As filed with the Securities and Exchange Commission on August 13, 2007

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BIOLEX, INC.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 2834 | | 56-2065137 |

| (State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (IRS Employer Identification No.) |

158 Credle Street

Pittsboro, North Carolina 27312

(919) 542-9901

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Jan Turek, President and Chief Executive Officer

158 Credle Street

Pittsboro, North Carolina 27312

(919) 542-9901

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

With copies to:

| | |

Jonathan L. Kravetz, Esq. Brian P. Keane, Esq. Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. One Financial Center Boston, MA 02111 (617) 542-6000 | | Todd W. Eckland, Esq. David G. Odrich, Esq. Pillsbury Winthrop Shaw Pittman LLP 1540 Broadway New York, NY 10036-4039 (212) 858-1000 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are being offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

| | | | |

| |

| Title of each class of securities to be registered | | Proposed Maximum

Aggregate Offering Price(1) | | Amount of Registration Fee(2) |

Common Stock, $0.001 par value per share | | $70,000,000 | | $2,149 |

| |

| (1) | Estimated solely for the purpose of calculating the amount of registration fee pursuant to Rule 457(o) under the Securities Act. Includes shares of common stock subject to the underwriters’ option to purchase additional shares of common stock. |

| (2) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| | |

PROSPECTUS | | |

Subject to Completion, dated August 13, 2007 |

Shares

Common Stock

Biolex, Inc. is offering shares of its common stock in an underwritten public offering. This is the initial public offering of shares of our common stock, for which no public market currently exists.

We have applied to have our common stock listed on The NASDAQ Global Market under the symbol “BLEX.” We anticipate that the initial public offering price will be between $ and $ per share.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 9 of this prospectus.

| | | | | | |

| | | Per Share | | Total |

Price to the public | | $ | | | $ | |

Underwriting discounts and commissions | | $ | | | $ | |

Proceeds to us (before expenses) | | $ | | | $ | |

We have granted the underwriters a 30-day option to purchase up to an additional shares of common stock from us on the same terms and conditions as set forth above if the underwriters sell more than shares of common stock in this offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on or about , 2007.

| | |

| LEHMAN BROTHERS | | DEUTSCHE BANK SECURITIES |

LEERINK SWANN & COMPANY

, 2007

TABLE OF CONTENTS

Until , 2007 (25 days after the commencement of this offering), all dealers that effect transactions in shares of our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered to you. We have not, and the underwriters have not, authorized anyone to provide you with additional or different information. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock.

For investors outside the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of shares of common stock and the distribution of this prospectus outside of the United States, except as may otherwise be described in this prospectus.

i

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and may not contain all of

the information that may be important to you in making an investment decision. You should read this summary together with the more detailed information, including our consolidated financial statements and the related notes, elsewhere in this prospectus. You should carefully consider, among other things, the matters discussed in “Risk Factors” beginning on page 9.Unless otherwise stated or the context requires otherwise, references in this prospectus to the “Company,” “Biolex,” “Biolex Therapeutics,” “we,” “us” and “our” refer to Biolex, Inc. and our subsidiaries.

BIOLEX, INC.

We are a clinical-stage biopharmaceutical company that uses our patented LEX System to develop hard-to-make therapeutic proteins and optimized monoclonal antibodies. The LEX System is a novel technology that genetically transforms the aquatic plantLemna to enable the production of biologic product candidates. Our proprietary product candidates are designed to provide superior efficacy/tolerability profiles and to address large, proven pharmaceutical markets.

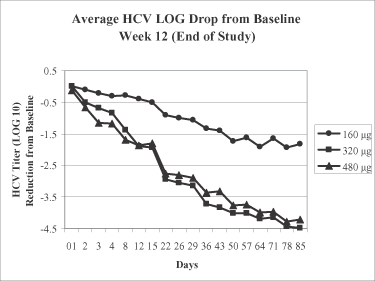

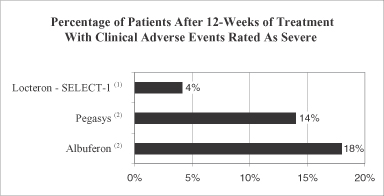

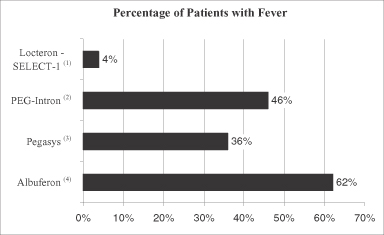

Our lead product candidate, Locteron, is in Phase 2 clinical trials and is the only controlled-release interferon alfa known to be currently in clinical development for the treatment of chronic hepatitis C. Locteron is designed to improve upon the current standard of patient care, pegylated interferon alfa administered weekly in combination with the antiviral drug ribavirin, which is associated with significant side effects. In a 32-patient Phase 2a clinical trial of Locteron administered once every two weeks in combination with ribavirin, an early virologic response, or EVR, was achieved by 100% (8/8) of hepatitis C patients treated with the 480 microgram, or 480 µg, dose of Locteron. Achievement of EVR, which is a specified reduction in viral load, has been broadly established to be a prerequisite for long-term response in hepatitis C patients. In addition, reported side effects were fewer and less severe than previously reported with other interferon products currently marketed or in development.

We have also developed two other product candidates that capitalize on the benefits of the LEX System, which we are advancing toward clinical trials: BLX-155, a direct-acting thrombolytic designed to dissolve blood clots in patients; and BLX-301, an anti-CD20 antibody we are optimizing for the treatment of non-Hodgkin’s B-cell lymphoma and other diseases. We believe that all of our product candidates have reduced clinical and regulatory risk profiles because they are based on well-understood proteins with proven mechanisms of action or clinical validation, and well-established regulatory pathways.

Our Product Candidates

We have focused our pipeline of product candidates on biologics that we believe can be enhanced by the LEX System. The LEX System facilitates the development of proteins whose complexity and other properties limit their commercial viability in traditional production systems. It also enables us to produce monoclonal antibodies that can be optimized with the objective of improving their potency and efficacy. By capitalizing on the significant benefits of the LEX System over traditional production systems, we are developing the following pipeline of product candidates.

Locteron

The World Health Organization estimates that as many as 130 million people worldwide are chronically infected with hepatitis C and that an additional three to four million people are infected each year. It is estimated that annual worldwide sales of interferon for the treatment of hepatitis C will increase from $2.8 billion in 2005 to

1

more than $5 billion by 2014. Under the current standard of care, interferon alfa is injected weekly for up to 48 weeks and is associated with significant side effects, including fatigue, flu-like symptoms, depression and anemia, resulting in high rates of patient non-compliance and discontinuation of therapy. Future treatment is expected to continue to consist of interferon in combination with one or more antiviral agents, which could heighten patient tolerability concerns, because the antiviral agents currently under development have been reported to cause additional side effects.

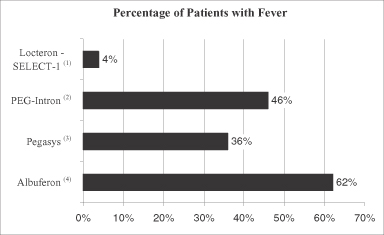

Locteron is designed to improve patient care by providing a more favorable side-effect profile and more convenient dosing. Locteron incorporates PolyActive, a controlled-release technology patented by our co-development partner OctoPlus N.V., which provides a gradual release of interferon alfa to patients without the high initial blood levels associated with the significant side effects experienced by patients today. Locteron is also formulated to allow dosing once every two weeks, a substantial improvement in patient convenience compared to currently marketed pegylated interferon alfa products that require dosing every week.

