1

Gerova Financial Group Ltd.

January 2010

A publicly traded specialty insurance group generating shareholder value by

acquiring low cost equity capital and investing in high yield secured credit

Asia Special Situation Acquisition Corp. (“ASSAC” or the “Company”) has filed a copy of its proxy statement with the

Securities and Exchange Commission (“SEC”) in connection with the proposed business combination. Shareholders,

warrantholders and other interested persons are urged to read the proxy statement and any other relevant documents

filed, or to be filed, by the Company with the SEC when such documents become available because they contain and will

contain important information. Such persons can also read the Company’s final prospectus dated January 16, 2008, its

Annual Report on Form 20-F for the fiscal year ended December 31, 2008 and other reports as filed with the SEC, for a

description of the security holdings of the Company’s officers and directors and their affiliates and their respective

interests in the successful consummation of the proposed business combination. The definitive proxy statement will be

mailed to shareholders and warrantholders, as the case may be, as of July 4, 2010 for voting on the proposed business

combination and related transactions. Shareholders, warrantholders and other interested persons will also be able to

obtain a copy of the definitive proxy statement, without charge, by directing a request to Asia Special Situation

Acquisition Corp., c/o Hodgson Russ LLP, 1540 Broadway, 24th Floor, New York, NY 10036. Free copies of these

documents can also be obtained, when available, at the SEC’s internet site (http://www.sec.gov).

This presentation does not constitute an offer of any securities for sale or a solicitation of an offer to buy any securities,

nor shall there be any sale of the securities in any state or jurisdiction in which such an offer, solicitation or sale would be

unlawful prior to the registration or qualification under the securities laws of any such state or jurisdiction. Any offer of

the securities will be made solely by means of a prospectus included in the registration statement and any prospectus

supplement that may be issued in connection with such offering.

2

Disclaimer

The statements contained in this presentation that are not purely historical are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1999.

The forward-looking statements include, but are not limited to, statements regarding the Company’s, Stillwater, Northstar, Allied Provident, Wimbledon or their respective management’s

expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or

circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,”

“might,” “plan,” “possible,” “potential,” “predicts,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does

not mean that a statement is not forward-looking. Forward-looking statements in this presentation may include, for example, statements about the Company’s, Stillwater’s, Northstar’s,

Allied Provident’s or Wimbledon’s:

ability to complete the Transaction;

the benefits of the Transaction;

the impairment of other financial institutions and its effect on our business;

requirements to post collateral or make payments due to declines in market value of assets subject to our collateral arrangements;

the fact that the adverse change in mortality, morbidity, lapsation or claims experience; determination of allowances and impairments taken on our investments is highly

subjective;

adverse changes in mortality, morbidity, lapsation or claims experience;

adverse capital and credit market conditions and their impact on our liquidity, access to capital and cost of capital;

changes in our financial strength and credit ratings and the effect of such changes on our future results of operations and financial condition;

inadequate risk analysis and underwriting;

general economic conditions or a prolonged economic downturn affecting the demand for insurance and reinsurance in our current and planned markets;

the availability and cost of collateral necessary for regulatory reserves and capital;

market or economic conditions that adversely affect the value of our investment securities or result in the impairment of all or a portion of the value of certain of our

investment securities;

market or economic conditions that adversely affect our ability to make timely sales of investment securities;

risks inherent in our risk management and investment strategy, including changes in investment portfolio yields due to interest rate or credit quality changes;

fluctuations in U.S. or foreign currency exchange rates, interest rates, or securities and real estate markets;

adverse litigation or arbitration results;

the adequacy of reserves, resources and accurate information relating to settlements, awards and terminated and discontinued lines of business;

the stability of and actions by governments and economies in the markets in which we operate;

competitive factors and competitors’ responses to our initiatives;

the success of our clients;

successful execution of our entry into new markets;

successful development and introduction of new products and distribution opportunities;

our ability to successfully integrate and operate reinsurance businesses that the Company acquires;

regulatory action that may be taken by state or foreign departments of insurance with respect to the Company, or any of its subsidiaries;

our dependence on third parties, including those insurance companies and reinsurers to which we cede some reinsurance, third-party investment managers and others;

the threat of natural disasters, catastrophes, terrorist attacks, epidemics or pandemics anywhere in the world where we or our clients do business;

changes in laws, regulations, and accounting standards applicable to the Company, its subsidiaries, or its business;

the effect of our status as an holding company and regulatory restrictions on our ability to pay principal of and interest on its debt obligations; and

other risks and uncertainties described in this document or the proxy statement of the Company filed with the SEC, including under the caption “Risk Factors” and in our other

filings with the SEC.

3

Forward Looking Statements

The forward-looking statements contained in this presentation are based on the Company’s current expectations and beliefs concerning

future developments and their potential effects. There can be no assurance that future developments affecting the Company will be those

that they have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond the

Company’s control) and other assumptions that may cause actual results or performance to be materially different from those expressed

or implied by these forward-looking statements. These risks and uncertainties include those factors described under the heading “Risk

Factors.” Specifically, some factors that could cause actual results to differ include:

the Company’s ability to complete its initial business combination within the specified time limits;

officers and directors allocating their time to other businesses or potentially having conflicts of interest with the Company’s

business or in approving the Transaction;

success in retaining or recruiting, or changes required in, the Company’s officers, key employees or directors following the

Transaction;

the potential liquidity and trading of the Company’s public securities;

the Company’s revenues and operating performance;

changes in overall economic conditions;

changes in insurance or tax regulations;

anticipated business development activities of the Company following the Transaction;

risks and costs associated with regulation of corporate governance and disclosure standards (including pursuant to Section 404 of

the Sarbanes-Oxley Act of 2002); and

other risks referenced from time to time in the Company’s filings with the SEC.

Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary

in material respects from those projected in these forward-looking statements. The Company does not undertake any obligation to update

or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required

under applicable securities laws.

All forward-looking statements included herein attributable to the Company or any person acting on either party’s behalf are expressly

qualified in their entirety by the cautionary statements contained or referred to in this section.

4

Forward Looking Statements

5

Acquire low cost equity by swapping ASSAC preferred with hedge funds looking to solve short term liquidity concerns

Balance sheet strength and growth accelerated through Gerova’s strategy of acquiring low cost equity capital by

acquiring unquoted securities at a discount from illiquid hedge fund forced sellers for unregistered public stock

Primary targets are hedge funds target that are the most dysfunctional, for example funds holding long dated

performing credits but exposed to short term redemption liabilities

Focus on enhancing or expanding near term shareholder value through valuation differential of unquoted financial

assets (c. 0.8x) and publicly quoted price-to-book of specialty reinsurers (c. 1.3-1.4x, like Greenlight Re, NASDAQ:

GLRE; Enstar Group, NASDAQ: ESGR)

Utilize equity capital to generate proven returns of 10% in direct commercial lending to niche markets energy, legal

and insurance (premium finance)

Higher yielding fixed income returns achievable through directly originated commercial credits to select markets -

energy, legal and insurance (premium finance)

Traditional insurance company portfolio management is sub-optimal with overweighting in low yielding fixed

income instruments

Our direct commercial credit origination capacity generates higher yielding portfolio (net 10%+)

Generate sustainable long term shareholder value through robust cash generation of proven alternative fixed income

portfolio strategy

Exploit the advantage of a non-US reinsurance carrier’s tax and low cost of leverage created through free float on

premiums

Higher yield has magnified ROE effects on insurance company balance sheets given low cost of float from structural

gearing

Insurance structure is inherently highly efficient - tax free compound return and customarily not bound by

Investment Company restrictions on portfolio allocations

We are a Cayman Islands holding company acquiring up to three specialty

reinsurers with a differentiated investment strategy and capital formation strategy

Investment proposition

6

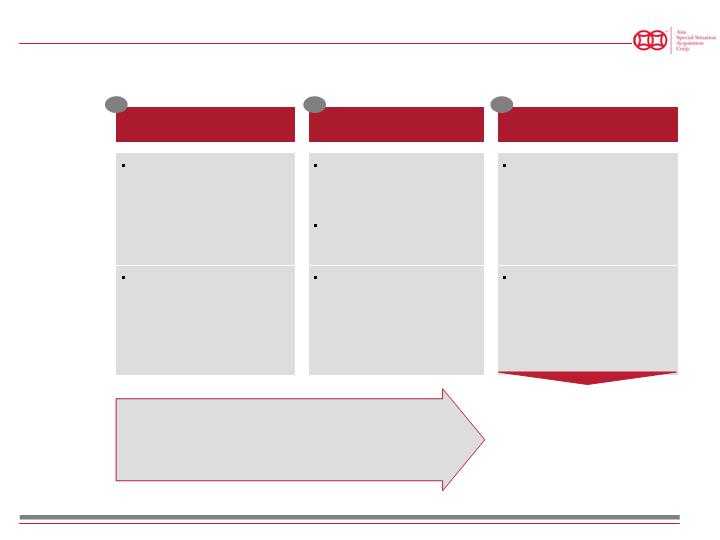

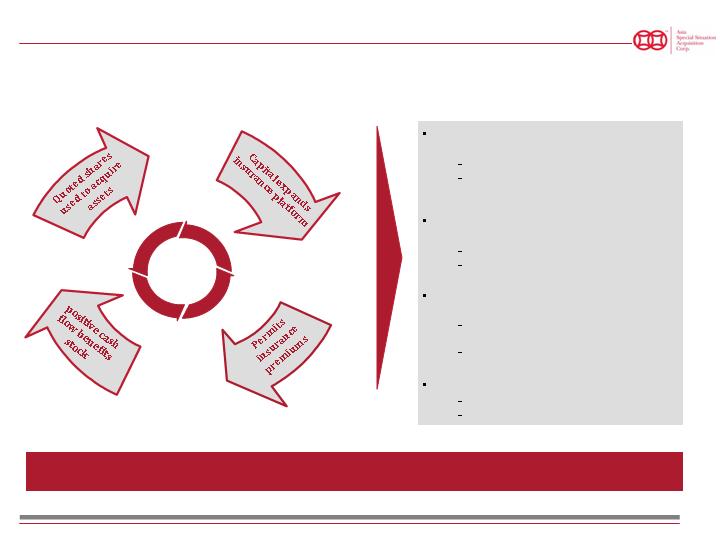

We use our insurance platform to expand a proven strategy

Capital Aggregation

Income Production

Scale-Up

Use public stock to acquire

unquoted assets from hedge

funds at a discount and

capitalize balance sheet

Maximize return on equity

through fixed income

strategy using commercial

lending platform

Exploit under-supply of

commercial credit to obtain

higher rates of return

Increase investable asset base

by using new regulatory

capital to write new insurance

business (up to 10:1 capital to

assets - no debt)

Acquired unquoted assets

contributed to insurance

company subsidiaries as

regulatory capital

Liquidate non-cash flow

producing financial assets

and redeploy to cash

generative commercial

lending

Deploy low cost insurance

float from premiums into

higher yielding commercial

credit

Pillars of

Activity

Our Plan of

Operation

1.

