Cautionary Note Regarding Forward-Looking Statements

Certain statements made in this Quarterly Report on Form 10-Q may constitute forward-looking statements about the Company and its business. Forward looking statements are statements that are not historical facts and include, but are not limited to, reserve and resource estimates, estimated value of the project, projected investment returns, anticipated mining and processing methods for the project, the estimated economics of the project, anticipated scandium recoveries, production rates, scandium grades, estimated capital costs, operating cash costs and total production costs, planned additional processing work and environmental permitting. The forward-looking statements in this report are subject to various risks, uncertainties and other factors that could cause the Company's actual results or achievements to differ materially from those expressed in or implied by forward looking statements. These risks, uncertainties and other factors include, without limitation, risks related to uncertainty in the demand for scandium and pricing assumptions; uncertainties related to raising sufficient financing to fund the Nyngan Scandium Project in a timely manner and on acceptable terms; changes in planned work resulting from logistical, technical or other factors; the possibility that results of work will not fulfill expectations and realize the perceived potential of the Company's properties; uncertainties involved in the estimation of scandium reserves and resources; the possibility that required permits may not be obtained in a timely manner or at all; the possibility that capital and operating costs may be higher than currently estimated and may preclude commercial development or render operations uneconomic; the possibility that the estimated recovery rates may not be achieved; risk of accidents, equipment breakdowns and labor disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in the work program; risks related to projected project economics, recovery rates, and estimated NPV and anticipated IRR and other factors identified in the Company's SEC filings and its filings with Canadian securities regulatory authorities. Forward-looking statements are based on the beliefs, opinions and expectations of the Company's management at the time they are made, and other than as required by applicable securities laws, the Company does not assume any obligation to update its forward-looking statements if those beliefs, opinions or expectations, or other circumstances, change.

Scandium International Corporate Overview

Scandium International is a specialty metals and alloys company focused on developing the production and sales of scandium and other specialty metals. The Company intends to utilize its knowhow and, in certain instances, patented technologies to maximize opportunities in scandium and other specialty metals.

The Company was formed in 2006, under the name Golden Predator Mines Inc. As part of a reorganization and spin-out of the Company’s precious metals portfolio in March 2009, the Company changed its name to EMC Metals Corp. In order to reflect our emphasis on mining for scandium minerals, effective November 19, 2014, we changed our name to Scandium International Mining Corp. The Company currently trades on the Toronto Stock Exchange under the symbol “SCY.”

Our focus of operations is the exploration and development of the Nyngan scandium deposit located in New South Wales (“NSW”), Australia (“Nyngan” or the “Nyngan Scandium Project”). We also hold exploration stage properties in Australia, known as the “Honeybugle Scandium Property,” and in Finland, known as the “Kiviniemi Scandium Property.” In addition, the Company is pursuing copper industry interest in our ion exchange (IX) technology and knowhow to recover scandium, cobalt and other critical metals from solvent extraction (SX) raffinate and other acidic waste streams in certain acid leach copper operations.

We acquired a 100% interest in the Nyngan Scandium Project in June of 2014 pursuant to the terms of a settlement agreement with Jervois Mining Ltd. of Melbourne, Australia. The project is held through our Australian subsidiary, EMC Metals Australia Pty Ltd. (“EMC Australia” or “EMC-A”), which also holds the Honeybugle Scandium Property.

Pursuant to a share exchange agreement dated June 14, 2017 between the Company and Scandium Investments LLC (“SIL”), the Company purchased SIL’s 20% interest in EMC Australia in exchange for 57,371,565 common shares of SCY and an additional 1,459,080 common shares as a royalty adjustment payment. Closing of the purchase of the EMC Australia shares was subject to shareholder approval, which the Company obtained at a special meeting of shareholders held on September 11, 2017. The transaction subsequently closed on October 9, 2017, with SCY holding a 100% ownership interest in EMC Australia. Under the terms of the share exchange agreement, SIL was granted the right to nominate two individuals to the board of the Company for so long as SIL held at least 15% of SCY’s issued and outstanding shares, and one director for so long as SIL held at least 5% but less than 15% of SCY’s issued and outstanding shares. Pursuant to the nomination rights, Peter Evensen and R. Christian Evensen were appointed as directors to the SCY Board on closing of the transaction.

During the third quarter of 2020, we focused on Nyngan Scandium Project activities including scandium marketing arrangements. In addition, we pursued copper industry interest in our ion exchange (IX) technology and knowhow to recover scandium, cobalt and other critical metals from solvent extraction (SX) raffinate and other acidic waste streams in certain acid leach copper operations..

Principal Properties Review

Nyngan Scandium Project (NSW, Australia)

Nyngan Property Description and Location

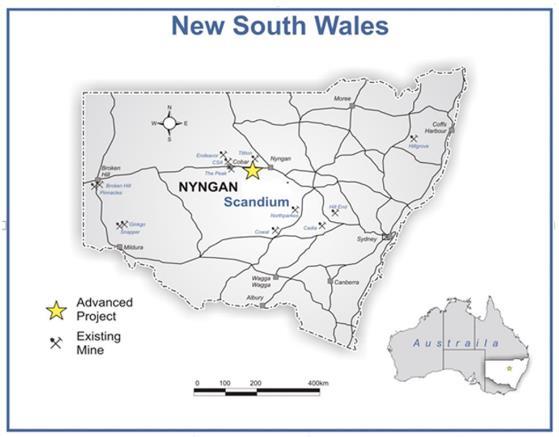

The Nyngan Scandium Project site is located approximately 450 kilometers northwest of Sydney, NSW, Australia and approximately 20 kilometers due west of the town of Nyngan, a rural town of approximately 2,900 people. The general area can be characterized as flat countryside and is classified as agricultural land, used predominantly for wheat farming and livestock grazing.

Figure 1: Location of Nyngan Project

Note: None of the Existing Mines identified in Figure 1 produce scandium.

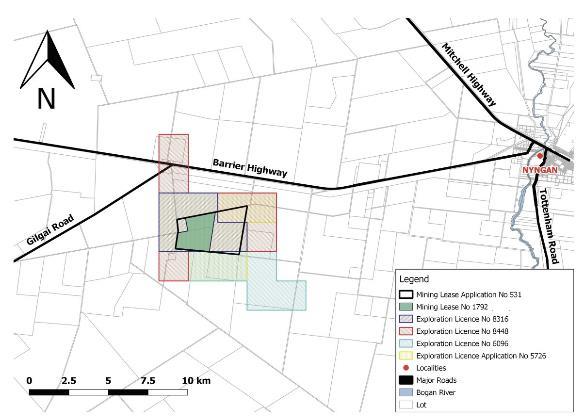

Figure 2: Location of the Exploration Licenses and Mining Lease for the Nyngan Scandium Project

Note: All Exploration Licenses and Leases described in Figure 2 are held 100% by EMC-A.

