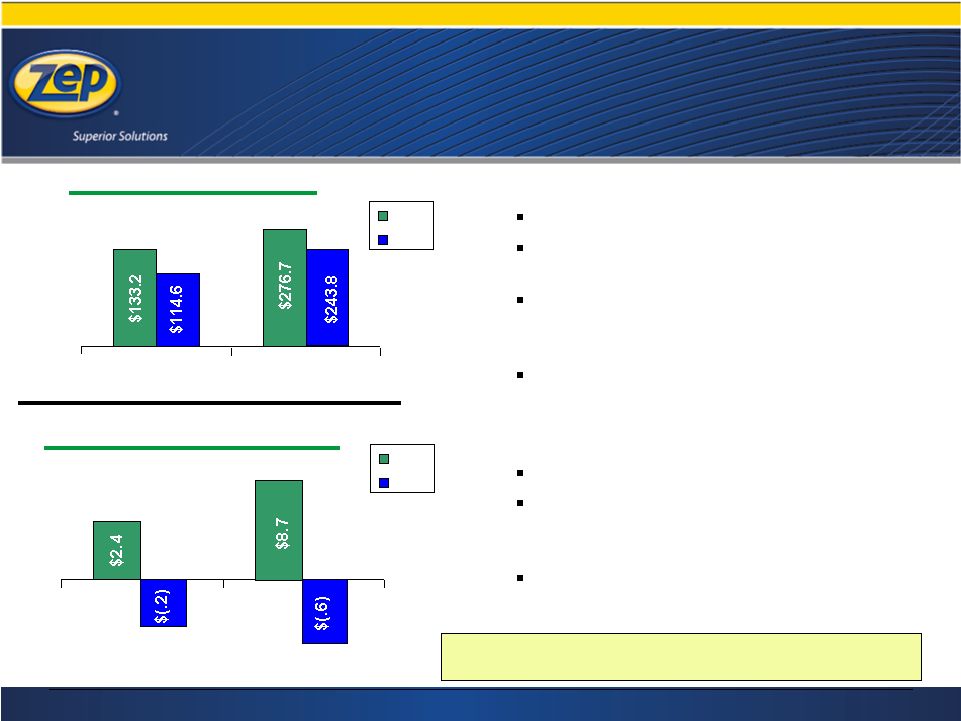

Non-GAAP Disclosure (continued) – We recently paid a fine of $3.8 million in connection with intentional misconduct on the part of certain non-executive employees resulting in our failure to comply with our wastewater discharge permit prior to 2003 at our primary manufacturing facility in Atlanta, Georgia. In connection with the investigation, the EPA and Zep each analyzed samples taken from certain sumps at this manufacturing facility, and the results led us to undertake further soil and groundwater studies. Based on the results to date of these studies, we plan to conduct voluntary remediation of the site and in May 2007 accrued a pre-tax liability of $5.0 million representing our best estimate of costs associated with remediation and other related groundwater issues over approximately five years at this site. The remediation will address issues that have developed in the past, during the almost fifty-year period we have been operating at the site. We believe that the expenses associated with this fine and remediation are non-recurring in nature and that such expenses are not reflective of our core operating performance. Accordingly, we believe it useful to exclude these expenses from our reported operating results. – During fiscal 2005, we undertook a restructuring initiative designed to streamline operations, improve customer service, and reduce transaction costs. In connection with these restructuring activities, we incurred a special charge of $4.5 million during the second quarter of fiscal 2005 to reflect the costs associated with the elimination of 70 salaried positions worldwide. We believe it is useful to exclude this charge from our reported operating results because it is unrelated to our core operating performance. – During fiscal 2004, we sold the National Chemical business, which marketed water treatment chemicals and services. While this sale was completed in fiscal 2004, we deferred the recognition of a portion of the total $1.5 million gain until the following fiscal year. This deferral was necessary because of concerns surrounding the collectability of consideration promised in exchange for National Chemical. We have adjusted our reported operating results to exclude the impact of the gains related to the sale of this business as the proceeds received from the sale are not relevant to our ongoing core operating performance. – We routinely dispose of certain classes of fixed assets in the normal course of business, such as equipment and vehicles used in the production and delivery of our products. Less frequent are sales of facilities operated by the company. However, in fiscal 2005, we recognized gains on such sales of $2.1 million. These sales were executed in fiscal 2005 pursuant to a specific review of our leased and owned facilities. While the evaluation of our resources is an on-going process, the company does not currently have plans involving similar facility sales and, therefore, believes it is useful to adjust reported operating results to present financial measures that exclude gains related to these sales. – We believe these measures are an important indicator of our operating strength and the performance of our business because they provide a link between profitability and operating cash flow. – We believe these measures adjust for items which are generally not indicative of our core operating performance. – We also believe that analysts and investors use EBIT, adjusted EBIT, EBITDA, adjusted EBITDA, adjusted operating profit, and adjusted net income as supplemental measures to evaluate the overall operating performance of companies in our industry. • We believe ROIC is a useful measure in providing investors with information regarding our performance. ROIC is a widely accepted measure of earnings efficiency in relation to total capital. We believe that the expenses associated with the environmental fine and remediation are non-recurring in nature and that such expenses are not reflective of our core operating performance. Accordingly, we believe it useful to exclude these expenses from adjusted ROIC. • Our management uses EBIT, adjusted EBIT, EBITDA, adjusted EBITDA, adjusted operating profit, and adjusted net income: – as measurements of operating performance because they assist us in comparing our operating performance on a consistent basis as they remove the impact of items not directly resulting from our core operations; – to evaluate the effectiveness of our operational strategies; and – to evaluate our capacity to fund capital expenditures and expand our business. Copyright 2009. Zep Inc. - All rights reserved. 29 |