UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

|

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

|

| |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-33824

Kennedy-Wilson Holdings, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

| | |

| Delaware | | 26-0508760 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

9701 Wilshire Blvd., Suite 700 Beverly Hills, CA | | 90212 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(310) 887-6400

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

______________________________________________________________________

|

| | |

| Title of Each Class | | Name of Each Exchange on which Registered |

| Common Stock, $.0001 par value | | NYSE |

Securities registered pursuant to Section 12(g) of the Act: None

______________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

|

| | | | | | | |

| Large accelerated filer | | x | | | Accelerated filer | | o |

| | | | | |

| Non-accelerated filer | | o | (Do not check if a smaller reporting company) | | Smaller reporting company | | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

Based on the last sale at the close of business on June 30, 2014, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $1,977,279,477.

The number of shares of common stock outstanding as of March 2, 2015 was 96,013,684.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this report incorporates certain information by reference from the registrant’s proxy statement for the annual meeting of stockholders to be held on or around June 11, 2015, which proxy statement will be filed no later than 120 days after the close of the registrant’s fiscal year ended December 31, 2014.

TABLE OF CONTENTS

|

| | | | |

| | | | | Page |

| | | PART I | | |

| Item 1. | | | | |

| Item 1A. | | | | |

| Item 1B. | | | | |

| Item 2. | | | | |

| Item 3. | | | | |

| Item 4. | | | | |

| | | | | |

| | | PART II | | |

| Item 5. | | | | |

| Item 6. | | | | |

| Item 7. | | | | |

| Item 7A. | | | | |

| Item 8. | | | | |

| Item 9. | | | | |

| Item 9A. | | | | |

| Item 9B. | | | | |

| | | | | |

| | | PART III | | |

| Item 10. | | | | |

| Item 11. | | | | |

| Item 12. | | | | |

| Item 13. | | | | |

| Item 14. | | | | |

| | | | | |

| | | PART IV | | |

| Item 15. | | | | |

FORWARD-LOOKING STATEMENTS

Statements made by us in this report and in other reports and statements released by us that are not historical facts constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are necessarily estimates reflecting the judgment of our senior management based on our current estimates, expectations, forecasts and projections and include comments that express our current opinions about trends and factors that may impact future operating results. Disclosures that use words such as “believe,” “anticipate,” “estimate,” “intend,” “could,” “plan,” “expect,” “project” or the negative of these, as well as similar expressions, are intended to identify forward-looking statements.

Forward-looking statements are not guarantees of future performance, rely on a number of assumptions concerning future events, many of which are outside of our control, and involve known and unknown risks and uncertainties that could cause our actual results, performance or achievement, or industry results, to differ materially from any future results, performance or achievements, expressed or implied by such forward-looking statements. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, we do not guarantee that the transactions and events described will happen as described (or that they will happen at all). For a further discussion of these and other factors that could impact our future results, performance or transactions, please carefully read “Risk Factors” in Part I, Item 1A below in addition to the following factors:

| |

| • | disruptions in general economic and business conditions, particularly in geographies where our business may be concentrated; |

| |

| • | volatility and disruption of the capital and credit markets, higher interest rates, higher loan costs, less desirable loan terms and a reduction in the availability of mortgage loans, all of which could increase costs and could limit our ability to acquire additional real estate assets; |

| |

| • | continued high levels of, or increases in, unemployment and general slowdowns in commercial activity; |

| |

| • | our leverage and ability to refinance existing indebtedness or incur additional indebtedness; |

| |

| • | an increase in our debt service obligations; |

| |

| • | our ability to generate a sufficient amount of cash to satisfy working capital requirements and to service our existing and future indebtedness; |

| |

| • | our ability to achieve improvements in operating efficiency; |

| |

| • | foreign currency fluctuations; |

| |

| • | performance of our foreign currency hedge instruments; |

| |

| • | adverse changes in the securities markets; |

| |

| • | our ability to retain our senior management and attract and retain qualified and experienced employees; |

| |

| • | our ability to retain major clients and renew related contracts; |

| |

| • | trends in use of large, full-service commercial real estate providers; |

| |

| • | changes in tax laws in the United States, Ireland, United Kingdom, Spain or Japan that reduce or eliminate deductions or other tax benefits we receive; |

| |

| • | our ability to repatriate investment funds in a tax-efficient manner; |

| |

| • | future acquisitions may not be available at favorable prices or upon advantageous terms and conditions; and |

| |

| • | costs relating to the acquisition of assets we may acquire could be higher than anticipated. |

Any such forward-looking statements, whether made in this report or elsewhere, should be considered in the context of the various disclosures made by us about our businesses including, without limitation, the risk factors discussed in this Annual Report. Except as required under the federal securities laws and the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”), we do not have any intention or obligation to update publicly any forward-looking statements, whether as a result of new information, future events, changes in assumptions, or otherwise.

In this report, (i) Kennedy-Wilson Holdings, Inc. is referred to as “Kennedy Wilson” or "KWH,"; (ii) Kennedy-Wilson Holdings, Inc. and its subsidiaries are collectively referred to as "The Company,” “we,” “us” or “our,” unless the context requires otherwise; and (iii) KWE refers to Kennedy Wilson Europe Real Estate plc, a London Stock Exchange listed company that the Company externally manages through a wholly owned subsidiary.

Assets Under Management or "AUM"

AUM generally refers to the properties and other assets with respect to which we provide (or participate in) oversight, investment management services and other advice, and which generally consist of real estate properties or loans, and investments in joint ventures. Our AUM is principally intended to reflect the extent of our presence in the real estate market, not the basis for determining our management fees. Our AUM consists of the total estimated fair value of the real estate properties and other real estate related assets either owned by third parties, wholly owned by us or held by joint ventures and other entities in which our sponsored funds or investment vehicles and client accounts have invested. Committed (but unfunded) capital from investors in our sponsored funds is not included in our AUM. The estimated value of development properties is included at estimated completion cost.

Operating Associates

Operating associates generally refer to individuals that are employed by or affiliated with third-party consultants, contractors, property managers or other service providers that we manage and oversee on a day-to-day basis with respect to our investments and services businesses.

Non-GAAP Measures and Certain Definitions

Consolidated EBITDA represents net income before noncontrolling interest income, interest expense, our share of interest expense included in income from unconsolidated investments, depreciation and amortization, our share of depreciation and amortization included in income from unconsolidated investments, loss on early extinguishment of corporate debt and income taxes for the Company. We do not adjust Consolidated EBITDA for gains or losses on the extinguishment of mortgage debt as we are in the business of purchasing discounted notes secured by real estate and, in connection with these note purchases, we may resolve these loans through discounted payoffs with the borrowers. Consolidated EBITDA is not a recognized term under U.S. generally accepted accounting principles, or GAAP, and does not purport to be an alternative to net earnings as a measure of operating performance or to cash flows from operating activities as a measure of liquidity. Additionally, Consolidated EBITDA is not intended to be a measure of free cash flow available for management's discretionary use, as it does not remove all non-cash items (such as acquisition related gains) or consider certain cash requirements such as interest payments, tax payments and debt service requirements. Our presentation of Consolidated EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Our management believes Consolidated EBITDA is useful in evaluating our operating performance compared to that of other companies in our industry because the calculation of Consolidated EBITDA generally eliminates the effects of financing and income taxes and the accounting effects of capital spending and acquisitions. Such items may vary for different companies for reasons unrelated to overall operating performance. Additionally, we believe Consolidated EBITDA is useful to investors to assist them in getting a more accurate picture of our results from operations.

Acquisition-related gains - Acquisition-related gains consist of non-cash gains recognized by the Company upon a GAAP required fair value measurement due to a business combination. These gains are typically recognized when the Company converts a loan into consolidated real estate owned and the fair value of the underlying real estate exceeds the basis in the previously held loan. These gains also arise when there is a change of control of an investment. The gain amount is based upon the fair value of the Company’s equity in the investment in excess of the carrying amount of the equity directly preceding the change of control.

