Kennedy-Wilson Holdings, Inc.

Supplemental Financial Information

Fourth Quarter and Full Year December 31, 2021

TABLE OF CONTENTS

| | | | | | | | |

| | |

| | |

| | |

| | |

| | |

| | |

| Supplemental Financial Information (unaudited) | | |

| | |

| Components of Value | | |

| | |

| Stabilized Portfolio | | |

| | |

| | |

| | |

| | |

| | |

| Lease-up Portfolio | | |

| | |

| | |

| | |

| Other Portfolio and Financial Information | | |

| | |

| | |

| | |

| EBITDA by Segment (Non-GAAP) | | |

| | |

| | |

Certain terms used in this release are defined below under the caption "Common Definitions". Certain information included in this release constitutes non-GAAP financial measures. For a definition of the non-GAAP financial measures used in this release, see "Common Definitions" below, and for a reconciliation of those measures to their most comparable GAAP measure, see the tables set forth in the Company's supplemental financial information included in this release and also available at www.kennedywilson.com.

| | | | | |

| |

|

|

| Contact: Daven Bhavsar, CFA | |

| Vice President of Investor Relations | |

| (310) 887-6400 | |

| dbhavsar@kennedywilson.com | 151 S. El Camino Drive |

| www.kennedywilson.com | Beverly Hills, CA 90212 |

|

NEWS RELEASE

KENNEDY WILSON REPORTS 4Q AND RECORD FULL YEAR 2021 RESULTS

BEVERLY HILLS, Calif. (February 23, 2022) - Kennedy-Wilson Holdings, Inc. (NYSE: KW) today reported the following results for the fourth quarter and full year of 2021:

| | | | | | | | | | | | | | | | | | | | |

| 4Q | Full Year |

| (Amounts in millions, except per share data) | 2021 | | 2020 | 2021 | | 2020 |

| GAAP Results | | | | | | |

| GAAP Net Income to Common Shareholders | $ | 37.5 | | | $ | 170.0 | | $ | 313.2 | | | $ | 92.9 | |

| Per Diluted Share | 0.27 | | | 1.21 | | 2.24 | | | 0.66 | |

| | | | | | |

| Non-GAAP Results | | | | | | |

| Adjusted EBITDA | $ | 187.4 | | | $ | 346.9 | | $ | 927.9 | | | $ | 608.0 | |

Adjusted Net Income | 85.5 | | | 222.8 | | 509.0 | | | 306.9 | |

“Our Q4 results reflected a strong finish to a year of record financial results, including annual Adjusted EBITDA and GAAP EPS, and represented the tremendous progress that Kennedy Wilson made in 2021," said William McMorrow, Chairman and CEO of Kennedy Wilson. “We continued to see values increase across our real estate portfolio as we focused on growing our NOI and investment management business. Kennedy Wilson has emerged from the pandemic a much stronger company, and the $300 million investment from Fairfax positions us well for continued long-term growth."

FY-21 and 4Q-21 Highlights

•FY-21 Adjusted EBITDA Increased by 53% to $928 million:

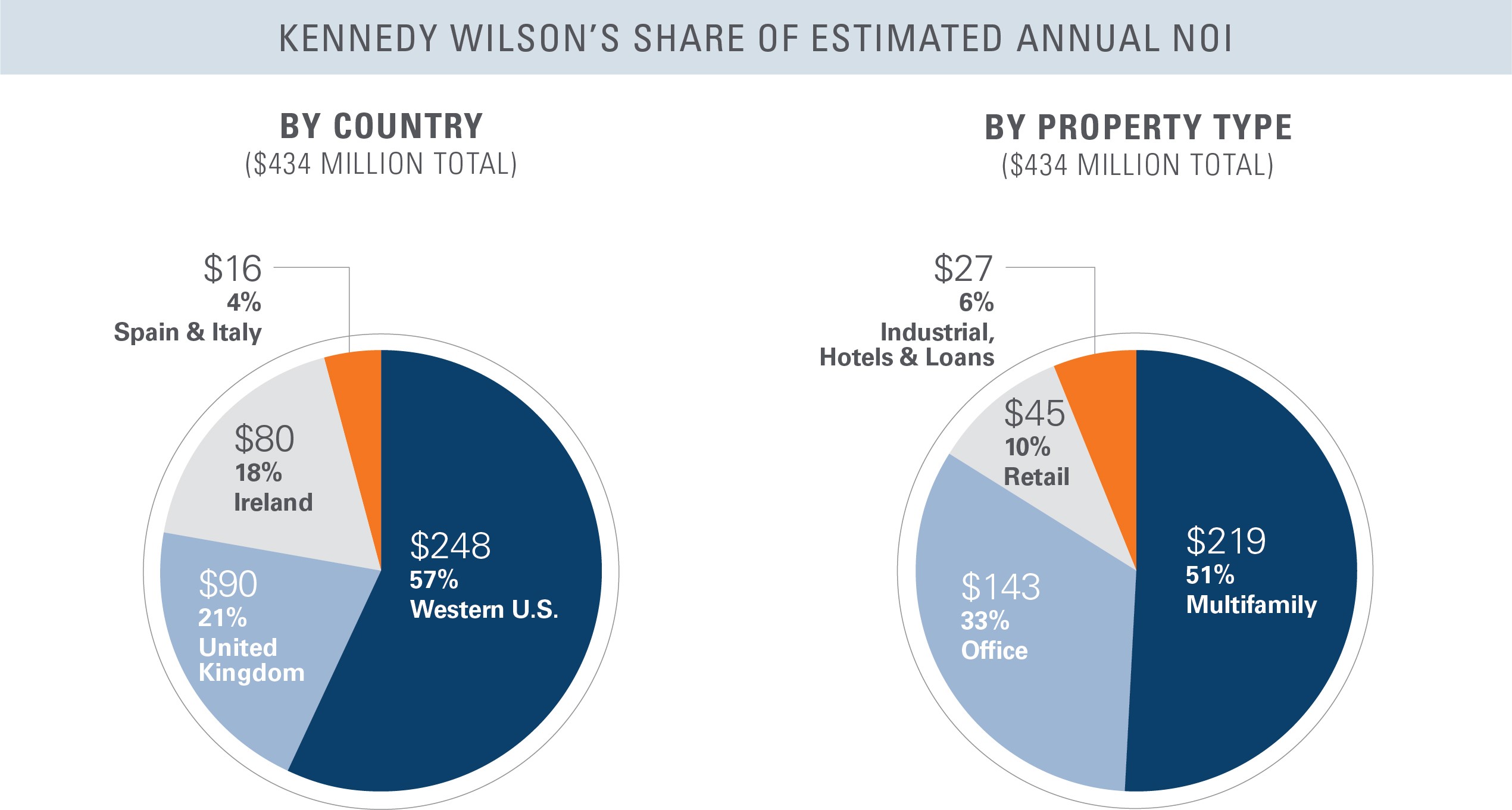

◦KW's share of recurring property NOI, loan income and fees totaled $434 million, an increase of $34 million from FY-20.

◦KW's share of gains and performance allocations increased by $353 million to $725 million in FY-21, including $324 million in fair-value and accrued performance allocations. In FY-20, KW's share of gains and performance allocations totaled $372 million, including $47 million in fair-value and accrued performance allocations.

•4Q-21 Adjusted EBITDA to $187 million (vs. $347 million in 4Q-20):

◦KW's share of recurring property NOI, loan income and fees totaled $126 million in 4Q-21, an increase of $31 million from 4Q-20.

◦KW's share of gains and performance allocations decreased by $164 million to $151 million in 4Q-21, including $157 million in fair-value and accrued performance allocations. In 4Q-20, KW's share of gains and performance allocations totaled $315 million, including $29 million in fair-value and accrued performance allocations.

•14% Growth of Multifamily NOI in 4Q-21 Drives Strong Same Property Performance1 :

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 4Q - 2021 vs. 4Q - 2020 | FY - 2021 vs. FY- 2020 |

| Occupancy | | Revenue | | NOI | Occupancy | | Revenue | | NOI |

| Multifamily - Market Rate | 0.6% | | 11.2% | | 13.7% | 0.5% | | 4.3% | | 4.5% |

| Multifamily - Affordable | 1.8% | | 6.2% | | 7.4% | 1.7% | | 4.0% | | 3.5% |

| Office | (2.1)% | | 5.3% | | 3.6% | (1.3)% | | 5.9% | | 6.2% |

| Total | | | 8.7% | | 8.9% | | | 4.8% | | 5.1% |

(1) Excludes minority-held investments

•Completed $5.9 billion in Investment Transactions in FY-21 Which Grew Estimated Annual NOI by $40 Million and Fee-Bearing Capital by $1.1 Billion:

| | | | | | | | | | | | | | | | | |

| FY-21 Summary | Gross Transaction Value

($ in millions) | | Est. Annual NOI To KW

($ in millions) | | Fee-Bearing Capital

($ in billions) |

| As of 4Q-20 | | | 394 | | | 3.9 | |

| Gross acquisitions and loan investments | $ | 4,064 | | | 64 | | | 1.6 | |

| Assets stabilized | — | | | 14 | | | — | |

| Operations | — | | | 7 | | | — | |

| Gross dispositions and loan repayments | 1,828 | | | (36) | | | (0.4) | |

| FX and other | — | | | (9) | | | (0.1) | |

| Total as of 4Q-21 | $ | 5,892 | | | $ | 434 | | | $ | 5.0 | |

•Completed $1.5 billion in Investment Transactions in 4Q-21 Which Grew Estimated Annual NOI by $21 Million and Fee-Bearing Capital by $200 Million:

| | | | | | | | | | | | | | | | | |

| 4Q-21 Summary | Gross Transaction Value

($ in millions) | | Est. Annual NOI To KW

($ in millions) | | Fee-Bearing Capital

($ in billions) |

| As of 3Q-21 | | | 413 | | | 4.8 | |

| Gross acquisitions and loan investments | $ | 1,321 | | | 16 | | | 0.4 | |

| Assets stabilized | — | | | 4 | | | — | |

| Operations | — | | | 4 | | | — | |

| Gross dispositions and loan repayments | 135 | | | (2) | | | (0.1) | |

| FX and other | — | | | (1) | | | (0.1) | |

| Total as of 4Q-21 | $ | 1,456 | | | $ | 434 | | | $ | 5.0 | |

•Continued Progress on Development and Lease-up Portfolio:

◦In 4Q-21, completed stabilization of Capital Dock in Dublin, Ireland and construction of Hanover Quay in Dublin, Ireland, and The Farm and Sanctuary in the Western U.S.

◦Development and lease up portfolio expected to add approximately $105 million in Estimated Annual NOI upon completion of construction by 2024 and stabilization by 2025.