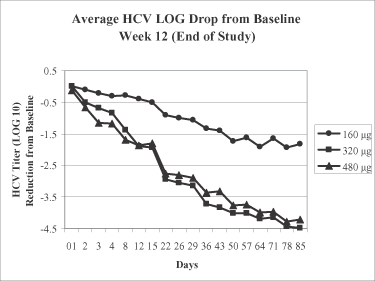

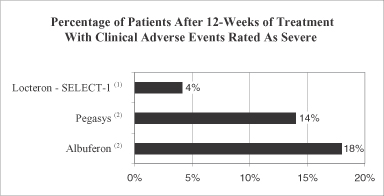

We are conducting a 12-week, Phase 2a clinical trial (SELECT-1) in Europe to evaluate four different doses of Locteron administered once every two weeks in combination with ribavirin in 32 treatment-naïve hepatitis C patients. In this trial, an EVR was achieved by 100% (8/8) of patients treated with the 480mg dose of Locteron and by 88% (7/8) of patients treated with the 320mg dose. In addition, patients receiving Locteron experienced fewer and less severe side effects than those previously reported for pegylated interferons and Albuferon, an albumin-fused interferon product currently under development. Accordingly, the objective of this trial has been met as we have identified a range of doses with an appropriate combination of viral reduction and favorable tolerability to proceed to a Phase 2b trial.

In the first half of 2008, we plan to initiate a 72-week, 100-patient Phase 2b clinical trial (SELECT-2) in Europe comparing three doses of Locteron in combination with ribavirin against a control arm treated with pegylated interferon alfa in combination with ribavirin. Patients will be treated for 48 weeks with a 24-week follow-up period. The results after 12 weeks of treatment with Locteron will be evaluated and will be the basis for dose selection for Phase 3 clinical trials. The overlap between the Phase 2 and Phase 3 trials is designed to expedite the development path of Locteron, with dosing in Phase 3 trials expected to commence in 2009. We are developing Locteron under an exclusive collaboration agreement with OctoPlus, the developer of PolyActive.

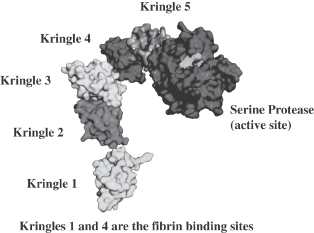

BLX-155

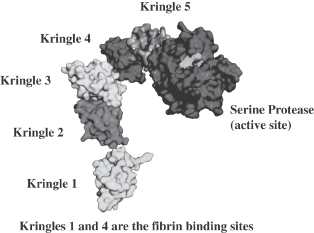

BLX-155 is a direct-acting thrombolytic that we are developing to dissolve blood clots in patients with certain diseases or conditions such as acute peripheral arterial disease, deep vein thrombosis and hemodialysis graft thrombosis. Thrombosis, the formation or presence of a blood clot, is a leading cause of morbidity and mortality and, according to the National Heart Lung and Blood Institute, is estimated to affect over 50 million people in the developed world. BLX-155 is the recombinant form of plasmin, a naturally occurring human enzyme responsible for dissolving fibrin, a key component of blood clots. Plasmin has been studied for a number of decades as a drug candidate for dissolving blood clots, but recombinant full-length human plasmin has not been successfully produced at commercially viable levels in traditional protein production systems.

In July 2007, our researchers presented results demonstrating the ability of the LEX System to produce full-length recombinant plasmin at commercially viable levels. This achievement provides us with a unique opportunity to pursue development and commercialization of a therapeutic protein with a known mechanism of action for which prior development historically had been prevented due to production challenges. As a direct-acting thrombolytic, we believe BLX-155 has the potential to provide efficacy and safety advantages over

2

plasminogen activators that dissolve blood clots indirectly, including tissue-type plasminogen activators, or t-PAs, which are the current standard of care. BLX-155 is currently in preclinical development, and we expect to commence a Phase 1 clinical trial in hemodialysis graft thrombosis patients in the first half of 2008.

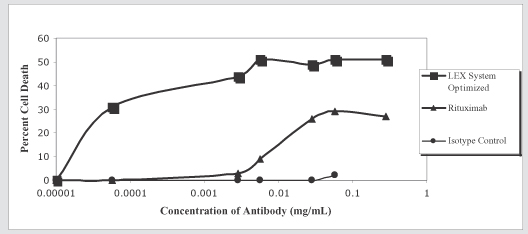

BLX-301

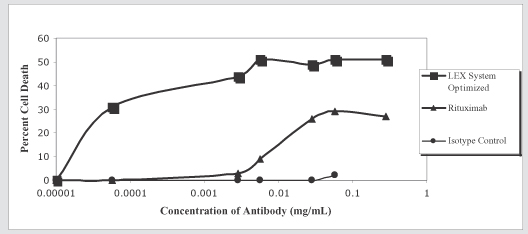

BLX-301 is an anti-CD20 antibody that we are optimizing for the treatment of non-Hodgkin’s B-cell lymphoma and other diseases. BLX-301 is based on the capability of the LEX System to optimize the glycosylation structure of monoclonal antibodies to increase their potency and efficacy. In May 2007, we announced preclinical results highlighting the ability of the LEX System to produce an anti-CD20 antibody with enhanced cytotoxicity and potentially lower side effects than Rituxan, the top selling treatment for non-Hodgkin’s B-cell lymphoma, which is also used to treat rheumatoid arthritis. BLX-301 is currently in preclinical development, and we expect to commence a Phase 1 clinical trial in non-Hodgkin’s B-cell lymphoma patients in 2009.

The LEX System

The market for therapeutic proteins is projected to grow at twice the rate of the market for small molecule drugs, or synthetic pharmaceutical compounds, and is expected to increase from $51 billion in 2005 to $87 billion in 2010, according to Kalorama Information. Therapeutic proteins have traditionally been produced primarily inmicrobial and mammalian systems. These traditional production systems, however, have a number of inherent drawbacks, including the need for significant capital investments, long lead times to establish manufacturing facilities, and high costs of production. In some instances, the commercialization of proteins has been prevented because production at commercially viable levels is not achievable in traditional systems or the use of traditional systems to produce certain proteins is blocked by existing process patents.

In addition, monoclonal antibodies are the fastest growing class of products in the pharmaceutical industry, with total sales growing from $4 billion in 2001 to $17 billion in 2005, and projected to reach $34 billion in 2010. Demand for improved production techniques results from recent research suggesting that the efficacy and potency of monoclonal antibodies can be enhanced by modifying their sugar-chain components, or glycosylation structures.

