Kennedy-Wilson Holdings, Inc.

WARRANT AGREEMENT

Dated as of March 8, 2022

Table of Contents

Page

Exhibits

Exhibit A: Form of Warrant Certificate A-1

Exhibit B: Form of Restricted Security Legend B-1

Exhibit C: Transfer Restriction Legend C-1

WARRANT AGREEMENT

WARRANT AGREEMENT, dated as of March 8, 2022, between Kennedy-Wilson Holdings, Inc., a Delaware corporation, as issuer (the “Company”), and the other signatories to this Warrant Agreement (as defined below), as the initial Holders (as defined in this Warrant Agreement).

Each party to this Warrant Agreement (as defined below) agrees as follows.

Section 1.Definitions.

“Affiliate” has the meaning set forth in Rule 144.

“Agent” means any Registrar or Exercise Agent.

“Aggregate Strike Price” means, with respect to the exercise of any Warrant that will be settled by Physical Settlement, an amount equal to the product of (a) the Warrant Entitlement on the Exercise Date for such exercise; and (b) the Strike Price on the Exercise Date for such exercise; provided, however, that the Aggregate Strike Price will be subject to Section 5(g).

“Board of Directors” means the Company’s board of directors or a committee of such board duly authorized to act on behalf of such board.

“Business Day” means any day other than a Saturday, a Sunday or any day on which the Federal Reserve Bank of New York is authorized or required by law or executive order to close or be closed.

“Capital Stock” of any Person means any and all shares of, interests in, rights to purchase, warrants or options for, participations in, or other equivalents of, in each case however designated, the equity of such Person, but excluding any debt securities convertible into such equity.

“Cashless Settlement” has the meaning set forth in Section 5(d)(i).

“Certificate” means a Physical Certificate or an Electronic Certificate.

“Close of Business” means 5:00 p.m., New York City time.

“Common Stock” means the common stock, $0.0001 par value per share, of the Company, subject to Section 5(g).

“Common Stock Change Event” has the meaning set forth in Section 5(g)(i).

“Company” means Kennedy-Wilson Holdings, Inc., a Delaware corporation.

“Dividend Threshold” has the meaning set forth in Section 5(e)(i)(4).

“Ex-Dividend Date” means, with respect to an issuance, dividend or distribution on the Common Stock, the first date on which shares of Common Stock trade on the applicable exchange or in the applicable market, regular way, without the right to receive such issuance, dividend or distribution (including pursuant to due bills or similar arrangements required by the relevant stock exchange). For the avoidance of doubt, any alternative trading convention on the

applicable exchange or market in respect of the Common Stock under a separate ticker symbol or CUSIP number will not be considered “regular way” for this purpose.

“Electronic Certificate” means any electronic book entry maintained by the Registrar that represents any Warrants.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“Exercise” means the exercise of any Warrant.

“Exercise Agent” has the meaning set forth in Section 3(e)(i).

“Exercise Consideration” means, with respect to the exercise of any Warrant, the type and amount of consideration payable to settle such exercise, determined in accordance with Section 5.

“Exercise Date” means, with respect to the Exercise of any Warrant, the first Business Day on which the requirements set forth in Section 5(c)(i) for such exercise are satisfied.

“Exercise Period” means the period from, and including, the Initial Issue Date to, and including, the Exercise Period Expiration Date.

“Exercise Period Expiration Date” means the seventh anniversary of the Initial Issue Date.

“Exercise Share” means any share of Common Stock issued or issuable upon exercise of any Warrant.

“Expiration Date” has the meaning set forth in Section 5(e)(i)(5).

“Exercise Notice” means a notice substantially in the form of the “Exercise Notice” set forth in Exhibit A.

“Expiration Time” has the meaning set forth in Section 5(e)(i)(5).

“Holder” means a person in whose name any Warrant is registered on the Registrar’s books.

“Initial Issue Date” means March 8, 2022.

“Last Reported Sale Price” of the Common Stock for any Trading Day means the closing sale price per share (or, if no closing sale price is reported, the average of the last bid price and the last ask price per share or, if more than one in either case, the average of the average last bid prices and the average last ask prices per share) of the Common Stock on such Trading Day as reported in composite transactions for the principal U.S. national or regional securities exchange on which the Common Stock is then listed. If the Common Stock is not listed on a U.S. national or regional securities exchange on such Trading Day, then the Last Reported Sale Price will be the last quoted bid price per share of Common Stock on such Trading Day in the over-the-counter market as reported by OTC Markets Group Inc. or a similar organization. If the Common Stock is not so quoted on such Trading Day, then the Last Reported Sale Price will be the average of the mid-point of the last bid price and the last ask price per share of Common Stock on such Trading Day from a nationally recognized independent investment banking firm the Company selects.

“Market Disruption Event” means, with respect to any date, the occurrence or existence, during the one-half hour period ending at the scheduled close of trading on such date on the principal U.S. national or regional securities exchange or other market on which the Common Stock is listed for trading or trades, of any material suspension or limitation imposed on trading (by reason of movements in price exceeding limits permitted by the relevant exchange or otherwise) in the Common Stock or in any options contracts or futures contracts relating to the Common Stock.

“Officer” means the Chairman of the Board of Directors, the Chief Executive Officer, the President, the Chief Operating Officer, the Chief Financial Officer, the Treasurer, any Assistant Treasurer, the Controller, the Secretary or any Vice-President of the Company.

“Open of Business” means 9:00 a.m., New York City time.

“Permitted Transferee” means Fairfax Financial Holdings Limited and its Affiliates.

“Person” or “person” means any individual, corporation, partnership, limited liability company, joint venture, association, joint-stock company, trust, unincorporated organization or government or other agency or political subdivision thereof. Any division or series of a limited liability company, limited partnership or trust will constitute a separate “person” under this Warrant Agreement.

“Physical Certificate” means any certificate (other than an Electronic Certificate) representing any Warrant(s), which certificate is substantially in the form set forth in Exhibit A, registered in the name of the Holder of such Warrant(s) and duly executed by the Company.

“Physical Settlement” has the meaning set forth in Section 5(d)(i).

“Purchase Agreement” means that certain 4.75% Series B Cumulative Perpetual Preferred Stock and Warrant Purchase Agreement, dated as of February 23, 2022, among the Corporation and the purchasers named therein.

“Record Date” means, with respect to any dividend or distribution on, or issuance to holders of, Common Stock, the date fixed (whether by law, contract or the Board of Directors or otherwise) to determine the holders of Common Stock that are entitled to such dividend, distribution or issuance.

“Reference Property” has the meaning set forth in Section 5(g)(i).

“Reference Property Unit” has the meaning set forth in Section 5(g)(i).

“Register” has the meaning set forth in Section 3(e)(ii).

“Registrar” has the meaning set forth in Section 3(e)(i).

“Registration Rights Agreement” means that certain Registration Rights Agreement, dated as of March 8, 2022, among the Company and the investors named therein.

“Restricted Security Legend” means a legend substantially in the form set forth in Exhibit B.

“Rule 144” means Rule 144 under the Securities Act (or any successor rule thereto), as the same may be amended from time to time.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Security” means any Warrant or Exercise Share.

“Series B Extinguishment” means the extinguishment of any shares of Series B Preferred Stock pursuant to, and subject to the conditions of, Section 8 of the Certificate of Designations governing the Series B Preferred Stock in full or partial satisfaction of the Aggregate Strike Price for any exercised Warrants.

“Series B Preferred Stock” means the 4.75% Series B Cumulative Perpetual Preferred Stock, $0.0001 par value per share, of the Company.

“Setoff Price” has the meaning set forth in the Certificate of Designations governing the Series B Preferred Stock.

“Settlement Method” means Cashless Settlement or Physical Settlement.

“Specified Courts” has the meaning set forth in Section 8(d).

“Spin-Off” has the meaning set forth in Section 5(e)(i)(3)(B).

“Spin-Off Valuation Period” has the meaning set forth in Section 5(e)(i)(3)(B).

“Strike Price” initially means $23.00 per share of Common Stock; provided, however, that the Strike Price is subject to adjustment pursuant to Sections 5(e) and 5(f). Each reference in this Warrant Agreement or any Certificate to the Strike Price as of a particular date without setting forth a particular time on such date will be deemed to be a reference to the Strike Price immediately after the Close of Business on such date.

