2005 5th Avenue, Suite 200

Seattle, Washington 98121

(206) 448-0884

Dear Fellow Shareholder:

On behalf of the Board of Directors and management of Sound Financial, Inc., we cordially invite you to attend a special meeting of Sound Financial, Inc. shareholders. The meeting will be held at 3:30 p.m., Pacific time, on November 19, 2008, at our main office located at 2005 5th Avenue, Suite 200, Seattle, Washington 98121.

Shareholders are being asked to consider and vote upon a proposal to approve the Sound Financial, Inc. 2008 Equity Incentive Plan. The Board of Directors has carefully considered the proposal and believes the plan will enhance the Company’s ability to recruit and retain quality directors and management. Accordingly, your Board of Directors unanimously recommends that you vote “FOR” the proposal.

We encourage you to attend the meeting in person. Whether or not you plan to attend the meeting, please complete, sign and date the enclosed proxy card and return it in the accompanying postage-paid return envelope or vote electronically via the Internet or telephone. See “How do I vote?” in the proxy statement for more details. Your prompt response will save us additional expense in soliciting proxies and will ensure that your shares are represented at the meeting. Returning the proxy or voting electronically does NOT deprive you of your right to attend the meeting and to vote your shares in person for the matter being acted upon at the special meeting.

Your Board of Directors and management are committed to the continued success of Sound Financial, Inc. and the enhancement of the value of your investment. As President and Chief Executive Officer, I want to express my appreciation for your confidence and support.

| | | |

| | | | |

| | | /s/ Laura Lee Stewart | |

| | | Laura Lee Stewart | |

| | | President and Chief Executive Officer | |

| | | | |

SOUND FINANCIAL, INC.

2005 5TH AVENUE, SUITE 200

SEATTLE, WASHINGTON 98121

(206) 448-0884

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held on November 19, 2008

NOTICE IS HEREBY GIVEN that a special meeting of shareholders of Sound Financial, Inc. will be held as follows:

| | TIME | | Wednesday, November 19, 2008, at 3:30 p.m |

| | | | |

| | PLACE | | Sound Community Bank 2005 5th Avenue, Suite 200 Seattle, Washington, 98121 |

| | | | |

| | BUSINESS | | (1) | Approval of the Sound Financial, Inc. 2008 Equity Incentive Plan; and |

| | | | |

| | | | (2) | Such other business as may properly come before the special meeting, or any adjournment or postponement thereof. |

| | | | |

| | RECORD DATE | | Holders of record of Sound Financial, Inc. common stock at the close of business on September 30, 2008, are entitled to receive this Notice and to vote at the meeting, or any adjournment or postponement thereof. |

| | | | |

| | PROXY VOTING | | A proxy statement and proxy card for the special meeting are enclosed. It is important that your shares be represented and voted at the meeting. You can vote your shares by completing and returning the enclosed proxy card. Registered shareholders, that is, shareholders who hold their stock in their own name, can also vote their shares over the Internet or by telephone. If Internet or telephone voting is available to you, voting instructions are printed on the proxy card sent to you. Regardless of the number of shares you own, your vote is very important. Please act today. |

| | BY ORDER OF THE BOARD OF DIRECTORS | |

| | /s/ Laura Lee Stewart | |

| | Laura Lee Stewart | |

| | President and Chief Executive Officer | |

| | | | |

Seattle, Washington

October 10, 2008

Important: The prompt return of your proxy saves us the expense of further requests. You can revoke your proxy and vote at the special meeting, if you choose to attend. A pre-addressed envelope is enclosed for your convenience. No postage is required if mailed within the United States.

SOUND FINANCIAL, INC.

2005 5th Avenue, Suite 200

Seattle, Washington 98121

(206) 448-0884

___________________________

PROXY STATEMENT

___________________________

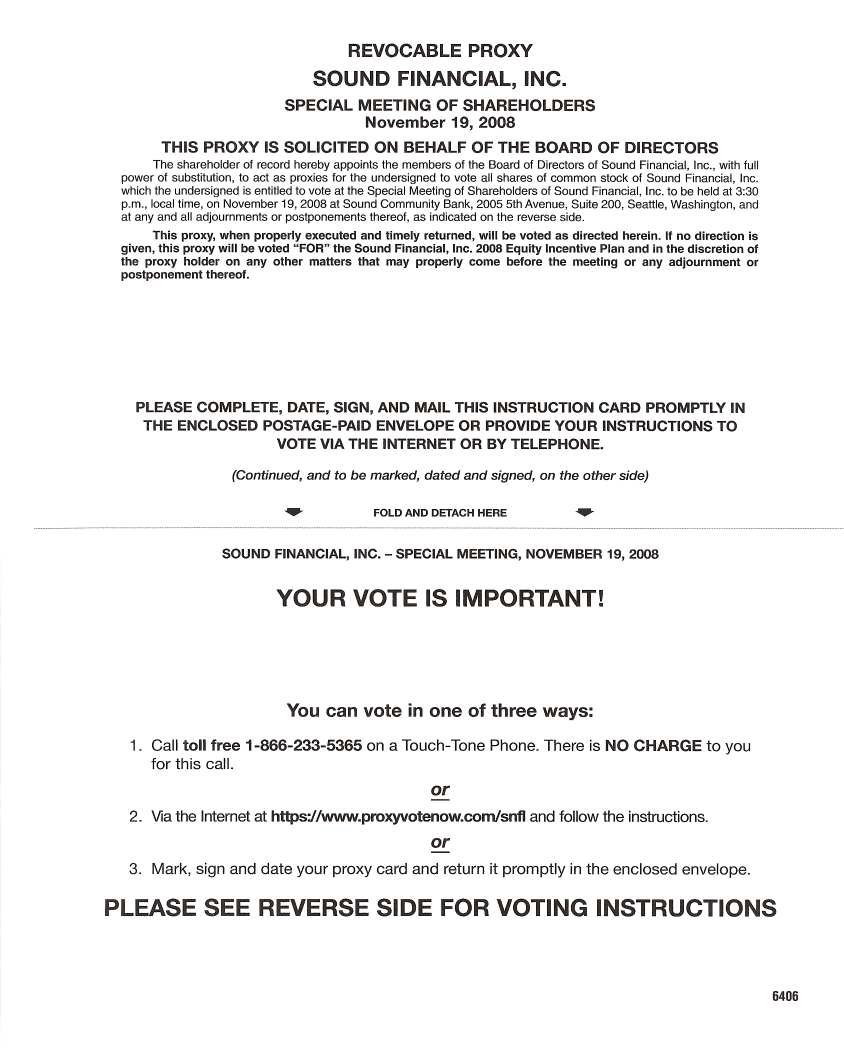

INTRODUCTION

The Board of Directors of Sound Financial, Inc. is using this proxy statement to solicit proxies from the holders of common stock of Sound Financial, Inc. for use at our special meeting of shareholders. The special meeting of shareholders will be held at 3:30 p.m., Pacific Time on Wednesday, November 19, 2008 at our main office, located at 2005 5th Avenue, Suite 200, Seattle, Washington 98121. By submitting your proxy, either by executing and returning the enclosed proxy card or by voting electronically via the Internet or by telephone, you authorize the Sound Financial, Inc. Board of Directors to represent you and vote your shares at the special meeting in accordance with your instructions. The Board of Directors also may vote your shares to adjourn the special meeting from time to time and will be authorized to vote your shares at any adjournments or postponements of the special meeting. This proxy statement and the accompanying materials are being mailed to shareholders on or about October 10, 2008.

Sound Financial, Inc. is referred to in this proxy statement from time to time as “Sound Financial” or the “Company.” Certain of the information in this proxy statement relates to Sound Community Bank, a wholly owned subsidiary of the Company, which is referred to in this proxy statement from time to time as the “Bank.”

INFORMATION ABOUT THE SPECIAL MEETING

What is the purpose of the special meeting?

At the special meeting, shareholders will be asked to vote on the following proposal:

Proposal 1. Approval of the Sound Financial, Inc. 2008 Equity Incentive Plan.

The shareholders also will transact any other business that may properly come before the special meeting although, as of the date of this proxy statement, the Board of Directors knows of no other business to be presented.

Who is entitled to vote?

The record date for the meeting is September 30, 2008. Only shareholders of record at the close of business on that date are entitled to notice of and to vote at the meeting. The only class of stock entitled to be voted at the meeting is the Company’s common stock. Each outstanding share of common stock is entitled to one vote on each matter before the special meeting. At the close of business on the record date, there were 2,948,063 shares of common stock outstanding and entitled to vote at the special meeting.

What if my shares are held in “street name” by a broker?

