MARCH 2020 DISCUSSION MATERIALS ST RI CT LY C ON FI DE NT IA L Materials Prepared For: [BANK NAME] Financial Institutions Group INVESTOR PRESENTATION Financial Data as of: Third Quarter 2021 NASDAQ: FGBI www.fgb.net

2 CERTAIN IMPORTANT INFORMATION CAUTION REGARDING FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended with respect to the financial condition, liquidity, results of operations, and future performance of our business. These forward-looking statements are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those that are not historical facts. Forward-looking statements include statements with respect to beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions that are subject to significant risks and uncertainties and are subject to change based on various factors (some of which are beyond our control, particularly with regard to developments related to the novel coronavirus (“COVID-19”)). Forward-looking statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “forecasts,” “intends,” “plans,” “targets,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would” and “could.” We caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. These forward-looking statements are subject to a number of factors and uncertainties, including, changes in general economic conditions, either nationally or in our market areas, that are worse than expected; the ongoing effects of the COVID-19 pandemic on First Guaranty Bancshares, Inc.’s (the “Company or “FGBI”) operations and financial performance; competition among depository and other financial institutions; inflation and changes in the interest rate environment that reduce our margins or reduce the fair value of financial instruments; adverse changes in the securities markets; changes in laws or government regulations or policies affecting financial institutions, including changes in regulatory fees and capital requirements; our ability to enter new markets successfully and capitalize on growth opportunities; our ability to successfully integrate acquired entities; changes in consumer spending, borrowing and savings habits; changes in accounting policies and practices, as may be adopted by the bank regulatory agencies, the Financial Accounting Standards Board, the Securities and Exchange Commission and the Public Company Accounting Oversight Board; changes in our organization, compensation and benefit plans; changes in our financial condition or results of operations that reduce capital available to pay dividends; increases in our provision for loan losses and changes in the financial condition or future prospects of issuers of securities that we own, which could cause our actual results and experience to differ from the anticipated results and expectations, expressed in such forward-looking statements. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. NON-GAAP FINANCIAL MEASURES Statements included in this presentation include non-GAAP financial measures and should be read along with the accompanying tables under the section titled “Non-GAAP Reconciliations.” The Company uses non-GAAP financial measures to analyze its performance. Management believes that non-GAAP financial measures provide additional useful information that allows readers to evaluate the ongoing performance of the Company and provide meaningful comparison to its peers. Non-GAAP financial measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and investors should consider the Company’s performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the Company. Non-GAAP financial measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the results or financial condition as reported under GAAP.

CORPORATE OVERVIEW

4 FIRST GUARANTY BANCSHARES, INC. ¹Non-GAAP measure. See “Certain Important Information – Non-GAAP Financial Measures” on slide 2 and “Non-GAAP Reconciliation” on slide 22 for additional information Note: Market data as of November 28, 2021; Financial information as of and for the nine months ended September 30, 2021 Source: Company documents, S&P Capital IQ Pro 2021 YTD AT A GLANCE 114 and counting Consecutive Quarterly Dividends Declared 87 Years in Banking Total Loans Total Assets Total Deposits Locations ATMs 4634 $2.8 $2.5 BillionBillion $2.1 Billion $19.2 Million 2021 YTD Net Income “#1 RANKED BEST SMALL BANK IN LOUISIANA & THE U.S.” Serving the community since 1934 34 locations throughout Louisiana & Texas including a loan production office in Lake Charles, LA NASDAQ: FGBI Market Cap: $216.7 M 2021 YTD ROAA: 0.92% 2021 YTD ROATCE1: 15.45% 2021 YTD Common Dividend: $0.48 per share Holding Company for First Guaranty Bank in Hammond, Louisiana FGBI BRANCH Newsweek Magazine

5 INVESTMENT HIGHLIGHTS Note: Financial information as of September 30, 2021 Source: Company documents $269.8 million in cash equivalents Net charge-offs / average loans of 0.07% 2021YTD; average of 0.44% from 1993 to 2020 Significant reduction in loan deferrals related to the pandemic over the last year Allowance for loan losses of $25.3 million; 1.22% of total loans 114 consecutive quarters of common dividends declared Dividend strategy implemented when the current ownership group took over in 1993 Significant common stock ownership by the Board and management ATTRACTIVE GROWTH STORYCONSISTENT EARNINGS CONSERVATIVE BALANCE SHEET COMMITMENT TO A COMMON DIVIDEND Profitable for 32 consecutive years Diverse earnings stream with an average ROAA of 0.81% from 2010 to 2020 Tangible book value growth of 969% from when current ownership group took over in 1993 to 2020 Significant opportunity for net interest margin expansion Strong and successful track record of organic growth Meaningful scale in key growth markets of Hammond, LA, Baton Rouge, LA, Shreveport, LA and Dallas, TX Acquisition strategy focused on expanding into new markets Two whole bank acquisitions completed since 2017

6 EXPERIENCED LEADERSHIP Alton B. Lewis Jr. Eric J. Dosch Chief Executive Officer & President Chief Executive Officer and President of First Guaranty Bancshares, Inc. since October 2009 Chief Executive Officer of First Guaranty Bank since October 2009 President of First Guaranty Bank since January 2013 Vice Chairman of First Guaranty Bancshares, Inc. and First Guaranty Bank since October 2009 Director of First Guaranty Bancshares Inc. and First Guaranty Bank since 2001 Partner of the law firm of Cashe, Lewis, Coudrain & Sandage and its predecessor from January 1980 to September 2009 Chief Financial Officer Chief Financial Officer of First Guaranty Bank and First Guaranty Bancshares, Inc. since May 2010 Treasurer, Secretary and Principal Accounting Officer at First Guaranty Bancshares, Inc. since 2010 Previous positions held in lending and credit including Chief Credit Officer Prior to association with First Guaranty Bank, he served as an Analyst with Livingston & Jefferson Holds the Chartered Financial Analyst designation and is a graduate of The Graduate School of Banking at Louisiana State University; undergraduate degree from Duke University in 2001 Source: Company documents Mark Ducoing SVP & Chief Deposit Officer Joined FGBI in 2019 Primary focus on lowering cost of deposits; leading to significant progress in improvement of deposit base since his arrival 38 years of banking experience with 15 of those years with Regions Financial Corporation Desiree Simmons SVP & Chief Administrative Officer Joined FGBI in 2009 Earned her Bachelor’s degree from Southeastern Louisiana University 25 years of banking experience 2014 graduate of The Graduate School of Banking at LSU

