Franklin Financial Network, Inc. (NYSE:FSB) Fourth Quarter 2015 Investor Call January 27, 2016 Exhibit 99.1

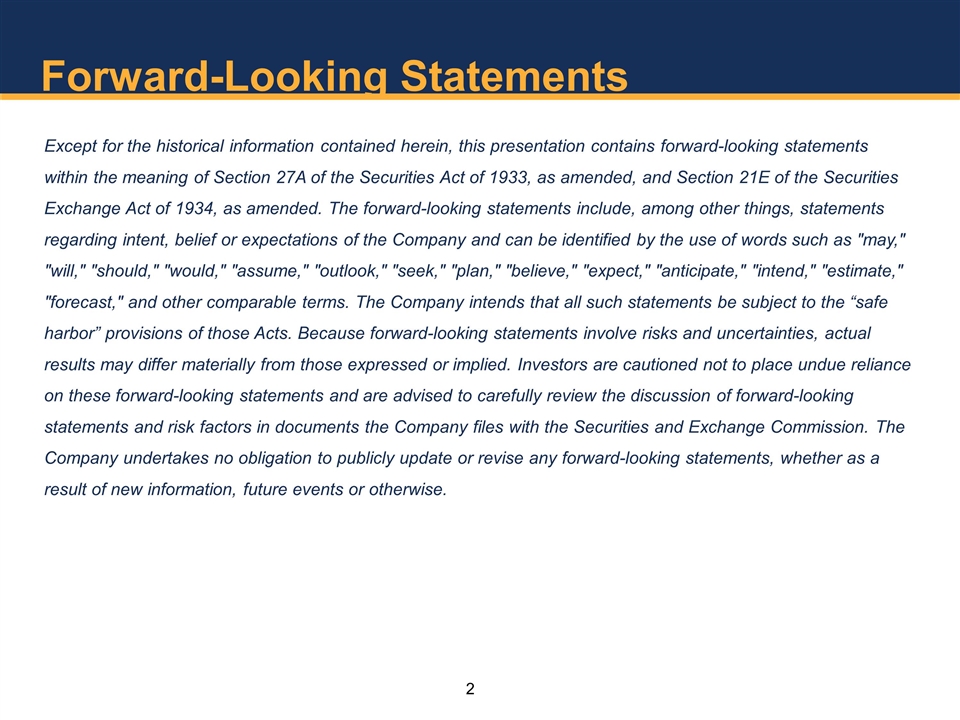

Forward-Looking Statements Except for the historical information contained herein, this presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The forward-looking statements include, among other things, statements regarding intent, belief or expectations of the Company and can be identified by the use of words such as "may," "will," "should," "would," "assume," "outlook," "seek," "plan," "believe," "expect," "anticipate," "intend," "estimate," "forecast," and other comparable terms. The Company intends that all such statements be subject to the “safe harbor” provisions of those Acts. Because forward-looking statements involve risks and uncertainties, actual results may differ materially from those expressed or implied. Investors are cautioned not to place undue reliance on these forward-looking statements and are advised to carefully review the discussion of forward-looking statements and risk factors in documents the Company files with the Securities and Exchange Commission. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Franklin Financial Network Trading Symbol: FSB (NYSE) Primary Subsidiary: Franklin Synergy Bank Bank opened in November 2007 Located 15 miles south of Nashville Headquarter county, Williamson, TN, among wealthiest in nation Recent News December 14, 2015: Announced plan to acquire Civic Bank & Trust in Nashville, TN September 30, 2015: Surpassed $2 billion total assets milestone April 27, 2015: FSB added Nashville-based Healthcare Banking team March 31, 2015: FSB completed IPO, raising $55 million in capital July 1, 2014: FSB acquired MidSouth Bank in Murfreesboro, TN

2015 Financial Highlights Earnings Net income: record earnings for the year ended December 31, 2015 Growth Continued robust loan growth: 63.6% (4Q 2015 vs. 4Q 2014) Asset Quality Excellent