2.

3.

Up to $130 billion in gated, suspended

or side-pocketed hedge fund assets

Market

Opportunity

ASSAC believes there is an

opportunity to acquire as

much as $10 billion in

unquoted financial assets to

generate shareholder value

as well as increase

regulatory capital

Business Model

7

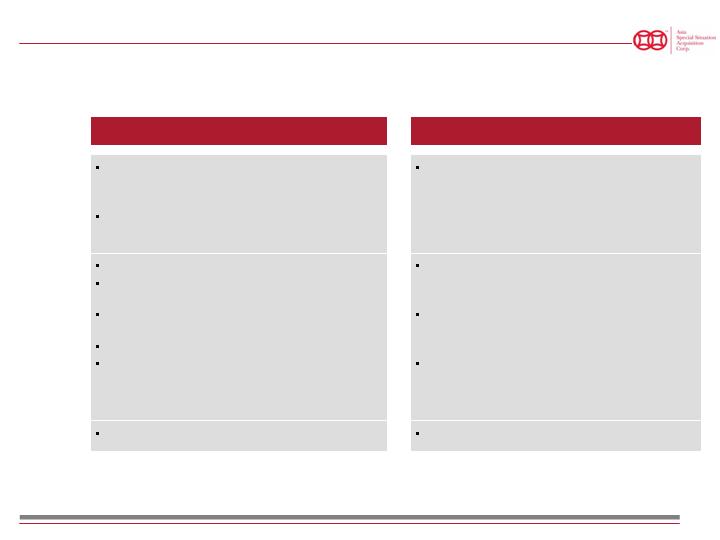

Inaugural $832 million transaction is proof of concept and provides core credit

origination business for insurance company investment portfolio management

Stillwater

Wimbledon

Stillwater has been investing in direct loan

origination strategies since 2003

Nine Delaware limited partnerships and five Cayman

Island exempt companies

Wimbledon Funds are primarily an asset backed

lending fund of funds established by Weston Capital

Management

Finance portfolios of senior secured loans

10% target net rate of return without need for

leverage

Senior secured credit facilities to manage portfolio

risk

In-house underwriting, origination and servicing

Primary target markets – life insurance, legal and

energy

The Fund invests in third party funds providing

credit to a range of industries

These investments may be coupled with warrants

or other equity securities

Generally issued by or made to small cap companies

Acquired portfolio is approximately $535 million

Acquired portfolio is approximately $114 million

Description

of

Operations

Portfolio

Value / Size

of Portfolio

Discounted financial assets and commercial credit platform acquired

8

Portfolio management and asset growth will be accomplished through up to

three insurance company operations

Northstar

Amalphis / Allied Provident

Owner of two separate reinsurance businesses in

Ireland and Bermuda

Alternative Asset Focus (like Greenlight Re)