7 Evan Singer SVP & Chief Mergers & Acquisitions Officer Joined FGBI in 2008 Background in Commercial Lending, Purchasing & Facilities, BSA/Fraud and Special Assets Earned his Bachelor’s degree from Marshall University 2011 graduate from The Graduate School of Banking at LSU EXPERIENCED LEADERSHIP Matthew Wise SVP & Chief Credit Officer Joined FGBI in 2021 19+ years of banking experience, most recently with Regions Bank Earned both Bachelor’s and Master’s degree from Louisiana State University Randy Vicknair SVP & Chief Lending Officer Joined FGBI in 2006 Previously held position of Chief Credit Officer Recognized as a member of the Independent Banker’s 40 Under 40 Emerging Community Bank Leaders

8 BOARD OF DIRECTORS Source: Company documents MARSHALL T. REYNOLDS Chairman of the Board of Directors Chairman of the Board, Champion Industries WILLIAM K. HOOD President, Hood Automotive Group ALTON B. LEWIS JR. Bio on Experienced Leadership Slide JACK ROSSI CPA, Consultant EDGAR R. SMITH III Chairman and CEO of Smitty’s Supply, Inc. Additional advisory board to provide insight and expertise to essential business interests including: • Oil & Gas Production • Agriculture & Forestry • Wholesale & Retail Expertise Advisory Board Includes: • Thomas D. “Tommy” Crump, Jr. • Carrell G. “Gil” Dowies, III • Dr. Phillip E. Fincher • John D. Gladney, M.D. • Britt L. Synco Holding Company & Bank Directors Additional Bank Directors ANTHONY J. BERNER, JR. Consultant, Gold Star Food Group GLORIA M. DYKES Owner, Dykes Beef Farm PHILLIP E. FINCHER Retired Economics Professor of Louisiana Tech University ROBERT H. GABRIEL President, Gabriel Building Supply Company ANDREW GASAWAY, JR. President, Gasaway-Gasaway-Bankston Architects EDWIN L. HOOVER, JR. President of Encore Development Corporation BRUCE MCANALLY Registered Pharmacist MORGAN S. NALTY Investment Banking Partner at Johnson, Rice & Company LLC JACK M. REYNOLDS Vice President, Pritchard Electric Co. NANCY C. RIBAS Owner, Ribas Holdings LLC and University Motors RICHARD W. SITMAN Board President, Dixie Business Center ANNA A. SMITH Southern University Chairman Emeritus

