UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| | | | |

| | | For the fiscal year ended May 31, 2008 | |

| | | | |

| [ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT | |

| | | | |

| | | For the transition period from _________ to ________ | |

| | | | |

| | | Commission file number: 333-145910 | |

| Bold View Resources, Inc. |

| (Exact name of registrant as specified in its charter) |

| Nevada | 20-8584329 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

| 800 N. Rainbow Blvd., Las Vegas, NV | 89107 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number: 702-948-5023 | |

| | |

| Securities registered under Section 12(b) of the Exchange Act: | |

| | |

| Title of each class | Name of each exchange on which registered |

| none | not applicable |

| | |

| Securities registered under Section 12(g) of the Exchange Act: | |

| | |

| Title of each class | Name of each exchange on which registered |

| none | not applicable |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Check whether the Issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [x] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [X] No [ ]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. Not available

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 2,230,000 as of May 31, 2008.

PART I

In General

In General

We are an exploration stage company that intends to engage in the exploration of mineral properties. We have acquired an option to purchase an interest in mineral claims that we refer to as the Cupro mineral claims. Exploration of these mineral claims is required before a final determination as to their viability can be made. Our option on this property is currently unexercised. In the event that we do not exercise our option, we will have no interest in the Cupro mineral claims and will not be entitled to receive back any monies spent to maintain the option.

Our plan of operations is to carry out exploration work on these claims in order to ascertain whether they possess commercially exploitable quantities of copper, zinc, molybdenum, and other metallic minerals. We will not be able to determine whether or not the Cupro mineral claims contain a commercially exploitable mineral deposit, or reserve, until appropriate exploratory work is done and geological and economic evaluations based on that work indicate economic viability.

Some geological and geochemical work was performed under Phase 1 of our exploration program during the reporting period. The work was performed by our consulting geologist, Mr. David Bridge, for a total cost of $17,000. We paid $9,440 in exploration expenses for the year, and the balance has just recently been invoiced to the company. Mr. Bridge performed the work in August 2007, and assays and reports were completed in November 2007. However, we just received a copy of these materials after the reporting period and have not had a chance to go over them with Mr. Bridge, as he is unavailable in the field on another project. As such, we have not been able to determine the impact of his work or the viability of exploitable resources on our claims.

We plan to review Mr. Bridge’s report and continue our work on Phase 1 of our exploration program. Once we receive the results of our Phase I exploration, our board of directors, in consultation with our consulting geologist, will assess whether to proceed with further exploration. Phase II of our exploration program will cost approximately $140,000. The existence of commercially exploitable mineral deposits in the Cupro mineral claims is unknown at the present time and we will not be able to ascertain such information until we receive and evaluate the results of our exploration program.

Our Option Agreement

Mr. W.A. Howell staked and recorded his ownership in the Cupro mineral claims under the mineral claim staking and recording procedures in place at that time in the Province of British Columbia. Under that system, a prospector in the field drives large wooden claim stakes into the ground outlining the boundaries of his mineral claim and subsequently records a description of the claim and the location of the claim stakes at the nearest Provincial Mining Recorder’s Office. A party is able to stake and record an interest in a particular mineral claim if no other party has

an interest in the said claim that is in good standing and on record at the Provincial Mining Recorder’s Office. There is no formal agreement between Mr. Howell and the Province of British Columbia.

Mr. Howell’s interest in the Cupro mineral claims will continue into perpetuity provided that the mineral claims remain in good standing by paying the applicable fee which is based upon whether exploration work takes place. If exploration work take places and expenditures are made for this purpose in an amount stipulated by the government, the claims can be maintained in good standing by simply remitting a filing fee to the Province of British Columbia that currently does not exceed $115. If no exploration work takes place, the claims can be kept in good standing by remitting to the Province of British Columbia the stipulated amount that otherwise was required to be expended for exploration work together with the payment of a filing fee or payment that currently does not exceed $115.

In order to extend the expiry dates of a mineral claim, the British Columbia government requires either (1) completion of exploration work on the mineral claims valued at an amount stipulated by the government and the payment of a filing fee; or (2) payment to the Province of British Columbia the stipulated amount that otherwise was required to be expended for exploration work in lieu of completing exploration work and the payment of a filing fee to maintain the mineral claims. When exploration work valued at an amount stipulated by the government is completed and a filing fee is remitted to the Province of British Columbia, the expiry dates of the mineral claims can be extended for a maximum of 10 additional years at a time. In the event that no exploration work is completed and a filing fee and additional fee are paid to the Province of British Columbia in lieu of completing exploration work, the expiry dates of the mineral claims can be extended for a maximum of only 1 additional year.

Under the terms of the Mining Option Agreement between Bold View Resources, Inc. and Mr. Howell, we acquired an option to purchase a 100% interest in the Cupro mineral claims. Under that Agreement, we have already paid Mr. Howell an initial sum of C$10 to acquire the option and an additional option payment of C$7,500, which was due prior to January 31, 2007. The Agreement also requires an additional C$15,000 prior to December 31, 2008 and an additional C$25,000 due prior to December 31, 2009. In addition, we incurred C$10,000 in exploration expenditures prior to December 31, 2007, and we must incur further exploration expenses of C$50,000 prior to December 31, 2008, and C$100,000 prior to December 31, 2009. Under the terms of the Mining Option Agreement, we are to exercise our option by making the above payments and incurring the above exploration expenses. We also agree to incur C$250,000 in exploration expenditures on or before October 31 of each year subsequent to 2009.

We will either satisfy the payment terms of the Mining Option Agreement in the time frame provided, thereby resulting in us exercising this option, or we will fail to satisfy the payment terms and be in default of the Mining Option Agreement. The Optionor can terminate the Mining Option Agreement if we fail to cure any default within 45 days after the receipt of notice of default. Our option will expire if we are in default of the Mining Option Agreement and fail to cure any default within 45 days after the receipt of notice of default.

We selected Cupro mineral properties based upon an independent geological report, which was commissioned from David J. Bridge, a Consulting Geologist. Mr. Bridge recommended a two-phase exploration program on these claims that will cost us approximately US$200,000.

