First Guaranty Bancshares, Inc. Investor Presentation April 2018 Financial Information as of December 31, 2017 and March 31, 2018 unless otherwise noted

Disclosures This presentation has been prepared by First Guaranty Bancshares, Inc. (“First Guaranty”) solely for informational purposes based on its own information, as well as information from public sources. This presentation has been prepared to assist interested parties in making their own evaluation of First Guaranty and does not purport to contain all of the information that may be relevant. In all cases, interested parties should conduct their own investigation and analysis of First Guaranty. Except as otherwise indicated, this presentation speaks as of the date hereof. The delivery of this presentation shall not, under any circumstances, create any implication there has been no change in the affairs of First Guaranty after the date hereof. This presentation includes industry and market data that we obtained from periodic industry publications, third‐party studies and surveys. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe the industry and market data to be reliable as of the date of this presentation, this information could prove to be inaccurate. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. In addition, we do not know all of the assumptions regarding general economic conditions or growth that were used in preparing the forecasts from the sources relied upon or cited herein. This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Management uses these “non‐GAAP” measures in its analysis of our performance. Management believes that these non‐GAAP financial measures allows for better comparability with prior periods, as well as with peers in the industry who provide a similar presentation, and provide a greater understanding of our ongoing operations. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non‐ GAAP performance measures that may be presented by other companies. A reconciliation of the non‐GAAP measures used in this presentation to the most directly comparable GAAP measures is provided in the Appendix to this presentation. Financial information is based off of unaudited financial statements as of March 31, 2019 unless otherwise noted. 1

Forward Looking Statements These slides and the accompanying oral presentation contain forward‐looking statements, which can be identified by the use of words such as “estimate,” “project,” “believe,” “intend,” “anticipate,” “assume,” “plan,” “seek,” “expect,” “will,” “may,” “should,” “indicate,” “would,” “believe,” “contemplate,” “continue,” “target” and words of similar meaning. These forward‐looking statements include, but are not limited to: – statements of our goals, intentions and expectations; – statements regarding our business plans, prospects, growth and operating strategies; – statements regarding the asset quality of our loan and investment portfolios; and – estimates of our risks and future costs and benefits. These forward‐looking statements are based on our current beliefs and expectations and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward‐looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. We are under no duty to and do not take any obligation to update any forward‐looking statements after the date of this presentation. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward‐looking statements: – our ability to manage our operations under the current economic conditions nationally and in our market area; – adverse changes in the financial industry, securities, credit and national local real estate markets (including real estate values); – risks related to a high concentration of loans secured by real estate located in our market area; – the impact of the Premier Bancshares acquisition; – our ability to enter new markets successfully and capitalize on growth opportunities; – significant increases in our loan losses, including as a result of our inability to resolve classified and non‐performing assets or reduce risks associated with our loans, and management’s assumptions in determining the adequacy of the allowance for loan losses; – credit risks of lending activities, including changes in the level and trend of loan delinquencies and write‐offs and in our allowance for loan losses and provision for loan losses; – competition among depository and other financial institutions; – our success in increasing our commercial real estate and commercial and industrial lending; 2

Forward Looking Statements (cont’d) – our ability to attract and maintain deposits and our success in introducing new financial products; – our ability to improve our asset quality even as we increase our commercial real estate and commercial and industrial lending; – changes in interest rates generally, including changes in the relative differences between short‐term and long‐term interest rates and in deposit interest rates, that may affect our net interest margin and funding sources; – fluctuations in the demand for loans; – technological changes that may be more difficult or expensive than expected; – changes in consumer spending, borrowing and savings habits; – increases in our cost of funds resulting from the current rising interest rate environment; – changes in laws or government regulations or policies affecting financial institutions, including the Dodd‐Frank Act and the JOBS Act, which could result in, among other things, increased deposit insurance premiums and assessments, capital requirements, regulatory fees and compliance costs, particularly the capital regulations, and the resources we have available to address such changes; – changes in accounting policies and practices, as may be adopted by the bank regulatory agencies, the Financial Accounting Standards Board, the Securities and Exchange Commission or the Public Company Accounting Oversight Board; – changes in our compensation and benefit plans, and our ability to retain key members of our senior management team and to address staffing needs in response to product demand or to implement our strategic plans; – loan delinquencies and changes in the underlying cash flows of our borrowers; – the impairment of our investment securities; – our ability to control costs and expenses, particularly those associated with operating as a publicly traded company; – the failure or security breaches of computer systems on which we depend; – the ability of key third‐party service providers to perform their obligations to us; and – other economic, competitive, governmental, regulatory and operational factors affecting our operations. Because of these and a wide variety of other uncertainties, many of which are beyond our control, our actual future results may be materially different from the results indicated by these forward‐looking statements. 3

