SCHEDULE 14A

(RULE 14A-101)

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant [X]

Filed by a party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material under Rule 14a-12

SCANDIUM INTERNATIONAL MINING CORP.

(Name of Registrant as Specified In Its Charter)

_______________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

| (1) | Title of each class of securities to which transaction applies: |

| | |

| | N/A |

| |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| | N/A |

| |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | N/A |

| |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| | N/A |

| |

| | |

| (5) | Total fee paid: |

| | |

| | N/A |

| |

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | Amount Previously Paid: |

| | |

| | N/A |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| | N/A |

| | |

| (3) | Filing Party: |

| | |

| | N/A |

| |

| (4) | Date Filed: |

| | |

| | N/A |

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

TAKE NOTICE that the annual general meeting of shareholders (the “Meeting”) of Scandium International Mining Corp. (the “Company”) will be held at Suite 1200 – 750 West Pender Street, Vancouver, British Columbia, V6C 2T8 on Wednesday, June 7, 2017 at 10:00 a.m. (Pacific Standard Time) for the following purposes:

| 1. | to receive the report of the directors; |

| | |

| 2. | to receive the audited financial statements of the Company for its fiscal year ended December 31, 2016 and the report of the auditors thereon; |

| | |

| 3. | to fix the number of directors at seven; |

| | |

| 4. | to elect directors of the Company for the ensuing year; |

| | |

| 5. | to re-appoint Davidson & Company LLP, Chartered Accountants, as auditors of the Company for the ensuing year, and to authorize the directors to fix the auditors’ remuneration; and |

| | |

| 6. | to transact any other business which may properly come before the Meeting, or any adjournment thereof. |

The Board of Directors has fixed April 17, 2017 as the record date for determining shareholders entitled to receive notice of, and to vote at, the Meeting or any adjournment or postponement thereof. Only shareholders of record at the close of business on that date will be entitled to notice of and to vote at the Meeting.

All shareholders are invited to attend the Meeting in person, but even if you expect to be present at the Meeting, you are requested to mark, sign, date and return the enclosed proxy card in accordance with the instructions set out in the notes to the proxy and any accompanying information from your intermediary as promptly as possible to ensure your representation. All proxies must be received by our transfer agent by no later than 48 hours prior to the time of the Meeting in order to be counted.

DATED at Vancouver, British Columbia, this 17th day of April, 2017.

ON BEHALF OF THE BOARD OF DIRECTORS

“George Putnam”

PRESIDENT & CEO

PROXY STATEMENT AND INFORMATION CIRCULAR

AS AT APRIL 17, 2017

ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 7, 2017

In this Proxy Statement and Information Circular, all references to “$” are references to United States dollars and all references to “C$” are references to Canadian dollars. As at April 17, 2017, one Canadian dollar was equal to approximately$0.75 in U.S. Currency.

GENERAL

The enclosed proxy is solicited by the Board of Directors (the “Board”) of Scandium International Mining Corp., a British Columbia corporation (the “Company” or “SCY”), for use at the Annual General Meeting of Shareholders (the “Meeting”) of SCY to be held at 10:00 a.m. (Pacific Standard Time) on Wednesday, June 7, 2017, at the offices of Morton Law LLP at Suite 1200 - 750 West Pender Street, Vancouver, British Columbia, V6C 2T8, and at any adjournment or postponement thereof.

This Proxy Statement and the accompanying proxy card are being mailed to our shareholders on or about May 9, 2017.

The cost of solicitation will be paid by the Company. The solicitation will be made primarily by mail. Proxies may also be solicited personally or by telephone by certain of the Company’s directors, officers and regular employees, who will not receive additional compensation therefore. In addition, the Company will reimburse brokerage firms, custodians, nominees and fiduciaries for their expenses in forwarding solicitation materials to beneficial owners.

Our administrative offices are located at 1430 Greg Street, Suite 501, Sparks, Nevada, 89431.

APPOINTMENT OF PROXYHOLDER

The persons named as proxyholder in the accompanying form of proxy were designated by the management of the Company (“Management Proxyholder”).A shareholder desiring to appoint some other person (“Alternate Proxyholder”) to represent him at the Meeting may do so by inserting such other person’s name in the space indicated or by completing another proper form of proxy.A person appointed as proxyholder need not be a shareholder of the Company. All completed proxy forms must be deposited with Computershare Trust Company of Canada (“Computershare”) not less than forty-eight (48) hours, excluding Saturdays, Sundays, and holidays, before the time of the Meeting or any adjournment of it unless the chairman of the Meeting elects to exercise his discretion to accept proxies received subsequently.

EXERCISE OF DISCRETION BY PROXYHOLDER

The proxyholder will vote for or against or withhold from voting the shares, as directed by a shareholder on the proxy, on any ballot that may be called for.In the absence of any such direction, the Management Proxyholder will vote in favour of matters described in the proxy. In the absence of any direction as to how to vote the shares, an Alternate Proxyholder has discretion to vote them as he or she chooses.

The enclosed form of proxy confers discretionary authority upon theproxyholder with respect to amendments or variations tomatters identified in the attached Notice of Meeting and other matters which may properlycome before the Meeting.At present, Management of the Company knows of no such amendments, variations or other matters.

1

PROXY VOTING

Registered Shareholders

If you are a registered shareholder, you may wish to vote by proxy whether or not you attend the Meeting in person. Registered shareholders electing to submit a proxy may do so by completing the enclosed form of proxy (the “Proxy”) and returning it to the Company’s transfer agent, Computershare, in accordance with the instructions on the Proxy. In all cases you should ensure that the Proxy is received at least 48 hours (excluding Saturdays, Sundays and holidays) before the Meeting or the adjournment thereof at which the Proxy is to be used.

Beneficial Shareholders

The following information is of significant importance to shareholders who do not hold shares in their own name (referred to as “Beneficial Shareholders”). Beneficial Shareholders should note that the only proxies that can be recognized and acted upon at the Meeting are those deposited by registered shareholders (those whose names appear on the records of the Company as the registered holders of shares).

If shares are listed in an account statement provided to a shareholder by a broker, then in almost all cases those shares will not be registered in the shareholder’s name on the records of the Company. Such shares will more likely be registered under the names of the shareholder’s broker or an agent of that broker. In the United States, the vast majority of such shares are registered under the name of Cede & Co. as nominee for The Depository Trust Company (which acts as depositary for many U.S. brokerage firms and custodian banks), and in Canada, under the name of CDS & Co. (the registration name for The Canadian Depository for Securities Limited, which acts as nominee for many Canadian brokerage firms).

Intermediaries are required to seek voting instructions from Beneficial Shareholders in advance of shareholders’ meetings. Every intermediary has its own mailing procedures and provides its own return instructions to clients.

If you are a Beneficial Shareholder:

You should carefully follow the instructions of your broker or intermediary in order to ensure that your shares are voted at the Meeting. The form of proxy supplied to you by your broker will be similar to the Proxy provided to registered shareholders by the Company. However, its purpose is limited to instructing the intermediary on how to vote on your behalf. Most brokers now delegate responsibility for obtaining instructions from clients to Broadridge Investor Communication Services (“Broadridge”) in the United States and in Canada. Broadridge mails a voting instruction form in lieu of a Proxy provided by the Company. The voting instruction form will name the same persons as the Company’s Proxy to represent you at the Meeting. You have the right to appoint a person (who need not be a Beneficial Shareholder of the Company), other than the persons designated in the voting instruction form, to represent you at the Meeting. To exercise this right, you should insert the name of the desired representative in the blank space provided in the voting instruction form. The completed voting instruction form must then be returned to Broadridge by mail or facsimile or given to Broadridge by phone or over the internet, in accordance with Broadridge’s instructions. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of shares to be represented at the Meeting.If you receive a voting instruction form from Broadridge, you cannot use it to vote shares directly at the Meeting - the voting instruction form must be completed and returned to Broadridge, in accordance with its instructions, well in advance of the Meeting in order to have the shares voted.

