UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2013

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-54752

LendingClub Corporation

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 51-0605731 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

71 Stevenson St., Suite 300 San Francisco, California | | 94105 |

| (Address of principal executive offices) | | (Zip Code) |

(415) 632-5600

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of October 31, 2013, there were 13,694,815 shares of the registrant’s common stock outstanding.

LENDINGCLUB CORPORATION

TABLE OF CONTENTS

Cautionary Note Regarding Forward-Looking Statements

This Quarterly Report on Form 10-Q (“Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 (“1933 Act”), as amended, and Section 21E of the Securities Exchange Act of 1934 (“1934 Act”), as amended, that involve substantial risks and uncertainties. Those sections of the 1933 Act and 1934 Act provide a “safe harbor” for forward-looking statements to encourage companies to provide prospective information about their financial performance so long as they provide meaningful, cautionary statements identifying important factors that could cause actual results to differ significantly from projected results.

All statements, other than statements of historical facts, included in this Report on Form 10-Q regarding our borrower members, credit scoring, Fair Isaac Corporation (“FICO”) scores, our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans, objectives of management and expected market growth are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will,” “would” or similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements include, among other things, statements about:

| | • | | our ability to attract potential borrowers to our lending platform; |

| | • | | the degree to which potential borrowers apply for, are approved for and actually borrow via a Member Loan; |

| | • | | the status of borrower members, the ability of borrower members to repay Member Loans and the plans of borrower members; |

| | • | | interest rates and origination fees on Member Loans; |

| | • | | our ability to service Member Loans and our ability, or the ability of third party collection agents, to pursue collection of delinquent and defaulted Member Loans; |

| | • | | our ability to retain WebBank or another third party banking institution as the lender of loans originated through our platform; |

| | • | | the functionality of the secondary market trading program; |

| | • | | expected rates of return provided to investors; |

| | • | | our ability to attract additional investors to the platform, to our funds, to separately managed accounts or to purchase loans; |

| | • | | our financial condition and performance, including our ability to remain profitable or cash flow positive; |

| | • | | our ability to retain and hire competent employees and appropriately staff our operations; |

| | • | | the lack of a public trading market for the member payment dependent Notes (“Notes”) and Trust Certificates (“Certificates”) and any inability to resell the Notes and Certificates; |

| | • | | our ability to prevent security breaks, disruption in service, and comparable events that could compromise the personal and confidential information held in our data systems, reduce the attractiveness of the platform or adversely impact our ability to service the loans; |

| | • | | our compliance with applicable local, state and federal laws, including the Investment Advisors Act of 1940, the Investment Company Act of 1940 and other laws; and |

| | • | | our compliance with applicable regulations and regulatory developments. |

We may not actually achieve the plans, intentions or expectations disclosed in forward-looking statements, and you should not place undue reliance on forward-looking statements. We have included important factors in the cautionary statements included in this Report, including in the “Risk Factors” section of our annual Report on Form 10-K, for a description of certain risks that could, among other things, cause actual results or events to differ materially from forward-looking statements contained in this Report. Forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

You should carefully read this Report completely and with the understanding that actual future results may be materially different from what we expect. We do not assume any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, other than as required by law.

1

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

LendingClub Corporation and Subsidiaries

Condensed Consolidated Balance Sheets (unaudited)

(in thousands, except per share data)

| | | | | | | | |

| | | September 30,

2013 | | | December 31,

2012 | |

| ASSETS | | | | | | | | |

Cash and cash equivalents | | $ | 62,186 | | | $ | 52,551 | |

Restricted cash | | | 8,747 | | | | 7,484 | |

Member Loans at fair value (includes $939,817 and $396,081 from consolidated Trust, respectively) | | | 1,516,676 | | | | 781,215 | |

Accrued interest receivable (includes $4,583 and $2,023 from consolidated Trust, respectively) | | | 12,801 | | | | 5,521 | |

Prepaid expenses and other assets | | | 2,578 | | | | 1,785 | |

Property, Equipment and Software, net | | | 8,407 | | | | 1,578 | |

Deposits | | | 253 | | | | 696 | |

| | | | | | | | |

Total Assets | | $ | 1,611,648 | | | $ | 850,830 | |

| | | | | | | | |

| LIABILITIES | | | | | | | | |

Accounts payable | | $ | 2,330 | | | $ | 1,210 | |

Accrued interest payable (includes $4,583 and $2,023 from consolidated Trust, respectively) | | | 14,549 | | | | 6,678 | |

Accrued expenses and other liabilities | | | 9,475 | | | | 3,366 | |

Payable to member investors | | | 457 | | | | 2,050 | |

Notes and Certificates at fair value (includes $939,817 and $396,081 from consolidated Trust, respectively) | | | 1,522,975 | | | | 785,316 | |

| | | | | | | | |

Total Liabilities | | | 1,549,786 | | | | 798,620 | |

| | | | | | | | |

Commitments and contingencies (seeNote 12) | | | | | | | | |

| PREFERRED STOCK | | | | | | | | |

Preferred stock | | $ | 103,219 | | | $ | 103,023 | |

| STOCKHOLDERS’ DEFICIT | | | | | | | | |

Common stock, $0.01 par value; 90,000,000 shares authorized at September 30, 2013 and December 31, 2012, respectively; 13,601,335 and 11,291,862 shares issued and outstanding at September 30, 2013 and December 31, 2012, respectively | | $ | 136 | | | $ | 123 | |

Additional paid-in capital | | | 11,694 | | | | 6,713 | |

Treasury stock (0 and 17,640 shares held at September 30, 2013 and December 31, 2012, respectively) | | | — | | | | (12 | ) |

Accumulated deficit | | | (53,187 | ) | | | (57,637 | ) |

| | | | | | | | |

Total Stockholders’ Deficit | | | (41,357 | ) | | | (50,813 | ) |

| | | | | | | | |

Total Liabilities, Preferred Stock and Stockholders’ Deficit | | $ | 1,611,648 | | | $ | 850,830 | |

| | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

2

LendingClub Corporation and Subsidiaries

Condensed Consolidated Statements of Operations (Unaudited)

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

Non-Interest Revenue: | | | | | | | | | | | | | | | | |

Origination fees | | $ | 25,245 | | | $ | 8,973 | | | $ | 55,229 | | | | 19,418 | |

Servicing fees | | | 942 | | | | 479 | | | | 2,461 | | | | 1,341 | |

Management fees | | | 869 | | | | 225 | | | | 2,082 | | | | 476 | |

Other revenue | | | 349 | | | | 137 | | | | 4,718 | | | | 255 | |

| | | | | | | | | | | | | | | | |

Total Non-Interest Revenue | | | 27,405 | | | | 9,814 | | | | 64,490 | | | | 21,490 | |

| | | | | | | | | | | | | | | | |

Net Interest Income: | | | | | | | | | | | | | | | | |

Total interest income | | | 51,386 | | | | 18,490 | | | | 124,771 | | | | 44,704 | |

Total interest expense | | | (51,370 | ) | | | (18,259 | ) | | | (124,727 | ) | | | (44,222 | ) |

| | | | | | | | | | | | | | | | |

Net Interest Income | | | 16 | | | | 231 | | | | 44 | | | | 482 | |

| | | | | | | | | | | | | | | | |

(Provision)/Benefit for loan losses on Member Loans at amortized cost | | | — | | | | (7 | ) | | | — | | | | 33 | |

Fair valuation adjustments, Member Loans | | | (15,613 | ) | | | (7,248 | ) | | | (37,877 | ) | | | (15,551 | ) |

Fair valuation adjustments, Notes and Certificates | | | 15,607 | | | | 7,107 | | | | 37,848 | | | | 15,322 | |

| | | | | | | | | | | | | | | | |

Net Interest Income after provision for loan losses and fair value adjustments | | | 10 | | | | 83 | | | | 15 | | | | 286 | |

| | | | | | | | | | | | | | | | |

Total Revenue | | | 27,415 | | | | 9,897 | | | | 64,505 | | | | 21,776 | |

| | | | | | | | | | | | | | | | |

Operating Expenses: | | | | | | | | | | | | | | | | |

Sales and marketing | | | (10,460 | ) | | | (4,743 | ) | | | (26,577 | ) | | | (12,151 | ) |

Origination and servicing | | | (4,996 | ) | | | (1,929 | ) | | | (11,045 | ) | | | (5,138 | ) |

General and administrative | | | (9,331 | ) | | | (4,107 | ) | | | (22,433 | ) | | | (10,517 | ) |

| | | | | | | | | | | | | | | | |

Total Operating Expenses | | | (24,787 | ) | | | (10,779 | ) | | | (60,055 | ) | | | (27,806 | ) |

| | | | | | | | | | | | | | | | |

Income (loss) before provision for income taxes | | | 2,628 | | | | (882 | ) | | | 4,450 | | | | (6,030 | ) |

