UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22110

| AdvisorShares Trust |

| (Exact name of registrant as specified in charter) |

| 4800 Montgomery Lane, Suite 150 |

| Bethesda, Maryland 20814 |

| (Address of principal executive offices) (Zip code) |

| Dan Ahrens |

| 4800 Montgomery Lane, Suite 150 |

| Bethesda, Maryland 20814 |

| (Name and address of agent for service) |

Registrant's telephone number, including area code: 1-877-843-3831

Date of fiscal year end: June 30

Date of reporting period: December 31, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

ADVISORSHARES TRUST

4800 Montgomery Lane

Suite 150

Bethesda, Maryland 20814

www.advisorshares.com

1.877.843.3831

Semi-Annual Report

December 31, 2016

TABLE OF CONTENTS

| 1 | |

| 4 | |

Schedules of Investments |

|

|

| 7 | |

| 9 | |

| 15 | |

| 17 | |

| 18 | |

| 19 | |

| 20 | |

| 23 | |

| 26 | |

| 35 | |

| 37 | |

| 40 | |

| 41 | |

| 42 | |

| 43 | |

| 60 | |

| 64 | |

| 70 | |

| 72 | |

| 74 | |

| 79 | |

| 80 | |

| 84 | |

| 90 | |

| 96 | |

| 106 | |

| 120 | |

Board Review of Investment Advisory and Sub-Advisory Agreements |

| 147 |

| 154 |

ADVISORSHARES TRUST

Letter from the CEO of AdvisorShares Investments, LLC

December 31, 2016

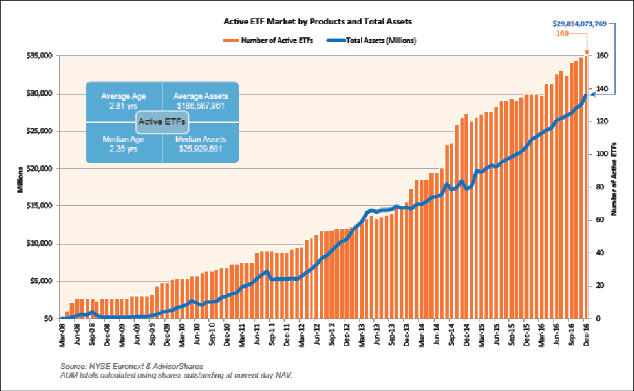

While pundits among the financial news media sometimes cite the outflows witnessed by actively managed funds, namely among mutual funds and hedge funds, they neglectfully illustrate an incomplete picture. As with every year-end since their inception, total net assets in the actively managed ETF space have witnessed a clear and steady incline. Through December 31, 2016, 160 actively managed ETFs were listed on U.S. exchanges with total net assets just shy of $30 billion. Twenty-three more actively managed ETFs traded at the end of 2016 than the previous year’s end, along with an approximately $7 billion increase in total net assets. Additionally, as more firms enter the actively managed ETF space, the trend slowly progresses towards a more proportional overall market share by fund sponsor. 2016 realized a net gain of eight new fund sponsors, which included Janus and J.P. Morgan.

Exhibit 1

As of December 31, 2016 | Source: NYSE Euronext & AdvisorShares

Exhibit one displays the aforementioned year-over-year growth of the actively managed ETF space. Taking a closer examination at the breakdown of the space’s constituents, the average fund age is 2.81 years, the median fund age is 2.35 years, average assets per fund are $186.587 million and the median assets per fund are $25.929 million. As one of the first entrants in the actively managed ETF space, AdvisorShares through the years has been a key participant among this established growth and has consistently delivered innovative new strategies, which are often industry-firsts for the actively managed ETF space. In July 2016, we launched the AdvisorShares Cornerstone Small Cap ETF (NYSE Arca: SCAP), which became the first actively managed ETF to successfully convert the track record from an already existing fund. In September 2016, we launched two more funds that became industry-firsts in their own rights. The AdvisorShares Focused Equity ETF (NYSE Arca: CWS) became the first ETF — passively managed or actively managed — to offer a variable compensation structure. CWS’ innovative fulcrum fee adjusts according to the fund’s performance versus its S&P 500 benchmark.

1

ADVISORSHARES TRUST

Letter from the CEO of AdvisorShares Investments, LLC (continued)

December 31, 2016

The AdvisorShares KIM Korea Equity ETF (NYSE Arca: KOR) became the first actively managed Korean equity ETF, sub-advised by South Korea’s largest independent asset manager and their well-established equity investment approach.

As our firm launched three new funds during the second-half of 2016, we also closed the AdvisorShares EquityPro ETF (NYSE Arca: EPRO) and the AdvisorShares YieldPro ETF (NASDAQ: YPRO) in October. Our international ADR strategy (NYSE Arca: AADR) changed sub-advisors on September 1st and was rebranded as the AdvisorShares Dorsey Wright ADR ETF while retaining the same ticker symbol.

While the cumulative assets under management of our ETF suite stood stagnant during the last six months, AdvisorShares realized the most collective four-star and five-star Morningstar-rated strategies for their overall risk-adjusted performances of any actively managed ETF sponsor through 2016’s conclusion. As of December 31, 2016, these funds included the AdvisorShares Wilshire Buyback ETF (NYSE Arca: TTFS), the AdvisorShares Dorsey Wright ADR ETF (NYSE Arca: AADR) and the AdvisorShares Newfleet Multi-Sector Income ETF (NYSE Arca: MINC), which all hold five-star ratings for their risk-adjusted performances among their respective Morningstar categories.

As we enter a new calendar year, we very much look forward to the opportunities on the path ahead for both AdvisorShares and the actively managed ETF space. We remain steadfastly committed to providing regular communications and updates regarding our firm, and our products — by delivering alpha-seeking solutions through the best investment technology available, which we believe fully-transparent ETFs represent. We sincerely thank you, our shareholders, for your continued trust and support. Here is to a healthy and prosperous 2017.

Best regards,

Noah Hamman

CEO, AdvisorShares Investments

An investment in the Funds is subject to risk, including the possible loss of principal amount invested. ADRs are subject to the risk of change in political or economic conditions and exchange rates in foreign countries. Certain funds may participate in leveraged transactions to include selling securities short which creates the risk of magnified capital losses. Under certain market conditions, short sales can increase the volatility and decrease the liquidity of certain securities or positions, and may lower the Fund’s return or result in a loss. There is no guarantee that the individual Funds’ will achieve the stated investment objectives. The risks associated with each Fund include the risks associated with the underlying ETFs, which can result in higher volatility, and are detailed in each Fund’s prospectus and on each Fund’s webpage.

The views in this report were those of the Fund’s CEO as of December 31, 2016 and may not reflect his views on the date that this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investments and do not constitute investment advice.

TTFS earned its five-star rating for its three-year, five-year and overall risk-adjusted performances from inception through December 31, 2016, out of 353 funds in Morningstar’s Foreign Mid-Cap Blend category over a three-year period, and out of 342 funds over a five-year period.

AADR earned its five-star rating for its three-year, five-year and overall risk-adjusted performances from inception through December 31, 2016, out of 306 funds in Morningstar’s Foreign Large Growth category over a three-year period, and out of 255 funds over a five-year period.

MINC earned its five-star rating for its three-year, five-year and overall risk-adjusted performances from inception through December 31, 2016, out of 438 funds in Morningstar’s Short-Term Bond category over a three-year period, and out of 350 funds over a five-year period.

2

ADVISORSHARES TRUST

Letter from the CEO of AdvisorShares Investments, LLC (continued)

December 31, 2016

The Morningstar Rating™ is provided for those exchange-traded funds (“ETFs”) with at least a three-year history. Ratings are based on the ETF’s Morningstar Risk-Adjusted Return measure which accounts for variation in monthly performance, placing more emphasis on downward variations and rewarding consistent performance. An ETF’s risk-adjusted return includes a brokerage commission estimate. This estimate is intended to reflect what an average investor would pay when buying or selling an ETF. PLEASE NOTE, this estimate is subject to change and the actual brokerage commission an investor pays may be higher or lower than this estimate. Morningstar compares each ETF’s risk-adjusted return to the open end mutual fund rating breakpoints for that category. Consistent with the open-end mutual fund ratings, the top 10% of ETFs in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. The overall rating for an ETF is based on a weighted average of the time-period ratings (e.g., the ETF’s 3, 5, and 10 year rating). The determination of an ETF’s rating does not affect the retail open end mutual fund data published by Morningstar. Past performance is no guarantee of future results.

3

ADVISORSHARES TRUST

As a shareholder of the Fund, you incur transaction cost and ongoing costs, including management fees and other Fund expenses. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The examples are based on an initial investment of $1,000 invested at July 1, 2016 and held for the period ended December 31, 2016.

Actual Expenses

The first line under each Fund in the table below provides information about actual account values and actual expenses. You may use the information, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid” to estimate the expenses attributable to your account during this period.

