Exhibit 99.2

EX99_2

HOME TO THE CLOUD

MERGER WITH DUPONT FABROS TECHNOLOGY JUNE 2017

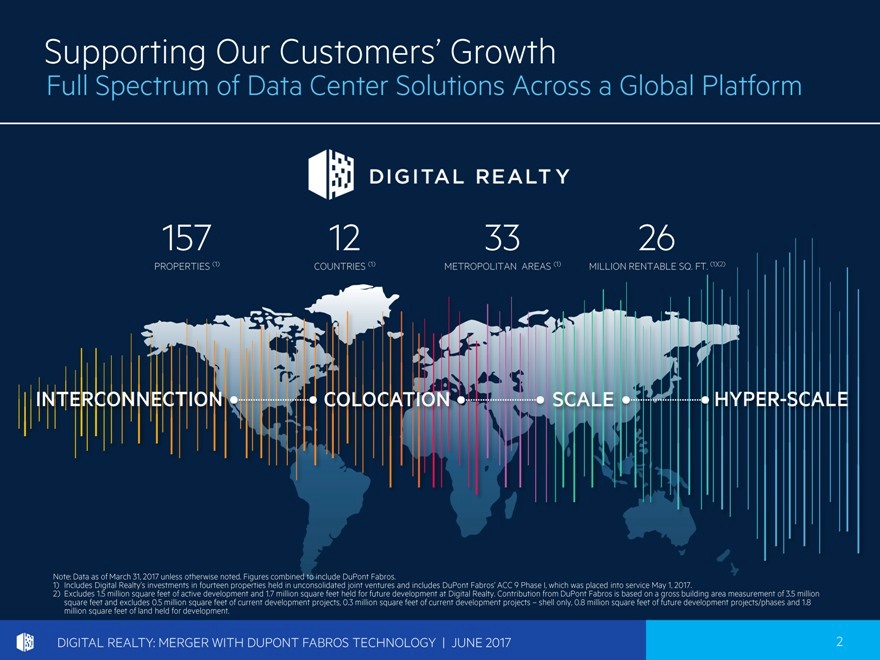

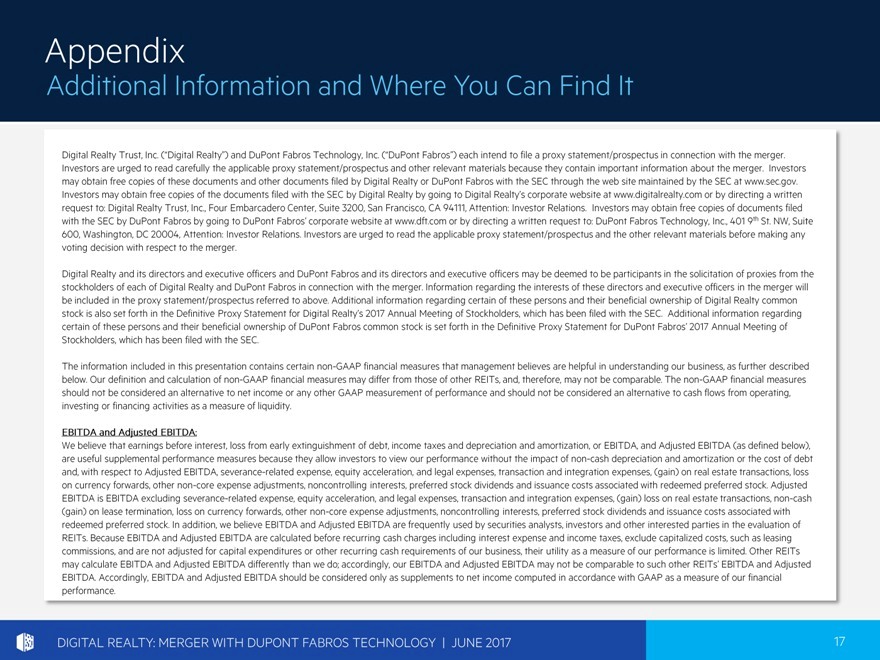

Supporting Our Customers_ Growth Full Spectrum of Data Center Solutions Across a Global Platform 157 12 33 26 PROPERTIES (1) COUNTRIES (1) METROPOLITAN AREAS MILLION RENTABLE SQ. (1) FT. (1)(2) INTERCONNECTI COLOCATI SCAL HYPER- ON ON E SCALE Note: Data as of March 31, 2017 unless otherwise noted. Figures combined to include DuPont Fabros. 1) 2) Includes Excludes Digital Realty_s 1.5 million square feet investments of active in fourteen properties development and 1.7 held in unconsolidated million square feet held for future development joint ventures and includes DuPont at Digital Realty. Fabros_ ACC Contribution from 9 Phase I, which was DuPont placed into service Fabros is based on a gross May 1, 2017. building only, 0.8 area measurement million square feet of of 3.5 future development million square feet projects/phases and excludes and 1.8 0.5 million square feet million square feet of current of land held for development. development projects, 0.3 million square feet of current development projects shell DIGITAL REALTY: MERGER WITH DUPONT FABROS TECHNOLOGY JUNE 2017