We have applied advanced genetic engineering to create our recombinant protein production system, theLemna Expression System, or LEX System, that addresses many of the drawbacks of traditional production systems. The LEX System facilitates the development of proteins whose complexity and other properties limit their commercial viability in traditional production systems. It also enables us to produce monoclonal antibodies that can be optimized with the objective of improving potency and efficacy. The strengths of the LEX System include:

| | • | | Production of Complex Proteins. We have not encountered a class of proteins that cannot be expressed by the LEX System. To date, as part of our research and development activities, we have produced more than 35 different proteins using the LEX System, including complex proteins that are challenging to produce in traditional production systems. For instance, the protein plasmin has been studied for several decades as a drug candidate for resolving blood clots, but production of full-length human plasmin at commercially viable levels has not been reported with any traditional recombinant production system. Our product candidate BLX-155, a recombinant full-length plasmin, can be produced at commercially viable levels using the LEX System. |

| | • | | Complex Protein Folding.Lemna is able to correctly produce proteins requiring folding or other complex processing, which is key to the efficient production of many proteins, including interferon alfa. Traditional production systems are unable to express interferon alfa that is correctly folded, therefore |

3

| | requiring a series of unfolding and refolding steps during purification that results in substantial yield loss and contributes to the high cost of production in these systems. |

| | • | | Optimization of Monoclonal Antibodies. The LEX System has demonstrated the capability to express monoclonal antibodies in which the glycosylation structure has been optimized to enhance the efficacy and potency of the antibodies. |

| | • | | Access to Product Candidates. TheLemna-based protein production system is a novel technology that we believe will provide us with multiple opportunities to produce proteins without conflicting with patent claims relating to the production of certain proteins in traditional production systems. For example, the LEX System allows us to produce the interferon alfa used in Locteron without conflicting with the patent claims covering the production of interferon alfa in a bacteria-based system. |

| | • | | Reduced Safety Risk.The LEX System contains no human or animal components, which can carry a risk of viral or other infectious agent contamination. |

| | • | | Reduced Capital Cost and Facility Timelines. We believe that the simplicity and other characteristics of the LEX System will result in capital investment requirements and timelines for implementation of manufacturing facilities that are substantially less than those associated with traditional systems. |

Our Strategy

Our objective is to become a leading biopharmaceutical company by developing and commercializing a diverse portfolio of best-in-class biologic products for large proven markets. The key elements of our strategy to achieve this objective are:

| | • | | leverage our extensive biopharmaceutical experience and the power of the LEX System to source and develop high-value product candidates; |

| | • | | continue to develop our current product candidates, Locteron, BLX-155 and BLX-301; |

| | • | | position Locteron as the interferon of choice for the treatment of chronic hepatitis C; |

| | • | | position BLX-155 to address multiple large-market indications involving blood clots; |

| | • | | establish an effective commercial infrastructure as we progress toward regulatory approval; and |

| | • | | continue to strategically partner with leading pharmaceutical and biotechnology companies. |

Risk Factors

Our business is subject to numerous risks, as more fully described in the section entitled “Risk Factors” immediately following this prospectus summary, including the following:

| | • | | We are a development stage company and have incurred significant losses since our inception. We had an accumulated deficit of $75.4 million as of March 31, 2007. |

| | • | | We expect to continue to incur significant losses for the foreseeable future, and we expect these losses to increase substantially as we conduct larger-scale trials for our drug candidates, commercialize any approved product candidates, hire additional personnel, and add operational, financial and management information systems. |

| | • | | The FDA has not previously approved products developed in a plant-based expression system, such as the LEX System, and our product candidates are still in the early stages of development and remain subject to clinical testing and regulatory approval. If we are unable to successfully develop and test our product candidates, we will not be successful. |

4

| | • | | Our success is largely dependent on the success of our lead product candidate, Locteron, which has been tested only in a limited number of patients over a short duration, and we cannot be certain that we will be able to obtain regulatory approval for or successfully commercialize this product candidate. |

| | • | | Even if any of our product candidates receives regulatory approval, if the approved product does not achieve broad market acceptance, the revenues that we generate from sales of the product will be limited. |

| | • | | If we are unable to protect our intellectual property and operate our business without infringing upon the intellectual property rights of others, our ability to commercialize our product candidates would be harmed. |

| | • | | We have never manufactured a product candidate on a commercial scale, and we will need to establish commercial-scale manufacturing capabilities if any of our or our collaboration partners’ product candidates receives regulatory approval. |

Corporate Information

We were incorporated in Delaware in September 1997. Our principal executive offices are located at 158 Credle Street, Pittsboro, North Carolina 27312, and our telephone number is (919) 542-9901. Our website address is www.biolex.com. The information on our website is not part of this prospectus. We have included our website address as a factual reference and do not intend it to be an active link to our website.

Our trademarks and service marks include Biolex, Biolex Therapeutics, the LEX System, theLemna Expression System, Locteron and our logo. This prospectus also includes trademarks and service marks of other persons.

5

The Offering

Common stock offered by us | shares |

Common stock to be outstanding after this offering | shares |

Underwriters’ option to purchase additional shares | shares |

Use of proceeds | We estimate that our net proceeds from this offering will be approximately $ million, assuming an initial public offering price of $ per share, the midpoint of the range listed on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering to fund clinical trials, preclinical testing and other research and development activities, and for general and administrative expenses, working capital needs and other general corporate purposes. For a more complete description of our intended use of the proceeds, see “Use of Proceeds.” |

Proposed NASDAQ Global Market symbol | BLEX |

Except as otherwise indicated, throughout this prospectus the number of shares of common stock to be outstanding after this offering is based on the number of shares outstanding as of August 1, 2007, and excludes:

| | • | | 9,456,007 shares of common stock issuable upon the exercise of stock options outstanding as of August 1, 2007, at a weighted average exercise price of $0.28 per share; |

| | • | | 93,640 shares of common stock issuable upon the exercise of warrants outstanding as of August 1, 2007, at a weighted average exercise price of $1.09 per share; and |

| | • | | 1,814,658 shares of common stock reserved for future awards under our stock plan. |

Unless otherwise indicated, all information contained in this prospectus assumes that the underwriters do not exercise their option to purchase up to additional shares of our common stock in this offering and also reflects:

| | • | | the conversion of all outstanding shares of our Class B non-voting common stock and our preferred stock into shares of our Class A voting common stock and the reclassification of our Class A voting common stock into common stock upon completion of this offering; |

| | • | | a -for- split of our common stock to be effected prior to the completion of this offering; and |

| | • | | the adoption of our amended and restated certificate of incorporation and restated bylaws upon the completion of this offering. |

6

Summary Consolidated Financial Data

(in thousands, except per share amounts)

The summary consolidated financial data set forth below should be read in conjunction with our consolidated financial statements and the related notes, “Selected Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results to be expected in any future period.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | | Three Months Ended March 31, | | | Period From

Sept. 19,

1997

(Inception)

Through

March 31, 2007 | |

| | | 2004 | | | 2005 | | | 2006 | | | 2006 | | | 2007 | | |

| | | | | | as restated | | | | | | (unaudited) | | | (unaudited) | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues | | $ | 719 | | | $ | 3,008 | | | $ | 5,017 | | | $ | 1,327 | | | $ | 724 | | | $ | 9,752 | |

Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | |

Research and development | | | 8,666 | | | | 14,448 | | | | 19,196 | | | | 5,084 | | | | 5,292 | | | | 60,632 | |

General and administrative | | | 2,400 | | | | 4,126 | | | | 4,370 | | | | 1,096 | | | | 1,114 | | | | 19,687 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 11,066 | | | | 18,574 | | | | 23,566 | | | | 6,180 | | | | 6,406 | | | | 80,319 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Loss from operations | | | (10,347 | ) | | | (15,566 | ) | | | (18,549 | ) | | | (4,853 | ) | | | (5,682 | ) | | | (70,567 | ) |

