“Safe Harbor” Forward Looking Statements

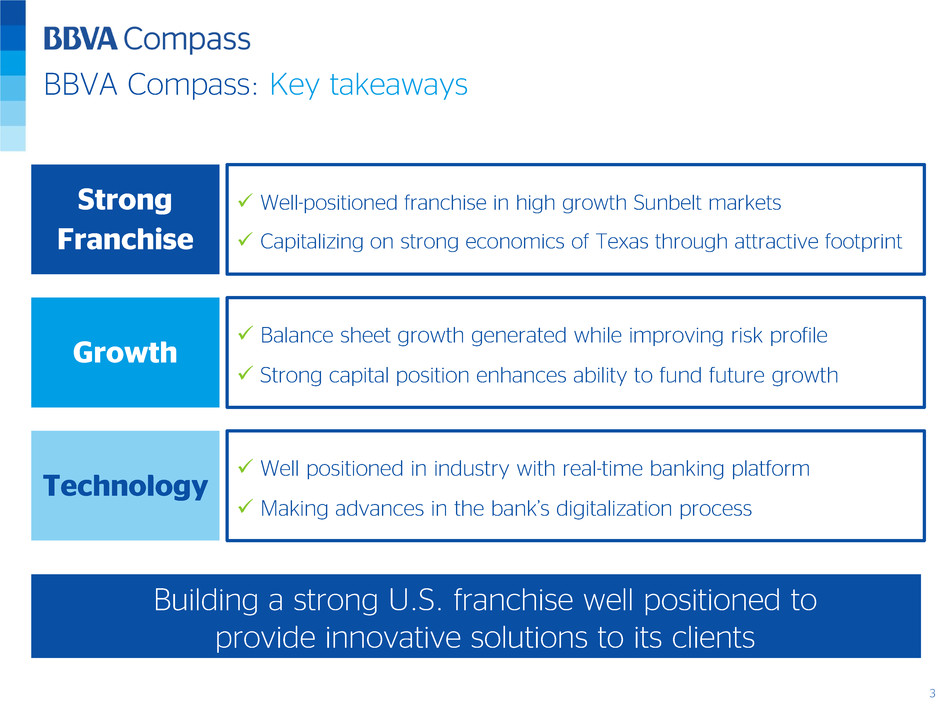

BBVA Compass: Key takeaways Strong Franchise Well-positioned franchise in high growth Sunbelt markets Capitalizing on strong economics of Texas through attractive footprint Growth Balance sheet growth generated while improving risk profile Strong capital position enhances ability to fund future growth Technology Well positioned in industry with real-time banking platform Making advances in the bank’s digitalization process Building a strong U.S. franchise well positioned to provide innovative solutions to its clients

1 Appendix: BBVA and Reconciliations 2 Financial Performance 3 Balance Sheet and Funding Profile4 Asset Quality 5 Capital Position 7 Regulation and Ratings BBVA Compass Overview 6 Sections

BBVA Compass Overview

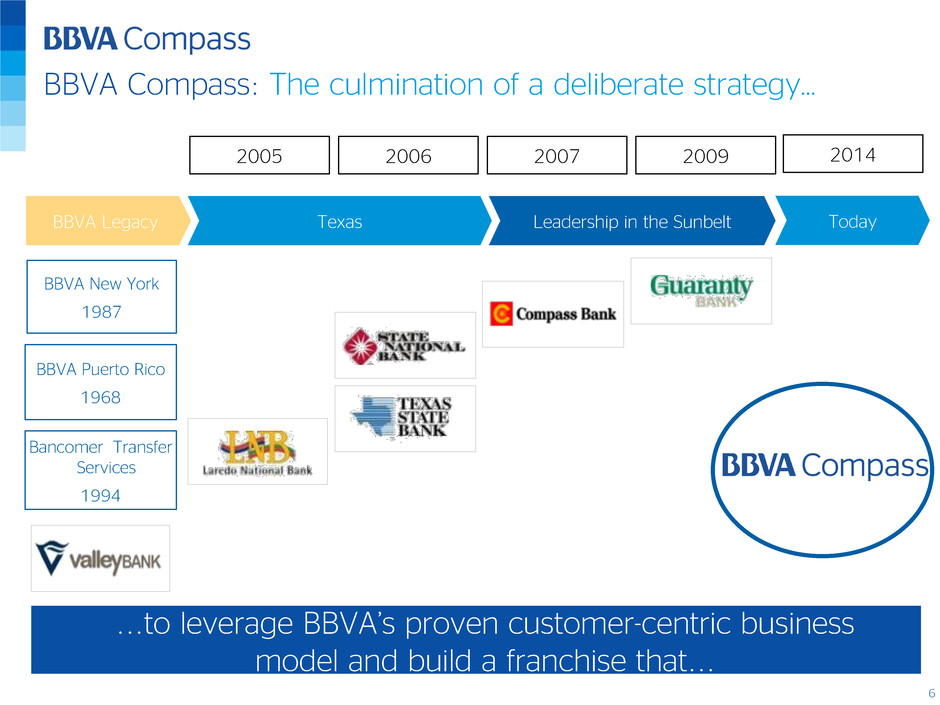

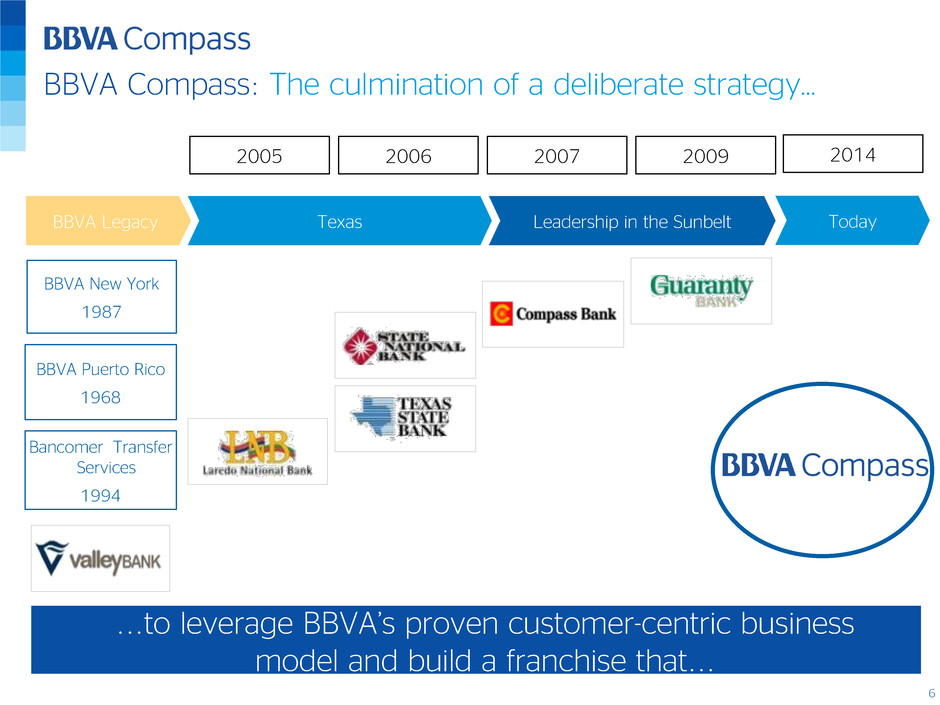

BBVA Legacy BBVA Puerto Rico 1968 BBVA New York 1987 Bancomer Transfer Services 1994 2006 2007 20092005 TodayTexas Leadership in the Sunbelt BBVA Compass: The culmination of a deliberate strategy… ...to leverage BBVA’s proven customer-centric business model and build a franchise that... 2014

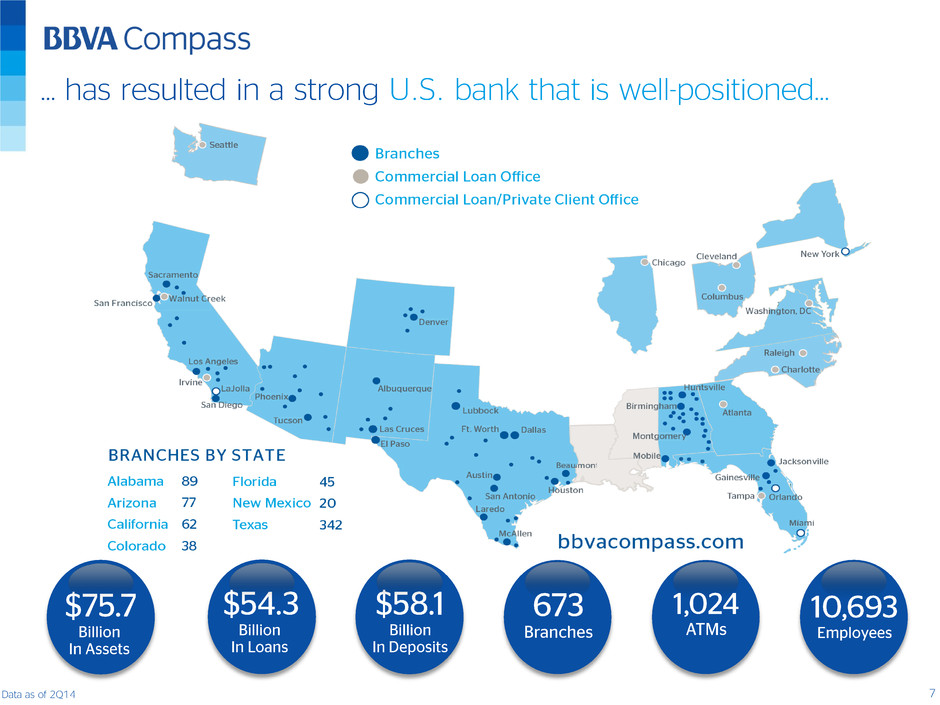

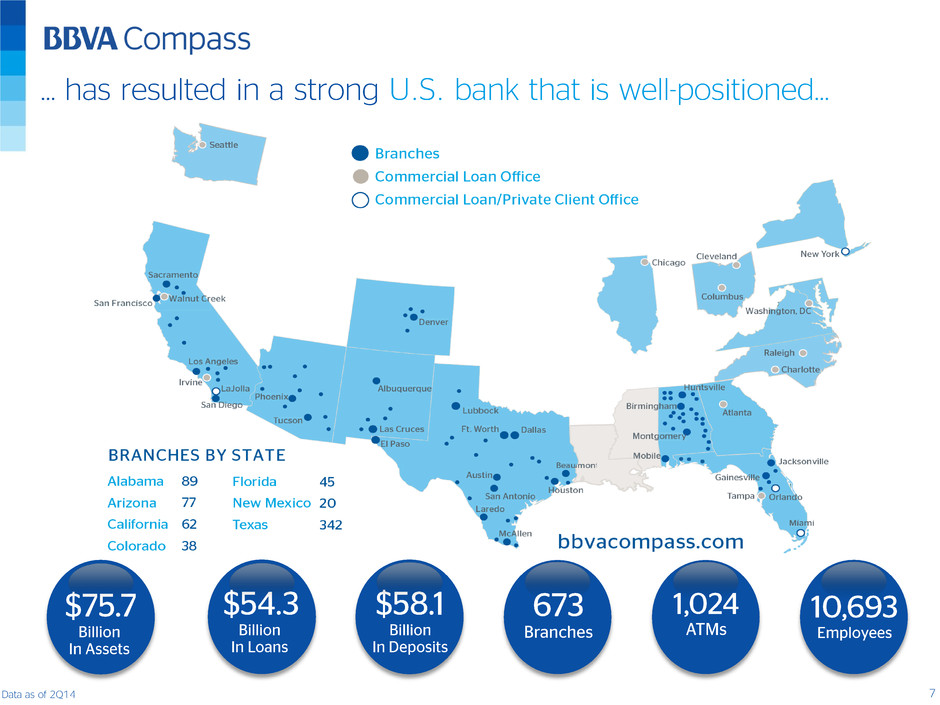

… has resulted in a strong U.S. bank that is well-positioned… Data as of 2Q14

Texas Deposits % of Bank Market Share Rank $30.3 58% 5.4% 4 Alabama Deposits % of Bank Market Share Rank $10.0 19% 11.7% 2 Colorado Deposits % of Bank Mkt Share Rank $2.0 4% 1.9% 8 Florida Deposits % of Bank Mkt Share Rank $2.9 5% 0.7% 21 New Mexico Deposits % of Bank Mkt Share Rank $0.6 1% 2.2% 11 Arizona Deposits % of Bank Mkt Share Rank $3.4 7% 3.8% 5 California Deposits % of Bank Mkt Share Rank $3.2 6% 0.3% 24 … with a leading franchise in the Sunbelt and a strong presence in Texas $ in billions Data as of June 30, 2013 Source: SNL Financial

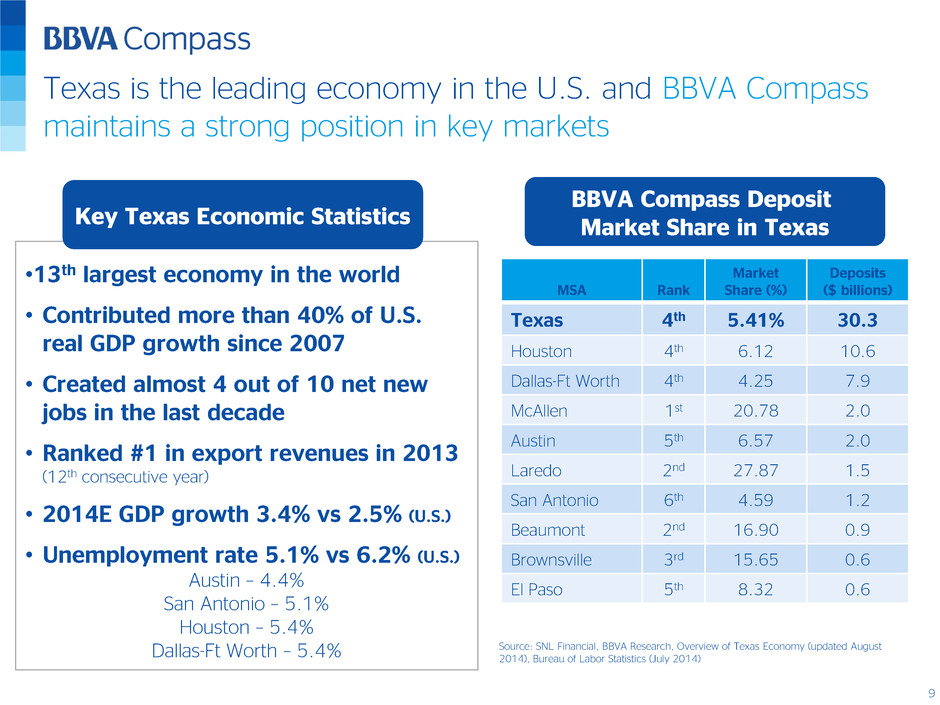

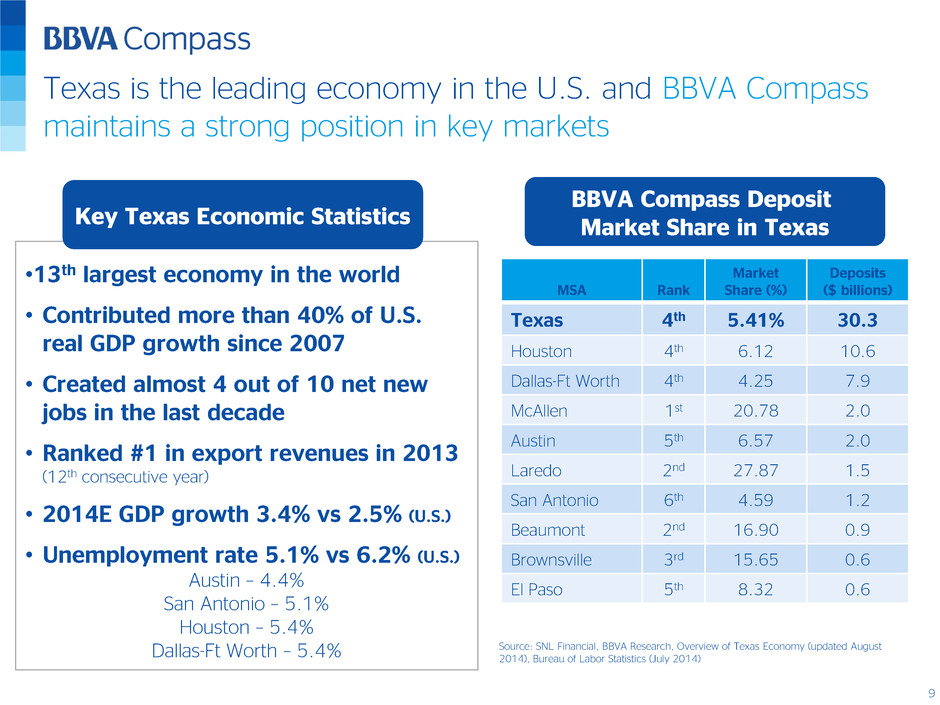

Texas is the leading economy in the U.S. and BBVA Compass maintains a strong position in key markets BBVA Compass Deposit Market Share in Texas MSA Rank Market Share (%) Deposits ($ billions) Texas 4th 5.41% 30.3 Houston 4th 6.12 10.6 Dallas-Ft Worth 4th 4.25 7.9 McAllen 1st 20.78 2.0 Austin 5th 6.57 2.0 Laredo 2nd 27.87 1.5 San Antonio 6th 4.59 1.2 Beaumont 2nd 16.90 0.9 Brownsville 3rd 15.65 0.6 El Paso 5th 8.32 0.6 Source: SNL Financial, BBVA Research, Overview of Texas Economy (updated August 2014), Bureau of Labor Statistics (July 2014) •13th largest economy in the world • Contributed more than 40% of U.S. real GDP growth since 2007 • Created almost 4 out of 10 net new jobs in the last decade • Ranked #1 in export revenues in 2013 (12th consecutive year) • 2014E GDP growth 3.4% vs 2.5% (U.S.) • Unemployment rate 5.1% vs 6.2% (U.S.) Austin – 4.4% San Antonio – 5.1% Houston – 5.4% Dallas-Ft Worth – 5.4% Key Texas Economic Statistics

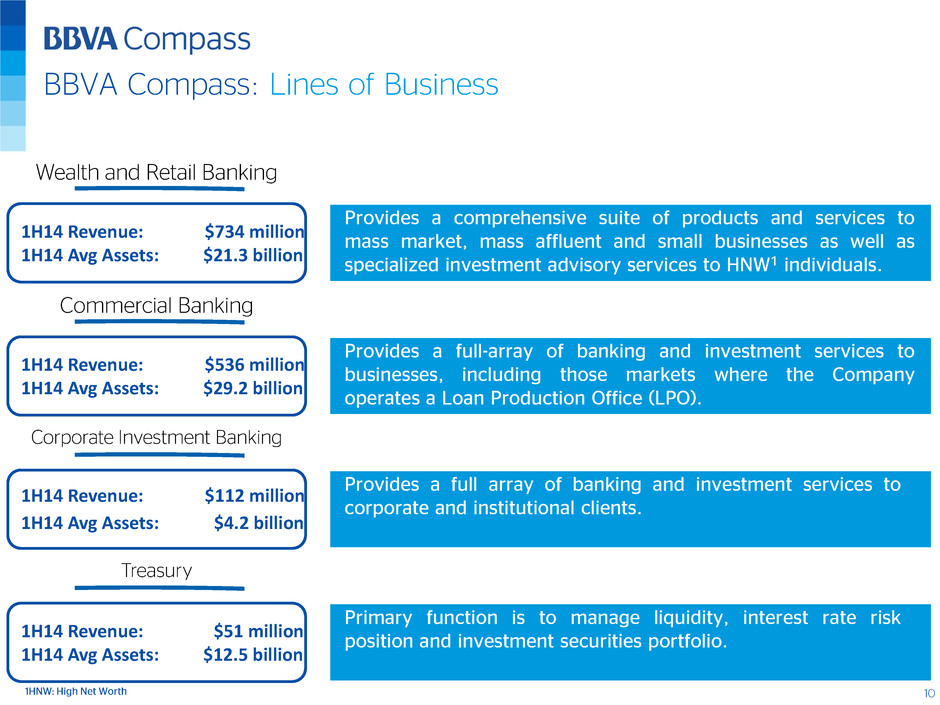

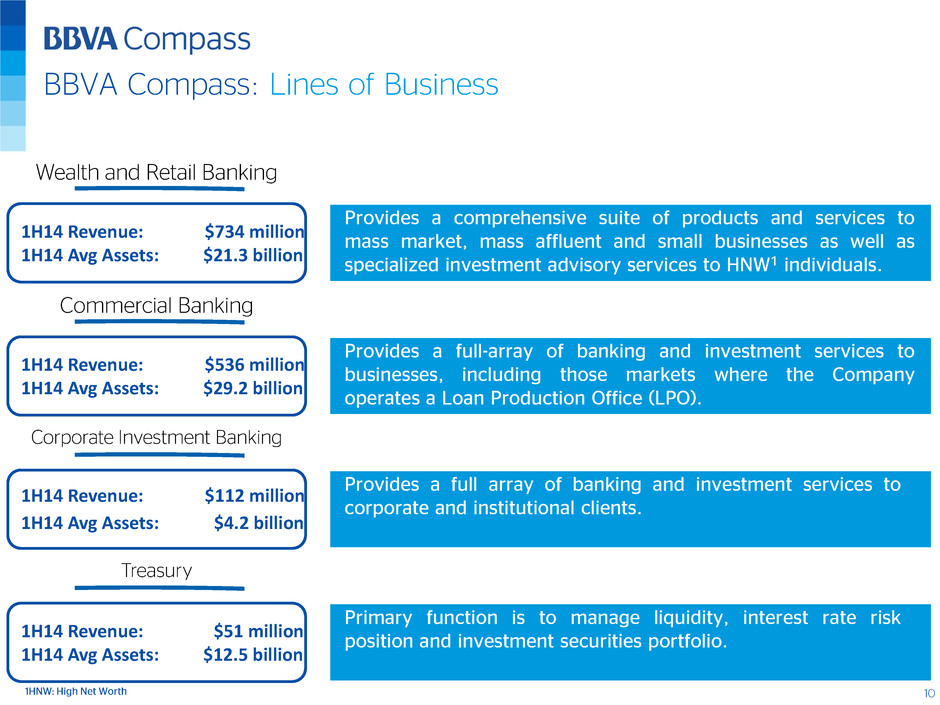

BBVA Compass: Lines of Business 1H14 Revenue: $734 million 1H14 Avg Assets: $21.3 billion Provides a comprehensive suite of products and services to mass market, mass affluent and small businesses as well as specialized investment advisory services to HNW1 individuals. 1H14 Revenue: $536 million 1H14 Avg Assets: $29.2 billion Provides a full-array of banking and investment services to businesses, including those markets where the Company operates a Loan Production Office (LPO). 1H14 Revenue: $112 million 1H14 Avg Assets: $4.2 billion Provides a full array of banking and investment services to corporate and institutional clients. 1H14 Revenue: $51 million 1H14 Avg Assets: $12.5 billion Primary function is to manage liquidity, interest rate risk position and investment securities portfolio.

