Exhibit 99.2

Third Quarter 2014 Earnings Presentation October 30, 2014 MSCI

Forward‐Looking Statements and Other Information �� Forward‐Looking Statements – Safe Harbor Statements �� This presentation may contain forward‐looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. You should not place undue reliance on forward‐looking statements because they involve known and unknown risks, uncertainties and other factors that are, in some cases, beyond our control and that could materially affect actual results, levels of activity, performance or achievements. For a discussion of risks and uncertainties that could materially affect actual results, levels of activity, performance or achievements, please see the most recent Annual Report on Form 10‐K for the fiscal year ended December 31, 2013 of MSCI Inc. (the “Company”) and its other periodic or current reports filed with the SEC. Any forward‐looking statements included in this presentation reflect the Company’s view as of the date of this presentation. The Company assumes no obligation to publicly update or revise these forward‐looking statements for any reason, whether as a result of new information, future events, or otherwise, except as required by law. �� Other Information �� Percentage changes and totals in this presentation may not sum due to rounding. �� Percentage changes are referenced to the comparable period in 2013, unless otherwise noted. �� Total sales include recurring subscription sales and non‐recurring sales. �� Notes and definitions relating to non‐GAAP measures and operating metrics used in this presentation, as well as definitions of Run Rate, Retention Rate and Organic Subscription Run Rate Growth ex FX, are provided on page 16. �� Due to the sale of Institutional Shareholder Services Inc. (“ISS”) and the Center for Financial Research and Analysis product line, results of our former Governance business are now reflected as discontinued operations in the financial statements of MSCI in the current quarter and for prior periods. The operating metrics for prior periods have also been updated to exclude the Governance business. �� We have historically reported the financial results and operating metrics for Energy and Commodity products on a standalone basis. Beginning with Q1’14, these results and metrics have been included in the Risk Management and Analytics products. Prior periods have been updated accordingly. 2

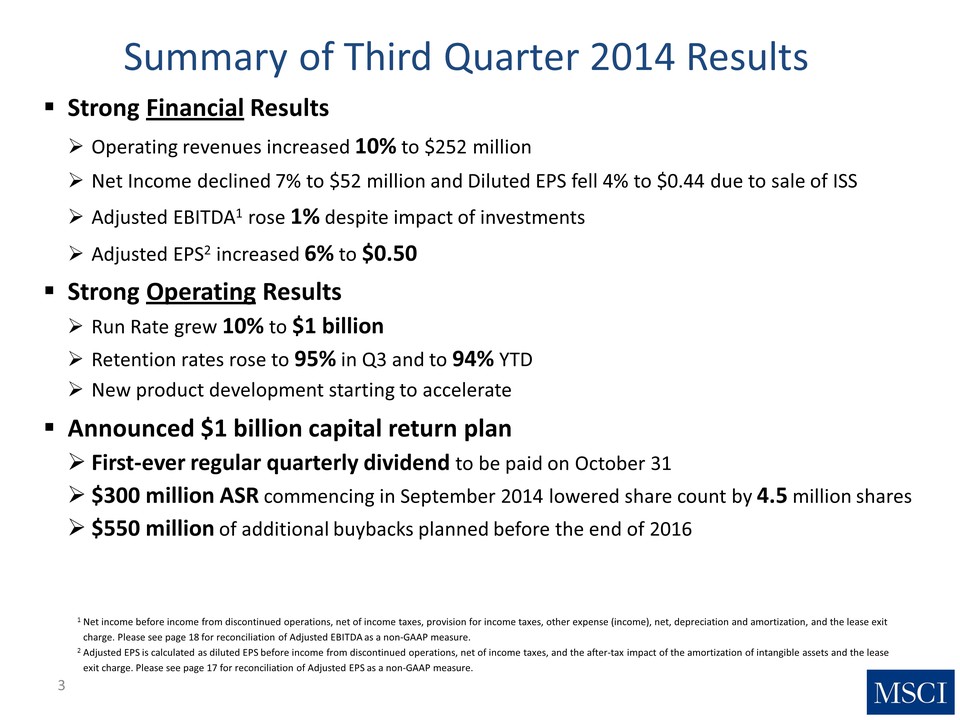

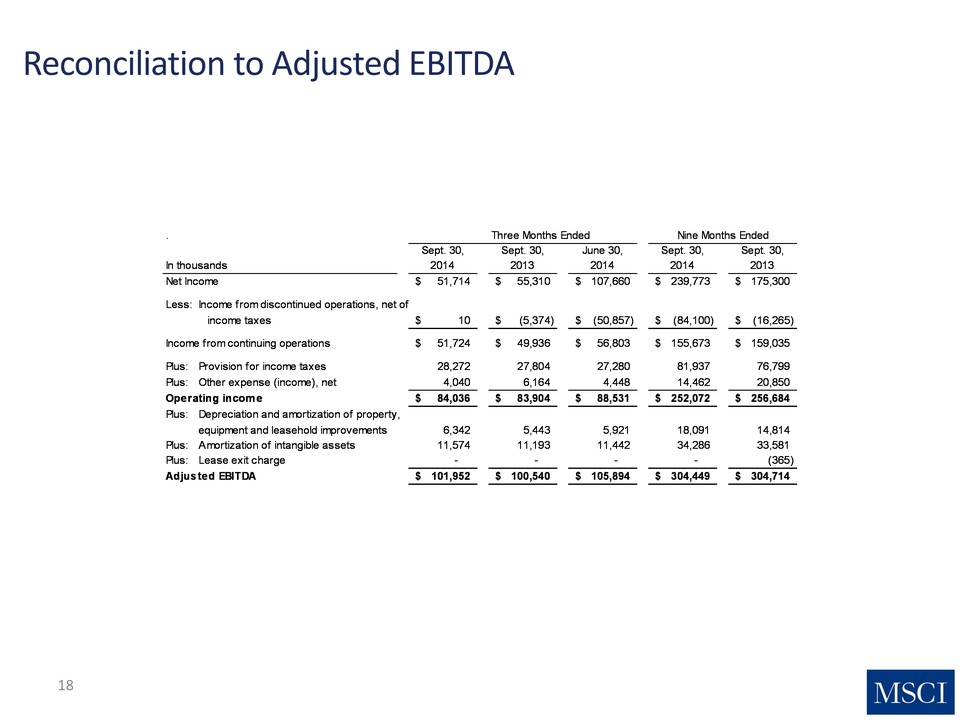

Summary of Third Quarter 2014 Results Strong Financial Results Operating revenues increased 10% to $252 million Net Income declined 7% to $52 million and Diluted EPS fell 4% to $0.44 due to sale of ISS Adjusted EBITDA1 rose 1% despite impact of investments Adjusted EPS2 increased 6% to $0.50 Strong Operating Results Run Rate grew 10% to $1 billion Retention rates rose to 95% in Q3 and to 94% YTD New product development starting to accelerate Announced $1 billion capital return plan First‐ever regular quarterly dividend to be paid on October 31 $300 million ASR commencing in September 2014 lowered share count by 4.5 million shares $550 million of additional buybacks planned before the end of 2016 Net income before income from discontinued operations, net of income taxes, provision for income taxes, other expense (income), net, depreciation and amortization, and the lease exit charge. Please see page 18 for reconciliation of Adjusted EBITDA as a non‐GAAP measure. Adjusted EPS is calculated as diluted EPS before income from discontinued operations, net of income taxes, and the after‐tax impact of the amortization of intangible assets and the lease exit charge. Please see page 17 for reconciliation of Adjusted EPS as a non‐GAAP measure. 3