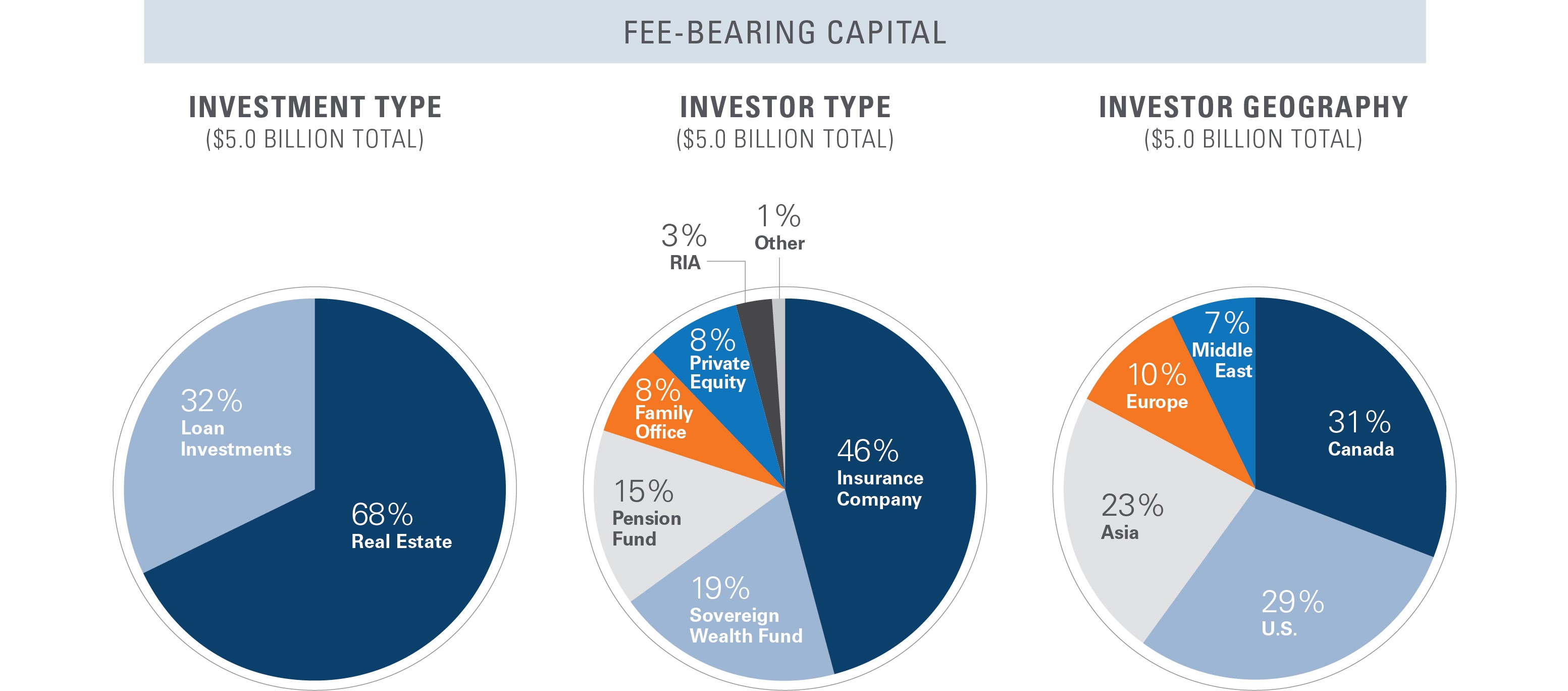

•28% Annual Growth in Fee-Bearing Capital: The Company's Fee-Bearing Capital totaled $5.0 billion as of YE-21, a 4% increase from 3Q-21 and a 28% increase from YE-20. In addition, the

Company has approximately $1.7 billion in additional non-discretionary capital with certain strategic partners that is available for investment.

◦20% Growth in Debt Platform in 4Q; 119% Growth in 2021: Completed loan investments totaling $344 million while loan repayments totaled $65 million, resulting in 20% growth in 4Q-21. The Company has a 8% ownership in its debt platform, which totals $2.0 billion of outstanding loans (including $279 million of future funding commitments) and $1.6 billion of Fee-Bearing Capital as of 4Q-21.

◦63% Growth in European Logistics Assets in 4Q, 236% Growth in 2021:

▪Acquired $334 million in logistics assets in 4Q-21, including $258 million through its European logistics platform and $76 million through its commingled fund.

▪The Company has a 20% ownership in its European logistics platform, which totals $938 million of assets and $337 million of Fee-Bearing Capital as of 4Q-21.

Investment Activity

•Capital Allocation:

◦In 4Q-21, the Company invested $333 million of cash with 72% allocated to new investments, 17% to capex, and 11% to its share repurchase program.

◦In FY-21, the Company invested $1.1 billion of cash, allocating 74% into new investments, 19% to capex, and 7% to its share repurchase program.

•Consolidated Portfolio Adds Two Wholly-owned Properties For $243 million in 4Q-21:

▪Western U.S. Multifamily Expansion: Acquired a 528-unit multifamily property located in Henderson, NV for $155 million, which added $6 million to Estimated Annual NOI.

▪United Kingdom Office: Acquired a premier office campus located on the South Coast of the U.K. for $88 million, which includes $11 million related to an 11-acre parcel approved for future development. The acquisition added $5 million to Estimated Annual NOI.

•Co-investment Portfolio Adds $1.1 billion in Investments in 4Q-21:

▪Kennedy Wilson completed $733 million of real estate investments and $344 million of debt investments in its Co-investment portfolio, which added $6 million to Estimated Annual NOI and $420 million in Fee-Bearing Capital.

•Strong Investment Performance Drove 4Q-21 Income from Unconsolidated Investments to $175 million (vs. $36 million in 4Q-20):

◦Principal co-investment income, which includes the Company's share of earnings, gains on sale, and changes in fair-value from its co-investment portfolio, grew to $119 million in 4Q-21 (vs $31 million in 4Q-20), primarily driven by $102 million in fair-value income related to the Company's unconsolidated investments during 4Q-21.

◦Performance allocations, which relates to the co-investments managed by Kennedy Wilson, grew to $56 million in 4Q-21 from $5 million in 4Q-20, due to the increase in the fair value of the Company's unconsolidated investments.

•FY-21 Income from Unconsolidated Investments Grows to $389 million (vs. $81 million in FY-20):

◦Principal co-investment income grew to $271 million in FY-21 (vs $78 million in FY-20), primarily due to $211 million related to the increase in fair-value of its unconsolidated investments.

◦Performance allocations grew to $118 million in FY-21 from $3 million in FY-20, due to the increase in the fair value of the Company's unconsolidated investments.

Balance Sheet

•$950 million in Cash and Available Lines of Credit: As of 4Q-21, Kennedy Wilson had cash and cash equivalents of $525 million(1) and $425 million of capacity on its $500 million revolving credit facility.

•Debt Profile: As of YE-21, the Company's share of debt had a weighted average annual interest rate of 3.5% and a weighted average maturity of 6.1 years. Approximately 88% of the Company's debt is either fixed or hedged using interest rate derivatives.

•Share Repurchase Program(2): In 4Q-21, the Company repurchased 1.6 million shares for $37 million. In FY-21, the Company repurchased 3.8 million shares for $81 million. Since the inception of the buyback in March 2018, the Company has repurchased and retired 17.4 million shares at a weighted-average price of $18.64 per share.

Subsequent Events

In 1Q-22, the Company borrowed $175 million on its revolving line of credit and currently has an outstanding balance of $250 million, with $250 million available to draw on its $500 million revolving line of credit.

In 1Q-22, the Company has completed total real estate acquisitions of $292 million and loan originations of $116 million, with another $431 million of investments under contract. The 1Q-22 real estate acquisitions and loan originations closed and under contract are expected to add approximately $14 million in Estimated Annual NOI. The Company's expected ownership interest in its closed and under contract investments is 36%. The Company's cash invested into these transactions is expected to total $215 million. Investments under contract are subject to customary closing conditions.

In 1Q-22, the Company announced that it entered into an agreement for a $300 million preferred investment in Kennedy Wilson by affiliates of Fairfax Financial Holdings (collectively, "Fairfax"). Under the terms of the agreement, Fairfax is purchasing $300 million in perpetual preferred stock carrying a 4.75% annual dividend rate and is callable by Kennedy Wilson at any time. Additionally, Fairfax acquired 7-year warrants for approximately 13.0 million common shares with an initial strike price of $23.00 per share, based on Kennedy Wilson’s closing price on February 9, 2022 and representing a premium of 2% to the daily volume weighted average price per share of Kennedy Wilson’s common stock over the past 20 trading days. The Company expects to use the proceeds to pay off in full its line of credit balance and to fund its development pipeline. The transaction is subject to customary closing conditions. Along with Fairfax’s equity investment, the previously announced joint venture debt platform between Fairfax and Kennedy Wilson increased its investment target from $2 billion to $5 billion.

Financial Statement Presentation Changes

As the Company's Co-Investment segment has grown, the Company has expanded the presentation of related items in the statements of income presented as this presentation reflects the prominence of this core business. The income from unconsolidated investments line caption has been expanded to show principal co-investments and performance allocations:

a.Principal co-investments consists of the Company’s share of net income and losses from Co-Investments and unrealized and realized gains on the Company's Co-Investments including any fair value adjustments

b.Performance allocations relate to special allocations to co-investments the Company manages based on the cumulative performance of the fund or investment and are subject to preferred return thresholds of its limited partners.

c.Performance allocations compensation relates to the performance allocation earned by certain commingled funds and separate account investments to be allocated to certain employees of the Company.

Footnotes

(1) Represents consolidated cash and includes $23 million of restricted cash, which is included in cash and cash equivalents. The Company's share of cash, including unconsolidated joint-ventures, totals $618 million.

(2) Future purchases under the program may be made in the open market, in privately negotiated transactions, through the net settlement of the Company's restricted stock grants or otherwise, with the amount and timing of the repurchases dependent on market conditions and subject to the Company's discretion. The program does not obligate the Company to repurchase any specific number of shares and, subject to compliance with applicable laws, may be suspended or terminated at any time without prior notice.

Conference Call and Webcast Details

Kennedy Wilson will hold a live conference call and webcast to discuss results at 9:00 a.m. PT/ 12:00 p.m. ET on Thursday, February 24. The direct dial-in number for the conference call is (844) 340-4761 for U.S. callers and (412) 717-9616 for international callers.

A replay of the call will be available for one week beginning one hour after the live call and can be accessed by (877) 344-7529 for U.S. callers and (412) 317-0088 for international callers. The passcode for the replay is 6132873.

