UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22110

AdvisorShares Trust

(Exact name of registrant as specified in charter)

4800 Montgomery Lane, Suite 150

Bethesda, Maryland 20814

(Address of principal executive offices) (Zip code)

Dan Ahrens

4800 Montgomery Lane, Suite 150

Bethesda, Maryland 20814

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-843-3831

Date of fiscal year end: June 30

Date of reporting period: June 30, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | The Report to Shareholders is attached herewith. |

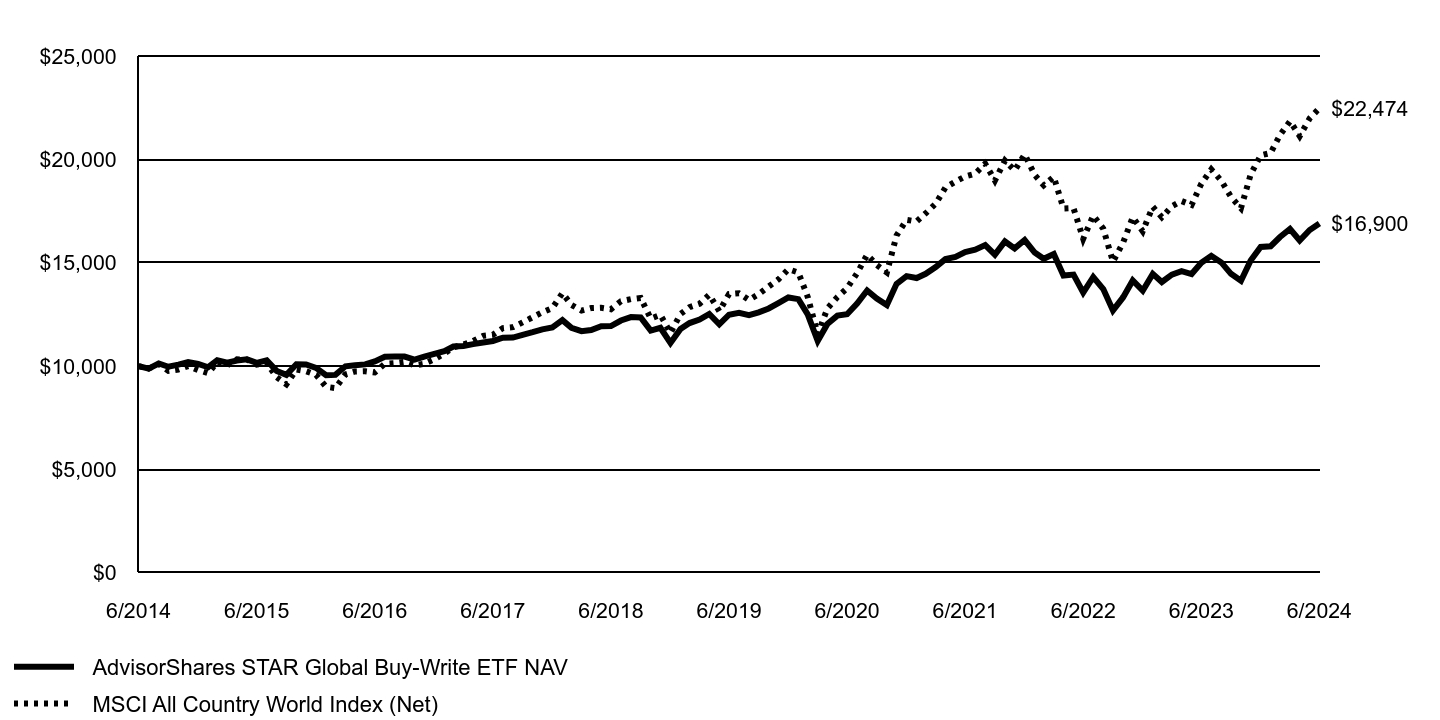

0001408970advisorshares:AdvisorSharesSTARGlobalBuyMinusWriteETFMKT3896AdditionalIndexMember2019-07-012024-06-30

AdvisorShares Dorsey Wright ADR ETF

AADR | Nasdaq Stock Market LLC

Annual Shareholder Report | JUNE 30, 2024

This annual shareholder report contains important information about AdvisorShares Dorsey Wright ADR ETF (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.advisorshares.com/about/literature-center. You can also request this information by contacting us at 1-877-843-3831.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Cost of $10K Investment | Cost Paid as % of $10K Investment |

|---|

| AdvisorShares Dorsey Wright ADR ETF | $125 | 1.10% |

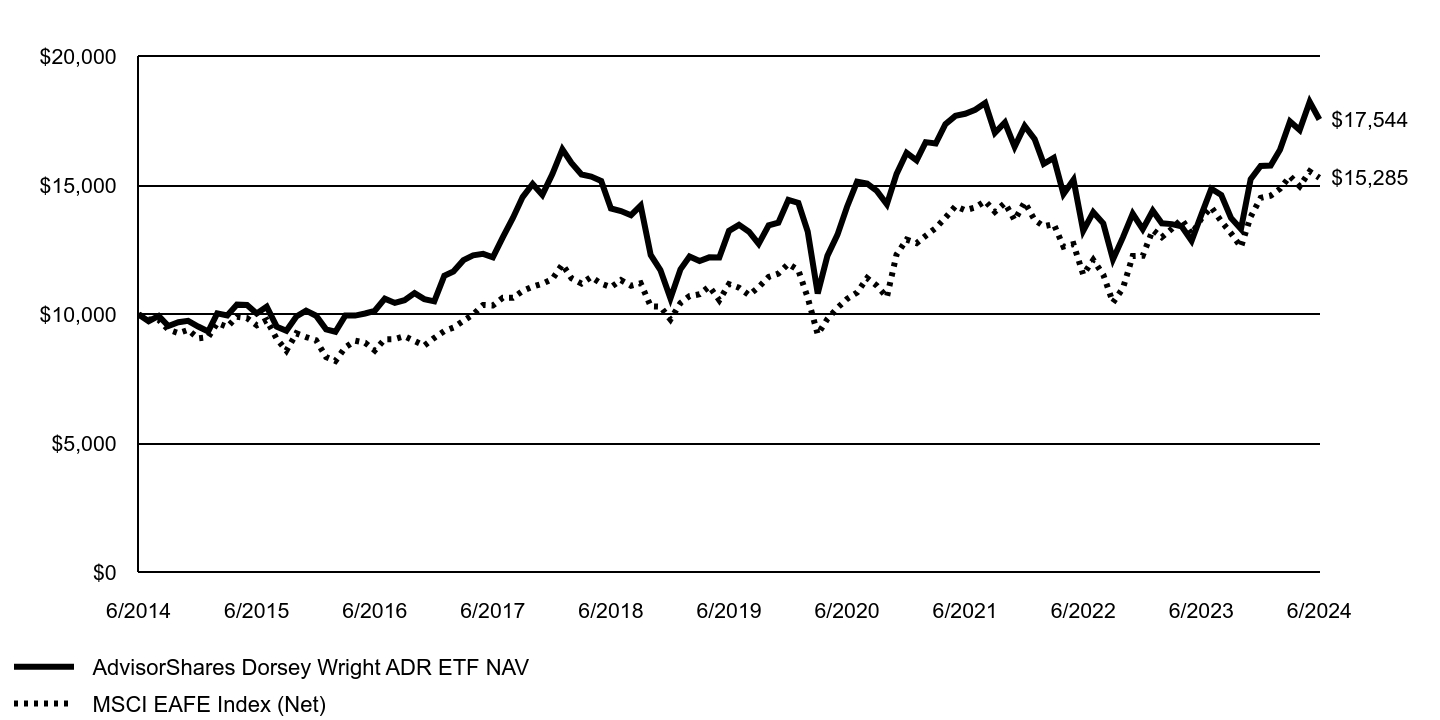

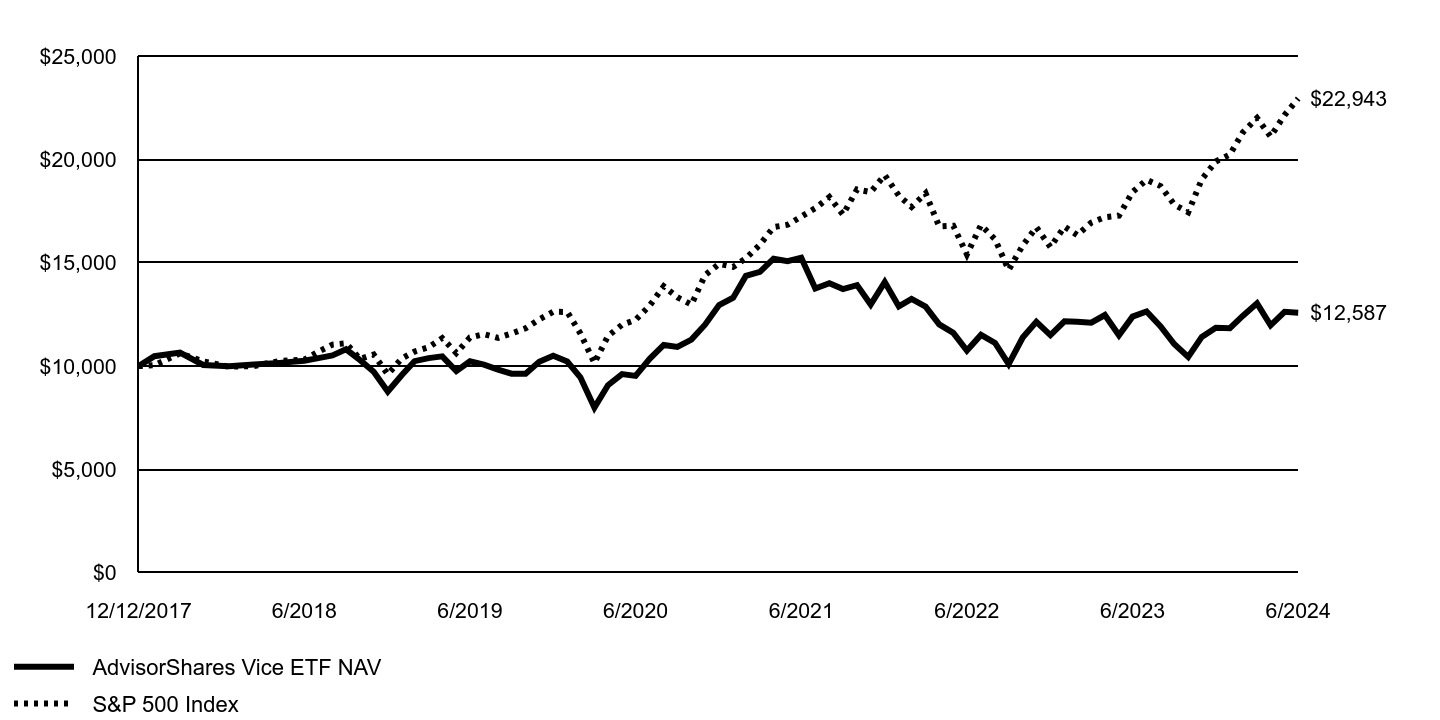

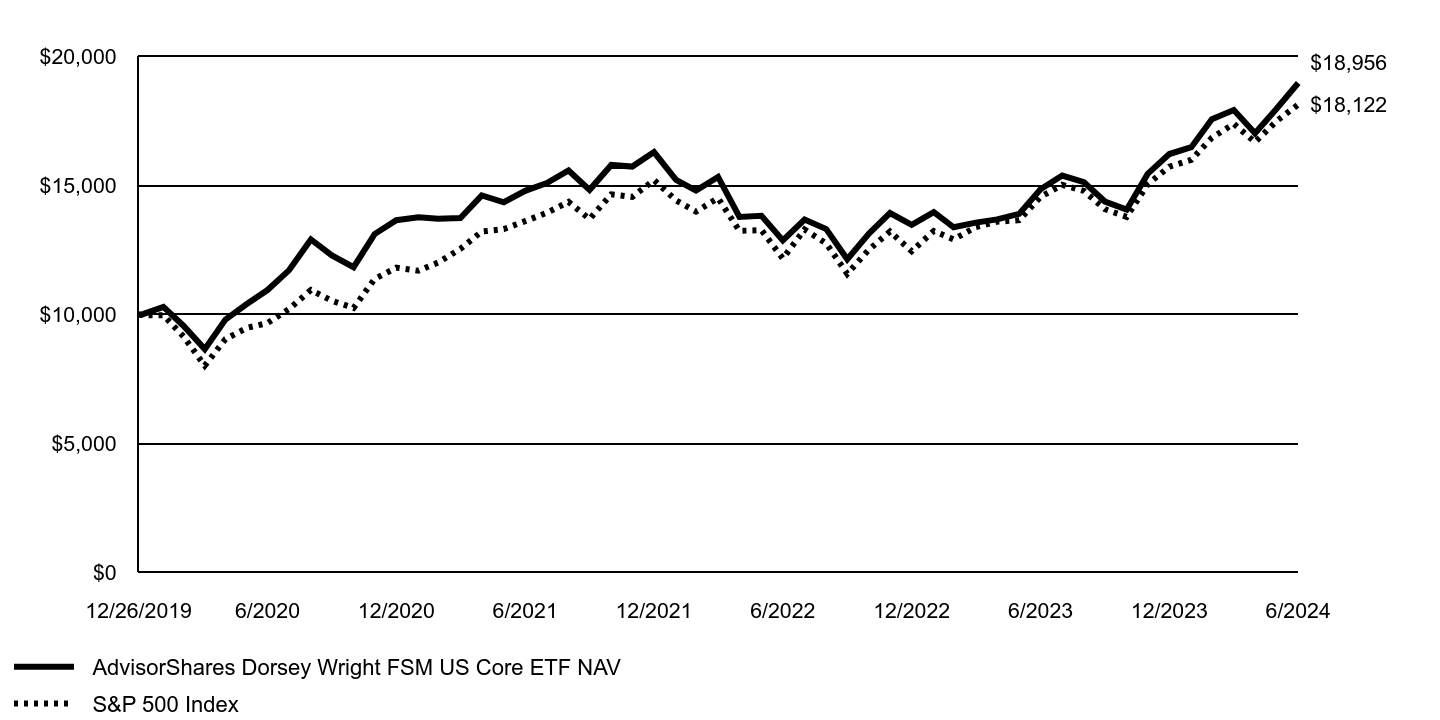

How did the Fund perform last year?

The AdvisorShares Dorsey Wright ADR ETF (ticker: AADR) finished the fiscal year ended June 30th, 2024, well ahead of its benchmark, the MSCI EAFE Index. The Fund was aided by factor tailwinds as momentum strategies across the globe turned in exemplary performances. In the US, for example, momentum was up nearly 40% over the last year and beat the next best factor (quality) by nearly 10%. Performance was consistent and the Fund beat its benchmark each quarter.

The second half of 2023 saw international markets perform well despite a 10% pullback in the back half of Q3. Often these pullbacks cause leadership changes as stocks declining by less during the drawdown gain relative strength. This largely did not happen though which allowed momentum strategies across the board to stay invested in areas that continued to demonstrate strength after the pullback. One of those areas was Latin America, where the Fund had an outsized position relative to the benchmark.

The first half of 2024 saw a continuation of 2023’s success as there was very little pullback at all and trends related to AI continued to lead the market higher. While the future is unknowable, we feel this resurgence in momentum is not a one hit wonder as studies over time have shown momentum to be the most durable and successful investment factor.