Although as a Beneficial Shareholder you may not be recognized directly at the Meeting for the purposes of voting shares registered in the name of your broker, you, or a person designated by you, may attend at the Meeting as proxyholder for your broker and vote your shares in that capacity. If you wish to attend the Meeting and indirectly vote your shares as proxyholder for your broker, or have a person designated by you do so, you should enter your own name, or the name of the person you wish to designate, in the blank space on the voting instruction form provided to you and return the same to your broker in accordance with the instructions provided by such broker, well in advance of the Meeting.

Alternatively, you can request in writing that your broker send you a legal proxy which would enable you, or a person designated by you, to attend at the Meeting and vote your shares.

0

REVOCATION OF PROXIES

In addition to revocation in any other manner permitted by law, a registered shareholder who has given a proxy may revoke it by:

| | (a) | executing a Proxy bearing a later date or by executing a valid notice of revocation, either of the foregoing to be executed by the registered shareholder or the registered shareholder’s authorized attorney in writing, or, if the shareholder is a corporation, under its corporate seal by an officer or attorney duly authorized, and by delivering the Proxy bearing a later date to Computershare at any time up to and including the last business day that precedes the day of the Meeting or, if the Meeting is adjourned, the last business day that precedes any reconvening thereof, or to the chairman of the Meeting on the day of the Meeting or any reconvening thereof, or in any other manner provided by law; or |

| | | |

| | (b) | personally attending the Meeting and voting the registered shareholders’ shares. |

A revocation of a Proxy will not affect a matter on which a vote is taken before the revocation.

Only registered shareholders have the right to revoke a Proxy. Non-Registered Holders who wish to change their vote must, at least seven days before the Meeting, arrange for their respective Intermediaries to revoke the Proxy on their behalf.

VOTING PROCEDURE

A quorum for the transaction of business at the Meeting is, subject to the special rights and restrictions attached to the share of any class or series of shares, one person who is a shareholder, or who is otherwise permitted to vote shares of the Company at a meeting of shareholders pursuant to its articles, present in person or by proxy. Broker non-votes occur when a person holding shares through a bank or brokerage account does not provide instructions as to how his or her shares should be voted and the broker does not exercise discretion to vote those shares on a particular matter. Abstentions and broker non-votes will be included in determining the presence of a quorum at the Meeting. However, an abstention or broker non-vote will not have any effect on the outcome for the election of directors.

Shares for which proxy cards are properly executed and returned will be voted at the Meeting in accordance with the directions noted thereon or, in the absence of directions, will be voted “FOR” fixing the number of directors at 7, “FOR” the election of each of the nominees to the Board named on the following page, “FOR” the resolution to ratify the appointment of Davidson & Company LLP, Chartered Accountants, as independent auditors of the Company for the fiscal year ended December 31, 2016 and to authorize the directors to fix their remuneration.It is not expected that any matters other than those referred to in this Proxy Statement will be brought before the Meeting. If, however, other matters are properly presented, the persons named as proxies will vote in accordance with their discretion with respect to such matters.

To be effective, each matter which is submitted to a vote of shareholders, other than for the election of directors and the approval of auditors, must be approved by a majority of the votes cast by the shareholders voting in person or by proxy at the Meeting.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

On April 17, 2017 (the “Record Date”), there were 229,361,261 shares of Common Stock issued and outstanding, each share carrying the right to one vote. Only shareholders of record at the close of business on the Record Date will be entitled to vote in person or by proxy at the Meeting or any adjournment thereof.

To the knowledge of the directors and executive officers of the Company, the beneficial owners or persons exercising control over Company shares carrying more than 5% of the outstanding voting rights are:

1

Name and Address

| Number of Shares(1)

| Nature of Ownership

| Approximate % of Total

Issued and Outstanding |

|

Willem Duyvesteyn

Reno, Nevada | 18,134,426(3) | Sole voting and investment control | 7.91% |

| 9,518,693(2)(3) | Shared voting and investment control | 4.15% |

Andrew Greig

Teneriffe, QLD, Australia | 19,610,400(4) | Sole voting and investment control | 8.55% |

| (1) | The information relating to the above share ownership was obtained by the Company from insider reports and beneficial ownership reports on Schedule 13D filed with the SEC or available at www.sedi.ca, or from the shareholder. |

| (2) | 9,518,693 of these Common Shares are registered in the name of Irene Duyvesteyn, and Mr. Duyvesteyn has voting and investment control over these Common Shares. |

| (3) | This figure does not include 2,500,000 shares issuable pursuant to exercise of stock options. |

| (4) | This figure does not include 1,100,000 shares issuable pursuant to exercise of stock options. |

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Except as disclosed herein, no Person has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in matters to be acted upon at the Meeting other than the election of directors and the appointment of auditors and as set out herein. For the purpose of this paragraph, “Person” shall include each person: (a) who has been a director, senior officer or insider of the Company at any time since the commencement of the Company’s last fiscal year; (b) who is a proposed nominee for election as a director of the Company; or (c) who is an associate or affiliate of a person included in subparagraphs (a) or (b).

PROPOSAL 1

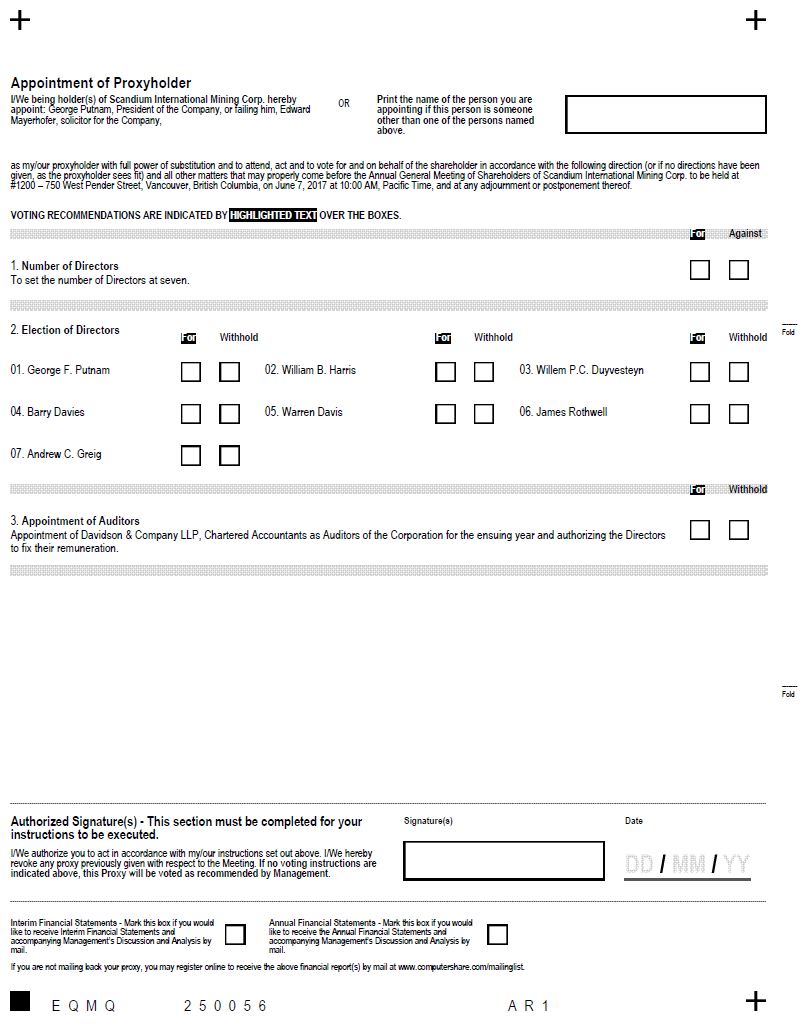

ELECTION OF DIRECTORS

The Board proposes that the following seven nominees be elected as directors at the Meeting, each of whom will hold office until the expiration of their term or until his or her successor shall have been duly appointed or elected and qualified: George Putnam, William Harris, Barry Davies, Willem Duyvesteyn, Warren Davis, James Rothwell, and Andrew Greig.

