SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| x | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 |

VIOLIN MEMORY, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ¨ | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-1 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

PRELIMINARY PROXY, SUBJECT TO COMPLETION

VIOLIN MEMORY, INC.

4555 Great America Parkway

Santa Clara, California 95054

Notice of Annual Meeting of Stockholders

The Board of Directors (“Board”) of Violin Memory, Inc. is soliciting proxies for its 2016 Annual Meeting of Stockholders (the “Annual Meeting”). This Proxy Statement and our Annual Report to Stockholders, which was filed with the Securities and Exchange Commission on April 6, 2016, are available to you on the Internet and are also being mailed to you. These proxy materials also include the proxy card for the Annual Meeting.

The Annual Meeting will be held at our principal executive offices located at 4555 Great America Parkway, Santa Clara, California 95054, on June 30, 2016, at 9:00 a.m., Pacific Time. We are holding our Annual Meeting to:

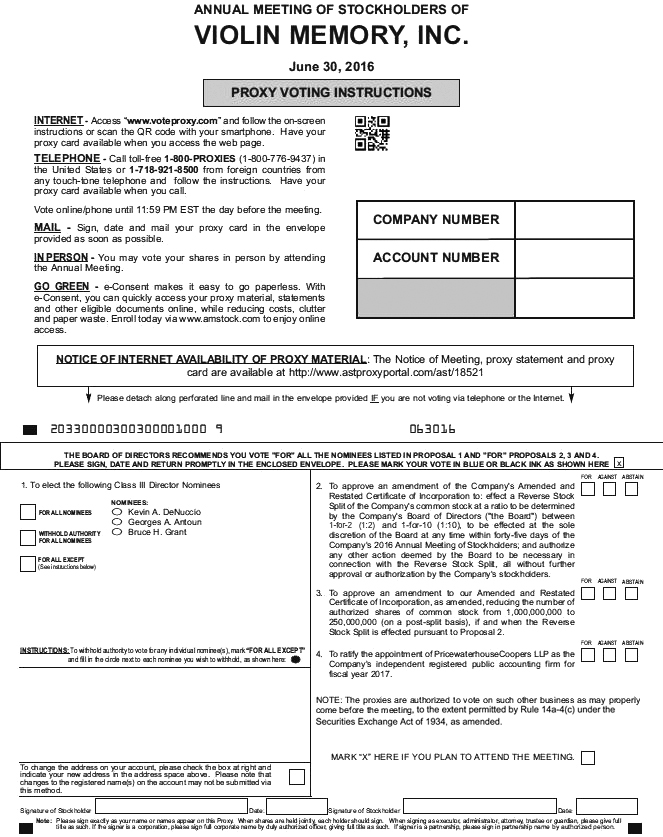

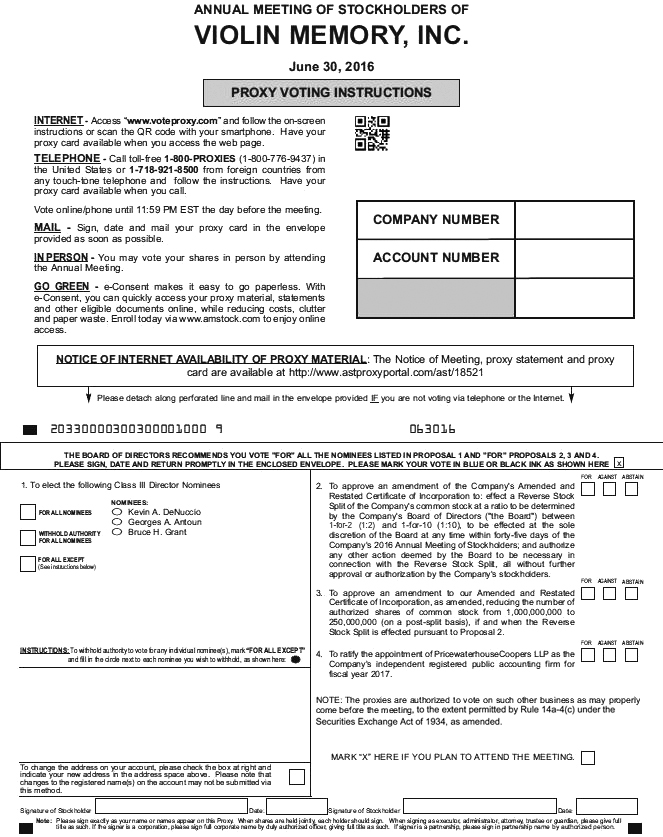

| | 1. | Elect three Class III directors to serve until the 2019 annual meeting of Stockholders or until their successors are elected and qualified; and |

| | 2. | Approve an amendment of our Amended and Restated Certificate of Incorporation to: effect a Reverse Stock Split of our common stock at a ratio between 1-for-2 (1:2) and 1-for-10 (1:10) to be determined by our Board of Directors (“Board”) to be effected at the sole discretion of our Board at any time within forty-five days following the Annual Meeting; and authorize any other action deemed by our Board to be necessary in connection with the Reverse Stock Split, all without further approval or authorization of our stockholders; |

| | 3. | Approve an amendment to our Amended and Restated Certificate of Incorporation, as amended, to reduce the number of authorized shares of common stock from 1,000,000,000 to 250,000,000 (on a post-split basis), if and when the Reverse Stock Split is effected pursuant to Proposal 2 (the “Authorized Share Reduction”); and |

| | 4. | Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2017. |

We also will transact any other business that may properly come before the Annual Meeting or at any adjournments or postponements of the Annual Meeting.

We have selected May 4, 2016, as the record date for determining the stockholders entitled to notice of the Annual Meeting and to vote at the Annual Meeting and at any adjournments or postponements of the Annual Meeting.

Please note that Clinton Relational Opportunity Master Fund, L.P., on behalf of itself and Imation Corp. (“Clinton”) has notified us that it intends to nominate three persons for election as directors to our Board at the Annual Meeting in opposition to the nominees recommended by our Board. You may receive solicitation materials from Clinton, including proxy materials and a GOLD proxy card. We are not responsible for the accuracy of any information provided by, or relating to, Clinton or its nominees contained in the solicitation materials filed or disseminated by, or on behalf of, Clinton or any other statements that Clinton may make.

Our Board does not endorse any of the Clinton nominees and unanimously recommends that you vote on the WHITE proxy card or voting instruction form “FOR ALL” of the nominees proposed by our Board. Our Board strongly urges you NOT to sign or return any proxy card sent to you by Clinton. If you have previously submitted a proxy card sent to you by Clinton, you can revoke that proxy and vote for our Board’s nominees and on the other matters to be voted upon at the Annual Meeting by using the enclosed WHITE proxy card. Only the latest validly executed proxy card that you submit will be counted.

|

| By Order of the Board of Directors, |

|

|

Gary Lloyd Secretary |

May [X], 2016

YOUR VOTE IS VERY IMPORTANT

Whether or not you plan to attend the Annual Meeting of Stockholders, we urge you to vote and submit your proxy. You may vote over the Internet, by telephone or by mail. Please review the instructions under the section entitled “How do I vote my shares?” of the attached proxy statement regarding each of these voting options.

VIOLIN MEMORY, INC.

PROXY STATEMENT

Annual Meeting of Stockholders

June 30, 2016

This proxy statement is being furnished to stockholders of Violin Memory, Inc. in connection with the solicitation of proxies by our Board for use at our 2016 Annual Meeting of Stockholders (the “Annual Meeting”), which is described below. This Proxy Statement and the accompanying WHITE proxy card will be mailed to stockholders on or about May 23, 2016.

References to “the Company,” “we,” “us” or “our” throughout this proxy statement mean Violin Memory, Inc.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

When and where will the Annual Meeting be held?

The Annual Meeting will be held on June 30, 2016, at 9:00 a.m., Pacific Time, at our principal executive offices, which are located at 4555 Great America Parkway, Santa Clara, California 95054.

What items will be voted on at the Annual Meeting?

