UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

[X]

ANNUAL REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year endedMay 31, 2015

Commission File Number:000-53284

NATIONAL GRAPHITE CORP.

(Exact name of Registrant as specified in its charter)

Nevada |

| 26-0665441 |

| |||||||

(State or other Jurisdiction of Incorporation or Organization) |

| (IRS Employer Identification No.) |

| |||||||

|

|

|

| |||||||

Linienstrasse75 Duesseldorf, Germany |

| 40237 |

| |||||||

(Address of principal executive offices) |

| (Zip Code) |

| |||||||

|

| |||||||||

Schadowstr. 72, Duesseldorf, Germany, D - 40212 | ||||||||||

(Former name or former address, if changed since last report)

Registrant’s telephone number, including area code: 49 172 6544175

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: Common Stock, $0.001 Par Value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No[X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes[X] No [ ]

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ ] No[X]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 0-K.[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

[ ] Large Accelerated Filer | [ ] Accelerated Filer |

|

|

[ ] Non-Accelerated Filer | [X]Smaller Reporting Company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes[ ] No [X]

The aggregate market value of the voting and non-voting common equity on November 30, 2014 held by non-affiliates of the registrant based on the price last sold on such date was approximately $21,884,784. Shares of common stock held by each officer and director and by each person who owns 10% or more of the outstanding common stock of the registrant have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes. Without acknowledging that any individual director of registrant is an affiliate, all directors have been included as affiliates with respect to shares owned by them.

As of November 15, 2016, there were 154,308,415 shares of the registrant’s Common Stock outstanding.

NATIONAL GRAPHITE CORP.

Report on Form 10-K

PART I.

|

| |

Item 1. | Business | 4 |

Item 1A. | Risk Factors | 12 |

Item 2. | Properties | 18 |

Item 3. | Legal Proceedings | 18 |

PART II.

|

| |

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 18 |

Item 6. | Selected Financial Data | 20 |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 21 |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 22 |

Item 8. | Financial Statements and Supplementary Data | 23 |

Item 9. | Changes In and Disagreements With Accountants on Accounting and Financial Disclosure | 35 |

Item 9A. | Changes and Procedures | 35 |

Item 9B. | Other Information | 36 |

PART III.

|

| |

Item 10. | Directors, Executive Officers and Corporate Governance | 36 |

Item 11. | Executive Compensation | 39 |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 40 |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 41 |

Item 14. | Principal Accountant Fees and Services | 41 |

PART IV.

|

|

|

Item 15. | Exhibits | 42 |

FORWARD-LOOKING STATEMENTS

This report contains statements that constitute “forward-looking statements.” These forward-looking statements can be identified by the use of predictive, future-tense or forward-looking terminology like “believes,” “anticipates,” “expects,” “estimates,” “envisions,” “plans,” “projects” or similar terms. These statements appear in a number of places in this report and include statements regarding our intent, belief or current expectations and those of our directors or officers with respect to, among other things: (i) trends affecting our financial condition or results of operations, (ii) our business and growth strategies, and (iii) our financing plans. You are cautioned that any forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. Factors that could adversely affect actual results and performance include, among others, the effect of inflation and other negative economic trends and developments on the business of our customers and other barriers, examples being government regulation and competition. All forward-looking statements attributable to us are expressly qualified in their entirety by this foregoing cautionary statement.

Unless otherwise noted, references in this report to the “Company,” National Graphite,” “NGRC,” “we,” “our,” or “us” meansNational Graphite Corp.

PART I.

ITEM 1.

BUSINESS

General Development of Business

National Graphite Corp., a Nevada corporation (“NGRC”), was originally incorporated in the State of Wyoming on October 19, 2006, as Sierra Ventures, Inc. and established a fiscal year end of May 31. On February 5, 2010 we filed an Amendment to Articles with the Wyoming Secretary of State and changed our name from “Sierra Ventures Inc.” to “Lucky Boy Silver Corp.” We changed our company name to National Graphite Corp. on May 9, 2012. We changed the name of our company to better reflect the direction and business of our company. On March 22, 2011, the corporation converted from a Wyoming corporation to a Nevada corporation pursuant to Wyoming Statutes Title 17, ch. 16, Sect.(s) 820, 821 and 1114 and Nevada Revised Statutes 92A.205. This conversion did not alter the number of authorized shares, or the number of issued and outstanding shares, of the corporation. The voting and other rights of the common and preferred shares of the company’s capital stock remain substantially similar under Nevada law. The powers of the company’s officers, directors and shareholders also remain substantially the same.

On September 30, 2014, the Company entered into a Share Exchange Agreement with Biotech Development Corp., a Nevada corporation (“BDC”) and the shareholders of BDC. In connection with the closing of this transaction, we acquired all of the issued and outstanding shares of BDC, which resulted in BDC becoming our wholly owned subsidiary (the “Acquisition”). The closing of the Acquisition occurred on October 24, 2014.

We currently conduct our business activities at the office of econico Deutschland GmbH at Schadowstr. 72, D - 40212 Duesseldorf, Germany, which consists of approximately 1453 square feet of office/commercial/industrial space. The lease at "Immermannstr." was terminated on 11/30/15 and the lease at "Schadowstr." started on 12/01/15.

National Graphite has never filed for bankruptcy and has never been subject to receivership or similar proceedings.

National Graphite’s common stock is currently trading on the Pink Sheets under the symbol NGRC.

Financial Information

The audited financial statements for the fiscal year ended May 31, 2015 are attached hereto as Item 8 in this annual report.

Business of Issuer

Prior to the acquisition of BDC we were a start-up, exploration stage, company engaged in the search for gold, silver, and related minerals. Our mineral properties were without known reserves and our proposed program was exploratory in nature.

With the acquisition of BDC complete we ceased all mining exploratory activities and focused in on the business opportunities afforded by the Acquisition.

BDC is a biopharmaceutical risk/cost-sharing company operating in Germany, founded in May 2013 to collaborate clinical stage companies that develops new biological entities or new therapeutically platforms in the treatment for various diseases, rare diseases and diseases with unmet needs.

NGRC shares the risks of developing biotechnological companies through all periods of growth after promising therapies and their underlying intellectual properties have been identified. NGRC plans to assist in the formation of business contacts, funding, and the strategic positioning of these clinical stage companies.

NGRC currently is collaborating with Proteo Inc. (www.proteo.de). Proteo Inc. is a clinical stage drug development company and is developing, and intends to promote and market biopharmaceuticals and other biotech products. Proteo currently focuses on the clinical development of ELAFIN for treatment of postoperative inflammatory complications in the surgical therapy of esophagus carcinoma. Clinical trials for further indications and preclinical research into new fields of application are being conducted.

NGRC is pursuing the commercial development of Proteo’s lead drug candidate ELAFIN, a human identic protein, in the treatment of postoperative inflammatory complications.

NGRC has a small staff of highly qualified and experienced managers who have successfully funded early stage pharmaceutical companies. Proteo’s achievements to date have been supported by different grants and private investment raised by NGRC managers. The company’s lead product is a patented protein based on the body’s own tools.

New biological Entity

Currently available pharmaceutical drugs cannot cover the requirements for innovative therapies in indications with highly recommended medical needs. These continuous medical needs opens a highly and still underachieved potential for the “Red Biotechnology”.

New therapeutically platforms

It is scientifically proven that the use of bio - technological methods, the therapeutic possibilities in medicine are well advanced in the development of drugs. Improved diagnoses pioneered the way to individualized, patient customized therapy. These innovation leads on to significant higher efficiency in the treatment accompanied by lower side effects and reduced expenses. The shorter hospitalization and quicker recovery warrant the higher price of biopharmaceutical therapies overall.

