Franklin Financial Network, Inc. (NYSE:FSB) Second Quarter 2019 Investor Call July 25, 2019 Exhibit 99.2

Forward-Looking Statements Except for the historical information contained herein, this presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The forward-looking statements include, among other things, statements regarding intent, belief or expectations of the Company and can be identified by the use of words such as "may," "will," "should," "would," "assume," "outlook," "seek," "plan," "believe," "expect," "anticipate," "intend," "estimate," "forecast," and other comparable terms. The Company intends that all such statements be subject to the “safe harbor” provisions of those Acts. Because forward-looking statements involve risks and uncertainties, actual results may differ materially from those expressed or implied. Investors are cautioned not to place undue reliance on these forward-looking statements and are advised to carefully review the discussion of forward-looking statements and risk factors in documents the Company files with the Securities and Exchange Commission. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless otherwise required by law. Use of non-GAAP Financial Measures Some of the financial data included in this presentation and our selected historical consolidated financial information are not measures of financial performance recognized by GAAP. Our management uses these non-GAAP financial measures in its analysis of our performance: "Common equity” is defined as total shareholders’ equity at end of period less the liquidation preference value of the preferred stock; “Tangible common equity” is common equity less goodwill and other intangible assets; “Total tangible assets” is defined as total assets less goodwill and other intangible assets; “Other intangible assets” is defined as the sum of core deposit intangible and SBA servicing rights; "Tangible book value per share" is defined as tangible common equity divided by total common shares outstanding. This measure is important to investors interested in changes from period-to-period in book value per share exclusive of changes in intangible assets; “Tangible common equity ratio” is defined as the ratio of tangible common equity divided by total tangible assets. We believe that this measure is important to many investors in the marketplace who are interested in relative changes from period-to period in common equity and total assets, each exclusive of changes in intangible assets; “Core Return on Average Tangible Common Equity” is defined as annualized core net income available to common shareholders divided by average tangible common equity; “Core Efficiency Ratio” is defined as noninterest expense divided by our operating revenue, which is equal to net interest income plus noninterest income with all adjusted to certain one-time expenses; “Core Diluted Earnings Per Share” is defined as reported earnings per share adjusted for certain one-time expenses; “Core Non-Interest Income” is defined as non-interest income adjusted for certain one-time items; “Core Non-Interest Expense” is defined as non-interest expense adjusted for certain one-time items; “Core Compensation Expense” is defined as compensation expense adjusted for certain one-time items; and “Core Net Income” is defined as “Net Income Available to Common Shareholders” adjusted for certain one-time items. “Pre-tax pre-provision core profit” is defined as pre-tax core net income and provision for loan losses. We believe these non-GAAP financial measures provide useful information to management and investors that is supplementary to our financial condition, results of operations and cash flows computed in accordance with GAAP; however, we acknowledge that our non-GAAP financial measures have a number of limitations. As such, you should not view these disclosures as a substitute for results determined in accordance with GAAP, and they are not necessarily comparable to non-GAAP financial measures that other companies use. 1

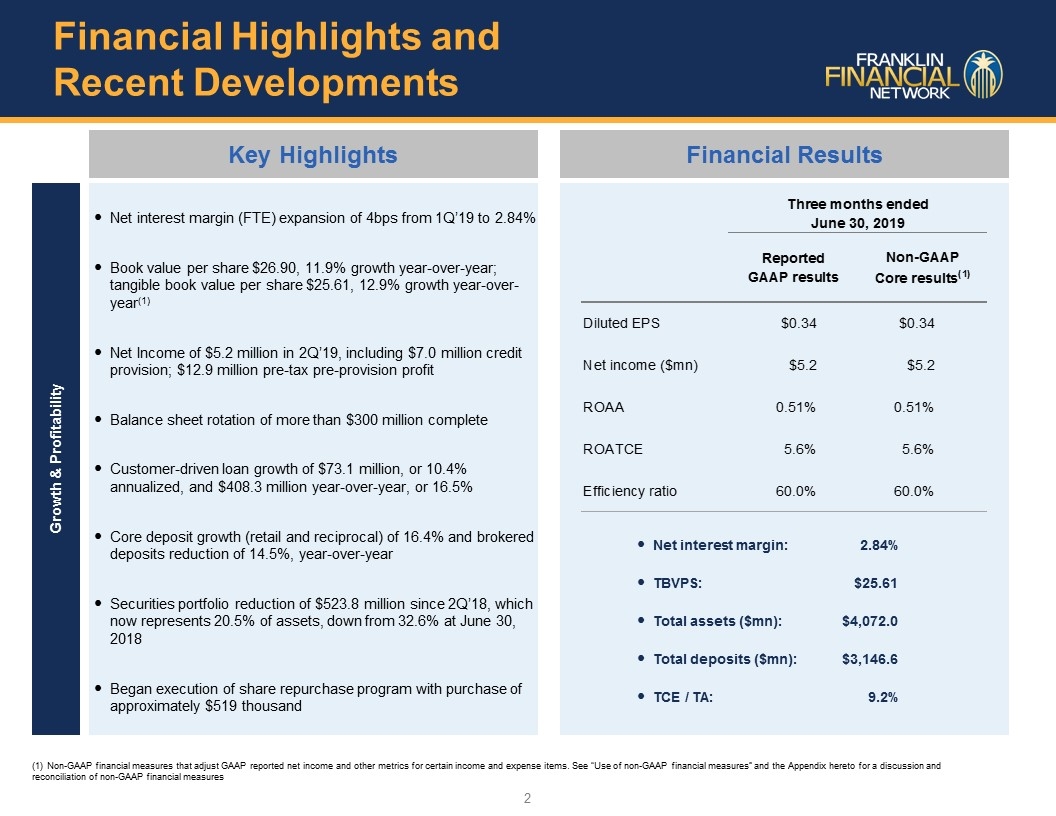

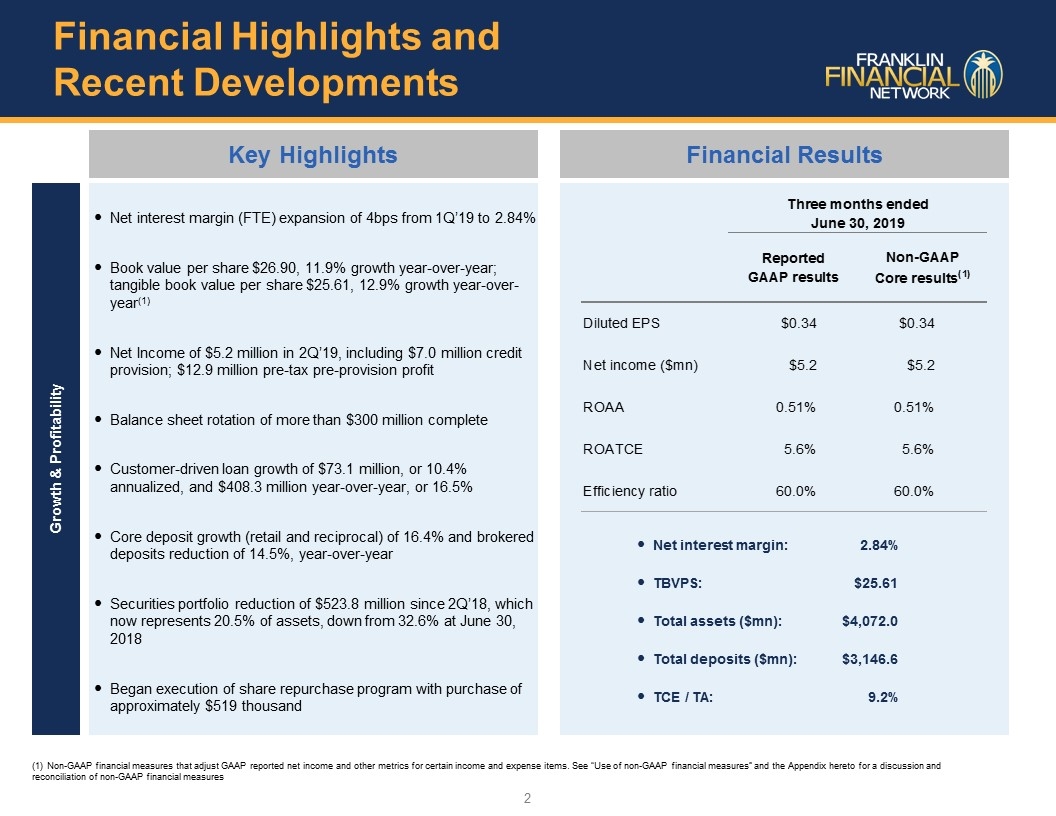

Key Highlights Financial Results Non-GAAP financial measures that adjust GAAP reported net income and other metrics for certain income and expense items. See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP financial measures 2 Financial Highlights and Recent Developments Growth & Profitability Net interest margin (FTE) expansion of 4bps from 1Q’19 to 2.84% Book value per share $26.90, 11.9% growth year-over-year; tangible book value per share $25.61, 12.9% growth year-over-year(1) Net Income of $5.2 million in 2Q’19, including $7.0 million credit provision; $12.9 million pre-tax pre-provision profit Balance sheet rotation of more than $300 million complete Customer-driven loan growth of $73.1 million, or 10.4% annualized, and $408.3 million year-over-year, or 16.5% Core deposit growth (retail and reciprocal) of 16.4% and brokered deposits reduction of 14.5%, year-over-year Securities portfolio reduction of $523.8 million since 2Q’18, which now represents 20.5% of assets, down from 32.6% at June 30, 2018 Began execution of share repurchase program with purchase of approximately $519 thousand # in red, placeholders Show same number on both sides Net interest margin: TBVPS: Total assets ($mn): Total deposits ($mn): TCE / TA: 2.84% $25.61 $4,072.0 $3,146.6 9.2%