Description and Location of the Cupro mineral claims

The Cupro mineral claims consist of the following claims located in the New Westminster Mining Division of British Columbia:

| TENURE | TYPE | NAME | GOOD TO DATE | STATUS | AREA ha |

| 539301 | Mineral | CUPRO | 2009/aug/14 | GOOD | 527.247 |

| 539307 | Mineral | | 2009/aug/14 | GOOD | 527.355 |

| 539311 | Mineral | | 2009/aug/14 | GOOD | 253.056 |

| 540085 | Mineral | CUPRO5 | 2008/aug/29 | GOOD | 126.576 |

| 549027 | Mineral | TOP1 | 2009/jan/10 | GOOD | 337.341 |

| 549028 | Mineral | TOP 2 | 2009/jan/10 | GOOD | 252.979 |

| 549029 | Mineral | TOP 3 | 2009/jan/10 | GOOD | 442.72 |

The Province of British Columbia owns the land covered by the Cupro mineral claims. Currently, we are not aware of any native land claims that might affect the title to the mineral claims or to British Columbia’s title to the property. Although we are unaware of any situation that would threaten these claims, it is possible that a native land claim could be made in the future. The federal and provincial government policy at this time is to consult with all potentially affected native bands and other stakeholders in the area of any potential commercial production. If we should encounter a situation where a native person or group claims an interest in these claims, we may choose to provide compensation to the affected party in order to continue with our exploration work, or if such an option is not available, we may have to relinquish any interest that we hold in these claims.

Prior to the expiry dates listed above, we plan to file for an extension of the Cupro mineral claims if we have exercised our option to purchase the claims from Mr. Howell. In order to extend the expiry dates of a mineral claim, the government requires either (1) completion of exploration work on the mineral claims valued at an amount stipulated by the government and the payment of a filing fee; or (2) payment to the Province of British Columbia the stipulated amount that otherwise was required to be expended for exploration work in lieu of completing exploration work and the payment of a filing fee to maintain the mineral claims.

Currently, an exploration work value of approximately $1.30 per acre is required during each of the first three years after a claim is acquired and an exploration work value of approximately $2.60 per acre is required in subsequent years. This stipulated amount of expenditures toward exploration work is set by the Province of British Columbia and can be altered in their sole discretion. Mr. W.A. Howell originally staked and recorded his ownership in the Cupro mineral claims. Exploration expenditures on the Cupro mineral claims must be completed and filed with

the Province in the required amounts per acre, depending on the claim, or this amount must be paid to the Province of British Columbia by the respective date. A maximum of ten years of work credit may be filed on a claim at a time.

The exploration fees we anticipate incurring over the coming twelve months will result in an extension of the expiry dates of the mineral claims for the maximum of ten years provided that a report and filing fee not exceeding $115 is remitted to the Province of British Columbia. In the event that no exploration work is completed and a filing fee is paid to the Province of British Columbia in lieu of completing exploration work, the expiry dates of the mineral claims can be extended only on an annual basis into perpetuity for a maximum of only one additional year. If the required exploration work expenditure is not completed and filed with the Province in any year or if a payment is not made to the Province of British Columbia in lieu of the required work within this year, the mineral claims will lapse and title with revert to the Province of British Columbia.

Geological Exploration Program in General

We have obtained an independent Geological Report and have acquired an option to purchase the Cupro mineral claims. David J. Bridge, Consulting Geologist, has prepared this Geological Report and reviewed all available exploration data completed on these mineral claims. A primary purpose of the geological report is to review information, if any, from the previous exploration of the mineral claims and to recommend exploration procedures to establish the feasibility of commercial production project on the mineral claims. The report, among other things, lists the mineral titles on the Cupro property, describes the location and access to the property, provides climate and physiographic information, contains a history and geology of the property, and reviews adjacent properties. The report also gives conclusions regarding potential mineralization of the mineral claims and recommended a further geological exploration program.

David J. Bridge is a geologist with offices at 380-1199 W. Pender Street, Vancouver, BC V6H 2R4

In his Geological Report, Mr. Bridge prepared a summary as follows:

The company has acquired a large property within the Harrison Lake volcanic package, situated on Mt. Woodside near Harrison Mills, BC., east of Mission City The property encompasses a number of showings which have characteristics of volcanogenic massive sulphide (VMS) deposits. In addition there is a silver-mercury showing at low elevations which was rediscovered about 1975, but which has not been explored in detail. The property was inspected August 14, 2007 accompanied by property owner Bill Howell, P. Geo. and Barry Price, M.Sc., P. Geo.

The property is situated adjacent to Harrison Mills BC, a small community between Mission and Agassiz on the Loughheed Highway on the north side of Fraser River, approximately 75 miles east of Vancouver Be. The CPR main rail line passes through the property. The Loughheed Highway and a number of

logging roads provide access to the property. Small private land holdings at lower elevations are occupied as residential Jots, but these do not affect the target areas.

The property contains the following showings:

| 1. | Ascot, Fab, Treblif Volcanogenic Massive Sulphide ("VMS") showings with copper, lead, zinc sulphides in stringer zones. |

| 2. | Fairplay, St. Alice VMS showings |

| 3. | HVB showing An Epithermal? Showing of Mercury/Copper-¬Silver mineralization in altered volcanics, possibly related to a major fault. |

| 4. | A fourth showing, the Valleyview/Midnight; VMS showing is just outside the east boundary of the property, on claims owned by Armstrong Sand and Gravel to the east of the Cupro property, and is occupied by a gravel and aggregate operation. |

The claims are situated at low to moderate elevations, within the influence of the Vancouver "maritime" climate, and can be worked for most of the year unless heavy snow falls.

The property is under-explored, although several Assessment reports are available which describe the work done fairly well. The volcanic package contains numerous gold, silver and VMS showings, of which the most prominent is the "Seneca" volcanogenic massive sulphide deposit, situated 10 kilometres to the north, and now being explored by Carat Explorations Ltd. Other VMS prospects in the same rock package are being explored at Norrish Creek and Chehalis Lake areas. As at the Seneca deposits to the north, mineralized footwall volcaniclastics and sediments and hangingwall unmineralized massive volcanic rocks have been recognized, which assists in defining the target for polymetallic volcanogenic massive sulphide (VMS) deposits.

A prominent linear is visible on topographic maps, landsat photos and air photos which trends from Seneca directly through the Cupro claims. This feature has not been prospected or explored.

This report summarizes work done on the various showings in the past and sets out a proposed exploration program and budget for the next two phases of exploration.

Suggested work involves:

Prospecting and mapping

Inspection of the known showings, with rock and soil samples Compilation of existing geochemical surveys

Airborne magnetic-VLF-radiometric surveys

IP surveys over favourable areas

Drilling of IP anomalies, airborne geophysical anomalies or geochemical anomalies

A first phase budget of US$ 60,000 and a second phase budget of US$ 140,000 for a total of US$ 200,000 is recommended.

We have done a portion of the work recommended in phase one and are currently reviewing the results with our consulting geologist. Our exploration program is exploratory in nature and there is no assurance that mineral reserves will be found. The details of the Geological Report are provided below.

Exploration History of the Cupro Mineral Claims

The history of the exploration of the mineral claims is described in the report that was prepared by our geological consultant, David J. Bridge. The following summary of the exploration history of the mineral claims is based on our consultant’s description.

A brief history of the showings within or near the property is derived from Minister of Mines Annual Reports, Assessment Reports and Minfile.