As to all holders of our common stock, the purpose of the Annual Meeting is to:

| | • | | Elect three Class III directors to serve until the 2019 annual meeting of Stockholders or until their successors are elected and qualified; |

| | • | | Approve an amendment of our Amended and Restated Certificate of Incorporation to effect a Reverse Stock Split of our common stock at a ratio between 1-for-2 (1:2) and 1-for-10 (1:10) as determined by our Board, to be effected in the sole discretion of our Board at any time within forty-five days following the Annual Meeting; and authorize any other action deemed by our Board to be necessary in connection with the Reverse Stock Split, all without further approval or authorization of our stockholders; |

| | • | | Approve an amendment to our Amended and Restated Certificate of Incorporation, as amended, to effect the Authorized Share Reduction to reduce the number of authorized shares of common stock from 1,000,000,000 to 250,000,000 (on a post-split basis), if and when the Reverse Stock Split is effected pursuant to Proposal 2 (the “Authorized Share Reduction”); and |

| | • | | Ratify the appointment of PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accounting firm for fiscal year 2017. |

We will also transact any other business that may properly come before the Annual Meeting or at any adjournments or postponements of the Annual Meeting.

How does the Board recommend that I vote?

Our Board unanimously recommends that you vote:

| | • | | FORthe approval of each director nominee; |

| | • | | FORthe approval of the Reverse Stock Split; |

| | • | | FORthe approval of the Authorized Share Reduction; and |

| | • | | FORthe ratification of the appointment of PwC as our independent registered public accounting firm for fiscal year 2017. |

1

Who is entitled to vote at the Annual Meeting?

Stockholders who owned Violin Memory, Inc.’s Common Stock (“Common Stock”) at the close of business on May 4, 2016, the record date for the Annual Meeting, may vote at the Annual Meeting. For each share of Common Stock held, stockholders are entitled to one vote for as many separate nominees as there are directors to be elected and one vote on any other matter presented.

Who will engage in a solicitation of proxies? Who will bear the cost of that solicitation?

Certain of our directors, officers and employees may solicit proxies on our behalf by mail, phone, fax, e-mail or in person. We will bear the cost of the solicitation of proxies. No additional compensation will be paid to our directors, officers or employees who may be involved in the solicitation of proxies.

Who will tabulate the votes and act as inspector of election?

A representative of American Stock Transfer & Trust Company, LLC (“AST”), our transfer agent, will act as the Inspector of Election at the Annual Meeting.

How do I vote my shares?

You may vote your shares in one of several ways, depending upon how you own your shares.

Shares registered directly in your name with Violin Memory, Inc. (through AST):

| | • | | In Writing: If you received printed proxy materials in the mail and wish to vote by mail, complete, sign, date and return the proxy card in the envelope that was provided to you, or provide it or a ballot distributed at the Annual Meeting directly to the Inspector of Election at the Annual Meeting when instructed. |

Shares of Common Stock held in “street” or “nominee” name (through a bank, broker or other nominee):

| | • | | If you own shares in “street name” through a broker and do not instruct your broker how to vote, your broker may not vote your shares on proposals determined to be “non-routine.” Of the proposals included in this proxy statement, the proposal to ratify the appointment of PwC as our independent registered public accounting firm for fiscal year 2017 is considered to be “routine.” The other proposals are considered to be “non-routine” matters. Therefore, if you do not provide your bank, broker or other nominee holding your shares in “street name” with voting instructions, those shares will count for quorum purposes, but will not be counted as shares present and entitled to vote on the election of directors.Therefore, it is important that you provide voting instructions to your bank, broker or other nominee. |

Regardless of how you own your shares, if you are a stockholder of record, you may vote by attending the Annual Meeting on June 30, 2016, at 9:00 a.m., Pacific Time, at our principal executive offices, which are located at 4555 Great America Parkway, Santa Clara, California 95054. If you hold your shares in “street” or “nominee,” you must obtain a proxy, executed in your favor, from the holder of record to vote in person at the Annual Meeting. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or vote by telephone or the Internet so that your vote will be counted if you later decide not to attend the Annual Meeting.

If you vote via the Internet, by telephone or return a proxy card by mail, but do not select a voting preference, the persons who are authorized on the proxy card and through the Internet and telephone voting facilities to vote your shares will vote:

| | • | | FORthe approval of each director nominee; |

| | • | | FORthe approval of the Reverse Stock Split; |

2

| | • | | FORthe approval of the Authorized Shares Reduction; and |

| | • | | FORratification of the appointment of PwC as our independent registered public accounting firm for fiscal year 2017. |

Our Board strongly urges that youNOTsign or return any proxy card sent by Clinton.

What should I do if I receive a proxy card from Clinton?

Clinton has notified us that it intends to nominate three persons for election as directors to our Board at the Annual Meeting in opposition to the nominees recommended by our Board. If Clinton proceeds with its alternative nominations, you may receive proxy solicitation materials from Clinton, including an opposition proxy statement and a GOLD proxy card. We are not responsible for the accuracy of any information contained in any proxy solicitation materials used by or on behalf of Clinton or any other statements Clinton may make.

Our Board does not endorse any of the Clinton nominees and unanimously recommends that you disregard any proxy card or solicitation materials that may be sent to you by or on behalf of Clinton. Voting to “WITHHOLD” with respect to any of Clinton’s nominees on its proxy card is NOT the same as voting FOR our Board’s nominees because a vote to “WITHHOLD” with respect to any of Clinton’s nominees on its proxy card will revoke any proxy you previously submitted. If you have already voted using the GOLD proxy card, you have the right to change your vote by voting via the Internet or by telephone by following the instructions on the WHITE proxy card sent by the Company, or by completing and mailing the enclosed WHITE proxy card in the enclosed prepaid envelope. Only the latest validly executed proxy card that you submit will be counted – any proxy may be revoked at any time prior to its exercise at the Annual Meeting by following the instructions below in the section entitled “How do I change or revoke my proxy?” If you have any questions or require any assistance with voting your shares, please contact our Investor Relations Department by email at ir@vmem.com or by phone at(650) 396-1525.

What does it mean if I receive more than one WHITE proxy card or voting instruction form?

It generally means that your shares are registered differently or are in more than one account. Please provide voting instructions for each WHITE proxy card or, if you vote via the Internet or by telephone, vote once for each WHITE proxy card that you receive to ensure that all of your shares are voted.

If Clinton proceeds with its alternative director nominations, you likely will receive multiple mailings from Clinton, and we likely will conduct multiple mailings prior to the Annual Meeting so that stockholders have our latest proxy information and materials to vote. We will send you a WHITE proxy card with each mailing, regardless of whether you have vote previously. Only the latest validly executed proxy you submit will be counted. If you wish to vote as recommended by our Board, you should submit only the WHITE proxy cards. Please refer to the section above entitled “What should I do if I receive a proxy card from Clinton?” for more information.

How do I change or revoke my proxy?

If you are a stockholder of record, you may revoke your proxy at any time before the Annual Meeting by giving our Secretary written notice of your revocation or by submitting a later-dated proxy, and you may revoke your proxy at the Annual Meeting by voting by ballot. Attendance at the Annual Meeting, by itself, will not revoke a proxy. You may revoke your proxy by telephone by calling: 1-800-776-9437 in the United States or 1-718-921-8500 from foreign countries and following the instructions or via the internet by going towww.voteproxy.com and following the instructions.

If you are a stockholder in “street” or “nominee” name, you may revoke your voting instructions by informing the bank, broker or other nominee in accordance with that entity’s procedures for revoking your voting instructions.

3

If you previously signed the gold proxy card sent to you by Clinton, you may change your vote by voting via the Internet or by telephone by following the instructions on the WHITE proxy card we sent to you, or by completing and mailing the enclosed WHITE in the enclosed pre-paid envelope. Submitting a gold proxy card sent to you by Clinton will revoke votes you previously made by means of our WHITE proxy card.

What constitutes a quorum for purposes of the Annual Meeting?

On May 4, 2016, the record date, we had 99,640,348 shares of Common Stock outstanding. Voting can only take place at the Annual Meeting if the holders of a majority of the total number of shares of the Common Stock outstanding and entitled to vote on the record date are present either in person or by proxy. Abstentions will be treated as present for purposes of determining the existence of a quorum.

How many votes are required to approve the proposals?