The webcast will be available at: https://services.choruscall.com/links/kw220224jlferCnT.html. A replay of the webcast will be available one hour after the original webcast on the Company’s investor relations web site for three months.

About Kennedy Wilson

Kennedy Wilson (NYSE:KW) is a leading global real estate investment company. We own, operate, and invest in real estate both on our own and through our investment management platform. We focus on multifamily and office properties located in the Western U.S., UK, and Ireland. For further information on Kennedy Wilson, please visit www.kennedywilson.com.

Kennedy-Wilson Holdings, Inc.

Consolidated Balance Sheets

(Unaudited)

(Dollars in millions)

| | | | | | | | | | | | | | |

| | | December 31, |

| | 2021 | | 2020 |

| Assets | | | | |

| Cash and cash equivalents | | $ | 524.8 | | | $ | 965.1 | |

| Accounts receivable | | 36.1 | | | 47.9 | |

| Real estate and acquired in place lease values (net of accumulated depreciation and amortization of $838.1 and $815.0) | | 5,059.8 | | | 4,720.5 | |

| Unconsolidated investments (including $1,794.8 and $1,136.5 at fair value) | | 1,947.6 | | | 1,289.3 | |

| Other assets | | 177.9 | | | 199.1 | |

| Loan purchases and originations | | 130.3 | | | 107.1 | |

| Total assets | | $ | 7,876.5 | | | $ | 7,329.0 | |

| | | | |

| Liabilities | | | | |

| Accounts payable | | $ | 18.6 | | | $ | 30.1 | |

| Accrued expenses and other liabilities | | 619.1 | | | 531.7 | |

| Mortgage debt | | 2,959.8 | | | 2,589.8 | |

| KW unsecured debt | | 1,852.3 | | | 1,332.2 | |

| KWE unsecured bonds | | 622.8 | | | 1,172.5 | |

| Total liabilities | | 6,072.6 | | | 5,656.3 | |

| Equity | | | | |

| Cumulative perpetual preferred stock | | 295.2 | | | 295.2 | |

| Common stock | | — | | | — | |

| Additional paid-in capital | | 1,679.6 | | | 1,725.2 | |

| Retained earnings | | 192.4 | | | 17.7 | |

| Accumulated other comprehensive loss | | (389.6) | | | (393.6) | |

| Total Kennedy-Wilson Holdings, Inc. shareholders’ equity | | 1,777.6 | | | 1,644.5 | |

| Noncontrolling interests | | 26.3 | | | 28.2 | |

| Total equity | | 1,803.9 | | | 1,672.7 | |

| Total liabilities and equity | | $ | 7,876.5 | | | $ | 7,329.0 | |

Kennedy-Wilson Holdings, Inc.

Consolidated Statements of Income

(Unaudited)

(Dollars in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended | | For the Year Ended |

| | December 31, | | December 31, |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Revenue | | | | | | | | |

| Rental | | $ | 110.8 | | | $ | 95.1 | | | $ | 390.5 | | | $ | 403.9 | |

| Hotel | | 7.9 | | | 3.5 | | | 17.1 | | | 13.9 | |

| Investment management fees | | 9.9 | | | 7.3 | | | 35.3 | | | 22.5 | |

| Property services fees | | 0.4 | | | 0.6 | | | 2.1 | | | 10.6 | |

| Loans and other | | 2.4 | | | 1.6 | | | 8.6 | | | 3.1 | |

| Total revenue | | 131.4 | | | 108.1 | | | 453.6 | | | 454.0 | |

| | | | | | | | |

| Income from unconsolidated investments | | | | | | | | |

| Principal co-investments | | 119.2 | | | 30.8 | | | 271.1 | | | 78.3 | |

| Performance allocations | | 55.9 | | | 5.2 | | | 117.9 | | | 2.7 | |

| Total income from unconsolidated investments | | 175.1 | | | 36.0 | | | 389.0 | | | 81.0 | |

| | | | | | | | |

| (Loss) gain on sale of real estate, net | | (4.3) | | | 290.3 | | | 412.7 | | | 338.0 | |

| | | | | | | | |

| Expenses | | | | | | | | |

| Rental | | 34.9 | | | 33.5 | | | 132.7 | | | 135.7 | |

| Hotel | | 4.9 | | | 2.9 | | | 12.7 | | | 13.8 | |

| Compensation and related | | 35.5 | | | 51.5 | | | 133.9 | | | 111.9 | |

| Share based compensation | | 6.8 | | | 7.8 | | | 28.7 | | | 32.3 | |

| Performance allocation compensation | | 38.8 | | | — | | | 42.0 | | | 0.2 | |

| General and administrative | | 8.6 | | | 8.5 | | | 33.3 | | | 34.6 | |

| Depreciation and amortization | | 41.0 | | | 44.5 | | | 166.3 | | | 179.6 | |

| Total expenses | | 170.5 | | | 148.7 | | | 549.6 | | | 508.1 | |

| Interest expense | | (51.0) | | | (52.0) | | | (192.4) | | | (201.9) | |

| Loss on early extinguishment of debt | | (7.1) | | | (7.9) | | | (45.7) | | | (9.3) | |

| Other (loss) income, net | | (1.3) | | | 0.6 | | | (5.0) | | | (2.3) | |

| Income before provision for income taxes | | 72.3 | | | 226.4 | | | 462.6 | | | 151.4 | |

| Provision for income taxes | | (28.0) | | | (53.9) | | | (126.2) | | | (43.6) | |

| Net income | | 44.3 | | | 172.5 | | | 336.4 | | | 107.8 | |

| Net (income) loss attributable to the noncontrolling interests | | (2.5) | | | 1.8 | | | (6.0) | | | 2.3 | |

| Preferred dividends | | (4.3) | | | (4.3) | | | (17.2) | | | (17.2) | |

| Net income attributable to Kennedy-Wilson Holdings, Inc. common shareholders | | $ | 37.5 | | | $ | 170.0 | | | $ | 313.2 | | | $ | 92.9 | |

| Basic earnings per share | | | | | | | | |

| Income per basic | | $ | 0.27 | | | $ | 1.23 | | | $ | 2.26 | | | $ | 0.66 | |

| Weighted average shares outstanding for basic | | 137,258,502 | | | 138,435,722 | | | 138,552,058 | | | 139,741,411 | |

| Diluted earnings per share | | | | | | | | |

| Income per diluted | | $ | 0.27 | | | $ | 1.21 | | | $ | 2.24 | | | $ | 0.66 | |

| Weighted average shares outstanding for diluted | | 137,782,173 | | | 140,742,482 | | | 140,132,435 | | | 140,347,365 | |

| Dividends declared per common share | | $ | 0.24 | | | $ | 0.22 | | | $ | 0.90 | | | $ | 0.88 | |

Kennedy-Wilson Holdings, Inc.

Adjusted EBITDA

(Unaudited)

(Dollars in millions)

The table below reconciles Adjusted EBITDA to net income attributable to Kennedy-Wilson Holdings, Inc. common shareholders, using Kennedy Wilson’s Pro-Rata share amounts for each adjustment item.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Net income attributable to Kennedy-Wilson Holdings, Inc. common shareholders | | $ | 37.5 | | | $ | 170.0 | | | $ | 313.2 | | | $ | 92.9 | |

| Non-GAAP adjustments: | | | | | | | | |

Add back (Kennedy Wilson's Share)(1): | | | | | | | | |

| Interest expense | | 62.5 | | | 59.6 | | | 229.8 | | | 231.9 | |

| Loss on early extinguishment of debt | | 7.1 | | | 7.9 | | | 45.7 | | | 9.3 | |

| Depreciation and amortization | | 41.2 | | | 45.0 | | | 167.1 | | | 181.7 | |

| Provision for income taxes | | 28.0 | | | 52.3 | | | 126.2 | | | 42.7 | |

| Preferred dividends | | 4.3 | | | 4.3 | | | 17.2 | | | 17.2 | |

| Share-based compensation | | 6.8 | | | 7.8 | | | 28.7 | | | 32.3 | |

| Adjusted EBITDA | | $ | 187.4 | | | $ | 346.9 | | | $ | 927.9 | | | $ | 608.0 | |

(1) See Appendix for reconciliation of Kennedy Wilson's Share amounts.

The table below provides a detailed reconciliation of Adjusted EBITDA to net income.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Net income | | $ | 44.3 | | | $ | 172.5 | | | $ | 336.4 | | | $ | 107.8 | |

| Non-GAAP adjustments: | | | | | | | | |

| Add back: | | | | | | | | |

| Interest expense | | 51.0 | | | 52.0 | | | 192.4 | | | 201.9 | |

| Loss on early extinguishment of debt | | 7.1 | | | 7.9 | | | 45.7 | | | 9.3 | |

| Kennedy Wilson's share of interest expense included in unconsolidated investments | | 12.2 | | | 8.3 | | | 40.2 | | | 33.0 | |

| Depreciation and amortization | | 41.0 | | | 44.5 | | | 166.3 | | | 179.6 | |

| Kennedy Wilson's share of depreciation and amortization included in unconsolidated investments | | 1.1 | | | 1.7 | | | 5.3 | | | 6.9 | |

| Provision for income taxes | | 28.0 | | | 53.9 | | | 126.2 | | | 43.6 | |

| Kennedy Wilson's share of taxes included in unconsolidated investments | | — | | | — | | | — | | | 1.1 | |

| Share-based compensation | | 6.8 | | | 7.8 | | | 28.7 | | | 32.3 | |

EBITDA attributable to noncontrolling interests(1) | | (4.1) | | | (1.7) | | | (13.3) | | | (7.5) | |

| Adjusted EBITDA | | $ | 187.4 | | | $ | 346.9 | | | $ | 927.9 | | | $ | 608.0 | |

(1) EBITDA attributable to noncontrolling interests includes $0.9 million and $1.2 million of depreciation and amortization, $0.7 million and $0.7 million of interest, and $0.0 million and $1.6 million of taxes, for the three months ended December 31, 2021 and 2020, respectively. EBITDA attributable to noncontrolling interests includes $4.5 million and $4.8 million of depreciation and amortization, $2.8 million and $3.0 million of interest, and $0.0 million and $2.0 million of taxes, for the year ended December 31, 2021 and 2020, respectively.

Kennedy-Wilson Holdings, Inc.

