May 26, 2016 Franklin Financial Network Annual Meeting Exhibit 99.1

Forward-Looking Statements Except for the historical information contained herein, this presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The forward-looking statements include, among other things, statements regarding intent, belief or expectations of the Company and can be identified by the use of words such as "may," "will," "should," "would," "assume," "outlook," "seek," "plan," "believe," "expect," "anticipate," "intend," "estimate," "forecast," and other comparable terms. The Company intends that all such statements be subject to the “safe harbor” provisions of those Acts. Because forward-looking statements involve risks and uncertainties, actual results may differ materially from those expressed or implied. Investors are cautioned not to place undue reliance on these forward-looking statements and are advised to carefully review the discussion of forward-looking statements and risk factors in documents the Company files with the Securities and Exchange Commission. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Agenda Official Business Franklin Synergy Bank Progress Report Questions

Business First Item: Election of Board of Directors Second Item: Ratification of Auditors Mandy Garland Appointed Judge of the Election Quorum Is Present, Either in Person or by Proxy Anyone Who Would Like to Vote in Person or Who Would Like to Change Their Proxy? Results of Ballot

Franklin Synergy Bank Board of Directors *denotes Franklin Financial Network Board of Director also Jimmy Allen* Hank Brockman* PJ Pratt Pam Stephens* Lee Moss David Kemp* Richard Herrington* Jim Cross Greg Waldron* Melody Sullivan* Ben Wynd*

The Success of Franklin Synergy Bank

Metrics that distinguish Franklin financial network Experienced Management Team with a Proven Track Record Robust Balance Sheet Growth Local Real Estate Lending Expertise Well Positioned in Attractive Markets Color Scheme 255 175 53 249 221 151 255 212 64 128 180 220 43 98 182 21 47 88 Superior Asset Quality Strong Profitability

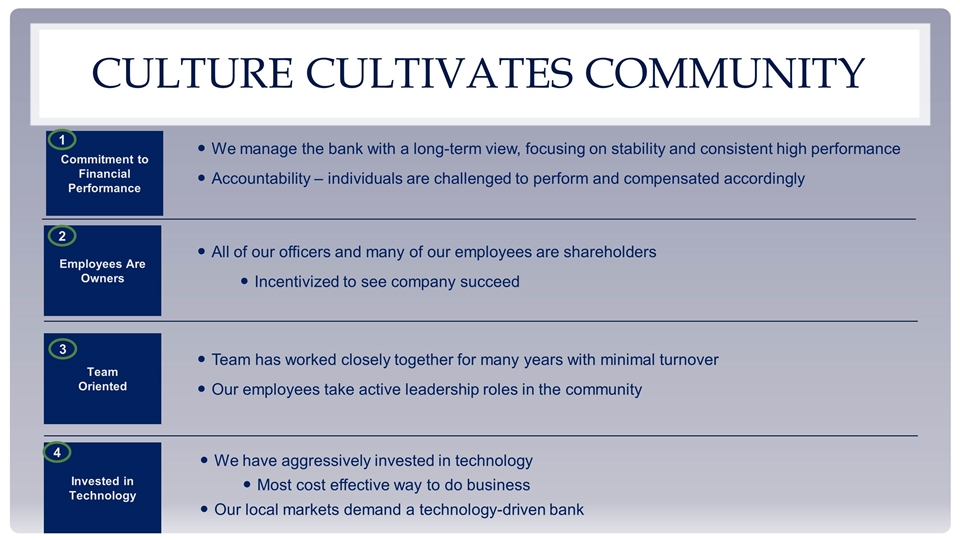

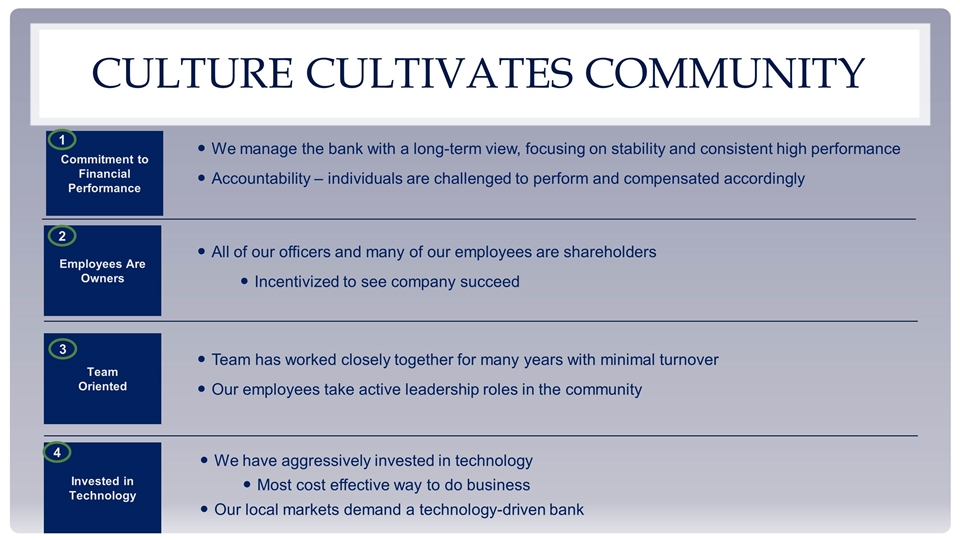

Culture Cultivates Community Color Scheme 255 175 53 249 221 151 255 212 64 128 180 220 43 98 182 21 47 88 Commitment to Financial Performance Employees Are Owners Team Oriented 1 2 3 Invested in Technology 4 We manage the bank with a long-term view, focusing on stability and consistent high performance Accountability – individuals are challenged to perform and compensated accordingly All of our officers and many of our employees are shareholders Incentivized to see company succeed Team has worked closely together for many years with minimal turnover Our employees take active leadership roles in the community We have aggressively invested in technology Most cost effective way to do business Our local markets demand a technology-driven bank