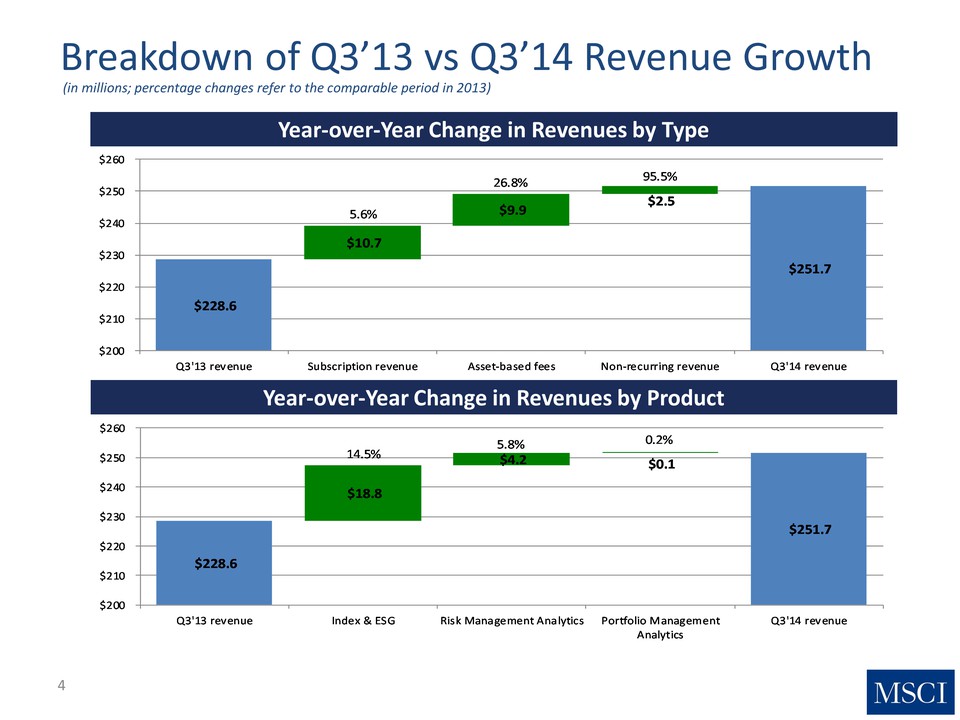

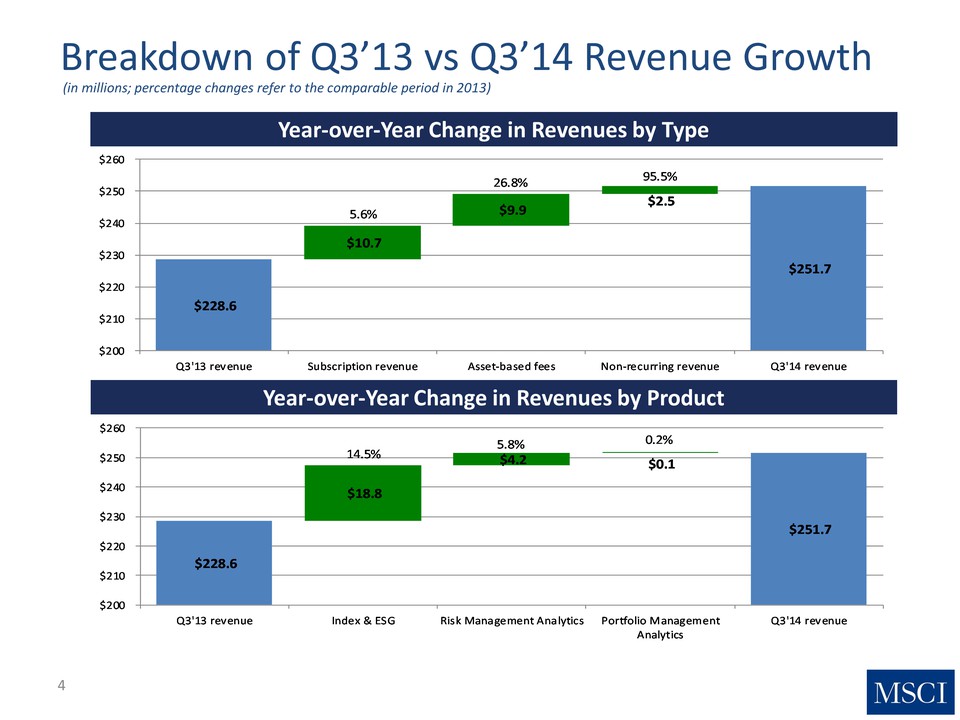

Breakdown of Q3’13 vs Q3’14 Revenue Growth 4 (in millions; percentage changes refer to the comparable period in 2013) Year‐over‐Year Change in Revenues by Type $228.6 $251.7 $10.7 $9.9 $2.5 $200 $210 $220 $230 $240 $250 $260 Q3'13 revenue Subscription revenue Asset‐based fees Non‐recurring revenue Q3'14 revenue 5.6% 26.8% 95.5% Year‐over‐Year Change in Revenues by Product $228.6 $251.7 $18.8 $4.2 $0.1 $200 $210 $220 $230 $240 $250 $260 Q3'13 revenue Index & ESG Risk Management Analytics Portfolio Management Analytics Q3'14 revenue 14.5% 5.8% 0.2%

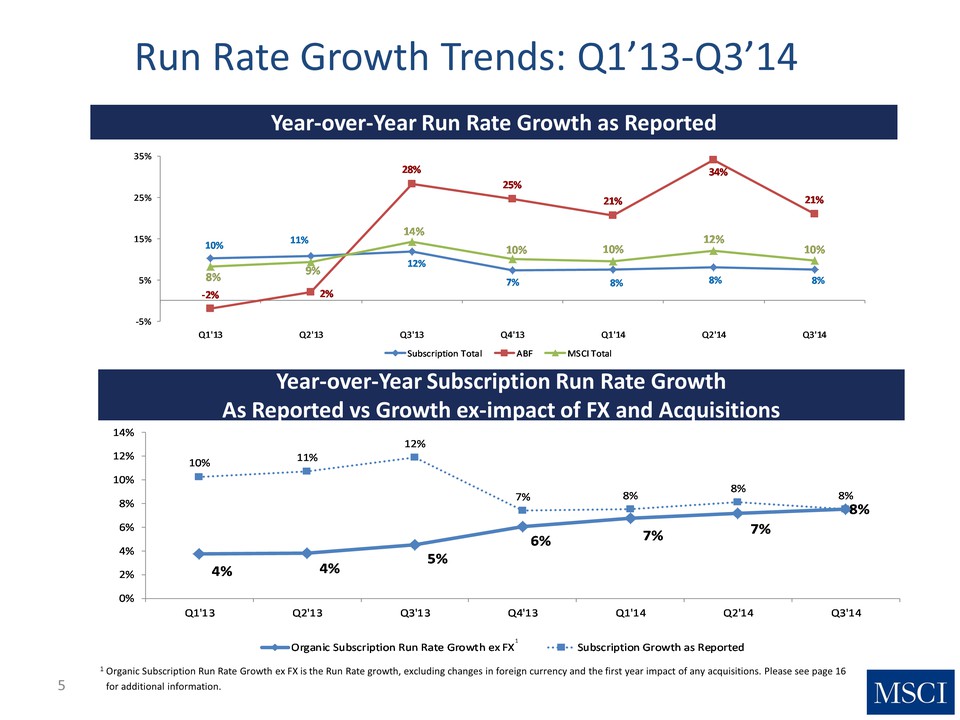

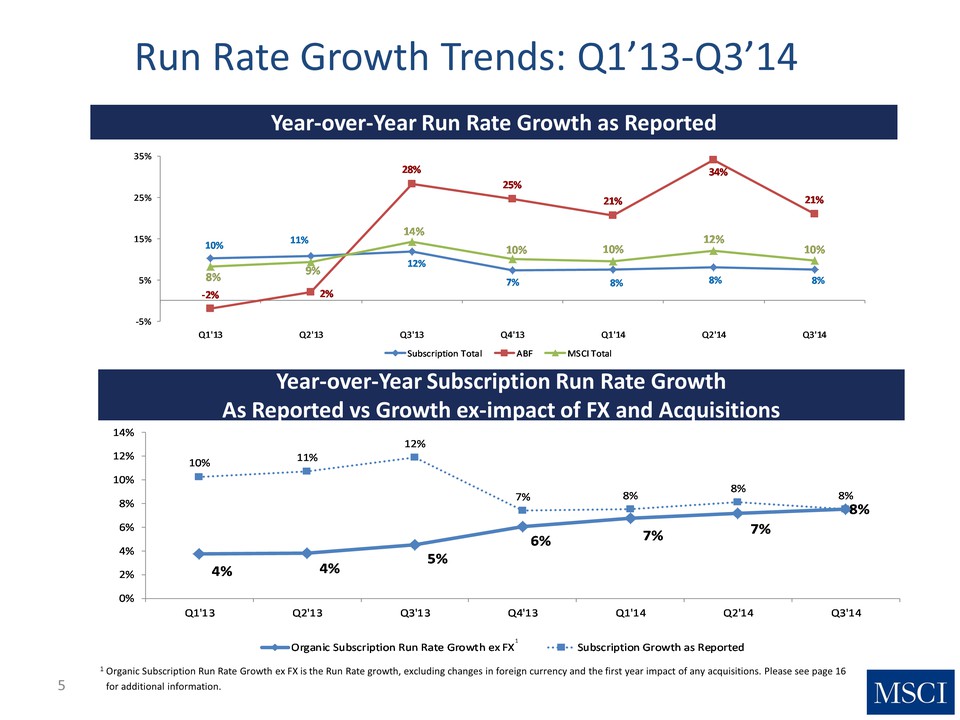

10% 11% 12% 7% 8% 8% 8% ‐2% 2% 28% 25% 21% 34% 21% 8% 9% 14% 10% 10% 12% 10% ‐5% 5% 15% 25% 35% Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 Subscription Total ABF MSCI Total Run Rate Growth Trends: Q1’13‐Q3’14 Year‐over‐Year Run Rate Growth as Reported Year‐over‐Year Subscription Run Rate Growth As Reported vs Growth ex‐impact of FX and Acquisitions 4% 4% 5% 6% 7% 7% 8% 10% 11% 12% 7% 8% 8% 8% 0% 2% 4% 6% 8% 10% 12% 14% Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 Organic Subscription Run Rate Growth ex FX Subscription Growth as Reported 1 1 Organic Subscription Run Rate Growth ex FX is the Run Rate growth, excluding changes in foreign currency and the first year impact of any acquisitions. Please see page 16 for additional information. 5

