MARCH 2020 DISCUSSION MATERIALS ST RI CT LY C ON FI DE NT IA L Materials Prepared For: [BANK NAME] Financial Institutions Group INVESTOR PRESENTATION Financial Data as of: First Quarter 2022 NASDAQ: FGBI www.fgb.net

2 CERTAIN IMPORTANT INFORMATION CAUTION REGARDING FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended with respect to the financial condition, liquidity, results of operations, and future performance of our business. These forward-looking statements are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those that are not historical facts. Forward-looking statements include statements with respect to beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions that are subject to significant risks and uncertainties and are subject to change based on various factors (some of which are beyond our control, particularly with regard to developments related to the novel coronavirus (“COVID-19”)). Forward-looking statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “forecasts,” “intends,” “plans,” “targets,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would” and “could.” We caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. These forward-looking statements are subject to a number of factors and uncertainties, including, changes in general economic conditions, either nationally or in our market areas, that are worse than expected; the ongoing effects of the COVID-19 pandemic on First Guaranty Bancshares, Inc.’s (the “Company or “FGBI”) operations and financial performance; competition among depository and other financial institutions; inflation and changes in the interest rate environment that reduce our margins or reduce the fair value of financial instruments; adverse changes in the securities markets; changes in laws or government regulations or policies affecting financial institutions, including changes in regulatory fees and capital requirements; our ability to enter new markets successfully and capitalize on growth opportunities; our ability to successfully integrate acquired entities; changes in consumer spending, borrowing and savings habits; changes in accounting policies and practices, as may be adopted by the bank regulatory agencies, the Financial Accounting Standards Board, the Securities and Exchange Commission and the Public Company Accounting Oversight Board; changes in our organization, compensation and benefit plans; changes in our financial condition or results of operations that reduce capital available to pay dividends; increases in our provision for loan losses and changes in the financial condition or future prospects of issuers of securities that we own, which could cause our actual results and experience to differ from the anticipated results and expectations, expressed in such forward-looking statements. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. NON-GAAP FINANCIAL MEASURES Statements included in this presentation include non-GAAP financial measures and should be read along with the accompanying tables under the section titled “Non-GAAP Reconciliations.” The Company uses non-GAAP financial measures to analyze its performance. Management believes that non-GAAP financial measures provide additional useful information that allows readers to evaluate the ongoing performance of the Company and provide meaningful comparison to its peers. Non-GAAP financial measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and investors should consider the Company’s performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the Company. Non-GAAP financial measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the results or financial condition as reported under GAAP.

CORPORATE OVERVIEW

5 EXPERIENCED LEADERSHIP Chief Executive Officer & President Chief Executive Officer and President of First Guaranty Bancshares, Inc. since October 2009 Chief Executive Officer of First Guaranty Bank since October 2009 President of First Guaranty Bank since January 2013 Vice Chairman of First Guaranty Bancshares, Inc. and First Guaranty Bank since October 2009 Director of First Guaranty Bancshares Inc. and First Guaranty Bank since 2001 Partner of the law firm of Cashe, Lewis, Coudrain & Sandage and its predecessor from January 1980 to September 2009 Chief Financial Officer Chief Financial Officer of First Guaranty Bank and First Guaranty Bancshares, Inc. since May 2010 Treasurer, Secretary and Principal Accounting Officer at First Guaranty Bancshares, Inc. since 2010 Previous positions held in lending and credit including Chief Credit Officer Prior to association with First Guaranty Bank, he served as an Analyst with Livingston & Jefferson Holds the Chartered Financial Analyst designation and is a graduate of The Graduate School of Banking at Louisiana State University; undergraduate degree from Duke University in 2001 Source: Company documents Mark Ducoing SVP & Chief Deposit Officer Joined FGBI in 2019 Primary focus on lowering cost of deposits; leading to significant progress in improvement of deposit base since his arrival 38 years of banking experience with 15 of those years with Regions Financial Corporation Earned his Bachelor’s degree in Finance from the University of New Orleans Desiree Simmons SVP & Chief Administrative Officer Joined FGBI in 2009 Earned her Bachelor’s degree in Mass Communications from Southeastern Louisiana University 25 years of banking experience 2014 graduate of The Graduate School of Banking at LSU Certified Financial Marketing Professional (CFMP) designation Formerly Series 7 & 63 licensed Alton B. Lewis Jr. Eric J. Dosch

6 Evan Singer SVP & Chief Mergers & Acquisitions Officer Joined FGBI in 2008 Background in Commercial Lending, Purchasing & Facilities, BSA/Fraud, Special Assets, and Mergers & Acquisitions Earned his Bachelor’s degree from Marshall University 2011 graduate from The Graduate School of Banking at LSU EXPERIENCED LEADERSHIP Matthew Wise SVP & Chief Credit Officer Joined FGBI in 2021 19+ years of banking experience, most recently with Regions Bank Earned both Bachelor’s and Master’s degree from Louisiana State University Randy Vicknair SVP & Chief Lending Officer Joined FGBI in 2006 Previously held position of Chief Credit Officer Recognized as a member of the Independent Banker’s 40 Under 40 Emerging Community Bank Leaders Earned his Bachelor’s degree in Finance and MBA from Southeastern Louisiana University 2010 graduate from The Graduate School of Banking at LSU Member of RMA-New Orleans/Baton Rouge Chapter Boards and RMA Risk Management Council Katherine Campbell VP & Controller Joined FGBI in 2011 10+ years of banking experience Holds the Certified Public Accountant designation Earned her Bachelor’s degree in Accounting and Finance from Southeastern Louisiana University Recognized as a member of the Edge of the Lake Northshore’s 2021 Top 40 Under 40 Business Leaders

7 BOARD OF DIRECTORS Source: Company documents MARSHALL T. REYNOLDS Chairman of the Board of Directors Chairman of the Board, Champion Industries WILLIAM K. HOOD President, Hood Automotive Group ALTON B. LEWIS JR. Bio on Experienced Leadership Slide JACK ROSSI CPA, Consultant EDGAR R. SMITH III Chairman and CEO of Smitty’s Supply, Inc. Additional advisory board to provide insight and expertise to essential business interests including: • Oil & Gas Production • Agriculture & Forestry • Wholesale & Retail Expertise Advisory Board Includes: • Thomas D. “Tommy” Crump, Jr. • Carrell G. “Gil” Dowies, III • Dr. Phillip E. Fincher • John D. Gladney, M.D. • Britt L. Synco Holding Company & Bank Directors Additional Bank Directors ANTHONY J. BERNER, JR. Consultant, Gold Star Food Group GLORIA M. DYKES Owner, Dykes Beef Farm PHILLIP E. FINCHER Retired Economics Professor of Louisiana Tech University ROBERT H. GABRIEL President, Gabriel Building Supply Company ANDREW GASAWAY, JR. President, Gasaway-Gasaway-Bankston Architects EDWIN L. HOOVER, JR. President of Encore Development Corporation BRUCE MCANALLY Registered Pharmacist MORGAN S. NALTY Investment Banking Partner at Johnson, Rice & Company LLC JACK M. REYNOLDS Vice President, Pritchard Electric Co. NANCY C. RIBAS Owner, Ribas Holdings LLC and University Motors RICHARD W. SITMAN Board President, Dixie Business Center ANNA A. SMITH Southern University Chairman Emeritus

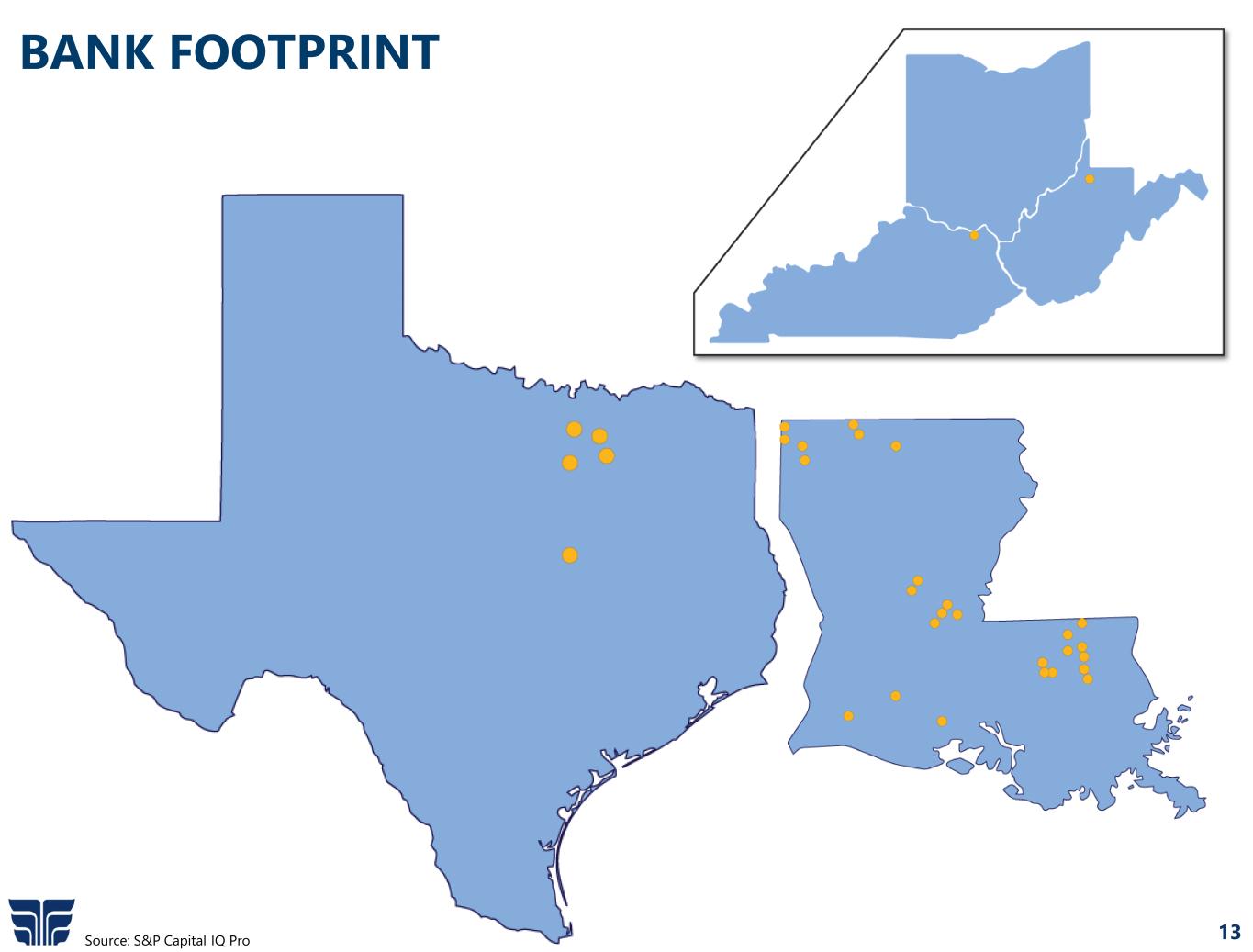

8 FIRST GUARANTY BANCSHARES, INC. ¹Non-GAAP measure. See “Certain Important Information – Non-GAAP Financial Measures” on slide 2 and “Non-GAAP Reconciliation” on slide 25 for additional information Note: Market data and financial information as of and for the three months ended March 31, 2022 Source: Company documents, S&P Capital IQ Pro 2022 YTD AT A GLANCE 115 and counting Consecutive Quarterly Dividends Declared 88 Years in Banking Total Loans Total Assets Total Deposits Locations ATMs 4936 $2.9 $2.6 BillionBillion $2.2 Billion $7.6 Million 2022 YTD Net Income Serving the community since 1934 36 locations throughout Louisiana & Texas including a loan production office in Lake Charles, LA and Mideast Market in KY and WV. NASDAQ: FGBI & FGBIP Market Cap: $256.6 Million as of 3/31/2022 2022 YTD ROATCE1: 16.88% 2022 YTD Cash Dividends Paid: $0.16 per common share Holding Company for First Guaranty Bank in Hammond, Louisiana

