UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

April 7, 2009

Date of Report (Date of earliest event reported)

Commission File Number:333-146627

Baron Energy Inc.

(Exact name of registrant as specified in its charter)

Nevada, United States

(State or other jurisdiction of incorporation or organization)

26-0582528

(I.R.S. Employer ID Number)

3753 Howard Hughes Parkway, Suite 135, Las Vegas, Nevada 89169

(Address of principal executive offices) (Zip code)

702-993-7424

(Issuer's telephone number)

Nevwest Explorations Corp.

(Former Name, Former Address and Former Fiscal Year if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) [ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) [ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

1

Item 1.01Entry Into a Material Definitive Agreement.

On April 7, 2009, Baron Energy, Inc. (the "Company") entered into an Acquisition Agreement with TMG Partners, LLC, a Nevada limited liability company ("TMG") and the holders of a majority of the membership interests of TMG. Pursuant to the terms of the Agreement (attached hereto as Exhibit 10.4), the Company has acquired 100% of the issued and outstanding membership interests of TMG in exchange for 9,000,000 restricted shares of common stock of the Company.

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

| Item 7.01 | Regulation FD Disclosure. |

| Item 9.01 | Financial Statements and Exhibits. |

Information Required for a Form 10SB Filing

PART I

Item 1. Business

Baron Energy Inc. was incorporated as Nevwest Explorations Corp. in the State of Nevada on July 24, 2007 to engage in the acquisition, exploration and development of natural resource properties. Effective September 2, 2008 we changed our name from Nevwest Explorations Corp. to Baron Energy Inc. We are an exploration stage company with no revenues and limited operating history.

The Company is seeking to acquire 100% of outstanding membership interests of TMG Partners, LLC, a Nevada liability company in exchange for 9,000,000 restricted shares of the Company’s common stock. The Company intends to acquire the outstanding membership interests remaining after the Agreement.

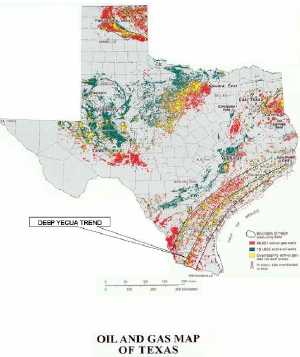

TMG Partners was founded on August 11, 2008 to exploit onshore deep gas reserves in the United States. TMG is engaged in the exploration of the Deep Yegua trend in South Texas.

PHASE I – DEEP YEGUA, South Texas

This deep gas play on the southern edge of Texas has an estimated ultimate recovery (EUR) of 250 BCF of gas. The target of this project is the Deep Yegua formation. The Deep Yegua formation in South Texas is a sparsely explored trend with high potential for becoming the source of yet untapped major gas reserves in the United States. This deep trend extends from the Mexican border through Starr and Brooks Counties as a deep high-potential exploration and development trend.

The Deep Yegua Gas Play is characterized by Eocene Age sandstone reservoirs producing natural gas from deep over-pressured reservoirs along the Texas Gulf Coast. The proposed exploration and development trend in this area ranges in depth from 11,000 feet to 15,000 feet.

2

The Deep Yegua Gas Trend contains 39 gas fields, with an average cumulative production of 28 BCFG per field, discovered between 1948 and 1989. The vast majority of these fields have been discovered since 1975, indicating that the Deep Yegua is an emerging play. The use of state-of–the-art 3-d seismic data integrated with geological information gleaned from the limited drilling in the trend has led to the identification of a vast structural/stratigraphic trend running NE-SW across the target area.

Traps for the gas in this play are predominantly structural, and are on Yegua growth faults, and possibly on shale ridges. Gas in fan sandstones in the extreme down dip part of the play may be stratigraphically trapped. Seals are provided by Yegua mudstones that in many cases enclose reservoir sandstones by faulting and anticlinal structures. The area of interest is comprised of large three-way closures trapped by the regional Jackson Shale, which overlies the Yegua formation and/or by deep buried faulting. The areas under closure include well over 2,500 acres and offer the potential of finding multiple sand bodies which can range from 50 feet to 150 feet in thickness.

Reservoirs in this play are slope and submarine fan sandstones in deltaic environments. Porosity in these sandstones can range up to 25 percent, and permeability can range up to 100 md (millidarcies). Depths to undiscovered reservoirs range from 8,000 feet to 25,000 feet. The overlaying sediments in the trend, Vicksburg and Frio formations, are well-established productive trends and as such are potential secondary targets for any drilling. In addition, the Jackson shale is a severly under-explored promising potential target.

The area of interest is on-trend with the recently discovered, and as yet, not fully developed, El Ebanito Field discovered by Total in 1998.

3

Project milestones:

| (i) | geological, engineering, and land review; (completed September ’08) |

| (ii) | land take off search, seismic search, and engineering planning; (completed October ’08) |

| (iii) | Leasing of mineral interests. (began November ’08) |

Seismic is shot and will be acquired and reprocessed by TMG

Competition

We are in direct competition with numerous oil and natural gas companies, drilling and income programs and partnerships exploring various areas of the Texas and elsewhere competing for properties. Many competitors are large, well-known oil and gas and/or energy companies, although no single entity dominates the industry. Many of our competitors possess greater financial and personnel resources enabling them to identify and acquire more economically desirable energy producing properties and drilling prospects than us. Additionally, there is competition from other fuel choices to supply the energy needs of consumers and industry. Management believes that there exists a viable market place for smaller producers of natural gas and oil.

Government Regulation

In the United States, legislation affecting the oil and gas industry has been pervasive and is under constant review for amendment or expansion. Pursuant to such legislation, numerous federal, state and local departments and agencies have issued extensive rules and regulations binding on the oil and gas industry and its individual members, some of which carry substantial penalties for failure to comply. These laws and regulations have a significant impact on oil and gas drilling, gas processing plants and production activities, increasing the cost of doing business and, consequently, affect profitability. Inasmuch as new legislation affecting the oil and gas industry is commonplace and existing laws and regulations are frequently amended or reinterpreted, Baron Energy may be unable to predict the future cost or impact of complying with these laws and regulations. Baron Energy considers the cost of environmental protection a ne cessary and manageable part of its business. Baron Energy has been able to plan for and comply with new environmental initiatives without materially altering its operating strategies.

Exploration and Production.

Baron Energy's operations are subject to various types of regulation at the federal, state and local levels. These regulations include requiring permits for the drilling wells; maintaining prevention plans; submitting notification and receiving permits related to the presence, use and release of certain materials incidental to oil and gas operations; and regulating the location of wells, the method of drilling and casing wells, the use, transportation, storage and disposal of fluids and materials used in connection with drilling and production activities, surface plugging and abandoning of wells and the transporting of production. Baron Energy's operations are also subject to various conservation matters, including the number of wells which may be drilled in a unit, and the unitization or pooling of oil and gas properties. In this regard, some states allow the forced pooling or integration of tracts to facilitate exploration w hile other states rely on voluntary pooling of lands and leases, which may make it more difficult to develop oil and gas properties. In addition state conservation laws establish maximum rates of production oil and gas wells, generally limit the venting or flaring of gas, and impose certain requirements regarding the ratable purchase of production. The effect of these regulations is to limit the amounts of oil and gas Baron Energy can produce from its wells and to limit the number of wells or the locations at which Baron Energy can drill.