Unless otherwise instructed, it is the intention of the persons named as proxies on the accompanying proxy card to vote shares represented by properly executed proxies for the election of such nominees. Although the Board anticipates that the seven nominees will be available to serve as directors of SCY, if any of them should be unwilling or unable to serve, it is intended that the proxies will be voted for the election of such substitute nominee or nominees as may be designated by the Board.

THE BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE SEVEN NOMINEES.

As part of its ongoing review of corporate governance policies, on September 2, 2014, the Board adopted a policy providing that in an uncontested election of directors, any nominee who receives a greater number of votes “withheld” than votes “for” will tender his or her resignation to the Chairman of the Board promptly following the shareholders’ meeting. The Board will consider the offer of resignation and will make a decision whether or not to accept it. In considering whether or not to accept the resignation, the Board will consider all factors deemed relevant by the members of the Board. The Board will be expected to accept the resignation except in situations where the considerations would warrant the applicable director continuing to serve on the Board. The Board will make its final decision and announce it in a press release within 90 days following the shareholders’ meeting. A director who tenders his or her resignation pursuant to this policy will not participate in any meeting of the Board at which the resignation is considered.

The following table sets out the names of the nominees, their positions and offices in the Company, principal occupations, the period of time that they have been directors of the Company, and the number of shares of the Company which each beneficially owns or over which control or direction is exercised.

2

Name, Residence and Present

Position with the Company

|

Director Since

| # of Shares Beneficially

Owned, Directly or

Indirectly, or Over

Which Control or

Direction is Exercised(1) |

Principal Occupation(1)

|

George F. Putnam

California, USA

Director, President and Chief

Executive Officer | May 3, 2010 | 4,542,010(5) | President and Chief Executive Officer of Scandium International Mining Corp. |

William B. Harris(2)(3)

Florida, USA

Director (Chairman of the

Board) | June 5, 2007 | 430,000(5) | Partner of Solo Management Group, LLC, an investment management and financial consulting company. |

Barry Davies

Kowloon, Hong Kong

Director | January 20, 2010 | 6,370,000(5) | President of Rudgear Holdings Ltd., a private investment company, since March 2006. |

Willem P.C. Duyvesteyn(4)

Nevada, USA

Director, Chief Technology

Officer | December 16, 2009 | 27,653,119(5)(6) | President and founder of The Technology Store, Inc. from 2000 until its acquisition by the Company in December 2009; President, Technology and Resource Development Inc. since December 2009. Both companies are involved in the development and commercialization of various mineral and energy related processes and projects. |

Warren Davis(2)

California, USA

Director

| May 30, 2012 | 1,683,529(5) | Consultant to Energy and Power Industry clients who are developing new projects with both conventional and advanced technology. |

James Rothwell(2)(3)

Washington, USA

Director | July 16, 2014 | 1,102,882(5) | Mr. Rothwell performs consulting assignments for mining and metals industry companies. |

Andrew Greig(3)

Teneriffe, QLD, Australia

Director

| August 21, 2015 | 19,610,400(5) | Mr. Greig is an Angel Capital Investor; identifying promising opportunities and providing capital, mentoring and advice through business start-up. |

|

| (1) | The information as to principal occupation, business or employment and shares beneficially owned or controlled is not within the knowledge of the management of the Company and has been furnished by the respective nominees. Unless otherwise stated, any nominees named above have held the principal occupation or employment indicated for at least five years. |

| (2) | Member of the Audit Committee. |

| (3) | Member of the Compensation Committee. |

| (4) | Nominee of Willem Duyvesteyn and Irene Duyvesteyn. In connection with the acquisition of The Technology Store, Inc. by the Company, Willem Duyvesteyn and Irene Duyvesteyn have the right to nominate one director to the Board. |

| (5) | These figures do not include the number of shares issuable pursuant to exercise of stock options as follows; 5,200,000 shares issuable to George Putnam, 2,450,000 shares issuable to William Harris, 2,100,000 shares issuable to Barry Davies; 2,500,000 shares issuable to Willem Duyvesteyn, 1,600,000 shares issuable to Warren Davis, 1,600,000 shares issuable to James Rothwell, and 1,100,000 shares issuable to Andrew Greig. |

| (6) | 9,518,693 of these Common Shares are registered in the name of Irene Duyvesteyn, and Mr. Duyvesteyn has voting and investment control over these Common Shares. |

George Putnam has extensive mining industry experience, having worked for over 20 years for BHP (now BHP-Billiton) and GE/Utah International. Mr. Putnam also served for three years as CFO of QGX Ltd., a TSX-listed mineral exploration and development company. The Board believes that Mr. Putnam’s expertise and experience in the mining industry is valuable to the Board.

William Harris has more than 35 years of experience in financial and executive management with public companies. Mr. Harris is also a board member of EnCore Energy Corp., Silver Predator Corp., and the former President and CEO of Hoechst Fibers Worldwide, a company involved in the global acetate and polyester business of Hoechst AG. Mr. Harris’ expertise and experience make him a valuable member of the Board.

3

Barry Davies is a mining engineer with over 30 years of engineering, operations, commercial and corporate management experience in the minerals industry, the majority of service with GE/Utah International and BHP (now BHP/Billiton). Mr. Davies’ experience and his independence from management make him a valuable member of the Board.

Willem Duyvesteynhas 40 years’ experience in the mining, mineral and energy industries. Prior to joining TTS, Mr. Duyvesteyn was Vice President and General Manager Minerals Technology for BHP for more than 10 years. Prior to BHP he served with AMAX as Director of Laterite Nickel projects. Mr. Duyvesteyn’s extensive experience make him a valuable member of the Board.

Warren Davishas held numerous senior roles in both minerals and electric power industries, with a focus on energy project development, project marketing and business strategy. Mr. Davis currently provides consulting services for several power plant contractors and electric power technology clients. His previous positions include roles with Black & Veach (15 years), Bechtel Power Corp (three years), and The General Electric Company (10 years). Mr. Davis worked for Utah International Inc. (seven years) in the minerals industry, specifically in exploration, acquisitions and strategy. He was founder and president of Golden Bear Energy Services, a start-up energy company, and has worked in numerous entrepreneurial energy development roles. Mr. Davis’ experience and his independence from management make him a valuable member of the Board.

James R. Rothwell has held numerous senior management roles and board positions in Canadian public mining companies, including Chairman of Shore Gold Inc. and Kensington Resources Ltd., Board Director for Motapa Diamonds Inc. and President, CEO and Director of Inca Pacific Resources and Dia Met Minerals Ltd. Prior to these Canadian company positions, he served for 27 years with Utah International and BHP in a number of business roles in the US, Canada, Brazil and Australia. With BHP, Mr. Rothwell’s operational experience included thermal coal, iron ore, coking coal, manganese, diamonds, and the leadership of the BHP Minerals marketing effort worldwide. He has served on minerals industry associations in Australia, the USA and Canada. Jim has a BA (Economics) and an MBA (Finance/Accounting) from Stanford University. Mr. Rothwell’s experience and his independence from management make him a valuable member of the Board.

Andrew Greig has 35 years of experience in the mining and natural resource industry with Bechtel Group Inc., a global engineering, construction and project management company. He brings direct experience in developing minerals, resource, power, refining, and chemical projects in 20 countries across six continents. A resident of Australia, Mr. Greig earned a graduate diploma in business from Monash University, Melbourne. Mr. Greig’s experience and his independence from management make him a valuable member of the Board.