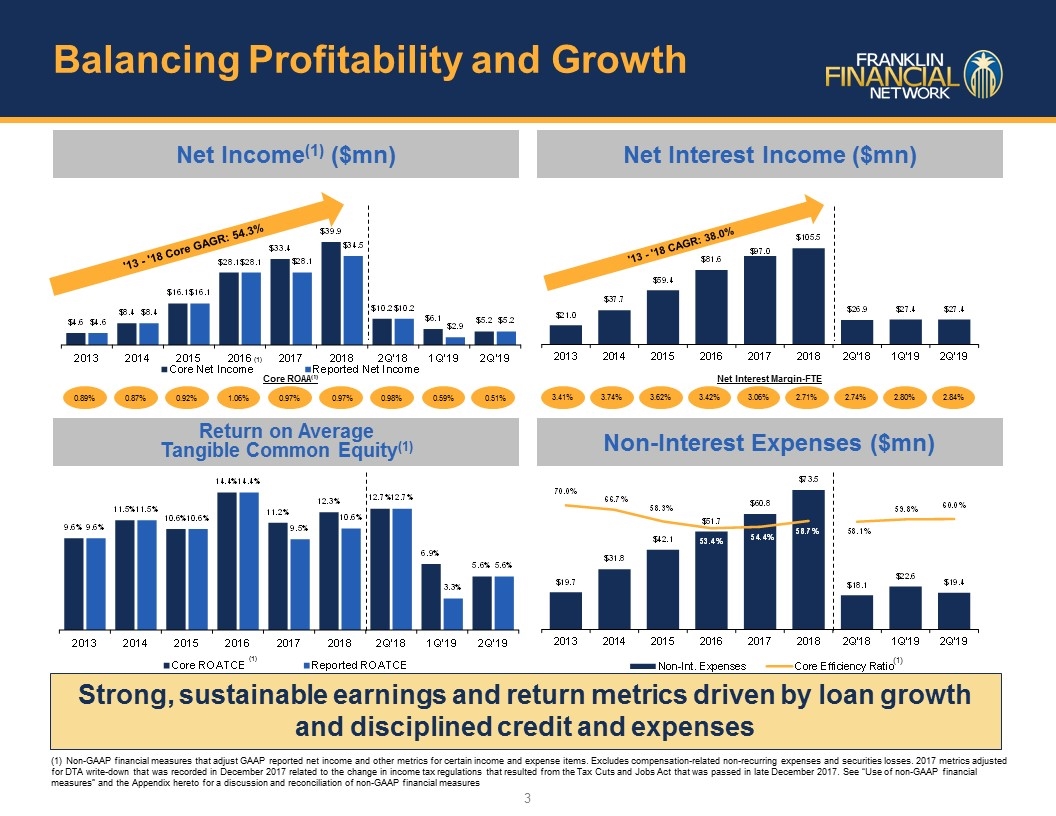

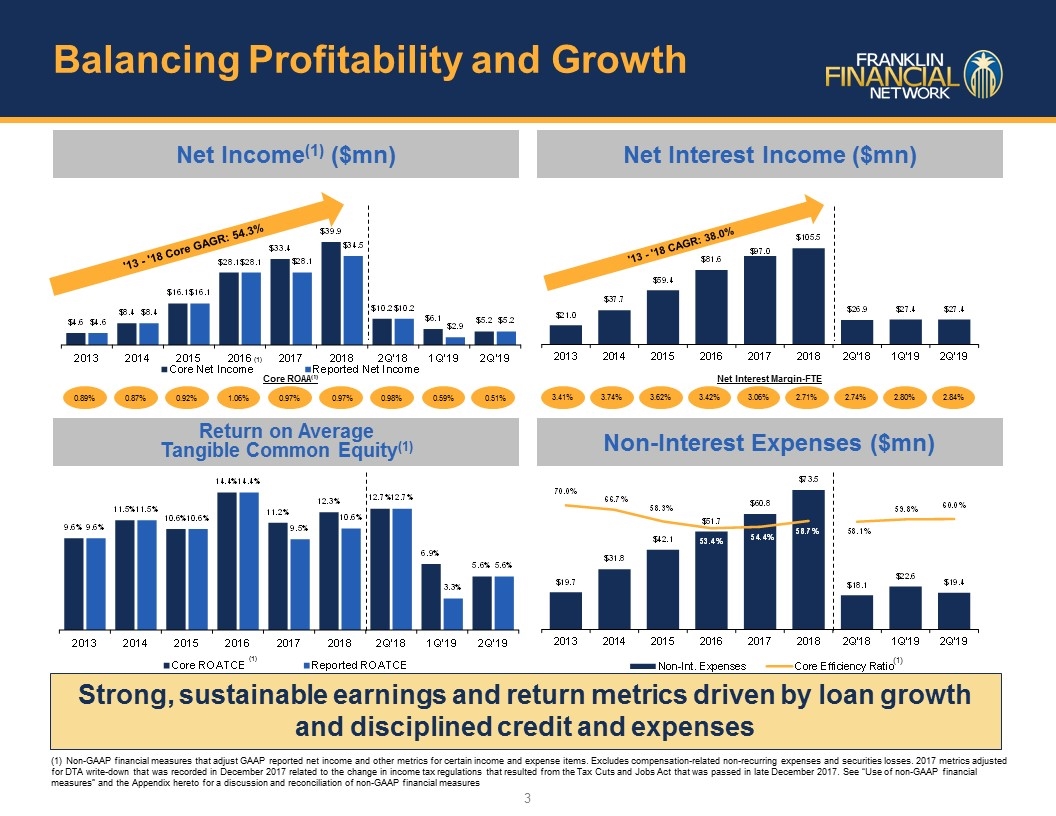

Non-GAAP financial measures that adjust GAAP reported net income and other metrics for certain income and expense items. Excludes compensation-related non-recurring expenses and securities losses. 2017 metrics adjusted for DTA write-down that was recorded in December 2017 related to the change in income tax regulations that resulted from the Tax Cuts and Jobs Act that was passed in late December 2017. See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP financial measures Balancing Profitability and Growth Net Income(1) ($mn) Net Interest Income ($mn) Return on Average Tangible Common Equity(1) Non-Interest Expenses ($mn) Strong, sustainable earnings and return metrics driven by loan growth and disciplined credit and expenses 3 (1) 0.89% 0.87% 0.92% 1.06% 0.97% 0.98% 0.59% 0.97% 0.51% (1) 3.41% Net Interest Margin-FTE 3.74% 3.62% 3.42% 3.06% 2.74% 2.80% 2.71% 2.84% Core ROAA(1) (1)