Surging health care expenses worldwide

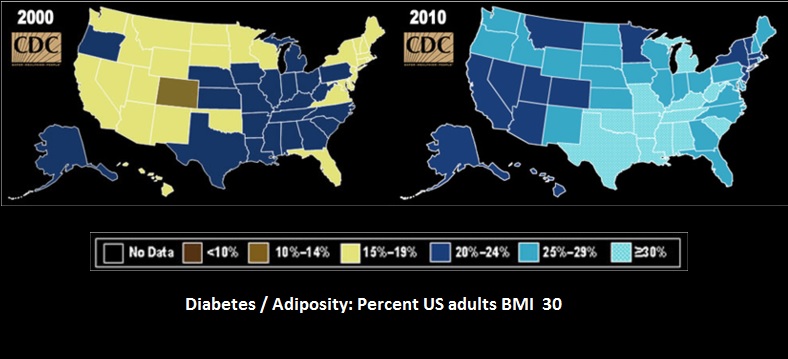

A health care study of the OECD shows that a German today is 80.2 years of age on average. 30 years ago the average life expectancy was almost 9 years shorter. These demographically shift and the increased prosperity associated with increased health consciousness implicate the increased demand for innovative pharmaceutical agents. Diseases like Alzheimer and carcinoma are predominantly age-related and rising adiposity leads to diabetes, coronary infarction and respiratory diseases.

Strong growing health care organizations in emerging markets

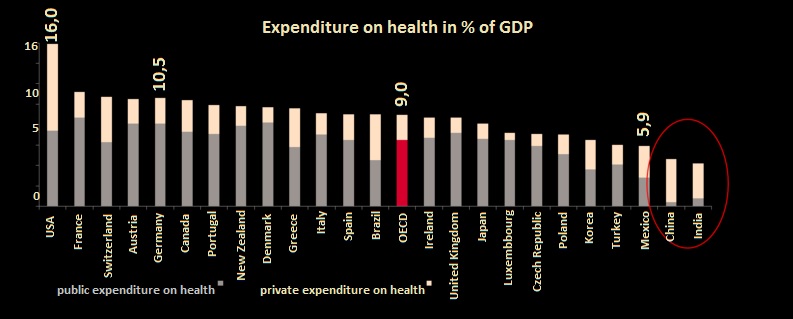

Emerging markets like BRICs (Brasilia, Russia, India, China and South Africa) are improving their health care systems and transfer the health care expenses from private to public. Therefore more people can effort cost-intensive biotechnological treatments and the market for these biotechnological products is expanding.

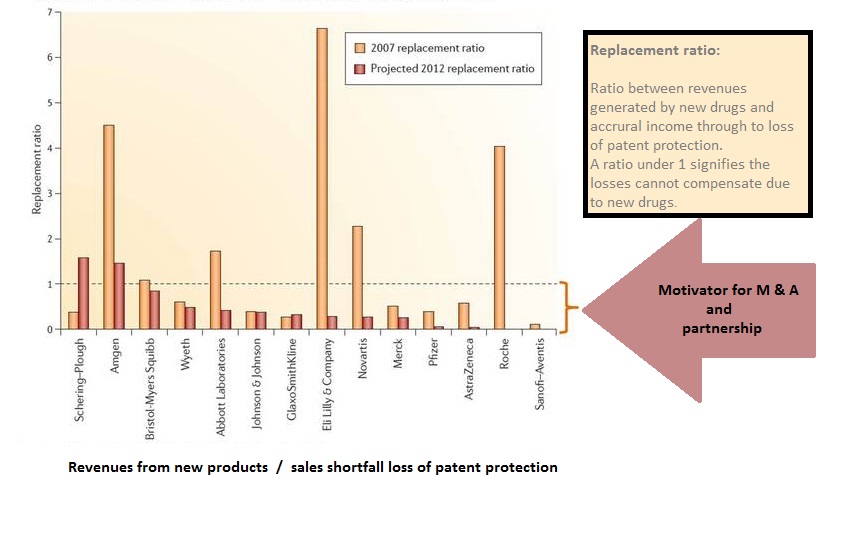

Liquidity for biopharmaceutical drugs though loss of patent protection

In the United States by 2018 drugs with a market potential of more than US$ 100 billion will lose the patent protection. Generic manufacturers will penetrate into the market with less expensive products which leads to a huge financial relief of the health care system. Therefore capacities for new innovative drugs of the biopharmaceutical industry are available.

(1)

Principal Products or Services.

ELAFIN

Currently the lead active agent Elafin is continuously validated.ELAFIN is a soluble endogenous protein produced by the human body and is a natural inhibitor of two tissue destroying enzymes, neutrophile elastases and proteinase-3. Both of these enzymes are known to be involved in the inflammatory response occurring in a variety of diseases. Furthermore,ELAFIN inactivates an additional enzyme (endogenous vascular elastics), which is involved in inflammatory damage to blood vessels.

ELAFIN is unique due to its human origin, its specificity for the relevant human proteases and its low toxic potential compared with synthetic alternatives. Due to its broad anti-inflammatory mode of action,ELAFIN represents a multi indication product.

Orphan Drug designation

ELAFIN was granted Orphan Drug designation by the FDA and the European pendant EMA for the treatment of PAH and the prevention of inflammatory complications of transthoracic esophagectomy.

Unique selling point

ELAFIN, a new biological entity is bringing a paradigm change in the treatment of severe inflammatory processes within the organism. The significantly good tolerance compared with synthetic alternatives means tremendous advantages in the treatment of inflammatory complications in the major surgery.

Clinical Development of ELAFIN

After developing a production procedure for ELAFIN, Proteo Inc. has initiated clinical trials to achieve governmental approval for the use of ELAFIN as a drug in Europe. For this purpose, the Company has contracted an experienced Contract Manufacturing Organization in Europe to produce ELAFIN in accordance with GMP (Goods Manufactured Practice) standards as required for clinical trials. The excellent tolerability of ELAFIN in human subjects was demonstrated in a Phase I clinical single dose escalating study. The drug candidate is currently in clinical development for three indications.

Treatment of Esophagus Carcinoma

Esophageal cancer mainly occurs in elder patients over 50. Complete surgical removal of the tumor offers the best chance of a cure. This surgical procedure, which can last up to 6 hours, is one of the most invasive surgical interventions and is associated with frequent and severe postoperative inflammatory complications leading to delayed recovery, prolonged need of intensive care and substantial postoperative mortality.

A doubled-blind, randomized, placebo-controlled Phase II clinical trial on the effect of ELAFIN on the postoperative inflammatory reactions and postoperative clinical course was conducted in patients undergoing esophagectomy for esophagus carcinoma. Proteo announced the favorable influence of ELAFIN treatment on the postoperative recovery in February 2011. The trial showed that intravenously administered ELAFIN has very clear positive effect on the period of recovery: 63 percent of the ELAFIN treated patients required only one day of intensive care. All patients in the placebo group needed several days of postoperative intensive medical care. In January 2010 Orphan Drug Designation was awarded to Proteo by the European Commission for the use of ELAFIN in the treatment of esophagus carcinoma. In March 2013, the US Food and Drug Administration (FDA) has granted orphan drug designation to ELAFIN for the prevention of inflammatory complications of transthoracic esophagectomy.

Currently, Proteo is preparing a double blind, randomized and placebo-controlled Phase III clinical trial in this acute therapy indication. Proteo has already obtained protocol assistance by the European Medicines Agency (EMA) and the trial is scheduled to start in 2016. The trial is designed to demonstrate efficacy, which is required for an application to receive marketing approval for the European market.

The European Commission has granted Orphan Drug Designation for ELAFIN to be used in the treatment of esophageal cancer and the FDA has granted Orphan Drug Designation for ELAFIN for the prevention of inflammatory complications of transthoracic esophagectomy within the United States. The EMA and the FDA agreed that no investigations in pediatric populations will be performed, as children are almost not affected by this kind of cancer.

Treatment of Coronary Bypass Patients

Coronary artery bypass surgery is a procedure performed to relieve angina pectoris and reduce the risk of death from coronary artery disease. It is the most frequently performed operation in cardiovascular surgery. This surgical procedure is associated with postoperative myocardial and systemic inflammation, which contributes to the substantial risk of postoperative myocardial infarction, pulmonary and renal failure as well as stroke. Cardiovascular surgeons agree that there is an urgent need for pharmaceuticals that can be administered to prevent these postoperative complications, to improve the overall benefit of bypass surgery for the patients.