1897-1888: Two claims were staked on the banks of the Fraser, on what is now the Fairplay and Queen Crown grants. A lengthy tunnel was driven into the hill from near the railway tracks, following the trace of two mineralized zones with polymetallic copper-lead zinc mineralization. Claims were also known as Lady Jane, Fat Man, Queen and St. Alice. No plans of the workings remain

1929: This property was acquired by the late Frank E Woodside as the FEW claims. There is no record of additional work done.

1966: Trenching was carried out on the Ascot property by Ascot Mines Ltd. on mineralized showings near the switchback on the access road (approximately the same location as the later 1971 work). Work was also done on the nearby PF and Midnight property (now within the sand and gravel operation) by C.J. Coveney for Bethex Exploration Ltd. An IP survey was completed, 6 trenches totaling 1,950 ft. were cut, and two drillholes totaling 1,056 feet were completed. A number of mineralized zones were explored.

1971: Mapping and sampling was done on the Fab claims, adjacent to the Ascot property by geologist David Cooke, P.Eng., for Gary Schell of Geoquest Ltd. Stringer and vein polymetallic mineralization was seen. Approximately $1,250 was expended.

1973: Harry Vernon Barley of Mission staked two claims on the copper-silver-mercury mineralized zones at the base of Mt. Woodside about 1 km east of Harrison River bridge. The property was inspected and sampled by geologist Barry Price, P.Geo in 1974 for Delphi Resources Ltd., a private company.

1981: A small program of mapping and sampling was done on the Treblif property (covering the same area as Fah) by Tim Sadlier Brown, P.Eng. for Invermay Resources Ltd. (Mel Pardek).

1984: A geological program was completed by Ken Northcote, Ph.D. for Star Mountain Resources Inc. on the Valleyview (Midnight) area claims to the east of the Cupro property. Grab, or selected samples, assayed from 0.016% to 10.20% copper, and containing up to 9.6 oz/ton silver over narrow widths. Approximately $9,700 was expended. K.E. Northcote and Associates Ltd. were contracted by Star Mountain Resources Inc. to-carry out a ground magnetometer survey on the Valley View and Goldtop claims and prepare a report outlining the results of this work.

1988: Also on the Valleyview claims, a geological program was completed by Marion Blank, B.Sc., for Gila Bend Resource Corp. The program looked at two showings:

1. Valley View Showing: A strong northeasterly trending zone of hydrothermal alteration with massive sulphide mineralization along two superimposed fracture patterns -020 degrees and 310 degrees. Major mineralization consists of coarse crystalline pyrite, less chalcopyrite, minor sphalerite and galena with silver values and trace gold values.

2. Stacey Creek Showing: A siliceous brecciated alteration zone with irregular veins of barite. Minor sulphide mineralization consisting of pyrite, chalcopyrite, galena and sphalerite occurs locally in association with sericitic and siliceous alteration. Minor gold values were also noted.

The work program included comprehensive mapping, magtnetometer and VLF EM surveys at a total cost of $46,000.

While minor other prospecting has been done on Mt. Woodside since that time (Murray MacLaren, personal communication) no other geological, geophysical, or geochemical work has been filed with the government.

Showings

The primary showings (geological evidence of local mineralization) of interest on the Cupro mineral claims property are noted below:

HVB showing.

This showing occurs along the west facing slope of Mt. Woodside where the fields adjoin the Highway. Along the slope are indications of probable shallow adits with some vein mineralization with Tetrahedrite (Copper Antimony sulphide) and minor Cinnabar (Mercuric sulphide) in quartz/carbonate veins. The property was briefly staked in about 1973 by Harry

Vernon Barley. BJ Price wrote up a brief summary for Delphi Resources Ltd, a private company, in 1974. Seven samples were taken by Price in 1974 and noted in our Geologist’s report.

Ascot Showing:

At the Ascot showing, the volcanic rocks are locally silicified and mineralized with sulphides, mainly pyrite, with minor amounts of chalcopyrite and a trace of sphalerite. Mineralization is associated with quartz stringers striking west-northwest and dipping steeply northeast in altered siliceous volcanic rocks including agglomerate or andesite flow breccia. A film of chalcocite coats the other sulphides where the stringers are vuggy. These sulphides also occur in small amounts in the country rock together with heavy concentrations of pyrite.

In the same vicinity, chalcopyrite is reported (Minfile) to occur in a shear in porphyritic andesite. The shear is 15 centimeters wide, strikes 110 degrees, dips 65 degrees southwest and is parallel to a band of grey, cherty pyritic rock about 3 meters wide. A sample of a sulphide-rich gossan zone yielded 0.35 per cent copper and less than 0.1 gram per ton gold.

Mineralization at the Ascot (or Fab) showing is described by D.L Cooke P.Eng. as follows: Pyrite Is the most widespread form of sulphide mineralization, and its abundance appears to be directly correlated with the intensity of fracturing and/or rock types. Little or no pyrite was observed in the massive rhyolite and dacite flows.

From a trace to about 5% pyrite was noted in the andesite flows, and up to 20% pyrite in some outcrops of rhyolitic fragmental rocks. Pyrite occurs both in disseminated cubes and as sub-massive sulphide associated with fractures and quartz stringers within these siliceous pyroclastic members. Like the fragmented host rocks, these areas of intense mineralization have not been traced for any appreciable distances.

Minor amounts of chalcopyrite and a trace of sphalerite are associated with quartz stringers in altered siliceous agglomerates near the southeast boundary of the (former) Fab No.2 claim. These sulphides also occur in small amounts together with the heavy pyrite impregnating the country rock.

Where some of the stringers are vuggy, a secondary black film of chalcocite coats the other sulphides. Traces of disseminated chalcopyrite also occur in association with pyrite.

Copper-zinc-silver mineralization in a similar volcanic setting has been reported on the adjacent Ascot claims to the east, and on the Seneca claims which lie several miles to the northwest on the west side of Harrison Lake.

Playfair showing

Although the Playfair showing appears to be covered by two crown-granted mineral claims, ownership of this property is uncertain. There were two "lodes" reported in 1897, explored from working near the railway level. Polymetallic mineralization is present but it is not known whether this is vein material or VMS or Kuroko type mineralization. The showing should be mapped and sampled in detail.

Recommendations from Our Consulting Geologist

In his Geological Report, Mr. Bridge prepared conclusions and recommendations of the exploration program as follows:

CONCLUSIONS

The Cupro property, which has been explored intermittently in the past by a number of junior companies, each with small claim holdings, has been assembled into one large property which can now be explored by modern geochemical and geophysical methods.

Although there are no immediate drill targets, comparison with adjacent VMS properties such as the Seneca property, suggests that similar massive sulphide mineralization could occur in the area.