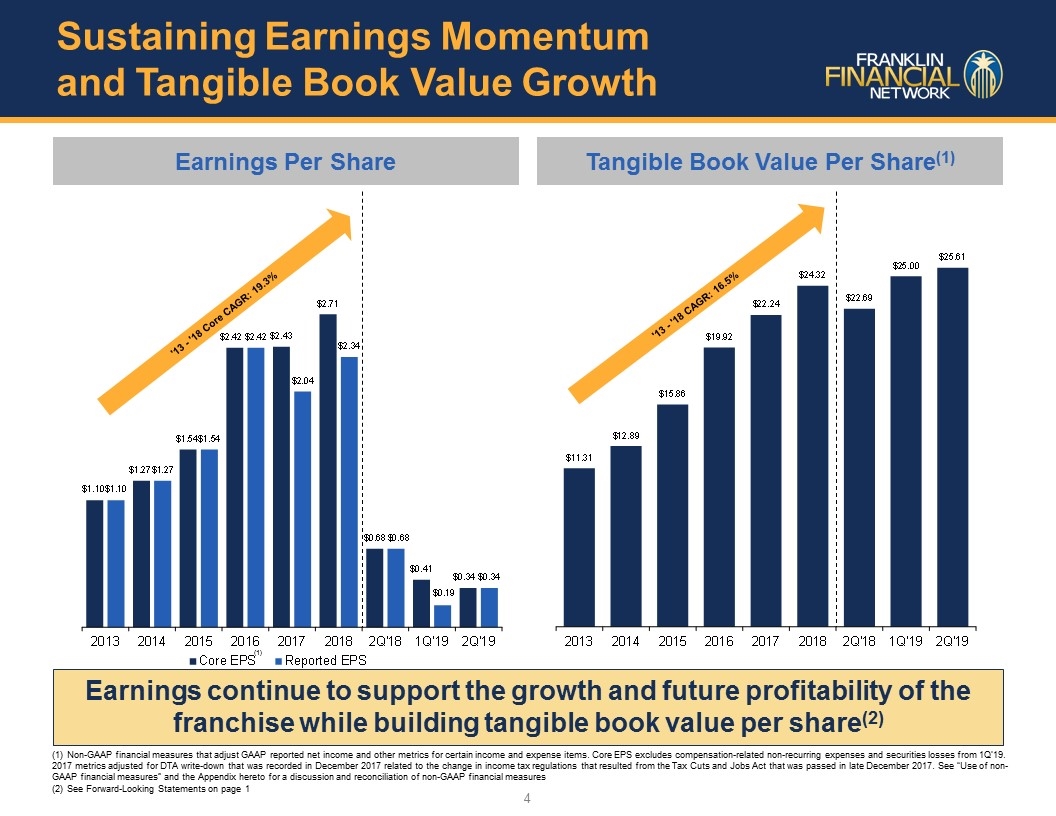

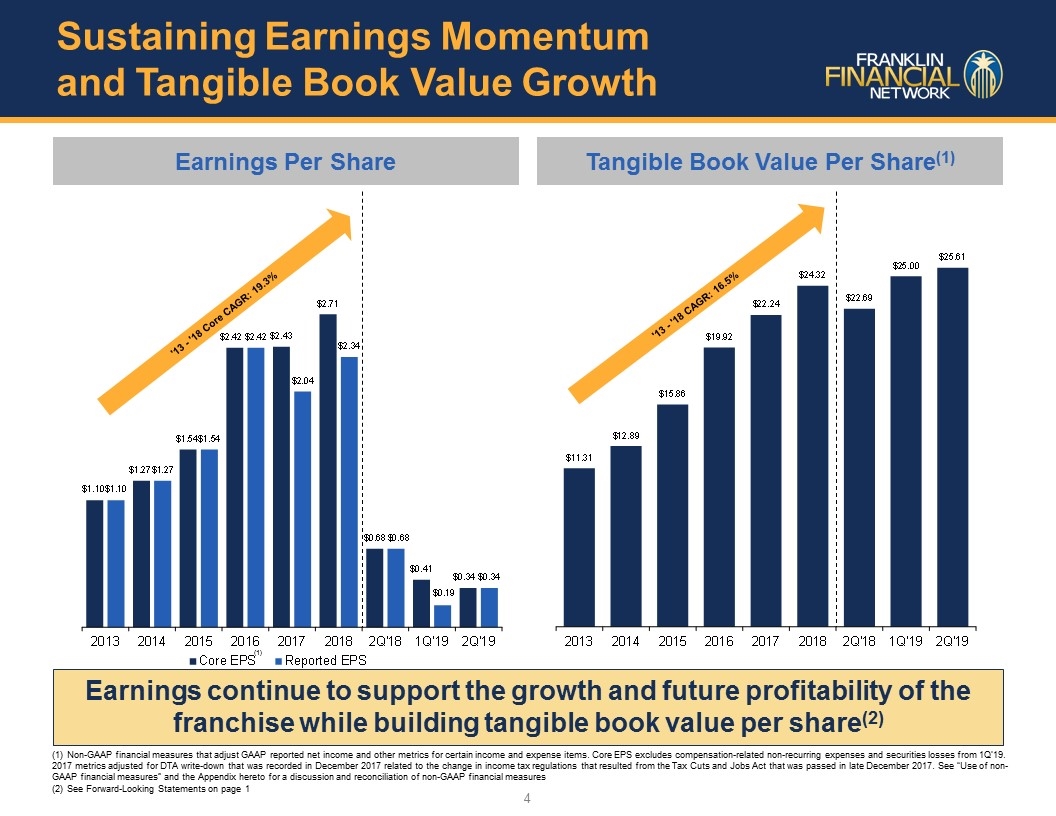

Earnings Per Share Tangible Book Value Per Share(1) Earnings continue to support the growth and future profitability of the franchise while building tangible book value per share(2) 4 Sustaining Earnings Momentum and Tangible Book Value Growth Non-GAAP financial measures that adjust GAAP reported net income and other metrics for certain income and expense items. Core EPS excludes compensation-related non-recurring expenses and securities losses from 1Q’19. 2017 metrics adjusted for DTA write-down that was recorded in December 2017 related to the change in income tax regulations that resulted from the Tax Cuts and Jobs Act that was passed in late December 2017. See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP financial measures See Forward-Looking Statements on page 1 (1)