The EMPIRE (ELAFIN Myocardial Protection from Ischemia Reperfusion Injury) Study is a placebo-controlled, double-blinded, Phase II clinical trial. The aim of the study is to investigate the efficacy and safety on intraoperative administered ELAFIN in coronary bypass surgery. The recruitment and treatment of patients into the EMPIRE study was started in the third quarter 2011. Up to date, two planned interim safety analysis of the EMPIRE study have already been conducted. No safety concerns were raised by the Data Monitoring Committee and the continuation of the trial was recommended. In the second quarter 2013, the protocol for the study has been revised to increase the number of study participants from 80 to 118. In July 2013, the first participant to the extension has been recruited. The study is being performed under the supervision of the cardiologist Dr. Peter Henrikson at NHS Lothian’s Edinburgh Heart Centre in association with the University of Edinburgh, one of the leading European universities in

the area of cardiovascular research. The study is funded by the Medical Research Council (MRC) and Chest Heart & Stroke Scotland (CHSS) with funding excess of GB£ 500,000.

Treatment of Kidney Transplantation

In August 2007, Proteo entered into a license agreement with Minapharm Pharmaceuticals SAE (“Minapharm”), a well-established Egyptian pharmaceutical company based in Cairo, for clinical development, production and marketing of ELAFIN. Proteo has granted Minapharm the right to exclusively market ELAFIN in Egypt and certain Middle Eastern and African countries. Minapharm has initiated a Phase II clinical trial on the use of ELAFIN in kidney transplantation patients. This trial is concerned with the prevention of acute organ rejection and will be conducted at the University of Cairo. The start and conduct of the trial may be influenced by the actual political situation in Egypt. Actually, the consequences cannot be overseen by management.

Preclinical Research - Pulmonary Arterial Hypertension and Lung Diseases

Pulmonary Arterial Hypertension (PAH) is a severe and, as yet, incurable lung disease which, if left untreated, is fatal within a few years. PAH is caused by the progressive narrowing of the pulmonary arterial blood vessels. This is due to a pathological proliferation of the muscle cells within the vessel wall and the subsequent transformation of the muscle cells into connective tissue. The resulting narrowing of the pulmonary artery blood vessels leads to a decrease in oxygen supply to the body and, due to increased pulmonary blood pressure, to a substantial overexertion of the heart. Affected patients suffer from severely reduced exercise capacity. While currently available treatments have increased life expectancy by 5 to 7 years by retarding the advancement of the disease, they cannot completely stop disease progression. ELAFIN represents a novel therapeutic approach to suppress and reverse the underlying arterial wall pathology, and address an unmet therapeutic need for PAH.

Proteo has obtained Orphan drug designation within the European Union for the use of ELAFIN for the treatment of pulmonary arterial hypertension and chronic thromboembolic pulmonary hypertension. Since 2008, Proteo has been cooperating with scientists at Stanford University in California with respect to the preclinical development in the field of pulmonary arterial hypertension and ventilator-induced injury. The group presented preclinical data on the Company’s drug substance ELAFIN at the Annual International Conference of the American Thoracic Society in New Orleans in May 2010. The data showed that the treatment with ELAFIN during mechanical ventilation largely prevented the inflammation in lungs of newborn mice. In August 2010 the cooperation agreement with Stanford University was extended by a further project. In the third quarter of 2011 the Stanford School of Medicine research team led by Marlene Rabinovich, was awarded a five-year, US$ 10.8 million grant from the National Heart, Lung and Blood Institute for the study of ELAFIN’s ability to treat three distinct lung diseases. The grant will fund one preclinical project for each disease, all three of which are notoriously difficult to treat pulmonary hypertension, ventilator-induced injury of immature lung in premature babies and chronic lung transplant rejections. The group has published further evidence for the use of ELAFIN in the treatment of newborn infants, whose lungs are incompletely developed in June 2012 (Am. J. Physiol. Lung Cell Mol. Physiol). At year-end 2012, the FDA granted Proteo Orphan Drug Designation to ELAFIN for the treatment of pulmonary arterial hypertension. In May 2012, the group presented the successful treatment of pulmonary arterial hypertension in an animal model at the Annual International Conference of the American Thoracic Society in Philadelphia. They demonstrated in a Sugen/Hypoxia animal model of pulmonary arterial hypertension that intravenous ELAFIN administration can improve the occlusion of pulmonary vessels associated with a pronounced improvement of the disease.

Recently published results from the NIH funded preclinical projects have provided insights into the positive therapeutic effects of ELAFIN in animal models of lung transplantation and PAH.

In June 2015, Nickel et al. published results showing that ELAFIN reverses pulmonary hypertension via caveolin-1-dependent bone morphogenetic protein signaling in an animal model of PAH. The potential of ELAFIN in the treatment of PAH was confirmed in further investigations using explanted lung tissue from PAH patients.

In July 2015, Jiang et al. published research demonstrating that ELAFIN and cyclosporine act synergistically to prevent irreversible damage to transplanted lung tissue. Treatment with ELAFIN maintained the blood circulation in the transplanted tissue and reduced the infiltration of rejection-promoting immune cells. The synergistic effect of ELAFIN and cyclosporine is thought to be due to a concurrent effect of ELAFIN on the innate immune system and of cyclosporine on the adaptive immune system, as well as an ELAFIN-mediated suppression of cyclosporine-induced tissue damage.

Recent publications

Jiang X, Nguyen TT, Tian W, Sung YK, Yuan K, Qian J, Rajadas J, Sallenave JM, Nickel NP, de Jesus Perez V, Rabinovitch M, Nicolls MR. Cyclosporine Does Not Prevent Microvascular Loss in Transplantation but Can Synergize With a Neutrophil Elastase Inhibitor, ELAFIN, to Maintain Graft Perfusion During Acute Rejection. Am J Transplant. 2015; 15:1768-81.

Nickel NP, Spiekerkoetter E, Gu M, Li CG, Li H, Kaschwich M, Diebold I, Hennigs JK, Kim KY, Miyagawa K, Wang L, Cao A, Sa S, Jiang X, Stockstill RW, Nicolls MR, Zamanian RT, Bland RD, Rabinovitch M. ELAFIN Reverses Pulmonary Hypertension via Caveolin-1-Dependent Bone Morphogenetic Protein Signaling. Am J Respir Crit Care Med. 2015; 191(11):1273-86

Nickel NP, Wang L, Li CG, Spiekerkoetter E, Rabinovitch M. The elastase inhibitor ELAFIN restores endothelial cell homeostasis in pulmonary arterial hypertension and attenuates vascular remodeling in the sugen/hypoxia rat model. Am J Respir Crit Care Med. 2013; 187: A1031

Hilgendorff A, Parai K, Ertsey R, Juliana Rey-Parra G, Thébaud B, Tamosiuniene R, Jain N, Navarro EF, Starcher BC, Nicolls MR, Rabinovitch M, Bland RD. Neonatal mice genetically modified to express the elastase inhibitor ELAFIN are protected against the adverse effects of mechanical ventilation on lung growth. Am J Physiol Lung Cell Mol Physiol. 2012 Aug 1;303(3):L215-27

Hilgendorff A, Parai K, Ertsey R, Jain N, Navarro EF, Peterson JL, Tamosiuniene R, Nicolls MR, Starcher BC, Rabinovitch M, Bland RD. Inhibiting lung elastase activity enables lung growth in mechanically ventilated newborn mice. Am J Respir Crit Care Med. 2011; 184: 537-46

Kim YM, Haghighat L, Spiekerkoetter E, Sawada H, Alvira CM, Wang L, Acharya S, Rodriguez-Colon G, Orton A, Zhao M, Rabinovitch M. Neutrophil elastase is produced by pulmonary artery smooth muscle cells and is linked to neointimal lesions. Am J Pathol. 2011; 179: 1560-72

Vascular Damage

Proteo entered into an agreement with the Molecular Imaging North Competence Center (MOIN CC) at the Christian-Albrechts-University of Kiel in April 2010. Under this agreement the effects of ELAFIN on vascular changes are being examined in animal models. The Federal State of Schleswig-Holstein is backing the creation and infrastructure of MOIN CC with EUR 8.2 Million using funding from the Federal State and the European Regional Development Fund (ERDF), as well as resources from the second German economic stimulus package. The researchers presented results of a biodistribution study with radiolabeled ELAFIN at the 25th Annual Congress of the European Association of Nuclear Medicine led in Milan, October 2012. They found high accumulation in the kidney and concluded that this could be of great importance in the future as within the treatment of reperfusion injury of the kidney.

