Unlocking the inherent value of under-resourced real estate Annual Report and Accounts 2016 Kennedy W ilson Europe R eal Estate Plc / A nnual R eport and A ccounts 2016

Baggot Plaza, Dublin LEED Gold certification In this Report Contents Strategic report 1 Who we are 2 Our business at a glance 4 How we performed in 2016 8 Chair’s introduction 10 Investment proposition 12 Our markets 16 Our business model 20 Our strategy and goals 22 KPIs, Group and EPRA measures 24 Resources and relationships 27 Responsible investments 35 Managing risk 42 Performance review 50 Finance review Governance 57 Letter from the Chair 59 Our statements of compliance 62 Leadership 67 Letter from the chair of the Nominations Committee 69 Effectiveness 70 Letter from the chair of the Audit Committee 74 Accountability 75 Letter from the chair of the Management Engagement Committee 76 Remuneration 77 Relations with shareholders 78 Directors’ report 80 Statement of Directors’ responsibilities Financials 82 Independent audit report 85 Consolidated income statement 86 Consolidated statement of comprehensive income 87 Consolidated balance sheet 88 Consolidated statement of changes in equity 90 Consolidated cash flow statement 92 Notes to the consolidated financial statements Additional information 145 Principal properties 146 Portfolio statistics and EPRA disclosures 149 Alternative performance measures 150 Additional disclosures 154 Directors, advisors and Company information 155 Shareholder information 155 Financial calendar 156 Definitions and glossary For more information Look for page references for additional content Links are illustrated with the following markers: Go to page For further relevant information go to the page reference. Extra web content See website for further content. www.kennedywilson.eu Governance Read about our framework, approach and how we manage our business. Go to page 57 Leadership Accountability Effectiveness Remuneration Relations with shareholders Our markets Read about key trends and conditions across our markets. Go to page 12 Investment proposition Read about the reasons to invest in KWE. Go to page 10 Responsible investments Read about our Priorities and EPRA sBPR performance for 2016. Go to page 27 Go to www.kennedywilson.eu/about-us/responsible- investments/

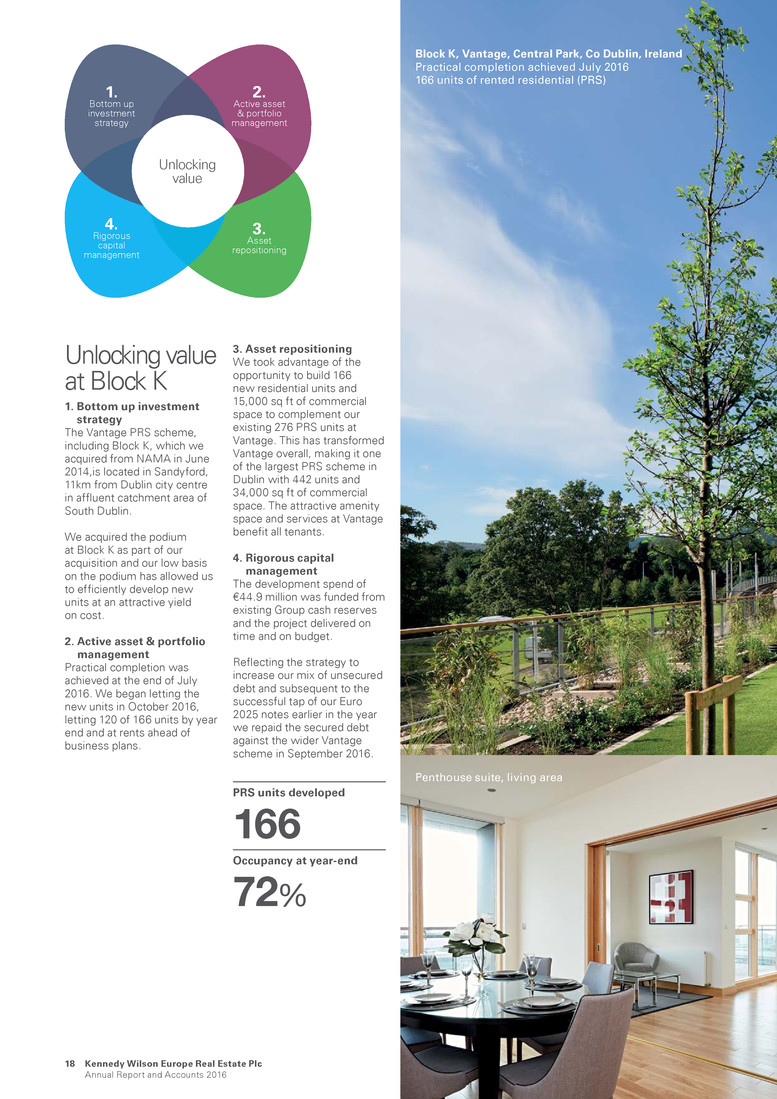

Unlocking value 2. Active asset & portfolio management 1. Bottom up investment strategy 3. Asset repositioning 4. Rigorous capital management Unlocking value We generate sustainable total returns by unlocking the inherent value of under–resourced real estate. Bottom up investment strategy We apply a bottom up approach to underwriting each asset we acquire, believing value can be found and enhanced in a variety of market conditions. Active asset & portfolio management We aim to bring practical solutions to our occupiers, to meet their evolving space needs, also allowing us to grow the quantum and duration of our income. Asset repositioning Many of our properties offer repositioning opportunities where we can undertake development or refurbishment to transform the property to meaningfully improve rents and capital values. Rigorous capital management We endeavour to keep our balance sheet efficient and ensure adequate flexibility to support our strategy. What we do How we do it Who we are Kennedy Wilson Europe Real Estate plc is a property company that invests in real estate across the UK, Ireland, Spain and Italy. Our portfolio of £2,882.2 million is primarily invested in office, retail, residential and industrial, weighted towards London and the South East of England and Dublin. By strategically acquiring assets from vendors who are not core real estate operators, we aim to unlock the inherent value of under-resourced real estate – namely properties that are under-managed or under-capitalised – to generate superior returns for our investors. Financial performance in 2016 Dividend per share growth +37.1% Dividend per share 48.0p Adjusted earnings per share growth +15.2% Adjusted earnings per share 55.2p Adjusted NAV per share growth +3.5% Adjusted NAV per share 1,215.9p S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 1

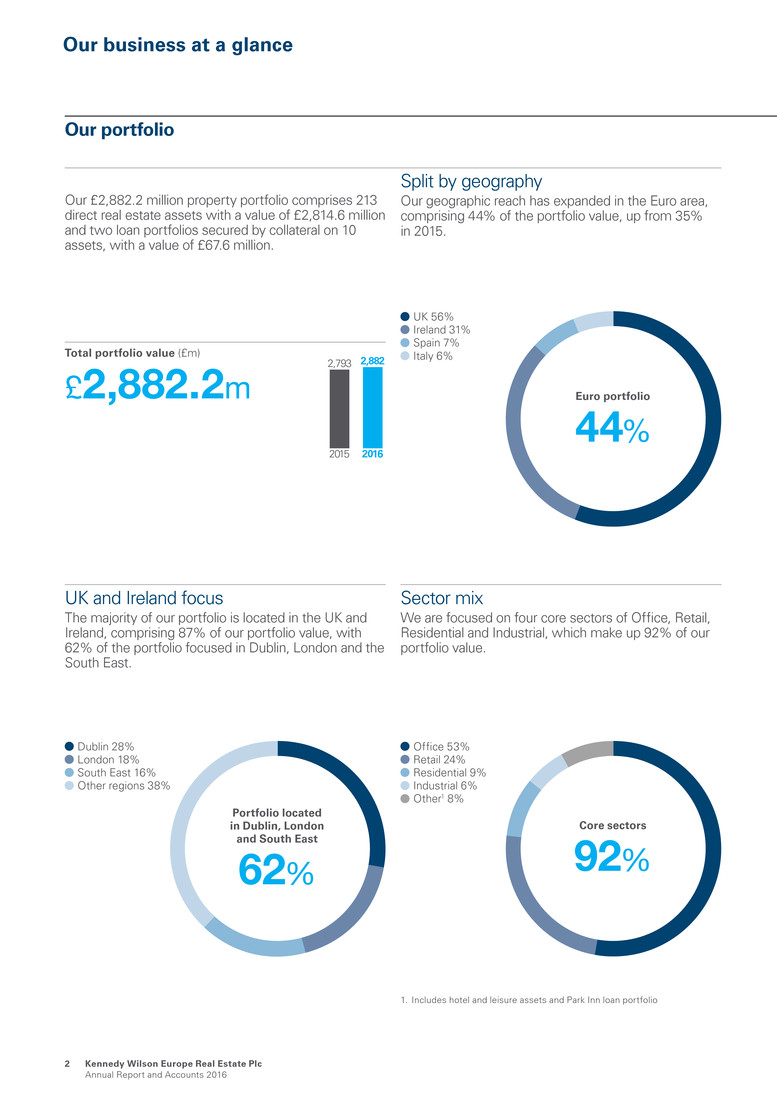

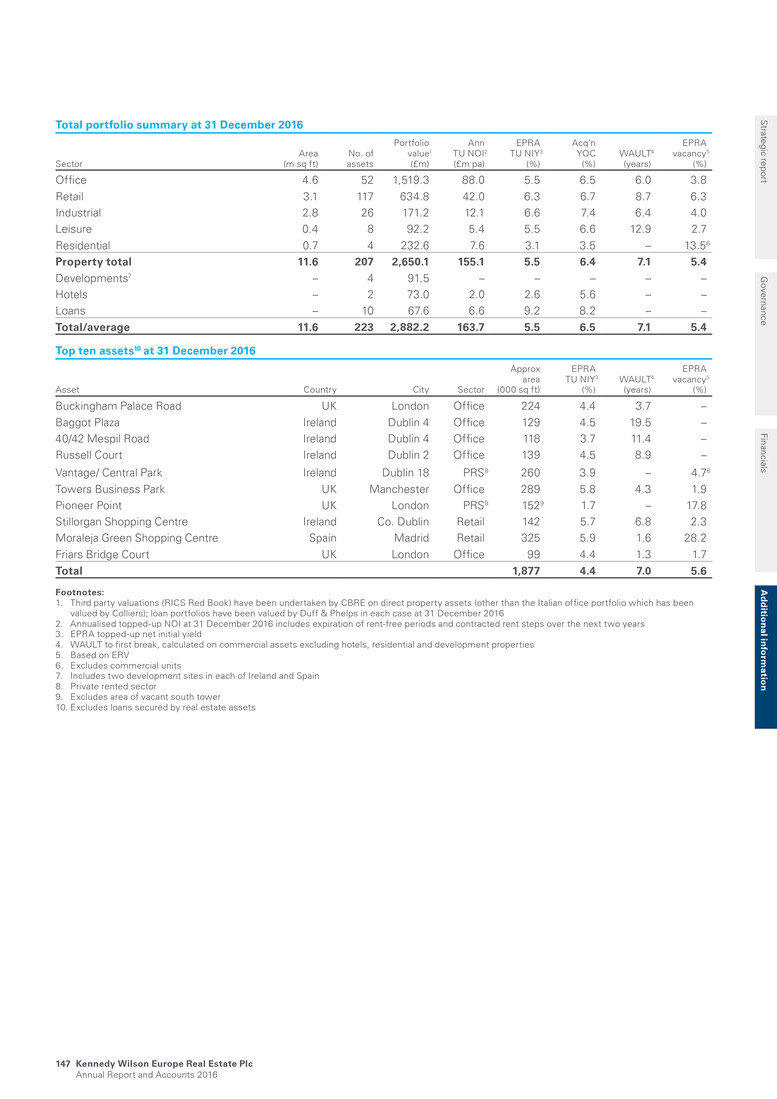

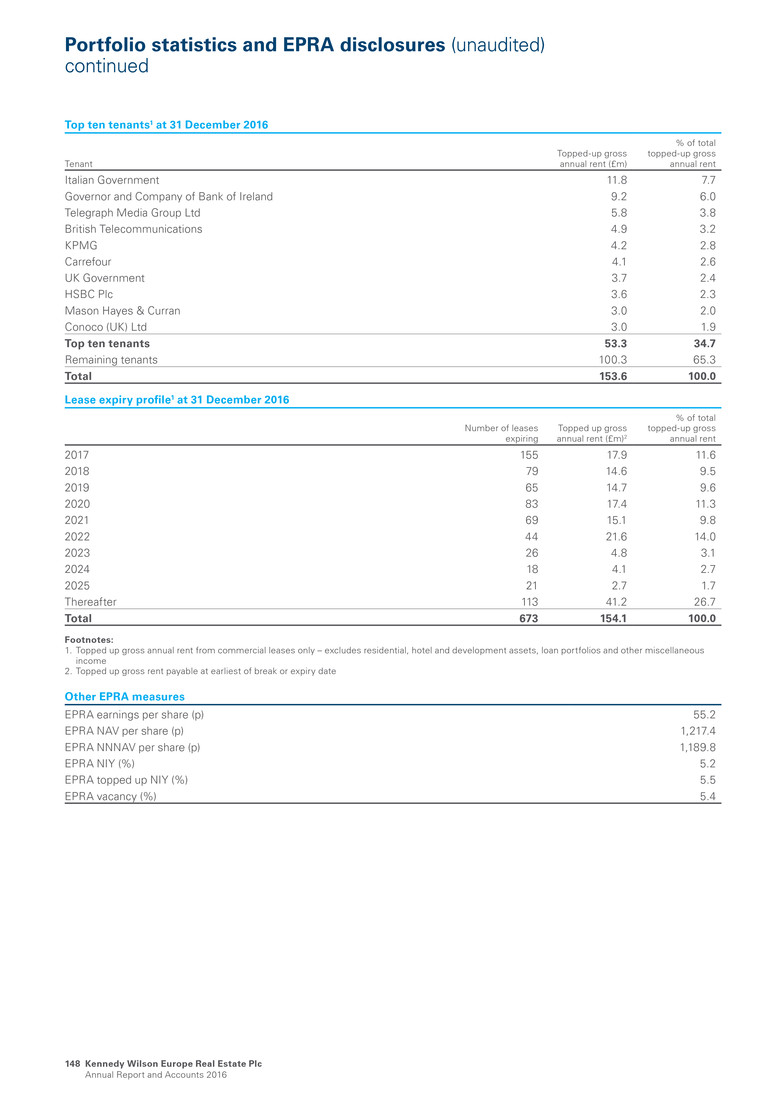

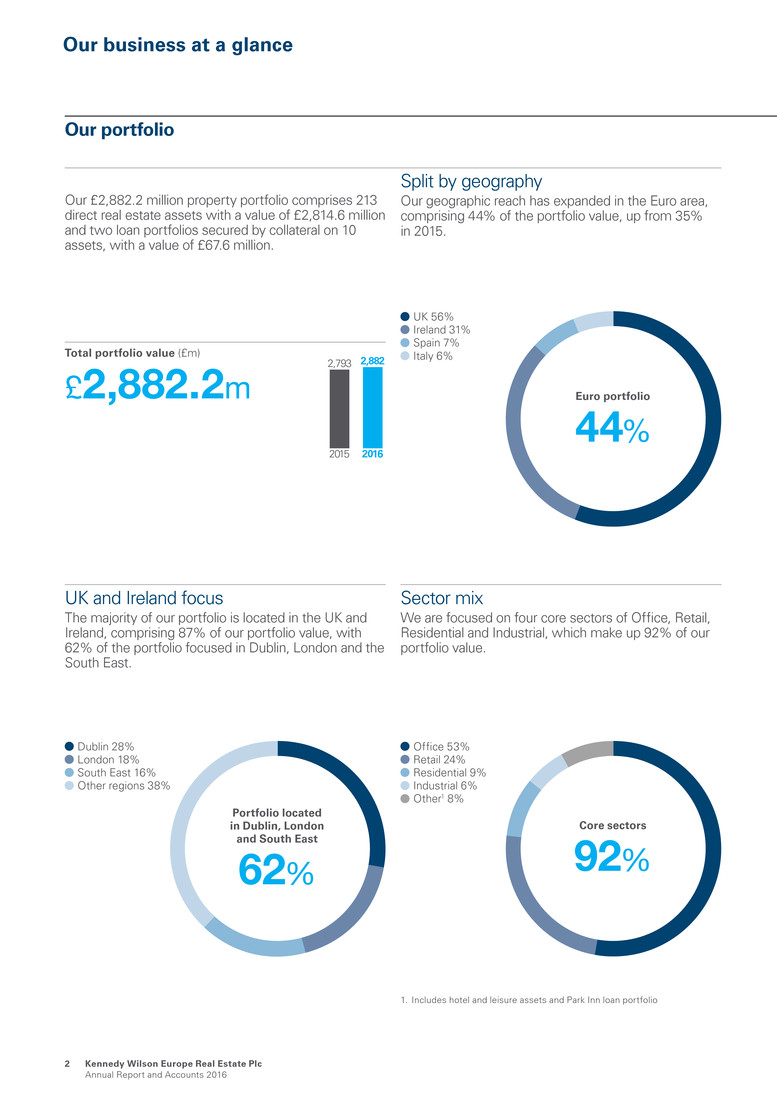

UK 56% Ireland 31% Spain 7% Italy 6% Euro portfolio 44% Core se ctors 92% Off_ice 53% Retail 24% Residential 9% Industrial 6% Other1 8% Portfolio located in Dublin, London an d South East 62% D ublin 28% London 18% South East 16% Other regions 38% 2,793 2015 2,882 2016 Our busine ss at a glanc e Split by geography Our geographic reach has expanded in the Euro area, comprising 44% of the portfolio value, up from 35% in 2015. Our portfolio Our £2,882.2 million property portfolio comprises 213 direct real estate assets with a value of £2,814.6 million and two loan portfolios secured by collateral on 10 assets, with a value of £67.6 million. UK and Ireland focus The majority of our portfolio is located in the UK and Ireland, comprising 87% of our portfolio value, with 62% of the portfolio focused in Dublin, London and the South East. Sector mix We are focused on four core sectors of Office, Retail, Residential and Industrial, which make up 92% of our portfolio value. Total portfolio value (£m) £ 2,882.2 m 1. Includes hotel and leisure assets and Park Inn loan portfolio K e n n e d y Wilson Europe Re al Estate Pl c Annual Report and Ac c o unts 2 016 2

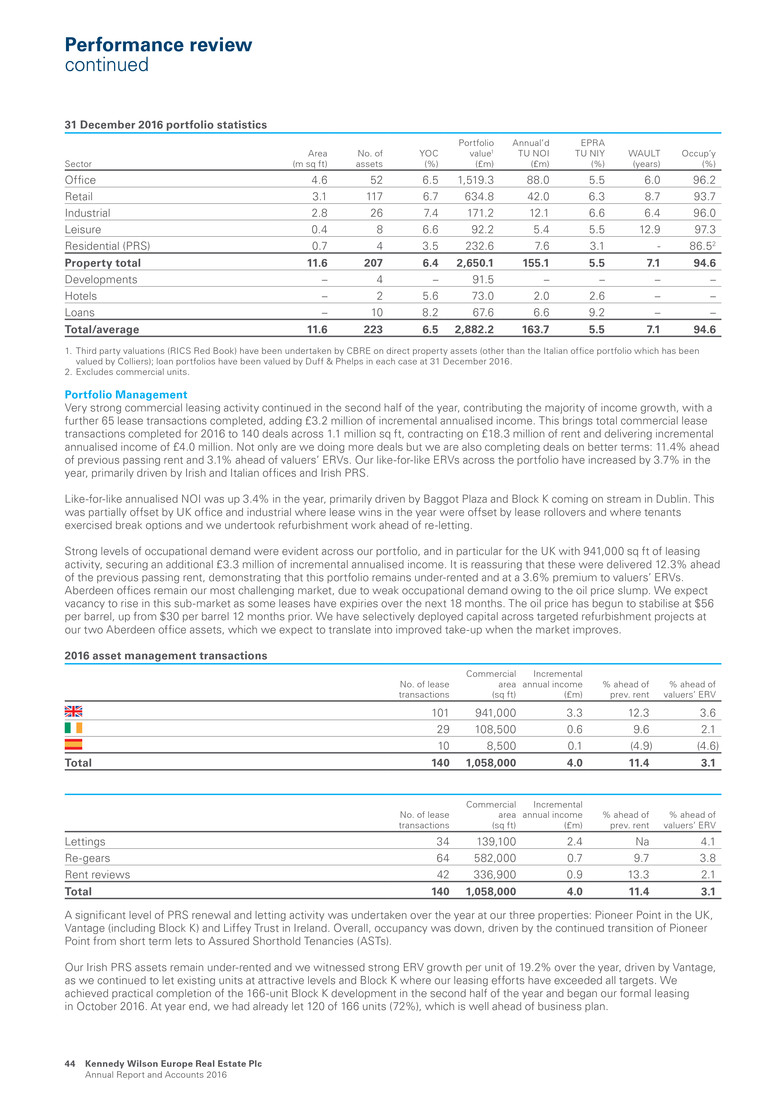

2016 portfolio metrics Annualised topped-up NOI (£m) £163.7m Occupancy (%) 95% Under-rented portfolio (%) 9.3% WAULT (years to break) 7.1 years Number of assets 223 Area (sq ft) 11.6m sq ft Our £2,882.2 million portfolio across 223 assets, continues to exhibit strong occupancy at 95% with relatively long lease maturities of 7.1 years (8.9 years to expiry), generating annualised topped-up NOI of £163.7 million, of which c. 16% of our rent roll benefits from fixed or inflation-linked uplifts. KWE delivered its best operational performance to date during 2016, completing 140 commercial leasing transactions across 1.1 million sq ft, adding £4.0 million of incremental annualised income. Occupier demand for our underlying markets remains robust, not only resulting in a strong volume of leasing wins but also on attractive terms, with deals completed at 11.4% ahead of previous passing rent and at a premium of 3.1% against valuers’ ERVs. We have reduced our asset pool from 302 properties at the end of 2015 to 223 at the end of 2016, with sales of £413.1 million, concluding our previously announced £200 million non-core disposal programme six months ahead of our June 2017 target. These sales, across 1.6 million sq ft, crystallised a yield spread of 180bps between yield on cost and exit yield on sale, at a premium to prior book value of 4.8% and delivering a return on cost of 31.8% over a 21-month hold period. See Principal properties and Portfolio statistics on pages 145 to 148 for more details. 165.7 2015 163.7 2016 96 2015 95 2016 7.3 2015 9.3 2016 7.3 2015 7.1 2016 302 2015 223 2016 11.8 2015 11.6 2016 S trateg ic rep o rt Governance Financials Additional information Kennedy Wilson Europe Real Estate Plc A n n u a l R e p o r t a n d A c c o u n t s 2016 3

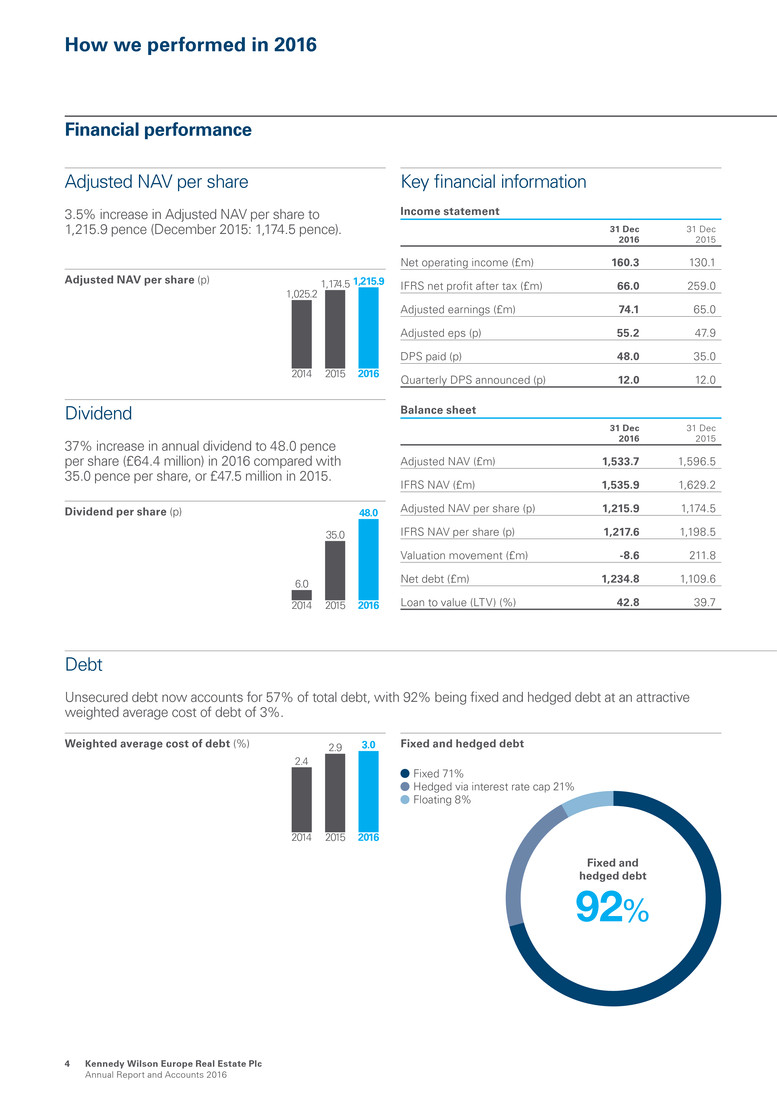

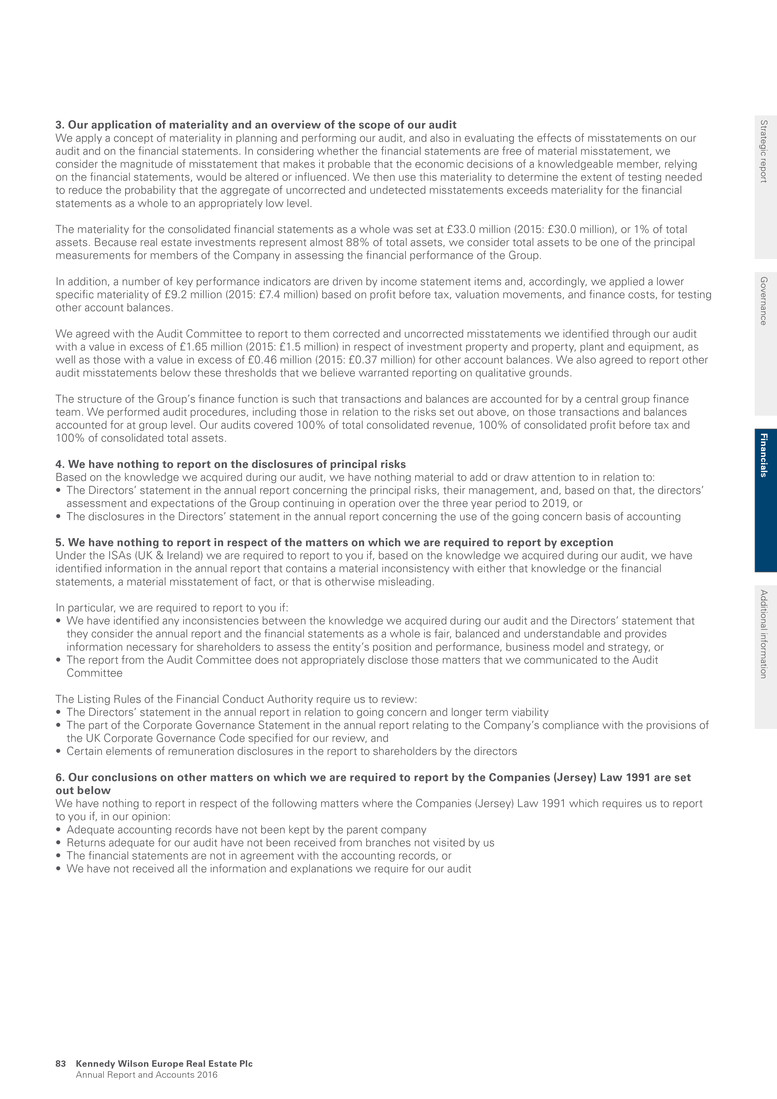

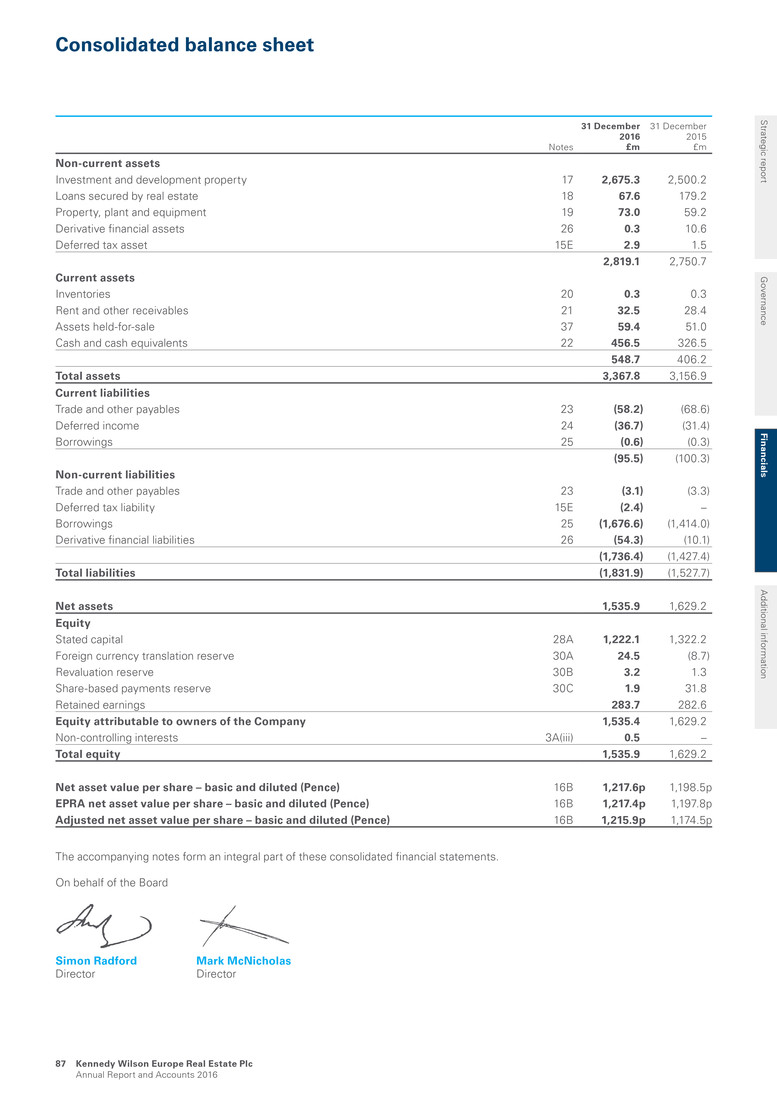

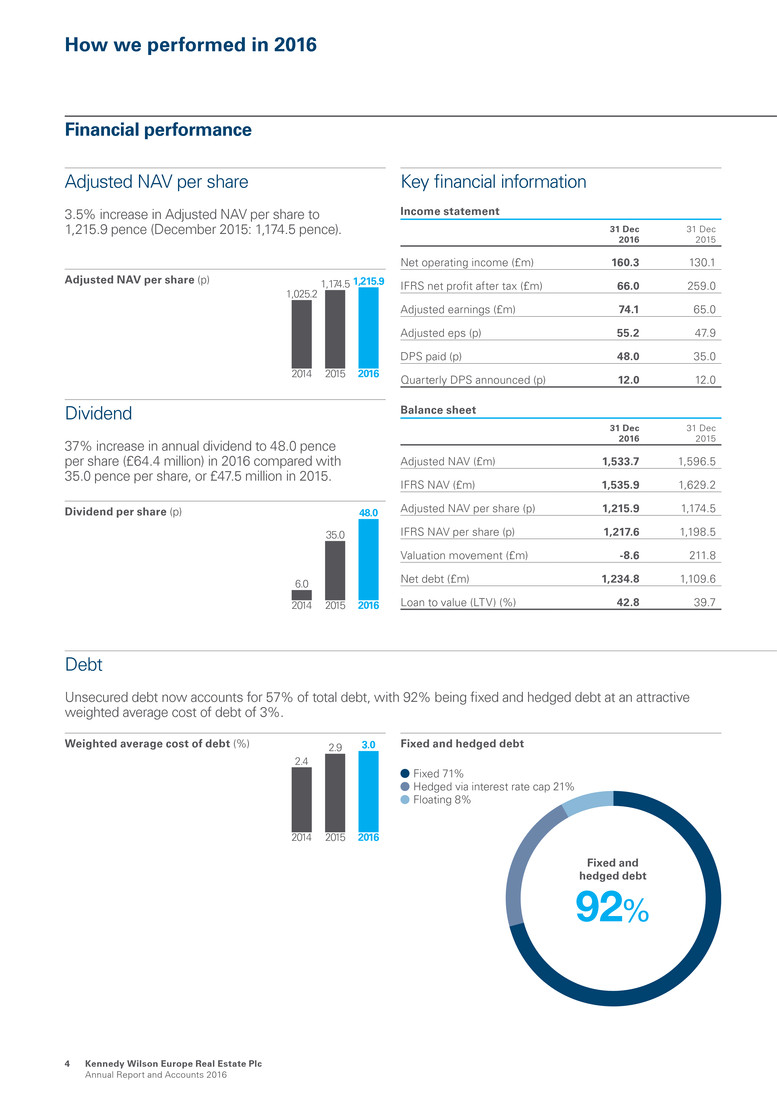

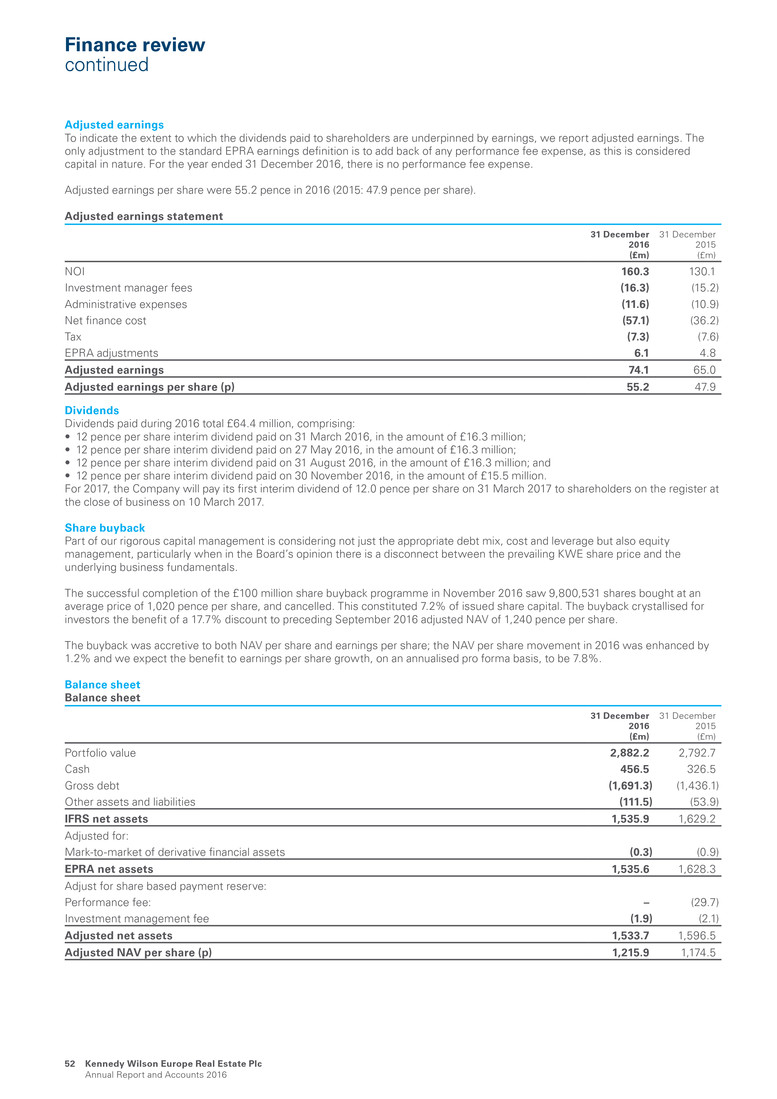

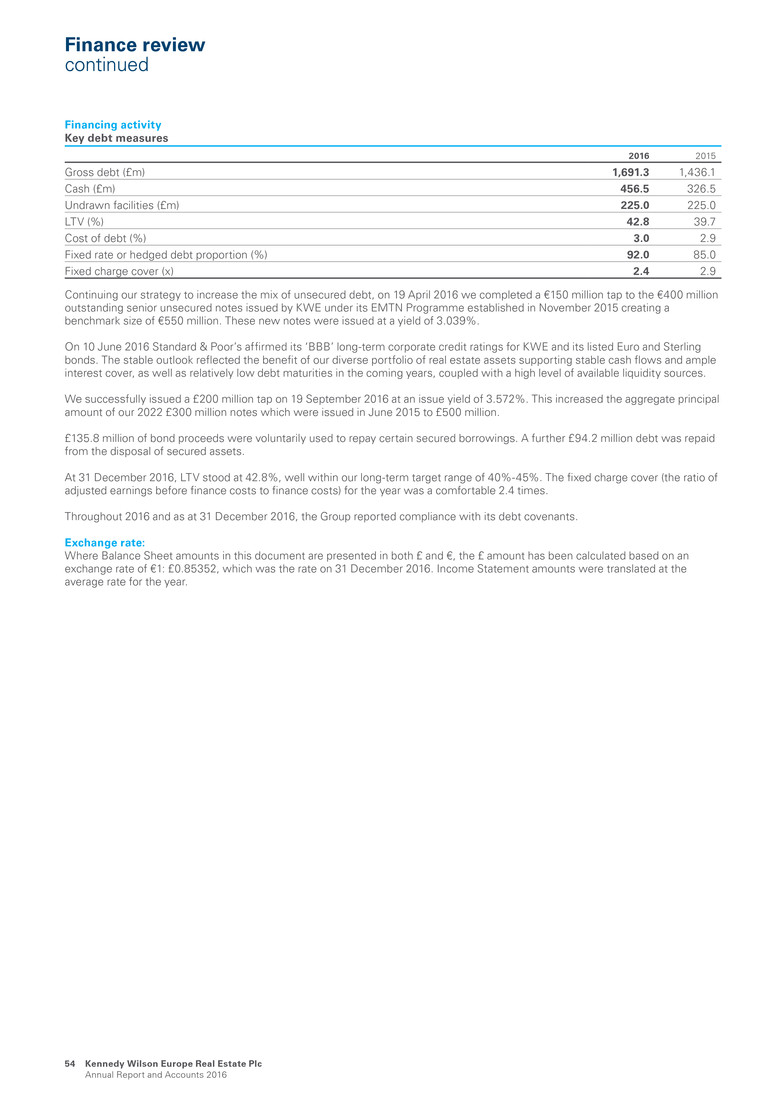

Key financial information How we performed in 2016 Fixed and hedged debt 92% Fixe d 71% Hed g e d v ia interest rate c ap 21% Flo ating 8% 1,025.2 1,174.5 1,215.9 2014 2015 2016 6.0 35.0 48.0 2014 2015 2016 2.9 3.0 2015 2.4 2014 2016 Financial performance Adjusted NAV per share 3.5% increase in Adjusted NAV per share to 1,215.9 pence (December 2015: 1,174.5 pence). Dividend 37% increase in annual dividend to 48.0 pence per share (£64.4 million) in 2016 compared with 35.0 pence per share, or £47.5 million in 2015. Income statement 31 Dec 2016 31 Dec 2015 Net operating income (£m) 160.3 130.1 IFRS net profit after tax (£m) 66.0 259.0 Adjusted earnings (£m) 74.1 65.0 Adjusted eps (p) 55.2 47.9 DPS paid (p) 48.0 35.0 Quarterly DPS announced (p) 12.0 12.0 Balance sheet 31 Dec 2016 31 Dec 2015 Adjusted NAV (£m) 1,533.7 1,596.5 IFRS NAV (£m) 1,535.9 1,629.2 Adjusted NAV per share (p) 1,215.9 1,174.5 IFRS NAV per share (p) 1,217.6 1,198.5 Valuation movement (£m) -8.6 211.8 Net debt (£m) 1,234.8 1,109.6 Loan to value (LTV) (%) 42.8 39.7 Debt Unsecured debt now accounts for 57% of total debt, with 92% being fixed and hedged debt at an attractive weighted average cost of debt of 3%. Adjusted NAV per share (p) Dividend per share (p) Weighted average cost of debt (%) Fixed and hedged debt Kennedy Wilson Europe Real Estate Plc A n n u a l R e p o r t a n d A c c o u n t s 2016 4

14.6 3.0 2.7 2.4 Residential Off_ice Industrial Retail 17 15 13 6 -2 Leisure Residential Off_ice Industrial Retail Valuation movement components Total valuation movement (£m) (8.6) Like-for-like valuation (16.6) 2016 acquisition valuation 2.6 2016 disposal valuation 5.4 Timing of total valuation movement (£m) H1 47.4 H2 (56.0) Currency of total valuation movement Euro (£m) 69.0 Sterling (£m) (77.6) Sector contributions to total valuation movement (£m) Office (30.4) Retail 5.5 Industrial (5.0) Residential 16.3 Other 5.0 Portfolio ERVs 9.2% under rented portfolio Under/(over) rented (%)1 3.7% like-for-like ERV growth Breakdown by sector (%) 1. Based on 31 December 2016 ERVs Total debt £1,691.3m Secured debt 43% Unsecured debt 57% Debt Unsecured debt now accounts for 57% of total debt, with 92% being fixed and hedged debt at an attractive weighted average cost of debt of 3%. Debt mix Unsecured debt £969.5 m Term to maturity: 7.1 years Total fixed cost: 3.5% Fixed debt: 100% Secured debt £721.8 m Term to maturity: 4.6 years Total fixed cost: 2.4% Fixed debt: 80% S trateg ic rep o rt Governance Financials Additional information Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 5