Summary Financial Overview Overview • Headquartered in Hammond, LA and originally founded in Amite, LA in 1934 • Operates 26 banking facilities located in the Hammond, Baton Rouge, Lafayette, Shreveport‐Bossier City, Dallas‐ Fort Worth‐Arlington, Waco MSAs • 3/31/2019 BV / share of $17.55, YTD EPS of $0.36 and dividend of $0.16 per share Financial Highlights (March 31, 2019) Metric Value Total Assets $1.91 billion Total Loans $1.30 billion Total Deposits $1.71 billion Common Equity $154.6 million YTD EPS $0.36 YTD ROAA 0.68% YTD ROACE 8.43% Tangible Book Value $16.86 Source: Company Filings 4

History Overview • Modern history begins in 1993 with the recapitalization of First Guaranty by a group of investors led by Marshall T. Reynolds Dollars in millions Snapshot (Then and Now) Metrics 1993 Q1'19 CAGR Total Assets: $158.80 $1,907.5 10.3% Total Loans: $105.0 $1,298.2 10.5% Book Value Per Share1 : $3.702 $46.68 10.3% Branches 6 26 (1) Source: Company filings, excludes the impact of stock splits and stock dividends (2) Book value per share as of March 31, 1993 post‐recapitalization 5

History Corporate Timeline Announces acquisition of Acquisition of Premier First Guaranty Homestead Bancorp, Inc. Bancshares, Inc. Bank founded in First Guaranty Hired Chief Amite, LA Bancshares, Inc. formed Announces Announces Deposit Officer, acquisition of acquisition of Mark Ducoing First Southwest Greensburg Bank Bancshares, Inc. 10% stock dividend 10% stock dividend 1934 1993 1999 2001 2007 2009 2010 2012 2015 2017 2019 Investor group led by Alton Lewis 10% stock dividend Hired Chief Lending Marshall T. Reynolds becomes CEO Officer, Brandon Long invests $3.6M as part of a recapitalization Announces IPO completed / acquisition of SBLF Preferred Woodlands Stock redeemed Bancorp, Inc. 103rd consecutive quarterly dividend paid on March 29, 2019 6

Historical BV/Share Growth Excluding the Impact of Stock Splits and Stock Dividends Historical Book Value/Share Growth $50.00 $45.00 $40.00 $35.00 $30.00 $25.00 $20.00 $15.00 $10.00 $5.00 $0.00 (1) Estimated book value per share as of March 31, 1993 post‐recapitalization Note: 2018 book value per share as of December 31 Source: Company filings, excludes the impact of stock splits and stock dividends 7

Cash Dividends on Common Stock (in Thousands) Cash Dividends on Common Stock $6,000 5,636 $5,000 $4,000 $3,000 $2,000 $1,000 $0 Source: Company filings 8

Insider Shareholder Base • First Guaranty has strong insider ownership • Over 48% of our shares are owned by insiders at both Bank and Holding Company • 8,807,175 current shares outstanding 9

Branch Footprint 10

Texas Market Update • First Guaranty completed the acquisition on June 16, 2017 • Texas loans have grown 36.6% to $174.9 million from $128.0 million at acquisition • Texas deposits have grown 36.7% to $173.9 million from $127.2 million at acquisition 11

Community Involvement First Guaranty is a strong contributor to the communities we serve. • Contributes over 2.0% of net earnings to the community • Contributed $413,663 to our local communities in 2018 • Every employee contributes at least four hours of community service annually • In 2018, our employees volunteered a total of 1,756 hours Source: Company filings 12