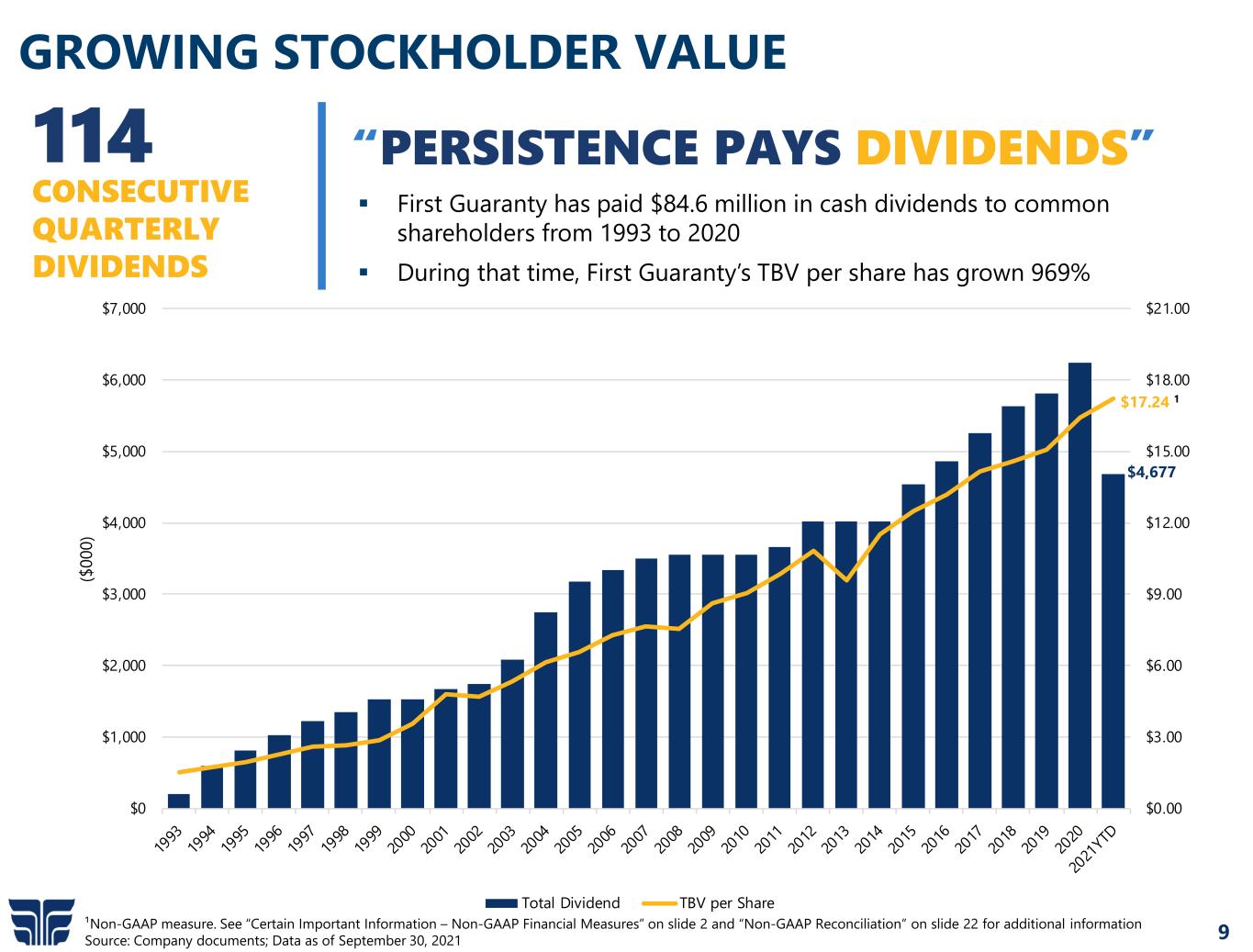

9 $0.00 $3.00 $6.00 $9.00 $12.00 $15.00 $18.00 $21.00 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 ($ 00 0) Total Dividend TBV per Share GROWING STOCKHOLDER VALUE ¹Non-GAAP measure. See “Certain Important Information – Non-GAAP Financial Measures” on slide 2 and “Non-GAAP Reconciliation” on slide 22 for additional information Source: Company documents; Data as of September 30, 2021 114 CONSECUTIVE QUARTERLY DIVIDENDS “PERSISTENCE PAYS DIVIDENDS” First Guaranty has paid $84.6 million in cash dividends to common shareholders from 1993 to 2020 During that time, First Guaranty’s TBV per share has grown 969% $4,677 $17.24 1

10 Year Milestone 1934 First Guaranty Bank is founded in Amite, LA 1993 Investor group led by Marshall Reynolds invests $3.6M as part of recapitalization 1999 Acquisition of First Southwest Bank 2001 Acquisition of Woodlands Bancorp, Inc. 2007 Acquisition of Homestead Bancorp, Inc.; First Guaranty Bancshares is formed 2009 Bank surpasses $1.0B in total assets; Alton Lewis becomes CEO 2011 Acquisition of Greensburg Bancshares, Inc. 2015 Initial Public Offering and listing on NASDAQ Exchange; SBLF Preferred Stock redeemed 2017 Acquisition of Premier Bancshares, Inc. 2019 Acquisition of Union Bancshares, Inc. 2021 Issued $34.5 million in non-cumulative perpetual preferred stock 2021 114th consecutive quarterly dividend declared $2,824,504 As se ts ($ 00 0) GROWTH MILESTONES Source: Company documents