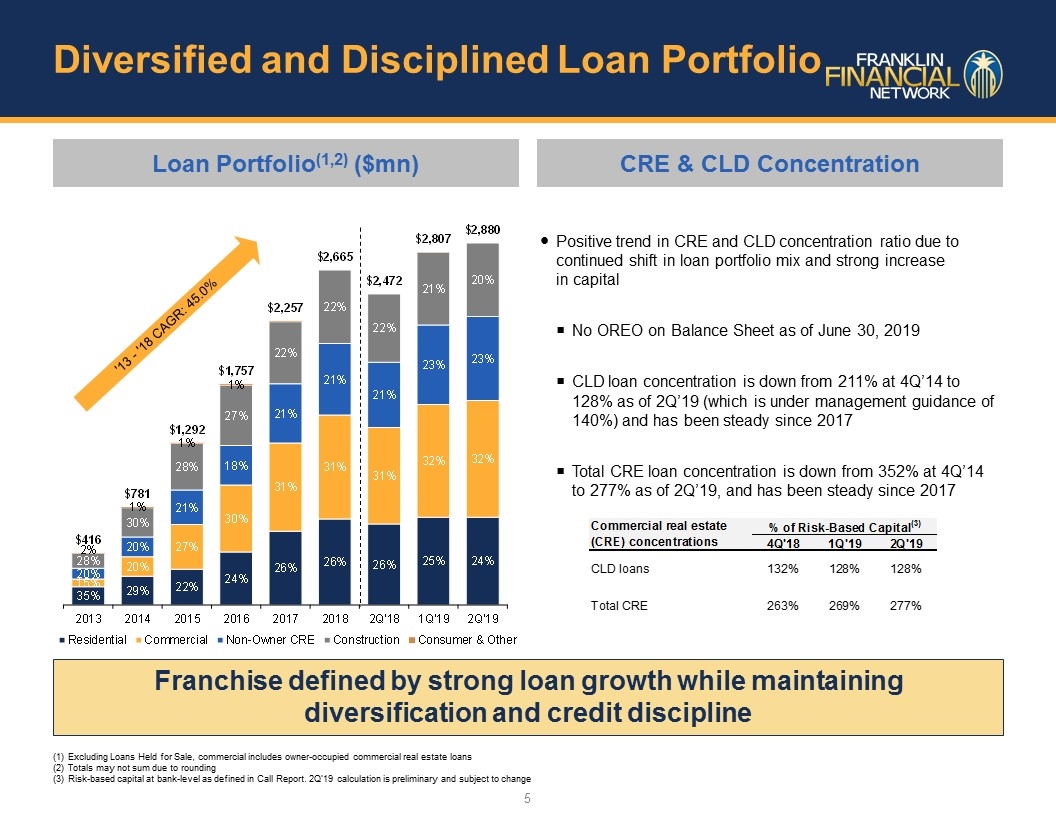

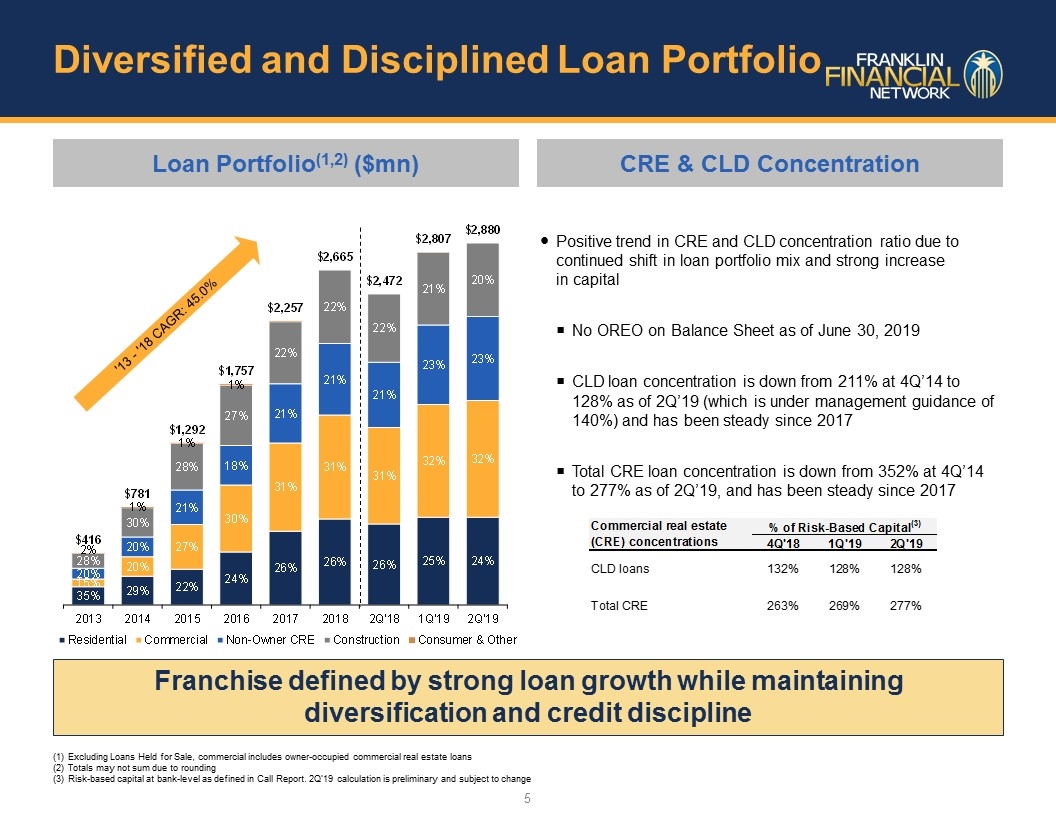

Diversified and Disciplined Loan Portfolio Loan Portfolio(1,2) ($mn) CRE & CLD Concentration Franchise defined by strong loan growth while maintaining diversification and credit discipline Excluding Loans Held for Sale, commercial includes owner-occupied commercial real estate loans Totals may not sum due to rounding Risk-based capital at bank-level as defined in Call Report. 2Q’19 calculation is preliminary and subject to change 5 Positive trend in CRE and CLD concentration ratio due to continued shift in loan portfolio mix and strong increase in capital No OREO on Balance Sheet as of June 30, 2019 CLD loan concentration is down from 211% at 4Q’14 to 128% as of 2Q’19 (which is under management guidance of 140%) and has been steady since 2017 Total CRE loan concentration is down from 352% at 4Q’14 to 277% as of 2Q’19, and has been steady since 2017

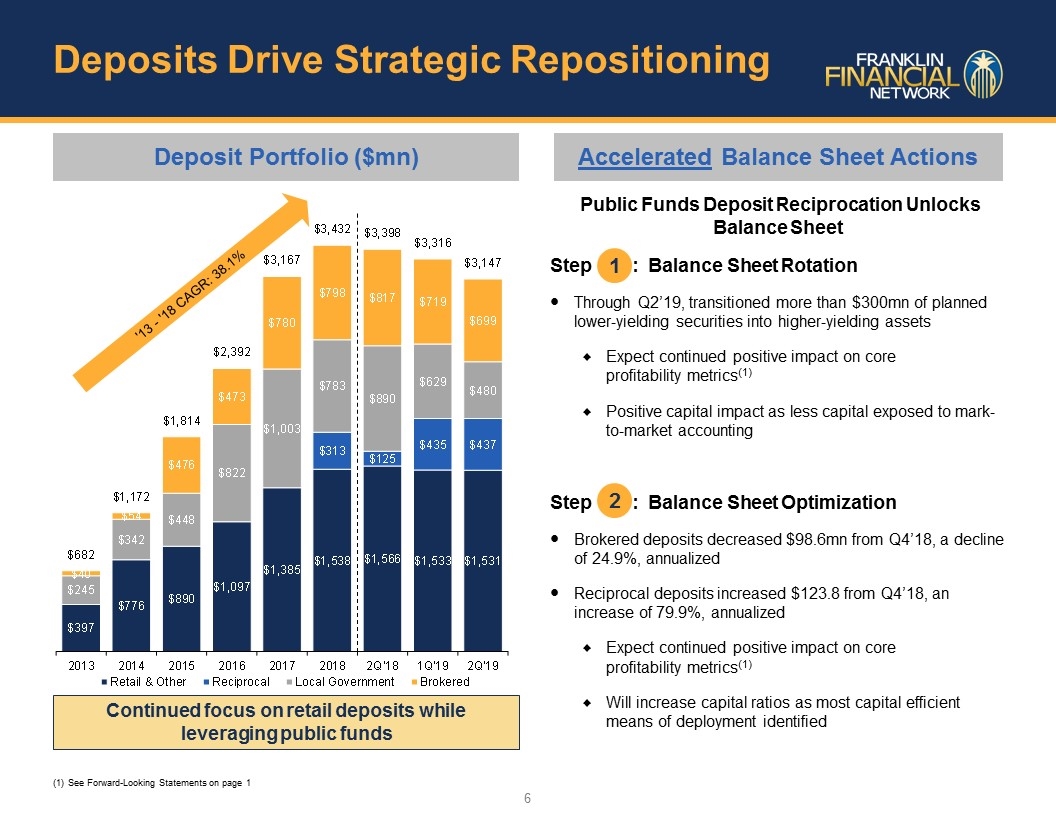

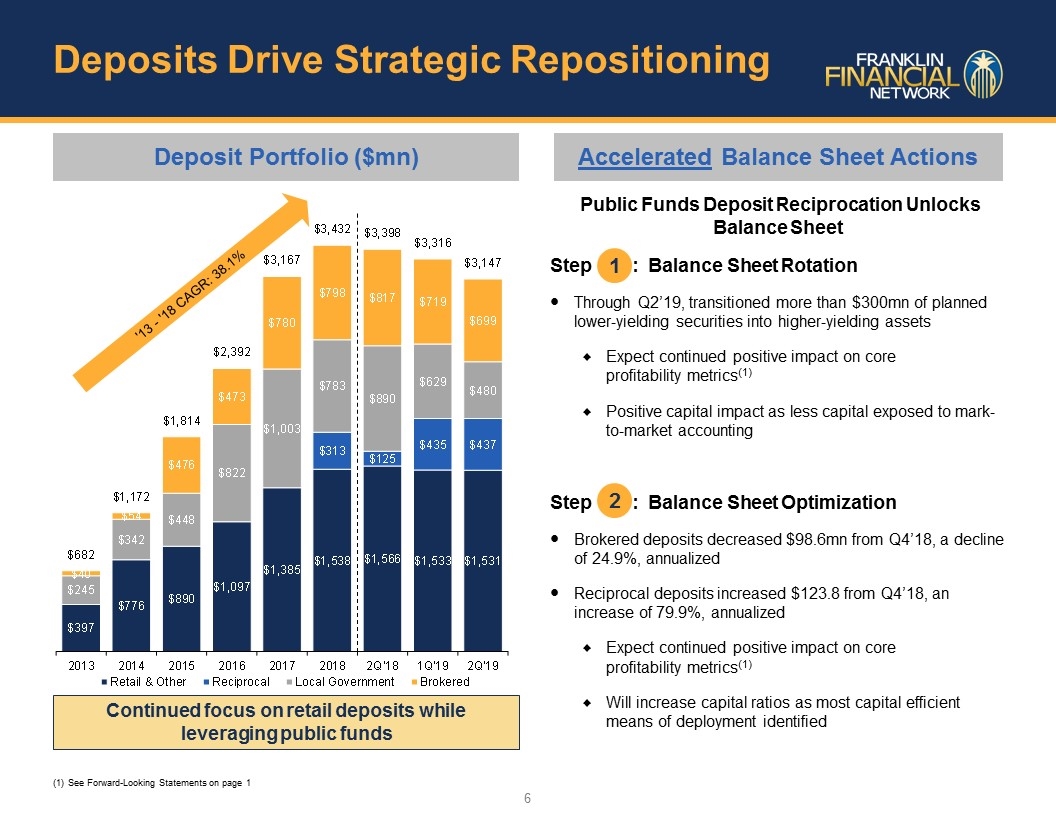

Public Funds Deposit Reciprocation Unlocks Balance Sheet Step : Balance Sheet Rotation Through Q2’19, transitioned more than $300mn of planned lower-yielding securities into higher-yielding assets Expect continued positive impact on core profitability metrics(1) Positive capital impact as less capital exposed to mark-to-market accounting Step : Balance Sheet Optimization Brokered deposits decreased $98.6mn from Q4’18, a decline of 24.9%, annualized Reciprocal deposits increased $123.8 from Q4’18, an increase of 79.9%, annualized Expect continued positive impact on core profitability metrics(1) Will increase capital ratios as most capital efficient means of deployment identified See Forward-Looking Statements on page 1 Accelerated Balance Sheet Actions Deposit Portfolio ($mn) Continued focus on retail deposits while leveraging public funds 6 Deposits Drive Strategic Repositioning 1 2