Nyngan Feasibility Study

On April 18, 2016, the Company announced the results of an independently prepared feasibility study on the Nyngan Scandium Project. The technical report on the feasibility study entitled “Feasibility Study – Nyngan Scandium Project, Bogan Shire, NSW, Australia” is dated May 4, 2016 and was independently compiled pursuant to the requirements of NI 43-101 (the “Feasibility Study”). The report was filed on May 6, 2016 and is available on SEDAR (www.sedar.com), on the Company’s website (www.scandiummining.com) and the SEC’s website (www.sec.gov). A full discussion on the technical report was provided in the Company’s Form 10Q for the quarterly period ending March 31, 2016, as filed with the SEC and on SEDAR on May 13, 2016.

The Feasibility Study concluded that the Nyngan Scandium Project has the potential to produce an average of 37,690 kilograms of scandium oxide (scandia) per year, at grades of 98.0%-99.8%, generating an after-tax cumulative cash flow over a 20 year Project life of US$629 million; with an NPV10% of US$177 million. The average process plant feed grade over the 20 year Project life is 409ppm of scandium.

The financial results of the Feasibility Study are based on a conventional flow sheet, employing continuous high pressure acid leach (HPAL) and solvent extraction (SX) techniques. The flow sheet was modeled and validated from METSIM modeling and considerable bench scale/pilot scale metallurgical test work utilizing Nyngan resource material. A number of the key elements of this flowsheet work have been protected by the Company under US patent applications.

The Feasibility Study has been developed and compiled to an accuracy level of +15%/-5% by a globally recognized engineering firm that has considerable expertise in laterite deposits and process facilities, as well as in smaller mining and processing projects, and has excellent familiarity with the Nyngan Scandium Project location and environment.

Nyngan Scandium Project Highlights

●

Capital cost estimate for the Project is US$87.1 million,

●

Annual scandium oxide product volume averages 37,690 kg per year over 20 years,

●

Annual revenue of US$75.4 million (oxide price assumption of US$2,000/kg),

●

Operating cost estimate for the Project is US$557/kg scandium oxide,

●

Project Constant Dollar NPV10% is US$177 million, NPV8% is US$225 million,

●

Project Constant Dollar IRR is 33.1%,

●

Oxide product grades of 98-99.8% based on customer requirements,

●

Project resource increases by 40% to 16.9 million tonnes, grading 235ppm Sc, at a 100ppm cut-off in the measured and indicated categories, and

●

Project Reserve totaling 1.43 million tonnes, grading 409ppm Sc was established on part of the resource.

DFS Conclusions and Recommendations

The production assumptions in the Feasibility Study are backed by solid independent flow sheet test work on the planned process for scandium recovery and consolidates a significant amount of metallurgical test work and prior study on the Nyngan Scandium Project. The entire body of work demonstrates a viable, conventional process flow sheet utilizing a continuous-system HPAL leaching process, and good metallurgical recoveries of scandium from the resource. The metallurgical assumptions are supported by various bench and pilot scale independent test work programs that are consistent with known outcomes in other laterite resources. The continuous autoclave configuration, as opposed to batch systems explored in previous flow sheets, is also a more conventional and current design choice.

The level of accuracy established in the Feasibility Study substantially reduces the uncertainty levels inherent in earlier studies. The greater confidence intervals around the Feasibility Study were achieved by reliance on significant project engineering work, a capital and operating cost estimate supported by detailed requirements and vendor pricing, plus one conditional offtake agreement and an independent marketing assessment, both supportive of the marketing assumptions on the business.

The Feasibility Study delivered a positive result on the Nyngan Scandium Project, and recommended the Nyngan Scandium Project owners seek finance and proceed to construction. Recommendations were made therein for additional immediate work, notably to win additional offtake agreements with customers, complete some optimizing flow sheet studies, and to initiate as early as possible detailed engineering required on certain long-lead capital items. The Company intends to act on these recommendations as financing permits.

Confirmatory Metallurgical Test Results

On June 29, 2016, we announced the results of a confirmatory metallurgical test work report from Altrius Engineering Services (AES) of Brisbane, Australia. The test work results directly relate to the list of recommended programs included in the Feasibility Study. AES devised and supervised these test work programs at the SGS laboratory in Perth, Australia and at the Nagrom laboratory in Brisbane, Australia.

The project DFS recommended a number of process flowsheet test work programs be investigated prior to commencing detailed engineering and construction. Those study areas included pressure leach (“HPAL”), counter-current decant circuits, solvent extraction (“SX”), and oxalate precipitation, with specific work steps suggested in each area. This latest test work program addressed all of these recommended areas, and the results confirm recoveries and efficiencies that either meet or exceed the parameters used in the DFS. Highlights of the testing are:

●

Pressure leach test work achieved 88% recoveries, from larger volume tests,

●

Settling characteristics of leach discharge slurry show substantial improvement,

●

Residue neutralization work meets or exceeds all environmental requirements as presented in the DFS and the environmental impact statement,

●

Solvent extraction circuit optimization tests generated improved performance, exceeding 99% recovery in single pass systems, and

●

Product finish circuits produced 99.8% scandium oxide, completing the recovery process from Nyngan ore to finished scandia product.

Engineering, Procurement and Construction Management Contract

On May 30, 2017, the Company announced that its subsidiary EMC Australia signed an Engineering, Procurement and Construction Management ("EPCM") contract with Lycopodium Minerals Pty Ltd ("Lycopodium"), to build the Nyngan Scandium Project in New South Wales, Australia. The EPCM contract also provides for start-up and commissioning services.

The EPCM contract appoints Lycopodium (Brisbane, QLD, Australia) to manage all aspects of project construction. Lycopodium is the principal engineering firm involved with the DFS. Lycopodium's continued involvement in project construction and commissioning ensures valuable technical and management continuity for the project during the construction and start-up of the project.

On October 19, 2017, we announced that Lycopodium has been instructed to initiate critical path engineering for the Nyngan Scandium Project. Lycopodium commenced work on select critical path components for the project, including design and specification engineering on the high-pressure autoclave unit, associated flash and splash vessels and several specialized high-pressure input pumps. The engineering work was completed in 2018 and will enable final supplier selection, firm component pricing and delivery dates for these key process components.

Environmental Permitting/Development Consent/Mining Lease

On May 2, 2016, the Company announced the filing of an Environmental Impact Statement (“EIS”) with the New South Wales Department of Planning and Environment (the “Department”) in support of the planned development of the Nyngan Scandium Project. The EIS was prepared by R.W. Corkery & Co. Pty. Limited, on behalf of the Company’s subsidiary, EMC Australia, to support an application for Development Consent for the Nyngan Scandium Project. The EIS is a complete document, including a Specialist Consultants Study Compendium, and was submitted to the Department on April 29, 2016.

EIS Highlights:

●

The EIS finds residual environmental impacts represent negligible risk.

●

The proposed development design achieves sustainable environmental outcomes.

●

The EIS finds net-positive social and economic outcomes for the community.

●

Nine independent environmental consulting groups conducted analysis over five years, and contributed report findings to the EIS.

●

The Nyngan Project development is estimated to contribute A$12.4M to the local and regional economies, and A$39M to the State and Federal economies, annually.

●

The EIS is fully aligned with the DFS and with a NSW Mining License Application for the Nyngan Project.