Income tax benefit | | | 85 | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Net Income (Loss) | | $ | 2,713 | | | $ | (882 | ) | | $ | 4,450 | | | $ | (6,030 | ) |

| | | | | | | | | | | | | | | | |

Basic net income (loss) per share attributable to common stockholders | | $ | — | | | $ | (0.09 | ) | | $ | — | | | $ | (0.62 | ) |

Diluted net income (loss) per share attributable to common stockholders | | $ | — | | | $ | (0.09 | ) | | $ | — | | | $ | (0.62 | ) |

Weighted-average shares of common stock used in computing basic net income (loss) per share | | | 13,328,103 | | | | 10,300,351 | | | | 12,614,487 | | | | 9,739,922 | |

Weighted-average shares of common stock used in computing diluted net income (loss) per share | | | 80,346,432 | | | | 10,300,351 | | | | 80,160,536 | | | | 9,739,922 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

LendingClub Corporation and Subsidiaries

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

| | | | | | | | |

| | | For the Nine Months Ended September 30, | |

| | | 2013 | | | 2012 | |

Cash flows from Operating Activities: | | | | | | | | |

Net income/(loss) | | $ | 4,450 | | | $ | (6,030 | ) |

Adjustments to reconcile net income (loss) to net cash used in operating activities: | | | | | | | | |

(Benefit) for loan losses | | | — | | | | (33 | ) |

Fair value adjustments, net | | | 29 | | | | 230 | |

Change in Loan Servicing Rights carried at fair value | | | 578 | | | | — | |

Stock based compensation and warrant expense | | | 3,345 | | | | 779 | |

Depreciation | | | 907 | | | | 182 | |

Other, net | | | — | | | | (42 | ) |

Changes in operating assets and liabilities | | | | | | | | |

Purchase of Member Loans sold | | | (250,433 | ) | | | — | |

Proceeds from sale of Member Loans | | | 250,433 | | | | — | |

Accrued interest receivable | | | (7,280 | ) | | | (4,123 | ) |

Prepaid expenses and other assets | | | (792 | ) | | | (568 | ) |

Deposits | | | 442 | | | | (513 | ) |

Accounts payable | | | 1,120 | | | | 16 | |

Accrued interest payable | | | 7,871 | | | | 5,060 | |

Accrued expenses and other liabilities | | | 5,532 | | | | 1,741 | |

| | | | | | | | |

Net cash provided by (used in) operating activities | | | 16,202 | | | | (3,301 | ) |

| | | | | | | | |

Cash flows from Investing Activities: | | | | | | | | |

Purchase of Member Loans | | | (1,115,774 | ) | | | (454,080 | ) |

Repayment of Member Loans | | | 341,256 | | | | 131,061 | |

Proceeds from recoveries and sale of charged-off Member Loans | | | 1,180 | | | | 216 | |

Net change in restricted cash | | | (1,264 | ) | | | (1,704 | ) |

Purchase of property and equipment, net | | | (7,736 | ) | | | (764 | ) |

| | | | | | | | |

Net cash used in investing activities | | | (782,338 | ) | | | (325,271 | ) |

| | | | | | | | |

Cash flows from Financing Activities: | | | | | | | | |

Payable to member investors | | | (1,593 | ) | | | 2,859 | |

Proceeds from issuance of Notes and Certificates | | | 1,115,694 | | | | 461,961 | |

Payments on Notes and Certificates | | | (339,048 | ) | | | (131,772 | ) |

Payments on charged-off Notes and Certificates from recoveries/sales of related charged off Member Loans | | | (1,139 | ) | | | (219 | ) |

Payments on loans payable | | | — | | | | (810 | ) |

Proceeds from exercise of warrants to acquire Series A convertible preferred stock and common stock | | | 326 | | | | 350 | |

Proceeds from issuance of Series B convertible preferred stock, net of issuance costs | | | — | | | | 27 | |

Proceeds from issuance of Series D convertible preferred stock, net of issuance costs | | | — | | | | 6,042 | |

Proceeds from issuance of Series E convertible preferred stock, net of issuance costs | | | — | | | | 17,344 | |

Proceed from issuance of common stock | | | 1,531 | | | | 487 | |

| | | | | | | | |

Net cash provided by financing activities | | | 775,771 | | | | 356,269 | |

| | | | | | | | |

Net increase in cash and cash equivalents | | | 9,635 | | | | 27,697 | |

Cash and cash equivalents, beginning of period | | | 52,551 | | | | 24,712 | |

| | | | | | | | |

Cash and cash equivalents, end of period | | $ | 62,186 | | | $ | 52,409 | |

| | | | | | | | |

Supplemental disclosure of cash flow information: | | | | | | | | |

Cash paid for interest | | $ | 116,746 | | | $ | 38,092 | |

Non-cash exercise of common stock warrants | | | 137 | | | | — | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

LENDINGCLUB CORPORATION AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1. Basis of Presentation

The condensed consolidated balance sheets as of September 30, 2013 and December 31, 2012, the condensed consolidated statements of operations for the three and nine months ended September 30, 2013 and 2012, respectively, and the condensed consolidated statements of cash flows for the nine months ended September 30, 2013 and 2012, respectively, have been prepared by LendingClub Corporation (“LendingClub”, “we”, “our”, the “Company” and “us”) in conformity with U.S. generally accepted accounting principles (“GAAP”) for interim financial information. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements.

The Company did not have any items of other comprehensive income/(loss) during any of the periods presented in the condensed consolidated financial statements as of and for the three and nine month periods ended September 30, 2013 and 2012, and therefore, we are not currently required to report comprehensive income/(loss).

In the opinion of management, all necessary adjustments (including only those of a normal recurring nature) have been made for a fair presentation of the financial position, results of operations, and cash flows for the interim periods presented. The results of operations for the interim periods are not necessarily indicative of the results for the full fiscal year. The unaudited interim condensed consolidated financial statements should be read in conjunction with the audited financial statements and notes thereto for the nine-month period ended December 31, 2012.

2. Summary of Significant Accounting Policies

Change in Fiscal Year

On December 19, 2012, our Board of Directors approved a change in our fiscal year-end from March 31stto December 31st. The change was effective as of December 31, 2012 and we filed a transition report with the Securities and Exchange Commission (“SEC”), which covered the nine-month period ending December 31, 2012. The accompanying interim condensed consolidated financial statements cover the period from January 1, 2013 through September 30, 2013, representing three quarters of our newly adopted fiscal year period and should be read in conjunction with our audited financial statements and notes thereto for the nine-month period ended December 31, 2012.

Consolidation Policies

Our condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiary, LC Advisors, LLC (“LCA”), a registered investment advisor, and LC Trust I (the “Trust”), a Delaware business trust. Our policy is to consolidate the accounts of entities in which we have a controlling financial interest. We determine whether we have a controlling financial interest in an entity by evaluating whether the entity is a voting interest entity or variable interest entity (“VIE”) and if the accounting guidance requires consolidation.

Voting interest entities are entities that have sufficient equity and provide the equity investors voting rights that enable them to make significant decisions relating to the entities’ operations. For these types of entities, our determination of whether we have a controlling financial interest is based on ownership of a majority of the entities’ voting equity interest or through control of management of the entities.

VIEs are entities that, by design, either (i) lack sufficient equity to permit the entity to finance its activities without additional subordinated financial support from other parties, or (ii) have equity investors that do not have the ability to make significant decisions relating to the entity’s operations through voting rights, or do not have the obligation to absorb the expected losses, or do not have the right to receive the residual returns of the entity. We determine whether we have a controlling financial interest in a VIE by considering whether our involvement with the VIE is significant and whether we are the primary beneficiary of the VIE based on the following:

| | 1. | We have the power to direct the activities of the VIE that most significantly impact the entity’s economic performance; |

| | 2. | The aggregate indirect and direct variable interests held by the Company have the obligation to absorb losses or the right to receive benefits from the entity that could be significant to the VIE; and, |

5

| | 3. | Qualitative and quantitative factors regarding the nature, size, and form of our involvement with the VIE. |

We believe our beneficial ownership of a controlling financial interest in the Trust has qualified and continues to qualify as an equity investment in a VIE that should be consolidated for financial accounting and reporting purposes. All intercompany accounts between the Company and LCA have been eliminated. In addition, due to the financial consolidation of the Trust we have also eliminated transactions between these entities and the Trust. We perform on-going reassessments on the status of the entities and whether facts or circumstances have changed in relation to our involvement in VIEs which could cause our conclusion to change.

