UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22110

AdvisorShares Trust

(Exact name of registrant as specified in charter)

4800 Montgomery Lane, Suite 150

Bethesda, Maryland 20814

(Address of principal executive offices) (Zip code)

Dan Ahrens

4800 Montgomery Lane, Suite 150

Bethesda, Maryland 20814

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-843-3831

Date of fiscal year end: June 30

Date of reporting period: June 30, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | The Report to Shareholders is attached herewith. |

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

ADVISORSHARES TRUST

4800 Montgomery Lane

Suite 150

Bethesda, Maryland 20814

www.advisorshares.com

1.877.843.3831

Annual Report

June 30, 2023

TABLE OF CONTENTS

Letter from the CEO of AdvisorShares Investments, LLC

June 30, 2023

For our fiscal year ended June 30, 2023, equity markets experienced a significant comeback late in the fiscal year. This was despite the ongoing war in Ukraine, a continuing recovery from COVID-19 lockdowns, soaring inflation, and rising consumer prices. In the US, the market mostly struggled through the second half of 2022, recovering early in 2023 and providing steady gains throughout the first half of 2023. Across the board, most asset classes were up for the fiscal year, including gold, international equities, and Bitcoin. One area that struggled was the fixed income market, as we saw the Federal Reserve aggressively increase interest rates, driving yields higher and bond prices lower. While this was difficult for bond investors, thankfully, it appears that these interest rate increases are achieving the goal of easing inflation.

Certainly, this year, our most challenging investment category was cannabis. Investors continue to eagerly anticipate federal cannabis reforms. Initially, regulatory changes were expected to occur early in the Biden presidency — given the President’s proclamation during the primaries that he would legalize cannabis for medical use, decriminalize cannabis possession, and release incarcerated non-violent cannabis offenders. When that didn’t occur, cannabis reform hopes shifted to the 2022 lame duck session of Congress as Democrats regained control of the House of Representatives. The legislation that many investors are focused on — the SAFE Banking Act — would make it easier for banks to serve legal cannabis businesses. Currently, due to cannabis’ illegal status at the federal level, it is very difficult for legally operating cannabis companies to find banking support. Unfortunately and despite strong support by the House of Representatives, SAFE Banking legislation was not presented for a Senate vote before the 2023 summer recess. As a result of the Senate’s inaction, we saw a significant decline in the prices of Canadian cannabis stocks and outflows in the AdvisorShares Pure US Cannabis ETF (ticker: MSOS). Thankfully, there is continued work and discussion in Congress focused on federal changes in policy regarding cannabis, and we remain optimistic that we will see those changes soon. However, there is no guarantee that these changes will happen as quickly as we would like, or if at all.

It is important to understand our lineup of ETFs and their underlying investment strategies are a bit unique, and we are not likely to move in tandem with the broader markets. For example, while equity markets rose significantly in the first half of 2023, most of our assets in the trust are focused on cannabis stocks, which resulted in an overall decline in our assets under management. However, given the uniqueness of our investment strategies, we have not seen a meaningful reduction in our outstanding shares. This demonstrates to us that our investors are taking a long-term, optimistic view of our ETF strategies. We are also fortunate to have some of our ETFs rank highly in their respective investment categories, which as we know is not an easy feat for active managers.

While it has been a challenging year for the firm, we remain incredibly thankful to our shareholders and appreciate the trust and confidence you have in us. We wish you nothing but health, happiness, and prosperity.

Sincerest regards,

Noah Hamman

CEO, AdvisorShares Investments

1

ADVISORSHARES TRUST

Letter from the CEO of AdvisorShares Investments, LLC (Continued)

June 30, 2023

Bitcoin is a cryptocurrency, a virtual currency designed to act as money and a form of payment outside the control of any one person, group, or entity, thus removing the need for third-party involvement in financial transactions.

For more information on AdvisorShares ETFs, including performance and holdings, please visit www.advisorshares.com.

Investing involves risk including possible loss of principal. The Advisor’s judgment about the markets, the economy, or companies may not anticipate actual market movements, economic conditions or company performance, and these factors may affect the return on your investment. The prices of equity securities rise and fall daily. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

There is no guarantee the Advisor’s investment strategy will be successful. When models and data prove to be incorrect or incomplete, any decisions made in reliance thereon expose the Fund to potential risks. In addition, the use of predictive models has inherent risk. Because predictive models are usually constructed based on historical data supplied by third parties, the success of relying on such models may depend heavily on the accuracy and reliability of the supplied historical data. The Fund’s particular allocations may have a significant effect on the Fund’s performance. Allocation risk is the risk that the selection of ETFs and the allocation of assets among such ETFs will cause the Fund to underperform other funds with a similar investment objective that do not allocate their assets in the same manner or the market as a whole. For a list of the asset class specific risks please see the prospectus.

The views in this report were those of the Advisor’s CEO as of June 30, 2023, and may not reflect his views on the date that this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investments and do not constitute investment advice.

2

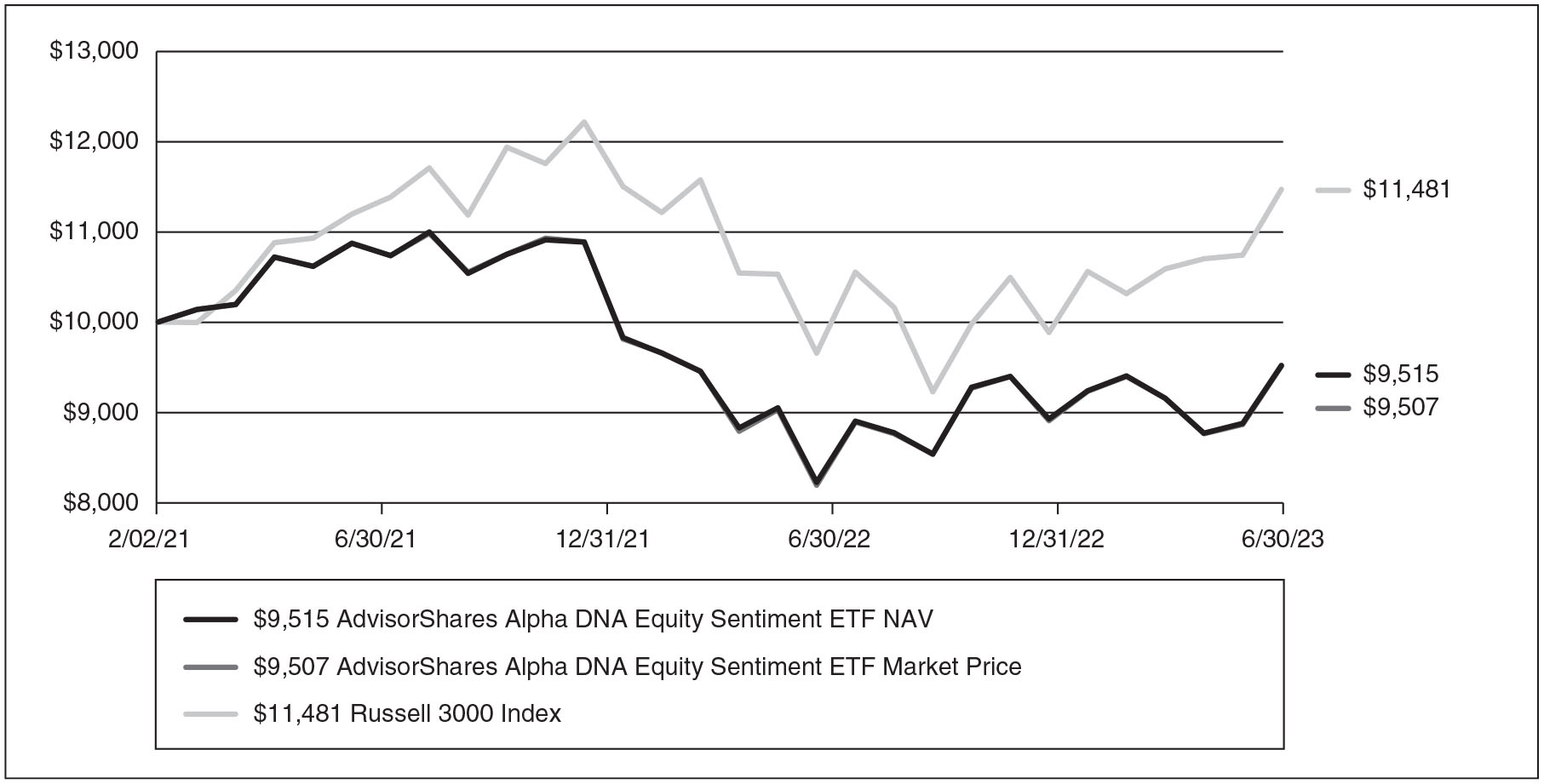

AdvisorShares Alpha DNA Equity Sentiment ETF (SENT)

The AdvisorShares Alpha DNA Equity Sentiment ETF’s (ticker: SENT) performance for the 12-month period ended June 30, 2023 was +15.89% (NAV) which is above average for hedged equity focused funds. Hedged equity funds are designed to provide index like returns from long equity and bearish returns from hedges that protect against the downside. When markets go up materially, you expect the hedge to drag the overall returns down. When markets go down, you expect the hedges to offer gains to the portfolio and generate upside potential when compared to the indices.

During the 12-month period ending June 30, 2023, the broad market indices were up. The S&P 500 Index (large cap — market cap weighted), Russell 3000 Index (all cap — market cap weighted), and Russell 2000 Index (small cap — market cap weighted) produced one-year returns ending June 30, 2023 of +19.59%, +18.95%, and +12.31%, respectively. The equal weight S&P 500 Index delivered just over +13.5%, demonstrating how the largest mega-cap companies of the market-cap weighted S&P 500 heavily contributed to performance.

SENT’s equity portfolio is equally weighted and all cap — about 30% large cap, 35% mid-cap, and 35% small cap (with modest periodic changes) — and employs a hedging strategy. For the previous 12 months ending June 30, 2023, SENT outperformed the equal weight S&P 500 and was just below the market-cap weighted S&P 500’s returns due to the cost of SENT’s hedging program.

The hedges employed in SENT’s strategy were particularly expensive during this time frame as the 1st half of 2022 saw a -20% decline in the broad markets, causing volatility to spike and driving up the cost of hedging. The 2nd half also had several months of volatile market performance which kept hedging costs elevated as a result.

The Russell 2000 Index measures the performance of the 2,000 smaller companies included in the Russell 3000 Index.

The Russell 3000 Index measures the performance of the largest 3,000 US companies representing approximately 98% of the investable US equity market.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period February 2, 2021* to June 30, 2023

3

HISTORICAL PERFORMANCE

Total Return as of June 30, 2023

| Since | ||||||||

| Inception | ||||||||

| 1 Year | 2/2/2021* | |||||||

| AdvisorShares Alpha DNA Equity Sentiment ETF NAV | 15.89 | % | -2.05 | % | ||||

| AdvisorShares Alpha DNA Equity Sentiment ETF Market Price** | 16.26 | % | -2.08 | % | ||||

| Russell 3000 Index | 18.95 | % | 5.91 | % | ||||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.01% and the net expense ratio is 1.01%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 1.35%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. | |

| ** | The price used to calculate market return (“Market Price”) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The Russell 3000 Index measures the performance of the largest 3,000 US companies representing approximately 98% of the investable US equity market.

4

ADVISORSHARES TRUST

AdvisorShares Dorsey Wright ADR ETF (AADR)

The AdvisorShares Dorsey Wright ADR ETF (ticker: AADR) finished the fiscal year ended June 30, 2023 behind its benchmark, the MSCI EAFE Index. The latter half of 2022 was especially volatile as markets struggled with slowing growth, high inflation, and geopolitical tensions in Russia/Ukraine. The first half of 2023 was a much better period by comparison, but a pronounced laggard rally (where previously poor performing stocks become x-the new darlings) caused a lag in the portfolio.

The second half of 2022 saw international markets perform solidly despite the issues mentioned above. The portfolio outperformed in Q3 as many of the more defensive names in the portfolio helped as markets declined at the end of the quarter. The market bottomed in October though, and that is when the laggard rally began with developed European equities generating explosive returns as fears revolving around the Russian War began to subside. Laggard rallies are always difficult for a momentum portfolio as we invest in stocks with positive relative strength, while laggards are the opposite. The same situation affected returns in Q1 2023, but we saw signs the portfolio was starting to right itself in Q2 2023 as the portfolio outperformed once again.

Despite the fund’s underperformance, we feel it should be short-lived and that AADR is well positioned as the world settles into the new normal and recently established trends begin to show longevity.

