UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrant x Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

ADVISORSHARES TRUST

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a) (2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: |

ADVISORSHARES TRUST

AdvisorShares TrimTabs Float Shrink ETF

NYSE Arca Ticker: TTFS

4800 Montgomery Lane, Suite 150

Bethesda, Maryland 20814

www.advisorshares.com

1.877.THE.ETF1

July 10, 2015

Dear Shareholder:

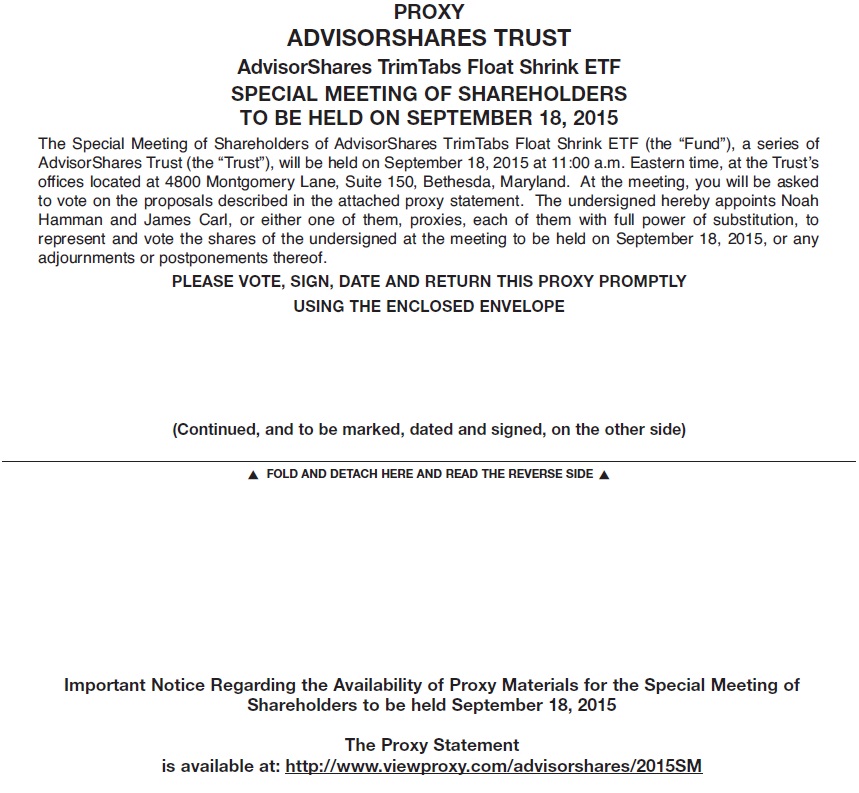

On behalf of the Board of Trustees of AdvisorShares Trust (the “Trust”), I cordially invite you to attend a Special Meeting of Shareholders of the AdvisorShares TrimTabs Float Shrink ETF (the “Fund”), a series of the Trust, to be held at 11:00 a.m. on September 18, 2015, at the Trust’s offices located at 4800 Montgomery Lane, Suite 150, Bethesda, Maryland 20814. The purpose of the meeting is to ask shareholders to approve (1) a new investment sub-advisory agreement between AdvisorShares Investments, LLC (the “Adviser”) and TrimTabs Asset Management, LLC (“TrimTabs”) and (2) the implementation of a manager of managers arrangement for the Fund that will permit the Adviser, in its capacity as the Trust’s investment adviser and subject to prior approval by the Board, to enter into and materially amend agreements with unaffiliated sub-advisers without obtaining the approval of the Fund’s shareholders.

Enclosed are a notice of the meeting and a proxy statement that includes additional information about the proposals. I hope that you find this information helpful and that you will promptly vote to approve the new sub-advisory agreement between the Adviser and TrimTabs on behalf of the Fund, as well as to approve the manager of managers arrangement for the Fund.

Your vote is extremely important, even if you only own a few of the Fund’s shares. Shareholder meetings of the Fund do not occur with great frequency, so I ask that you take the time to carefully consider and vote on these important proposals. Please read the enclosed information carefully before voting. If you have questions, please call the Trust at 1.877.THE.ETF1.

I appreciate your participation and prompt response and thank you for your continued support.

Sincerely,

Noah Hamman

Trustee and President

PROMPT EXECUTION AND RETURN OF THE ENCLOSED PROXY CARD IS REQUESTED. A SELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE, ALONG WITH INSTRUCTIONS ON HOW TO VOTE BY INTERNET OR TELEPHONE SHOULD YOU PREFER TO VOTE BY ONE OF THOSE METHODS.

ADVISORSHARES TRUST

AdvisorShares TrimTabs Float Shrink ETF

NYSE Arca Ticker: TTFS

4800 Montgomery Lane, Suite 150

Bethesda, Maryland 20814

www.advisorshares.com

1.877.THE.ETF1

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

SCHEDULED FOR SEPTEMBER 18, 2015

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders of the AdvisorShares TrimTabs Float Shrink ETF (the “Fund”), a series of AdvisorShares Trust (the “Trust”), a Delaware statutory trust, will be held at the Trust’s offices, located at 4800 Montgomery Lane, Suite 150, Bethesda, Maryland, on September 18, 2015 at 11:00 a.m. Eastern time, for the following purposes:

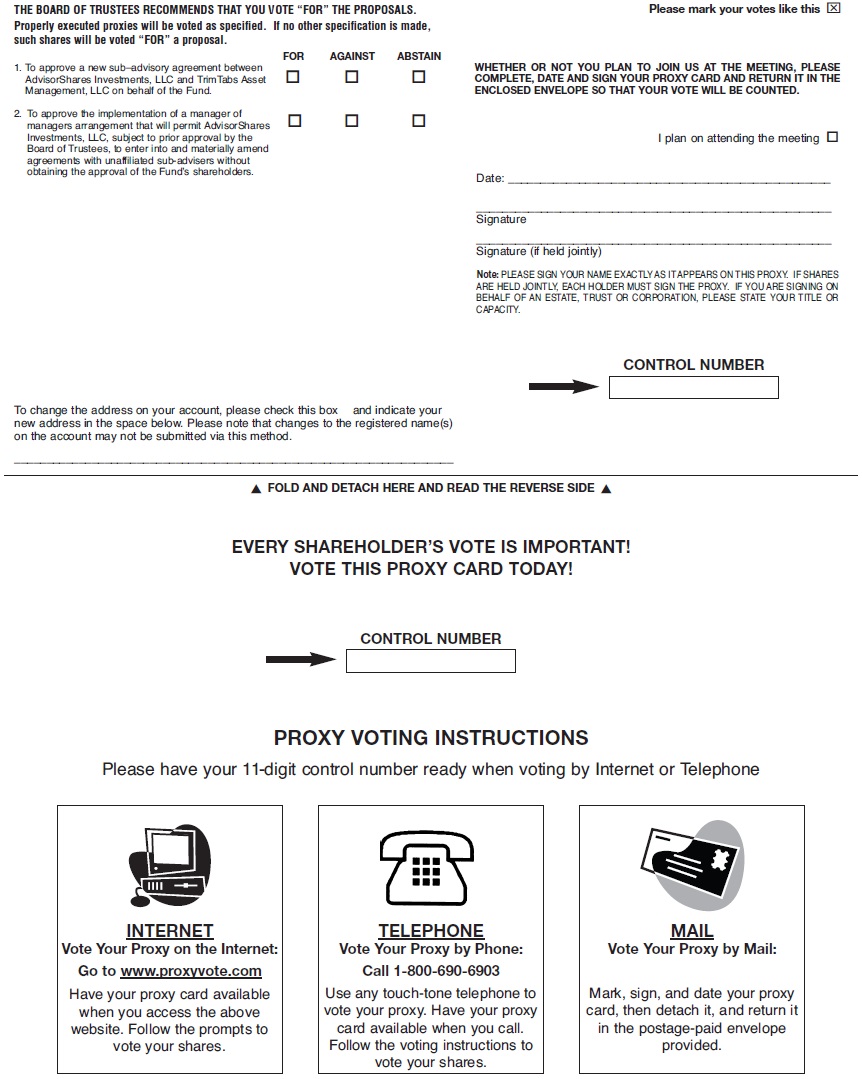

| 1. | To approve a new investment sub-advisory agreement between AdvisorShares Investments, LLC (the “Adviser”) and TrimTabs Asset Management, LLC on behalf of the Fund; and |

| 2. | To approve the implementation of a manager of managers arrangement that will permit the Adviser, subject to prior approval by the Trust’s Board of Trustees, to enter into and materially amend agreements with unaffiliated sub-advisers without obtaining the approval of the Fund’s shareholders. |

Shareholders of the Fund may also be asked to transact such other business as may properly come before the meeting or any adjournments thereof.

After careful consideration, the Board of Trustees of the Trust recommends that you vote “FOR” the proposals.

