First Guaranty Bancshares, Inc. Investor Presentation April 2018 Financial Information as of December 31, 2017 and March 31, 2018 unless otherwise noted First Guaranty Bancshares, Inc. To Acquire Union Bancshares, Inc.

Forward Looking Statements This communication contains forward‐looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, First Guaranty’s and Union Bancshares’s expectations or predictions of future financial or business performance or conditions. Forward‐looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible” or “potential,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward‐looking statements are subject to numerous assumptions, risks and uncertainties, which change over time, are difficult to predict and are generally beyond the control of either company. Forward‐looking statements speak only as of the date they are made and we assume no duty to update forward‐looking statements. Actual results may differ materially from current projections. In addition to factors previously disclosed in First Guaranty’s reports filed with the Securities and Exchange Commission (“SEC”) and those identified elsewhere in this communication, the following factors, among others, could cause actual results to differ materially from forward‐looking statements or historical performance: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate any definitive merger agreement between First Guaranty and Union Bancshares; the outcome of any legal proceedings that may be instituted against First Guaranty or Union Bancshares; the ability to obtain regulatory approvals and meet other closing conditions to the merger, including the risk that approval by Union Bancshares shareholders is not obtained, and the risk that regulatory approvals required for the merger are not obtained or are obtained subject to conditions that are not anticipated; delay in closing the merger; difficulties and delays in integrating the Union Bancshares business or fully realizing cost savings and other benefits; business disruption following the merger; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of First Guaranty’s products and services; customer borrowing, repayment, investment and deposit practices; customer disintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions and divestitures; economic conditions; the impact, extent and timing of technological changes and capital management activities; litigation; increased capital requirements, other regulatory requirements or enhanced regulatory supervision; and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