Adjusted EBITDA represents Consolidated EBITDA, as defined above, adjusted to exclude corporate merger and acquisition related expenses, share based compensation expense for the Company and EBITDA attributable to noncontrolling interests. Our management uses Adjusted EBITDA to analyze our business because it adjusts Consolidated EBITDA for items we believe do not accurately reflect the nature of our business going forward or that relate to non-cash compensation expense or noncontrolling interests. Such items may vary for different companies for reasons unrelated to overall operating performance. Additionally, we believe Adjusted EBITDA is useful to investors to assist them in getting a more accurate picture of our results from operations. However, Consolidated EBITDA and Adjusted EBITDA are not recognized measurements under GAAP and when analyzing our operating performance, readers should use Consolidated EBITDA and Adjusted EBITDA in addition to, and not as an alternative for, net income as determined in accordance with GAAP. Because not all companies use identical calculations, our presentation of Consolidated EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies. Furthermore, Consolidated EBITDA and Adjusted EBITDA are not intended to be a measure of free cash flow for our management’s discretionary use, as it does not remove all non-cash items (such as acquisition related gains) or consider certain cash requirements such as tax and debt service payments. The amounts shown for Consolidated EBITDA and Adjusted EBITDA also differ from the amounts calculated under similarly titled definitions in our debt instruments, which are further adjusted to

reflect certain other cash and non-cash charges and are used to determine compliance with financial covenants and our ability to engage in certain activities, such as incurring additional debt and making certain restricted payments.

Adjusted fees refers to the Company’s investment management, property services and research fees adjusted to include fees eliminated in consolidation and Kennedy Wilson’s share of fees in unconsolidated service businesses.

Adjusted Net Asset Value is calculated by KWE as net asset value adjusted to include properties and other investment interests at fair value and to exclude certain items not expected to be realized in a long-term investment property business model such as the fair value of financial derivatives and deferred taxes on property valuation surpluses.

Adjusted Net Income represents Consolidated Adjusted Net Income as defined below, adjusted to exclude net income attributable to noncontrolling interests, before depreciation and amortization.

Consolidated Adjusted Net Income represents net income before depreciation and amortization, our share of depreciation and amortization included in income from unconsolidated investments and share based compensation expense.

Consolidated investment account refers to the sum of the Company’s equity in: cash held by consolidated investments, consolidated real estate and acquired in-place leases, unconsolidated investments and consolidated loans gross of accumulated depreciation and amortization.

Equity partners refers to subsidiaries that we consolidate in our financial statements under GAAP (other than wholly-owned subsidiaries), including KWE, and third-party equity providers.

Investment account refers to the consolidated investment account presented after noncontrolling interest in invested assets gross of accumulated depreciation.

PART I

Company Overview

Kennedy Wilson is a vertically integrated global real estate investment and services company with over $18.1 billion in assets under management. Founded in 1977, we have owned and operated real estate related investments for over 37 years on behalf of our shareholders and our clients. We have over 450 employees in 25 offices throughout the United States, the United Kingdom, Ireland, Jersey, Spain and Japan and manage and work with over 4,000 operating associates. We focus on adding value for our shareholders through sourcing global opportunistic investment opportunities. Also, our services business creates additional value through fee generation and strategic investment management.

The following is our business model:

| |

| • | Identify countries and markets with an attractive investment landscape |

| |

| • | Establish operating platforms and service businesses in our target markets |

| |

| • | Develop local intelligence and create long-lasting relationships; primarily with financial institutions |

| |

| • | Leverage relationships and local knowledge to drive proprietary investment opportunities with a focus on off-market transactions |

| |

| • | Acquire high quality assets, either on our own or with strategic partners, utilizing cash from our balance sheet and typically financing them on a long-term basis |

| |

| • | Reposition assets and enhance cash flows post-acquisition |

| |

| • | Continuously evaluate and selectively harvest asset and entity value through strategic realizations utilizing both the public and private markets |

| |

| • | Utilize our services businesses to meet client needs, strengthen relationships with financial institutions, and position the Company as a valuable resource and partner to these institutions for any future real estate opportunities |

Our strategy has resulted in a strong track record of creating both asset and entity value for the benefit of our shareholders and partners over various real estate cycles.

Kennedy Wilson Europe Real Estate plc, or KWE (LSE: KWE), closed its initial public offering in February 2014 and a follow-on offering in October 2014, raising approximately $2.2 billion in gross proceeds. KWE, whose ordinary shares are listed on the London Stock Exchange’s main market and is a member of the FTSE 250 Index, acquires real estate and real estate-related assets in Europe. Since its inception through December 31, 2014, KWE has acquired 82 direct real estate assets with approximately 6.6 million square feet and five loan portfolios totaling $2.4 billion in purchase price.

KWE is externally managed by one of our wholly-owned subsidiaries (“KWE Manager”) pursuant to an investment management agreement in which we will be entitled to receive certain management and performance fees. KWE Manager is paid an annual management fee (payable quarterly in arrears) equal to 1% of KWE’s adjusted net asset value (reported by KWE to be $2.1 billion at December 31, 2014) and certain performance fees. The management fee payable to KWE Manager is paid half in cash and half in shares of KWE. We are also entitled to receive an annual performance fee equal to 20% of the lesser of (i) the excess of the shareholder return for the relevant year (defined as the change in KWE’s adjusted net asset value per ordinary share plus dividends paid) over a 10% annual return hurdle, and (ii) the excess of year-end adjusted net asset value per ordinary share over a “high water mark.” The performance fee is payable in shares of KWE that vest equally over a three-year period. No such fee has been earned by Kennedy Wilson as of December 31, 2014.

As of December 31, 2014, Kennedy Wilson owns approximately 20.2 million ordinary shares of KWE (with a cost basis of $333.8 million) or approximately 14.9% of the total issued share capital of KWE.

Due to the terms of the investment management agreement and Kennedy Wilson's equity ownership interest in KWE, pursuant to the guidance set forth in FASB Accounting Standards Codification Subtopic 810 - Consolidation (“Subtopic 810”), the results and financial position of KWE are consolidated in our financial statements. As such, fees earned by KWE Manager are eliminated in the attached consolidated financial statements. Pursuant to the investment management agreement, subject to certain exceptions, KWE will be provided priority access to all real estate or real estate loan opportunities sourced by us in Europe that are within the parameters of KWE’s investment policy.