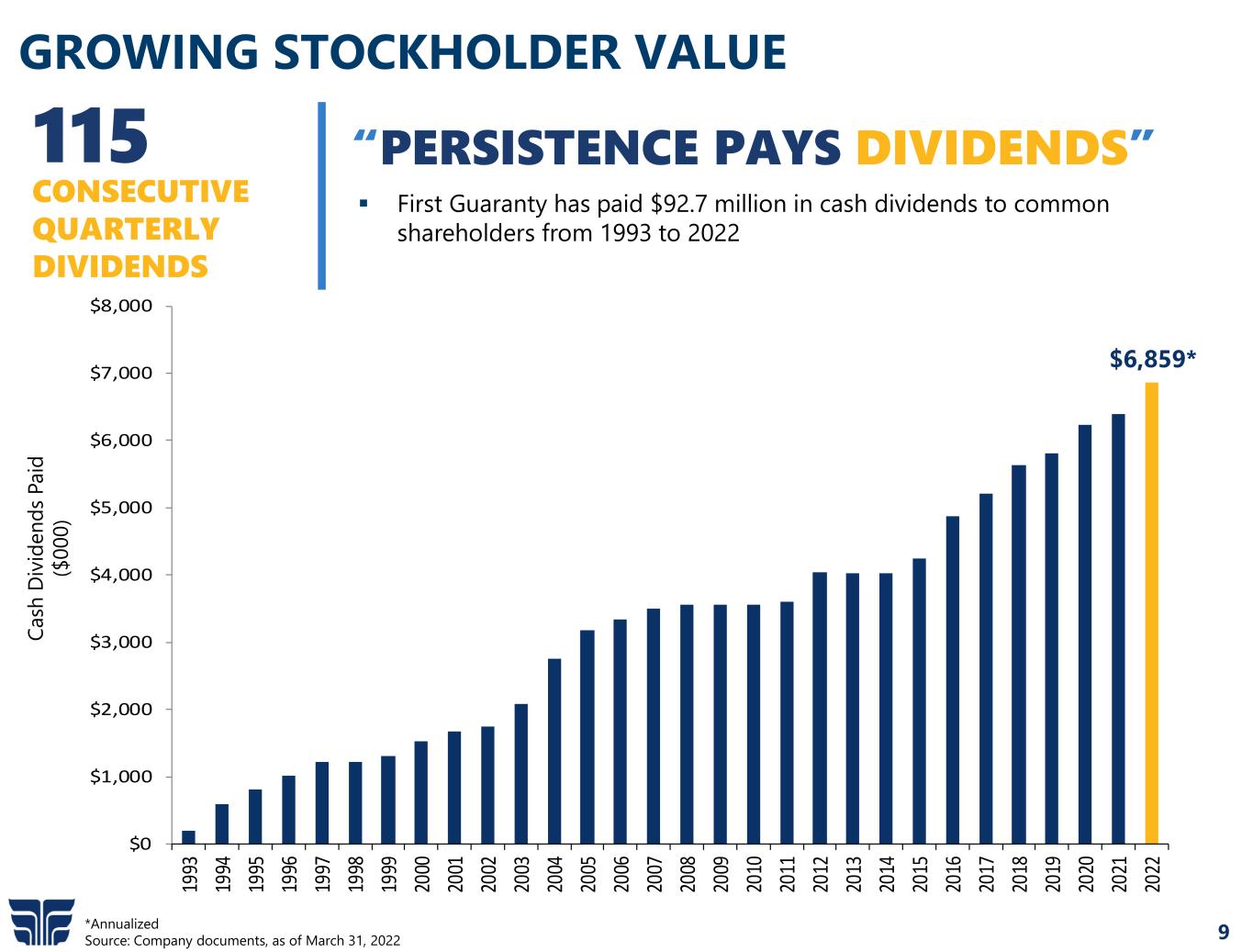

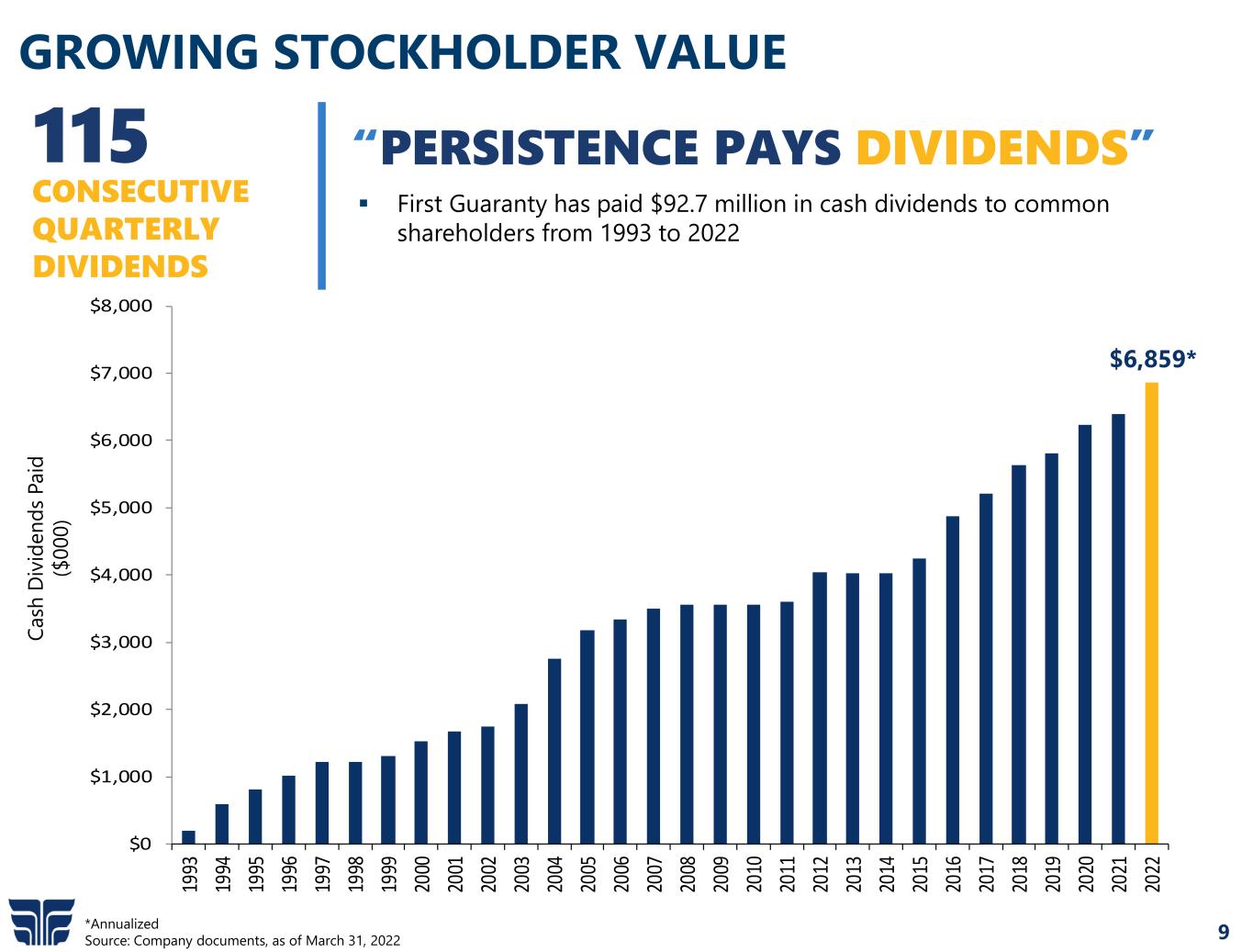

9 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 19 93 19 94 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 GROWING STOCKHOLDER VALUE *Annualized Source: Company documents, as of March 31, 2022 115 CONSECUTIVE QUARTERLY DIVIDENDS “PERSISTENCE PAYS DIVIDENDS” First Guaranty has paid $92.7 million in cash dividends to common shareholders from 1993 to 2022 $6,859* Ca sh D iv id en ds P ai d ($ 00 0)

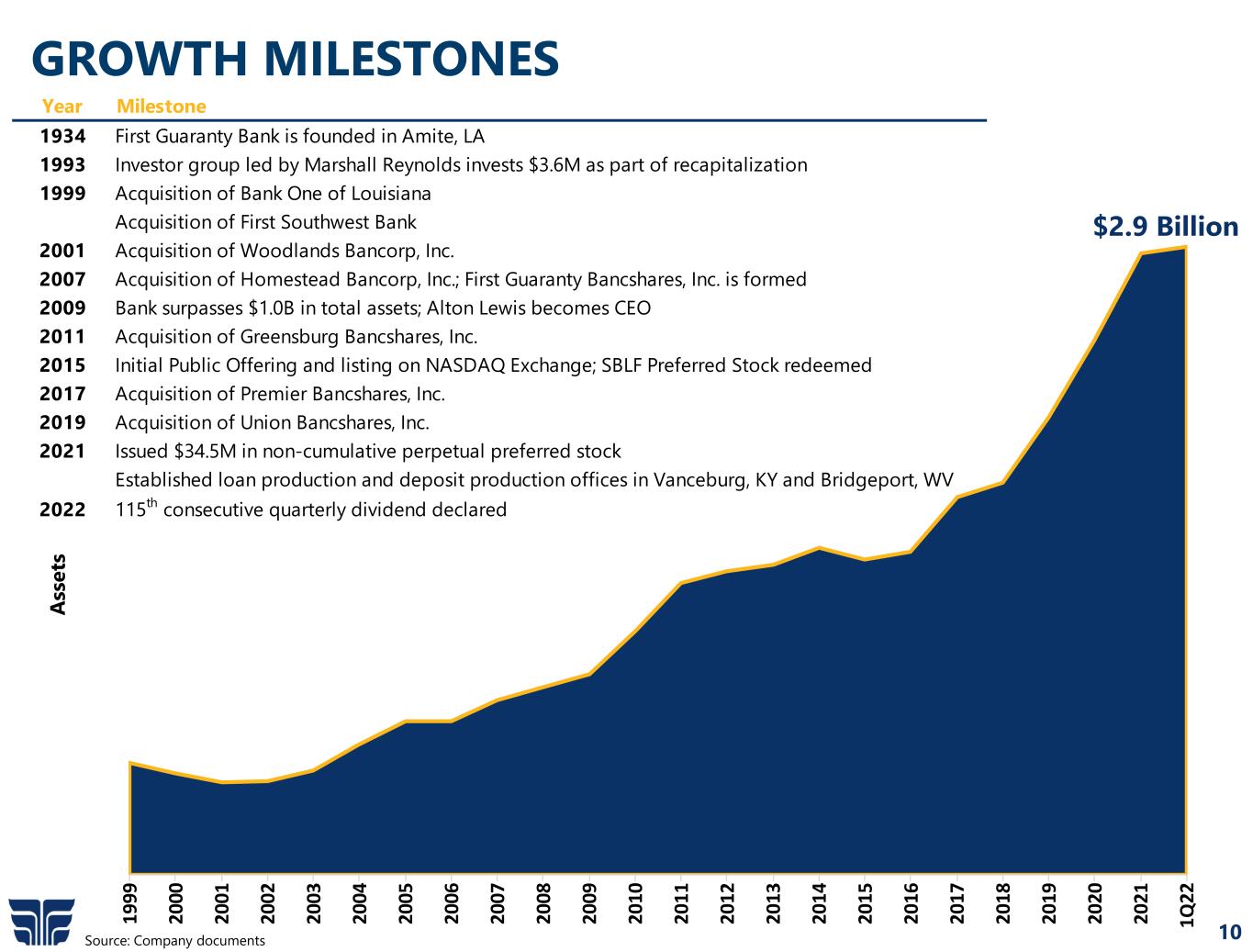

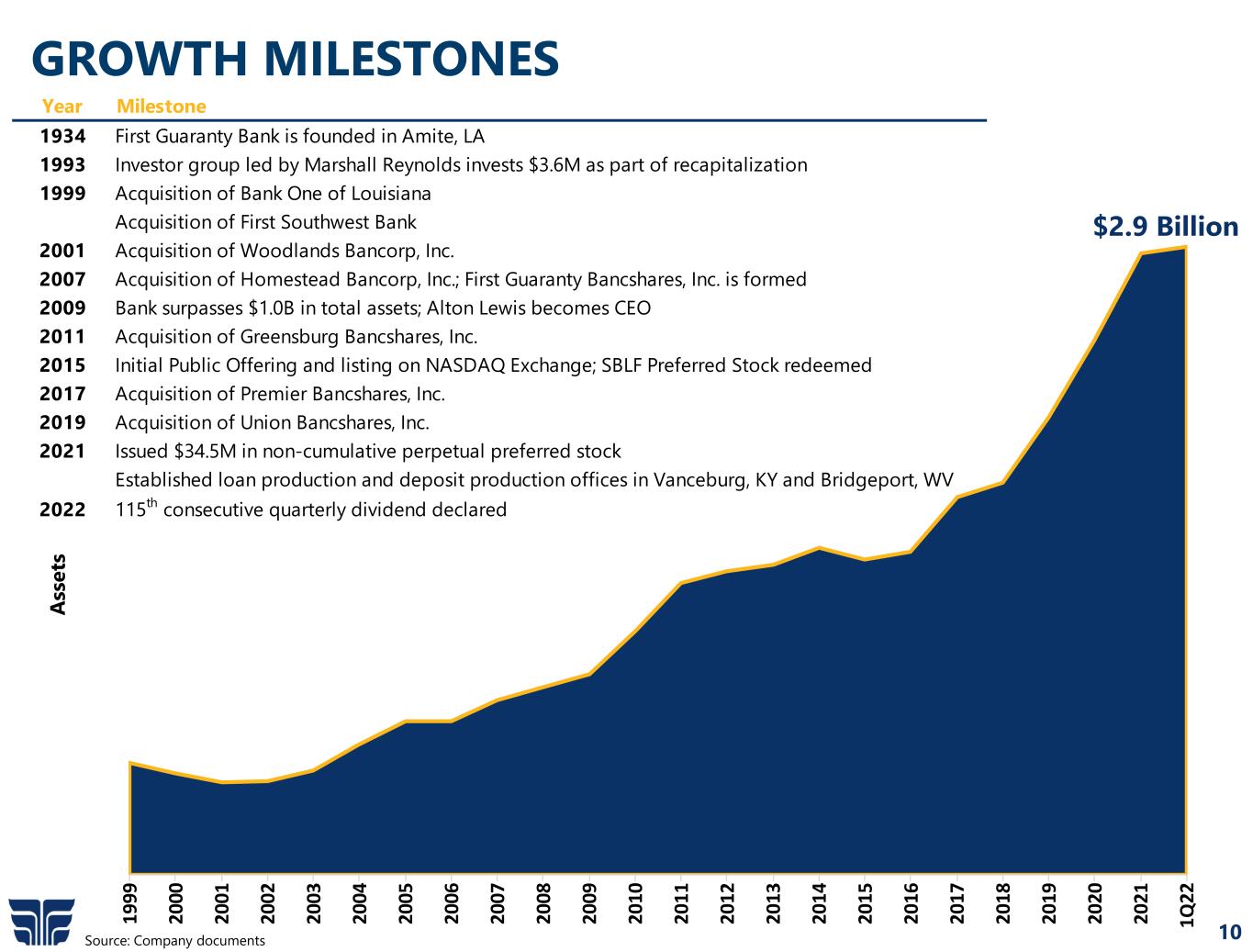

10 Year Milestone 1934 First Guaranty Bank is founded in Amite, LA 1993 Investor group led by Marshall Reynolds invests $3.6M as part of recapitalization 1999 Acquisition of Bank One of Louisiana Acquisition of First Southwest Bank 2001 Acquisition of Woodlands Bancorp, Inc. 2007 Acquisition of Homestead Bancorp, Inc.; First Guaranty Bancshares, Inc. is formed 2009 Bank surpasses $1.0B in total assets; Alton Lewis becomes CEO 2011 Acquisition of Greensburg Bancshares, Inc. 2015 Initial Public Offering and listing on NASDAQ Exchange; SBLF Preferred Stock redeemed 2017 Acquisition of Premier Bancshares, Inc. 2019 Acquisition of Union Bancshares, Inc. 2021 Issued $34.5M in non-cumulative perpetual preferred stock Established loan production and deposit production offices in Vanceburg, KY and Bridgeport, WV 2022 115th consecutive quarterly dividend declared GROWTH MILESTONES Source: Company documents $2.9 Billion A ss et s 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 1Q 22