… through differentiated technology An opportunity to gain a competitive advantage…

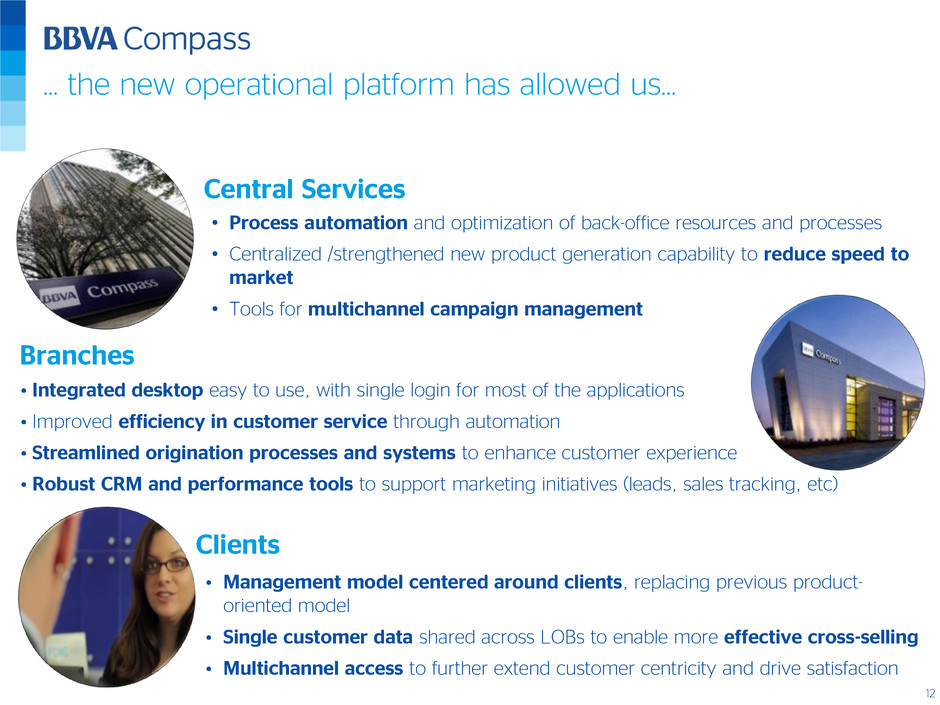

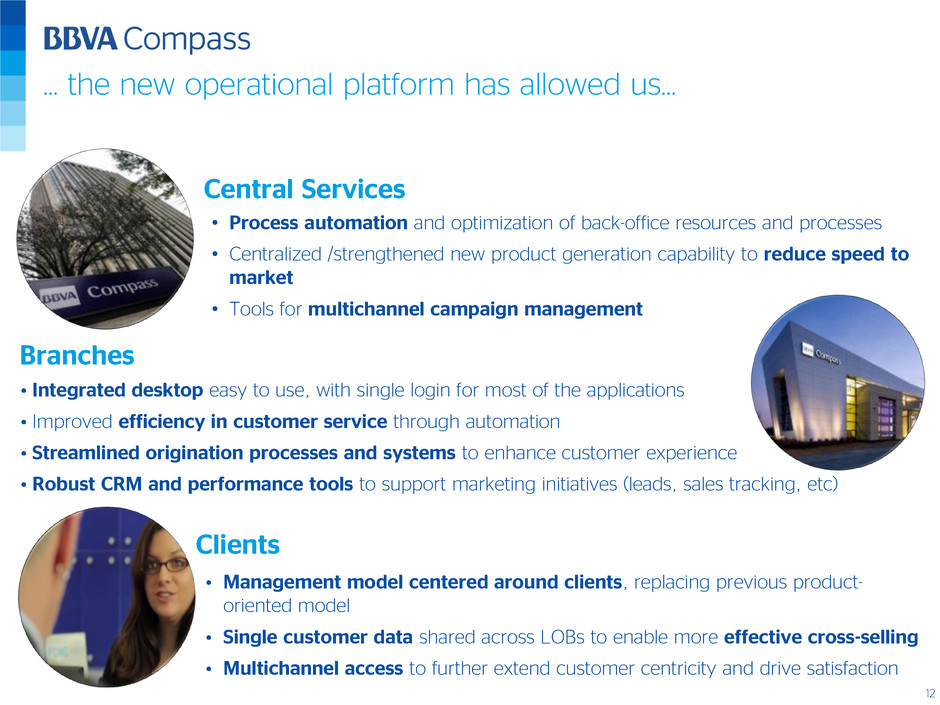

• Process automation and optimization of back-office resources and processes • Centralized /strengthened new product generation capability to reduce speed to market • Tools for multichannel campaign management Central Services • Integrated desktop easy to use, with single login for most of the applications • Improved efficiency in customer service through automation • Streamlined origination processes and systems to enhance customer experience • Robust CRM and performance tools to support marketing initiatives (leads, sales tracking, etc) Branches Clients • Management model centered around clients, replacing previous product- oriented model • Single customer data shared across LOBs to enable more effective cross-selling • Multichannel access to further extend customer centricity and drive satisfaction … the new operational platform has allowed us…

2013 Best in Mobile Functionality Award in Javelin Strategy & Research's sixth annual Mobile Banking Financial Institution Scorecard BBVA Compass offers one of the largest mobile platforms in the U.S.

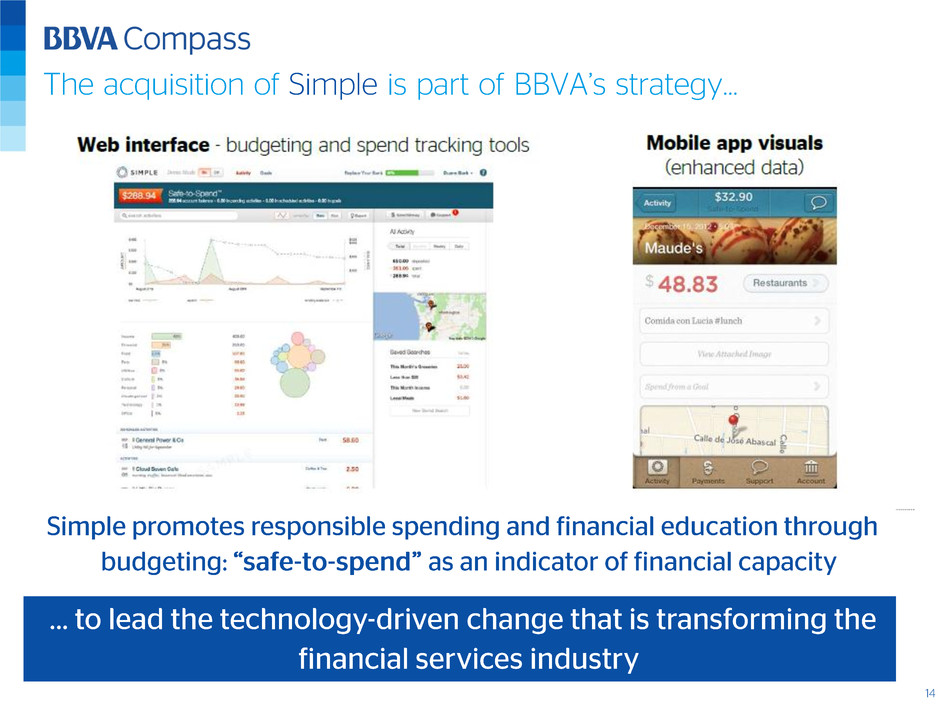

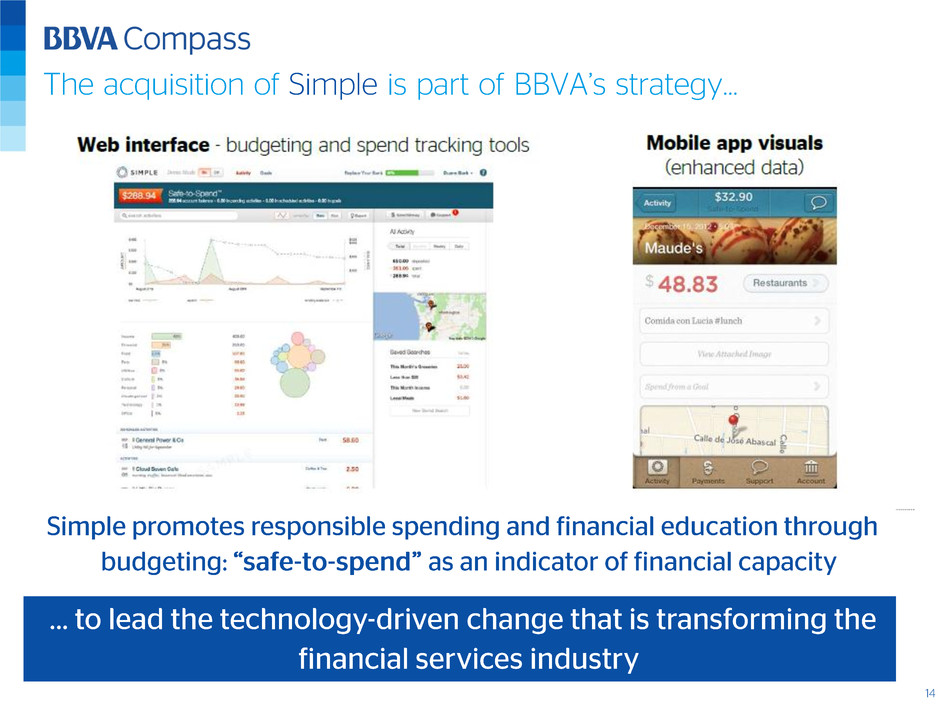

The acquisition of Simple is part of BBVA’s strategy…

#1 in American Banker’s annual reputation survey Source: 2014 American Banker/Reputation Institute Survey of Bank Reputations

Financial Performance

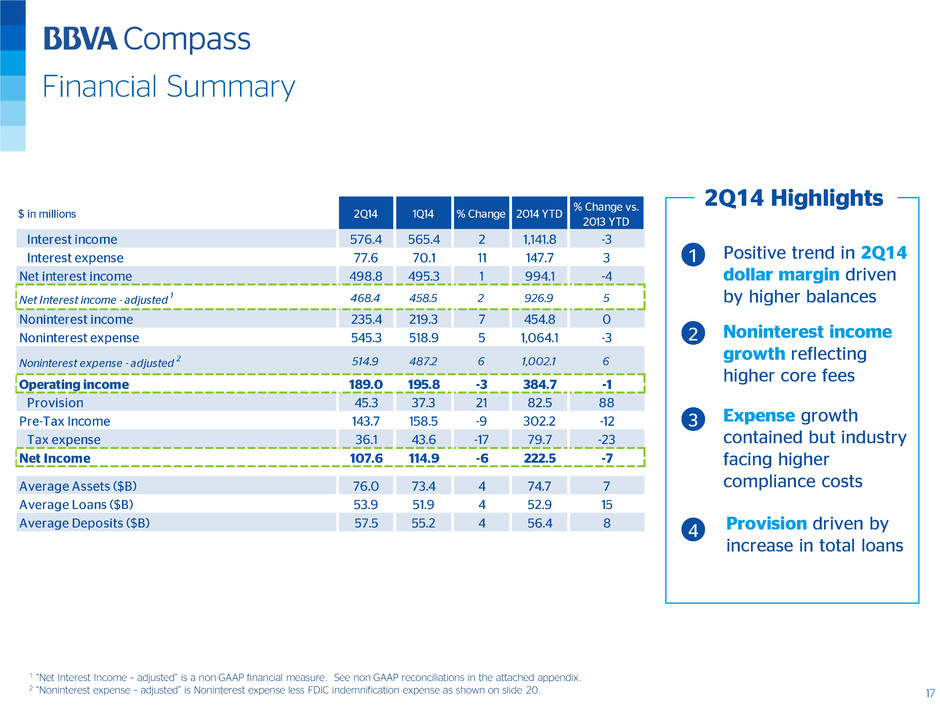

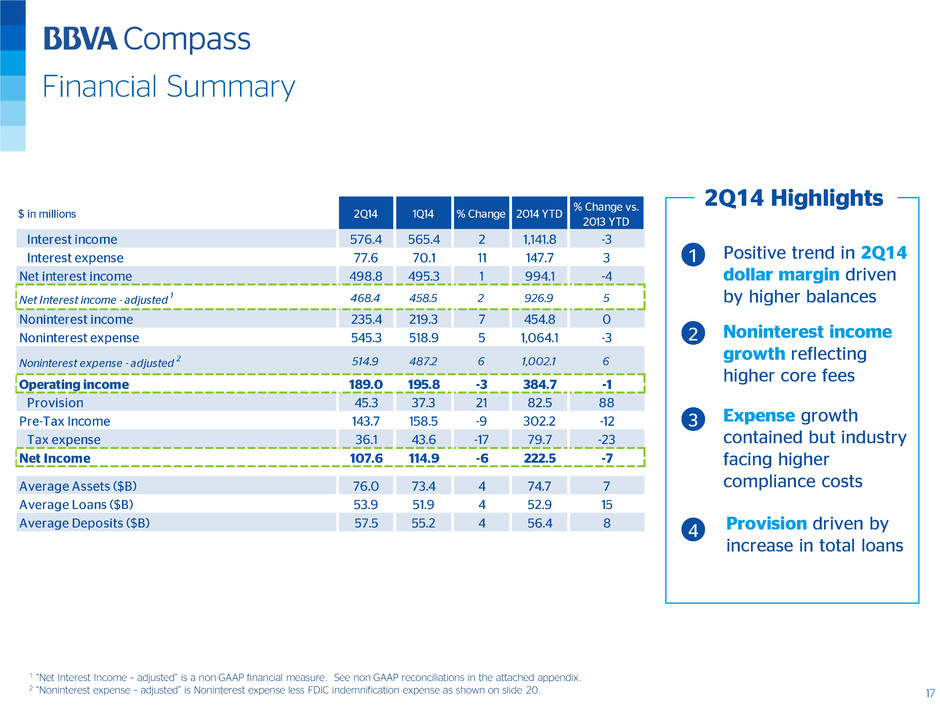

Financial Summary Positive trend in 2Q14 dollar margin driven by higher balances Provision driven by increase in total loans Noninterest income growth reflecting higher core fees 2Q14 Highlights Expense growth contained but industry facing higher compliance costs 1 2 3 4 1 “Net Interest Income – adjusted” is a non-GAAP financial measure. See non-GAAP reconciliations in the attached appendix. 2 “Noninterest expense – adjusted” is Noninterest expense less FDIC indemnification expense as shown on slide 20.

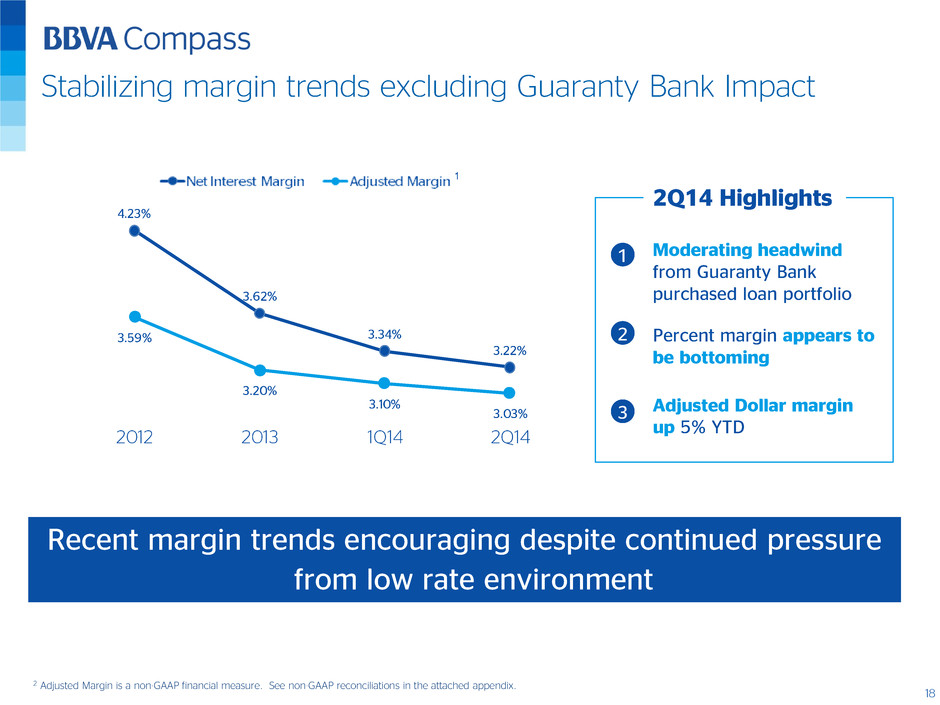

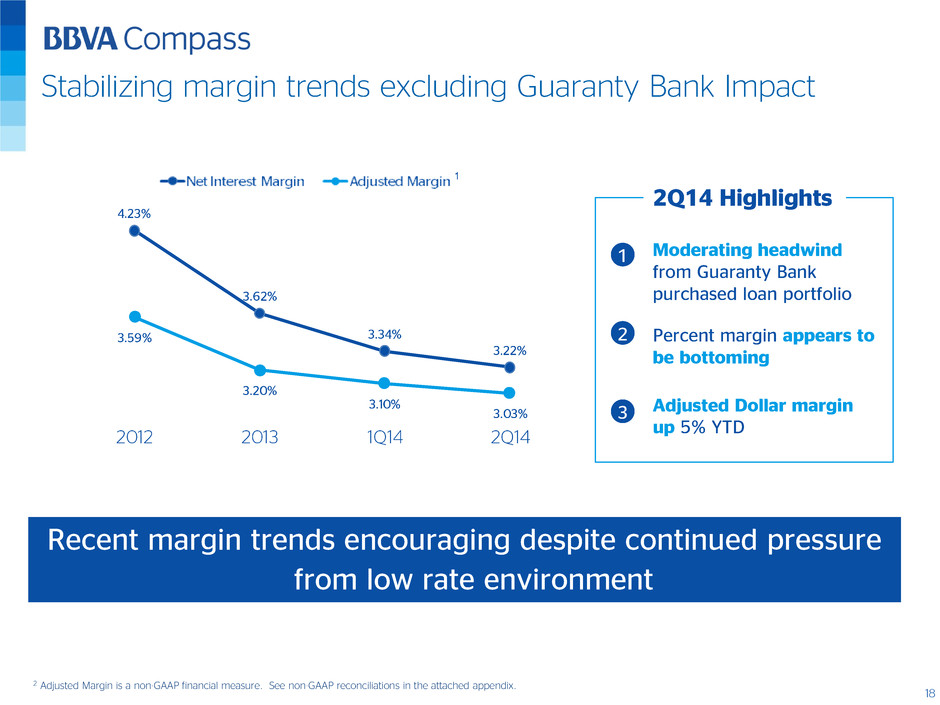

Stabilizing margin trends excluding Guaranty Bank Impact Moderating headwind from Guaranty Bank purchased loan portfolio Percent margin appears to be bottoming 2Q14 Highlights Adjusted Dollar margin up 5% YTD 1 2 3 Recent margin trends encouraging despite continued pressure from low rate environment 1 2 Adjusted Margin is a non-GAAP financial measure. See non-GAAP reconciliations in the attached appendix.