“Subsidiary” means, with respect to any Person, (a) any corporation, association or other business entity (other than a partnership or limited liability company) of which more than 50% of the total voting power of the Capital Stock entitled (without regard to the occurrence of any contingency, but after giving effect to any voting agreement or stockholders’ agreement that effectively transfers voting power) to vote in the election of directors, managers or trustees, as applicable, of such corporation, association or other business entity is owned or controlled, directly or indirectly, by such Person or one or more of the other Subsidiaries of such Person; and (b) any partnership or limited liability company where (x) more than fifty percent (50%) of the capital accounts, distribution rights, equity and voting interests, or of the general and limited partnership interests, as applicable, of such partnership or limited liability company are owned or controlled, directly or indirectly, by such Person or one or more of the other Subsidiaries of such Person, whether in the form of membership, general, special or limited partnership or limited liability company interests or otherwise; and (y) such Person or any one or more of the other Subsidiaries of such Person is a controlling general partner of, or otherwise controls, such partnership or limited liability company.

“Successor Person” has the meaning set forth in Section 5(g)(ii).

“Tender/Exchange Offer Valuation Period” has the meaning set forth in Section 5(e)(i)(5).

“Trading Day” means any day on which (a) trading in the Common Stock generally occurs on the principal U.S. national or regional securities exchange on which the Common Stock is then listed or, if the Common Stock is not then listed on a U.S. national or regional securities exchange, on the principal other market on which the Common Stock is then traded;

and (b) there is no Market Disruption Event. If the Common Stock is not so listed or traded, then “Trading Day” means a Business Day.

“Transfer-Restricted Security” means any Security that constitutes a “restricted security” (as defined in Rule 144); provided, however, that such Security will cease to be a Transfer-Restricted Security upon the earliest to occur of the following events:

(a) such Security is sold or otherwise transferred to a Person (other than the Company or an Affiliate of the Company) pursuant to a registration statement that was effective under the Securities Act at the time of such sale or transfer;

(b) such Security is sold or otherwise transferred to a Person (other than the Company or an Affiliate of the Company) pursuant to an available exemption (including Rule 144) from the registration and prospectus-delivery requirements of, or in a transaction not subject to, the Securities Act and, immediately after such sale or transfer, such Security ceases to constitute a “restricted security” (as defined in Rule 144); and

(c) such Security is eligible for resale, by a Person that is not an Affiliate of the Company and that has not been an Affiliate of the Company during the immediately preceding three (3) months, pursuant to Rule 144 without any limitations thereunder as to volume, manner of sale, availability of current public information or notice.

“Transfer Restriction Legend” means a legend substantially in the form set forth in Exhibit C.

“Warrant” means each warrant issued by the Company pursuant to, and having the terms, and conferring to the Holders thereof the rights, set forth in, this Warrant Agreement. Subject to the terms of this Warrant Agreement, each Warrant will be exercisable for shares of Common Stock based on the Warrant Entitlement and Strike Price.

“Warrant Agreement” means this Warrant Agreement, as amended or supplemented from time to time.

“Warrant Entitlement” initially means 1.0000 share of Common Stock per Warrant; provided, however, that the Warrant Entitlement is subject to adjustment pursuant to Sections 5(e) and 5(f). Each reference in this Warrant Agreement or any Certificate to the Warrant Entitlement as of a particular date without setting forth a particular time on such date will be deemed to be a reference to the Warrant Entitlement immediately after the Close of Business on such date.

Section 2.Rules of Construction. For purposes of this Warrant Agreement:

(a) “or” is not exclusive;

(b) “including” means “including without limitation”;

(c) “will” expresses a command;

(d) the “average” of a set of numerical values refers to the arithmetic average of such numerical values;

(e) a merger involving, or a transfer of assets by, a limited liability company, limited partnership or trust will be deemed to include any division of or by, or an allocation of assets to a

series of, such limited liability company, limited partnership or trust, or any unwinding of any such division or allocation;

(f) words in the singular include the plural and in the plural include the singular, unless the context requires otherwise;

(g) “herein,” “hereof” and other words of similar import refer to this Warrant Agreement as a whole and not to any particular Section or other subdivision of this Warrant Agreement, unless the context requires otherwise;

(h) references to currency mean the lawful currency of the United States of America, unless the context requires otherwise; and

(i) the exhibits, schedules and other attachments to this Warrant Agreement are deemed to form part of this Warrant Agreement.

Section 3.The Warrants.

(a)Original Issuance of Warrants. On the Initial Issue Date, there will be originally issued an aggregate of thirteen million forty-three thousand four hundred seventy-eight (13,043,478) Warrants, which Warrants will be initially registered in the name of the purchasers listed on Schedule I to the Purchase Agreement.

(b)Form, Dating and Denominations.

(i)Form and Date of Certificates Representing Warrants. Each Certificate representing any Warrant will (1) be substantially in the form set forth in Exhibit A; (2) bear the legends required by Section 3(f) and may bear notations, legends or endorsements required by law, stock exchange rule or usage; and (3) be dated as of the date it is executed by the Company.

(ii)Electronic Certificates; Physical Certificates. The Warrants will be originally issued initially in the form of one or more Physical Certificates. Electronic Certificates may be exchanged for Physical Certificates, and Physical Certificates may be exchanged for Electronic Certificates, upon request by the Holder thereof pursuant to customary procedures, Section 3(g).

(iii)Electronic Certificates; Interpretation. For purposes of this Warrant Agreement, (1) each Electronic Certificate will be deemed to include the text of the form of Certificate set forth in Exhibit A; (2) any legend, registration number or other notation that is required to be included on a Certificate will be deemed to be affixed to any Electronic Certificate notwithstanding that such Electronic Certificate may be in a form that does not permit affixing legends thereto; (3) any reference in this Warrant Agreement to the “delivery” of any Electronic Certificate will be deemed to be satisfied upon the registration of the electronic book entry representing such Electronic Certificate in the name of the applicable Holder; (4) upon satisfaction of any applicable requirements of the Delaware General Corporation Law, the Certificate of Incorporation and the Bylaws of the Company, and any related requirements of the Registrar, in each case for the issuance of Warrants in the form of one or more Electronic Certificates, such Electronic Certificates will be deemed to be executed by the Company.

(iv)No Bearer Certificates; Denominations. The Warrants will be issued only in registered form and only in denominations equal to a whole numbers of Warrants.

(v)Registration Numbers. Each Certificate representing any Warrant(s) will bear a unique registration number that is not affixed to any other Certificate representing any other outstanding Warrant.

(c)Execution and Delivery.

(i)Due Execution by the Company. A duly authorized Officer will sign each Certificate representing any Warrant on behalf of the Company by manual or facsimile signature.

(d)Method of Payment. The Company will pay all cash amounts due on any Warrant of any Holder by check mailed to the address of such Holder set forth in the Register; provided, however, that the Company will instead pay such cash amounts by wire transfer of immediately available funds to the account of such Holder specified in a written request of such Holder delivered to the Company no later than the Close of Business on the date that is ten (10) Business Days immediately before the date such payment is due (or specified in the related Exercise Notice, if applicable).

(e)Registrar and Exercise Agent.

(i)Generally. The Company designates its principal U.S. executive offices as an office or agency where Warrants may be presented for (1) registration of transfer or for exchange (the “Registrar”); and (2) exercise (the “Exercise Agent”). At all times when any Warrant is outstanding, the Company will maintain an office in the continental United States constituting the Registrar and Exercise Agent.

(ii)Maintenance of the Register. The Company will keep, or cause there to be kept, a record (the “Register”) of the names and addresses of the Holders, the number of Warrants held by each Holder and the transfer, exchange and exercise of the Warrants. Absent manifest error, the entries in the Register will be conclusive and the Company and each Agent may treat each Person whose name is recorded as a Holder in the Register as a Holder for all purposes. The Register will be in written form or in any form capable of being converted into written form reasonably promptly. The Company will provide a copy of the Register to any Holder upon its request as soon as reasonably practicable.

(iii)Subsequent Appointments. By notice to each Holder, the Company may, at any time, appoint any Person (including any Subsidiary of the Company) to act as Registrar or Exercise Agent.