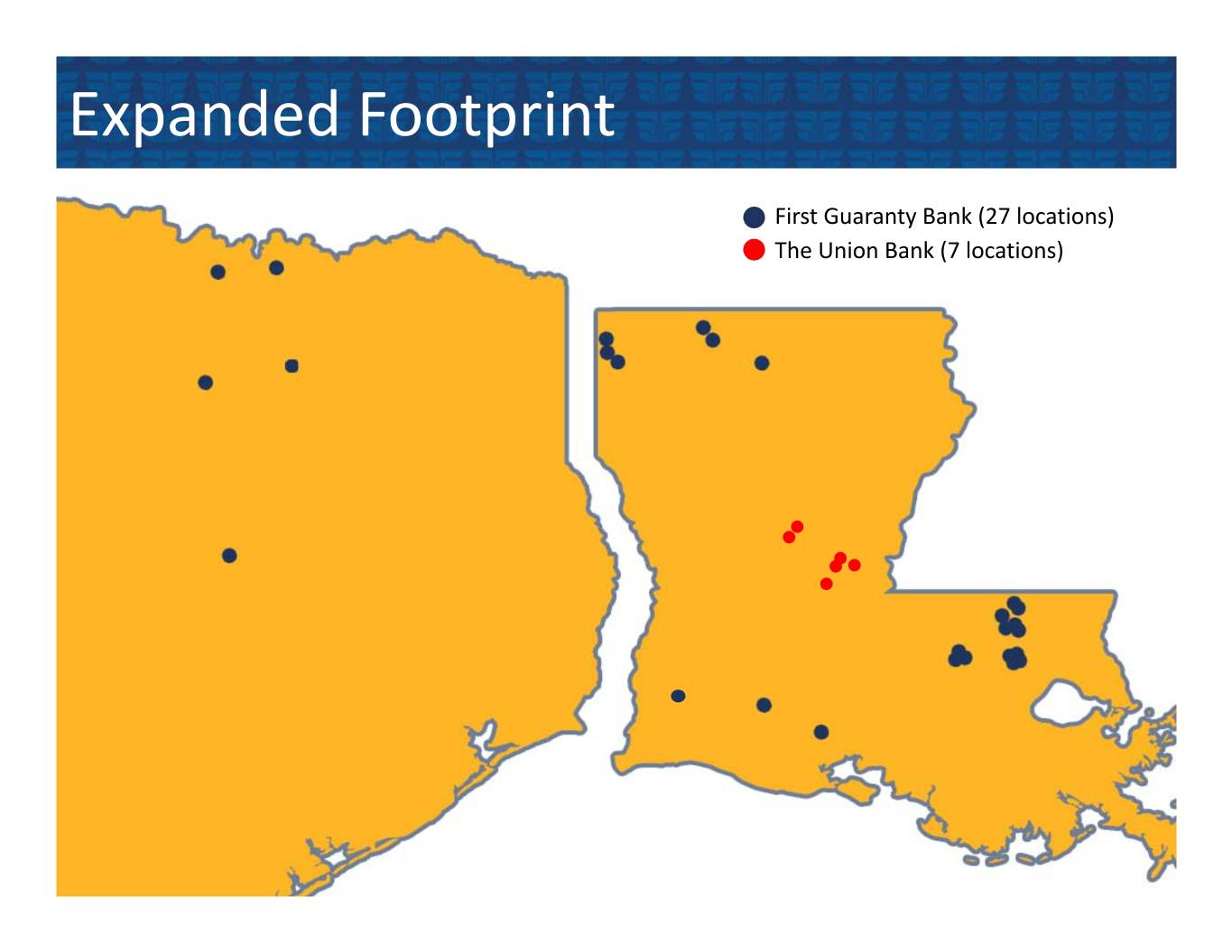

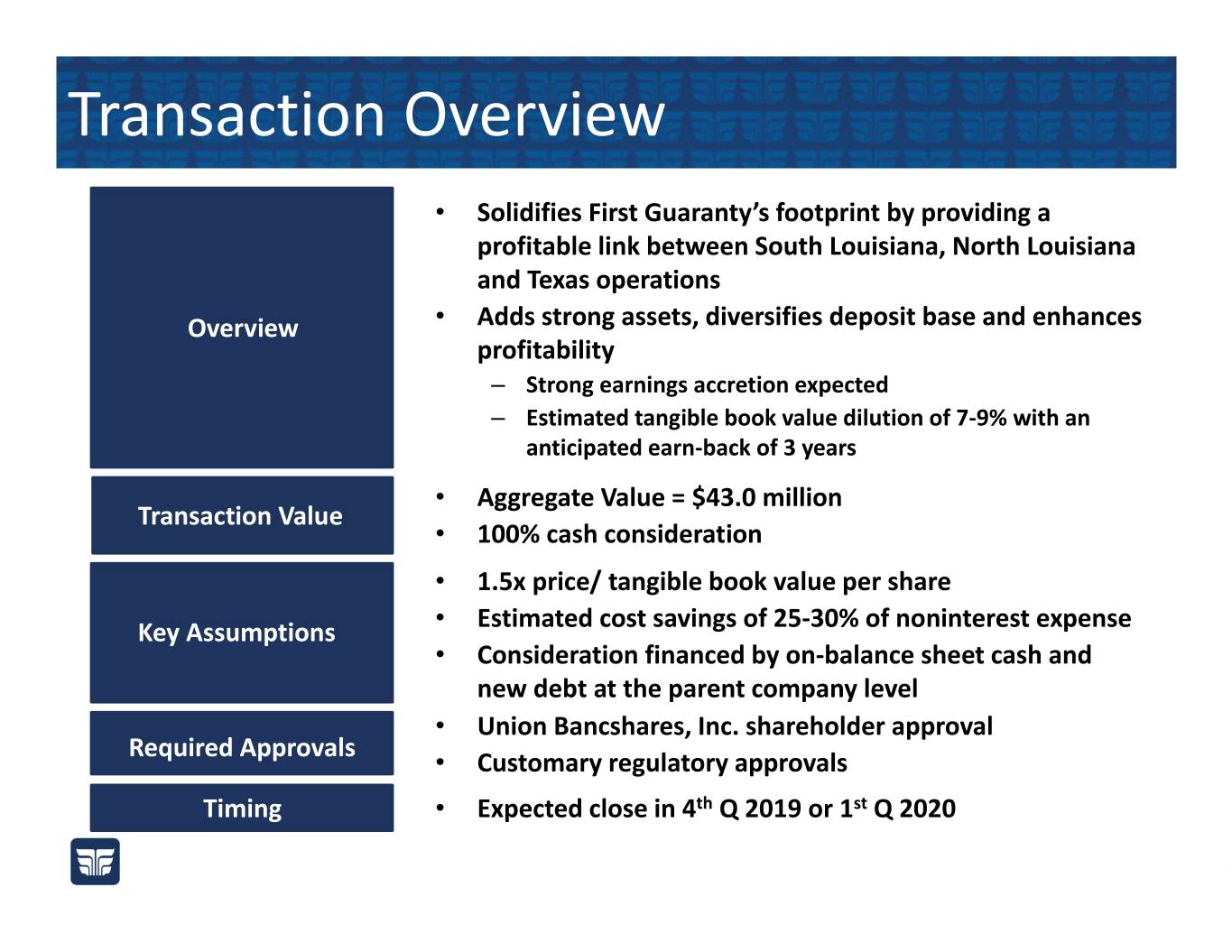

Transaction Overview • Solidifies First Guaranty’s footprint by providing a profitable link between South Louisiana, North Louisiana and Texas operations Overview • Adds strong assets, diversifies deposit base and enhances profitability – Strong earnings accretion expected – Estimated tangible book value dilution of 7‐9% with an anticipated earn‐back of 3 years • Aggregate Value = $43.0 million Transaction Value • 100% cash consideration • 1.5x price/ tangible book value per share • Estimated cost savings of 25‐30% of noninterest expense Key Assumptions • Consideration financed by on‐balance sheet cash and new debt at the parent company level • Union Bancshares, Inc. shareholder approval Required Approvals • Customary regulatory approvals Timing • Expected close in 4th Q 2019 or 1st Q 2020