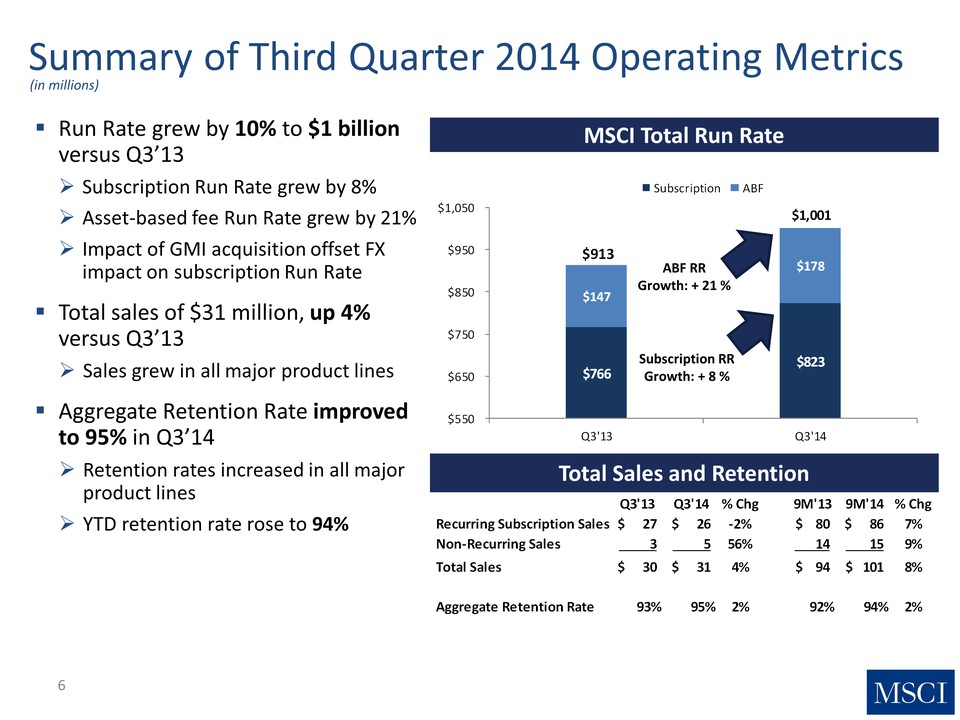

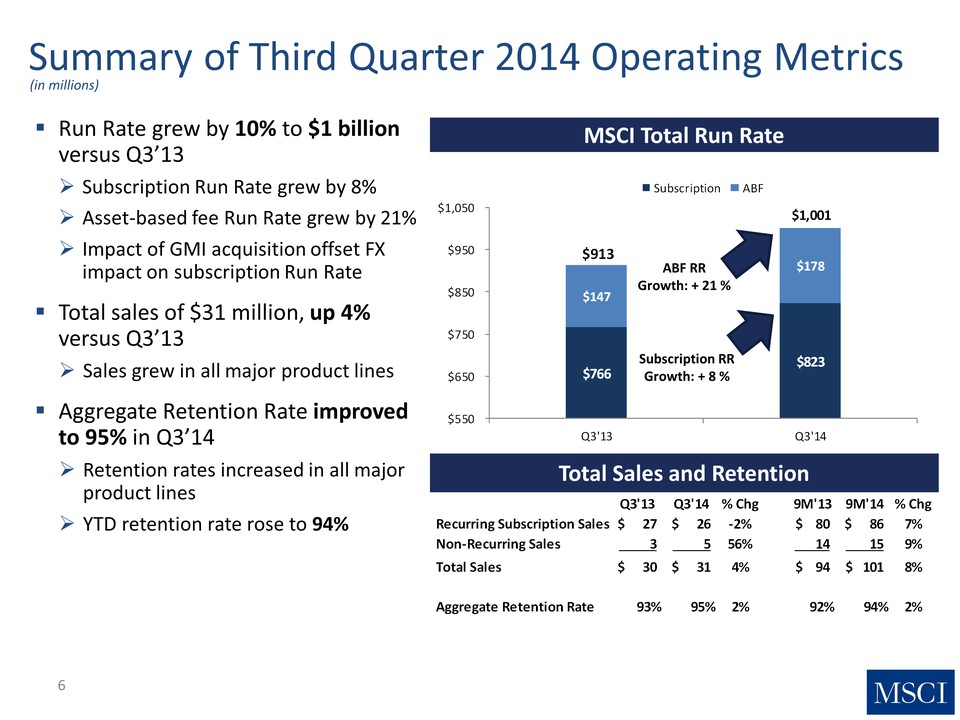

Summary of Third Quarter 2014 Operating Metrics 6 (in millions) �� Run Rate grew by 10% to $1 billion versus Q3’13 �� Subscription Run Rate grew by 8% �� Asset‐based fee Run Rate grew by 21% �� Impact of GMI acquisition offset FX impact on subscription Run Rate �� Total sales of $31 million, up 4% versus Q3’13 �� Sales grew in all major product lines �� Aggregate Retention Rate improved to 95% in Q3’14 �� Retention rates increased in all major product lines �� YTD retention rate rose to 94% MSCI Total Run Rate $766 $823 $147 $178 $913 $1,001 $550 $650 $750 $850 $950 $1,050 Q3'13 Q3'14 Subscription ABF Subscription RR Growth: + 8% ABF RR Growth: + 21 % Total Sales and Retention Q3'13 Q3'14 % Chg 9M'13 9M'14 % Chg Recurring Subscription Sales 27 $ 26 $ ‐2% 80 $ 86 $ 7% Non‐Recurring Sales 3 5 56% 14 15 9% Total Sales 30 $ 31 $ 4% 94 $ 101 $ 8% Aggregate Retention Rate 93% 95% 2% 92% 94% 2%

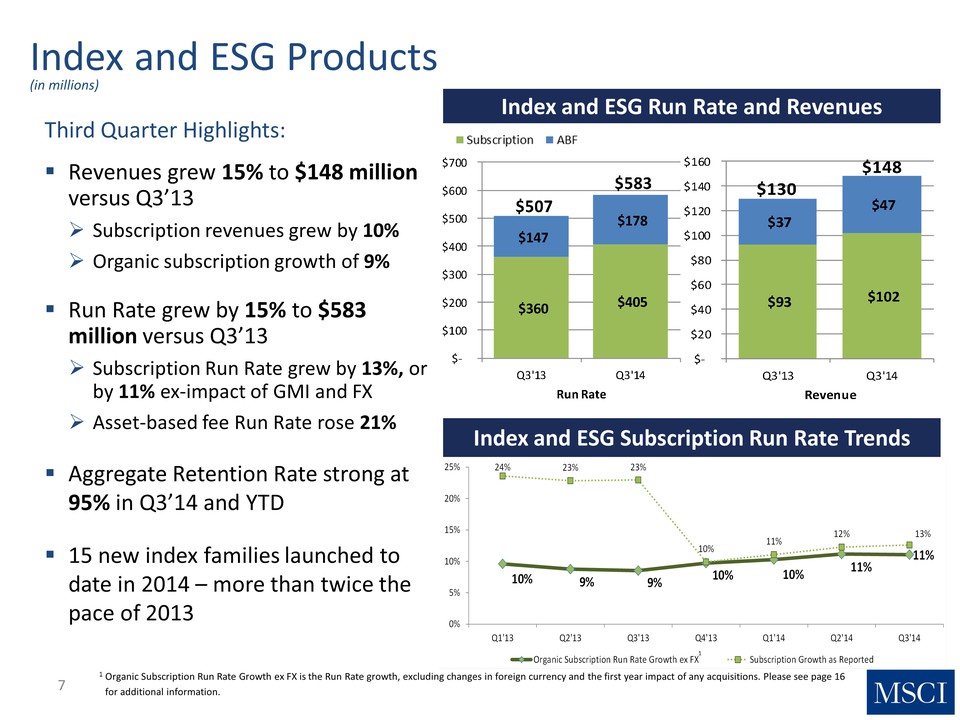

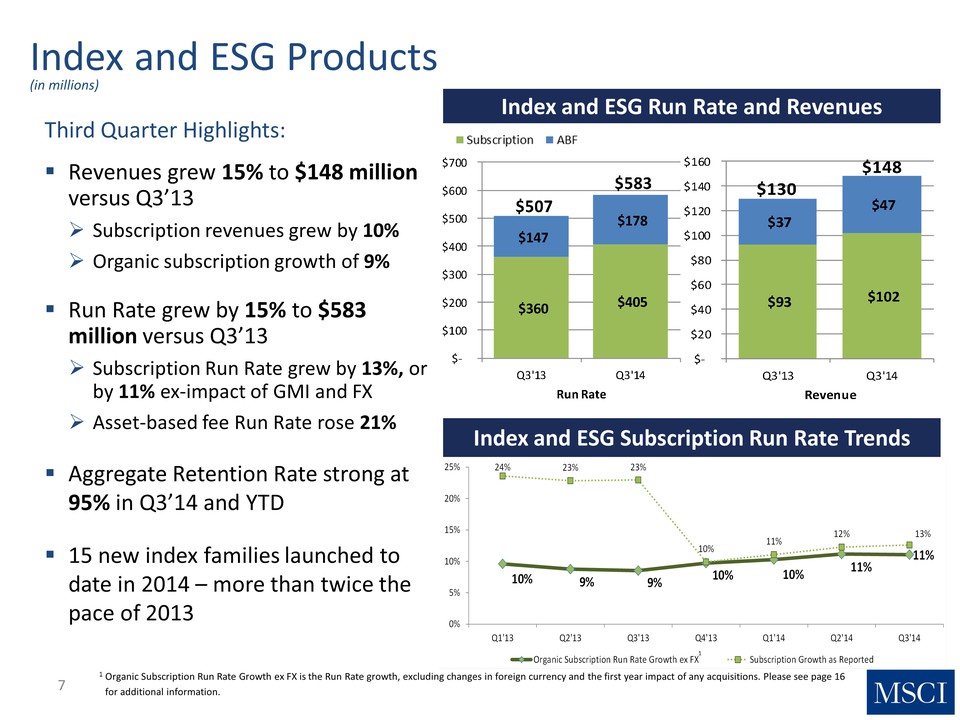

10% 9% 9% 10% 10% 11% 11% 24% 23% 23% 10% 11% 12% 13% 0% 5% 10% 15% 20% 25% Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 Organic Subscription Run Rate Growth ex FX Subscription Growth as Reported Index and ESG Products 7 (in millions) Third Quarter Highlights: �� Revenues grew 15% to $148 million versus Q3’13 �� Subscription revenues grew by 10% �� Organic subscription growth of 9% �� Run Rate grew by 15% to $583 million versus Q3’13 �� Subscription Run Rate grew by 13%, or by 11% ex‐impact of GMI and FX �� Asset‐based fee Run Rate rose 21% �� Aggregate Retention Rate strong at 95% in Q3’14 and YTD �� 15 new index families launched to date in 2014 – more than twice the pace of 2013 $360 $405 $147 $178 $507 $583 $‐ $100 $200 $300 $400 $500 $600 $700 Q3'13 Q3'14 Run Rate $93 $102 $37 $47 $130 $148 $‐ $20 $40 $60 $80 $100 $120 $140 $160 Q3'13 Q3'14 Revenue Index and ESG Subscription Run Rate Trends 1 Index and ESG Run Rate and Revenues 1 Organic Subscription Run Rate Growth ex FX is the Run Rate growth, excluding changes in foreign currency and the first year impact of any acquisitions. Please see page 16 for additional information.