The election of directors in Proposal 1 will be determined by the three nominees receiving the greatest number of votes from shares eligible to vote. The affirmative vote of a majority of the outstanding shares of our Common Stock is required to approve the Reverse Stock Split and reduction of authorized shares of Common Stock as set forth in Proposals 2 and 3. To ratify the appointment of PwC as our independent registered public accounting firm as set forth in Proposal 4, the affirmative vote of a majority of the voting power of the Common Stock present in person or by proxy at the Annual Meeting is required.

Can I attend the Annual Meeting in person?

We cordially invite and encourage all of our stockholders to attend the Annual Meeting in person. Persons who are not stockholders may attend only if invited by us. Stockholders of record must bring a copy of the Notice or proxy card or their brokerage statement showing ownership on the record date in order to be admitted to the Annual Meeting. You should also be prepared to present photo identification for admittance.

Will any other matters be presented at the Annual Meeting?

We do not expect any matters, other than those included in this proxy statement, to be presented at the Annual Meeting. If other matters are properly presented, the individuals named as proxies will have discretionary authority to vote your shares on those other matters as may properly come before the Annual Meeting, to the extent permitted by Rule 14a-4(c) under the Exchange Act.

Who will bear the cost of soliciting votes for the annual meeting?

The cost of preparing, printing, mailing and distributing this Proxy Statement, the accompanying proxy materials, and the cost of soliciting proxies on behalf of the Board, which may be made by standard mail, e-mail, other electronic channels of communication, telephone or personally by our directors, officers or employees, will be borne by the Company. None of the Company’s directors, officers or employees will receive any additional or special compensation for soliciting your proxy.

We will provide copies of these proxy materials to banks, brokerage houses, fiduciaries and custodians holding in their names shares of our common stock beneficially owned by others in “street name” so that they may forward these proxy materials to the beneficial owners. The Company will, on request, reimburse brokers, banks and other nominees for their reasonable expenses in sending our proxy materials and voting instruction forms to “street name” beneficial owners to obtain their voting instructions.

The Company’s aggregate expenses related to the solicitation in excess of those normally spent for an annual meeting of shareholders as a result of the potential proxy contest and excluding salaries and wages of our officers and regular employees, are expected to be approximately $100,000.

4

Appendix IV to this Proxy Statement sets forth information relating to certain of our directors, officers and employees who are considered “participants” in this proxy solicitation under the rules of the SEC by reason of their position as the Company’s directors, officers and employees or because they may be soliciting proxies on our behalf.

Who can help answer my questions?

If you have any questions about the Annual Meeting, voting or your ownership of our stock, please contact our investor relations department by e-mail atir@vmem.com or by phone at (650) 396-1525.

BACKGROUND OF THE SOLICITATION

Our Settlement with Clinton in 2014

On April 12, 2014, the Company and Clinton Relational Opportunity Master Fund, L.P. (together with its affiliates, “Clinton”) entered into a settlement agreement (the “Settlement Agreement”) for the purpose of, among other things, settling a potential proxy contest with respect to the election of directors to our Board of Directors (“Board”) at the Company’s 2014 annual meeting of stockholders. The following is a summary of the material terms of, and certain other information related to, the Settlement Agreement:

| | • | | On April 12, 2014, we increased the size of our Board from seven to eight members and appointed Vivekanand Mahadevan as a Class II Director of the Board to fill the newly created Board seat. Mr. Mahadevan’s term expired at the 2015 annual meeting of stockholders, and he was re-elected to the Board at the 2015 annual meeting. Mr. Mahadevan continues to serve on our Board, and his current term will continue until our 2018 annual meeting of stockholders. |

| | • | | On April 12, 2014, effective immediately upon Mr. Mahadevan’s appointment to our Board, Mr. Mahadevan was appointed to the Audit Committee of the Board, and he continues to serve on the Audit Committee. |

| | • | | Clinton withdrew its nomination letter to the Company and agreed to cause all shares of the Company’s common stock beneficially owned by it and its affiliates to vote in favor of (i) the election of each of our Board’s nominees for election as a Class I Director and (ii) the approval of both of the other proposals set forth in our proxy materials for our 2014 annual meeting of stockholders. |

| | • | | Clinton also agreed to observe normal and customary standstill provisions set forth in the Settlement Agreement. |

Events Relating to the 2016 Annual Meeting

The following is a chronology of events leading to this proxy solicitation.

On June 30, 2015, Clinton sent a letter to our Board expressing a number of concerns about the Company, its management, and its financial condition. Clinton also stated its belief that the best path to maximizing stockholder value was an orderly sales process of the Company and that the sales process should be announced publicly.

On July 13, 2015, Kevin A. DeNuccio, our president, chief executive officer and a director, on behalf of the Board, sent a letter to Clinton responding to Clinton’s June 30, 2015 letter. Mr. DeNuccio, among other things, suggested a meeting with Clinton to discuss the matters Clinton raised, and also suggested that the meeting take place pursuant to a mutually agreeable nondisclosure agreement.

On July 13, 2015, Clinton sent an email to Mr. DeNuccio stating that Clinton would not agree to enter into a nondisclosure agreement, and proposing a meeting with the Company in August.

5

On July 14, 2015, Mr. DeNuccio sent a letter to Clinton containing detailed responses to the matters raised by Clinton in its June 30, 2015 letter, including Clinton’s expectations concerning the Company’s performance, Clinton’s concerns about the Company’s go-to-market strategy, the Company’s viability, and Clinton’s belief that the Company’s technology should be sold immediately. Mr. DeNuccio stated that the Board would continue to make its decisions based upon the best interests of all of Violin’s stockholders.

On July 30, 2015, Clinton sent a letter to our Board in response to Mr. DeNuccio’s July 14, 2015 letter to Clinton. Clinton expressed its disagreement with the information in Mr. DeNuccio’s letter and stated that, unless the Company’s performance improved, Clinton would consider seeking the election of replacements to our Board at the 2016 annual meeting of stockholders.

On August 28, 2015, there was a conference call between Mr. DeNuccio, Cory Sindelar, our Chief Financial Officer, Richard Nottenburg, our Chairman of the Board, and Joseph De Perio, a representative of Clinton to discuss the Company’s financial results for the second fiscal quarter ended July 31, 2015. Mr. De Perio stated that the Company’s financial performance was not good enough and expressed concerns regarding the Company’s go-to-market strategy and leadership. Mr. Nottenburg agreed to meet with Mr. De Perio in person the following week to continue the discussion.

On August 31, 2015, Mr. Nottenburg met with Mr. De Perio in New York City. Mr. De Perio expressed concerns around the Company’s execution, sales leadership, revenue guidance for the third quarter of fiscal 2016 and his expectations for the Company’s capital requirements. Mr. De Perio stated that he believed the Company has exceptional technology and customers and that we should begin an orderly sales process. Mr. De Perio stated that unless the Company’s performance improved and/or the Company was sold, Clinton would run a slate of directors at the next annual meeting. Mr. De Perio expressed the need to add a CEO with storage expertise to the Board. Mr. Nottenburg recommended that Mr. De Perio spend more time with the management team, and suggested a visit to Violin’s corporate offices.

On September 14, 2015, Messrs. DeNuccio, Sindelar and Said Ouissal, our SVP of Field Operations, met with Mr. De Perio and Robert Fernander, a Clinton representative and Director of Imation, at Violin’s corporate offices to discuss our business, our product transition, go-to-market changes and the actions management was taking to grow revenue.

On October 28, 2015, Mr. Nottenberg met with Mr. De Perio. At this meeting, Mr. De Perio presented a list of demands in order to avoid a contested election of directors. The demands consisted of replacing two current directors with two new directors, of which one being a storage executive and the other having a finance background; hiring an investment banker and running a public sale process; our agreement to a covenant prohibiting the raising of additional capital; and implementing a retention program for key technical talent.

On November 4, 2015, Mr. De Perio called Mr. Nottenburg to solicit feedback on the proposal as outlined above. As Clinton did not want to possess material non-public information, we believe that it was inappropriate at that time to discuss the actions that the Company was already taking, including the hiring of an investment banker. Consequently, Mr. Nottenburg informed Mr. De Perio that the Board had no response at that time.