Shareholders of record as of the close of business on July 1, 2015 are entitled to notice of, and to vote at, the meeting or any adjournment or postponement thereof. If you attend the meeting, you may vote your shares in person. If you do not expect to attend the meeting, please complete, date, sign and return promptly in the enclosed envelope the accompanying proxy card. This is important to ensure a quorum at the meeting.

In addition to voting by mail, you also may authorize your vote either by telephone or via the internet, as follows:

| To Vote by Telephone: | To Vote by Internet: | |||||

| (1) | Read the Proxy Statement and have the enclosed proxy card at hand. | (1) | Read the Proxy Statement and have the enclosed proxy card at hand. | |||

| (2) | Call the toll-free number that appears on the enclosed proxy card. | (2) | Go to the website that appears on the enclosed proxy card. | |||

| (3) | Enter the control number set forth on the enclosed proxy card and follow the simple instructions. | (3) | Enter the control number set forth on the enclosed proxy card and follow the simple instructions. | |||

We call your attention to the accompanying proxy statement and ask that you read it carefully before you vote. You are requested to complete, date, and sign the enclosed proxy card and return it promptly in the postage-paid envelope provided for that purpose. Your proxy card also provides instructions for voting via telephone or the internet if you wish to take advantage of these voting options. We encourage you to vote your shares by telephone or internet as those methods will reduce the time and costs associated with this proxy solicitation.

Proxies may be revoked prior to the meeting by timely executing and submitting a revised proxy using one of the methods noted above, by giving written notice of revocation to the Fund prior to the meeting, or by voting in person at the meeting.

If you should have any questions regarding the enclosed proxy material or need assistance in voting your shares, please contact your financial representative or the Trust at 1.877.THE.ETF1.

By Order of the Board of Trustees

Dan Ahrens

Secretary

July 10, 2015

YOUR VOTE IS VERY IMPORTANT TO US REGARDLESS OF THE NUMBER OF SHARES YOU OWN. SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE MEETING ARE REQUESTED TO COMPLETE, SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED ENVELOPE, WHICH NEEDS NO POSTAGE IF MAILED IN THE UNITED STATES. IT IS IMPORTANT THAT YOUR PROXY CARD BE RETURNED PROMPTLY.

FOR YOUR CONVENIENCE, YOU MAY ALSO VOTE BY TELEPHONE OR INTERNET BY FOLLOWING THE ENCLOSED INSTRUCTIONS. IF YOU VOTE BY TELEPHONE OR INTERNET, PLEASE DO NOT RETURN YOUR PROXY CARD UNLESS YOU DECIDE TO CHANGE YOUR VOTE.

| 2 |

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and avoid the time and expense involved in validating your vote if you fail to sign your proxy card properly.

1.Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card.

2.Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration on the proxy card.

3.Other Accounts: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example:

Corporate Accounts | Valid Signature | |

| ABC Corp. | ABC Corp. (by John Doe, Treasurer) | |

| ABC Corp. | John Doe, Treasurer | |

| ABC Corp. c/o John Doe, Treasurer. | John Doe | |

| ABC Corp. Profit Sharing Plan. | John Doe, Trustee | |

Trust Accounts | ||

| ABC Trust | Jane B. Doe, Trustee | |

| Jane B. Doe, Trustee u/t/d 12/28/78 | Jane B. Doe | |

Custodial or Estate Accounts | ||

| John B. Smith, Cust. f/b/o John B. Smith, Jr. UGMA | John B. Smith | |

| John B. Smith | John B. Smith, Jr., Executor | |

YOUR VOTE IS IMPORTANT. PLEASE VOTE YOUR SHARES PROMPTLY, NO MATTER HOW MANY SHARES YOU OWN.

| 3 |

PROXY STATEMENT

ADVISORSHARES TRUST

AdvisorShares TrimTabs Float Shrink ETF

NYSE Arca Ticker: TTFS

4800 Montgomery Lane, Suite 150

Bethesda, Maryland 20814

www.advisorshares.com

1.877.THE.ETF1

SPECIAL MEETING OF SHAREHOLDERS SCHEDULED FOR SEPTEMBER 18, 2015

WHO IS ASKING FOR MY VOTE?

The Board of Trustees (the “Board”) of AdvisorShares Trust (the “Trust”) is sending this Proxy Statement, the attached Notice of Special Meeting, and the enclosed proxy card on or about July 16, 2015, to all shareholders of record who have a beneficial interest in the AdvisorShares TrimTabs Float Shrink ETF (the “Fund”) as of the close of business on July 1, 2015 (the “Record Date”). The Board is soliciting your vote for a special meeting of shareholders (the “Special Meeting”) of the Fund.

WHEN AND WHERE WILL THE SPECIAL MEETING BE HELD?

The Special Meeting will be held at the offices of the Trust, 4800 Montgomery Lane, Suite 150, Bethesda, Maryland 20814, and is scheduled for September 18, 2015 at 11:00 a.m. Eastern time, as will any adjournment(s) or postponement(s) of the Special Meeting.

WHY IS THE SPECIAL MEETING BEING HELD?

The Special Meeting is being held for the following purposes:

| 1. | To approve a new investment sub-advisory agreement between AdvisorShares Investments, LLC (the “Adviser”) and TrimTabs Asset Management, LLC (“TrimTabs”) on behalf of the Fund; and |

| 2. | To approve the implementation of a manager of managers arrangement that will permit the Adviser, subject to prior approval by the Board, to enter into and materially amend agreements with unaffiliated sub-advisers without obtaining the approval of the Fund’s shareholders. |

Shareholders of the Fund may also be asked to transact such other business as may properly come before the Special Meeting or any adjournments thereof in the discretion of the proxies or their substitutes. If approved, the implementation of a proposal is not contingent on the approval of any other proposal.

WHO IS ELIGIBLE TO VOTE?

All shareholders of record as of the close of business on the Record Date are eligible to vote. (See “How Do I Vote?” and “General Information” for a more detailed discussion of voting procedures).

| 1 |

Each share of the Fund is entitled to one vote and fractional shares are counted as a fractional vote. The Fund had 4,200,000 shares issued and outstanding as of the Record Date.

WHY DID YOU SEND ME THIS BOOKLET?

This booklet is a Proxy Statement. It provides you with information you should review before voting on the proposals listed above and in the Notice of Special Meeting for the Fund. You are receiving these proxy materials, including one proxy card, because you have the right to vote on these important proposals concerning your investment in the Fund.

The word “you” is used in this Proxy Statement to refer to the person or entity that owns the shares and accordingly has voting rights in connection with the shares. For a pension plan, the trustee for the plan generally has the right to vote the shares owned through the plan.

WHICH PROPOSALS DO I VOTE ON?

You are being asked to vote on both of the proposals.

HOW DO I VOTE?

You may vote in person, by mail, telephone or internet. Joint owners must each sign the proxy card. Shareholders of the Fund whose shares are held by nominees, such as brokers, may vote their shares by contacting their respective nominee. If your proxy is properly returned by the close of business on September 17, 2015 if you vote by mail, or by 11:59 pm Eastern time on September 17, 2015 if you vote by telephone or internet, your proxy will be voted in accordance with your instructions. If a proxy card is not marked to indicate voting instructions with respect to a proposal but is signed, dated and returned, it will be treated as an instruction to vote the shares “FOR” the proposal and in accordance with the judgment of the persons appointed as proxies upon any other matter that may properly come before the Special Meeting.

If a shareholder wishes to participate in the Special Meeting, but does not wish to give a proxy by telephone or internet, the shareholder may still submit by mail the proxy card sent with the Proxy Statement or attend the Special Meeting in person. Should shareholders require additional information regarding the Special Meeting, they may contact the proxy solicitor (discussed below) toll-free at 1-855-973-0090.

A shareholder may revoke a proxy at any time prior to the vote on a proposal by filing with the Trust a written revocation or a duly executed proxy bearing a later date. In addition, any shareholder who attends the Special Meeting in person may vote by ballot at the Special Meeting, thereby canceling any proxy previously given.

WHO WILL SOLICIT MY PROXY?

The Trust has retained Alliance Shareholder Communications, a professional proxy solicitation firm (“Solicitor”), to assist in the solicitation of proxies, at an estimated cost of $46,000. All expenses in connection with the Special Meeting, including the printing, mailing, solicitation and vote tabulation and expenses, legal fees, and out-of-pocket expenses incurred in connection therewith, will be borne by TrimTabs. As the date of the Special Meeting approaches, certain shareholders may receive a telephone call from a representative of the Solicitor if their votes have not yet been received. Authorization to permit the Solicitor to execute proxies may be obtained by telephonic instructions from shareholders of the Fund. Proxies that are solicited and obtained telephonically will be recorded in accordance with certain procedures.

| 2 |

In situations where a telephonic proxy is solicited, the Solicitor’s representative is required to ask for each shareholder’s full name, address, social security or employer identification number, title (if the shareholder is authorized to act on behalf of an entity, such as a corporation), the number of shares owned, and to confirm that the shareholder has received the proxy materials in the mail. The Solicitor’s representative has the responsibility to explain the process, read the proposals on the proxy card, and ask for the shareholder’s instructions on the proposals. Although the Solicitor’s representative is permitted to answer questions about the process, he or she is not permitted to recommend to the shareholder how to vote, other than reading any recommendation set forth in the Proxy Statement. The Solicitor’s representative will record the shareholder’s instructions on the proxy card. Within approximately 72 hours of soliciting telephonic voting instructions, the shareholder will be sent a letter or email to confirm his or her vote and asking the shareholder to call the Solicitor immediately if his or her instructions are not correctly reflected in the confirmation.