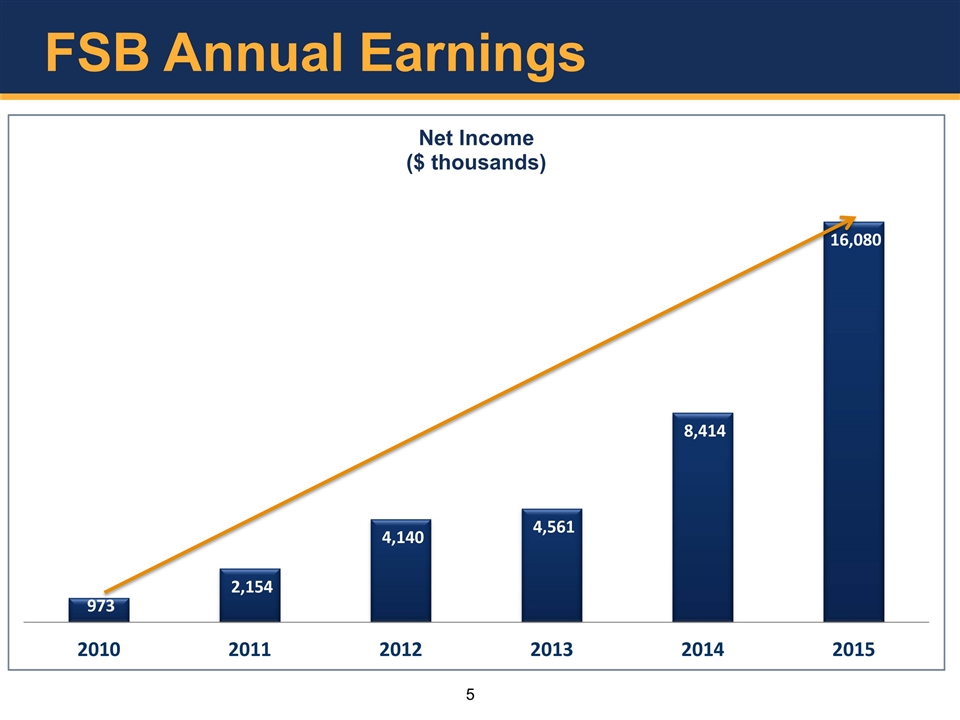

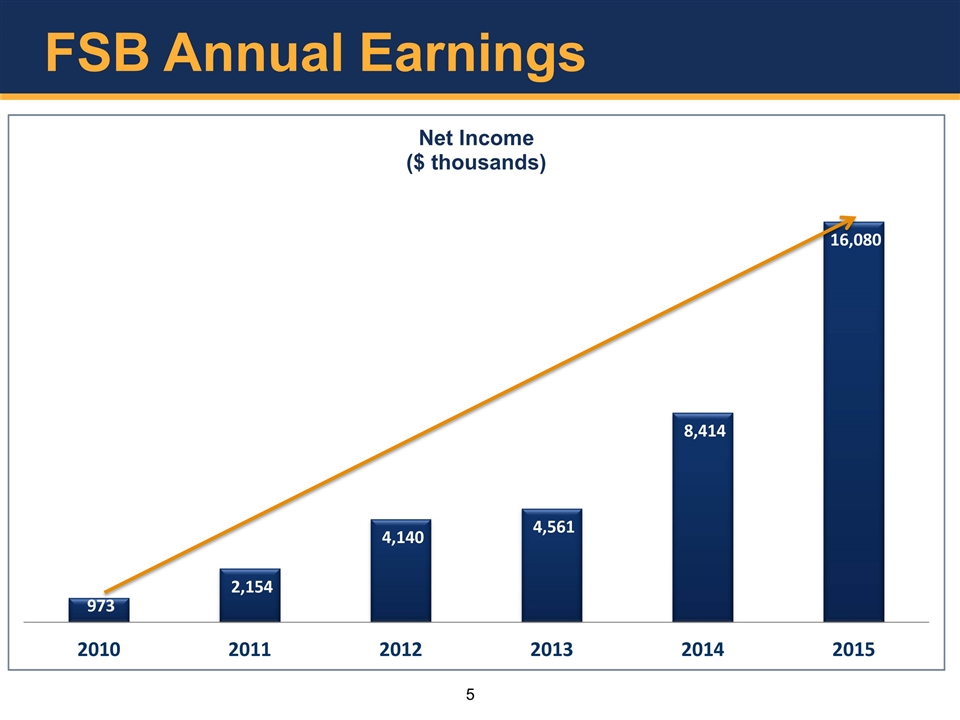

FSB Annual Earnings

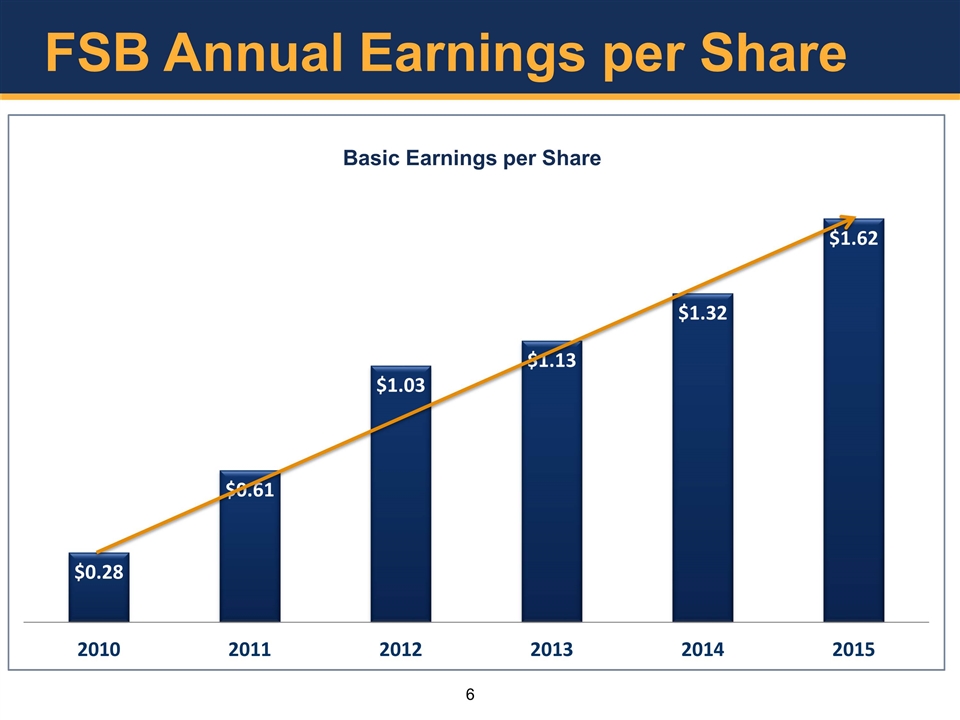

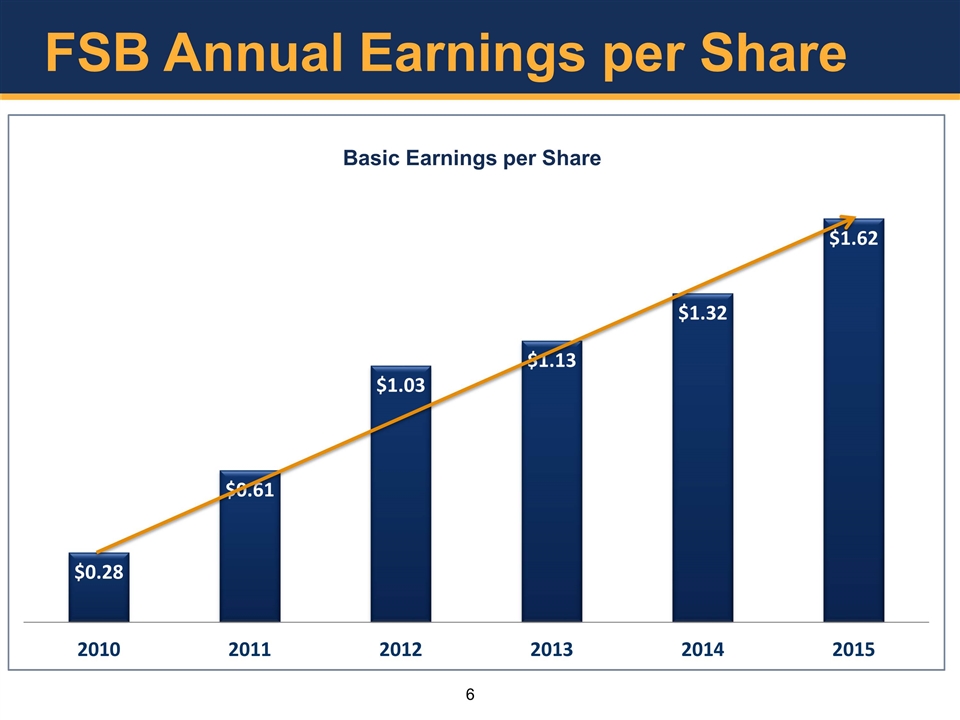

FSB Annual Earnings per Share

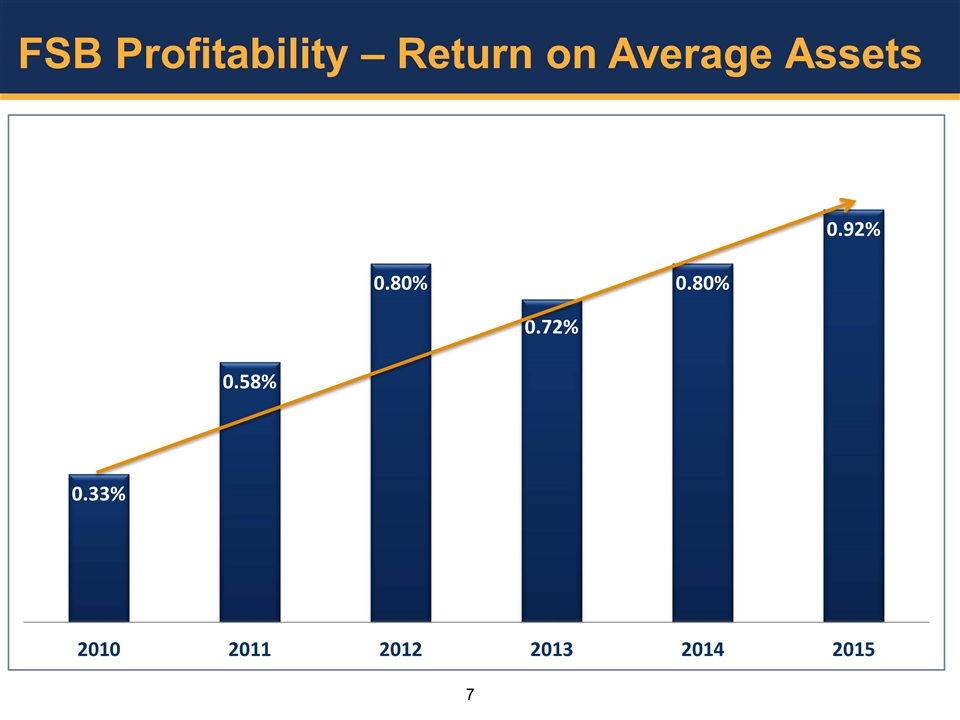

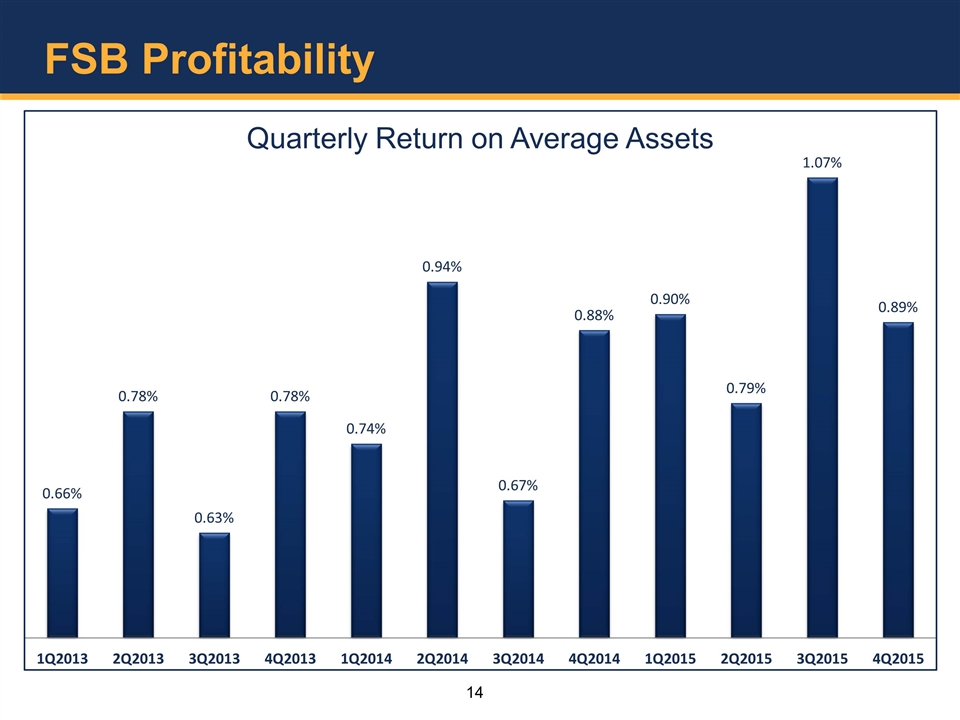

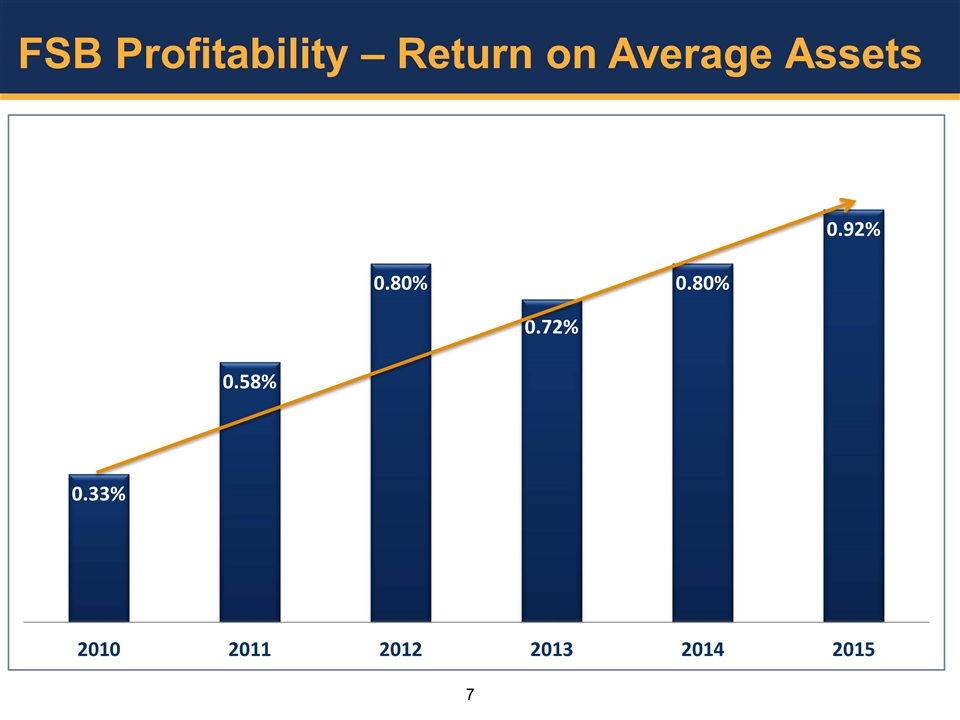

FSB Profitability – Return on Average Assets

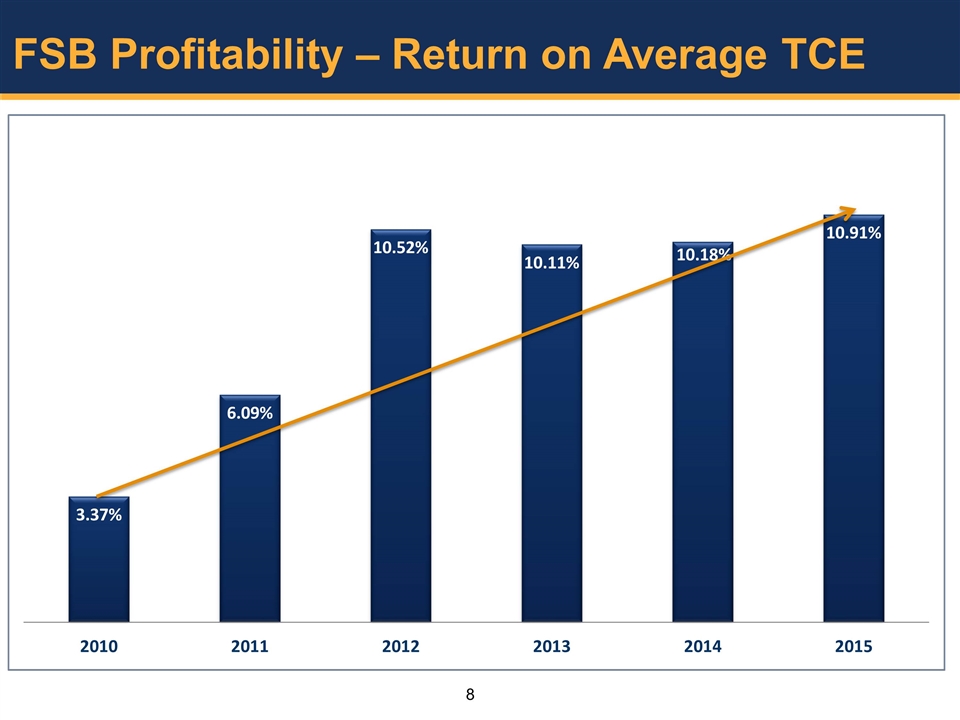

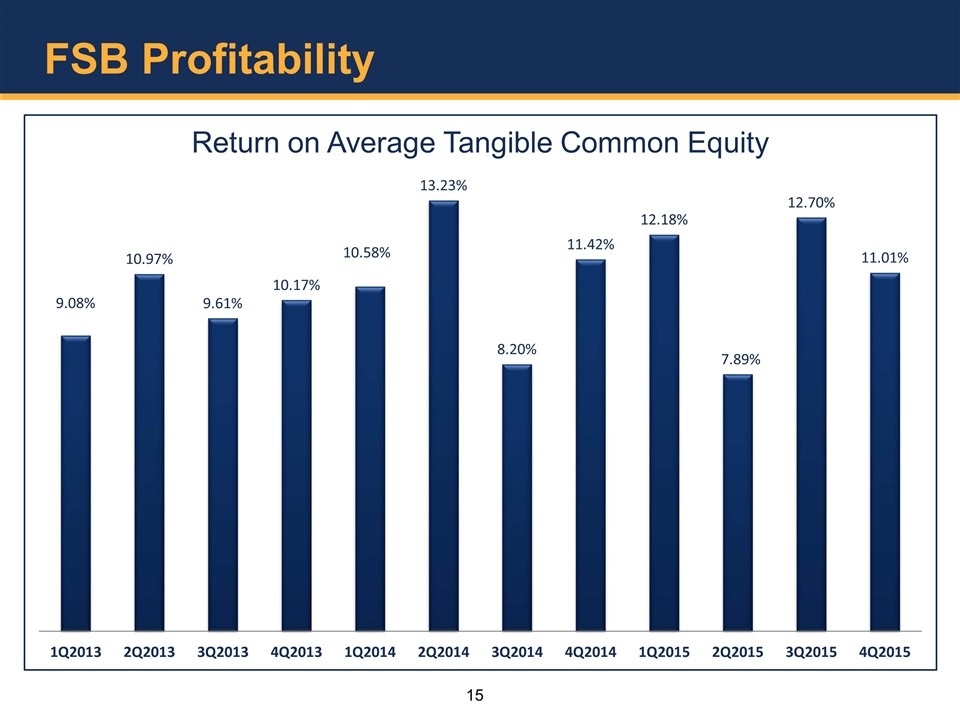

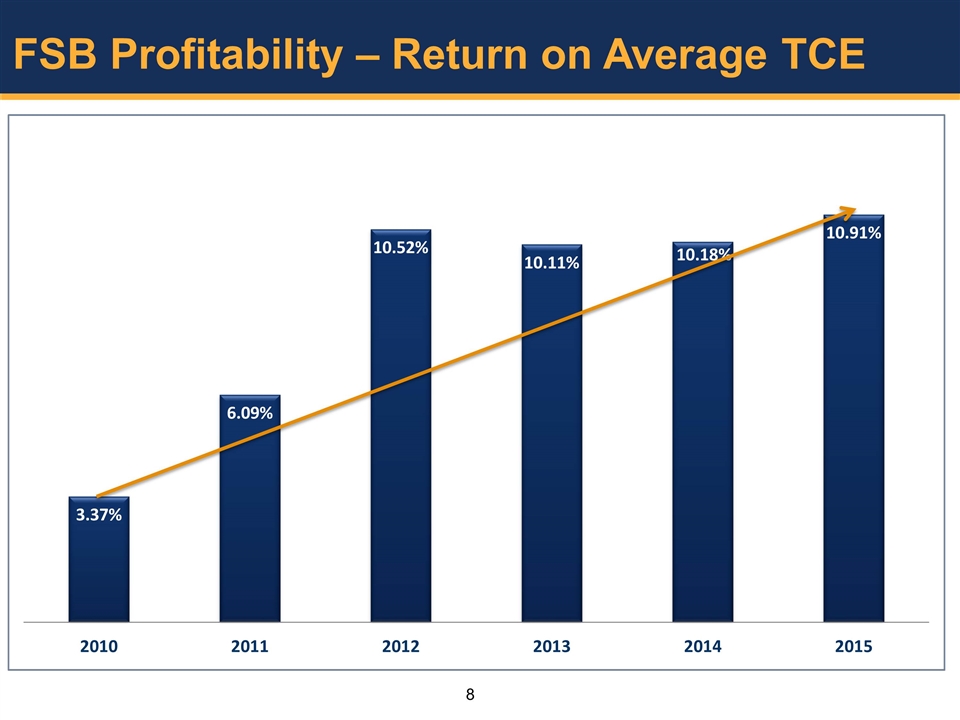

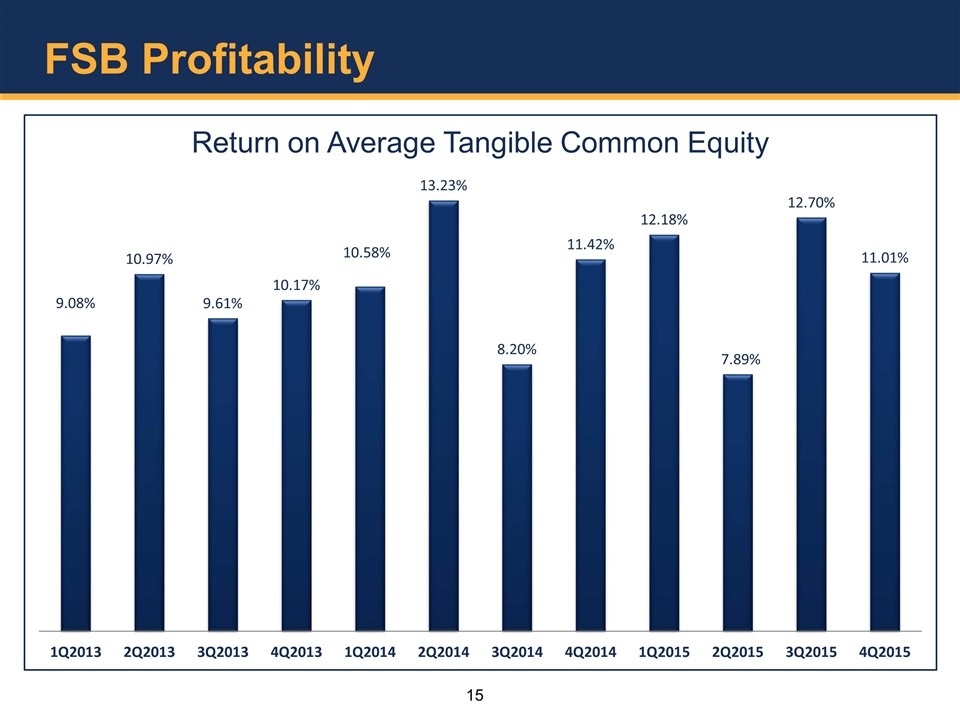

FSB Profitability – Return on Average TCE

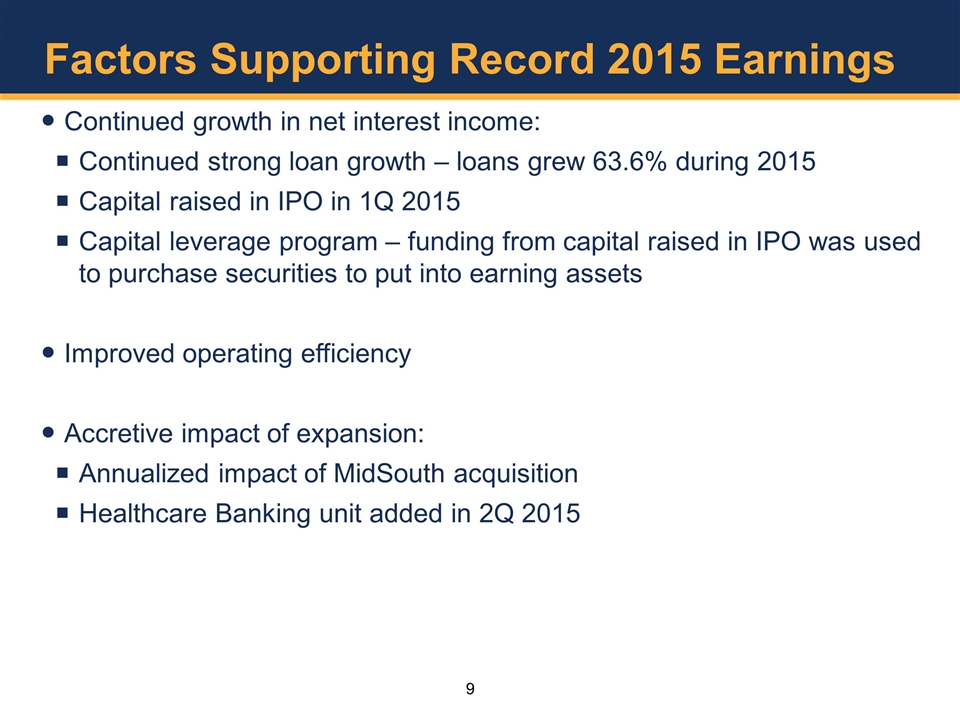

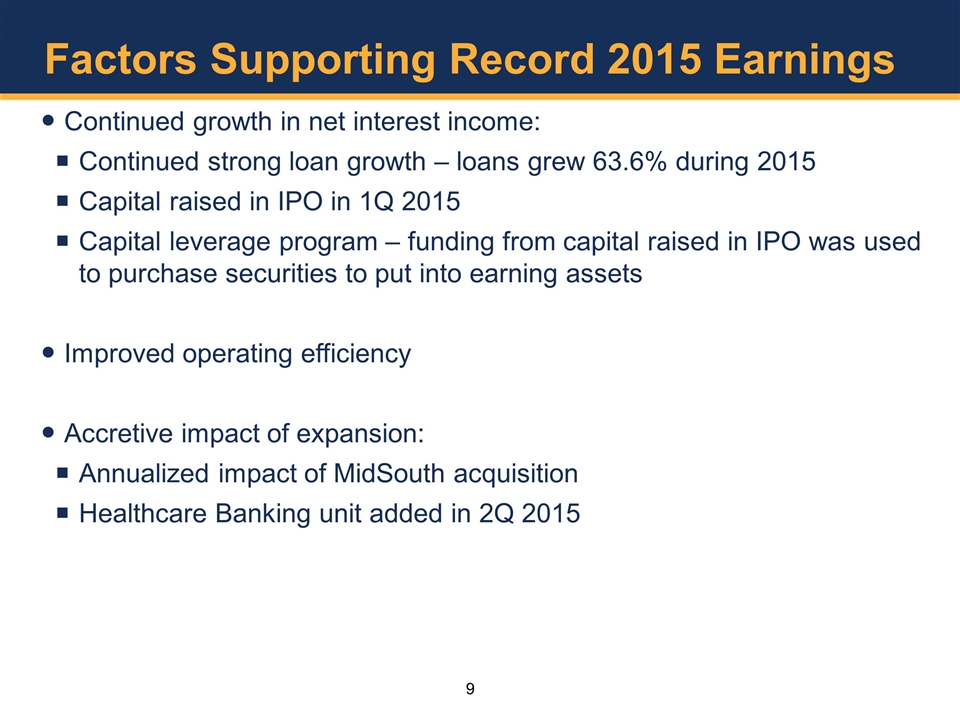

Factors Supporting Record 2015 Earnings Continued growth in net interest income: Continued strong loan growth – loans grew 63.6% during 2015 Capital raised in IPO in 1Q 2015 Capital leverage program – funding from capital raised in IPO was used to purchase securities to put into earning assets Improved operating efficiency Accretive impact of expansion: Annualized impact of MidSouth acquisition Healthcare Banking unit added in 2Q 2015