The MSCI EAFE Index is an unmanaged free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period June 30, 2013 to June 30, 2023

5

HISTORICAL PERFORMANCE

Total Return as of June 30, 2023

| 1 Year | 3 Year | 5 Year | 10 Year | |||||||||||||

| AdvisorShares Dorsey Wright ADR ETF NAV | 4.69 | % | -0.75 | % | -0.35 | % | 5.20 | % | ||||||||

| AdvisorShares Dorsey Wright ADR ETF Market Price* | 4.55 | % | -0.61 | % | -0.33 | % | 5.19 | % | ||||||||

| MSCI EAFE Index (Net) | 18.77 | % | 8.93 | % | 4.39 | % | 5.41 | % | ||||||||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.00% and the net expense ratio is 1.00%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 1.10%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | The price used to calculate market return (“Market Price”) is determined by using the closing price listed on the Nasdaq and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The MSCI EAFE Index is an unmanaged free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. One cannot invest directly in an index.

6

ADVISORSHARES TRUST

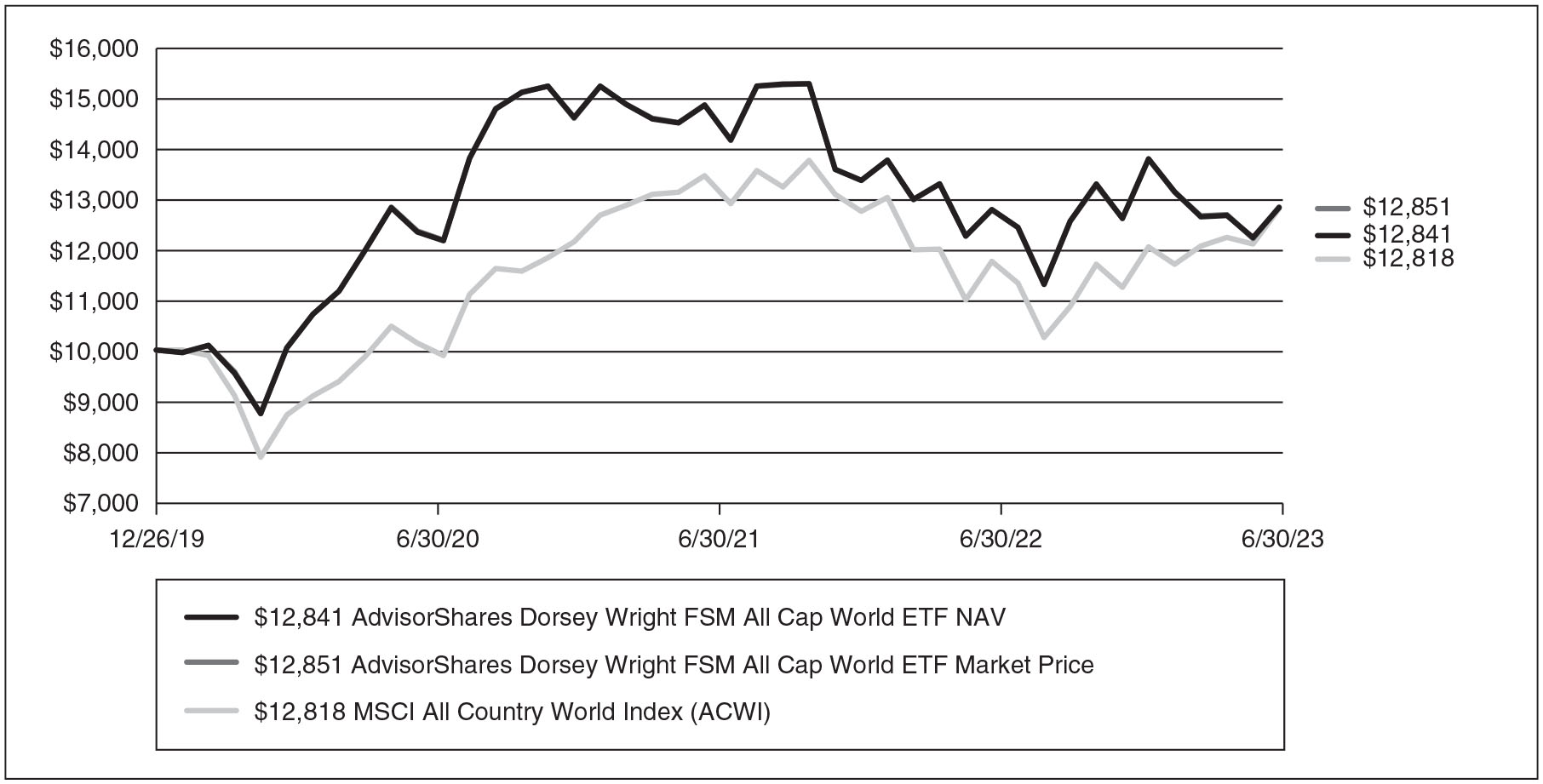

AdvisorShares Dorsey Wright FSM All Cap World ETF (DWAW)

During the fiscal year ended June 30, 2023, the AdvisorShares Dorsey Wright FSM All Cap World ETF (ticker: DWAW) lagged its benchmark, the MSCI ACWI Index. Much of the underperformance took place in the first quarter of 2023 as growth, an area DWAW underweighted entering the year, vastly outpaced value. In May, DWAW adjusted its growth position to take advantage of the high relative strength in large cap growth and picked up non-US developed market exposure. The strong start by international developed equities slowed in the second quarter which dragged down DWAW despite the fund picking up large cap growth in May. Most momentum and relative strength strategies have struggled so far in 2023 due to the quick change in leadership that began in late 2022 and became more entrenched early in 2023.

There has been plenty of commentary on the narrowness of market performers this year with just a few names producing most of the major indices’ returns this year. These names also happened to be some of the biggest losers in 2022, so relative strength strategies like DWAW had little to no exposure entering 2023.

Looking ahead, the growth theme has shown no sign of slowing down yet. However, there are still worries that the reliance on so few names, coupled with exceptionally strong performances, will not be able to carry over into the second half. Nonetheless, the market has begun to broaden out on the domestic front over the last month and a half which is a welcome sign moving forward. Even though DWAW picked up some international exposure, it did it at a time when relative strength had peaked. It would not be a shock if this was changed in August, the next evaluation period, if the most recent trends persist.

The MSCI All Country World Index (Net) is an unmanaged free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period December 26, 2019* to June 30, 2023

7

HISTORICAL PERFORMANCE

Total Return as of June 30, 2023

| Since | ||||||||||||

| Inception | ||||||||||||

| 1 Year | 3 Year | 12/26/2019* | ||||||||||

| AdvisorShares Dorsey Wright FSM All Cap World ETF NAV | 4.63 | % | 4.74 | % | 7.38 | % | ||||||

| AdvisorShares Dorsey Wright FSM All Cap World ETF Market Price** | 4.71 | % | 4.77 | % | 7.40 | % | ||||||

| MSCI All Country World Index (ACWI) | 16.53 | % | 10.99 | % | 7.32 | % | ||||||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.28% and the net expense ratio is 1.28%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.99%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. | |

| ** | The price used to calculate market return (“Market Price”) is determined by using the closing price listed on the Nasdaq and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The MSCI All Country World Index (Net) is an unmanaged free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. One cannot invest directly in an index.

8

ADVISORSHARES TRUST

AdvisorShares Dorsey Wright FSM US Core ETF (DWUS)

During the fiscal year ended June 30, 2023, the AdvisorShares Dorsey Wright FSM U.S. Core ETF (ticker: DWUS) lagged its benchmark, the S&P 500 Index. Much of the underperformance took place in the first quarter of 2023 as growth, an area DWUS was underweight, vastly outpaced value. In May, DWUS adjusted its growth position to take advantage of the high relative strength in large cap growth. Most momentum and relative strength strategies have struggled so far in 2023 due to the quick change in leadership that began in late 2022 and became more entrenched early in 2023.

There has been plenty of commentary on the narrowness of market performers this year with just a few names producing most of the major indices’ returns this year. These names also happened to be some of the biggest losers in 2022, so relative strength strategies like DWUS had little to no exposure to them entering 2023. This dampened DWUS’s performance going into 2023. However, the portfolio adjusted and added exposure to the new strength in growth that led DWUS to perform much better in the second quarter.

Looking ahead, the growth theme has shown no signs of slowing down yet. However, there are still worries that the reliance on so few names, coupled with exceptionally strong performances, will not be able to carry over into the second half. Nonetheless, the market has begun to broaden over the last month and a half, which is a welcome sign moving forward. While returns may not be as strong as they were in the first half, there have not been any signs that stocks will reverse significantly lower, giving a cautiously optimistic picture for the rest of the year.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period December 26, 2019* to June 30, 2023

9

HISTORICAL PERFORMANCE

Total Return as of June 30, 2023

| Since | ||||||||||||

| Inception | ||||||||||||

| 1 Year | 3 Year | 12/26/2019* | ||||||||||

| AdvisorShares Dorsey Wright FSM US Core ETF NAV | 15.38 | % | 10.69 | % | 11.90 | % | ||||||

| AdvisorShares Dorsey Wright FSM US Core ETF Market Price** | 15.61 | % | 10.74 | % | 11.88 | % | ||||||

| S&P 500 Index | 19.59 | % | 14.60 | % | 11.27 | % | ||||||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.17% and the net expense ratio is 1.17%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.99%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. | |

| ** | The price used to calculate market return (“Market Price”) is determined by using the closing price listed on the Nasdaq and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