Hypothetical Example for Comparison Purposes

The second line under each Fund in the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses for the period. You may use this information to compare the ongoing costs of investing in the Funds and other ETF funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the hypothetical example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

In addition, if these transactional costs were included, your costs would have been higher.

Fund Name |

| Beginning |

| Ending |

| Annualized |

| Expenses | |||||

AdvisorShares Athena High Dividend ETF |

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 1,000.00 |

| $ | 1,097.90 |

| 0.99 | % |

| $ | 5.23 |

| |

| $ | 1,000.00 |

| $ | 1,020.21 |

| 0.99 | % |

| $ | 5.04 |

| |

AdvisorShares Cornerstone Small Cap ETF |

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 1,000.00 |

| $ | 1,192.70 |

| 0.90 | % |

| $ | 4.81 | (3) | |

| $ | 1,000.00 |

| $ | 1,020.67 |

| 0.90 | % |

| $ | 4.58 |

| |

AdvisorShares Dorsey Wright ADR ETF(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 1,000.00 |

| $ | 1,035.80 |

| 1.25 | % |

| $ | 6.41 |

| |

| $ | 1,000.00 |

| $ | 1,018.90 |

| 1.25 | % |

| $ | 6.36 |

| |

AdvisorShares Focused Equity ETF |

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 1,000.00 |

| $ | 1,037.80 |

| 0.75 | % |

| $ | 2.14 | (5) | |

| $ | 1,000.00 |

| $ | 1,021.42 |

| 0.75 | % |

| $ | 3.82 |

| |

4

ADVISORSHARES TRUST

Shareholder Expense Examples (continued)

Fund Name |

| Beginning |

| Ending |

| Annualized |

| Expenses | |||||

AdvisorShares Gartman Gold/Euro ETF |

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 1,000.00 |

| $ | 905.90 |

| 0.65 | % |

| $ | 3.12 |

| |

| $ | 1,000.00 |

| $ | 1,021.93 |

| 0.65 | % |

| $ | 3.31 |

| |

AdvisorShares Gartman Gold/Yen ETF |

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 1,000.00 |

| $ | 974.90 |

| 0.65 | % |

| $ | 3.24 |

| |

| $ | 1,000.00 |

| $ | 1,021.93 |

| 0.65 | % |

| $ | 3.31 |

| |

AdvisorShares Global Echo ETF |

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 1,000.00 |

| $ | 1,011.30 |

| 1.50 | % |

| $ | 7.60 |

| |

| $ | 1,000.00 |

| $ | 1,017.64 |

| 1.50 | % |

| $ | 7.63 |

| |

AdvisorShares KIM Korea Equity ETF |

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 1,000.00 |

| $ | 922.90 |

| 0.99 | % |

| $ | 2.45 | (6) | |

| $ | 1,000.00 |

| $ | 1,020.21 |

| 0.99 | % |

| $ | 5.04 |

| |

AdvisorShares Madrona Domestic ETF |

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 1,000.00 |

| $ | 1,102.20 |

| 1.25 | % |

| $ | 6.62 |

| |

| $ | 1,000.00 |

| $ | 1,018.90 |

| 1.25 | % |

| $ | 6.36 |

| |

AdvisorShares Madrona Global Bond ETF |

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 1,000.00 |

| $ | 997.00 |

| 0.95 | % |

| $ | 4.78 |

| |

| $ | 1,000.00 |

| $ | 1,020.42 |

| 0.95 | % |

| $ | 4.84 |

| |

AdvisorShares Madrona International ETF |

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 1,000.00 |

| $ | 1,106.60 |

| 1.25 | % |

| $ | 6.64 |

| |

| $ | 1,000.00 |

| $ | 1,018.90 |

| 1.25 | % |

| $ | 6.36 |

| |

AdvisorShares Market Adaptive Unconstrained Income ETF |

|

|

|

|

|

|

|

|

|

| |||

| $ | 1,000.00 |

| $ | 1,013.60 |

| 0.99 | % |

| $ | 5.02 |

| |

| $ | 1,000.00 |

| $ | 1,020.21 |

| 0.99 | % |

| $ | 5.04 |

| |

AdvisorShares Meidell Tactical Advantage ETF |

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 1,000.00 |

| $ | 1,099.90 |

| 1.35 | % |

| $ | 7.15 |

| |

| $ | 1,000.00 |

| $ | 1,018.40 |

| 1.35 | % |

| $ | 6.87 |

| |

AdvisorShares Morgan Creek Global Tactical ETF |

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 1,000.00 |

| $ | 981.20 |

| 1.25 | % |

| $ | 6.24 |

| |

| $ | 1,000.00 |

| $ | 1,018.90 |

| 1.25 | % |

| $ | 6.36 |

| |

AdvisorShares Newfleet Multi-Sector Income ETF |

|

|

|

|

|

|

|

|

|

| |||

| $ | 1,000.00 |

| $ | 1,008.30 |

| 0.75 | % |

| $ | 3.80 |

| |

| $ | 1,000.00 |

| $ | 1,021.42 |

| 0.75 | % |

| $ | 3.82 |

| |

5

ADVISORSHARES TRUST

Shareholder Expense Examples (continued)

Fund Name |

| Beginning |

| Ending |

| Annualized |

| Expenses | ||||

AdvisorShares Pacific Asset Enhanced Floating Rate ETF |

|

|

|

|

|

|

|

|

| |||

| $ | 1,000.00 |

| $ | 1,044.50 |

| 1.10 | % |

| $ | 5.67 | |

| $ | 1,000.00 |

| $ | 1,019.66 |

| 1.10 | % |

| $ | 5.60 | |

AdvisorShares Peritus High Yield ETF |

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 1,000.00 |

| $ | 1,108.90 |

| 1.26 | % |

| $ | 6.70 | |

| $ | 1,000.00 |

| $ | 1,018.85 |

| 1.26 | % |

| $ | 6.41 | |

AdvisorShares QAM Equity Hedge ETF |

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 1,000.00 |

| $ | 1,036.10 |

| 1.50 | % |

| $ | 7.70 | |

| $ | 1,000.00 |

| $ | 1,017.64 |

| 1.50 | % |

| $ | 7.63 | |

AdvisorShares Ranger Equity Bear ETF |

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 1,000.00 |

| $ | 873.60 |

| 1.63 | % |

| $ | 7.70 | |

| $ | 1,000.00 |

| $ | 1,016.99 |

| 1.63 | % |

| $ | 8.29 | |

AdvisorShares Sage Core Reserves ETF |

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 1,000.00 |

| $ | 1,004.10 |

| 0.35 | % |

| $ | 1.77 | |

| $ | 1,000.00 |

| $ | 1,023.44 |

| 0.35 | % |

| $ | 1.79 | |

AdvisorShares STAR Global Buy-Write ETF |

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 1,000.00 |

| $ | 1,035.70 |

| 1.85 | % |

| $ | 9.49 | |

| $ | 1,000.00 |

| $ | 1,015.88 |

| 1.85 | % |

| $ | 9.40 | |

AdvisorShares Wilshire Buyback ETF(7) |

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 1,000.00 |

| $ | 1,158.00 |

| 0.90 | % |

| $ | 4.90 | |

| $ | 1,000.00 |

| $ | 1,020.67 |

| 0.90 | % |

| $ | 4.58 | |

____________

(1) Expense ratios reflect expense caps through the period ended December 31, 2016.

(2) Expenses are calculated using each Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 184/365 (to reflect the six-month period).

(3) Actual Expenses Paid are equal to the Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 178/365 (to reflect commencement of operations to December 31, 2016).

(4) Formerly known as, AdvisorShares WCM/BNY Mellon focused Growth ADR ETF.

(5) Actual Expenses Paid are equal to the Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 102/365 (to reflect commencement of operations to December 31, 2016).

(6) Actual Expenses Paid are equal to the Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 94/365 (to reflect commencement of operations to December 31, 2016).

(7) Formerly known as, AdvisorShares TrimTabs Float Shrink ETF.