(f)Legends.

(i)Restricted Security Legend. Each Certificate representing any Warrant that is a Transfer-Restricted Security will bear the Restricted Security Legend.

(ii)Transfer Restriction Legend. Each Certificate representing any Warrant will bear the Transfer Restriction Legend.

(iii)Other Legends on Certificates. The Certificate representing any Warrant may bear any other legend or text, not inconsistent with this Warrant Agreement, as may be required by applicable law or by any securities exchange or automated quotation system on which such Warrant is traded or quoted or as may be otherwise reasonably determined by the Company to be appropriate.

(iv)Acknowledgement and Agreement by the Holders. A Holder’s acceptance of any Warrant represented by a Certificate bearing any legend required by this Section 3(f) will constitute such Holder’s acknowledgement of, and agreement to comply with, the restrictions set forth in such legend.

(v)Legends on Exercise Shares.

(1)Each Exercise Share will bear a legend substantially to the same effect as the Restricted Security Legend if the Warrant upon the exercise of which such Exercise Share was issued was (or would have been had it not been exercised) a Transfer-Restricted Security at the time such Exercise Share was issued; provided, however, that such Exercise Share need not bear such a legend if (i) the Exercise Share would not be a Transfer-Restricted Security or (ii) the Company determines, in its reasonable discretion, that such Exercise Share need not bear such a legend.

(2)Notwithstanding anything to the contrary in Section 3(f)(v)(1), an Exercise Share need not bear a legend pursuant to Section 3(f)(v)(1) if such Exercise Share is issued in an uncertificated form that does not permit affixing legends thereto, provided the Company takes measures (including, if applicable, the assignment thereto of a “restricted” CUSIP number) that it reasonably deems appropriate to enforce the transfer restrictions referred to in such legend.

(g)Transfers and Exchanges; Transfer Taxes; Certain Transfer Restrictions.

(i)Provisions Applicable to All Transfers and Exchanges.

(1)Permitted Transferees. Notwithstanding anything to the contrary in this Warrant Agreement, without the prior written consent of the Company, no Warrant, or any beneficial or other interest therein, will be transferred, pledged or otherwise disposed of to any Person that is not a Permitted Transferee. Any purported transfer, pledge or other disposition in violation of this Section 3(g)(i)(1) will be void and without any force or effect.

(2)No Services Charge; Transfer Taxes. The Company and the Agents will not impose any service charge on any Holder for any transfer, exchange or exercise of any Warrant, but the Company, the Registrar and the Exercise Agent may require payment of a sum sufficient to cover any transfer tax or similar governmental charge that may be imposed in connection with any transfer, exchange or exercise of any Warrant, other than exchanges pursuant to Section 3(h) not involving any transfer.

(3)No Transfers or Exchanges of Fractional Shares. Notwithstanding anything to the contrary in this Warrant Agreement, all transfers or exchanges of Warrants must be in an amount representing a whole number of Warrants, and no fractional Warrant may be transferred or exchanged.

(4)Legends. Each Certificate representing any Warrant that is issued upon transfer of, or in exchange for, another Warrant will bear each legend, if any, required by Section 3(f).

(5)Settlement of Transfers and Exchanges. Upon satisfaction of the requirements of this Warrant Agreement to effect a transfer or exchange of any Warrant, the Company will cause such transfer or exchange to be effected as soon

as reasonably practicable but in no event later than the fifth (5th) Business Day after the date of such satisfaction.

(ii)Transfers and Exchanges of Warrants.

(1)Subject to this Section 3(g), a Holder of any Warrant(s) represented by a Certificate may (x) transfer any whole number of such Warrant(s) to one or more other Person(s); and (y) exchange any whole number of such Warrant(s) for an equal number of Warrants represented by one or more other Certificates; provided, however, that, to effect any such transfer or exchange, such Holder must (A) if such Certificate is a Physical Certificate, surrender such Physical Certificate to the office of the Registrar, together with any endorsements or transfer instruments reasonably required by the Company or the Registrar; and (B) deliver to the Company and the Registrar such certificates or other documentation or evidence as the Company and the Registrar may reasonably require to determine that such transfer complies with the Securities Act and other applicable securities laws.

(2)Upon the satisfaction of the requirements of this Warrant Agreement to effect a transfer or exchange of any whole number of a Holder’s Warrant(s) represented by a Certificate (such Certificate being referred to as the “old Certificate” for purposes of this Section 3(g)(ii)(2)):

(A)such old Certificate will be promptly cancelled pursuant to Section 3(l);

(B)if only part of the Warrants represented by such old Certificate is to be so transferred or exchanged, then the Company will issue, execute and deliver, in accordance with Section 3(c), one or more Certificates that (x) each represent a whole number of Warrants and, in the aggregate, represent a total number of Warrants equal to the number of Warrants represented by such old Certificate not to be so transferred or exchanged; (y) are registered in the name of such Holder; and (z) bear each legend, if any, required by Section 3(f);

(C)in the case of a transfer to a transferee, the Company will issue, execute and deliver, in accordance with Section 3(c), one or more Certificates that (x) each represent a whole number of Warrants and, in the aggregate, represent a total number of Warrants equal to the number of Warrants to be so transferred; (y) are registered in the name of such transferee; and (z) bear each legend, if any, required by Section 3(f); and

(D)in the case of an exchange, the Company will issue, execute and deliver, in accordance with Section 3(c), one or more Certificates that (x) each represent a whole number of Warrants and, in the aggregate, represent a total number of Warrants equal to the number of Warrants to be so exchanged; (y) are registered in the name of the Person to whom such old Certificate was registered; and (z) bear each legend, if any, required by Section 3(f).

(iii)Transfers of Warrants Subject to Exercise. Notwithstanding anything to the contrary in this Warrant Agreement, the Company and the Registrar will not be required to register the transfer of or exchange any Warrant that has been surrendered for exercise.

(h)Exchange and Cancellation of Exercised Warrants.

(i)Partial Exercises of Physical Certificates. If only a portion of a Holder’s Warrants represented by a Physical Certificate (such Physical Certificate being referred to as the “old Physical Certificate” for purposes of this Section 3(h)(i)) is exercised pursuant to Section 5, then, as soon as reasonably practicable after such old Physical Certificate is surrendered for such exercise, the Company will cause such old Physical Certificate to be exchanged, pursuant and subject to Section 3(g)(ii), for (1) one or more Physical Certificates that each represent a whole number of Warrants and, in the aggregate, represent a total number of Warrants equal to the number of Warrants represented by such old Physical Certificate that are not to be so exercised and deliver such Physical Certificate(s) to such Holder; and (2) a Physical Certificate representing a whole number of Warrants equal to the number of Warrants represented by such old Physical Certificate that are to be so exercised, which Physical Certificate will be exercised pursuant to the terms of this Warrant Agreement; provided, however, that the Physical Certificate referred to in this clause (2) need not be issued at any time after which such Warrants subject to such exercise are deemed to cease to be outstanding pursuant to Section 3(m).

(ii)Cancellation of Warrants that Are Exercised. If a Holder’s Warrant(s) represented by a Certificate (or any portion thereof that has not theretofore been exchanged pursuant to Section 3(h)(i)) (such Certificate being referred to as the “old Certificate” for purposes of this Section 3(h)(ii)) are exercised pursuant to Section 5, then, promptly after the later of the time such Warrant(s) are deemed to cease to be outstanding pursuant to Section 3(m) and the time such old Certificate is surrendered for such exercise, (1) such old Certificate will be cancelled pursuant to Section 3(l); and (2) in the case of a partial exercise, the Company will issue, execute and deliver to such Holder, in accordance with Section 3(c), one or more Certificates that (x) each represent a whole number of Warrants and, in the aggregate, represent a total number of Warrants equal to the number of Warrants represented by such old Certificate that are not to be so exercised; (y) are registered in the name of such Holder; and (z) bear each legend, if any, required by Section 3(f).