4

Environmental.

Our exploration, development, and production of oil and gas, including our operation of saltwater injection and disposal wells, are subject to various federal, state and local environmental laws and regulations. Such laws and regulations can increase the costs of planning, designing, installing and operating oil and gas wells. Our domestic activities are subject to a variety of environmental laws and regulations, including but not limited to, the Oil Pollution Act of 1990 ("OPA"), the Clean Water Act ("CWA"), the Comprehensive Environmental Response, Compensation and Liability Act ("CERCLA"), the Resource Conservation and Recovery Act ("RCRA"), the Clean Air Act ("CAA"), and the Safe Drinking Water Act ("SDWA"), as well as state regulations promulgated under comparable state statutes. We are also subject to regulations governing the handling, transportation, storage, and disposal of naturally occurring radioactive materials th at are found in our oil and gas operations. Civil and criminal fines and penalties may be imposed for non-compliance with these environmental laws and regulations. Additionally, these laws and regulations require the acquisition of permits or other governmental authorizations before undertaking certain activities, limit or prohibit other activities because of protected areas or species, and impose substantial liabilities for cleanup of pollution.

Under the OPA, a release of oil into water or other areas designated by the statute could result in the company being held responsible for the costs of remediating such a release, certain OPA specified damages, and natural resource damages. The extent of that liability could be extensive, as set forth in the statute, depending on the nature of the release. A release of oil in harmful quantities or other materials into water or other specified areas could also result in the company being held responsible under the CWA for the costs of remediation, and civil and criminal fines and penalties.

CERCLA and comparable state statutes, also known as "Superfund" laws, can impose joint and several and retroactive liability, without regard to fault or the legality of the original conduct, on certain classes of persons for the release of a "hazardous substance" into the environment. In practice, cleanup costs are usually allocated among various responsible parties. Potentially liable parties include site owners or operators, past owners or operators under certain conditions, and entities that arrange for the disposal or treatment of, or transport hazardous substances found at the site. Although CERCLA, as amended, currently exempts petroleum, including but not limited to, crude oil, gas and natural gas liquids from the definition of hazardous substance, our operations may involve the use or handling of other materials that may be classified as hazardous substances under CERCLA. Furthermore, there can be no assurance that the exemption will be preserved in future amendments of the act, if any.

RCRA and comparable state and local requirements impose standards for the management, including treatment, storage, and disposal of both hazardous and non-hazardous solid wastes. We generate hazardous and non-hazardous solid waste in connection with its routine operations. From time to time, proposals have been made that would reclassify certain oil and gas wastes, including wastes generated during drilling, production and pipeline operations, as "hazardous wastes" under RCRA which would make such solid wastes subject to much more stringent handling, transportation, storage, disposal, and clean-up requirements. This development could have a significant impact on our operating costs. While state laws vary on this issue, state initiatives to further regulate oil and gas wastes could have a similar impact. Because oil and gas exploration and production, and possibly other activities, have been conducted at some of our properties by previous owners and operators, materials from these operations remain on some of the properties and in some instances require remediation. In addition, in certain instances we have agreed to indemnify sellers of producing properties from which we have acquired reserves against certain liabilities for environmental claims associated with such properties. While we do not believe that costs to be incurred by us for compliance and remediating previously or currently owned or operated properties will be material, there can be no guarantee that such costs will not result in material expenditures.

Additionally, in the course of our routine oil and gas operations, surface spills and leaks, including casing leaks, of oil or other materials occur, and we incur costs for waste handling and environmental compliance. Moreover, we are able to control directly the operations of only those wells for which we act as the operator. Management believes that the company is in substantial compliance with applicable environmental laws and regulations.

We do not anticipate being required in the near future to expend amounts that are material in relation to our total capital expenditures program by reason of environmental laws and regulations, but inasmuch as such laws and regulations are

5

frequently changed, we are unable to predict the ultimate cost of compliance. There can be no assurance that more stringent laws and regulations protecting the environment will not be adopted or that we will not otherwise incur material expenses in connection with environmental laws and regulations in the future.

Occupational Health and Safety.

Baron Energy is also subject to laws and regulations concerning occupational safety and health. Due to the continued changes in these laws and regulations, and the judicial construction of many of them, Baron Energy is unable to predict with any reasonable degree of certainty its future costs of complying with these laws and regulations. Baron Energy considers the cost of safety and health compliance a necessary and manageable part of its business. Baron Energy has been able to plan for and comply with new initiatives without materially altering its operating strategies.

Baron Energy is subject to certain laws and regulations relating to environmental remediation activities associated with past operations, such as the Comprehensive Environmental Response, Compensation, and Liability Act ("CERCLA") and similar state statutes. In response to liabilities associated with these activities, accruals have been established when reasonable estimates are possible. Such accruals primarily include estimated costs associated with remediation. Baron Energy has used discounting to present value in determining its accrued liabilities for environmental remediation or well closure, but no material claims for possible recovery from third party insurers or other parties related to environmental costs have been recognized in Baron Energy's financial statements. Baron Energy adjusts the accruals when new remediation responsibilities are discovered and probable costs become estimable, or when current remediation est imates must be adjusted to reflect new information.

Taxation

The operations of the Company, as is the case in the petroleum industry generally, are significantly affected by federal tax laws. Federal, as well as state, tax laws have many provisions applicable to corporations which could affect the future tax liability of the Company.

Commitments and Contingencies

Baron Energy is liable for future restoration and abandonment costs associated with its oil and gas properties. These costs include future site restoration, post closure and other environmental exit costs. The costs of future restoration and well abandonment have not been determined in detail. State regulations require operators to post bonds that assure that well sites will be properly plugged and abandoned. Each state in which Baron Energy operates requires a security bond varying in value from state to state and depending on the number of wells that Baron Energy operates. Management views this as a necessary requirement for operations within each state and does not believe that these costs will have a material adverse effect on its financial position as a result of this requirement.

Item 1A. RISK FACTORS

An investment in our common stock involves a number of risks. These risks include those described in this confidential private placement memorandum and others we have not anticipated or discussed. Before you purchase the Securities you should carefully consider the information about risks identified below, as well as the information about risks stated in other parts of this memorandum and in our filings with the Commission that we have incorporated by reference in this memorandum. Any of the risks discussed below or elsewhere in this memorandum or in our Commission filings, and other risks we have not anticipated or discussed, could have a material impact on our business, results of operations, and financial condition. As a result, they could have an impact on our ability to pay any amounts due with respect to the Securities, or our stock price.

Risks Relating to Our Business

We have a limited operating history, and we may not be able to operate profitably in the near future, if at all.

6

We have a limited operating history. Businesses which are starting up or in their initial stages of development present substantial business and financial risks and may suffer significant losses from which they cannot recover. We will face all of the challenges of a new business enterprise, including but not limited to, locating suitable office space, engaging the services of qualified support personnel and consultants, establishing budgets and implementing appropriate financial controls and internal operating policies and procedures. We will need to attract and retain a number of key employees and other service personnel..

We have limited operating capital.

We have sufficient capital for current operations through our cash position and current cash flow (need to revise: there are no revenues or cash flow). However to continue growth and to fund our expansion plans we will require additional financing.. The amount of capital available to us is limited, and may not be sufficient to enable us to fully execute our growth plans without additional fund raising. Additional financing may be required to meet our objectives and provide more working capital for expanding our development and marketing capabilities and to achieve our ultimate plan of expansion and full scale of operations. There can be no assurance that we will be able to obtain such financing on attractive terms, if at all. We have no firm commitments for additional cash funding beyond the proceeds of the recently completed private placement.