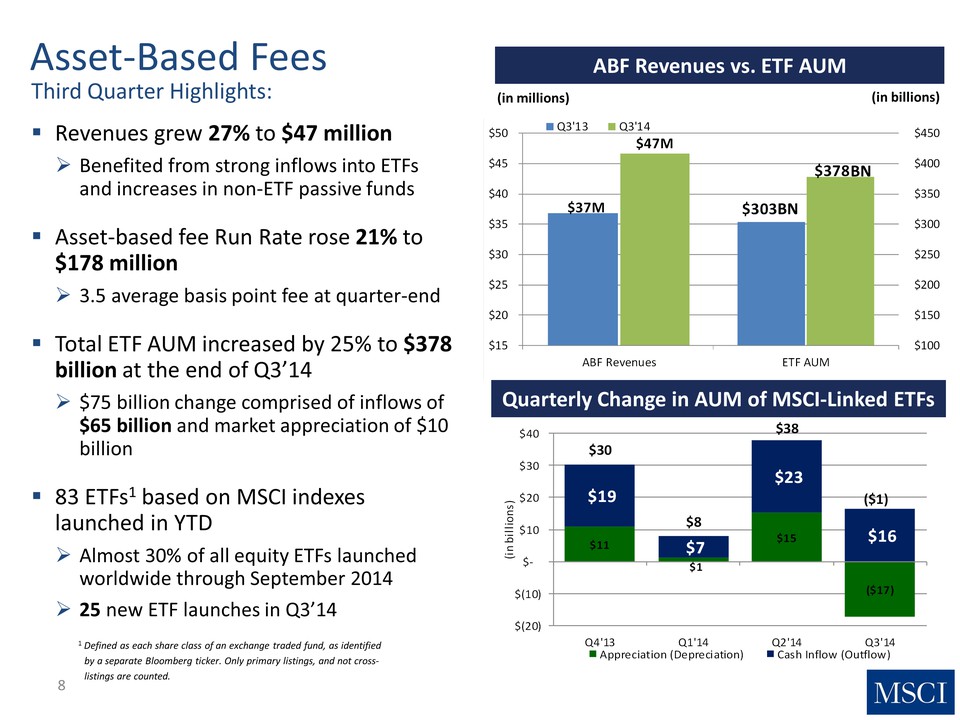

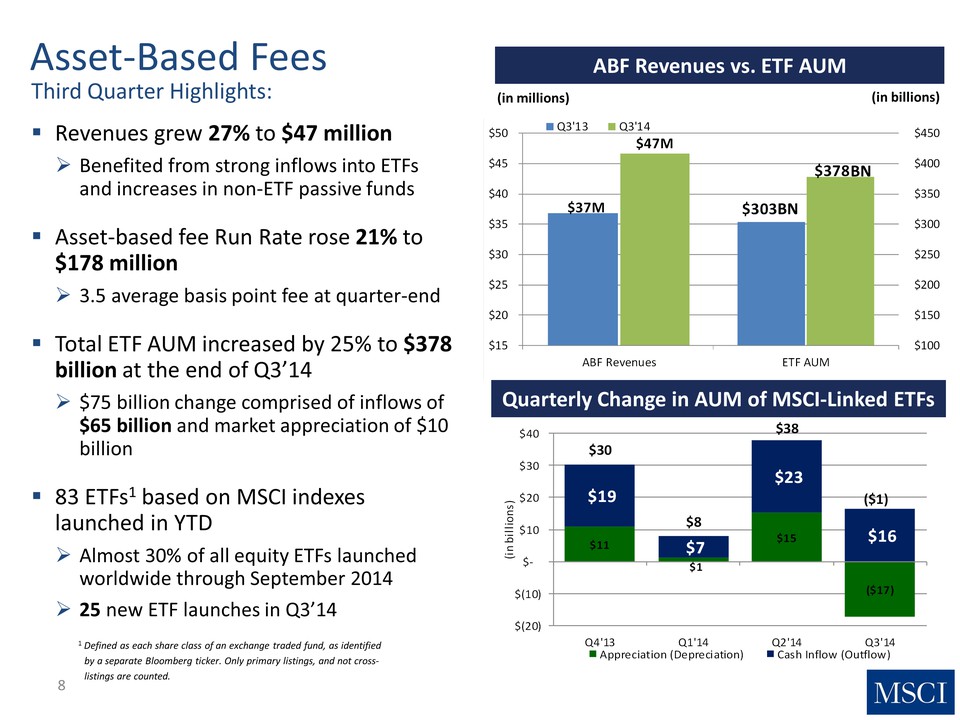

Asset‐Based Fees 8 Third Quarter Highlights: �� Revenues grew 27% to $47 million �� Benefited from strong inflows into ETFs and increases in non‐ETF passive funds �� Asset‐based fee Run Rate rose 21% to $178 million �� 3.5 average basis point fee at quarter‐end �� Total ETF AUM increased by 25% to $378 billion at the end of Q3’14 �� $75 billion change comprised of inflows of $65 billion and market appreciation of $10 Billion �� 83 ETFs1 based on MSCI indexes launched in YTD �� Almost 30% of all equity ETFs launched worldwide through September 2014 �� 25 new ETF launches in Q3’14 ABF Revenues vs. ETF AUM $37M $47M $15 $20 $25 $30 $35 $40 $45 $50 ABF Revenues Q3'13 Q3'14 $303 $378 $100 $150 $200 $250 $300 $350 $400 $450 ETF AUM (in millions) (in billions) Quarterly Change in AUM of MSCI‐Linked ETFs BN BN 1 Defined as each share class of an exchange traded fund, as identified by a separate Bloomberg ticker. Only primary listings, and not crosslistings are counted. $11 $1 $15 ($17) $19 $7 $23 $16 $30 $8 $38 ($1) $(20) $(10) $‐ $10 $20 $30 $40 Q4'13 Q1'14 Q2'14 Q3'14 (in billions) Appreciation (Depreciation) Cash Inflow (Outflow)

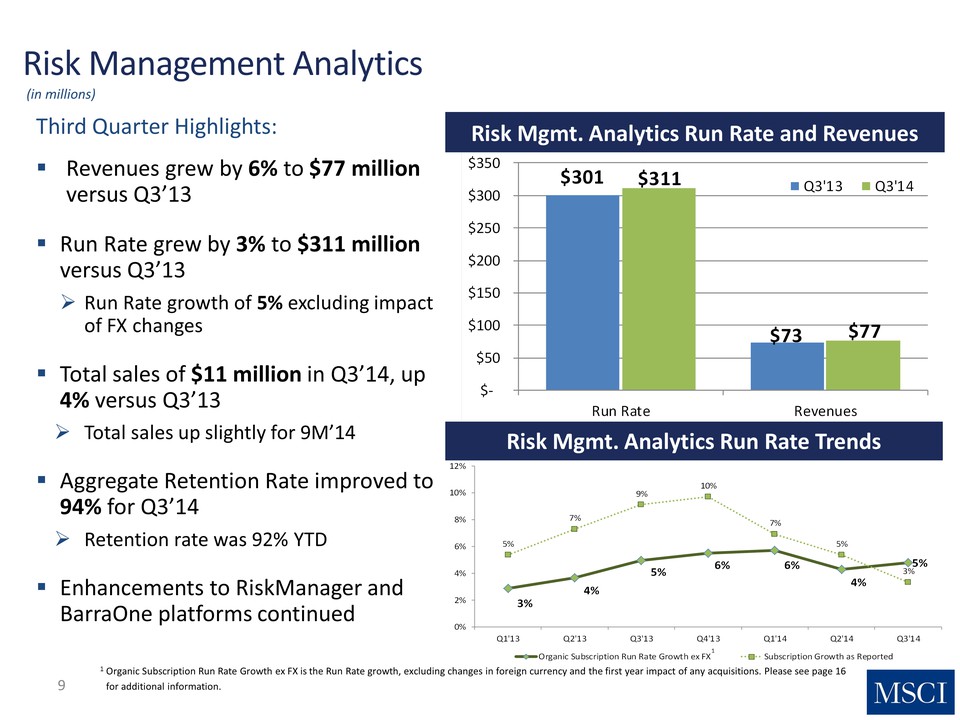

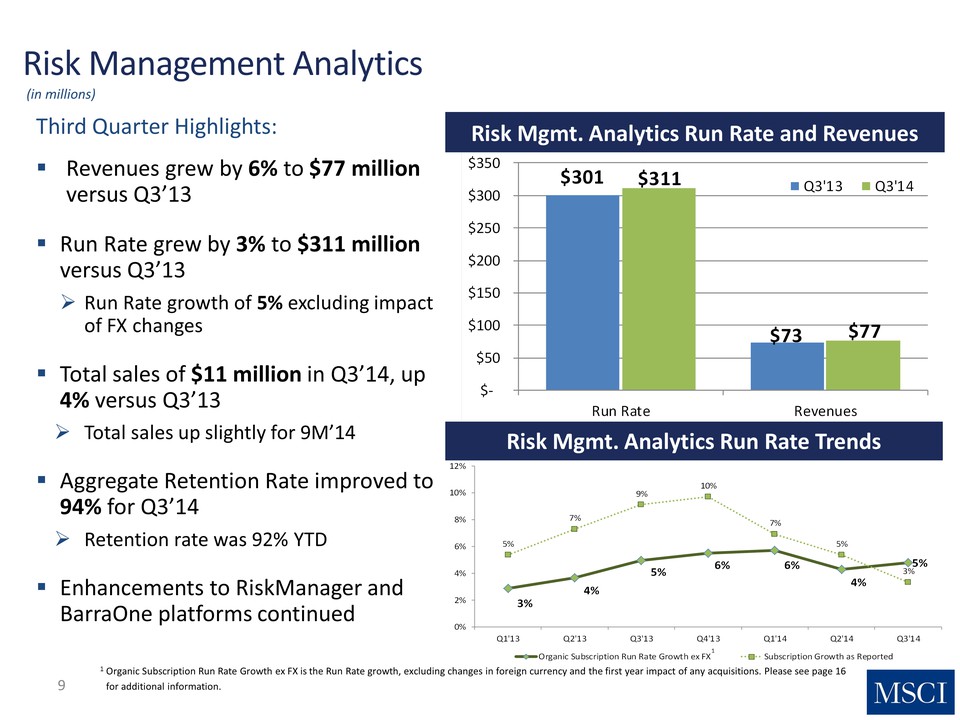

3% 4% 5% 6% 6% 4% 5% 5% 7% 9% 10% 7% 5% 3% 0% 2% 4% 6% 8% 10% 12% Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 Organic Subscription Run Rate Growth ex FX Subscription Growth as Reported $301 $73 $311 $77 $‐ $50 $100 $150 $200 $250 $300 $350 Run Rate Revenues Q3'13 Q3'14 9 Risk Management Analytics Risk Mgmt. Analytics Run Rate and Revenues (in millions) Third Quarter Highlights: �� Revenues grew by 6% to $77 million versus Q3’13 �� Run Rate grew by 3% to $311 million versus Q3’13 �� Run Rate growth of 5% excluding impact of FX changes �� Total sales of $11 million in Q3’14, up 4% versus Q3’13 �� Total sales up slightly for 9M’14 �� Aggregate Retention Rate improved to 94% for Q3’14 �� Retention rate was 92% YTD �� Enhancements to RiskManager and BarraOne platforms continued Risk Mgmt. Analytics Run Rate Trends 1 1 Organic Subscription Run Rate Growth ex FX is the Run Rate growth, excluding changes in foreign currency and the first year impact of any acquisitions. Please see page 16 for additional information.

