Exhibit 99.1

Exhibit 99.1 SYNACOR DRIVING GROWTH AND PROFITABILITY IN CLOUD – BASED SOFTWARE AND ADVERTISING INVESTOR PRESENTATION MARCH 2019 Contains proprietary and confidential information owned by Synacor, Inc. © / 2018 Synacor, Inc.

SAFE HARBOR “Safe Harbor” statement under the Private Securities Litigation Reform Act of 1995: This presentation contains forward-looking statements concerning Synacor’s expected financial performance as well as Synacor’s strategic and operational plans. The achievement or success of the matters covered by such forward-looking statements involves risks, uncertainties and assumptions. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, the company’s results could differ materially from the results expressed or implied by the forward-looking statements the company makes. Synacor is under no obligation to, and expressly disclaims any such obligation to, update or alter forward-looking statements, whether as a result of new information, future events, or otherwise. The risks and uncertainties referred to above include - but are not limited to - risks associated with: execution of Synacor’s plans and strategies; the loss of a significant customer; the company’s ability to obtain new customers; expectations regarding consumer taste and user adoption of applications and solutions; developments in Internet browser software and search advertising technologies; developments in display advertising technologies and practices; general economic conditions; expectations regarding the company’s ability to timely expand the breadth of services and products or introduction of new services and products; consolidation within the cable and telecommunications industries; changes in the competitive dynamics in the market for online search and display advertising; the risk that security measures could be breached and unauthorized access to subscriber data could be obtained; potential third party intellectual property infringement claims; and the price volatility of Synacor’s common stock. Further information on these and other factors that could affect the company’s financial results is included in filings it makes with the Securities and Exchange Commission from time to time, including the section entitled “Risk Factors” in the company’s most recent Form10-K filed with the SEC. These documents are available on the SEC Filings section of the Investor Information section of the company’s website at investor.synacor.com. 2

INVESTMENT HIGHLIGHTS 1 Growing recurring software revenue with 75% gross margins and strong renewal rates 2 Advertising business at scale driving customer value and cross-selling opportunities 3 Enviable customer reach among 4,000+ operators, content providers and enterprises worldwide 4 Improving profitability through performance optimization 3

TWO DISTINCT SEGMENTS WITH MULTIPLE GROWTH PLATFORMS SOFTWARESoftware-as-a-Service, Service Revenue, Subscription and Perpetual Licensing ADVERTISING Search and Advertising, Value-added Sales and Services Email/Collaboration Platform Identity Management Platform Advanced Portal Experiences Advertising Solutions for Publishers 4

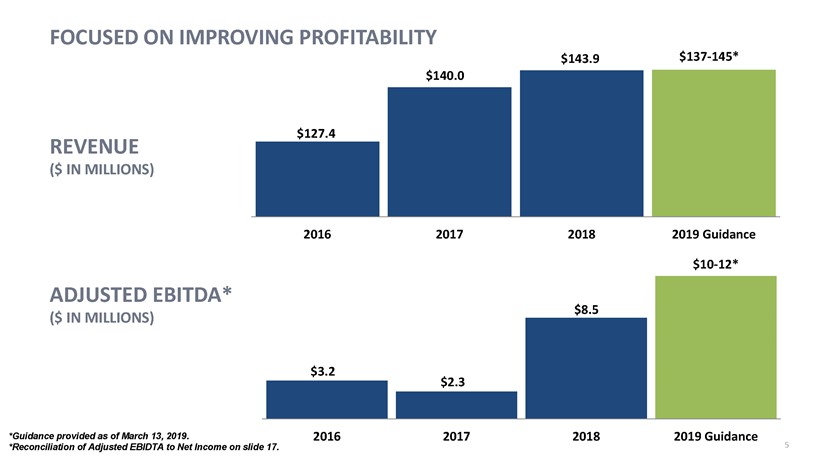

FOCUSED ON IMPROVING PROFITABILITY REVENUE ($ IN MILLIONS) $127.4 $140.0 $143.9$137-145* 2016 2017 2018 2019 Guidance ADJUSTED EBITDA* ($ IN MILLIONS) $3.2 $2.3 $8.5$10-12* 2016 2017 2018 2019 Guidance *Guidance provided as of March 13, 2019. *Reconciliation of Adjusted EBIDTA to Net Income on slide 17. 5