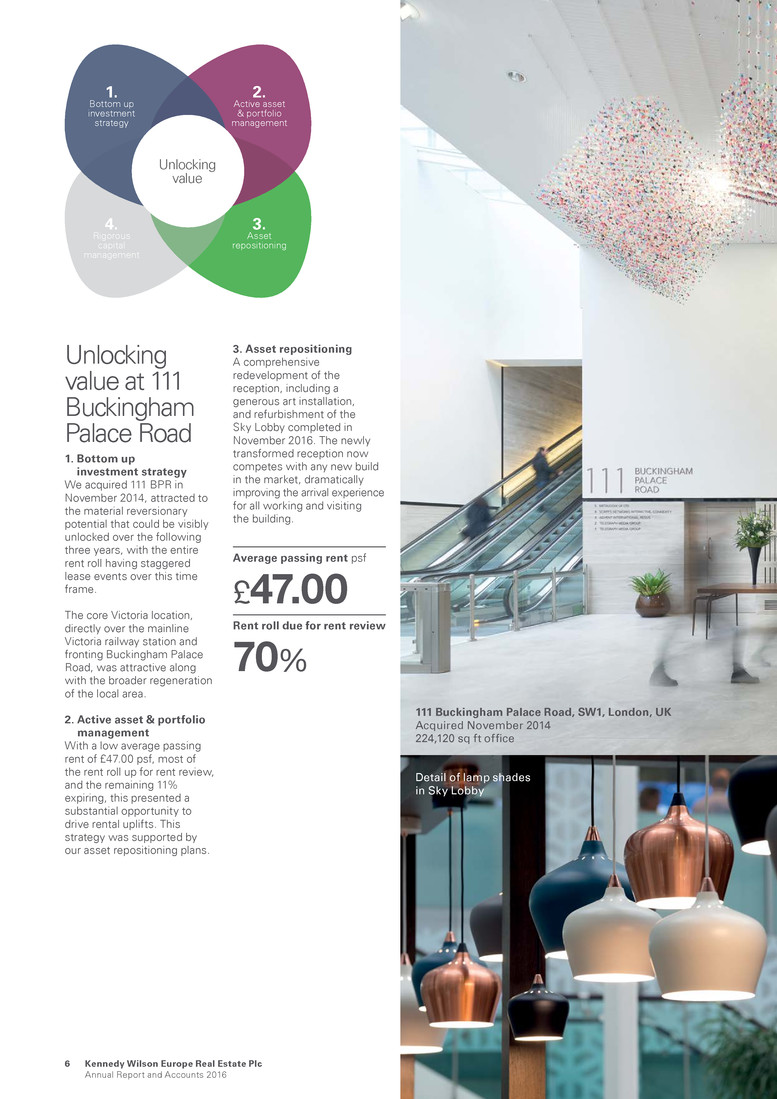

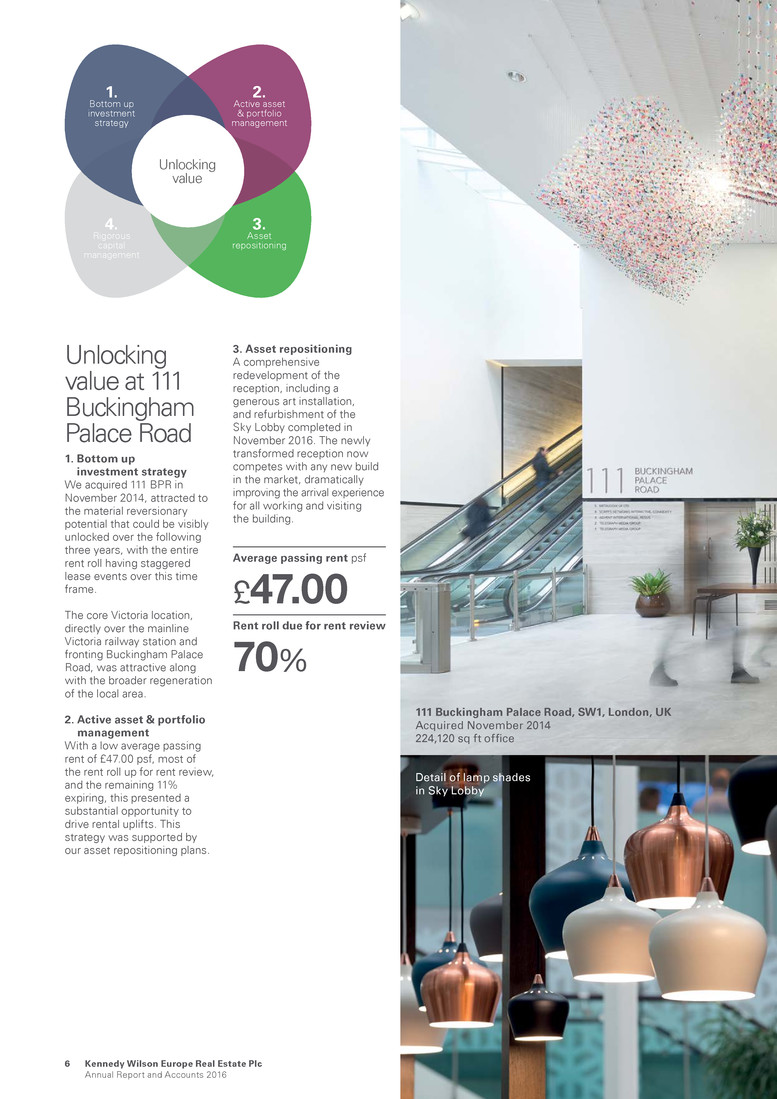

111 Buckingham Palace Road, SW1, London, UK Acquired November 2014 224,120 sq ft office Detail of lamp shades in Sky Lobby Unlocking value at 111 Buckingham Palace Road 1. Bottom up investment strategy We acquired 111 BPR in November 2014, attracted to the material reversionary potential that could be visibly unlocked over the following three years, with the entire rent roll having staggered lease events over this time frame. The core Victoria location, directly over the mainline Victoria railway station and fronting Buckingham Palace Road, was attractive along with the broader regeneration of the local area. 2. Active asset & portfolio management With a low average passing rent of £47.00 psf, most of the rent roll up for rent review, and the remaining 11% expiring, this presented a substantial opportunity to drive rental uplifts. This strategy was supported by our asset repositioning plans. 3. Asset repositioning A comprehensive redevelopment of the reception, including a generous art installation, and refurbishment of the Sky Lobby completed in November 2016. The newly transformed reception now competes with any new build in the market, dramatically improving the arrival experience for all working and visiting the building. Average passing rent psf £47.00 Rent roll due for rent review 70% Unlocking value 2. Active asset & portfolio management 1. Bottom up investment strategy 3. Asset repositioning 4. Rigorous capital management Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 6

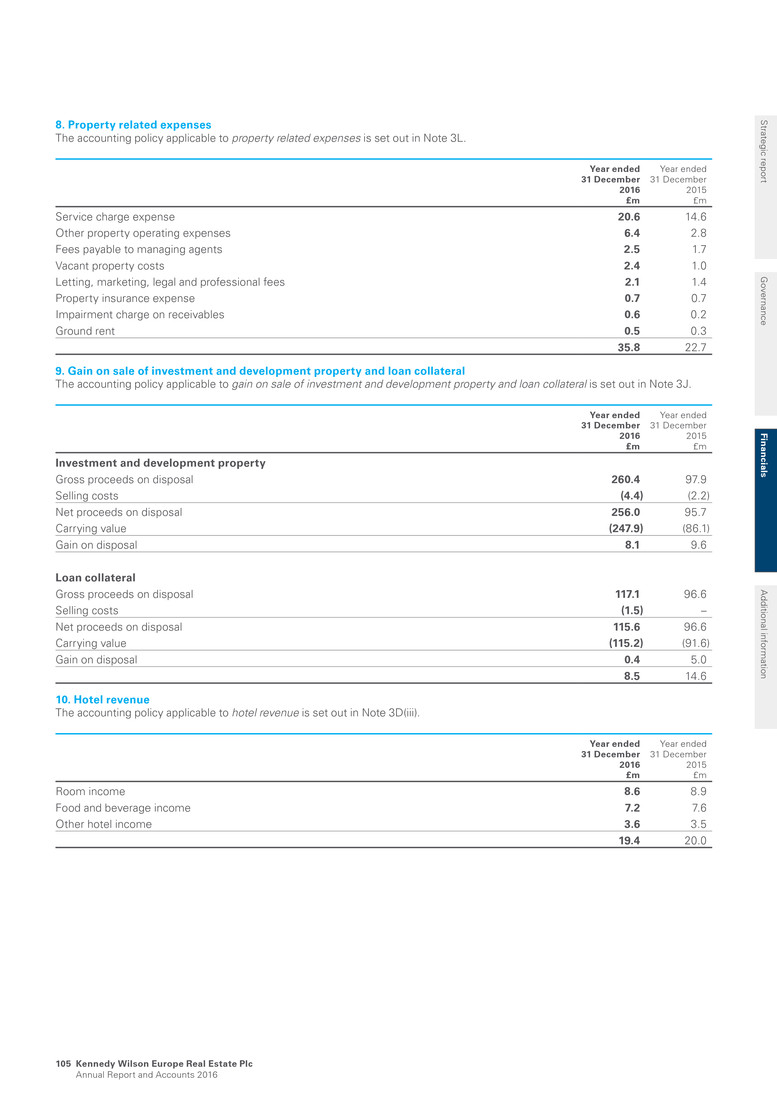

Sky Lobby café Polished plaster above the escalator framed by ‘halo lighting’ Brass detail in the main reception 7 Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 Meet the artist Known mainly for her suspended sculptures, Claire Morgan’s work has been exhibited in museums and galleries around the world, including Europe, the United States and Asia. Her work reflects her interest in natural processes and hanging materials, and probes elemental conditions of humans in their natural habitat. Background to the art installation The art is the centre piece of the reception, filling the volume of space. The design shows the organic movement through the reception to the escalators whilst also holding its geometric shape. Meet the architect Eric Parry, owner and founder of Eric Parry Architects, is a leader in his field and member of the Royal Academy. His practice has received more than 30 awards, and Parry himself holds an honorary doctorate from the University of Bath. A former president of the Architectural Association, Parry’s work is often enhanced by the work of accomplished artists. Background to the refurbishment The new design doubles the floor area of the reception and brings in light through both the 6m-high listed arches and 15m-high skylight. The reconfiguration also opens up the escalator space to create a calming transition- zone to the newly created Sky Lobby, which comprises a café, relaxed space and flexible work area. S trateg ic rep o rt G overnance Financials A dditional inform ation

Chair’s introduction On behalf of the Board, I am pleased to present our full-year results for 2016. The investment management team delivered significant operational wins across the portfolio, delivering its best leasing results to date; a notable achievement in a year marked by significant political and capital market turbulence. In this context, the Group delivered a solid financial performance, growing earnings and delivering on the annual dividend target. At the same time the team improved the mix of unsecured debt and extended debt maturities whilst keeping our average cost of debt low. The portfolio stands at £2,882.2 million, primarily driven by £295.9 million of acquisition and capital expenditure activity and £165.1 million in foreign exchange gain, owing to material Euro appreciation relative to Sterling. This was offset by very profitable disposal activity and a modest portfolio valuation decline of £8.6 million or only -0.3%. The team also delivered considerable development projects, achieving practical completion, on time and budget, at both Baggot Plaza, Dublin 4, which is let to Bank of Ireland for 25 years, and Block K, Central Park, Dublin 18, where 166 new PRS units were built adjacent to our existing Vantage scheme. Notably, we have already let 72% of the units in the three months to December 2016. Furthermore, the significant refurbishments completions at 111 Buckingham Palace Road, Victoria, London SW1 and Portmarnock Hotel, Co. Dublin, have transformed both properties and are expected to drive income to the bottom line. The business benefitted from active balance sheet management in the year, utilising both of KWE’s unsecured bonds, raising £318.6 million by tapping the 2025 Euro bond by €150 million and the 2022 Sterling bond by £200 million, increasing the bonds outstanding to €550 million and £500 million, respectively. Together they extended our debt maturities to 6.1 years and locked in additional fixed rate debt. “KWE reported a solid financial performance, with strong earnings growth and delivery of the annual dividend target of 48.0 pence per share. In a year marked by material political and capital market turbulence, we undertook an accretive share buyback programme and continuously assess the best use of capital to ensure efficient balance sheet management. The Board is alert that the potential for increased volatility remains high. In this context, the business is on a solid foundation to deliver attractive investor returns.“ Charlotte Valeur Chair, Kennedy Wilson Europe Real Estate Plc Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 8

Along with the rest of the UK listed real estate sector, and despite strong progress across all parts of the business, we witnessed a material disconnect between KWE’s share price and the underlying business. As part of our ongoing commitment to balance sheet management, we undertook a £100 million share buyback programme, which was accretive to both earnings and NAV per share. We continue to monitor how we can best deliver sustainable total returns for shareholders and have distributed £164.4 million in 2016 through a combination of dividends and share buybacks. Results The Group delivered Adjusted NAV per share of 1,215.9 pence, up 3.5% over December 2015. Adjusted earnings per share were 55.2 pence per share (£74.1 million in total) and basic earnings per share were 49.1 pence per share (£66.0 million in total). To view the Finance review go to pages 50 to 54. Dividends Dividends of 48.0 pence per share, or £64.4 million were paid during the year, reflecting a dividend cover based on 2016 adjusted earnings of 1.1 times, and a 37% increase on the 35.0 pence per share paid in 2015. The Board announces a quarterly interim dividend of 12.0 pence per share. The quarterly dividend will be paid on 31 March 2017 to shareholders on the register at the close of business on 10 March 2017. In the context of the material disposals delivered to date, the Board is comfortable with the level of the dividend being both sustainable and offering an attractive dividend yield to shareholders of c. 5%. The Board will continue to assess the appropriate dividend pay-out on a quarterly basis. Industry achievements In March 2016, the shares of KWE became constituent members of the FTSE EPRA/NAREIT Global Real Estate Index Series and the GPR 250 Index Series. These are both important specialist indices for our investors, in addition to the FTSE 250 Index, which KWE has been a member of since 2014. The Company is a fee-paying member of EPRA, the European trade body for listed real estate securities, and follows EPRA’s Best Practice Recommendations for both operational (EPRA BPRs) and sustainability (EPRA sBPRs) reporting disclosure. In 2015, we achieved EPRA Silver and Bronze for operational and sustainable reporting disclosures respectively, and aim to further improve on this. For further details on Responsible investments go to pages 27 to 33. Outlook The investment and occupier markets across our business remain open and active, illustrated by our record-breaking leasing and disposal activity, both ahead of preceding valuations and delivering attractive returns. We expect the period of market uncertainty to persist and market volatility to potentially increase, as it remains too early to ascertain the impact of the UK’s negotiations to exit the EU and the impact that will have on the UK and the rest of Europe. The Board remains alert to both potential risks and opportunities for KWE’s business. With £539.7 million of disposals since 2015, the natural evolution away from smaller lot sizes demonstrates that our wholesale to retail strategy is working. It has not only improved the portfolio quality but also delivered solid occupancy, longer leases and attractive profits. KWE benefits from a diversified portfolio, both geographically and by sector, low capital commitments and ample liquidity to capitalise on potential opportunities. This, combined with KWE’s unique blend of debt and equity skills, strong market relationships and a wealth of experience working through market dislocations, places the business on a solid foundation. Charlotte Valeur Chair Strateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 9

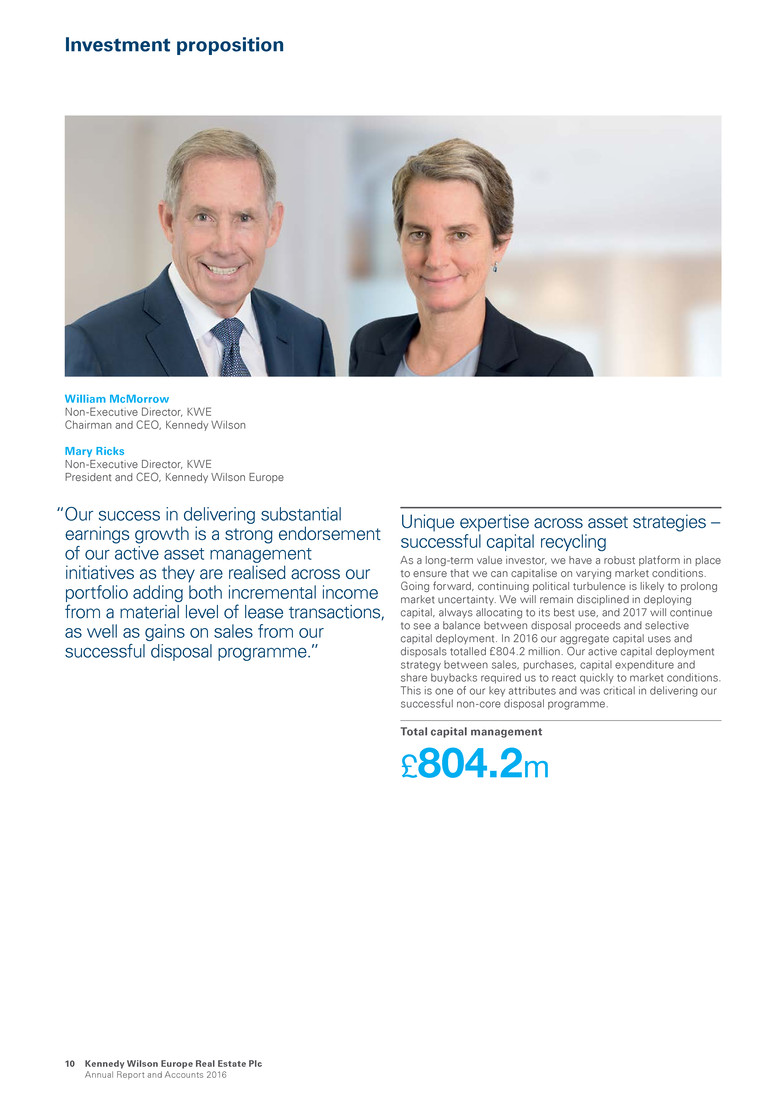

Unique expertise across asset strategies – successful capital recycling As a long-term value investor, we have a robust platform in place to ensure that we can capitalise on varying market conditions. Going forward, continuing political turbulence is likely to prolong market uncertainty. We will remain disciplined in deploying capital, always allocating to its best use, and 2017 will continue to see a balance between disposal proceeds and selective capital deployment. In 2016 our aggregate capital uses and disposals totalled £804.2 million. Our active capital deployment strategy between sales, purchases, capital expenditure and share buybacks required us to react quickly to market conditions. This is one of our key attributes and was critical in delivering our successful non-core disposal programme. Total capital management £804.2m Investment proposition “Our success in delivering substantial earnings growth is a strong endorsement of our active asset management initiatives as they are realised across our portfolio adding both incremental income from a material level of lease transactions, as well as gains on sales from our successful disposal programme.” William McMorrow Non-Executive Director, KWE Chairman and CEO, Kennedy Wilson Mary Ricks Non-Executive Director, KWE President and CEO, Kennedy Wilson Europe Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 10

A track record of value creation – growing income through asset management We aim to add value at acquisition, through asset management and asset repositioning, meaning that we are not reliant on market rental growth to generate our returns. In 2016 we completed 140 commercial leases transactions, 11.4% ahead of previous passing rents and 3.1% ahead of valuers’ ERV. We delivered like-for-like ERV growth of 3.7% and like-for-like NOI growth of 3.4%. Once we have achieved our asset management, our non-core programme allows us to crystallise valuation gains. Over the year we sold 89 assets for £413.1 million at a premium to book value of 4.8% and a return on cost of 31.8%. Total return on cost on disposals 31.8% Financial flexibility to implement our strategy We aim for an efficient mix of equity and debt to support our returns without taking undue risk. Over the year we have shown our commitment to our unsecured debt strategy by tapping both our Euro 2025 and Sterling 2022 notes, raising £391.6 million and further locking in fixed rate debt. Our unsecured debt is now 57% of our total debt. Our term to maturity is a comfortable 6.1 years and our financing capacity sits at £681.5 million, giving us ample liquidity to be able to react to potential market opportunities that may arise in 2017. Total liquidity £681.5m Delivering strong returns for shareholders – diversified cash flows underpin dividends Our total return model rewards investors through a secure income base that is poised for future growth. In 2016 we delivered on our 48.0 pence per share dividend target, up 37.1% over 2015’s 35.0 pence per share. The 2016 dividend contributed 4.1% to our 7.6% total accounting return over the year. In addition, we undertook a £100 million share buyback, returning a total of £164.4 million to shareholders. The share buyback was accretive to both NAV per share and earnings per share, enhancing the NAV per share movement in 2016 by 1.2% and we expect the pro forma annualised earnings per share growth to be 7.8%. Capital returned to shareholders in 2016 £164.4m Incentivised to deliver for shareholders KW owns 23.6% of KWE, which is its largest single investment. With 50% of the investment manager fee paid in shares, KW is highly incentivised to deliver value over the long term, to the benefit of all shareholders. Payment of Investment Manager fee in shares 50.0% Strateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 11

Our markets Market overview The four geographic areas in which we invest all posted positive economic growth, providing strong support to the underlying occupational markets. The UK held steady with GDP growth of 1.8% in the face of significant political uncertainty over its future exit negotiations from the EU. With this backdrop, the underlying occupational and investment markets remained resilient. Whilst both overall take-up and investment volumes are down against 2015 peak levels, they remain healthy against the 10-year averages. The Irish and Spanish economies lead the way with GDP growth of 3.4% and 3.1%, respectively. Irish occupational markets were strong across all sectors, with Spanish property fundamentals also on an upward trajectory. “The portfolio’s geographic diversification was hugely beneficial in 2016, with our Euro assets cushioning the UK valuation volatility. The occupational and investment markets in which we operate have been more resilient and active than market commentators anticipated.“ Peter Collins Chief Operating Officer, Kennedy Wilson Europe Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 12

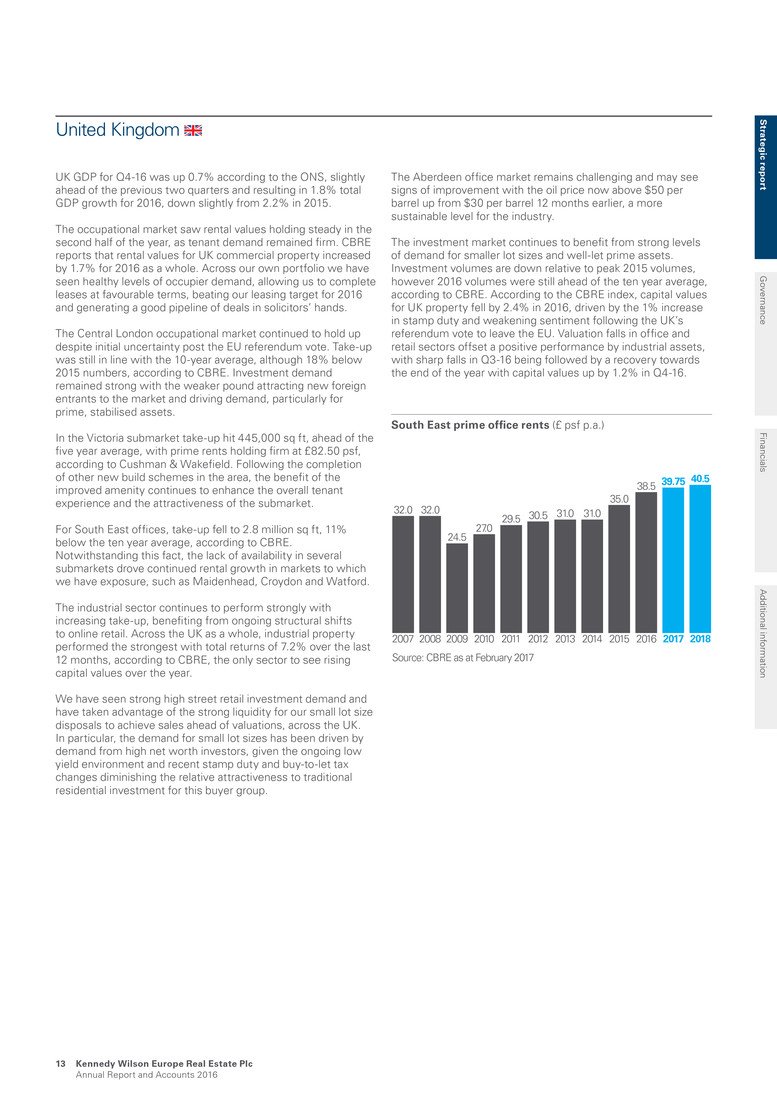

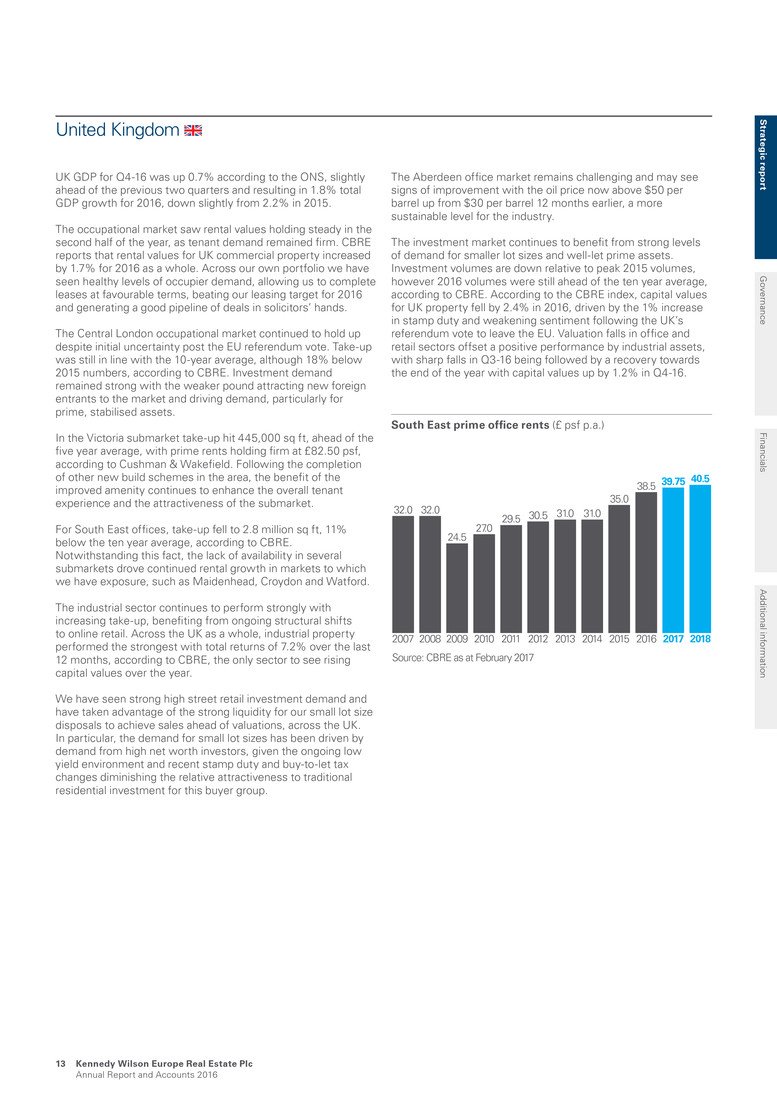

UK GDP for Q4-16 was up 0.7% according to the ONS, slightly ahead of the previous two quarters and resulting in 1.8% total GDP growth for 2016, down slightly from 2.2% in 2015. The occupational market saw rental values holding steady in the second half of the year, as tenant demand remained firm. CBRE reports that rental values for UK commercial property increased by 1.7% for 2016 as a whole. Across our own portfolio we have seen healthy levels of occupier demand, allowing us to complete leases at favourable terms, beating our leasing target for 2016 and generating a good pipeline of deals in solicitors’ hands. The Central London occupational market continued to hold up despite initial uncertainty post the EU referendum vote. Take-up was still in line with the 10-year average, although 18% below 2015 numbers, according to CBRE. Investment demand remained strong with the weaker pound attracting new foreign entrants to the market and driving demand, particularly for prime, stabilised assets. In the Victoria submarket take-up hit 445,000 sq ft, ahead of the five year average, with prime rents holding firm at £82.50 psf, according to Cushman & Wakefield. Following the completion of other new build schemes in the area, the benefit of the improved amenity continues to enhance the overall tenant experience and the attractiveness of the submarket. For South East offices, take-up fell to 2.8 million sq ft, 11% below the ten year average, according to CBRE. Notwithstanding this fact, the lack of availability in several submarkets drove continued rental growth in markets to which we have exposure, such as Maidenhead, Croydon and Watford. The industrial sector continues to perform strongly with increasing take-up, benefiting from ongoing structural shifts to online retail. Across the UK as a whole, industrial property performed the strongest with total returns of 7.2% over the last 12 months, according to CBRE, the only sector to see rising capital values over the year. We have seen strong high street retail investment demand and have taken advantage of the strong liquidity for our small lot size disposals to achieve sales ahead of valuations, across the UK. In particular, the demand for small lot sizes has been driven by demand from high net worth investors, given the ongoing low yield environment and recent stamp duty and buy-to-let tax changes diminishing the relative attractiveness to traditional residential investment for this buyer group. The Aberdeen office market remains challenging and may see signs of improvement with the oil price now above $50 per barrel up from $30 per barrel 12 months earlier, a more sustainable level for the industry. The investment market continues to benefit from strong levels of demand for smaller lot sizes and well-let prime assets. Investment volumes are down relative to peak 2015 volumes, however 2016 volumes were still ahead of the ten year average, according to CBRE. According to the CBRE index, capital values for UK property fell by 2.4% in 2016, driven by the 1% increase in stamp duty and weakening sentiment following the UK’s referendum vote to leave the EU. Valuation falls in office and retail sectors offset a positive performance by industrial assets, with sharp falls in Q3-16 being followed by a recovery towards the end of the year with capital values up by 1.2% in Q4-16. South East prime office rents (£ psf p.a.) 32.0 32.0 24.5 27.0 29.5 30.5 31.0 31.0 38.5 35.0 39.75 40.5 2007 Source: CBRE as at February 2017 2008 2009 2010 2011 2012 2013 2014 20162015 2017 2018 United Kingdom Strategic report Governance Financials Additional information K e n n e d y W i l s o n E u r o p e R e a l E s t a t e P l c A n nual Report and Accounts 2016 13

Ireland The Irish economy continues to outperform, with unemployment down to 7.2% at the end of the year and with employment numbers pushing past the two million mark for the first time since 2009, according to the Central Statistics Office. This has supported consumer spending, with retail sales up 3.4% year-on-year to December 2016. This has led to retailer expansions and new entrants in the market, according to CBRE, and we expect our shopping centres to benefit from this in due course. Across the hotel market, ADR and RevPAR metrics are up significantly, according to CBRE, and we expect Portmarnock Hotel and Golf Links to benefit now that the works are complete – its award as 2016 Irish Golf Resort of the Year is a very positive early win, given the importance of tour operators in this market. Property investment volumes were up a healthy 29% year-on-year to €4.5 billion, according to CBRE. It is worth noting that almost one-third of the improvement was owing to Blanchardstown and Liffey Valley shopping centres, which are positive endorsements to the institutional interest from new entrants to the market. Year-on-year Dublin office take-up was 2.6 million sq ft, nearly on par with 2015, according to CBRE, and the Dublin city centre vacancy rate reduced to 4.7%. Prime rents ended the year at €62.50 psf, up 14% year-on-year, according to CBRE, with prime office yields at 4.65%. This bodes well for our under-rented Dublin CBD office portfolio, where average passing rents are €40.65 psf and average ERVs are €47.50 psf. The Dublin suburban office market represented almost one- quarter of all take-up in 2016, with nearly three-quarters of the Q4-16 suburban leasing activity focused on the South suburbs, according to CBRE. Prime rents are now €27.50 psf, significantly in excess of our average South Dublin suburban office passing rents of €17.35 psf. Our portfolio remains reversionary, with ERVs at €24.35 psf. 40/42 Mespil Road, Dublin 4 Part of Opera portfolio Acquired June 2014 118,000 sq ft city centre office Dublin is expected to benefit from potential job relocations from companies seeking to realign their geographic footprint after the EU referendum. A number of UK-based financial services firms have already announced that they have either settled on Dublin as their new EU base, or are seriously considering it. The PRS market performed well throughout the year, and we benefited from continued growth at both Vantage (including Block K) and Liffey Trust. In December 2016, the Irish Government imposed a 4% rental cap on ‘rent pressure zones’ for a period of three years. This relates to areas where rents have increased 7% or more in four of the last six quarters and in the first instance impacts the Dublin market. Our recently developed Block K units, at Vantage are exempt from this rental cap, as will be any existing unit which has undergone substantial refurbishment. Dublin prime office rents (£ psf p.a.) 63.0 58.0 35.0 32.0 30.0 27.0 35.0 45.0 62.5 55.0 64.0 67.0 2007 Source: Historical data as per CBRE as at February 2017. Forecasts as per Savills as at February 2017 2008 2009 2010 2011 2012 2013 2014 20162015 2017 2018 Our markets continued K e n n e d y W i l s o n E u r o p e R e a l E s t a t e P l c A n nual Report and Accounts 2016 14

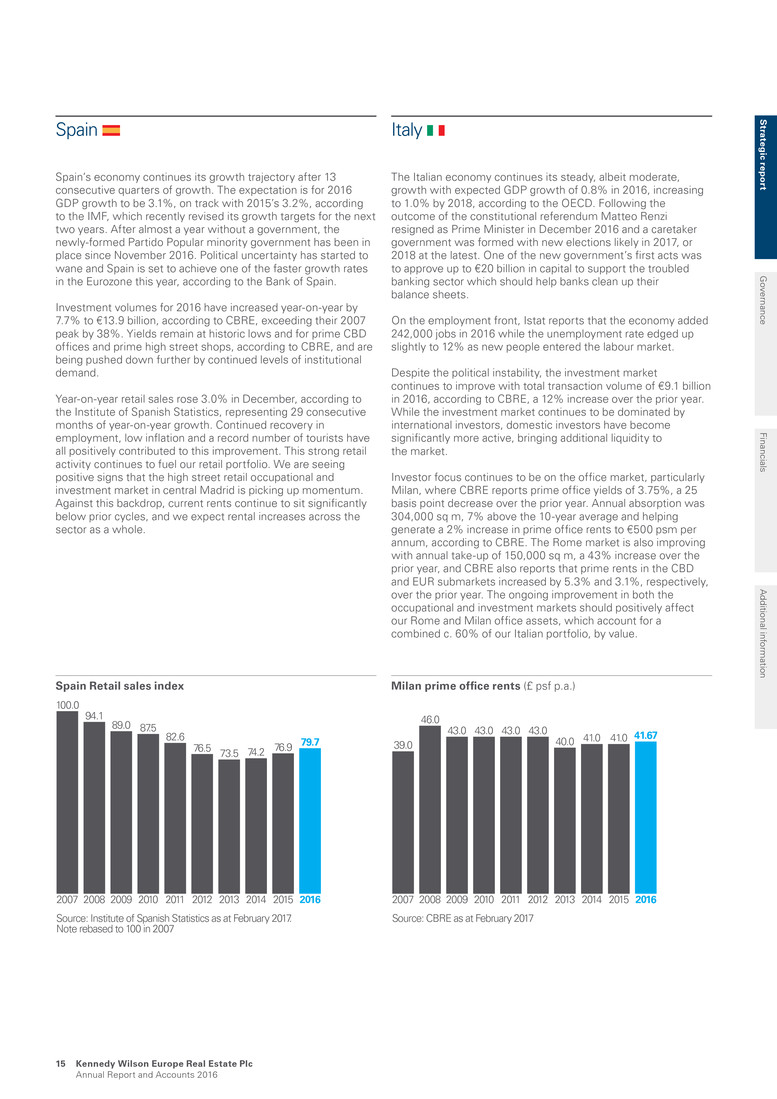

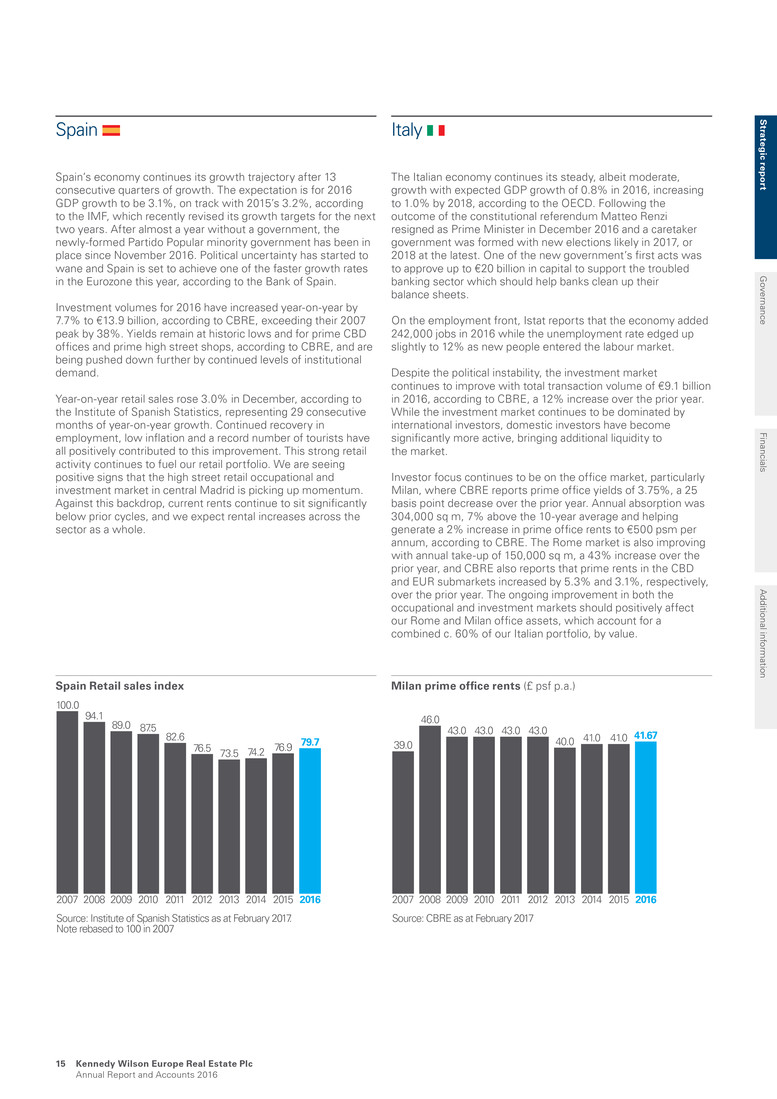

Spain Spain’s economy continues its growth trajectory after 13 consecutive quarters of growth. The expectation is for 2016 GDP growth to be 3.1%, on track with 2015’s 3.2%, according to the IMF, which recently revised its growth targets for the next two years. After almost a year without a government, the newly-formed Partido Popular minority government has been in place since November 2016. Political uncertainty has started to wane and Spain is set to achieve one of the faster growth rates in the Eurozone this year, according to the Bank of Spain. Investment volumes for 2016 have increased year-on-year by 7.7% to €13.9 billion, according to CBRE, exceeding their 2007 peak by 38%. Yields remain at historic lows and for prime CBD offices and prime high street shops, according to CBRE, and are being pushed down further by continued levels of institutional demand. Year-on-year retail sales rose 3.0% in December, according to the Institute of Spanish Statistics, representing 29 consecutive months of year-on-year growth. Continued recovery in employment, low inflation and a record number of tourists have all positively contributed to this improvement. This strong retail activity continues to fuel our retail portfolio. We are seeing positive signs that the high street retail occupational and investment market in central Madrid is picking up momentum. Against this backdrop, current rents continue to sit significantly below prior cycles, and we expect rental increases across the sector as a whole. Spain Retail sales index 100.0 94.1 89.0 87.5 82.6 76.5 73.5 74.2 79.776.9 2007 Source: Institute of Spanish Statistics as at February 2017. Note rebased to 100 in 2007 2008 2009 2010 2011 2012 2013 2014 20162015 Italy The Italian economy continues its steady, albeit moderate, growth with expected GDP growth of 0.8% in 2016, increasing to 1.0% by 2018, according to the OECD. Following the outcome of the constitutional referendum Matteo Renzi resigned as Prime Minister in December 2016 and a caretaker government was formed with new elections likely in 2017, or 2018 at the latest. One of the new government’s first acts was to approve up to €20 billion in capital to support the troubled banking sector which should help banks clean up their balance sheets. On the employment front, Istat reports that the economy added 242,000 jobs in 2016 while the unemployment rate edged up slightly to 12% as new people entered the labour market. Despite the political instability, the investment market continues to improve with total transaction volume of €9.1 billion in 2016, according to CBRE, a 12% increase over the prior year. While the investment market continues to be dominated by international investors, domestic investors have become significantly more active, bringing additional liquidity to the market. Investor focus continues to be on the office market, particularly Milan, where CBRE reports prime office yields of 3.75%, a 25 basis point decrease over the prior year. Annual absorption was 304,000 sq m, 7% above the 10-year average and helping generate a 2% increase in prime office rents to €500 psm per annum, according to CBRE. The Rome market is also improving with annual take-up of 150,000 sq m, a 43% increase over the prior year, and CBRE also reports that prime rents in the CBD and EUR submarkets increased by 5.3% and 3.1%, respectively, over the prior year. The ongoing improvement in both the occupational and investment markets should positively affect our Rome and Milan office assets, which account for a combined c. 60% of our Italian portfolio, by value. Milan prime office rents (£ psf p.a.) 39.0 46.0 43.0 43.0 43.0 43.0 40.0 41.0 41.6741.0 2007 Source: CBRE as at February 2017 2008 2009 2010 2011 2012 2013 2014 20162015 Strategic report Governance Financials Additional information K e n n e d y W i l s o n E u r o p e R e a l E s t a t e P l c Annual Report and Accounts 2016 15