If your shares are held in “street name” by a broker, your broker is required to vote those shares in accordance with your instructions. If you do not give instructions to your broker, your broker nevertheless will be entitled to vote the shares with respect to “discretionary” items, but will not be permitted to vote your shares with respect to any “non-discretionary” items. In the case of non-discretionary items, the shares will be treated as “broker non-votes.” Whether an item is discretionary is determined by the exchange rules governing your broker. The proposal to approve the Sound Financial, Inc. 2008 Equity Incentive Plan is a “non-discretionary” item.

What if my shares are held in Sound Financial’s employee stock ownership plan?

We maintain an employee stock ownership plan that owns 115,560 shares, or 3.9% of the outstanding shares of the Company’s common stock. Employees of the Company and the Bank participate in the employee stock ownership plan. Each participant instructs the trustee of the plan how to vote the shares of common stock allocated to his or her account under the employee stock ownership plan. As of the voting record date, no allocations have been made to participants under the employee stock ownership plan. As a result, the trustee will vote the shares in the plan at its discretion or as directed by the plan administrator, which direction would be to vote the shares “FOR” the proposal set forth in this proxy statement.

How many shares must be present to hold the special meeting?

A quorum must be present at the special meeting for any business to be conducted. The presence at the special meeting, in person or by proxy, of the holders of a majority of the shares of common stock outstanding on the record date will constitute a quorum. Proxies received but marked as abstentions or broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting. Our holding company, Sound Community MHC, owns 55% of our outstanding shares. Accordingly, Sound Community MHC’s presence alone at the special meeting will constitute a quorum.

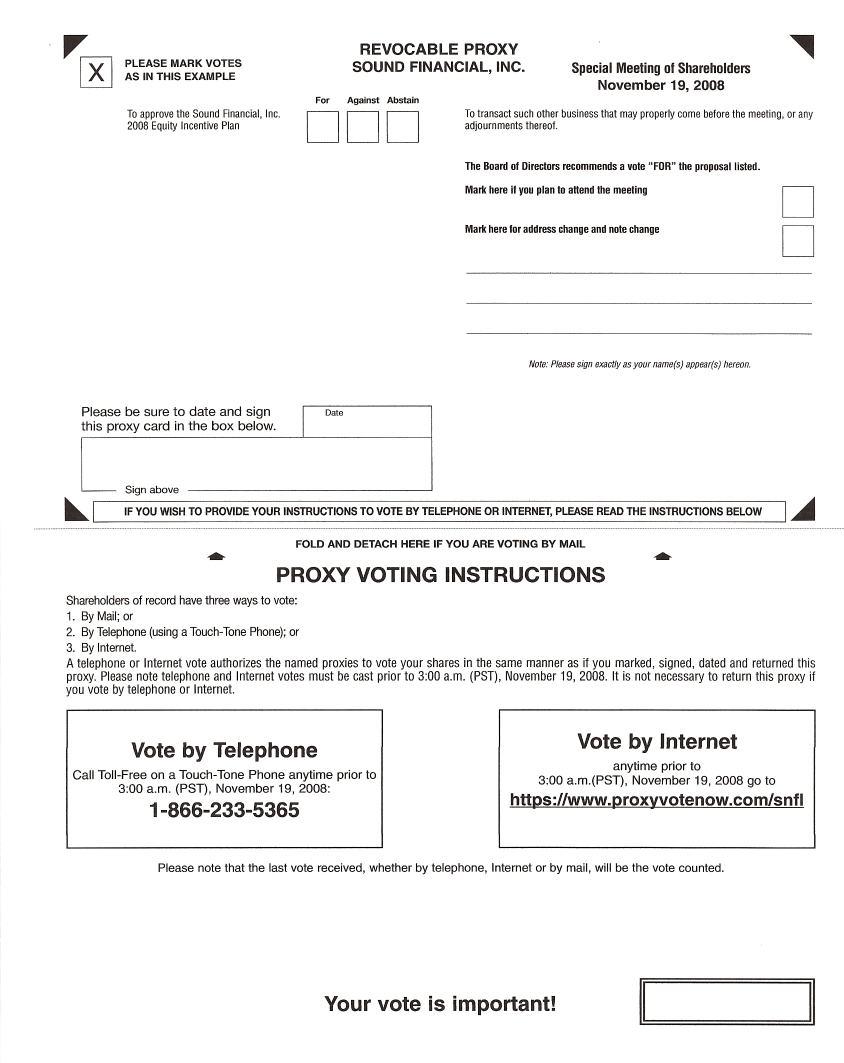

How do I vote?

1. You may vote by mail. ��If you properly complete and sign the accompanying proxy card and return it in the enclosed envelope, it will be voted in accordance with your instructions.

2. You may vote by telephone. If you are a registered shareholder, that is, if you hold your stock in your own name, you may vote by telephone by following the instructions included with the proxy card. If you vote by telephone, you do not have to mail in your proxy card.

3. You may vote on the internet. If you are a registered shareholder, that is, if you hold your stock in your own name, you may vote on the Internet by following the instructions included with the proxy card. If you vote on the Internet, you do not have to mail in your proxy card.

4. You may vote in person at the special meeting. If you plan to attend the special meeting and wish to vote in person, we will give you a ballot at the meeting. However, if your shares are held in the name of your broker, bank or other nominee, you will need to obtain a proxy form from the named holder of your shares indicating that you were the beneficial owner of those shares on the record date for voting at the special meeting.

Can I vote by telephone or on the Internet if I am not a registered shareholder?

If your shares are held in “street name” by a broker or other nominee, you should check the voting form used by that firm to determine whether you will be able to vote by telephone or on the Internet.

Can I change my vote after I submit my proxy?

If you are a registered shareholder, you may revoke your proxy and change your vote at any time before the polls close at the special meeting by:

| | · | properly completing, signing and submitting another proxy with a later date before the special meeting; |

| | · | voting by telephone or on the Internet -- your latest telephone or Internet vote will be counted; |

| | · | giving written notice of the revocation of your proxy to the Company’s Secretary prior to the special meeting; or |

| | · | voting in person at the special meeting. |

Your proxy will not be revoked by your mere attendance at the special meeting; you must actually vote at the meeting to revoke a prior proxy.

If you have instructed a broker, bank or other nominee to vote your shares, you must follow directions received from your nominee to change those instructions.

What if I do not specify how my shares are to be voted?

If you submit an executed proxy but do not indicate any voting instructions, your shares will be voted “FOR” approval by the Sound Financial, Inc. 2008 Equity Incentive Plan.

Will any other business be conducted at the special meeting?

The Board of Directors knows of no other business that will be conducted at the special meeting. If any other proposal properly comes before the shareholders for a vote at the meeting, however, the proxy holders will vote your shares in accordance with their best judgment.

How many votes are required to approve the proposal?

Approval of the Sound Financial, Inc. 2008 Equity Incentive Plan requires approval by a majority of the total votes eligible to be cast by shareholders, in person or by proxy, on the matter at the special meeting. Under this requirement, abstentions, broker non-votes and a shareholder’s failure to vote will all have the same effect as a vote against the proposal. Sound Community MHC, however, owns 55% of Sound Financial, Inc.’s outstanding common stock and intends to vote its shares in favor of the proposal, thus assuring that a majority of the total votes eligible to be cast by shareholders will be obtained.

Approval of the Sound Financial, Inc. 2008 Equity Incentive Plan also requires approval by a majority of the total votes actually cast by shareholders other than by Sound Community MHC, in person or by proxy, on the matter at the special meeting. Under this requirement, abstentions will have the same effect as a vote against the proposal; broker non-votes and a shareholder’s failure to vote will have no effect on the vote.

How does the Board of Directors recommend I vote on the proposal?

Your Board of Directors recommends that you vote “FOR” approval of the Sound Financial, Inc. 2008 Equity Incentive Plan.

PROPOSAL I

APPROVAL OF SOUND FINANCIAL, INC.

2008 EQUITY INCENTIVE PLAN

Purpose

The purpose of the Sound Financial, Inc. 2008 Equity Incentive Plan, hereafter referred to as the “Incentive Plan,” is to promote the long-term success of Sound Financial and increase shareholder value by:

| | · | attracting and retaining key employees and directors; |

| | · | encouraging directors and key employees to focus on long-range objectives; and |

| | · | further linking the interests of directors, officers and employees directly to the interests of the shareholders. |

The Incentive Plan, if approved by shareholders, will provide Sound Financial with an additional tool to attract, motivate and retain the most qualified management and other personnel and link the interests of directors, officers and employees with the interests of shareholders. In furtherance of these objectives, our Board of Directors has adopted the Incentive Plan, subject to approval by the shareholders at this meeting.

The Incentive Plan will allow Sound Financial to grant or award stock options, stock appreciation rights, restricted stock and restricted stock units to directors, advisory directors, officers and other employees of Sound Financial or Sound Community Bank. The Incentive Plan will become effective as of the date it is approved by the shareholders.