With volcanic packages such as the Harrison Lake formation (host to the Seneca deposits and the Cupro showings), deposits are generally found in strongly altered “footwall” volcanic (tuffs and volcanic sediments) generally at a sedimentary interface. The deposits are overlain by relatively unaltered, massive “Hangingwall” volcanics which are fresh and unmineralized. Such a ssuccession is present at Mr. Woodside, where the known showings are at the base of the mountain, overlain by massives and volcaniclastics. This provides a good exploration target, and it appears that Footwall and Hanginwall sequences have been recognized.

RECOMMEDATIONS

Initially, base maps should be prepared at a favorable scale. New TRIM topographical maps are appropriate, and can be purchased in digital format.

1

A comprehensive prospecting and mapping program is suggested, to be followed by geochemical soil and silt stream sediment surveys and rock sampling. Any anomalous areas should have Induced Polarization (IP) survey grids completed to try and outline areas with sulphides.

An airborne geophysical multi-sensor survey might be useful, in light of the steep and relatively inaccessible terrain on the north slope of the mountain. If areas of interest are outlined by any one or more of the above noted surveys, a program of diamond drilling would follow.

Exploration Budget

| Phase I | Exploration Expenditure |

| Compilation of Geochemical data | $ | 7,000 |

| Prospecting | $ | 8,000 |

| Geochemical mapping, sampling | $ | 18,000 |

| Vehicles, Fuel | $ | 5,500 |

| Room & Board | $ | 4,500 |

| Analyses | $ | 6,000 |

| Supplies | $ | 1,000 |

| Report | $ | 6,000 |

| | $ | 55,000 |

| Contingencies @10% approximately | $ | 5,000 |

| Phase I Total | $ | 60,000 |

| | | |

| Phase II | | |

Geophysical surveys and drilling | $ | 140,000 |

| Phase II Total | $ | 140,000 |

| | | |

| Total, Phases I and II | $ | 200,000 |

We completed a portion of Phase 1 during the reporting period and because of a delay in receiving the results, we are currently evaluating that work program Upon our review of the results, we will assess whether the results are sufficiently positive to warrant additional phases of the exploration program. We will make this decision to proceed with further phases based upon our consulting geologist’s review of the results and his recommendations. In order to complete Phase I and any additional phases, we will need to raise additional capital. We plan to raise additional capital in the amount of $125,000 to $150,000 during the fiscal year ending May 31, 2009 by seeking additional funds from existing investors or by offering equity securities to new investors.

Competition

The mineral exploration industry, in general, is intensely competitive, and even if commercial quantities of reserves are discovered, a ready market may not exist for the sale of the reserves.

Most companies operating in this industry are more established and have greater resources to engage in the production of mineral claims. We were incorporated on January 30, 2007 and our operations are not well established. Our resources at the present time are limited. We may exhaust all of our resources and be unable to complete the exploration of the Cupro mineral claims. There is also significant competition to retain qualified personnel to assist in conducting mineral exploration activities. If a commercially viable deposit is found to exist and we are unable to retain additional qualified personnel, we may be unable to enter into production and achieve

profitable operations. These factors set forth above could inhibit our ability to compete with other companies in the industry and enter into production of the mineral claims if a commercial viable deposit is found to exist.

Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in our not receiving an adequate return on invested capital.

Compliance with Government Regulation

The main agency that governs the exploration of minerals in the Province of British Columbia, Canada, is the Ministry of Energy and Mines.

The Ministry of Energy and Mines manages the development of British Columbia's mineral resources, and implements policies and programs respecting their development while protecting the environment. In addition, the Ministry regulates and inspects the exploration and mineral production industries in British Columbia to protect workers, the public and the environment.

The material legislation applicable to Bold View Resources, Inc. is the Mineral Tenure Act, administered by the Mineral Titles Branch of the Ministry of Energy and Mines. The initial phase of our exploration program will consist of hand trenching, sampling, mapping, and possibly a segment of an electronic based geological exploration technique referred to as Induced Polarization. The practice in British Columbia under this act has been to request permission for such a program in a letter to the B.C. Ministry of Energy and Mines. Permission is usually granted within one week. Should a follow-up exploration program be undertaken, it would probably be intended to refine information garnered in the first phase employing the same methods of exploration.

The B.C. Ministry of Energy and Mines administers the Mines Act, the Health, Safety and Reclamation Code and the Mineral Exploration Code. Ongoing exploration programs likely will be expanded to include activities such as line cutting, machine trenching and drilling. In such circumstance, a reclamation deposit is usually required in the amount of $3,000 to $5,000. The process of requesting permission and posting the deposit usually takes about 2 weeks. The deposit is refundable upon a Ministry of Energy and Mines inspector’s determination that the exploration program has resulted in no appreciable disturbance to the environment.

The Mineral Tenure Act and its regulations govern the procedures involved in the location, recording and maintenance of mineral and placer titles in British Columbia. The Mineral Tenure Act also governs the issuance of mining leases, which are long term entitlements to minerals, designed as production tenures. At this phase in the process, a baseline environmental study would have to be produced. Such a study could take many months and cost in excess of $100,000.

All mineral exploration activities carried out on a mineral claim or mining lease in British Columbia must be in compliance with the Mines Act. The Mines Act applies to all mines during exploration, development, construction, production, closure, reclamation and abandonment. Additionally, the provisions of the Health, Safety and Reclamation Code for mines in British Columbia contain standards for employment, occupational health and safety, accident investigation, work place conditions, protective equipment, training programs, and site supervision. Also, the Mineral Exploration Code contains standards for exploration activities including construction and maintenance, site preparation, drilling, trenching and work in and about a water body.

Additional approvals and authorizations may be required from other government agencies, depending upon the nature and scope of the proposed exploration program. If the exploration activities require the falling of timber, then either a free use permit or a license to cut must be issued by the Ministry of Forests. Items such as waste approvals may be required from the Ministry of Environment, Lands and Parks if the proposed exploration activities are significantly large enough to warrant them.

If we progress to the production phase, production of minerals in the Province of British Columbia will require prior approval of applicable governmental regulatory agencies. We cannot be certain that such approvals will be obtained. The cost and delay involved in attempting to obtain such approvals cannot be known in advance.

We will also have to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy any environmental damage caused such as refilling trenches after sampling or cleaning up fuel spills. Our initial exploration program does not require any reclamation or remediation because of minimal disturbance to the ground. The amount of these costs is not known at this time because we do not know the extent of the exploration program we will undertake, beyond completion of the recommended exploration phase described above, or if we will enter into production on the property. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on our earnings or competitive position in the event a potentially economic deposit is discovered.

Employees

We have no employees other than our president and CEO, Mr. Howie, and our Secretary and Treasurer, Mrs. Zimmerman. We conduct our business largely through agreements with consultants and other independent third party vendors.

Research and Development Expenditures

We have not incurred any research or development expenditures since our incorporation.

Subsidiaries

We have neither formed, nor purchased any subsidiaries since our incorporation.