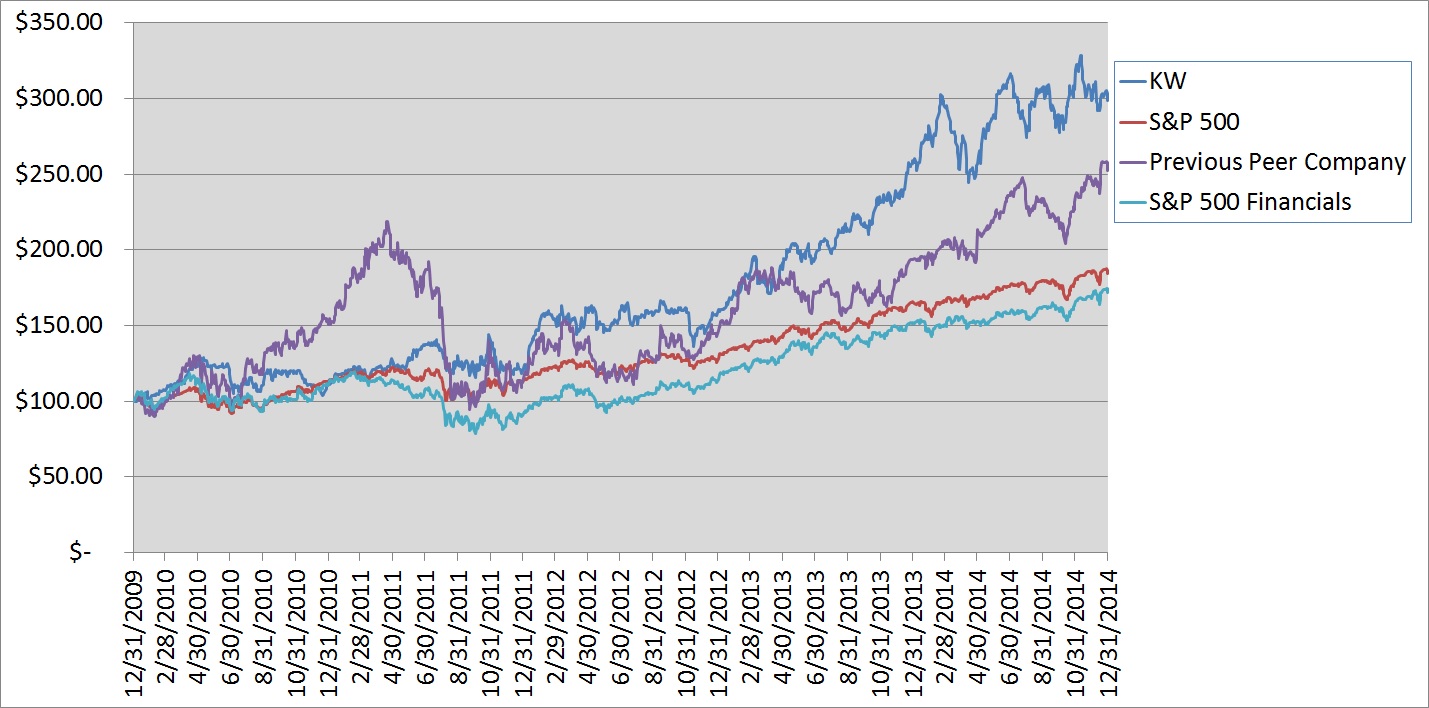

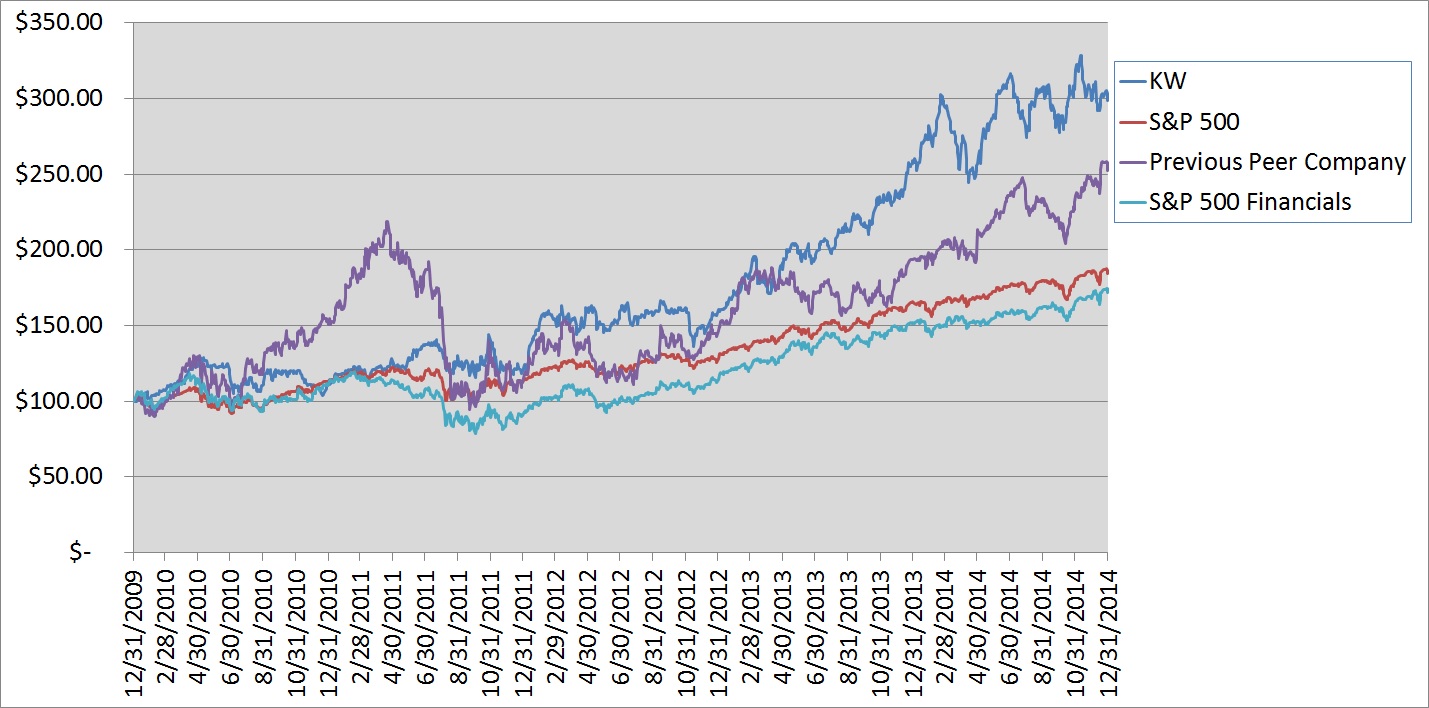

Since going public on November 13, 2009 through December 31, 2014, the annualized total rate of return (including dividends) of our common stock (NYSE: KW) was 24.3%, compared to the return of the S&P 500 index of 13.8%. Past stock price performance is not necessarily indicative of future stock price performance.

Recent Developments

In January 2015, Kennedy Wilson entered into a purchase agreement with a wholly-owned subsidiary of Winthrop Realty Trust to acquire a 61.5% interest in Vintage Housing Holdings, LLC (“VHH”) for approximately $86 million. VHH owns certain interests in 30 multi-family properties totaling 5,485 units, which have been capitalized using tax credit financing. Upon the closing of the transaction, the property developer and current manager of VHH will own the remaining 38.5% of the equity interests and maintain its role as manager. Including the assumption of approximately $328 million of property debt, along with third party equity interests and unrestricted cash, the Company’s purchase values the 30 property portfolio at approximately $486 million. The closing of the acquisition is expected to be consummated in the first half of 2015, subject to customary closing conditions.

In February 2015, KWE closed the acquisition of 163 of 180 mixed-use properties located throughout the United Kingdom for a purchase price of £443.6 million or approximately $670 million. The closing of the balance of the portfolio under contract (17 properties for a total of £59.4 million or approximately $89 million) is scheduled to take place on a staggered basis during the next 12 months as various conditions under the purchase agreement are satisfied.

On February 25, 2015 our board of directors approved a $0.12 per share quarterly dividend, a 33% increase from the previous quarter, to common shareholders of record as of March 31, 2015 with a payment date of April 8, 2015. The quarterly payment equates to an annual dividend of $0.48 per common share.

Business Segments

Our operations are defined by two core business units: KW Investments and KW Services. KW Investments invests our capital in real estate-related assets. KW Services provides a full array of real estate-related services to the Company and its investment partners, third party owners, and lenders, with a strong focus on financial institution based clients. Included in KW services is our management of KWE. The two segments have a symbiotic relationship and work closely together. KW Services provides insight and creates investment opportunities for KW Investments while KW Investments provides clients the ability to utilize the capabilities of KW Services.

KW Investments

We invest our capital in real estate assets and loans secured by real estate either on our own or with strategic partners through publicly traded companies, joint ventures, separate accounts, or funds. We are typically the general partner in these joint ventures with a promoted interest in the profits of our investments beyond our ownership percentage. The Company has an average ownership interest across all investments of approximately 32% as of December 31, 2014. Our equity partners include public shareholders, financial institutions, foundations, endowments, high net worth individuals and other institutional investors.