On November 9, 2015, Clinton sent a letter to our Board proposing, among other things: the replacement of two current directors with two new directors; that the Company engage an investment banker to execute a sales process of the Company; and the implementation of a retention plan for certain of the Company engineering and development employees. Clinton also stated that it intended to issue a public announcement of its intentions following the Company’s public announcement of third quarter financial results.

On December 1, 2015, in response in part by Clinton demand for greater shareholder representation on the Board, the Company appointed Donald J. Listwin to the Board. In addition to Mr. Listwin’s extensive business experience, especially in the technology industry and his experience as a director of other companies, Mr. Listwin owns approximately 3% of the Company’s outstanding Common Stock.

6

On December 2, 2015, the Company publicly disclosed its decision to explore strategic alternatives and our engagement of an investment banker to assist us with the process. On the same date, Mr. DeNuccio and Mr. Sindelar spoke by telephone with Clinton to discuss our financial results for the third fiscal quarter ended October 31, 2016.

On December 14, 2015, Messrs. DeNuccio and Sindelar spoke by telephone with Mr. De Perio to discuss our public announcement of our review of strategic alternatives and to discuss the possible impact of a Clinton public announcement of its intention to seek to replace two of our directors on our business. During this telephone conversation, Clinton proposed that our Board be reduced to six directors and the appointment of two Clinton designees. If implemented, this action would have reduced the Board’s then current members of nine by five. In addition, Clinton already had Mr. Mahadevan on the Board. Other than the appointment of Clinton’s additional appointees, we demonstrated our continued responsiveness through a public exploration of strategic alternatives and increased stockholder representation on the Board.

On January 8, 2016, Clinton, on behalf of itself and Imation Corporation (“Imation”), issued a public announcement that it intended to notify the Company of its intention to nominate three candidates for election to our Board. The public announcement also stated Clinton’s belief that the Company should be sold to a strategic buyer prior to the 2016 annual meeting of stockholders.

On January 12, 2016, Clinton provided written notice to the Company of its intention, together with Imation, to present a proposal to nominate three persons for election as directors at the 2016 annual meeting of stockholders (“Clinton’s Notice”).

On February 19, 2016, Clinton sent a letter to our Board stating that it was willing to enter into a confidentiality agreement so that Clinton could be afforded the opportunity to voice its opinion on the acceptability of any proposals to purchase the Company.

On February 29, 2016, the Company sent to Clinton a draft confidentiality agreement that provided, among other things: that the Company would provide certain confidential information to Clinton regarding the review of strategic alternatives; and that the Company would disclose publicly all material, non-public information provided to Clinton pursuant to the confidentiality agreement on or before March 11, 2016. In other words, the confidentiality agreement required Clinton to maintain the confidentiality of the information provided for a period of ten days. The confidentiality agreement did not include any restrictions on Clinton’s ability to trade in the Company’s common stock after the public disclosure of the information provided to Clinton pursuant to the confidentiality agreement. Clinton did not respond to the draft confidentiality agreement.

On March 10, 2016, the Company publicly announced its financial results for the fourth quarter ended January 31, 2016, and the results of the Company’s review of the strategic alternatives. With the assistance of our investment bankers, Jefferies LLC, we conducted a robust process to explore a relationship with a broad number of industry players to get a full understanding of the best way to create value for our stockholders, including a potential sale of the Company. The process included both inbound and outbound inquiries with over 40 companies that we determined could benefit from the technology and value proposition that the Company offers in the marketplace. The results of the process had more than 15 companies engaging with us at various levels of evaluation and exploration. The process resulted with no company making an offer to acquire the Company. The process was successful in that it revealed multiple go-to-market and technology relationship opportunities, which we intend to pursue.

On March 11, 2016, Messrs. DeNuccio and Sindelar spoke by telephone with Mr. De Perio to discuss the Company’s financial results for the fourth quarter ended January 31, 2016, and the results of the Company’s review of strategic alternatives.

On March 16, 2016, Messrs. DeNuccio and Sindelar spoke by telephone with Mr. De Perio regarding a proposed resolution of the issues raised by Clinton’s Notice. During the telephone conversation, Clinton agreed that

7

Mr. DeNuccio should remain in his position as Chief Executive Officer. Clinton proposed a resolution that included the following: the resignations of two of the Company’s directors; the appointment of two Clinton designees to the Board with appropriate committee representation; Clinton’s agreement to a one year stand-still agreement; and the Company’s agreement to reimburse Clinton for its legal fees and expenses. In response, Mr. DeNuccio proposed reducing the Board from nine to six directors. Clinton stated that it was amenable to reducing the Board to six directors including one Clinton designee. Mr. DeNuccio advised Clinton that Bruce H. Grant, who through affiliated entities beneficially owns nearly 10% of the Company’s common stock, would consider becoming a director and suggested that Mr. Grant should be Clinton’s designee. In response, Mr. De Perio stated that he did not believe that Mr. Grant would best represent Clinton’s interests. However, Mr. De Perio stated that, in order to resolve the matter, Clinton would agree to a Board consisting of seven directors including Mr. Grant and one Clinton designee.

On March 24, 2016, Messrs. DeNuccio and Sindelar spoke by telephone with Mr. De Perio to continue discussions concerning a potential resolution. During the telephone conversation, Mr. De Perio stated for the first time that the Clinton designee must be himself instead of one of the three persons Clinton had nominated in the Clinton Letter. Messrs. DeNuccio and Sindelar stated that they would communicate Clinton’s requirement to the Board.

On March 30, 2016, Messrs. DeNuccio and Sindelar spoke by telephone with Mr. De Perio and informed him that Mr. De Perio would not be acceptable as the Clinton designee because the Board concluded that, in view of the proposed reduction of the number of directors, it would be important to have a director with industry experience. Mr. De Perio stated that Clinton would not accept the Company’s position.

Between April 7 and April 13, 2016, Messrs. DeNuccio, Grant and Nottenburg met in person or telephonically with Mr. Michael Wall, one of Clinton’s proposed Board nominees. Given Mr. Wall’s prior work experience as a chief executive officer in the storage industry, they concluded that Mr. Wall would make an acceptable Board member and would replace some of the industry experience that would be lost with the proposed down-sizing of the Board from nine directors to seven. Mr. Wall expressed his willingness to join our Board.

On April 8, 2016, Mr. De Perio telephoned Mr. DeNuccio and advised Mr. DeNuccio that Clinton would agree to limit the term of Mr. De Perio’s service as a director to 18 months. Mr. DeNuccion advised Mr. De Perio that the Company would consider the proposal.

On April 18, 2016, Mr. DeNuccio telephoned Mr. De Perio and advised Mr. De Perio that the Company would not accept Mr. De Perio as a director for the reasons previously communicated to Clinton. In a final attempt to resolve the matter, Mr. DeNuccio shared with Mr. De Perio the fact that the Board was willing to accept Mr. Wall as Clinton’s representative on the Board. Mr. De Perio refused.

On April 18, 2016, Clinton confirmed by email its “last offer” to resolve the matter, which included the following: Clinton would cease its efforts to contest the election of the Company’s nominees for election to the Board upon the appointment of Mr. De Perio to the Board and his appointment to unidentified Board committees; Clinton would agree that, after a period of eighteen months, Mr. De Perio would be replaced by a new director to be agreed upon by Clinton and the Company or an industry expert nominee to be reasonably agreed upon by Clinton and the Company; and Clinton would agree to standstill and non-disparagement restrictions during the period that Mr. De Perio served as a director.

On April 27, Mr. De Perio, on behalf of Imation and Clinton, sent a letter to our Board that included, among other things, certain information to be included in a preliminary proxy that Mr. De Perio stated Clinton would file after the close of our first quarter for fiscal year 2017 on April 30, 2016. The information included Clinton’s positions regarding the background of Clinton’s solicitation of proxies and the reasons for the solicitation. The letter also set forth Clinton’s views of the costs, to Clinton and the Company, for the proxy contest. Finally, the letter stated that Clinton would settle the proxy contest if Mr. De Perio is appointed to the Board immediately and has requisite Committee memberships. The letter also stated that Mr. De Perio would step down from the Board

8

after 18 months and would be replaced by a person to be agreed upon or another industry expert designated by the Company who would be agreeable to Clinton, and that Clinton’s agreement would not be withheld unreasonably. Finally, the letter stated that Clinton would agree to standstill and non-disparagement restrictions during the period Mr. De Perio served on the Board. The letter is Annex I to this proxy statement. We urge stockholders to read the letter.