Conclusion statement in the EIS:

“In light of the conclusions included throughout this Environmental Impact Statement, it is assessed that the Proposal could be constructed and operated in a manner that would satisfy all relevant statutory goals and criteria, environmental objectives and reasonable community expectations.”

Development Consent:

The EIS is the foundation document submitted by a developer intending to build a mine facility in Australia. The Nyngan Scandium Project is considered a State Significant Project, in that capital cost exceeds A$30 million, which means State agencies are designated to manage the investigation and approval process for granting a Development Consent, from the Minister of Planning and Environment. This Department will manage the review of the Proposal through a number of State and local governmental agencies.

The EIS is a self-contained set of documents used to seek a Development Consent. It is however, supported in many ways by the Feasibility Study.

On November 10, 2016, the Company announced that the Development Consent had been granted. This Development Consent represents an approval to develop the Nyngan Scandium Project and is based on the EIS. The Development Consent follows an in-depth review of the EIS, the project plan, community impact studies, public EIS exhibition and commentary, and economic viability, and involved more than 12 specialized governmental agencies and groups.

Mining Lease:

During July 2019, EMC Australia received notice of approval for its Mining Lease application. The Mining Lease (“ML 1792”) overlays select areas previously covered by Exploration Licenses. The ML represents the final major development approval required from the NSW Government to begin construction on the project. The ML 1792 grant is issued for a period of 21 years and is based on the development plans and intent submitted in the ML Application. The ML can be modified by NSW regulatory agencies, as requested by EMC Australia over time, to reflect changing operating conditions.

In addition to these two key governmental approvals, other required licenses and permits must be acquired but are considered routine and require only compliance with fixed standards and objective measurements. These remaining approvals include submittal of numerous plans and reports supporting compliance with Development Consent and Mining Lease. In addition, the following water, roads, dam and electrical access reviews and arrangements must be finalized:

●

Water Supply Works and Use Approval and Water Access License,

●

State and local approval for construction of the intersection of the Site Access Road and Gilgai Road,

●

An approval from the NSW Dams Safety Committee for the design and construction of the Residue Storage Facility, and

●

A high voltage connection agreement with Essential Energy.

The 2019 ML 1792 grant covers 810 acres (370 hectares) of surface area fully owned by the Company, an area adequate to construct and operate a scandium mine of a scale outlined in the definitive Feasibility Study. The Company had originally filed a mining lease application (MLA 531) covering an area of 874 hectares, which was granted in 2017 as a Mining Lease, and later ruled invalid. The reduction in area between the initial and the replacement ML grants represented acreage protested in an “Agricultural Land’ objection lodged by a local landowner. The landowner holds freehold surface ownership over a portion of the original grant.

On September 10, 2020, The Company announced receipt of a Final Determination letter from the Deputy Secretary, Mining, Exploration and Geoscience resolving the outstanding objection filed by the landowner in 2016.

Written advice from the Department to the Company makes clear that all required independent investigative processes, and all affected party comment periods, are now completed, and the Department’s decision is final. There are further State Courts of Appeal available to the landowner, but the facts supporting this final decision are confirmed by the NSW Department of Primary Industry and follow governing Law. We believe the NSW Government will defend its decisions in any court of appeals to which it would be summoned.

This Final Determination from the NSW Government will again allow all measured and indicated resource included in the Nyngan Scandium Project Definitive Feasibility Study (“DFS”) to be reinstated in a new Mining Lease grant, for which the Company intends to file application.

Downstream Scandium Products

In February 2011, we announced the results of a series of laboratory-scale tests investigating the production of aluminum-scandium master alloys directly from aluminum oxide and scandium oxide feed materials. The overall objective of this research was to demonstrate and commercialize the production of aluminum-scandium master alloy using impure scandium oxide as the scandium source, potentially significantly improving the economics of aluminum-scandium master alloy production. In October 2019, the Company was granted Patent No. 10450634, titled “Scandium-Containing Master Alloys And Method For Making The Same.”

During the 2015-2017 timeframe, we continued our own internal laboratory-scale investigations into the production of aluminum-scandium master alloys, furthering our understanding of commercial processes, and achievable recoveries. We also advanced our abilities to make a commercial-grade 2% scandium master alloy product.

On March 2, 2017, we announced the signing of a Memorandum of Understanding ("MOU") with Weston Aluminium Pty Ltd. ("Weston") of Chatswood, NSW, Australia. The MOU defines a cooperative commercial alliance to jointly develop the capability to manufacture aluminum-scandium master alloy. The intended outcome of this alliance will be to develop the capability to offer Nyngan Scandium Project aluminum alloy customers scandium in form of Al-Sc master alloy, should customers prefer that product form.

The MOU outlines steps to jointly establish the manufacturing parameters, metallurgical processes, and capital requirements to convert Nyngan Scandium Project scandium product into Master Alloy, on Weston's existing production site in NSW. The MOU does not include a binding contract with commercial terms at this stage, although the intent is to pursue the necessary technical elements to arrive at a commercial contract for conversion of scandium oxide to master alloy, and to do so prior to first mine production from the Nyngan Scandium Project.

On March 5, 2018, the Company announced that it had initiated a small scale pilot program (4kg scale) at the Alcereco Inc. metallurgical research facilities in Kingston, Ontario, to confirm and refine previous lab-scale work on the manufacture of aluminum-scandium 2% master alloy (MA). The program advanced the process understanding for commercial scale upgrade of Nyngan scandium oxide product to master alloy product.

The 2018 pilot program consisted of 5 separate trials on two MA product types, production of MA in various forms, and dross analysis to ascertain scandium recoveries to product. The mass of master alloy and product variants produced in the program totaled approximately 20kg and was completed in December of 2018. The results of the program included the successful production of 2% grade MA, with recoveries of scandium to product of 85%.

A second phase of the small-scale pilot program was initiated in the first half of 2019, again at 4kg scale, building on the work done in phase I. The results of this second program included successful production of 2% grade MA, with improvements in form of rapid kinetics, and recoveries of scandium to product of +90%.

On March 5, 2018, the Company also announced that it filed for patent protection on certain process refinements for master alloy manufacture that it believes are novel methods, and also on certain product variants that it believes represent novel forms of introducing scandium more directly into aluminum alloys.

Master Alloy Capability Demonstrated

On February 24, 2020, the Company announced the completion of a three year, three stage program to demonstrate the capability to manufacture aluminum-scandium master alloy (Al-Sc2%), from scandium oxide, using a patent pending melt process involving aluminothermic reactions.

This master alloy capability will allow the Company to offer scandium product from the Nyngan Scandium Project in a form that is used directly by aluminum alloy manufacturers globally, either major integrated manufacturers or smaller wrought or casting alloy consumers.

Research Highlights:

●

Program achieved full 2% target product quality requirement,

●

Sc recoveries from oxide exceeded target, demonstrated in final tests,

●

The microstructure and metal quality meet major alloy producers’ specifications,

●

Rapid kinetics achieved, important for commercial viability,

●

Individual testing batches done at 4kg scale, and

●

Successful program testing forms a basis for a larger scale demonstration facility, supporting large scale samples required for industrial aluminum alloy trials.

