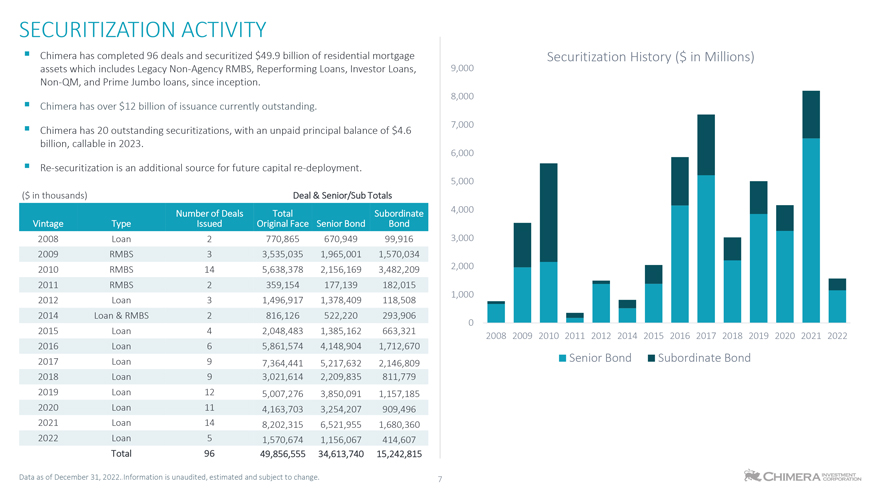

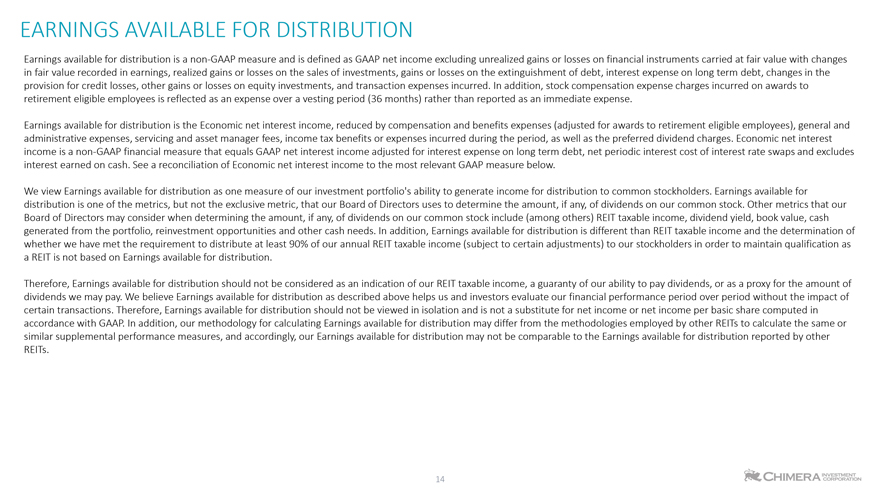

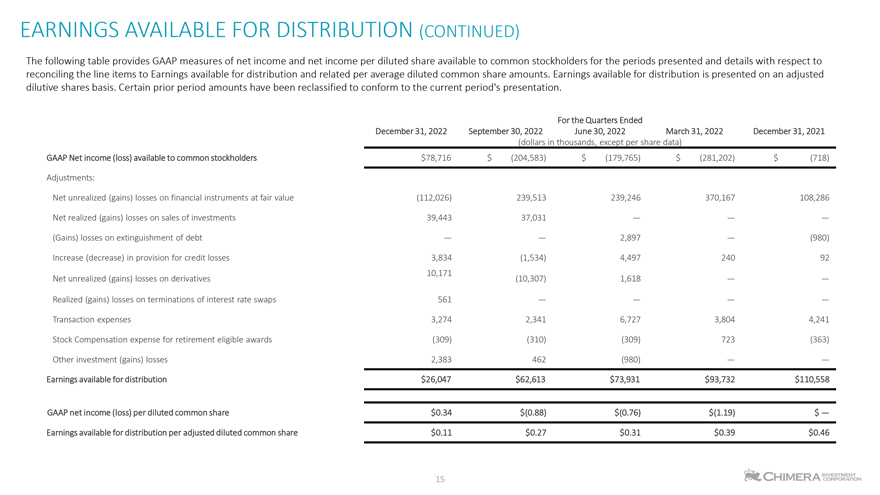

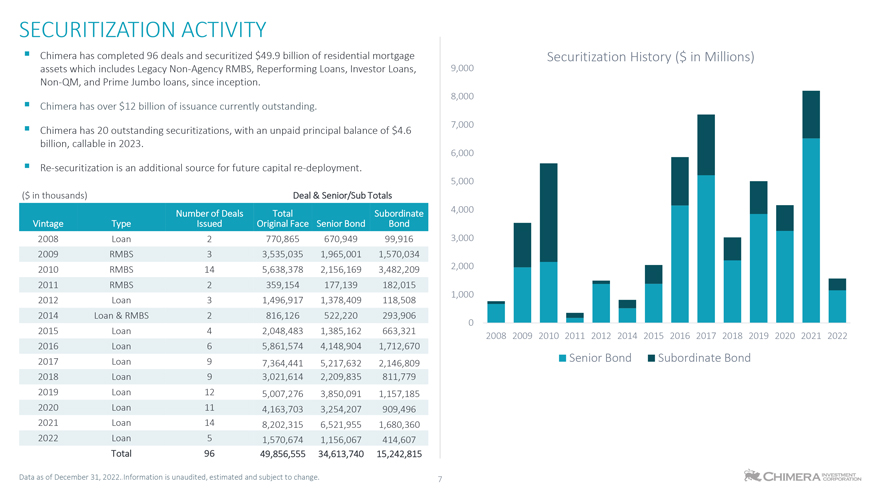

SECURITIZATION ACTIVITY Chimera has completed 96 deals and securitized $49.9 billion of residential mortgage Securitization History ($ in Millions) assets which includes Legacy Non-Agency RMBS, Reperforming Loans, Investor Loans, 9,000 Non-QM, and Prime Jumbo loans, since inception. 8,000 Chimera has over $12 billion of issuance currently outstanding. 7,000 Chimera has 20 outstanding securitizations, with an unpaid principal balance of $4.6 billion, callable in 2023. 6,000 Re-securitization is an additional source for future capital re-deployment. 