Patents and Trademarks

We do not own, either legally or beneficially, any patent or trademark.

A smaller reporting company is not required to provide the information required by this Item.

Item 1B. Unresolved Staff Comments

A smaller reporting company is not required to provide the information required by this Item.

We have acquired an option to purchase the Cupro mineral claims. We do not own or lease any property.

Mineral Claims

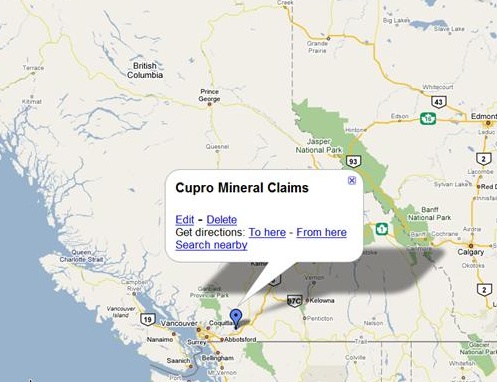

The Cupro group of reverted crown granted mineral claims is located adjacent to Harrison Mills, BC, a small community between Mission and Agassiz on the Loughheed Highway on the north side of the Fraser River, approximately 75 miles east of Vancouver, B.C. The CPR main line passes through the property. The Loughheed Highway and a number of logging roads provide access to the property. The following maps indicate the location of the Cupro mineral claims within the surrounding area.

Map 1

Map 2

Corporate Offices

Our principal offices are located at 800 North Rainbow Blvd, Ste 208, Las Vegas, NV 89107. Our phone number is 702-948-5023. Our agent for service of process in Nevada is Nevada State Resident Agent Services, Inc., 3838 Raymert Drive, Suite 10A, Las Vegas, NV 89121.

Item 3. Legal Proceedings

We are not a party to any pending legal proceeding. We are not aware of any pending legal proceeding to which any of our officers, directors, or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material interest adverse to us.

Item 4. Submission of Matters to a Vote of Security Holders

No matters were submitted to a vote of the Company's shareholders during the quarter ended May 31, 2008.

PART II

Item 5. Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our common stock is currently quoted on the OTC Bulletin Board (“OTCBB”), which is sponsored by FINRA. The OTCBB is a network of security dealers who buy and sell stock. The dealers are connected by a computer network that provides information on current "bids" and "asks", as well as volume information. Our shares are quoted on the OTCBB under the symbol “BLVW.OB.”

The following table sets forth the range of high and low bid quotations for our common stock for each of the periods indicated as reported by the OTCBB. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| Fiscal Year Ending May 31, 2008 |

| Quarter Ended | | High $ | | Low $ |

| May 31, 2008 | | n/a | | n/a |

Penny Stock

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the

market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty selling our securities.

Holders of Our Common Stock

As of May 31, 2008, we had 2,230,000 shares of our common stock issued and outstanding, held by 36 shareholders of record.

Dividends

The Company has not declared, or paid, any cash dividends since inception and does not anticipate declaring or paying a cash dividend for the foreseeable future.

Nevada law prohibits our board from declaring or paying a dividend where, after giving effect to such a dividend, (i) we would not be able to pay our debts as they came due in the ordinary course of our business, or (ii) our total assets would be less than the sum of our total liabilities plus the amount that would be needed, if the corporation were to be dissolved at the time of distribution, to satisfy the rights of any creditors or preferred stockholders.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have any equity compensation plans.

Item 6. Selected Financial Data

A smaller reporting company is not required to provide the information required by this Item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. We intend such forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and are including this statement for purposes of complying with those safe-harbor provisions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse affect on our operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Further information concerning our business, including additional factors that could materially affect our financial results, is included herein and in our other filings with the SEC.

Plan of Operation in the Next Twelve Months

Our plan of operations is to proceed with the exploration of the Cupro mineral claims to determine whether there are commercially exploitable reserves of copper, zinc, molybdenum, and other metallic minerals. We have entered into a Mining Option Agreement regarding the Cupro mineral claims and intend to proceed with the initial exploration program as recommended by our consulting geologist.

Our total expenditures over the next twelve months, excluding costs associated with being a public company, are anticipated to be approximately $74,313 as we undertake Phase I exploration. Specifically, we expect to incur approximately $60,000 in connection with the commencement of Phase I of our recommended geological work program. We will also expend C$15,000 in connection with the Option Agreement and monies due to Mr. Howell prior to December 31, 2008, or approximately $14,313. We had a working capital deficit in the amount of $4,108 as of May 31, 2008. As such, we have insufficient funds to cover our anticipated expenditures in the next twelve months. However, we plan to raise equity financing in the amount of $125,000 to $150,000, and that should be enough to cover the approximately $74,313

in anticipated expenditures in the next twelve months. Any remaining monies will be carried forward to complete Phase I and begin Phase II. Because of the uncertainties inherent in foreign currency exchange rates, there are uncertainties in our operational costs. Our accounting is in US$ while our Option Agreement payments and other expenses generally require payment in CAN$.

Some geological and geochemical work was performed under Phase 1 of our exploration program during the reporting period. The work was performed by our consulting geologist, Mr. David Bridge, for a total cost of $17,000. We paid $9,440 in exploration expenses for the year, and the balance has just recently been invoiced to the company. Mr. Bridge performed the work in August 2007, and assays and reports were completed in November 2007. However, we just received a copy of these materials after the reporting period and have not had a chance to go over them with Mr. Bridge, as he is unavailable in the field on another project. As such, we have not been able to determine the impact of his work or the viability of exploitable resources on our claims.

We plan to review Mr. Bridge’s report and continue our work on Phase 1 of our exploration program. Once we receive the results of our Phase I exploration, our board of directors, in consultation with our consulting geologist, will assess whether to proceed with further exploration. In making this determination to proceed with a further exploration program, we will make an assessment as to whether the results of the Phase I exploration program are sufficiently positive to enable us to proceed. This assessment will include an evaluation of our cash reserves after the completion of the initial exploration, the price of minerals, and the market for the financing of mineral exploration projects at the time of our assessment.

In the event the results of our initial exploration program prove not to be sufficiently positive to proceed with further exploration on the Cupro mineral claims, we intend to seek out and acquire interests in other North American mineral exploration properties, which, in the opinion of our consulting geologist, offer attractive mineral exploration opportunities. If we are unable locate and acquire such prospects, we may be forced to seek other business opportunities. Presently, we have not given any consideration to the acquisition of other exploration properties because we have only recently commenced our initial exploration program and have not received any results.

In the event our Phase II mineral exploration program is undertaken, it would likely result in significantly more geological data than Phase I because much of the infrastructure constructed in Phase I will still be available during Phase II exploration.