The MSCI EAFE Index is an unmanaged free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

GROWTH OF AN ASSUMED $10,000 INVESTMENT

| | MSCI EAFE Index (Net) |

|---|

| AdvisorShares Dorsey Wright ADR ETF NAV | |

|---|

| 6/2014 | $10,000 | $10,000 |

| 7/2014 | $9,736 | $9,804 |

| 8/2014 | $9,941 | $9,789 |

| 9/2014 | $9,551 | $9,412 |

| 10/2014 | $9,697 | $9,276 |

| 11/2014 | $9,754 | $9,402 |

| 12/2014 | $9,533 | $9,076 |

| 1/2015 | $9,338 | $9,121 |

| 2/2015 | $10,042 | $9,666 |

| 3/2015 | $9,960 | $9,519 |

| 4/2015 | $10,386 | $9,908 |

| 5/2015 | $10,368 | $9,857 |

| 6/2015 | $10,036 | $9,578 |

| 7/2015 | $10,297 | $9,777 |

| 8/2015 | $9,527 | $9,057 |

| 9/2015 | $9,366 | $8,597 |

| 10/2015 | $9,921 | $9,269 |

| 11/2015 | $10,146 | $9,125 |

| 12/2015 | $9,951 | $9,002 |

| 1/2016 | $9,422 | $8,351 |

| 2/2016 | $9,331 | $8,198 |

| 3/2016 | $9,962 | $8,732 |

| 4/2016 | $9,956 | $8,985 |

| 5/2016 | $10,037 | $8,903 |

| 6/2016 | $10,142 | $8,604 |

| 7/2016 | $10,609 | $9,040 |

| 8/2016 | $10,446 | $9,047 |

| 9/2016 | $10,550 | $9,158 |

| 10/2016 | $10,823 | $8,970 |

| 11/2016 | $10,593 | $8,792 |

| 12/2016 | $10,506 | $9,092 |

| 1/2017 | $11,498 | $9,356 |

| 2/2017 | $11,659 | $9,490 |

| 3/2017 | $12,099 | $9,751 |

| 4/2017 | $12,288 | $9,999 |

| 5/2017 | $12,343 | $10,366 |

| 6/2017 | $12,214 | $10,348 |

| 7/2017 | $12,993 | $10,646 |

| 8/2017 | $13,734 | $10,642 |

| 9/2017 | $14,542 | $10,907 |

| 10/2017 | $15,046 | $11,073 |

| 11/2017 | $14,626 | $11,189 |

| 12/2017 | $15,433 | $11,369 |

| 1/2018 | $16,389 | $11,939 |

| 2/2018 | $15,863 | $11,400 |

| 3/2018 | $15,416 | $11,194 |

| 4/2018 | $15,333 | $11,450 |

| 5/2018 | $15,167 | $11,193 |

| 6/2018 | $14,101 | $11,056 |

| 7/2018 | $14,003 | $11,328 |

| 8/2018 | $13,841 | $11,109 |

| 9/2018 | $14,214 | $11,206 |

| 10/2018 | $12,300 | $10,314 |

| 11/2018 | $11,718 | $10,301 |

| 12/2018 | $10,622 | $9,801 |

| 1/2019 | $11,744 | $10,445 |

| 2/2019 | $12,238 | $10,711 |

| 3/2019 | $12,064 | $10,779 |

| 4/2019 | $12,208 | $11,082 |

| 5/2019 | $12,200 | $10,550 |

| 6/2019 | $13,233 | $11,175 |

| 7/2019 | $13,466 | $11,034 |

| 8/2019 | $13,203 | $10,748 |

| 9/2019 | $12,729 | $11,056 |

| 10/2019 | $13,448 | $11,453 |

| 11/2019 | $13,550 | $11,582 |

| 12/2019 | $14,434 | $11,958 |

| 1/2020 | $14,312 | $11,709 |

| 2/2020 | $13,206 | $10,650 |

| 3/2020 | $10,807 | $9,229 |

| 4/2020 | $12,265 | $9,825 |

| 5/2020 | $13,078 | $10,253 |

| 6/2020 | $14,167 | $10,602 |

| 7/2020 | $15,136 | $10,849 |

| 8/2020 | $15,060 | $11,407 |

| 9/2020 | $14,778 | $11,110 |

| 10/2020 | $14,261 | $10,667 |

| 11/2020 | $15,438 | $12,320 |

| 12/2020 | $16,255 | $12,893 |

| 1/2021 | $15,960 | $12,756 |

| 2/2021 | $16,667 | $13,042 |

| 3/2021 | $16,615 | $13,342 |

| 4/2021 | $17,363 | $13,743 |

| 5/2021 | $17,684 | $14,191 |

| 6/2021 | $17,764 | $14,032 |

| 7/2021 | $17,919 | $14,137 |

| 8/2021 | $18,182 | $14,387 |

| 9/2021 | $17,026 | $13,969 |

| 10/2021 | $17,426 | $14,313 |

| 11/2021 | $16,487 | $13,647 |

| 12/2021 | $17,290 | $14,345 |

| 1/2022 | $16,783 | $13,652 |

| 2/2022 | $15,831 | $13,411 |

| 3/2022 | $16,059 | $13,497 |

| 4/2022 | $14,661 | $12,624 |

| 5/2022 | $15,208 | $12,718 |

| 6/2022 | $13,232 | $11,538 |

| 7/2022 | $13,957 | $12,113 |

| 8/2022 | $13,524 | $11,538 |

| 9/2022 | $12,127 | $10,459 |

| 10/2022 | $12,991 | $11,021 |

| 11/2022 | $13,896 | $12,262 |

| 12/2022 | $13,297 | $12,272 |

| 1/2023 | $14,014 | $13,266 |

| 2/2023 | $13,524 | $12,989 |

| 3/2023 | $13,495 | $13,311 |

| 4/2023 | $13,406 | $13,687 |

| 5/2023 | $12,848 | $13,108 |

| 6/2023 | $13,853 | $13,704 |

| 7/2023 | $14,862 | $14,148 |

| 8/2023 | $14,620 | $13,606 |

| 9/2023 | $13,736 | $13,141 |

| 10/2023 | $13,305 | $12,608 |

| 11/2023 | $15,235 | $13,778 |

| 12/2023 | $15,744 | $14,510 |

| 1/2024 | $15,763 | $14,594 |

| 2/2024 | $16,372 | $14,861 |

| 3/2024 | $17,469 | $15,350 |

| 4/2024 | $17,138 | $14,957 |

| 5/2024 | $18,228 | $15,536 |

| 6/2024 | $17,544 | $15,285 |

AVERAGE ANNUAL TOTAL RETURN

| Fund/Index | 1 year | 5 year | 10 year |

|---|

| AdvisorShares Dorsey Wright ADR ETF NAV | 26.65% | 5.80% | 5.78% |

| AdvisorShares Dorsey Wright ADR ETF Market Price* | 26.69% | 5.81% | 5.78% |

| MSCI EAFE Index (Net) | 11.54% | 6.46% | 4.33% |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

* The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the exchange included at the beginning of this shareholder report and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV, and are not individually redeemed from the Fund.

The MSCI EAFE Index is an unmanaged free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. One cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The Fund may be non-diversified and may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund's shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value.

The following table outlines key fund statistics as of 6/30/2024.

- Fund net assets$25,675,310

- Total advisory fees paid$161,647

- Total number of portfolio holdings36

- Period portfolio turnover rate45%

The table below shows the investment makeup of the Fund as of 6/30/2024.

| Sector | % of Net Assets |

|---|

| Apparel | 1.7% |

| Food Service | 1.9% |

| Insurance | 2.1% |

| Miscellaneous Manufacturing | 2.3% |

| Building Materials | 2.3% |

| Beverages | 2.3% |

| Computers | 2.5% |

| Electric | 2.6% |

| Transportation | 2.9% |

| Software | 2.9% |

| Electronics | 3.9% |

| Diversified Financial Services | 4.5% |

| Other | 67.9% |

| Money Market Fund | 8.9% |

| Assets Less Liabilities | (8.7)% |

| Total | 100.0% |

Availability of Additional Information

If you wish to find additional information about the Fund such as the prospectus, financial information, portfolio holdings and proxy voting, please see the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Fund Services, LLC

AdvisorShares Dorsey Wright FSM All Cap World ETF

DWAW | Nasdaq Stock Market LLC

Annual Shareholder Report | JUNE 30, 2024

This annual shareholder report contains important information about AdvisorShares Dorsey Wright FSM All Cap World ETF (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.advisorshares.com/about/literature-center. You can also request this information by contacting us at 1-877-843-3831.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Cost of $10K Investment | Cost Paid as % of $10K Investment |

|---|

| AdvisorShares Dorsey Wright FSM All Cap World ETF | $111 | 0.98% |

How did the Fund perform last year?

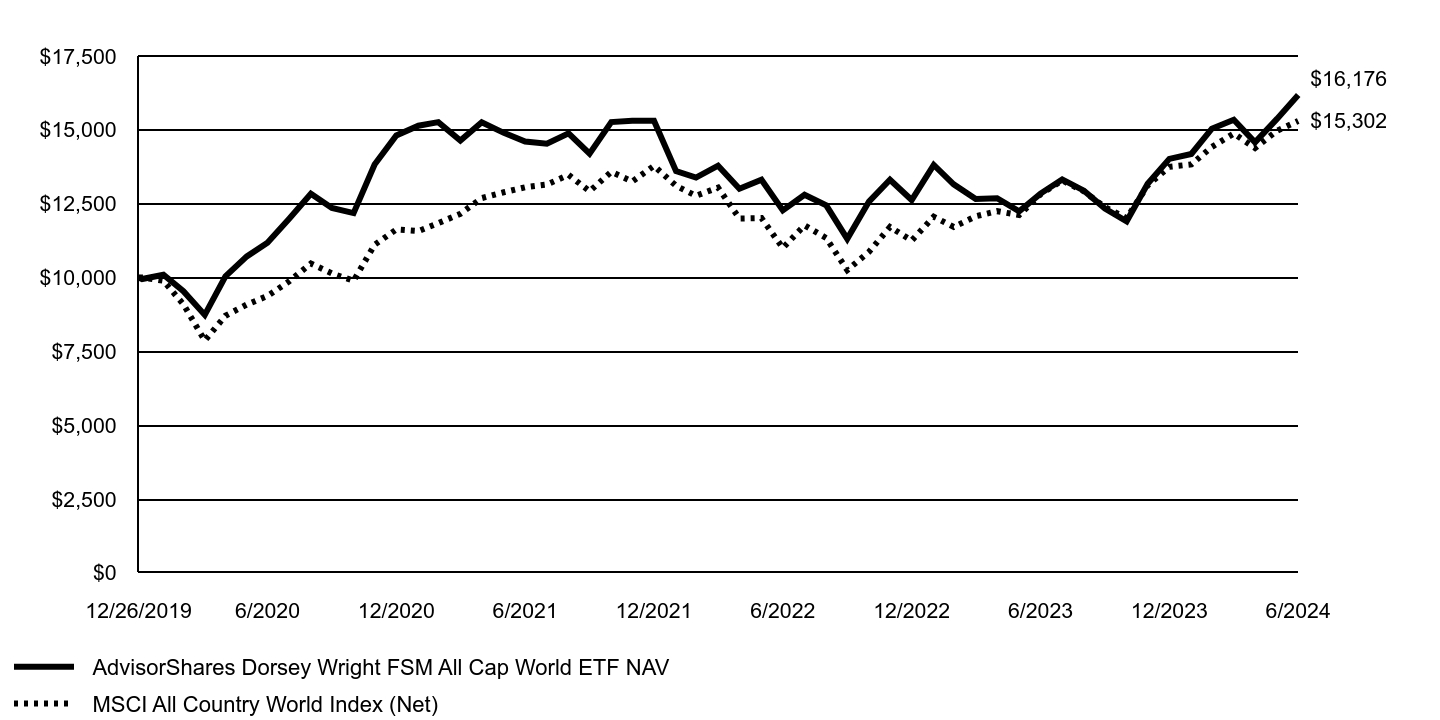

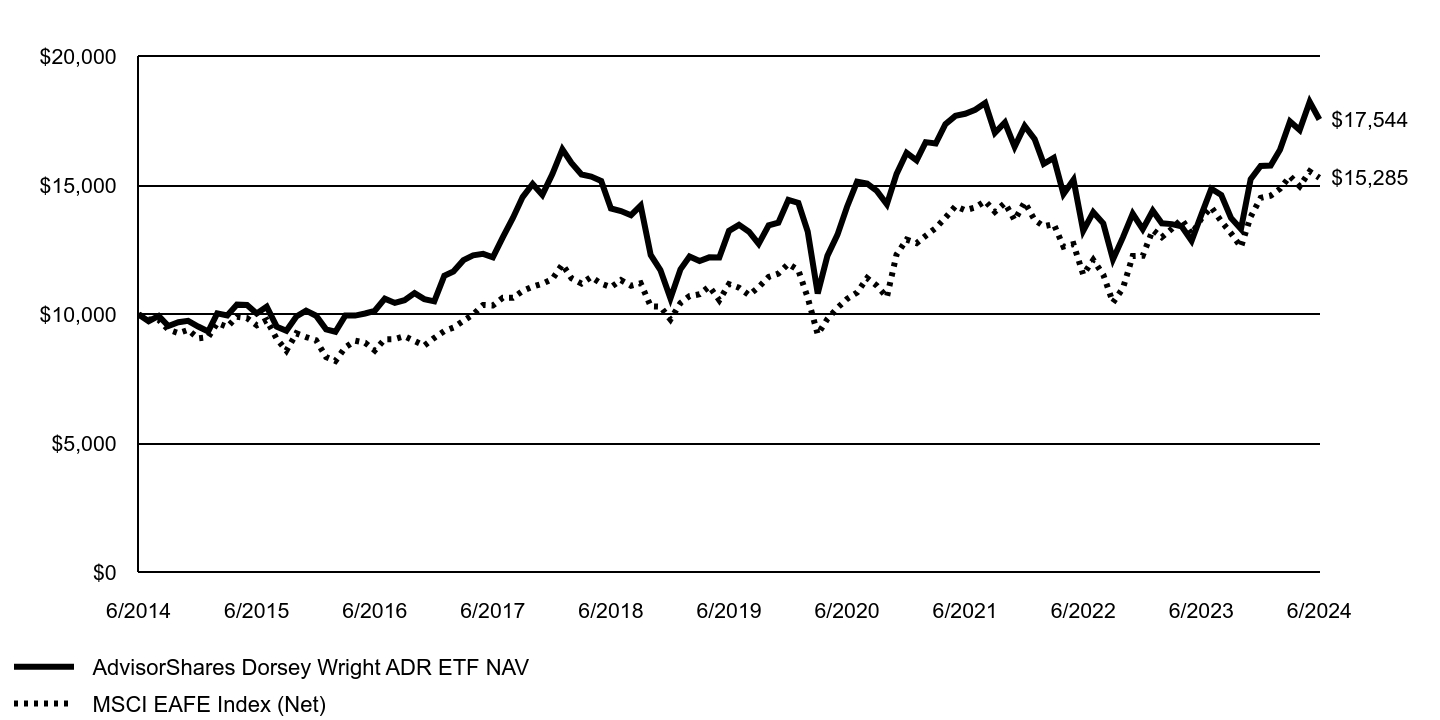

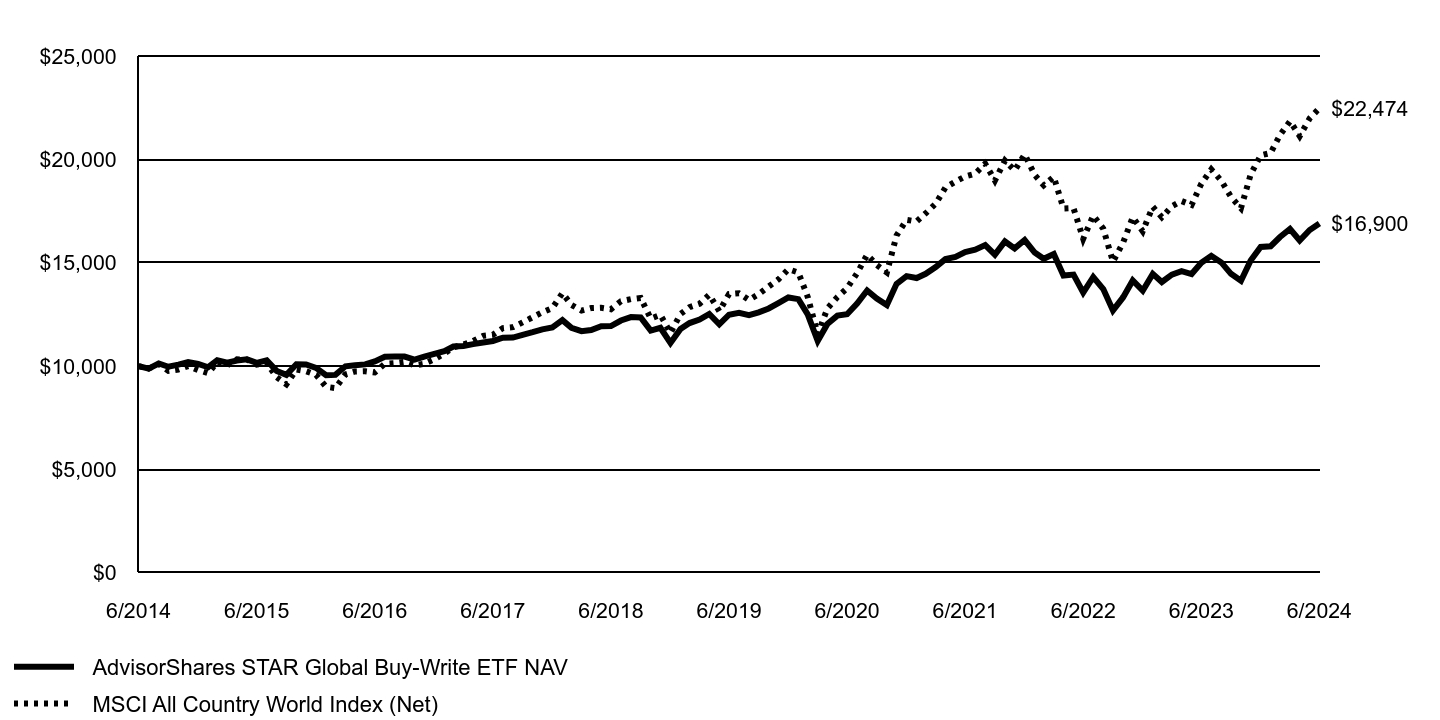

During the fiscal year ended June 30, 2024, the AdvisorShares Dorsey Wright FSM All Cap World ETF (ticker: DWAW) outperformed its benchmark, the MSCI ACWI Index.

The Fund is built on a foundation of momentum and relative strength to select the strongest funds from a universe of broad ETFs that cover size, styles, and global themes. The momentum factor has struggled for a few years before returning to favor in the back half of 2023 and continuing its strong run in the first half of 2024. Market strength was concentrated in just a few names with the lion’s shares of contribution to the S&P 500 Index’s return coming from a handful of names.

DWAW was able to capitalize on the narrow market with its exposure to the Invesco QQQ Trust (QQQ) and eventual exposure to the iShares Morningstar Growth ETF (ILCG) both of which were heavily weighted to the few names that drove broad market performance. DWAW picked up exposure to the momentum factor via the iShares MSCI USA Momentum Factor ETF (MTUM) in February which highlights the strength in momentum strategies over the last few quarters.