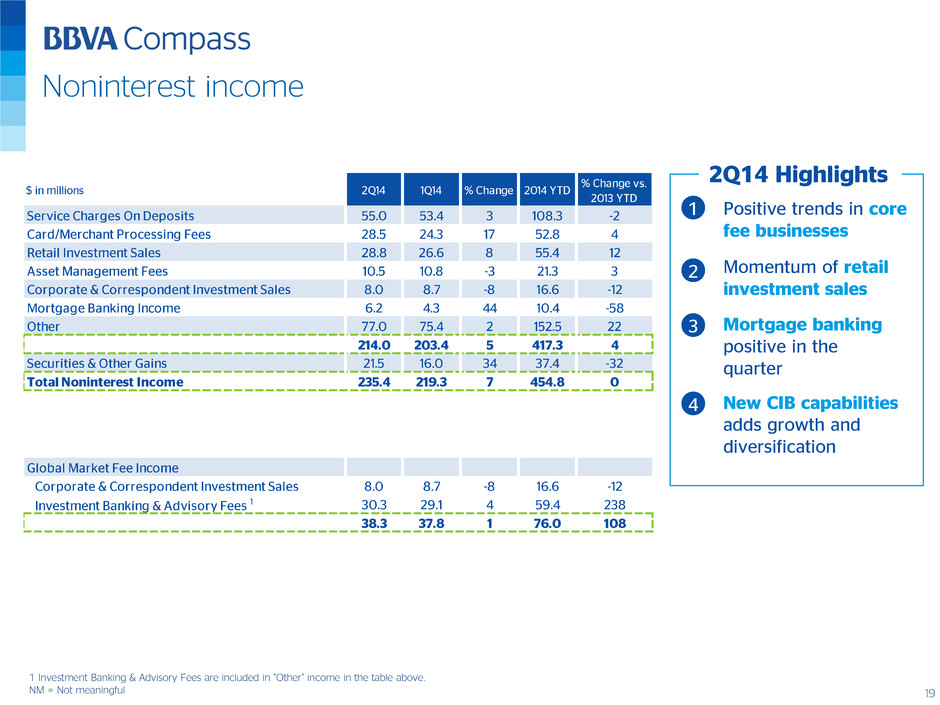

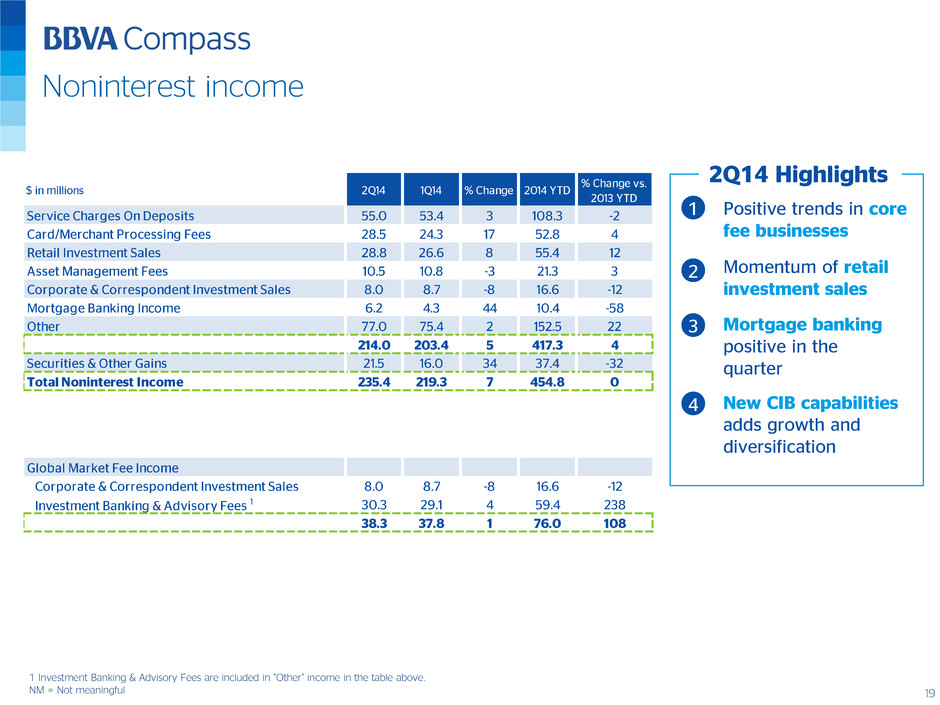

Noninterest income • Positive trends in core fee businesses • New CIB capabilities adds growth and diversification • Momentum of retail investment sales c 2Q14 Highlights • Mortgage banking positive in the quarter 1 Investment Banking & Advisory Fees are included in “Other” income in the table above. NM = Not meaningful 1 2 3 4

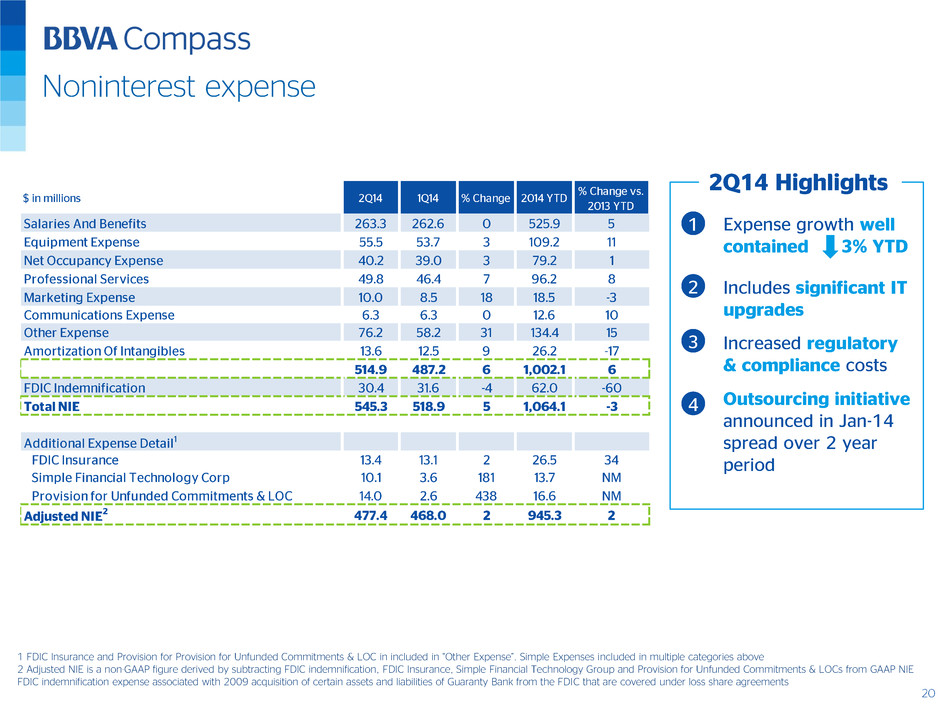

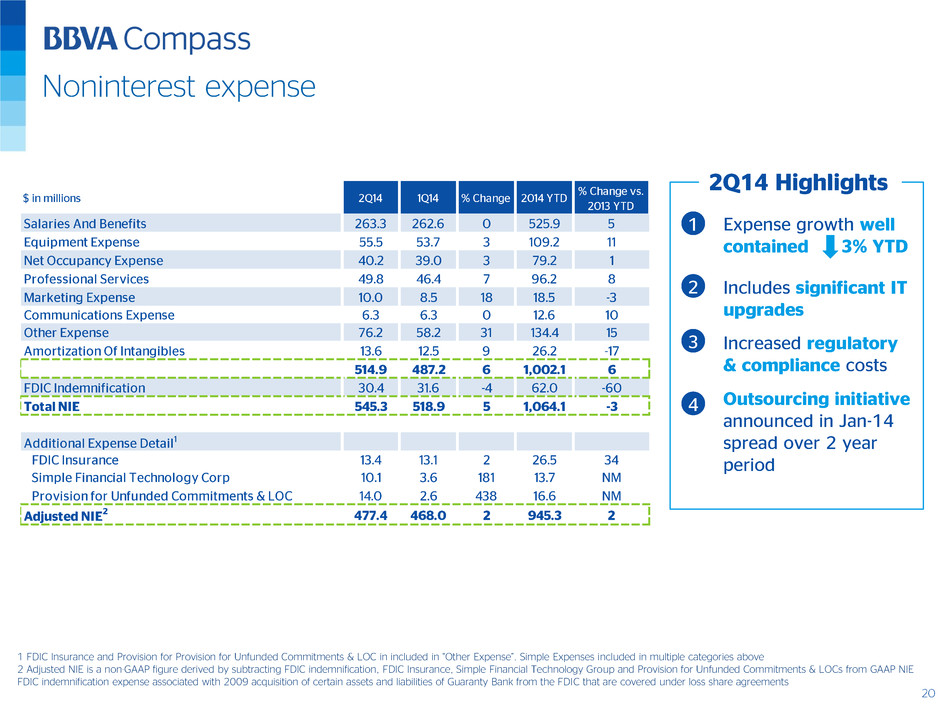

Noninterest expense • Expense growth well contained 3% YTD • Outsourcing initiative announced in Jan-14 spread over 2 year period • Includes significant IT upgrades c 2Q14 Highlights • Increased regulatory & compliance costs 1 FDIC Insurance and Provision for Provision for Unfunded Commitments & LOC in included in “Other Expense”. Simple Expenses included in multiple categories above 2 Adjusted NIE is a non-GAAP figure derived by subtracting FDIC indemnification, FDIC Insurance, Simple Financial Technology Group and Provision for Unfunded Commitments & LOCs from GAAP NIE FDIC indemnification expense associated with 2009 acquisition of certain assets and liabilities of Guaranty Bank from the FDIC that are covered under loss share agreements 1 2 3 4

Asset Quality

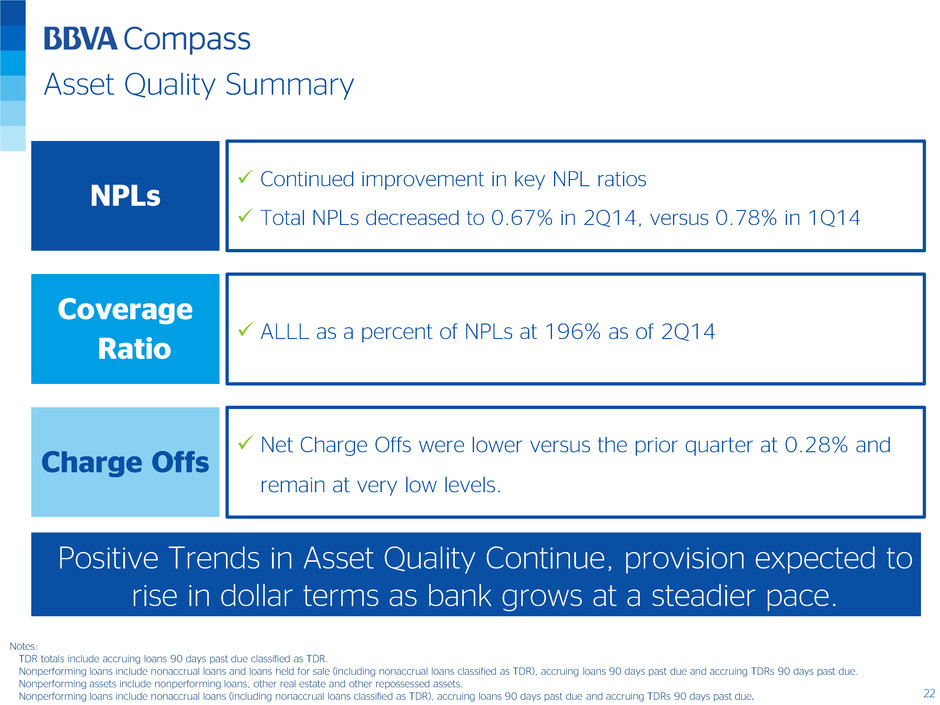

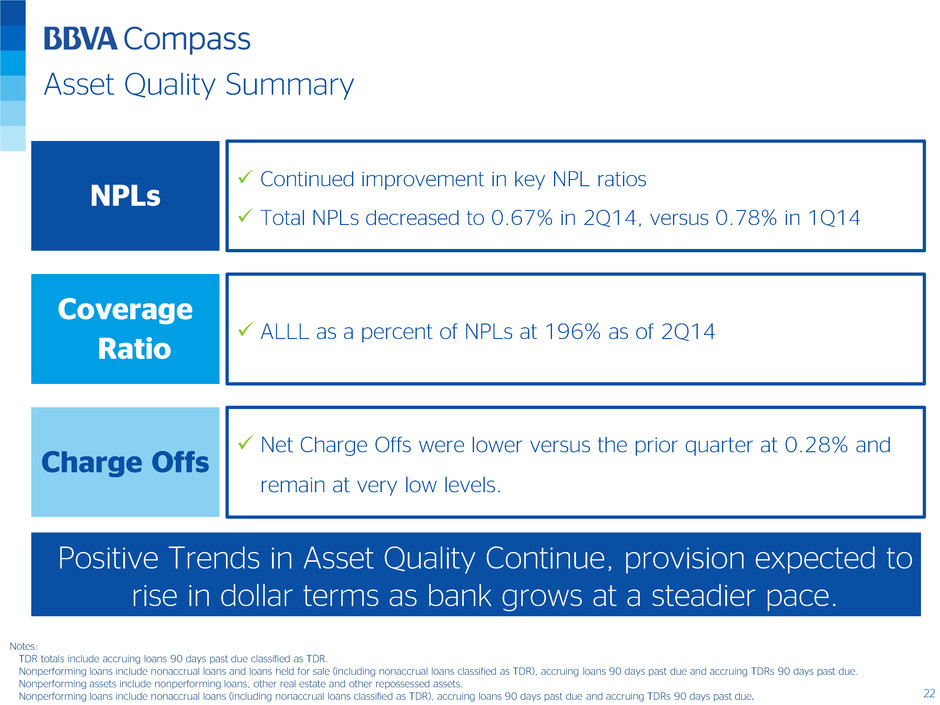

Asset Quality Summary NPLs Continued improvement in key NPL ratios Total NPLs decreased to 0.67% in 2Q14, versus 0.78% in 1Q14 Coverage Ratio ALLL as a percent of NPLs at 196% as of 2Q14 Charge Offs Net Charge Offs were lower versus the prior quarter at 0.28% and remain at very low levels. Positive Trends in Asset Quality Continue, provision expected to rise in dollar terms as bank grows at a steadier pace. Notes: TDR totals include accruing loans 90 days past due classified as TDR. Nonperforming loans include nonaccrual loans and loans held for sale (including nonaccrual loans classified as TDR), accruing loans 90 days past due and accruing TDRs 90 days past due. Nonperforming assets include nonperforming loans, other real estate and other repossessed assets. Nonperforming loans include nonaccrual loans (including nonaccrual loans classified as TDR), accruing loans 90 days past due and accruing TDRs 90 days past due

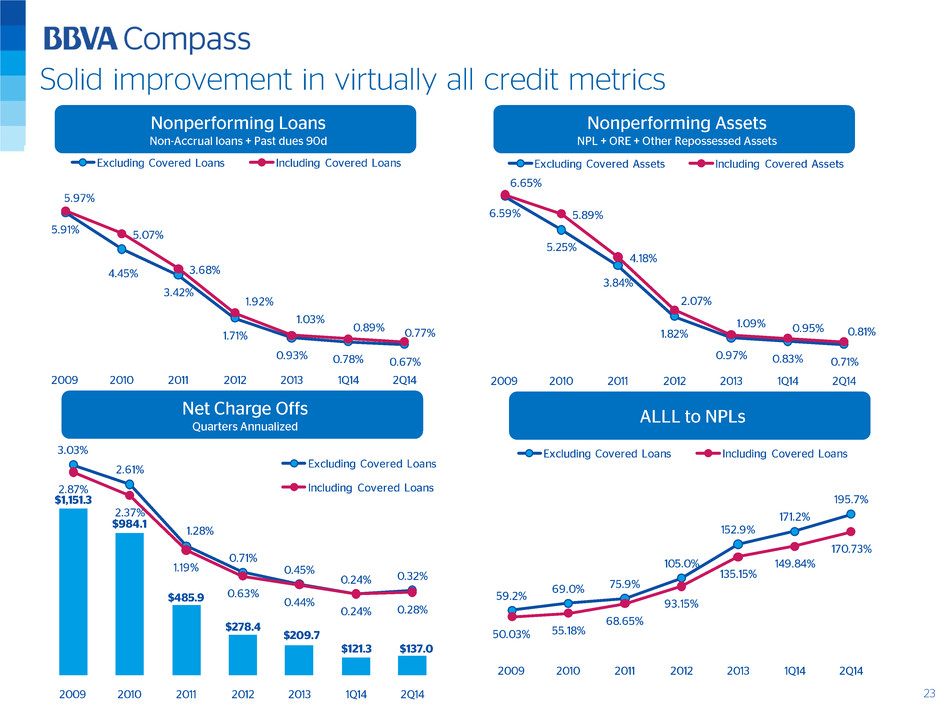

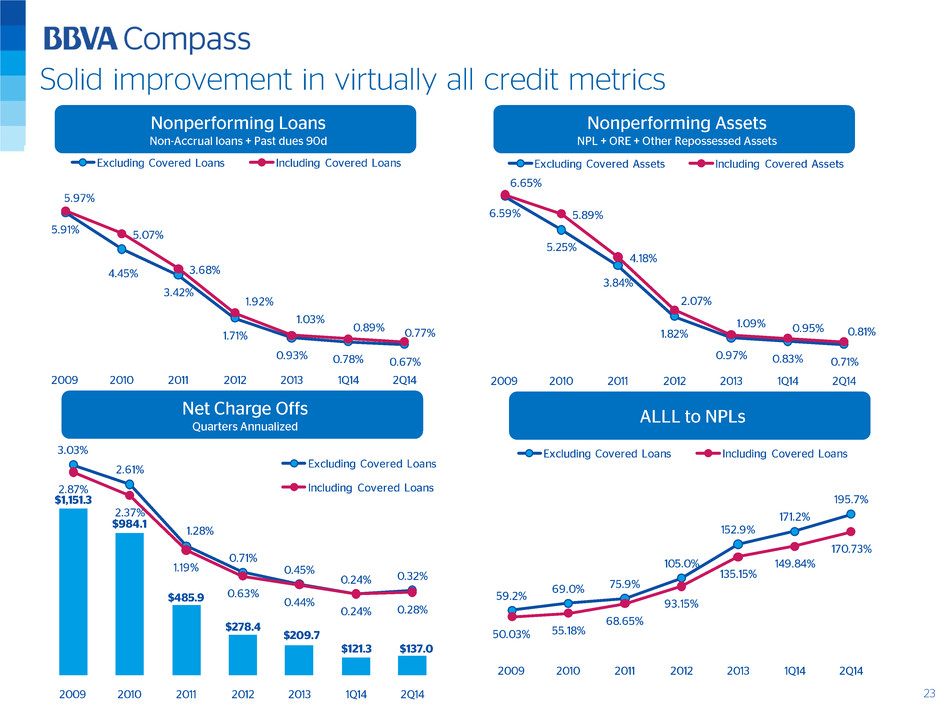

Solid improvement in virtually all credit metrics

Balance Sheet and Funding Profile

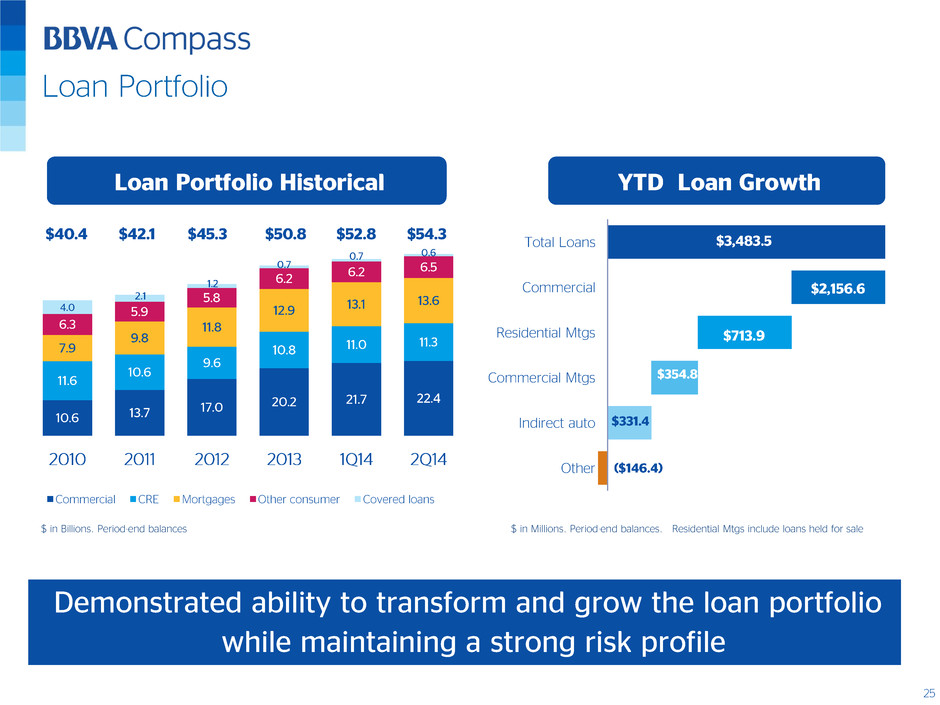

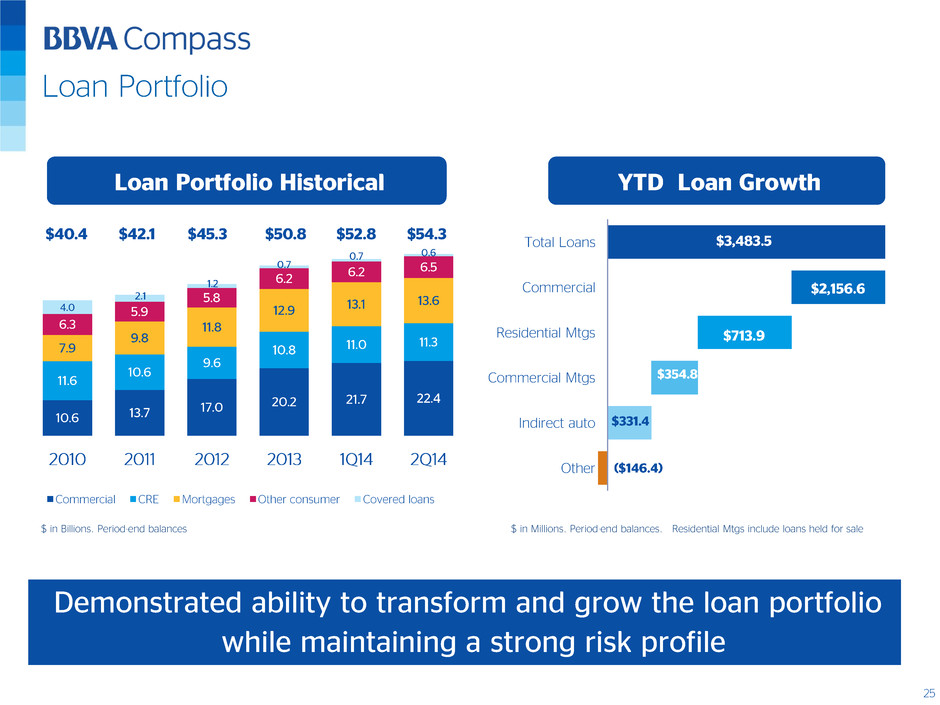

Commercial CRE Mortgages Other consumer Covered loans Loan Portfolio Historical $ in Billions. Period-end balances YTD Loan Growth Loan Portfolio Demonstrated ability to transform and grow the loan portfolio while maintaining a strong risk profile Total Loans Commercial Residential Mtgs Commercial Mtgs Indirect auto Other $ in Millions. Period-end balances. Residential Mtgs include loans held for sale