Adjusted Net Income

(Unaudited)

(Dollars in millions, except share data)

The table below reconciles Adjusted Net Income to net income attributable to Kennedy-Wilson Holdings, Inc. common shareholders, using Kennedy Wilson’s Pro-Rata share amounts for each adjustment item.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Net income attributable to Kennedy-Wilson Holdings, Inc. common shareholders | | $ | 37.5 | | | $ | 170.0 | | | $ | 313.2 | | | $ | 92.9 | |

| Non-GAAP adjustments: | | | | | | | | |

Add back (Kennedy Wilson's Share)(1): | | | | | | | | |

| Depreciation and amortization | | 41.2 | | | 45.0 | | | 167.1 | | | 181.7 | |

| Share-based compensation | | 6.8 | | | 7.8 | | | 28.7 | | | 32.3 | |

| Adjusted Net Income | | $ | 85.5 | | | $ | 222.8 | | | $ | 509.0 | | | $ | 306.9 | |

| | | | | | | | |

| Weighted average shares outstanding for diluted | | 137,782,173 | | | 140,742,482 | | | 140,132,435 | | | 140,347,365 | |

(1) See Appendix for reconciliation of Kennedy Wilson's Share amounts.

The table below provides a detailed reconciliation of Adjusted Net Income to net income.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Net income | | $ | 44.3 | | | $ | 172.5 | | | $ | 336.4 | | | $ | 107.8 | |

| Non-GAAP adjustments: | | | | | | | | |

| Add back: | | | | | | | | |

| Depreciation and amortization | | 41.0 | | | 44.5 | | | 166.3 | | | 179.6 | |

| Kennedy Wilson's share of depreciation and amortization included in unconsolidated investments | | 1.1 | | | 1.7 | | | 5.3 | | | 6.9 | |

| Share-based compensation | | 6.8 | | | 7.8 | | | 28.7 | | | 32.3 | |

| Preferred dividends | | (4.3) | | | (4.3) | | | (17.2) | | | (17.2) | |

Net income attributable to the noncontrolling interests, before depreciation and amortization(1) | | (3.4) | | | 0.6 | | | (10.5) | | | (2.5) | |

| Adjusted Net Income | | $ | 85.5 | | | $ | 222.8 | | | $ | 509.0 | | | $ | 306.9 | |

| | | | | | | | |

| Weighted average shares outstanding for diluted | | 137,782,173 | | | 140,742,482 | | | 140,132,435 | | | 140,347,365 | |

(1) Includes $0.9 million and $1.2 million of depreciation and amortization for the three months ended December 31, 2021 and 2020, respectively, and $4.5 million and $4.8 million for the year ended December 31, 2021 and 2020, respectively.

Forward-Looking Statements

Statements made by us in this report and in other reports and statements released by us that are not historical facts constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are necessarily estimates reflecting the judgment of our senior management based on our current estimates, expectations, forecasts and projections and include comments that express our current opinions about trends and factors that may impact future operating results. Disclosures that use words such as "believe," "anticipate," "estimate," "intend," "may," "could," "plan," "expect," "project" or the negative of these, as well as similar expressions, are intended to identify forward-looking statements. These statements are not guarantees of future performance, rely on a number of assumptions concerning future events, many of which are outside of our control, and involve known and unknown risks and uncertainties that could cause our actual results, performance or achievement, or industry results, to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. These risks and uncertainties may include the factors and the risks and uncertainties described elsewhere in this report and other filings with the Securities and Exchange Commission (the "SEC"), including the Item 1A. "Risk Factors" section of our Annual Report on Form 10-K for the year ended December 31, 2020, as amended by our subsequent filings with the SEC. Any such forward-looking statements, whether made in this report or elsewhere, should be considered in the context of the various disclosures made by us about our businesses including, without limitation, the risk factors discussed in our filings with the SEC. Except as required under the federal securities laws and the rules and regulations of the SEC, we do not have any intention or obligation to update publicly any forward-looking statements, whether as a result of new information, future events, changes in assumptions, or otherwise.

Common Definitions

· “KWH,” "KW," “Kennedy Wilson,” the "Company," "we," "our," or "us" refers to Kennedy-Wilson Holdings, Inc. and its wholly-owned subsidiaries.

· “Adjusted EBITDA” represents net income before interest expense, loss on early extinguishment of debt, our share of interest expense included in unconsolidated investments, depreciation and amortization, our share of depreciation and amortization included in unconsolidated investments, provision for income taxes, our share of taxes included in unconsolidated investments, share-based compensation expense for the Company and EBITDA attributable to noncontrolling interests.

Please also see the reconciliation to GAAP in the Company’s supplemental financial information included in this release and also available at www.kennedywilson.com. Our management uses Adjusted EBITDA to analyze our business because it adjusts net income for items we believe do not accurately reflect the nature of our business going forward or that relate to non-cash compensation expense or noncontrolling interests. Such items may vary for different companies for reasons unrelated to overall operating performance. Additionally, we believe Adjusted EBITDA is useful to investors to assist them in getting a more accurate picture of our results from operations. However, Adjusted EBITDA is not a recognized measurement under GAAP and when analyzing our operating performance, readers should use Adjusted EBITDA in addition to, and not as an alternative for, net income as determined in accordance with GAAP. Because not all companies use identical calculations, our presentation of Adjusted EBITDA may not be comparable to similarly titled measures of other companies. Furthermore, Adjusted EBITDA is not intended to be a measure of free cash flow for our management’s discretionary use, as it does not remove all non-cash items (such as acquisition-related gains) or consider certain cash requirements such as tax and debt service payments. The amount shown for Adjusted EBITDA also differs from the amount calculated under similarly titled definitions in our debt instruments, which are further adjusted to reflect certain other cash and non-cash charges and are used to determine compliance with financial covenants and our ability to engage in certain activities, such as incurring additional debt and making certain restricted payments.

· “Adjusted Fees’’ refers to Kennedy Wilson’s gross investment management and property services fees adjusted to include Kennedy Wilson's share of fees eliminated in consolidation, and performance fees included in unconsolidated investments. Our management uses Adjusted fees to analyze our investment management business because the measure removes required eliminations under GAAP for properties in which the Company provides services but also has an ownership interest. These eliminations understate the economic value of the investment management and property services fees and makes the Company comparable to other real estate companies that provide investment management but do not have an ownership interest in the properties they manage. Our management believes that adjusting GAAP fees to reflect these amounts eliminated in consolidation presents a more holistic measure of the scope of our investment management business.

· “Adjusted Net Income” represents net income before depreciation and amortization, our share of depreciation and amortization included in unconsolidated investments, share-based compensation, preferred dividends and net income attributable to the noncontrolling interests, before depreciation and amortization. Please also see the reconciliation to GAAP in the Company’s supplemental financial information included in this release and also available at www.kennedywilson.com.

· “Annual Return on Loans” is a metric that applies to our real estate debt business that represents the sum of annual interest income, transaction fees and the payback of principal for discounted loan purchases, amortized over the life of the loans and divided by the principal balances of the loans.

· “Cap rate” represents the net operating income of an investment for the year preceding its acquisition or disposition, as applicable, divided by the purchase or sale price, as applicable. Cap rates set forth in this presentation only includes data from income-producing properties. We calculate cap rates based on information that is supplied to us during the acquisition diligence process. This information is not audited or reviewed by independent accountants and may be presented in a manner that is different from similar information included in our financial statements prepared in accordance with GAAP. In addition, cap rates represent historical performance and are not a guarantee of future NOI. Properties for which a cap rate is provided may not continue to perform at that cap rate.

· "Equity partners" refers to non-wholly-owned subsidiaries that we consolidate in our financial statements under U.S. GAAP and third-party equity providers.

· "Estimated Annual NOI" is a property-level non-GAAP measure representing the estimated annual net operating income from each property as of the date shown, inclusive of rent abatements (if applicable). The calculation excludes depreciation and amortization expense, and does not capture the changes in the value of our properties that result from use or market conditions, nor the level of capital expenditures, tenant improvements, and leasing commissions necessary to maintain the operating performance of our properties. For the Company's hotel portfolio, the Company provides a trailing-12 month NOI of $8.8 million, which excludes the period during which the hotel was fully closed due to restrictions related the COVID-19 pandemic. Additionally, for assets wholly-owned and fully occupied by KW, the Company provides an estimated NOI for valuation purposes of $4.1 million, which includes an assumption for applicable market rents. Any of the enumerated items above could have a material effect on the performance of our properties. Also, where specifically noted, for properties purchased in 2021, the NOI represents estimated Year 1 NOI from our original underwriting. Estimated year 1 NOI for properties purchased in 2021 may not be indicative of the actual results for those properties. Estimated annual NOI is not an indicator of the actual annual net operating income that the Company will or expects to realize in any period. Please also see the definition of "Net operating income" below. The Company does not provide a reconciliation for estimated annual NOI to its most directly comparable forward-looking GAAP financial measure, because it is unable to provide a meaningful or accurate estimation of each of the component reconciling items, and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and/or amount of various items that would impact estimated annual NOI, including, for example, gains on sales of depreciable real estate and other items that have not yet occurred and are out of the Company’s control. For the same reasons, the Company is unable to meaningfully address the probable significance of the unavailable information and believes that providing a reconciliation for estimated annual NOI would imply a degree of precision as to its forward-looking net operating income that would be confusing or misleading to investors.

· "Fee-Bearing Capital" represents total third-party committed or invested capital that we manage in our joint-ventures and commingled funds that entitle us to earn fees, including without limitation, asset management fees, construction management fees, acquisition and disposition fees and/or promoted interest, if applicable.

· "Gross Asset Value” refers to the gross carrying value of assets, before debt, depreciation and amortization, and net of noncontrolling interests.

· "Internal Rate of Return" (“IRR”) is based on cumulative contributions and distributions to Kennedy Wilson on each investment that has been sold and is the leveraged internal rate of return on equity invested in the investment. The IRR measures the return to Kennedy Wilson on each investment, expressed as a compound rate of interest over the entire investment period. This return does take into account carried interest, if applicable, but excludes management fees, organizational fees, or other similar expenses.

· "Net operating income" or " NOI” is a non-GAAP measure representing the income produced by a property calculated by deducting certain property expenses from property revenues. Our management uses net operating income to assess and compare the performance of our properties and to estimate their fair value. Net operating income does not include the effects of depreciation or amortization or gains or losses from the sale of properties because the effects of those items do not necessarily represent the actual change in the value of our properties resulting from our value-add initiatives or changing market conditions. Our management believes that net operating income reflects the core revenues and costs of operating our properties and is better suited to evaluate trends in occupancy and lease rates. Please also see the reconciliation to GAAP in the Company’s supplemental financial information included in this release and also available at www.kennedywilson.com.

· "Noncontrolling interests" represents the portion of equity ownership in a consolidated subsidiary not attributable to Kennedy Wilson.