Our business model Real estate operators Expert local presence Debt and equity synergies Excellent relationships Strong pricing discipline Unlocking value 2. Active asset & portfolio management 1. Bottom up investment strategy 3. Asset repositioning 4. Rigorous capital management Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 16 Financial Equity provided by our shareholders, debt provided by our unsecured and secured stakeholders and ongoing retained profits from operations. Intellectual The Investment Manager’s deep understanding of our markets and its specialist approach to due diligence, development, asset and portfolio management. Human The Investment Manager’s team of equity, debt, property and finance specialists. Social/relationships The Investment Manager’s extensive relationships with financial institutions and other real estate owners, and its close ties with contractors, planners, councils, consultants and its end occupier customers property and finance specialists. Investors Accretive acquisitions along with existing portfolio providing secure and growing income, underpinning dividends, value enhancing projects and ongoing recycling to crystallising profits on disposals. See Resources and relationships page 24. Occupiers High quality commercial and residential property, meeting their space requirements, business and personal needs. Communities Working with communities in proximity to our major assets. See Social responsibility on page 29. KW Employees Interesting and challenging careers in a growing and successful business. Suppliers Potential to grow their business through a mutually beneficial long-term partnership. Key inputs How we unlock value Value we create for stakeholders

KWE unlocks the value of real estate that has been under- managed or under-capitalised by its previous owners. We use our strong balance sheet to acquire assets, which we source through our excellent relationships with financial institutions, administrators and other vendors who are not natural real estate operators. We then use our asset management and development skills to release each asset’s inherent value, for the benefit of all our stakeholders. The key components of our business model are described below. How we unlock value Our aims We generate sustainable total returns by unlocking the inherent value of under-resourced real estate. 1. Bottom up invstment strategy We apply a bottom up approach to underwriting each asset we acquire, believing value can be found and enhanced in a variety of market conditions. 2. Active asset and portfolio management We aim to bring practical solutions to our occupiers, to meet their evolving space needs, also allowing us to grow the quantum and duration of our income. 3. Asset repositioning Many of our properties offer repositioning opportunities where we can undertake development and refurbishment to transform the property to meaningfully improve rents and capital values. 4. Rigorous capital management We endeavour to keep our balance sheet efficient and ensure adequate flexibility to support our real estate strategy. The components Real estate operators Asset management sits at the heart of our value creation. During due diligence we produce a business plan for every asset, so the asset management team can start implementing actions on day one. An experienced in-house development team also helps to generate new thinking about the best way to develop an asset. KWE has permanent capital, so we can take a long-term view of each asset’s potential. An asset that is currently a core part of our portfolio may present asset management or development opportunities in several years’ time. We will also dispose of assets, for example where we have completed our value enhancement initiatives, so we can recycle the proceeds into other opportunities. Expert local presence Having expert people located in each of our markets is crucial for capitalising on local opportunities. We continue to grow to support our business and the wider KW team has grown to over 90 employees, comprising asset managers, investment specialists, and finance and operations, located in the UK, Ireland, Spain, Jersey and Luxembourg. This local expert knowledge and presence ensures we take a bottom-up approach to investment and asset management, and gives us the infrastructure to execute large portfolio transactions. Strong pricing discipline Our distinctive investment strategy opens up a wide range of opportunities for us, meaning we can be highly selective about the ones we pursue and can exercise strong risk-return pricing discipline. We apply the KW team’s expertise and resources to perform detailed due diligence on everything we buy, whether it is a single asset or a large portfolio. This means we develop a deep understanding of what we are acquiring and the value we can add to it, enabling us to determine the appropriate price. This differentiates us from private equity firms, who are amongst our main competitors for the portfolios we acquire. Excellent relationships The Investment Manager and its advisors have excellent, strong relationships with financial institutions, as well as other potential sellers of under-resourced assets such as government agencies, commercial real estate lenders, receivers, REITs and property funds. These relationships give us a critical advantage in sourcing attractive investment opportunities, either off-market or with limited competition. Our ability to expeditiously complete transactions encourages vendors to transact with us and leads to repeat deal flow. Debt and equity synergies The Investment Manager and its advisors employ debt and equity professionals who work seamlessly together. Uniquely among our listed peers, this allows us to invest in both direct real estate and loans, and to carefully assess the quality of both the debt and the underlying property asset before making a purchasing decision. Acquiring debt at a discount to its market value gives us control of the underlying asset. We can then execute asset management strategies that create further value for our shareholders. Our business structure Being externally managed has a number of advantages for us. In particular, we have access to the experience and relationships of KW’s senior management and to the expertise of KW’s substantial wider team in Europe, at a cost to us that is substantially less then employing those resources in-house. Our business platform also benefits from the Investment Manager’s robust systems and processes, which it continues to enhance, and from our strong corporate governance, which ensures we meet our compliance, regulatory and filing requirements in each of the jurisdictions we operate in. See Resources and relationships, page 24 and Leadership, pages 62 to 66. S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 17

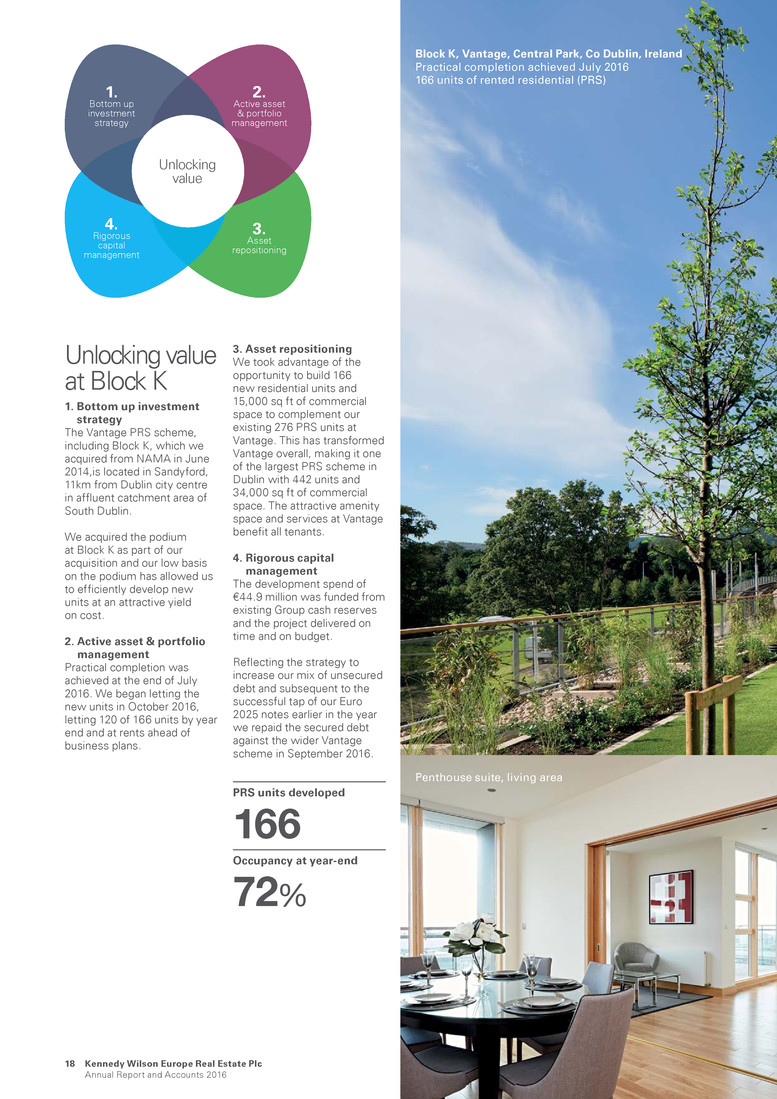

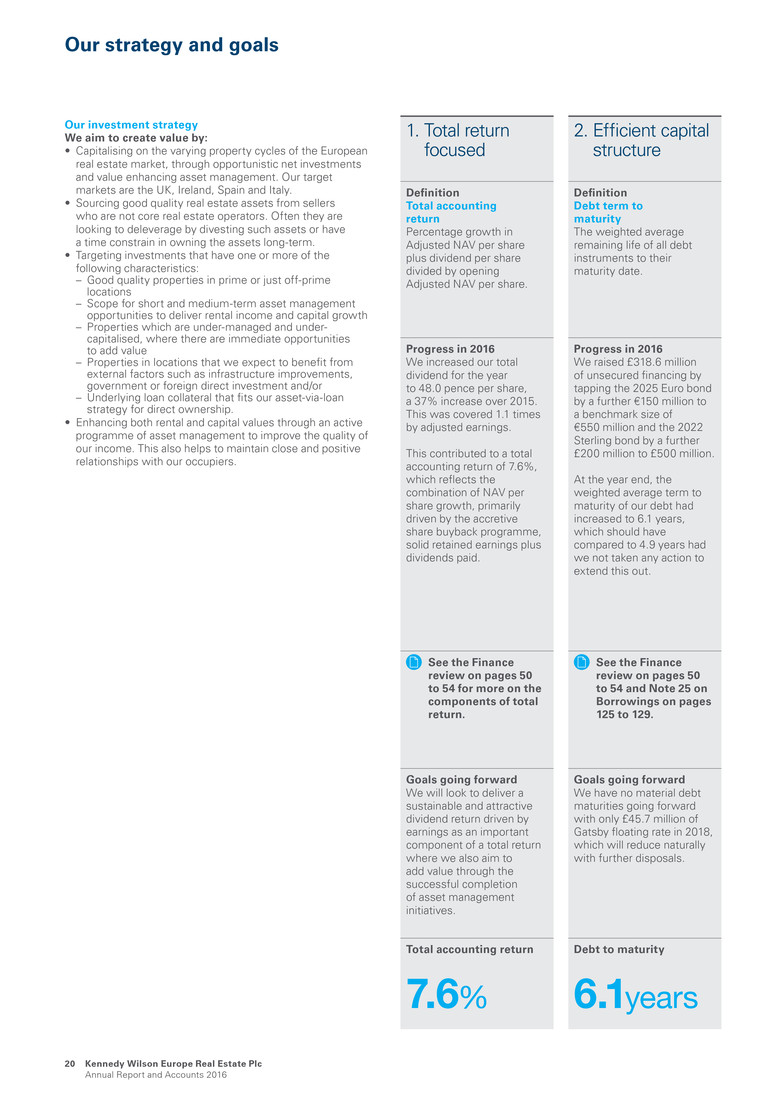

Unlocking value 2. Active asset & portfolio management 1. Bottom up investment strategy 3. Asset repositioning 4. Rigorous capital management Penthouse suite, living area Block K, Vantage, Central Park, Co Dublin, Ireland Practical completion achieved July 2016 166 units of rented residential (PRS) Unlocking value at Block K 1. Bottom up investment strategy The Vantage PRS scheme, including Block K, which we acquired from NAMA in June 2014,is located in Sandyford, 11km from Dublin city centre in affluent catchment area of South Dublin. We acquired the podium at Block K as part of our acquisition and our low basis on the podium has allowed us to efficiently develop new units at an attractive yield on cost. 2. Active asset & portfolio management Practical completion was achieved at the end of July 2016. We began letting the new units in October 2016, letting 120 of 166 units by year end and at rents ahead of business plans. 3. Asset repositioning We took advantage of the opportunity to build 166 new residential units and 15,000 sq ft of commercial space to complement our existing 276 PRS units at Vantage. This has transformed Vantage overall, making it one of the largest PRS scheme in Dublin with 442 units and 34,000 sq ft of commercial space. The attractive amenity space and services at Vantage benefit all tenants. 4. Rigorous capital management The development spend of €44.9 million was funded from existing Group cash reserves and the project delivered on time and on budget. Reflecting the strategy to increase our mix of unsecured debt and subsequent to the successful tap of our Euro 2025 notes earlier in the year we repaid the secured debt against the wider Vantage scheme in September 2016. PRS units developed 166 Occupancy at year-end 72% Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 18

Tenant amenity loungePenthouse suite bedroom S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 19

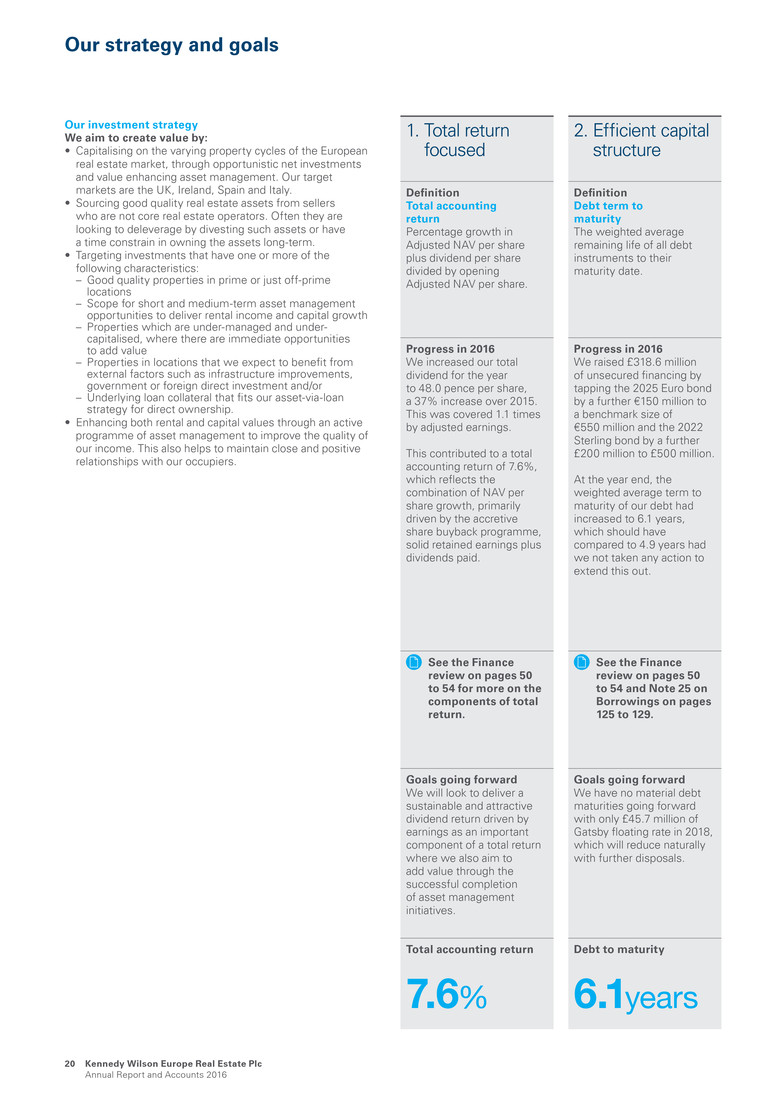

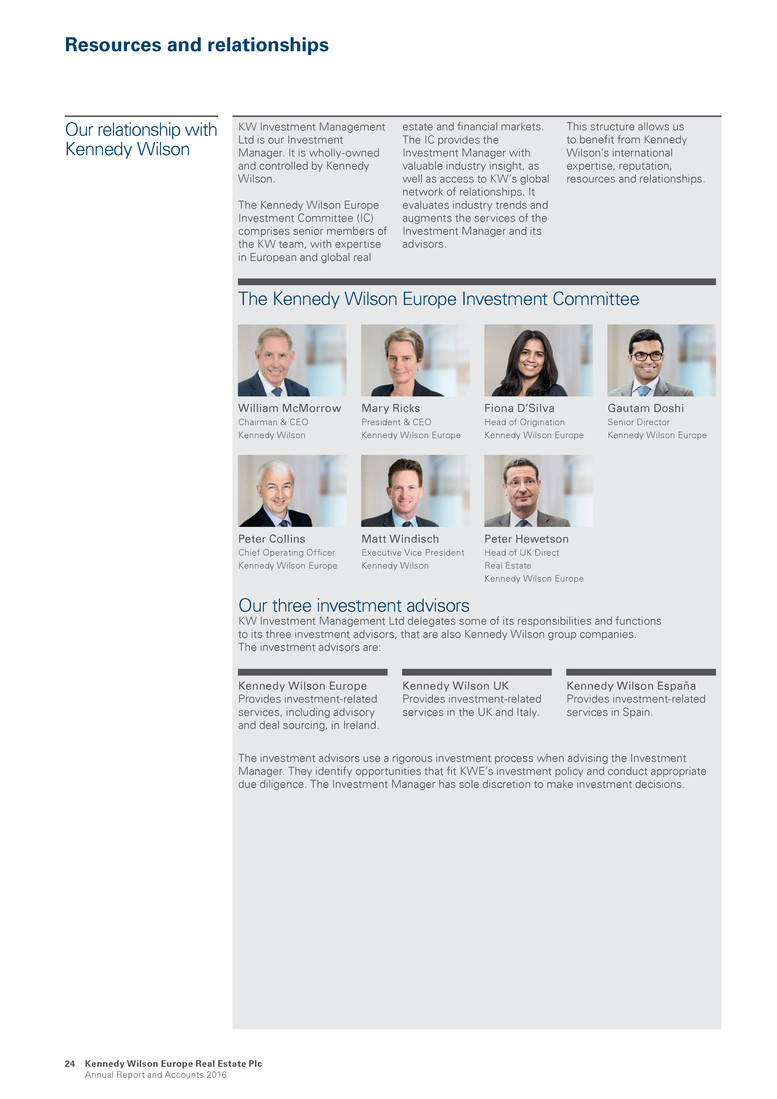

1. Total return focused Definition Total accounting return Percentage growth in Adjusted NAV per share plus dividend per share divided by opening Adjusted NAV per share. Progress in 2016 We increased our total dividend for the year to 48.0 pence per share, a 37% increase over 2015. This was covered 1.1 times by adjusted earnings. This contributed to a total accounting return of 7.6%, which reflects the combination of NAV per share growth, primarily driven by the accretive share buyback programme, solid retained earnings plus dividends paid. See the Finance review on pages 50 to 54 for more on the components of total return. Goals going forward We will look to deliver a sustainable and attractive dividend return driven by earnings as an important component of a total return where we also aim to add value through the successful completion of asset management initiatives. Total accounting return 7.6% 2. Efficient capital structure Definition Debt term to maturity The weighted average remaining life of all debt instruments to their maturity date. Progress in 2016 We raised £318.6 million of unsecured financing by tapping the 2025 Euro bond by a further €150 million to a benchmark size of €550 million and the 2022 Sterling bond by a further £200 million to £500 million. At the year end, the weighted average term to maturity of our debt had increased to 6.1 years, which should have compared to 4.9 years had we not taken any action to extend this out. See the Finance review on pages 50 to 54 and Note 25 on Borrowings on pages 125 to 129. Goals going forward We have no material debt maturities going forward with only £45.7 million of Gatsby floating rate in 2018, which will reduce naturally with further disposals. Debt to maturity 6.1years Our investment strategy We aim to create value by: • Capitalising on the varying property cycles of the European real estate market, through opportunistic net investments and value enhancing asset management. Our target markets are the UK, Ireland, Spain and Italy. • Sourcing good quality real estate assets from sellers who are not core real estate operators. Often they are looking to deleverage by divesting such assets or have a time constrain in owning the assets long-term. • Targeting investments that have one or more of the following characteristics: – Good quality properties in prime or just off-prime locations – Scope for short and medium-term asset management opportunities to deliver rental income and capital growth – Properties which are under-managed and under- capitalised, where there are immediate opportunities to add value – Properties in locations that we expect to benefit from external factors such as infrastructure improvements, government or foreign direct investment and/or – Underlying loan collateral that fits our asset-via-loan strategy for direct ownership. • Enhancing both rental and capital values through an active programme of asset management to improve the quality of our income. This also helps to maintain close and positive relationships with our occupiers. Our strategy and goals Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 20

3. Creating value through asset management Definition Target incremental NOI from asset management The combination of contracted income from agreements from lease and key asset management events over the next two years. Progress in 2016 We made further strong progress with our asset management initiatives, delivering £4.0 million of incremental annualised NOI across 140 commercial lease transactions, 1.1m sq ft, delivering an uplift over previous passing rent of 11.4% and outperforming valuers’ ERVs by 3.1%. We achieved practical completion at Block K (72% let by December 2016) and Baggot Plaza, converting previously contracted income into topped-up annualised NOI of £163.7 million. See the Performance review on pages 42 to 49 for more detail on our asset management initiatives and progress with our developments. Goals going forward We are aiming to generate a target incremental NOI of £14.5 million by the end of 2018 from selected asset management initiatives. Target incremental NOI from asset management £14.5m 4. Recycle capital Definition Total capital management The total volume of disposals, acquisitions, capital expenditure invested across the portfolio and other financial capital uses, such as share buybacks or repayment of debt. Progress in 2016 In 2016 our disposals totalled £413.1 million against our capital uses of £391.1 million, which included acquisitions of £184.1 million, capital expenditure of £106.7 million and share buyback of £100.0 million. Our disposals comprised 89 properties across 1.6 million sq ft. The programme crystallised a yield spread of 180bps between yield on cost and exist yield on sale, at a premium to book value of 4.8%, delivering a return on cost of 31.8% over a 21 month hold period. See the Performance review on page 43 for more detail on our disposal programme. Goals going forward We have identified a further £150 million of non-core disposals. Total capital management £804.2m Thames House, Waterside Park, Bracknell, UKPart of the South East office portfolio Acquired July 2015 33,700 sq ft suburban office “Last year we announced a further £200 million of non-core disposals to be completed by June 2017, as part of our ongoing programme to crystallise on asset management completions and continue to prune the portfolio. This tranche of sales formed part of £413.1 million of total sales over 2016, completing well ahead of our target date and delivering strong returns ahead of previous book values.“ Mary Ricks President and CEO, Kennedy Wilson Europe S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 21

We use the following financial and non-financial metrics to track the implementation of our strategy and our operational and financial performance. Bartley Wood Business Park, Hook, UK Part of the South East office portfolio Acquired July 2015 113,672 sq ft suburban office Yield on cost Definition The estimated annual NOI at the date of purchase divided by the purchase price using actual purchaser’s costs. Exit yield on sale Definition The estimated annual NOI at the date of sale divided by the sale price using seller’s costs. Link to business model Shows our ability to source assets at attractive entry points. Links to business model: Performance in 2016 We sold £413.1 million across 89 properties, crystallising a yield spread of 180bps when comparing the yield on cost of 7.6% versus the exit yield of 5.8%. Sales generating £104 million of total return and an attractive return on cost of 31.8%. Measures 180bps Yield spread between YOC and exit yield 5.8% Exit yield on 2016 sales KPIs, Group and EPRA measures Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 22

Adjusted NAV Definition IFRS net asset value adjusted by deducting any management fee and performance fee accounted for in the share-based payment reserve. Adjusted NAV per share Definition Adjusted NAV (as defined above) divided by the number of shares in issue at the relevant reporting date. Link to business model Shows our ability to add value to our properties, through asset management, development activities and realise profits on disposal. Links to business model: Performance in 2016 The adjusted NAV per share growth was 1,215.9 pence, a 3.5% increase for the year. This was driven by the accretive £100 million share buyback programme, solid retained earnings as well as a small element of foreign exchange gain. Measures 1,215.9p Adjusted NAV per share 3.5% Adjusted NAV per share growth Adjusted earnings Definition EPRA earnings adjusted by adding back the performance fee expense. Adjusted earnings per share Definition Adjusted Earnings (as defined above) divided by the weighted average number of shares in issue in the relevant period. Link to business model Shows our ability to generate earnings that cover our dividend payouts, which are a key part of our total return to shareholders. Links to business model: Performance in 2016 Adjusted earnings per share were 55.2 pence for the year. This is an increase of 15.2% on the prior period owing to the benefit of acquisitions along with successful leasing levels; partly offset by disposal activity. Measures 55.2p Adjusted earnings per share 15.2% Adjusted earnings per share growth EPRA vacancy Definition ERV of vacant space divided by ERV of the whole asset portfolio. WAULT Definition The weighted average lease term remaining to first break across the portfolio weighted by contracted rental income, excluding loans, hotels, development and residential properties. Link to business model Shows the security of cash flow, through tenants’ willingness to occupy our properties and to sign up to long leases. Links to business model: Performance in 2016 The portfolio vacancy increased slightly from the end of 2015 as we brought on development completions that are not fully let, like Block K. Our lease terms remain favourable with the WAULT to first break at 7.1 years, with the WAULT to expiry at an attractive 8.9 years. Measures 5.4% EPRA vacancy 7.1years WAULT (to first break) Loan to value (LTV) Definition Loan to value is the ratio of net debt (gross debt less cash) to the total portfolio value (value of investment and development properties, loans secured by real estate and hotels). Weighted average interest rate (WAIR) Definition The Group’s interest rate across all drawn facilities weighted by all drawn debt at the period end. Link to business model Shows that we have an affordable and appropriate level of gearing for our business model and compared to our target range. Links to business model: Performance in 2016 LTV at year end was 42.8% as a result of financing activity during the year which also saw the proportion of unsecured debt increase to 57% of the total borrowings. WAIR is 3.0% and the weighted average term to maturity improved during 2016. Measures 42.8% Loan to value 3.0% WAIR S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 23

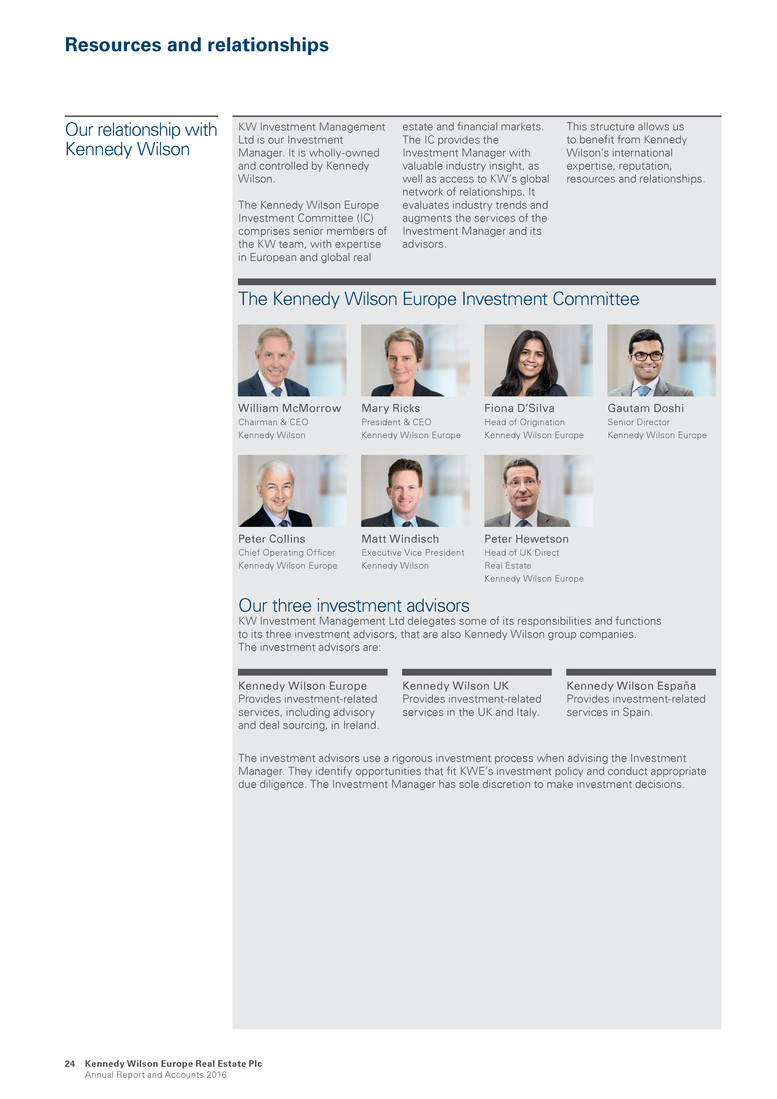

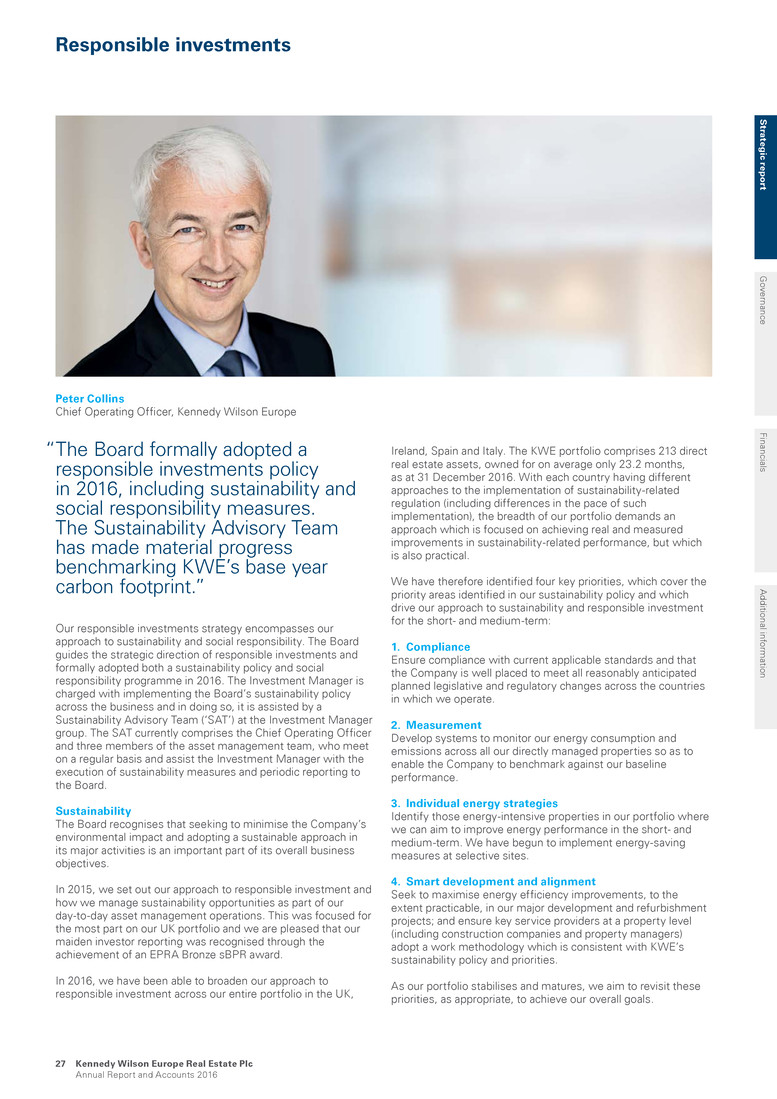

Resources and relationships Our relationship with Kennedy Wilson KW Investment Management Ltd is our Investment Manager. It is wholly-owned and controlled by Kennedy Wilson. The Kennedy Wilson Europe Investment Committee (IC) comprises senior members of the KW team, with expertise in European and global real estate and financial markets. The IC provides the Investment Manager with valuable industry insight, as well as access to KW’s global network of relationships. It evaluates industry trends and augments the services of the Investment Manager and its advisors. This structure allows us to benefit from Kennedy Wilson’s international expertise, reputation, resources and relationships. Kennedy Wilson Europe Provides investment-related services, including advisory and deal sourcing, in Ireland. Kennedy Wilson UK Provides investment-related services in the UK and Italy. Kennedy Wilson España Provides investment-related services in Spain. The Kennedy Wilson Europe Investment Committee William McMorrow Chairman & CEO Kennedy Wilson Mary Ricks President & CEO Kennedy Wilson Europe Fiona D’Silva Head of Origination Kennedy Wilson Europe Gautam Doshi Senior Director Kennedy Wilson Europe Peter Collins Chief Operating Officer Kennedy Wilson Europe Matt Windisch Executive Vice President Kennedy Wilson Peter Hewetson Head of UK Direct Real Estate Kennedy Wilson Europe Our three investment advisors KW Investment Management Ltd delegates some of its responsibilities and functions to its three investment advisors, that are also Kennedy Wilson group companies. The investment advisors are: The investment advisors use a rigorous investment process when advising the Investment Manager. They identify opportunities that fit KWE’s investment policy and conduct appropriate due diligence. The Investment Manager has sole discretion to make investment decisions. Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 24

Supported by KW’s team culture KW’s strong team culture ensures that the team’s broad and complementary skill sets in equity, debt and real estate all work towards delivering total shareholder return for KWE. This enables the KW team to capitalise on numerous investment opportunities across all facets of the real estate market. KW’s track record in Europe and its reputation as a reliable counterparty that closes deals quickly strengthens the Investment Manager’s sourcing ability and puts KWE in a strong position to capitalise on opportunities as appropriate. As KWE’s portfolio has grown, we have benefited from KW expanding its European management and advisory team. This has increased from around 50 people at the time of the IPO in February 2014 to over 90 at the year end, with senior local managers representing each part of the business. These professionals further strengthen KW’s local contacts with agents, brokers, joint venture partners, private equity participants and vendors. Orion Business Park, Ipswich, UK Acquired November 2016 203,370 sq ft industrial park S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 25

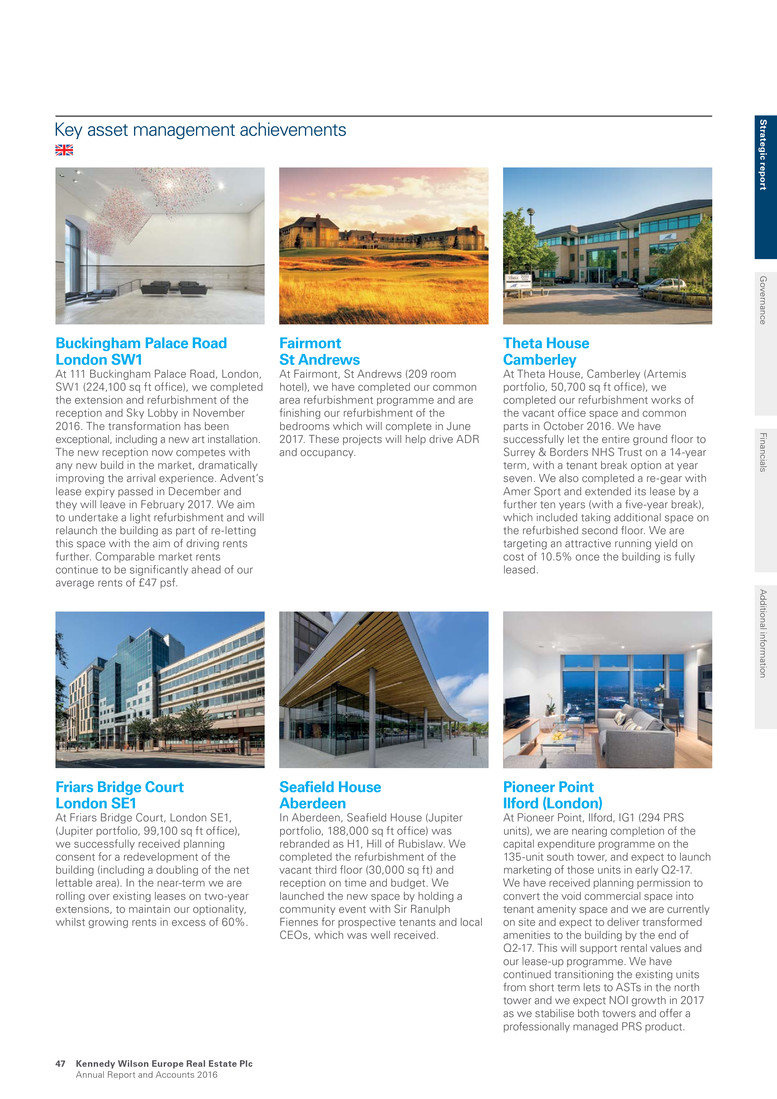

Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 26 New refurbished floor Refurbished reception area New reception entrance Theta House, Camberley, UK (Artemis portfolio) Acquired March 2014 50,700 sq ft suburban office Unlocking value 2. Active asset & portfolio management 1. Bottom up investment strategy 3. Asset repositioning 4. Rigorous capital management Unlocking value at Theta House 1. Bottom up investment strategy We acquired Theta House in March 2014, as part of the Artemis portfolio. The property was fully occupied by two tenants but we knew at acquisition that the main tenant, occupying 66% of the area, would vacate on lease expiry in February 2016. Having underwritten this lease event, we could price the acquisition to reflect the leasing risk and make plans to execute on what we saw as an attractive asset management opportunity. Theta House is well located close to Junction 4 of the M3, in the heart of the Blackwater Valley office market. 2. Active asset & portfolio management We undertook a full refurbishment of vacant areas and common parts, completing in October 2016. We successfully let the entire ground floor to Surrey & Borders NHS Trust on a 14-year lease (with a seven-year break). We also completed a re-gear with Amer Sport ahead of its lease expiry in October 2017. We achieved both a ten-year lease extension (with a five-year break), and an expansion into additional space on the refurbished second floor. Total refurbishment spend £1.9m Stabilised yield on cost 10.5%

Responsible investments “The Board formally adopted a responsible investments policy in 2016, including sustainability and social responsibility measures. The Sustainability Advisory Team has made material progress benchmarking KWE’s base year carbon footprint.” Our responsible investments strategy encompasses our approach to sustainability and social responsibility. The Board guides the strategic direction of responsible investments and formally adopted both a sustainability policy and social responsibility programme in 2016. The Investment Manager is charged with implementing the Board’s sustainability policy across the business and in doing so, it is assisted by a Sustainability Advisory Team (‘SAT’) at the Investment Manager group. The SAT currently comprises the Chief Operating Officer and three members of the asset management team, who meet on a regular basis and assist the Investment Manager with the execution of sustainability measures and periodic reporting to the Board. Sustainability The Board recognises that seeking to minimise the Company’s environmental impact and adopting a sustainable approach in its major activities is an important part of its overall business objectives. In 2015, we set out our approach to responsible investment and how we manage sustainability opportunities as part of our day-to-day asset management operations. This was focused for the most part on our UK portfolio and we are pleased that our maiden investor reporting was recognised through the achievement of an EPRA Bronze sBPR award. In 2016, we have been able to broaden our approach to responsible investment across our entire portfolio in the UK, Peter Collins Chief Operating Officer, Kennedy Wilson Europe Ireland, Spain and Italy. The KWE portfolio comprises 213 direct real estate assets, owned for on average only 23.2 months, as at 31 December 2016. With each country having different approaches to the implementation of sustainability-related regulation (including differences in the pace of such implementation), the breadth of our portfolio demands an approach which is focused on achieving real and measured improvements in sustainability-related performance, but which is also practical. We have therefore identified four key priorities, which cover the priority areas identified in our sustainability policy and which drive our approach to sustainability and responsible investment for the short- and medium-term: 1. Compliance Ensure compliance with current applicable standards and that the Company is well placed to meet all reasonably anticipated planned legislative and regulatory changes across the countries in which we operate. 2. Measurement Develop systems to monitor our energy consumption and emissions across all our directly managed properties so as to enable the Company to benchmark against our baseline performance. 3. Individual energy strategies Identify those energy-intensive properties in our portfolio where we can aim to improve energy performance in the short- and medium-term. We have begun to implement energy-saving measures at selective sites. 4. Smart development and alignment Seek to maximise energy efficiency improvements, to the extent practicable, in our major development and refurbishment projects; and ensure key service providers at a property level (including construction companies and property managers) adopt a work methodology which is consistent with KWE’s sustainability policy and priorities. As our portfolio stabilises and matures, we aim to revisit these priorities, as appropriate, to achieve our overall goals. S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 27

1. Compliance Meeting UK Minimum Energy Efficiency Standards In March 2015 the UK Government introduced the Minimum Energy Efficiency Standards, aimed at preventing new lettings of properties in England and Wales with an Energy Performance Certificate (‘EPC’) rating of F or G. In preparation for these standards coming into effect on 1 April 2018, we have recorded 100% coverage of EPCs across our UK portfolio during 2016 and identified a watch list of at-risk assets (with EPC ratings of F or G). A key part of our business plan is to purchase under-managed real estate in strong locations, which can often lead to assets being acquired with lower EPC ratings; ordinarily, these are then improved once they enter our repositioning and asset management programme. We have begun implementing a remedial programme for those properties in our portfolio with lower EPC ratings to ensure compliance when the regulations come into effect in 2018. This includes reviewing and improving the EPC by ensuring the appropriate investment is undertaken as part of our wider asset management plan. Our asset management initiatives are driven by the timing of the next lease event, our wider capex programme and whether it forms part of our non-core disposal programme. In this report, and on an ongoing basis, we intend to monitor our EPC ratings against ERVs, with a view to more accurately representing those properties in refurbishment, vacant or in rent free periods. KWE UK portfolio EPC rating summary as at 31 December 2016 100% coverage EPC ratings by ERV B A C D E F G 7% 24% 40% 22% 6% 1% At risk Currently not at risk 0% 2. Measurement We are now in our second year of data collection. This has allowed us to compare between the two reporting periods (which matches our financial reporting periods) to evaluate progress, which we believe is a first essential step to improve environmental performance. We intend to collect and present data reflecting the greenhouse gas footprint of the Company’s directly managed assets. We believe this allows for a clear understanding of the greenhouse gas output that we directly influence, and can subsequently manage, versus the greenhouse gases generated by our tenants’ activities, which we cannot manage directly. As such, the consolidation of our greenhouse gas reporting follows the operational control approach as defined by the Greenhouse Gas Protocol. With the expansion of our data collection programme to include Ireland, Spain and Italy, we are analysing ways to streamline our data gathering and reporting across all invested jurisdictions. Within this report, where there are gaps in data collection, we have pro-rated the data available to provide an estimate annual figure (this affects 6% of report coverage by kilowatt hour of energy use). Performance summary As the data collection programme now includes three new countries we have re-stated 2015 data to reflect the increases in data coverage and improvements in data quality. We have also added an emissions baseline (our re-stated 2015 greenhouse gas emissions) to allow for like-for-like performance analysis. See EPRA sBPR tables on pages 32 to 33 for further details. There are 19 buildings in the like-for-like portfolio where we can compare 2016 greenhouse gas emissions to those generated in 2015. This set of assets has seen a 4% reduction in electricity usage and a 3% reduction in natural gas usage by kilowatt hour of energy use. The Fairmont Hotel is one of the properties in the like-for-like portfolio. It is the second highest emitter of greenhouse gases in the KWE directly managed portfolio and, as such, it has been selected as one of the focus sites for our energy efficiency programme. In 2016, we have achieved a 16% year-on-year reduction in gas usage and a 12% year-on-year reduction in greenhouse gas emissions at the hotel. These savings have been realised by implementing various site level energy reduction initiatives, including upgrading the combined heat and power (‘CHP’) plant and conducting energy reduction and sustainability training with on-site staff. As a result of our acquisition activity during 2015 and 2016, our pool of directly managed assets has grown from 31 to 39 assets. This gives us a good opportunity to implement our sustainability programme over a larger base of assets. Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 28 Responsible investments continued