In the event our board of directors, in consultation with our consulting geologist, chooses to complete the Phase I and Phase II mineral exploration programs, we will require additional financing. The objective of the Phase I work is to identify areas that have a strong likelihood of hosting mineral deposits that can be explored further during Phase II. The objective of Phase II work is to commence diamond drilling in areas identified in Phase I to obtain core samples for geochemical analysis.

Upon the completion of the first two exploration phases, or any additional programs, which are successful in identifying mineral deposits, we will have to spend substantial funds on further drilling and engineering studies before we know that we have discovered a mineral reserve. A mineral reserve is a commercially viable mineral deposit.

Purchase of Significant Equipment

We do not intend to purchase any significant equipment over the next twelve months.

Results of Operations for the year ended May 31, 2008 and period from Inception (January 30, 2007) to May 31, 2008

We did not earn any revenues from inception through the period ending May 31, 2008. We do not anticipate earning revenues until such time that we are able to locate and exploit commercial reserves of copper, zinc, molybdenum, and other metallic minerals. We are presently in the exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on the Cupro mineral properties, or if such resources are discovered, that we will enter into commercial production.

We incurred operating expenses in the amount of $34,377 for the year ended May 31, 2008, and $42,108 from our inception on January 30, 2007 to May 31, 2008. The operating expenses for the year ended May 31, 2008 included general and administrative expenses in the amount of $24,937 and mining exploration expenses in the amount of $9,440. The operating expenses for period from inception (January 30, 207) to May 31, 2008 included general and administrative expenses in the amount of $32,668 and mining exploration expenses in the amount of $9,440.

We anticipate our operating expenses will increase as we undertake our plan of operations. The increase will be attributable to undertaking the additional phases of our geological exploration program and the professional fees associated with our becoming a reporting company under the Securities Exchange Act of 1934.

We incurred a net loss of $34,377 for the year ended May 31, 2008 and $42,108 from our inception on January 30, 2007 through period ending May 31, 2008. Our losses for all periods are attributable to operating expenses and our lack of revenue.

Liquidity and Capital Resources

We had cash of $705 as our only current asset as of May 31, 2008. We had current liabilities of $4,813 as of May 31, 2008. We therefore had a working capital deficit of $4,108 as of May 31, 2008.

We have not attained profitable operations and are dependent upon obtaining financing to pursue exploration activities. For these reasons our auditors stated in their report that they have substantial doubt we will be able to continue as a going concern.

Off Balance Sheet Arrangements

As of May 31, 2008, there were no off balance sheet arrangements.

Going Concern

We have not attained profitable operations and are dependent upon obtaining financing to pursue exploration activities. For these reasons our auditors stated in their report that they have substantial doubt we will be able to continue as a going concern.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

A smaller reporting company is not required to provide the information required by this Item.

Item 8. Financial Statements and Supplementary Data

See the financial statements annexed to this annual report.

Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

None

Item 9A(T). Controls and Procedures

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in company reports filed or submitted under the Securities Exchange Act of 1934 (the “Exchange Act”) is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include without limitation, controls and procedures designed to ensure that information required to be disclosed in company reports filed or submitted under the Exchange Act is accumulated and communicated to management, including our chief executive officer and treasurer, as appropriate to allow timely decisions regarding required disclosure.

As required by Rules 13a-15 and 15d-15 under the Exchange Act, our chief executive officer and chief financial officer carried out an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures as of May 31, 2008. Based on their evaluation, they concluded that our disclosure controls and procedures were effective.

Our internal control over financial reporting is a process designed by, or under the supervision of, our chief executive officer and chief financial officer and effected by our board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of our financial reporting and the preparation of our financial statements for external purposes in accordance with generally accepted accounting principles. Internal control over financial reporting includes policies and procedures that pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of our assets; provide reasonable assurance that transactions are recorded as necessary to permit preparation of our financial statements in accordance with generally accepted accounting principles, and that

our receipts and expenditures are being made only in accordance with the authorization of our board of directors and management; and provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on our financial statements.

Under the supervision and with the participation of our management, including our chief executive officer, we conducted an evaluation of the effectiveness of our internal control over financial reporting based on the criteria established in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”). Based on this evaluation under the criteria established in Internal Control – Integrated Framework, our management concluded that our internal control over financial reporting was effective as of May 31, 2008.

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit us to provide only management’s report in this annual report.

During the most recently completed fiscal quarter, there has been no change in our internal control over financial reporting that has materially affected or is reasonably likely to materially affect, our internal control over financial reporting.

Item 9B. Other Information

None

PART III

Item 10. Directors, Executive Officers and Corporate Governance

The following information sets forth the names of our current directors and executive officers, their ages as of May 31, 2008 and their present positions.

| Name | Age | Position Held with the Company |

| Richard Howie | 49 | President, Chief Executive Officer, and Director |

| Marilyn Zimmerman | 53 | Treasurer, Secretary and Director |

Set forth below is a brief description of the background and business experience of executive officers and directors.

Richard Howie is our President, Chief Executive Officer, and one of our directors. As President, Mr. Howie is responsible for the day-to-day management of the Company and for the continued strategic evolution of its mineral exploration and development programs.

Mr. Howie, a metallurgical engineer, has a 26-year career related to the mining industry. Responsibilities have included sales and engineering design for cyclone classifiers for grinding circuits and cyclone separators with pumping systems for mining operations, as well as working with a team for recycling system design, tailing system design, sales, and implementation for operations in the mining and sand and gravel processing industry.

Mr. Howie has served as Vice President of Process Engineers and Equipment Corporation in Spokane, Washington, since 1993. The company provides tailing system design, sales, and implementation for customers in the mining and sand and gravel processing industry. Mr. Howie will initially devote 10% of his time to Bold View Resources, Inc.

Marilyn Zimmerman is our Secretary, Treasurer and a director. As Secretary and Treasurer, Mrs. Zimmerman is responsible for all filings, record keeping and administrative functions for the Company. Mrs. Zimmerman has a background as a business administrator and has worked in Las Vegas in that capacity for more than five years.

Family Relationships

There are no family relationships between or among the directors, executive officers or persons nominated or chosen by us to become directors or executive officers.

Involvement in Certain Legal Proceedings

To the best of our knowledge, during the past five years, none of the following occurred with respect to a present or former director, executive officer, or employee: (1) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (2) any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); (3) being subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his or her involvement in any type of business, securities or banking activities; and (4) being found by a court of competent jurisdiction (in a civil action), the SEC or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

Audit Committee

We do not have a separately-designated standing audit committee. The entire Board of Directors performs the functions of an audit committee, but no written charter governs the actions of the Board when performing the functions of what would generally be performed by an audit committee.