Executive Officers

The following sets forth certain information regarding executive officers of the Company. Information pertaining to Mr. Putnam and Mr. Duyvesteyn, each of whom are a director and executive officer of the Company, may be found in the section entitled “Directors”.

| Name | Position with the Company | Age as of the Annual Meeting |

| Edward Dickinson | Chief Financial Officer | 70 |

| John Thompson | Vice President, General Manager - Australia | 69 |

| Nigel Ricketts | Vice President, Project and Market Development | 54 |

Edward Dickinson,Chief Financial Officer, joined the Company in September 2011. Prior to joining the CompanyMr. Dickinson was employed by Altair Nanotechnologies Inc. from August 1996 to August 2011 where he held several senior management positions including Chief Financial Officer, Director of Finance, Corporate Secretary and Senior Director – Program and Contract management. From 1994 to 1996, Mr. Dickinson was employed by the Southern California Edison Company as a negotiator of non-utility power generation contracts. Mr. Dickinson was Vice President and Director of Geolectric Power Company during 1993 and 1994, and from 1987 through 1992 was the Director of Finance and Administration for OESI Power Corporation. Prior to 1987, Mr. Dickinson served in various financial and program management positions at the U.S. Department of Energy. Mr. Dickinson, who is a certified public accountant, obtained a Master’s degree in Accounting from California State University, Northridge.

4

John Thompson, Vice President, General Manager - Australia, joined the Company in May 2011. Mr. Thompson’s mining career spans 41 years in senior management roles with Utah Development Company, BHP (now BHP Billiton), Newcrest Mining and QGX Ltd., managing and developing mineral projects in Australia, New Zealand, Mongolia and the United States. He has held numerous other leadership roles in the mining industry, including four Mine/General Manager roles in coking coal, gold and titanium/iron sands operations and a General Manager position at Newcrest overseeing five operating gold businesses in Australia. Mr. Thompson has a Bachelor of Science degree in Mining and Petroleum Engineering from the University of Queensland, and is a Fellow of the Australian Institute of Mining and Metallurgy.

Nigel Ricketts, Vice President Project and Market Development, joined the Company in July 2016. Dr. Ricketts is a metallurgist with a 30-year career in mine project, engineering, flowsheet design, and advanced research in metallurgy and alloy development. His career spans numerous specialty, base, and precious metals projects, including projects and processes targeting magnesium, aluminum, gold, copper, lateritic nickel, palladium and PGM's, lead-zinc, and scandium. Dr. Ricketts' previous roles include project engineering with Altrius Engineering Services, AMEC Minproc Ltd., AMEC Mining & Metals, CSIRO, Pasminco, BHP, Worley Parsons, and Chesser Resources. He has a degree in metallurgy from the University of South Australia and a PhD in Chemical Engineering from Monash University. He is a member of the Australasian Institute of Mining and Metallurgy and a Chartered Professional (Metallurgy) with the AusIMM.

INVOLVEMENT IN CERTAIN LEGAL PROCEEDINGS

During the past ten years, none of the persons currently serving as executive officers and/or directors of the Company has been the subject matter of any of the following legal proceedings that are required to be disclosed pursuant to Item 401(f) of Regulation S-K including: (a) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (b) any criminal convictions; (c) any order, judgment, or decree permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; (d) any finding by a court, the SEC or the CFTC to have violated a federal or state securities or commodities law, any law or regulation respecting financial institutions or insurance companies, or any law or regulation prohibiting mail or wire fraud; (e) any sanction or order of any self-regulatory organization or registered entity or equivalent exchange, association or entity; or (f) any material proceedings in which such person is a party adverse to SCY or any of its subsidiaries or has a material interest adverse to SCY or any of its subsidiaries. Further, no such legal proceedings are believed to be contemplated by governmental authorities against any director, executive officer or affiliate of SCY, any owner of record or beneficially of more than five percent of the Company’s Common Stock, or any associate of such director, executive officer, affiliate of SCY, or security holder.

SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Company’s Common Stock as of April 17, 2017 by:

| (i) | each director of SCY; |

| (ii) | each of the Named Executive Officers of SCY; and |

| (iii) | all directors and executive officers as a group. |

Except as noted below, SCY believes that the beneficial owners of the Common Stock listed below, based on information furnished by such owners, have sole voting and investment power with respect to such shares.

Name of

Beneficial Owner | Shares

Beneficially Owned[1] | Percentage of Shares

Beneficially Owned[1] |

|

| George Putnam | 4,542,010 | 1.98% |

| William Harris | 430,000 | 0.19% |

| Barry Davies | 6,370,000 | 2.78% |

| Willem Duyvesteyn | 27,653,119(2) | 12.06% |

| Warren Davis | 1,683,529 | 0.73% |

| James Rothwell | 1,102,882 | 0.48% |

5

Name of

Beneficial Owner | Shares

Beneficially Owned[1] | Percentage of Shares

Beneficially Owned[1] |

|

| Andrew Greig | 19,610,400 | 8.55% |

| John Thompson | 3,436,200 | 1.50% |

| Edward Dickinson | 540,708 | 0.24% |

| Nigel Ricketts | Nil | 0.00% |

| All officers and directors (10) persons | 65,368,848 | 28.50% |

| (1) | These amounts exclude beneficial ownership of securities not currently outstanding but which are reserved for immediate issuance on exercise of stock options as follows; 5,200,000 shares issuable to George Putnam, 2,450,000 shares issuable to William Harris, 2,100,000 shares issuable to Barry Davies; 2,500,000 shares issuable to Willem Duyvesteyn, 1,600,000 shares issuable to Warren Davis, 1,600,000 shares issuable to James Rothwell,1,100,000 shares issuable to Andrew Greig, 1,960,000 shares issuable to John Thompson, 1,510,000 shares issuable to Edward Dickinson, and 220,000 shares issuable to Nigel Ricketts. |

| (2) | 9,518,693 of these Common Shares are registered in the name of Irene Duyvesteyn, and Mr. Duyvesteyn has voting and investment control over these Common Shares. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires SCY's directors, executive officers and persons who own more than 10% of a registered class of SCY’s securities to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of SCY. Directors, executive officers and greater than 10% shareholders are required by SEC regulation to furnish SCY with copies of all Section 16(a) reports they file.

To SCY’s knowledge, based solely on a review of Forms 3 and 4, as amended, furnished to it during its most recent fiscal year, and Form 5, as amended, furnished to it with respect to such year, SCY believes that during the year ended December 31, 2016, its directors, executive officers and greater than 10% shareholders complied with all Section 16(a) filing requirements of the Securities Exchange Act of 1934.

DIRECTORS AND EXECUTIVE OFFICERS

The following table contains information regarding the members and nominees of the Board and the Executive Officers of SCY as of the Record Date:

| Name | Age | Position | Position Held Since |

| George Putnam | 63 | Director, President, CEO | May 3, 2010 |

| William Harris | 70 | Director | June 5, 2007 |

| | | Chairman | April 2, 2010 |

| Barry Davies | 67 | Director | January 20, 2010 |

Willem Duyvesteyn

| 72

| Director

CTO | December 16, 2009

October 28, 2015 |

|

| Warren Davis | 72 | Director | May 30, 2012 |

| James Rothwell | 67 | Director | July 16, 2014 |

| Andrew Greig | 60 | Director | August 21, 2015 |

| Edward Dickinson | 70 | CFO | August 15,2011 |

| John Thompson | 69 | Vice President Project Development | March 8, 2011 |

| Nigel Ricketts | 54 | Vice President Project and Market Development | June 30, 2016 |

All of the officers identified above serve at the discretion of the Board and have consented to act as officers of the Company.

RELATIONSHIPS AMONG DIRECTORS OR EXECUTIVE OFFICERS

There are no family relationships among any of the existing directors or executive officers of SCY.

6

COMPENSATION COMMITTEE

The Company’s compensation policies and programs are designed to be competitive with similar mining companies and to recognize and reward executive performance consistent with the success of the Company’s business. These policies and programs are intended to attract and retain capable and experienced people. The Compensation Committee’s role and philosophy is to ensure that the Company’s compensation goals and objectives, as applied to the actual compensation paid to the Company’s Chief Executive Officer and other executive officers, are aligned with the Company’s overall business objectives and with shareholder interests.

In addition to industry comparables, the Compensation Committee considers a variety of factors when determining both compensation policies and programs and individual compensation levels. These factors include the long-range interests of the Company and its shareholders, overall financial and operating performance of the Company and the Compensation Committee’s assessment of each executive’s individual performance and contribution toward meeting corporate objectives.