Investment Portfolio & Asset/Liability Loan / Deposit Improvement • First Guaranty has been reducing the 77.0% 75.9% percentage of securities as a portion 76.0% 75.2% of total assets in recent years and 75.0% 74.2% concentrating on higher yielding 74.0% loans 73.0% 72.0% 71.6% 71.0% • Investment portfolio is positioned to 70.0% efficiently fund loan growth 69.0% 2016 2017 2018 1Q2019 Securities as Percentage of Balance Sheet Loan Interest Income 35.0% 33.3% 80,000 74,955 30.0% 28.7% 70,000 64,836 25.0% 22.3% 60,000 54,034 19.6% 50,000 45,495 20.0% 40,000 15.0% 30,000 10.0% 20,000 5.0% 10,000 0.0% 0 2016 2017 2018 1Q2019 2016 2017 2018 1Q2019* Source: SNL Financial, Company filings *Annualized 13

Loan Portfolio Total Loans ($million) Loan Portfolio (3/31/2019) Consumer & $1,400 $1,298 Other, 6.0% $1,225 Farmland, 1.5% $1,200 $1,149 C&D, 11.0% $1,000 $949 C&I, 16.1% $800 Agricultural, 1‐4 Family, 1.7% 13.8% $600 Multifamily, $400 Non‐farm Non‐ 3.2% Residential, $200 46.7% $0 2016 2017 2018 1Q2019 Total Loans: $1.30 billion Yield on Loans: 5.87%* Non‐farm Non‐residential CRE Portfolio (3/31/2019) Yield on Loans 6.00% 5.87% Top CRE Lending Industries 5.80% Hotel / Motel 5.60% 5.55% Owner Occupied, Non‐ Retail 5.40% 37.2% owner 5.16% Occupied, Industrial & Warehouse 5.20% 5.11% 62.8% Manufacturing 5.00% 4.80% Office Buildings 4.60% Source: Company Filings 2016 2017 2018 1Q2019* *Annualized 14

Loan Credit Quality NPAs / Assets NCOs / Avg. Loans 1.60% 1.48% 0.60% 0.54% 1.40% 0.50% 1.20% 0.40% 1.00% 0.84% 0.77% 0.30% 0.23% 0.80% 0.18% 0.55% 0.20% 0.60% 0.40% 0.10% 0.20% 0.00% 0.00% ‐0.10% ‐0.02% 2016 2017 2018 1Q2019 2016 2017 2018 1Q2019* Loan Loss Reserves / Total Loans Reserves / NPAs 1.40% 120.00% 1.17% 107.48% 1.20% 100.00% 1.00% 0.88% 0.80% 0.85% 80.00% 74.69% 0.80% 62.88% 60.00% 50.04% 0.60% 0.40% 40.00% 0.20% 20.00% 0.00% 0.00% 2016 2017 2018 1Q2019 2016 2017 2018 1Q2019 Source: Company Filings *Annualized 15

We’re growing places • Expand on additional technological solutions – implementing nCino; a bank operating system • Seek additional Merger & Acquisition opportunities to expand our footprint • FGB Center –a main office expansion – under construction • Completion date December 2019 • Continue to increase wallet share of current customer base and grow in newer markets • By continuing to develop our product and service mix • New Amite branch under construction and designing new branch for Kentwood 16

Fanatical Employees FANATICAL PEOPLE MAKE FANATICAL BANKERS Graduate School of Banking 23: Attendees 11: Sr Management 7: Management 5: Rising Stars 17

Investing in First Guaranty • First Guaranty has a long history of TBV growth and has been a consistent dividend payer • First Guaranty has long history of creating shareholder value • Book Value per one 1993 share has increased from $3.70 to $46.68 since 1993 • First Guaranty has paid $73,941,000 in cash dividends to common shareholders since 1993 18