Building on the energy reduction programme implemented at 111 BPR in 2015, we undertook significant investment into various energy efficiency measures in 2016. These include: Lighting controls have been improved to enable more efficient use A rolling LED lighting change programme is in place Quarterly tenant engagement meetings include energy performance and reduction A collaborative asset performance programme has been commissioned, working across site engineering teams focusing on improving building management system controls, with the aim of further reducing natural gas usage, and electricity usage in summer months Collecting and analysing automated sub-meter readings to target energy wastage (as part of the KWE sustainability data programme) Introduction of a bee hotel and signing up to The Victoria BID Air Quality Pledge Certificate Most of the changes at 111 BPR have related to building controls, which has resulted in a 15% decrease in natural gas consumption year-on-year, leading to a 10% overall reduction in greenhouse gas emissions. We are looking to implement further energy improvements at 111 BPR and if such improvements are successful we expect to see continued reductions in emissions in 2017. 3. Individual energy strategies In 2015 we identified 111 Buckingham Palace Road (‘111 BPR’) as one of our major energy users and started a programme to improve its energy efficiency. This year we have added four other high priority ‘focus sites’ across our portfolio which, together with 111 BPR, account for 51% of KWE’s Scope 1 and 2 greenhouse gas emissions. Our focus sites with individual energy strategies include: 111 Buckingham Palace Road, London 224,120 sq ft multi-let office Baggot Plaza, Dublin 129,300 sq ft single let office Fairmont Hotel, St Andrews 209 bed 5-star hotel Vantage, Central Park, Dublin 442 residential unit estate Moraleja Green, Madrid 324,800 sq ft community shopping centre Social responsibility In May 2016, the Board formally adopted a social responsibility programme with a particular focus on working with communities in proximity to our major assets and a budget of £50,000. Over the year we supported two significant social causes and events at our major assets: • At Hill of Rubislaw, we hosted a talk by Sir Ranulph Fiennes in partnership with Marie Curie Cancer Care, and made a £10,000 donation to Marie Curie • At Towers Business Park, we raised £7,500 for Francis House Children’s Hospice by hosting fundraising events with the tenants Hill of Rubislaw, Aberdeen Sir Ranulph Fiennes (left) in partnership with Marie Curie Towers Business Park, Manchester Fundraising efforts for Francis House Children’s Hospice S trateg ic rep o rt G overnance Financials A dditional inform ation Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 29

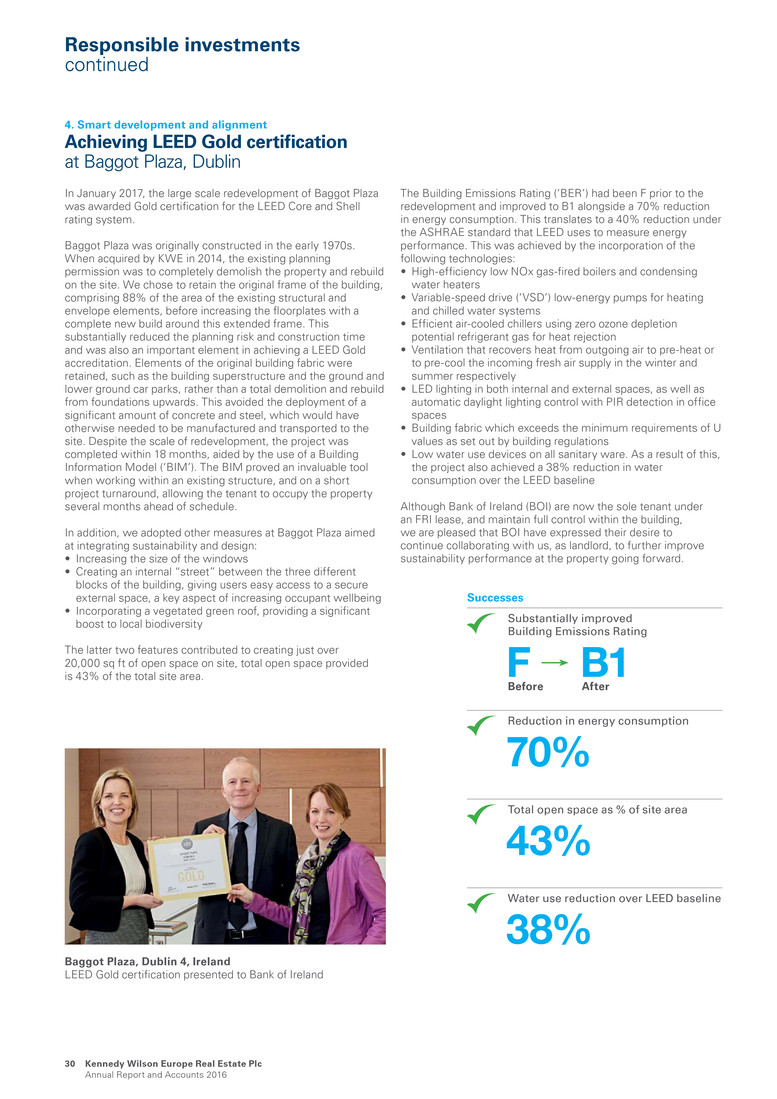

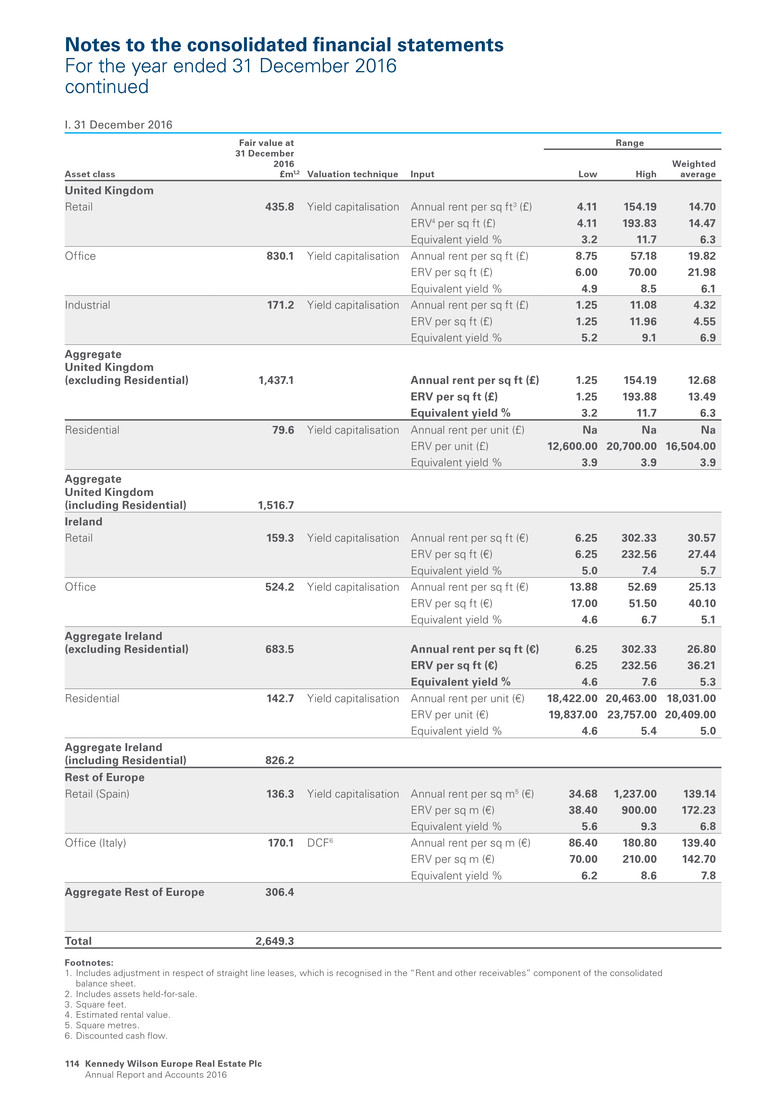

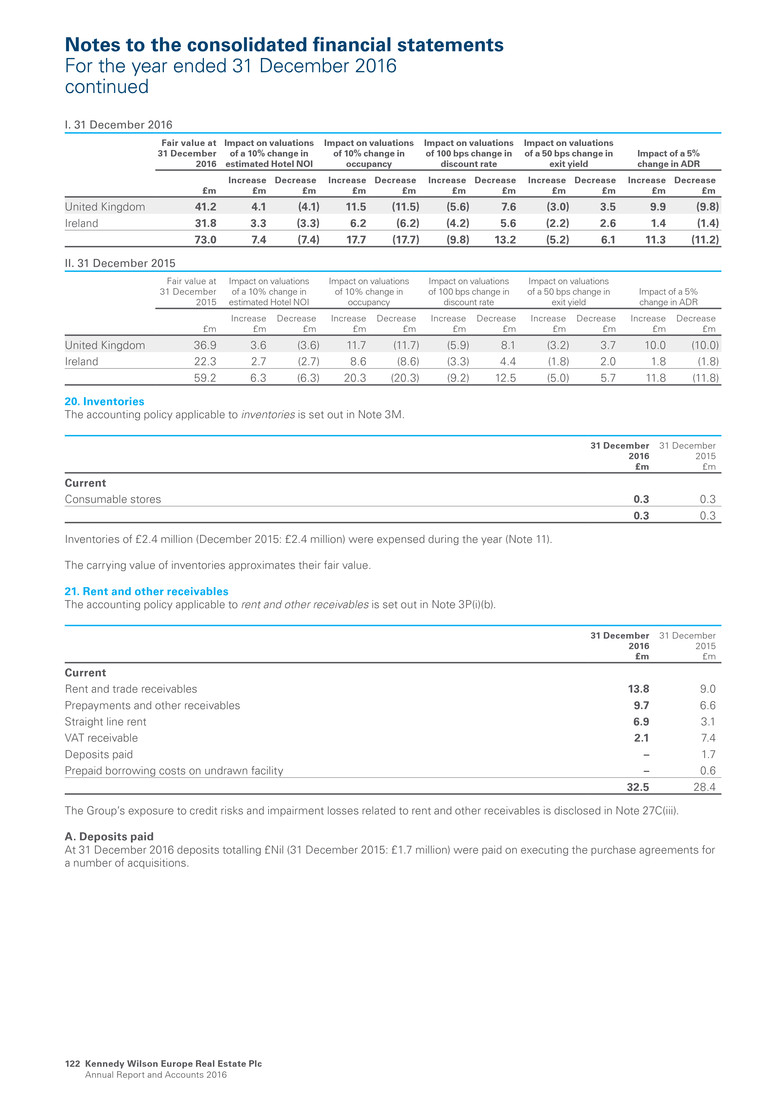

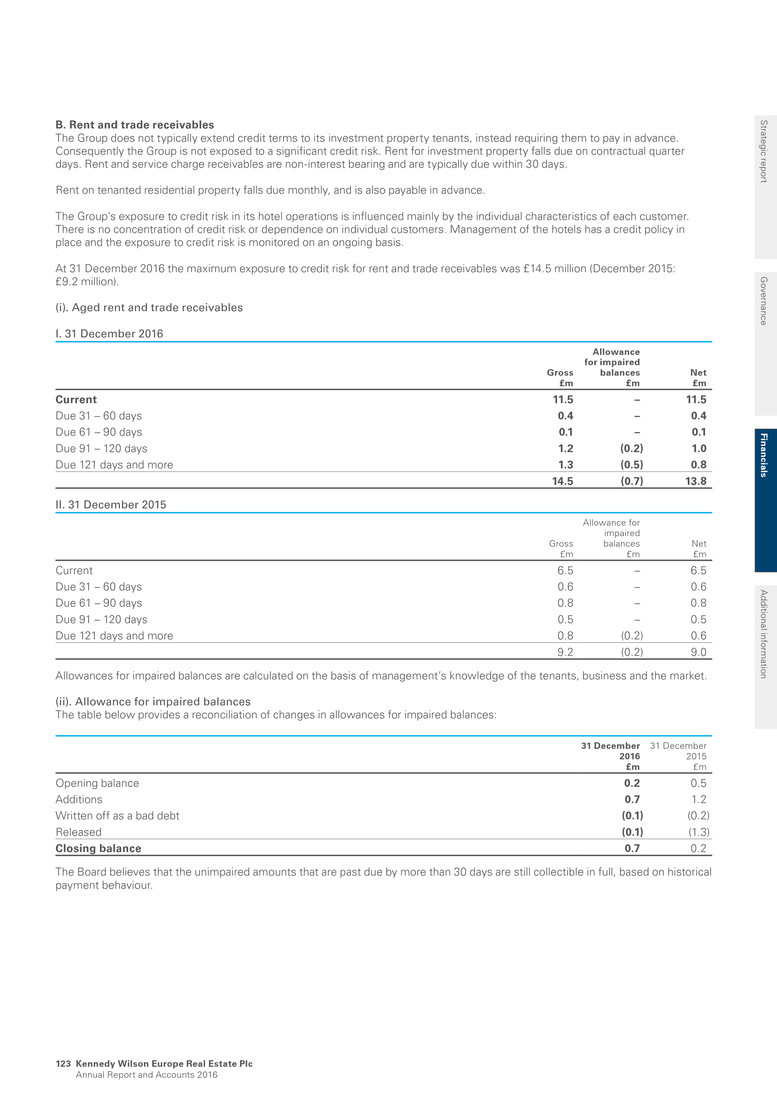

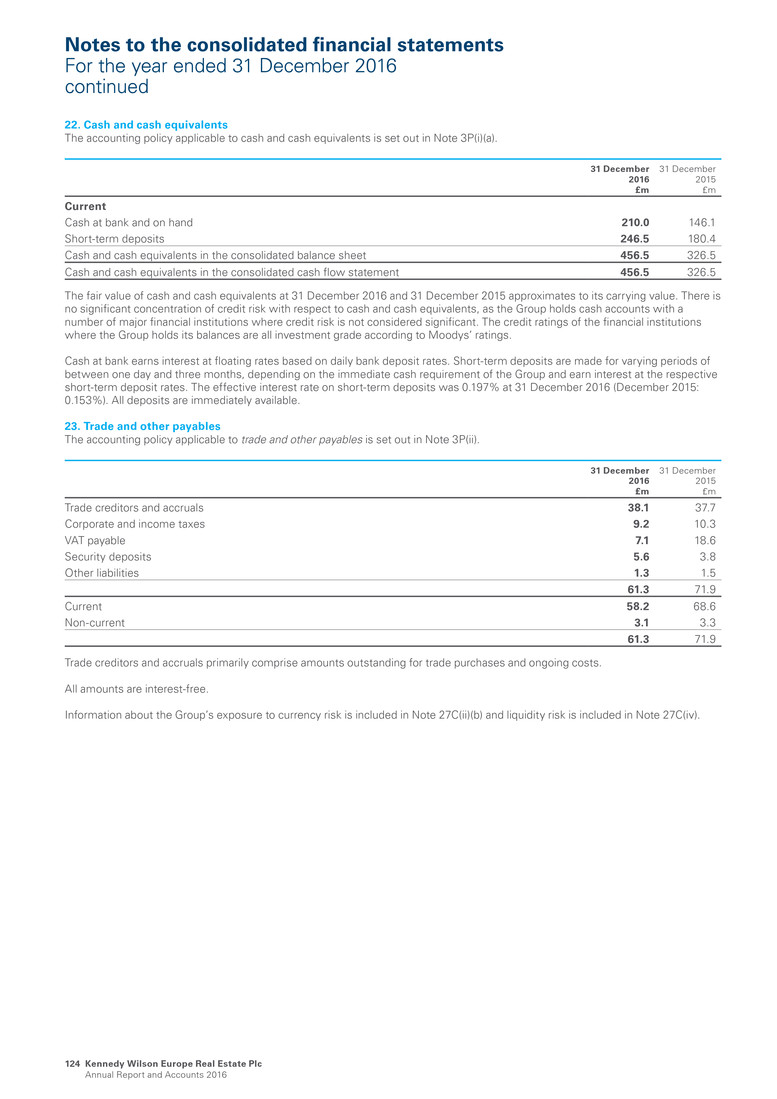

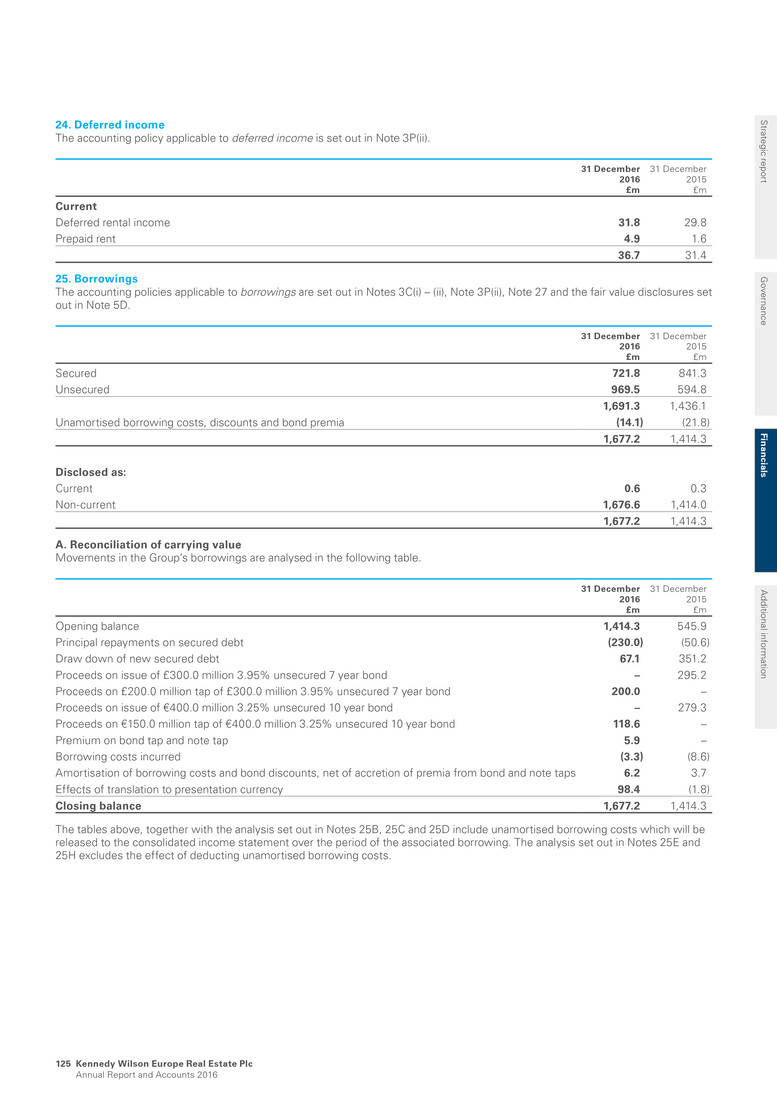

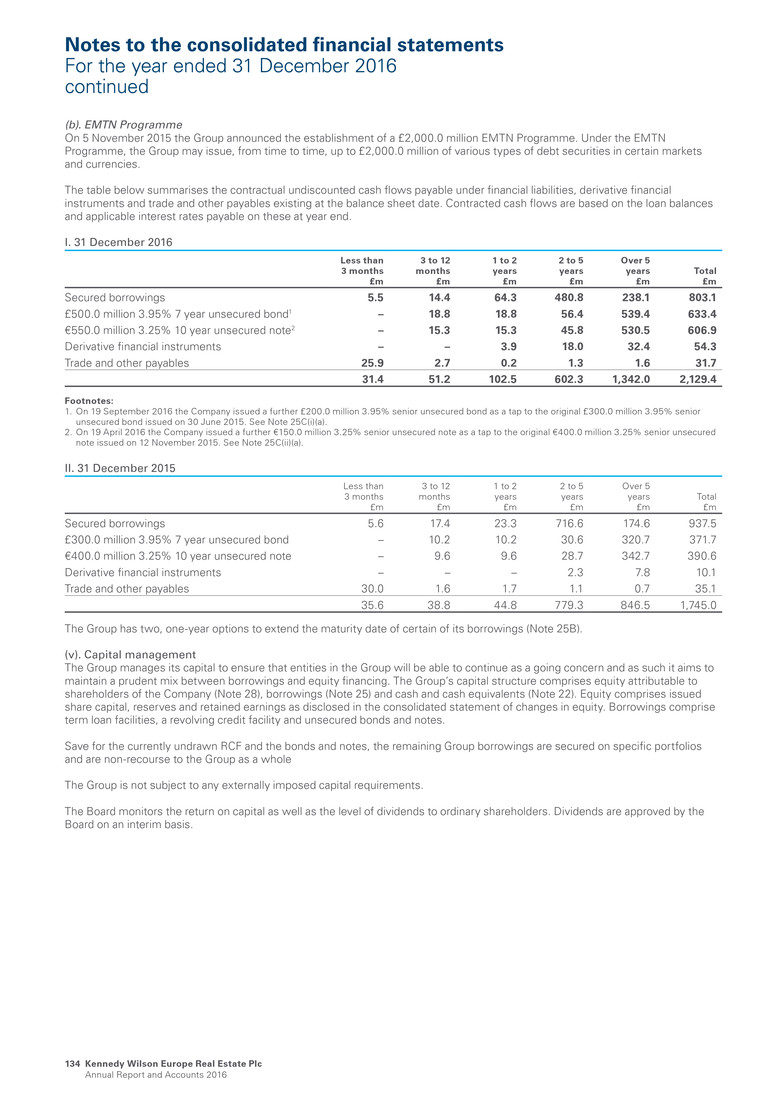

4. Smart development and alignment Achieving LEED Gold certification at Baggot Plaza, Dublin In January 2017, the large scale redevelopment of Baggot Plaza was awarded Gold certification for the LEED Core and Shell rating system. Baggot Plaza was originally constructed in the early 1970s. When acquired by KWE in 2014, the existing planning permission was to completely demolish the property and rebuild on the site. We chose to retain the original frame of the building, comprising 88% of the area of the existing structural and envelope elements, before increasing the floorplates with a complete new build around this extended frame. This substantially reduced the planning risk and construction time and was also an important element in achieving a LEED Gold accreditation. Elements of the original building fabric were retained, such as the building superstructure and the ground and lower ground car parks, rather than a total demolition and rebuild from foundations upwards. This avoided the deployment of a significant amount of concrete and steel, which would have otherwise needed to be manufactured and transported to the site. Despite the scale of redevelopment, the project was completed within 18 months, aided by the use of a Building Information Model (‘BIM’). The BIM proved an invaluable tool when working within an existing structure, and on a short project turnaround, allowing the tenant to occupy the property several months ahead of schedule. In addition, we adopted other measures at Baggot Plaza aimed at integrating sustainability and design: • Increasing the size of the windows • Creating an internal “street” between the three different blocks of the building, giving users easy access to a secure external space, a key aspect of increasing occupant wellbeing • Incorporating a vegetated green roof, providing a significant boost to local biodiversity The latter two features contributed to creating just over 20,000 sq ft of open space on site, total open space provided is 43% of the total site area. Baggot Plaza, Dublin 4, Ireland LEED Gold certification presented to Bank of Ireland The Building Emissions Rating (‘BER’) had been F prior to the redevelopment and improved to B1 alongside a 70% reduction in energy consumption. This translates to a 40% reduction under the ASHRAE standard that LEED uses to measure energy performance. This was achieved by the incorporation of the following technologies: • High-efficiency low NOx gas-fired boilers and condensing water heaters • Variable-speed drive (‘VSD’) low-energy pumps for heating and chilled water systems • Efficient air-cooled chillers using zero ozone depletion potential refrigerant gas for heat rejection • Ventilation that recovers heat from outgoing air to pre-heat or to pre-cool the incoming fresh air supply in the winter and summer respectively • LED lighting in both internal and external spaces, as well as automatic daylight lighting control with PIR detection in office spaces • Building fabric which exceeds the minimum requirements of U values as set out by building regulations • Low water use devices on all sanitary ware. As a result of this, the project also achieved a 38% reduction in water consumption over the LEED baseline Although Bank of Ireland (BOI) are now the sole tenant under an FRI lease, and maintain full control within the building, we are pleased that BOI have expressed their desire to continue collaborating with us, as landlord, to further improve sustainability performance at the property going forward. Successes Substantially improved Building Emissions Rating F B1 Before After Reduction in energy consumption 70% Total open space as % of site area 43% Water use reduction over LEED baseline 38% Responsible investments continued Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 30

S trateg ic rep o rt G overnance Financials A dditional inform ation 31 Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016