Recent publications

Zhao Y, Kaschwich M, Culman J, Marx M, Lützen U, Wiedow O, Henze E, Zuhayra M. In-vivo imaging of Tc-99m labeled ELAFIN in rats. Eur J Nucl Med Mol Imaging (2012) 39 (Suppl 2): S417-418

Kaschwich M, Zhao Y, Marx M, Culman J, Lützen U, Kötz K, Henze E, Wiedow O, Zuhayra M. Radiomarkierung des menschlichen Elastase- Inhibitors, ELAFIN, mit Tc-99m und Untersuchung der Biodistribution mittels Hi-SPECT in Ratten. 2012 Nuklearmedizin 51 (2): A110

Life-threatening Infections

In 2010 the Company has signed a cooperative research and development agreement with the US Army Medical Research Institute of Infectious Diseases (“USAMRIID”). This agreement allows USAMRIID to use Proteo's ELAFIN and related scientific data in order to plan and conduct preclinical research on the development of new therapeutic strategies to combat life-threatening infectious diseases, in an investigation into the use of ELAFIN as a co-therapy with antibiotics.

(2)

Markets

MARKET POTENTIAL

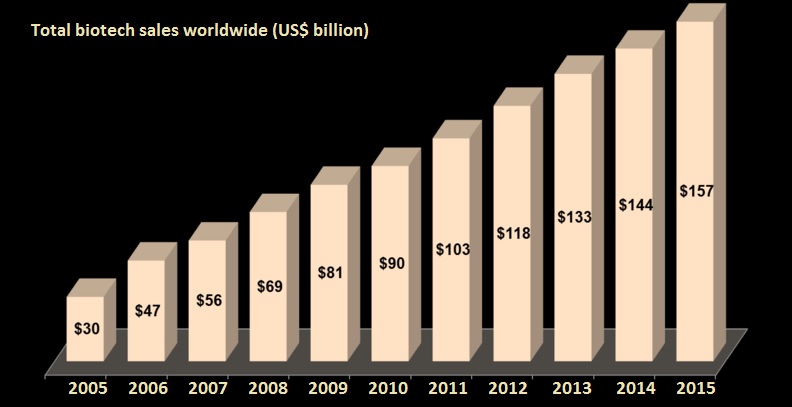

The biotech-section belongs with an estimated annual growth of more than 11% to the most interesting branches. The sales in 2010 reached US $91 Billion and are expected to grow by 2016 up to more than US$ 150 Billion. In context to other sectors the demand for pharmaceuticals is independent from economic situation and propensity. This trend consolidates even more through established health care systems in growing markets. Stable demand alone is not enough keeping this sales growth. The motor behind the biotech industry is the power of innovation which improves the medicine by more effective and safer products for rare diseases or diseases with unmet needs. This continuous development leads to an improvement in quality of life for the patients.

Source: http://www.bbbiotech.ch/de/bb-biotech/biotech-sektor/sektor-in-zahlen/

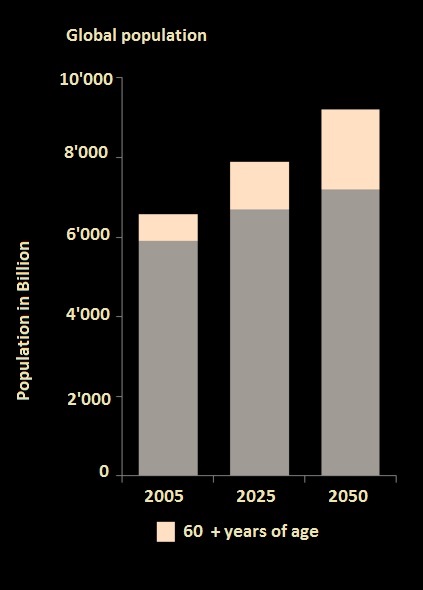

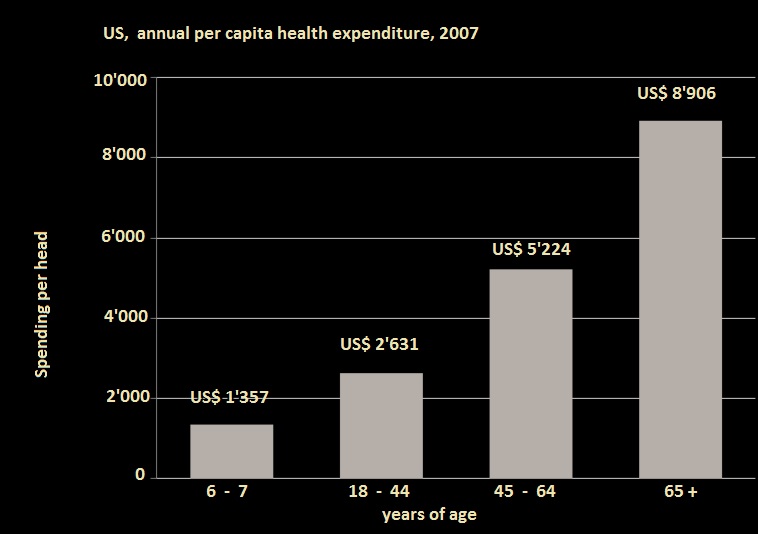

In general elder people are consuming more pharmaceuticals and are more prone to chronic diseases. Also expensive treatments are often required. Additional the demand in treatments of cardiac and lung failure is needed.

Source: United Nations, Department of Economic and Social Affairs

Source: US Department of Health and Human Services “Health United States 2007”

Source: OECD Health Data 208, WHO Health Data 2008

Source: CDC

In 2012 sales shortfall of US$ 11.5 billion about loss of patent protection. Endeavours by big pharmaceutical companies these shortfalls compensating through their own development of new drugs are undistinguished successful. Therefore since the last decade take-overs and partnership agreements increased significantly. Small biotech companies with their innovative technology and lack of resources to commercialize their products benefit from advantageous circumstances creating capacities for further innovation.

Source: Nature Reviews Drug Discovery, vol. January 10th2011

Number of acquisitions at a high level

The big pharmaceutical companies see as a result of patent losses (up to 2015 patents run with a turnover of approximately USD 200 billion) forced to fill its product pipeline through acquisitions of companies with promising products Accompanied with the historically lowest valuation of biotech companies. Thus, the generic Teva took about a Cephalon for $ 6 billion smaller biotechnology companies such as Andays (acquired by Roche) and Adolor achieved (by Cubist) takeover prices with premiums of more than 100%. The current wave of mergers for years is still in progress and will give a significant boost to the biotech sector.

Moody's sees pick-up in pharmaceutical industry M&A in 2013

LONDON, April 23 | Mon Apr 22, 2013 7:01pm EDT (Reuters) - Cash-rich drug companies are likely to make more acquisitions in 2013 after a thin year for deals in 2012, ratings agencyMoody's Investors Service said on Tuesday.

In a review of the global sector reiterating a “stable” outlook,Moody's said leading companies such as Roche, Pfizer andNovartis had deleveraged after big deals three or four years ago and could start shopping again.

AstraZeneca is also looking for acquisitions to strengthen its limited drug pipeline.

“Cash levels have been rising at certain players and debt funding is likely to remain inexpensive, setting the stage for heightened M&A activity this year,” the agency said.

“However, we would expect such acquisitions to generally be small to mid-sized rather than transformational.” Bolt-on acquisitions of between $1 billion and $2 billion a year can be digested by large pharmaceutical groups without risking their credit ratings, but larger deals are generally negative since they are often financed with debt.

In 2012, the sector saw few sizeable transactions, with the exception of Gilead's $11 billion purchase of Pharmasset and the joint acquisition of Amylin for $7 billion by Bristol-Myers Squibb and AstraZeneca.”

COMMERCIALIZATION PLAN

During the regulatory approval process NGRC intends to establish strategic alliances or partnerships in the pharmaceutical industry manufacturing, promoting and distributing the new drug. Similarly the Company will gain income from royalties.