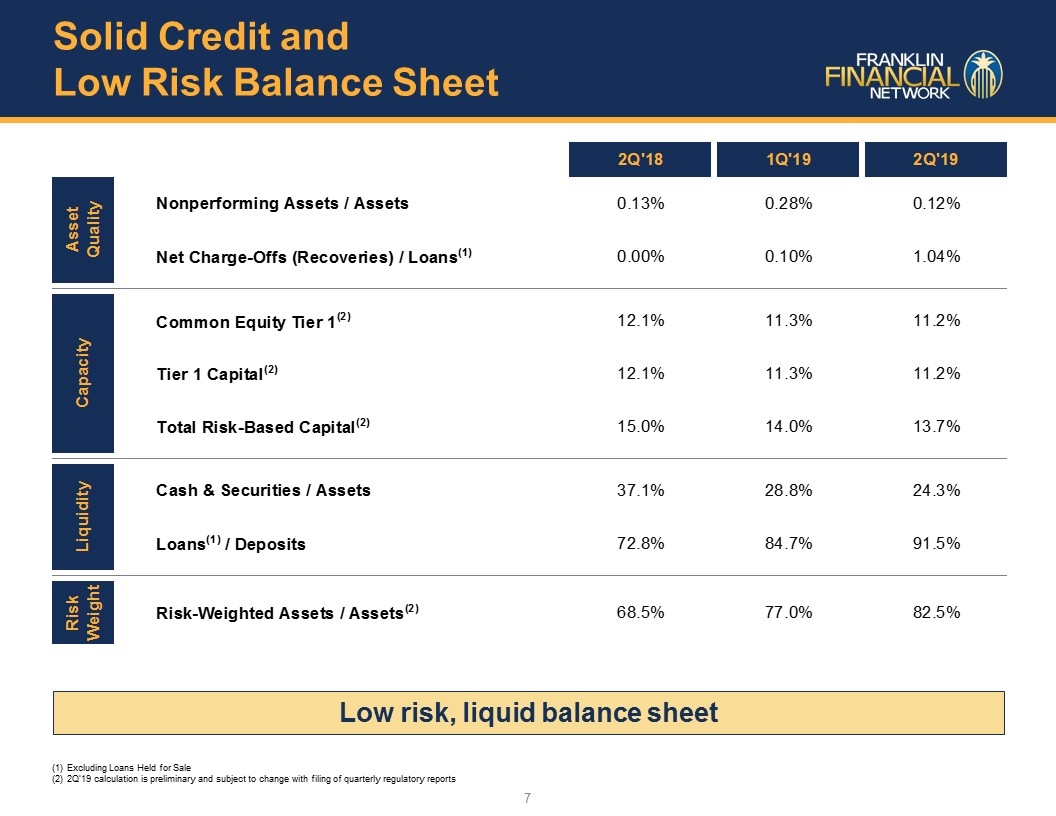

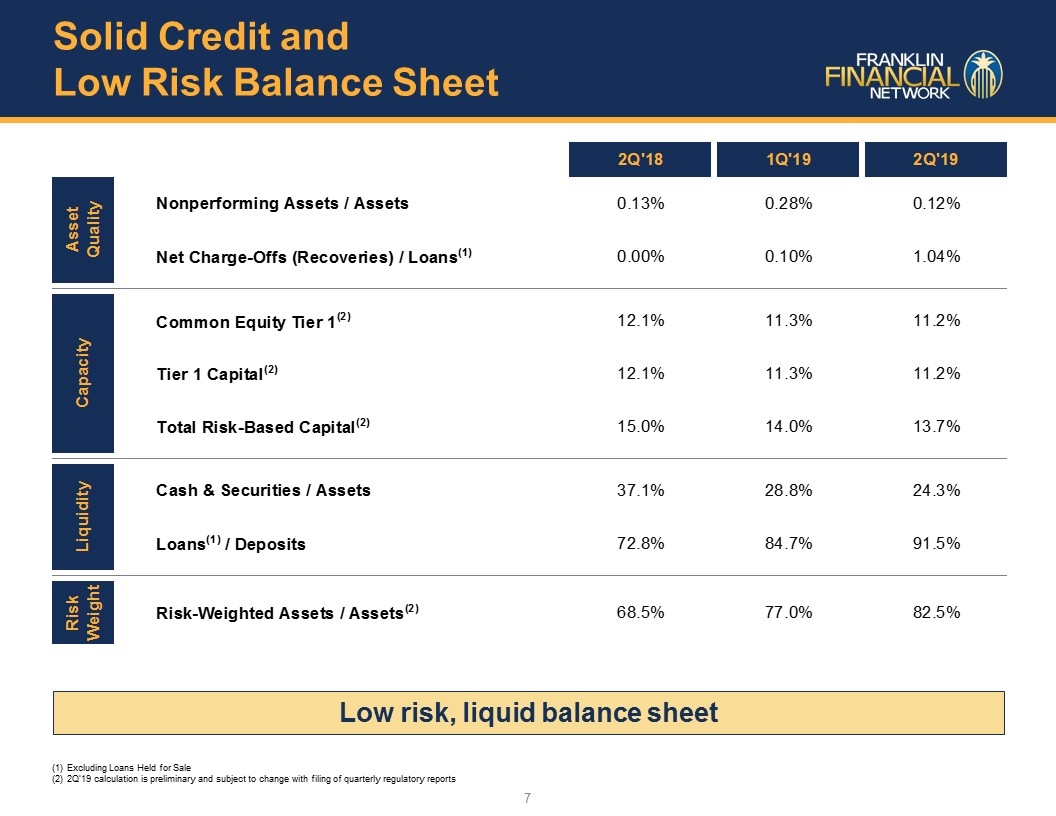

Excluding Loans Held for Sale 2Q’19 calculation is preliminary and subject to change with filing of quarterly regulatory reports Low risk, liquid balance sheet 7 Solid Credit and Low Risk Balance Sheet