Louisiana meets Texas Commercial 19

fgb.net 888.375.3093 NASDAQ: FGBI 20

Appendix

Historical Balance Sheets (Dollars in thousands) Year Ended December 31, 2016 2017 2018 March 31, 2019 Assets Cash and due from banks 17,840 37,205 127,416 165,735 Federal funds sold 271 823 549 416 Cash and cash equivalents 18,111 38,028 127,965 166,151 Available for sale, at fair value 397,473 381,535 296,977 268,918 Held to maturity, at cost 101,863 120,121 108,326 105,878 Investment securities 499,336 501,656 405,303 374,796 Federal Home Loan Bank stock, at cost 1,816 2,351 2,393 2,407 Loans, held for sale 0 1,308 344 537 Loans, net of unearned income 948,921 1,149,014 1,225,268 1,298,156 Allowance for loan losses 11,114 9,225 10,776 11,001 Net loans 937,807 1,139,789 1,214,492 1,287,155 Premises and equipment, net 23,519 38,020 39,695 41,728 Goodwill 1,999 3,472 3,472 3,472 Intangible assets, net 1,056 4,424 3,528 3,375 Other real estate, net 359 1,281 1,138 1,120 Accrued interest receivable 7,039 7,982 6,716 7,707 Other assets 9,904 12,119 12,165 19,043 Total Assets 1,500,946 1,750,430 1,817,211 1,907,491 Liabilities Noninterest‐bearing demand 231,094 251,617 244,516 252,205 Interest‐bearing demand 479,810 611,677 594,359 608,256 Savings 97,280 104,661 109,958 112,238 Time 517,997 581,331 680,789 738,450 Total deposits 1,326,181 1,549,286 1,629,622 1,711,149 Short‐term borrowings 6,500 15,500 0 0 Accrued interest payable 1,931 2,488 3,952 4,975 Long‐term borrowings 22,100 22,774 19,838 19,105 Junior subordinated debentures 14,630 14,664 14,700 14,709 Other liabilities 5,255 1,735 1,815 2,971 Total Liabilities 1,376,597 1,606,447 1,669,927 1,752,909 Equity Common Stock 8,369 8,807 8,807 8,807 Surplus 81,000 92,268 92,268 92,268 Retained earnings 38,979 44,464 53,347 55,070 Accumulated other comprehensive income (3,999) (1,556) (7,138) (1,563) Total Equity 124,349 143,983 147,284 154,582 Total Liabilities & Shareholder's Equity 1,500,946 1,750,430 1,817,211 1,907,491 Source: Company filings 22

Historical Income Statements (Dollars in thousands) Year Ended December 31, For Three Months Ended 2016 2017 2018 3/31/2019 Income Statement Interest Income 58,532 67,546 78,390 21,975 Interest Expense 10,140 14,393 21,366 7,382 Net Interest Income 48,392 53,153 57,024 14,593 Provision for Loan Losses 3,705 3,822 1,354 787 Service charges, commissions and fees 4,247 4,575 5,110 1,136 Net gains on securities 3,799 1,397 (1,830) (402) Net gain (loss) on sale of loans 14 311 278 11 Other Noninterest Income 1,395 2,057 1,722 556 Total Noninterest Income 9,455 8,340 5,280 1,301 Salaries and employee benefits 16,577 20,113 22,888 5,962 Occupancy & Equipment 4,242 4,505 5,601 1,485 Other Expense 12,066 13,903 14,786 3,721 Total Noninterest Expense 32,885 38,521 43,275 11,168 Net Income before Taxes 21,257 19,150 17,675 3,939 Provision for Taxes 7,164 7,399 3,462 807 Net Income Avail to Common 14,093 11,751 14,213 3,132 Source: Company filings 23