Focus on Aluminum Alloy Applications for Scandium Products

The Company is in the process of obtaining sales agreements for scandium products produced from our Nyngan Scandium Project. Our focus is on the use of scandium as an alloying ingredient in aluminum-based products. The specific scandium product forms we intend to sell from the Nyngan project include both scandium oxide (Sc2O3) and aluminum-scandium master alloys (Al-Sc 2%).

Scandium as an alloying agent in aluminum allows for aluminum metal products that are much stronger, more easily weldable and exhibit improved performance at higher temperatures than current aluminum-based materials. This means lighter structures, lower manufacturing costs and improved performance in areas that aluminum alloys do not currently compete.

Aluminum Alloy Research Partner – Alcereco

In 2015, the Company entered into a memorandum of understanding (“MOU”) with Alcereco Inc. of Kingston, Ontario (“Alcereco”), forming a strategic alliance to develop markets and applications for aluminum alloys containing scandium. To further that alliance, and to reinforce the capability of both companies to deliver product developed for scandium aluminum alloy markets, Scandium International and Alcereco also signed an offtake agreement governing sales terms of scandium oxide product produced from the Nyngan Scandium Project. The offtake agreement specifies prices, delivery volumes and timeframes for commencement of delivery of scandium oxide product. The offtake agreement does not provide for a mandatory annual minimum purchase volume of scandium oxide by Alcereco, and there is no requirement for payment in lieu of purchase.

The MOU represented keen mutual interest in foundry-based test work on aluminum alloys containing scandium, based on understandings that Alcereco’s team had gained from prior work with Alcan Aluminum, and based on SCY’s twin goals of understanding and identifying quality applications for scandium, and also understanding the scandium value proposition for customers.

During December 2017, the Company revised and renewed the scandium product offtake agreement with Alcereco. The revised agreement extends the deadline for initial production and shipments from the Nyngan Scandium Project from December 1, 2017, to as late as December 1, 2020. The revised offtake agreement does not provide for a mandatory annual minimum purchase volume of scandium oxide by Alcereco, and there is no requirement for payment in lieu of purchase. The Parties remain free to agree to further extensions on this offtake agreement, but it is unlikely that the Nyngan Scandium Project will be in production and able to deliver product within the next 24 months.

The Company has sponsored research work as contemplated by the MOU with Alcereco and with multiple other unrelated entities in separate locations. This work develops and documents the improvement in strength characteristics scandium can deliver to aluminum alloys without degrading other key properties. The team has run multiple alloy mix programs where scandium loading is varied, in order to look at response to scandium additions on a cost/benefit basis. This work has been done in the context of industries and applications where these particular alloys are popular today.

These programs are focused on 1000 series, 3000 Series, 5000 Series and 7000 Series Al-Sc alloys, and have served to make independent data and volume samples available for sales efforts.

The results of our research work are positive, and consistent with the body of published literature available today on aluminum scandium alloys. We are observing noteworthy strengthening effects with scandium additions above 0.1%, and dramatic strengthening improvements with additions of 0.35%, while preserving or enhancing other alloy properties and characteristics. We have also demonstrated that altering the combinations of scandium loads and alloy hardening process techniques has significant effect on the final alloy properties, offering the opportunity to tune alloy characteristics to suit specific applications. These findings are considered commercially sensitive, and the data is not intended for public disclosure at this time, although the findings and data are being shared with select potential customers under specific non-disclosure agreement protections, as is deemed relevant to their specific areas of commercial interest.

Letters of Intent

During 2018 and 2019, the Company announced that it entered into letter of intent (“LOI”) agreements with nine unrelated partnering entities. In each LOI, we have agreed to contribute scandium samples, either in form of scandium master alloy product, or aluminum-scandium alloy product, for trial testing by the partners in their downstream manufacturing applications. Each of the parties to the LOI agreements have agreed to report the parameters and general results of the testing program utilizing these scandium-containing alloys, upon completion of testing. The Company has signed no additional industry partnering LOI’s to date in 2020, but does plan to continue the LOI program of introducing scandium for trial testing by partners through agreements in the future.

These formal LOI agreements, with distinct industry segment leaders, represent a key marketing program demonstrating precisely how scandium will perform in specific products, and in production-specific environments. Potential scandium customers insist on these sample testing opportunities, directly in their research facilities or on their shop floor, to ensure their full understanding of the impacts, benefits, and costing implications of introducing scandium into their traditional aluminum feedstocks.

The partnering entities in these LOI agreements are set out below:

Austal Ltd. (“Austal”) headquartered in Henderson, Western Australia, (Australia). Austal is a public corporation, listed on the Australian Stock Exchange (ASB.ASX), with shipbuilding facilities in Perth, Australia, Mobile, Alabama (USA), Vung Tau, Vietnam and Balamban, Cebu (Philippines). The company maintains a focus on research and development of emerging maritime technologies and cutting-edge ship designs, and is a recognized world leader in the design and construction of large aluminum commercial and defense vessels.

Impression Technologies Ltd. (“ITL”), based in Coventry, UK. ITL is a privately-held technology company, developing and licensing its advanced aluminum forming technology, Hot Form Quench (“HFQ®”), to automotive, aerospace, rail and electronics industries, globally. ITL manufactures custom parts for customers with its patented HFQ® technology, which enables the single-pass forming of complex, lightweight, high-strength aluminum parts that cannot otherwise be similarly formed today.

PAB Coventry Ltd. (“PAB”), based in Coventry, UK. PAB is a privately-held manufacturing and prototyping company offering specialty metal parts and design capabilities, serving the automotive, aerospace, defense and HVAC industries. PAB has been a well-known parts and forms supplier to the premium market segment of the British automotive industry for decades.

Eck Industries Inc. (“Eck”), based in Manitowoc, Wisconsin, USA. Eck is a privately-held manufacturer of precision sand cast parts, and engineering services. Eck Industries operates a 210,000 sq. ft. facility with over 250 employees, and 110 customers. Customer segments include commercial aircraft parts, automotive and trucking cast parts, military drivetrain casings, marine propulsion system castings, and military aerospace components.

Grainger & Worrall Ltd. (“GW”), based in Shropshire, UK. GW is a privately-held manufacturer of precision sand cast parts, and engineering services. GW is a well-recognized precision air-set sand cast parts manufacturer in the UK, specializing in low to intermediate volume cast parts for commercial automotive, motorsports/racing, defense, marine, and aerospace applications.

Gränges AB (“Gränges”), based in Stockholm, Sweden. Gränges is a public company, traded on the NASDAQ Stockholm Stock Exchange (GRNG:OMX), and a large global player in the rolled aluminum products business, with production assets in Europe, USA, and China, and a worldwide customer base, majority concentrated in the USA. Gränges is focused on advanced aluminum materials, and holds a leading global position in rolled products for brazed heat exchangers, which it estimates at 20%.

Ohm & Häner Metallwerk GmbH & Co. GK (“O&H”), based in Olpe, Germany. O&H is a privately-held manufacturer of sand cast and gravity die cast parts, using metal alloys, servicing a significant, global customer base. O&H produces over 3,000 individual cast parts, and currently works with over 40 different alloys, primarily aluminum and copper-based alloys.