Reports to Security Holders

The public may read and copy any materials the Company files with the SEC at the SEC’s public reference room at 100 F Street, NE, Washington D.C. 20549, on official business days during the hours of 10 a.m. to 3 p.m. Eastern Time. Information may be obtained on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC athttp://www.sec.gov.

ITEM 1A.

RISK FACTORS

FORWARD-LOOKING STATEMENTS

This report contains statements that constitute “forward-looking statements.” These forward-looking statements can be identified by the use of predictive, future-tense or forward-looking terminology like “believes,” “anticipates,” “expects,” “estimates,” “envision” or similar terms. These statements appear in a number of places in this report and include statements regarding our intent, belief or current expectations and those of our directors or officers with respect to, among other things: (i) trends affecting our financial condition or results of operations, (ii) our business and growth strategies, and (iii) our financing plans. You are cautioned that any forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. Factors that could adversely affect actual results and performance include, among others, the effect of inflation and other negative economic trends and developments on the business of our customers and other barriers, government regulation and competition. All forward-looking statements attributable to us are expressly qualified in their entirety by the foregoing cautionary statement.

BUSINESS RISKS

Because the Company has a limited history and expects to generate operating losses for the foreseeable future, it may not achieve profitability for some time, it at all.

The Company is an early stage of development and, therefore, has a limited history of operations. The Company is faced with all of the risks associated with a company in the early stage of development. In addition, the Company’s business is subject to numerous risks associated with a new company engaged in the financing of pharmaceutical products being developed by its Corporate Partners. Such risks include, among other things, competition from well-established and well capitalized companies and anticipated development difficulties and risks associated with the need for regulatory approval from the FDA and similar government regulatory bodies around the world. Because the Corporate Partners are focused on product development, the Company has not received any revenues generated by the targeted products to date. The Company expects to incur losses for the foreseeable future. The process of developing the Company Corporate Partner’s products requires significant clinical trials, as well as regulatory approvals, each of which is costly and does not result in revenues or profits. There can be no assurance that the Company’s endeavors will ever generate sufficient commercial sales or achieve profitability. Should this be the case, investors could lose their entire investment.

The products the Company funds on are still under development and the market might not accept them.

Commercialization of the products the Company funds and supports will depend upon successful completion of clinical studies, FDA approval and the approval of other regulatory bodies around the world. The Company’s Corporate Partners’ products are in different stages of development, and none of them have received regulatory approval or been released for commercial sale. The Company’s long-term viability will depend on successful clinical development of products. The Company’s Corporate Partners’ will need to conduct significant additional clinical studies, and invest significant additional amounts before its products can be sold. There is no assurance that the Company and its Corporate Partners will be able to develop products with commercial potential even if it invests a substantial amount of money in such development. In addition, potential products that appear promising at early stages of development may fail for a number of reasons, including the possibility that the products may be ineffective, less effective than the products of our competitors, or that they may cause unexpected, harmful side effects. Furthermore, successful commercialization will require sufficient funds to manufacture, market and sell the products to customers if a development/commercial partnerships are not achieved. Success in marketing the products developed by its Corporate Partners will be a substantially dependent on the performance of competitive products on the market at the time, as well as the availability of resources to promote, distribute and sell products. There can be no assurance that the efforts will be successful in gaining acceptance of the products among the targeted customers (see “Description of Business”).

If the Company’s Corporate Partners fail to obtain regulatory approvals for the products under development from the United States Food and Drug Administration and similar regulatory agencies in other countries, they will not be able to sell the products.

The Company’s Corporate Partners must receive government regulatory approval for its products before they can be commercialized. The clinical trials of any product candidates the Company or its collaborative partners develop must comply with regulations established by federal, state and local government authorities in the United States, principally the FDA, and by similar agencies in other countries. The regulatory process is time consuming and expensive and subject to potential delays. Delays in the regulatory process will necessarily delay the launch of the products. Failure to obtain regulatory approval, or significant delays in the process, will materially and adversely affect our business, financial condition and results operations, in which case you may lose your entire investment.

There can be no assurance that the Company’s corporate partners will not encounter delays or rejections based on the ability to enroll enough patients to complete the clinical trials or on changes in regulatory agency policies during the period in which a drug is developed or the period required for review of any application for regulatory agency approval of a particular product.

Any of these potential delays or setbacks in obtaining regulatory agency approvals could adversely affect the ability to pursue the Company’s strategy. These delays or setbacks can impose additional costs and diminish any competitive advantages that the Company or its collaborative partners may attain. Any delays or setbacks could materially and adversely affect the Company’s business, financial condition and results of operations.

In addition, even if the FDA grants approval for a drug, the potential market may be limited by the specific clinical indications for which an approval is granted. Failure to comply with regulatory requirements could adversely affect the Company and, among other things, result in fines, suspension of regulatory approvals, operating restrictions and criminal prosecution.

In order to market the products outside of the U.S., the Company’s corporate partners must comply with numerous and varying regulatory requirements of other countries regarding safety and effectiveness. The approval procedures vary among countries and can involve additional product testing and additional administrative review periods. The time required to obtain approval in other countries might differ from that required to obtain FDA approval. The regulatory approval process in other countries includes all the risks associated with obtaining FDA approval, detailed above. Approval by the FDA does not ensure approval by the regulatory authorities of other countries. The Company cannot be certain that it or its corporate partners will obtain any regulatory approvals in other countries, and the failure to obtain these approvals may materially and adversely affect the company‘s business, financial condition and results of operations.

The products developed by the Company’s Corporate Partners may not be sufficiently attractive to induce other companies to have interest in partnering to commercialize its products.

The business strategy of the Company’s Corporate Partners involves developing products to a stage which can be partnered with larger pharmaceutical companies to further develop and commercialize the products. There can be no assurance that any products the Company developed by its Corporate Partners will be attractive to any larger pharmaceutical company, or that such partnerships will be available on terms that the Company consider acceptable. Each of the product candidates is intended to improve or replace existing therapies or procedures, and other companies may conclude that hospitals, physicians or patients may not see these products as more safe or more effective than these existing therapies or procedures. Further our competitors may develop new technologies or products which are more effective, or less costly, or that seem more effective or cost-effective than the products developed by its Corporate Partners, thereby making such partnerships difficult or impossible to obtain.

If the Company and its Corporate Partners are unable to raise additional capital on acceptable terms, it may be unable to complete planned clinical trials, obtain necessary regulatory approvals or commercialize products developed by its Corporate Partners.

The Company will require substantial future capital in order to continue to work with its partners and conduct research and development, clinical trials and regulatory activities necessary to bring potential products to market. There can be no assurance that additional funding will be available on acceptable terms. Failure to satisfy our capital requirements will adversely affect the Company’s business, financial condition and results of operations because the Company would be left without the capital required to fund the complete product development, obtain regulatory approvals, or establish sales, marketing and distribution capabilities. The Company and its Corporate Partners’ future capital requirements will depend on many factors, including:

o

The progress of research, preclinical testing and clinical trials;

o

The time and costs involved in obtaining regulatory approvals;

o

The costs involved in filing and prosecuting patent applications and enforcing patent claims of actual and future active agents; and

o

Success in establishing strategic alliances and activities for product commercialization.

The Company intends to seek additional funding through strategic alliances and may seek funding through private or public sales of its securities or by licensing all or portion of its intellectual properties and assignable interests. This funding may significantly dilute existing stockholders or may limit the Company‘s rights to distribution. There can be no assurance, however, that the Company will be able to obtain additional funding on reasonable terms, or at all. If the Company cannot obtain adequate funds, the Company may curtail significantly its financing of its existing or new product development programs and/or product candidates being developed by its Corporate Partners. In any of these cases, the Company would be required to seek additional financing through borrowings, debt or equity financing, or other means of financing in order to continue operations. Such financing, if required, may not be available to the Company or may be available to it only on unfavorable terms. Should the Company be unable to raise additional capital, on acceptable terms, you could lose your entire investment.

The Company will need to establish collaborative business relationships with other companies to successfully develop and commercialize products developed by its Corporate Partners.

