ANNUAL REPORT AND ACCOUNTS 2015 K en n ed y W ilso n E u ro p e R eal E state P lc / A n n u al R ep o rt an d A cco u n ts 2015

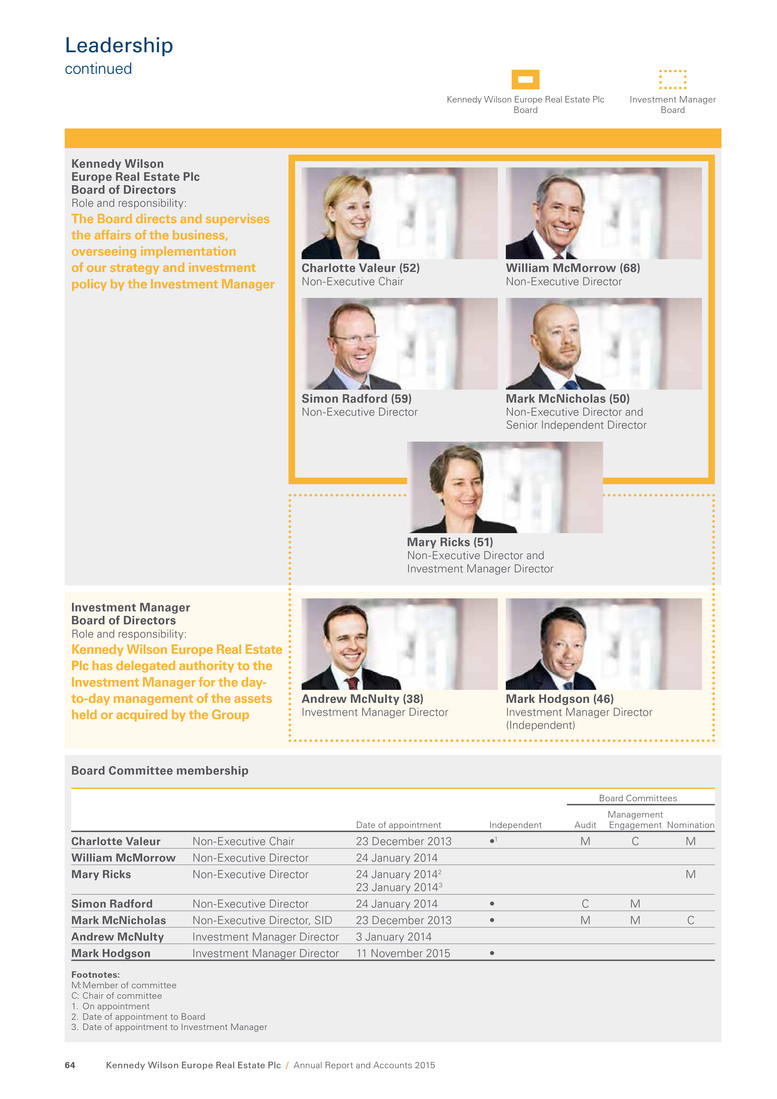

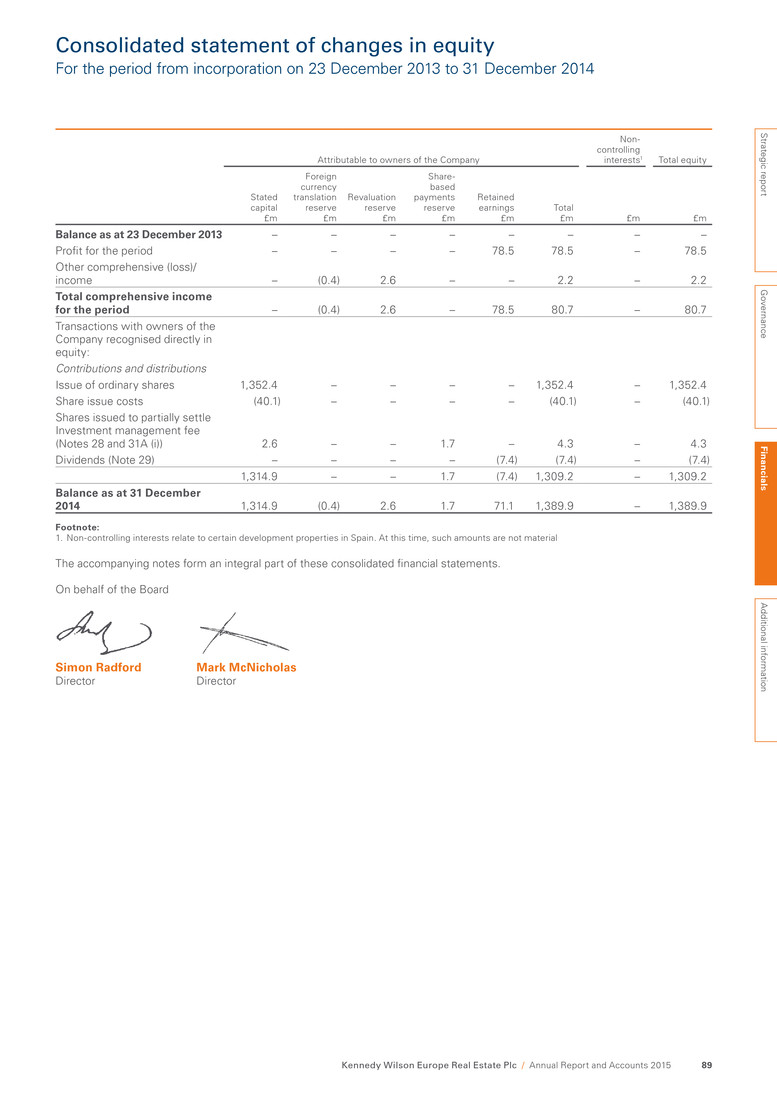

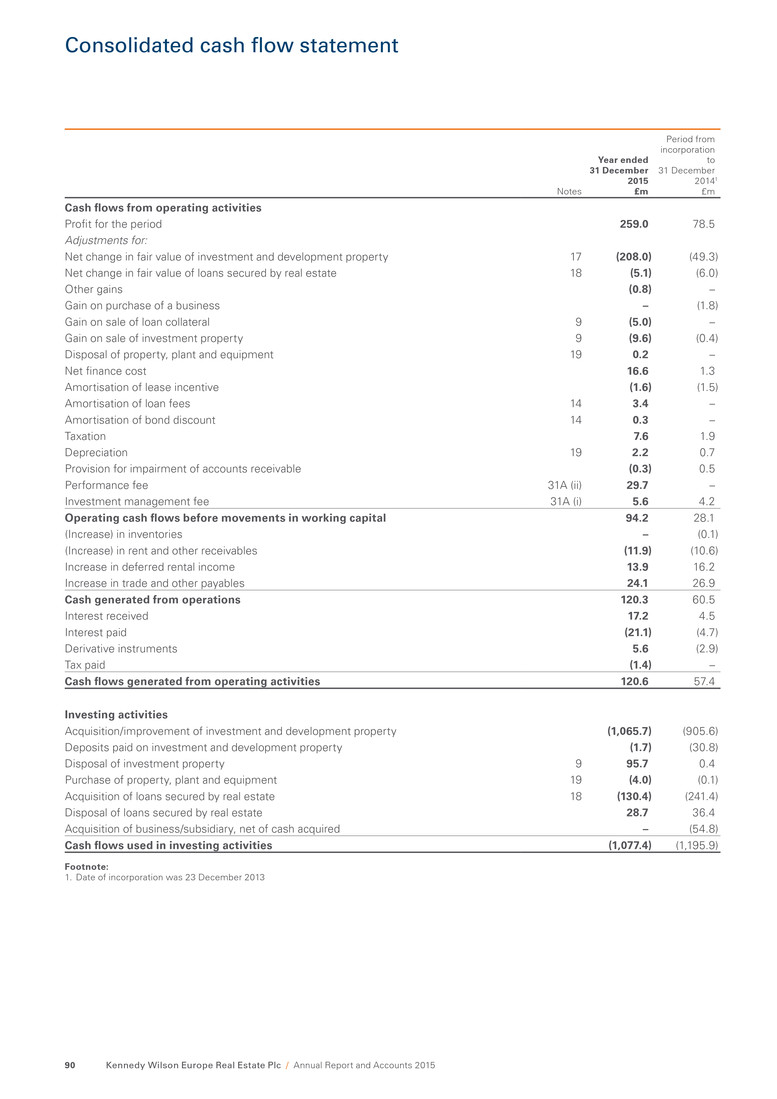

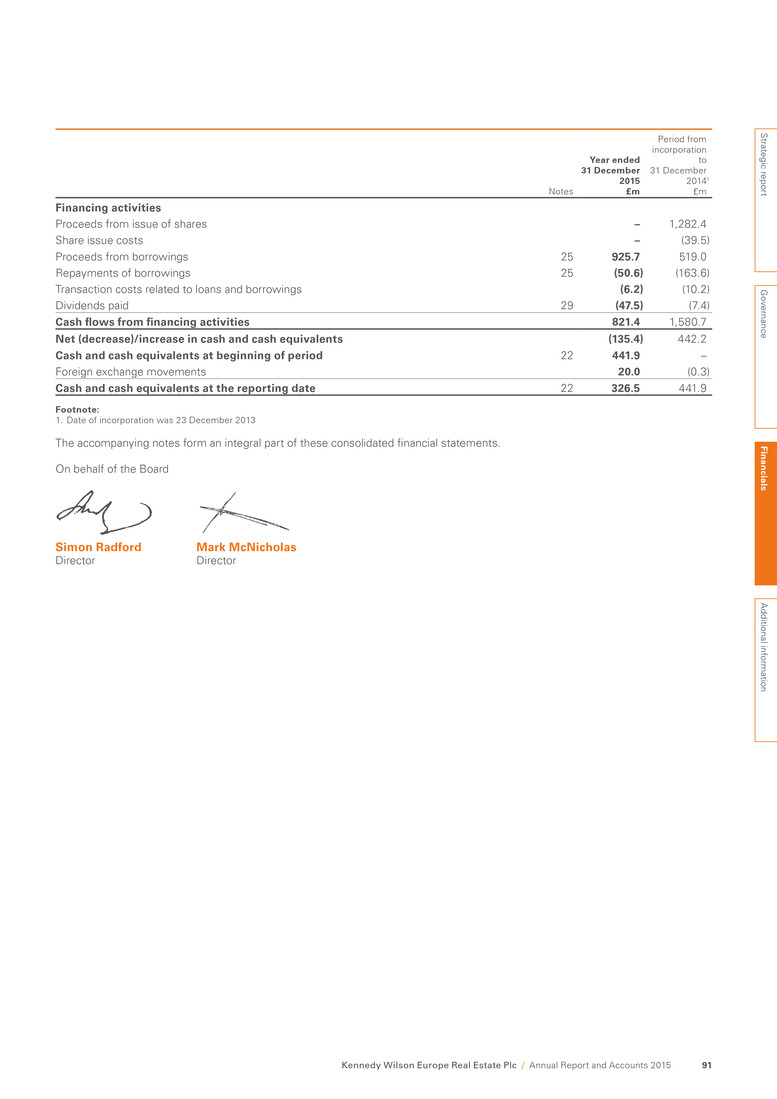

UK Ireland Spain Italy 6% 5% 24% Dublin London South East Other regions 65% 22% 19% 18% 41% £2,793m £2,793m 89% U K & Ire la nd 59% Dub lin, Lo nd on & th e So ut h Ea st In this report Contents Front cover image: 6 Lochside Avenue, Edinburgh, UK Office comprehensive refurbishment completed in 2015 Leadership Effectiveness Accountability Remuneration Relations with shareholders Strategic report 1 Who we are 2 Our business at a glance 4 How we performed in 2015 8 Chair’s introduction 10 Investment proposition 12 Our markets 18 Our business model 20 Our strategy and goals 24 KPIs, Group and EPRA measures 26 Resources and relationships 28 Responsible investments 32 Managing risk 38 Performance review 48 Finance review Financials 81 Statement of Directors’ responsibilities 82 Independent audit report 85 Consolidated income statement 86 Consolidated statement of comprehensive income 87 Consolidated balance sheet 88 Consolidated statement of changes in equity 90 Consolidated cash flow statement 92 Notes to the consolidated financial statements Additional information 146 Principal properties 147 Portfolio statistics and EPRA disclosures 150 Investment policy 152 Additional disclosures 153 Directors, advisors and Company information 154 Shareholder information 154 Financial calendar 155 Definitions and glossary For further information about our business, go to: www.kennedywilson.eu Look for page references for additional content Links are illustrated with the following marker: Governance 55 Letter from the Chair 56 Application of the principles of the Code 58 Code compliance statement 59 Directors’ statements 60 Leadership 65 Biographies 66 Effectiveness 67 Nomination Committee report 69 Accountability 70 Audit Committee report 74 Management Engagement Committee report 76 Remuneration 77 Relations with shareholders 78 Directors’ report Mary Ricks talks about how Kennedy Wilson Europe Real Estate Plc (KWE) has performed in 2015 pages 38 to 45 Peter Collins, COO, outlines key trends and conditions in our markets pages 12 to 16 KWE: our business at a glance pages 2 to 3 Governance: how we manage our business pages 55 to 79 Go to page For further relative information go to the page reference

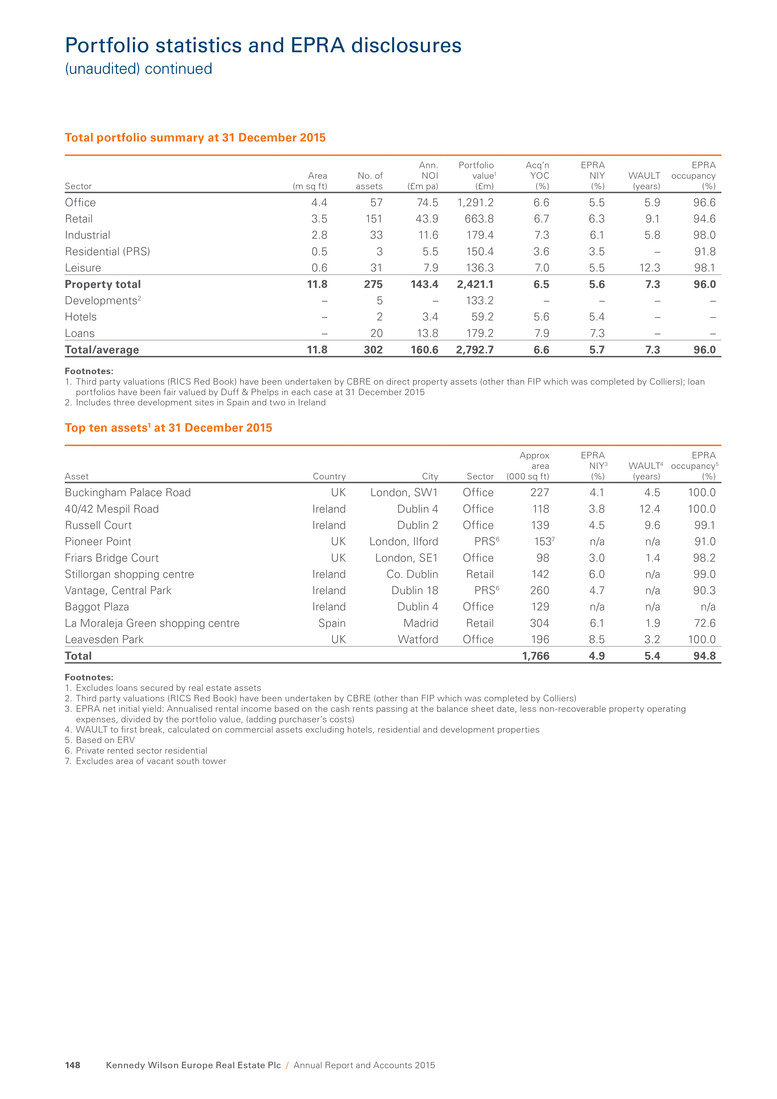

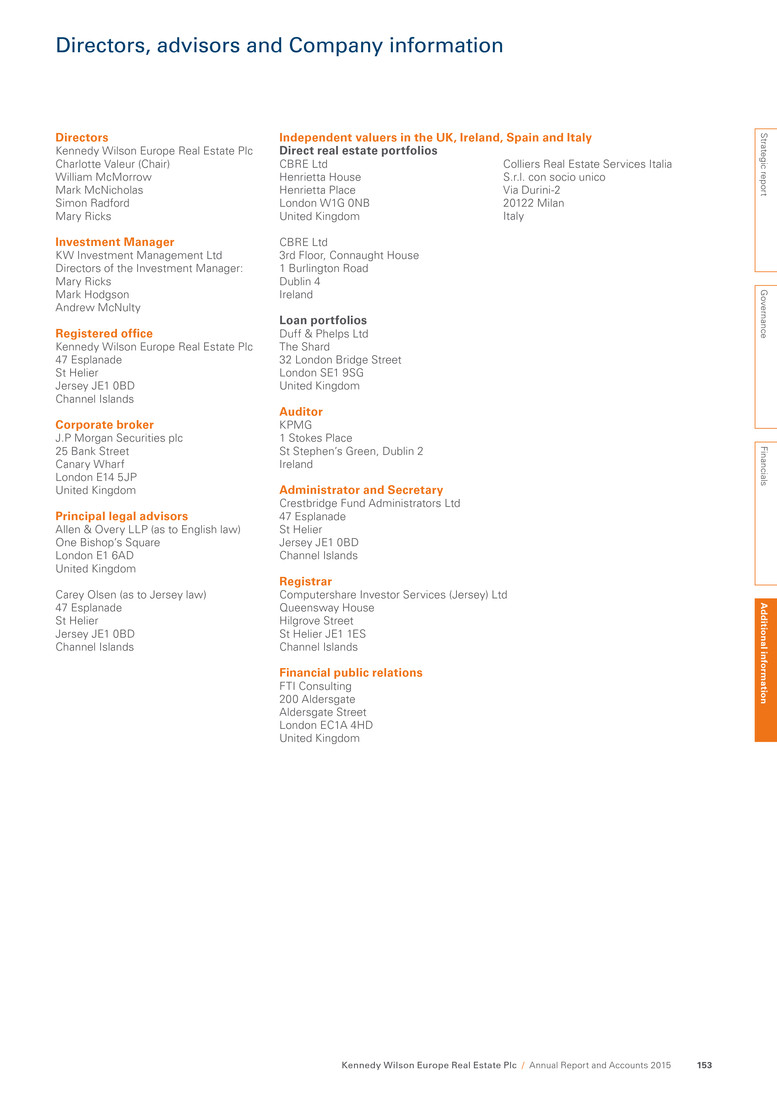

Portfolio statistics £2,793m Portfolio value 302 Assets 11.8m sq ft Area 6.5% Acquisition yield on cost 7.3 years Weighted average unexpired lease term (9.2 years to expiry) 96.0% EPRA occupancy Image: Pioneer Point, Ilford, London, UK Private rented sector residential acquired in 2015 S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 2015 1 Who we are Kennedy Wilson Europe Real Estate Plc (LSE: KWE) is a property company that invests in real estate and real estate loans across Europe. Our portfolio is valued at £2,793 million and is primarily invested in office and retail in the UK and Ireland, as well as in Spain and Italy. By strategically acquiring from vendors such as financial institutions, administrators and other vendors who are not core real estate operators, we aim to unlock the inherent value of under-resourced real estate – namely properties that are under-managed or under-capitalised – in order to generate superior returns for our shareholders. We listed on the Premium segment of the London Stock Exchange (LSE) in February 2014. Our shares are included in the FTSE 250 Index, in the Real Estate Holding & Development sub-sector and with effect from 21 March 2016 – two specialist real estate indices – the GPR 250 Index Series and the FTSE EPRA/NAREIT Global Real Estate Index Series. Our investment manager Our investment manager, KW Investment Management Ltd, is part of the Kennedy Wilson (NYSE: KW) group. KW is a global real estate investment company. KW owns, operates and invests in real estate both on its own and through its investment management platform. With the support of its investment advisors and the KW Europe Investment Committee, the Investment Manager actively manages KWE’s portfolio, under the overall supervision of our Board. See Resources and relationships (page 26) and Governance (pages 55 to 79).

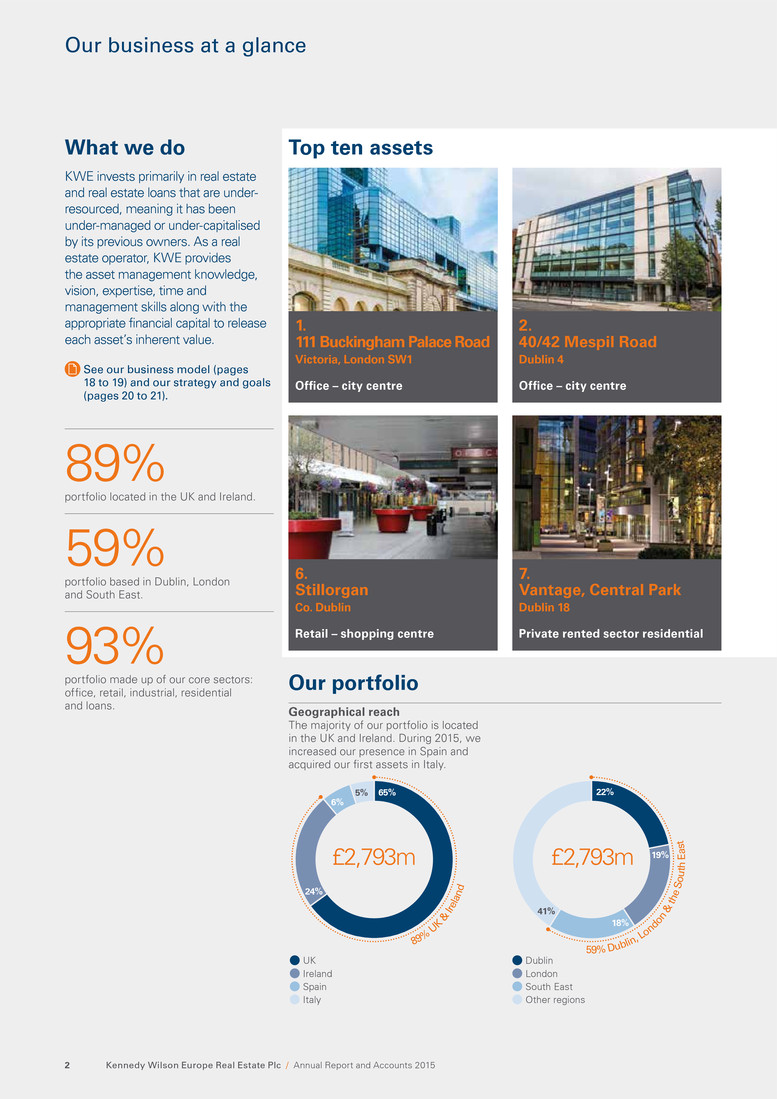

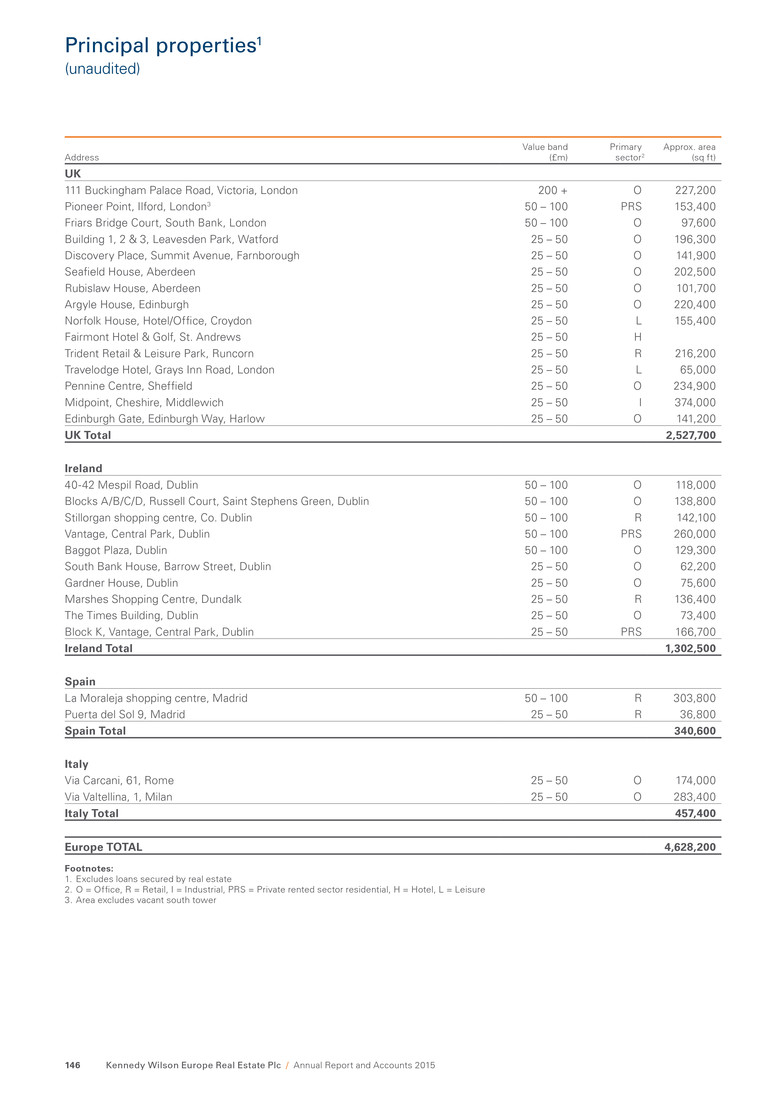

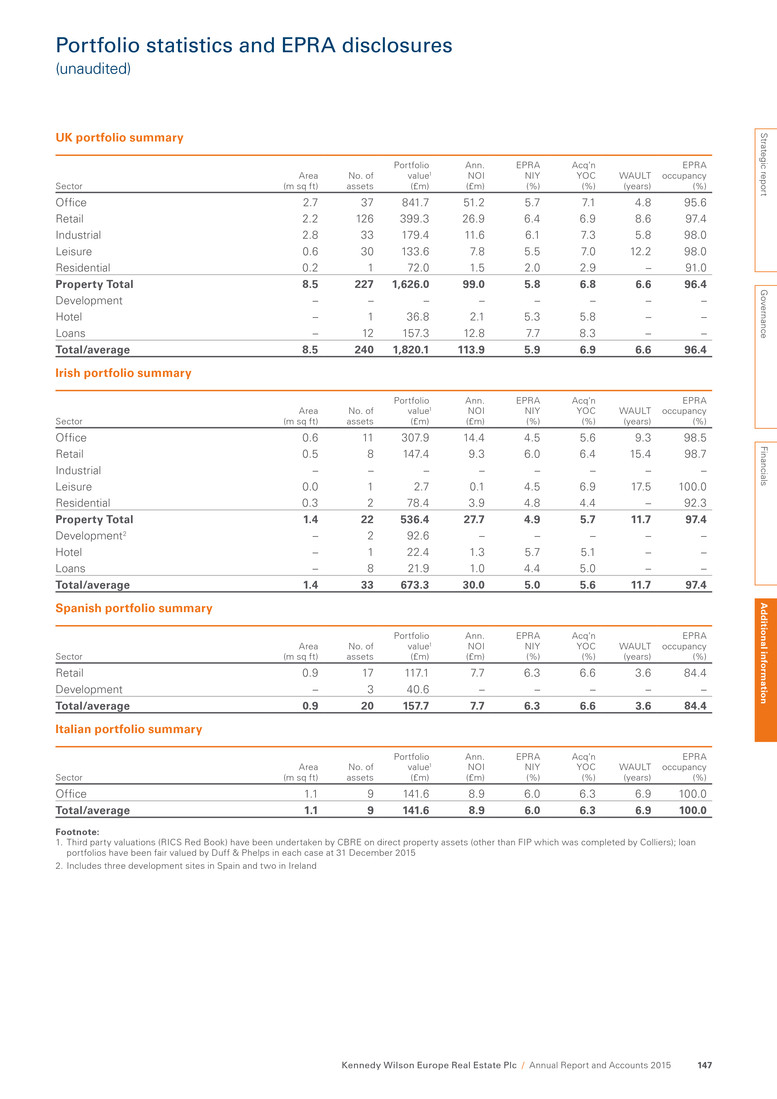

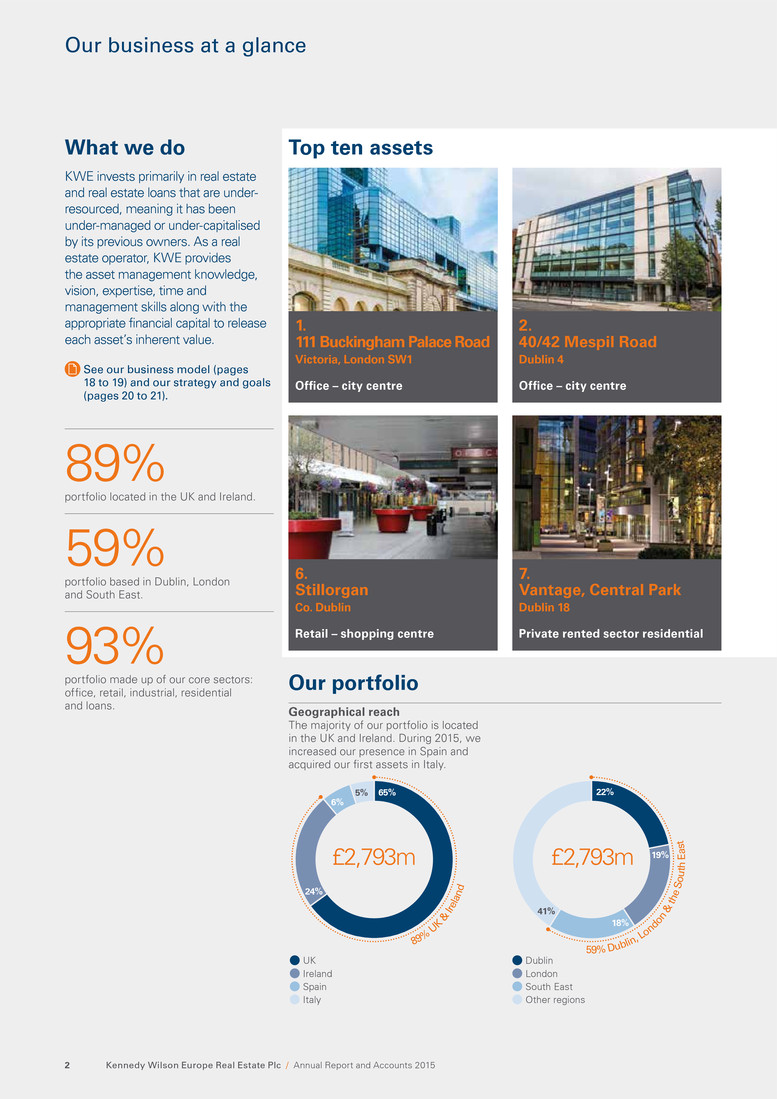

UK Ireland Spain Italy 6% 5% 24% Dublin London South East Other regions 65% 22% 19% 18% 41% £2,793m £2,793m 89% U K & Ire la nd 59% Dub lin, Lo nd on & th e So ut h Ea st 7. Vantage, Central Park Dublin 18 6. Stillorgan Co. Dublin 1. 111 Buckingham Palace Road Victoria, London SW1 2. 40/42 Mespil Road Dublin 4 Geographical reach The majority of our portfolio is located in the UK and Ireland. During 2015, we increased our presence in Spain and acquired our first assets in Italy. Our portfolio What we do KWE invests primarily in real estate and real estate loans that are under- resourced, meaning it has been under-managed or under-capitalised by its previous owners. As a real estate operator, KWE provides the asset management knowledge, vision, expertise, time and management skills along with the appropriate financial capital to release each asset’s inherent value. See our business model (pages 18 to 19) and our strategy and goals (pages 20 to 21). Top ten assets 89% portfolio located in the UK and Ireland. 59% portfolio based in Dublin, London and South East. 93% portfolio made up of our core sectors: office, retail, industrial, residential and loans. Retail – shopping centre Office – city centre Private rented sector residential Office – city centre Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 20152 Our business at a glance

Off_ice Retail Residential Industrial Loans Other1 49% 25% 7% 6% 6% 7% 93% co re se ct or s £2,793m 3. Russell Court Dublin 2 4. Pioneer Point Ilford, London IG1 8. Baggot Plaza Dublin 4 5. Friars Bridge Court South Bank, London SE1 9. La Moraleja Green Madrid 10. Leavesden Park Watford Sector mix Our core sectors are office, retail, industrial and residential. Together with loans, these sectors made up 93% of our portfolio at the year end. See top ten assets table on page 148. Footnote: 1. Includes hotel and leisure assets Office – city centre Office – city centre Retail – shopping centre Private rented sector residential Office – suburban Office – city centre Strategic report G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 2015 3

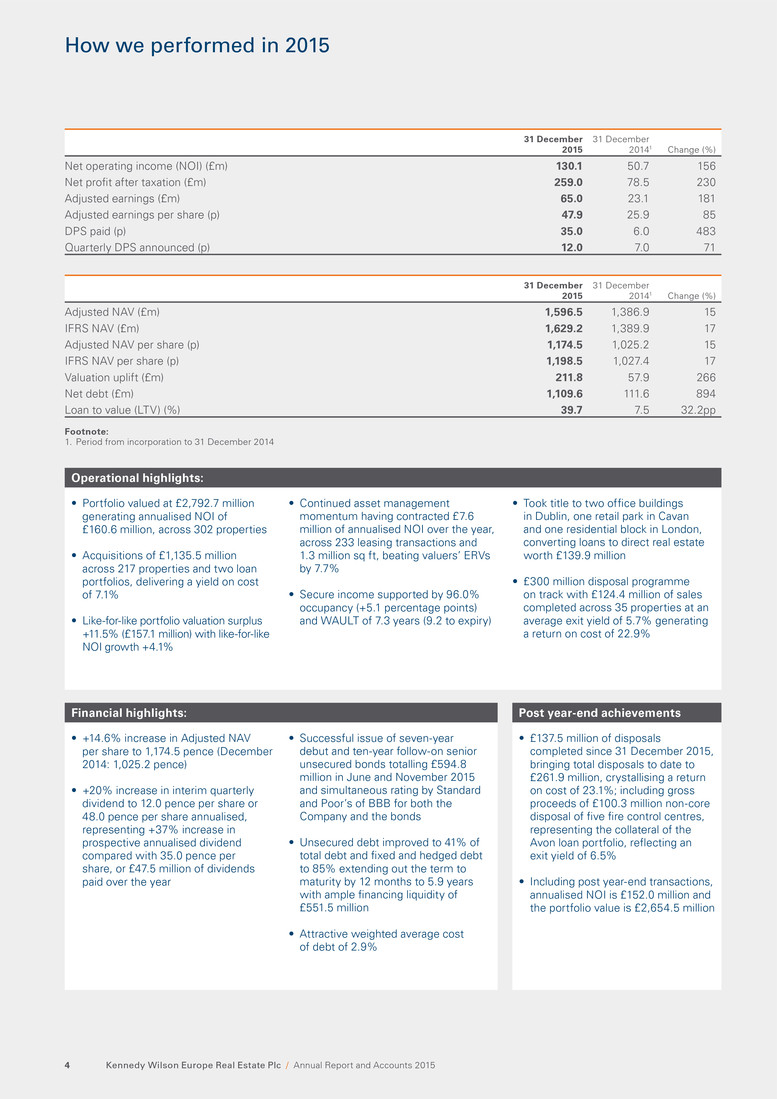

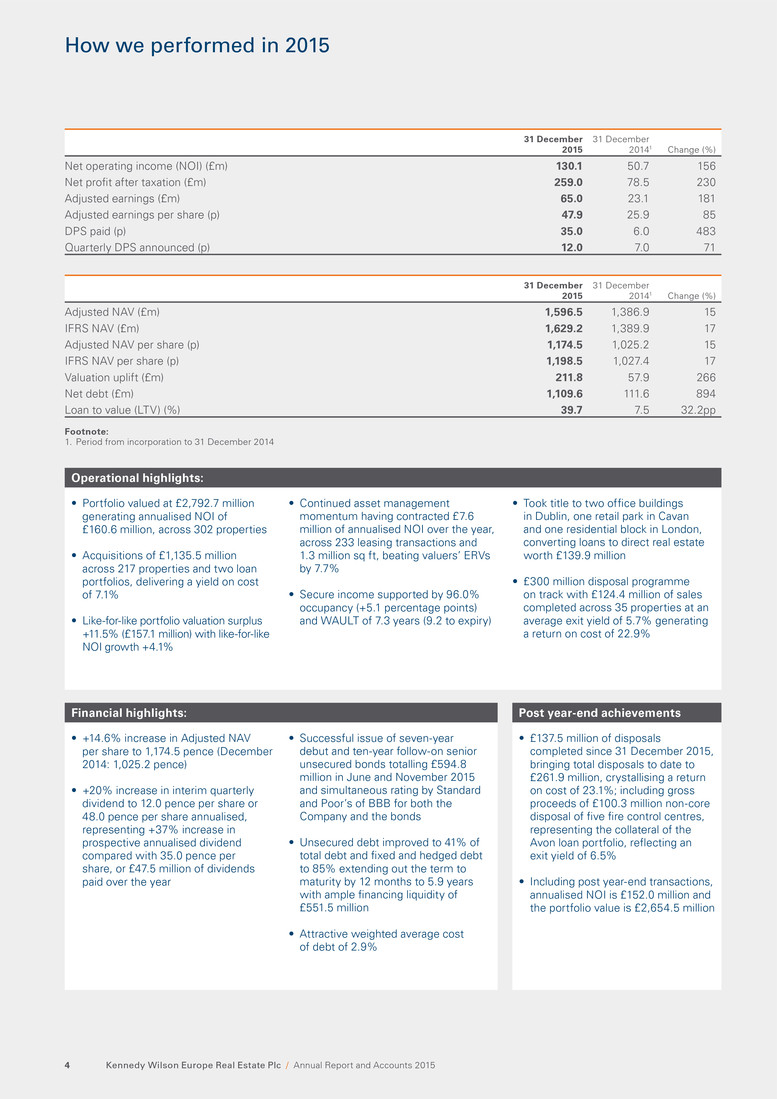

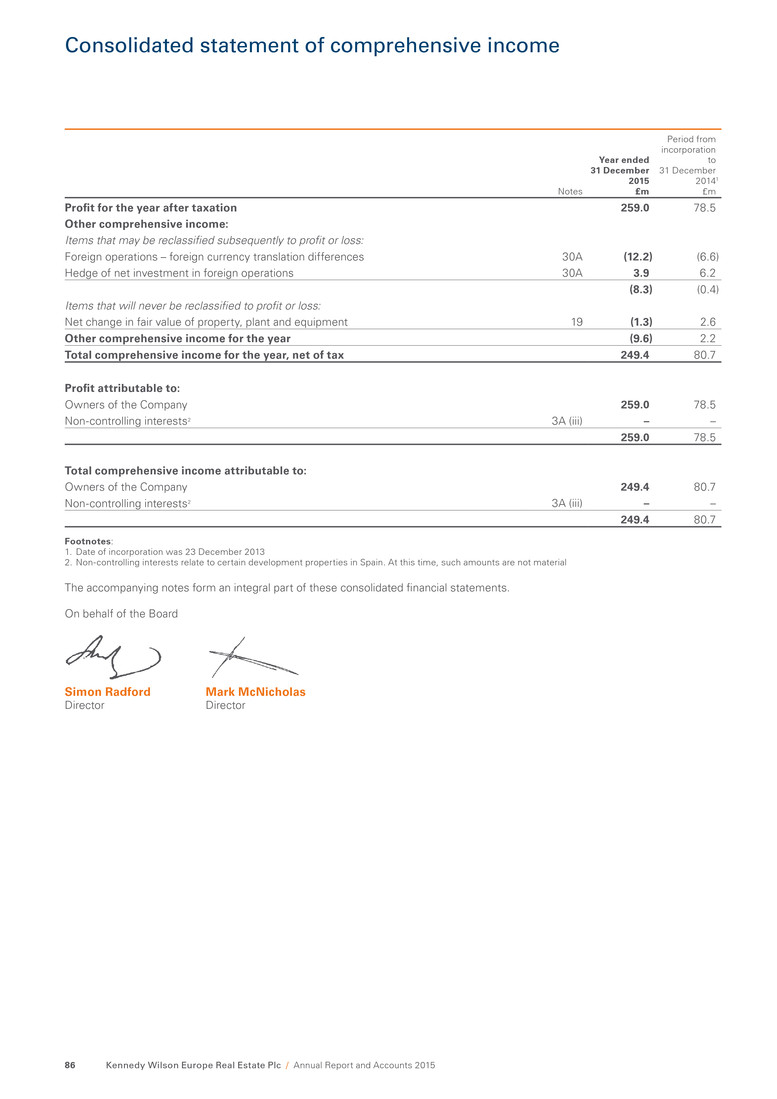

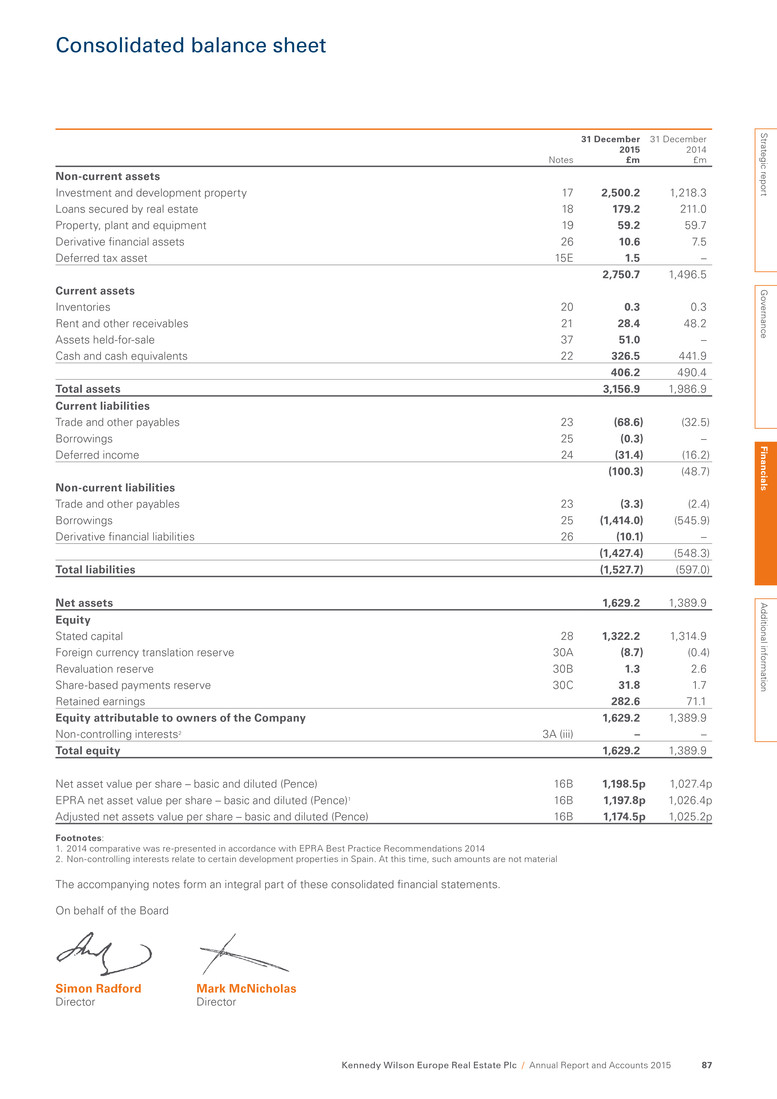

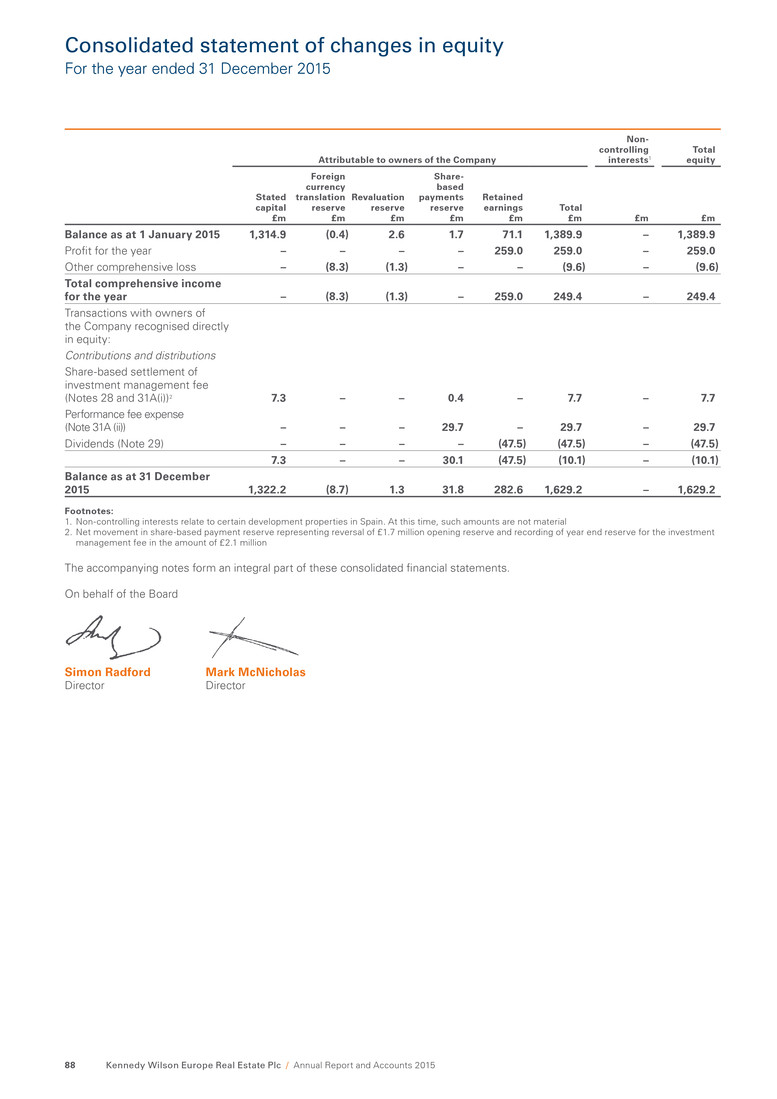

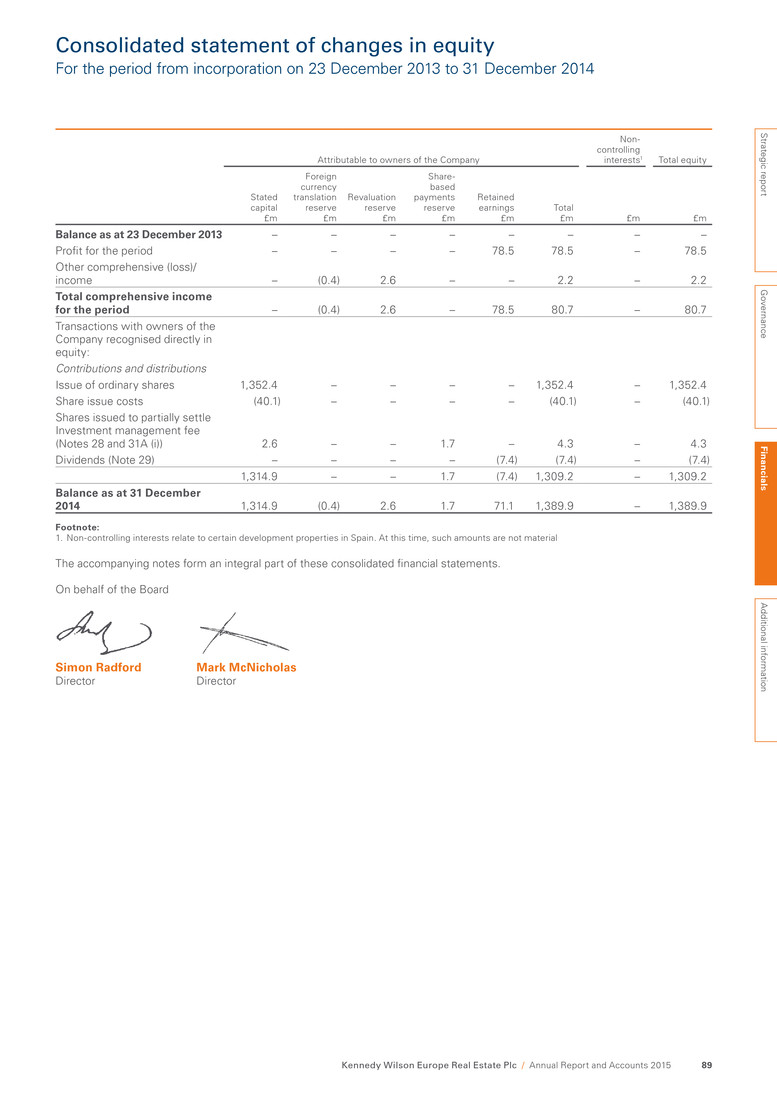

• Portfolio valued at £2,792.7 million generating annualised NOI of £160.6 million, across 302 properties • Acquisitions of £1,135.5 million across 217 properties and two loan portfolios, delivering a yield on cost of 7.1% • Like-for-like portfolio valuation surplus +11.5% (£157.1 million) with like-for-like NOI growth +4.1% • +14.6% increase in Adjusted NAV per share to 1,174.5 pence (December 2014: 1,025.2 pence) • +20% increase in interim quarterly dividend to 12.0 pence per share or 48.0 pence per share annualised, representing +37% increase in prospective annualised dividend compared with 35.0 pence per share, or £47.5 million of dividends paid over the year • £137.5 million of disposals completed since 31 December 2015, bringing total disposals to date to £261.9 million, crystallising a return on cost of 23.1%; including gross proceeds of £100.3 million non-core disposal of five fire control centres, representing the collateral of the Avon loan portfolio, reflecting an exit yield of 6.5% • Including post year-end transactions, annualised NOI is £152.0 million and the portfolio value is £2,654.5 million • Continued asset management momentum having contracted £7.6 million of annualised NOI over the year, across 233 leasing transactions and 1.3 million sq ft, beating valuers’ ERVs by 7.7% • Secure income supported by 96.0% occupancy (+5.1 percentage points) and WAULT of 7.3 years (9.2 to expiry) • Took title to two office buildings in Dublin, one retail park in Cavan and one residential block in London, converting loans to direct real estate worth £139.9 million • £300 million disposal programme on track with £124.4 million of sales completed across 35 properties at an average exit yield of 5.7% generating a return on cost of 22.9% • Successful issue of seven-year debut and ten-year follow-on senior unsecured bonds totalling £594.8 million in June and November 2015 and simultaneous rating by Standard and Poor’s of BBB for both the Company and the bonds • Unsecured debt improved to 41% of total debt and fixed and hedged debt to 85% extending out the term to maturity by 12 months to 5.9 years with ample financing liquidity of £551.5 million • Attractive weighted average cost of debt of 2.9% Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 20154 How we performed in 2015 31 December 2015 31 December 20141 Change (%) Net operating income (NOI) (£m) 130.1 50.7 156 Net profit after taxation (£m) 259.0 78.5 230 Adjusted earnings (£m) 65.0 23.1 181 Adjusted earnings per share (p) 47.9 25.9 85 DPS paid (p) 35.0 6.0 483 Quarterly DPS announced (p) 12.0 7.0 71 31 December 2015 31 December 20141 Change (%) Adjusted NAV (£m) 1,596.5 1,386.9 15 IFRS NAV (£m) 1,629.2 1,389.9 17 Adjusted NAV per share (p) 1,174.5 1,025.2 15 IFRS NAV per share (p) 1,198.5 1,027.4 17 Valuation uplift (£m) 211.8 57.9 266 Net debt (£m) 1,109.6 111.6 894 Loan to value (LTV) (%) 39.7 7.5 32.2pp Footnote: 1. Period from incorporation to 31 December 2014 Operational highlights: Post year-end achievementsFinancial highlights:

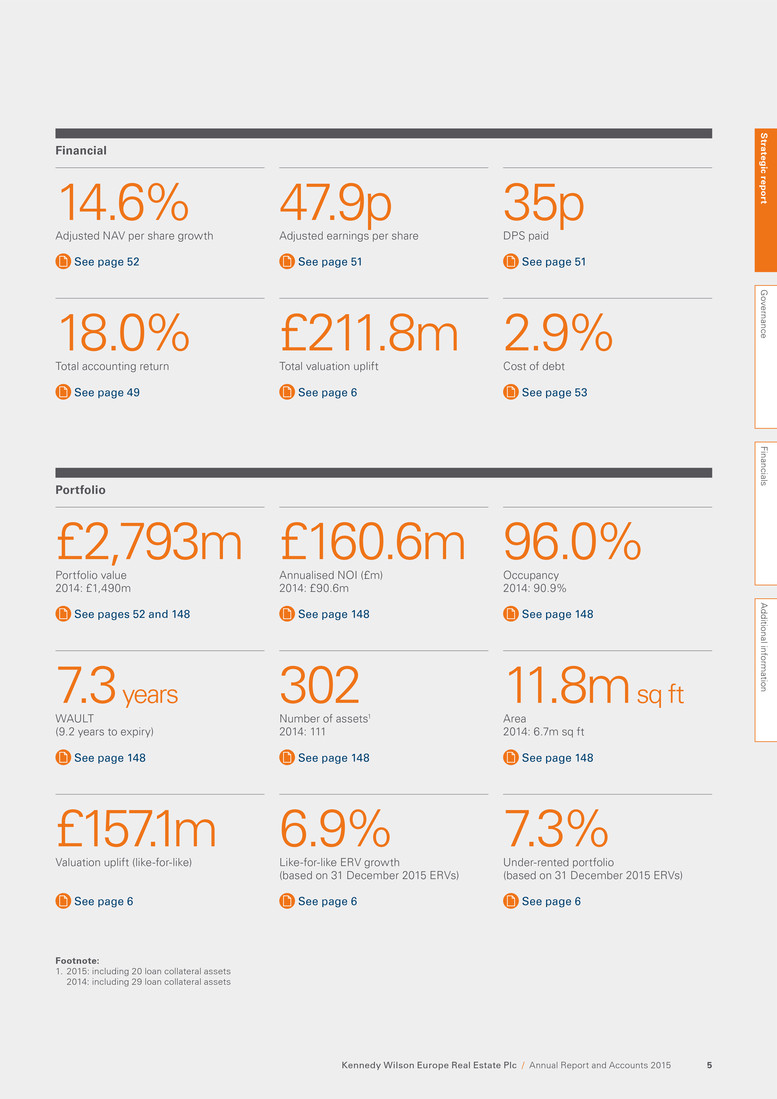

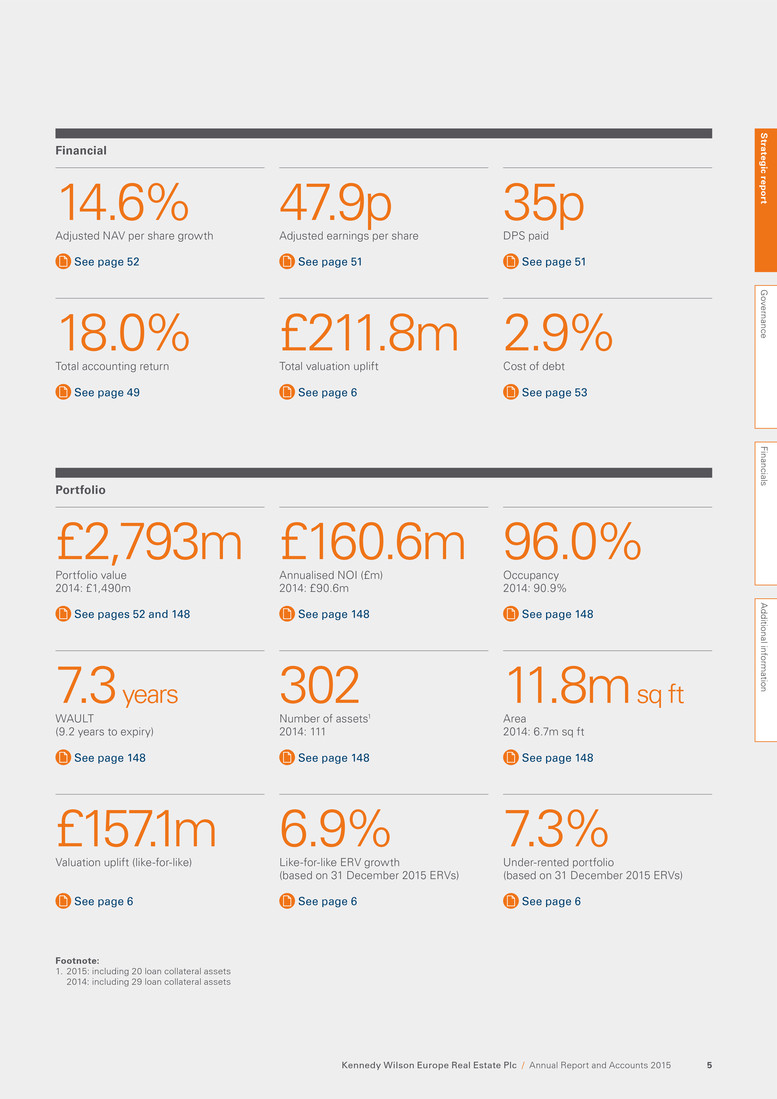

14.6% Adjusted NAV per share growth See page 52 £2,793m Portfolio value 2014: £1,490m See pages 52 and 148 18.0% Total accounting return See page 49 7.3 years WAULT (9.2 years to expiry) See page 148 £157.1m Valuation uplift (like-for-like) See page 6 47.9p Adjusted earnings per share See page 51 £160.6m Annualised NOI (£m) 2014: £90.6m See page 148 £211.8m Total valuation uplift See page 6 302 Number of assets1 2014: 111 See page 148 6.9% Like-for-like ERV growth (based on 31 December 2015 ERVs) See page 6 35p DPS paid See page 51 96.0% Occupancy 2014: 90.9% See page 148 2.9% Cost of debt See page 53 11.8m sq ft Area 2014: 6.7m sq ft See page 148 7.3% Under-rented portfolio (based on 31 December 2015 ERVs) See page 6 Financial Portfolio Footnote: 1. 2015: including 20 loan collateral assets 2014: including 29 loan collateral assets S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 2015 5

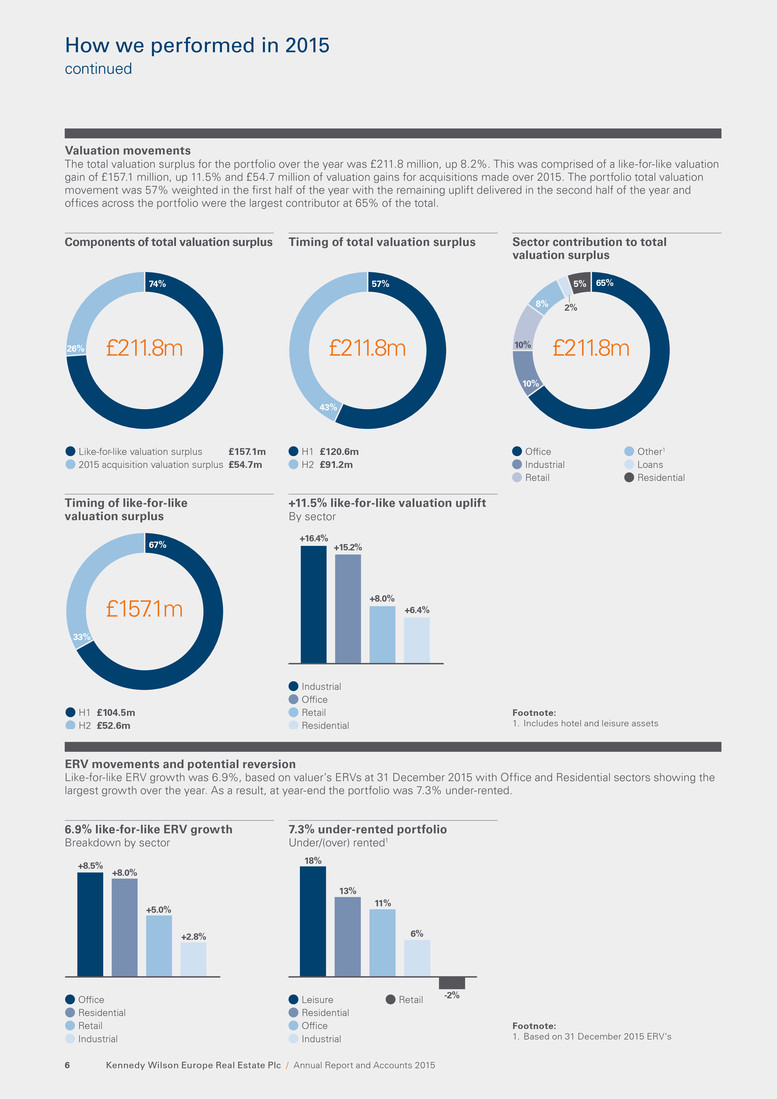

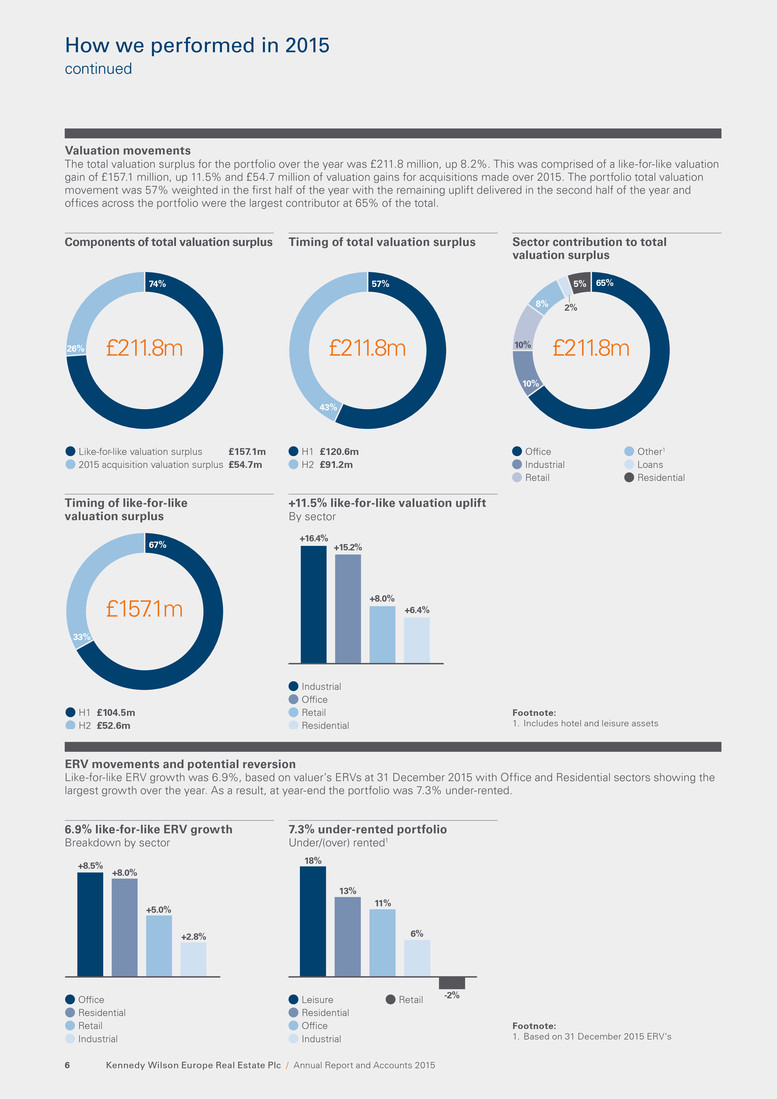

H1 £120.6m H2 £91.2m 43% 57% 65% 8% 2% 5% 10% 10%£211.8m £211.8m Like-for-like valuation surplus £157.1m 2015 acquisition valuation surplus £54.7m 26% 74% £211.8m Off_ice Industrial Retail Other1 Loans Residential H1 £104.5m H2 £52.6m 33% 67% £157.1m Industrial Off_ice Retail Residential +16.4% +8.0% +15.2% +6.4% Leisure Residential Off_ice Industrial RetailOff_ice Residential Retail Industrial +8.5% -2% 6% 11% 13% 18% +5.0% +8.0% +2.8% Timing of total valuation surplusComponents of total valuation surplus Timing of like-for-like valuation surplus +11.5% like-for-like valuation uplift By sector 6.9% like-for-like ERV growth Breakdown by sector 7.3% under-rented portfolio Under/(over) rented1 Sector contribution to total valuation surplus Valuation movements ERV movements and potential reversion The total valuation surplus for the portfolio over the year was £211.8 million, up 8.2%. This was comprised of a like-for-like valuation gain of £157.1 million, up 11.5% and £54.7 million of valuation gains for acquisitions made over 2015. The portfolio total valuation movement was 57% weighted in the first half of the year with the remaining uplift delivered in the second half of the year and offices across the portfolio were the largest contributor at 65% of the total. Like-for-like ERV growth was 6.9%, based on valuer’s ERVs at 31 December 2015 with Office and Residential sectors showing the largest growth over the year. As a result, at year-end the portfolio was 7.3% under-rented. Footnote: 1. Based on 31 December 2015 ERV’s Footnote: 1. Includes hotel and leisure assets Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 20156 How we performed in 2015 continued

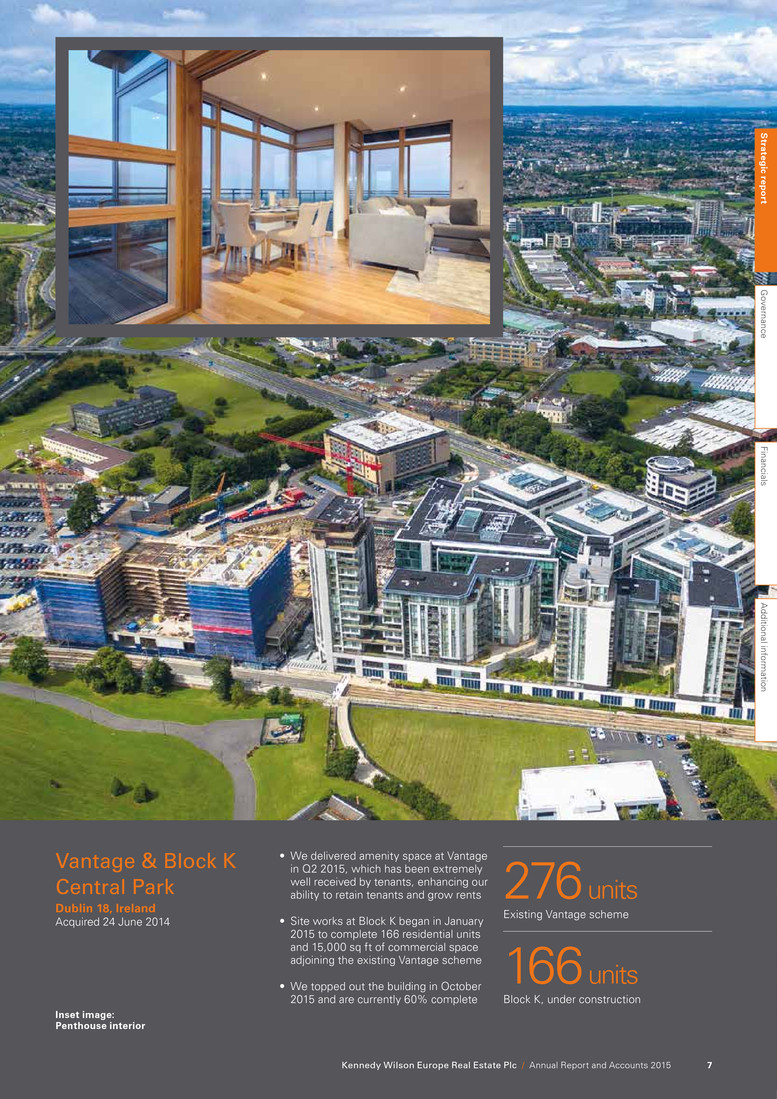

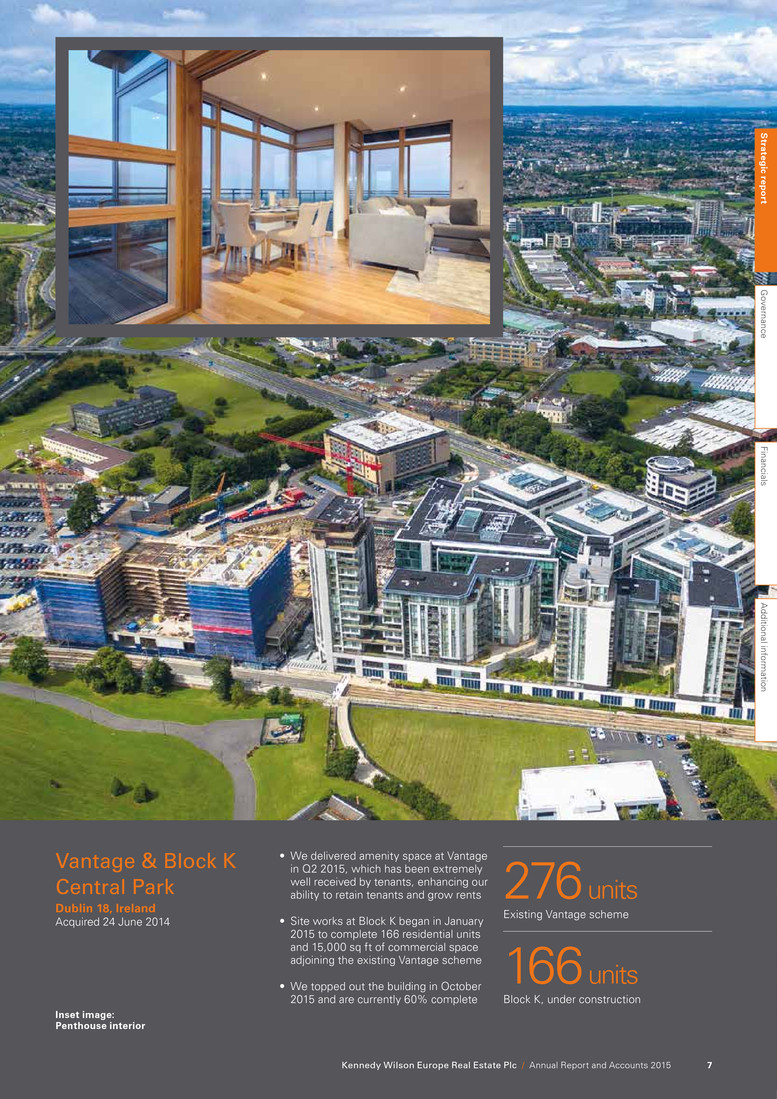

Vantage & Block K Central Park Dublin 18, Ireland Acquired 24 June 2014 276 units Existing Vantage scheme 166 units Block K, under construction • We delivered amenity space at Vantage in Q2 2015, which has been extremely well received by tenants, enhancing our ability to retain tenants and grow rents • Site works at Block K began in January 2015 to complete 166 residential units and 15,000 sq ft of commercial space adjoining the existing Vantage scheme • We topped out the building in October 2015 and are currently 60% complete Inset image: Penthouse interior S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 2015 7

Charlotte Valeur Chair, Kennedy Wilson Europe Real Estate Plc Our business is performing well and I am pleased to report strong operational and financial results for 2015. The portfolio stands at £2,792.7 million, on the back of £1,135.5 million of transactions completed and a total valuation surplus of £211.8 million, up 8.2%. The expertise of our asset management and development teams has been evidenced in the growth in our asset valuation earnings and dividend during the year, and the building blocks for further income and value enhancement are firmly embedded. The portfolio has also benefited from significant balance sheet management. KWE entered the unsecured bond market with the successful rating by Standard and Poor’s of BBB for KWE and both the £300 million debut seven-year bond in June 2015 and the €400 million ten-year bond in November 2015, shortly after we announced a £2,000 million Euro Medium Term Note (EMTN) programme. This enables us to access the unsecured debt capital markets, diversify our funding sources and extend our debt maturities. Results KWE delivered adjusted NAV per share of 1,174.5 pence per share (adjusted NAV of £1,596.5 million). The portfolio value movement is primarily owing to acquisitions and a total valuation surplus of £211.8 million. Adjusted earnings per share of 47.9 pence per share (£65.0 million) and basic earnings per share of 191.0 pence, were both up materially over 2014, owing primarily to acquisition-led growth during 2015 and the timing of the 2014 acquisitions, which were weighted towards the back-end of the year. A YEAR OF NOTABLE MILESTONES The 2015 financial results illustrate material progress across all parts of the business. I am pleased to report that both operational and financial results are ahead of business plans and as a result we have grown the quarterly interim dividend a further 20% over the previous quarter. The prospective dividend of 12.0 pence per share, or 48.0 pence per share on an annualised basis, reflects the Board’s confidence in the team’s ability to deliver income growth across the existing portfolio as well as secure cash flows from our accretive investments. Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 20158 Chair’s introduction

The Investment Manager has also invested in developing its finance and portfolio management systems, to ensure we continue to meet monthly reporting deadlines for our significantly expanded portfolio. A new approach to ‘on boarding’ new assets was also rolled out across the portfolio. This focuses on the critical first 90 days of ownership and ensures we take new assets onto the balance sheet in a systematic fashion. The Board The Board works closely with the Investment Manager and its advisors to achieve a high standard of governance, which remains a key priority. The Company is a fee-paying member of EPRA, the European trade body for listed real estate securities, and follows EPRA’s Best Practice Recommendations for reporting disclosure. In addition, KWE is a member of the Association of Investment Companies (AIC) and acknowledges the AIC Code of Corporate Governance. To demonstrate our commitment to applying high standards of corporate governance, we report against the UK Corporate Governance Code 2014. Outlook The real estate investment market across our four regions, the UK, Ireland, Spain and Italy, are all at different positions in their respective property cycles, providing us with a wider menu of entry points. Whilst all four markets remain competitive, KWE has a unique blend of debt and equity skills, strong market relationships and multi-sector approach. This drives pricing discipline and allows us to execute on attractive investment opportunities to accretively deploy capital and grow income and values, so we can deliver strong returns for shareholders. We are conscious of the current uncertainty in global investment markets, exacerbated in the UK by Brexit concerns. At this stage, we are not seeing that uncertainty feed into our occupier base, which is well diversified across countries and sectors. We continue to actively monitor the risk of investment market volatility feeding into the underlying fundamentals in which we operate. Bearing this in mind, property fundamentals across the UK and Ireland remain positive and investments across offices as well as selected residential and retail properties in key cities continue to perform well. In Spain, we remain positive on consumers’ prospects and are pleased to have increased our retail exposure there, and in Italy, a market we entered in October 2015, we remain focused on offices and retail sectors in the north of the country and are seeing increasing opportunities. Charlotte Valeur Chair Strategic goals The Board is delighted with the investment management team’s success in delivering against our goals for the year. During 2015 we focused on: • Delivering total returns for shareholders with a focus on dividend returns • Ensuring an efficient capital structure • Employing accretive asset management initiatives, and • Recycling capital to actively manage the portfolio. Refer to the Performance review on pages 38 to 45 for further details on our achievements. Dividends Dividends of 35.0 pence per share, or £47.5 million were paid during the year, reflecting a dividend cover based on 2015 adjusted earnings of 1.4 times. The Board has announced an increase in the quarterly interim dividend of 20% to 12.0 pence per share or 48.0 pence annualised, representing a 37% uplift over 2015 and implying an attractive dividend yield of 4.5%, as at 25 February 2016. KWE continues to deliver robust, quarter- on-quarter dividend growth, as the portfolio’s accretive acquisitions deliver improving sustainable cash flows. The Board believes the new dividend level provides an appropriate balance between NOI growth within the portfolio, and our planned net investments, taking into account future disposals. The Board will continue to monitor the portfolio cash flows and the resulting dividend coverage ratio to provide shareholders with a secure dividend whilst maintaining sufficient headroom to provide business flexibility. An enhanced platform The Investment Manager and its advisors have continued to enhance the platform that supports our business, enabling the Group to execute and manage our investments across multiple jurisdictions. KWE has access to top professionals across real estate asset management, development, investment, and finance and operations, across the UK, Ireland, Spain, Italy, Jersey and Luxembourg. During the year, the investment management group added a further 26 employees, including 13 new asset managers and development managers. This took its total employees at year end to over 80, up from approximately 50 at the time of the IPO in February 2014. S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 2015 9

1. We have unique expertise across asset strategies Our ability to invest in direct real estate and in real estate loans differentiates us from our peers. We have a robust platform in place to ensure that we can react quickly and underwrite entire portfolios or single assets. Our ability to maintain pricing discipline across multiple sectors and jurisdictions allows us to source and acquire high-quality assets, in attractive markets with good growth prospects. £1,135.5m Total amount invested in the year 2. We have a track record of value creation We add value at the point of acquisition and through asset management, which means that we are not reliant on market rental growth to generate returns. In 2015, we achieved a like-for-like portfolio valuation surplus of 11.5% or £157.1 million and like-for-like NOI growth of 4.1%. Disposals allow us to crystallise valuation gains and to recycle the capital into attractive opportunities. 23% Total return on cost on disposals William McMorrow Non-Executive Director, KWE Chairman and CEO, Kennedy Wilson Mary Ricks Non-Executive Director, KWE President and CEO, Kennedy Wilson Europe FIVE REASONS TO INVEST IN KWE KWE has quickly and successfully built a portfolio with critical mass. The excellent cash flows from these assets underpin the dividend and we will continue to grow those cash flows, as we execute our asset management plans. The portfolio contains significant embedded value that we have yet to unlock for KWE’s shareholders and we look forward to building on our success to date. Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 201510 Investment proposition

4. We are delivering strong returns for shareholders We aim to reward investors through a secure income base that is poised for future growth and by investing in assets where we believe there is good potential for capital growth through our asset management expertise. In 2015, the successful implementation of our strategy enabled us to grow our dividend substantially. Our total dividend in respect of the year was 35 pence per share. We are growing our quarterly interim dividend by 20% to 12 pence per share which reflects an annualised dividend for 2016 of 48 pence per share, reflecting a prospective dividend yield of 4.5%2 and an uplift of 37% over 2015. 48p 2016 prospective dividend 5. The Investment Manager is incentivised to deliver for shareholders KW owns 18.2% of KWE, which is its largest single investment. This holding is steadily increasing, with 50% of the investment manager fee and 100% of any performance fee paid in shares. Of KW’s holding, a significant majority is KW’s own cash investment with the remaining coming from issuing shares to satisfy the investment manager fees. KW is therefore highly incentivised to deliver value over the long term, to the benefit of all shareholders. 18.2% Kennedy Wilson’s ownership of KWE 100% of performance fee is paid in shares 3. We have the financial flexibility to implement our strategy KWE aims for an efficient mix of equity and debt to support our returns without taking undue risks. Our debt portfolio includes both secured and unsecured debt finance, with an average term to maturity of 5.9 years and financing capacity of £551 million at year end. This gives us the flexibility to continue to implement our investment strategy. We have worked hard to lock in the robust cash flows from our portfolio by fixing our interests costs at low rates, with 85% of our debt either fixed or hedged. Our weighted average cost of debt is just 2.9%. £672m Pro forma financing capacity1 Footnotes: 1. Including proceeds from completed post year end disposals 2. Based on a share price of 1056 pence at 25 February 2016 Mary Ricks President and CEO, Kennedy Wilson Europe Our business remains in robust operational health with ample liquidity. This will allow us to selectively capitalise on investment opportunities across our target regions that may arise from potential market dislocations, given the current volatile state of capital markets. S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 2015 11

Peter Collins Chief Operating Officer, Kennedy Wilson Europe INSIGHTS, TRENDS AND OPPORTUNITY KWE’s ability to invest across multiple sectors across our target jurisdictions of the UK, Ireland, Italy and Spain presents us with opportunities as these regions and sectors have different property cycles, enabling us to maintain strong pricing discipline. London Street, Norwich – Gatsby portfolio Well-located regional high street retail is seeing increasingly positive performance with good occupier demand. Fishponds Industrial Estate, Wokingham We see a continued momentum across distribution and logistics in the industrial sector. Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 201512 Our markets

Source: CBRE as at February 2016 60 68 63 53 58 58 63 70 70 75 82 87 ‘06 ‘07 ‘08 ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 ‘16 ‘17 Source: CBRE as at February 2016 32 32 32 25 27 30 31 31 31 35 37 38 ‘06 ‘07 ‘08 ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 ‘16 ‘17 Source: Historical data as per CBRE research as at February 2016; forecasts as per Savills research as at February 2016 60 63 58 35 32 30 27 35 45 55 65 70 ‘06 ‘07 ‘08 ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 ‘16 ‘17 Despite significant capital market volatility and worries about a global economic slowdown, the UK continues to show positive signs in terms of consumer confidence, employment levels and earnings growth. Preliminary ONS estimates show that the economy grew by 2.2% overall for 2015 supported by the service sector and, importantly, is estimated to be performing ahead of the pre-crisis peak. London continues to lead the recovery with growth for 2015 at 3.4%, according to EY. Central London office take-up for 2015 was 14.5 million sq ft, which compares favourably to the ten-year average take up of 12.7 million sq ft according to CBRE. Our two Central London office sub-markets of Victoria and Southbank continue to benefit from robust rental growth, with 2015 at 10.3% for Victoria and 8.7% for Southbank, according to JLL. The wider economic recovery is also helping regional office markets. According to CBRE, South East office vacancy now sits at 5.7%, below its long-term average of 7.1%, and the South East is benefiting from robust occupational demand, up by 20% or more than 500,000 sq ft compared to 2014. Combined with tight supply, this has delivered rental growth of 12.9% over the year. Victoria prime office rents (£/sq ft p.a.) According to the Central Bank, the Irish economy is continuing to gather momentum and is forecast to grow by 4.8% in 2016. Economic indicators are strong, with retail sales up sharply, unemployment dipping below 9% and consumer sentiment at a 15-year high, according to the Central Statistics Office of Ireland. In the Dublin property market, where 89% of our Irish portfolio is located by value, this economic growth is translating into improved occupational demand across our key sectors. Ireland United Kingdom South East prime office rents (£/sq ft p.a.) Dublin prime office rents (£/sq ft p.a.) As the economy strengthens, we have seen an improvement across our industrial portfolio with year-on-year rental growth of 18.4% and continued momentum across distribution and logistics, with demand outweighing supply. Well-located regional high street retail is seeing increasingly positive performance, with good occupier demand and rental growth of 3.6% across the UK, according to IPD. We expect our own portfolio to benefit over the next four years, as c. 90% of our income is subject to a lease event where we will be able to capitalise on further rental growth and c. 50% is subject to upward only rent reviews. Strategic report Governance Financials Additional information Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 2015 13

Source: PRTB as at February 2016 ‘06 ‘07 ‘08 ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 High: 1326 Low: 965 900 1,000 1,100 1,200 1,300 1,400 Spain Preliminary estimates for Q4 GDP growth came in at 0.8%, in line with expectations and the previous quarter with the economy delivering its tenth straight quarter of growth, according to the National Statistics Institute. This brings 2015 GDP growth to 3.2%, more than double the 1.4% growth of 2014 and the fastest level since 2007. The fall in energy prices will support this further by boosting disposable income. Puerta del Sol 9, Madrid A forecast decline in unemployment will support consumer confidence and trading across our retail portfolio. Baggot Plaza, Dublin 4 Positive rental evidence bodes well for our investment and development portfolio. The investment market has been dominated by office transactions but after several years of slow activity, the retail market is back on investors’ radars as good economic forecasts and increased liquidity are starting to drive this market. In excess of €3 billion of retail investments were transacted in 2015 which is higher than the 2006 peak according to Savills. The market imbalance between tight supply and strong investment demand is putting increasing pressure on pricing, encouraging our strategy of acquiring smaller, more liquid lot sizes, which we can execute off-market or selectively marketed deals. Dublin apartment rents (€/month) Dublin prime office take-up is well ahead of previous years and the ten-year average which is pushing rents up further with 2015 producing year-on-year office CBD rental growth of 22%, according to CBRE and prime Grafton Street Zone A rents are up by 14%. Residential apartment rents in Dublin have also grown by an average of 11.3%, according to the Private Residential Tenancies Board, supporting income growth at our Private Rented Sector (PRS) residential portfolios. In late 2015, the Irish Government amended the current residential rent review provisions, so that for the next four years, rent reviews will be every two years (rather than annually). While this will provide some relief for tenants in a market where supply shortages continue to drive rents upwards, there is no cap on rents, which will continue to be reviewed to market levels and it will not have a significant impact on expected longer-term returns from the sector. This is particularly true at the premium end of the market where our portfolio is well positioned. CBRE hotel data to the end of December 2015 shows Dublin Hotel RevPar up by c. 22%. All this positive rental evidence bodes well for our investment and development portfolio generally and for improving income generation, with c. 350,000 sq ft of rent reviews pending on our Dublin office space between now and the end of 2018. Ireland continued Block K, Vantage, Dublin Economic growth is translating into improved occupational demand across our key sectors. K e n n e d y Wil son Eu rope R e al E s t a t e P l c / Annual Report and Accounts 201514 O ur mar ke t s continued

Source: CBRE as at February 2016 38 39 46 43 43 43 43 40 41 41 43 45 ‘06 ‘07 ‘08 ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 ‘16 ‘17 Source: CBRE as at February 2016 ‘06 ‘07 ‘08 ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 7.1 10.1 6.2 3.8 3.3 2.5 2.3 4.9 10.5 12.8 The economic recovery has been slow in Italy. While a full picture of 2015 is not yet available, with official fourth quarter figures yet to be finalised, positives include a moderate pick up in industrial production, household disposable income and consumer confidence. However, these are offset by unemployment which remains in the low double-digits and appears uneven in its evolution. We expect continued quantitative easing to buoy the region. The investment market remains competitive, reaching €8.1 billion in 2015, up 55% on the previous year and in line with ten-year average volumes, according to CBRE. Milan remains the most attractive office market, with improved leasing fundamentals, take-up set to reach its ten-year average, tenant incentives in decline and the investment market remaining the most liquid. Our largest office asset in Italy is in the city centre of Milan, near the successful Porta Nuova business district. Italy Milan prime office rents (€/sqm/m) Annual investment volume (€bn) Spain continued We remained focused on retail, where we believe the underlying consumer fundamentals are encouraging. 2015 was the turning point for consumer spending, with the retail sales index surpassing 100 for the first time since 2010, according to the Bank of Spain. Whilst unemployment remains high, having peaked in 2013 at 26%, the fourth quarter of 2015 came in at 21%, representing the biggest decline on record. The forecast for 2018 is for a further drop to 15.5%, according to the Spanish Ministry of Economy and Competitiveness, which will support consumer confidence and trading across our retail portfolio. This comprises Carrefour & Dia grocery outlets and La Moraleja Green shopping centre which we acquired at the end of the year, along with our proposed redevelopment of Puerta del Sol 9 in Madrid into a flagship retail store. Strategic report Governance Financials Additional information Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 2015 15

There remain opportunities to acquire loans in our target markets and we expect to continue to be more active in the UK and Ireland. We are unlikely to undertake loan transactions in Spain and Italy to the same extent as in the UK and Ireland, which are more lender-friendly markets as our ultimate goal remains taking title to the underlying real estate. As a result, our NPL strategy in this region will be limited to where we have direct line of sight to the real estate. Overseas lenders to the Non-performing loans (NPLs) UK market still hold significant levels of non-performing loans, according to Deloitte, which we anticipate will be marketed gradually as these lenders recognise the level of mark-to-market write-downs required. In addition, we are tracking several commercial mortgage-backed securities (CMBS) transactions in the UK which have come to the end of their fixed life. There has been a slowdown in the level of loans available to buy in Ireland. The banks and NAMA are still the main sellers but they are often enforcing loans rather than disposing of them. We continue to track several loans that have not yet come to market. Via Carcani, 61, Rome Our FIP portfolio acquired off-market brings us secure seven-year income. Spegazzini, Rome The investment market remains competitive in Italy, up 55% on the previous year. Italy continued We continue to expect to see the most significant investment opportunities arising from fixed-life funds in liquidation or where sponsors have been unable to execute on business plans, generating a good pipeline of off-market opportunities. For instance our FIP portfolio was acquired off-market, and we benefit from secure seven-year government income. Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 201516 Our markets continued

Pioneer Point loan Ilford, London IG1, UK Acquired 18 May 2015 as part of asset via loan (AVL) strategy Underlying collateral 294 PRS units 54% Discount to unpaid principal balance (UPB) 294 PRS units to let • Acquired non-performing loan for £68.5 million, compared to UPB of £149 million • Plan to transform scheme into a professionally run PRS operation by refurbishing existing units and adding an amenity package in the 12,600 sq ft of vacant commercial space, upon receiving planning permission • Completed AVL strategy on 5 February 2016 and now hold the property as direct real estate S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 2015 17

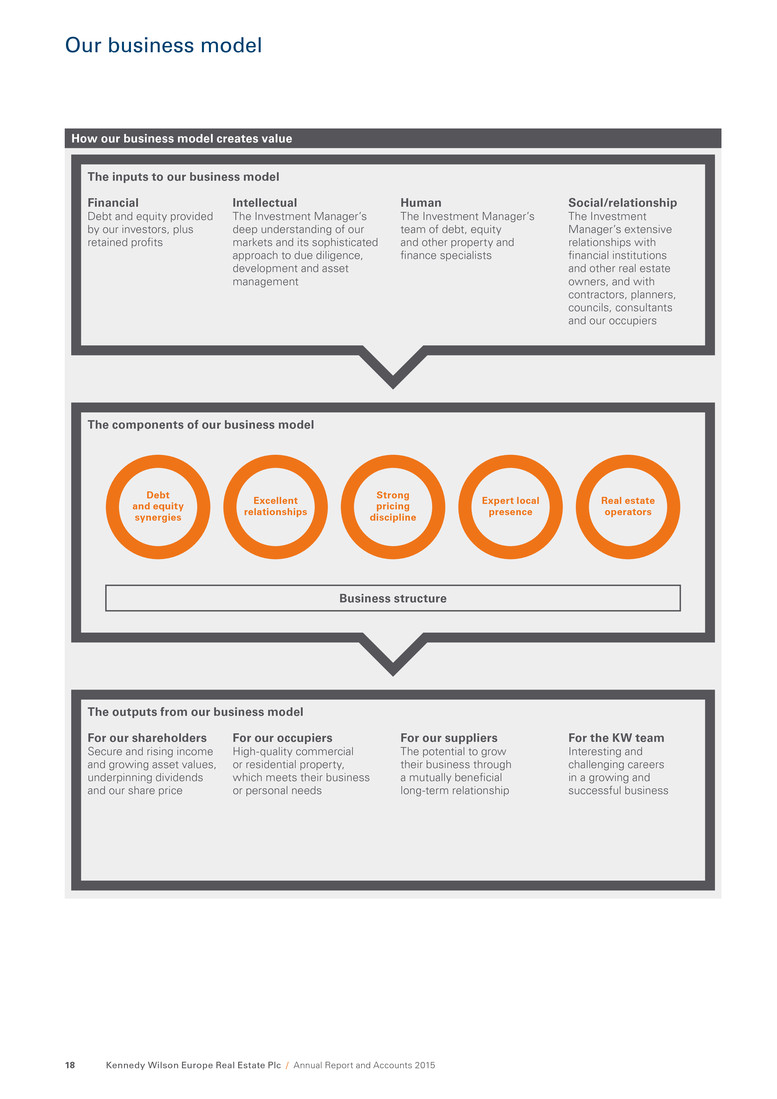

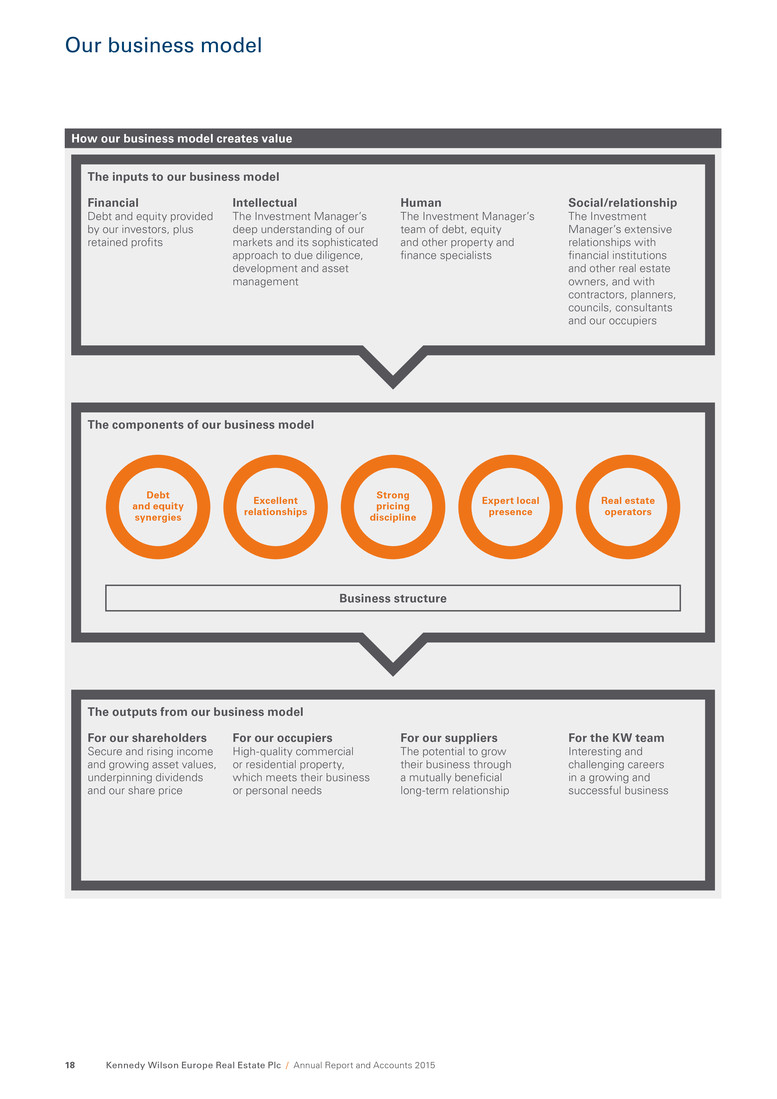

Financial Debt and equity provided by our investors, plus retained profits Intellectual The Investment Manager’s deep understanding of our markets and its sophisticated approach to due diligence, development and asset management Human The Investment Manager’s team of debt, equity and other property and finance specialists Social/relationship The Investment Manager’s extensive relationships with financial institutions and other real estate owners, and with contractors, planners, councils, consultants and our occupiers Debt and equity synergies Excellent relationships Strong pricing discipline Expert local presence Real estate operators For our shareholders Secure and rising income and growing asset values, underpinning dividends and our share price For our occupiers High-quality commercial or residential property, which meets their business or personal needs For our suppliers The potential to grow their business through a mutually beneficial long-term relationship For the KW team Interesting and challenging careers in a growing and successful business Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 201518 Our business model How our business model creates value The inputs to our business model The components of our business model Business structure The outputs from our business model