AML Technologies (“AML”), an Adelaide, Australia based start-up company with proprietary technology for applying aluminum alloys to additive layer manufacturing processes, also commonly referred to as 3D printing.

Bronze-Alu Group (“BAL”), based in La Couture-Boussey, northern France. BAL is a privately-held manufacturer of precision high-pressure die cast parts, and offers prototyping, machining, finishing and engineering services, employing both aluminum and copper-based alloys. BAL exports approximately 80% of its products to customers outside of France.

These LOI agreements are part of a developing strategy by the Company to engage with innovative, research-capable partners, willing to test scandium in their applications. The Company also has similar agreements with other research capable partners who do not wish to be publicly named at this time. We are selecting and approaching these specific partners because we have an understanding, from our commissioned alloy mixing programs, that scandium additions can make value-added contributions to their specific products, and we have the alloy samples to enable an expedient uptake on that validation. The scandium market for aluminum alloys needs to be built, and that construction should be seen as underway in the most direct sense. The Company plans to conduct further application-specific programs in pursuit of sales contracts with quality, predominantly existing aluminum alloy customers across numerous industry segments.

Cerium-Scandium Aluminum Alloy Program Agreement

On February 27, 2020, the Company announced signing a Program Agreement with Eck Industries (“ECK”) located in Manitowoc, Wisconsin, to pursue novel alloy development of a combined cerium-scandium aluminum alloy, based on previous work done independently by the companies in this area.

The companies intend to pursue alloy refinements in both wrought and cast alloy applications, specifically targeting property improvements related to strength, corrosion resistance, and heat-working tolerance, principally in A5000 series alloys.

Program Highlights:

●

Joint economic and technical support to alloy design,

●

Joint sharing of previous data, and new data produced from this program,

●

Samples production for customer trials, either as cast products, or wrought sample shapes for various potential customers and alloy manufacturers,

●

Initial high value application expected to be in marine applications, and

●

Program work is protected by existing patent applications filed by ECK.

Nyngan Scandium Project - Planned Activities for 2020-2021

The following steps are planned for the Nyngan Project during the 2020 and 2021 calendar years:

●

Complete master alloy pilot trials and optimization work in Q1 2020 (completed),

●

Pursue additional offtake agreements in support of planned future scandium sales,

●

With offtakes, seek construction financing for project, mid 2021,

●

Commence site construction with signed offtakes, with anticipated completion over 14 months, and

●

Initiate project commissioning earliest end 2022, with product available for sale by early 2023.

Other Properties Review

Honeybugle Scandium Property (NSW, Australia)

On April 2, 2014, the Company announced that it had secured a 100% interest in an exploration license (EL 7977) covering 34.7 square kilometers in New South Wales, Australia. The license area we call the ‘Honeybugle Scandium Property’ is located approximately 24 kilometers west-southwest from the Company’s Nyngan Scandium Project and approximately 36 kilometers southwest from the town of Nyngan, NSW.

Exploration rights for the Honeybugle Scandium Property include certain minimum expenditure requirements. The Company intends to fulfill those minimum expenditure requirements.

Honeybugle Drill Results

On May 7, 2014, the Company announced completion of an initial program of 30 air core (“AC”) drill holes on the property, specifically at the Seaford anomaly, targeting scandium (Sc). Results on 13 of these holes are shown in detail, in the table below. These holes suggest the potential for scandium mineralization on the property similar to Nyngan.

Highlights of initial drilling program results include the following:

The highest 3-meter intercept graded 572 ppm scandium (hole EHAC 11).

EHAC 11 also generated two additional high grade scandium intercepts, grading 510 ppm and 415 ppm, each over 3 meters.

34

The program identified a 13-hole cluster which was of particular interest; intercepts on these 13 holes averaged 270 ppm scandium over a total 273 meters, at an average continuous thickness of 21 meters per hole, representing a total of 57% (354 meters) of total initial program drilling.

35

The 13 holes produced 29 individual (3-meter) intercepts over 300 ppm, representing 31% of the mineralized intercepts in the 273 meters of interest.

36

This initial 30-hole AC exploratory drill program generated a total of 620 meters of scandium drill/assay results, over approximately 1 square kilometer on the property.

Kiviniemi Scandium Property (Eastern Finland Province, Finland)

On September 25, 2017, the Company announced that its wholly-owned subsidiary company, Scandium International Mining Corp., Norway AS, was granted a reservation on an Exploration License for the Kiviniemi Scandium property in central Finland from the Finnish regulatory body governing mineral exploration and mining in Finland. The exploration license was subsequently granted during August 2018.

The Geological Survey of Finland (“GTK”) conducted airborne survey work on the area in 1986, conducted exploration drilling on the property in 2008-2010, and published those program results on their public GTK website in 2016. The Company’s Exploration License area is approximately 24.6 hectares (0.25 square kilometer), identical to the historic GTK exploration license on the property.

Highlights

●

Kiviniemi property previously identified for scandium and explored by GTK.

●

Property is a high iron content, medium grade scandium target, located on surface, with on-site upgrade potential.

●

Early resource upgrade work done for GTK promising, confirmed by SCY.

●

Property is all-weather accessible, close to infrastructure.

●

Finland location is mining-friendly and ideally suited to EU customer markets.

Kiviniemi Summary

The Kiviniemi property represents a medium grade scandium resource target that has remained unrecognized and overlooked by exploration work, largely due to the absence of the more commonly sought-after minerals in the region, specifically copper, nickel and cobalt. We believe that Kiviniemi is Europe’s largest underdeveloped primary scandium resource.

The target has benefited significantly from valuable early exploration work by the GTK, which has advanced the property to a stage where successful metallurgical investigations may prove value that offsets grade concerns. SCY estimates roughly US$2M of work value has been directed at this property to date, including field work, drilling programs, assay work, overheads, and metallurgical upgrade studies, but firm numbers are not available.

We intend to undertake a limited drill program to augment the existing GTK data and provide more sample material for metallurgical test work programs to define economic site upgrade possibilities on the scandium mineralization observed to date.

Critical Metals Recovery Technology Program

On May 13, 2020, we announced the Company’s pursuit of copper industry interest in our ion exchange (IX) technology and knowhow to recover scandium, cobalt and other critical metals from solvent extraction (SX) raffinate and other acidic waste streams in certain acid leach copper operations.

Recovery metals targeted by this application include cobalt, copper, nickel, scandium, and zinc, and possibly other metals and rare earth elements, depending on recovery economics. The suitability of this IX technology, and the target metal opportunities, vary with the specifics of individual orebodies, and associated SX plant characteristics. Depending on specific project variables, and the value and volume of critical metals recovered, the end result economics are expected to be significant to the parties involved.

Concept Highlights

●

IX technology offers rapid deployment to existing Cu operation waste streams,

●

Recoveries target critical metals with transparent, established markets,

●

Includes potential for significant scandium production alongside other valuable products,

●

Represents near term production sources that can address security of supply issues, conflict metal issues, and concentrated supply source issues,

●

Represents a project focus on metals prominent in the US Critical Metals priority list, and on production from US and North American operation locations, and

●

Promises real potential to deliver positive economic benefits to both SCY and the established copper producers that can host this program.

