UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

| | | | | | | | | | | | | | | | | |

| Filed by the Registrant | x | | Filed by a Party other than the Registrant | ¨ | |

| | | | | |

| Check the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

| | |

LendingClub Corporation (Name of Registrant as Specified in its Charter)

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

| | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

x

| No fee required. |

¨

| Fee paid previously with preliminary materials. |

¨

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

595 Market Street, Suite 200

San Francisco, California 94105

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 2, 2022

To Our Stockholders:

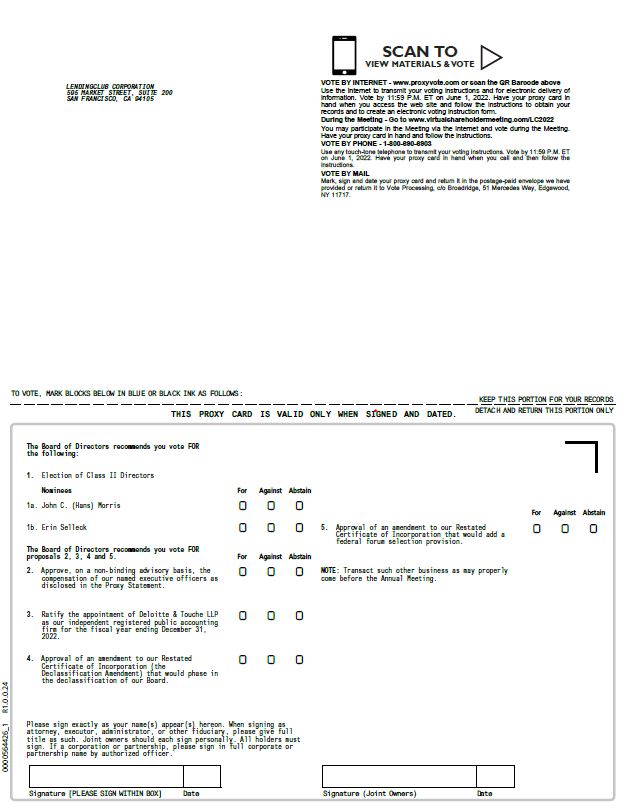

NOTICE IS HEREBY GIVEN that the 2022 Annual Meeting of Stockholders of LendingClub Corporation (the “Company,” “LendingClub,” “we,” “us” and “our”) will be held on June 2, 2022 at 9:00 a.m. Eastern Time via the Internet at www.virtualshareholdermeeting.com/LC2022 (the “Annual Meeting”). There is no physical location for the Annual Meeting.

At the Annual Meeting, you will be asked to:

1.Elect John C. (Hans) Morris and Erin Selleck as Class II directors, each of whom is currently serving on our Board of Directors, to serve until the 2025 Annual Meeting of Stockholders and until his or her successor has been elected and qualified or his or her earlier death, resignation or removal;

2.Approve, on a non-binding advisory basis, the compensation of our named executive officers as disclosed in the Proxy Statement;

3.Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022;

4.Approve a management proposal to amend the Company’s Restated Certificate of Incorporation to phase in the declassification of our Board of Directors; and

5.Approve a management proposal to amend the Company’s Restated Certificate of Incorporation to add a federal forum selection provision.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on April 11, 2022 are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof.

By Order of the Board of Directors,

Brandon Pace

Chief Administrative Officer and Corporate Secretary

San Francisco, California

April 19, 2022

Whether or not you expect to participate in the Annual Meeting, please vote via the Internet, by phone, or complete, date, sign and promptly return the accompanying proxy in the enclosed postage-paid envelope (if applicable) so that your shares may be represented at the Annual Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 2, 2022: THIS PROXY STATEMENT, PROXY, AND THE ANNUAL REPORT ARE AVAILABLE AT WWW.PROXYVOTE.COM

Dear Stockholders,

Millions of everyday Americans have insufficient financial reserves and often turn to a limited set of higher cost debt solutions to bridge cashflow gaps and manage their financial lives. As one of a small number of fintech companies with a national bank charter, we are uniquely positioned to leverage technology, data science, and a unique marketplace bank model to increase consumer access to credit, lower their borrowing costs and improve the return on their savings. Since our founding, we have helped more than 4 million individual LendingClub members achieve their financial goals with fairness, simplicity and heart.

In 2021, we successfully completed the Radius Bank acquisition, thereby enhancing the resilience and earnings trajectory of our business. We delivered record revenue and profitability in 2021 and have issued guidance for another record breaking 2022. With our award-winning banking product, market-leading unsecured lending capabilities, innovation-oriented culture and seasoned executive team, we believe we can deliver strong financial results while simultaneously investing in the infrastructure and people to grow our business and product offerings over a multi-year period.

The Board and management are keenly focused on positioning the Company to best serve our various stakeholders. With respect to our stockholders and customers, we are cognizant of various macroeconomic uncertainties but believe we are well positioned financially, strategically and operationally to continue to successfully execute against our plan and deliver on our mission. With respect to our employees, safety remains a priority and we have grounded our 2022 return to office strategy in public health guidance while maintaining flexibility for our employees. Our focus on people matters has driven strong employee engagement, enabled relatively low attrition and earned a number of external recognitions, including various Top Workplaces awards, a perfect score of 100 in the Human Rights Campaign Foundation’s 2022 Corporate Equality Index, and inclusion on Bloomberg’s 2022 Gender-Equality Index. With respect to our community, we have included in this proxy statement our first ESG disclosure and would encourage you to read about how we believe LendingClub is inherently and authentically aligned with supporting ESG causes. This represents the first step in what we expect will be a multi-year effort to bolster our communications and disclosures on this increasingly important topic.

Diversity and inclusion are core to our corporate culture, and we strive to create a workplace that is welcoming and empowering for all. In addition to anti-racism, inclusive hiring and breaking-bias trainings, we have executive-sponsored programs designed to provide women and under-represented individuals with leadership tools and growth opportunities. Further, we promote policies and regulations that prevent and/or address discrimination, including with respect to the use of artificial intelligence and fair and responsible lending to communities of color. Retaining a diverse Board remains an important consideration as we contemplate future appointments. To that end, our Nominating and Corporate Governance Committee is continuing its search for director candidates that bring diversity to the Board. We remain committed to appointing an ethnically diverse director in 2022.

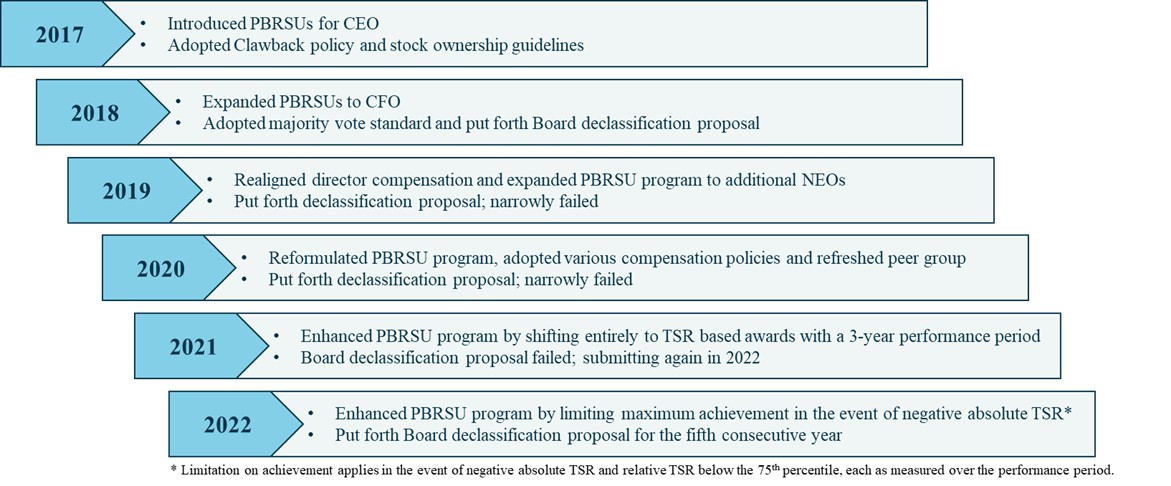

The Company also continues to solicit and be responsive to stockholder feedback. We have enhanced our performance-based equity program, most recently by shifting to entirely multi-year TSR-based awards and implementing a payout cap in the event of certain negative absolute TSR scenarios. We also continue to believe in the merits of a declassified board and have again submitted a proposal this year to phase out our current classified board structure. Further, we have also again submitted a proposal to add a federal forum selection provision to our Certificate of Incorporation. This provision will allow the Company to consolidate and more efficiently manage procedural aspects of securities litigation, which we believe is in the best interest of the Company and its stockholders.

On behalf of the Board, thank you for your investment in LendingClub. We remain optimistic about our future and committed to creating value for our stockholders, as well as our customers, employees and communities.

Finally, we would like to acknowledge the deeply troubling and saddening events unfolding in Ukraine. Our hearts go out to all those affected, including some of our own employees. We wish everyone the very best for 2022.

Sincerely,

Scott Sanborn, Chief Executive Officer and member of the Board

John C. (Hans) Morris, Independent Chairman of the Board

| | | | | | | | |

| 2022 PROXY STATEMENT | PROXY SUMMARY |

PROXY SUMMARY

April 19, 2022

| | | | | | | | |

| Proposal | Board Recommendation | Page |

| Proposal One: Election of Class II directors | For each nominee | |

| Proposal Two: Advisory vote to approve the compensation of our named executive officers | For | |

| Proposal Three: Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the 2022 fiscal year | For | |

| Proposal Four: Management proposal to amend the Company’s Restated Certificate of Incorporation to phase in the declassification of the Board of Directors | For | |

| Proposal Five: Management proposal to amend the Company’s Restated Certificate of Incorporation to add a federal forum selection provision | For | |

The Notice of Internet Availability of Proxy Materials (the “Notice”), Proxy Statement, form of proxy and Annual Report on Form 10-K for the year ended December 31, 2021 (the “Annual Report”) will be first distributed and made available to stockholders on or about April 19, 2022.