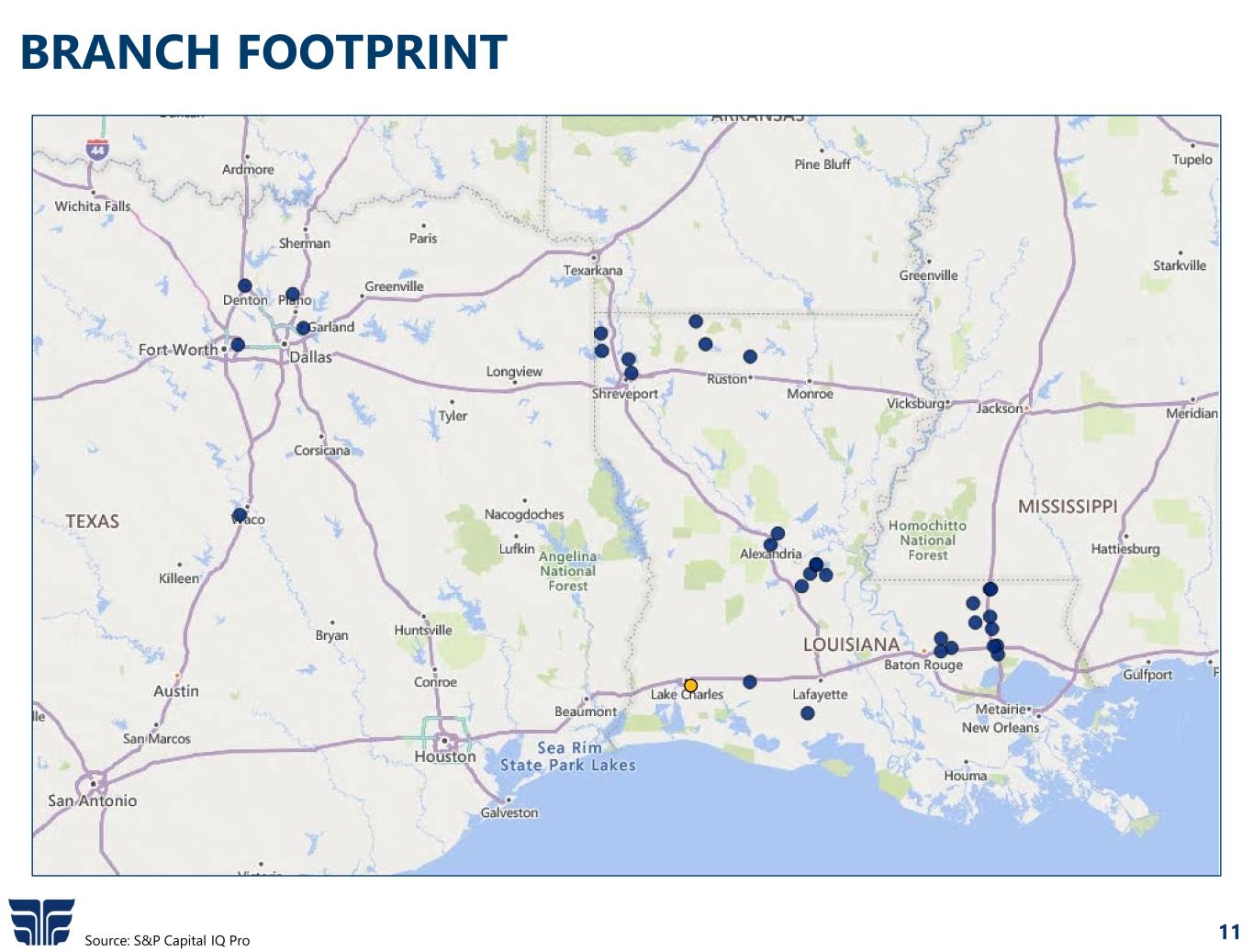

11 BRANCH FOOTPRINT Source: S&P Capital IQ Pro

12 KEY MARKETS Source: S&P Capital IQ Pro, Forbes, Wall Street Journal, Louisiana State University, Barksdale Air Force, Southeastern Louisiana University, Shreveport Business Bureau Hammond MSA Baton Rouge MSA Shreveport MSA Dallas MSA Major transportation hub Distribution hub for Wal-Mart and Winn Dixie Home of Southeastern Louisiana University (enrollment ~15,400) Healthcare industry jobs make up 16.9% of jobs in the MSA – including employer Blue Cross Blue Shield of Louisiana 2nd largest city by population and 2nd largest by deposits in Louisiana Hub of the Southeast petro chemical industry Political hub of the state of Louisiana – state government is the largest employer Home of Louisiana State University (enrollment ~31,500) Diversified economy; employment services, government, education, and wholesale / retail trade Barksdale Air Force Base is the largest employer, sustaining a population of ~53,810 active duty servicemen, family members, civilian employees and retirees Contains Las Vegas-style gaming industry 5.7% 8.4% 3.3% 11.8% 3.8% 1.1% -0.8% 7.5% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% Hammond, LA Baton Rouge, LA Shreveport-Bossier City, LA Dallas-Fort Worth- Arl ington, TX Median HHI Growth Median 2026 Proj. Pop. Growth Headquarters location of five Fortune 100 companies (Exxon, McKesson, AT&T, Energy Transfer & American Airlines) Home of Dallas/Fort Worth International, the 4th busiest airport in the country Fourth fastest growing MSA in the country from 2010 - 2019 DEMOGRAPHIC HIGHLIGHTS DEPOSIT BREAKDOWN (AS OF 6/30/21) Deposits ($M) Banking Centers Market Rank Deposit Market Share (%) Hammond, LA $972.5 8 1 37.5 Baton Rouge, LA $349.4 5 10 1.3 Shreveport-Bossier City, LA $219.2 4 11 2.1 Dallas-Fort Worth- Arlington, TX $238.9 4 81 0.0

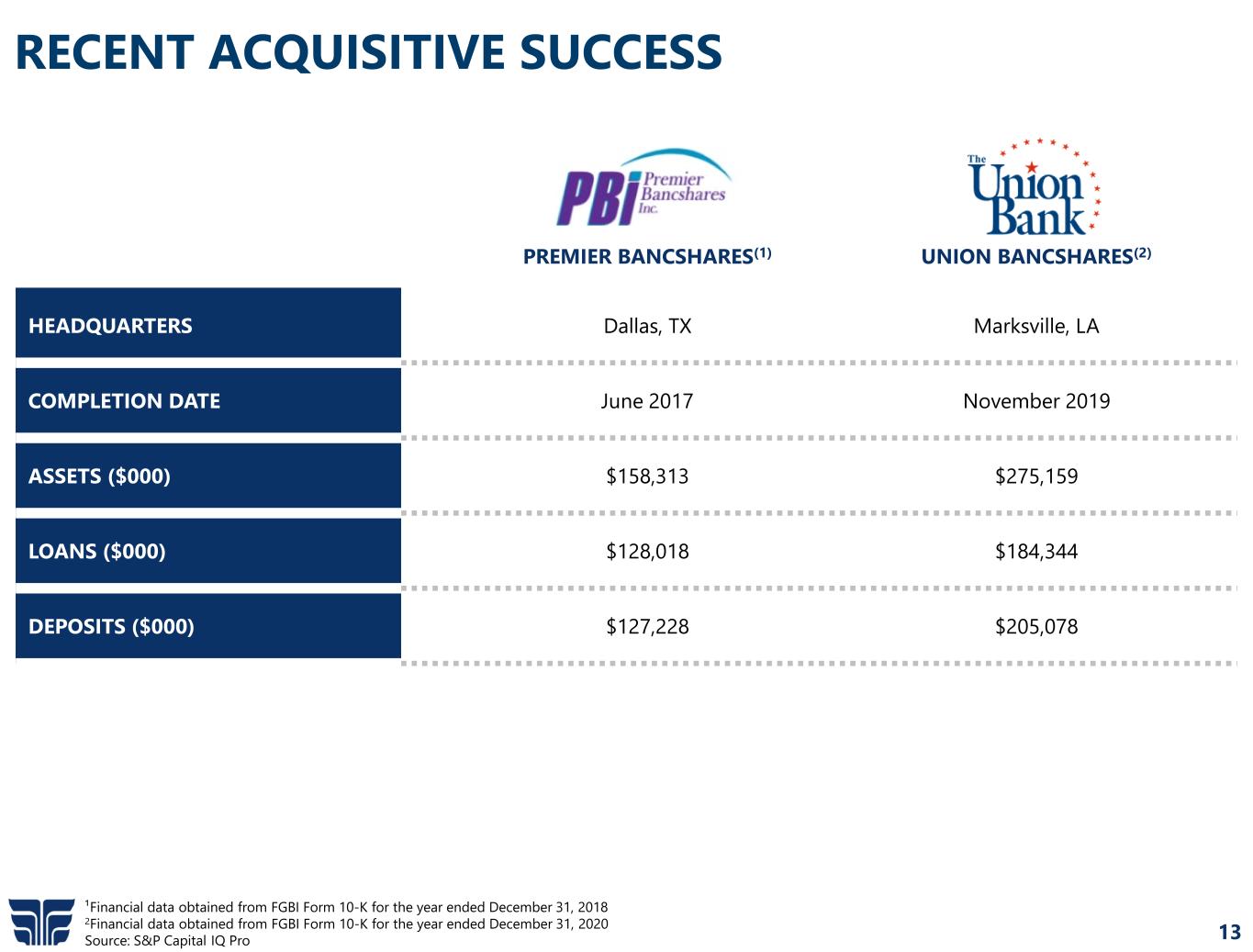

13 RECENT ACQUISITIVE SUCCESS ¹Financial data obtained from FGBI Form 10-K for the year ended December 31, 2018 2Financial data obtained from FGBI Form 10-K for the year ended December 31, 2020 Source: S&P Capital IQ Pro PREMIER BANCSHARES(1) UNION BANCSHARES(2) HEADQUARTERS Dallas, TX Marksville, LA COMPLETION DATE June 2017 November 2019 ASSETS ($000) $158,313 $275,159 LOANS ($000) $128,018 $184,344 DEPOSITS ($000) $127,228 $205,078