Program Discussion

The copper industry is fully aware of the opportunity to harvest valuable metals from copper process waste streams, and the industry does so with significant success today in precious metals. Most specialty metals recovery work has historically been considered un-economic, based on effective recovery costs and recovered metals pricing. The technology in this area has advanced, improving both operating costs and recoveries. New, technology-driven uses for critical metals are stressing supply channels. Traditional jurisdiction risk concerns are now multiplied by ethical sourcing issues, and long-term sustainability questions, all of which elevate the interest in broader, more localized sourcing. These issues are receiving heightened governmental and industry priority, and metals markets customers are now seeking and favoring new, economic, responsible solutions.

On the basis of this dynamic critical metals opportunity, and the fact that SCY has a significant capability to apply advanced mineral recovery technologies to the separation of critical metals from both ores and waste streams, the Company began a search for a North American copper industry host, in order to build a Critical Metals Recovery (CRM) Project. This effort immediately recognized an attractive economic value from recovery of multiple metals, specifically metals used in lithium-ion battery manufacture, along with scandium, zinc and other metals present in source systems employing solvent extraction techniques.,

The potential new revenue stream of the combined metals residual varies by orebody, and also by the specifics of the mineral processing systems in place, but collectively the metals basket is more instantly marketable and shows superior economics to the solo scandium target we had in mind at the start. This IX technology also represents a viable precursor for direct refining cobalt, nickel and potentially copper into high purity sulfate product forms, as required for battery manufacture, specifically in the electric vehicle (EV) industry.

This SCY program is led by SCY’s Chief Technology Officer, Willem P.C. Duyvesteyn, who is the primary inventor of close to 100 US patents and patent applications in the field of materials processing and commercial recovery processes for base metals, specialty metals, and chemical compounds. The Company has filed for patent protection on various aspects of its relevant technical program ideas with the US Patent Office, using technical information from preliminary bench scale testing with actual copper SX raffinate solutions.

The Company believes this work can be demonstrated with a working and successful copper plant installation, with proven knowhow, and intends to pursue a copper industry partner to demonstrate the economic viability of this technology. It is the Company’s intent to fully participate in the operation, ownership and production economics associated with a plant asset that is developed in concert with that partner.

This new critical metals recovery program contains a scandium component that utilizes the same technology applied to other targeted critical metals recoveries. This program is intended to allow SCY to benefit from early and attractive scandium production, in addition to producing a basket of other metals with currently established markets. The program has the potential to generate commercial scale scandium production from the USA and the Americas, which produces little or no scandium today. Early scandium production can be expected to more quickly build the nascent scandium market globally, thus supporting the development of the Company’s Nyngan and Honeybugle scandium assets in Australia.

Other Developments – Third Quarter 2020

Patent Application For Use Of Scandium In Lithium-Ion Batteries

On September 24, 2020 the Company announced the filing of a provisional patent application with the US Patent Office seeking patent rights on various applications of scandium in lithium ion batteries. The patent application covers a number of scandium enhancements, including doping potential for both anodes and cathodes, and for solid electrolytes.

Patent Application Highlights:

●

US Patent Application filed for use of scandium in lithium ion battery applications.

●

Scandium doping applications are explained for anodes, cathodes and electrolytes.

●

Scandium offers conductivity advantages as a dopant, over other options, and

●

Scandium in other aluminum components offers numerous property improvements, including conductivity, strength and corrosion resistance.

Patent Application Discussion:

Rechargeable lithium ion batteries (LIBs) are a staple of everyday life. The search for improved performance through design and materials advances is intense today. Considerable effort is being expended in developing next-generation materials for LIBs that will make batteries safer, lighter, more durable, faster to charge, more powerful, and more cost-effective. A sampling of some of the more public efforts are as follows:

●

Minimizing or removing cobalt from cathode materials, based on cost, supply and geographic sourcing issues.

●

Improving the durability of liquid electrolytes with dopants, or substitution with safer and higher performing liquid or solid electrolyte systems.

●

Designing for higher voltage potential by utilizing different anode or cathode materials.

●

Determining combinations of metals that can better withstand harsh internal conditions.

●

Scandium, along with other specialty metals, has a clear role to play in each of these areas.

One particularly promising area for scandium contributions is in a lithium nickel manganese oxide (LNMO) battery. The cathode in this design substitutes manganese for cobalt, and supports a higher nickel content as well. The substitution then delivers higher working potentials (voltage), higher energy densities, and faster charge/discharge rates, all of which offer the promise of improved battery performance.

Delivering on that promise requires a number of improvements, including employing a dopant for stabilization of the manganese in the LNMO cathode, potential stabilization of lithium titanate (LTO) anode materials as well, and use of dopants to improve the conductivity of both these anode and cathode materials. Conventional liquid electrolytes may see improved function and longevity with the improved cathode and anode conductivity. Scandium represents a suitable and effective dopant in each of these applications.

Solid electrolytes represent another potential break-through improvement in LIBs. They will handle higher voltages, higher temperatures, greater power densities, are potentially easier to package, and are considered safer in use. Scandium represents a suitable and effective dopant in these applications, analogous to the use of scandium to stabilize solid zirconia electrolytes in solid oxide fuel cells.

Lithium ion batteries employ aluminum in a number of areas, specifically in cathode structure, current connectors, and in general battery structure. Aluminum-scandium alloys represent an enhanced aluminum alloy option, based on their combination of conductivity and strength.

The intent of this SCY patent filing was to advise the battery industry that scandium is a prospective dopant choice for enhanced performance of LIBs, both under existing design parameters and in particular for next-gen LNMO batteries. We want to ensure that battery research and design groups consider scandium additions, amongst their various materials choices, as they race to build a better lithium ion battery.

The Company’s operating intent remains focused on producing a scandium product, and advises that it considers the lithium ion battery markets to be a viable application for use.

Operating results - Revenues and Expenses

The Company’s results on a year-to-date basis reflect lower operating costs. Cash expenditures were down by $403,694 due to lower consulting fees, travel expenditures, general and administrative fees, and exploration expenses. Also, during the nine-month period the Company received funds from the sale of a royalty interest.

The Company’s results when comparing Q3 2020 to Q3 2019 reflect a decrease of $173,426 in cash operating costs due to lower consulting fees, exploration, travel expenditures, general and administrative fees and professional fees.

Summary of quarterly results

A summary of the Company’s quarterly results is shown below at Table 10.

