Investor Day Presentation December 7, 2017 EXHIBIT 99.1

Confidential Legal Disclosure Some of the statements in this presentation, including statements regarding investor demand and anticipated future product offerings and financial results are "forward-looking statements." The words "anticipate,” “appear,” "believe,“ “continue,” “could,” "estimate," "expect," "intend," "may," “outlook,” "plan," "predict," "project,“ “target,” "will," "would" and similar expressions may identify forward-looking statements, although not all forward-looking statements contain these identifying words. Factors that could cause actual results to differ materially from those contemplated by these forward-looking statements include: the outcomes of pending governmental investigations and pending or threatened litigation, which are inherently uncertain; developments in the state and federal regulatory environment impacting our business, the impact of recent management changes and the ability to continue to retain key personnel; ability to achieve cost savings from recent restructurings; our ability to continue to attract and retain new and existing retail and institutional investors; competition; overall economic conditions; demand for the types of loans facilitated by us; default rates and those factors set forth in the section titled “Risk Factors” in our most recent Quarterly Report on Form 10-Q and Annual Report on Form 10- K, each filed with the SEC. We may not actually achieve the plans, intentions or expectations disclosed in forward-looking statements, and you should not place undue reliance on forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in forward-looking statements. We do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. This presentation contains non-GAAP measures relating to our performance. In addition, we have included certain pro forma adjustments in our presentation of operating expenses, contribution margin, adjusted EBITDA and adjusted EBITDA margin. We have chosen to present non-GAAP measures because we believe that these measures provide investors a consistent basis for assessing our performance, and help to facilitate comparisons of our operating results, across different periods. We believe these non-GAAP measures provide useful information as to the effectiveness of our marketing initiatives in driving revenue as well as the effectiveness of originating and servicing loans in driving revenue. The amounts used to arrive at these non-GAAP measures all appear on the face of our consolidated statements of operations or in the notes to the financial statements (for stock-based compensation) and do not otherwise eliminate or accelerate any amounts in contravention of GAAP. These measures may be different from non-GAAP financial measures used by other companies. The presentation of this financial information, which is not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered in isolation of, or as a substitute for, the financial information prepared and presented in accordance with generally accepted accounting principles. You can find the reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measures in the Appendix at the end of this presentation. Information in this presentation is not an offer to sell securities or the solicitation of an offer to buy securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. Additional information about LendingClub is available in the prospectus for our notes, which can be obtained on our website at https://www.lendingclub.com/legal/prospectus. 2

Scott Sanborn Chief Executive Officer

Company Overview Scott Sanborn, Chief Executive Officer Our Borrowers Steve Allocca, President Credit Sid Jajodia, Chief Investment OfficerSammy Soohoo, SVP, Credit Risk Our Investors Patrick Dunne, Chief Capital Officer Investor Panel Andrew Deringer, VP, Financial Institutions Philip Bartow, Portfolio Manager, RiverNorth Brian Graham, CEO, Alliance Partners Amanda Magliaro, MD, Head of Global Structured Finance Distribution, Citi Marketplace & Technology/Product Sameer Gulati, COO Financials Tom Casey, Chief Financial Officer Today’s agenda 4

Borrowers earn savings and financial control Investors earn solid returns LendingClub screens borrowers, facilitates the transaction, and services the loans Founded in 2007 and headquartered in San Francisco, CA 5

Investors FICO Range2 Median Income2 2M+ Mainstream Consumers1 Borrowers 600-850 $62K 70+ Institutions 60+ Managed Accounts 40+ Banks 180K+ Self-directed Individuals 1) Across all products. 2) Personal loan borrowers in Q3 2017. FICO range reflects LendingClub’spersonal loans credit policy. 6

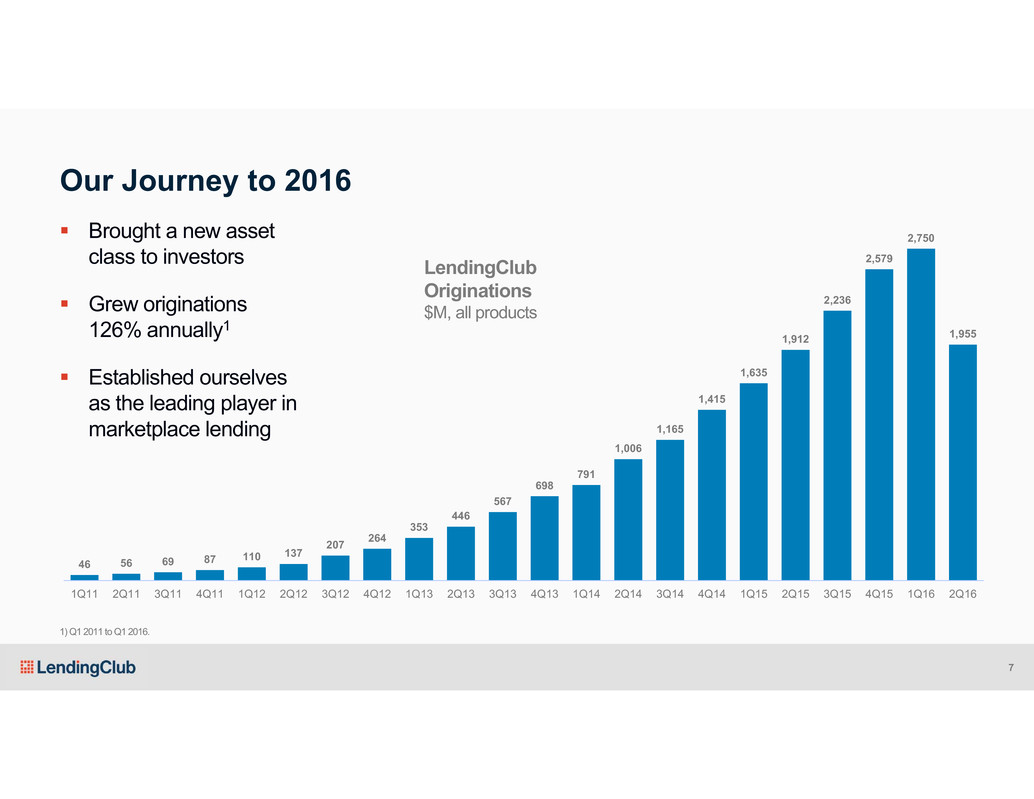

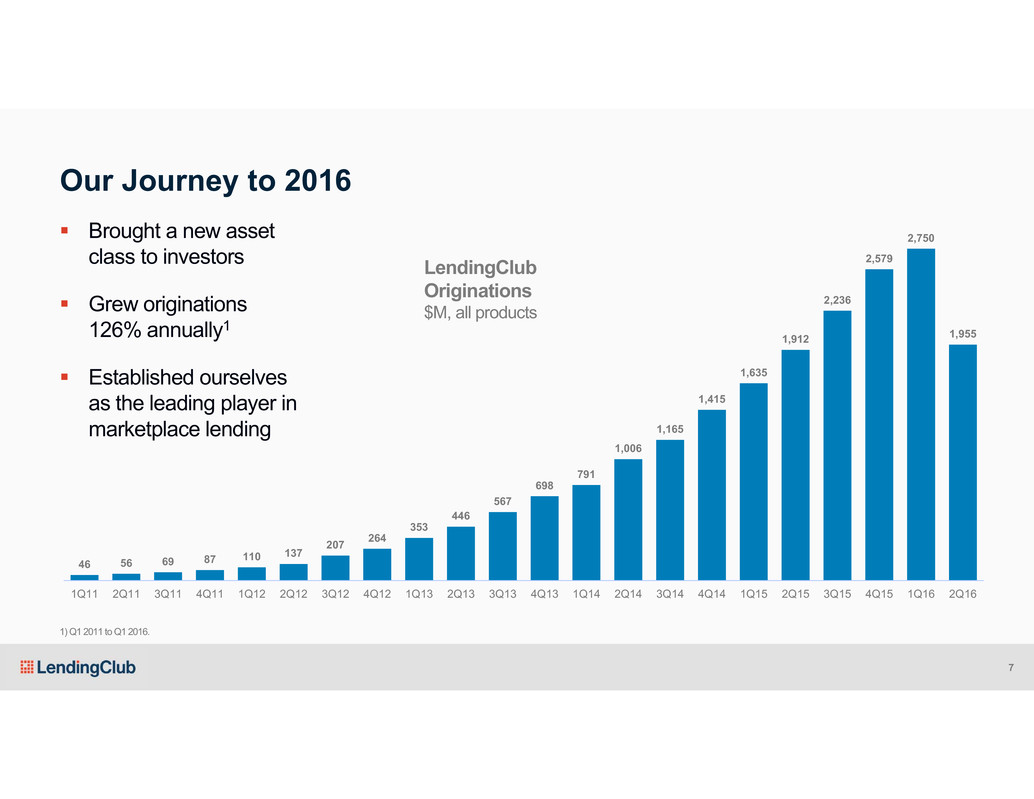

LendingClub Originations $M, all products Brought a new asset class to investors Grew originations 126% annually1 Established ourselves as the leading player in marketplace lending Our Journey to 2016 1) Q1 2011 to Q1 2016. 46 56 69 87 110 137 207 264 353 446 567 698 791 1,006 1,165 1,415 1,635 1,912 2,236 2,579 2,750 1,955 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 7

Stabilized and transformed the Investor business Rebuilt the management team We’ve come a long way since Q2 2016 8

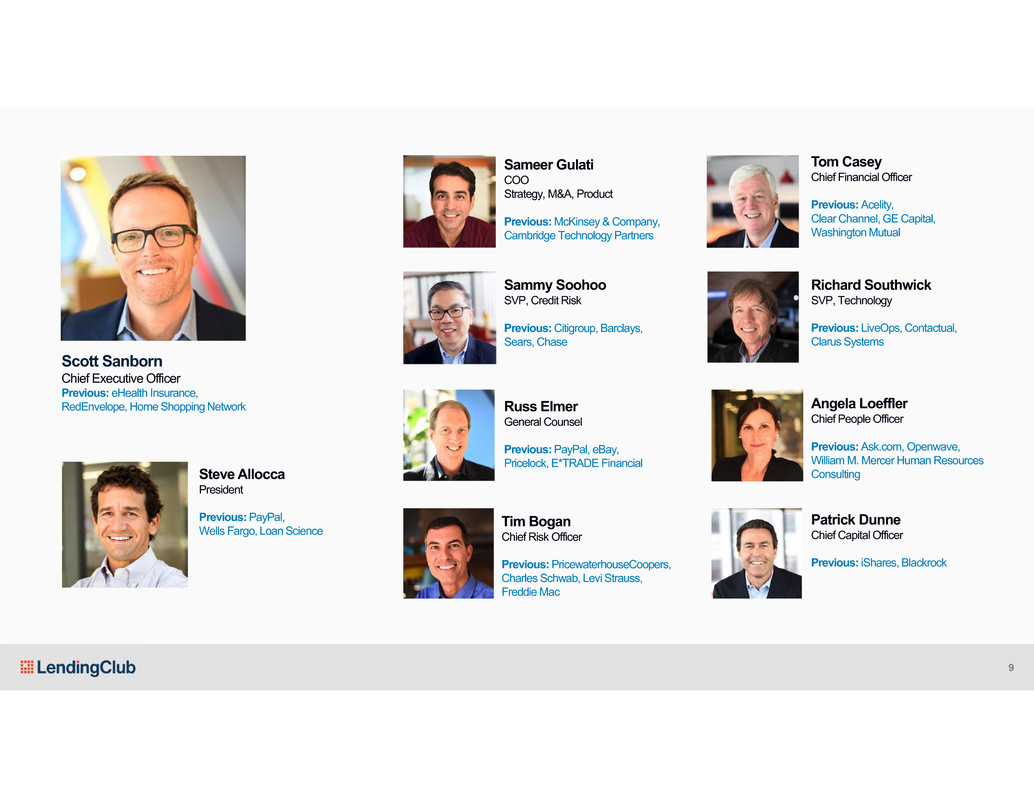

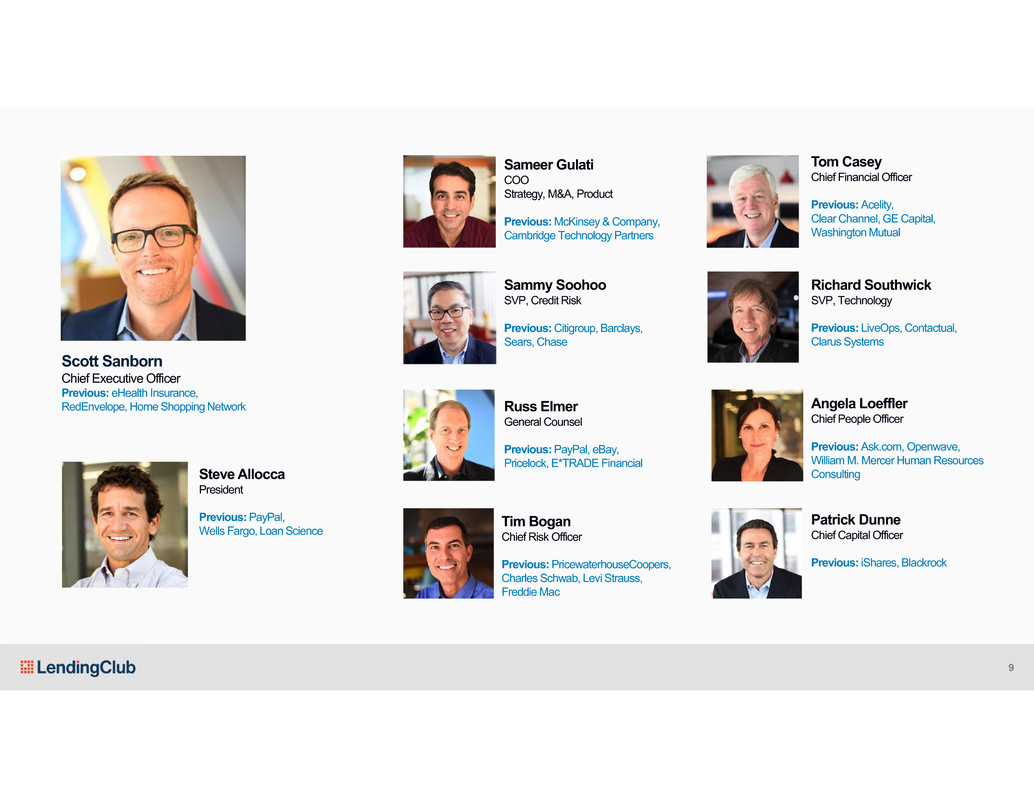

Scott Sanborn Chief Executive Officer Previous: eHealth Insurance, RedEnvelope, Home Shopping Network Tom Casey Chief Financial Officer Previous: Acelity, Clear Channel, GE Capital, Washington Mutual Richard Southwick SVP, Technology Previous: LiveOps, Contactual, Clarus Systems Sammy Soohoo SVP, Credit Risk Previous: Citigroup, Barclays, Sears, Chase Angela Loeffler Chief People Officer Previous: Ask.com, Openwave, William M. Mercer Human Resources Consulting Russ Elmer General Counsel Previous: PayPal, eBay, Pricelock, E*TRADE Financial Tim Bogan Chief Risk Officer Previous: PricewaterhouseCoopers, Charles Schwab, Levi Strauss, Freddie Mac Sameer Gulati COO Strategy, M&A, Product Previous: McKinsey & Company, Cambridge Technology Partners Patrick Dunne Chief Capital Officer Previous: iShares, Blackrock Steve Allocca President Previous: PayPal, Wells Fargo, Loan Science 9

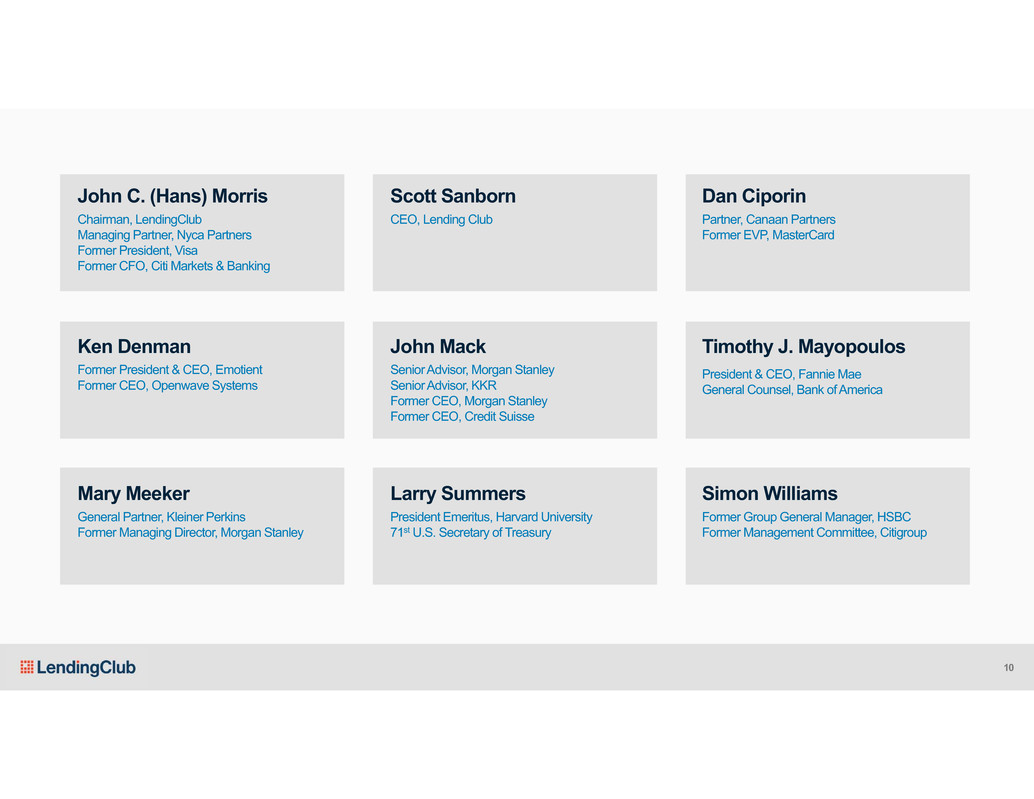

John C. (Hans) Morris Chairman, LendingClub Managing Partner, Nyca Partners Former President, Visa Former CFO, Citi Markets & Banking Ken Denman Former President & CEO, Emotient Former CEO, OpenwaveSystems Mary Meeker General Partner, Kleiner Perkins Former Managing Director, Morgan Stanley Larry Summers President Emeritus, Harvard University 71st U.S. Secretary of Treasury John Mack Senior Advisor, Morgan Stanley Senior Advisor, KKR Former CEO, Morgan Stanley Former CEO, Credit Suisse Scott Sanborn CEO, Lending Club Dan Ciporin Partner, Canaan Partners Former EVP, MasterCard Timothy J. Mayopoulos President & CEO, Fannie Mae General Counsel, Bank of America Simon Williams Former Group General Manager, HSBC Former Management Committee, Citigroup 10

Where we are today Improved borrower product with new features, and more in testing Launched Auto Refinance May 2016 legacy issues Tightened credit in response to changing environment Expanded technology infrastructure, including enterprise risk platform New credit model with significantly improved risk discernment Evolved investor business: securitization, investor platform, use of balance sheet Relaunched asset management business Achieved highest-revenue quarter in company history 11

1) Federal Reserve Bank of St. Louis, “Real Median Household Income in the United States,” not seasonally adjusted, 2017. 2) US Census, “Median and Average Sales Price of Houses Sold,” adjusted from nominal to real data using CPI, 2017. 3) The Henry J. Kaiser Family Foundation, “2017 Employer Health Benefits Survey,” 2017. 4) CollegeBoard, “Trends in Higher Education,” 2017. Real change since 2000 (%) The challenge facing many Americans 1% Increase in median house- hold income1 31% Increase in median new home sale price2 102% Increase in mean employee healthcare premiums3 69% Increase in mean 4-year public college cost4 12

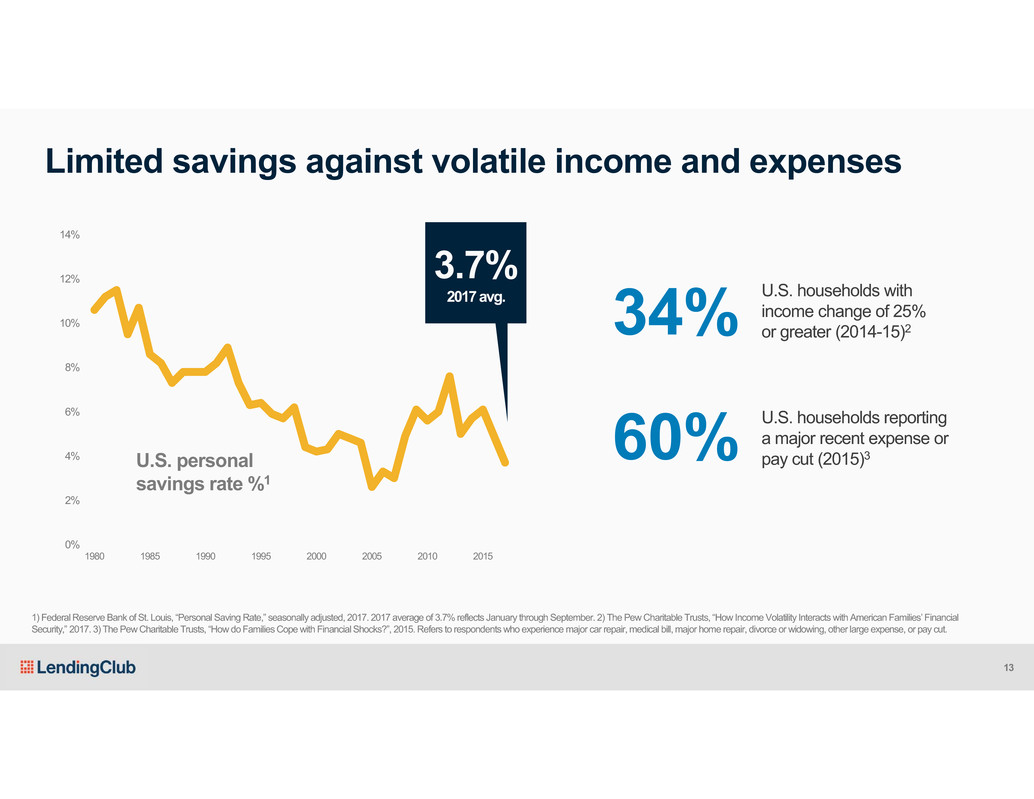

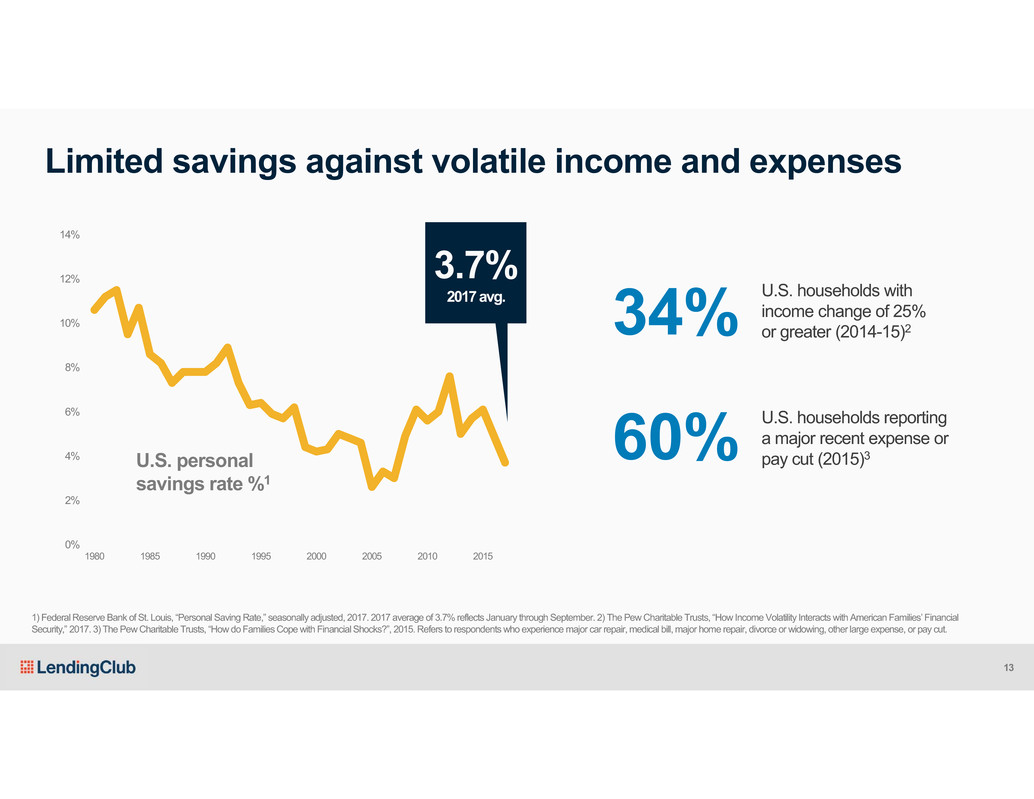

0% 2% 4% 6% 8% 10% 12% 14% 1980 1985 1990 1995 2000 2005 2010 2015 U.S. personal savings rate %1 U.S. households with income change of 25% or greater (2014-15)234% 60% U.S. households reporting a major recent expense or pay cut (2015)3 Limited savings against volatile income and expenses 3.7% 2017 avg. 1) Federal Reserve Bank of St. Louis, “Personal Saving Rate,” seasonally adjusted, 2017. 2017 average of 3.7% reflects January through September. 2) The Pew Charitable Trusts, “How Income Volatility Interacts with American Families’ Financial Security,” 2017. 3) The Pew Charitable Trusts, “How do Families Cope with Financial Shocks?”, 2015. Refers to respondents whoexperience major car repair, medical bill, major home repair, divorce or widowing, other large expense, or pay cut. 13

of American families hold credit card debt144% $9,600 Credit cards often bridge the gap Average household credit card balance2 1) Federal Reserve, “Changes in U.S. Family Finances from 2013 to 2016: Evidence from the Survey of Consumer Finances,” 2017. 2) Federal Reserve Bank of New York, “Do We Know What We Owe? Consumer debt as reported by borrowers and lenders,” 2015. Referenced Consumer Credit Panel data includes carried outstanding balances as well as some share of monthly “convenience use” balances. 14

1) Based on responses from 2,862 borrowers in a survey of randomly selected borrowers conducted from 1/1/17 – 9/30/17. Borrowerswho received a loan via LendingClub to consolidate existing debt or pay off their credit card balance received an average interest rate of 15.8% and reported an average interest rate on outstanding debt or credit cards of 20.4%. Transaction fees range from 1% to 6%, assumed to be 5.03% in this scenario, reflecting average fee during 2017 Q1-Q3 for LendingClub personal loan borrowers. Best APR is available to borrowers with excellent credit. Assumed 3% annual fees for cards as percentage of cycle-ending balances (CFPB, “The Consumer Credit Card Market,” 2015). 2) Credit card minimum monthly payments schedule assumes interest payment on existing balance in period plus 1% of outstanding balance plus fees. 3) 3-year paydown scenarios imply eliminated loan balance at end of period. Interest and fee savings with LendingClub ~$2,800 ~$900 We offer a better alternative Credit Card MinimumPayments Only2 Interest and Fees1 ~$5,900 Ending Balance ~$7,000 3-Year Pay Down3 ~$4,000 $0 ~$3,100 $0 3-year loan comparison: LendingClub personal loan vs. credit card $10K starting balance 15

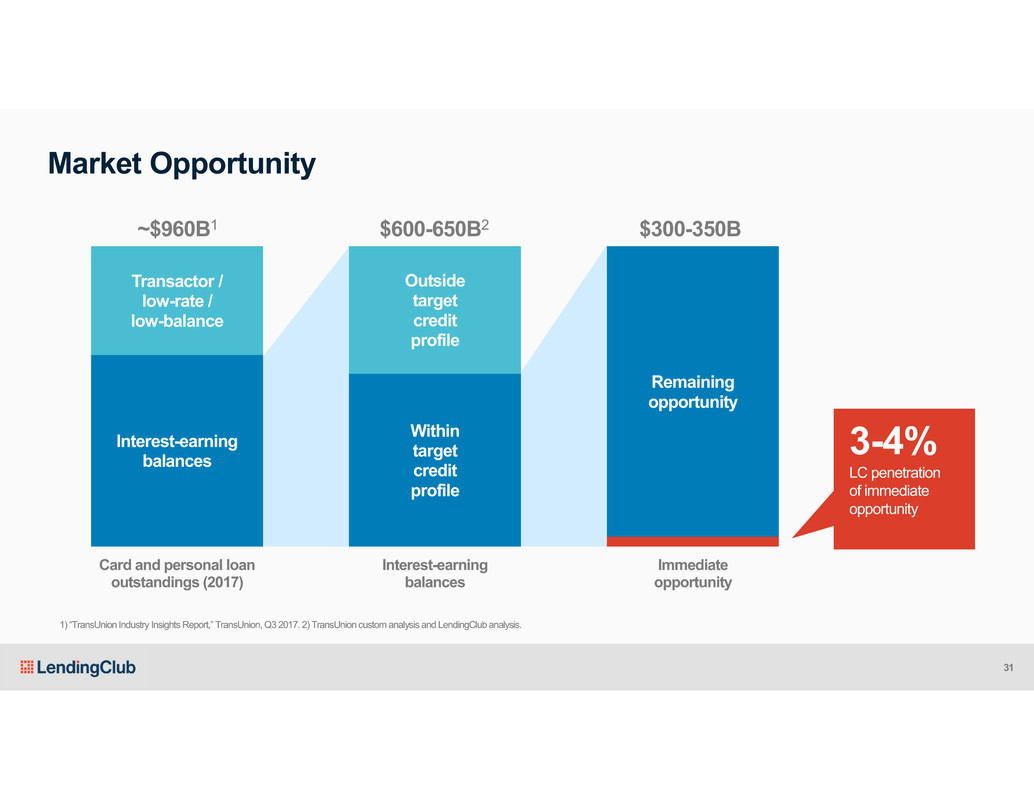

$300-350B Large opportunity and a track record of growing into it 1) See page 31. 2) See page 30. Addressable Market Opportunity Track Record in Personal Loans Credit card refinance and debt consolidation1 1% 10% 2012 2017 LendingClub share of U.S. personal loan outstanding balances2 16

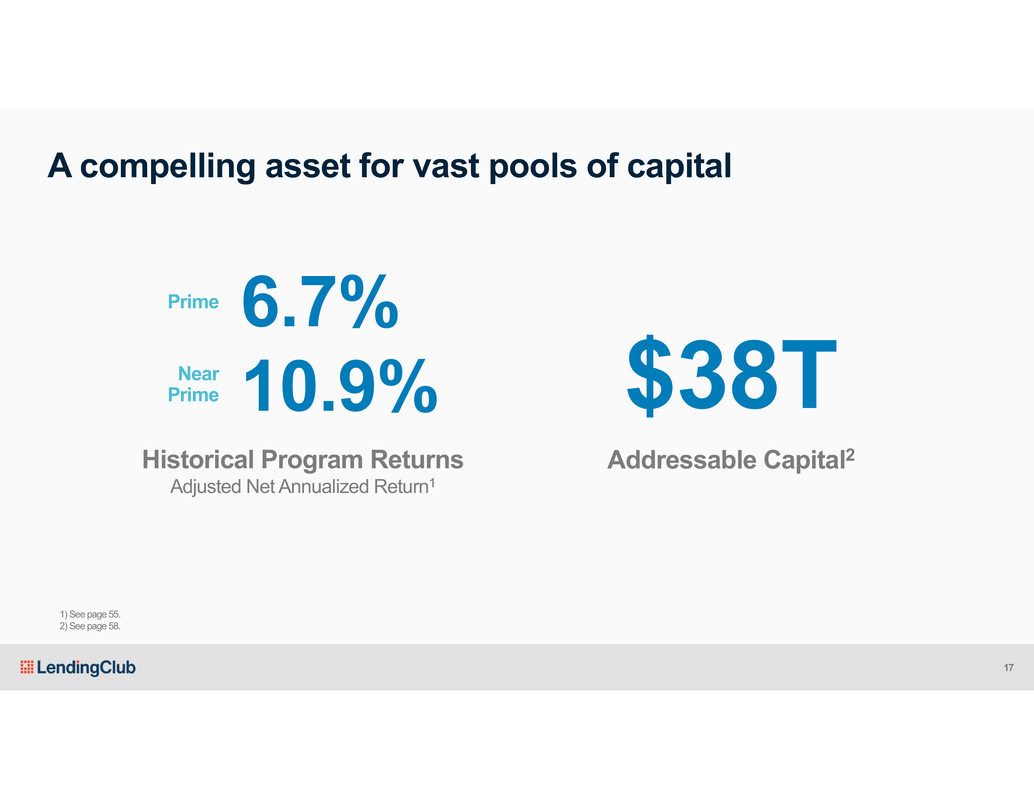

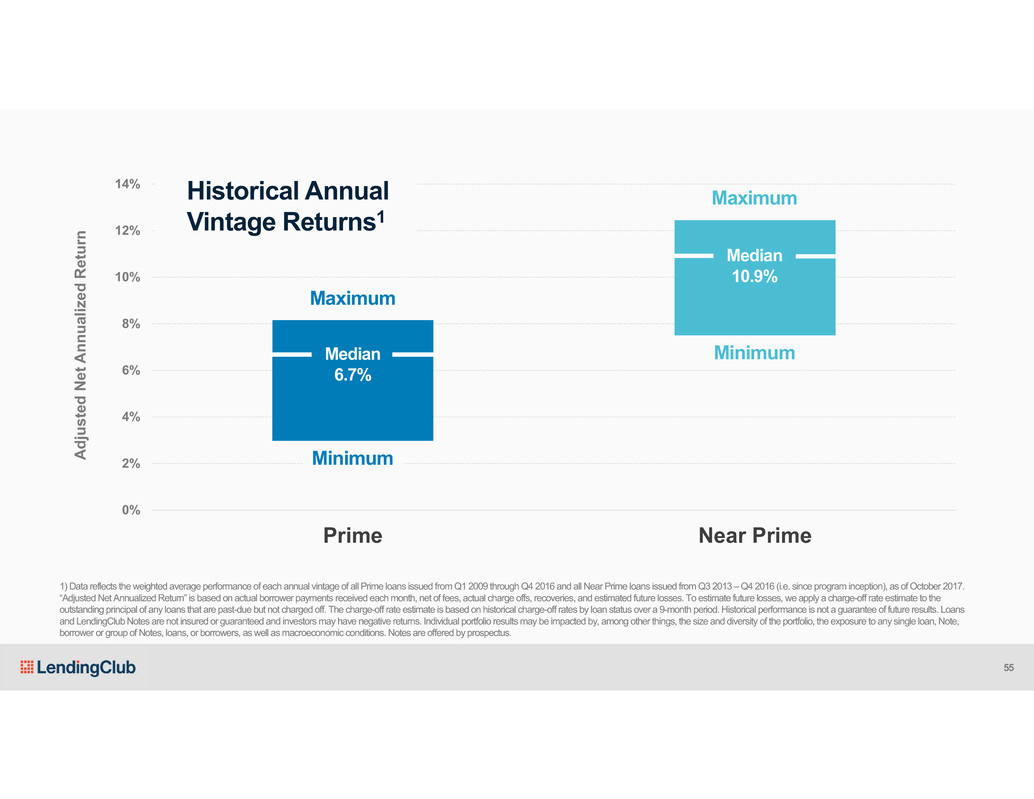

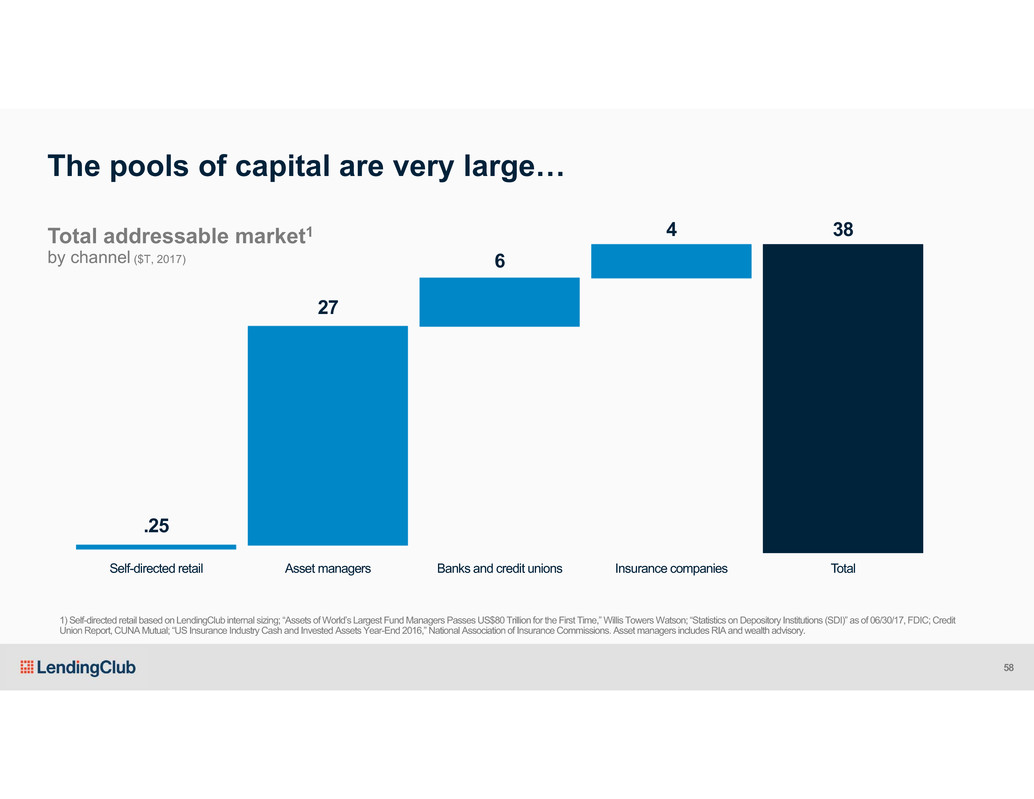

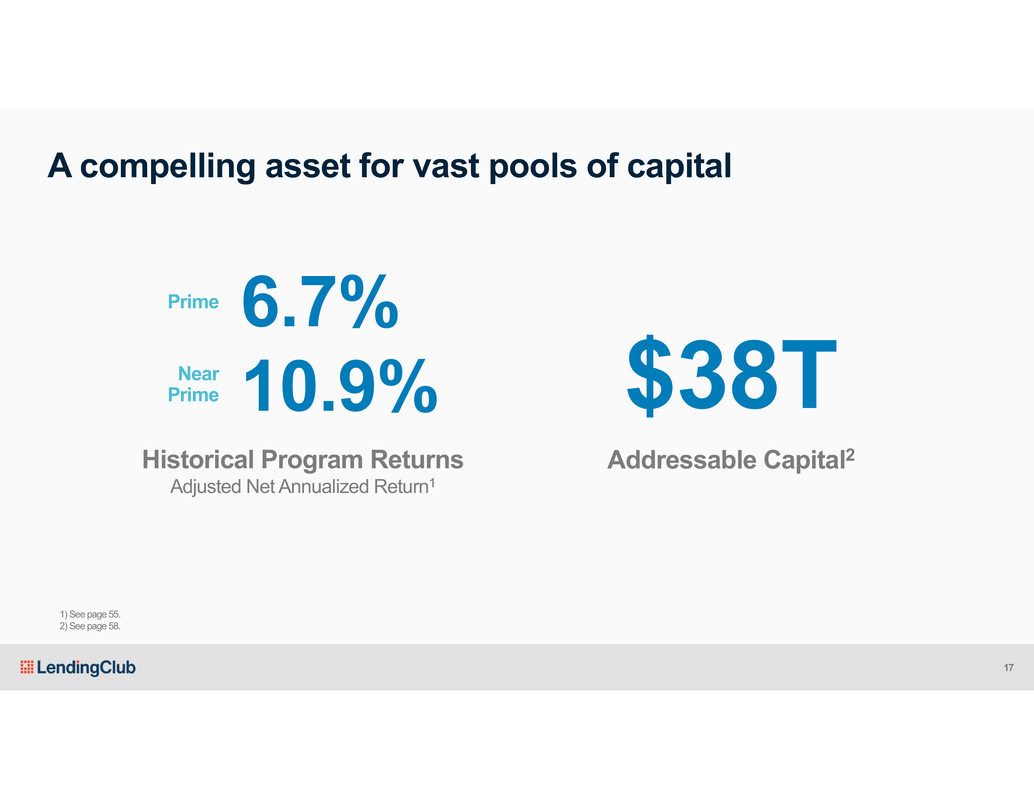

A compelling asset for vast pools of capital Prime Addressable Capital2 $38T Historical Program Returns Adjusted Net Annualized Return1 6.7% 10.9%Near Prime 1) See page 55. 2) See page 58. 17

Our DNA Virtuous Cycle of Scale Marketplace Model Data & Analytics Technology & Product Development 18

Scalable and capital light Efficient marketing due to wide credit box Flexible and resilient in response to environment Our Marketplace Model 19