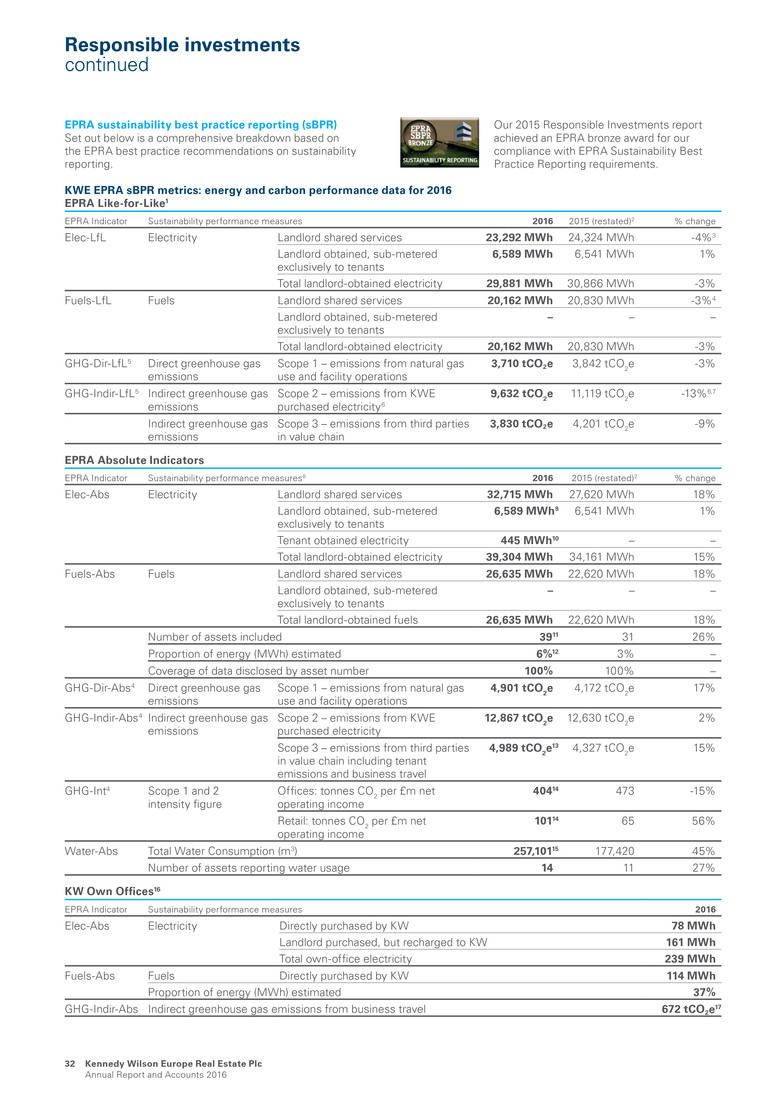

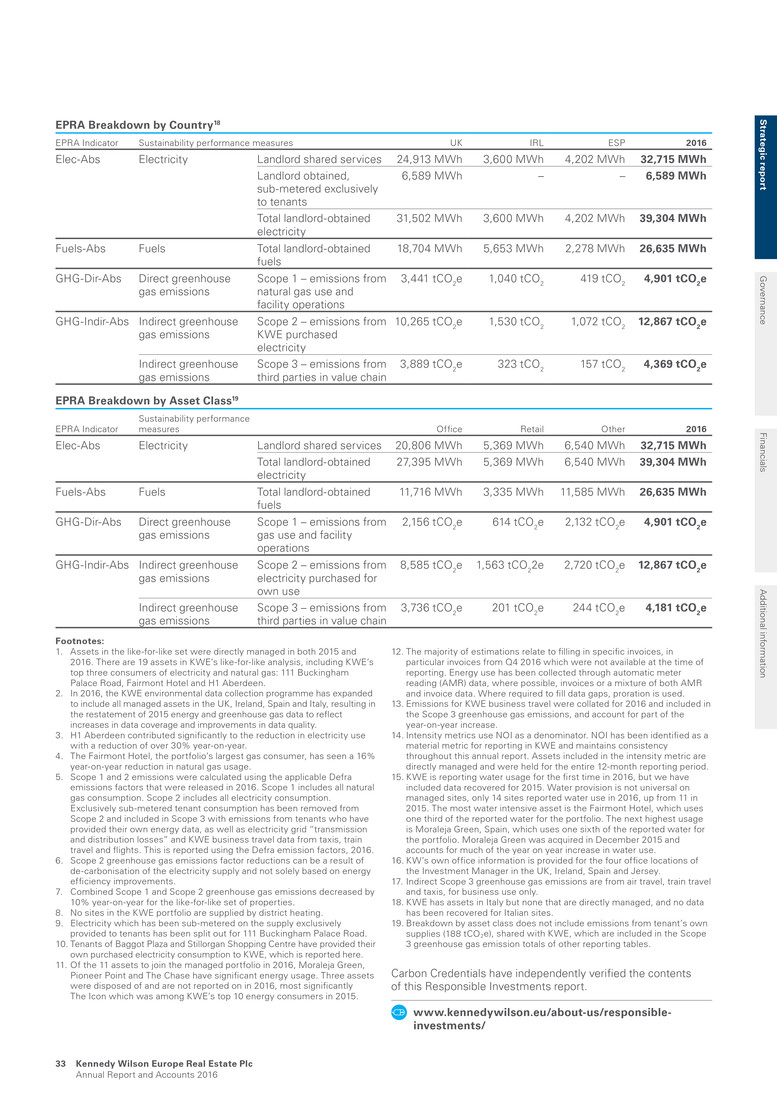

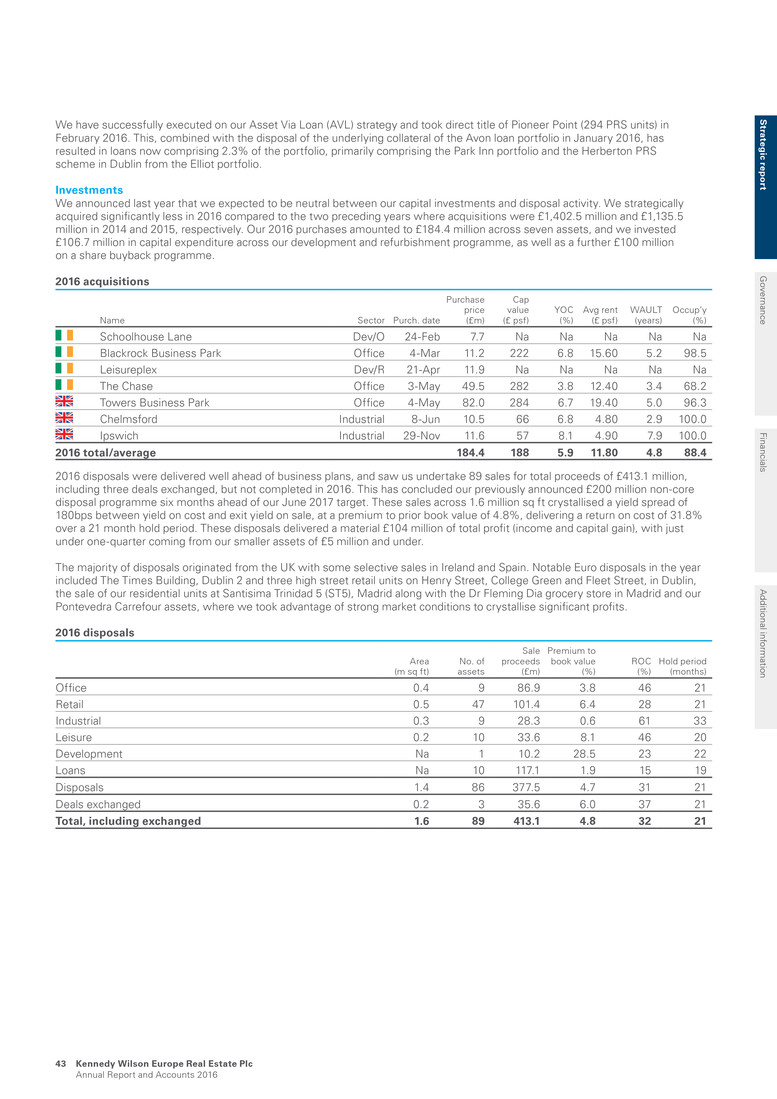

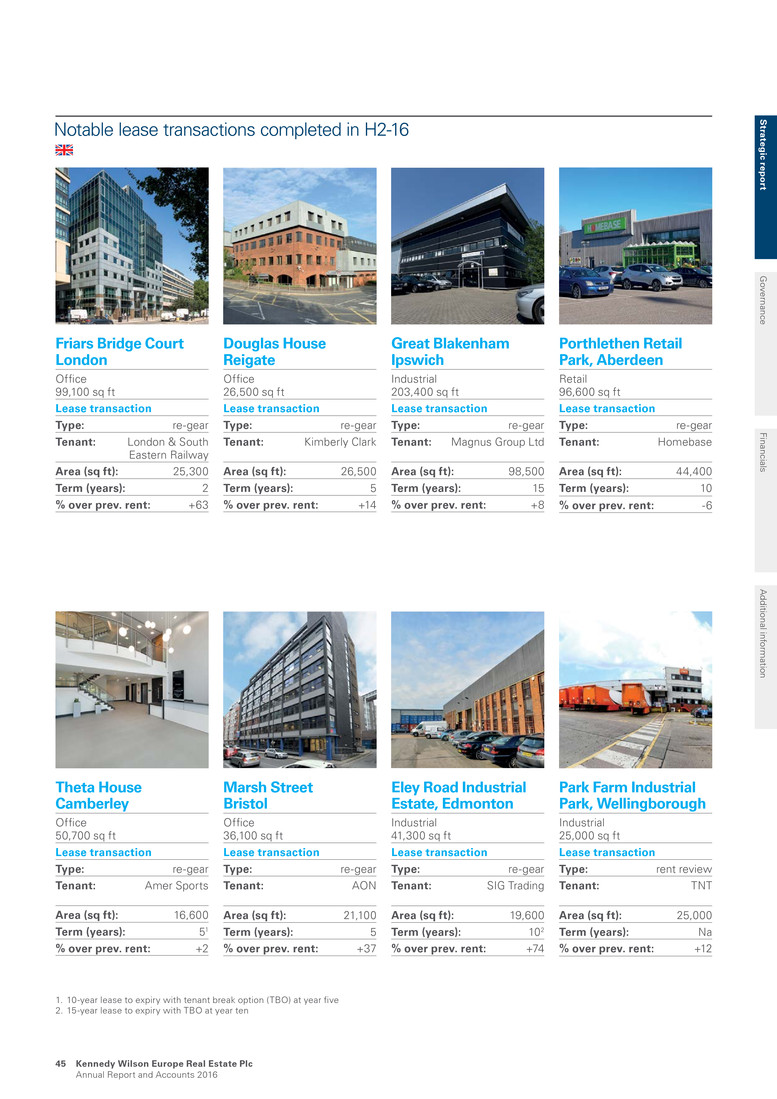

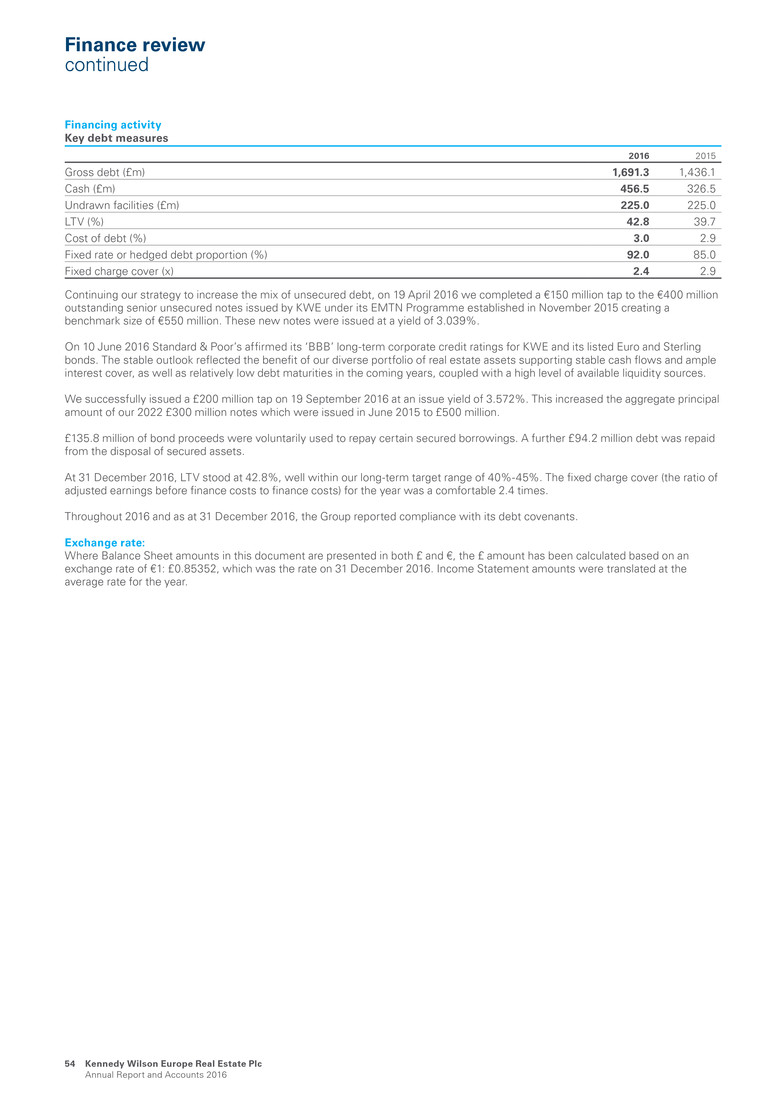

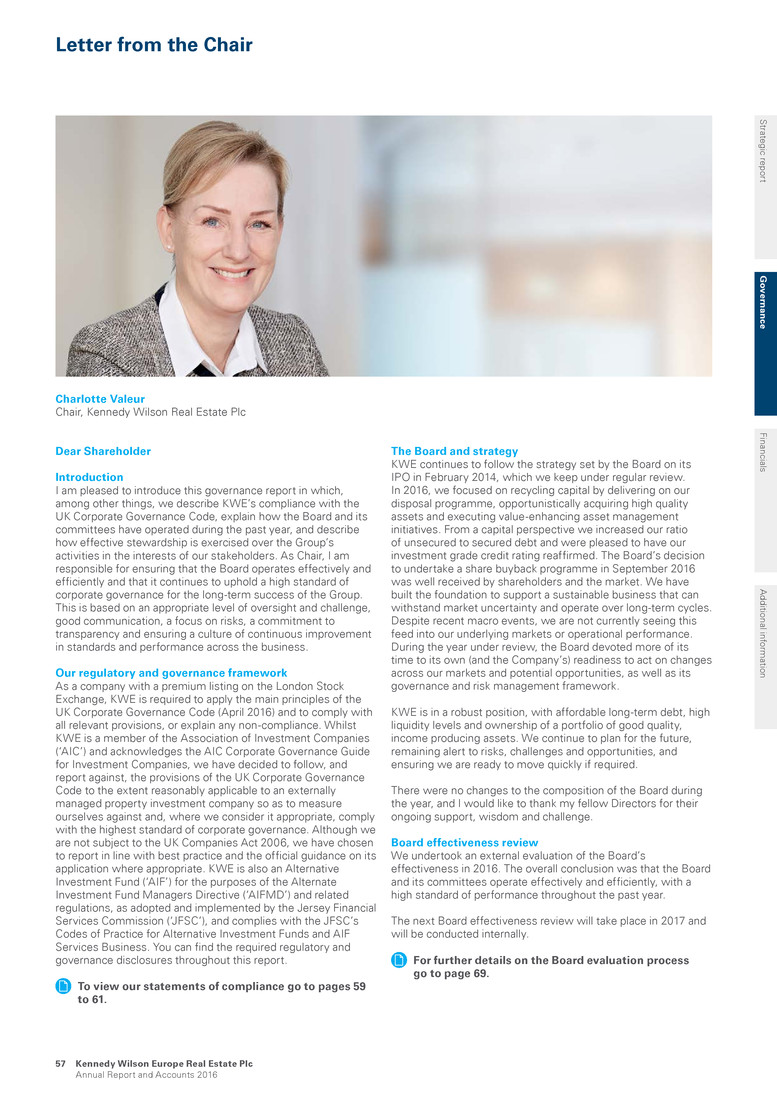

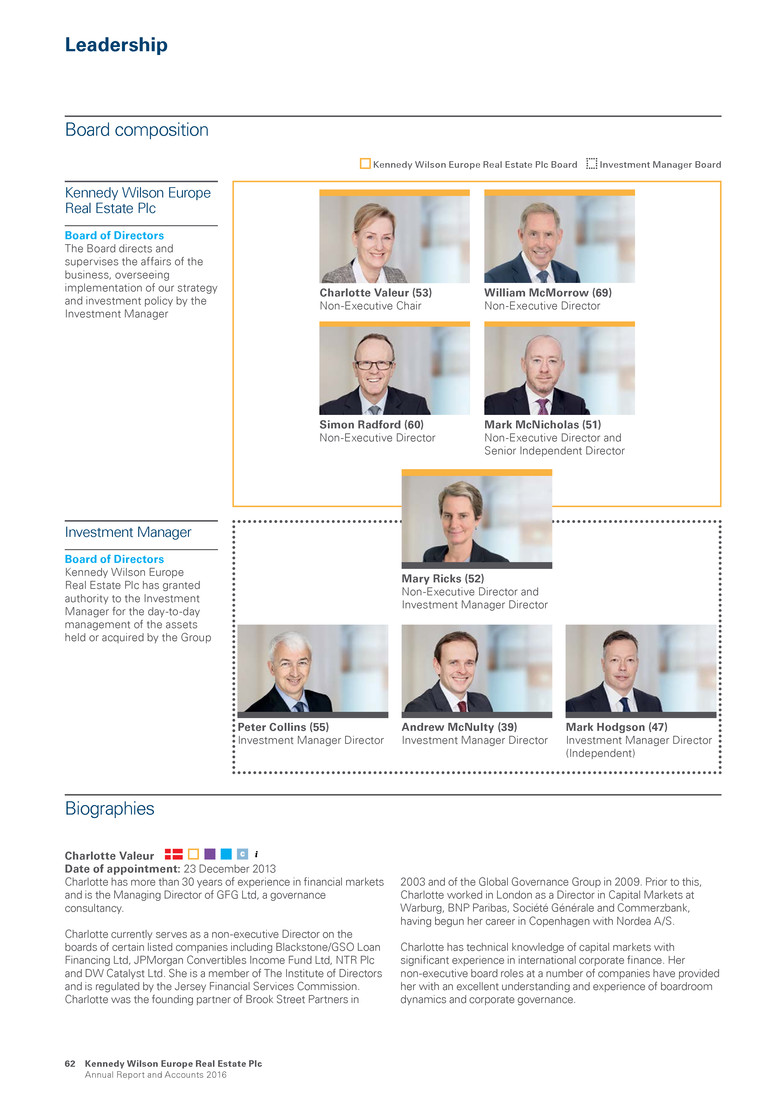

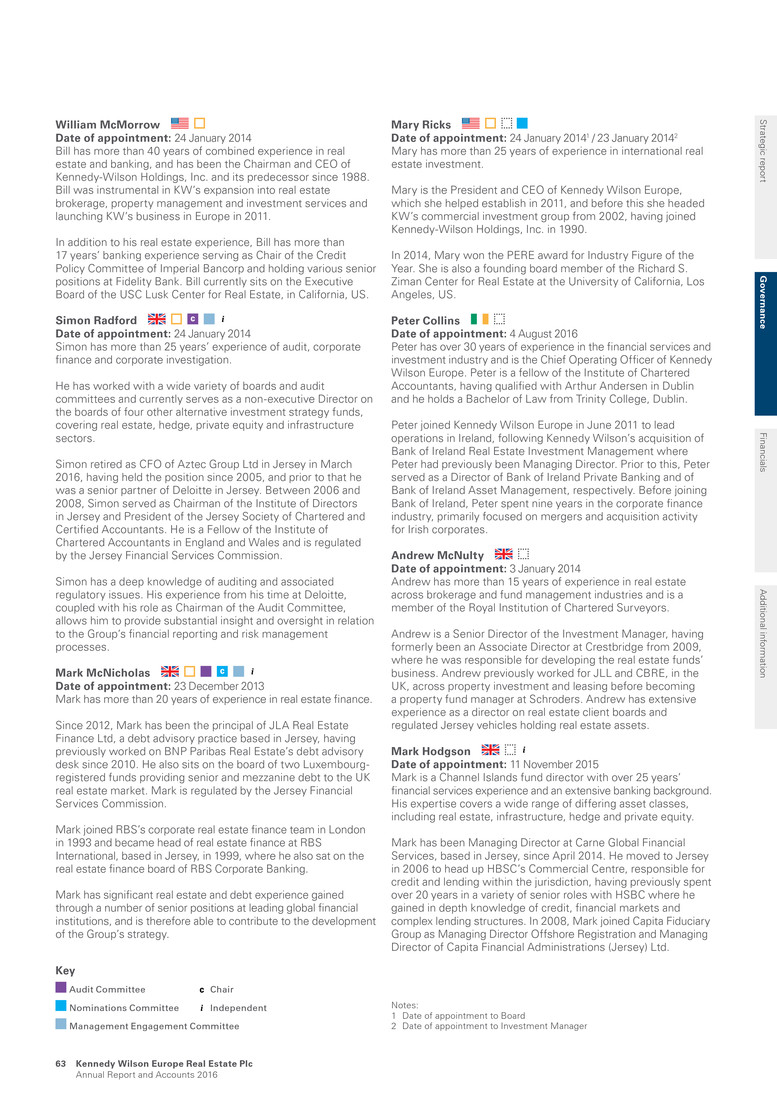

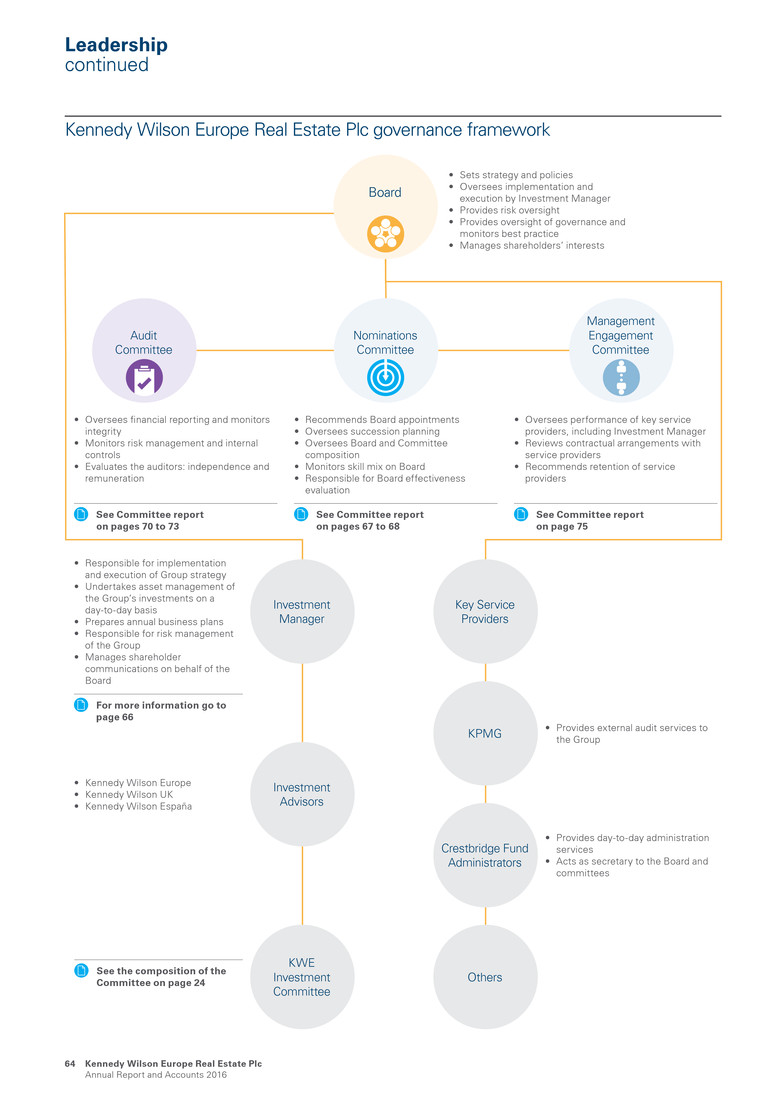

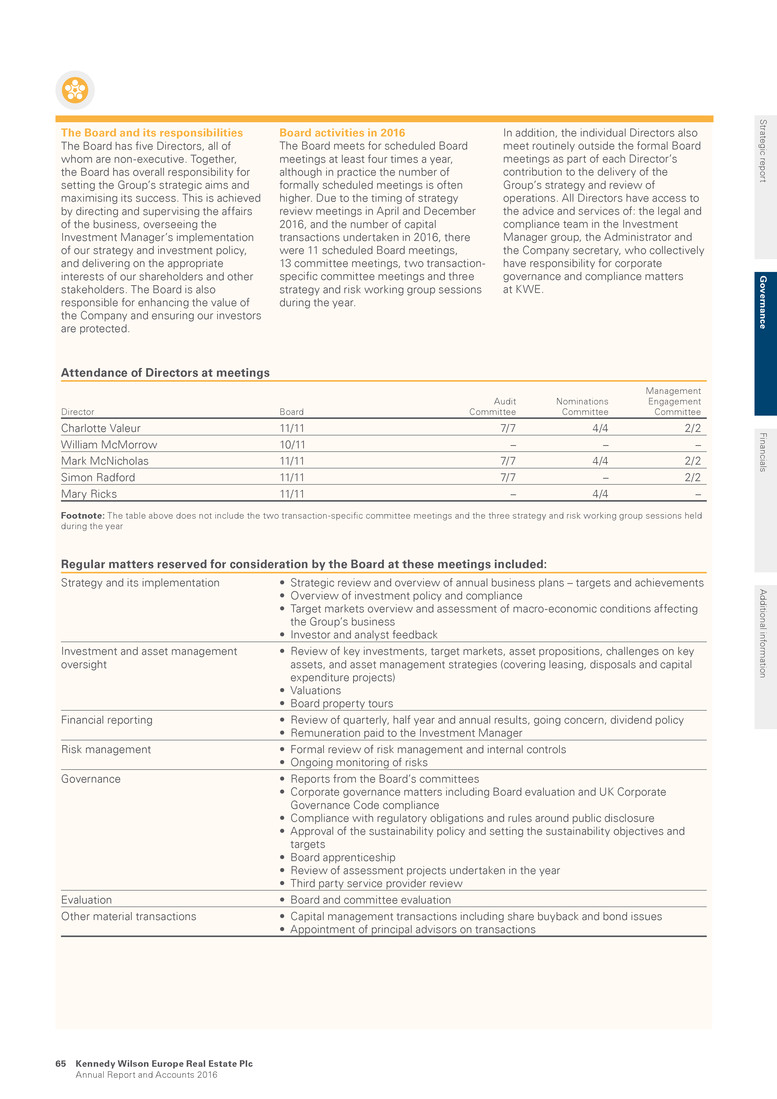

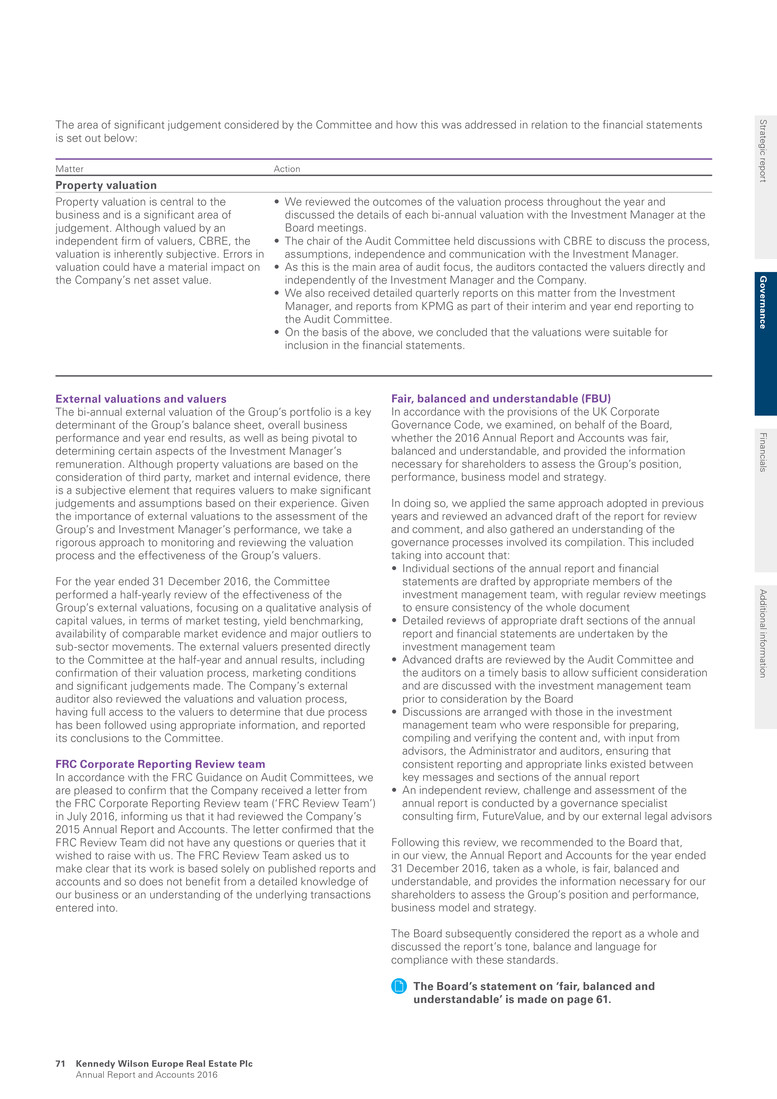

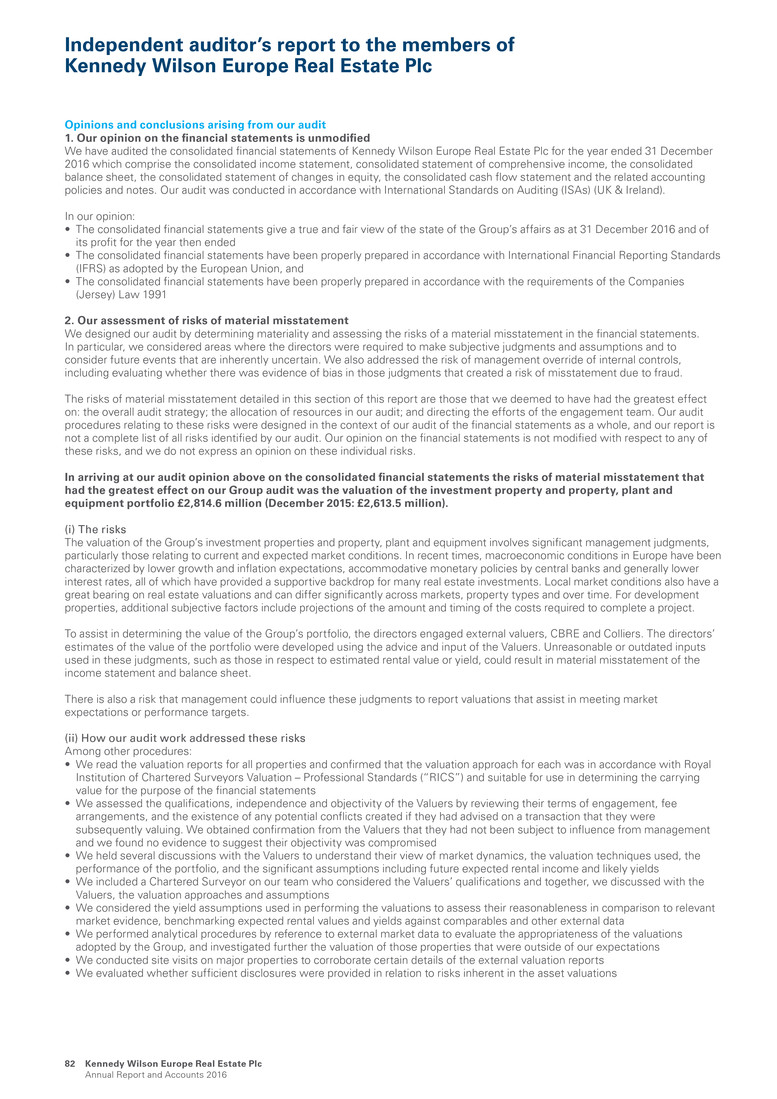

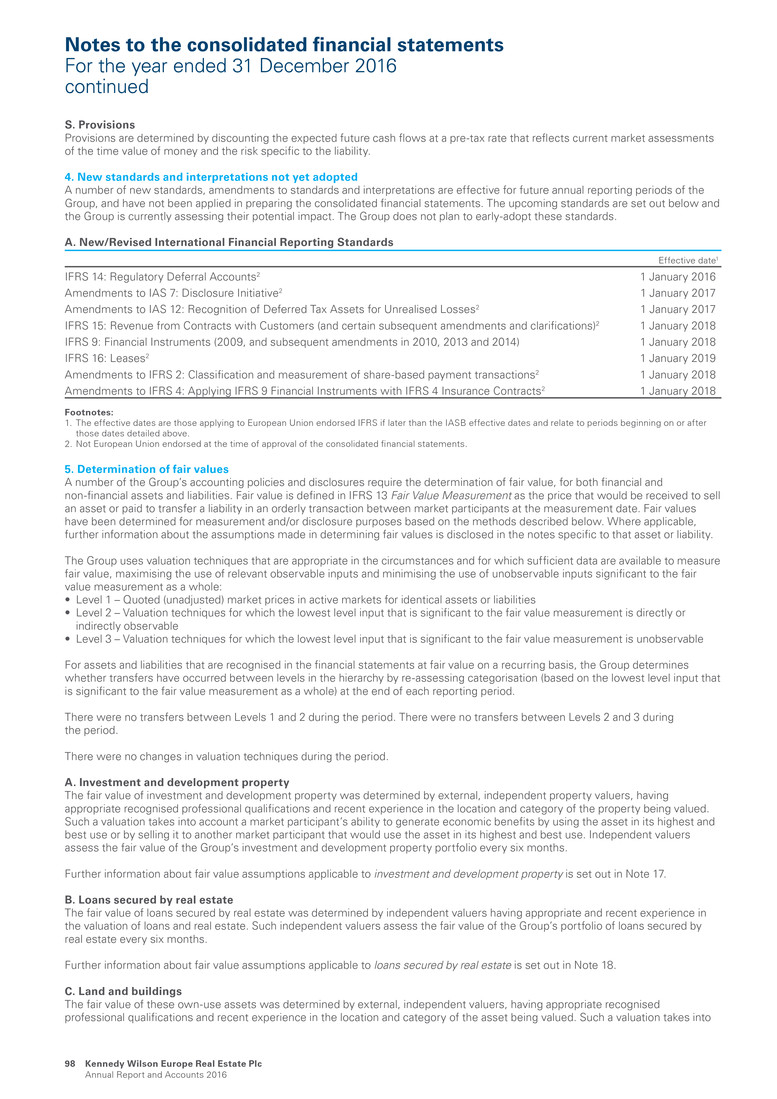

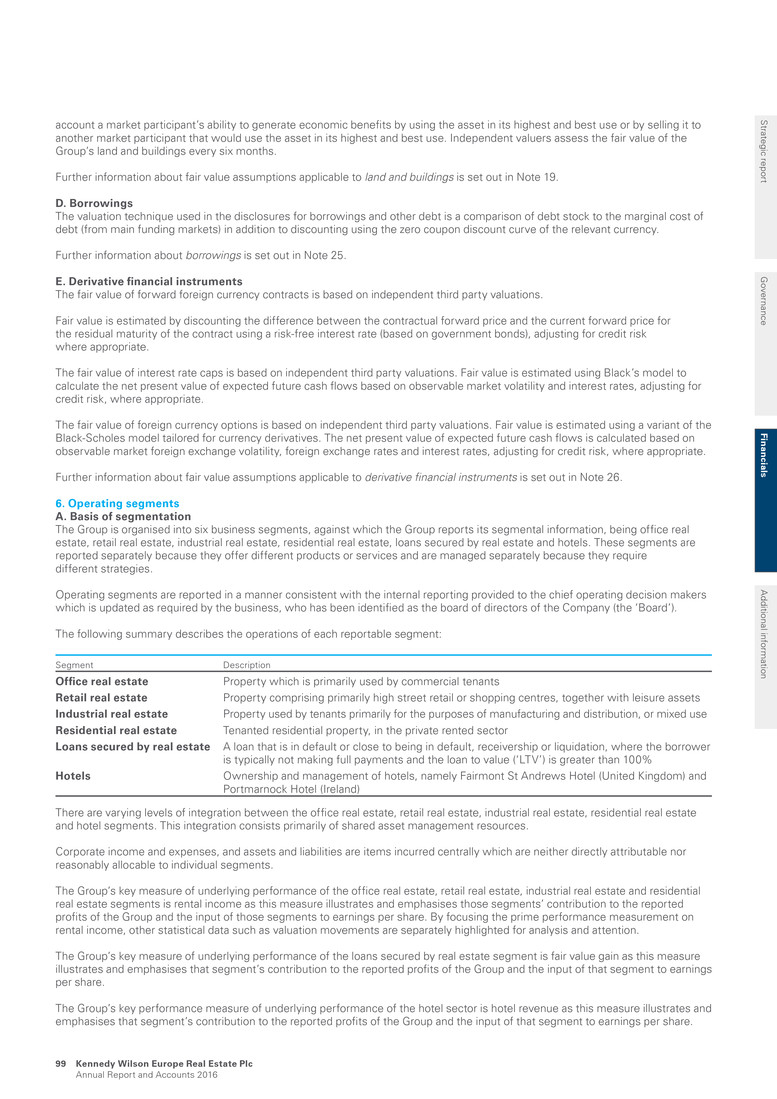

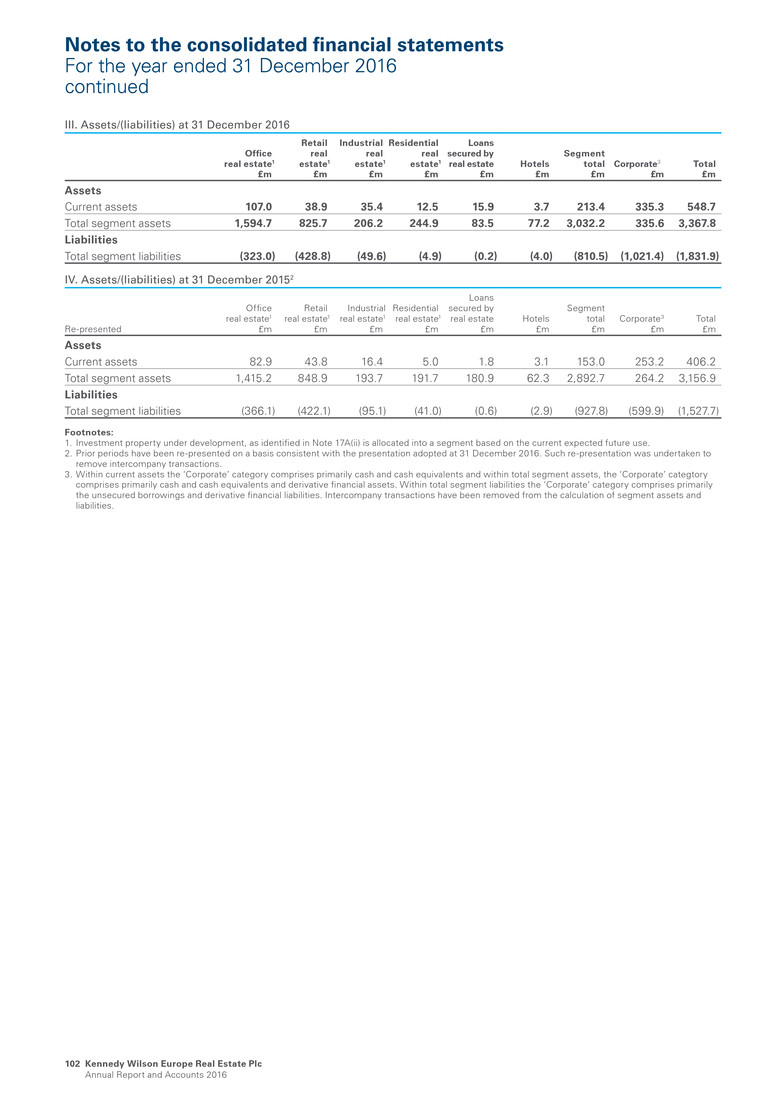

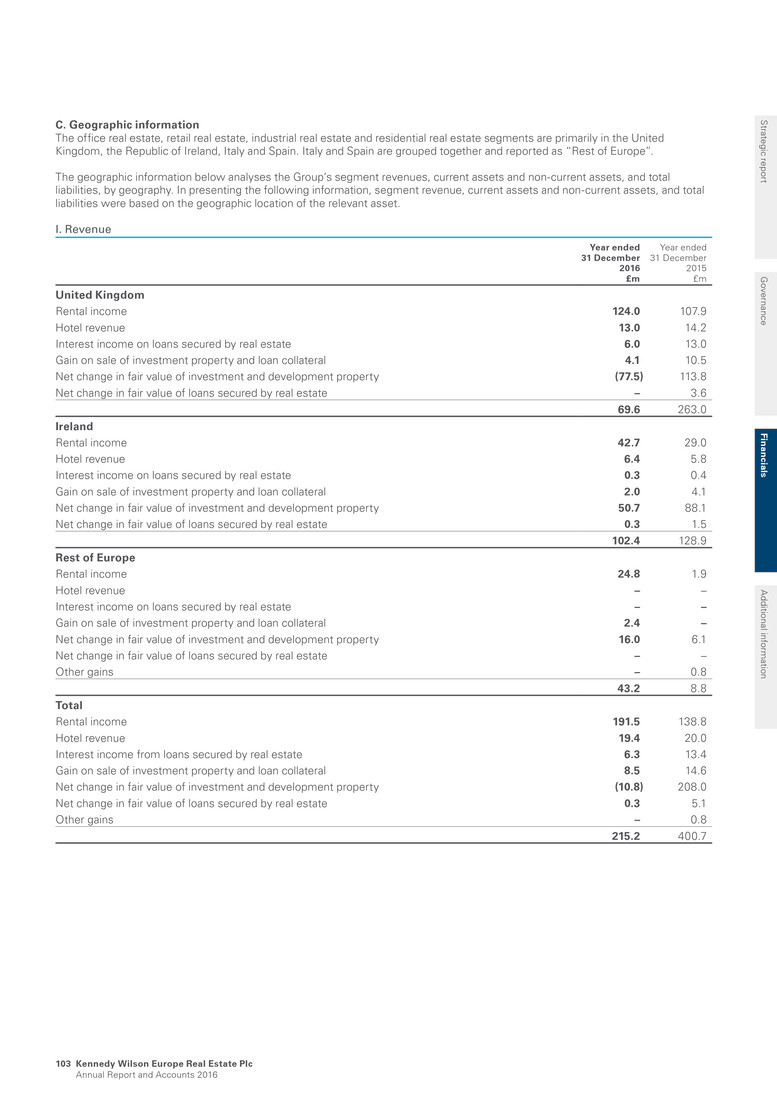

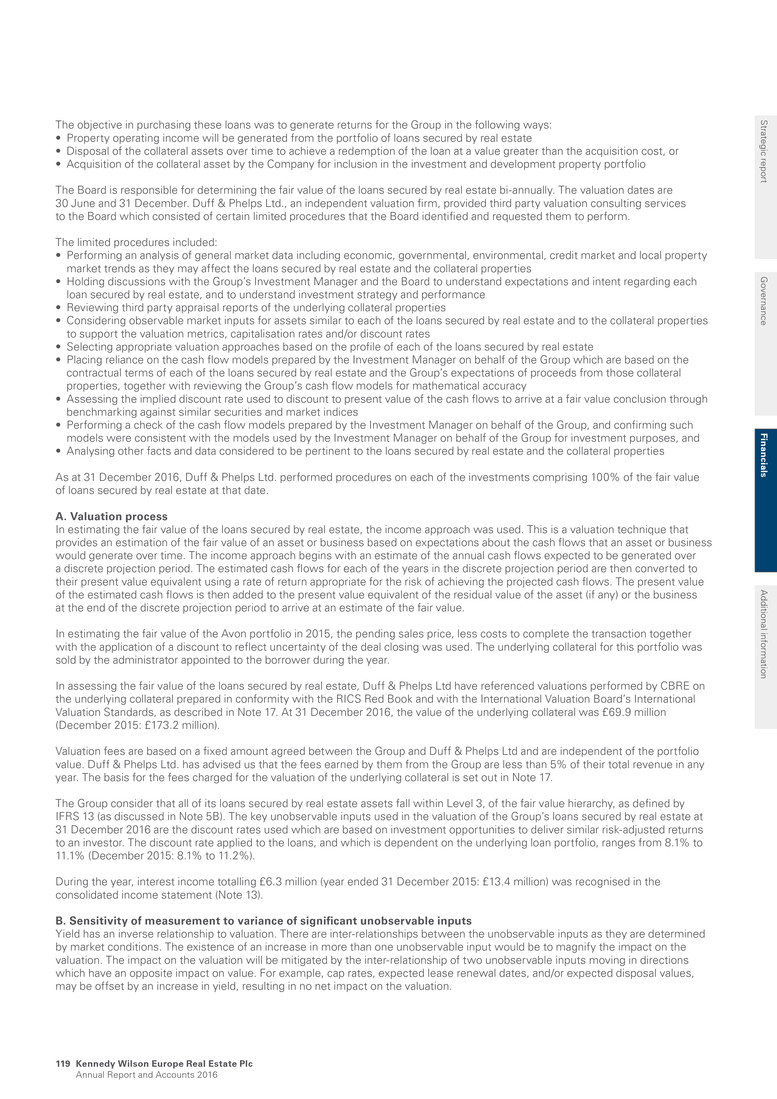

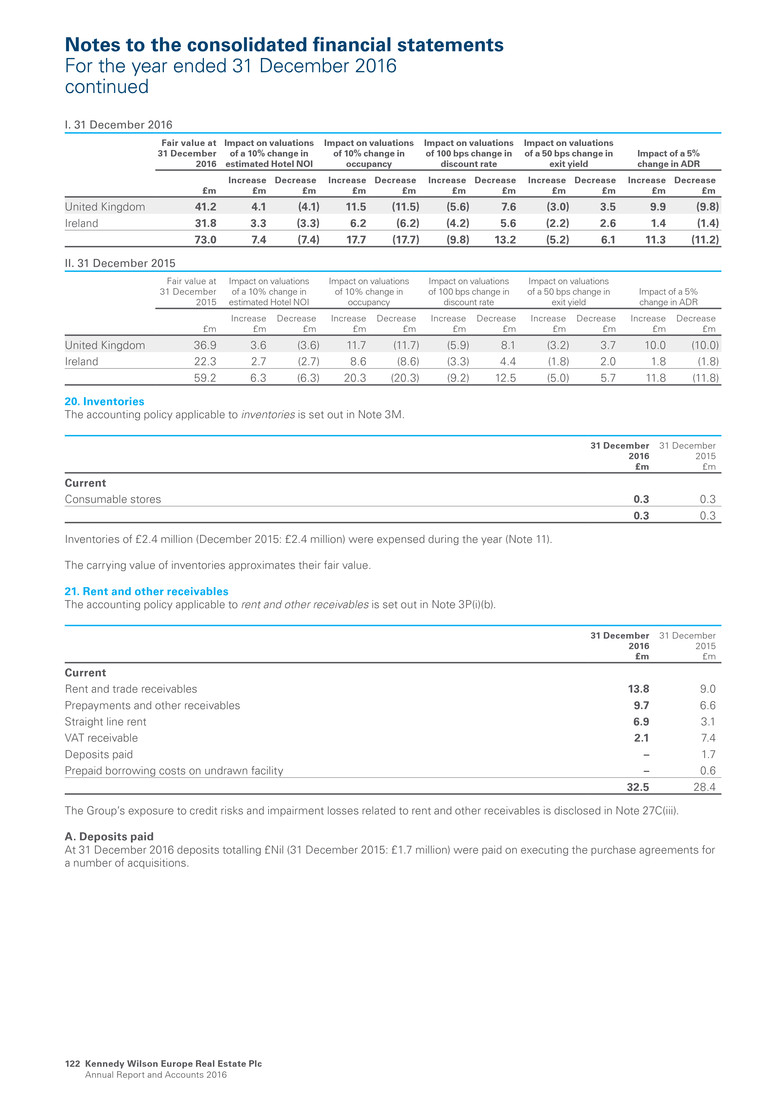

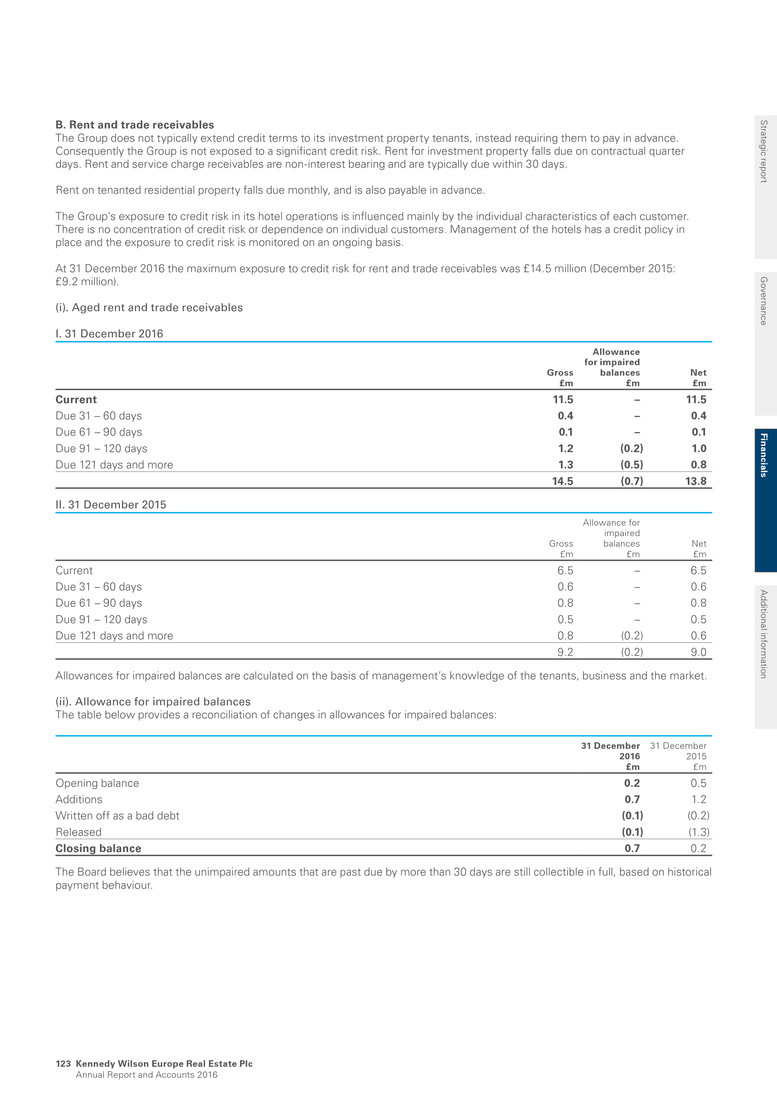

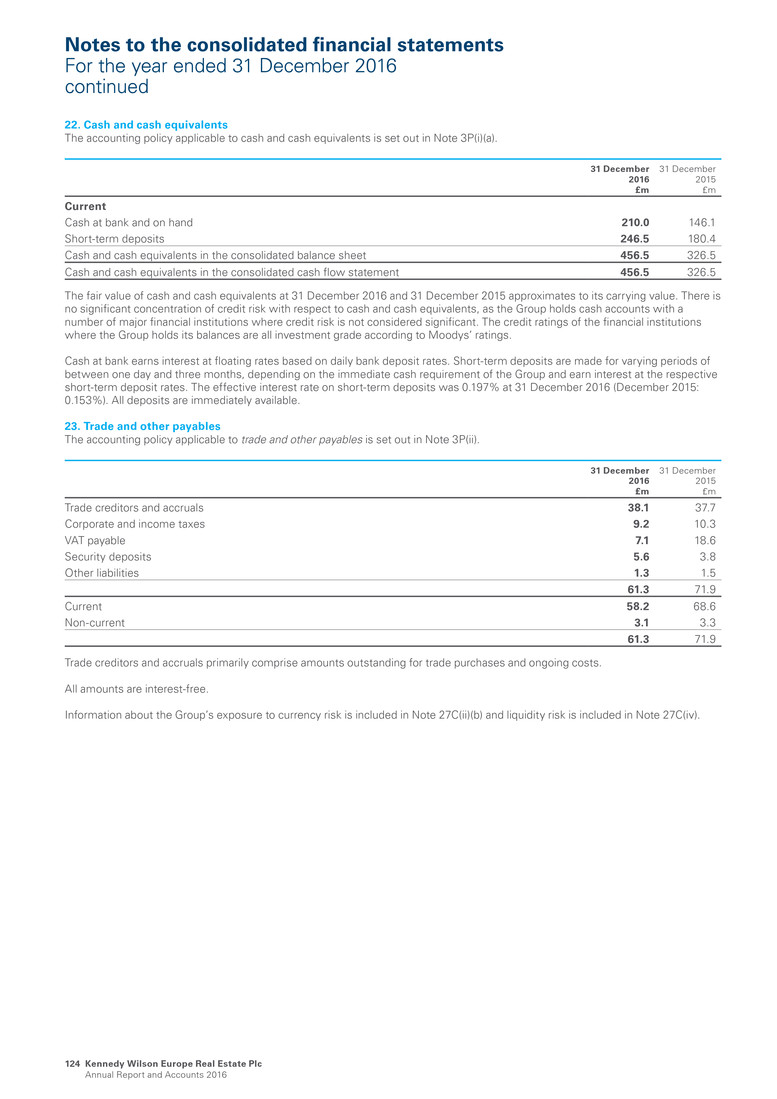

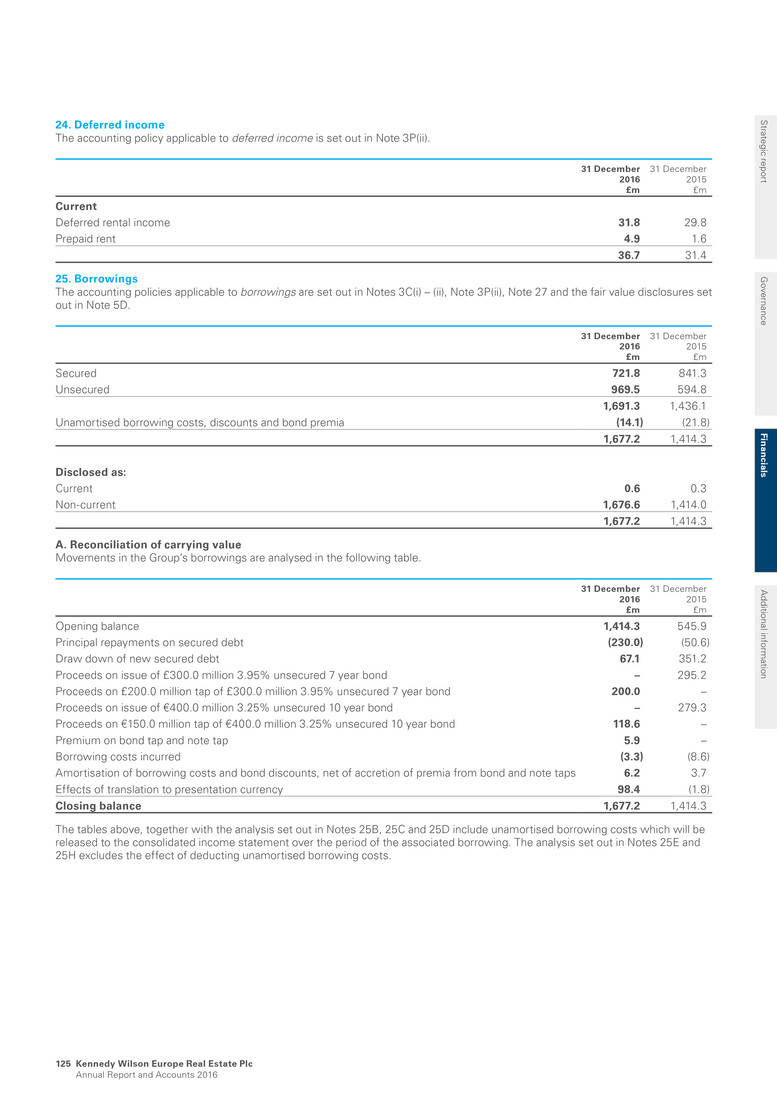

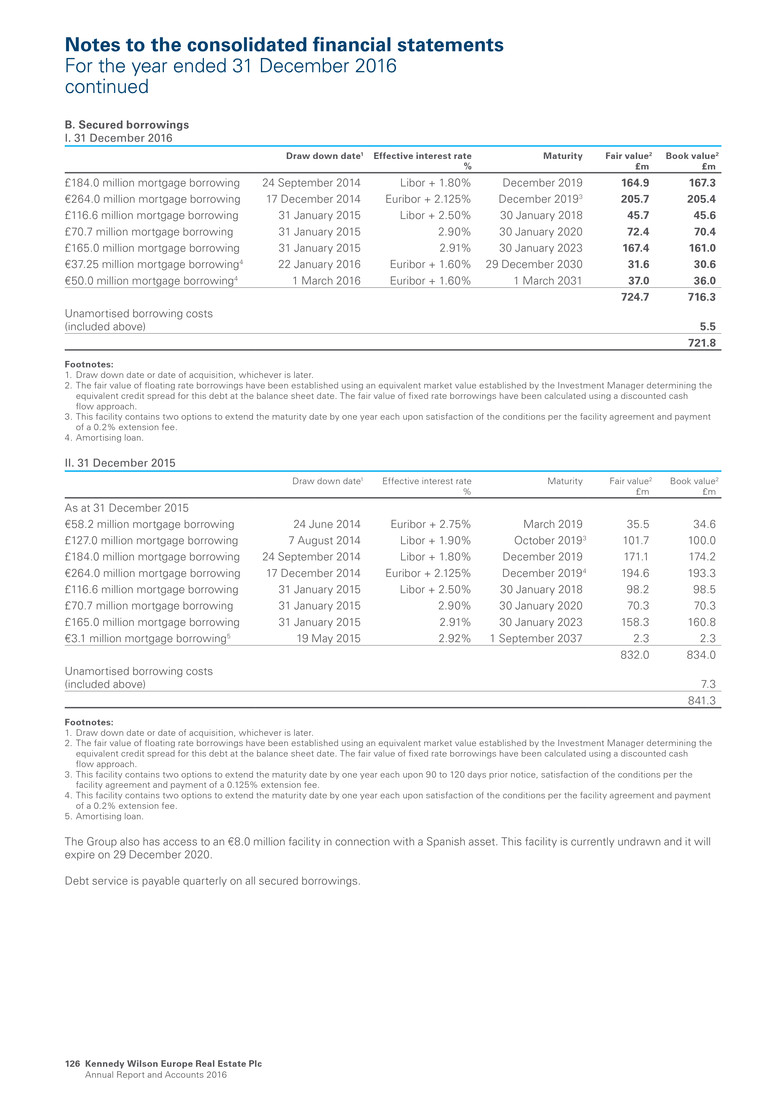

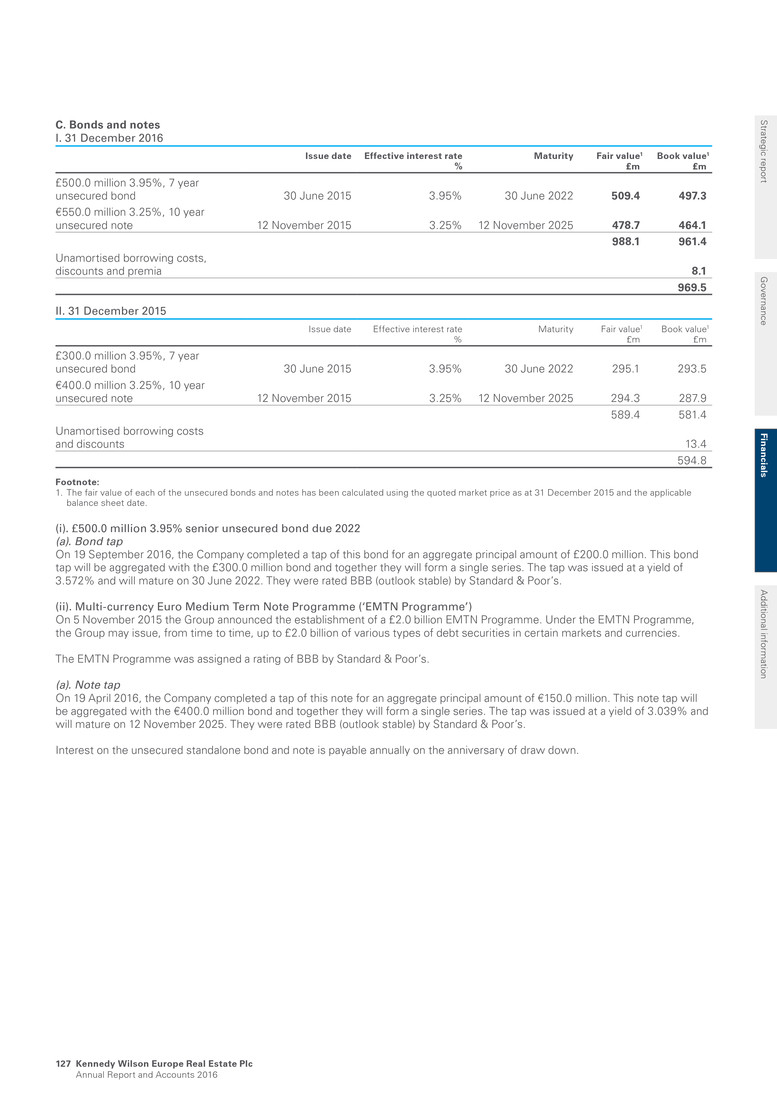

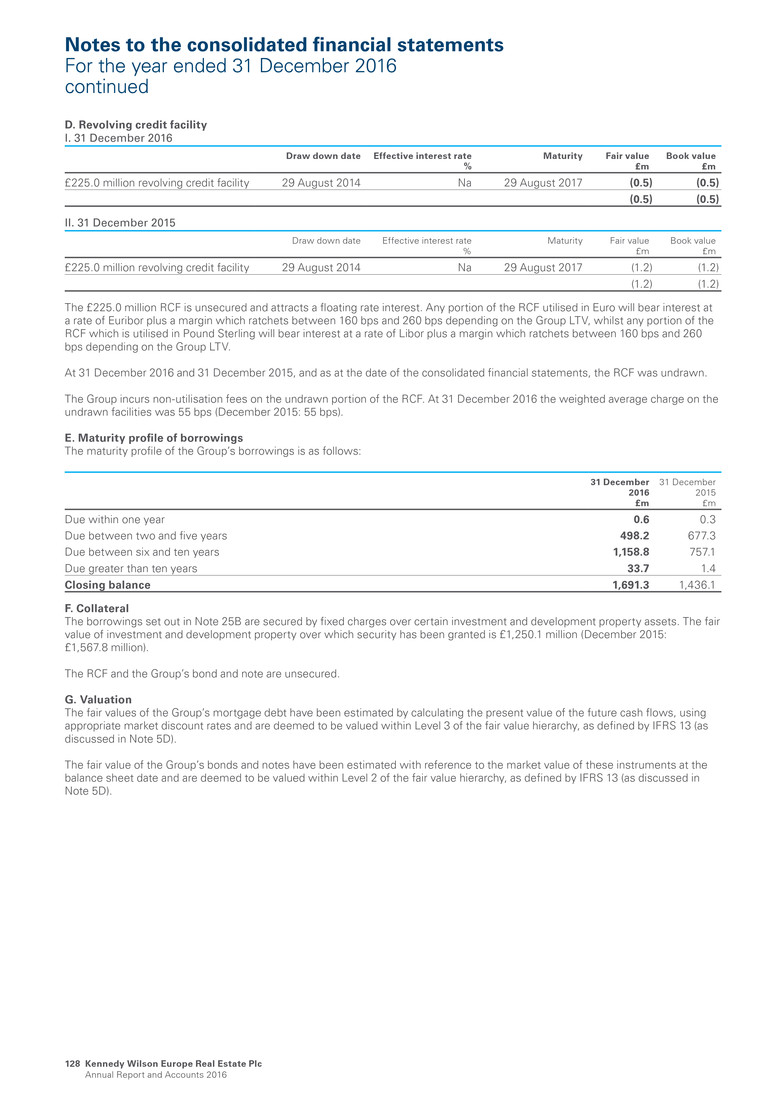

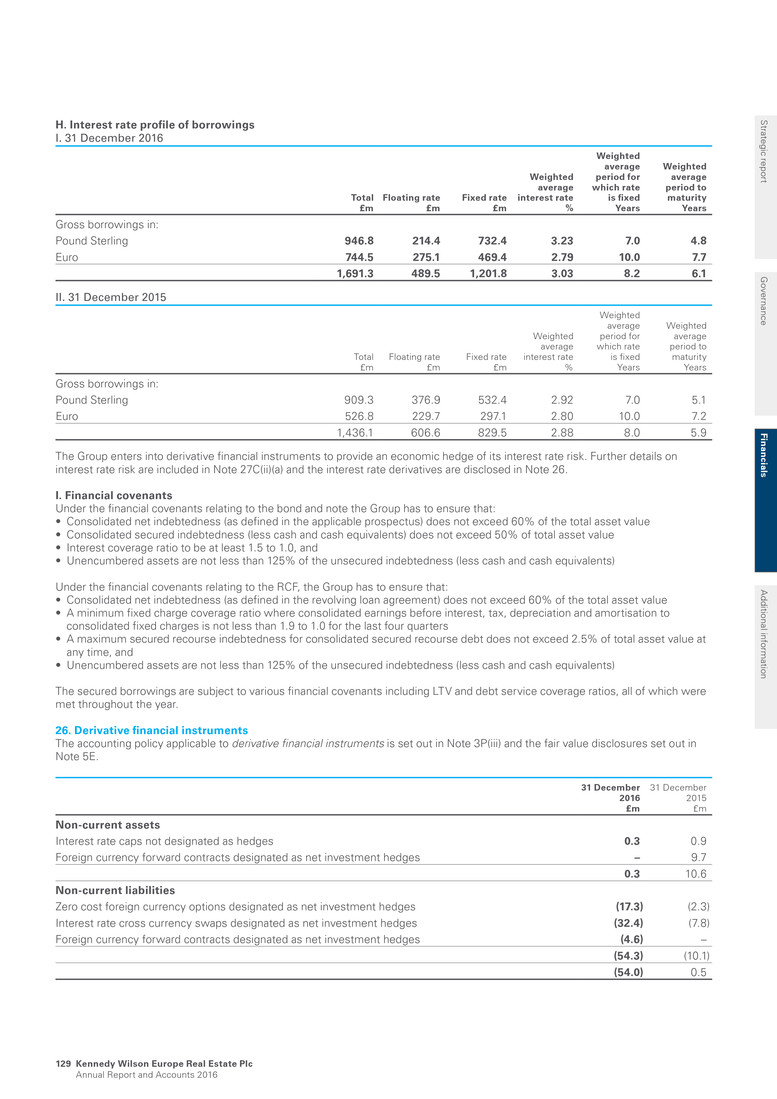

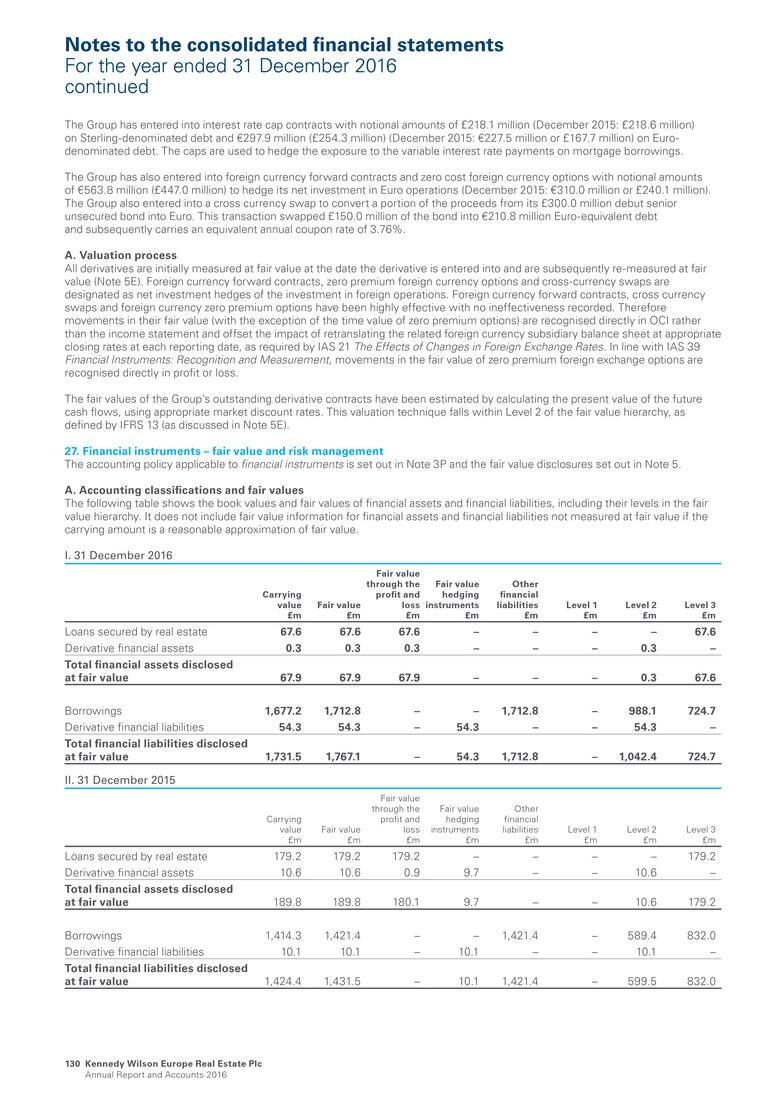

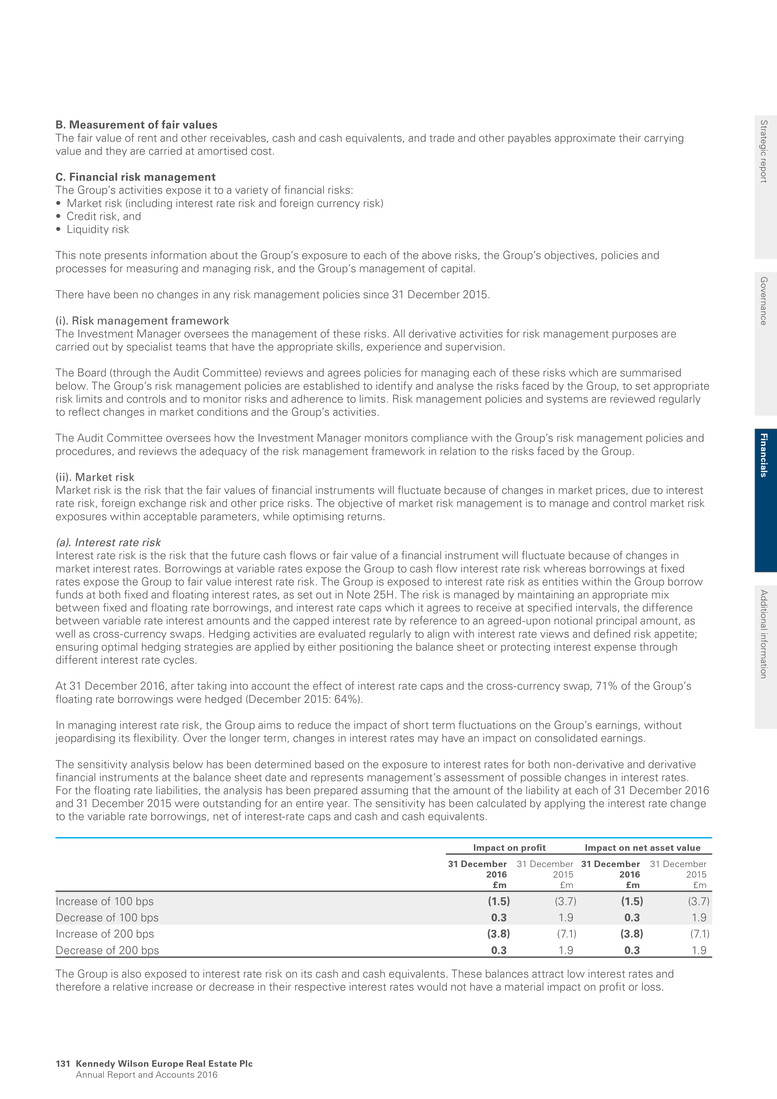

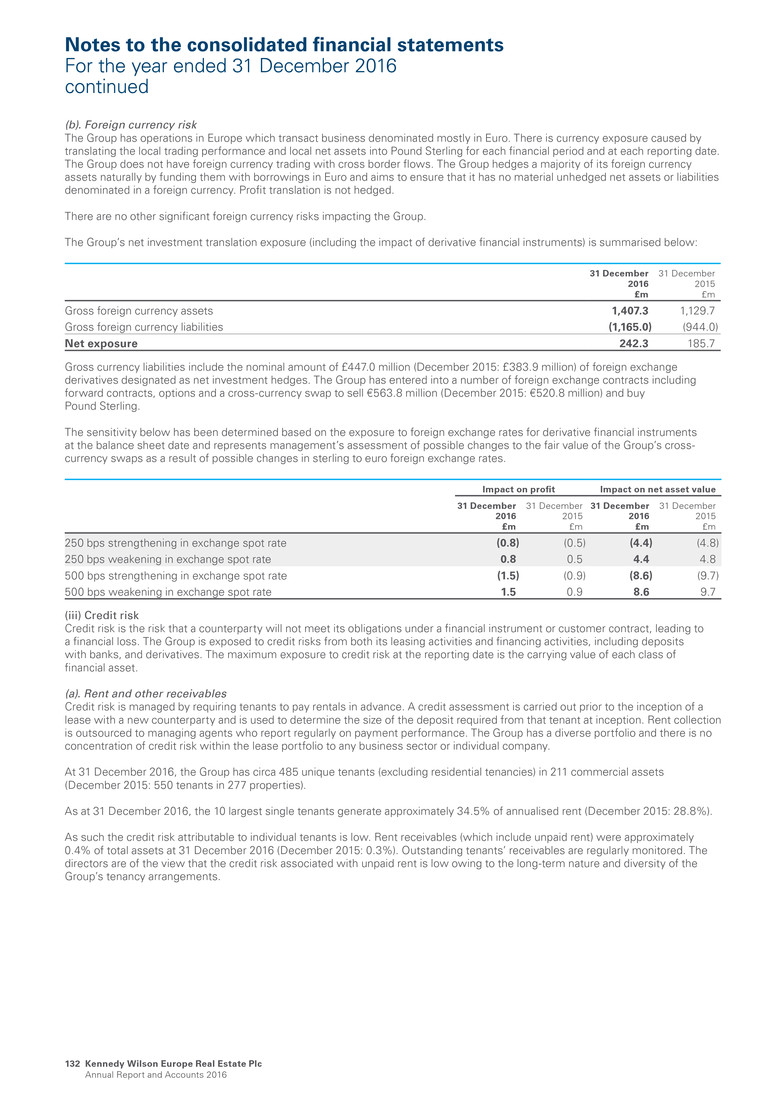

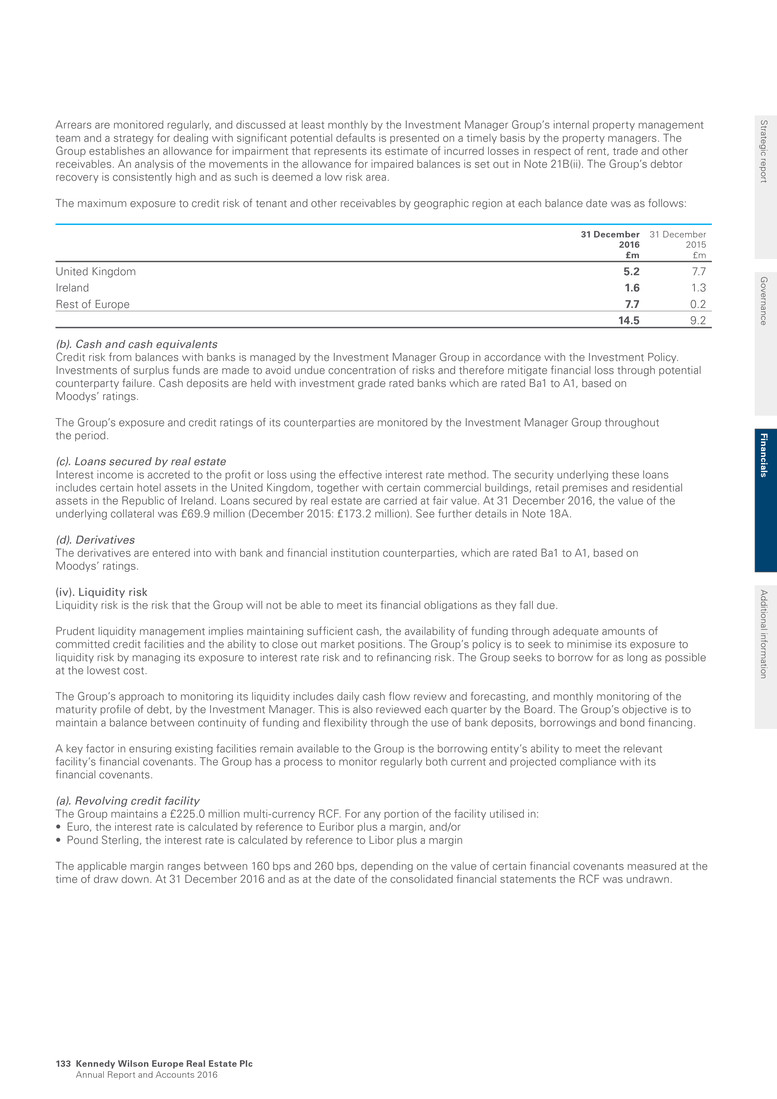

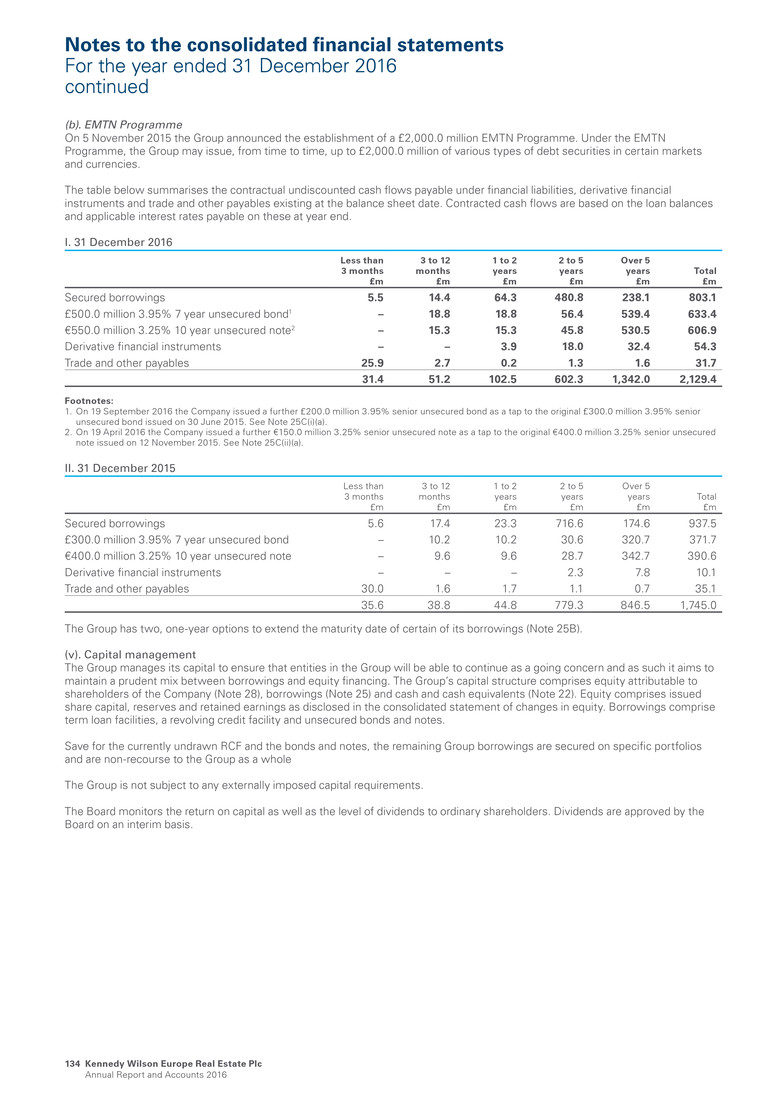

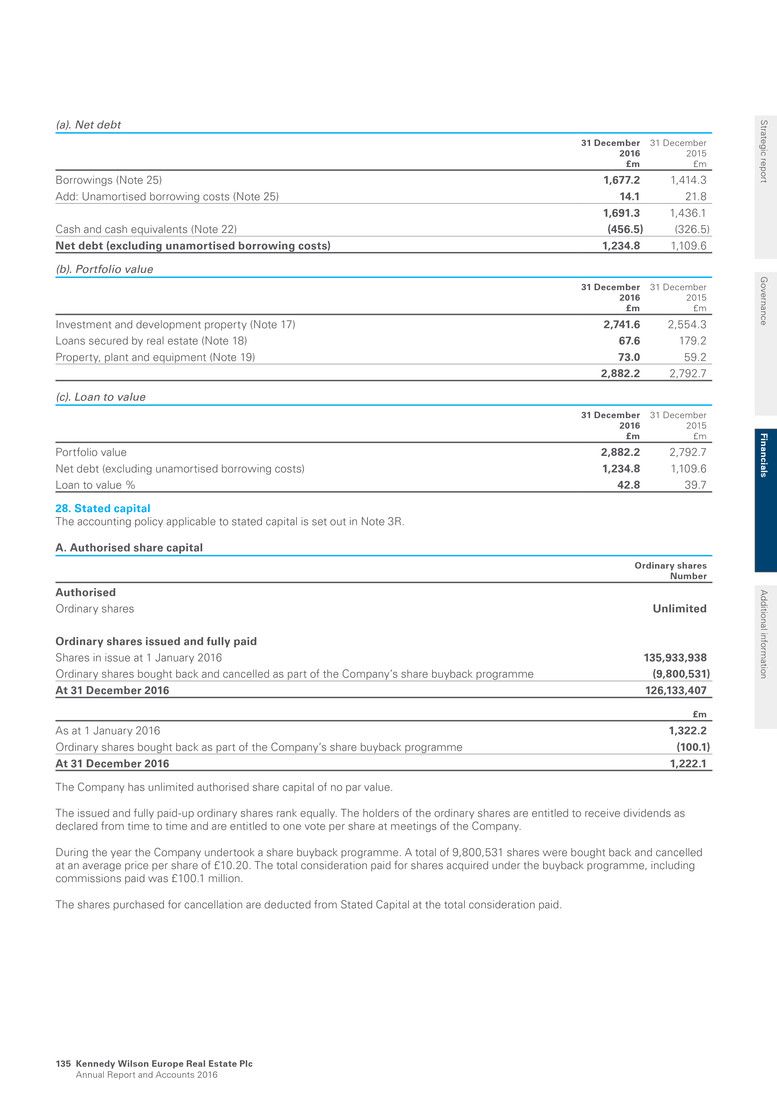

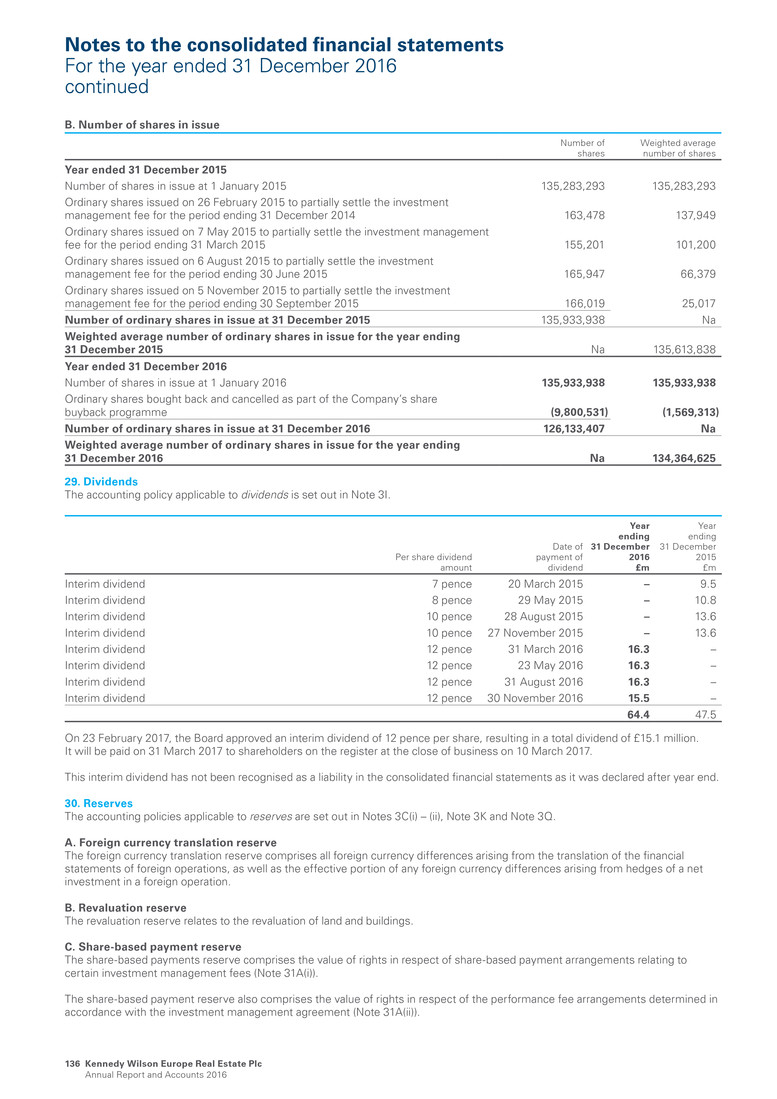

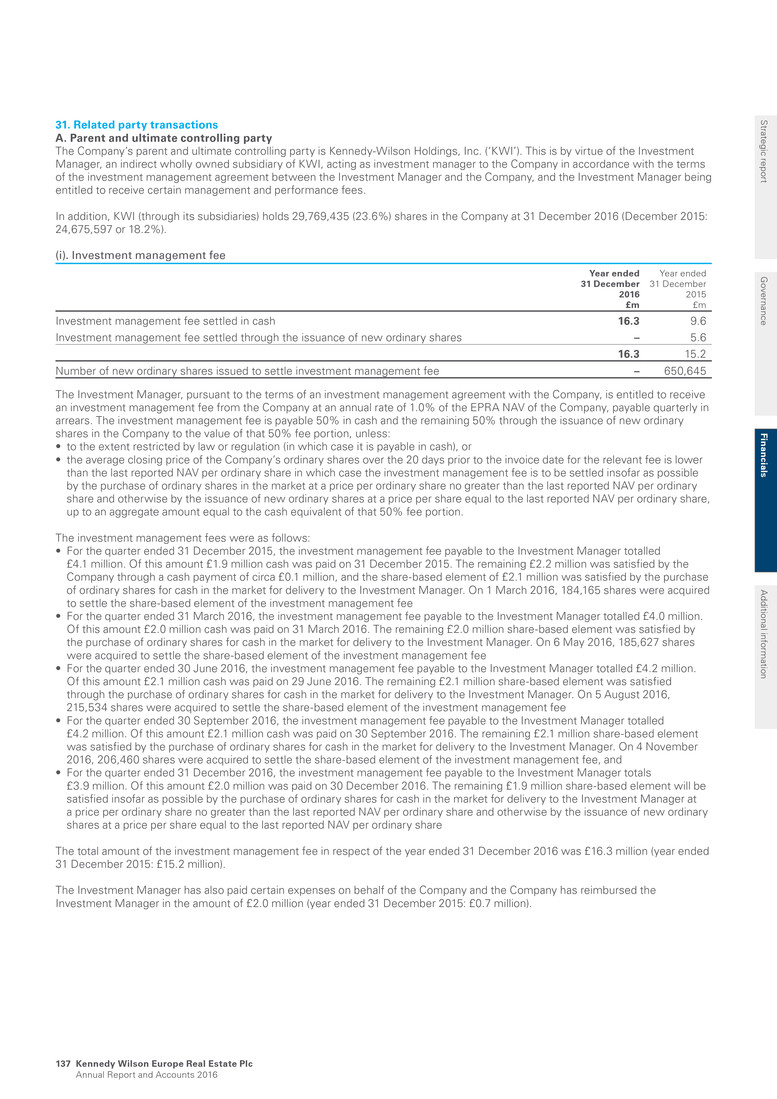

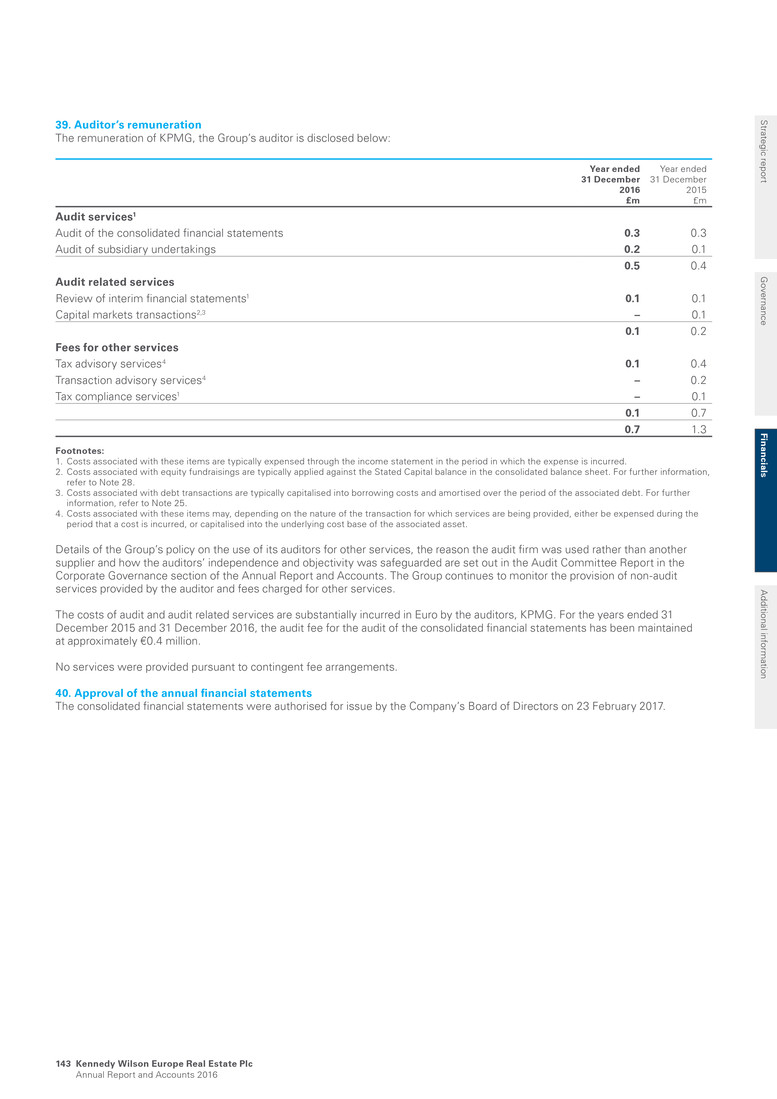

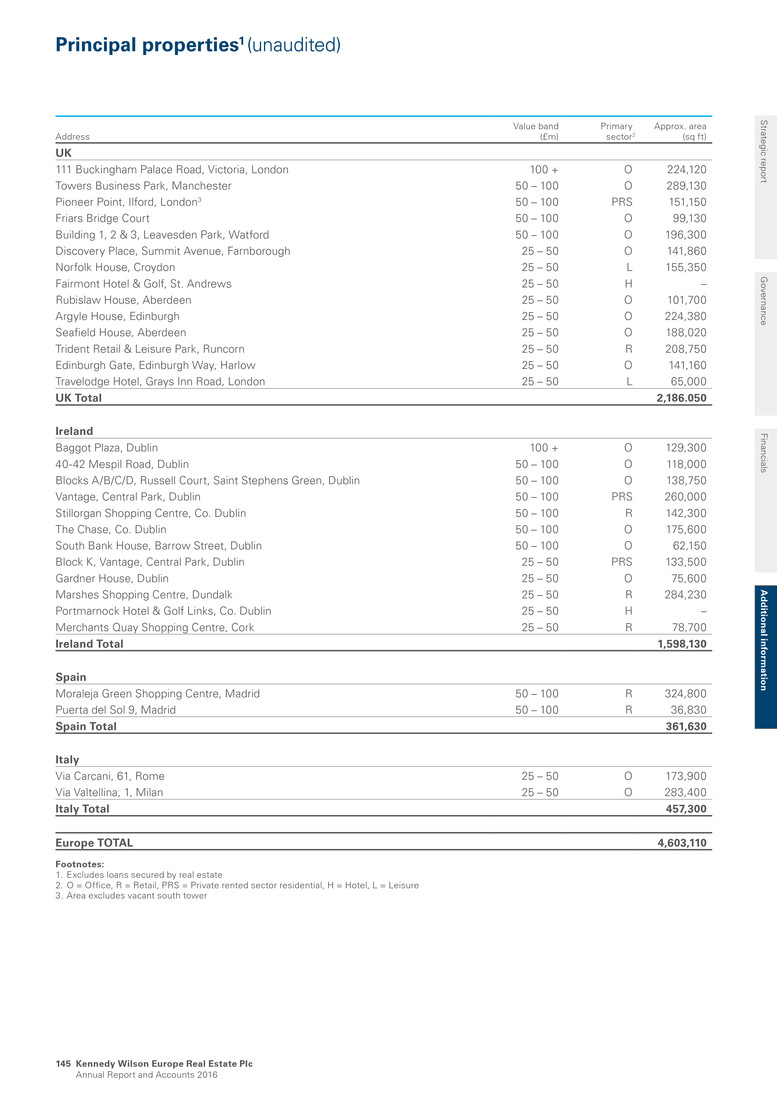