LendingClub Corporation (“LendingClub”, the “Company”, “we”, “us”, “our”) operates America’s leading digital marketplace bank. As a digitally native, vertically integrated, customer-focused company, and one of a small number of fintech companies with a national bank charter, we are uniquely positioned to create a next generation of financial products and services to improve our members’ financial health. We do this by bringing together the best of both worlds – fintech and banking – leveraging data and technology to increase consumer access to credit, lower their borrowing costs, and improve the return on their savings while delivering a seamless experience that focuses on fairness and simplicity.

The Company was founded in 2006 and brought a traditional credit product – the installment loan – into the digital age by leveraging technology, data science and a unique marketplace model. In doing so, we became one of the largest providers of unsecured personal loans in the United States. In February 2021, LendingClub completed the acquisition of an award-winning digital bank, Radius Bancorp, Inc. (“Radius”), becoming a bank holding company and forming LendingClub Bank, National Association, as its wholly-owned subsidiary through which we operate the vast majority of our business. The result is a combination of complementary strengths that create an economically attractive and resilient digital marketplace bank. Upon the closing of the Radius acquisition, we also obtained a commercial lending business that includes commercial and industrial loans, commercial real estate loans, small business loans, and equipment loans and leases.

Our primary consumer products include unsecured personal loans, secured auto refinance loans, and patient and education finance loans. Our consumer loan and deposit customers – our “members” – can gain access to a broader range of financial products and services designed to help them digitally optimize their lending, spending and savings. Economic volatility and the current rising costs of healthcare, housing, education and more have contributed to millions of everyday Americans having insufficient financial reserves or living paycheck to paycheck, including nearly half of those earning over $100,000 annually. They often turn to a limited set of higher cost debt solutions to bridge cashflow gaps and manage their financial lives. Our mission is to empower our members on a path to better financial health, giving them new ways to pay less on their debt and earn more on their savings. Since 2007, over 4 million individuals have become members, joining the Club to help achieve their financial goals.

For consumer depositors, we offer checking accounts, high-yield savings accounts, and certificates of deposit. Our checking accounts deliver an award-winning digital experience, customer friendly features, such as ATM fee rebates, no overdraft fees, early direct deposits, rewards and competitive interest rates. We also offer a range of small business accounts.

| | | | | | | | |

LENDINGCLUB CORPORATION | 1 |

| | | | | | | | |

| 2022 PROXY STATEMENT | PROXY SUMMARY |

To execute on our vision, grow the business responsibly and create value for our stockholders, it is critical that we have a sophisticated, dedicated and committed management team, overseen by an independent Board of Directors (the “Board”) with substantial and relevant expertise.

| | |

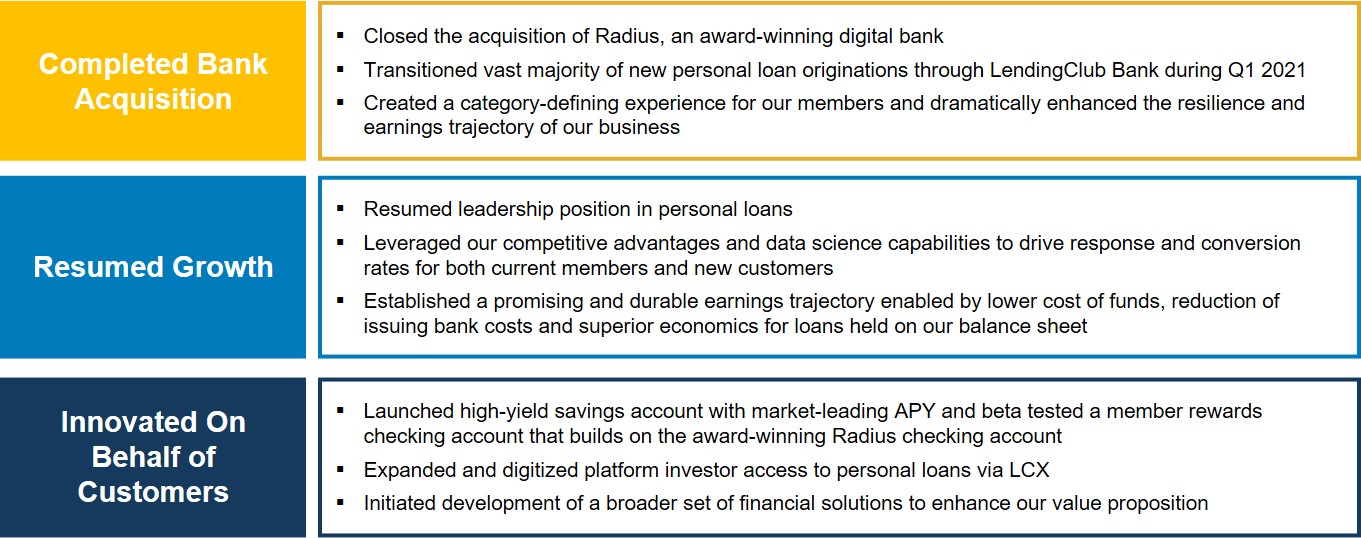

| 2021 Strategic Priorities and Results |

Our management team and Board are deeply focused on the evolution, execution and oversight of our strategy. Below is a summary of key 2021 strategic priorities and how we executed against them.

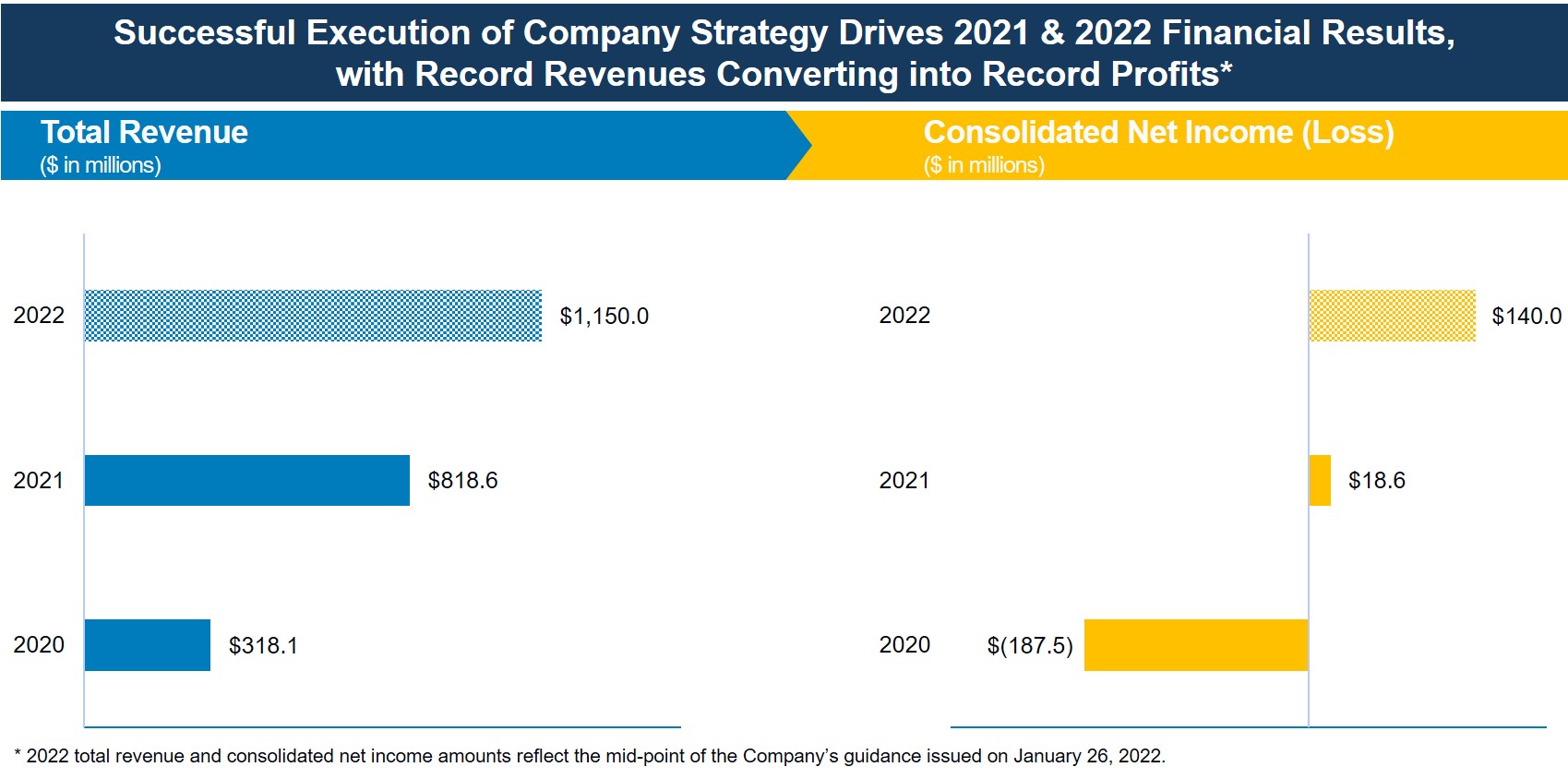

Executing against our 2021 strategic priorities drove record financial results in 2021, and we have issued guidance for another record breaking year in 2022. Below is a summary of our total revenue and GAAP consolidated net income/loss performance.

Our Board believes it is important to maintain an open dialogue with stockholders to understand their views on the Company, its strategy and its governance and compensation practices. Therefore, we engage with stockholders regularly and solicit

| | | | | | | | |

LENDINGCLUB CORPORATION | 2 |

| | | | | | | | |

| 2022 PROXY STATEMENT | PROXY SUMMARY |

feedback annually on our compensation and governance practices from many of the governance departments of our largest institutional stockholders.