BUSINESS HIGHLIGHTS

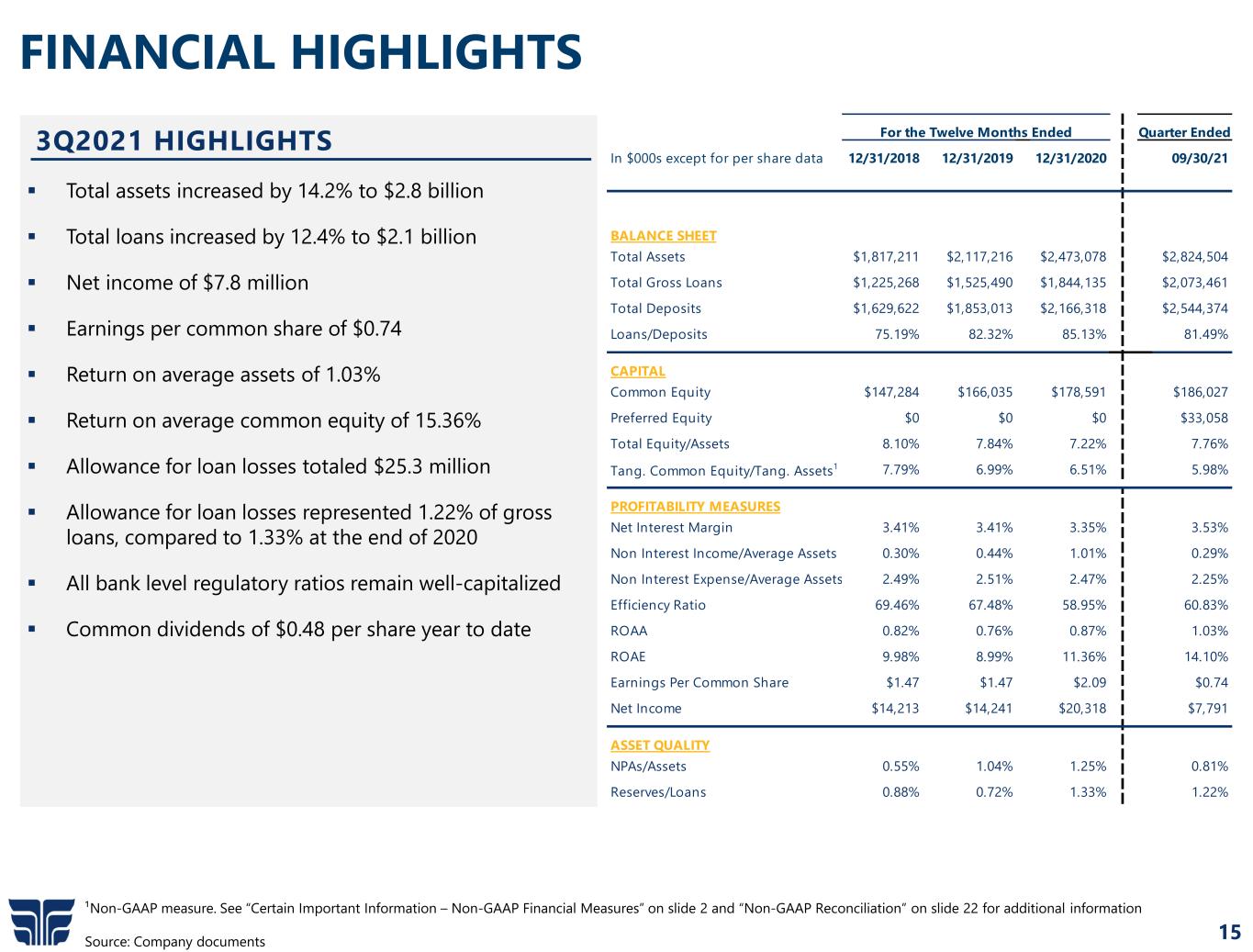

15 FINANCIAL HIGHLIGHTS Total assets increased by 14.2% to $2.8 billion Total loans increased by 12.4% to $2.1 billion Net income of $7.8 million Earnings per common share of $0.74 Return on average assets of 1.03% Return on average common equity of 15.36% Allowance for loan losses totaled $25.3 million Allowance for loan losses represented 1.22% of gross loans, compared to 1.33% at the end of 2020 All bank level regulatory ratios remain well-capitalized Common dividends of $0.48 per share year to date 3Q2021 HIGHLIGHTS ¹Non-GAAP measure. See “Certain Important Information – Non-GAAP Financial Measures” on slide 2 and “Non-GAAP Reconciliation” on slide 22 for additional information Source: Company documents For the Twelve Months Ended In $000s except for per share data 12/31/2018 12/31/2019 12/31/2020 09/30/21 BALANCE SHEET Total Assets $1,817,211 $2,117,216 $2,473,078 $2,824,504 Total Gross Loans $1,225,268 $1,525,490 $1,844,135 $2,073,461 Total Deposits $1,629,622 $1,853,013 $2,166,318 $2,544,374 Loans/Deposits 75.19% 82.32% 85.13% 81.49% CAPITAL Common Equity $147,284 $166,035 $178,591 $186,027 Preferred Equity $0 $0 $0 $33,058 Total Equity/Assets 8.10% 7.84% 7.22% 7.76% Tang. Common Equity/Tang. Assets1 7.79% 6.99% 6.51% 5.98% PROFITABILITY MEASURES Net Interest Margin 3.41% 3.41% 3.35% 3.53% Non Interest Income/Average Assets 0.30% 0.44% 1.01% 0.29% Non Interest Expense/Average Assets 2.49% 2.51% 2.47% 2.25% Efficiency Ratio 69.46% 67.48% 58.95% 60.83% ROAA 0.82% 0.76% 0.87% 1.03% ROAE 9.98% 8.99% 11.36% 14.10% Earnings Per Common Share $1.47 $1.47 $2.09 $0.74 Net Income $14,213 $14,241 $20,318 $7,791 ASSET QUALITY NPAs/Assets 0.55% 1.04% 1.25% 0.81% Reserves/Loans 0.88% 0.72% 1.33% 1.22% Quarter Ended

