- CRMD Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

CorMedix (CRMD) DEF 14ADefinitive proxy

Filed: 30 Aug 22, 4:00pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

SCHEDULE 14A INFORMATION

____________________

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant | ☒ | |

Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material Pursuant to § 240.14a-12 |

CorMedix Inc.

(Name of Registrant as Specified In Its Charter)

_____________________________________________________________________

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required | |

☐ | Fee paid previously with preliminary materials. | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11 |

CORMEDIX INC.

300 Connell Drive, Suite 4200

Berkeley Heights, New Jersey 07922

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD OCTOBER 13, 2022

TO THE STOCKHOLDERS OF CORMEDIX INC.

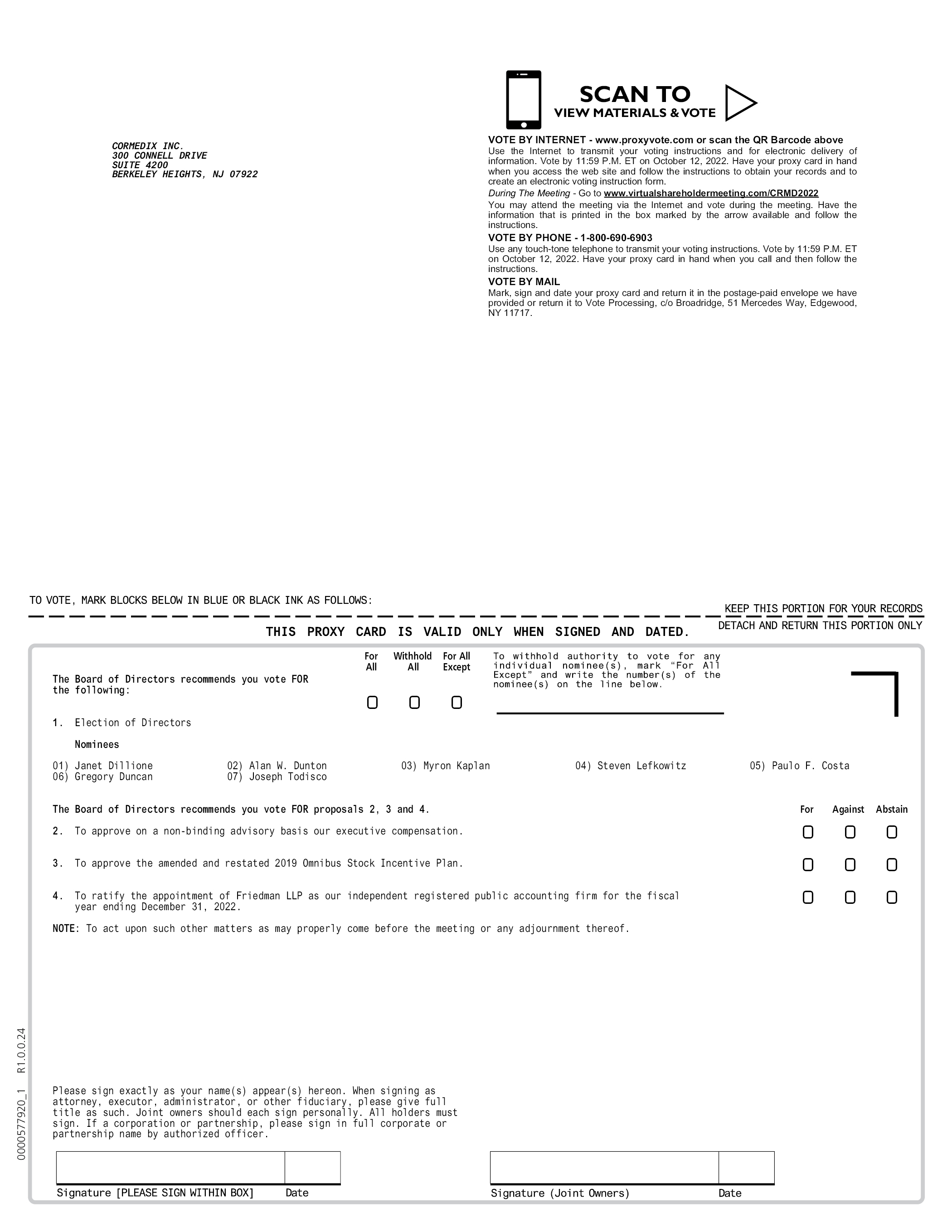

The Annual Meeting of Stockholders of CorMedix Inc. will be held on October 13, 2022, at 9:00 a.m. Eastern time. The 2022 Annual Meeting will be a virtual-only meeting conducted via live webcast, with no physical in-person meeting. You will be able to attend and participate in the Annual Meeting live via the Internet at www.virtualshareholdermeeting.com/CRMD2022. The 2022 Annual Meeting is being held for the following purposes:

1. To elect seven directors to serve until the 2023 Annual Meeting of Stockholders and until their successors are duly elected and qualified;

2. To approve on a non-binding advisory basis our executive compensation;

3. To approve the amended and restated 2019 Omnibus Stock Incentive Plan;

4. To ratify the appointment of Friedman LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022; and

5. To act upon such other matters as may properly come before the meeting or any adjournment thereof.

These matters are more fully described in the proxy statement accompanying this notice.