2

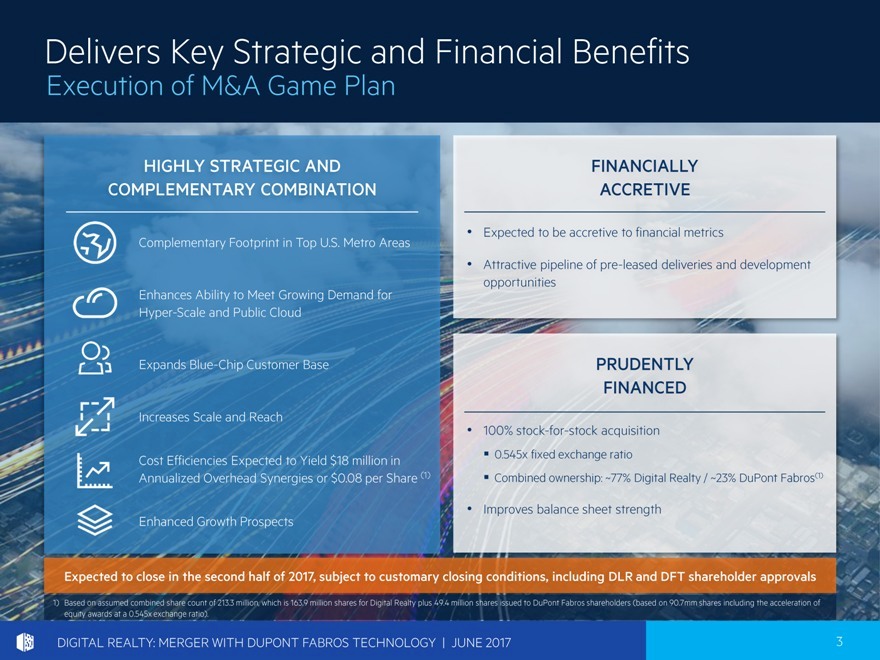

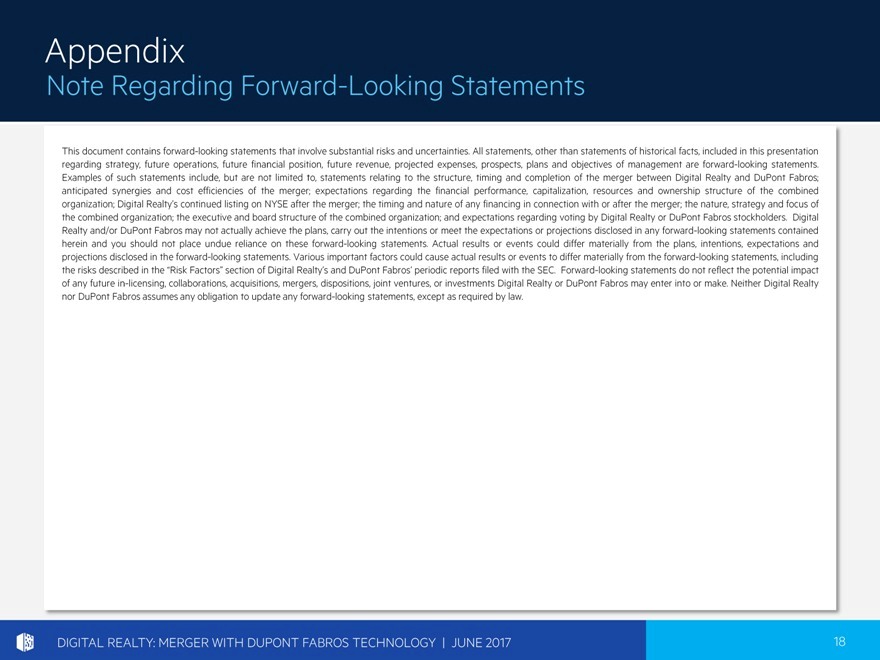

Delivers Key Strategic and Financial Benefits Execution of M&A Game Plan HIGHLY STRATEGIC AND COMPLEMENTARY COMBINATION Complementary Footprint in Top U.S. Metro Areas Enhances Ability to Meet Growing Demand for Hyper-Scale and Public Cloud Expands Blue-Chip Customer Base Increases Scale and Reach Cost Efficiencies Expected to Yield $18 million in Annualized Overhead Synergies or $0.08 per Share (1) Enhanced Growth Prospects FINANCIALLY ACCRETIVE Expected to be accretive to financial metrics Attractive pipeline of pre-leased deliveries and development opportunities PRUDENTLY FINANCED 100% stock-for-stock acquisition 0.545x fixed exchange ratio Combined ownership: 77% Digital Realty / 23% DuPont Fabros (1) Improves balance sheet strength Expected to close in the second half of 2017, subject to customary closing conditions, including DLR and DFT shareholder approvals 1) Based on assumed combined share count of 213.3 million, which is 163.9 million shares for Digital Realty plus 49.4 million shares issued to DuPont Fabros shareholders (based on 90.7mm shares including the acceleration of equity awards at a 0.545x exchange ratio).DIGITAL REALTY: MERGER WITH DUPONT FABROS TECHNOLOGY JUNE 2017

3

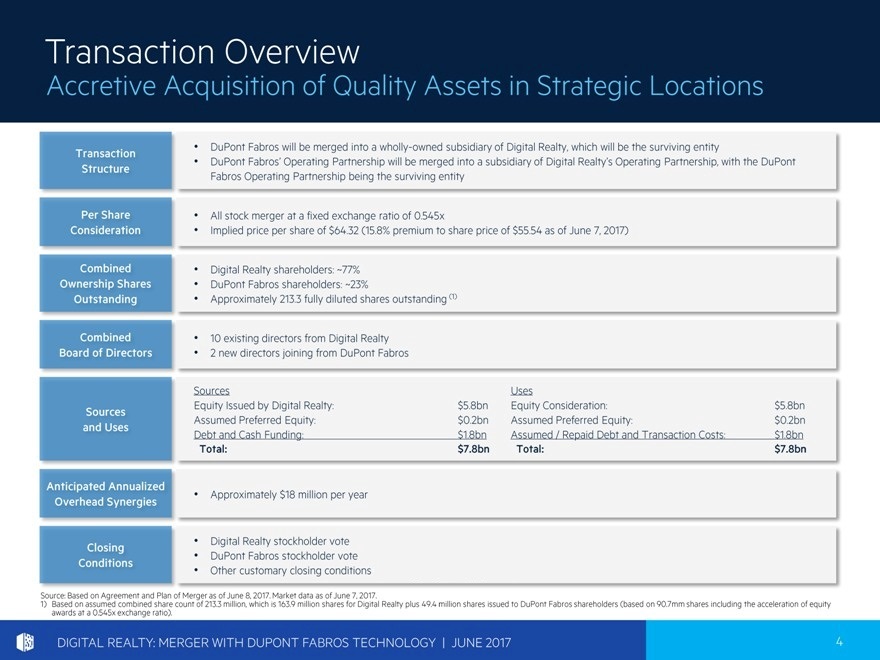

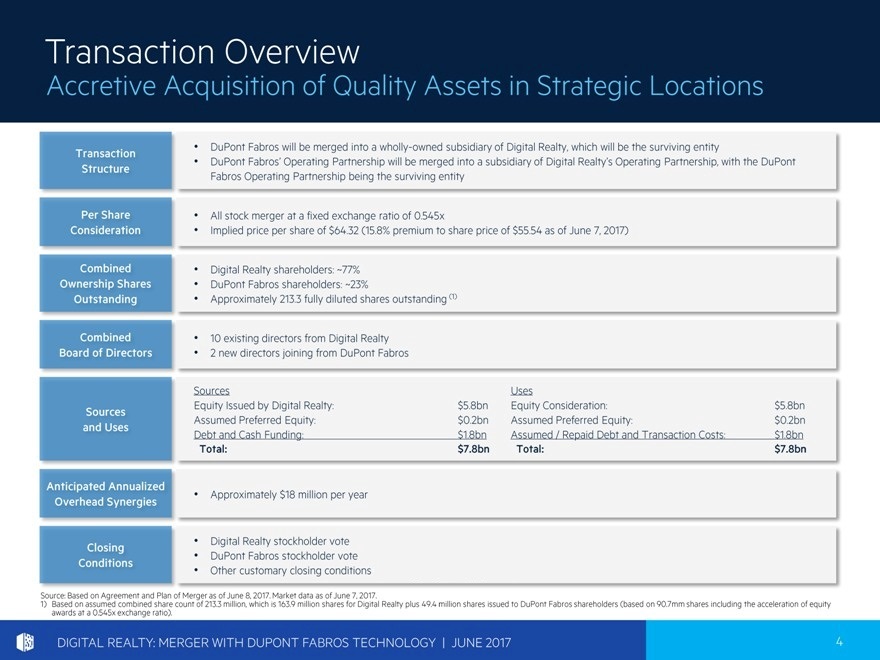

Transaction Overview Accretive Acquisition of Quality Assets in Strategic Locations Transaction Structure Per Share Consideration Combined Ownership Shares Outstanding Combined Board of Directors Sources and Uses Anticipated Annualized Overhead Synergies Closing Conditions DuPont Fabros will be merged into a wholly-owned subsidiary of Digital Realty, which will be the surviving entity DuPont Fabros_ Operating Partnership will be merged into a subsidiary of Digital Realty_s Operating Partnership, with the DuPont Fabros Operating Partnership being the surviving entity All stock merger at a fixed exchange ratio of 0.545x Implied price per share of $64.32 (15.8% premium to share price of $55.54 as of June 7, 2017) Digital Realty shareholders: 77% DuPont Fabros shareholders: 23% Approximately 213.3 fully diluted shares outstanding (1) 10 existing directors from Digital Realty 2 new directors joining from DuPont Fabros Sources Uses Equity Issued by Digital Realty: $5.8bn Equity Consideration: $5.8bn Assumed Preferred Equity: $0.2bn Assumed Preferred Equity: $0.2bn Debt and Cash Funding: $1.8bn Assumed / Repaid Debt and Transaction Costs: $1.8bn Total: $7.8bn Total: $7.8bn Approximately $18 million per year Digital Realty shareholder vote DuPont Fabros shareholder vote Other customary closing conditions (including regulatory approval) Source: Based on Agreement and Plan of Merger as of June 8, 2017. Market data as of June 7, 2017. Based on assumed combined share count of 213.3 million, which is 163.9 million shares for Digital Realty plus 49.4 million shares issued to DuPont Fabros shareholders (based on 90.7mm shares including the acceleration of equity awards at a 0.545x exchange ratio).DIGITAL REALTY: MERGER WITH DUPONT FABROS TECHNOLOGY JUNE 2017