10

ADVISORSHARES TRUST

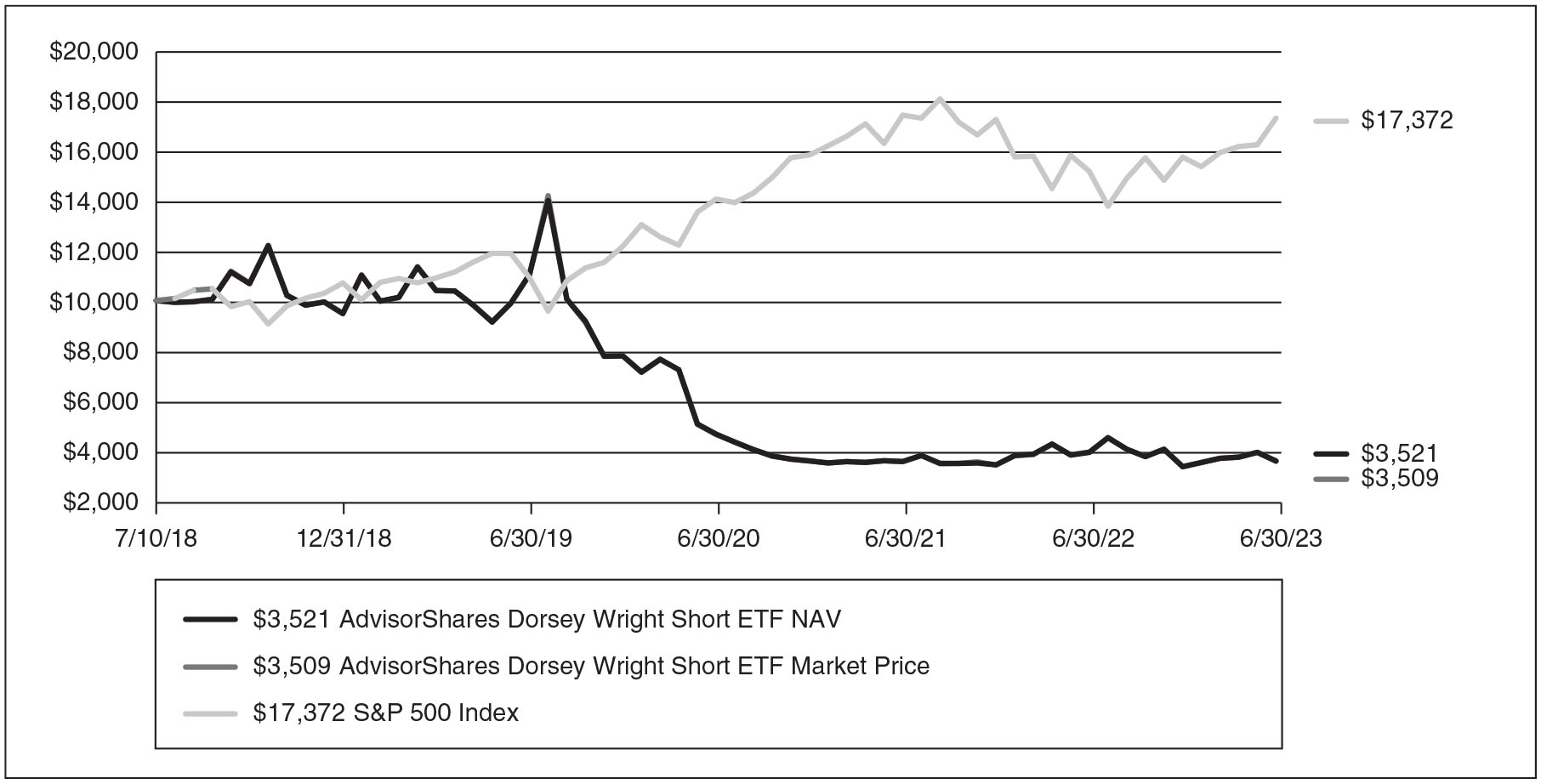

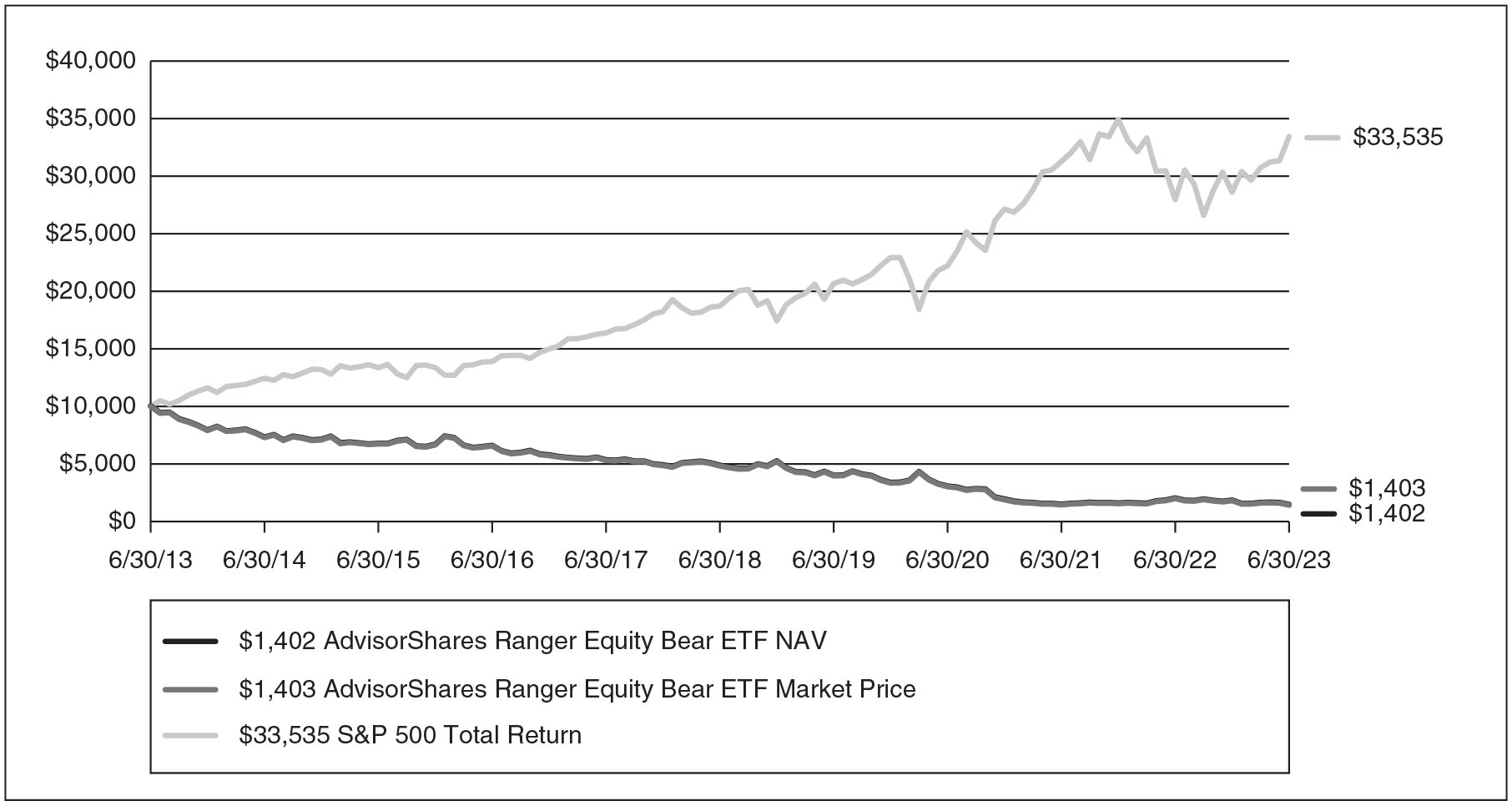

AdvisorShares Dorsey Wright Short ETF (DWSH)

The AdvisorShares Dorsey Wright Short ETF (ticker: DWSH) finished the fiscal year ended June 30, 2023, ahead of its benchmark, the inverse of the S&P 500 Index. The market was close to a bottom at the start of the fiscal year but managed to end the year higher despite the bear market in US equities in 2022.

In the second half of 2022, US Equity markets rose slightly, but endured high volatility as the bear market searched for a bottom. This kind of volatility is tough for a relative strength strategy, and thus we saw the portfolio underperform during this time as leadership changed after the October bottom. In the first half of 2023, our shorts were able to lose less than the S&P 500 gained. Much of this came from shorting high-profile decliners such as Silicon Valley Bank and Signature Bank.

Our asset class rankings show a much-improved picture for equities in 2023, meaning the short fund will have a tougher time going forward, but we still feel like the use of the product as a hedge continues to remain attractive when needed as relative strength can guide the portfolio toward individual names showing pronounced weakness and thus potential outperformance.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period July 10, 2018* to June 30, 2023

11

HISTORICAL PERFORMANCE

Total Return as of June 30, 2023

| Since | ||||||||||||

| Inception | ||||||||||||

| 1 Year | 3 Year | 7/10/2018* | ||||||||||

| AdvisorShares Dorsey Wright Short ETF NAV | -16.31 | % | -23.13 | % | -18.94 | % | ||||||

| AdvisorShares Dorsey Wright Short ETF Market Price** | -16.27 | % | -23.26 | % | -18.99 | % | ||||||

| S&P 500 Index | 19.59 | % | 14.60 | % | 11.75 | % | ||||||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 2.69% and the net expense ratio is 2.69%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 1.25%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. | |

| ** | The price used to calculate market return (“Market Price”) is determined by using the closing price listed on the Nasdaq and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

12

ADVISORSHARES TRUST

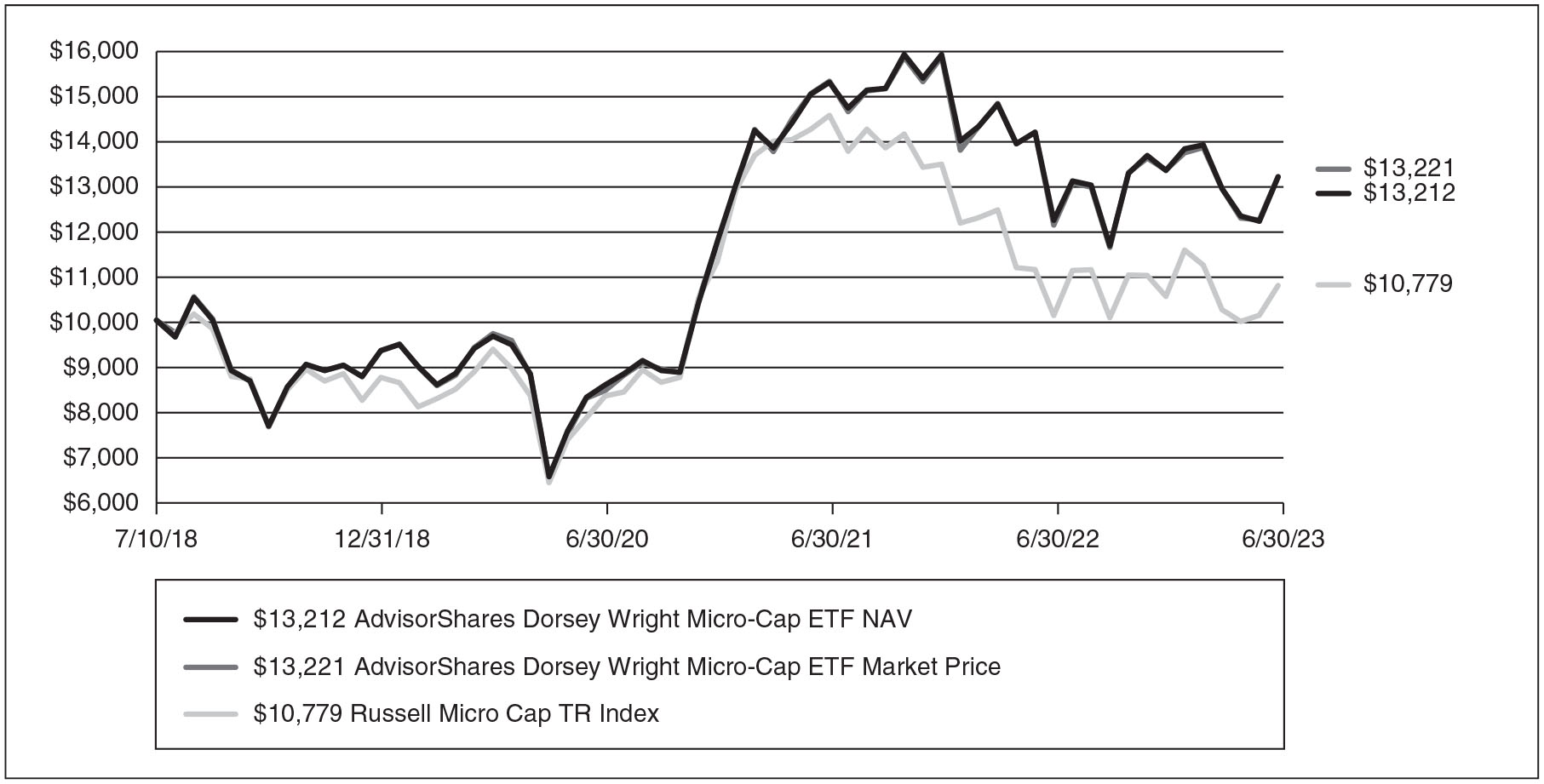

AdvisorShares Dorsey Wright Small Company ETF (DWMC)

The AdvisorShares Dorsey Wright Small Company ETF (ticker: DWMC) finished the fiscal year ended June 30, 2023, ahead of its benchmark, the Russell Micro-Cap Index. Although returns were positive, the path to achieving those returns was fraught with peril. Small/Micro cap stocks were some of the worst hit areas during the many declines, but relative strength was able to guide us toward names that outperformed.

Microcaps rallied strongly off the June 2022 bottom with indications we were heading into a new bull market. It can be tough for a relative strength strategy to perform well off a market bottom as leadership typically changes, and because of that we saw DWMC lag the benchmark during the rally. The September/October decline though was a continuation of the previous downtrend established earlier in the year, and DWMC was able to outperform during the decline as less sensitive areas of the market held up better. Luckily, the October lows proved more durable, and the ensuing rally saw DWMC outpace the benchmark through February 2023. The Silicon Valley Bank collapse in March, though, hit the space especially hard and sent it to new lows by May. Once again though, DWMC bested the benchmark as it was less exposed to some of the harder hit areas.

Given stretched consumer sentiment, we feel the prospects for micro-cap stocks continue to be strong despite the bear market. Valuations for smaller stocks continue to be attractive relative to large caps, with a large valuation gap between the smallest and largest companies. This can persist for long periods but doesn’t last forever. We believe the fund is well-positioned to capitalize on a narrowing valuation gap when it comes.

The Russell Micro-Cap Index measures the performance of the micro cap segment of the U.S. equity market. It includes 1,000 of the smallest securities in the Russell 2000 Index based on a combination of their market cap and current index membership and it also includes up to the next 1,000 stocks.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period July 10, 2018* to June 30, 2023

13

HISTORICAL PERFORMANCE

Total Return as of June 30, 2023

| Since | ||||||||||||

| Inception | ||||||||||||

| 1 Year | 3 Year | 7/10/2018* | ||||||||||

| AdvisorShares Dorsey Wright Small Company ETF NAV | 7.94 | % | 15.61 | % | 5.76 | % | ||||||

| AdvisorShares Dorsey Wright Small Company ETF Market Price** | 8.96 | % | 16.21 | % | 5.78 | % | ||||||

| Russell Micro-Cap Index | 6.63 | % | 9.09 | % | 1.52 | % | ||||||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.95% and the net expense ratio is 1.95%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 1.25%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. | |

| ** | The price used to calculate market return (“Market Price”) is determined by using the closing price listed on the Nasdaq and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The Russell Micro-Cap Index measures the performance of the micro cap segment of the U.S. equity market. It includes 1,000 of the smallest securities in the Russell 2000 Index based on a combination of their market cap and current index membership and it also includes up to the next 1,000 stocks.