· "Performance allocations" relates to allocations to the general partner, special limited partner or asset manager of Kennedy Wilson's co-investments it manages based on the cumulative performance of the fund and are subject to preferred return thresholds of the limited partners.

· "Performance allocation compensation" - the compensation committee of the Company’s board of directors approved and reserved up to thirty-five percent (35%) of any performance allocation earned by certain commingled funds and separate account investments to be allocated to certain non-NEO employees of the Company.

· "Principal co-investments" consists of the Company’s share of income or loss earned on investments in which the Company can exercise significant influence but does not have control. Income from unconsolidated investments includes income from ordinary course operations of the underlying investment, gains on sale, fair value gains and losses "Pro-Rata" represents Kennedy Wilson's share calculated by using our proportionate economic ownership of each asset in our portfolio. Please also refer to the pro-rata financial data in our supplemental financial information.

· "Property NOI" or "Property-level NOI" is a non-GAAP measure calculated by deducting the Company's Pro-Rata share of rental and hotel property expenses from the Company's Pro-Rata rental and hotel revenues. Please also see the reconciliation to GAAP in the Company’s supplemental financial information included in this release and also available at www.kennedywilson.com.

· "Real Estate Assets Under Management" ("AUM") generally refers to the properties and other assets with respect to which we provide (or participate in) oversight, investment management services and other advice, and which generally consist of real estate properties or loans, and investments in joint ventures. Our AUM is principally intended to reflect the extent of our presence in the real estate market, not the basis for determining our management fees. Our AUM consists of the total estimated fair value of the real estate properties and other real estate related assets either owned by third parties, wholly-owned by us or held by joint ventures and other entities in which our sponsored funds or investment vehicles and client accounts have invested. Committed (but unfunded) capital from investors in our sponsored funds is not included in our AUM. The estimated value of development properties is included at estimated completion cost.

· "Return on Equity" is a ratio calculated by dividing the net cash distributions of an investment to Kennedy Wilson, after the cost of leverage, if applicable, by the total cash contributions by Kennedy Wilson over the lifetime of the investment.

· “Same property” refers to properties in which Kennedy Wilson has an ownership interest during the entire span of both periods being compared. The same property information presented throughout this report is shown on a cash basis and excludes non-recurring expenses. This analysis excludes properties that are either under development or undergoing lease up as part of our asset management strategy.

Note about Non-GAAP and certain other financial information included in this presentation

In addition to the results reported in accordance with U.S. generally accepted accounting principles ("GAAP") included within this presentation, Kennedy Wilson has provided certain information, which includes non-GAAP financial measures (including Adjusted EBITDA, Adjusted Net Income, Net Operating Income, and Adjusted Fees, as defined above). Such information is reconciled to its closest GAAP measure in accordance with the rules of the SEC, and such reconciliations are included within this presentation. These measures may contain cash and non-cash acquisition-related gains and expenses and gains and losses from the sale of real-estate related investments. Consolidated non-GAAP measures discussed throughout this report contain income or losses attributable to non-controlling interests. Management believes that these non-GAAP financial measures are useful to both management and Kennedy Wilson's shareholders in their analysis of the business and operating performance of the Company. Management also uses this information for operational planning and decision-making purposes. Non-GAAP financial measures are not and should not be considered a substitute for any GAAP measures. Additionally, non-GAAP financial measures as presented by Kennedy Wilson may not be comparable to similarly titled measures reported by other companies. Annualized figures used throughout this release and supplemental financial information, and our estimated annual net operating income metrics, are not an indicator of the actual net operating income that the Company will or expects to realize in any period.

KW-IR

| | | | | | | | |

| | |

| | |

| Supplemental Financial Information |

| | |

| | |

Kennedy-Wilson Holdings, Inc.

Capitalization Summary

(Unaudited)

(Dollars in millions, except per share data)

| | | | | | | | | | | | | | |

| | December 31, 2021 | | December 31, 2020 |

| | | | |

| Market Data | | | | |

| Common stock price per share | | $ | 23.88 | | | $ | 17.89 | |

| Common stock and convertible preferred stock | | | | |

| Common stock shares outstanding | | 137,954,479 | | | 141,365,323 | |

Shares of common stock underlying convertible perpetual preferred stock(1) | | 12,009,608 | | | 12,000,000 | |

| Total Common stock outstanding and underlying convertible preferred stock | | 149,964,087 | | | 153,365,323 | |

| | | | |

| Equity Market Capitalization | | $ | 3,581.1 | | | $ | 2,743.7 | |

| | | | |

| Kennedy Wilson's Share of Debt | | | | |

Kennedy Wilson's share of property debt(2) | | 4,945.0 | | | 4,105.8 | |

| Senior notes payable | | 1,800.0 | | | 1,150.0 | |

| Kennedy Wilson Europe bonds | | 626.2 | | | 1,177.2 | |

| Credit Facility | | 75.0 | | | 200.0 | |

| Total Kennedy Wilson's share of debt | | 7,446.2 | | | 6,633.0 | |

| Total Capitalization | | $ | 11,027.3 | | | $ | 9,376.7 | |

| Less: Kennedy Wilson's share of cash | | (617.9) | | | (1,033.2) | |

| Total Enterprise Value | | $ | 10,409.4 | | | $ | 8,343.5 | |

(1) Assumes conversion of $300 million convertible perpetual preferred investment based on current conversion price of $24.98 per share. The preferred stock is callable by Kennedy Wilson on and after October 15, 2024.

(2) Includes Kennedy Wilson's share of debt at Vintage Housing Holdings of $462 million, based on economic ownership.

Kennedy-Wilson Holdings, Inc.

Components of Value Summary

As of December 31, 2021

(Unaudited, Dollars in millions)

Below are key valuation metrics provided to assist in the calculation of a sum-of-the-parts valuation of the Company as of December 31, 2021. Please note that excluded below is the potential value of the Company's future promoted interest as well as the value of the Company's team and brand.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Kennedy Wilson's Share | | |

| Investments | | Description | | Occupancy | | Est. Annual NOI(1)(2) | | Page # |

| Income Producing Assets | | | | | | | | |

| 1 | Multifamily(3) | | 30,218 units | | 95.4% | | $ | 219.3 | | | |

| 2 | Office | | 10.1 million square feet | | 92.3% | | 143.2 | | | |

| 3 | Retail and Industrial | | 10.9 million square feet | | 94.8% | | 53.7 | | | |

| 4 | Hotels | | 1 hotels / 265 hotel rooms | | N/A | | 8.8 | | | |

| 5 | Loans | | 30 loan investments KW Loan Balance of $135.2 million | | N/A | | 9.4 | | | |

| Total | | | | | | $ | 434.4 | | | |

| | | | | | |

| Lease-up, Development, and Non-income Producing Assets | | | | KW Gross Asset Value | | |

| 6 | Lease-up Portfolio(5)(6) | | 895 multifamily units 1.4 million office sq. ft. 0.9 million retail sq. ft. | | 40.3% | | $ | 648.6 | | | |

| 7 | Development Projects(5)(6) | | 4,252 multifamily units 0.5 million office sq. ft. 0.1 million industrial sq. ft. One five-star resort | | N/A | | 630.7 | | | |

| 8 | Residential, and other(5) | | 19 investments | | N/A | | 276.7 | | | |

| Total | | | | | | $ | 1,556.0 | | | |

|

| Investment Management | | Fee-Bearing Capital | | Adj. Fees(7) | | |

| 9 | Investment Management | | Asset management fees (T-12) | | $5,000 | | $ | 36.1 | | | |

| 10 | Investment Management | | Performance fees (T-12) | | | | 117.9 | | | |

| Total | | | | | | $ | 154.0 | | | |

| | | | | | | | | |

|

| Net Debt | | | | | | Total | | |

| 11 | KW Share of Debt(4) | | Secured and Unsecured Debt | | | | $ | 7,446.2 | | | |

| 12 | KW Share of Cash | | Cash | | | | (617.9) | | | |

| Total Net Debt | | | | | | $ | 6,828.3 | | | |

(1) Please see “common definitions” for a definition of estimated annual NOI and a description of its limitations. The Company does not provide a reconciliation for estimated annual NOI to its most directly comparable forward looking GAAP financial measure, because it is unable to provide a meaningful or accurate estimation of each of the component reconciling items, and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and/or amount of various items that would impact estimated annual NOI, including, for example, gains on sales of depreciable real estate and other items that have not yet occurred and are out of the Company’s control. For the same reasons, the Company is unable to meaningfully address the probable significance of the unavailable information and believes that providing a reconciliation for estimated annual NOI would imply a degree of precision as to its forward-looking net operating income that would be confusing or misleading to investors.

(2) Based on weighted-average ownership figures held by KW.

(3) Includes 8,595 affordable units the Company holds an interest in through its Vintage Housing Holdings platform. Kennedy Wilson's equity investment in Vintage Housing Holdings has a fair value of $157.9 million as of December 31, 2021.

(4) Includes Kennedy Wilson's share of debt at Vintage Housing Holdings of $462 million, based on economic ownership.

(5) See additional detail related to Lease-up, Development, and Non-income Producing Assets, as of December 31, 2021. KW Share of Debt below is included in the Net Debt amounts within the Components of Value Summary above.

| | | | | | | | | | | | | | | | | | | | |

| | KW Gross Asset Value | | KW Share of Debt | | Investment Account (GAV-share of debt) |

| Lease-up - Multifamily and Commercial | | $ | 648.6 | | | $ | 145.6 | | | $ | 503.0 | |

| Development - Multifamily, Commercial, and Hotel | | 630.7 | | | 301.4 | | | 329.3 | |

| Loans, residential, and other | | 276.7 | | | 16.8 | | | 259.9 | |

| Lease-up, Development, and Non-income Producing Assets | | $ | 1,556.0 | | | $ | 463.8 | | | $ | 1,092.2 | |

(6) Includes $111.5 million of gross asset value related to development that the Company owns through its investment in Vintage Housing Holdings as of December 31, 2021.

(7) Annual figures are representative of the trailing 12 months and are not indicators of the actual results that the Company will or expects to realize in any period.

Kennedy-Wilson Holdings, Inc.