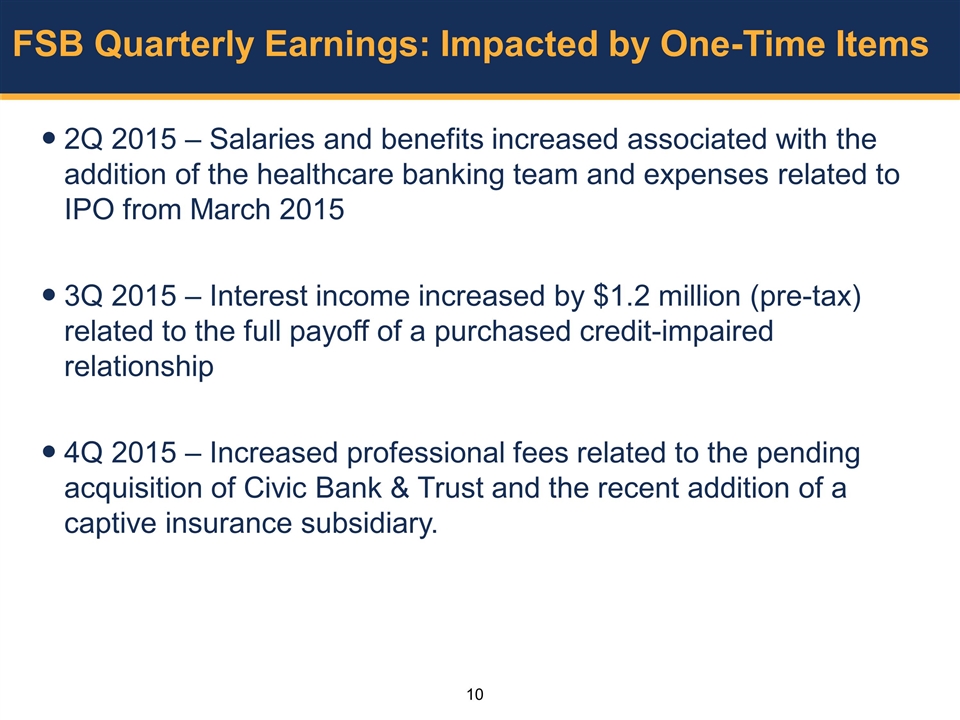

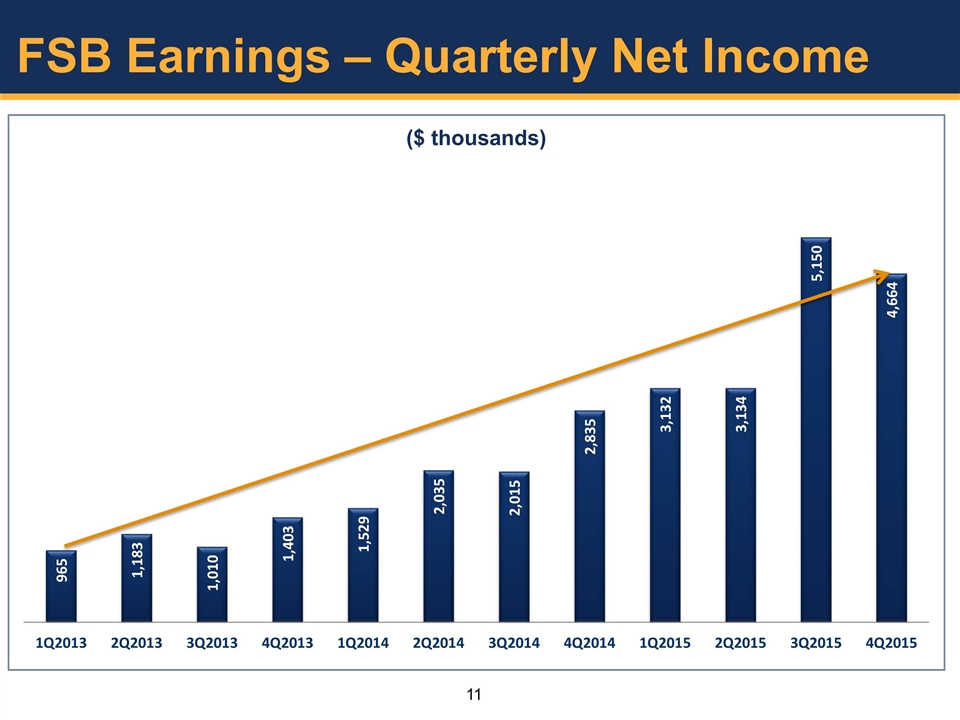

FSB Quarterly Earnings: Impacted by One-Time Items 2Q 2015 – Salaries and benefits increased associated with the addition of the healthcare banking team and expenses related to IPO from March 2015 3Q 2015 – Interest income increased by $1.2 million (pre-tax) related to the full payoff of a purchased credit-impaired relationship 4Q 2015 – Increased professional fees related to the pending acquisition of Civic Bank & Trust and the recent addition of a captive insurance subsidiary.

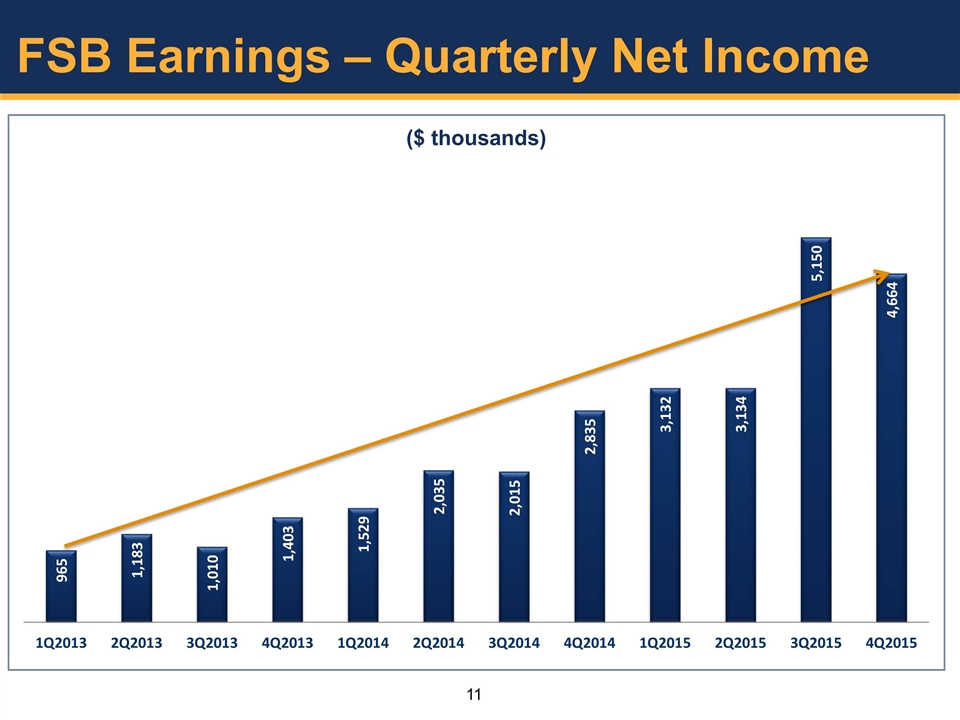

FSB Earnings – Quarterly Net Income

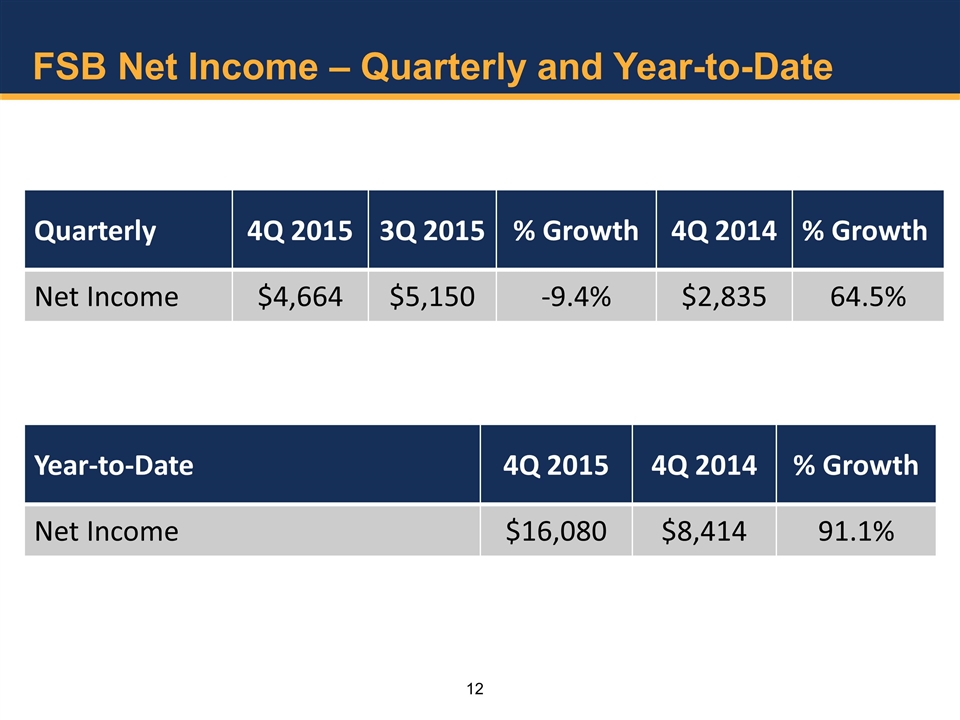

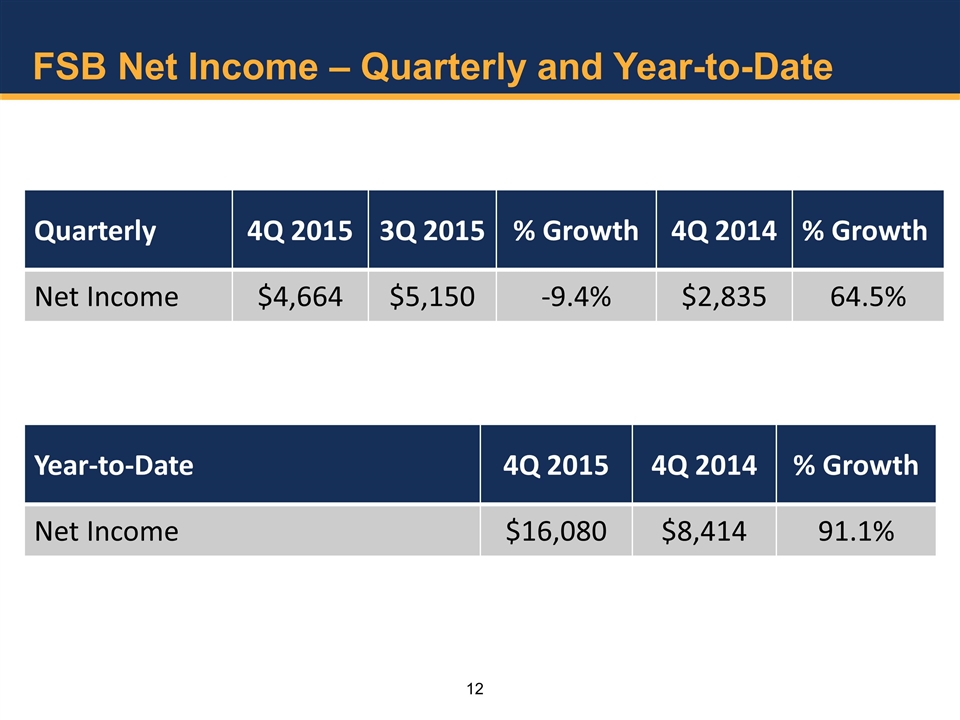

FSB Net Income – Quarterly and Year-to-Date Quarterly 4Q 2015 3Q 2015 % Growth 4Q 2014 % Growth Net Income $4,664 $5,150 -9.4% $2,835 64.5% Year-to-Date 4Q 2015 4Q 2014 % Growth Net Income $16,080 $8,414 91.1%