16 $949 $1,149 $1,225 $1,525 $1,844 $2,073 $0 $500 $1,000 $1,500 $2,000 $2,500 2016Y 2017Y 2018Y 2019Y 2020Y 2021YTD $1,501 $1,750 $1,817 $2,117 $2,473 $2,825 $0 $600 $1,200 $1,800 $2,400 $3,000 2016Y 2017Y 2018Y 2019Y 2020Y 2021YTD FINANCIAL TRENDS Source: Company documents YTD as of September 30, 2021 TOTAL ASSETS ($M) TOTAL GROSS LOANS ($M) TOTAL DEPOSITS ($M) LOAN / DEPOSIT RATIO (%) $1,326 $1,549 $1,630 $1,853 $2,166 $2,544 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 2016Y 2017Y 2018Y 2019Y 2020Y 2021YTD 71.55% 74.16% 75.19% 82.32% 85.13% 81.49% 65.00% 70.00% 75.00% 80.00% 85.00% 90.00% 2016Y 2017Y 2018Y 2019Y 2020Y 2021YTD

17 3.39% 3.33% 3.41% 3.41% 3.35% 3.37% 2.50% 2.75% 3.00% 3.25% 3.50% 3.75% 2016Y 2017Y 2018Y 2019Y 2020Y 2021YTD 0.97% 0.71% 0.82% 0.76% 0.87% 0.92% 0.00% 0.25% 0.50% 0.75% 1.00% 2016Y 2017Y 2018Y 2019Y 2020Y 2021YTD EARNINGS POWER ¹Non-GAAP measure. See “Certain Important Information – Non-GAAP Financial Measures” on slide 3 and “Non-GAAP Reconciliation” on slide 32 for additional information Source: Company documents YTD as of September 30, 2021 RETURN ON AVERAGE TANGIBLE COMMON EQUITY(1) (%) NET INTEREST MARGIN (%) RETURN ON AVERAGE ASSETS (%) 11.64% 9.15% 10.77% 9.68% 13.08% 15.45% 0.00% 4.00% 8.00% 12.00% 16.00% 2016Y 2017Y 2018Y 2019Y 2020Y 2021YTD NET INCOME ($000) $14,093 $11,751 $14,213 $14,241 $20,318 $19,248 $0 $5,000 $10,000 $15,000 $20,000 $25,000 2016Y 2017Y 2018Y 2019Y 2020Y 2021YTD

18 Commercial & Industrial 16.5% Non-Farm Non- Residential 40.9% Residential Real Estate 18.7% Consumer & Other 12.9% Agriculture & Farm 3.1% C&D 7.9% LOAN PORTFOLIO Source: Company documents YTD as of September 30, 2021 Loan yield of 5.06% YTD 2021 Loan growth of 12.4% during 2021 SBA/USDA lending program represents a significant opportunity for loan growth in Louisiana and Texas • Emphasis on this program has yielded strong results – $55.9 million total SBA/USDA balance as of September 30, 2021 (excluding PPP) • $43.2 million in PPP loans in the loan portfolio as of September 30, 2021 Commercial leases represent 10.8% of the loan portfolio, providing higher yields and shorter average lives than real estate secured loans Oil & Gas related loans made up approximately 5.3% funded and 1.1% unfunded of the total loan portfolio as of September 30, 2021 • None of the loans are exploration & production related Hotel and Hospitality loans totaled $156.6 million, or 7.6% of the total loan portfolio as of September 30, 2021 • All hotels flagged by major brands LOAN PORTFOLIO COMPOSITION 9/30/21 HIGHLIGHTS ($000s) 2016Y 2017Y 2018Y 2019Y 2020Y 2021YD Commercial & Industrial $193,969 $230,638 $200,877 $268,256 $353,028 $343,428 Non-Farm Non-Residential 417,014 530,293 586,263 616,536 824,137 850,614 Residential Real Estate 147,661 175,573 215,678 313,608 317,168 390,146 Consumer & Other 63,011 55,185 59,443 108,868 148,783 267,683 Agriculture & Farm 44,921 47,205 41,509 49,451 55,215 64,223 C&D 84,239 112,603 124,644 172,247 150,841 165,090 Total Gross Loans $950,815 $1,151,497 $1,228,414 $1,528,966 $1,849,172 $2,081,184 LESS: Unearned Income 1,894 2,483 3,146 3,476 5,037 7,723 Total Loans $948,921 $1,149,014 $1,225,268 $1,525,490 $1,844,135 $2,073,461 Loan Portfolio Detail

19 1.48% 0.84% 0.55% 1.04% 1.25% 0.81% 0.23% 0.54% -0.02% 0.36% 0.08% 0.07% -0.50% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 2016 2017 2018 2019 2020 2021YTD NPAs/ASSETS NCOs / AVERAGE LOANS Real Estate 79.1% Commercial & Consumer 20.9% CONSERVATIVE CREDIT CULTURE Source: Company documents YTD as of September 30, 2021 NONACCRUAL LOANS BY TYPE 9/30/21 HISTORICAL ASSET QUALITY NPAs/ASSETS & NCOs/LOANS (in thousands) 12/31/2016 12/31/2017 12/31/2018 12/31/2019 12/31/2020 9/30/2021 NONACCRUAL LOANS $21,674 $12,550 $8,743 $14,403 $15,576 $17,751 90 DAY LOANS AND GREATER BUT STILL ACCRUING $179 $839 $145 $2,639 $13,091 $2,600 PERFORMING RESTRUCTURED LOANS $2,987 $2,138 $1,288 $0 $0 $0 OREO $359 $1,281 $1,138 $4,879 $2,240 $2,531 NONPERFORMING ASSETS $25,199 $16,808 $11,314 $21,921 $30,907 $22,882 NPAs / ASSETS 1.48% 0.84% 0.55% 1.04% 1.25% 0.81% NONACCRUAL LOANS / ASSETS 1.44% 0.72% 0.48% 0.68% 0.63% 0.63% ALL / TOTAL LOANS 1.17% 0.80% 0.88% 0.72% 1.33% 1.22%