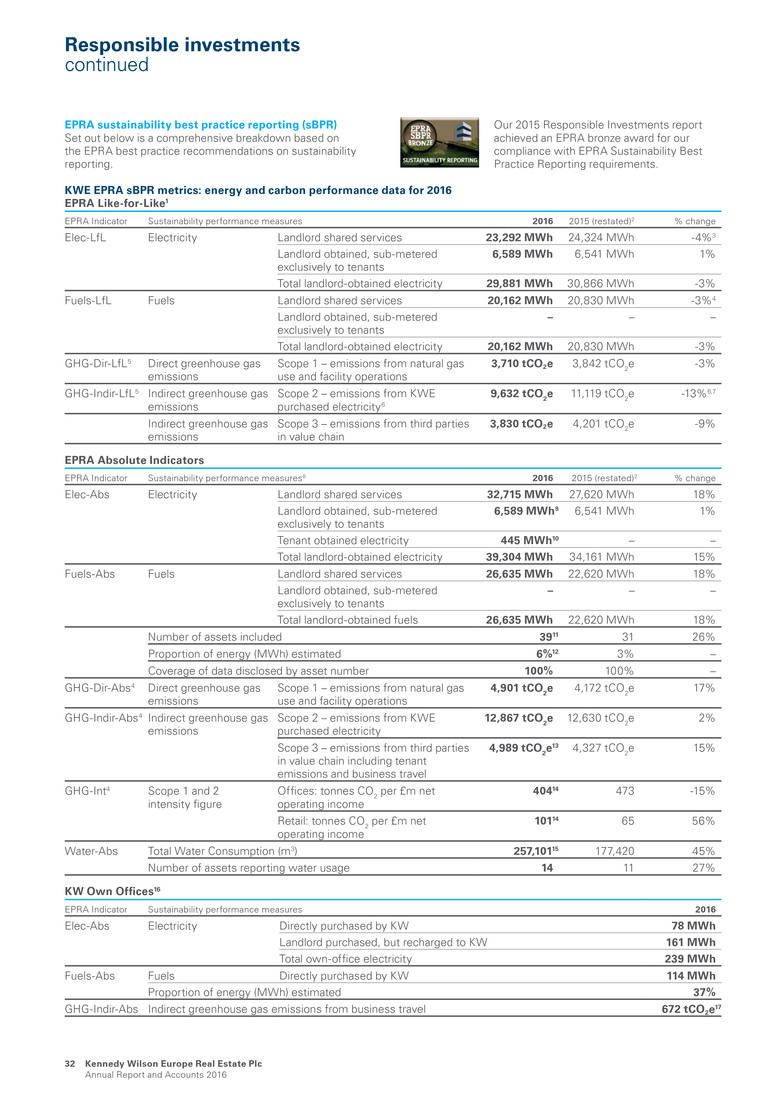

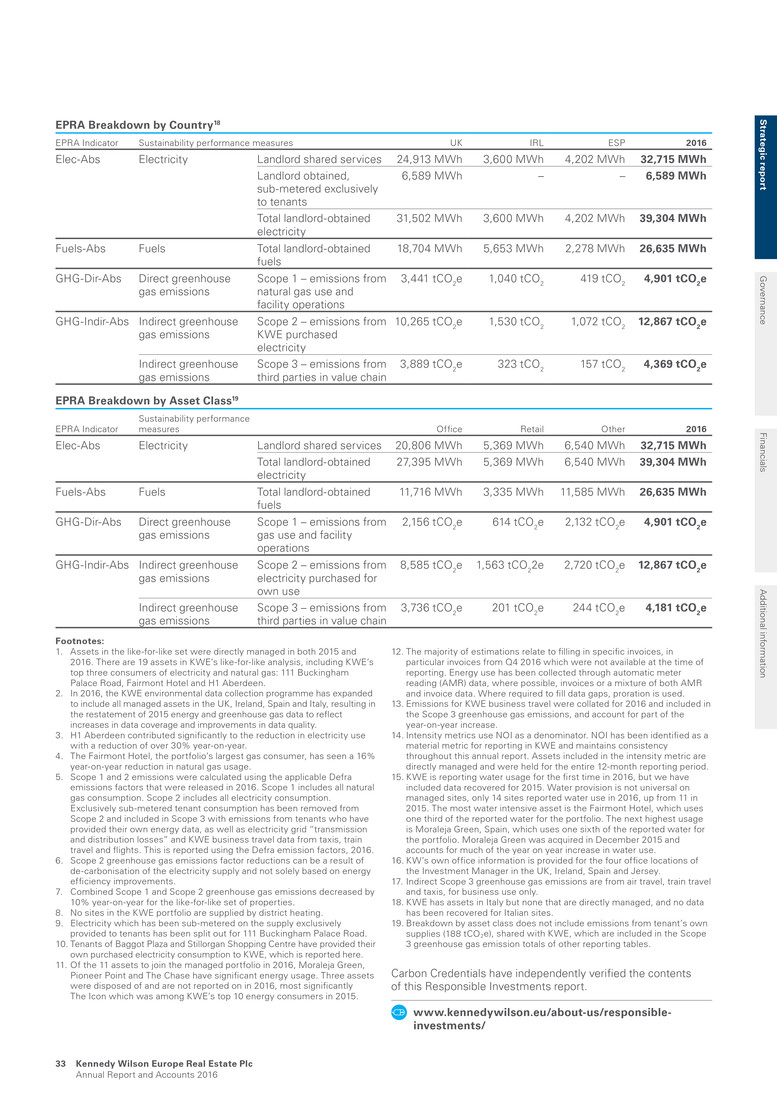

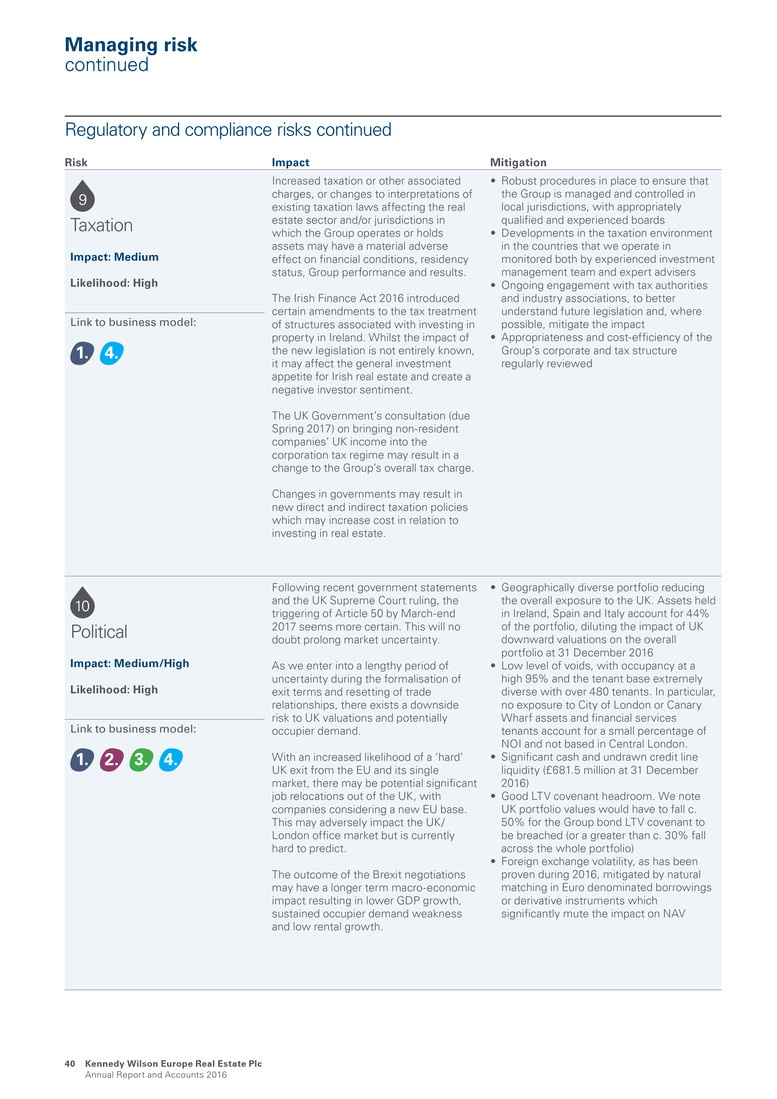

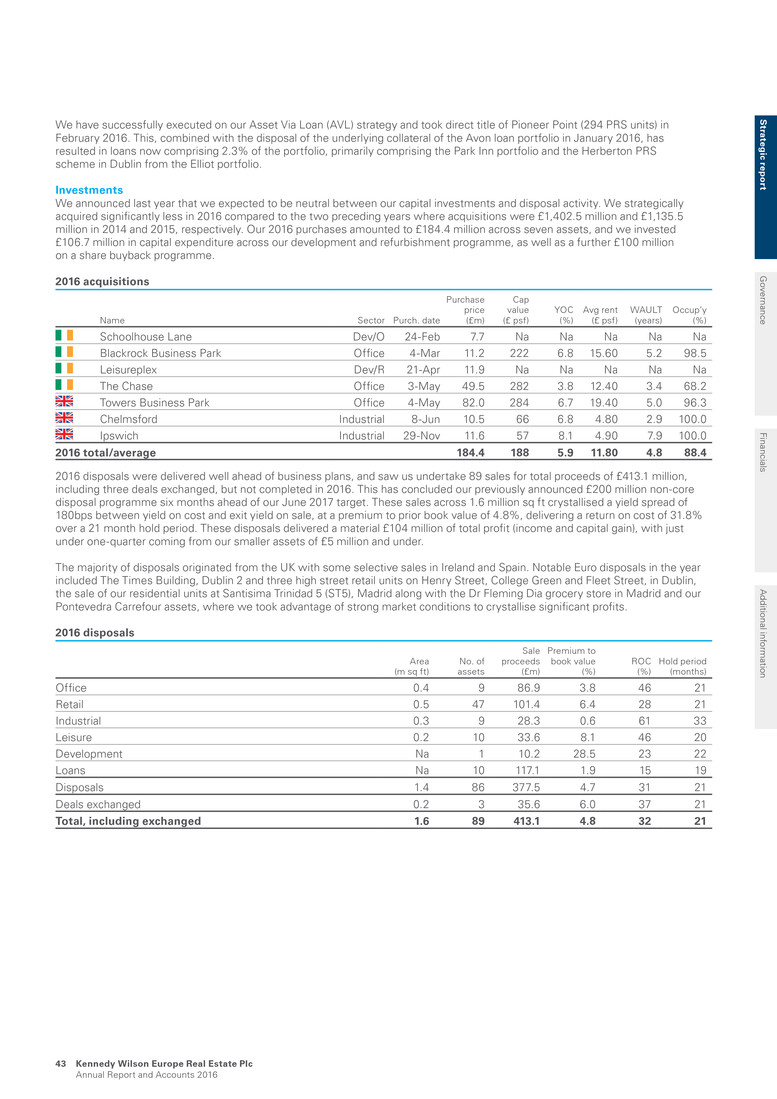

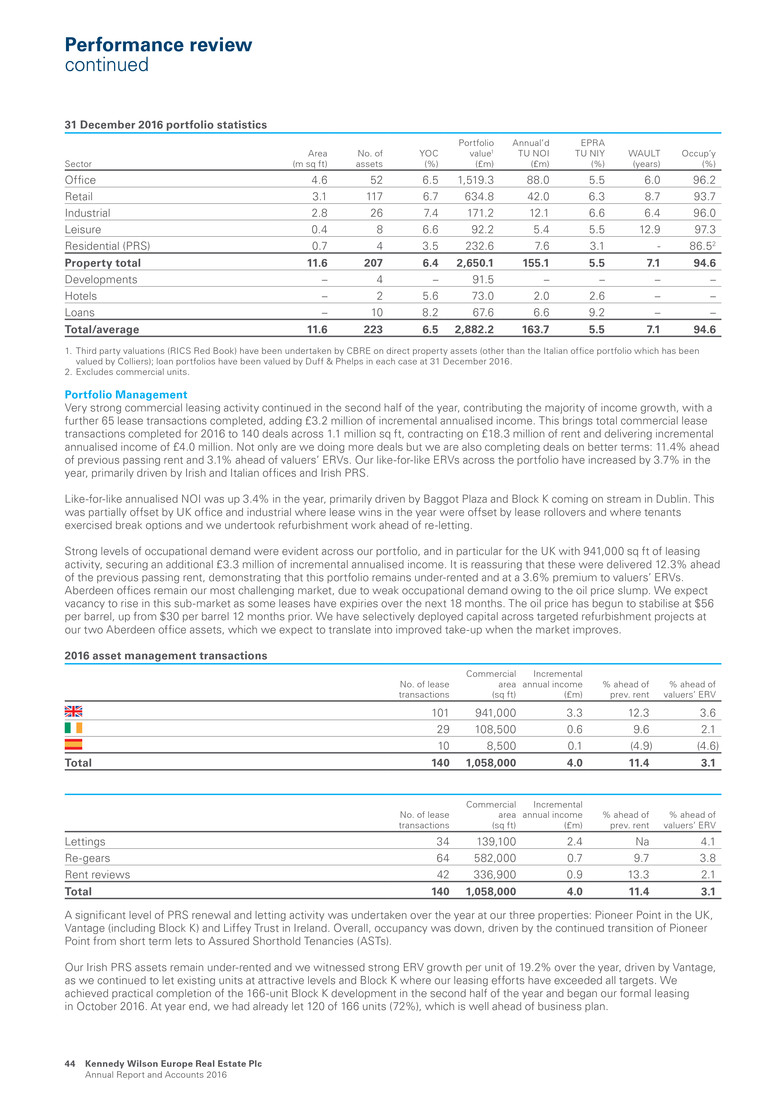

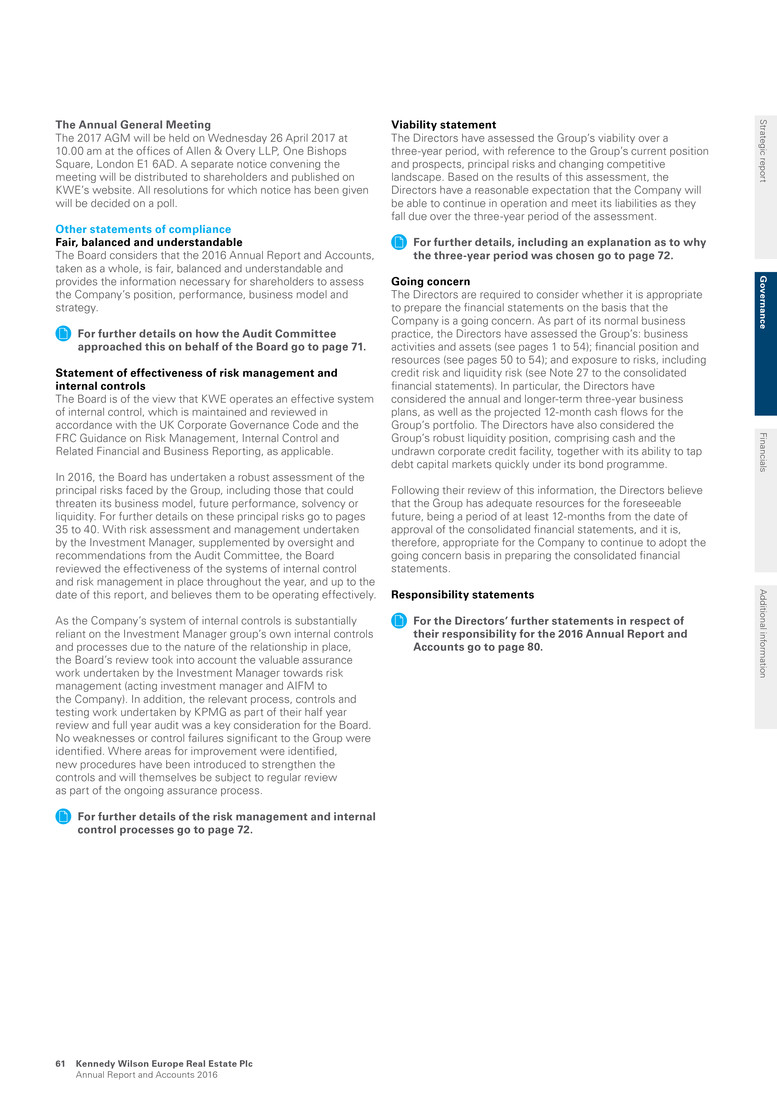

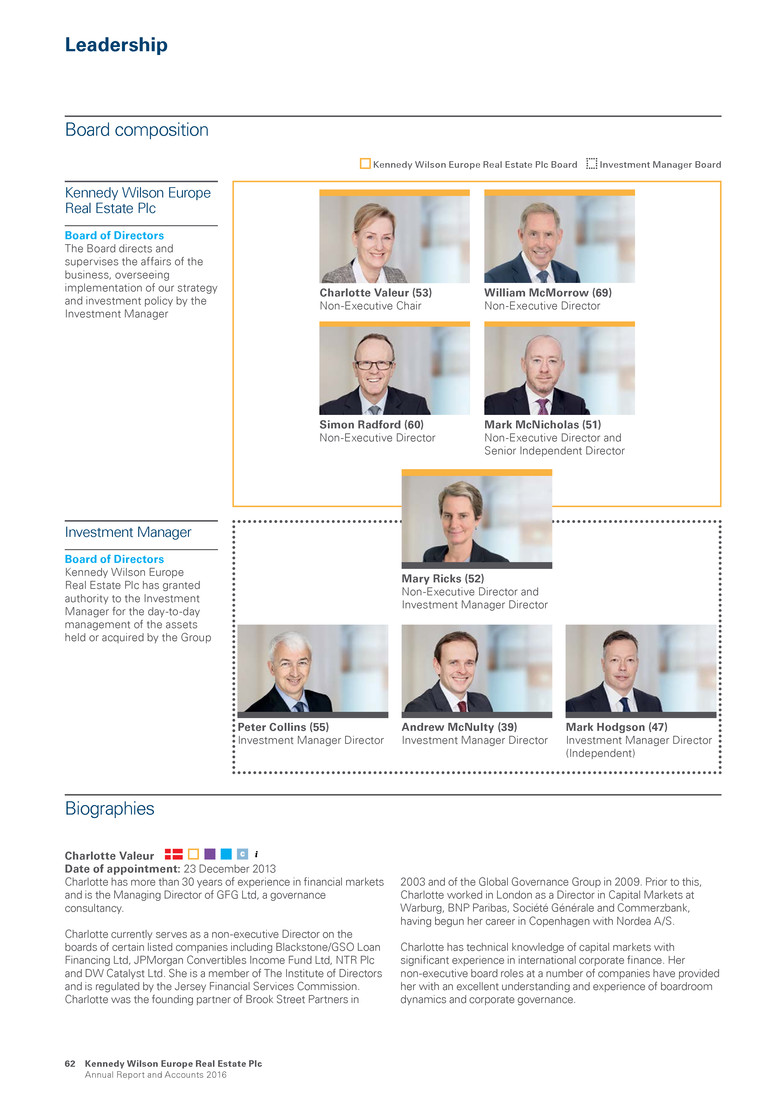

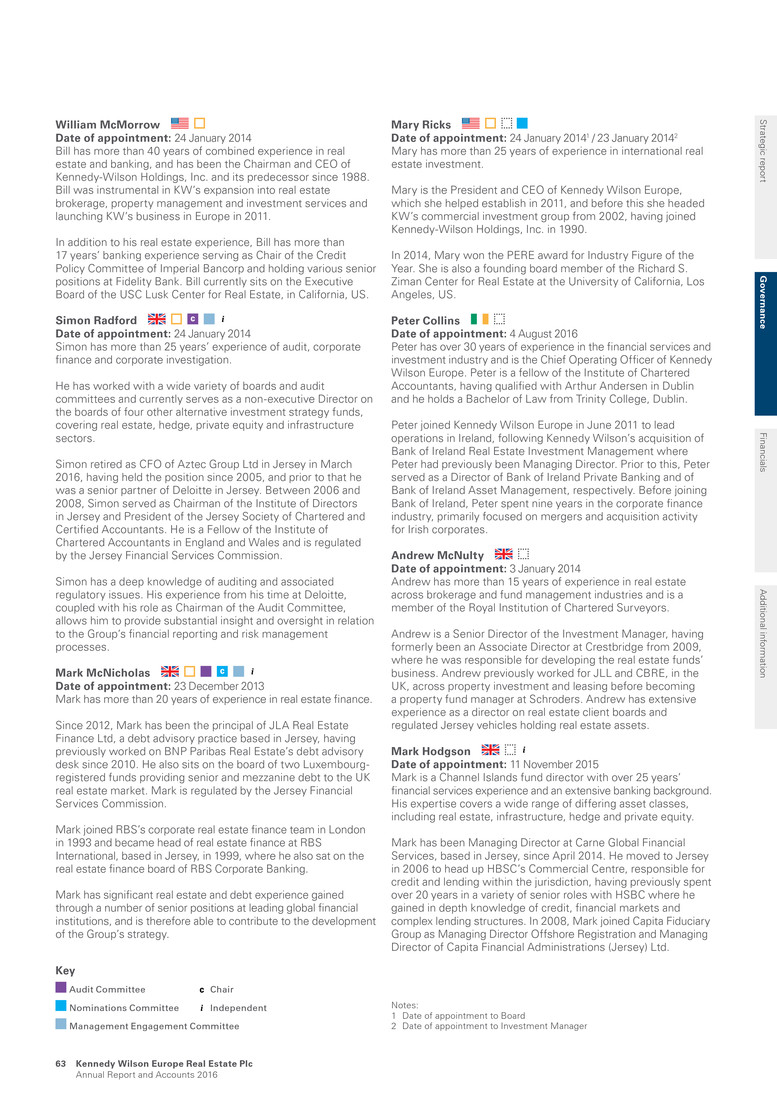

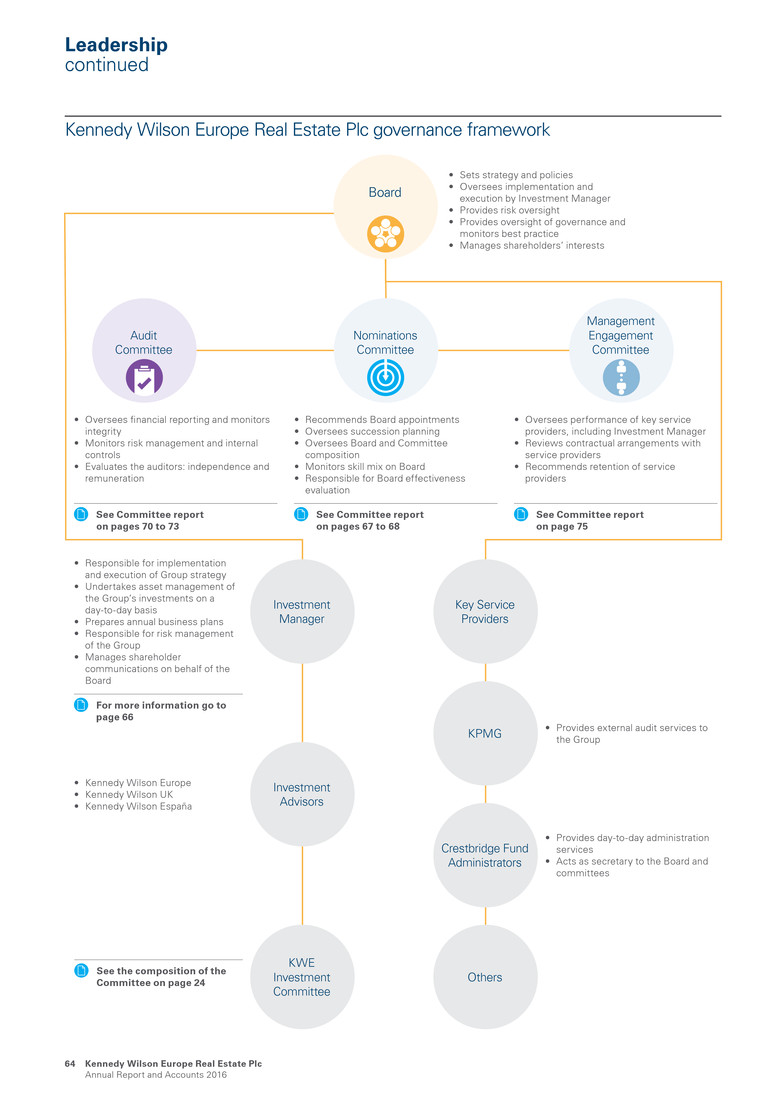

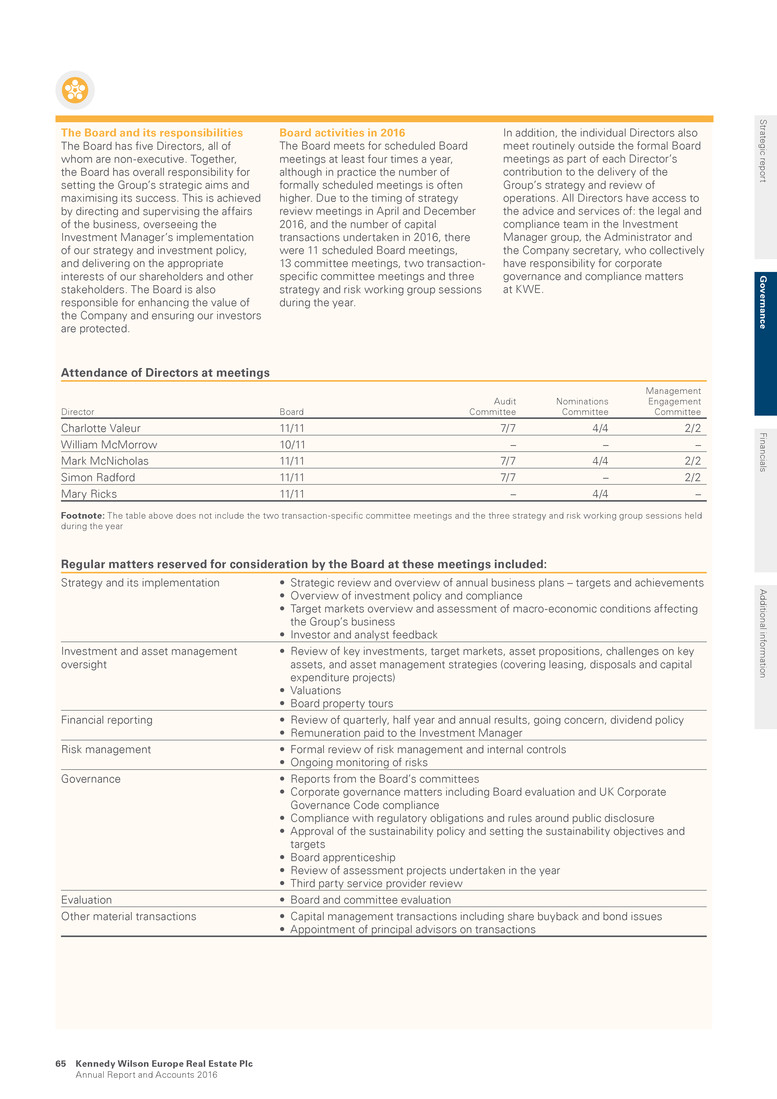

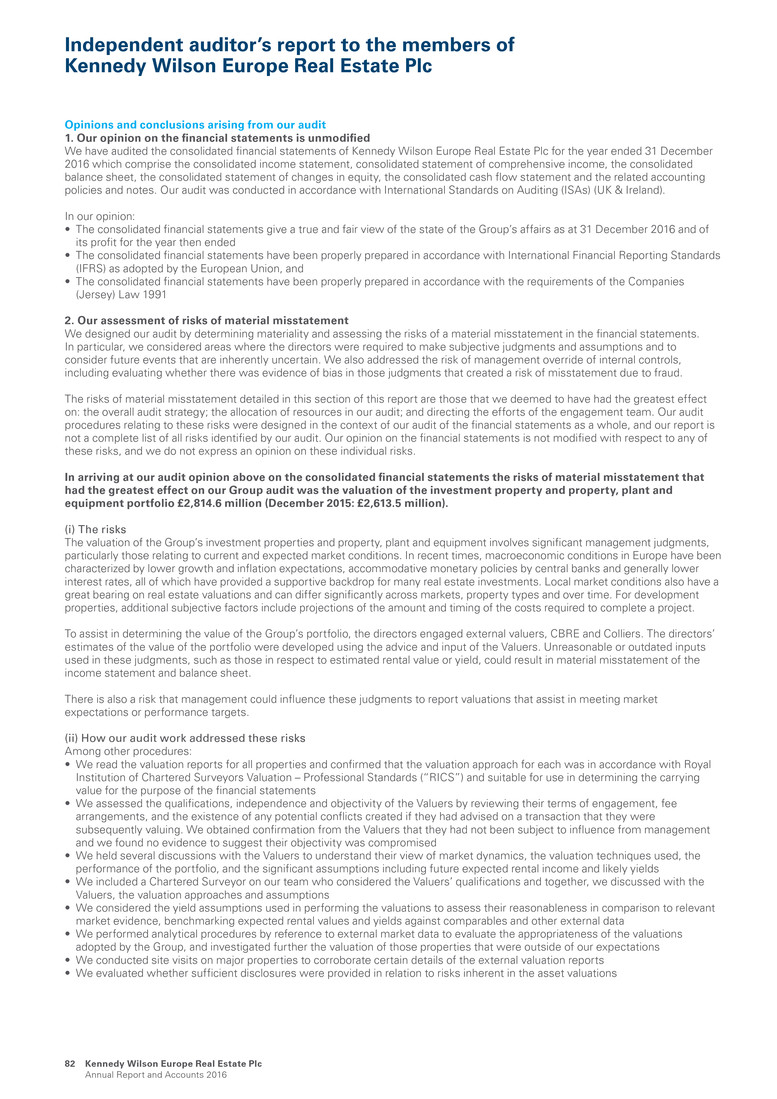

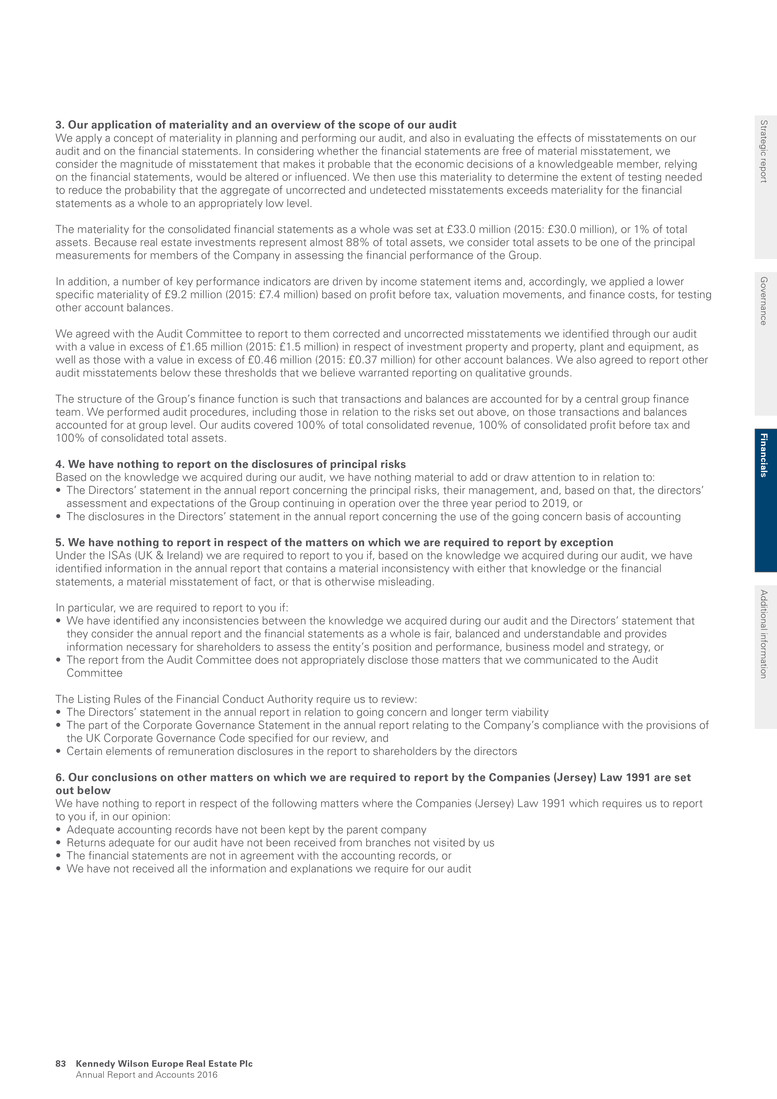

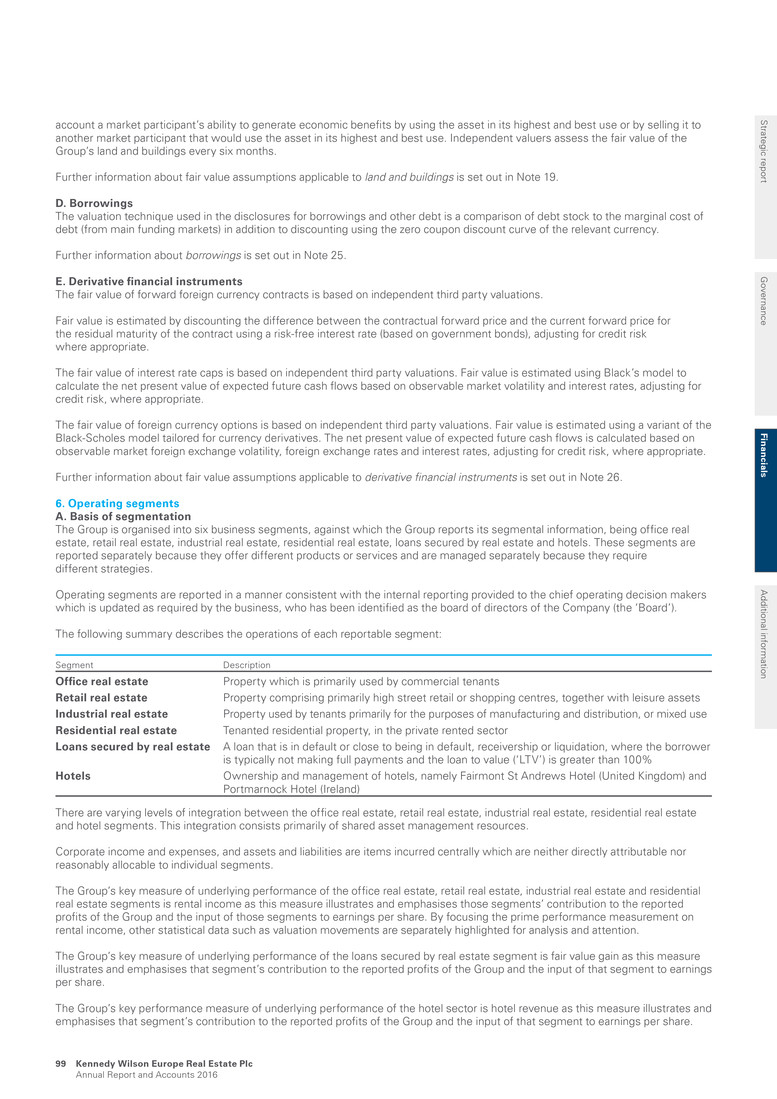

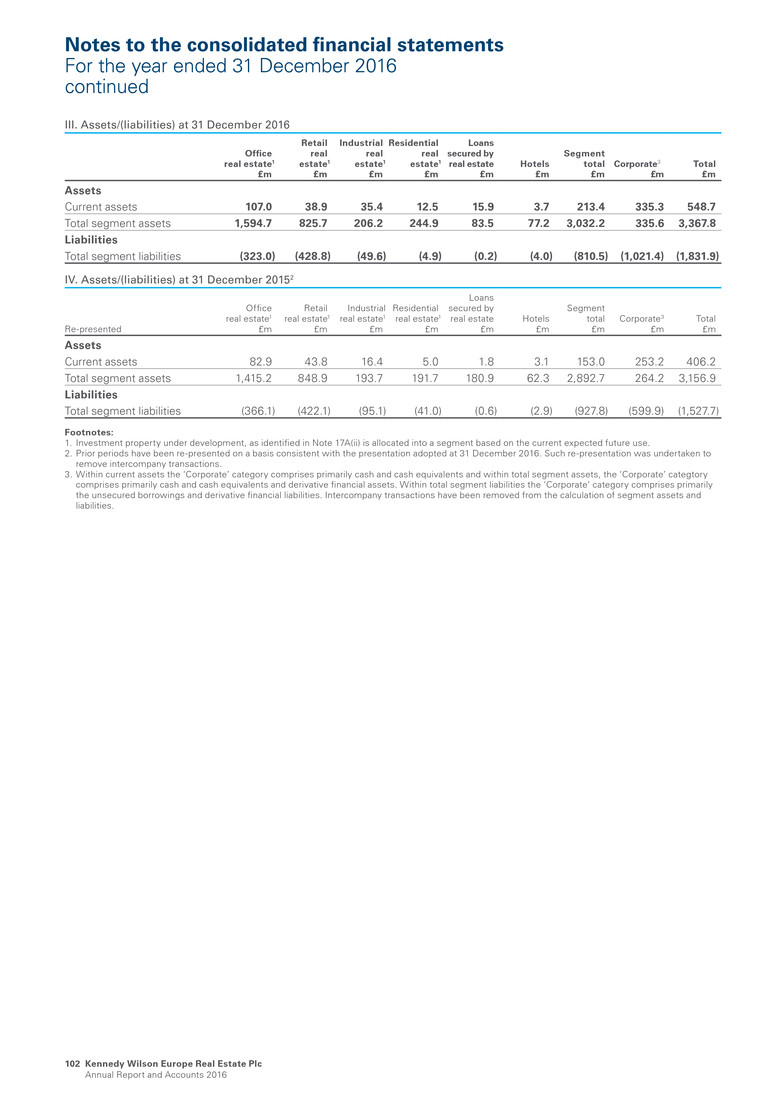

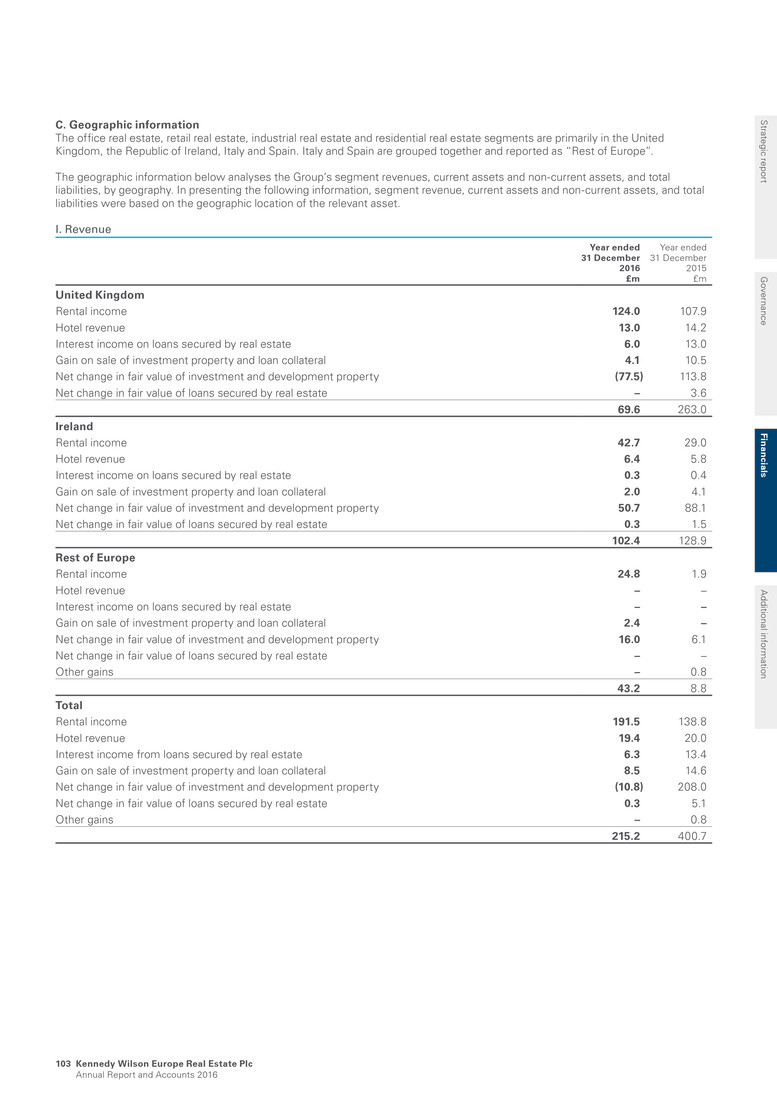

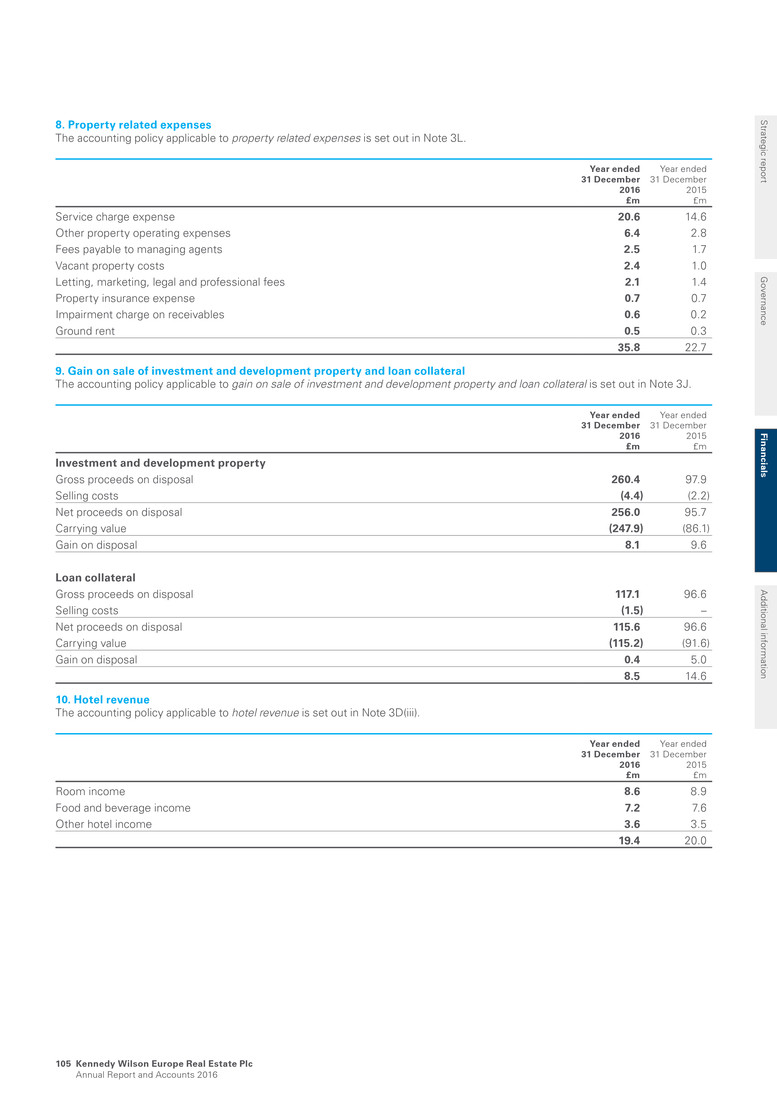

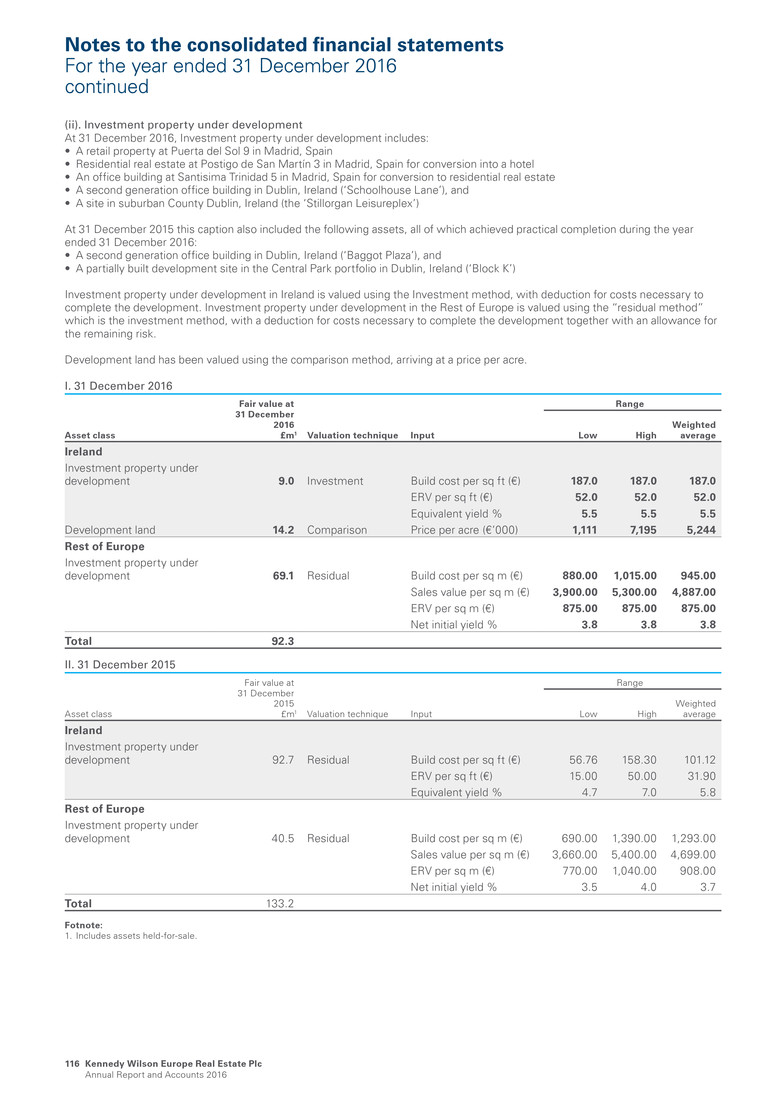

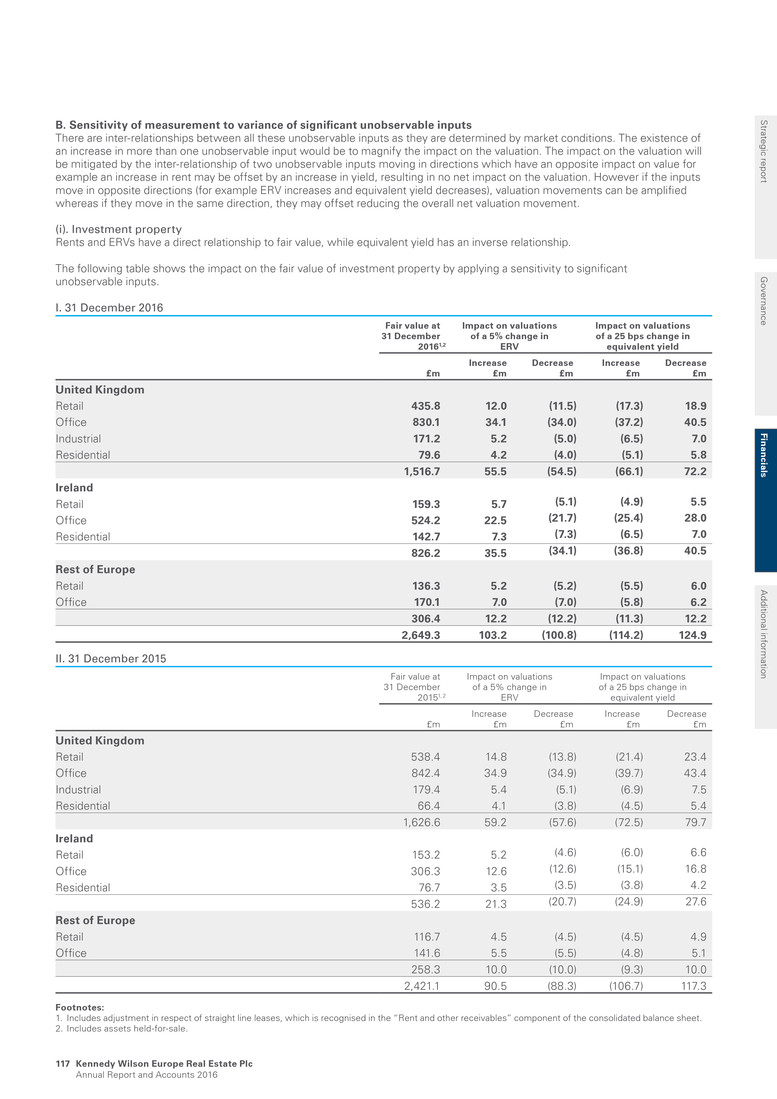

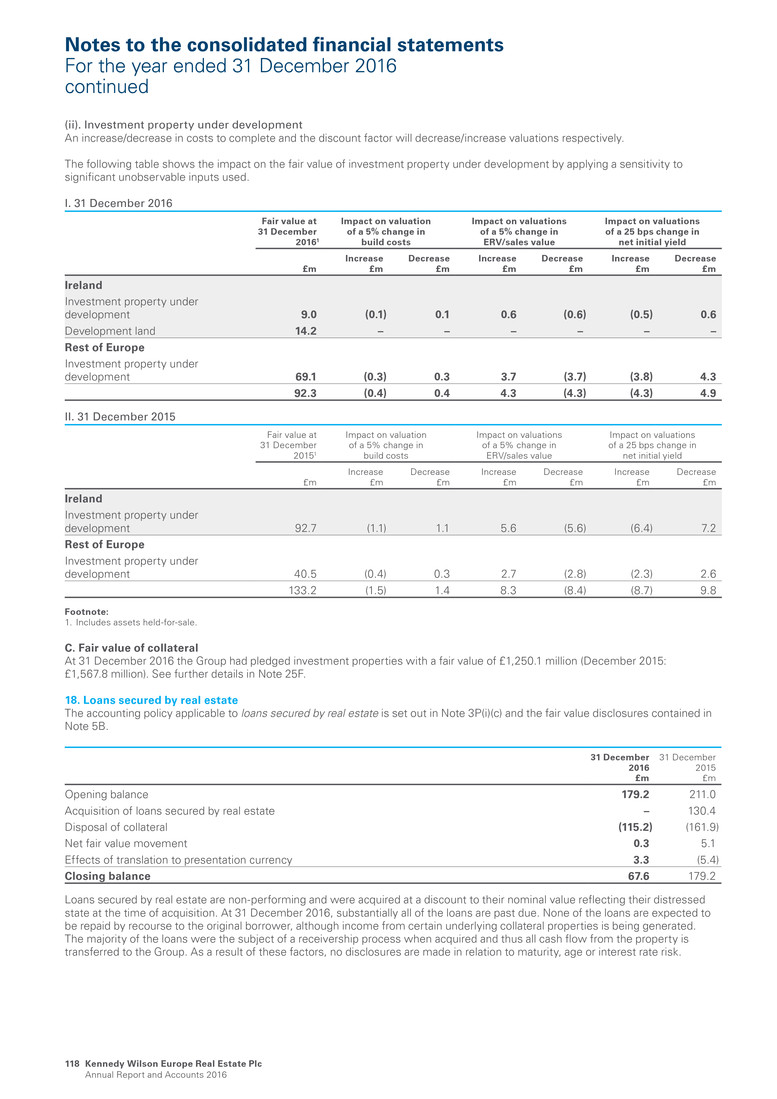

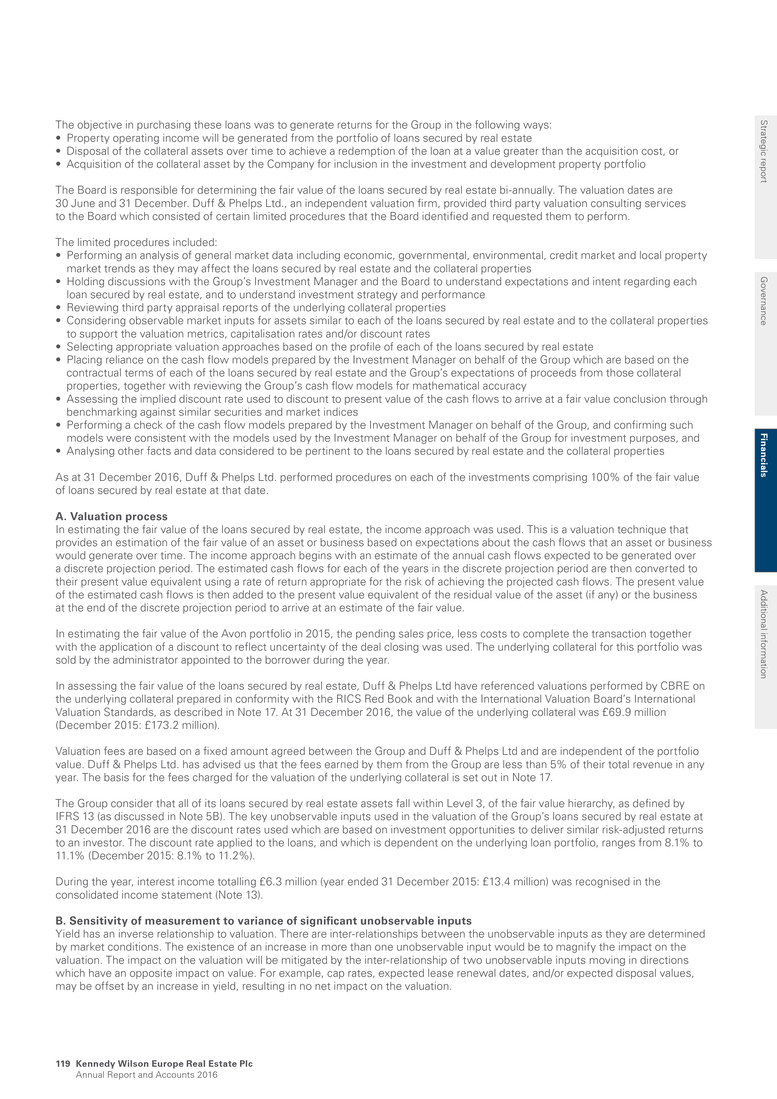

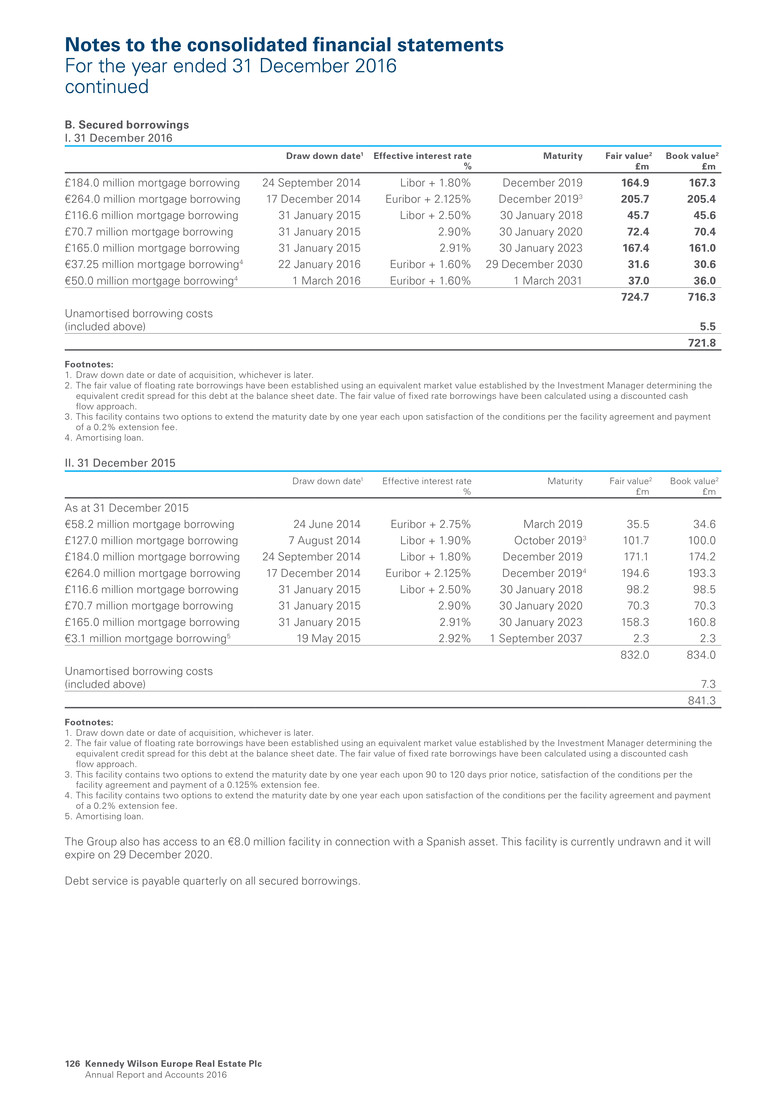

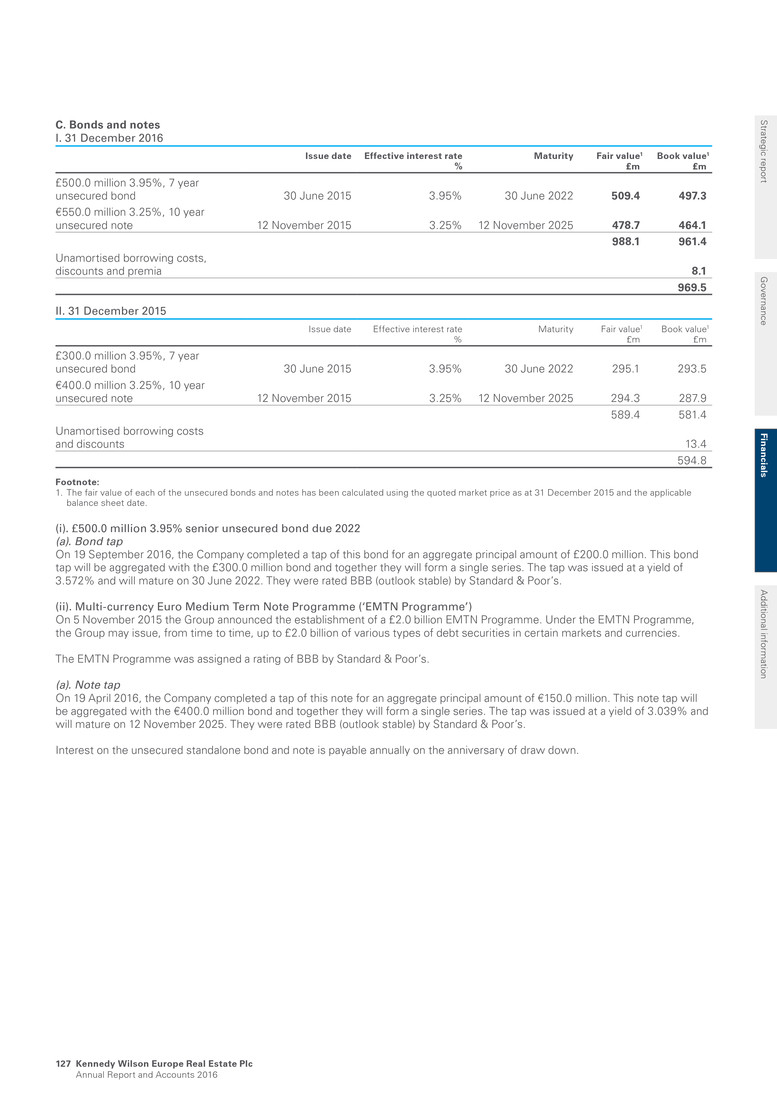

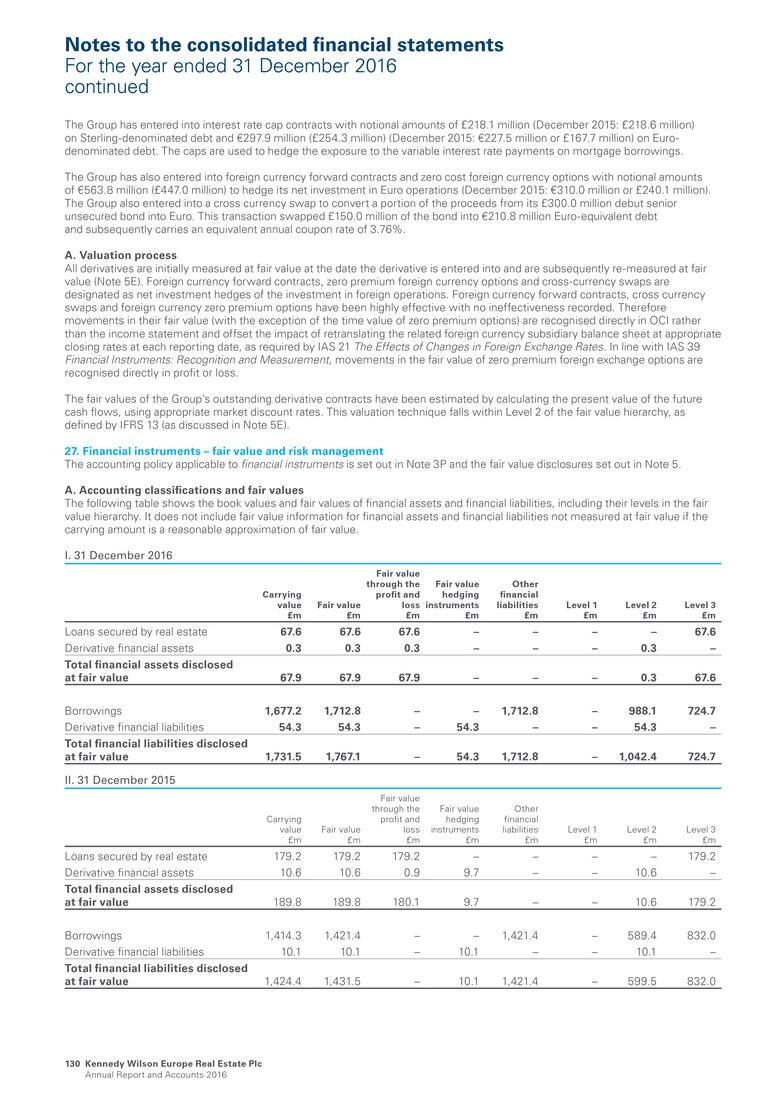

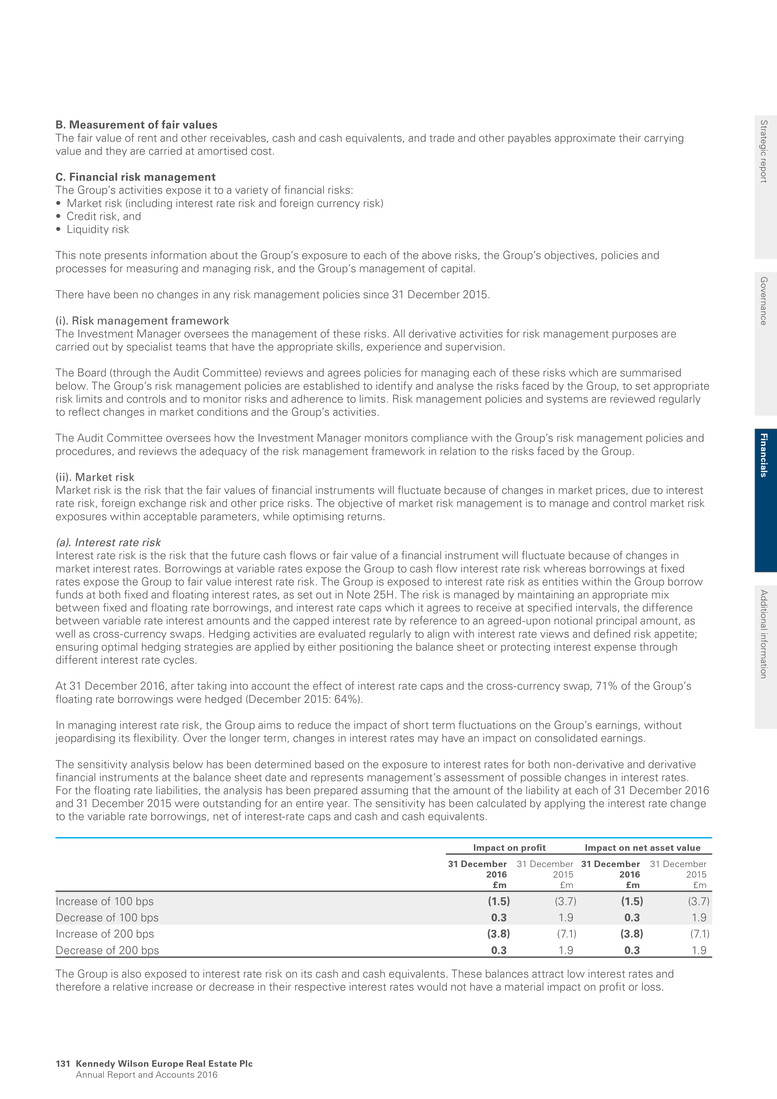

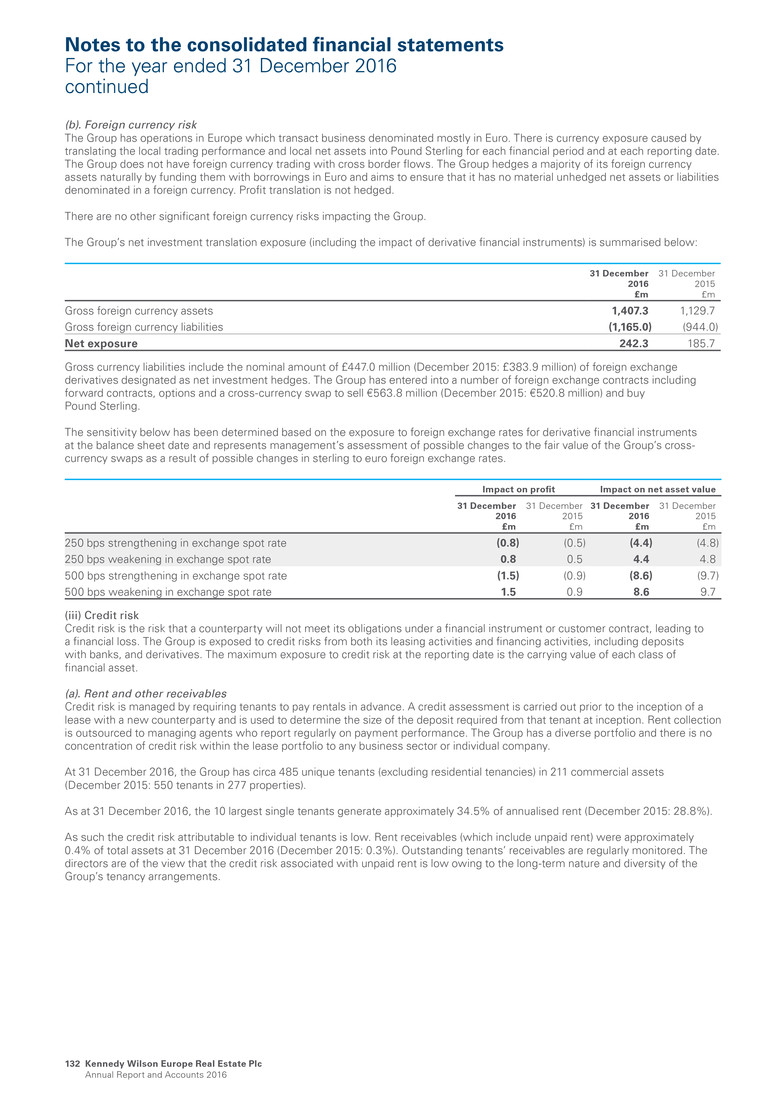

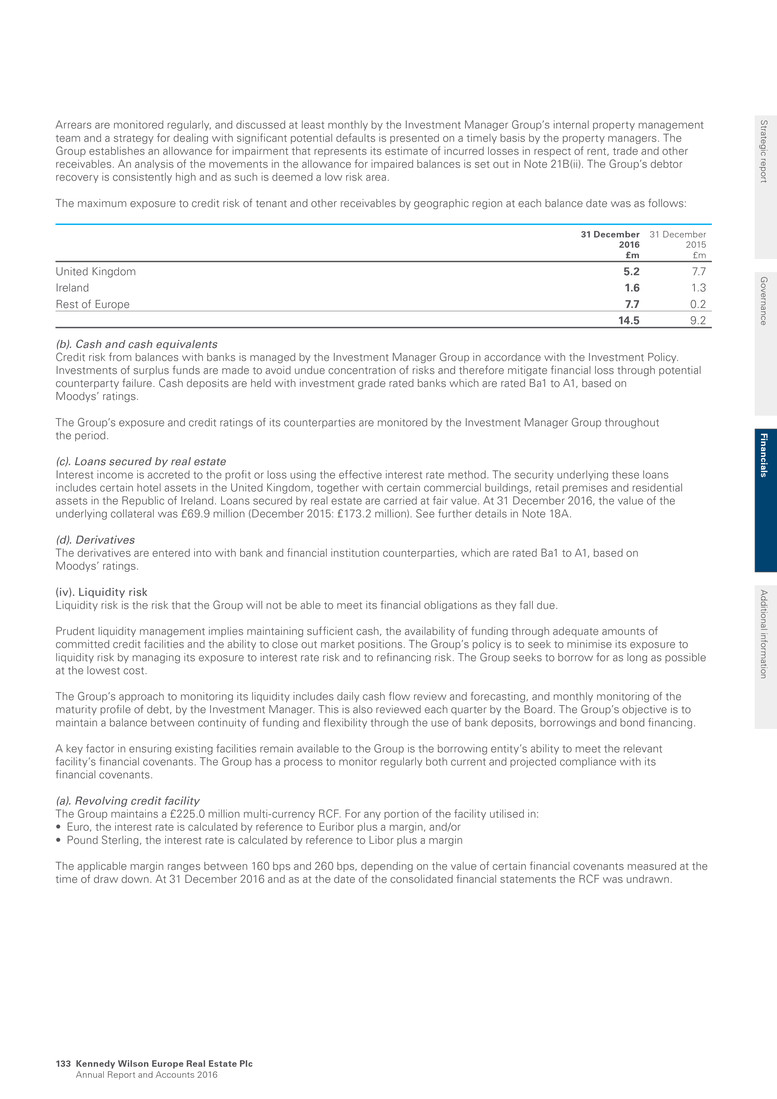

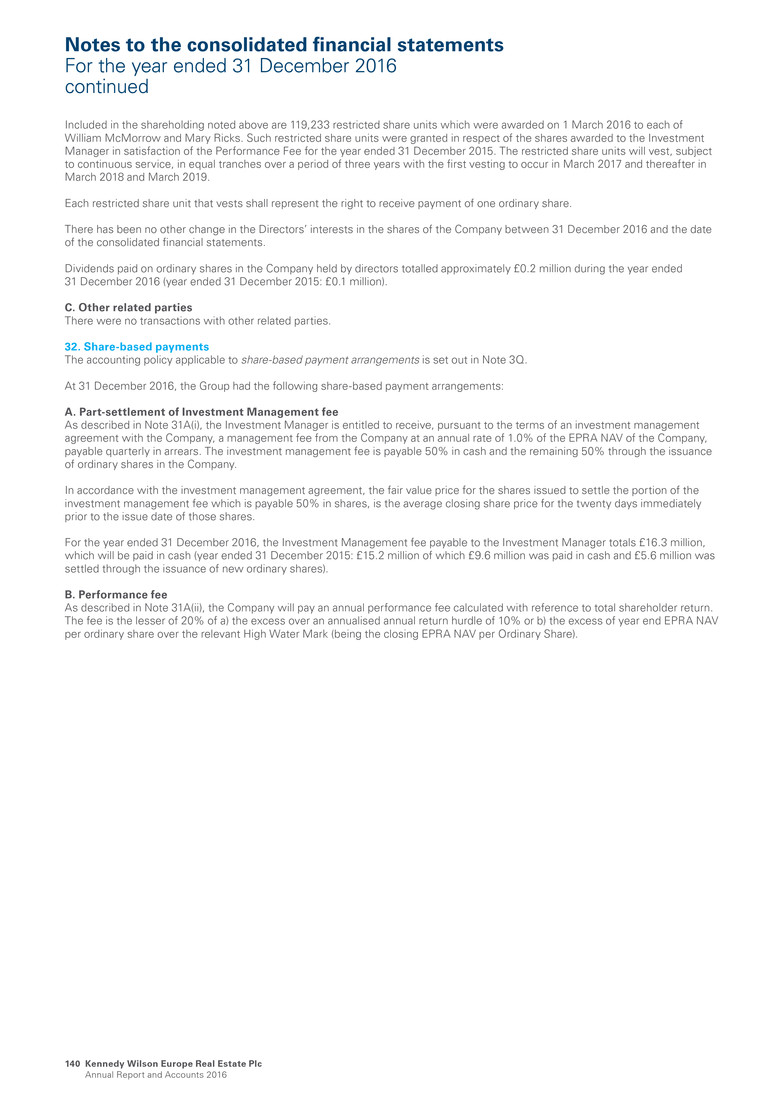

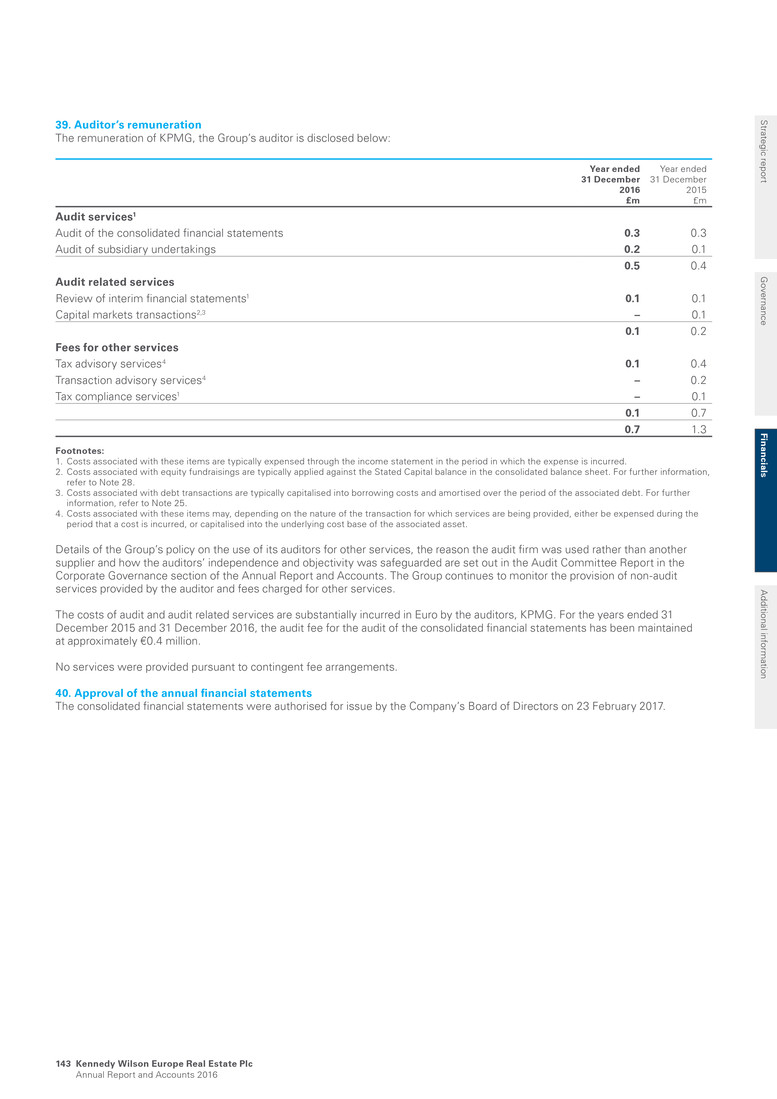

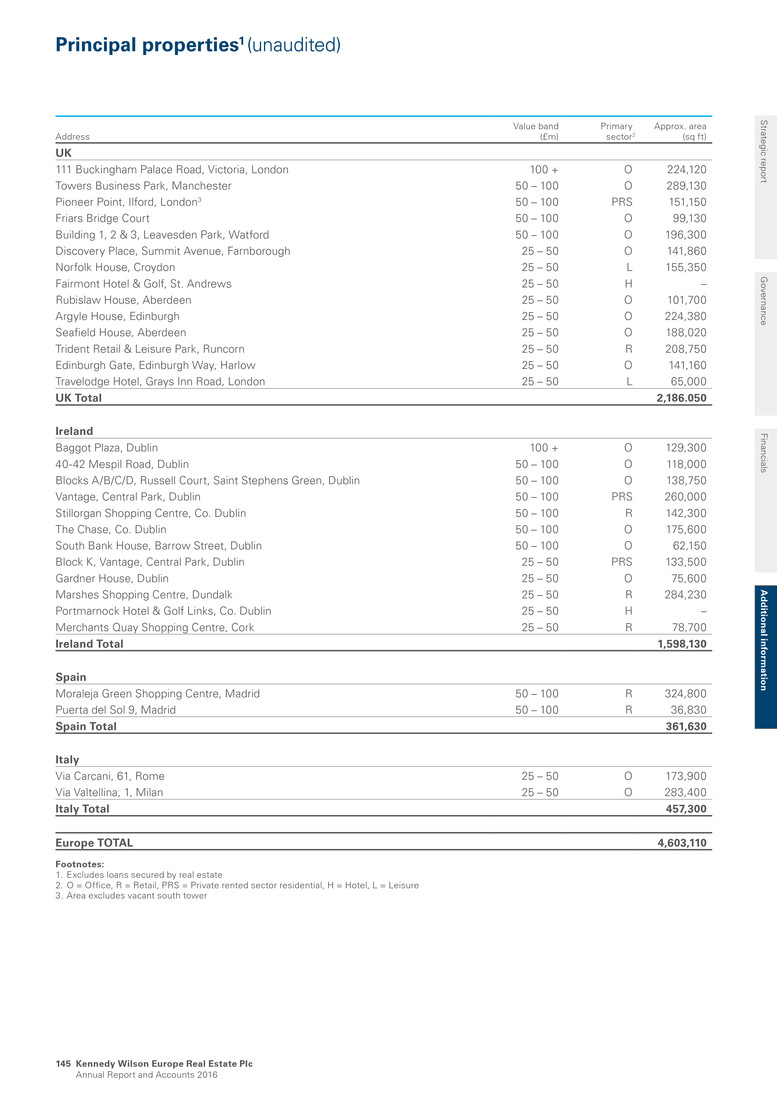

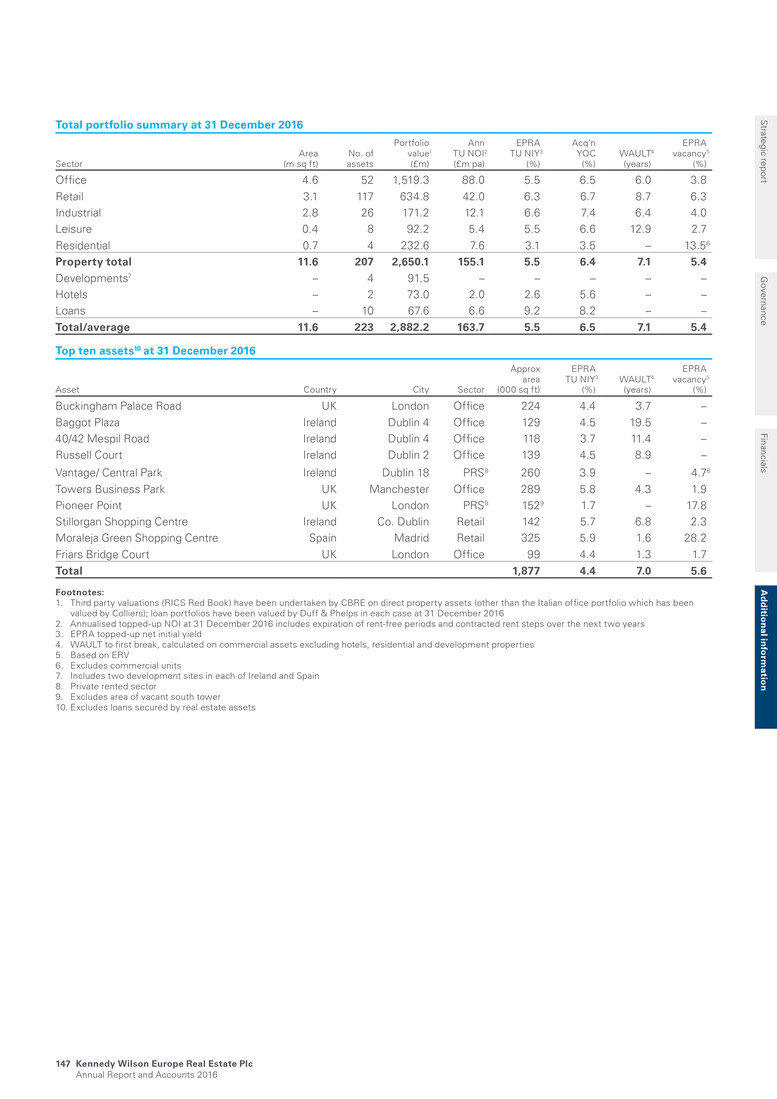

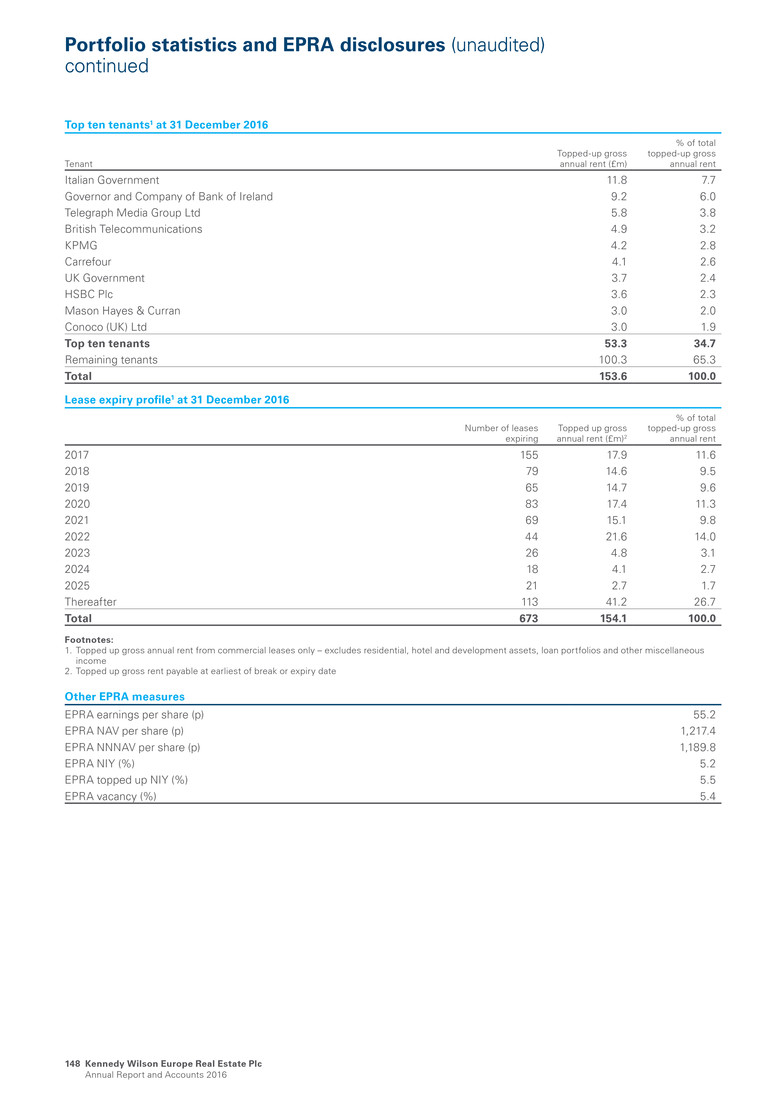