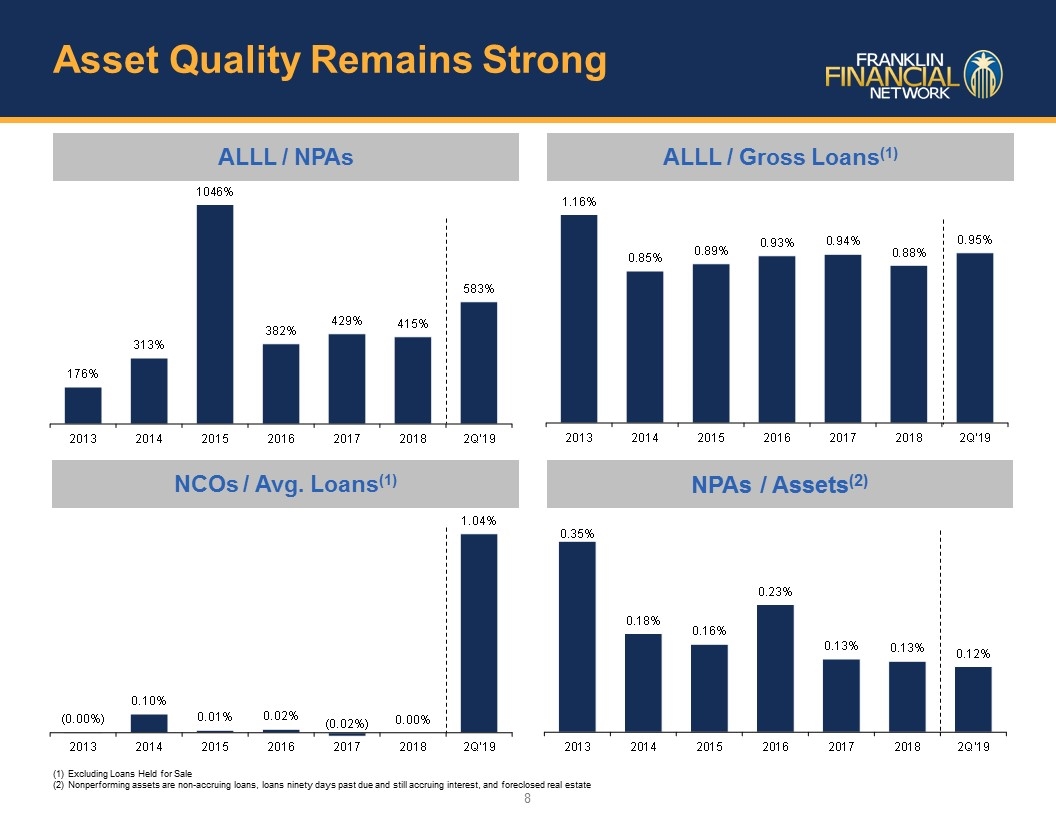

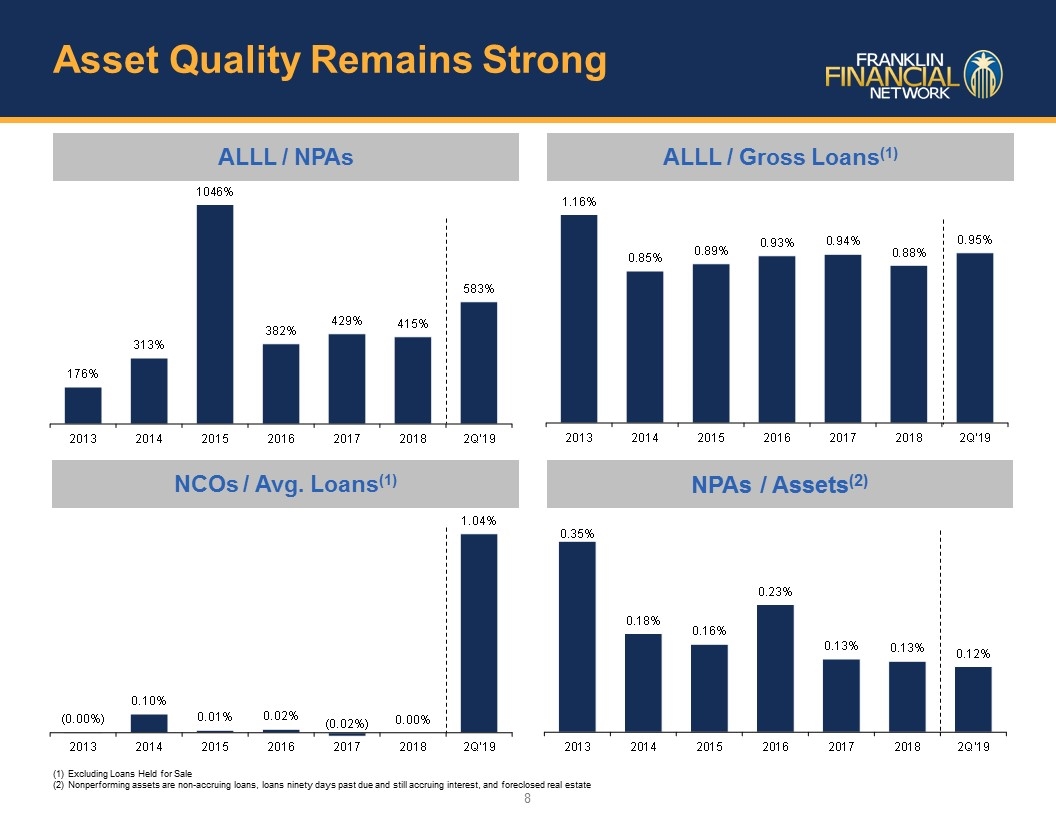

ALLL / NPAs ALLL / Gross Loans(1) NCOs / Avg. Loans(1) NPAs / Assets(2) 8 Excluding Loans Held for Sale Nonperforming assets are non-accruing loans, loans ninety days past due and still accruing interest, and foreclosed real estate Asset Quality Remains Strong

Key Drivers of FSB Performance 9 Growth Profitability Asset Quality Proven, Successful Banking Model

Appendix

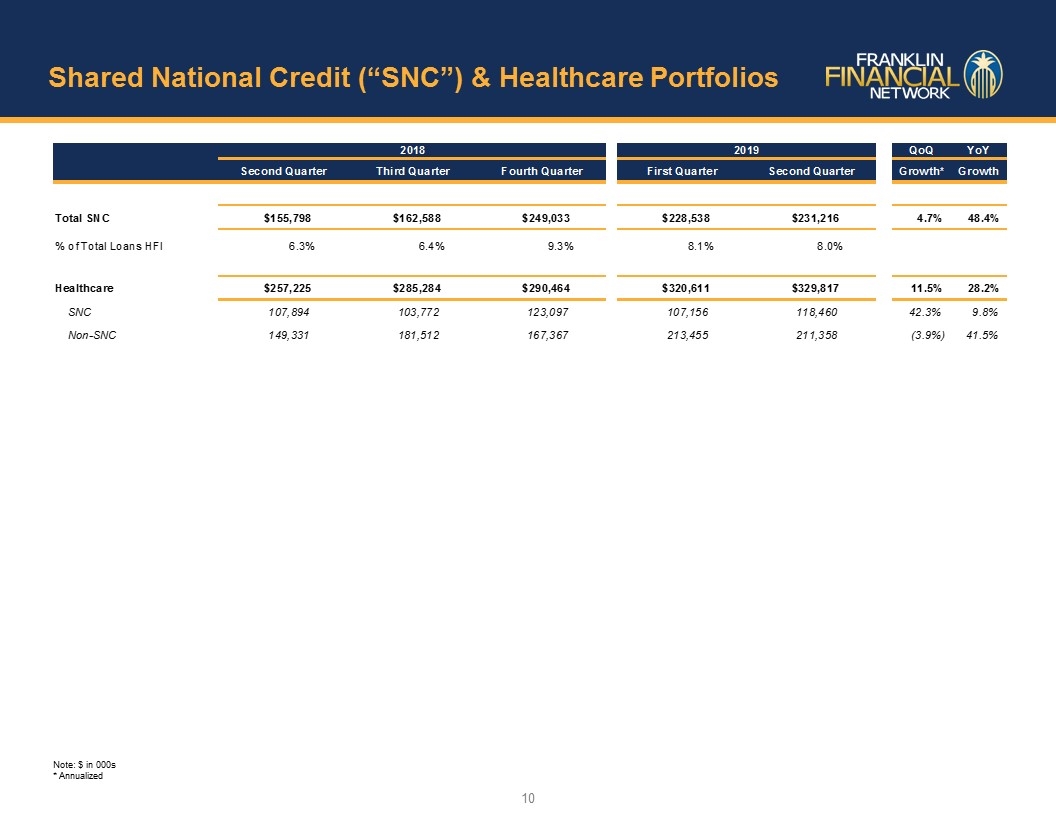

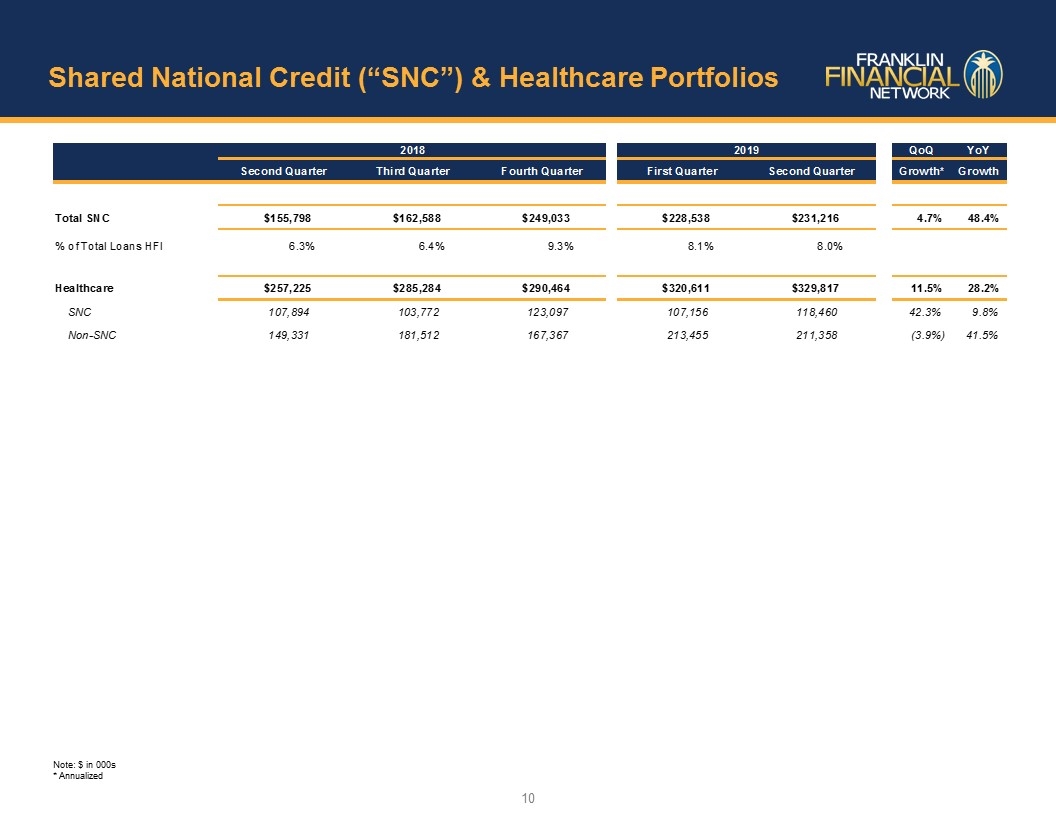

Shared National Credit (“SNC”) & Healthcare Portfolios Note: $ in 000s * Annualized 10