Given that there were no changes to the “last offer” provided by Clinton, we concluded that there was nothing further to discuss. Due to this impasse, and the expectation of a contested election, we decided to retain the Board size at nine to avoid any potentially costly litigation brought by Clinton if we changed the Board size from nine to six. By maintaining the Board size at nine, we also maintained the appropriate level of industry experience, and with the proposed election of Mr. Grant, we would continue to add significant stockholder representation on the Board. As of March 31, 2016, the Board and executive officers owned approximately 5% of the outstanding shares of the Company. With the addition of Mr. Grant, should he be elected at the Annual Meeting, this ownership would increase to 15% of the outstanding shares of the Company. In addition, Mr. Mahadevan, Clinton’s original designee in 2014, continues to serve on our Board.

9

CORPORATE GOVERNANCE

Corporate Governance Guidelines; Code of Business Conduct and Ethics and Code of Ethics for Senior Financial Officers

We have adopted a Code of Business Conduct and Ethics (the “Code”) that applies to each of our directors, officers and employees. It addresses various topics, including:

| • | | compliance with laws, rules and regulations, including the Foreign Corrupt Practices Act; |

| • | | corporate opportunities; |

| • | | competition and fair dealing; |

| • | | equal employment and working conditions; |

| • | | giving and accepting gifts; |

| • | | compensation or reimbursement to customers; |

| • | | protection and proper use of company assets; and |

| • | | payments to government personnel and political contributions. |

We also have adopted a Code of Ethics for Senior Financial Officers (the “Code for Senior Financial Officers”) applicable to our Chief Executive Officer, Chief Financial Officer and other key management employees addressing ethical issues. The Code and the Code for Senior Financial Officers are posted on our website. Any waiver to the Code must be approved by our Board or our Nominating and Governance Committee and must be timely disclosed as required by applicable law. Any waiver to the Code for Senior Financial Officers must be approved by our Audit Committee and must be timely disclosed as required by applicable law. We also have implemented whistleblower procedures that establish formal protocols for receiving and handling complaints from employees. Any concerns regarding accounting or auditing matters reported under these procedures will be communicated promptly to our Audit Committee.

Board Composition

Our Board currently is composed of nine directors, all of whom are “independent directors” as defined under the rules of the New York Stock Exchange (“NYSE”), except for Mr. DeNuccio, our President and Chief Executive Officer. Our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws provide that the authorized number of directors shall be not less than five and not more than thirteen, with the exact number to be fixed from time to time by a resolution of the majority of the Board. There are no family relationships among any of our directors or executive officers.

Our Board met a total of ten times during fiscal year 2016 and acted twice by unanimous written consent. During fiscal year 2016, all of our directors attended at least 75% of the meetings of our Board held during their tenure and 75% of the meetings of any Board committees upon which they served and held during their tenure. The Board does not have a policy requiring director attendance at annual meetings of our stockholders.

Board Leadership Structure

The Board selects the Chairman of the Board in the manner and upon the criteria that it deems best for the Company at the time of selection. The Board does not have a prescribed policy on whether the roles of the Chairman and Chief Executive Officer should be separate or combined, but recognizes the value to the Company of the separation

10

of these positions. Currently, the roles of Chairman and Chief Executive Officer are separate, and the Board will continue to evaluate whether this leadership structure is in the best interests of the stockholders on a regular basis.

The Chairman of the Board, Richard N. Nottenburg, presides over each Board meeting. The Chairman serves as liaison between our Chief Executive Officer and the other directors, approves meeting agendas and schedules and notifies other members of the Board regarding any significant concerns of stockholders or interested parties of which he becomes aware. The Chairman presides over stockholders’ meetings and provides advice and counsel to the Chief Executive Officer.

Board Committees

We have established an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee and a Strategic Alternatives Committee. We believe that the composition of these committees meets the criteria for independence under, and the functioning of these committees complies with, the applicable requirements of, the Sarbanes-Oxley Act of 2002, the current rules of the NYSE and the rules and regulations of the Securities and Exchange Commission (SEC”). We intend to comply with future requirements as they become applicable to us. Each committee has the composition and responsibilities described below.

Audit Committee — Messrs. Kurtz, Mahadevan, Walrod and Ms. Bo-Linn serve on our Audit Committee. Mr. Kurtz is the chairperson of the Committee. Our Audit Committee assists our Board in fulfilling its legal and fiduciary obligations in matters involving our accounting, auditing, financial reporting, internal control and legal compliance functions, and is directly responsible for the approval of the services performed by our independent accountants and review of their reports regarding our accounting practices and systems of internal accounting controls. Our Audit Committee also oversees the audit efforts of PwC, our independent registered public accounting firm, and takes actions as it deems necessary to satisfy itself that the accountants are independent of management. Our Audit Committee is also responsible for monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to financial statements and accounting matters. Our Board has determined that all members of the Audit Committee are audit committee financial experts, as defined by the rules promulgated by the SEC, and have the requisite financial sophistication as defined under the applicable rules and regulations of the NYSE. The Audit Committee met ten times during fiscal year 2016.

Compensation Committee — Messrs. Antoun, Lang, Nottenburg and Ms. Bo-Linn serve on our Compensation Committee. Mr. Lang is the chairperson of the Committee. Our Compensation Committee assists our Board in meeting its responsibilities with regard to oversight and determination of executive compensation and assesses whether our compensation structure establishes appropriate incentives for officers and employees. Our Compensation Committee reviews and makes recommendations to our Board with respect to our major compensation plans, policies and programs. In addition, our Compensation Committee reviews and makes recommendations for approval by the independent members of our Board regarding the compensation for our executive officers, establishes and modifies the terms and conditions of employment of our executive officers and administers our equity plans. The Compensation Committee met five times during fiscal 2016 and acted ten times by unanimous written consent.

Nominating and Corporate Governance Committee — Messrs. Lang, Nottenburg and Walrod serve on our Nominating and Corporate Governance Committee. Mr. Walrod is the chairperson of the Committee. Our Nominating and Corporate Governance Committee is responsible for making recommendations to our Board regarding candidates for directorships and the size and composition of the Board. Our Nominating and Corporate Governance Committee also is responsible for overseeing our corporate governance guidelines, and reporting and making recommendations to the Board concerning corporate governance matters. The Nominating and Corporate Governance Committee met nine times during fiscal year 2016.

Strategic Alternatives Committee — Messrs. DeNuccio, Kurtz, Listwin, Nottenburg and Walrod served on our Strategic Alternatives Committee. Mr. Nottenburg was the chairperson of the Committee. Our Strategic Alternatives

11

Committee was anad hoccommittee formed in November 2015 to: (i) provide oversight of a review by management of the Company’s strategic alternatives and (ii) direct management and the Company’s financial and legal advisors regarding day-to-day processes in connection with the strategic review. The review of the Company’s strategic alternatives has been completed. As of March 31, 2016, the Strategic Alternatives Committee met four times.

Directors’ Stock Ownership Policy

In order to better align the interests of our directors and those of our stockholders, all current directors, no later than April 2018, and all future directors, within three years of becoming directors, are required to own that number of shares of our common stock equal in market value, at the time(s) of purchase(s), to three times their base annual retainer, which is discussed below in the section entitled “Compensation of Directors.” Our directors are permitted, but are not required, to accept shares of our common stock in lieu of all or a part of the payment of the base annual retainer in cash.

Copies of Corporate Governance and Other Materials Available

The following documents are available for downloading or printing on our web site at www.vmem.com, by selecting “Company,” then “Investors,” then “Corporate Governance” then either “Committee Composition” or “Code of Conduct,” and then the links to the documents listed below:

| | • | | Audit Committee Charter |

| | • | | Compensation Committee Charter |

| | • | | Nominating and Governance Committee Charter |

| | • | | Corporate Governance Guidelines |

| | • | | Code of Business Conduct and Ethics |

| | • | | Code of Ethics for Senior Financial Officers |

Compensation Committee Interlocks and Insider Participation

Messrs. Antoun, Lang, Nottenburg and Ms. Bo-Linn serve as members of our Compensation Committee. None of the members of our Compensation Committee is or has in the past served as an officer or employee of the Company. None of our executive officers currently serves, or in the past year has served, as a member of a board of directors or compensation committee of any entity that has one or more executive officers serving on our Board or Compensation Committee.