The MSCI All Country World Index is an unmanaged free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

GROWTH OF AN ASSUMED $10,000 INVESTMENT

| | MSCI All Country World Index (Net) |

|---|

| AdvisorShares Dorsey Wright FSM All Cap World ETF NAV | |

|---|

| 12/26/2019 | $10,000 | $10,000 |

| 12/31/2019 | $9,948 | $10,001 |

| 1/31/2020 | $10,093 | $9,890 |

| 2/29/2020 | $9,536 | $9,091 |

| 3/31/2020 | $8,733 | $7,864 |

| 4/30/2020 | $10,040 | $8,706 |

| 5/31/2020 | $10,715 | $9,085 |

| 6/30/2020 | $11,176 | $9,375 |

| 7/31/2020 | $11,991 | $9,871 |

| 8/31/2020 | $12,837 | $10,475 |

| 9/30/2020 | $12,353 | $10,138 |

| 10/31/2020 | $12,180 | $9,891 |

| 11/30/2020 | $13,824 | $11,110 |

| 12/31/2020 | $14,807 | $11,626 |

| 1/31/2021 | $15,141 | $11,573 |

| 2/28/2021 | $15,260 | $11,841 |

| 3/31/2021 | $14,638 | $12,158 |

| 4/30/2021 | $15,259 | $12,689 |

| 5/31/2021 | $14,898 | $12,887 |

| 6/30/2021 | $14,607 | $13,057 |

| 7/31/2021 | $14,530 | $13,147 |

| 8/31/2021 | $14,883 | $13,476 |

| 9/30/2021 | $14,191 | $12,919 |

| 10/31/2021 | $15,264 | $13,578 |

| 11/30/2021 | $15,304 | $13,251 |

| 12/31/2021 | $15,309 | $13,781 |

| 1/31/2022 | $13,602 | $13,105 |

| 2/28/2022 | $13,384 | $12,766 |

| 3/31/2022 | $13,787 | $13,043 |

| 4/30/2022 | $13,006 | $11,999 |

| 5/31/2022 | $13,313 | $12,013 |

| 6/30/2022 | $12,273 | $11,000 |

| 7/31/2022 | $12,801 | $11,768 |

| 8/31/2022 | $12,444 | $11,335 |

| 9/30/2022 | $11,309 | $10,250 |

| 10/31/2022 | $12,571 | $10,868 |

| 11/30/2022 | $13,311 | $11,711 |

| 12/31/2022 | $12,624 | $11,251 |

| 1/31/2023 | $13,811 | $12,057 |

| 2/28/2023 | $13,156 | $11,711 |

| 3/31/2023 | $12,657 | $12,073 |

| 4/30/2023 | $12,683 | $12,246 |

| 5/31/2023 | $12,243 | $12,115 |

| 6/30/2023 | $12,841 | $12,818 |

| 7/31/2023 | $13,321 | $13,288 |

| 8/31/2023 | $12,939 | $12,916 |

| 9/30/2023 | $12,332 | $12,382 |

| 10/31/2023 | $11,904 | $12,010 |

| 11/30/2023 | $13,171 | $13,118 |

| 12/31/2023 | $14,018 | $13,748 |

| 1/31/2024 | $14,182 | $13,829 |

| 2/29/2024 | $15,038 | $14,422 |

| 3/31/2024 | $15,342 | $14,875 |

| 4/30/2024 | $14,576 | $14,384 |

| 5/31/2024 | $15,371 | $14,969 |

| 6/30/2024 | $16,176 | $15,302 |

AVERAGE ANNUAL TOTAL RETURN

| Fund/Index | 1 year | Since Inception 12/26/2019 |

|---|

| AdvisorShares Dorsey Wright FSM All Cap World ETF NAV | 25.97% | 11.25% |

| AdvisorShares Dorsey Wright FSM All Cap World ETF (MKT)* | 25.81% | 11.23% |

| MSCI All Country World Index (Net) | 19.38% | 9.89% |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

* The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the exchange included at the beginning of this shareholder report and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV, and are not individually redeemed from the Fund.

The MSCI All Country World Index (Net) is an unmanaged free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. One cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The Fund may be non-diversified and may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund's shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value.

The following table outlines key fund statistics as of 6/30/2024.

- Fund net assets$79,975,410

- Total advisory fees paid$586,901

- Total number of portfolio holdings4

- Period portfolio turnover rate154%

The table below shows the investment makeup of the Fund as of 6/30/2024.

| Sector | % of Net Assets |

|---|

| Equity Fund | 99.9% |

| Money Market Funds | 3.7% |

| Assets Less Liabilities | (3.6)% |

| Total | 100.0% |

Availability of Additional Information

If you wish to find additional information about the Fund such as the prospectus, financial information, portfolio holdings and proxy voting, please see the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Fund Services, LLC

AdvisorShares Dorsey Wright FSM US Core ETF

DWUS | Nasdaq Stock Market LLC

Annual Shareholder Report | JUNE 30, 2024

This annual shareholder report contains important information about AdvisorShares Dorsey Wright FSM US Core ETF (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.advisorshares.com/about/literature-center. You can also request this information by contacting us at 1-877-843-3831.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Cost of $10K Investment | Cost Paid as % of $10K Investment |

|---|

| AdvisorShares Dorsey Wright FSM US Core ETF | $107 | 0.94% |

How did the Fund perform last year?

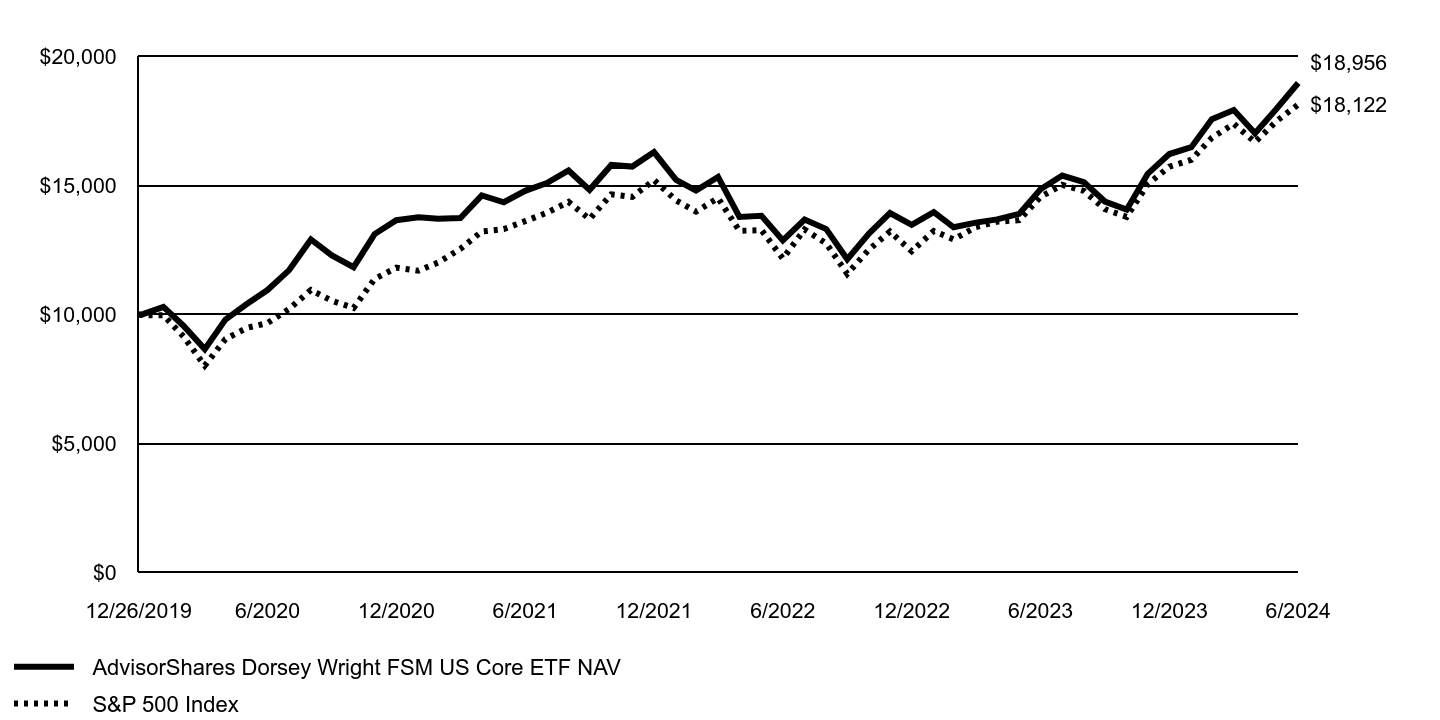

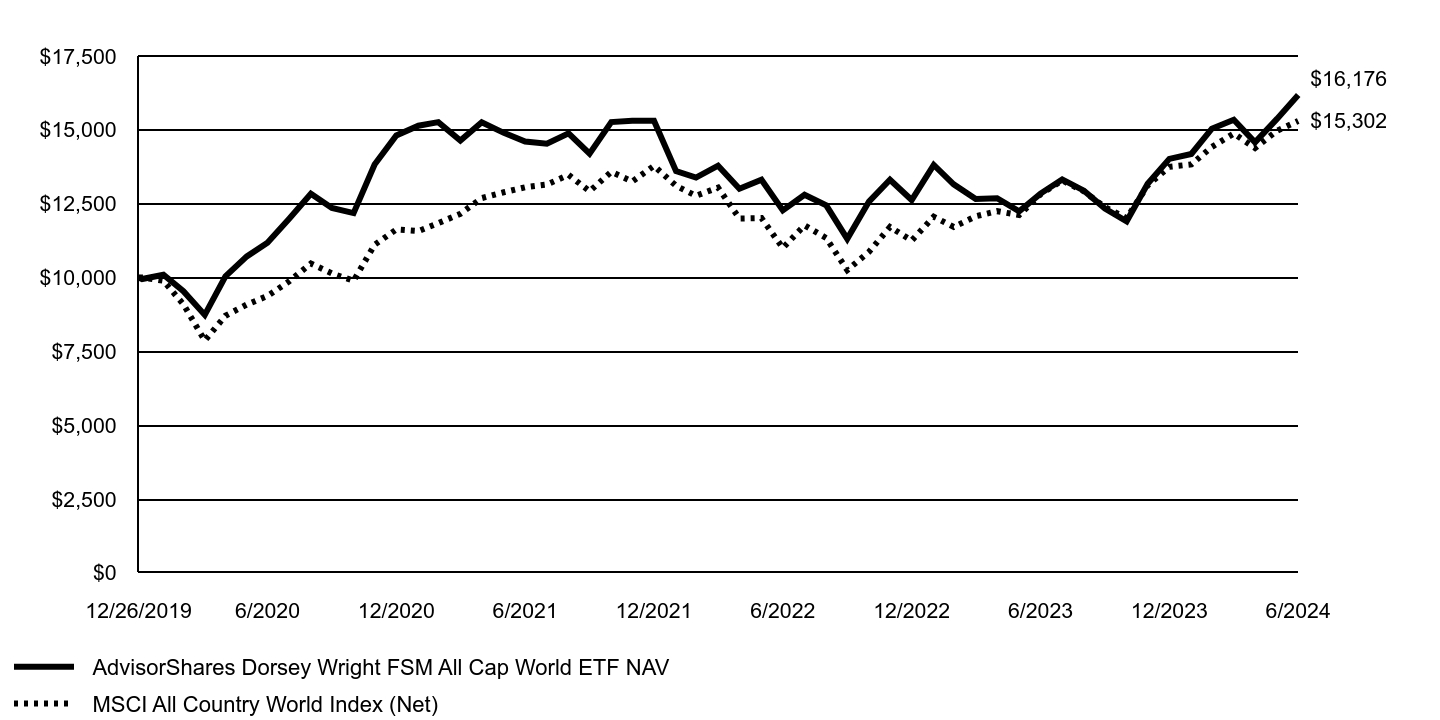

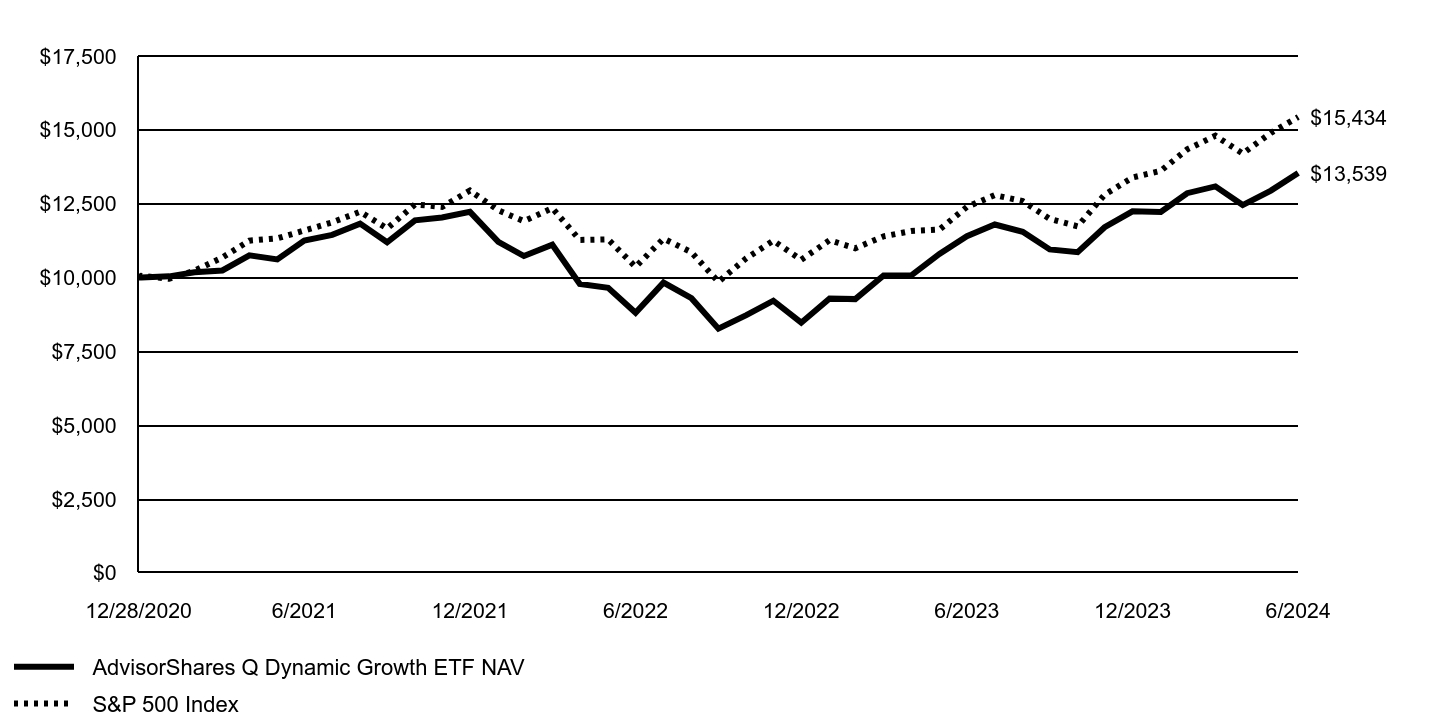

During the fiscal year ended June 30, 2024, the AdvisorShares Dorsey Wright FSM US Core ETF (ticker: DWUS) outperformed its benchmark, the S&P 500 Index.

The Fund is built on a foundation of momentum and relative strength to select the strongest funds from a small lineup of US large cap core equity ETFs. The momentum factor has struggled for a few years before catching fire in the back half of 2023 and has continued its strong run in the first half of 2024. Market strength was concentrated in just a few names with the lion’s shares of contribution to the S&P 500 Index’s return coming from a handful of names.

DWUS was able to capitalize on the narrow market with its exposure to the Invesco QQQ Trust which is heavily weighted to the few names that drove broad market performance. DWUS picked up exposure to the momentum factor via the iShares MSCI USA Momentum Factor ETF (MTUM) in February which highlights the strength in momentum strategies over the last few quarters.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

GROWTH OF AN ASSUMED $10,000 INVESTMENT

| | S&P 500 Index |

|---|

| AdvisorShares Dorsey Wright FSM US Core ETF NAV | |

|---|

| 12/26/2019 | $10,000 | $10,000 |

| 12/31/2019 | $10,000 | $9,974 |

| 1/31/2020 | $10,292 | $9,970 |

| 2/29/2020 | $9,563 | $9,149 |

| 3/31/2020 | $8,657 | $8,019 |

| 4/30/2020 | $9,801 | $9,047 |

| 5/31/2020 | $10,401 | $9,478 |

| 6/30/2020 | $10,943 | $9,667 |

| 7/31/2020 | $11,716 | $10,212 |

| 8/31/2020 | $12,903 | $10,946 |

| 9/30/2020 | $12,282 | $10,530 |

| 10/31/2020 | $11,828 | $10,250 |

| 11/30/2020 | $13,110 | $11,372 |

| 12/31/2020 | $13,647 | $11,809 |

| 1/31/2021 | $13,760 | $11,690 |

| 2/28/2021 | $13,701 | $12,012 |

| 3/31/2021 | $13,727 | $12,538 |

| 4/30/2021 | $14,606 | $13,207 |

| 5/31/2021 | $14,341 | $13,300 |

| 6/30/2021 | $14,782 | $13,610 |

| 7/31/2021 | $15,082 | $13,933 |

| 8/31/2021 | $15,569 | $14,357 |

| 9/30/2021 | $14,821 | $13,689 |

| 10/31/2021 | $15,784 | $14,648 |

| 11/30/2021 | $15,722 | $14,547 |

| 12/31/2021 | $16,284 | $15,199 |

| 1/31/2022 | $15,207 | $14,412 |

| 2/28/2022 | $14,793 | $13,981 |

| 3/31/2022 | $15,322 | $14,500 |

| 4/30/2022 | $13,775 | $13,235 |

| 5/31/2022 | $13,820 | $13,260 |

| 6/30/2022 | $12,865 | $12,165 |

| 7/31/2022 | $13,674 | $13,287 |

| 8/31/2022 | $13,301 | $12,745 |

| 9/30/2022 | $12,136 | $11,571 |

| 10/31/2022 | $13,126 | $12,508 |

| 11/30/2022 | $13,923 | $13,207 |

| 12/31/2022 | $13,467 | $12,446 |

| 1/31/2023 | $13,960 | $13,228 |

| 2/28/2023 | $13,373 | $12,905 |

| 3/31/2023 | $13,552 | $13,379 |

| 4/30/2023 | $13,678 | $13,588 |

| 5/31/2023 | $13,892 | $13,647 |

| 6/30/2023 | $14,843 | $14,549 |

| 7/31/2023 | $15,373 | $15,016 |

| 8/31/2023 | $15,119 | $14,777 |

| 9/30/2023 | $14,368 | $14,073 |

| 10/31/2023 | $14,054 | $13,777 |

| 11/30/2023 | $15,439 | $15,035 |

| 12/31/2023 | $16,207 | $15,718 |

| 1/31/2024 | $16,470 | $15,982 |

| 2/29/2024 | $17,552 | $16,835 |

| 3/31/2024 | $17,907 | $17,377 |

| 4/30/2024 | $17,012 | $16,667 |

| 5/31/2024 | $17,977 | $17,494 |

| 6/30/2024 | $18,956 | $18,122 |

AVERAGE ANNUAL TOTAL RETURN

| Fund/Index | 1 year | Since Inception 12/26/2019 |

|---|

| AdvisorShares Dorsey Wright FSM US Core ETF NAV | 27.72% | 15.23% |

| AdvisorShares Dorsey Wright FSM U.S. Core ETF (MKT)* | 27.77% | 15.22% |

| S&P 500 Index | 24.56% | 14.08% |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

* The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the exchange included at the beginning of this shareholder report and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV, and are not individually redeemed from the Fund.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The Fund may be non-diversified and may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund's shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value.