Code of Ethics

As of May 31, 2008, we had not adopted a Code of Ethics for Financial Executives, which would include our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

Item 11. Executive Compensation

Summary Compensation Table

The table below summarizes all compensation awarded to, earned by, or paid to both to our officers and to our directors for all services rendered in all capacities to us for our fiscal years ended May 31, 2008 and 2007.

| SUMMARY COMPENSATION TABLE |

Name and principal position | Year | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) |

| Richard Howie, President, CEO and Director | 2008 2007 | 0 0 | 0 0 | 0 0 | 0 0 | 0 0 | 0 0 | 0 0 | 0 0 |

| Marilyn Zimmerman, Secretary, Treasurer and Director | 2008 2007 | 0 0 | 0 0 | 0 0 | 0 0 | 0 0 | 0 0 | 0 0 | 0 0 |

Narrative Disclosure to the Summary Compensation Table

Although we do not currently compensate our officers, we reserve the right to provide compensation at some time in the future. Our decision to compensate officers depends on the availability of our cash resources with respect to the need for cash to further our business purposes.

Stock Option Grants

We have not granted any stock options to the executive officers or directors since our inception.

Outstanding Equity Awards at Fiscal Year-End

The table below summarizes all unexercised options, stock that has not vested, and equity incentive plan awards for each named executive officer as of May 31, 2008.

| OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END |

| OPTION AWARDS | STOCK AWARDS |

Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested (#) |

| Richard Howie, President, CEO and Director | - | - | - | - | - | - | - | - | - |

| Marilyn Zimmerman, Secretary, Treasurer and Director | - | - | - | - | - | - | - | - | - |

Compensation of Directors

We do not pay any compensation to our directors at this time. However, we reserve the right to compensate our directors in the future with cash, stock, options, or some combination of the above.

Stock Option Plans

We did not have a stock option plan in place as of May 31, 2008.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The following table sets forth, as of May 31, 2008 certain information as to shares of our common stock owned by (i) each person known by us to beneficially own more than 5% of our outstanding common stock, (ii) each of our directors, and (iii) all of our executive officers and directors as a group:

| Title of Class | Name and address of beneficial owner | Number of Shares of Common Stock | Percentage of Common Stock (1) |

| Common Stock | Richard Howie 1011 W. 25th Ave Spokane, WA 99203 | 1,000,000 | 44.8% |

| Common Stock | Marilyn Zimmerman 9573 Gainey Ranch Ave. Las Vegas, NV 89147 | 500,000 | 22.4% |

| Common Stock | All Officers and Directors as a Group (one person) | 1,500,000 | 67.3% |

| (1) | The percent of class is based on 2,230,000 shares of common stock issued and outstanding as of May 31, 2008 |

The persons named above have full voting and investment power with respect to the shares indicated. Under the rules of the Securities and Exchange Commission, a person (or group of persons) is deemed to be a "beneficial owner" of a security if he or she, directly or indirectly, has or shares the power to vote or to direct the voting of such security, or the power to dispose of or to direct the disposition of such security. Accordingly, more than one person may be deemed to be a beneficial owner of the same security. A person is also deemed to be a beneficial owner of any security, which that person has the right to acquire within 60 days, such as options or warrants to purchase our common stock.

Item 13. Certain Relationships and Related Transactions, and Director Independence

None of our directors or executive officers, nor any proposed nominee for election as a director, nor any person who beneficially owns, directly or indirectly, shares carrying more than 5% of the voting rights attached to all of our outstanding shares, nor any members of the immediate family (including spouse, parents, children, siblings, and in-laws) of any of the foregoing persons has any material interest, direct or indirect, in any transaction over the last two years or in any presently proposed transaction which, in either case, has or will materially affect us.

As of the date of this annual report, our common stock is traded on the OTC Bulletin Board (the “Bulletin Board”). The Bulletin Board does not impose on us standards relating to director independence or the makeup of committees with independent directors, or provide definitions of independence.

Item 14. Principal Accounting Fees and Services

Below is the table of Audit Fees (amounts in US$) billed by our auditor in connection with the audit of the Company’s annual financial statements for the years ended:

Financial Statements for the Year Ended May 31 | Audit Services | Audit Related Fees | Tax Fees | Other Fees |

| 2008 | $4,250 | $3,500 | $0 | $0 |

| 2007 | $7,000 | $1,313 | $0 | $0 |

PART IV

Item 15. Exhibits, Financial Statements Schedules

Index to Financial Statements Required by Article 8 of Regulation S-X:

| Audited Financial Statements: |

| |

| |

| |

| |

| |

| |

| (1) | Incorporated by reference to the Registration Statement on Form SB-2 filed with the Securities and Exchange Commission on September 7, 2007. |

SIGNATURES

In accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| BOLD VIEW RESOURCES, INC. |

| By: | /s/ Richard Howie |

| | Richard Howie |

| | President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer and Director August 18, 2008 |

In accordance with Section 13 or 15(d) of the Exchange Act, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated:

| By: | By: |

/s/ Marilyn Zimmerman Marilyn Zimmerman Secretary, Treasurer and Director August 18, 2008 | /s/ Richard Howie Richard Howie President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer and Director August 18, 2008 |

MOORE & ASSOCIATES, CHARTERED

ACCOUNTANTS AND ADVISORS

PCAOB REGISTERED

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Bold View Resources, Inc.

(An Exploration Stage Company)

We have audited the accompanying balance sheets of Bold View Resources, Inc. (An Exploration Stage Company) as of May 31, 2008 and 2007, and the related statements of operations, stockholders’ equity and cash flows for the years ended May 31, 2008, from inception on January 30, 2007 through May 31, 2007 and from inception on January 30, 2007 through May 31, 2008. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Bold View Resources, Inc. (An Exploration Stage Company) as of May 31, 2008 and 2007, and the related statements of operations, stockholders’ equity and cash flows for the years ended May 31, 2008, from inception on January 30, 2007 through May 31, 2007 and from inception on January 30, 2007 through May 31, 2008, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 4 to the financial statements, the Company has not yet established an ongoing source of revenues, which raises substantial doubt about its ability to continue as a going concern. Management’s plans concerning these matters are also described in Note 4. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Moore & Associates, Chartered

Moore & Associates Chartered

Las Vegas, Nevada

July 7, 2008

2675 S. Jones Blvd. Suite 109, Las Vegas, NV 89146 (702) 253-7499 Fax (702) 253-7501

BOLD VIEW RESOURCES, INC. (An Exploration Stage Company)

| ASSETS | | | |

| | May 31, 2008 | | May 31, 2007 |

| | | | |

| CURRENT ASSETS | | | |

| | | | |

| Cash | $ | 705 | | $ | 37,693 |

| | | | | | |

| Total Current Assets | | 705 | | | 37,693 |

| | | | | | |

| TOTAL ASSETS | $ | 705 | | $ | 37,693 |

| | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | | | | | |

| | | | | | |

| CURRENT LIABILITIES | | | | | |

| | | | | | |

| Accounts payable | $ | 4,813 | | $ | 7,424 |

| | | | | | |

| Total Current Liabilities | | 4,813 | | | 7,424 |

| | | | | | |

| STOCKHOLDERS' EQUITY (DEFICIT) | | | | | |

| | | | | | |

Common stock; 50,000,000 shares authorized, at $0.001 par value, 2,230,000 shares issued and outstanding | | 2,230 | | | 2,230 |

| Additional paid-in capital | | 35,770 | | | 35,770 |

| Deficit accumulated during the exploration stage | | (42,108) | | | (7,731) |

| | | | | | |

| Total Stockholders' Equity (Deficit) | | (4,108) | | | 30,269 |

| | | | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY (DEFCIT) | $ | 705 | | $ | 37,693 |

The accompanying notes are an integral part of these financial statements.