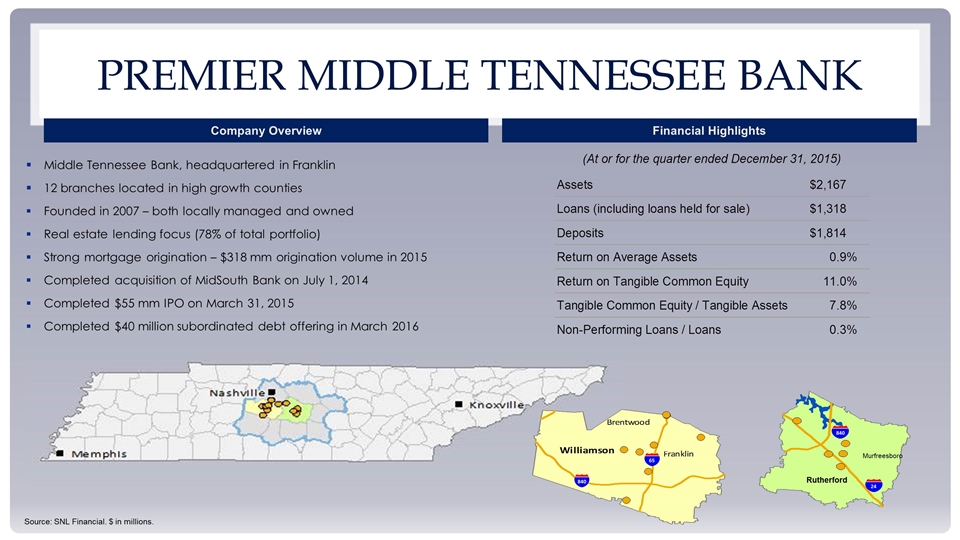

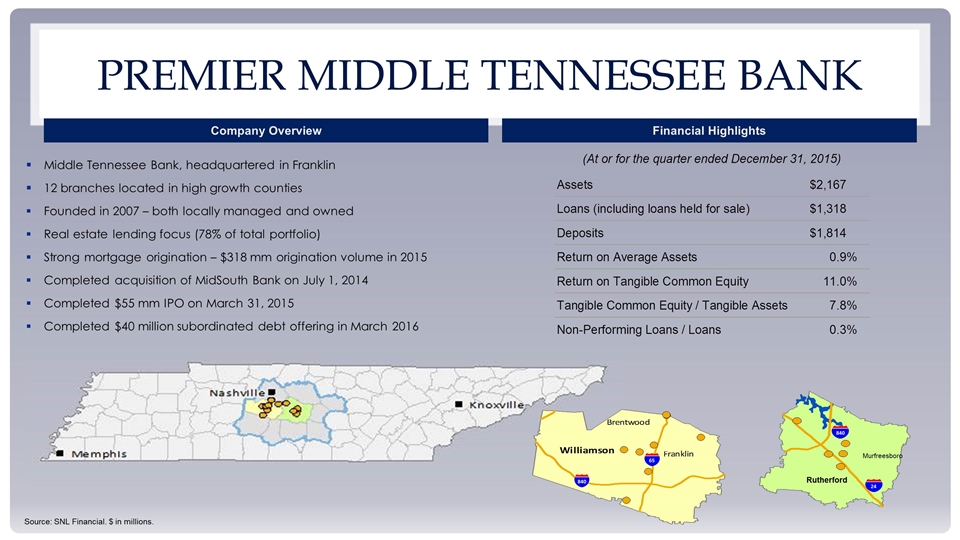

Middle Tennessee Bank, headquartered in Franklin 12 branches located in high growth counties Founded in 2007 – both locally managed and owned Real estate lending focus (78% of total portfolio) Strong mortgage origination – $318 mm origination volume in 2015 Completed acquisition of MidSouth Bank on July 1, 2014 Completed $55 mm IPO on March 31, 2015 Completed $40 million subordinated debt offering in March 2016 Premier Middle Tennessee Bank Company Overview Financial Highlights Source: SNL Financial. $ in millions. 24 840 Murfreesboro Rutherford 840 65

Our mission statement Our Mission is to build a legacy company by: Creating shareholder value Cultivating strong customer relationships Fostering an extraordinary team of directors, officers, and employees We will profitably market technology advantaged financial products and services to relationship-oriented local businesses, professionals, consumers, and community banks.

Managing Banking Success Key Dynamic of Bank Success - Managing Competing and Conflicting Objectives: Soundness Growth Profitability Corporate Citizenship