5,000 ($ in thousands) Deal & Senior/Sub Totals Number of Deals Total Subordinate 4,000 Vintage Type Issued Original Face Senior Bond Bond 2008 Loan 2 Type 770,865 670,949 99,916 3,000 2009 RMBS 3 3,535,035 1,965,001 1,570,034 2010 RMBS 14 5,638,378 2,156,169 3,482,209 2,000 2011 RMBS 2 359,154 177,139 182,015 1,000 2012 Loan 3 1,496,917 1,378,409 118,508 2014 Loan & RMBS 2 816,126 522,220 293,906 0 2015 Loan 4 2,048,483 1,385,162 663,321 2008 2009 2010 2011 2012 2014 2015 2016 2017 2018 2019 2020 2021 2022 2016 Loan 6 5,861,574 4,148,904 1,712,670 Senior Bond Subordinate Bond 2017 Loan 9 7,364,441 5,217,632 2,146,809 2018 Loan 9 3,021,614 2,209,835 811,779 2019 Loan 12 5,007,276 3,850,091 1,157,185 2020 Loan 11 4,163,703 3,254,207 909,496 2021 Loan 14 8,202,315 6,521,955 1,680,360 2022 Loan 5 1,570,674 1,156,067 414,607 Total 96 49,856,555 34,613,740 15,242,815 Data as of December 31, 2022..Information is unaudited, estimated and subject to change. 7