KWE unlocks the value of real estate that has been under-managed or under-capitalised by its previous owners. We use our strong balance sheet to acquire assets, which we source through our excellent relationships with financial institutions, administrators and other vendors who are not natural real estate operators. We then use our asset management and development skills to release each asset’s inherent value, for the benefit of all our stakeholders. The key components of our business model are described below. Our business structure Being externally managed has a number of advantages for us. In particular, we have access to the experience and relationships of KW’s senior management and to the expertise of KW’s substantial wider team in Europe, at a cost to us that is substantially less then employing those resources in-house. Our business platform also benefits from the Investment Manager’s robust systems and processes, which it continues to enhance, and from our strong corporate governance, which ensures we meet our compliance, regulatory and filing requirements in each of the jurisdictions we operate in. See Resources and relationships on page 26 for more on our relationship with the Investment Manager. Debt and equity synergies The Investment Manager and its advisors employ debt and equity professionals who work seamlessly together. Uniquely among our listed peers, this allows us to invest in both direct real estate and loans, and to carefully assess the quality of both the debt and the underlying property asset before making a purchasing decision. Acquiring debt at a discount to its market value gives us control of the underlying asset. We can then execute asset management strategies (see below) that create further value for our shareholders. Strong pricing discipline Our distinctive investment strategy opens up a wide range of opportunities for us, meaning we can be highly selective about the ones we pursue and can exercise strong risk-return pricing discipline. We apply the KW team’s expertise and resources to perform detailed due diligence on everything we buy, whether it is a single asset or a large portfolio. This means we develop a deep understanding of what we are acquiring and the value we can add to it, enabling us to determine the appropriate price. This differentiates us from private equity firms, who are amongst our main competitors for the portfolios we acquire. Real estate operators Asset management sits at the heart of our value creation. During due diligence we produce a business plan for every asset, so the asset management team can start implementing actions on day one. An experienced in-house development team also helps to generate new thinking about the best way to develop an asset. KWE has permanent capital, so we can take a long-term view of each asset’s potential. An asset that is currently a core part of our portfolio may present asset management or development opportunities in several years’ time. We will also dispose of assets, for example where we have completed our value enhancement initiatives, so we can recycle the proceeds into other opportunities. Expert local presence Having expert people located in each of our markets is crucial for capitalising on local opportunities. We continue to grow to support our business and the wider KW team has grown to over 80 employees, comprising asset managers, investment specialists, and finance and operations, located in the UK, Ireland, Spain, Jersey and Luxembourg. This local expert knowledge and presence ensures we take a bottom- up approach to investment and asset management, and gives us the infrastructure to execute large portfolio transactions. Excellent relationships The Investment Manager and its advisors have excellent, strong relationships with financial institutions, as well as other potential sellers of under-resourced assets such as government agencies, commercial real estate lenders, receivers, REITs and property funds. These relationships give us a critical advantage in sourcing attractive investment opportunities, either off-market or with limited competition. Our ability to expeditiously complete transactions encourages vendors to transact with us and leads to repeat deal flow. S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 2015 19

Our investment strategy We aim to create value by: • Capitalising on the recovery of the European real estate sector, through opportunistic investments and value enhancing asset management. Our target markets are the UK, Ireland, Spain and Italy. • Sourcing good quality real estate assets from sellers such as financial institutions, administrators and other vendors who are not core real estate operators. Often they are looking to deleverage by divesting such assets. • Targeting investments, directly or through loans, that have one of more of the following characteristics: – good quality properties in prime or just off-prime locations – underlying loan collateral that fits our asset-via-loan strategy for direct ownership – scope for short and medium-term asset management opportunities to deliver rental income and capital growth – properties which are under-managed and under-capitalised, where there are immediate opportunities to add value and/or – properties in locations that we expect to benefit from external factors such as infrastructure improvements, government or foreign direct investment. • Enhancing both rental and capital values through an active programme of asset management to improve the quality of our income. This also helps to maintain close and positive relationships with our tenants. 2. Efficient capital structure Progress in 2015 We continued to optimise our capital structure, including: • Issuing a £300 million, seven-year, unsecured, BBB rated bond • Establishing a £2,000 million EMTN programme and issuing €400 million of ten-year, unsecured, BBB rated loan notes • Agreeing vendor financing secured on the Gatsby portfolio of £348.9 million At the year end, the weighted average term to maturity of our debt had increased to 5.9 years (31 December 2014: 4.9 years) and the weighted average cost of debt was 2.9% (2014: 2.4%). The LTV was 39.7%. Announced quarterly interim dividend of 12 pence per share, or an annualised dividend of 48 pence per share, up 37% on 2015. See the Finance review on pages 48 to 53 for more on our capital structure 1. Income growth 2. Solid dividend Progress in 2015 We increased our total dividend for the year to 35 pence per share, which was covered 1.4 times by earnings. This contributed to a solid total accounting return of 18%, which reflects the increase in our net asset value plus dividends. Targeting £19.4 million of incremental NOI from selected asset management, over the next two years, of which £8.2 million is contracted. See the Finance review on pages 48 to 53 for more on the components of total return 1. Total return focused Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 201520 Our strategy and goals Great progress meeting our 2015 goals 2016 goals

Progress in 2015 We made further strong progress with our asset management initiatives, delivering £7.6 million of incremental annualised NOI across 1.3m sq ft and 233 lease transactions. Our Irish development projects, at Baggot Plaza and Block K, Central Park, continued to be on budget and on track to achieve practical completion by summer 2016. £200 million of further disposals announced to be completed from June 2016 to June 2017. See the Performance review on pages 38 to 45 for more detail on our asset management initiatives and progress with our developments 3. Creating value through asset management Progress in 2015 In 2015 our disposals totalled £124.4 million and we remain on track to reach our disposal target of £300 million. The return on cost on our disposals was 23%, demonstrating our ability to realise value. We will selectively invest where market dislocation exists and we see opportunities to unlock value of under-resourced real estate. See the Performance review on pages 38 to 45 for more detail on our disposal programme 3. Recycling capital 4. Opportunistic investment 4. Recycle capital Mary Ricks President and CEO, Kennedy Wilson Europe Our £300 million non-core disposal programme announced in August 2015 is delivering a return on cost of 23% on £262 million of sales to date. Capital recycling remains a high priority and we are targeting a further £200 million of disposals by June 2017 as we crystallise on asset management completions and continue to prune the portfolio. S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 2015 21 Great progress meeting our 2015 goals 2016 goals

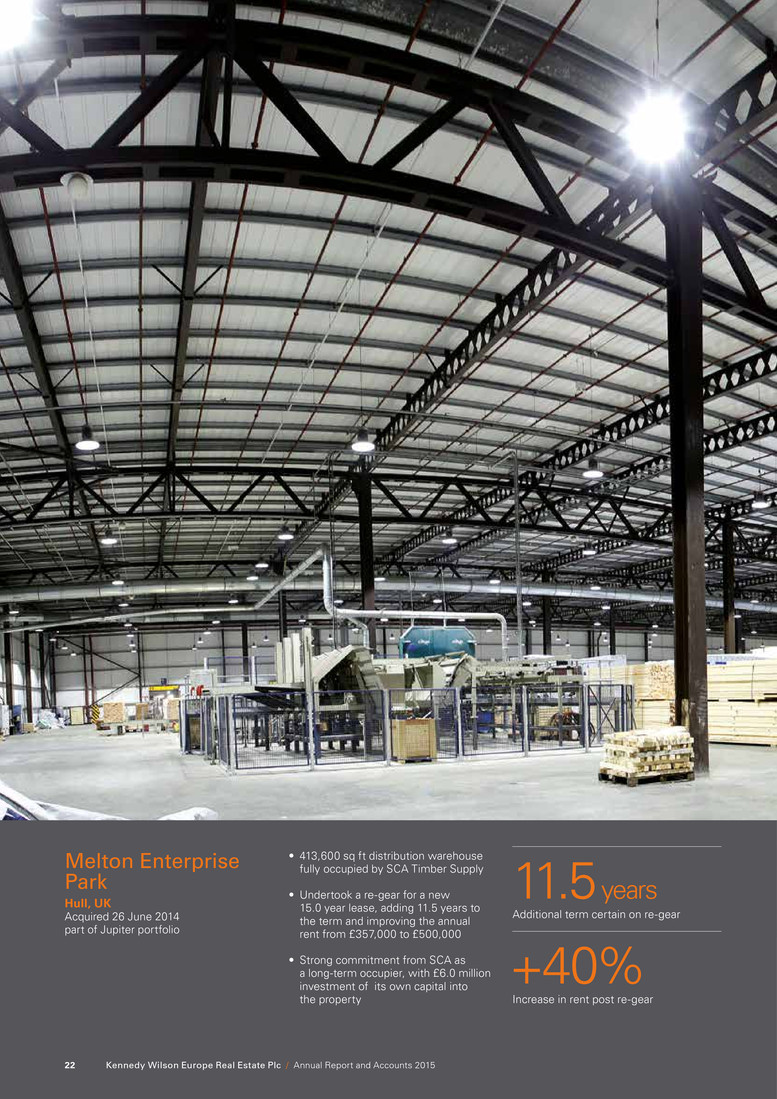

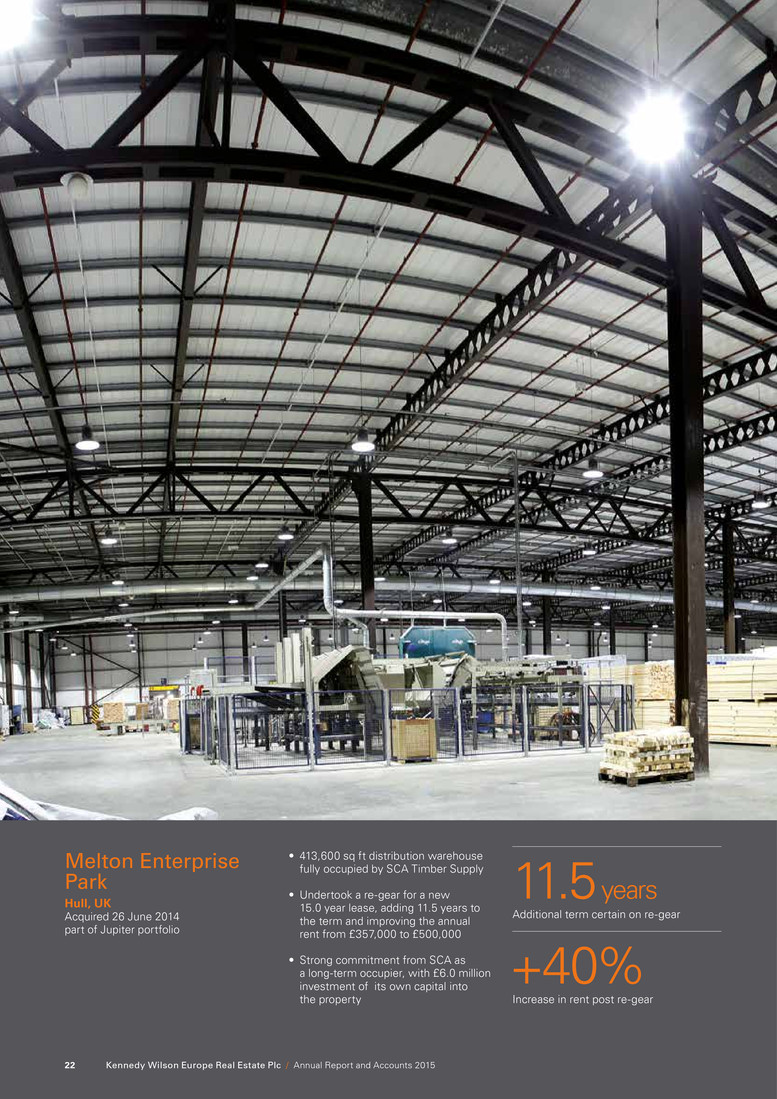

Melton Enterprise Park Hull, UK Acquired 26 June 2014 part of Jupiter portfolio 11.5 years Additional term certain on re-gear +40% Increase in rent post re-gear • 413,600 sq ft distribution warehouse fully occupied by SCA Timber Supply • Undertook a re-gear for a new 15.0 year lease, adding 11.5 years to the term and improving the annual rent from £357,000 to £500,000 • Strong commitment from SCA as a long-term occupier, with £6.0 million investment of its own capital into the property Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 201522

+247% Capital value uplift since acquisition 4 months Rent free period on re-gear S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 2015 23

We use the following financial and non-financial metrics to track the implementation of our strategy and our operational and financial performance. Yield on cost The estimated annual NOI at the date of purchase, divided by the purchase price using actual purchaser’s cost Relevance to strategy Shows our ability to source assets at attractive entry points Performance in 2015 The yield on cost across our 2015 acquisitions of £1,135.5 million was 7.1%, this compares to our total performance yield on cost of 6.6% Performance in 2015 The adjusted NAV per share growth was 14.6% for the year. This was driven primarily through a strong valuation surplus but also gains on sale in the year where the premium achieved to preceding valuation was 5.8% Relevance to strategy Shows our ability to buy well and to add value to our properties through asset management and development activities Adjusted NAV The EPRA NAV after adjusting for the impact of the performance fee which is accounted for in the share-based payments reserve. The EPRA NAV definition excludes certain items not expected to be realised in a long-term investment property business model, such as the fair value of certain financial derivatives Adjusted NAV per share Adjusted NAV divided by the number of shares in issue at the period end 7.1% 2015 acquisition yield on cost 6.6% Total portfolio yield on cost at 31 December 2015 1,174.5p Adjusted NAV per share 14.6% Adjusted NAV per share growth Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 201524 KPIs, Group and EPRA measures Measures, definition and performance

Performance in 2015 Adjusted earnings per share were 47.9 pence for the year. This is an increase of 85% on the prior period owing to a full year of 2014 operating income and supplemented by 2015 acquisition activity Adjusted earning per share covered the 2015 paid dividend of 35 pence per share 1.4 times Performance in 2015 The portfolio occupancy improved by 5.1 percentage points over the year from 90.9% at the end of 2014 to 96.0% at the end of 2015. The WAULT to first break is an attractive 7.3 years, with the WAULT to expiry at 9.2 years Performance in 2015 LTV at year end was 39.7% driven by the financing activity during the year including the issue to two senior unsecured bonds meaning that we now have a flexible mix of secured and unsecured finance WAIR is 2.9% and the weighted average term to maturity improved during 2015 by 12 months from 4.9 years to 5.9 years Relevance to strategy Shows that we have appropriate and affordable levels of gearing Relevance to strategy Shows our ability to generate earnings that cover our dividend payouts, which are a key part of our total return to shareholders Relevance to strategy Shows the security of cash flow, through tenants’ willingness to occupy them and to sign up to long leases EPRA occupancy Estimated Rental Value (ERV) of portfolio which is let, divided by the ERV of the whole portfolio, excluding loans, hotels and development properties WAULT The weighted average unexpired lease term remaining to first break across the portfolio, weighted by contracted rental income, excluding loans, hotels, development and residential properties LTV Loan to value is the ratio of net debt (gross debt less cash) to the total portfolio value (value of investment and development properties, loans secured by real estate and hotels) WAIR The weighted average interest rate is the Group’s interest rate across all drawn facilities weighted by all drawn debt at the period end Adjusted earnings EPRA earnings adding back the performance fee which is considered capital in nature. EPRA Earnings is a measure of the underlying operating performance of an investment property company excluding fair value gains, investment property disposals and other items that are not considered to be part of the core activity Adjusted earnings per share Adjusted earnings divided by the weighted average number of ordinary shares in issue during the period 39.7% Loan to value 2.9% WAIR 47.9p Adjusted earnings per share 85% Adjusted earnings per share growth 96.0% EPRA occupancy 7.3 years WAULT S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 2015 25 Measures, definition and performance

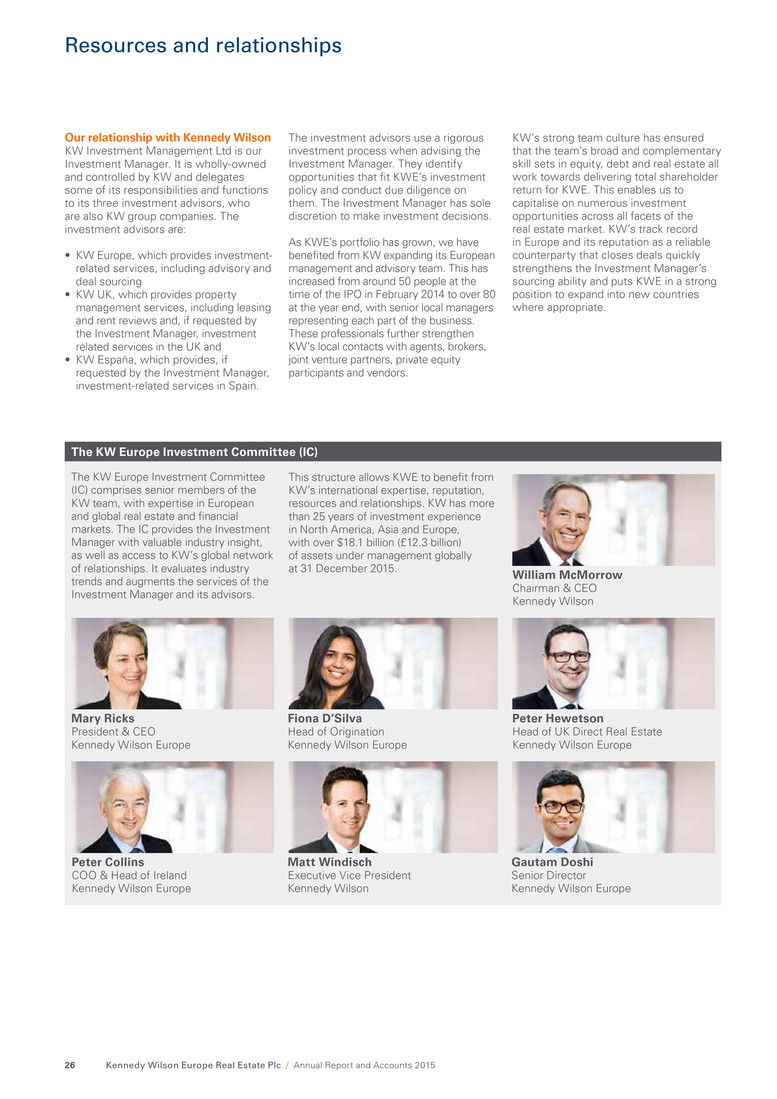

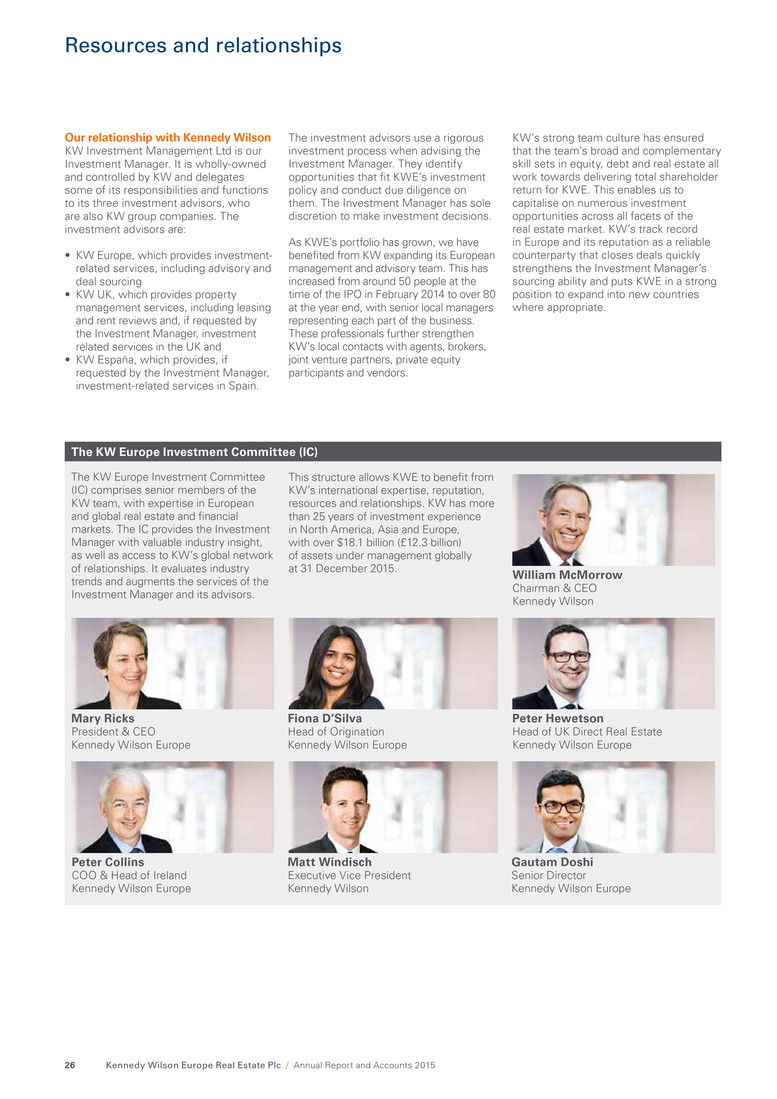

Our relationship with Kennedy Wilson KW Investment Management Ltd is our Investment Manager. It is wholly-owned and controlled by KW and delegates some of its responsibilities and functions to its three investment advisors, who are also KW group companies. The investment advisors are: • KW Europe, which provides investment- related services, including advisory and deal sourcing • KW UK, which provides property management services, including leasing and rent reviews and, if requested by the Investment Manager, investment related services in the UK and • KW España, which provides, if requested by the Investment Manager, investment-related services in Spain. The investment advisors use a rigorous investment process when advising the Investment Manager. They identify opportunities that fit KWE’s investment policy and conduct due diligence on them. The Investment Manager has sole discretion to make investment decisions. As KWE’s portfolio has grown, we have benefited from KW expanding its European management and advisory team. This has increased from around 50 people at the time of the IPO in February 2014 to over 80 at the year end, with senior local managers representing each part of the business. These professionals further strengthen KW’s local contacts with agents, brokers, joint venture partners, private equity participants and vendors. KW’s strong team culture has ensured that the team’s broad and complementary skill sets in equity, debt and real estate all work towards delivering total shareholder return for KWE. This enables us to capitalise on numerous investment opportunities across all facets of the real estate market. KW’s track record in Europe and its reputation as a reliable counterparty that closes deals quickly strengthens the Investment Manager’s sourcing ability and puts KWE in a strong position to expand into new countries where appropriate. The KW Europe Investment Committee (IC) comprises senior members of the KW team, with expertise in European and global real estate and financial markets. The IC provides the Investment Manager with valuable industry insight, as well as access to KW’s global network of relationships. It evaluates industry trends and augments the services of the Investment Manager and its advisors. Fiona D’Silva Head of Origination Kennedy Wilson Europe Matt Windisch Executive Vice President Kennedy Wilson Gautam Doshi Senior Director Kennedy Wilson Europe Peter Collins COO & Head of Ireland Kennedy Wilson Europe Peter Hewetson Head of UK Direct Real Estate Kennedy Wilson Europe Mary Ricks President & CEO Kennedy Wilson Europe William McMorrow Chairman & CEO Kennedy Wilson This structure allows KWE to benefit from KW’s international expertise, reputation, resources and relationships. KW has more than 25 years of investment experience in North America, Asia and Europe, with over $18.1 billion (£12.3 billion) of assets under management globally at 31 December 2015. Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 201526 The KW Europe Investment Committee (IC) Resources and relationships

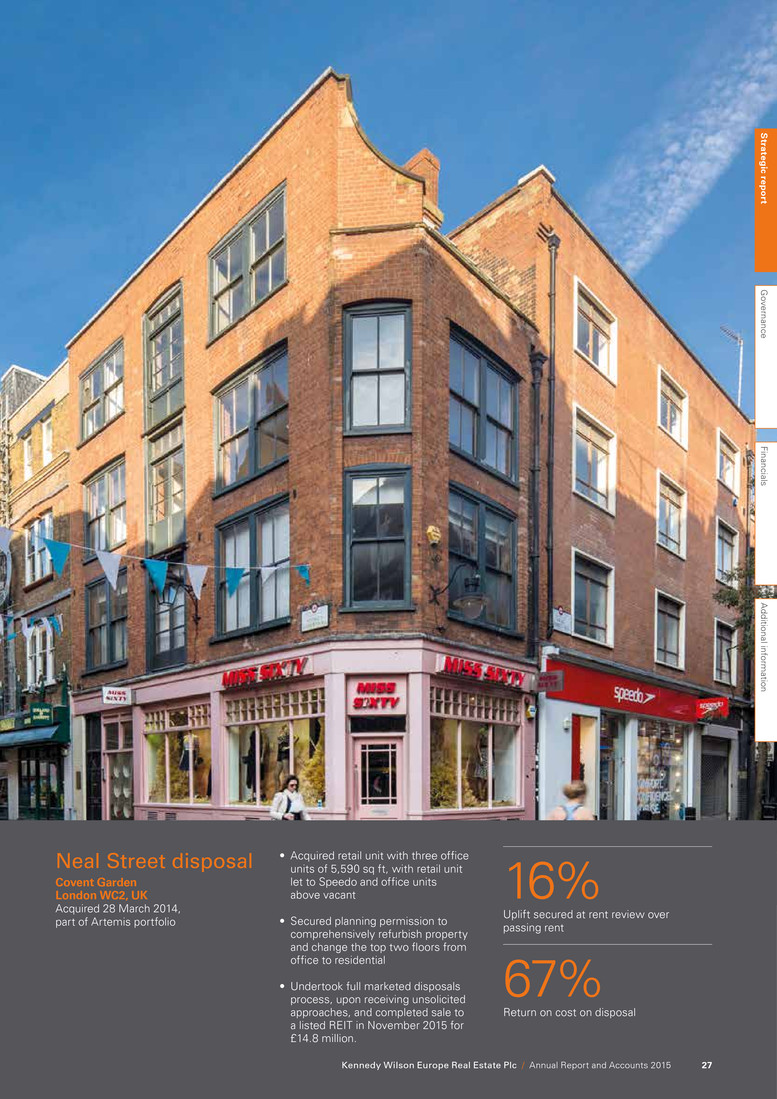

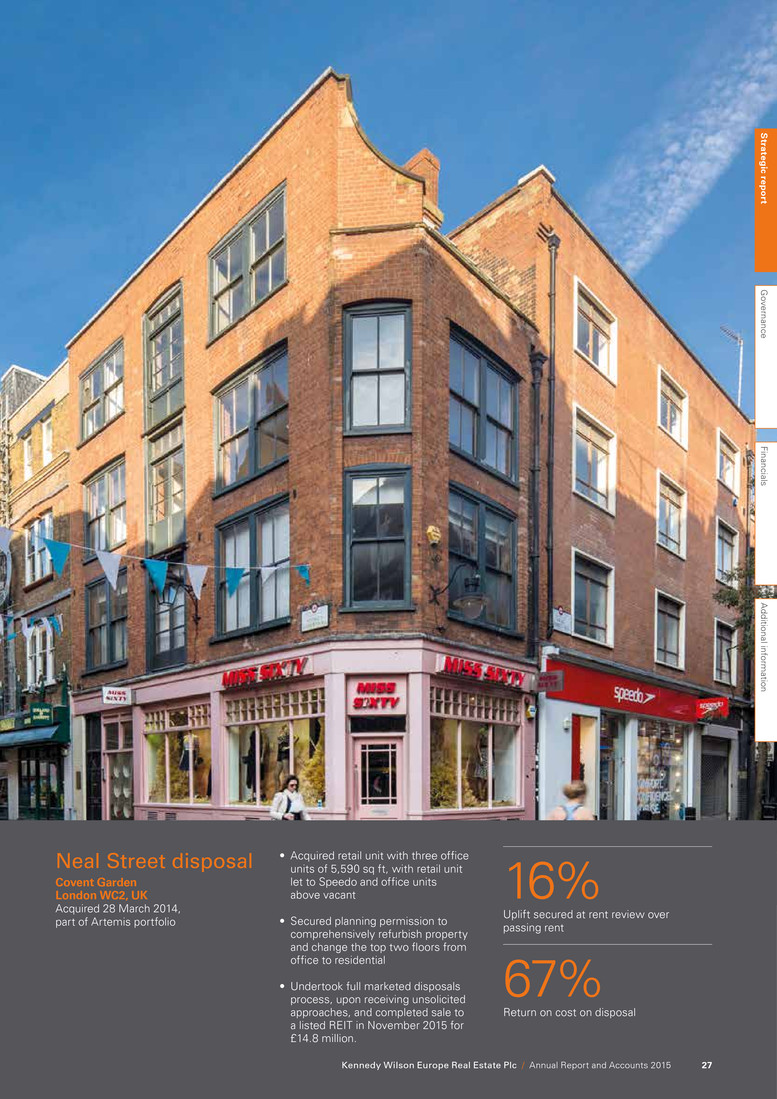

Neal Street disposal Covent Garden London WC2, UK Acquired 28 March 2014, part of Artemis portfolio 16% Uplift secured at rent review over passing rent 67% Return on cost on disposal • Acquired retail unit with three office units of 5,590 sq ft, with retail unit let to Speedo and office units above vacant • Secured planning permission to comprehensively refurbish property and change the top two floors from office to residential • Undertook full marketed disposals process, upon receiving unsolicited approaches, and completed sale to a listed REIT in November 2015 for £14.8 million. S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 2015 27

4% 0% 22% 39% 13% 6% 2% 14% Currently not at risk A B C D E F G At risk EPC unknown We recognise that energy use in buildings contributes significantly to global emissions of carbon dioxide. At the same time, buildings are themselves particularly vulnerable to the impacts of climate change, including extreme weather, sea level rise and flooding. We are therefore integrating a responsible investment approach into our investment decisions and asset management. This mitigates the risks associated with climate change, improves the quality and efficiency of our buildings, enhances occupier satisfaction and, ultimately, leads to increased long-term values. Understanding our responsible investment approach Throughout the last year, we have been working with Carbon Credentials Energy Services to understand how best to address our responsible investment obligations and set actionable goals. Our first task was to understand the environmental issues facing our UK business. Through actively engaging with our key stakeholders both internally and externally, such as senior management and the Board, our property managers, our tenants and our investors, we identified clear areas for immediate action. These include mitigating legislative risks, measuring our carbon emissions, improving corporate transparency and identifying opportunities to improve our assets’ energy performance. Mitigating legislative risk In 2015, KWE reviewed the energy and carbon legislation affecting the UK business and our assets. As part of this, we reviewed Energy Performance Certificates (EPCs) across the portfolio, to comprehensively prepare for EPC compliance to the Minimum Energy Efficiency Standards (MEES) in 2018. Our approach to EPCs has ensured that any risk associated with the MEES requirements is effectively managed, and that all relevant EPC data informs our energy management programme. Of the assets currently classified with an F or G rating, or with an unknown EPC, 43% of the passing rent is under refurbishment, (bringing those EPCs out of the at risk category), or is in the process of being sold. Where we found underperforming EPCs, we have begun implementing a remedial programme. This includes either reviewing the EPC or ensuring that appropriate investment is undertaken, as part of our wider asset management plan, to improve the EPC and remove the compliance risk. Our approach to properties with unknown EPC ratings depends on the timing of the next lease event, our asset management and capex plans, and whether it forms part of our disposal programme. KWE UK portfolio EPC rating summary as at 31 December 2015: Measuring carbon emissions Whilst KWE does not fall into the UK’s mandatory emissions reporting scheme, we have chosen to quantify our UK greenhouse gas (GHG) emissions in accordance with Section 7 of the UK Companies Act 2006 (Strategic Report and Directors’ Report) Regulations 2013. We have followed Defra’s Environmental Reporting Guidelines and have used the UK Government’s 2015 Conversion Factors for Company Reporting to calculate carbon (CO2) equivalent emissions from corresponding activity data. We use an operational control approach for our data boundary, and we do not report data for our single-let properties or other properties where we have no management control. This reporting boundary ensures we measure and manage the impacts we can directly control. As such, our baseline measurements relate to all 21 properties in the UK that fell under Operational Control during 2015: this represents £581.61 million of investment value and £30.02 million of annualised NOI, or 35.0% and 27.1% of our total UK direct real estate portfolio, respectively. The next table shows our tonnes of carbon equivalent (tCO2e) emissions from building electricity and natural gas use during 2015. KWE UK portfolio carbon emission summary for 2015 (tCO2e) 2015 Scope 1 emissions from natural gas combustion 3,348 Scope 2 emissions from purchased electricity 15,008 Total Scope 1 and 2 18,355 Scope 1 and 2 tCO2e per £m net operating income Office: 567 Retail: 40 78% EPC ratings by passing rent We have been working across the business to make responsible investing part of day-to-day approach. It means that we can mitigate against environmental risks by making our buildings better quality and more efficient. At the same time, we can enhance the space for occupiers and, ultimately, increase the underlying value of the asset over the long-term. Fraser Kennedy Head of Finance, Kennedy Wilson Europe Footnotes: 1. Asset values as at 31 December 2015; for those assets disposed of during 2015, sales price has been used 2. NOI as at 31 December; for those disposed of during 2015, NOI at exit has been used Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 201528 Responsible investments

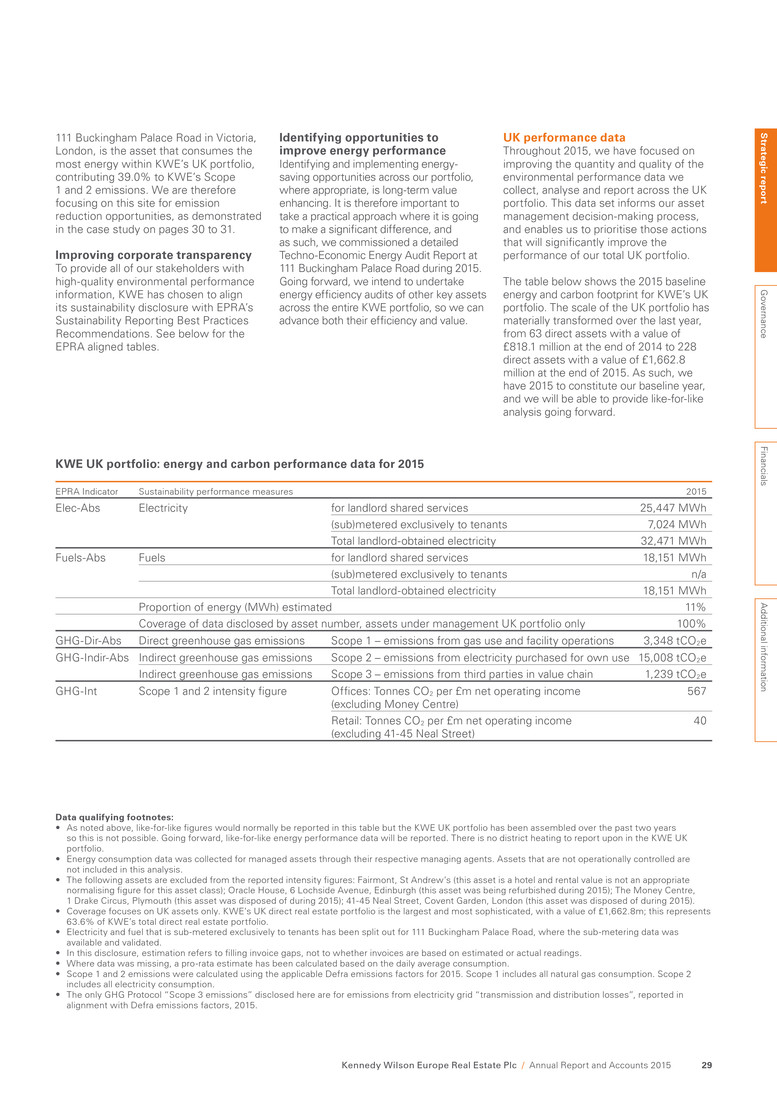

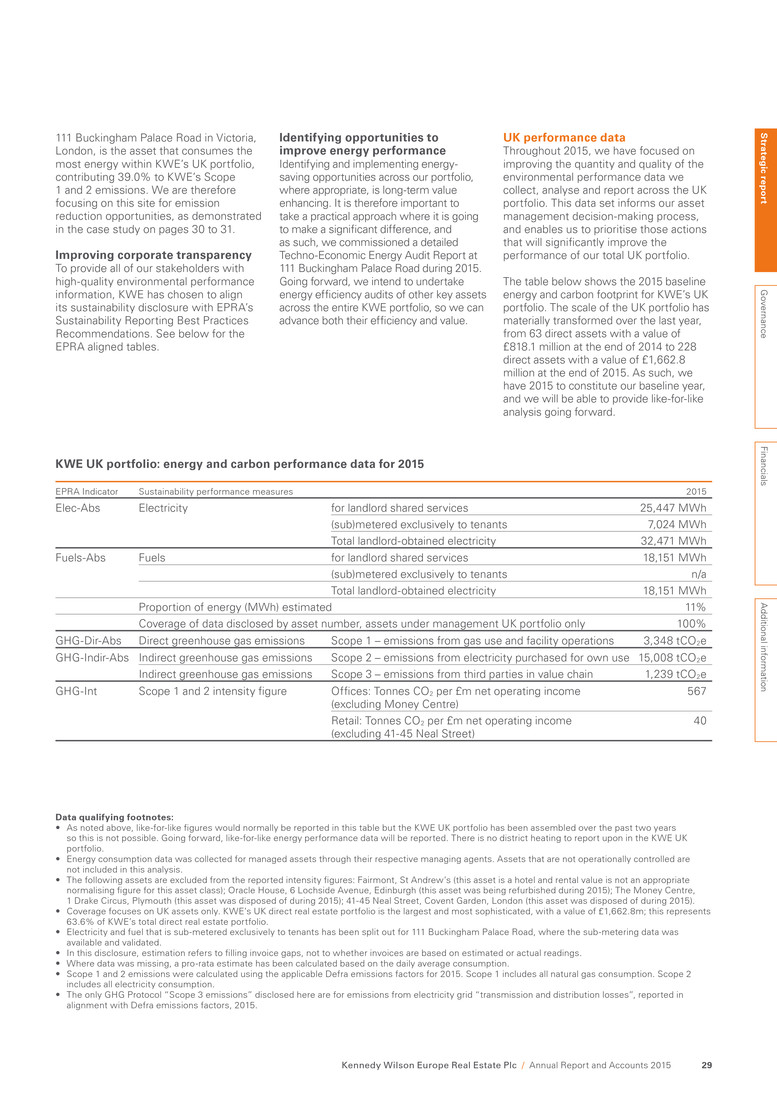

111 Buckingham Palace Road in Victoria, London, is the asset that consumes the most energy within KWE’s UK portfolio, contributing 39.0% to KWE’s Scope 1 and 2 emissions. We are therefore focusing on this site for emission reduction opportunities, as demonstrated in the case study on pages 30 to 31. Improving corporate transparency To provide all of our stakeholders with high-quality environmental performance information, KWE has chosen to align its sustainability disclosure with EPRA’s Sustainability Reporting Best Practices Recommendations. See below for the EPRA aligned tables. Identifying opportunities to improve energy performance Identifying and implementing energy- saving opportunities across our portfolio, where appropriate, is long-term value enhancing. It is therefore important to take a practical approach where it is going to make a significant difference, and as such, we commissioned a detailed Techno-Economic Energy Audit Report at 111 Buckingham Palace Road during 2015. Going forward, we intend to undertake energy efficiency audits of other key assets across the entire KWE portfolio, so we can advance both their efficiency and value. KWE UK portfolio: energy and carbon performance data for 2015 EPRA Indicator Sustainability performance measures 2015 Elec-Abs Electricity for landlord shared services 25,447 MWh (sub)metered exclusively to tenants 7,024 MWh Total landlord-obtained electricity 32,471 MWh Fuels-Abs Fuels for landlord shared services 18,151 MWh (sub)metered exclusively to tenants n/a Total landlord-obtained electricity 18,151 MWh Proportion of energy (MWh) estimated 11% Coverage of data disclosed by asset number, assets under management UK portfolio only 100% GHG-Dir-Abs Direct greenhouse gas emissions Scope 1 – emissions from gas use and facility operations 3,348 tCO2e GHG-Indir-Abs Indirect greenhouse gas emissions Scope 2 – emissions from electricity purchased for own use 15,008 tCO2e Indirect greenhouse gas emissions Scope 3 – emissions from third parties in value chain 1,239 tCO2e GHG-Int Scope 1 and 2 intensity figure Offices: Tonnes CO2 per £m net operating income (excluding Money Centre) 567 Retail: Tonnes CO2 per £m net operating income (excluding 41-45 Neal Street) 40 Data qualifying footnotes: • As noted above, like-for-like figures would normally be reported in this table but the KWE UK portfolio has been assembled over the past two years so this is not possible. Going forward, like-for-like energy performance data will be reported. There is no district heating to report upon in the KWE UK portfolio. • Energy consumption data was collected for managed assets through their respective managing agents. Assets that are not operationally controlled are not included in this analysis. • The following assets are excluded from the reported intensity figures: Fairmont, St Andrew’s (this asset is a hotel and rental value is not an appropriate normalising figure for this asset class); Oracle House, 6 Lochside Avenue, Edinburgh (this asset was being refurbished during 2015); The Money Centre, 1 Drake Circus, Plymouth (this asset was disposed of during 2015); 41-45 Neal Street, Covent Garden, London (this asset was disposed of during 2015). • Coverage focuses on UK assets only. KWE’s UK direct real estate portfolio is the largest and most sophisticated, with a value of £1,662.8m; this represents 63.6% of KWE’s total direct real estate portfolio. • Electricity and fuel that is sub-metered exclusively to tenants has been split out for 111 Buckingham Palace Road, where the sub-metering data was available and validated. • In this disclosure, estimation refers to filling invoice gaps, not to whether invoices are based on estimated or actual readings. • Where data was missing, a pro-rata estimate has been calculated based on the daily average consumption. • Scope 1 and 2 emissions were calculated using the applicable Defra emissions factors for 2015. Scope 1 includes all natural gas consumption. Scope 2 includes all electricity consumption. • The only GHG Protocol “Scope 3 emissions” disclosed here are for emissions from electricity grid “transmission and distribution losses”, reported in alignment with Defra emissions factors, 2015. UK performance data Throughout 2015, we have focused on improving the quantity and quality of the environmental performance data we collect, analyse and report across the UK portfolio. This data set informs our asset management decision-making process, and enables us to prioritise those actions that will significantly improve the performance of our total UK portfolio. The table below shows the 2015 baseline energy and carbon footprint for KWE’s UK portfolio. The scale of the UK portfolio has materially transformed over the last year, from 63 direct assets with a value of £818.1 million at the end of 2014 to 228 direct assets with a value of £1,662.8 million at the end of 2015. As such, we have 2015 to constitute our baseline year, and we will be able to provide like-for-like analysis going forward. S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 2015 29