Table 10. Quarterly Results Summary (US$)

| | | | |

| | | | | | | | | |

| Net Sales | - | - | - | - | - | - | - | - |

| Net Income (Loss) attributable to Scandium Mining Corp. | (265,057) | (270,463) | (146,014) | (311,807) | (443,426) | (859,934) | (332,766) | (543,316) |

Basic and diluted Net Income (Loss) per share attributable to Scandium Mining Corp. | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.01) | (0.00) | (0.00) |

Results of Operations for the three months ended September 30, 2020

The net loss for the quarter was $265,057, a decrease of $178,369 from $443,426 in the same quarter of the prior year. Details of the individual items contributing to the decreased net loss are set out below at Table 11:

Table 11. Variance Analysis for Net Loss

| Q3 2020 vs. Q3 2019 - Variance Analysis |

| Item | Variance Favourable / (Unfavourable) | Explanation |

| Consulting | $57,660 | The Company released several contractors who were no longer required, resulting in this positive variance in the current quarter positive variance in the current quarter. |

| General and administrative | $56,316 | The decrease in this expense is due to the downturn of activity in Q3 2020 compared to Q3 2019. |

| Travel and entertainment | $32,316 | In Q3 2019, the Company did extensive travel in Europe. In Q3 2020 there was no travel expense at all as the Company focused on cash preservation. |

| Exploration | $27,134 | Limited work was done on our exploration projects in Q3 2020. Higher levels of activity occurred in Q3 2019 resulting in this positive variance. |

| Stock-based compensation | $4,844 | All outstanding options have been fully expensed prior to Q3 2020 resulting in no charge in this quarter. In the corresponding quarter of 2019, there were still unvested options being expensed. |

| Foreign exchange | $1,537 | The Company maintains a significant portion of our cash in Canadian dollar accounts. Subsequently, when the US currency lowers in value relative to Canadian currency (weakens), a book foreign exchange gain is recognized. The US dollar weakened against most world currencies in Q3 2020 creating the favorable variance. |

| Professional fees | $118 | Costs are very much the same for the comparative quarters. |

| Insurance | $(240) | The slightly higher cost in Q3 2020 is due to overall increases in insurance premiums for the Company’s operations. |

| Salaries and benefits | $(1,316) | This unfavourable variance is due to foreign exchange impacts to accrued payments due individuals. |

Results of Operations for the nine months ended September 30, 2020

The net loss for the nine-month period was $681,534, a decrease of $954,592 from $1,636,126 in the same nine-month period of the prior year. Details of the individual items contributing to the decreased net loss are set out below at Table 12:

Table 12. Variance Analysis for Net Loss

| Nine-months ended September 30, 2020 vs. nine-months ended September 30, 2019 - Variance Analysis |

| Item | Variance Favourable / (Unfavourable) | Explanation |

| Sale of royalty interest | $382,430 | In January of 2020 the Company sold a royalty interest for net proceeds of $382,430. This was a non-recurring event. |

| Consulting | $194,516 | The Company released several contractors who were no longer required, resulting in this positive variance in the current 9-month period. |

| Stock-based compensation | $169,104 | In the first nine months of 2020 the Company issued 8,885,000 stock options at an average price of C$0.065. In the comparative period in 2019, the Company issued 5,075,000 stock options at an average price of C$0.15. The lower price of the options issued in the current year resulted in a much lower expense despite more options being issued. |

| General and administrative | $109,250 | The decrease in this expense is due to the downturn of activity in 2020 compared to 2019. |

| Travel and entertainment | $54,820 | Less travel in 2020 was due to an overall decrease in Company activities when compared to 2019. Also in Q3 2019, the Company did extensive travel in Europe. |

| Exploration | $45,108 | With the Company in a conservation of cash mode in 2020, less funds were expended on this activity. |

| Professional fees | $13,521 | Lower 2020 activity levels resulted in the favourable variance. |

| Salaries and benefits | $(591) | This unfavourable variance is due to foreign exchange impacts on accrued payments due individuals. |

| Insurance | $(1,210) | The slightly higher cost in 2020 is due to overall increases in insurance premiums for the Company’s operations. |

| Foreign exchange | $(12,356) | The Company maintains a significant portion of our cash in Canadian dollar accounts. Subsequently, when the US currency rises in value relative to Canadian currency (strengthens), a book foreign exchange loss is recognized. The US dollar strengthened against most world currencies in 2020 creating the unfavorable variance. |

Cash flow discussion for the nine-month period ended September 30, 2020 compared to September 30, 2019

The cash inflow for operating activities was $30,257, an increase of $1,056,349 (September 30, 2019 – ($1,026,092)), due mainly to the sale of a royalty interest and overall lower operating costs.

Cash inflows from financing activities of $Nil reflect the fact that there were no private placements or options exercised in the current nine month period when compared to the nine month period ended September 30, 2019, in which there was private placements of $799,483, and options exercised of $160,996.

Financial Position

Cash

The Company’s cash position increased during the nine-month period by $30,257 to $145,825 (December 31, 2019 - $115,568) due mainly to the sale of a royalty interest.

Prepaid expenses and receivables

Prepaid expenses and accounts receivable decreased by $30,811 to $14,952 during the nine-month period due to funds received from cancellation of promotion events and the amortization of prepaid expenditures (December 31, 2019 - $45,763).

Property and equipment

Property and equipment consist of computer equipment at the Sparks, Nevada office. The decrease of $1,730 to $5,237 (December 2019 - $6,967) is due to amortization of that computer equipment in the quarter.

Mineral interests

Mineral interests remained the same at $704,053.

Accounts payable, accrued liabilities and accounts payable with related parties

Accounts payable has increased by $420,874 to $959,098 (December 2019– $538,224) due to the continued deferral of salaries to certain individuals.

Capital Stock

Capital stock remained the same at $109,375,661 (December 31, 2019 - $109,375,661).

Additional paid-in capital increased by $258,376, to $6,194,450 (December 31, 2019 - $5,936,074) as a result of the expensing of stock options.

Liquidity and Capital Resources

At September 30, 2020, the Company had a working capital of $(798,321) including cash of $145,825 as compared to a working capital of $(376,893) including cash of $115,568 at December 31, 2019.

At September 30, 2020, the Company had a total of 34,250,000 stock options exercisable between CAD$0.065 and CAD$0.37 that have the potential upon exercise to generate a total of C$5,664,125 in cash over the next four and a half years. There is no assurance that these securities will be exercised. The Company’s continued development is contingent upon its ability to raise sufficient financing both in the short and long term. There are no guarantees that additional sources of funding will be available to the Company; however, management is committed to pursuing all possible sources of financing in order to execute its business plan. The Company continues its cost control measures to conserve cash to meet its operational obligations.

Outstanding share data

At the date of this report, the Company has 313,282,595 issued and outstanding common shares and 29,950,000 stock options currently outstanding at a weighted average exercise price of CAD$0.165.

Off-balance sheet arrangements

At September 30, 2020, the Company had no material off-balance sheet arrangements such as guarantee contracts, contingent interest in assets transferred to an entity, derivative instruments obligations or any obligations that trigger financing, liquidity, market or credit risk to the Company.

Transactions with related parties

During the 9-month period ended September 30, 2020, the Company expensed $196,551 for stock-based compensation for stock options issued to Company directors. During the 9-month period ended September 30, 2019, the Company expensed $314,104 for stock-based compensation for stock options issued to Company directors.

During the 9-month period ended September 30, 2020, the Company accrued a consulting fee of $76,500 to one of its directors.

As at September 30, 2020, the Company owed $578,353 to various directors and officers of the Company (December 31, 2019 - $269,165).

Proposed Transactions

There are no proposed transactions outstanding other than as disclosed.