Use of Estimates

The preparation of our condensed consolidated financial statements and related disclosures in conformity with U.S. GAAP requires management to make judgments, assumptions and estimates that affect the amounts reported in our condensed consolidated financial statements and accompanying notes. We base our estimates on historical experience and on various other factors we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of certain assets and liabilities. These judgments, assumptions and estimates include but are not limited to the following: (i) revenue recognition; (ii) fair value determinations for Member Loans, Notes and Certificates; (iii) stock-based compensation expense; (iv) provision for income taxes, net of valuation allowance for deferred tax assets; and (v) loan servicing asset/liability fair value determination. These judgments, estimates and assumptions are inherently subjective in nature and actual results may differ from these judgments, estimates and assumptions, and the differences could be material.

Cash and Cash Equivalents

Cash and cash equivalents include various unrestricted deposits with financial institutions in checking, money market and short-term certificate of deposit accounts. We consider all highly liquid investments with stated maturity dates of three months or less from the date of purchase to be classified as cash equivalents. Cash equivalents are recorded at cost, which approximates fair value.

Restricted Cash

Restricted cash consists primarily of the Company’s funds in certain checking, money market and certificate of deposit accounts that are: (i) pledged to or held in escrow by our correspondent banks as security for transactions processed on or related to our platform; (ii) pledged through a credit support agreement with a Certificate holder and (iii) received from Member investors but not yet applied to their accounts on the platform and transferred to segregated bank accounts that hold investors’ funds.

Member Loans

Beginning October 13, 2008, we have elected the fair value option for Member Loan investments that were financed by Notes and also for the related Notes. Since March 2011, we have also elected the fair value option for all Member Loan investments financed by Certificates and the related Certificates. Under this election, origination fees and all costs incurred in the origination process are recognized in earnings as earned or incurred. Member Loans accounted for under the fair value option are initially measured at fair value. Gains and losses from initial measurement and subsequent changes in fair value are recognized in earnings. Interest income on Member Loans is calculated based on the interest rate of the Member Loan and recorded as interest income.

The fair value election for Member Loans, Notes and Certificates allows symmetrical accounting for the timing and amounts recognized for both expected unrealized losses and charge-offs on the Member Loans and the related Notes and Certificates, consistent with the member payment dependent design of the Notes and Certificates.

Member Loans Sold to Unrelated Third Party Purchasers

From January 1, 2013 through June 30, 2013, origination fees and direct Member Loan origination/acquisition costs for loans that were subsequently sold to unrelated third party purchasers and met the accounting requirements for a sale of loans were deferred and included in the overall net investment in the loans purchased. Accordingly, the origination fees for such loans were not included in origination fee revenue and the direct loan origination costs for such loans were not included in operating expenses. A gain or loss on the sale of loans was recorded on the sale date. As part of the sale agreement, we retained the rights to service these sold loans and calculated a gain or loss on the sale of loans sold with servicing retained based on the net proceeds from the sale of loans, after allocation of proceeds from/(toward) the recording of any net servicing asset/(liability), minus the net investment in the loans being sold. Gains on loans sold were previously reported in “Gain on Sale of Member Loans” and have been reclassified to “Other revenue” in the Condensed Consolidated Statement of Operations.

6

Effective July 1, 2013, we elected the fair value option for loans that are sold to unrelated third party purchasers. Under this election, all origination fees and all direct costs incurred in the origination process are recognized in earnings as earned or incurred and are not deferred. Beginning July 1, 2013, origination fees for loans purchased and subsequently sold to unrelated third party purchasers are included in “Origination Fees” and direct loan origination costs are included in “Origination and Servicing” operating expense on the Condensed Consolidated Statement of Operations. Loans sold to unrelated third party purchasers that are accounted for under the fair value option are initially measured at fair value. Gains and losses from initial measurement at fair value are recognized in earnings.

For loans sold to unrelated third party purchasers with servicing retained, we estimate the fair value of the loan servicing asset or liability considering the contractual servicing fee revenue, adequate compensation for our servicing obligation, the current principal balances of the loans and projected servicing revenues given projected defaults and prepayments (if significant) over the remaining lives of the loans. We initially record servicing assets and liabilities at fair value. Subsequently, servicing assets and liabilities are carried at fair value and changes in fair value are reported in non-interest income in the period in which the change occurs.

Additionally, we will record a liability for significant estimated post-sale obligations or contingent obligations to the purchaser of the loans, if any, such as delinquent/fraudulent loan repurchase obligations or excess loss indemnification obligations.

Member Loans at Fair Value and Notes and Certificates at Fair Value

We use fair value measurements to record Member Loans and Notes and Certificates at fair value on a recurring basis and in our fair value disclosures. The aggregate fair values of the Member Loans and underlying Notes and Certificates are reported as separate line items in the assets and liabilities sections of our condensed consolidated balance sheets using the methods and disclosures related to fair value accounting that are described in ASC 820,Fair Value Measurements and Disclosures, which provides a framework for measuring the fair value of assets and liabilities.

Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. Changes in the fair value of the Member Loans and Notes and Certificates are recognized, on a gross basis, in earnings.

We determine the fair value of the Member Loans and Notes and Certificates in accordance with the fair value hierarchy that requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs, which generally requires significant management judgment. ASC 820 establishes the following hierarchy for categorizing these inputs:

| | |

| Level 1 – | | Quoted market prices in active markets for identical assets or liabilities. |

| |

| Level 2 – | | Significant other observable inputs (e.g., quoted prices for similar items in active markets, quoted prices for identical or similar items in markets that are not active, inputs other than quoted prices that are observable such as interest rate and yield curves, and market-corroborated inputs). |

| |

| Level 3 – | | Valuation generated from model-based techniques that use inputs that are significant and unobservable in the market. These unobservable assumptions reflect estimates of inputs that market participants would use in pricing the asset or liability. Valuation techniques include use of option pricing models, discounted cash flow methodologies or similar techniques, which incorporate management’s own estimate of assumptions that market participants would use in pricing the instrument or valuations that require significant management judgment or estimation. |

Since observable market prices and inputs are not available for similar assets and liabilities, the Member Loans and Notes and Certificates are considered Level 3 financial instruments. We estimated the fair values of Member Loans and their related Notes and Certificates using a discounted cash flow valuation methodology. The estimated fair value of Member Loans is computed by projecting the future contractual cash flows to be received on the loans, adjusting those cash flows for our expectations of prepayments (if significant), defaults and losses over the life of the loans and recoveries, if any. We then discount those projected net cash flows to a present value, which is the estimated fair value. Our expectation of future defaults and losses on loans is based on analyses of actual defaults and losses that occurred on the various credit grades of Member Loans over the past several years. Expected recoveries reflect actual historical recovery experience for the various types of defaulted loans, the contractual arrangements with collection agencies and actual proceeds received on sales of defaulted loans. The discount rates for the projected net cash flows of the Member Loans are our estimates of the rates of return that investors in unsecured consumer credit obligations would require when investing in the various credit grades of Member Loans.

LendingClub’s and the Trust’s obligation to pay principal and interest on any Note or Certificate is equal to the pro-rata portion of the payments, if any, received on the related Member Loan subject to applicable fees. The gross effective interest rate associated

7

with Notes or Certificates is the same as the interest rate earned on the underlying Member Loans. At September 30, 2013, the discounted cash flow methodology used to estimate the Notes’ and Certificates’ fair values uses the same projected net cash flows as their related Member Loans. The discount rates for the projected net cash flows of the Notes and Certificates are our estimates of the rates of return, including risk premiums (if significant) that investors in unsecured consumer credit obligations would require when investing in Notes issued by LendingClub and Certificates issued by the Trust with cash flows dependent on specific credit grades of Member Loans.

For additional discussion on this topic, including the adjustments to the estimated fair values of Loans and Notes and Certificates, as discussed above, seeNote 4 – Member Loans at Fair Value and Notes and Certificates at Fair Value.

Accrued Interest Receivable

Interest income on Member Loans is calculated based on the interest rate of the loan and recorded as interest income as earned. Member Loans reaching 120 days delinquent are classified as non-accrual loans, and we stop accruing interest and reverse all accrued but unpaid interest as of such date.