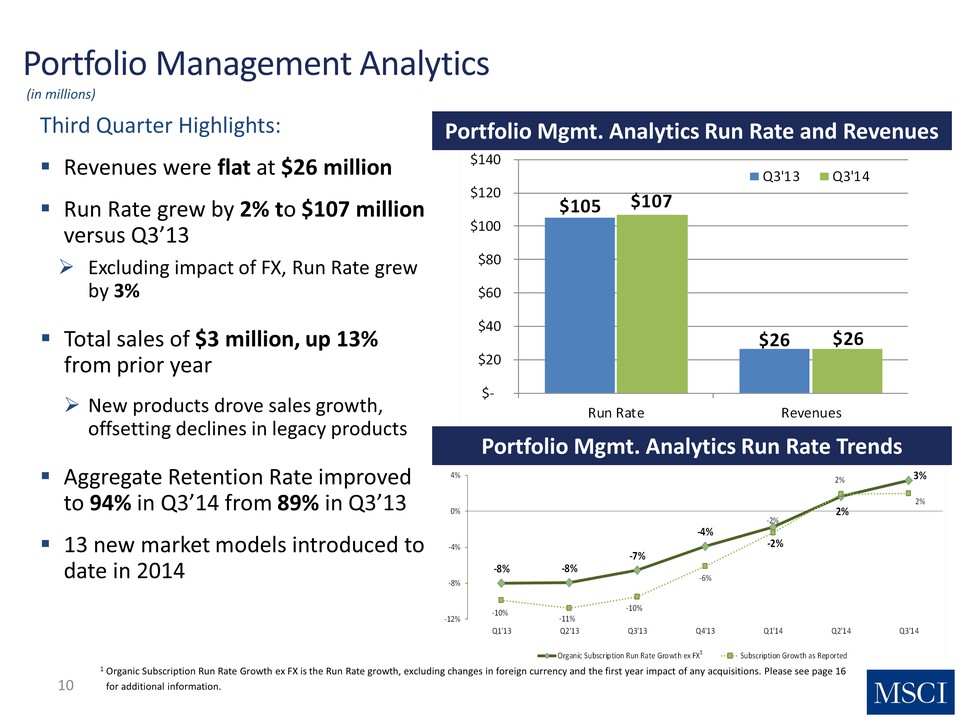

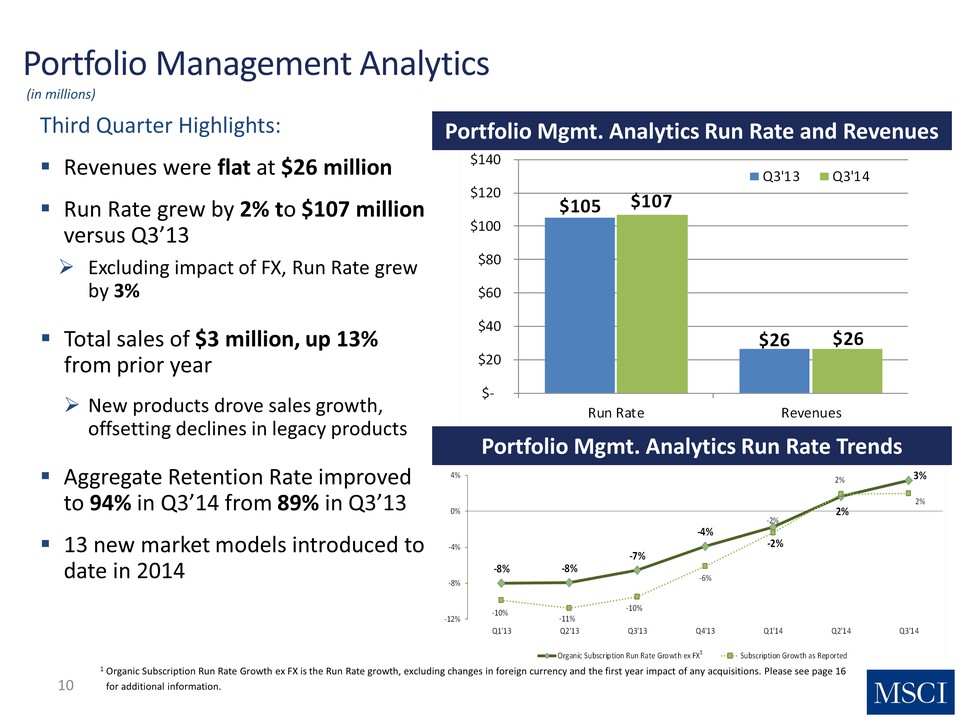

‐8% ‐8% ‐7% ‐4% ‐2% 2% 3% ‐10% ‐11% ‐10% ‐6% ‐2% 2% 2% ‐12% ‐8% ‐4% 0% 4% Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 Organic Subscription Run Rate Growth ex FX Subscription Growth as Reported $105 $26 $107 $26 $‐ $20 $40 $60 $80 $100 $120 $140 Run Rate Revenues Q3'13 Q3'14 10 Portfolio Management Analytics (in millions) Third Quarter Highlights: �� Revenues were flat at $26 million �� Run Rate grew by 2% to $107 million versus Q3’13 �� Excluding impact of FX, Run Rate grew by 3% �� Total sales of $3 million, up 13% from prior year �� New products drove sales growth, offsetting declines in legacy products �� Aggregate Retention Rate improved to 94% in Q3’14 from 89% in Q3’13 �� 13 new market models introduced to date in 2014 Portfolio Mgmt. Analytics Run Rate and Revenues Portfolio Mgmt. Analytics Run Rate Trends 1 1 Organic Subscription Run Rate Growth ex FX is the Run Rate growth, excluding changes in foreign currency and the first year impact of any acquisitions. Please see page 16 for additional information.