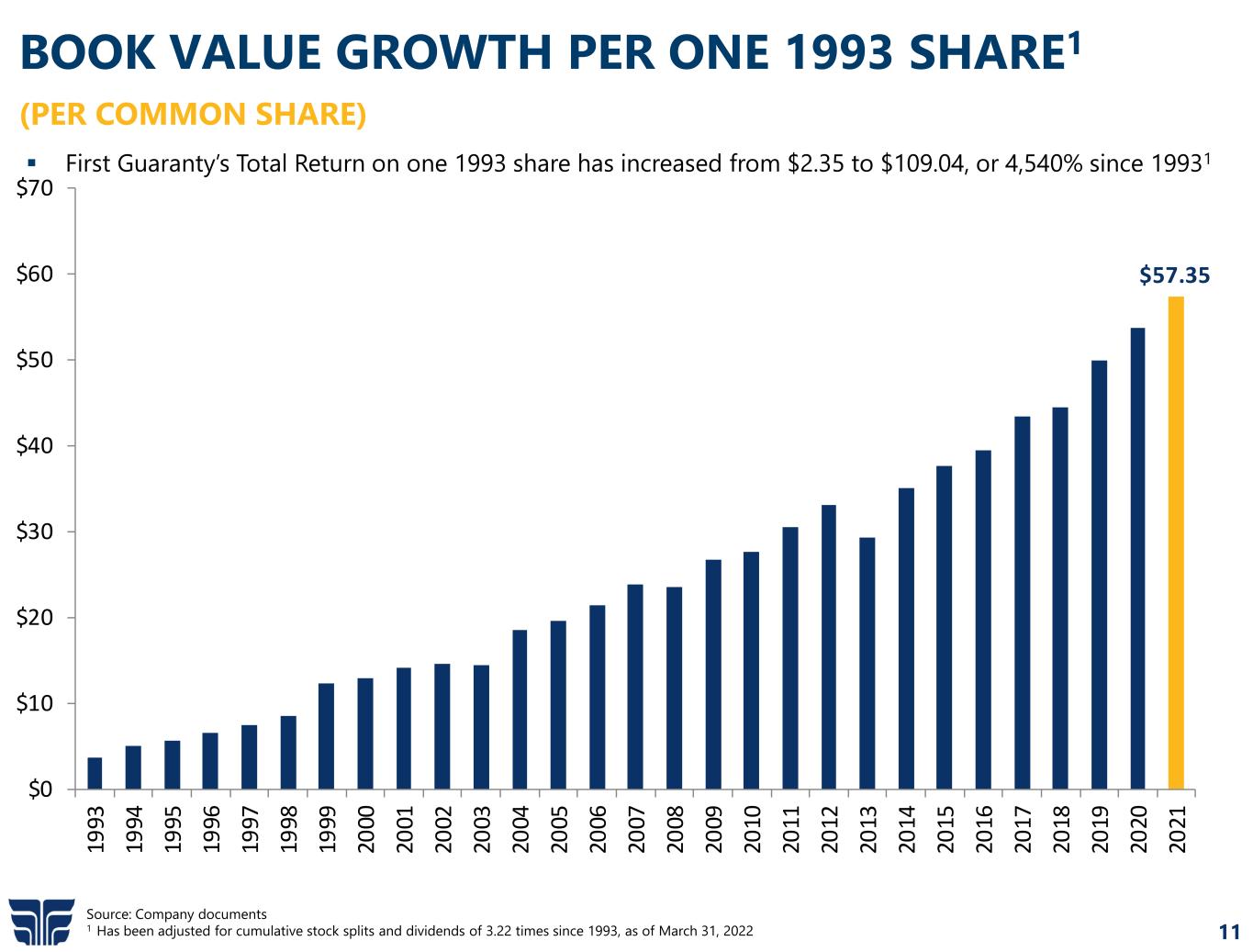

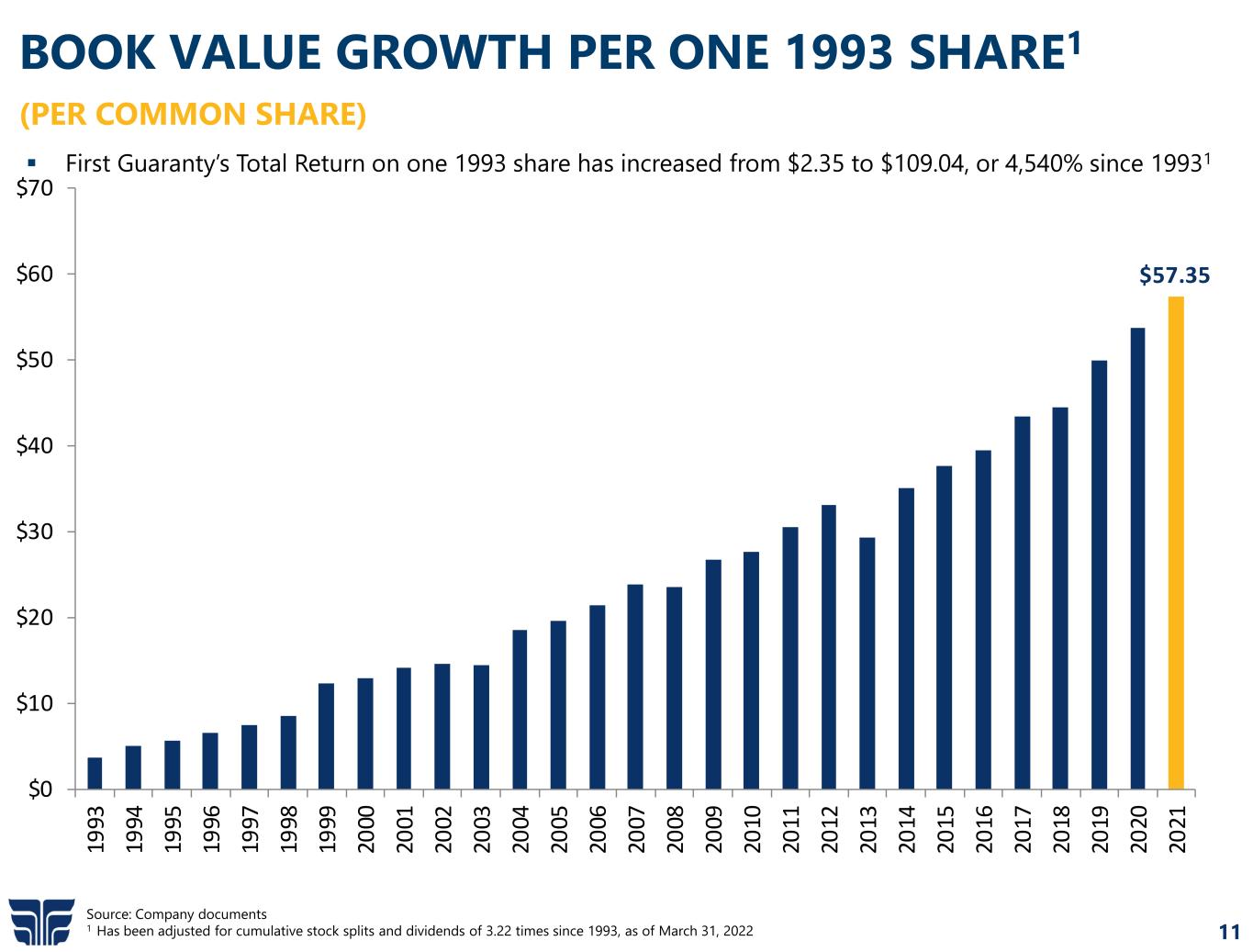

11 BOOK VALUE GROWTH PER ONE 1993 SHARE1 (PER COMMON SHARE) Source: Company documents 1 Has been adjusted for cumulative stock splits and dividends of 3.22 times since 1993, as of March 31, 2022 First Guaranty’s Total Return on one 1993 share has increased from $2.35 to $109.04, or 4,540% since 19931 $57.35 $0 $10 $20 $30 $40 $50 $60 $70 19 93 19 94 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21

12 EMBRACING NEW TECHNOLOGIES Q2 is a leading software provider that has transformed our customers’ digital financial experience. Our Online Banking platform is so much more than just Online Banking, below are some of the additional capabilities that are part of FGB’s Online Banking experience COMING SOON… FGB Jr App – for our youngest bankers to begin their banking journey early FGB Online Banking Cardswap PFM Biller Direct ClickSwitch Credit Aware Autobooks CRM & MCIF – provide a 360 degree view of customer relationships through organized data allowing FGB to drastically improve marketing efforts

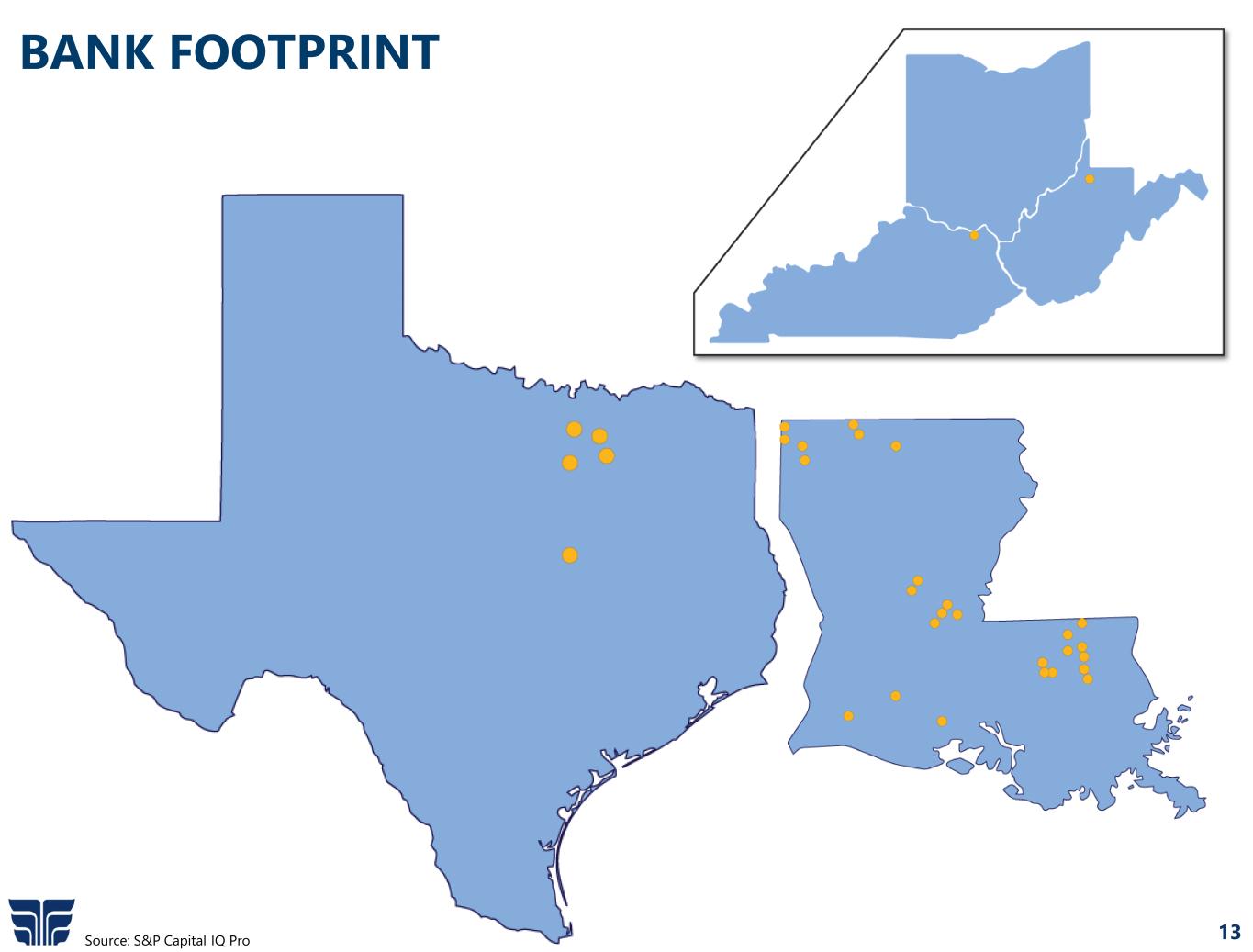

13 BANK FOOTPRINT Source: S&P Capital IQ Pro

14 Accretive to earnings as of 1/31/22 • $64.5 million in loans booked as of 12/31/21 • $120 million in loans booked as of 3/31/22 • Growth of $55.5 million or 86% Current Pipeline for 2022 • $67 million in loans Approved $30 million In Process $37 million CONTINUED SUCCESS IN THE MIDEAST OH KY WV • 2 offices (DPO and LPO) WV, KY • 12 team members