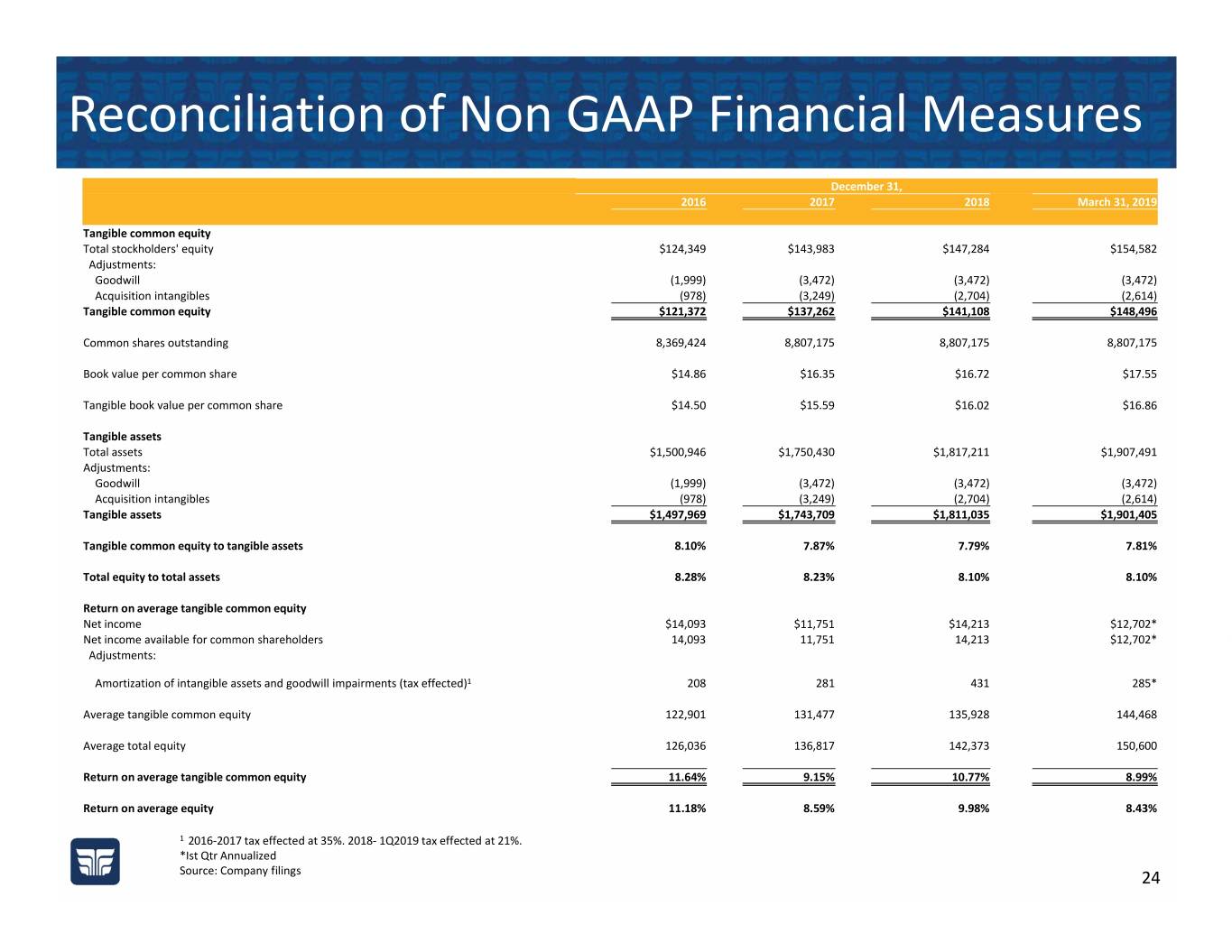

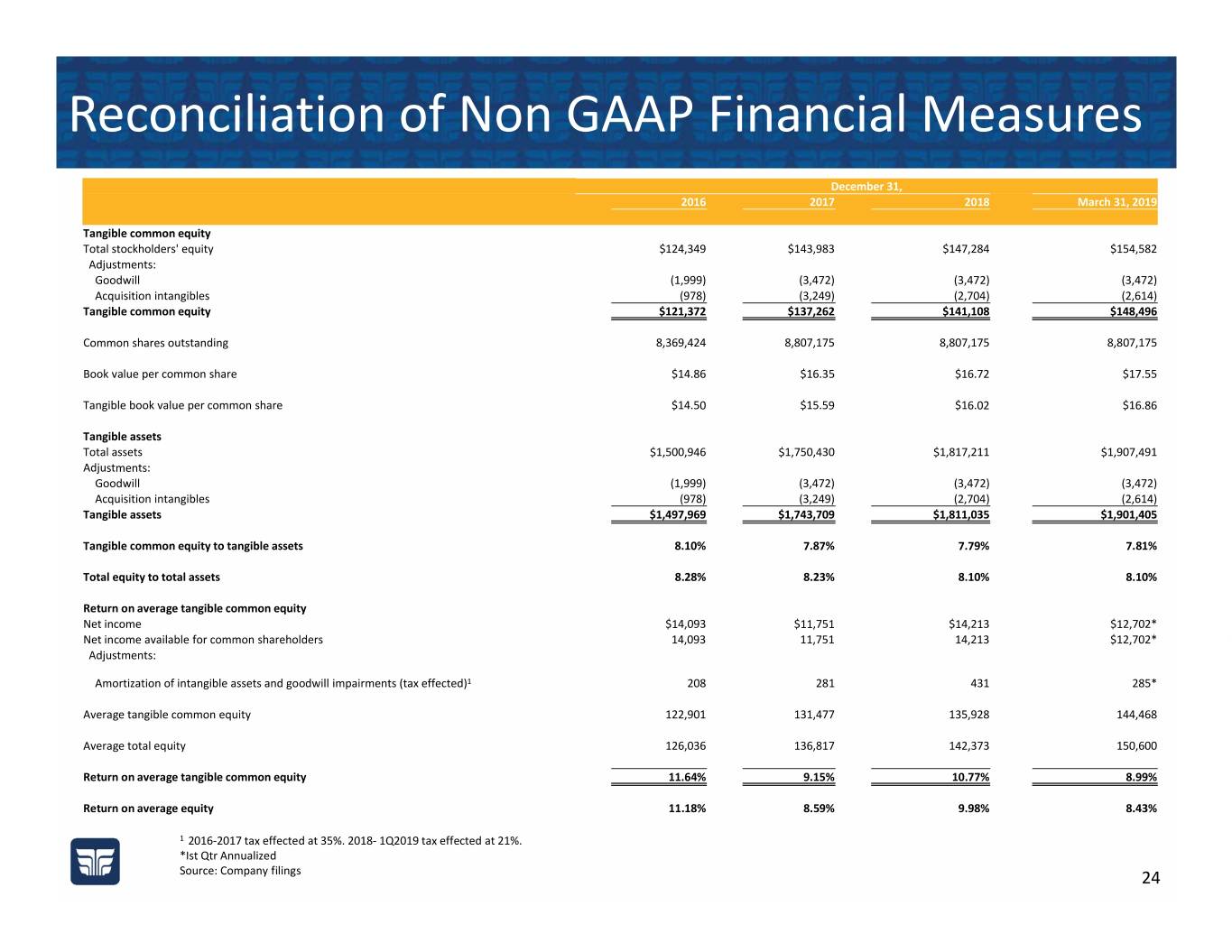

Reconciliation of Non GAAP Financial Measures December 31, 2016 2017 2018 March 31, 2019 Tangible common equity Total stockholders' equity $124,349 $143,983 $147,284 $154,582 Adjustments: Goodwill (1,999) (3,472) (3,472) (3,472) Acquisition intangibles (978) (3,249) (2,704) (2,614) Tangible common equity $121,372 $137,262 $141,108 $148,496 Common shares outstanding 8,369,424 8,807,175 8,807,175 8,807,175 Book value per common share $14.86 $16.35 $16.72 $17.55 Tangible book value per common share $14.50 $15.59 $16.02 $16.86 Tangible assets Total assets $1,500,946 $1,750,430 $1,817,211 $1,907,491 Adjustments: Goodwill (1,999) (3,472) (3,472) (3,472) Acquisition intangibles (978) (3,249) (2,704) (2,614) Tangible assets $1,497,969 $1,743,709 $1,811,035 $1,901,405 Tangible common equity to tangible assets 8.10% 7.87% 7.79% 7.81% Total equity to total assets 8.28% 8.23% 8.10% 8.10% Return on average tangible common equity Net income $14,093 $11,751 $14,213 $12,702* Net income available for common shareholders 14,093 11,751 14,213 $12,702* Adjustments: Amortization of intangible assets and goodwill impairments (tax effected)1 208 281 431 285* Average tangible common equity 122,901 131,477 135,928 144,468 Average total equity 126,036 136,817 142,373 150,600 Return on average tangible common equity 11.64% 9.15% 10.77% 8.99% Return on average equity 11.18% 8.59% 9.98% 8.43% 1 2016‐2017 tax effected at 35%. 2018‐ 1Q2019 tax effected at 21%. *Ist Qtr Annualized Source: Company filings 24