BOLD VIEW RESOURCES, INC. (An Exploration Stage Company)

Statements of Operations

| | For the Year Ended May 31, 2008 | | From Inception on January 30, 2007 Through May 31, 2007 | | From Inception on January 30, 2007 Through May 31, 2008 |

| | | | | | |

| REVENUES | $ | - | | $ | - | | $ | - |

| | | | | | | | | |

| OPERATING EXPENSES | | | | | | | | |

| | | | | | | | | |

| Mining exploration | | 9,440 | | | - | | | 9,440 |

| General and administrative | | 24,937 | | | 7,731 | | | 32,668 |

| | | | | | | | | |

| Total Expenses | | 34,377 | | | 7,731 | | | 42,108 |

| | | | | | | | | |

| LOSS FROM OPERATIONS | | (34,377) | | | (7,731) | | | (42,108) |

| | | | | | | | | |

| INCOME TAX EXPENSE | | - | | | - | | | - |

| | | | | | | | | |

| NET LOSS | $ | (34,377) | | $ | (7,731) | | $ | (42,108) |

| | | | | | | | | |

| BASIC LOSS PER SHARE | $ | (0.02) | | $ | (0.00) | | | |

| | | | | | | | | |

WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING | | 2,230,000 | | | 2,230,000 | | | |

The accompanying notes are an integral part of these financial statements.

BOLD VIEW RESOURCES, INC. (An Exploration Stage Company)

Statements of Stockholders' Equity (Deficit)

| | Common Stock | | | | Deficit Accumulated During the Exploration | | |

| | Shares | | Amount | | Capital | | Stage | | (Deficit) |

| | | | | | | | | | |

Balance at inception on January 30, 2007 | | - | | $ | - | | $ | - | | $ | - | | $ | - |

| | | | | | | | | | | | | | | |

Issuance of Common Stock in March 2007 for cash at $0.001 per share | | 1,500,000 | | | 1,500 | | | - | | | - | | | 1,500 |

| | | | | | | | | | | | | | | |

Issuance of Common Stock in March 2007 for cash at $0.05 per share | | 340,000 | | | 340 | | | 16,660 | | | - | | | 17,000 |

| | | | | | | | | | | | | | | |

Issuance of Common Stock in April 2007 for cash at $0.05 per share | | 390,000 | | | 390 | | | 19,110 | | | - | | | 19,500 |

| | | | | | | | | | | | | | | |

Net loss since inception through May 31, 2007 | | - | | | - | | | - | | | (7,731) | | | (7,731) |

| | | | | | | | | | | | | | | |

| Balance, May 31, 2007 | | 2,230,000 | | | 2,230 | | | 35,770 | | | (7,731) | | | 30,269 |

| | | | | | | | | | | | | | | |

Net loss for the year ended May 31, 2008 | | - | | | - | | | - | | | (34,377) | | | (34,377) |

| | | | | | | | | | | | | | | |

| Balance, May 31, 2008 | | 2,230,000 | | $ | 2,230 | | $ | 35,770 | | $ | (42,108) | | $ | (4,108) |

The accompanying notes are an integral part of these financial statements.

BOLD VIEW RESOURCES, INC. (An Exploration Stage Company)Statements of Cash Flows

| | For the Year Ended May 31, 2008 | | From Inception on January 30, 2007 Through May 31, 2007 | | From Inception on January 30, 2007 Through May 31, 2008 |

| | | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | |

| | | | | | |

| Net loss | $ | (34,377) | | $ | (7,731) | | $ | (42,108) |

Adjustments to reconcile net income to net cash provided by operations: | | | | | | | | |

| Common stock issued for services | | - | | | - | | | - |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts Payable | | (2,611) | | | 7,424 | | | 4,813 |

| | | | | | | | | |

Net Cash Used by Operating Activities | | (36,988) | | | (307) | | | (37,295) |

| | | | | | | | | |

CASH FLOWS FROM INVESTING ACTIVITIES | | - | | | - | | | - |

| | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | |

| | | | | | | | | |

Proceeds from issuance of common stock | | - | | | 38,000 | | | 38,000 |

| | | | | | | | | |

Net Cash Used by Financing Activities | | - | | | 38,000 | | | 38,000 |

| | | | | | | | | |

| NET DECREASE IN CASH | | (36,988) | | | 37,693 | | | 705 |

| | | | | | | | | |

| CASH AT BEGINNING OF PERIOD | | 37,693 | | | - | | | - |

| | | | | | | | | |

| CASH AT END OF PERIOD | $ | 705 | | $ | 37,693 | | $ | 705 |

| | | | | | | | | |

| | | | | | | | | |

SUPPLIMENTAL DISCLOSURES OF CASH FLOW INFORMATION | | | | | | | | |

| | | | | | | | | |

| CASH PAID FOR: | | | | | | | | |

| | | | | | | | | |

| Interest | $ | - | | $ | - | | $ | - |

| Income Taxes | $ | - | | $ | - | | $ | - |

The accompanying notes are an integral part of these financial statements.

BOLD VIEW RESOURCES, INC. (AN EXPLORATION STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

1. DESCRIPTION OF BUSINESS, HISTORY AND SUMMARY OF SIGNIFICANT POLICIES

Description of business – Bold View Resources, Inc. (hereinafter referred to as the “Company”) located in Las Vegas, Nevada was incorporated in Nevada on January 30, 2007 The Company is in the mineral exploration and development business. The Company has not commenced significant operations.

History – The Company was incorporated under the laws of the State of Nevada on January 30, 2007.

Development Stage Company – The accompanying financial statements have been prepared in accordance with the Statement of Financial Accounting Standards No. 7 “Accounting and Reporting by Development-Stage Enterprises”. A development-stage enterprise is one in which planned principal operations have not commenced or if its operations have commenced; there has been no significant revenue there from. The Company has not commenced its planned principal operations and therefore is considered a Development Stage Company.

Year-end – The Company’s year-end is May 31.

Use of estimates - The preparation of consolidated financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Revenue and expense recognition – Revenues are recognized when received. Costs and expenses are recognized during the period in which they are incurred