Property, Equipment and Software

Property, equipment and software consists of computer equipment and software, office furniture and equipment, construction in progress, leasehold improvements and internal use software and website development costs are recorded at cost, less accumulated depreciation and amortization.

| | • | | For computer equipment and software and office furniture and equipment: Depreciation and amortization is straight-lined over the estimated useful life of each asset class, which generally ranges from two to five years. |

| | • | | For construction in progress: When the project is complete, costs associated with the project are transferred to the leasehold improvement account or software account and amortized accordingly. |

| | • | | For leasehold improvements: Costs are amortized over the terms of the lease or the estimated useful life, whichever is shorter. |

| | • | | For internal use software and website development costs: Development costs are capitalized when preliminary development efforts are successfully completed and it is probable that the project will be completed and the software will be used as intended. Internal use software and website development costs are amortized on a straight line basis over the project’s estimated useful life, generally three years. |

Capitalized internal use software development costs consist of salaries and payroll related costs for employees and fees paid to third-party consultants who are directly involved in development efforts. Costs related to preliminary project activities and post implementation activities including training and maintenance are expensed as incurred. Costs incurred for upgrades and enhancements that are considered to be probable to result in additional functionality are capitalized.

Long-lived Assets

In accordance with ASC 360,Property, Plant, and Equipment, we evaluate potential impairments of our long-lived assets whenever events or changes in circumstances indicate that the carrying amount of the assets may not be recoverable. Events or changes in circumstances that could result in impairment include, but are not limited to, underperformance relative to historical or projected future operating results, significant changes in the manner of use of the acquired assets or the strategy for the Company’s overall business and significant negative industry or economic trends. Determination of recoverability of long-lived assets is based on an estimate of undiscounted future cash flows resulting from the use of the asset and its eventual disposition. Measurement of an impairment loss for long-lived assets that management expects to hold and use is based on the fair value of the asset. When an impairment loss is recognized, the carrying amount of the asset is reduced to its estimated fair value. For the nine months ended September 30, 2013 and 2012, there was no impairment of long-lived assets.

Payable to Member Investors

Payable to member investors primarily represents payments-in-process received from member investors that, as of the last day of the period, have not been credited to their accounts on the platform and transferred to the separate bank account that holds investors’ uninvested funds in trust for them.

8

Revenue Recognition

We recognize revenue in accordance with ASC 605,Revenue Recognition.Revenues primarily result from fees earned. Fees include loan origination fees (paid by borrower members), servicing fees (paid by investor members and certain Certificate holders) and management fees (paid by certain Certificate holders).

Origination Fees

The loan origination fee charged to each borrower member is determined by the term and credit grade of that borrower’s Member Loan and, as of September 30, 2013 and September 30, 2012, ranged from 1.11% to 5.00% of the aggregate Member Loan amount. The Member Loan origination fees are included in the annual percentage rate calculation provided to the borrower member and is subtracted from the gross loan proceeds prior to disbursement of the loan funds to the borrower member. A Member Loan is considered issued when we record the transfer of funds to the borrower member’s account on our platform and we initiate an ACH transaction to transfer funds from our platform’s correspondent bank account to the borrower member’s bank account.

Because of the election to account for Member Loans at fair value, origination fees on Member Loans are recognized upon origination of the loan as a component of non-interest revenue.

Servicing Fees

We record servicing fees paid by Note and certain Certificate holders, which are based on the payments serviced on the related Member Loans, as a component of non-interest revenue when received. Servicing fees can be, and have been, modified or waived at management’s discretion.

Management Fees

LCA acts as the general partner for certain private funds (the “Funds”) in which it has made no capital contributions and does not receive any allocation of the Funds’ income, expenses, gains, losses or any carried interest. Each Fund invests in a Certificate pursuant to a set investment strategy. LCA charges limited partners in the Funds a management fee, payable monthly in arrears, based on a limited partner’s capital account balance at month end.

LCA also earns management fees on separately managed accounts (“SMA”), payable monthly in arrears, based on the month-end balances in the SMA accounts.

Management fees are a component of non-interest revenue in the condensed consolidated statements of operations and are recorded as earned. Management fees can be, and have been, modified or waived at the discretion of LCA.

Sales, Marketing and Advertising Expense

Sales, marketing and advertising costs, including borrower and investor acquisition costs, are expensed as incurred and included in “Sales and marketing” on the condensed consolidated statement of operations.

Fair Valuation Adjustments of Member Loans at Fair Value and Notes and Certificates at Fair Value

We include in earnings the estimated unrealized fair value gains or losses during the period of Member Loans, and the offsetting estimated unrealized fair value losses or gains on related Notes and Certificates. As discussed earlier inNote 2, at September 30, 2013, we estimated the fair values of Member Loans and related Notes and Certificates using a discounted cash flow valuation methodology. At each reporting period, we recognize fair valuation adjustments for the Member Loans and the related Notes and Certificates. The fair valuation adjustment for a given principal amount of a Member Loan will be approximately equal to the corresponding estimated fair valuation adjustment on the combined principal amounts of related Notes and Certificates because the same net cash flows of the Member Loan and the related Notes and/or Certificates are used in the discounted cash flow valuation methodology.

Concentrations of Credit Risk

Financial instruments that potentially subject us to significant concentrations of credit risk consist principally of cash and cash equivalents, restricted cash, Member Loans financed directly by LendingClub and the related accrued interest receivable, and deposits with service providers. We hold our cash and cash equivalents and restricted cash in accounts at regulated domestic financial institutions. We are exposed to credit risk in the event of default by these institutions to the extent the amount recorded on the balance sheet exceeds the FDIC insured amounts. As of September 30, 2013, the Company has net credit risk exposure on $0.4 million of fair value of Member Loans held that were financed directly by LendingClub. At September 30, 2012, we had net credit risk exposure on $0.5 million of fair value of Member Loans held that were financed directly by LendingClub.

9

Stock-based Compensation

All stock-based awards made to employees are recognized in the condensed consolidated financial statements based on their respective grant date fair values. Any benefits of tax deductions in excess of recognized compensation cost are reported as a financing cash inflow and cash outflow from operating activities. The stock-based compensation related to awards that are expected to vest is amortized using the straight-line method over the vesting term of the stock-based award, which is generally four years.

The fair value of share-option awards is estimated on the date of grant using the Black-Scholes option pricing model. The Black-Scholes option pricing model considers, among other factors, the expected term of the option award, expected volatility of our stock price and expected future dividends, if any.

Forfeitures of awards are estimated at the time of grant and revised, as necessary, in subsequent periods if actual forfeitures differ from initial estimates or if future forfeitures are expected to differ from recent actual or previously expected forfeitures. Stock-based compensation expense is recorded net of estimated forfeitures, such that expense is recorded only for those stock-based awards that are expected to vest.

Stock-based awards issued to non-employees are accounted for in accordance with provisions of ASC 718-505-50,Equity-Based Payments to Non-Employees, which requires that equity awards be recorded at their fair value. We use the Black-Scholes option pricing model to estimate the value of options granted to non-employees at each vesting date to determine the appropriate charge to stock-based compensation. The assumed volatility of the price of our common stock was based on comparative public-company stock price volatility.

Reclassifications

During the third quarter of 2013, we changed the definitions used to classify operating expenses. Operating expenses were formerly classified as Sales, marketing and customer service, Engineering, and General and administrative. Our new categories of operating expenses are Sales and marketing, Origination and servicing, and General and administrative. As a result of the new classification, loan origination and servicing costs which were previously included in Sales, marketing and customer service are now included as a separate financial statement line and engineering costs which represent technology related expenses are categorized within General and administrative expenses. The changes had no impact to the total operating expenses or net income. Prior period amounts have been reclassified to conform to the current presentation.

Impact of New Accounting Standards

We do not expect recently issued accounting pronouncements to have any impact on our results of operations, financial position, or cash flow for the three and nine months ended September 30, 2013.

3. Net Income/(Loss) Attributable to Common Stockholders

We present basic earnings (loss) per share (“EPS”) in accordance with ASC 260. Under ASC 260, basic EPS is the amount of earnings available to each share of common stock outstanding during the reporting period. Diluted EPS is the amount of earnings available to each share of common stock outstanding during the reporting period adjusted to include the effect of potentially dilutive common shares. Potentially dilutive common shares include incremental shares issued for stock options, convertible preferred stock and warrants. Potentially dilutive common shares are excluded from the computation of dilutive EPS in periods in which the effect would be antidilutive.

We calculate EPS using the two-class method. The two-class method allocates earnings that otherwise would have been available to common shareholders to holders of participating securities. We consider all series of our convertible preferred stock to be participating securities due to their non-cumulative dividend rights. As such, earnings allocated to these participating securities, which include participation rights in undistributed earnings (seeNote 7 – Preferred Stock), are subtracted from net income to determine total undistributed earnings to be allocated to common stockholders. All participating securities are excluded from basic weighted-average common shares outstanding.