Stabilized Portfolio

As of December 31, 2021

(Unaudited, Dollars in millions)

The following information reflects Kennedy Wilson's Pro-Rata share of Estimated Annual NOI (from stabilized income-producing properties) by geography and property type, as of December 31, 2021, of which 65% is derived from wholly-owned assets.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Pacific Northwest | Southern California | Northern California | Mountain West | U.K. | Ireland | Italy | Spain | Total |

| Multifamily - Market Rate | $ | 44.5 | | $ | 24.0 | | $ | 23.5 | | $ | 65.8 | | $ | — | | $ | 31.2 | | $ | — | | $ | — | | $ | 189.0 | |

| Multifamily - Affordable | 19.5 | | 3.4 | | 2.5 | | 4.9 | | — | | — | | — | | — | | 30.3 | |

| Commercial - Office | 18.5 | | 11.1 | | 9.5 | | 2.4 | | 61.9 | | 30.7 | | 9.1 | | — | | 143.2 | |

| Commercial - Retail | 0.9 | | 3.5 | | — | | 5.4 | | 19.3 | | 9.4 | | — | | 6.3 | | 44.8 | |

| Commercial - Industrial | — | | — | | — | | 0.3 | | 8.3 | | 0.2 | | — | | 0.1 | | 8.9 | |

| Hotels | — | | — | | — | | — | | — | | 8.8 | | — | | — | | 8.8 | |

| Loans | 1.7 | | 3.3 | | 2.3 | | 1.3 | | 0.8 | | — | | — | | — | | 9.4 | |

| Total Estimated Annual NOI | $ | 85.1 | | $ | 45.3 | | $ | 37.8 | | $ | 80.1 | | $ | 90.3 | | $ | 80.3 | | $ | 9.1 | | $ | 6.4 | | $ | 434.4 | |

Kennedy-Wilson Holdings, Inc.

Segment Investment Summary

As of December 31, 2021

(Unaudited)

(Dollars in millions, except Fee-Bearing Capital)

The following summarizes Kennedy Wilson's income-producing stabilized portfolio by segment. Excluded below are lease-up, development, and residential and other investments.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stabilized Portfolio |

| KW Segment | Description | Balance Sheet Classification | Multifamily Units | Commercial Rentable Sq. Ft. | Hotels | Loan Investments | KW Share of Est. Annual NOI(1) | Fee-Bearing Capital(2) ($bn) | KW Gross Asset Value | Ownership(3) |

| 1) Consolidated | Consists primarily of wholly-owned real estate investments | Consolidated | 9,439 | 7.1 | 1 | — | $281.5 | $— | $5,091.8 | 97.9% |

| | | | | | | | | | |

| 2) Co-investment Portfolio: | | | | | | | | | |

| ~50% owned | Consists primarily of 50/50 investments with partners and our Vintage Housing joint-venture | Unconsolidated | 15,509 | 1.0 | — | — | 114.2 | 4.0 | 2,351.1 | 46.6% |

| Minority-held | Includes fund investments, loans, and other minority-held investments | Unconsolidated | 5,270 | 12.9 | — | 30 | 38.7 | 1.0 | 749.7 | 11.3% |

| Co-investment Portfolio | | 20,779 | 13.9 | — | 30 | $152.9 | $5.0 | $3,100.8 | 26.0% |

| | | | | | | | | | |

| Total Stabilized Portfolio | | 30,218 | 21.0 | 1 | 30 | $434.4 | $5.0 | $8,192.6 | 49.6% |

(1) Please see “common definitions” for a definition of Estimated Annual NOI and a description of its limitations, including the inability to provide a reconciliation to its most directly comparable forward-looking GAAP

financial measure.

(2) Includes Fee-Bearing Capital related to lease-up, development, and non-income producing assets.

(3) Weighted average ownership figures based on the Company’s share of NOI and are presented on a pre-promote basis.

Kennedy-Wilson Holdings, Inc.

Multifamily Portfolio

As of December 31, 2021

(Unaudited)

(Dollars in millions, except average rents per unit)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Consolidated | | Co-Investment (Unconsolidated) | | | | | | | | | |

| Multifamily | # of Assets | |

Market-Rate Units | | Market-Rate Units |

Vintage Housing Affordable Units | Total # of Units | | Occupancy

(Asset Level) | | Occupancy

(KW Share) | | Average Monthly Rents Per Market Rate Unit(1)(2) | | KW Share of Estimated Annual NOI(3) |

| Mountain West | 40 | | | 5,106 | | | 4,457 | | 1,592 | | 11,155 | | | 95.2 | % | | 95.3 | % | | $ | 1,388 | | | $ | 70.7 | |

| Pacific Northwest | 46 | | | 1,973 | | | 2,797 | | 5,623 | | 10,393 | | | 95.9 | | | 95.2 | | | 1,787 | | | 64.0 | |

| Southern California | 10 | | | 1,054 | | | 1,446 | | 704 | | 3,204 | | | 95.2 | | | 94.8 | | | 2,076 | | | 27.4 | |

| Northern California | 9 | | | 1,306 | | | 952 | | 676 | | 2,934 | | | 95.7 | | | 96.2 | | | 2,024 | | | 26.0 | |

| Total Western U.S. | 105 | | | 9,439 | | | 9,652 | | 8,595 | | 27,686 | | | 95.5 | % | | 95.3 | % | | $ | 1,663 | | | $ | 188.1 | |

Ireland(4) | 11 | | | — | | | 2,532 | | — | | 2,532 | | | 96.0 | | | 96.0 | | | 2,600 | | | 31.2 | |

Total Stabilized(5) | 116 | | | 9,439 | | | 12,184 | | 8,595 | | 30,218 | | | 95.6 | % | | 95.4 | % | | $ | 1,749 | | | $ | 219.3 | |

| | | | | | | | | | | | | | | |

| Lease-up Assets | 3 | | | — | | | 333 | | 562 | | 895 | | | See page 26 for more information |

| Development Projects | 19 | | | 1,021 | | | 1,663 | | 1,568 | | 4,252 | | | See page 27 for more information |

| Total | 22 | | | 1,021 | | | 1,996 | | 2,130 | | 5,147 | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Total Multifamily | 138 | | | 10,460 | | | 14,180 | | 10,725 | | 35,365 | | | | | | | | | |

(1) Average Monthly Rents Per Unit is defined as the total potential monthly rental revenue (actual rent for occupied units plus market rent for vacant units) divided by the number of units, and are weighted-averages based on the Company's ownership percentage in the underlying properties.

(2) Average Monthly Rents Per Market Rate Unit for the market rate portfolio based on Kennedy Wilson's share of units. Average Monthly Rents Per Unit for the affordable portfolio are $867, $951, $1,011, and $954 for Mountain West, Pacific Northwest, Southern California and Northern California, respectively.

(3) Please see “common definitions” for a definition of estimated annual NOI and a description of its limitations.

(4) Estimated foreign exchange rates are €0.88 = $1 USD and £0.74 = $1 USD, related to NOI.

(5) Includes 8,595 affordable units the Company owners through its Vintage platform, which the Company has a 39% economic ownership interest in.

Kennedy-Wilson Holdings, Inc.

Office Portfolio

As of December 31, 2021

(Unaudited)

(Dollars and Square Feet in millions, except average rent per sq ft)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Office | # of Assets | | Consolidated Rentable Sq. Ft. | Co-Investment

Rentable Sq. Ft.

(Unconsolidated) | Total

Rentable Sq. Ft. | |

Occupancy

(Asset Level) | |

Occupancy

(KW Share) | | Average Annual Rent per sq ft(1) | | Kennedy Wilson's Share of Estimated Annual NOI(2) |

| Pacific Northwest | 3 | | | 0.6 | | 0.6 | | 1.2 | | | 98.4 | % | | 99.9 | % | | $ | 25.8 | | | $ | 18.5 | |

Southern California(3) | 6 | | | 0.2 | | 1.3 | | 1.5 | | | 84.6 | | | 89.2 | | | 62.3 | | | 11.1 | |

| Northern California | 7 | | | 0.3 | | 1.5 | | 1.8 | | | 88.8 | | | 81.6 | | | 35.8 | | | 9.5 | |

| Mountain West | 5 | | | — | | 1.7 | | 1.7 | | | 89.0 | | | 89.5 | | | 19.2 | | | 2.4 | |

| Total Western U.S. | 21 | | | 1.1 | | 5.1 | | 6.2 | | | 89.6 | % | | 91.3 | % | | 34.5 | | | 41.5 | |

United Kingdom(4) | 14 | | | 1.6 | | 0.6 | | 2.2 | | | 88.6 | | | 88.1 | | | 39.4 | | | 61.9 | |

Ireland(4)(5) | 8 | | | 0.5 | | 0.5 | | 1.0 | | | 97.7 | | | 98.6 | | | 44.7 | | | 30.7 | |

Italy(4) | 7 | | | 0.7 | | — | | 0.7 | | | 100.0 | | | 100.0 | | | 15.1 | | | 9.1 | |

Total Europe(4) | 29 | | | 2.8 | | 1.1 | | 3.9 | | | 92.9 | % | | 92.8 | % | | 35.3 | | | 101.7 | |

| | | | | | | | | | | | | |

| Total Stabilized | 50 | | | 3.9 | | 6.2 | | 10.1 | | | 90.9 | % | | 92.3 | % | | $ | 35.0 | | | $ | 143.2 | |

| | | | | | | | | | | | | |

| Lease-up Assets | 11 | | | 0.9 | | 0.5 | | 1.4 | | | See page 26 for more information |

| Development Projects | 5 | | | 0.1 | | 0.4 | | 0.5 | | | See page 27 for more information |

| Total | 16 | | | 1.0 | | 0.9 | | 1.9 | | | |

| | | | | | | | | | | | | |

| Total Office | 66 | | | 4.9 | | 7.1 | | 12.0 | | | | | | | | | |

(1) Average Annual Rent per Sq. Ft. represents contractual rents as in-place as of December 31, 2021 and are weighted-averages based on the Company's ownership percentage in the underlying properties.

(2) Please see “common definitions” for a definition of estimated annual NOI and a description of its limitations.

(3) The information presented in this row for Southern California office assets includes our corporate headquarters wholly-owned by KW comprising 58,000 sq. ft., $35.0 million of debt, 100% occupancy, $3.0 million in Estimated Annual NOI and KW Gross Asset Value of $66.3 million as of December 31, 2021.

(4) Estimated foreign exchange rates are €0.88 = $1 USD and £0.74 = $1 USD, related to NOI.

(5) The information presented in this row for Ireland office assets includes our Irish headquarters wholly-owned by KW comprising 16,000 sq. ft., 100% occupancy, $1.1 million in Estimated Annual NOI and KW Gross Asset Value of $29.2 million as of December 31, 2021

Kennedy-Wilson Holdings, Inc.

Retail and Industrial Portfolio

As of December 31, 2021

(Unaudited)

(Dollars and Square Feet in millions, except average rent per sq ft)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Retail and Industrial | # of Assets | | Consolidated Rentable Sq. Ft. | Co-Investment

Rentable Sq. Ft.