The following table outlines key fund statistics as of 6/30/2024.

- Fund net assets$111,940,230

- Total advisory fees paid$738,177

- Total number of portfolio holdings3

- Period portfolio turnover rate99%

The table below shows the investment makeup of the Fund as of 6/30/2024.

| Holdings | % of Net Assets |

|---|

| Equity Fund | 99.8% |

| Money Market Fund | 0.2% |

| Assets Less Liabilities | -% |

| Total | 100.0% |

Availability of Additional Information

If you wish to find additional information about the Fund such as the prospectus, financial information, portfolio holdings and proxy voting, please see the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Fund Services, LLC

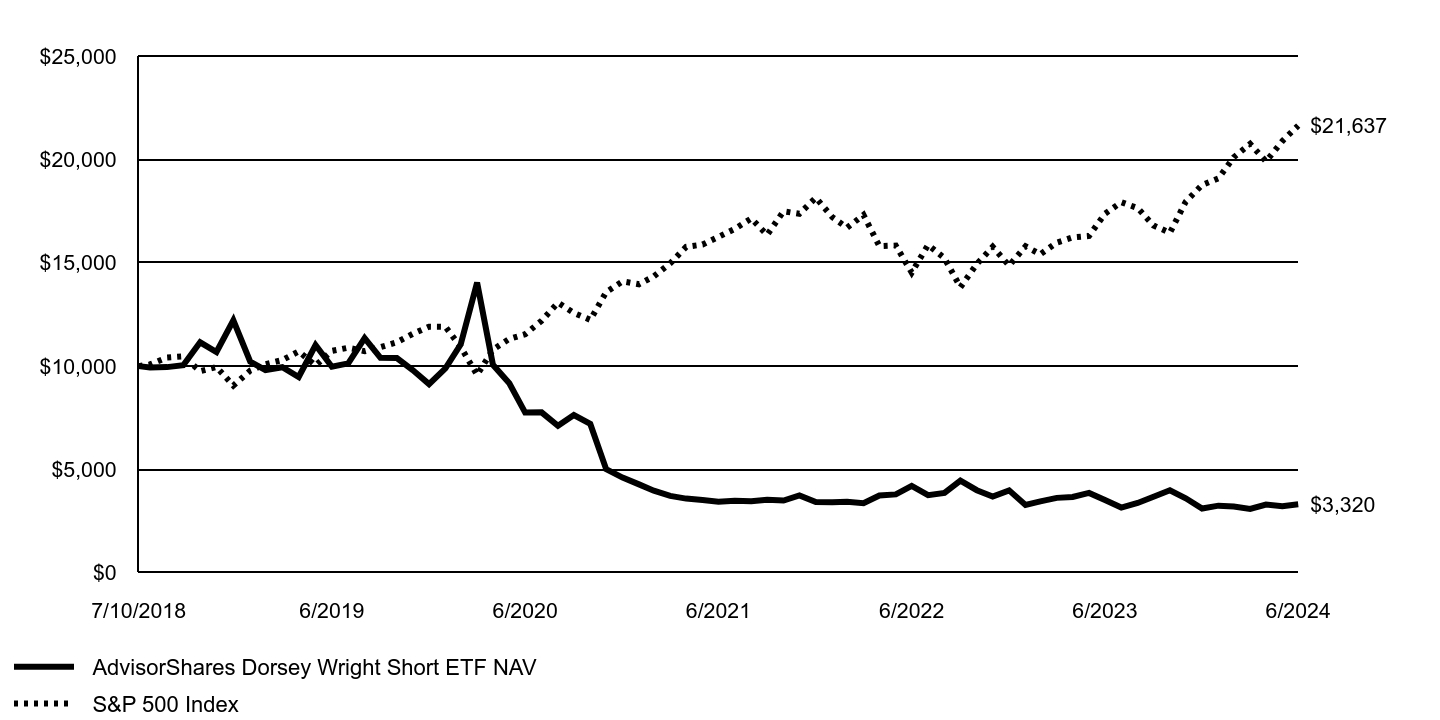

AdvisorShares Dorsey Wright Short ETF

DWSH | Nasdaq Stock Market LLC

Annual Shareholder Report | JUNE 30, 2024

This annual shareholder report contains important information about AdvisorShares Dorsey Wright Short ETF (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.advisorshares.com/about/literature-center. You can also request this information by contacting us at 1-877-843-3831.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Cost of $10K Investment | Cost Paid as % of $10K Investment |

|---|

| AdvisorShares Dorsey Wright Short ETF | $366 | 3.77% |

How did the Fund perform last year?

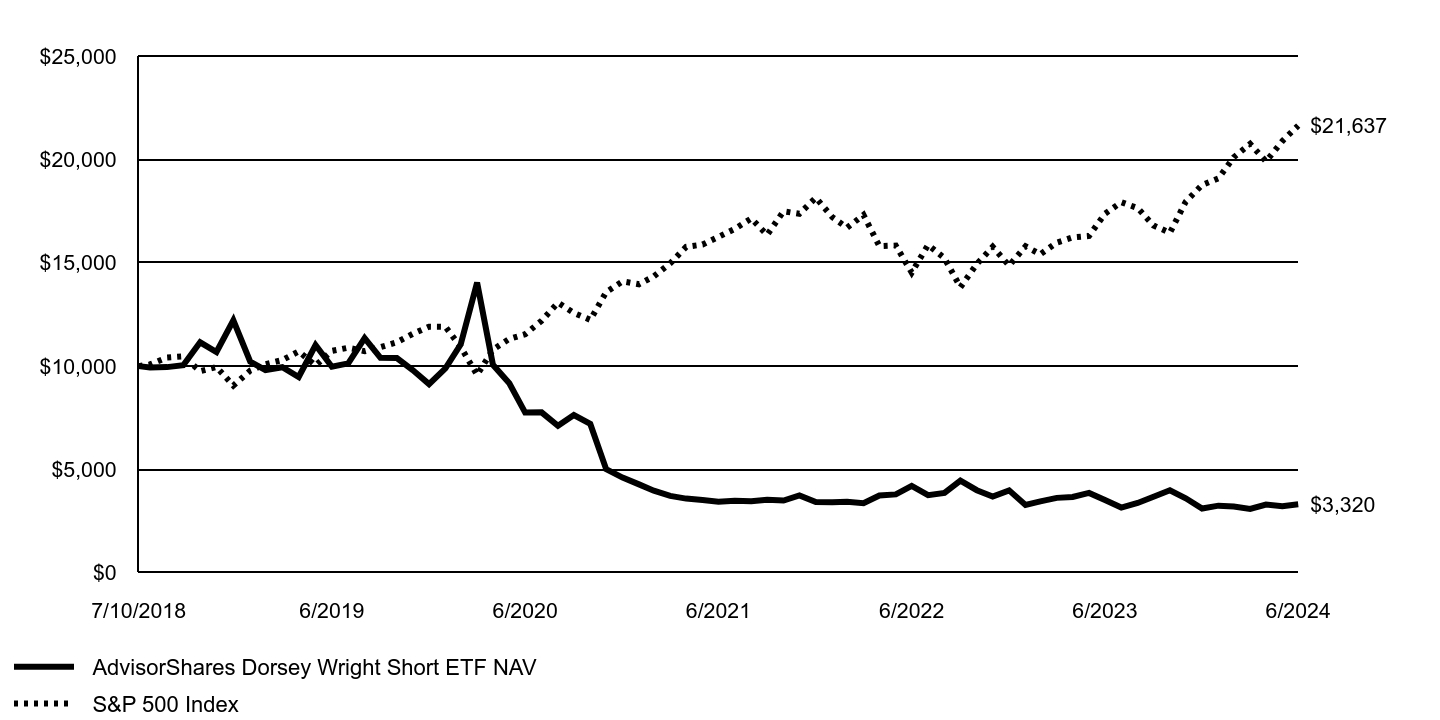

The AdvisorShares Dorsey Wright Short ETF (ticker: DWSH) finished the fiscal year ended June 30th, 2024, well ahead of its benchmark, the inverse of the S&P 500 Index. Downside momentum helped the fund tremendously as laggard stocks have been underperforming. Much of this has come from the fact that the S&P 500’s returns have been dominated by the largest cap stocks. Meanwhile, the smaller cap stocks haven’t performed as well. This has set up opportunities to outperform by shorting these smaller cap stocks while largely avoiding shorts in large caps.

The second half of 2023 saw the Fund underperform the benchmark as many of the laggards rebounded sharply off the bottom in October. Despite this, the first half of 2024 provided many opportunities for the Fund to outperform. In fact, while the S&P 500 rallied over 15% in the first half, DWSH managed to post a positive return of 6.67%. Also, currently nearly 20% of the Fund has declined over 40% since we shorted them showing the stark divergence in the market. While it’s hard to say whether this level of outperformance will remain, we know over time these stocks are more likely to have negative outcomes as companies rarely collapse in a positive trend.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

GROWTH OF AN ASSUMED $10,000 INVESTMENT

| | S&P 500 Index |

|---|

| AdvisorShares Dorsey Wright Short ETF NAV | |

|---|

| 7/10/2018 | $10,000 | $10,000 |

| 7/31/2018 | $9,932 | $10,085 |

| 8/31/2018 | $9,952 | $10,414 |

| 9/30/2018 | $10,045 | $10,473 |

| 10/31/2018 | $11,152 | $9,757 |

| 11/30/2018 | $10,683 | $9,956 |

| 12/31/2018 | $12,214 | $9,057 |

| 1/31/2019 | $10,218 | $9,783 |

| 2/28/2019 | $9,812 | $10,097 |

| 3/31/2019 | $9,945 | $10,293 |

| 4/30/2019 | $9,476 | $10,710 |

| 5/31/2019 | $11,022 | $10,029 |

| 6/30/2019 | $9,973 | $10,736 |

| 7/31/2019 | $10,134 | $10,891 |

| 8/31/2019 | $11,354 | $10,718 |

| 9/30/2019 | $10,403 | $10,919 |

| 10/31/2019 | $10,388 | $11,155 |

| 11/30/2019 | $9,808 | $11,560 |

| 12/31/2019 | $9,129 | $11,909 |

| 1/31/2020 | $9,892 | $11,904 |

| 2/29/2020 | $11,054 | $10,924 |

| 3/31/2020 | $14,040 | $9,575 |

| 4/30/2020 | $10,062 | $10,803 |

| 5/31/2020 | $9,168 | $11,317 |

| 6/30/2020 | $7,753 | $11,542 |

| 7/31/2020 | $7,766 | $12,193 |

| 8/31/2020 | $7,112 | $13,069 |

| 9/30/2020 | $7,632 | $12,573 |

| 10/31/2020 | $7,205 | $12,238 |

| 11/30/2020 | $5,014 | $13,578 |

| 12/31/2020 | $4,606 | $14,100 |

| 1/31/2021 | $4,280 | $13,958 |

| 2/28/2021 | $3,975 | $14,343 |

| 3/31/2021 | $3,725 | $14,971 |

| 4/30/2021 | $3,592 | $15,770 |

| 5/31/2021 | $3,520 | $15,880 |

| 6/30/2021 | $3,444 | $16,251 |

| 7/31/2021 | $3,491 | $16,637 |

| 8/31/2021 | $3,466 | $17,142 |

| 9/30/2021 | $3,532 | $16,345 |

| 10/31/2021 | $3,499 | $17,490 |

| 11/30/2021 | $3,742 | $17,369 |

| 12/31/2021 | $3,424 | $18,148 |

| 1/31/2022 | $3,420 | $17,208 |

| 2/28/2022 | $3,437 | $16,693 |

| 3/31/2022 | $3,365 | $17,313 |

| 4/30/2022 | $3,740 | $15,803 |

| 5/31/2022 | $3,797 | $15,832 |

| 6/30/2022 | $4,207 | $14,525 |

| 7/31/2022 | $3,759 | $15,865 |

| 8/31/2022 | $3,867 | $15,218 |

| 9/30/2022 | $4,464 | $13,816 |

| 10/31/2022 | $3,998 | $14,935 |

| 11/30/2022 | $3,696 | $15,769 |

| 12/31/2022 | $3,992 | $14,861 |

| 1/31/2023 | $3,287 | $15,795 |

| 2/28/2023 | $3,459 | $15,409 |

| 3/31/2023 | $3,628 | $15,975 |

| 4/30/2023 | $3,672 | $16,224 |

| 5/31/2023 | $3,868 | $16,295 |

| 6/30/2023 | $3,521 | $17,372 |

| 7/31/2023 | $3,157 | $17,930 |

| 8/31/2023 | $3,380 | $17,644 |

| 9/30/2023 | $3,680 | $16,803 |

| 10/31/2023 | $3,996 | $16,450 |

| 11/30/2023 | $3,608 | $17,952 |

| 12/31/2023 | $3,110 | $18,767 |

| 1/31/2024 | $3,251 | $19,083 |

| 2/29/2024 | $3,214 | $20,102 |

| 3/31/2024 | $3,093 | $20,749 |

| 4/30/2024 | $3,306 | $19,901 |

| 5/31/2024 | $3,229 | $20,888 |

| 6/30/2024 | $3,320 | $21,637 |

AVERAGE ANNUAL TOTAL RETURN

| Fund/Index | 1 year | 5 year | Since Inception 7/10/2018 |

|---|

| AdvisorShares Dorsey Wright Short ETF NAV | | | |

| AdvisorShares Dorsey Wright Short ETF (MKT)* | | | |

| S&P 500 Index | 24.56% | 15.05% | 13.80% |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

* The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the exchange included at the beginning of this shareholder report and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV, and are not individually redeemed from the Fund.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The Fund may be non-diversified and may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund's shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value.

The following table outlines key fund statistics as of 6/30/2024.

- Fund net assets$10,989,121

- Total advisory fees paid$127,282

- Total number of portfolio holdings102

- Period portfolio turnover rate253%

The table below shows the investment makeup of the Fund as of 6/30/2024.

| Sector | % of Net Assets |

|---|

| Retail | (10.0)% |

| Healthcare - Products | (8.7)% |

| Biotechnology | (7.9)% |

| REITS | (6.4)% |

| Pharmaceuticals | (5.4)% |

| Media | (5.0)% |

| Software | (4.5)% |

| Computers | (4.5)% |

| Transportation | (4.4)% |

| Internet | (3.6)% |

| Semiconductors | (3.3)% |

| Commercial Services | (3.1)% |

| Other | (39.5)% |

| Money Market Fund | 237.1% |

| Assets Less Liabilities | (30.8)% |

| Total | 100.0% |

Availability of Additional Information

If you wish to find additional information about the Fund such as the prospectus, financial information, portfolio holdings and proxy voting, please see the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Fund Services, LLC