We do not intend to pay dividends to our shareholders.

We do not currently intend to pay cash dividends on our common stock and do not anticipate paying any dividends at any time in the foreseeable future. At present, we will follow a policy of retaining all of our earnings, if any, to finance development and expansion of our business.

Our officers and directors have limited liability, and we are required in certain instances to indemnify our officers and directors for breaches of their fiduciary duties.

We have adopted provisions in our Articles of Incorporation and Bylaws which limit the liability of our officers and directors and provide for indemnification by us of our officers and directors to the full extent permitted by Nevada corporate law. Our articles generally provide that our officers and directors shall have no personal liability to us or our shareholders for monetary damages for breaches of their fiduciary duties as directors, except for breaches of their duties of loyalty, acts or omissions not in good faith or which involve intentional misconduct or knowing violation of law, acts involving unlawful payment of dividends or unlawful stock purchases or redemptions, or any transaction from which a director derives an improper personal benefit. Such provisions substantially limit our shareholders' ability to hold officers and directors liable for breaches of fiduciary duty, and may require us to indemnify our office rs and directors.

We face intense competition.

We compete against many other energy companies, some of which have considerably greater resources and abilities. These competitors may have greater marketing and sales capacity, established distribution networks, significant goodwill and global name recognition.

We depend significantly upon the continued involvement of our present management.

Our success depends to a significant degree upon the involvement of our management, who are in charge of our strategic planning and operations. We may need to attract and retain additional talented individuals in order to carry out our business objectives. The competition for such persons could be intense and there are no assurances that these individuals will be available to us.

Our business is subject to extensive regulation.

7

As many of our activities are subject to federal, state and local regulation, and as these rules are subject to constant change or amendment, there can be no assurance that our operations will not be adversely affected by new or different government regulations, laws or court decisions applicable to our operations.

Government regulation and liability for environmental matters may adversely affect our business and results of operations.

Crude oil and natural gas operations are subject to extensive federal, state and local government regulations, which may be changed from time to time. Matters subject to regulation include discharge permits for drilling operations, drilling bonds, reports concerning operations, the spacing of wells, unitization and pooling of properties and taxation. From time to time, regulatory agencies have imposed price controls and limitations on production by restricting the rate of flow of crude oil and natural gas wells below actual production capacity in order to conserve supplies of crude oil and natural gas. There are federal, state and local laws and regulations primarily relating to protection of human health and the environment applicable to the development, production, handling, storage, transportation and disposal of crude oil and natural gas, byproducts thereof and other substances and materials produced or used in connection with crude oil and natural gas operations. In addition, we may inherit liability for environmental damages caused by previous owners of property we purchase or lease. As a result, we may incur substantial liabilities to third parties or governmental entities. We are also subject to changing and extensive tax laws, the effects of which cannot be predicted. The implementation of new, or the modification of existing, laws or regulations could have a material adverse effect on us.

The crude oil and natural gas reserves we will report in our SEC filings will be estimates and may prove to be inaccurate.

There are numerous uncertainties inherent in estimating crude oil and natural gas reserves and their estimated values. The reserves we will report in our filings with the SEC will only be estimates and such estimates may prove to be inaccurate because of these uncertainties. Reservoir engineering is a subjective and inexact process of estimating underground accumulations of crude oil and natural gas that cannot be measured in an exact manner. Estimates of economically recoverable crude oil and natural gas reserves depend upon a number of variable factors, such as historical production from the area compared with production from other producing areas and assumptions concerning effects of regulations by governmental agencies, future crude oil and natural gas prices, future operating costs, severance and excise taxes, development costs and work-over and remedial costs. Some or all of these assumptions may in fact vary considerabl y from actual results. For these reasons, estimates of the economically recoverable quantities of crude oil and natural gas attributable to any particular group of properties, classifications of such reserves based on risk of recovery, and estimates of the future net cash flows expected therefrom prepared by different engineers or by the same engineers but at different times may vary substantially. Accordingly, reserve estimates may be subject to downward or upward adjustment. Actual production, revenue and expenditures with respect to our reserves will likely vary from estimates, and such variances may be material.

Crude oil and natural gas development, re-completion of wells from one reservoir to another reservoir, restoring wells to production and drilling and completing new wells are speculative activities and involve numerous risks and substantial and uncertain costs.

Our growth will be materially dependent upon the success of our future development program. Drilling for crude oil and natural gas and reworking existing wells involves numerous risks, including the risk that no commercially productive crude oil or natural gas reservoirs will be encountered. The cost of drilling, completing and operating wells is substantial and uncertain, and drilling operations may be curtailed, delayed or cancelled as a result of a variety of factors beyond our control, including:

- unexpected drilling conditions;

- pressure or irregularities in formations;

- equipment failures or accidents;

- inability to obtain leases on economic terms, where applicable;

- adverse weather conditions;

- compliance with governmental requirements; and

8

•shortages or delays in the availability of drilling rigs or crews and the delivery of equipment.

Drilling or reworking is a highly speculative activity. Even when fully and correctly utilized, modern well completion techniques such as hydraulic fracturing and horizontal drilling do not guarantee that we will find crude oil and/or natural gas in our wells. Hydraulic fracturing involves pumping a fluid with or without particulates into a formation at high pressure, thereby creating fractures in the rock and leaving the particulates in the fractures to ensure that the fractures remain open, thereby potentially increasing the ability of the reservoir to produce oil or gas. Horizontal drilling involves drilling horizontally out from an existing vertical well bore, thereby potentially increasing the area and reach of the well bore that is in contact with the reservoir. Our future drilling activities may not be successful and, if unsuccessful, such failure would have an adverse effect on our future results of operations and fina ncial condition. We cannot assure you that our overall drilling success rate or our drilling success rate for activities within a particular geographic area will not decline. We may identify and develop prospects through a number of methods, some of which do not include lateral drilling or hydraulic fracturing, and some of which may be unproven. The drilling and results for these prospects may be particularly uncertain. Our drilling schedule may vary from our capital budget. The final determination with respect to the drilling of any scheduled or budgeted prospects will be dependent on a number of factors, including, but not limited to:

- the results of previous development efforts and the acquisition, review and analysis of data;

- the availability of sufficient capital resources to us and the other participants, if any, for the drillingof the prospects;

- the approval of the prospects by other participants, if any, after additional data has been compiled;

- economic and industry conditions at the time of drilling, including prevailing and anticipated pricesfor crude oil and natural gas and the availability of drilling rigs and crews;

- our financial resources and results;

- the availability of leases and permits on reasonable terms for the prospects; and

- the success of our drilling technology.

We cannot assure you that these projects can be successfully developed or that the wells discussed will, if drilled, encounter reservoirs of commercially productive crude oil or natural gas. There are numerous uncertainties in estimating quantities of proved reserves, including many factors beyond our control.

Crude oil and natural gas prices are highly volatile in general and low prices will negatively affect our financial results.