(Unconsolidated) | Total

Rentable Sq. Ft. | |

Occupancy

(Asset Level) | |

Occupancy

(KW Share) | | Average Annual Rent per sq ft(1) | | Kennedy Wilson's Share of Estimated Annual NOI(2) |

| Mountain West | 10 | | | 0.6 | | 0.8 | | 1.4 | | | 93.2 | % | | 88.6 | % | | $ | 11.5 | | | $ | 5.7 | |

| Pacific Northwest | 1 | | | 0.1 | | — | | 0.1 | | | 100.0 | | | 100.0 | | | 17.8 | | | 0.9 | |

| Southern California | 5 | | | 0.2 | | 0.9 | | 1.1 | | | 95.1 | | | 95.4 | | | 20.9 | | | 3.5 | |

| Northern California | 1 | | | — | | 0.1 | | 0.1 | | | 100.0 | | | 100.0 | | | 4.0 | | | — | |

| Total Western U.S. | 17 | | | 0.9 | | 1.8 | | 2.7 | | | 93.9 | % | | 90.8 | % | | 13.9 | | | 10.1 | |

United Kingdom(3) | 90 | | | 1.6 | | 5.6 | | 7.2 | | | 98.2 | | | 96.4 | | | 13.1 | | | 27.6 | |

Ireland(3) | 4 | | | 0.4 | | 0.2 | | 0.6 | | | 95.5 | | | 94.4 | | | 23.5 | | | 9.6 | |

Spain(3) | 3 | | | 0.3 | | 0.1 | | 0.4 | | | 94.7 | | | 93.9 | | | 21.4 | | | 6.4 | |

Total Europe(3) | 97 | | | 2.3 | | 5.9 | | 8.2 | | | 97.8 | % | | 95.8 | % | | 15.6 | | | 43.6 | |

| | | | | | | | | | | | | |

| Total Stabilized | 114 | | | 3.2 | | 7.7 | | 10.9 | | | 97.1 | % | | 94.8 | % | | $ | 15.2 | | | $ | 53.7 | |

| | | | | | | | | | | | | |

| Lease-up Assets | 8 | | | 0.2 | | 0.7 | | 0.9 | | | See page 26 for more information |

| Development Projects | 2 | | | — | | 0.1 | | 0.1 | | | See page 27 for more information |

| Total | 10 | | | 0.2 | | 0.8 | | 1.0 | | | |

| | | | | | | | | | | | | |

| Total Retail and Industrial | 124 | | | 3.4 | | 8.5 | | 11.9 | | | | | | | | | |

(1) Average Annual Rent per Sq. Ft. represents contractual rents as in-place as of December 31, 2021 and are weighted-averages based on the Company's ownership percentage in the underlying properties.

(2) Please see “common definitions” for a definition of estimated annual NOI and a description of its limitations..

(3) Estimated foreign exchange rates are €0.88 = $1 USD and £0.74 = $1 USD, related to NOI.

Kennedy-Wilson Holdings, Inc.

Hotel, Loans, Residential and Other Investment Summary

As of December 31, 2021

(Unaudited)

(Dollars in millions, except ADR)

| | | | | | | | | | | | | | | | | | | | | | | |

| Hotel | # of Assets | | Hotel Rooms | | Average Daily Rate(2) | | Kennedy Wilson's Share of Estimated Annual NOI(1) |

Ireland(3) | 1 | | | 265 | | | $ | 358.7 | | | $ | 8.8 | |

| Total Hotel | 1 | | | 265 | | | $ | 358.7 | | | $ | 8.8 | |

| | | | | | | |

| Development | 1 | | | 150 | | | See page 25 for more information |

| Total Hotel | 2 | | | 415 | | | | | |

(1) Please see “common definitions” for a definition of estimated annual NOI and a description of its limitations.

(2) Average Daily Rate data is based on the most recent 12 months.

(3) Estimated foreign exchange rates are €0.88 = $1 USD and £0.74 = $1 USD, related to NOI.

| | | | | | | | | | | | | | | | | | | | | | | |

| Loans | # of Loans | | Average Interest Rate | | Loan Balance (KW Share) | | Kennedy Wilson's Share of Annual Interest Income |

| Pacific Northwest | 4 | | | 7.4 | % | | $ | 22.6 | | | $ | 1.7 | |

| Southern California | 10 | | | 7.4 | % | | 44.9 | | | 3.3 | |

| Northern California | 8 | | | 6.8 | % | | 34.3 | | | 2.3 | |

| Mountain West | 4 | | | 6.2 | % | | 20.3 | | | 1.3 | |

| Total Western U.S. | 26 | | | 7.0 | % | | 122.1 | | | $ | 8.6 | |

United Kingdom(1) | 4 | | | 5.8 | % | | 13.1 | | | 0.8 | |

| Total Loans | 30 | | | 6.9 | % | | 135.2 | | | $ | 9.4 | |

(1) Estimated foreign exchange rates are €0.88 = $1 USD and £0.74 = $1 USD, related to Loan Balance and Annual Interest Income.

| | | | | | | | | | | | | | | | | | | | | | | |

| Residential and Other | # of Investments | | Residential Units/Lots | | Total Acres | | KW Gross Asset Value |

| Southern California | 2 | | | — | | | 535 | | | $ | 19.6 | |

| Hawaii | 5 | | | 223 | | | 3,242 | | | 181.6 | |

| Total Western U.S. | 7 | | | 223 | | | 3,777 | | | 201.2 | |

United Kingdom(1) | 1 | | | — | | | 1 | | | 4.5 | |

| Total Residential and Loans | 8 | | | 223 | | | 3,778 | | | $ | 205.7 | |

| | | | | | | |

| Other Investments | 11 | | | — | | | — | | | 71.0 | |

| Total Residential and Other | 19 | | | 223 | | | 3,778 | | | $ | 276.7 | |

(1) Estimated foreign exchange rates are €0.88 = $1 USD and £0.74 = $1 USD, related to Gross Asset Value.

Kennedy-Wilson Holdings, Inc.

Lease-up Portfolio

As of December 31, 2021

(Unaudited)

(Dollars in millions)

Lease-up Portfolio

This section includes the Company's assets that are undergoing lease-up. There is no certainty that these assets will reach stabilization in the time periods shown. In addition, the cost to complete lease-up assets is subject to many uncertainties that are beyond our control, and the actual costs may be significantly higher than the estimates shown below. All dollar amounts are Kennedy Wilson's share.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property | Location | Type | KW Ownership | # of Assets | Commercial Sq. Ft. | Leased % | KW Share Est Stabilized NOI | KW Est. Costs to Complete(1) | KW Gross Asset Value |

| 2022 | | | | | | | | | |

| Hanover Quay | Ireland(2) | Office | 60% | 1 | | 69,000 | | — | | $ | 2.5 | | $ | 2.5 | | $ | 40.2 | |

| Stockley Park | United Kingdom(2) | Office | 100% | 1 | | 54,000 | | — | | 2.5 | | 0.2 | | 39.2 | |

| Maidenhead | United Kingdom(2) | Office | 100% | 1 | | 65,000 | | — | | 2.7 | | 0.1 | | 37.3 | |

| 2022 Subtotal | | 3 | | 188,000 | | — | % | $ | 7.7 | | $ | 2.8 | | $ | 116.7 | |

| 2023 | | | | | | | | | |

| The Oaks | Southern California | Office | 100% | 1 | | 357,000 | | 59 | % | $ | 6.3 | | $ | 10.9 | | $ | 130.0 | |

| 136 El Camino | Southern California | Office | 100% | 1 | | 30,000 | | — | | 2.5 | | 8.9 | | 50.7 | |

| Hamilton Landing H7 | Northern California | Office | 100% | 1 | | 61,000 | | — | | 1.5 | | 5.8 | | 16.6 | |

| Various | United Kingdom(2) | Office | 100% | 2 | | 281,000 | | 34 | | 8.4 | | 15.7 | | 142.7 | |

| 2023 Subtotal | | 5 | | 729,000 | | 42 | % | $ | 18.7 | | $ | 41.3 | | $ | 340.0 | |

| | | | | | | | | |

| Total Lease-Up | | 8 | | 917,000 | | 33 | % | $ | 26.4 | | $ | 44.1 | | $ | 456.7 | |

Note: The table above excludes minority-held investments and four wholly-owned assets expected to sell, totaling 333 units, 1.4 million commercial sq. ft., and KW Gross Asset Value of $131.9 million.

(1) Figures shown in this column are an estimate of KW's remaining costs to develop to completion or to complete the entitlement process, as applicable, as of December 31, 2021. Total remaining costs may be financed with third-party cash contributions, proceeds from projected sales, and/or debt financing. These figures are budgeted costs and are subject to change. There is no guarantee that the Company will be able to secure the project-level debt financing that is assumed in the figures above. If the Company is unable to secure such financing, the amount of capital that the Company will have to invest to complete the projects above may significantly increase.

(2) Estimated foreign exchange rates are €0.88 = $1 USD and £0.74 = $1 USD, related to NOI.

Kennedy-Wilson Holdings, Inc.

Development Projects - Income Producing

As of December 31, 2021

(Unaudited)

(Dollars in millions)

Development Projects - Income Producing

This section includes the market rate development or redevelopment projects that the Company is undergoing or considering, and excludes Vintage Housing Holdings and residential investments. The scope of these projects may change. There is no certainty that the Company will develop or redevelop any or all of these potential projects. In addition, the cost to complete development projects is subject to many uncertainties that are beyond our control, and the actual costs may be significantly higher than the estimates shown below. All dollar amounts are shown at Kennedy Wilson's share.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | If Completed | | Current | | |

| Property | Location | Type | Status | KW Ownership | Est. Completion Date(1) | Est. Stabilization Date | Commercial Sq. Ft. | MF Units / Hotel Rooms | KW Share