Director Nomination Policy

The Nominating and Corporate Governance Committee is responsible for identifying, evaluating, recruiting and recommending qualified candidates to our Board for nomination or election. The Board nominates directors for election at each annual meeting of stockholders and elects new directors to fill vacancies if they occur.

Our Corporate Governance Guidelines require that independent directors may not be executive officers or employees of the Company, may not have material relationships, as determined by the Board, with the Company, and may not have any other relationships which, in the opinion of the Board, could interfere with the exercise of independent judgment in fulfilling the responsibilities of a director. In addition, service as a director should not present the appearance of any conflict of interest, and directors should be independent of any particular constituency and able to represent all of the Company’s stockholders.

12

The Board strives to find directors who are experienced and dedicated individuals with diverse backgrounds, perspectives and skills. Our Corporate Governance Guidelines contain membership criteria that call for candidates to be selected for their ethical character, personal and professional reputation, ability to exercise sound business judgment, accomplishments in their field, credentials and recognition, relevant expertise and experience, and the ability to offer advice and guidance to our chief executive officer based on that expertise and experience. In addition, we expect each director to be committed to enhancing stockholder value and to have sufficient time to effectively carry out their duties as a director. The Nominating and Corporate Governance Committee also seeks to ensure that a majority of our directors are independent under the NYSE rules and that one or more of our directors is an “audit committee financial expert” under SEC rules.

Prior to our annual meeting of stockholders, the Nominating and Corporate Governance Committee identifies director nominees first by evaluating the current directors whose terms will expire at the annual meeting and who are willing to continue in service. The candidates are evaluated based on the criteria described above, the candidate’s prior service as a director, and the needs of the board of directors for any particular talent and experience. If a director no longer wishes to continue in service, if the Nominating and Corporate Governance Committee decides not to re-nominate a director, or if a vacancy is created on the board of directors because of a resignation or an increase in the size of the board or other event, then the Nominating and Corporate Governance Committee will consider whether to replace the director or to decrease the size of the Board. If the decision is to replace a director, the Nominating and Corporate Governance Committee will consider various candidates for Board membership, including those suggested by Committee members, by other Board members, a director search firm engaged by the Committee, or our stockholders. Prospective nominees are evaluated by the Nominating and Corporate Governance Committee based on the membership criteria described above and set forth in our corporate governance guidelines.

A stockholder who wishes to recommend a prospective nominee to the Board for consideration by the Nominating and Corporate Governance Committee should notify our Corporate Secretary in writing at our principal executive office. Such notice must be delivered to our office by the deadline relating to stockholder proposals to be considered for inclusion in our proxy materials, as publicly announced by us prior to the meeting.

Each notice delivered by a stockholder who wishes to recommend a prospective nominee to the Board for consideration by the Nominating and Corporate Governance Committee generally must include the following information about the prospective nominee:

| | • | | the nominee’s name, age, business address and residential address; |

| | • | | the nominee’s principal occupation; |

| | • | | the number of shares of our capital stock owned by the nominee; |

| | • | | a description of all compensation and other relationships during the past three years between the stockholder and the nominee; |

| | • | | any other information relating to the nominee required to be disclosed pursuant to Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”); and |

| | • | | the nominee’s written consent to serve as a director if elected. |

The Nominating and Corporate Governance Committee may require any prospective nominee recommended by a stockholder to furnish such other information as the Nominating and Corporate Governance Committee reasonably may require to determine the person’s eligibility to serve as an independent director or that could be material to a stockholder’s understanding of the person’s independence or lack thereof.

Role of the Board in Risk Oversight

One of the key functions of our Board is informed oversight of our risk management process. Our Board does not have a standing risk management committee, but instead administers this oversight function directly, as well as

13

through our standing committees that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure. Our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. Our Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function. Our Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

Communications with Directors

Stockholders and interested parties may contact our directors to provide comments, to report concerns, or to ask a question, by mail at the following address: Secretary, Violin Memory, Inc., 4555 Great America Parkway, Santa Clara, CA 95054.

14

BOARD OF DIRECTORS

Our Board is divided into three classes, each serving staggered, three-year terms. At the Annual Meeting, stockholders will be asked to elect three persons to serve as directors until our 2019 annual meeting.See “Proposal No. 1 — Election of Directors.”

Below are the names and ages of our nine directors as of April 30, 2016, the year each became a director, each director’s principal occupation or employment for at least the last five years, and other public company directorships held by each director.

Unless authority is withheld, the persons named as proxies in the voting materials available to you or in the accompanying proxy will vote for the election of Kevin A. DeNuccio, Georges A. Antoun and Bruce H. Grant. As of the date of this Proxy Statement, each director nominee has consented to being named in this Proxy Statement and to serving as a director if elected. We have no reason to believe that any nominee will be unable to serve as a director. However, if any nominee is unable to serve or for good cause will not serve, the persons named as proxies will have discretionary authority to vote for the election of such substitute nominee as our Board may propose. The election of directors in Proposal 1 will be determined by a plurality of the votes cast at the Annual Meeting, meaning the three nominees receiving the greatest number of votes from shares eligible to vote will be elected. An abstention or a broker non-vote on Proposal 1 will not have any effect on the election of directors.

Our directors and their ages as of April 30, 2016, are set forth below:

| | | | |

Name | | Age | | Position |

Kevin A. DeNuccio | | 56 | | President, Chief Executive Officer and Director |

Richard N. Nottenburg (2)(3) | | 62 | | Chairman of the Board |

Georges A. Antoun (2) | | 58 | | Director |

Cheemin Bo-Linn (1)(2) | | 62 | | Director |

William H. Kurtz (1) | | 59 | | Director |

Lawrence J. Lang (2)(3) | | 57 | | Director |

Donald J. Listwin | | 57 | | Director |

Vivekanand Mahadevan (1) | | 62 | | Director |

David B. Walrod (1)(3) | | 50 | | Director |

| (1) | Member of the Audit Committee |

| (2) | Member of the Compensation Committee |

| (3) | Member of the Nominating and Corporate Governance Committee |

Our Board is divided into three classes, each serving staggered, three-year terms:

| | • | | Our Class I directors are Dr. Richard N. Nottenburg, David B. Walrod and William H. Kurtz, and their terms will expire at our 2017 annual meeting of stockholders; |

| | • | | Our Class II directors are Lawrence J. Lang, Vivekanand Mahadevan and Donald J. Listwin, and their terms will expire at our 2018 annual meeting of stockholders; and |

| | • | | Our Class III are directors Kevin A. DeNuccio, Georges A. Antoun, and Cheemin Bo-Linn, whose terms will expire at our 2016 annual meeting of stockholders. Ms. Bo-Linn has decided not to stand for election during our Annual Meeting. |

As a result, only one class of directors will be elected at each annual meeting of stockholders, with the other classes continuing for the remainder of their respective terms.

Kevin A. DeNuccio is our President and Chief Executive Officer and has served as a member of our Board since February 2014. Previously, he served as Chief Executive Officer of Metaswitch Networks Ltd., a

15

telecommunications hardware and software company, from February 2010 until June 2012. He remained a member of the Metaswitch Networks’ board of directors until joining us. Mr. DeNuccio served as President and Chief Executive Officer of Redback Networks Inc., a provider of edge routers, from August 2001 until its acquisition by Ericsson in January 2007. Redback Networks was reorganized pursuant to Chapter 11 of the Bankruptcy Code in 2003. From 1995 to 2001, he held a number of executive positions at Cisco Systems, including senior vice president of worldwide service provider operations. Prior to joining Cisco, Mr. DeNuccio was President and CEO of Bell Atlantic Network Integration, a wholly owned subsidiary of Bell Atlantic (now Verizon Communications). He has also held senior management positions at both Unisys Corporation and Wang Laboratories network integration and worldwide channel partner businesses. Mr. DeNuccio previously served on numerous public and private boards of directors including Juniper Networks, Redback Networks, JDS Uniphase Corporation, KPMG LLP consulting (BearingPoint), Netpliance (TippingPoint), Salesnet and SanDisk. He currently serves on the board of directors of Calix, GrndCntrl, SevOne, and Northeastern University. Mr. DeNuccio earned a master’s degree in business administration from Columbia University and a bachelor’s degree in Finance from Northeastern University. Our Board has concluded that Mr. DeNuccio should serve as a director due to his outstanding record within the technology industry, wealth of industry experience and the perspective and experience he brings as our President and Chief Executive Officer.