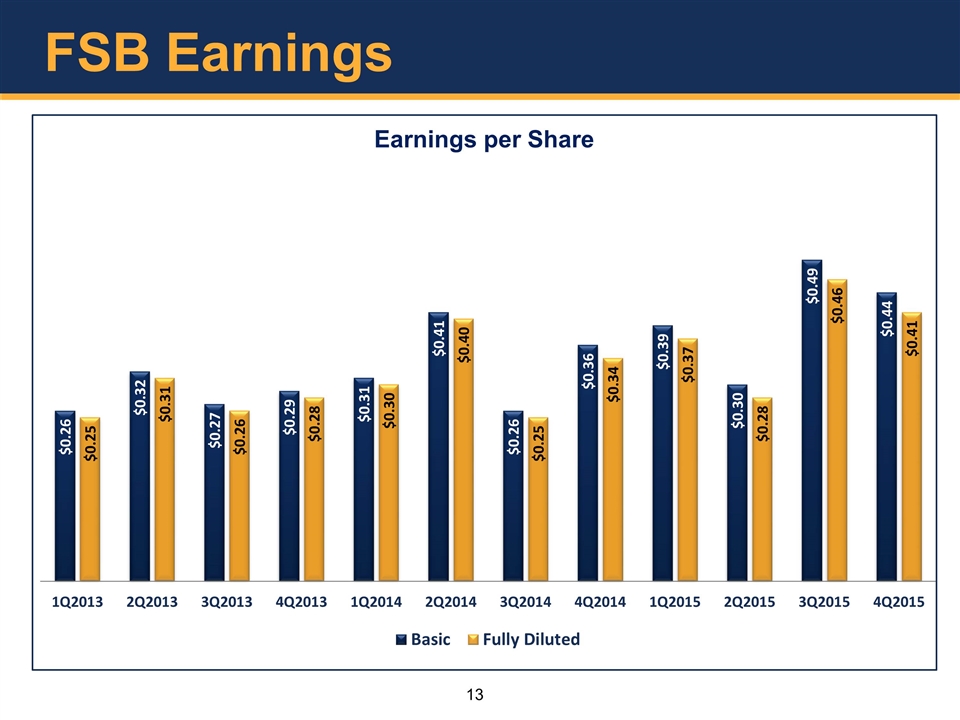

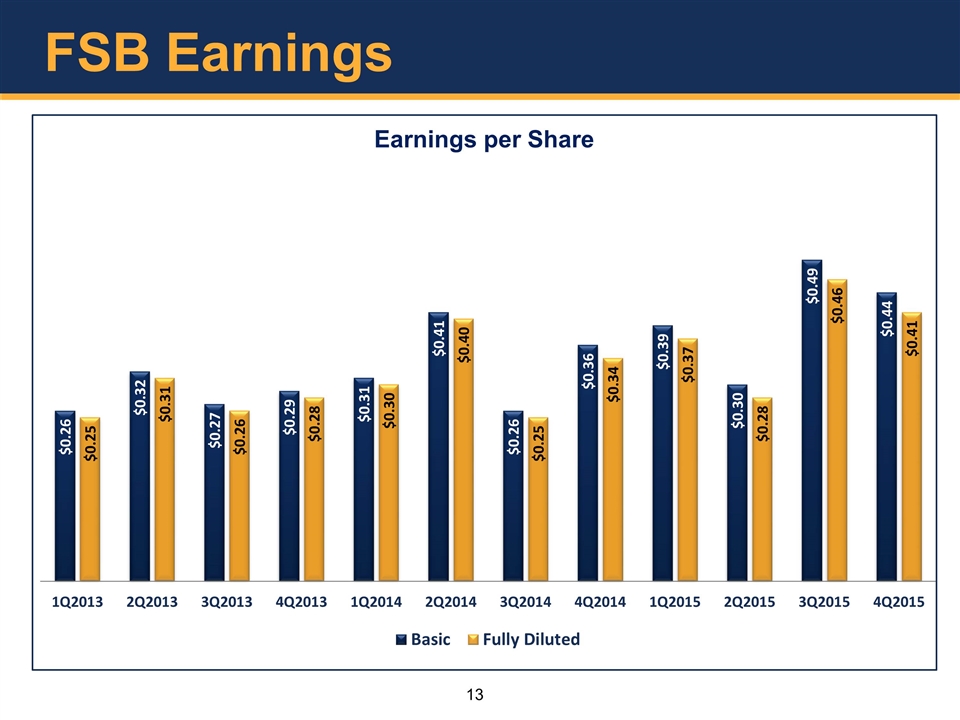

FSB Earnings

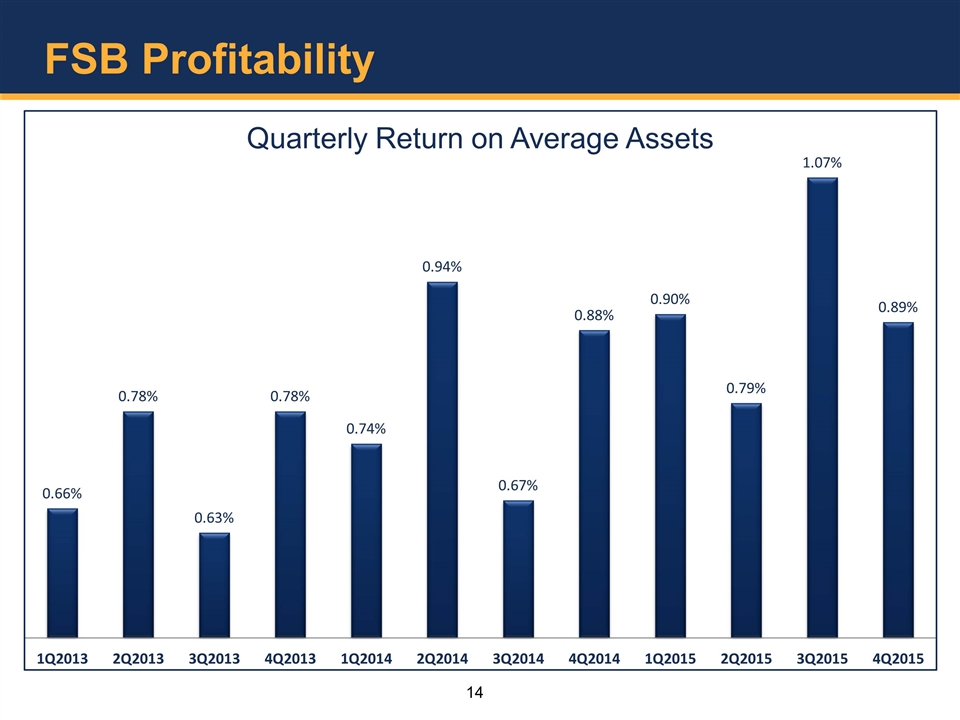

FSB Profitability

FSB Profitability

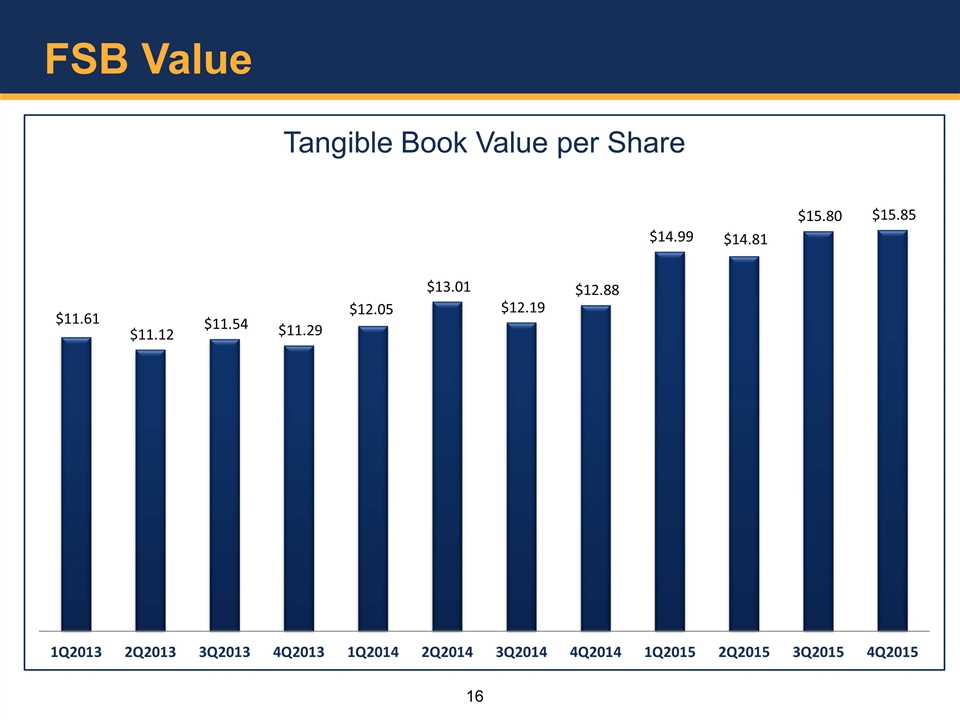

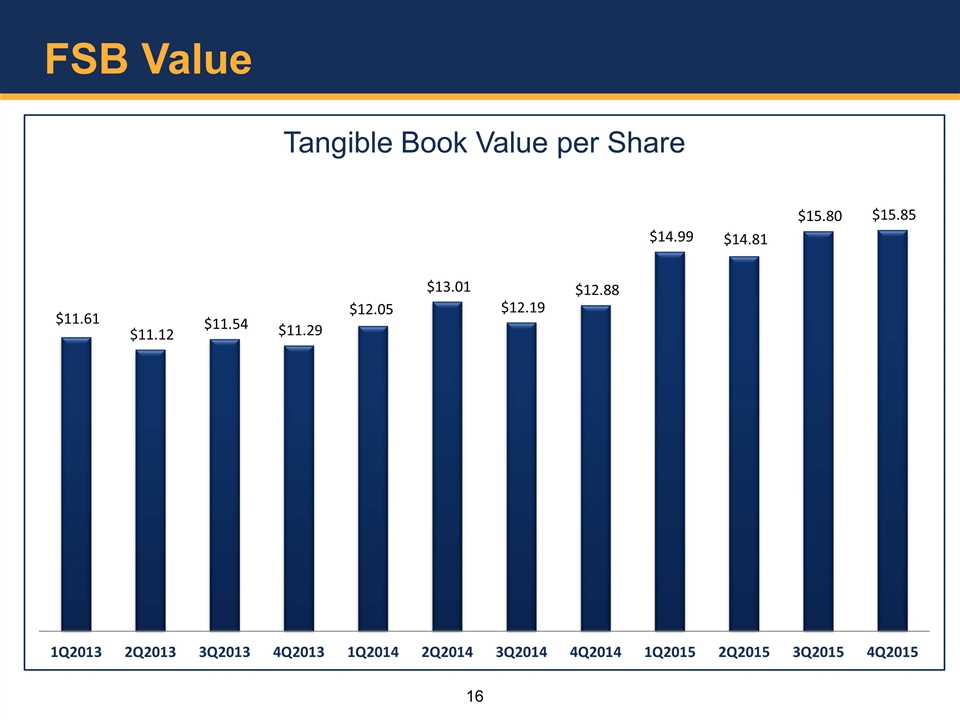

FSB Value

Growth

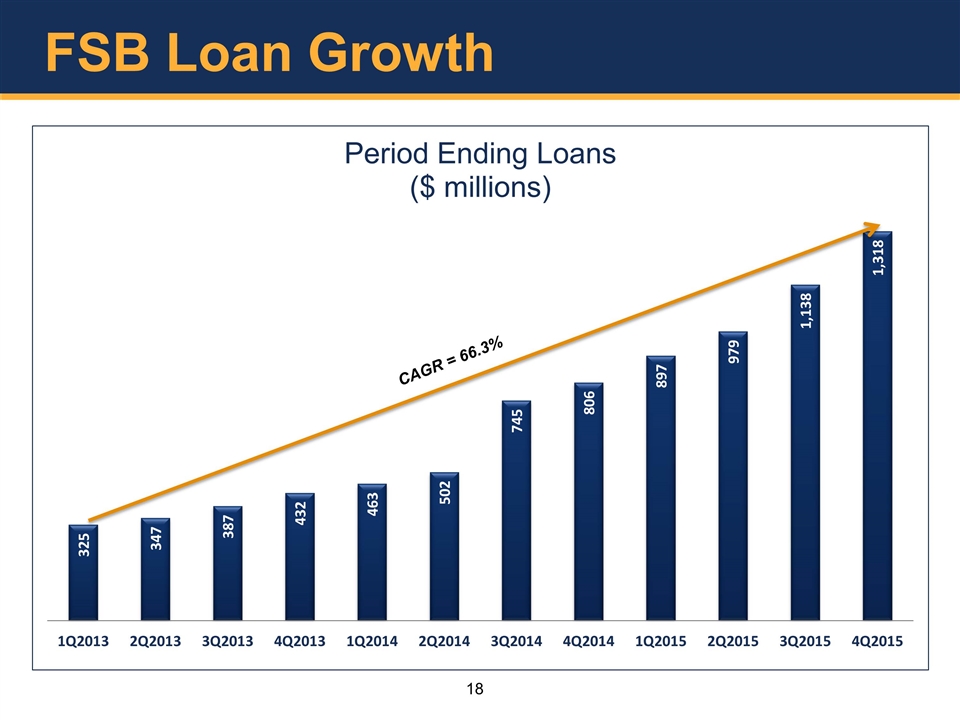

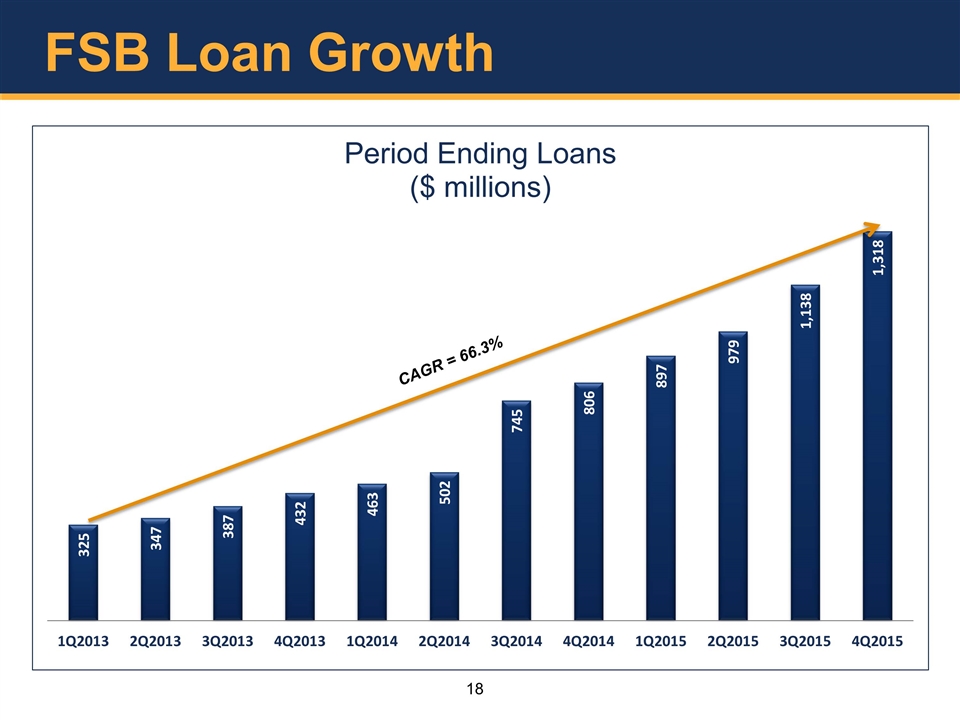

FSB Loan Growth CAGR = 66.3%

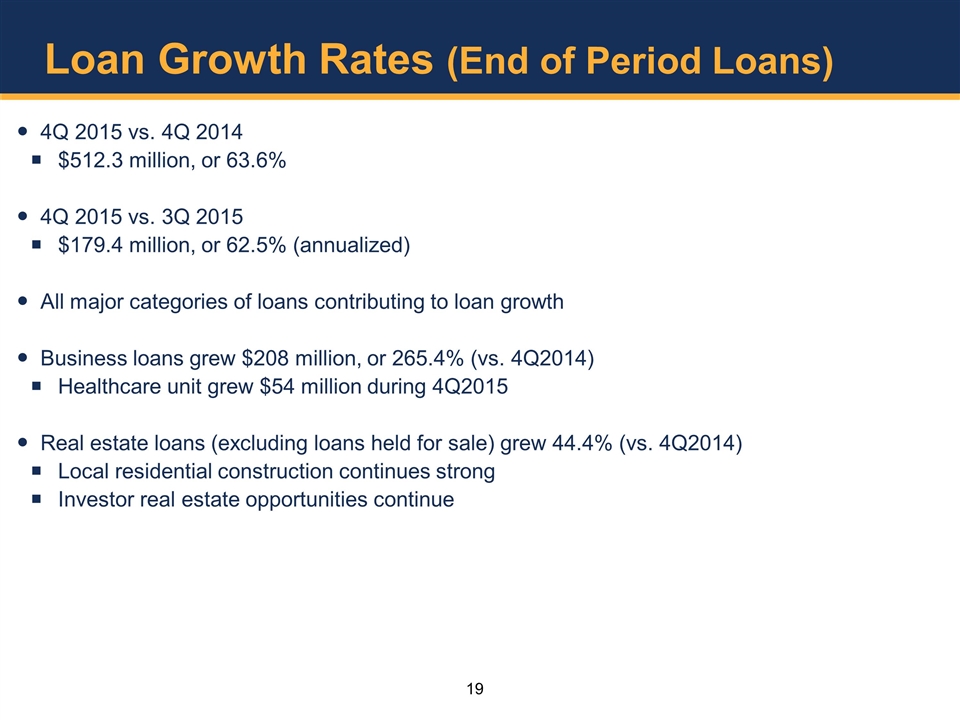

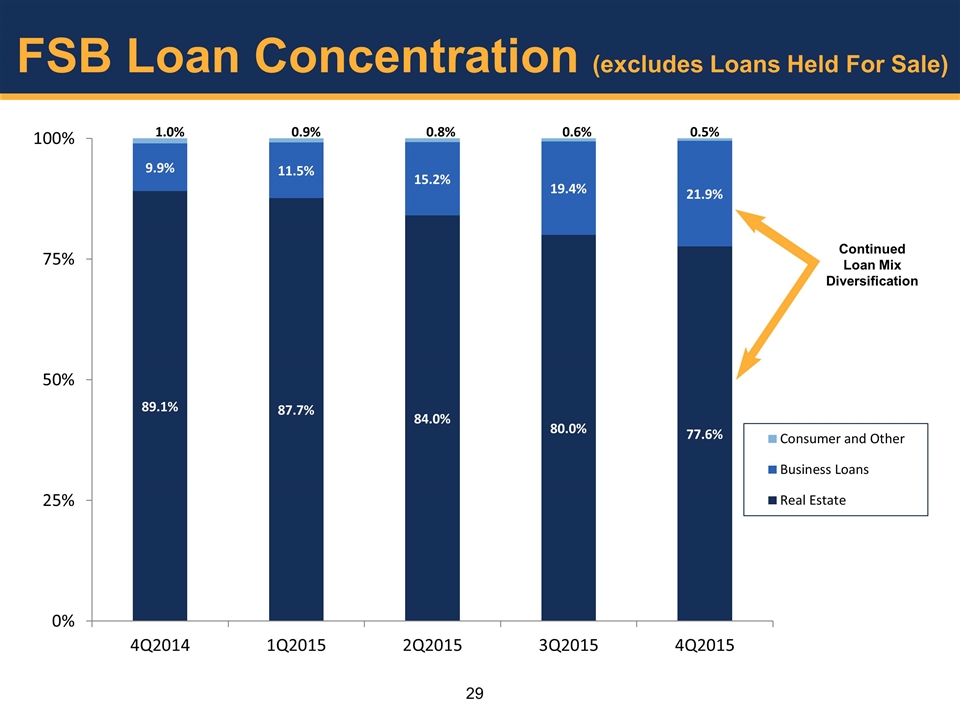

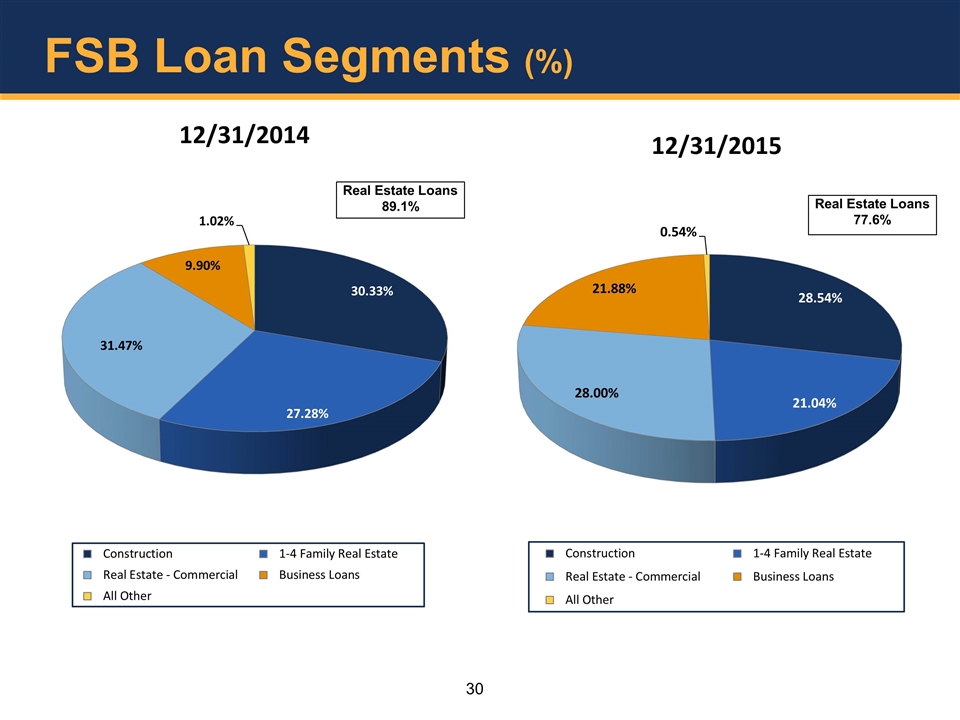

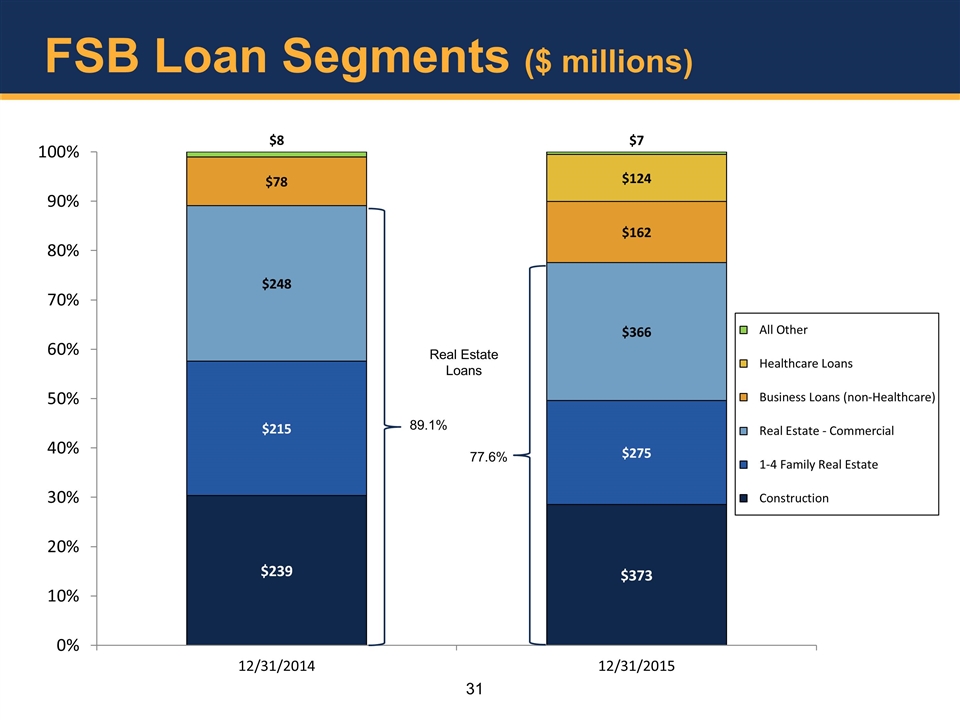

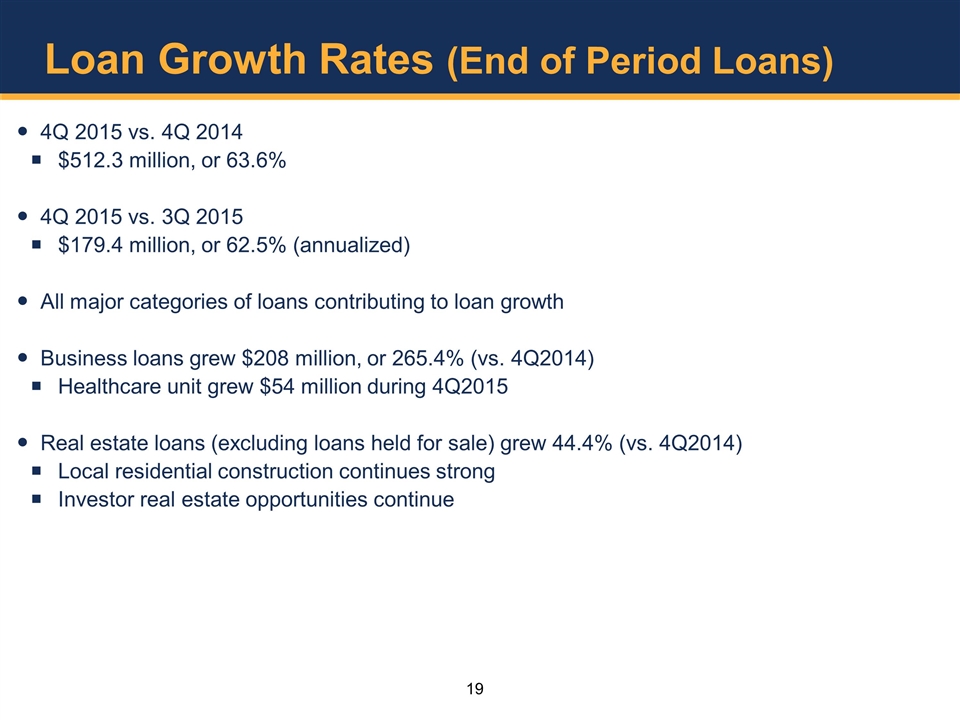

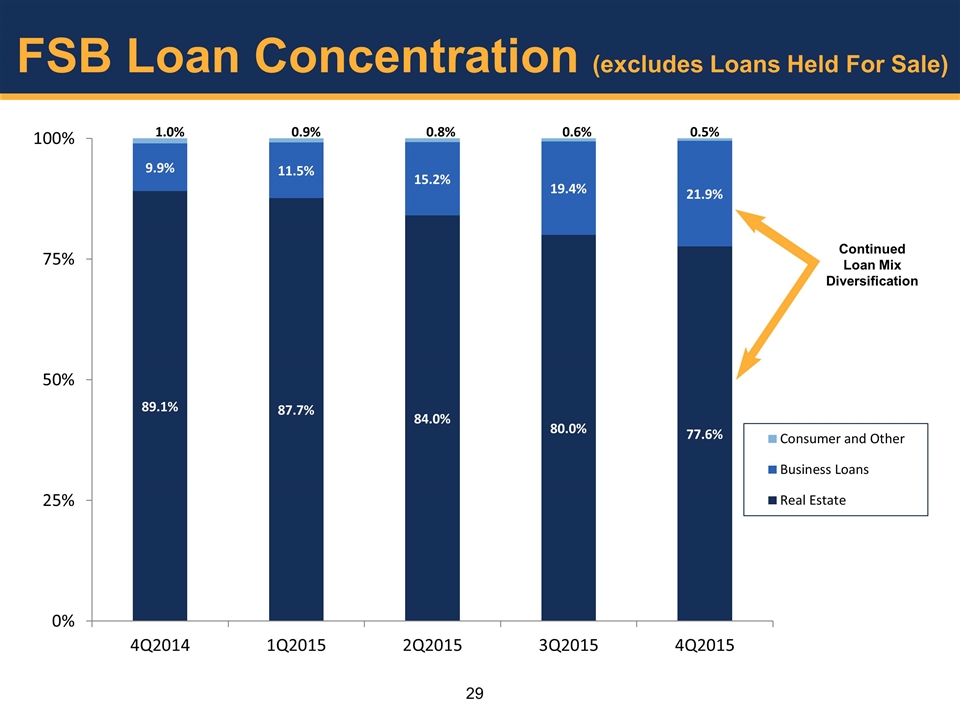

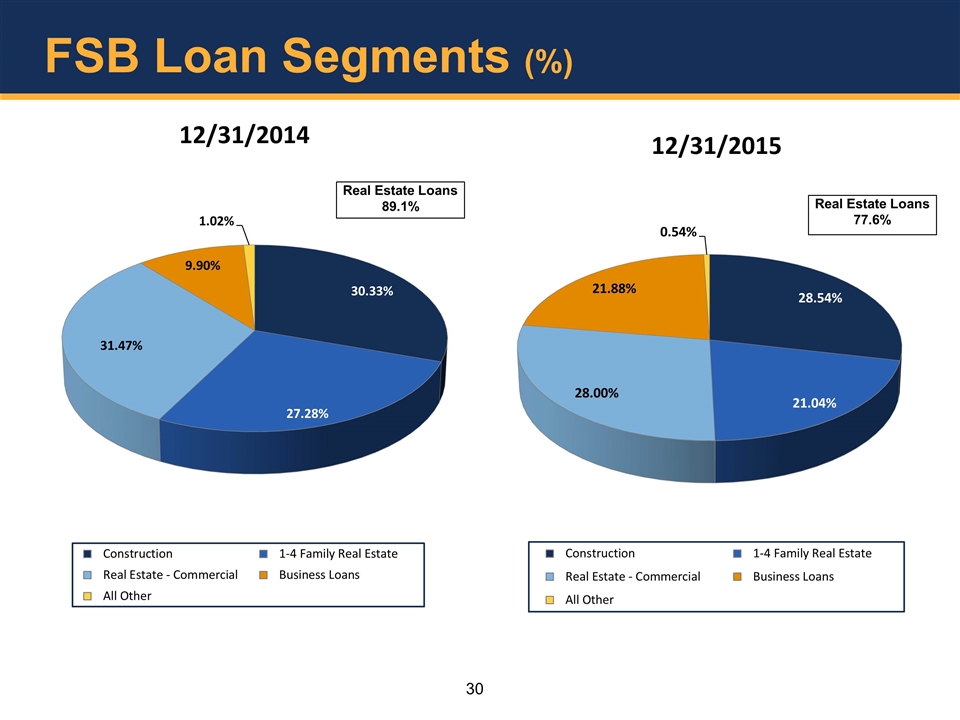

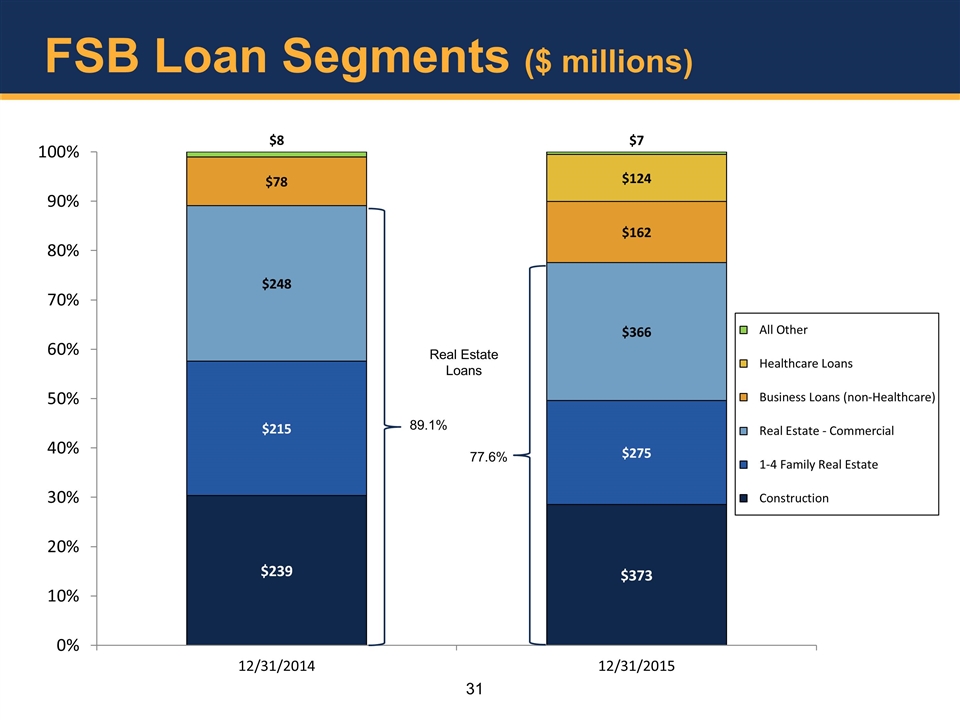