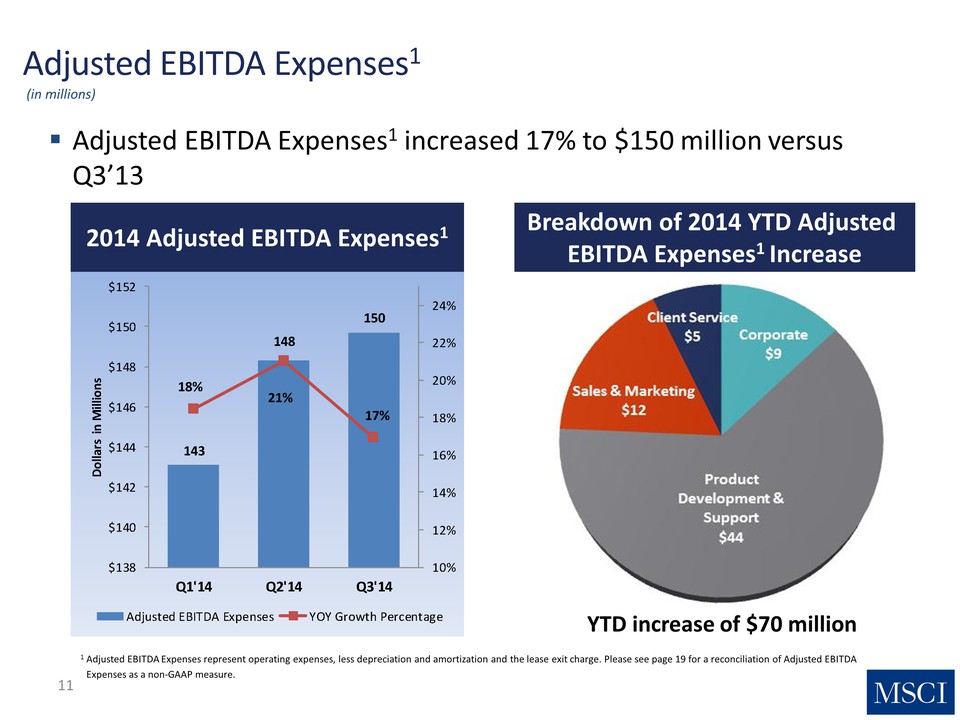

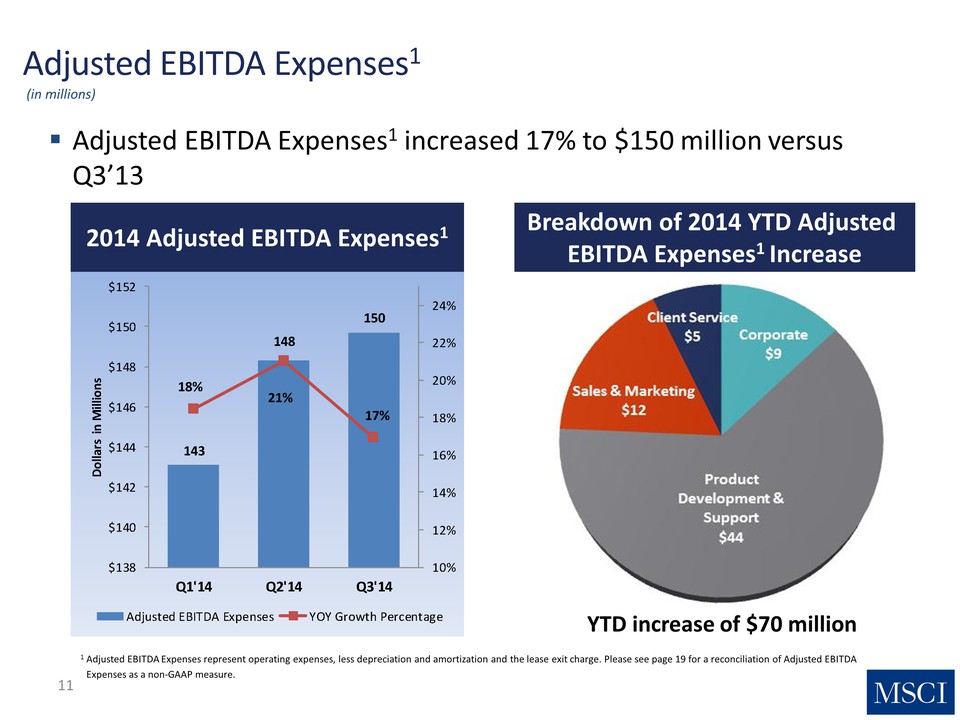

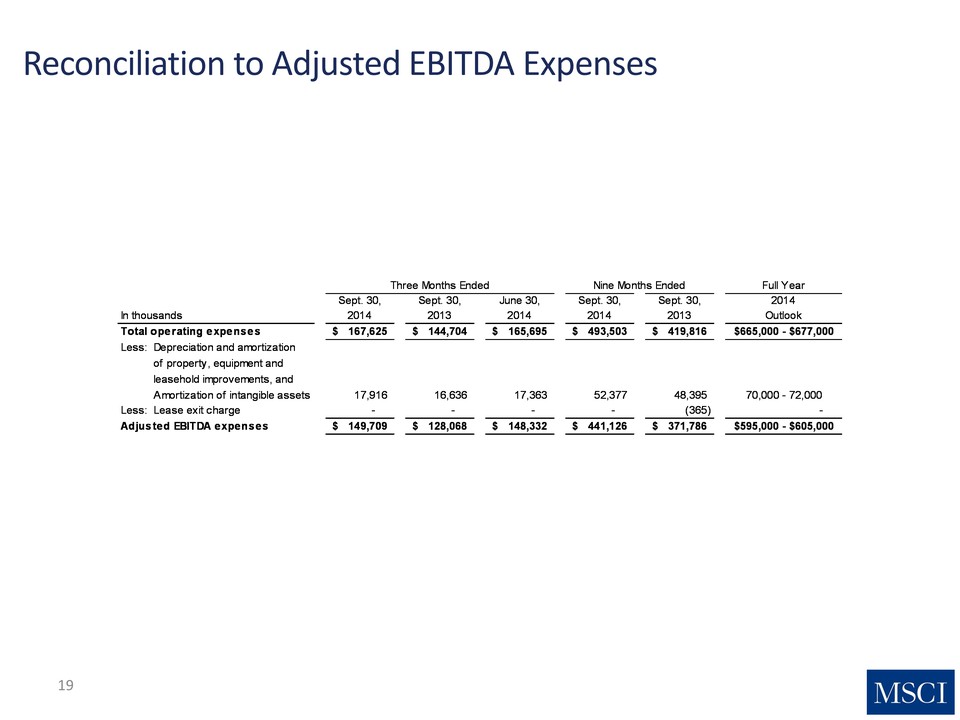

11 Adjusted EBITDA Expenses1 2014 Adjusted EBITDA Expenses1 (in millions) 1 Adjusted EBITDA Expenses represent operating expenses, less depreciation and amortization and the lease exit charge. Please see page 19 for a reconciliation of Adjusted EBITDA Expenses as a non‐GAAP measure. �� Adjusted EBITDA Expenses1 increased 17% to $150 million versus Q3’13 143 148 150 18% 21% 17% 10% 12% 14% 16% 18% 20% 22% 24% $138 $140 $142 $144 $146 $148 $150 $152 Q1'14 Q2'14 Q3'14 Dollars in Millions Adjusted EBITDA Expenses YOY Growth Percentage Breakdown of 2014 Adjusted EBITDA Expenses1 Increase Client Service 8% Corp Infra 12% Product Development & Support 63% Sales & Marketing 17%

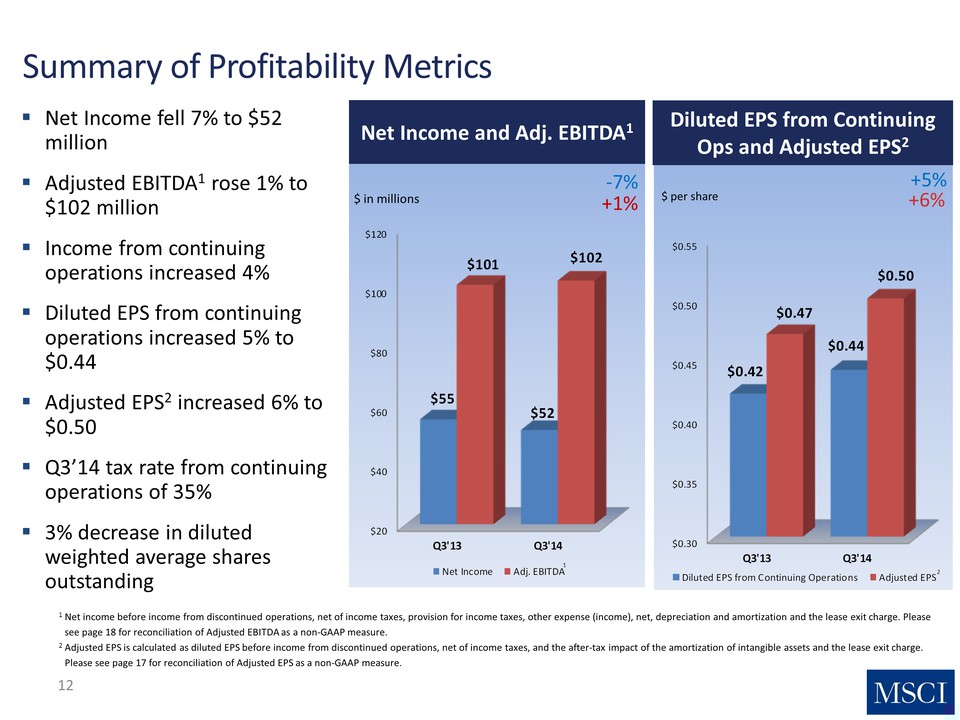

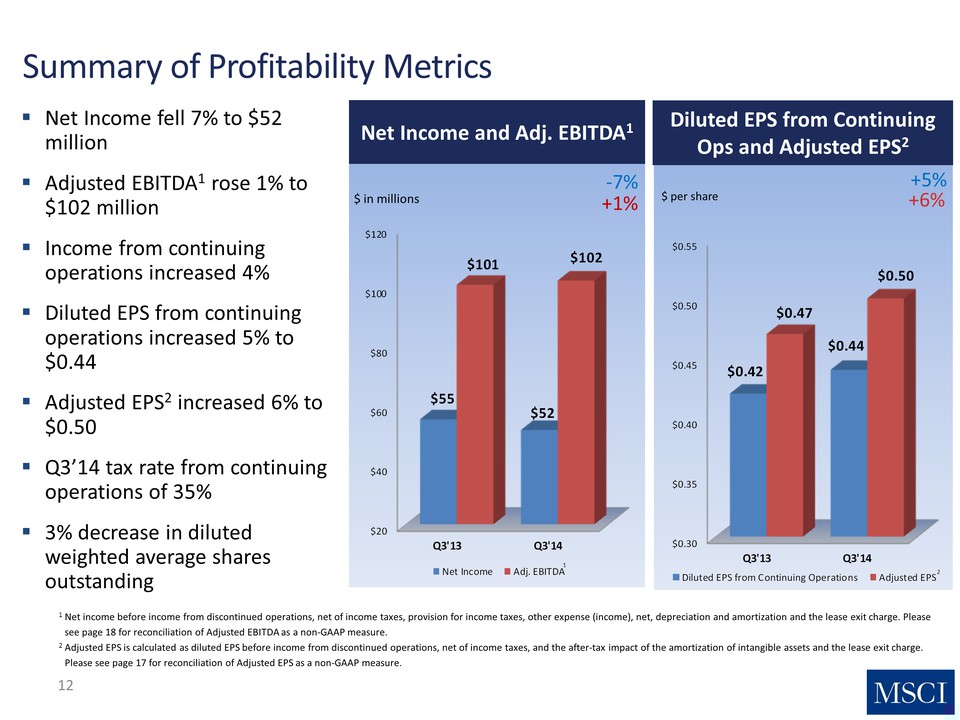

12 Summary of Profitability Metrics 1 Net income before income from discontinued operations, net of income taxes, provision for income taxes, other expense (income), net, depreciation and amortization and the lease exit charge. Please see page 18 for reconciliation of Adjusted EBITDA as a non‐GAAP measure. 2 Adjusted EPS is calculated as diluted EPS before income from discontinued operations, net of income taxes, and the after‐tax impact of the amortization of intangible assets and the lease exit charge. Please see page 17 for reconciliation of Adjusted EPS as a non‐GAAP measure. $ per share +5% +6% +1% $ in millions ‐7% Net Income and Adj. EBITDA1 Diluted EPS from Continuing Ops and Adjusted EPS2 �� Net Income fell 7% to $52 Million �� Adjusted EBITDA1 rose 1% to $102 million �� Income from continuing operations increased 4% �� Diluted EPS from continuing operations increased 5% to $0.44 �� Adjusted EPS2 increased 6% to $0.50 �� Q3’14 tax rate from continuing operations of 35% �� 3% decrease in diluted weighted average shares outstanding 1 2 $ in millions -7% +1% $120 $101 $102 $100 $80 $55 $52 $60 $40 $20 Q3’13 Q3’14 Net Income Adj. EBITDA $ per share +5% +6% $0.55 $0.50 $0.45 $0.40 $0.35 $0.30 $0.42 $0.47 $0.44 $0.50 Diluted EPS from Continuing Operations Adjusted EPS