The following are product types we invest in through the KW Investments segment:

Multifamily

We pursue multifamily acquisition opportunities where we believe we can unlock value through a myriad of strategies, including institutional management, asset rehabilitation, repositioning and creative recapitalization. We focus primarily on apartments in supply-constrained, infill markets. As of December 31, 2014, we hold investments in 20,721 multifamily apartment units across 105 properties primarily located in the Western United States, Ireland and Japan.

Commercial

We source, acquire, and finance various types of commercial real estate which includes office, industrial, retail, and mixed-use assets. After acquisition, the properties are generally repositioned to enhance market value. Assets are either sold as part of property-specific investment strategies designed to deliver above-market returns to our clients and shareholders or held if producing above average returns. As of December 31, 2014, we own interests in 127 commercial properties, totaling over 14 million square feet, located throughout the United States, United Kingdom, Ireland, and Japan.

Loan Originations/Discounted Loan Purchases

We acquire and/or originate loans secured by real estate. Our acquisitions and originations include individual notes on all real estate property types as well as portfolios of loans purchased from financial institutions, corporations and government agencies. We deliver value through loan resolutions, discounted payoffs, and sales. We also convert certain loans into a direct ownership in the underlying real estate collateral. Our discounted loan pool portfolio as of December 31, 2014 had current unpaid principal balance ("UPB") of $1.1 billion. Also, as of December 31, 2014, our loan originations portfolio has an unpaid principal balance of $48.7 million with a weighted average interest rate of 10.1%.

Our loan investment portfolio is principally related to loans acquired at a discount from their contractual balance due as a result of deteriorated credit quality of the borrower. Such loans are underwritten by us based on the value of the underlying real estate collateral. Due to the discounted purchase price, we seek and are generally able to accomplish near term realization of the loan in a cash settlement or by obtaining title to the property. Accordingly, the credit quality of the borrower is not of substantial importance to our evaluation of the risk of recovery from the investment.

Hotel, Residential and Other

We also invest in hotels. In certain cases, we may pursue residential for sale housing acquisition opportunities, including land for entitlements, finished lots, urban infill condominium sites and partially finished and finished condominium projects. We also invest in marketable securities, which are typically real-estate related. We hold investments in over 4200 acres, 177 residential units, 619 lots and 975 hotel rooms.

While our core investments have been in the specific markets and locations listed above, we will evaluate opportunities to earn above market returns across many other segments and geographic locations.

Investment account

In 2014, together with our equity partners, we acquired $3.2 billion of real estate and loans secured by real estate at purchase price. These acquisitions were comprised of the following: 58% commercial, 22% multifamily, 11% loans secured by real estate and 9% other.

At December 31, 2014, we and our equity partners held a real estate and real estate related investment portfolio with assets at a book value of approximately $9.1 billion, with approximately 45% leverage. The Company has an average ownership interest across all of its investments of approximately 32% as of December 31, 2014. The following table depicts how our equity in the portfolio is derived from the financial statement captions in our audited consolidated balance sheet as of December 31, 2014:

|

| | | | | | | |

| (Dollars in millions) | | December 31, 2014 | December 31,

2013 |

| Real estate and acquired in-place lease values, gross of accumulated depreciation and amortization of $121.8 and $26.3, respectively | | $ | 4,349.9 |

| $ | 714.4 |

|

| Loans | | 313.4 |

| 56.8 |

|

| Investment debt | | (2,195.9 | ) | (401.8 | ) |

| Cash held by consolidated investments | | 763.1 |

| 8.0 |

|

Unconsolidated investments(1), gross of accumulated depreciation and amortization of $69.4 and $106.0, respectively | | 532.7 |

| 865.2 |

|

Other(2) | | 97.2 |

| 4.0 |

|

| Consolidated investment account | | 3,860.4 |

| 1,246.6 |

|

| Less: | | | |

Noncontrolling interests on investments, gross of depreciation and amortization of $50.6 and $4.5, respectively | | (2,193.4 | ) | (55.1 | ) |

| Investment account | | $ | 1,667.0 |

| $ | 1,191.5 |

|

(1) Excludes $28.9 million and $26.9 million related to our investment in a servicing platform in Spain, as of December 31, 2014 and December 31, 2013, respectively.

(2) Includes marketable securities, which are part of other assets, as well as net other assets of consolidated investments.

The following table breaks down our investment account information derived from the audited consolidated balance sheet, by investment type and geographic location as of December 31, 2014:

|

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | | Commercial(1) | | Multifamily(2) | | Loans Secured by Real Estate(3) | | Residential, Hotel, and Other(4) | | Total |

| Western U.S. | | $ | 229.1 |

| | $ | 411.2 |

| | $ | 75.2 |

| | $ | 183.3 |

| | $ | 898.8 |

|

| Japan | | 3.6 |

| | 78.1 |

| | — |

| | 0.4 |

| | 82.1 |

|

| United Kingdom | | 186.3 |

| | 3.4 |

| | 41.7 |

| | 15.5 |

| | 246.9 |

|

| Ireland | | 64.1 |

| | 69.5 |

| | 30.1 |

| | 123.3 |

| (6) | 287.0 |

|

| Subtotal | | $ | 483.1 |

| | $ | 562.2 |

| | $ | 147.0 |

| | $ | 322.5 |

| | $ | 1,514.8 |

|

KW share of cash held by consolidated investments(5) | | | | | | | | | | 152.2 |

|

| Total | | | | | | | | | | $ | 1,667.0 |

|

(1) Includes the following with respect to our share of investments made and held directly by KWE (based on our 14.9% ownership interest in KWE): $102.1 million investment account balance related to 62 commercial properties in the United Kingdom; and $26.1 million investment account balance related to 14 commercial properties in Ireland.

(2) Includes $7.9 million investment account balance related to 2 multifamily properties in Ireland from our share of investments made and held directly by KWE (based on our 14.9% ownership interest in KWE).

(3) Includes the following with respect to our share of investments made and held directly by KWE (based on our 14.9% ownership interest in KWE): $25.9 million investment account balance related to two loan portfolios in the United Kingdom comprising 6 loans secured by 11 real estate assets with a current UPB of $275.5 million; and $21.7 million investment account balance related to two loan portfolios in Ireland comprising 15 loans secured by 18 real estate assets with a current UPB of $353.5 million.

(4)Includes the following with respect to our share of investments made and held directly by KWE (based on our 14.9% ownership interests in KWE): $6.8 million investment account balance related to one hotel in the United Kingdom, $6.8 million investment account balance related to one hotel in Ireland and one acre of development land, and $1.0 million investment account balance related to a residential project in Spain. The hotel in the United Kingdom comprises of 520 acres and 209 hotel rooms and the hotel in Ireland comprises of 171 acres and 138 hotel rooms.

(5) Includes $102.3 million in cash held directly by KWE (based on our 14.9% ownership interest in KWE).

(6) Includes $1.0 million investment account balance related to a residential project in Spain.