Soundness

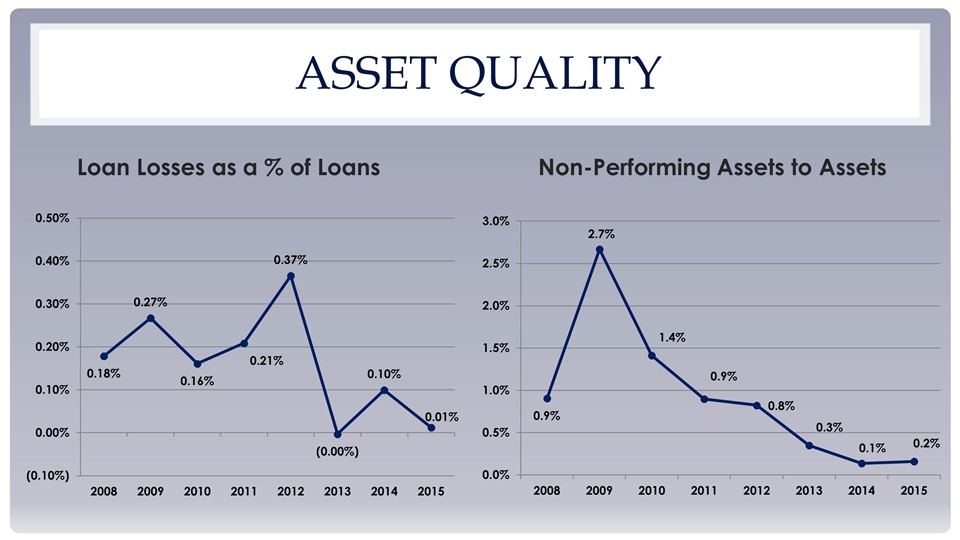

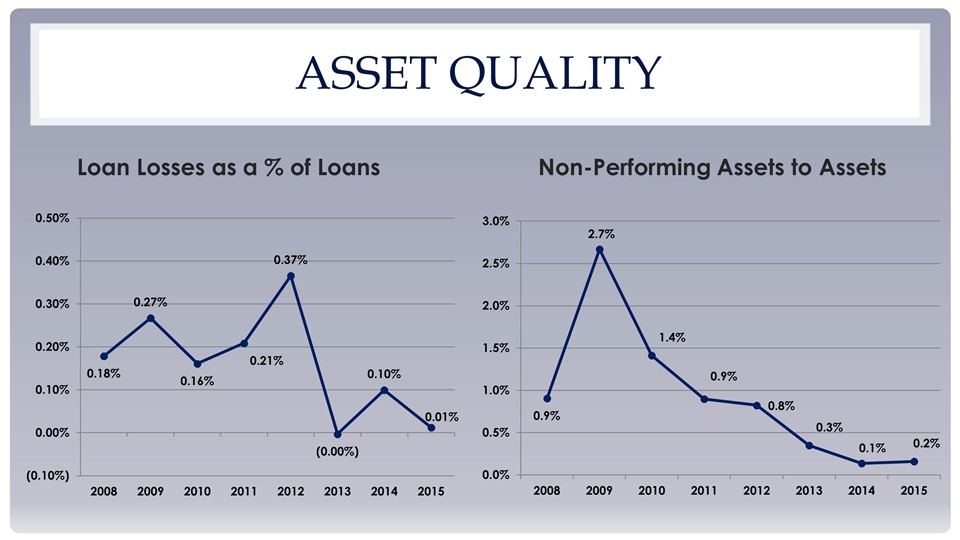

Asset Quality

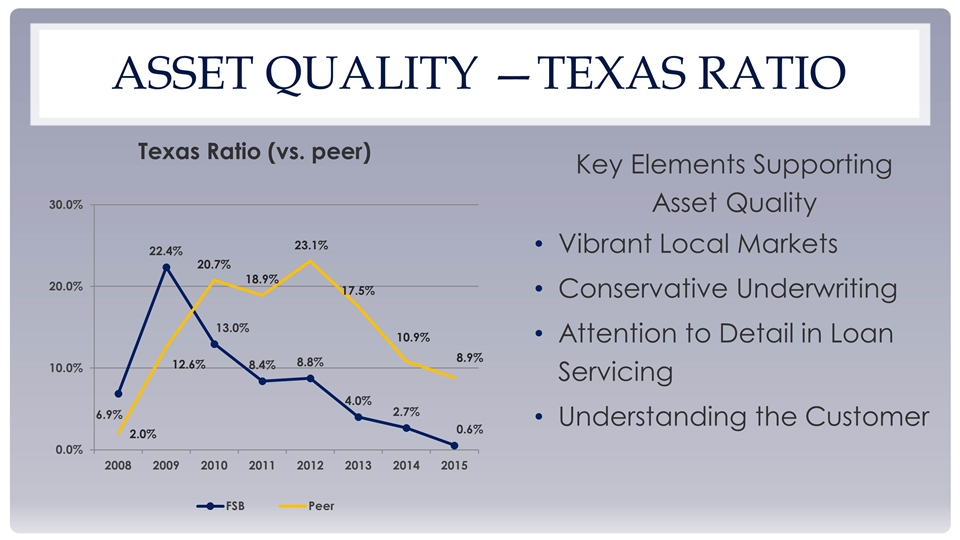

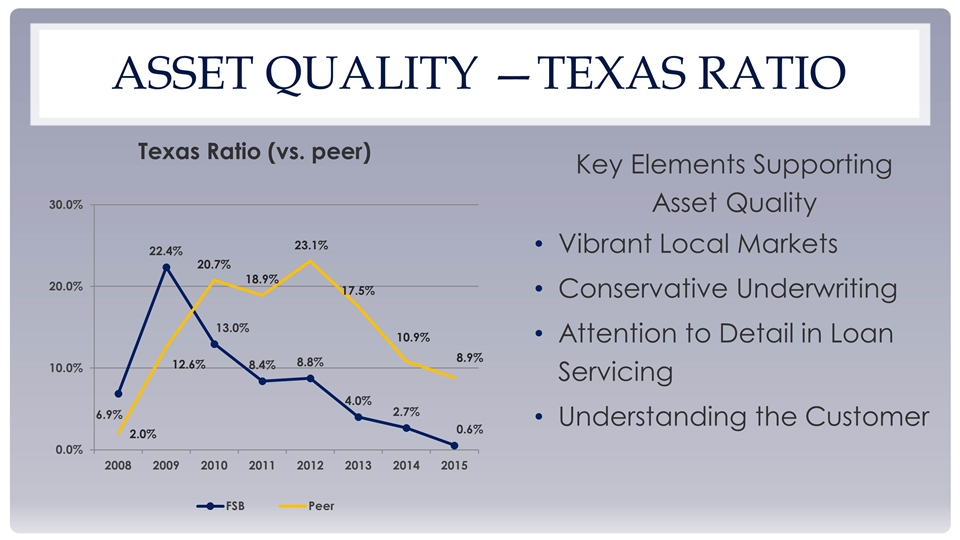

Asset Quality —Texas ratio Key Elements Supporting Asset Quality Vibrant Local Markets Conservative Underwriting Attention to Detail in Loan Servicing Understanding the Customer