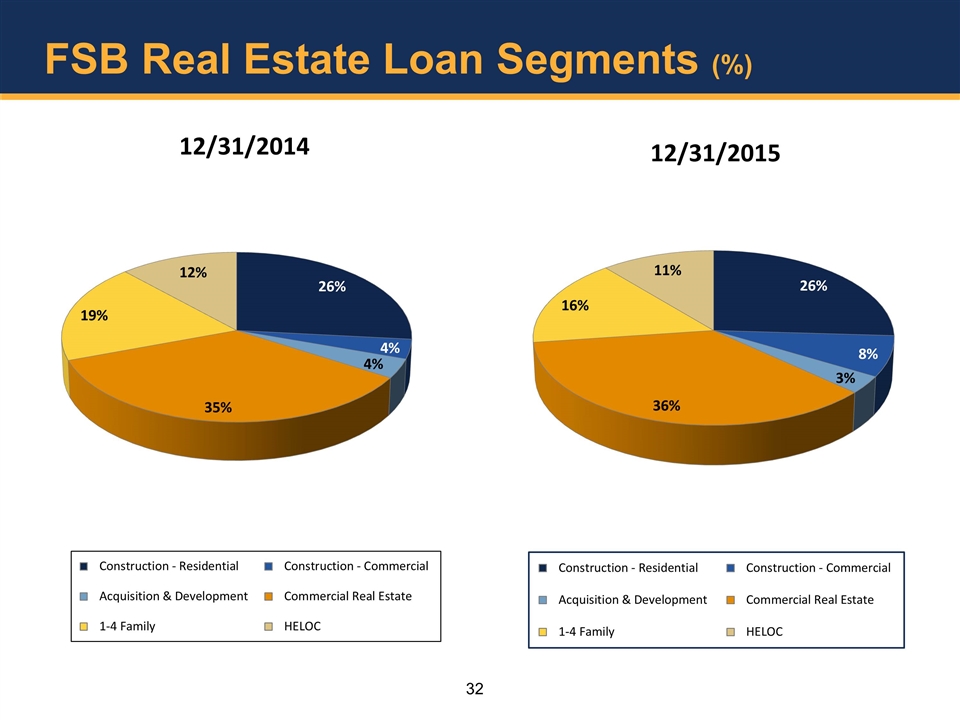

Loan Growth Rates (End of Period Loans) 4Q 2015 vs. 4Q 2014 $512.3 million, or 63.6% 4Q 2015 vs. 3Q 2015 $179.4 million, or 62.5% (annualized) All major categories of loans contributing to loan growth Business loans grew $208 million, or 265.4% (vs. 4Q2014) Healthcare unit grew $54 million during 4Q2015 Real estate loans (excluding loans held for sale) grew 44.4% (vs. 4Q2014) Local residential construction continues strong Investor real estate opportunities continue

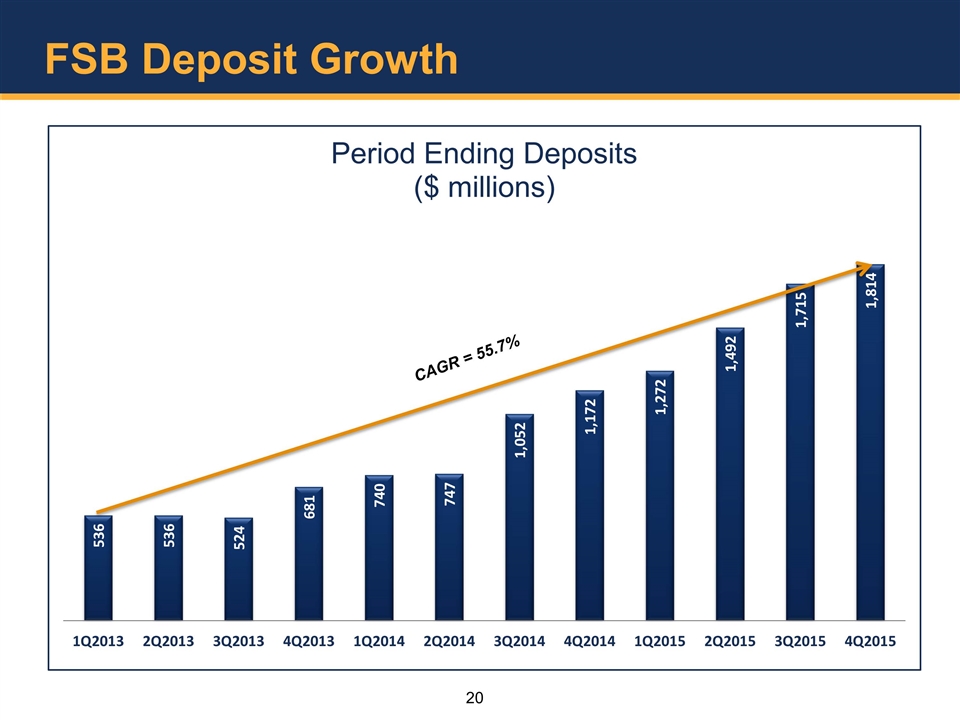

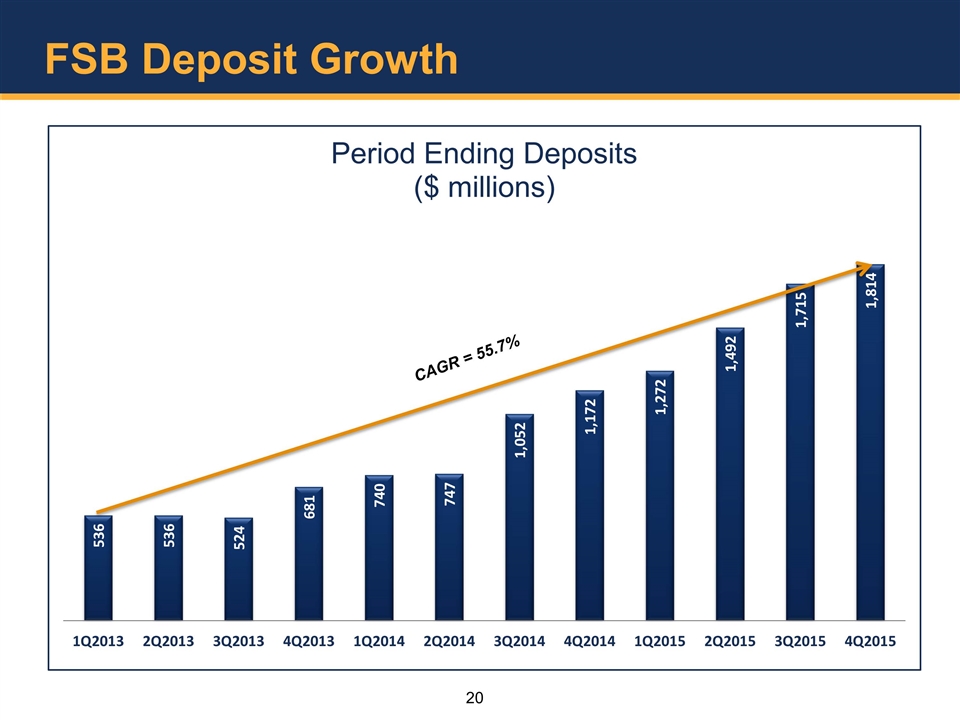

FSB Deposit Growth CAGR = 55.7%

4Q 2015 vs. 4Q 2014 $642,000, or 54.8% 4Q 2015 vs. 3Q 2015 $99,000, or 23.0% (annualized) Deposit Growth Rates (End of Period Deposits)