Electricity Natural gas Tenant Landlord/tenant electricity split 96% 4% 55% 45% Site electricity and gas Landlord 111 Buckingham Palace Road (111 BPR) is the largest office building in our UK portfolio. We have already invested in a number of energy conservation measures in the building, including the installation of air handling unit optimisers, improved Building Management System controllers and energy efficient lighting in communal areas. Additionally we have worked with Telegraph Media Group, the largest tenant at 111 BPR who complies with the Energy Savings Opportunity Scheme, to identify further energy efficiency opportunities in the building. We have worked with Carbon Credentials Energy Services to carry out a Techno- Economic Energy Audit Report at the site and provide energy saving recommendations. The energy audit was commissioned to enable us to build on our previous initiatives and to help us understand the property’s full energy performance potential. Each year, 15.7 GWh of electricity and gas is consumed at 111 BPR. Within this, approximately 55% of electricity consumption is attributable to the tenants, with the remaining 45% used by central landlord plant and equipment. The building already has a detailed sub-metering system, which allows consumption to be broken down into parent sub-meter and plant equipment level where required. Energy saving recommendations identified by the Techno-Economic Energy Audit The Techno-Economic Energy Audit highlighted four key areas for improvement, which will lead to both immediate and longer-term reductions in energy use. These areas are: Energy usage at 111 Buckingham Palace Road Optimisation and upgrades – A number of opportunities to upgrade the building have been highlighted. Through improved control and low-cost investment relating to the central plant, building management system and lighting, we forecast an annual saving of up to £38,800. Engagement – Thermal conditions vary throughout the building, as they are currently dictated by each tenant. This leads to high levels of equipment energy consumption, as the plant has long running hours and heating and cooling can be required simultaneously. Improving tenant engagement through increasing awareness initiatives and implementing a change to the ‘out of hours’ working process will drive significant energy savings. Renewables – The large roof space at 111 BPR offers the possibility of installing solar photovoltaics (PV). The roof’s structural properties are to be further analysed by a solar PV installation company. Lifecycle replacement – An asset replacement strategy that looks beyond the manufacturer’s expected lifecycle will deliver significant energy savings over a five to ten-year programme. At the point of replacement, all major plant equipment will be assessed for energy efficient alternatives. Plant equipment sizing and location will also be carefully considered in relation to current operations, improved controls and future enhancement. 15.7 GWh Total electricity and gas usage Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 201530 Responsible investments continued Case Study – 111 Buckingham Palace Road, Victoria, London SW1

Identified savings opportunities Implementing energy conservation measures is expected to lead to the following efficiencies: 1.8 GWh Energy consumption saved £195,500 Annual tenant utility cost savings 12% Site level energy consumption saving 26% Saving of landlord attributed electricity S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 2015 31 Case Study – 111 Buckingham Palace Road, Victoria, London SW1

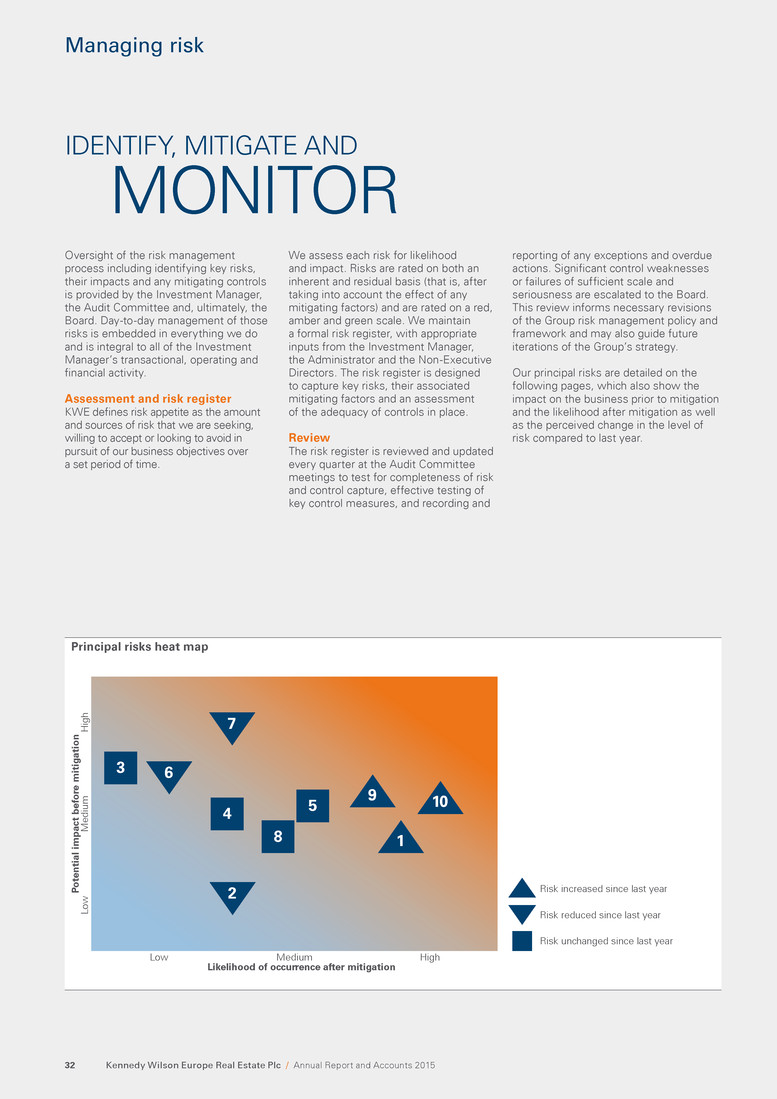

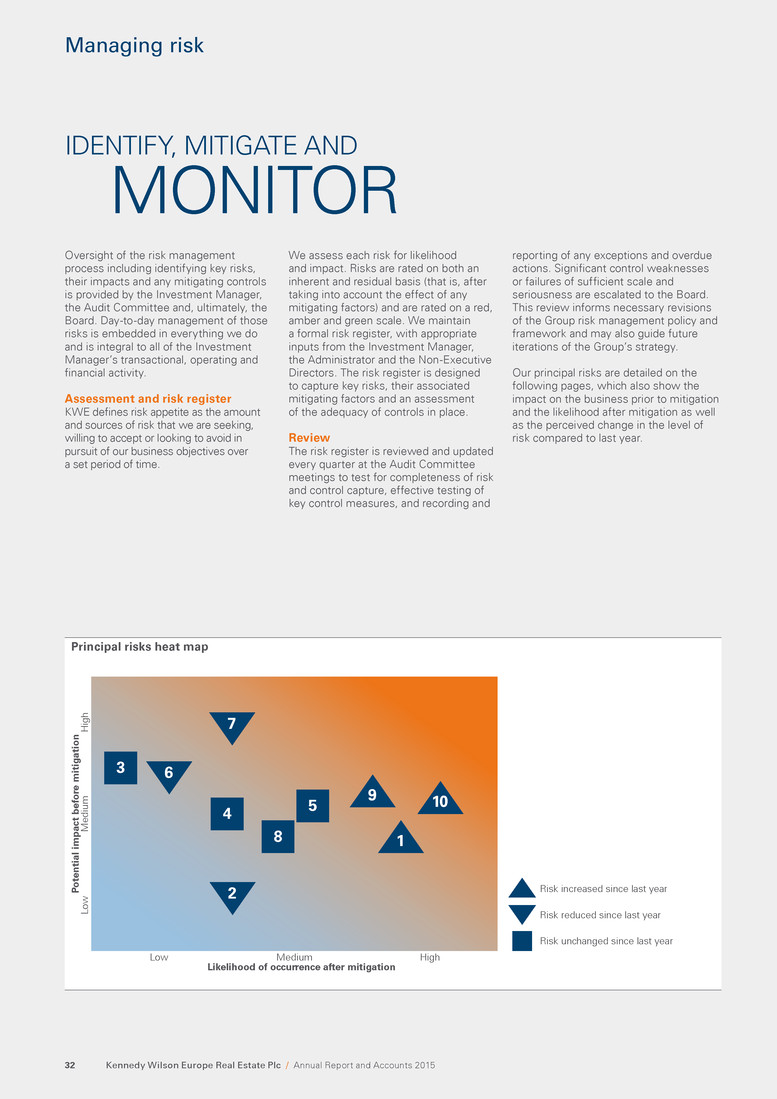

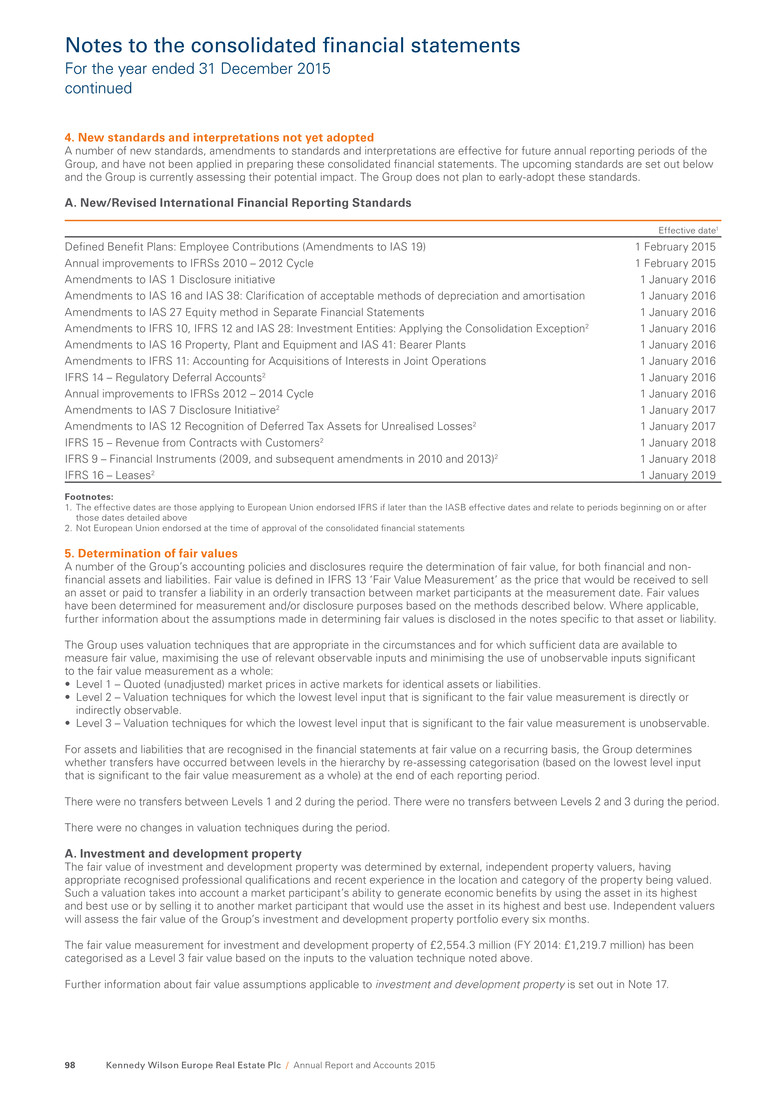

Likelihood of occurrence after mitigation Medium HighLow Po tential impact be fo re miti gatio n Mediu m Hig h Lo w Risk increased since last year Risk reduced since last year Risk unchanged since last year 3 4 5 8 2 6 7 1 9 10 IDENTIFY, MITIGATE AND MONITOR Oversight of the risk management process including identifying key risks, their impacts and any mitigating controls is provided by the Investment Manager, the Audit Committee and, ultimately, the Board. Day-to-day management of those risks is embedded in everything we do and is integral to all of the Investment Manager’s transactional, operating and financial activity. Assessment and risk register KWE defines risk appetite as the amount and sources of risk that we are seeking, willing to accept or looking to avoid in pursuit of our business objectives over a set period of time. We assess each risk for likelihood and impact. Risks are rated on both an inherent and residual basis (that is, after taking into account the effect of any mitigating factors) and are rated on a red, amber and green scale. We maintain a formal risk register, with appropriate inputs from the Investment Manager, the Administrator and the Non-Executive Directors. The risk register is designed to capture key risks, their associated mitigating factors and an assessment of the adequacy of controls in place. Review The risk register is reviewed and updated every quarter at the Audit Committee meetings to test for completeness of risk and control capture, effective testing of key control measures, and recording and Principal risks heat map reporting of any exceptions and overdue actions. Significant control weaknesses or failures of sufficient scale and seriousness are escalated to the Board. This review informs necessary revisions of the Group risk management policy and framework and may also guide future iterations of the Group’s strategy. Our principal risks are detailed on the following pages, which also show the impact on the business prior to mitigation and the likelihood after mitigation as well as the perceived change in the level of risk compared to last year. Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 201532 Managing risk

Principal risks and uncertainties Macro-economic risks Risk Impact Mitigation 1 General economic conditions Link to 2015 goals: 1, 3, 4 Turbulence in stock markets and weak global and European growth indicators coupled with a concern that central banks are unable or unwilling to provide support, remain a concern in our current markets of operation – the United Kingdom, Ireland, Spain and Italy. A slowdown in economic recovery increases the risk of lower than expected rental levels, occupancy deterioration and asset valuation uncertainty. • The Board and Investment Manager regularly review the economic environment to assess whether any changes in outlook present risks, as well as opportunities which should be taken into account in the execution of our strategy. • The Investment Manager has a broad investment mandate, which gives it flexibility to invest across the real estate markets in Europe with limited restrictions across asset class, sector or capital structure, resulting in diversification of risk across the portfolio. • Any deterioration in the occupier market would have a muted short- term effect on the Group’s turnover, due to high occupancy levels (96.0%) and long WAULT (7.3 years). 2 Availability of finance Link to 2015 goals: 2, 4 Reduced appetite for real estate lending may adversely impact our ability to refinance facilities and reduce our financing capacity for future investments. • The Group’s borrowings are diversified between fixed and floating debt and benefit from a weighted average term to maturity of 5.9 years. We are committed to maintaining the Group’s BBB (stable) credit rating through careful management of unencumbered asset ratios. • The Investment Manager maintains strong relationships with our financing partners, credit rating agencies and advisors in the various jurisdictions in which we operate. The establishment of our £2,000 million EMTN programme during 2015 further diversifies our financing options. Strategic risks Risk Impact Mitigation 3 Failure to implement and poor execution of the investment strategy Link to 2015 goals: 1, 3, 4 Poor execution of our investment strategy could result in a significant underperformance and reduced profitability. Specific execution risks include, among others: • timing of investment and divestment decisions • incorrect allocation of capital • exposure to any development risk or significant refurbishment programme • failure to implement the approved business plan • excessive exposure to one particular sector, asset, tenant or regional concentration. • The Investment Manager has a strong investment sourcing capability and maintains long-standing market relationships, to ensure access to future opportunities. • Expert local knowledge, combined with a significant and continued investment in people and infrastructure, provides an effective base upon which to deliver the investment strategy. • All investment decisions are subject to risk evaluation, taking into account the expected returns and risk appetite. Thereafter, KPIs and financial metrics are continuously monitored to track performance and, if necessary, adapt business plan to achieve targets. S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 2015 33