The following table breaks down our investment account information derived from the audited consolidated balance sheet, by investment type and geographic location as of December 31, 2013:

|

| | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | Commercial | | Multifamily | | Loans Secured by Real Estate | | Residential and Other | | Total |

| Western U.S. | $ | 252.0 |

| | $ | 277.8 |

| | $ | 112.5 |

| | $ | 150.9 |

| | $ | 793.2 |

|

| Japan | 4.5 |

| | 91.4 |

| | — |

| | 0.4 |

| | 96.3 |

|

| United Kingdom | 108.4 |

| | — |

| | 27.3 |

| | — |

| | 135.7 |

|

| Ireland | 102.1 |

| | 51.4 |

| | 8.3 |

| | — |

| | 161.8 |

|

| Subtotal | $ | 467.0 |

| | $ | 420.6 |

| | $ | 148.1 |

| | $ | 151.3 |

| | $ | 1,187.0 |

|

| KW share of cash held by consolidated investments | | | | | | | | | 4.5 |

|

| Total | | | | | | | | | $ | 1,191.5 |

|

KW Services

KW Services offers a comprehensive line of real estate services for the full lifecycle of real estate ownership to clients that include shareholders of KWE, financial institutions, institutional investors, insurance companies, developers, builders and government agencies. KW Services has five main lines of business: investment management, property services, research, brokerage, and auction and conventional sales. These five business lines generate revenue for us through fees and commissions.

We manage over 71 million square feet of properties for the Company and its investment partners (including KWE) in the United States, Europe, and Asia, which includes assets we have ownership interests in and third party owned assets. With 25 offices throughout the United States, the United Kingdom, Ireland, Jersey, Spain and Japan, we have the capabilities and resources to provide property services to real estate owners as well as the experience, as a real estate investor, to understand client concerns. The managers of KW Services have an extensive track record in their respective lines of business and in the real estate community as a whole. Their knowledge and relationships are an excellent driver of businesses through the services business as well as on the investment front.

Additionally, KW Services plays a critical role in supporting our investment strategy by providing local market intelligence and real-time data for evaluating investments, generating proprietary transaction flow and creating value through efficient implementation of asset management or repositioning strategies.

Investment Management

Our investment management division, provides acquisition, asset management and disposition services to our equity partners as well as to third parties. Currently, we have seven closed end funds for which we serve as general partner and manager and separate accounts with strategic partners. In addition, we serve as the manager of KWE and are entitled to receive management fees (50% of which are paid in KWE shares) equal to 1% of KWE’s adjusted net asset value (reported by KWE to be $2.1 billion at December 31, 2014) and certain performance fees. Under US GAAP, we are required to consolidate the results of KWE and as such fees earned from KWE are eliminated in consolidation.

Property Services

Our property services division manages commercial real estate for third-party clients, fund investors, and investments held by Kennedy Wilson. In addition to earning property management fees, consulting fees, leasing commissions, construction management fees, disposition fees, and accounting fees, the property services division gives Kennedy Wilson insight into local markets and potential acquisitions. Leveraging over 37 years of real estate experience, we approach property management from the perspective of an owner and are active in identifying and implementing value creation strategies. The division has a proven track record of success in managing stabilized as well as value-add investments.

Research

Meyers Research LLC or Meyers, a wholly-owned subsidiary of Kennedy Wilson, is a premier consulting practice and provider of data for residential real estate development and new home construction. Meyers’ offers a national perspective as well as local expertise to homebuilders, multifamily developers, lenders and financial institutions. These relationships have led to investment opportunities with homebuilders in the Western U.S. region. We believe Zonda™, a Meyers innovation launched in October 2013, is the housing industry's most comprehensive solution for smart business analysis, real-time market data reporting and economic and housing data in one place and on-the-go.

Brokerage

Our brokerage division represents tenants and landlords on every aspect of site selection, negotiation and occupancy. The division also specializes in innovative marketing programs tailored to client objectives for all types of investment grade and income producing real estate. The division's property marketing programs combine proven techniques with its detailed market knowledge to create optimum results.

Auction and Conventional Sales

The auction and conventional sales division provides innovative marketing and sales strategies for all types of commercial and residential real estate, including single family homes, mixed-use developments, estate homes, multifamily dwellings, new home projects, and conversions. Generally the division's auction sales business is countercyclical to the traditional sales real estate market and has been a bellwether for us in forecasting market conditions.

Value Creation

Kennedy Wilson’s differentiated and unique approach to investing is the cornerstone of how we create value for our shareholders. Our investment philosophy is based on three core fundamentals:

| |

| • | Leverage our global footprint and complementary investments and services businesses to identify attractive investment markets across the world. |

| |

| • | Selectively invest in opportunities across many real estate product types with a goal of maximizing cash flow and return on capital. |

| |

| • | Actively manage assets and finance them conservatively to generate stable, predictable and growing cash flows for shareholders and clients. |

Kennedy Wilson is able to create value for its shareholders in the following ways:

| |

| • | We are able to identify and acquire attractive real estate assets across many markets, in part due to the significant proprietary deal flow driven from an established global network of industry relationships, particularly with financial institutions. This can create value by allowing us to maintain and develop a large pipeline of attractive opportunities. |

| |

| • | Our operating expertise allows us to focus on opportunistic investments where we can increase the value of assets and cash flows, such as distressed real estate owners or lenders seeking liquidity, under-managed or under-leased assets, and repositioning opportunities. |

| |

| • | Many times, these investments are acquired at a discount to replacement cost or recent comparative sales, thereby offering opportunities to achieve above average total returns. In many cases this may lead to significant additional returns, such as a promoted interest, based on the performance of the assets. |

| |

| • | In many instances, our long-lasting and deep relationships with financial institutions allow us to refinance loans to reduce interest rates and/or increase borrowings due to property appreciation and thereby obtain cash flow to use for new investments. We generally implement this strategy after our value add initiatives have been executed, thus allowing us to maintain moderate levels of leverage. |

| |

| • | KW Services plays a critical role in supporting our investment strategy by providing local market intelligence and real-time data for evaluating investments, generating proprietary transaction flow and creating value through efficient implementation of asset management or repositioning strategies. |

| |

| • | We understand that real estate is cyclical. Our management team employs a multi-cyclical approach that has resulted in our AUM being globally diversified across many sectors of real estate while maintaining a healthy liquidity position and adequate access to capital. |

Industry Overview

United States

The U.S. economy continued to gain momentum in 2014 as equity and real estate prices continued their upward trend. Robust employment growth and continued underlying strength in the broader economy allowed the Federal Reserve to wind down its massive bond buying purchase program during 2014, which started in the wake of the 2008 financial crisis. Low interest rates continued to force investors into riskier assets and U.S. real estate returns, as measured by the FTSE NAREIT 50 Index, posted their largest annual gain since 2006.

U.S. real estate market conditions remained favorable in 2014 marked by a strengthening economy and low borrowing costs. The improving economic landscape led to strengthening fundamentals across all property types. Vacancy rates continued to fall across commercial properties and due to higher residential home prices, renter demand for apartments continued to expand at a steady pace.

Looking ahead, we believe the prospect of higher asset values and cash flows in an improving economy with continued job growth outweigh the risks of higher short term U.S. treasury rates in 2015. Furthermore, we believe that continued growth in the U.S. economy will once again drive improvements in fundamentals for all real estate types, including the prospects of higher occupancies, rent growth, property values, and increases in capital availability.

Europe

While the U.S economy showed signs of strength, the European market continued to show signs of improving confidence and market sentiment. Many European countries appear to be at or have moved past their cyclical "trough." Against this backdrop of improving market sentiment and positive signals from leading indicators, commercial real estate investment activity has continued to increase, driven by strong cross-regional capital flows into the direct investment market and improved availability of debt. We believe that continued improvement in the underlying economic fundamentals of Europe will result in a favorable investment outlook for European commercial real estate.

United Kingdom

Since mid-2003, the U.K. recovery has become more established as investor sentiment has strengthened. London continues to be an attractive real estate market due to foreign capital investment and a strong global presence. Much of the foreign

capital has targeted the London location, causing a polarization (in terms of pricing and levels of activity) between London and the rest of the country. Though vacancy rates may have dropped and the U.K.’s economic recovery remains fragile, forecasts of GDP growth for 2015 are encouraging.