Our revenues, operating results, profitability, cash flow, future rate of growth and ability to borrow funds or obtain additional capital, as well as the carrying value of our properties, are substantially dependent upon prevailing prices of crude oil and natural gas. Lower crude oil and natural gas prices also may reduce the amount of crude oil and natural gas that we can produce economically. Historically, the markets for crude oil and natural gas have been very volatile, and such markets are likely to continue to be volatile in the future. Prices for crude oil and natural gas are subject to wide fluctuation in response to relatively minor changes in the supply of and demand for crude oil and natural gas, market uncertainty and a variety of additional factors that are beyond our control, including:

- worldwide and domestic supplies of crude oil and natural gas;

- the level of consumer product demand;

- weather conditions;

- domestic and foreign governmental regulations;

- the price and availability of alternative fuels;

- political instability or armed conflict in oil producing regions;

- the price and level of foreign imports; and

- overall domestic and global economic conditions.

It is extremely difficult to predict future crude oil and natural gas price movements with any certainty. Declines in crude oil and natural gas prices may materially adversely affect our financial condition, liquidity, ability to finance planned capital expenditures and results of operations. Further, oil and gas prices do not move in tandem.

9

Risks Related To Share Ownership

The market price for our common stock may be volatile, and you may not be able to sell our stock at a favorable price or at all.

Many factors could cause the market price of our common stock to rise and fall, including:

- actual or anticipated variations in our quarterly results of operations;

- changes in market valuations of companies in our industry;

- changes in expectations of future financial performance;

- fluctuations in stock market prices and volumes;

- issuances of common stock or other securities in the future;

- the addition or departure of key personnel;

- announcements by us or our competitors of acquisitions, investments or strategic alliances; and

- the increase or decline in the price of oil and natural gas.

It is possible that the proceeds from sales of our common stock may not equal or exceed the prices you paid for it plus the costs and fees of making the sales.

10

Substantial sales of our common stock, or the perception that such sales might occur, could depress the market price of our common stock.

We cannot predict whether future issuances of our common stock or resales in the open market will decrease the market price of our common stock. The impact of any such issuances or resales of our common stock on our market price may be increased as a result of the fact that our common stock is thinly, or infrequently, traded. The exercise of any options or the vesting of any restricted stock that we may grant to directors, executive officers and other employees in the future, the issuance of common stock in connection with acquisitions and other issuances of our common stock could have an adverse effect on the market price of our common stock. In addition, future issuances of our common stock may be dilutive to existing shareholders. Any sales of substantial amounts of our common stock in the public market, or the perception that such sales might occur, could lower the market price of our common stock.

We have anti-takeover defenses that could delay or prevent an acquisition and could adversely affect the price of our common stock.

Provisions in our certificate of incorporation and by-laws and provisions of Nevada law could delay, defer or prevent an acquisition or change in control of us or otherwise adversely affect the price of our common stock. Nevada law also contains certain provisions that may have an anti-takeover effect and otherwise discourage third parties from effecting transactions with us.

Our common stock is considered "penny stock" securities under Exchange Act rules, which may limit the marketability of our securities.

Our securities are considered low-priced or "designated" securities under rules promulgated under the Exchange Act. Under these rules, broker/dealers participating in transactions in low-priced securities must first deliver a risk disclosure document which describes the risks associated with such stocks, the broker/dealer's duties, the customer's rights and remedies, certain market and other information, and make a suitability determination approving the customer for low-priced stock transactions based on the customer's financial situation, investment experience and objectives. Broker/dealers must also disclose these restrictions in writing to the customer and obtain specific written consent of the customer, and provide monthly account statements to the customer. The likely effect of these restrictions is a decrease in the willingness of broker/dealers to make a market in the stock, decreased liquidity of the stock and increas ed transaction costs for sales and purchases of the stock as compared to other securities.

IN ADDITION TO THE RISK FACTORS SET FORTH ABOVE, THE COMPANY IS SUBJECT TO NUMEROUS OTHER RISKS SPECIFIC TO THE PARTICULAR BUSINESS OF THE COMPANY, AS WELL AS GENERAL BUSINESS RISK. INVESTORS ARE URGED TO CONSIDER ALL OF THE RISKS INHERENT IN THE COMPANY'S SECURITIES PRIOR TO PURCHASING OR MAKING AN INVESTMENT DECISION. THE COMPANY'S SECURITIES ARE HIGHLY SPECULATIVE AND INVOLVE A VERY HIGH DEGREE OF RISK.

11

Item 2. Management's Discussion and Analysis or Plan of Operation

FORWARD LOOKING STATEMENTS

This quarterly report contains forward-looking statements that involve risk and uncertainties. We use words such as "anticipate", "believe", "plan", "expect", "future", "intend", and similar expressions to identify such forward-looking statements. Investors should be aware that all forward-looking statements contained within this filing are good faith estimates of management as of the date of this filing. Our actual results could differ materially from those anticipated in these forward-looking statements.

GENERAL INFORMATION

You should read the following summary together with the financial statements and related notes that appear elsewhere in this report. In this report, unless the context otherwise denotes, references to "we", "us", "our", "Company", "TMG" and "TMG Partners" are to TMG Partners, LLC.

TMG Partners, LLC was organized in the State of Nevada on August 11, 2008 to engage in the acquisition, exploration and development of natural resource properties. We are an exploration stage company with no revenues and limited operating history. The principal executive offices are located at 1630 Ringlind Blvd., Sarasota, FL 34236

During the year ended January 31, 2009, members and investors contributed $1,075,000 in cash to the Company. In addition, certain members contributed services total $65,000, which were valued at $.02 per unit based on the initial contribution of the members

RESULTS OF OPERATIONS

THE PERIOD AUGUST 11, 2008 (INCEPTON) THROUGH JANUARY 31, 2009

REVENUES

We had no revenues during the period August 11, 2008 (inception) through January 31, 2009.

PROFESSIONAL FEES

For the period August 11, 2008 (inception) through January 31, 2009, our professional fees were $161,460.

GENERAL AND ADMINISTRATIVE EXPENSES

For the period August 11, 2008 (inception) through January 31, 2009, our general and administrative expenses were $5,425.

INVENTORY

For the period August 11, 2008 (inception) through January 31, 2009, we had a write down of oil inventory of $20,182 due to the decrease in the market price for oil.

NET LOSS

For the period August 11, 2008 (inception) through January 31, 2009, our net loss was $187,067

LIQUIDITY AND CAPITAL RESOURCES

As of January 31, 2009 we had working capital of $97,933. As of January 31, 2009, we had members equity during the development stage of $952,933.

TMG will need to generate revenues to achieve profitability. To the extent that increases in its operating expenses precede or are not subsequently followed by commensurate revenues, or that TMG is unable to adjust operating expense levels accordingly, the Company's business, results of operations and financial condition would be materially and adversely affected. There can be no assurances that the Company can achieve or sustain profitability or that the Company's operating losses will not increase in the future.

12

If we experience a shortage of funds prior to generating revenues from operations we may utilize funds from our director, who has informally agreed to advance funds to allow us to pay for operating costs, however he has no formal commitment, arrangement or legal obligation to advance or loan funds to us.

Our financial statements are prepared using accounting principles generally accepted in the United States of America applicable to a going concern which contemplates the realization of assets and liquidation of liabilities in the normal course of business. We are in the process of establishing a sufficient ongoing source of revenues to cover its operating costs. The ability of the Company to continue as a going concern is dependent on our ability to fulfill our business plan.