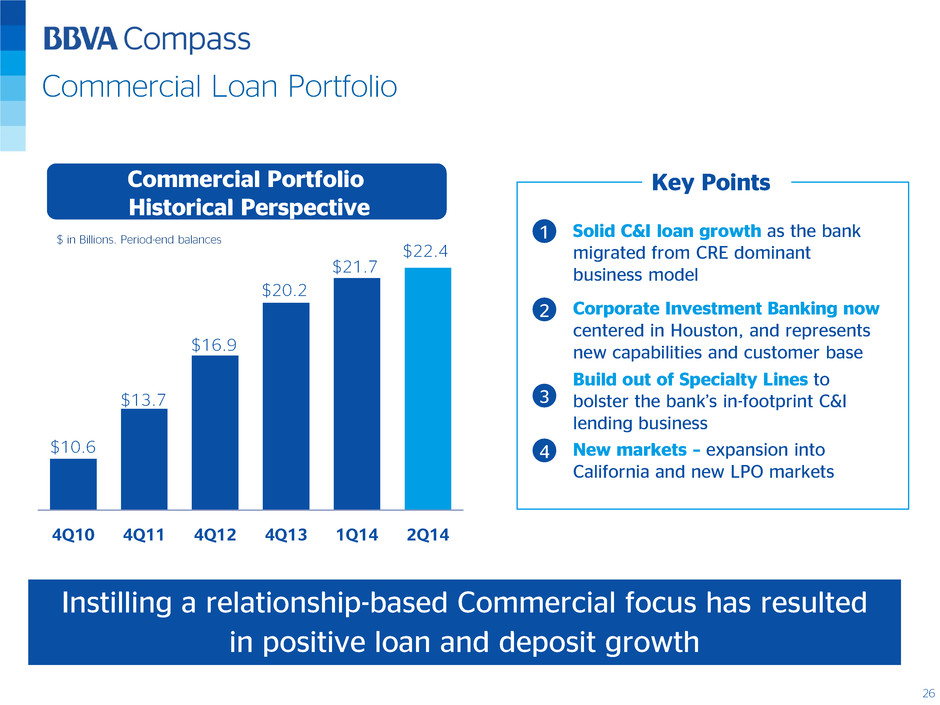

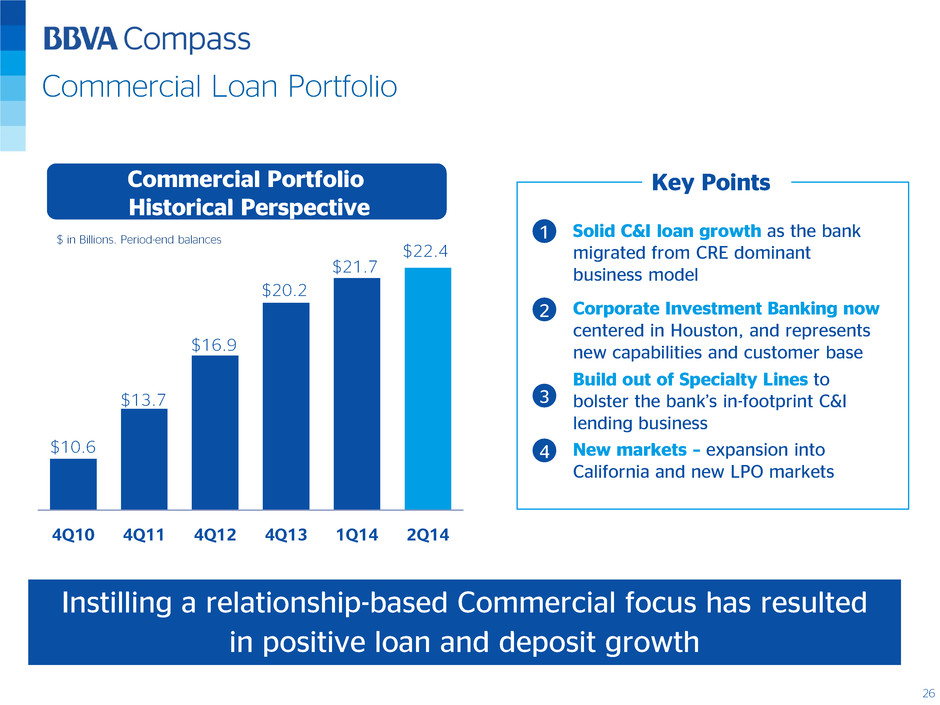

Commercial Loan Portfolio Commercial Portfolio Historical Perspective 4Q10 4Q11 4Q12 4Q13 1Q14 2Q14 $10.6 $13.7 $16.9 $20.2 $21.7 $22.4 $ in Billions. Period-end balances • Solid C&I loan growth as the bank migrated from CRE dominant business model • New markets – expansion into California and new LPO markets • Corporate Investment Banking now centered in Houston, and represents new capabilities and customer base Key Points • Build out of Specialty Lines to bolster the bank’s in-footprint C&I lending business Instilling a relationship-based Commercial focus has resulted in positive loan and deposit growth 1 2 3 4

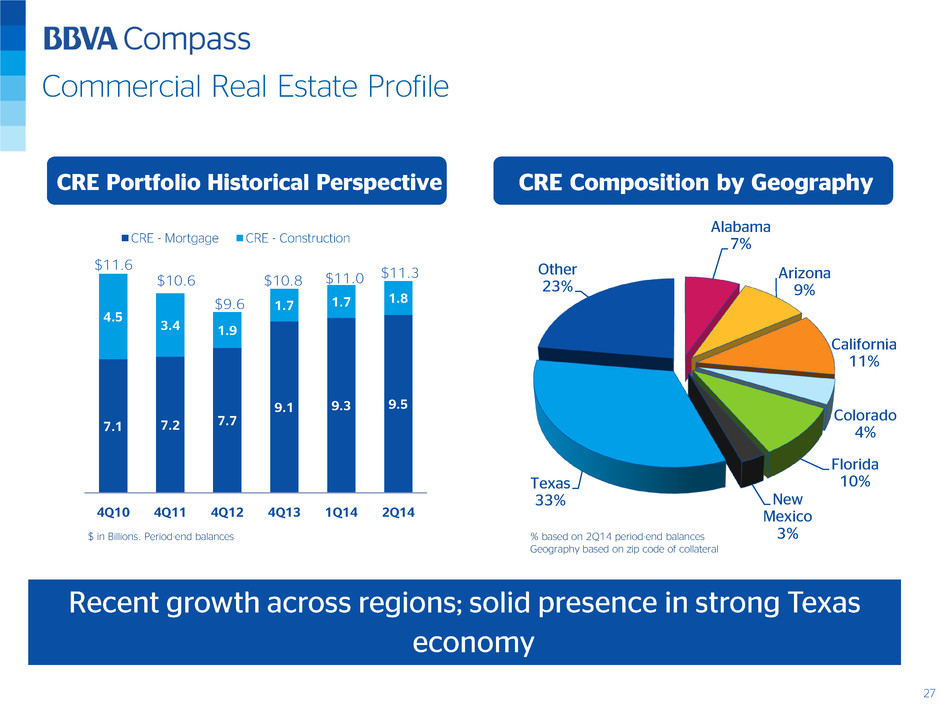

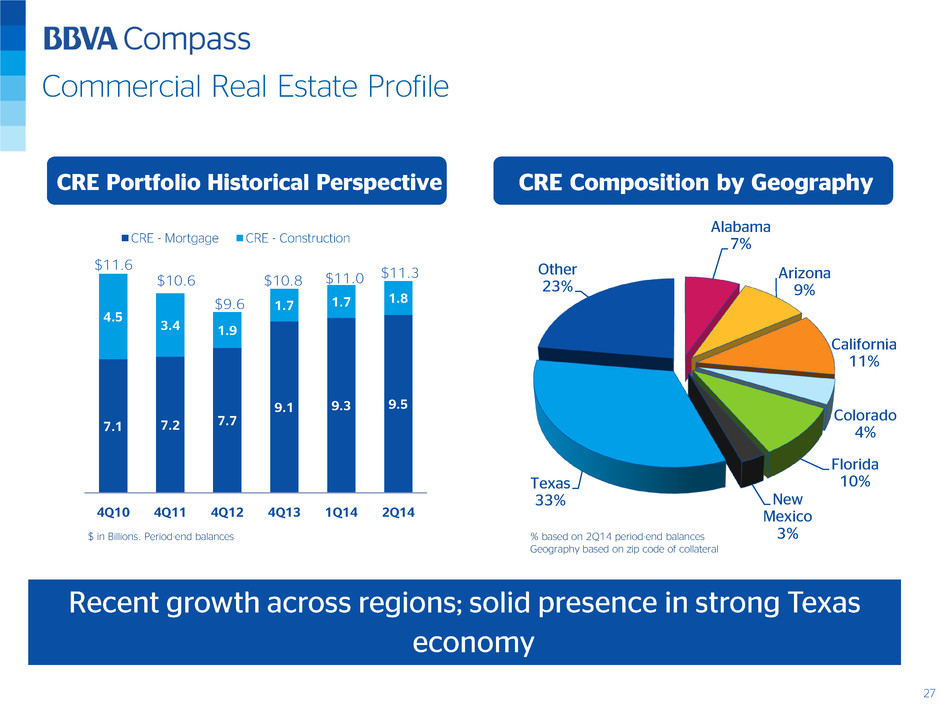

CRE Composition by Geography Commercial Real Estate Profile Alabama 7% Arizona 9% California 11% Colorado 4% Florida 10% New Mexico 3% Texas 33% Other 23% 7.1 7.2 7.7 9.1 9.3 9.5 4.5 3.4 1.9 1.7 1.7 1.8 4Q10 4Q11 4Q12 4Q13 1Q14 2Q14 CRE - Mortgage CRE - Construction $11.3 $10.8 $9.6 $11.6 $10.6 $11.0 CRE Portfolio Historical Perspective $ in Billions. Period-end balances % based on 2Q14 period-end balances Geography based on zip code of collateral

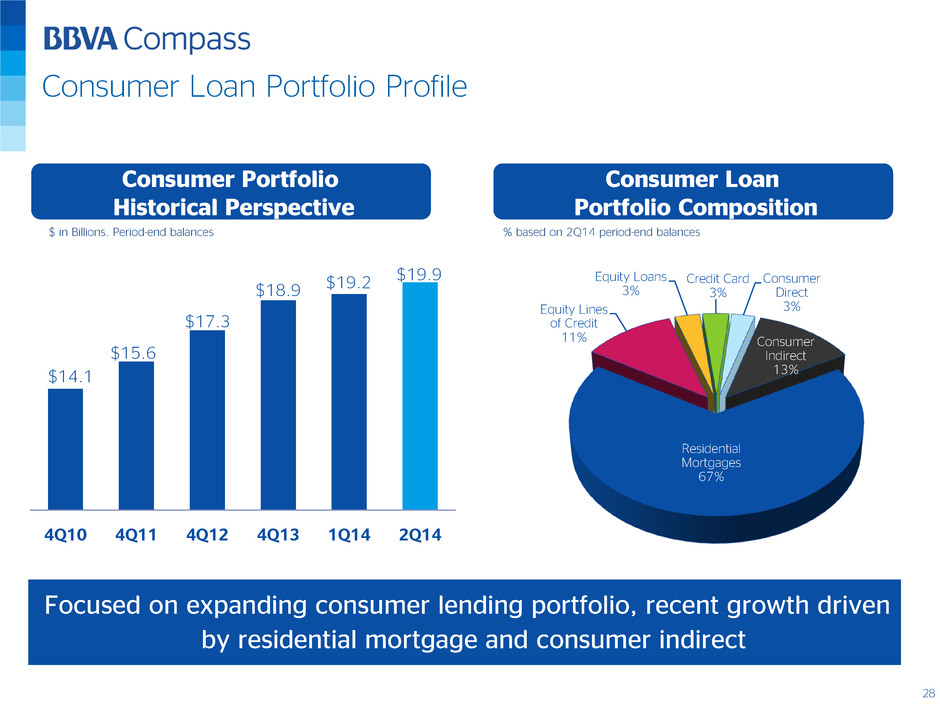

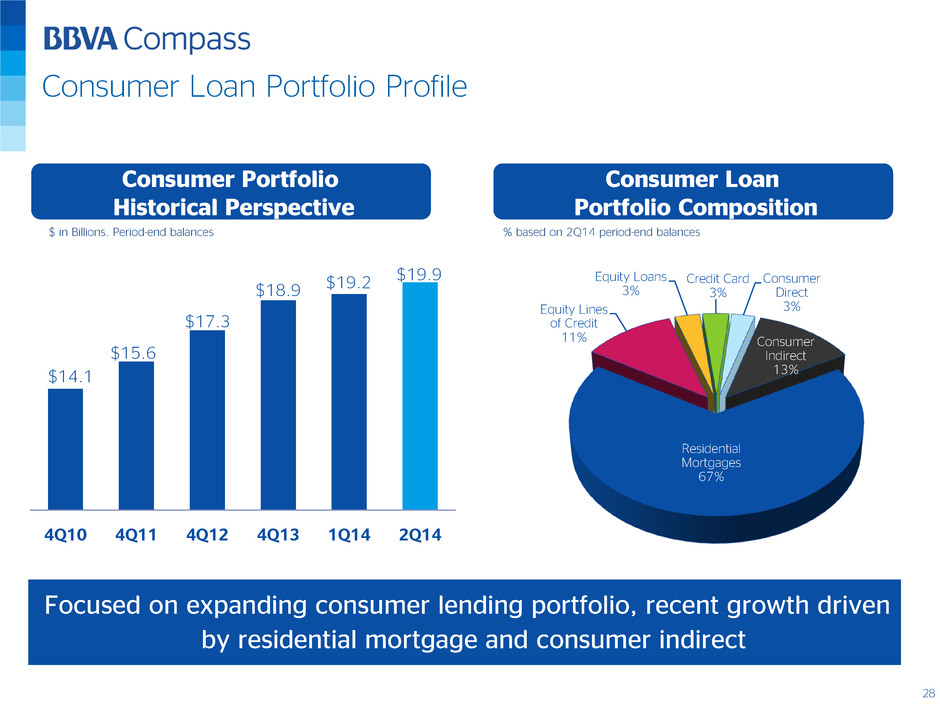

Consumer Loan Portfolio Composition Residential Mortgages 67% Equity Lines of Credit 11% Equity Loans 3% Credit Card 3% Consumer Direct 3% Consumer Indirect 13% Consumer Portfolio Historical Perspective 4Q10 4Q11 4Q12 4Q13 1Q14 2Q14 $18.9 $19.2 $19.9 $17.3 $15.6 $14.1 $ in Billions. Period-end balances % based on 2Q14 period-end balances Consumer Loan Portfolio Profile Focused on expanding consumer lending portfolio, recent growth driven by residential mortgage and consumer indirect

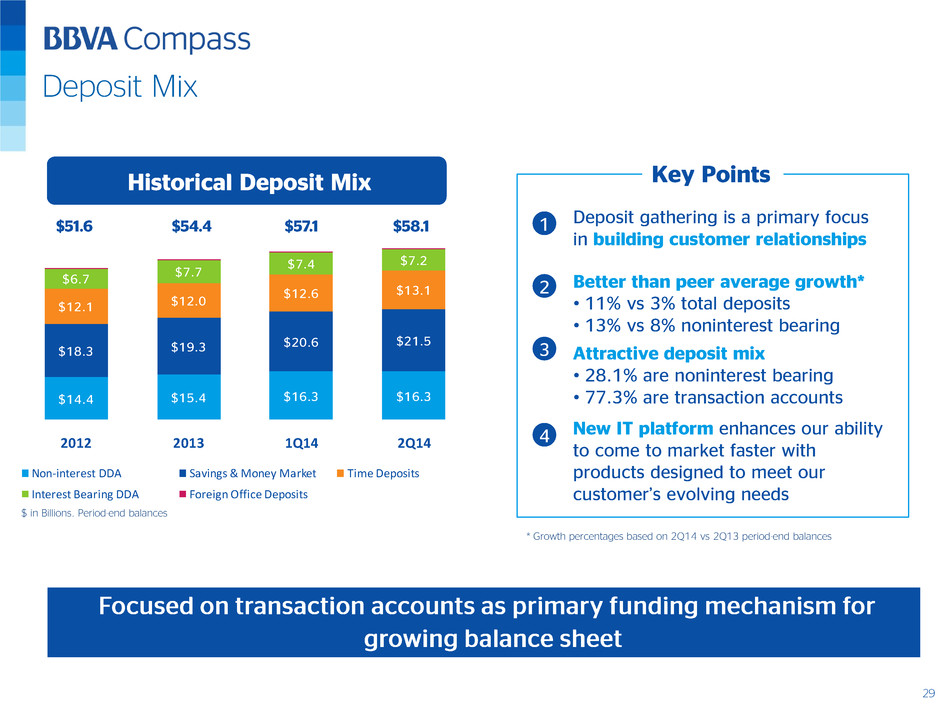

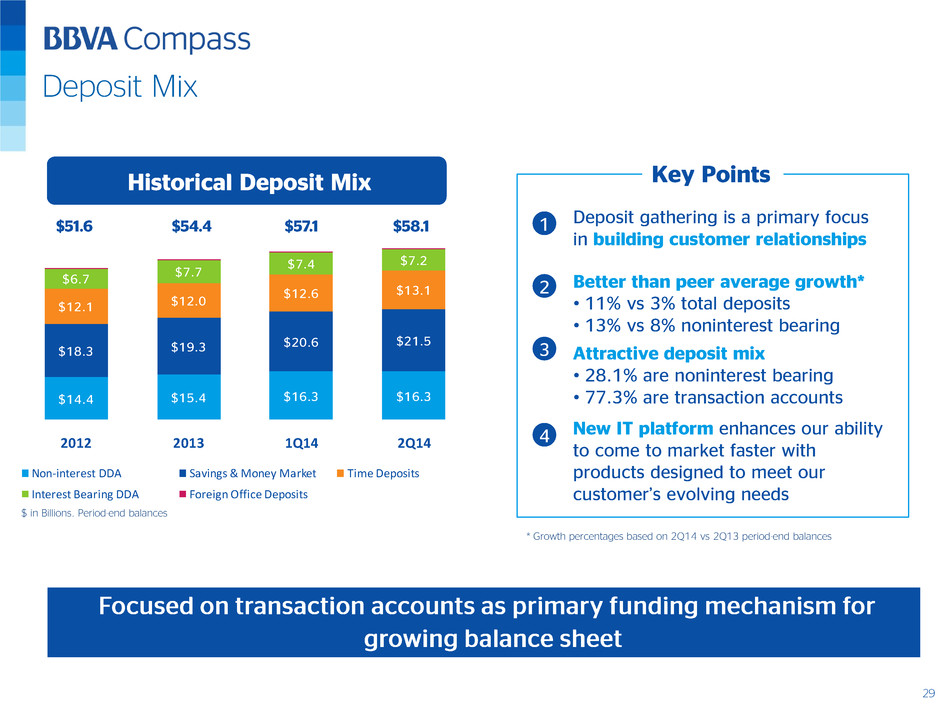

$14.4 $15.4 $16.3 $16.3 $18.3 $19.3 $20.6 $21.5 $12.1 $12.0 $12.6 $13.1 $6.7 $7.7 $7.4 $7.2 2012 2013 1Q14 2Q14 Non-interest DDA Savings & Money Market Time Deposits Interest Bearing DDA Foreign Office Deposits Deposit Mix Historical Deposit Mix $ in Billions. Period-end balances • Attractive deposit mix • 28.1% are noninterest bearing • 77.3% are transaction accounts • New IT platform enhances our ability to come to market faster with products designed to meet our customer’s evolving needs Better than peer average growth* • 11% vs 3% total deposits • 13% vs 8% noninterest bearing Key Points • Deposit gathering is a primary focus in building customer relationships * Growth percentages based on 2Q14 vs 2Q13 period-end balances 3 2 1 4

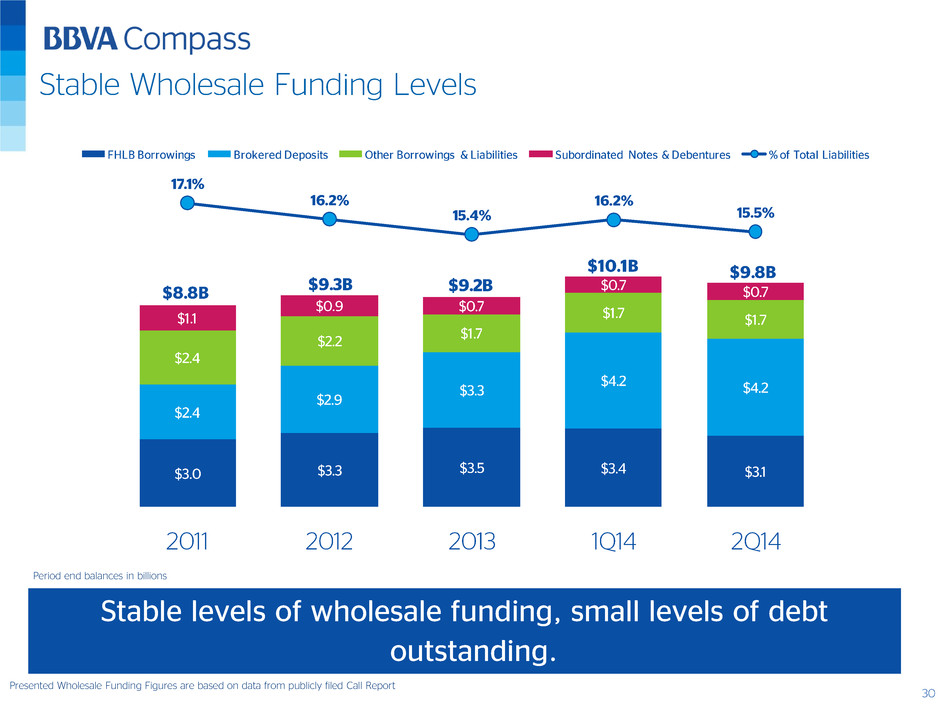

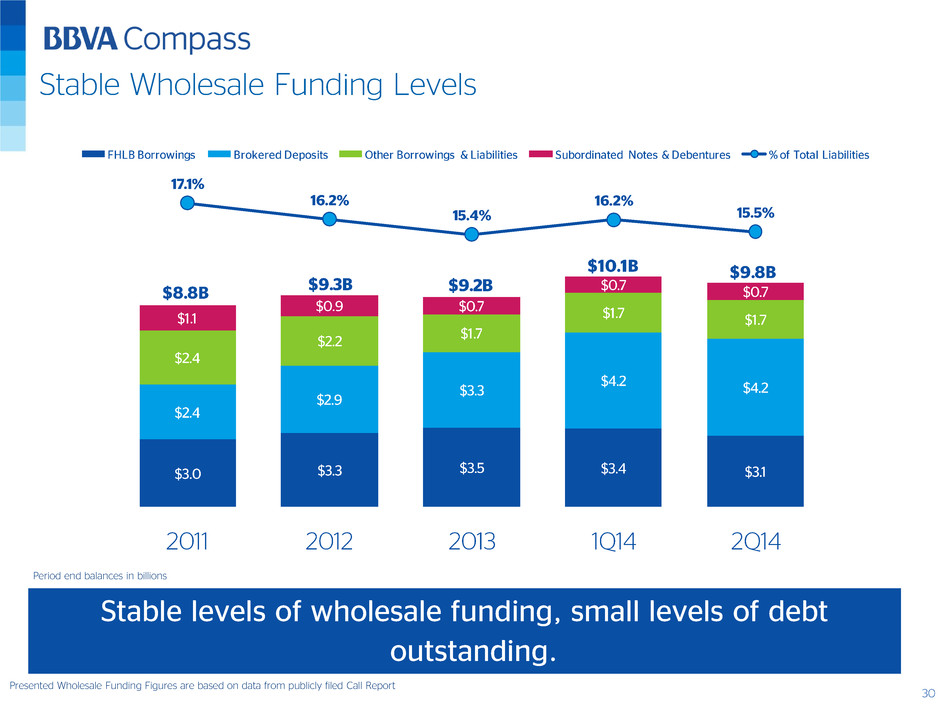

Stable Wholesale Funding Levels Presented Wholesale Funding Figures are based on data from publicly filed Call Report Stable levels of wholesale funding, small levels of debt outstanding. Period end balances in billions