Ireland

The Irish economy continues to expand with upward revisions in performance outputs. Irish GDP is expected to grow by more than 3.5% this year, and Ireland is expected to be one of the fastest growing EU countries. Transaction volumes and property value improvements exceeded all expectations over the last 12 months. The office market benefited from a material uptick in occupier demand, and the apartment sector continues to experience growth driven by strong demographics and limited new supply. With the continued deleveraging from NAMA and other financial institutions, we believe 2015 will be another busy year for the Irish property market.

Spain

Spain's economic growth continues unabated from 2013. Whilst GDP remains below pre-recession peak, it has the potential to be one of the fastest growing economies in Europe over the coming years. Improved employment forecasts would boost consumer confidence and subsequently drive rental growth. Assets are still being offloaded by SAREB, the bad bank of the Spanish government, and other financial institutions. We believe the real estate market for Spain will be attractive due to continued low interest rates, an improving economic backdrop, and increased investor appetite from both individual and institutional investors.

Japan

The economic stimulus program in Japan instituted by Prime Minister Abe has led to a weakening of the Japanese yen against most major currencies and continues to create a tailwind for asset prices. The prospect of hosting the 2020 Summer Olympics has strengthened corporate demand in Tokyo. In addition, capital continues to flow into the country from a variety of investment sources, both domestic and international. We believe that there will be a continued interest in the Japanese real estate market due to its attractive exchange rate and low interest rates.

Competition

We compete with a range of global, national and local real estate firms, individual investors and other corporations, both private and public. Because of our unique mix of investments and services businesses, we compete with companies that invest in real estate and loans secured by real estate along with brokerage and property management companies as well as companies that invest in real estate and loans secured by real estate. Our investment business competes with real estate investment partnerships, real estate investments trusts, private equity firms and other investment companies and regional investors and developers. We believe that our relationships with the sellers and our ability to close an investment transaction in a short time period at competitive pricing provide us a competitive advantage. The real estate services business is both highly fragmented and competitive. We compete with real estate brokerage and auction companies on the basis of our relationship with property owners, quality of service, and commissions charged. We compete with property management and leasing firms also on the basis of our relationship with clients, the range and quality of services provided, and fees and commissions charged.

Competitive Strengths

We have a unique platform from which to execute our investment and services strategy. The combination of a service business and an investment platform provides several competitive strengths when compared to other real estate buyers operating stand-alone or investment-focused firms and may allow us to generate superior risk-adjusted returns. Our investment strategy focuses on investments that offer significant appreciation potential through intensive property management, leasing, repositioning, redevelopment and the opportunistic use of capital. We differentiate ourselves from other firms in the industry with our full service, investment oriented structure. Whereas most other firms use an investment platform to obtain additional service business revenue, we use our service platform to enhance the investment process and ensure the alignment of interests with our investors.

Our competitive strengths include:

| |

| • | Transaction experience: Our Executive Committee has more than 125 years of combined real estate experience and has been working and investing together on average for over 15 years. Members of the Executive Committee have collectively acquired, developed and managed in excess of $20 billion of real estate investments in the United States, the United Kingdom, Ireland, Spain and Japan throughout various economic cycles, both at our Company and throughout their careers. |

| |

| • | Extensive relationship and sourcing network: We leverage our services business in order to source off-market deals. In addition, the Executive Committee and our acquisition team have transacted deals in nearly every major metropolitan market on the West Coast of the United States, as well as in the United Kingdom, Ireland, Spain and Japan. Their local presence and reputation in these markets have enabled them to cultivate key relationships with major holders of property inventory, in particularly financial institutions, throughout the real estate community. |

| |

| • | Structuring expertise and speed of execution: Prior acquisitions completed by us have taken a variety of forms including direct property investments, joint ventures, exchanges involving stock or operating partnership units, participating loans and investments in performing and non-performing mortgages at various capital stack positions with the objective of long-term ownership. We believe we have developed a reputation of being able to quickly execute, as well as originate and creatively structure acquisitions, dispositions and financing transactions. |

| |

| • | Vertically integrated platform for operational enhancement: We have over 450 employees in both KW Investments and KW Services, with 25 regional offices throughout the United States, the United Kingdom, Ireland, Spain, Jersey and Japan and manage and oversee over 4,000 operating associates. We have a hands-on approach to real estate investing and possess the local expertise in property management, leasing, construction management, development and investment sales, which we believe enable us to invest successfully in selected submarkets. |

| |

| • | Risk protection and investment discipline: We underwrite our investments based upon a thorough examination of property economics and a critical understanding of market dynamics and risk management strategies. We conduct an in-depth sensitivity analysis on each of our acquisitions. This analysis applies various economic scenarios that include changes to rental rates, absorption periods, operating expenses, interest rates, exit values and holding periods. We use this analysis to develop our disciplined acquisition strategies. |

Foreign Currency

Approximately 45% of our investment account is invested through our foreign platforms in their local currencies. Investment level debt is generally incurred in local currencies and we consider our equity investment as the appropriate exposure to evaluate for hedging purposes. Fluctuations in foreign exchanges rates may have a significant impact on the results of our operations. In order to manage the effect of these fluctuations, we generally hedge our book equity exposure to foreign currencies through currency forward contracts and options. We typically hedge 50%-100% of book equity exposure against these foreign currencies.

Transaction-based Results

A significant portion of our cash flow is tied to transaction activity which can affect an investor’s ability to compare our financial condition and results of operations on a quarter-by-quarter basis or to easily evaluate the breadth of our operation. Historically, this variability has caused our revenue, operating income, net income and cash flows to be tied to transaction activity, which is not necessarily concentrated in any one quarter. In addition, our operating results can be affected by acquisition-related gains, which often can cause concentrated gain recognition in particular periods. While acquisition related gains can have a material result on our net income, because it arises from remeasurement of asset value, it does not affect operating income or cash flow.

Employees

As of December 31, 2014, we have over 450 employees in 25 offices throughout the United States, the United Kingdom, Ireland, Spain, Jersey and Japan and manage and oversee over 4,000 operating associates. We believe that we have been able to attract and maintain high quality employees. There are no employees subject to collective bargaining agreements. In addition, we believe we have a good relationship with our employees.

Available Information

Information about us is available on our website (http://www.kennedywilson.com) (this website address is not intended to function as a hyperlink, and the information contained in, or accessible from, our website is not intended to be a part of this filing). We make available on our website, free of charge, copies of our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements on Schedule 14A and amendments to those reports and other statements filed or furnished pursuant to Section 13(a), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after filing or submitting such material electronically or otherwise furnishing it to the SEC. In addition, we have previously filed registration statements and other documents with the SEC. Any document we file may be inspected, without charge, at the SEC's public reference room at 100 F Street NE, Washington, D.C. 20549 or at the SEC's internet address at http://

www.sec.gov (this website address is not intended to function as a hyperlink, and the information contained in, or accessible from, the SEC's website is not intended to be a part of this filing). Information related to the operation of the SEC's public reference room may be obtained by calling the SEC at 1-800-SEC-0330.

Our results of operations and financial condition can be adversely affected by numerous risks. You should carefully consider the risk factors detailed below in conjunction with the other information contained in this report. If any of the following risks actually occur, our business, financial condition, operating results, cash flows and future prospects could be materially adversely affected.

Risks Related to Our Business

The success of our business is significantly related to general economic conditions and the real estate industry, and, accordingly, our business could be harmed by an economic slowdown and downturn in real estate asset values, property sales and leasing activities.

Our business is closely tied to general economic conditions in the real estate industry. As a result, our economic performance, the value of our real estate and real estate secured notes, and our ability to implement our business strategies may be significantly and adversely affected by changes in national and local economic conditions. The condition of the real estate markets in which we operate is cyclical and depends on the condition of the economy in the United States, United Kingdom, Ireland, Spain and Japan as a whole and to the perceptions of investors of the overall economic outlook. Rising interest rates, declining employment levels, declining demand for real estate, declining real estate values or periods of general economic slowdown or recession or the perception that any of these events may occur have negatively impacted the real estate market in the past and may in the future negatively impact our operating performance. In addition, the economic condition of each local market where we operate may depend on one or more key industries within that market, which, in turn, makes our business sensitive to the performance of those industries.