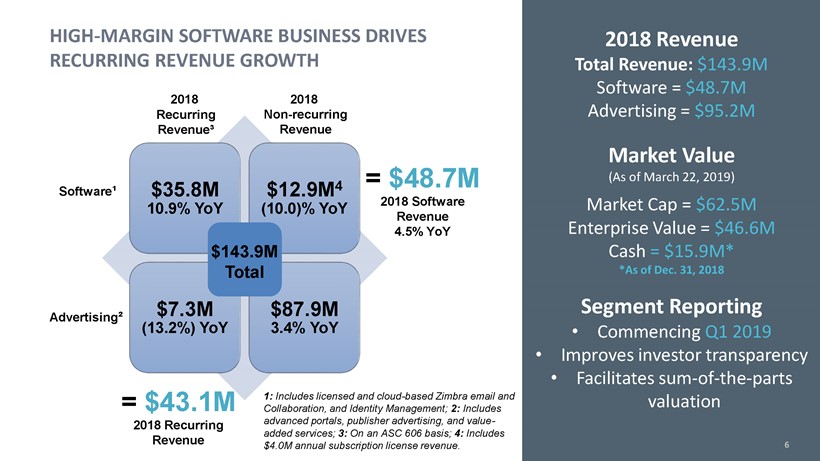

HIGH-MARGIN SOFTWARE BUSINESS DRIVES RECURRING REVENUE GROWTH 2018 Recurring Revenue³ Software¹ $35.8M 10.9% YoY 2018Non-recurring Revenue $12.9M4 (10.0)% YoY = $48.7M 2018 Software Revenue 4.5% YoY $143.9M Total Advertising2 $7.3M (13.2%) YoY $87.9M 3.4% YoY = $43.1M 2018 Recurring Revenue 1: Includes licensed and cloud-based Zimbra email and Collaboration, and Identity Management; 2: Includes advanced portals, publisher advertising, and value- added services; 3: On an ASC 606 basis; 4: Includes $4.0M annual subscription license revenue. 2018 Revenue Total Revenue: $143.9M Software = $48.7M Advertising = $95.2M Market Value (As of March 22, 2019) Market Cap = $62.5M Enterprise Value = $46.6M Cash= $15.9M* *As of Dec. 31, 2018 Segment Reporting • Commencing Q1 2019 • Improves investor transparency • Facilitatessum-of-the-parts valuation 6

COST REDUCTIONS AND PERFORMANCE OPTIMIZATION DRIVING IMPROVED PROFITABILITY • 2018 cost reductions focused onright-sizing, and facility and data center consolidation • 2019 cost focus on third-party services and discretionary spending • Optimizing performance around two business segments, software and advertising • Committed to balancing profitability with disciplined investments in revenue growth 2018 Announced Cost Reductions $8.0M 2018 Savings Realized $3.2M Savings Carryover to 2019 and 2020 $4.8M 7

ENGAGING TECH PLATFORM SOFTWARE ADVERTISING EMAIL & COLLABORATION PLATFORM IDENTITY MANAGEMENT PLATFORM ADVANCED PORTAL EXPERIENCES ADVERTISING SOLUTIONS FOR PUBLISHERS 8