6

ADVISORSHARES ATHENA HIGH DIVIDEND ETF

Schedule of Investments

December 31, 2016 (Unaudited)

Investments |

| Shares |

| Value | |

COMMON STOCKS — 99.7% |

|

|

|

|

|

|

|

|

|

|

|

Auto Manufacturers — 4.3% |

|

|

|

|

|

Ford Motor Co. |

| 15,372 |

| $ | 186,462 |

General Motors Co. |

| 4,663 |

|

| 162,459 |

Total Auto Manufacturers |

|

|

|

| 348,921 |

|

|

|

|

|

|

Banks — 10.2% |

|

|

|

|

|

Banco de Chile (Chile)(a) |

| 2,580 |

|

| 181,761 |

Grupo Aval Acciones y Valores SA (Colombia)(a)(b) |

| 27,842 |

|

| 221,066 |

Grupo Financiero Santander Mexico SAB de CV, Class B (Mexico)(a) |

| 36,189 |

|

| 260,199 |

PacWest Bancorp |

| 2,862 |

|

| 155,807 |

Total Banks |

|

|

|

| 818,833 |

|

|

|

|

|

|

Chemicals — 2.6% |

|

|

|

|

|

Braskem SA (Brazil)(a) |

| 9,903 |

|

| 210,043 |

|

|

|

|

|

|

Commercial Services — 3.0% |

|

|

|

|

|

Macquarie Infrastructure Corp. |

| 2,984 |

|

| 243,793 |

|

|

|

|

|

|

Diversified Financial Services — 4.0% |

|

|

| ||

Navient Corp. |

| 8,774 |

|

| 144,157 |

Waddell & Reed Financial, Inc., Class A |

| 9,009 |

|

| 175,765 |

Total Diversified Financial Services |

|

|

|

| 319,922 |

|

|

|

|

|

|

Electric — 8.4% |

|

|

|

|

|

Atlantica Yield PLC (Spain) |

| 8,484 |

|

| 164,165 |

Huaneng Power International, Inc. (China)(a)(b) |

| 9,772 |

|

| 254,463 |

NRG Yield, Inc., Class C |

| 16,334 |

|

| 258,077 |

Total Electric |

|

|

|

| 676,705 |

|

|

|

| ||

Engineering & Construction — 2.3% |

|

|

| ||

Grupo Aeroportuario del Centro Norte SAB de CV (Mexico)(a)(b) |

| 5,367 |

| 185,376 | |

|

|

|

|

|

|

Gas — 2.1% |

|

|

|

|

|

CenterPoint Energy, Inc. |

| 6,951 |

|

| 171,273 |

|

|

|

|

|

|

Media — 3.2% |

|

|

|

|

|

Gannett Co., Inc. |

| 26,082 |

|

| 253,256 |

|

|

|

|

|

|

Mining — 3.1% |

|

|

|

|

|

Sibanye Gold Ltd. (South Africa)(a)(b) |

| 35,157 |

|

| 248,208 |

|

|

|

|

|

|

Office/Business Equipment — 2.5% |

|

|

| ||

Pitney Bowes, Inc. |

| 13,091 |

|

| 198,852 |

Investments |

| Shares |

| Value | |

COMMON STOCKS (continued) |

|

|

| ||

|

|

|

|

|

|

Oil & Gas — 10.7% |

|

|

|

|

|

Helmerich & Payne, Inc.(b) |

| 1,748 |

| $ | 135,295 |

HollyFrontier Corp. |

| 5,588 |

|

| 183,063 |

PBF Energy, Inc., Class A(b) |

| 6,836 |

|

| 190,588 |

Vermilion Energy, Inc. (Canada) |

| 4,580 |

|

| 193,139 |

Western Refining, Inc. |

| 4,285 |

|

| 162,187 |

Total Oil & Gas |

|

|

|

| 864,272 |

|

|

|

|

|

|

Pipelines — 4.8% |

|

|

|

|

|

ONEOK, Inc. |

| 3,079 |

|

| 176,766 |

SemGroup Corp., Class A |

| 4,999 |

|

| 208,708 |

Total Pipelines |

|

|

|

| 385,474 |

|

|

|

|

|

|

Real Estate Investment Trusts — 13.0% |

|

|

| ||

Annaly Capital Management, Inc. |

| 19,620 |

|

| 195,611 |

CoreCivic, Inc. |

| 7,547 |

|

| 184,600 |

HCP, Inc. |

| 6,515 |

|

| 193,626 |

Hospitality Properties Trust |

| 8,998 |

|

| 285,597 |

Quality Care Properties, Inc.* |

| 1,633 |

|

| 25,311 |

Starwood Property Trust, Inc. |

| 7,525 |

|

| 165,174 |

Total Real Estate Investment Trusts |

|

|

|

| 1,049,919 |

|

|

|

|

|

|

Retail — 7.3% |

|

|

|

|

|

Abercrombie & Fitch Co., Class A |

| 14,916 |

|

| 178,992 |

GameStop Corp., Class A |

| 8,926 |

|

| 225,471 |

Staples, Inc. |

| 19,799 |

|

| 179,181 |

Total Retail |

|

|

|

| 583,644 |

|

|

|

| ||

Telecommunications — 10.1% |

|

|

| ||

AT&T, Inc. |

| 4,850 |

|

| 206,270 |

CenturyLink, Inc. |

| 7,552 |

|

| 179,586 |

Chunghwa Telecom Co. Ltd. (Taiwan)(a)(b) |

| 6,665 |

|

| 210,281 |

Frontier Communications Corp. |

| 65,115 |

|

| 220,089 |

Total Telecommunications |

|

|

|

| 816,226 |

|

|

|

|

|

|

Toys/Games/Hobbies — 2.2% |

|

|

|

|

|

Mattel, Inc. |

| 6,442 |

|

| 177,477 |

|

|

|

|

|

|

Transportation — 5.9% |

|

|

|

|

|

Euronav NV (Belgium) |

| 28,219 |

|

| 224,341 |

Ship Finance International Ltd. (Norway)(b) |

| 17,013 |

|

| 252,643 |

Total Transportation |

|

|

|

| 476,984 |

Total Common Stocks |

|

|

|

|

|

|

|

|

| 8,029,178 | |

|

|

|

| ||

See accompanying Notes to Financial Statements.

7

ADVISORSHARES ATHENA HIGH DIVIDEND ETF

Schedule of Investments (continued)

December 31, 2016 (Unaudited)

Investments |

| Shares/ |

| Value | |||

MONEY MARKET FUND — 0.0%** |

|

|

|

| |||

JP Morgan US Government Money Market Fund – Institutional Class, 0.41%(c) (Cost $2,102) |

|

| 2,102 |

| $ | 2,102 |

|

|

|

|

|

| |||

REPURCHASE AGREEMENTS — 13.9%(d) |

|

|

|

| |||

Citigroup Global Markets, Inc., dated 12/30/16, due 01/03/17, 0.53%, total to be received $259,812, (collateralized by various U.S. Government Agency Obligations, 2.00% – 8.50%, 12/01/17 – 01/01/47, totaling $264,171) |

| $ | 259,804 |

|

| 259,804 |

|

JP Morgan Securities LLC, dated 12/30/16, due 01/03/17, 0.50%, total to be received $77,002, (collateralized by various U.S. Government Agency Obligations, |

|

| 77,000 |

|

| 77,000 |

|

Merrill Lynch Pierce Fenner & Smith, Inc., dated 12/30/16, due 01/03/17, 0.50%, total to be received $259,811, (collateralized by various U.S. Government Agency Obligations, 1.74% – 6.00%, 08/01/22 – 01/15/49, totaling $264,312) |

|

| 259,804 |

|

| 259,804 |

|

Mizuho Securities USA, Inc., dated 12/30/16, due 01/03/17, 0.48%, total to be received $259,811, (collateralized by various U.S. Government Agency Obligations, 2.00% – 6.50%, 07/01/24 – 09/20/46, totaling $264,333) |

|

| 259,804 |

|

| 259,804 |

|

RBC Dominion Securities, Inc., dated 12/30/16, due 01/03/17, 0.52%, total to be received $259,812, (collateralized by various U.S. Government Agency Obligations, 0.88% – 7.00%, 02/13/17 – 01/01/47, totaling $264,250) |

|

| 259,804 |

|

| 259,804 |

|

Total Repurchase Agreements |

|

|

|

|

| 1,116,216 |

|

Total Investments – 113.6% (Cost $8,669,370) |

|

|

|

|

| 9,147,496 |

|

Liabilities in Excess of Other Assets – (13.6%) |

|

|

|

|

| (1,094,488 | ) |

Net Assets — 100.0% |

|

|

|

| $ | 8,053,008 |

|

____________

PLC – Public Limited Company

* Non-income producing security.

** Less than 0.05%.

(a) American Depositary Receipt.

(b) All or a portion of security is on loan. The aggregate market value of the securities on loan is $1,234,159; the aggregate market value of the collateral held by the fund is $1,261,197. The aggregate market value of the collateral includes non-cash U.S. Treasury securities collateral having a value of $144,981.

(c) Rate shown reflects the 7-day yield as of December 31, 2016.

(d) Collateral received from brokers for securities lending was invested in these short-term investments.