Should you require additional information regarding the Special Meeting, you may contact the Solicitor toll-free at 1-855-973-0090.

In addition to solicitation by mail, certain officers and representatives of the Fund, officers and employees of the Adviser or its affiliates and certain financial services firms and their representatives, who will receive no extra compensation for their services, may solicit votes by telephone, emails, fax, or other communication.

HOW CAN I OBTAIN MORE INFORMATION ABOUT THE FUND?

Additional information about the Fund is available in its prospectus, statement of additional information and shareholder reports.

You can obtain copies of the prospectus, statement of additional information and shareholder reports of the Fund, upon request, without charge, by writing to the Trust at 4800 Montgomery Lane, Suite 150, Bethesda, Maryland 20814, by calling 1.877.THE.ETF1, or by accessing the Trust’s website at www.advisorshares.com, or on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov. This Proxy Statement should be read in conjunction with those documents.

WHAT IS THE REQUIRED VOTE FOR THE PROPOSALS?

Approval of each proposal requires the affirmative vote of a “majority of the outstanding voting securities” of the Fund, which is defined in the Investment Company Act of 1940 (the “1940 Act”) to mean the affirmative vote of the lesser of: (i) 67% or more of the shares of the Fund present at the Special Meeting if the holders of more than 50% of the outstanding shares of the Fund are present or represented by proxy or (ii) more than 50% of the outstanding shares of the Fund.

HOW DOES THE BOARD RECOMMEND THAT I VOTE?

The Board recommends that shareholders of the Fund vote “FOR” each of the proposals described in this Proxy Statement.

| 3 |

PROPOSAL 1: APPROVAL OF A NEW SUB-ADVISORY AGREEMENT FOR THE FUND

WHAT IS PROPOSAL 1?

Shareholders of the Fund are being asked to approve a new sub-advisory agreement between the Adviser and TrimTabs (the “New Sub-Advisory Agreement”).

On May 31, 2015, TrimTabs concluded a transaction with Silk Partners, L.P., an affiliate of Siget NY Partners, LP, a Family Office of Simon Glick and Seymour Pluchenik, pursuant to which a wholly-owned subsidiary of Silk Partners, L.P. acquired a controlling interest in TrimTabs (the “Transaction”). The Transaction caused a change of control of TrimTabs under the 1940 Act, resulting in the assignment and automatic termination of the investment sub-advisory agreement dated May 9, 2011 between the Adviser and TrimTabs (the “Prior Sub-Advisory Agreement”).

On May 27, 2015, the Trust’s Board of Trustees (the “Board”), including a majority of the Trustees who are not “interested persons” of the Trust, as defined by the 1940 Act (the “Independent Trustees”), unanimously approved, subject to shareholder approval, the New Sub-Advisory Agreement. To ensure continuous management of the Fund between the time of the termination of the Prior Sub-Advisory Agreement and the approval of the New Sub-Advisory Agreement, the Board also approved an interim investment sub-advisory agreement between the Adviser and TrimTabs (the “Interim Sub-Advisory Agreement”). Pursuant to the terms of the Interim Sub-Advisory Agreement, TrimTabs will continue to provide sub-advisory services to the Fund under substantially the same terms as provided for by the Prior Sub-Advisory Agreement. The Interim Sub-Advisory Agreement took effect immediately upon the termination of the Prior Sub-Advisory Agreement and will remain in effect for a period of 150 days or until shareholders approve the New Sub-Advisory Agreement, whichever is sooner. Therefore, it is very important that shareholders entitled to vote on the approval of the New Sub-Advisory Agreement do so before the term of the Interim Sub-Advisory Agreement ends.

IF APPROVED, HOW WILL THE NEW SUB-ADVISORY AGREEMENT AFFECT ME AS A SHAREHOLDER OF THE FUND?

The approval of the New Sub-Advisory Agreement should not have any effect on your investment experience as a shareholder of the Fund. TrimTabs will continue to provide the same sub-advisory services to the Fund under the New Sub-Advisory Agreement as it provided under the Prior Sub-Advisory Agreement and approval of the New Sub-Advisory Agreement will not result in any change to the Fund’s investment objective, principal investment strategies, or investment policies.

WILL THE FUND’S FEES FOR INVESTMENT SUB-ADVISORY SERVICES INCREASE?

No. The fee rate under the New Sub-Advisory Agreement is identical to the fee rate under the Prior Sub-Advisory Agreement.

WHAT ARE THE TERMS OF THE NEW SUB-ADVISORY AGREEMENT?

General Information. The following description of the material terms of the New Sub-Advisory Agreement is qualified in its entirety by reference to the form of New Sub-Advisory Agreement attached hereto as Appendix A. The material terms of the New Sub-Advisory Agreement are substantially identical in all material respects to the material terms of the Prior Sub-Advisory Agreement.

| 4 |

Investment Sub-Advisory Services. In accordance with the terms of the New Sub-Advisory Agreement, TrimTabs, subject to the supervision of the Adviser and the Board, will manage all of the securities and other assets of the Fund in accordance with the Fund’s investment objective, policies and restrictions as stated in the Fund’s prospectus and statement of additional information, as currently in effect and as amended or supplemented from time to time (referred to collectively as the “Prospectus”). As part of the services it provides, TrimTabs is responsible for, among other things: (i) determining which assets will be purchased, retained or sold by the Fund, and what portion of the assets will be invested or held uninvested in cash; (ii) placing orders with or through brokers or dealers to carry out the brokerage policy set forth in the Prospectus, or as the Board or the Adviser may direct in writing from time to time, in conformity with all federal securities laws; (iii) using its best efforts to seek out the best overall terms when executing Fund transactions and selecting brokers or dealers; (iv) maintaining all books and records with respect to transactions involving the Fund’s assets, as required by the 1940 Act; and (v) furnishing to the Adviser and the Board such reasonably requested periodic and special reports, balance sheets or financial information, and such other information with regard to its affairs as the Adviser or Board may reasonably request.

TrimTabs will pay the overhead and salary expenses it incurs in furnishing the services provided by it pursuant to the New Sub-Advisory Agreement. The services to be provided under the New Sub-Advisory Agreement are identical to those that were provided under the Prior Sub-Advisory Agreement.

Sub-Advisory Fee. The fee to be paid to TrimTabs under the New Sub-Advisory Agreement is the same as the fee that was paid under the Prior Sub-Advisory Agreement. For its investment sub-advisory services provided to the Fund, TrimTabs would continue to be entitled to an annual fee of 0.64% based on the average daily net assets of the Fund.

Liability and Indemnification. The New Sub-Advisory Agreement provides that TrimTabs will indemnify and hold harmless the Adviser from and against any and all claims, losses, liabilities, or damages (including reasonable attorney’s fees and other related expenses) however arising from or in connection with the performance of TrimTabs’ obligations under the New Sub-Advisory Agreement; provided, however, that TrimTabs’ obligation will be reduced to the extent that the claim against, or the loss, liability or damage experienced by the Adviser, is caused by or is otherwise directly related to the Adviser’s own willful misfeasance, bad faith or gross negligence, or to the reckless disregard of its duties under the agreement.

The New Sub-Advisory Agreement provides that the Adviser will indemnify and hold harmless TrimTabs from and against any and all claims, losses, liabilities, or damages (including reasonable attorney’s fees and other related expenses) however arising from or in connection with the performance of TrimTabs’ obligations under this Agreement; provided, however, that the Adviser’s obligation will be reduced to the extent that the claim against, or the loss, liability or damage experienced by TrimTabs, is caused by or is otherwise directly related to TrimTabs’ own willful misfeasance, bad faith or gross negligence, or to the reckless disregard of its duties under this Agreement.

The liability and indemnification provisions of the New Sub-Advisory Agreement and the Prior Sub-Advisory Agreement are identical.

Term of the New Sub-Advisory Agreement. The New Sub-Advisory Agreement will take effect after it is approved by the Fund’s shareholders. The New Sub-Advisory Agreement provides that it will remain in effect for an initial term of one year following its effective date. Thereafter, the New Sub-Advisory Agreement will continue in effect for successive annual periods only so long as such continuance is specifically approved at least annually (i) by either the Board or by vote of a majority of the outstanding voting securities, as defined in the 1940 Act, of the Fund and (ii) in either event, by the vote of a majority of the Independent Trustees cast in person at a meeting called for the purpose of voting on such approval.

| 5 |

The term provisions of the New Sub-Advisory Agreement and the Prior Sub-Advisory Agreement are substantially identical.