The current members of the Compensation Committee are James Rothwell, Andrew Greig and William Harris, each of whom are independent directors. The function of the Compensation Committee is to assist the Board in fulfilling its responsibilities relating to the compensation practices of the executive officers of the Company. The Compensation Committee has been empowered to review the compensation levels of the executive officers of the Company and to report thereon to the Board; to review the strategic objectives of the stock option and other stock-based compensation plans of the Company and to set stock based compensation; and to consider any other matters which, in the Compensation Committee’s judgment, should be taken into account in reaching the recommendation to the Board concerning the compensation levels of the Company’s executive officers.

Report on Executive Compensation

This report on executive compensation has been authorized by the Compensation Committee. The Board assumes responsibility for reviewing and monitoring the long-range compensation strategy for the senior management of the Company although the Compensation Committee guides it in this role. The Board determines the type and amount of compensation for the President and CEO. The Board also reviews the compensation of the Company’s senior executives. The Compensation Committee has not considered the implications of the risks associated with the Company’s compensation policies and practices.

The Compensation Committee makes the final determination on compensation for directors and senior executives of the Company. The Compensation Committee will take recommendations from the CEO as to what appropriate levels of compensation should be for senior executives. The Compensation Committee does not delegate the authority to determine compensation for directors and senior officers to other persons.

Philosophy and Objectives

The compensation program for the senior management of the Company is designed to ensure that the level and form of compensation achieves certain objectives, including:

| (a) | attracting and retaining talented, qualified and effective executives; |

| | |

| (b) | motivating the short and long-term performance of these executives; and |

| | |

| (c) | better aligning their interests with those of the Company’s shareholders. |

In compensating its senior management, the Company has employed a combination of base salary and equity participation through its stock option plan. The Company’s NEOs, as that term is defined in Form 51-102F6, and directors are not permitted to purchase financial instruments, including, for greater certainty, prepaid variable forward contracts, equity swaps, collars or units of exchange funds, that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the NEO or director.

7

Elements of the Compensation Program

The significant elements of compensation awarded to the Named Executive Officers (as defined below) are a cash salary and stock options. The Company does not presently have a long-term incentive plan for its Named Executive Officers. There is no policy or target regarding allocation between cash and non-cash elements of the Company’s compensation program. The Compensation Committee reviews annually the total compensation package of each of the Company’s executives on an individual basis, against the backdrop of the compensation goals and objectives described above, and makes recommendations to the Board concerning the individual components of their compensation.

Cash Salary

As a general rule, the Company seeks to offer its Named Executive Officers a compensation package that is in line with that offered by other companies in our industry, and as an immediate means of rewarding the Named Executive Officers for efforts expended on behalf of the Company.

Equity Participation

The Company believes that encouraging its executives and employees to become shareholders is the best way of aligning their interests with those of its shareholders. Equity participation is accomplished through the Company’s stock option plan. Stock options are granted to senior executives taking into account a number of factors, including the amount and term of options previously granted, base salary and bonuses and competitive factors. Options are generally granted to senior executives which vest on terms established by the Board.

Perquisites and Other Personal Benefits

The Company’s Named Executive Officers are not generally entitled to significant perquisites or other personal benefits not offered to the Company’s other employees.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth all information concerning the total compensation of the Company’s president, chief executive officer, chief financial officer, and the three other most highly compensated officers during the last fiscal year (the “Named Executive Officers”) during the last two completed fiscal years for services rendered to the Company in all capacities.

Name and

Principal

Position

| Year

| Salary

($)

| Bonus

($)

| Stock

Awards

($)

| Option

Awards(1

)($)

| Non-Equity

Incentive Plan

Compensation

($)

| Nonqualified

Deferred

Compensation

Earnings

($) | All Other

Compensation

($)

| Total ($)

|

George

Putnam,

President,

CEO and

Director | 2016 | $200,000 | $Nil | $Nil | $62,556 | $Nil | $Nil | $Nil | $262,556 |

| 2015 | $200,000 | $Nil | $Nil | $205,116 | $Nil | $Nil | $Nil | $405,116 |

Edward

Dickinson,

CFO | 2016 | $90,000 | $Nil | $Nil | $33,203 | $Nil | $Nil | $Nil | $123,203 |

| 2015 | $90,000 | $Nil | $Nil | $41,184 | $Nil | $Nil | $Nil | $131,184 |

John

Thompson,

V.P. General

Manager,Australia | 2016 | $66,618 | $Nil | $Nil | $49,804 | $Nil | $Nil | $Nil | $116,422 |

| 2015 | $67,143 | $Nil | $Nil | $41,184 | $Nil | $Nil | $Nil | $108,327 |

Willem

Duyvesteyn

CTO and

Director | 2016 | $102,000 | $Nil | $Nil | $41504 | $Nil | $Nil | $Nil | $143,504 |

| 2015 | $102,000 | $Nil | $Nil | $73,970 | $Nil | $Nil | $Nil | $175,970 |

Nigel

Ricketts,V.P.

Project and

Market

Development | 2016 | $52,444 | $Nil | $Nil | $55,312 | $Nil | $Nil | $Nil | $107,756 |

| 2015 | $Nil | $Nil | $Nil | $Nil | $Nil | $Nil | $Nil | $Nil |

(1) The determination of the value of option awards is based upon the Black-Scholes Option pricing model, details and assumptions of which are set out in Note 6 to the Company’s consolidated financial statements for the fiscal year ended December 31, 2016.

8

DIRECTOR COMPENSATION

No cash compensation was paid to any director of the Company for the director’s services as a director during the financial year ended December 31, 2016, other than the reimbursement of out-of-pocket expenses.

The Company has no standard arrangement pursuant to which directors are compensated by the Company for their services in their capacity as directors except for the granting from time to time of incentive stock options in accordance with the policies of the TSX. During the most recently completed financial year, no incentive stock options were granted to directors, including directors who are Named Executive Officers.

AGGREGATED STOCK OPTION EXERCISES DURING THE MOST RECENTLY COMPLETED FISCAL YEAR AND FISCAL YEAR-END OPTION VALUES

No stock options were exercised by the directors during the Company’s fiscal year ended December 31, 2016.

OUTSTANDING EQUITY AWARDS AT THE MOST RECENTLY COMPLETED FISCAL YEAR

Name | Option-based Awards | Share-based Awards |

Number of

securities

underlying

unexercised

options

(#)

| Option

exercise

price

(C$) | Option

expiration

date | Value of

Unexerci

sed in-

the

money

options(

US$) | Number of

shares or units

of shares that

have not vested

(#)

(2)

| Market or

payout value of

share based

awards that

have not vested

($)

|

William Harris

| 400,000

200,000

350,000

400,000

800,000

300,000 | $0.08

$0.10

$0.12

$0.14

$0.10

$0.13 | Apr. 24, 2017(3)

May 9, 2018

July 25, 2019

Apr. 17, 2020

Nov. 5, 2020

Feb. 12, 2021 | $56,202

$25,322

$39,100

$38,728

$101,288

$31,280 | N/A | N/A |

Barry Davies

| 400,000

200,000

300,000

400,000

500,000

300,000 | $0.08

$0.10

$0.12

$0.14

$0.10

$0.13 | Apr. 24, 2017(3)

May 9, 2018

Apr. 24, 2017

Apr. 17,2020

Nov. 5, 2020

Feb. 12, 2021 | $56,202

$25,322

$33,515

$39,100

$63,305

$31,280 | N/A | N/A |

9

Willem Duyvesteyn

| 400,000

200,000

200,000

400,000

400,000

500,000

500,000 | $0.08

$0.07

$0.10

$0.12

$0.14

$0.10

$0.13 | Apr. 24, 2017(3)

Aug. 8, 2017(3)

May 9, 2018

July 25, 2019

Apr. 17, 2020

Nov. 5, 2020

Feb. 12, 2021 | $56,202

$29,791

$25,322

$44.686

$39,100

$63,305

$52,134 | N/A | N/A |

George Putnam

| 400,000

400,000

200,000

550,000

400,000

2,500,000

750,000 | $0.08

$0.07

$0.10

$0.12

$0.14

$0.10

$0.13 | Apr, 24, 2017(3)