SUMMARY OF SCHEDULE OF INVESTMENTS

|

| % of | ||

Auto Manufacturers |

| 4.3 | % |

|

Banks |

| 10.2 |

|

|

Chemicals |

| 2.6 |

|

|

Commercial Services |

| 3.0 |

|

|

Diversified Financial Services |

| 4.0 |

|

|

Electric |

| 8.4 |

|

|

Engineering & Construction |

| 2.3 |

|

|

Gas |

| 2.1 |

|

|

Media |

| 3.2 |

|

|

Mining |

| 3.1 |

|

|

Office/Business Equipment |

| 2.5 |

|

|

Oil & Gas |

| 10.7 |

|

|

Pipelines |

| 4.8 |

|

|

Real Estate Investment Trusts |

| 13.0 |

|

|

Retail |

| 7.3 |

|

|

Telecommunications |

| 10.1 |

|

|

Toys/Games/Hobbies |

| 2.2 |

|

|

Transportation |

| 5.9 |

|

|

Money Market Fund |

| 0.0 | ** | |

Repurchase Agreements |

| 13.9 |

|

|

Total Investments |

| 113.6 |

|

|

Liabilities in Excess of Other Assets |

| (13.6 | ) | |

Net Assets |

| 100.0 | % | |

____________

** Less than 0.05%.

See accompanying Notes to Financial Statements.

8

ADVISORSHARES CORNERSTONE SMALL CAP ETF

Schedule of Investments

December 31, 2016 (Unaudited)

Investments |

| Shares |

| Value | |

COMMON STOCKS — 97.7% |

|

|

|

|

|

|

|

|

|

|

|

Airlines — 0.9% |

|

|

|

|

|

SkyWest, Inc. |

| 671 |

| $ | 24,458 |

|

|

|

|

| |

Auto Manufacturers — 0.4% |

|

|

|

|

|

Wabash National Corp.* |

| 633 |

|

| 10,014 |

|

|

|

|

| |

Auto Parts & Equipment — 1.3% |

|

|

|

|

|

Cooper Tire & Rubber Co. |

| 287 |

|

| 11,150 |

Douglas Dynamics, Inc. |

| 415 |

|

| 13,965 |

Spartan Motors, Inc. |

| 954 |

|

| 8,825 |

Total Auto Parts & Equipment |

|

|

|

| 33,940 |

|

|

|

|

| |

Banks — 4.7% |

|

|

|

|

|

BancFirst Corp. |

| 121 |

|

| 11,259 |

Cardinal Financial Corp. |

| 408 |

|

| 13,378 |

Central Pacific Financial Corp. |

| 363 |

|

| 11,406 |

Chemical Financial Corp. |

| 263 |

|

| 14,247 |

Eagle Bancorp, Inc.* |

| 352 |

|

| 21,454 |

Hancock Holding Co. |

| 287 |

|

| 12,370 |

National Bank Holdings Corp., Class A |

| 306 |

|

| 9,758 |

TriState Capital Holdings, Inc.* |

| 702 |

|

| 15,514 |

WashingtonFirst Bankshares, Inc. |

| 396 |

|

| 11,480 |

Total Banks |

|

|

|

| 120,866 |

|

|

|

|

| |

Beverages — 0.2% |

|

|

|

|

|

Boston Beer Co., Inc. (The), Class A* |

| 38 |

|

| 6,454 |

|

|

|

|

| |

Biotechnology — 0.8% |

|

|

|

|

|

ANI Pharmaceuticals, Inc.* |

| 142 |

|

| 8,608 |

ARIAD Pharmaceuticals, Inc.* |

| 965 |

|

| 12,005 |

Total Biotechnology |

|

|

|

| 20,613 |

|

|

|

|

| |

Building Materials — 1.8% |

|

|

|

|

|

AAON, Inc. |

| 270 |

|

| 8,923 |

Gibraltar Industries, Inc.* |

| 415 |

|

| 17,285 |

Louisiana-Pacific Corp.* |

| 474 |

|

| 8,973 |

NCI Building Systems, Inc.* |

| 730 |

|

| 11,425 |

Total Building Materials |

|

|

|

| 46,606 |

|

|

|

|

| |

Chemicals — 1.9% |

|

|

|

|

|

Balchem Corp. |

| 121 |

|

| 10,154 |

Chemours Co. (The) |

| 438 |

|

| 9,675 |

Ferro Corp.* |

| 692 |

|

| 9,916 |

Innospec, Inc. |

| 142 |

|

| 9,727 |

Rayonier Advanced Materials, Inc. |

| 564 |

|

| 8,720 |

Total Chemicals |

|

|

|

| 48,192 |

|

|

|

|

| |

Coal — 0.6% |

|

|

|

|

|

SunCoke Energy, Inc.* |

| 1,274 |

|

| 14,447 |

Investments |

| Shares |

| Value | |

COMMON STOCKS (continued) |

|

|

|

|

|

|

|

|

|

|

|

Commercial Services — 8.2% |

|

|

|

|

|

ABM Industries, Inc. |

| 225 |

| $ | 9,189 |

Alarm.com Holdings, Inc.* |

| 332 |

|

| 9,240 |

Albany Molecular Research, Inc.* |

| 477 |

|

| 8,948 |

Apollo Education Group, Inc.* |

| 1,011 |

|

| 10,009 |

Bridgepoint Education, Inc.* |

| 948 |

|

| 9,603 |

Capella Education Co. |

| 113 |

|

| 9,921 |

Career Education Corp.* |

| 1,016 |

|

| 10,251 |

DeVry Education Group, Inc. |

| 180 |

|

| 5,616 |

Forrester Research, Inc. |

| 206 |

|

| 8,848 |

Grand Canyon Education, Inc.* |

| 242 |

|

| 14,145 |

Green Dot Corp., Class A* |

| 318 |

|

| 7,489 |

HealthEquity, Inc.* |

| 306 |

|

| 12,399 |

HMS Holdings Corp.* |

| 524 |

|

| 9,516 |

Insperity, Inc. |

| 249 |

|

| 17,667 |

Kelly Services, Inc., Class A |

| 408 |

|

| 9,351 |

LendingTree, Inc.* |

| 52 |

|

| 5,270 |

LifeLock, Inc.*(a) |

| 564 |

|

| 13,491 |

Navigant Consulting, Inc.* |

| 481 |

|

| 12,593 |

On Assignment, Inc.* |

| 197 |

|

| 8,700 |

Quad/Graphics, Inc. |

| 422 |

|

| 11,343 |

ServiceSource International, Inc.* |

| 1,591 |

|

| 9,037 |

Total Commercial Services |

|

|

|

| 212,626 |

|

|

|

|

|

|

Computers — 4.7% |

|

|

|

|

|

3D Systems Corp.* |

| 467 |

|

| 6,207 |

Barracuda Networks, Inc.* |

| 460 |

|

| 9,858 |

Carbonite, Inc.* |

| 687 |

|

| 11,267 |

Engility Holdings, Inc.* |

| 256 |

|

| 8,627 |

Insight Enterprises, Inc.* |

| 289 |

|

| 11,687 |

Mentor Graphics Corp. |

| 377 |

|

| 13,908 |

Qualys, Inc.* |

| 197 |

|

| 6,235 |

Silver Spring Networks, Inc.* |

| 656 |

|

| 8,731 |

Sykes Enterprises, Inc.* |

| 256 |

|

| 7,388 |

Tessera Holding Corp. |

| 346 |

|

| 15,293 |

Varonis Systems, Inc.* |

| 329 |

|

| 8,817 |

Vocera Communications, Inc.* |

| 692 |

|

| 12,795 |

Total Computers |

|

|

|

| 120,813 |

|

|

|

|

|

|

Diversified Financial Services — 2.1% |

|

|

| ||

Cowen Group, Inc., Class A*(a) |

| 665 |

|

| 10,307 |

Greenhill & Co., Inc. |

| 338 |

|

| 9,363 |

INTL FCStone, Inc.* |

| 301 |

|

| 11,920 |

LendingClub Corp.*(a) |

| 1,598 |

|

| 8,389 |

WageWorks, Inc.* |

| 204 |

|

| 14,790 |

Total Diversified Financial Services |

|

|

|

| 54,769 |

See accompanying Notes to Financial Statements.