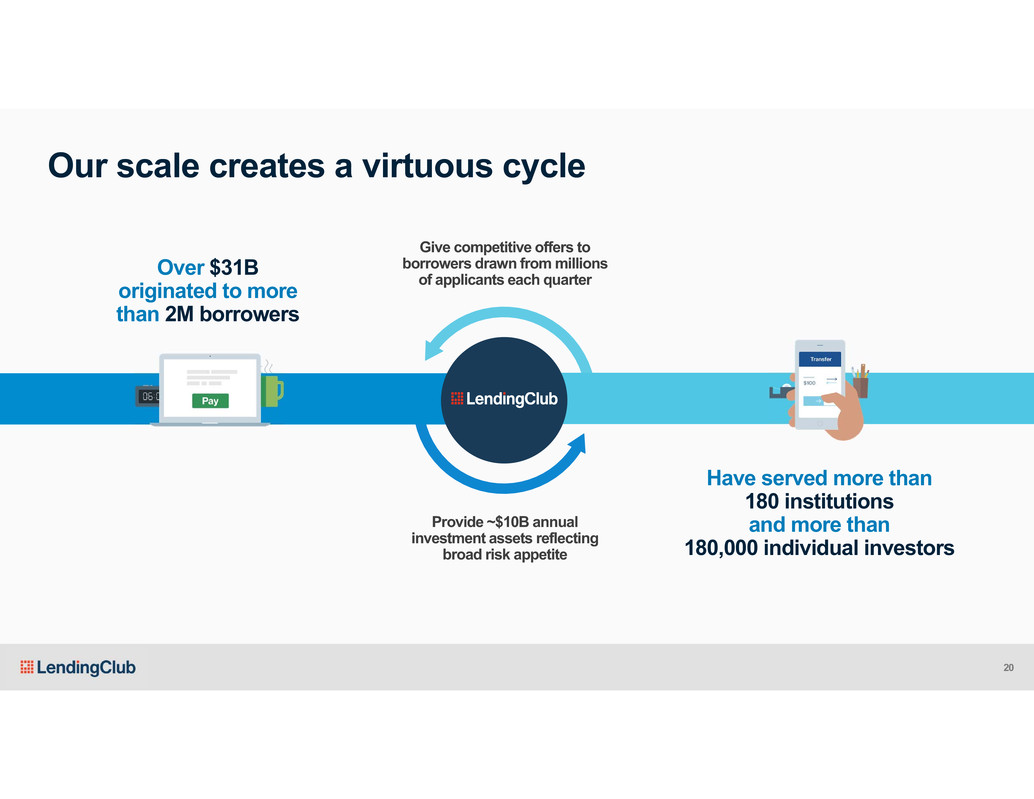

Have served more than 180 institutions and more than 180,000 individual investors Over $31B originated to more than 2M borrowers Our scale creates a virtuous cycle Provide ~$10B annual investment assets reflecting broad risk appetite Give competitive offers to borrowers drawn from millions of applicants each quarter 20

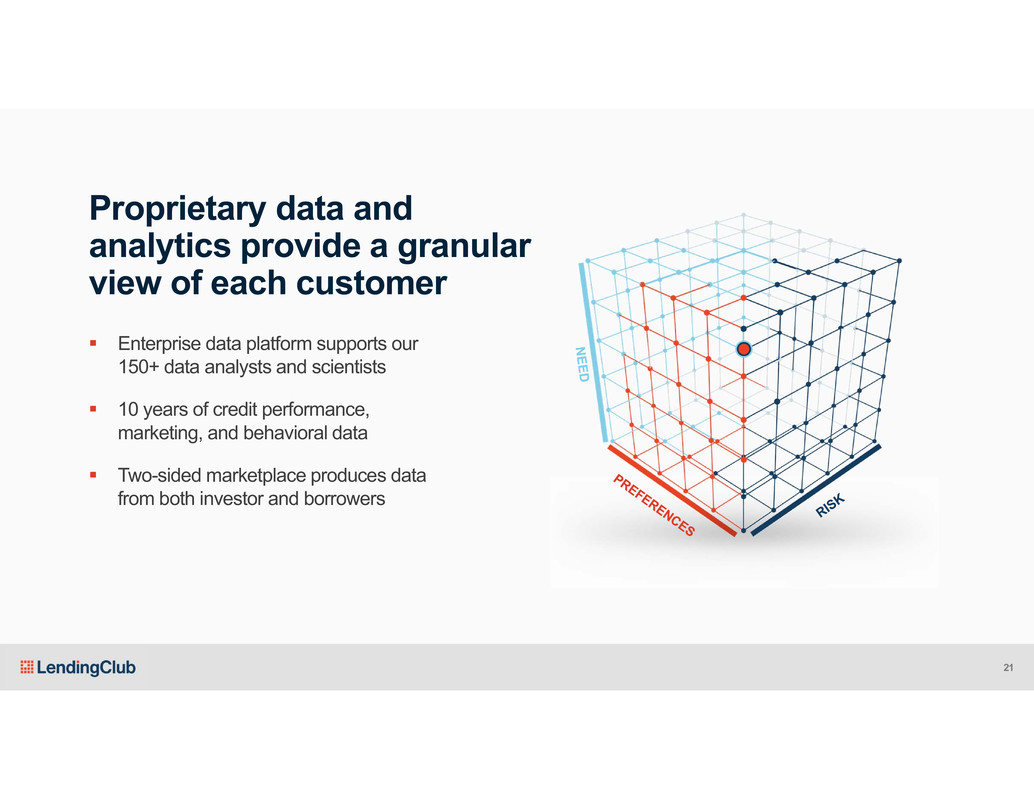

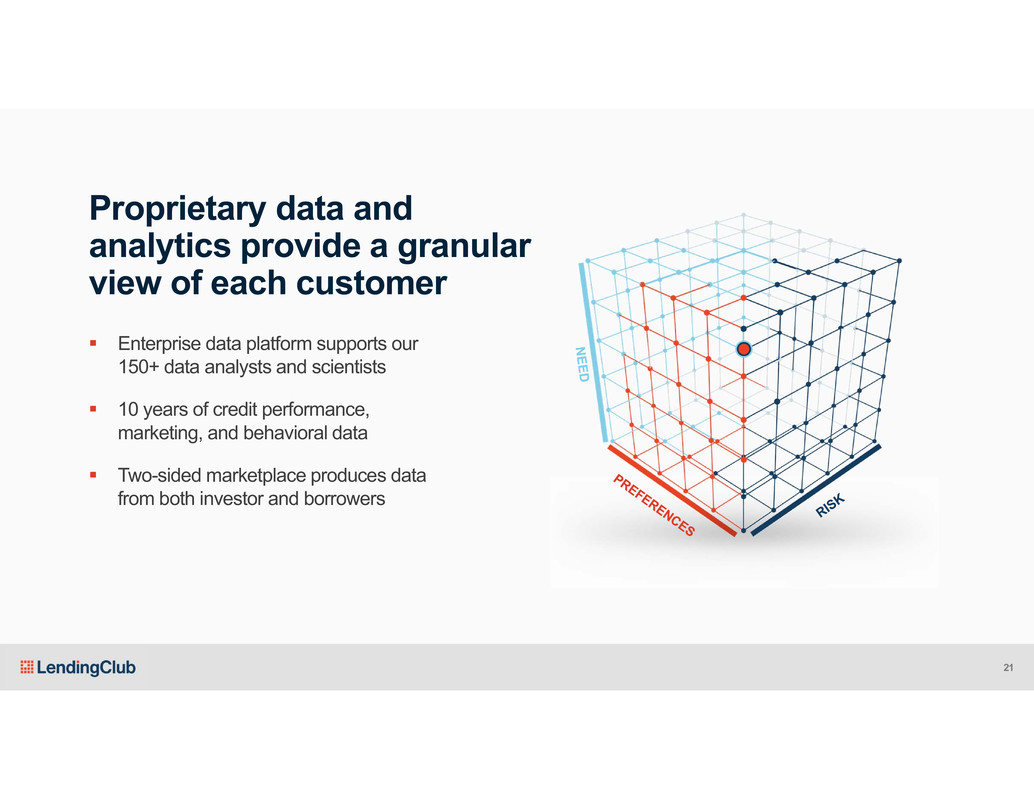

Enterprise data platform supports our 150+ data analysts and scientists 10 years of credit performance, marketing, and behavioral data Two-sided marketplace produces data from both investor and borrowers Proprietary data and analytics provide a granular view of each customer 21

~25% of staff in product and engineering Product innovation culture Code releases every two weeks $350M+ spent on development since inception1 Better experience through technology 1) Through Q3 2017. 22

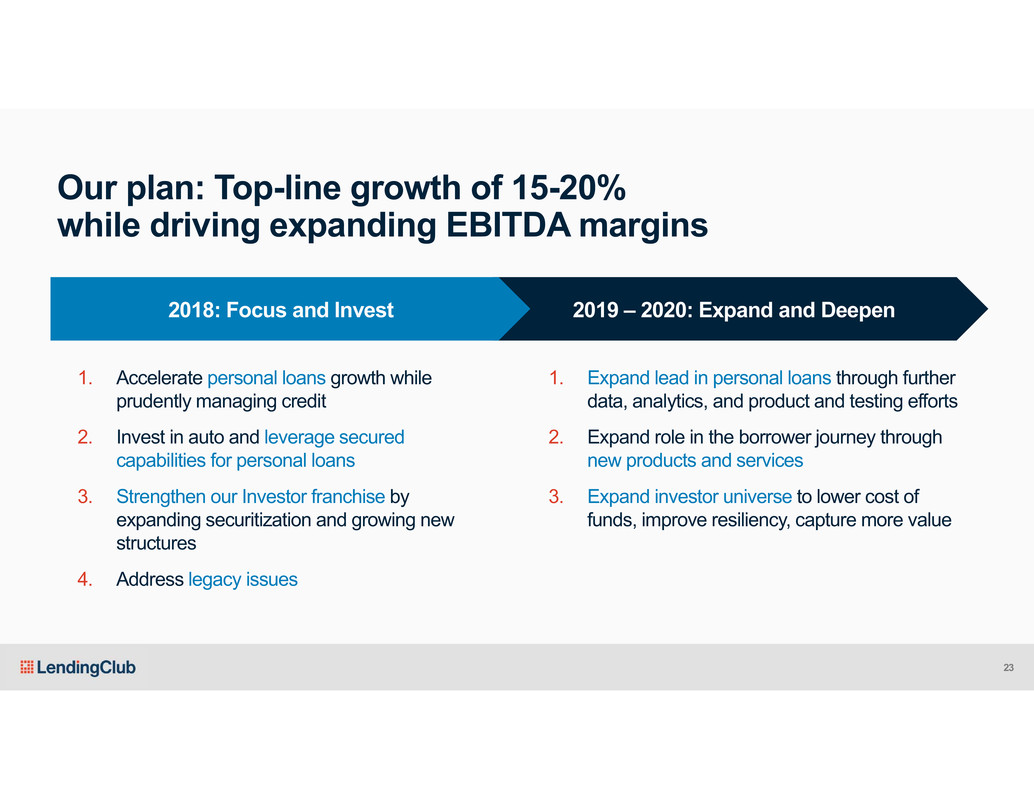

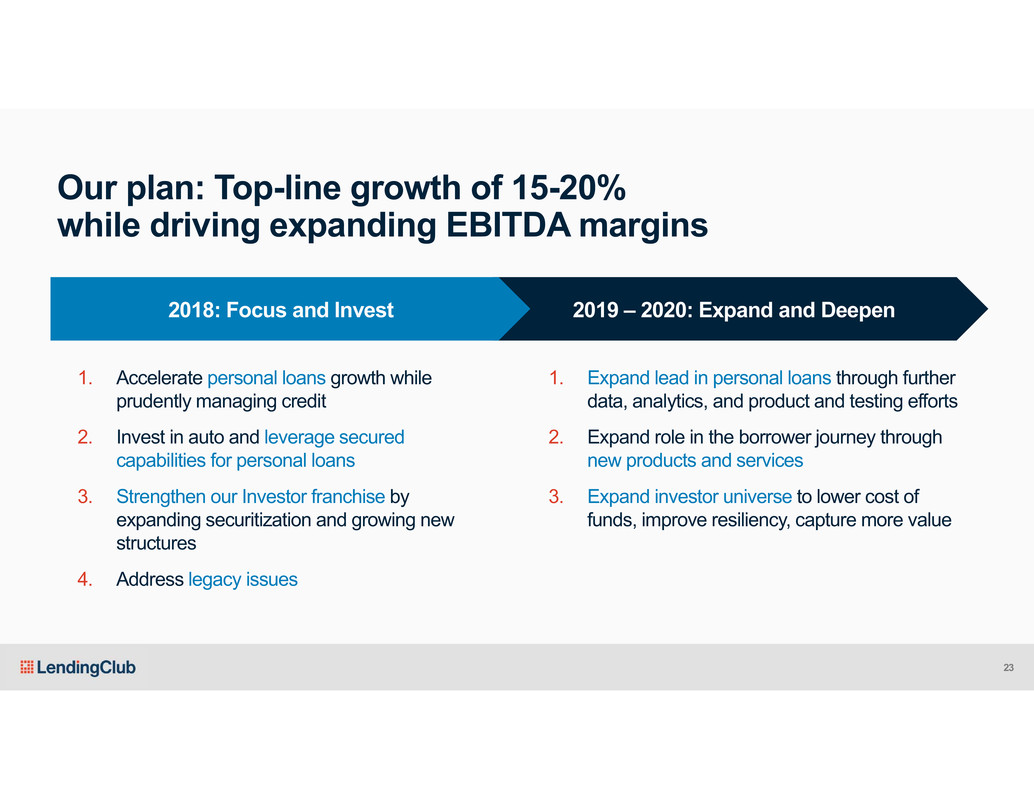

1. Accelerate personal loans growth while prudently managing credit 2. Invest in auto and leverage secured capabilities for personal loans 3. Strengthen our Investor franchise by expanding securitization and growing new structures 4. Address legacy issues 1. Expand lead in personal loans through further data, analytics, and product and testing efforts 2. Expand role in the borrower journey through new products and services 3. Expand investor universe to lower cost of funds, improve resiliency, capture more value 2018: Focus and Invest 2019 – 2020: Expand and Deepen Our plan: Top-line growth of 15-20% while driving expanding EBITDA margins 23

1. Unsecured online lending is a large and growing market, serving a critical customer need 2. LendingClub as the leader is uniquely positioned to go after this market a) The marketplace model is the right one with broad consumer demand and investor appetite b) We have strong credit, tech and product capabilities that are difficult to replicate at this scale c) We have the right blend of team and culture to win 3. Solid plan to deliver growth, while investing for the future Key takeaways 24

Steve Allocca President

Are not highly satisfied with present financial condition1 Have a current or recent financial goal2 Many Americans want to do better 1) CFSI, “Understanding and Improving Financial Health in America,” 2014. 2) CFPB “National Financial Well-Being Survey,” 2017; assuming 249M adults Americans, of which 63% have a current or recent financial goal. 175M 156M 26

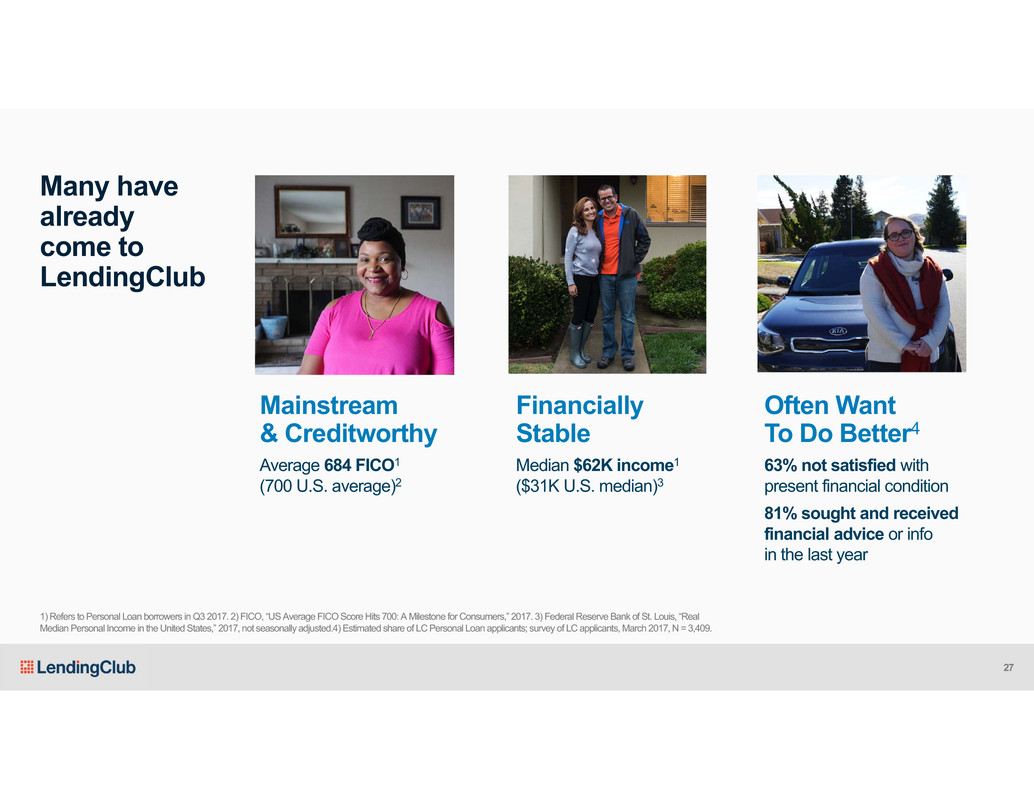

1) Refers to Personal Loan borrowers in Q3 2017. 2) FICO, “US Average FICO Score Hits 700: A Milestone for Consumers,” 2017. 3) Federal Reserve Bank of St. Louis, “Real Median Personal Income in the United States,” 2017, not seasonally adjusted.4) Estimated share of LC Personal Loan applicants; survey of LC applicants, March 2017, N = 3,409. Many have already come to LendingClub Mainstream & Creditworthy Average 684 FICO1 (700 U.S. average)2 Financially Stable Median $62K income1 ($31K U.S. median)3 Often Want To Do Better4 63% not satisfied with present financial condition 81% sought and received financial advice or info in the last year 27

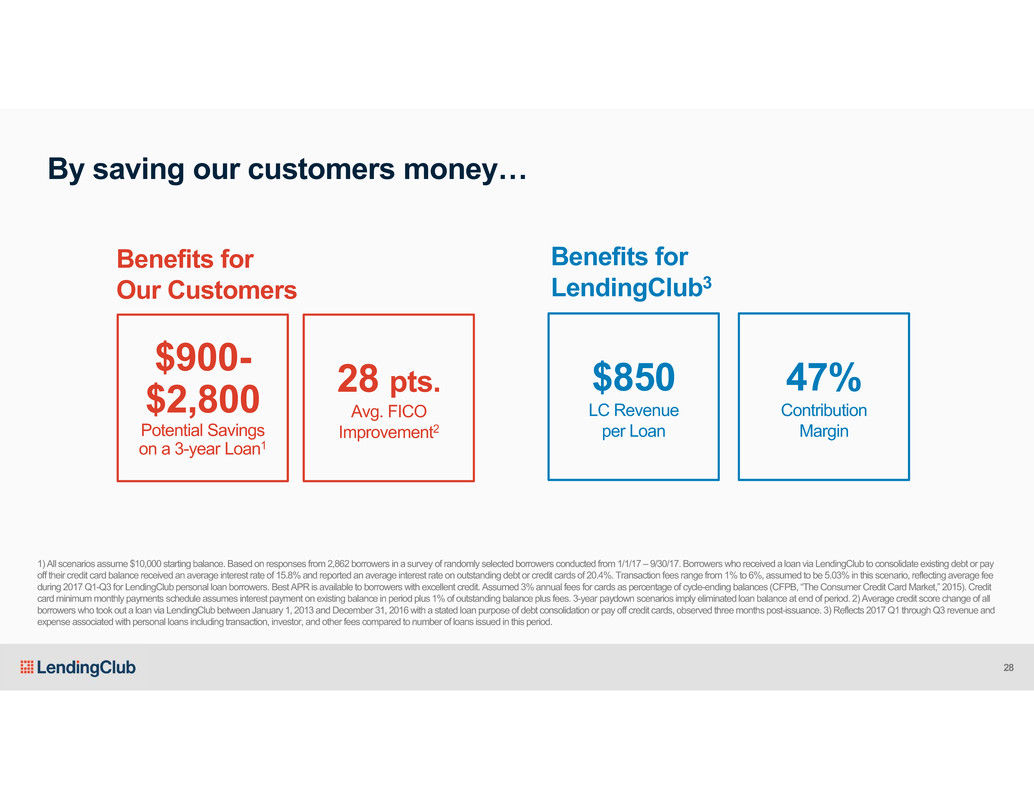

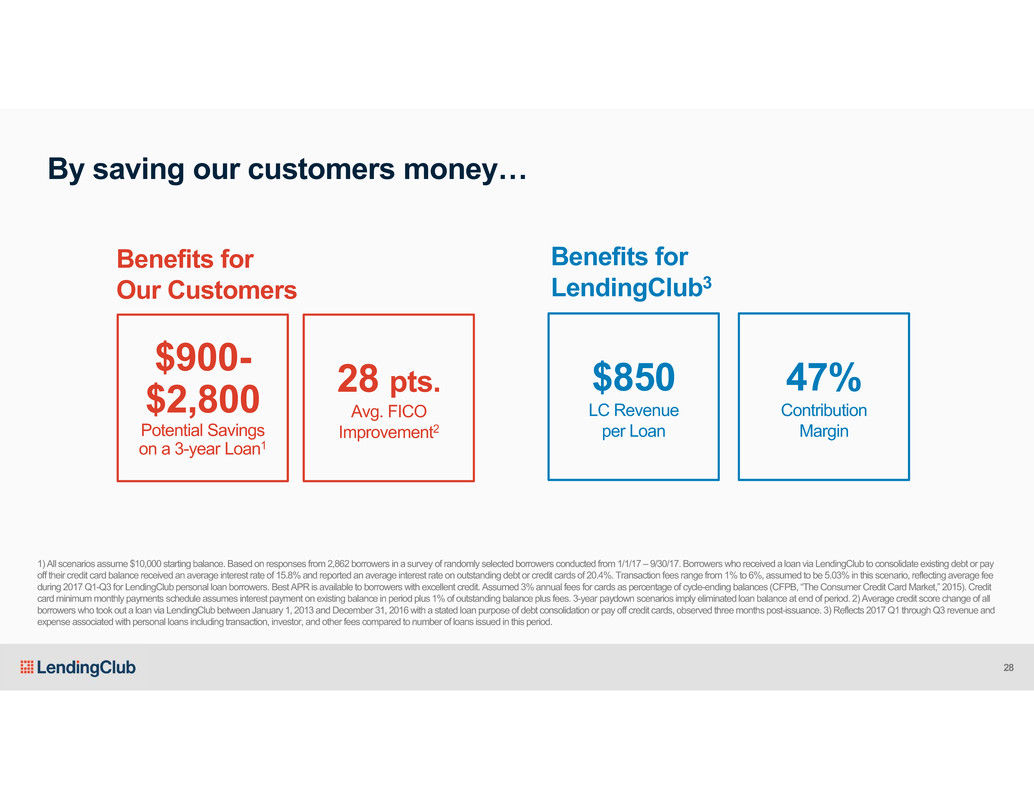

By saving our customers money… 1) All scenarios assume $10,000 starting balance. Based on responses from 2,862 borrowers in a survey of randomly selected borrowers conducted from 1/1/17 – 9/30/17. Borrowers who received a loan via LendingClub to consolidate existing debt or pay off their credit card balance received an average interest rate of 15.8% and reported an average interest rate on outstanding debt or credit cards of 20.4%. Transaction fees range from 1% to 6%, assumed to be 5.03% in this scenario, reflecting average fee during 2017 Q1-Q3 for LendingClub personal loan borrowers. Best APR is available to borrowers with excellent credit. Assumed 3% annual fees for cards as percentage of cycle-ending balances (CFPB, “The Consumer Credit Card Market,” 2015). Credit card minimum monthly payments schedule assumes interest payment on existing balance in period plus 1% of outstanding balance plus fees. 3-year paydown scenarios imply eliminated loan balance at end of period. 2) Average credit score change of all borrowers who took out a loan via LendingClub between January 1, 2013 andDecember 31, 2016with a stated loan purpose of debt consolidation or pay off credit cards, observed three months post-issuance. 3) Reflects 2017 Q1 through Q3 revenue and expense associated with personal loans including transaction, investor, and other fees compared to number of loans issued in this period. Benefits for Our Customers 28 pts. Avg. FICO Improvement2 $900- $2,800 Potential Savings on a 3-year Loan1 Benefits for LendingClub3 47% Contribution Margin $850 LC Revenue per Loan 28

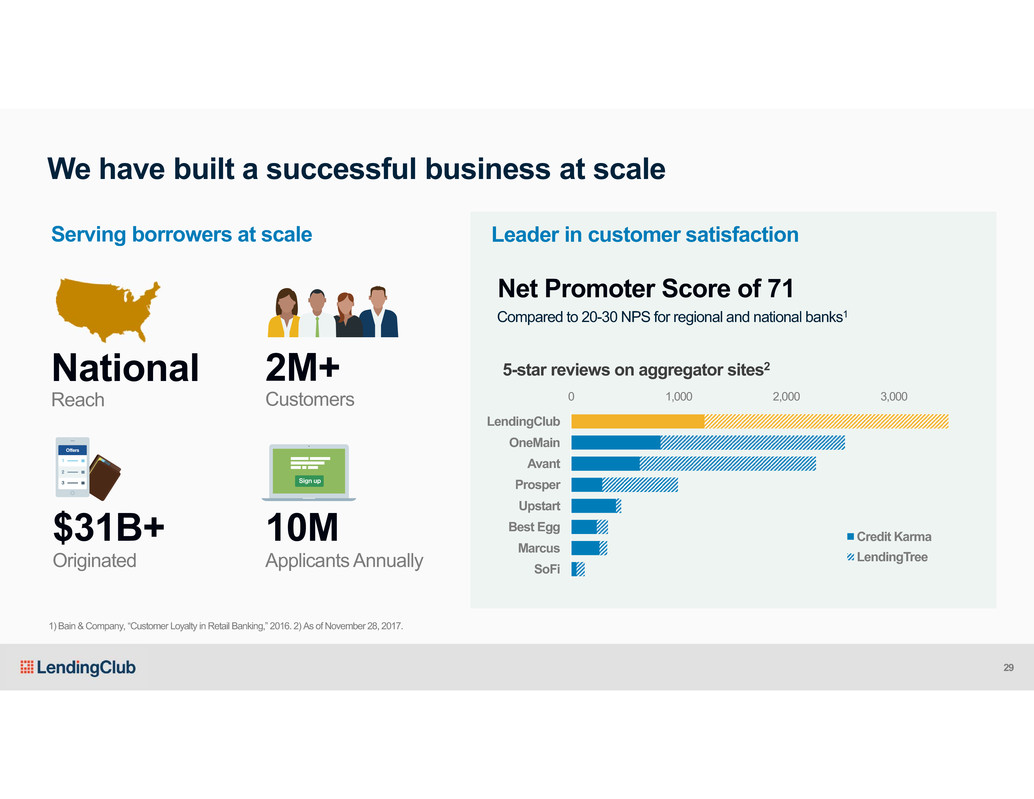

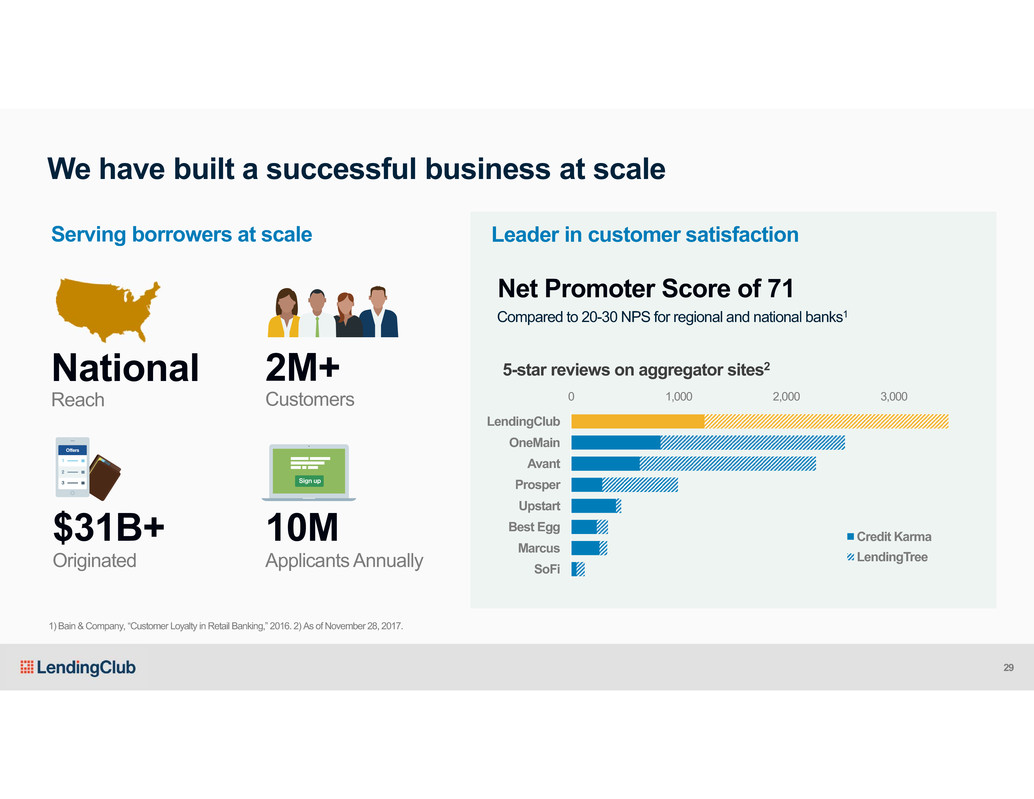

1) Bain & Company, “Customer Loyalty in Retail Banking,” 2016. 2) As of November 28, 2017. Serving borrowers at scale Leader in customer satisfaction 0 1,000 2,000 3,000 LendingClub OneMain Avant Prosper Upstart Best Egg Marcus SoFi 5-star reviews on aggregator sites2 Credit Karma LendingTree National 2M+ $31B+ 10M Reach Customers Originated Applicants Annually Net Promoter Score of 71 Compared to 20-30 NPS for regional and national banks1 We have built a successful business at scale 29

1) “TransUnion Industry Insights Report,” TransUnion, Q3 2017. 47 53 66 83 100 112 2012 2013 2014 2015 2016 2017 U.S. Personal Loan Balances Outstanding1 $B 1% 10% >2x LendingClub Share 30

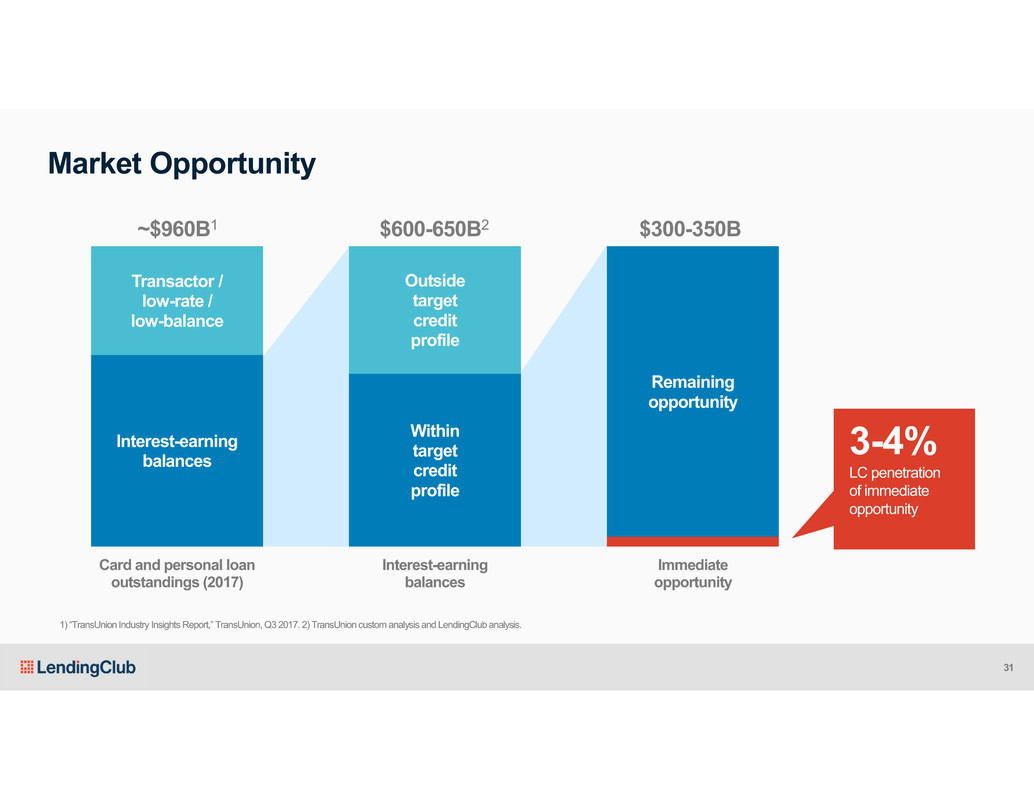

Interest-earning balances Transactor / low-rate / low-balance Within target credit profile Outside target credit profile Remaining opportunity Card and personal loan outstandings (2017) Interest-earning balances Immediate opportunity 3-4% LC penetration of immediate opportunity ~$960B1 $300-350B$600-650B2 1) “TransUnion Industry Insights Report,” TransUnion, Q3 2017. 2) TransUnion custom analysis and LendingClub analysis. Market Opportunity 31

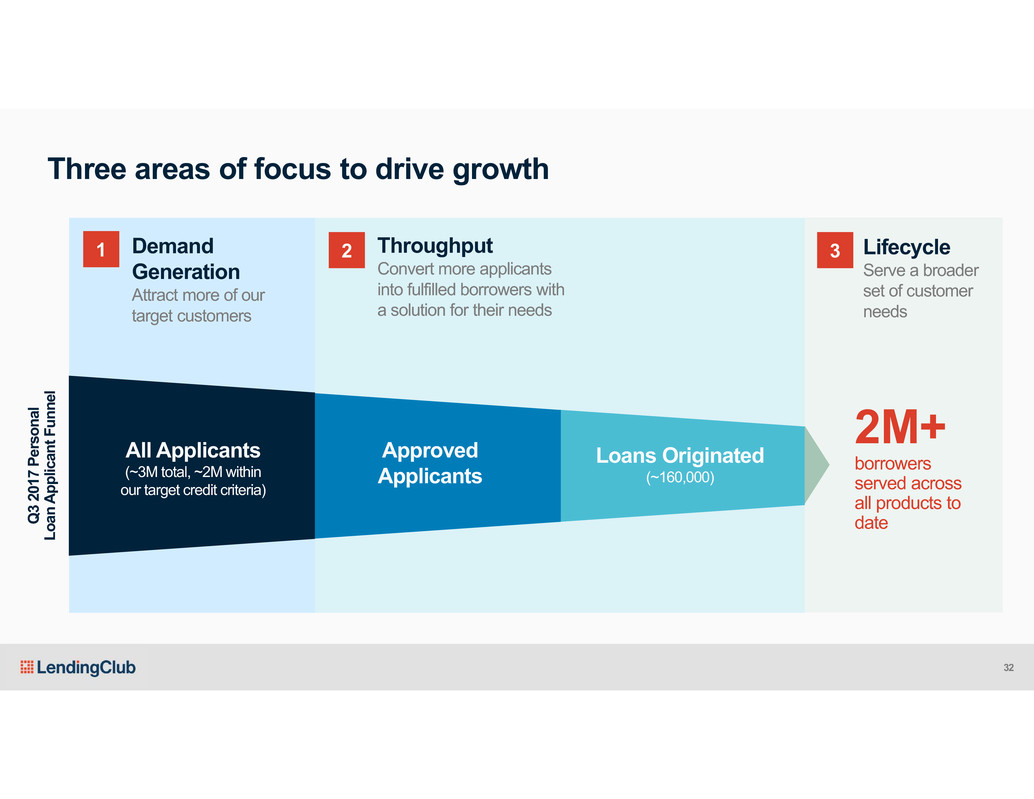

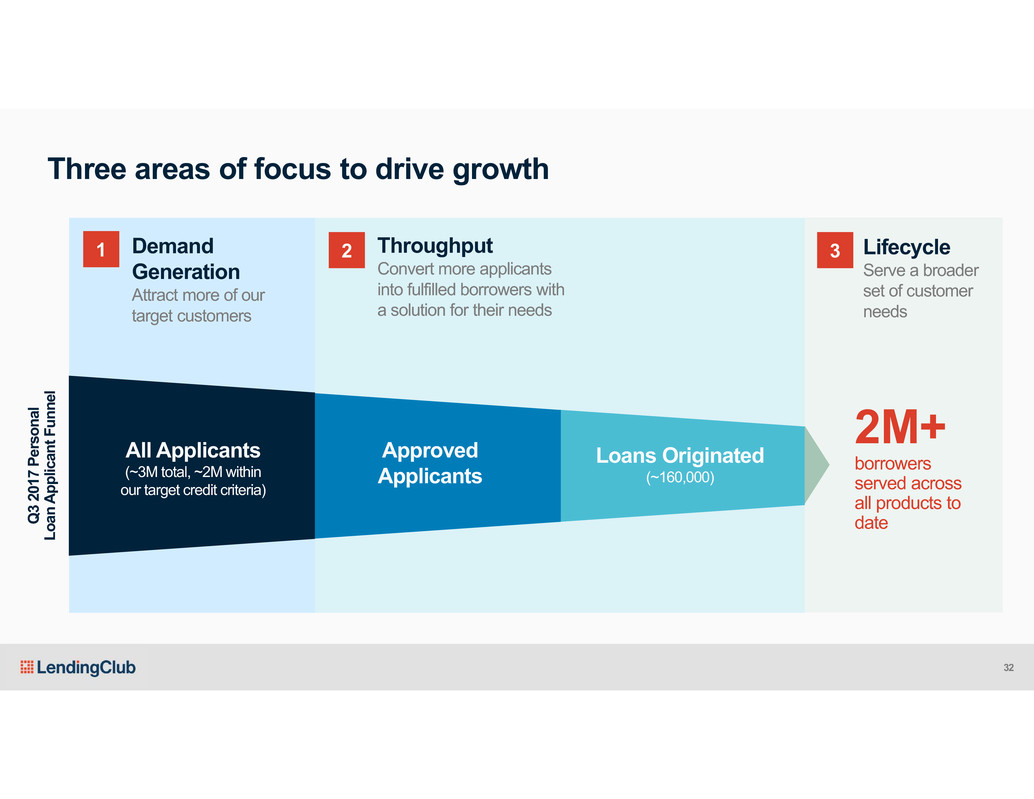

Q 3 2 0 1 7 P e r s o n a l L o a n A p p l i c a n t F u n n e l Demand Generation Attract more of our target customers Throughput Convert more applicants into fulfilled borrowers with a solution for their needs Lifecycle Serve a broader set of customer needs 2M+ borrowers served across all products to date All Applicants (~3M total, ~2M within our target credit criteria) Approved Applicants Loans Originated (~160,000) Three areas of focus to drive growth 1 2 3 32

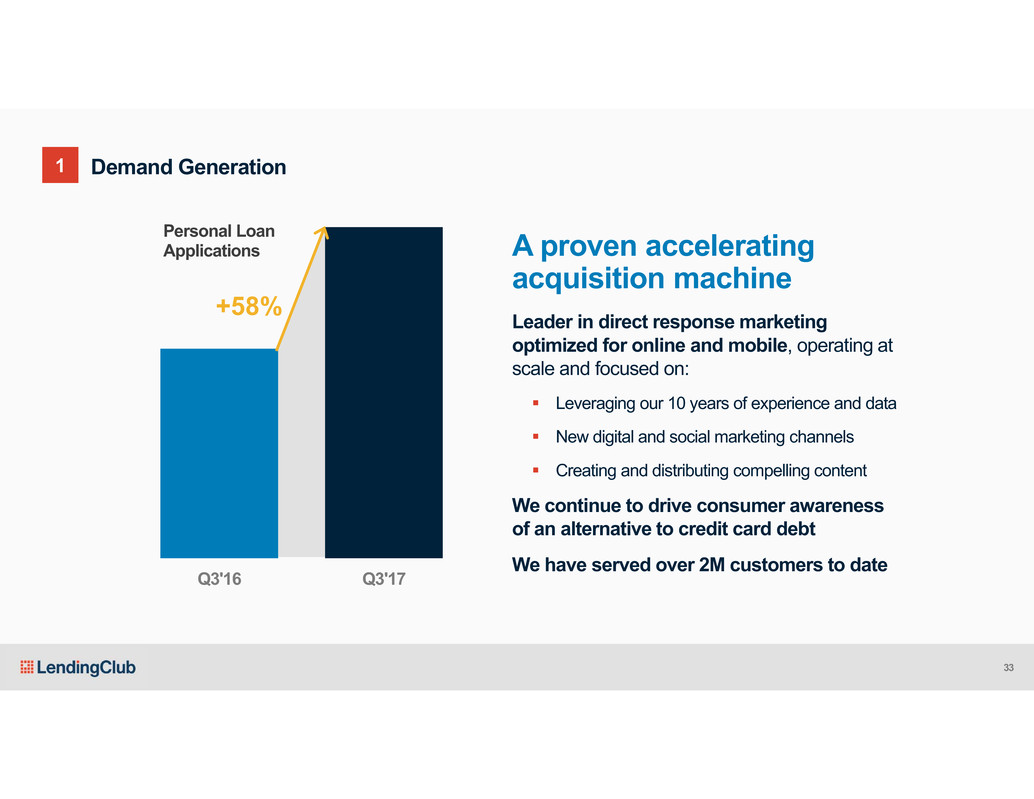

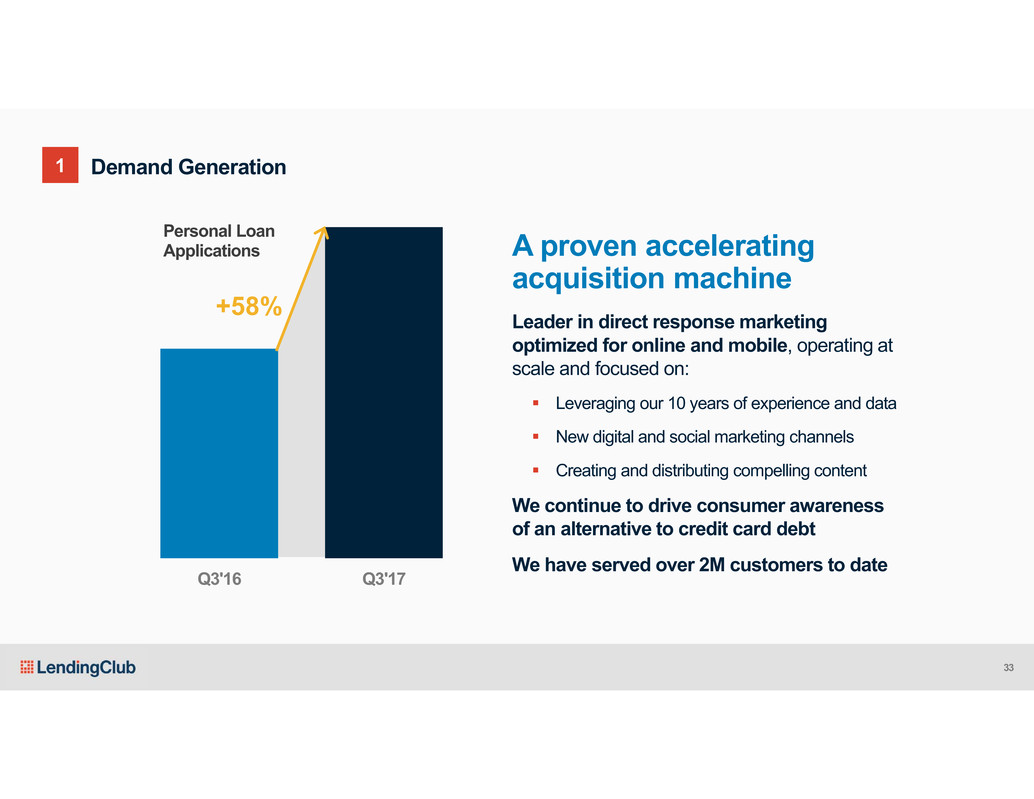

Q3'16 Q3'17 Personal Loan Applications +58% Leader in direct response marketing optimized for online and mobile, operating at scale and focused on: Leveraging our 10 years of experience and data New digital and social marketing channels Creating and distributing compelling content We continue to drive consumer awareness of an alternative to credit card debt We have served over 2M customers to date A proven accelerating acquisition machine Demand Generation1 33