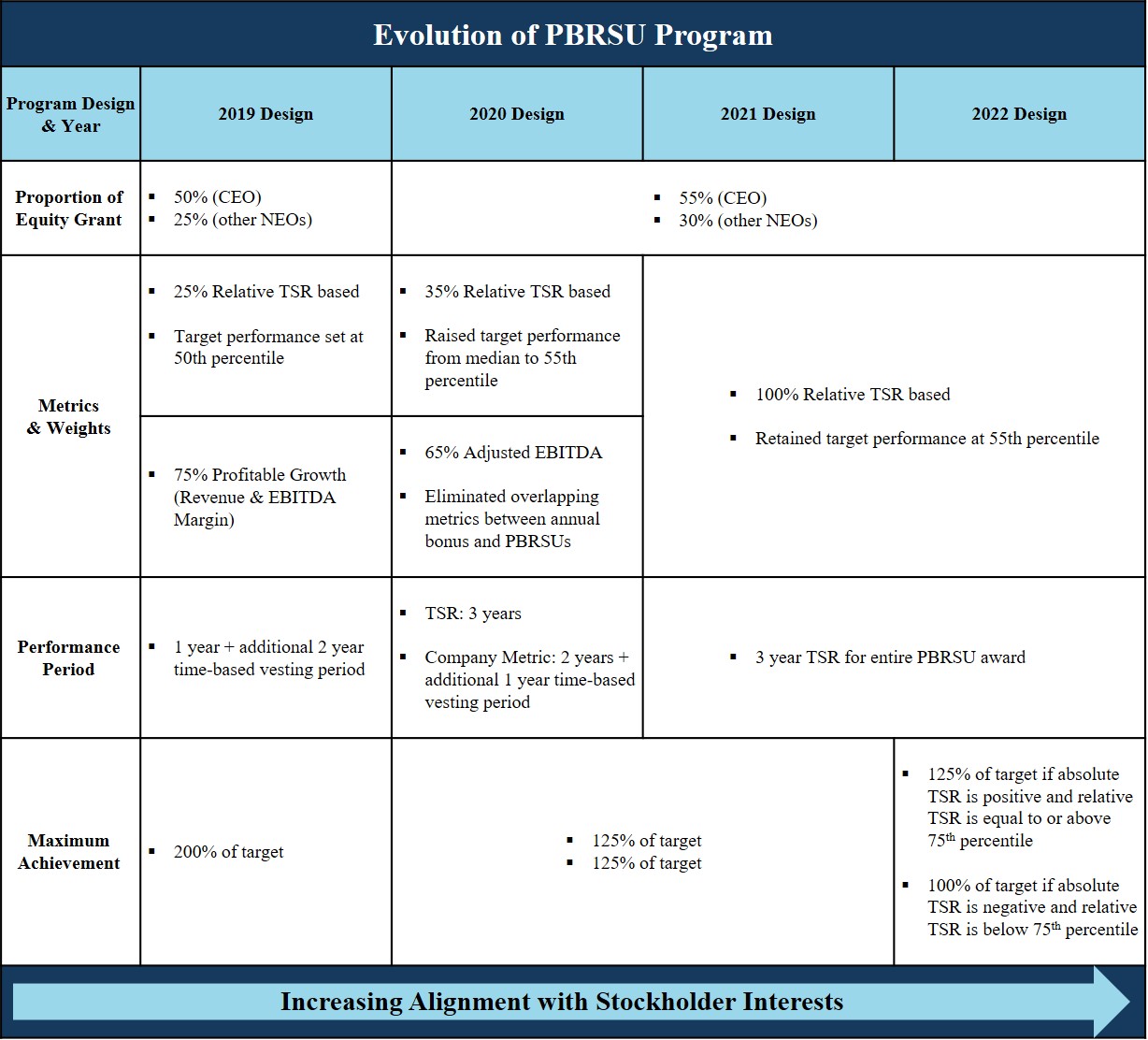

Overall, the stockholders we engaged with expressed support for our strategy and compensation and governance practices; including efforts to declassify the Board and the timeline for soliciting approval to remove the supermajority voting requirement to amend our governing documents. In particular, stockholders appreciated the inherent social good of the Company’s business model and the evolution of our compensation programs and practices, including the adjustments we have made to our performance-based restricted stock unit (“PBRSU”) program over the past few years. Further, stockholders appreciated the transformational impact of the Radius acquisition and recognized the importance of ensuring the Company recruits and retains human capital necessary to execute and advance its strategy.

| | |

| Executive Compensation Aligned with Corporate Results |

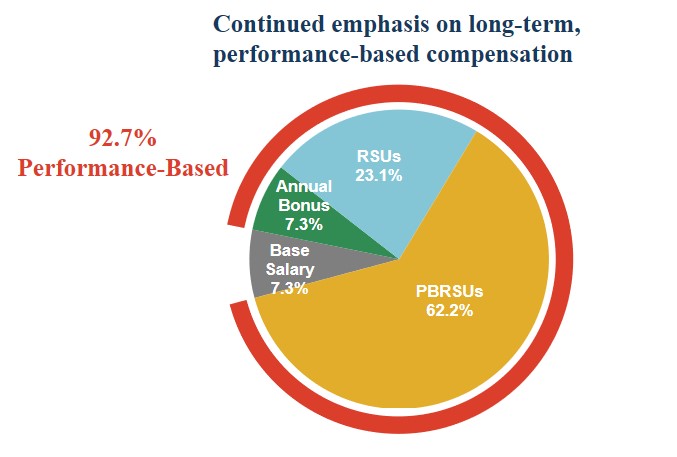

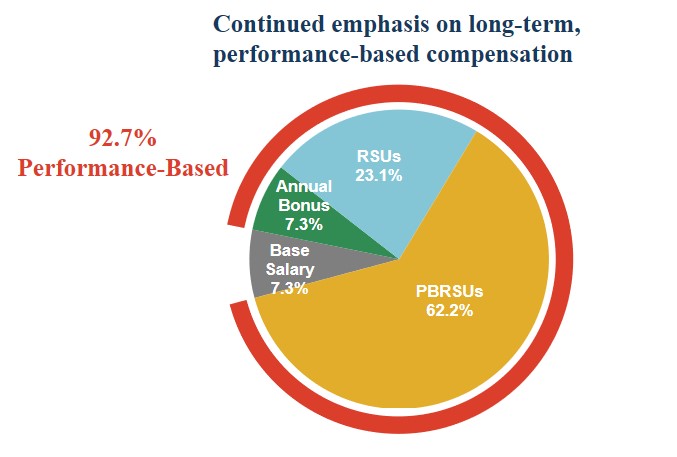

We believe that our compensation approach supports our objective of focusing on performance-based compensation, reflecting an opportunity for financial upside based on company and individual performance and no or reduced payouts when we do not meet our performance goals. Our emphasis on equity awards provides a direct link between stockholder interests and the interests of our executive officers, thereby motivating our executive officers to focus on increasing our value over the long term. Below is a summary of our 2021 executive compensation program.

2021 Executive Compensation Program

| | | | | | | | | | | |

| Element | Form | Description | Performance Link |

| Base Salary | Cash | Salaries are competitive and appropriate based on financial services industry and the size and complexity of our business, and represent the only element of our compensation program that is not performance-based |

Target Annual

Cash Bonus | Cash | Cash bonuses reward our executive officers for achieving pre-defined annual financial and operational goals that support our long-term business strategy | Net revenue, GAAP consolidated net income/loss and loan originations, with no payouts if threshold performance not met; final amounts may be adjusted to reflect individual performance |

Target

Equity-Based Compensation | RSUs | Long-term equity aligns compensation with stockholders’ long-term interests and promotes retention | Stock price performance over a three-year vesting period |

| PBRSUs | Long-term performance-based equity aligns compensation with stockholder returns | PBRSUs earned only if relative TSR thresholds are met over a three-year performance period, with target performance at the 55th percentile |

| | | | | | | | |

LENDINGCLUB CORPORATION | 3 |

| | | | | | | | |

| 2022 PROXY STATEMENT | PROXY SUMMARY |

Pay Outcomes Demonstrate Strong Alignment between Pay and Performance

Our orientation towards performance-based compensation provides a direct link between stockholder interests and the interests of our executive officers and is intended to result in a reduction from target compensation in the event our performance goals are not met. The below graphic shows the composition of our CEO’s target compensation in 2021, with equity awards valued in accordance with FASB ASC Topic 718; and the percent that is considered performance-based, demonstrating strong alignment in our compensation structure between pay and performance.