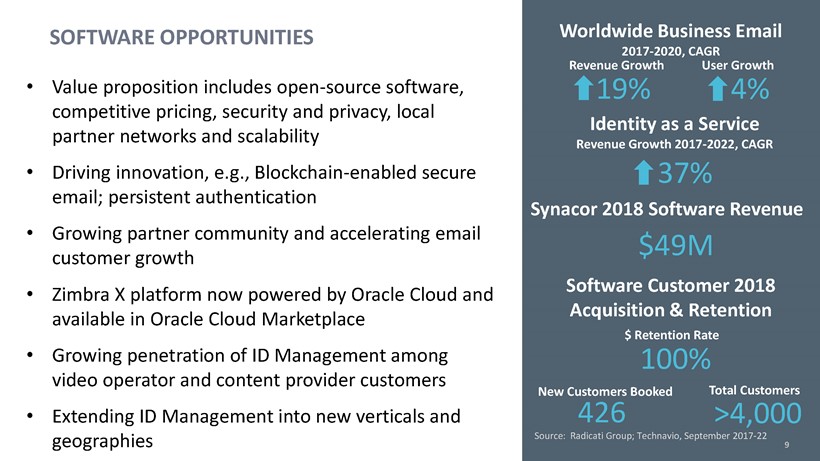

| SOFTWARE | OPPORTUNITIES |

•Value proposition includes open-source software, competitive pricing, security and privacy, local partner networks and scalability

•Driving innovation, e.g., Blockchain-enabled secure email; persistent authentication

•Growing partner community and accelerating email customer growth

•Zimbra X platform now powered by Oracle Cloud and available in Oracle Cloud Marketplace

•Growing penetration of ID Management among video operator and content provider customers

• Extending ID Management into new verticals and geographies Worldwide Business Email 2017-2020, CAGR Revenue Growth User Growth 19% 4% Identity as a Service Revenue Growth 2017-2022, CAGR Synacor 2018 Software Revenue $49M Software Customer 2018 Acquisition & Retention $ Retention Rate 100% New Customers Booked 426 Total Customers >4,000 Source: RadicatiGroup; Technavio, September2017-22 9

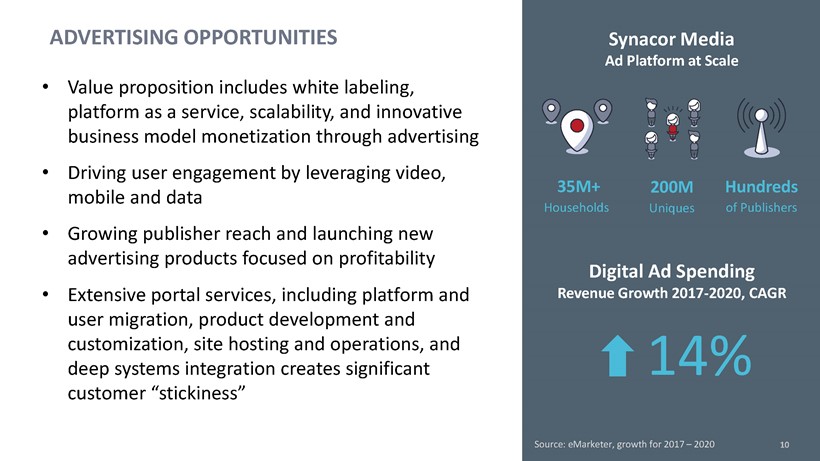

ADVERTISING OPPORTUNITIES • Value proposition includes white labeling, platform as a service, scalability, and innovative business model monetization through advertising • Driving user engagement by leveraging video, mobile and data • Growing publisher reach and launching new advertising products focused on profitability • Extensive portal services, including platform and user migration, product development and customization, site hosting and operations, and deep systems integration creates significant customer “stickiness” Synacor Media Ad Platform at Scale 35M+ Households 200M Uniques Hundreds of Publishers Digital Ad Spending Revenue Growth 2017-2020, CAGR 14% Source: eMarketer, growth for 2017 – 2020 10