Termination. The New Sub-Advisory Agreement may be terminated with respect to the Fund at any time, without the payment of any penalty, (i) by vote of a majority of the Trustees, or by vote of a majority of the outstanding voting securities of the Fund, or by the Adviser, in each case, upon sixty (60) days’ written notice to TrimTabs; (ii) by the Adviser upon breach by TrimTabs of any representation or warranty contained in Paragraphs 6 and 8 of the New Sub-Advisory Agreement (see Appendix A), if such breach has not been cured within twenty days of TrimTab’s receipt of written notice of such breach; (iii) by the Adviser immediately upon written notice to TrimTabs if TrimTabs becomes unable to discharge its duties and obligations under the New Sub-Advisory Agreement; or (iv) by TrimTabs upon 120 days’ written notice to the Adviser and the Fund. If approved, the New Sub-Advisory Agreement will terminate automatically and immediately in the event of its assignment, as that term is defined by the 1940 Act, or in the event of a termination of the investment advisory agreement between the Adviser and the Trust.

The termination provisions of the New Sub-Advisory Agreement and the Prior Sub-Advisory Agreement are identical.

WHAT FACTORS WERE CONSIDERED BY THE BOARD?

At a meeting on May 27, 2015, the Board, including the Independent Trustees, considered the approval of the New Sub-Advisory Agreement, noting that it had considered and approved the annual renewal of the Prior Sub-Advisory Agreement at its February 23, 2015 meeting. At the meetings, the Board reviewed and discussed information and analysis provided by TrimTabs and the Adviser. At the May meeting, the Board also reviewed and discussed information provided by Silk Partners, L.P. regarding the Transaction. All of this information formed the primary, but not exclusive, basis for the Board’s determination. Below is a summary of the factors considered by the Board and the conclusions that formed the basis for the Board’s approval and recommendation to Fund shareholders. The Board did not identify any single piece of information discussed below that was all-important, controlling or determinative of its decision.

Nature, Extent and Quality of the Services to be Provided. In considering the nature, extent and quality of the services provided by TrimTabs, the Board reviewed the portfolio management services provided to the Fund. The most recent Form ADV for TrimTabs also was provided to the Board, as were the TrimTabs’ responses to a detailed series of questions that requested, among other things, information about the background and experience of the portfolio managers primarily responsible for the day-to-day management of the Fund. The Board also considered TrimTabs’ overall quality of personnel, operations, and financial condition, its investment advisory capabilities, and information concerning its compliance function, operational capabilities, and portfolio management team. The Board noted that TrimTabs generally does not expect any change in its resources or capabilities as a result of the Transaction except that it expects to have additional financial resources available to it in the future. Based on the factors above, as well as those discussed below, the Board concluded that it was satisfied with the nature, extent and quality of the services provided to the Fund by TrimTabs.

Performance.The Board was provided information regarding the Fund’s performance. Information also was provided regarding factors impacting the performance of the Fund, outlining current market conditions, and explaining its expectations and strategies for the future. Based on this information, the Board concluded that it was satisfied with the investment results that TrimTabs has been able to achieve for the Fund.

| 6 |

Cost of Services, Profitability, and Economies of Scale. In concluding that the sub-advisory fee payable with respect to the Fund was reasonable, the Board reviewed a report of the sub-advisory fee paid by the Advisor to TrimTabs, the fees waived and/or expenses reimbursed by TrimTabs over the period, the costs and other expenses incurred by TrimTabs in providing advisory services, and the profitability analysis with respect to the Fund. The Board also reviewed information comparing the advisory fees paid by the Fund to those paid by comparable funds. The Board noted that the proposed fee under the New Sub-Advisory Agreement is the same as the fee under the Prior Sub-Advisory Agreement. The Board concluded that the fee appeared reasonable in light of the services rendered. In addition, the Board considered whether economies of scale were realized during the period of the Prior Sub-Advisory Agreement and concluded that no significant economies of scale had yet been achieved.

Conclusion. Based on its deliberations and evaluation of the information described above, the Board, including the Independent Trustees, concluded that the terms of the New Sub-Advisory Agreement, including the fee, are fair and reasonable in light of the services that TrimTabs provides to the Fund. For these reasons, the Board unanimously approved the New Sub-Advisory Agreement.

WHO IS TRIMTABS?

TrimTabs, a limited liability company organized under the laws of Delaware, is located at 3 Harbor Drive, Suite 112, Sausalito, California 94965. TrimTabs is owned by Managing Member and CEO Charles Biderman, Silk Partners, L.P., and four other individuals holding minority interests in the firm. As of May 31, 2015, TrimTabs had approximately $241 million in assets under management.

As the Fund’s sub-adviser, TrimTabs is responsible for developing and maintaining the Fund’s investment program in a manner consistent with the Fund’s investment objective and principal investment strategies and policies and managing the Fund on a day-to-day basis, including the selection of the Fund’s investments. TrimTab’s sub-advisory activities are subject to the oversight of the Adviser and the Board.

The names and principal occupations of TrimTab’s key personnel are set forth below. Unless otherwise indicated, the business address of each person listed below is 3 Harbor Drive, Suite 112, Sausalito, California 94965.

| Name | Principal Occupation |

| Charles Biderman | Chief Executive Officer and Portfolio Manager |

| Minyi Chen | Executive Vice President and Portfolio Manager |

For additional information about TrimTabs, you may visit its website at trimtabs.com. Copies of TrimTab’s public filings also may be viewed on the SEC’s EDGAR Database, which can be accessed on the SEC’s website at www.sec.gov.

WHAT HAPPENS IF THE NEW SUB-ADVISORY AGREEMENT IS NOT APPROVED BY SHAREHOLDERS?

If the New Sub-Advisory Agreement is not approved by the Fund’s shareholders, TrimTabs will continue to serve as the Fund’s sub-adviser pursuant to the terms of the Interim Sub-Advisory Agreement and the Board will consider all alternatives available to the Fund. The Board will take such action as it deems necessary and in the best interests of the Fund and its shareholders.

THE BOARD RECOMMENDS THAT SHAREHOLDERS OF THE FUND VOTE “FOR” THE APPROVAL OF THE NEW SUB-ADVISORY AGREEMENT.

| 7 |

PROPOSAL 2: APPROVAL OF A MANAGER OF MANAGERS ARRANGEMENT

WHAT IS PROPOSAL 2?

The Fund’s investment management services are currently being provided by the Adviser pursuant to an investment advisory agreement between the Adviser and the Trust on behalf of the Fund. Subject to the approval of the Board and of the shareholders of the Fund, the Adviser is permitted to engage sub-advisers to provide investment advisory services to the Fund. If the Adviser delegates sub-advisory duties to a sub-adviser, it remains responsible for monitoring and evaluating the performance of the sub-adviser.

A sub-adviser is responsible, subject to the general supervision of the Adviser and the Board, for the purchase, retention and sale of securities for the Fund. The Adviser monitors the investment program of the sub-adviser to the Fund, reviews all data and financial reports prepared by the sub-adviser, establishes and maintains communications with the sub-adviser, and oversees all matters relating to the purchase and sale of investment securities, corporate governance, and regulatory compliance reports. The Adviser also currently oversees and monitors the performance of the Fund’s sub-adviser and is responsible for determining whether to recommend to the Board that a particular sub-advisory agreement be entered into or terminated. A determination of whether to recommend the termination of the sub-advisory agreement depends on a number of factors, including, but not limited to, the sub-adviser’s performance record while managing the Fund.

Generally, a fund must obtain shareholder approval to retain a new sub-adviser or make a material modification to an existing sub-advisory agreement. However, on March 11, 2013, the SEC issued an order permitting the Trust and the Adviser to enter into or materially modify a new sub-advisory agreement with an unaffiliated sub-adviser, subject to approval by the Board (including a majority of Independent Trustees), without requiring approval from the Fund’s shareholders (the “SEC Order”). Shareholders of the Fund are being asked to approve the implementation of the SEC Order with respect to the Fund. Approval of this proposal should help the Fund avoid unnecessary costs and provide the Fund with additional flexibility to achieve its investment objective.

The process to obtain shareholder approval of new sub-advisory arrangements can take several months and cost hundreds of thousands of dollars. For these reasons, requiring shareholder approval of changes to the sub-advisory arrangements for the Fund could result in minimal additional value to shareholders but significant expenditure of time and money. If this proposal is approved, the Fund will be able to select one or more unaffiliated sub-advisers solely on the basis of merit without concern for the costs and time required to solicit and obtain shareholder approval. In all cases, shareholder interests will continue to be protected because the Board will review and approve all sub-advisory arrangements and will monitor the performance of each sub-adviser on an ongoing basis. The Adviser, not the Fund, will continue to pay all sub-advisory fees. The Adviser’s and each sub-adviser’s fees are generally subject to Board review and approval on an annual basis. The Board will continue to monitor the level of fees paid to the Adviser and each sub-adviser and will have the opportunity to lower such fees if it determines that the Adviser has achieved cost advantages or economies of scale from any sub-advisory arrangement that should be passed on to the Fund’s shareholders.