FINANCIAL HIGHLIGHTS

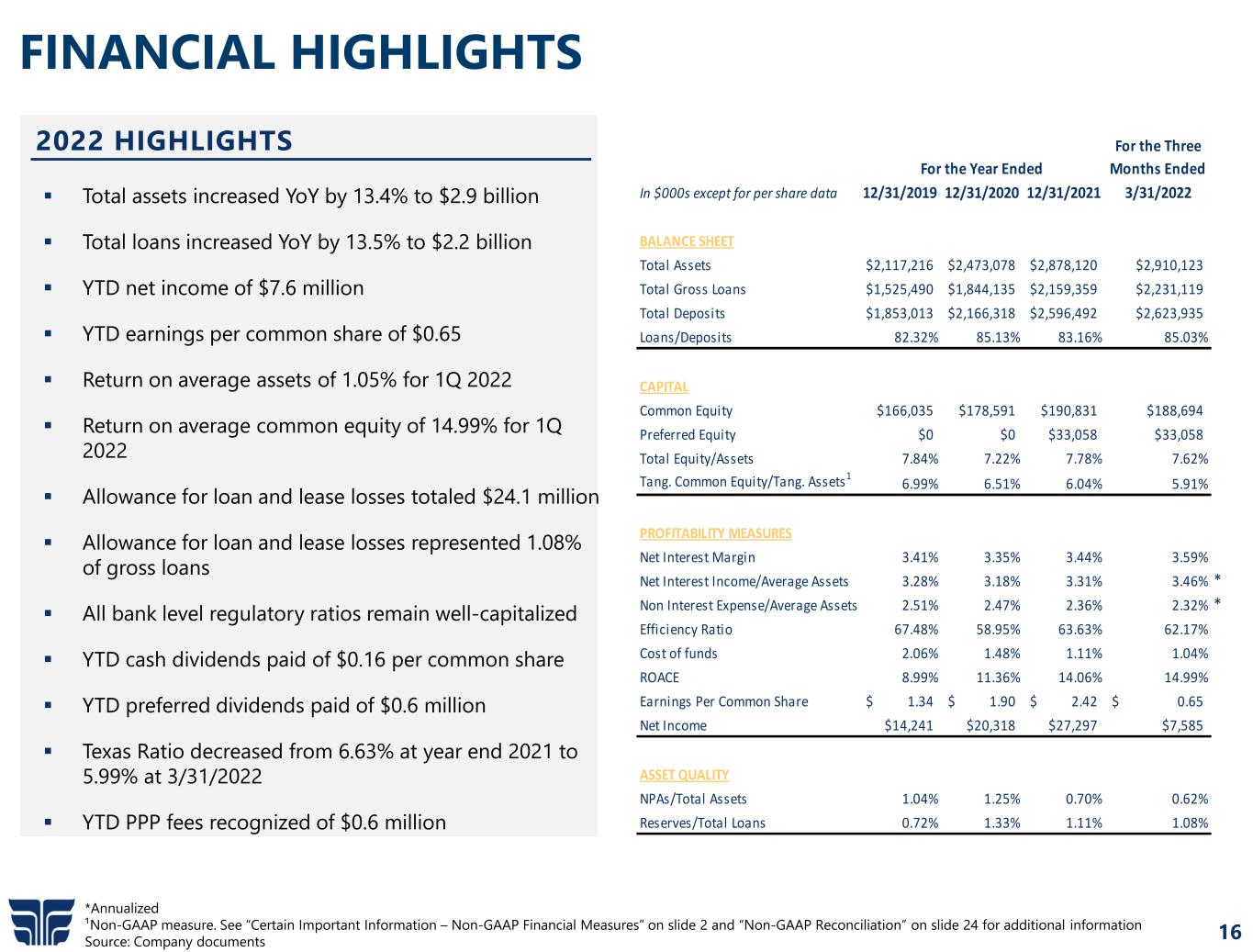

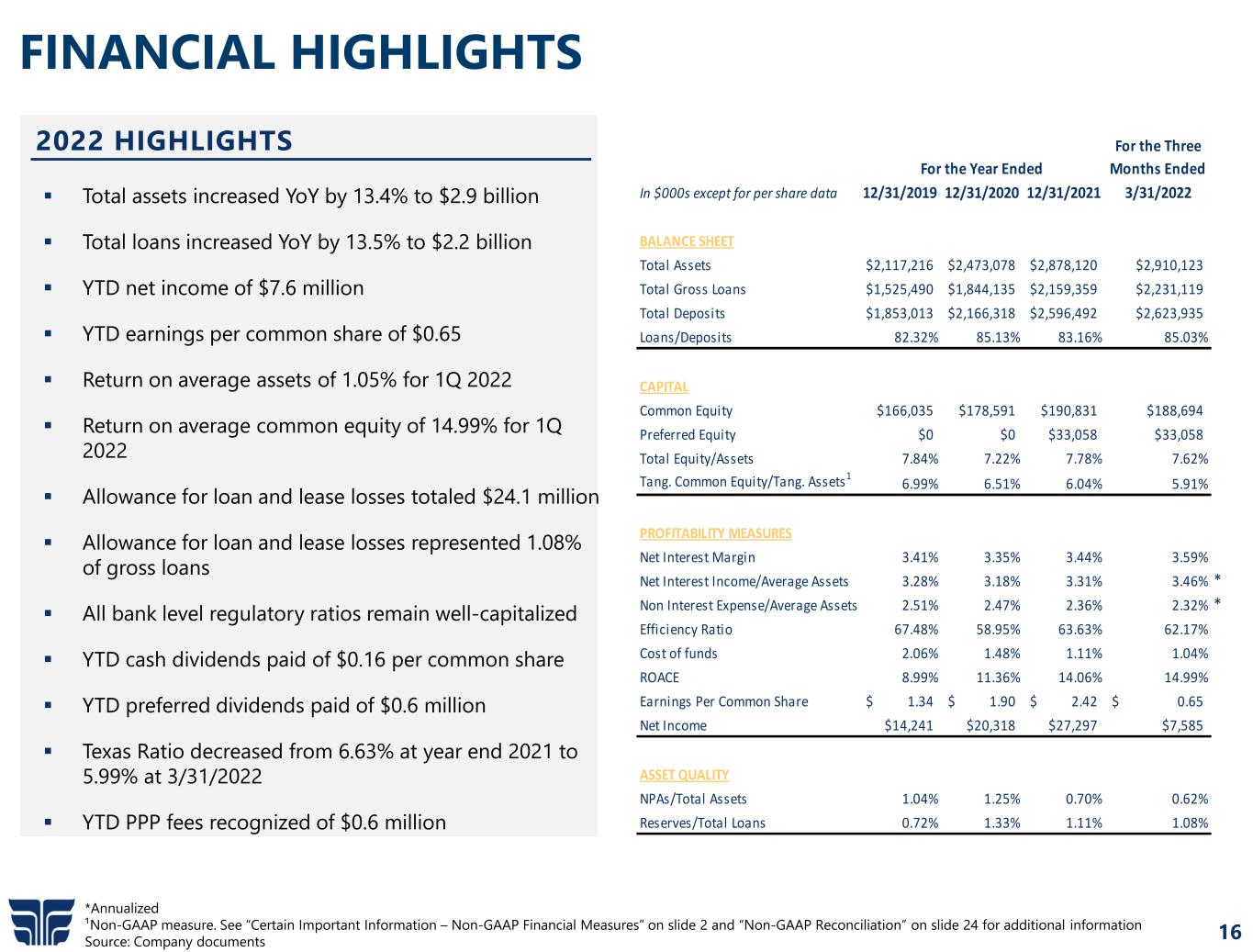

16 FINANCIAL HIGHLIGHTS Total assets increased YoY by 13.4% to $2.9 billion Total loans increased YoY by 13.5% to $2.2 billion YTD net income of $7.6 million YTD earnings per common share of $0.65 Return on average assets of 1.05% for 1Q 2022 Return on average common equity of 14.99% for 1Q 2022 Allowance for loan and lease losses totaled $24.1 million Allowance for loan and lease losses represented 1.08% of gross loans All bank level regulatory ratios remain well-capitalized YTD cash dividends paid of $0.16 per common share YTD preferred dividends paid of $0.6 million Texas Ratio decreased from 6.63% at year end 2021 to 5.99% at 3/31/2022 YTD PPP fees recognized of $0.6 million 2022 HIGHLIGHTS *Annualized ¹Non-GAAP measure. See “Certain Important Information – Non-GAAP Financial Measures” on slide 2 and “Non-GAAP Reconciliation” on slide 24 for additional information Source: Company documents In $000s except for per share data 12/31/2019 12/31/2020 12/31/2021 3/31/2022 BALANCE SHEET Total Assets $2,117,216 $2,473,078 $2,878,120 $2,910,123 Total Gross Loans $1,525,490 $1,844,135 $2,159,359 $2,231,119 Total Deposits $1,853,013 $2,166,318 $2,596,492 $2,623,935 Loans/Deposits 82.32% 85.13% 83.16% 85.03% CAPITAL Common Equity $166,035 $178,591 $190,831 $188,694 Preferred Equity $0 $0 $33,058 $33,058 Total Equity/Assets 7.84% 7.22% 7.78% 7.62% Tang. Common Equity/Tang. Assets1 6.99% 6.51% 6.04% 5.91% PROFITABILITY MEASURES Net Interest Margin 3.41% 3.35% 3.44% 3.59% Net Interest Income/Average Assets 3.28% 3.18% 3.31% 3.46% * Non Interest Expense/Average Assets 2.51% 2.47% 2.36% 2.32% * Efficiency Ratio 67.48% 58.95% 63.63% 62.17% Cost of funds 2.06% 1.48% 1.11% 1.04% ROACE 8.99% 11.36% 14.06% 14.99% Earnings Per Common Share 1.34$ 1.90$ 2.42$ 0.65$ Net Income $14,241 $20,318 $27,297 $7,585 ASSET QUALITY NPAs/Total Assets 1.04% 1.25% 0.70% 0.62% Reserves/Total Loans 0.72% 1.33% 1.11% 1.08% For the Year Ended For the Three Months Ended