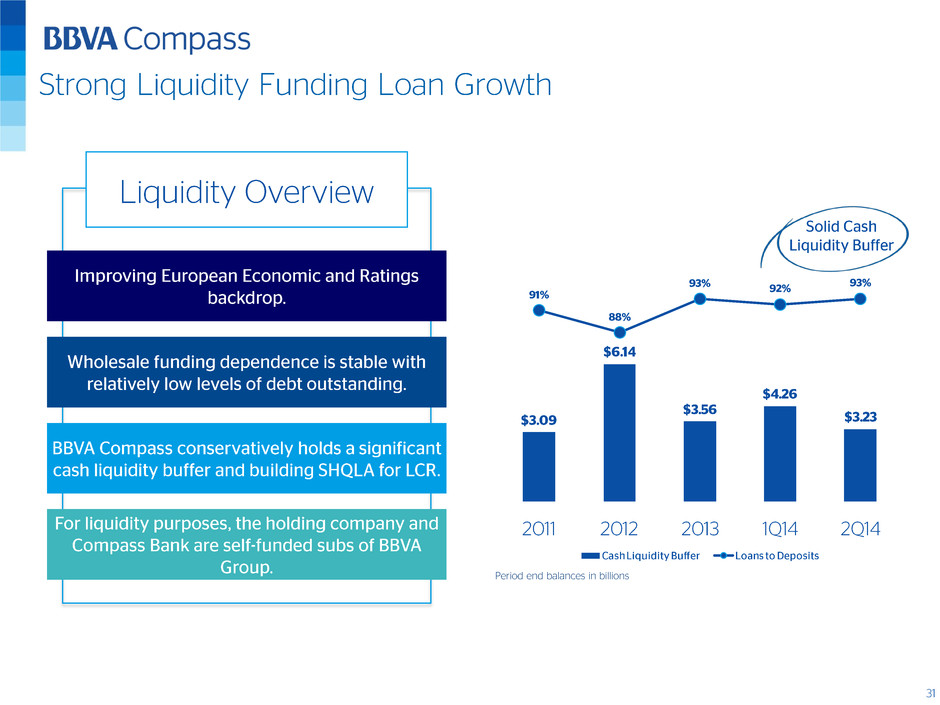

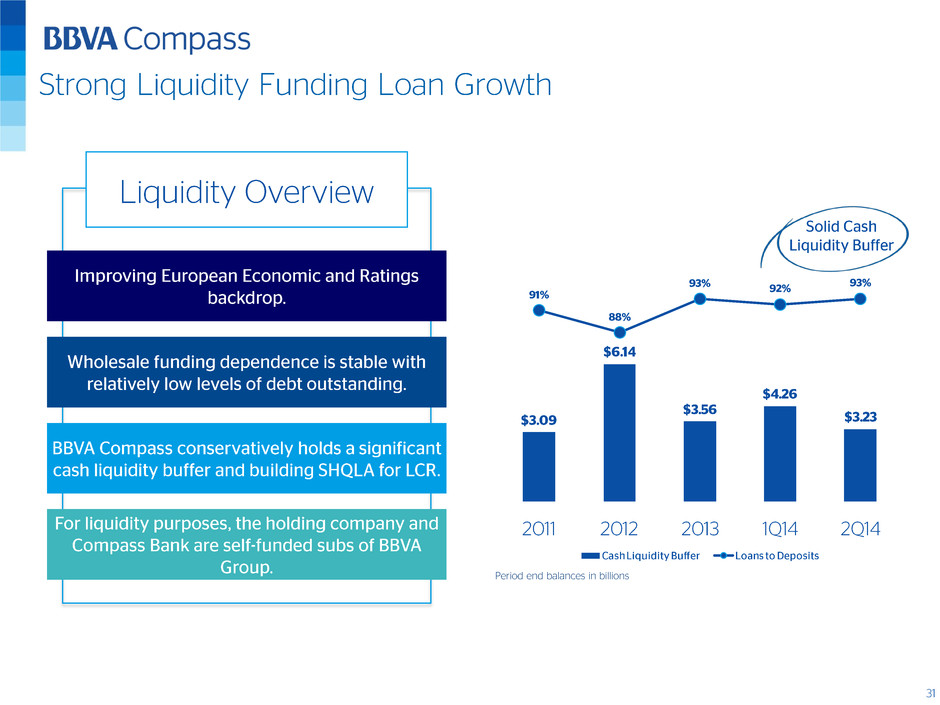

60% 65% 70% 75% 80% 85% 90% 95% $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 $9.00 Strong Liquidity Funding Loan Growth Period end balances in billions

Capital Position

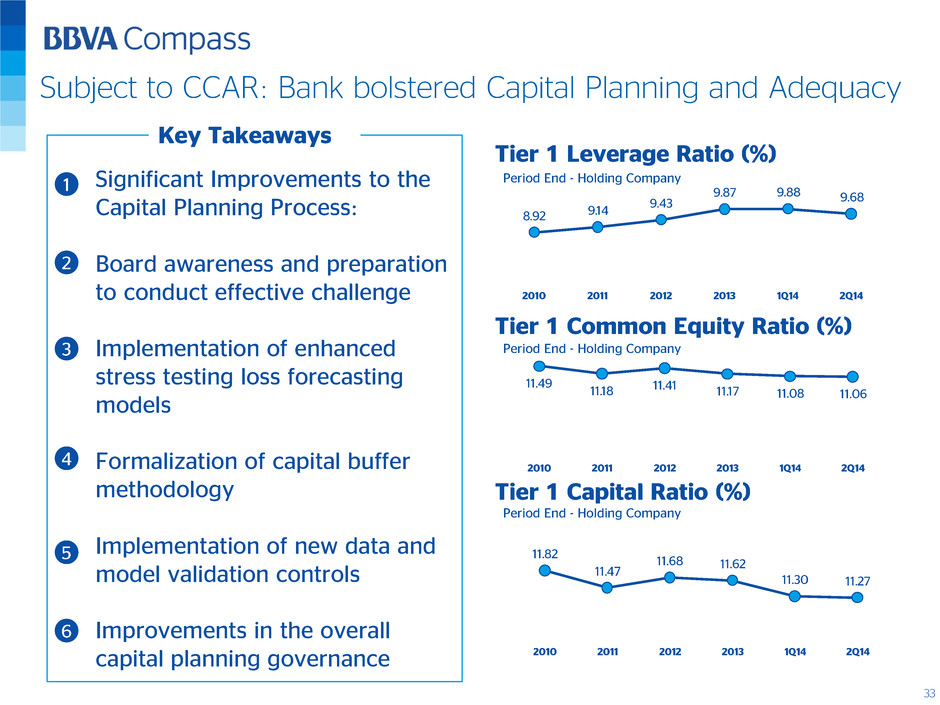

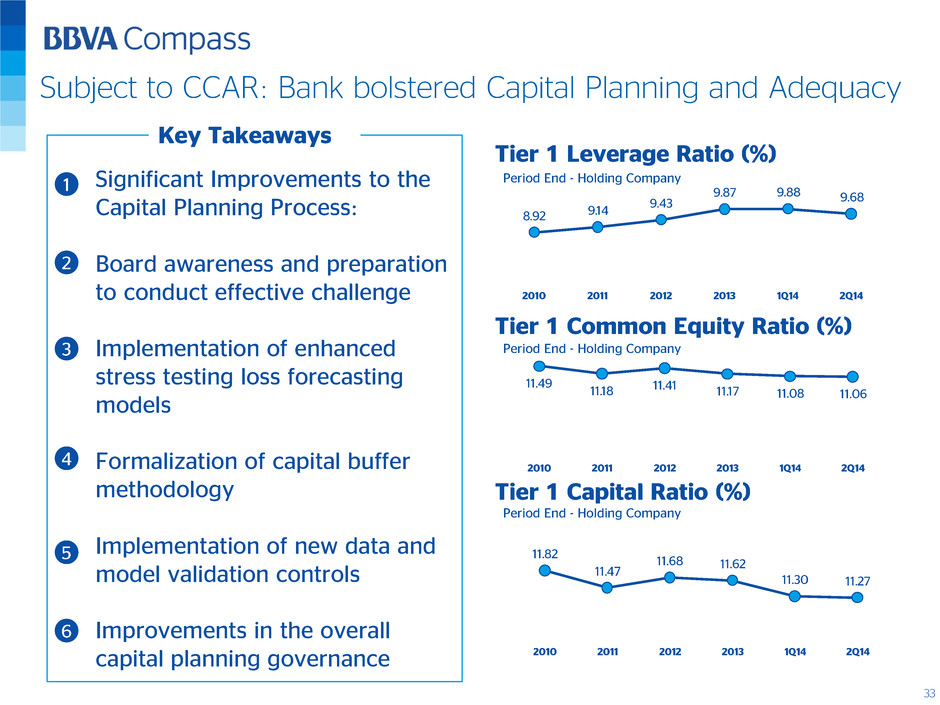

Subject to CCAR: Bank bolstered Capital Planning and Adequacy Tier 1 Leverage Ratio (%) Tier 1 Common Equity Ratio (%) Tier 1 Capital Ratio (%) c Significant Improvements to the Capital Planning Process: Board awareness and preparation to conduct effective challenge Implementation of enhanced stress testing loss forecasting models Formalization of capital buffer methodology Implementation of new data and model validation controls Improvements in the overall capital planning governance Key Takeaways Period End - Holding Company Period End - Holding Company Period End - Holding Company

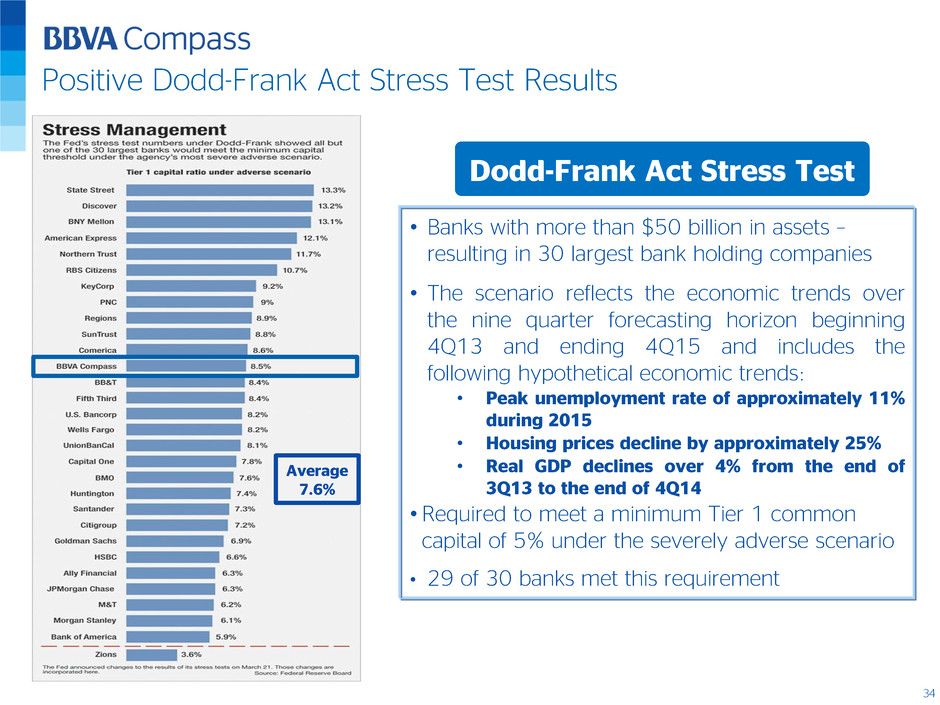

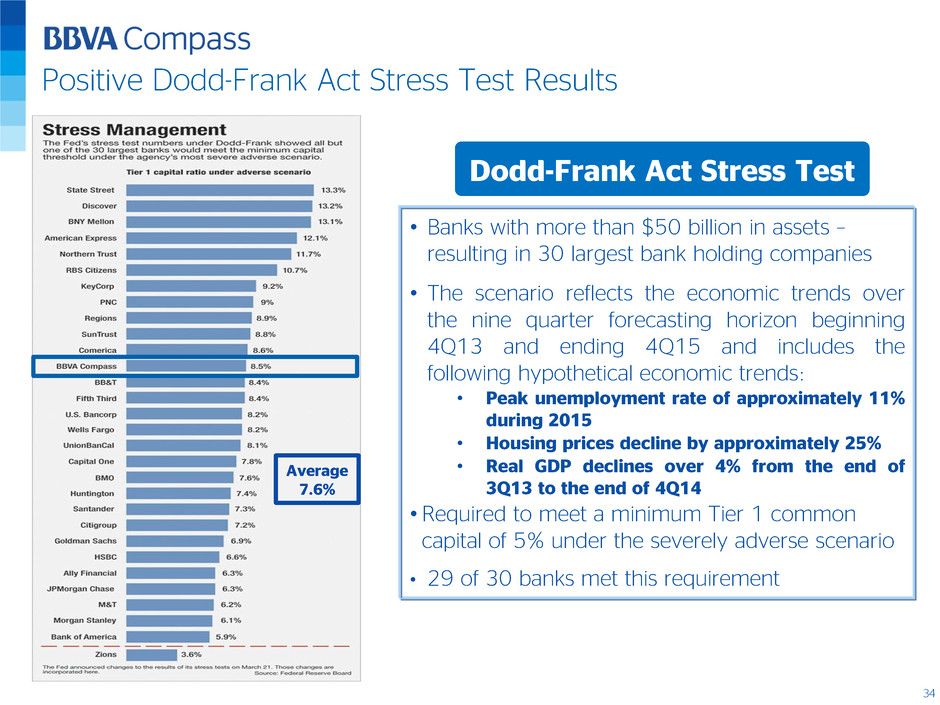

Positive Dodd-Frank Act Stress Test Results Dodd-Frank Act Stress Test • Banks with more than $50 billion in assets – resulting in 30 largest bank holding companies • The scenario reflects the economic trends over the nine quarter forecasting horizon beginning 4Q13 and ending 4Q15 and includes the following hypothetical economic trends: • Peak unemployment rate of approximately 11% during 2015 • Housing prices decline by approximately 25% • Real GDP declines over 4% from the end of 3Q13 to the end of 4Q14 • Required to meet a minimum Tier 1 common capital of 5% under the severely adverse scenario • 29 of 30 banks met this requirement Average 7.6%

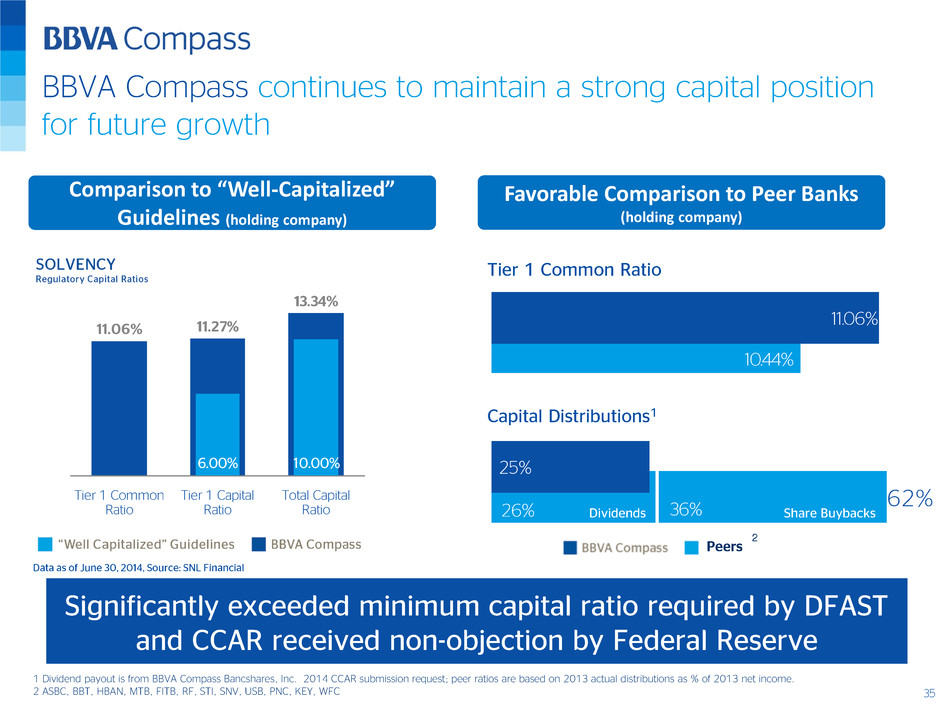

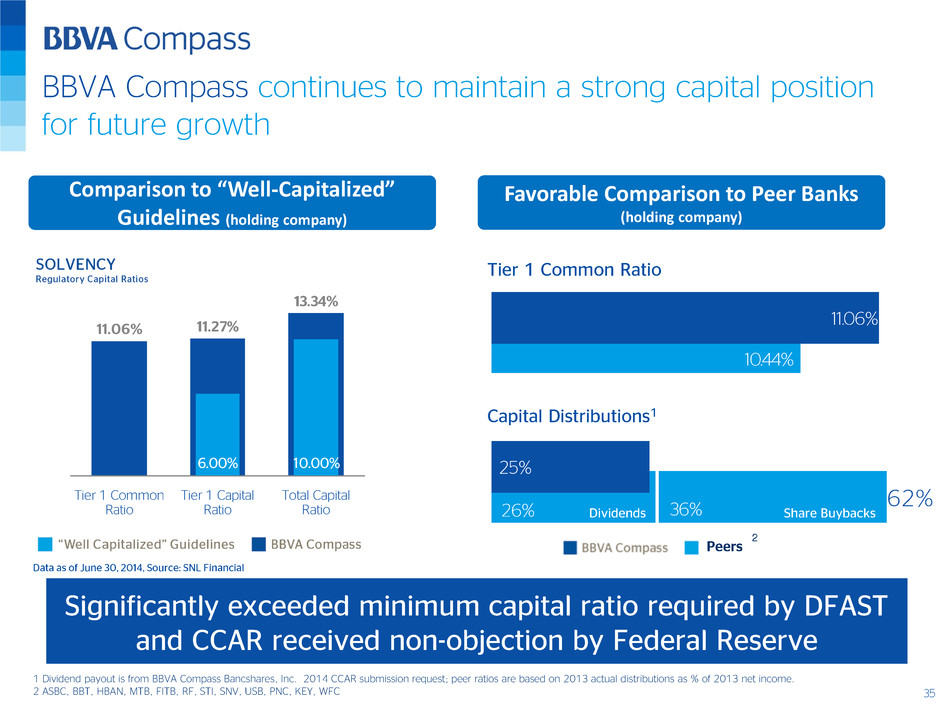

Favorable Comparison to Peer Banks (holding company) Comparison to “Well-Capitalized” Guidelines (holding company) BBVA Compass continues to maintain a strong capital position for future growth Significantly exceeded minimum capital ratio required by DFAST and CCAR received non-objection by Federal Reserve Tier 1 Common Ratio Tier 1 Capital Ratio Total Capital Ratio 2 1 Dividend payout is from BBVA Compass Bancshares, Inc. 2014 CCAR submission request; peer ratios are based on 2013 actual distributions as % of 2013 net income. 2 ASBC, BBT, HBAN, MTB, FITB, RF, STI, SNV, USB, PNC, KEY, WFC Tier 1 Common Ratio Capital Distributions1 Dividends Share Buybacks 62%

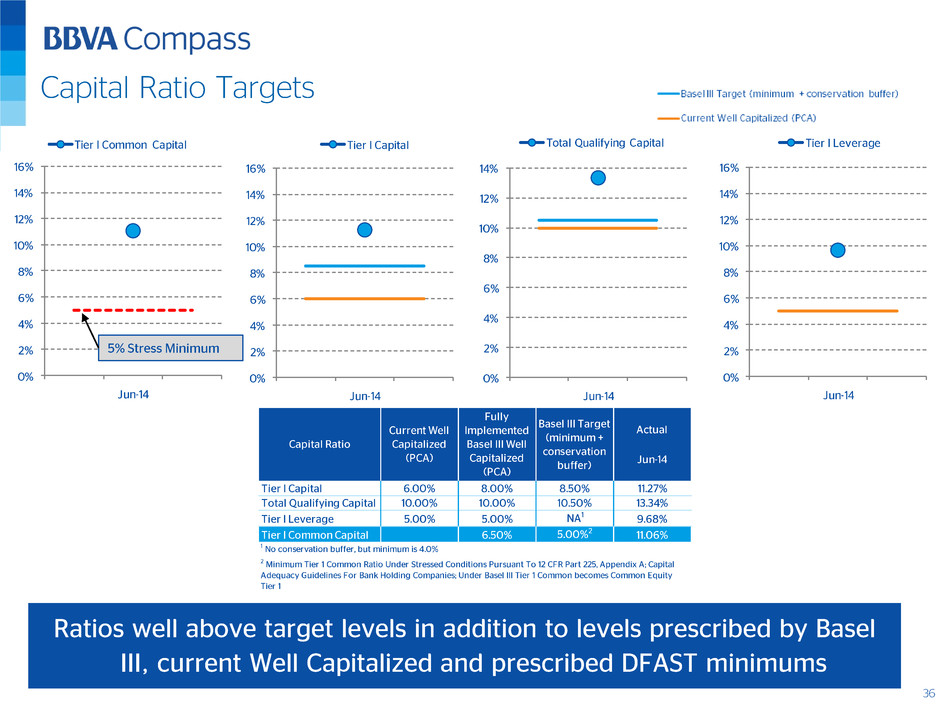

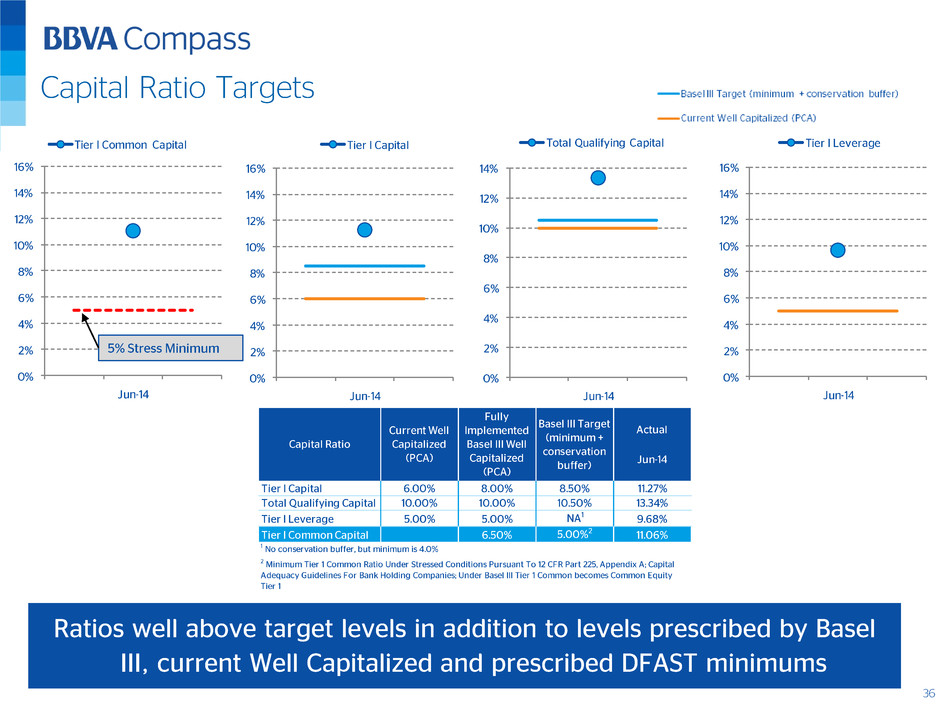

Capital Ratio Targets Ratios well above target levels in addition to levels prescribed by Basel III, current Well Capitalized and prescribed DFAST minimums