A summary of the Incentive Plan is set forth below. This summary is, however, qualified by and subject to the more complete information set forth in the Incentive Plan, a copy of which is attached to this document as Appendix A. We believe the Incentive Plan complies with the requirements of the Office of Thrift Supervision, our primary federal banking regulator. The Office of Thrift Supervision does not endorse or approve the Incentive Plan in any manner.

If this plan is approved, and awards are granted under the plan, it may have a dilutive effect on Sound Financial’s shareholders and will impact Sound Financial’s net income and shareholders’ equity, although the actual results cannot be determined until the plan is implemented.

Administration of the Incentive Plan

The Incentive Plan is required to be administered by a committee of the Board of Directors of Sound Financial, consisting of at least two members, each of whom must be a “Non-Employee Director” and an “Outside Director,” as those terms are described in the Incentive Plan. The existing Compensation Committee of the Board of Directors meets these requirements and will be charged with the responsibility of administering the Incentive Plan (the “Compensation Committee”). The Compensation Committee will:

| | · | select persons to receive stock options, stock appreciation rights and restricted stock awards from among the eligible participants; |

| | · | determine the types of awards and the number of shares to be awarded to participants; |

| | · | set the terms, conditions and provisions of the stock options or stock appreciation rights and restricted stock awards consistent with the terms of the Incentive Plan; and |

| | · | establish rules for the administration of the Incentive Plan. |

The Compensation Committee has the power to interpret the Incentive Plan and to make all other determinations necessary or advisable for its administration.

In granting awards under the Incentive Plan, the Compensation Committee will consider, among other factors, the position and years of service of the individual, the value of the individual’s services to Sound Financial and its subsidiaries and the added responsibilities of these individuals as employees, directors and officers of a public company.

Number of Shares That May Be Awarded

The aggregate number of shares of Sound Financial common stock reserved and available for issuance under the Incentive Plan is 202,237, which represents 6.86% of the total outstanding shares. The fair market value of such shares is approximately $1.5 million, based on the closing price of the common stock of Sound Financial on September 30, 2008. Only shares actually issued to participants or retained or surrendered to satisfy tax withholding obligations for awards under the Incentive Plan count against this total number of shares available under the Incentive Plan. The 202,237 shares of Sound Financial common stock available under the Incentive Plan are subject to adjustment in the event of certain business reorganizations.

The Incentive Plan provides for the use of authorized but unissued shares or treasury shares to fund awards. Treasury shares are previously issued shares of Sound Financial common stock that are no longer outstanding as a result of having been repurchased or otherwise reacquired by the company. We intend to fund awards under the Incentive Plan with treasury shares to the extent available. To the extent we use authorized but unissued shares, rather than treasury shares, to fund awards under the plan, the awards will have the effect of diluting the holdings of persons who own our common stock. Assuming all awards under the Incentive Plan are awarded and exercised through the use of authorized but unissued common stock, current shareholders would be diluted by approximately 6.4%.

Under the Incentive Plan, the Compensation Committee may grant stock options and stock appreciation rights that, upon exercise, result in the issuance of 144,455 shares of Sound Financial common stock. This amount represents 4.90% of the amount of Sound Financial common stock currently outstanding. The Incentive Plan also provides that no person may be granted stock options and stock appreciation rights with respect to more than 36,113 shares of Sound Financial common stock. Under the Incentive Plan, the Compensation Committee may grant restricted stock and restricted stock units for an aggregate of 57,782 shares of Sound Financial common stock. This amount represents 1.96% of the amount of shares outstanding. The Incentive Plan also provides that no person may be granted restricted stock or restricted stock units for more than 14,445 shares of Sound Financial.

Eligibility to Receive Awards

The Compensation Committee may grant awards under the Incentive Plan to directors, advisory directors, officers and employees of Sound Financial and its subsidiaries. The Compensation Committee will select persons to receive awards among the eligible participants and determine the number of shares

for each award granted. There are approximately 93individuals who currently are eligible to receive awards under the Incentive Plan.

Terms and Conditions of Awards Under the Incentive Plan

Stock Options. The Compensation Committee may grant stock options to purchase shares of Sound Financial common stock at a price that is not less than the fair market value of the common stock on the date the option is granted. The fair market value is the closing sales price for the common stock (or closing bid, if no sales were reported) as reported on the Over-the-Counter Bulletin Board on the date of the grant.

Stock options may not be exercised later than 10 years after the grant date. Subject to the limitations imposed by the provisions of the Internal Revenue Code, certain of the options granted under the Incentive Plan to officers and employees may be designated as “incentive stock options.” Incentive stock options may not be exercised later than 10 years after the grant date. Options that are not designated and do not otherwise qualify as incentive stock options are referred to in this document as “non-qualified stock options.”

The Compensation Committee will determine the time or times at which a stock option may be exercised in whole or in part and the method or methods by which, and the forms in which, payment of the exercise price with respect to the stock option may be made. Except as described under “Acceleration of Vesting,” all stock options granted must vest over at least five years. Unless otherwise determined by the Compensation Committee or set forth in the written award agreement evidencing the grant of the stock option, upon termination of service of the participant for any reason other than for cause, all stock options then currently exercisable by the participant shall remain exercisable for one year for terminations due to death or disability and three months for other terminations, or until the expiration of the stock option by its terms if sooner.

Stock options granted and outstanding will require an expense accrual by Sound Financial each quarter based on the anticipated value of the options. This valuation is based on a number of factors, including the vesting period for the options, the exercise price and the fair market value of the common stock.

Stock Appreciation Rights. The Compensation Committee may grant stock appreciation rights, which give the recipient of the award the right to receive the excess of the market value of the shares represented by the stock appreciation rights on the date exercised over the exercise price. The exercise price may not be less than the fair market value of the common stock on the date the right is granted. Upon the exercise of a stock appreciation right, the holder will receive the amount due in shares of Sound Financial common stock. Stock appreciation rights may be related to stock options (“tandem stock appreciation rights”), in which case the exercise of one award will reduce to that extent the number of shares represented by the other award. Stock appreciation rights may not be exercised later than 10 years after the grant date.

Unless otherwise determined by the Compensation Committee or set forth in the written award agreement evidencing the grant of the stock appreciation right, upon termination of service of the participant for any reason other than for cause, all stock appreciation rights then currently exercisable by the participant shall remain exercisable for one year for terminations due to death or disability and three months for other terminations, or until the expiration of the stock appreciation right by its terms if sooner. The Compensation Committee will determine the time or times at which a stock appreciation right may be exercised in whole or in part; however, except as described under “Acceleration of Vesting,” all rights granted must vest over at least five years.

Stock appreciation rights will require an expense accrual by Sound Financial each year for the appreciation on the stock appreciation rights that it anticipates will be exercised. The amount of the accrual is dependent upon whether, and the extent to which, the stock appreciation rights are granted and the amount, if any, by which the market value of the stock appreciation rights exceeds the exercise price.

Restricted Stock Awards. The Compensation Committee is authorized to grant restricted stock, which are shares of Sound Financial common stock subject to forfeiture and limits on transfer until the shares vest, and restricted stock units, which are rights to receive shares of Sound Financial common stock subject to similar limits as on restricted stock.

The Compensation Committee will establish a restricted period of at least five years, subject to acceleration as described under “Acceleration of Vesting,” during which, or at the expiration of which, the restricted stock awards vest and shares of common stock awarded shall no longer be subject to forfeiture or restrictions on transfer.

During the vesting period the recipient of restricted stock will have all the rights of a shareholder, including the power to vote and the right to receive dividends with respect to those shares. No such rights apply to restricted stock units, until shares are issued for those units. Shares of restricted stock and restricted stock units generally may not be sold, assigned, transferred, pledged or otherwise encumbered by the participant during the restricted period.

The Compensation Committee has the right to determine any other terms and conditions, not inconsistent with the Incentive Plan, upon which a restricted stock award shall be granted.

Acceleration of Vesting

Upon a change in control of Sound Financial or upon the termination of the award recipients’ service due to death or disability, all unvested awards under the Incentive Plan vest as of the date of that change in control or termination.

Subject to compliance with applicable OTS regulations, the Compensation Committee also has the authority, in its discretion, to accelerate the time at which any or all of the restrictions will lapse with respect to any awards, or to remove any or all of such restrictions, whenever it may determine that this action is appropriate by reason of changes in applicable tax or other laws or other changes in circumstances occurring after the grant date.

Forfeiture of Awards

If the holder of an unvested award terminates service other than due to death, disability or a change in control, the unvested award will be forfeited by the holder. Upon any termination of service for cause, all stock options or stock appreciation rights not previously exercised shall be immediately forfeited by the holder.