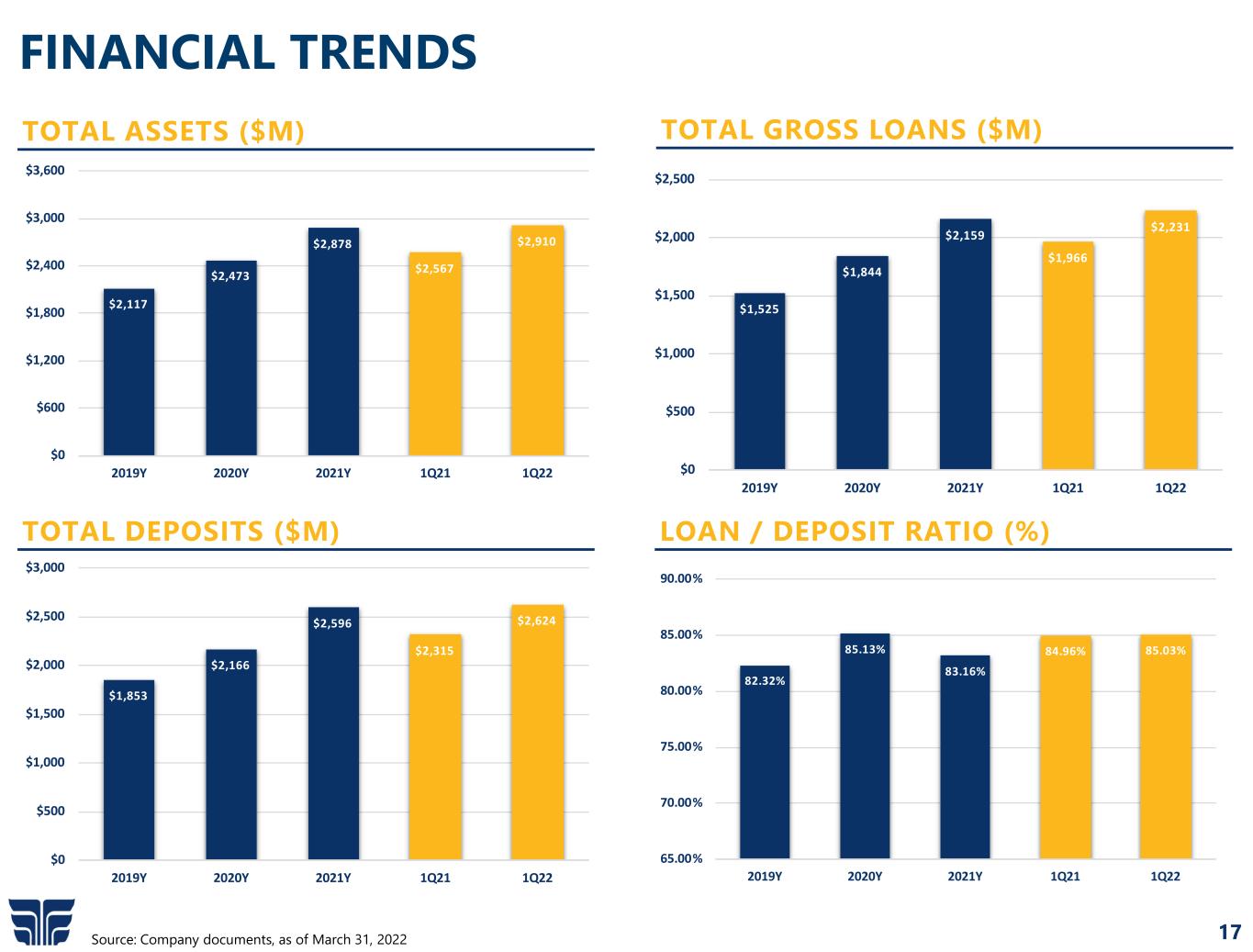

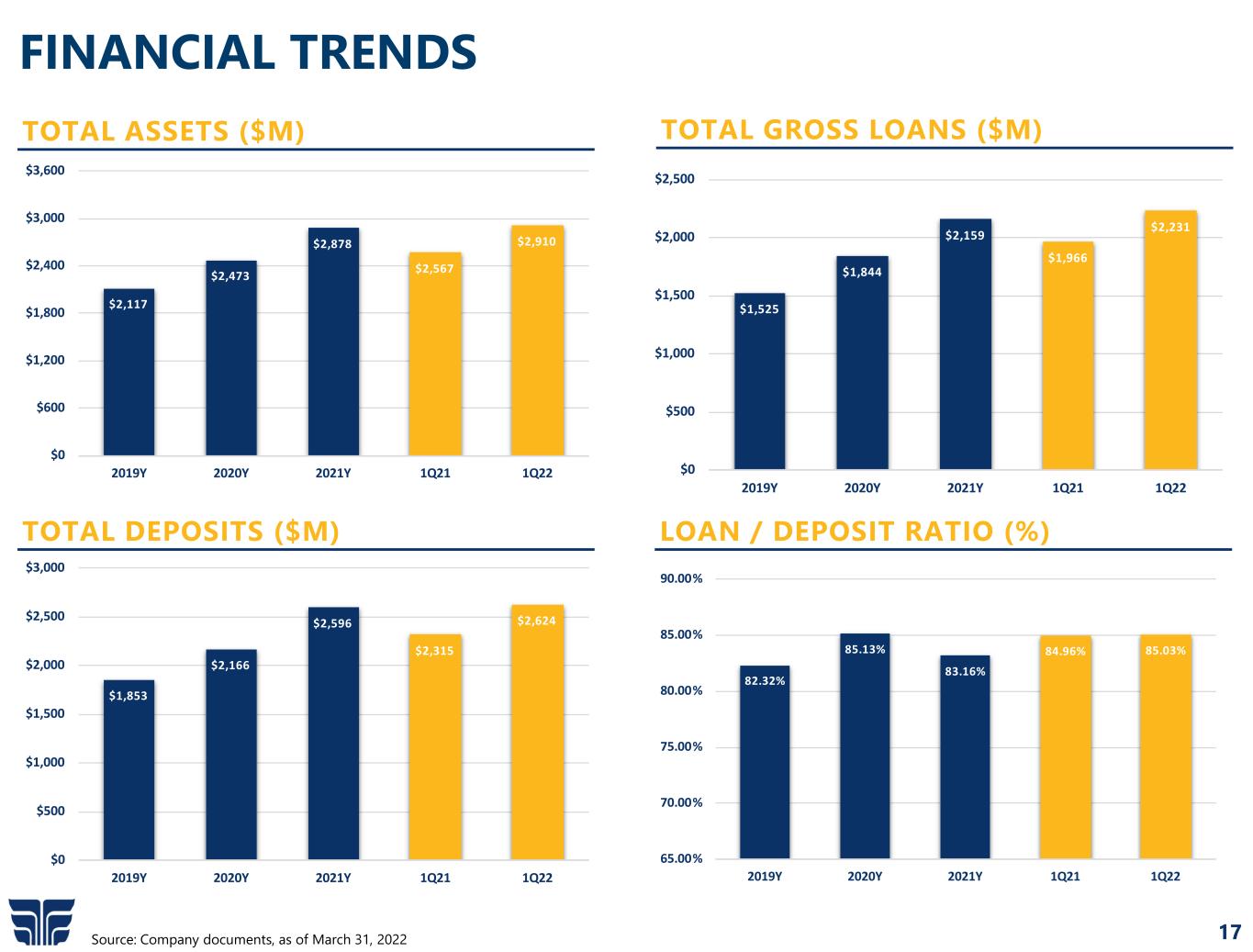

17 FINANCIAL TRENDS Source: Company documents, as of March 31, 2022 TOTAL ASSETS ($M) TOTAL GROSS LOANS ($M) TOTAL DEPOSITS ($M) LOAN / DEPOSIT RATIO (%) $2,117 $2,473 $2,878 $2,567 $2,910 $0 $600 $1,200 $1,800 $2,400 $3,000 $3,600 2019Y 2020Y 2021Y 1Q21 1Q22 $1,525 $1,844 $2,159 $1,966 $2,231 $0 $500 $1,000 $1,500 $2,000 $2,500 2019Y 2020Y 2021Y 1Q21 1Q22 $1,853 $2,166 $2,596 $2,315 $2,624 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 2019Y 2020Y 2021Y 1Q21 1Q22 82.32% 85.13% 83.16% 84.96% 85.03% 65.00% 70.00% 75.00% 80.00% 85.00% 90.00% 2019Y 2020Y 2021Y 1Q21 1Q22

18 EARNINGS POWER ¹Non-GAAP measure. See “Certain Important Information – Non-GAAP Financial Measures” on slide 2 and “Non-GAAP Reconciliation” on slide 25 for additional information Source: Company documents, for the three months ended March 31, 2022 RETURN ON AVERAGE TANGIBLE COMMON EQUITY(1) (%) NET INTEREST MARGIN (%) RETURN ON AVERAGE ASSETS (%) NET INCOME ($000) $14,241 $20,318 $27,297 $5,023 $7,585 $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 2019Y 2020Y 2021Y 1Q21 1Q22 3.41% 3.35% 3.44% 3.25% 3.59% 2.50% 2.75% 3.00% 3.25% 3.50% 3.75% 2019Y 2020Y 2021Y 1Q21 1Q22 0.76% 0.87% 1.01% 0.80% 1.05% 0.00% 0.25% 0.50% 0.75% 1.00% 1.25% 2019Y 2020Y 2021Y 1Q21 1Q22 9.68% 13.08% 15.98% 13.03% 16.88% 0.00% 4.00% 8.00% 12.00% 16.00% 2019Y 2020Y 2021Y 1Q21 1Q22