WHAT ARE THE CONDITIONS OF THE EXEMPTIVE RELIEF GRANTED PURSUANT TO THE SEC ORDER?

Under the terms of the SEC Order, the Fund and the Adviser are, and would continue to be, subject to several conditions imposed by the SEC. For instance, as requested in this proposal, shareholder approval is required before the Adviser and the Fund may implement the arrangement described above permitting the Adviser to enter into or materially amend sub-advisory agreements with unaffiliated sub-advisers. Further, under the conditions of the SEC Order, within 90 days after a change to a sub-advisory arrangement, the Fund’s shareholders must be provided with an information statement that contains information about the sub-adviser and sub-advisory agreement that would be contained in a proxy statement. In addition, in order to rely on the manager of managers relief, a majority of the Board must consist of Independent Trustees and the nomination of new or additional Independent Trustees must be at the discretion of the then-existing Independent Trustees. The SEC Order does not apply to sub-advisory agreements with affiliated sub-advisers.

| 8 |

WHAT FACTORS WERE CONSIDERED BY THE BOARD OF TRUSTEES?

In determining whether it was appropriate to approve the proposed manager of managers arrangement and to recommend approval of such arrangement to shareholders, the Board, including the Independent Trustees, considered certain information and representations provided by the Adviser. After carefully considering the Fund’s contractual arrangement under which the Adviser has been engaged as an investment adviser, and the Adviser’s experience in recommending and monitoring sub-advisers, the Board believes that it is appropriate to allow the recommendation, supervision and evaluation of sub-advisers to be conducted by the Adviser. The Board also believes that this approach would be consistent with shareholders’ expectations that the Adviser will use its expertise to recommend to the Board qualified candidates to serve as sub-advisers.

The Board will continue to provide oversight of the sub-adviser selection and engagement process. The Board, including a majority of the Independent Trustees, will continue to evaluate and consider for approval all new or amended sub-advisory agreements. In addition, under the 1940 Act, the Board, including a majority of the Independent Trustees, is required to annually review and consider for renewal such agreements after the initial term. Upon entering into, renewing or amending a sub-advisory agreement, the Adviser and the sub-adviser have a legal duty to provide to the Board information on pertinent factors.

The Board also considered that shareholder approval of this proposal will not result in an increase or decrease in the total amount of investment advisory fees paid by the Fund to the Adviser. In the past, when engaging sub-advisers and entering into sub-advisory agreements, the Adviser has negotiated fees with sub-advisers, and will continue to do so. These fees are paid directly by the Adviser and not by the Fund. Therefore, any fee reduction or increase negotiated by the Adviser may be either beneficial or detrimental to the Adviser. The fees paid by the Fund to the Adviser and the fees paid by the Adviser to the sub-adviser are considered by the Board in approving and renewing the investment advisory and sub-advisory agreements. Any increase in the investment advisory fee paid to the Adviser by the Fund would continue to require shareholder approval. If shareholders approve this proposal, the Adviser, pursuant to the advisory agreement and other agreements, will continue to provide the same level of management and administrative services to the Fund as it is currently providing.

The Board concluded that it is appropriate and in the interests of the Fund’s shareholders to provide the Adviser and the Board with maximum flexibility to recommend, supervise and evaluate unaffiliated sub-advisers without incurring the unnecessary delay or expense of obtaining shareholder approval. This process will allow the Fund to operate more efficiently. Currently, to appoint a sub-adviser to the Fund or to materially amend a sub-advisory agreement, the Trust must call and hold a shareholder meeting of the Fund, create and distribute proxy materials, and solicit proxy votes from the Fund’s shareholders. This process is time-consuming and costly, and some of the costs may be borne by the Fund. While shareholders would no longer have any control over the hiring of unaffiliated sub-advisers, without the delay inherent in holding a shareholder meeting, the Board and the Adviser would be able to act more quickly to appoint an unaffiliated sub-adviser or materially amend a sub-advisory agreement with an unaffiliated sub-adviser with less expense when the Board and the Adviser believe that the change would benefit the Fund.

| 9 |

WHAT HAPPENS IF THE IMPLEMENTATION OF THE MANAGER OF MANAGERS ARRANGEMENT IS NOT APPROVED BY SHAREHOLDERS?

If the shareholders of the Fund do not approve the manager of managers arrangement, then the proposal will not be implemented and the Adviser will continue to obtain approval from shareholders before entering into or amending agreements with unaffiliated sub-advisers on behalf of the Fund.

THE BOARD RECOMMENDS THAT SHAREHOLDERS OF THE FUND VOTE “FOR” APPROVAL OF THE MANAGER OF MANAGERS ARRANGEMENT.

| 10 |

GENERAL INFORMATION

Service Providers

The principal executive offices of the Trust and the Adviser are located at 4800 Montgomery Lane, Suite 150, Bethesda, Maryland 20814. The Trust’s administrator, custodian, transfer agent and securities lending agent is The Bank of New York Mellon, which is located at 101 Barclay Street, New York, New York 10286. The Fund’s distributor is Foreside Fund Services, LLC, which is located at Three Canal Plaza, Suite 100, Portland, Maine 04101. Counsel to the Trust isMorgan, Lewis & Bockius LLP, which is located at 2020 K Street, NW, Washington, DC 20006.

Affiliated Brokerage

For the fiscal year ended June 30, 2015, the Fund paid no commissions on portfolio brokerage transactions to any broker who may be deemed to be a direct or indirect affiliated person of the Fund.

Owners of Fund Shares

Although the Fund does not have information concerning the beneficial ownership of shares held in the names of Depository Trust Company (“DTC”) participants as of the Record Date, the name and percentage ownership of each DTC participant that owned of record 5% or more of the outstanding shares of the Fund is set forth below.

| DTC Participant | Percentage of Ownership |

LPL Financial Corporation 9785 Towne Centre Drive San Diego, CA 92121-1968 | 5.16% |

The Bank of New York Mellon 525 William Penn Place Suite 153-040 Pittsburgh, PA 15259 | 5.75% |

TD Ameritrade Clearing, Inc. 1005 N. Ameritrade Place Bellevue, NE 68005 | 7.51% |

Pershing LLC One Pershing Plaza Jersey City, NJ 07399 | 7.93% |

National Financial Services LLC 499 Washington Boulevard Jersey City, NJ 07310 | 19.62% |

Charles Schwab & Co., Inc. 2423 E. Lincoln Drive Phoenix, AZ 85016-1215 | 20.62% |

As of the Record Date, the Trustees and officers of the Trust owned of record, in aggregate, less than 1% of the outstanding shares of the Fund.

| 11 |

Quorum and Voting Requirements

Shareholders of record as of the close of business on the Record Date are entitled to notice of and to vote at the Special Meeting. Each whole share is entitled to one vote and each fractional share is entitled to a proportionate fractional vote. The presence in person or by proxy of one-third (331/3%) of all shares of the Fund entitled to vote will constitute a quorum for the transaction of business at the Special Meeting. In the absence of a quorum or in the event that a quorum is present at the Special Meeting, but votes sufficient to approve a proposal are not received, the Special Meeting may be adjourned without notice other than announcement at the meeting.

Approval of the proposals requires the affirmative vote of a “majority of the outstanding voting securities” (as defined in the 1940 Act) of the Fund, which means the affirmative vote of the lesser of (1) 67% or more of the shares of the Fund present at the Special Meeting if the holders of more than 50% of the outstanding shares of the Fund are present or represented by proxy or (2) more than 50% of the outstanding shares of the Fund.

For purposes of determining whether shareholders of the Fund have approved the proposals, abstentions and broker non-votes will be counted as shares present at the Special Meeting for quorum purposes, but will not be counted for or against the proposals. For this reason, abstentions and broker non-votes effectively will be a vote against a proposal. Broker non-votes are shares held by a broker or nominee as to which instructions have not been received from the beneficial owners or persons entitled to vote and the broker or nominee does not have discretionary voting power.

Submitting and Revoking Your Proxy

All properly executed and unrevoked proxies received in time for the Special Meeting and any adjournments or postponements thereof will be voted as instructed by shareholders. If you execute your proxy but give no voting instructions, your shares that are represented by proxies will be voted “FOR” the proposals. In addition, if other matters are properly presented for voting at the Special Meeting, the persons named as proxies will vote on such matters in accordance with their best judgment.

To ensure that your vote is recorded promptly, please vote as soon as possible, even if you plan to attend the Special Meeting in person. Shareholders have three options for submitting their votes: (1) by internet, (2) by phone, or (3) by mail. We encourage you to vote by internet or phone. It is convenient and it saves the Fund significant postage and processing costs. In addition, when you vote by internet or phone prior to the date of the Special Meeting, your vote is recorded immediately and there is no risk that postal delays will cause your vote to arrive late and, therefore, not be counted. If you plan to attend the Special Meeting, you may also submit your vote in person, and any previous votes that you submitted, whether by internet, phone or mail, will be superseded by the vote that you cast at the Special Meeting.

