As filed with the Securities and Exchange Commission on November 2, 2009

(Registration No. 333-162029)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Southfield Energy Corporation

(Exact name of registrant as specified in its charter)

| Nevada | | 1311 | | 20-5361270 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

1240 Blalock Road, Suite 150

Houston, Texas 77055

( 713) 266-3700

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Ben Roberts

Chief Executive Officer

Southfield Energy Corporation

1240 Blalock Road, Suite 150

Houston, Texas 77055

Telephone: (713) 266-3700

Facsimile: (713) 266-3701

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Locke Lord Bissell & Liddell LLP

600 Travis Street, Suite 3400

Houston, Texas 77002

(713) 226-1249

Attn: J. Eric Johnson

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company x |

| | (Do not check if a smaller reporting company) | |

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities To Be Registered | | Amount to be Registered | | | Proposed Maximum Offering Price Per Unit | | | Proposed Maximum Aggregate Offering Price | | | Amount of Registration Fee | |

| Three Year 10% Notes | | $ | 10,000,000 | | | | 100 | % | | $ | 10,000,000 | | | $ | 558 | |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

| The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. |

SUBJECT TO COMPLETION DATED [●] , 2009 |

PROSPECTUS

Southfield Energy Corporation

$10,000,000 Three Year 10% Notes

We are offering up to $10,000,000 in aggregate principal amount of our Three Year Notes (“3 Year Notes”) in a direct public offering on a continuous basis (the “Offering”). A minimum initial investment of $1,000 is required. The Offering will end upon the earlier of the receipt of the maximum aggregate principal amount of $10,000,000 or one year from the effective date of this prospectus (the “Closing”).

We will issue the 3 Year Notes in denominations of at least $1,000, subject to the initial investment requirement of $1,000. The 3 Year Notes shall mature three years from the date of issuance. The 3 Year Notes shall bear interest at a fixed rate (calculated based on a 365-day year) of ten percent (10%) per annum. We will pay interest on a 3 year Note on a quarterly basis in arrears; simple interest will accrue from the date of purchase.

We are offering the 3 Year Notes on a “self-underwritten” basis, with no minimum. The officers and directors of the Company intend to sell the 3 Year Notes directly, who will not be separately compensated therefor. The intended methods of communication include, without limitation, telephone and personal contact. For more information, see the section titled “Plan of Distribution” herein. However, we reserve the right to utilize broker-dealers, placement agents and/or finders (“Placement Agent”), where permitted by law, to assist us in locating potential investors, in which case we will pay commissions and non-accountable expenses of up to 11% of the gross offering price of the 3 Year Notes. The Placement Agent will not be required to sell any specific number or dollar amount of securities but will use their best efforts to sell the 3 Year Notes.

We do not have to sell any minimum amount of 3 Year Notes to accept and use the proceeds from this Offering. We cannot assure you that all or any portion of the 3 Year Notes we are offering will be sold. If we fail to raise the maximum aggregate principal amount of $10,000,000, we may not be able to execute our business plan. We have not made any arrangements to place any of the proceeds from this Offering in an escrow, trust or similar account. You will not be entitled to the return of your investment. The 3 Year Notes are not listed on any securities exchange and there is no public trading market for the 3 Year Notes. We have the right to reject any subscription, in whole or in part, for any or no reason. We may redeem the 3 Year Notes in whole or in part and from time to time after one year from the closing, but upon at least 15 days prior written notice to you.

You should read this prospectus and any applicable prospectus supplement carefully before you invest in the 3 Year Notes. These 3 Year Notes are our general unsecured obligations and will rank junior and be subordinate in right of payment to all future senior debt. The 3 Year Notes will not be secured by liens on any of our assets. Payment of the 3 Year Notes is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”), any governmental or private insurance fund, or any other entity. We will establish an initial interest reserve equal to six months interest and deposit such reserve with a third party as subscriptions are accepted.

The 3 Year Notes will not be issued under and indenture and there will be no trustee to represent your interests.

See “Risk Factors” beginning on page 12 for certain factors you should consider before buying the 3 Year Notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | Per 3 Year Note | | | Total | |

| Public offering price | | $ | 1,000 | | | $ | 10,000,000 | |

| Underwriting Commission and Non-Accountable Expense Allowance (1) | | $ | 110 | | | $ | 1,100,000 | |

| Other Expenses (2) | | $ | 100 | | | $ | 100,000 | |

| Proceeds, before expenses, to Southfield Energy Corporation | | $ | 880 | | | $ | 8,800,000 | |

(1) Assuming a Placement Agent is retained, represents the maximum amount of commissions and non-accountable expenses to be paid assuming the maximum aggregate principal amount of $10,000,000 is raised.

(2) Includes professional services fees, printing and distribution costs and Offering related travel and communication costs.

The date of this prospectus is [●], 2009.

TABLE OF CONTENTS

| About this Prospectus | | | 5 | |

| Where You Can Find More Information | | | 5 | |

| Cautionary Statement Concerning Forward-Looking Statements | | | 6 | |

| Prospectus Summary | | | 8 | |

| Risk Factors | | | 12 | |

| Use of Proceeds | | | 22 | |

| Description of 3 Year Notes | | | 23 | |

| Material Tax Consequences | | | 26 | |

| Capitalization | | | 31 | |

| Management���s Discussion and Analysis of Financial Condition and Results of Operations | | | 32 | |

| Quantitative and Qualitative Disclosures About Market Risk | | | 39 | |

| Business | | | 40 | |

| Management | | | 52 | |

| Director and Executive Officer Compensation | | | 55 | |

| Certain Relationships and Related Party Transactions | | | 57 | |

| Security Ownership of Certain Beneficial Owners and Management | | | 58 | |

| Plan of Distribution | | | 59 | |

| Legal Matters | | | 60 | |

| Experts | | | 60 | |

| Changes In and Disagreements With Accountants On Accounting and Financial Disclosure | | | 60 | |

| Index to Financial Statements | | | F-1 | |

ABOUT THIS PROSPECTUS

This prospectus highlights selected information about us and our 3 Year Notes but does not contain all the information that you should consider before investing in the 3 Year Notes. You should read this entire prospectus carefully, including the information included under the heading “Risk Factors.”

You should rely only on the information contained in this prospectus or to which we have referred you. We a have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where such offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only. Our business, financial condition, results of operations and prospects may have changed since that date.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC, under the Securities Act of 1933, as amended (the “Securities Act”), a registration statement on Form S-1 with respect to the 3 Year Notes offered in this prospectus. This prospectus, which constitutes part of the registration statement, does not contain all the information set forth in the registration statement or the exhibits and schedules which are part of the registration statement, portions of which are omitted as permitted by the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”). Statements made in this prospectus regarding the contents of any contract or other document are summaries of the material terms of the contract or document. With respect to each contract or document filed as an exhibit to the registration statement, reference is made to the corresponding exhibit. For further information pertaining to us and to the 3 Year Notes offered by this prospectus, reference is made to the registration statement, including the exhibits and schedules thereto, copies of which may be inspected, without charge, at the public reference facilities of the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Copies of all or any portion of the registration statement may be obtained from the SEC at prescribed rates. Information on the public reference facilities may be obtained by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains a web site that contains reports, proxy and information statements, and other information that is filed electronically with the SEC. The web site can be accessed at www.sec.gov.