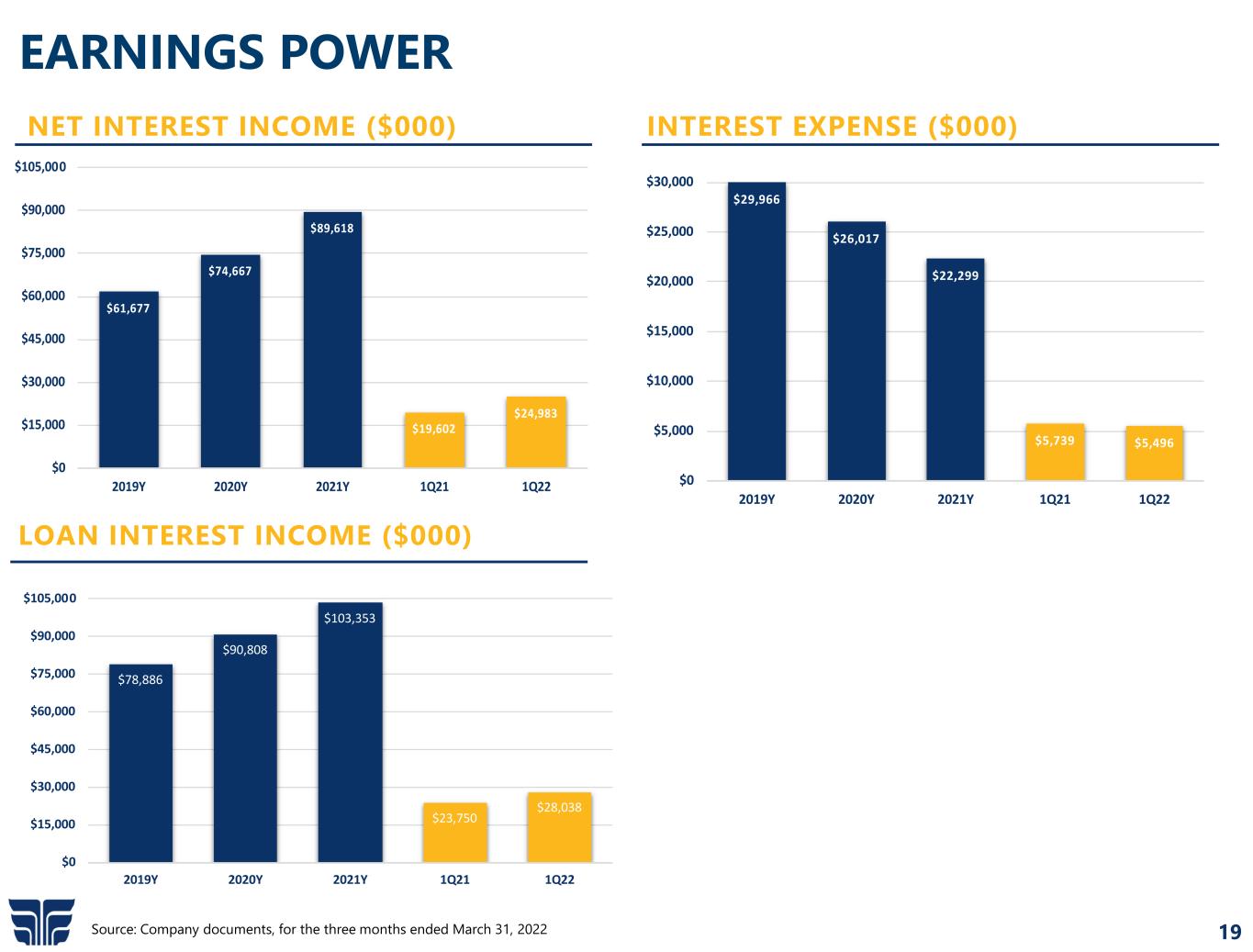

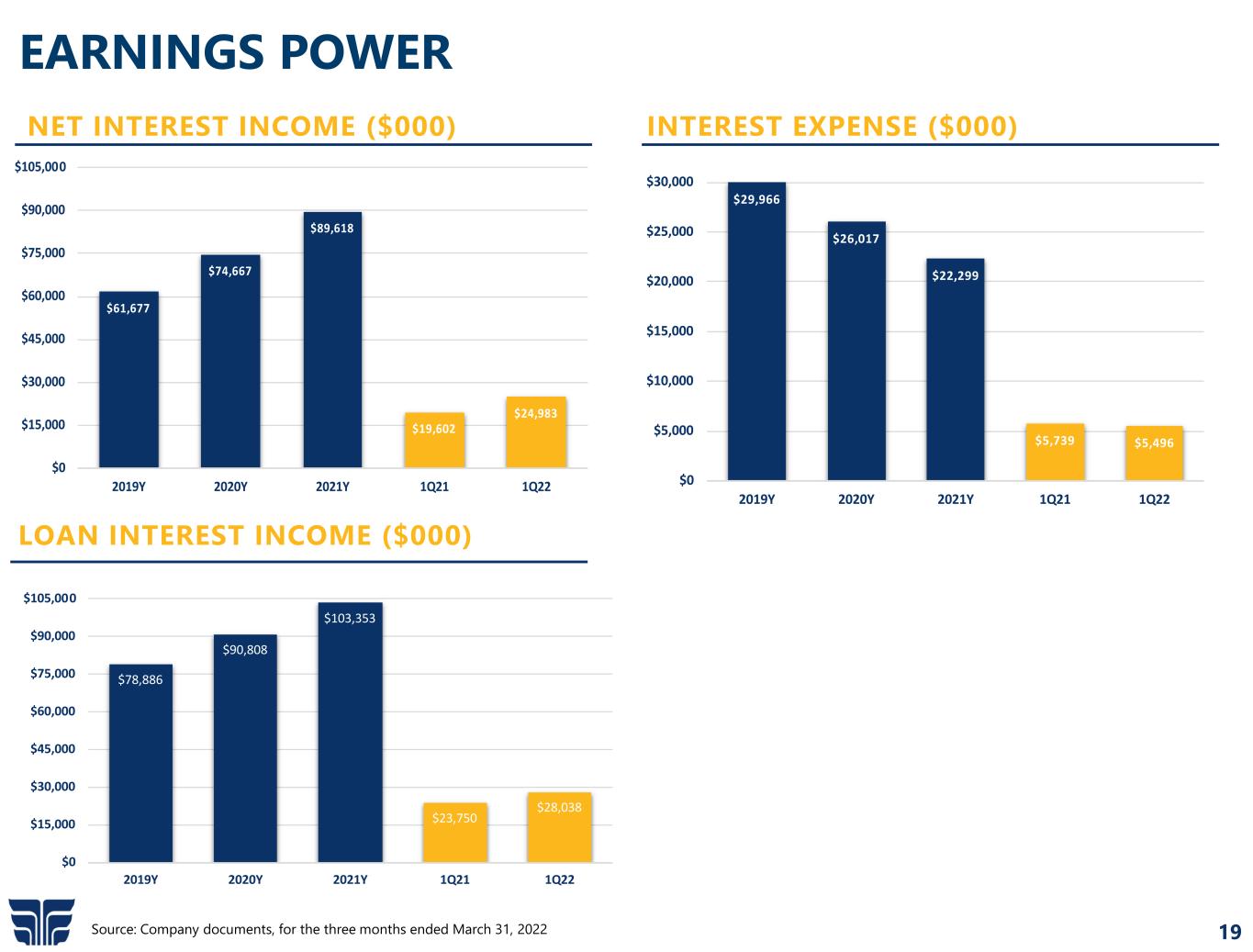

19 EARNINGS POWER NET INTEREST INCOME ($000) $61,677 $74,667 $89,618 $19,602 $24,983 $0 $15,000 $30,000 $45,000 $60,000 $75,000 $90,000 $105,000 2019Y 2020Y 2021Y 1Q21 1Q22 INTEREST EXPENSE ($000) $29,966 $26,017 $22,299 $5,739 $5,496 $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 2019Y 2020Y 2021Y 1Q21 1Q22 Source: Company documents, for the three months ended March 31, 2022 LOAN INTEREST INCOME ($000) $78,886 $90,808 $103,353 $23,750 $28,038 $0 $15,000 $30,000 $45,000 $60,000 $75,000 $90,000 $105,000 2019Y 2020Y 2021Y 1Q21 1Q22

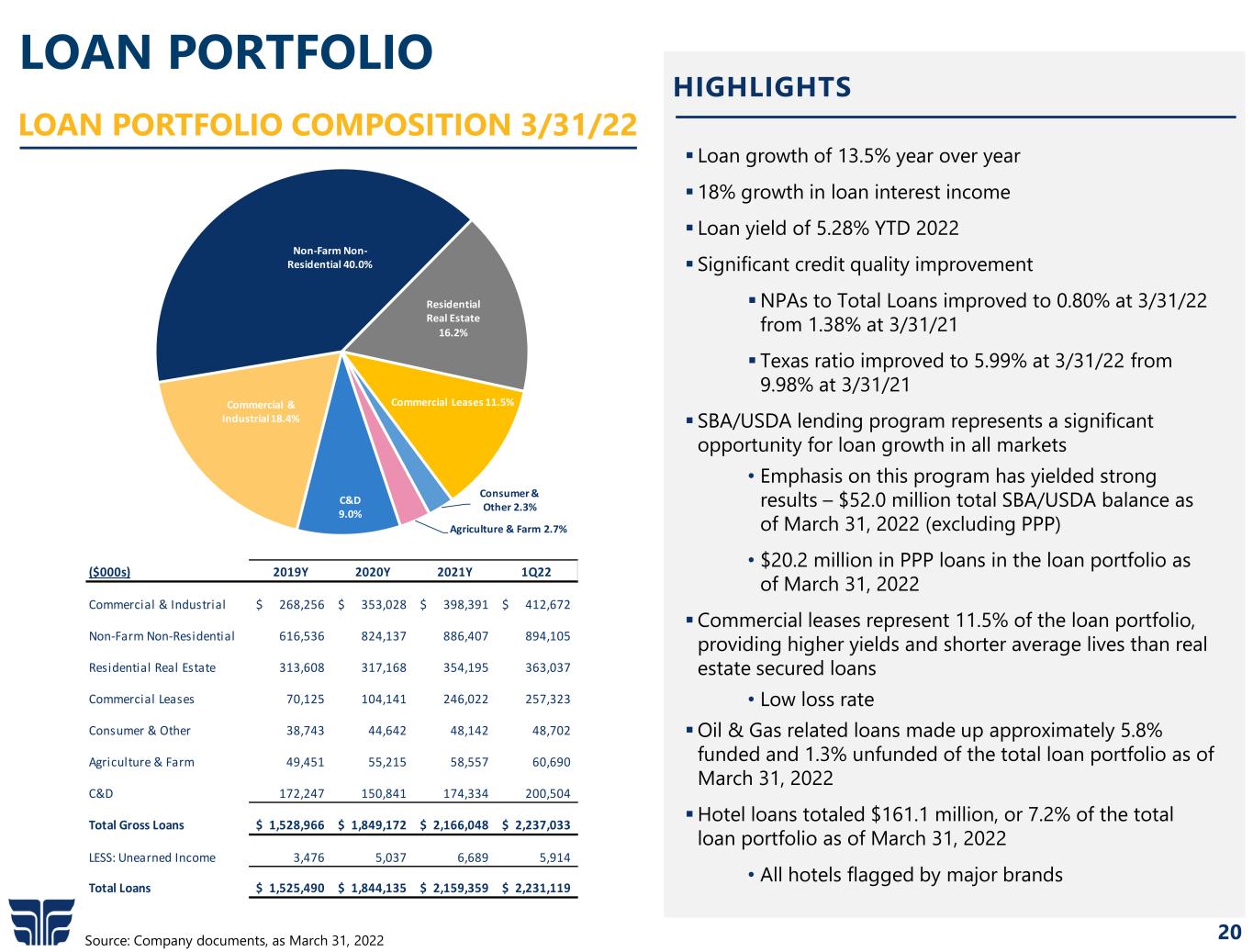

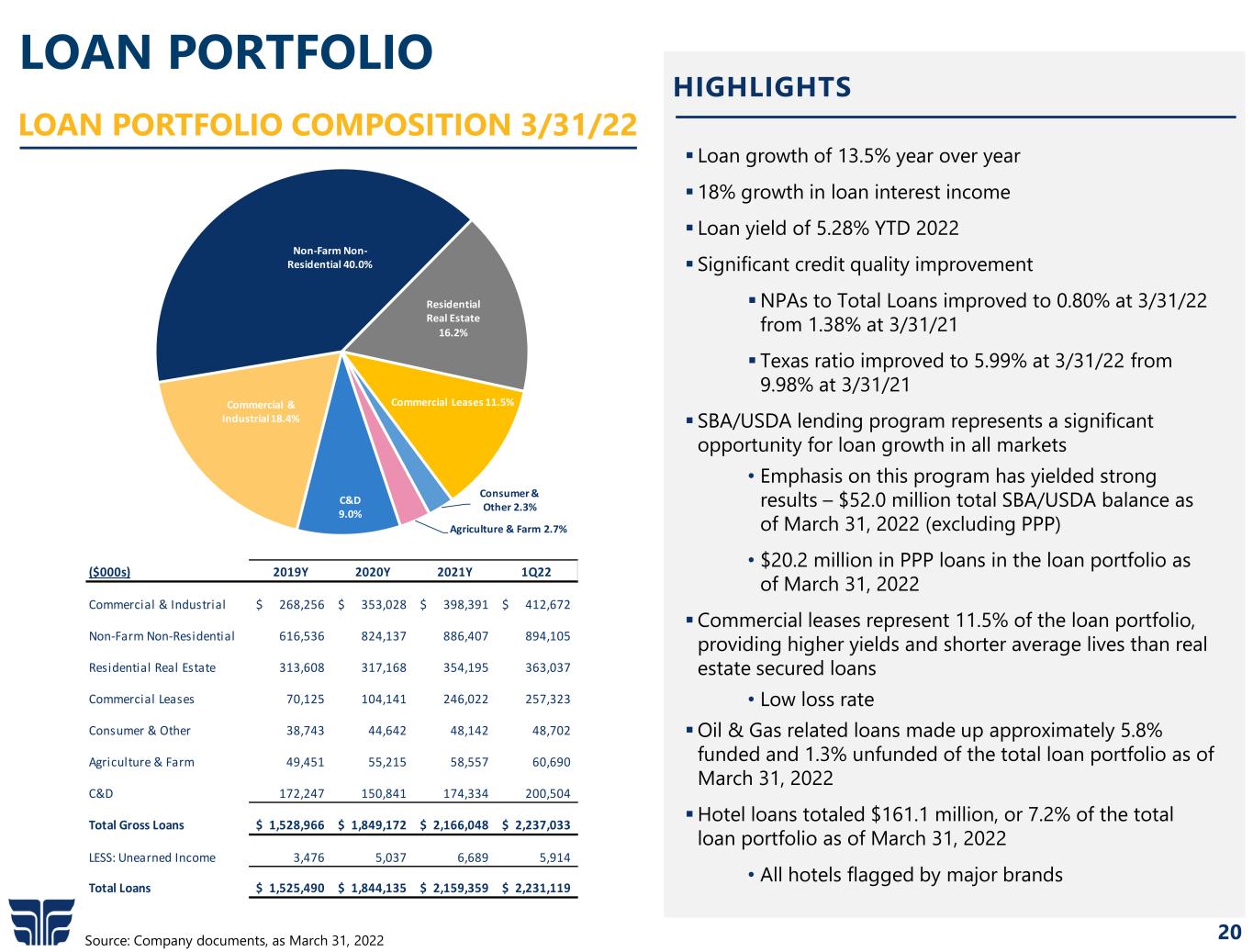

20 ($000s) 2019Y 2020Y 2021Y 1Q22 Commercial & Industrial 268,256$ 353,028$ 398,391$ 412,672$ Non-Farm Non-Residential 616,536 824,137 886,407 894,105 Residential Real Estate 313,608 317,168 354,195 363,037 Commercial Leases 70,125 104,141 246,022 257,323 Consumer & Other 38,743 44,642 48,142 48,702 Agriculture & Farm 49,451 55,215 58,557 60,690 C&D 172,247 150,841 174,334 200,504 Total Gross Loans 1,528,966$ 1,849,172$ 2,166,048$ 2,237,033$ LESS: Unearned Income 3,476 5,037 6,689 5,914 Total Loans 1,525,490$ 1,844,135$ 2,159,359$ 2,231,119$ LOAN PORTFOLIO Source: Company documents, as March 31, 2022 Loan growth of 13.5% year over year 18% growth in loan interest income Loan yield of 5.28% YTD 2022 Significant credit quality improvement NPAs to Total Loans improved to 0.80% at 3/31/22 from 1.38% at 3/31/21 Texas ratio improved to 5.99% at 3/31/22 from 9.98% at 3/31/21 SBA/USDA lending program represents a significant opportunity for loan growth in all markets • Emphasis on this program has yielded strong results – $52.0 million total SBA/USDA balance as of March 31, 2022 (excluding PPP) • $20.2 million in PPP loans in the loan portfolio as of March 31, 2022 Commercial leases represent 11.5% of the loan portfolio, providing higher yields and shorter average lives than real estate secured loans • Low loss rate Oil & Gas related loans made up approximately 5.8% funded and 1.3% unfunded of the total loan portfolio as of March 31, 2022 Hotel loans totaled $161.1 million, or 7.2% of the total loan portfolio as of March 31, 2022 • All hotels flagged by major brands HIGHLIGHTS Commercial & Industrial18.4% Non-Farm Non- Residential 40.0% Residential Real Estate 16.2% Commercial Leases 11.5% Consumer & Other 2.3% Agriculture & Farm 2.7% C&D 9.0% LOAN PORTFOLIO COMPOSITION 3/31/22