| | | | | | | | |

LENDINGCLUB CORPORATION | 4 |

| | | | | | | | |

| 2022 PROXY STATEMENT | PROXY SUMMARY |

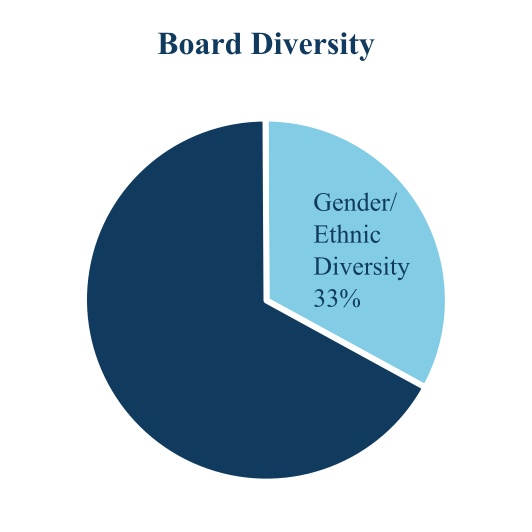

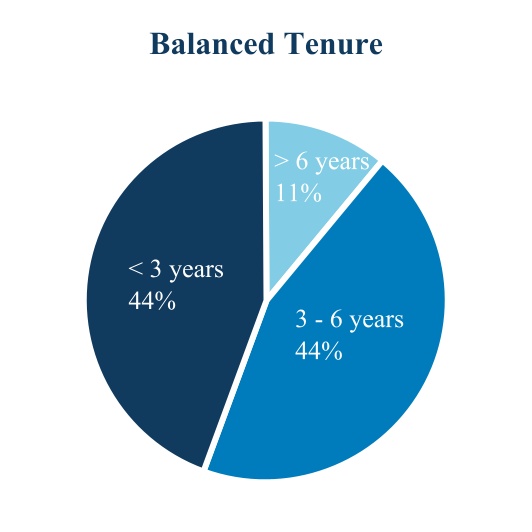

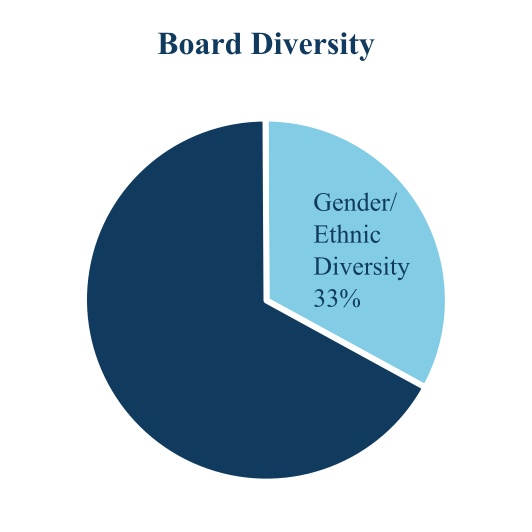

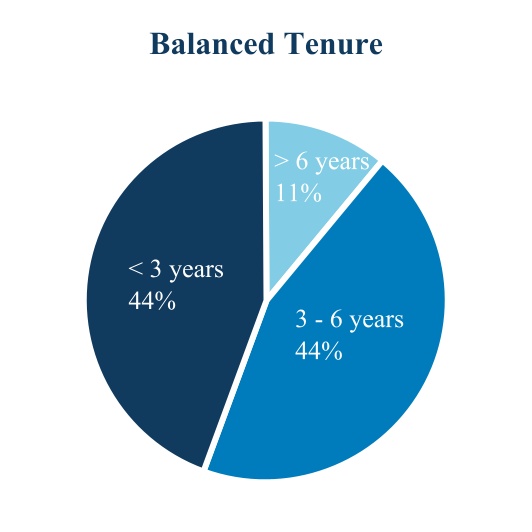

The Board maintains a robust refreshment process and has long been focused on ensuring that the skills and experiences of the Board align with the Company’s evolving business. In the past four years, the Board has appointed four new members, all of whom brought different but relevant skills to our Board. Recently, in order to pursue other interests and opportunities, Susan Athey decided to not stand for re-election to the Board, and therefore her Board service will end when her existing term expires at the upcoming Annual Meeting. The information in the table and graphs below describes the current composition of our Board and Board committees.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Current Directors | Susan Athey | Thomas Casey Chief Financial Officer | Allan Landon | Timothy Mayopoulos | Patricia McCord | John C. (Hans) Morris Independent Chairman | Scott Sanborn Chief Executive Officer | Erin Selleck | Michael Zeisser |

| Age | 51 | 59 | 74 | 63 | 68 | 63 | 52 | 65 | 57 |

| Director Since | 2018 | 2021 | 2021 | 2016 | 2017 | 2013 | 2016 | 2021 | 2019 |

| Independent | a | | a | a | a | a | | a | a |

| Current Committee Membership |

| Audit | | | Chair | a | | | | a | |

| Compensation | | | a | | a | | | | Chair |

| Credit Risk and Finance | | | a | | | Chair | | a | |

| Nominating and Corporate Governance | Chair | | | | a | a | | | a |

| Operational Risk | a | | | Chair | | | | a | |

| Skills & Experience |

| Consumer Banking | | a | a | a | | a | | a | |

| Fintech | | a | a | a | | a | a | | |

| Consumer Internet | a | a | | | a | a | a | | a |

| Financial Markets | a | a | a | a | | a | a | a | a |

| Legal/Regulatory | | | a | a | a | a | | a | |

| Marketing/ PR | a | | | | a | | a | | |

| Compensation/ Employee Matters | | a | a | | a | a | a | | a |

| Public Board Experience | a | | a | a | | a | | a | a |

| Risk Management | a | | a | a | | a | | a | |

| Technology/ Product | a | a | | | a | a | a | | a |

| | | | | | | | |

LENDINGCLUB CORPORATION | 5 |

| | | | | | | | |

| 2022 PROXY STATEMENT | PROXY SUMMARY |

Some of the statements in this Proxy Statement, including statements regarding financial results, our ability to effectuate and the effectiveness of Company strategy, the design of our compensation programs, Board composition, Company performance, and the ability to realize certain financial and strategic benefits from the acquisition of Radius are “forward-looking statements.” The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “outlook,” “plan,” “predict,” “project,” “will,” “would” and similar expressions may identify forward-looking statements, although not all forward-looking statements contain these identifying words. Factors that could cause actual results to differ materially from those contemplated by these forward-looking statements include the impact of global economic, political, market, health and social events or conditions and those factors set forth in the section titled “Risk Factors” in our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, each as filed with the Securities and Exchange Commission (the “SEC”), as well as in our subsequent filings made with the SEC. We may not actually achieve the plans, intentions or expectations disclosed in forward-looking statements, and you should not place undue reliance on forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in forward-looking statements. We do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

| | | | | | | | |

LENDINGCLUB CORPORATION | 6 |

| | | | | | | | |

| 2022 PROXY STATEMENT | ENVIRONMENTAL, SOCIAL AND GOVERNANCE |

ENVIRONMENTAL, SOCIAL AND GOVERNANCE

| | |

| Economic volatility and the current rising costs of healthcare, housing, education, and more have contributed to millions of everyday Americans having insufficient financial reserves or living paycheck to paycheck, including nearly half of those earning more than $100,000 annually. They often turn to a limited set of higher cost debt solutions to bridge cashflow gaps and manage their financial lives. Our mission is to empower our members on a path to better financial health, giving them new ways to pay less on their debt and earn more on their savings. Since 2007, over 4 million individuals have become members, joining the Club to help achieve their financial goals. |

| | |

| Our values are the foundation of what we strive to be, individually and collectively. They guide all aspects our business, from strategic corporate decisions to promotions/hiring. |

Do What’s Right

We are committed to acting with honesty and integrity. We act in the best interest of our members and everyone involved. We recognize that trust and confidence are critical to our marketplace, so we stand up for what’s right — even when it’s hard.

Make Impossible Happen

We look beyond what is possible today to boldly imagine new and better ways to improve the lives of our members. We take on big challenges and drive relentlessly forward to overcome all obstacles to make our vision a reality.

Know Your Stuff

We are a data-driven business. Each of us must be an expert in our areas, continuously rooted in a deep understanding of the data. We measure our efforts so that we can manage, make well-informed decisions, and identify new opportunities.

Be Confident With Humility

We are exceptionally capable individuals who put our egos aside and focus on our collective goals. We listen first and assume positive intent. We get the right people together to inform our collective perspective, evaluate the implications, and debate the trade-offs — so we can move forward quickly, collaboratively, and with confidence.

Evolve With Purpose

We embrace and create change. While we set our strategy for the long term, we stay flexible to adapt to new opportunities. We test bold ideas in real-world situations, without the fear of failure, so we can improve and evolve.

Act Like An Owner

We take ownership and hold ourselves accountable to our commitments. We roll up our sleeves and pick up tasks that need doing, even if they’re not in our job description. We are committed to LendingClub’s future and we act that way.

| | | | | | | | |

LENDINGCLUB CORPORATION | 7 |

| | | | | | | | |

| 2022 PROXY STATEMENT | ENVIRONMENTAL, SOCIAL AND GOVERNANCE |

| | |

| COVID-19 created challenges across the economy, including to our business and customers. In response to the pandemic, we implemented a number of initiatives to support our borrowers and employees. |

| | |

| Borrowers |

|

| For our existing borrowers, we waived late fees and rapidly launched new hardship plans, including Skip-a-Pay and other hardship programs. Our Skip-a-Pay program, which we continued until May 2021, allowed borrowers to skip monthly payments in two-month increments, for a total of six-months. We delivered and continue to offer other hardship programs, including an interest-only program and a 50% payment program which allows borrowers to make reduced payments for up to three months. These measures helped borrowers preserve their financial health in a difficult economic and credit environment. Most borrowers that enrolled in a hardship plan have since resumed payments on their loans. |

| | |

| Skip-a-Pay |

| Skip monthly payments in 2 month increments |

|

| Interest-Only |

| Make interest-only payments for up to 3 months |

|

| | |

| Facilitated over $870 million of PPP loans to small businesses |

| | |

| To support our small business borrowers, we leveraged our digital banking capabilities to support the Paycheck Protection Program (“PPP”). Throughout the pandemic, we cumulatively facilitated over $870 million of PPP loans to help small businesses keep over 75,000 people employed. |

| | |

| In addition, we dramatically increased our customer support capacity at the onset of the pandemic to help borrowers navigate the financial hardships caused by COVID-19. For example, we tripled the number of call center staff available to help over the phone, launched self-service options online and added COVID-specific resources to our website. |

|

| Employees |

|

| We’ve always been committed to advancing a safe work environment for our employees. With that principle in mind, in March 2020, we rapidly and effectively implemented a work from home program and are grounding our return to office strategy in public health guidance in combination with the needs of our employees. |

|

| We also instituted additional paid leave policies to support our employees during this unprecedented time. In particular, we extended crisis pay to our hourly employees so that they did not need to choose between getting paid or protecting their team members and families if they became sick or had to look after children or other family members. These actions protected the physical well-being and financial security of our employees throughout the pandemic so that they are in a position to care for their health, while also supporting our members. |

| | | | | | |

| We aim to do our part in conserving the environment. Key actions we’ve taken to support the environment include: | | | | |

Light Physical Footprint

As a digital marketplace bank we operate online, which provides our members with access to banking services anywhere, anytime. This reduces the environmental impact associated with brick and mortar bank branches, including the impact of members visiting a bank branch.

Sustainability

We advocate for the use of sustainable or re-usable products in our spaces, such as providing compostable materials in our offices, and in our work, such as leveraging electronic signature platforms when possible.

Facilities

We lease LEED certified buildings in San Francisco (LEED Gold) and Utah (LEED Silver*). When renovating our facilities, we emphasize recycling and the use of environmentally friendly materials.