At any time before it has been voted at the Meeting, your proxy may be revoked in one of the following ways: (i) by sending a signed, written letter of revocation to the Secretary of the Trust, (ii) by properly executing a later-dated proxy (by the methods of voting described above) or (iii) by attending the Meeting and voting in person. If your shares are held in the name of a bank, broker or other holder of record, you will receive other instructions that you must follow in order to vote.

| 12 |

Shareholder Communications and Proposals

The Board has provided for a process by which shareholders may send communications to the Board. If a shareholder wishes to send a communication to the Board, the communication should be submitted in writing to the Secretary of the Trust, c/o AdvisorShares Trust, 4800 Montgomery Lane, Suite 150, Bethesda, Maryland 20814, who will forward such communication to the Board.

The Trust is organized as a Delaware statutory trust and, as such, the Trust is not required to, and does not, hold annual shareholder meetings. Nonetheless, the Board may call a special meeting of shareholders for action by shareholder vote as may be required by the 1940 Act or as required or permitted by the Trust’s Agreement and Declaration of Trust and By-Laws. Shareholders who wish to present a proposal for action at a future meeting should submit a written proposal to the Secretary of the Trust, c/o AdvisorShares Trust, 4800 Montgomery Lane, Suite 150, Bethesda, Maryland 20814 for inclusion in a future proxy statement. Shareholder proposals to be presented at any future meeting of a Trust must be received by the Trust in writing within a reasonable amount of time before the Trust solicits proxies for that meeting in order to be considered for inclusion in the proxy materials for that meeting. Whether a proposal is included in a proxy statement will be determined in accordance with applicable federal and state laws. Shareholders retain the right to request that a meeting of the shareholders be held for the purpose of considering matters requiring shareholder approval.

Shareholders Sharing the Same Address

Only one copy of this Proxy Statement will be delivered to shareholders of the Fund residing at the same address, unless the Fund has received instructions to the contrary. If you would like to receive an additional copy, please write to the Trust at 4800 Montgomery Lane, Suite 150, Bethesda, Maryland 20814, or call 1-877-843-3831. Shareholders wishing to receive separate copies of the Trust’s shareholder reports, proxy statements and information statements in the future, and shareholders sharing an address who wish to receive a single copy if they are receiving multiple copies, should also contact the Trust as indicated above.

Other Business

The Board knows of no business to be presented at the Special Meeting other than the matters set forth in this Proxy Statement. If any other matters properly come before the Special Meeting, and on all matters incidental to the conduct of the Meeting, the persons named as proxies will vote the proxies in accordance with their judgment.

REMEMBER — YOUR VOTE COUNTS EVEN IF YOU HAVE REDEEMED YOUR SHARES BETWEEN THE RECORD DATE AND THE DATE OF THE MEETING!

Your vote is extremely important, even if you only own a few of the Fund’s shares. The Special Meeting will have to be adjourned without conducting any business if a sufficient number of shares of the Fund entitled to vote in person or by proxy at the Special Meeting are not represented at the Special Meeting. In that event, the Fund would continue to solicit votes for a certain period of time in an attempt to achieve a quorum. Your vote could be critical in allowing the Fund to hold the Special Meeting as scheduled, so please return your proxy card immediately or vote by internet or telephone.

| 13 |

If your completed proxy card is not received, you may be contacted by representatives of the Fund, employees or agents of the Adviser or TrimTabs, representatives of other financial intermediaries, or our proxy solicitor, Alliance Shareholder Communications, and reminded to vote your shares.

By Order of the Board of Trustees

Noah Hamman

Trustee and President

July 10, 2015

| 14 |

APPENDIX A

FORM OF

NEW INVESTMENT SUB-ADVISORY AGREEMENT

| A-1 |

INVESTMENT SUB-ADVISORY AGREEMENT

AGREEMENT made as of the ____ day of __________ 2015 by and between AdvisorShares Investments, LLC, a Delaware limited liability company with its principal place of business at 4800 Montgomery Lane, Suite 150, Bethesda, MD 20814 (the “Adviser”), and TrimTabs Asset Management, LLC, a Delaware limited liability company with its principal place of business at 3 Harbor Drive, Suite 112, Sausalito, CA 94965 (the “Sub-Adviser”).

WHEREAS, AdvisorShares Trust, a Delaware statutory trust (the “Trust”), is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”); and

WHEREAS, the Adviser has entered into an Investment Advisory Agreement dated June 2, 2009(the “Advisory Agreement”) with the Trust, pursuant to which the Adviser acts as investment adviser to the series of the Trust set forth on Schedule A attached hereto (each a “Fund” and, collectively, the “Funds”), as such schedule may be amended by mutual agreement of the parties hereto; and

WHEREAS, the Adviser and the Sub-Adviser previously entered into an Investment Sub-Advisory Agreement dated as of May 9, 2011, and an Interim Investment Sub-Advisory Agreement dated as of May 31, 2015, pursuant to which the Adviser, with the approval of the Trust, retained the Sub-Adviser to provide investment sub-advisory services in connection with the management of the Fund; and

WHEREAS, the previous agreements between the Adviser and the Sub-Adviser each terminated and the Adviser and the Sub-Adviser desire to enter into this Agreement to continue the sub-advisory arrangement as described herein;

NOW, THEREFORE, the parties hereto agree as follows:

| 1. | Duties of the Sub-Adviser. Subject to supervision by the Adviser and the Trust’s Board of Trustees, the Sub-Adviser shall manage all of the securities and other assets of a Fund entrusted to it hereunder (the “Assets”), including the purchase, retention and disposition of the Assets, in accordance with the Fund’s investment objectives, policies and restrictions as stated in theFund’s prospectus and statement of additional information, as currently in effect and as amended or supplemented from time to time (referred to collectively as the “Prospectus”), and subject to the following: |

| (a) | The Sub-Adviser shall, subject to subparagraph (b), determine from time to time what Assets will be purchased, retained or sold by the Fund, and what portion of the Assets will be invested or held uninvested in cash. |

| (b) | In the performance of its duties and obligations under this Agreement, the Sub-Adviser shall act in conformity with the Trust’s Declaration of Trust (as defined herein) and the Prospectus and with the instructions and directions of the Adviser and of the Board of Trustees of the Trust and will conform to and comply with the requirements of the 1940 Act, the Internal Revenue Code of 1986, as amended (the “Code”), and all other applicable federal and state laws and regulations, as each is amended from time to time. |

| A-2 |

| (c) | The Sub-Adviser shall determine the Assets to be purchased or sold by the Fund as provided in subparagraph (a) and will place orders with or through such persons, brokers or dealers to carry out the policy with respect to brokerage set forth in theFund’s Prospectus or as the Board of Trustees or the Adviser may direct in writing from time to time, in conformity with all federal securities laws. In executing Fund transactions and selecting brokers or dealers, the Sub-Adviser will use its best efforts to seek on behalf of the Fund the best overall terms available. In assessing the best overall terms available for any transaction, the Sub-Adviser shall consider all factors that it deems relevant, including the breadth of the market in the security, the price of the security, the financial condition and execution capability of the broker or dealer, and the reasonableness of the commission, if any, both for the specific transaction and on a continuing basis. In evaluating the best overall terms available, and in selecting the broker-dealer to execute a particular transaction, the Sub-Adviser may also consider the brokerage and research services provided (as those terms are defined in Section 28(e) of the Securities Exchange Act of 1934 (the “Exchange Act”)). Consistent with any guidelines established by the Board of Trustees of the Trust and Section 28(e) of the Exchange Act, the Sub-Adviser is authorized to pay to a broker or dealer who provides such brokerage and research services a commission for executing a portfolio transaction for the Fund which is in excess of the amount of commission another broker or dealer would have charged for effecting that transaction if, but only if, the Sub-Adviser determines in good faith that such commission was reasonable in relation to the value of the brokerage and research services provided by such broker or dealer viewed in terms of that particular transaction or in terms of the overall responsibilities of the Sub-Adviser to its discretionary clients, including the Fund. In addition, the Sub-Adviser is authorized to allocate purchase and sale orders for securities to brokers or dealers (including brokers and dealers that are affiliated with the Adviser, Sub-Adviser or the Trust’s principal underwriter) if the Sub-Adviser believes that the quality of the transaction and the commission are comparable to what they would be with other qualified firms. In no instance, however, will theAssets be purchased from or sold to the Adviser, Sub-Adviser, the Trust’s principal underwriter, or any affiliated person of either the Trust, Adviser, the Sub-Adviser or the principal underwriter, acting as principal in the transaction, except to the extent permitted by the Securities and Exchange Commission (“SEC”) and the 1940 Act. |