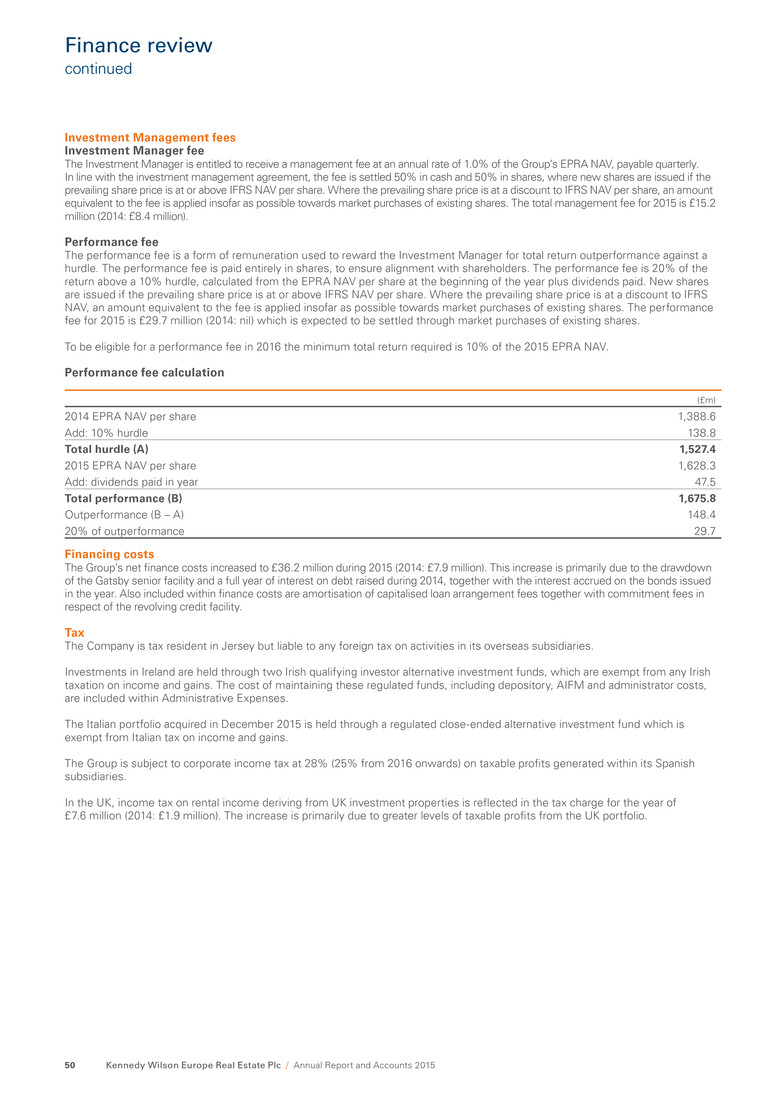

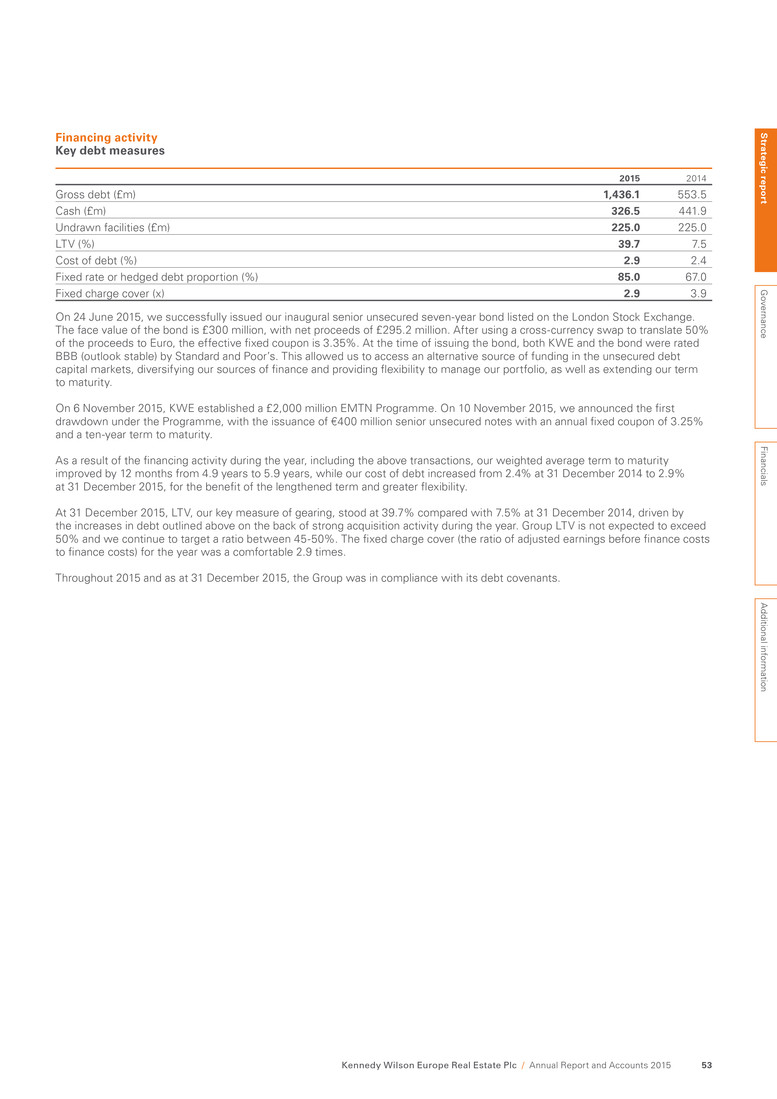

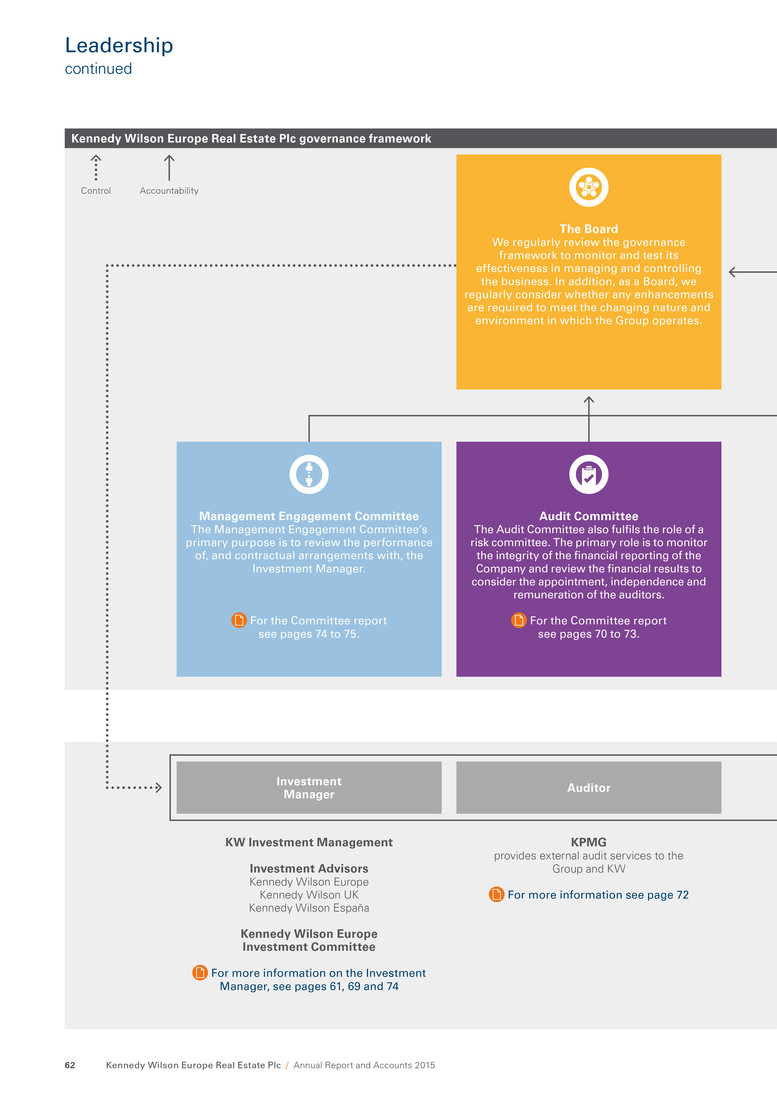

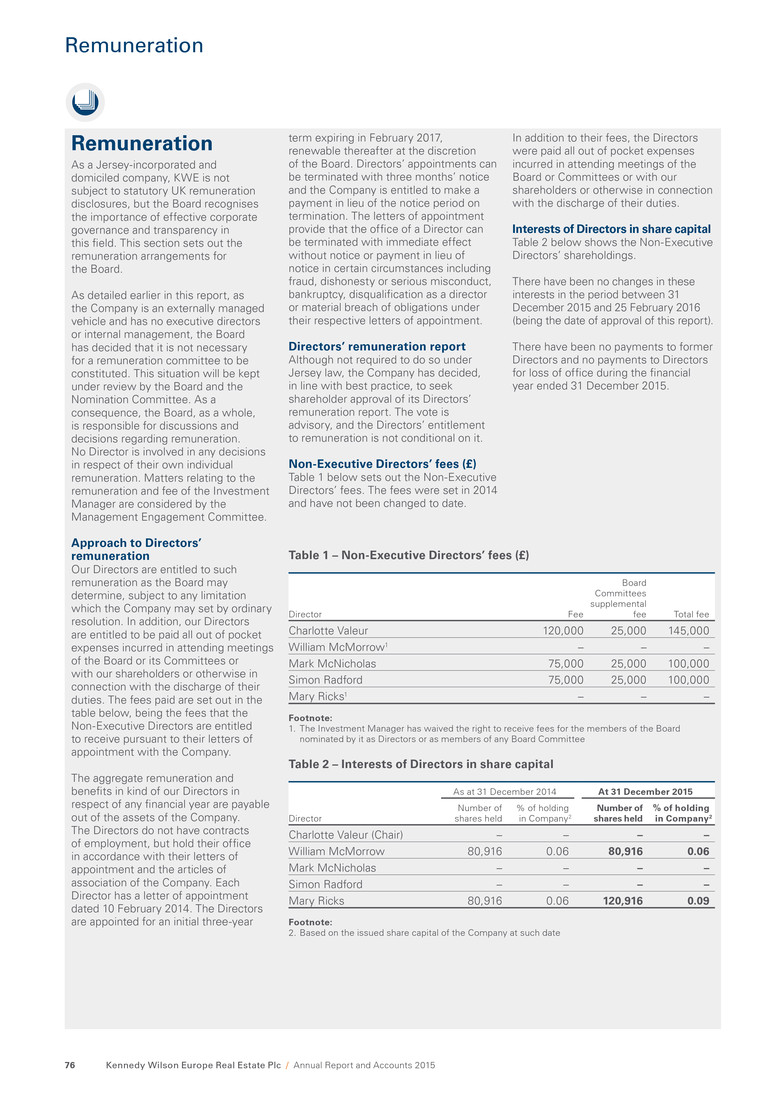

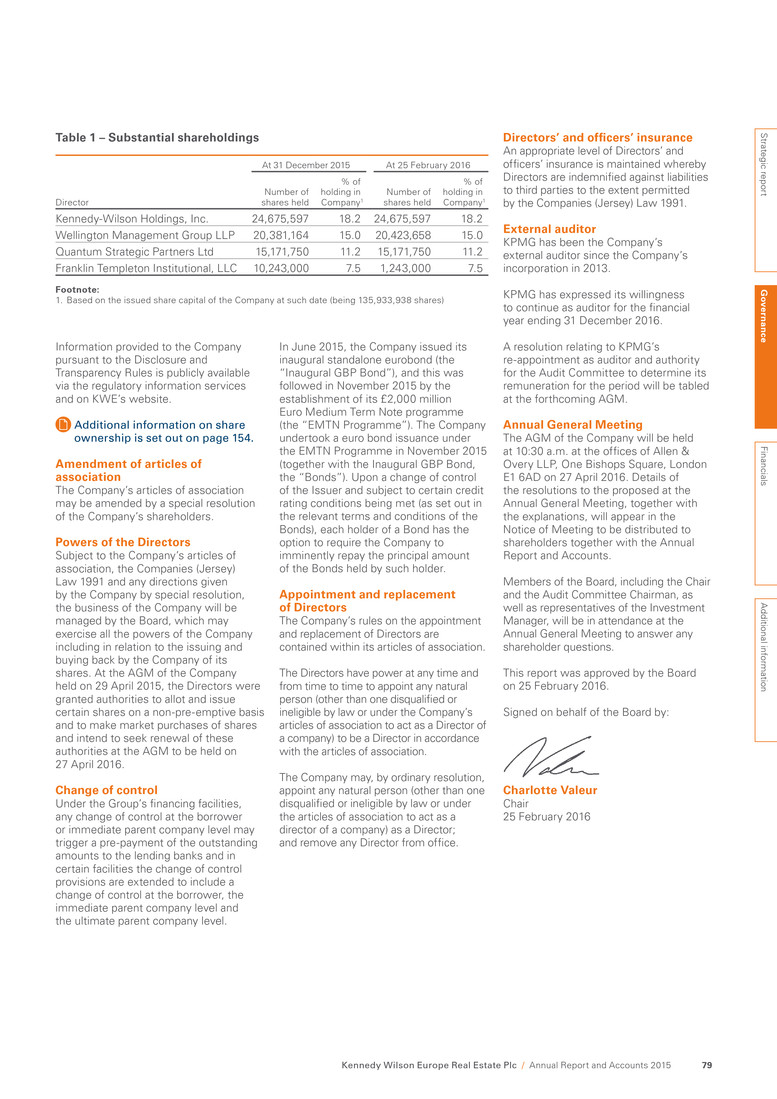

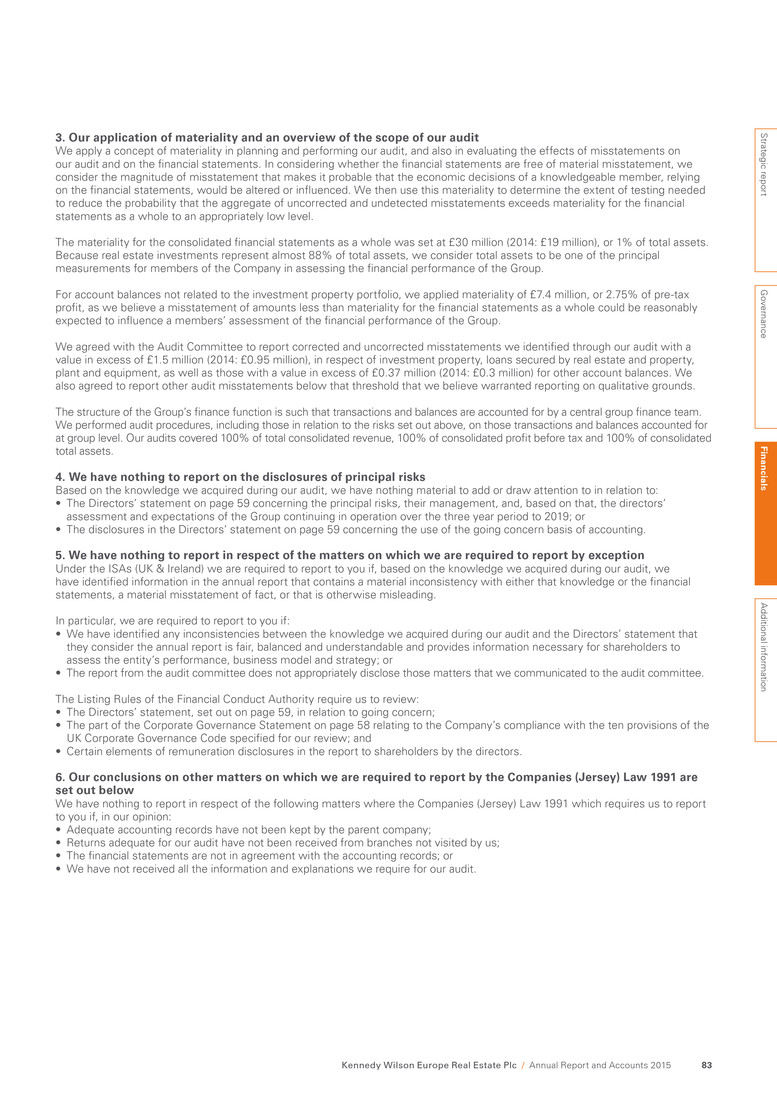

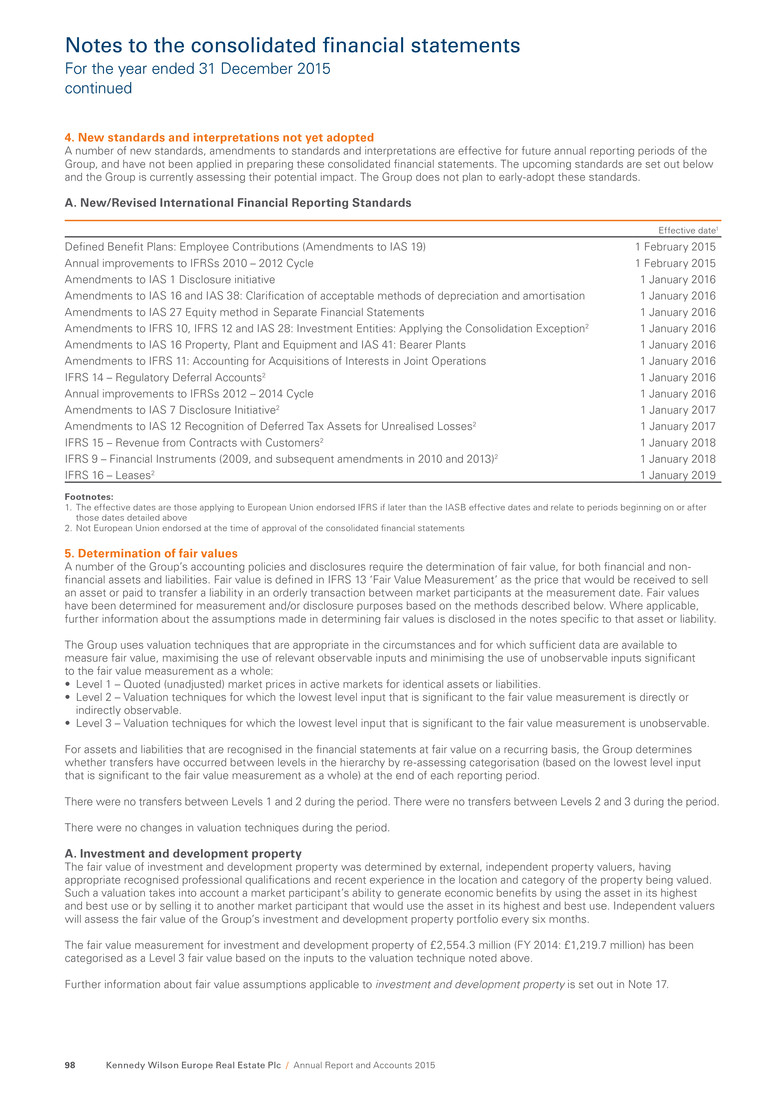

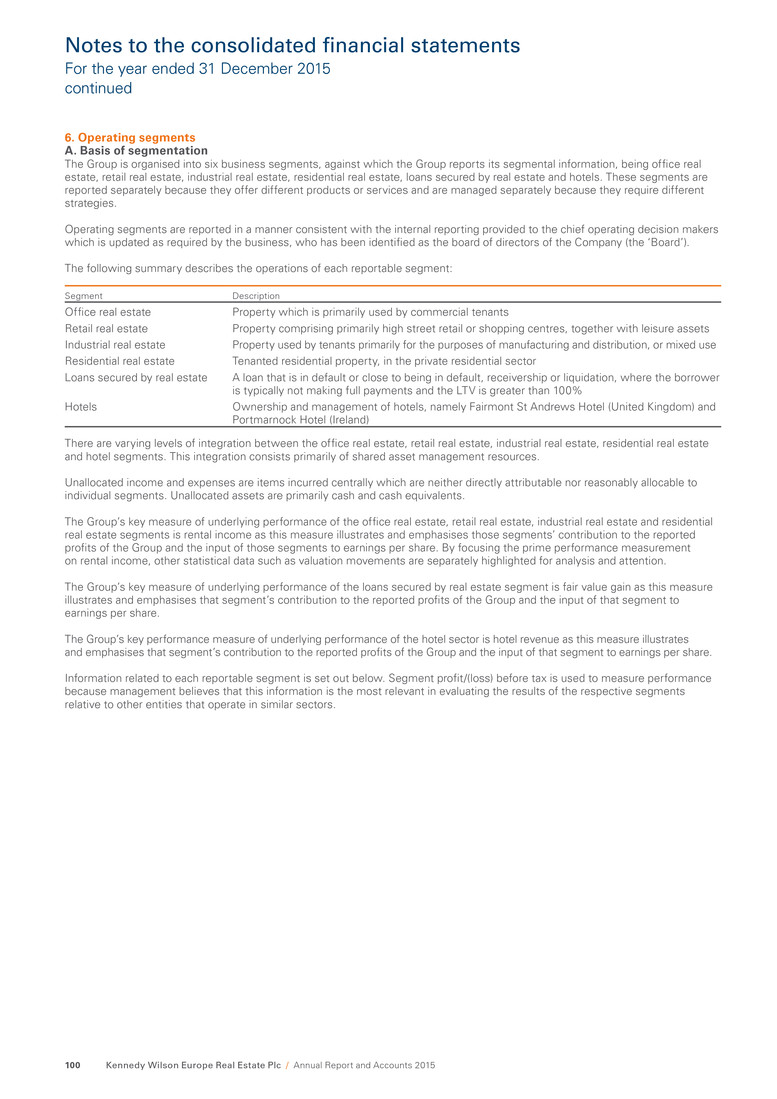

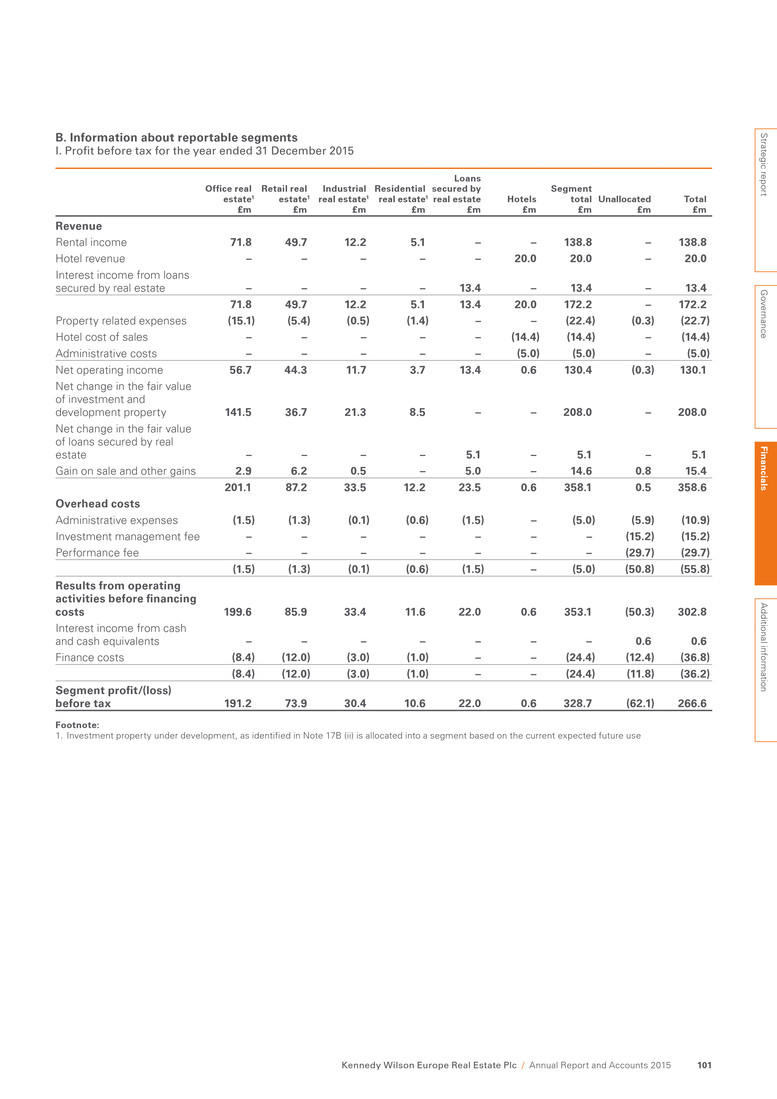

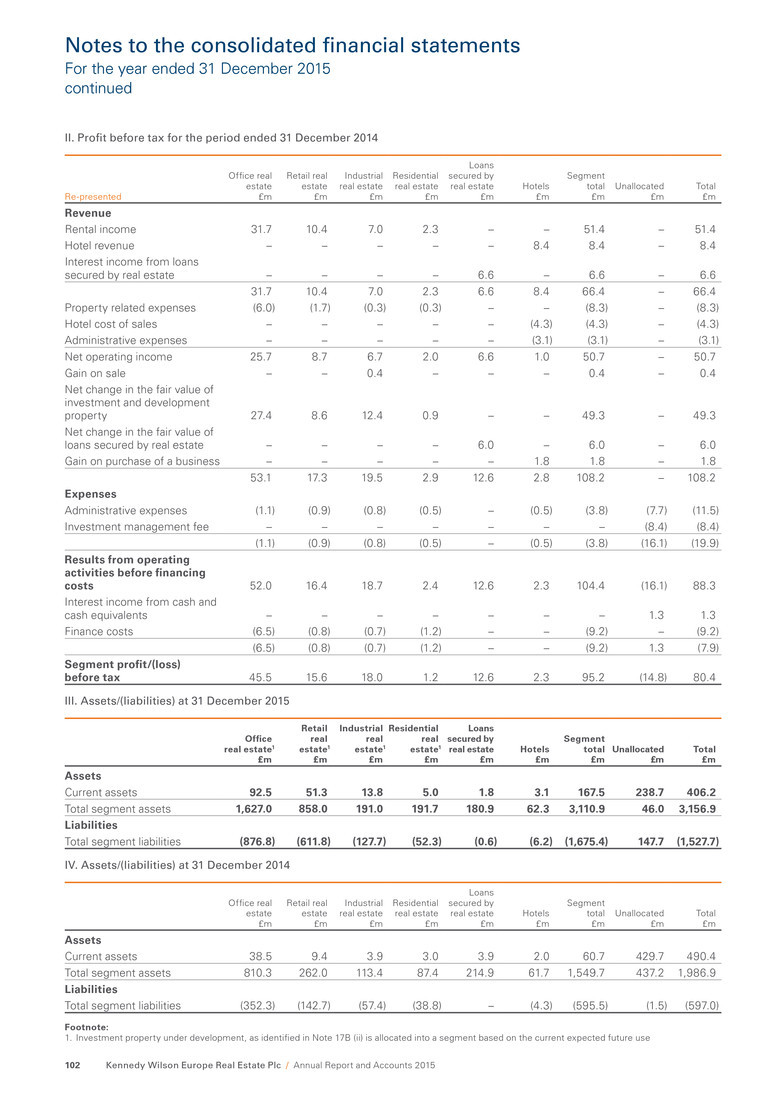

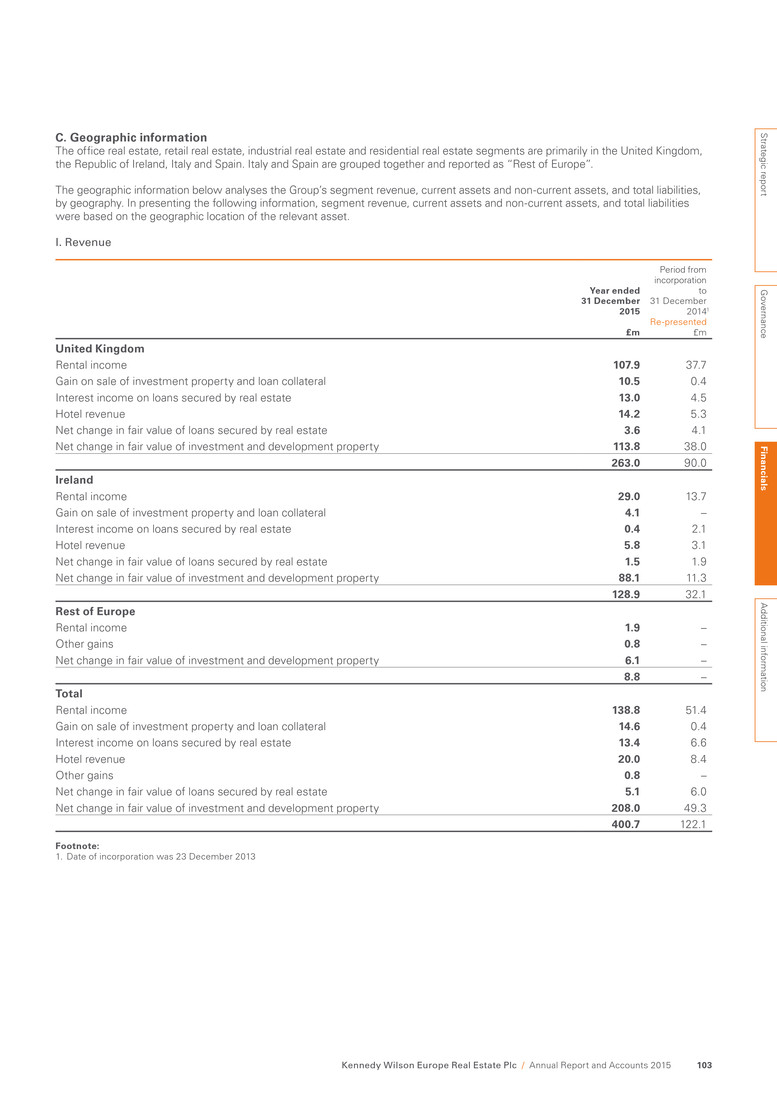

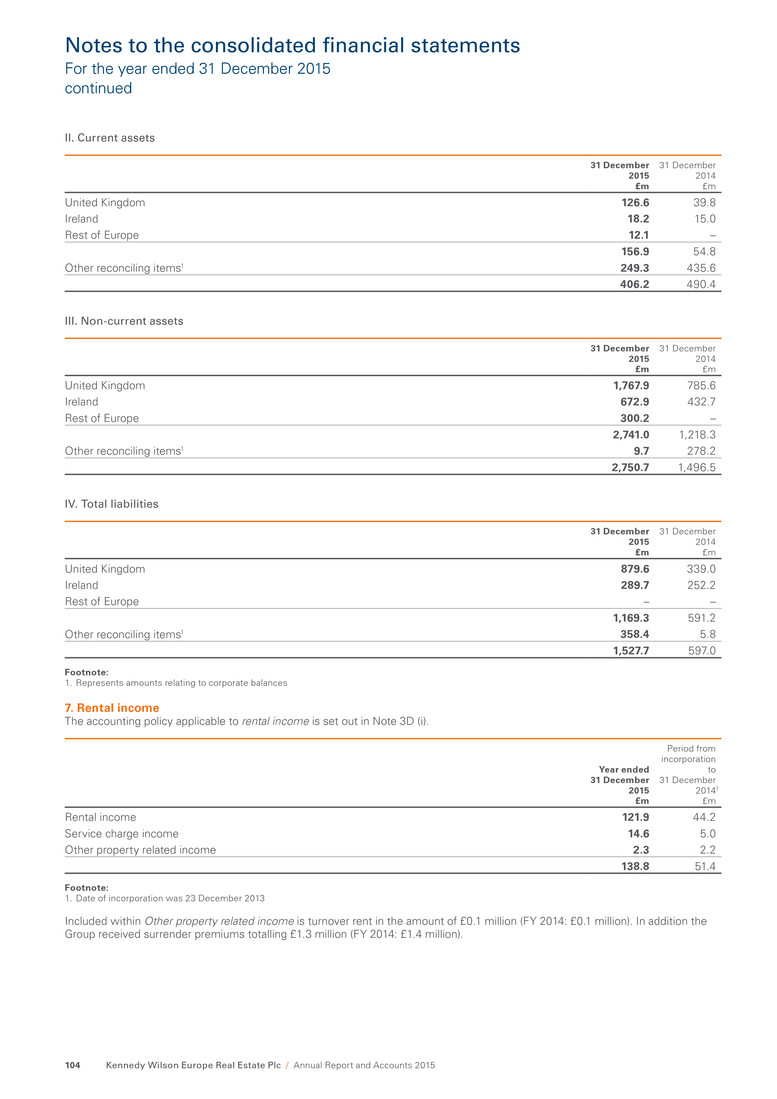

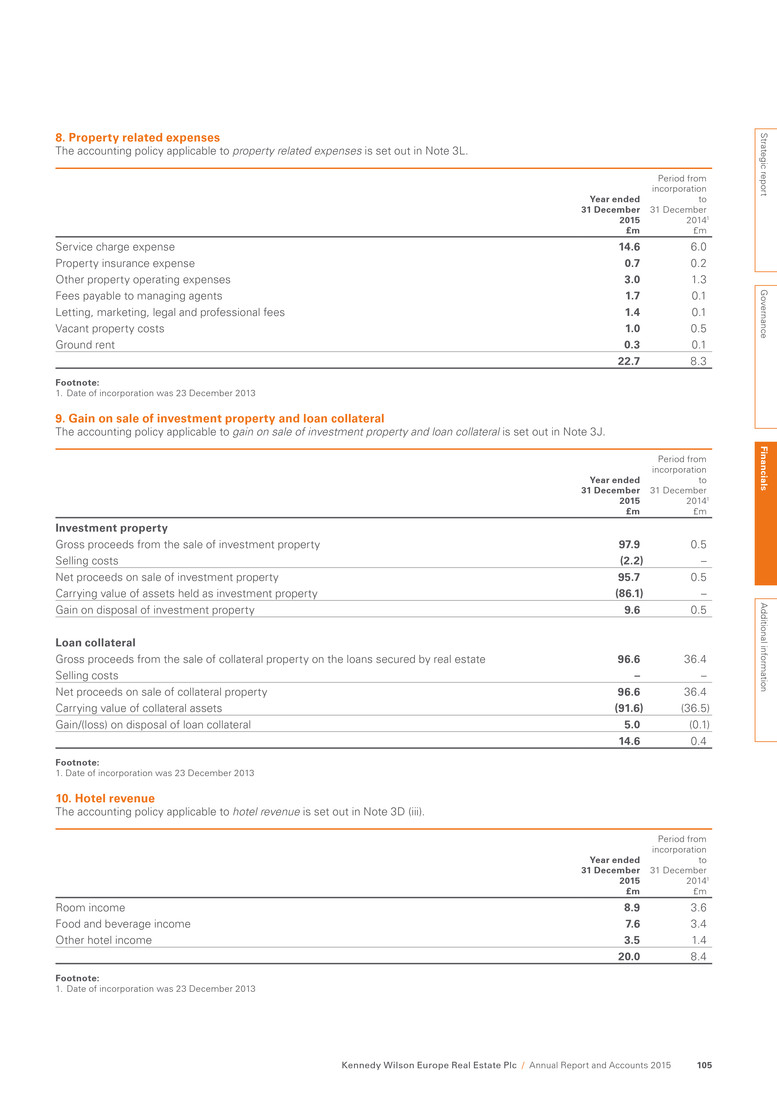

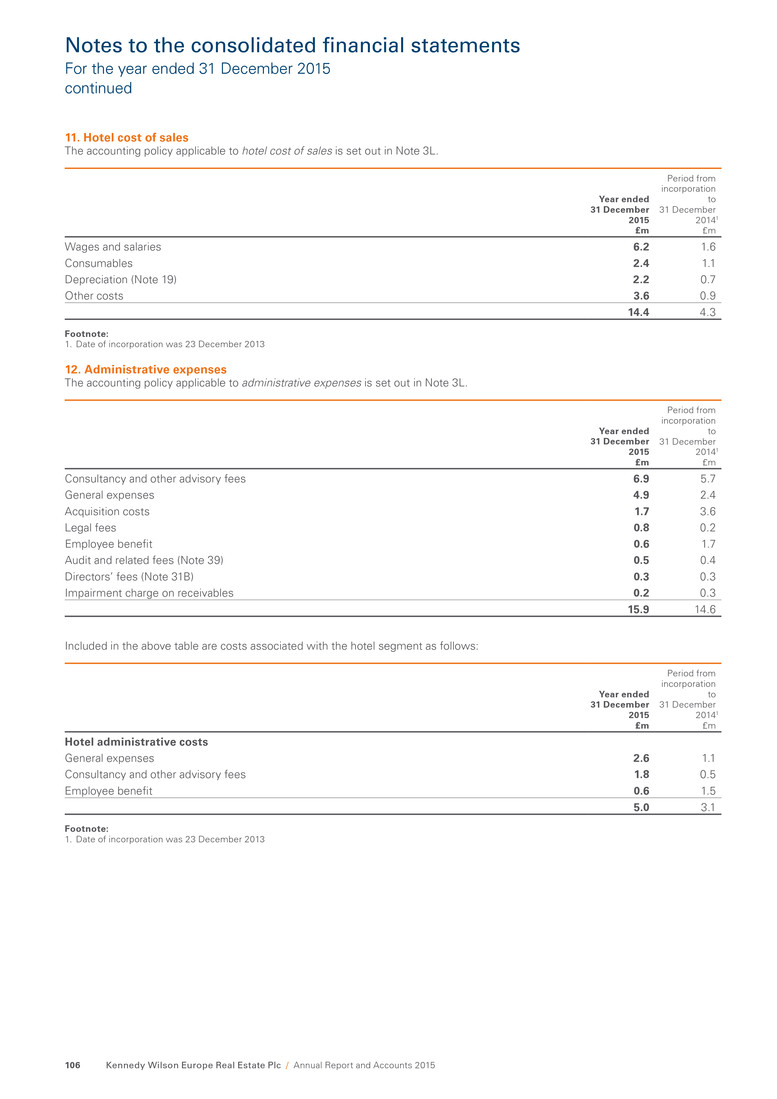

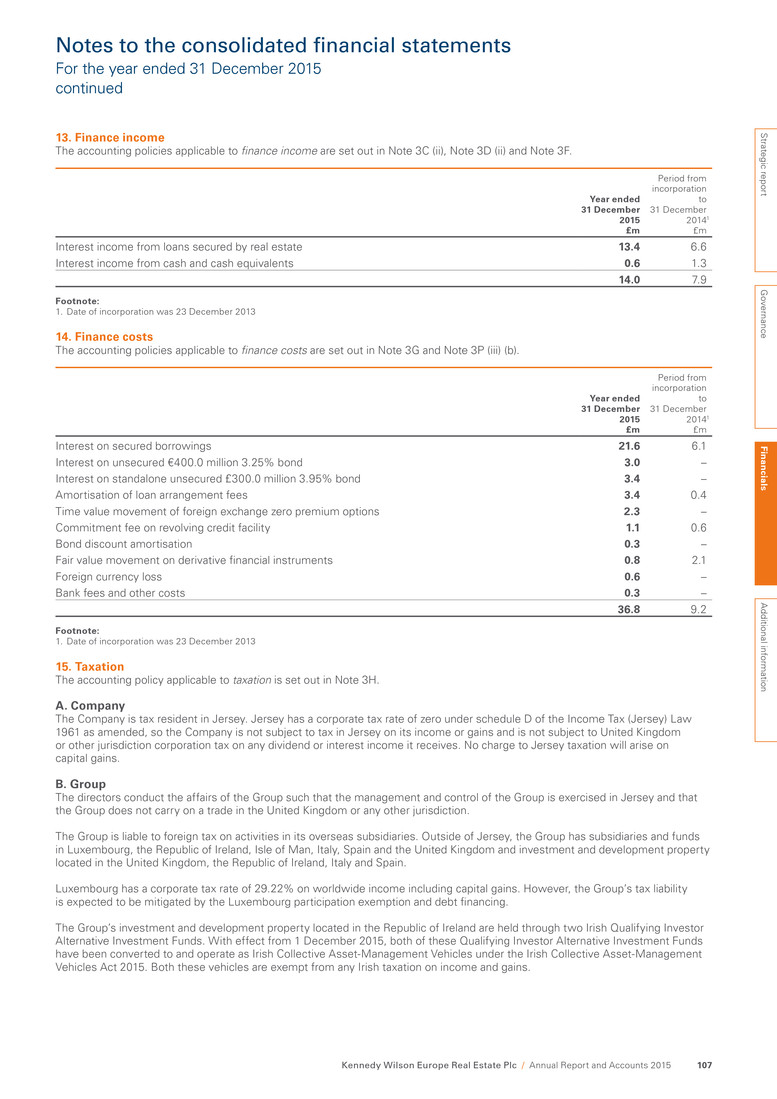

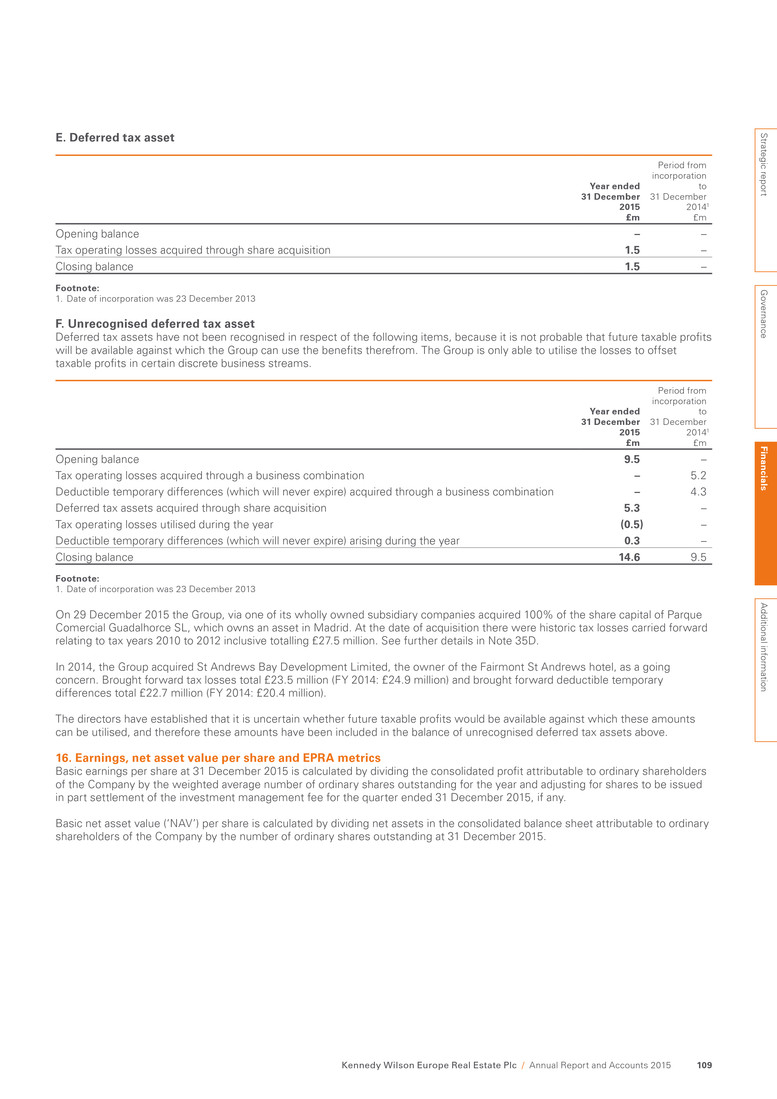

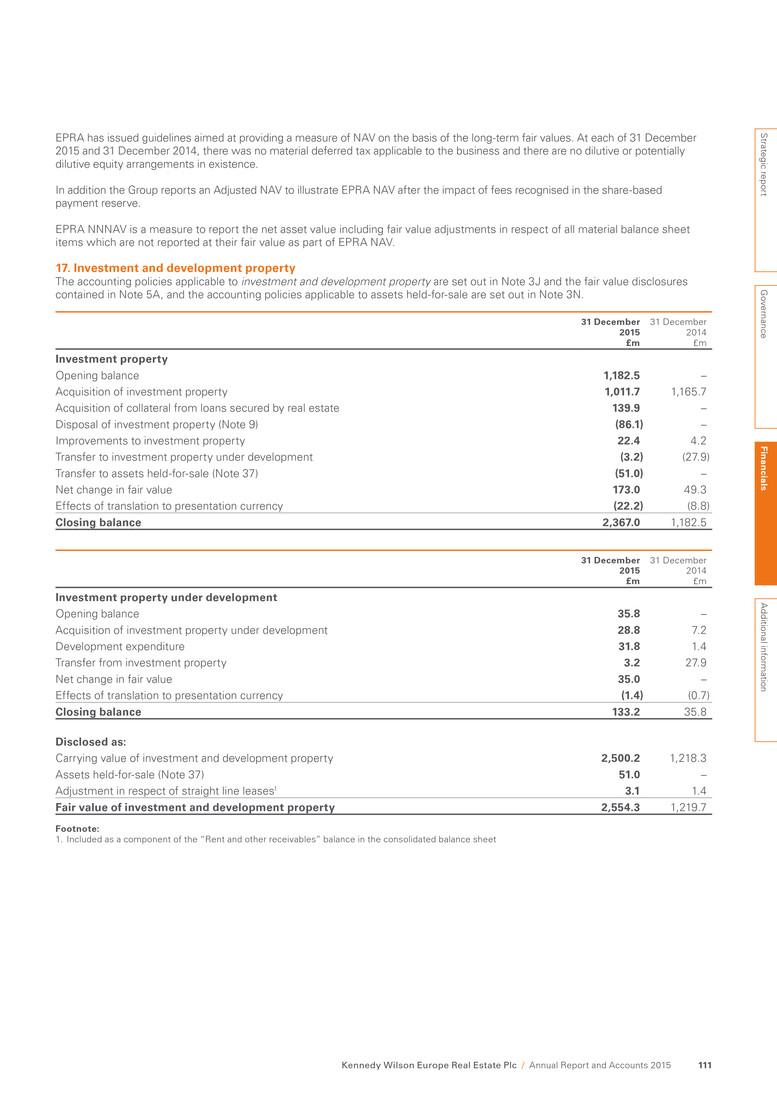

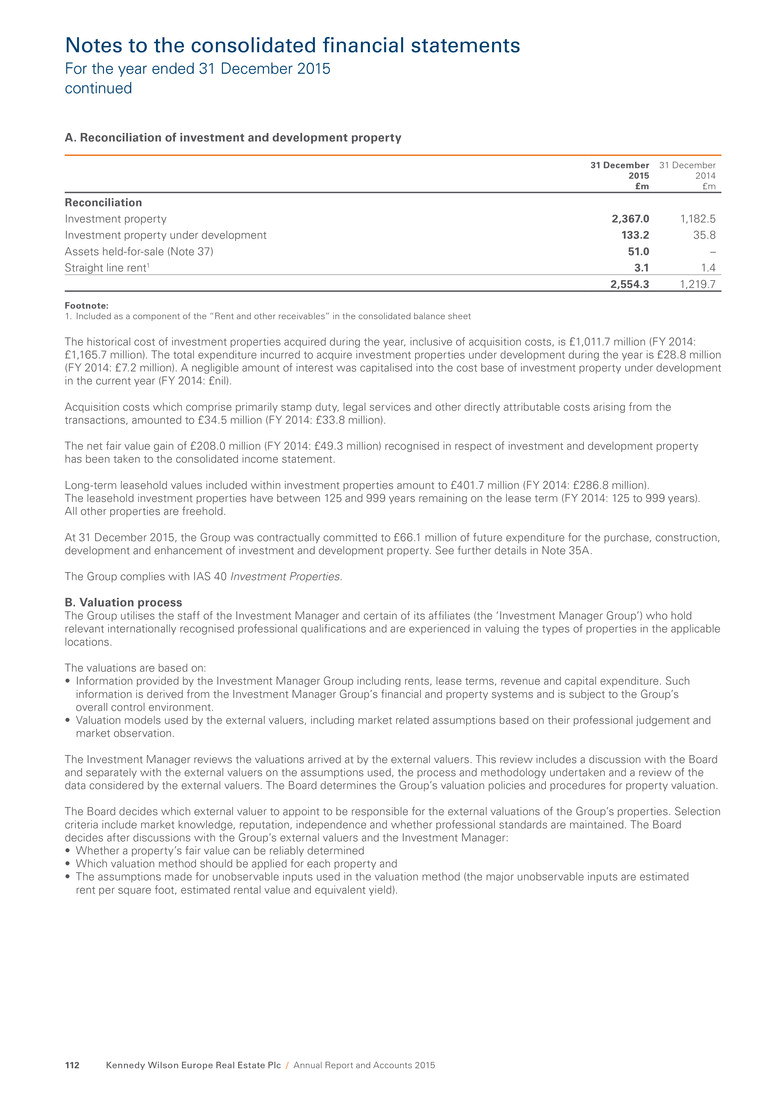

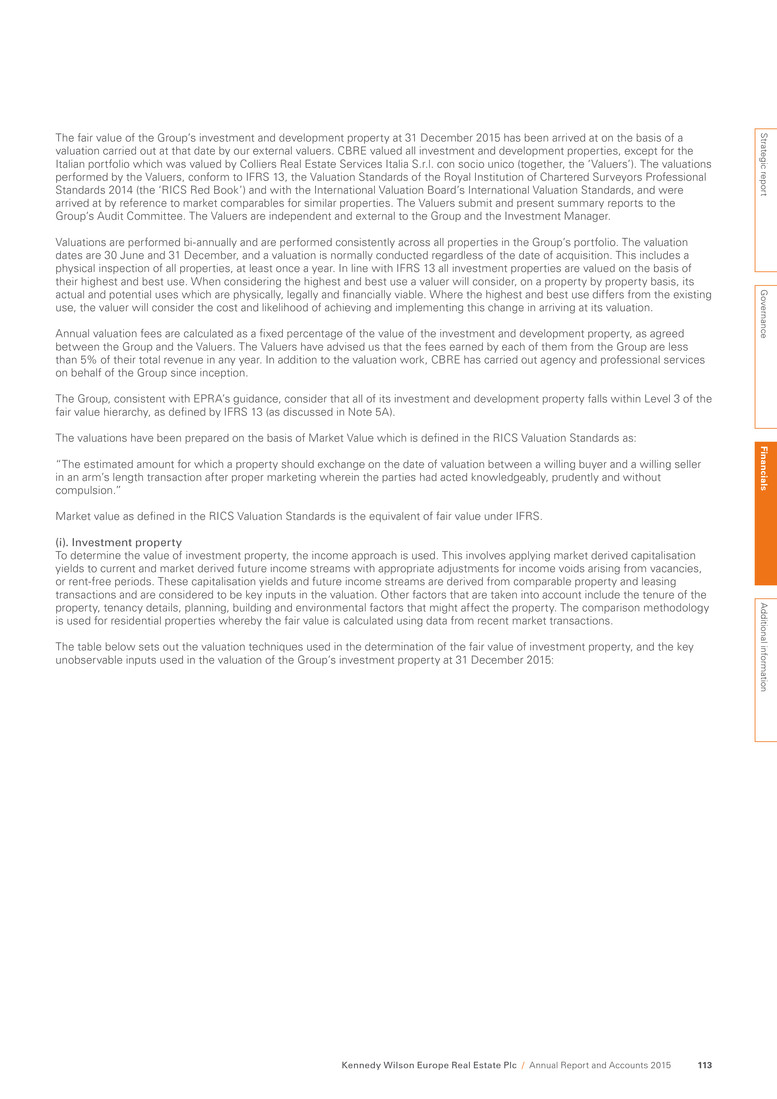

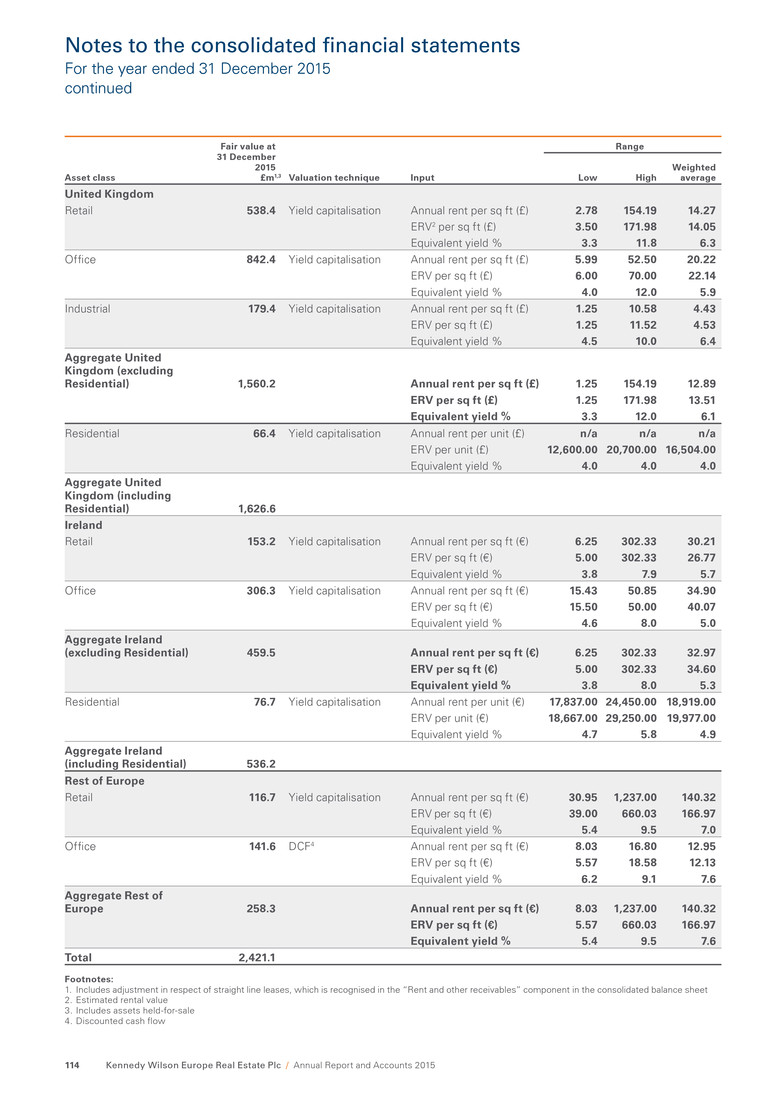

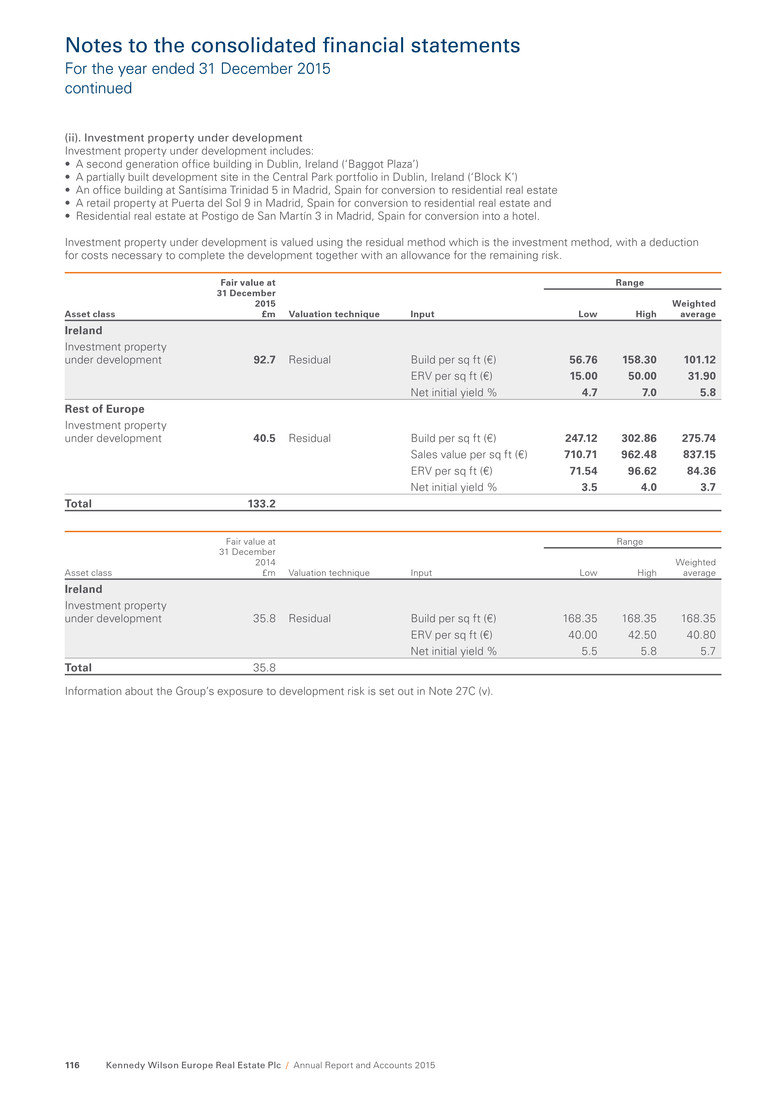

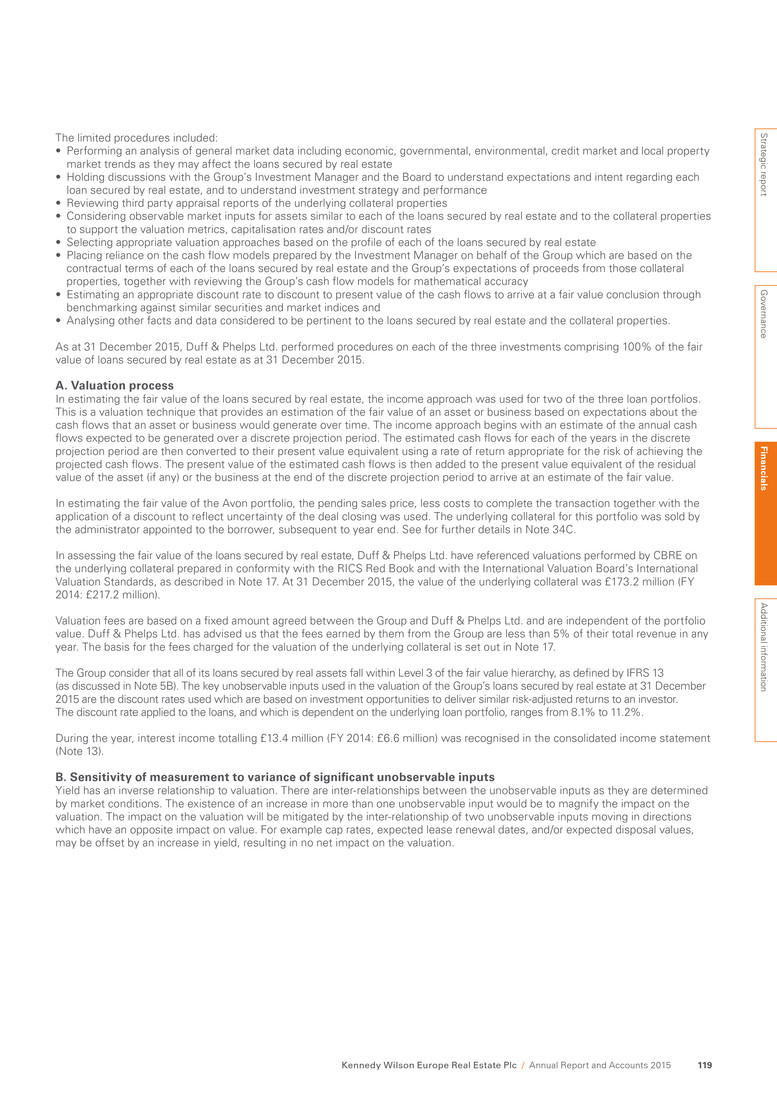

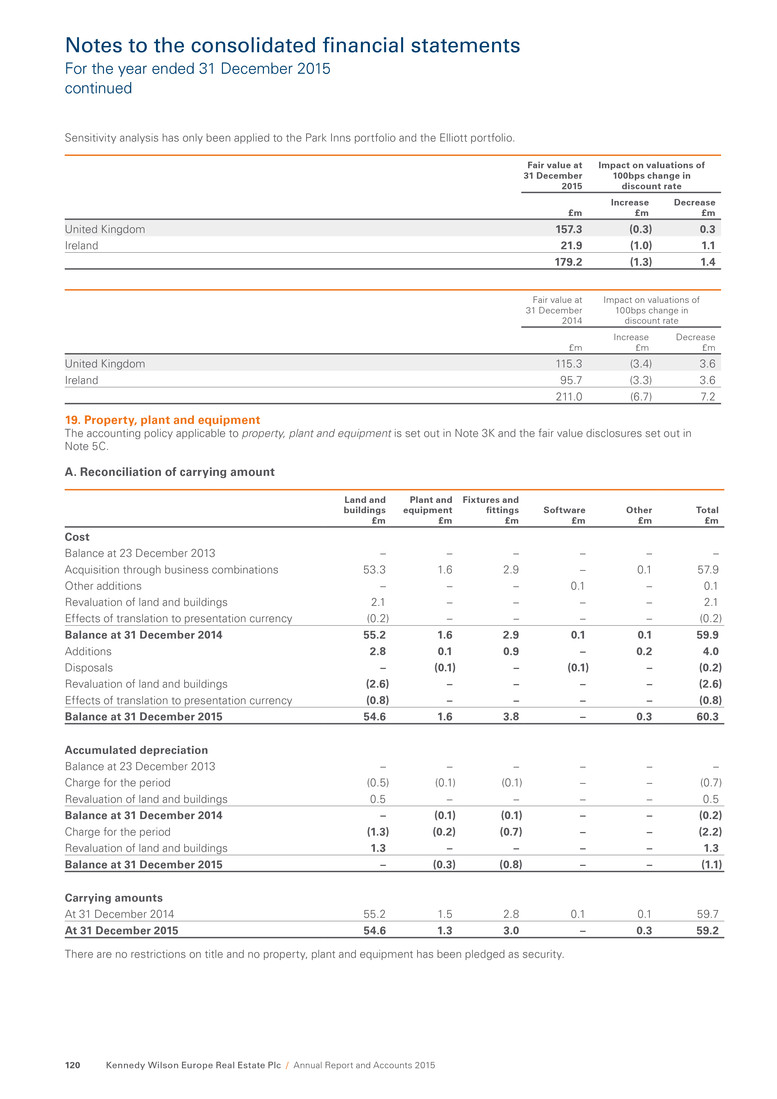

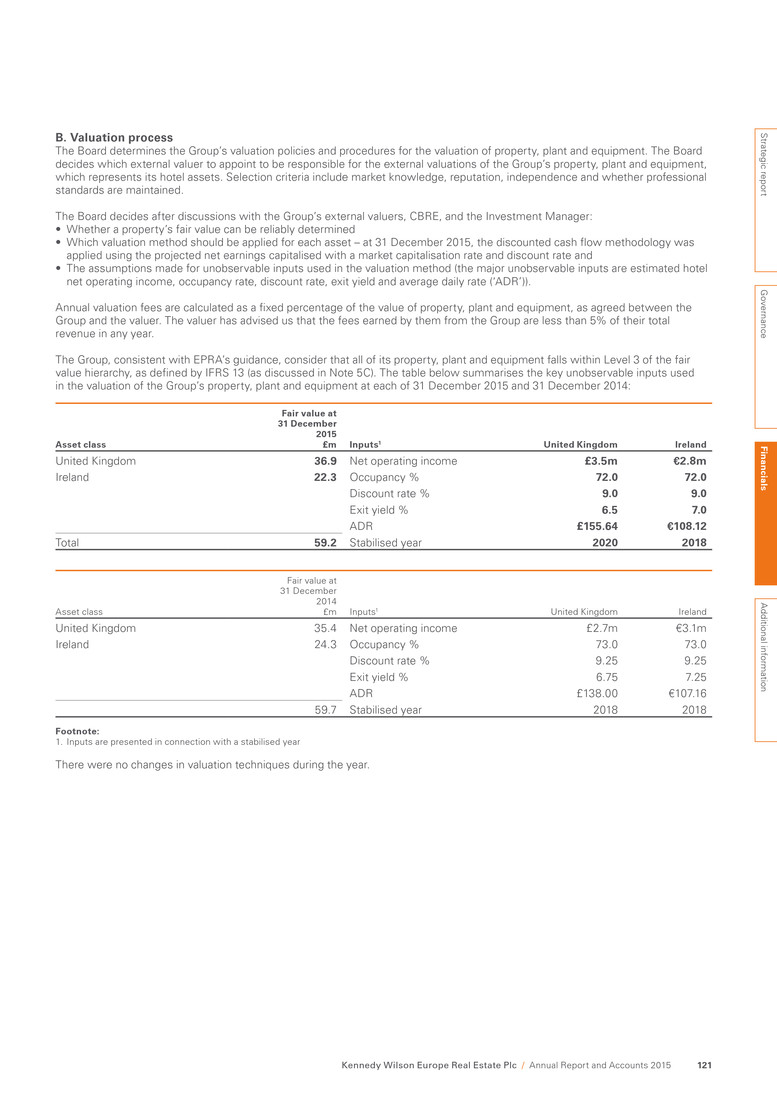

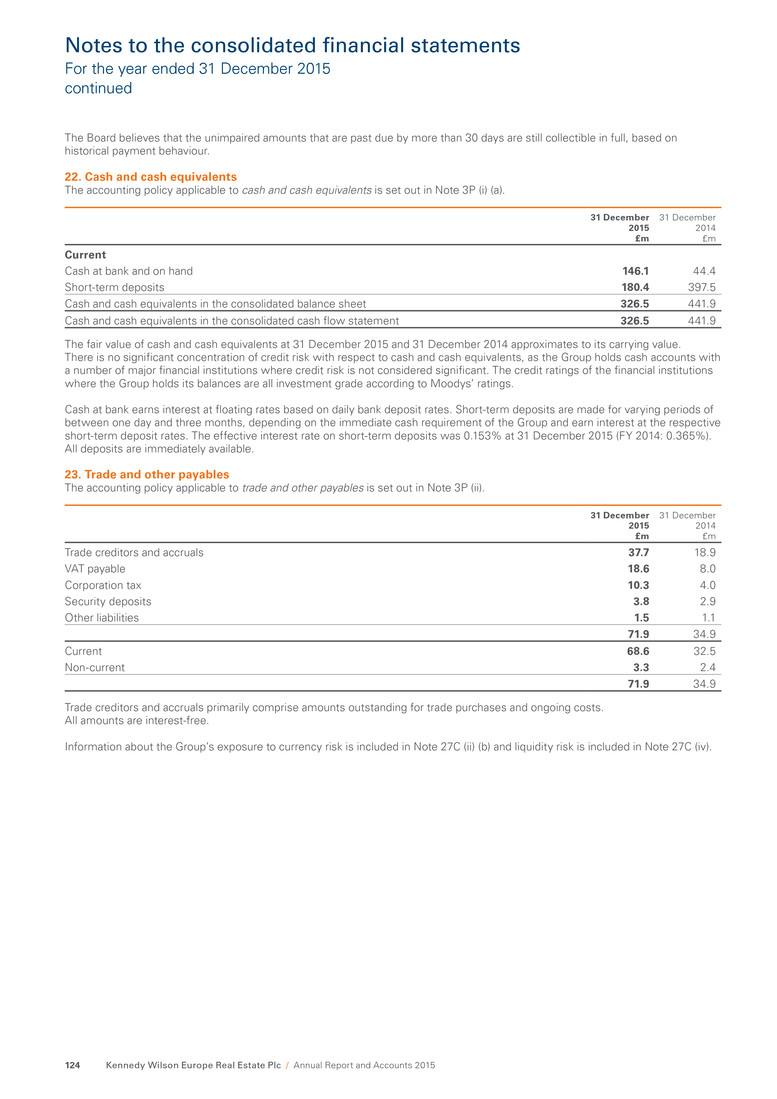

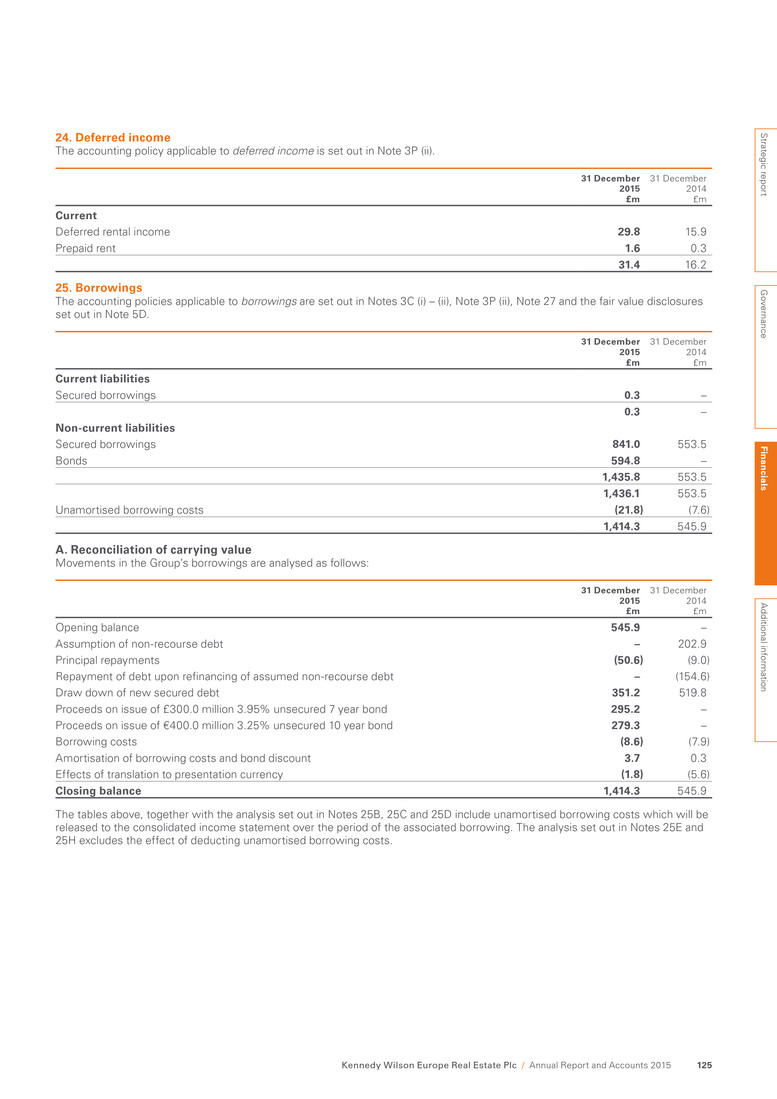

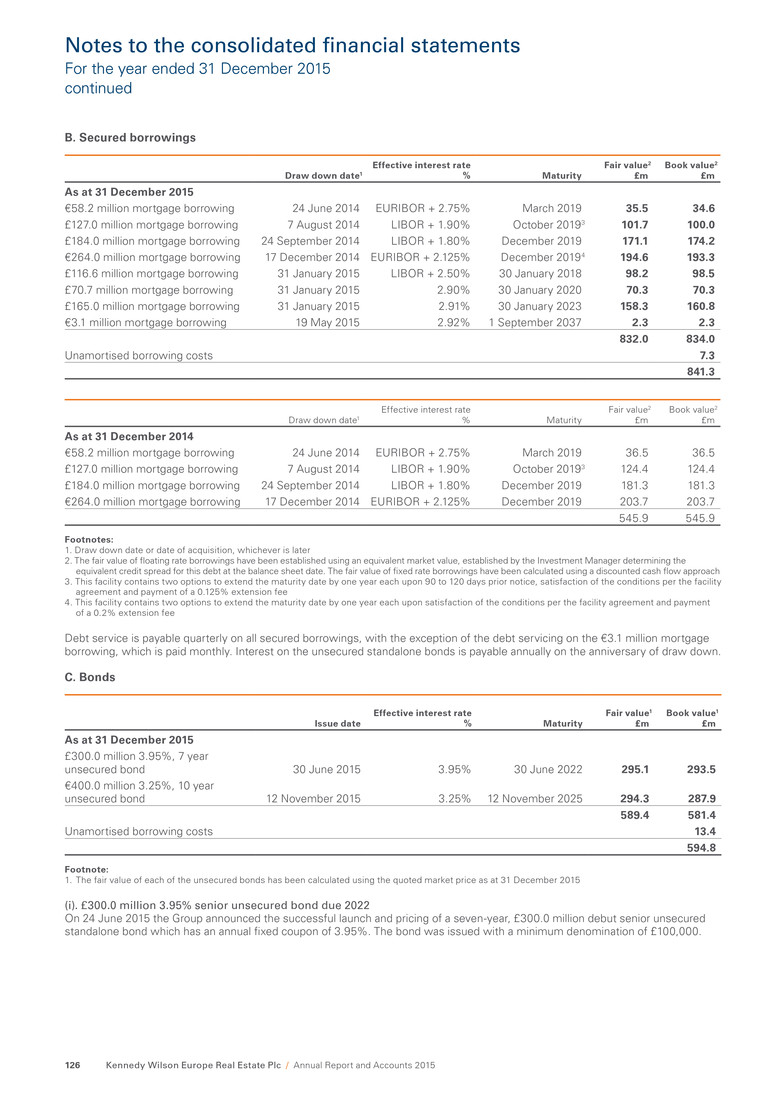

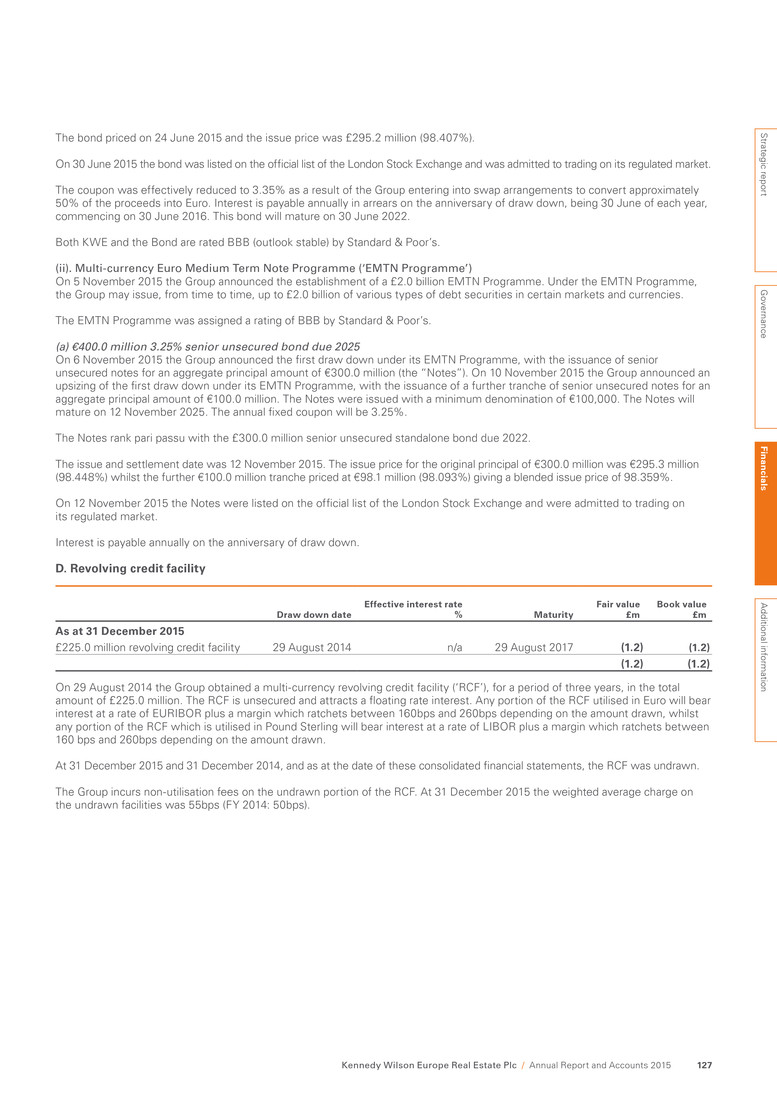

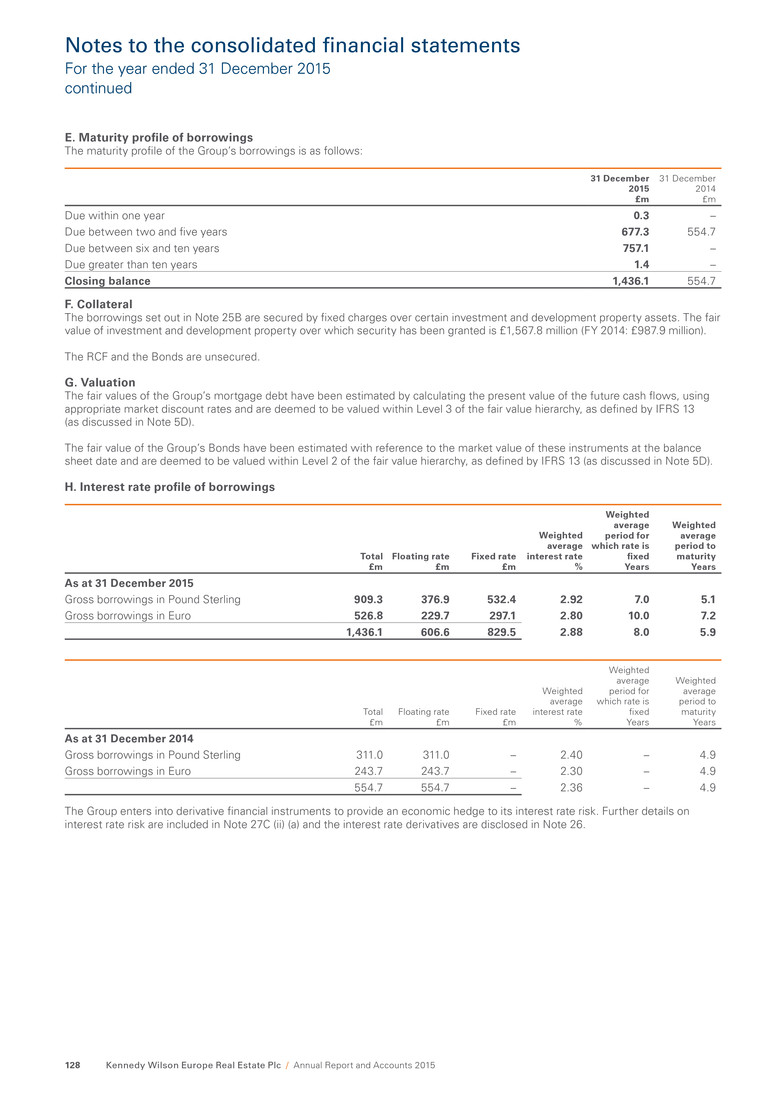

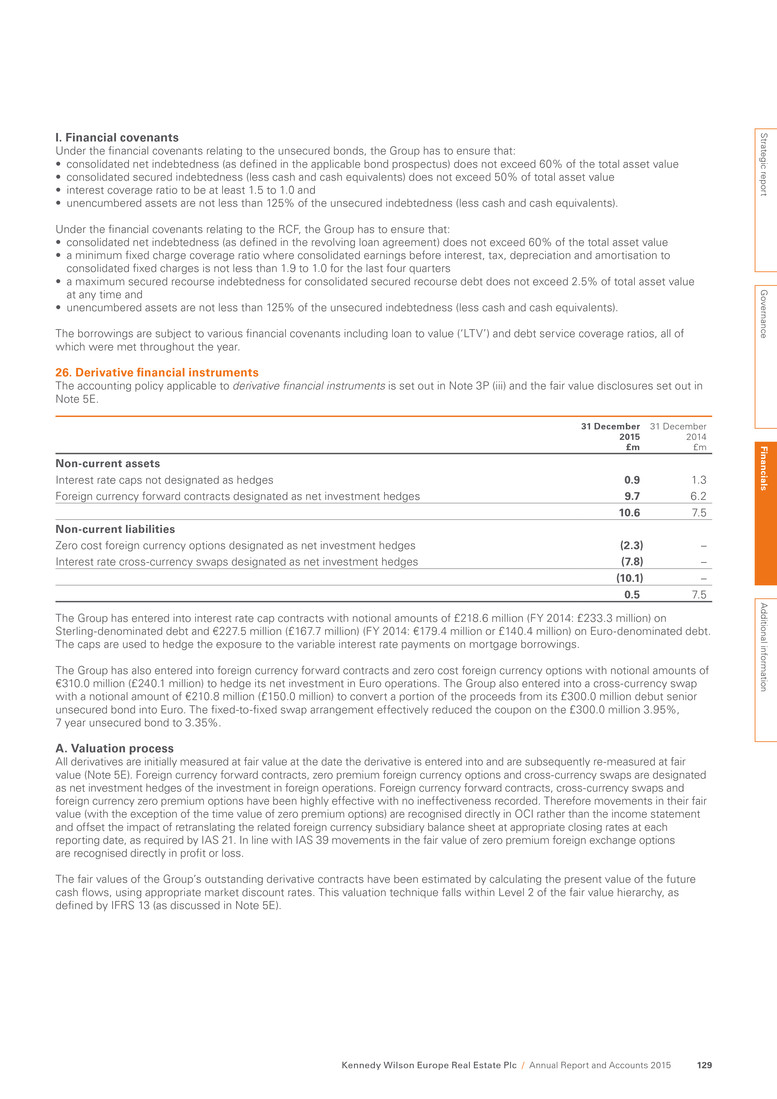

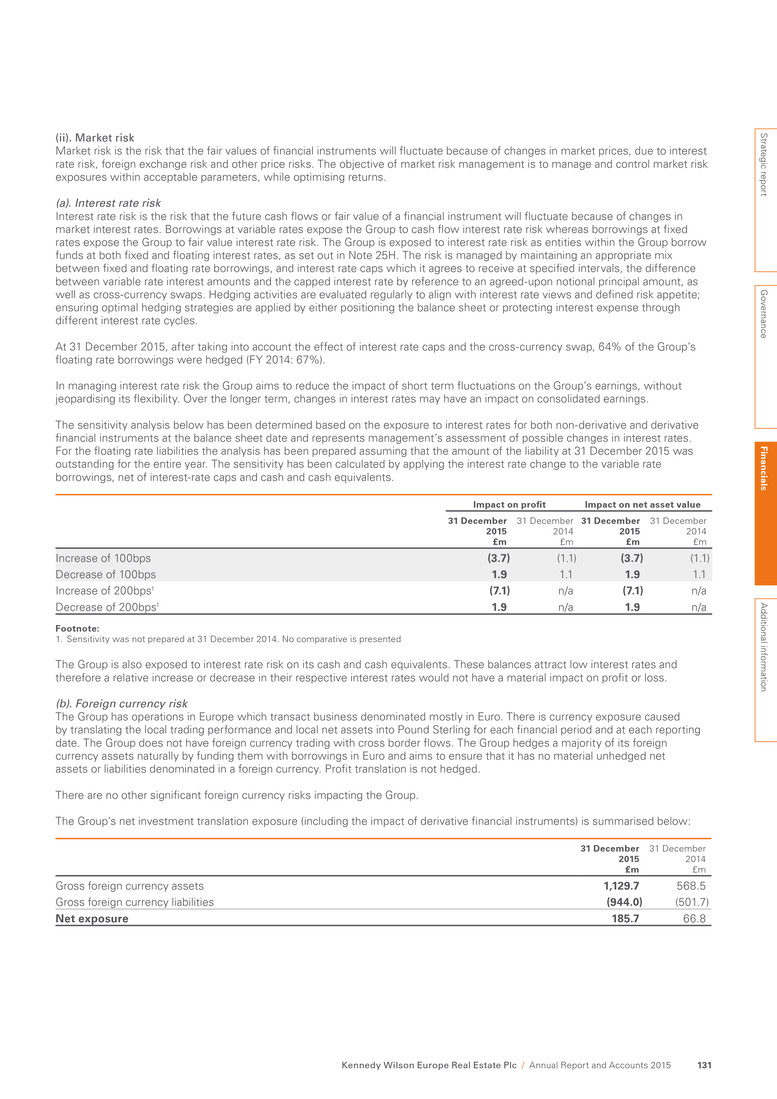

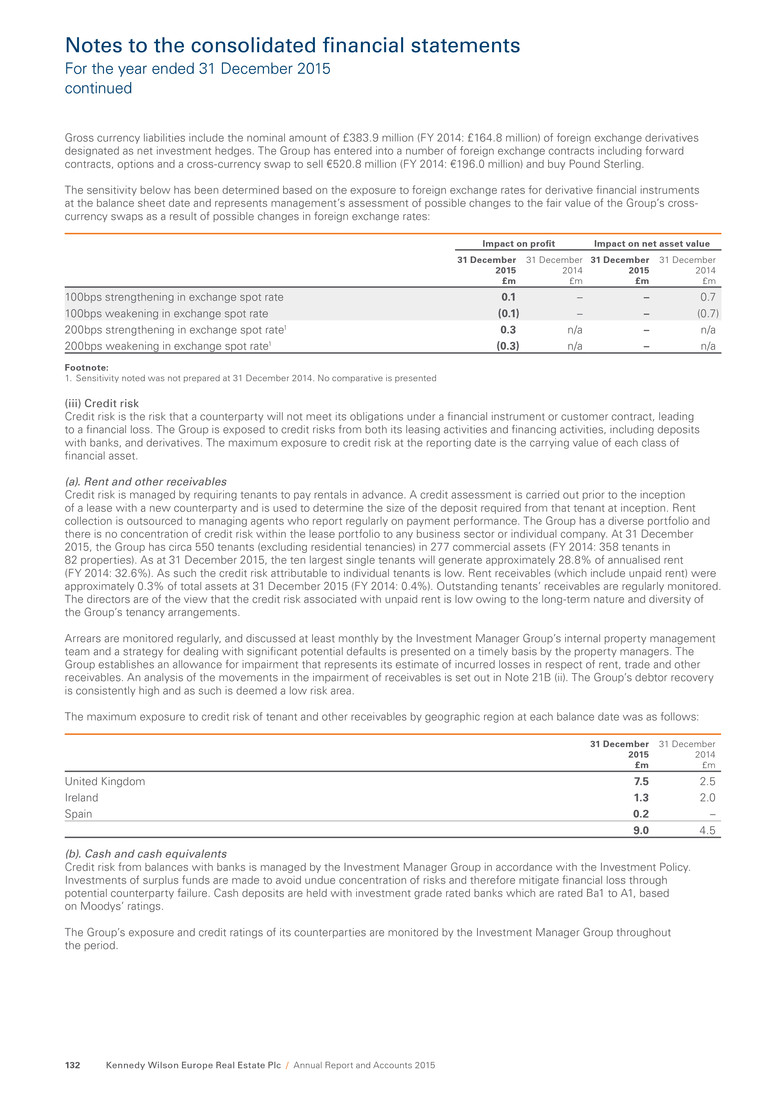

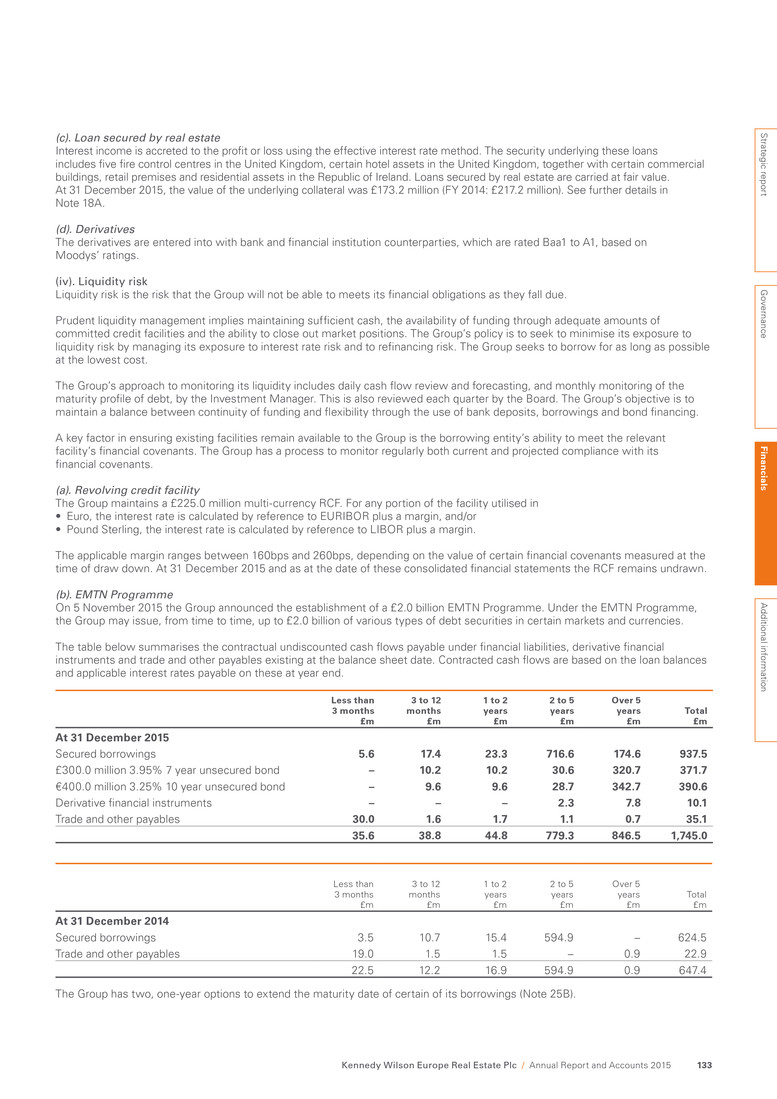

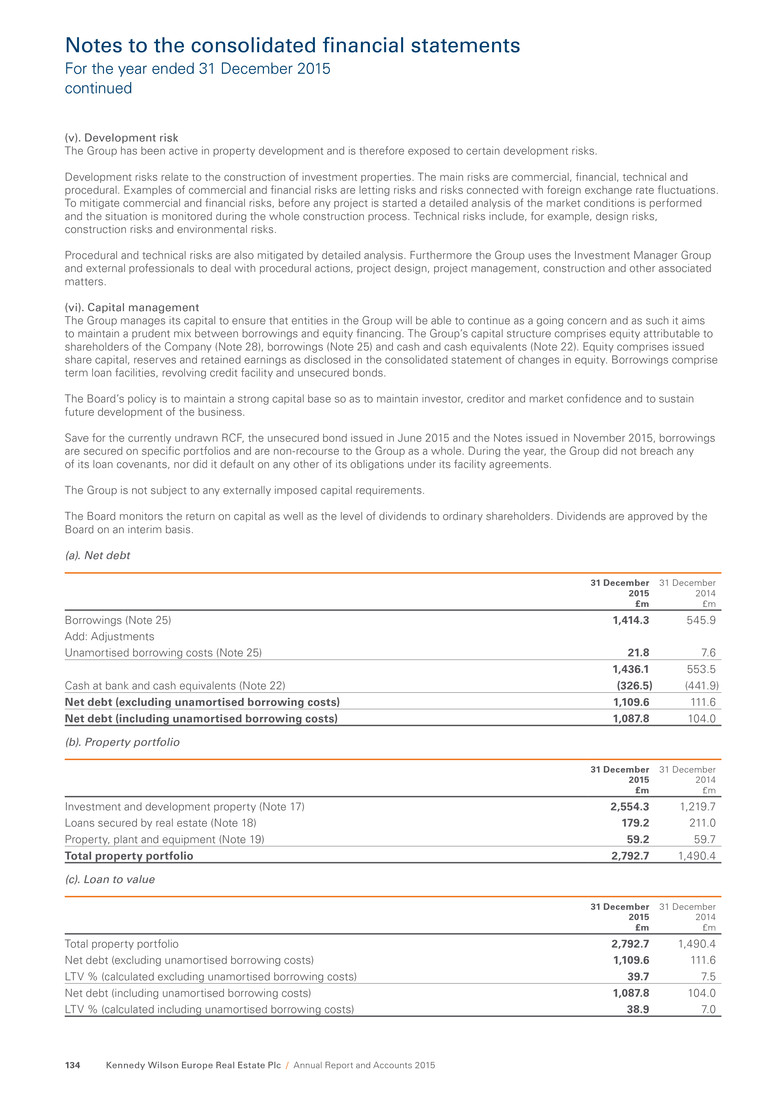

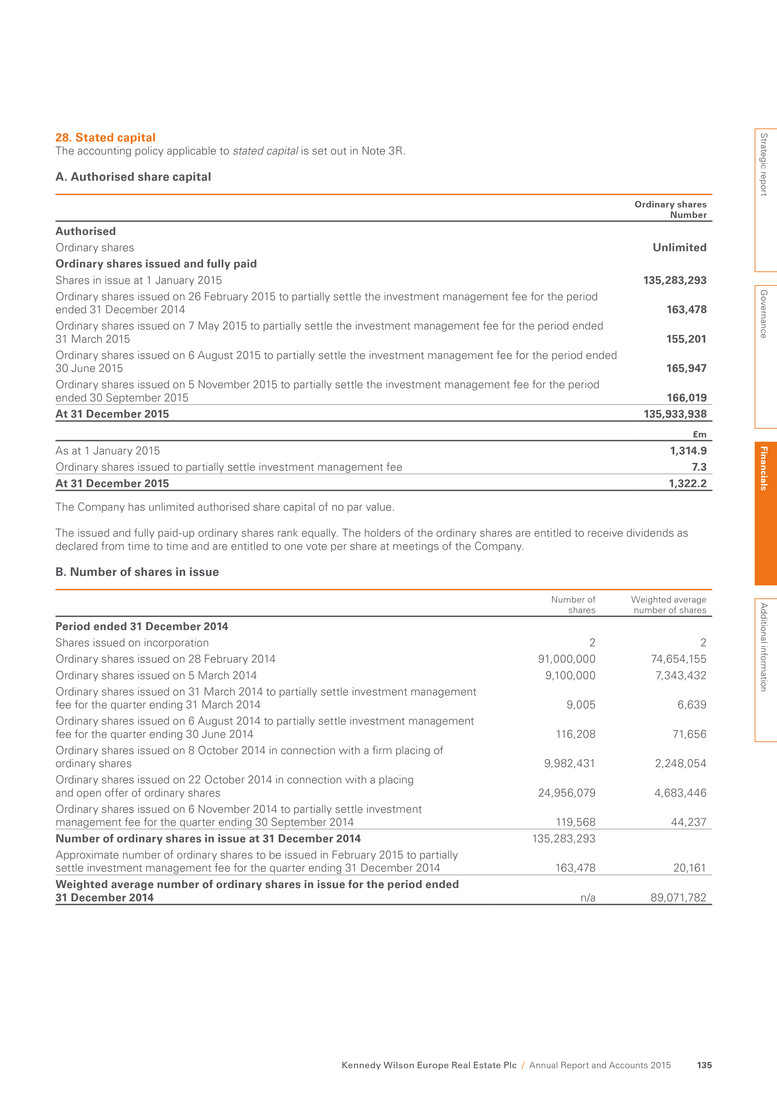

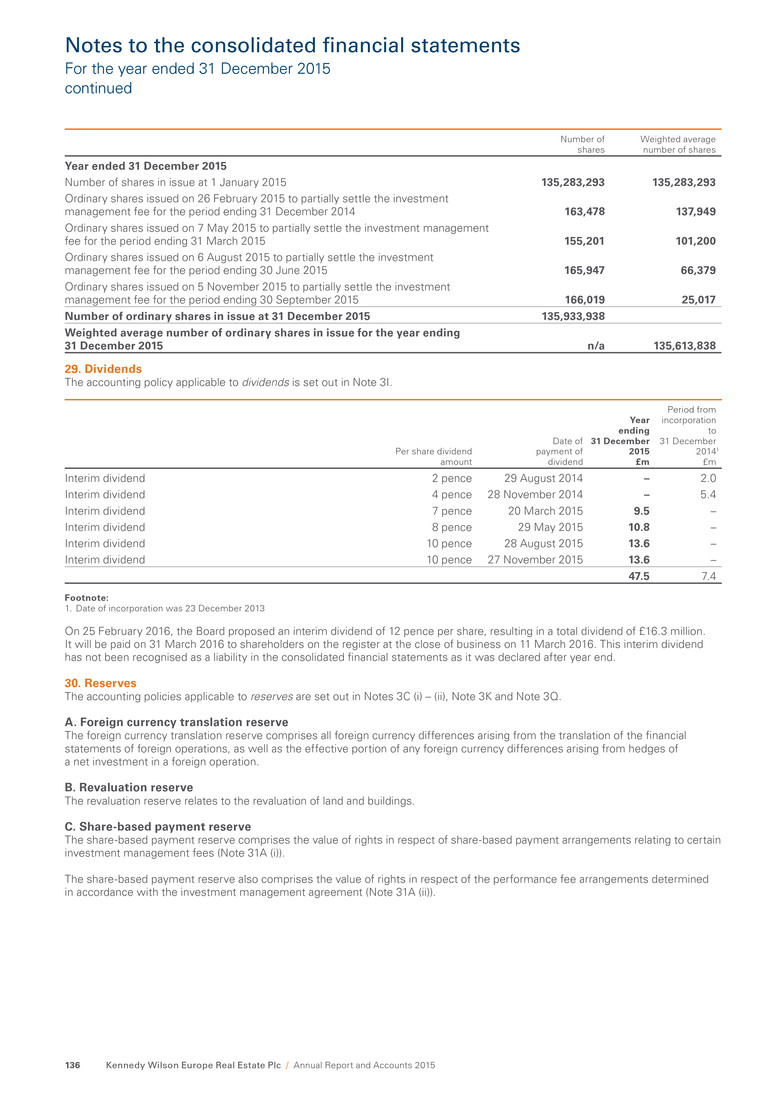

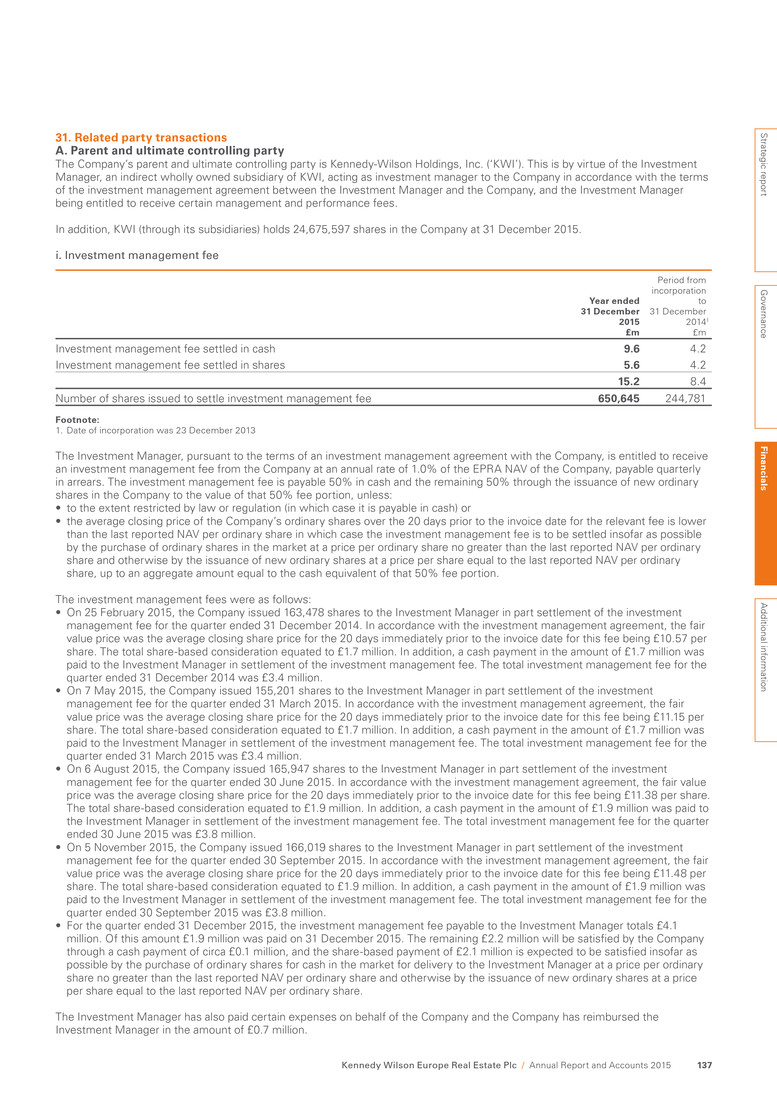

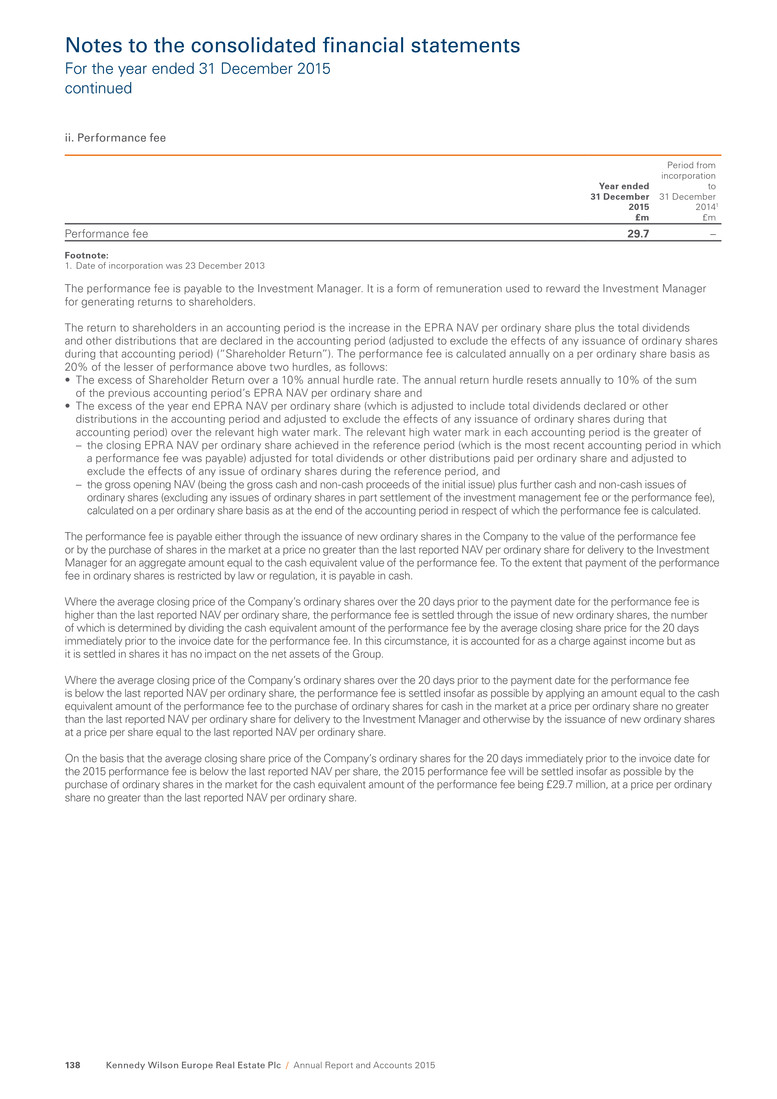