* Utah offices are pending LEED Silver certification.

| | | | | | | | |

LENDINGCLUB CORPORATION | 8 |

| | | | | | | | |

| 2022 PROXY STATEMENT | ENVIRONMENTAL, SOCIAL AND GOVERNANCE |

| | |

| LendingClub is a social impact business with a mission of empowering our members on their path to better financial health. We advance this mission through a technology enabled business model focused on the economic empowerment of Americans across the income spectrum, especially those that have not been well served by traditional banks. |

| | |

| This aspiration, combined with our values, has driven us to lead the financial industry in advancing several policies and programs designed to reduce disparities, protect consumers and small business from irresponsible financing practices, and encourage innovation that supports financial health. |

| | |

| Competitive Interest Rates and Increased Savings |

|

| Our technology is fundamental to our ability to deliver better rates and products. Over the past 15 years, we’ve refined our artificial intelligence-driven credit decisioning and machine-learning models with more than 150 billion cells of data and over $70 billion in loans. With this underwriting technology, we’re able to underwrite loans more efficiently, which enables us to offer lower interest rates to our borrowers. |

| | |

| A Federal Reserve study found that LendingClub-facilitated loans maintain exceptionally low default rates while extending access to credit to riskier borrowers. |

| | |

| On average, LendingClub members save nearly $1,000 over the term of a personal loan. |

| | |

| Research from the Federal Reserve Bank of St. Louis found that LendingClub loans have had lower APRs than credit cards across FICO bands. Additionally, researchers from the Federal Reserve Bank of Philadelphia have found that “consumers pay smaller spreads on loans from LendingClub than from credit card borrowing”, which is supported by our data that indicates that our members save nearly $1,000 on average over the term of a personal loan from LendingClub Bank. |

| | |

| In addition to providing lower APRs, we have focused on being a responsible lender and have voluntarily committed to a 36% APR cap on our loans. We have also supported legislation in California and Illinois to establish statewide 36% APR caps. Through our support of the American FinTech Council, we also marshal fintech support for federal 36% APR cap legislation. |

| | |

| As a new digital marketplace bank, we are also placing emphasis on helping our members build up savings through products and services built to help them make the most of their money, like our award winning high-yield savings and rewards checking accounts. |

| | |

| Fighting Discrimination |

|

| We are committed to fighting discrimination in the financial services industry. For example, we were the first company to express support for “disparate impact” regulation when these anti-discrimination protections were recently under reconsideration by the federal government. Through comment letters to the Consumer Financial Protection Bureau (the “CFPB”), Federal Trade Commission and the U.S. Department of Housing and Urban Development, we articulated and advocated for the pro-innovation value of disparate impact regulation. We have also worked with the National Community Reinvestment Coalition (NCRC) on a consensus statement from civil rights organizations and fintech companies in support of strengthening these critical anti-discrimination protections. Further, we have supported disparate impact regulation in order to prevent algorithmic discrimination in lending to communities of color. |

| | |

| “The value of disparate impact analysis was recently pointed out, and endorsed by, the largest personal loan company in the country, LendingClub, in its responses to requests for input by the CFPB.” |

| – Mike Calhoun, President of the Center for Responsible Lending, Senate Testimony 2019 |

|

| | |

| Financial Health |

|

| Through our digital marketplace bank, we help our members on their path towards financial health by enabling them to pay less on their debt and earn more on their savings. By receiving a loan through LendingClub’s platform, many of our members take the first step toward financial health by refinancing out of higher cost debt. |

| | | | | | | | |

LENDINGCLUB CORPORATION | 9 |

| | | | | | | | |

| 2022 PROXY STATEMENT | ENVIRONMENTAL, SOCIAL AND GOVERNANCE |

| | | | | | | | |

| In fact, our borrowers have told us that approximately 80% of personal loans received through LendingClub’s platform are used for refinancing or consolidating credit card debt. They also told us that we improved their financial health by reducing the APR on their debt by approximately 4 percentage points on average while providing a responsible paydown plan. And we believe we are well positioned to increase our engagement with existing members by offering additional products and services to enable them to manage and improve their financial health. | | A typical LendingClub personal loan borrower saves 4 percentage points in interest, while being provided a responsible paydown plan to help them regain control of their financial health. |

| | |

| Financial Inclusion |

|

| We promote an inclusive financial system in which responsible innovation of products and practices cultivate better financial health outcomes. We strive to lend to those underserved by traditional banks and our digital marketplace allows us to fill credit gaps for consumers where bank branches may be less available, making for a financial system that is more accessible to all Americans. For example, our small business program with Accion Opportunity Fund has seen over 50% of its loans go to minority-owned businesses, as compared to less than 10% of loans by conventional small business lending banks. |

|

| Researchers from the Federal Reserve Bank of Philadelphia have found that that “LendingClub’s consumer lending activities have penetrated areas that may be underserved by traditional banks, such as in highly concentrated markets and in areas that have fewer bank branches per capita. |

|

| We’ve also advocated for policies that encourage lending to minority-owned small businesses, such as urging the CFPB to implement Section 1071 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which requires lenders to report data on how they are serving minority- and women-owned firms. We believe that such policies will encourage innovation in lending that may allow better inclusion of minority- and women-owned businesses by the financial services industry. |

|

| Helping Small Business |

|

| We are focused on supporting small businesses. We’ve partnered with the nonprofit community development financial institution Accion Opportunity Fund to increase small business owners’ access to transparent, affordable, and responsible credit. We believe that our small business lending activities have helped create or sustain over 100,000 jobs, in addition to the over 75,000 people that were able to remain employed with PPP loans that we facilitated. |

| | |

| Through our partnership with Accion Opportunity Fund, we have achieved 5x and 4x the representation of minority-owned and women-owned businesses, respectively, in our small business lending, compared to conventional banks. |

| | |

| We also helped form the Responsible Business Lending Coalition to drive responsible practices in the small business lending sector. With the Responsible Business Lending Coalition, we co-wrote the Small Business Borrowers Bill of Rights, the first cross-sector consensus on responsible small business lending and the rights that small business owners deserve when obtaining a loan. Since its creation, the Small Business Borrowers Bill of Rights has been signed by over 110 nonprofits, community development financial institutions, fintechs and banks and has inspired a wave of small business protection laws across the U.S. |

| | |

| We believe that innovation in the financial services industry can lower prices for small businesses. However, in order for small business customers to identify and benefit from lower prices, they need to be able to easily compared the prices they are being offered. Accordingly, LendingClub and its coalition partners helped lead the passage of the nation’s first small business truth-in-lending law, California Senate Bill 1235, to help protect small businesses from irresponsible lending that disproportionately harms entrepreneurs of color. Similar legislation has since passed in New York and has been introduced in Connecticut, Maryland, New Jersey and North Carolina. Finally, we recently endorsed a bill introduced in the United States House and Senate that would extend the transparency standards of the federal Truth in Lending Act to small business financing. |

| | | | | | | | |

LENDINGCLUB CORPORATION | 10 |

| | | | | | | | |

| 2022 PROXY STATEMENT | ENVIRONMENTAL, SOCIAL AND GOVERNANCE |

| | |

| We are committed to sound and effective corporate governance practices. We have established a strong governance foundation through highly qualified directors, with strong oversight provided by our independent chairman. Further we have instituted significant stock ownership requirements for Board members and executives to promote strong alignment with stockholder interests. We also pursue robust stockholder engagement each year and have been responsive to stockholder feedback on key issues, including Board vote requirements, Board declassification, supermajority voting requirements and executive compensation programs. |

| | |

| We have also established key policies and guidelines that align with responsibly building value for our stockholders, including, among others, the following: |

| | | | | | | | |

| Corporate Governance Guidelines | | Business Conduct and Ethics Policy |

| Our Corporate Governance Guidelines promote the effective functioning of our Board and its committees, promote the interests of our stockholders, ensure a common set of expectations as to how our Board, its committees, individual directors and management should perform their functions, and provide a flexible framework within which the Board may conduct its business. | | Our business conduct and ethics policy applies to all our directors, officers and employees and promotes certain actions, including honest and ethical conduct, compliance with laws, rules and regulations, the protection of LendingClub assets (including corporate opportunities and confidential information), and fair dealing practices, among others. |

| | |

| Officer Stock Ownership Guidelines | | Non-Employee Director Ownership Guidelines |

| Under guidelines adopted by our Compensation Committee, our CEO should hold equity in LendingClub with a value of six times base salary, our CFO should hold equity with a value of three times base salary, and all other Section 16 officers should hold equity with a value of two times base salary. For additional information, see the section titled “Additional Governance Measures — Stock Ownership Guidelines” on page 40. | | Each non-employee director should hold an equity stake in LendingClub equal to at least $400,000 in value. For additional information, see the section titled “Director Compensation — Director Stock Ownership Guidelines” on page 24. |

| | |

| Human Capital/ Diversity & Inclusion |

| | |

| Our success depends, in large part, on our ability to recruit, develop, motivate and retain employees with the skills to execute our strategy. We compete in a competitive market for talent and aim to distinguish ourselves by offering our employees the opportunity to make a meaningful positive impact on the financial health of Americans in an innovative technology oriented environment, while offering competitive compensation and benefits. Our compensation programs consist primarily of base salary, corporate bonus and equity awards. Our benefits programs include comprehensive health, dental and welfare benefits, including a 401(k) matching program and mental health tools. We are committed to providing equal pay for equal work. To support this, we’ve instituted pay equity assessments and benchmark ourselves against industry best practices. |

| | |

| We strive to create an environment where our employees feel that they are reaching their full potential, are highly engaged and are doing what they do best every day to accomplish our mission and vision. We support our employees professionally through onboarding programs, on-the-job training, career development sessions and performance check-ins. We monitor employee satisfaction and engagement through semi-annual engagement surveys. We’ve also earned a number of external recognitions, including a national Top Workplaces 2022 award; Top Workplaces awards for our Lehi, Utah office for every year in which we have operated an office there (2020, 2021, 2022); a perfect score of 100 in the Human Rights Campaign Foundation’s 2022 Corporate Equality Index; and inclusion on Bloomberg’s 2022 Gender-Equality Index. |

| | |

| Leading Workplace |

| National Top Workplaces 2022 |

| Lehi, Utah Top Workplaces 2020, 2021 & 2022 |

| Human Rights Campaign Foundation’s 2022 Corporate Equality Index |

| Bloomberg’s 2022 Gender-Equality Index |

| | |

| We continue to work hard to create a workplace that is welcoming and empowering for all. In addition to anti-racism, inclusive hiring and breaking-bias trainings for all of our employees, we have executive-sponsored programs designed to provide women and under-represented individuals with leadership tools and growth opportunities. Further, we have employee resource groups and an allyship program designed to empower our employees to advocate for the growth of minorities and build a more diverse and inclusive workplace. We have also established a program focused on supplier diversity to encourage contracts and partnerships with minority-owned businesses. |