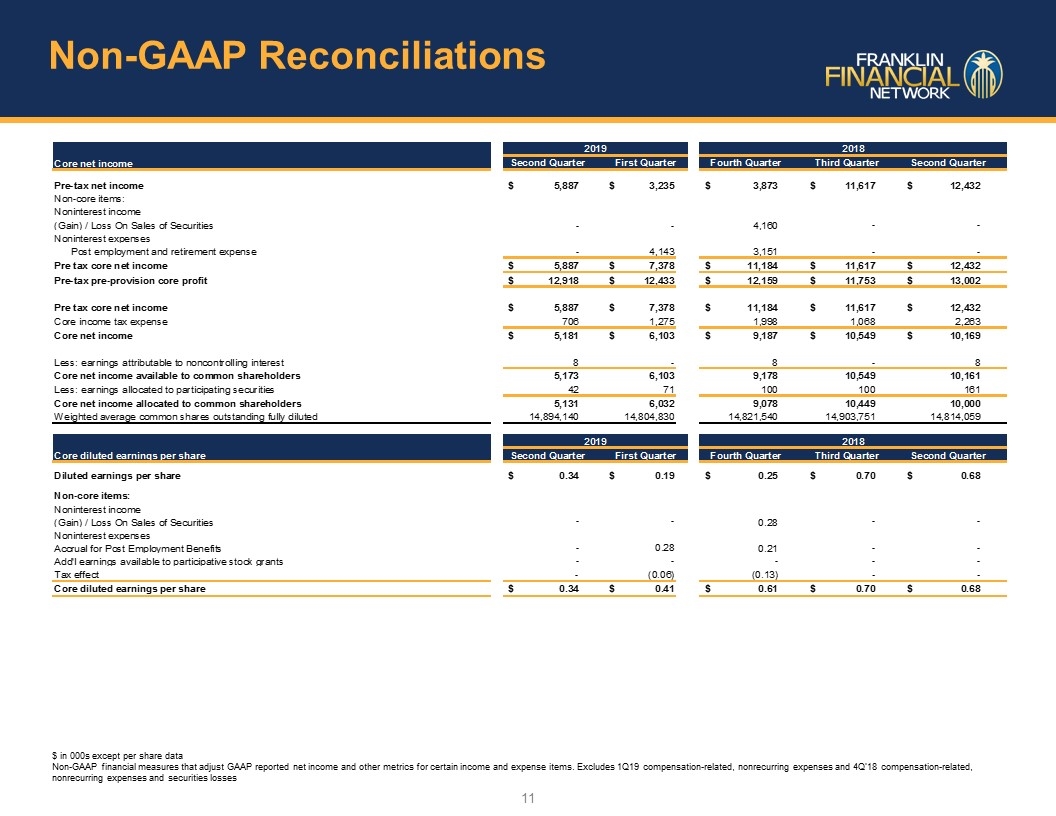

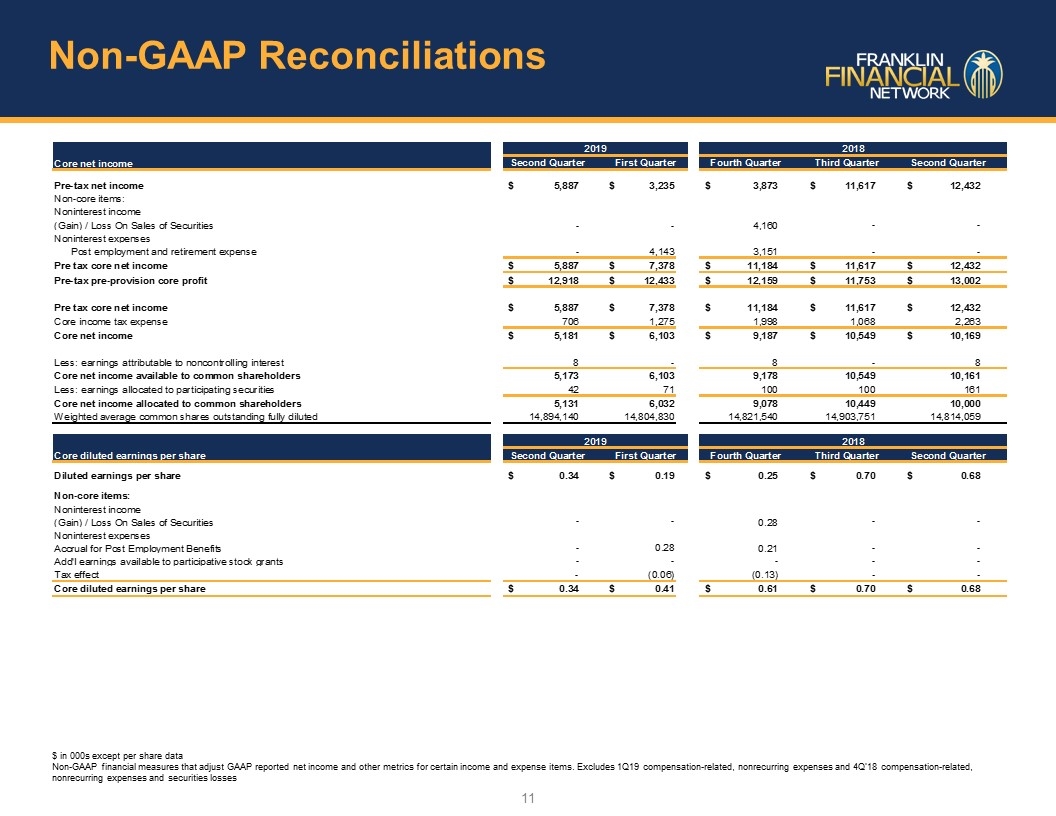

Non-GAAP Reconciliations 11 $ in 000s except per share data Non-GAAP financial measures that adjust GAAP reported net income and other metrics for certain income and expense items. Excludes 1Q19 compensation-related, nonrecurring expenses and 4Q’18 compensation-related, nonrecurring expenses and securities losses