Regulation and Ratings

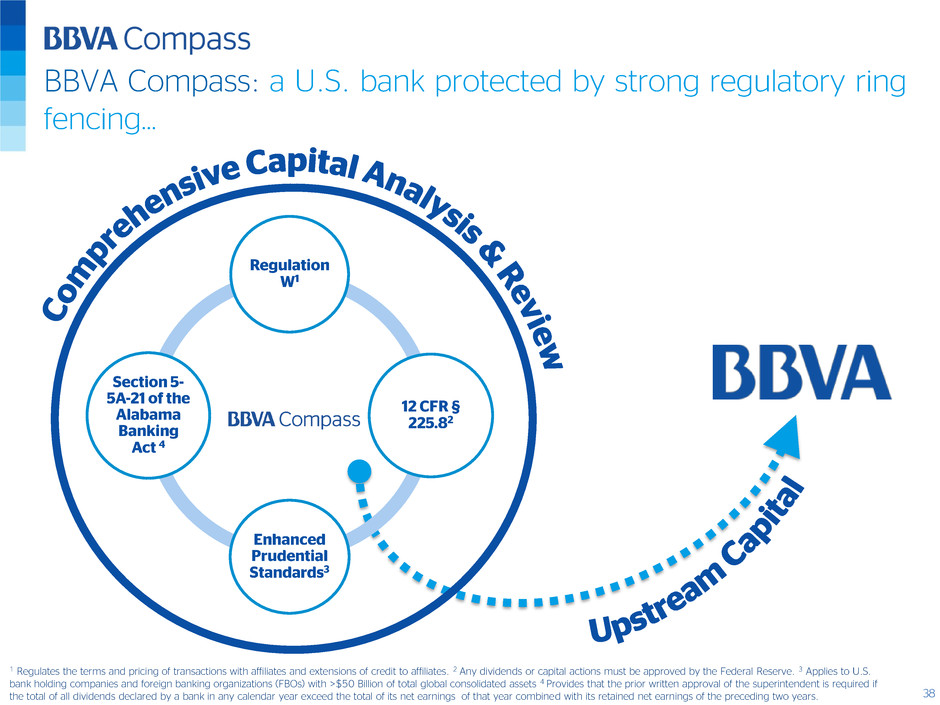

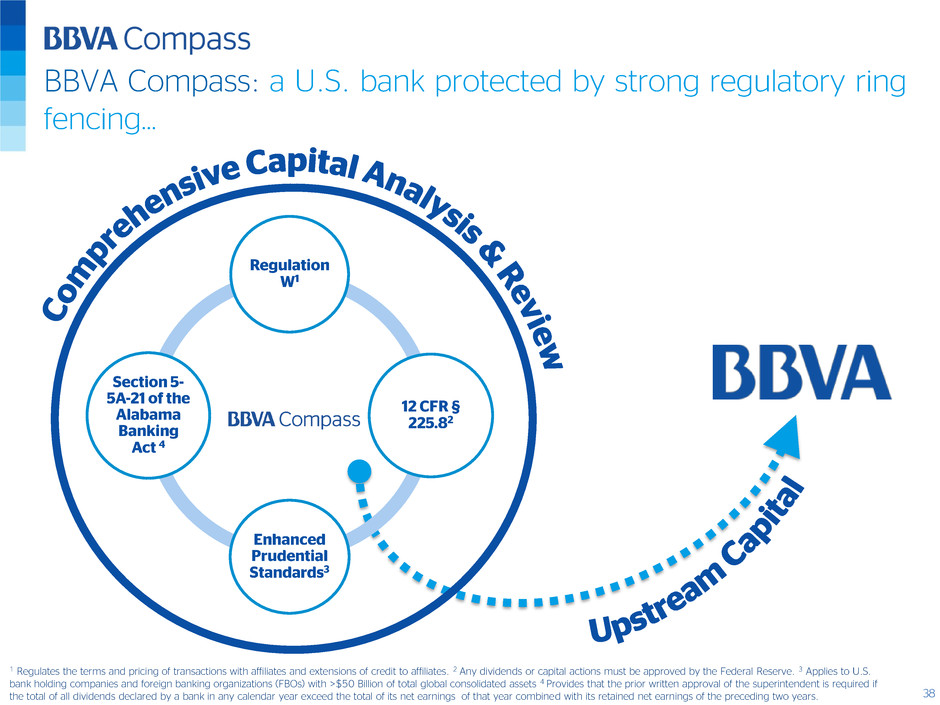

1 Regulates the terms and pricing of transactions with affiliates and extensions of credit to affiliates. 2 Any dividends or capital actions must be approved by the Federal Reserve. 3 Applies to U.S. bank holding companies and foreign banking organizations (FBOs) with >$50 Billion of total global consolidated assets 4 Provides that the prior written approval of the superintendent is required if the total of all dividends declared by a bank in any calendar year exceed the total of its net earnings of that year combined with its retained net earnings of the preceding two years. BBVA Compass Bancshares BBVA Compass: a U.S. bank protected by strong regulatory ring fencing…

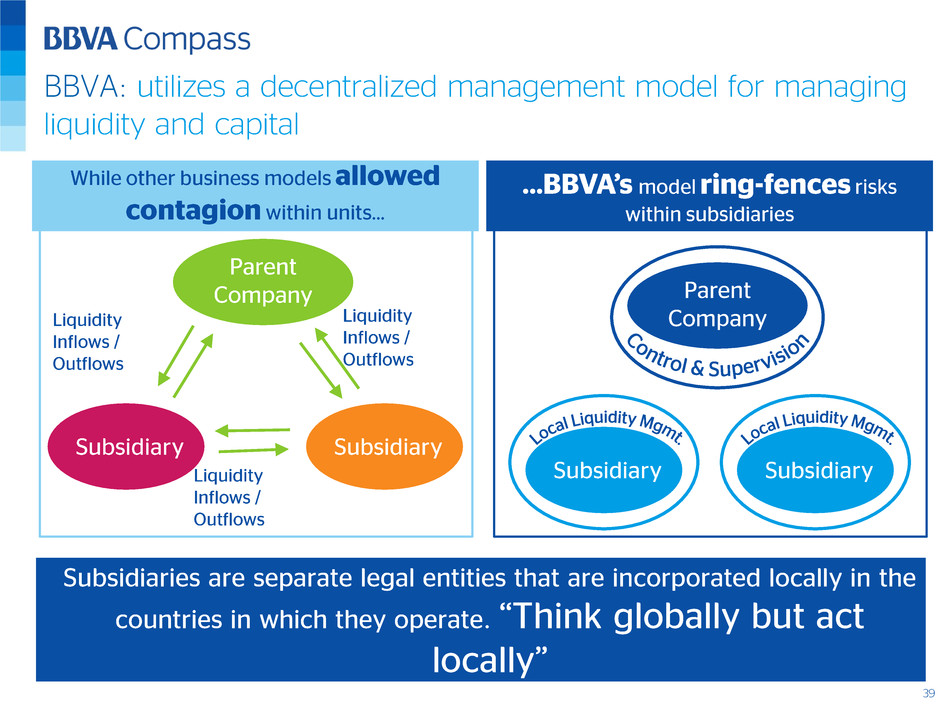

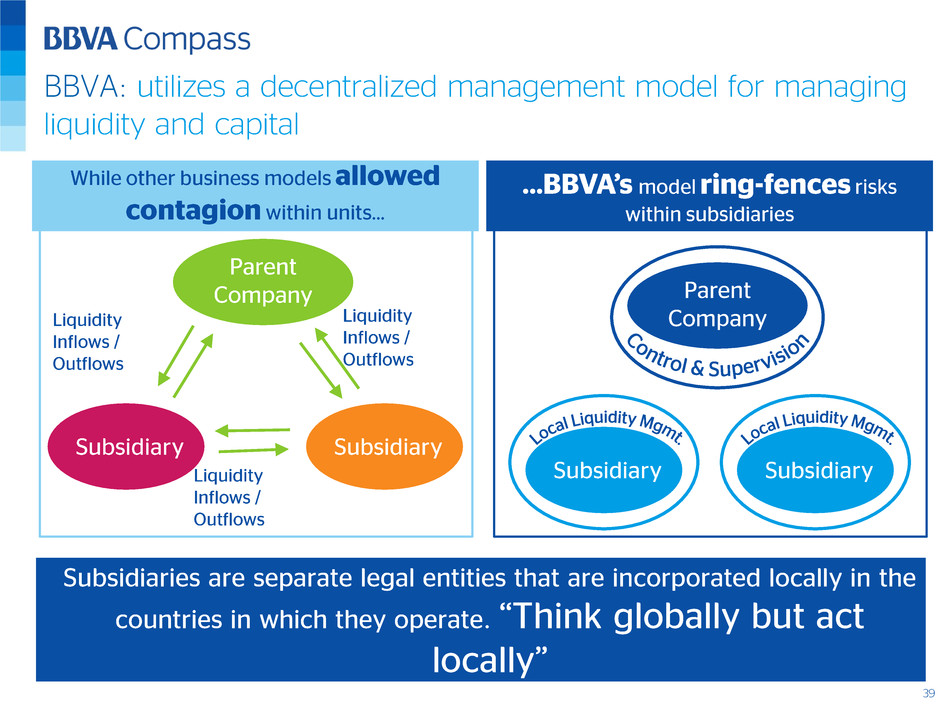

Subsidiaries are separate legal entities that are incorporated locally in the countries in which they operate. “Think globally but act locally” BBVA: utilizes a decentralized management model for managing liquidity and capital

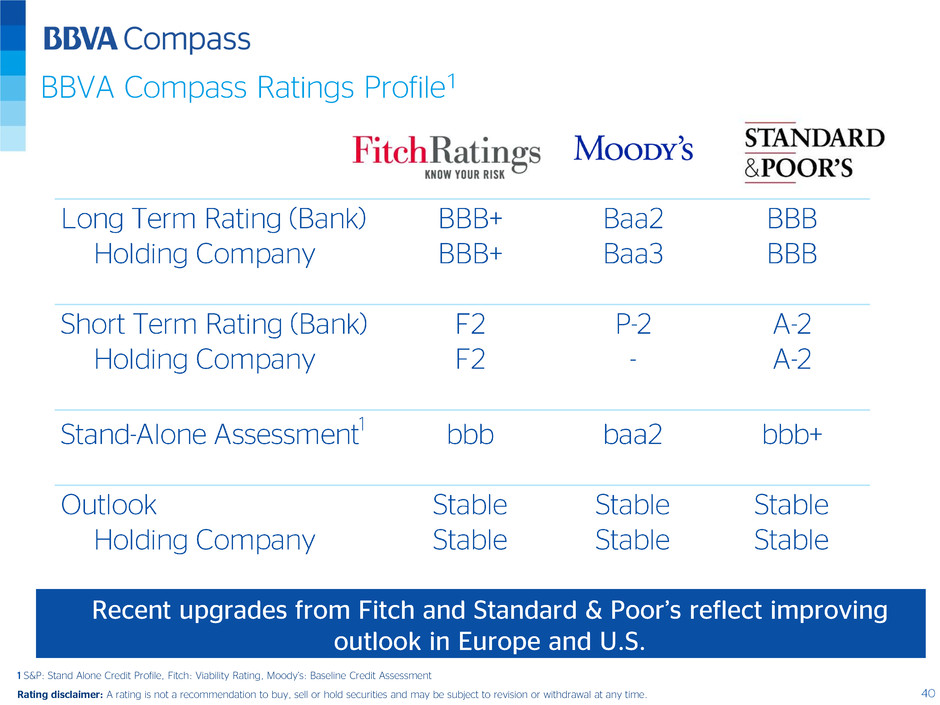

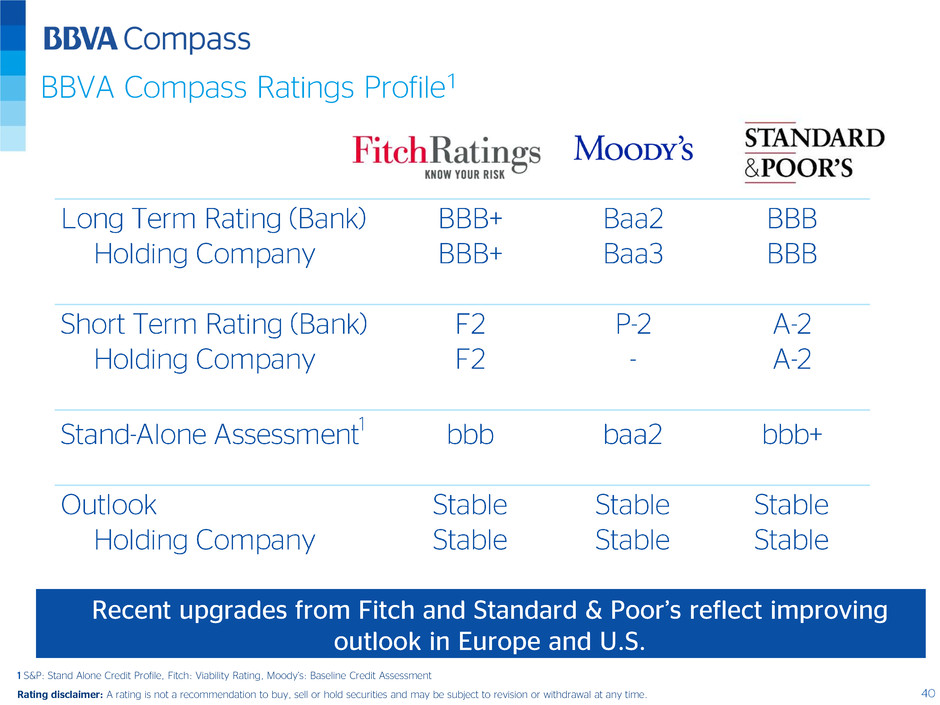

BBVA Compass Ratings Profile1 S&P: Stand Alone Credit Profile, Fitch: Viability Rating, Moody’s: Baseline Credit Assessment Rating disclaimer: A rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. Recent upgrades from Fitch and Standard & Poor’s reflect improving outlook in Europe and U.S.

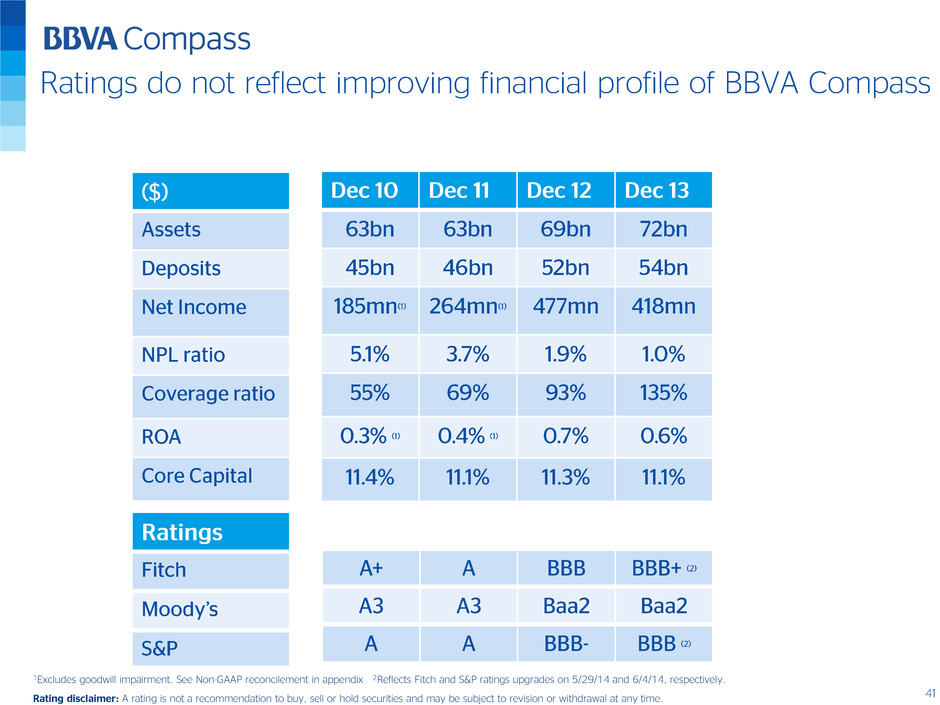

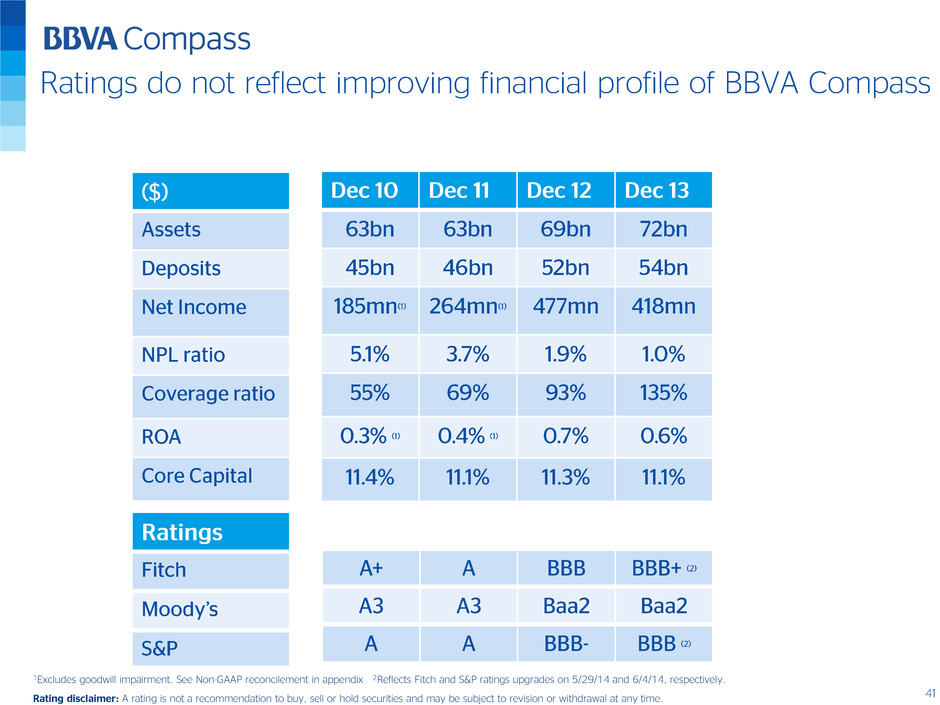

Ratings do not reflect improving financial profile of BBVA Compass 1Excludes goodwill impairment. See Non-GAAP reconcilement in appendix 2Reflects Fitch and S&P ratings upgrades on 5/29/14 and 6/4/14, respectively. Rating disclaimer: A rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

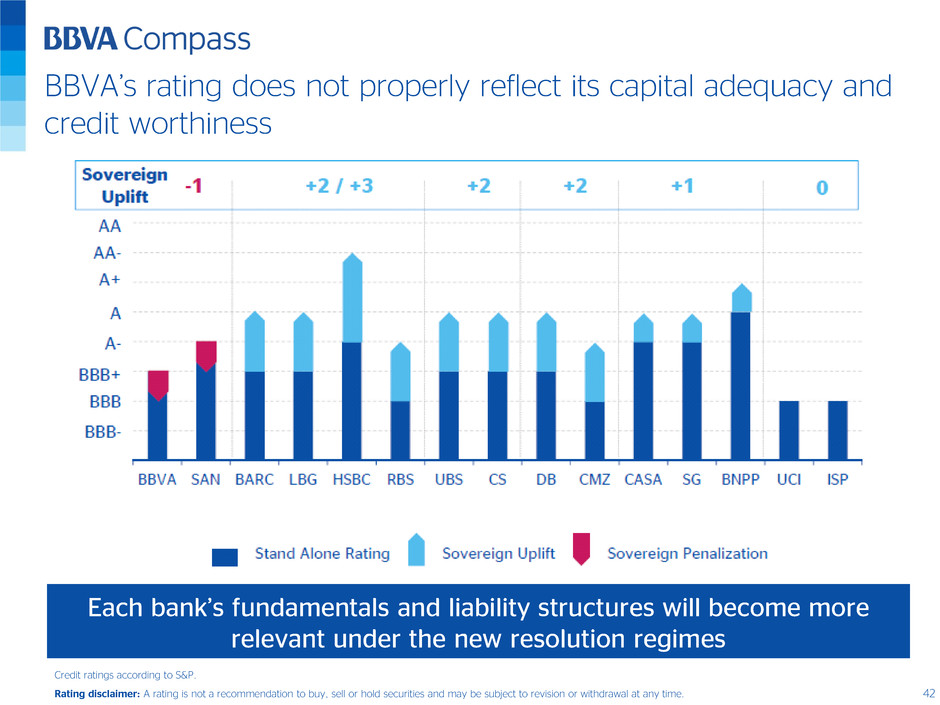

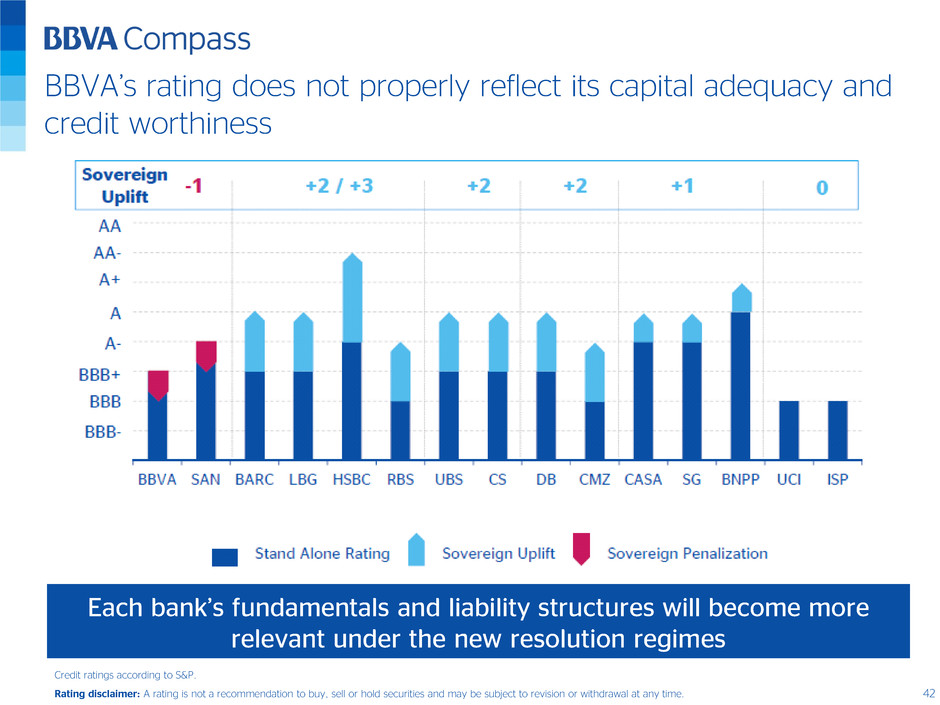

BBVA’s rating does not properly reflect its capital adequacy and credit worthiness Each bank’s fundamentals and liability structures will become more relevant under the new resolution regimes Credit ratings according to S&P. Rating disclaimer: A rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time