9

ADVISORSHARES CORNERSTONE SMALL CAP ETF

Schedule of Investments (continued)

December 31, 2016 (Unaudited)

Investments |

| Shares |

| Value | |

COMMON STOCKS (continued) |

|

|

|

|

|

|

|

|

|

|

|

Electric — 0.4% |

|

|

|

|

|

Avista Corp. |

| 235 |

| $ | 9,398 |

|

|

|

|

|

|

Electrical Components & Equipment — 0.3% |

|

|

| ||

Powell Industries, Inc. |

| 225 |

|

| 8,775 |

|

|

|

|

|

|

Electronics — 0.7% |

|

|

|

|

|

Knowles Corp.* |

| 586 |

|

| 9,792 |

TASER International, Inc.* |

| 346 |

|

| 8,387 |

Total Electronics |

|

|

|

| 18,179 |

|

|

|

|

|

|

Energy – Alternate Sources — 1.1% |

|

|

| ||

FutureFuel Corp. |

| 685 |

|

| 9,522 |

Green Plains, Inc. |

| 287 |

|

| 7,993 |

Sunrun, Inc.*(a) |

| 1,907 |

|

| 10,126 |

Total Energy – Alternate Sources |

|

|

|

| 27,641 |

|

|

|

|

|

|

Engineering & Construction — 1.3% |

|

|

| ||

Argan, Inc. |

| 308 |

|

| 21,729 |

Exponent, Inc. |

| 180 |

|

| 10,854 |

Total Engineering & Construction |

|

|

|

| 32,583 |

|

|

|

|

|

|

Entertainment — 1.1% |

|

|

|

|

|

Churchill Downs, Inc. |

| 90 |

|

| 13,540 |

Marriott Vacations Worldwide Corp. |

| 180 |

|

| 15,273 |

Total Entertainment |

|

|

|

| 28,813 |

|

|

|

|

|

|

Environmental Control — 0.5% |

|

|

|

|

|

Casella Waste Systems, Inc., Class A* |

| 1,055 |

|

| 13,092 |

|

|

|

|

|

|

Food — 1.6% |

|

|

|

|

|

Fresh Del Monte Produce, Inc. |

| 263 |

|

| 15,946 |

Sanderson Farms, Inc.(a) |

| 114 |

|

| 10,743 |

SpartanNash Co. |

| 363 |

|

| 14,353 |

Total Food |

|

|

|

| 41,042 |

|

|

|

|

|

|

Hand/Machine Tools — 0.4% |

|

|

|

|

|

Kennametal, Inc. |

| 318 |

|

| 9,941 |

|

|

|

|

|

|

Healthcare – Products — 6.1% |

|

|

|

|

|

Cerus Corp.*(a) |

| 1,697 |

|

| 7,382 |

CryoLife, Inc.* |

| 581 |

|

| 11,126 |

Halyard Health, Inc.* |

| 256 |

|

| 9,467 |

ICU Medical, Inc.* |

| 90 |

|

| 13,261 |

Inogen, Inc.* |

| 173 |

|

| 11,620 |

LeMaitre Vascular, Inc. |

| 529 |

|

| 13,405 |

LivaNova PLC* |

| 135 |

|

| 6,071 |

Luminex Corp.* |

| 422 |

|

| 8,537 |

Masimo Corp.* |

| 263 |

|

| 17,726 |

Investments |

| Shares |

| Value | |

COMMON STOCKS (continued) |

|

|

|

|

|

|

|

|

|

|

|

Healthcare – Products (continued) |

|

|

| ||

Merit Medical Systems, Inc.* |

| 543 |

| $ | 14,390 |

NuVasive, Inc.* |

| 144 |

|

| 9,700 |

OraSure Technologies, Inc.* |

| 986 |

|

| 8,657 |

Orthofix International NV* |

| 173 |

|

| 6,259 |

Vascular Solutions, Inc.* |

| 197 |

|

| 11,052 |

Zeltiq Aesthetics, Inc.* |

| 236 |

|

| 10,271 |

Total Healthcare – Products |

|

|

|

| 158,924 |

|

|

|

|

|

|

Healthcare – Services — 0.3% |

|

|

|

|

|

Healthways, Inc.* |

| 373 |

|

| 8,486 |

|

|

|

|

|

|

Home Furnishings — 0.9% |

|

|

|

|

|

Ethan Allen Interiors, Inc. |

| 235 |

|

| 8,660 |

iRobot Corp.* |

| 256 |

|

| 14,963 |

Total Home Furnishings |

|

|

|

| 23,623 |

|

|

|

|

|

|

Household Products/Wares — 1.4% |

|

|

| ||

ACCO Brands Corp.* |

| 775 |

|

| 10,114 |

Central Garden & Pet Co.*(a) |

| 453 |

|

| 14,990 |

SodaStream International Ltd. (Israel)* |

| 262 |

|

| 10,341 |

Total Household Products/Wares |

|

|

|

| 35,445 |

|

|

|

|

|

|

Insurance — 1.7% |

|

|

|

|

|

MBIA, Inc.* |

| 1,099 |

|

| 11,759 |

NMI Holdings, Inc., Class A* |

| 1,244 |

|

| 13,249 |

OneBeacon Insurance Group Ltd., Class A |

| 611 |

|

| 9,807 |

Universal Insurance Holdings, Inc. |

| 353 |

|

| 10,025 |

Total Insurance |

|

|

|

| 44,840 |

|

|

|

|

|

|

Internet — 2.6% |

|

|

|

|

|

FireEye, Inc.*(a) |

| 739 |

|

| 8,794 |

Groupon, Inc.*(a) |

| 2,230 |

|

| 7,404 |

Imperva, Inc.* |

| 241 |

|

| 9,254 |

Liquidity Services, Inc.* |

| 849 |

|

| 8,278 |

Mimecast Ltd.* |

| 606 |

|

| 10,847 |

RingCentral, Inc., Class A* |

| 391 |

|

| 8,055 |

Stamps.com, Inc.* |

| 90 |

|

| 10,319 |

WebMD Health Corp.* |

| 104 |

|

| 5,155 |

Total Internet |

|

|

|

| 68,106 |

|

|

|

|

|

|

Iron/Steel — 1.8% |

|

|

|

|

|

AK Steel Holding Corp.*(a) |

| 2,103 |

|

| 21,472 |

Cliffs Natural Resources, Inc.*(a) |

| 1,432 |

|

| 12,043 |

Schnitzer Steel Industries, Inc., Class A |

| 479 |

|

| 12,310 |

Total Iron/Steel |

|

|

|

| 45,825 |

See accompanying Notes to Financial Statements.

10

ADVISORSHARES CORNERSTONE SMALL CAP ETF

Schedule of Investments (continued)

December 31, 2016 (Unaudited)

