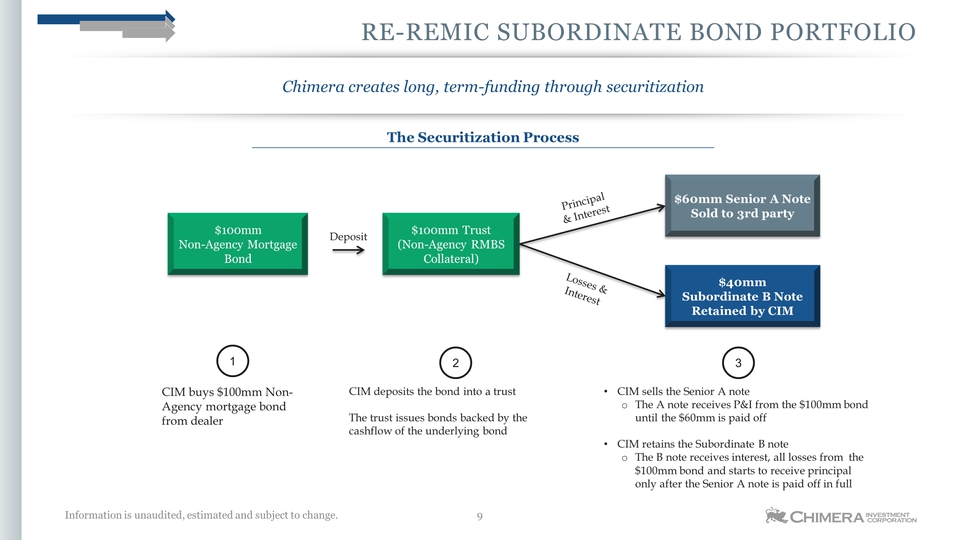

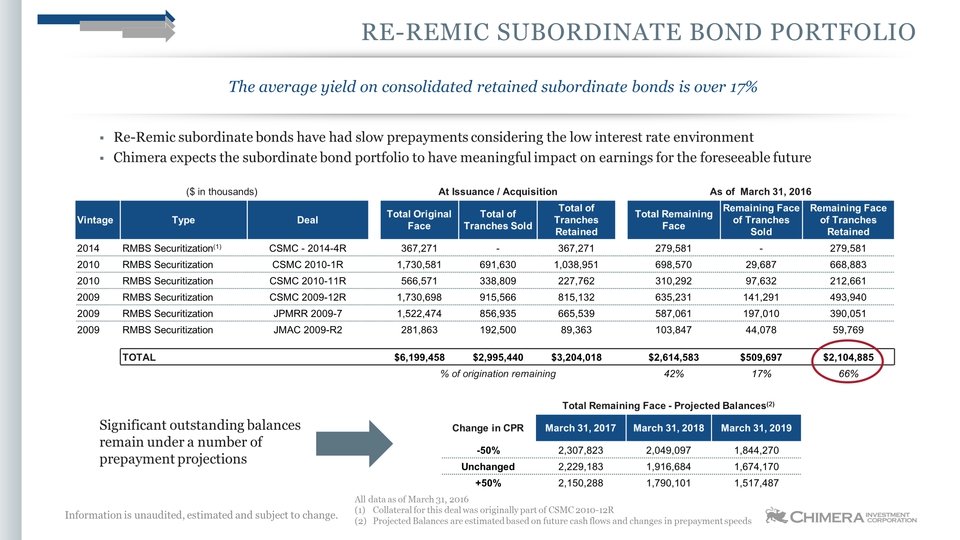

Re-Remic Subordinate Bond Portfolio Information is unaudited, estimated and subject to change. The average yield on consolidated retained subordinate bonds is over 17% Re-Remic subordinate bonds have had slow prepayments considering the low interest rate environmentChimera expects the subordinate bond portfolio to have meaningful impact on earnings for the foreseeable future ($ in thousands) At Issuance / Acquisition As of March 31, 2016 Vintage Type Deal Total Original Face Total of Tranches Sold Total of Tranches Retained Total Remaining Face Remaining Face of Tranches Sold Remaining Face of Tranches Retained 2014 RMBS Securitization(1) CSMC - 2014-4R 367,271 - 367,271 279,581 - 279,581 2010 RMBS Securitization CSMC 2010-1R 1,730,581 691,630 1,038,951 698,570 29,687 668,883 2010 RMBS Securitization CSMC 2010-11R 566,571 338,809 227,762 310,292 97,632 212,661 2009 RMBS Securitization CSMC 2009-12R 1,730,698 915,566 815,132 635,231 141,291 493,940 2009 RMBS Securitization JPMRR 2009-7 1,522,474 856,935 665,539 587,061 197,010 390,051 2009 RMBS Securitization JMAC 2009-R2 281,863 192,500 89,363 103,847 44,078 59,769 TOTAL $6,199,458 $2,995,440 $3,204,018 $2,614,583 $509,697 $2,104,885 % of origination remaining 42% 17% 66% Total Remaining Face - Projected Balances(2) Change in CPR March 31, 2017 March 31, 2018 March 31, 2019 -50% 2,307,823 2,049,097 1,844,270 Unchanged 2,229,183 1,916,684 1,674,170 +50% 2,150,288 1,790,101 1,517,487 Significant outstanding balances remain under a number of prepayment projections All data as of March 31, 2016Collateral for this deal was originally part of CSMC 2010-12RProjected Balances are estimated based on future cash flows and changes in prepayment speeds