Enabling “yes” to more customers – Data and modeling Throughput2 Key Strengths Credit Risk Assessment Optimized Identity & Fraud 10 Years of data Machine learning/modeling Non-traditional & proprietary data Credit risk talent 50 Custom attributes in new model Bank transaction data 34

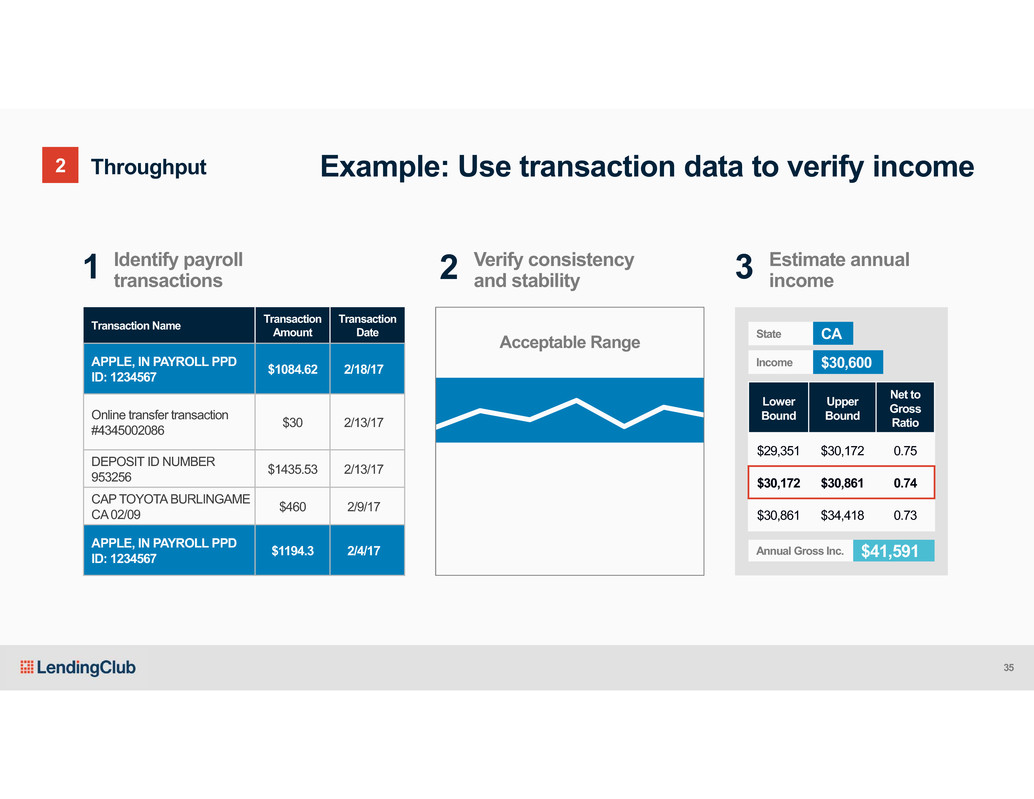

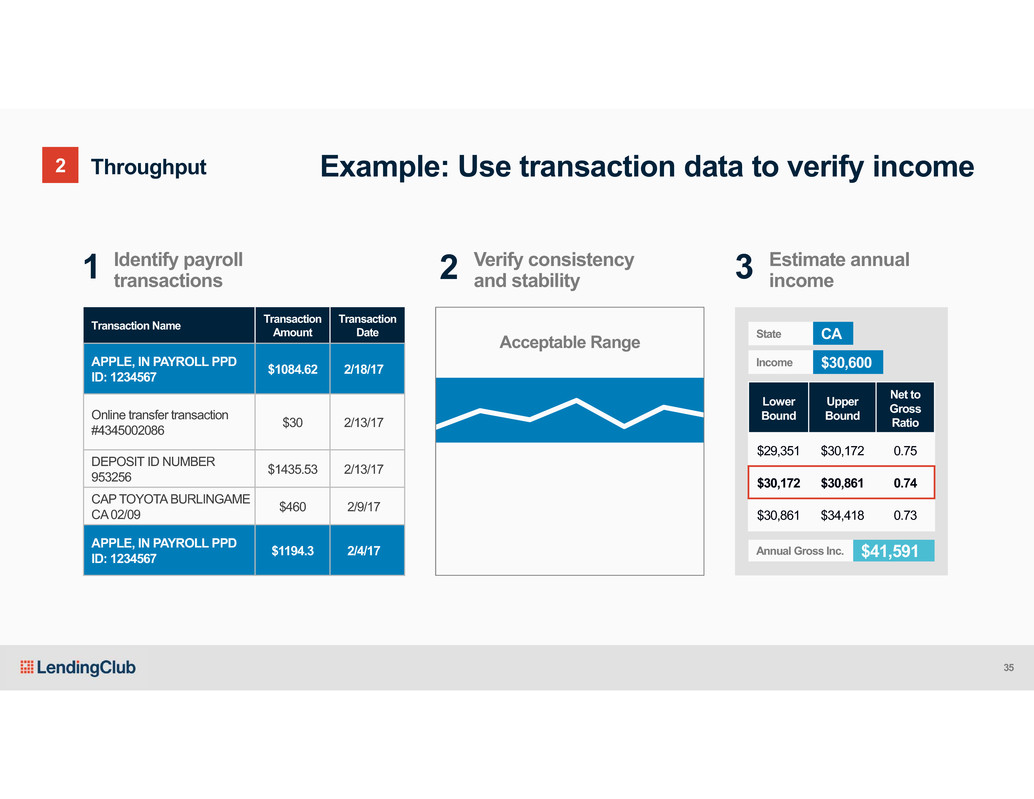

Throughput2 Transaction Name Transaction Amount Transaction Date APPLE, IN PAYROLL PPD ID: 1234567 $1084.62 2/18/17 Online transfer transaction #4345002086 $30 2/13/17 DEPOSIT ID NUMBER 953256 $1435.53 2/13/17 CAP TOYOTA BURLINGAME CA 02/09 $460 2/9/17 APPLE, IN PAYROLL PPD ID: 1234567 $1194.3 2/4/17 Identify payroll transactions1 Verify consistency and stability2 Acceptable Range Estimate annual income3 Lower Bound Upper Bound Net to Gross Ratio $29,351 $30,172 0.75 $30,172 $30,861 0.74 $30,861 $34,418 0.73 State CA Income $30,600 Annual Gross Inc. $41,591 Example: Use transaction data to verify income 35

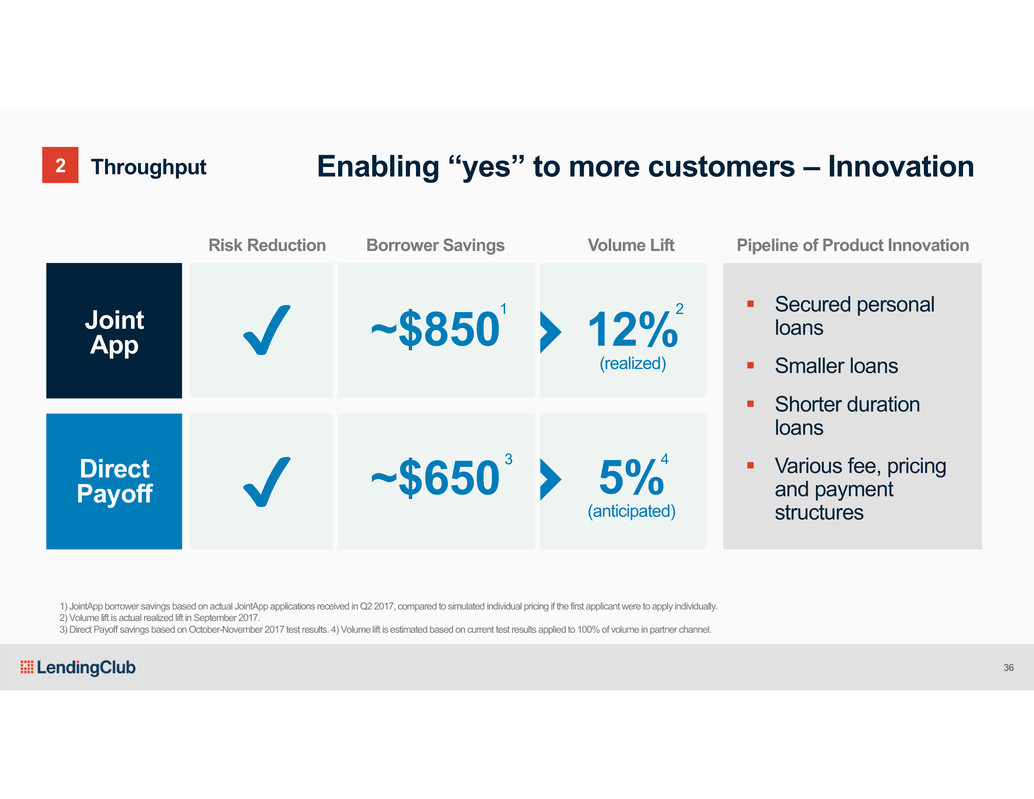

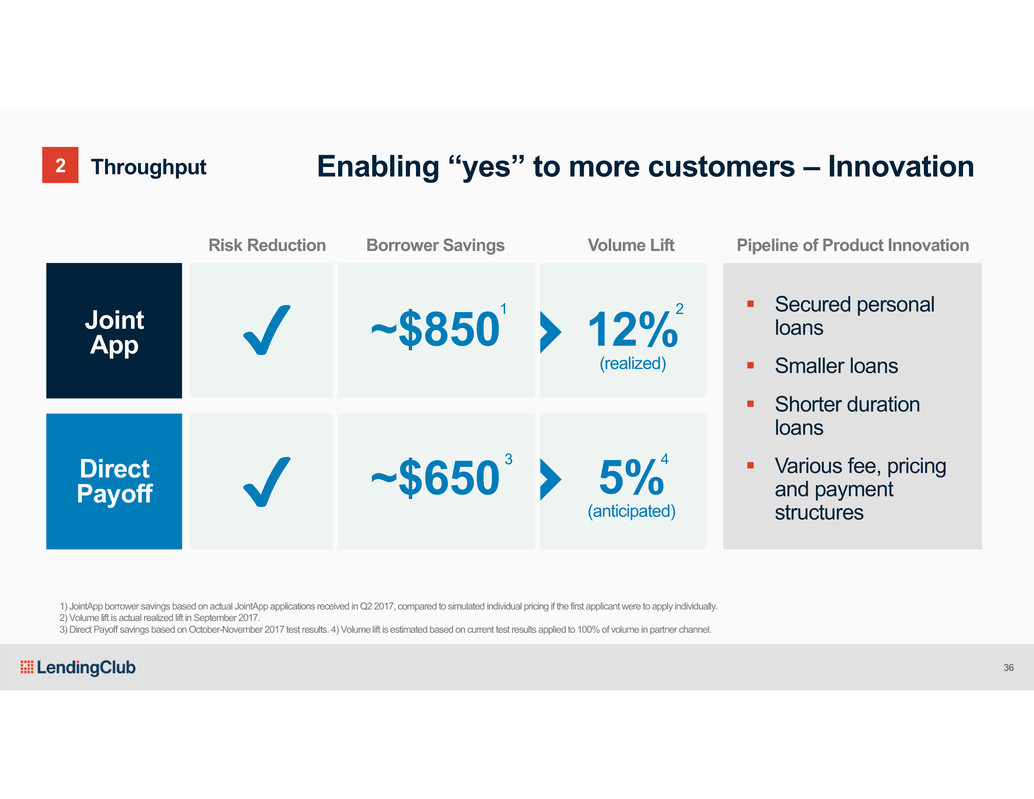

Secured personal loans Smaller loans Shorter duration loans Various fee, pricing and payment structures Risk Reduction Borrower Savings Volume Lift ~$850 12% (realized) ~$650 5% (anticipated) Pipeline of Product Innovation 1) JointAppborrower savings based on actual JointAppapplications received in Q2 2017, compared to simulated individual pricing if the first applicant were to apply individually. 2) Volume lift is actual realized lift in September 2017. 3) Direct Payoff savings based on October-November 2017 test results. 4) Volume lift is estimated based on current test results applied to 100% of volume in partner channel. Joint App Direct Payoff Enabling “yes” to more customers – InnovationThroughput2 ✔ ✔ 1 2 3 4 36

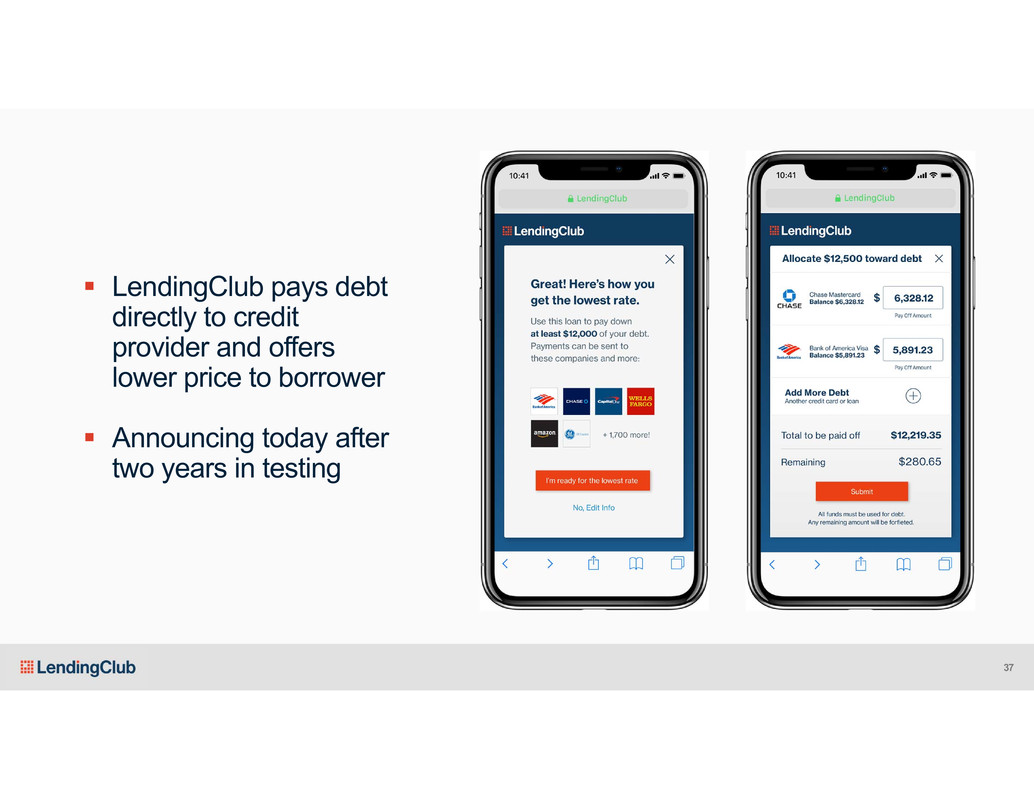

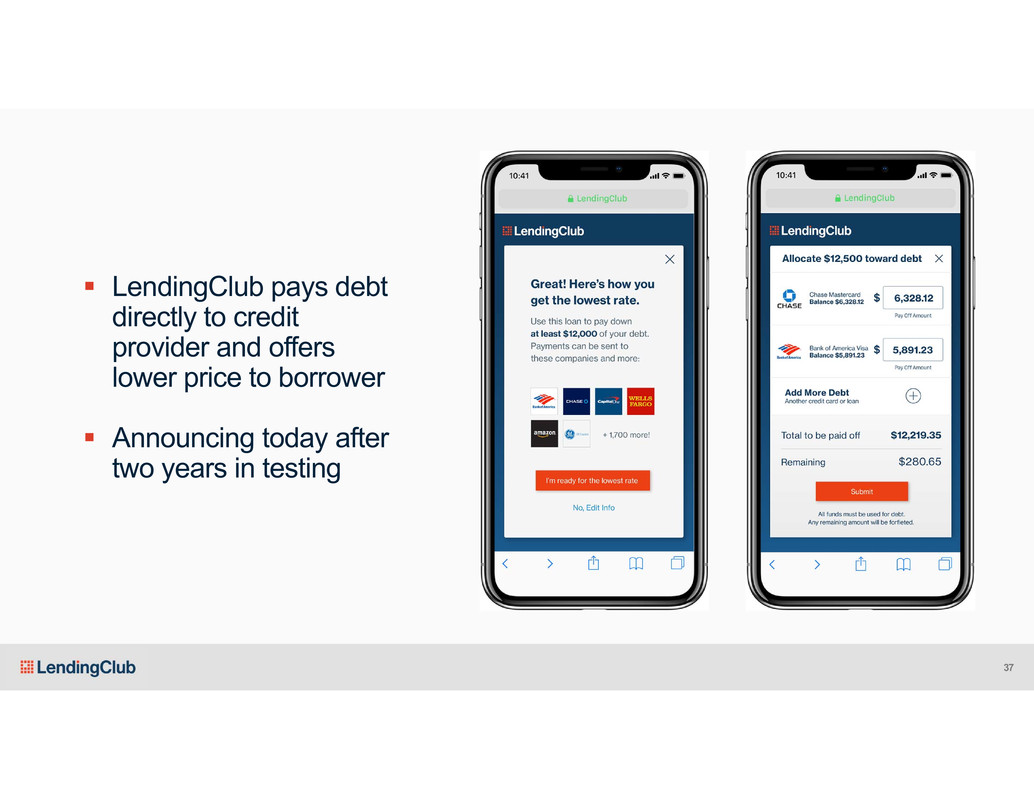

LendingClub pays debt directly to credit provider and offers lower price to borrower Announcing today after two years in testing 37

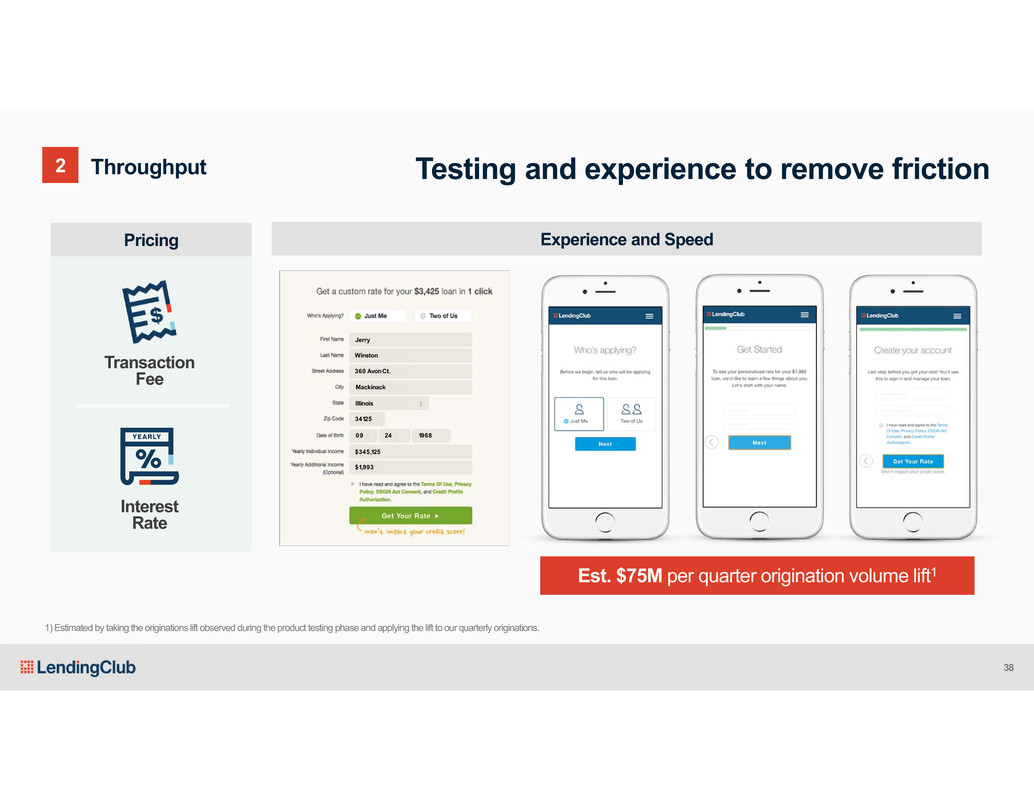

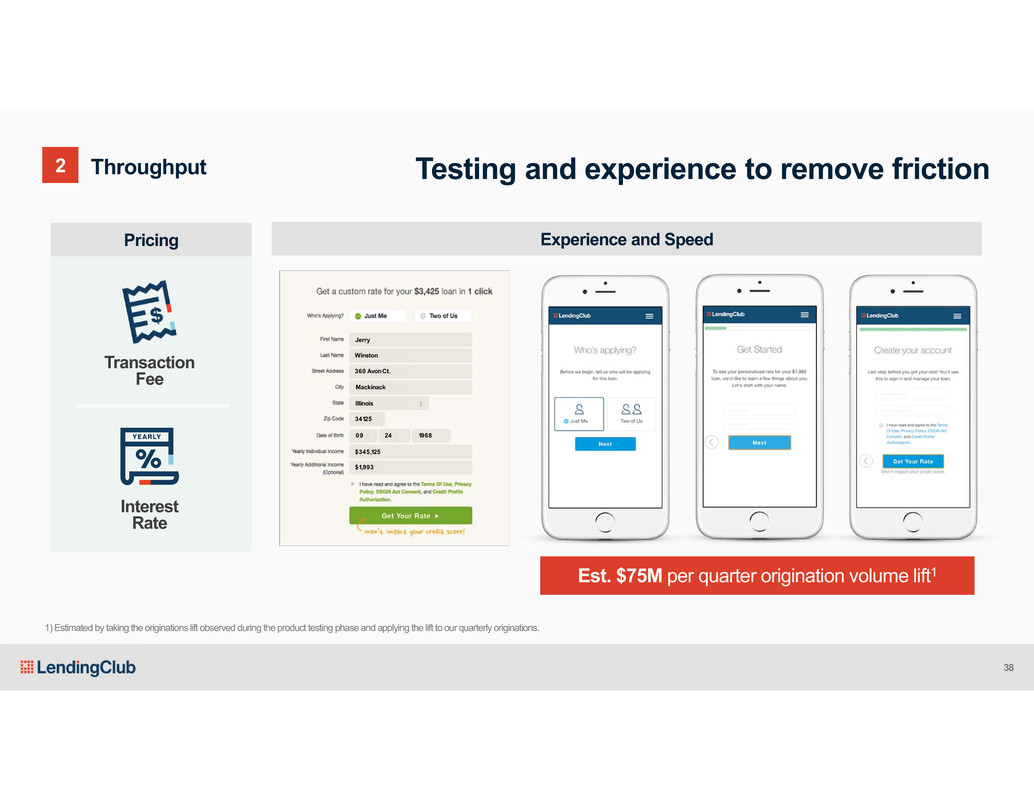

Testing and experience to remove friction Transaction Fee Interest Rate Experience and Speed Est. $75M per quarter origination volume lift1 1) Estimated by taking the originations lift observed during the product testing phase and applying the lift to our quarterly originations. Throughput2 Pricing Jerry Winston 360 Avon Ct. Mackinack Illinois 34125 09 24 1968 $345,125 $1,993 38

Repeat Borrowers Past borrowers come back to LendingClub for a subsequent personal loan Additional Loan Products Serve additional credit needs of current and past borrowers through other loan products Non-Lending Products Serve non-lending financial empowerment needs of current and past borrowers Lifecycle3 Serving broader customer needs 39

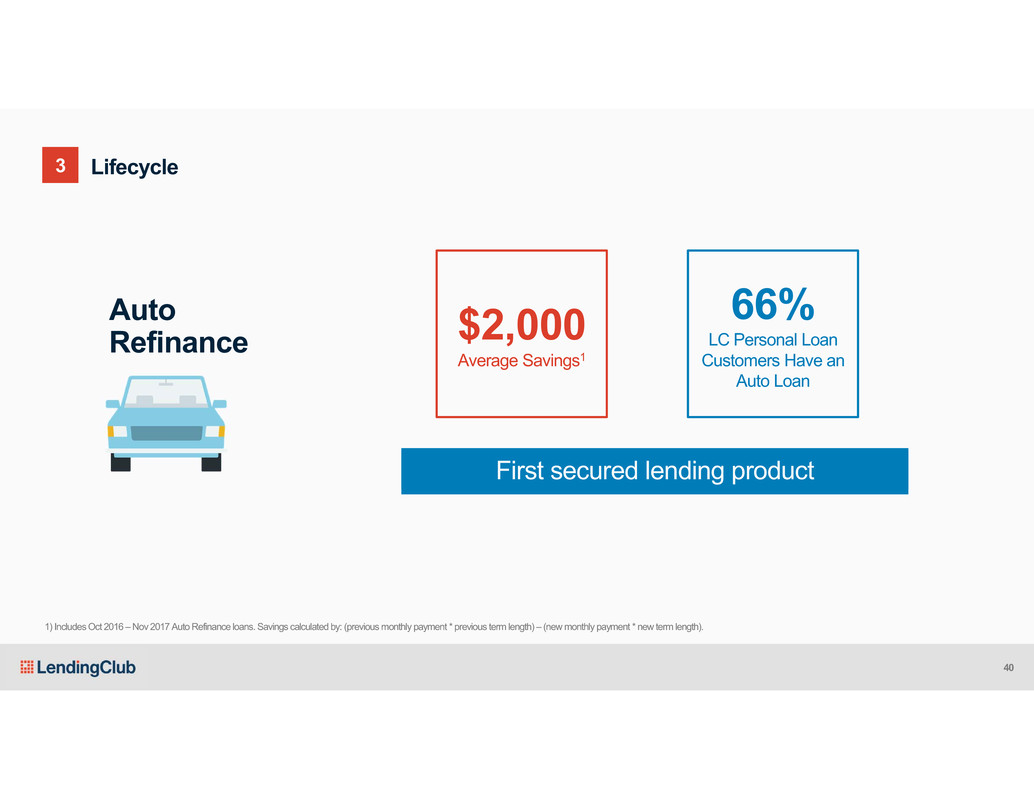

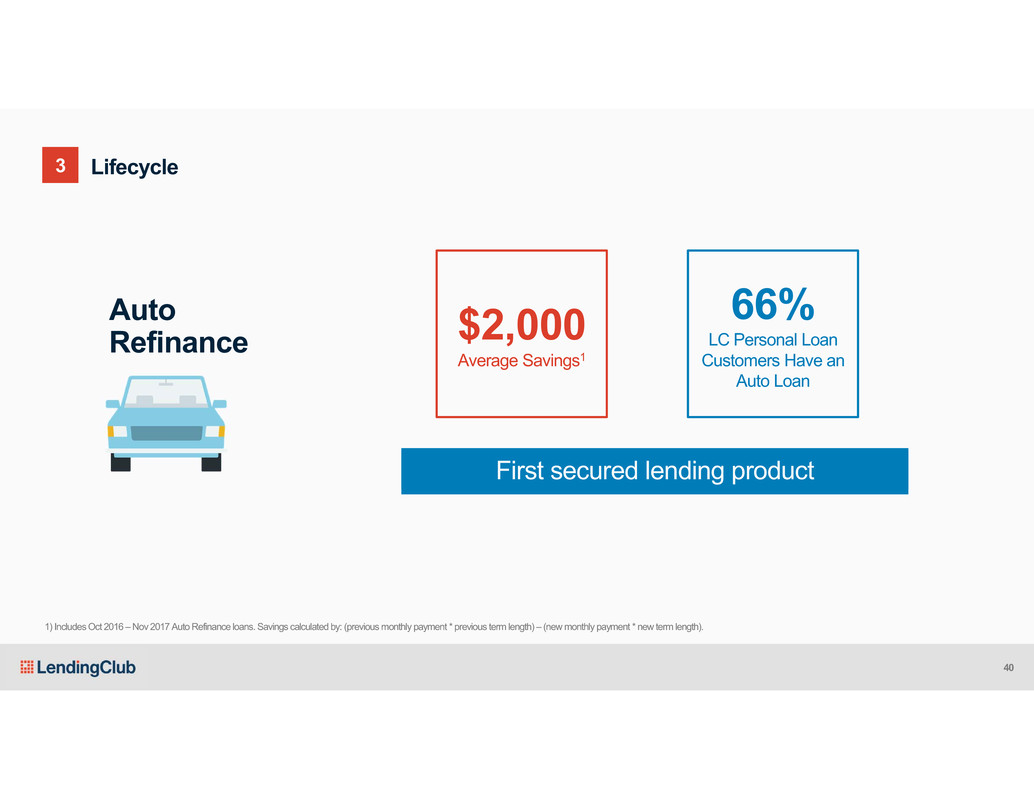

$2,000 Average Savings1 66% LC Personal Loan Customers Have an Auto Loan First secured lending product Auto Refinance 1) Includes Oct 2016 –Nov 2017 Auto Refinance loans. Savings calculated by: (previous monthly payment * previous term length) – (new monthly payment * new term length). Lifecycle3 40

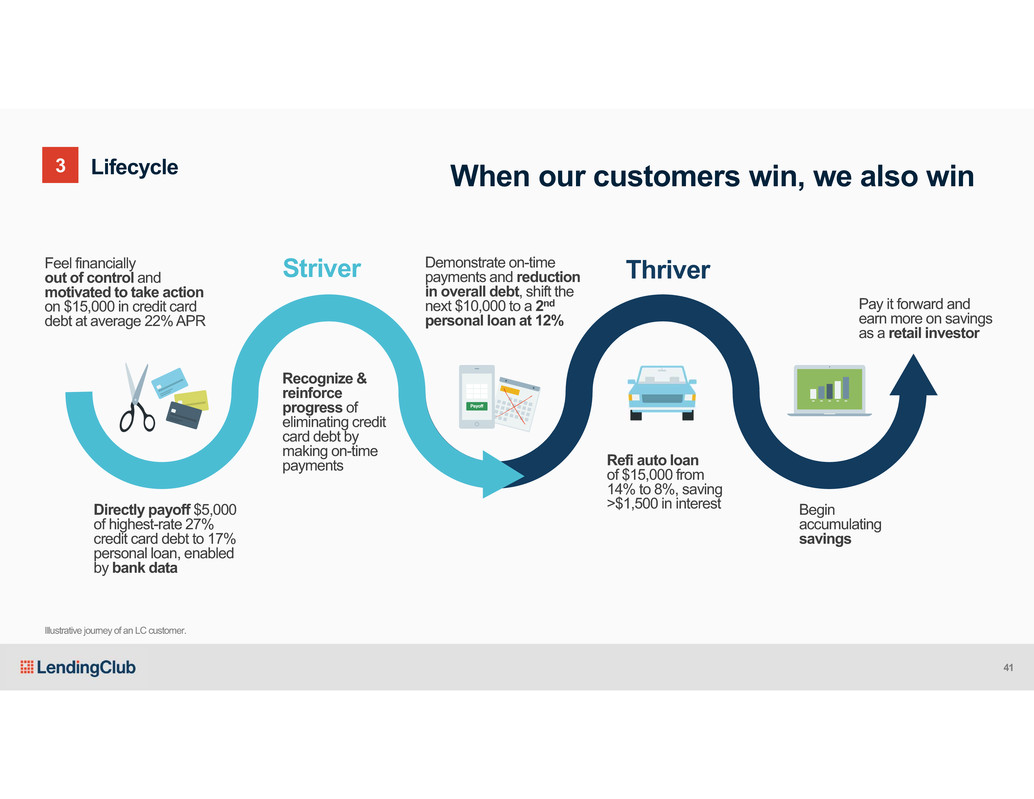

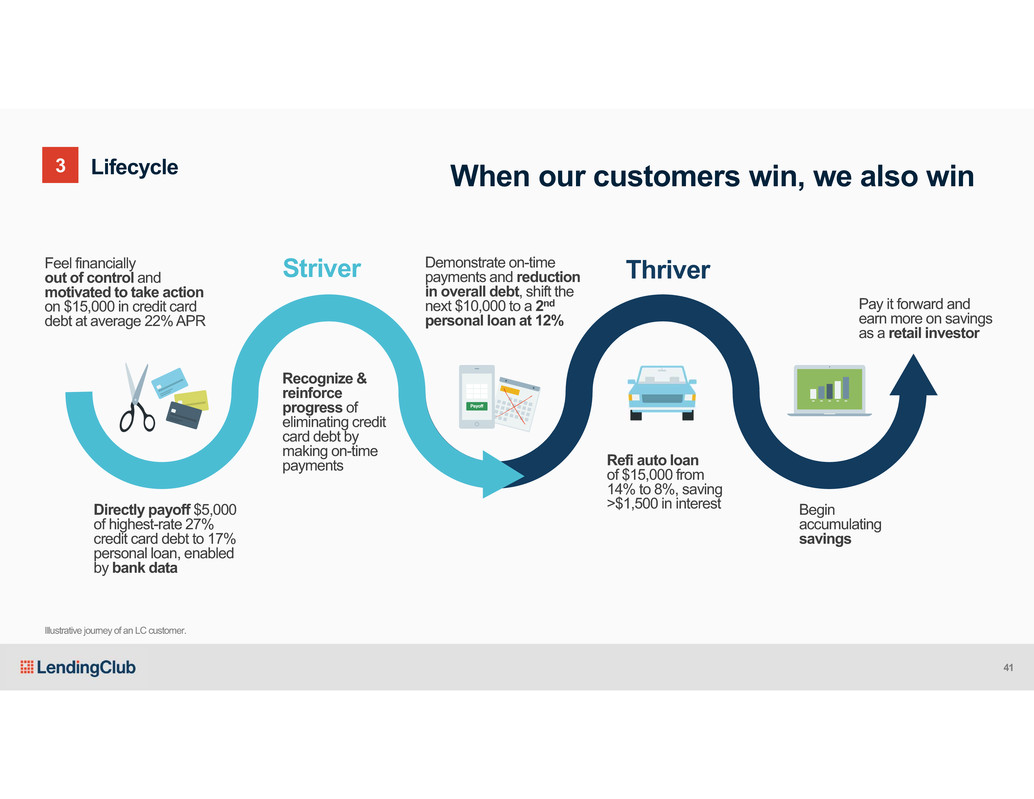

Feel financially out of control and motivated to take action on $15,000 in credit card debt at average 22% APR Directly payoff $5,000 of highest-rate 27% credit card debt to 17% personal loan, enabled by bank data Refi auto loan of $15,000 from 14% to 8%, saving >$1,500 in interest Pay it forward and earn more on savings as a retail investor Striver ThriverDemonstrate on-time payments and reduction in overall debt, shift the next $10,000 to a 2nd personal loan at 12% Begin accumulating savings Recognize & reinforce progress of eliminating credit card debt by making on-time payments When our customers win, we also win Illustrative journey of an LC customer. Lifecycle3 41

Sid Jajodia SVP, Chief Investment Officer Sammy Soohoo SVP, Credit Risk

Credit is fundamental BorrowerSay yes more. Better rates. Investor Credit Attractive, predictable returns. 43

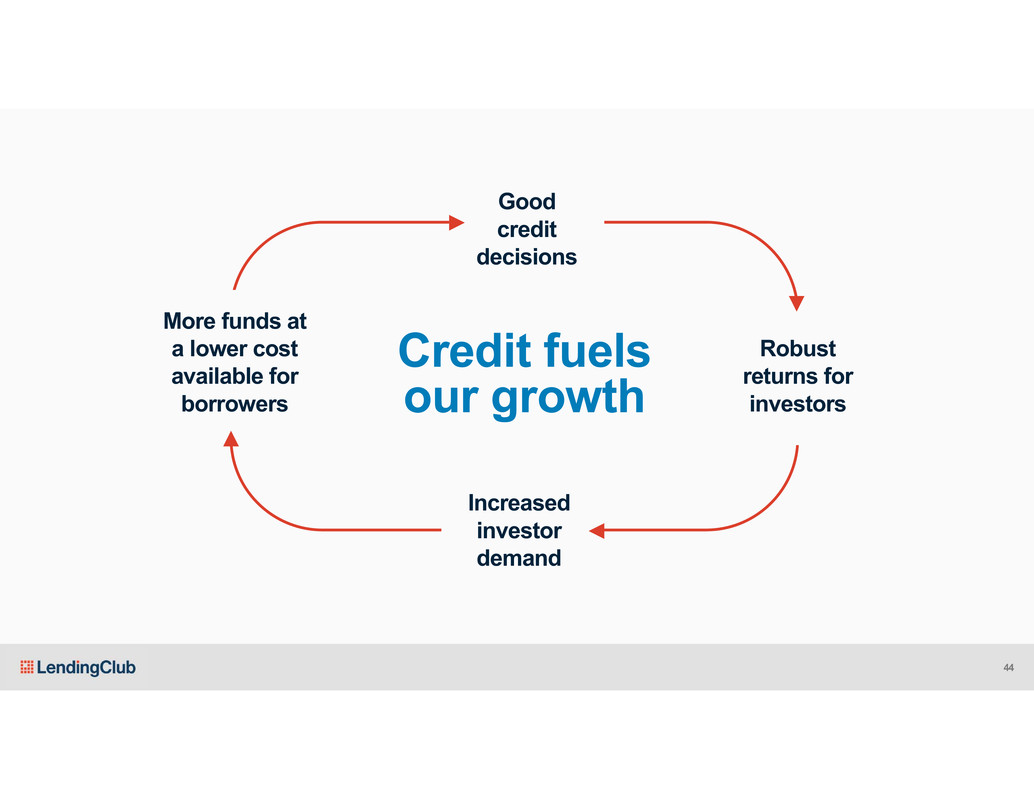

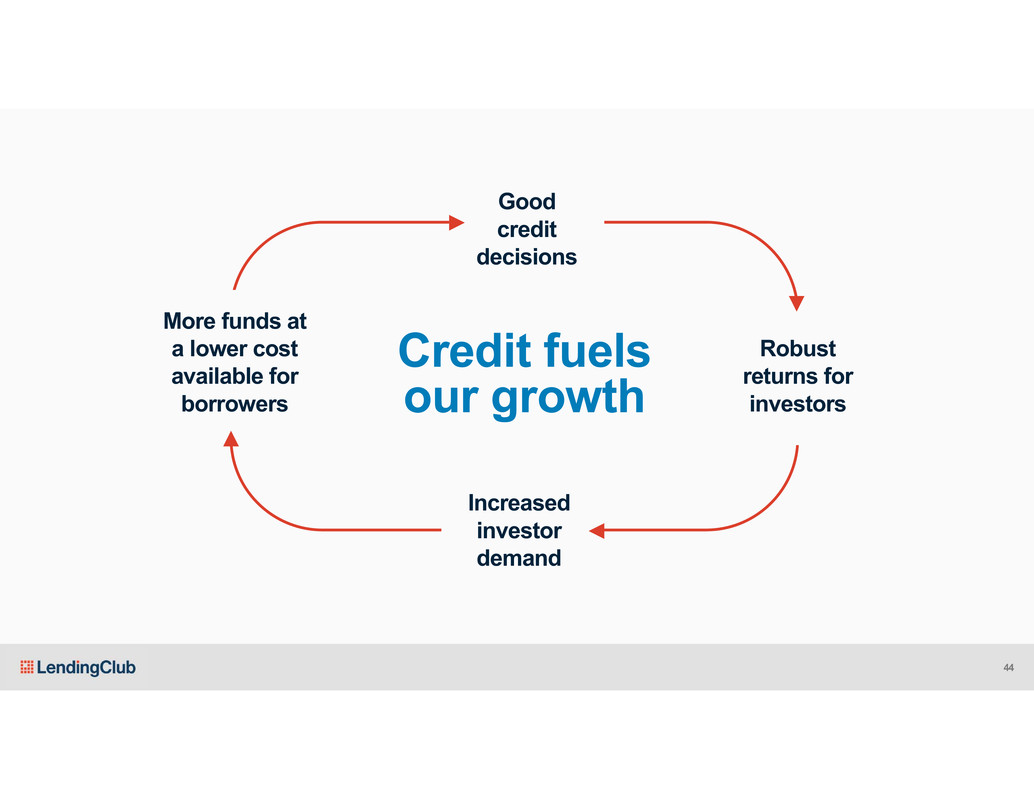

Robust returns for investors Increased investor demand More funds at a lower cost available for borrowers Good credit decisions Credit fuels our growth 44