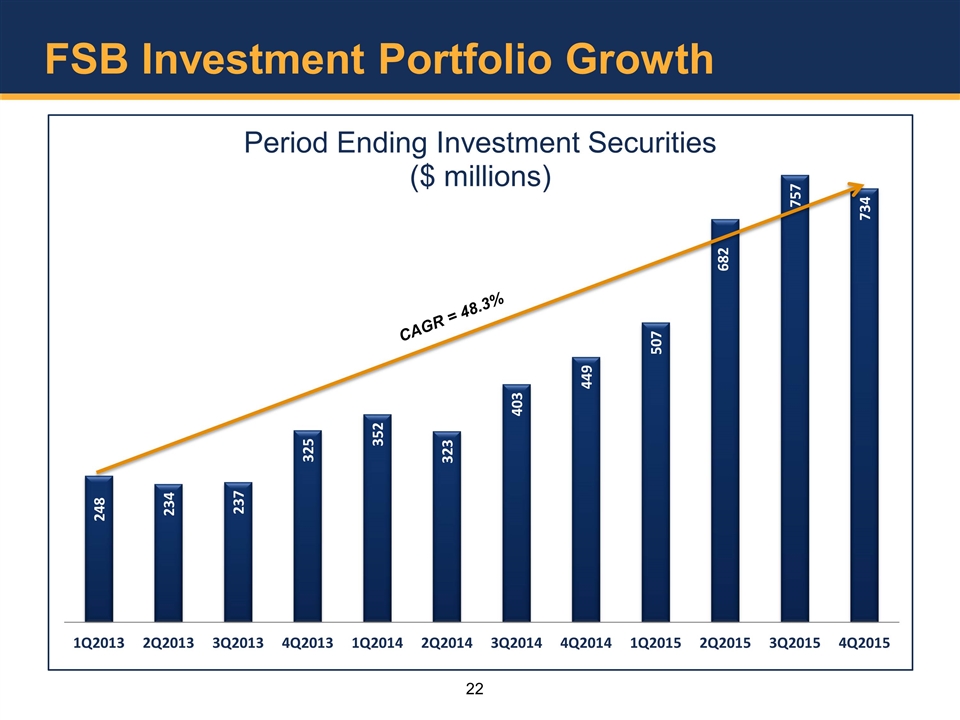

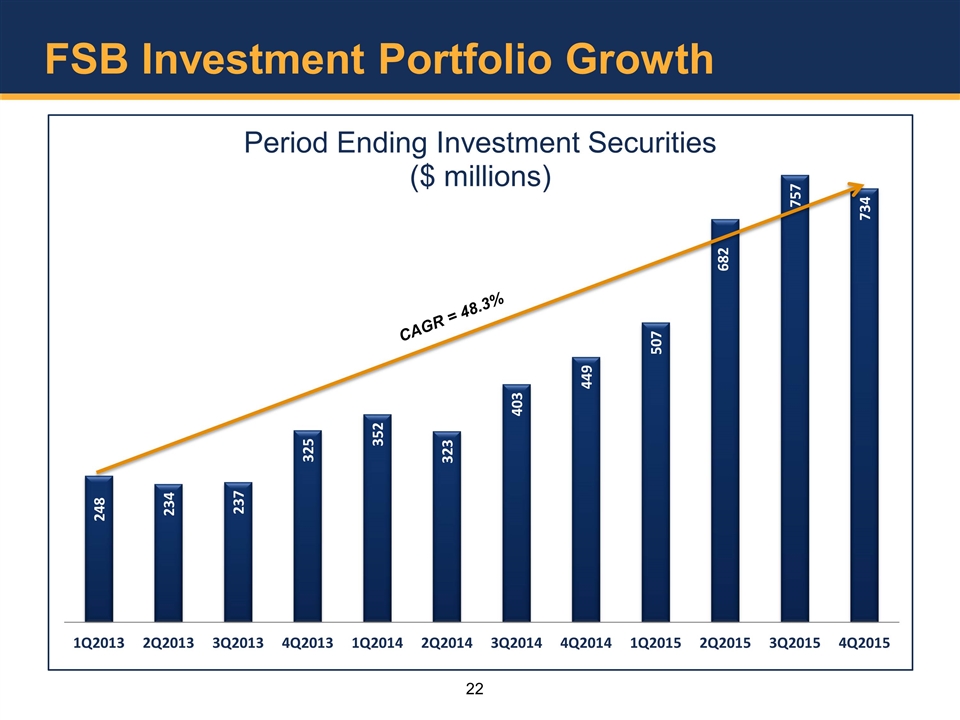

FSB Investment Portfolio Growth CAGR = 48.3%

Investment Portfolio Growth Elevated growth in 2Q 2015 and 3Q 2015 reflects Bank’s capital leverage program Change in 4Q 2015 reflects reduction of investments due to the growth in the Bank’s loan portfolio

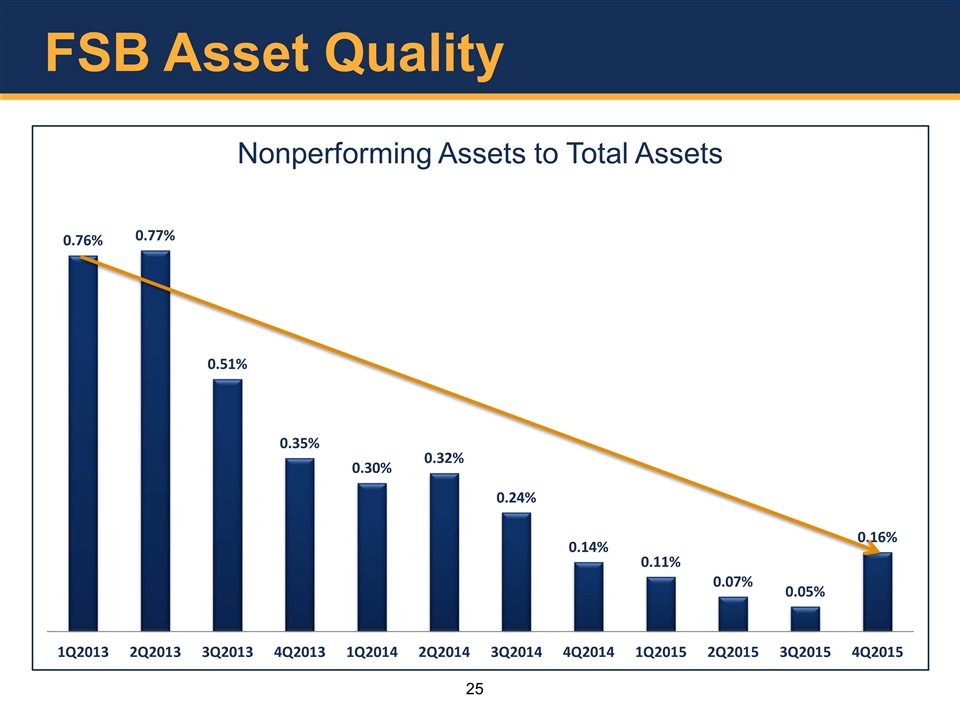

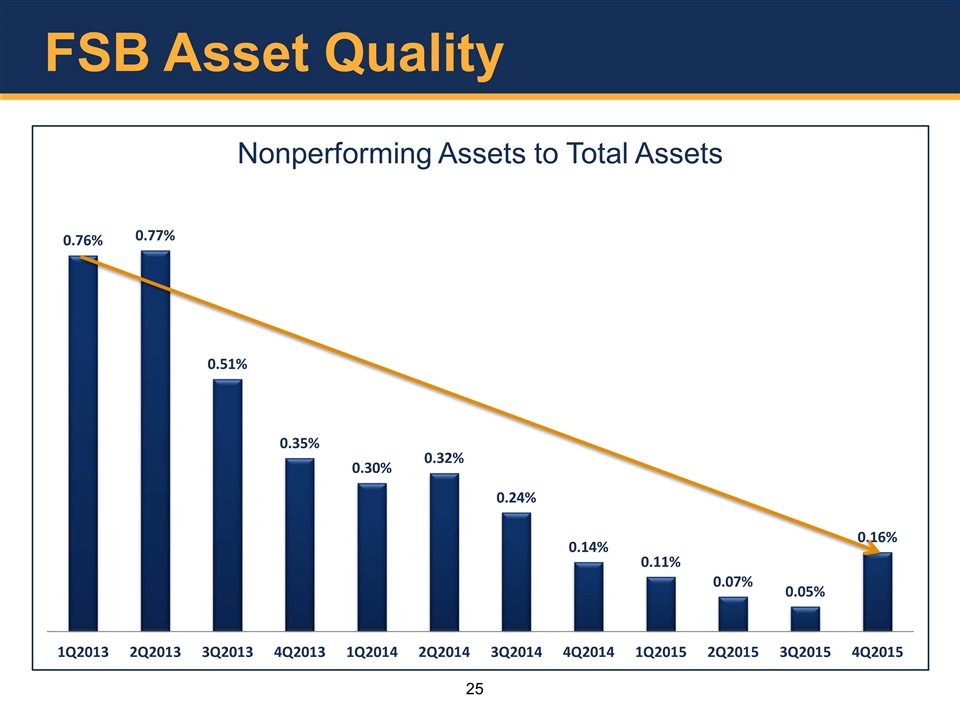

Asset Quality

FSB Asset Quality

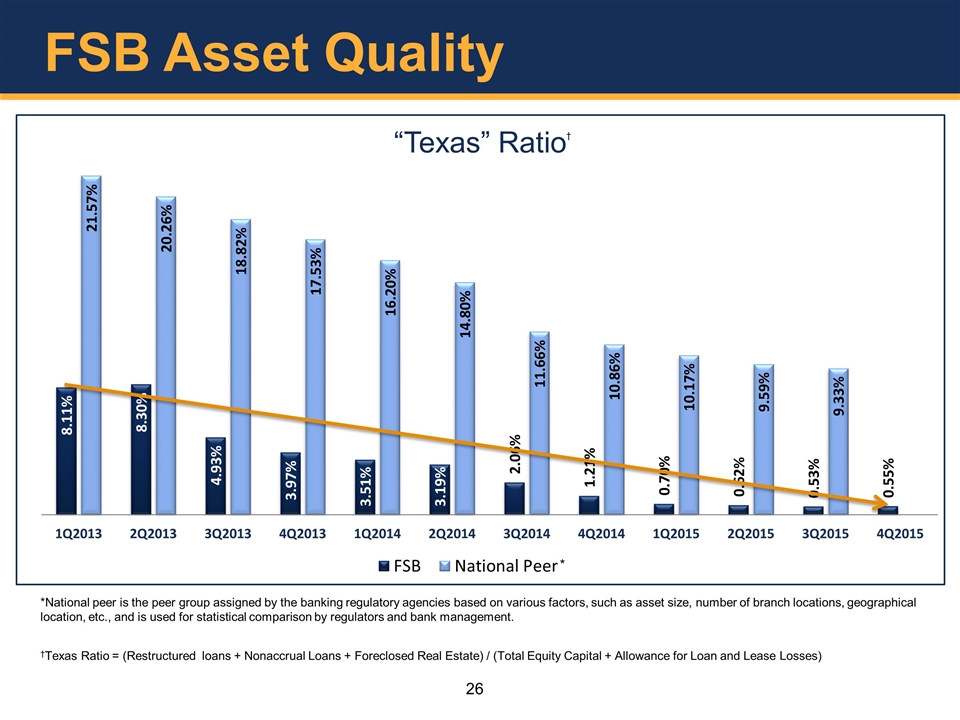

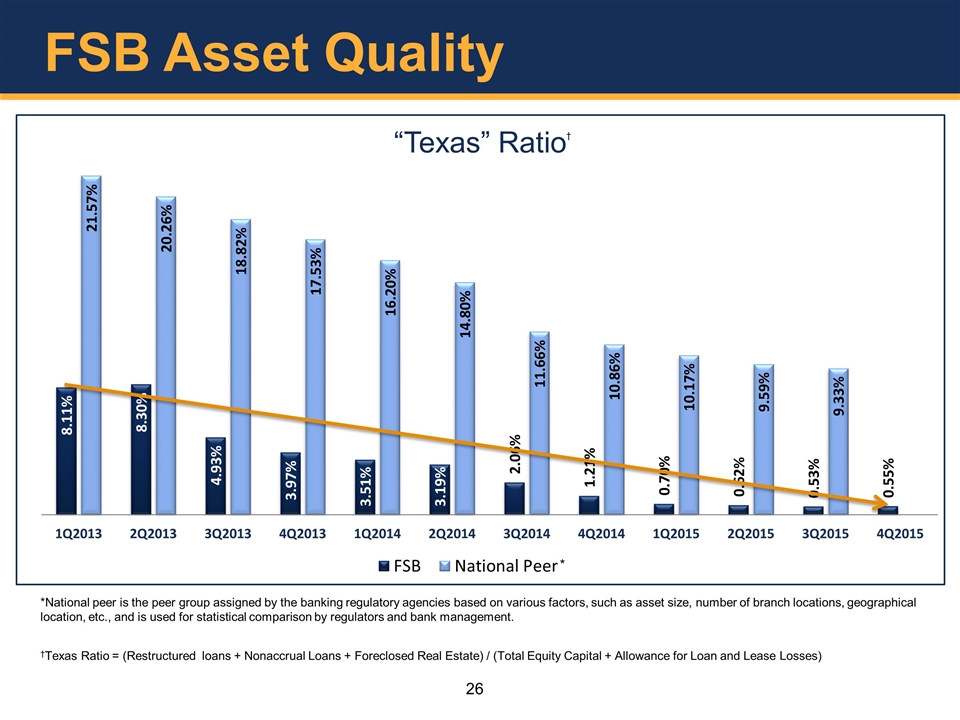

FSB Asset Quality *National peer is the peer group assigned by the banking regulatory agencies based on various factors, such as asset size, number of branch locations, geographical location, etc., and is used for statistical comparison by regulators and bank management. * †Texas Ratio = (Restructured loans + Nonaccrual Loans + Foreclosed Real Estate) / (Total Equity Capital + Allowance for Loan and Lease Losses) †