20 HIGHLIGHTS Weighted average rate is 0.9% YTD 2021 compared to 1.1% YTD 2020 Noninterest-bearing deposits increased by $88.2 million to $499.6 million 2021YTD, representing 19.6% of total deposits year to date Total time deposits decreased from 33.5% of total deposits at year end 2020 to 23.5% of total deposits 2021YTD Public funds totaled $885.3 million, or 34.8% of total deposits at September 30, 2021 Weighted average rate of 0.5% YTD 2021 Opportunity for increased earnings as a higher percentage of public funds are collateralized by reciprocal deposit insurance • Allows for public funds to be invested in higher yielding loans versus securities Mark Ducoing was hired in 2019 to serve as Chief Deposit Officer and is responsible for the ongoing emphasis on lowering the cost of deposits DEPOSIT PORTFOLIO Source: Company documents YTD as of September 30, 2021 9/30/2021 DEPOSIT MIX Demand - Noninterest 19.6% Demand - Interest 49.0% Savings 7.9% Time Deposits 23.5% ($000) 2016Y 2017Y 2018Y 2019Y 2020Y 2021YTD Demand - Noninterest Bearing $231,094 $251,617 $244,516 $325,888 $411,416 $499,649 Demand - Interest Bearing 479,810 611,677 594,359 635,942 860,394 1,245,969 Savings 97,280 104,661 109,958 135,156 168,879 200,094 Time Deposits 517,997 581,331 680,789 756,027 725,629 598,662 Total Deposits $1,326,181 $1,549,286 $1,629,622 $1,853,013 $2,166,318 $2,544,374 Weighted Average Rate 0.7% 0.9% 1.3% 1.7% 1.1% 0.9% Deposit Composition