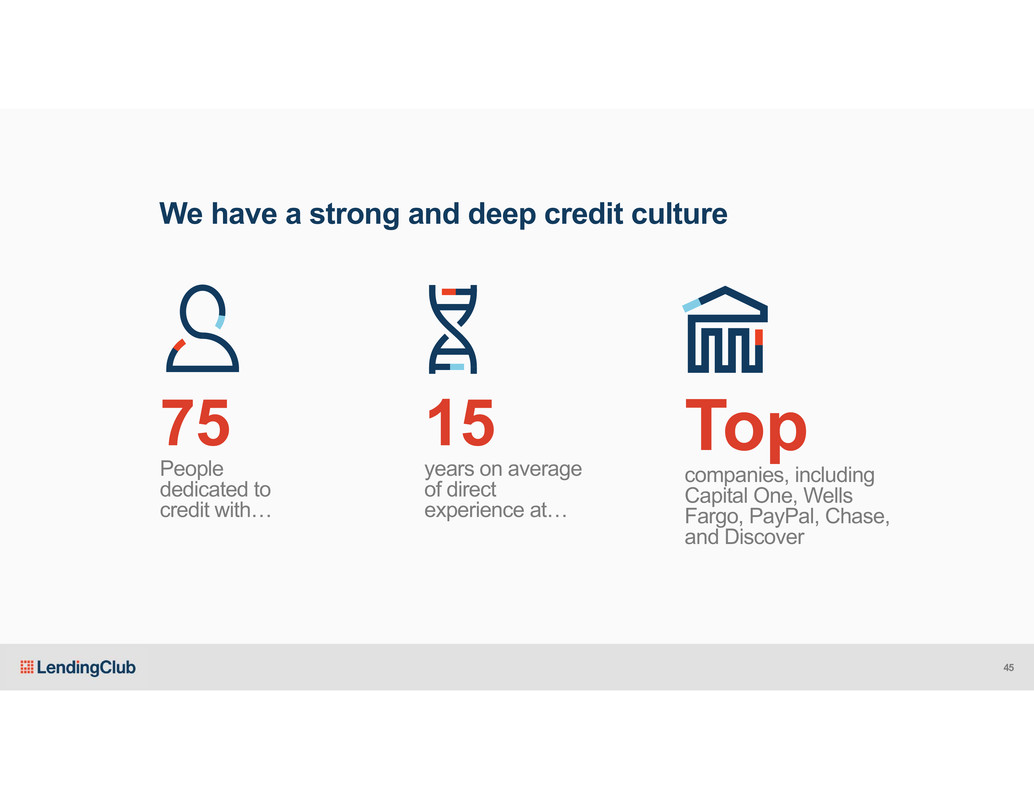

We have a strong and deep credit culture 75 People dedicated to credit with… 15 years on average of direct experience at… Top companies, including Capital One, Wells Fargo, PayPal, Chase, and Discover 45

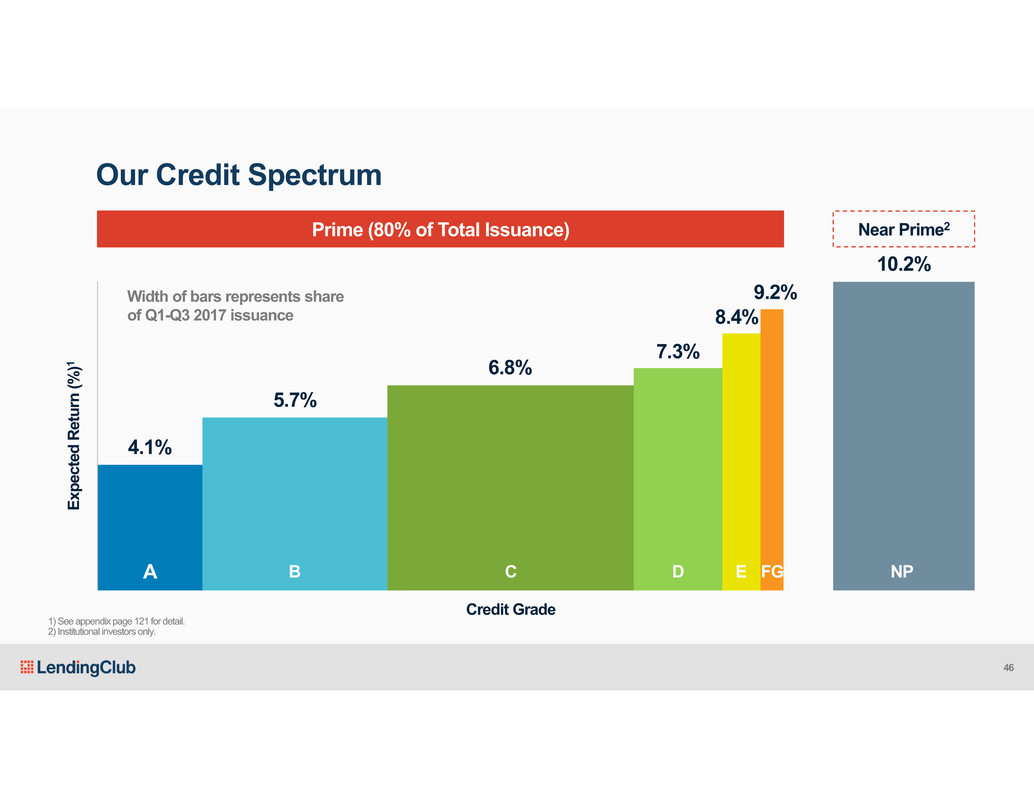

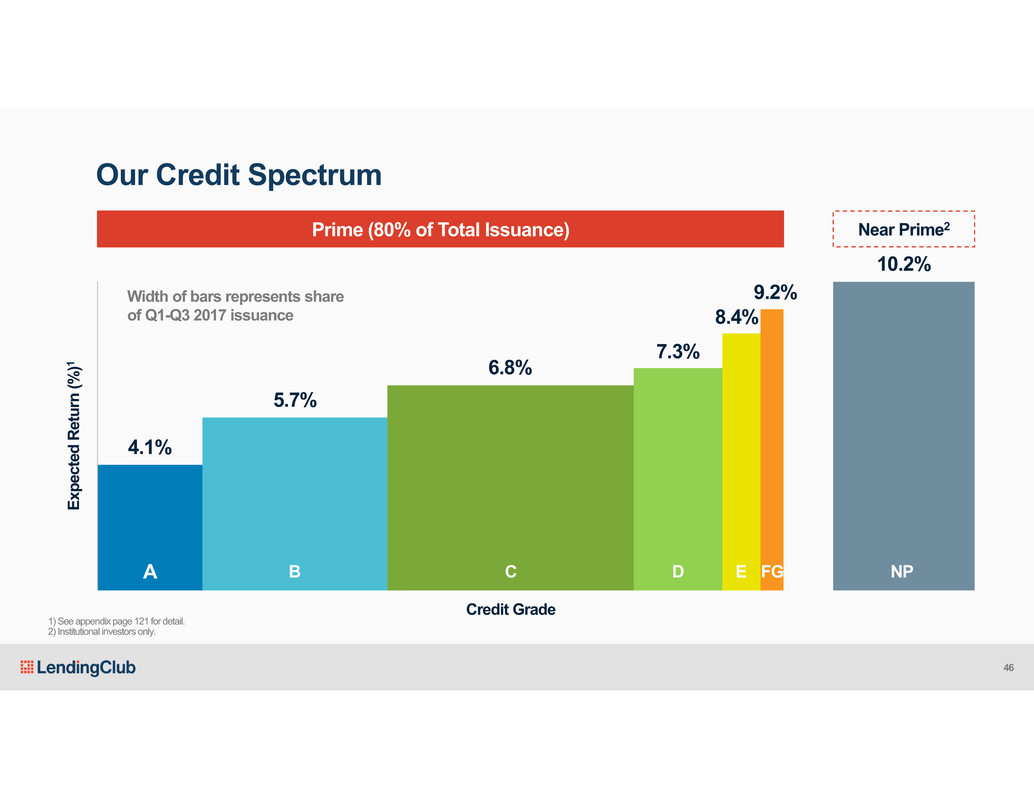

Our Credit Spectrum A B C D E FG 4.1% 5.7% 6.8% 7.3% 8.4% 9.2% 10.2% E x p e c t e d R e t u r n ( % ) 1 Credit Grade Width of bars represents share of Q1-Q3 2017 issuance Prime (80% of Total Issuance) Near Prime2 NP 1) See appendix page 121 for detail. 2) Institutional investors only. 46

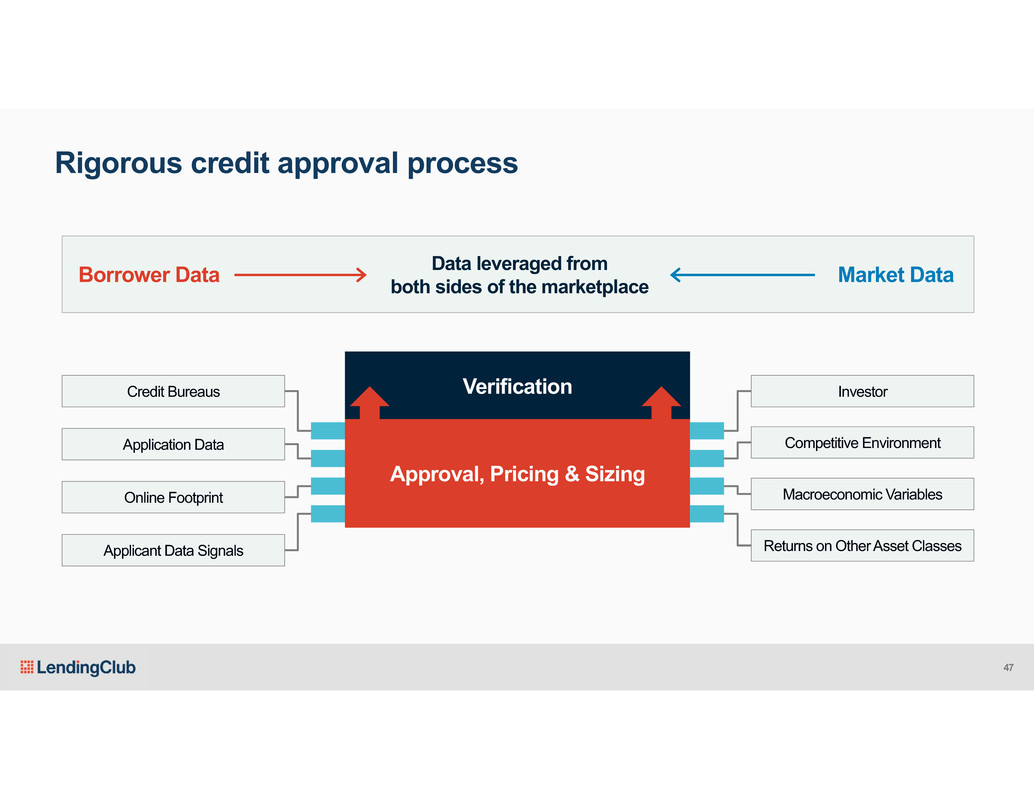

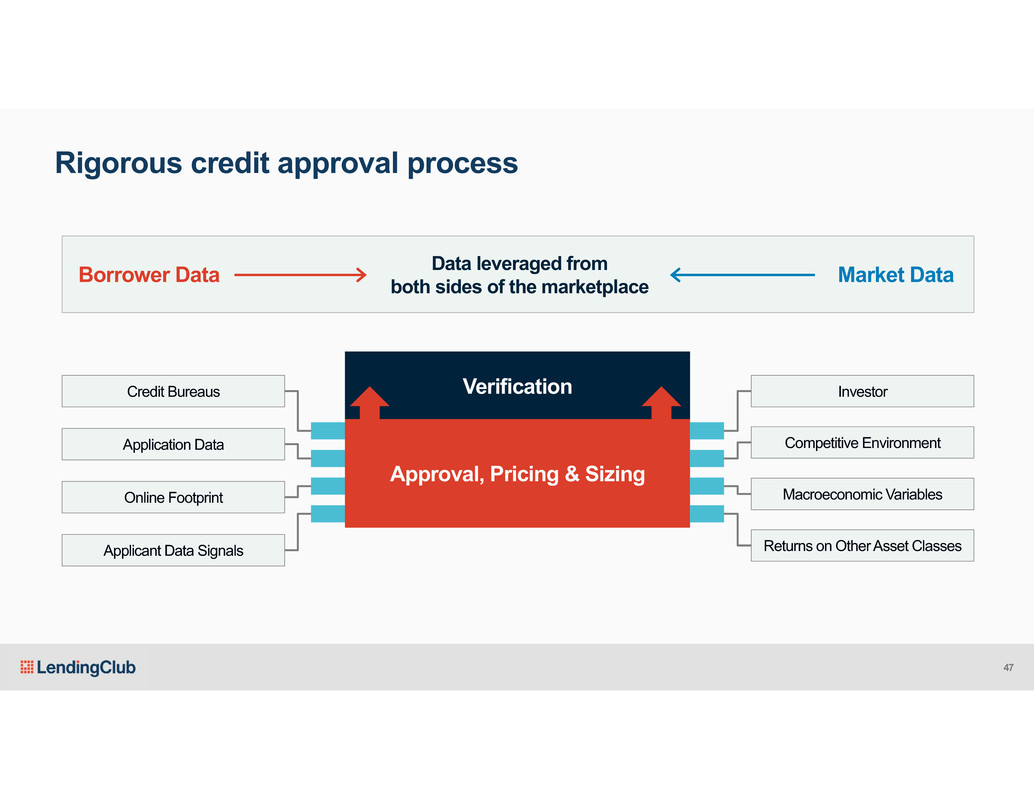

Verification Approval, Pricing & Sizing Credit Bureaus Online Footprint Application Data Applicant Data Signals Investor Macroeconomic Variables Competitive Environment Returns on Other Asset Classes Rigorous credit approval process Data leveraged from both sides of the marketplaceBorrower Data Market Data 47

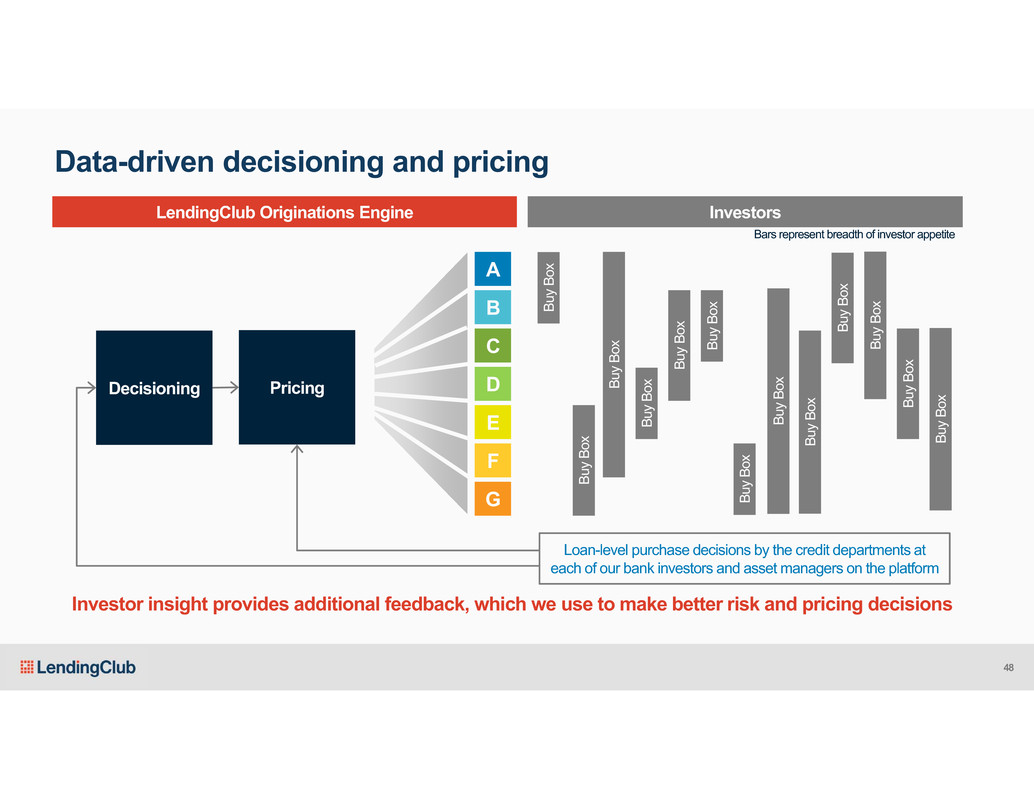

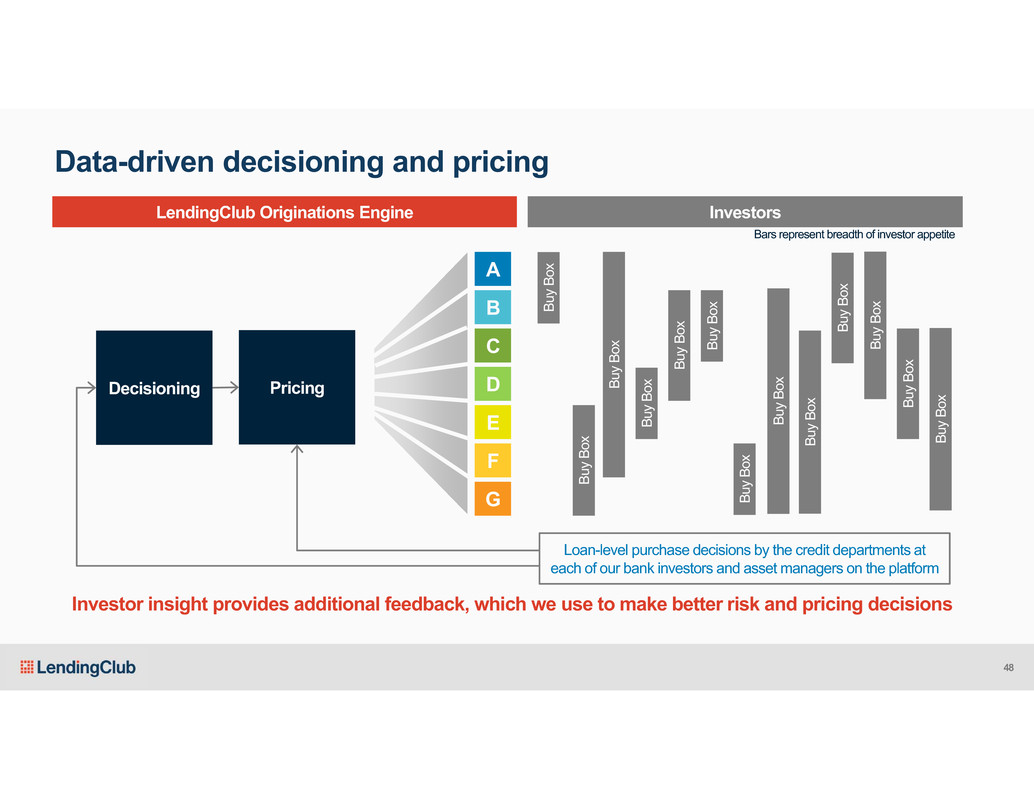

LendingClub Originations Engine Decisioning A B C D E F G Pricing B u y B o x B u y B o x B u y B o x B u y B o x B u y B o x B u y B o x B u y B o x B u y B o x B u y B o x B u y B o x B u y B o x B u y B o x Bars represent breadth of investor appetite B u y B o x Investors Loan-level purchase decisions by the credit departments at each of our bank investors and asset managers on the platform Data-driven decisioning and pricing Investor insight provides additional feedback, which we use to make better risk and pricing decisions 48

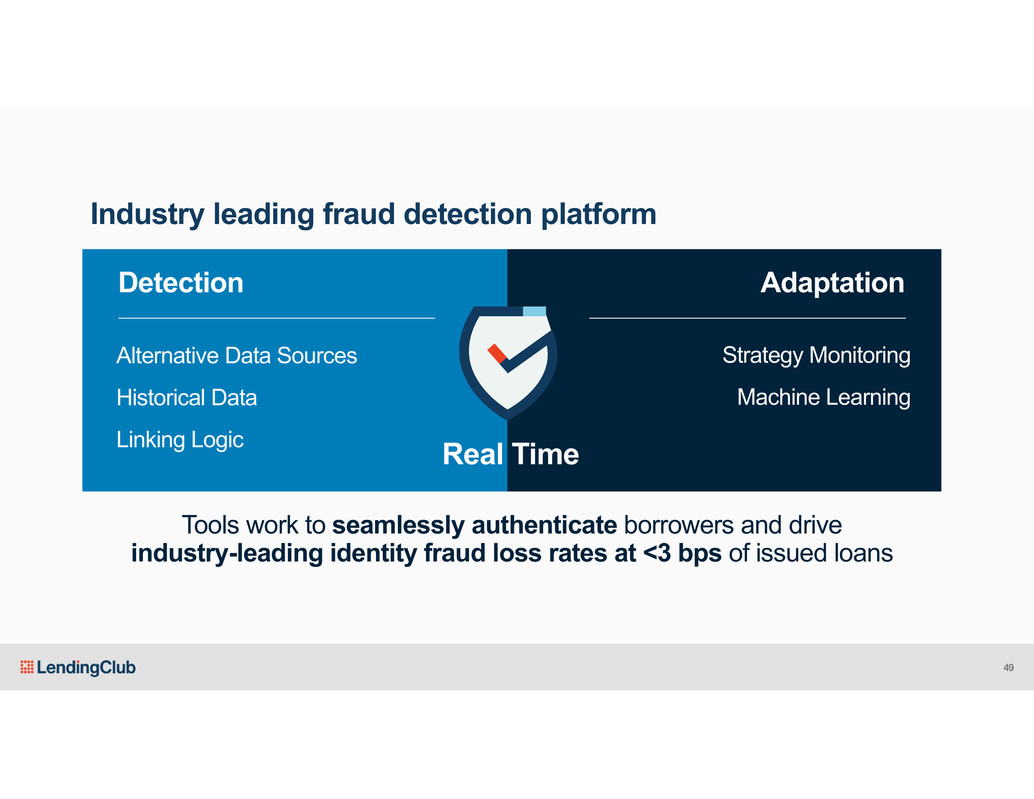

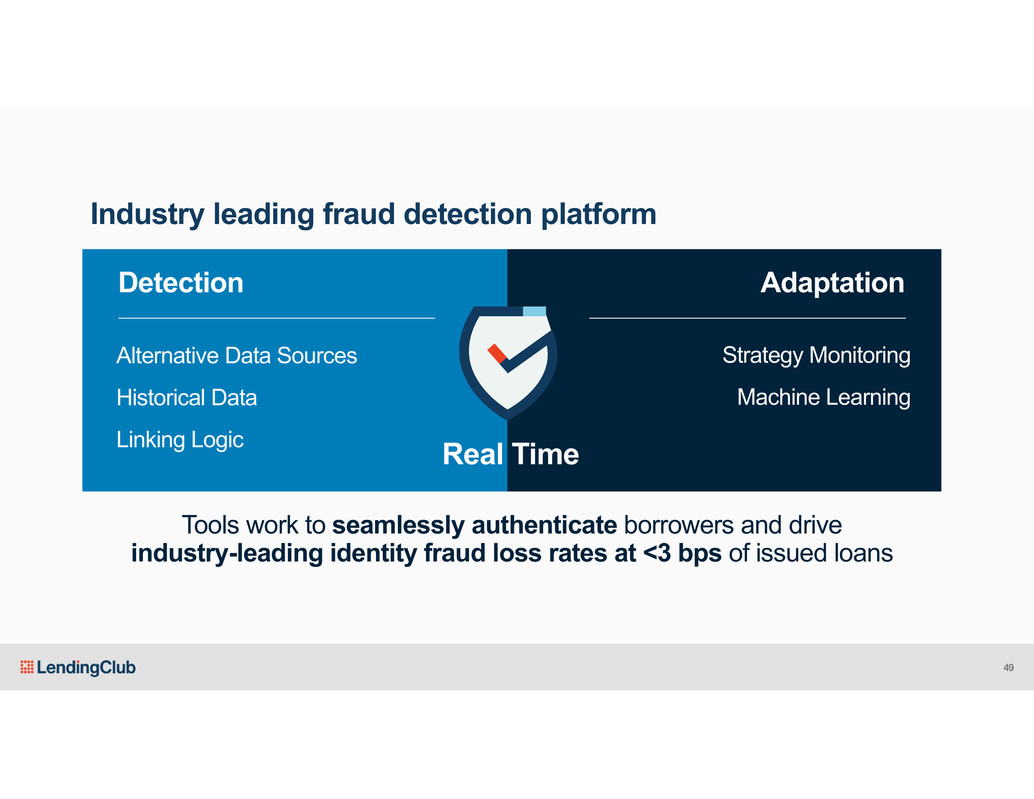

Adaptation Detection Alternative Data Sources Historical Data Linking Logic Strategy Monitoring Machine Learning Real Time Tools work to seamlessly authenticate borrowers and drive industry-leading identity fraud loss rates at <3 bps of issued loans Industry leading fraud detection platform 49

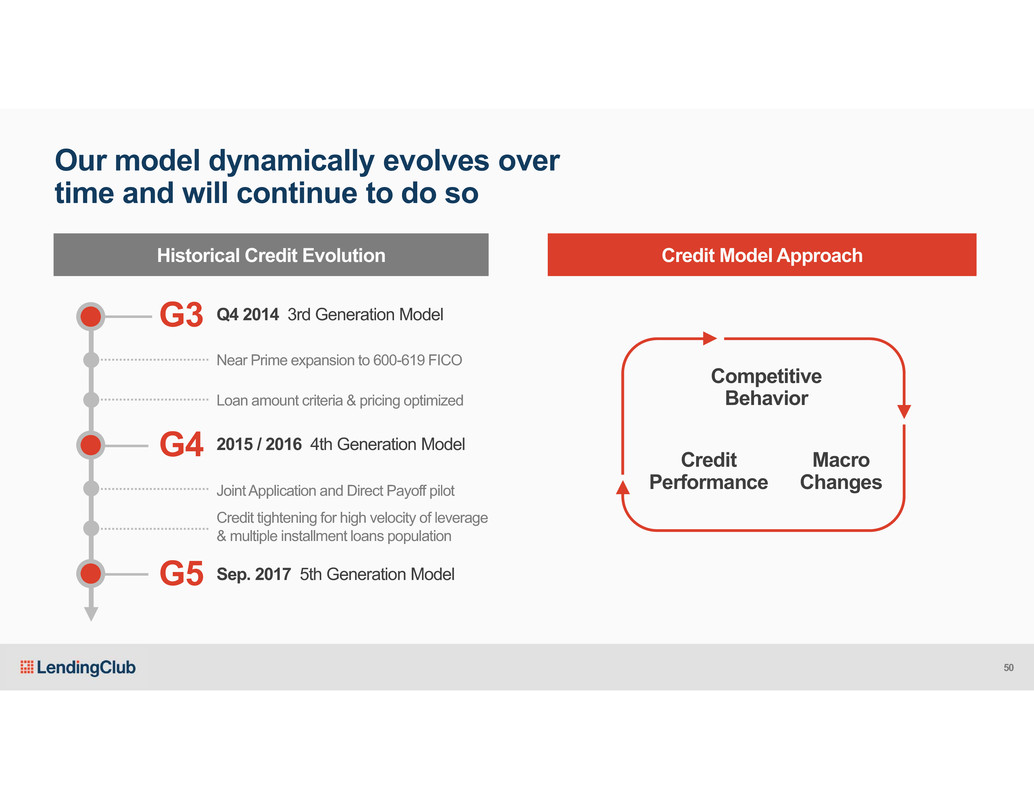

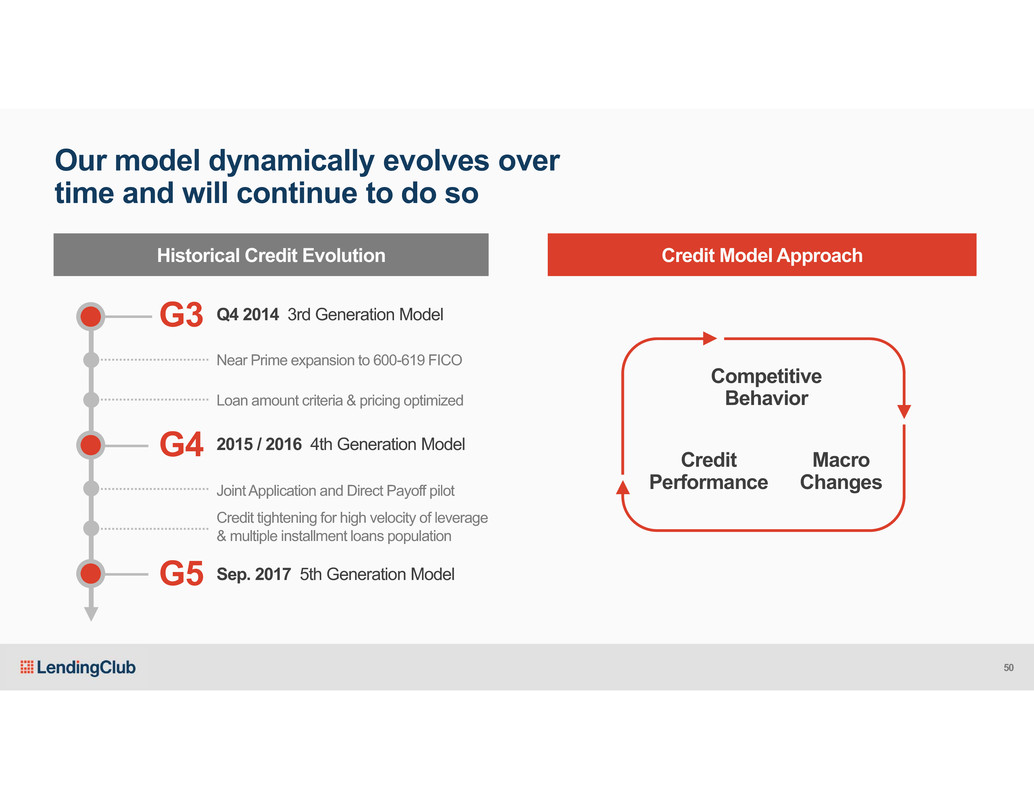

Historical Credit Evolution G3 Q4 2014 3rd Generation Model G4 2015 / 2016 4th Generation Model G5 Sep. 2017 5th Generation Model Near Prime expansion to 600-619 FICO Loan amount criteria & pricing optimized Joint Application and Direct Payoff pilot Credit tightening for high velocity of leverage & multiple installment loans population Credit Model Approach Our model dynamically evolves over time and will continue to do so Competitive Behavior Credit Performance Macro Changes 50

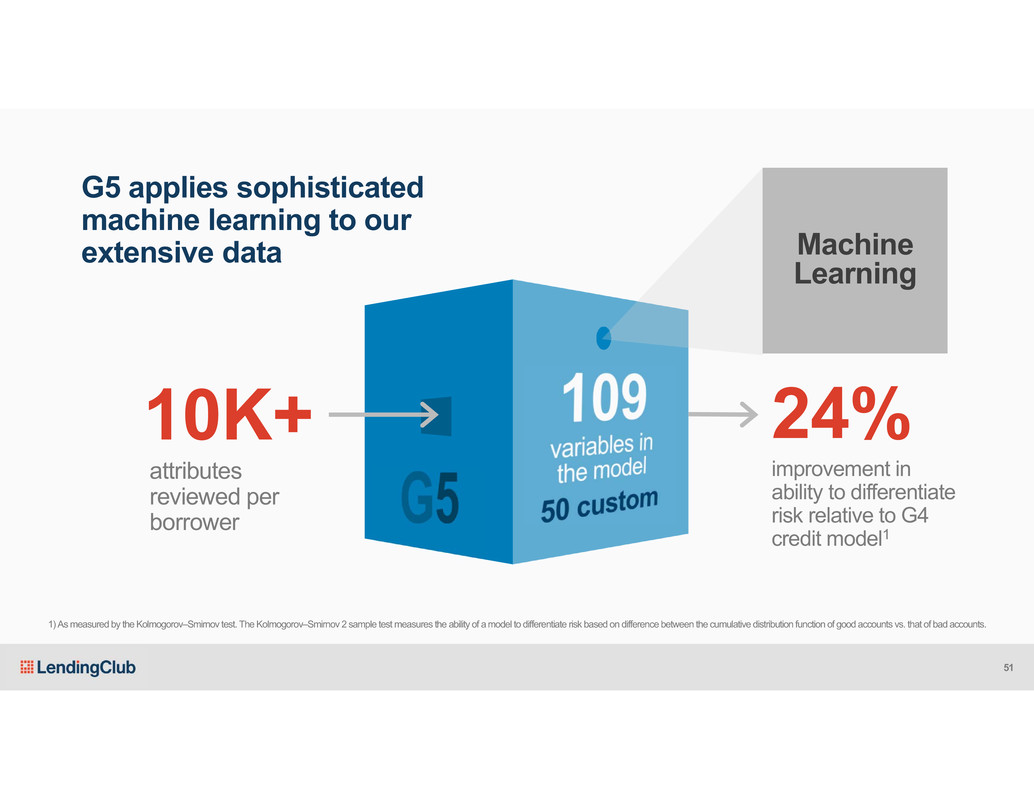

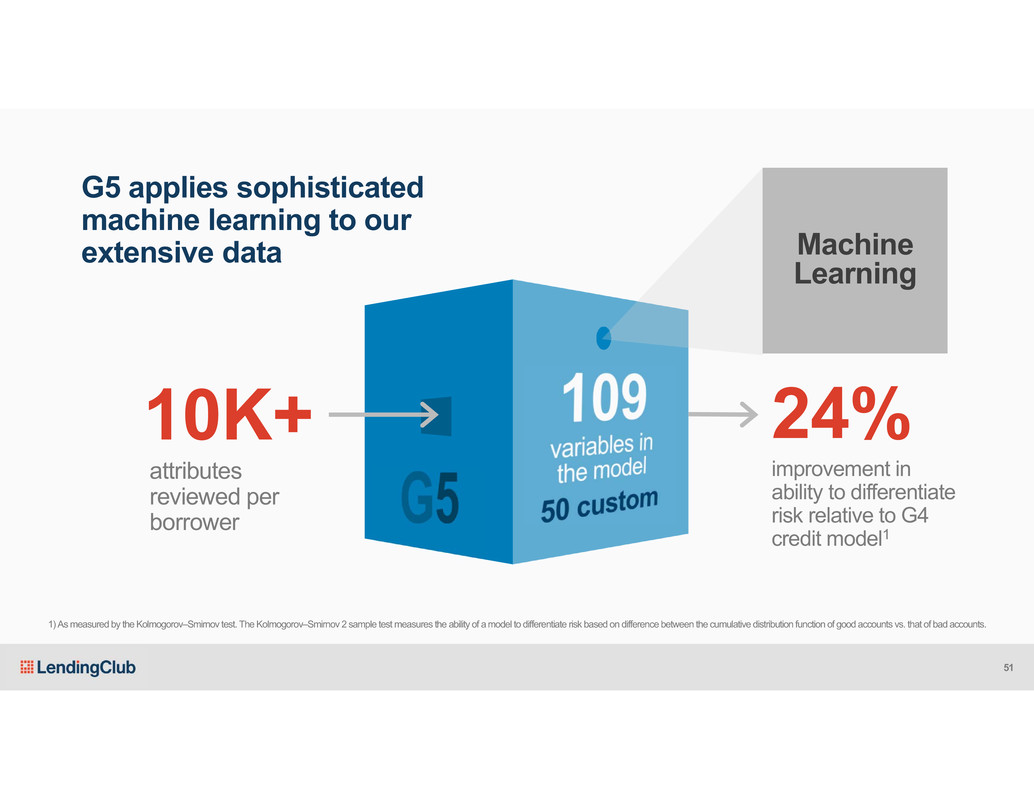

attributes reviewed per borrower 24% improvement in ability to differentiate risk relative to G4 credit model1 10K+ G5 applies sophisticated machine learning to our extensive data Machine Learning 1) As measured by the Kolmogorov–Smirnov test. The Kolmogorov–Smirnov 2 sample test measures the ability of a model to differentiate risk based on difference between the cumulative distribution function of good accounts vs. that of bad accounts. 51

0% 8% 16% 24% 32% 40% D1 D2 D3 D4 D5 D6 D7 D8 D9 D10 Population Decile (by risk score) FICO G4 G5 60+ Day Delinquency, Bankruptcy, or Charge-Off Rate1 1) As of February 2017. “60+ Day Delinquency, Bankruptcy, or Charge-Off Rate” is estimated using the credit bureau data (includes information on all credit lines including LendingClub loans) for Q4’15 and Q1’16 prime loan applications received by LendingClub. It is defined as percentage of accounts that have gone 60+ days delinquent, entered bankruptcy, or charged-off. Backtested data is hypothetical and is provided for information purposes only. Backtested data does not represent actual results and is not a prediction of future results. Actual results may vary. Backtested data has inherent limitations, including that historical borrower populations are not necessarily indicative of future borrower populations. Individual results may vary and projections can change. Past performance is no guarantee of future results. G5 allows us to discern between borrowers better than ever Improves risk differentiation across all borrowers Captures greater risk of default in the population we decline The remaining population benefits from more attractive pricing 52

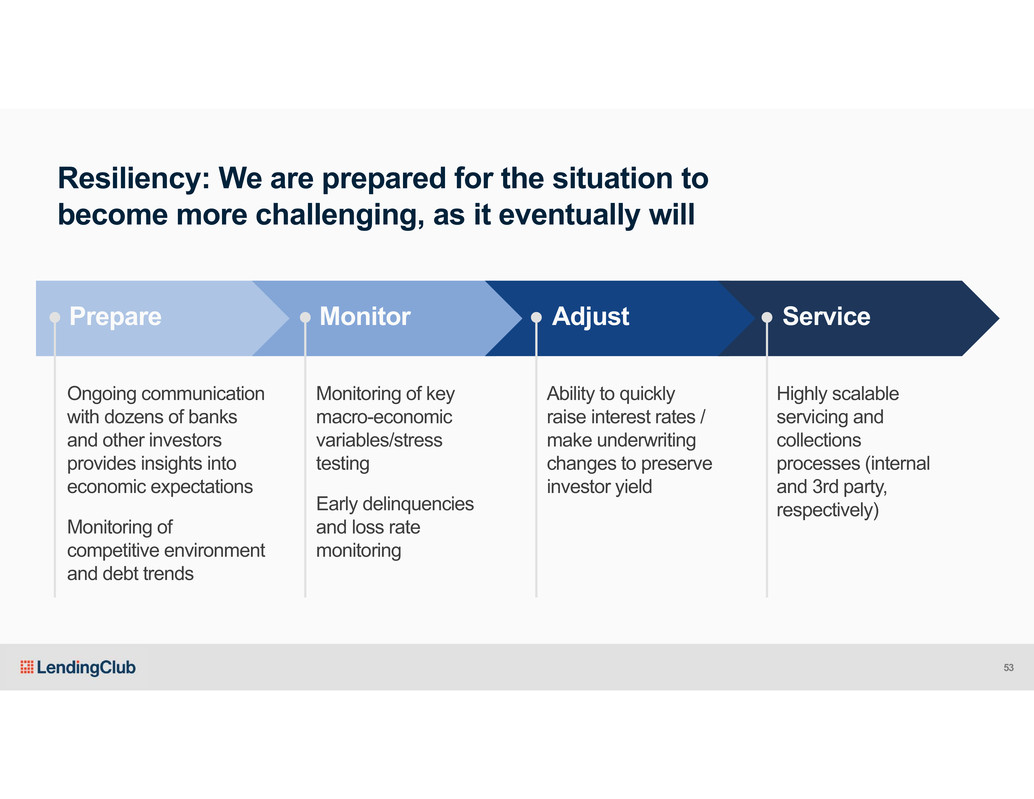

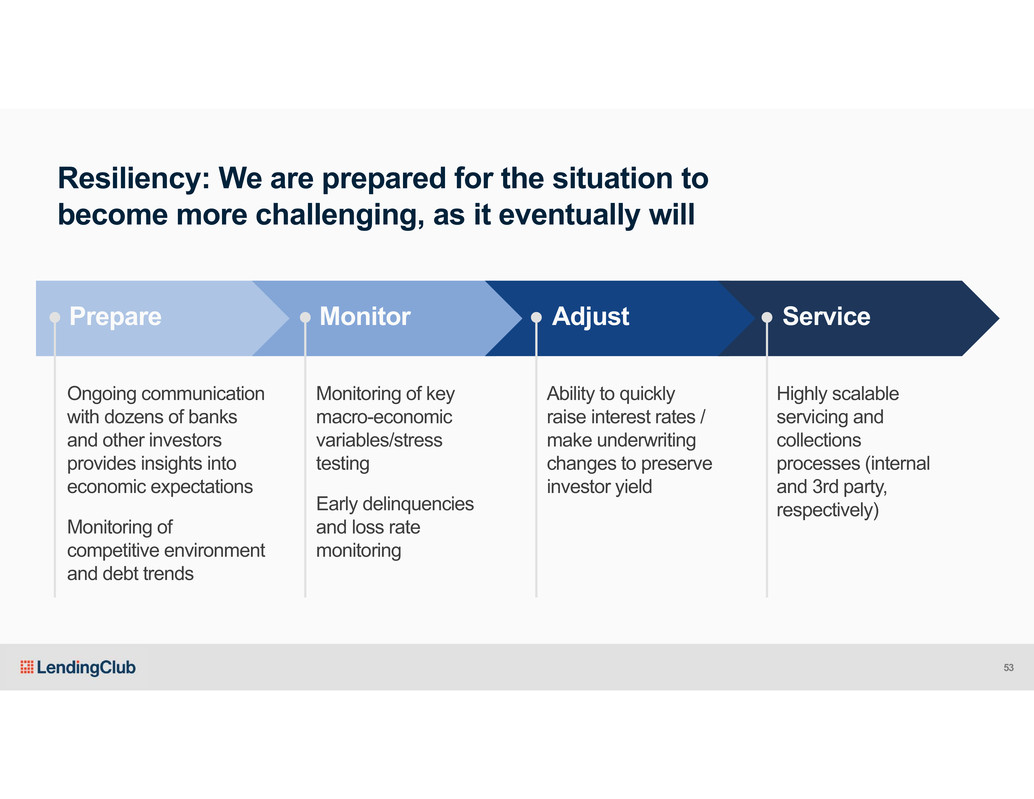

Prepare Monitor Adjust Service Ongoing communication with dozens of banks and other investors provides insights into economic expectations Monitoring of competitive environment and debt trends Resiliency: We are prepared for the situation to become more challenging, as it eventually will Monitoring of key macro-economic variables/stress testing Early delinquencies and loss rate monitoring Ability to quickly raise interest rates / make underwriting changes to preserve investor yield Highly scalable servicing and collections processes (internal and 3rd party, respectively) 53