The Company will rely on a number of significant collaborative relationships with contract research organizations (“CROs”), analytical testing companies, contract manufacturing companies, and other pharmaceutical companies for manufacturing, clinical studies, regulatory filing, and sales and marketing of our Corporate Partners’ products. Reliance on collaborative relationships poses a number of risks, including, but not limited to, the following:

o

The Company cannot effectively control whether contractors and corporate partners will devote sufficient resources to its program or products;

o

Disputes may arise in the future with respect to the ownership of rights to technology developed with corporate partners;

o

Disagreements with corporate partners could delay or terminate the research, development or commercialization of product candidates, or result in litigation or arbitration;

o

Corporate partners have considerable discretion in electing whether to accept additional work and may decline to continue to work with the Company at critical stages of product development, or they may elect to pursue technologies or products either on their own or on collaboration with the Company’s competitors; and

o

Corporate partners with marketing rights may choose to devote fewer resources to the marketing of the Company‘s products than they do to developed internally.

Given these risks, the Company‘s current and future collaborative efforts may not be successful. Failure of these efforts could delay the product development or impair commercialization of the products.

The Company has no clinical/regulatory or manufacturing facilities, and the Company has no experience in the complicated tasks of preparing FDA filings, clinical studies or the commercial manufacturing of drugs. The Company intends to solely rely on third-party contract manufacturers to supply, store and distribute the potential products developed by its Corporate Partners for clinical trials, to assist in preparing filings for the FDA and other regulatory bodies, and to manage clinical studies. The Company’s reliance on these third-party CROSs and manufacturers will expose us to the following risks, any of which could delay product development, clinical trials, the approval of products by the FDA, and the commercialization of our Corporate Partners’ products, and result in higher costs, deprive us of potential product revenues, or even lead to the failure of products to achieve regulatory approval:

o

Control manufacturers often encounter difficulties in achieving volume production, quality control and quality assurance. Accordingly, a manufacturer might not be able to manufacture sufficient quantities of drugs to meet the Company‘s clinical schedules or to commercialize products.

o

Contract manufacturers are obliged to operate in accordance with FDA-mandate good manufacturing practices (“GMPs”). A failure of these contract manufacturers to follow GMPs and to document their adherence to such practices may lead to significant delays in the availability of material for clinical study, may delay filing or approval of marketing applications for the products developed by its Corporate Partners, may result in product recalls, and may adversely affect the Company’s reputation in the marketplace.

o

For each of the current product candidates, National Graphite Corp. expects that its Corporate Partners will initially be forced to rely on a single contract manufacturer. Changing these or future manufacturers may be difficult because the member of potential manufacturers is limited. Changing manufacturers may require revalidation of the manufacturing processes and procedures in accordance with FDA-mandated GMPs. This revalidation may be costly and time consuming. It may be difficult or impossible for the Company and it Corporate Partners to find replacement manufacturers on acceptable terms quickly, or at all. Therefore, until such time as multiple manufacturing souces are established, there is a risk that a sole source may not be able to deliver the needed quantities of product. Furthermore, a sole source of supply may result in less favorable terms to National Graphite Corp. than might be available to larger competitors.

o

The contract manufacturers may not perform as agreed or may not remain in the contract manufacturing business for the time required to produce, store and distribute the products successfully.

Drug manufacturers are subject to ongoing, periodic, an announced inspections by the FDA and corresponding state and foreign agencies to ensure strict compliance with the GMPs, other government regulations and corresponding foreign standards. While the Company’s Corporate Partners are obligated to audit the performance of third-party contractors, the Company does not have control over our third-party manufacturers’ compliance with these regulations and standards. Though the Company anticipates obtaining indemnities from third-party manufacturers, these indemnities may not completely protect National Graphite Corp. from

liability, from potential mistakes and misbehavior of third-party contractors.

The ability of the Company and its Corporate Partners to commercialize the products may be limited if potential users of the products are unable to obtain adequate reimbursement from third-party payers.

Most people in the United States are dependent on third-party payers, such as Medicare and other Government health administration authorities and private health insurers, to pay for medical expenses, including drug prescriptions. The Company‘s ability to make profits from the sale of the products developed by its Corporate Partners will depend on the willingness of these third-party payers to pay prices sufficient to support such profits. Most third-party payers cover orphan diseases therapy and generally provide reimbursement for products similar to the product candidates. The Company does not have any say in product pricing. The Company expects its Corporate Partners not to plan to charge any more for the products than what other companies charge for branded orphan drugs and expects most third-party payers to cover them. However, there can be no guarantee that such government and other third-party payers will reimburse patients, in whole or in part, for the costs of the products or that the amount of such reimbursement will be sufficient for the Company to achieve profitability.

Significant uncertainty exists as to the reimbursement status of newly approved healthcare products. Each of the product candidates is intended to improve or replace existing therapies or procedures. These third-party payers may conclude that the products are not safer, more effective or more cost-effective than these existing therapies or procedures. Therefore, third-party payers may not approve the products for reimbursement.

If third-party payers seem likely not to approve the products for reimbursement, physicians or their patients may opt for a competing product that is approved for reimbursement. This would significantly reduce the value of the Company and adversely affect its viability. Furthermore, any potential corporate partner or acquisition interest from other companies will depend in part on these third-party payers appearing likely to reimburse patients for the costs of the products.

Moreover, the trend toward managed healthcare in the United States, the growth of health maintenance organizations and legislative proposals to reform healthcare and government insurance programs could significantly influence the purchase of healthcare services and products resulting in lower prices and reduced demand for the products which could adversely affect the value of the Company and its viability.

In addition, legislation and regulations affecting the pricing of pharmaceuticals may change in ways that could significantly lower the revenue and profit potential of the Company, and thereby lower its potential market value. While it is difficult to predict the likelihood of any of these legislative or regulatory proposals, if the government or a regulatory agency adopts these proposals, they could materially and adversely affect the Company‘s business, financial condition and results of operations.

If the Company’s Corporate Partners are unable to protect their patent and intellectual proprietary rights, competitors may develop and market products with similar product benefits, which may significantly reduce demand for the products.

The following factors are important to the Company’s success:

o

Patent protection for each of the Corporate Partners product candidates;

o

Corporate Partners maintaining trade secrets;

o

Corporate Partners not infringing on the proprietary rights of others, and

o

Corporate Partners preventing others from infringing on their proprietary rights.

The Corporate Partners will be able to protect their proprietary rights from unauthorized use by third parties only to the extent that their proprietary rights are covered by valid and enforceable patents or are effectively maintained as trade secrets, and they have adequate capital to prosecute infringements of their patents and trade secrets.

It is anticipated that the Corporate Partners plan to protect their proprietary position by filing United States and foreign patent applications related to its proprietary technology, inventions and improvements that are important to the development of its business. Because the patent position of pharmaceutical products involves complex legal and factual questions, the issuance, scope and enforceability of patents cannot be predicted with certainty. Patents, if issued, may be challenged, invalidated or circumvented. Thus, any patents owned or licensed from others may not provide any protection against competitors. The pending applications, those the Corporate Partners may file in the future, and those they may license from third parties, may not result in patents being issued. And, if issued, they may not provide adequate proprietary protection or competitive advantages against competitors with similar technology. Furthermore, others may independently develop similar technologies or duplicate any technology that the Corporate Partners have developed. The laws of many foreign countries do not protect intellectual property rights to the same extend as do the laws of the United States.

The Corporate Partners also rely on their trade secrets, know-how and technology, which are not protected by patents, to

maintain competitive position. The Company anticipates its Corporate Partners plan to protect this information by entering into confidentiality agreements with parties that have access to it, such as collaborators, employees and consultants. Any of these parties may breach the agreements and disclose the confidential information, or the competitors might learn of the information in some other way. If any trade secret, know-how or other technology not protected by a patent were to be disclosed to or independently developed by a competitor, the business and financial condition could be materially and adversely affected.

The Corporate Partners may not be able to develop methods to scale-up manufacturing of the products to large volumes, which would prevent development for clinical studies or large scale commercial use.