After effectiveness of the registration statement, which includes this prospectus, we will be required to comply with the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, accordingly, will file current reports on Form 8-K, quarterly reports on Form 10-Q, annual reports on Form 10-K, proxy statements and other information with the SEC. Those reports, proxy statements and other information will be available for inspection and copying at the public reference facilities, the SEC web site referred to above and our own website at www.southfieldenergy.com.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference in this prospectus contain or incorporate by reference certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements include statements regarding our plans, beliefs or current expectations and may be signified by the words “could,” “should,” “expect,” “project,” “estimate,” “believe,” “anticipate,” “intend,” “budget,” “plan,” “forecast,” “predict” and other similar expressions. Forward-looking statements appear in a number of places throughout this prospectus and the documents incorporated by reference into this prospectus with respect to, among other things: profitability; planned capital expenditures; estimates of oil and gas production; estimates of future oil and gas prices; estimates of oil and gas reserves; our future financial condition or results of operations; and our business strategy and other plans and objectives for future operations.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate, may differ materially from those made in or suggested by the forward-looking statements made in this prospectus. In addition, even if our results of operations, financial condition and liquidity and the development of the industry in which we operate are consistent with the forward-looking statements contained in this prospectus, those results or developments may not be indicative of results or developments in subsequent periods.

The following listing represents some, but not necessarily all, of the risk factors that may cause actual results to differ from those anticipated or predicted:

| • | the volatility of oil, natural gas and natural gas liquid prices; |

| | • | estimation, development and acquisition of oil and gas reserves; |

| | • | cash flow, liquidity and financial condition; |

| | • | business and financial strategy; |

| | • | amount, nature and timing of capital expenditures; |

| | • | availability and terms of capital; |

| | • | timing and amount of future production of oil and gas; |

| | • | availability of drilling, production and well service equipment for our operators; |

| | • | operating costs and other expenses; |

| | • | prospect development and property acquisitions; |

| | • | marketing of oil, natural gas and natural gas liquids; |

| | • | competition in the oil and gas industry; |

| | • | the impact of weather and the occurrence of natural disasters such as fires, earthquakes and other catastrophic events; |

| | • | governmental regulation of the oil and gas industry; |

| | • | developments in oil-producing and gas-producing countries; |

| | • | strategic plans, expectations and objectives for future operations; |

| | • | the costs and legal liabilities associated with being a “public” company; |

| | • | the amount of time required by management to comply with being a public company; |

| | • | the depletion of our oil and gas assets at a rate faster than anticipated; |

| | • | our ability to generate sufficient revenues and cash flow to meet our short and long term obligations; |

| | • | our ability to hire and retain qualified personnel to execute our operations; and |

| | • | global demand for and supply of oil & natural gas. |

You should also read carefully the factors described in the “Risk factors” section beginning on page 12 to better understand the risks and uncertainties inherent in our business and underlying any forward-looking statements.

PROSPECTUS SUMMARY

This summary highlights information about us and the Offering contained elsewhere in this prospectus. Because it is a summary, it does not contain all the information that you should consider before investing in our 3 Year Notes. You should read the entire prospectus carefully before making an investment decision, including the information presented under the heading “Risk Factors” and the historical financial statements and the accompanying notes thereto included elsewhere in this prospectus.

All references in this prospectus to “we,” “us,” “our,” “Company” and “Southfield” refer to Southfield Energy Corporation.

Overview

We are an independent energy company based in Houston, Texas that invests in the exploration, development, and production of moderate risk, oil and gas wells in the United States. We focus on partnering alongside proven operators with strong track records of success. The Company’s core strategy is to earn revenue from existing non-operated working interests while investing in new opportunities to increase our oil and gas production and reserves; primarily through acquisitions of existing production and working interest investments in drilling programs of experienced and successful oil and gas operators active in Texas, Louisiana and Oklahoma.

We currently focus our efforts on our oil and natural gas properties on the Mary King Estell lease in the Richard King Field of Nueces County, Texas. We intend on building our business by acquiring additional non-operated working interests in productive oil and natural gas wells and other oil and gas interests. A non-operated working interest grants us a proportionate share of the property’s oil and gas production, and requires us to pay a proportionate share of the costs associated with drilling and production without acting as the operator of the property’s wells.

We have a non-operated working interest in five gas wells in the Richard King Field of Nueces County, Texas. Durango Resources Corporation is the operator of the wells.

Our Properties

We currently have the following oil and gas property interests:

| Property | | Non-Operated Working Interest | | | Net Revenue Interest | | | Area (acres) | |

| Richard King Field | | | 15 | % | | | 11.25 | % (1) | | | 160 | |

(1) Based on a 75% net revenue interest for all working interest owners.

We are mainly focused on the following activities:

| | · | Identifying attractive investment opportunities in the oil and gas industry with moderate risk and favorable upside potential; |

| | · | Negotiating the acquisition of working interests on terms that we feel are favorable to us; |

| | · | Acquiring non-operated working interests in oil and gas wells and mineral interests that we can exploit for the benefit of our stockholders; |

| | · | Earning secure and reliable revenue from non-operated working interests while engaging in the exploration and development of oil and gas properties to generate additional revenue; and |

| | · | Managing the return on our investments to replace reserves and increase revenue through re-investment activities. |

The following table sets forth summary information about our net oil and gas assets as of December 31, 2008:

| Estimated Proved Reserves at | | | | Reserve-to- | | Estimated 2008 |

| December 31, 2008(1) | | Production for the Year | | Production | | Production |

| Oil | | NGL | | Gas | | Total | | Ended December 31, 2008 | | Ratio | | Decline |

| (Bbl) | | (Bbl) | | (MMcf) | | (BOE)(2) | | (BOE)(2) | | (Years)(3) | | Rate(4) |

| | | | | | | | | | | | | |

| 5,690 | | 1,780 | | 217 | | 43,637 | | 7,127 | | 6.12 | | 14% |

| | (1) | Proved Reserves are those quantities of petroleum which, by analysis of geological and engineering data, can be estimated with reasonable certainty to be commercially recoverable, from a given date forward, from known reservoirs and under current economic conditions, operating methods, and government regulations. |

| | (2) | Barrels of oil Equivalent (BOE) is a unit of energy that approximates the energy released by burning one barrel of oil. A BOE is typically 6,000 cubic feet of natural gas. BOE calculations are estimates due to the variance of btu content amongst barrels of oil and cubic feet of natural gas. BOE’s in the above table are used as an approximation for measuring the total energy contained in oil and natural gas either produced or remaining as reserves. |

| | (3) | This ratio estimates the number of years that it would require to produce our remaining reserves assuming that production rates are held constant. |

| | (4) | Estimated production decline measures the petroleum produced as a percentage of the total reserves remaining at the end of the period plus production in that period. |