Growth

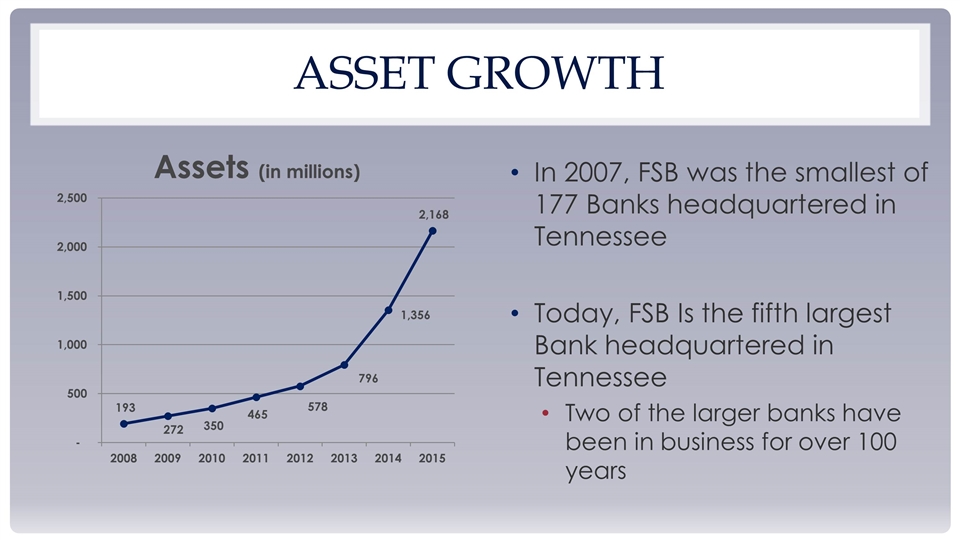

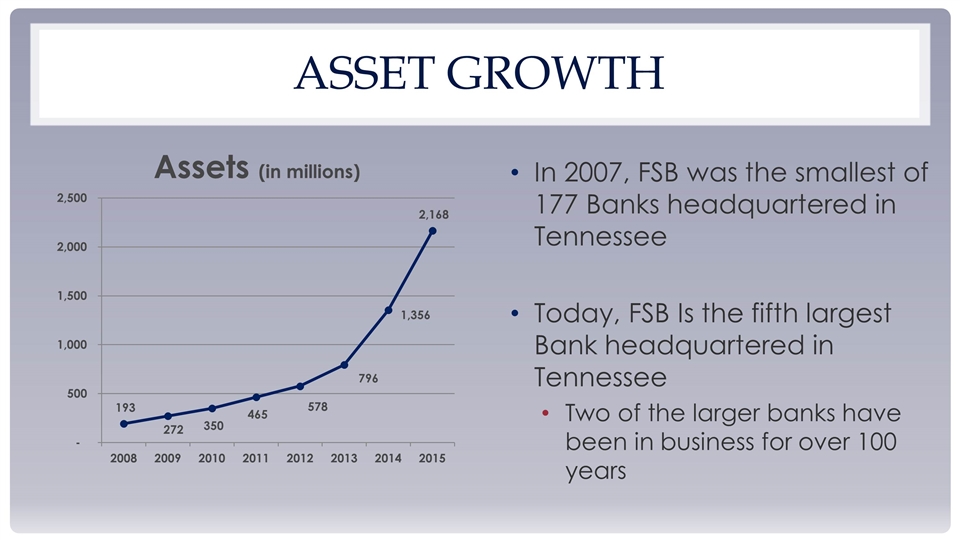

Asset Growth In 2007, FSB was the smallest of 177 Banks headquartered in Tennessee Today, FSB Is the fifth largest Bank headquartered in Tennessee Two of the larger banks have been in business for over 100 years