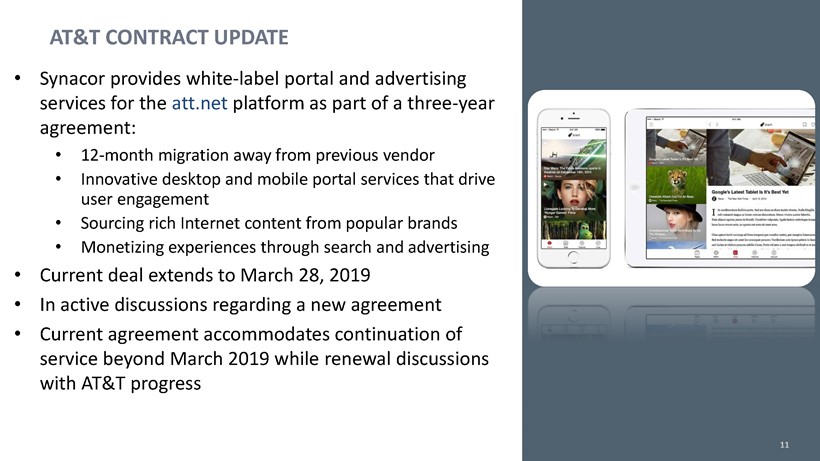

AT&T CONTRACT UPDATE

• Synacor provides white-label portal and advertising services for the att.net platform as part of a three-year agreement:

• 12-month migration away from previous vendor

• Innovative desktop and mobile portal services that drive user engagement

• Sourcing rich Internet content from popular brands

• Monetizing experiences through search and advertising

• Current deal extends to March 28, 2019

• In active discussions regarding a new agreement

• Current agreement accommodates continuation of service beyond March 2019 while renewal discussions with AT&T progress11

ENVIABLE CUSTOMER REACH

Over 100 Operator and Content Provider Customers, More than 4,000 Enterprise and Government Customers, Hundreds of Publisher Customers, Over 1,900 Channel Partners Operator and Content Provider Customers Enterprise Customers Partners 12

INVESTMENT HIGHLIGHTS 1 Growing recurring software revenue with 75% gross margins and strong renewal rates 2 Advertising business at scale driving customer value and cross-selling opportunities 3 Enviable customer reach among 4,000+ operators, content providers and enterprises worldwide 4 Improving profitability through performance optimization 13

THANK YOU SYNACOR 14

APPENDIX SYNACOR 15

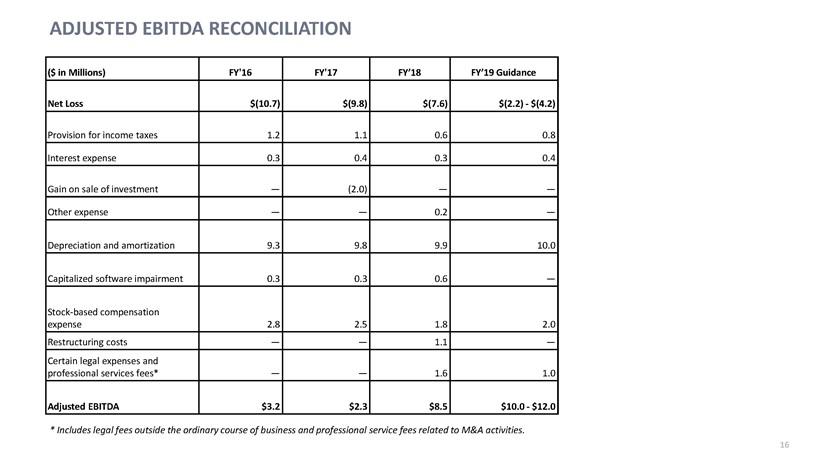

ADJUSTED EBITDA RECONCILIATION ($ in Millions) FY’16 FY’17 FY’18 FY’19 Guidance Net Loss $(10.7) $(9.8) $(7.6) $(2.2) - $(4.2) Provision for income taxes 1.2 1.1 0.6 0.8 Interest expense 0.3 0.4 0.3 0.4 Gain on sale of investment — (2.0) — — Other expense — — 0.2 —Depreciation and amortization 9.3 9.8 9.9 10.0 Capitalized software impairment 0.3 0.3 0.6 — Stock-based compensation expense 2.8 2.5 1.8 2.0

Restructuring costs — — 1.1 — Certain legal expenses and professional services fees* — — 1.6 1.0 Adjusted EBITDA $3.2 $2.3 $8.5 $10.0—$12.0 * Includes legal fees outside the ordinary course of business and professional service fees related to M&A activities.16