| | | | | | | | |

LENDINGCLUB CORPORATION | 11 |

| | | | | | | | |

| 2022 PROXY STATEMENT | ENVIRONMENTAL, SOCIAL AND GOVERNANCE |

| | | | | |

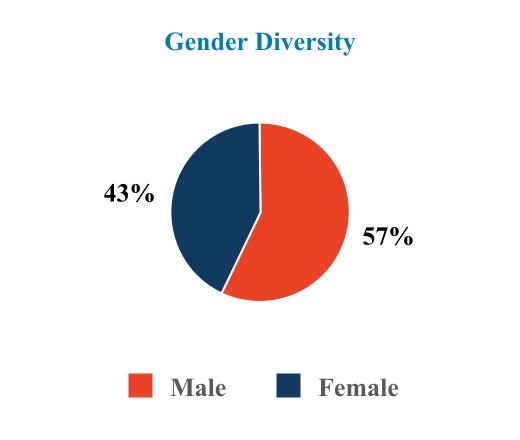

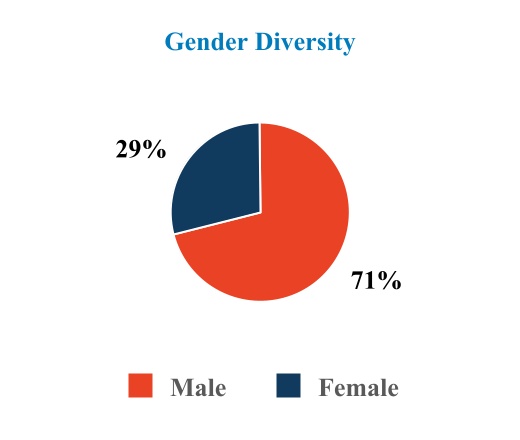

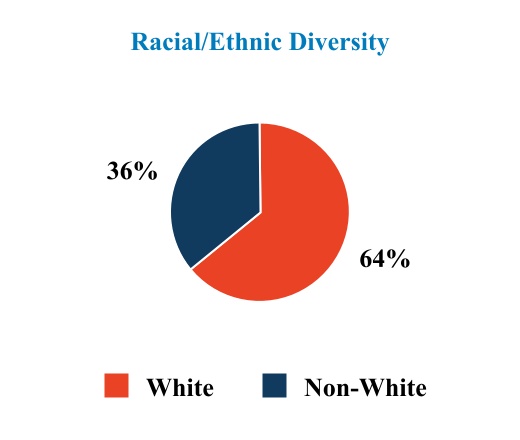

| We believe that having a diverse and inclusive workplace delivers better outcomes for our members and enables our employees to be their best. |

| | |

| We also treat diversity as an important consideration when making hiring decisions. We believe that the diversity of our employee base should represent the diversity of our customer base. For open roles at all levels of our workforce, including leadership positions (i.e., VP level and above), we aim for a 50% diverse candidate slate and diverse interview panel. We promote policies and regulations that prevent and/or address discrimination, including with respect to the use of artificial intelligence and fair and responsible lending to communities of color. Recently our efforts were recognized by Top Workplaces as a Diversity, Equity and Inclusion Standout Company, reflecting our employee involvement, hiring processes, development practices and inclusive benefits. We intend to continue undertaking measures to enhance our efforts with respect to diversity and inclusion. |

|

| Regarding diversity on our Board, with past appointments we were able to enhance the diversity of the Board. For example, Adrienne Harris brought many attributes to our Board, including gender and ethnic diversity. However, effective September 2021 she departed our Board in connection with her nomination and appointment to serve as superintendent of the New York State Department of Financial Services. Her departure follows the departure of another ethnically diverse director, Ken Denman; who departed our Board in connection with the closing of the Radius acquisition in February 2021. Retaining a diverse Board remains an important consideration as we contemplate future appointments. To that end, our Nominating and Corporate Governance Committee has initiated a search for director candidates and we are committed to appointing an ethnically diverse director in 2022. |

|

| Workforce Demographics |

|

| Below is a summary of certain demographic information of our full-time workforce as of December 31, 2021, and specifically those employees that serve in leadership positions (i.e., VP level and above). |

Full-Time Workforce

Leadership Workforce

| | | | | | | | |

LENDINGCLUB CORPORATION | 12 |

| | | | | | | | |

| 2022 PROXY STATEMENT | BOARD OF DIRECTORS AND CORPORATE GOVERNANCE |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

LendingClub Board

Our Board oversees the strategy and overall business affairs of the Company. A key principle of our Company is maintaining the highest level of trust with customers, regulators, stockholders and employees. We have an active and engaged Board that is committed to fulfilling its fiduciary duties to our Company and stockholders and helping us continue to earn the trust of our stakeholders. Currently all members of our Board also serve on the board of directors of our banking subsidiary, LendingClub Bank, and therefore are entrusted with monitoring and ensuring the safety and soundness of our banking operations as required by applicable banking regulations. Our Board is also responsible, in conjunction and consultation with the Compensation Committee, for periodically reviewing the performance of our CEO and for providing oversight of talent development and retention. Further, our Board is responsible, in conjunction and consultation with the Nominating and Corporate Governance Committee, for oversight of our progress and disclosures with respect to Environmental, Social and Governance (“ESG”) matters.

Our Board currently has nine members and will reduce to eight members after the Annual Meeting in connection with Ms. Athey’s decision to not stand for re-election. The Board may establish a different number of authorized directors from time to time by resolution. Seven of our current directors are independent within the meaning of the listing standards of the New York Stock Exchange (“NYSE”). Our Board is currently divided into three staggered classes of directors. At each annual meeting of stockholders, a class of directors is elected for a three-year term to succeed the same class whose term is then expiring. Our Board has proposed to phase out the classified board structure subject to stockholder approval of Proposal Four of this Proxy Statement at the Annual Meeting. If that proposal passes, our Board will phase into a structure in which all directors will be up for election each year to serve a term ending at the next annual meeting of stockholders.

Our Class II directors standing for re-election, if elected, will continue to serve as directors until the 2025 Annual Meeting of Stockholders and until his or her successor has been elected and qualified, or until his or her earlier death, resignation or removal.

Stockholder Outreach and Feedback

Our Board believes it is important to maintain an open dialogue with stockholders to understand their views on the Company, its strategy and its governance and compensation practices. Therefore, we engage with stockholders regularly and solicit feedback annually on our compensation and governance practices from many of the governance departments of our largest institutional stockholders. Consistent with prior years, members of our management team participated in these conversations, and stockholders were also offered the opportunity to speak with a member of our Board. In the Fall of 2021, we reached out to stockholders representing, in aggregate, an estimated 45% of our then outstanding shares and held meetings with those that requested a discussion. Some stockholders declined our invitation for a discussion citing a lack of questions or concerns. In addition to our Fall 2021 stockholder outreach, we maintain ongoing dialogue with many of our stockholders through our investor relations program. In total, during 2021 we had conversations with stockholders holding, in aggregate, an estimated 28% of our outstanding shares.

Overall, the stockholders we engaged with expressed support for our strategy and compensation and governance practices. In particular, stockholders appreciated the inherent social good of the Company’s business model and the evolution of our compensation programs and practices, including the adjustments we have made to our PBRSU program over the past few years. Further, stockholders appreciated the transformational impact of the Radius acquisition and recognized the importance of ensuring the Company recruits and retains the human capital necessary to execute and advance its strategy.

Given that our stockholder base remains somewhat concentrated and fluid following the acquisition of Radius, the Board has determined to not put forth an amendment to remove the provision requiring a supermajority vote to amend our governing documents in 2022. However, the Board is committed to including it as a proposal in our 2023 proxy statement. Overall, stockholders have been receptive and supportive of the Board’s timeline for soliciting approval to remove the supermajority voting requirement to amend our governing documents.

| | | | | | | | |

LENDINGCLUB CORPORATION | 13 |

| | | | | | | | |

| 2022 PROXY STATEMENT | BOARD OF DIRECTORS AND CORPORATE GOVERNANCE |

Board Leadership

John C. (Hans) Morris serves as the independent Chairman of our Board.

While our Corporate Governance Guidelines do not require the separation of offices of the Chairperson of the Board and the Chief Executive, the Board believes an independent Chairperson reinforces the independence of our Board as a whole and results in an effective balancing of responsibilities, experience and independent perspective that meets the current corporate governance needs and oversight responsibilities of our Board. We believe this structure provides consistent and effective oversight of our management and is optimal for us and our stockholders.

In selecting Mr. Morris as the independent Chairman, the Board considered his strong and relevant experience in financial services technology and the financial services industry, ability to provide effective leadership and facilitate open dialogue, and ability to devote sufficient time and attention to the position.

Board Role in Risk Oversight

Management is responsible for assessing and managing risk, subject to Board oversight directly and through its committees. The oversight responsibility of the Board and its committees is informed by reports from our management team, including our Chief Risk Officer and an internal audit team, that are designed to provide visibility to the Board about the identification and assessment of key risks and our risk mitigation strategies. In addition, the Board has requested and has been receiving regular updates from management regarding our response to the COVID-19 pandemic and its impacts on us and our customers, employees and other stakeholders, and our efforts to mitigate these impacts.

The Board has delegated to the Operational Risk Committee and Credit Risk and Finance Committee (each comprised of independent directors) primary responsibility for the oversight of risk management. The Operational Risk Committee is primarily focused on reputational, legal, compliance and operational risk. The Credit Risk and Finance Committee is primarily focused on credit, market, interest rate and liquidity risk. In accordance with their charters, the Operational Risk Committee and Credit Risk and Finance Committee (collectively, the “Risk Committees”) assist our Board in its oversight of our key risks, including credit, technology and security, strategic, legal, regulatory (other than related to our financial reporting), compliance and operational risks, as well as the guidelines, policies and processes for monitoring and mitigating such risks. The Operational Risk Committee meets with members of our information technology department at least once per year to assess information security risks (including cybersecurity risks) and to evaluate the status of our cybersecurity efforts, which include a broad range of tools and training initiatives that are designed to work together to protect the data and systems used in our business. We have also established Management Risk Committees to oversee our enterprise risk management program and provide a central oversight function to identify, measure, monitor, evaluate and escalate key risks (including cybersecurity risk) for oversight at the Board level.