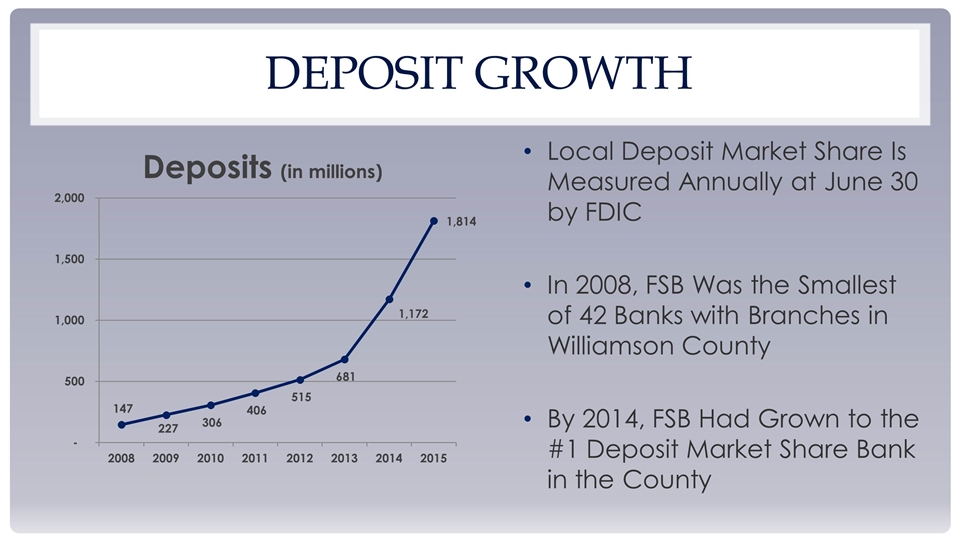

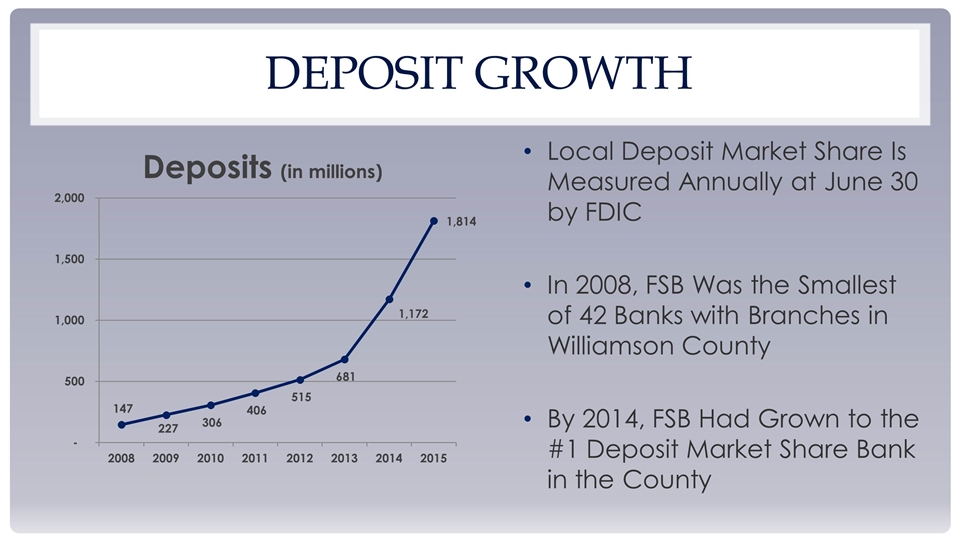

Deposit Growth Local Deposit Market Share Is Measured Annually at June 30 by FDIC In 2008, FSB Was the Smallest of 42 Banks with Branches in Williamson County By 2014, FSB Had Grown to the #1 Deposit Market Share Bank in the County

