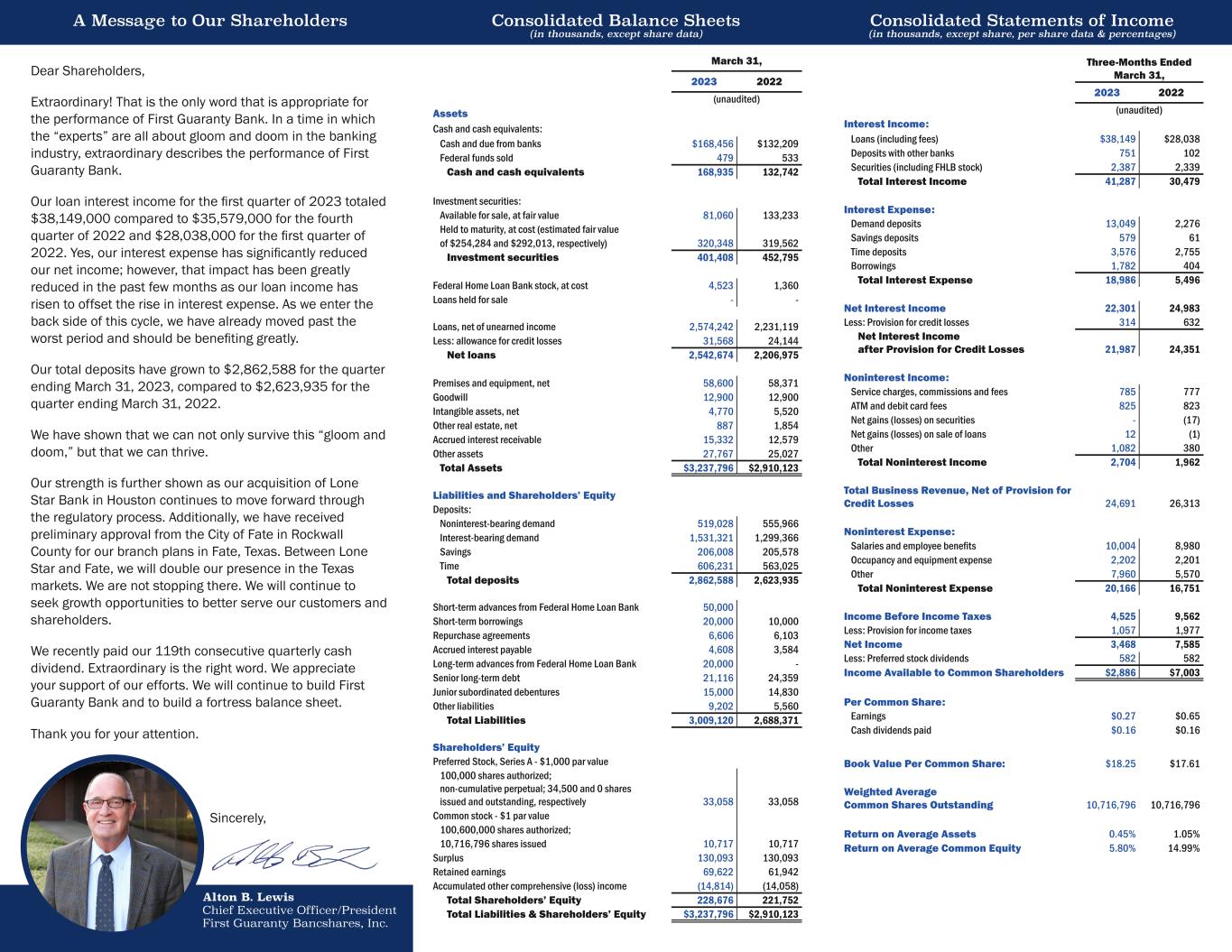

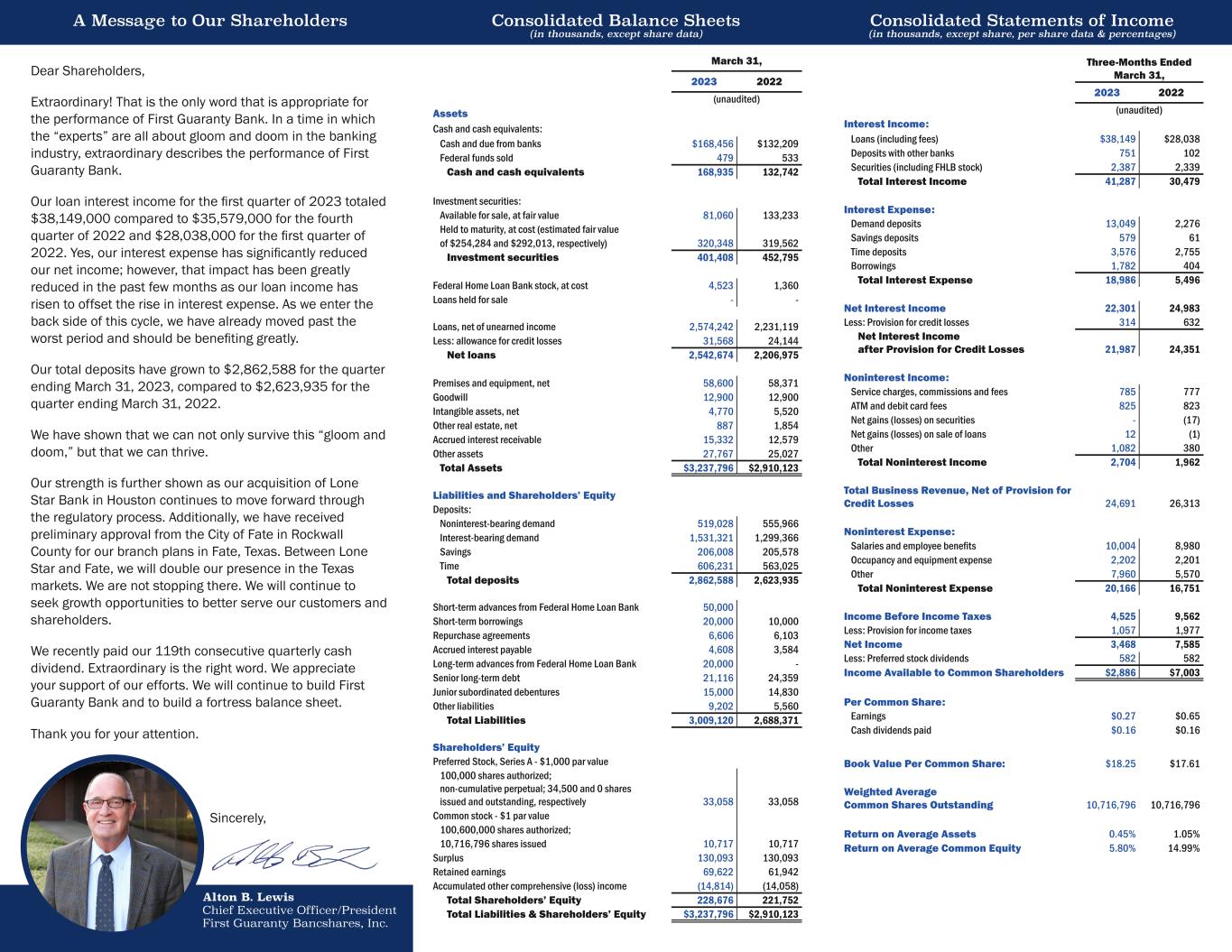

Alton B. Lewis Chief Executive Officer/President First Guaranty Bancshares, Inc. A Message to Our Shareholders Consolidated Balance Sheets (in thousands, except share data) Consolidated Statements of Income (in thousands, except share, per share data & percentages) Sincerely, March 31, 2023 2022 (unaudited) Assets Cash and cash equivalents: Cash and due from banks $168,456 $132,209 Federal funds sold 479 533 Cash and cash equivalents 168,935 132,742 Investment securities: Available for sale, at fair value 81,060 133,233 Held to maturity, at cost (estimated fair value of $254,284 and $292,013, respectively) 320,348 319,562 Investment securities 401,408 452,795 Federal Home Loan Bank stock, at cost 4,523 1,360 Loans held for sale - - Loans, net of unearned income 2,574,242 2,231,119 Less: allowance for credit losses 31,568 24,144 Net loans 2,542,674 2,206,975 Premises and equipment, net 58,600 58,371 Goodwill 12,900 12,900 Intangible assets, net 4,770 5,520 Other real estate, net 887 1,854 Accrued interest receivable 15,332 12,579 Other assets 27,767 25,027 Total Assets $3,237,796 $2,910,123 Liabilities and Shareholders’ Equity Deposits: Noninterest-bearing demand 519,028 555,966 Interest-bearing demand 1,531,321 1,299,366 Savings 206,008 205,578 Time 606,231 563,025 Total deposits 2,862,588 2,623,935 Short-term advances from Federal Home Loan Bank 50,000 Short-term borrowings 20,000 10,000 Repurchase agreements 6,606 6,103 Accrued interest payable 4,608 3,584 Long-term advances from Federal Home Loan Bank 20,000 - Senior long-term debt 21,116 24,359 Junior subordinated debentures 15,000 14,830 Other liabilities 9,202 5,560 Total Liabilities 3,009,120 2,688,371 Shareholders’ Equity Preferred Stock, Series A - $1,000 par value 100,000 shares authorized; non-cumulative perpetual; 34,500 and 0 shares issued and outstanding, respectively 33,058 33,058 Common stock - $1 par value 100,600,000 shares authorized; 10,716,796 shares issued 10,717 10,717 Surplus 130,093 130,093 Retained earnings 69,622 61,942 Accumulated other comprehensive (loss) income (14,814) (14,058) Total Shareholders’ Equity 228,676 221,752 Total Liabilities & Shareholders’ Equity $3,237,796 $2,910,123 Three-Months Ended March 31, 2023 2022 (unaudited) Interest Income: Loans (including fees) $38,149 $28,038 Deposits with other banks 751 102 Securities (including FHLB stock) 2,387 2,339 Total Interest Income 41,287 30,479 Interest Expense: Demand deposits 13,049 2,276 Savings deposits 579 61 Time deposits 3,576 2,755 Borrowings 1,782 404 Total Interest Expense 18,986 5,496 Net Interest Income 22,301 24,983 Less: Provision for credit losses 314 632 Net Interest Income after Provision for Credit Losses 21,987 24,351 Noninterest Income: Service charges, commissions and fees 785 777 ATM and debit card fees 825 823 Net gains (losses) on securities - (17) Net gains (losses) on sale of loans 12 (1) Other 1,082 380 Total Noninterest Income 2,704 1,962 Total Business Revenue, Net of Provision for Credit Losses 24,691 26,313 Noninterest Expense: Salaries and employee benefits 10,004 8,980 Occupancy and equipment expense 2,202 2,201 Other 7,960 5,570 Total Noninterest Expense 20,166 16,751 Income Before Income Taxes 4,525 9,562 Less: Provision for income taxes 1,057 1,977 Net Income 3,468 7,585 Less: Preferred stock dividends 582 582 Income Available to Common Shareholders $2,886 $7,003 Per Common Share: Earnings $0.27 $0.65 Cash dividends paid $0.16 $0.16 Book Value Per Common Share: $18.25 $17.61 Weighted Average Common Shares Outstanding 10,716,796 