Founded in 2004 by Dresdner (now Commerzbank),

Argus Insurance and Stillwater’s US Funds of Funds

Owner of reinsurance business in Barbados

Specialty reinsurance company in markets where

reinsurance options are limited

FY ‘09 $12 million net income

Opportunistic acquisition of a book of reinsurance

portfolios available at a discount as a result of the

existing owners statutory constraints

Authorized to conduct general insurance business,

including sale of property, general liability, business

interruption and political risk

Strategy is to build a portfolio of frequency and

severity reinsurance agreements that fills a gap in

the market where traditional companies don’t play

Primary cedent is Reinsurance Group of America,

with $2.2 trillion of life reinsurance in force and

assets of more than $22 billion

Over 117,000 policies, $812M in assets, $120M in

capital, with post transaction group net equity

increased to over $800M

For the 6 months of fiscal ‘09, $19.3 million net

income on revenue of $39.7 million

For 9-months ending 30 Sept ’09, generated

revenues of $21.5M and net income of $9.1M

Approximately $87 million acquisition price

Description

of

Operations

Portfolio

Strategy

Financial

Quick Facts

Insurance company acquisitions

9

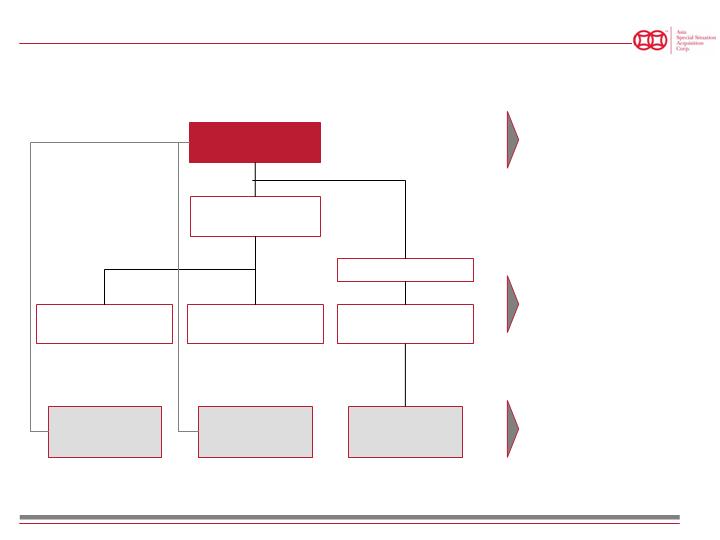

Quality assets have been identified by ASSAC for acquisition

Gerova Financial Group Ltd.

(f/k/a ASSAC)

Northstar Group

Holdings Ltd

Northstar Re

Ireland

Northstar Re

Bermuda

Amalphis Group

Stillwater Fund

Assets

(Delaware)

Stillwater Fund

Assets

(Cayman)

Allied Provident

Insurance Companies

Wimbledon Fund

Assets

(Cayman)

100%

100%

100%

100%

81.5%

100%

100%

100%

Listed on the NYSE Amex -

(eligible for big board

subject to number of

shareholder requirement)

Grow insurance policies in

force and invest ‘float’ funds

in cash flow generating fixed

income assets

Focus on senior secured

credit origination and the

reallocation of any equity

investments to fixed income

Transaction assets

10

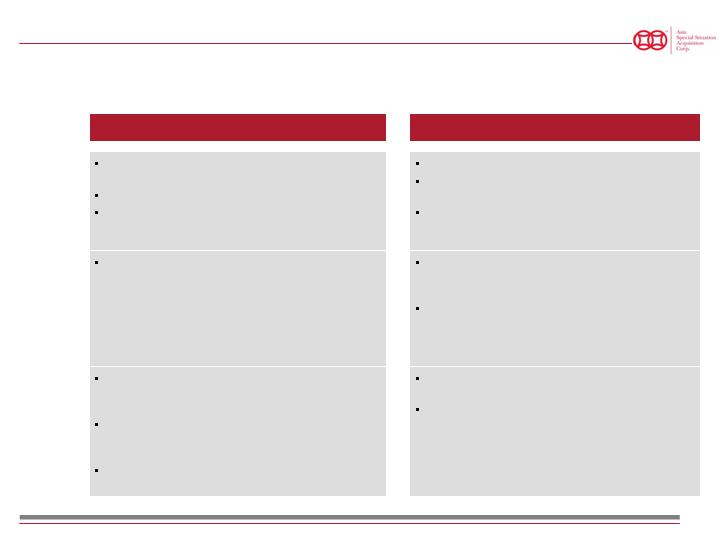

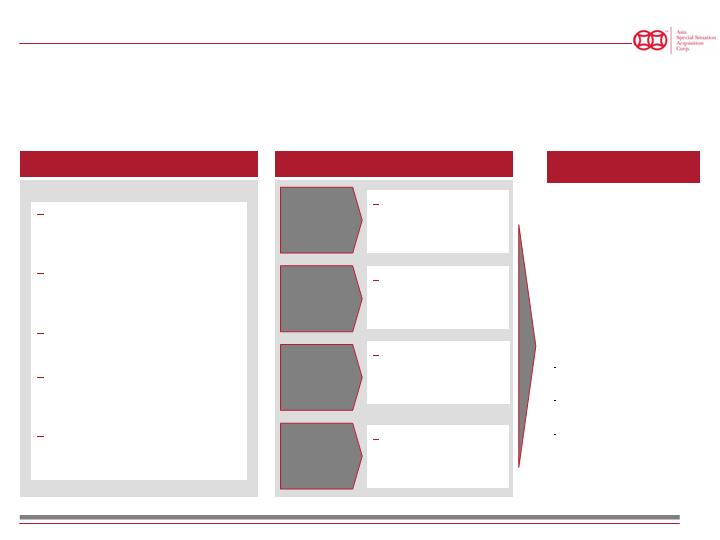

Our legal structure and capital structure together with our investment strategy all

combine to enhance shareholder value

Virtuous Cycle

Public

Securities

Equity

Capital

Regulatory

Capital

Investment

Portfolio

Grow

ROE

Favorable discounted investment entry

point

Liquidity solution for ‘trapped’ investors

Average purchase price 0.8x adjusted book

value

Investment vehicle unlocks shareholder

value

New equity counts towards regulatory capital

Ability to generate cash though direct lending

Repositioning of assets provides significant

valuation arbitrage opportunity

Specialty reinsurance companies trade at 1.3 -

1.4x price-to-book value (eg. GLRE; ESGR)

Creates a 50%+ premium on acquisition

Enhance shareholder value by growing ROA

Ability to generate cash though direct lending

Prioritization of asset investment strategy

Our investment thesis exploits an immediate valuation arbitrage between discounted asset values and public company premiums,

enables significant leverage via a 10:1 lending ratio and attracts advantageous tax treatment due to the offshore nature of our assets

Differentiated Product Offering

11

Fixed Income Track Record

Historically generated average of 10% net returns on direct

lending portfolio with primary exposure to three distinct target

markets - energy, legal and insurance (without giving effect to

leverage)