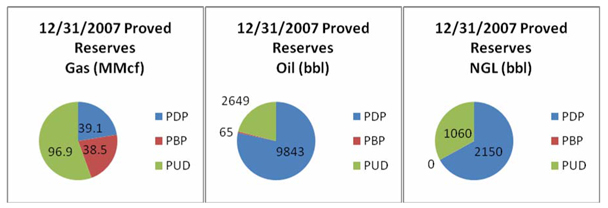

Proved Reserves as of 12/31/2008

| | | Aldwell Unit | | | Mary King Estell | |

| | | Oil (bbl) | | | Gas (MMcf) | | | Oil (bbl) | | | Gas (MMcf) | |

| PDP | | | 4,094 | | | | 10.8 | | | | 40 | | | | 38.6 | |

| PBP | | | 0 | | | | 0 | | | | 129 | | | | 75.6 | |

| PUD | | | 1,279 | | | | 4.6 | | | | 149 | | | | 87.8 | |

| Total | | | 5,372 | | | | 15.4 | | | | 318 | | | | 202 | |

Engineering abbreviations are as follows: Proved Developed Reserves (PDP), Proved Behind Pipe Reserves (PBP), and Proved Undeveloped Reserves (PUD)

We also make equity investments in other oil and gas companies. In September and October 2008, we purchased an aggregate of 350,000 shares of common stock of Meridian Resources Corporation, an exploration and production company whose shares trade on the New York Stock Exchange under the ticker symbol “TMR.” As of December 31, 2008, we incurred an unrealized holding loss of $325,465 on our investment. As of December 31, 2008 the net market value of our investment was $199,500, comprising approximately 22.2% of total assets. In June 2009, we sold an aggregate of 100,000 shares of common stock of Meridian Resources and realized a loss of $134,096. Although we do not own equity investments in any other company, we may buy such equities in the future. We do not have any current plans, proposals or arrangements, written or otherwise, to increase our equity investment in Meridian Resources Corporation or any other company.

In the future, we may expand the scope of our investments depending on whether we find any unique investment opportunities and if we have sufficient capital to execute such plans. Our future business plans may include the acquisition of mineral lease interests, purchase of existing production and infrastructure and equipment.

Our principal office is located at 1240 Blalock Road, Suite 150, Houston, Texas 77055. We currently lease approximately 3,000 square feet and incurred approximately $25,000 in rent expense for 2008. We believe the size of our office space is sufficient for our business purposes.

The Offering

| | Securities Offered | | We are offering up to $10,000,000 in aggregate principal amount of our 3 Year Notes. The Company will establish an initial interest reserve equal to six months interest and deposit with a third party as subscriptions are received. See “Description of 3 Year Notes.” |

| | | | |

| | Denominations | | Increments of at least $1,000. |

| | | | |

| | Minimum Investment | | A minimum initial investment of $1,000 is required. |

| | | | |

| | Form of Investment | | Investments in 3 Year Notes may be made by check or wire. |

| | | | |

| | Interest Rate | | Fixed interest rate, calculated using 365-day year, of 10% per annum. |

| | Payment of Interest | | Interest is payable on a quarterly basis in arrears. |

| | | |

| | 3 Year Maturity | | 3 Year Notes shall mature 3 years from the date of your purchase. |

| | | |

| | Redemption by Us | | We may redeem the 3 Year Notes at any time after one year from the date of purchase and upon 15 days prior written notice to you for a price equal to principal plus interest accrued to the date of redemption. |

| | | |

| | Subordinated | | 3 Year Notes are general unsecured obligations and will rank junior and be subordinate in right of payment to all future senior debt. The 3 Year Notes will not be secured by liens on any of our assets. This means that if we are unable to pay our debts when due, the 3 Year Notes would all be paid, if at all, after any payment would be made on any senior debt. |

| | | |

| | Event of Default | | An event of default on the 3 Year Notes is generally defined as a default in the payment of principal, or a default in the payment of interest, our becoming subject to certain events of bankruptcy or insolvency, or our failure to comply with any covenant contained in the prospectus. |

| | | | |

| | No Indenture or Trustee | | The 3 Year Notes will not be governed by an indenture and no trustee will represent the interest of our investors. |

| | | |

| | Use of Proceeds | | If all the 3 Year Notes offered by this prospectus are sold, we expect to receive approximately $8,800,000 in net proceeds after deducting all costs and expenses associated with this Offering, assuming a Placement Agent is retained. We intend to use the net proceeds from this Offering to first pay for operating expenses, including management compensation related to the operation of the Company. We then plan on using the proceeds to purchase working interests in existing oil and gas production and new drilling opportunities. Further, we will reserve an amount of money equal to the first six months of interest payments due under the 3 Year Notes for payment of such interest. See “Use of Proceeds” for more information. |

| | | | |

| | Material Tax Consequences | | For a discussion of material federal income tax consequences that may be relevant to prospective 3 Year Note holders who are individual citizens or residents of the United States, please read “Material Tax Consequences.” |

| | | | |

| | Listing and Trading Symbol | | Our 3 Year Notes have not been approved for trading on any exchange and we have no current plans to request such a listing. |

| | | |

| | Risk Factors | | See “Risk Factors” on page 12 and other information included in this prospectus and any prospectus supplement for a discussion of factors you should carefully consider before investing in the 3 Year Notes. |

Our Company

We were incorporated in the State of Nevada on July 5, 2005 with the objective to own and acquire producing oil and gas properties and to participate in the drilling of new oil & gas wells. Our principal office is located at 1240 Blalock Road, Suite 150, Houston, Texas 77055. Our telephone number is (713) 266-3700. Information about us can be found at www.southfieldenergy.com .. Information contained in our website does not constitute part of this prospectus.

Other Information

We expect to make our periodic reports and other information filed or furnished to the SEC available, free of charge, through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus.

RISK FACTORS

The nature of our business activities subjects us to certain hazards and risks. You should consider carefully the following risk factors together with all of the other information included in this prospectus in evaluating an investment in our 3 Year Notes.

The risk factors set forth below are not the only risks that may affect our business. Our business could also be impacted by additional risks not currently known to us or that we currently deem to be immaterial. If any of the following risks were actually to occur, our business, financial condition or results of operations could be materially adversely affected. In that case, we might not be able to pay the principal and interest on our 3 Year Notes, and you could lose part or all of your investment.

Risks Related to Our Business

We may not have sufficient cash flow from operations to pay interest on the 3 Year Notes when due or to repay principal upon maturity.

Revenue and profit from oil and gas is uncertain. Prices may drop lower than they are today. We expect to invest in working interests in new oil and gas wells. These investments may not be profitable and we may lose our entire investment. Oil and gas properties are depleting assets and we will have to successfully continue to find additional oil and gas to offset the natural decline of producing wells in which we own an interest. These uncertainties are a material risk of investing in oil and gas and may materially affect our ability to make interest payments when due and to repay principal upon maturity.