EPRA sustainability best practice reporting (sBPR) Set out below is a comprehensive breakdown based on the EPRA best practice recommendations on sustainability reporting. KWE EPRA sBPR metrics: energy and carbon performance data for 2016 EPRA Like-for-Like1 EPRA Indicator Sustainability performance measures 2016 2015 (restated)2 % change Elec-LfL Electricity Landlord shared services 23,292 MWh 24,324 MWh -4%3 Landlord obtained, sub-metered exclusively to tenants 6,589 MWh 6,541 MWh 1% Total landlord-obtained electricity 29,881 MWh 30,866 MWh -3% Fuels-LfL Fuels Landlord shared services 20,162 MWh 20,830 MWh -3%4 Landlord obtained, sub-metered exclusively to tenants – – – Total landlord-obtained electricity 20,162 MWh 20,830 MWh -3% GHG-Dir-LfL5 Direct greenhouse gas emissions Scope 1 – emissions from natural gas use and facility operations 3,710 tCO2e 3,842 tCO2e -3% GHG-Indir-LfL5 Indirect greenhouse gas emissions Scope 2 – emissions from KWE purchased electricity6 9,632 tCO2e 11,119 tCO2e -13% 6,7 Indirect greenhouse gas emissions Scope 3 – emissions from third parties in value chain 3,830 tCO2e 4,201 tCO2e -9% EPRA Absolute Indicators EPRA Indicator Sustainability performance measures8 2016 2015 (restated)2 % change Elec-Abs Electricity Landlord shared services 32,715 MWh 27,620 MWh 18% Landlord obtained, sub-metered exclusively to tenants 6,589 MWh9 6,541 MWh 1% Tenant obtained electricity 445 MWh10 – – Total landlord-obtained electricity 39,304 MWh 34,161 MWh 15% Fuels-Abs Fuels Landlord shared services 26,635 MWh 22,620 MWh 18% Landlord obtained, sub-metered exclusively to tenants – – – Total landlord-obtained fuels 