Interest (expense) income, net | | | (57 | ) | | | (421 | ) | | | 774 | | | | 152 | | | | (35 | ) | | | (1,734 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Loss before income taxes | | | (10,404 | ) | | | (15,987 | ) | | | (17,774 | ) | | | (4,701 | ) | | | (5,717 | ) | | | (72,301 | ) |

Income tax benefit | | | — | | | | 170 | | | | 277 | | | | 31 | | | | 35 | | | | 482 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net loss | | | (10,404 | ) | | | (15,817 | ) | | | (17,497 | ) | | | (4,670 | ) | | | (5,682 | ) | | | (71,819 | ) |

Less: accretion of mandatorily redeemable convertible preferred stock | | | (1,165 | ) | | | (3,034 | ) | | | (5,600 | ) | | | (1,369 | ) | | | (1,495 | ) | | | (16,772 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net loss attributable to common stockholders | | $ | (11,569 | ) | | $ | (18,851 | ) | | $ | (23,097 | ) | | $ | (6,039 | ) | | $ | (7,177 | ) | | $ | (88,591 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Basic and diluted net loss attributable to common stockholders per share | | $ | (42.91 | ) | | $ | (65.25 | ) | | $ | (68.52 | ) | | $ | (20.18 | ) | | $ | (14.93 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Shares used in the calculation of basic and diluted net loss per share | | | 270 | | | | 289 | | | | 337 | | | | 299 | | | | 481 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Pro forma basic and diluted net loss per share (unaudited)(1) | | | | | | | | | | $ | (0.29 | ) | | | | | | $ | (0.09 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Shares used to compute pro forma basic and diluted net loss per share (unaudited)(1) | | | | | | | | | | | 60,145 | | | | | | | | 60,288 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(1) | The pro forma basic and diluted net loss per share gives effect to the conversion of all outstanding shares of preferred stock into common stock upon completion of this offering. |

The following summary balance sheet data as of March 31, 2007 is presented:

| | • | | on a pro forma basis to give effect to: |

| | • | | the sale by us of 25,663,339 shares of our Series CC preferred stock on May 18, 2007 at $1.18 per share in exchange for $25.0 million in cash and the conversion of a $5.0 million convertible note and accrued interest payable to a related party, less transaction expenses; and |

7

| | • | | the conversion of all outstanding shares of our Class B non-voting common stock and our preferred stock into shares of our Class A voting common stock and the reclassification of our Class A voting common stock into common stock upon completion of this offering; and |

| | • | | on a pro forma as adjusted basis to give further effect to our sale of shares of common stock in this offering at an assumed initial public offering price of $ per share, the midpoint of the range listed on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| | | | | | | | | | | |

| | | As of March 31, 2007 |

| | | Actual | | | Pro Forma | | | Pro Forma As Adjusted(1) |

| | | (unaudited) |

Balance Sheet Data: | | | | | | | | | | | |

Cash and cash equivalents | | $ | 8,708 | | | $ | 32,542 | | | $ | |

Working capital | | | 2,505 | | | | 26,622 | | | | |

Total assets | | | 19,172 | | | | 43,007 | | | | |

Long-term liabilities | | | 10,690 | | | | 5,690 | | | | |

Total liabilities | | | 17,921 | | | | 12,638 | | | | |

Mandatorily redeemable convertible preferred stock | | | 73,070 | | | | — | | | | |

Additional paid-in-capital | | | 3,635 | | | | 105,736 | | | | |

Deficit accumulated during development stage | | | (75,421 | ) | | | (75,421 | ) | | | |

Total stockholders’ equity (deficit) | | | (71,819 | ) | | | 30,369 | | | | |

(1) | A $1.00 increase (decrease) in the assumed initial public offering price of $ per share would increase (decrease) each of the pro forma as adjusted cash and cash equivalents, working capital, total assets, additional paid-in capital and total stockholders’ equity by $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. The pro forma as adjusted information discussed above is illustrative only and following the completion of this offering will be adjusted based on the actual public offering price and other terms of this offering determined at pricing. |

8

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully read and consider the risks and uncertainties described below together with all of the other information contained in this prospectus, including the consolidated financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in our common stock. If any of these risks actually occur, our business, business prospects, financial condition, results of operations or cash flows could be materially harmed. In any such case, the trading price of our common stock could decline, and you could lose all or part of your investment.

Risks Related to Our Financial Position

We are a development stage company and have incurred significant losses since our inception, and we expect to incur losses for the foreseeable future and may never reach profitability.

We are a development stage company and have been engaged in designing and developing product candidates since 1997. Since our inception we have incurred significant operating losses and, as of March 31, 2007, we had an accumulated deficit of $75.4 million. We have not generated any revenue from the sale of our product candidates to date. We had net losses of $10.4 million, $15.8 million, $17.5 million and $5.7 million for the three years ended December 31, 2006 and the three months ended March 31, 2007, respectively. Since our inception, we have incurred $60.6 million of research and development expenses. We expect to continue to incur research and development and other significant operating expenses and capital expenditures and anticipate that our expenses and losses will increase substantially in the foreseeable future as we:

| | • | | initiate additional Phase 2 trials of Locteron for the treatment of chronic hepatitis C, including a Phase 2b clinical trial that we expect to initiate in the first half of 2008; |

| | • | | complete preclinical development of BLX-155 and initiate clinical trials, if supported by positive preclinical data; |

| | • | | initiate Phase 3 clinical development of Locteron, if supported by the Phase 2 results; |

| | • | | begin to establish commercial manufacturing facilities and establish sales and marketing functions; |

| | • | | continue preclinical development of BLX-301 and initiate clinical trials, if supported by positive preclinical data; |

| | • | | identify additional product candidates and acquire rights from third parties to product candidates through licenses, acquisitions or other means; |

| | • | | commercialize any approved product candidates; |

| | • | | hire additional clinical, scientific, manufacturing/quality and management personnel; and |

| | • | | add operational, financial and management information systems and personnel. |

We must generate significant revenue to achieve and maintain profitability. Even if we succeed in developing and commercializing one or more of our product candidates, we may not be able to generate sufficient revenue and we may never be able to achieve or maintain profitability.

9

If we fail to obtain the capital necessary to fund our operations, we will be unable to successfully develop and commercialize our product candidates.

Although we have raised substantial capital to date, we will require substantial future capital in order to complete the clinical development of and to commercialize our lead product candidate, Locteron, and to complete the preclinical and clinical development of and to commercialize our two preclinical stage product candidates, BLX-155 and BLX-301. Our future capital requirements will depend on many factors that are currently unknown to us, including:

| | • | | the timing of initiation, progress, results and costs of our planned Phase 2 clinical trials of Locteron for the treatment of chronic hepatitis C; |

| | • | �� | the timing of initiation, progress, results and costs of any Phase 3 clinical trials of Locteron we may initiate based on the results of our Phase 2 trials, which will be affected by interactions with the FDA and similar foreign regulatory authorities and our continuing evaluation of third-party intellectual property relevant to our commercialization plans and other factors; |

| | • | | the results of preclinical studies of our two preclinical product candidates, BLX-155 and BLX-301, and the timing of initiation, progress, results and costs of any clinical trials of these product candidates that we may initiate based on the preclinical results; |

| | • | | the costs of establishing commercial manufacturing facilities and of establishing sales and marketing functions; |

| | • | | the scope, progress, results, and costs of preclinical development, clinical trials, and regulatory review of any new product candidates for which we may initiate development; |

| | • | | the costs of preparing, filing, and prosecuting patent applications and maintaining, enforcing, and defending intellectual property-related claims; |

| | • | | our ability to establish strategic collaborations and licensing or other arrangements on terms favorable to us; |

| | • | | the costs to satisfy our obligations under potential future collaborations; and |

| | • | | the timing, receipt, and amount of sales or royalties, if any, from any approved product candidates. |