Transferability of Awards

Stock options, stock appreciation rights and unvested restricted stock awards may be transferred upon the death of the holder to whom it was awarded, by will or the laws of inheritance. Stock options and stock appreciation rights may be transferred during the lifetime of the holder to whom it was awarded only pursuant to a qualified domestic relations order.

Amendment and Termination of the Incentive Plan

The Incentive Plan shall continue in effect for a term of 10 years, after which no further awards may be granted. The board of directors may at any time amend, suspend or terminate the Incentive Plan or any portion thereof, except to the extent shareholder approval is necessary or required for purposes of any applicable federal or state law or regulation or the rules of any stock exchange or automated quotation system on which our common stock may then be listed or quoted. Shareholder approval will generally be required with respect to an amendment to the Incentive Plan that will: (i) increase the aggregate number of securities that may be issued under the plan, except as specifically set forth under the plan; (ii) materially increase the benefits accruing to participants under the Incentive Plan; (iii) materially change the requirements as to eligibility for participation in the Incentive Plan; or (iv) change the class of persons eligible to participate in the Incentive Plan. No amendment, suspension or termination of the Incentive Plan, however, will impair the rights of any participant, without his or her consent, in any award already granted.

Federal Income Tax Consequences

Under current federal tax law, non-qualified stock options granted under the Incentive Plan will not result in any taxable income to the optionee at the time of grant or any tax deduction to Sound Financial. Upon the exercise of a non-qualified stock option, the excess of the market value of the shares acquired over their cost is taxable to the optionee as compensation income and is generally deductible by Sound Financial. The optionee’s tax basis for the shares is the market value of the shares at the time of exercise.

Neither the grant nor the exercise of an incentive stock option under the Incentive Plan will result in any federal tax consequences to either the optionee or Sound Financial, although the difference between the market price on the date of exercise and the exercise price is an item of adjustment included for purposes of calculating the optionee’s alternative minimum tax. Except as described below, at the time the optionee sells shares acquired pursuant to the exercise of an incentive stock option, the excess of the sale price over the exercise price will qualify as a long-term capital gain if the applicable holding period is satisfied. If the optionee disposes of the shares within two years of the date of grant or within one year of the date of exercise, an amount equal to the lesser of (i) the difference between the fair market value of the shares on the date of exercise and the exercise price, or (ii) the difference between the exercise price and the sale price will be taxed as ordinary income and Sound Financial will be entitled to a deduction in the same amount. The excess, if any, of the sale price over the sum of the exercise price and the amount taxed as ordinary income will qualify as long-term capital gain if the applicable holding period is satisfied. If the optionee exercises an incentive stock option more than three months after his or her termination of employment, he or she generally is deemed to have exercised a non-qualified stock option. The time frame in which to exercise an incentive stock option is extended in the event of the death or disability of the optionee.

The exercise of a stock appreciation right will result in the recognition of ordinary income by the recipient on the date of exercise in an amount of cash and/or the fair market value on that date of the shares acquired pursuant to the exercise. Sound Financial will be entitled to a corresponding deduction.

Recipients of shares granted under the Incentive Plan will recognize ordinary income on the date that the shares are no longer subject to a substantial risk of forfeiture, in an amount equal to the fair market value of the shares on that date. In certain circumstances, a holder may elect to recognize ordinary income and determine the fair market value on the date of the grant of the restricted stock. Recipients of shares granted under the Incentive Plan will also recognize ordinary income equal to their dividend or dividend equivalent payments when these payments are received.

Proposed Awards Under the Incentive Plan

No awards have been proposed by the Board of Directors as of the date of this proxy statement.

Vote Required for Approval

Approval of the Incentive Plan requires the affirmative vote of (i) a majority of the shares eligible to be cast, in person or by proxy, on the matter at the special meeting, and (ii) a majority of the shares actually cast, in person or by proxy, on the matter, other than the votes cast by Sound Community MHC. Sound Community MHC, which owns 55% of Sound Financial’s outstanding common stock, intends to vote its shares in favor of the Incentive Plan.

Your Board of Directors recommends that you vote “FOR” this proposal.

STOCK OWNERSHIP

Stock Ownership of Significant Shareholders, Directors and Executive Officers

The following table shows, as of September 30, 2008, the voting record date, the beneficial ownership of the Company’s common stock by: (1) any persons or entities known by management to beneficially own more than 5% of the outstanding shares of the Company’s common stock; (2) each director and director nominee of the Company; (3) each executive officer of the Company named in the 2007 Summary Compensation Table appearing below; and (4) all of the directors and executive officers of Sound Financial as a group. Beneficial ownership is determined in accordance with the rules of the SEC. The address of each of the beneficial owners, except where otherwise indicated, is the Company’s address. As of September 30, 2008, there were 2,948,063 shares of Company common stock issued and outstanding.

| Name of Beneficial Owner | | Number of Shares Beneficially Owned(1) | | Percent of Common Stock Outstanding |

| Significant Shareholders | | | | | | |

| | Sound Community MHC(2) | | | 1,621,435 | | | 55.00% |

| | | | | | | |

| Directors and Executive Officers | | | | | | |

| | Tyler K. Myers, Director and Chairman of the Board | | | 25,000 | (3) | | 0.85% |

| | David S. Haddad, Jr., Director and Vice Chairman of the Board | | | 15,000 | (4) | | 0.51% |

| | Laura Lee Stewart, President, Chief Executive Officer and Director | | | 24,934 | (5) | | 0.85% |

| | Robert F. Carney, Director | | | 6,000 | (6) | | 0.20% |

| | Debra Jones, Director | | | 5,000 | | | 0.17% |

| | Milton L. McMullen, Director | | | 7,500 | (7) | | 0.25% |

| | Rogelio Riojas, Director | | | 20,000 | | | 0.68% |

| | James E. Sweeney, Director | | | 10,100 | (8) | | 0.34% |

| | Matthew P. Deines, Executive Vice President and Chief Financial Officer | | | 16,085 | (9) | | 0.55% |

| | Marlene L. Price, Senior Vice President and Lending Manager | | | 5,079 | (10) | | 0.17% |

| | Directors and executive officers of Sound Financial as a group (12 persons) | | | 149,626 | | | 5.08% |

(Footnotes begin on following page.)

____________________

(1) | Except as otherwise noted in these footnotes, the nature of beneficial ownership for shares reported in this table is sole voting and investment power. |

(2) | Sound Community MHC is a federally chartered mutual holding company, the principal business of which is to hold at least a majority of the outstanding shares of Sound Financial. It filed a Schedule 13D beneficial ownership report with the SEC on January 8, 2008. The executive officers and directors of Sound Community MHC also are shareholders and executive officers and/or directors of Sound Financial. |

(3) | Includes 2,294 shares held in Mr. Myers’ IRA, 17,706 shares in his 401(k) account and 5,000 in a partnership, in which he is a partner. |

(4) | Shares are held in Mr. Haddad’s IRA. |

. (5) | Includes 14,934 shares in Ms. Stewart’s 401(k) account and 10,000 shares owned by her business partner. |

(6) | Includes 5,000 shares held in Mr. Carney’s IRA. |

(7) | Shares are held in a family trust. |

(8) | Includes 10,000 shares held in Mr. Sweeney’s IRA and 100 shares held by his children. |

(9) | Includes 10,885 held in Mr. Deines’ 401(k) account and 200 shares in UTMA accounts for his sons, of which he is trustee. |

(10) | Shares are held in Ms. Price’s 401(k) account. |

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Director Compensation

Directors of the Bank (excluding Laura Lee Stewart, the President and Chief Executive Officer of the Bank, who receives no separate compensation for her service as a director) receive compensation for their service on the board of directors of the Bank. They receive no separate compensation for their service on the board of directors of Sound Financial. This director compensation is used to attract and retain qualified persons to serve as non-employee directors. In setting their compensation, the board of directors considers the significant amount of time and level of skill required for director service. The types and levels of director compensation are reviewed specially by the Compensation Committee, which makes recommendations for approval by the Board of Directors. For the year ended December 31, 2007, this compensation consisted of fees of $12,000 for the year, paid monthly, plus $825 for each board meeting attended, for a maximum of $21,900. The directors are not paid additional fees for service on various board committees.

The following table provides compensation information for each non-employee member of the board of directors of the Bank during the year ended December 31, 2007.

| | Fees Earned or Paid in Cash | | | | |

| Tyler K. Myers | | $ | 21,900 | | | $ | 21,900 | |

| David S. Haddad, Jr. | | | 21,075 | | | | 21,075 | |

| Robert F. Carney | | | 21,900 | | | | 21,900 | |

| Debra Jones | | | 21,900 | | | | 21,900 | |

| Milton L. McMullen | | | 21,900 | | | | 21,900 | |

| Rogelio Riojas | | | 21,900 | | | | 21,900 | |

| James E. Sweeney | | | 21,900 | | | | 21,900 | |

Directors are provided or reimbursed for travel and lodging and other customary out-of-pocket expenses incurred in attending out-of-town board and committee meetings, industry conferences and continuing education seminars up to $3,500 per year, per director. Any incremental spousal costs in connection with those meetings, conferences and seminars are paid for by the directors personally. The Bank also pays the premiums on directors’ and officers’ liability insurance.