We have only a limited ability to change our portfolio promptly in response to economic or other conditions. Certain significant expenditures, such as debt service costs, real estate taxes, and operating and maintenance costs, are generally not reduced when market conditions are poor. These factors impede us from responding quickly to changes in the performance of our investments and could adversely impact our business, financial condition and results of operations. We have experienced in past years, and expect in the future to be negatively impacted by, periods of economic slowdown or recession, and corresponding declines in the demand for real estate and related services, within the markets in which we operate. The previous recession and the downturn in the real estate market have resulted in and may result in:

| |

| • | a general decline in rents due to defaulting tenants or less favorable terms for renewed or new leases; |

| |

| • | a decline in actual and projected sale prices of our properties, resulting in lower returns on the properties in which we have invested; |

| |

| • | higher interest rates, higher loan costs, less desirable loan terms and a reduction in the availability of mortgage loans, all of which could increase costs and limit our ability to acquire additional real estate assets; and |

| |

| • | a decrease in the availability of lines of credit and the public equity and debt markets and other sources of capital used to purchase real estate investments and distressed notes; |

| |

| • | fewer purchases and sales of properties by clients, resulting in a decrease in property management fees and brokerage commissions. |

If the economic and market conditions that prevailed in 2008 and 2009 were to return, our business performance and profitability could deteriorate. If this were to occur, we could fail to comply with certain financial covenants in our unsecured revolving credit facilities, which would force us to seek an amendment with our lenders. We may be unable to obtain any necessary waivers or amendments on satisfactory terms, if at all, which could result in the principal and interest of the debt to become immediately due. In addition, in an extreme deterioration of our business, we could have insufficient liquidity to meet our debt service obligations when they come due in future years.

Adverse developments in the credit markets may harm our business, results of operations and financial condition.

Disruptions in the credit markets may adversely affect our business of providing advisory services to owners, investors and occupiers of real estate in connection with the leasing, disposition and acquisition of property. If our clients are unable to procure credit on favorable terms, there may be fewer completed leasing transactions, dispositions and acquisitions of property. In addition, if purchasers of real estate are not able to procure favorable financing, resulting in the lack of disposition opportunities

for our funds and projects, our services businesses will generate lower incentive fees and we may also experience losses of co-invested equity capital if the disruption causes a permanent decline in the value of investments made.

In recent years, the credit markets have experienced significant price volatility, dislocations and liquidity disruptions. These circumstances have materially impacted liquidity in the financial markets, making terms for certain financings less attractive, and, in some cases, have resulted in the unavailability of financing, even for companies that are otherwise qualified to obtain financing. Continued volatility and uncertainty in the credit markets may negatively impact our ability to access additional financing for our capital needs. Additionally, due to this uncertainty, we may be unable to refinance or extend our existing debt, or the terms of any refinancing may not be as favorable as the terms of our existing debt. A prolonged downturn in the financial markets may cause us to seek alternative sources of potentially less attractive financing and may require us to adjust our business plan. These events also may make it more difficult or costly for us to raise capital through the incurrence of additional secured or unsecured debt, which could materially and adversely affect us.

We could lose part or all of our investments in real estate assets, which could have a material adverse effect on our financial condition and results of operations.

There is the inherent possibility in all of our real estate investments that we could lose all or part of our investment. Real estate investments are generally illiquid, which may affect our ability to change our portfolio in response to changes in economic and other conditions. Moreover, we may not be able to unilaterally decide the timing of the disposition of an investment, and as a result, we may not control when and whether any gain will be realized or loss avoided. The value of our investments can also be diminished by:

| |

| • | civil unrest, acts of war and terrorism and acts of God, including earthquakes, hurricanes and other natural disasters (which may result in uninsured or underinsured losses); |

| |

| • | the impact of present or future legislation in the United States, United Kingdom, Ireland, Spain and Japan (including environmental regulation, changes in laws concerning foreign ownership of property, changes in tax rates, changes in zoning laws and laws requiring upgrades to accommodate disabled persons) and the cost of compliance with these types of legislation; and |

| |

| • | liabilities relating to claims, to the extent insurance is not available or is inadequate. |

We may be unsuccessful in renovating the properties we acquire, resulting in investment losses.

Part of our investment strategy is to locate and acquire real estate assets that we believe are undervalued and to improve them to increase their resale value. Acquiring properties that are not yet fully developed or in need of substantial renovation or redevelopment entails several risks, particularly the risk that we overestimate the value of the property or that the cost or time to complete the renovation or redevelopment will exceed the budgeted amount. Such delays or cost overruns may arise from:

| |

| • | shortages of materials or skilled labor; |

| |

| • | a change in the scope of the original project; |

| |

| • | difficulty in obtaining necessary zoning, land-use, environmental, building, occupancy and other governmental permits and authorizations; |

| |

| • | the discovery of structural or other latent defects in the property after we acquire the property; and |

| |

| • | delays in obtaining tenants. |

Any failure to complete a redevelopment project in a timely manner and within budget or to sell or lease the project after completion could have a material adverse effect upon our business, results of operation and financial condition.

Our significant operations in the United Kingdom, Ireland, Spain and Japan expose our business to risks inherent in conducting business in foreign markets.

As of December 31, 2014, approximately 56% of our revenues were sourced from our foreign operations in the United Kingdom, Ireland, Spain and Japan. Accordingly, our firm-wide results of operations depends significantly on our foreign operations. Conducting business abroad carries significant risks, including:

| |

| • | restrictions and problems relating to the repatriation of profits; |

| |

| • | difficulties and costs of staffing and managing international operations; |

| |

| • | the burden of complying with multiple and potentially conflicting laws; |

| |

| • | laws restricting foreign companies from conducting business; |

| |

| • | unexpected changes in regulatory requirements; |

| |

| • | the impact of different business cycles and economic instability; |

| |

| • | political instability and civil unrest; |

| |

| • | greater difficulty in perfecting our security interests, collecting accounts receivable, foreclosing on secured assets and protecting our interests as a creditor in bankruptcies in certain geographic regions; |

| |

| • | potentially adverse tax consequences; |

| |

| • | share ownership restrictions on foreign operations; |

| |

| • | tariff regimes of the countries in which we do business; and |

| |

| • | geographic, time zone, language and cultural differences between personnel in different areas of the world. |

Our investment in, and relationship with, Kennedy Wilson Europe Real Estate Plc presents risks to our business.

In February 2014, we invested approximately $203 million in cash and non-cash assets in Kennedy Wilson Europe Real Estate Plc, or KWE, in connection with its initial public offering. In addition, after KWE’s initial public offering, we invested another $126.0 million on various dates throughout 2014, including $75 million in KWE’s follow-on offering in October 2014. As of December 31, 2014 we held a 14.9% interest in KWE and currently act as its investment manager pursuant to an investment management agreement that provides for the payment to us of certain management and performance fees.

Subject to certain exceptions, the investment management agreement requires us to provide KWE with priority access to all real estate or real estate loan opportunities that we source in Europe and that are within the parameters of KWE’s investment policy. Accordingly, we will be required to offer to KWE investment opportunities in Europe that we otherwise would have been able to pursue ourselves, and the management and performance fees, if any, we may earn with respect to these opportunities may be less than the profits we would have earned had we invested in these opportunities directly. There are exceptions to our requirement to offer European investment opportunities to KWE, and, if we believe an exception applies and we pursue the relevant opportunity ourselves, KWE may disagree.

Although we are entitled to receive management and performance fees pursuant to the management agreement, the fees we actually receive may not be significant. Moreover, if KWE’s portfolio does not perform favorably, we may not receive any performance fees.