CASH USED IN OPERATING ACTIVITIES

Cash used in operating activities for the period August 11, 2008 (inception) through January 31, 2009 was $220,000.

CASH USED IN INVESTING ACTIVITIES

Cash used in investing activities for the period August 11, 2008 (inception) through January 31, 2009 was $855,000.

CASH PROVIDED BY FINANCING ACTIVITIES

Cash provided by financing activities for the period August 11, 2008 (inception) through January 31, 2009 was $1,075,000.

CRITICAL ACCOUNTING POLICIES

ASSET RETIREMENT OBLIGATIONS

We have significant obligations to remove tangible equipment and facilities associated with our oil and gas wells and our gathering systems, and to restore land at the end of oil and gas production operations. Our removal and restoration obligations are associated with plugging and abandoning wells and our gathering systems. Estimating the future restoration and removal costs is difficult and requires us to make estimates and judgments because most of the removal obligations are many years in the future and contracts and regulations often have vague descriptions of what constitutes removal. Asset removal technologies and costs are constantly changing, as are regulatory, political, environmental, safety and public relations considerations. Inherent in the present value calculations are numerous assumptions and judgments including the ultimate settlement amounts, inflation factors, credit adjusted discount rates, timing of settl ements and changes in the legal, regulatory, environmental and political environments.

FULL COST CEILING LIMITATION

Under the full cost method, we are subject to quarterly calculations of a ceiling or limitation on the amount of our oil and natural gas properties that can be capitalized on our balance sheet. If the net capitalized costs of our oil and natural gas properties exceed the cost center ceiling, we are subject to a ceiling test write down to the extent of such excess. If required, it would reduce earnings and impact stockholders' equity in the period of occurrence and result in lower amortization expense in future periods. The discounted present value of our proved reserves is a major component of the ceiling calculation and represents the component hat requires the most subjective judgments. However, he associated prices of oil and natural gas reserves that are included in the discounted present value of the reserves do not require judgment. The ceiling calculation dictates that prices and costs in effect as of the last day of th e quarter are held constant. However, we may not be subject to a write down if prices increase subsequent to the end of a quarter in which a write down might otherwise be required. If oil and natural gas prices decline, even if for only a short period of time, or if we have downward revisions to our estimated proved reserves, it is possible that write downs of our oil and natural gas properties could occur in the future.

Item 3.Properties

The leasehold properties are in the Deep Yegua formation in southeast Texas, and located at or below 10,000 feet in depth. Numerous individual leases comprise the total package operated by the Company.

13

Item 4. Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information on the ownership of Baron Energy Inc. voting securities by officers, directors and major shareholders as well as those who own beneficially more than five percent of our common stock as of the date of this annual report:

| Name of Beneficial Owner (1) | No. of Shares | Percentage of Ownership |

| Albert Abah | 12,000,000 | 45.8% |

| All Officers and Directors as a Group | 0 | 0% |

(1)The person named may be deemed to be a "parent" and "promoter" of the Company, within the meaning of such terms under the Securities Act of 1933, as amended.

Item 5. Directors and Executive Officers, Promoters and Control Persons

The officer and directors of Baron Energy Inc. (formerly Nevwest Explorations Corp.), whose one year term will expire as noted below are:

| Name & Address | Age | Position | Date First Elected | Term Expires |

| Michael Maguire | 56 | President, | 09/12/08 | 7/31/09 |

| Celebration, FL | Secretary, | (Director since 08/15/08) | ||

| Treasurer, | ||||

| CFO, CEO & | ||||

| Director | ||||

| Lou Schiliro | 37 | Director | 09/12/08 | 7/31/09 |

The foregoing persons are promoters of Baron Energy Inc., as that term is defined in the rules and regulations promulgated under the Securities and Exchange Act of 1933.

Directors are elected to serve until the next annual meeting of stockholders and until their successors have been elected and qualified. Officers are appointed to serve until the meeting of the board of directors following the next annual meeting of stockholders and until their successors have been elected and qualified.

Mr. Maguire currently devotes 30 to 40 hours per week to company matters.

No executive officer or director of the corporation has been the subject of any order, judgment, or decree of any court of competent jurisdiction, or any regulatory agency permanently or temporarily enjoining, barring, suspending or otherwise limiting him or her from acting as an investment advisor, underwriter, broker or dealer in the securities industry, or as an affiliated person, director or employee of an investment company, bank, savings and loan association, or insurance company or from engaging in or continuing any conduct or practice in connection with any such activity or in connection with the purchase or sale of any securities.

No executive officer or director of the corporation has been convicted in any criminal proceeding (excluding traffic violations) or is the subject of a criminal proceeding which is currently pending.

Background Information

Michael Maguirehas been Vice-President, COO, and Director of the Company since August 15, 2008. As of September 12, 2008, upon Mr. Abah’s resignation from the Company, Mr. Maguire was appointed as Interim CEO, Interim CFO, and Interim Secretary.

14

Mr. Maguire has over thirty years of experience in the oil & gas industry. Mr. Maguire has a Bachelors degree in chemistry from Mt. St Mary’s College and a Masters degree in engineering from the University of Texas, Mr. Maguire also has a MBA from Wharton School of Business.

As a registered Professional Engineer he has a broad range of experience in, civil, mechanical and environmental engineering disciplines. Mr. Maguire has been responsible for community relations; environmental, construction and operating permits negotiations; selection and management of equipment vendors, fabricators and constructor. In addition, his technical knowledge and experience extends to design of gasification systems, fuel feedstock preparation, combustion processes, direct fired steam boilers, process water conditioning and potable water distillation.

Since 1992 Mr. Maguire has been president and owner/operator of West Texas Recovery, a private full service oil & gas company. Since May 1996 until now, Mr. Maguire also was also Vice-President of Engineering for International Power Group, a public company.

Lou Schilirohas been a director of the Company since September 12, 2008.

Mr. Schiliro graduated from West Virginia University, with a Bachelors in International Relations, 1993. He then attended George Mason University and received his Master in International Transactions, 1995. He began working for the US Department of Commerce, International Trade Administration in 1995 as a Trade Specialist. As a Trade Specialist his job was to create distribution and sales opportunities for US manufactures. In 1997 he was hired to create an International Sales program for SAFECO inc. SAFECO was a safety Equipment Distributor of personal protective equipment. In 1999 he co-founded Global Protection, which is a Homeland Security equipment company. Since 1999 Mr. Schiliro has served Global Protection as its Director of Operations. Since September 2008, Mr. Schiliro is also an officer and director of Elko Ventures Inc. a public resource exploration company.

Code of Ethics

Our board of directors adopted our code of ethical conduct that applies to all of our employees and directors, including our principal executive officer, principal financial officer, principal accounting officer or controller, and persons performing similar functions.

We believe the adoption of our Code of Ethical Conduct is consistent with the requirements of the Sarbanes-Oxley Act of 2002.

Our Code of Ethical Conduct is designed to deter wrongdoing and to promote:

- Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest betweenpersonal and professional relationships;

- Full, fair, accurate, timely and understandable disclosure in reports and documents that we file or submit tothe Securities & Exchange Commission and in other public communications made by us;

- Compliance with applicable governmental laws, rules and regulations;

- The prompt internal reporting to an appropriate person or persons identified in the code of violations of ourCode of Ethical Conduct; and

- Accountability for adherence to the Code.