Stillwater Capital Partners has been investing in direct loan

origination strategies since 2002 (firm manages about $1.0

billion)

Generated a net annualized return of approximately 10% with very

low volatility (direct lending portfolio)

The fund boasts one of the highest risk-adjusted returns worldwide

in its class

HFM Week nominated the Stillwater Asset Backed Fund as

Fund of the Year in 2008

HedgeFund.Net named the Stillwater Asset Backed Fund the #1

Risk Adjusted fund in its asset class for 2006, 2007 and 2008

Barclays ranked the Stillwater Asset Backed Fund as the sixth

best-performing fixed income fund over the three years ending

September 30th 2008 world-wide

12

The advantages that are attributed to an insurance company which can

invest from its own balance sheet are well established

……“the insurance group delivered an

underwriting gain for the sixth consecutive

year. This means that our $58.5 billion of

insurance “float” – money that doesn’t belong to

us but that we hold and invest for our own

benefit – cost us less than zero. In fact, we were

paid $2.8 billion to hold our float during 2008.

Charlie and I find this enjoyable”…….

Insurance companies manage money

that is not theirs yet they retain the

investment gains for their shareholders

The insurance float is totally non-

dilutive to equity holders and can

dramatically increase

Return on Equity

…….“Our smaller insurers [at Berkshire] are just

as outstanding in their own way as the “big

three”, regularly delivering valuable float to us

at a negative cost. We aggregate their results

below under “Other Primary.” For space

reasons, we don’t discuss these insurers

individually. But be assured that Charlie and I

appreciate the contribution of each.”

Established benefits of investing from an

insurance company’s balance sheet

Warren Buffett attests to this in Berkshire

Hathaway’s Annual Report, FY 2008

Advantages of Insurance Company

13

This model allows insurance companies to capture a positive pricing mechanism and

provide a defined liquidity pathway for hedge funds or lenders that hold illiquid assets

or may be in breach of regulatory capital ratios

New Business Model

Systemic Mismatch

Structural asset – liability

mismatch

Long duration assets with short

duration liabilities

Suspension of redemptions

Breach of regulatory conditions

and risk of insolvency

Illiquid assets moved to ‘side-

pockets’

Favorable Macro

Tax

Treatment

Non-US insurance

companies accumulate

investment earnings tax

free

US Fiscal

Deficit

US fiscal debt may result

in an increase in taxes –

improving appeal of tax

advantaged investments

Monetary

Policy

Rising interest rates will

have negative effect on

bond prices and

insurance capital

Real Estate

We believe commercial

real estate is ‘next shoe

to drop’ and will create

liquidity demands

Insurance Companies

competing in asset

classes such as asset

backed lending

Ability to:

Acquire at discount

Provide liquidity

Fixed income investing

Sustainable Advantage of Insurance Platform

14

The offshore nature of the acquisitions will ensure that the transaction will attract

advantageous US tax treatment. This will lead to significant value arbitrage when

compared to a domestic based investment scheme

Notes: (1) Shown for tax impact illustrative purposes only

(2) Illustrative EPS calculated from $700m assets, earning 10% a year, and 110m shares.