| (d) | The Sub-Adviser shall maintain all books and records with respect to transactions involving the Assets required by subparagraphs (b)(1), (5), (6), (7), (8), (9) and (10) and paragraph (f) of Rule 31a-1 under the 1940 Act. The Sub-Adviser shall keep the books and records relating to the Assets required to be maintained by the Sub-Adviser under this Agreement and shall timely furnish to the Adviser all information relating to the Sub-Adviser’s services under this Agreement needed by the Adviser to keep the other books and records of the Fund required by Rule 31a-1 under the 1940 Act. The Sub-Adviser agrees that all records that it maintains on behalf of the Fund are property of the Fund and the Sub-Adviser will surrender promptly to the Fund any of such records upon the Fund’s request; provided, however, that the Sub-Adviser may retain a copy of such records. In addition, for the duration of this Agreement, the Sub-Adviser shall preserve for the periods prescribed by Rule 31a-2 under the 1940 Act any such records as are required to be maintained by it pursuant to this Agreement, and shall transfer said records to any successor sub-adviser upon the termination of this Agreement (or, if there is no successor sub-adviser, to the Adviser). |

| A-3 |

| (e) | The Sub-Adviser shall provide theFund’s custodian on each business day with information relating to all transactions concerning the Assets and shall provide the Adviser with such information upon request of the Adviser. |

| (f) | The Sub-Adviser shall promptly notify the Adviser of any financial condition that is reasonably and foreseeably likely to impair the Sub-Adviser’s ability to fulfill its commitment under this Agreement. |

| (g) | The Sub-Adviser shall be responsible for reviewing proxy solicitation materials or voting and handling proxies in relation to the securities held as Assets in the Fund. |

| (h) | In performance of its duties and obligations under this Agreement, the Sub-Adviser shall not consult with any other sub-adviser to the Fund or a sub-adviser to a portfolio that is under common control with the Fund concerning the Assets, except as permitted by the policies and procedures of the Fund. The Sub-Adviser shall not provide investment advice to any assets of the Fund other than the Assets. |

| (i) | On occasions when the Sub-Adviser deems the purchase or sale of a security to be in the best interest of the Fund as well as other clients of the Sub-Adviser, the Sub-Adviser may, to the extent permitted by applicable law and regulations, aggregate the order for securities to be sold or purchased. In such event, the Sub-Adviser will allocate securities so purchased or sold, as well as the expenses incurred in the transaction, in a manner the Sub-Adviser reasonably considers to be equitable and consistent with its fiduciary obligations to the Fund and to such other clients under the circumstances. |

| (j) | The Sub-Adviser shall furnish to the Adviser or the Board of Trustees such reasonably requested periodic and special reports, balance sheets or financial information, and such other information with regard to its affairs as the Adviser or Board of Trustees may reasonably request. Upon the request of the Adviser, the Sub-Adviser shall also furnish to the Adviser any other information relating to the Assets that is required to be filed by the Adviser or the Trust with the SEC or sent to shareholders under the 1940 Act (including the rules adopted thereunder) or any exemptive or other relief that the Adviser or the Trust obtains from the SEC. |

| A-4 |

| To the extent permitted by law, the services to be furnished by the Sub-Adviser under this Agreement may, at the sole discretion of the Sub-Advisor and consistent with the requirements of the 1940 Act, be furnished through the medium of any of the Sub-Adviser’s partners, officers, employees or control affiliates; provided, however, that the use of such mediums does not relieve the Sub-Adviser from any obligation or duty under this Agreement. |

| 2. | Duties of the Adviser. The Adviser shall continue to have responsibility for all services to be provided to theFund pursuant to the Advisory Agreement and shall oversee and review the Sub-Adviser’s performance of its duties under this Agreement; provided, however, that in connection with its management of the Assets, nothing herein shall be construed to relieve the Sub-Adviser of responsibility for compliance with the Trust’s Declaration of Trust (as defined herein), the Prospectus, the instructions and directions of the Board of Trustees of the Trust, the requirements of the 1940 Act, the Code, and all other applicable federal and state laws and regulations, as each is amended from time to time. |

| 3. | Delivery of Documents. The Adviser has furnished the Sub-Adviser with copies of each of the following documents: |

(a) The Trust’s Agreement and Declaration of Trust, as filed with the Secretary of State of Delaware (such Agreement and Declaration of Trust, as in effect on the date of this Agreement and as amended from time to time, herein called the “Declaration of Trust”);

(b) By-Laws of the Trust (such By-Laws, as in effect on the date of this Agreement and as amended from time to time, are herein called the “By-Laws”);

(c) Prospectus of the Fund;

(d) Resolutions of the Trust’s Board of Trustees approving the engagement of the Sub-Adviser as a sub-adviser to the Fund;

(e) Resolutions, policies and procedures adopted by the Trust’s Board of Trustees with respect to the Assets to the extent such resolutions, policies and procedures may affect the duties of the Sub-Adviser hereunder;

(f) A list of the Trust’s principal underwriter and each affiliated person of the Adviser, the Trust or the principal underwriter; and

(g) A list of each other investment sub-adviser to the Fund.

| A-5 |

The Adviser shall promptly furnish the Sub-Adviser from time to time with copies of all amendments of or supplements to the foregoing. Until so provided, the Sub-Adviser may continue to rely on those documents previously provided. The Adviser shall not, and shall not permit the Fund to use the Sub-Adviser’s name or make representations regarding Sub-Adviser or its affiliates without prior written consent of Sub-Adviser, such consent not to be unreasonably withheld. Notwithstanding the foregoing, the Sub-Adviser’s approval is not required when the information regarding the Sub-Adviser used by the Adviser or the Fund is limited to information disclosed in materials provided by the Sub-Adviser to the Adviser and the information is used (a) as required by applicable law, rule or regulation, in the Prospectus of the Fund or in Fund shareholder reports or proxy statements; or (b) as may be otherwise specifically approved in writing by the Sub-Adviser prior to use.

| 4. | Compensation to the Sub-Adviser. For the services to be provided by the Sub-Adviser pursuant to this Agreement, the Adviser will pay the Sub-Adviser, and the Sub-Adviser agrees to accept as full compensation therefor, a sub-advisory fee at the rate specified in Schedule A, which is attached hereto and made part of this Agreement. The fee will be calculated based on the average daily value of the Assetsunder the Sub-Adviser’s management and will be paid to the Sub-Adviser monthly. For the avoidance of doubt, notwithstanding the fact that the Agreement has not been terminated, no fee will be accrued under this Agreement with respect to any day that the value of the Assets under the Sub-Adviser’s management equals zero. Except as may otherwise be prohibited by law or regulation (including any then current SEC staff interpretation), the Sub-Adviser may, in its sole discretion and from time to time, waive a portion of its fee. |

| Except for expenses assumed or agreed to be paid by the Sub-Adviser pursuant hereto, the Sub-Adviser shall not be liable for any costs or expenses of the Trust including, without limitation, (a) interest (short or leverage) and taxes, (b) brokerage commissions and other costs in connection with the purchase or sale of securities or other investment instruments with respect to the Fund, and (c) operational or administrative expenses of the Trust (including custodial and administrative fees), and (d) accounting and legal expenses. The Sub-Adviser will pay its own overhead and salary expenses incurred in furnishing the services to be provided by it pursuant to this Agreement. |

| 5. | Indemnification. The Sub-Adviser shall indemnify and hold harmless the Adviser from and against any and all claims, losses, liabilities or damages (including reasonable attorney’s fees and other related expenses) however arising from or in connection with the performance of the Sub-Adviser’s obligations under this Agreement; provided, however, that the Sub-Adviser’s obligation under this Paragraph 5 shall be reduced to the extent that the claim against, or the loss, liability or damage experienced by the Adviser, is caused by or is otherwise directly related to the Adviser’s own willful misfeasance, bad faith or gross negligence, or to the reckless disregard of its duties under this Agreement. |

| The Adviser shall indemnify and hold harmless the Sub-Adviser from and against any and all claims, losses, liabilities or damages (including reasonable attorney’s fees and other related expenses) however arising from or in connection with the performance of the Sub-Adviser’s obligations under this Agreement; provided, however, that the Adviser’s obligation under this Paragraph 5 shall be reduced to the extent that the claim against, or the loss, liability or damage experienced by the Sub-Adviser, is caused by or is otherwise directly related to the Sub-Adviser’s own willful misfeasance, bad faith or gross negligence, or to the reckless disregard of its duties under this Agreement. |

| A-6 |

| 6. | Representations and Warranties of Sub-Adviser. The Sub-Adviser represents and warrants to the Adviser and the Funds as follows: |

(a) The Sub-Adviser is registered as an investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”);

(b) The Sub-Adviser will immediately notify the Adviser of the occurrence of any event that would disqualify the Sub-Adviser from serving as an investment adviser of an investment company pursuant to Section 9(a) of the 1940 Act;