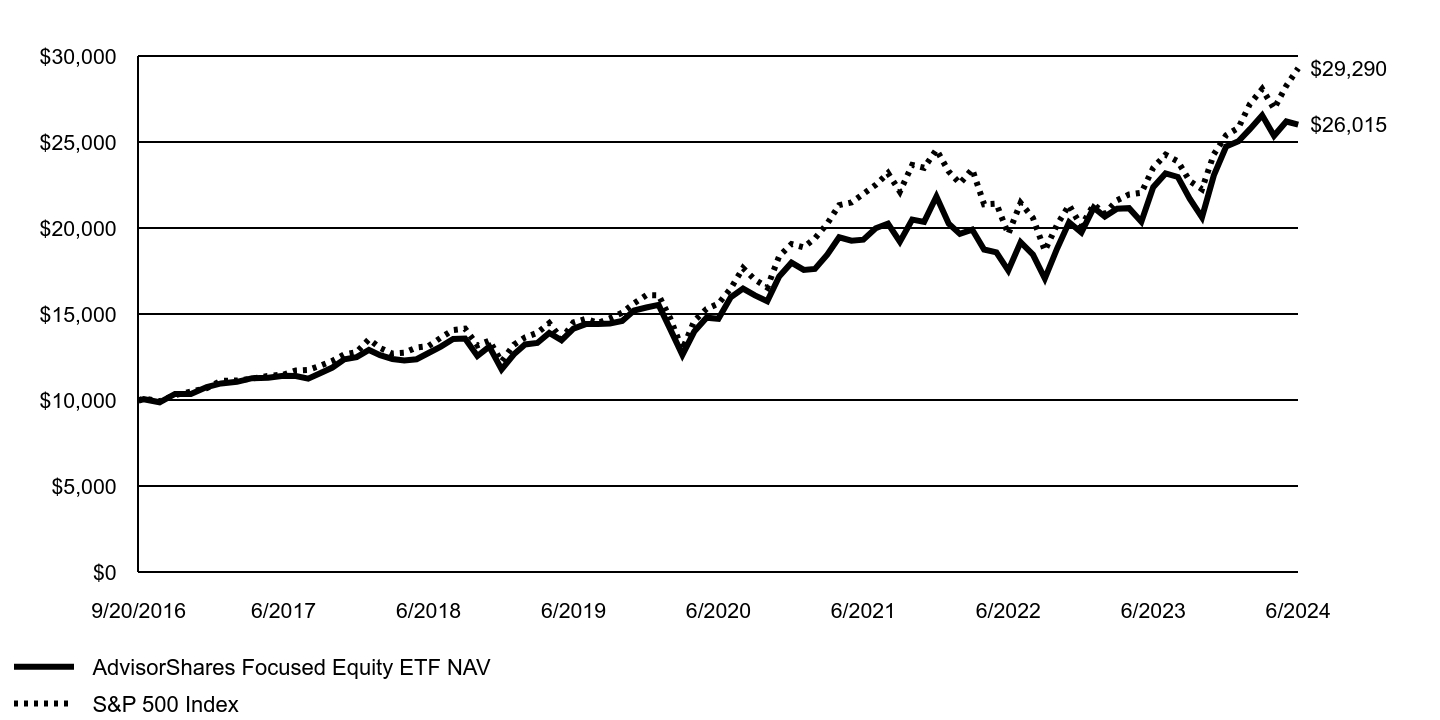

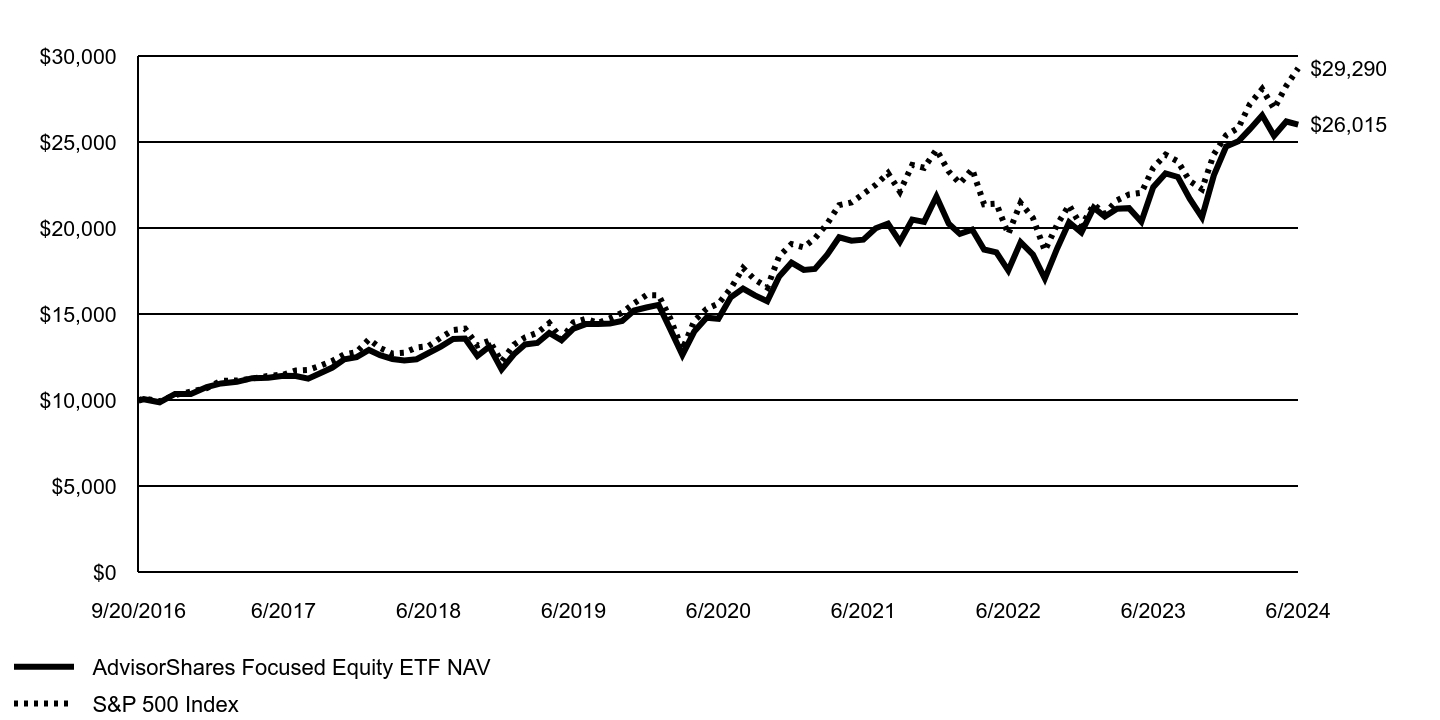

AdvisorShares Focused Equity ETF

Annual Shareholder Report | JUNE 30, 2024

This annual shareholder report contains important information about AdvisorShares Focused Equity ETF (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.advisorshares.com/about/literature-center. You can also request this information by contacting us at 1-877-843-3831.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Cost of $10K Investment | Cost Paid as % of $10K Investment |

|---|

| AdvisorShares Focused Equity ETF | $78 | 0.72% |

How did the Fund perform last year?

For the 12 months ended June 30, 2024, the AdvisorShares Focused Equity ETF (ticker: CWS) gained 16.20% (NAV) and 15.84% (market price).

CWS is an exchange-traded fund that aims to provide superior returns through a diversified portfolio of 25 high-quality stocks. The stocks in the portfolio are equally weighted at the start of each year, and no changes are made throughout the year (except for mergers or buyouts).

Over the past year, CWS benefitted from a resilient U.S. economy and lower inflation. The Fund’s performance can be impacted by the health of the broader economy and financial market conditions. CWS tends to perform well relative to the broader market when monetary conditions are more restrictive. While this has been an important factor in previous years, it was less so in the past year as the Federal Reserve left interest rates unchanged.

The Fund’s performance can be influenced by geo-political conditions, especially our positions in defense and aerospace companies. Additionally, CWS can be subjected to transient market trends. CWS tends to perform well when high-quality stocks are in favor. The Fund also did well this year as economically cyclical stocks gained favor, and investors foresaw a stronger economy and lower inflation.

We continue to be optimistic for the Fund. CWS seeks to invest in companies with very strong balance sheets and lasting competitive advantages. These attributes should help the Fund’s holdings weather whatever comes their way.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

GROWTH OF AN ASSUMED $10,000 INVESTMENT

| | S&P 500 Index |

|---|

| AdvisorShares Focused Equity ETF NAV | |

|---|

| 9/20/2016 | $10,000 | $10,000 |

| 9/30/2016 | $10,080 | $10,137 |

| 10/31/2016 | $9,901 | $9,952 |

| 11/30/2016 | $10,385 | $10,321 |

| 12/31/2016 | $10,378 | $10,525 |

| 1/31/2017 | $10,789 | $10,725 |

| 2/28/2017 | $10,996 | $11,151 |

| 3/31/2017 | $11,087 | $11,164 |

| 4/30/2017 | $11,302 | $11,278 |

| 5/31/2017 | $11,331 | $11,437 |

| 6/30/2017 | $11,439 | $11,508 |

| 7/31/2017 | $11,428 | $11,745 |

| 8/31/2017 | $11,274 | $11,781 |

| 9/30/2017 | $11,590 | $12,024 |

| 10/31/2017 | $11,919 | $12,305 |

| 11/30/2017 | $12,400 | $12,682 |

| 12/31/2017 | $12,524 | $12,823 |

| 1/31/2018 | $12,936 | $13,557 |

| 2/28/2018 | $12,635 | $13,057 |

| 3/31/2018 | $12,417 | $12,726 |

| 4/30/2018 | $12,333 | $12,774 |

| 5/31/2018 | $12,398 | $13,082 |

| 6/30/2018 | $12,762 | $13,163 |

| 7/31/2018 | $13,131 | $13,652 |

| 8/31/2018 | $13,581 | $14,097 |

| 9/30/2018 | $13,596 | $14,177 |

| 10/31/2018 | $12,587 | $13,208 |

| 11/30/2018 | $13,137 | $13,478 |

| 12/31/2018 | $11,810 | $12,261 |

| 1/31/2019 | $12,688 | $13,243 |

| 2/28/2019 | $13,259 | $13,668 |

| 3/31/2019 | $13,343 | $13,934 |

| 4/30/2019 | $13,923 | $14,498 |

| 5/31/2019 | $13,497 | $13,577 |

| 6/30/2019 | $14,177 | $14,534 |

| 7/31/2019 | $14,441 | $14,743 |

| 8/31/2019 | $14,444 | $14,509 |

| 9/30/2019 | $14,478 | $14,781 |

| 10/31/2019 | $14,623 | $15,101 |

| 11/30/2019 | $15,228 | $15,649 |

| 12/31/2019 | $15,402 | $16,121 |

| 1/31/2020 | $15,556 | $16,115 |

| 2/29/2020 | $14,160 | $14,788 |

| 3/31/2020 | $12,652 | $12,962 |

| 4/30/2020 | $14,008 | $14,623 |

| 5/31/2020 | $14,814 | $15,320 |

| 6/30/2020 | $14,747 | $15,624 |

| 7/31/2020 | $15,998 | $16,505 |

| 8/31/2020 | $16,496 | $17,692 |

| 9/30/2020 | $16,103 | $17,020 |

| 10/31/2020 | $15,765 | $16,567 |

| 11/30/2020 | $17,208 | $18,381 |

| 12/31/2020 | $18,007 | $19,087 |

| 1/31/2021 | $17,585 | $18,895 |

| 2/28/2021 | $17,638 | $19,416 |

| 3/31/2021 | $18,462 | $20,266 |

| 4/30/2021 | $19,478 | $21,347 |

| 5/31/2021 | $19,282 | $21,497 |

| 6/30/2021 | $19,341 | $21,998 |

| 7/31/2021 | $20,001 | $22,521 |

| 8/31/2021 | $20,275 | $23,206 |

| 9/30/2021 | $19,221 | $22,126 |

| 10/31/2021 | $20,502 | $23,677 |

| 11/30/2021 | $20,370 | $23,513 |

| 12/31/2021 | $21,844 | $24,566 |

| 1/31/2022 | $20,269 | $23,295 |

| 2/28/2022 | $19,677 | $22,598 |

| 3/31/2022 | $19,925 | $23,437 |

| 4/30/2022 | $18,768 | $21,393 |

| 5/31/2022 | $18,606 | $21,432 |

| 6/30/2022 | $17,547 | $19,663 |

| 7/31/2022 | $19,194 | $21,476 |

| 8/31/2022 | $18,475 | $20,600 |

| 9/30/2022 | $17,085 | $18,703 |

| 10/31/2022 | $18,829 | $20,217 |

| 11/30/2022 | $20,348 | $21,347 |

| 12/31/2022 | $19,758 | $20,117 |

| 1/31/2023 | $21,193 | $21,381 |

| 2/28/2023 | $20,679 | $20,859 |

| 3/31/2023 | $21,138 | $21,625 |

| 4/30/2023 | $21,170 | $21,963 |

| 5/31/2023 | $20,379 | $22,058 |

| 6/30/2023 | $22,388 | $23,516 |

| 7/31/2023 | $23,183 | $24,271 |

| 8/31/2023 | $22,981 | $23,885 |

| 9/30/2023 | $21,718 | $22,746 |

| 10/31/2023 | $20,637 | $22,268 |

| 11/30/2023 | $23,075 | $24,301 |

| 12/31/2023 | $24,750 | $25,405 |

| 1/31/2024 | $25,051 | $25,832 |

| 2/29/2024 | $25,753 | $27,212 |

| 3/31/2024 | $26,559 | $28,087 |

| 4/30/2024 | $25,372 | $26,940 |

| 5/31/2024 | $26,199 | $28,276 |

| 6/30/2024 | $26,015 | $29,290 |

AVERAGE ANNUAL TOTAL RETURN

| Fund/Index | 1 year | 5 year | Since Inception 9/20/2016 |

|---|

| AdvisorShares Focused Equity ETF NAV | 16.20% | 12.91% | 13.08% |

| AdvisorShares Focused Equity ETF (MKT)* | 15.84% | 12.98% | 13.08% |

| S&P 500 Index | 24.56% | 15.05% | 14.82% |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

* The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the exchange included at the beginning of this shareholder report and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV, and are not individually redeemed from the Fund.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The Fund may be non-diversified and may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund's shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value.

The following table outlines key fund statistics as of 6/30/2024.

- Fund net assets$154,194,978

- Total advisory fees paid$549,905

- Total number of portfolio holdings26

- Period portfolio turnover rate18%

The table below shows the investment makeup of the Fund as of 6/30/2024.

| Sector | % of Net Assets |

|---|

| Leisure Time | 3.1% |

| Chemicals | 3.3% |

| Media | 3.3% |

| Real Estate | 3.4% |

| Packaging & Containers | 3.5% |

| Computers | 3.6% |

| Water | 3.7% |

| Food | 3.8% |

| Machinery - Diversified | 4.1% |

| Insurance | 4.2% |

| Pharmaceuticals | 4.2% |

| Aerospace/Defense | 4.7% |

| Other | 54.4% |

| Money Market Fund | 0.8% |

| Assets Less Liabilities | (0.1)% |

| Total | 100.0% |

Availability of Additional Information

If you wish to find additional information about the Fund such as the prospectus, financial information, portfolio holdings and proxy voting, please see the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Fund Services, LLC

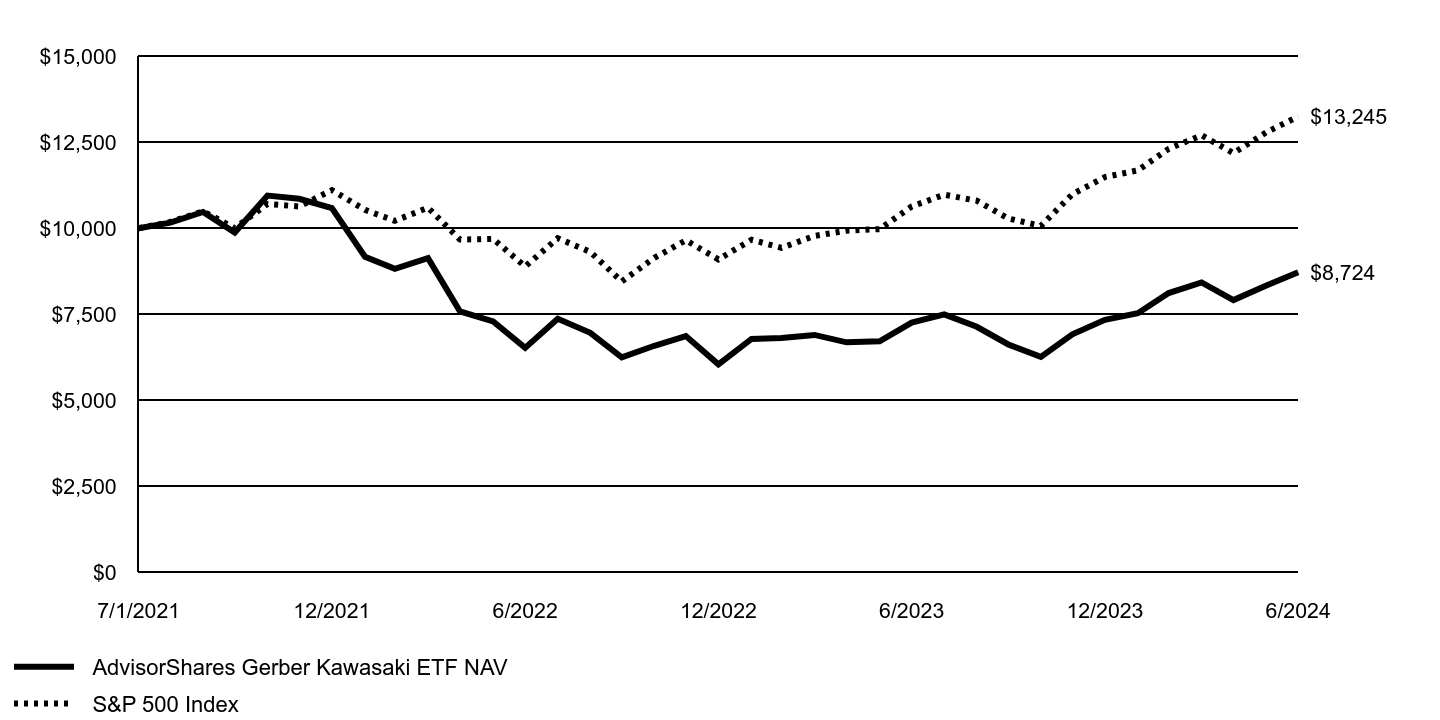

AdvisorShares Gerber Kawasaki ETF

Annual Shareholder Report | JUNE 30, 2024

This annual shareholder report contains important information about AdvisorShares Gerber Kawasaki ETF (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.advisorshares.com/about/literature-center. You can also request this information by contacting us at 1-877-843-3831.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Cost of $10K Investment | Cost Paid as % of $10K Investment |

|---|

| AdvisorShares Gerber Kawasaki ETF | $83 | 0.75% |

How did the Fund perform last year?

The AdvisorShares Gerber Kawasaki ETF (ticker: GK) had a very solid performance during the past fiscal year ended June 30, 2024. We made significant shifts in our overall allocations, moving away from clean energy investments and into AI-related investments. We see the opportunity in AI as a unique, decade-long investment thesis that will transform our society in many visible and yet-to-be-seen ways.

This shift away from large positions like Tesla and into our new top holding, NVIDIA, resulted in much better performance for the Fund over the last 12 months. Despite the Biden administration's focus on clean energy, these investments performed poorly due to high interest rates and poor execution from many of the solar and electric vehicle companies we previously owned. Conversely, our AI investments have performed very well with much higher profits and revenue growth, as well as, in our opinion, significant future potential.