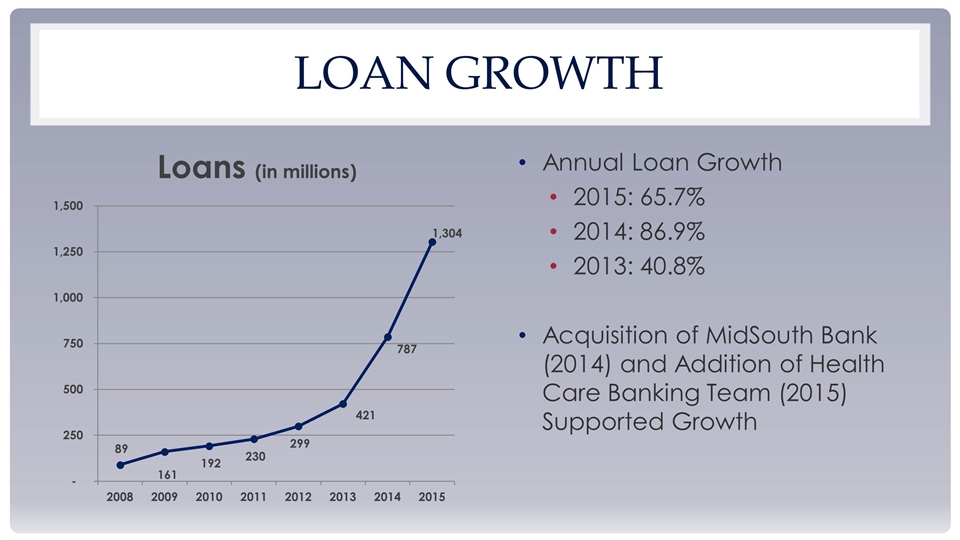

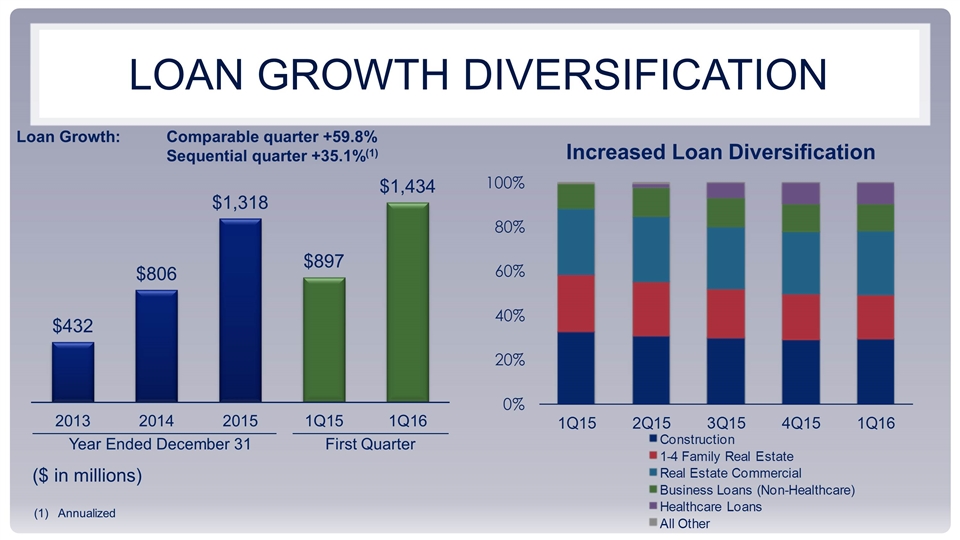

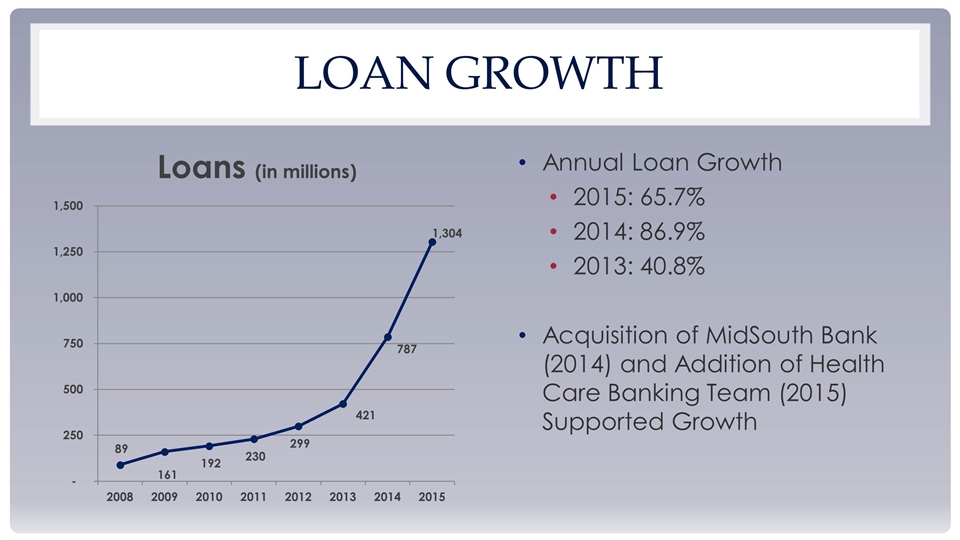

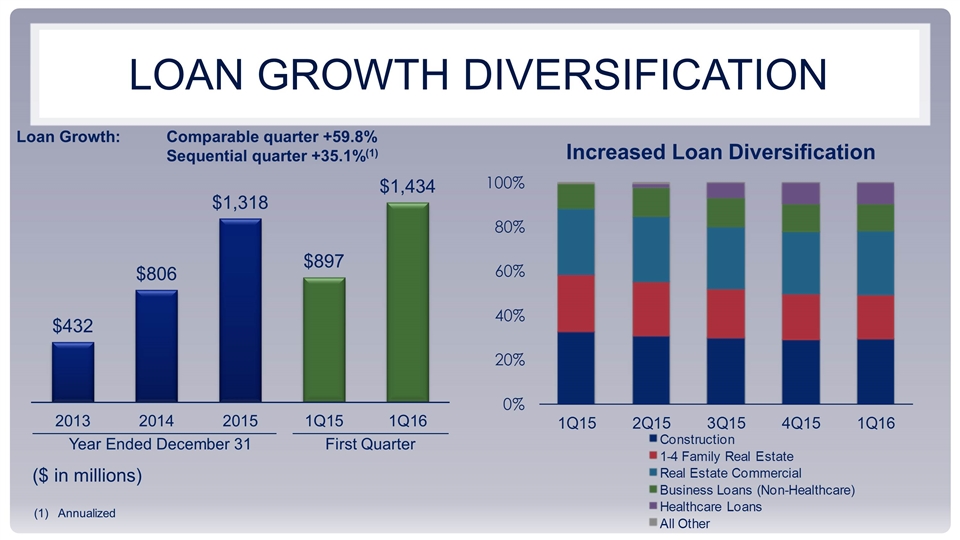

Loan Growth Annual Loan Growth 2015: 65.7% 2014: 86.9% 2013: 40.8% Acquisition of MidSouth Bank (2014) and Addition of Health Care Banking Team (2015) Supported Growth

Profitability

Growth in Net Income and EPS

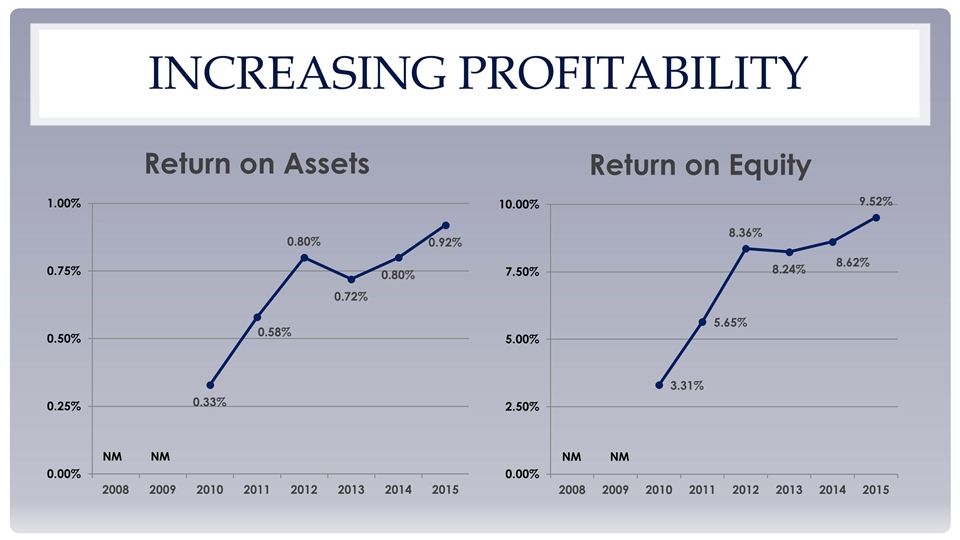

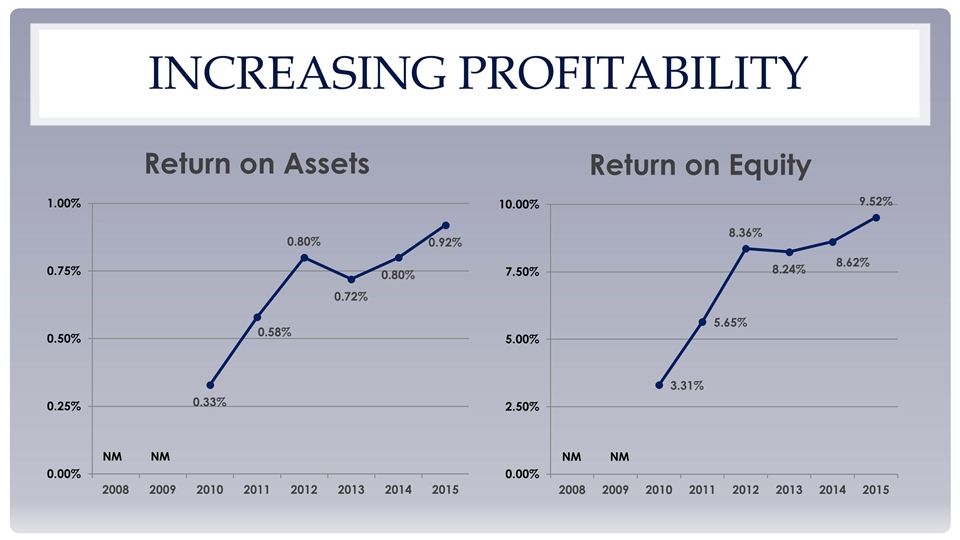

Increasing Profitability

Key Elements of Profitability Team Focus on Building Long Term Profitability Economies of Scale Use of Technology to Manage Operating Costs

Corporate Citizenship

Corporate Citizenship Provide Leadership for Civic, Professional, and Charitable Organizations within the Community As “Trustee of Public Faith”, Adhere to Regulatory Guidelines and Practices