In addition, the management agreement may be terminated, including for reasons that are beyond our control, in which case we will receive no management or performance fees. Although we are entitled to a termination fee if we are terminated as manager under certain circumstances, KWE may disagree that such a fee is owed or otherwise refuse to pay us a termination fee. In such an event, we may become involved in expensive legal proceedings and may never recover a termination fee.

The ongoing debt crisis in Europe could harm our business, financial condition and results of operations.

Since the establishment of our European operations in 2011, our business in Europe has become an increasingly important part of our business, and we expect to continue to grow our European presence over time. A number of European countries are continuing to experience high borrowing costs and recessionary conditions, and many European banks and investors have incurred substantial losses on real estate-related assets in recent years. Current macroeconomic conditions in Europe remain subject to significant uncertainty and could make the valuation of real estate-related assets difficult. Continued weakness or a worsening of those conditions could negatively impact the value of our existing investments and harm our ability to sell those investments and identify attractive investment opportunities in the future. These developments could harm our business, financial condition and results of operations.

Our joint venture activities subject us to unique third-party risks, including risks that other participants may become bankrupt or take action contrary to our best interests.

We have used joint ventures for large real estate investments, real estate developments, and the purchase of loans secured by real estate. We plan to continue to acquire interests in additional limited and general partnerships, joint ventures and other enterprises, which we collectively refer to as joint ventures, formed to own or develop real property or interests in real property or note pools. We have acquired and may acquire non-controlling interests in joint ventures, and we may also acquire interests as a passive investor without rights to actively participate in the management of the joint ventures. Investments in joint ventures involve additional risks, including the possibility that the other participants may become bankrupt or have economic or other business interests or goals that are inconsistent with ours, that we will not have the right or power to direct the management and policies of the joint ventures and that other participants may take action contrary to our instructions or requests and against our policies and objectives. Should a participant in a material joint venture investment act contrary to our interests, our business, results

of operations and financial condition could significantly suffer. Moreover, we cannot be certain that we will continue these investments or that we can identify suitable joint venture partners and form new joint ventures in the future.

We purchase distressed loans and loan portfolios that may have a higher risk of default and delinquencies than newly originated loans, and, as a result, we may lose part or all of our investment in such loans and loan portfolios.

From time-to-time we purchase loans and loan portfolios that are unsecured or secured by real or personal property. These loans and loan portfolios in some cases may be non-performing or sub-performing and may be in default at the time of purchase. In general, the distressed loans and loan portfolios we acquire are speculative investments and have a greater than normal risk of future defaults and delinquencies as compared to newly originated loans. Returns on loan investments depend on the borrower’s ability to make required payments or, in the event of default, our security interests, if any, and our ability to foreclose and liquidate whatever property that secures the loans and loan portfolios. We may be unable to collect on a defaulted loan or foreclose on security successfully or in a timely fashion. There may also be instances when we are able to acquire title to an underlying property and sell it but not make a profit on its investment.

If we are unable to identify, acquire and integrate suitable acquisition targets, our future growth will be impeded.

Acquisitions and expansion have been, and will continue to be, a significant component of our growth strategy. While maintaining our existing business lines, we intend to continue to pursue a sustained growth strategy by increasing revenues from existing clients, expanding the breadth of our service offerings, seeking selective co-investment opportunities and pursuing strategic acquisitions. Our ability to manage our growth will require us to effectively integrate new acquisitions into our existing operations while managing development of principal properties. We expect that significant growth in several business lines occurring simultaneously will place substantial demands on our managerial, administrative, operational and financial resources. We may be unable to successfully manage all factors necessary for a successful expansion of our business. Moreover, our strategy of growth depends on the existence of and our ability to identify attractive and synergistic acquisition targets. The unavailability of suitable acquisition targets, or our inability to find them, may result in a decline in business, financial condition and results of operations.

Our business is highly dependent upon the economy and real estate market in California, which has the potential for natural disasters.

We have a high concentration of our business activities in California. Consequently, our business, results of operations and financial condition depend on general trends in California’s economy and real estate market. California historically has been vulnerable to certain natural disaster risks, such as earthquakes, floods, wild fires and erosion-caused mudslides. The existence of adverse economic conditions or the occurrence of natural disasters in California could have a material adverse effect on our business, financial condition and results of operations.

We own real estate properties located in Hawaii, which subjects us to unique risks relating to, among other things, Hawaii’s economic dependence on fluctuating tourism, the isolated location of Hawaii and the potential for natural disasters.

We conduct operations and own properties in Hawaii. Consequently, our business, results of operations and financial condition depend on and are affected by general trends in Hawaii’s economy and real estate market. Hawaii’s economy, although it has significantly recovered, experienced a significant downturn in the most recent recession. Real estate market declines may negatively affect our ability to sell property at a profit. In addition, Hawaii’s economy largely depends on tourism, which is subject to fluctuation. Hawaii historically has also been vulnerable to certain natural disaster risks, such as tsunamis, hurricanes and earthquakes, which could cause damage to properties owned by us or property values to decline in general. Hawaii’s remote and isolated location also may create additional operational costs and expenses, which could have a material adverse impact on our financial results.

We may not be successful in competing with companies in the real estate services and investment industry, some of which may have substantially greater resources than we do.

Real estate investment and services businesses are highly competitive. Our principal competitors include both large multinational companies and national and regional firms, such as Jones Lang LaSalle, Inc. and CBRE Group, Inc. Many of our competitors have greater financial resources and a broader global presence than we do. We compete with companies in the United States, United Kingdom, Ireland, Spain and Japan, with respect to:

| |

| • | selling commercial and residential properties on behalf of customers through brokerage and auction services; |

| |

| • | leasing and property management, including construction and engineering services; |

| |

| • | purchasing commercial and residential properties, as well as undeveloped land for our own account; and |

| |

| • | acquiring secured and unsecured loans. |

Our services operations must compete with a growing number of national firms seeking to expand market share. We may be unable to compete effectively, maintain current fee levels or arrangements, purchase investment properties profitably or avoid increased competition.

If we are unable to maintain or develop new client relationships, our service business and financial condition could be substantially impaired.

We are highly dependent on long-term client relationships and on revenues received for services with third-party owners and related parties. A considerable amount of our revenues are derived from fees related to our service business. The majority of our property management agreements are cancelable prior to their expiration by the client for any reason on as little as 30 to 60 days’ notice. These agreements also may not be renewed when their respective terms expire. Our failure to maintain existing relationships or to develop and maintain new client relationships, or our loss of a substantial number of management agreements, could materially and adversely affect our business, financial condition and results of operations.

Decreases in the performance of the properties we manage are likely to result in a decline in the amount of property management fees and leasing commissions we generate.

Our property management fees are generally structured as a percentage of the revenues generated by the properties that we manage. Similarly, our leasing commissions typically are based on the value of the lease commitments. As a result, our revenues are adversely affected by decreases in the performance of the properties we manage and declines in rental value. Property performance will depend upon, among other things, our ability to control operating expenses (some of which are beyond our control), financial conditions generally and in the specific areas where properties are located and the condition of the real estate market generally. If the performance or rental values of the properties we manage decline, the management fees and leasing commissions we derive from such properties could be materially adversely affected.

Our reliance on third-parties to operate certain of our properties may harm our business.

In some instances, we rely on third party property managers and hotel operators to manage our properties. These third parties are directly responsible for the day-to-day operation of our properties with limited supervision by us, and they often have potentially significant decision-making authority with respect to those properties. Our ability to direct and control how our properties are managed on a day-to-day basis may be limited because we will engage third parties to perform this function. Thus, the success of our business may depend in large part on the ability of our third party property managers to manage the day-to-day operations, and any adversity experienced by our property managers could adversely impact the operation and profitability of our properties