We cannot assure you that additional funds will be available when we need them on terms that are acceptable to us, or at all. If adequate funds are not available on a timely basis, we may be required to:

| | • | | terminate or delay clinical trials or other development for one or more of our product candidates; |

| | • | | delay our establishment of sales and marketing capabilities, commercial manufacturing capabilities, or other activities that may be necessary to commercialize our product candidates; or |

| | • | | curtail significant drug development programs that are designed to identify new product candidates. |

We believe that the proceeds we receive from this offering and our existing cash and investment securities will be sufficient to support our current operating plan into 2009. However, our operating plan may change as a result of many factors currently unknown to us, and we may need additional funds sooner than planned. In addition, we may seek additional capital due to favorable market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans.

10

Risks Related to the Development and Regulatory Approval of Our Product Candidates

Our success is largely dependent on the success of our lead product candidate, Locteron, and we cannot be certain that we will be able to obtain regulatory approval for or successfully commercialize this product candidate.

We have invested a significant portion of our time and financial resources in the development of our lead product candidate, Locteron, for the treatment of chronic hepatitis C. We anticipate that our success will depend largely on the receipt of regulatory approval and successful commercialization of this product candidate, which will depend on several factors, including the following:

| | • | | our ability to provide acceptable evidence of its safety and efficacy, and the receipt of marketing approval from the FDA and any similar foreign regulatory authorities, particularly given that the FDA has not previously approved a product developed in a plant-based expression system, such as the LEX System; |

| | • | | establishing commercial-scale manufacturing capabilities; |

| | • | | establishing an internal sales force or collaborating with pharmaceutical companies or contract sales organizations to market and sell Locteron, if approved; and |

| | • | | acceptance of Locteron, if approved, in the medical community and by patients and third-party payors. |

Many of these factors are beyond our control. Accordingly, we cannot assure you that we will ever be able to generate revenues through the sale of Locteron.

Our product candidates are still in the early stages of development and remain subject to clinical testing and regulatory approval. If we are unable to successfully develop and test our product candidates, we will not be successful.

To date, we have not marketed, distributed or sold any product candidates. The success of our business depends substantially upon our ability to develop and commercialize our product candidates successfully. We currently have only three product candidates, all of which are in the early stages of development: Locteron is currently in Phase 2 clinical trials and both BLX-155 and BLX-301 are in preclinical development. To date we have not completed any Phase 2 or Phase 3 clinical trials. Our product candidates are prone to the risks of failure inherent in drug development. Before obtaining regulatory approvals for the commercial sale of Locteron, BLX-155, BLX-301 or any other product candidate for a target indication, we must demonstrate with substantial evidence gathered in well-controlled clinical trials, and, with respect to approval in the United States, to the satisfaction of the FDA and, with respect to approval in other countries, similar regulatory authorities in those countries, that the product candidate is safe and effective for use for that target indication. Satisfaction of these and other regulatory requirements is costly, time consuming, uncertain, and subject to unanticipated delays. Despite our efforts, our product candidates may not:

| | • | | offer improvement over existing, comparable drugs; |

| | • | | be proven safe and effective in clinical trials; |

| | • | | meet applicable regulatory standards; or |

| | • | | be successfully commercialized. |

Positive results in preclinical studies of a product candidate may not be predictive of similar results in humans during clinical trials, and promising results from early clinical trials of a product candidate may not be replicated in later clinical trials. Interim results of a clinical trial do not necessarily predict final results. A number of companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in late-stage clinical trials even after achieving promising results in early-stage development. Accordingly, the results from the completed preclinical studies and clinical trials and ongoing clinical trials for Locteron and the

11

completed and ongoing preclinical studies for BLX-155 and BLX-301 may not be predictive of the results we may obtain in later stage trials or studies. Our preclinical studies or clinical trials may produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional preclinical studies or clinical trials, or to discontinue clinical trials altogether. We do not expect any of our product candidates to be commercially available for at least several years and some or all may never become commercially available.

If clinical trials for our product candidates are prolonged or delayed, we may be unable to commercialize our product candidates on a timely basis, which would require us to incur additional costs and delay our receipt of any revenue from potential product sales.

We cannot predict whether we will encounter problems with any of our completed, ongoing or planned clinical trials that will cause us or any regulatory authority to delay or suspend those clinical trials or delay the analysis of data derived from them. A number of events, including any of the following, could delay the completion of our ongoing and planned clinical trials and negatively impact our ability to obtain regulatory approval for, and to market and sell, a particular product candidate, including our clinical-stage product candidate Locteron:

| | • | | conditions imposed on us or our collaborators by the FDA or any foreign regulatory authority regarding the scope or design of our clinical trials; |

| | • | | delays in obtaining, or our inability to obtain, required approvals from institutional review boards, or IRBs, or other reviewing entities at clinical sites selected for participation in our clinical trials; |

| | • | | insufficient supply or deficient quality of our product candidates or other materials necessary to conduct our clinical trials; |

| | • | | delays in obtaining regulatory agency agreement for the conduct of our clinical trials; |

| | • | | lower than anticipated enrollment and retention rate of subjects in clinical trials for a variety of reasons, including size of patient population, nature of trial protocol, the availability of approved effective treatments for the relevant disease and competition from other clinical trial programs for similar indications; |

| | • | | serious and unexpected drug-related side effects experienced by patients in clinical trials; or |

| | • | | failure of our third-party contractors to meet their contractual obligations to us in a timely manner. |

Clinical trials may also be delayed or terminated as a result of ambiguous or negative interim results. In addition, a clinical trial may be suspended or terminated by us, the FDA, the IRBs at the sites where the IRBs are overseeing a trial, or a data safety monitoring board, or DSMB, overseeing the clinical trial at issue, or other regulatory authorities due to a number of factors, including:

| | • | | failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols; |

| | • | | inspection of the clinical trial operations or trial sites by the FDA or other regulatory authorities resulting in the imposition of a clinical hold; |

| | • | | varying interpretation of data by the FDA or similar foreign regulatory authorities; |

| | • | | failure to achieve primary or secondary endpoints or other failure to demonstrate efficacy; |

| | • | | unforeseen safety issues; or |

| | • | | lack of adequate funding to continue the clinical trial. |

Additionally, changes in regulatory requirements and guidance may occur and we may need to amend clinical trial protocols to reflect these changes. Amendments may require us to resubmit our clinical trial protocols to IRBs for reexamination, which may impact the cost, timing or successful completion of a clinical trial.

12

We do not know whether our clinical trials will begin as planned, will need to be restructured or will be completed on schedule, if at all. Delays in our clinical trials will result in increased development costs for our product candidates. In addition, if we experience delays in completion of, or if we terminate, any of our clinical trials, the commercial prospects for our product candidates may be harmed and our ability to generate product revenues will be delayed. Furthermore, many of the factors that cause, or lead to, a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of a product candidate.