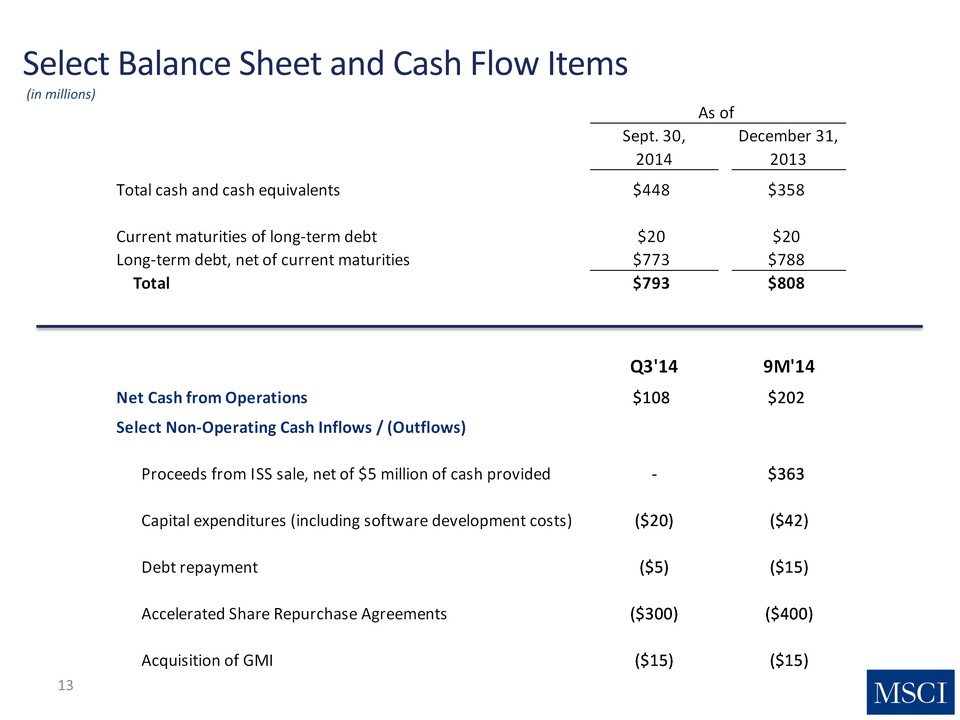

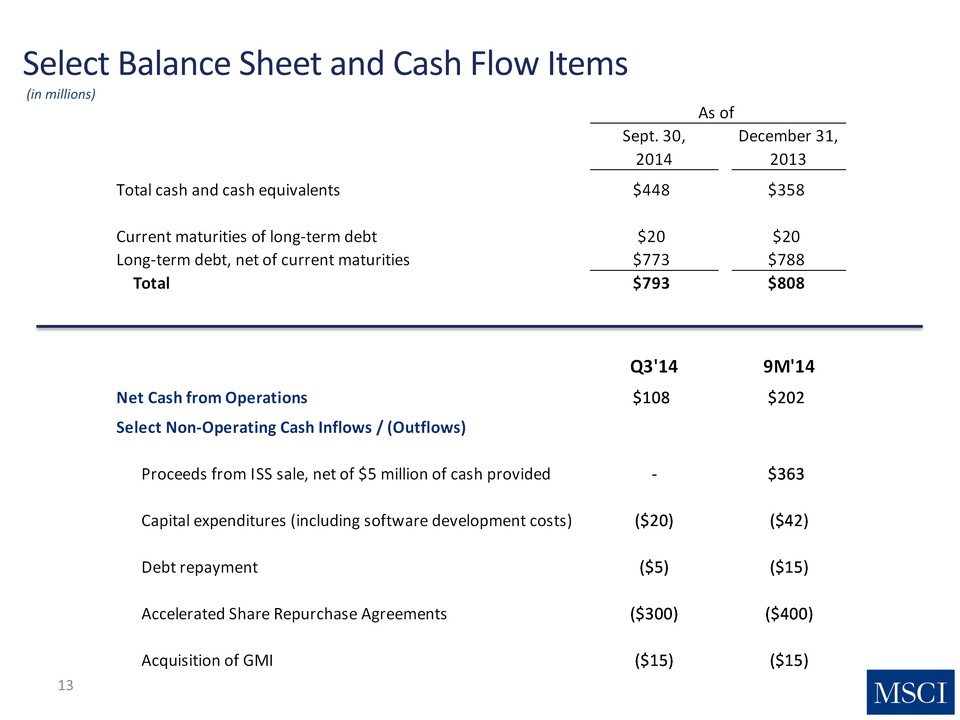

Sept. 30, 2014 December 31, 2013 Total cash and cash equivalents $448 $358 Current maturities of long‐term debt $20 $20 Long‐term debt, net of current maturities $773 $788 Total $793 $808 Q3'14 9M'14 Net Cash from Operations $108 $202 Select Non‐Operating Cash Inflows / (Outflows) Proceeds from ISS sale, net of $5 million of cash provided ‐ $363 Capital expenditures (including software development costs) ($20) ($42) Debt repayment ($5) ($15) Accelerated Share Repurchase Agreements ($300) ($400) Acquisition of GMI ($15) ($15) As of 13 Select Balance Sheet and Cash Flow Items (in millions)

14 Key Guidance: No Change �� 2014 Adjusted EBITDA Expenses1 projected to be in the range of $595‐ $605 million �� Cash flow from operations projected to be $275‐$325 million in 2014 �� 2014 capital expenditures projected to be $50‐$55 million �� Full Year 2014 tax rate expected to be approximately 36% �� Rate of Adjusted EBITDA Expenses1 growth is expected to decline in 2015 versus the 17‐19% growth implied by our 2014 Adjusted EBITDA Expenses1 guidance 1 Adjusted EBITDA Expenses represent operating expenses, less depreciation and amortization and the lease exit charge. Please see page 19 for a reconciliation of Adjusted EBITDA Expenses as a non‐GAAP measure.

Summary of Third Quarter 2014 Results 15 Strong Financial Results �� Operating revenues increased 10% to $252 million �� Net Income declined 7% to $52 million and Diluted EPS fell 4% to $0.44 due to sale of ISS �� Adjusted EBITDA1 rose 1% despite impact of investments �� Adjusted EPS2 increased 6% to $0.50 Strong Operating Results �� Run Rate grew 10% to $1 billion �� Retention rates rose to 95% in Q3 and to 94% YTD �� New product development starting to accelerate Announced $1 billion capital return plan �� First‐ever regular quarterly dividend to be paid on October 31 �� $300 million ASR commencing in September 2014 lowered share count by 4.5 million shares �� $550 million of additional buybacks planned before the end of 2016 1 Net income before income from discontinued operations, net of income taxes, provision for income taxes, other expense (income), net, depreciation and amortization, and the lease exit charge. Please see page 18 for reconciliation of Adjusted EBITDA as a non‐GAAP measure. 2 Adjusted EPS is calculated as diluted EPS before income from discontinued operations, net of income taxes, and the after‐tax impact of the amortization of intangible assets and the lease exit charge. Please see page 17 for reconciliation of Adjusted EPS as a non‐GAAP measure.

16 Use of Non‐GAAP Financial Measures and Operating Metrics �� MSCI Inc. has presented supplemental non‐GAAP financial measures as part of this presentation. A reconciliation is provided that reconciles each non‐GAAP financial measure with the most comparable GAAP measure. The presentation of non‐GAAP financial measures should not be considered as alternative measures for the most directly comparable GAAP financial measures. These measures are used by management to monitor the financial performance of the business, inform business decision making and forecast future results. �� Adjusted EBITDA is defined as net income before income from discontinued operations, net of income taxes, provision for income taxes, other expense (income), net, depreciation and amortization and the lease exit charge. �� Adjusted Net Income and Adjusted EPS are defined as net income and EPS, respectively, before income from discontinued operations, net of income taxes, and the after‐tax impact of the provision for amortization of intangible assets and the lease exit charge. �� Adjusted EBITDA Expenses represent operating expenses, less depreciation and amortization and the lease exit charge. �� We believe that adjusting for depreciation and amortization may help investors compare our performance to that of other companies in our industry as we do not believe that other companies in our industry have as significant a portion of their operating expenses represented by these items. Additionally, we believe that adjusting for income from discontinued operations, net of income tax, provides investors with a meaningful trend of results for our continuing operations. Finally, we believe that adjusting for one time and non‐recurring expenses such as the lease exit charge is useful to management and investors because it allows for an evaluation of MSCI’s underlying operating performance. We believe that the non‐GAAP financial measures presented in this earnings presentation facilitate meaningful period‐to‐period comparisons and provide a baseline for the evaluation of future results. �� Adjusted EBITDA, Adjusted EBITDA Expenses, Adjusted Net Income and Adjusted EPS are not defined in the same manner by all companies and may not be comparable to other similarly titled measures of other companies. �� The Run Rate at a particular point in time represents the forward‐looking revenues for the next 12 months from all subscriptions and investment product licenses we currently provide to our clients under renewable contracts or agreements assuming all contracts or agreements that come up for renewal are renewed and assuming then‐current currency exchange rates. For any license where fees are linked to an investment product’s assets or trading volume, the Run Rate calculation reflects for ETF fees, the market value on the last trading day of the period, and for fees related to non‐ETF funds and futures and options, the most recent periodic fee earned under such license or subscription. The Run Rate does not include fees associated with “one‐time” and other non‐recurring transactions. In addition, we remove from the Run Rate the fees associated with any subscription or investment product license agreement with respect to which we have received a notice of termination or non‐renewal during the period and determined that such notice evidences the client’s final decision to terminate or not renew the applicable subscription or agreement, even though such notice is not effective until a later date. �� Organic Subscription Run Rate Growth ex FX is defined as the period over period Run Rate growth, excluding the impact of changes in foreign currency. Changes in foreign currency are calculated by applying the end of period currency exchange rate from the comparable prior period to current period foreign currency denominated Run Rate. This metric also excludes the impact on the growth in subscription Run Rate of the acquisitions of IPD, InvestorForce and GMI for their respective first year of operations as part of MSCI. �� The Aggregate Retention Rates for a period are calculated by annualizing the cancellations for which we have received a notice of termination or we believe there is an intention to not renew during the period and we believe that such notice or intention evidences the client’s final decision to terminate or not renew the applicable agreement, even though such notice is not effective until a later date. This annualized cancellation figure is then divided by the subscription Run Rate at the beginning of the year to calculate a cancellation rate. This cancellation rate is then subtracted from 100% to derive the annualized Aggregate Retention Rate for the period. The Aggregate Retention Rate is computed on a product‐by‐product basis. Therefore, if a client reduces the number of products to which it subscribes or switches between our products, we treat it as a cancellation. In addition, we treat any reduction in fees resulting from renegotiated contracts as a cancellation in the calculation to the extent of the reduction. For the calculation of the Core Retention Rate, the same methodology is used except the cancellations in the period are reduced by the amount of product swaps.