The amount of cash we actually generate will depend upon numerous factors related to our business including, among other things:

| | • | the amount of oil and gas our operators produce; |

| | • | the prices at which our operators sell our oil and gas production; |

| | • | the level of our operating costs, including fees and reimbursement of expenses expended to operate the company and to compensate its management team, board of directors and employees; |

| | • | our ability to replace declining reserves; |

| | • | prevailing economic conditions; |

| | • | the level of competition we face; |

| | • | fuel conservation measures and alternate fuel requirements; and |

| | • | government regulation and taxation. |

In addition, the actual amount of cash that we will have available to make payments on the principal and interest of the 3 Year Notes will depend on other factors, including:

| | • | the level of our expenditures for acquisitions of additional oil and gas investments; |

| | • | our ability to make borrowings or to raise additional capital in the future; |

| | • | sources of cash used to fund acquisitions; |

| | • | debt service requirements of our 3 Year Notes or future financing agreements; |

| | • | fluctuations in our working capital needs; |

| | • | general and administrative expenses; |

| | • | timing and collectability of any receivables; and |

| | • | the amount of cash reserves established by our management team for the proper conduct of our business. |

All of our current revenues are generated by our interest in the Richard King Field. Delays or interruptions in our interests in the Richard King Field natural gas and production operations including, but not limited to, the failure of third parties on which we rely to provide key services, could negatively impact our revenues.

Approximately 80% of our oil and natural gas revenue for the year ended December 31, 2008 and the six months ended June 30, 2009 was derived from the Richard King Field. Should the production in this field decrease at a rate faster than anticipated, our revenues and cash flow to make payments on the 3 Year Notes could be adversely affected. In connection with the Richard King Field, we have partnered with Durango Resources Corporation as operator. The failure of Durango Resources to perform its duties as operator in the Richard King Field could prevent us from generating revenues. In addition, events referred to as force majeure, such as an act of God, act of a public enemy, fire, flood, lightning, etc. could prevent us from generating revenues.

Effective September 2009, we sold our assets located in the Aldwell Unit to Mariner Energy, Inc., the operator, for approximately $300,000, excluding a six percent sales commission. The Aldwell Unit accounted for the balance of our oil and natural gas revenue for the year ended December 31, 2008 and the six months ended June 30, 2009. As such, for the remainder of the fiscal year, our future revenues will be derived primarily from our Richard King Field properties.

Our business may be harmed by failures of third party operators on which we rely.

Our ability to manage and mitigate the various risks associated with our operations in Nueces County, Texas, is limited since we rely on third parties to operate our projects. We are a non-operating interest owner in our properties. With respect to our non-operated working interests, we have entered into agreements with third party operators for the conduct and supervision of drilling, completion and production operations. In the event that commercial quantities of oil and natural gas are discovered on one of our properties, the success of the oil and natural gas operations on that property depends in large measure on whether the operator of the property properly performs its obligations. The failure of such operators and their contractors to perform their services in a proper manner could result in materially adverse consequences to the owners of interests in that particular property, including us.

We cannot control activities on properties we do not operate. Our inability to fund required capital expenditures with respect to non-operated properties may result in a reduction or forfeiture of our interests in those properties.

Other companies operated all of our production as of June 30, 2009. We have limited ability to exercise influence over operations for these properties or their associated costs. Our dependence on the operator and other working interest owners for these projects and our limited ability to influence operations and associated costs could prevent the realization of our targeted returns on capital with respect to exploration, exploitation, development or acquisition activities. The success and timing of exploration, exploitation and development activities on properties operated by others depend upon a number of factors determined by the operator, including:

| | • | the timing and amount of capital expenditures; |

| | • | the operator's expertise and financial resources; |

| | • | approval of other participants in drilling wells; and |

| | • | selection of drilling, completion and production equipment. |

Where we are not the majority owner or operator of a particular oil and natural gas project, we may have no control over the timing or amount of capital expenditures associated with the project. If we are not willing and able to fund required capital expenditures relating to a project when required by the majority owner or operator, our interests in the project may be reduced or forfeited.

Because oil and gas properties are depleting asset s we must drill new wells or make acquisitions in order to maintain our production and reserves and sustain our payments of principal and interest to the 3 Year Note holders over time.

Producing oil and gas reservoirs are characterized by declining production rates. Because our reserves and production decline continually over time, we will need to drill additional wells or make acquisitions to sustain revenue over time. We may be unable to accomplish this if:

| | • | Sellers do not agree to sell any assets to us; |

| | • | we are unable to identify attractive drilling or acquisition opportunities in our area of operations; |

| | • | we are unable to agree on investment terms or a purchase price for assets that are attractive to us; or |

| | • | we are unable to obtain financing for acquisitions on economically acceptable terms. |

We will require substantial capital expenditures to replace our production and reserves, which will reduce our available cash for interest and principal payments. We may be unable to obtain needed capital or financing due to our financial condition, which could adversely affect our ability to replace our production and proved reserves.

To fund our projects, we will be required to use cash generated from our operations in addition to the proceeds of this Offering. We may also engage in additional borrowings or obtain financing from the issuance of additional equity interests in the Company, or some combination thereof. To the extent our production declines faster than we anticipate or the cost to acquire additional reserves is greater than we anticipate, we will require a greater amount of capital to maintain our production and proved reserves. The use of cash generated from operations to fund oil and gas investments will reduce cash available to pay interest and principal on our 3 Year Notes. Our ability to obtain bank financing or to access the capital markets for future equity or debt offerings may be limited by our financial condition at the time of any such financing or offering, the covenants in our 3 Year Notes or future financing agreements, adverse market conditions or other contingencies and uncertainties that are beyond our control. Our failure to obtain the funds necessary for future oil and gas investments could materially affect our business, results of operations, financial condition and ability to pay interest and principal on the 3 Year Notes.

Any new wells in which we participate are subject to substantial risks that could reduce our ability to make profits from operations.

Investments that we believe will increase revenue, may nevertheless result in losses. Any oil and gas investment involves potential risks, including, among other things:

| | • | the validity of our assumptions about reserves, future production, revenues and costs, including synergies; |

| | • | a decrease in our liquidity by using a significant portion of our available cash to finance investments; |

| | • | a significant increase in our interest expense or financial leverage if we incur additional debt to finance investments; |

| | • | the diversion of management’s attention from other business concerns; and |

| | • | an inability to hire, train or retain qualified personnel to manage and operate our growing business and assets. |

We could lose our ownership interests in our properties due to a title defect of which we are not presently aware.

As is customary in the oil and gas industry, only a perfunctory title examination, if any, is conducted at the time properties believed to be suitable for drilling operations are first acquired. Before starting drilling operations, a more thorough title examination is usually conducted and curative work is performed on known significant title defects. We typically depend upon title opinions prepared at the request of the operator of the property to be drilled. The existence of a title defect on one or more of the properties in which we have an interest could render it worthless and could result in a large expense to our business. Industry standard forms of operating agreements usually provide that the operator of an oil and natural gas property is not to be monetarily liable for loss or impairment of title. The operating agreements to which we are a party provide that, in the event of a monetary loss arising from title failure, the loss shall be borne by all parties in proportion to their interest owned.

The prices of oil and gas have reached historic highs in recent years and are highly volatile. A sustained decline in these commodity prices would cause a decline in our cash flow from operations, which may force us to reduce principal and interest payments on the 3 Year Notes or cease paying them altogether.