Unanticipated side effects during the clinical development of Locteron may result in an interruption, delay or halt in clinical trials and could result in the denial of regulatory approval by the FDA or other regulatory authorities.

The active agent in our product candidate Locteron is interferon alfa, variants of which are currently marketed in the United States and elsewhere for treatment of chronic hepatitis C. Treatment of patients with interferon alfa has historically been associated with significant adverse side effects, including severe flu-like symptoms, depression, suicidal thoughts and attempts, fatigue, alopecia, bone marrow toxicity (thrombocytopenia, neutropenia), endocrine disorders, hepatotoxicity, cardiovascular and pulmonary disorders, pancreatitis, worsening of autoimmune disorders, sleep disorders, arthralgia, myalgia and ophthalmologic disorders. A number of participants in our Phase 2a clinical trial for Locteron have experienced adverse events adjudicated or determined by trial investigators to be potentially attributable to Locteron, although most of these adverse events have been rated as mild and only one such adverse event was rated as severe. We cannot assure you, however, that the favorable safety and tolerability profile suggested by Locteron in our Phase 2a clinical trial will be replicated in future trials that will be required prior to regulatory approval. In addition, these future clinical trials may demonstrate that the gradual release of interferon alfa does not reduce the frequency, duration or severity of side effects commonly experienced by patients treated with currently marketed pegylated interferons and with Albuferon.

Because Locteron has only been tested in a limited number of patients over a short duration, we cannot assure you that Locteron’s efficacy or safety and tolerability profile suggested to date will be replicated in the future.

To date, Locteron has only been tested in a very limited number of patients, including a total of 32 patients (eight patients per dose cohort) in our European multi-center, open-label Phase 2a clinical trial. Furthermore, most of the adverse side effects observed in our Phase 2a trial were based on symptoms that are measured subjectively, as they are subject to both varying perceptions by the patients and varying interpretations by our clinical investigators, including by virtue of their characterization as mild, moderate, severe or serious and their varying effect on diverse patient populations. Accordingly, and because observed significant adverse effects have been associated with currently marketed variants of interferon alfa, we cannot assure you that the favorable safety and tolerability profile suggested by Locteron in our completed early-stage clinical trials will be replicated in larger, later-stage trials. In addition, a definitive comparison of Locteron with currently marketed drugs or other drugs in clinical development requires a controlled, head-to-head clinical trial. To date, the longest a patient has been dosed with Locteron has been for 12 weeks. The anticipated dosing period for Locteron, if approved, is expected to be 48 weeks in the most prevalent genotype of hepatitis C patients. Accordingly, we cannot assure you that the results indicated by Locteron in early trials will be replicated in longer trials that will be required prior to regulatory approval. Unanticipated side effects could cause us, the FDA or other regulatory authorities or IRBs to interrupt, delay or halt clinical trials and could result in the denial of regulatory approval by the FDA or other regulatory authorities of Locteron.

13

If side effects are identified after our product candidates are approved and on the market, we may be required to change the labeling of any such products, or withdraw any such products from the market, any of which would hinder or preclude our ability to generate revenues.

Even if Locteron or any of our other product candidates receives marketing approval, we or others may later identify undesirable side effects. As greater numbers of patients use a drug following its approval, side effects and other problems may be observed after approval that were not seen or anticipated during pre-approval clinical trials. In that event a number of potentially significant negative consequences could result, including:

| | • | | regulatory authorities may withdraw their approval of the product; |

| | • | | regulatory authorities may require the addition of labeling statements, such as warnings or contraindications; |

| | • | | we may be required to change the way the product is administered, conduct additional clinical trials or change the labeling of the product; |

| | • | | we could be sued and held liable for harm caused to patients; and |

| | • | | our reputation may suffer. |

Even if our product candidates receive regulatory approval in the United States, we may never receive approval or commercialize our products outside of the United States.

In order to market any products outside of the United States, we must establish and comply with numerous and varying regulatory requirements of other countries regarding safety and efficacy. Approval procedures vary among countries and can involve additional product testing and additional administrative review periods. The time required to obtain approval in other countries might differ from that required to obtain FDA approval. The regulatory approval process in other countries may include all of the risks detailed above regarding FDA approval in the United States as well as other risks. Regulatory approval in one country does not ensure regulatory approval in another, but a failure or delay in obtaining regulatory approval in one country may have a negative effect on the regulatory process in others. Failure to obtain regulatory approval in other countries or any delay or setback in obtaining such approval would impair our ability to develop foreign markets for our product candidates.

Both before and after marketing approval, our product candidates are subject to ongoing regulatory requirements, and if we fail to comply with these continuing requirements, we could be subject to a variety of sanctions and the sale of any approved commercial products could be suspended.

Both before and after regulatory approval to market a particular product candidate, the manufacturing, labeling, packaging, adverse event reporting, storage, advertising, promotion and record keeping related to the product are subject to extensive regulatory requirements. If we fail to comply with the regulatory requirements of the FDA and other applicable U.S. and foreign regulatory authorities, we could be subject to administrative or judicially imposed sanctions, including:

| | • | | restrictions on the products or manufacturing processes; |

| | • | | untitled or warning letters; |

| | • | | civil or criminal penalties; |

| | • | | product seizures or detentions; |

14

| | • | | voluntary or mandatory product recalls and related publicity requirements; |

| | • | | suspension or withdrawal of regulatory approvals; |

| | • | | total or partial suspension of production; and |

| | • | | refusal to approve pending applications for marketing approval of new products or supplements to approved applications. |

We deal with hazardous materials and must comply with environmental laws and regulations, which can be expensive and restrict how we do business.

Certain of our drug development activities involve the controlled storage, use, and disposal of hazardous materials. We are subject to federal, state, and local laws and regulations governing the use, manufacture, storage, handling, and disposal of these hazardous materials. Although we believe that our safety procedures for the handling and disposing of these materials comply with the standards prescribed by these laws and regulations, we cannot eliminate the risk of accidental contamination or injury from these materials.

In the event of an accident, state or federal authorities may curtail our use of these materials, and we could be liable for any civil damages that result, which may exceed our financial resources and may seriously harm our business. Because we believe that our laboratory and materials handling policies and practices sufficiently mitigate the likelihood of materials liability or third-party claims, we currently carry no insurance covering such claims. An accident could damage, or force us to shut down, our operations.

Risks Related to the Commercialization of Our Product Candidates

Even if any of our product candidates receives regulatory approval, if the approved product does not achieve broad market acceptance, the revenues that we generate from sales of the product will be limited.

Even if Locteron, BLX-155 or BLX-301, or any other product candidates we may develop or acquire in the future, obtain regulatory approval, they may not gain broad market acceptance among physicians, healthcare payors, patients, and the medical community. The degree of market acceptance for any approved product candidate will depend on a number of factors, including:

| | • | | timing of market introduction of competitive products; |

| | • | | demonstration of clinical safety and efficacy compared to other products; |

| | • | | prevalence and severity of adverse side effects; |

| | • | | availability of reimbursement from managed care plans and other third-party payors; |

| | • | | convenience and ease of administration; |

| | • | | other potential advantages of alternative treatment methods; and |

| | • | | ineffective marketing and distribution support of our products. |

If our approved drugs fail to achieve broad market acceptance, we may not be able to generate significant revenue and our business would suffer.

15

If we are unable to establish sales and marketing capabilities or enter into agreements with third parties to market and sell our product candidates, we may be unable to generate product revenue.