Executive Compensation

The following table sets forth a summary of certain information concerning the compensation paid by the Bank for services rendered in all capacities during the years ended December 31, 2007 and 2006, to the President and Chief Executive Officer of the Bank and the two other highest compensated executive officers of the Bank, whose total compensation for 2007 exceeded $100,000. We will use the term “named executive officers” in this proxy statement to refer to the persons listed in this table.

2007 Summary Compensation Table

Name and Principal Position | | | | | | Non-Equity Incentive Plan Compensation(1) | | | | | | | |

| | | | | | | | | | | | | | |

| LAURA LEE STEWART | 2007 | | | $255,000 | | | | $45,686 | | | | $55,408 | | | | $356,094 | |

President, Chief Executive Officer and Director | 2006 | | | $233,939 | | | | $73,762 | | | | $19,508 | | | | $327,209 | |

| | | | | | | | | | | | | | | | | | |

| MATTHEW P. DEINES | 2007 | | | $127,680 | | | | $19,304 | | | | $21,451 | | | | $168,435 | |

Executive Vice President and Chief Financial Officer | 2006 | | | $114,148 | | | | $37,507 | | | | $21,432 | | | | $173,087 | |

| | | | | | | | | | | | | | | | | | |

| MARLENE L. PRICE | 2007 | | | $108,268 | | | | $24,385 | | | | $25,966 | | | | $158,619 | |

Senior Vice President and

Lending Manager | 2006 | | | $101,019 | | | | $26,817 | | | | $16,753 | | | | $144,589 | |

_____________________

| (1) | The following table reflects amounts earned by each of the named executive officers under our non-equity incentive plans during the year ended December 31, 2007, as follows: |

| Named Executive Officer | | Annual Bonus Plan | | Quarterly

Bonus Plan | | Deferred Bonus Plan | | Total |

| | | | | | | | | |

| Laura Lee Stewart | | $31,293 | | --- | | $14,393 | | $45,686 |

| Matthew P. Deines | | $15,537 | | --- | | $ 3,767 | | $19,304 |

| Marlene L. Price | | $ 4,827 | | $17,163 | | $ 2,395 | | $24,385 |

______________________

| (2) | The amounts included in this column for the year ended December 31, 2007, consist of the following: |

Named Executive Officer | | 401(k) Contribution | | Payment for Accrued Vacation(a) | | Payment for Executive Medical Benefits | | Premium for Bank-Owned Life Insurance | | Matching Charitable Contribution | | Total |

| | | | | | | | | | | | | |

| Laura Lee Stewart | | $6,861 | | $37,493 | | $2,849 | | $4,205(b) | | $4,000(c) | | $55,408 |

| Matthew P. Deines | | $6,871 | | $ 8,839 | | $5,741 | | --- | | --- | | $21,451 |

| Marlene L. Price | | $5,570 | | $16,039 | | $4,357 | | --- | | --- | | $25,966 |

___________________________

| | (a) | The Bank has a policy that all vacation earned and not used by an employee during the year be paid to the employee in cash. |

| | (b) | This reflects the premium the Bank paid in 2007 for bank-owned life insurance to help fund a supplemental executive retirement plan for Ms. Stewart, which provides for payment of accrued amounts upon her death or disability prior to retirement age. See “Supplemental Executive Retirement.” |

| | (c) | The Bank has a policy to match up to $4,000 in charitable contributions made by Ms. Stewart to charities of her choice that are tax-exempt organizations under Section 501(c)(3) of the Internal Revenue Code of 1986, as amended. |

Employment Agreements

The Bank has entered into an employment agreement with Ms. Stewart, which has a three-year term with continuing special one-year extensions, subject to approval by the board of directors. The effective date of this agreement was January 1, 2007. Ms. Stewart’s base salary in 2008 is $269,025. The amount of her special base salary is reviewed by the Compensation Committee each year. The employment agreement provides for no salary reductions; participation in any stock-based compensation plans; supplemental executive retirement plan approved by the board of directors; and participation in any other retirement plans, group insurance and other benefits provided to full time Bank employees generally and in which executive officers participate. Ms. Stewart also is entitled to expense reimbursement, and professional and educational dues and expenses for programs related to the Bank’s operations, including travel costs.

Under the employment agreement, if Ms. Stewart’s employment is terminated for any reason other than cause, death, retirement, or disability, or if she resigns following certain events such as relocation or demotion, she will be entitled to her salary for the remaining term of the agreement and continued eligibility under the health benefit programs for executive officers. The employment agreement includes an agreement not to compete with the Bank and the Company in the delivery of financial services for a period of 18 months following termination of employment. The value of compensation and benefits payable under the agreement is capped so as to prevent imposition of the golden parachute tax under Section 280G of the Internal Revenue Code. Assuming Ms. Stewart’s employment had been involuntarily terminated as of December 31, 2007, exclusive of any required cutback under Section 280G of the Internal Revenue Code, Ms. Stewart would have been entitled to receive $21,250 per month and continued group health and insurance benefits over the next two years, which was the remaining term of her employment agreement at that date.

Cash Bonus Plans

We maintain three non-equity incentive cash bonus plans, a special incentive bonus plan (“Annual Bonus Plan”), a quarterly incentive bonus plan (“Quarterly Bonus Plan”) and a deferred compensation bonus plan (“Deferred Bonus Plan”).

The Annual Bonus Plan provides for special cash bonuses to designated senior managers, including all the named executive officers, upon the achievement of pre-established performance goals established by the board of directors. Under the Annual Bonus Plan, prior to the earnings override discussed below, Ms. Stewart, Mr. Deines and Ms. Price are entitled to receive a maximum bonus of up to 33%, 33% and 6%, respectively, of their base salary, depending on how actual performance compares with quantitative and qualitative goals established by the Compensation Committee. The performance goals under the Annual Bonus Plan are the same for all participants and are based on overall corporate performance. The quantitative goals include performance factors relating to asset size, capital level, delinquency ratio, return on assets and equity, levels of non-interest income and non-interest expense, net interest margin, charge-offs and the size of the loan portfolio. The qualitative goals are non-financial corporate goals that require leadership of senior management and are ranked based on their relative importance to our operations. Participants earn credits for the quantitative factors, based on the level of importance assigned to each factor and the actual level of performance compared to the targeted goals set for each factor. Participants also earn credits for accomplishing the qualitative goals established by the Committee. Ms. Stewart’s bonus is based 50% on meeting qualitative goals and 50% on meeting quantitative goals, while Mr. Deines’ and Ms. Price’s bonuses are based 40% on meeting qualitative goals and 60% on meeting quantitative goals. Each individual’s bonus level based on meeting the qualitative and quantitative goals is subject to an earnings override. The board of directors establishes a target net earnings level. To the extent actual net earnings is below or above that target, the bonus level may be decreased or increased by up to 50%. With a possible 50% increase from the earnings override, Ms. Stewart’s, Mr. Deines’ and Ms. Price’s maximum bonus under this plan is increased to 49.5%, 49.5% and 9%, respectively, of their base salary. For the year ended December 31, 2007, Ms. Stewart, Mr. Deines

and Ms. Price earned, respectively, 74.4%, 73.8% and 73.8% of the bonus credits available under their plan for the year. As a result of these earned bonus credits, Ms. Stewart, Mr. Deines and Ms. Price received bonuses of 24.5%, 24.3% and 4.4% of base salary, which were decreased by 50% as a result of the earnings override, resulting in final bonuses of 12.3%, 12.1% and 2.2% of base salary.

The Quarterly Bonus Plan is a quarterly, non-equity incentive plan for officers and employees. Ms. Price is the only named executive officer that participates in this plan. The goals under the Quarterly Bonus Plan for Ms. Price, which are set by the President and Chief Executive Officer, are sales incentives for residential and consumer loan production for her performance individually and the performance of her department managers. Sales incentives include levels of loan originations by her and managers reporting to her, the number of saleable loans in the portfolio and the volume of the mortgage servicing portfolio. The determination of the level of bonus is the result of her and her team’s performance under these goals. The bonus earned under the Quarterly Bonus Plan is subject to the same earnings override as the Annual Bonus Plan. For the year ended December 31, 2007, Ms. Price’s quarterly bonuses totaled 15.9% of her base salary.