4

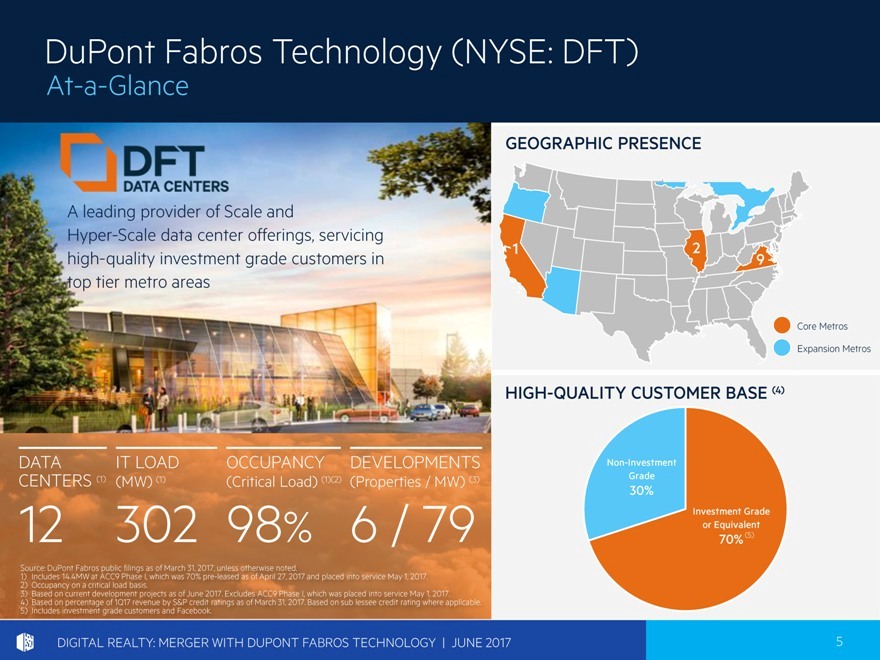

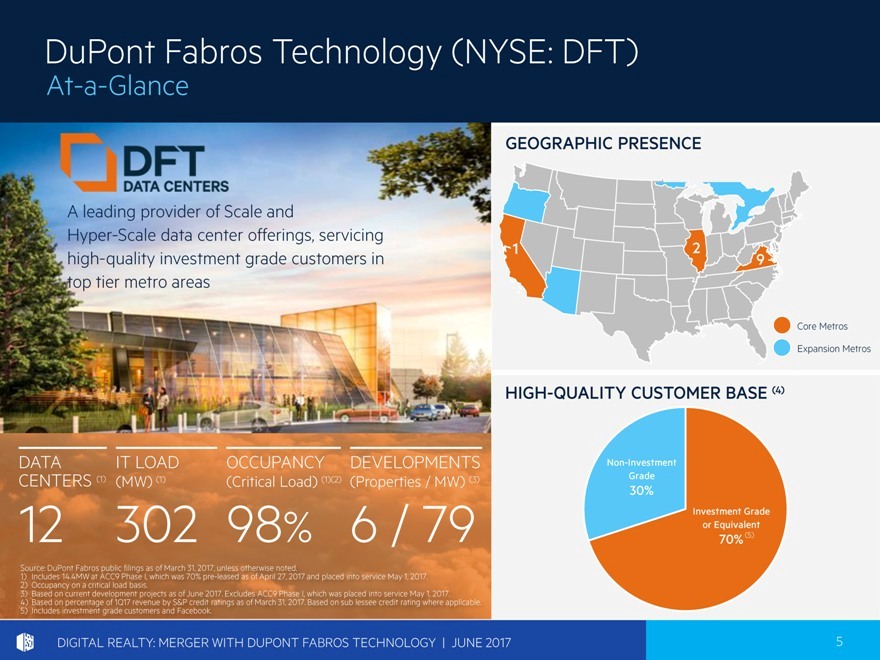

DuPont Fabros Technology (NYSE: DFT) At-a-Glance A leading provider of Scale and Hyper-Scale data center offerings, servicing high-quality investment grade customers in top tier metro areas DATA IT LOAD OCCUPANC DEVELOPME CENTER (MW) (1) Y NTS S (1) (Critical Load) (Properties/ 12 302 (1)(2) MW) (3) Source: 1) Includes DuPont 14.4MW Fabros at ACC9 Phase I, public filings as which was of March 31, 70% pre-leased as 98 2017, unless otherwise noted. % of April 27, 2017 6and placedinto service May 2) Occupancy 1, 2017. on a critical load basis. 3) Based on current service May 1, 2017. development projects as of June 2017. Excludes ACC9 Phase I, which was placed into 4) Based on percentage of rating where applicable. 1Q17 revenue by S&P credit ratings as of March 31, 2017. Based on sub lessee credit 5) Includes investment grade customers and Facebook. 79 [Graphic Appears Here] HIGH-QUALITY CUSTOMER BASE (4) [CATE GORY NAME] [VAL [CATE UE] GORY NAME] [VAL (5) UE] OGY JUNE 2017 DIGITAL REALTY: MERGER WITH DUPONT FABROS TECHNOLOGY JUNE 2017

5

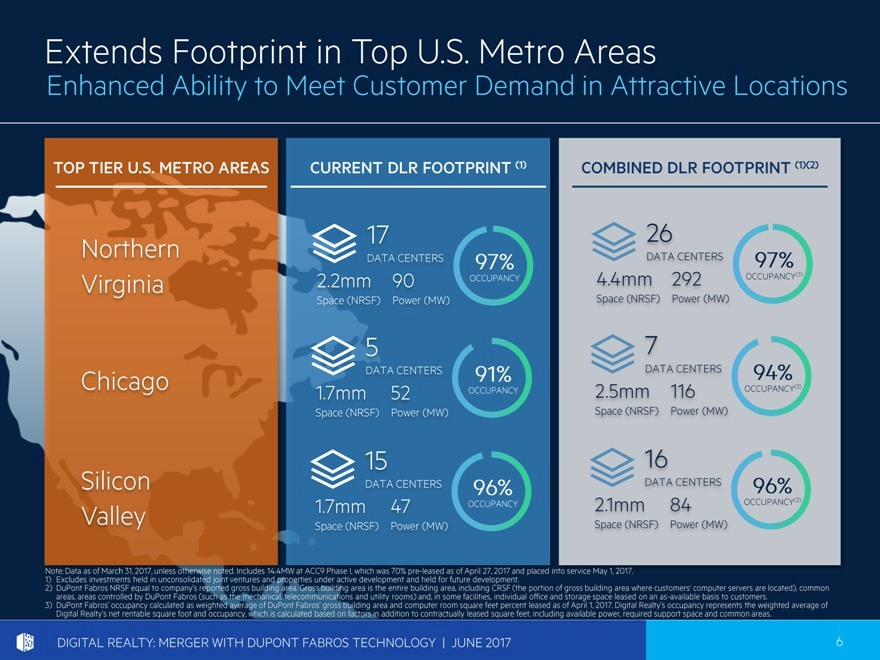

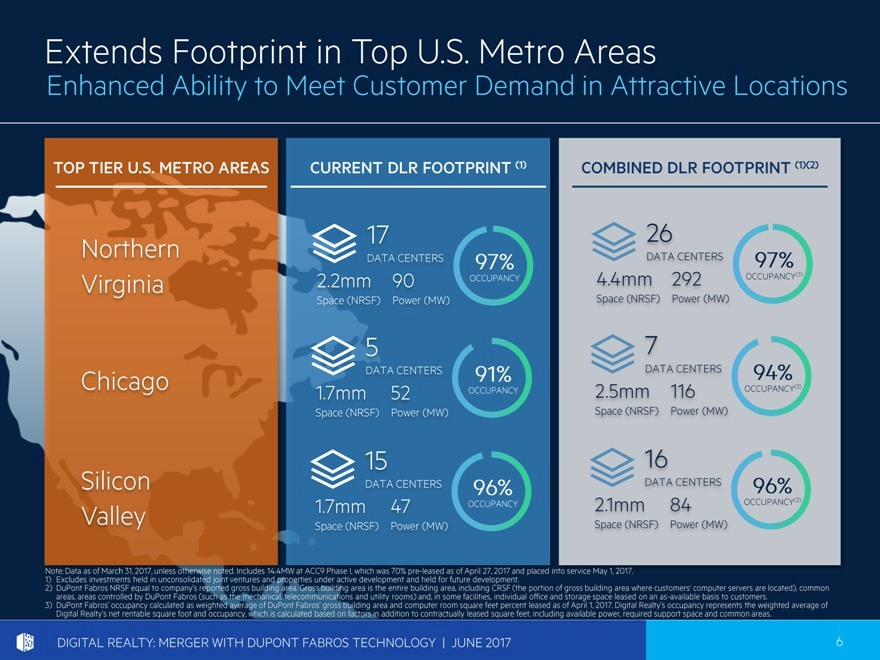

Extends Footprint in Top U.S. Metro Areas Enhanced Ability to Meet Customer Demand in Attractive Locations TOP TIER U.S. METRO CURRENT DLR FOOTPRINT COMBINED DLR FOOTPRINT (1)(2) AREAS (1) 17 26 Northern DATA DATA CENTERS 97% CENTERS 97% Virginia 2. OCCUPANCY 4.4 OCCUPANCY(3) Space Power Space Power (NRSF) (MW) (NRSF) (MW) 5 7 DATA DATA CENTERS 91% CENTERS 94% Chicago 1.7 OCCUPANCY 2.5 OCCUPANCY(3) Space Power Space Power (NRSF) (MW) (NRSF) (MW) 15 16 Silicon DATA DATA CENTERS 96% CENTERS 96% 1.7 OCCUPANCY 2.1 OCCUPANCY(3) Valley Space Power Space Power (NRSF) (MW) (NRSF) (MW) Note: Data as of March 31, 2017, unless otherwise noted. Includes 14.4MW at ACC9 Phase I, which was 70% pre-leased as of April 27, 2017 and placed into service May 1, 2017. Excludes investments held in unconsolidated joint ventures and properties under active development and held for future development. DuPont Fabros NRSF equal to company_s reported gross building area. Gross building area is the entire building area, including CRSF (the portion of gross building area where customers_ computer servers are located), common areas, areas controlled by DuPont Fabros (such as the mechanical, telecommunications and utility rooms) and, in some facilities, individual office and storage space leased on an as-available basis to customers. DuPont Fabros_ occupancy calculated as weighted average of DuPont Fabros_ gross building area and computer room square feet percent leased as of April 1, 2017. Digital Realty_s occupancy represents the weighted average of Digital Realty_s net rentable square foot and occupancy, which is calculated based on factors in addition to contractually leased square feet, including available power, required support space and common areas.DIGITAL REALTY: MERGER WITH DUPONT FABROS TECHNOLOGY JUNE 2017