The other standing Board committees oversee risks associated with their respective areas of responsibility. For example, our Audit Committee has the responsibility for overseeing the integrity of our financial reporting, including related policies and procedures, compliance with legal and regulatory requirements affecting financial reporting, and overseeing our internal audit function. Our Nominating and Corporate Governance Committee seeks to ensure that our Board is properly constituted to meet its statutory, fiduciary and corporate governance oversight obligations, and evaluates risk arising from governance matters. Our Compensation Committee evaluates risks arising from our compensation policies and practices, as more fully described in the section “Executive Compensation – Compensation Discussion and Analysis – Compensation Risk Assessment” below.

Director Independence

Under the rules of the NYSE, independent directors must comprise a majority of a listed company’s board of directors. In addition, the rules of the NYSE require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees be independent. Under the rules of the NYSE, a director will only qualify as an “independent director” if, among other things, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Our Board has reviewed its composition, the composition of its committees and the independence of each director. Based upon information provided by each director concerning his or her background, employment and affiliations,

| | | | | | | | |

LENDINGCLUB CORPORATION | 14 |

| | | | | | | | |

| 2022 PROXY STATEMENT | BOARD OF DIRECTORS AND CORPORATE GOVERNANCE |

including family relationships, our Board has determined that Susan Athey, Allan Landon, Timothy Mayopoulos, Patricia McCord, John C. (Hans) Morris, Erin Selleck, and Michael Zeisser, representing seven of our current nine directors (and all of our current non-employee directors), do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the listing requirements and rules of the NYSE. In making this determination, our Board considered the current and prior relationships that each non-employee director has with our Company and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director.

Meetings and Attendance

In 2021, the Board held 7 meetings (including regularly scheduled and special meetings) and acted by unanimous written consent 5 times. Each director attended at least 75% of the aggregate of (i) the total number of meetings of our Board held during the period for which he or she has been a director and (ii) the total number of meetings held by all committees of our Board on which he or she served during the periods that he or she served. Although we do not have a formal policy regarding annual meeting attendance by members of our Board, we encourage our directors to attend. All current directors attended our 2021 Annual Meeting of Stockholders.

In addition, each member of our Board is also a board member of our banking subsidiary, LendingClub Bank. In 2021, LendingClub Bank held a total of 41 meetings of the board or meetings of committees of the board. Each director attended at least 75% of the aggregate of (i) the total number of meetings of the board of LendingClub Bank during the period for which he or she has been a director and (ii) the total number of meetings held by all committees of the board of LendingClub Bank on which he or she served during the periods that he or she served.

Often, in conjunction with the regularly scheduled meetings of the Board, the independent directors also meet in executive sessions outside the presence of management. The independent Chairman of our Board, among other responsibilities, presides over such meetings.

Board Committees

Our Board has established an Audit Committee, a Compensation Committee, a Credit Risk and Finance Committee, a Nominating and Corporate Governance Committee and an Operational Risk Committee. The current composition and responsibilities of each of the committees of our Board are described below. Note, however, that Susan Athey recently decided to not stand for re-election to the Board and therefore her Board service will end when her existing term expires at the Annual Meeting. Effective as of the Annual Meeting, Michael Zeisser will serve as chair of the Nominating and Corporate Governance Committee.

Members serve on committees until their resignation or until otherwise determined by our Board. Each of these committees has a written charter, which, along with our Corporate Governance Guidelines, are available on our website at http://ir.lendingclub.com under the heading “Corporate Governance.”

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director | | Audit Committee | | Compensation Committee | | Credit Risk

and Finance Committee | | Nominating and Corporate Governance Committee | | Operational Risk Committee |

| Susan Athey | | | | | | | | Chair | | ü |

| Allan Landon | | Chair | | ü | | ü | | | | |

| Timothy Mayopoulos | | ü | | | | | | | | Chair |

| Patricia McCord | | | | ü | | | | ü | | |

| John C. (Hans) Morris | | | | | | Chair | | ü | | |

| Erin Selleck | | ü | | | | ü | | | | ü |

| Michael Zeisser | | | | Chair | | | | ü | | |

| | | | | | | | |

LENDINGCLUB CORPORATION | 15 |

| | | | | | | | |

| 2022 PROXY STATEMENT | BOARD OF DIRECTORS AND CORPORATE GOVERNANCE |

Audit Committee

The current members of our Audit Committee are Allan Landon (chair), Timothy Mayopoulos and Erin Selleck. All of the members of our Audit Committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and the NYSE. Our Board has determined that Mr. Landon is an Audit Committee financial expert as defined under the applicable rules of the SEC and has the requisite financial sophistication as defined under the applicable rules and regulations of the NYSE. While other members of our Audit Committee may have the expertise to be designated an audit committee financial expert, the Board made a specific finding only as it relates to Mr. Landon.

In addition, Audit Committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In order to be considered independent for purposes of Rule 10A-3, a member of an Audit Committee of a listed company may not, other than in his or her capacity as a member of the Audit Committee, the Board or any other committee of the Board (i) accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries or (ii) be an affiliated person of the listed company or any of its subsidiaries.

All of the members of our Audit Committee are independent directors as defined under the applicable rules and regulations of the SEC and the NYSE.

Our Audit Committee oversees financial risk exposures, including monitoring the integrity of our consolidated financial statements, internal controls over financial reporting, our internal audit function and the independence of our independent registered public accounting firm. Our Audit Committee receives internal control-related assessments and reviews and discusses our annual and quarterly consolidated financial statements with management. In fulfilling its oversight responsibilities with respect to compliance matters affecting financial reporting, our Audit Committee meets at least quarterly with management, our internal audit department, our independent registered public accounting firm, our internal legal counsel and compliance department to discuss risks related to our financial risk exposures.

During 2021, our Audit Committee held 16 meetings.

Compensation Committee

The current members of our Compensation Committee are Allan Landon, Patricia McCord and Michael Zeisser (chair). All of the members of our Compensation Committee are independent under the applicable rules and regulations of the SEC and the NYSE.

Our Compensation Committee oversees our executive officer and director compensation arrangements, plans, policies and programs and administers our cash-based and equity-based compensation plans and arrangements for employees generally. Our Compensation Committee also oversees our broader compensation philosophy and approach to human capital. From time to time and as it deems appropriate, our Compensation Committee may delegate its authority to subcommittees and, with respect to non-executive officer compensation, to our officers.

During 2021, our Compensation Committee held 6 meetings and acted by unanimous written consent 7 times.

Credit Risk and Finance Committee

The current members of our Credit Risk and Finance Committee are Allan Landon, John C. (Hans) Morris (chair) and Erin Selleck. Our Credit Risk and Finance Committee assists our Board in its oversight of our key risks, including credit, market, interest rate and liquidity risk, as well as the guidelines, policies and processes for monitoring and mitigating such risks. The Credit Risk and Finance Committee assists the Board in monitoring our risk management system, including ensuring that it is commensurate with our size, complexity and risk profile.

During 2021, the Credit Risk and Finance Committee held 4 meetings.

| | | | | | | | |

LENDINGCLUB CORPORATION | 16 |

| | | | | | | | |

| 2022 PROXY STATEMENT | BOARD OF DIRECTORS AND CORPORATE GOVERNANCE |

Nominating and Corporate Governance Committee

The current members of our Nominating and Corporate Governance Committee are Susan Athey (chair), Patricia McCord, John C. (Hans) Morris and Michael Zeisser. All of the members of our Nominating and Corporate Governance Committee are independent under the applicable rules and regulations of the NYSE.

Our Nominating and Corporate Governance Committee seeks to ensure that our Board is properly constituted to meet its statutory, fiduciary and corporate governance oversight. Our Nominating and Corporate Governance Committee will advise our Board on corporate governance matters and board performance matters, including making recommendations regarding director nominations and new appointments, the structure and composition of our Board and Board committees and developing, recommending and monitoring compliance with corporate governance guidelines and policies and our code of conduct and ethics. Our Nominating and Corporate Governance Committee, in conjunction with our Board, also provides oversight of our progress and disclosures with respect to Environmental, Social and Governance (“ESG”) matters.

During 2021, our Nominating and Corporate Governance Committee held 3 meetings.

Operational Risk Committee

The current members of our Operational Risk Committee are Susan Athey, Timothy Mayopoulos (chair) and Erin Selleck. Our Operational Risk Committee assists our Board in its oversight of our key risks, including technology and security (including cybersecurity risk), strategic, legal, regulatory (other than related to our financial reporting), compliance and operational risks, as well as the guidelines, policies and processes for monitoring and mitigating such risks.

During 2021, our Operational Risk Committee held 4 meetings.

Director Skills and Experience

Our nominees and continuing directors provide a balanced mix of skills and attributes to best oversee our business. Although the Board currently believes that its members have the necessary skills and expertise, the Board regularly monitors the evolution of the Company and the fintech industry and as part of its refreshment process evaluates its ability to continue to provide necessary skills and experience.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nominees and Continuing Directors | Thomas Casey Chief Financial Officer | Allan Landon | Timothy Mayopoulos | Patricia McCord | John C. (Hans) Morris Independent Chairman | Scott Sanborn Chief Executive Officer | Erin Selleck | Michael Zeisser |

| Skills & Experience |

| Consumer Banking | a | a | a | | a | | a | |

| Fintech | a | a | a | | a | a | | |

| Consumer Internet | a | | | a | a | a | | a |

| Financial Markets | a | a | a | | a | a | a | a |

| Legal/Regulatory | | a | a | a | a | | a | |

| Marketing/ PR | | | | a | | a | | |

| Compensation/ Employee Matters | a | a | | a | a | a | | a |

| Public Board Experience | | a | a | | a | | a | a |

| Risk Management | | a | a | | a | | a | |

| Technology/ Product | a | | | a | a | a | | a |

| | | | | | | | |

LENDINGCLUB CORPORATION | 17 |

| | | | | | | | |

| 2022 PROXY STATEMENT | BOARD OF DIRECTORS AND CORPORATE GOVERNANCE |

Additional Governance Measures

For information regarding additional governance measures we have implemented in recent years, please see the section titled “Additional Governance Measures” beginning on page 40.

Business Conduct and Ethics Policy

Our Board adopted a business conduct and ethics policy that applies to all of our employees, officers and directors, including our CEO, CFO and our other executive officers. The full text of the business conduct and ethics policy is posted on the investor relations section of our website at http://ir.lendingclub.com under the heading “Corporate Governance.” We intend to disclose future amendments to certain provisions of our business conduct and ethics policy, or waivers of provisions contained therein, on our website or in public filings.