The oil and gas markets are highly volatile, and future oil and gas prices are uncertain. Oil and gas prices reached historically high levels in mid 2008, when oil sold for over $140 per barrel and natural gas sold for over $12 per thousand cubic feet (mcf). However, as of the date of this Offering, prices for oil and natural gas are currently fluctuating between $60-80 per barrel and $3-5 per mcf, less than 50% of their previous highs. Prices for oil and gas may fluctuate widely in response to relatively minor changes in the supply of and demand for oil and gas, market uncertainty and a variety of additional factors, such as:

| | • | domestic and foreign supply of and demand for oil and gas; |

| | • | overall domestic and global political and economic conditions, including those in the Middle East, Africa and South America; |

| | • | actions of the Organization of Petroleum Exporting Countries and other state-controlled oil companies relating to oil price and production controls; |

| | • | the impact of increasing liquefied natural gas, or LNG, deliveries to the United States; |

| | • | technological advances affecting energy consumption and energy supply; |

| | • | domestic and foreign governmental regulations and taxation; |

| | • | the impact of energy conservation efforts; |

| | • | the capacity, cost and availability of oil and gas pipelines and other transportation facilities, and the proximity of these facilities to our wells; and |

| | • | the price and availability of alternative fuels. |

Our revenue, profitability and cash flow depend upon the prices and demand for oil and gas, and a drop in prices can significantly affect our financial results and impede our growth. We may not be able to sustain payments of principal and interest to the 3 Year Note holders during periods of lower commodity prices.

Future price declines may result in another write-down of our asset carrying values, which could adversely affect our results of operations and limit our ability to borrow and make payments on the principal and interest to the 3 Year Note holders.

Due to low commodity prices for oil and gas at December 31, 2008, we were required to impair our assets located in the Aldwell Unit. An impairment test was conducted using data in a reserve report prepared by a reserve engineering firm. While conducting the impairment test, management determined that the estimated undiscounted future net cash flow provided in the reserve report was less that the carrying value of the Aldwell Unit on the Company’s Balance Sheet on December 31, 2008 and that the assets were subject to impairment. The assets were subsequently impaired.

Further declines in oil and gas prices may result in our having to make substantial downward adjustments to our estimated proved reserves. If this occurs, or if our estimates of production or economic factors change, accounting rules may require us to write down, as a noncash expense, the carrying value of our oil and gas properties for impairments. We are required to perform impairment tests on our assets whenever events or changes in circumstances warrant a review of our assets. To the extent such tests indicate a reduction of the estimated useful life or estimated future cash flows of our assets, the carrying values may not be recoverable and therefore require write-downs. We may incur further impairment charges in the future, which could materially affect our results of operations in the period incurred and our ability to borrow funds, which in turn may adversely affect our ability to generate revenues.

Our future hedging activities could result in financial losses or could reduce our income, which may adversely affect our ability to repay interest and principal on the 3 Year Notes when due.

To achieve more predictable cash flow and to reduce our exposure to adverse fluctuations in the prices of oil and gas, we may enter into derivative arrangements covering a significant portion of our oil and gas production that could result in both realized and unrealized hedging losses.

Our estimated proved reserves are based on many assumptions that may prove to be inaccurate. Any material inaccuracies in these reserve estimates or underlying assumptions will materially affect the quantities and present value of our proved reserves.

It is not possible to measure underground accumulations of oil or gas in an exact way. Oil and gas reserve engineering requires subjective estimates of underground accumulations of oil and gas and assumptions concerning future oil, natural gas and natural gas liquid (“NGL”) prices, production levels, and operating and development costs. In estimating our level of proved oil and gas reserves, we and our independent reservoir engineers make certain assumptions that may prove to be incorrect, including assumptions relating to:

| | • | a constant level of future oil, NGL and gas prices; |

| | • | future production levels; |

| | • | operating and development costs; |

| | • | the effects of regulation; and |

If these assumptions prove to be incorrect, our estimates of proved reserves, the economically recoverable quantities of oil, NGL and gas attributable to any particular group of properties, the classifications of reserves based on risk of recovery and our estimates of the future net cash flows from our proved reserves could change significantly. Over time, we may make material changes to reserve estimates to take into account changes in our assumptions and the results of actual drilling and production.

The present value of future net cash flows from our estimated proved reserves is not necessarily the same as the current market value of our estimated proved oil and gas reserves. We base the estimated discounted future net cash flows from our estimated proved reserves on prices and costs in effect on the day of estimate. However, actual future net cash flows from our oil and gas properties also will be affected by factors such as:

| | • | the actual prices we receive for oil, NGL and gas; |

| | • | our actual operating costs in producing oil, NGL and gas; |

| | • | the amount and timing of actual production; |

| | • | the amount and timing of our capital expenditures; |

| | • | supply of and demand for oil, NGL and gas; and |

| | • | changes in governmental regulations or taxation. |

The timing of both our production and our incurrence of expenses in connection with the production and development of oil and gas properties will affect the timing of actual future net cash flows from proved reserves, and thus their actual present value. In addition, the 10% discount factor we use when calculating discounted future net cash flows in compliance with the Financial Accounting Standards Board’s Statement of Financial Accounting Standards No. 69 may not be the most appropriate discount factor based on interest rates in effect from time to time and risks associated with us or the oil and gas industry in general.

Producing oil and gas involves numerous risks and uncertainties that could adversely affect our financial condition or results of operations and, as a result, limit our ability to pay principal and interest payments to our 3 Year Note holders.

As non-operated working interest owners we do not operate wells; however, we share in the costs of production for these wells. The operating cost of a well includes variable costs, and increases in these costs can adversely affect the economics of a well. Furthermore, our producing operations may be curtailed or delayed or become uneconomical as a result of other factors, including:

| | • | high costs, shortages or delivery delays of equipment, labor or other services; |

| | • | unexpected operational events and/or conditions; |

| | • | reductions in oil, NGL and gas prices; |

| | • | limitations in the market for oil, NGL and gas; |

| | • | adverse weather conditions; |

| | • | facility or equipment malfunctions; |

| | • | equipment failures or accidents; |

| | • | pipe or cement failures or casing collapses; |

| | • | compliance with environmental and other governmental requirements; |

| | • | environmental hazards, such as gas leaks, oil spills, pipeline ruptures and discharges of toxic gases; |

| | • | lost or damaged oilfield work over and service tools; |

| | • | unusual or unexpected geological formations or pressure or irregularities in formations; |

| | • | uncontrollable flows of oil, gas or well fluids. |

If any of these factors were to occur with respect to a particular field, we could lose all or a part of our investment in the field, or we could fail to realize the expected benefits from the field, either of which could materially and adversely affect our revenue and profitability.

We may incur debt to enable us to pay our interest and principal payments, which may negatively affect our ability to execute our business plan.

If we use borrowings under a credit facility to meet 3 Year Note obligations for an extended period of time rather than toward funding future investments and other matters relating to our operations, we may be unable to support or grow our business. Such a curtailment of our business activities, combined with our payment of principal and interest on our future indebtedness to pay these distributions, will reduce our cash available to make payments of principal and interest on our 3 Year Notes and will materially affect our business, financial condition and results of operations.