6

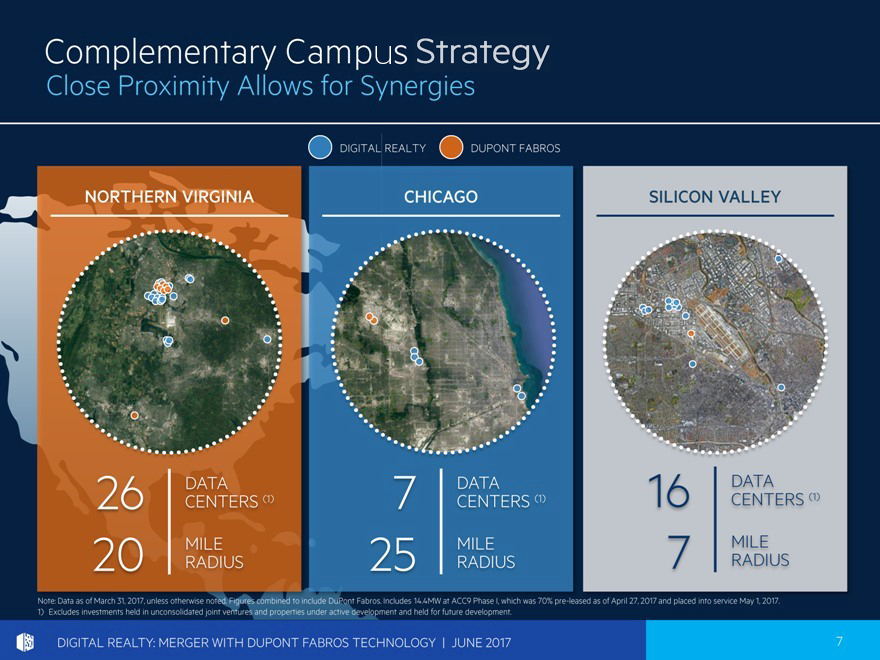

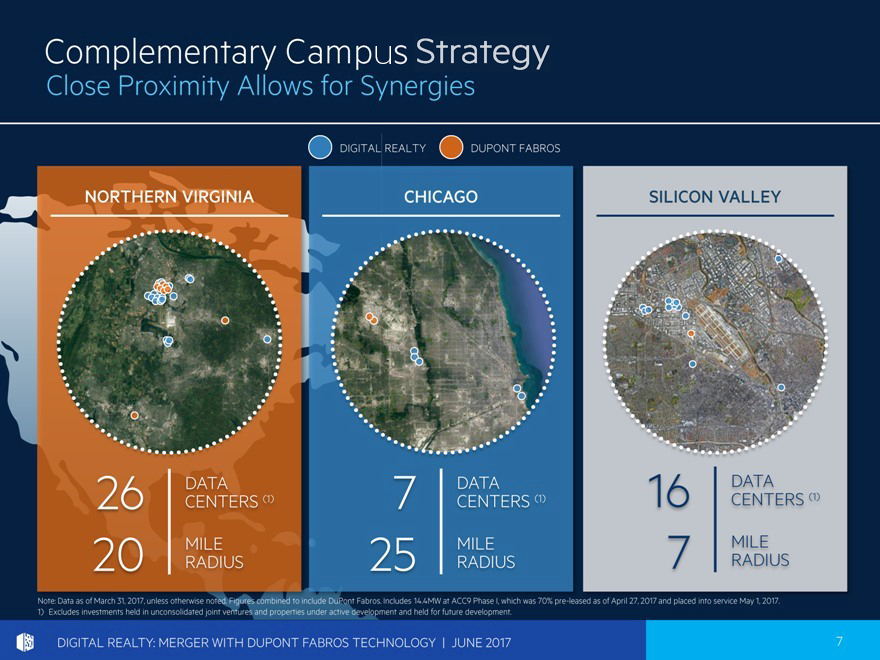

Complementary Campus Strategy Close Proximity Allows for Synergies DIGITAL DUPONT REALTY FABROS NORTHERN VIRGINIA CHICAGO SILICON VALLEY ATA 1 DATA 26 CENTERS DATA 2 CENTER CENTER ) (1) (1) MILE 20 RADIUS MILE 5 RADIUS 7 RADIUS MILE Note: Data as of March 31, 2017, unless otherwise noted. Figures combined to include DuPont Fabros. Includes 14.4MW at ACC9 Phase I, which was 70% pre-leased as of April 27, 2017 and placed into service May 1, 2017.

1) Excludes investments held in unconsolidated joint ventures and properties under active development and held for future development. DIGITAL REALTY: MERGER WITH DUPONT FABROS TECHNOLOGY JUNE 2017

7

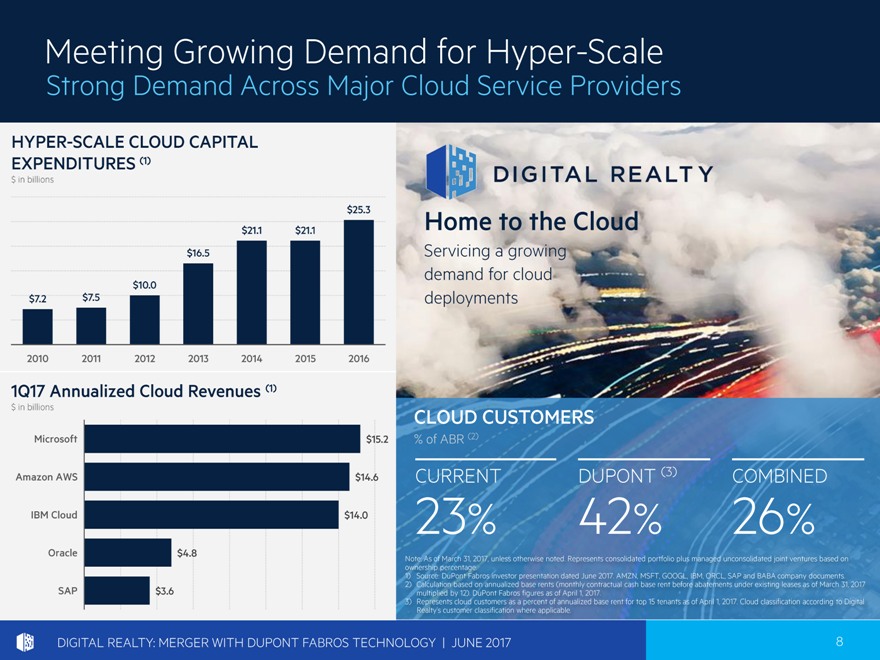

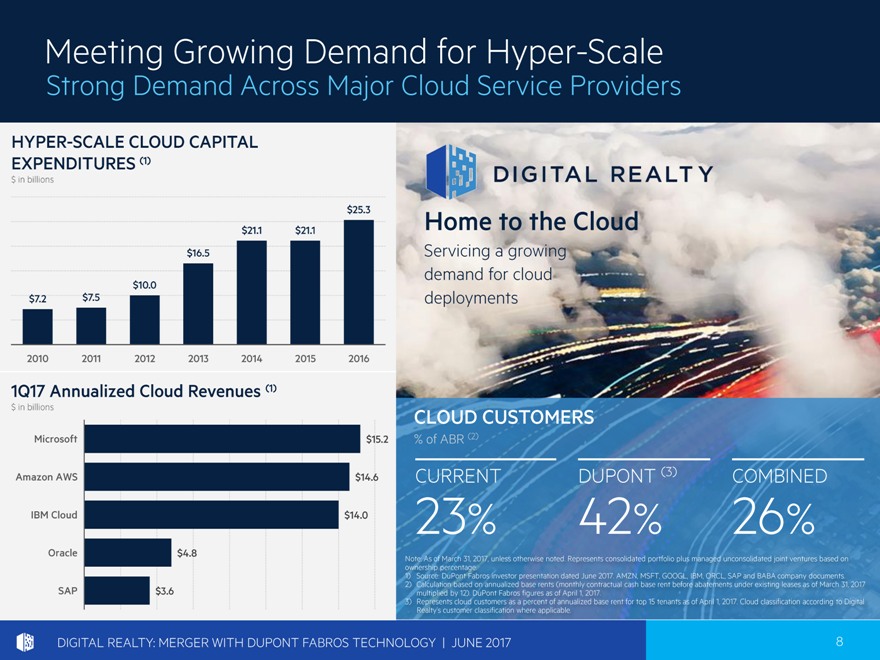

Meeting Growing Demand for Hyper-Scale Strong Demand Across Major Cloud Service Providers HYPER-SCALE CLOUD CAPITAL EXPENDITURES (1) $ in billions Home to the Cloud Servicing a growing demand for cloud deployments CLOUD CUSTOMERS % of ABR (2) CURRENT DUPONT (3) COMBINED 23% 42% 26% Note: As of March 31, 2017, unless otherwise noted. Represents consolidated portfolio plus managed unconsolidated joint ventures based on ownership percentage. Source: DuPont Fabros investor presentation dated June 2017. AMZN, MSFT, GOOGL, IBM, ORCL, SAP and BABA company documents. Calculation based on annualized base rents (monthly contractual cash base rent before abatements under existing leases as of March 31, 2017 multiplied by 12). DuPont Fabros figures as of April 1, 2017. Represents cloud customers as a percent of annualized base rent for top 15 tenants as of April 1, 2017. Cloud classification according to Digital Realty_s customer classification where applicable. DIGITAL REALTY: MERGER WITH DUPONT FABROS TECHNOLOGY JUNE 2017