14

ADVISORSHARES TRUST

AdvisorShares Focused Equity ETF (CWS)

For the 12 months ended June 30, 2023, the AdvisorShares Focused Equity ETF (ticker: CWS) gained 27.59% (NAV) and 28.10% (market price).

CWS’s performance was greatly helped by the overall market’s turn towards caution. The initial burst of bullish sentiment following COVID-19 gradually gave way to a more conservative and skeptical market. This worked in favor of CWS. The fund was also aided by the generally conservative and high-quality stocks it holds. The portfolio is purposely designed for long-term performance. As such, the near-term fluctuations in the market don’t have a major impact on our investing results. The fund benefited greatly from the overall market’s rally since its low in October 2022. Many of CWS’s holdings have rallied 20% or 30%, and a few have gained much more.

We continue to be optimistic for the fund. A slowing economy in 2024 would have little impact on many of CWS’s holdings since they generally have a defensive posture. Also, most of the holdings have very strong balance sheets that should help them weather whatever comes their way. We’ve designed CWS so that it holds firms we see as having lasting competitive advantages.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period September 20, 2016* to June 30, 2023

15

HISTORICAL PERFORMANCE

Total Return as of June 30, 2023

| Since | ||||||||||||||||

| Inception | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | 9/20/2016* | |||||||||||||

| AdvisorShares Focused Equity ETF NAV | 27.59 | % | 14.93 | % | 11.90 | % | 12.63 | % | ||||||||

| AdvisorShares Focused Equity ETF Market Price** | 28.10 | % | 15.90 | % | 11.96 | % | 12.68 | % | ||||||||

| S&P 500 Index | 19.59 | % | 14.60 | % | 12.31 | % | 13.45 | % | ||||||||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.09% and the net expense ratio is 1.09%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding the range from 0.65% to 0.85%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. | |

| ** | The price used to calculate market return (“Market Price”) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

16

ADVISORSHARES TRUST

AdvisorShares Gerber Kawasaki ETF (GK)

The AdvisorShares Gerber Kawasaki ETF (ticker: GK) had very respectable performance for the fiscal year ended June 30, 2023, after completing the bear market cycle. Hitting a new low in December 2022, the fund rebounded dramatically over the last six months, producing positive returns for shareholders for the fiscal year and a dividend paid from income generated from our investments. GK recovered value rapidly: in the first six months of 2023 the fund achieved a 20% return (NAV) which handily beat the S&P 500 Index. Unfortunately, during 2022, growth investments were hammered which included GK and our investment in the consumer, technology, and climate sectors. This trend reversed itself in 2023: these sectors are outperforming and GK’s portfolio investments have done well, as we would expect in a positive economic environment.

In particular, we witnessed a complete turnaround in securities like NVIDIA and Tesla which are top holdings of the fund. In 2022, these stocks lost tremendous value, but have since gained it back in 2023. We’ve seen similar trends in the various sectors that we are invested in.

We are hopeful that in the new economic cycle GK will continue its outperformance as it has in the last six months. During the remainder of 2023, our goal is to recover the value lost by GK in the market decline of 2022. We believe our focus on AI and technology, climate change investments, and the consumer will pay off for our shareholders over the long term and we remain more confident than ever in our multi thematic investment approach. Thank you for your patience during the bear market of 2022. We are excited about the new bull cycle that began in 2023 that, hopefully, will continue for some time.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period July 2, 2021* to June 30, 2023

17

HISTORICAL PERFORMANCE

Total Return as of June 30, 2023

| Since | ||||||||

| Inception | ||||||||

| 1 Year | 7/2/2021* | |||||||

| AdvisorShares Gerber Kawasaki ETF NAV | 11.21 | % | -14.81 | % | ||||

| AdvisorShares Gerber Kawasaki ETF Market Price** | 11.09 | % | -14.82 | % | ||||

| S&P 500 Index | 19.59 | % | 3.12 | % | ||||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.43% and the net expense ratio is 1.43%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.75%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. | |

| ** | The price used to calculate market return (“Market Price”) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

18

ADVISORSHARES TRUST

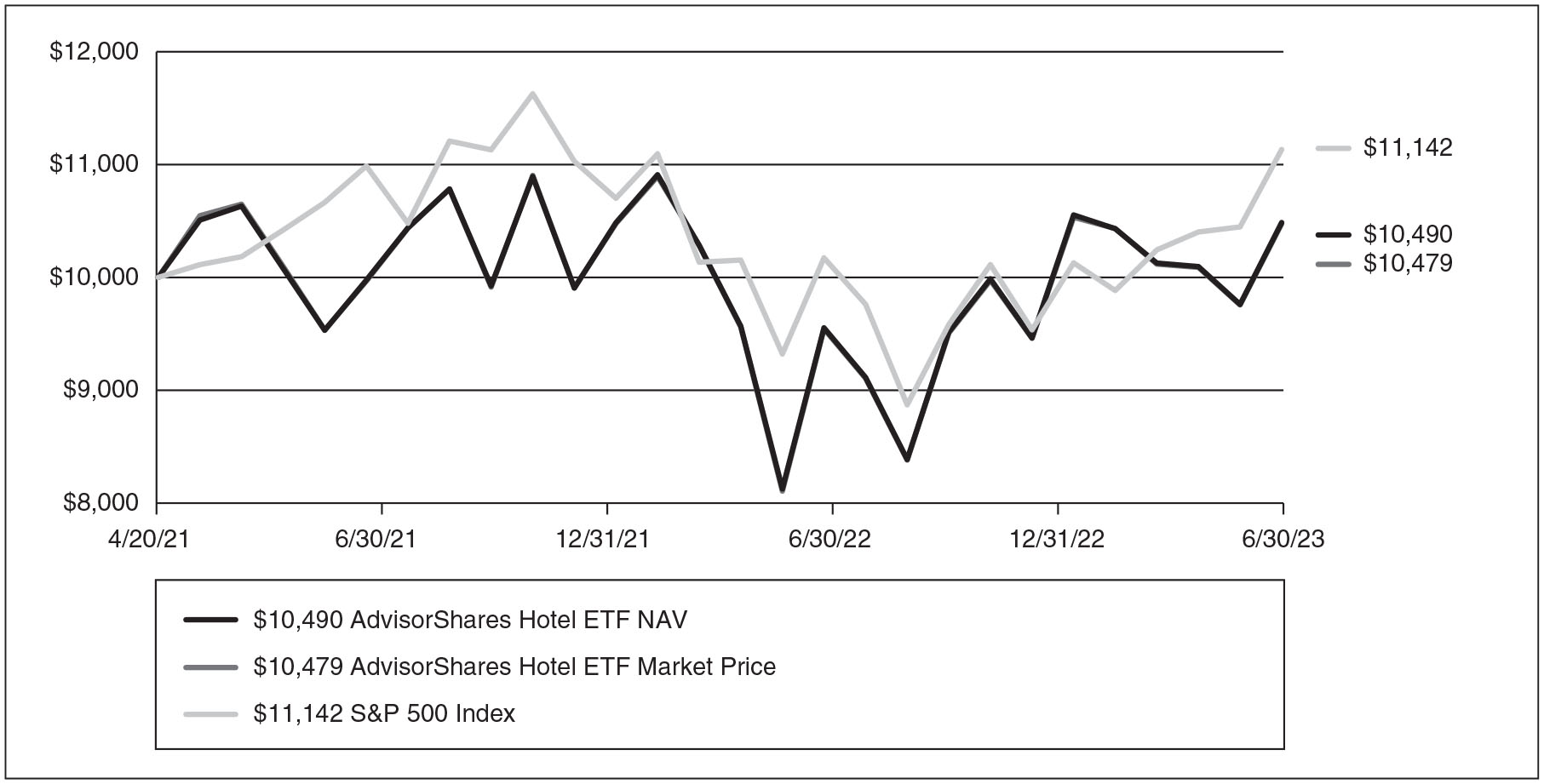

AdvisorShares Hotel ETF (BEDZ)

The AdvisorShares Hotel ETF (ticker: BEDZ) was launched in the Spring of 2021. During the past fiscal year (July 1, 2022, to June 30, 2023), the Fund achieved a return of +29.33% (NAV), outperforming the S&P 500 Index. BEDZ’s performance closely aligns with the success of the hotel industry, which plays a crucial role in the global travel and tourism sector. This industry encompasses various types of accommodations, including luxury hotels, resorts, budget hotels, boutique hotels, and more. The hotel industry is significantly influenced by economic conditions, travel trends, technological advancements, and global events. Despite concerns of a potential recession, growth has been driven by the strong desire to travel post-pandemic and an increase in corporate travel. Investors considering a focused fund within this industry should have a long-term perspective.

We maintain an optimistic outlook on the future growth of the hotel and travel sector as the world gradually returns to a more normal business travel environment. While we hold a positive view of the overall hotel industry, BEDZ aims to achieve relative outperformance through careful selection of individual securities within the hotel sector and related areas, supported by effective trading techniques.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period April 20, 2021* to June 30, 2023

19

HISTORICAL PERFORMANCE

Total Return as of June 30, 2023

| Since | ||||||||

| Inception | ||||||||

| 1 Year | 4/20/2021* | |||||||

| AdvisorShares Hotel ETF NAV | 29.33 | % | 2.20 | % | ||||

| AdvisorShares Hotel ETF Market Price** | 29.49 | % | 2.15 | % | ||||

| S&P 500 Index | 19.59 | % | 5.05 | % | ||||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.33% and the net expense ratio is 1.33%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.99%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. | |

| ** | The price used to calculate market return (“Market Price”) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

20

ADVISORSHARES TRUST

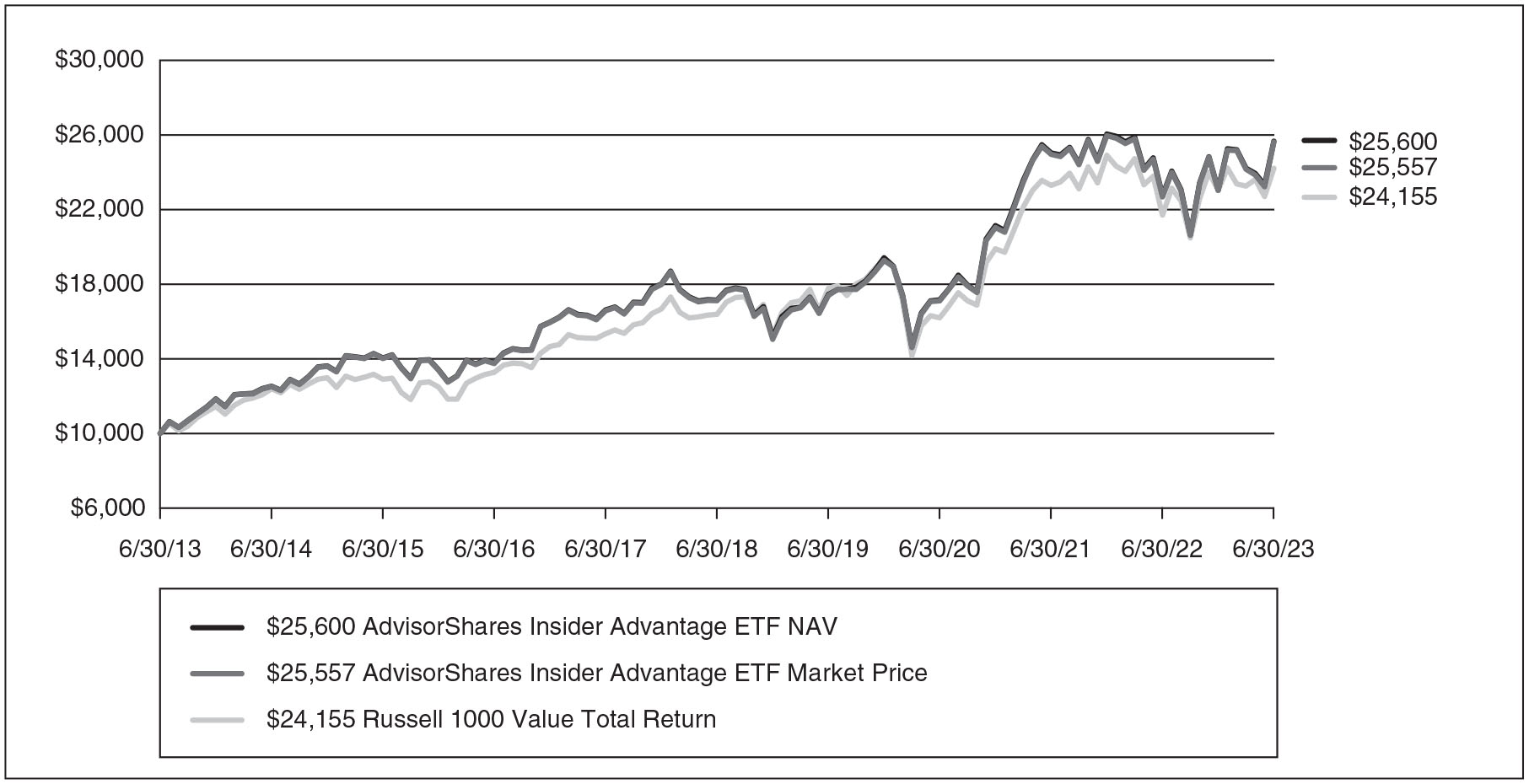

AdvisorShares Insider Advantage ETF (SURE)

The AdvisorShares Insider Advantage ETF (ticker: SURE) was launched in September 2022.* Through June 30, 2023, SURE had 10 months of performance, with a return of 11.38% (NAV) since its inception. The fund’s performance tracks a basket of companies actively repurchasing their outstanding stock and/or paying dividends. With the pace of new stock buybacks and dividends remaining stable, SURE provides investors with a compelling opportunity to capitalize on these shareholder-friendly practices. SURE’s portfolio holds companies that we believe have displayed a commitment to returning value to their shareholders, indicating a strong financial position and management’s confidence in future growth prospects.