Investments |

| Shares |

| Value | |

COMMON STOCKS (continued) |

|

|

|

|

|

|

|

|

|

|

|

Leisure Time — 1.8% |

|

|

|

|

|

Callaway Golf Co. |

| 1,048 |

| $ | 11,486 |

Drew Industries, Inc.* |

| 135 |

|

| 14,546 |

Fox Factory Holding Corp.* |

| 396 |

|

| 10,989 |

Nautilus, Inc.*(a) |

| 581 |

|

| 10,749 |

Total Leisure Time |

|

|

|

| 47,770 |

|

|

|

|

|

|

Lodging — 0.8% |

|

|

|

|

|

Belmond Ltd., Class A (United Kingdom)* |

| 790 |

|

| 10,547 |

Monarch Casino & Resort, Inc.* |

| 353 |

|

| 9,100 |

Total Lodging |

|

|

|

| 19,647 |

|

|

|

|

|

|

Machinery – Diversified — 1.3% |

|

|

|

|

|

Alamo Group, Inc. |

| 142 |

|

| 10,806 |

Chart Industries, Inc.* |

| 294 |

|

| 10,590 |

DXP Enterprises, Inc.* |

| 349 |

|

| 12,124 |

Total Machinery – Diversified |

|

|

|

| 33,520 |

|

|

|

|

|

|

Media — 0.4% |

|

|

|

|

|

TiVo Corp.* |

| 469 |

|

| 9,802 |

|

|

|

|

|

|

Metal Fabricate/Hardware — 0.4% |

|

|

| ||

Haynes International, Inc. |

| 229 |

|

| 9,845 |

|

|

|

|

|

|

Mining — 0.4% |

|

|

|

|

|

Stillwater Mining Co.* |

| 709 |

|

| 11,422 |

|

|

|

|

|

|

Miscellaneous Manufacturing — 2.3% |

|

|

| ||

Fabrinet (Thailand)* |

| 377 |

|

| 15,193 |

Harsco Corp. |

| 842 |

|

| 11,451 |

John Bean Technologies Corp. |

| 225 |

|

| 19,339 |

Smith & Wesson Holding Corp.*(a) |

| 685 |

|

| 14,440 |

Total Miscellaneous Manufacturing |

|

|

|

| 60,423 |

|

|

|

|

|

|

Office Furnishings — 0.3% |

|

|

|

|

|

Herman Miller, Inc. |

| 256 |

|

| 8,755 |

|

|

|

|

|

|

Oil & Gas — 2.5% |

|

|

|

|

|

Callon Petroleum Co.* |

| 640 |

|

| 9,837 |

Carrizo Oil & Gas, Inc.* |

| 197 |

|

| 7,358 |

CVR Energy, Inc.(a) |

| 539 |

|

| 13,685 |

Denbury Resources, Inc.* |

| 2,939 |

|

| 10,815 |

Matador Resources Co.*(a) |

| 389 |

|

| 10,021 |

Unit Corp.* |

| 438 |

|

| 11,769 |

Total Oil & Gas |

|

|

|

| 63,485 |

Investments |

| Shares |

| Value | |

COMMON STOCKS (continued) |

|

|

|

|

|

|

|

|

|

|

|

Oil & Gas Services — 1.9% |

|

|

|

|

|

Archrock, Inc. |

| 774 |

| $ | 10,217 |

Helix Energy Solutions Group, Inc.* |

| 756 |

|

| 6,668 |

McDermott International, Inc.* |

| 1,712 |

|

| 12,652 |

Newpark Resources, Inc.* |

| 1,227 |

|

| 9,202 |

Oil States International, Inc.* |

| 275 |

|

| 10,725 |

Total Oil & Gas Services |

|

|

|

| 49,464 |

|

|

|

|

|

|

Packaging & Containers — 0.5% |

|

|

|

|

|

Greif, Inc., Class A |

| 249 |

|

| 12,776 |

|

|

|

|

|

|

Pharmaceuticals — 2.7% |

|

|

|

|

|

Amphastar Pharmaceuticals, Inc.* |

| 529 |

|

| 9,744 |

Anika Therapeutics, Inc.* |

| 218 |

|

| 10,673 |

Corcept Therapeutics, Inc.* |

| 1,581 |

|

| 11,478 |

Prestige Brands Holdings, Inc.* |

| 204 |

|

| 10,629 |

Supernus Pharmaceuticals, Inc.* |

| 407 |

|

| 10,277 |

Teligent, Inc.*(a) |

| 1,090 |

|

| 7,205 |

Xencor, Inc.* |

| 416 |

|

| 10,949 |

Total Pharmaceuticals |

|

|

|

| 70,955 |

|

|

|

|

|

|

Private Equity — 0.3% |

|

|

|

|

|

Kennedy-Wilson Holdings, Inc. |

| 365 |

|

| 7,482 |

|

|

|

|

|

|

Real Estate — 0.6% |

|

|

|

|

|

HFF, Inc., Class A |

| 263 |

|

| 7,956 |

St Joe Co. (The)*(a) |

| 446 |

|

| 8,474 |

Total Real Estate |

|

|

|

| 16,430 |

|

|

|

|

|

|

Real Estate Investment Trusts — 9.6% |

|

|

| ||

Acadia Realty Trust |

| 218 |

|

| 7,124 |

Agree Realty Corp. |

| 256 |

|

| 11,789 |

Ares Commercial Real Estate Corp. |

| 694 |

|

| 9,529 |

CareTrust REIT, Inc. |

| 564 |

|

| 8,640 |

CoreSite Realty Corp. |

| 180 |

|

| 14,287 |

Corporate Office Properties Trust |

| 337 |

|

| 10,521 |

EastGroup Properties, Inc. |

| 135 |

|

| 9,968 |

Education Realty Trust, Inc. |

| 182 |

|

| 7,699 |

First Industrial Realty Trust, Inc. |

| 365 |

|

| 10,238 |

Four Corners Property Trust, Inc. |

| 398 |

|

| 8,167 |

Getty Realty Corp. |

| 376 |

|

| 9,584 |

iStar, Inc.* |

| 823 |

|

| 10,180 |

LaSalle Hotel Properties |

| 351 |

|

| 10,695 |

Lexington Realty Trust |

| 838 |

|

| 9,050 |

See accompanying Notes to Financial Statements.

11

ADVISORSHARES CORNERSTONE SMALL CAP ETF

Schedule of Investments (continued)

December 31, 2016 (Unaudited)

Investments |

| Shares |

| Value | |

COMMON STOCKS (continued) |

|

|

| ||

|

|

|

|

|

|

Real Estate Investment Trusts (continued) |

|

|

| ||

Mack-Cali Realty Corp. |

| 332 |

| $ | 9,635 |

National Health Investors, Inc. |

| 101 |

|

| 7,491 |

National Storage Affiliates Trust |

| 388 |

|

| 8,563 |

Pebblebrook Hotel Trust |

| 299 |

|

| 8,895 |

Piedmont Office Realty Trust, Inc., Class A |

| 372 |

|

| 7,779 |

Potlatch Corp. |

| 190 |

|

| 7,913 |

Ramco-Gershenson Properties Trust |

| 446 |

|

| 7,395 |

Rexford Industrial Realty, Inc. |

| 384 |

|

| 8,905 |

Sabra Health Care REIT, Inc. |

| 322 |

|

| 7,863 |

Silver Bay Realty Trust Corp. |

| 540 |

|

| 9,256 |

Summit Hotel Properties, Inc. |

| 626 |

|

| 10,035 |

Urstadt Biddle Properties, Inc., Class A |

| 396 |

|

| 9,548 |

Washington Real Estate Investment Trust |

| 256 |

|

| 8,369 |

Total Real Estate Investment Trusts |

|

|

|

| 249,118 |

|

|

|

|

|

|

Retail — 2.6% |

|

|

|

|

|

Arcos Dorados Holdings, Inc., Class A (Uruguay)* |

| 1,657 |

|

| 8,948 |

Big 5 Sporting Goods Corp. |

| 481 |

|

| 8,345 |

Francesca’s Holdings Corp.* |

| 481 |

|

| 8,672 |

Jack in the Box, Inc. |

| 142 |

|

| 15,853 |

Ollie’s Bargain Outlet Holdings, Inc.*(a) |

| 283 |

|

| 8,051 |

Potbelly Corp.* |

| 543 |

|

| 7,005 |

Wendy’s Co. (The) |

| 723 |

|

| 9,775 |

Total Retail |

|

|

|

| 66,649 |

|

|

|

|

|

|

Savings & Loans — 2.5% |

|

|

|

|

|

Bank Mutual Corp. |

| 951 |

|

| 8,987 |

Flagstar Bancorp, Inc.* |

| 346 |

|

| 9,321 |

Meridian Bancorp, Inc. |

| 539 |

|

| 10,187 |

Northfield Bancorp, Inc. |

| 602 |

|

| 12,022 |

Northwest Bancshares, Inc.(a) |

| 626 |

|

| 11,287 |

OceanFirst Financial Corp. |

| 475 |

|

| 14,264 |

Total Savings & Loans |

|

|

|

| 66,068 |

|

|

|

|

|

|

Semiconductors — 6.0% |

|

|

|

|

|

Alpha & Omega Semiconductor Ltd.* |

| 353 |

|

| 7,508 |

Amkor Technology, Inc.* |

| 1,290 |

|

| 13,610 |

Applied Micro Circuits Corp.* |

| 1,178 |

|

| 9,719 |

CEVA, Inc.* |

| 401 |

|

| 13,454 |

Investments |

| Shares |

| Value | |

COMMON STOCKS (continued) |

|

|

| ||

|

|

|

|

|

|

Semiconductors (continued) |

|

|

|

|

|

FormFactor, Inc.* |

| 855 |

| $ | 9,576 |

Inphi Corp.* |

| 512 |

|

| 22,845 |

Intersil Corp., Class A |

| 593 |

|

| 13,224 |

MaxLinear, Inc., Class A* |

| 754 |

|

| 16,437 |

Mellanox Technologies Ltd. (Israel)* |

| 187 |

|

| 7,648 |

Nanometrics, Inc.* |

| 376 |

|

| 9,423 |

Power Integrations, Inc. |

| 158 |

|

| 10,720 |

Silicon Laboratories, Inc.* |

| 159 |

|

| 10,335 |

Veeco Instruments, Inc.* |

| 369 |

|

| 10,756 |

Total Semiconductors |

|

|

|

| 155,255 |

|

|

|

|

|

|

Software — 5.0% |

|

|

|

|

|

2U, Inc.* |

| 270 |

|

| 8,140 |

Actua Corp.* |

| 695 |

|

| 9,730 |

Acxiom Corp.* |

| 310 |

|

| 8,308 |

Bazaarvoice, Inc.* |

| 1,439 |

|

| 6,979 |

Blackbaud, Inc. |

| 114 |

|

| 7,296 |

CommVault Systems, Inc.* |

| 180 |

|

| 9,252 |

CyberArk Software Ltd. (Israel)* |

| 166 |

|

| 7,553 |

Ebix, Inc.(a) |

| 294 |

|

| 16,773 |

HubSpot, Inc.* |

| 158 |

|

| 7,426 |

MINDBODY, Inc., Class A* |

| 550 |

|

| 11,715 |

Paycom Software, Inc.*(a) |

| 187 |

|

| 8,507 |

RealPage, Inc.* |

| 398 |

|

| 11,940 |

SPS Commerce, Inc.* |

| 109 |

|

| 7,618 |

Synchronoss Technologies, Inc.* |

| 204 |

|

| 7,813 |

Total Software |

|

|

|

| 129,050 |

|

|

|

|

|

|

Telecommunications — 4.4% |

|

|

|

|

|

Cincinnati Bell, Inc.* |

| 418 |

|

| 9,342 |

Consolidated Communications Holdings, Inc. |

| 334 |

|

| 8,968 |

DigitalGlobe, Inc.* |

| 332 |

|

| 9,512 |

Extreme Networks, Inc.* |

| 2,151 |

|

| 10,820 |

Gigamon, Inc.* |

| 270 |

|

| 12,298 |

Iridium Communications, Inc.*(a) |

| 813 |

|

| 7,805 |

Ixia* |

| 683 |

|

| 10,996 |

LogMeIn, Inc. |

| 173 |

|

| 16,703 |

Lumos Networks Corp.* |

| 535 |

|

| 8,357 |

NETGEAR, Inc.* |

| 180 |

|

| 9,783 |

NeuStar, Inc., Class A* |

| 318 |

|

| 10,621 |

Total Telecommunications |

|

|

|

| 115,205 |

|

|

|

|

|

|

Textiles — 0.8% |

|

|

|

|

|

Culp, Inc. |

| 287 |

|

| 10,662 |

See accompanying Notes to Financial Statements.