5.5% 6.0% 7.9% 3.4% 11.5% -0.7% -2% 0% 2% 4% 6% 8% 10% 12% 14% Expected Charge-off Rate Projected IRR Stress tests project attractive relative returns even in a downturn1 Baseline Moderate Recession Protracted Slump 1) Results for Prime program stress test. See appendix page 122 for detail. 54

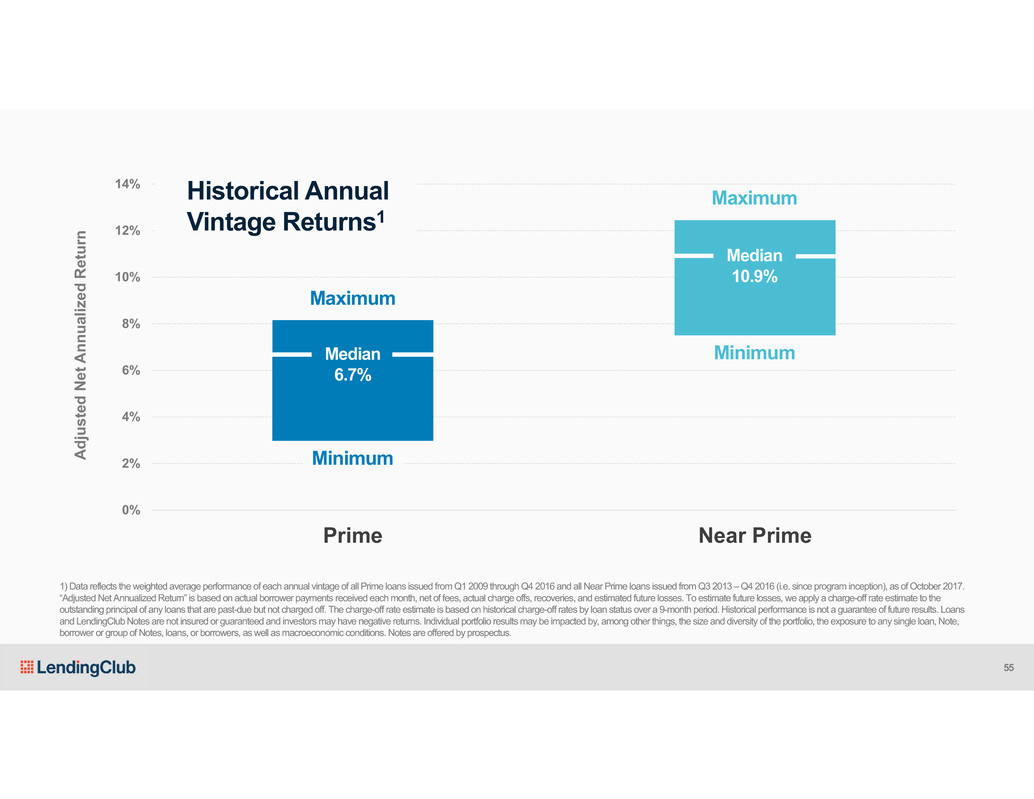

0% 2% 4% 6% 8% 10% 12% 14% Prime Near Prime A d j u s t e d N e t A n n u a l i z e d R e t u r n Median 10.9% Median 6.7% Maximum Minimum Maximum Minimum 1) Data reflects the weighted average performance of each annual vintage of all Prime loans issued from Q1 2009 through Q4 2016 and all Near Prime loans issued from Q3 2013 –Q4 2016 (i.e. since program inception), as of October 2017. “Adjusted Net Annualized Return” is based on actual borrower payments received each month, net of fees, actual charge offs, recoveries, and estimated future losses. To estimate future losses, we apply a charge-off rate estimate to the outstanding principal of any loans that are past-due but not charged off. The charge-off rate estimate is based on historical charge-off rates by loan status over a 9-month period. Historical performance is not a guarantee of future results. Loans and LendingClubNotes are not insured or guaranteed and investors may have negative returns. Individual portfolio results may be impacted by, among other things, the size and diversity of the portfolio, the exposure to any single loan, Note, borrower or group of Notes, loans, or borrowers, as well as macroeconomic conditions. Notes are offered by prospectus. Historical Annual Vintage Returns1 55

Patrick Dunne Chief Capital Officer

Continuing to deliver innovative investor products and expand our investor base All loans originated and issued by our federally regulated issuing bank partners. Borrowers Investors 57

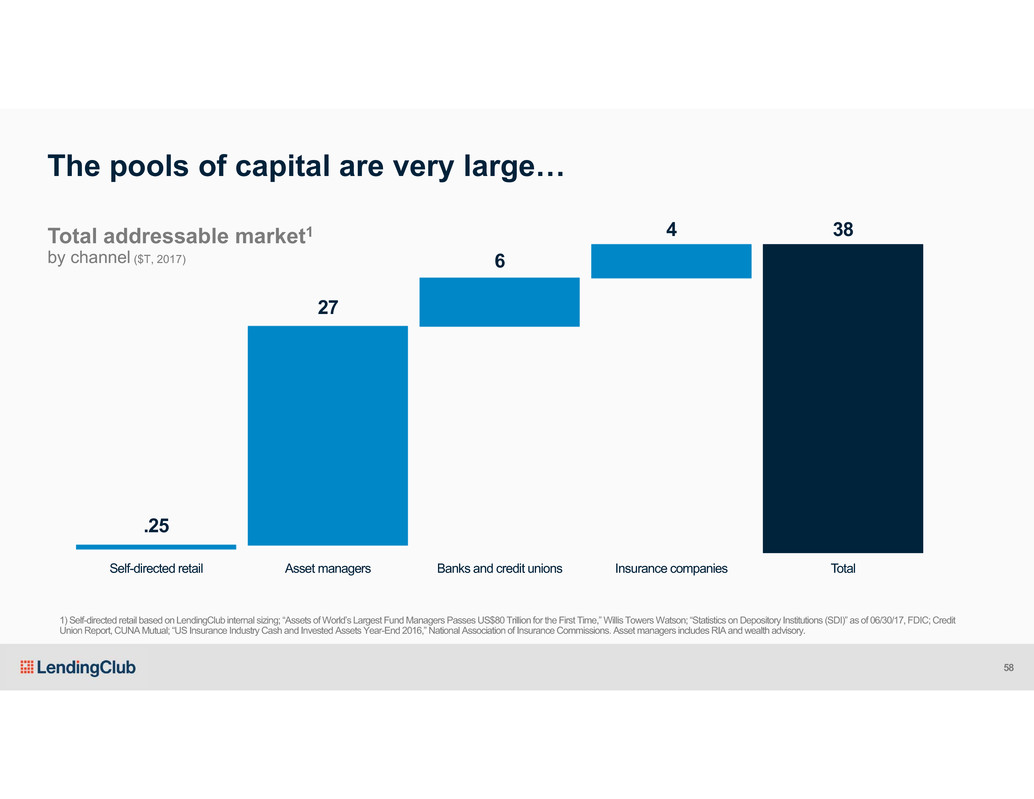

Asset managers Banks and credit unions Insurance companies Total 27 6 4 38 Self-directed retail .25 The pools of capital are very large… Total addressable market1 by channel ($T, 2017) 1) Self-directed retail based on LendingClub internal sizing; “Assets of World’s Largest Fund Managers Passes US$80 Trillion for the First Time,” Willis Towers Watson; “Statistics on Depository Institutions (SDI)” as of 06/30/17, FDIC; Credit Union Report, CUNA Mutual; “US Insurance Industry Cash and Invested Assets Year-End 2016,” National Association of Insurance Commissions. Asset managers includes RIA and wealth advisory. 58

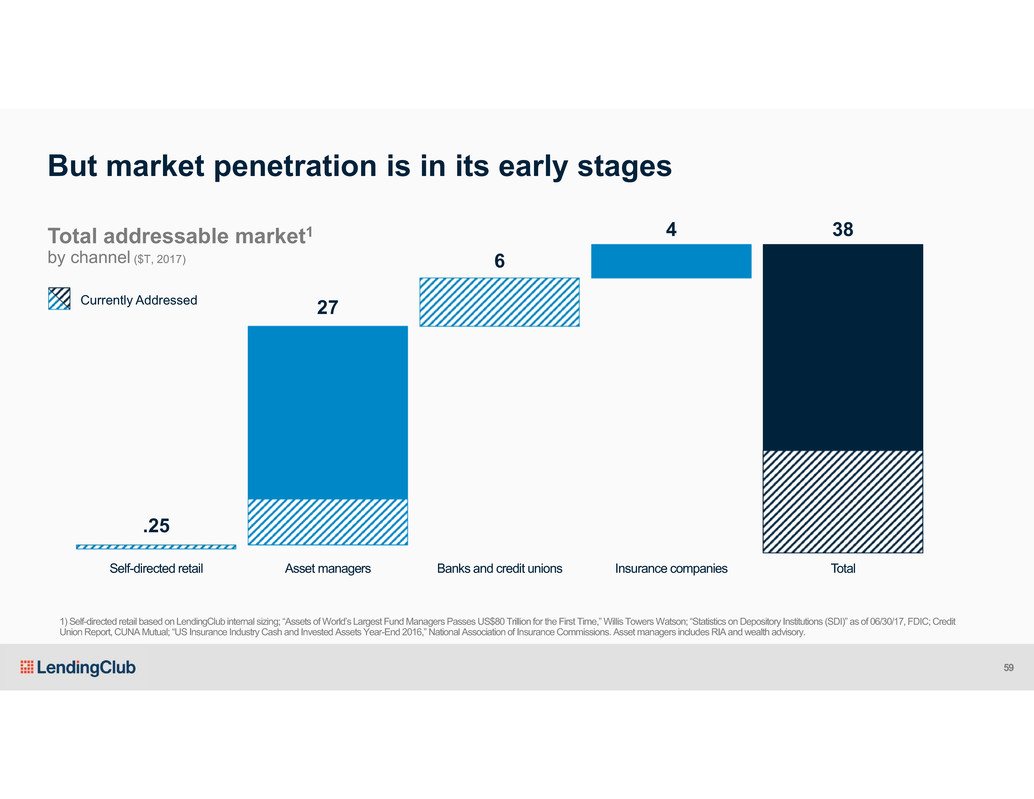

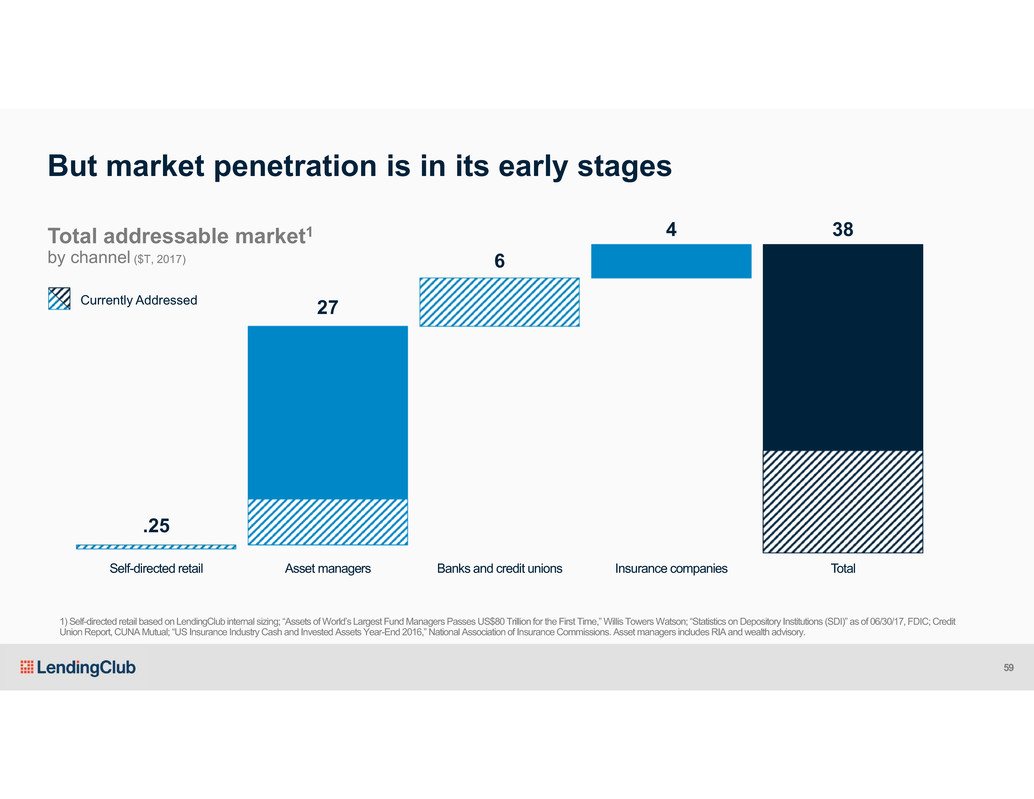

Currently Addressed 27 6 4 38 .25 But market penetration is in its early stages Asset managers Banks and credit unions Insurance companies TotalSelf-directed retail 1) Self-directed retail based on LendingClub internal sizing; “Assets of World’s Largest Fund Managers Passes US$80 Trillion for the First Time,” Willis Towers Watson; “Statistics on Depository Institutions (SDI)” as of 06/30/17, FDIC; Credit Union Report, CUNA Mutual; “US Insurance Industry Cash and Invested Assets Year-End 2016,” National Association of Insurance Commissions. Asset managers includes RIA and wealth advisory. Total addressable market1 by channel ($T, 2017) 59

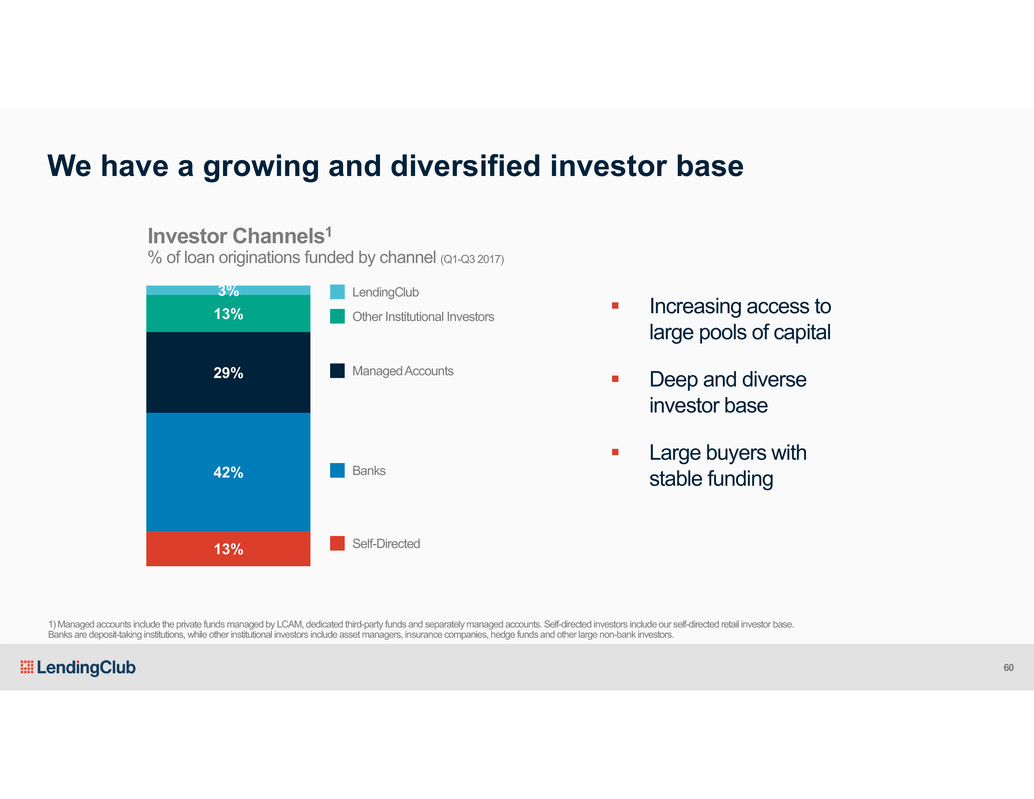

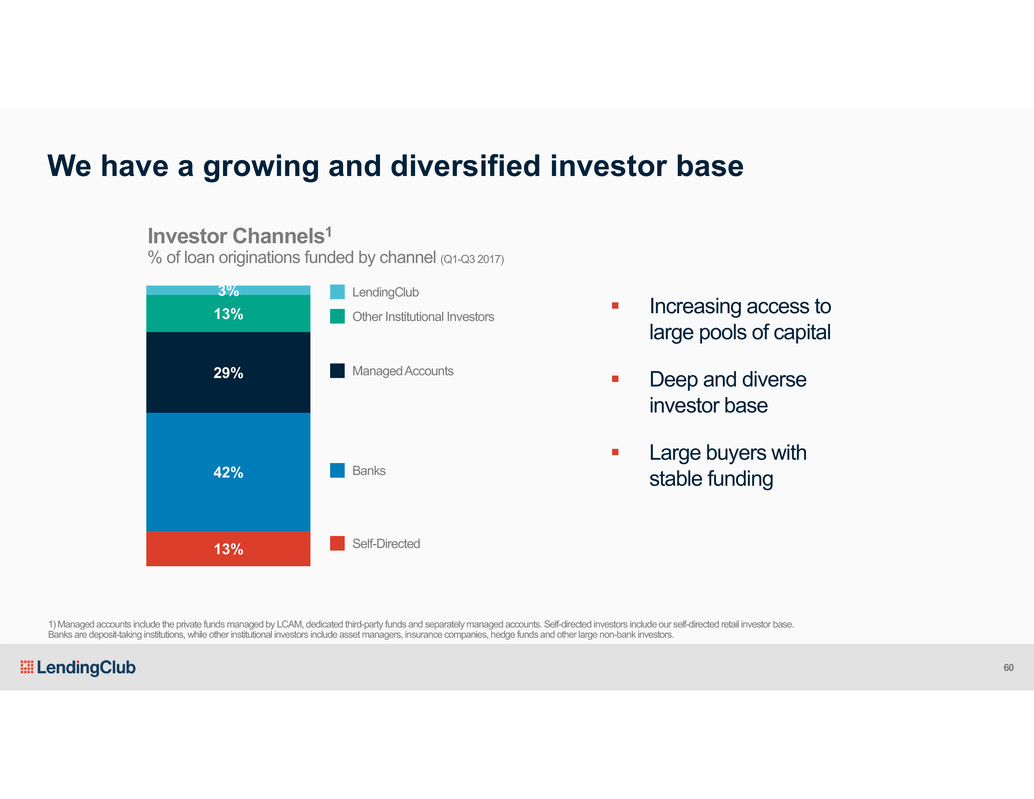

Increasing access to large pools of capital Deep and diverse investor base Large buyers with stable funding We have a growing and diversified investor base 13% 42% 29% 13% 3% Investor Channels1 % of loan originations funded by channel (Q1-Q3 2017) 1) Managed accounts include the private funds managed by LCAM, dedicated third-party funds and separately managed accounts. Self-directed investors include our self-directed retail investor base. Banks are deposit-taking institutions, while other institutional investors include asset managers, insurance companies, hedge funds and other large non-bank investors. LendingClub Other Institutional Investors Managed Accounts Banks Self-Directed 60

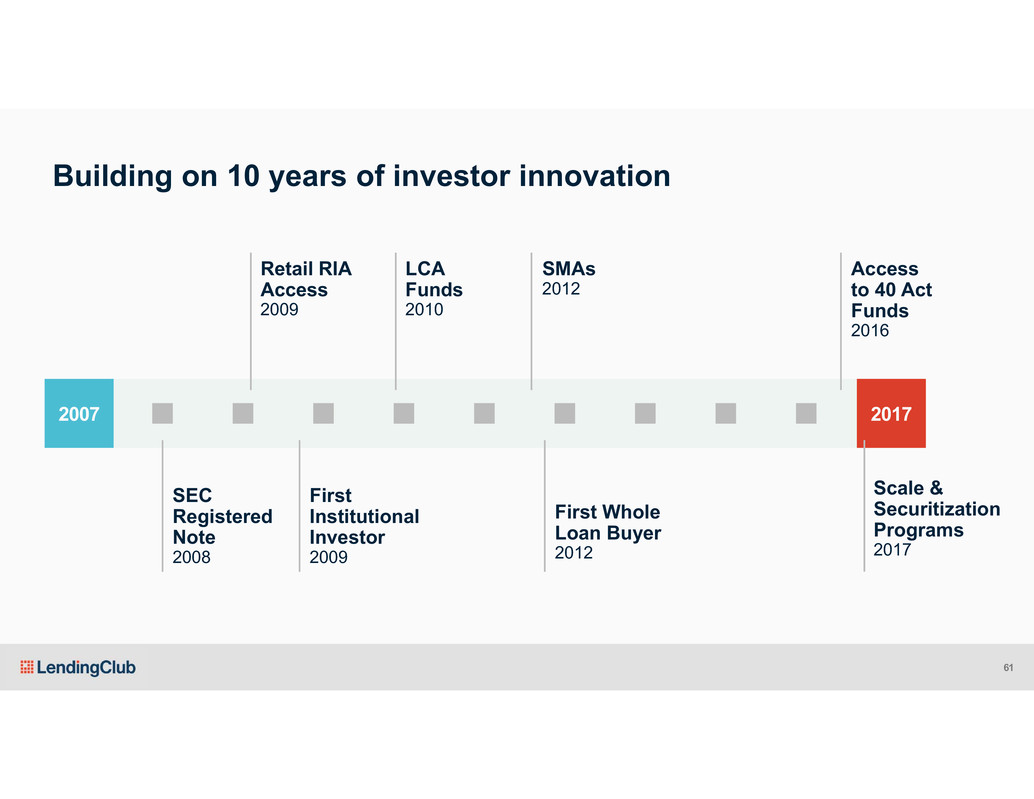

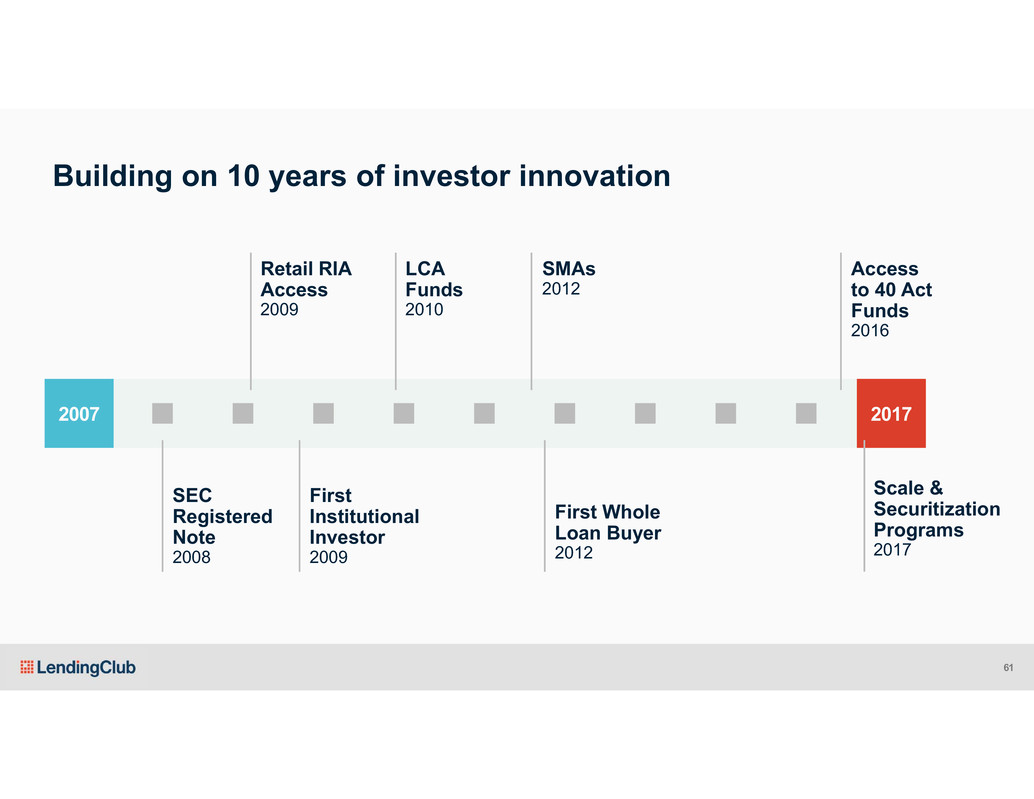

Building on 10 years of investor innovation SEC Registered Note 2008 2007 2017 LCA Funds 2010 First Institutional Investor 2009 First Whole Loan Buyer 2012 Retail RIA Access 2009 SMAs 2012 Access to 40 Act Funds 2016 Scale & Securitization Programs 2017 61

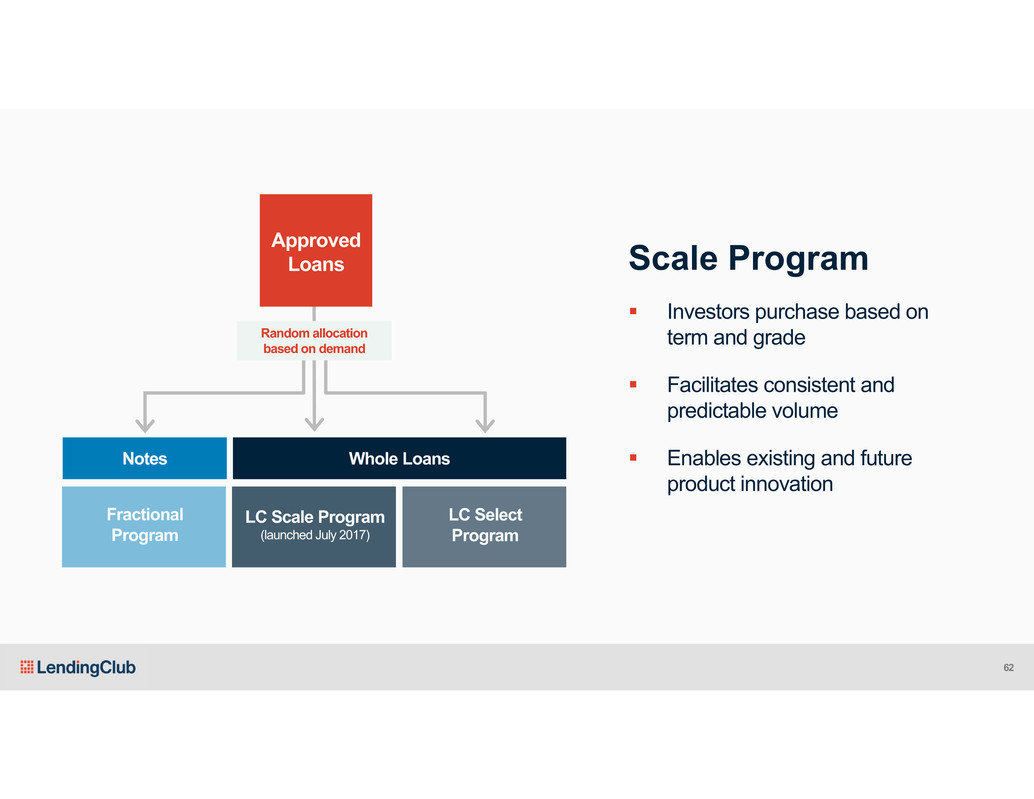

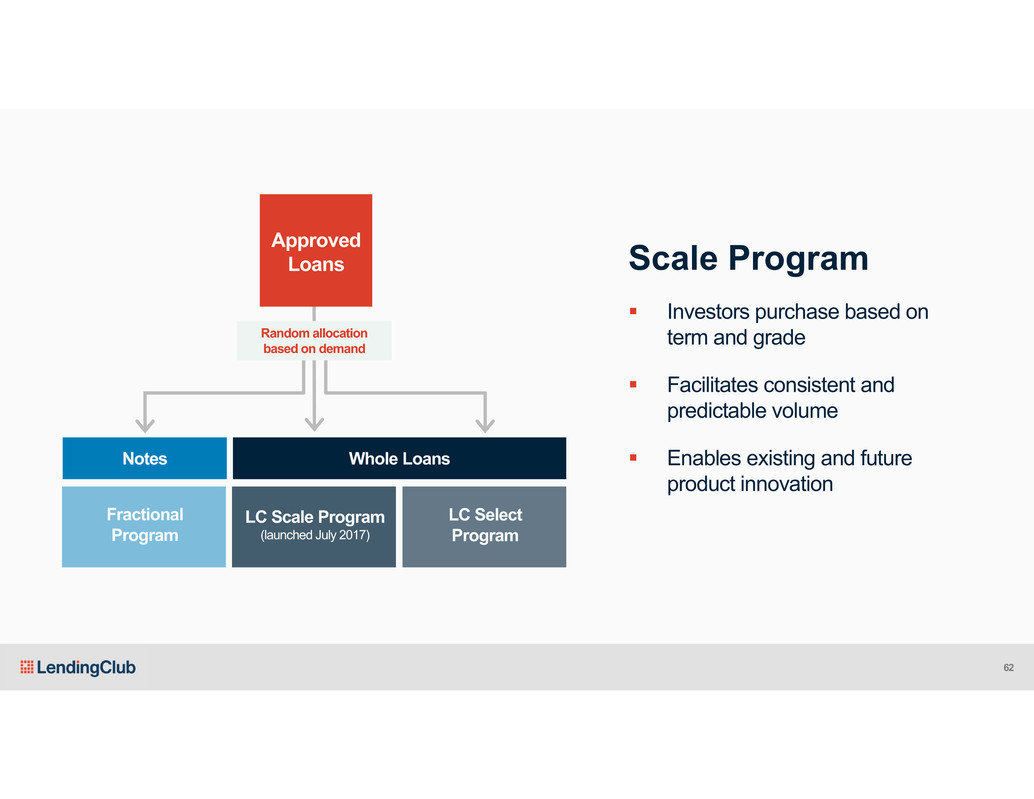

Investors purchase based on term and grade Facilitates consistent and predictable volume Enables existing and future product innovation Approved Loans Fractional Program LC Scale Program (launched July 2017) LC Select Program Random allocation based on demand Whole LoansNotes Scale Program 62

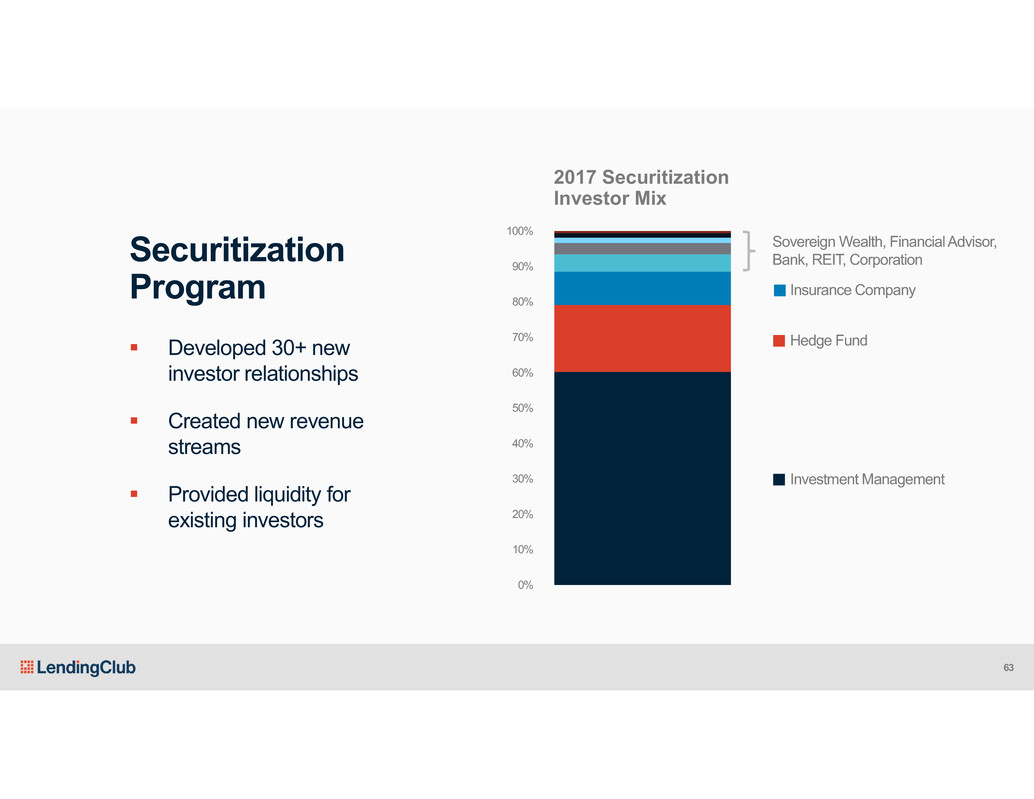

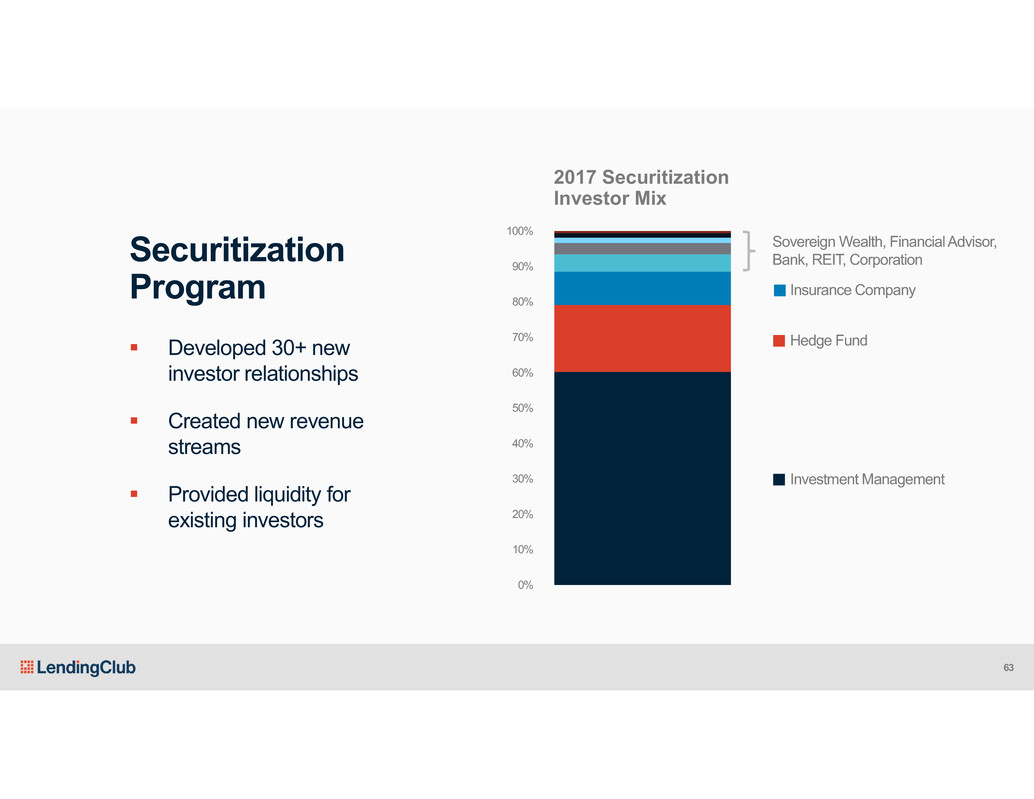

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Corporation REIT Bank Financial Advisor Insurance Companies Sovereign Wealth Hedge Fund Investment Management Securitization Program 2017 Securitization Investor Mix Developed 30+ new investor relationships Created new revenue streams Provided liquidity for existing investors Insurance Company Investment Management Hedge Fund Sovereign Wealth, Financial Advisor, Bank, REIT, Corporation 63

Investors served >40 >60 >180,000 >70 Increased investor breadth and depth A B C D E A B C D E NP A B C D EBanks Retail Managed Institutional A B C D E NP FG FG FG LendingClub continues to facilitate the issuance of F and G grade borrower loans, but they are temporarily unavailable for sale to external investors. 64

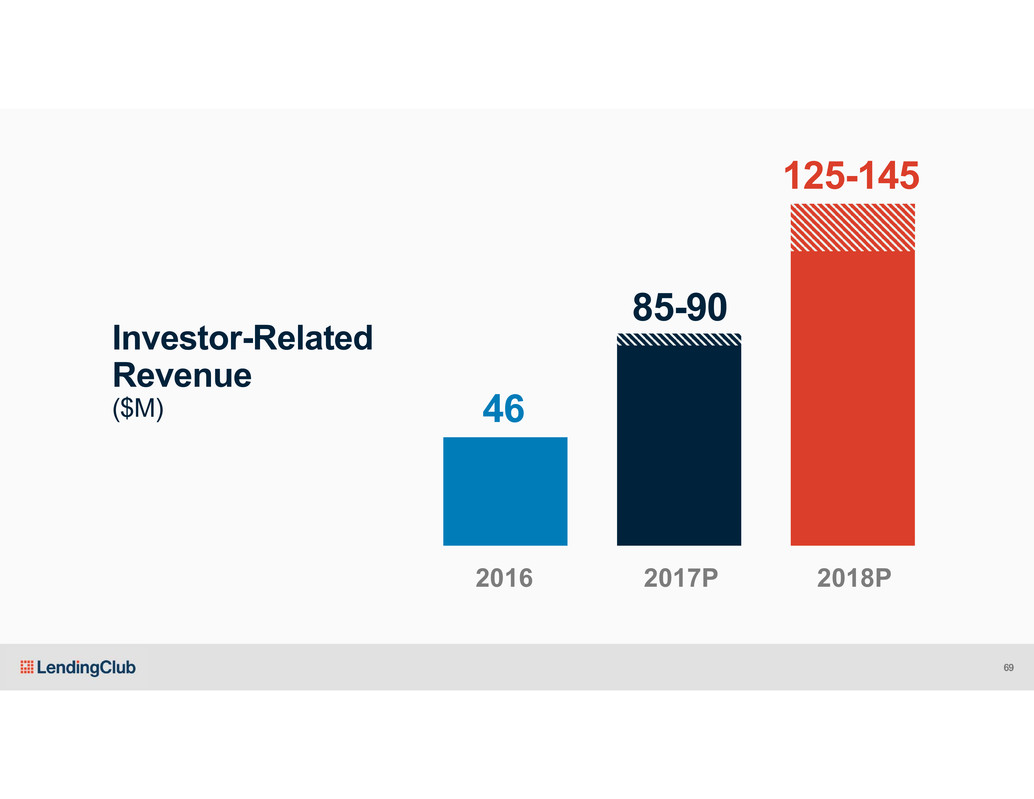

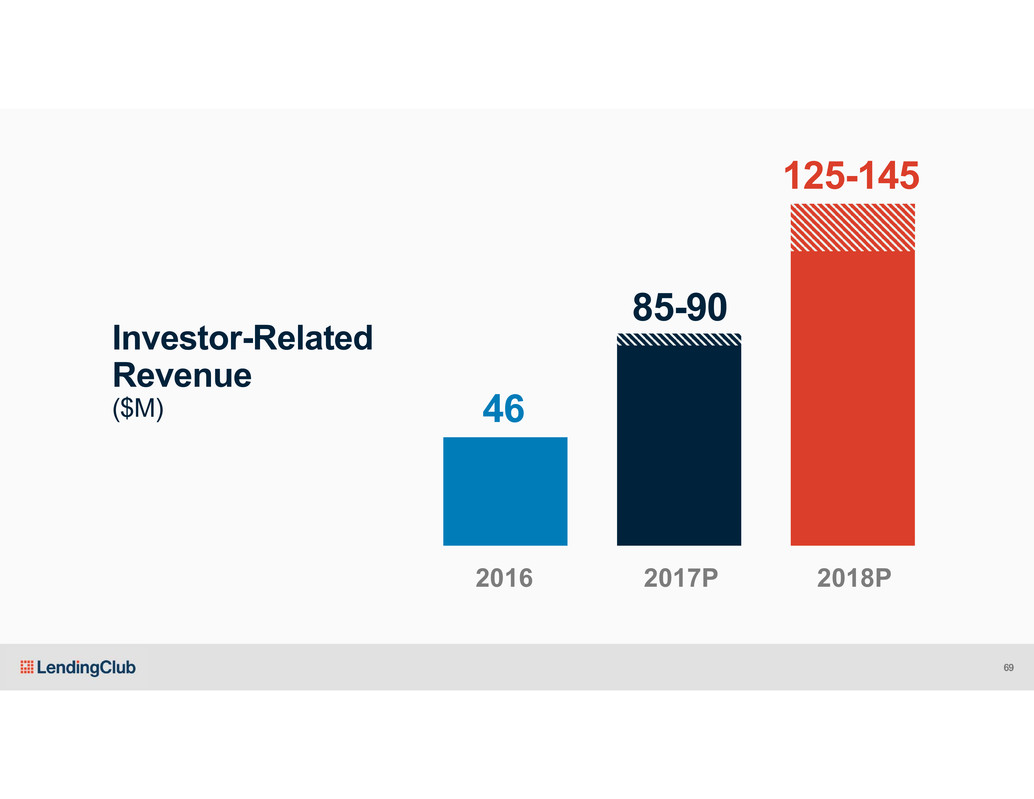

2016 2017P 85-90 46Investor-Related Revenue ($M) 65

Whole LoansNotes Securitization CLUB Certificates Private Funds & ETP Banks Institutions Dedicated funds Large asset managers Insurance companies Banks Institutions Dedicated funds Large asset managers Insurance companies Institutions Dedicated funds Large asset managers Insurance companies Institutions Self-directed retail Dedicated funds Financial advisors Self-directed retail 2007 2017 2017 20182013 66