26,635 MWh 22,620 MWh 18% Number of assets included 3911 31 26% Proportion of energy (MWh) estimated 6%12 3% – Coverage of data disclosed by asset number 100% 100% – GHG-Dir-Abs4 Direct greenhouse gas emissions Scope 1 – emissions from natural gas use and facility operations 4,901 tCO2e 4,172 tCO2e 17% GHG-Indir-Abs4 Indirect greenhouse gas emissions Scope 2 – emissions from KWE purchased electricity 12,867 tCO2e 12,630 tCO2e 2% Scope 3 – emissions from third parties in value chain including tenant emissions and business travel 4,989 tCO2e 13 4,327 tCO2e 15% GHG-Int4 Scope 1 and 2 intensity figure Offices: tonnes CO2 per £m net operating income 40414 473 -15% Retail: tonnes CO2 per £m net operating income 10114 65 56% Water-Abs Total Water Consumption (m3) 257,10115 177,420 45% Number of assets reporting water usage 14 11 27% KW Own Offices16 EPRA Indicator Sustainability performance measures 2016 Elec-Abs Electricity Directly purchased by KW 78 MWh Landlord purchased, but recharged to KW 161 MWh Total own-office electricity 239 MWh Fuels-Abs Fuels Directly purchased by KW 114 MWh Proportion of energy (MWh) estimated 37% GHG-Indir-Abs Indirect greenhouse gas emissions from business travel 672 tCO2e17 Our 2015 Responsible Investments report achieved an EPRA bronze award for our compliance with EPRA Sustainability Best Practice Reporting requirements. Kennedy Wilson Europe Real Estate Plc Annual Report and Accounts 2016 32 Responsible investments continued