Aug. 8, 2017(3)

May 9, 2018

July.25, 2019

Apr. 17, 2020

Nov. 5, 2020

Feb. 12, 2021 | $56,202

$59,581

$25,322

$61,433

$39,100

$316,526

$78,201 | N/A | N/A |

Warren Davis

| 400,000

200,000

300,000

400,000

300,000

| $0.07

$0.10

$0.12

$0.14

$0.13 | Aug. 8, 2017(3)

May 9, 2018

July 25, 2019

Apr. 17, 2020

Feb. 12, 2021 | $59,581

$25,322

$33,515

$39,100

$31,280 | N/A | N/A |

James Rothwell

| 400,000

400,000

300,000 | $0.12

$0.14

$0.13 | July 25, 2019

Apr. 17, 2020

Feb. 12, 2021 | $44,686

$39,100

$31,280 | N/A | N/A |

Andrew Greig

| 400,000

300,000 | $0.12

$0.13 | Aug. 28, 2018

Feb. 12, 2021

| $46,176

$31,280 | N/A | N/A |

| (1) | “Value of unexercised in-the-money options” is calculated by determining the difference between the market value of the securities underlying the options at the date referred to and the exercise price of the options and is not necessarily indicative of the value (i.e. loss or gain) that will actually be realized by the directors. |

| (2) | “in-the-money options” means the excess of the market value of the Company’s shares on December 31, 2016 over the exercise price of the options. |

| (3) | Options were exercised during the first quarter of 2017. |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets out information as of the end of the fiscal year ended December 31, 2016 with respect to compensation plans under which equity securities of the Company are authorized for issuance.

| Plan Category | Number of securities

to be issued upon

exercise of outstanding

options, warrants and

rights

(a) |

Weighted-average

exercise price of

outstanding options,

warrants and rights

(b) | Number of securities

remaining available for

future issuances under

equity compensation

plan [excluding securities

reflected in column (a)]

(c) |

| Equity compensation plans approved by security holders | 21,820,000 | $0.11 | 11,937,080 |

| Equity compensation plans not approved by security holders | Nil | Nil | Nil |

| Total: | 21,820,000 | $0.11 | 11,937,080 |

TERMINATION AND CHANGE OF CONTROL BENEFITS

The following contracts, agreements, plans, and arrangements provide for payments to the applicable Named Executive Officers following or in connection with any termination (whether voluntary, involuntary or constructive), resignation, retirement, a change in control of the company or a change in such Named Executive Officers’ responsibilities:

10

George Putnam - the Company entered into a letter agreement effective May 1, 2010 with George Putnam, pursuant to which Mr. Putnam agreed to act as President and CEO of the Company. Mr. Putnam receives a base salary of $200,000 per year. The Compensation Committee has discretion to award an annual bonus, and will review Mr. Putnam’s base salary on an annual basis. Mr. Putnam received an initial grant of 2,000,000 stock options, 25% of which vested immediately, and the remainder of which vested in three equal installments every six months thereafter. Mr. Putnam is entitled to termination payments in the amount of six months’ base salary if he is terminated without cause in his first year of employment, and six months’ base salary plus one month salary for each year of full service to a maximum of twenty-four months, if terminated after the first year of employment. If Mr. Putnam is terminated pursuant to a change in control, he is entitled to a termination payment equivalent to three times his base salary.

Edward Dickinson – the Company entered into a letter agreement effective September 1, 2011 with Edward Dickinson, pursuant to which Mr. Dickinson agreed to act as chief financial officer of the Company and its subsidiaries. Mr. Dickinson receives a base salary of $75,000 per year, reflecting a 50% time commitment to the Company. If the job content and demands exceed a 50% time commitment then the Company may consider expanding Mr. Dickinson’s role and adjusting this compensation accordingly to reflect additional time and work commitment. Mr. Dickinson received an initial grant of 300,000 stock options, 20% of which vested immediately, and the remainder of which vested in four equal instalments every six months thereafter. Mr. Dickinson is entitled to participate in the Company’s stock option plan. If Mr. Dickinson is terminated pursuant to a change in control, he is entitled to a termination payment equal to one year’s base salary.

John D. Thompson – the Company entered into a letter agreement effective February 8, 2011 with John D. Thompson, pursuant to which Mr. Thompson agreed to act as VP, Project Development of the Company and its subsidiaries. Mr. Thompson receives a base salary of A$90,000 per year, reflecting his support to the Company on a 50% basis. If the position and job requirements expand to a full time commitment, the Company may discuss with Mr. Thompson on appropriate compensation changes. Mr. Thompson received an initial grant of 500,000 stock options exercisable for a term of 5 years, 20% which vested immediately, and the remainder of which vested in four equal instalments every six months thereafter. Mr. Thompson is entitled to a termination payment equal to six months’ base salary plus one additional month of salary for each full year of services, to a maximum of twenty-four months. If Mr. Thompson is terminated pursuant to a change of control, he is entitled to a termination payment equal to two times his base salary. Other than the agreements described above, the Company and its subsidiaries are not parties to any contracts, and have not entered into any plans or arrangements which require compensation to be paid to any of the Named Executive Officers in the event of:

| (a) | resignation, retirement or any other termination of employment with the Company or one of its subsidiaries; |

| (b) | a change of control of the Company or one of its subsidiaries; or |

| (c) | a change in the director, officer or employee’s responsibilities following a change of control of the Company. |

BOARD OF DIRECTORS MEETINGS AND COMMITTEES

During the fiscal year ended December 31, 2016, the Board held four directors’ meetings. All other matters which required Board approval were consented to in writing by all of the Company’s directors.

The Board has established an Audit Committee and a Compensation Committee. The Board has no standing nominating committee. Each of the Audit and Compensation Committees is responsible to the full Board. The functions performed by these committees are summarized below:

Audit Committee. The Board has an Audit Committee composed of three directors, William Harris (Chair), Warren Davis, and James Rothwell. Prior to October 28, 2015, Barry Davies served on the Audit Committee. All members of the Audit Committee are “independent” and “financially literate” in accordance with Multilateral Instrument 52-110Audit Committees (“NI 52-110”). The Audit Committee reviews all financial statements of the Company prior to their publication, reviews audits or communications, recommends the appointment of independent auditors, reviews and approves the professional services to be rendered by independent auditors and reviews fees for audit services. The Audit Committee meets both separately with auditors (without management present) as well as with management present. The meetings with the auditors discuss the various aspects of the Company’s financial presentation in the areas of audit risk and Canadian generally accepted accounting principles. Specifically, the audit committee has:

| (a) | reviewed and discussed the audited financial statements with management; |

11

| (b) | discussed with the independent auditors the matters required to be discussed by the statement on Auditing Standards No. 61, as amended; and |

| | |

| (c) | received the written disclosures and the letter from the independent accountant required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence, and has discussed with the independent accountant the independent accountant’s independence. |

A copy of the text of the Company’s audit committee charter can be found on the Company’s website at www.scandiummining.com.

Based on the foregoing review and discussions, the audit committee recommend to the Board that the audited financial statements should be included in our Annual Report on Form 10-K for the year ended December 31, 2015 filed with the SEC.

Submitted by the Audit Committee.

William Harris, Chair

Warren Davis, Member

James Rothwell, Member

Compensation Committee. The Compensation Committee reviews and approves the compensation of SCY’s officers, reviews and administers SCY’s stock option plan and makes recommendations to the Board regarding such matters. The members of the Compensation Committee are William Harris, Andrew Greig, and James Rothwell. Each of the Compensation Committee members is an independent director. The Board has adopted a written charter for the Compensation Committee, a copy of which can be found on the Company’s website at www.scandiumminingcom.

Nominating Committee. No Nominating Committee has been appointed. Nominations of directors are made by the Board. The Board is of the view that the present management structure does not warrant the appointment of a Nominating Committee.