15

| Item 6.Executive Compensation | ||||||||||

| The current Board of Directors is comprised of Mr. Maguire and Mr. Schiliro. | ||||||||||

| SUMMARY COMPENSATION TABLE | ||||||||||

| Name and Principal Position | Year | Salary | Bonus | Stock Awards | Option Awards | Non- Equity Incentive Plan Compen- sation | Change in Pension Value and Non- qualified Deferred Compen- sation Earnings | All Other Compen- sation | Total | |

| Albert | 2008 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Abah, | 2007 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| (former) | ||||||||||

| CEO & | ||||||||||

| Director | ||||||||||

| Michael | 2008 | 66,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Maguire, | ||||||||||

| CEO, | ||||||||||

| CFO, | ||||||||||

| Director | ||||||||||

| Lou | 2008 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Schiliro, | ||||||||||

| Director | ||||||||||

An employment agreement between the Company and Mr. Maguire exists.

On July 24, 2007, a total of 3,000,000 shares of common stock were issued to Mr. Abah in exchange for cash in the amount of $15,000 U.S., or $.005 per share. The terms of this stock issuance was as fair to the Company, in the opinion of the board of directors, as could have been made with an unaffiliated third party. Subsequent to a 2 for 1 forward stock split on September 2, 2008, Mr. Abah held 6,000,000 shares of common stock. Subsequent to a second 2 for 1 forward stock split on February 24, 2009, Mr. Abah held 12,000,000 shares of common stock.

Only Mr. Schiliro has agreed to work with no remuneration until such time as the Company receives sufficient revenues necessary to provide management salaries for all executive levels. At this time, we cannot accurately estimate when sufficient revenues will occur to implement this compensation, or what the amount of the compensation will be for Mr. Schiliro.

There are no annuity, pension or retirement benefits proposed to be paid to officers, directors or employees in the event of retirement at normal retirement date pursuant to any presently existing plan provided or contributed to by the Company or any of its subsidiaries, if any.

Item 7.Certain Relationships and Related Transactions

Mr. Abah was not paid for any underwriting services that he performed on our behalf with respect to our recent offering.

16

On July 24, 2007, a total of 3,000,000 shares of common stock were issued to Mr. Abah in exchange for $15,000 US, or $.005 per share. All these shares are “restricted” securities, as that term is defined by the Securities Act of 1933, as amended, and are held by our officer and director. (See "Principal Stockholders".)

Item 8.Legal Proceedings

We are not currently involved in any legal proceedings and we are not aware of any pending or potential legal actions.

Item 9.Market Price of and Dividends on the Registrant's Common Equity and Related Stockholder Matters

Our common stock is currently listed for trading on the OTC Bulletin Board under the symbol BROE (formerly NVWT). There has been no active trading market.

Of the 26,200,000 shares of common stock outstanding as of March 14, 2009, 12,000,000 shares are owned by Albert Abah, a former officer and director, and may only be resold in compliance with Rule 144 of the Securities Act of 1933.

As of March 14, 2009, we have 26,200,000 Shares of $0.001 par value common stock issued and outstanding, held by 29 shareholders of record.

The stock transfer agent for our securities is Holladay Stock Transfer.

Dividends

We have never declared or paid any cash dividends on our common stock. For the foreseeable future, we intend to retain any earnings to finance the development and expansion of our business, and we do not anticipate paying any cash dividends on its common stock. Any future determination to pay dividends will be at the discretion of the Board of Directors and will be dependent upon then existing conditions, including our financial condition and results of operations, capital requirements, contractual restrictions, business prospects, and other factors that the board of directors considers relevant.

Section Rule 15(g) of the Securities Exchange Act of 1934

The Company's shares are covered by Section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Regulation, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser's written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding of the function of the penny stock market, such as "bid" and "offer" quotes, a dealers "spread" and broker/dealer compensation; the broker/dealer compensation, the broker/dealers duties to its customers, including the disclosures required by any other penny stock disclosure rules; and the customers rights and remedies in causes of fraud in penny stock transactions.

Securities authorized for issuance under equity compensation plans

We do not have any equity compensation plans and accordingly we have no securities authorized for issuance thereunder.

Section 16(a)

Based solely upon a review of Form 3 and 4 furnished by us under Rule 16a-3(d) of the Securities Exchange Act of 1934, we are not aware of any individual who failed to file a required report on a timely basis required by Section 16(a) of the Securities Exchange Act of 1934.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

17

There were no shares of common stock or other securities purchased by the issuer or affiliated purchasers during the year ended July 31, 2008.

Item 10.Recent Sale of Unregistered Securities

August 29, 2008 - Sold 1,400,000 shares of common stock for $350,000. October 16, 2008 - Sold 600,000 shares of common stock for $150,000. January 29, 2009 - Sold 200,000 shares of common stock for $50,000.

Item 11. Description of Registrant’s Securities to be Registered

From inception (July 24, 2007) through July 31, 2008, Baron sold 6,000,000 shares of its common stock to its directors at $0.0025 per share, or $15,000 cash and 6,000,000 shares of its common stock to 28 unaffiliated investors at $0.01 per share, or $60,000 cash. Upon completion of the acquisition of the TMG membership interests, in full, an additional 9,000,000 shares will be issued to 23 new shareholders of Baron Energy

Effective September 2, 2008 the Company affected a forward stock spilt of the issued and outstanding shares of common stock on a two new for one old basis. Authorized capital remained at 75,000,000 common shares and par value remained at $.001 per share

Effective Ferbruary 24, 2009, the Company affected a forward stock spilt of the issued and outstanding shares of common stock on a two new for one old basis. Authorized capital is now 150,000,000 and par value remained at $.001 per share.

Item 12.Indemnification of Directors and Officers

The Company has adopted provisions in its Articles of Incorporation and Bylaws that limit the liability of its officers and directors and provide for indemnification by the Company of its officers and directors to the full extent permitted by Nevada corporate law. The Company's articles generally provide that its officers and directors shall have no personal liability to the Company or its stockholders for monetary damages for breaches of their fiduciary duties as directors, except for breaches of their duties of loyalty, acts or omissions not in good faith or which involve intentional misconduct or knowing violation of law, acts involving unlawful payment of dividends or unlawful stock purchases or redemptions, or any transaction from which a director derives an improper personal benefit. Such provisions substantially limit the shareholders' ability to hold officers and directors liable for breaches of fiduciary duty, and may require the Company to indemnify its officers and directors.