A pass-through security holding a basket of loans A fixed income security with a CUSIP Works within existing bond market infrastructure Eligible in existing asset manager portfolios CLUB Certificates 67

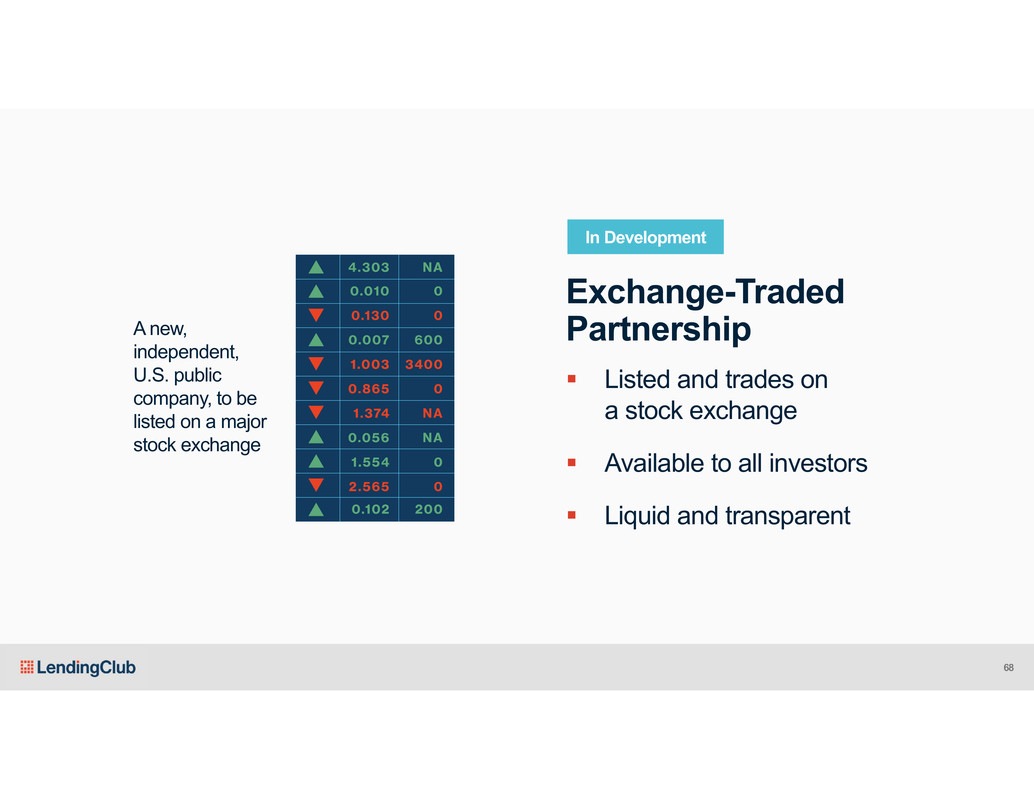

A new, independent, U.S. public company, to be listed on a major stock exchange Listed and trades on a stock exchange Available to all investors Liquid and transparent Exchange-Traded Partnership In Development 68

2018P2017P2016 85-90 46 125-145 Investor-Related Revenue ($M) 69

Marketplace Lending Treasuries US Aggregate US Corporate Investment Grade US Corporate High Yield Municipal Bond US Mortgage-Backed Securities 0% 1% 2% 3% 4% 5% 6% 0 2 4 6 8 10 12 14 3 - Y e a r T o t a l R e t u r n ( % ) Weighted Average Maturity (Years) An attractive investment Source: Bloomberg, as of 9/30/2017. “Marketplace Lending”=Orchard Index; “US Corporate High Yield”= Bloomberg Barclays US Corporate High Yield Index; “US Corporate Investment Grade”=Bloomberg Barclays Corporate Investment Grade Index; “Municipal Bond”=Bloomberg Barclays Municipal Bond Index; “US Mortgage Backed Securities”=Bloomberg Barclays US Mortgage Backed Securities Index; “Treasuries”=Bloomberg Barclays US Treasury Index; “US Aggregate”=Bloomberg Barclays Aggregate Index. Historical performance is not a guarantee of future results. Actual returns experienced by any individual portfolio may be impacted by, among other things, the size and diversity of the portfolio, the exposure to any single loan, borrower or group of loans or borrowers, as well as macroeconomic conditions. 70

Andrew Deringer LendingClub VP, Head of Financial Institutions Group Investor Panel Brian Graham Alliance Partners Chief Executive Officer Philip Bartow RiverNorth Portfolio Manager Amanda Magliaro Citi Managing Director and Head of Global Structured Finance Distribution

Sameer Gulati COO

Company Overview Scott Sanborn, Chief Executive Officer Our Borrowers Steve Allocca, President Credit Sid Jajodia, Chief Investment OfficerSammy Soohoo, SVP, Credit Risk Our Investors Patrick Dunne, Chief Capital Officer Investor Panel Andrew Deringer, VP, Financial Institutions Philip Bartow, Portfolio Manager, RiverNorth Brian Graham, CEO, Alliance Partners Amanda Magliaro, MD, Head of Global Structured Finance Distribution, Citi Marketplace & Technology/Product Sameer Gulati, COO Financials Tom Casey, Chief Financial Officer Recap: today’s agenda 73

Attractive Economics Scalability Resiliency Extensibility Marketplace Power 1 2 3 4 74

LendingClub continues to facilitate the issuance of F and G grade borrower loans, but they are temporarily unavailable for sale to external investors. Broad, Leading Credit Box Attractive Economics Efficiently reaching a broad population of borrowers A B C D B C D E FG A B C D E B a n k s R e t a i l M a n a g e d I n s t i t u t i o n a l B C D E FG E A A FG NP NP ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ Typical bank competitor Typical specialty finance competitor Limited Credit Box Competitors ✓ 1 75

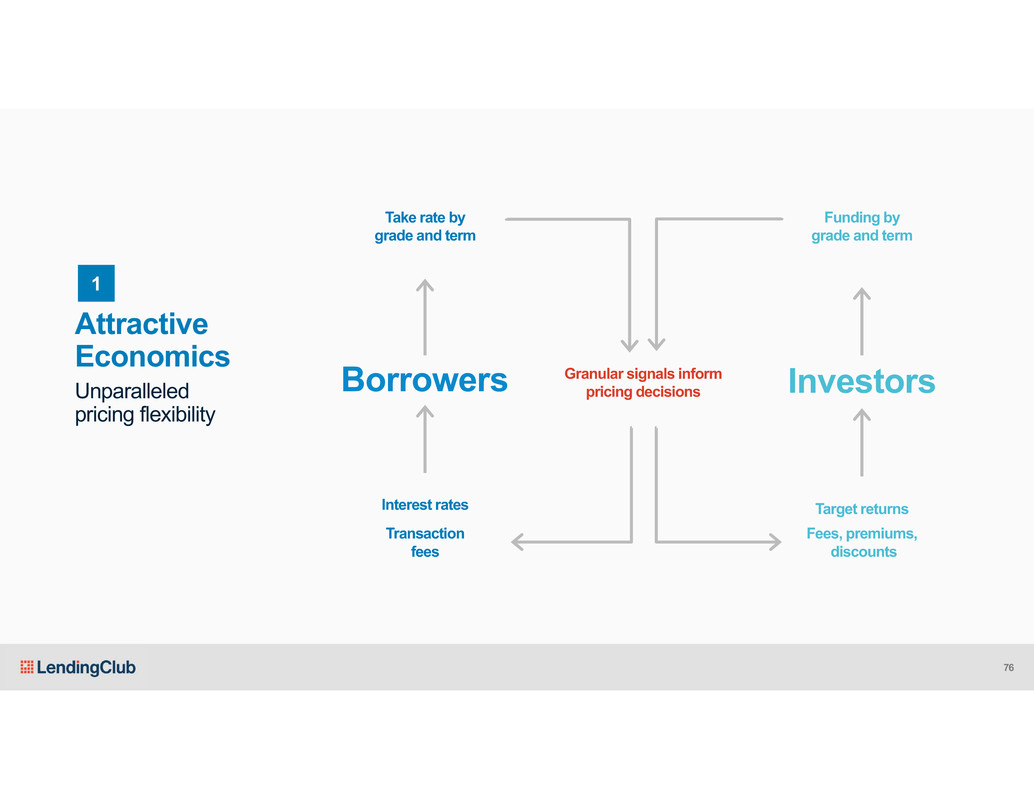

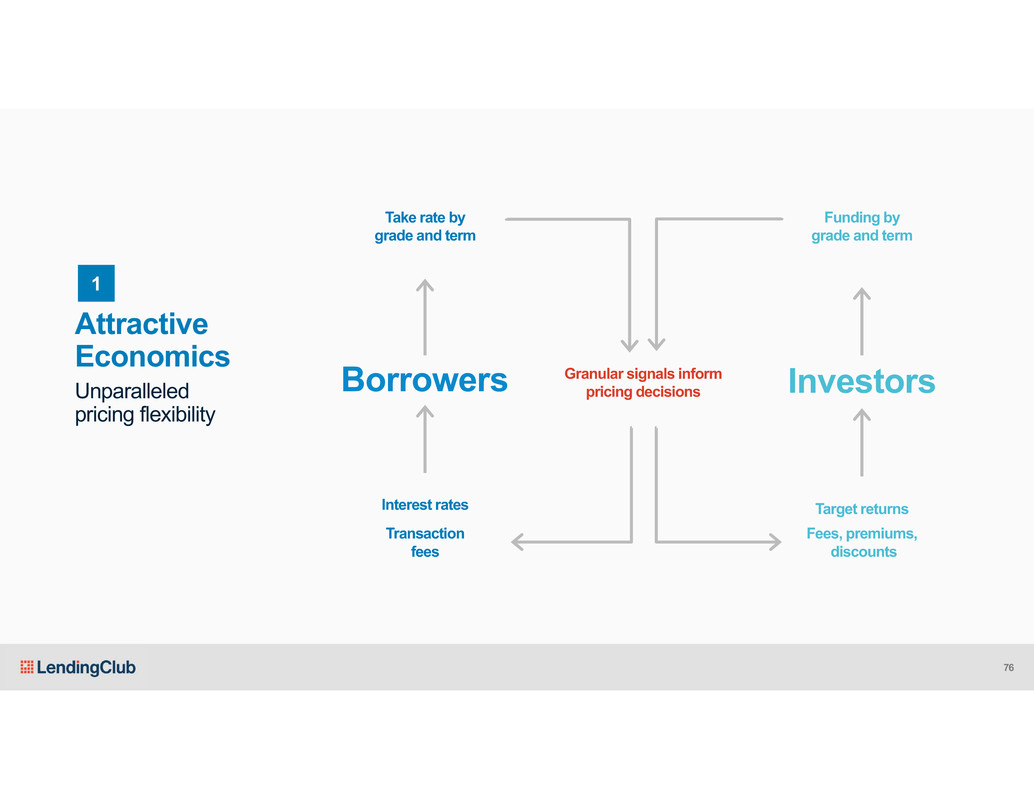

Granular signals inform pricing decisions InvestorsBorrowers Funding by grade and term Transaction fees Take rate by grade and term Interest rates Target returns Fees, premiums, discounts Attractive Economics Unparalleled pricing flexibility 1 76

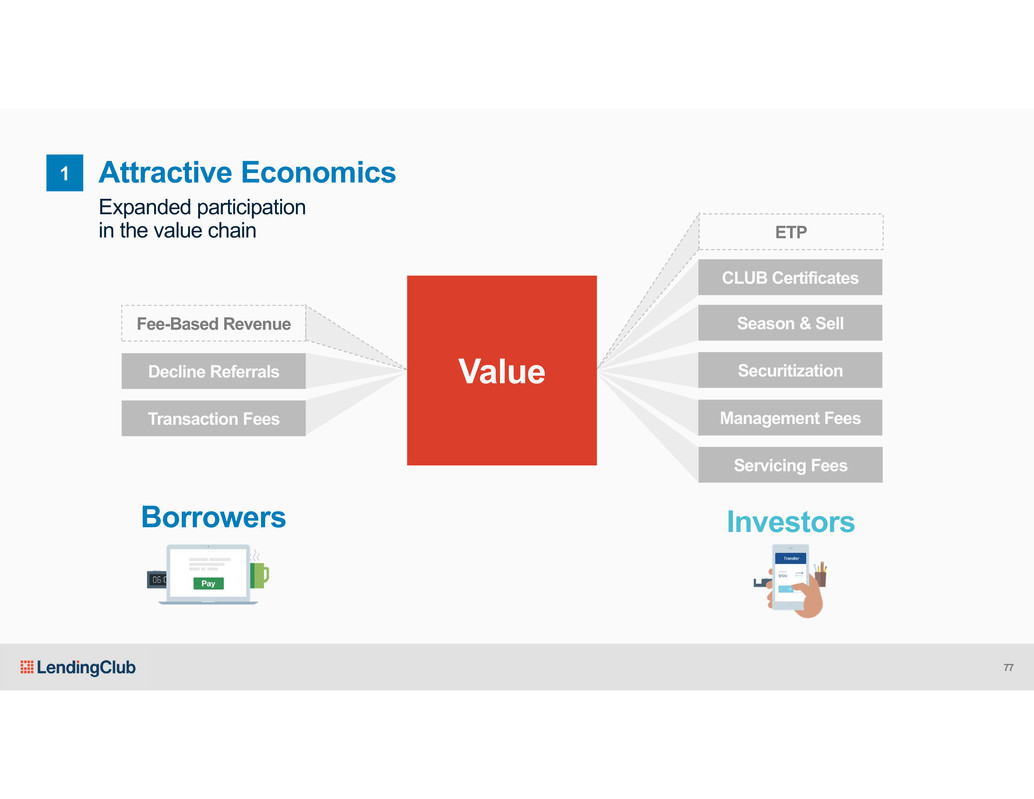

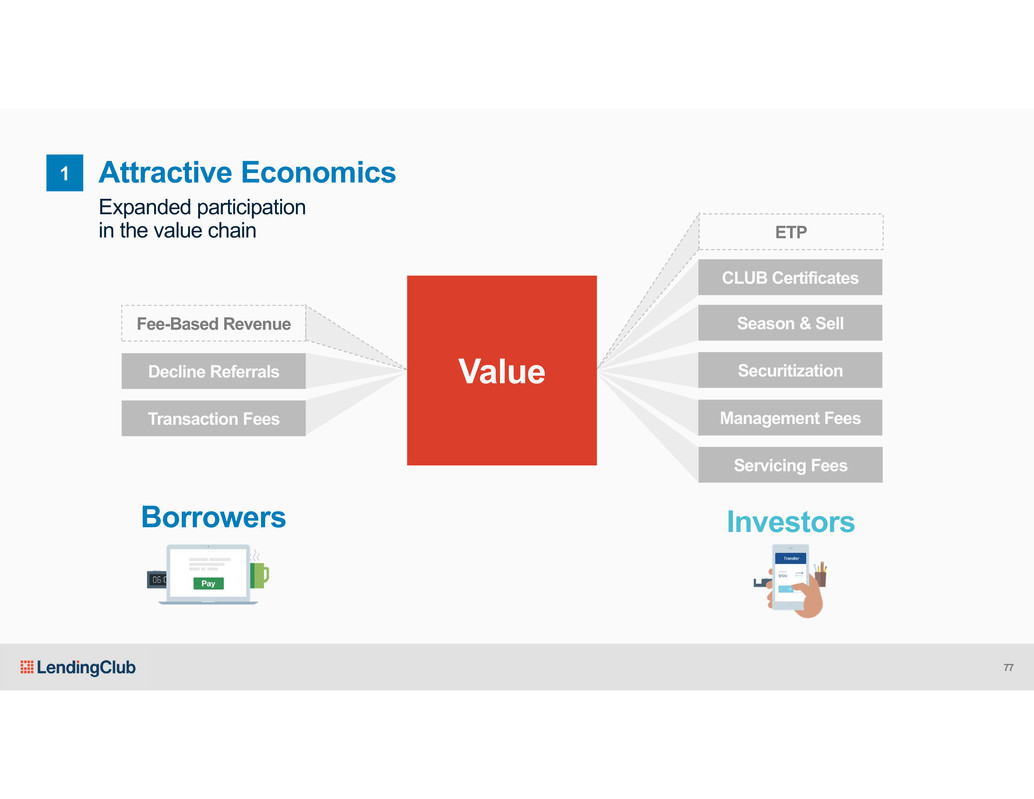

Borrowers Investors Value Fee-Based Revenue Transaction Fees Decline Referrals Management Fees Securitization Season & Sell CLUB Certificates ETP Attractive Economics Expanded participation in the value chain 1 Servicing Fees 77

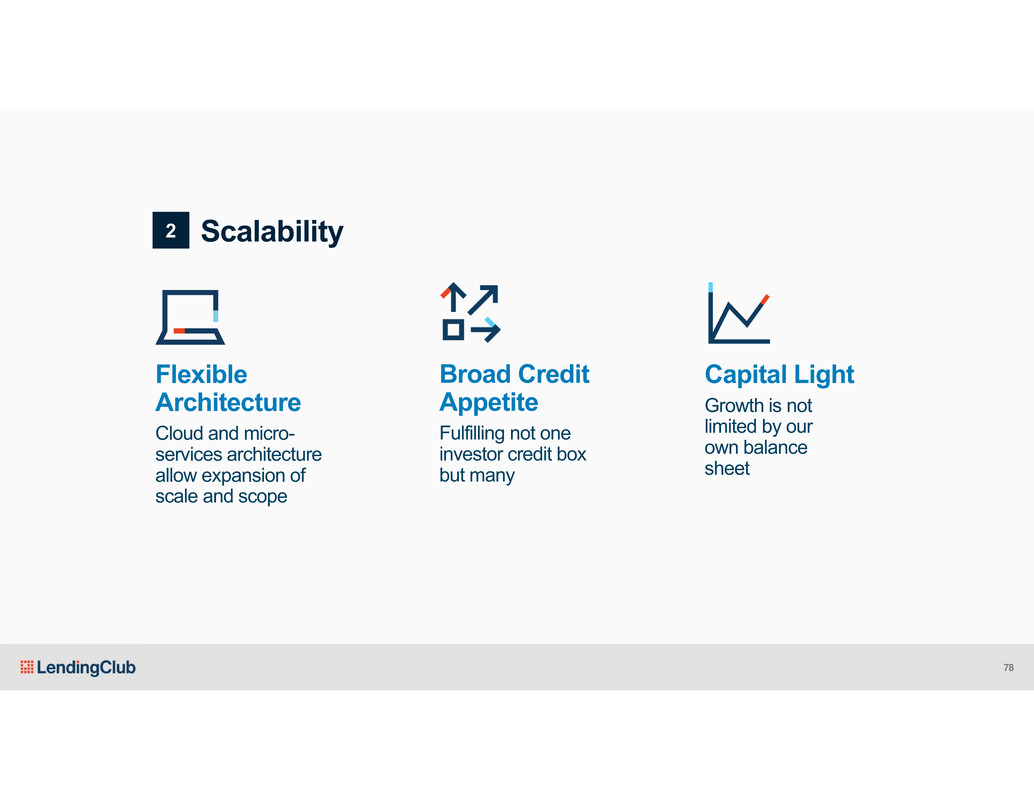

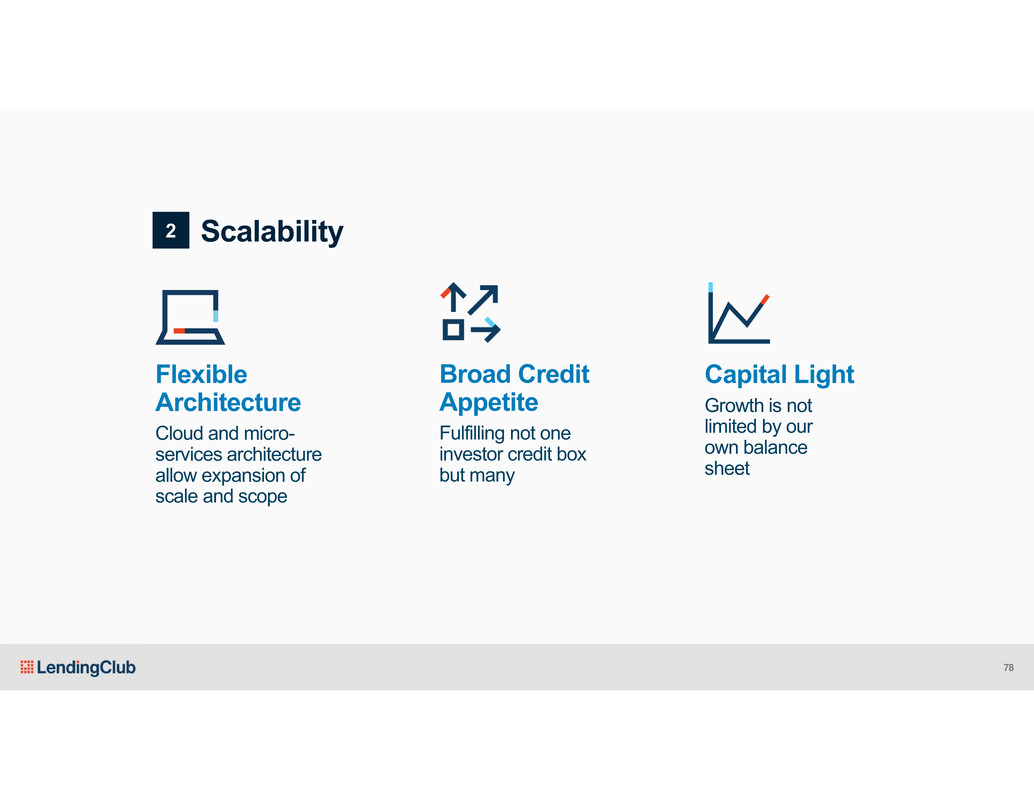

Capital Light Growth is not limited by our own balance sheet Scalability Broad Credit Appetite Fulfilling not one investor credit box but many Flexible Architecture Cloud and micro- services architecture allow expansion of scale and scope 2 78

Shock Absorber Balance Sheet Resiliency Flexible Funding Mix Control Over Short-term Pricing Tools 3 79

Data Providers Borrower Aggregators Banks Retail Investors Secondary Market Investor Tools Ratings Agencies Leverage Providers Institutional Investors Borrowers Extensibility Growing with our ecosystem 4 80

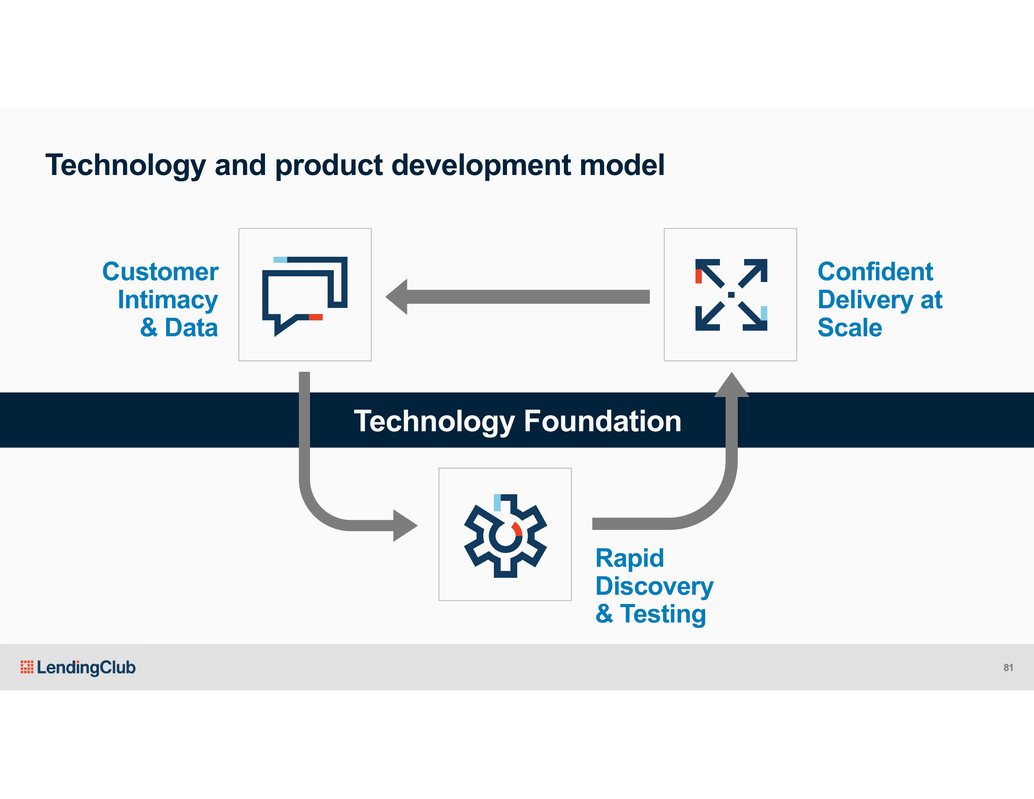

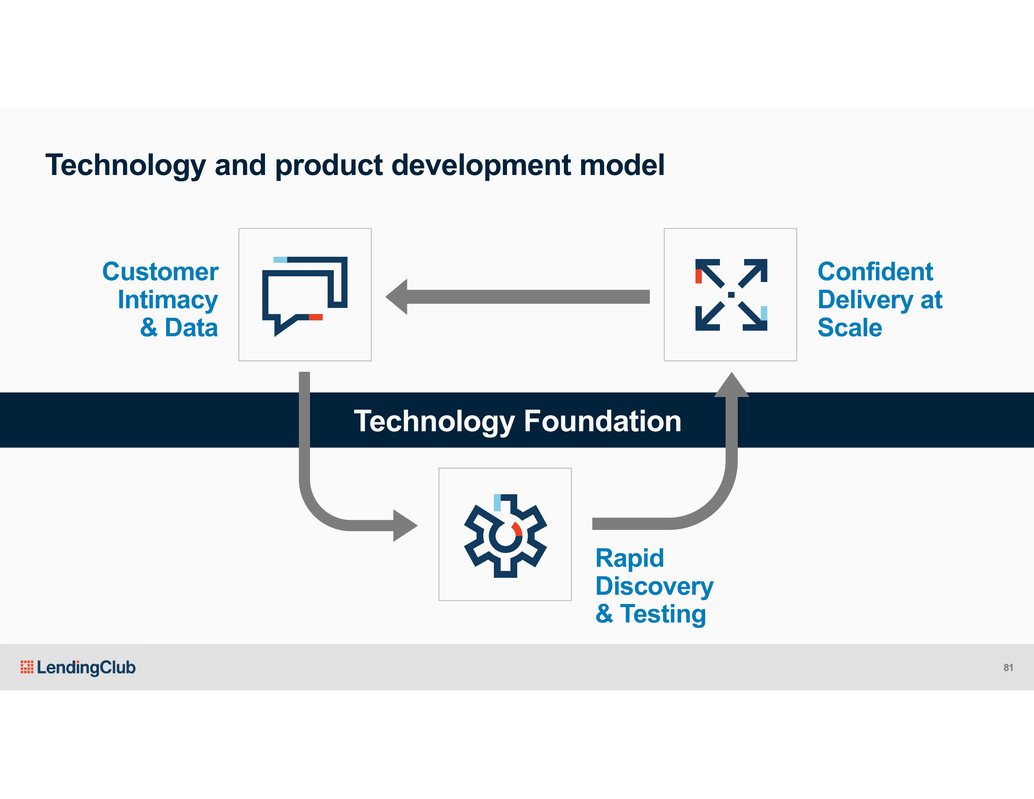

Technology Foundation Technology and product development model Customer Intimacy & Data Rapid Discovery & Testing Confident Delivery at Scale 81

Customer Intimacy & Data Real-time user experience observation Cross-company customer research teams Constant feasibility, usability, NPS studies 82

Rapid Discovery & Testing Dozens of tests running at any given time Lean startup test methodology Faster insights driven by significant customer volume Fast paths for compliance and legal review 83

Confident Delivery at Scale Two week release cycle Flexible, modularized technology architecture 84

Technology Foundation Technology foundation powers our growth Cloud Microservices Data Lake Cyber Security 85

The industry relies on tedious forms that take as long as 30 minutes to complete, which results in significant abandonment rates 86

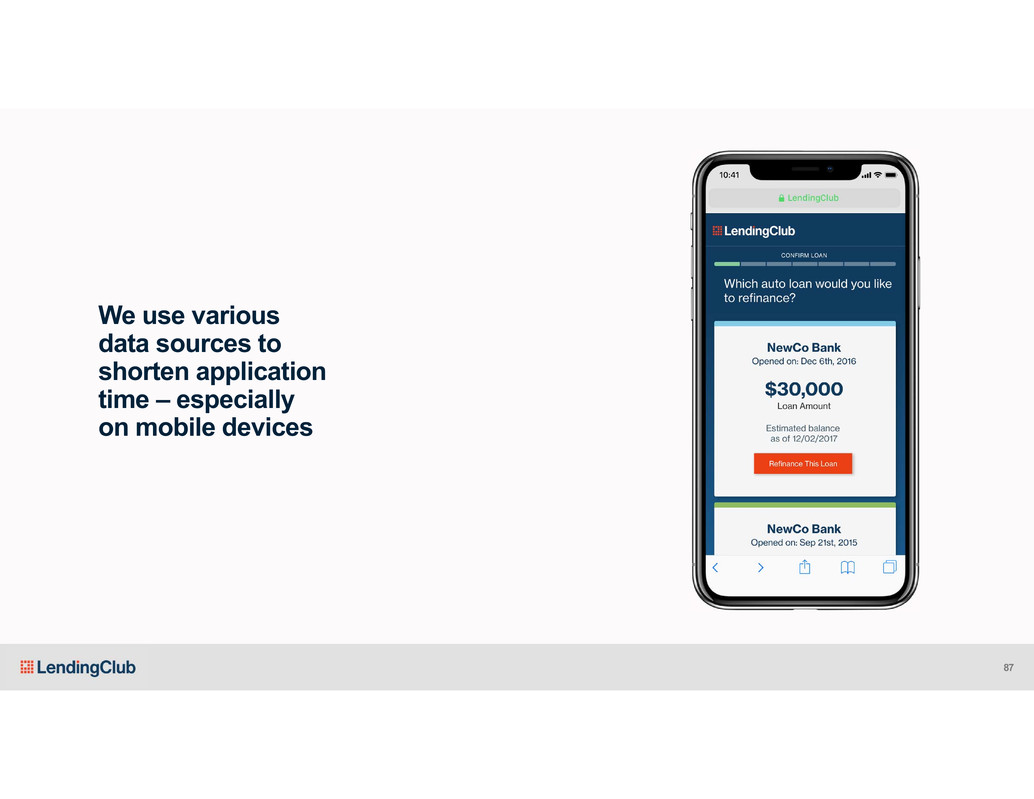

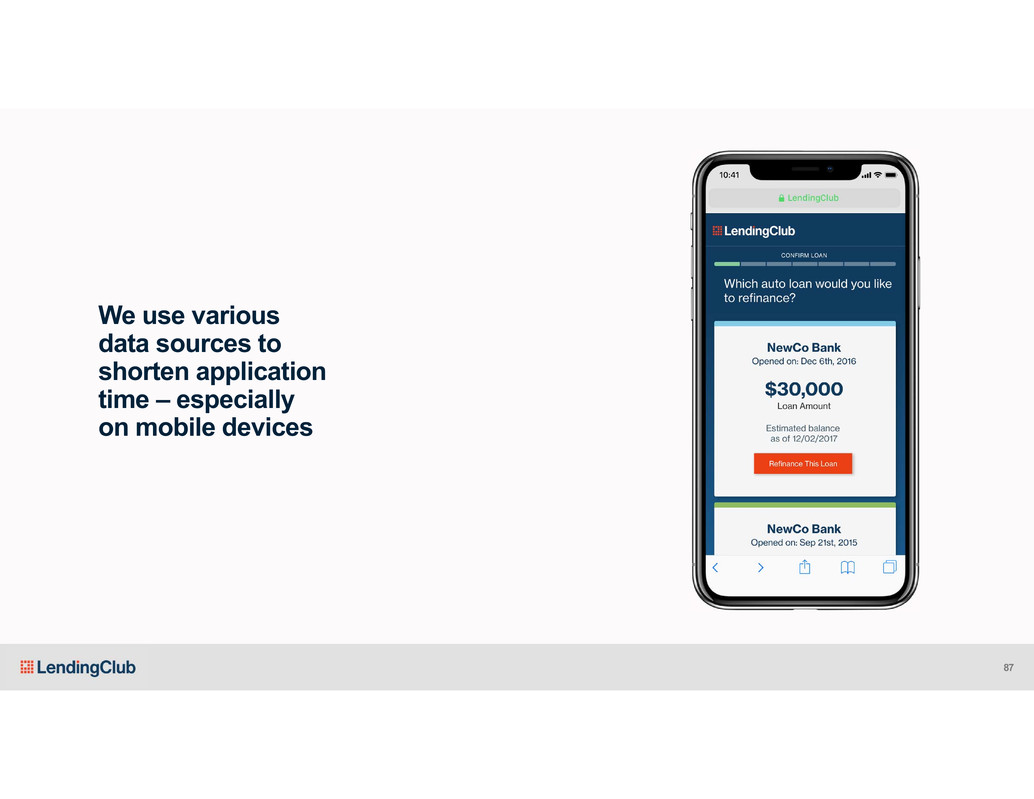

We use various data sources to shorten application time – especially on mobile devices 87

We’re finding ways to eliminate manual entry altogether… 88

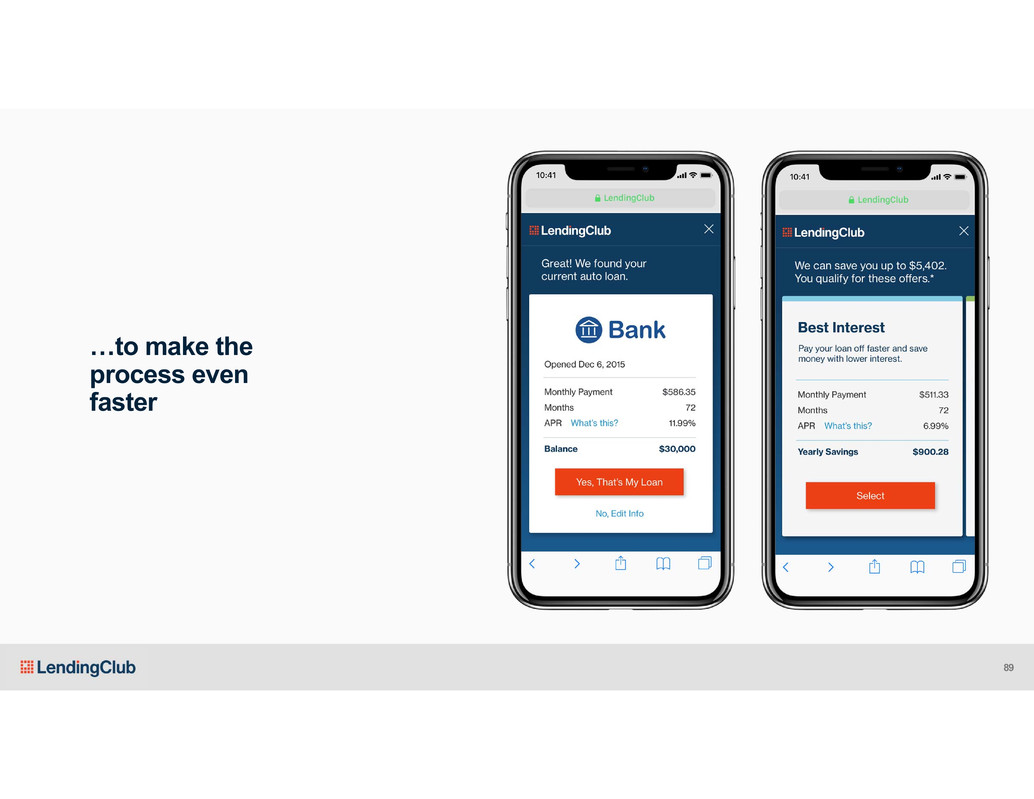

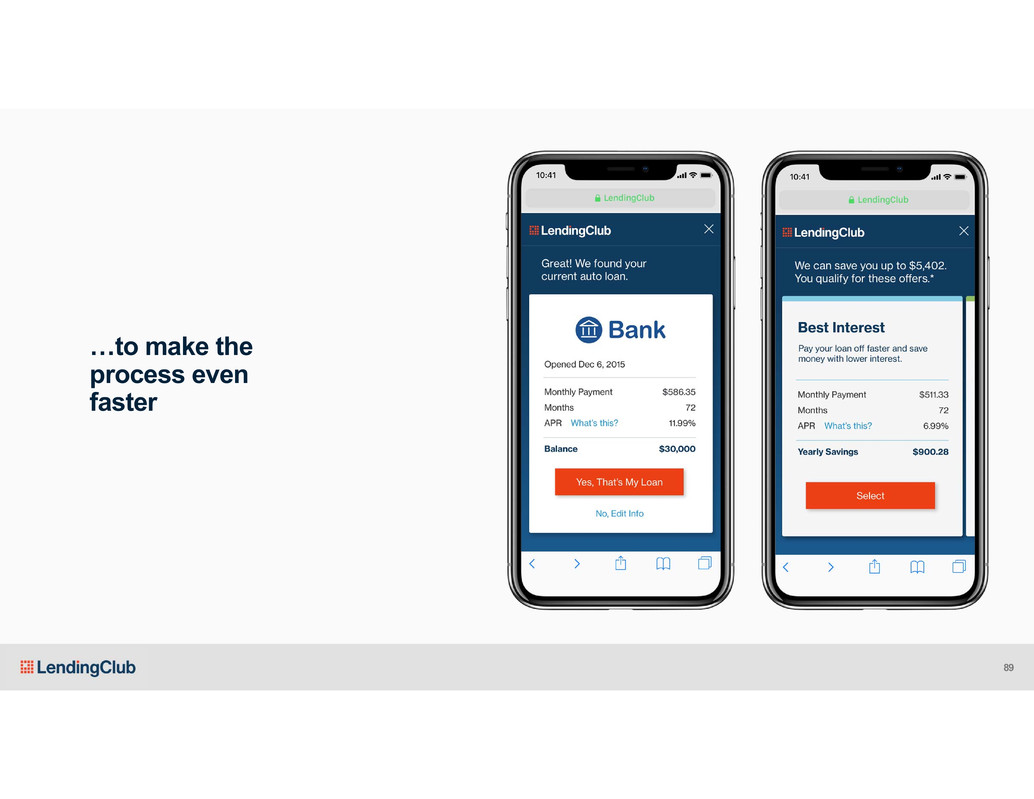

…to make the process even faster 89

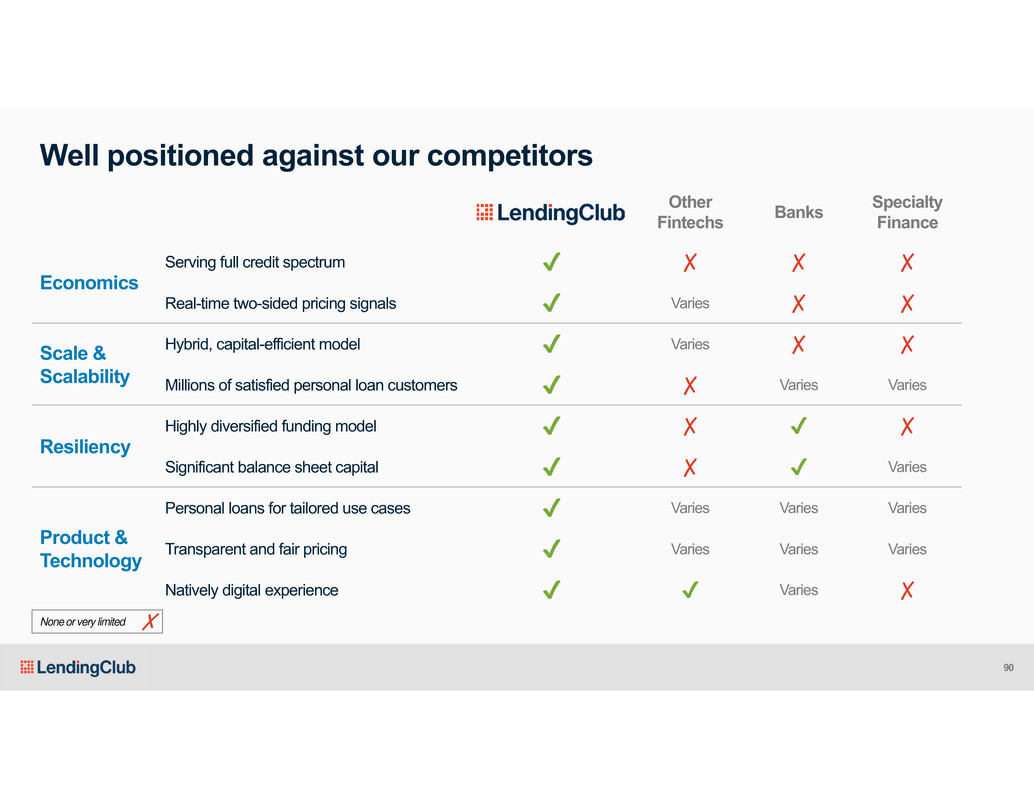

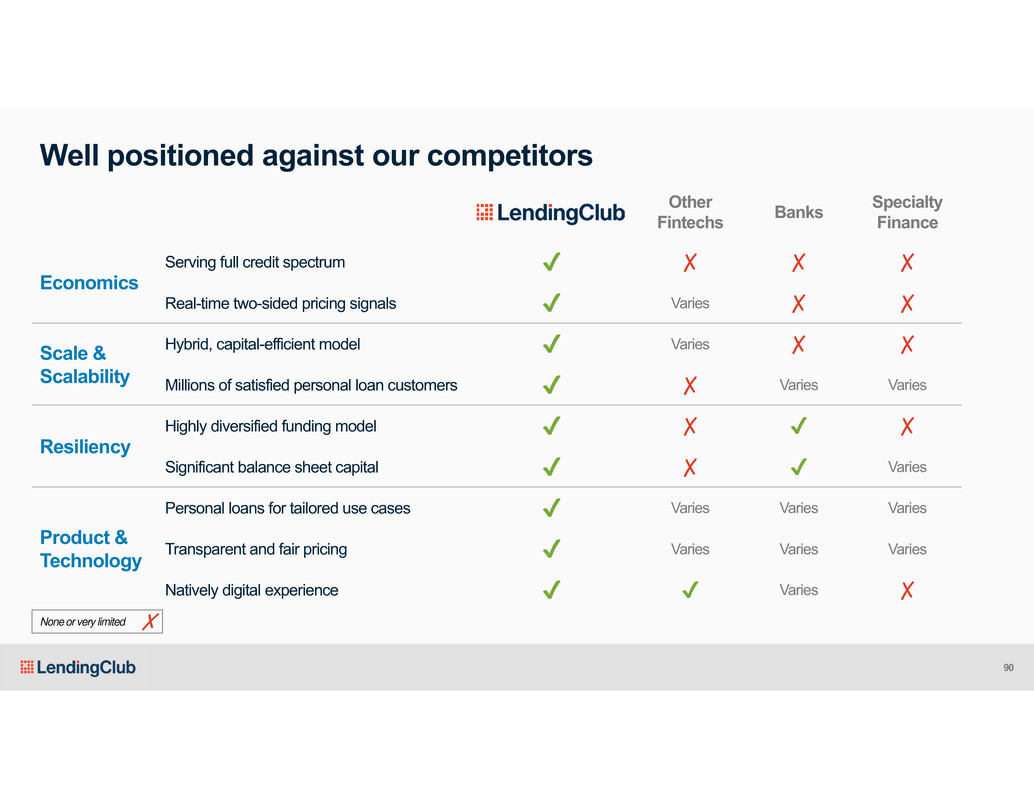

Well positioned against our competitors Other Fintechs Banks Specialty Finance Economics Serving full credit spectrum ✔ ✗ ✗ ✗ Real-time two-sided pricing signals ✔ Varies ✗ ✗ Scale & Scalability Hybrid, capital-efficient model ✔ Varies ✗ ✗ Millions of satisfied personal loan customers ✔ ✗ Varies Varies Resiliency Highly diversified funding model ✔ ✗ ✔ ✗ Significant balance sheet capital ✔ ✗ ✔ Varies Product & Technology Personal loans for tailored use cases ✔ Varies Varies Varies Transparent and fair pricing ✔ Varies Varies Varies Natively digital experience ✔ ✔ Varies ✗ ✗None or very limited 90