10

The following is a reconciliation of basic EPS to diluted EPS for the three and nine months ended September 30, 2013 and 2012 respectively:

| | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| ($ in thousands, except EPS) | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

Net income/(loss) | | $ | 2,713 | | | $ | (882 | ) | | $ | 4,450 | | | $ | (6,030 | ) |

Less: Earnings allocated to participating securities (1) | | $ | 2,713 | | | $ | — | | | $ | 4,450 | | | $ | — | |

Net income/(loss) available to common shareholders after required adjustments for the calculation of basic and diluted earnings per common share | | $ | — | | | $ | (882 | ) | | $ | — | | | $ | (6,030 | ) |

| | | | | | | | | | | | | | | | |

Basic weighted average common shares outstanding | | | 13,328,103 | | | | 10,300,351 | | | | 12,614,487 | | | | 9,739,922 | |

Weighted average effect of dilutive securities: | | | | | | | | | | | | | | | | |

Preferred Stock | | | 60,026,463 | | | | — | | | | 59,941,389 | | | | — | |

Stock Options | | | 6,482,703 | | | | — | | | | 6,792,704 | | | | — | |

Warrants | | | 509,163 | | | | — | | | | 811,956 | | | | — | |

| | | | | | | | | | | | | | | | |

Diluted weighted average common shares outstanding | | | 80,346,432 | | | | 10,300,351 | | | | 80,160,536 | | | | 9,739,922 | |

Earnings per common share | | | | | | | | | | | | | | | | |

Basic | | $ | — | | | $ | (0.09 | ) | | $ | — | | | $ | (0.62 | ) |

Diluted | | $ | — | | | $ | (0.09 | ) | | $ | — | | | $ | (0.62 | ) |

| (1) | In a period with net income, both earnings and dividends (if any) are allocated to participating securities. In a period with a net loss, only dividends (if any) are allocated to participating securities. |

The following table summarizes the equity shares excluded from the dilutive EPS calculation as they were deemed to be antidilutive for the three and nine months ended September 30, 2013 and 2012 respectively:

| | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

Excluded Securities: | | | | | | | | | | | | | | | | |

Stock Options | | | 1,148,679 | | | | 8,566,158 | | | | 600,451 | | | | 8,353,549 | |

Convertible Preferred Stock | | | — | | | | 58,905,918 | | | | — | | | | 58,905,918 | |

Warrants | | | — | | | | 1,519,717 | | | | — | | | | 1,519,717 | |

| | | | | | | | | | | | | | | | |

Total | | | 1,148,679 | | | | 68,991,793 | | | | 600,451 | | | | 68,779,184 | |

| | | | | | | | | | | | | | | | |

4. Member Loans at Fair Value and Notes and Certificates at Fair Value

At September 30, 2013 and December 31, 2012, Member Loans and Notes and Certificates measured at fair value on a recurring basis (in thousands) were:

| | | | | | | | | | | | | | | | |

| | | Member Loans at fair value | | | Notes and Certificates at fair value | |

| | | September 30, 2013 | | | December 31, 2012 | | | September 30, 2013 | | | December 31, 2012 | |

Aggregate principal balance outstanding | | $ | 1,534,340 | | | $ | 791,774 | | | $ | 1,540,631 | | | $ | 795,842 | |

Fair valuation adjustments | | | (17,664 | ) | | | (10,559 | ) | | | (17,656 | ) | | | (10,526 | ) |

| | | | | | | | | | | | | | | | |

Fair Value | | $ | 1,516,676 | | | $ | 781,215 | | | $ | 1,522,975 | | | $ | 785,316 | |

| | | | | | | | | | | | | | | | |

11

We determined the fair values of Member Loans and Notes and Certificates using inputs and methods that are categorized in the fair value hierarchy of ASC 820, as follows (in thousands):

| | | | | | | | | | | | | | | | |

| | | Level 1 Inputs | | | Level 2 Inputs | | | Level 3 Inputs | | | Fair Value | |

September 30, 2013 | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | |

Member Loans at fair value | | $ | — | | | $ | — | | | $ | 1,516,676 | | | $ | 1,516,676 | |

Liabilities | | | | | | | | | | | | | | | | |

Notes and Certificates at fair value | | $ | — | | | $ | — | | | $ | 1,522,975 | | | $ | 1,522,975 | |

December 31, 2012 | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | |

Member Loans at fair value | | $ | — | | | $ | — | | | $ | 781,215 | | | $ | 781,215 | |

Liabilities | | | | | | | | | | | | | | | | |

Notes and Certificates at fair value | | $ | — | | | $ | — | | | $ | 785,316 | | | $ | 785,316 | |

Instruments are categorized in the Level 3 valuation hierarchy based on the significance of unobservable factors in the overall fair value measurement. Our fair value approach for Level 3 instruments primarily uses unobservable inputs, but may also include observable, actively quoted components derived from external sources. As a result, the realized and unrealized gains and losses for assets and liabilities within the Level 3 category presented in the tables below may include changes in fair value that were attributable to both observable and unobservable inputs.

The following table presents additional information about Level 3 assets and liabilities measured at fair value on a recurring basis for the nine months ended September 30, 2013 (in thousands):

| | | | | | | | |

| | | Member Loans | | | Notes and Certificates | |

Fair value at December 31, 2012 | | $ | 781,215 | | | $ | 785,316 | |

Issuances | | | 1,366,207 | | | | 1,115,694 | |

Principal repayments | | | (341,256 | ) | | | (339,048 | ) |

Loans sold to third parties | | | (250,433 | ) | | | — | |

Recoveries from sale and collection of charged-off loans | | | (1,180 | ) | | | (1,139 | ) |

| | | | | | | | |

Carrying value before fair value adjustments | | | 1,554,553 | | | | 1,560,823 | |

Fair valuation adjustments, included in earnings | | | (37,877 | ) | | | (37,848 | ) |

| | | | | | | | |

Fair value at September 30, 2013 | | $ | 1,516,676 | | | $ | 1,522,975 | |

| | | | | | | | |

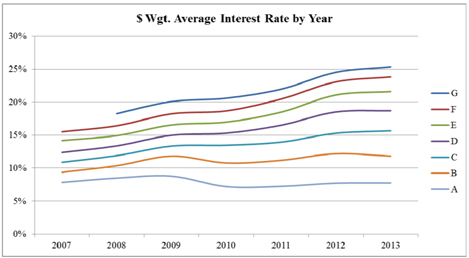

At September 30, 2013, Member Loans underlying Notes and Certificates have original terms of 36 months or 60 months and are paid monthly with fixed interest rates ranging from 6.03% to 26.06% and various maturity dates through September 2018.

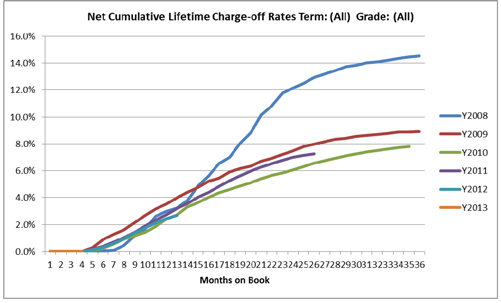

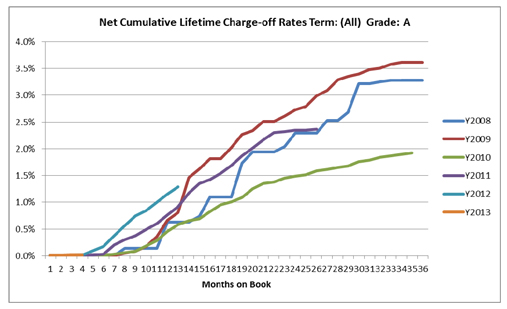

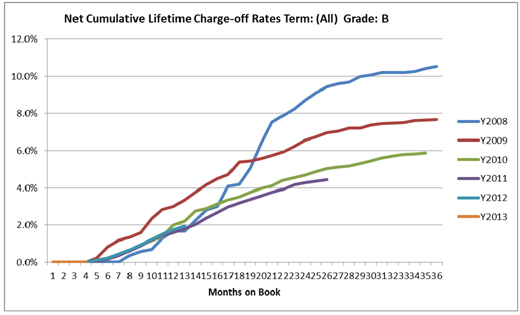

As discussed previously inNote 2 – Summary of Significant Accounting Policies, fair values for Member Loans and the related Notes and Certificates are determined using a discounted cash flow model utilizing estimates for credit losses, prepayments, changes in the interest rate environment, and other factors. For Notes and Certificates, we also consider risk factors such as the Company’s continued profitability, ability to operate on a cash-flow positive basis and liquidity position. The majority of fair valuation adjustments included in earnings is attributable to changes in estimated instrument-specific future credit losses. All fair valuation adjustments were related to Level 3 instruments for the nine months ended September 30, 2013. A specific loan that is projected to have higher future default losses than previously estimated has lower expected future cash flows over its remaining life, which reduces its estimated fair value. Conversely, a specific loan that is projected to have lower future default losses than previously estimated has increased expected future cash flows over its remaining life, which increases its fair value. Because the payments to holders of Notes and Certificates directly reflect the payments received on Member Loans, a reduction or increase of the expected future payments on Member Loans will decrease or increase the estimated fair values of the related Notes and Certificates. Expected losses and actual loan charge-offs on Member Loans are offset to the extent that the loans are financed by Notes and Certificates that absorb the related loan losses.