(i)Replacement Certificates. If a Holder of any Warrant(s) claims that the Certificate(s) representing such Warrant(s) have been mutilated, lost, destroyed or wrongfully taken, then the Company will issue, execute and deliver, in accordance with Section 3(c), a replacement Certificate representing such Warrant(s) upon surrender to the Company or the Registrar of such mutilated Certificate, or upon delivery to the Company or the Registrar of evidence of such loss, destruction or wrongful taking reasonably satisfactory to the Company and the Registrar. In the case of a lost, destroyed or wrongfully taken Certificate representing any Warrant(s), the Company and Registrar Agent may require the Holder thereof to provide such security or indemnity that is reasonably satisfactory to the Company and the Registrar to protect the Company and the Registrar from any loss that any of them may suffer if such Certificate is replaced.

Every replacement Warrant issued pursuant to this Section 3(i) will, upon such replacement, be deemed to be an outstanding Warrant, entitled to all of the benefits of this Warrant Agreement equally and ratably with all other Warrants then outstanding.

(j)Registered Holders. Only the Holder of any Warrant(s) will have rights under this Warrant Agreement as the owner of such Warrant(s).

(k)No Rights as a Stockholder. Except as otherwise specifically provided in this Warrant Agreement or in Section 9(a) of the Certificate of Designations governing the Series B

Preferred Stock, prior to the time at which a Holder that exercises any Warrant is deemed, pursuant to Section 5(c)(ii), to become the holder of record of the Exercise Share(s) issuable to settle such exercise, (i) the Holder shall not be entitled to vote or receive dividends on, or be deemed the holder of, such Exercise Share(s) for any purpose; and (ii) nothing contained in this Warrant Agreement will be construed to confer upon the Holder, as such, any of the rights of a stockholder of the Company or any right to vote, give or withhold consent to any corporate action (whether any reorganization, issue of stock, reclassification of stock, consolidation, merger, conveyance or otherwise), receive notice of meetings, receive dividends or subscription rights, or otherwise.

(l)Cancellation. The Company may at any time deliver any Warrant to the Registrar for cancellation. The Exercise Agent will forward to the Registrar each Warrant duly surrendered to them for transfer, exchange, payment or exercise. The Company will cause the Registrar to promptly cancel all Warrants so surrendered to it in accordance with its customary procedures.

(m)Outstanding Warrants.

(i)Generally. The Warrants that are outstanding at any time will be deemed to be those Warrants that, at such time, have been duly executed by the Company, excluding those Warrants that have theretofore been (1) cancelled by the Registrar or delivered to the Registrar for cancellation in accordance with Section 3(l); (2) paid or settled in full upon their exercise in accordance with this Warrant Agreement; or (3) deemed to cease to be outstanding to the extent provided in, and subject to, clause (ii) (iii) or (iv) of this Section 3(m).

(ii)Replaced Warrants. If any Certificate representing any Warrant is replaced pursuant to Section 3(i), then such Warrant will cease to be outstanding at the time of such replacement, unless the Registrar and the Company receive proof reasonably satisfactory to them that such Warrant is held by a “bona fide purchaser” under applicable law.

(iii)Exercised Warrants. If any Warrant(s) are exercised, then, at the Close of Business on the Exercise Date for such exercise (unless there occurs a default in the delivery of the Exercise Consideration due pursuant to Section 5 upon such exercise): (1) such Warrant(s) will be deemed to cease to be outstanding; and (2) the rights of the Holder(s) of such Warrant(s), as such, will terminate with respect to such Warrant(s), other than the right to receive such Exercise Consideration as provided in Section 5.

(iv)Warrants Remaining Unexercised as of the Exercise Period Expiration Date. If any Warrant(s) are otherwise outstanding as of the Close of Business on the Exercise Period Expiration Date, then such Warrant(s) will cease to be outstanding as of immediately after the Close of Business on the Exercise Period Expiration Date.

Section 4.No Right of Redemption by the Company

The Company does not have the right to redeem the Warrants at its election.

Section 5.Exercise of Warrants.

(a)Generally. The Warrants may be exercised only pursuant to the provisions of this Section 5.

(b)Exercise of Warrants.

(i)Exercise Right; When Warrants May Be Submitted for Exercise. Subject to Section 5(c)(i)(3), Holders will have the right to submit all, or any whole number of Warrants that is less than all, of their Warrants for Exercise at any time during the Exercise Period.

(ii)Exercises of Fractional Warrants Not Permitted. Notwithstanding anything to the contrary in this Warrant Agreement, in no event will any Holder be entitled to exercise a number of Warrants that is not a whole number.

(c)Exercise Procedures.

(i)Requirements for Holders to Exercise Their Exercise Right.

(1)Generally. To exercise any Warrant represented by a Certificate, the Holder of such Warrant must (v) complete, sign and deliver to the Exercise Agent an Exercise Notice (at which time, in the case such Certificate is an Electronic Certificate, such Exercise will become irrevocable); (w) if such Certificate is a Physical Certificate, deliver such Physical Certificate to the Exercise Agent (at which time such Exercise will become irrevocable); (x) furnish any endorsements and transfer documents that the Company or the Exercise Agent may reasonably require; (y) (subject to Section 5(g)) deliver the Aggregate Strike Price for such exercise in accordance with Section 5(c)(i)(2) (if Physical Settlement applies to such exercise); and (z) if applicable, pay any documentary or other taxes pursuant to Section 6(d).

(2)Delivery of Aggregate Strike Price. Subject to Section 5(g), the Holder of an exercised Warrant that will be settled by Physical Settlement will deliver the Aggregate Strike Price for such exercise to the Company in any combination of the following: (A) in cash (by (x) certified or official bank check payable to the order of the Company and delivered to the Company at its principal executive offices in the United States; or (y) such other method as may be acceptable to the Company); or (B) by Series B Extinguishment. If any portion of the Aggregate Exercise Price is to be paid by a Series B Extinguishment of any shares of Series B Preferred Stock, then, on the date on which such shares of Series B Preferred Stock have been delivered to the Company for cancellation in accordance Section 8 of the Certificate of Designations governing the Series B Preferred Stock and all other conditions with respect thereto set forth in Section 8(b) of such Certificate of Designations have been satisfied, an amount equal to the Setoff Price for such shares of Series B Preferred Stock will be deemed to have been paid in respect of such portion of the Aggregate Exercise Price. If any portion of the Aggregate Exercise Price is to be paid in cash, then such portion will be deemed to have been paid on the date on which such cash is actually received by the Company. For the avoidance of doubt, if the Setoff Price for any shares of Series B Preferred Stock that are extinguished pursuant to a Series B Extinguishment is less than the Aggregate Strike Price due in respect of the exercise of any Warrant, then the shortfall must be paid in cash or by a Series B Extinguishment of additional share(s) of Series B Preferred Stock.

(3)Exercise Permitted only During Business Hours. Warrants may be surrendered for Exercise only after the Open of Business and before the Close of Business on a day that is a Business Day that occurs during the Exercise Period.

(ii)When Holders Become Stockholders of Record of the Shares of Common Stock Issuable Upon Exercise. The Person in whose name any share of Common Stock is

issuable upon exercise of any Warrant will be deemed to become the holder of record of such share as of the Close of Business on the Exercise Date for such exercise.

(d)Settlement upon Exercise.

(i)Settlement Method. Upon the exercise of any Warrant, the Company will settle such exercise by paying or delivering, as applicable and as provided in this Section 5(d), shares of Common Stock, together, if applicable, with cash in lieu of fractional shares, in the amounts set forth in either (x) Section 5(d)(ii)(1) (a “Physical Settlement”); or (y) Section 5(d)(ii)(2) (a “Cashless Settlement”), subject to Section 5(d)(v). The Settlement Method applicable to the exercise of any Warrant will be the Settlement Method set forth in the Optional Exercise Notice for such exercise, subject to Section 5(d)(v).

(ii)Exercise Consideration. Subject to Section 5(d)(iii), Section 5(g) and Section 7(b), the consideration due upon settlement of the exercise of each Warrant will consist of the following:

(1)Physical Settlement. If Physical Settlement applies to such exercise, a number of shares of Common Stock equal to the Warrant Entitlement in effect immediately after the Close of Business on the Exercise Date for such exercise; or

(2)Cashless Settlement. If Cashless Settlement applies to such exercise, a number of shares of Common Stock equal to the greater of (x) zero; and (y) an amount equal to:

where:

WE = the Warrant Entitlement in effect immediately after the Close of Business on the Exercise Date for such exercise;

VP = the Last Reported Sale Price per share of Common Stock on the Exercise Date for such exercise; and

SP = the Strike Price in effect immediately after the Close of Business on such Exercise Date.