(3) Market capitalization illustration assumes P/E multiple of 15

Beneficial tax treatment

NorthstarRe and Allied

Provident are offshore

insurance businesses, and

therefore exempt from US

taxation

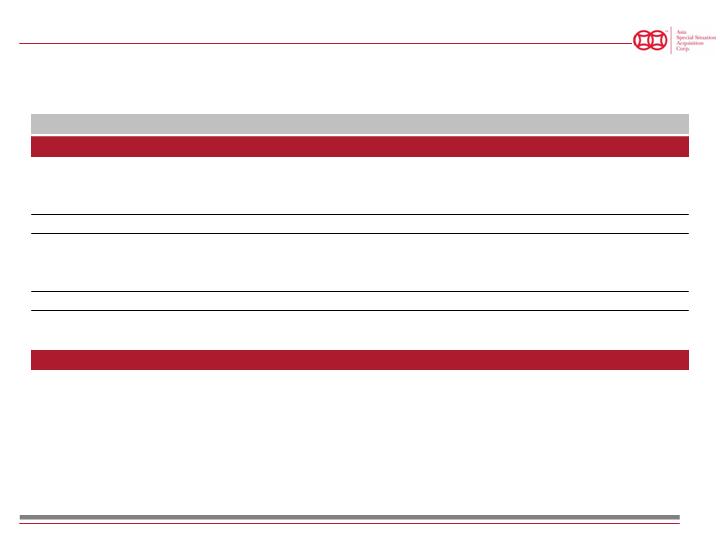

Incremental EPS – 35% tax rate

Incremental EPS – 0% tax rate

Market Cap – 35% tax rate

Market Cap – 0% tax rate

Effect of Tax Efficiency - earnings per share and market-cap growth

EPS US$

Market-cap

US$ billion

14

15

Marshall Manley, Chairman and CEO. Mr. Manley has had a long and distinguished career in business, including serving as President and CEO of City Investing Co., a Fortune 200, New York Stock Exchange listed conglomerate with 400 subsidiaries, including Motel 6, Rheem Manufacturing Company, World Color Press, Servomation, Wood Brothers Homes, General Development, Hayes International and Guerdon. While at City Investing, Mr. Manley undertook one of the largest voluntary tax-free corporate liquidations in U.S. history ultimately delivering over $8.0 billion to public shareholders. Mr. Manley also served as Chairman of Wood Brothers Homes. Included among the major and better known subsidiaries of City Investing was Home Insurance Company, then the 16th largest property and casualty insurance company in the USA. Manley was President and CEO of the Home Group (which later changed its name to AmBase Corp.), a NYSE-listed diversified financial services company that provides property and casualty insurance and reinsurance, capital market, wealth management, real estate development, banking, insurance premium financing, venture capital investing and mortgage services. Manley also served as Chairman of Home Insurance Co., a subsidiary of Home Group. Mr. Manley helped take Home Group from a loss (before taxes) of $282 million in 1985 to income (before taxes) of $714 million from 1986 to 1989 prior to its sale to a foreign insurance company for over $1.0 billion. Mr Manley was also responsible for Usi Re, a reinsurance subsidiary of Home Group that was during his tenure the 13th largest reinsurance company in the United States. Prior to his corporate career, Manley was a prominent practicing attorney and served as a named partner at two major Los Angeles law firms.

Dr. Gary T. Hirst, President. Dr. Hirst was previously Chief Investment Officer of Hirst Investment Management, manager of Hirst Metastrategy Fund, a fund of hedge funds (ranked no. 3 risked adjusted FoFs by MARHedge – ‘03). Former Director of Alpine Select A.G., a publicly traded (Swiss Exchange) investment company based in Zug, Switzerland. Investor in Greenlight Re at organizational private placement round (pre-IPO). Dr. Hirst was also a former director of offshore reinsurance company and is currently a director of Florida domiciled property and casualty carrier. Dr. Hirst holds a Bachelor of Science (B.S.) Magna Cum Laude, 1975, University of Miami, and a Juris Doctor (J.D.) Cum Laude, 1979, University of Miami School of Law, and a Doctor of Medicine (M.D.), 1990, University of Texas Health Science Center at San Antonio. He is admitted to the Bar of the State of Florida.

Tore Nag, COO. Mr. Nag held various senior executive positions at Nordea Bank and its predecessor, Christiania Bank og Kreditkasse, with full P&L responsibilities for

twenty-four years (1982-2006. The bank assigned him to manage strategic turn-arounds where he was responsible for restructuring several banking units in varied

jurisdictions and restoring them to profitability. For the five years ending in September 2006, Mr. Nag managed the New York City branch of Christiania Bank as CEO the Americas. During his tenure in New York, he merged three US banking operations successfully with fundamental business/administrative/system changes, and turned operating losses in 2001 into profits of approximately $50.0 million by 2005. Christiania Bank og Kreditkasse was founded in 1848 in Norway and in 2000 at the time of the merger with MeritaNordbanken the bank was Norway's second largest bank approximately 10 million customers, approximately 1,400 branch offices and a leading net-banking position with 5.2 million e-customers. Nordea shares are listed on the NASDAQ OMX, and the exchanges in Copenhagen, Helsinki and Stockholm.

Michael Kantor, Director. Since 1997, Mr. Kantor has been a partner at Mayer Brown LLP, a leading international law firm. He has extensive experience in market

access issues, as well as the expansion of client activities in foreign markets through trade, direct investment, joint ventures, and strategic business alliances. Prior to

joining Mayer Brown, Mr. Kantor was the United States Secretary of Commerce (1996-1997) appointed by President Clinton and prior to that he served as United

States Trade Representative (1993-1996). He served as National Chairman of the Clinton/Gore 1992 Presidential Campaign. Mr. Kantor serves on the Board of

Directors of CB Richard Ellis, the US Advisory Board of ING Americas, the International Advisory Board of Fleishman-Hillard and as a senior advisor to Morgan

Stanley. Previously, he served on the Board of Directors of Korea First Bank and Monsanto.

Jack Doueck, Director. Co-founder of the Stillwater family of funds, a $1.0 billion asset management firm based in New York. Stillwater funds were a founding

shareholder of Northstar Group Holdings, parent of Northstar Re. Several Stillwater products have been recognized by various leading hedge fund industry tracking

services. Mr. Doueck was the sponsor for one of the first convertible bond arbitrage hedge funds in January 1992. He is a published author and has been a featured

speaker at alternative investment conferences around the world on hedge fund dues diligence and asset backed lending. He currently serves on the Board of Directors

of several charitable organizations. Mr. Doueck graduated Valedictorian, Summa Cum Laude, from Yeshiva University in 1985 and has attended the Bernard Revel

Graduate School.