Despite a new 1% U.S. federal tax on them, share buybacks set a worldwide record of $1.3 trillion in 2022. And this growth does not appear to be an isolated event: buybacks have nearly tripled in value since 2012. This trend indicates that the management teams of these companies are confident in their growth strategies and believe that returning capital to shareholders is an effective way to demonstrate that confidence. As such, investors who are seeking both stability and the potential for increased returns may find this fund appealing, given its attractive combination of buybacks and dividends from companies with strong fundamentals and a shareholder-friendly approach. We maintain an optimistic outlook for SURE.

| * | On September 1, 2022, the AdvisorShares DoubleLine Value Equity ETF (DBLV) was renamed the AdvisorShares Insider Advantage ETF. DBLV had different portfolio managers and investment strategy than the AdvisorShares Insider Advantage ETF. |

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period June 30, 2013 to June 30, 2023

21

HISTORICAL PERFORMANCE

Total Return as of June 30, 2023

| 1 Year | 3 Year | 5 Year | 10 Year | |||||||||||||

| AdvisorShares Insider Advantage ETF NAV | 12.78 | % | 14.33 | % | 8.38 | % | 9.86 | % | ||||||||

| AdvisorShares Insider Advantage ETF Market Price* | 12.95 | % | 14.38 | % | 8.38 | % | 9.84 | % | ||||||||

| Russell 1000 Value Total Return | 11.54 | % | 14.30 | % | 8.11 | % | 9.22 | % | ||||||||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.96% and net expense ratio is 0.96%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.90%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | The price used to calculate market return (“Market Price”) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The Russell 1000 Value Total Return Index measures the performance of the large-cap value segment of the U.S. equity market. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected and historical growth rates.

22

ADVISORSHARES TRUST

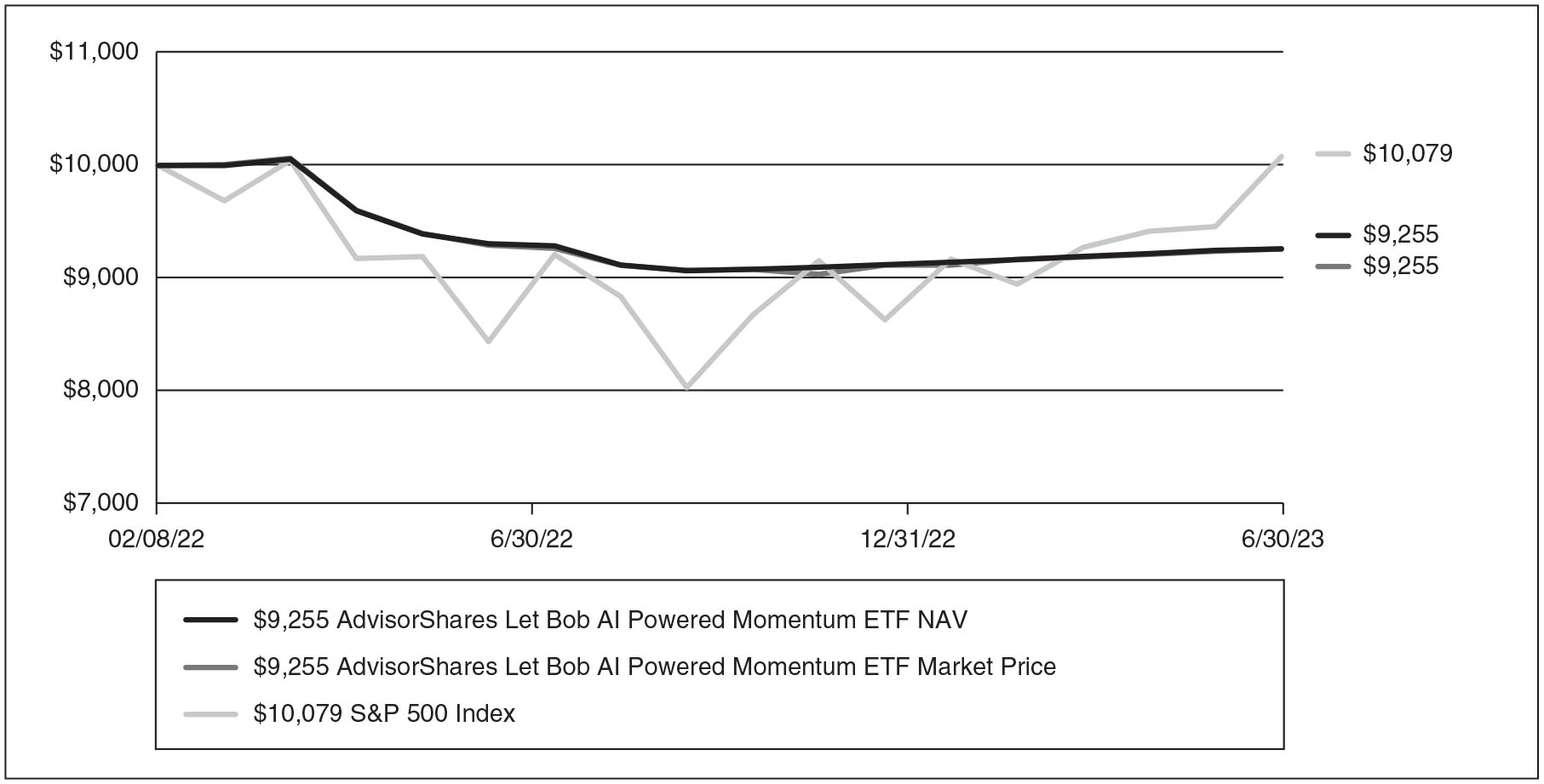

AdvisorShares Let Bob AI Powered Momentum ETF (LETB)

The AdvisorShares Let Bob AI Momentum ETF (ticker: LETB) finished the fiscal year ended June 30,2023 with a return of -0.36% (market). We maintained a defensive cash position for most of this time frame, as LETB’s tactical investment strategy uses macro technical analysis to identify asset classes expected to perform well in upward trending markets.

Overall, the stock market was very volatile during the fiscal year. The Federal Reserve tightened monetary policy as inflation rose, reaching a 40-year high. The Fed’s unprecedented series of interest rate increases sent stocks into a bear market. The war in Ukraine also led to supply chain disruptions and higher energy prices throughout the global economy.

Investor concerns over rising interest rates, slowing economic growth, and persistently high inflation have subsided in recent months. Markets have started off strong, with the Fed leaving rates unchanged for the first time since March 2022. If the current market conditions persist, we expect LETB’s investment model to continue to signal us to seek opportunities in high momentum names.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period February 9, 2022* to June 30, 2023

23

HISTORICAL PERFORMANCE

Total Return as of June 30, 2023

| Since | ||||||||

| Inception | ||||||||

| 1 Year | 2/9/2022* | |||||||

| AdvisorShares Let Bob AI Powered Momentum ETF NAV | -0.50 | % | -5.42 | % | ||||

| AdvisorShares Let Bob AI Powered Momentum ETF Market Price** | -0.36 | % | -5.43 | % | ||||

| S&P 500 Index | 19.59 | % | 0.57 | % | ||||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.56% and the net expense ratio is 1.56%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.99%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. | |

| ** | The price used to calculate market return (“Market Price”) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

24

ADVISORSHARES TRUST

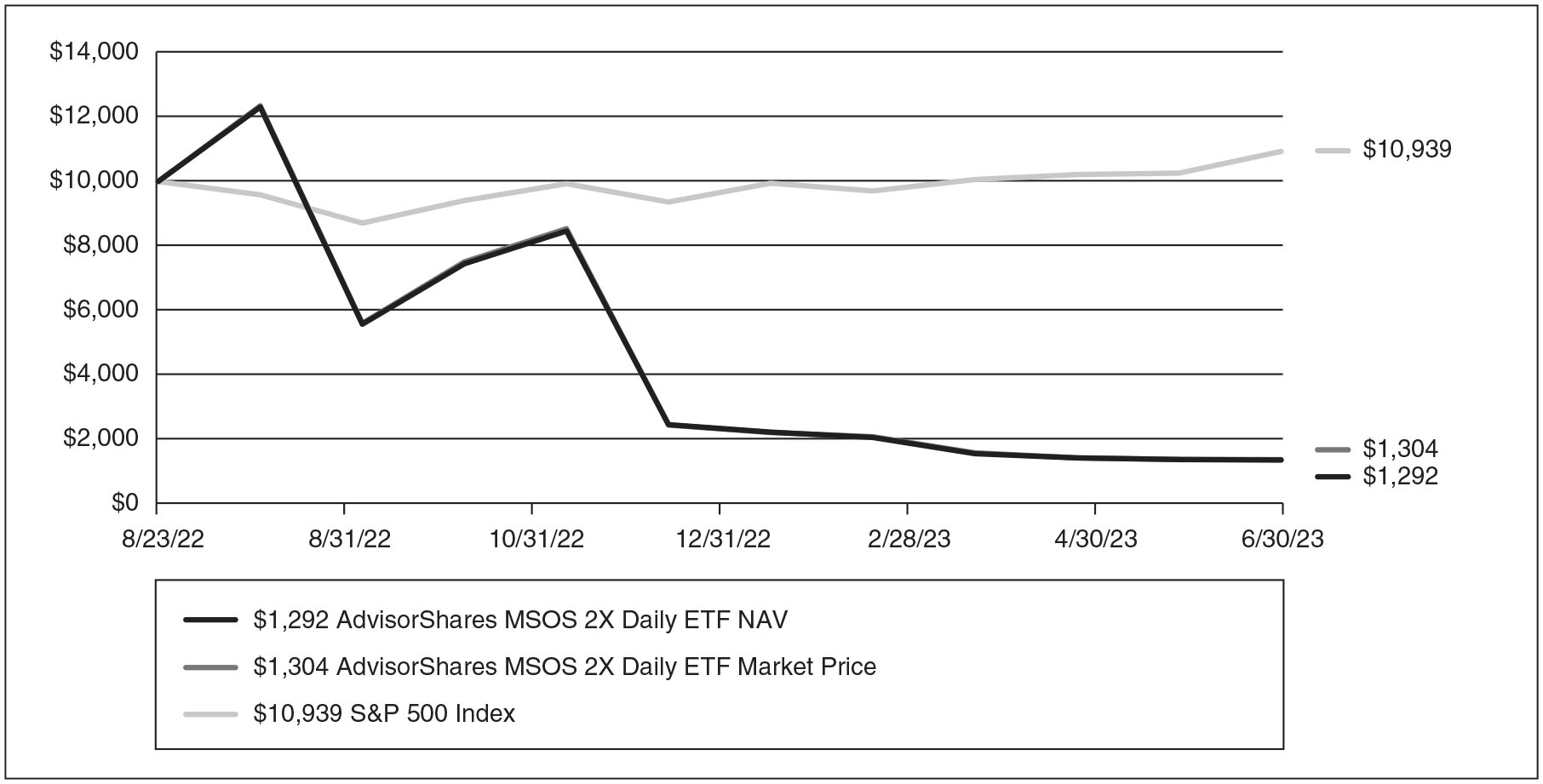

AdvisorShares MSOS 2x Daily ETF (MSOX)

The AdvisorShares MSOS 2X Daily ETF (ticker: MSOX) launched August 23, 2022. The Fund seeks to provide two times (2x) the daily exposure of the AdvisorShares Pure US Cannabis ETF (MSOS) in a single trade and is designed for sophisticated investors looking to gain magnified exposure to the U.S. cannabis sector. Since its inception through June 30, 2023, MSOX had a return of -87.08% (NAV).