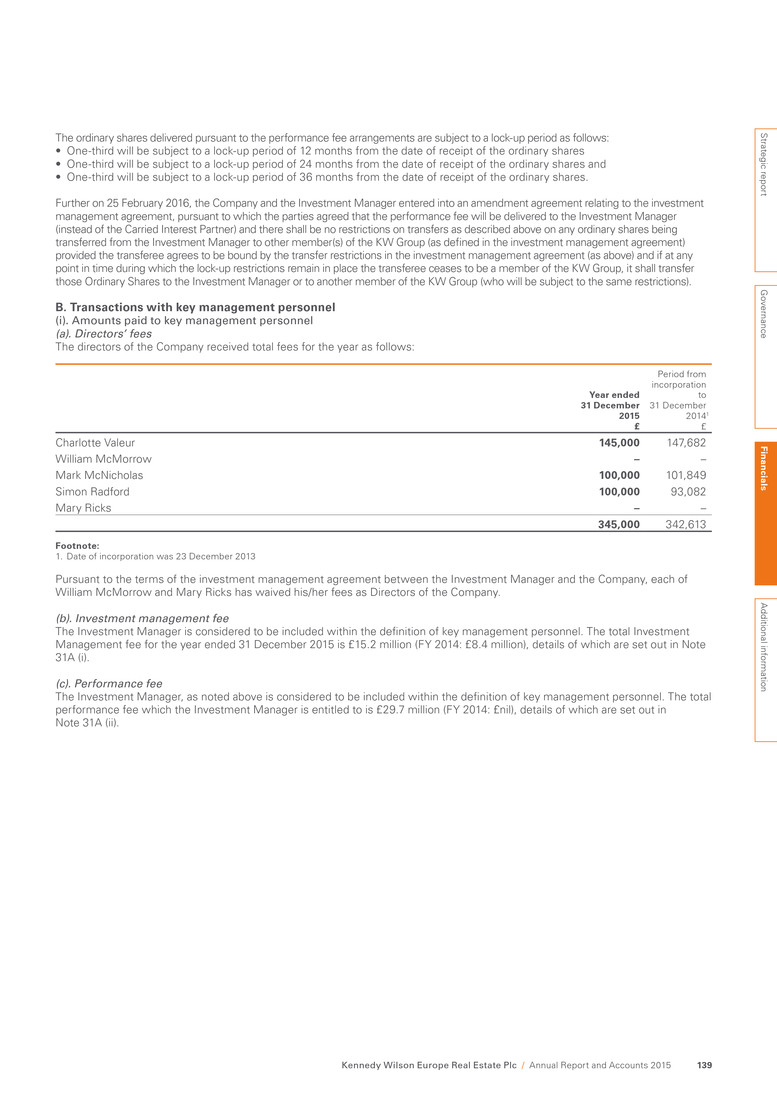

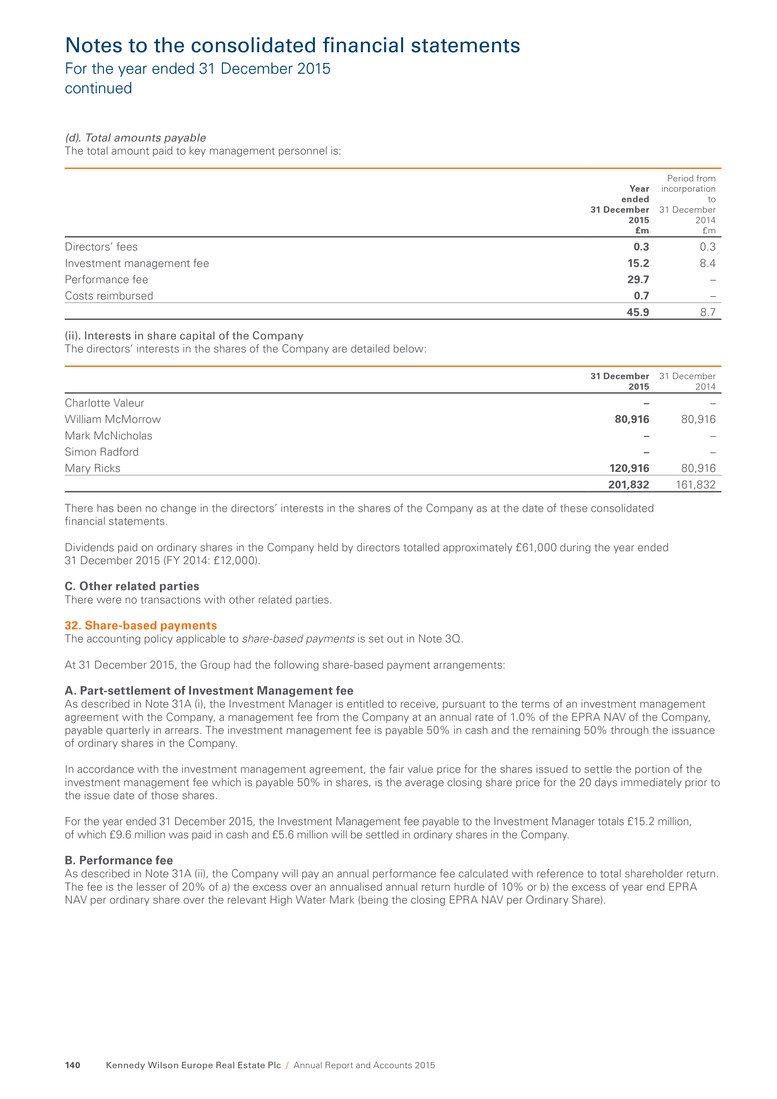

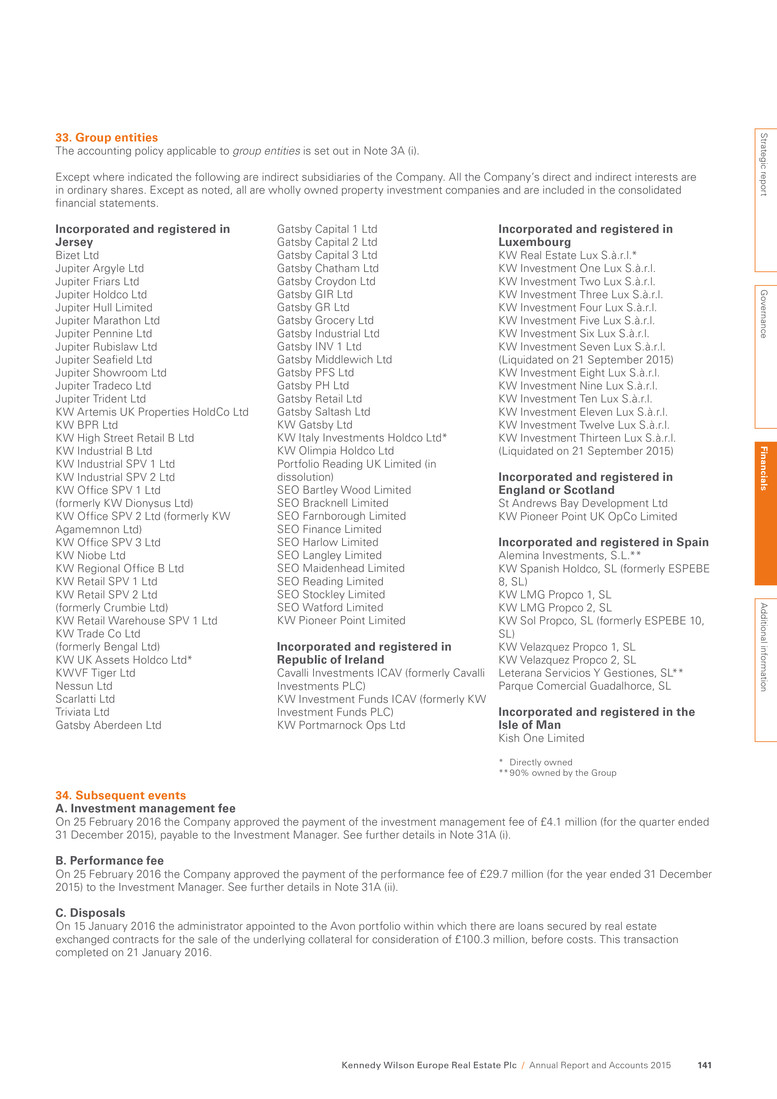

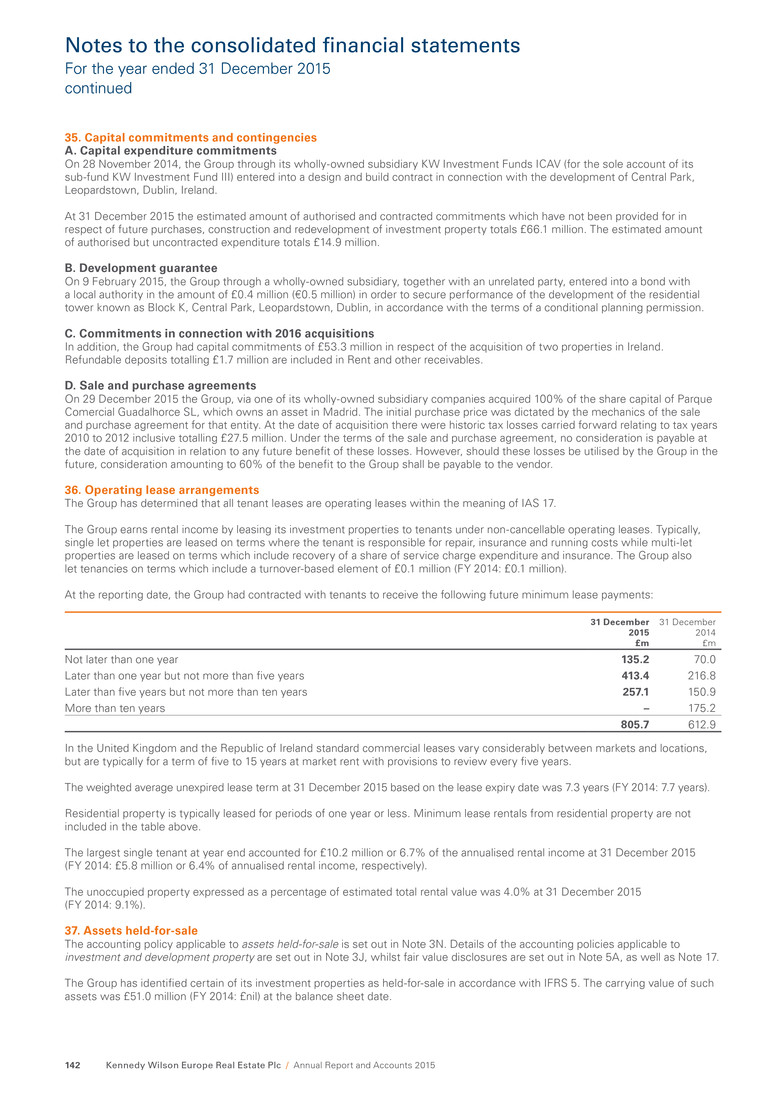

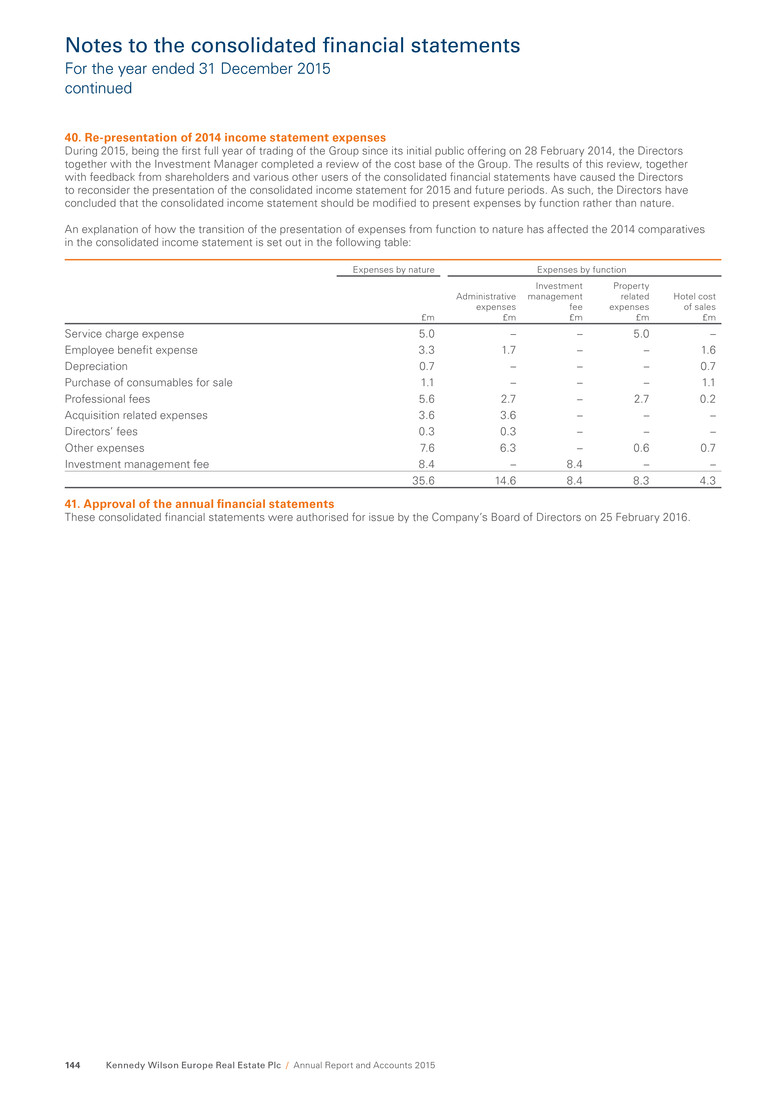

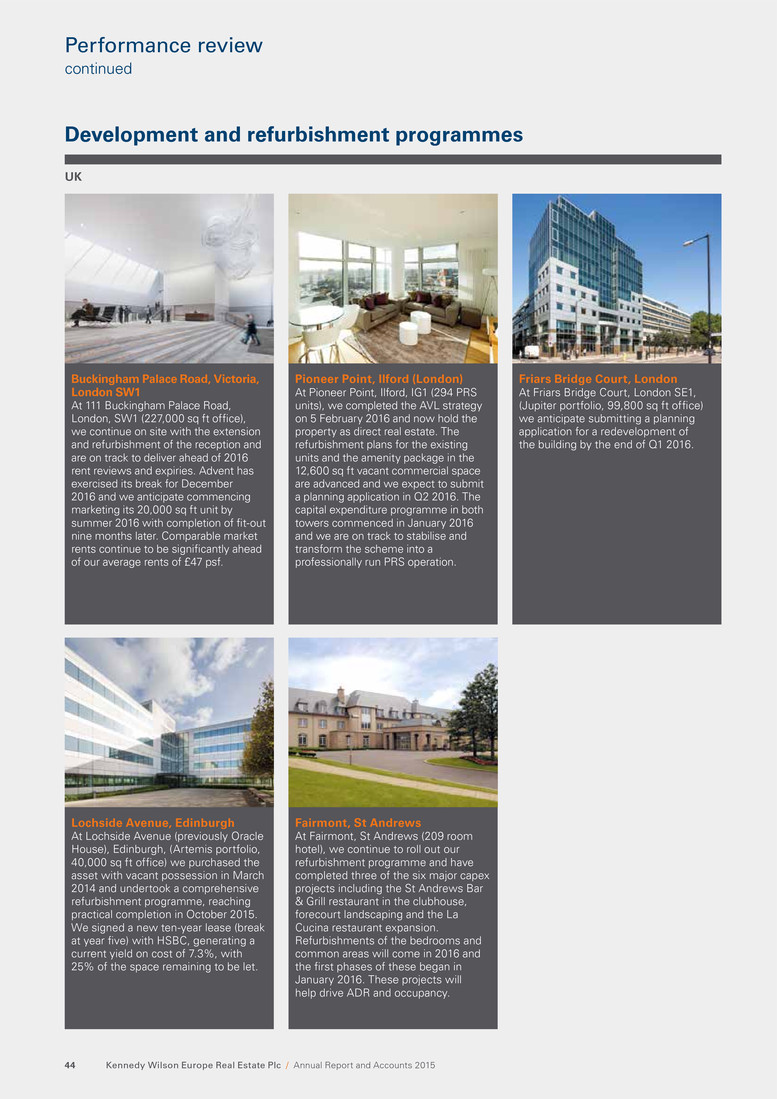

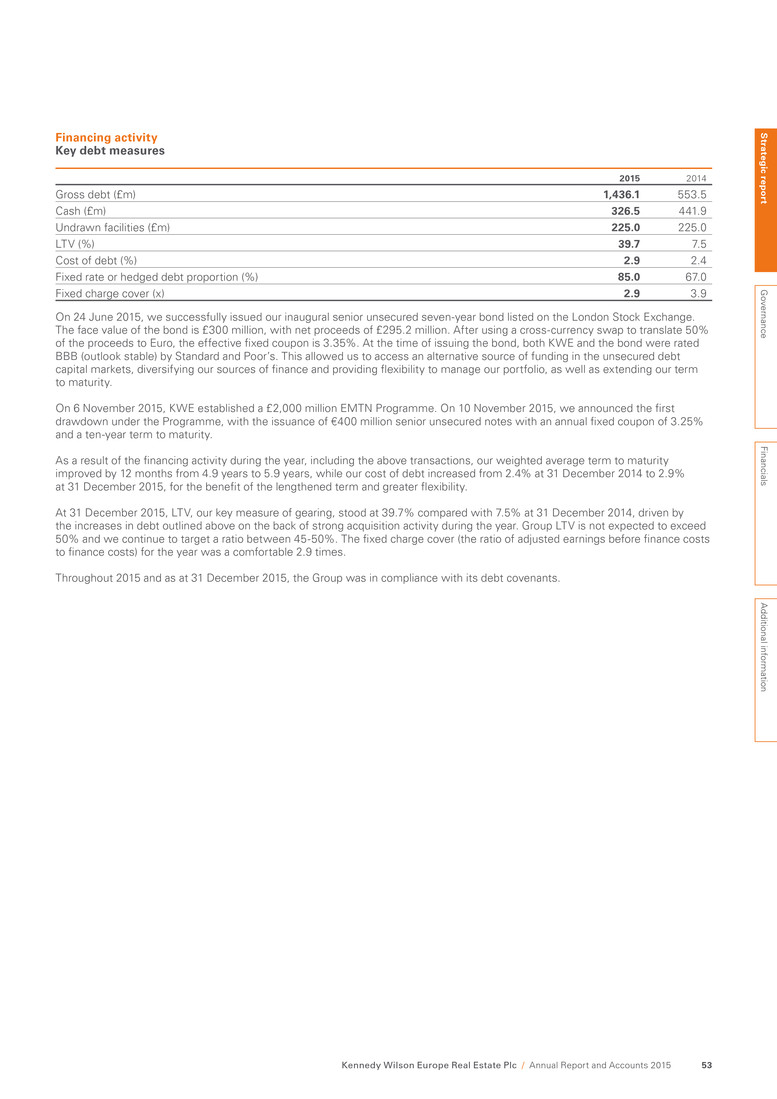

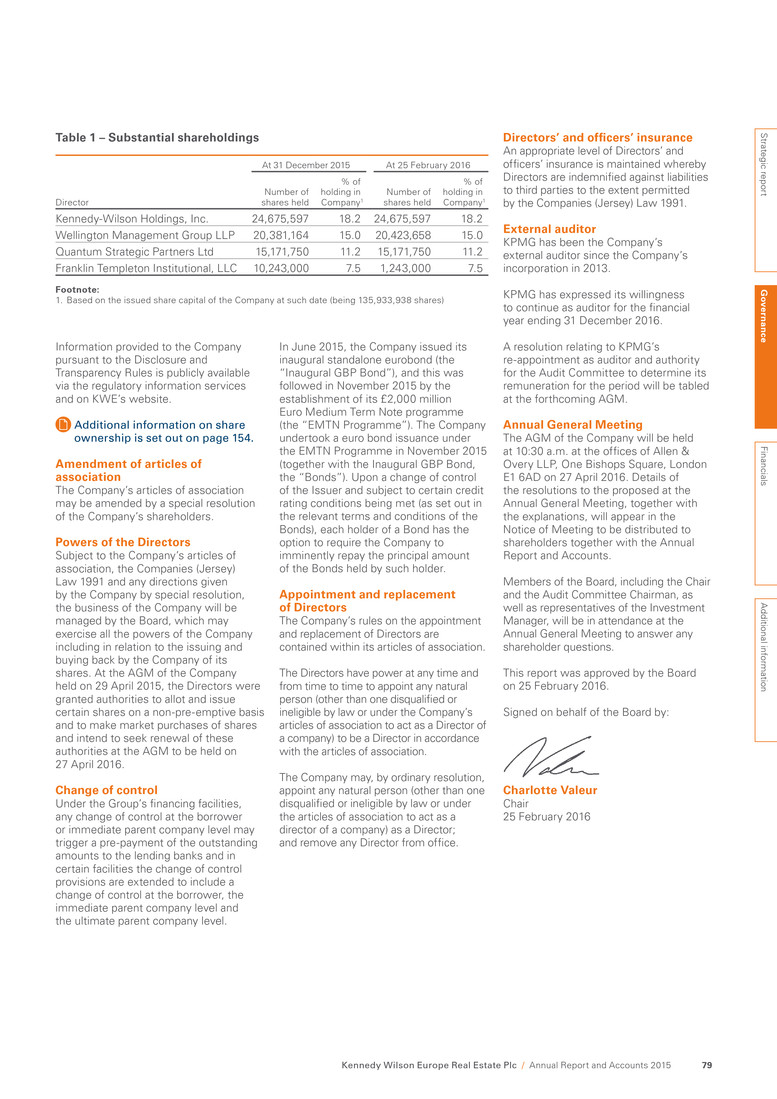

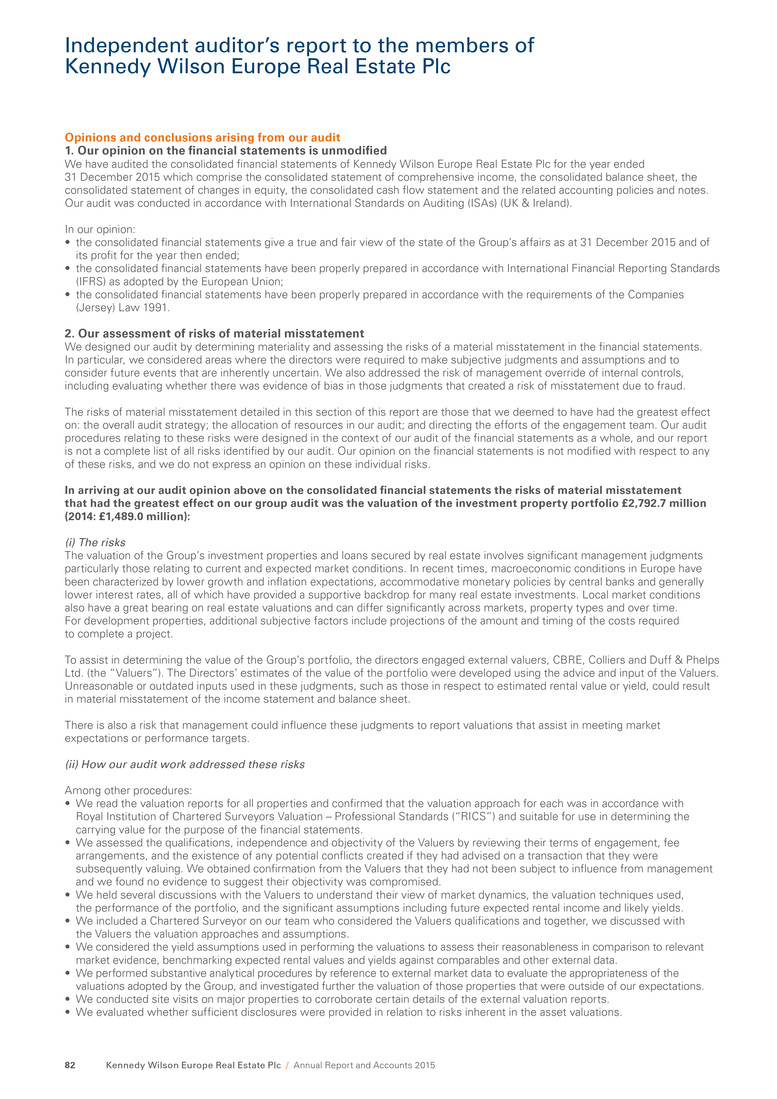

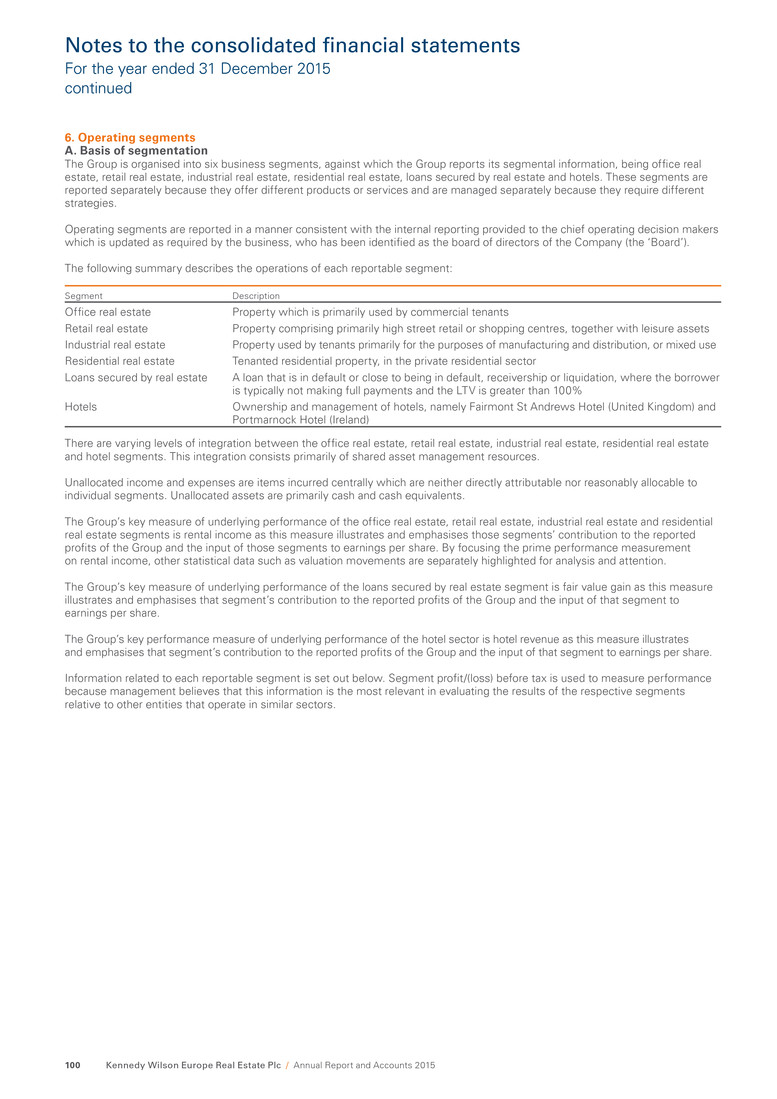

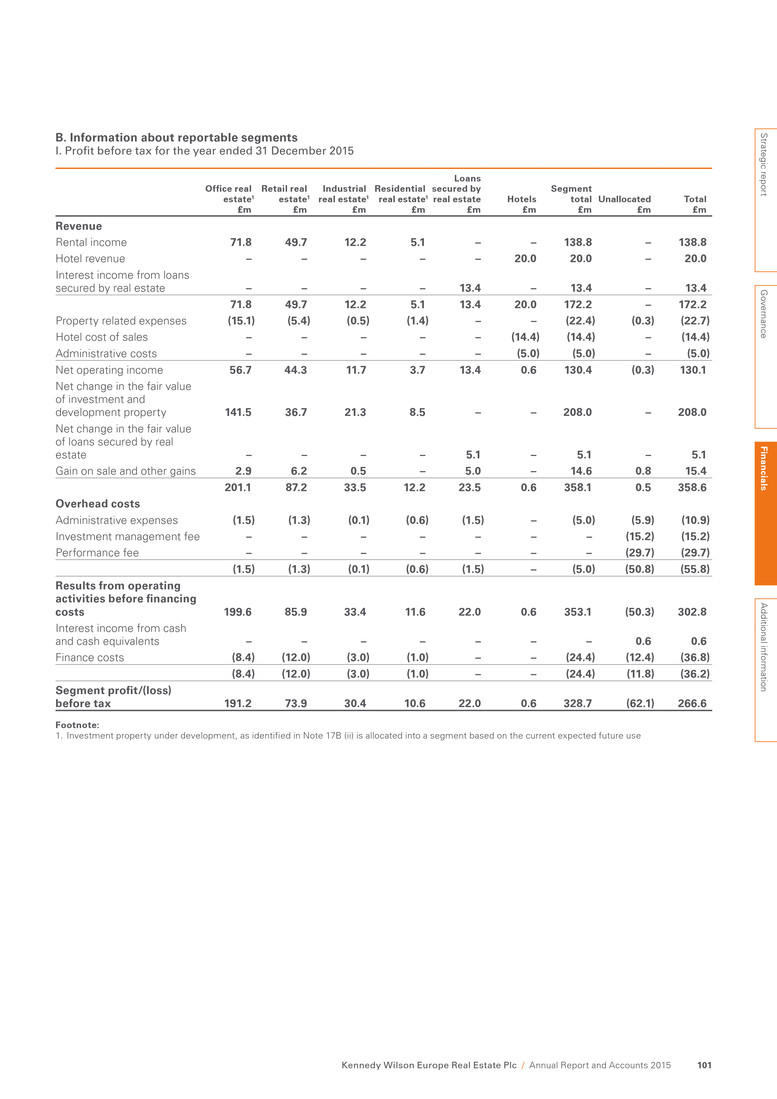

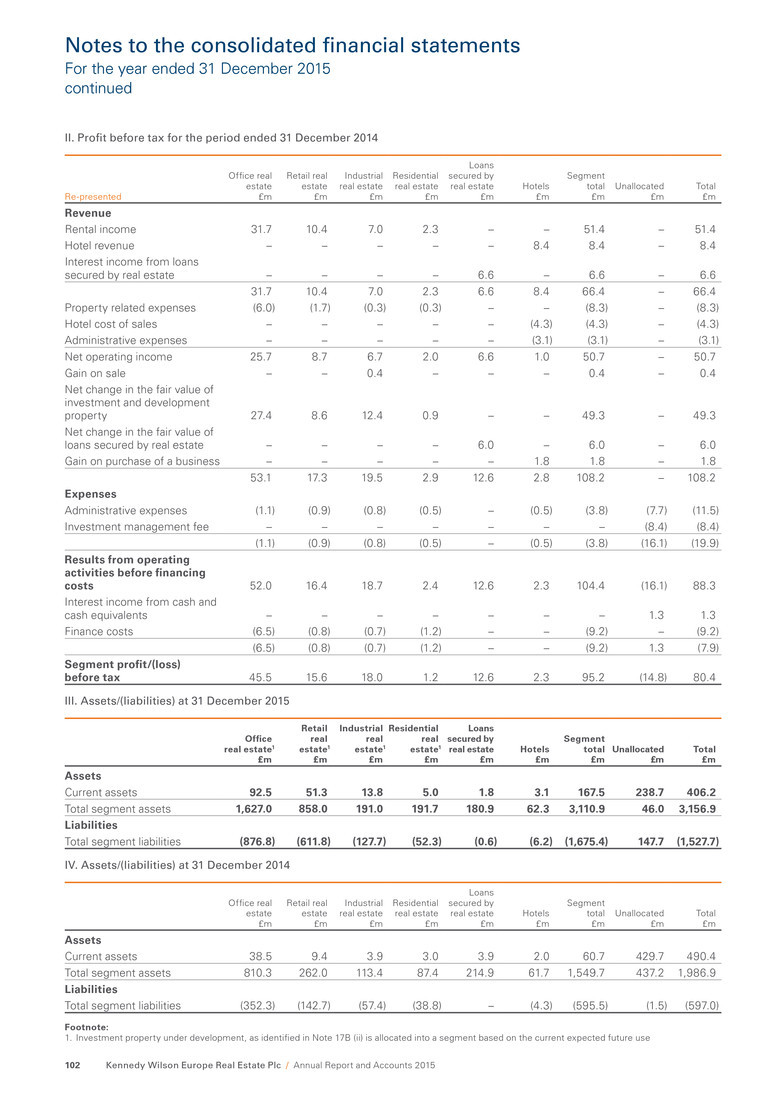

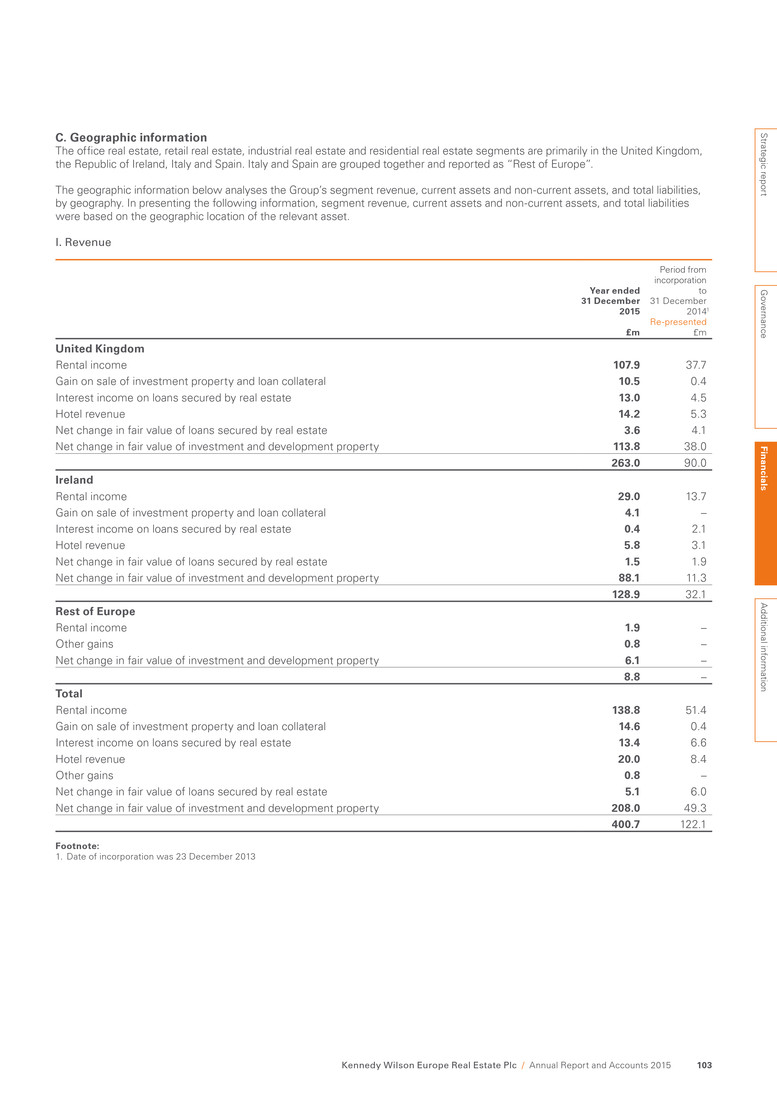

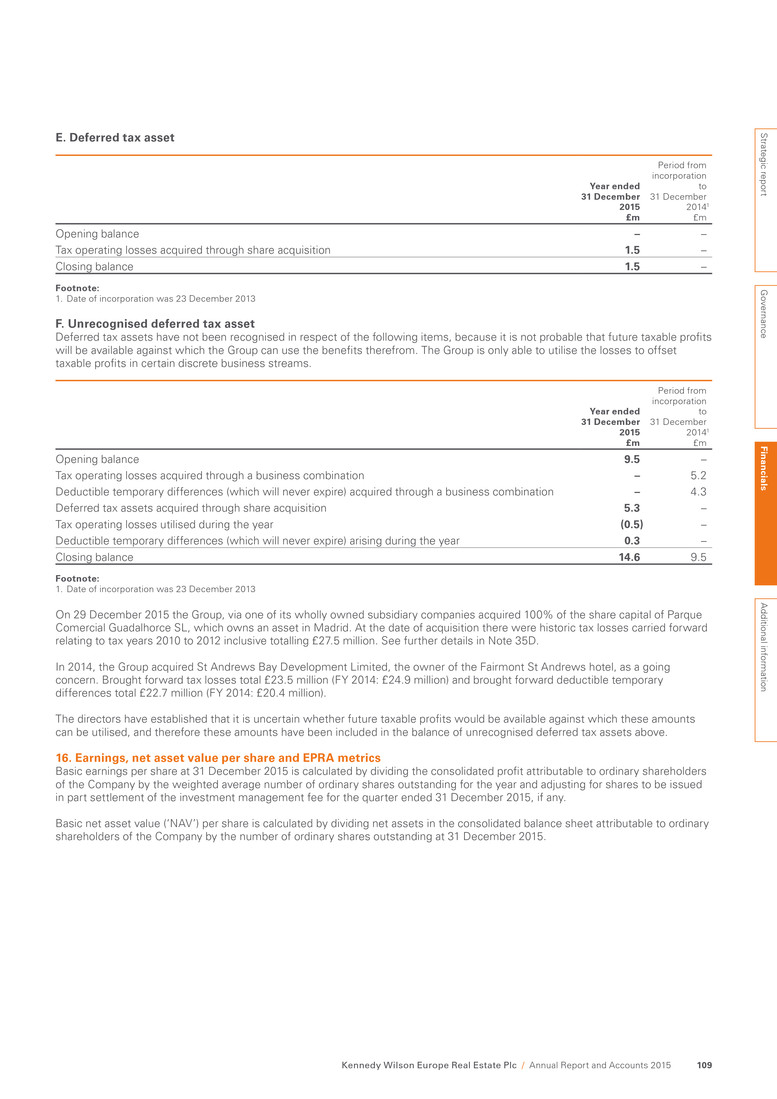

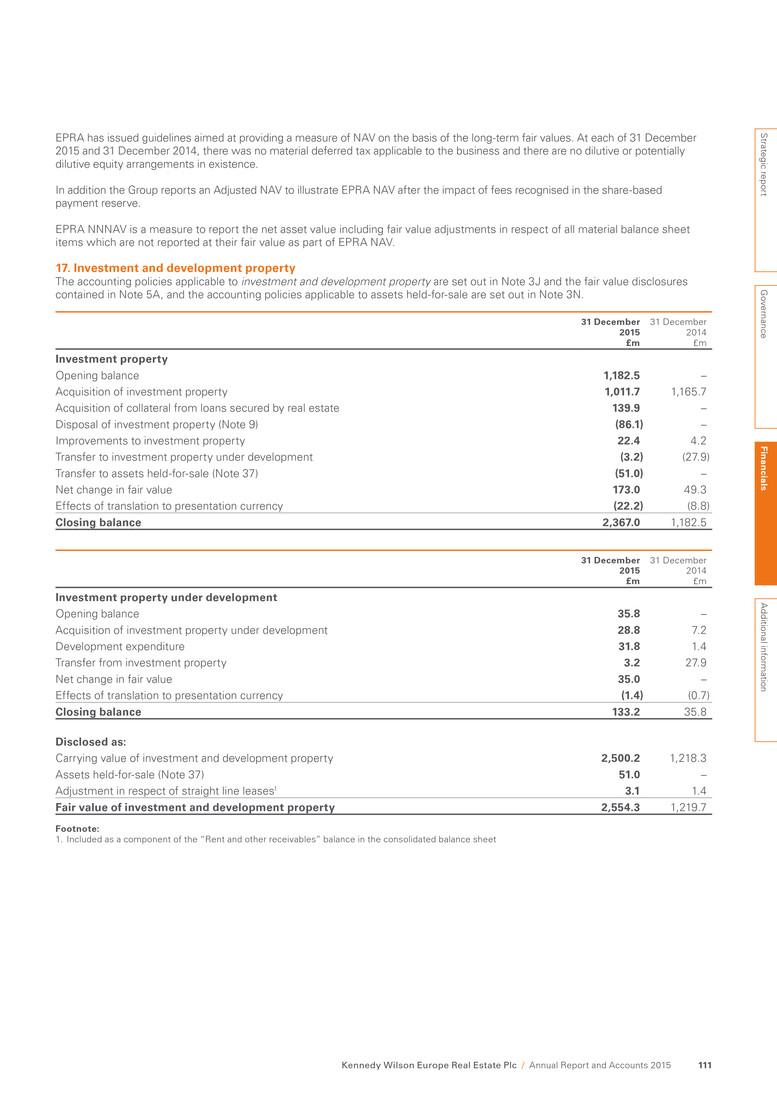

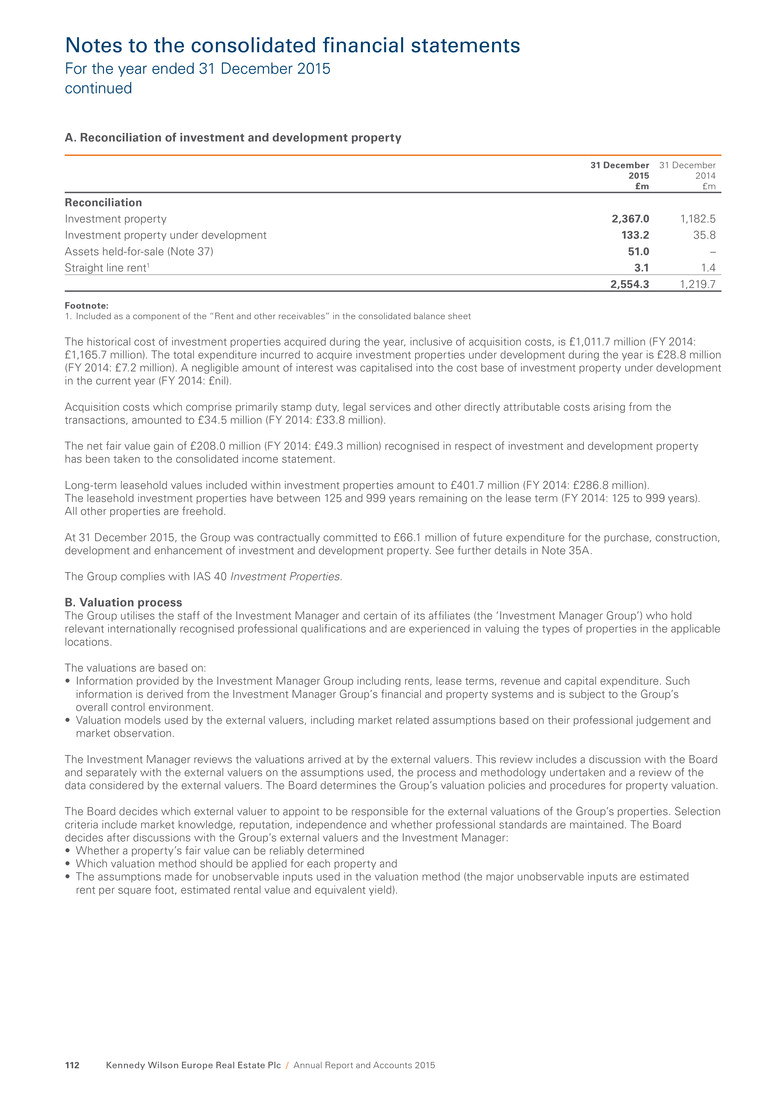

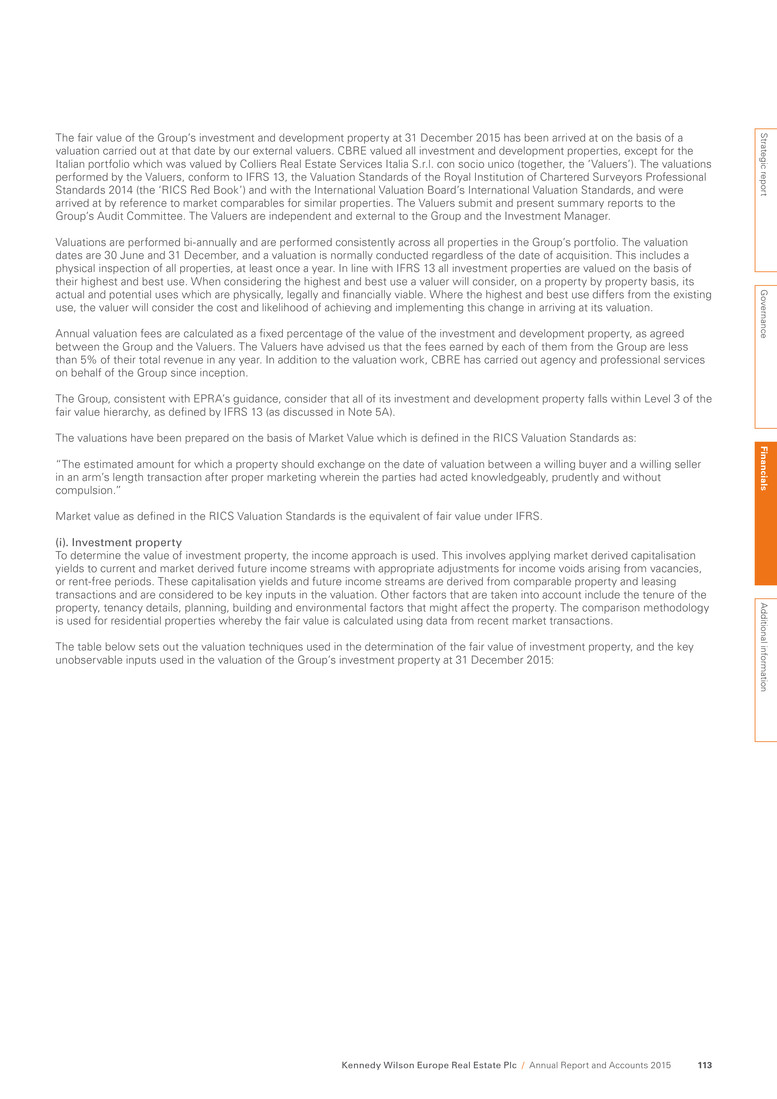

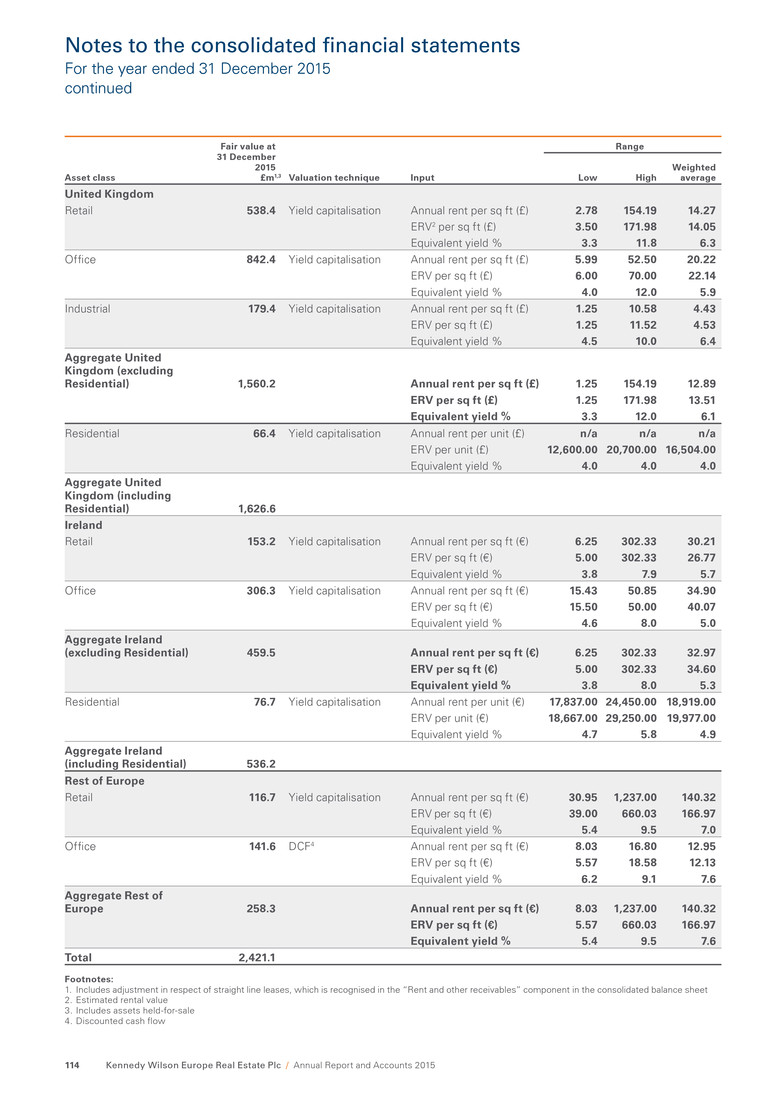

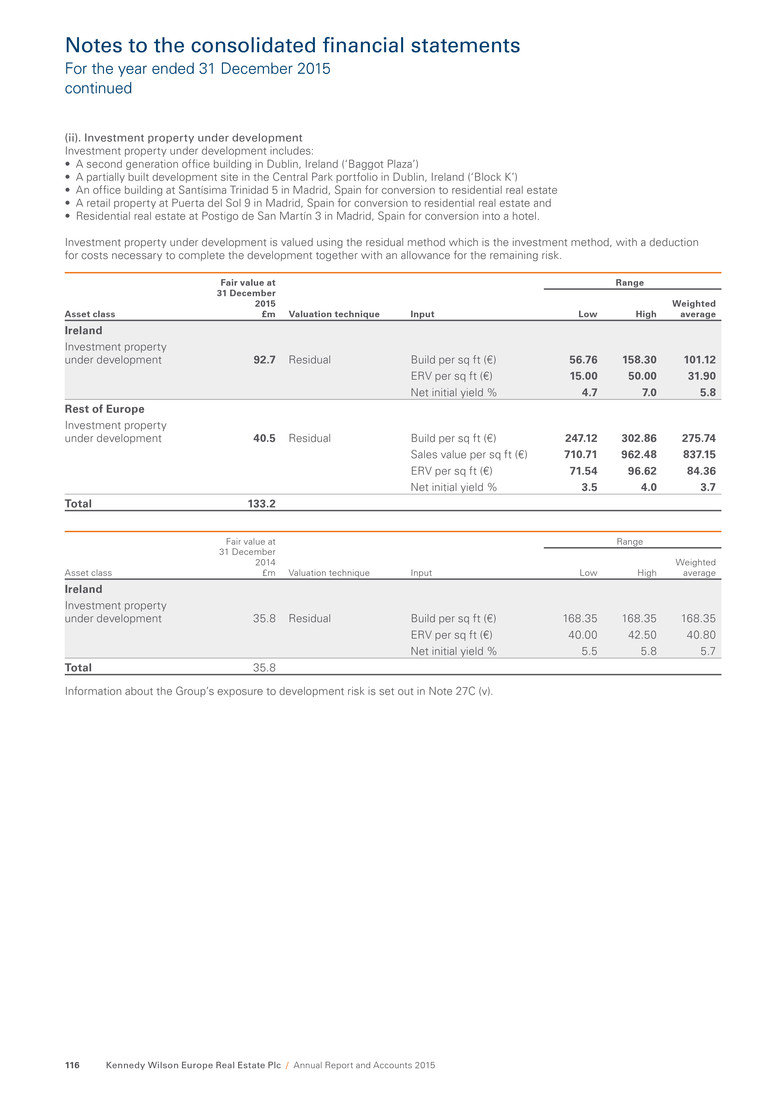

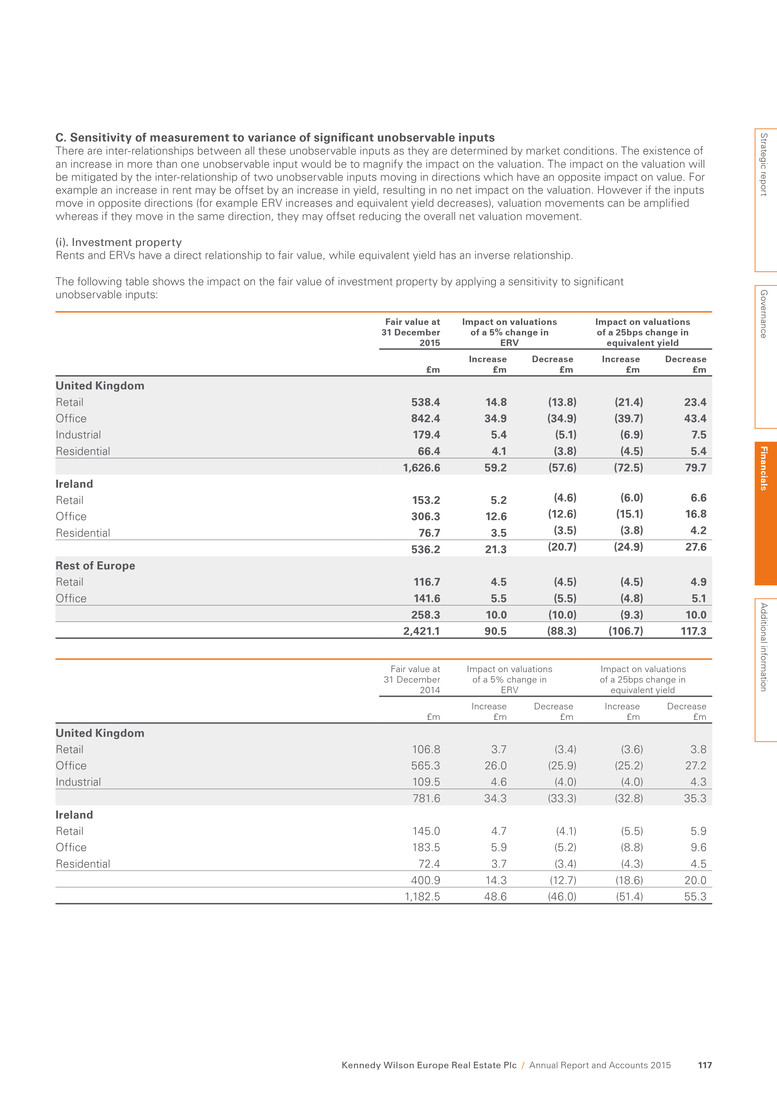

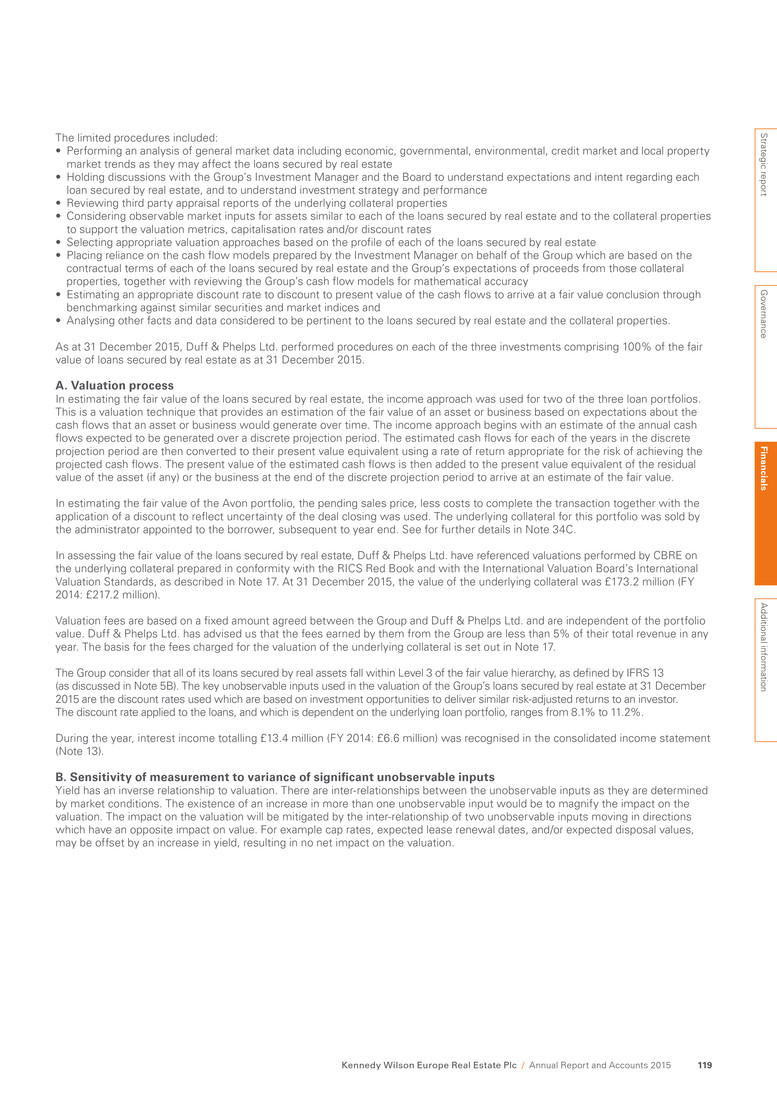

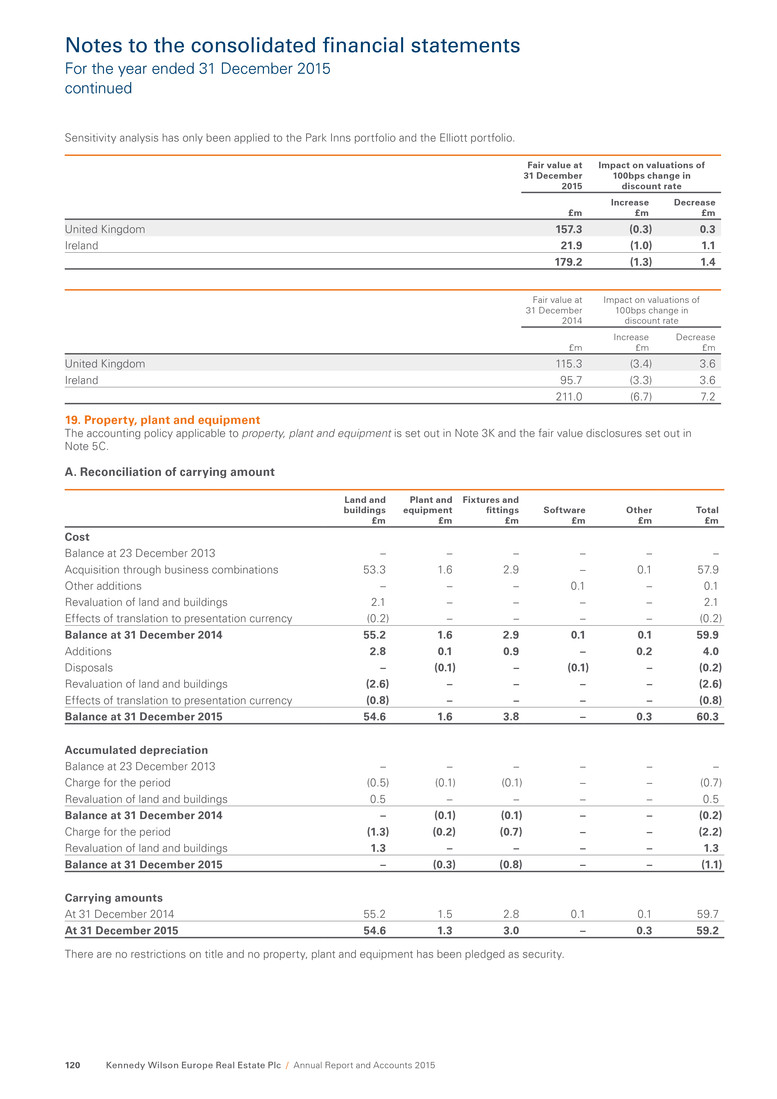

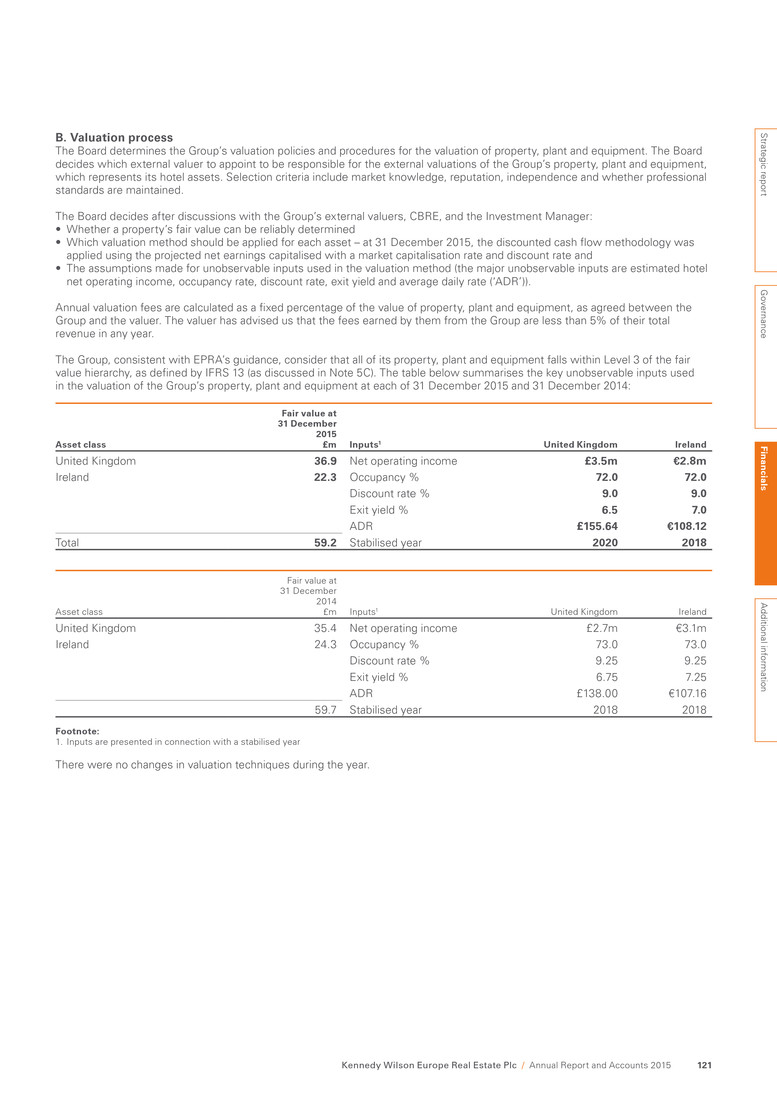

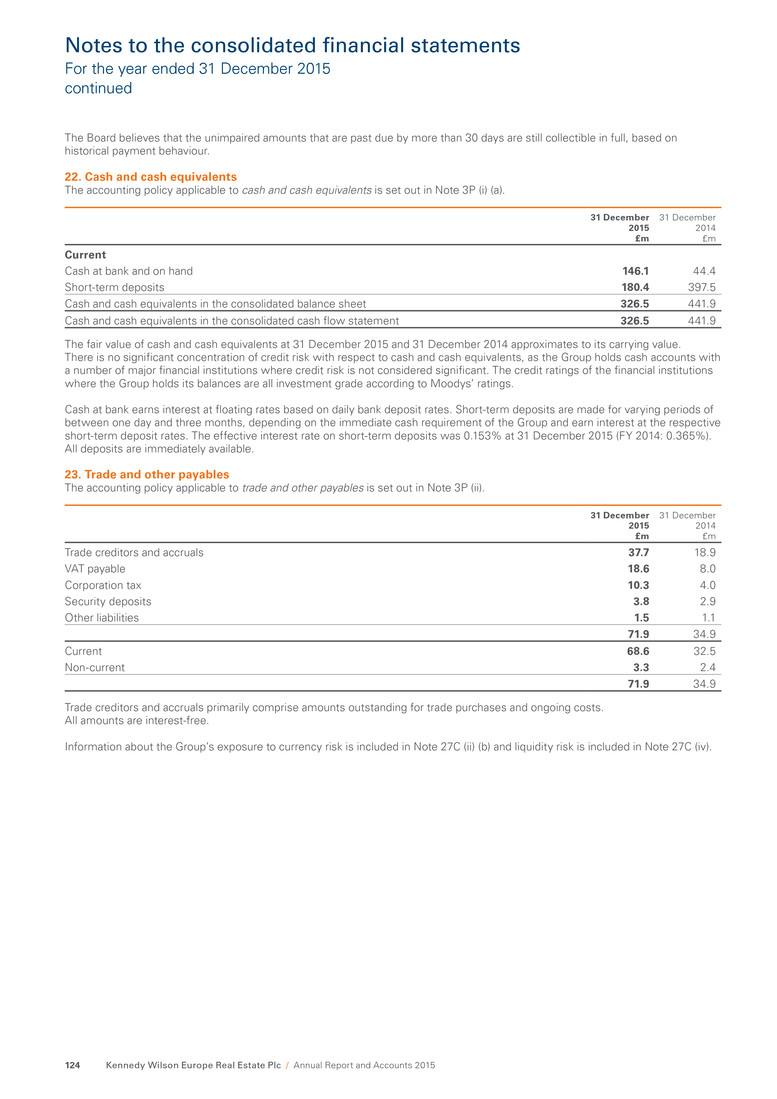

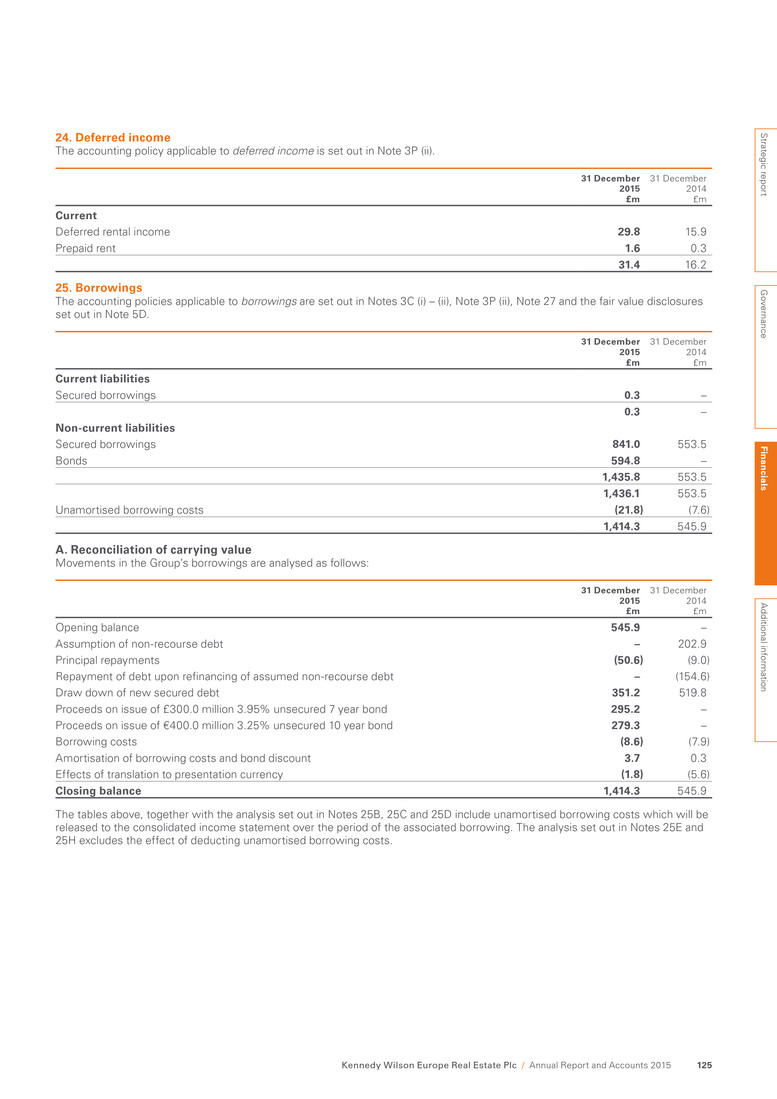

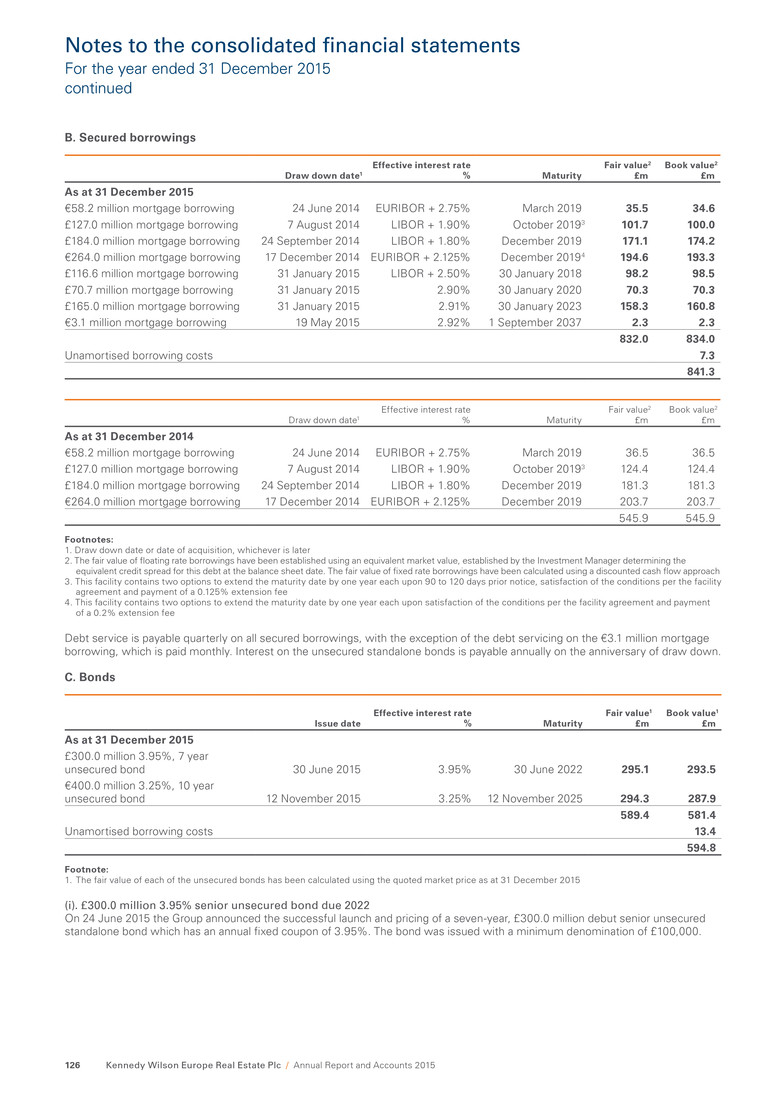

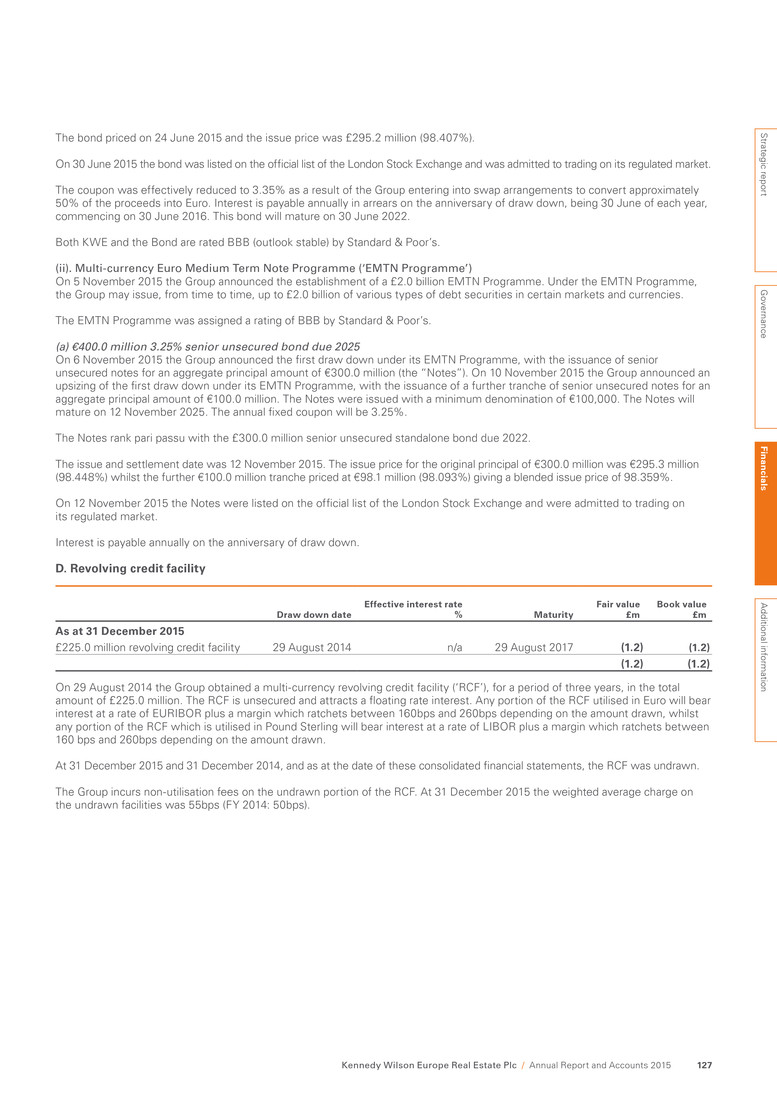

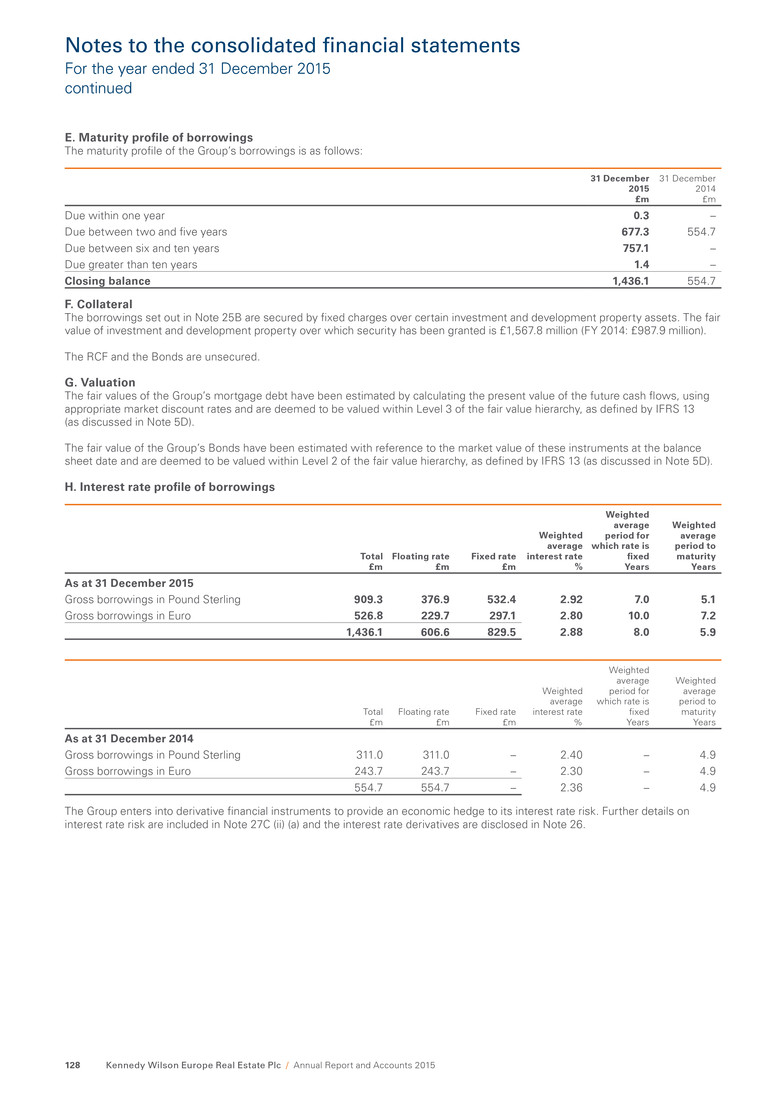

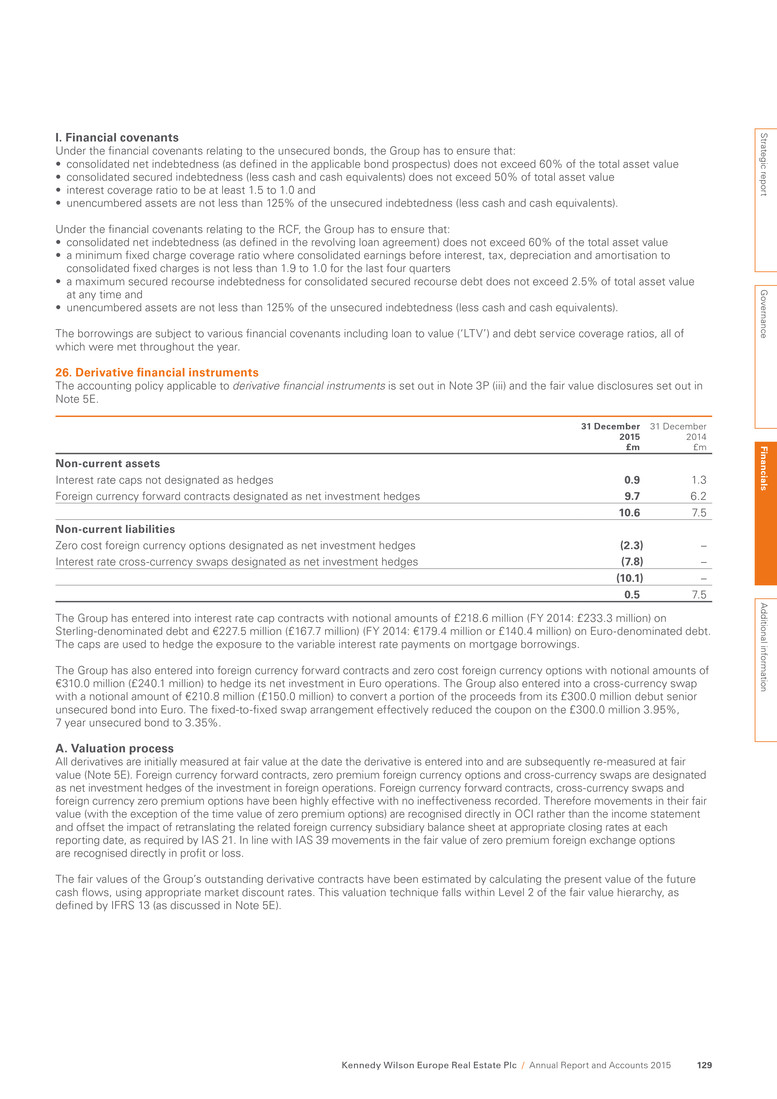

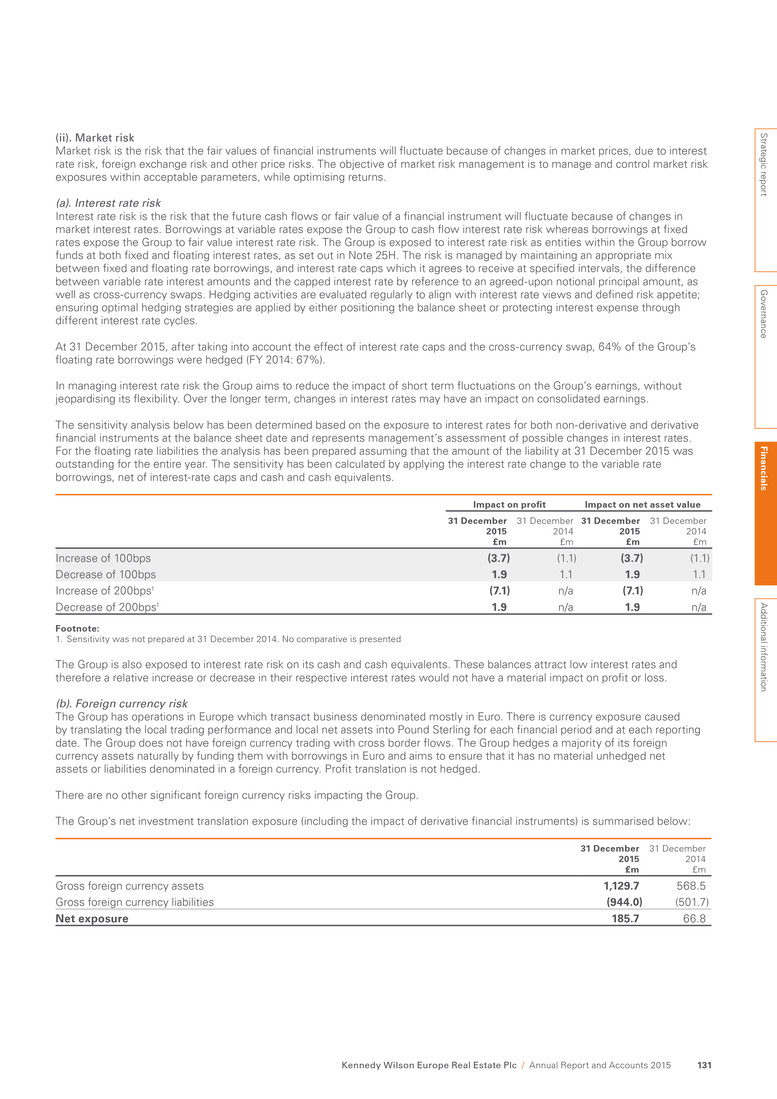

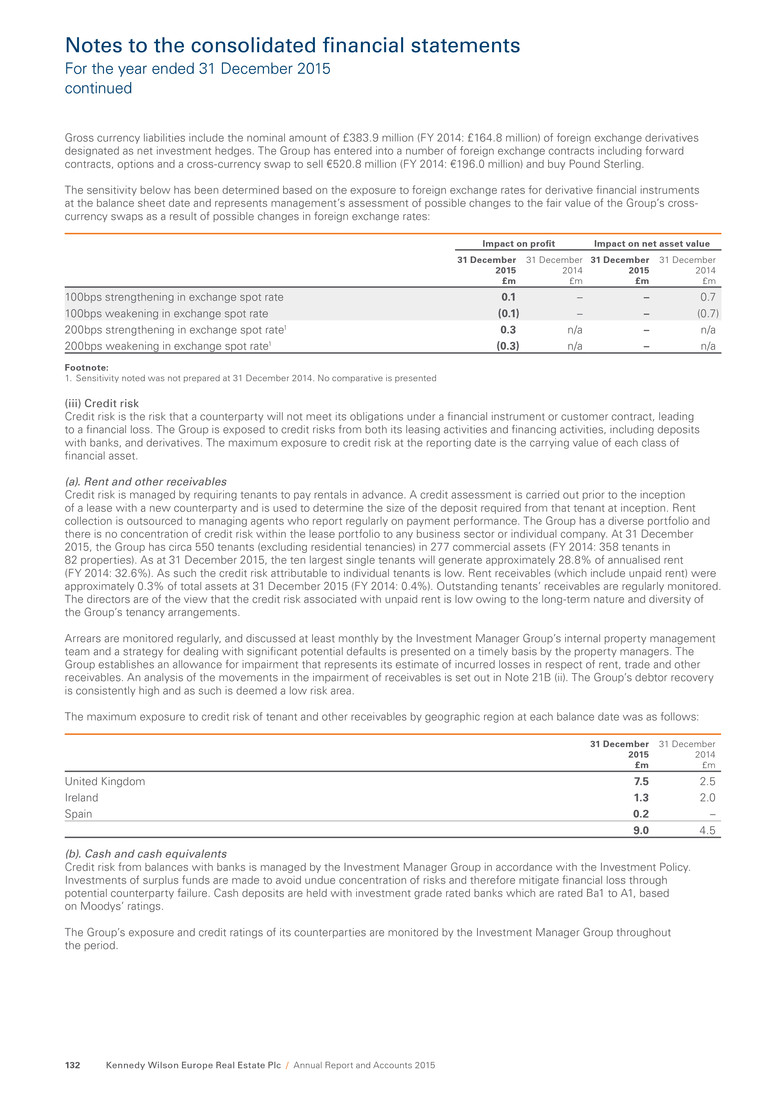

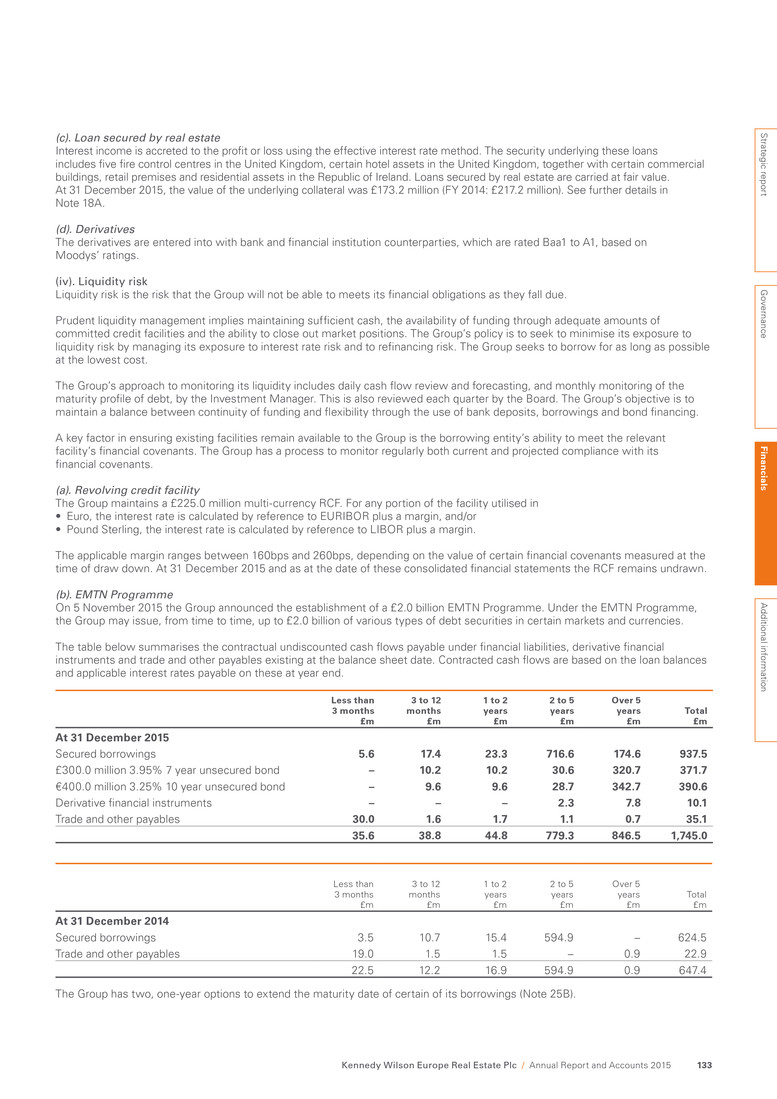

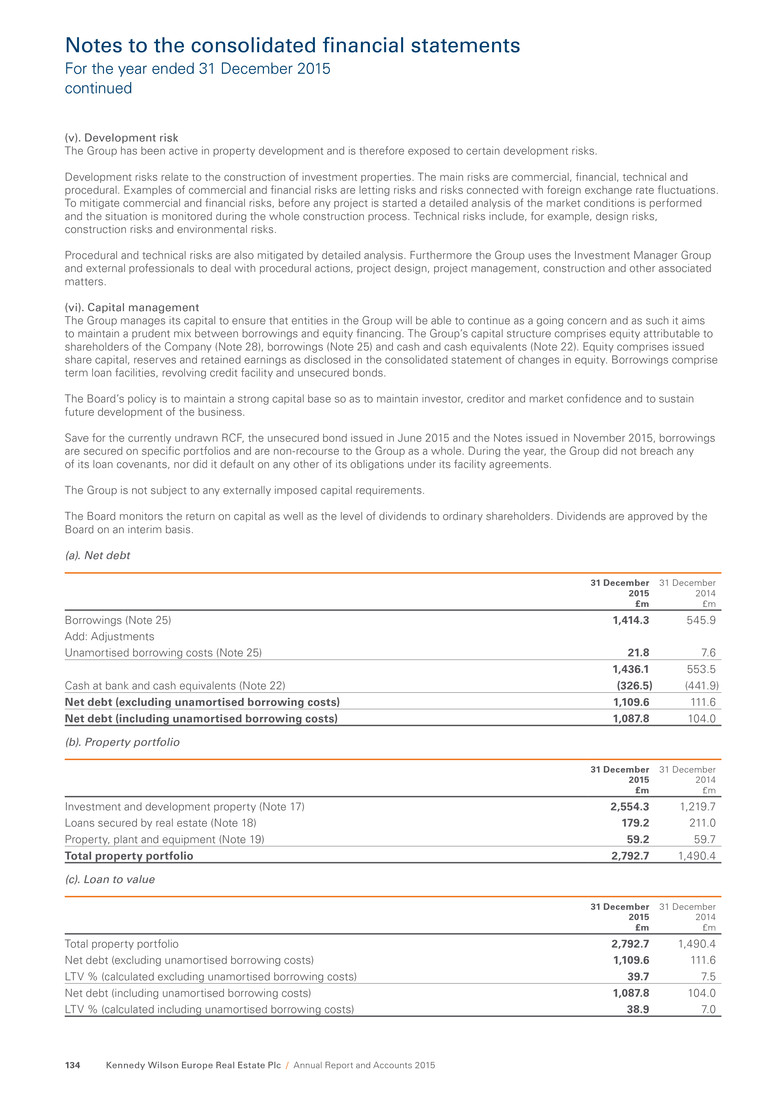

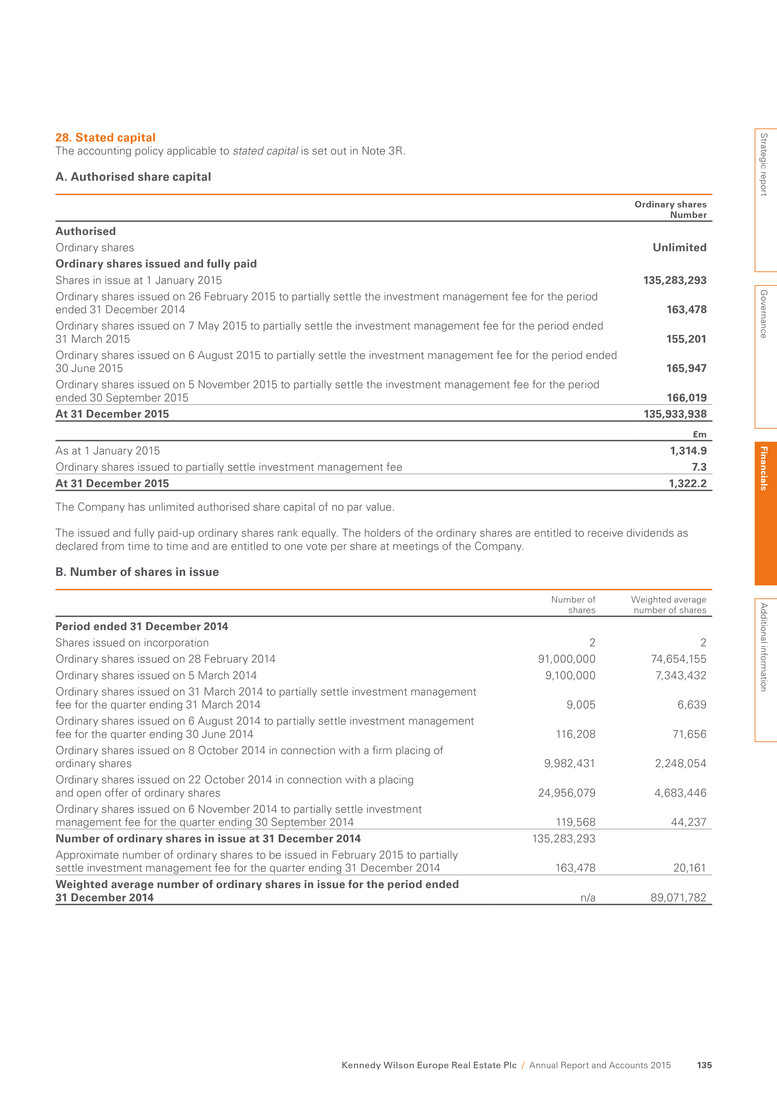

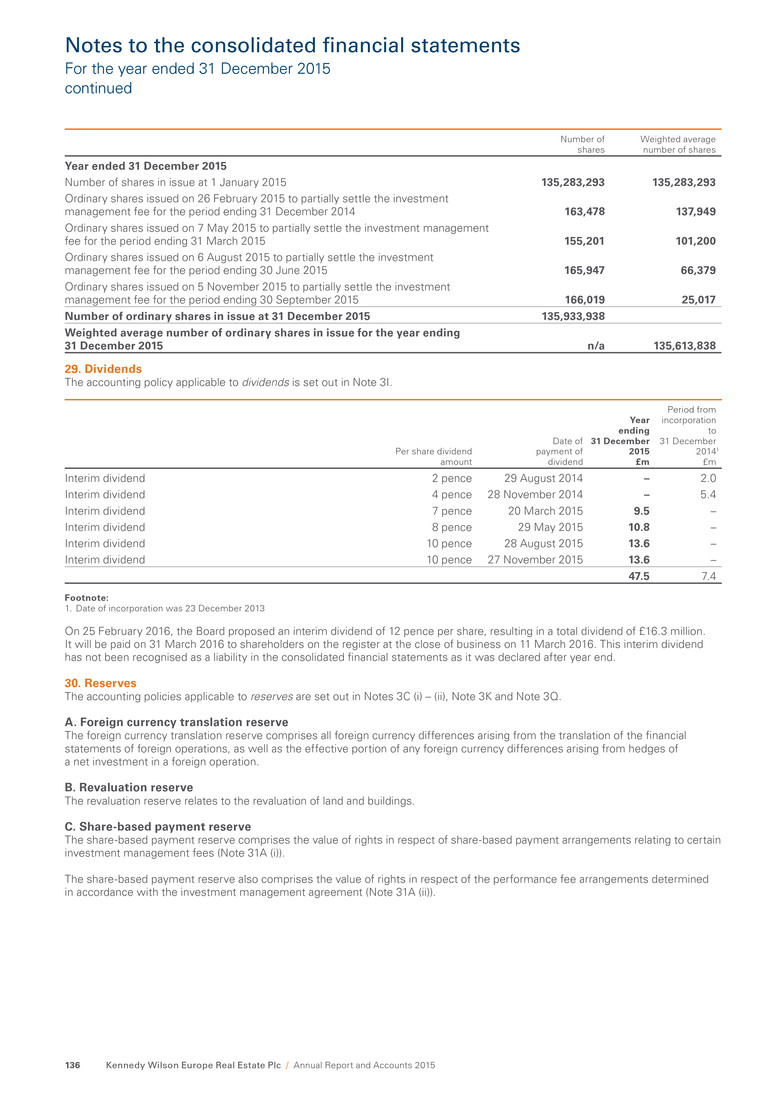

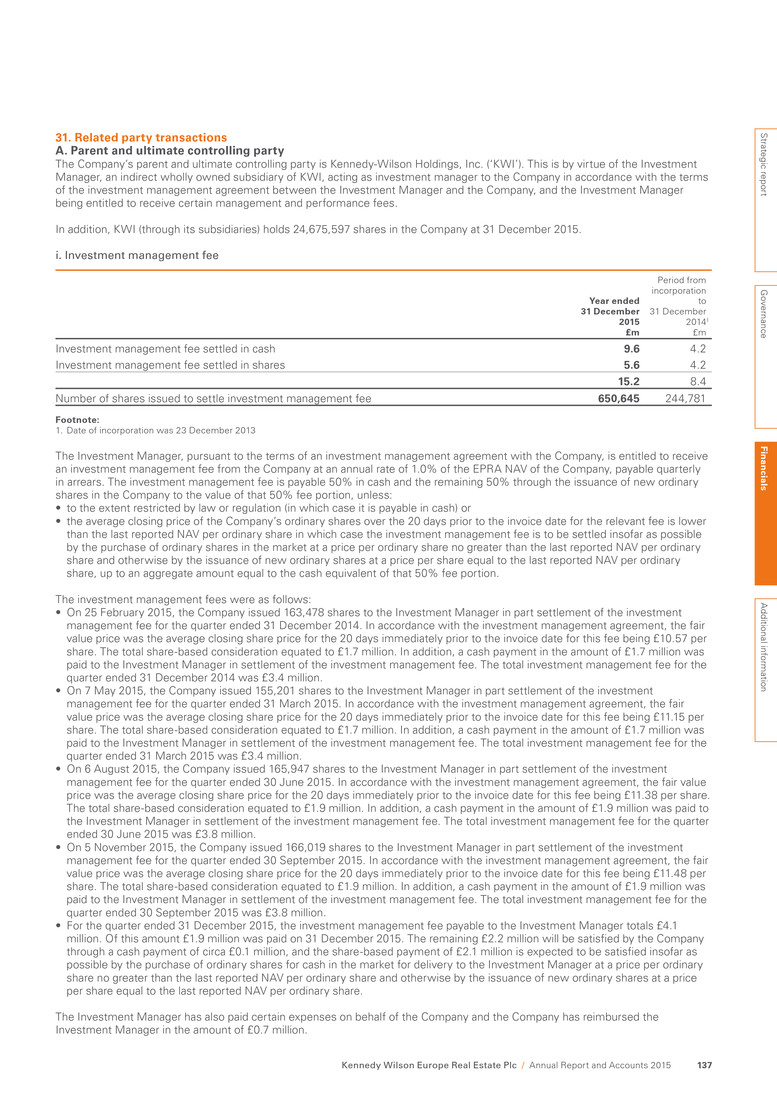

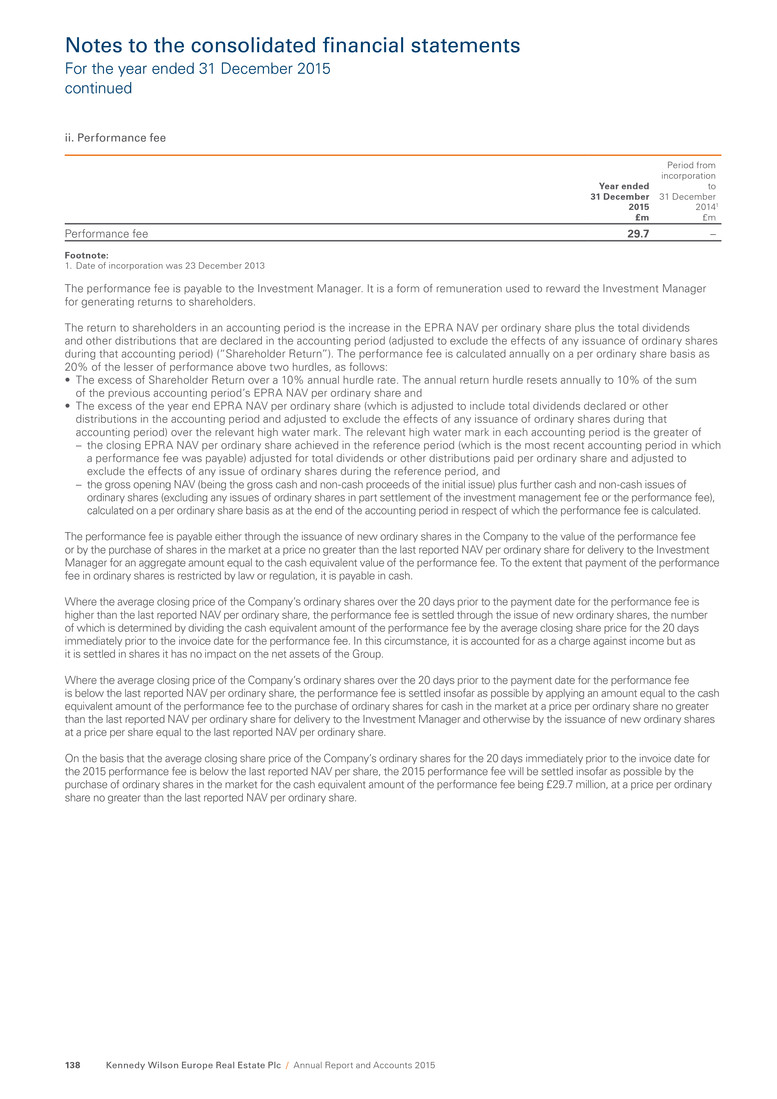

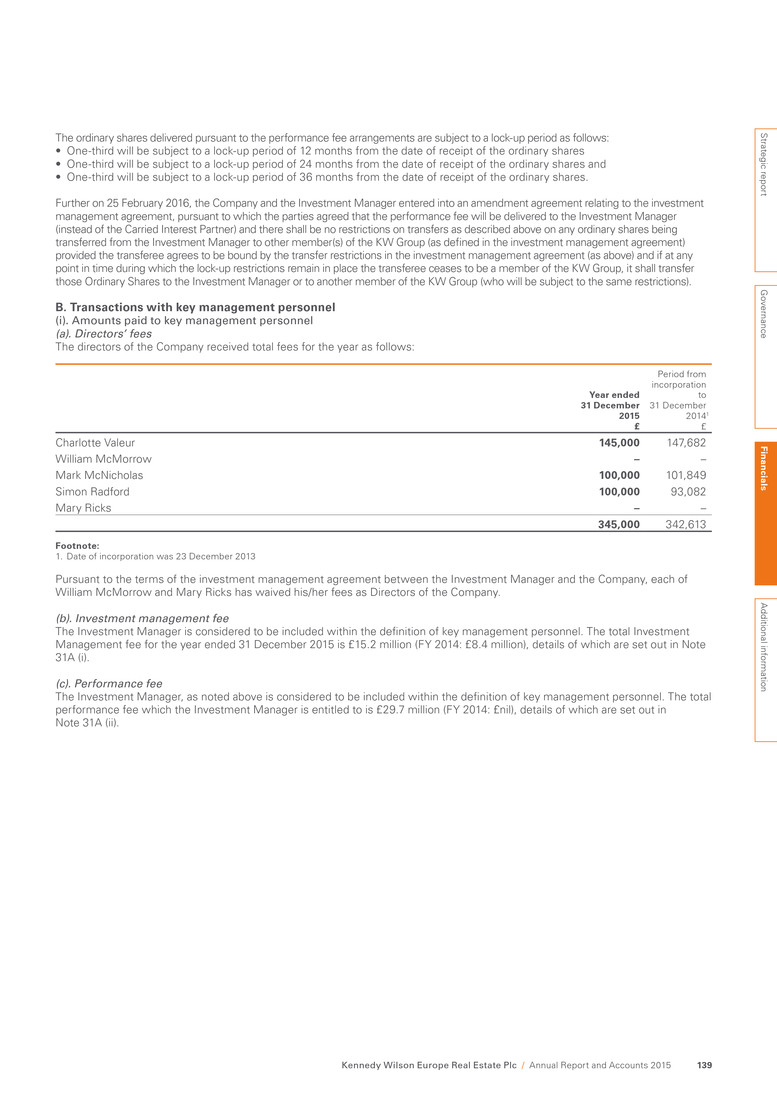