Richard N. Nottenburg has served as a member of our Board since February 2014 and as Chairman of the Board since June 2014. Dr. Nottenburg, an investor in early stage technology companies and a management consultant, served as President and Chief Executive Officer and a member of the board of directors of Sonus Networks, Inc. from June 2008 through October 2010. From July 2004 until May 2008, Dr. Nottenburg was an officer with Motorola, Inc., ultimately serving as its Executive Vice President, Chief Strategy Officer and Chief Technology Officer. Dr. Nottenburg is currently a member of the board of directors of Verint Systems Inc. (where he is also chairman of the compensation committee). Dr. Nottenburg holds a B.S. in Electrical Engineering from Polytechnic Institute of New York, an M.S. in Electrical Engineering from Colorado State University, and a Doctor of Science in Electrical Engineering from the Ecole Polytechnique Federale de Lausanne in Lausanne, Switzerland. Our Board has concluded that Dr. Nottenburg’s financial and business expertise, including his diversified background of managing technology companies, serving as a chief executive officer, and serving as a director of public technology companies, give him the qualifications and skills to serve as a director.

Georges J. Antoun has served as a member of our Board since June 2014. Mr. Antoun has served as President of North America Commercial Business for First Solar, Inc., a global provider of comprehensive solar systems, since July 2015. From July 2011 to July 2015, Mr. Antoun was Chief Operating Officer of First Solar. From January 2007 to July 2011, Mr. Antoun was the Head of Product Area IP & Broadband Networks for Telefonaktiebolaget L.M. Ericsson. Before joining Ericsson, from August 2001 to January 2007, Mr. Antoun was Senior Vice President of Worldwide Sales & Operations at Redback Networks, which Ericsson acquired in January 2007. Redback Networks was reorganized pursuant to Chapter 11 of the Bankruptcy Code in 2003. After the acquisition of Redback Networks, Mr. Antoun was promoted to Chief Executive Officer of the Redback entity at Ericsson until 2009. Prior to Redback Networks, from 1996 to 2001, Mr. Antoun worked at Cisco Systems where he served in various executive roles including Vice President of Worldwide Systems Engineering and Field Marketing, Vice President of Worldwide Optical Operations and Vice President of Carrier Sales. Mr. Antoun also serves on the board of directors of Ruckus Wireless, Inc. Mr. Antoun holds a B.S. in Engineering from the University of Louisiana at Lafayette, an M.S. in Information Systems from NYU Poly and an Executive Management degree from the Ericsson program at Columbia University. Our Board has concluded that Mr. Antoun should serve as a director due to his vast executive and technical experience.

William H. Kurtz has served as a member of our Board since November 2014 and chairs Violin’s Audit Committee. Mr. Kurtz joined Bloom Energy, a developer of fuel cell systems for on-site power generation, and served as Chief Financial Officer from March 2008 until May 2015. In May 2015, Mr. Kurtz assumed the role of Chief Commercial Officer and focused on the development of Bloom’s international business and arranged several commercial functions for the company. From September 2005 to March 2008, Mr. Kurtz served as

16

Executive Vice President and Chief Financial Officer of Novellus Systems, Inc., a global semiconductor equipment company. From March 2004 until August 2005, Mr. Kurtz served as Senior Vice President and Chief Financial Officer of Engenio Information Technologies, Inc., a designer and manufacturer of high-performance modular enterprise storage systems. From July 2001 to February 2004, Mr. Kurtz served as Chief Operating Officer and Chief Financial Officer of 3PARdata, Inc., a data storage company. From August 1998 to June 2001, Mr. Kurtz served as Executive Vice President and Chief Financial Officer of Scient Corporation, a provider of professional services. From July 1983 to August 1998, Mr. Kurtz served in various capacities at AT&T, including Vice President of Cost Management and Chief Financial Officer of AT&T’s Business Markets Division. Prior to joining AT&T, he worked at Price Waterhouse, now PricewaterhouseCoopers LLP. Mr. Kurtz is a certified public accountant (inactive). Our Board has concluded that Mr. Kurtz should serve as a director because of his vast financial and business experience.

Lawrence J. Lang has served as a member of the Board since April 2010. From June 2015 to the present, Mr. Lang has served as President and Chief Executive Officer of PLUMgrid, Inc, which provides software-defined networking products. From September 2010 to November 2013, Mr. Lang has served as President and Chief Executive Officer of Quorum Labs, Inc., a company which provides high availability and disaster recovery computing products and services. He previously served as Vice President and General Manager of the Services and Mobility Business Unit of Cisco Systems, Inc. from December 2001 to November 2009. Mr. Lang served on the board of directors of Infineta Systems, Inc., a provider of inter-datacenter, wide-area network optimization solutions, from May 2012 until the sale of its assets to Riverbed Networks, Inc. in February 2013. He also previously served on the board of directors of BelAir Networks Inc., a provider of carrier-grade Wi-Fi equipment, from March 2010 until May 2012, when it was acquired by Ericsson, Inc. He currently advises and invests in various early-stage technology companies. Mr. Lang holds an M.S. in Operations Research from Stanford University and a B.S.E. in Electrical Engineering from Duke University. Our Board has concluded that Mr. Lang should serve as a director due to his background of more than twenty years of global business-building experience and as an executive in the technology industry.

Donald J. Listwinhas served as a member of our Board since December 2015. Mr. Listwin currently serves as Chief Executive Officer of the Canary Foundation, a non-profit organization. From June 2008 to January 2012, Mr. Listwin served as Chief Executive Officer of Sana Security, and from September 2000 to September 2004 as Chief Executive Officer of Openwave Systems. From June 1997 to September 2000, Mr. Listwin served as Executive Vice President of Cisco Systems. Mr. Listwin previously served on numerous public and private boards of directors, including ETEK International, Isilon Storage, JDS Uniphase Corporation, Openwave Systems, Phone.com, Redback Networks, Cisco Systems, TIBCO Software, Clustrix, Genologics, Joyent, Sana Security, the National Cancer Institute, the Board of Scientific Advisors, the Fred Hutchinson Cancer Center, and the Moffitt Melanoma Cancer Center. Mr. Listwin currently serves on the boards of directors of Calix, D-Wave Systems, PLUMgrid, Teradici, and the Canary Foundation. Mr. Listwin also serves as a Consulting Professor of Radiology at Stanford University. Mr. Listwin earned a B.E. in electrical engineering and was awarded an honorary Doctor of Laws degree, both from the University of Saskatchewan. Our Board has concluded that Mr. Listwin should serve as a director due to his extensive business experience and experience as a director of other companies as well as owning approximately 3% of the Company’s outstanding Common Stock.

Vivekanand Mahadevan has served as a member of our Board since April 2014 after being designated by Clinton to represent its interests. Mr. Mahadevan is Chief Executive Officer of Dev Solutions, Inc., a technology consulting firm focused on data analytics, security, storage and cloud markets, and has held that position since January 2013. Previously, Mr. Mahadevan was Chief Strategy Officer of NetApp, Inc., a storage and data management company, from November 2010 to March 2012. From January 2009 to September 2010, Mr. Mahadevan was Vice President of Marketing and Business Line Executive at LSI Corp., a semiconductor and software company. From December 2007 through June 2008, he served as Chief Executive Officer of Deeya Energy, Inc., an energy storage technology company. Mr. Mahadevan serves on the board of directors of Overland Storage, Inc., formerly Overland Data, Inc. Mr. Mahadevan has a B.S. from the Indian Institute of Technology, Madras, and an M.S. and MBA from the University of Iowa. Our Board has concluded that

17

Mr. Mahadevan should serve as a director because of his executive experience in the technology industry and specifically his experience in the enterprise storage space.