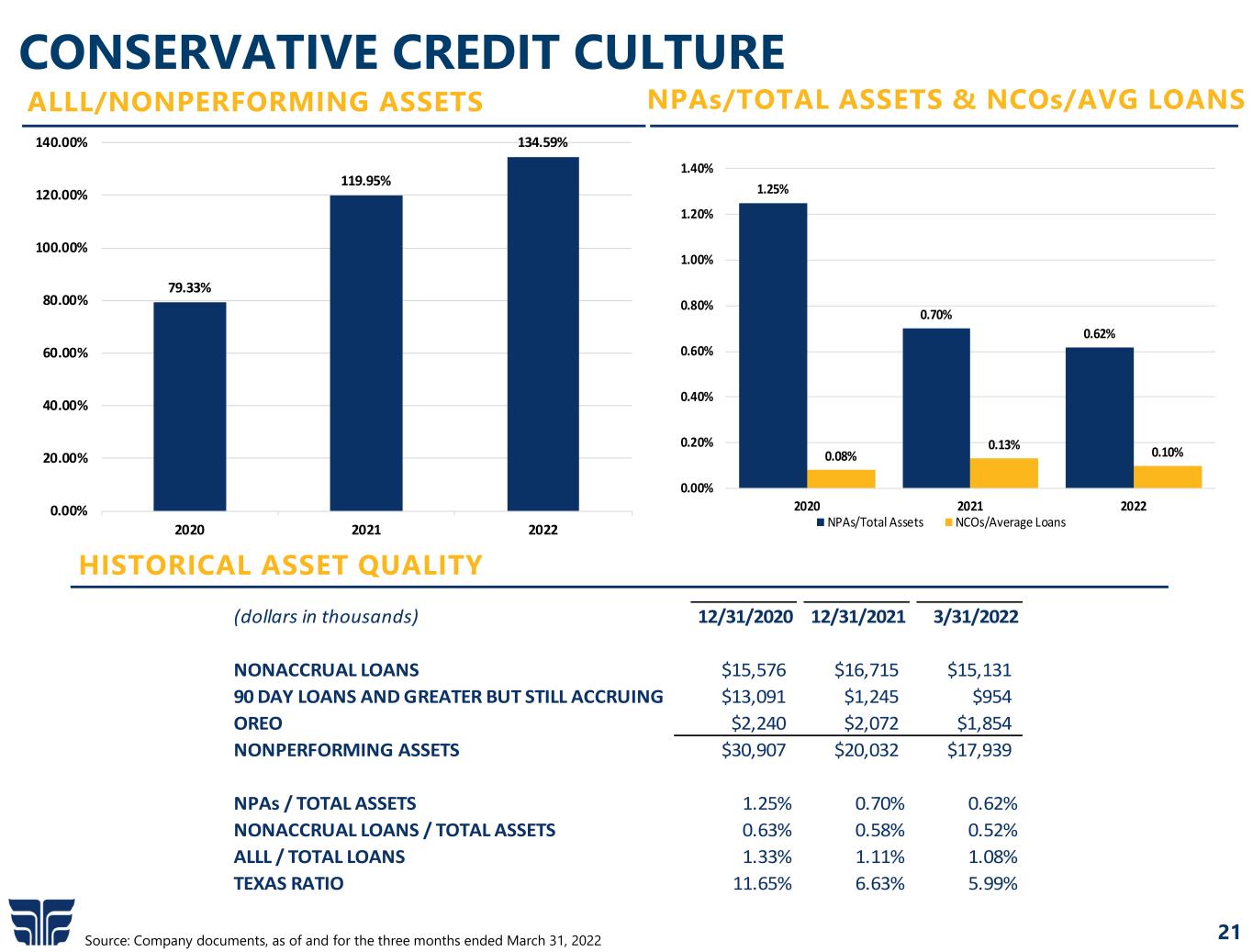

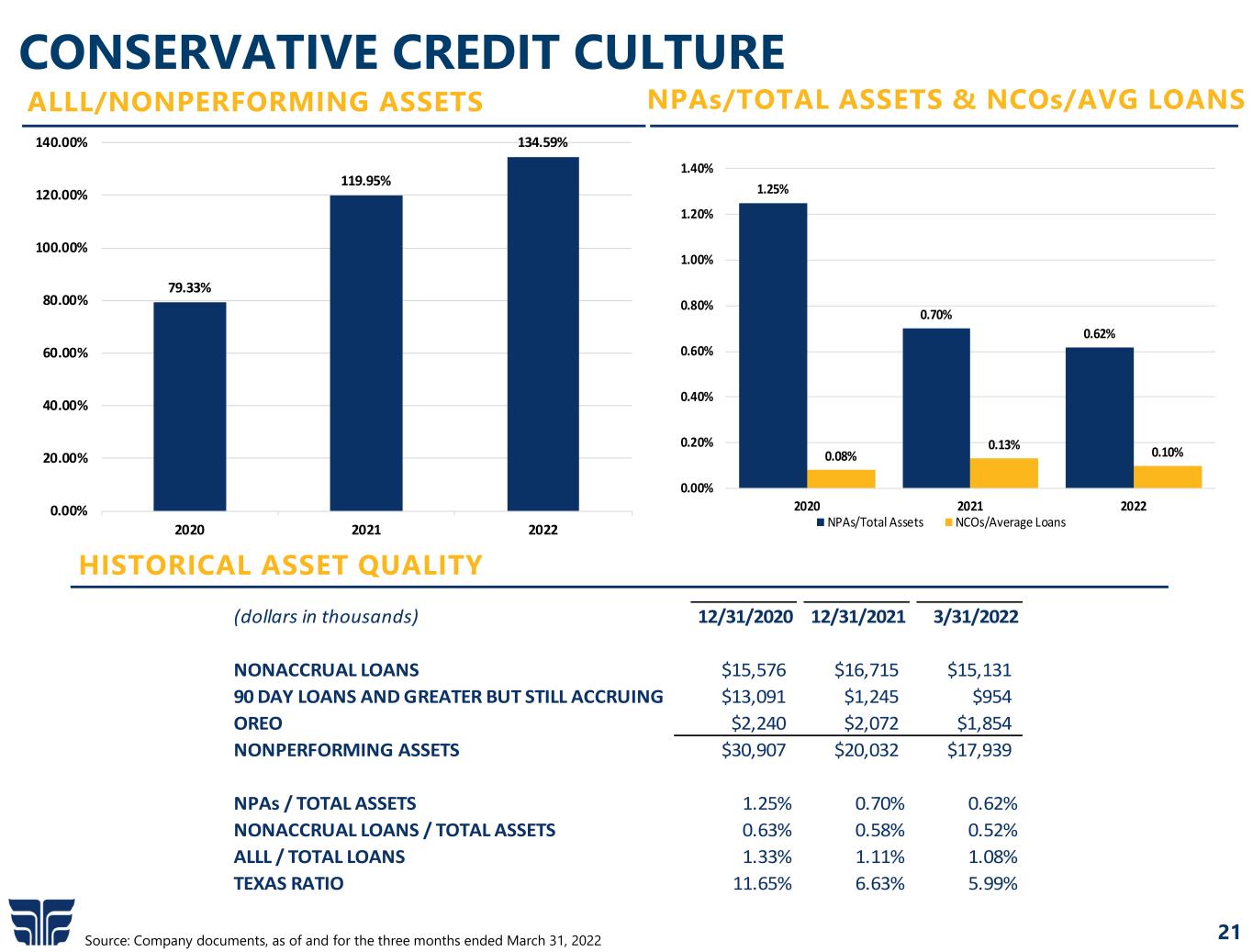

21 79.33% 119.95% 134.59% 0.00% 20.00% 40.00% 60.00% 80.00% 100.00% 120.00% 140.00% 2020 2021 2022 CONSERVATIVE CREDIT CULTURE Source: Company documents, as of and for the three months ended March 31, 2022 ALLL/NONPERFORMING ASSETS HISTORICAL ASSET QUALITY NPAs/TOTAL ASSETS & NCOs/AVG LOANS 1.25% 0.70% 0.62% 0.08% 0.13% 0.10% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 2020 2021 2022 NPAs/Total Assets NCOs/Average Loans (dollars in thousands) 12/31/2020 12/31/2021 3/31/2022 NONACCRUAL LOANS $15,576 $16,715 $15,131 90 DAY LOANS AND GREATER BUT STILL ACCRUING $13,091 $1,245 $954 OREO $2,240 $2,072 $1,854 NONPERFORMING ASSETS $30,907 $20,032 $17,939 NPAs / TOTAL ASSETS 1.25% 0.70% 0.62% NONACCRUAL LOANS / TOTAL ASSETS 0.63% 0.58% 0.52% ALLL / TOTAL LOANS 1.33% 1.11% 1.08% TEXAS RATIO 11.65% 6.63% 5.99%