In 2007, Mr. Deines and Ms. Price participated in the Deferred Bonus Plan. The amount of deferred bonus earned each year is based on the same performance goals, multiples and earnings override used in the Annual Cash Bonus Plan, except that Mr. Deines and Ms. Price were eligible to receive, respectively, up to 8% and 6% of their base salary, prior to the earnings override and up to 12% and 9% based on the maximum increase from the earnings override. The deferred account balance for each participant earns interest at our one-year time deposit rate. Payments begin at the later of the participant reaching age 65 or experiencing a separation of service from the Bank, and they are paid out in equal monthly installments over 10 years. Earlier payout is provided for in case of death or disability. Each participant is an unsecured creditor of the Bank until all deferred funds are distributed. For the year ended December 31, 2007, Mr. Deines and Ms. Price each earned 73.8% of the bonus credits available under their plan for the year. As a result of these earned bonus credits, Mr. Deines and Ms. Price received bonuses of 6.0% and 4.6%, which were decreased by 50% as a result of the earnings override, resulting in final bonuses of 3.0% and 2.2% of base salary.

Supplemental Executive Retirement

Effective in 2007, the board of directors adopted a supplemental executive retirement plan (“SERP”) for Ms. Stewart to provide her with additional retirement income of $121,307 per year from age 66, for the rest of her life. These payments are subject to a non-compete clause for the first 24 months after retirement. The SERP is an unfunded, non-contributory defined benefit plan evidenced by an Executive Long Term Compensation Agreement between Ms. Stewart and the Bank. Under GAAP, we are required to accrue an amount towards this obligation every year. There was no SERP accrual for Ms. Stewart in 2006. A SERP accrual of $94,706 was recorded for the year ended December 31, 2007. If Ms. Stewart voluntarily leaves the Bank before age 66, she receives no benefit under the SERP. The SERP provides for earlier payments in the event of death or disability. In the event of an involuntary termination of Ms. Stewart without cause or a change in control of the Bank, Ms. Stewart is entitled immediately to the accrued liability under the SERP (with any applicable cutback for payments after a change in control as required by Section 280G of the Internal Revenue Code). The cost of the benefits payable to Ms. Stewart under the SERP is expected to be offset by the earnings on bank-owned life insurance purchased by the Bank. Ms. Stewart has no direct interest in these insurance policies and is a general unsecured creditor with respect to payments owed under the SERP.

Other Benefits

We maintain an employee stock ownership plan for employees of Sound Financial and the Bank that beneficially owns 115,560 shares of common stock or 3.9% of the shares Sound Financial common stock outstanding. The employee stock ownership plan used funds borrowed from Sound Financial to

purchase the shares. Shares purchased by the employee stock ownership plan with the proceeds of that loan are held in a suspense account and released to participants’ accounts as debt service payments are made. Shares released from the employee stock ownership plan are allocated to each eligible participant’s employee stock ownership plan account based on the ratio of each such participant’s eligible compensation to the total eligible compensation of all eligible employee stock ownership plan participants. Benefits are payable upon retirement or other separation from service, or upon termination of the plan.

Medical premiums for senior managers, including all named executive officers, are 100% paid by the Bank. In addition, these individuals receive $1,000 a year to cover co-payments and other uncovered medical expenses under the comprehensive medical plan.

We offer a qualified, tax-exempt retirement plan to our employees with a cash or deferred feature qualifying under Section 401(k) of the Code (the “401(k) Plan”). During 2007, we matched each 401(k) contribution (other than catch-up contributions) in an amount equal to 50% of the participant’s 401(k) deferrals for the year up to 7% of their salary. In addition, all employees, including executive officers, received a special 401(k) contribution of 1% of their salary in 2007. We also have the ability to make a discretionary profit sharing contribution under the 401(k) Plan, though no such contribution was made in 2007. The last profit sharing contribution to the 401(k) plan was made in 2004.

ADDITIONAL INFORMATION

Proxy Solicitation Costs

The Company will pay the costs of soliciting proxies. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of the Company’s common stock. In addition to this mailing, our directors, officers and employees may solicit proxies personally, electronically or by telephone, without additional compensation. We have also retained Regan & Associates, Inc. to solicit proxies for the special meeting for a fee, including expenses, of $8,000.

Shareholder Proposals for 2009 Annual Meeting

In order to be eligible for inclusion in Sound Financial’s proxy materials for next year’s annual meeting of shareholders, any shareholder proposal to take action at such meeting must be received in writing at Sound Financial’s main office at 2005 5th Avenue, Suite 200, Seattle, Washington 98121, no later than December 22, 2008. Any such proposals shall be subject to the requirements of the proxy rules adopted under the Securities and Exchange Act of 1934, as amended.

If a shareholder proposal does not meet the above requirements for inclusion in the Corporation’s proxy materials, it may still be considered for presentation at the 2009 annual meeting, if it is received in writing at the Corporation’s main office no later than five days before the date of the meeting. The persons named in the enclosed form of proxy will have the discretion to vote on any such submitted proposal in accordance with their best judgment.

OTHER MATTERS

We are not aware of any business to come before the special meeting other than those matters described in this proxy statement. However, if any other matter should properly come before the meeting, it is intended that holders of the proxies will act in accordance with their best judgment.

APPENDIX A

SOUND FINANCIAL, INC.

2008 EQUITY INCENTIVE PLAN

TABLE OF CONTENTS

| | PAGE |

| ARTICLE I PURPOSE | 1 |

| | |

| | Section 1.1 | General Purpose of the Plan. | 1 |

| | | | |

| ARTICLE II DEFINITIONS | 1 |

| | |

| ARTICLE III AVAILABLE SHARES | 4 |

| | |

| | Section 3.1 | Shares Available Under the Plan. | 4 |

| | Section 3.2 | Shares Available for Options and Stock Appreciation Rights. | 4 |

| | Section 3.3 | Shares Available for Restricted Stock Awards. | 4 |

| | Section 3.4 | Additional OTS Restrictions. | 4 |

| | Section 3.5 | Computation of Shares Issued. | 5 |

| | | | |

| ARTICLE IV ADMINISTRATION | 5 |

| | |

| | Section 4.1 | Committee. | 5 |

| | Section 4.2 | Committee Powers. | 5 |

| | | | |

| ARTICLE V STOCK OPTIONS | 6 |

| | |

| | Section 5.1 | Grant of Options. | 6 |

| | Section 5.2 | Size of Option. | 6 |

| | Section 5.3 | Exercise Price. | 6 |

| | Section 5.4 | Exercise Period. | 6 |

| | Section 5.5 | Vesting Date. | 7 |

| | Section 5.6 | Additional Restrictions on Incentive Stock Options. | 7 |

| | Section 5.7 | Method of Exercise. | 7 |

| | Section 5.8 | Limitations on Options. | 8 |

| | Section 5.9 | Prohibition Against Option Repricing. | 9 |

| | | | |

| ARTICLE VI STOCK APPRECIATION RIGHTS | 9 |

| | |

| | Section 6.1 | Grant of Stock Appreciation Rights. | 9 |

| | Section 6.2 | Size of Stock Appreciation Right. | 9 |

| | Section 6.3 | Exercise Price. | 9 |

| | Section 6.4 | Exercise Period. | 10 |

| | Section 6.5 | Vesting Date. | 10 |

| | Section 6.6 | Method of Exercise. | 10 |

| | Section 6.7 | Limitations on Stock Appreciation Rights. | 11 |

| | Section 6.8 | Prohibition Against Stock Appreciation Right Repricing. | 11 |

| | | | |

| ARTICLE VII RESTRICTED STOCK AWARDS | 12 |

| | |

| | Section 7.1 | In General. | 12 |

| | Section 7.2 | Vesting Date. | 12 |

| | Section 7.3 | Dividend Rights. | 13 |

| | Section 7.4 | Voting Rights. | 13 |

| | Section 7.5 | Designation of Beneficiary. | 13 |

| | Section 7.6 | Manner of Distribution of Awards. | 13 |

| | | | |

| ARTICLE VIII SPECIAL TAX PROVISION | 13 |

| | |

| | Section 8.1 | Tax Withholding Rights. | 13 |

| | | | |

| ARTICLE IX AMENDMENT AND TERMINATION | 14 |

| | |

| | Section 9.1 | Termination | 14 |

| | Section 9.2 | Amendment. | 14 |

| | Section 9.3 | Adjustments in the Event of Business Reorganization. | 14 |

| | | | |

| ARTICLE X MISCELLANEOUS | 14 |

| | |

| | Section 10.1 | Status as an Employee Benefit Plan. | 14 |

| | Section 10.2 | No Right to Continued Employment. | 15 |

| | Section 10.3 | Construction of Language. | 15 |

| | Section 10.4 | Governing Law. | 15 |

| | Section 10.5 | Headings. | 15 |

| | Section 10.6 | Non-Alienation of Benefits. | 15 |

| | Section 10.7 | Notices. | 15 |

| | Section 10.8 | Approval of Shareholders. | 15 |

SOUND FINANCIAL, INC.