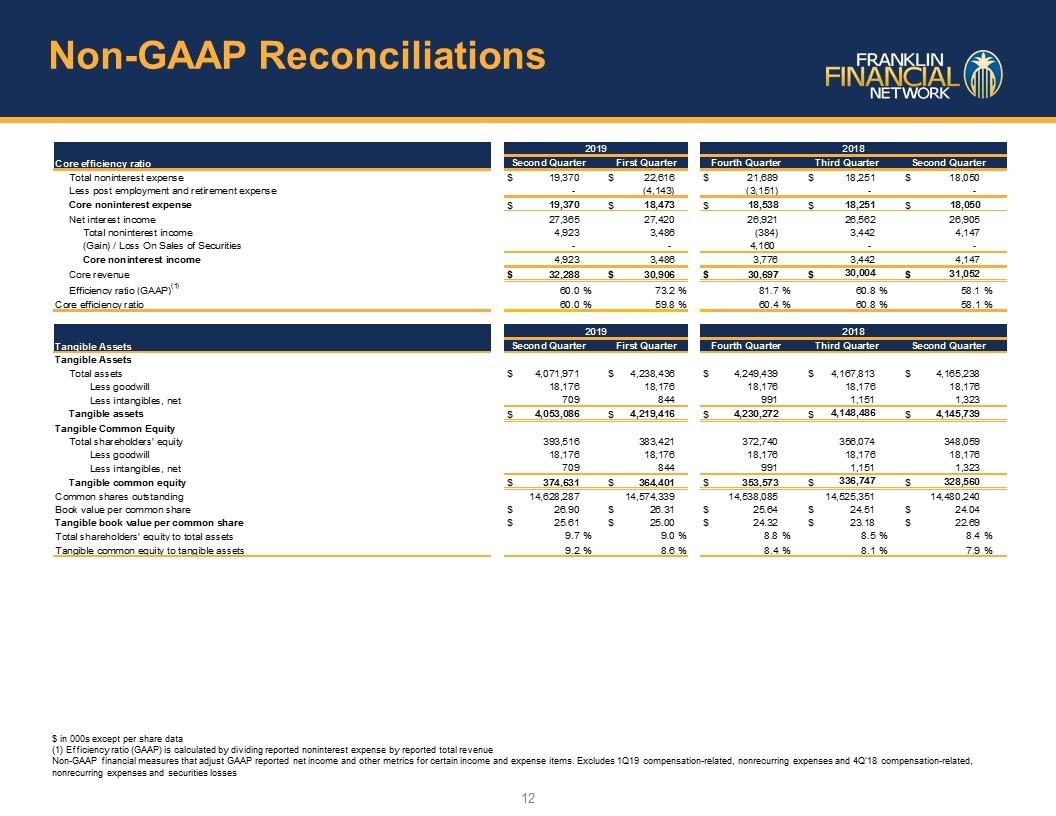

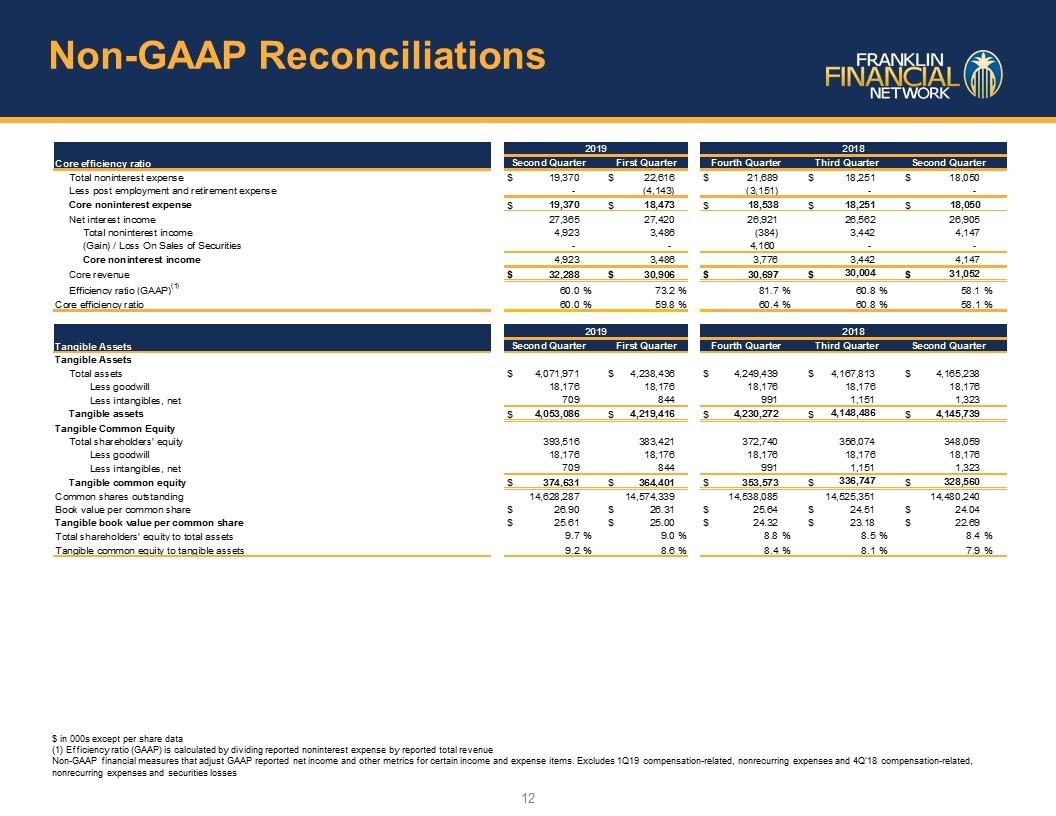

Non-GAAP Reconciliations 12 $ in 000s except per share data (1) Efficiency ratio (GAAP) is calculated by dividing reported noninterest expense by reported total revenue Non-GAAP financial measures that adjust GAAP reported net income and other metrics for certain income and expense items. Excludes 1Q19 compensation-related, nonrecurring expenses and 4Q’18 compensation-related, nonrecurring expenses and securities losses

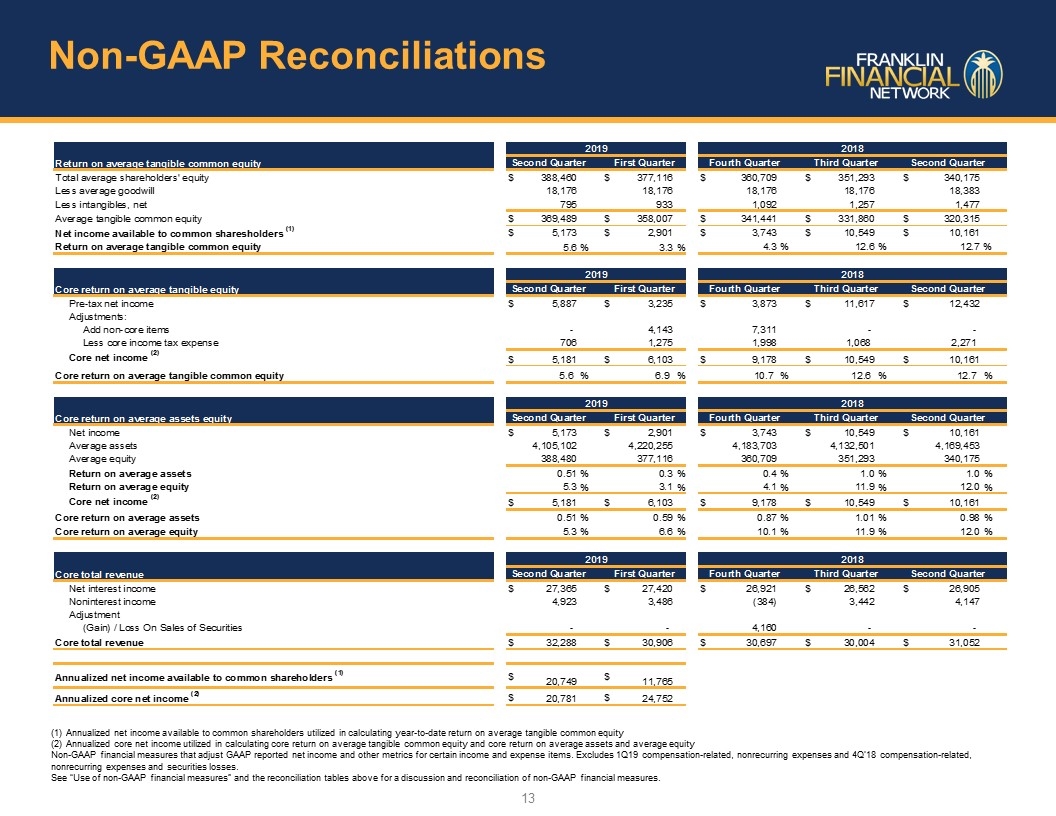

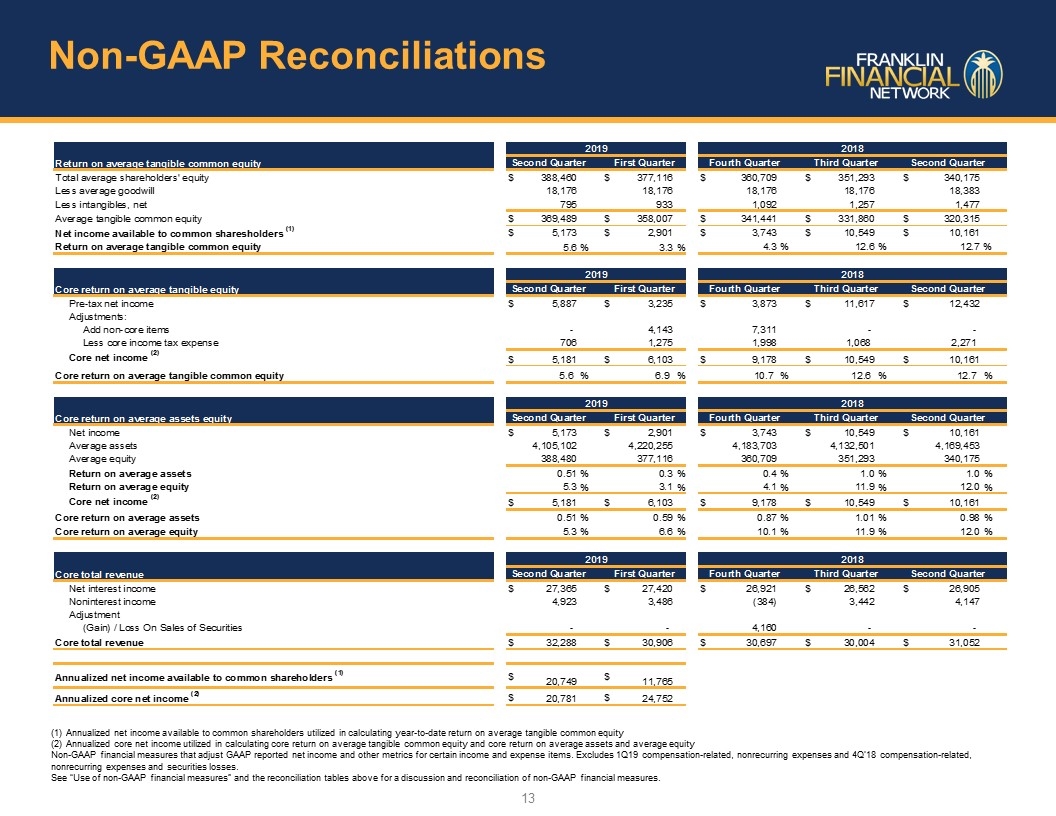

Non-GAAP Reconciliations 13 Annualized net income available to common shareholders utilized in calculating year-to-date return on average tangible common equity Annualized core net income utilized in calculating core return on average tangible common equity and core return on average assets and average equity Non-GAAP financial measures that adjust GAAP reported net income and other metrics for certain income and expense items. Excludes 1Q19 compensation-related, nonrecurring expenses and 4Q’18 compensation-related, nonrecurring expenses and securities losses. See “Use of non-GAAP financial measures” and the reconciliation tables above for a discussion and reconciliation of non-GAAP financial measures.