(iii)Payment of Cash in Lieu of any Fractional Share of Common Stock. Subject to Section 7(b), in lieu of delivering any fractional share of Common Stock otherwise due upon exercise of any Warrant, the Company will pay cash based on the Last Reported Sale Price per share of Common Stock on the Exercise Date for such exercise (or, if such Exercise Date is not a Trading Day, the immediately preceding Trading Day).

(iv)Delivery of Exercise Consideration. Except as provided in Sections 5(e)(i)(3)(B), 5(e)(i)(5) and 5(g)(i)(C), the Company will pay or deliver, as applicable, the Exercise Consideration due upon exercise of any Warrant on or before the second (2nd) Business Day immediately after the Exercise Date for such exercise.

(v)No Cashless Settlement if any Shares of Series B Preferred Stock Remain Outstanding. Notwithstanding anything to the contrary in this Warrant Agreement, Cashless Settlement of any Warrant will not be permitted unless and until no shares of Series B Preferred Stock issued pursuant to the Purchase Agreement remain outstanding.

(e)Strike Price and Warrant Entitlement Adjustments.

(i)Events Requiring an Adjustment to the Strike Price and the Warrant Entitlement. Each of the Strike Price and the Warrant Entitlement will be adjusted from time to time as follows:

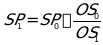

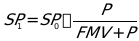

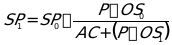

(1)Stock Dividends, Splits and Combinations. If the Company issues solely shares of Common Stock as a dividend or distribution on all or substantially all shares of the Common Stock, or if the Company effects a stock split or a stock combination of the Common Stock (in each case excluding an issuance solely pursuant to a Common Stock Change Event, as to which Section 5(g) will apply), then each of the Strike Price and the Warrant Entitlement will be adjusted based on the following formulas:

and

where:

SP0 = the Strike Price in effect immediately before the Open of Business on the Ex-Dividend Date for such dividend or distribution, or immediately before the Open of Business on the effective date of such stock split or stock combination, as applicable;

SP1 = the Strike Price in effect immediately after the Open of Business on such Ex-Dividend Date or effective date, as applicable;

WE0 = the Warrant Entitlement in effect immediately before the Open of Business on such Ex-Dividend Date or effective date, as applicable;

WE1 = the Warrant Entitlement in effect immediately after the Open of Business on such Ex-Dividend Date or effective date, as applicable;

OS0 = the number of shares of Common Stock outstanding immediately before the Open of Business on such Ex-Dividend Date or effective date, as applicable, without giving effect to such dividend, distribution, stock split or stock combination; and

OS1 = the number of shares of Common Stock outstanding immediately after giving effect to such dividend, distribution, stock split or stock combination.

If any dividend, distribution, stock split or stock combination of the type described in this Section 5(e)(i)(1) is declared or announced, but not so paid or made, then each of the Strike Price and the Warrant Entitlement will be readjusted, effective as of the date the Board of Directors determines not to pay such dividend or distribution or to effect such stock split or stock combination, to the Strike Price and the Warrant Entitlement, respectively, that would then be in effect had such dividend, distribution, stock split or stock combination not been declared or announced.

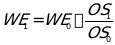

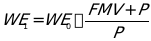

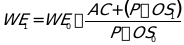

(2)Rights, Options and Warrants. If the Company distributes, to all or substantially all holders of Common Stock, rights, options or warrants (other than rights issued or otherwise distributed pursuant to a stockholder rights plan, as to which Section 5(e)(i)(3)(A) and Section 5(e)(vi) will apply) entitling such holders, for a period of not more than sixty (60) calendar days after the Record Date of such distribution, to subscribe for or purchase shares of Common Stock at a price per share that is less than the average of the Last Reported Sale Prices per share of Common Stock for the ten (10) consecutive Trading Days ending on, and including, the Trading Day immediately before the date such distribution is announced, then each of the Strike Price and the Warrant Entitlement will be adjusted based on the following formulas:

and

where:

SP0 = the Strike Price in effect immediately before the Open of Business on the Ex-Dividend Date for such distribution;

SP1 = the Strike Price in effect immediately after the Open of Business on such Ex-Dividend Date;

WE0 = the Warrant Entitlement in effect immediately before the Open of Business on such Ex-Dividend Date;

WE1 = the Warrant Entitlement in effect immediately after the Open of Business on such Ex-Dividend Date;

OS = the number of shares of Common Stock outstanding immediately before the Open of Business on such Ex-Dividend Date;

Y = a number of shares of Common Stock obtained by dividing (x) the aggregate price payable to exercise such rights, options or warrants

by (y) the average of the Last Reported Sale Prices per share of Common Stock for the ten (10) consecutive Trading Days ending on, and including, the Trading Day immediately before the date such distribution is announced; and

X = the total number of shares of Common Stock issuable pursuant to such rights, options or warrants.

To the extent such rights, options or warrants are not so distributed, each of the Strike Price and the Warrant Entitlement will be readjusted to the Strike Price and the Warrant Entitlement, respectively, that would then be in effect had the adjustment thereto for such distribution been made on the basis of only the rights, options or warrants, if any, actually distributed. In addition, to the extent that shares of Common Stock are not delivered after the expiration of such rights, options or warrants (including as a result of such rights, options or warrants not being exercised), the Strike Price and the Warrant Entitlement will be readjusted to the Strike Price and the Warrant Entitlement, respectively, that would then be in effect had the adjustment thereto for such distribution been made on the basis of delivery of only the number of shares of Common Stock actually delivered upon exercise of such rights, option or warrants.

For purposes of this Section 5(e)(i)(2), in determining whether any rights, options or warrants entitle holders of Common Stock to subscribe for or purchase shares of Common Stock at a price per share that is less than the average of the Last Reported Sale Prices per share of Common Stock for the ten (10) consecutive Trading Days ending on, and including, the Trading Day immediately before the date the distribution of such rights, options or warrants is announced, and in determining the aggregate price payable to exercise such rights, options or warrants, there will be taken into account any consideration the Company receives for such rights, options or warrants and any amount payable on exercise thereof, with the value of such consideration, if not cash, to be determined by the Board of Directors.

(3)Spin-Offs and Other Distributed Property.

(A)Distributions Other than Spin-Offs. If the Company distributes shares of its Capital Stock, evidences of the Company’s indebtedness or other assets or property of the Company, or rights, options or warrants to acquire the Company’s Capital Stock or other securities, to all or substantially all holders of the Common Stock, excluding:

(I)dividends, distributions, rights, options or warrants for which an adjustment to the Strike Price and the Warrant Entitlement is required (or would be required without regard to Section 5(e)(iii)) pursuant to Section 5(e)(i)(1) or 5(e)(i)(2);

(II)dividends or distributions paid exclusively in cash for which an adjustment to the Strike Price and the Warrant Entitlement is required (or would be required assuming the Dividend Threshold were zero and or would be required without regard to Section 5(e)(iii)) pursuant to Section 5(e)(i)(4);

(III)rights issued or otherwise distributed pursuant to a stockholder rights plan, except to the extent provided in Section 5(e)(vi);

(IV)Spin-Offs for which an adjustment to the Strike Price and the Warrant Entitlement is required (or would be required without regard to Section 5(e)(iii)) pursuant to Section 5(e)(i)(3)(B);

(V)a distribution solely pursuant to a tender offer or exchange offer for shares of Common Stock, as to which Section 5(e)(i)(5) will apply; and

(VI)a distribution solely pursuant to a Common Stock Change Event, as to which Section 5(g) will apply,

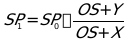

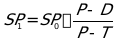

then each of the Strike Price and the Warrant Entitlement will be adjusted based on the following formulas:

and

where:

SP0 = the Strike Price in effect immediately before the Open of Business on the Ex-Dividend Date for such distribution;

SP1 = the Strike Price in effect immediately after the Open of Business on such Ex-Dividend Date;

WE0 = the Warrant Entitlement in effect immediately before the Open of Business on such Ex-Dividend Date;

WE1 = the Warrant Entitlement in effect immediately after the Open of Business on such Ex-Dividend Date;

P = the average of the Last Reported Sale Prices per share of Common Stock for the ten (10) consecutive Trading Days ending on, and including, the Trading Day immediately before such Ex-Dividend Date; and

FMV = the fair market value (as determined by the Company in good faith and in a commercially reasonable manner), as of such Ex-Dividend Date, of the shares of Capital Stock, evidences of indebtedness, assets, property, rights, options or warrants distributed per share of Common Stock pursuant to such distribution;

provided, however, that, if FMV is equal to or greater than P, then, in lieu of the foregoing adjustments to the Strike Price and the Warrant Entitlement, each Holder will receive, for each Warrant held by such Holder on the Record Date for such distribution, at the same time and on the same terms as holders of Common Stock, the amount and kind of shares of Capital Stock, evidences of indebtedness, assets, property, rights, options or warrants that such Holder would have received in such distribution if such Holder had owned, on such Record Date, a number of shares of Common Stock equal to the Warrant Entitlement in effect on such Record Date.