Our operations are subject to operational hazards and unforeseen interruptions for which we may not be adequately insured.

Operators of our wells are subject to a variety of operating risks in our wells, gathering systems and associated facilities, such as leaks, explosions, mechanical problems and natural disasters, all of which could cause substantial financial losses. Any of these or other similar occurrences could result in the disruption of our operations, substantial repair costs, personal injury or loss of human life, significant damage to property, environmental pollution, impairment of our operations and substantial revenue losses.

We currently possess a Business Owners insurance policy which includes property, business interruption and general liability insurance at levels we believe are appropriate for an early stage company; however, insurance against all operational risk is not available to us. We are not fully insured against all risks. In addition, pollution and environmental risks generally are not fully insurable.

Shortages of drilling rigs, supplies, oilfield services, equipment and crews could delay our operations and reduce our available cash.

To the extent that in the future we acquire and develop undeveloped properties, higher commodity prices generally increase the demand for drilling rigs, supplies, services, equipment and crews, and can lead to shortages of, and increasing costs for, drilling equipment, services and personnel. Shortages of, or increasing costs for, experienced drilling crews and equipment and services could restrict our future ability to drill wells and conduct operations. Any delay in the drilling of new wells or significant increase in drilling costs could reduce our future revenues and cash available for distribution.

The third parties on whom we rely for gathering and transportation services are subject to complex federal, state and other laws that could adversely affect the cost, manner or feasibility of conducting our business.

The operations of the third parties on whom we rely for gathering and transportation services are subject to complex and stringent laws and regulations that require obtaining and maintaining numerous permits, approvals and certifications from various federal, state and local government authorities. These third parties may incur substantial costs in order to comply with existing laws and regulation. If existing laws and regulations governing such third party services are revised or reinterpreted, or if new laws and regulations become applicable to their operations, these changes may affect the costs that we pay for such services. Similarly, a failure to comply with such laws and regulations by the third parties on whom we rely could have a material adverse effect on our business, financial condition, and results of operations.

If third-party pipelines and other facilities interconnected to our gas pipelines and processing facilities become partially or fully unavailable to transport gas, our revenues from operations could be adversely affected.

We depend upon third party pipelines and other facilities that provide delivery options to and from pipelines and processing facilities that our operators utilize. If any of these third-party pipelines and other facilities become partially or fully unavailable to transport gas, or if the gas quality specifications for these pipelines or facilities change so as to restrict our ability to transport gas on these pipelines or facilities, our revenues and cash available to make principal and interest payments to the 3 Year Note holders could be adversely affected.

Our operations are subject to various litigation risks that could increase our expenses, impact our profitability and lower the value of your investment in us.

We are not currently involved in any litigation; however, the nature of our operations exposes us to possible future litigation claims. There is a risk that any claim could be adversely decided against us, which could harm our financial condition and results of operations. Similarly, the costs associated with defending against any claim could dramatically increase our expenses, as litigation is often very expensive. Possible litigation matters may include, but are not limited to, environmental damage and remediation, insurance coverage, property rights and easements and the maintenance of oil and gas leases. Should we become involved in any litigation we will be forced to direct our limited resources to defending against or prosecuting the claim(s), which could impact our profitability and lower the value of your investment in us.

Our business is subject to environmental legislation and any changes in such legislation could prevent us from earning revenues.

The oil and gas industry is subject to many laws and regulations that govern the protection of the environment, health and safety and the management, transportation and disposal of hazardous substances. These laws and regulations may require the removal or remediation of pollutants and may impose civil and criminal penalties for any violations thereof. Some of the laws and regulations authorize the recovery of natural resource damages by the government, injunctive relief and the imposition of stop, control, remediation and abandonment orders.

Complying with environmental and natural resource laws and regulations may increase our operating costs as well as restrict the scope of our operations. Any regulatory changes that impose additional environmental restrictions or requirements on us could affect us in a similar manner. If the costs of such compliance or changes exceed our budgeted costs, we may not be able to earn revenues.

We may become an “investment company” as defined in the Investment Company Act of 1940.

Under the Investment Company Act of 1940 (the “Act”), as amended, we may be deemed to be an inadvertent investment company if it is determined that the value of the Company’s equity investment in Meridian Resources Corporation account for more than 40% of the total value of the Company’s assets, and no other exemption is available. As of June 30, 2009 our investment in Meridian Resources Corporation comprised only approximately 11.1% of total assets but this percentage can increase in the future if the price per share of Meridian Resources common stock increases. As well, if we make other equity investments in other oil and gas companies, these investments will be aggregated with our Meridian Resources investment to determine if we surpass the 40% threshold. If so, and if we were to be deemed an inadvertent investment company, we believe that we may be eligible for temporary relief from the application of the Act if we have a bona fide intent to be engaged primarily, as soon as reasonably possible (in any event within one year), in a business other than that of investing, reinvesting, owning, holding or trading in securities. We may also sell a number of shares of common stock of Meridian Resources or any other future equity investments in other companies to lower the percentage below 40%. However, we may sell such stock at times that may not be ideal for us which adversely affect the price we receive. We do not have any current plans, proposals or arrangements, written or otherwise, to increase our equity investment in Meridian Resources Corporation or any other company.

Investment companies are subject to substantial regulation concerning management, operations, transactions with affiliated persons, portfolio composition, including restrictions with respect to diversification and industry concentration and other restrictions, and, unless we complied with the Act, we would be prohibited from engaging in transactions involving interstate commerce. To comply, we would be required to significantly modify our operating structure and file reports with the SEC regarding various aspects of our business. The cost of such compliance would result in the Company incurring substantial additional annual expenses. In addition, compliance with the Act may not be consistent with the Company’s current business strategies.

Risks Related to this Offering

We may issue additional debt, including notes that are senior to the current 3 Year Notes , without your approval.

The amount of additional debt that can be raised by us is not limited. W e may issue an unlimited number of notes that are senior to the 3 Year Notes without your approval.

3 Year Note Holders will not have the same rights to vote on matters submitted to the shareholders for consideration and approval as the holders of common shares.

Certain matters, such as the appointment of directors, amendment of corporate documents, etc. must be submitted to a vote of the shareholders for approval. The 3 Year Note Holders will not have voting rights on such matters as do the common shareholders.

3 Year Note Holders will have very limited liquidity for their 3 Year Notes. We do not intend nor expect to request that Southfield be listed for trading on any exchange.

The Company does not intend nor expect to list the 3 Year Notes registered in this Offering for trading on any exchange or over-the-counter listing service. As a result, the Holders of the 3 Year Notes are not expected to have any market liquidity in their investment and should be prepared to hold the 3 Year Notes to Maturity.

As a result of investing in our 3 Year Notes, you may become subject to state and local taxes.

Interest earned on the 3 Year Notes will be taxed by the Federal and state governments in accordance with current and future tax laws. You should expect to pay taxes at your marginal rate for investments of this type.

Some of our officers and directors have relationships with other companies in the oil and natural gas industry that could result in conflicts of interest.