Insofar as indemnification for liability arising under the Securities Act may be permitted to directors, officers and controlling persons of the Company pursuant to the foregoing provisions, or otherwise, the Company has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Company of expenses incurred or paid by a director, officer or controlling person of the Company in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being offered, the Company will, unless in the opinion of its counsel, the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question of whether such indemnific ation by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

18

| Item 13. Financial Statements and Supplementary Data. | |

| REPORT OFINDEPENDENTPUBLICACCOUNTINGFIRM | 20 |

| FINANCIALSTATEMENTS: | |

| BALANCESHEET | 21 |

| STATEMENT OFEXPENSES | 22 |

| STATEMENT OFCHANGES INMEMBERS’ EQUITY | 23 |

| STATEMENT OFCASHFLOWS | 24 |

| NOTES TOFINANCIALSTATEMENTS | 25 |

19

To the Board of Directors and Members of

TMG Partners, LLC

Sarasota, Florida

We have audited the accompanying balance sheet of TMG Partners, LLC (a development stage company) as of January 31, 2009 and the related statements of expenses, members’ equity, and cash flows for the period from August 11, 2008 (inception) through January 31, 2009. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant est imates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of TMG Partners, LLC for the period described in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that TMG Partners, LLC will continue as a going concern. As discussed in Note 2 to the financial statements, the Company suffered losses from operations and has a working capital deficiency, which raises substantial doubt about its ability to continue as a going concern. Management’s plans regarding those matters also are described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Malone & Bailey, P.C.

www.malone-bailey.com

Houston, Texas

March 26, 2009

20

| TMG PARTNERS, LLC | |||

| (An Exploration Stage Company) | |||

| Balance Sheet | |||

| ASSETS | |||

| As of | |||

| January 31, | |||

| 2009 | |||

| Current Assets | |||

| Deposits | $ | 2,105 | |

| Other receivables | 116,010 | ||

| Oil inventory | 9,389 | ||

| Total Current Assets | 127,504 | ||

| Unproved oil and gas properties | 855,000 | ||

| TOTAL ASSETS | $ | 982,504 | |

| LIABILITIES & MEMBERS' EQUITY | |||

| Current Liabilities | |||

| Accounts Payable | $ | 29,571 | |

| Total Current Liabilities | 29,571 | ||

| Members' Equity | |||

| Members' investments | 1,140,000 | ||

| Deficit accumulated during exploration stage | (187,067 | ) | |

| Total Members' Equity | 952,933 | ||

| TOTAL LIABILITIES & MEMBERS’ EQUITY | $ | 982,504 | |

| See notes to the financial statements. | |||

21

| TMG PARTNERS, LLC | |||

| (An Exploration Stage Company) | |||

| Statement of Expenses | |||

| August 11, 2008 (inception) through January 31, 2009 | |||

| Professional fees | $ | 161,460 | |

| Write-down of oil inventory | 20,182 | ||

| General & Administrative Expenses | 5,425 | ||

| Loss from Operations | (187,067 | ) | |

| Net Loss | $ | (187,067 | ) |

| See notes to the financial statements. | |||

22

| TMG PARTNERS, LLC | |||||||||

| (An Exploration Stage Company) | |||||||||

| Statement of Changes in Members' Equity | |||||||||

| From August 11, 2008 (Inception) through January 31, 2009 | |||||||||

| Deficit Accumulated During Exploration Stage | |||||||||

| Members | Total | ||||||||

| Balance, August 11, 2008 | $ | - | $ | - | $ | - | |||

| Units issued for services at | |||||||||

| inception on August 11, 2008 | |||||||||

| @ $0.02 per unit | 65,000 | - | 65,000 | ||||||

| Units issued for cash at | |||||||||

| @ $0.50 per unit | 1,075,000 | 1,075,000 | |||||||

| Net loss | - | (187,067 | ) | (187,067 | ) | ||||

| Balance, January 31, 2009 | $ | 1,140,000 | $ | (187,067 | ) | $ | 952,933 | ||

| See notes to the financial statements. | |||||||||

23

| TMG PARTNERS, LLC | |||

| (An Exploration Stage Company) | |||

| Statement of Cash Flows | |||

| August 11, 2008 | |||

| (inception) | |||

| through | |||

| January 31, 2009 | |||

| CASH FLOWS FROM OPERATING ACTIVITIES | |||

| Net loss | $ | (187,067 | ) |

| Adjustments to reconcile net loss to net cash | |||

| provided by (used in) operating activities: | |||

| Members' equity for services | 65,000 | ||

| Write-down of oil inventory | 20,182 | ||

| Changes in operating assets and liabilities: | |||

| Deposits | (2,105 | ) | |

| Other receivables | (116,010 | ) | |

| Inventory | (29,571 | ) | |

| Accounts payable | 29,571 | ||

| Net cash used in operating activities | (220,000 | ) | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |||

| Acquisition of Oil and Gas Properties | (855,000 | ) | |

| Net cash used in investing activities | (855,000 | ) | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |||

| Proceeds from issuance of members' equity | 1,075,000 | ||

| Net cash provided by financing activities | 1,075,000 | ||

| Net increase in cash | - | ||

| Cash at beginning of period | - | ||

| Cash at end of year | $ | - | |

| SUPPLEMENTAL DISCLOSURES OF CASH | |||

| FLOW INFORMATION | |||

| Cash paid during year for : | |||

| Interest | $ | - | |

| Income Taxes | $ | - | |

| See notes to the financial statements. | |||

24

TMG PARTNERS, LLC

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

For the Period From August 11, 2008 (inception) through January 31, 2009

NOTE 1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Organization

TMG Partners, LLC (the “Company” or “TMG”) was incorporated in the State of Nevada on August 11, 2008 to engage in the acquisition, exploration and development of natural resource properties. We are an exploration stage company with no revenues and limited operating history. The principal executive offices are located at 1630 Ringling Blvd., Sarasota, FL 34236.

Basis of Presentation

The accompanying audited financial statements of TMG have been prepared in accordance with accounting principles generally accepted in the United States of America.

Exploration Stage Company

On August 11, 2008 (the inception date), TMG commenced oil and gas exploration activities. As of January 31, 2009, TMG has not produced a sustainable positive cash flow from its oil and gas operations. Accordingly, TMG’s activities have been accounted for as those of an “Exploration Stage Enterprise” as set forth in SFAS No. 7, “Accounting for Development Stage Entities.” Among the disclosures required by SFAS No. 7 are that TMG’s financial statements be identified as those of an exploration stage company. In addition, the statements of expenses, members’ equity and cash flows are required to disclose all activity since TMG’s date of inception.

TMG will continue to prepare its financial statements and related disclosures in accordance with SFAS No. 7 until such time that TMG’s oil and gas properties have generated significant revenues.

Use of Estimates

In preparing financial statements in conformity with accounting principles generally accepted in the United States of America, management is required to make estimates and assumptions. These estimates and assumptions may affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, and revenues and expenses during the reporting period. Actual results could differ from those estimates.

Cash Equivalents

The Company considers all demand deposits with banks and short-term investments with a maturity of three months or less at the date of purchase to be cash equivalents. At January 31, 2009 the Company had no cash equivalents.

Inventories

Crude oil inventories are carried at the lower of current market value or cost.

Oil and Gas Properties, Full Cost Method

TMG uses the full cost method of accounting for oil and gas producing activities. Costs to acquire mineral interests in oil and gas properties, to drill and equip exploratory wells used to find proved reserves, and to drill and equip development wells, including directly related overhead costs and related asset retirement costs are capitalized.

Under this method of accounting, all costs, including internal costs directly related to acquisition, exploration and development activities are capitalized as oil and gas property costs. Properties not subject to amortization consist of exploration and development costs which are evaluated on a property-by-property basis. Amortization of these unproved property costs begins when the properties become proved or their values become impaired. TMG assesses the realizability of unproved properties, if any, on at least an annual basis or when there has been an indication that impairment in value may have occurred. Impairment of unproved properties is assessed based on management's intention with regard to future exploration and development of individually significant properties and the ability of TMG to obtain funds to finance such exploration and development. If the

25

TMG PARTNERS, LLC

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

For the Period From August 11, 2008 (inception) through January 31, 2009

results of an assessment indicate that the properties are impaired, the amount of the impairment is added to the capitalized costs to be amortized.