The Company and its Corporate Partners have no internal manufacturing facility capable of producing commercial quantities of its potential products. The Corporate Partners will need to contract with third-party manufacturers to produce the products for clinical trials and, ultimately, for the market.

Contract manufacturers may not be able to provide sufficient quantities of the products within an acceptable time frame. Failure by the manufacturers to do so could delay those clinical trials and result in delays in obtaining regulatory approval and commercialization of the products, either of which could adversely impact our business.

The competition in the pharmaceutical industry is intense and if the Products fail to compete effectively, its financial results will suffer.

The business is characterized by extensive research efforts, rapid developments, periodic breakthroughs and intense competition. The Company cannot ensure that the products it supports will compete successfully or that research and development by others will not render its products obsolete or uneconomical. The failure to compete effectively would materially and adversely affect our business, financial condition and results of operations. We expect that successful competition will depend, among other things, on product efficacy, safety, reliability, availability, timing and scope of regulatory approval, and price. Specifically, we expect crucial factors will include the relative speed with which our Corporate Partners can research and develop products, complete laboratory and preclinical testing, and fulfill the requirements of the regulatory approval processes. We expect competition to increase as technological advances are made and commercial application broadens. In each of the potential product areas, there is substantial competition from large pharmaceutical, biotechnology and other companies, as well as universities and public and private institutions. Relative to our Corporate Partners, most of these entities have substantially greater financial and business resources, research and development staffs, facilities, and experience in conducting clinical trials and obtaining regulatory approvals, as well as experience in manufacturing, marketing, selling promoting and advertising pharmaceutical products.

Rapid technological change could make the products obsolete.

Pharmaceutical technologies have historically undergone, and will most likely continue to undergo, rapid and significant change and improvement. The future for our investments will depend in large part on our Corporate Partners ability to maintain their competitive position with respect to these rapidly evolving technologies. Any pharmaceutical products or processes that develops may become obsolete before they recover expenses incurred in connection with their development. Obsolescence of the products and technology would materially and adversely affect our business, financial condition and results of operations.

If the Company is not able to hire and retain qualified scientific, administrative, financial, sales and marketing, and other personnel, the Company may not be able to successfully achieve its goals.

The Company currently depends heavily on its management team, scientific consultants and collaborators. As the Company grows, its plans to hire additional key person who are expected to become critical to the success of the Company. The loss of any of these individuals’ services might significantly delay or prevent the achievement of business objectives and could materially and adversely affect our business, financial condition and results of operations. The Company does not maintain key person life insurance on any these individuals.

The Company’s success depends, in large part, on its ability to attract and retain qualified scientific and management personnel. The Company faces intense competition for such personnel and consultants. The Company cannot ensure that it will be able to attract and retain these persons or persons of similar capability in the future.

Further, the Company expects that our potential expansion into areas and activities requiring new and additional expertise will place additional requirements on the Company’s management, operational and financial resources. The Company expects these demands to require an increase in management and scientific personnel and the development of additional expertise by existing personnel. The failure to attract and retain such personnel or to develop such expertise could materially and adversely affect prospects for the Company’s success.

RISKS RELATED TO GOVERNMENT REGULATION OF THE COMPANY’S BUSINESS

Government Regulations

The Company’s operations may be subject to potentially costly governmental regulations. Compliance with such federal and state regulations and laws may require a significant investment of resources, including both financial resources and personnel expertise. Future changes in government regulations, environmental, consumer, and other applicable laws could increase the costs incurred in operating the Company’s business. The nature and scope of future legislation and government programs affecting the Company’s operations cannot be predicted, and there can be no assurances that any current or future legislation or government programs will not have an adverse impact on the Company’s business, products or operations.

Penny Stock Regulations

If a market develops and the price of the Company's stock is below $5.00 per share, or the Company does not have $2,000,000 in net tangible assets, or is not listed on an exchange or on the NASDAQ National Market System, among other conditions, the Company's shares may be subject to a rule promulgated by the Securities and Exchange Commission (the “SEC”) that imposes additional sales practice requirements on brokerdealers who sell such securities to persons other than established customers and institutional accredited investors. For transactions covered by the rule, the brokerdealer must make a special suitability determination for the purchaser and receive the purchaser's written consent to the transaction prior to the sale. Furthermore, if the price of the Company's stock is below $5.00, and does not meet the conditions set forth above, sales of the Company's stock in the secondary market will be subject to certain additional new rules promulgated by the SEC. These rules generally require, among other things, that brokers engaged in secondary trading of stock provide customers with written disclosure documents, monthly statements of the market value of penny stocks, disclosure of the bid and asked prices, and disclosure of the compensation to the brokerdealer and disclosure of the sales person working for the brokerdealer. These rules and regulations may affect the ability of brokerdealers to sell the Company's securities, thereby limiting the liquidity of the Company's securities.

TAX RISKS

C Corporation Tax Status

The Company is presently a C Corporation under the Internal Revenue Code of 1986. All items of income and loss of the Company are taxed first at the corporate level and any dividends distributed to shareholders are taxed at the shareholder level as well.

IN ADDITION TO THE FOREGOING RISKS, BUSINESSES ARE OFTEN SUBJECT TO RISKS THAT ARE NOT FORESEEN OR FULLY APPRECIATED BY MANAGEMENT.

ITEM 2.

PROPERTIES

The Company owns no real property and has a lease agreement for its principal executive offices and related facilities located in approximately3,553 square feet of space atLindemannstr. 75,D- 40237Duesseldorf, Germany. During the year endedMay 31, 2015,the Company leased approximately1,604square feet of space atImmermannstr. 65 A, D-40210,Duesseldorf, Germanylease payments were $2,589.The lease at "Lindemannstr." has been terminated as of 10/31/14 and the lease at "Immermannstr." started on 11/1/14.

ITEM 3.

LEGAL PROCEEDINGS

We are not a party to any pending legal proceeding. No federal, state or local governmental agency is presently contemplating any proceeding against the Company. No director, executive officer or affiliate of the Company or owner of record or beneficially of more than five percent of the Company's common stock is a party adverse to the Company or has a material interest adverse to the Company in any proceeding.

PART II.

ITEM 5.

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is traded on Pink Sheets under the symbol “NGRC.” The CUSIP number for the Issuer’s common stock is 636268203. The following table sets forth, in U.S. dollars the high and low sale prices for each of the calendar quarters indicated, as reported by the Pink Sheets. The prices in the table may not represent actual transactions and do not include retail markups, markdowns or commissions.

|

| Company Common Stock Prices |

| |||||

|

| High |

|

| Low |

| ||

2015 |

|

|

|

|

|

| ||

Quarter endedMay 31 |

| $ | 0.25 |

|

| $ | 0.05 |

|

Quarter endedFebruary 28 |

|

| 0.48 |

|

|

| 0.20 |

|

Quarter ended November 30 |

|

| 0.73 |

|

|

| 0.35 |

|

Quarter endedAugust 31 |

|

| 0.60 |

|

|

| 0.25 |

|

|

|

|

|

|

|

|

|

|

2014 |

|

|

|

|

|

|

|

|

Quarter endedMay 31 |

| $ | 0.62 |

|

| $ | 0.50 |

|

Quarter endedFebruary28 |

|

| 1.20 |

|

|

| 0.36 |

|

Quarter endedNovember 30 |

|

| 1.72 |

|

|

| 0.45 |

|

Quarter endedAugust 31 |

|

| 6.90 |

|

|

| 1.39 |

|

There is currently a limited public market for the Common Stock and there can be no assurance that an active trading market will develop or, if one does develop, that it will be maintained. However, should such a market arise, the possibility or actual sale into the market of shares of the Company's Common Stock as permitted under Rule 144 of the Securities Act of 1933 may adversely affect prevailing market prices, if any, for the Company's Common Stock and could impair the Company's ability to raise capital through the sale of its equity securities. In order to qualify for unrestricted resale of Common Stock under Rule 144, certain holding periods must be met and a legal opinion setting forth the exemption from registration must be provided. Further, there is no assurance that Rule 144 will be applicable to the Company and investors may not be able to rely on its provisions now or in the future.