Experienced team

16

16

Historical pro-forma balance sheet and income statement

* Most recent 6 months of insurance operations

Notes: (1) Balance sheet figures summarized from the unaudited pro forma condensed combined balance sheet figures, as detailed in the proxy statement

(2) Income statement listed above does not include ASSAC operations or income expenses from Stillwater and Wimbledon assets

$000s

Assets

Cash & Equivalents

104,019

Investments

800,448

Contracted / Other assets

509,861

Deferred acquisition costs

110,214

Total Assets

1,524,542

Liabilities

Trade Payables

2,102

Borrowings

10,000

Contracted Liabilities

679,866

Total Liabilities

691,968

Equity

Total shareholders equity

832,574

Total shareholders equity & liability

1,524,542

$000s

Revenues

Policy premiums, interest, fees

41,191

Investment income

10,303

Other income

601

Total Revenues

52,095

Expenses

Loss and Loss adjustment expenses

23,778

Policy acquisition costs

1,017

Other expenses

2,510

Total Expenses

27,305

Net Income

24,790

Pro-forma Balance Sheet

Pro-forma Six Month Statement of

Insurance Operations*

17

17

Gerova Financial will match low cost, long term liabilities with

higher yielding, long term assets

Financial projection assumptions

Assets

Liabilities

Capitalization

High quality fixed income securities, complemented by investments with more limited liquidity

Maturities greater than 5 years

Individual asset yields targeted at 6-10%

Life reinsurance contracts with maturities greater than 5 years

Implied costs of insurance float targeted at 3–4%

Assumes $833M starting equity, subject to final asset valuations, transaction fees and possible

redemptions

No additional capital raises or exercise of warrants assumed

Invested asset leverage grows to ~6.5x shareholders equity

18

18

Projected financial statements highlight the attractiveness of the

proposed transaction

Pro-forma

2010

2011

2012

2013

2014

Income Statement

Revenues

Reinsurance revenues

292,490

550,780

925,525

1,365,298

1,837,921

Net investment income

147,051

241,487

379,929

547,586

735,439

Total revenues

439,541

792,268

1,305,454

1,912,884

2,573,360

Expenses

Reinsurance expenses

296,096

557,993

938,144

1,383,087

1,861,907

Other expenses

4,456

8,833

16,206

24,600

35,719

Total expenses

300,553

566,826

954,350

1,407,687

1,897,626

Net Income

138,989

225,442

351,104

505,197

675,734

Balance Sheet

Assets

1,524,542

3,330,296

5,829,378

9,576,040

13,158,925

17,453,096

Liabilities

691,968

2,358,733

4,632,272

8,027,932

11,105,619

14,724,057

Equity

832,574

971,563

1,197,005

1,548,109

2,053,305

2,729,039

Projected financials

Notes: (1) Opening balance sheet numbers derived from unaudited pro forma condensed combined balance sheet, as detailed in the proxy statement

(2) Asset leverage as modelled increases to a maximum of 6.4x equity in 2013

19

19

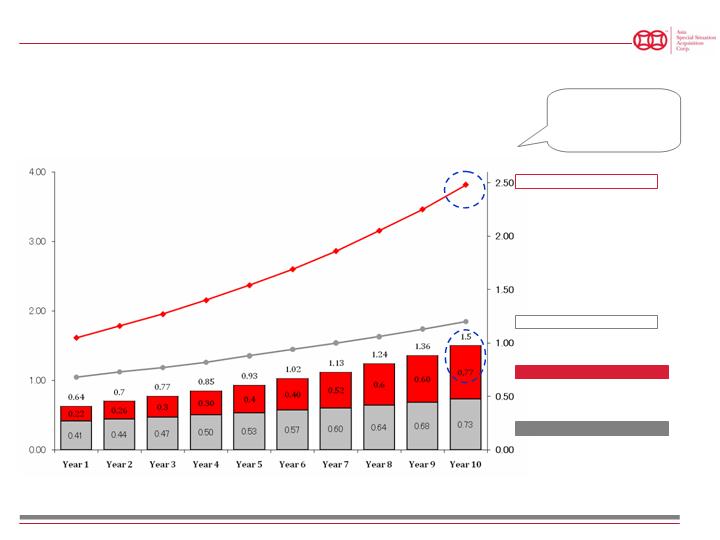

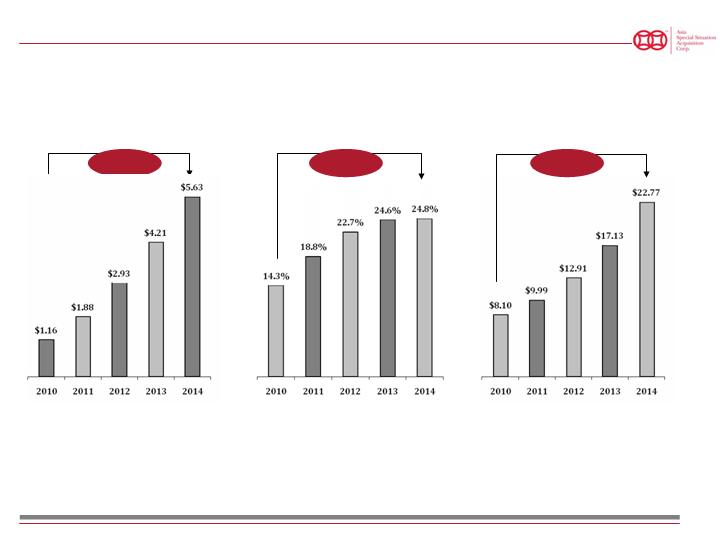

Earnings per Share

Return on Equity

Book value per share

CAGR

49%

CAGR

15%

CAGR

29%

Financial metrics

Notes: (1) Book value per share calculated as shareholder’s equity divided by common shares outstanding.