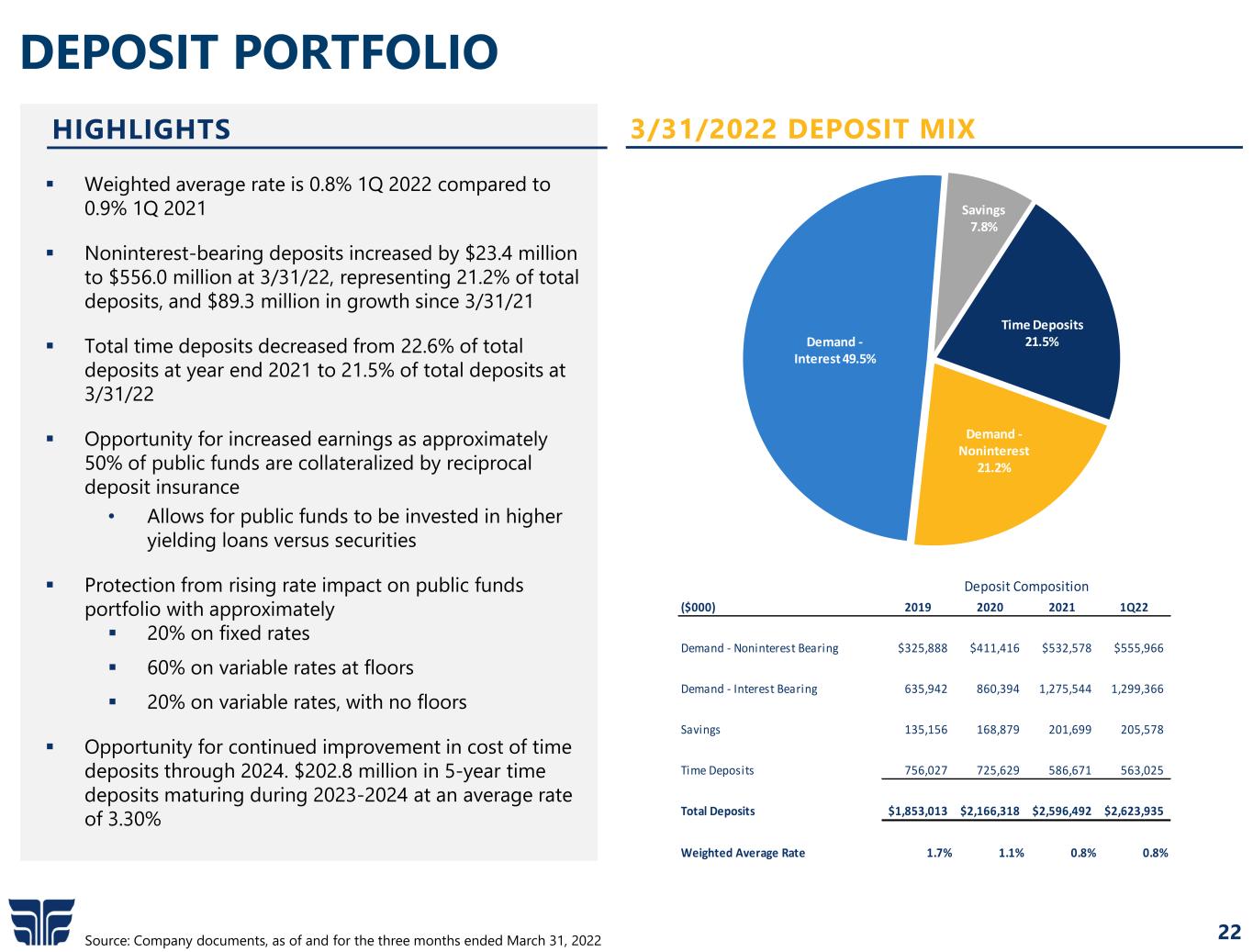

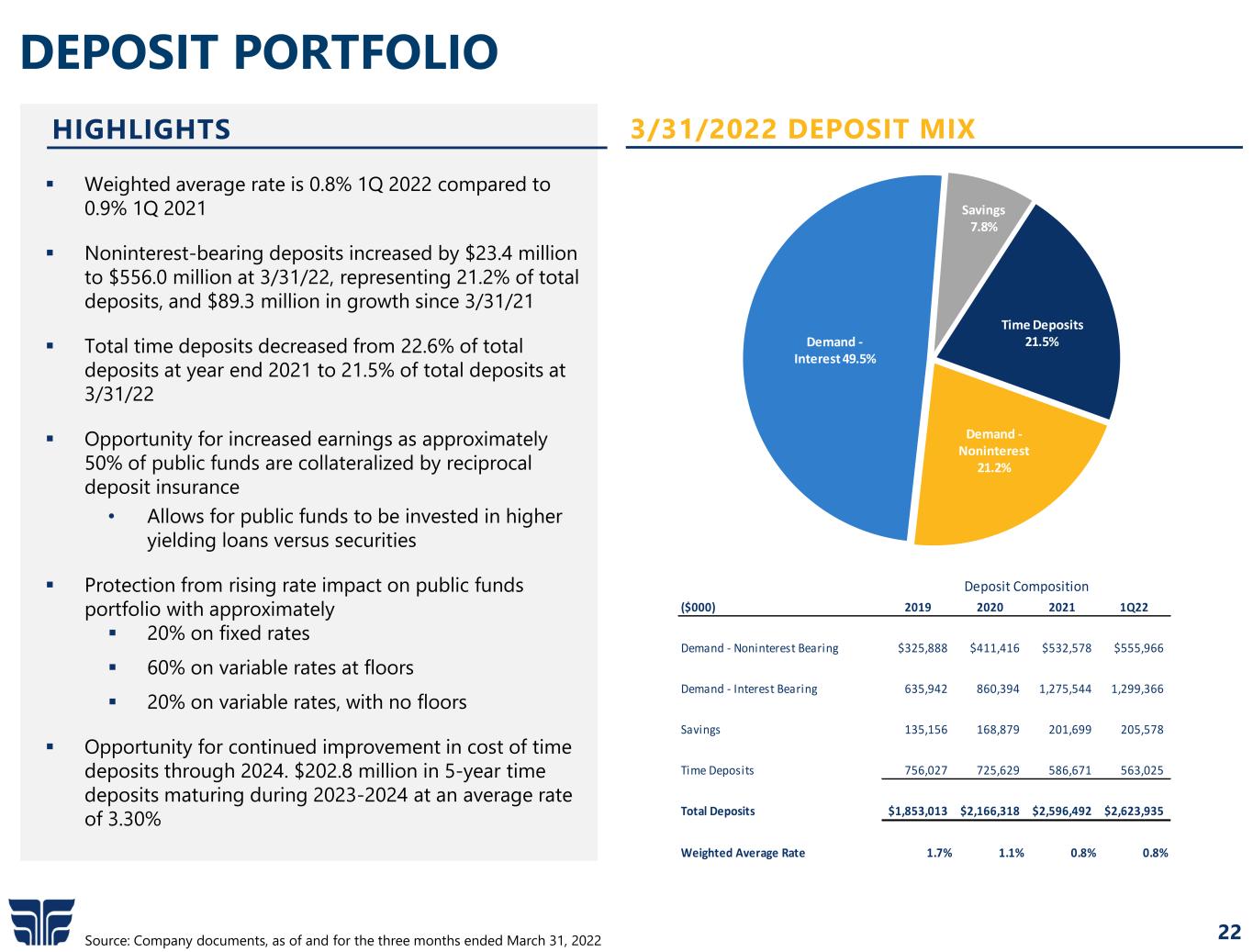

22 HIGHLIGHTS Weighted average rate is 0.8% 1Q 2022 compared to 0.9% 1Q 2021 Noninterest-bearing deposits increased by $23.4 million to $556.0 million at 3/31/22, representing 21.2% of total deposits, and $89.3 million in growth since 3/31/21 Total time deposits decreased from 22.6% of total deposits at year end 2021 to 21.5% of total deposits at 3/31/22 Opportunity for increased earnings as approximately 50% of public funds are collateralized by reciprocal deposit insurance • Allows for public funds to be invested in higher yielding loans versus securities Protection from rising rate impact on public funds portfolio with approximately 20% on fixed rates 60% on variable rates at floors 20% on variable rates, with no floors Opportunity for continued improvement in cost of time deposits through 2024. $202.8 million in 5-year time deposits maturing during 2023-2024 at an average rate of 3.30% DEPOSIT PORTFOLIO Source: Company documents, as of and for the three months ended March 31, 2022 3/31/2022 DEPOSIT MIX Demand - Noninterest 21.2% Demand - Interest 49.5% Savings 7.8% Time Deposits 21.5% ($000) 2019 2020 2021 1Q22 Demand - Noninterest Bearing $325,888 $411,416 $532,578 $555,966 Demand - Interest Bearing 635,942 860,394 1,275,544 1,299,366 Savings 135,156 168,879 201,699 205,578 Time Deposits 756,027 725,629 586,671 563,025 Total Deposits $1,853,013 $2,166,318 $2,596,492 $2,623,935 Weighted Average Rate 1.7% 1.1% 0.8% 0.8% Deposit Composition

BIGGER | STRONGER | MORE PROFITABLE FIRST GUARANTY BANCSHARES, INC.

APPENDIX

25 NON-GAAP RECONCILIATION Source: Company documents Tangible common equity, tangible assets, and tangible book value per share are non-GAAP financial measures calculated using GAAP amounts. Tangible common equity is calculated by excluding the balance of goodwill and the core deposit intangible from the calculation of shareholders’ equity. Tangible assets are calculated by excluding the balance of goodwill and other intangible assets from the calculation of total assets. Tangible book value per share is calculated by dividing tangible common equity by the number of shares outstanding. FGBI believes that these non-GAAP financial measures provide information to investors that is useful in understanding its financial condition, because, in the case of the tangible common equity to tangible assets ratio, the ratio is an additional measure used to assess capital adequacy and, in the case of tangible book value per share, tangible book value per share is an additional measure used to assess FGBI’s value. Because not all companies use the same calculations of tangible common equity and tangible assets, this presentation may not be comparable to other similarly titled measures calculated by other companies. A reconciliation of these non-GAAP financial measures is provided below (dollars in thousands, except per share data). Dollars in thousands, except per share data 2019 2020 2021 2022 Total common stockholders' equity (GAAP) $166,035 $178,591 $190,831 $188,694 LESS: Goodwill and other intangible assets $19,469 $18,715 $17,951 17,777 Tangible common equity (non-GAAP) $146,566 $159,876 $172,880 $170,917 Shares outstanding 10,716,796 10,716,796 10,716,796 10,716,796 Book value per common share $15.49 $16.66 $17.81 $17.61 Tangible book value per common share (non-GAAP) $13.68 $14.92 $16.13 $15.95 Total assets (GAAP) $2,117,216 $2,473,078 $2,878,120 $2,910,123 LESS: Goodwill and other intangible assets $19,469 $18,715 $17,951 $17,777 Tangible assets (non-GAAP) $2,097,747 $2,454,363 $2,860,169 $2,892,346 Tangible common equity to tangible assets (GAAP) 6.99% 6.51% 6.04% 5.91% As of December 31, As of March 31,

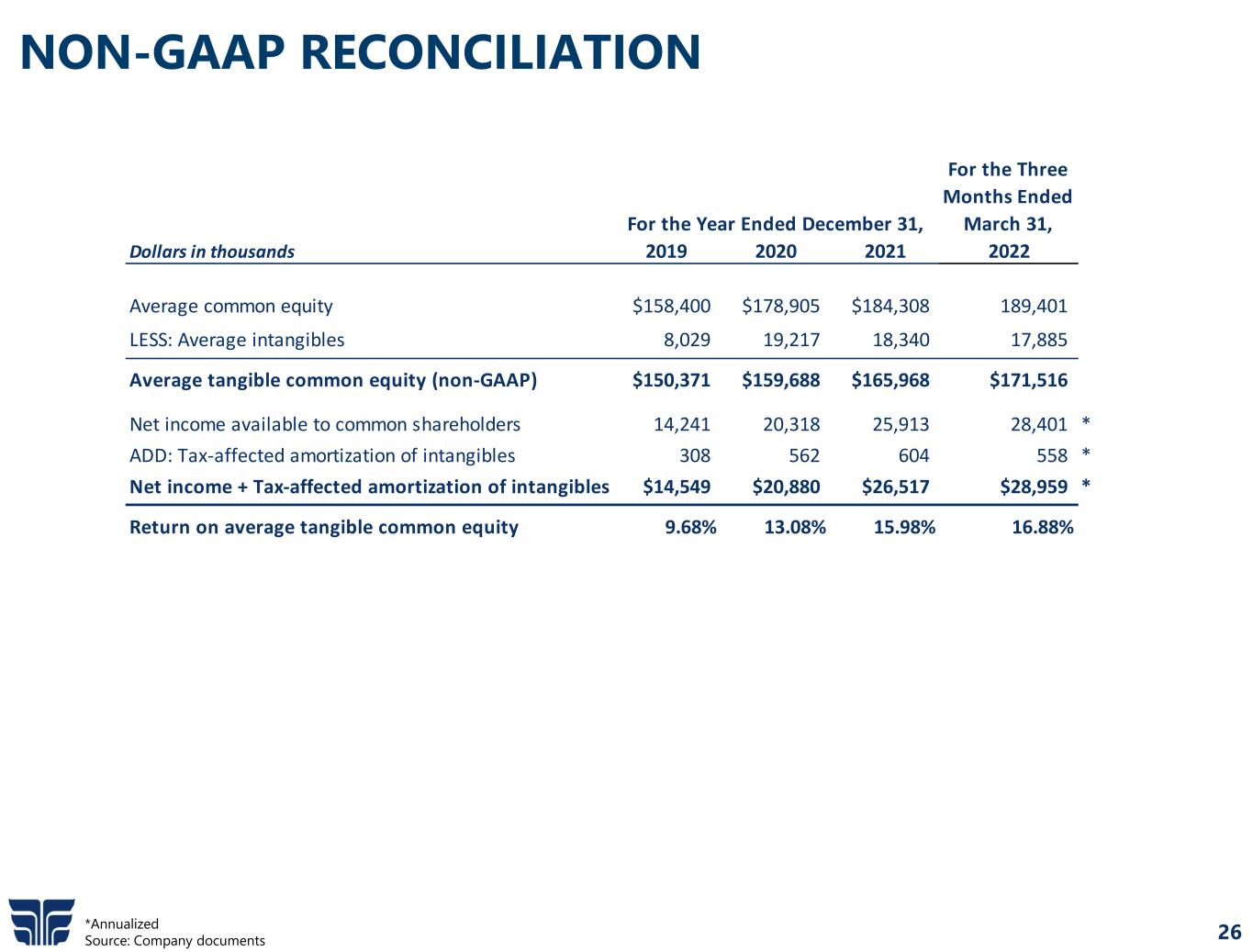

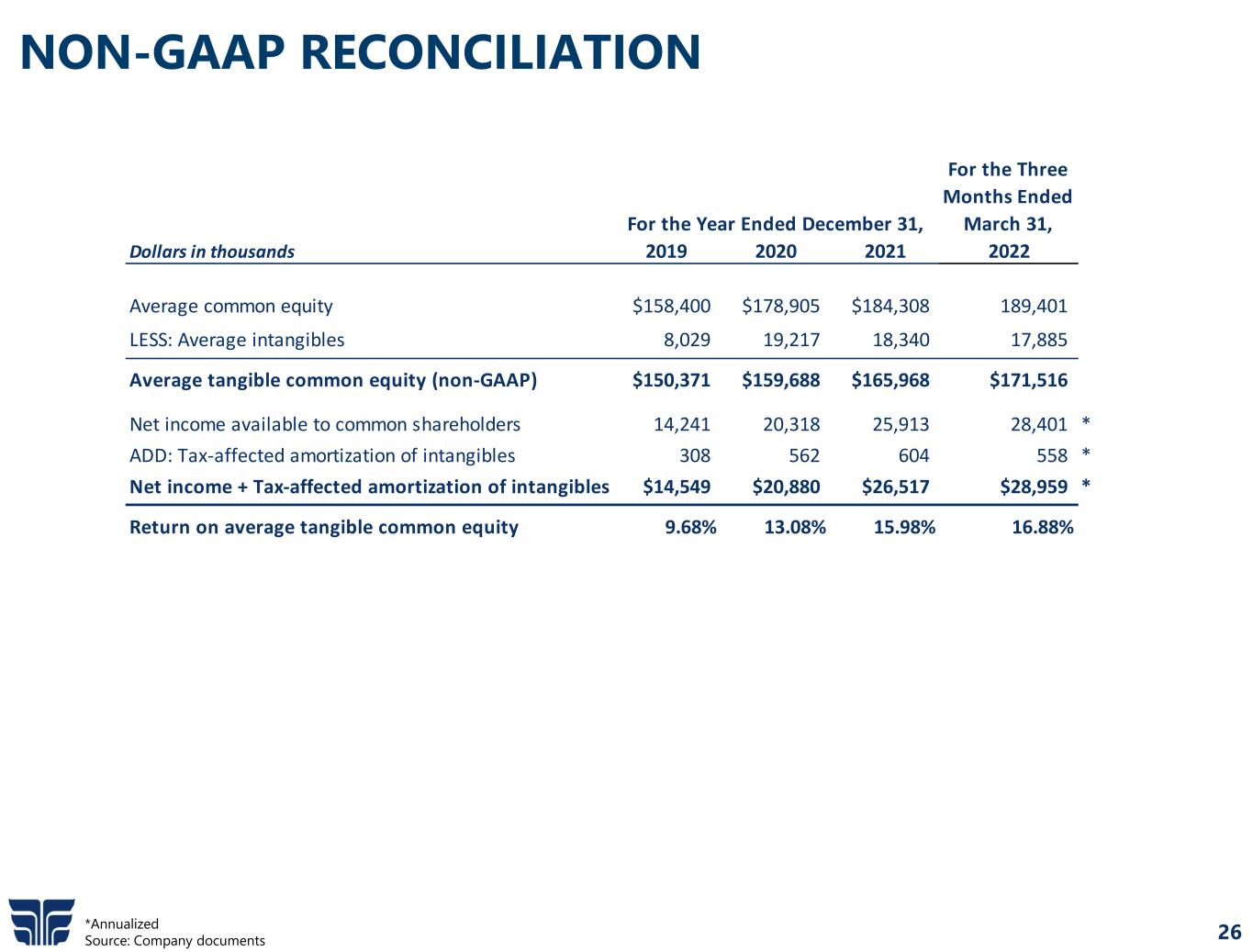

26 NON-GAAP RECONCILIATION *Annualized Source: Company documents Dollars in thousands 2019 2020 2021 2022 Average common equity $158,400 $178,905 $184,308 189,401 LESS: Average intangibles 8,029 19,217 18,340 17,885 Average tangible common equity (non-GAAP) $150,371 $159,688 $165,968 $171,516 Net income available to common shareholders 14,241 20,318 25,913 28,401 * ADD: Tax-affected amortization of intangibles 308 562 604 558 * Net income + Tax-affected amortization of intangibles $14,549 $20,880 $26,517 $28,959 * Return on average tangible common equity 9.68% 13.08% 15.98% 16.88% For the Year Ended December 31, For the Three Months Ended March 31,