Some of our officers and directors serve as officers and directors of other companies engaged in the oil and natural gas industry and may have other relationships with such companies. For example, Chet Gutowsky and Tyson Rohde both serve as officers and directors of Biotricity Corporation, an alternative energy company located in Houston, Texas. To the extent those companies are involved in ventures in which we may participate, or compete for acquisitions or financial resources with us, the relevant director will face a conflict of interest. In the event such a conflict arises, the relevant director will be required to disclose the nature and extent of the conflict and abstain from voting for or against any action of the board of directors that is or could be affected by the conflict.

We are dependent upon our key officers and employees and our inability to retain and attract key personnel could significantly hinder our growth strategy and cause our business to fail.

A loss of one or more of our current directors, officers or key employees could severely and negatively impact our operations and delay or preclude us from achieving our business objectives. Our executive officers have a combined experience of approximately 50 years in the oil and gas industry. We have not entered into employment agreements with our officers, and we could suffer the loss of key individuals for one reason or another at any time in the future. There is no guarantee that we could attract or locate other individuals with similar skills or experience to carry out our business objectives.

Our directors and officers hold significant positions in our shares of common stock and their interests may not always be aligned with those of our other shareholders.

As of June 30, 2009 our directors and officers beneficially own 18.9% of our outstanding common stock. See “Security Ownership of Certain Beneficial Owners and Management.” This shareholding level will allow the directors, officers and certain beneficial owners to have a significant degree of influence on matters that are required to be approved by shareholders, including the election of directors and the approval of significant transactions. The short-term interests of our directors, officers and certain beneficial owners may not always be aligned with the long-term interests of our shareholders, and vice versa. Because our directors, officers and certain beneficial owners have a significant degree of influence on matters that are required to be approved by our shareholders, they could influence the approval of transactions.

The 3 Year Notes will not be issued under the protections of the Trust Indenture Act of 1939.

The Trust Indenture Act of 1939, as amended (the “Indenture Act”), unlike the Securities Act and the Exchange Act which are generally limited to disclosure issues, goes beyond disclosure and imposes regulation over the form and content of debt securities. The Indenture Act governs the substantive requirements of a trust indenture which sets forth, among other things, all obligations of and restrictions of a bond issuer, the rights of bondholders on default by the issuer and the relationship between the trustee and bondholders. The issuance of our 3 Year Notes are exempt from the application of the Indenture Act and therefore, we are not required to utilize an indenture or comply with the Indenture Act. Because no indenture is available, the rights afforded to bondholders under the Indenture Act do not apply.

The 3 Year Notes are being offered without an indenture. You should be aware that the absence of a trustee and indenture could have a material, adverse effect on your investment in the 3 Year Notes.

Issuances of debt are often issued under an indenture agreement that contains, among other items, covenants, default provisions, rights and remedies of investors, and the general administration of debt securities. Under an indenture, a trustee serves as an impartial third party to oversee the property of the trust and administer the trust in accordance with the provisions of the indenture for the benefit of the issuer and investors. Because this Offering is being made directly by the Company to investors, and because there is no minimum offering amount before the Company may apply the proceeds of this Offering as described under the “Use of Proceeds”, the Company is not retaining the services of a trustee, nor will it issue an indenture governing the 3 Year Notes. Further, many of the responsibilities of the trustee including the payment of interest, may be handled by a third party paying agent that we may retain. We believe this approach is the most cost-effective method of issuance of 3 Year Notes for a company of our size. Instead, the complete terms and conditions governing the 3 Year Notes are included in this prospectus and in the Subscription Agreement. Because we are not issuing the 3 Year Notes in conjunction with an indenture, material differences from what is often under an indenture agreement including: covenants, default provisions, rights and remedies of investors, and the administration of the 3 Year Notes, may arise from this prospectus. You should note that certain rights and privileges customarily afforded to investors under indenture agreements, will not be afforded to you in this Offering, and should therefore understand that your investment in the 3 Year Notes could be adversely affected. You should also note that the absence of a trustee could adversely affect your investment in the 3 Year Notes.

There will be no trustee for the 3 Year Notes to enforce the rights of investors.

The 3 Year Notes will not be issued pursuant to an indenture, and there will be no indenture trustee to enforce the rights of holders of the 3 Year Notes if Southfield breaches any of the covenants contained in this prospectus, including the promise to pay principal and interest. In the event of any such breach, a holder of the 3 Year Notes, or a group of holders acting together, would, as a practical matter, need to retain legal counsel to enforce rights against Southfield, which might be prohibitively expensive.

The 3 Year Notes lack certain covenants typically found in other public debt securities.

The 3 Year Notes lack the protection of several financial and other restrictive covenants typically associated with comparable offerings of registered notes, including:

· incurrence of additional indebtedness;

· payment of dividends and other restricted payments;

· sale of assets and the use of proceeds therefrom; and

· transactions with affiliates.

We expect to receive net proceeds from this Offering of approximately $8.8 million, assuming the maximum offering of $10.0 million is raised and further assuming that we will engage the services of a Placement Agent to assist in selling the 3 Year Notes. In such event, we estimate that we would pay Placement Agent commissions of up to $800,000 and a non-accountable expense allowance of up to $300,000. In addition, we will incur Other Expenses of up to $100,000. Other Expenses below include legal, accounting and engineering fees, printing and distribution costs for the Offering and Offering related travel and communication costs. From the Net proceeds to Company, an amount of money will be reserved to make the first six months interest payments due on the 3 Year Notes. Such interest payments will be managed by a third party project manager (a “Servicing Agent”), and paid as due to the 3 Year Note holders.

Estimated Offering expenses:

| Total Offering Amount | | $ | 10,000,000 | |

| | | | | |

| Sales Commissions | | | 800,000 | |

| | | | | |

| Non-Accountable Expense Allowance | | | 300,000 | |

| | | | | |

| Other Expenses | | | 100,000 | |

| | | | | |

| Net Proceeds to Company | | $ | 8,800,000 | |

We intend to use the estimated net proceeds of the Offering to first pay for operating expenses, including management compensation related to the operation of the Company. We then intend to use the proceeds to purchase non-operated working interests in new and existing oil and gas projects. We may also make equity investments in other oil and gas companies. Further, we may acquire mineral lease interests, purchase interests in oil and gas properties with existing production, make investments in the drilling and completion of new wells, purchase certain oil and gas infrastructure and equipment, and use the proceeds for other general corporate purposes. Additionally, we may also use a portion of the proceeds of the offering to address future capital requirements to convert proved behind pipe reserves and proved undeveloped reserves into proved developed producing reserves.

The goal of management will be to maximize the returns available from the investment of the capital raised in this Offering through an investment strategy designed to manage risk through portfolio diversification. In order to achieve that goal, management will reserve the right to make related investments outside of the scope of our primary current expectations as market conditions change and as unique opportunities present themselves. This discretion by management may allow for the use of proceeds in ways other than those described above when management and the Board of Directors finds it is in the best interests of the shareholders and 3 Year Note holders to do so.

DESCRIPTION OF 3 YEAR NOTES

The complete terms of the 3 Year Notes are set forth under this Description of 3 Year Notes and, together with the Subscription Agreement provided to prospective investors with this prospectus, constitute the entire agreement between us and any prospective investor with respect to the 3 Year Notes. The 3 Year Notes are not evidenced by any indenture or other like agreement and if you invest in the 3 Year Notes, your interest will not be represented by any trustee or other representative. See “Risk Factors” beginning on page 12 for certain factors you should consider before buying the 3 Year Notes .