Est. Stabilized NOI | KW Est. Total Cost(1) | Est. Yield on Cost | | KW Costs Incurred(2) | KW Est. Costs to Complete(2) | |

| Kildare | Ireland(3) | Office | Under Construction | 100% | 2022 | 2022 | 65,000 | | — | | $ | 4 | | $ | 63 | | 6% | | $ | 53 | | $ | 10 | | | |

| River Pointe | Mountain West | Multifamily | Under Construction | 100% | 2022 | 2023 | — | | 89 | | 1 | | 23 | | 6% | | 12 | | 11 | | | |

| 38° North Phase II | Nor. California | Multifamily | Under Construction | 100% | 2023 | 2024 | — | | 172 | | 4 | | 73 | | 6% | | 7 | | 66 | | | |

| Dovetail | Mountain West | Multifamily | Under Construction | 90% | 2023 | 2024 | — | | 240 | | 3 | | 56 | | 6% | | 10 | | 46 | | | |

| Oxbow | Mountain West | Multifamily | Under Construction | 51% | 2023 | 2024 | — | | 268 | | 3 | | 41 | | 6% | | 6 | | 35 | | | |

| Two10 | Pacific Northwest | Multifamily | Under Construction | 90% | 2023 | 2024 | — | | 210 | | 3 | | 60 | | 5% | | 7 | | 53 | | | |

| Coopers Cross | Ireland(3) | Office | Under Construction | 50% | 2023 | 2024 | 395,000 | | — | | 12 | | 168 | | 7% | | 77 | | 91 | | | |

| Coopers Cross | Ireland(3) | Multifamily | Under Construction | 50% | 2023 | 2024 | — | | 471 | | 6 | | 125 | | 5% | | 91 | | 34 | | | |

| Grange | Ireland(3) | Multifamily | Under Construction | 50% | 2023 | 2024 | 7,000 | | 287 | | 3 | | 70 | | 5% | | 36 | | 34 | | | |

| Kona Village Resort | Hawaii | Hotel | Under Construction | 50% | 2023 | 2024 | — | | 150 | | 21 | | 342 | | 6% | | 210 | | 132 | | | |

The Cornerstone (formerly "Leisureplex") | Ireland(3) | Mixed-Use | Under Construction | 50% | 2024 | 2025 | 20,000 | | 232 | | 3 | | 71 | | 5% | | 21 | | 50 | | | |

| University Glen Phase II | So. California | Multifamily | Planning Received | 100% | 2024 | 2025 | — | | 310 | | 6 | | 109 | | 6% | | 2 | | 107 | | | |

| Bend | Mountain West | Multifamily | In Planning | 43% | TBD | TBD | — | | TBD | TBD | TBD | TBD | | 18 | | TBD | | |

| | | | | | | 487,000 | | 2,429 | | $ | 69 | | $ | 1,201 | | 6% | | $ | 550 | | $ | 669 | | | |

Note: The table above excludes minority-held development projects and two development projects where the scope is still being explored, totaling 405 multifamily units, 0.2 million commercial sq. ft. and KW Gross Asset Value of $57 million.

(1) Figures shown in this column are an estimate of KW's remaining costs to develop to completion or to complete the entitlement process, as applicable, as of December 31, 2021. Total remaining costs may be financed with third-party cash contributions, proceeds from projected sales, and/or debt financing. Kennedy Wilson expects to fund $285 million of its share of remaining costs to complete with cash. These figures are budgeted costs and are subject to change. There is no guarantee that the Company will be able to secure the project-level debt financing that is assumed in the figures above. If the Company is unable to secure such financing, the amount of capital that the Company will have to invest to complete the projects above may significantly increase. KW cost to complete differs from KW share total capitalization as the latter includes costs that have already been incurred to date while the former relates to future estimated costs.

(2) Includes land costs.

(3) Estimated foreign exchange rates are €0.88 = $1 USD and £0.74 = $1 USD, related to NOI.

Kennedy-Wilson Holdings, Inc.

Vintage Housing Holdings - Lease-up Assets and Development Projects

As of December 31, 2021

(Unaudited)

(Dollars in millions)

Lease-up Assets and Development Projects - Vintage Housing Holdings

This section includes the Company's lease-up assets and development projects or redevelopment projects that the Company is undergoing or considering through its Vintage platform, which the Company has a 39% ownership interest in. The Company expects to have no cash equity basis in these projects at completion due to the use of property level debt and proceeds from the sale of tax credits. The scope of these projects may change. There is no certainty the lease-up assets will reach stabilization or the Company will develop or redevelop any or all of these potential projects. All dollar amounts are Kennedy Wilson's share.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | If Completed | Current |

| Property | Location | Status | Est. Completion Date(1) | Est. Stabilization Date | MF Units | Est. Cash to KW(2) | KW Share

Est. Stabilized NOI | KW Cash Basis | Leased % |

| The Farm | Pacific Northwest | Lease-up | n/a | 2022 | 354 | | 3.0 | | 2.2 | | — | | 61 |

| Sanctuary | Mountain West | Lease-up | n/a | 2022 | 208 | | 0.2 | | 0.5 | | — | | 23 |

| Quinn | Pacific Northwest | Under Construction | 2022 | 2023 | 227 | | 2.8 | | 1.1 | | — | | NA |

| Station | Pacific Northwest | Under Construction | 2022 | 2023 | 197 | | 2.7 | | 0.9 | | — | | NA |

| The Point | Pacific Northwest | Under Construction | 2022 | 2023 | 161 | | 1.5 | | 0.8 | | — | | NA |

| Springview | Mountain West | Under Construction | 2023 | 2023 | 180 | | 0.6 | | 0.5 | | — | | NA |

| Spanish Springs | Mountain West | In Planning | 2024 | 2024 | 257 | | 4.1 | | 0.7 | | 3.8 | | NA |

| Folsom | Northern California | In Planning | 2024 | 2025 | 136 | | 3.0 | | 0.4 | | 3.0 | | NA |

| University Glen | Southern California | In Planning | 2024 | 2025 | 170 | | 0.9 | | 0.4 | | 0.1 | | NA |

| Beacon Hill | Pacific Northwest | In Planning | 2024 | 2025 | 240 | | 5.8 | | 1.0 | | 5.7 | | NA |

| | | 2,130 | | $ | 24.6 | | $ | 8.5 | | $ | 12.6 | | |

(1) The actual completion date for projects is subject to several factors, many of which are not within our control. Accordingly, the projects identified may not be completed when expected, or at all. Kennedy Wilson expects to have no cash equity basis in these projects at completion.

(2) Represents the total cash Kennedy Wilson currently expects to receive from paid developer fees and proceeds from the sale of tax credits. Payment of the developer fee is contingent on the Company’s ability to meet certain criteria as outlined in each project’s Limited Partnership Agreement and may vary based on a number of factors.

Kennedy-Wilson Holdings, Inc.

Debt and Liquidity Schedule

As of December 31, 2021

(Unaudited)

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated | | Unconsolidated | | |

| Maturity | Consolidated Secured(1) | | Kennedy Wilson Europe Unsecured Bonds(2) | | KW Unsecured Debt | | Unconsolidated Secured | | KW Share(3) |

| 2022 | $ | 17.4 | | | $ | — | | | — | | | $ | 776.5 | | | $ | 197.3 | |

| 2023 | 374.9 | | | — | | | — | | | 629.7 | | | 546.5 | |

| 2024 | 513.9 | | | — | | | 75.0 | | (4) | 720.0 | | | 876.5 | |

| 2025 | 482.3 | | | 626.2 | | | — | | | 992.9 | | | 1,398.1 | |

| 2026 | 478.2 | | | — | | | — | | | 1,252.9 | | | 820.9 | |

| 2027 | 247.7 | | | — | | | — | | | 290.0 | | | 388.0 | |

| 2028 | 336.5 | | | — | | | — | | | 199.7 | | | 427.0 | |

| 2029 | 31.6 | | | — | | | 600.0 | | | 329.4 | | | 686.3 | |

| 2030 | 39.3 | | | — | | | 600.0 | | | 215.1 | | | 676.6 | |

| 2031 | 431.6 | | | — | | | 600.0 | | | 195.9 | | | 1,102.5 | |

| Thereafter | 21.7 | | | — | | | — | | | 790.8 | | | 326.5 | |

| Total | $ | 2,975.1 | | | $ | 626.2 | | | $ | 1,875.0 | | | $ | 6,392.9 | | | $ | 7,446.2 | |

| | | | | | | | | |

| Cash | (173.9) | | | (188.4) | | | (162.5) | | | (364.1) | | | (617.9) | |

| | | | | | | | | |

| Net Debt | $ | 2,801.2 | | | $ | 437.8 | | | $ | 1,712.5 | | | $ | 6,028.8 | | | $ | 6,828.3 | |

(1) Excludes $17.8 million of unamortized loan fees and unamortized net premium of $2.5 million, as of December 31, 2021.

(2) Excludes $1.3 million of unamortized loan fees and unamortized net discount of $2.1 million, as of December 31, 2021.

(3) Includes Kennedy Wilson's share of debt at Vintage Housing Holdings of $462 million, based on economic ownership.

(4) Represents principal balance of credit facility of $75.0 million.

| | | | | | | | | | | |

| Weighted Average |

| Debt Type | Annual Interest Rate | | Years to Maturity |

| Consolidated Secured | 3.1% | | 4.9 |

| Kennedy Wilson Europe Unsecured Bonds | 3.2% | | 3.9 |

| KW Unsecured Debt | 4.7% | | 8.4 |

| Unconsolidated Secured | 3.0% | | 6.3 |

| Total (KW Share) | 3.5% | | 6.1 |

Kennedy-Wilson Holdings, Inc.

Debt and Liquidity Schedule (continued)

As of December 31, 2021

(Unaudited)

(Dollars in millions)

Kennedy Wilson has exposure to fixed and floating rate debt through its corporate debt along with debt encumbering its consolidated properties and its joint venture investments. The table below details Kennedy Wilson's share of consolidated and unconsolidated debt by interest rate type.

| | | | | | | | | | | | | | | | | | | | | | | |

| KW Share of Debt(1) |

| (Dollars in millions) | Fixed Rate Debt | | Floating with Interest Rate Caps | | Floating without Interest Rate Caps | | Total KW Share of Debt |

| Secured Investment Level Debt | $ | 2,931.1 | | | $ | 1,139.8 | | | $ | 874.1 | | | $ | 4,945.0 | |

| Kennedy Wilson Europe Unsecured Bonds | 626.2 | | | — | | | — | | | 626.2 | |

| KW Unsecured Debt | 1,800.0 | | | 46.4 | | | 28.6 | | | 1,875.0 | |

| Total | $ | 5,357.3 | | | $ | 1,186.2 | | | $ | 902.7 | | | $ | 7,446.2 | |

| % of Total Debt | 72 | % | | 16 | % | | 12 | % | | 100 | % |

(1) Includes Kennedy Wilson's share of debt at Vintage Housing Holdings of $462 million, based on economic ownership.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| KW Share of Secured Investment Debt(1) | | |

| (Dollars in millions) | Multifamily | | Office | | Retail | | Industrial | | Hotels | | Residential and Other | | Total | | % of KW Share |

| Pacific Northwest | $ | 892.9 | | | $ | 106.9 | | | $ | 8.9 | | | $ | — | | | $ | — | | | $ | — | | | $ | 1,008.7 | | | 20 | % |

| Southern California | 266.2 | | | 162.9 | | | 30.9 | | | — | | | — | | | — | | | 460.0 | | | 9 | % |