We do not currently have an organization for the sales, marketing and distribution of pharmaceutical products. In order to market any products that may be approved by the FDA, we must build our sales, marketing, managerial and other non-technical capabilities or make arrangements with third parties to perform these services. If we are unable to establish adequate sales, marketing and distribution capabilities, whether independently or with third parties, we may not be able to generate product revenue and may not become profitable.

If government and third-party payors fail to provide adequate coverage and reimbursement rates for any of our product candidates that receive regulatory approval, our revenue and prospects for profitability will be harmed.

In both domestic and foreign markets, our sales of any future products will depend in part upon the availability of reimbursement from third-party payors. Such third-party payors include government health programs such as Medicare, managed care providers, private health insurers, and other organizations. These third-party payors are increasingly attempting to contain healthcare costs by demanding price discounts or rebates and limiting both coverage and the amounts that they will pay for new drugs, and, as a result, they may not cover or provide adequate payment for our product candidates. We might need to conduct post-marketing studies in order to demonstrate the cost-effectiveness of any future products to such payors’ satisfaction. Such studies might require us to commit a significant amount of management time and financial and other resources. Our future products might not ultimately be considered cost-effective. Adequate third-party reimbursement might not be available to enable us to maintain price levels sufficient to realize an appropriate return on investment in product development.

U.S. and foreign governments continue to propose and pass legislation designed to reduce the cost of healthcare. For example, in some foreign markets, the government controls the pricing and profitability of prescription pharmaceuticals. In the United States, we expect that there will continue to be federal and state proposals to implement similar governmental controls. In addition, recent changes in the Medicare program and increasing emphasis on managed care in the United States will continue to put pressure on pharmaceutical product pricing. Cost control initiatives could decrease the price that we would receive for any products in the future, which would limit our revenue and profitability. Accordingly, legislation and regulations affecting the pricing of pharmaceuticals might change before our product candidates are approved for marketing. Adoption of such legislation could further limit reimbursement for pharmaceuticals.

For example, the Medicare Prescription Drug Improvement and Modernization Act of 2003, or MMA, changes the way Medicare will cover and pay for pharmaceutical products. The legislation expanded Medicare coverage for drug purchases by the elderly and disabled and introduced new reimbursement methodologies, based on average sales prices for drugs that are administered in an in-patient setting or by physicians. In addition, this legislation provides authority for limiting the number of drugs that will be covered in any therapeutic class. Although we do not know what impact the new reimbursement methodologies will have on the prices of new drugs, we expect that there will be added pressure to contain and reduce costs. These cost reduction initiatives and other provisions of this legislation could decrease the coverage and price that we receive for any approved products and could seriously harm our business. While the MMA applies only to drug benefits for Medicare beneficiaries, private payors often follow Medicare coverage policy and payment limitations in setting their own reimbursement rates, and any reduction in reimbursement that results from the MMA may result in a similar reduction in payments from private payors.

16

Recent federal legislation and actions by state and local governments may permit re-importation of drugs from foreign countries into the United States, including foreign countries where the drugs are sold at lower prices than in the United States, which could materially adversely affect our operating results and our overall financial condition.

We may face competition for any of our product candidates, once approved, from lower priced products from foreign countries that have placed price controls on pharmaceutical products. The MMA contains provisions that may change U.S. importation laws and expand pharmacists’ and wholesalers’ ability to import lower priced versions of our product candidates and competing products from Canada, where there are government price controls. These changes to U.S. importation laws will not take effect unless and until the Secretary of Health and Human Services certifies that the changes will pose no additional risk to the public’s health and safety and will result in a significant reduction in the cost of products to consumers. The Secretary of Health and Human Services has not yet announced any plans to make this required certification. As directed by Congress, a task force on drug importation conducted a comprehensive study regarding the circumstances under which drug importation could be safely conducted and the consequences of importation on the health, medical costs and development of new medicines for U.S. consumers. The task force issued its report in December 2004, finding that there are significant safety and economic issues that must be addressed before importation of prescription drugs is permitted. However, a number of federal legislative proposals have been made to implement the changes to the U.S. importation laws without any certification, and to broaden permissible imports in other ways. Even if the changes do not take effect, and other changes are not enacted, imports from Canada and elsewhere may continue to increase due to market and political forces, and the limited enforcement resources of the FDA, the U.S. Customs Service and other government agencies. For example, Public Law No. 109-295, which was signed into law in October 2006 and provides appropriations for the Department of Homeland Security for the 2007 fiscal year, expressly prohibits the U.S. Customs Service from using funds to prevent individuals from importing from Canada less than a 90-day supply of a prescription drug for personal use, when the drug otherwise complies with the Federal Food, Drug, and Cosmetic Act, or FDCA. Further, several states and local governments have implemented importation schemes for their citizens, and, in the absence of federal action to curtail such activities, we expect other states and local governments to launch importation efforts. The importation of foreign products that compete with any of our approved product candidates could negatively impact our profitability.

The markets for our product candidates are subject to intense competition. If we are unable to compete effectively, our product candidates may be rendered noncompetitive or obsolete.

Many large pharmaceutical and biotechnology companies, academic institutions, governmental agencies, and other public and private research organizations are pursuing the development of novel drugs that target the same indications we are targeting with our product candidates. We face, and expect to continue to face, intense and increasing competition as new products enter the market and advanced technologies become available. If approved, we would expect Locteron, BLX-155 and BLX-301 to compete with approved drugs and product candidates currently under development, including the following:

| | • | | Locteron. If approved, we would expect Locteron to compete with currently approved forms of interferon alfa, including PEG-Intron, currently marketed by Schering-Plough Corporation, and Pegasys, currently marketed by Hoffmann-La Roche. We would also expect Locteron to compete with any product candidate for the treatment of chronic hepatitis C currently under development that is successful in obtaining approval, including Albuferon, currently under development in Phase 3 by Human Genome Sciences and Novartis. |

| | • | | BLX-155. If approved, we would expect BLX-155 to compete with Activase, currently marketed by Genentech, and presently used off-label in the potential indications targeted by us. We would also expect BLX-155 to compete with any direct-acting thrombolytic product candidate currently under development that is successful in obtaining approval for clot lysis, including micro-plasmin, human-derived plasmin, under development by Thrombogenics, Talecris, and Nuvelo, respectively. |

17

| | • | | BLX-301. If approved, we would expect BLX-301 to compete with Rituxan, which is currently marketed by Genentech, Biogen-Idec and Hoffmann-La Roche. We would also expect BLX-301 to compete with any anti-CD20 monoclonal antibody product candidate currently under development that is successful in obtaining approval for non-Hodgkins lymphoma, including HuMax-CD20, under development by GenMab A/S and GlaxoSmithKline, and TRU-015, under development by Trubion Pharmaceuticals and Wyeth. |

Many of our competitors have:

| | • | | significantly greater financial, technical and human resources than we have and may be better equipped to discover, develop, manufacture and commercialize product candidates; |

| | • | | more extensive experience in preclinical testing and clinical trials, obtaining regulatory approvals and manufacturing and marketing pharmaceutical products; |

| | • | | product candidates that have been approved or are in late-stage clinical development; or |

| | • | | collaborative arrangements in our target markets with leading companies and research institutions. |

Competitive products may render our products obsolete or noncompetitive before we can recover the expenses of developing and commercializing our product candidates. Furthermore, the development of new treatment methods or the widespread adoption or increased utilization of any vaccine or development of other products or treatments for the diseases we are targeting could render our product candidates noncompetitive, obsolete or uneconomical. If we successfully develop and obtain approval for our product candidates, we will face competition based on the safety and effectiveness of our product candidates, the timing of their entry into the market in relation to competitive products in development, the availability and cost of supply, marketing and sales capabilities, reimbursement coverage, price, patent position and other factors. If we successfully develop product candidates but those product candidates do not achieve and maintain market acceptance, our business will not be successful.