APPENDIX

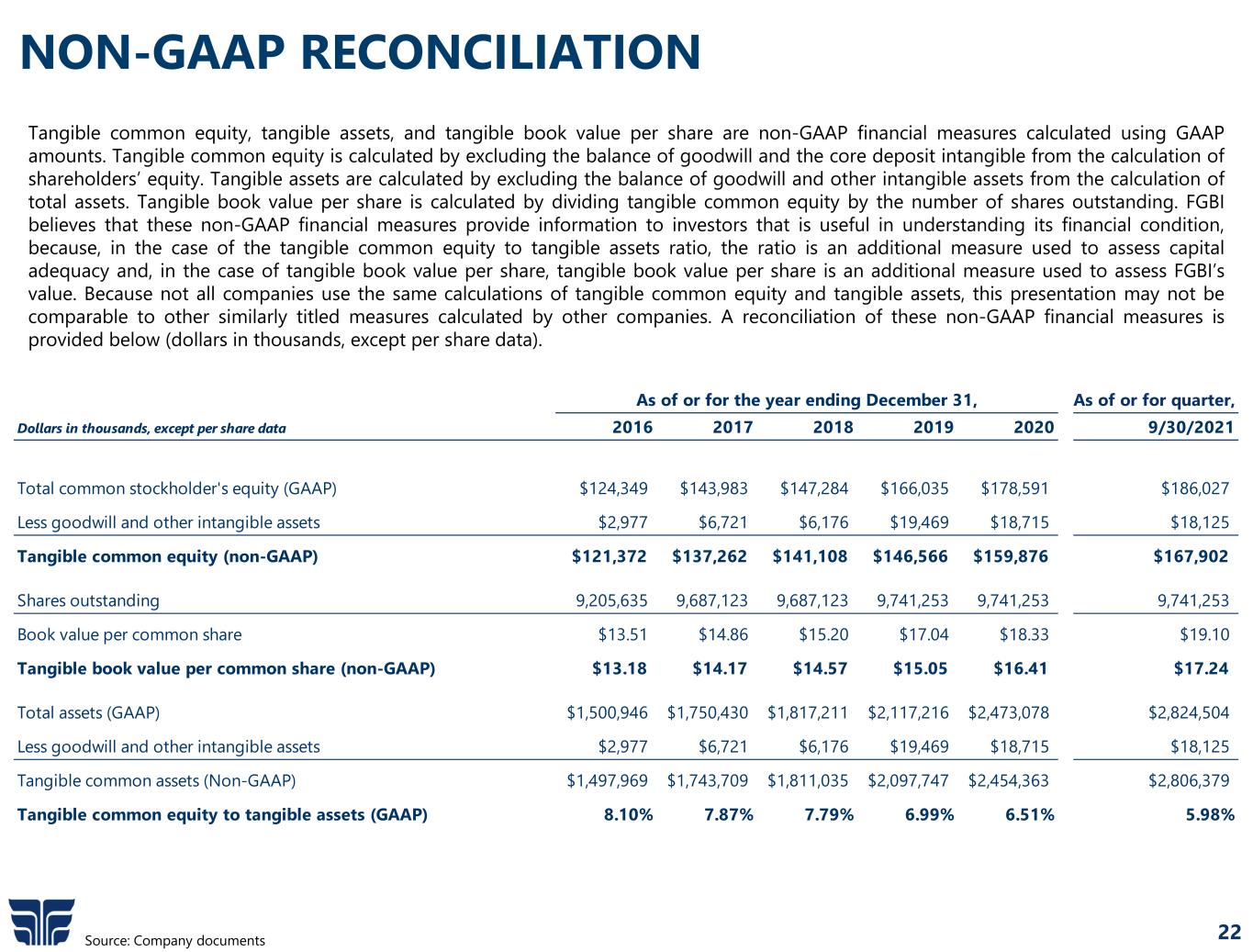

22 NON-GAAP RECONCILIATION Source: Company documents Tangible common equity, tangible assets, and tangible book value per share are non-GAAP financial measures calculated using GAAP amounts. Tangible common equity is calculated by excluding the balance of goodwill and the core deposit intangible from the calculation of shareholders’ equity. Tangible assets are calculated by excluding the balance of goodwill and other intangible assets from the calculation of total assets. Tangible book value per share is calculated by dividing tangible common equity by the number of shares outstanding. FGBI believes that these non-GAAP financial measures provide information to investors that is useful in understanding its financial condition, because, in the case of the tangible common equity to tangible assets ratio, the ratio is an additional measure used to assess capital adequacy and, in the case of tangible book value per share, tangible book value per share is an additional measure used to assess FGBI’s value. Because not all companies use the same calculations of tangible common equity and tangible assets, this presentation may not be comparable to other similarly titled measures calculated by other companies. A reconciliation of these non-GAAP financial measures is provided below (dollars in thousands, except per share data). As of or for quarter, Dollars in thousands, except per share data 2016 2017 2018 2019 2020 9/30/2021 Total common stockholder's equity (GAAP) $124,349 $143,983 $147,284 $166,035 $178,591 $186,027 Less goodwill and other intangible assets $2,977 $6,721 $6,176 $19,469 $18,715 $18,125 Tangible common equity (non-GAAP) $121,372 $137,262 $141,108 $146,566 $159,876 $167,902 Shares outstanding 9,205,635 9,687,123 9,687,123 9,741,253 9,741,253 9,741,253 Book value per common share $13.51 $14.86 $15.20 $17.04 $18.33 $19.10 Tangible book value per common share (non-GAAP) $13.18 $14.17 $14.57 $15.05 $16.41 $17.24 Total assets (GAAP) $1,500,946 $1,750,430 $1,817,211 $2,117,216 $2,473,078 $2,824,504 Less goodwill and other intangible assets $2,977 $6,721 $6,176 $19,469 $18,715 $18,125 Tangible common assets (Non-GAAP) $1,497,969 $1,743,709 $1,811,035 $2,097,747 $2,454,363 $2,806,379 Tangible common equity to tangible assets (GAAP) 8.10% 7.87% 7.79% 6.99% 6.51% 5.98% As of or for the year ending December 31,

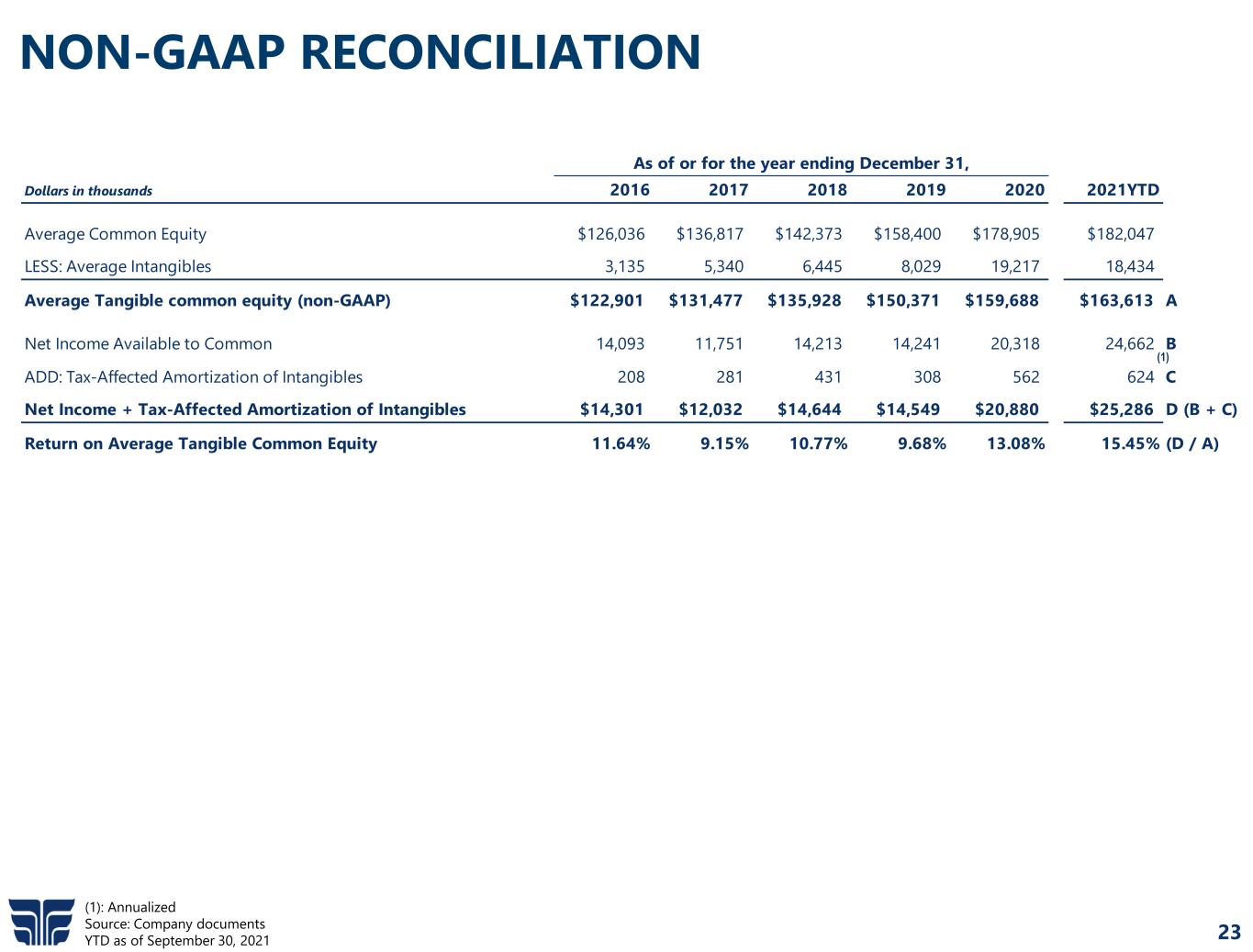

23 NON-GAAP RECONCILIATION (1): Annualized Source: Company documents YTD as of September 30, 2021 Dollars in thousands 2016 2017 2018 2019 2020 2021YTD Average Common Equity $126,036 $136,817 $142,373 $158,400 $178,905 $182,047 LESS: Average Intangibles 3,135 5,340 6,445 8,029 19,217 18,434 Average Tangible common equity (non-GAAP) $122,901 $131,477 $135,928 $150,371 $159,688 $163,613 A Net Income Available to Common 14,093 11,751 14,213 14,241 20,318 24,662 B ADD: Tax-Affected Amortization of Intangibles 208 281 431 308 562 624 C Net Income + Tax-Affected Amortization of Intangibles $14,301 $12,032 $14,644 $14,549 $20,880 $25,286 D (B + C) Return on Average Tangible Common Equity 11.64% 9.15% 10.77% 9.68% 13.08% 15.45% (D / A) As of or for the year ending December 31, (1)