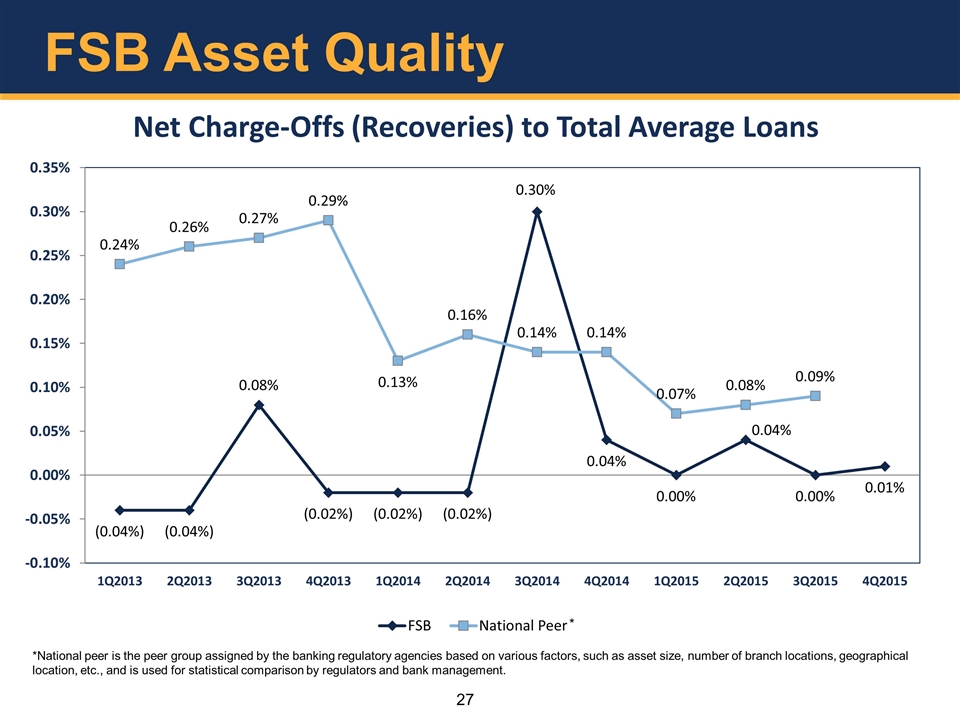

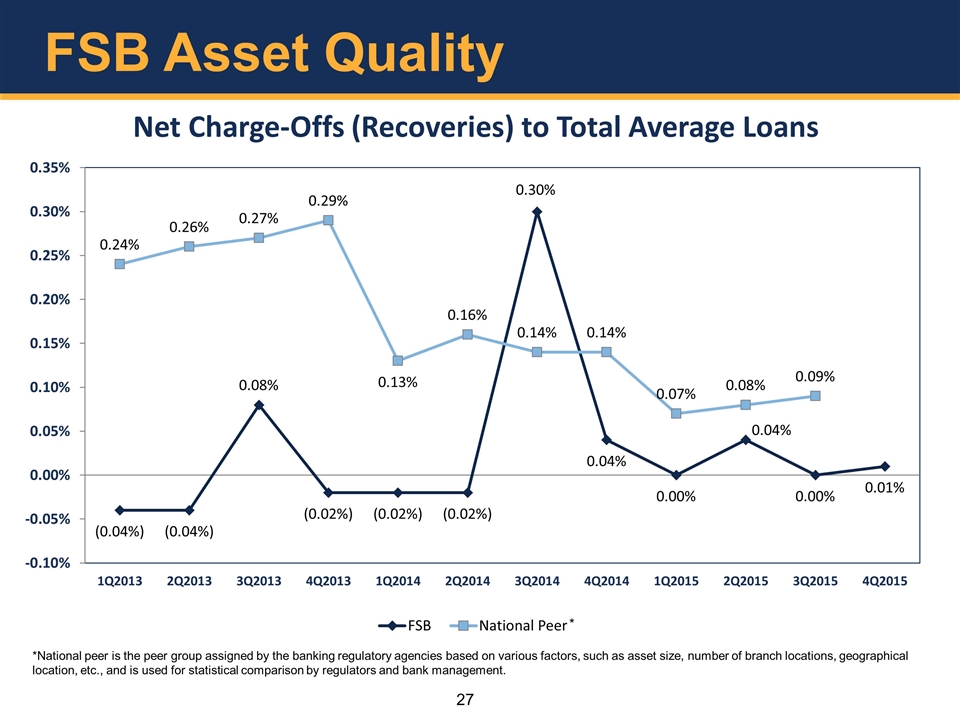

FSB Asset Quality

Real Estate Lending

FSB Loan Concentration (excludes Loans Held For Sale)

FSB Loan Segments (%)

FSB Loan Segments ($ millions)

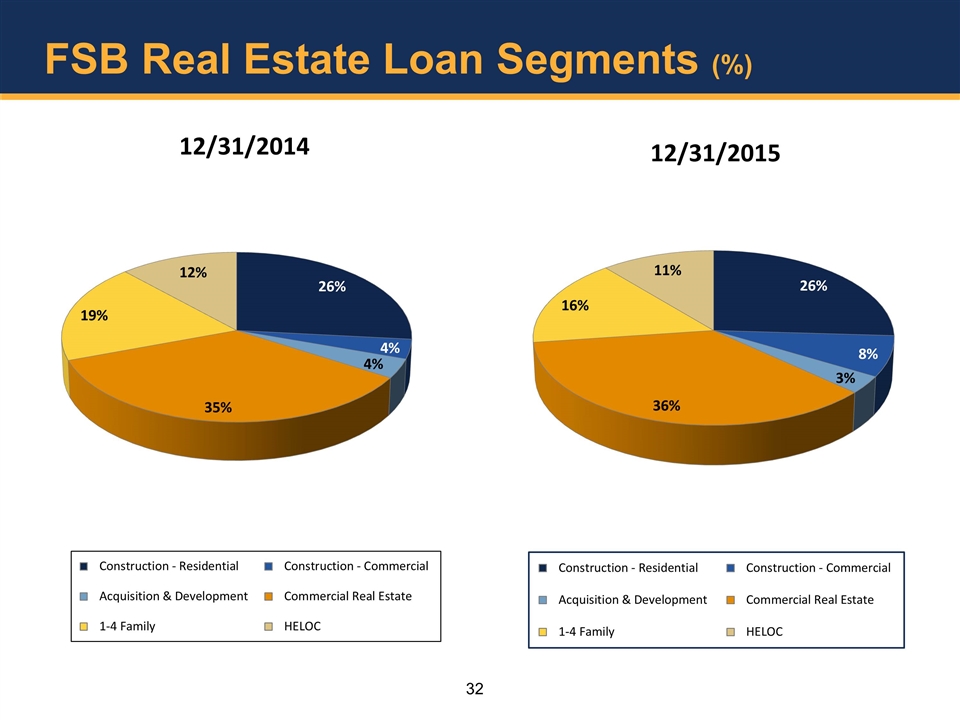

FSB Real Estate Loan Segments (%)

Long Term Plan Metrics

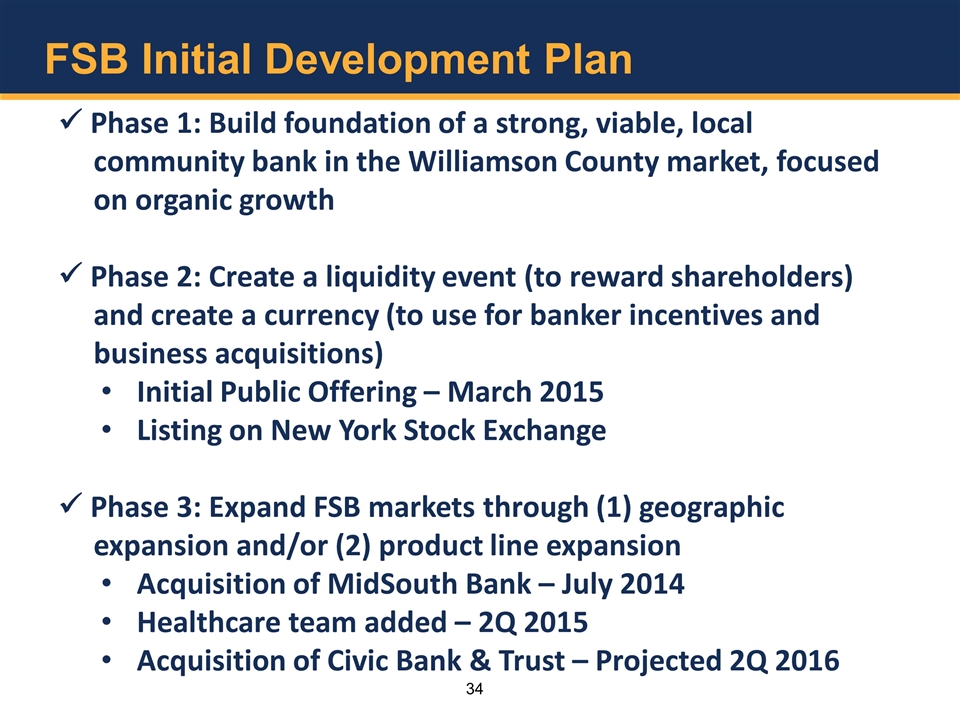

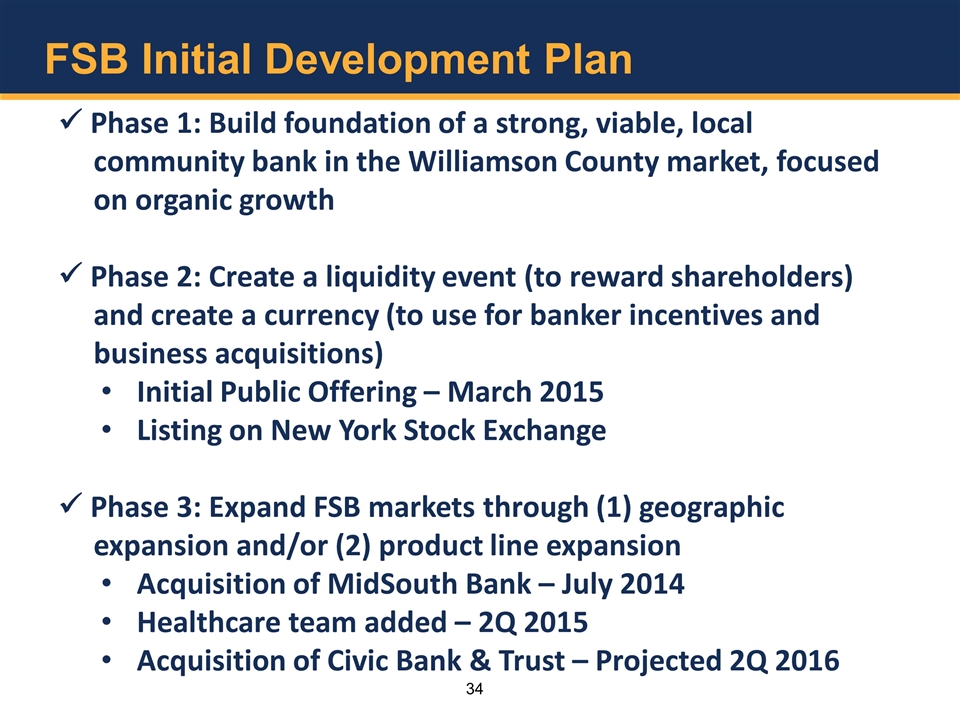

FSB Initial Development Plan ü Phase 1: Build foundation of a strong, viable, local community bank in the Williamson County market, focused on organic growth ü Phase 2: Create a liquidity event (to reward shareholders) and create a currency (to use for banker incentives and business acquisitions) Initial Public Offering – March 2015 Listing on New York Stock Exchange ü Phase 3: Expand FSB markets through (1) geographic expansion and/or (2) product line expansion Acquisition of MidSouth Bank – July 2014 Healthcare team added – 2Q 2015 Acquisition of Civic Bank & Trust – Projected 2Q 2016