We continue to view the clean energy sector as a great opportunity and regularly evaluate investments in that space. However, until there are better conditions for climate-related investments, we have moved it to the sidelines from being a major theme in the Fund. Our primary focus now is on technology and AI, followed by consumer discretionary, healthcare, clean energy (monitoring opportunities), and real estate.

We are optimistic about the future and believe we are well-positioned for the Fund to perform well moving forward. We anticipate a lower interest rate environment, which could benefit many of our investments.

Thank you for your patience and support over the last several years. We have now had two positive fiscal years in a row with double-digit returns, and we hope to continue this streak well into the future. However, markets are uncertain, and we are actively managing the Fund for opportunities that we see today and in the future.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

GROWTH OF AN ASSUMED $10,000 INVESTMENT

| | S&P 500 Index |

|---|

| AdvisorShares Gerber Kawasaki ETF NAV | |

|---|

| 7/1/2021 | $10,000 | $10,000 |

| 7/31/2021 | $10,163 | $10,184 |

| 8/31/2021 | $10,473 | $10,493 |

| 9/30/2021 | $9,879 | $10,005 |

| 10/31/2021 | $10,951 | $10,706 |

| 11/30/2021 | $10,857 | $10,632 |

| 12/31/2021 | $10,587 | $11,109 |

| 1/31/2022 | $9,175 | $10,534 |

| 2/28/2022 | $8,826 | $10,218 |

| 3/31/2022 | $9,132 | $10,598 |

| 4/30/2022 | $7,586 | $9,674 |

| 5/31/2022 | $7,295 | $9,691 |

| 6/30/2022 | $6,529 | $8,891 |

| 7/31/2022 | $7,375 | $9,711 |

| 8/31/2022 | $6,967 | $9,315 |

| 9/30/2022 | $6,256 | $8,457 |

| 10/31/2022 | $6,591 | $9,142 |

| 11/30/2022 | $6,871 | $9,653 |

| 12/31/2022 | $6,051 | $9,097 |

| 1/31/2023 | $6,790 | $9,668 |

| 2/28/2023 | $6,817 | $9,432 |

| 3/31/2023 | $6,905 | $9,779 |

| 4/30/2023 | $6,691 | $9,931 |

| 5/31/2023 | $6,721 | $9,975 |

| 6/30/2023 | $7,261 | $10,634 |

| 7/31/2023 | $7,500 | $10,975 |

| 8/31/2023 | $7,141 | $10,800 |

| 9/30/2023 | $6,628 | $10,285 |

| 10/31/2023 | $6,267 | $10,069 |

| 11/30/2023 | $6,922 | $10,989 |

| 12/31/2023 | $7,345 | $11,488 |

| 1/31/2024 | $7,536 | $11,681 |

| 2/29/2024 | $8,120 | $12,305 |

| 3/31/2024 | $8,429 | $12,701 |

| 4/30/2024 | $7,918 | $12,182 |

| 5/31/2024 | $8,342 | $12,786 |

| 6/30/2024 | $8,724 | $13,245 |

AVERAGE ANNUAL TOTAL RETURN

| Fund/Index | 1 year | Since Inception 7/1/2021 |

|---|

| AdvisorShares Gerber Kawasaki ETF NAV | 20.16% | |

| AdvisorShares Gerber Kawasaki (MKT)* | 20.12% | |

| S&P 500 Index | 24.56% | 9.83% |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

* The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the exchange included at the beginning of this shareholder report and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV, and are not individually redeemed from the Fund.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The Fund may be non-diversified and may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund's shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value.

The following table outlines key fund statistics as of 6/30/2024.

- Fund net assets$22,492,411

- Total advisory fees paid$0

- Total number of portfolio holdings30

- Period portfolio turnover rate53%

The table below shows the investment makeup of the Fund as of 6/30/2024.

| Sector | % of Net Assets |

|---|

| Auto Manufacturers | 0.7% |

| Retail | 1.1% |

| Apparel | 1.2% |

| REITS | 1.4% |

| Biotechnology | 2.2% |

| Venture Capital | 2.9% |

| Media | 3.9% |

| Equity Fund | 4.0% |

| Building Materials | 4.3% |

| Diversified Financial Services | 4.3% |

| Home Builders | 4.9% |

| Lodging | 7.5% |

| Other | 61.1% |

| Money Market Fund | 0.7% |

| Assets Less Liabilities | (0.2)% |

| Total | 100.0% |

Availability of Additional Information

If you wish to find additional information about the Fund such as the prospectus, financial information, portfolio holdings and proxy voting, please see the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Fund Services, LLC

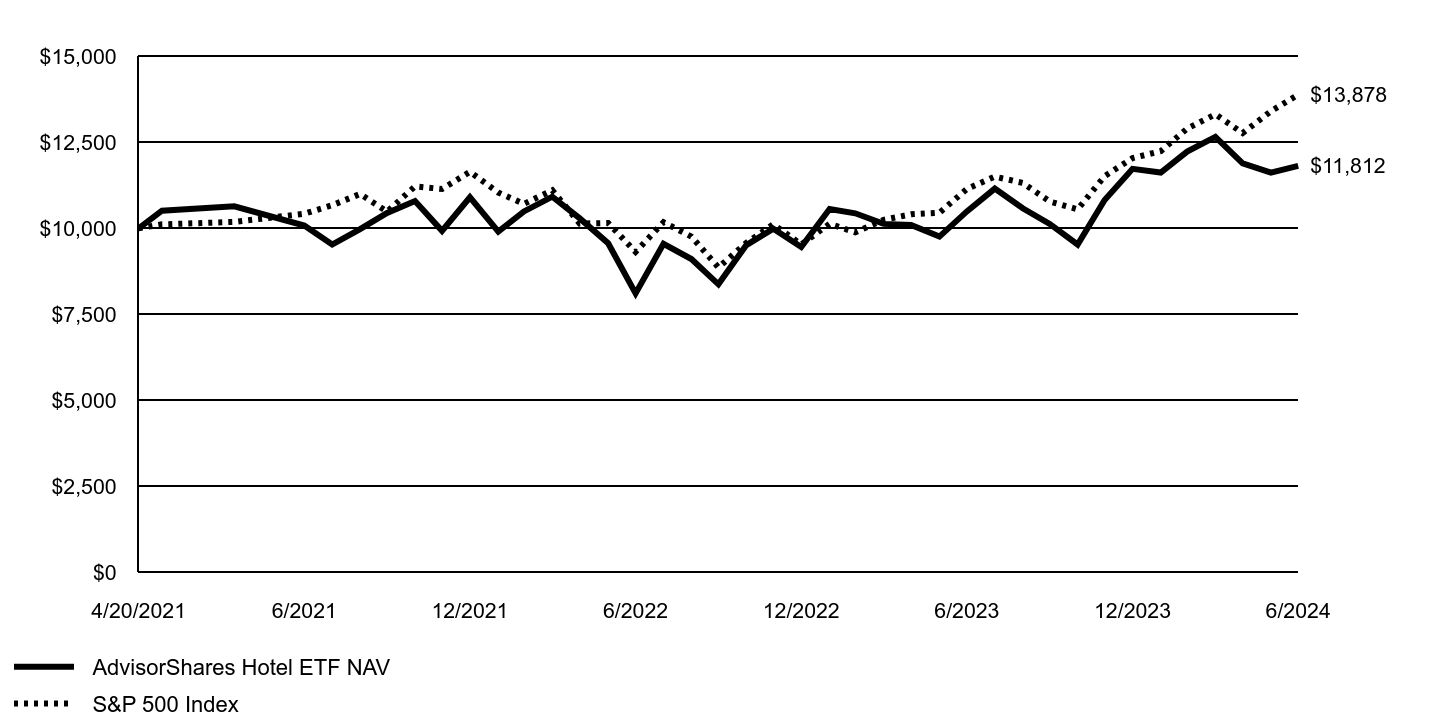

Annual Shareholder Report | JUNE 30, 2024

This annual shareholder report contains important information about AdvisorShares Hotel ETF (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.advisorshares.com/about/literature-center. You can also request this information by contacting us at 1-877-843-3831.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Cost of $10K Investment | Cost Paid as % of $10K Investment |

|---|

| AdvisorShares Hotel ETF | $105 | 0.99% |

How did the Fund perform last year?

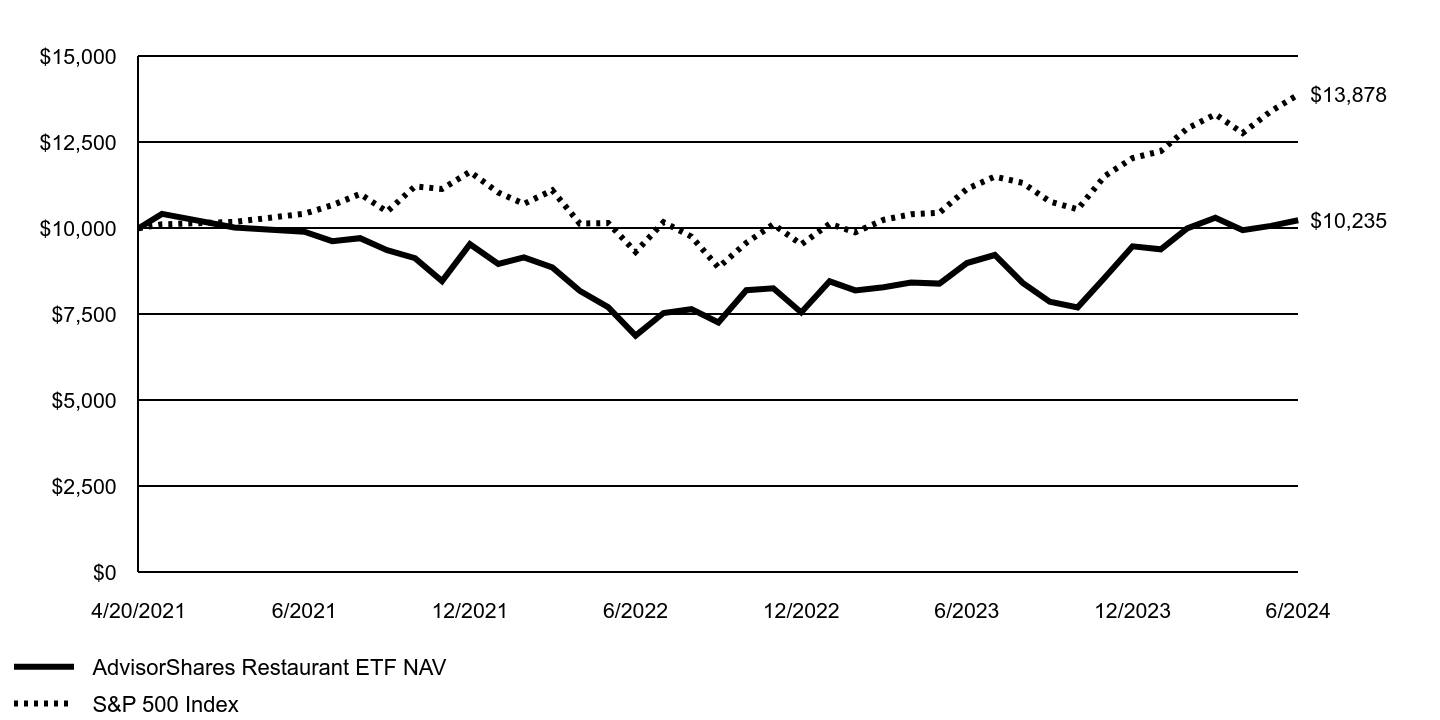

During the past fiscal year, the AdvisorShares Hotel ETF (ticker: BEDZ) achieved a modestly positive return but underperformed the S&P 500 Index.

BEDZ's performance is closely tied to the hotel industry, a crucial part of the global travel and tourism sector, including luxury hotels, resorts, budget hotels, and boutique hotels. The industry's performance is influenced by economic conditions, evolving travel trends, technological advancements, and global events. Despite concerns about a potential recession and geopolitical tensions, the sector has shown resilience. Leisure travel thrived, driven by strong consumer confidence and pent-up demand. However, the recovery of business travel was slower, impacting overall growth. Airlines reported increases in passenger numbers and improved load factors, but higher fuel costs and operational challenges limited their profit margins.

We remain optimistic about the future growth of the travel sector, supported by increasing interest in diverse destinations, technological advancements, and the impact of baby boomers.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

GROWTH OF AN ASSUMED $10,000 INVESTMENT

| | S&P 500 Index |

|---|

| AdvisorShares Hotel ETF NAV | |

|---|

| 4/20/2021 | $10,000 | $10,000 |

| 4/30/2021 | $10,512 | $10,114 |

| 5/31/2021 | $10,637 | $10,185 |

| 6/30/2021 | $10,081 | $10,423 |

| 7/31/2021 | $9,528 | $10,670 |

| 8/31/2021 | $9,976 | $10,995 |

| 9/30/2021 | $10,443 | $10,484 |

| 10/31/2021 | $10,790 | $11,218 |

| 11/30/2021 | $9,925 | $11,140 |

| 12/31/2021 | $10,901 | $11,640 |

| 1/31/2022 | $9,905 | $11,037 |

| 2/28/2022 | $10,489 | $10,707 |

| 3/31/2022 | $10,917 | $11,104 |

| 4/30/2022 | $10,287 | $10,136 |

| 5/31/2022 | $9,565 | $10,155 |

| 6/30/2022 | $8,111 | $9,316 |

| 7/31/2022 | $9,550 | $10,175 |

| 8/31/2022 | $9,107 | $9,760 |

| 9/30/2022 | $8,374 | $8,862 |

| 10/31/2022 | $9,512 | $9,579 |

| 11/30/2022 | $9,987 | $10,114 |

| 12/31/2022 | $9,459 | $9,532 |

| 1/31/2023 | $10,558 | $10,130 |

| 2/28/2023 | $10,435 | $9,883 |

| 3/31/2023 | $10,128 | $10,246 |

| 4/30/2023 | $10,097 | $10,406 |

| 5/31/2023 | $9,759 | $10,451 |

| 6/30/2023 | $10,490 | $11,142 |

| 7/31/2023 | $11,151 | $11,500 |

| 8/31/2023 | $10,581 | $11,317 |

| 9/30/2023 | $10,126 | $10,777 |

| 10/31/2023 | $9,529 | $10,551 |

| 11/30/2023 | $10,820 | $11,514 |

| 12/31/2023 | $11,726 | $12,037 |

| 1/31/2024 | $11,619 | $12,239 |

| 2/29/2024 | $12,225 | $12,893 |

| 3/31/2024 | $12,655 | $13,308 |

| 4/30/2024 | $11,881 | $12,764 |

| 5/31/2024 | $11,615 | $13,397 |

| 6/30/2024 | $11,812 | $13,878 |

AVERAGE ANNUAL TOTAL RETURN

| Fund/Index | 1 year | Since Inception 4/20/2021 |

|---|

| AdvisorShares Hotel ETF NAV | 12.61% | 5.35% |

| AdvisorShares Hotel ETF (MKT)* | 12.70% | 5.34% |

| S&P 500 Index | 24.56% | 10.80% |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

* The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the exchange included at the beginning of this shareholder report and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV, and are not individually redeemed from the Fund.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The Fund may be non-diversified and may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund's shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value.

The following table outlines key fund statistics as of 6/30/2024.