8

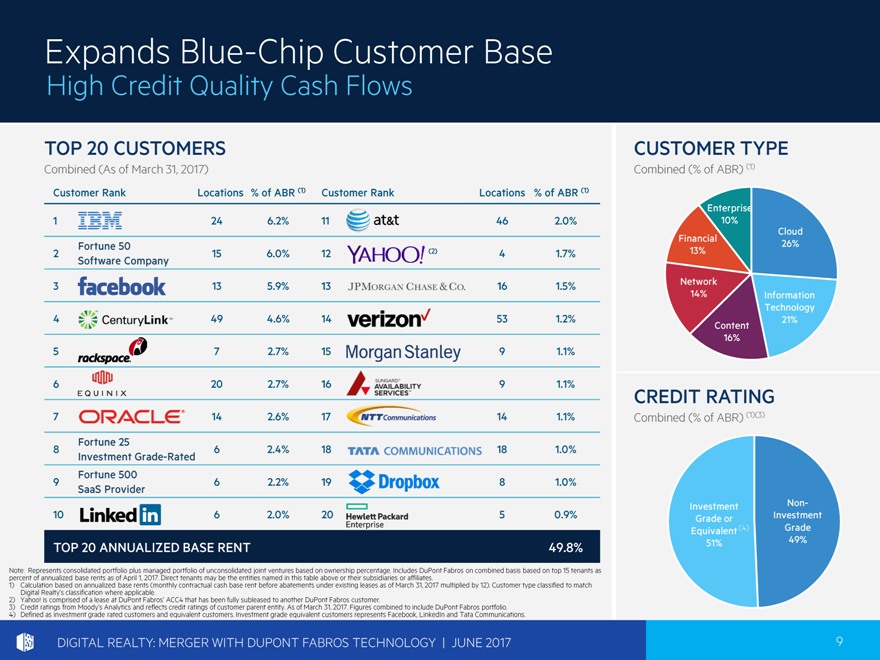

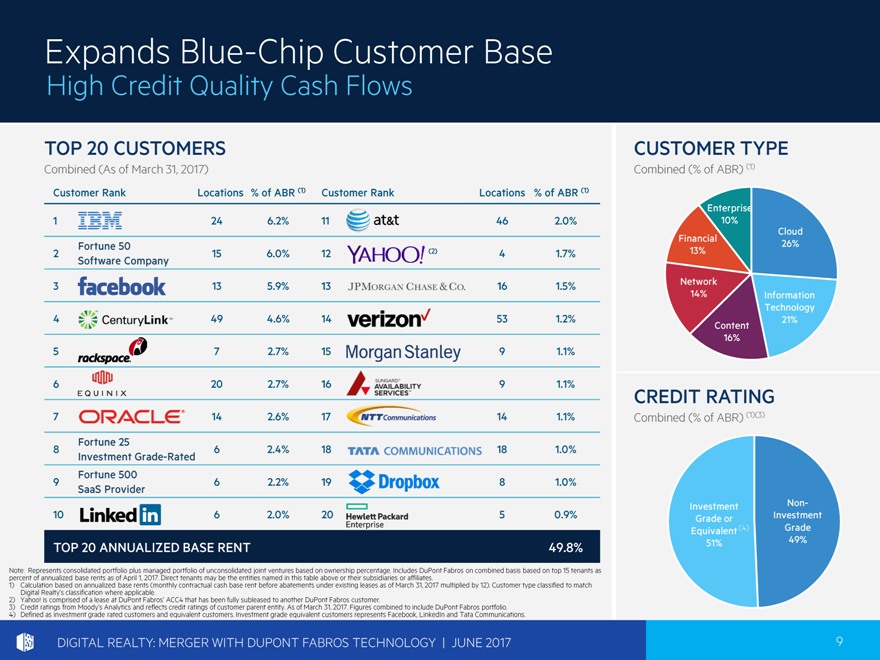

Expands Blue-Chip Customer Base High Credit Quality Cash Flows TOP 20 CUSTOMERS Combined (As of March 31, 2017) % of ABR Customer Rank Locations % of ABR (1) Customer Rank Locations (1) 1 24 6.2% 11 46 2.0% Fortune 50 2 Software Company 15 6.0% 12 (2) 4 1.7% 3 13 5.9% 13 16 1.5% 4 49 4.6% 14 53 1.2% 5 7 2.7% 15 9 1.1% 6 20 2.7% 16 9 1.1% 7 14 2.6% 17 14 1.1% Fortune 25 8 6 2.4% 18 18 1.0% Investment Grade- 9 Fortune Rated 500 6 2.2% 19 8 1.0% SaaS Provider 10 6 2.0% 20 5 0.9% TOP 20 ANNUALIZED BASE RENT 49.8% basis based on Note: Represents consolidated portfolio plus managed portfolio of unconsolidated joint ventures based on top 15 tenants as percent of annualized base rents as of April 1, 2017. Direct tenants may be the entities named in this table above or their subsidiaries or ownership percentage. Includes DuPont Fabros on combined affiliates. Calculation based on annualized base rents (monthly contractual cash base rent before abatements under existing leases as of March 31, 2017 multiplied by 12). Customer type classified to match Digital Realty_s classification where applicable. Yahoo! is comprised of a lease at DuPont Fabros_ ACC4 that has been fully subleased to another DuPont Fabros customer. Credit ratings from Moody_s Analytics and reflects credit ratings of customer parent entity. As of March 31, 2017. Figures combined to include DuPont Fabros portfolio. Defined as investment grade rated customers and equivalent customers. Equivalent customers represents Facebook, LinkedIn and Tata Communications. CUSTOMER TYPE Combined (% of ABR) (1) Enter prise 10% Finan Cloud cial 26% 13% Netwo rk Inform 14% ation Techn Conte ology nt 21% 16% CREDIT RATING Combined (% of ABR) (1)(3) Invest 0% ment Non-Grade Invest or ment (4) Equiv Grade alent 49% 51% DIGITAL REALTY: MERGER WITH DUPONT FABROS TECHNOLOGY JUNE 2017