Due to its exclusive emphasis on the United States and use of leverage, the MSOX is particularly vulnerable to volatility arising from U.S. cannabis legislation and potential modifications to such laws. The Fund’s future performance is anticipated to be influenced by the ongoing expansion of state-by-state cannabis sales in the U.S., and it may also be significantly impacted by expected reforms in federal cannabis laws.

Given the current price levels, we maintain a strongly optimistic outlook on the U.S. cannabis market and the likelihood of favorable changes in U.S. federal cannabis regulations.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period August 24, 2022* to June 30, 2023

25

HISTORICAL PERFORMANCE

Total Return as of June 30, 2023

| Since | ||||

| Inception | ||||

| 8/24/2022* | ||||

| AdvisorShares MSOS 2x Daily ETF NAV | -87.08 | % | ||

| AdvisorShares MSOS 2x Daily ETF Market Price** | -86.96 | % | ||

| S&P 500 Index | 9.39 | % | ||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.12% and net expense ratio is 1.12%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.95%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. | |

| ** | The price used to calculate market return (“Market Price”) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

26

ADVISORSHARES TRUST

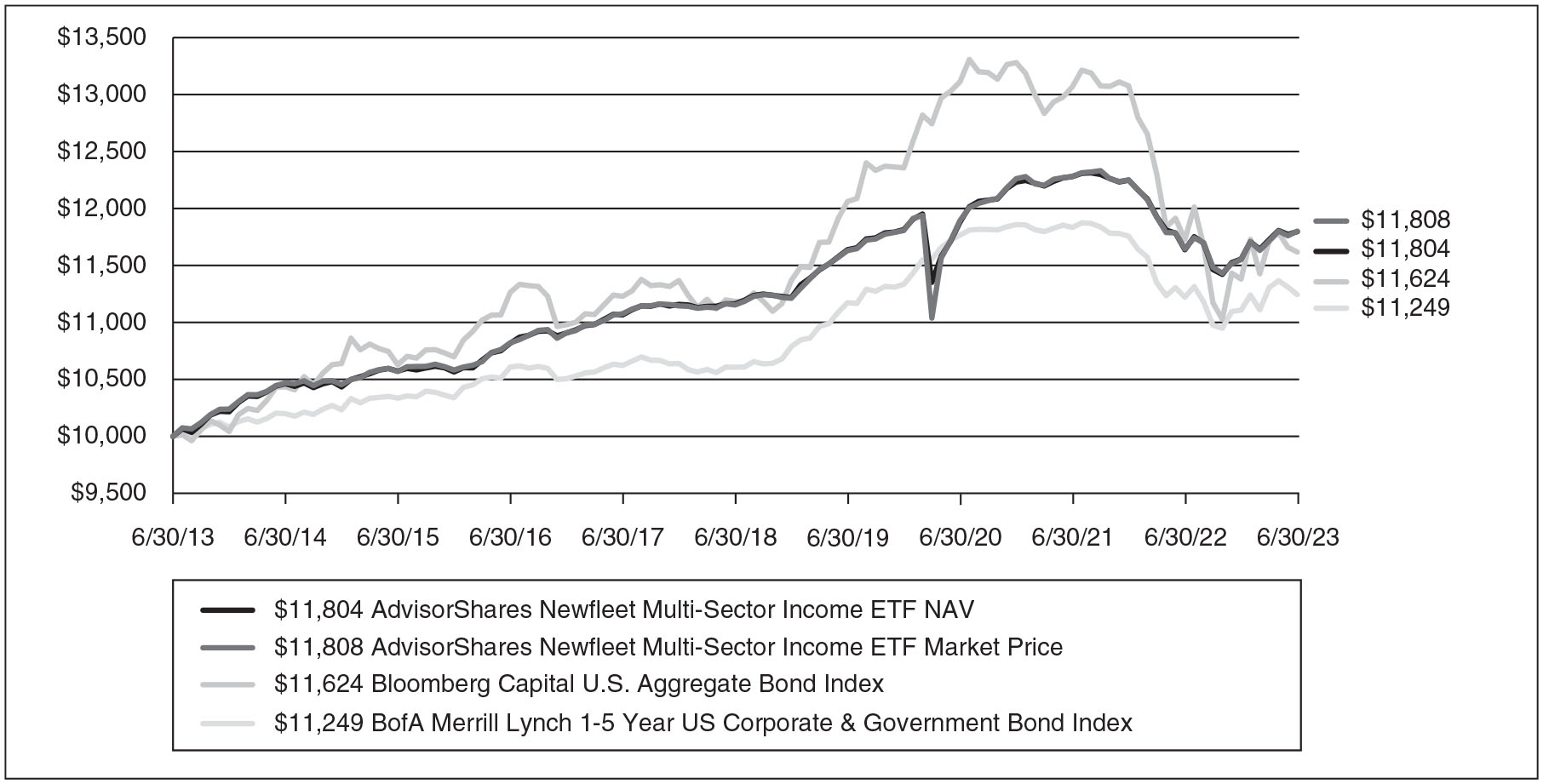

AdvisorShares Newfleet Multi-Sector Income ETF (MINC)

The AdvisorShares Newfleet Multi-Sector Income ETF (ticker: MINC) posted a return of 1.36%, based on NAV and 1.33%, based on market price as compared to -0.94% for the Bloomberg U.S. Aggregate Bond Index and 0.21% for the BofA Merrill lynch 1-5 Year U.S. Corporate & Government Bond Index for the 1-year period ended June 30, 2023.

Global central banks continued to fight inflation during the second half of 2022 with a series of unusually large policy rate increases. 2023 has been a year of transition. China’s transition from a strict zero-COVID policy to a more broad reopening of its economy brought stronger initial economic data releases that later faded, with new calls for stimulus emerging by the end of the period. In the U.S., we saw the Federal Reserve (Fed) in transition as it opted to hold its federal funds rate steady for the first time in more than a year after raising the target rate at every meeting since March of 2022. Economic growth is transitioning towards a slower pace in some parts of the world and proving more resilient in others. Unfortunately, we have yet to witness a transition towards peace in Eastern Europe. Financial markets continue to take most of these transitions in stride and seem to be embracing the view that any pain related to these changes would be shallow and short-lived. Washington was able to put its differences aside temporarily to address the U.S. debt ceiling, and the stresses in the banking system that emerged at the end of the first quarter have largely abated. Though this is certainly welcome news, it warrants monitoring.

During the one-year period, MINC’s underweight to U.S. Treasuries and allocation to bank loans contributed to the outperformance for the period. A solid technical driven by limited loan supply, hawkish Fed comments and solid economic numbers are resetting rate expectations higher and pushing out recession expectations further into the future. Allocation to and issue selection within asset backed securities had a positive impact on performance. Though a low unemployment rate, high number of job openings, and wage gains mitigate the effects of higher rates on the consumer, excess savings have come down significantly. Issue selection within investment grade corporate bonds positively contributed to performance primarily driven by the Fund’s overweight to BBB securities which outperformed versus higher quality bonds within the sector. The Fund’s higher quality bias within corporate high yield bonds and issue selection within non-agency mortgage-backed securities (RMBS) detracted from performance. The rapid move higher in rates extended the average lives of certain RMBS due to much slower prepayments.

MINC’s multi-sector relative value approach enables the ETF to take advantage of opportunities when events that trigger volatility, such as inflation worries or concerns around the banking industry, affect valuations. In the current environment, we believe some of the best total return and yield opportunities can be found in spread sectors. However, given the risk of a recession, the Fund’s exposure to spread sectors that would typically be more negatively impacted, such as corporate high yield and bank loans, are at historically low levels. Credit selection and positioning remain key. Specific sectors that demonstrate the best relative value for us include out-of-index/off-the-run asset-backed securities (ABS), non-agency RMBS and BBB-rated corporate investment grade bonds.

The Bloomberg U.S. Aggregate Bond Index measures the performance of the U.S. investment grade bond market.

The BofA Merrill Lynch 1-5 Year U.S. Corporate & Government Bond Index tracks the performance of US dollar denominated investment grade debt publicly issued in the US domestic market, including US Treasury, US agency, foreign government, supranational and corporate securities, with a remaining term to final maturity less than 5 years, calculated on a total return basis.

27

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period June 30, 2013 to June 30, 2023

HISTORICAL PERFORMANCE

Total Return as of June 30, 2023

| 1 Year | 3 Year | 5 Year | 10 Year | |||||||||||||

| AdvisorShares Newfleet Multi-Sector Income ETF NAV | 1.36 | % | -0.24 | % | 1.12 | % | 1.67 | % | ||||||||

| AdvisorShares Newfleet Multi-Sector Income ETF Market Price* | 1.33 | % | -0.27 | % | 1.14 | % | 1.67 | % | ||||||||

| Bloomberg U.S. Aggregate Bond Index | -0.94 | % | -3.96 | % | 0.77 | % | 1.52 | % | ||||||||

| BofA Merrill Lynch 1-5 Year U.S. Corporate & Government Bond Index | 0.21 | % | -1.51 | % | 1.18 | % | 1.18 | % | ||||||||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.76% and net expense ratio is 0.76%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.75%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | The price used to calculate market return (“Market Price”) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The Bloomberg U.S. Aggregate Bond Index measures the performance of the U.S. investment grade bond market. One cannot invest directly in an index.

The BofA Merrill Lynch 1-5 Year U.S. Corporate & Government Bond Index tracks the performance of US dollar denominated investment grade debt publicly issued in the US domestic market, including US Treasury, US agency, foreign government, supranational and corporate securities, with a remaining term to final maturity less than 5 years, calculated on a total return basis. One cannot invest directly in an index.

28

ADVISORSHARES TRUST

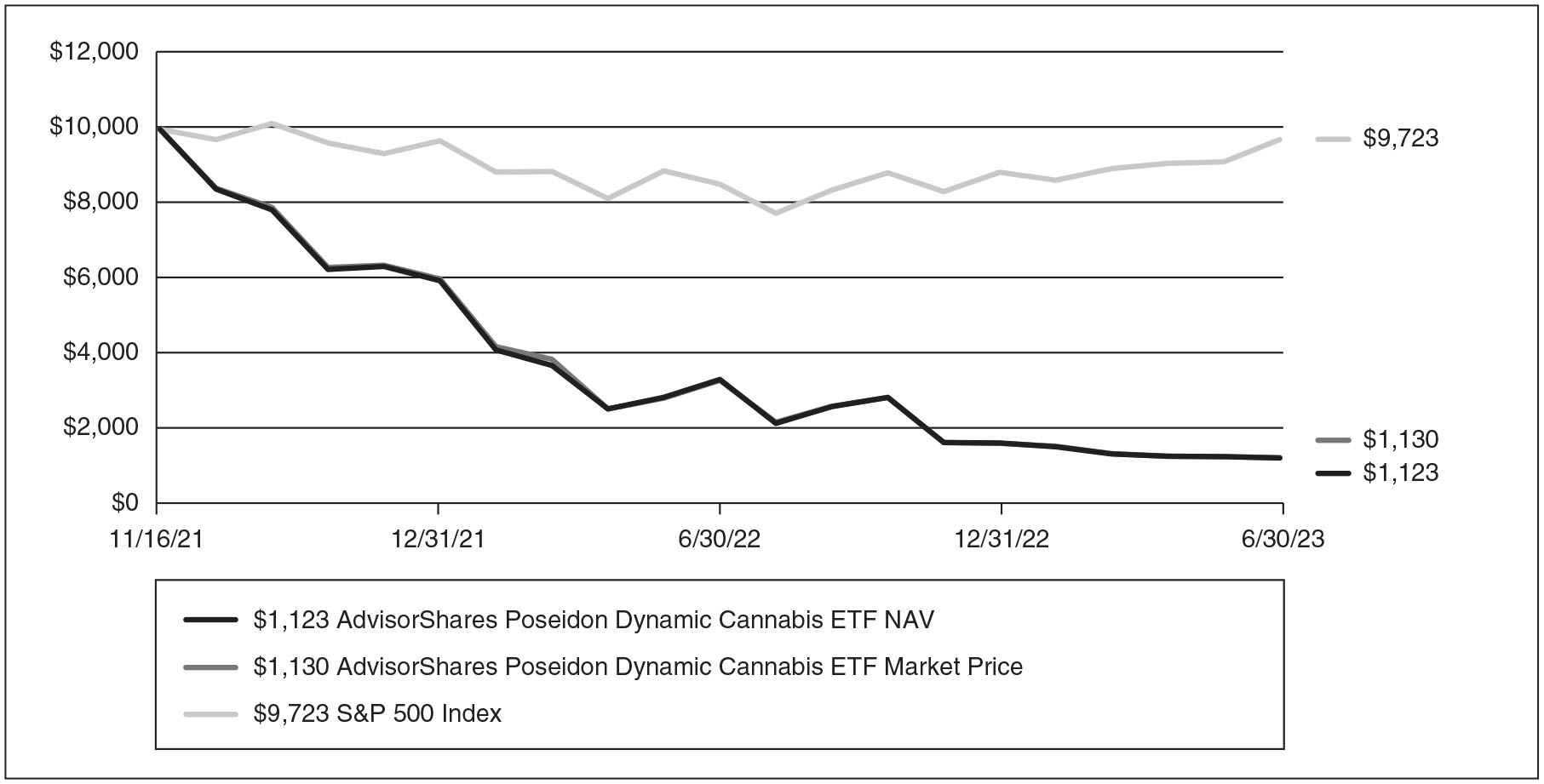

AdvisorShares Poseidon Dynamic Cannabis ETF (PSDN)

The AdvisorShares Poseidon Dynamic Cannabis ETF (ticker: PSDN) launched in November of 2021. During the fiscal year ended June 30, 2023, while its performance has been negative, PSDN has experienced new share creations of nearly $1 million of inflows. These inflows were despite incredibly challenging times in cannabis and broader markets. PSDN can actively use moderate levels of leverage, at portfolio management’s discretion, and had an average leverage position of 1.08% during the fiscal year.