- Fund net assets$3,371,772

- Total advisory fees paid$0

- Total number of portfolio holdings25

- Period portfolio turnover rate94%

The table below shows the investment makeup of the Fund as of 6/30/2024.

| Sector | % of Net Assets |

|---|

| Commercial Services | 5.9% |

| Leisure Time | 10.2% |

| Internet | 21.6% |

| REITS | 27.6% |

| Lodging | 31.6% |

| Money Market Fund | 4.3% |

| Assets Less Liabilities | (1.2)% |

| Total | 100.0% |

Availability of Additional Information

If you wish to find additional information about the Fund such as the prospectus, financial information, portfolio holdings and proxy voting, please see the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Fund Services, LLC

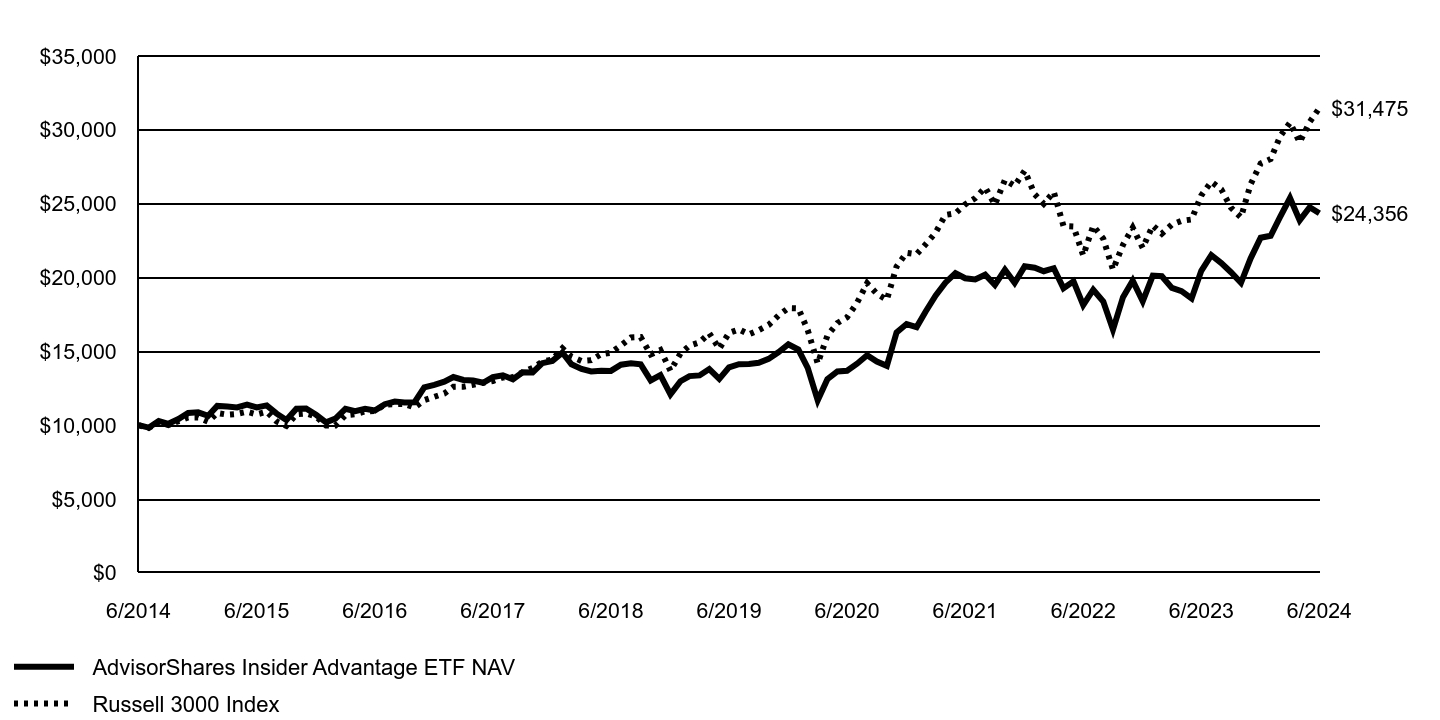

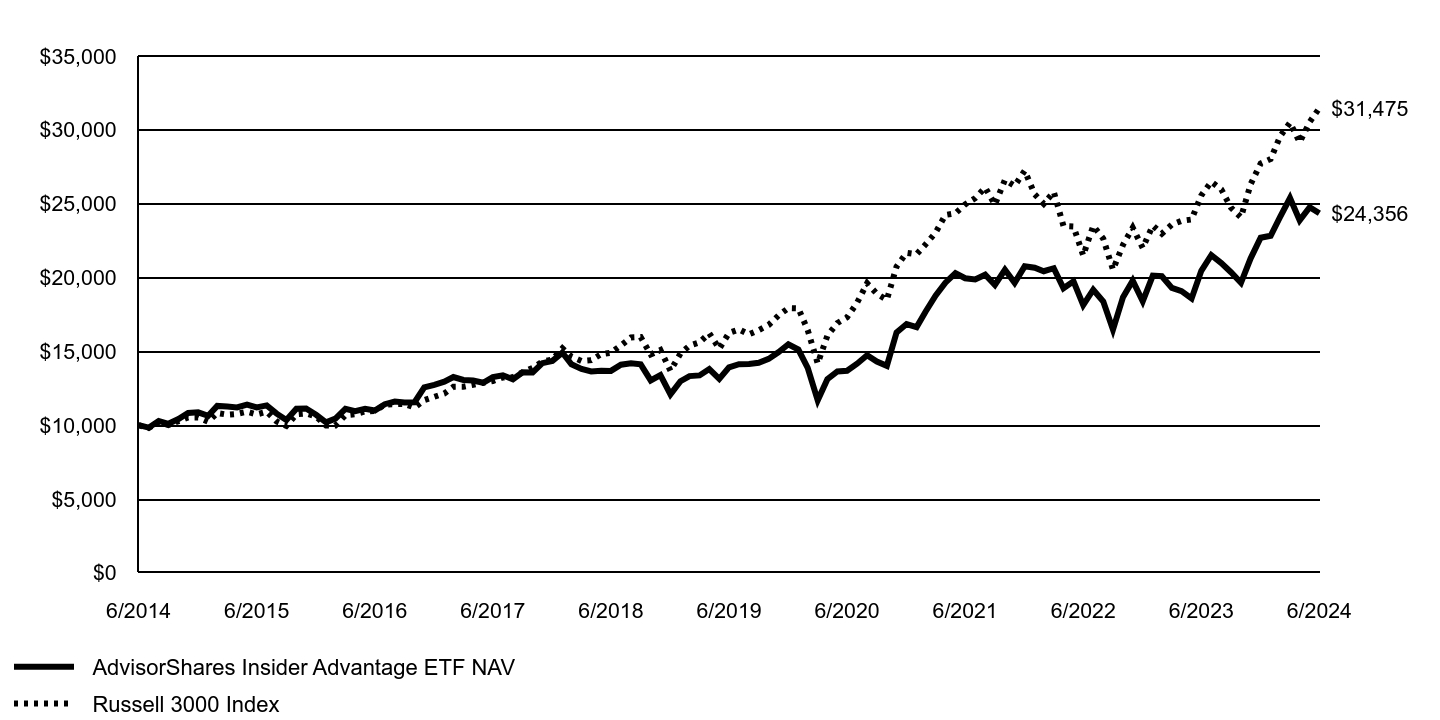

AdvisorShares Insider Advantage ETF

Annual Shareholder Report | JUNE 30, 2024

This annual shareholder report contains important information about AdvisorShares Insider Advantage ETF (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.advisorshares.com/about/literature-center. You can also request this information by contacting us at 1-877-843-3831.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Cost of $10K Investment | Cost Paid as % of $10K Investment |

|---|

| AdvisorShares Insider Advantage ETF | $99 | 0.90% |

How did the Fund perform last year?

The AdvisorShares Insider Advantage ETF (ticker: SURE) recorded positive returns for the fiscal year ended June 30, 2024. The Fund’s strategy is designed to follow a group of corporations that are actively buying back their own shares and distributing dividends.

SURE has taken advantage of the substantial level of recent buybacks and dividends, offering investors a way to benefit from these corporate actions that, we believe, tend to reward shareholders. SURE invests in companies that have demonstrated a tendency to deliver value back to their shareholders which can suggest robust financial health of a company, as well as management's belief in the company's potential for future growth. Additionally, the Fund has seen a favorable influence from the current disinflationary trend on its performance. Moreover, discrepancies in market dynamics, especially the different performances between large-cap versus mid-and small-cap companies, as well as technology firms compared to other industries, considerably affected the Fund’s results as SURE equally weighs the companies in its portfolio.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

GROWTH OF AN ASSUMED $10,000 INVESTMENT

| | Russell 3000 Index |

|---|

| AdvisorShares Insider Advantage ETF NAV | |

|---|

| 6/2014 | $10,000 | $10,000 |

| 7/2014 | $9,834 | $9,803 |

| 8/2014 | $10,289 | $10,214 |

| 9/2014 | $10,094 | $10,001 |

| 10/2014 | $10,414 | $10,276 |

| 11/2014 | $10,824 | $10,525 |

| 12/2014 | $10,868 | $10,525 |

| 1/2015 | $10,634 | $10,232 |

| 2/2015 | $11,304 | $10,825 |

| 3/2015 | $11,259 | $10,715 |

| 4/2015 | $11,202 | $10,763 |

| 5/2015 | $11,394 | $10,912 |

| 6/2015 | $11,205 | $10,729 |

| 7/2015 | $11,339 | $10,909 |

| 8/2015 | $10,783 | $10,250 |

| 9/2015 | $10,347 | $9,952 |

| 10/2015 | $11,111 | $10,738 |

| 11/2015 | $11,131 | $10,797 |

| 12/2015 | $10,705 | $10,576 |

| 1/2016 | $10,197 | $9,979 |

| 2/2016 | $10,446 | $9,976 |

| 3/2016 | $11,113 | $10,678 |

| 4/2016 | $10,949 | $10,744 |

| 5/2016 | $11,113 | $10,936 |

| 6/2016 | $10,996 | $10,959 |

| 7/2016 | $11,420 | $11,394 |

| 8/2016 | $11,602 | $11,423 |

| 9/2016 | $11,540 | $11,441 |

| 10/2016 | $11,556 | $11,193 |

| 11/2016 | $12,556 | $11,694 |

| 12/2016 | $12,734 | $11,922 |

| 1/2017 | $12,943 | $12,147 |

| 2/2017 | $13,261 | $12,599 |

| 3/2017 | $13,065 | $12,607 |

| 4/2017 | $13,028 | $12,741 |

| 5/2017 | $12,871 | $12,871 |

| 6/2017 | $13,256 | $12,987 |

| 7/2017 | $13,380 | $13,232 |

| 8/2017 | $13,109 | $13,258 |

| 9/2017 | $13,584 | $13,581 |

| 10/2017 | $13,572 | $13,877 |

| 11/2017 | $14,198 | $14,299 |

| 12/2017 | $14,354 | $14,442 |

| 1/2018 | $14,911 | $15,203 |

| 2/2018 | $14,124 | $14,642 |

| 3/2018 | $13,812 | $14,349 |

| 4/2018 | $13,638 | $14,403 |

| 5/2018 | $13,694 | $14,810 |

| 6/2018 | $13,675 | $14,907 |

| 7/2018 | $14,096 | $15,401 |

| 8/2018 | $14,194 | $15,942 |

| 9/2018 | $14,124 | $15,968 |

| 10/2018 | $13,032 | $14,793 |

| 11/2018 | $13,396 | $15,089 |

| 12/2018 | $12,088 | $13,685 |

| 1/2019 | $12,977 | $14,859 |

| 2/2019 | $13,323 | $15,382 |

| 3/2019 | $13,372 | $15,606 |

| 4/2019 | $13,799 | $16,230 |

| 5/2019 | $13,133 | $15,179 |

| 6/2019 | $13,913 | $16,246 |

| 7/2019 | $14,128 | $16,487 |

| 8/2019 | $14,149 | $16,151 |

| 9/2019 | $14,223 | $16,434 |

| 10/2019 | $14,490 | $16,788 |

| 11/2019 | $14,936 | $17,426 |

| 12/2019 | $15,481 | $17,929 |

| 1/2020 | $15,121 | $17,910 |

| 2/2020 | $13,876 | $16,444 |

| 3/2020 | $11,688 | $14,182 |

| 4/2020 | $13,111 | $16,061 |

| 5/2020 | $13,642 | $16,919 |

| 6/2020 | $13,686 | $17,306 |

| 7/2020 | $14,162 | $18,289 |

| 8/2020 | $14,735 | $19,614 |

| 9/2020 | $14,313 | $18,900 |

| 10/2020 | $14,021 | $18,492 |

| 11/2020 | $16,281 | $20,741 |

| 12/2020 | $16,851 | $21,675 |

| 1/2021 | $16,643 | $21,578 |

| 2/2021 | $17,700 | $22,253 |

| 3/2021 | $18,785 | $23,050 |

| 4/2021 | $19,652 | $24,238 |

| 5/2021 | $20,301 | $24,349 |

| 6/2021 | $19,951 | $24,949 |

| 7/2021 | $19,866 | $25,371 |

| 8/2021 | $20,190 | $26,095 |

| 9/2021 | $19,496 | $24,924 |

| 10/2021 | $20,522 | $26,610 |

| 11/2021 | $19,643 | $26,205 |

| 12/2021 | $20,757 | $27,236 |

| 1/2022 | $20,662 | $25,634 |

| 2/2022 | $20,425 | $24,988 |

| 3/2022 | $20,628 | $25,799 |

| 4/2022 | $19,273 | $23,484 |

| 5/2022 | $19,740 | $23,452 |

| 6/2022 | $18,133 | $21,490 |

| 7/2022 | $19,174 | $23,506 |

| 8/2022 | $18,378 | $22,629 |

| 9/2022 | $16,467 | $20,531 |

| 10/2022 | $18,668 | $22,214 |

| 11/2022 | $19,787 | $23,374 |

| 12/2022 | $18,386 | $22,005 |

| 1/2023 | $20,129 | $23,521 |

| 2/2023 | $20,086 | $22,971 |

| 3/2023 | $19,300 | $23,585 |

| 4/2023 | $19,075 | $23,837 |

| 5/2023 | $18,582 | $23,929 |

| 6/2023 | $20,451 | $25,563 |

| 7/2023 | $21,508 | $26,480 |

| 8/2023 | $20,976 | $25,968 |

| 9/2023 | $20,359 | $24,731 |

| 10/2023 | $19,640 | $24,076 |

| 11/2023 | $21,300 | $26,321 |

| 12/2023 | $22,696 | $27,717 |

| 1/2024 | $22,829 | $28,024 |

| 2/2024 | $24,084 | $29,541 |

| 3/2024 | $25,383 | $30,494 |

| 4/2024 | $23,873 | $29,152 |

| 5/2024 | $24,759 | $30,530 |

| 6/2024 | $24,356 | $31,475 |

AVERAGE ANNUAL TOTAL RETURN

| Fund/Index | 1 year | 5 year | 10 year |

|---|

| AdvisorShares Insider Advantage ETF NAV | 19.10% | 11.85% | 9.31% |

| AdvisorShares Insider Advantage ETF (MKT)* | 18.93% | 11.85% | 9.29% |

| Russell 3000 Index | 23.13% | 14.14% | 12.15% |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

* The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the exchange included at the beginning of this shareholder report and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV, and are not individually redeemed from the Fund.

The Russell 3000 Index is broad market, capitalization-weighted index comprised of the largest 3,000 U.S. companies and represents 98% of the investable U.S. equity market.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The Fund may be non-diversified and may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund's shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value.

The following table outlines key fund statistics as of 6/30/2024.

- Fund net assets$47,118,372

- Total advisory fees paid$243,188

- Total number of portfolio holdings101

- Period portfolio turnover rate246%

The table below shows the investment makeup of the Fund as of 6/30/2024.

| Sector | % of Net Assets |

|---|

| Transportation | 0.8% |

| Pharmaceuticals | 0.9% |

| Packaging & Containers | 0.9% |

| Distribution/Wholesale | 0.9% |

| Advertising | 0.9% |

| Real Estate | 1.0% |

| Coal | 1.0% |

| Auto Manufacturers | 1.0% |

| Biotechnology | 1.0% |

| Entertainment | 1.0% |

| Media | 1.1% |

| Cosmetics/Personal Care | 1.1% |

| Other | 87.8% |

| Money Market Fund | 0.3% |

| Assets Less Liabilities | 0.3% |

| Total | 100.0% |

Availability of Additional Information

If you wish to find additional information about the Fund such as the prospectus, financial information, portfolio holdings and proxy voting, please see the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Fund Services, LLC

