible assets” is defined as total assets less goodwill and other intangible assets;“Other intangible assets” is defined as the sum of core deposit intangible and SBA servicing rights;"Tangible book value per share" is defined as tangible common equity divided by total common shares outstanding. This measure is important to investors interested in changes from period-to-period in book value per share exclusive of changes in intangible assets;“Tangible common equity ratio” is defined as the ratio of tangible common equity divided by total tangible assets. We believe that this measure is important to many investors in the marketplace who are interested in relative changes from period-to period in common equity and total assets, each exclusive of changes in intangible assets;“Core Return on Average Tangible Common Equity” is defined as annualized core net income available to common shareholders divided by average tangible common equity;“Core Efficiency Ratio” is defined as noninterest expense divided by our operating revenue, which is equal to net interest income plus noninterest income with all adjusted to certain one-time expenses;“Core Diluted Earnings Per Share” is defined as reported earnings per share adjusted for certain one-time expenses;“Core Non-Interest Income” is defined as non-interest income adjusted for certain one-time items;“Core Non-Interest Expense” is defined as non-interest expense adjusted for certain one-time items;“Core Compensation Expense” is defined as compensation expense adjusted for certain one-time items;“Core Net Income” is defined as “Net Income Available to Common Shareholders” adjusted for certain one-time items;“Pre-tax core net income” is defined as pre-tax net income adjusted for certain one-time noninterest income and noninterest expense items; and“Pre-tax pre-provision core profit” is defined as pre-tax core net income and provision for loan losses. We believe these non-GAAP financial measures provide useful information to management and investors that is supplementary to our financial condition, results of operations and cash flows computed in accordance with GAAP; however, we acknowledge that our non-GAAP financial measures have a number of limitations. As such, you should not view these disclosures as a substitute for results determined in accordance with GAAP, and they are not necessarily comparable to non-GAAP financial measures that other companies use.