12

ADVISORSHARES CORNERSTONE SMALL CAP ETF

Schedule of Investments (continued)

December 31, 2016 (Unaudited)

Investments |

| Shares/ Principal |

| Value | |||

COMMON STOCKS (continued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Textiles (continued) |

|

|

|

|

|

|

|

UniFirst Corp. |

|

| 69 |

| $ | 9,912 |

|

Total Textiles |

|

|

|

|

| 20,574 |

|

|

|

|

|

|

|

|

|

Transportation — 0.3% |

|

|

|

|

|

|

|

Atlas Air Worldwide Holdings, Inc.* |

|

| 152 |

|

| 7,927 |

|

|

|

|

|

|

|

|

|

Trucking & Leasing — 0.5% |

|

|

|

|

|

|

|

GATX Corp.(a) |

|

| 121 |

|

| 7,451 |

|

Greenbrier Cos., Inc. (The)(a) |

|

| 152 |

|

| 6,316 |

|

Total Trucking & Leasing |

|

|

|

|

| 13,767 |

|

|

|

|

|

|

|

|

|

Total Common Stocks |

|

|

|

|

|

|

|

|

|

|

|

| 2,533,900 |

| |

|

|

|

|

|

|

|

|

MONEY MARKET FUND — 0.8% |

|

|

|

|

|

|

|

STIT – Government & Agency Portfolio, Institutional Class, 0.43%(b) |

|

| 20,002 |

|

| 20,002 |

|

|

|

|

|

|

|

|

|

REPURCHASE AGREEMENT — 7.5%(c) |

|

|

|

| |||

HSBC Securities USA, Inc., dated 12/30/16, due 01/03/17, 0.45%, total to be received $193,503, (collateralized by various U.S. Government Agency Obligations, |

|

|

|

|

|

|

|

| $ | 193,498 |

|

| 193,498 |

| |

Total Investments — 106.0% |

|

|

|

|

|

|

|

|

|

|

|

| 2,747,400 |

| |

Liabilities in Excess of Other Assets — (6.0%) |

|

|

|

|

| (156,109 | ) |

Net Assets — 100.0% |

|

|

|

| $ | 2,591,291 |

|

____________

PLC — Public Limited Company

* Non-income producing security.

(a) All or a portion of security is on loan. The aggregate market value of the securities on loan is $235,704; the aggregate market value of the collateral held by the fund is $244,358. The aggregate market value of the collateral includes non-cash U.S. Treasury securities collateral having a value of $50,860.

(b) Rate shown reflects the 7-day yield as of December 31, 2016.

(c) Collateral received from brokers for securities lending was invested in these short-term investments.

SUMMARY OF SCHEDULE OF INVESTMENTS

|

| % of | |

Airlines |

| 0.9 | % |

Auto Manufacturers |

| 0.4 |

|

Auto Parts & Equipment |

| 1.3 |

|

Banks |

| 4.7 |

|

Beverages |

| 0.2 |

|

Biotechnology |

| 0.8 |

|

Building Materials |

| 1.8 |

|

Chemicals |

| 1.9 |

|

Coal |

| 0.6 |

|

Commercial Services |

| 8.2 |

|

Computers |

| 4.7 |

|

Diversified Financial Services |

| 2.1 |

|

Electric |

| 0.4 |

|

Electrical Components & Equipment |

| 0.3 |

|

Electronics |

| 0.7 |

|

Energy – Alternate Sources |

| 1.1 |

|

Engineering & Construction |

| 1.3 |

|

Entertainment |

| 1.1 |

|

Environmental Control |

| 0.5 |

|

Food |

| 1.6 |

|

Hand/Machine Tools |

| 0.4 |

|

Healthcare – Products |

| 6.1 |

|

Healthcare – Services |

| 0.3 |

|

Home Furnishings |

| 0.9 |

|

Household Products/Wares |

| 1.4 |

|

Insurance |

| 1.7 |

|

Internet |

| 2.6 |

|

Iron/Steel |

| 1.8 |

|

Leisure Time |

| 1.8 |

|

Lodging |

| 0.8 |

|

Machinery – Diversified |

| 1.3 |

|

Media |

| 0.4 |

|

Metal Fabricate/Hardware |

| 0.4 |

|

Mining |

| 0.4 |

|

Miscellaneous Manufacturing |

| 2.3 |

|

Office Furnishings |

| 0.3 |

|

Oil & Gas |

| 2.5 |

|

Oil & Gas Services |

| 1.9 |

|

Packaging & Containers |

| 0.5 |

|

Pharmaceuticals |

| 2.7 |

|

Private Equity |

| 0.3 |

|

Real Estate |

| 0.6 |

|

Real Estate Investment Trusts |

| 9.6 |

|

Retail |

| 2.6 |

|

Savings & Loans |

| 2.5 |

|

Semiconductors |

| 6.0 |

|

See accompanying Notes to Financial Statements.

13

ADVISORSHARES CORNERSTONE SMALL CAP ETF

Schedule of Investments (continued)

December 31, 2016 (Unaudited)

SUMMARY OF SCHEDULE OF INVESTMENTS (continued)

|

| % of | |

Software |

| 5.0 | % |

Telecommunications |

| 4.4 |

|

Textiles |

| 0.8 |

|

Transportation |

| 0.3 |

|

Trucking & Leasing |

| 0.5 |

|

Money Market Fund |

| 0.8 |

|

Repurchase Agreement |

| 7.5 |

|

Total Investments |

| 106.0 |

|

Liabilities in Excess of Other Assets |

| (6.0 | ) |

Net Assets |

| 100.0 | % |

See accompanying Notes to Financial Statements.

14

ADVISORSHARES DORSEY WRIGHT ADR ETF

(Formerly AdvisorShares WCM/BNY Mellon Focused Growth ADR ETF)

Schedule of Investments

December 31, 2016 (Unaudited)