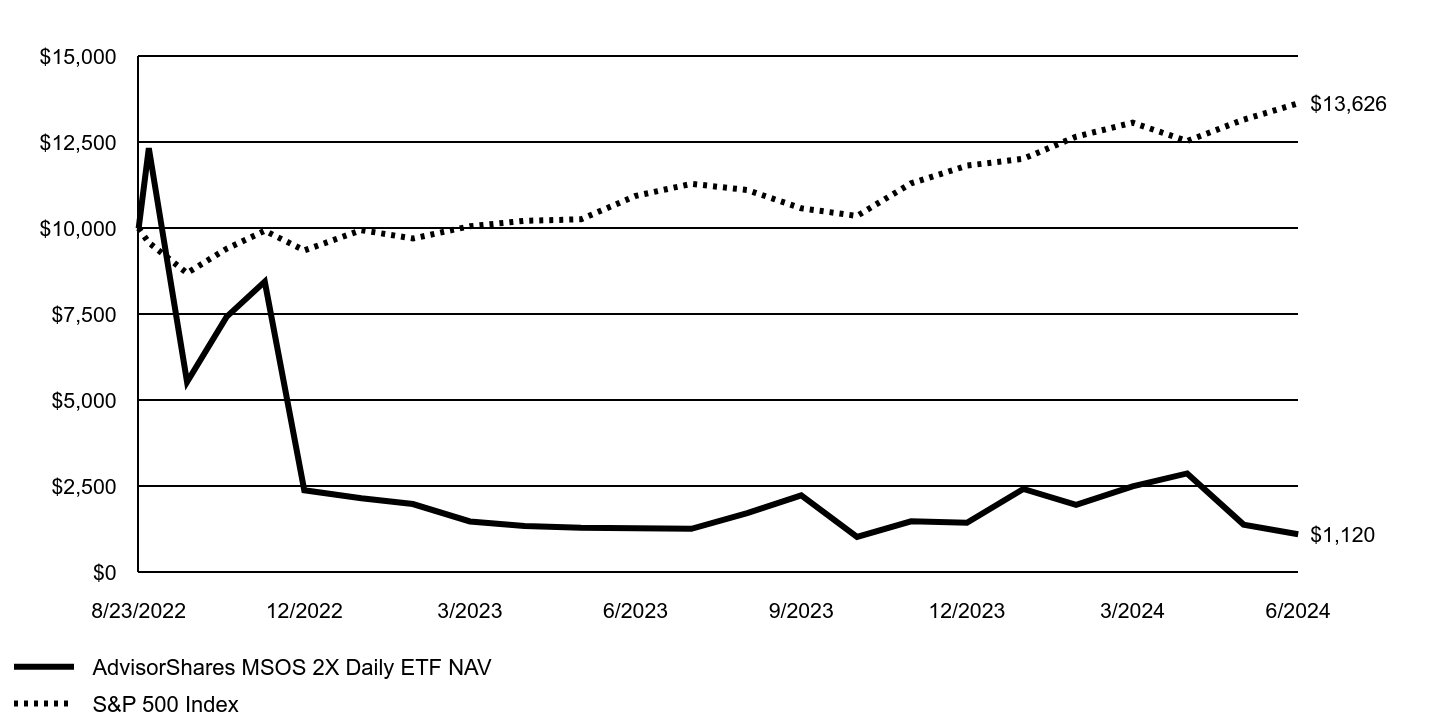

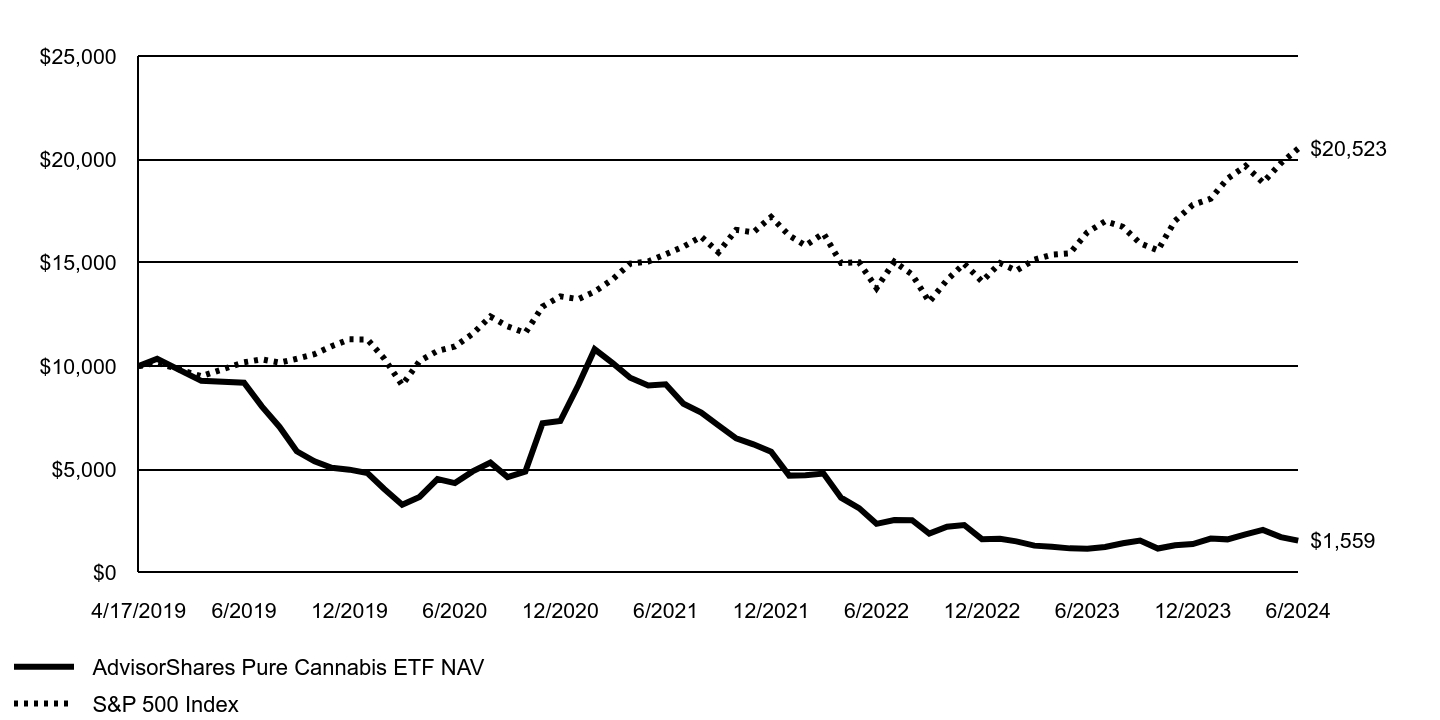

AdvisorShares MSOS 2X Daily ETF

Annual Shareholder Report | JUNE 30, 2024

This annual shareholder report contains important information about AdvisorShares MSOS 2X Daily ETF (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.advisorshares.com/about/literature-center. You can also request this information by contacting us at 1-877-843-3831.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Cost of $10K Investment | Cost Paid as % of $10K Investment |

|---|

| AdvisorShares MSOS 2X Daily ETF | $89 | 0.95% |

How did the Fund perform last year?

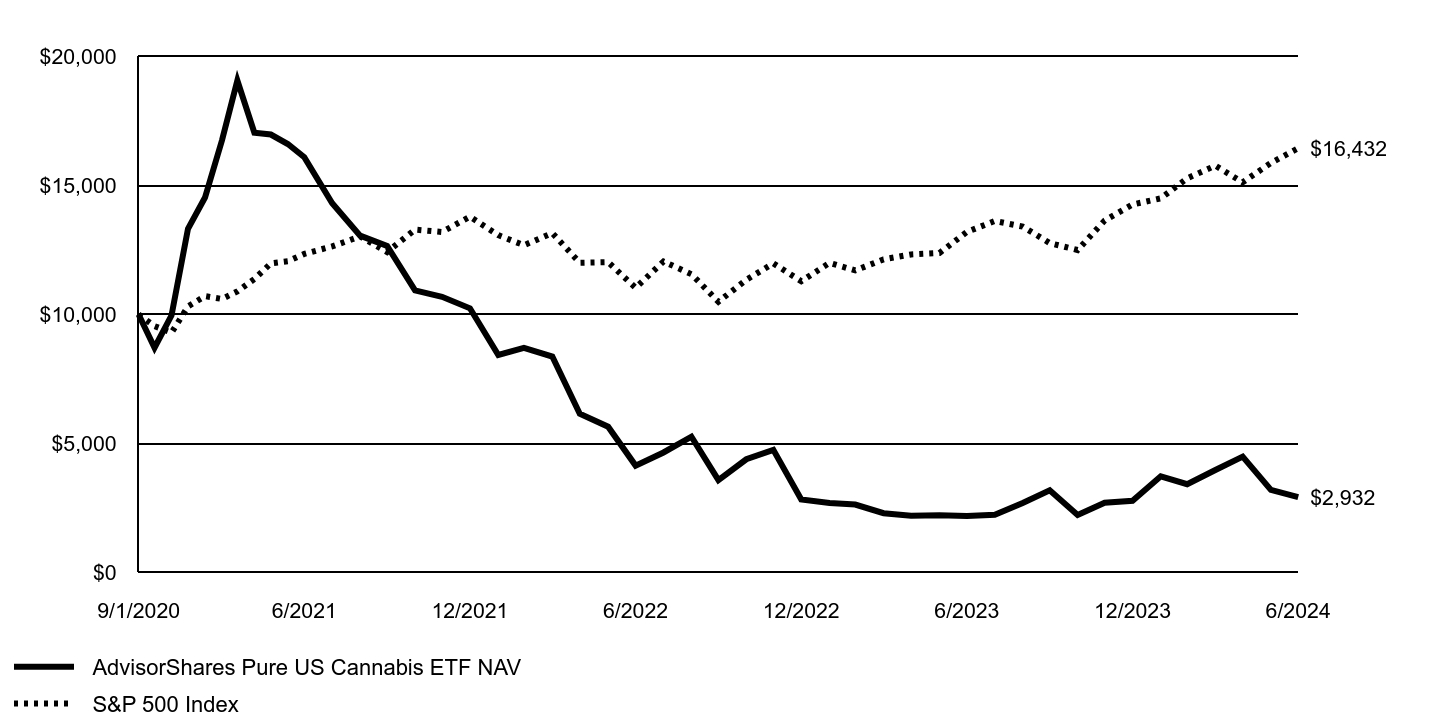

The AdvisorShares MSOS 2X Daily ETF (ticker: MSOX) aims to offer daily leveraged exposure to the AdvisorShares Pure US Cannabis ETF (MSOS) in a single trade, catering to sophisticated investors seeking amplified exposure to the U.S. cannabis sector. Over the 12 months ended June 30, 2024, MSOX experienced increasingly negative returns.

Due to its leveraged strategy and exclusive focus on the U.S. cannabis industry, MSOX is particularly sensitive to volatility from changes in U.S. cannabis legislation. The Fund’s future performance is expected to be influenced by the evolving regulatory environment, including the expansion of state-by-state cannabis sales and potential Federal reforms.

Despite current price levels, we maintain a strong optimistic outlook on the U.S. cannabis market and anticipate favorable changes in U.S. cannabis regulations.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

GROWTH OF AN ASSUMED $10,000 INVESTMENT

| | S&P 500 Index |

|---|

| AdvisorShares MSOS 2X Daily ETF NAV | |

|---|

| 8/23/2022 | $10,000 | $10,000 |

| 8/31/2022 | $12,326 | $9,583 |

| 9/30/2022 | $5,538 | $8,700 |

| 10/31/2022 | $7,428 | $9,405 |

| 11/30/2022 | $8,452 | $9,930 |

| 12/31/2022 | $2,397 | $9,358 |

| 1/31/2023 | $2,165 | $9,946 |

| 2/28/2023 | $1,998 | $9,704 |

| 3/31/2023 | $1,491 | $10,060 |

| 4/30/2023 | $1,359 | $10,217 |

| 5/31/2023 | $1,307 | $10,261 |

| 6/30/2023 | $1,292 | $10,939 |

| 7/31/2023 | $1,279 | $11,291 |

| 8/31/2023 | $1,733 | $11,111 |

| 9/30/2023 | $2,251 | $10,581 |

| 10/31/2023 | $1,042 | $10,359 |

| 11/30/2023 | $1,495 | $11,305 |

| 12/31/2023 | $1,455 | $11,818 |

| 1/31/2024 | $2,434 | $12,017 |

| 2/29/2024 | $1,973 | $12,659 |

| 3/31/2024 | $2,513 | $13,066 |

| 4/30/2024 | $2,886 | $12,532 |

| 5/31/2024 | $1,401 | $13,154 |

| 6/30/2024 | $1,120 | $13,626 |

AVERAGE ANNUAL TOTAL RETURN

| Fund/Index | 1 year | Since Inception 8/23/2022 |

|---|

| AdvisorShares MSOS 2X Daily ETF NAV | | |

| AdvisorShares MSOS 2X Daily ETF (MKT)* | | |

| S&P 500 Index | 24.56% | 18.18% |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

* The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the exchange included at the beginning of this shareholder report and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV, and are not individually redeemed from the Fund.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The Fund may be non-diversified and may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund's shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value.

The following table outlines key fund statistics as of 6/30/2024.

- Fund net assets$59,265,552

- Total advisory fees paid$312,372

- Total number of portfolio holdings3

- Period portfolio turnover rate0%

The table below shows the investment makeup of the Fund as of 6/30/2024. This does not represent the Fund's market exposure due to the exclusion of derivatives.

| Sector | % of Net Assets |

|---|

| Money Market Fund | 7.5% |

| Assets Less Liabilities | 92.5% |

| Total | 100.0% |

Availability of Additional Information

If you wish to find additional information about the Fund such as the prospectus, financial information, portfolio holdings and proxy voting, please see the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Fund Services, LLC

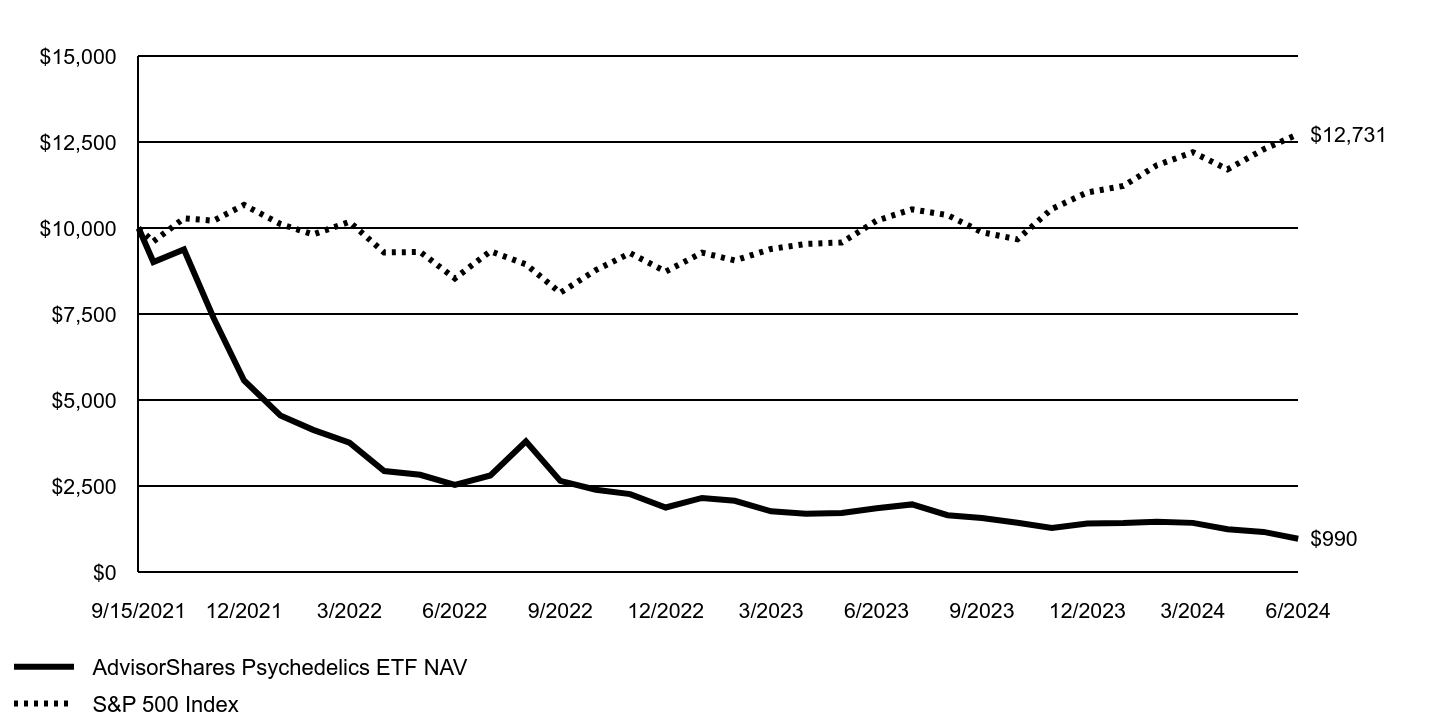

AdvisorShares Psychedelics ETF

Annual Shareholder Report | JUNE 30, 2024

This annual shareholder report contains important information about AdvisorShares Psychedelics ETF (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.advisorshares.com/about/literature-center. You can also request this information by contacting us at 1-877-843-3831.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Cost of $10K Investment | Cost Paid as % of $10K Investment |

|---|

| AdvisorShares Psychedelics ETF | $76 | 0.99% |

How did the Fund perform last year?

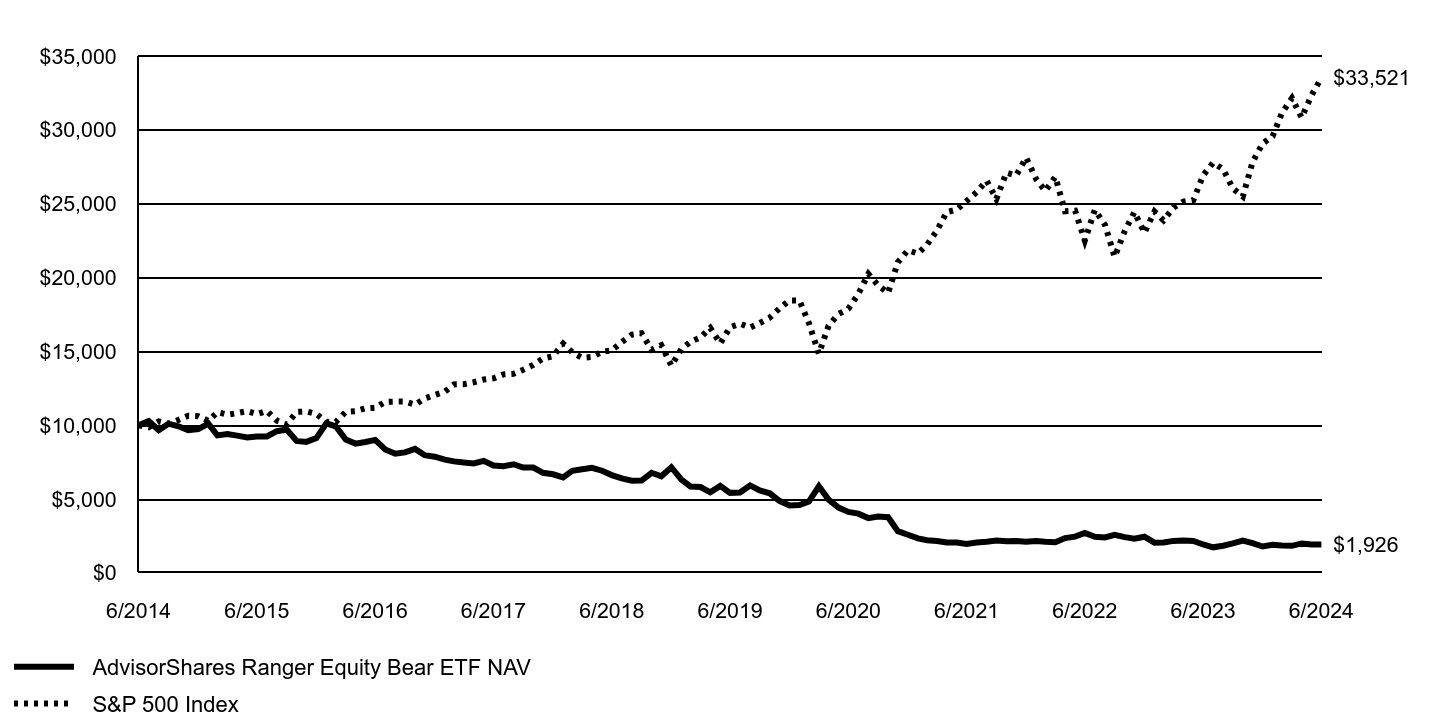

The AdvisorShares Psychedelics ETF (ticker: PSIL) recorded negative returns for the fiscal year ended June 30, 2024. Since its inception, the Fund’s performance has been volatile and predominantly negative.

Investing in psychedelics is relatively new and highly concentrated, consisting mainly of micro-cap securities. The industry, still in its early stages, is marked by companies primarily engaged in research and development of psychedelic therapies that have yet to gain widespread acceptance or regulation. This leads to significant market fluctuations, driven by shifts in investor sentiment influenced by regulatory updates, clinical trial outcomes, and broader market conditions.