The 3 Year Notes

The 3 Year Notes are general obligation instruments and are issued as such. The following are the terms under which the 3 Year Notes are offered.

General

The Offering of the 3 Year Notes pursuant to this prospectus is limited to the aggregate principal amount of $10,000,000 and will be general unsecured liabilities of the Company, and will rank junior and be subordinate in right of payment to all future senior debt the Company may acquire. The 3 Year Notes will not be secured by liens on any of our assets and are general obligations of the Company. The 3 Year Notes will be issued in denominations of at least $1,000 and multiples thereof as may be authorized by the Company. A minimum purchase of $1,000 is required. The 3 Year Notes will mature three years from the date of purchase.

Interest and Type of 3 Year Notes

The interest rate on the 3 Year Notes will be fixed at 10% per annum calculated based on a 365-day year. Interest due on the 3 Year Notes will be paid to the holder of record on the last day of each quarter on a quarterly basis in arrears. Simple interest will accrue on the 3 Year Notes from the date of purchase when an executed Subscription Agreement and payment is received and accepted by us or at the office of the Placement Agent, if applicable. The issue date will be the same as the date of purchase. Principal and interest will be paid to the holder of the 3 Year Note specified by the subscriber in the Subscription Agreement.

The total pay out to an investor on a $10,000 investment in a 3 Year Note will be $13,000 over its term. All payments of principal and interest will be made in U.S. dollars.

Servicing Agent

The Company may contract with a Servicing Agent to assist in managing the payment of the interest and principal to the 3 Year Note holders. Under a management agreement with the Servicing Agent, the Company will establish an initial interest reserve equal to six months interest and deposit with the Servicing Agent as subscriptions are received. The Servicing Agent will be obligated to facilitate interest payments to the 3 Year Note holders, including payment under the initial interest reserve, among other duties. In exchange, we will pay the Servicing Agent cash and/or the value of our common stock not exceeding an aggregate of $100,000 per year.

Acceptance

An offer of the 3 Year Notes will be accepted by the Company upon the receipt by you of a countersigned signature page to the Subscription Agreement.

Rejection

The Company may reject your offer of 3 Year Notes for any reason or no reason at all. Any rejection will result in any funds tendered by you to be promptly returned, without deduction or interest.

Book Entry

The Company shall cause to be kept at an office or agency, to be maintained by the Company or one of its agents, a register in which the Company shall provide for the ownership of the 3 Year Notes and any transfer thereof.

Reregistration

Upon written request, submission of legal authorization, and subject to Company approval, you may reregister 3 Year Notes to be held in the name of a related entity, so long as it is not deemed a transfer involving monetary consideration.

No Mandatory Redemption

The 3 Year Notes are not subject to any mandatory redemption. No holder of a 3 Year Note shall have any right whatsoever to require the Company to purchase or to redeem any 3 Year Note prior to the stated maturity date.

Optional Redemption

The 3 Year Notes are subject to redemption at the option of the Company in whole or in part from time to time of the principal amount plus accrued interest to such date. After one year from the date of purchase, the Company may elect to redeem or call any or all of the 3 Year Notes at its discretion with fifteen (15) days notice to the investor.

Subordination

The 3 Year Notes are general unsecured obligations and will rank junior and be subordinate in right of payment to all future senior debt. The 3 Year Notes will not be secured by liens on any of our assets. This means that if we are unable to pay our debts when due, the 3 Year Notes would all be paid, if at all, after any payment would be made on any senior debt.

Additional Covenants of the Company

In addition to the covenants expressed elsewhere in this prospectus, the Company also covenants the following:

| | · | to preserve its corporate existence; |

| | · | to insure its properties in such amounts and by such methods as may be deemed reasonably adequate by the Company, pay all lawful taxes and claims for labor, materials and supplies in respect to its properties; and |

| | · | to authorize the operators of oil and gas properties in which we have invested to perform their duties. |

Limitations On Mergers

The Company will not consolidate with or merge into any corporation or convey or transfer its assets in their entirety or substantial entirety unless the successor corporation expressly assumes in writing the payment of principal and interest on all 3 Year Notes as they come due, in accordance with the covenants in this Offering. Upon any such consolidation, merger, conveyance or transfer, the successor corporation will succeed to and be substituted for the Company under this prospectus and, thereafter, the Company will be relieved of all obligations under the prospectus and 3 Year Notes.

Default and Notice Thereof

The occurrence of only any of the following events will constitute an event of default:

| | · | failure for 60 days to pay the interest when due on any of the 3 Year Notes; |

| | · | failure for 30 days to pay the principal when due on any of the 3 Year Notes; |

| | · | failure for 60 days after notice to perform any other covenant or agreement contained in this prospectus; or |

| | · | the occurrence of acts of bankruptcy, insolvency or reorganizations. |

The Company shall notify the 3 Year Note holders of the occurrence of any of the above events of default known to it. If the events of default continue, the 3 Year Note holders may pursue any remedies available to them in a court of proper jurisdiction. Because there is no trustee acting on your behalf, you or a group of holders will have to file a claim against the Company.

Waiver of Default

You may waive any event of default. Upon any such waiver, such default shall cease to exist and shall be deemed to have been cured.

Notice

Notice to holders shall be in writing and mailed or faxed to each holder of 3 Year Notes, at the address or facsimile number of such holder as it appears in the Subscription Agreement. Notice to the Company shall be in writing and mailed or faxed to us at the address and facsimile number in the Subscription Agreement.

Restrictions on Transfer

The Company does not expect to list the 3 Year Notes for trading on any exchange or listing service. It is not expected that there will be any liquid market for the sale of the 3 Year Notes. 3 Year Note Holders should expect to hold their 3 Year Notes until maturity.

Amendments

With the consent of the holders of a majority in principal amount of outstanding 3 Year Notes, the Company, if authorized by board resolution, may enter into a supplement for the purpose of adding any provisions or changing in any manner or eliminating any of the provisions in the 3 Year Notes or modifying in any manner the rights of the holders of 3 Year Notes. Upon the execution of any supplement, the provisions of the 3 Year Notes shall be modified in accordance therewith. Any supplement executed may not confirm to any requirements of the Indenture Act. We may also obtain the consent of an individual holder for the purpose of adding any provisions or changing in any manner or eliminating any of the provisions in his or her 3 Year Notes or modifying in any manner the rights of such holder.

No personal liability of directors, officers, employees and stockholders

No director, officer, employee, incorporator or stockholder of the Company shall have any liability for any obligations of the Company under the 3 Year Notes, the prospectus for any claim based on, in respect of, or by reason of, such obligations or their creation. Each 3 Year Note holder waives and releases all such liability. The waiver and release are part of the consideration for issuance of the 3 Year Notes. Such waiver may not be effective to waive liabilities under the federal securities laws and it is the view of the Securities and Exchange Commission that such a waiver is against public policy.

Voting Rights