9

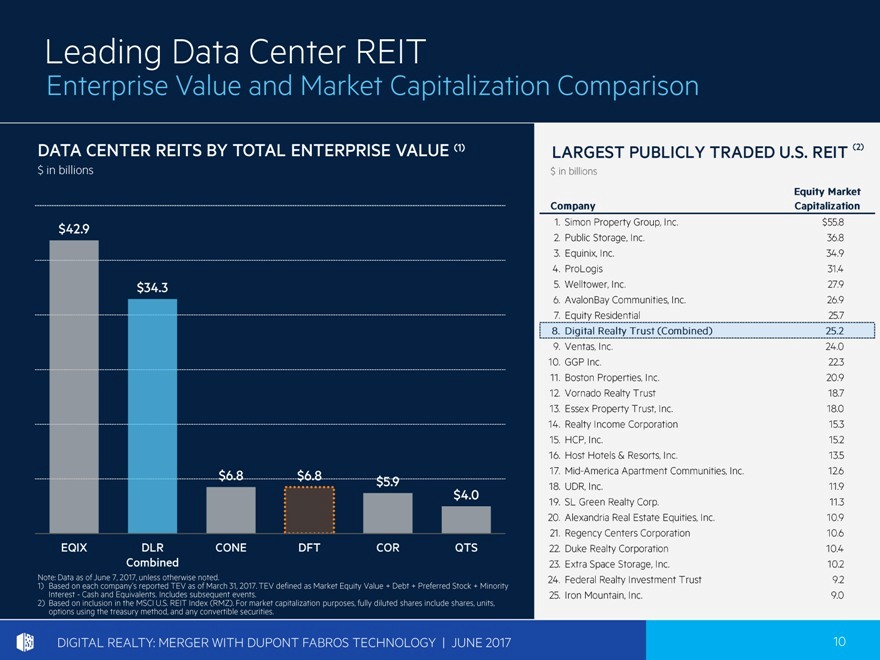

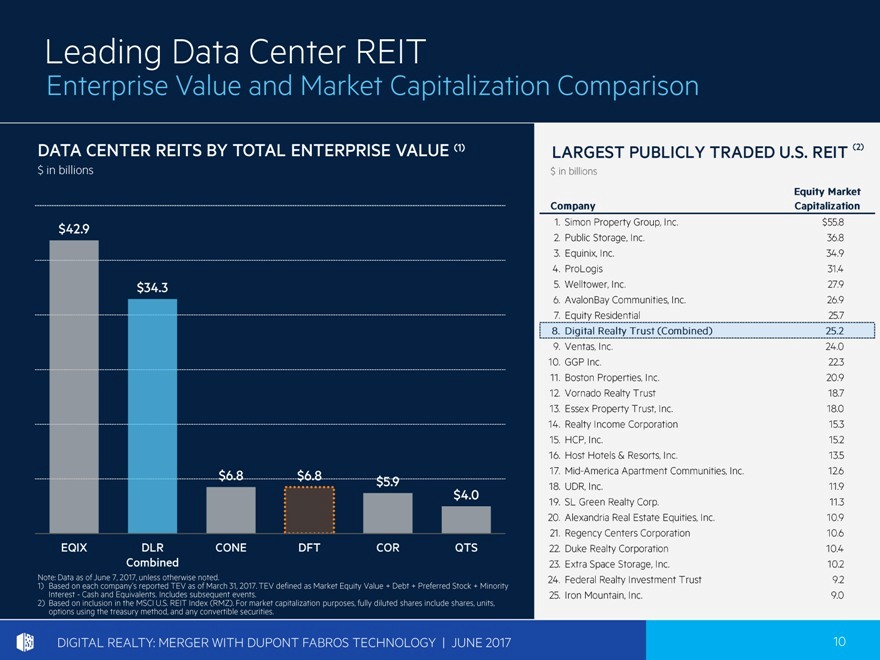

Leading Data Center REIT Enterprise Value and Market Capitalization Comparison DATA CENTER REITS BY TOTAL ENTERPRISE VALUE (1) $ in billions $42.9 $34.3 $6.8 $6.8 $5.9 $4.0 EQIX DLR CONE DFT COR QTS Combined Note: Data as of June 7, 2017, unless otherwise noted. Based on each company_s reported TEV as of March 31, 2017. TEV defined as Market Equity Value + Debt + Preferred Stock + Minority Interest - Cash and Equivalents. Includes subsequent events. Based on inclusion in the MSCI U.S. REIT Index (RMZ). For market capitalization purposes, fully diluted shares include shares, units, options using the treasury method, and any convertible securities. DIGITAL REALTY: ACQUISITION OF DUPONT FABROS TECHNOLOGY LARGEST PUBLICLY TRADED U.S. REIT (2) $ in billions Equity Market Company Capitalization 1. Simon Property Group, Inc. $55.8 2. Public Storage, Inc. 36.8 3. Equinix, Inc. 34.9 4. ProLogis 31.4 5. Welltower, Inc. 27.9 6. AvalonBay Communities, Inc. 26.9 7. Equity Residential 25.7 8. Digital Realty Trust (Combined) 25.2 9. Ventas, Inc. 24.0 10. GGP Inc. 22.3 11. Boston Properties, Inc. 20.9 12. Vornado Realty Trust 18.7 13. Essex Property Trust, Inc. 18.0 14. Realty Income Corporation 15.3 15. HCP, Inc. 15.2 16. Host Hotels & Resorts, Inc. 13.5 17. Mid-America Apartment Communities, Inc. 12.6 18. UDR, Inc. 11.9 19. SL Green Realty Corp. 11.3 20. Alexandria Real Estate Equities, Inc. 10.9 21. Regency Centers Corporation 10.6 22. Duke Realty Corporation 10.4 23. Extra Space Storage, Inc. 10.2 24. Federal Realty Investment Trust 9.2 25. Iron Mountain, Inc. 9.0 JUNE 2017 10 DIGITAL REALTY: MERGER WITH DUPONT FABROS TECHNOLOGY JUNE 2017

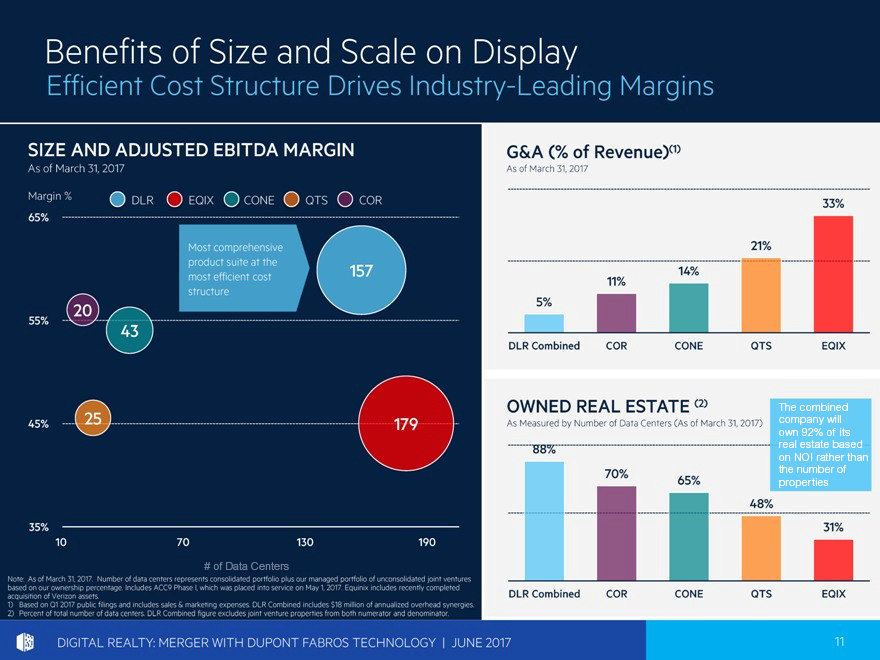

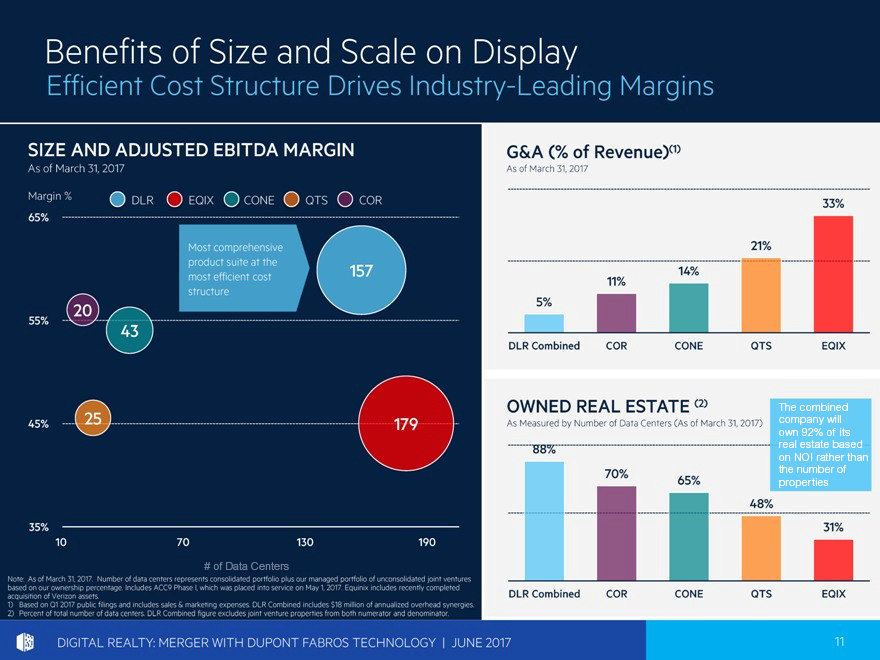

Benefits of Size and Scale on Display Efficient Cost Structure Drives Industry-Leading Margins SIZE AND ADJUSTED EBITDA MARGIN As of March 31, 2017 G&A (% of Revenue)(1) As of March 31, 2017 DLRCombined COR CONE QTS EQIX OWNED REAL ESTATE (2) The combined company will own 92% of its real estate based on NOI rather than the number of properties 45% 25 179 As Measured by # of Data Centers (As of March 31, 2017) Realty 35% 10 70 130 190 Number of Data Centers Note: As of March 31, 2017. Number of data centers represents consolidated portfolio plus our managed portfolio of unconsolidated joint ventures based on our ownership percentage. Includes ACC9 Phase I, which was placed into service on May 1, 2017. Equinix includes recently completed acquisition of Verizon assets. Based on Q1 2017 public filings and includes sales & marketing expenses. DLR Combined includes $18 million of annualized synergies. Percent of total number of data centers. DLR Combined figure excludes joint venture properties from both numerator and denominator. [Graphic Appears Here] [Graphic Appears Here] DIGITAL REALTY: MERGER WITH DUPONT FABROS TECHNOLOGY JUNE 2017