Critical Accounting Estimates

The preparation of financial statements in conformity with generally accepted accounting policies requires management of the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. These estimates are based on past experience, industry trends and known commitments and events. By their nature, these estimates are subject to measurement uncertainty and the effects on the financial statements of changes in such estimates in future periods could be significant. Actual results will likely differ from those estimates.

Stock-based compensation

The Company uses the Black-Scholes option pricing model to calculate the fair value of stock options and compensatory warrants granted. This model is subject to various assumptions. The assumptions the Company makes will likely change from time to time. At the time the fair value is determined, the methodology the Company uses is based on historical information, as well as anticipated future events. The assumptions with the greatest impact on fair value are those for estimated stock volatility and for the expected life of the instrument.

Future income taxes

The Company accounts for tax consequences of the differences in the carrying amounts of assets and liabilities and their tax bases using tax rates expected to apply when these temporary differences are expected to be settled. When the future realization of income tax assets does not meet the test of being more likely than not to occur, a valuation allowance in the amount of the potential future benefit is taken and no future income tax asset is recognized. The Company has taken a valuation allowance against all such potential tax assets.

Mineral properties and exploration and development costs

The Company capitalizes the costs of acquiring mineral rights at the date of acquisition. After acquisition, various factors can affect the recoverability of the capitalized costs. The Company’s recoverability evaluation of our mineral properties and equipment is based on market conditions for minerals, underlying mineral resources associated with the assets and future costs that may be required for ultimate realization through mining operations or by sale. The Company is in an industry that is exposed to a number of risks and uncertainties, including exploration risk, development risk, commodity price risk, operating risk, ownership and political risk, funding and currency risk, as well as environmental risk. Bearing these risks in mind, the Company has assumed recent world commodity prices will be achievable. The Company has considered the mineral resource reports by independent engineers on the Nyngan Scandium Project in considering the recoverability of the carrying costs of the mineral properties. All of these assumptions are potentially subject to change, out of our control, however such changes are not determinable. Accordingly, there is always the potential for a material adjustment to the value assigned to mineral properties and equipment.

Recent Accounting Pronouncements

Accounting Standards Update 2019-12 – Income Taxes (Topic 740) The Financial Accounting Standards Board issued this Update as part of its initiative to reduce complexity in accounting standards. This standard is effective for interim and annual reporting periods beginning after December 15, 2020, with early adoption permitted. The Company is currently evaluating the impact this guidance will have on its financial statements.

Accounting Standards Update 2019-01 – Leases (Topic 842) Codification Improvements - Issue 3 Transition Disclosures Related to Topic 250, Accounting Changes and Error Corrections. The amendments in this Update clarify the Board’s original intent by explicitly providing an exception to the paragraph 250-10-50-3 interim disclosure requirements in the Topic 842 transition disclosure requirements. Accounting Standards Update 2020-05 – Revenue from Contracts with Customers (Topic 606) and Leases (Topic 842) changed the effective date for Leases (Topic 842) to fiscal years beginning after December 15, 2021, and interim periods within fiscal years beginning after December 15, 2022. The Company has evaluated that this guidance will have little or no impact on its financial statements.

Accounting Standards Update 2018-13 – Fair Value Measurement (Topic 840) Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement. The amendments in this update apply to all entities that are required, under existing GAAP, to make disclosures about recurring or nonrecurring fair value measurements. This standard is effective for interim and annual reporting periods beginning after December 15, 2019, with early adoption permitted. The Company has adopted this policy which has no material effect to the consolidated financial statements.

Financial instruments and other risks

The Company’s financial instruments consist of cash, receivables, accounts payable, accounts payable with related parties, accrued liabilities and promissory notes payable. It is management's opinion that the Company is not exposed to significant interest, currency or credit risks arising from its financial instruments. The fair values of these financial instruments approximate their carrying values unless otherwise noted. The Company has its cash primarily in three commercial banks: (i) one in Vancouver, British Columbia, Canada, (ii) one in Mackay, Queensland, Australia, and (iii) one in Chicago, Illinois, United States.

Information Regarding Forward-Looking Statements

This Management’s Discussion and Analysis of Financial Condition and Results of Operations contain certain forward-looking statements. Forward-looking statements include but are not limited to those with respect to the prices of metals, the estimation of mineral resources and reserves, the realization of mineral reserve estimates, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, currency fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims and limitations on insurance coverage and the timing and possible outcome of pending litigation. In certain cases, forward-looking statements can be identified by the use of words such as “plans,” “expects” or “does not expect,” “is expected,” “estimates”, “intends,” “anticipates” or “does not anticipate,” or “believes” or variations of such words and phrases, or statements that certain actions, events or results “may,” “could,” “would,” or “will” be taken, occur or be achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of Scandium International to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, the actual results of current exploration activities, conclusions or economic evaluations, changes in project parameters as plans continue to be refined, possible variations in grade and or recovery rates, failure of plant, equipment or processes to operate as anticipated, accidents, labor disputes or other risks of the mining industry, delays in obtaining government approvals or financing or incompletion of development or construction activities, risks relating to the integration of acquisitions, to international operations, and to the prices of metals and risks relating to the COVID-19 pandemic. While Scandium International has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Scandium International expressly disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

Not applicable.

Item 4. Controls and Procedures

Disclosure controls and procedures

The Company’s management is responsible for establishing and maintaining adequate disclosure controls and procedures. The Company’s management, including our principal executive officer and our principal financial officer, evaluated the effectiveness of our disclosure controls and procedures (as defined in Exchange Act Rule 13a-15(e)) as of the end of the period covered by this report. Based on that evaluation, the principal executive officer and principal financial officer concluded that as of the end of the period covered by this report, the Company has maintained effective disclosure controls and procedures in all material respects, including those necessary to ensure that information required to be disclosed in reports filed or submitted with the SEC (i) is recorded, processed, and reported within the time periods specified by the SEC, and (ii) is accumulated and communicated to management, including the principal executive officer and principal financial officer, as appropriate to allow for timely decision regarding required disclosure.

Changes in Internal Control

There have been no changes in internal control over financial reporting that occurred during the last fiscal quarter that have materially affected, or are reasonably likely to materially affect, internal control over financial reporting.

PART II – OTHER INFORMATION

Item 1. Legal Proceedings

We are not aware of any material current, pending, or threatened litigation with respect to the Company.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

Not applicable.

Item 3. Defaults Upon Senior Securities.

Not applicable.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Other Information

Not applicable.

Item 6. Exhibits

Certification of the Principal Executive Officer, pursuant to Rule 13a-14(a) or 15d-14(a) of the U.S. Securities Exchange Act of 1934 (filed herewith)

Certification of the Principal Financial Officer, pursuant to Rule 13a-14(a) or 15d-14(a) of the U.S. Securities Exchange Act of 1934 (filed herewith)

Section 1350 Certification of the Principal Executive Officer (filed herewith)

Section 1350 Certification of the Principal Financial Officer (filed herewith)

101

Financial Statements from the Quarterly Report on Form 10-Q of the Company for the nine months ended September 30, 2020, formatted in XBRL (filed herewith)