To the extent such distribution is not so paid or made, each of the Strike Price and the Warrant Entitlement will be readjusted to the Strike Price and the Warrant Entitlement, respectively, that would then be in effect had the adjustment thereto been made on the basis of only the distribution, if any, actually made or paid.

(B)Spin-Offs. If the Company distributes or dividends shares of Capital Stock of any class or series, or similar equity interests, of or relating to an Affiliate or Subsidiary or other business unit of the Company to all or substantially all holders of the Common Stock (other than solely pursuant to (x) a Common Stock Change Event, as to which Section 5(g) will apply; or (y) a tender offer or exchange offer for shares of Common Stock, as to which Section 5(e)(i)(5) will apply), and such Capital Stock or equity interests are listed or quoted (or will be listed or quoted upon the consummation of the transaction) on a U.S. national securities exchange (a “Spin-Off”), then each of the Strike Price and the Warrant Entitlement will be adjusted based on the following formulas

and

where:

SP0 = the Strike Price in effect immediately before the Open of Business on the Ex-Dividend Date for such Spin-Off;

SP1 = the Strike Price in effect immediately after the Open of Business on such Ex-Dividend Date;

WE0 = the Warrant Entitlement in effect immediately before the Open of Business on such Ex-Dividend Date;

WE1 = the Warrant Entitlement in effect immediately after the Open of Business on such Ex-Dividend Date;

P = the average of the Last Reported Sale Prices per share of Common Stock for each Trading Day in the Spin-Off Valuation Period; and

FMV = the product of (x) the average of the Last Reported Sale Prices per share or unit of the Capital Stock or equity interests distributed in such Spin-Off over the ten (10) consecutive Trading Day period (the “Spin-Off Valuation Period”) beginning on, and including, such Ex-Dividend Date (such average to be determined as if references to Common Stock in the definitions of “Last Reported Sale Price,” “Trading Day” and “Market Disruption Event” were instead references to such Capital Stock or equity interests); and (y) the number of shares or units of such Capital Stock or equity interests distributed per share of Common Stock in such Spin-Off.

The adjustment to the Strike Price and the Warrant Entitlement pursuant to this Section 5(e)(i)(3)(B) will be calculated as of the Close of Business on the last Trading Day of the Spin-Off Valuation Period but will be given effect immediately after the Open of Business on the Ex-Dividend Date for the Spin-Off, with retroactive effect. If any Warrant is exercised and the Exercise Date for such exercise occurs during the Spin-Off Valuation Period, then, notwithstanding anything to the contrary in this Warrant Agreement, the Company will, if necessary, delay the settlement of such exercise until the second (2nd) Business Day after the Last Trading Day of the Spin-Off Valuation Period.

To the extent any dividend or distribution of the type described in this Section 5(e)(i)(3)(B) is declared but not made or paid, each of the Strike Price and the Warrant Entitlement will be readjusted to the Strike Price and the Warrant Entitlement, respectively, that would then be in effect had the adjustment thereto been made on the basis of only the dividend or distribution, if any, actually made or paid.

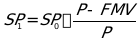

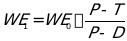

(4)Cash Dividends or Distributions. If any cash dividend or distribution is made to all or substantially all holders of Common Stock (other than a regular quarterly cash dividend that does not exceed the Dividend Threshold per share of Common Stock), then each of the Strike Price and the Warrant Entitlement will be adjusted based on the following formulas:

and

where:

SP0 = the Strike Price in effect immediately before the Open of Business on the Ex-Dividend Date for such dividend or distribution;

SP1 = the Strike Price in effect immediately after the Open of Business on such Ex-Dividend Date;

WE0 = the Warrant Entitlement in effect immediately before the Open of Business on such Ex-Dividend Date;

WE1 = the Warrant Entitlement in effect immediately after the Open of Business on such Ex-Dividend Date;

P = the Last Reported Sale Price per share of Common Stock on the Trading Day immediately before such Ex-Dividend Date;

D = the cash amount distributed per share of Common Stock in such dividend or distribution; and

T = an amount (subject to the proviso below, the “Dividend Threshold”) initially equal to $0.24 per share of Common Stock; provided, however, that (x) if such dividend or distribution is not a regular quarterly cash dividend on the Common Stock, then the Dividend Threshold will be deemed to be zero ($0.00) per share of Common Stock with respect to such dividend or distribution; and (y) the Dividend Threshold will be adjusted in the same manner as, and at the same time and for the same events for which, the Strike Price is adjusted pursuant to Section 5(e)(i)(1);

provided, however, that, if D is equal to or greater than P, then, in lieu of the foregoing adjustments to the Strike Price and the Warrant Entitlement, each Holder will receive, for each Warrant held by such Holder on the Record Date for such dividend or distribution, at the same time and on the same terms as holders of Common Stock, the amount of cash that such Holder would have received in such dividend or distribution if such Holder had owned, on such Record Date, a number of shares of Common Stock equal to the Warrant Entitlement in effect on such Record Date. To the extent such dividend or distribution is declared but not made or paid, each of the Strike Price and the Warrant Entitlement will be readjusted to the Strike Price and the Warrant Entitlement, respectively, that would then be in effect had the adjustment thereto been made on the basis of only the dividend or distribution, if any, actually made or paid.

(5)Tender Offers or Exchange Offers. If the Company or any of its Subsidiaries makes a payment in respect of a tender offer or exchange offer for shares of Common Stock (other than solely pursuant to an odd-lot tender offer pursuant to Rule 13e-4(h)(5) under the Exchange Act), and the value (determined as of the Expiration Time by the Company in good faith and in a commercially

reasonable manner) of the cash and other consideration paid per share of Common Stock in such tender or exchange offer exceeds the Last Reported Sale Price per share of Common Stock on the Trading Day immediately after the last date (the “Expiration Date”) on which tenders or exchanges may be made pursuant to such tender or exchange offer (as it may be amended), then each of the Strike Price and the Warrant Entitlement will be adjusted based on the following formulas:

and

where:

SP0 = the Strike Price in effect immediately before the time (the “Expiration Time”) such tender or exchange offer expires;

SP1 = the Strike Price in effect immediately after the Expiration Time;

WE0 = the Warrant Entitlement in effect immediately before the Expiration Time;

WE1 = the Warrant Entitlement in effect immediately after the Expiration Time;

P = the average of the Last Reported Sale Prices per share of Common Stock over the ten (10) consecutive Trading Day period (the “Tender/Exchange Offer Valuation Period”) beginning on, and including, the Trading Day immediately after the Expiration Date;

OS0 = the number of shares of Common Stock outstanding immediately before the Expiration Time (including all shares of Common Stock accepted for purchase or exchange in such tender or exchange offer);

AC = the aggregate value (determined as of the Expiration Time by the Company in good faith and in a commercially reasonable manner) of all cash and other consideration paid for shares of Common Stock purchased or exchanged in such tender or exchange offer; and

OS1 = the number of shares of Common Stock outstanding immediately after the Expiration Time (excluding all shares of Common Stock accepted for purchase or exchange in such tender or exchange offer);

provided, however, that the Strike Price will in no event be adjusted up, and the Warrant Entitlement will in no event be adjusted down, pursuant to this Section 5(e)(i)(5), except to the extent provided in the last paragraph of this Section 5(e)(i)(5).