Tom Casey Chief Financial Officer

Building Scale Significant Growth Capital Light Model Expanding Margins 92

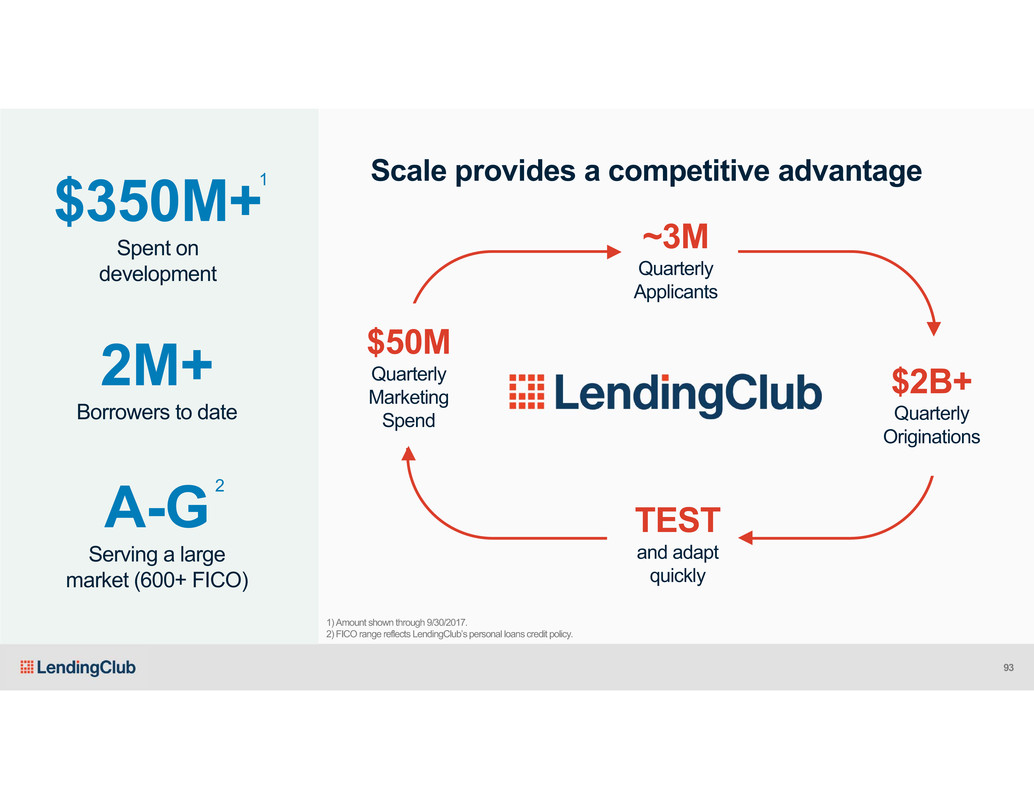

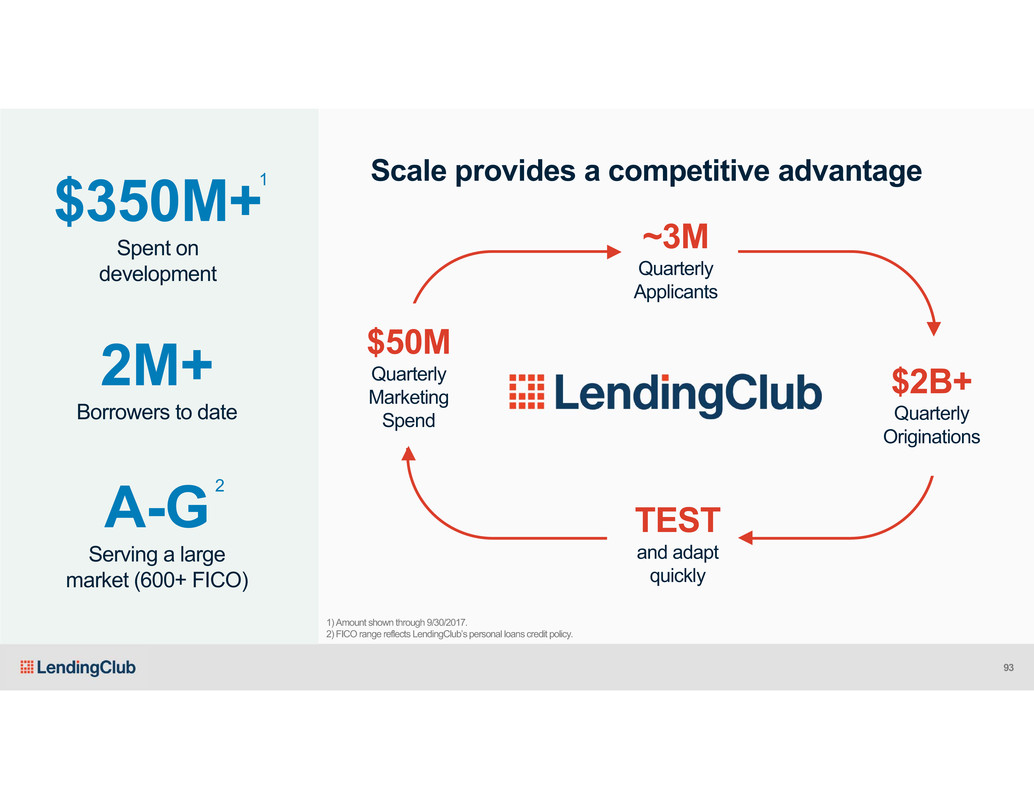

$2B+ Quarterly Originations $50M Quarterly Marketing Spend Scale provides a competitive advantage $350M+ Spent on development 2M+ Borrowers to date A-G Serving a large market (600+ FICO) 1 2 1)Amount shown through 9/30/2017. 2) FICO range reflects LendingClub’spersonal loans credit policy. ~3M Quarterly Applicants TEST and adapt quickly 93

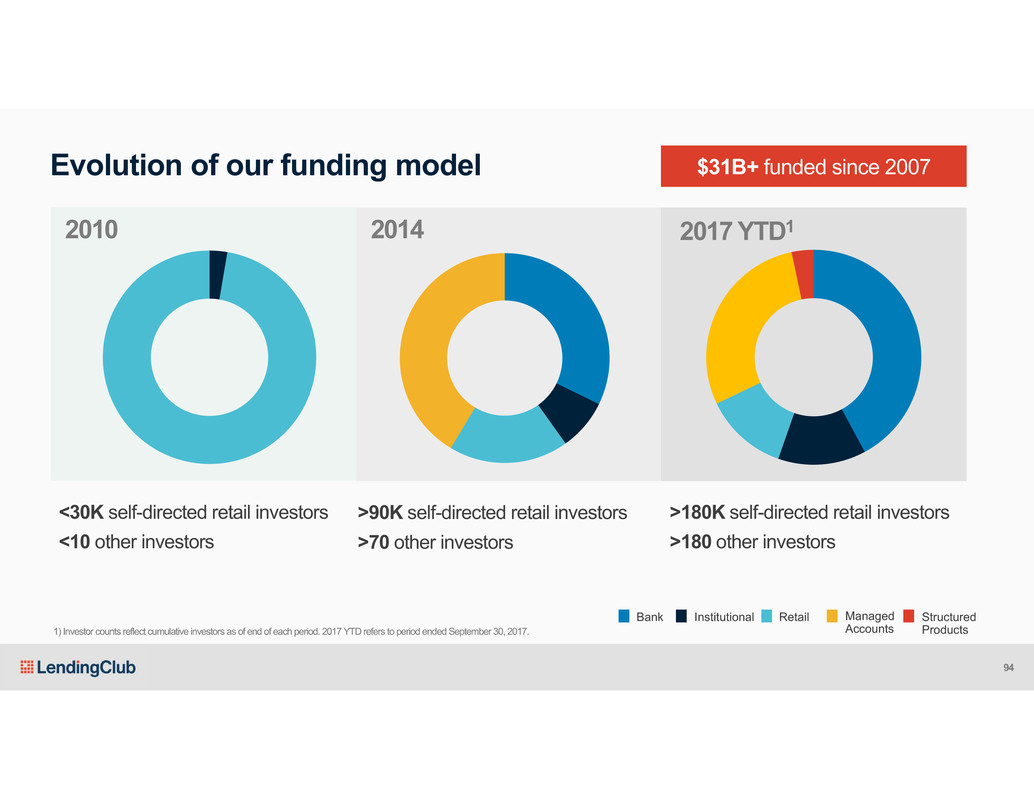

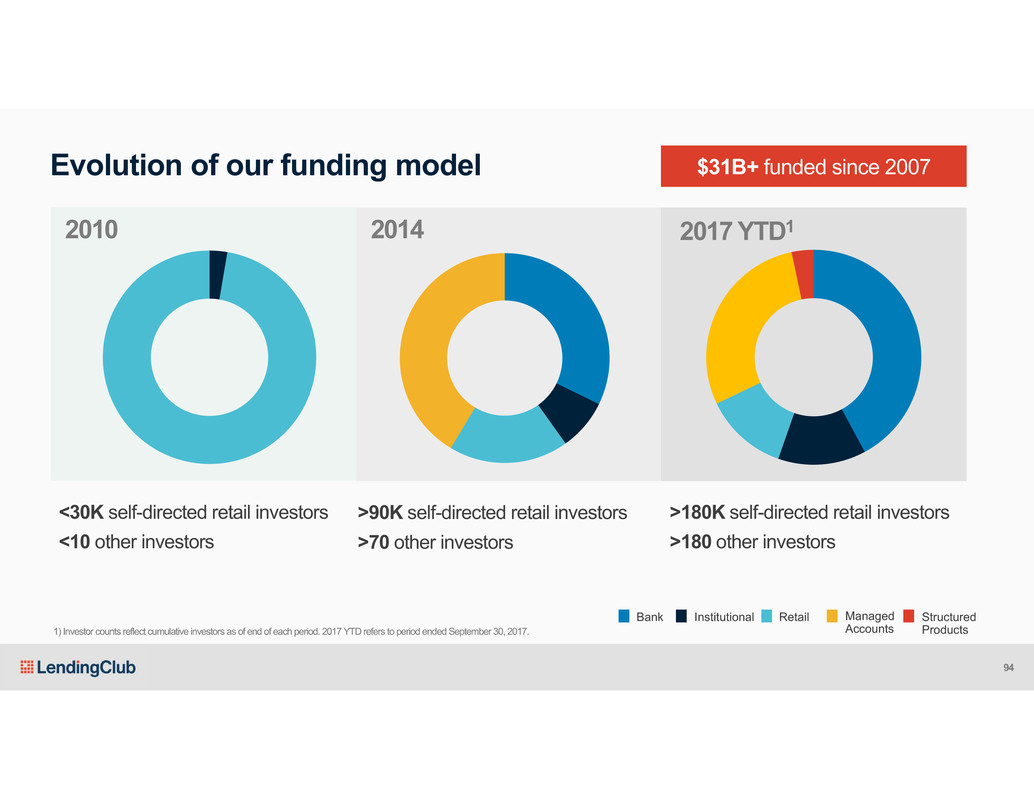

$31B+ funded since 2007 2010 2014 2017 YTD1 Evolution of our funding model <30K self-directed retail investors <10 other investors Bank Institutional Retail Managed Accounts Structured Products >90K self-directed retail investors >70 other investors >180K self-directed retail investors >180 other investors 1) Investor counts reflect cumulative investors as of end of each period. 2017 YTD refers to period ended September 30, 2017. 94

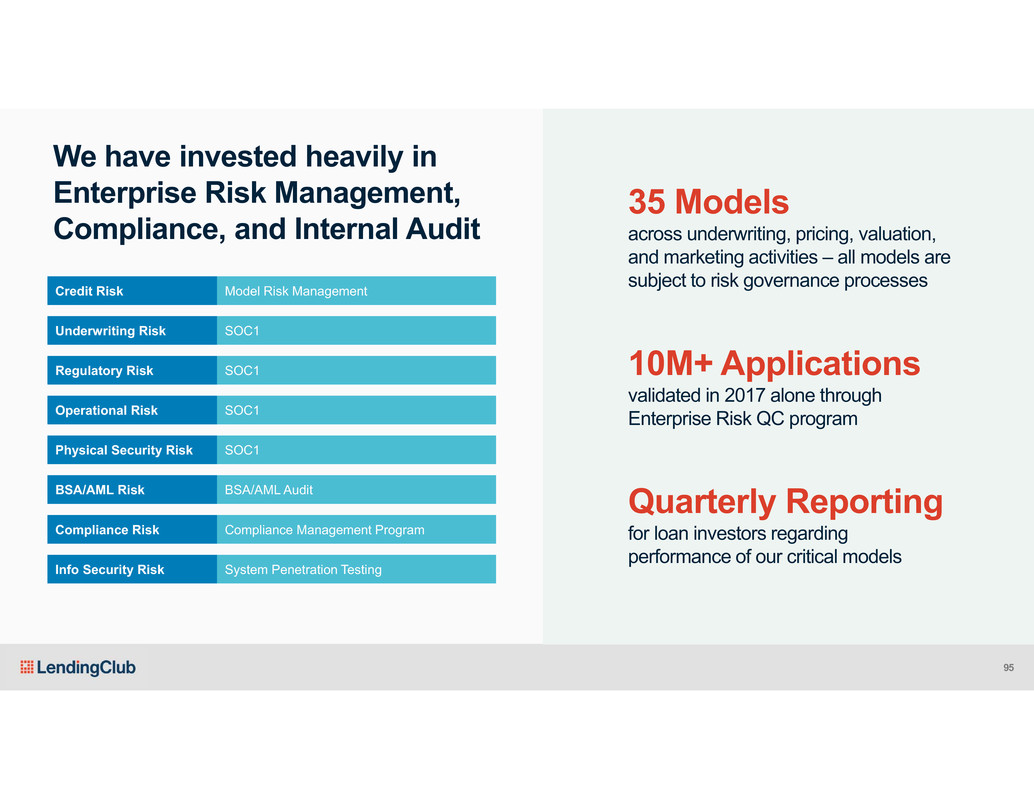

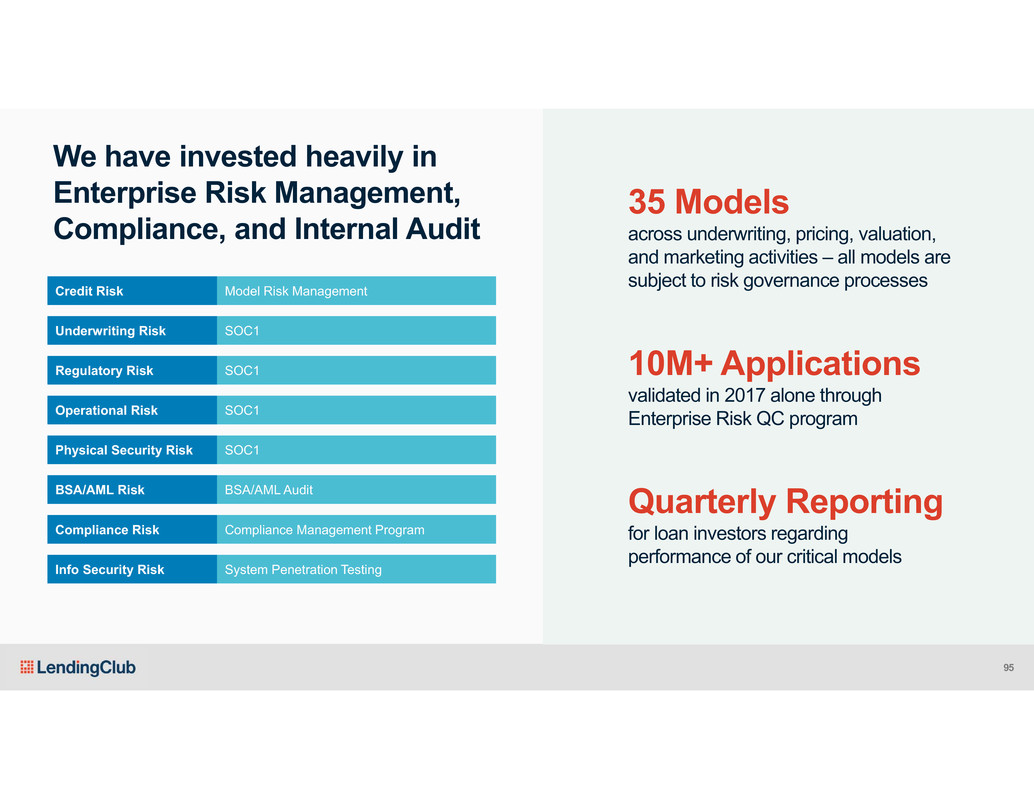

We have invested heavily in Enterprise Risk Management, Compliance, and Internal Audit 10M+ Applications validated in 2017 alone through Enterprise Risk QC program 35 Models across underwriting, pricing, valuation, and marketing activities – all models are subject to risk governance processes Quarterly Reporting for loan investors regarding performance of our critical models Credit Risk Model Risk Management Underwriting Risk SOC1 Regulatory Risk SOC1 Operational Risk SOC1 Physical Security Risk SOC1 BSA/AML Risk BSA/AML Audit Compliance Risk Compliance Management Program Info Security Risk System Penetration Testing 95

Borrower Profile 2017 Annualized Investor Return 2017 Annualized Scale allows us to deliver significant value to stakeholders… 2017 Annualized Avg. FICO 684 Avg. Loan Size $13K Avg. Savings Per Borrower 4601 bps Principal Outstanding Interest Payment Savings >$11B ~$345M- 500M2 Originations ~$8B Rev. Yield ~6.5% Variable Costs ~3.5% CM% Target CM$ ~45-50% $250M Targeted Return 4-10% Principal Outstanding >$11B Returns Paid to Investors3 >$800M 1)Based on responses from 2,862 borrowers in a survey of randomly selected borrowers conducted from 1/1/17 – 9/30/17. These borrowers reported an average interest rate on outstanding debt or credit cards of 20.4%. Using a loan via LendingClub these borrowers consolidated existing debt or paid off their credit card balance at an average interest rate of 15.8%, exclusive of transaction and other fees (late fees, etc.). 2)Outstanding personal loan savings calculated for a borrower universe ranging from the percentage who reported using LendingClub loans to refinance or payoff their credit card to the full population, by taking average personal loans monthly servicing portfolio balance in 2017, multiplying by a savings rate of 4.6%, and annualizing the savings for the full year. 3)Returns paid to personal loan investors calculated using annualized Q3 2017 distributions, reduced by weighted-average loss rates on total serviced loans. 96

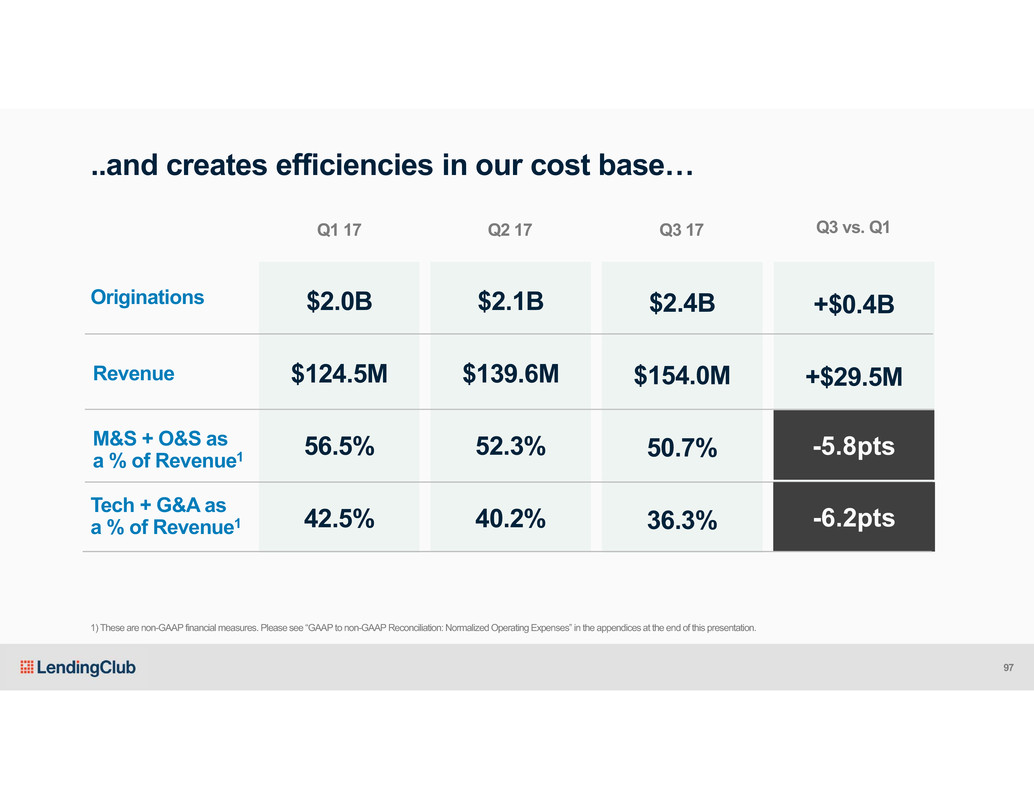

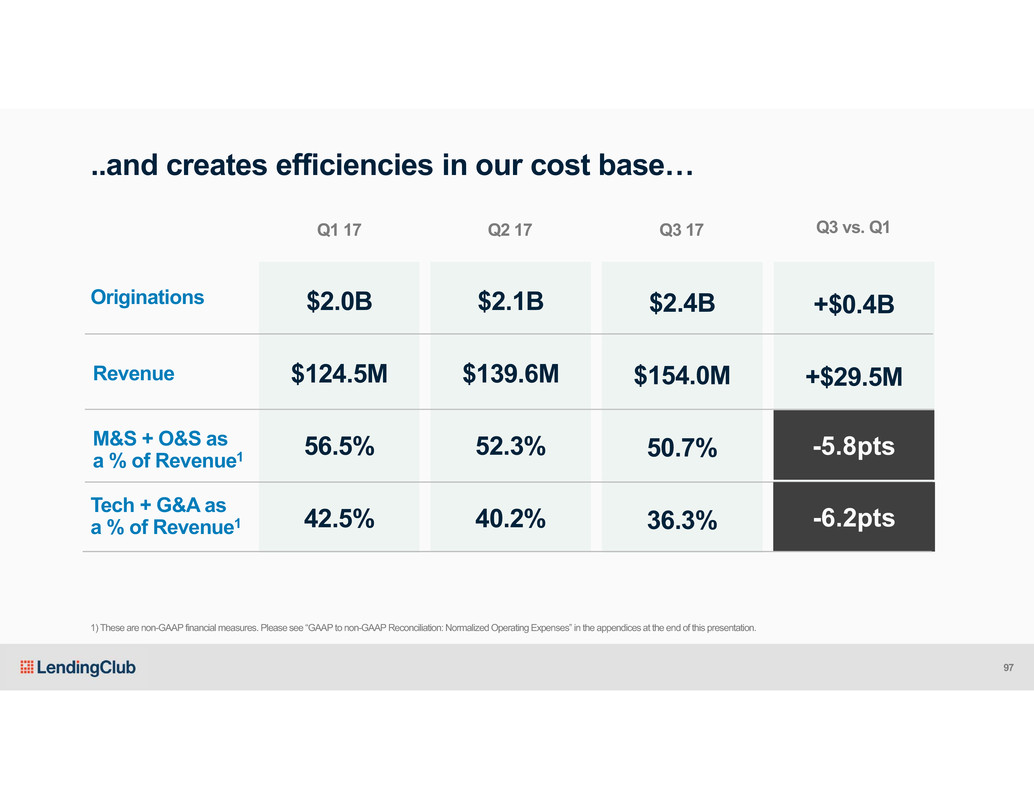

Q2 17 $2.1B $139.6M 52.3% 40.2% Q1 17 Q3 17 $2.0B $124.5M 56.5% 42.5%Tech + G&A asa % of Revenue1 Revenue $2.4B $154.0M 50.7% 36.3% Originations Q3 vs. Q1 +$0.4B +$29.5M ..and creates efficiencies in our cost base… 1) These are non-GAAP financial measures. Please see “GAAP to non-GAAP Reconciliation: Normalized Operating Expenses” in the appendices at the end of this presentation. -6.2pts M&S + O&S as a % of Revenue1 -5.8pts 97

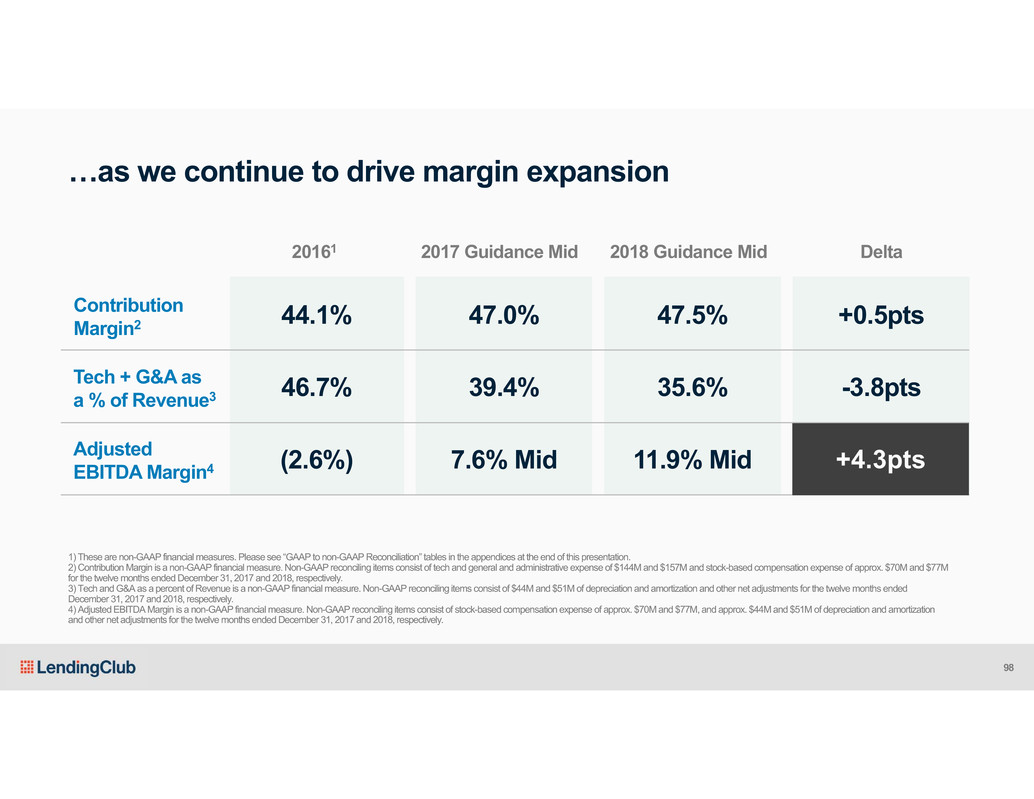

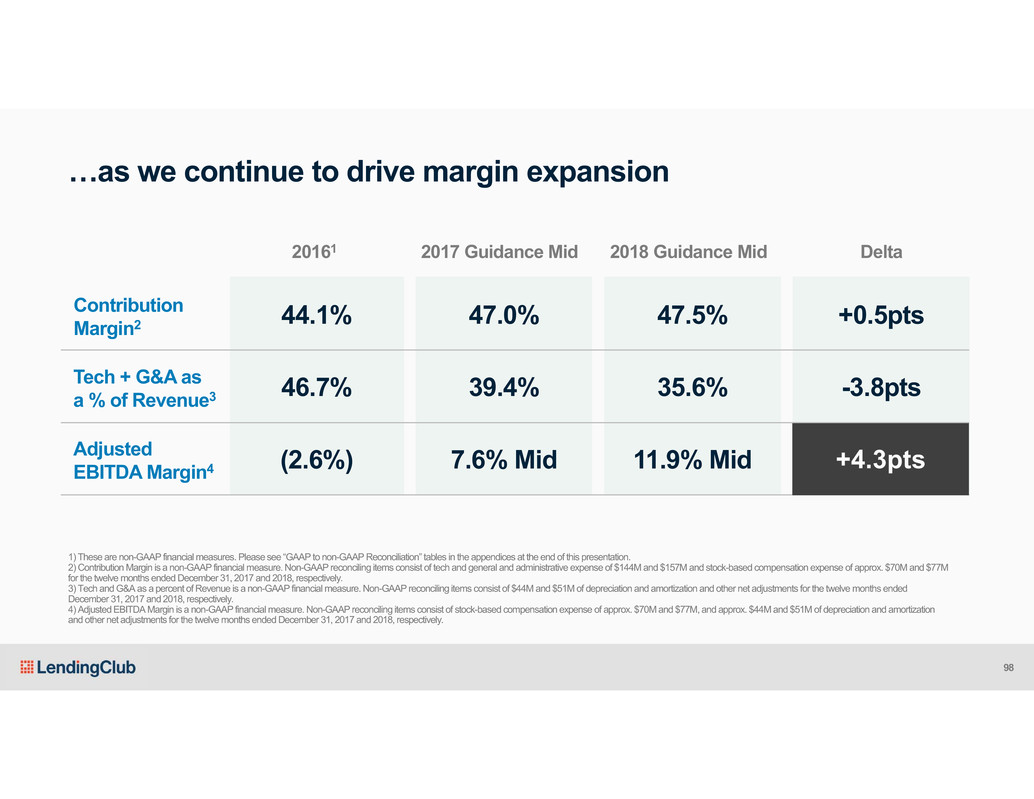

…as we continue to drive margin expansion 2017 Guidance Mid 47.0% 39.4% 7.6% Mid 20161 2018 Guidance Mid Delta 44.1% 46.7% (2.6%) Tech + G&A as a % of Revenue3 47.5% 35.6% 11.9% Mid +0.5pts -3.8pts Contribution Margin2 Adjusted EBITDA Margin4 +4.3pts 1) These are non-GAAP financial measures. Please see “GAAP to non-GAAP Reconciliation” tables in the appendices at the end of this presentation. 2) Contribution Margin is a non-GAAP financial measure. Non-GAAP reconciling items consist of tech and general and administrative expense of $144M and $157M and stock-based compensation expense of approx. $70M and $77M for the twelve months ended December 31, 2017 and 2018, respectively. 3) Tech and G&A as a percent of Revenue is a non-GAAP financial measure. Non-GAAP reconciling items consist of $44M and $51M of depreciation and amortization and other net adjustments for the twelve months ended December 31, 2017 and 2018, respectively. 4) Adjusted EBITDA Margin is a non-GAAP financial measure. Non-GAAP reconciling items consist of stock-based compensation expense of approx. $70M and $77M, and approx. $44M and $51M of depreciation and amortization and other net adjustments for the twelve months ended December 31, 2017 and 2018, respectively. 98

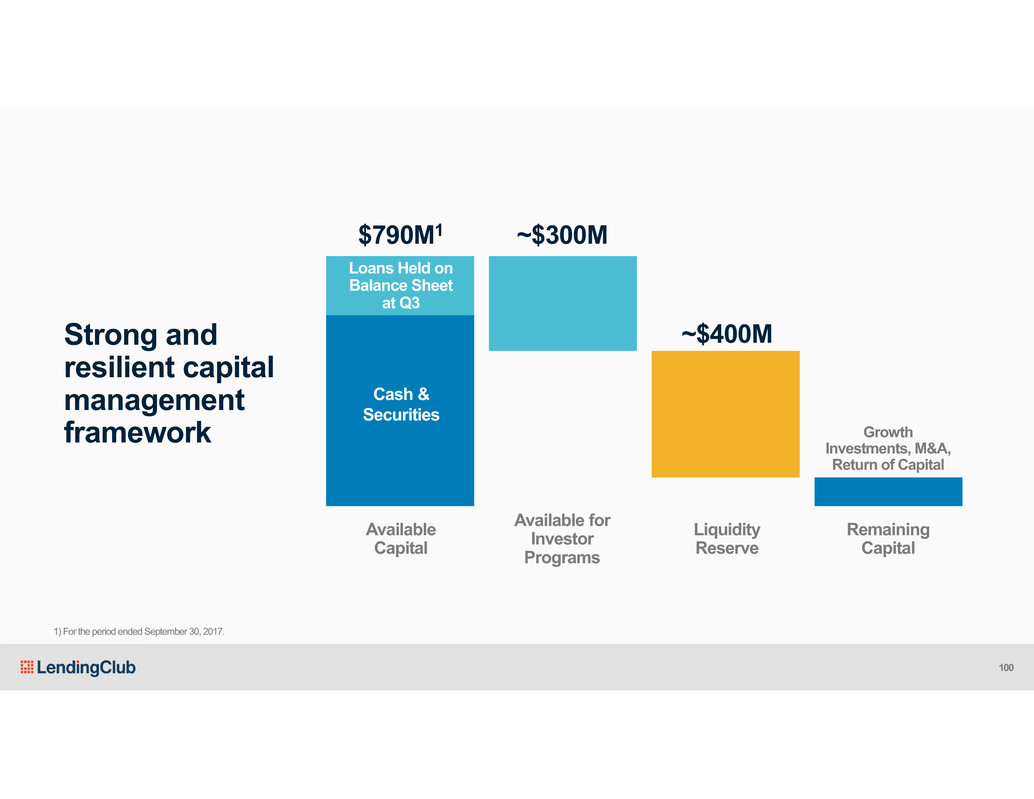

Resiliency Extending the investor base Strong Liquidity Structured products provide liquidity and a targeted investment profile in multiple market environments Skin in the Game 5% minimum risk retention requirement, aligning our interest with investors Supports Growth Value added capital markets capability provides value to the borrower and revenue expansion Capital Management Strategy 1 2 3 4 99

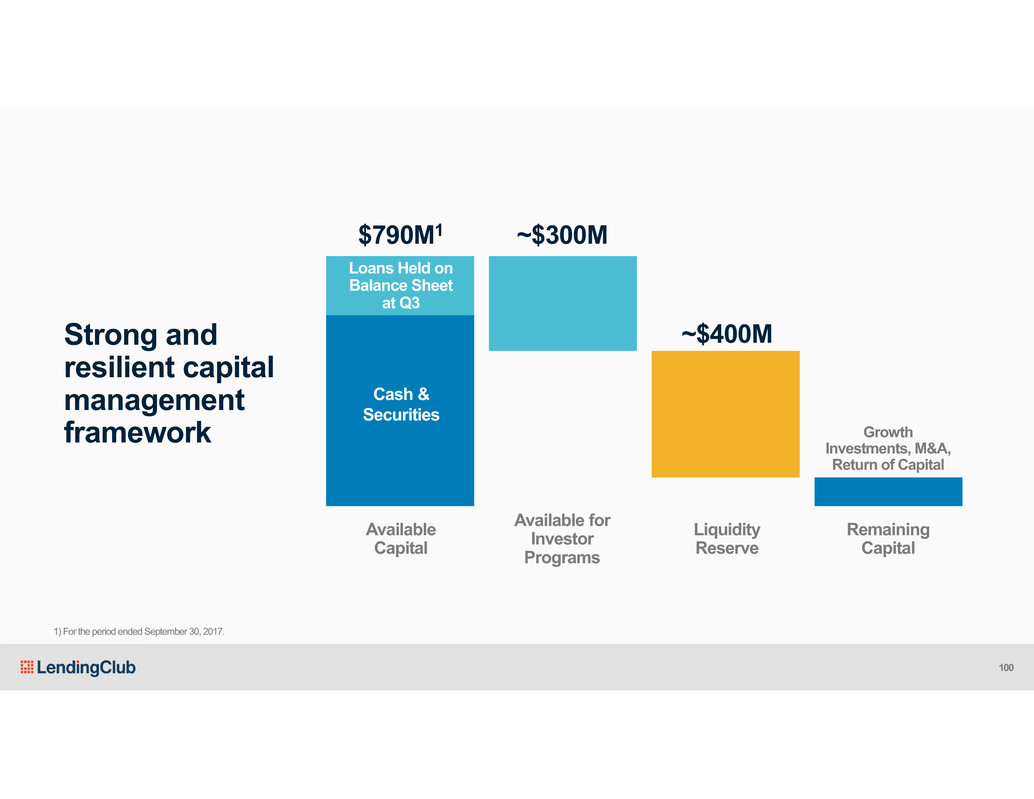

Available Capital Available for Investor Programs Cash & Securities $790M1 ~$300M Growth Investments, M&A, Return of Capital Remaining Capital Strong and resilient capital management framework Loans Held on Balance Sheet at Q3 ~$400M Liquidity Reserve 1) For the period ended September 30, 2017. 100

Market Growth Consumers will continue going online for their credit needs New Revenue Streams We are creating brand new revenue streams and growing revenue Product Improvements We are well-positioned to take greater share of the market Key Investments While making key investments to support long-term growth Growth will be driven by 4 key areas 1 2 3 4 101

The market is growing – and we are taking a greater share by: 47 53 66 83 100 112 2012 2013 2014 2015 2016 2017 U.S. Personal Loan Balances Outstanding1 $B 1% 10%LendingClub Share Attracting target customers Converting applicants to borrowers Serving a broader set of needs >2x 1) “TransUnion Industry Insights Report,” TransUnion, Q3 2017. 102