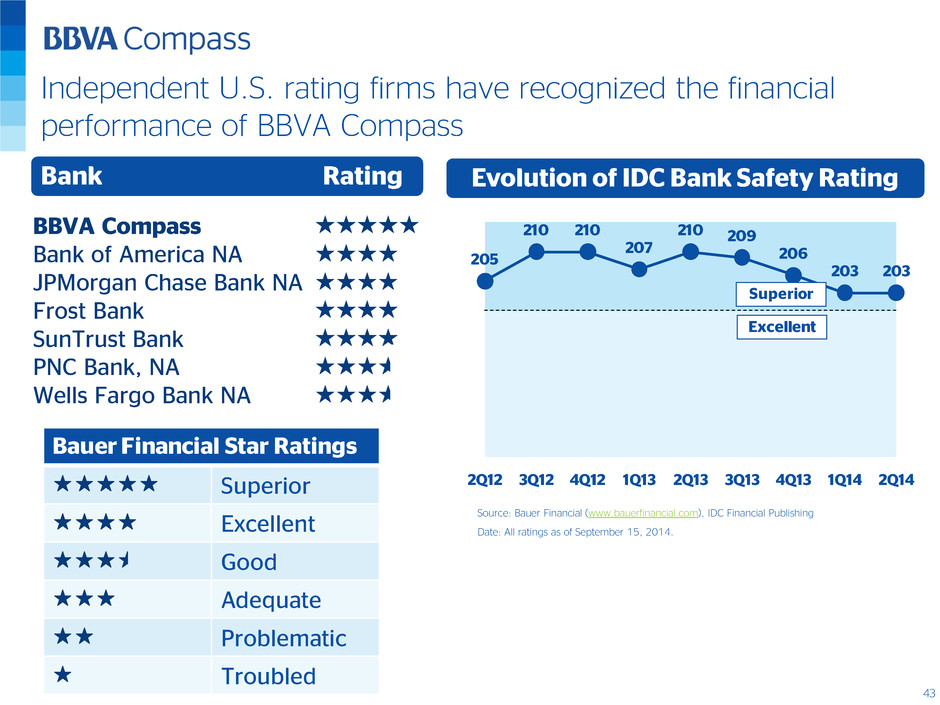

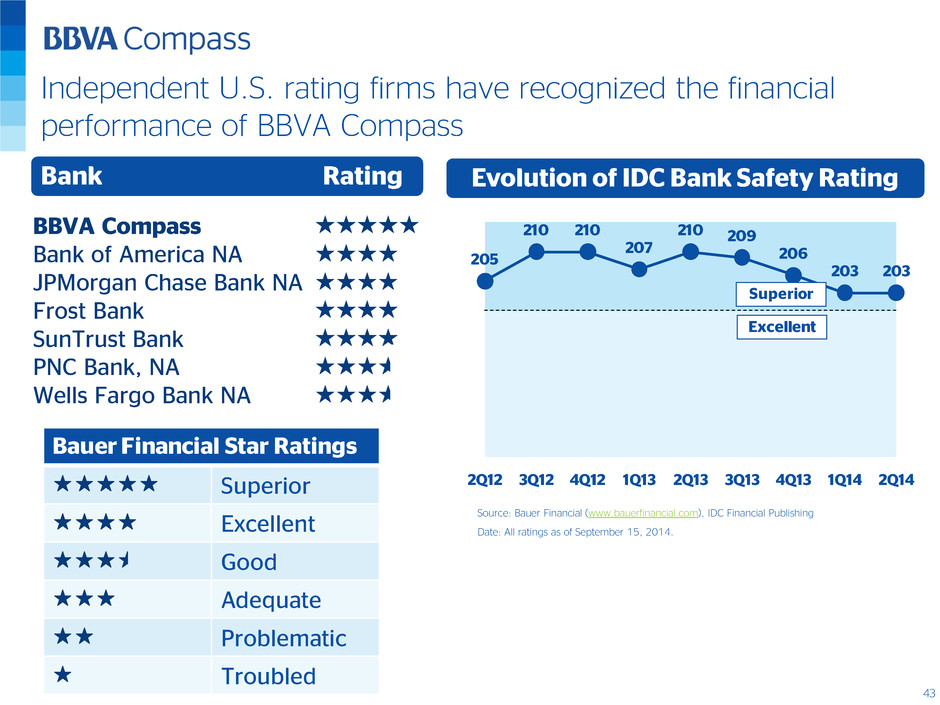

Independent U.S. rating firms have recognized the financial performance of BBVA Compass Source: Bauer Financial (www.bauerfinancial.com), IDC Financial Publishing Date: All ratings as of September 15, 2014. Superior Excellent Good Adequate roblematic Troubled BBVA Compass Bank of America NA JPMorgan Chase Bank NA Frost Bank SunTrust Bank PNC Bank, NA Wells Fargo Bank NA

Appendix: BBVA and Reconciliations

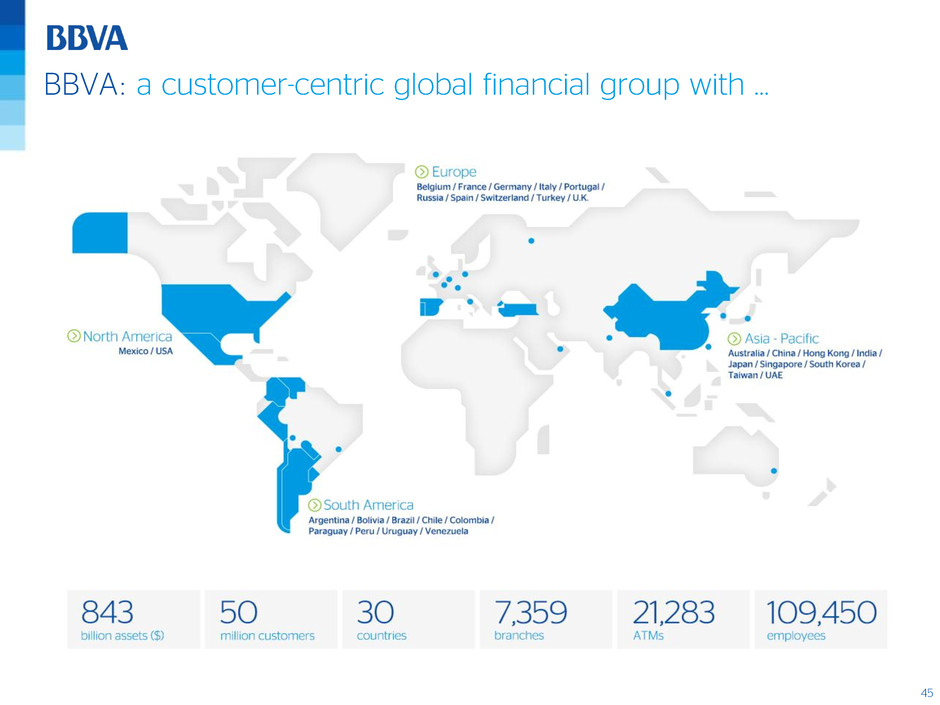

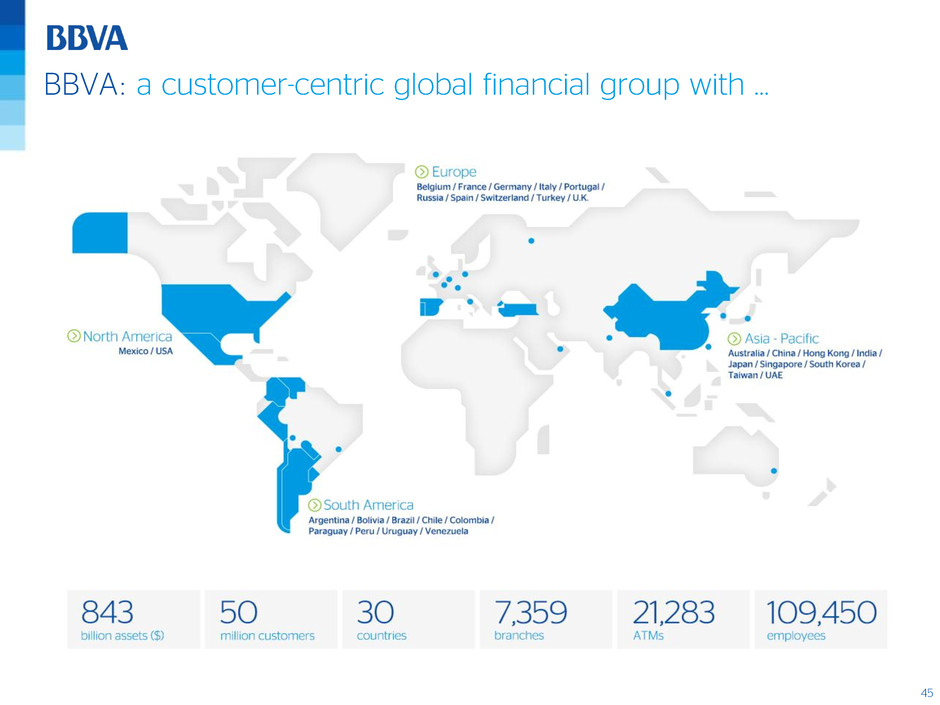

BBVA: a customer-centric global financial group with …

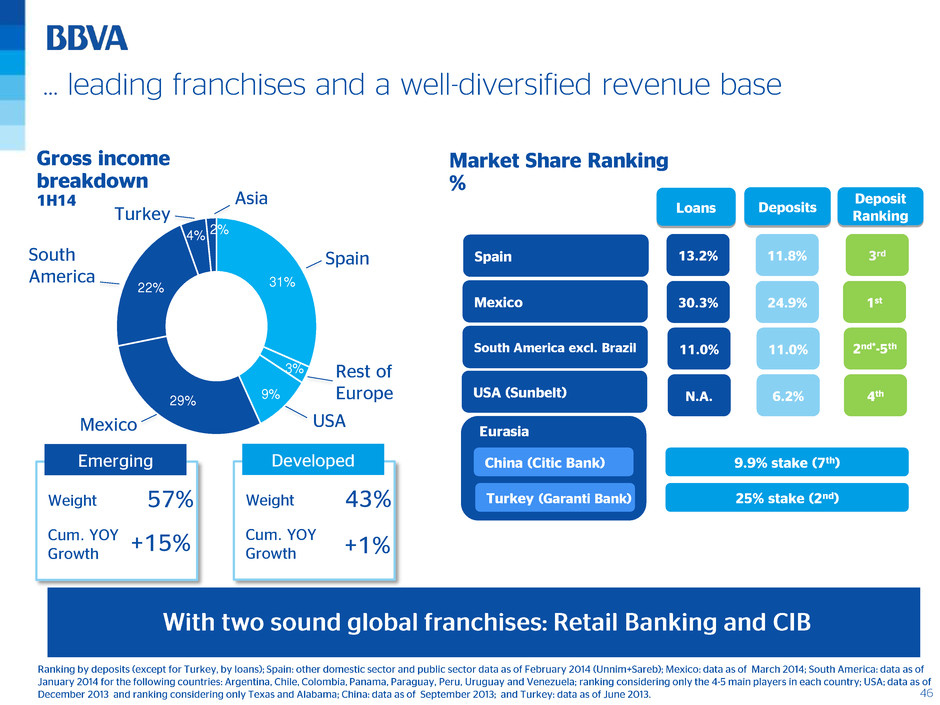

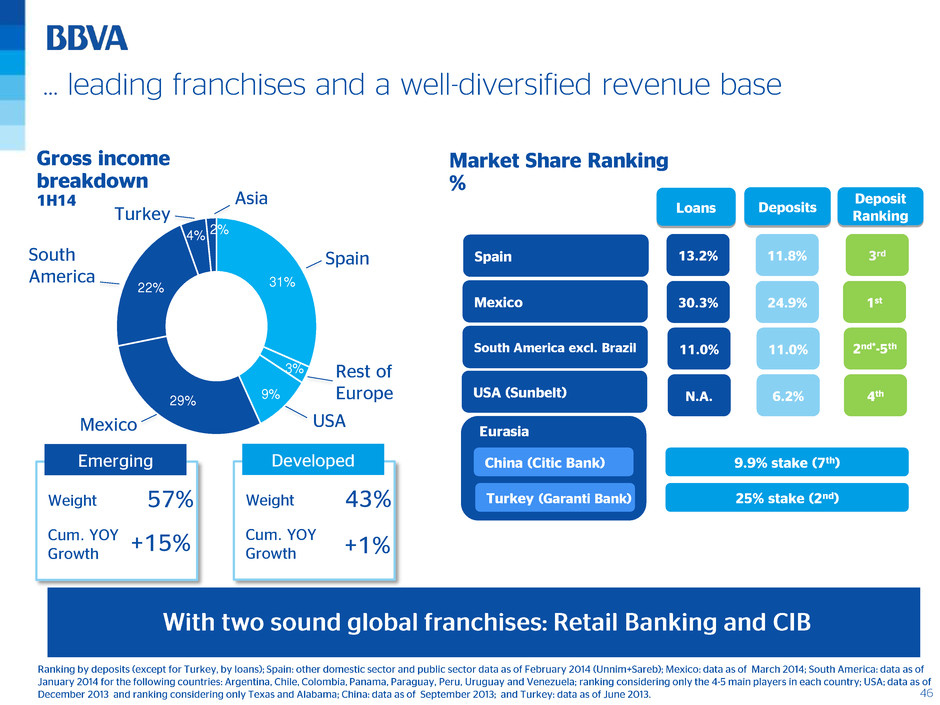

… leading franchises and a well-diversified revenue base Gross income breakdown 1H14 Market Share Ranking % 31% 3% 9%29% 22% 4% 2% Spain Asia Turkey South America Mexico USA Rest of Europe Eurasia Deposit Ranking Deposits Spain Mexico South America excl. Brazil USA (Sunbelt) China (Citic Bank) Turkey (Garanti Bank) 13.2% 30.3% 11.0% N.A. 11.8% 24.9% 11.0% 6.2% 3rd 1st 4th 9.9% stake (7th) 25% stake (2nd) Loans Eurasia 2nd*-5th Emerging Weight 57% Cum. YOY Growth +15% Developed Weight 43% Cum. YOY Growth +1%

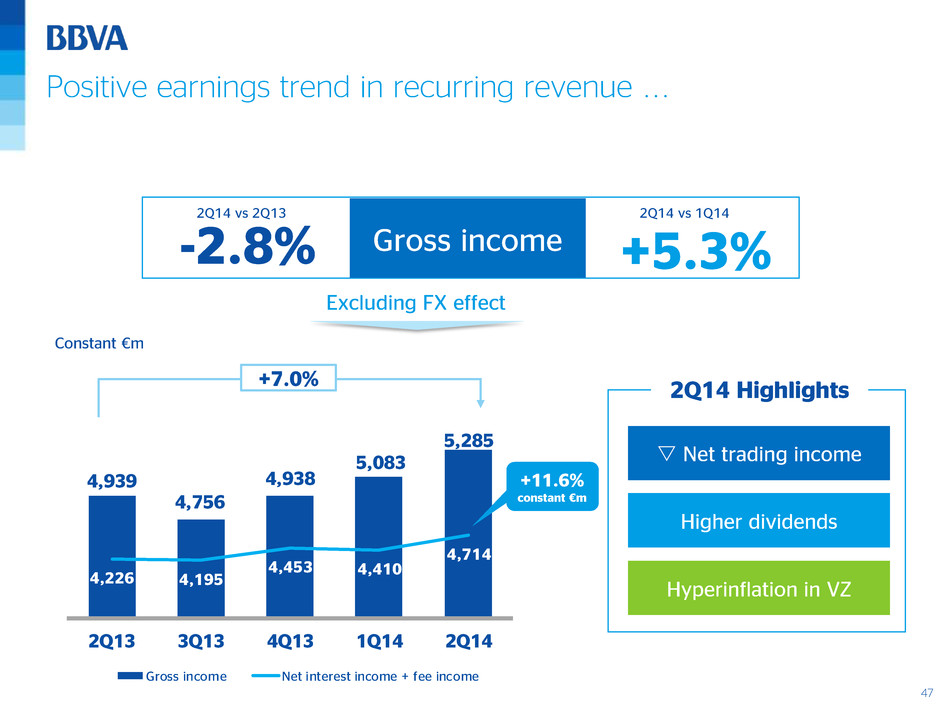

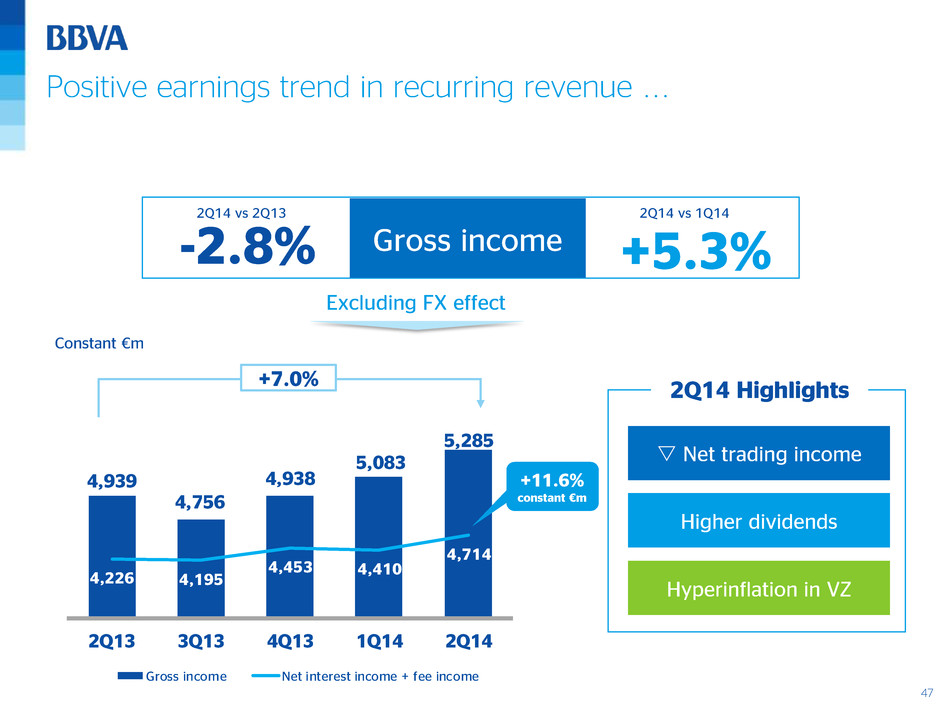

Positive earnings trend in recurring revenue ... +7.0% Constant €m Excluding FX effect +5.3%-2.8% Gross income 2Q14 vs 2Q13 2Q14 vs 1Q14 2Q14 Highlights Net trading income Higher dividends Hyperinflation in VZ 4,939 4,756 4,938 5,083 5,285 4,226 4,195 4,453 4,410 4,714 2Q13 3Q13 4Q13 1Q14 2Q14 Gross income Net interest income + fee income +11.6% constant €m