11

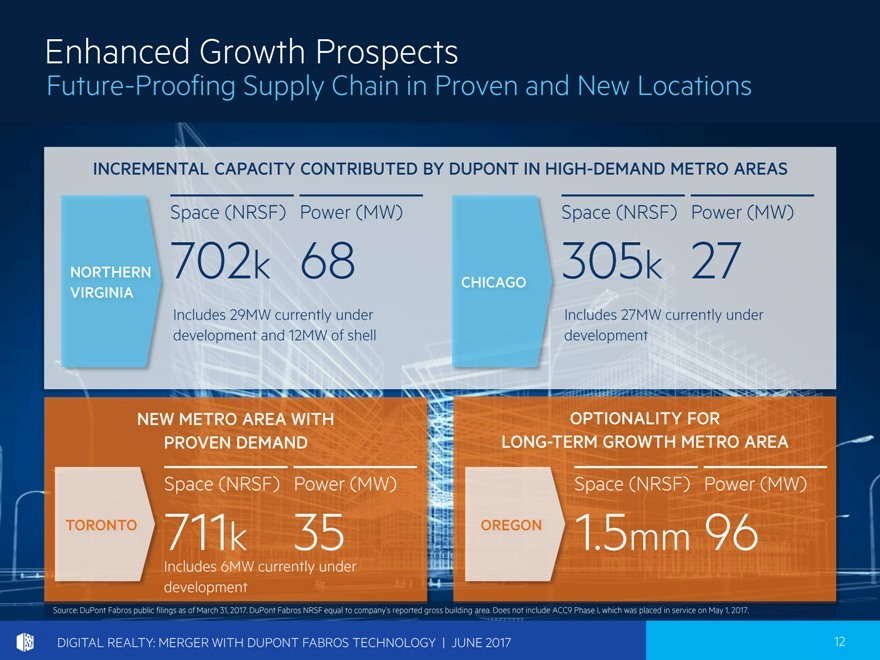

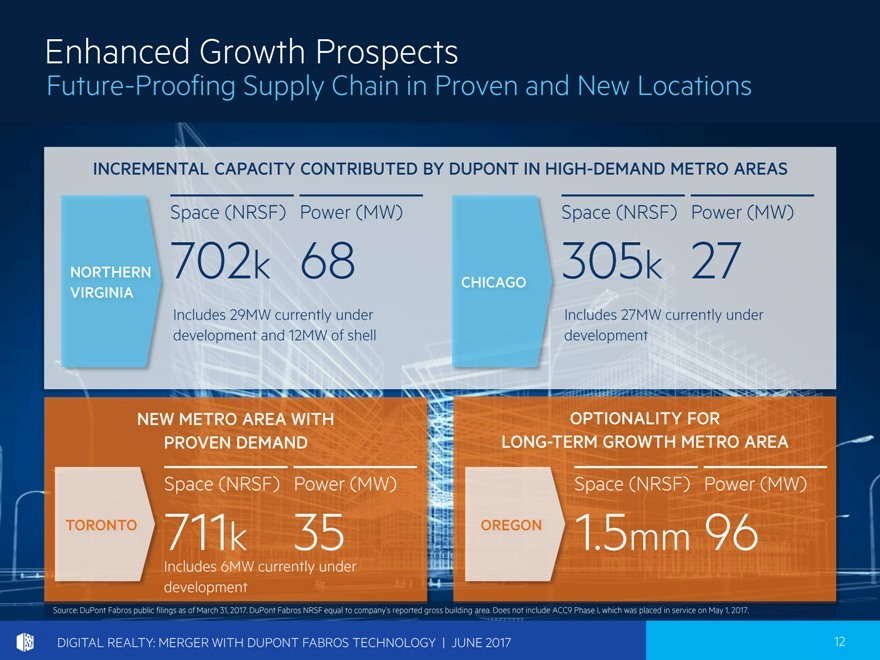

Enhanced Growth Prospects Future-Proofing Supply Chain in Proven and New Locations INCREMENTAL CAPACITY CONTRIBUTED BY DUPONT IN HIGH-DEMAND METRO Source: DuPont Fabros public filings as of March 31, 2017. DuPont Fabros NRSF equal to company_s reported gross building area. Does not include ACC9 Phase I, which was placed in service on May 1, 2017. DIGITAL REALTY: MERGER WITH DUPONT FABROS TECHNOLOGY JUNE 2017