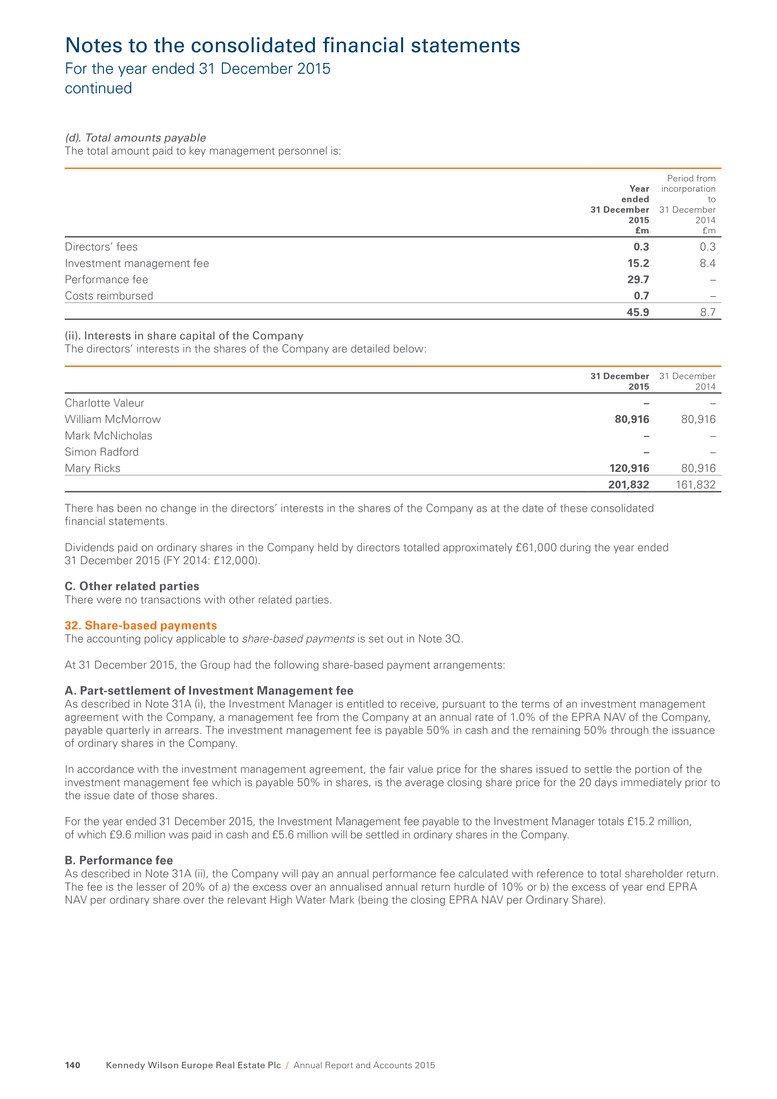

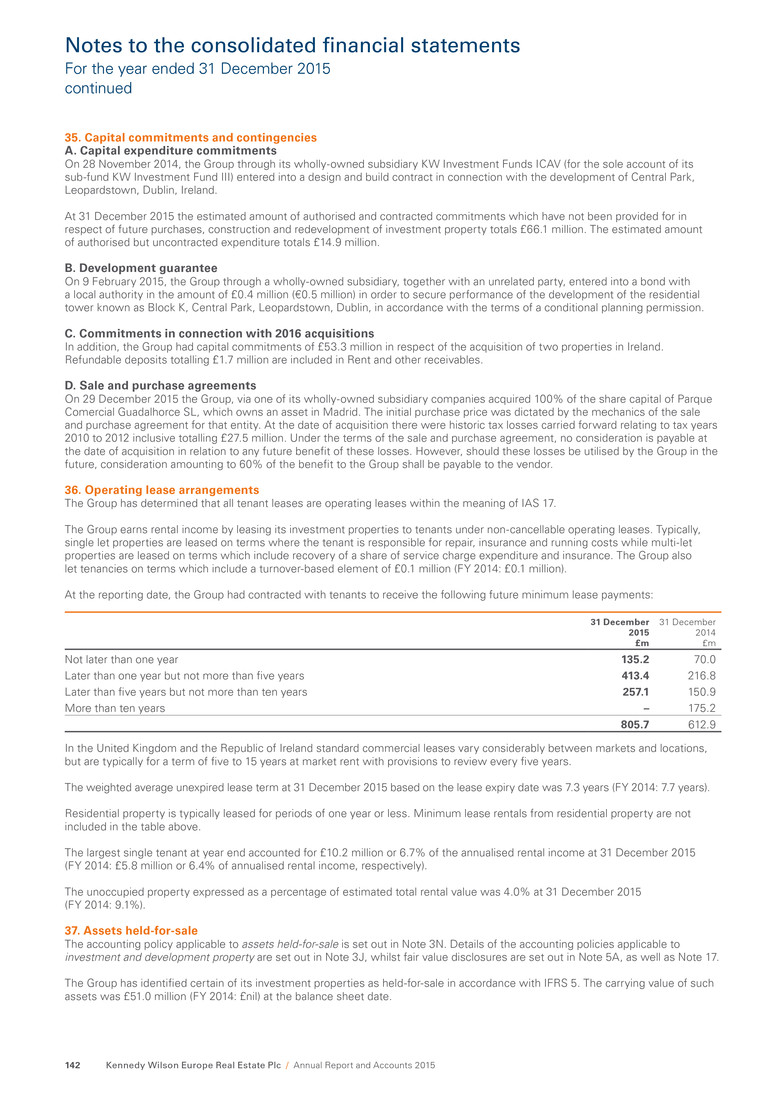

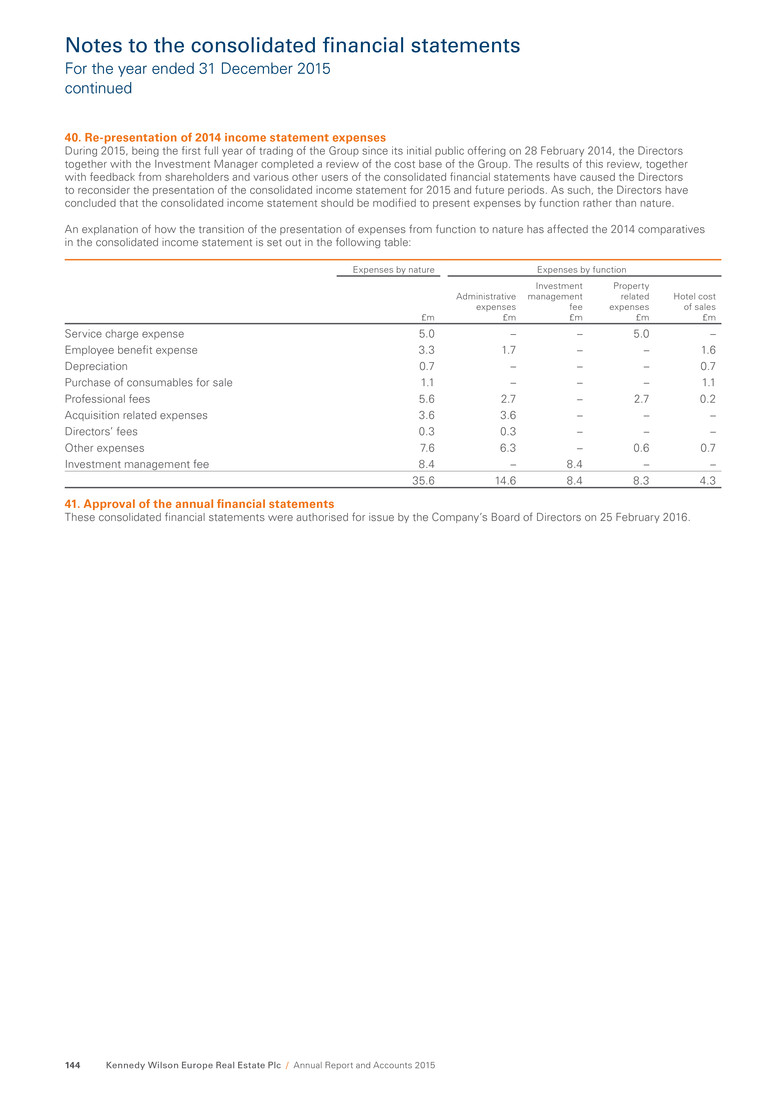

Strategic risks continued Risk Impact Mitigation 4 Development and construction Link to 2015 goals: 1, 3 Property development projects inherently carry risks with them. These include: • planning risk: the inability to secure planning consent due to political, legislative, regulatory and other risks inherent in the planning environment • construction risk: timing delays, reliance on third parties, including the risk of contractor failure, and additional cost overruns • occupier risk: occupiers may be reluctant to take space upon project completion. • At any point, aggregate development costs will not exceed 15% of the Group’s most recently published NAV, thereby reducing the overall potential impact of development risk. • The Investment Manager has a strong and experienced construction and development management team. They undertake extensive consultation, design and technical work prior to beginning any project, as well as engaging with relevant authorities at a local and national level, to ensure development proposals are in line with current and emerging policy. • For each project, we make a judgement about apportioning of construction risk. Where we retain this risk, we fix costs early in the process, subject to other market factors, with key contractors subject to a formal tender process and ongoing financial covenant review. • Market cycle and likely customer demand are assessed before committing to new developments and pre-lets are secured where