First Quarter 2016 Update

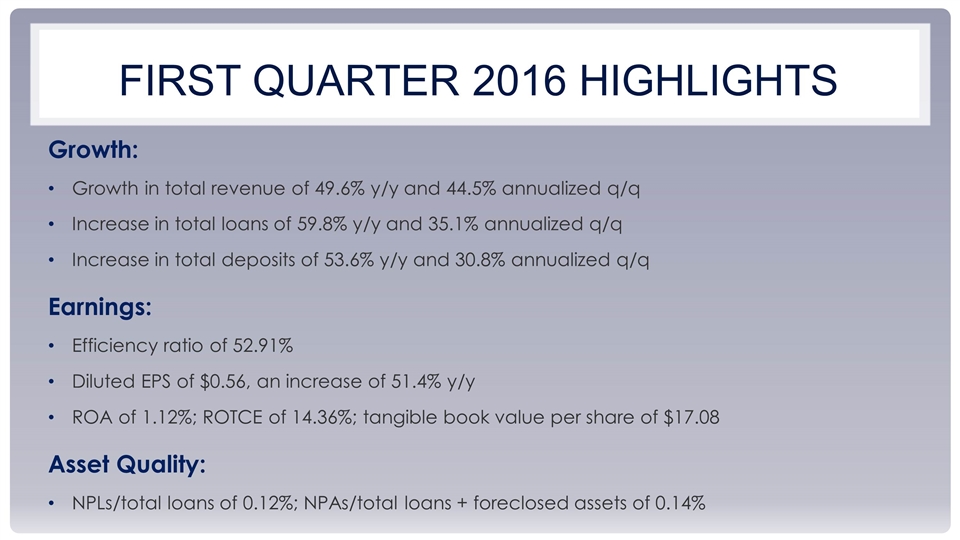

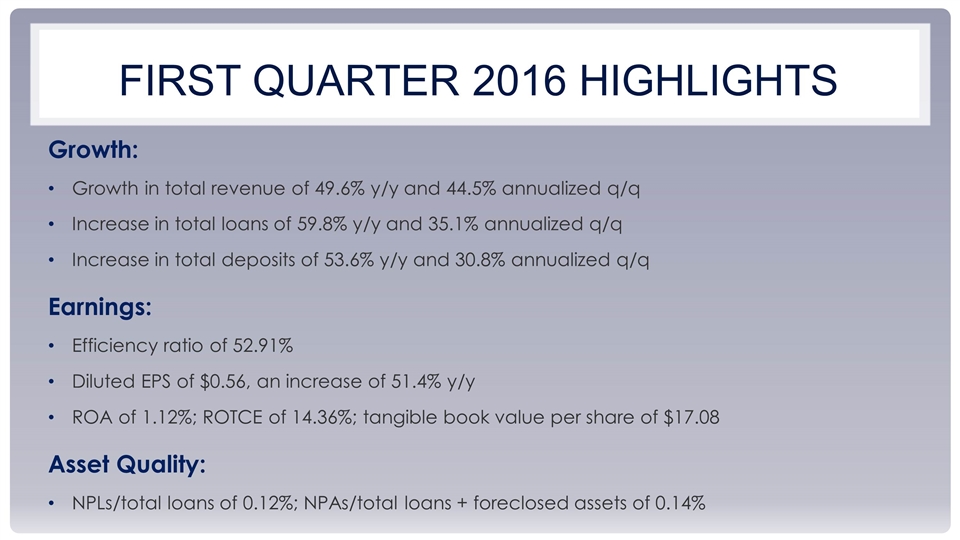

First Quarter 2016 Highlights Growth: Growth in total revenue of 49.6% y/y and 44.5% annualized q/q Increase in total loans of 59.8% y/y and 35.1% annualized q/q Increase in total deposits of 53.6% y/y and 30.8% annualized q/q Earnings: Efficiency ratio of 52.91% Diluted EPS of $0.56, an increase of 51.4% y/y ROA of 1.12%; ROTCE of 14.36%; tangible book value per share of $17.08 Asset Quality: NPLs/total loans of 0.12%; NPAs/total loans + foreclosed assets of 0.14%

First Quarter Loan Growth Diversification ($ in millions) Loan Growth:Comparable quarter +59.8% Sequential quarter +35.1%(1) Increased Loan Diversification Year Ended December 31 Annualized