The market price of National Graphite’s common stock will likely fluctuate significantly in response to the following factors, some of which are beyond the Company’s control: variations in its quarterly operating results; changes in financial estimates of its revenues and operating results by securities analysts; changes in market valuations of similar companies; announcements by us of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; additions or departures of key personnel; future sales of its common stock; stock market price and volume fluctuations attributable to inconsistent trading volume levels of its stock; commencement of, or involvement in, litigation.

On November 15, 2016, the last bid and ask of our common stock as reported on the Pink Sheets was $0.07 and $0.11, respectively.

Holders

There were approximately 39 holders of record of the Company’s Common Stock as of May 31, 2015. Subsequent to the period covered by this report, there were approximately 227 holders of record of the Company’s Common Stock as of November 15, 2016.

Dividends

Common Stock - No dividends have ever been paid on the Common Stock and the Company does not currently anticipate paying any cash or other dividends on the Common Stock. Future dividend policy will be determined by the Board of Directors of the Company in light of prevailing financial need and earnings, if any, of the Company and other relevant factors.

Preferred Stock - No dividends have ever been paid on the Preferred Stock and the Company does not currently anticipate paying any cash or other dividends on the Preferred Stock. Future dividend policy will be determined by the Board of Directors of the Company in light of prevailing financial need and earnings, if any, of the Company and other relevant factors.

Payment of dividends on the Common Stock and Preferred Stock is within the discretion of the Board of Directors, is subject to state law, and will depend upon the Company's earnings, if any, its capital requirements, financial condition and other relevant factors.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table sets forth information as of May 31, 2015 with respect to our equity compensation plans previously approved by stockholders and equity compensation plans not previously approved by stockholders.

|

| Equity Compensation Plan Information |

| |||||||

Plan Category |

| Number of securities to be issued upon exercise of outstanding options, warrants and rights |

|

| Weighted average exercise price of outstanding options, warrants and rights |

|

| Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

| |

|

| (a) |

|

| (b) |

|

| (c) |

| |

Equity compensation plans approved by stockholders |

| 0 |

|

| $ | 0 |

|

| 0 |

|

Equity compensation plans not approved by stockholders |

| 0 |

|

|

| 0 |

|

| 0 |

|

Total |

| 0 |

|

| $ | 0 |

|

| 0 |

|

Issuer Purchases of Equity Securities

There were no stock repurchases during the year ended May 31, 2015.

Recent Sales of Unregistered Securities

On September 20, 2014, preferred stockholders elected to convert 675,000 shares of preferred stock into 67,500,000 shares of common stock. No underwriters were used. The securities were issued pursuant to an exemption from registration provided by Section 4(2) and Regulation S of the Securities Act of 1933. The individuals receiving the common stock were intimately acquainted with the Company’s business plan and proposed activities at the time of issuance, and possessed information on the Company necessary to make an informed investment decision.

On September 30, 2014 the Company issued 25,000,000 shares of common stock for the acquisition of National Graphite Corporation in exchange for 100 percent of the issued and outstanding shares of NGRC. No underwriters were used. The securities were issued pursuant to an exemption from registration provided by Section 4(2) and Regulation S of the Securities Act of 1933. The individuals receiving the common stock were intimately acquainted with the Company’s business plan and proposed activities at the time of issuance, and possessed information on the Company necessary to make an informed investment decision.

During the period ended May 31, 2015, the Company received cash proceeds of $821,781 in exchange for 85 stock subscriptions to issued 18,891,080 shares of the Company's common stock. No underwriters were used. The securities were issued pursuant to an exemption from registration provided by Section 4(2) and Registration S of the Securities Act of 1933.

Subsequent to the period covered by this report, the Company has entered into various subscription agreements with various unrelated third parties. Pursuant to these agreements, the Company has received an aggregate of $1,323,037, in return for 40,626,819 shares of common stock. No underwriters were used. The securities were issued pursuant to an exemption from registration provided by Section 4(2) and Regulation S of the Securities Act of 1933. The individuals receiving the common stock were intimately acquainted with the Company’s business plan and proposed activities at the time of issuance, and possessed information on the Company necessary to make an informed investment decision.

ITEM 6.

SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 7.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of our financial condition and results of operations should be read in conjunction with the financial statements and related notes to the financial statements included elsewhere in this periodic report. Some of the statements under “Management’s Discussion and Analysis,” “Description of Business” and elsewhere herein may include forward-looking statements which reflect our current views with respect to future events and financial performance. These statements include forward-looking statements both with respect to us specifically and the alternative fuels engines industry in general. Statements which include the words “expect,” “intend,” “plan,” “believe,” “project,” “anticipate,” “will,” and similar statements of a future or forward-looking nature identify forward-looking statements for purposes of the federal securities laws or otherwise. The safe harbor provisions of the federal securities laws do not apply to any forward-looking statements contained in this registration statement.

All forward-looking statements address such matters that involve risks and uncertainties. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. We undertake no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise.

If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary materially from what we projected. Any forward-looking statements you read herein reflect our current views with respect to future events and are subject to these and other risks, uncertainties and assumptions relating to our written and oral forward-looking statements attributable to us or individuals acting on our behalf and such statements are expressly qualified in their entirety by this paragraph.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenue, expenses, and related disclosure of contingent assets and liabilities. We believe the following critical accounting policies affect our more significant judgments and estimates used in the preparation of our consolidated financial statements. Actual results may differ from these estimates under different assumptions or conditions.

CRITICAL ACCOUNTING POLICIES: Our significant accounting policies are described in Note 1 to the consolidated financial statements for the year ended May 31, 2015. The following are our critical accounting policies:

Research and Development

Research and development costs are charged to operations as they are incurred. Legal fees and other direct costs incurred are expensed as incurred. Research and development costs totaled $1,020,240 and $91,204 during the fiscal years ended May 31, 2015 and 2014, respectively.

Foreign Currency Translation

The functional currency of the Company is the Euro. Accordingly, assets and liabilities of the subsidiary are translated into U.S. dollars at period-end exchange rates. Sales and expenses are translated at the average exchange rates in effect for the period. The resulting translation gains or losses are recorded as a component of accumulated other comprehensive income in the consolidated statement of stockholders’ equity (deficit). There were no gains or losses resulting from foreign currency transactions as of May 31, 2015 and 2014.

The exchange rates used to calculate values and results for the years ended May 31, 2015 and 2014 were as follows (USD1):

Year-end Rates | Average Period Rates | ||

May 31, 2015 | 0.9097 | 0.8312 | |

May 31, 2014 | 0.7335 | 0.7370 |

FINANCIAL POSITION

Our current assets increased by $25,958, from $4,893 at May 31, 2014 to $30,851 at May 31, 2015. The increase is primarily attributable to an increase in cash and deposits.

Our net property and equipment was $-0- on May 31, 2015 as compared to $-0- at May 31, 2014. There were no investments in net property and equipment during the 2015 fiscal year.

We funded our operations primarily through sales of unregistered securities. The Company’s stockholders’ deficit increased from $(955,892) at May 30, 2014 to a stockholders' deficit of $(2,924,181) as of May 31, 2015. The primary reason for the increase was the Company's net loss for the year ended May 31, 2015.

REVENUES. There were $-0- revenues during the year ended May 31, 2015 and May 31, 2014

RESEARCH AND DEVELOPMENT. Research and development expenses increased to $1,020,240 during the year ended May 31, 2015 from $91,204 during the 2014 fiscal year. This increase is due to an increase in costs relating to the development and procurement of patents, related to the Company’s investment in ELAFIN.

OTHER OPERATING EXPENSES. General and administrative expenses increased from $3,416 during the year ended May 31, 2014 to $1,147,336 during the year ended May 31, 2015. Overall Total Operating Expenses increased by $2,072,951.

OTHER INCOME (EXPENSE). Other expense increased by $233,084 from $(33,797) in 2014 to $199,287 in 2015. This change arose primarily due to increased interest expenses, and a change in foreign currency transaction gain (loss).

NET LOSS. As a result of the above and other factors, the Company's consolidated net loss attributable to common stockholders was $1,968,289 or $0.02 per common share in 2015, as compared to $128,417 or $0.01 per common share in 2014.

LIQUIDITY AND CAPITAL RESOURCES