The cannabis sector largely peaked in February 2021 and has been mostly negative for 18 months through June 30, 2023. It is our belief that most of the initial decline was attributable to overly optimistic expectations. Declines over the last year are likely from a dwindling of custody access that caused forced selling coupled with continued investor expectations of federal reform, which has failed to materialize. As a result, analyst and investor expectations have repriced lower along with lowering guidance through 2024.

As we enter the second half of 2023, we do not expect any meaningful federal progress on cannabis reform. Our focus remains on more of a bottom-up approach driven by portfolio companies’ management execution, capital allocation, and unlocking profitable growth organically and through strategic merger and acquisition.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period November 17, 2021* to June 30, 2023

29

HISTORICAL PERFORMANCE

Total Return as of June 30, 2023

| Since | ||||||||

| Inception | ||||||||

| 1 Year | 11/17/2021* | |||||||

| AdvisorShares Poseidon Dynamic Cannabis ETF NAV | -54.11 | % | -74.08 | % | ||||

| AdvisorShares Poseidon Dynamic Cannabis ETF Market Price** | -53.88 | % | -73.99 | % | ||||

| S&P 500 Index | 19.59 | % | -1.72 | % | ||||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 2.59% and the net expense ratio is 2.59%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.99%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. | |

| ** | The price used to calculate market return (“Market Price”) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

30

ADVISORSHARES TRUST

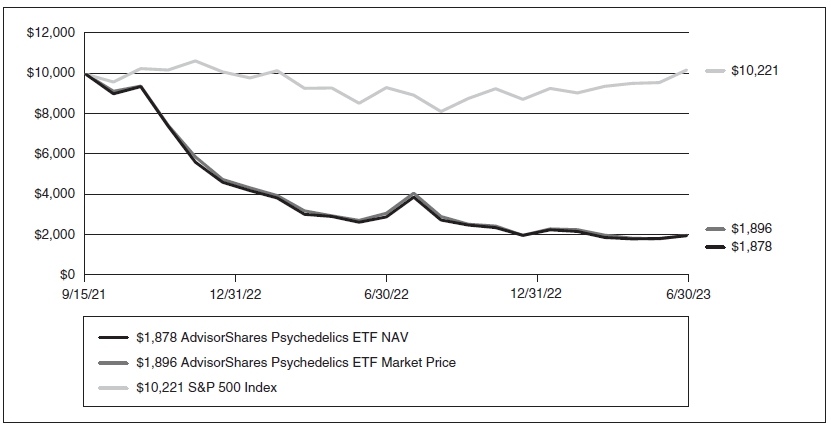

AdvisorShares Psychedelics ETF (PSIL)

The AdvisorShares Psychedelics ETF (ticker: PSIL) was launched on September 15, 2021. The Fund recorded a return of -26.55% (NAV) for the fiscal year ended June 30, 2023. Since its inception, the Fund’s performance has been volatile and predominantly negative. This can be attributed to the fact that the psychedelics market is relatively new and highly concentrated, consisting mainly of micro-cap securities.

Given the nature of the industry, extreme volatility should be expected. The psychedelic sector primarily comprises biotech and pharmaceutical companies focused on mental health. The value of these companies is primarily derived from their intellectual property and drug or treatment pipelines.

Despite the negative performance observed in the past year, we believe psychedelics hold significant potential for long-term investors who are aware of the risks associated with this emerging and nascent industry.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period September 16, 2021* to June 30, 2023

31

HISTORICAL PERFORMANCE

Total Return as of June 30, 2023

| Since | ||||||||

| Inception | ||||||||

| 1 Year | 9/16/2021* | |||||||

| AdvisorShares Psychedelics ETF NAV | -26.55 | % | -60.74 | % | ||||

| AdvisorShares Psychedelics ETF Market Price** | -28.45 | % | -60.52 | % | ||||

| S&P 500 Index | 19.59 | % | 1.23 | % | ||||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 3.11% and the net expense ratio is 3.11%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.99%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. | |

| ** | The price used to calculate market return (“Market Price”) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

32

ADVISORSHARES TRUST

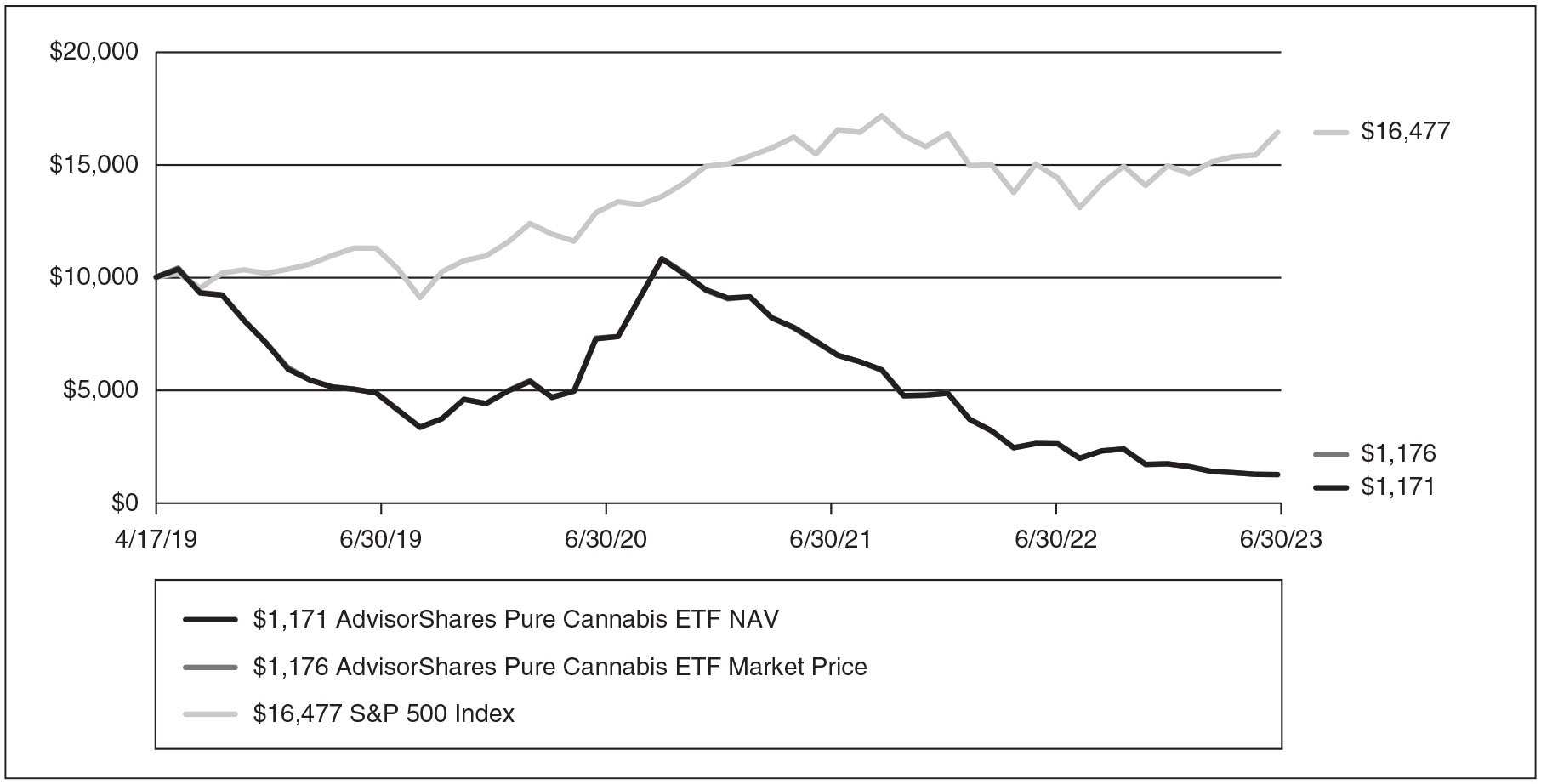

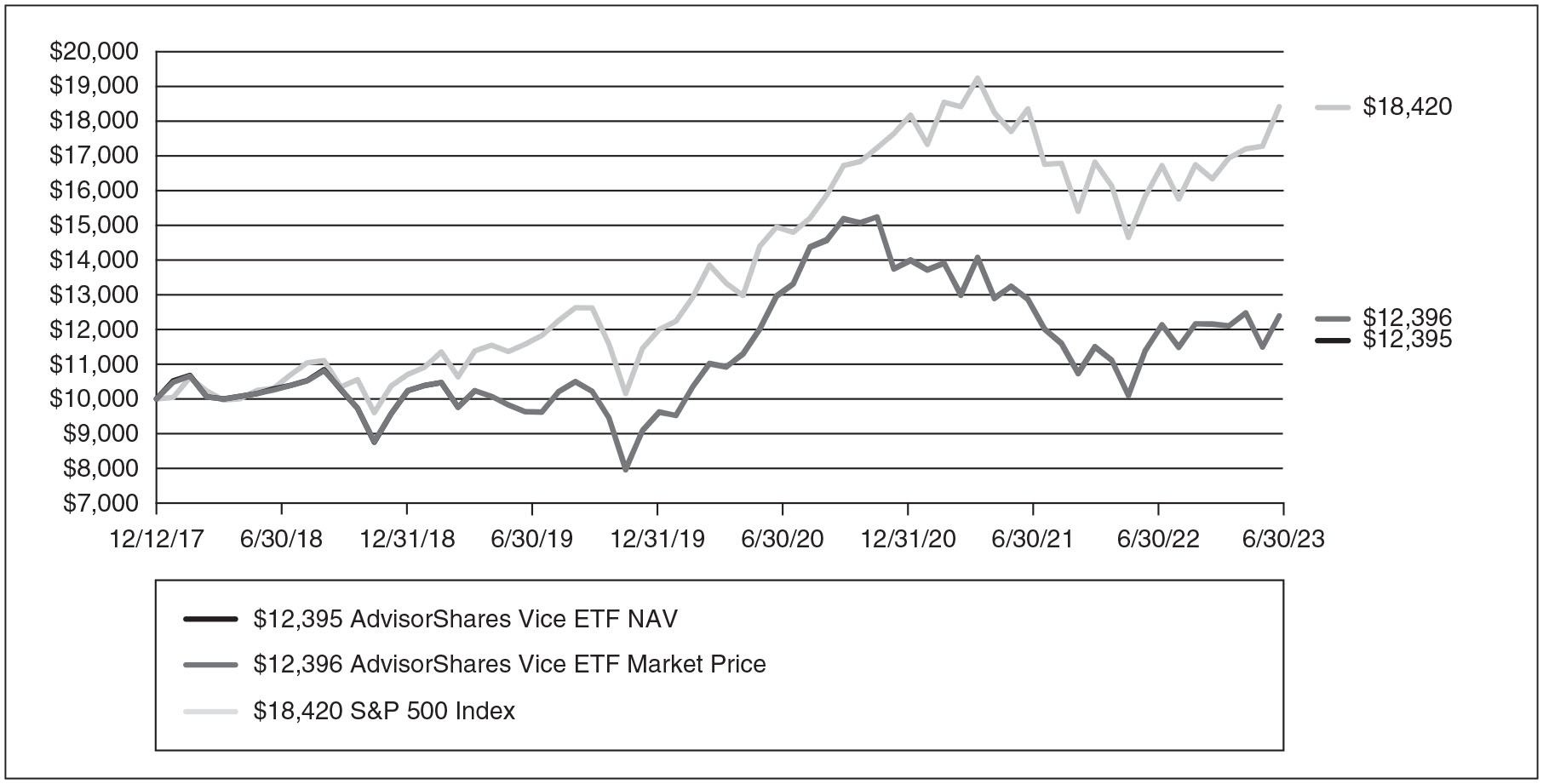

AdvisorShares Pure Cannabis ETF (YOLO)

The AdvisorShares Pure Cannabis ETF (ticker: YOLO) experienced negative returns during the previous fiscal year, which is reflective of the overall performance of the cannabis sector. From July 1, 2022, to June 30, 2023, YOLO recorded a return of -50.63% (NAV). Following the U.S. elections in February 2021, cannabis stocks reached a peak but have since faced a long decline. This was due to the market’s expectation of some form of cannabis legalization, which has been slow to materialize at the federal level.