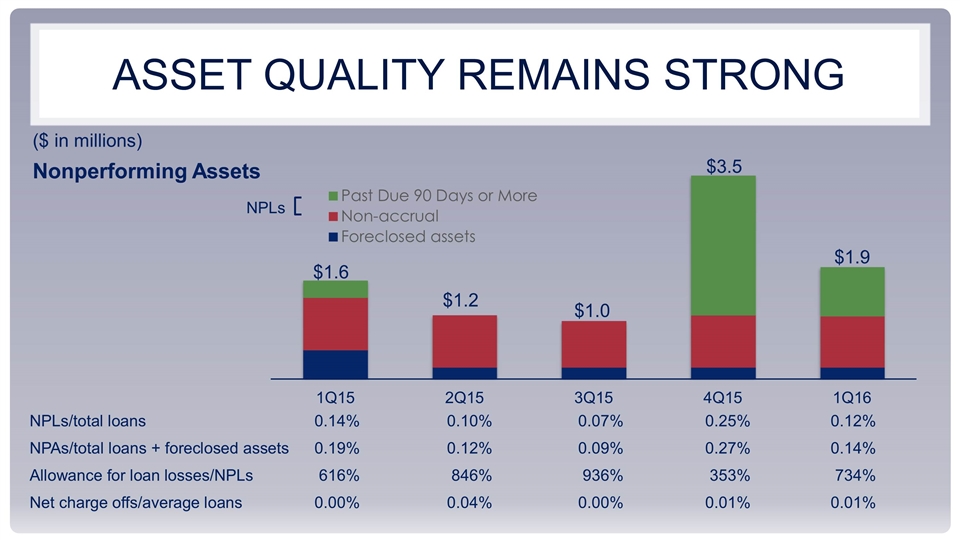

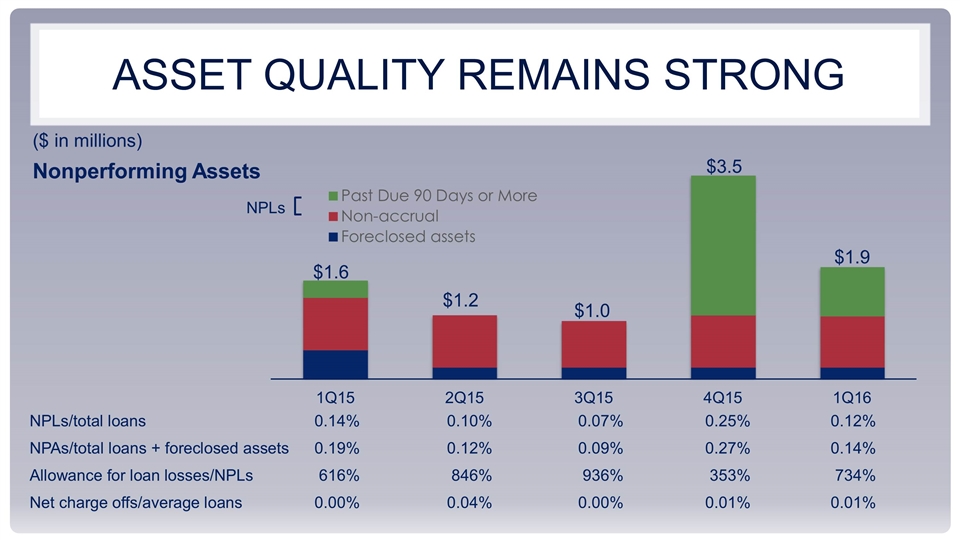

Asset Quality Remains Strong ($ in millions) Nonperforming Assets NPLs/total loans0.14%0.10%0.07%0.25%0.12% NPAs/total loans + foreclosed assets0.19% 0.12% 0.09% 0.27% 0.14% Allowance for loan losses/NPLs 616% 846% 936% 353% 734% Net charge offs/average loans 0.00% 0.04% 0.00% 0.01% 0.01% $1.6 $1.2 $1.0 $3.5 NPLs $1.9

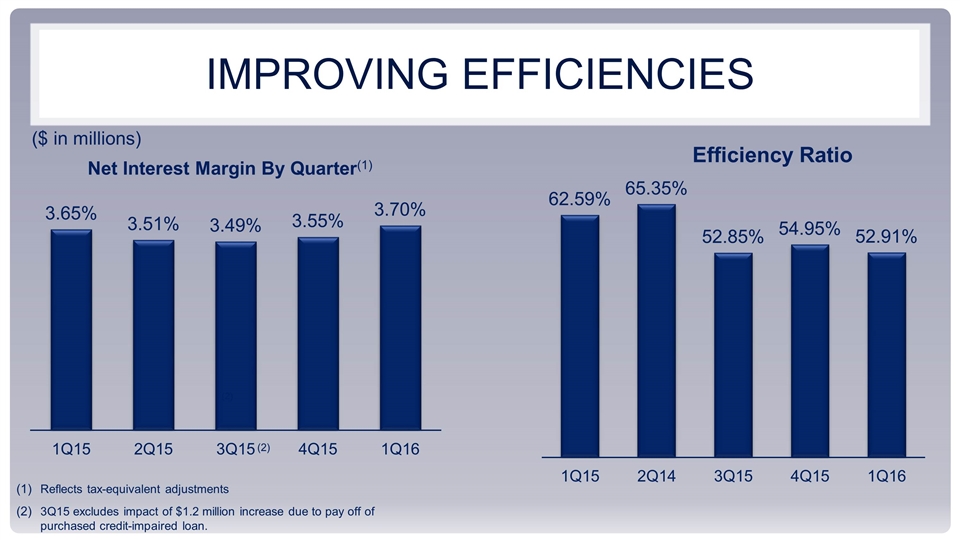

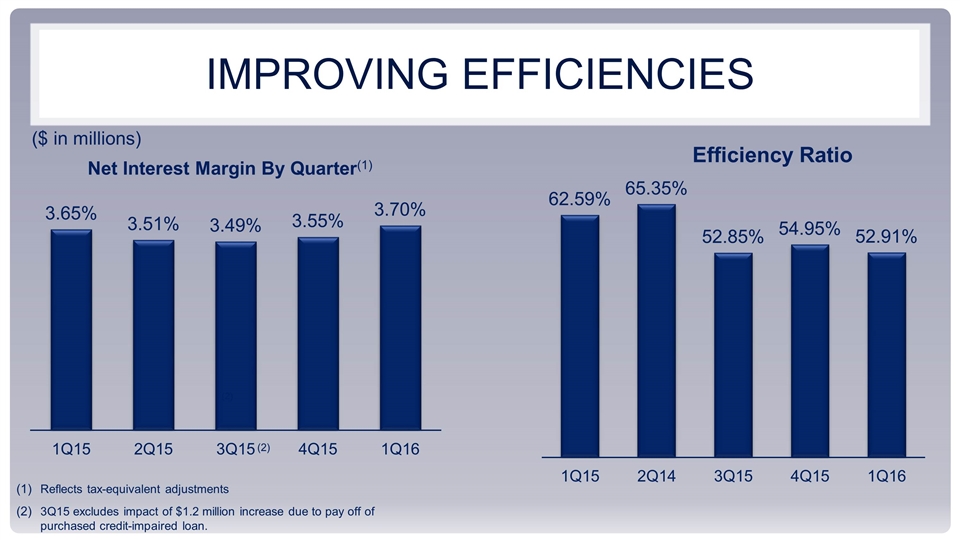

Improving Efficiencies ($ in millions) Net Interest Margin By Quarter(1) Reflects tax-equivalent adjustments 3Q15 excludes impact of $1.2 million increase due to pay off of purchased credit-impaired loan. (2) Efficiency Ratio (2)

Questions