The adjustment to the Strike Price and the Warrant Entitlement pursuant to this Section 5(e)(i)(5) will be calculated as of the Close of Business on the last Trading Day of the Tender/Exchange Offer Valuation Period but will be given effect immediately after the Expiration Time, with retroactive effect. If any Warrant is exercised and the Exercise Date for such exercise occurs on the Expiration Date or during the Tender/Exchange Offer Valuation Period, then, notwithstanding anything to the contrary in this Warrant Agreement, the Company will, if necessary, delay the settlement of such exercise until the second (2nd) Business Day after the last Trading Day of the Tender/Exchange Offer Valuation Period.

To the extent such tender or exchange offer is announced but not consummated (including as a result of being precluded from consummating such tender or exchange offer under applicable law), or any purchases or exchanges of shares of Common Stock in such tender or exchange offer are rescinded, each of the Strike Price and the Warrant Entitlement will be readjusted to the Strike Price and the Warrant Entitlement, respectively, that would then be in effect had the adjustment thereto been made on the basis of only the purchases or exchanges of shares of Common Stock, if any, actually made, and not rescinded, in such tender or exchange offer.

(ii)No Adjustments in Certain Cases.

(1)Where Holders Participate in the Transaction or Event Without Exercising. Notwithstanding anything to the contrary in Section 5(e)(i), the Company is not required to adjust the Strike Price or the Warrant Entitlement for a transaction or other event otherwise requiring an adjustment pursuant to Section 5(e)(i) (other than a stock split or combination of the type set forth in Section 5(e)(i)(1) or a tender or exchange offer of the type set forth in Section 5(e)(i)(5)) if each Holder participates, at the same time and on the same terms as holders of Common Stock, and solely by virtue of being a Holder of the Warrants, in such transaction or event without having to exercise such Holder’s Warrants and as if such Holder had owned, on the Record Date for such transaction or event, a number of shares of Common Stock equal to the product of (i) the Warrant Entitlement in effect on such Record Date; and (ii) the number of Warrants held by such Holder on such Record Date.

(2)Certain Events. The Company will not be required to adjust the Strike Price or the Warrant Entitlement except pursuant to Section 5(e)(i). Without limiting the foregoing, the Company will not be required to adjust the Strike Price or the Warrant Entitlement on account of:

(A)except as otherwise provided in Section 5(e)(i), the sale of shares of Common Stock for a purchase price that is less than the market price per share of Common Stock or less than the Strike Price;

(B)the issuance of any shares of Common Stock pursuant to any present or future plan providing for the reinvestment of dividends or interest payable on the Company’s securities and the investment of

additional optional amounts in shares of Common Stock under any such plan;

(C)the issuance of any shares of Common Stock or options or rights to purchase shares of Common Stock pursuant to any present or future employee, director or consultant benefit plan or program of, or assumed by, the Company or any of its Subsidiaries;

(D)the issuance of any shares of Common Stock pursuant to any option, warrant, right or convertible or exchangeable security of the Company outstanding as of the Initial Issue Date; or

(E)solely a change in the par value of the Common Stock.

(iii)Adjustment Deferral. If an adjustment to the Strike Price and the Warrant Entitlement otherwise required by this Warrant Agreement would result in a change of less than one percent (1%) to the Strike Price, then the Company may, at its election, defer such adjustment to the Strike Price and the Warrant Entitlement, except that all such deferred adjustments must be given effect immediately upon the earliest of the following: (1) when all such deferred adjustments would result in a change of at least one percent (1%) to the Strike Price; and (2) the Exercise Date of any Warrant.

(iv)Adjustments Not Yet Effective. Notwithstanding anything to the contrary in this Warrant Agreement, if:

(1)a Warrant is exercised;

(2)the Record Date, effective date or Expiration Time for any event that requires an adjustment to the Strike Price pursuant to Section 5(e)(i) has occurred on or before the Exercise Date for such exercise, but an adjustment to the Strike Price or the Warrant Entitlement for such event has not yet become effective as of such Exercise Date;

(3)the Exercise Consideration due upon such exercise includes any whole shares of Common Stock; and

(4)such shares are not entitled to participate in such event (because they were not held on the related Record Date or otherwise),

then, solely for purposes of such exercise, the Company will, without duplication, give effect to such adjustment on such Exercise Date. In such case, if the date on which the Company is otherwise required to deliver the Exercise Consideration due upon such exercise is before the first date on which the amount of such adjustment can be determined, then the Company will delay the settlement of such exercise until the second (2nd) Business Day after such first date.

(v)Adjustments Where Exercising Holders Participate in the Relevant Transaction or Event. Notwithstanding anything to the contrary in this Warrant Agreement, if:

(1)an adjustment to the Strike Price or the Warrant Entitlement for any dividend or distribution becomes effective on any Ex-Dividend Date pursuant to Section 5(e)(i);

(2)a Warrant is exercised;

(3)the Exercise Date for such exercise occurs on or after such Ex-Dividend Date and on or before the related Record Date;

(4)the Exercise Consideration due upon such exercise includes any whole shares of Common Stock based on a Strike Price or Warrant Entitlement that is adjusted for such dividend or distribution; and

(5)such shares would be entitled to participate in such dividend or distribution (including pursuant to Section 5(c)(ii)),

then such adjustment will not be given effect for such exercise and the shares of Common Stock issuable upon such exercise based on such unadjusted Strike Price and unadjusted Warrant Entitlement will not be entitled to participate in such dividend or distribution, but there will be added, to the Exercise Consideration otherwise due upon such exercise, the same kind and amount of consideration that would have been delivered in such dividend or distribution with respect to such shares of Common Stock had such shares been entitled to participate in such dividend or distribution.

(vi)Stockholder Rights Plans. If any shares of Common Stock are to be issued upon exercise of any Warrant and, at the time of such exercise, the Company has in effect any stockholder rights plan, then the Holder of such Warrant will be entitled to receive, in addition to, and concurrently with the delivery of, the consideration otherwise due upon such exercise, the rights set forth in such stockholder rights plan, unless such rights have separated from the Common Stock at such time, in which case, and only in such case, the Strike Price and the Warrant Entitlement will be adjusted pursuant to Section 5(e)(i)(3)(A) on account of such separation as if, at the time of such separation, the Company had made a distribution of the type referred to in such Section 5(e)(i)(3)(A) to all holders of Common Stock, subject to potential readjustment in accordance with the last paragraph of Section 5(e)(i)(3)(A).

(vii)Determination of the Number of Outstanding Shares of Common Stock. For purposes of Section 5(e)(i), the number of shares of Common Stock outstanding at any time will (1) include shares issuable in respect of scrip certificates issued in lieu of fractions of shares of Common Stock; and (2) exclude shares of Common Stock held in the Company’s treasury (unless the Company pays any dividend or makes any distribution on shares of Common Stock held in its treasury).

(viii)Rounding of Calculations. All calculations with respect to the Strike Price and adjustments thereto will be made to the nearest cent (with half of one cent rounded upwards), and all calculations with respect to the Warrant Entitlement and adjustments thereto will be made to the nearest 1/10,000th of a share of Common Stock (with 5/100,000ths rounded upward).

(f)Voluntary Adjustments.

(i)Generally. To the extent permitted by law and applicable stock exchange rules, the Company, from time to time, may (but is not required to) decrease the Strike Price by any amount, or increase the Warrant Entitlement by any amount, if (1) the Board of Directors determines that such decrease or increase, as applicable, is in the Company’s best interest or that such decrease or increase, as applicable, is advisable to avoid or diminish any income tax imposed on holders of Common Stock or rights to purchase Common Stock as a result of any dividend or distribution of shares (or rights to acquire

shares) of Common Stock or any similar event; (2) such decrease or increase, as applicable, is in effect for a period of at least twenty (20) Business Days; and (3) such decrease or increase, as applicable, is irrevocable during such period.

(ii)Notice of Voluntary Adjustment. If the Board of Directors determines to decrease the Strike Price or increase the Warrant Entitlement pursuant to Section 5(f)(i), then, no later than the first Business Day of the related twenty (20) Business Day period referred to in Section 5(f)(i), the Company will send notice to each Holder (with a copy to the Exercise Agent) of such decrease or increase, as applicable, quantifying the amount thereof and stating the period during which such decrease or increase, as applicable, will be in effect.