In its deliberations for selecting candidates for nominees as director, the Board considers the candidate’s knowledge of the mineral exploration industry and involvement in community, business and civic affairs. Any nominee for director made by the Board must be highly qualified with regard to some or all these attributes. In searching for qualified director candidates to fill vacancies on the Board, the Board solicits its current Board for names of potentially qualified candidates. The Board would then consider the potential pool of director candidates, select the candidate the Board believes best meets the then-current needs of the Board, and conduct a thorough investigation of the proposed candidate’s background to ensure there is no past history, potential conflict of interest or regulatory issue that would cause the candidate not to be qualified to serve as a director of SCY. Additionally, the Board annually reviews the Board’s size, structure, composition and functioning, to ensure an appropriate blend and balance of diverse skills and experience.

MANAGEMENT CONTRACTS

The Company is not a party to a management contract with anyone other than directors or Named Executive Officers of the Company.

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

None of the current or former directors, executive officers, employees, and proposed nominees for election as directors or their associates is or has since the beginning of the last completed financial year, been indebted to the Company or any of its subsidiaries or indebted to another entity where such indebtedness is or was the subject of a guarantee, support agreement, letter of credit or other similar instrument or understanding provided by the Company or any of its subsidiaries.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Except as disclosed herein, since the commencement of the Company’s most recently completed financial year, no informed person of the Company, nominee for director or any associate or affiliate of an informed person or nominee, had any material interest, direct or indirect, in any transaction or any proposed transaction which has materially affected or would materially affect the Company or any of its subsidiaries.

12

An “informed person” means: (a) a director or executive officer of the Company; (b) a director or executive officer of a person or company that is itself an informed person or subsidiary of the Company; (c) any person or company who beneficially owns, directly or indirectly, voting securities of the company or who exercises control or director over voting securities of the Company or a combination of both carrying more than 10% of the voting rights other than voting securities held by the person or company as underwriter in the course of a distribution; and (d) the Company itself, if and for so long as it has purchased, redeemed or otherwise acquired any of its shares.

REPORT OF CORPORATE GOVERNANCE

The British Columbia Securities Commission has issued guidelines on corporate governance disclosure for non-venture issuers as set out in National Instrument 58-101 (the “Policy”). The Policy addresses matters relating to constitution and independence of directors, the functions to be performed by the directors of a company and their committees and effectiveness and evaluation of proposed corporate governance guidelines and best practices specified by the Canadian securities regulators. The Company’s approach to corporate governance in the context of the specific issues outlined in Form 58-101F1 is set out below.

Board of Directors

The Board currently consists of seven directors, and it is proposed that all seven be nominated at the Meeting. Of the seven proposed directors, a majority of individuals qualify as independent directors. A director is independent if he or she has no direct or indirect “material relationship” with the Company. A “material relationship” is a relationship which could, in the view of the Board, be reasonably expected to interfere with the exercise of the director’s independent judgment. The following table outlines the Company’s independent and non-independent directors, and the basis for a determination that a director is non-independent:

| Name of Director | Independent/Non-Independent |

| George Putnam | Non-Independent (serves as President and CEO of the Company) |

| William Harris | Independent (serves as Chairman of the Company) |

| Barry Davies | Independent |

| Willem Duyvesteyn | Non-Independent (serves as CTO of the Company and holds more than 10% of the Company’s outstanding shares) |

| Warren Davis | Independent |

| James Rothwell | Independent |

| Andrew Greig | Independent |

William Harris, an independent director, is the Chairman of the Board. Mr. Harris’ primary roles as Chairman are to chair all meetings of the Board and to manage the affairs of the Board, including ensuring the Board is organized properly, functions effectively and meets its obligations and responsibilities. The Chairman’s responsibilities include, among other things, ensuring effective relations and communications among Board members.

The Board holds meetings as considered appropriate to deal with the matters arising from developments in the business and affairs of the Company from time to time. During the fiscal year ended December 31, 2016, the Board held four meetings. In addition to the business conducted at such meetings, various other matters were approved by written resolution signed by all members of the Board.

The attendance record for each director of the Company during the fiscal year ended December 31, 2016 was as follows:

| Name of Director | Meetings Attended |

| George Putnam | 4 of 4 |

| William Harris | 4 of 4 |

| Barry Davies | 4 of 4 |

| James Rothwell | 4 of 4 |

| Willem Duyvesteyn | 3 of 4 |

| Warren Davis | 4 of 4 |

| Andrew Greig | 1 of 1 |

13

The attendance record for each member of the Audit Committee during the fiscal year ended December 31, 2016 was as follows:

| Name of Director | Meetings Attended |

| William Harris | 4 of 4 |

| Barry Davies | 3 of 3 |

| Warren Davis | 4 of 4 |

| James Rothwell | 4 of 4 |

The attendance record for each member of the Compensation Committee during the fiscal year ended December 31, 2016 was as follows:

| Name of Director | Meetings Attended |

| William Harris | 1 of 1 |

| Barry Davies | 1 of 1 |

| Warren Davis | 1 of 1 |

| James Rothwell | 1 of 1 |

The Board’s policy is to hold independent directors’ meetings as deemed necessary. At these independent directors’ meetings, non-independent and members of management are not in attendance. During the fiscal year ended December 31, 2016, the independent directors held no meetings.

The Board does not have a policy regarding a Board members’ attendance at annual meetings of shareholders. One director attended the Company’s 2016 annual meeting of shareholders.

Certain directors of the Company are also presently directors of other issuers that are reporting issuers in Canada or elsewhere. Information as to such other directorships is set out below:

| Name of Director | Reporting Issuers |

| George Putnam | None |

William Harris

| Silver Predator Corp.

EnCore Energy Corp. |

| Barry Davies | None |

| Willem Duyvesteyn | None |

| Warren Davis | None |

| James Rothwell | None |

| Andrew Greig | None |

Board Mandate

The Board has not adopted a written mandate but understands that its role is to (i) assume responsibility for the overall stewardship and development of the Company and monitoring of its business decisions, (ii) identify the principal risks and opportunities of the Company’s business and ensuring the implementation of appropriate systems to manage these risks, (iii) ethically manage the Company and perform succession planning, including appointing, training and monitoring of senior management and directors, (iv) implement a communication policy for the Company, and (v) ensure the integrity of the Company’s internal financial controls and management information systems.

Board Leadership Structure

The Board does not have an express policy regarding the separation of the roles of the Chairman of the Board and Chief Executive Officer, as the Board believes that it is in the best interests of the Company to make that determination based on the position and direction of the Company and the membership of the Board. The Board has reviewed the Company’s current Board leadership structure. George Putnam has been the Company’s Chief Executive Officer since May 2010, while William Harris has been the Company’s Chairman of the Board since April 2010. In light of the composition of the Board, the Company’s size, the nature of the Company’s business, the regulatory framework under which the Company operates, the Company’s shareholder base, the Company’s peer group and other relevant factors, the Board believes that the current leadership structure is appropriate. Mr. Putnam and Mr. Harris bring complimentary attributes to the Company’s business operations and strategic plans and generally are focused on somewhat different aspects of the Company’s operations.

14

The Company does not have a lead independent director. Given the size of the Board, the Board believes that the presence of five independent directors out of the seven directors currently on the Board, is sufficient independent oversight of the Chairman of the Board and Chief Executive Officer. The independent directors work well together in the current Board structure and the Board does not believe that selecting a lead independent director would add significant benefits to the Board oversight role.

Also, the Board does not have a formal policy with respect to the consideration of diversity when assessing directors and director candidates, but considers diversity as part of its overall assessment of the Board’s functions and needs.

Board’s Role in Risk Oversight

The understanding, identification and management of risk are essential elements for the successful management of the Company. Management is charged with the day-to-day management of the risks the Company faces. However, the Board, directly and indirectly through its committees, is actively involved in the oversight of the Company’s risk management policies. The Board is charged with overseeing enterprise risk management, generally, and with reviewing and discussing with management the Company’s major risk exposure (whether financial, operating or otherwise) and the steps management has taken to monitor, control and manage these exposures. Additionally, the Compensation Committee oversees the Company’s compensation policies generally, in part to determine whether or not they create risks that are reasonably likely to have a material adverse effect on the Company.