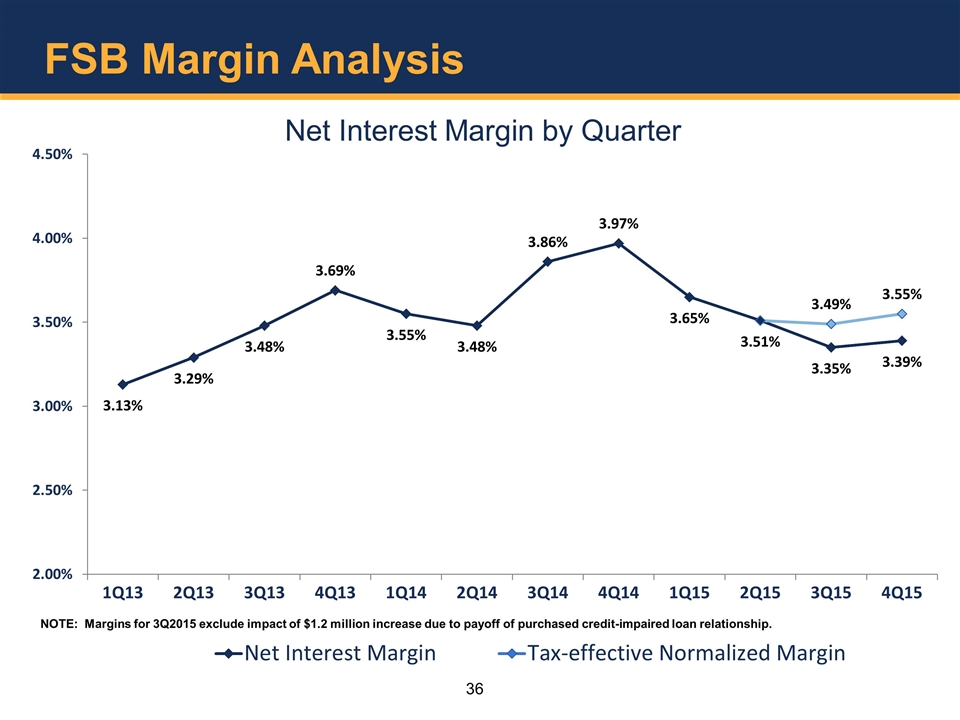

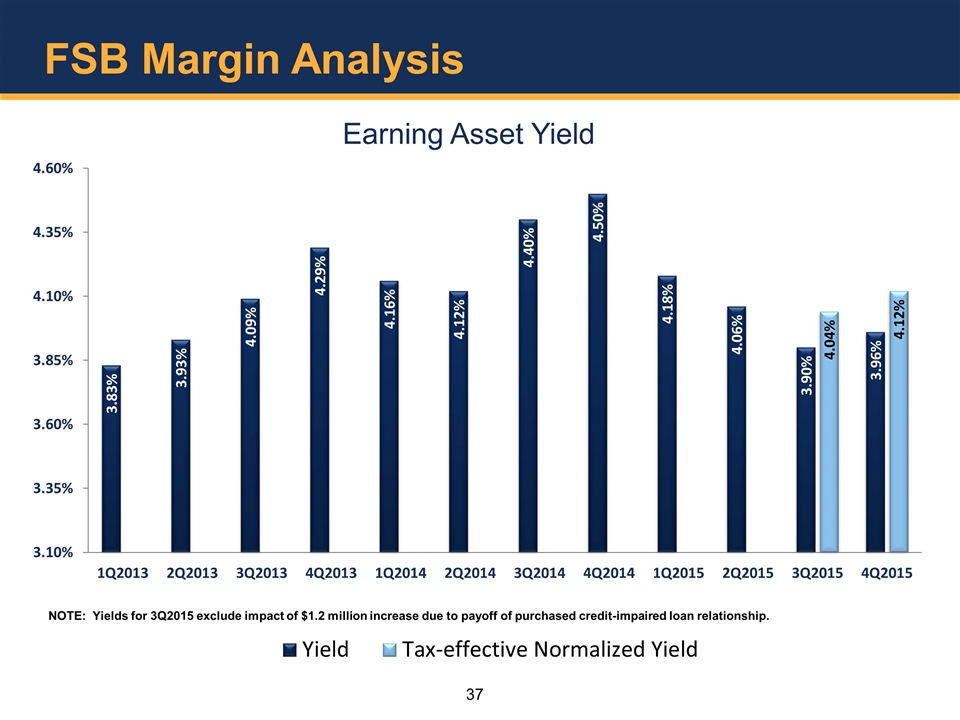

Keys to Enhancing Continued Profitability Improve interest margins

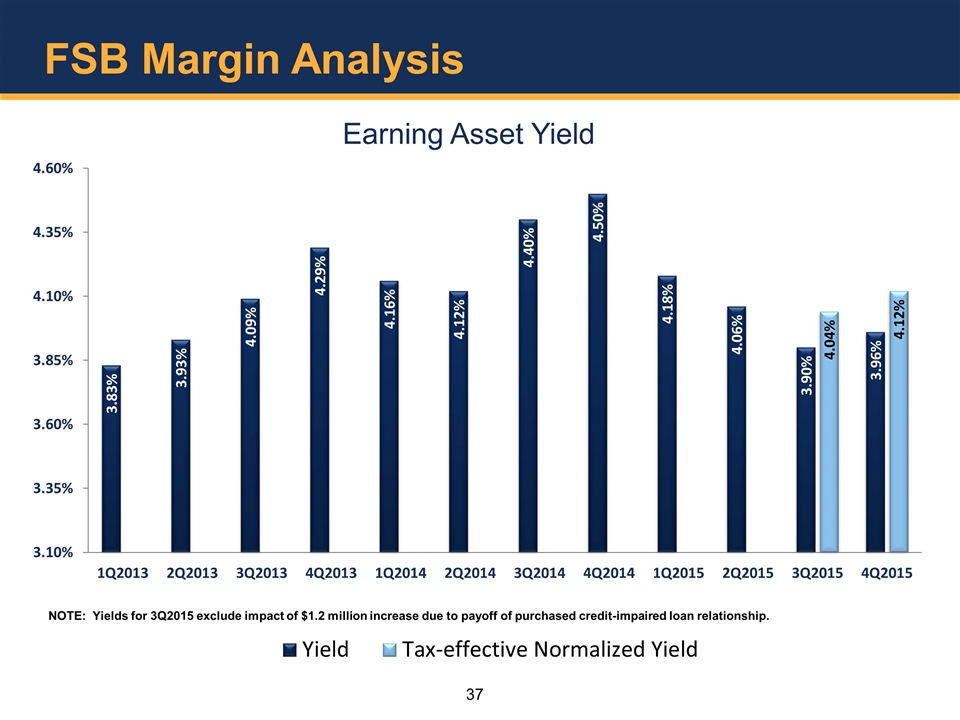

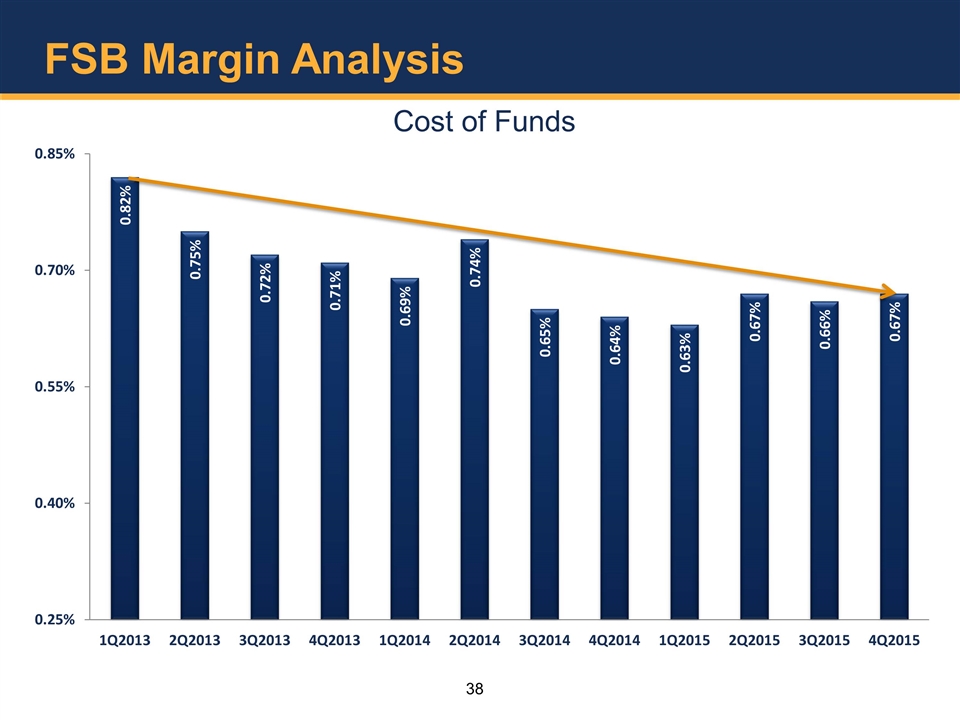

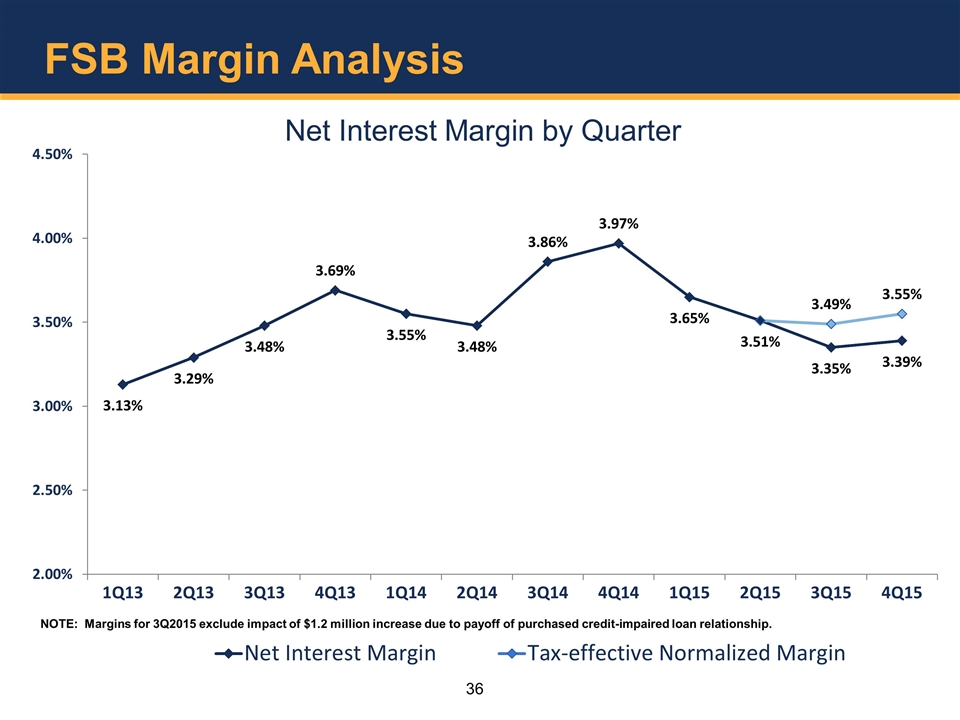

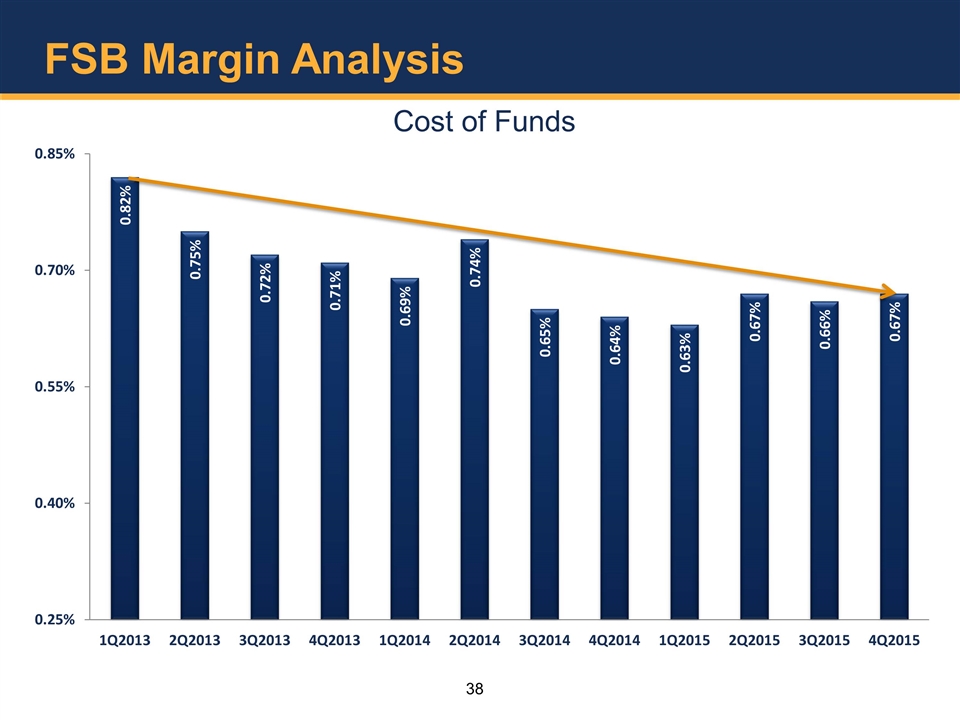

FSB Margin Analysis

FSB Margin Analysis

FSB Margin Analysis

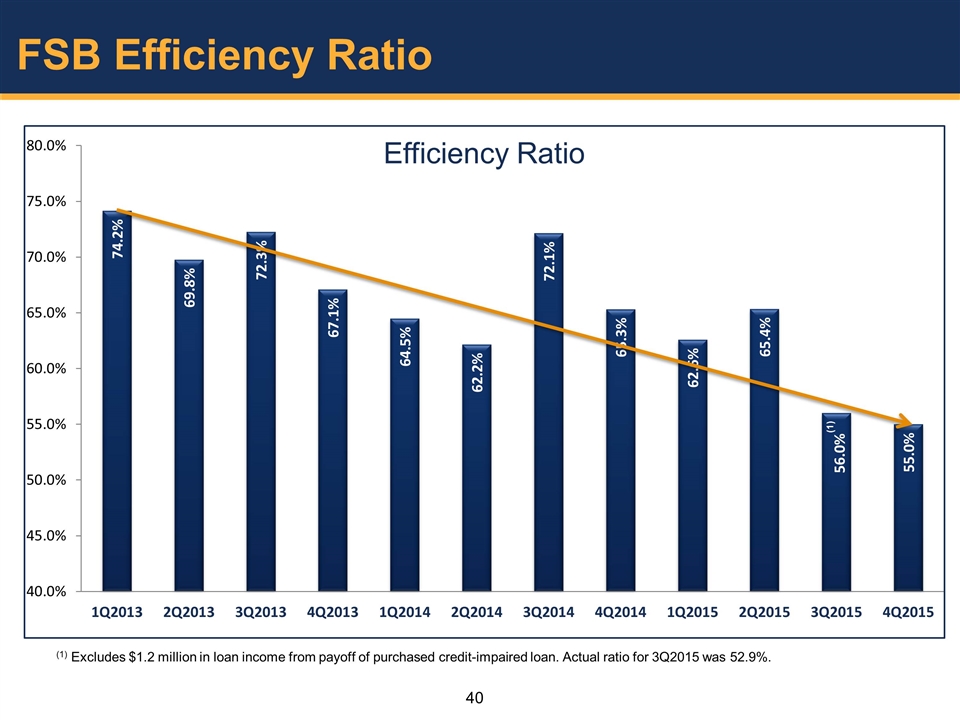

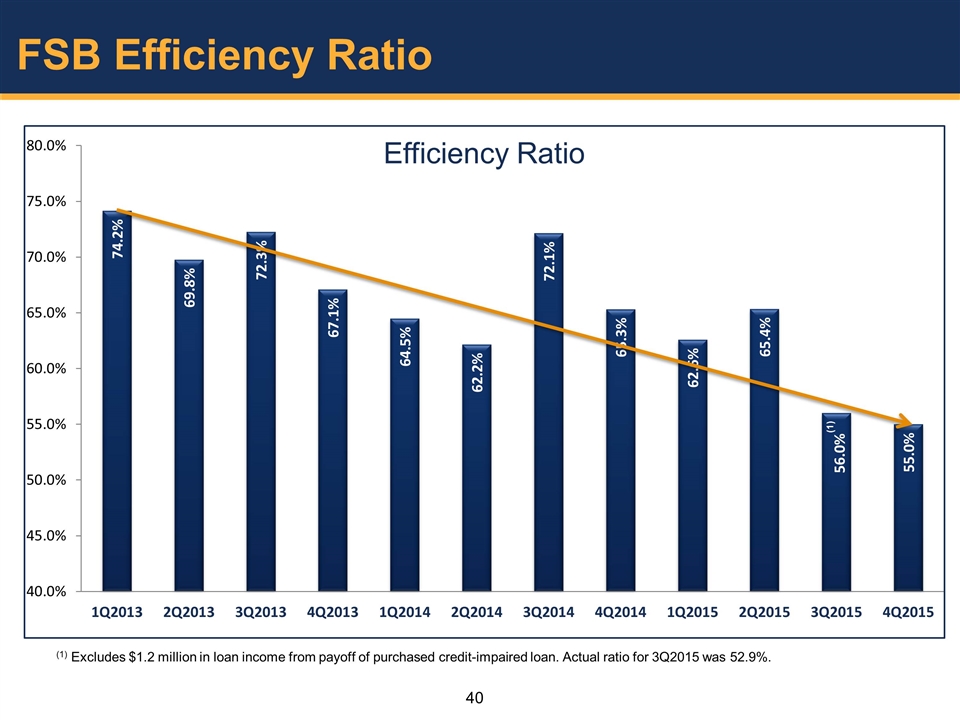

Keys to Enhancing Continued Profitability Improve interest margins Improve efficiency ratio

FSB Efficiency Ratio (1) Excludes $1.2 million in loan income from payoff of purchased credit-impaired loan. Actual ratio for 3Q2015 was 52.9%.

Keys to Enhancing Continued Profitability Improve interest margins Improve efficiency ratio Optimize non-interest income

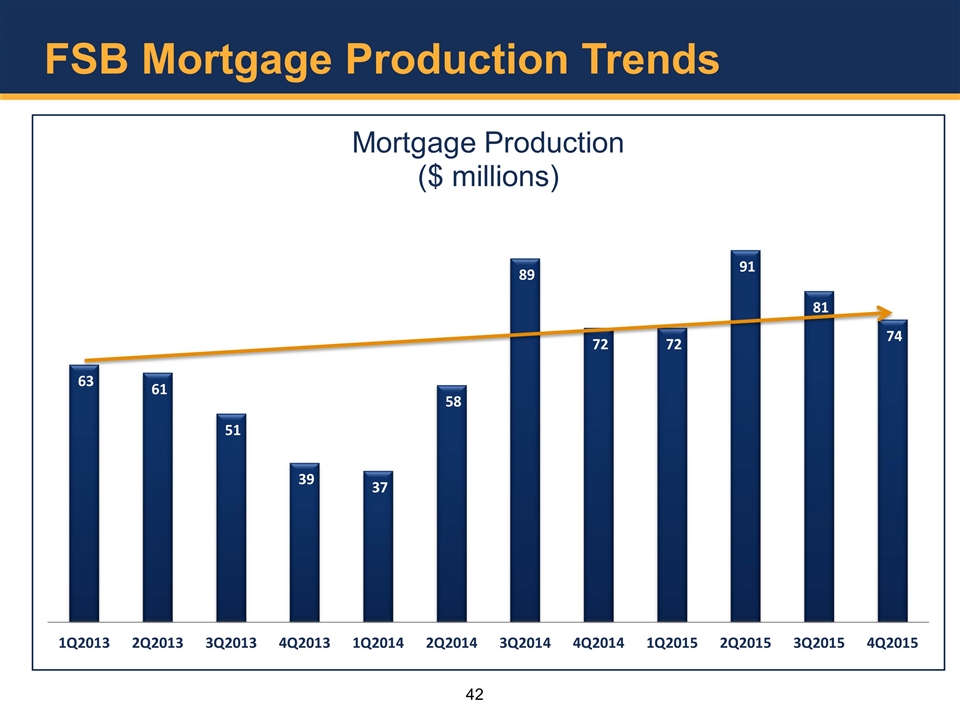

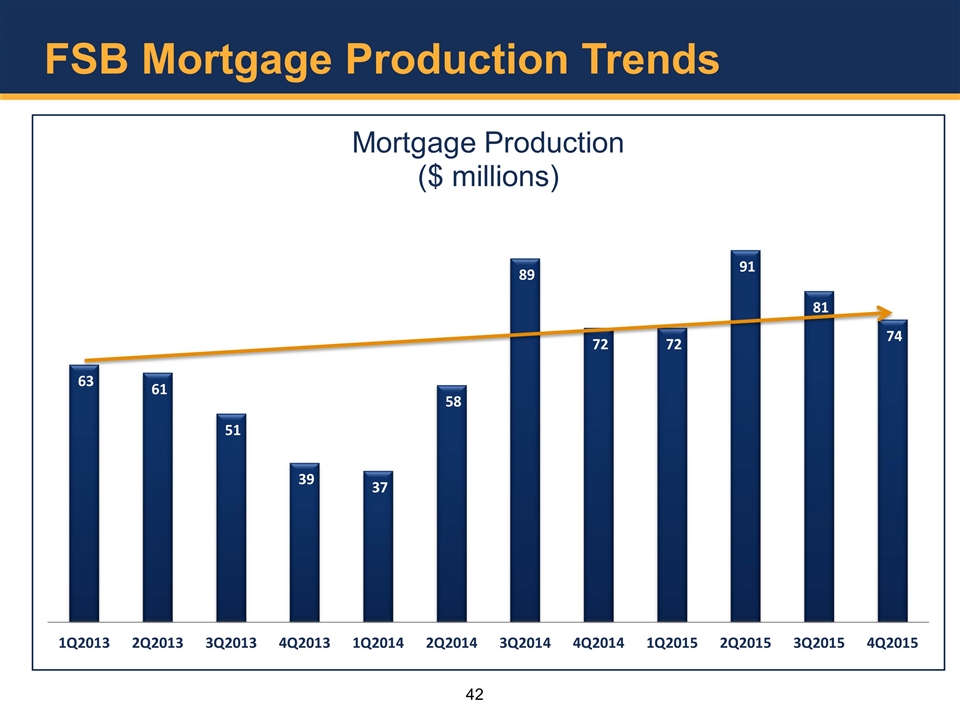

FSB Mortgage Production Trends

Key Elements of FSB Performance Growth Real Estate Lending Asset Quality Proven, Successful Banking Model