(c) The Sub-Adviser is fully authorized under all applicable law to serve as Sub-Adviser to the Funds and to perform the services described under this Agreement;

(d) The Sub-Adviser is a limited liability company duly organized and validly existing under the laws of the state of Delawarewith the power to own and possess its assets and carry on its business as it is now being conducted;

(e) The execution, delivery and performance by the Sub-Adviser of this Agreement are within the Sub-Adviser’s powers and have been duly authorized by all necessary action on the part of its members, and no action by or in respect of, or filing with, any governmental body, agency or official is required on the part of the Sub-Adviser for the execution, delivery and performance by the Sub-Adviser of this Agreement, and the execution, delivery and performance by the Sub-Adviser of this Agreement do not contravene or constitute a default under (i) any provision of applicable law, rule or regulation, (ii) the Sub-Adviser’s governing instruments, or (iii) any agreement, judgment, injunction, order, decree or other instrument binding upon the Sub-Adviser;

(f) This Agreement is a valid and binding agreement of the Sub-Adviser;

(g) The Form ADV of the Sub-Adviser previously provided to the Adviser is a true and complete copy of the form filed with the SEC and the information contained therein is accurate and complete in all material respects as of its filing date, and does not omit to state any material fact necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading;

(h) The Sub-Adviser shall not divert any Fund’s portfolio securities transactions to a broker or dealer in consideration of such broker or dealer’s promotion or sales of shares of the Fund, any other series of the Trust, or any other registered investment company.

| A-7 |

| 7. | Duration and Termination. |

(a)Duration. This Agreement shall become effective upon the date first above written, provided that this Agreement shall not take effect with respect to a Fund unless it has first been approved by a vote of a majority of those Trustees of the Trust, who are not parties to this Agreement or interested persons of any such party, cast in person at a meeting called for the purpose of voting on such approval. This Agreement shall continue in effect for a period of one year from the date hereof, subject thereafter to being continued in force and effect from year to year if specifically approved each year by the Board of Trustees or by the vote of a majority of the Fund’s outstanding voting securities. In addition to the foregoing, each renewal of this Agreement must be approved by the vote of a majority of the Fund’s Trustees who are not parties to this Agreement or interested persons of any such party, cast in person at a meeting called for the purpose of voting on such approval. Prior to voting on the renewal of this Agreement, the Board of Trustees of the Fund may request and evaluate, and the Sub-Adviser shall furnish, such information as may reasonably be necessary to enable the Fund’s Board to evaluate the terms of this Agreement.

(b)Termination. Notwithstanding whatever may be provided herein to the contrary, this Agreement may be terminated at any time, without payment of any penalty:

(i) By vote of a majority of the Board of Trustees of the Fund, or by vote of a majority of the outstanding voting securities of the Fund, or by the Adviser, in each case, upon sixty (60) days written notice to the Sub-Adviser;

(ii) By the Adviser upon breach by the Sub-Adviser of any representation or warranty contained in Paragraphs 6 and 8 hereof, which shall not have been cured within twenty (20) days of the Sub-Adviser’s receipt of written notice of such breach;

(iii) By the Adviser immediately upon written notice to the Sub-Adviser if the Sub-Adviser becomes unable to discharge its duties and obligations under this Agreement; or

(iv) By the Sub-Adviser upon 120 days written notice to the Adviser and the Fund.

This Agreement shall terminate automatically and immediately in the event of its assignment, or in the event of a termination of the Advisory Agreement with the Trust. As used in this Paragraph 7, the terms “assignment” and “vote of a majority of the outstanding voting securities” shall have the respective meanings set forth in the 1940 Act and the rules and regulations thereunder, subject to such exceptions as may be granted by the SEC under the 1940 Act.

| 8. | Compliance Program of the Sub-Adviser. The Sub-Adviser hereby represents and warrants that: |

| A-8 |

| (a) | in accordance with Rule 206(4)-7 under the Advisers Act, the Sub-Adviser has adopted and implemented and will maintain written policies and procedures reasonably designed to prevent violation by the Sub-Adviser and its supervised persons (as such term is defined in the Advisers Act) of the Advisers Act and the rules the SEC has adopted under the Advisers Act; and |

| (b) | to the extent that the Sub-Adviser’s activities or services could affect the Fund, the Sub-Adviser has adopted and implemented and will maintain written policies and procedures that are reasonably designed to prevent violation of the “federal securities laws” (as such term is defined in Rule 38a-1 under the 1940 Act) by the Fund and the Sub-Adviser (the policies and procedures referred to in this Paragraph 8(b), along with the policies and procedures referred to in Paragraph 8(a), are referred to herein as the Sub-Adviser’s “Compliance Program”). |

| 9. | Confidentiality. Subject to the duty of the Adviser or Sub-Adviser to comply with applicable law, including any demand of any regulatory or taxing authority having jurisdiction, the parties hereto shall treat as confidential all non-public information pertaining to the Fund and the actions of the Sub-Adviser and the Fund in respect thereof. It is understood that any information or recommendation supplied by the Sub-Adviser in connection with the performance of its obligations hereunder is to be regarded as confidential and for use only by the Adviser, the Fund, the Board of Trustees, or such persons as the Adviser may designate in connection with the Fund. It is also understood that any information supplied to the Sub-Adviser in connection with the performance of its obligations hereunder, particularly, but not limited to, any list of investments which, on a temporary basis, may not be bought or sold for the Fund is to be regarded as confidential and for use only by the Sub-Adviser in connection with its obligation to provide investment advice and other services to the Fund. The parties acknowledge and agree that all nonpublic personal information with regard to shareholders in the Fund shall be deemed proprietary information of the Adviser, and that the Sub-Advisor shall use that information solely in the performance of its duties and obligations under this Agreement and shall take reasonable steps to safeguard the confidentiality of that information. Further, the Sub-Adviser shall maintain and enforce adequate security procedures with respect to all materials, records, documents and data relating to any of its responsibilities pursuant to this Agreement including all means for the effecting of investment transactions. |

| 10. | Reporting of Compliance Matters. |

| (a) | The Sub-Adviser shall promptly provide to the Trust’s Chief Compliance Officer (“CCO”) the following documents: |

| (i) | reasonable access, at the Sub-Adviser’s principal office or such other place as may be mutually agreed to by the parties, to all SEC examination correspondences, including correspondences regarding books and records examinations and “sweep” examinations, issued during the term of this Agreement, in which the SEC identified any concerns, issues or matters (such correspondences are commonly referred to as “deficiency letters”) relating to any aspect of the Sub-Adviser’s investment advisory business and the Sub-Adviser’s responses thereto; provided that the Sub-Adviser may redact from such correspondences client specific confidential information, material subject to the attorney-client privilege, and material non-public information, that the Sub-Adviser reasonably determines should not be disclosed to the Trust’s CCO; |

| A-9 |

| (ii) | a report of any material violations of the Sub-Adviser’s Compliance Program or any “material compliance matters” (as such term is defined in Rule 38a-1 under the 1940 Act) that have occurred with respect to the Sub-Adviser’s Compliance Program; |

| (iii) | on a quarterly basis, a report of any material changes to the policies and procedures that compose the Sub-Adviser’s Compliance Program; |

| (iv) | a copy of the Sub-Adviser’s chief compliance officer’s report (or similar document(s) which serve the same purpose) regarding his or her annual review of the Sub-Adviser’s Compliance Program, as required by Rule 206(4)-7 under the Advisers Act; and |

| (v) | an annual (or more frequently as the Trust’s CCO may reasonably request) representation regarding the Sub-Adviser’s compliance with Paragraphs 6 and 7 of this Agreement. |

| (b) | The Sub-Adviser shall also provide the Trust’s CCO with reasonable access, during normal business hours, to the Sub-Adviser’s facilities for the purpose of conducting pre-arranged on-site compliance related due diligence meetings with personnel of the Sub-Adviser. |

| 11. | The Name “AdvisorShares”. The Adviser grants to the Sub-Adviser a sublicense to use the name “AdvisorShares” (the “Name”). The foregoing authorization by the Adviser to the Sub-Adviser to use the Name is not exclusive of the right of the Adviser itself to use, or to authorize others to use, the Name; the Sub-Adviser acknowledges and agrees that, as between the Sub-Adviser and the Adviser, the Adviser has the right to use, or authorize others to use, the Name. The Sub-Adviser shall (1) only use the Name in a manner consistent with uses approved by the Adviser. Notwithstanding the foregoing, neither the Sub-Adviser nor any affiliate or agent of it shall make reference to or use the Name or any of Adviser’s respective affiliates or clients names without the prior approval of Adviser, which approval shall not be unreasonably withheld or delayed. The Sub-Adviser hereby agrees to make all reasonable efforts to cause any affiliate or agent of the Sub-Adviser to satisfy the foregoing obligation. |

| 12. | Governing Law. This Agreement shall be governed by the internal laws of the State of Delaware, without regard to conflict of law principles; provided, however, that nothing herein shall be construed as being inconsistent with the 1940 Act. |