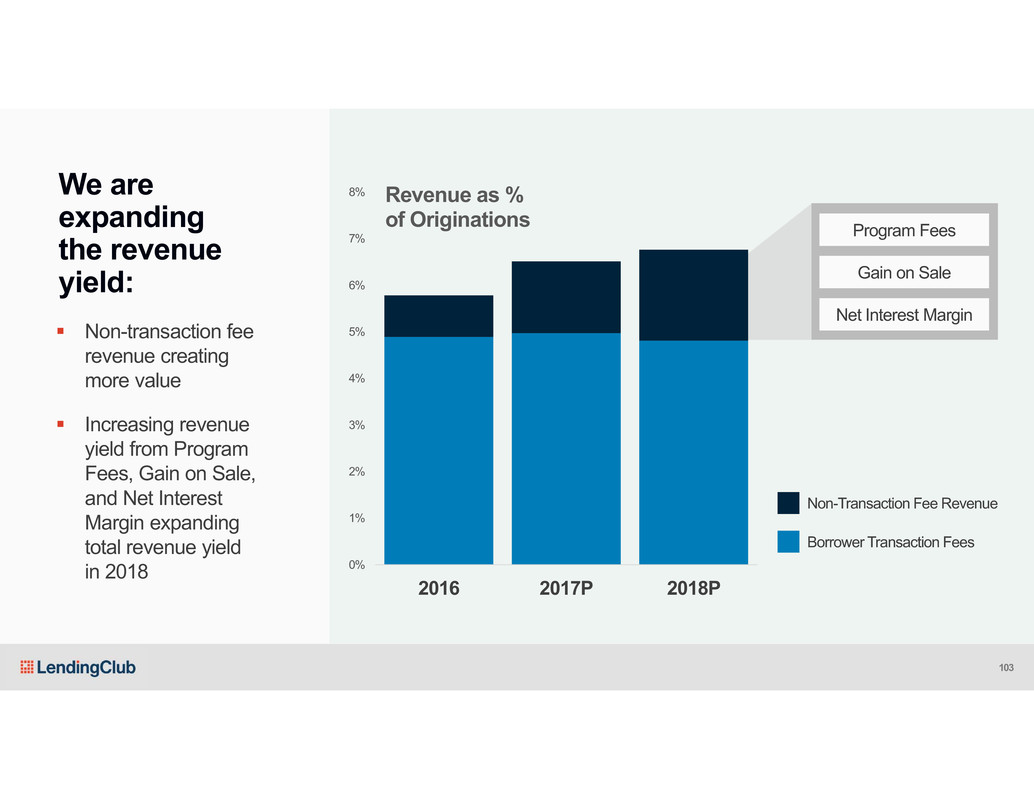

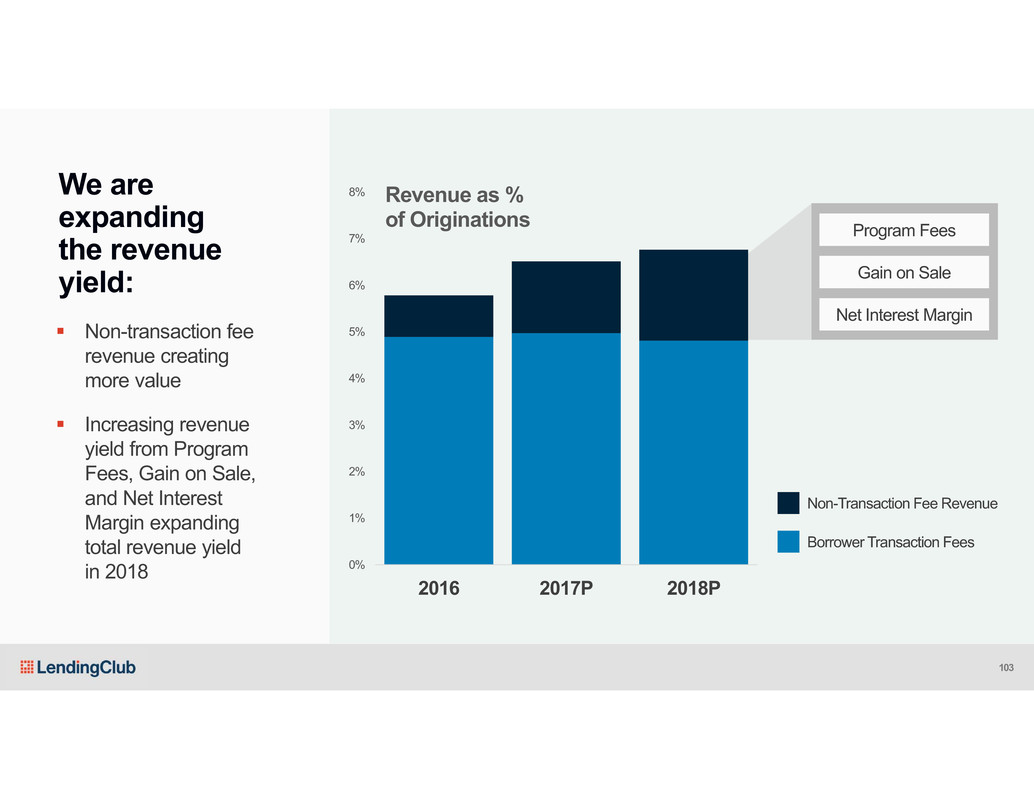

We are expanding the revenue yield: Non-transaction fee revenue creating more value Increasing revenue yield from Program Fees, Gain on Sale, and Net Interest Margin expanding total revenue yield in 2018 0% 1% 2% 3% 4% 5% 6% 7% 8% 2016 2017P 2018P Revenue as % of Originations Program Fees Non-Transaction Fee Revenue Borrower Transaction Fees Gain on Sale Net Interest Margin 103

2017 Guidance Update 2017 Net Revenue Adjusted EBITDA1 $573M-$578M $42M-$46M GAAP Net Income ($72M)-($68M) Q4 17 $155M-$160M $16M-$20M ($10M)-($6M) 1) Adjusted EBITDA is a non-GAAP financial measure. Non-GAAP reconciling items consist of stock-based compensation of approx. $15M and $70M, and approx. $11M and $44M of depreciation and amortization and other net adjustments for the three and twelve months ended December 31, 2017, respectively. Why are we updating the range? Q4 volumes are in-line with our expectations but… …we now expect a ($3M) timing impact to both our Revenue & EBITDA from holding the residual from our recent securitization 104

Core Business Growing Market Taking Share with New Initiatives Increasing Revenue Legacy Legal Costs 105

$25M OPEX $10M Auto $15M Technology We continue to make bets on future growth 106

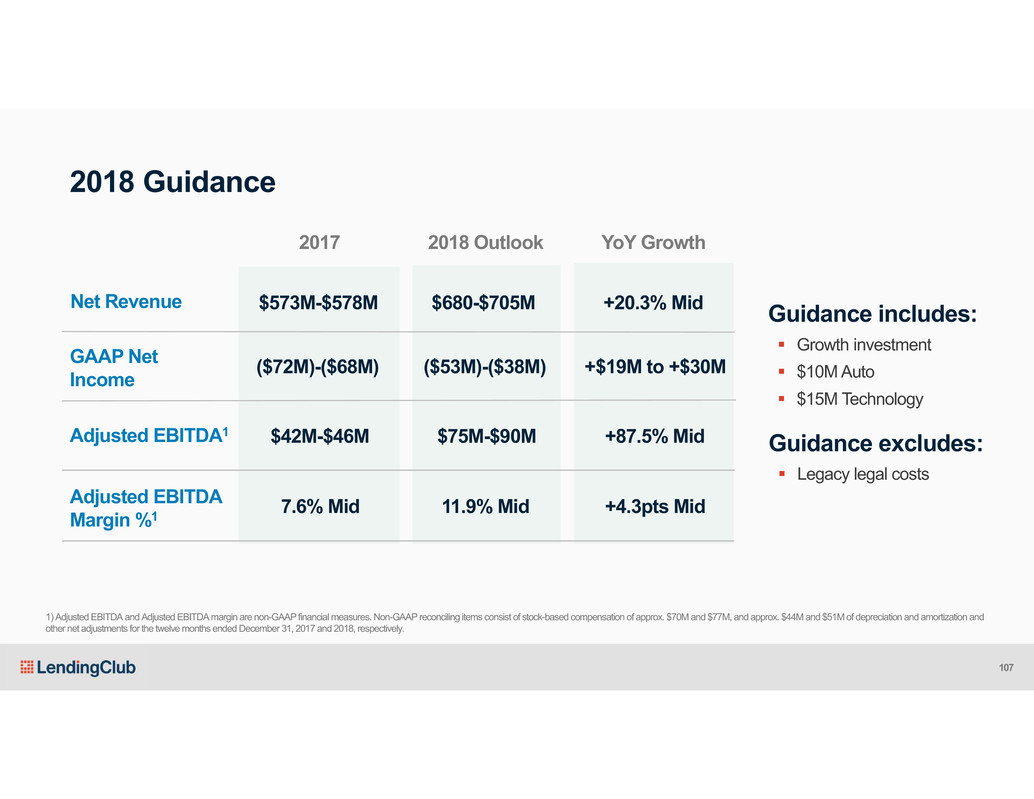

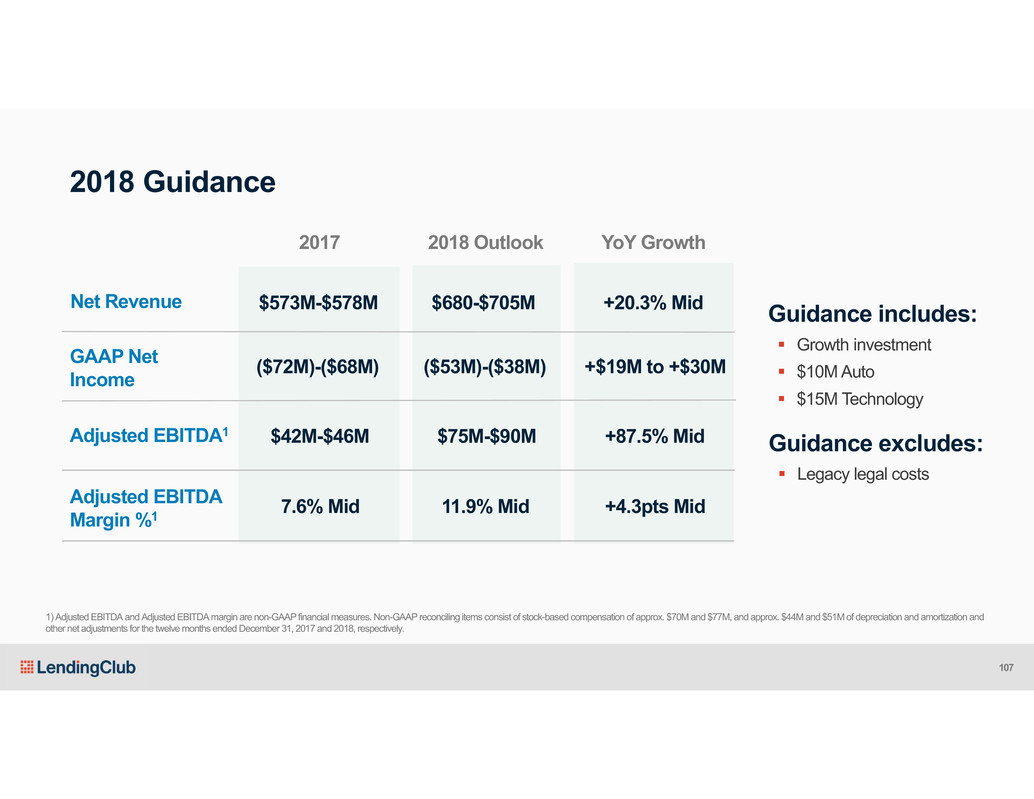

2018 Guidance Guidance includes: Growth investment $10M Auto $15M Technology 1) Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. Non-GAAP reconciling items consist of stock-based compensation of approx. $70M and $77M, and approx. $44M and $51M of depreciation and amortization and other net adjustments for the twelve months ended December 31, 2017 and 2018, respectively. Guidance excludes: Legacy legal costs 2017 2018 Outlook Net Revenue Adjusted EBITDA1 $573M-$578M $680-$705M $42M-$46M $75M-$90M Adjusted EBITDA Margin %1 GAAP Net Income +20.3% Mid +87.5% Mid 7.6% Mid 11.9% Mid ($72M)-($68M) ($53M)-($38M) YoY Growth +4.3pts Mid +$19M to +$30M 107

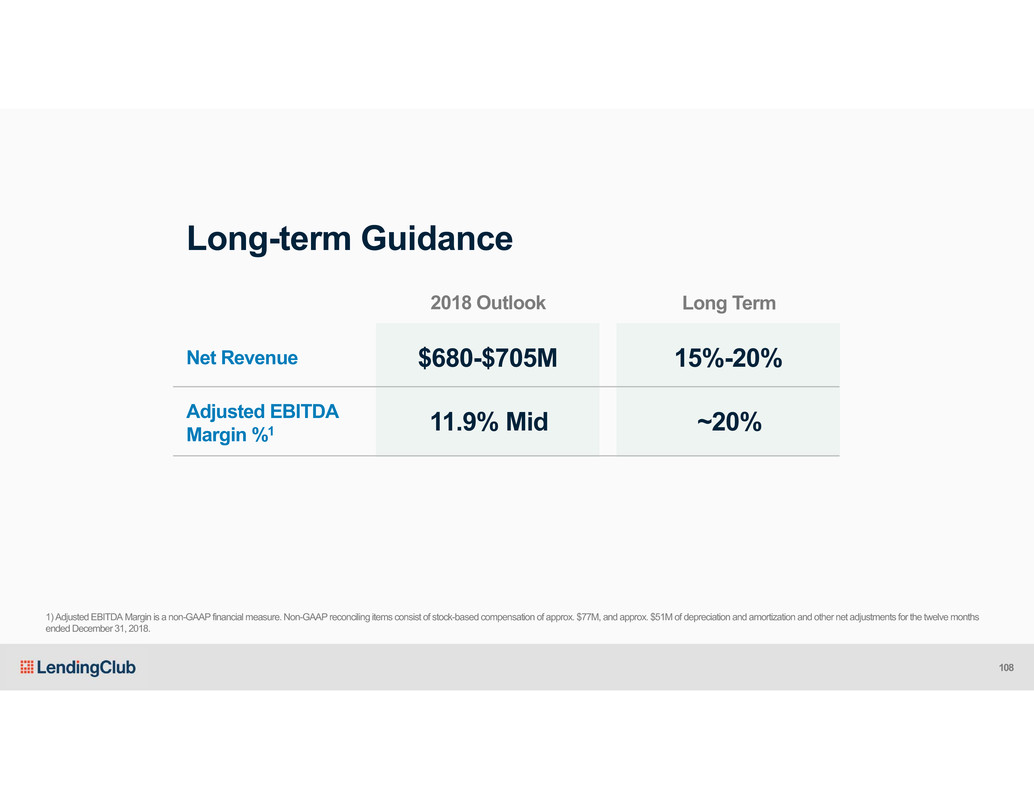

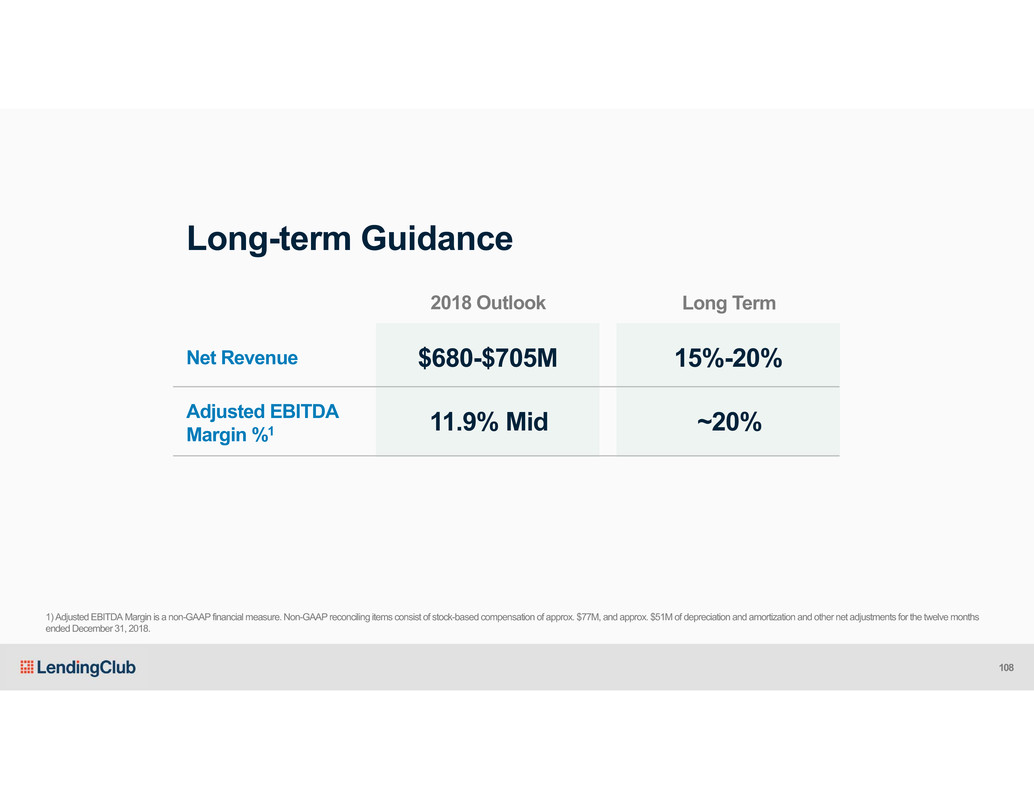

Long-term Guidance 2018 Outlook Long Term Net Revenue $680-$705M 15%-20% Adjusted EBITDA Margin %1 11.9% Mid ~20% 1) Adjusted EBITDA Margin is a non-GAAP financial measure. Non-GAAP reconciling items consist of stock-based compensation of approx. $77M, and approx. $51M of depreciation and amortization and other net adjustments for the twelve months ended December 31, 2018. 108

Building Scale Significant Growth Capital Light Model Expanding Margins 109

Scott Sanborn Chief Executive Officer

1. Unsecured online lending is a large and growing market, serving a critical customer need 2. LendingClub as the leader is uniquely positioned to go after this market a) The marketplace model is the right one with broad consumer demand and investor appetite b) We have strong credit, tech and product capabilities that are difficult to replicate at this scale c) We have the right blend of team and culture to win 3. Solid plan to deliver growth, while investing for the future Key takeaways 111

Q&AQ&A

Appendix

Financial Recons & Metrics

GAAP to Non-GAAP Reconciliation: Normalized Operating Expenses (in thousands, except percentages) (unaudited) Three Months Ended 1Q17 2Q17 3Q17 Total GAAP net revenue $124,482 $139,573 $154,030 GAAP sales and marketing $54,583 $55,582 $59,570 Stock-based compensation expense 2,299 1,967 1,591 One-time non-recurring expense 687 435 143 Non-GAAP normalized sales and marketing (M&S) $51,597 $53,180 $57,836 % Total non-GAAP net revenue 41.4% 38.1% 37.5% GAAP origination and servicing $20,449 $21,274 $21,321 Stock-based compensation expense 1,416 1,354 1,049 One-time non-recurring expense 238 132 — Non-GAAP normalized origination and servicing (O&S) $18,795 $19,788 $20,272 % Total non-GAAP net revenue 15.1% 14.2% 13.2% Non-GAAP normalized M&S and O&S $70,392 $72,968 $78,108 % Total non-GAAP net revenue 56.5% 52.3% 50.7% 116

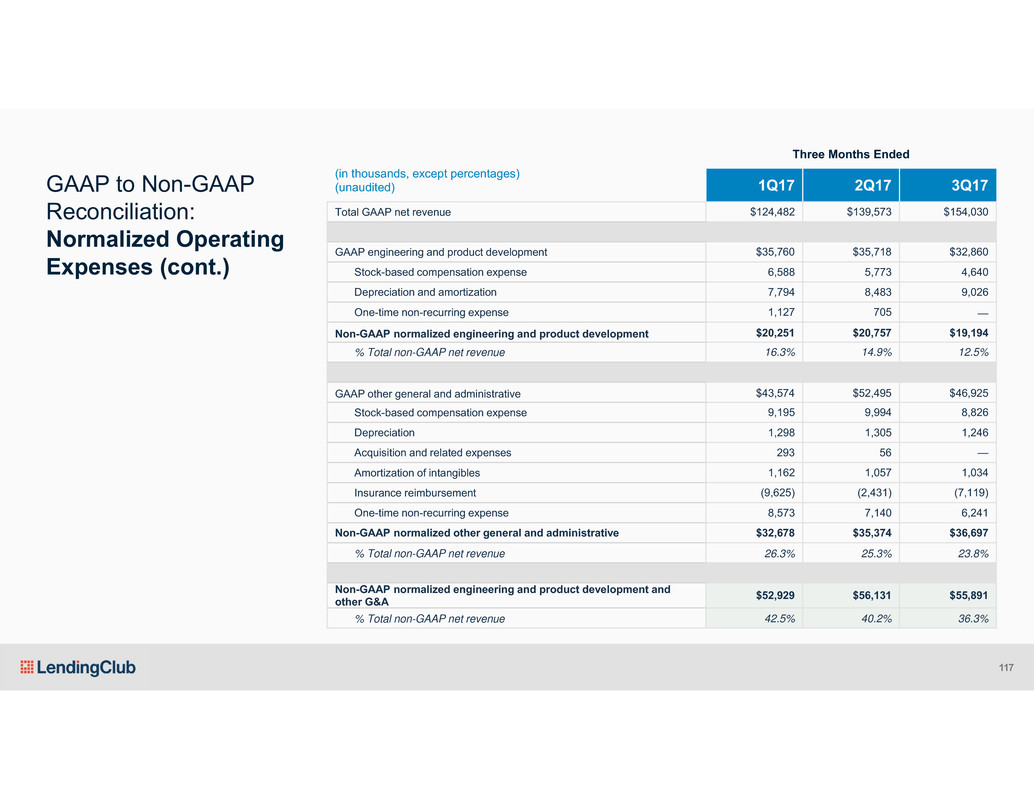

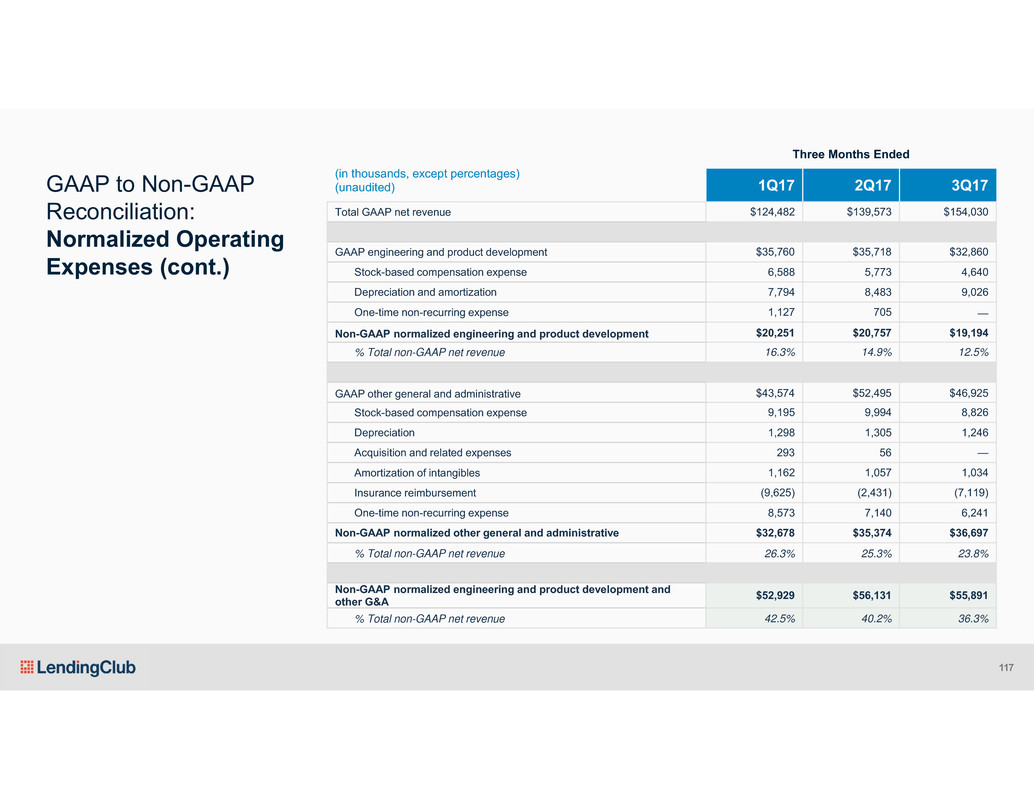

GAAP to Non-GAAP Reconciliation: Normalized Operating Expenses (cont.) (in thousands, except percentages) (unaudited) Three Months Ended 1Q17 2Q17 3Q17 Total GAAP net revenue $124,482 $139,573 $154,030 GAAP engineering and product development $35,760 $35,718 $32,860 Stock-based compensation expense 6,588 5,773 4,640 Depreciation and amortization 7,794 8,483 9,026 One-time non-recurring expense 1,127 705 — Non-GAAP normalized engineering and product development $20,251 $20,757 $19,194 % Total non-GAAP net revenue 16.3% 14.9% 12.5% GAAP other general and administrative $43,574 $52,495 $46,925 Stock-based compensation expense 9,195 9,994 8,826 Depreciation 1,298 1,305 1,246 Acquisition and related expenses 293 56 — Amortization of intangibles 1,162 1,057 1,034 Insurance reimbursement (9,625) (2,431) (7,119) One-time non-recurring expense 8,573 7,140 6,241 Non-GAAP normalized other general and administrative $32,678 $35,374 $36,697 % Total non-GAAP net revenue 26.3% 25.3% 23.8% Non-GAAP normalized engineering and product development and other G&A $52,929 $56,131 $55,891 % Total non-GAAP net revenue 42.5% 40.2% 36.3% 117

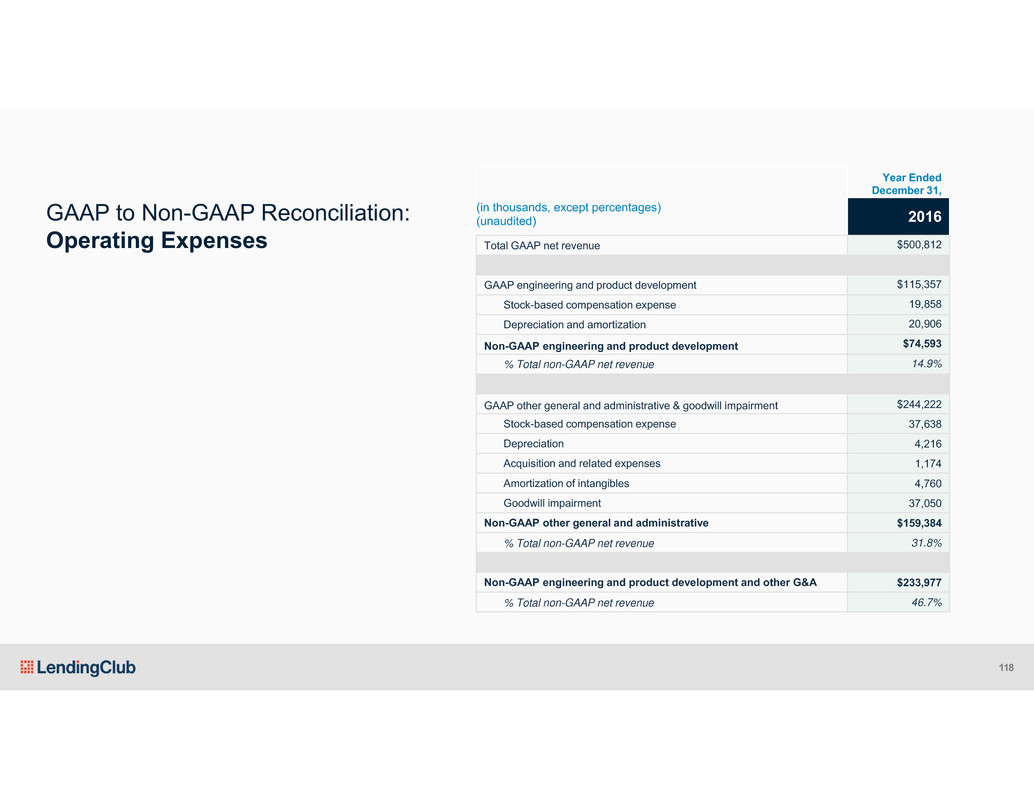

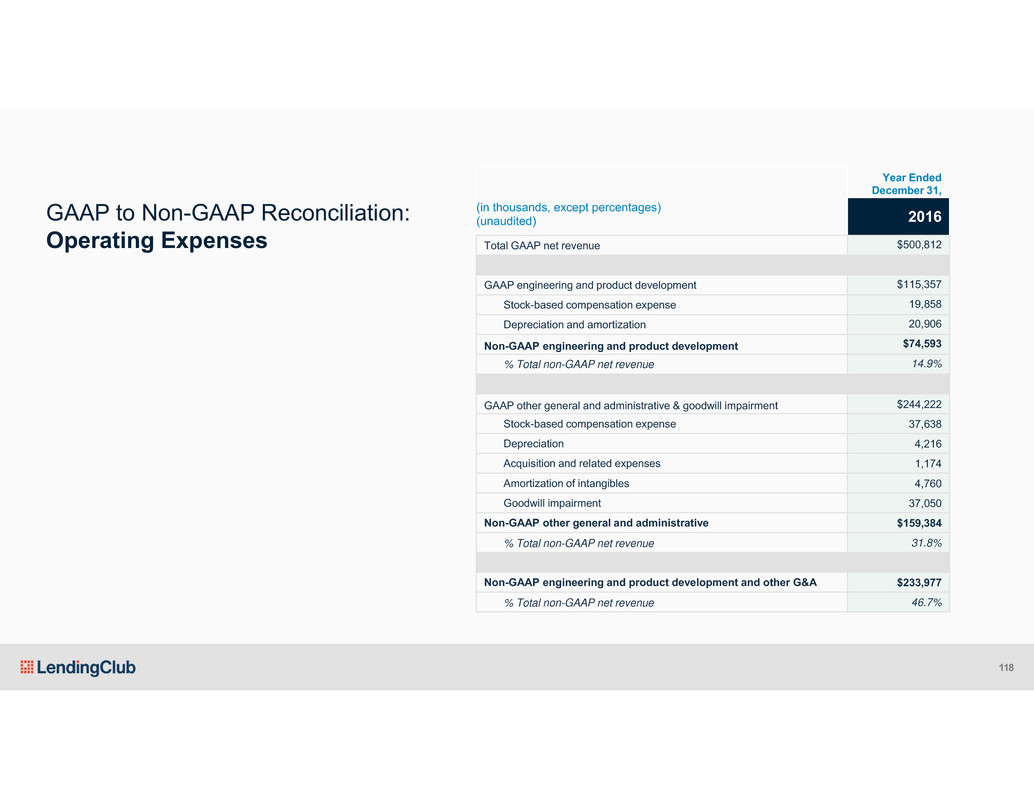

GAAP to Non-GAAP Reconciliation: Operating Expenses (in thousands, except percentages) (unaudited) Year Ended December 31, 2016 Total GAAP net revenue $500,812 GAAP engineering and product development $115,357 Stock-based compensation expense 19,858 Depreciation and amortization 20,906 Non-GAAP engineering and product development $74,593 % Total non-GAAP net revenue 14.9% GAAP other general and administrative & goodwill impairment $244,222 Stock-based compensation expense 37,638 Depreciation 4,216 Acquisition and related expenses 1,174 Amortization of intangibles 4,760 Goodwill impairment 37,050 Non-GAAP other general and administrative $159,384 % Total non-GAAP net revenue 31.8% Non-GAAP engineering and product development and other G&A $233,977 % Total non-GAAP net revenue 46.7% 118

GAAP to Non-GAAP Reconciliation: Contribution Definition and Reconciliation Contribution is a non-GAAP financial measure that we calculate as consolidated net income (loss), excluding general and administrative expense, stock-based compensation expense, income tax expense (benefit) and (income) loss attributable to noncontrolling interests. Contribution margin is calculated by dividing contribution by total net revenue. (in thousands, except percentages) (unaudited) Year Ended December 31, 2016 GAAP consolidated net income (loss) $(145,969) GAAP general and administrative expense: Engineering and product development 115,357 Other general and administrative 207,172 Goodwill impairment 37,050 Stock-based compensation expense: Sales and marketing 7,546 Origination and servicing 4,159 Income tax expense (benefit) (4,228) (Income) loss attributable to noncontrolling interest — Contribution $221,087 Total net revenue $500,812 Contribution margin 44.1% 119

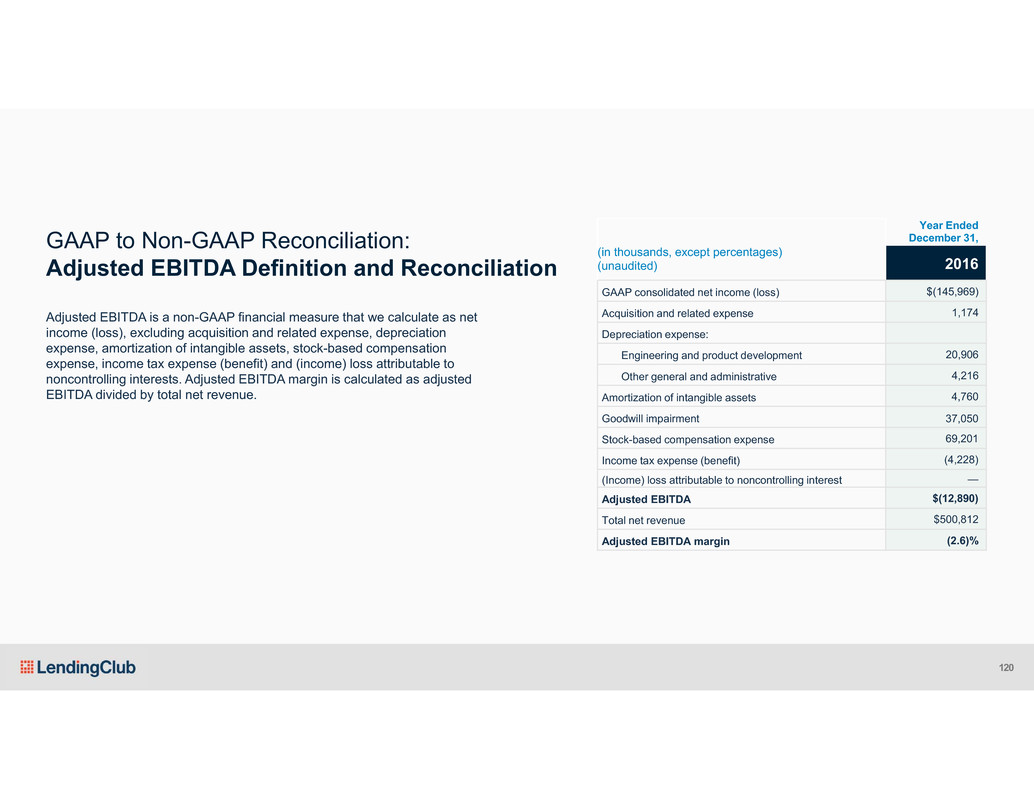

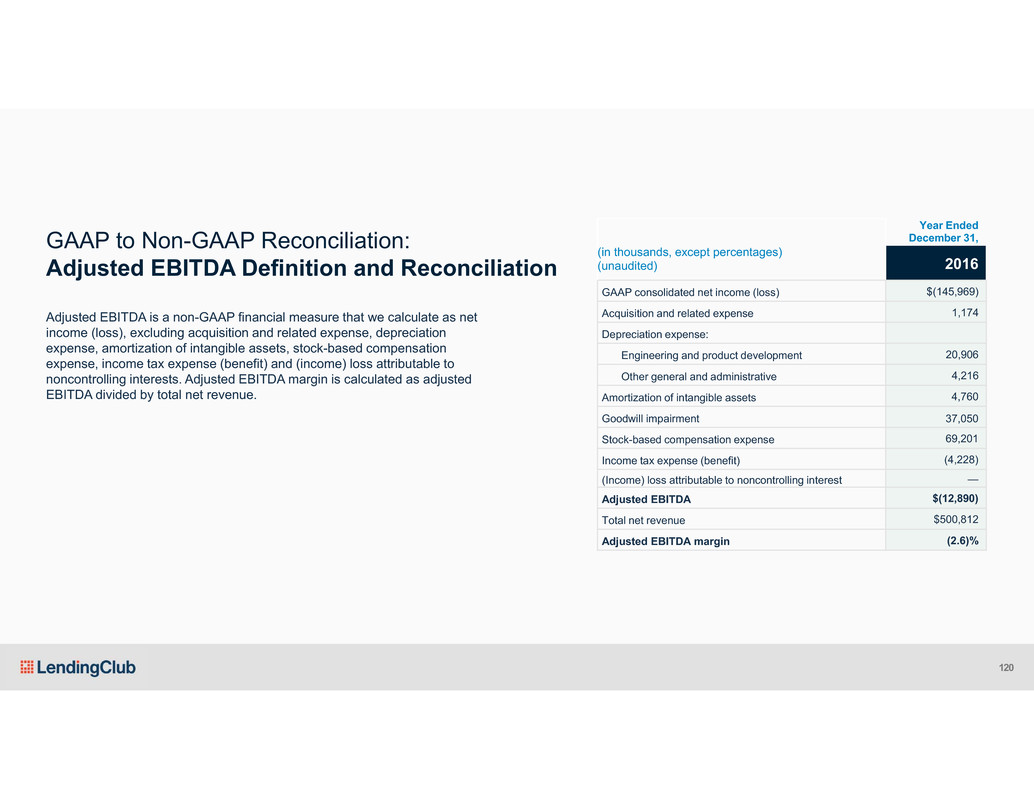

GAAP to Non-GAAP Reconciliation: Adjusted EBITDA Definition and Reconciliation Adjusted EBITDA is a non-GAAP financial measure that we calculate as net income (loss), excluding acquisition and related expense, depreciation expense, amortization of intangible assets, stock-based compensation expense, income tax expense (benefit) and (income) loss attributable to noncontrolling interests. Adjusted EBITDA margin is calculated as adjusted EBITDA divided by total net revenue. (in thousands, except percentages) (unaudited) Year Ended December 31, 2016 GAAP consolidated net income (loss) $(145,969) Acquisition and related expense 1,174 Depreciation expense: Engineering and product development 20,906 Other general and administrative 4,216 Amortization of intangible assets 4,760 Goodwill impairment 37,050 Stock-based compensation expense 69,201 Income tax expense (benefit) (4,228) (Income) loss attributable to noncontrolling interest — Adjusted EBITDA $(12,890) Total net revenue $500,812 Adjusted EBITDA margin (2.6)% 120

Expected Returns The hypothetical loan grade and term mix used to calculate weighted average projected returns was generated by applying the fifth generation credit model to all actual loans facilitated from October 2, 2017 through October 29, 2107 (Prime) and January 2017 through May 2017 (Near Prime), except for exclusions of certain grades as describedbelow. This hypothetical mix is for illustrative purposes only and is not a guarantee or indication of future inventory distribution. This analysis uses elements of backtesting. Backtesting is hypothetical and is provided for information purposes only. Backtesteddata has inherent limitations, including that historical borrower populations are not necessarily indicative of future borrower populations. Projected Return is a measure of the estimated annualized return rate on invested principal using an internal rate of return (IRR) methodologyusing a monthly term. Monthly cash flow projections are calculated as follows: the scheduled principal and interest payments based on the Interest Rate minus the amount of such principal and interest payments lost due to Expected Charge-Off Rate (w/ Prepayment) minus fees. Monthly IRR figures are annualized by multiplying the monthly IRR figure by 12. Projected Return figures are reported on a pre-tax basis. Projected levered returns are based on the latest leverage terms provided by a major leverage provider and assume maximum leverage. Projected levered returns do not include any A grade loans. Projected return figures are for illustration only, are not a promise of future results, and may not accurately reflect actual returns. Actual returns experienced by any individual portfolio may be impacted by, among other things, the size and diversity of the portfolio, the exposure to any single loan, borrower or group of loans or borrowers, aswell as macroeconomic conditions. Individual results may vary and projections are subject to change. The information presented is not intended to be investment advice, guidance, or a guarantee of the performance of any loan. Individual results may vary and projections can change. Past performance is no guarantee of future results. 121

Stress Tests Sources: LendingClub and Moody’s Analytics, Inc. (“Moody’s”). As of November 2017. These projections were determined using a combination of LendingClub data and analysis by Moody’s. Moody’s calculated stress multiples which were applied to Lending Club’s expected performance. Moody’s loss and prepayment model was developed using LendingClub data and macroeconomic variables. These results are presented for illustrative purposes only and are not intended as a projection or guarantee of future results. The economic data provided by Moody’s Analytics, Inc. and its affiliates (“Moody’s”) that Lending Club Corporation used in part to generate the information contained in this white paper is proprietary to Moody’s Analytics, Inc. and its affiliates (“Economic Data”). You recognize and agree that Moody’s is not acting as a financial advisor in providing the Economic Data, and the Economic Data is not a recommendation to buy, hold or sell any securities or any other form of investment advice. You agree that neither you nor Moody’s intends to create a fiduciary relationship between Moody’s and you, and you will make your own decision to extend, call, purchase or sell any loan or security or make any other financial decision. You acknowledge that Moody’s does not intend or agree to be named as an “expert” under applicable securities laws “Projected Return” is a measure of the estimated annualized return rate on invested principal using an internal rate of return (IRR) methodologyusing a monthly term. Monthly cash flow projections are calculated as follows: the scheduled principal and interest payments based on the Interest Rate minus the amount of such principal and interest payments lost due to Expected Charge-Off Rate (w/ Prepayment) minus fees (see “Maximum Expected Fees” for a summary of applicable fees). Monthly IRR figures are annualized by multiplying the monthly IRR figure by 12. Projected Returns are calculated based on grade and maturity mix described in the “Average Interest Rate” section of this disclaimer. Projected Return is not a promise of future results and may not accurately reflect actual returns. Actual returns experienced by any individual portfolio may be impacted by, among other things, the size and diversity of the portfolio, the exposure to any single loan, borrower or group of loans or borrowers, as well as macroeconomic conditions. Individual results may vary and projections are subject to change. The information presented is not intended to be investment advice, guidance, or a guarantee of the performance of any loan. Individual results may vary and projections can change. Past performance is no guarantee of future results. “Average Interest Rate” the hypothetical loan grade and term mix used to calculate weighted average interest rate was generated by applying the fifth generation credit model to all actual loans facilitated from October 2, 2017 through October 29, 2107. This hypothetical mix is for illustrative purposes only and is not a guarantee or indication of future inventory distribution. This analysis uses elements of backtesting. Backtesting is hypothetical and is provided for information purposes only. Backtesteddata has inherent limitations, including that historical borrower populations are not necessarily indicative of future borrower populations. “Expected Charge-Off Rate (w/ Prepayment)” is LendingClub’s projection of the aggregate dollar amount of loan principal charged-off, net of any amounts recovered and accounting for the impact of amounts prepaid, as an annualized percentage of the aggregate dollar amount of loan principal for all loans issued under the Prime Program after November 7, 2017. Expected Charge-Off Rate (w/ Prepayment) is not a promise of future results and may not accurately reflect actual charge-off or prepayment rates. Actual charge-off and prepayment rates experienced by any individual portfolio may be impacted by, among other things, the size and diversity of the portfolio, the exposure to any single loan, borrower or group of loans or borrowers, as well as macroeconomic conditions. “Expected Lost Interest Due to Charge-Offs” is LendingClub’s estimate of the impact of estimate of the interest lost due to charge-offs. The estimate for uncollected interest is calculated from Expected Charge-Off Rates (w/Prepayment) and the expected time period prior to charge-off during which borrowers do not make interest and principal payments and is based on the grade and maturity mix described in the “Average Interest Rate” disclaimer. These rates are subject to change. Expected Charge-Off Rates (w/Prepayment) may not reflect actual charge-off rates and individual results are likely to vary. This information is not a promise of future results. See "Expected Charge-Off Rate (w/ Prepayment)" for more information. “Maximum Expected Fees” is the aggregate estimated impact of LendingClub’s servicing fee (1%), collection fee (18%), recovery fee (18%), and an administrative fee (0.10%). We estimate the collection feebased on Expected Charge-Off Rates (w/Prepayment) and the expected number of late payments that will be collected on past due loans with a given grade and term. 122