12

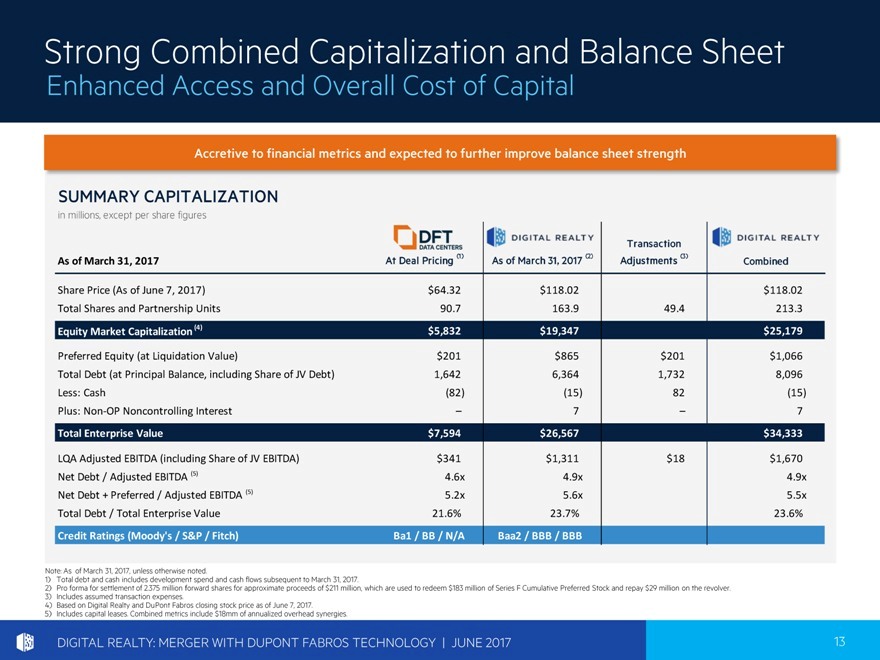

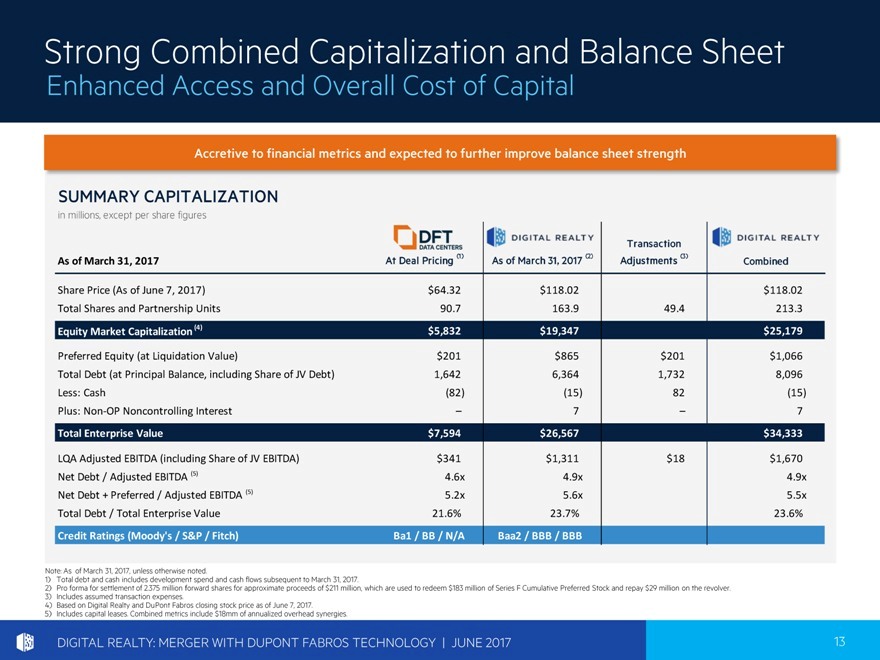

Strong Combined Capitalization and Balance Enhanced Access and Overall Cost of Capital Sheet Accretive to financial metrics and expected to further improve balance sheet strength SUMMARY CAPITALIZATION in millions, except per share figures Transaction As of March 31, 2017 (1) Adjustments(2) As of March 31, 2017 At Deal Pricing Combined Share Price (As of June 7, 2017) $64.32 $118.02 $118.02 Total Shares and Partnership Units .7 49.4 Equity Market Capitalization (3) $5,832 $19,347 $25,179 Preferred Equity (at Liquidation Value) $201 $865 $201 $1,066 Total Debt (at Principal Balance) 1,642 6,364 1,732 8,096 Less: Cash (82) (15) 82 (15) Plus: Non-OP Noncontrolling Interest _ 7 _ 7 Total Enterprise Value $7,594 $26,567 $34,333 LQA Adjusted EBITDA (4) $341 $1,311 $18 $1,670 Net Debt / Adjusted EBITDA (4) 4.6x 4.9x 4.9x Net Debt + Preferred / Adjusted EBITDA (4) 5.2x 5.6x 5.5x Total Debt / Total Enterprise Value 21.6% 23.7% 23.6% Credit Ratings (Moody’s / S&P / Fitch) Ba1 / BB / N/A Baa2 / BBB / BBB Note: As of March 31, 2017, unless otherwise noted. Pro forma for settlement of 2.375 million forward shares for approximate proceeds of $211 million, which are used to redeem $183 million of Series F Cumulative Preferred Stock and repay $29 million on the revolver. Includes assumed transaction expenses. Based on Digital Realty and DuPont Fabros closing stock price as of June 7, 2017. Includes share of JV EBITDA, JV debt and capital leases. Combined metrics include $18mm of annualized overhead synergies. DIGITAL REALTY: MERGER WITH DUPONT FABROS TECHNOLOGY JUNE 2017

13

Best Practices Governance Leadership Fully Aligned with Shareholders BOARD OF DIRECTORS SHAREHOLDER-FRIENDLY COMPOSITION GOVERNANCE PRACTICES Currently10 directors serving on the Board De-Staggered Board ü De-Staggered Board Laurence Chapman named Chairman of the Board Majority of directors’ compensation is paid in ü Majority of our directors’ compensation is paid in in May equity stock Six of the ten directors joined in the past four years Each director maintains a sizable investment in ü Each director maintains a sizable investment in Digital Realty Digital Realty Three new directors added in the past year: Mary Hogan Preusse, Mark Patterson and Afshin The Board and senior management are required ü The board and senior management are required Mohebbi to meet minimum stock ownership requirements to meet minimum stock ownership requirements As part of the proposed acquisition, the Board will ü Substantial majority of management’s long-term Since 2014, the substantial majority of comprise of 12 directors (Digital Realty_s ten existing incentive compensation is tied to relative total management’s long-term incentive compensation directors plus two directors to be designated by shareholder return plan has been tied to relative total shareholder DuPont Fabros) return DIGITAL REALTY: MERGER WITH DUPONT FABROS TECHNOLOGY JUNE 2017

14

Leading Global Multi-Product Data Center Extending Advantages for Our Customers Provider Unmatched Value Proposition Strengthens and Future Proofs Position in Strategic Metro Areas Improves Customer Base with Creditworthy Tenants Complementary Businesses with Significant Synergies Expected to be Accretive to Financial Metrics and Growth Proven Ability to Execute DIGITAL REALTY: MERGER WITH DUPONT FABROS TECHNOLOGY JUNE 2017

15

Appendix Disclosures Digital Realty

DIGITAL REALTY: MERGER WITH DUPONT FABROS TECHNOLOGY JUNE 2017

16

Appendix

Digital Realty Trust, Inc. (“Digital Realty”) and DuPont Fabros Technology, Inc. (“DuPont Fabros”) each intend to file a proxy statement/prospectus in connection with the merger. Investors are urged to read carefully the proxy statement/prospectus and other relevant materials because they contain important information about the merger. Investors may obtain free copies of these documents and other documents filed by Digital Realty with the SEC through the web site maintained by the SEC at www.sec.gov. In addition, investors may obtain free copies of the documents filed with the SEC by Digital Realty at the SEC_s web site at www.sec.gov or by going to Digital Realty_s corporate website at www.digitalrealty.com or by directing a written request to: Digital Realty Trust, Inc., Four Embarcadero Center, Suite 3200, San Francisco, CA 94111, Attention: Investor Relations. Investors are urged to read the proxy statement/prospectus and the other relevant materials before making any voting decision with respect to the merger. Digital Realty and its directors and executive officers and DuPont Fabros Technology, Inc. (_DuPont Fabros_) and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of each of Digital Realty and DuPont Fabros in connection with the merger. Information regarding the interests of these directors and executive officers in the merger will be included in the proxy statement/prospectus referred to above. Additional information regarding certain of these persons and their beneficial ownership of Digital Realty common stock is also set forth in the Definitive Proxy Statement for Digital Realty_s 2017 Annual Meeting of Stockholders, which has been filed with the SEC. Additional information regarding certain of these persons and their beneficial ownership of DuPont Fabros common stock is set forth in the Definitive Proxy Statement for DuPont Fabros 2017 Annual Meeting of Stockholders, which has been filed with the SEC. Investors may obtain free copies of the documents filed with the SEC by DuPont Fabros at the SEC_s web site at www.sec.gov or by going to DuPont Fabros_ corporate website at www.dft.com or by directing a written request to: DuPont Fabros Technology, Inc., 401 9th St. NW, Suite 600, Washington, DC 20004, Attention: Investor Relations. The information included in this presentation contains certain non-GAAP financial measures that management believes are helpful in understanding our business, as further described below. Our definition and calculation of non-GAAP financial measures may differ from those of other REITs, and, therefore, may not be comparable. The non-GAAP financial measures should not be considered an alternative to net income or any other GAAP measurement of performance and should not be considered an alternative to cash flows from operating, investing or financing activities as a measure of liquidity. EBITDA and Adjusted EBITDA: We believe that earnings before interest, loss from early extinguishment of debt, income taxes and depreciation and amortization, or EBITDA, and Adjusted EBITDA (as defined below), are useful supplemental performance measures because they allow investors to view our performance without the impact of non-cash depreciation and amortization or the cost of debt and, with respect to Adjusted EBITDA, severance-related expense, equity acceleration, and legal expenses, transaction and integration expenses, (gain) on real estate transactions, loss on currency forwards, other non-core expense adjustments, noncontrolling interests, preferred stock dividends and issuance costs associated with redeemed preferred stock. Adjusted EBITDA is EBITDA excluding severance-related expense, equity acceleration, and legal expenses, transaction and integration expenses, (gain) loss on real estate transactions, non- cash (gain) on lease termination, loss on currency forwards, other non-core expense adjustments, noncontrolling interests, preferred stock dividends and issuance costs associated with redeemed preferred stock. In addition, we believe EBITDA and Adjusted EBITDA are frequently used by securities analysts, investors and other interested parties in the evaluation of REITs. Because EBITDA and Adjusted EBITDA are calculated before recurring cash charges including interest expense and income taxes, exclude capitalized costs, such as leasing commissions, and are not adjusted for capital expenditures or other recurring cash requirements of our business, their utility as a measure of our performance is limited. Other REITs may calculate EBITDA and Adjusted EBITDA differently than we do; accordingly, our EBITDA and Adjusted EBITDA may not be comparable to such other REITs_ EBITDA and Adjusted EBITDA. Accordingly, EBITDA and Adjusted EBITDA should be considered only as supplements to net income computed in accordance with GAAP as a measure of our financial performance. DIGITAL REALTY: MERGER WITH DUPONT FABROS TECHNOLOGY JUNE 2017

17

Appendix Note Regarding Forward-Looking Statements This document contains forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts, included in this presentation regarding our strategy, future operations, future financial position, future revenue, projected expenses, prospects, plans and objectives of management are forward-looking statements. Examples of such statements include, but are not limited to, statements relating to the structure, timing and completion of our merger with DuPont Fabros; anticipated synergies and cost efficiencies of the merger; our expectations regarding the financial performance, capitalization, resources and ownership structure of the combined organization; our continued listing on NYSE after the merger; the timing and nature of any financing in connection with or after the merger; the nature, strategy and focus of the combined organization; the executive and board structure of the combined organization; and expectations regarding voting by Digital Realty or DuPont Fabros stockholders. Digital Realty and/or DuPont Fabros may not actually achieve the plans, carry out the intentions or meet the expectations or projections disclosed in our forward-looking statements and you should not place undue reliance on these forward-looking statements. Actual results or events could differ materially from the plans, intentions, expectations and projections disclosed in the forward-looking statements. Various important factors could cause actual results or events to differ materially from the forward-looking statements, including the risks described in the _Risk Factors_ section of Digital Realty_s and DuPont Fabros_ periodic reports filed with the SEC. Forward-looking statements do not reflect the potential impact of any future in-licensing, collaborations, acquisitions, mergers, dispositions, joint ventures, or investments Digital Realty may enter into or make. Digital Realty does not assume any obligation to update any forward-looking statements, except as required by law. DIGITAL REALTY: MERGER WITH DUPONT FABROS TECHNOLOGY JUNE 2017

18