2008 EQUITY INCENTIVE PLAN

ARTICLE I

PURPOSE

Section 1.1 General Purpose of the Plan.

The purpose of the Plan is to promote the long-term growth and profitability of Sound Financial, Inc., to provide directors, advisory directors, officers and employees of Sound Financial, Inc. and its affiliates with an incentive to achieve corporate objectives, to attract and retain individuals of outstanding competence and to provide such individuals with an equity interest in Sound Financial, Inc.

ARTICLE II

DEFINITIONS

The following definitions shall apply for the purposes of this Plan, unless a different meaning is plainly indicated by the context:

Affiliate means any "parent corporation" or "subsidiary corporation" of the Company, as those terms are defined in Section 424(e) and (f) respectively, of the Code.

Award means the grant by the Committee of an Incentive Stock Option, a Non-Qualified Stock Option, a Stock Appreciation Right, a Restricted Stock Award or any other benefit under this Plan.

Award Agreement means a written instrument evidencing an Award under the Plan and establishing the terms and conditions thereof.

Beneficiary means the Person designated by a Participant to receive any Shares subject to a Restricted Stock Award made to such Participant that become distributable, or to have the right to exercise any Options or Stock Appreciation Rights granted to such Participant that are exercisable, following the Participant's death.

Board means the Board of Directors of Sound Financial, Inc. and any successor thereto.

Change in Control means any of the following events:

(a) any third person, including a "group" as defined in Section 13(d)(3) of the Securities Exchange Act of 1934, becomes the beneficial owner of shares of the Company with respect to which 25% or more of the total number of votes for the election of the Board may be cast;

(b) as a result of, or in connection with, any cash tender offer, merger or other business combination, sale of assets or contested election, or combination of the foregoing, the persons who were directors of the Company shall cease to constitute a majority of the Board;

(c) the stockholders of the Company approve an agreement providing either for a transaction in which the Company will cease to be an independent publicly owned corporation or for a sale or other disposition of all or substantially all the assets of the Company; or

(d) a tender offer or exchange offer for 25% or more of the total outstanding Shares of the Company is commenced (other than such an offer by the Company).

Code means the Internal Revenue Code of 1986, as amended from time to time.

Committee means the Committee described in Article IV.

Company means Sound Financial, Inc., a Federal corporation, and any successor thereto.

Disability means a condition of incapacity of a Participant which renders that person unable to engage in the performance of his or her duties by reason of any medically determinable physical or mental impairment which can be expected to result in death or which has lasted or can be expected to last for a continuous period of not less than twelve (12) months. Notwithstanding the above, the term Disability in connection with Incentive Stock Options shall have the meaning specified in Section 22(e)(3) of the Code.

Effective Date means the date on which the Plan is approved by the stockholders of Sound Financial, Inc.

Exchange Act means the Securities Exchange Act of 1934, as amended.

Exercise Period means the period during which an Option or Stock Appreciation Right may be exercised.

Exercise Price means the price per Share at which Shares subject to an Option may be purchased upon exercise of the Option and on the basis of which the Shares due upon exercise of a Stock Appreciation Right is computed.

Fair Market Value means, with respect to a Share on a specified date:

(a) If the Shares are listed on any established stock exchange, the closing sales price for such stock (or the closing bid, if no sales were reported) as quoted on the Composite Tape or other comparable reporting system for the exchange on the applicable date, or if the applicable date is not a trading day, on the trading day immediately preceding the applicable date;

(b) If the Shares are not traded on a national securities exchange but are traded on the over-the-counter market, if sales prices are not regularly reported for the Shares for the trading day referred to in clause (a), and if bid and asked prices for the Shares are regularly reported, the mean between the bid and the asked price for the Shares at the close of trading in the over-the-counter market on the applicable date, or if the applicable date is not a trading day, on the trading day immediately preceding the applicable date; and

(c) In the absence of such markets for the Shares, the Fair Market Value shall be determined in good faith by the Committee.

Family Member means with respect to any Participant:

(a) the lineal ascendants and lineal descendants of such Participant or his spouse, or any one or more of them, or

(b) an entity wholly owned by, including, but not limited to, a trust the exclusive beneficiaries of which are, one or more of the lineal ascendants or lineal descendants of such Participant or his spouse, or wholly owned jointly by one or more of them and the Participant.

Incentive Stock Option means a right to purchase Shares that is granted to an employee of the Company or any Affiliate that is designated by the Committee to be an Incentive Stock Option and that is intended to satisfy the requirements of Section 422 of the Code.

Non-Qualified Stock Option means a right to purchase Shares that is not intended to qualify as an Incentive Stock Option or does not satisfy the requirements of Section 422 of the Code.

Option means either an Incentive Stock Option or a Non-Qualified Stock Option.

Option Holder means, at any relevant time with respect to an Option, the person having the right to exercise the Option.

Participant means any director, advisory director, officer or employee of the Company or any Affiliate who is selected by the Committee to receive an Award.

Permitted Transferee means, with respect to any Participant, a Family Member of the Participant to whom an Award has been transferred as permitted hereunder.

Person means an individual, a corporation, a partnership, a limited liability company, an association, a joint-stock company, a trust, an estate, an unincorporated organization and any other business organization or institution.

Plan means the Sound Financial, Inc. 2008 Equity Incentive Plan, as amended from time to time.

Qualified Domestic Relations Order means a Domestic Relations Order that:

(a) clearly specifies:

(i) The name and last known mailing address of the Option Holder and of each person given rights under such Domestic Relations Order;

(ii) the amount or percentage of the Option Holder's benefits under this Plan to be paid to each person covered by such Domestic Relations Order;

(iii) the number of payments or the period to which such Domestic Relations Order applies; and

(iv) the name of this Plan; and

(b) does not require the payment of a benefit in a form or amount that is:

(i) not otherwise provided for under the Plan; or

(ii) inconsistent with a previous Qualified Domestic Relations Order.

For the purposes of this Plan, a "Domestic Relations Order" means a judgment, decree or order, including the approval of a property settlement that is made pursuant to a state domestic relations or community property law and relates to the provision of child support, alimony payments or marital property rights to a spouse, child or other dependent of a Participant.

Restricted Stock Award means an award of Shares or Share Units pursuant to Article VII.

Service means, unless the Committee provides otherwise in an Award Agreement, service in any capacity as a director, advisory director, officer or employee of the Company or any Affiliate.

Share means a share of common stock, par value $.01 per share, of Sound Financial, Inc.

Share Unit means the right to receive a Share at a specified future date.

Stock Appreciation Right means the right to receive a payment in Shares measured by the increase in the Fair Market Value of a Share over the Exercise Price of that Stock Appreciation Right.

Stock Appreciation Right Holder means, at any relevant time with respect to a Stock Appreciation Right, the person having the right to exercise the Stock Appreciation Right.

Termination for Cause means termination upon an intentional failure to perform stated duties, a breach of a fiduciary duty involving personal dishonesty which results in material loss to the Company or one of its Affiliates or a willful violation of any law, rule or regulation (other than traffic violations or similar offenses) or a final cease-and-desist order which results in material loss to the Company or one of its Affiliates. Notwithstanding the above, if a Participant is subject to a different definition of termination for cause in an employment or severance or similar agreement with the Company or any Affiliate, such other definition shall control.

Vesting Date means the date or dates on which the grant of an Option or Stock Appreciation Right is eligible to be exercised or the date or dates on which a Restricted Stock Award ceases to be forfeitable.

ARTICLE III

AVAILABLE SHARES

Section 3.1 Shares Available Under the Plan.

Subject to adjustment under Article IX, the maximum aggregate number of Shares representing Awards shall not exceed 202,237 Shares. Shares representing tandem Stock Appreciation Rights shall for such purpose only be counted as either Shares representing Options outstanding or Stock Appreciation Rights outstanding, but not as both.

Section 3.2 Shares Available for Options and Stock Appreciation Rights.

Subject to adjustment under Article IX and the limitations under Section 3.4 below, the maximum aggregate number of Shares which may be issued upon exercise of Options and Stock Appreciation Rights shall be 144,455 Shares, and the maximum aggregate number of Shares which may be issued upon exercise of Options and Stock Appreciation Rights to any one individual in any calendar year shall be 36,113 Shares.

Section 3.3 Shares Available for Restricted Stock Awards.

Subject to adjustment under Article IX and the limitations under Section 3.4 below, the maximum number of Shares which may be issued upon award or vesting of Restricted Stock Awards under the Plan shall be 57,782 Shares and the maximum aggregate number of Shares which may be issued upon award or vesting of Restricted Stock Awards to any one individual in any calendar year shall be 14,445.

Section 3.4 Additional OTS Restrictions.