(2) Return on Equity calculated as net income for the year divided by shareholder’s equity.

(3) Earnings per share calculated as net income for the year divided by common shares outstanding.

Key financial metrics reinforce management’s positive outlook

20

20

Gerova Financial is forecast to have a significant enterprise value

Enterprise value creation

Enterprise Valuation Summary at Closing

Estimated Price Per Share (1)

$9.94

Total Basic Shares Outstanding

119,872,867

Warrants Outstanding

17,550,000

Fully Diluted Shares Outstanding

137,422,867

Fully Diluted Equity Value

$1,365,983,298

Less: Estimated Cash (2)

$95,901,000

Enterprise Value

$1,270,082,298

2010E Net Income

$138,988,935

2011E Net Income

$225,442,106

2010 P/E Multiple

9.8x

2011 P/E Multiple

6.1x

Notes: (1) Current market price as at January 4, 2010

(2) Estimated cash derived from the unaudited pro forma condensed combined balance sheet, as detailed in the proxy statement

21

Investors are looking for…

Supporting Gerova Financial Metrics

Transparent investment

ASSAC is a fully reporting company with the SEC and complies with

public company disclosure regime

Compounded investment returns

Non-US insurance companies are generally tax exempt

Enhance ROE by growing portfolio through acquired insurance

reserves at ratio of 10:1

Proven management team

Exceptional management team, responsible for building successful

financial and asset management businesses

Ideal vehicle for proven financial market executives

Focused acquisition & growth strategy

Strategy to acquire investment funds at prices that are a discount to

current carrying values

Distressed pricing for a sound business and a unleveraged b/s

Low cost growth that is non dilutive

‘Float’ money is low cost cash to fuel growth

Insurance ‘float’ is totally non-dilutive to equity holders

Well timed investment

Identified the right place and the right time to take advantage of

dislocation in the financial markets and industry wide de-leveraging

Innovative investment model

Utilize an insurance core to take advantages of intrinsic benefits

Utilize direct lending strategies to enhance fixed income portfolio

Flexible investment strategy

Insurance companies are exempt from Investment Company Act

maintaining investment strategy flexibility

Investment in Gerova Financial offers a compelling opportunity for

current and future shareholders

Attractive investment opportunity

23

ASSAC has entered into merger agreements and asset purchase agreements

to consummate the proposed transaction

Northstar Agreement

Amalphis Agreement

Stillwater Agreement

Wimbledon Agreement

Acquire Northstar Holdings

Acquire shareholders equity in Northstar Insurance

$7M cash

$120M performance note

Acquire 81.5% controlling interest

$57M in the form of 57,000 Pref

Shares, to convert to 7.6M

ordinary shares

Merger agreements 100% of Domestic Stillwater Funds

Asset purchase agreements substantially all the assets of the

Offshore Stillwater Funds

Cash fee of $12M, and approx.

650,000 Pref Shares based on

NAV of $650M, converting to

66.7M ordinary shares based

on an audited NAV of $500M

Newly formed acquisition subsidiary Allied Provident will

acquire all of the net assets through an asset purchase

agreement

106,000 Pref Shares based on

~NAV of $106M, converting to

10.7M ordinary shares based

on an audited NAV of $80M

Nature of Transaction

Consideration to be Paid

Notes: (1) Preference Shares have a liquidation value of $1,000 per share. Ordinary Shares have a conversion price of $7.50 per share commencing

on 31 July 2010, at a rate of 1/6th of the Conversion Shares per month through to December 31, 2010

Transaction Terms

24

Asia Special Situation Acquisition Corp (ASSAC) is a special purpose

investment company with a mandate to invest in a non-American

operating company with exposure to the Asian market

ASSAC is a blank check company domiciled in the Cayman Islands and listed on the NYSE Amex: CIO.

ASSAC’s core asset is $US115 million cash held in trust, raised via an IPO in January 2008

ASSAC is mandated to invest in a hospitality business or a financial services business that is principally

in Asia, through either an asset acquisition or share purchase transaction

In November 2009, ASSAC terminated its merger agreement with its prior Asian target and negotiated

payment of a break-fee following the target’s independent placement of $315 million in debt and equity.

Following the termination, ASSAC identified an exciting opportunity for its shareholders centered on the

acquisition and consolidation of discounted financial assets

In December 2009 ASSAC executed merger agreements with new targets in this industry, and is

targeting an ASSAC shareholder meeting on January 19, 2010 to vote on the proposed transaction

ASSAC’s corporate existence terminates on January 23, 2010

ASSAC history

Identify Macro

Opportunity

Identify

Attractive

Segment of

Market

Align Investment

with Key Trends

Investment to Fit

ASSAC Mandate

25

ASSAC has identified a significant opportunity to take advantage of the dislocation

of financial markets and the associated de-leveraging of financial companies by

acquiring financial assets in exchange for restricted publicly traded stock

ASSAC Investment Process

Identified Assets

Structural asset to

liability mismatch

in the financial

industry

Insurance

companies have

positive tax and

leverage

implications

Asset in the

financial services

sector with

exposure to

Asian market

Defined

liquidity

pathway for

funds with

significant short

term liabilities

Northstar Insurance

Companies

Stillwater Funds

Allied Provident

Group

ASSAC investment process