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee are or have at any time during the past fiscal year been one of our officers or employees. None of our executive officers currently serve or in the past fiscal year have served as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board or our Compensation Committee.

Information Regarding Our Directors

The following table sets forth the names, ages and certain other information for each of the directors with terms expiring at the Annual Meeting (and who are also nominees for election as a director at the Annual Meeting) and for each of the continuing members of our Board:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director Nominees | | Class | | Age | | Position | | Director Since | | Current

Term

Expires | | Expiration of Term for Which Nominated |

John C. (Hans) Morris(1)(2) | | II | | 63 | | Director | | 2013 | | 2022 | | 2025 |

Erin Selleck(2)(3)(4) | | II | | 65 | | Director | | 2021 | | 2022 | | 2025 |

| Continuing Directors | | | | | | | | | | | | |

| Thomas Casey | | III | | 59 | | CFO and Director | | 2021 | | 2023 | | — |

Allan Landon(2)(4)(5) | | I | | 74 | | Director | | 2021 | | 2024 | | — |

Timothy Mayopoulos(3)(4) | | I | | 63 | | Director | | 2016 | | 2024 | | — |

Patricia McCord(1)(5) | | I | | 68 | | Director | | 2017 | | 2024 | | — |

| Scott Sanborn | | III | | 52 | | CEO and Director | | 2016 | | 2023 | | — |

Michael Zeisser(1)(5) | | III | | 57 | | Director | | 2019 | | 2023 | | — |

(1)Member of the Nominating and Corporate Governance Committee

(2)Member of the Credit Risk and Finance Committee

(3)Member of the Operational Risk Committee

(4)Member of the Audit Committee

(5)Member of the Compensation Committee

Note that under Proposal Four of this Proxy Statement, we are proposing to amend our Restated Certificate of Incorporation, as amended (the “Restated Certificate of Incorporation”), to provide that any director elected to the Board after the date of the Annual Meeting be elected for a term expiring at the next annual meeting of stockholders.

Further, note that Susan Athey recently decided to not stand for re-election to the Board and therefore her Board service will end when her existing term expires at the Annual Meeting.

| | | | | | | | |

LENDINGCLUB CORPORATION | 18 |

| | | | | | | | |

| 2022 PROXY STATEMENT | BOARD OF DIRECTORS AND CORPORATE GOVERNANCE |

Nominees for Director

John C. (Hans) Morris joined our Board in February 2013. Mr. Morris is the managing partner of Nyca Partners, a venture capital company focused on fintech established in 2014. From January 2010 until January 2014, he served as a managing director and special advisor at General Atlantic, a growth equity firm. Mr. Morris was previously President of Visa, Inc. from 2007 to 2009. Prior to Visa, Mr. Morris spent 27 years at Citigroup, Inc., a banking and financial services company, and its predecessor companies in various leadership positions, with his final position as Chief Financial Officer and Head of Finance, Technology and Operations for Citi Markets and Banking. Mr. Morris also serves on the board of directors of Payoneer Global, Inc., AvidXchange Holdings, Inc. and several privately held companies. Mr. Morris holds a B.A. in government from Dartmouth College. Mr. Morris was chosen to serve on our Board because of his extensive experience in the banking and financial services industry and his financial expertise.

Erin Selleck joined our Board in February 2021. Prior to her retirement in 2014, Ms. Selleck served as Senior Executive Vice President and Treasurer for MUFG Union Bank, a key subsidiary of Japan’s Mitsubishi UFJ Financial Group (MUFG), one of the world’s largest financial organizations. Her accomplishments at Union Bank include successfully guiding the bank through the 2008 financial crisis, growing the bank’s balance sheet, and navigating an increasingly challenging economic and regulatory environment in the banking industry. Before joining MUFG Union Bank, Ms. Selleck served as Vice President and Manager in Corporate Treasury at Bank of America. Ms. Selleck served on the board of Broadway Financial Corp/Broadway Federal Bank from 2015 until March 2021. Ms. Selleck holds a B.A. in Sociology and an M.B.A. from University of California at Berkeley. Ms. Selleck was chosen to serve on our Board because of her extensive experience in the banking and financial services industry.

Continuing Directors

Thomas Casey has served as our Chief Financial Officer since September 2016 and joined our Board in February 2021. Mr. Casey was previously the Executive Vice President and Chief Financial Officer at Acelity L.P. Inc., a medical device company, from November 2014 to August 2016 and was responsible for the entire range of financial functions, including financial accounting, reporting, and planning and analysis. From 2009 to July 2013, Mr. Casey was Executive Vice President and Chief Financial Officer for Clear Channel Outdoor, Inc., an advertising company. He has also served as Executive Vice President and Chief Financial Officer of Washington Mutual, Inc., Vice President of General Electric Company and Senior Vice President and Chief Financial Officer of GE Financial Assurance. Mr. Casey holds a B.S. degree in accounting from King’s College in Wilkes-Barre, PA. Mr. Casey was chosen as a member of our Board because of the perspective he brings as Chief Financial Officer and his experience with and knowledge of our Company and the banking industry.

Allan Landon joined our Board in February 2021. Since June 2011, Mr. Landon has served as Assistant Dean and Adjunct Professor at David Eccles School of Business, University of Utah. His teachings cover business leadership and banking courses and help develop experiential learning programs. He also directs the Utah Center for Financial Services. From July 2011 to July 2018, Mr. Landon was Operating Partner at Community BanCapital and CBC Management GP, an Investment Management company. From 2004 to 2010, Mr. Landon served as Chairman and Chief Executive Officer of Bank of Hawaii. Before joining Bank of Hawaii, Mr. Landon was the Chief Financial Officer of First American Bank. Earlier Mr. Landon was a partner with Ernst & Young, serving public and privately-owned community, regional banks and other financial institutions. Mr. Landon is a member of the Boards of Directors of Whistic, Inc. and Electronic Caregiver, Inc., and, from September 2014 to June 2021, served on the Board of Directors of State Farm Mutual Automobile Insurance. Mr. Landon holds a B.S. from Iowa State University. Mr. Landon was chosen to serve on our Board because of his extensive experience in the banking and financial services industry.

Timothy J. Mayopoulos joined our Board in August 2016. Since January 2019, Mr. Mayopoulos has been President of Blend Labs, Inc., a publicly traded enterprise software company making consumer lending simpler, faster and safer. From 2012 to 2018, Mr. Mayopoulos served as President and Chief Executive Officer of Fannie Mae, one of the largest providers of mortgage credit in the United States. Mr. Mayopoulos joined Fannie Mae in 2009 in the wake of the financial crisis. He initially served as Fannie Mae’s General Counsel, and in 2010 was named Chief Administrative Officer. He was promoted to CEO in June 2012, and, in that role, led the company’s support of the U.S. housing market and its efforts to create a better housing finance system for the future. Before joining Fannie Mae, Mr. Mayopoulos was General Counsel of Bank of America, held senior management positions at Donaldson, Lufkin & Jenrette, Credit Suisse First Boston and Deutsche Bank, and practiced law at Davis Polk & Wardwell. Mr. Mayopoulos is a member of the Boards of Directors of Blend Labs, Inc., Science Applications International Corporation (SAIC) and Valon Technologies, Inc. He is a graduate of Cornell University

| | | | | | | | |

LENDINGCLUB CORPORATION | 19 |

| | | | | | | | |

| 2022 PROXY STATEMENT | BOARD OF DIRECTORS AND CORPORATE GOVERNANCE |

and the New York University School of Law. Mr. Mayopoulos was chosen to serve on our Board because of his extensive experience in the financial, legal and regulatory sectors.

Patricia McCord joined our Board in December 2017. Since January 2013, Ms. McCord has served as the Principal of Patty McCord Consulting, which advises companies and CEOs on culture and leadership. Ms. McCord served as Chief Talent Officer of Netflix, Inc. from 1998 to 2012. Prior to Netflix, Ms. McCord was Human Resources Director at Pure Atria from 1994 through 1997 where she managed all human resources functions and directed all management development programs. Ms. McCord was a Human Resources Manager at Borland from 1992 through 1994 and Diversity Programs Manager at Sun Microsystems from 1988 through 1992. Ms. McCord was chosen to serve on our Board because of her extensive human resources and development programs experience.

Scott Sanborn has served as our Chief Executive Officer since June 2016. Mr. Sanborn previously served as our President from April 2016 to May 2017, Chief Operating and Marketing Officer from April 2013 to March 2016 and Chief Marketing Officer from May 2010 to March 2013. From November 2008 to February 2010, Mr. Sanborn served as the Chief Marketing and Revenue Officer for eHealthInsurance, an e-commerce company. Mr. Sanborn holds a B.A. from Tufts University. Mr. Sanborn has significant executive and leadership experience and has been a driver of our strategy and growth for nearly 10 years and instrumental in transforming the Company from a small privately held company to a publicly traded company and industry leader. Mr. Sanborn was chosen as a member of our Board because of the perspective he brings as Chief Executive Officer and his experience with and knowledge of our Company and the fintech industry.

Michael Zeisser has been a member of our Board since September 2019. Mr. Zeisser currently serves as the Managing Partner of FMZ Ventures, a growth equity investment fund focused on experienced economy and marketplace ecosystems. From 2013 to April 2018, Mr. Zeisser served in a number of capacities for the Alibaba Group, most recently as Chairman, U.S. Investments where he led Alibaba’s strategic investments outside of Asia. From 2003 to 2013, Mr. Zeisser served as Senior Vice President of Liberty Interactive Corporation, where he led investments in digital media, online gaming, and commerce. Prior to joining Liberty Media, Mr. Zeisser was a partner at McKinsey & Company. Mr. Zeisser also serves on the board of directors of Global Technology Acquisition Corp. I and several privately held companies. Previously, Mr. Zeisser served on the board of directors of Shutterfly, Trip Advisor, IAC, TIME Inc. and XO Group. Mr. Zeisser graduated from the University of Strasbourg, France and the J.L. Kellogg Graduate School of Management at Northwestern University. Mr. Zeisser was chosen to serve on our Board because of his extensive experience in corporate development, strategy and consumer marketplaces.

Considerations in Evaluating Director Nominees