Position Descriptions

To date, the Board has not adopted written position descriptions for the Chairman, the chair of each Committee of the Board, or of the CEO. Currently, William Harris serves as the independent Chairman of the Board. The prime responsibility of the Chairman of the Board is to provide leadership to the Board and to enhance Board effectiveness.

Orientation and Continuing Education

When new directors are appointed, they receive orientation on the Company’s business, current projects and industry and on the responsibilities of directors. With respect to continuing education, Board meetings may include presentations by the Company’s management and employees to give the directors additional insight into the Company’s business.

Ethical Business Conduct

The Board has adopted a written code of conduct applicable to officers and directors of the Company, entitled “Code of Ethics, Trading Restrictions and Whistleblowing”. A copy of this code of conduct is available on SEDAR at www.sedar.com.

Other than adoption of the code of conduct, the Board does not take any formal measures to encourage and promote a culture of ethical business conduct. The Board is of the view that that the fiduciary duties placed on individual directors by the Company’s governing corporate legislation and the common law, together with the corporate statutory restrictions on an individual director’s participation in decisions of the Board in which the director has an interest, are sufficient to ensure that the Board operates independently of management and in the best interests of the Company.

Nomination of Directors

The Board annually evaluates the size of the Board and persons as nominees for the position of director of the Company. The Board’s process for nomination of candidates has been an informal process to date but one in which the entire Board is involved. The Board itself reviews candidates for the Board and its executive officers and reviews succession planning on a regular basis.

15

Compensation

The Board has established a Compensation Committee, comprised of three independent directors, William Harris, Andrew Greig, and James Rothwell. The function of the Compensation Committee is to review, on an annual basis, the compensation paid to the Company’s executive officers and to the directors, and to make recommendations on compensation to the Board. In addition, the Committee reviews the compensation plans for the Company’s non-executive staff. The process adopted with respect to the review of compensation for the Company’s directors and senior officers is set out under the heading “Compensation Discussion and Analysis” above.

Other Board Committees

The Board has no committees other than the Compensation Committee and the Audit Committee.

Assessments

The Board annually, and at such other times as it deems appropriate, reviews the performance and effectiveness of the Board, the directors and its committees to determine whether changes in size, personnel or responsibilities are warranted. To assist in its review, the Board conducts informal surveys of its directors and receives reports from each committee respecting its own effectiveness.

Shareholder Communications

The Company values the views of its shareholders (current and future shareholders, employees and others). Any shareholder who wishes to communicate with the Board may do so in writing, by telephone or fax or by email to the Company as follows:

Suite 501 – 1430 Greg Street, Sparks, Nevada, 89431

Tel: (775) 355-9500

Fax: (775) 355-9506

Email: edward.dickinson@scandiummining.com

AUDIT COMMITTEE

Pursuant to National Instrument 52-110Audit Committees of the Canadian Securities Administrators, the Company is required to disclose annually in its Information Circular certain information concerning the constitution of its audit committee and its relationship with its independent auditor, as set forth in the following:

The primary function of the audit committee (the “Committee”) is to assist the Board in fulfilling its financial oversight responsibilities by reviewing (a) the financial reports and other financial information provided by the Company to regulatory authorities and shareholders; (b) the systems for internal corporate controls which have been established by the Board and management; and (c) overseeing the Company’s financial reporting processes generally. In meeting these responsibilities, the Committee monitors the financial reporting process and internal control system; reviews and appraises the work of external auditors and provides an avenue of communication between the external auditors, senior management and the company’s Board. The Committee is also mandated to review and approve all material related party transactions.

The Audit Committee’s Charter

The Company has adopted an Audit Committee Charter, a copy of which can be found on the Company’s website at www.scandiummining.com.

Composition of the Audit Committee

The Committee is comprised of William Harris, Warren Davis, and James Rothwell. All of the Audit Committee members are considered to be financially literate in that each Committee member has the ability to read and understand a set of financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can presumably be expected to be raised by the Company’s financial statements.

16

Relevant Education and Experience

William Harris currently serves as a board member of EnCore Energy Corp. and Silver Predator Corp. Mr. Harris has more than 35 years of experience in financial and executive management with public companies. He has an understanding of the accounting principles used by the Company to prepare its financial statements.

Warren Davis currently provides consulting services for several power plant contractors and electric power technology clients. Mr. Davis has held numerous senior roles in both minerals and electric power industries, and has an understanding of the accounting principles used by the Company to prepare its financial statements.

James Rothwell has a BA (Economics) and an MBA (finance/Accounting) from Stanford University. Mr. Rothwell has held numerous senior management roles and board positions in Canadian public mining companies, including Chairman of Shore Gold Inc. and Kensington Resources Ltd., director for Motapa Diamonds Inc. and President, CEO and Director of Inca Pacific Resources and Dia Met Minerals Ltd. Mr. Rothwell has an understanding of the accounting principles used by the Company to prepare its financial statements.

Audit Committee Financial Expert

William Harris is the Chair and the “financial expert” of the Audit Committee. Mr. Harris is an independent director.

Audit Committee Oversight

Since the commencement of the Company’s most recently completed financial year, the Company’s Board has not failed to adopt a recommendation of the Audit Committee to nominate or compensate an external auditor.

Reliance on Certain Exemptions

The Company has not relied on the exemptions contained in sections 2.4, 3.2, 3.3(2), 3.4, 3.5, 3.6, 3.8 or Part 8 of NI 52-110.

Pre-Approval Policies and Procedures

The audit committee has not adopted specific policies and procedures for the engagement of non-audit services. Subject to the requirements of NI 52-110, the engagement of non-audit services is considered by the Company’s Board, and where applicable the Audit Committee, on a case-by-case basis.

External Auditor Service Fees

The fees for services provided by Davidson & Company LLP to us in each of the fiscal years ended December 31, 2015 and 2016 were as follows:

| Fees | 2015 | 2016 |

| Audit Fees | $46,250 | $38,818 |

| Audit Related Fees | $Nil | $Nil |

| Tax Fees | $7,408 | $4,869 |

| All Other Fees | $Nil | $Nil |

| Total | $53,658 | $43,687 |

| (1) | “Audit Fees” include fees necessary to perform the annual audit and quarterly reviews of the Company’s consolidated financial statements. Audit Fees include fees for review of tax provisions and for accounting consultations on matters reflected in the financial statements. Audit Fees also include audit or other attest services required by legislation or regulation, such as comfort letters, consents, reviews of securities filings and statutory audits. |

| | |

| (2) | “Audit-Related Fees” include services that are traditionally performed by the auditor. These audit-related services include employee benefit audits, due diligence assistance, accounting consultations on proposed transactions, internal control reviews and audit or attest services not required by legislation or regulation. |

| | |

| (3) | “Tax Fees” include fees for all tax services other than those included in “Audit Fees” and “Audit-Related Fees”. This category includes fees for tax compliance, tax planning and tax advice. Tax planning and tax advice includes assistance with tax audits and appeals, tax advice related to mergers and acquisitions, and requests for rulings or technical advice from tax authorities. |

| | |

| (4) | “All Other Fees” include all other non-audit services. |

17

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

Davidson & Company LLP (“Davidson”), Chartered Accountants, was appointed as SCY’s independent auditors in January 2008. Davidson served as SCY’s independent auditors for the fiscal year ended December 31, 2016, and has been appointed by the Board to continue as SCY’s independent auditor for the fiscal year ending December 31, 2017, and until the next annual general meeting of shareholders.

Representatives of Davidson are expected to be present at the Meeting, will have the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions from shareholders.

Although the appointment of Davidson is not required to be submitted to a vote of shareholders, the Board believes it appropriate as a matter of policy to request that shareholders ratify the appointment of the independent auditors for the fiscal year ending December 31, 2017. In the event a majority of the votes cast at the Meeting are not voted in favor of ratification, the adverse vote will be considered as a direction to the Board to select other auditors for the fiscal year ending December 31, 2017.