It’s important to note that as a specialty sector, cannabis stocks often exhibit low correlation with the broader market. Despite the ongoing sell-off and underperformance in the past year and beyond, we maintain a positive long-term outlook for the cannabis market. We believe the current under-valued prices present growth opportunities, and we anticipate significant legislative reform and market development within the cannabis industry. Many investors believe that the industry’s success hinges on federal law reform in the United States. Given the nature of the cannabis industry, high volatility should be anticipated.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period April 17, 2019* to June 30, 2023

33

HISTORICAL PERFORMANCE

Total Return as of June 30, 2023

| Since | ||||||||||||

| Inception | ||||||||||||

| 1 Year | 3 Year | 4/17/2019* | ||||||||||

| AdvisorShares Pure Cannabis ETF NAV | -50.63 | % | -35.40 | % | -39.37 | % | ||||||

| AdvisorShares Pure Cannabis ETF Market Price** | -50.54 | % | -35.37 | % | -39.91 | % | ||||||

| S&P 500 Index | 19.59 | % | 14.60 | % | 12.62 | % | ||||||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.02% and net expense ratio is 1.02%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.74%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. | |

| ** | The price used to calculate market return (“Market Price”) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

34

ADVISORSHARES TRUST

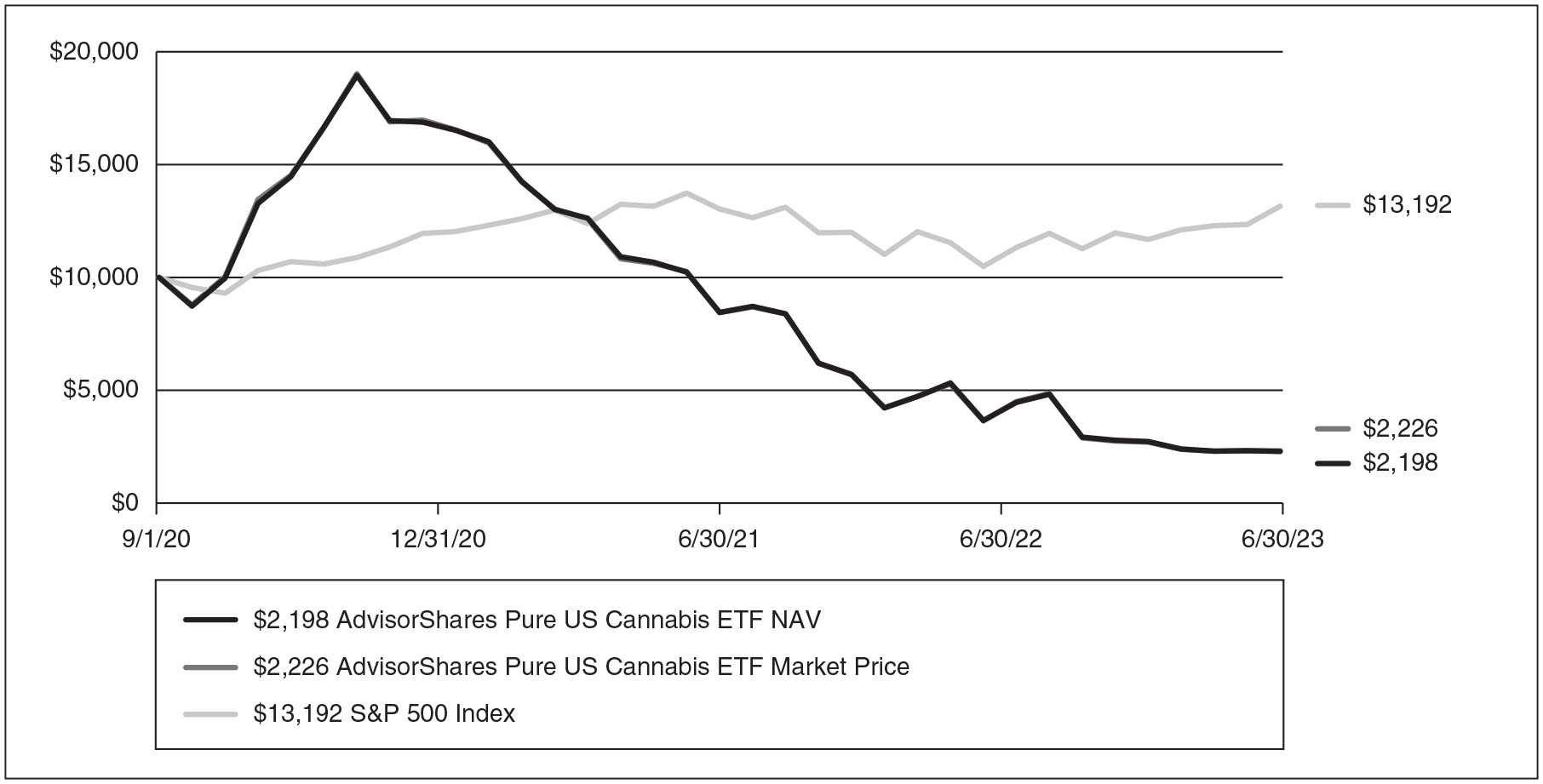

AdvisorShares Pure US Cannabis ETF (MSOS)

The AdvisorShares Pure US Cannabis ETF (ticker: MSOS) launched in September 2020. The Fund recorded a return of -47.04% (NAV) for the fiscal year ended June 30, 2023. Being a focused U.S.-only cannabis fund, MSOS’s performance has been highly volatile since its inception. The decline in cannabis stocks, collectively, can be attributed to slower-than-expected developments in U.S. cannabis law reforms, following a peak in February 2021. The absence of Federal cannabis reform has various impacts on U.S. cannabis stock prices as they trade mostly on secondary exchanges in Canada and over the counter (OTC) in the U.S. and with limited availability for trading in U.S. bank and brokerage firms.

Given its complete focus on the U.S., MSOS is particularly susceptible to volatility stemming from U.S. cannabis laws and potential changes to those laws. Future performance of MSOS is expected to be influenced by the continued growth of state-by-state U.S. cannabis sales and could be significantly affected by anticipated Federal reforms in cannabis laws.

Considering the current price levels, we hold a strong optimistic view on the U.S. cannabis market and the likelihood of positive changes in U.S. Federal laws pertaining to cannabis.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period September 1, 2020* to June 30, 2023

35

HISTORICAL PERFORMANCE

Total Return as of June 30, 2023

| Since | ||||||||

| Inception | ||||||||

| 1 Year | 9/1/2020* | |||||||

| AdvisorShares Pure US Cannabis ETF NAV | -47.04 | % | -41.48 | % | ||||

| AdvisorShares Pure US Cannabis ETF Market Price** | -46.48 | % | -41.22 | % | ||||

| S&P 500 Index | 19.59 | % | 10.29 | % | ||||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.81% and net expense ratio is 0.81%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.74%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. | |

| ** | The price used to calculate market return (“Market Price”) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

36

ADVISORSHARES TRUST

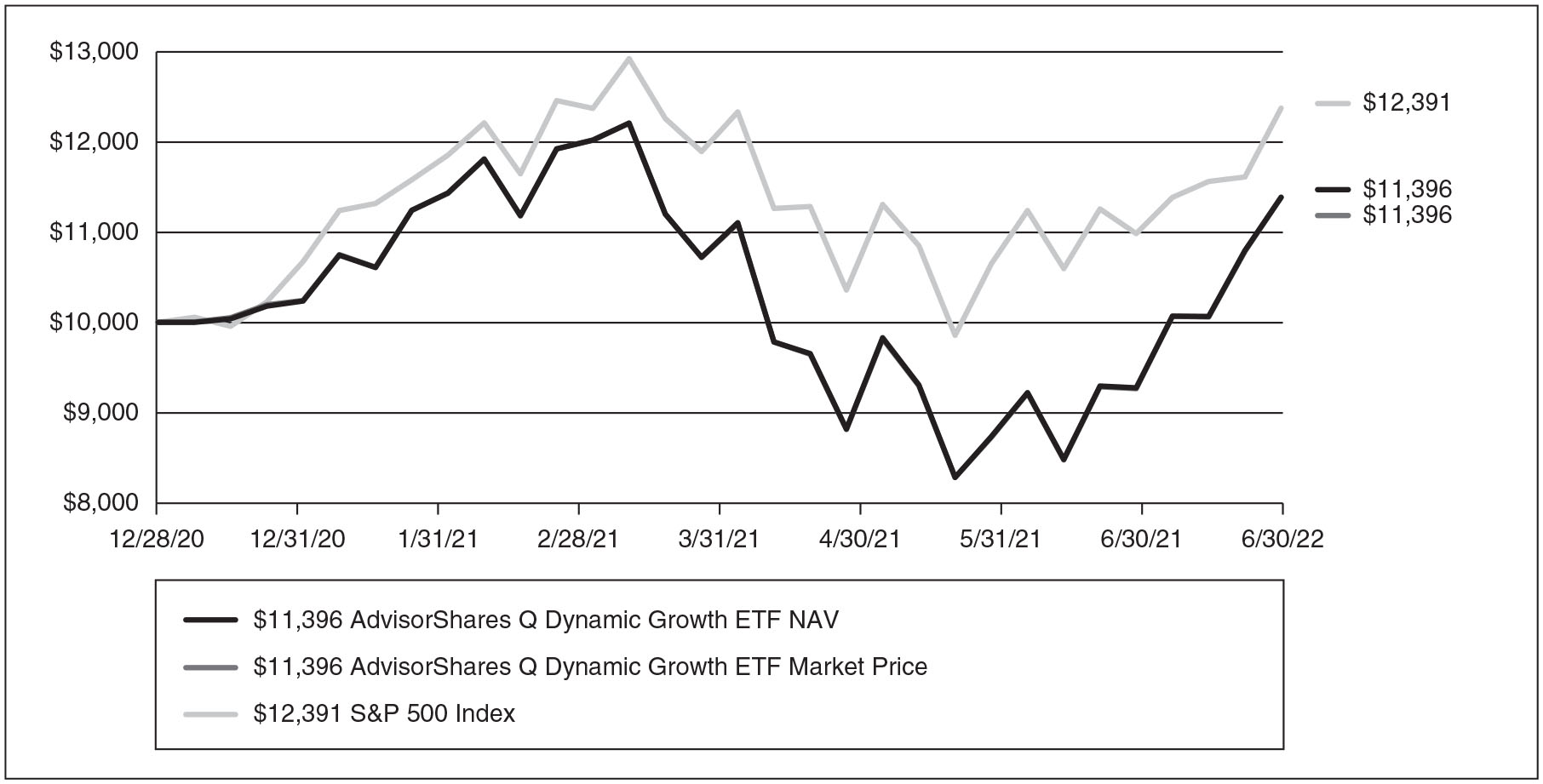

AdvisorShares Q Dynamic Growth ETF (QPX)

For the twelve-month period ended in June 2023, the AdvisorShares Q Dynamic Growth ETF (ticker: QPX) finished ahead its benchmark, the S&P 500 Index.

The previous twelve months were a banner year in terms of risk management. Virtually all available long-only diversification allocations failed due to liquidity being drained by the Federal Reserve. There was no ‘black-swan’ event either, thus QPX’s proprietary Q Implied Volatility Index™ (QIX)* did not trigger a tactical rebalance towards a defensive allocation. As a result, the QIX was revised in 2023 to include a third ‘partial risk-off’ trigger.

Throughout the period, QPX continued a heavy weighting to large-cap stocks and the technology sector, as this exposure has a significantly higher risk/reward characteristics (as well as the opportunity for asymmetric bets) than other segments of the market. QPX’s investment strategy is purely quantitative in nature and portfolio allocations will reflect what is perceived to be the best long-term risk/reward sectors per QPX’s model.

| * | The QIX is a proprietary indicator designed to tactically and unemotionally identify market volatility. QIX is reviewed daily and determines certain allocation changes. |