Investments |

| Shares |

| Value | |

COMMON STOCKS — 98.6% |

|

|

|

|

|

|

|

|

|

|

|

Airlines — 2.4% |

|

|

|

|

|

Latam Airlines Group SA (Chile)*(a)(b) |

| 53,859 |

| $ | 440,567 |

|

|

|

|

|

|

Banks — 13.3% |

|

|

|

|

|

Banco Bradesco SA (Brazil)(b) |

| 50,827 |

|

| 442,703 |

Banco do Brasil SA (Brazil)(b) |

| 57,571 |

|

| 478,991 |

Banco Santander Brasil SA |

| 64,299 |

|

| 571,618 |

Itau Unibanco Holding SA |

| 41,646 |

|

| 428,121 |

Sberbank of Russia PJSC (Russia)(b) |

| 42,065 |

|

| 487,113 |

Total Banks |

|

|

|

| 2,408,546 |

|

|

|

|

|

|

Building Materials — 2.7% |

|

|

|

|

|

CRH PLC (Ireland)(b) |

| 14,049 |

|

| 483,005 |

|

|

|

|

|

|

Chemicals — 8.9% |

|

|

|

|

|

Braskem SA (Brazil)(a)(b) |

| 27,499 |

|

| 583,254 |

Sinopec Shanghai Petrochemical Co., Ltd. (China)(a)(b) |

| 8,464 |

|

| 458,156 |

Sociedad Quimica y Minera de |

| 20,263 |

|

| 580,535 |

Total Chemicals |

|

|

|

| 1,621,945 |

|

|

|

|

|

|

Commercial Services — 6.8% |

|

|

|

|

|

New Oriental Education & Technology Group, Inc. (China)*(b) |

| 12,245 |

|

| 515,515 |

TAL Education Group (China)*(a)(b) |

| 10,174 |

|

| 713,706 |

Total Commercial Services |

|

|

|

| 1,229,221 |

|

|

|

|

|

|

Diversified Financial Services — 2.4% |

|

|

| ||

KB Financial Group, Inc. |

| 12,070 |

|

| 425,950 |

|

|

|

|

|

|

Electric — 16.7% |

|

|

|

|

|

Empresa Distribuidora Y Comercializadora Norte (Argentina)*(a)(b) |

| 56,720 |

|

| 1,579,652 |

Pampa Energia SA (Argentina)*(a)(b) |

| 41,397 |

|

| 1,441,030 |

Total Electric |

|

|

|

| 3,020,682 |

|

|

|

|

|

|

Food — 2.9% |

|

|

|

|

|

Cosan Ltd., Class A (Brazil) |

| 69,340 |

|

| 520,743 |

|

|

|

|

|

|

Insurance — 5.1% |

|

|

|

|

|

Chubb Ltd. |

| 3,820 |

|

| 504,698 |

Tokio Marine Holdings, Inc. (Japan)(b) |

| 10,472 |

|

| 428,200 |

Total Insurance |

|

|

|

| 932,898 |

Investments |

| Shares |

| Value | |

COMMON STOCKS (continued) |

|

|

|

|

|

|

|

|

|

|

|

Internet — 2.6% |

|

|

|

|

|

Ctrip.com International Ltd. (China)*(a)(b) |

| 11,791 |

| $ | 471,640 |

|

|

|

|

|

|

Iron/Steel — 4.9% |

|

|

|

|

|

Cia Siderurgica Nacional SA (Brazil)*(a)(b) |

| 102,710 |

|

| 331,753 |

Ternium SA (Luxembourg)(b) |

| 23,424 |

|

| 565,690 |

Total Iron/Steel |

|

|

|

| 897,443 |

|

|

|

|

|

|

Lodging — 2.8% |

|

|

|

|

|

China Lodging Group Ltd. (China)*(b) |

| 9,810 |

|

| 508,550 |

|

|

|

|

|

|

Mining — 3.6% |

|

|

|

|

|

Cia de Minas Buenaventura SAA (Peru)(b) |

| 33,359 |

|

| 376,289 |

Newcrest Mining Ltd. (Australia)(a)(b) |

| 18,630 |

|

| 267,527 |

Total Mining |

|

|

|

| 643,816 |

|

|

|

|

|

|

Oil & Gas — 8.0% |

|

|

|

|

|

LUKOIL PJSC (Russia)(b) |

| 7,991 |

|

| 448,455 |

Petroleo Brasileiro SA (Brazil)*(b) |

| 57,867 |

|

| 585,035 |

Ultrapar Participacoes SA (Brazil)(a)(b) |

| 20,130 |

|

| 417,496 |

Total Oil & Gas |

|

|

|

| 1,450,986 |

|

|

|

|

|

|

Real Estate — 6.4% |

|

|

|

|

|

Cresud SACIF y A (Argentina)*(a)(b) |

| 26,086 |

|

| 411,376 |

IRSA Inversiones y Representaciones SA (Argentina)*(a)(b) |

| 23,152 |

|

| 426,923 |

Xinyuan Real Estate Co., Ltd. (China)(b) |

| 65,594 |

|

| 325,346 |

Total Real Estate |

|

|

|

| 1,163,645 |

|

|

|

|

|

|

Semiconductors — 3.6% |

|

|

|

|

|

Silicon Motion Technology Corp. (Taiwan)(b) |

| 15,452 |

|

| 656,401 |

|

|

|

|

|

|

Software — 2.6% |

|

|

|

|

|

SAP SE (Germany)(b) |

| 5,496 |

|

| 475,019 |

|

|

|

|

|

|

Telecommunications — 2.9% |

|

|

|

|

|

Nice Ltd. (Israel)(b) |

| 7,581 |

|

| 521,270 |

Total Common Stocks |

|

|

|

| 17,872,327 |

|

|

|

|

|

|

MONEY MARKET FUND — 1.2% |

|

|

|

|

|

Invesco Government & Agency Portfolio – Private Investment Class, 0.14%(c) (Cost $225,376) |

| 225,376 |

|

| 225,376 |

See accompanying Notes to Financial Statements.

15

ADVISORSHARES DORSEY WRIGHT ADR ETF

(Formerly AdvisorShares WCM/BNY Mellon Focused Growth ADR ETF)

Schedule of Investments (continued)

December 31, 2016 (Unaudited)

Investments |

| Principal |

| Value | |||

REPURCHASE AGREEMENTS — 13.4%(d) | |||||||

Citigroup Global Markets, Inc., dated 12/30/16, due 01/03/17, 0.53%, total to be received $568,242, (collateralized by various U.S. Government Agency Obligations, 2.00% – 8.50%, 12/01/17 – 01/01/47, totaling $577,777) |

| $ | 568,225 |

|

| 568,225 |

|

JP Morgan Securities LLC, dated 12/30/16, due 01/03/17, 0.50%, total to be received $168,415, (collateralized by various U.S. Government Agency Obligations, 0.00% – 1.38%, 04/13/17 – 08/31/21, totaling $171,349) |

|

| 168,410 |

|

| 168,410 |

|

Merrill Lynch Pierce Fenner & Smith, Inc., dated 12/30/16, due 01/03/17, 0.50%, total to be received $568,241, (collateralized by various U.S. Government Agency Obligations, 1.74% – 6.00%, 08/01/22 – 01/15/49, totaling $578,084) |

|

| 568,225 |

|

| 568,225 |

|

Mizuho Securities USA, Inc., dated 12/30/16, due 01/03/17, 0.48%, total to be received $568,240, (collateralized by various U.S. Government Agency Obligations, 2.00% – 6.50%, 07/01/24 – 09/20/46, totaling $578,131) |

|

| 568,225 |

|

| 568,225 |

|

RBC Dominion Securities, Inc., dated 12/30/16, due 01/03/17, 0.52%, total to be received $568,241, (collateralized by various U.S. Government Agency Obligations, 0.88% – 7.00%, 02/13/17 – 01/01/47, totaling $577,950) |

|

| 568,225 |

|

| 568,225 |

|

Total Repurchase Agreements |

|

|

|

|

|

|

|

|

|

|

|

| 2,441,310 |

| |

Total Investments — 113.2% |

|

|

|

|

|

|

|

|

|

|

|

| 20,539,013 |

| |

Liabilities in Excess of Other Assets – (13.2%) |

|

|

|

|

| (2,399,052 | ) |

Net Assets — 100.0% |

|

|

|

| $ | 18,139,961 |

|

____________

PLC — Public Limited Company

* Non-income producing security.

(a) All or a portion of security is on loan. The aggregate market value of the securities on loan is $2,783,077; the aggregate market value of the collateral held by the fund is $2,892,302. The aggregate market value of the collateral includes non-cash U.S. Treasury securities collateral having a value of $450,992.

(b) American Depositary Receipt.

(c) Rate shown reflects the 7-day yield as of December 31, 2016.

(d) Collateral received from brokers for securities lending was invested in these short-term investments.

SUMMARY OF SCHEDULE OF INVESTMENTS

|

| % of | |

Airlines |

| 2.4 | % |

Banks |

| 13.3 |

|

Building Materials |

| 2.7 |

|

Chemicals |

| 8.9 |

|

Commercial Services |

| 6.8 |

|

Diversified Financial Services |

| 2.4 |

|

Electric |

| 16.7 |

|

Food |

| 2.9 |

|

Insurance |

| 5.1 |

|

Internet |

| 2.6 |

|

Iron/Steel |

| 4.9 |

|

Lodging |

| 2.8 |

|

Mining |

| 3.6 |

|

Oil & Gas |

| 8.0 |

|

Real Estate |

| 6.4 |

|

Semiconductors |

| 3.6 |

|

Software |

| 2.6 |

|

Telecommunications |

| 2.9 |

|

Money Market Fund |

| 1.2 |

|

Repurchase Agreements |

| 13.4 |

|

Total Investments |

| 113.2 |

|

Liabilities in Excess of Other Assets |

| (13.2 | ) |

Net Assets |

| 100.0 | % |

See accompanying Notes to Financial Statements.

16

ADVISORSHARES FOCUSED EQUITY ETF

Schedule of Investments

December 31, 2016 (Unaudited)

Investments |

| Shares |

| Value | |

COMMON STOCKS — 99.4% |

|

|

|

|

|

|

|

|

|

|

|

Aerospace/Defense — 3.9% |

|

|

|

|

|

HEICO Corp. |

| 3,937 |

| $ | 303,740 |

|

|

|

|

|

|

Banks — 4.0% |

|

|

|

|

|

Signature Bank* |

| 2,075 |

|

| 311,665 |

|

|

|

|

|

|

Building Materials — 3.9% |

|

|

|

|

|

Continental Building Products, Inc.* |

| 13,354 |

|

| 308,477 |

|

|

|

|

|

|

Chemicals — 11.9% |

|

|

|

|

|

Axalta Coating Systems Ltd.* |

| 11,495 |

|

| 312,664 |

RPM International, Inc. |

| 5,747 |

|

| 309,361 |

Sherwin-Williams Co. (The) |

| 1,149 |

|

| 308,782 |

Total Chemicals |

|

|

|

| 930,807 |

|

|

|

|

|

|

Commercial Services — 4.0% |

|

|

|

|

|

Moody’s Corp. |

| 3,279 |

|

| 309,111 |

|

|

|

|