David B. Walrod has served as a member of our Board since September 2011. Mr. Walrod has served on the board of directors of LumaSense Technologies, Inc., a provider of temperature and gas sensing instruments, since November 2005, TrustID, Inc., a provider of physical authentication solutions, since December 2009. Superior Care Pharmacy, Inc., a pharmacy services provider, since March 2010 and also as its president since March 2010,and Pier 88, LLC, an investment management company since September 2013. Mr. Walrod has served as Executive-in-Residence at Vodafone, a telecommunications provider, since August 2012, and as an independent investor and advisor since April 2007. He has also served as a Venture Partner of Bridgescale Partners, a venture capital investment company, from April 2009 to December 2011 and a General Partner of Oak Investment Partners, a venture capital investment company, from March 1999 to April 2007. Mr. Walrod received a J.D. from Harvard Law School, a Ph.D. in Physics from the Massachusetts Institute of Technology and a B.A. in Physics from the University of California, Berkeley. Our Board has concluded that Mr. Walrod should serve as a director due to his extensive board experience as a venture capitalist investing in growth technology companies, which brings industry and investment experience to the board of directors.

Director Nominee

Bruce H. Grant, 56, has been nominated by our Board for election to the Board to replace Cheemin Bo-Linn, who has decided not to stand for election. Mr. Grant has been the chairman of Applied Value LLC, a management consulting firm with offices in New York and Stockholm that specializes in cost and capital efficiency. Since December 20014, Mr. Grant also has been the chairman of Garden Growth Capital LLC and Garden Growth Industries AB, which are investment firms that acquire ownership positions in public and private companies. Since June 2005, Mr. Grant has been the chairman of Applied Venture Capital LLC, which invests in early stages of private companies. Mr. Grant serves on the boards of directors of a number of public and private companies in Sweden and also serves as a director of Friends of Hand in Hand International, a member of the Hand in Hand Network, a global group of non-governmental organizations working to fight poverty in ten countries. Mr. Grant holds a BSc in Chemistry and Mathematics and an MSc in Business Economics from the University of Gothenburg in Sweden and is a PhD Candidate at Chalmers University of Technology in Sweden. Our Board has concluded that Mr. Grant should serve as a director because of his extensive management consulting experience, his experience as a director and his substantial equity ownership position (nearly 10%) in the Company.

EXECUTIVE OFFICERS

The following sets forth to biographical information of our executive officers as of April 30, 2016:

| | | | | | |

Name | | Age | | | Position |

Kevin A. DeNuccio | | | 56 | | | President, Chief Executive Officer and Director |

Cory J. Sindelar | | | 47 | | | Chief Financial Officer |

Ebrahim Abassi | | | 61 | | | Chief Operating Officer |

Said Ouissal | | | 39 | | | Senior Vice President, Worldwide Field Operations |

A description of the business experience ofKevin A. DeNuccio is provided above under the heading “Board of Directors.”

Cory J. Sindelar has served as our Chief Financial Officer since December 2011. Prior to joining us, Mr. Sindelar served as the Chief Financial Officer from March 2011 to December 2011 and as a Consultant from December 2010 to March 2011 of Kilopass Technology, Inc., a memory semiconductor company. He also previously served as Chief Financial Officer of Ikanos Communications, Inc., a semiconductor and software provider, from September 2006 to July 2010. From 2003 to 2006, Mr. Sindelar held various finance positions at

18

EMC Corporation. From 2000 to 2003, Mr. Sindelar was Vice President, Corporate Controller and Principal Accounting Officer at Legato Systems, Inc., which was acquired by EMC. Mr. Sindelar holds a B.S. in Business Administration from Georgetown University.

Ebrahim Abassihas served as our Chief Operating Officer since March 2016. Mr. Abbasi previously served as our Senior Vice President of Operations since 2014. Prior to joining us, and beginning in 2012, Mr. Abbasi was employed by Roamware, Inc. (now Mobileum), a provider of voice and data roaming solutions. Mr. Abbasi held the position of President at Roamware and was responsible for the operations organization. Prior to joining Roamware in 2012, Mr. Abbasi held the position of President and Chief Operating Officer at Force10 Networks, Inc., a computer networking company that developed and marketed Ethernet switches. From 2001 to 2009, Mr. Abbasi held the position of Senior Vice President of Operations at Redback Networks, Inc., a telecommunications equipment company. Mr. Abbasi holds both a bachelor’s and a master’s degree in electrical engineering from the University of Tehran.

Said Ouissalas served as our Senior Vice President, Worldwide Field Operations, since May 2015 after serving as our Senior Vice President of Product Management and Strategy since March 2014. Prior to joining us in March 2014, Mr. Ouissal served as Vice President, Product Management, for Juniper Networks from October 2012 to April 2014. From June 2009 to September of 2012, Mr. Ouissal held the position of Vice President, Strategy and Customer Engagement, at Ericsson. From December 2001 to June 2009, Mr. Ouissal held the position of Director and Vice President, Systems Engineering, for Redback Networks. Prior to joining Redback Networks, Mr. Ouissal held various research and development, engineering, and operational and technical support positions with a number of companies, including Conxion, Versatel, Alcatel, Xylan, Bay Networks and Lucent Technologies. Mr. Ouissal holds a bachelor’s degree in computer science from the Saxion University of Applied Sciences in the Netherlands.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 31, 2016, the number of shares of common stock beneficially owned by:

| | • | | each person or group of persons known to us to be the beneficial owner of more than 5% of our common stock; |

| | • | | each of our named executive officers and directors; and |

| | • | | all or our named executive officers and directors as a group. |

Unless otherwise noted below, the address of each beneficial owner listed in the table is: c/o Violin Memory, Inc., 4555 Great America Parkway, Santa Clara, California 95054.

We have determined beneficial ownership in accordance with the rules and regulations of the SEC. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons and entities named in the table below have sole voting and investment power with respect to all shares of common stock that they beneficially own, subject to applicable community property laws. Except as otherwise indicated, each director and named executive officer (1) has sole investment and voting power with respect to the securities indicated or (2) shares investment and/or voting power with that individual’s spouse.

19

Applicable percentage beneficial ownership data is based on 99,169,243 shares of our common stock outstanding as of March 31, 2016. In computing the number of shares of capital stock beneficially owned by a person and the percentage beneficial ownership of that person, we deemed outstanding shares subject to options, restricted stock units and warrants held by that person that are currently exercisable or exercisable or vesting within 60 days of March 31, 2016. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person. Beneficial ownership representing less than one percent is denoted with an “*”.

| | | | | | | | |

Name and Address of Beneficial Owner | | Number of

Shares

Beneficially

Owned (1) | | | Percentage

of Class | |

5% Stockholders: | | | | | | | | |

Bruce H. Grant (2) | | | 9,450,000 | | | | 9.5 | % |

Entities affiliated with Toshiba (3) | | | 9,161,126 | | | | 9.2 | % |

Entities affiliated with Wellington Management Group LLP (4) | | | 6,317,226 | | | | 6.4 | % |

Mark N. Rosenblatt (5) | | | 5,374,710 | | | | 5.4 | % |

| | |

Executive Officers and Directors: | | | | | | | | |

Kevin A. DeNuccio (6) | | | 3,598,054 | | | | 3.6 | % |

Cory J. Sindelar (7) | | | 460,667 | | | | * | |

Ebrahim Abassi (8) | | | 1,312,500 | | | | 1.3 | % |

Said Ouissal (9) | | | 407,582 | | | | * | |

Georges A. Antoun (10) | | | 138,666 | | | | * | |

Cheemin Bo-Linn (11) | | | 100,928 | | | | * | |

William H. Kurtz (12) | | | 48,258 | | | | * | |

Lawrence J. Lang (13) | | | 465,326 | | | | * | |

Donald J. Listwin (14) | | | 2,836,000 | | | | 2.9 | % |

Vivekanand Mahadevan (15) | | | 90,700 | | | | * | |

Richard N. Nottenburg (16) | | | 288,333 | | | | * | |

David B. Walrod (17) | | | 508,303 | | | | * | |

All Executive Officers and Directors as a group (12 persons) | | | 10,255,317 | | | | 10.3 | % |