Costs of oil and gas properties are amortized using the units of production method. There was no production in the year ended January 31, 2009, therefore no amortization was recorded.

Under full cost accounting rules for each cost center, capitalized costs of proved properties, less accumulated amortization and related deferred income taxes, shall not exceed an amount (the "cost ceiling") equal to the sum of (a) the present value of future net cash flows from estimated production of proved oil and gas reserves, based on current economic and operating conditions, discounted at 10 percent, plus (b) the cost of properties not being amortized, plus (c) the lower of cost or estimated fair value of any unproved properties included in the costs being amortized, less (d) any income tax effects related to differences between the book and tax basis of the properties involved. If capitalized costs exceed this limit, the excess is charged as an impairment expense. There was no impairment in the year ended January 31, 2009.

Income Taxes

The Company is not a tax paying entity for federal or state income tax purposes, and thus no income tax expense has been recorded in the financial statements. The income or loss of the Company is taxed to the members in their respective returns.

Recently Issued Accounting Pronouncements

In May 2008, the FASB issued SFAS No. 162, THE HIERARCHY OF GENERALLY ACCEPTED ACCOUNTING PRINCIPLES, (SFAS 162), which identifies a consistent framework for selecting accounting principles to be used in preparing financial statements for nongovernmental entities that are presented in conformity with United States generally accepted accounting principles (GAAP). The current GAAP hierarchy was criticized due to its complexity, ranking position of FASB Statements of Financial Accounting Concepts and the fact that it is directed at auditors rather than entities. SFAS 162 will be effective 60 days following the United States Securities and Exchange Commission's (SEC's) approval of the Public Company Accounting Oversight Board amendments to AU Section 411, THE

MEANING OF PRESENT FAIRLY IN CONFORMITY WITH GENERALLY ACCEPTED ACCOUNTING PRINCIPLES . The FASB does not expect that SFAS 162 will have a change in current practice, and the Company does not believe that SFAS 162 will have an impact on operating results, financial position or cash flows.

On December 31, 2008, the SEC published the final rules and interpretations updating its oil and gas reporting requirements. Many of the revisions are updates to definitions in the existing oil and gas rules to make them consistent with the petroleum resource management system, which is a widely accepted standard for the management of petroleum resources that was developed by several industry organizations. Key revisions include changes to the pricing used to estimate reserves utilizing a 12-month average price rather than a single day spot price which eliminates the ability to utilize subsequent prices to the end of a reporting period when the full cost ceiling was exceeded and subsequent pricing exceeds pricing at the end of a reporting period, the ability to include nontraditional resources in reserves, the use of new technology for determining reserves, and permitting disclosure of probable and possible reserves. The SEC w ill require companies to comply with the amended disclosure requirements for registration statements filed after January 1, 2010, and for annual reports on Form 10-K for fiscal years ending on or after December 15, 2009. Early adoption is not permitted. We are currently assessing the impact that the adoption will have on our disclosures, operating results, financial position and cash flows.

In December 2007, the FASB issued SFAS No. 141, Business Combinations (SFAS 141R), and SFAS No. 160, Accounting andReporting of Noncontrolling Interest in Consolidated Financial Statements, an amendment of ARB No. 51 (SFAS 160). SFAS 141R and SFAS 160 will significantly change the accounting for and reporting of business combination transactions and noncontrolling (minority) interests in consolidated financial statements. SFAS 141R retains the fundamental requirements in Statement 141, Business Combinations, while providing additional definitions, such as the definition of the acquirer in a purchase and improvements in the application of how the acquisition method is applied. SFAS 160 will change the accounting and reporting for minority interests, which will be recharacterized as noncontrolling interests, and classified as a component of equity. These Statements become simultaneously effective January 1, 2009. Early adoption is not permitted. The Company is currently assessing the impact, if any, that the adoption of this pronouncement will have on the Company’s operating results, financial position or cash flows.

26

TMG PARTNERS, LLC

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

For the Period From August 11, 2008 (inception) through January 31, 2009

NOTE 2. GOING CONCERN

As shown in the accompanying financial statements, we have incurred net losses of $187,067 and negative operating cash flows totaling $220,000 for the period from August 11, 2008 (inception) through January 31, 2009. These conditions raise substantial doubt as to our ability to continue as a going concern. In response to these conditions, we are considering merging into a public company. The financial statements do not include any adjustments that might be necessary if we are unable to continue as a going concern

NOTE 3. OIL AND GAS PROPERITES

TMG entered into a joint venture agreement with OIL Investments Leases, Inc. for the purpose of acquiring oil and gas leases in South Texas. As of January 31, 2009, TMG has spent $855,000 on leases in the designated areas.

NOTE 4. MEMBERS’ EQUITY

During the year ended January 31, 2009, members and investors contributed $1,075,000 in cash to the Company. In addition, certain members contributed services totaling $65,000, which were valued at $0.02 per unit based on the initial contribution of the members. Funds from investments are maintained in a trust account, which has a balance of $116,010 and is reported as other receivables on our balance sheet. In addition, all cash used in operations and for investments in unproved properties were disbursed from this same escrow account. As of January 31, 2009, total members’ equity was $952,933.

NOTE 5. COMMITMENTS AND CONTINGENCIES

The Company entered into an agreement to acquire certain leases. Under the terms of the agreement, the Company committed approximately $1,300,000 of funds for leases. As of January 31, 2009, the Company had paid $855,000 of the total $1,300,000 commitment and is obligated to pay the remaining upon request.

The Company as of January 31, 2009 has no pending litigation.

27

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

The following unaudited pro forma condensed consolidated financial information for the periods indicated below have been derived by the application of pro forma adjustments, which give the effect to the April 6, 2009 acquisition by Baron Energy Inc (the “Company”) of all of the members’ equity in TMG Partners, LLC, for an aggregate purchase price of $982,504 (the “Purchase Price”), subject to adjustment as provided therein (the “Transaction”). The Company issued 9,000,000 shares of common stock valued at $982,504, based on the fair value of the net assets received. There were no transaction costs. The preliminary purchase price allocation was:

| Other receivables | $ | 116,010 |

| Deposits | 2,105 | |

| Oil inventory | 9,389 | |

| Oil and gas properties | 855,000 | |

| Total | $ | 982,504 |

The unaudited pro forma condensed combined statements of expenses for the year ended July 31, 2008 and six months ended January 31, 2009, gives effect to the acquisition of TMG Partners, LLC as if it had occurred on August 1, 2007.

The unaudited pro forma condensed combined statement of expenses for the fiscal year ended July 31, 2008, has been prepared based on the Company’s historical condensed statement of expenses for the fiscal year ended July 31, 2008. The unaudited pro forma condensed combined statement of expenses for the six months ended January 31,2009, has been prepared based on the Company’s historical condensed statement of expenses for the six months ended January 31, 2009 and the historical condensed statement of expenses of TMG Partners, LLC for the period from August 11, 2008 (inception) through January 31, 2009. The unaudited pro forma adjustments were based upon available information and assumptions that the Company believes are reasonable under the circumstances.

The unaudited pro forma condensed combined financial information was prepared using the acquisition method of accounting with the assets acquired and liabilities assumed recorded at their estimated fair values.