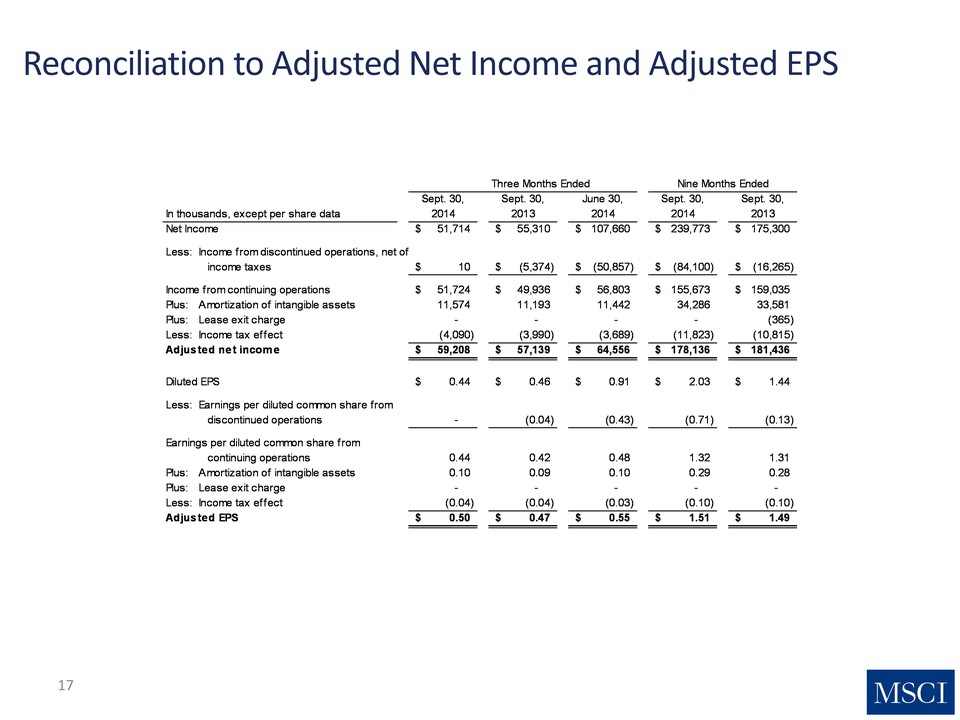

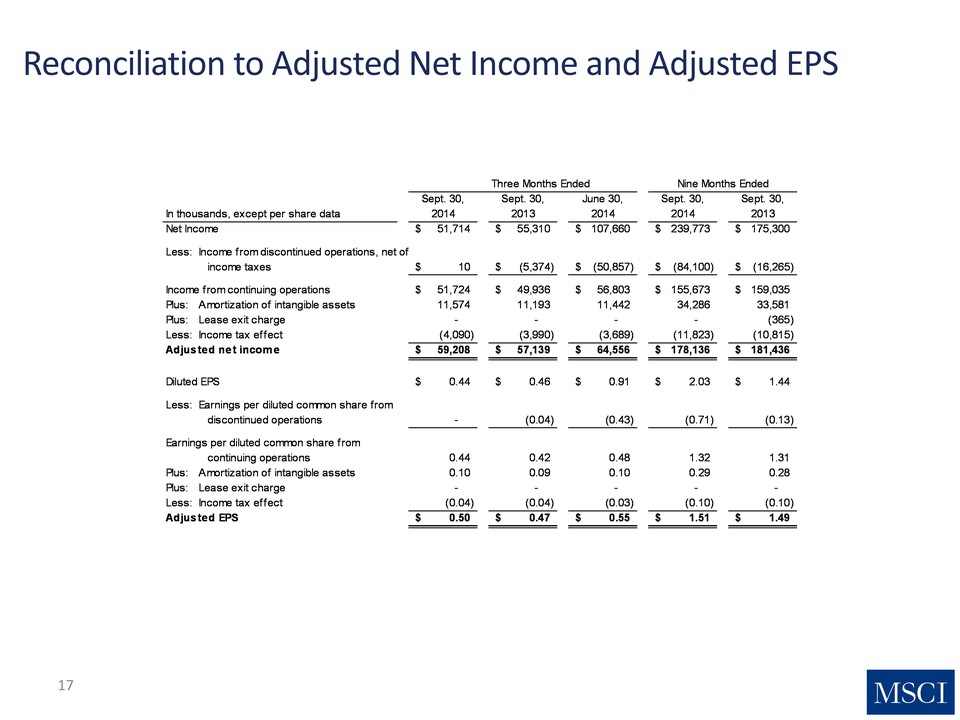

17 Reconciliation to Adjusted Net Income and Adjusted EPS Three Months Ended Nine Months Ended Sept. 30, Sept. 30, June 30, Sept. 30, Sept. 30, In thousands, except per share data 2014 2013 2014 2014 2013 Net Income 51,714 $ 55,310 $ 107,660 $ 239,773 $ 175,300 $ Less: Income from discontinued operations, net of income taxes 10 $ (5,374) $ (50,857) $ (84,100) $ (16,265) $ Income from continuing operations 51,724 $ 49,936 $ 56,803 $ 155,673 $ 159,035 $ Plus: Amortization of intangible assets 11,574 11,193 11,442 34,286 33,581 Plus: Lease exit charge - - - - (365) Less: Income tax effect (4,090) (3,990) (3,689) (11,823) (10,815) Adjusted net income 59,208 $ 57,139 $ 64,556 $ 178,136 $ 181,436 $ Diluted EPS 0.44 $ 0.46 $ 0.91 $ 2.03 $ 1.44 $ Less: Earnings per diluted common share from discontinued operations - (0.04) (0.43) (0.71) (0.13) Earnings per diluted common share from continuing operations 0.44 0.42 0.48 1.32 1.31 Plus: Amortization of intangible assets 0.10 0.09 0.10 0.29 0.28 Plus: Lease exit charge - - - - - Less: Income tax effect (0.04) (0.04) (0.03) (0.10) (0.10) Adjusted EPS 0.50 $ 0.47 $ 0.55 $ 1.51 $ 1.49 $

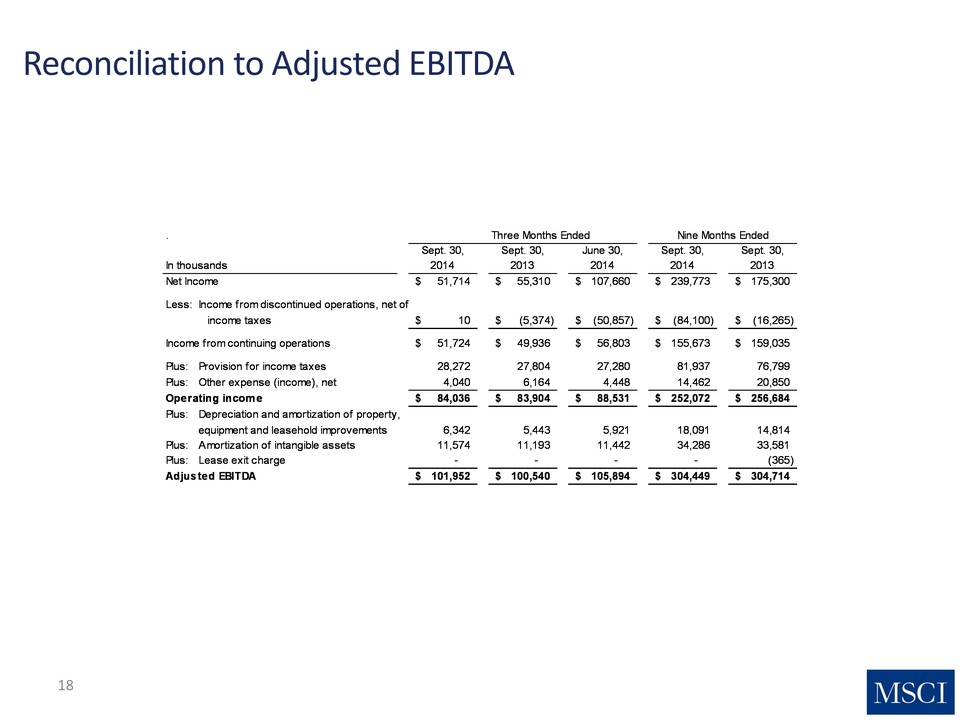

18 Reconciliation to Adjusted EBITDA . Three Months Ended Nine Months Ended Sept. 30, Sept. 30, June 30, Sept. 30, Sept. 30, In thousands 2014 2013 2014 2014 2013 Net Income 51,714 $ 55,310 $ 107,660 $ 239,773 $ 175,300 $ Less: Income from discontinued operations, net of income taxes 10 $ (5,374) $ (50,857) $ (84,100) $ (16,265) $ Income from continuing operations 51,724 $ 49,936 $ 56,803 $ 155,673 $ 159,035 $ Plus: Provision for income taxes 28,272 27,804 27,280 81,937 76,799 Plus: Other expense (income), net 4,040 6,164 4,448 14,462 20,850 Operating income 84,036 $ 83,904 $ 88,531 $ 252,072 $ 256,684 $ Plus: Depreciation and amortization of property, equipment and leasehold improvements 6,342 5,443 5,921 18,091 14,814 Plus: Amortization of intangible assets 11,574 11,193 11,442 34,286 33,581 Plus: Lease exit charge - - - - (365) Adjusted EBITDA 101,952 $ 100,540 $ 105,894 $ 304,449 $ 304,714 $

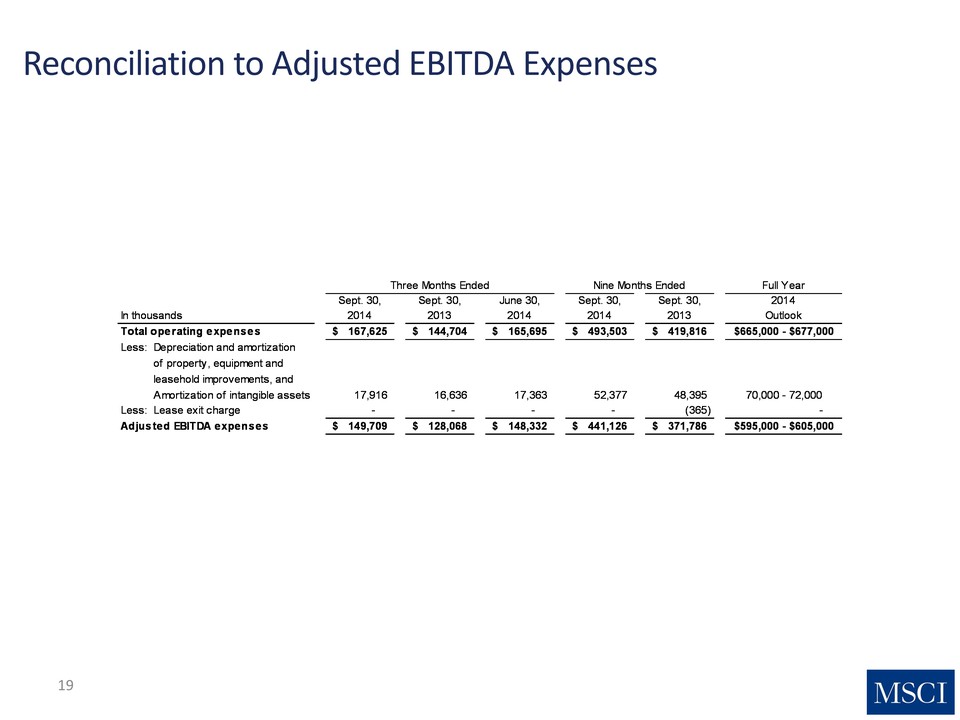

19 Reconciliation to Adjusted EBITDA Expenses Full Year Sept. 30, Sept. 30, June 30, Sept. 30, Sept. 30, 2014 In thousands 2014 2013 2014 2014 2013 Outlook Total operating expenses 167,625 $ 144,704 $ 165,695 $ 493,503 $ 419,816 $ $665,000 - $677,000 Less: Depreciation and amortization of property, equipment and leasehold improvements, and Amortization of intangible assets 17,916 16,636 17,363 52,377 48,395 70,000 - 72,000 Less: Lease exit charge - - - - (365) - Adjusted EBITDA expenses 149,709 $ 128,068 $ 148,332 $ 441,126 $ 371,786 $ $595,000 - $605,000 Three Months Ended Nine Months Ended