appropriate. Operational risks Risk Impact Mitigation 5 Leverage and Treasury Link to 2015 goals: 2 Adverse interest rate or foreign currency movements may result in reduced earnings. Breach of bank facility or bond covenants could result in default and the requirement to repay debt ahead of planned maturities. Lack of control over bank accounts and cash movements across multiple jurisdictions and/or failure to monitor the creditworthiness of counterparties could result in sub-optimal returns or financial loss. • Interest rate risk is mitigated through a combination of fixed rate debt and derivative instruments, such as interest rate caps. As at 31 December 2015 85% of our borrowings were fixed or subject to hedging. • Foreign currency movements are offset by a combination of natural hedging through local currency borrowing and derivative instruments, such as cross-currency swaps. As at 31 December 2015 83% of Euro assets are hedged in this manner. • We regularly monitor our LTV and associated covenants, both on an actual and forecast. Our prudent treasury management policy ensures the Group always carries a sufficient level of cash to deal with unforeseen contingencies, as well as ensuring loan documentation includes cure rights for covenant breaches. • The Investment Manager provides a dedicated treasury management team, with cash control and monthly cash sweep mechanisms in place across the Group. The credit-rating and deposit rates of our banking partners are continuously monitored. Kennedy Wilson Europe Real Estate Plc / Annual Report and Accounts 201534 Managing risk continued