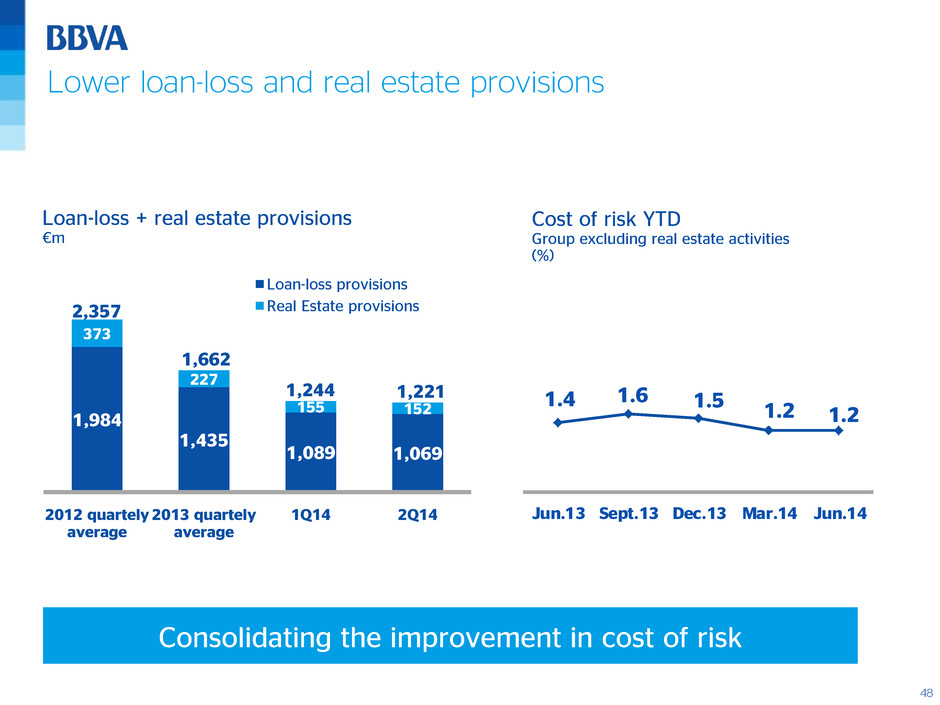

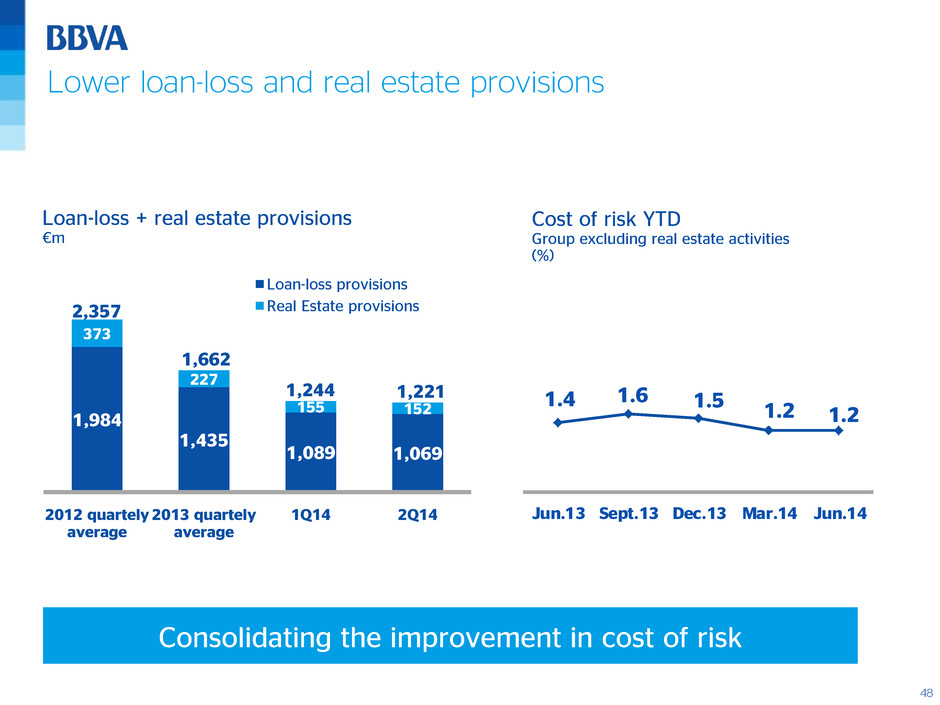

1,984 1,435 1,089 1,069 373 227 155 152 2,357 1,662 1,244 1,221 2012 quartely average 2013 quartely average 1Q14 2Q14 Loan-loss provisions Real Estate provisions Lower loan-loss and real estate provisions Loan-loss + real estate provisions €m Consolidating the improvement in cost of risk 1.4 1.6 1.5 1.2 1.2 Jun.13 Sept.13 Dec.13 Mar.14 Jun.14 Cost of risk YTD Group excluding real estate activities (%)

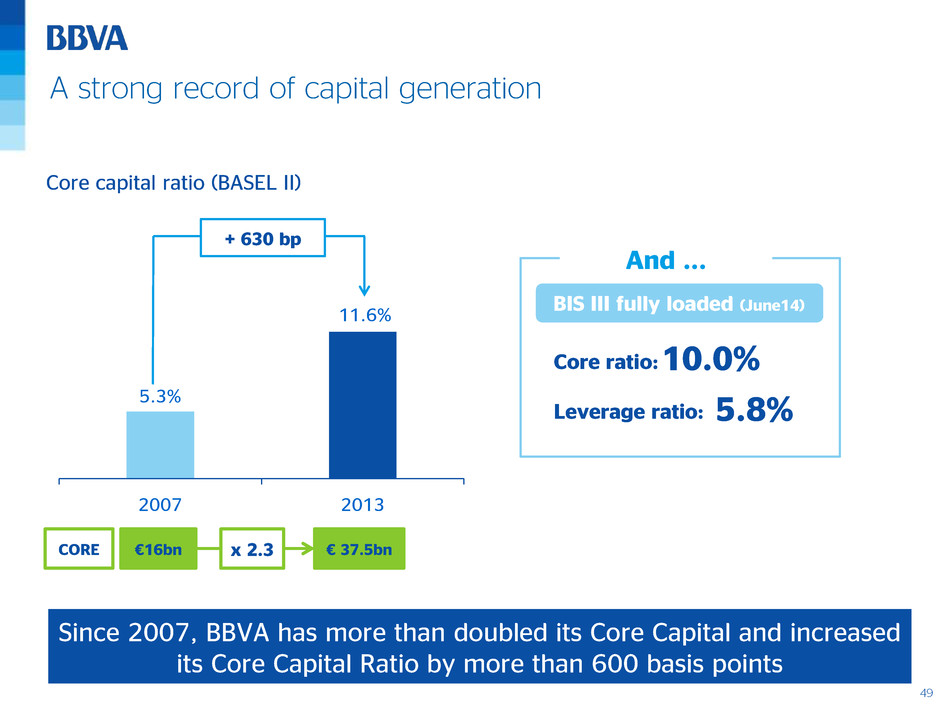

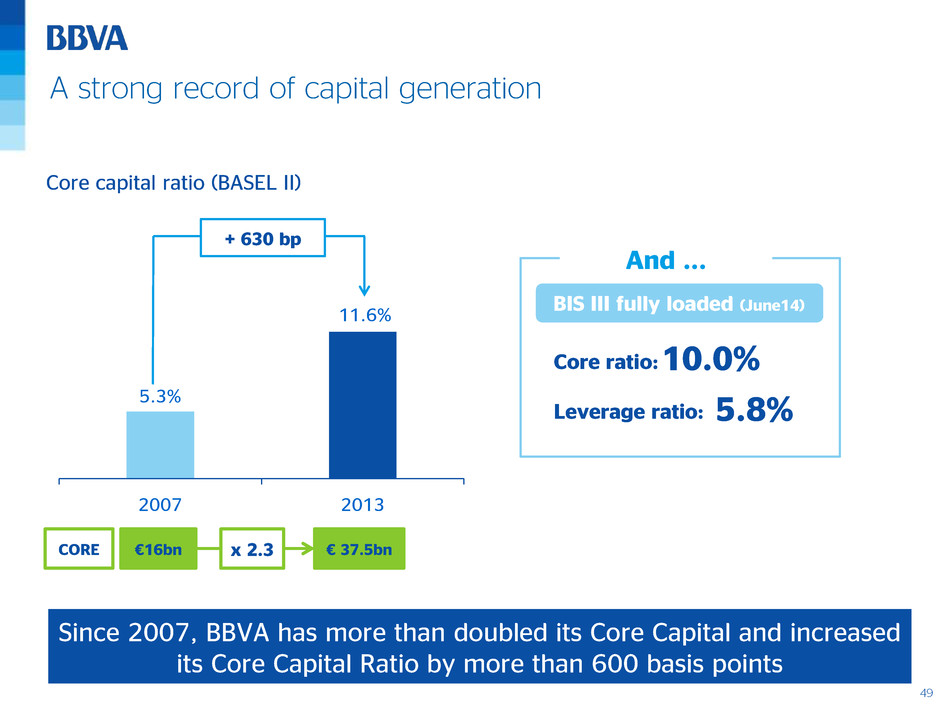

+ 630 bp Core capital ratio (BASEL II) CORE €16bn € 37.5bnx 2.3 Since 2007, BBVA has more than doubled its Core Capital and increased its Core Capital Ratio by more than 600 basis points 5.3% 11.6% 2007 2013 Leverage ratio: 5.8% And ... Core ratio:10.0% BIS III fully loaded (June14) A strong record of capital generation

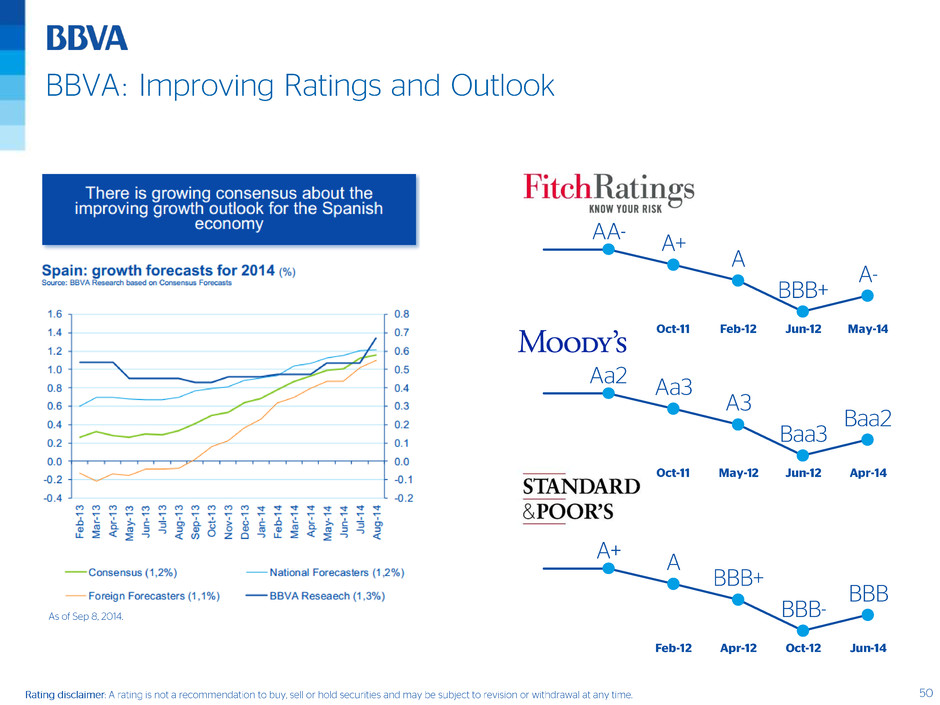

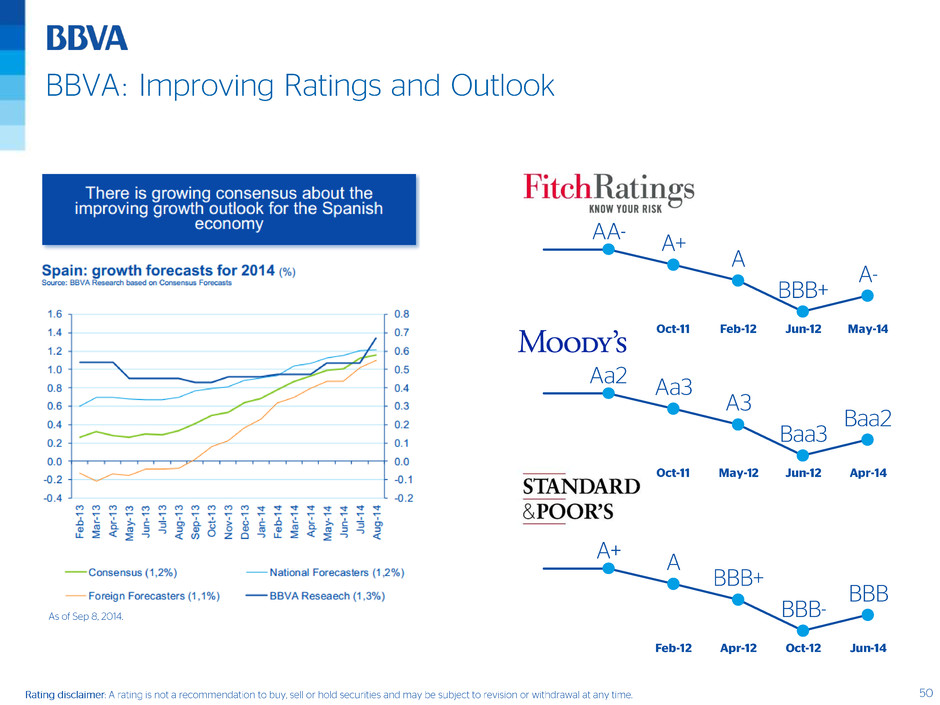

BBVA: Improving Ratings and Outlook

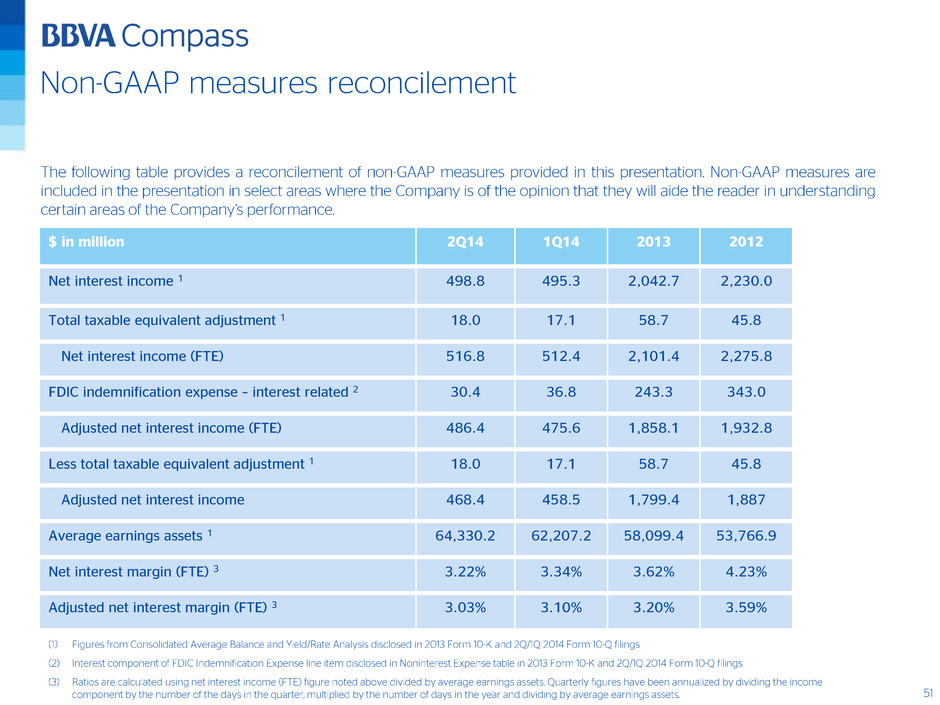

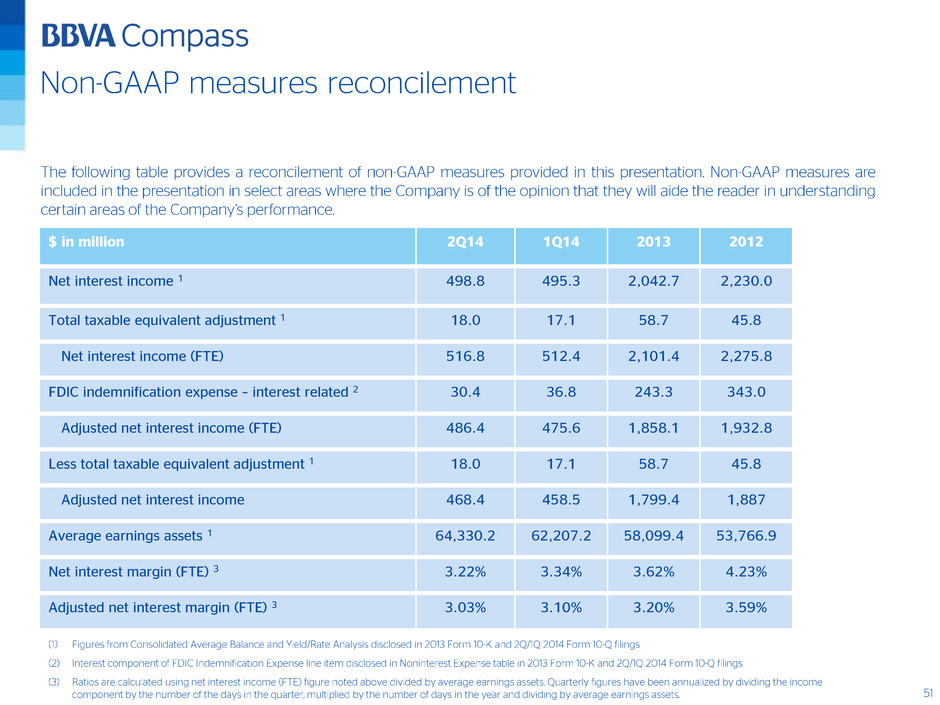

Non-GAAP measures reconcilement $ in million 2Q14 1Q14 2013 2012 Net interest income 1 498.8 495.3 2,042.7 2,230.0 Total taxable equivalent adjustment 1 18.0 17.1 58.7 45.8 Net interest income (FTE) 516.8 512.4 2,101.4 2,275.8 FDIC indemnification expense – interest related 2 30.4 36.8 243.3 343.0 Adjusted net interest income (FTE) 486.4 475.6 1,858.1 1,932.8 Less total taxable equivalent adjustment 1 18.0 17.1 58.7 45.8 Adjusted net interest income 468.4 458.5 1,799.4 1,887 Average earnings assets 1 64,330.2 62,207.2 58,099.4 53,766.9 Net interest margin (FTE) 3 3.22% 3.34% 3.62% 4.23% Adjusted net interest margin (FTE) 3 3.03% 3.10% 3.20% 3.59%

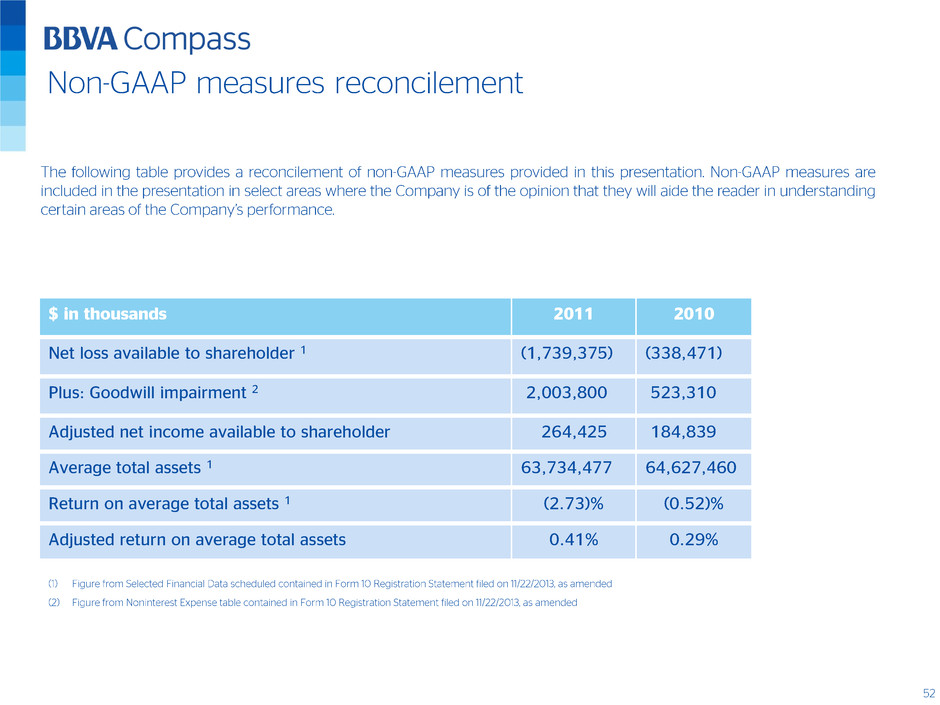

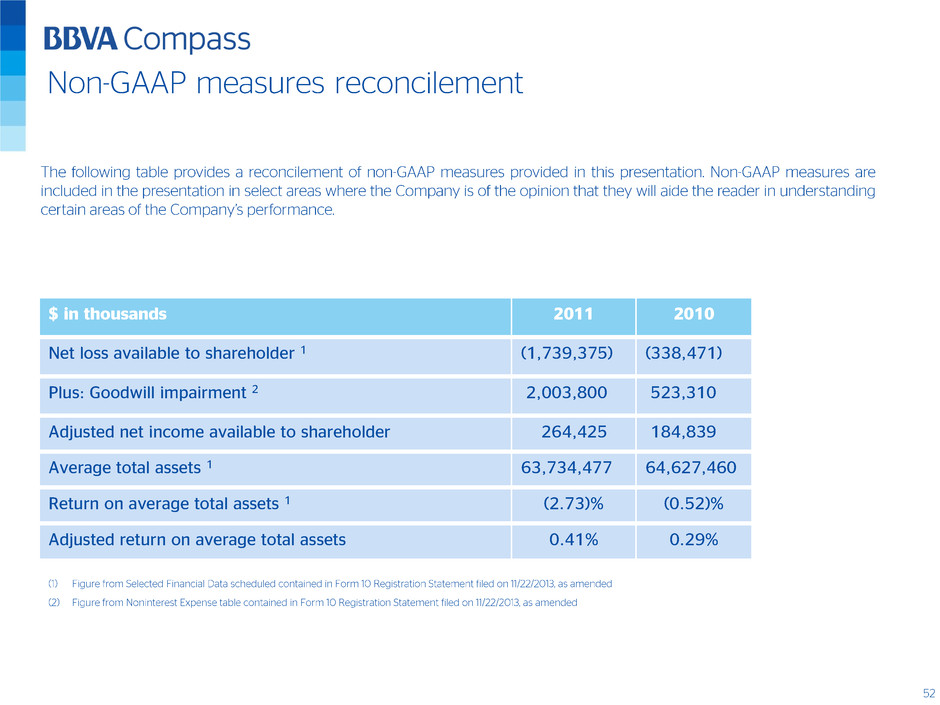

Non-GAAP measures reconcilement $ in thousands 2011 2010 Net loss available to shareholder 1 (1,739,375) (338,471) Plus: Goodwill impairment 2 2,003,800 523,310 Adjusted net income available to shareholder 264,425 184,839 Average total assets 1 63,734,477 64,627,460 Return on average total assets 1 (2.73)% (0.52)% Adjusted return on average total assets 0.41% 0.29%

US Investor Relations Ed Bilek EVP, Investor Relations 205.297.3331 ed.bilek@bbva.com Contact New BBVA US Investor Relations App Gives investors mobile access to the latest news, SEC Filings, presentations, videos, fact sheets and other company information from BBVA Compass Bancshares, Inc.