10,716,796 Return on Average Assets 0.45% 1.05% Return on Average Common Equity 5.80% 14.99% Dear Shareholders, Extraordinary! That is the only word that is appropriate for the performance of First Guaranty Bank. In a time in which the “experts” are all about gloom and doom in the banking industry, extraordinary describes the performance of First Guaranty Bank. Our loan interest income for the first quarter of 2023 totaled $38,149,000 compared to $35,579,000 for the fourth quarter of 2022 and $28,038,000 for the first quarter of 2022. Yes, our interest expense has significantly reduced our net income; however, that impact has been greatly reduced in the past few months as our loan income has risen to offset the rise in interest expense. As we enter the back side of this cycle, we have already moved past the worst period and should be benefiting greatly. Our total deposits have grown to $2,862,588 for the quarter ending March 31, 2023, compared to $2,623,935 for the quarter ending March 31, 2022. We have shown that we can not only survive this “gloom and doom,” but that we can thrive. Our strength is further shown as our acquisition of Lone Star Bank in Houston continues to move forward through the regulatory process. Additionally, we have received preliminary approval from the City of Fate in Rockwall County for our branch plans in Fate, Texas. Between Lone Star and Fate, we will double our presence in the Texas markets. We are not stopping there. We will continue to seek growth opportunities to better serve our customers and shareholders. We recently paid our 119th consecutive quarterly cash dividend. Extraordinary is the right word. We appreciate your support of our efforts. We will continue to build First Guaranty Bank and to build a fortress balance sheet. Thank you for your attention.