Fair value adjustment gains/(losses) for Member Loans were $(15.6 million) and $(7.2 million) for the three months ended September 30, 2013 and 2012, respectively, and $(37.9 million) and $(15.6 million) for the nine months ended September 30, 2013 and 2012, respectively. The fair value adjustments for Member Loans were largely offset by the fair value adjustments of the Notes and Certificates due to the member payment dependent design of the Notes and Certificates and because the principal balances of the Member Loans were very close to the combined principal balances of the Notes and Certificates. Accordingly, the net fair value adjustment gains/(losses) for Member Loans, Notes and Certificates were $(0.006 million) and $(0.141 million) for the three months ended September 30, 2013 and 2012, respectively, and $(0.029 million) and $(0.229 million) for the nine months ended September 30, 2013 and 2012, respectively.

12

At September 30, 2013, we had 1,097 Member Loans that were 90 days or more past due including non-accrual loans and loans where the borrower has filed for bankruptcy or is deceased, which had a total outstanding principal balance of $12.3 million, aggregate adverse fair value adjustments totaling $10.9 million and an aggregate fair value of $1.4 million. At December 31, 2012, we had 576 Member Loans that were 90 days or more past due including non-accrual loans and loans where the borrower has filed for bankruptcy or is deceased, which had a total outstanding principal balance of $6.4 million, aggregate adverse fair value adjustments totaling $5.7 million and an aggregate fair value of $0.7 million.

Significant Unobservable Inputs

The following table presents quantitative information about the significant unobservable inputs used for certain of our Level 3 fair value measurements at September 30, 2013 (in thousands):

| | | | | | | | | | | | | | | | |

| | | | | | | | | | Range of Inputs | |

| | | Fair Value | | | Valuation Techniques | | Unobservable Input | | Minimum | | | Maximum | |

Member Loans | | $ | 1,516,676 | | | Discounted cash flow | | Discount rate | | | 5.5 | % | | | 13.2 | % |

| | | | | | | | Net cumulative expected loss | | | 2.1 | % | | | 29.3 | % |

Notes & Certificates | | $ | 1,522,975 | | | Discounted cash flow | | Discount rate | | | 5.5 | % | | | 13.2 | % |

| | | | | | | | Net cumulative expected loss | | | 2.1 | % | | | 29.3 | % |

The valuation technique used for our Level 3 assets and liabilities, as presented in the previous table, is described as follows:

Discounted cash flow – Discounted cash flow valuation techniques generally consist of developing an estimate of future cash flows that are expected to occur over the life of a financial instrument and then discounting those cash flows at a rate of return that results in the fair value amount.

Significant unobservable inputs presented in the previous table are those we consider significant to the estimated fair values of the Level 3 assets and liabilities. We consider unobservable inputs to be significant, if by their exclusion, the estimated fair value of the Level 3 asset or liability would be impacted by a significant percentage change, or based on qualitative factors such as the nature of the instrument and significance of the unobservable inputs relative to other inputs used within the valuation. Following is a description of the significant unobservable inputs provided in the table.

Discount rate – Discount rate is a rate of return used to discount future expected cash flows to arrive at a present value, the fair value, of a financial instrument. The discount rates for the projected net cash flows of Member Loans are our estimates of the rates of return that investors in unsecured consumer credit obligations would require when investing in the various credit grades of Member Loans. The discount rates for the projected net cash flows of the Notes and Certificates are our estimates of the rates of return that investors in unsecured consumer credit obligations would require when investing in Notes issued by LendingClub and Certificates issued by the Trust with cash flows dependent on specific grades of Member Loans. Discount rates for existing Member Loans, Notes and Certificates are adjusted to reflect the time value of money. A risk premium component is implicitly included in the discount rates to reflect the amount of compensation market participants require due to the uncertainty inherent in the instruments’ cash flows resulting from risks such as credit and liquidity.

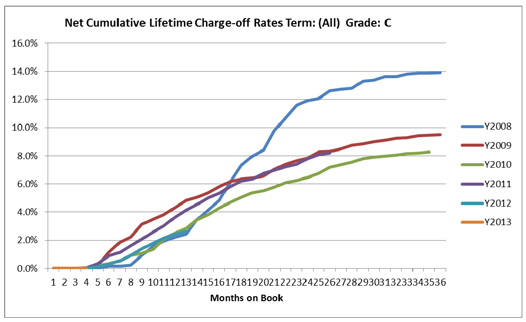

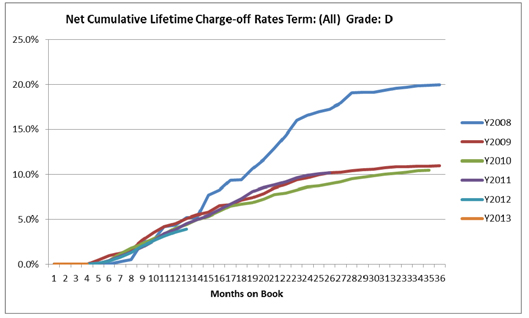

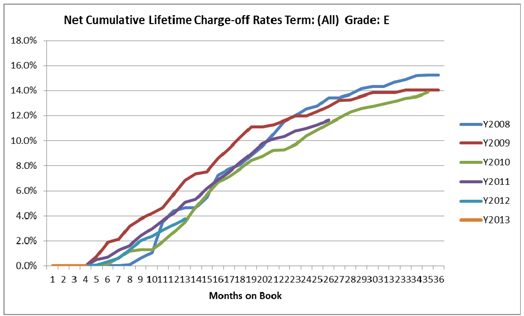

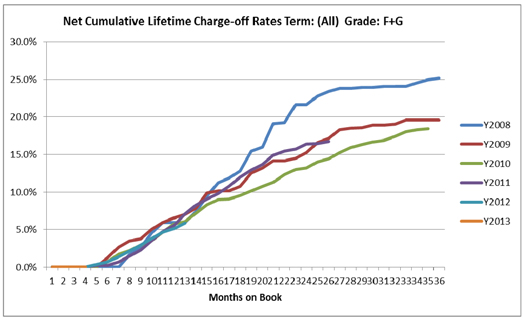

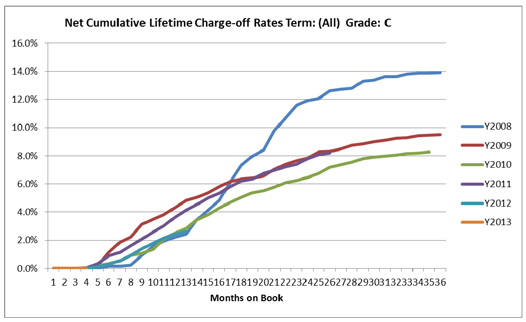

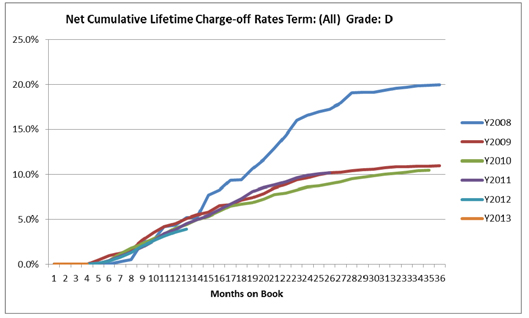

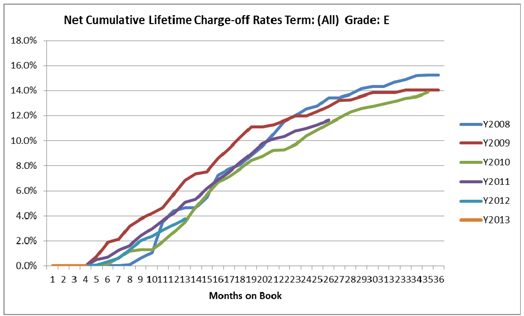

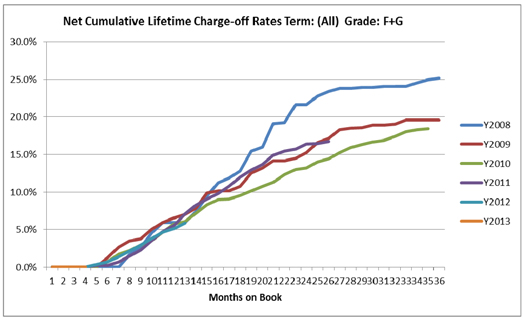

Net cumulative expected loss – Net cumulative expected loss is an estimate of the net cumulative principal payments that will not be repaid over the entire life of a new Member Loan, Note or Certificate, expressed as a percentage of the original principal amount of the Member Loan, Note or Certificate. The estimated net cumulative loss is the sum of the net losses estimated to occur each month of the life of a new Member Loan, Note or Certificate. Therefore, the total net losses estimated to occur over the remaining maturity of existing Member Loans, Notes and Certificates are less than the estimated net cumulative losses of comparable new Member Loans, Notes and Certificates. A given month’s estimated net losses are a function of two variables:

| | (i) | estimated default rate, which is an estimate of the probability of not collecting the remaining contractual principal amounts owed and, |

| | (ii) | estimated net loss severity, which is the percentage of contractual principal cash flows lost in the event of a default, net of the average net recovery, expected to be received on a defaulted Loan, Note or Certificate. |

Significant Recurring Level 3 Fair Value Asset and Liability Input Sensitivity

The discounted cash flow technique that we use to determine the fair value of our Level 3 Member Loans, Notes and Certificates at fair value requires determination of relevant inputs and assumptions, some of which represent significant unobservable inputs as indicated in the preceding table. Accordingly, changes in these unobservable inputs may have a significant impact on fair

13

value. Certain of these unobservable inputs will (in isolation) have a directionally consistent impact on the fair value of the instrument for a given change in that input. Alternatively, the fair value of the instrument may move in an opposite direction for a given change in another input. For example, increases in the discount rate and estimated net cumulative loss rates will reduce the estimated fair value of Member Loans, Notes and Certificates. When multiple inputs are used within the valuation technique of a Loan, Note or Certificate at fair value, a change in one input in a certain direction may be offset by an opposite change in another input.

5. Deposits

We had deposits of $0.3 and $0.7 million as of September 30, 2013 and December 31, 2012, respectively. The majority of this balance at September 30, 2013, was comprised of deposits related to operating leases (seeNote 12 – Commitments and Contingencies). The decrease in the deposit balance from December 2012 is due to the return of a significant portion of a deposit placed with a payment service provider that processed investor payment transactions. As of June 30, 2013, we are no longer utilizing the services of this provider and expect to have our full deposit returned to us pursuant to the terms of our agreement. As of September 30, 2013, the remaining deposit balance related to this vendor was $0.014 million.

6. Related Party Transactions

Several of our executive officers and directors (including immediate family members) have opened investor member accounts with LendingClub, made deposits and withdrawals to their accounts and funded portions of Member Loans via purchases of Notes and Certificates. All Note and Certificate purchases made by related parties were conducted on terms and conditions that were not more favorable than those obtained by other investors.

The following table summarizes deposits and withdrawals made by related parties for the nine months ended September 30, 2013 and ending account balances as of September 30, 2013 and December 31, 2012 (in thousands).

| | | | | | | | | | | | | | | | |

| | | For the nine months ended

September 30, 2013 | | | As of September 30,

2013 | | | As of December 31,

2012 | |

Related Party | | Deposits | | | Withdrawals | | | Account Balance | | | Account Balance | |

Executive Officers | | $ | — | | | $ | 20 | | | $ | 38 | | | $ | 39 | |

Directors | | | 1,868 | | | | 297 | | | | 5,042 | | | | 3,105 | |

| | | | | | | | | | | | | | | | |

| | $ | 1,868 | | | $ | 317 | | | $ | 5,080 | | | $ | 3,144 | |

| | | | | | | | | | | | | | | | |

14

7. Preferred Stock

Convertible Preferred Stock (in thousands, except share amounts)

Preferred stock is issuable in series, and the Board of Directors is authorized to determine the rights, preferences and terms of each series. The following table provides details regarding each Series of preferred stock authorized by the Board of Directors.

| | | | | | | | |

| | | September 30,

2013 | | | December 31,

2012 | |

Preferred stock, $0.01 par value; 61,617,516 total shares authorized at September 30, 2013 and December 31, 2012: | | | | | | | | |

Series A convertible preferred stock, 17,006,275 shares designated at September 30, 2013 and December 31, 2012; 16,501,612 and 16,317,747 shares issued and outstanding at September 30, 2013 and December 31, 2012; aggregate liquidation preference of $17,574 and $17,371 at September 30, 2013 and December 31, 2012. | | $ | 17,376 | | | $ | 17,181 | |

Series B convertible preferred stock, 16,410,526 shares designated at September 30, 2013 and December 31, 2012; 16,394,325 and 16,394,324 shares issued and outstanding at September 30, 2013 and December 31, 2012 ; aggregate liquidation preference of $12,280 and $12,167 at September 30, 2013 and December 31, 2012. | | | 12,165 | | | | 12,164 | |

Series C convertible preferred stock, 15,621,609 shares designated at September 30, 2013 and December 31, 2012; 15,621,609 shares issued and outstanding at September 30, 2013 and December 31, 2012, aggregate liquidation preference of $24,490 at September 30, 2013 and December 31, 2012. | | | 24,388 | | | | 24,388 | |

Series D convertible preferred stock, 9,007,678 shares designated at September 30, 2013 and December 31, 2012; 9,007,678 shares issued and outstanding at September 30, 2013 and December 31, 2012; aggregate liquidation preference of $32,044 at September 30, 2013 and December 31, 2012. | | | 31,943 | | | | 31,943 | |

Series E convertible preferred stock, 3,571,428 shares designated at September 30, 2013 and December 31, 2012; 2,500,000 shares issued and outstanding at September 30, 2013 and December 31, 2012; aggregate liquidation preference of $17,500 at September 30, 2013 and December 31, 2012. | | | 17,347 | | | | 17,347 | |

| | | | | | | | |

| | $ | 103,219 | | | $ | 103,023 | |

| | | | | | | | |

The outstanding shares of convertible preferred stock are not mandatorily redeemable. The sale of all, or substantially all, of the Company’s assets, a consolidation or merger with another company, or a transfer of voting control in excess of fifty percent (50%) of the Company’s voting power are all events which are deemed to be a liquidation and would trigger the payment of liquidation preferences under the preferred stock agreements. All such events require approval of the Board. Therefore, based on the guidance of SEC Accounting Series Release No. 268, “Presentation in Financial Statements of Redeemable Preferred Stocks,” the contingently redeemable convertible preferred stock has been classified outside of the stockholders’ equity section as certain of these factors are outside the control of the Company. The significant terms of outstanding Series A, Series B, Series C, Series D and Series E convertible preferred stock are as follows:

Conversion – Each share of convertible preferred stock is convertible, at the option of the holder, initially, into one share of common stock (subject to adjustments for events of dilution). Each share of convertible preferred stock will automatically be converted upon the earlier of: (i) the closing of an underwritten public offering of our common stock with aggregate gross proceeds that are at least $30.0 million; or (ii) the consent of the holders of a 55% majority of outstanding shares of convertible preferred stock, voting together as a single class, on an as-converted to common stock basis. The Company’s preferred stock agreements contain certain anti-dilution provisions, whereby if the Company issues additional shares of capital stock for an effective price lower than the conversion price for a series of preferred stock immediately prior to such issue, then the existing conversion price of such series of preferred stock will be reduced. The Company determined that while its convertible preferred stock contains certain anti-dilution features, the conversion feature embedded within its convertible preferred stock does not require bifurcation under the guidance of ASC 815,Derivatives and Hedging Activities.

Liquidation preference – Upon any liquidation, winding up or dissolution of us, whether voluntary or involuntary (a “Liquidation Event”), before any distribution or payment shall be made to the holders of any common stock, the holders of convertible preferred stock shall, on a pari passu basis, be entitled to receive by reason of their ownership of such stock, an amount per share of Series A convertible preferred stock equal to $1.065 (as adjusted for stock splits, recapitalizations and the like) plus all declared and unpaid dividends (the “Series A Preferred Liquidation Preference”), an amount per share of Series B convertible preferred stock equal to $0.7483 (as adjusted for stock splits, recapitalizations and the like) plus all declared and unpaid dividends (the “Series B Preferred Liquidation Preference”), an amount per share of Series C convertible preferred stock equal to $1.5677 (as adjusted for stock splits, recapitalizations and the like), an amount per share of Series D convertible preferred stock equal to $3.557 and an amount per share of Series E convertible preferred stock equal to $7.00 (as adjusted for stock splits, recapitalizations and the like). However, if upon any such Liquidation Event, our assets shall be insufficient to make payment in full to all holders of convertible preferred stock of their respective liquidation preferences, then the entire assets of ours legally available for distribution shall be distributed with equal priority between the preferred holders based upon the amounts such series was to receive. Any excess assets, after payment in full of the liquidation preferences to the convertible preferred stockholders, are then allocated to the holders of common and preferred stockholders, pro-rata, on an as-if-converted to common stock basis.