(g)Effect of Common Stock Change Event.

(i)Generally. If there occurs any:

(1)recapitalization, reclassification or change of the Common Stock, other than (x) changes solely resulting from a subdivision or combination of the Common Stock, (y) a change only in par value or from par value to no par value or no par value to par value or (z) stock splits and stock combinations that do not involve the issuance of any other series or class of securities;

(2)consolidation, merger, combination or binding or statutory share exchange involving the Company;

(3)sale, lease or other transfer of all or substantially all of the assets of the Company and its Subsidiaries, taken as a whole, to any Person; or

(4)other similar event,

and, as a result of which, the Common Stock is converted into, or is exchanged for, or represents solely the right to receive, other securities, cash or other property, or any combination of the foregoing (such an event, a “Common Stock Change Event,” and such other securities, cash or property, the “Reference Property,” and the amount and kind of Reference Property that a holder of one (1) share of Common Stock would be entitled to receive on account of such Common Stock Change Event (without giving effect to any arrangement not to issue or deliver a fractional portion of any security or other property), a “Reference Property Unit”), then, notwithstanding anything to the contrary in this Warrant Agreement,

(A)from and after the effective time of such Common Stock Change Event, (I) the consideration due upon exercise of any Warrant will be determined in the same manner as if each reference to any number of shares of Common Stock in this Section 5 or in Section 6, or in any related definitions, were instead a reference to the same number of Reference Property Units;

(B)if such Reference Property Unit includes, but does not consist entirely of, cash (it being understood, for the avoidance of doubt, that clause (C) below will apply instead of this clause (B) if such Reference Property Unit consists entirely of cash), then, from and after the effective time of such Common Stock Change Event, there will be deducted or removed, as applicable, from the Aggregate Strike Price otherwise payable to exercise any Warrant pursuant to Section 5(c)(i), and

from the cash that would otherwise be included in the Exercise Consideration due, pursuant to Section 5(d), to settle such exercise, in each case pursuant to Physical Settlement, a cash amount, per Warrant, equal to the product of (I) the Warrant Entitlement on the Exercise Date for such exercise; and (II) the lesser of (x) the Strike Price on the Exercise Date for such exercise; and (y) the amount of cash included in such Reference Property Unit;

(C)if such Reference Property Unit consists entirely of cash, then (I) from and after the effective time of such Common Stock Change Event, no delivery of the Aggregate Strike Price will be required to exercise any Warrant; and (II) the Company will settle each exercise of any Warrant whose Exercise Date occurs on or after the date of the effective time of such Common Stock Change Event by paying, on or before the tenth (10th) Business Day immediately after such Exercise Date, cash in an amount, per Warrant, equal to the product of (I) the Warrant Entitlement; and (II) the excess, if any, of (x) the amount of cash included in such Reference Property Unit over (y) the Strike Price (it being understood, for the avoidance of doubt, that the amount set forth in this clause (II) will be zero if the amount set forth in clause (x) is not greater than the amount set forth in clause (y)); and

(D)for these purposes, the Last Reported Sale Price of any Reference Property Unit or portion thereof that does not consist of a class of securities will be the fair value of such Reference Property Unit or portion thereof, as applicable, determined in good faith by the Company (or, in the case of cash denominated in U.S. dollars, the face amount thereof).

If the Reference Property consists of more than a single type of consideration to be determined based in part upon any form of stockholder election, then the composition of the Reference Property Unit will be deemed to be the weighted average of the types and amounts of consideration actually received, per share of Common Stock, by the holders of Common Stock. The Company will notify the Holders of such weighted average as soon as practicable after such determination is made. For the avoidance of doubt, the occurrence of a Common Stock Change Event will not, in itself, impact a Holder’s ability to deliver the Aggregate Strike Price by Series B Extinguishment pursuant to Section 5(c)(i)(2) of shares of Series B Preferred Stock that are then outstanding.

(ii)Execution of Supplemental Instruments. On or before the date the Common Stock Change Event becomes effective, the Company and, if applicable, the resulting, surviving or transferee Person (if not the Company) of such Common Stock Change Event (the “Successor Person”) will execute and deliver such supplemental instruments, if any, as the Company reasonably determines are necessary or desirable (which supplemental instruments will, for the avoidance of doubt, not require the consent of any Holder) to (y) provide for subsequent adjustments to the Strike Price and the Warrant Entitlement pursuant to Section 5(e)(i) in a manner consistent with this Section 5(g) (including giving effect, in the Company’s reasonable discretion, to the Dividend Threshold in a manner that reflects the nature and value of the Reference Property Unit); and (z) contain such other provisions, if any, as the Company reasonably determines are appropriate to preserve the economic interests of the Holders and to give effect to Section 5(g)(i). If the Successor Person is not the Company, or the Reference Property includes shares of stock or other securities or assets (other than cash) of a Person other than the Successor Person, then the Company will cause such Successor Person or Person, as

applicable, to execute and deliver a joinder to this Warrant Agreement assuming the obligations of the Company under this Warrant Agreement, or the obligation to deliver such Reference Property upon exercise of the Warrants, as applicable.

(iii)Notice of Common Stock Change Event. The Company will provide notice of each Common Stock Change Event to Holders no later than the second (2nd) Business Day after the effective date of the Common Stock Change Event.

Section 6.Certain Provisions Relating to the Issuance of Common Stock.

(a)Equitable Adjustments to Prices. Whenever this Warrant Agreement requires the Company to calculate the average of the Last Reported Sale Prices, or any function thereof, over a period of multiple days (including to calculate or an adjustment to the Strike Price), the Company will make appropriate adjustments, if any, to those calculations to account for any adjustment to the Strike Price pursuant to Section 5(e)(i) that becomes effective, or any event requiring such an adjustment to the Strike Price where the Ex-Dividend Date, effective date or Expiration Date, as applicable, of such event occurs, at any time during such period.

(b)Reservation of Shares of Common Stock. At all times when any Warrant is outstanding, the Company will reserve (out of its authorized and not outstanding shares of Common Stock that are not reserved for other purposes), for delivery upon exercise of the Warrants, a number of shares of Common Stock that would be sufficient to settle the exercise of all Warrant(s) then outstanding (assuming, for these purposes, that each such Warrant is settled by the delivery of a number of shares of Common Stock equal to the then-applicable Warrant Entitlement).

(c)Status of Shares of Common Stock; Covenant Regarding Par Value. Each share of Common Stock delivered upon exercise of any Warrant of any Holder will be a newly issued or treasury share and will be duly authorized, validly issued, fully paid, non-assessable, free from preemptive rights and free of any lien or adverse claim (except to the extent of any lien or adverse claim created by the action or inaction of such Holder or the Person to whom such share of Common Stock will be delivered). If the Common Stock is then listed on any securities exchange, or quoted on any inter-dealer quotation system, then the Company will use commercially reasonable efforts to cause each such share of Common Stock, when so delivered, to be admitted for listing on such exchange or quotation on such system. The Company will not engage in any transaction or take any action that would cause the Strike Price to be less than the par value per share of Common Stock.

(d)Taxes Upon Issuance of Common Stock. The Company will pay any documentary, stamp or similar issue or transfer tax or duty due on the issue of any shares of Common Stock upon exercise of any Warrant of any Holder, except any tax or duty that is due because such Holder requests those shares to be registered in a name other than such Holder’s name.

Section 7.Calculations.

(a)Responsibility; Schedule of Calculations. Except as otherwise provided in this Warrant Agreement, the Company will be responsible for making all calculations called for under this Warrant Agreement or the Warrants, including determinations of the Strike Price and the Last Reported Sale Prices. The Company will make all calculations in good faith, and, absent manifest error, its calculations will be final and binding on all Holders. The Company will provide a schedule of such calculations to any Holder upon written request.

(b)Calculations Aggregated for Each Holder. The composition of the Exercise Consideration due upon exercise of any Warrant of any Holder will be computed based on the

total number of Warrants of such Holder being exercised with the same Exercise Date. Any cash amounts due to such Holder in respect thereof will, after giving effect to the preceding sentence, be rounded to the nearest cent.

Section 8.Miscellaneous.

(a)Notices.