As long as the Plan is subject to OTS regulations as applicable on the Effective Date, subject to adjustment under Article IX, the following additional restrictions shall apply:

(a) No Participant shall receive Options and Stock Appreciation Rights with respect to more than 36,113 Shares.

(b) No Participant shall receive Restricted Stock Awards with respect to more than 14,445 Shares.

(c) No director or advisory director who is not also an employee of the Company or its Affiliates shall receive Options and Stock Appreciation Rights with respect to more than 7,222 Shares, and all such directors and advisory directors as a group shall not receive Options and Stock Appreciation Rights with respect to more than 43,336 Shares.

(d) No director or advisory director who is not also an employee of the Company or its Affiliates shall receive Restricted Stock Awards with respect to more than 2,889 Shares, and all such directors and advisory directors as a group shall not receive Restricted Stock Awards with respect to more than 17,334 Shares.

(e) No Award may vest beginning earlier than one year from the Effective Date of the Plan and all Awards shall vest in annual installments of not more than 20% of the total Award.

(f) The Vesting Date of an Award may only be accelerated in the event of death, disability or a Change in Control.

(g) Directors and executive officers of the Company must exercise or forfeit their Options and SAR Awards in the event Sound Community Bank, the Company’s wholly-owned operating

subsidiary, becomes critically undercapitalized (as defined in 12 C.F.R. Part 565.4), is subject to OTS enforcement action, or receives a capital directive under 12 C.F.R. Part 565.7.

Section 3.5 Computation of Shares Issued.

For purposes of this Article III, Shares shall be considered issued pursuant to the Plan only if actually issued upon the exercise of an Option or Stock Appreciation Right or in connection with a Restricted Stock Award. Any Award subsequently forfeited, in whole or in part, shall not be considered issued.

ARTICLE IV

ADMINISTRATION

Section 4.1 Committee.

(a) The Plan shall be administered by a Committee appointed by the Board for that purpose and consisting of not less than two (2) members of the Board. Each member of the Committee shall be an "Outside Director" within the meaning of Section 162(m) of the Code or a successor rule or regulation, a "Non-Employee Director" within the meaning of Rule 16b-3(b)(3)(i) under the Exchange Act or a successor rule or regulation and an "Independent Director" under the corporate governance rules and regulations imposing independence standards on committees performing similar functions promulgated by any national securities exchange or quotation system on which Shares are listed.

(b) The act of a majority of the members present at a meeting duly called and held shall be the act of the Committee. Any decision or determination reduced to writing and signed by all members shall be as fully effective as if made by unanimous vote at a meeting duly called and held.

(c) The Committee's decisions and determinations under the Plan need not be uniform and may be made selectively among Participants, whether or not such Participants are similarly situated.

Section 4.2 Committee Powers.

Subject to the terms and conditions of the Plan and such limitations as may be imposed by the Board, the Committee shall be responsible for the overall management and administration of the Plan and shall have such authority as shall be necessary or appropriate in order to carry out its responsibilities, including, without limitation, the authority:

(a) to interpret and construe the Plan, and to determine all questions that may arise under the Plan as to eligibility for participation in the Plan, the number of Shares subject to Awards to be issued or granted, and the terms and conditions thereof;

(b) with the consent of the Participant, to the extent deemed necessary by the Committee, amend or modify the terms of any outstanding Award or accelerate or defer the Vesting Date thereof;

(c) to adopt rules and regulations and to prescribe forms for the operation and administration of the Plan; and

(d) to take any other action not inconsistent with the provisions of the Plan that it may deem necessary or appropriate.

All decisions, determinations and other actions of the Committee made or taken in accordance with the terms of the Plan shall be final and conclusive and binding upon all parties having an interest therein.

ARTICLE V

STOCK OPTIONS

Section 5.1 Grant of Options.

(a) The Committee may, in its discretion, grant to a Participant an Option to purchase Shares, subject to the limitations of the Plan, including Section 3.4 above. An Option must be designated as either an Incentive Stock Option or a Non-Qualified Stock Option and, if not designated as either, shall be a Non-Qualified Stock Option. Only employees of the Company or its Affiliates may receive Incentive Stock Options.

(b) Any Option granted shall be evidenced by an Award Agreement which shall:

(i) specify the number of Shares covered by the Option;

(ii) specify the Exercise Price;

(iii) specify the Exercise Period;

(iv) specify the Vesting Date; and

(v) contain such other terms and conditions not inconsistent with the Plan as the Committee may, in its discretion, prescribe.

Section 5.2 Size of Option.

Subject to the restrictions of the Plan, the number of Shares as to which a Participant may be granted Options shall be determined by the Committee, in its discretion.

Section 5.3 Exercise Price.

The price per Share at which an Option may be exercised shall be determined by the Committee, in its discretion, provided, however, that the Exercise Price shall not be less than the Fair Market Value of a Share on the date on which the Option is granted.

Section 5.4 Exercise Period.

The Exercise Period during which an Option may be exercised shall commence on the Vesting Date. It shall expire on the earliest of:

(a) the date specified by the Committee in the Award Agreement;

(b) the last day of the three-month period commencing on the date of the Participant's termination of Service, other than on account of death, Disability or a Termination for Cause;

(c) the last day of the one-year period commencing on the date of the Participant's termination of Service due to death or Disability;

(d) as of the time and on the date of the Participant's termination of Service due to a Termination for Cause; or

(e) the last day of the ten-year period commencing on the date on which the Option was granted.

An Option that remains unexercised at the close of business on the last day of the Exercise Period shall be canceled without consideration at the close of business on that date.

Section 5.5 Vesting Date.

(a) The Vesting Date for each Option Award shall be determined by the Committee and specified in the Award Agreement.

(b) Unless otherwise determined by the Committee and specified in the Award Agreement:

(i) if the Participant of an Option Award terminates Service prior to the Vesting Date for any reason other than death or Disability, any unvested Option shall be forfeited without consideration;

(ii) if the Participant of an Option Award terminates Service prior to the Vesting Date on account of death or Disability, the Vesting Date shall be accelerated to the date of the Participant's termination of Service; and

(iii) if a Change in Control occurs prior to the Vesting Date of an Option Award that is outstanding on the date of the Change in Control, the Vesting Date shall be accelerated to the earliest date of the Change in Control.

Section 5.6 Additional Restrictions on Incentive Stock Options.

An Option designated by the Committee to be an Incentive Stock Option shall be subject to the following provisions:

(a) Notwithstanding any other provision of this Plan to the contrary, no Participant may receive an Incentive Stock Option under the Plan if such Participant, at the time the award is granted, owns (after application of the rules contained in Section 424(d) of the Code) stock possessing more than ten (10) percent of the total combined voting power of all classes of stock of the Company or its Affiliates, unless (i) the option price for such Incentive Stock Option is at least 110 percent of the Fair Market Value of the Shares subject to such Incentive Stock Option on the date of grant and (ii) such Option is not exercisable after the date five (5) years from the date such Incentive Stock Option is granted.

(b) Each Participant who receives Shares upon exercise of an Option that is an Incentive Stock Option shall give the Company prompt notice of any sale of Shares prior to a date which is two years from the date the Option was granted or one year from the date the Option was exercised. Such sale shall disqualify the Option as an Incentive Stock Option.

(c) The aggregate Fair Market Value (determined with respect to each Incentive Stock Option at the time such Incentive Stock Option is granted) of the Shares with respect to which Incentive Stock Options are exercisable for the first time by a Participant during any calendar year (under this Plan or any other plan of the Company or an Affiliate) shall not exceed $100,000.

(d) Any Option under this Plan which is designated by the Committee as an Incentive Stock Option but fails, for any reason, to meet the foregoing requirements shall be treated as a Non-Qualified Stock Option.

Section 5.7 Method of Exercise.

(a) Subject to the limitations of the Plan and the Award Agreement, an Option Holder may, at any time on or after the Vesting Date and during the Exercise Period, exercise his or her right to purchase all or any part of the Shares to which the Option relates; provided, however, that the minimum number of Shares which may be purchased at any time shall be 100, or, if less, the total number of Shares relating to the Option which remain un-purchased. An Option Holder shall exercise an Option to purchase Shares by:

(i) giving written notice to the Committee, in such form and manner as the Committee may prescribe, of his or her intent to exercise the Option;

(ii) delivering to the Committee full payment for the Shares as to which the Option is to be exercised; and

(iii) satisfying such other conditions as may be prescribed in the Award Agreement.

(b) The Exercise Price of Shares to be purchased upon exercise of any Option shall be paid in full:

(i) in cash (by certified or bank check or such other instrument as the Company may accept); or

(ii) if and to the extent permitted by the Committee, in the form of Shares already owned by the Option Holder having an aggregate Fair Market Value on the date the Option is exercised equal to the aggregate Exercise Price to be paid; or

(iii) by a combination thereof.