If a successful product liability claim or series of claims is brought against us for uninsured liabilities or in excess of insured liabilities, we could incur substantial liability.

The use of our product candidates in clinical trials and the sale of any products for which we obtain marketing approval expose us to the risk of product liability claims. Product liability claims might be brought against us by consumers, health care providers or others selling or otherwise coming into contact with our products. If we cannot successfully defend ourselves against product liability claims, we could incur substantial liabilities. In addition, regardless of merit or eventual outcome, product liability claims may result in:

| | • | | decreased demand for any approved product candidates; |

| | • | | impairment of our business reputation; |

| | • | | withdrawal of clinical trial participants; |

| | • | | costs of related litigation; |

| | • | | distraction of management’s attention from our primary business; |

| | • | | substantial monetary awards to patients or other claimants; |

| | • | | the inability to successfully commercialize any approved product candidates. |

We have obtained product liability insurance coverage for our clinical trials with a $5.0 million annual aggregate coverage limit. However, our insurance coverage may not be sufficient to reimburse us for any expenses or losses we may suffer. Moreover, insurance coverage is becoming increasingly expensive, and, in the future, we may not be able to maintain insurance coverage at a reasonable cost or in sufficient amounts to protect

18

us against losses due to liability. If and when we obtain marketing approval for any of our product candidates, we intend to expand our insurance coverage to include the sale of commercial products; however, we may be unable to obtain this product liability insurance on commercially reasonable terms. On occasion, large judgments have been awarded in class action lawsuits based on drugs that have had unanticipated side effects. A successful product liability claim or series of claims brought against us could cause our stock price to decline and, if judgments exceed our insurance coverage, could decrease our cash and adversely affect our business.

Risks Related to Our Dependence on Third Parties

We rely on third parties to conduct our clinical trials, and those third parties may not perform satisfactorily, including failing to meet established deadlines for the completion of such clinical trials.

We do not have the ability to independently conduct clinical trials for our product candidates, and we rely on third parties, such as contract research organizations, medical institutions, and clinical investigators, to perform this function. Our reliance on these third parties for clinical development activities reduces our control over these activities. Furthermore, these third parties may also have relationships with other entities, some of which may be our competitors. Although we have, in the ordinary course of business, entered into agreements with these third parties, we continue to be responsible for confirming that each of our clinical trials is conducted in accordance with its general investigational plan and protocol. Moreover, the FDA requires us to comply with regulations and standards, commonly referred to as good clinical practices, for conducting, recording and reporting the results of clinical trials to assure that data and reported results are credible and accurate and that the trial participants are adequately protected. Our reliance on third parties does not relieve us of these responsibilities and requirements. If these third parties do not successfully carry out their contractual duties or meet expected deadlines, we may be delayed in obtaining regulatory approvals for our product candidates and may be delayed in our efforts to successfully commercialize our product candidates for targeted diseases.

We rely heavily upon our collaboration with OctoPlus for the development of Locteron, and the loss of OctoPlus as a partner, or any adverse developments in the collaboration, would materially harm our business.

In February 2005, we entered into a co-development agreement with OctoPlus to develop and commercialize Locteron. Locteron combines our proprietary BLX-883 interferon alfa with OctoPlus’ PolyActive drug delivery technology. We are subject to a number of risks associated with our dependence on this collaboration with OctoPlus, including:

| | • | | We and OctoPlus could disagree as to development plans, including clinical trials or regulatory approval strategy, or as to which additional indications for Locteron should be pursued. Disputes regarding the collaboration agreement that delay or terminate the development, receipt of regulatory approvals or commercialization of Locteron would harm our business and could result in significant litigation or arbitration. |

| | • | | OctoPlus could fail to devote sufficient resources towards the development and approval of Locteron. After the time periods stated in the collaboration agreement, OctoPlus could shift its research and development resources to other product opportunities. |

| | • | | OctoPlus may not be able to provide sufficient resources to ensure the efficient and timely production of Locteron. |

| | • | | OctoPlus may not be able to scale up its manufacturing process for the production of Locteron to produce quantities suitable for Phase 3 clinical supply or commercialization. |

Furthermore, OctoPlus may terminate our collaboration agreement upon 60 days notice upon the occurrence of certain events, subject to the survival of certain obligations, or upon our material breach of the collaboration agreement. If OctoPlus does not perform its obligations under, or devote sufficient resources to, our collaboration, or if we and OctoPlus do not work effectively together, Locteron may not be successfully developed and

19

commercialized. Although our agreement provides for non-exclusive access to the OctoPlus controlled-release technology in the event that OctoPlus opts out of further development or terminates for convenience, we would need to establish an alternative arrangement for production and may not be able to do so in a timely manner, on acceptable terms, or at all.

Conflicts may arise with our collaborators, resulting in renegotiation or termination of, or litigation related to, our agreements with them, which would adversely affect our revenues.

Conflicts could arise between us and our collaborators, including OctoPlus, as to royalty rates, milestone payments or other commercial terms. Similarly, the parties may disagree as to which party owns or has the right to commercialize intellectual property that is developed during the course of the relationship or as to other non-commercial terms. If such a conflict were to arise, our collaborators might attempt to compel renegotiation of certain terms of their agreements or terminate their agreements entirely, and we might lose the benefits of the agreements. Either we or our collaborators might initiate litigation to determine commercial obligations, establish intellectual property rights or resolve other disputes under the related agreements. Such litigation could be costly to us and require substantial attention of management. If we were unsuccessful in such litigation, we could lose the commercial benefits of the agreements, be liable for other financial damages and suffer losses of intellectual property or other rights that are the subject of dispute. Any of these adverse outcomes could cause our business strategy to fail.

If we do not establish additional collaborations, we may have to alter our development plans.

Our drug development programs and potential commercialization of our product candidates will require substantial additional cash to fund expenses. Our strategy includes potentially collaborating with leading pharmaceutical and biotechnology companies to assist us in furthering development and potential commercialization of some of our product candidates, including Locteron, in some or all geographies. It may be difficult to enter into one or more of such collaborations in the future. We face significant competition in seeking appropriate collaborators and these collaborations are complex and time-consuming to negotiate and document. We may not be able to negotiate collaborations on acceptable terms, or at all. If that were to occur, we may have to curtail the development of a particular product candidate, reduce or delay its development program or one or more of our other development programs, delay its potential commercialization or reduce the scope of our sales or marketing activities, or increase our expenditures and undertake development or commercialization activities at our own expense. If we elect to increase our expenditures to fund development or commercialization activities on our own, we may need to obtain additional capital, which may not be available to us on acceptable terms, or at all. If we do not have sufficient funds, we will not be able to bring our product candidates to market and generate product revenue.

Risks Related to Our Intellectual Property

If we are unable to adequately protect the intellectual property relating to our product candidates, or if we infringe the rights of others, our ability to successfully commercialize our product candidates will be harmed.