15

Dividends – If and when declared by the Board, the holders of Series A, Series B, Series C, Series D and Series E convertible preferred stock, on a pari passu basis, will be entitled to receive non-cumulative dividends at a rate of 6% per annum in preference to any dividends on common stock (subject to adjustment for certain events). The holders of Series A, Series B, Series C, Series D and Series E convertible preferred stock are also entitled to receive with common stockholders, on an as-if-converted basis, any additional dividends issued by us. As of September 30, 2013, we have not declared any dividends.

Voting rights – Generally, preferred stockholders have one vote for each share of common stock that would be issuable upon conversion of preferred stock. Voting as a separate class, and on an as-if-converted to common stock basis, the Series A convertible preferred stockholders are entitled to elect two members of the Board, the holders of Series B convertible preferred stockholders are entitled to elect one member of the Board. The Series C and Series D convertible preferred stockholders are not entitled to elect a member of the Board. The Series E convertible preferred stockholders are entitled to nominate members to the Board, this nominee is subject to the vote of all convertible preferred stockholders. The holders of common stock, voting as a separate class, are entitled to elect one member of the Board. The remaining directors are elected by the preferred stockholders and common stockholders voting together as a single class on an as-if-converted to common stock basis.

8. Common Stock and Stockholders’ Deficit

Common Stock

At September 30, 2013, we have shares of common stock authorized and reserved for future issuance as follows:

| | | | |

Options to purchase common stock | | | 9,488,881 | |

Options available for future issuance | | | 1,411,490 | |

Convertible preferred Series A stock warrants | | | 411,288 | |

Common stock warrants | | | 138,299 | |

| | | | |

Total common stock authorized and reserved for future issuance | | | 11,449,958 | |

| | | | |

During the nine months ended September 30, 2013, we issued 2,100,402 shares of common stock in exchange for proceeds of $1.5 million upon the exercise of stock options.

Convertible preferred Series A stock warrants are fully exercisable with an exercise price of $1.065 per share. The warrants may be exercised at any time on or before January 2018.

Common stock warrants are fully exercisable with exercise prices between $0.01 and $1.5677 per share. The warrants may be exercised at any time on or before February 2021.

Accumulated Deficit

We have incurred operating losses since our inception through December 31, 2012. For the three and nine months ended September 30, 2013, we had net income of approximately $2.7 million and $4.5 million, respectively. For the three and nine months ended September 30, 2012, we had net losses of $0.9 million and $6.0 million, respectively. We have an accumulated deficit of $53.2 million and a stockholders’ deficit of $41.4 million, at September 30, 2013.

9. Stock-Based Compensation

Under our 2007 Stock Incentive Plan, or the Option Plan, we may grant options to purchase shares of common stock to employees, executives, directors and consultants at exercise prices not less than the fair market value at date of grant for incentive stock options and not less than 85% of the fair market value at the date of grant for non-statutory options. During the second quarter, the Board of Directors increased the total number of options under the Option Plan by 1.8 million for a total of 15,859,948 options. The options granted through September 30, 2013 are stock options that generally expire ten years from the date of grant and generally vest 25% twelve months from the date of grant, and ratably over the next 12 quarters thereafter, provided the grantee remains continuously employed by the Company through each vesting date (“service-based options”); however, the Board of Directors retains the authority to grant options with different terms.

16

We did not grant any service-based options in the three months ended September 30, 2013. For the nine months ended September 30, 2013, we granted service-based stock options to purchase 1,566,750 shares of common stock with a weighted average exercise price of $5.81 per share, a weighted average grant date fair value of $8.95 per share and a total estimated fair value of approximately $21.9 million.

We used the Black-Scholes option pricing model to estimate the fair value of stock options granted with the following assumptions:

| | | | |

| | | Nine Months Ended

September 30, 2013 | |

Assumed forfeiture rate (annual %) | | | 5.0 | % |

Expected dividend yield | | | 0.0 | % |

Assumed stock price volatility | | | 63.5 | % |

Weighted average risk-free rate | | | 1.10 | % |

Expected life (years) | | | 6.25 | |

Options activity under the Option Plan for the nine month period ended September 30, 2013 is summarized as follows:

| | | | | | | | |

| | | Stock Options Issued

and

Outstanding | | | Weighted

Average

Exercise Price | |

Balances, at December 31, 2012 | | | 10,255,222 | | | $ | 1.19 | |

Options Granted | | | 1,566,750 | | | | 5.81 | |

Options Exercised | | | (2,100,402 | ) | | | 0.73 | |

Options Forfeited/Expired | | | (232,689 | ) | | | 2.03 | |

| | | | | | | | |

Balances, September 30, 2013 | | | 9,488,881 | | | $ | 2.03 | |

| | | | | | | | |

A summary of outstanding options, options vested and options vested and expected to vest as of September 30, 2013, is as follows:

| | | | | | | | | | | | |

| | | Stock Options Issued

and

Outstanding | | | Weighted Average

Remaining

Contractual Life

(Years) | | | Weighted

Average

Exercise Price | |

Options Outstanding | | | 9,488,881 | | | | 8.25 | | | $ | 2.03 | |

Options Vested | | | 3,125,677 | | | | 7.21 | | | $ | 0.76 | |

Options Vested and Expected to Vest | | | 9,089,708 | | | | 8.22 | | | $ | 1.98 | |

A summary by weighted average exercise price of outstanding options, options vested, and options vested and expected to vest at September 30, 2013, is as follows:

| | | | | | | | | | | | | | | | |

Exercise Price Range | | Stock Options

Outstanding | | | Weighted Average

Remaining Contractual

Life of Outstanding Stock

Options (Years) | | | Number of

Stock Options

Vested | | | Number of Stock

Options Vested and

Expected to Vest | |

$0.01 - $1.00 | | | 5,152,706 | | | | 7.40 | | | | 2,724,812 | | | | 5,049,203 | |

$1.01 - $5.00 | | | 3,187,925 | | | | 9.13 | | | | 388,654 | | | | 2,989,216 | |

$5.01 - $10.00 | | | 1,148,250 | | | | 9.62 | | | | 12,211 | | | | 1,051,289 | |

| | | | | | | | | | | | | | | | |

$0.01 - $10.00 | | | 9,488,881 | | | | 8.25 | | | | 3,125,677 | | | | 9,089,708 | |

| | | | | | | | | | | | | | | | |

17

We recognized $1.9 million and $0.3 million of stock-based compensation expense related to stock options for the three months ended September 30, 2013 and 2012, respectively. We recognized $3.3 million and $0.8 million of stock-based compensation expense related to stock options for the nine months ended September 30, 2013 and 2012, respectively. As of September 30, 2013, total unrecognized compensation cost was $15.9 million and these costs are expected to be recognized over the next 3.2 years.

No net income tax benefit has been recognized relating to stock-based compensation expense and no tax benefits have been realized from exercised stock options.

10. Income Taxes

We account for income taxes using the asset and liability method as codified in ASC 740. Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carryforwards. A valuation allowance is recorded to reduce deferred tax assets to the amount that is more likely than not to be realized. A full valuation allowance has been recorded against net deferred tax assets of $24.5 and $23.9 million at September 30, 2013 and December 31, 2012, respectively.

We recorded no net provision for income taxes for the nine month period ended September 30, 2013 because the minimum corporate income tax liabilities due on our taxable income will be offset by usage of prior years’ net operating loss and tax credit carryforwards. We recorded no net provision or benefit for income taxes in the three and nine month periods ended September 30, 2012 when we incurred taxable losses due to the full valuation allowance for deferred tax assets recorded in those periods then ended. Payments of minimum amounts due to state taxing authorities that are not related to the level of our taxable income or loss are recorded as operating expenses instead of income tax expense.

Our policy is to recognize interest and penalties accrued on any unrecognized tax benefits as a component of income tax expense. We did not have any material changes in unrecognized tax benefits and there were no interest expense or penalties on any unrecognized tax benefits during the three months ended September 30, 2013 and 2012 respectively.