The Board has fixed the close of business on August 23, 2022 as the record date for the determination of stockholders entitled to notice of and to vote at the meeting or any adjournment thereof. A list of stockholders eligible to vote at the meeting will be available for review online during the Annual Meeting at www.virtualshareholdermeeting.com/CRMD2022.

This year, the meeting will take place virtually at www.virtualshareholdermeeting.com/CRMD2022. However, to assure your representation at the meeting, you are urged to vote by proxy by following the instructions contained in the accompanying proxy statement. You may revoke your proxy in the manner described in the proxy statement at any time before it has been voted at the meeting. Any stockholder attending the meeting may vote during the online meeting even if he or she has returned a proxy. Your vote is important. Whether or not you plan to attend the virtual annual meeting, we hope that you will vote as soon as possible.

Important Notice Regarding Internet Availability of Proxy Materials for the Annual Meeting to be Held on October 13, 2022: CorMedix Inc.’s Proxy Statement, 2021 Annual Report and Form of Proxy Card are also available at https://materials.proxyvote.com/21900C.

We are pleased to take advantage of the Securities and Exchange Commission, or SEC, rules that allow us to furnish proxy materials, including this notice, and the proxy statement (including an electronic proxy card for the meeting) for the annual meeting via the Internet. Taking advantage of these rules allows us to lower the cost of delivering annual meeting materials to our stockholders and reduce the environmental impact of printing and mailing these materials.

Berkeley Heights, New Jersey

Dated: August 30, 2022

By Order of the Board of Directors,

/s/ Phoebe Mounts

Secretary

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Q: | Why are you holding a virtual meeting? | |

A: | Due to the public health impact of COVID-19 and to support the health and well-being of our employees, stockholders and directors, this year’s Annual Meeting will be held in a virtual meeting format only. The virtual format will provide stockholders enhanced access to, participation in and communication in the Annual Meeting regardless of their geographic location. The audio of the entire Annual Meeting will be available for one year on the Company’s website after the meeting. | |

Q: | How do I attend the Annual Meeting? | |

A: | You can access the Annual Meeting at www.virtualshareholdermeeting.com/CRMD2022. You must enter the 16-digit control number found on your Notice of Internet Availability or Proxy Card. If you are a beneficial owner, you must contact your bank, broker or other institution where you hold your account if you have questions about obtaining your control number. | |

Q: | How can I ask questions during the Annual Meeting? | |

A: | The virtual format of the Annual Meeting allows stockholders to communicate with us during the Annual Meeting so they can ask questions of our management. Stockholder questions may be submitted in the field provided in the web portal during the Annual Meeting for consideration. Detailed guidelines for submitting written questions during the Annual Meeting are available at www.virtualshareholdermeeting.com/CRMD2022. You can also submit questions in advance of the Annual Meeting by visiting www.proxyvote.com. | |

Q: | What if I need technical assistance during the Annual Meeting? | |

A: | If you encounter any difficulties accessing the Annual Meeting during the check-in or meeting time, you should call 1-800-586-1548 (US) or 303-562-9288 (International) for technical assistance. | |

Q: | Who may vote at the meeting? | |

A: | The Board has set August 23, 2022 as the record date for the meeting. If you owned shares of our common stock or shares of our Series E and Series G preferred stock at the close of business on August 23, 2022, you may attend and vote at the meeting. Each common stockholder is entitled to one vote for each share of common stock held on all matters to be voted on. As of August 23, 2022, there were 41,208,210 shares of our common stock outstanding and entitled to vote at the meeting. Additionally, each Series E preferred stockholder is entitled to approximately 6.20 votes for each share of Series E preferred stock held on all matters to be voted on and each Series G preferred stockholder is entitled to approximately 23.63 votes for each share of Series G preferred stock held on all matters to be voted on. As of August 23, 2022, there were 89,623 shares of our Series E preferred stock and 89,999 shares of our Series G preferred stock outstanding and entitled to vote at the meeting. Pursuant to their respective terms, as of the record date, the shares of Series E stock represent a total of 556,045 votes and the shares of Series G preferred stock represent a total of 2,126,432 votes. Such shares of Series E and G preferred stock vote together with our shares of common stock as a single class on all matters submitted to a vote of the holders of our common stock. The outstanding shares of common stock, shares of Series E preferred stock and shares of Series G preferred stock represent an aggregate of 43,890,687 votes entitled to be cast at the meeting. Our outstanding Series C-3 preferred stock is non-voting and therefore has no voting rights at the Annual Meeting. | |

Q: | What is the difference between holding shares as a stockholder of record and as a beneficial owner? | |

A: | If your shares of common stock are registered directly in your name with our transfer agent, VStock Transfer, LLC, you are considered, with respect to those shares, a “stockholder of record.” If you are a stockholder of record, we have sent the Notice of Internet Availability of Proxy Materials to you directly. All shares of Series E and Series G preferred stock are held of record by the persons in whose name certificates for such shares have been issued, which current owners are affiliates of Elliott Associates, L.P. (“Elliott Associates”). |

1

If your shares of common stock are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of shares held in street name. In that case, the Notice of Internet Availability of Proxy Materials has been forwarded to you by your broker, bank, or other holder of record who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, nominee, trustee or other holder of record on how to vote your shares by using the voting instruction card you receive from your broker, nominee, trustee or other holder of record. | ||

Q: | What is the quorum requirement for the meeting? | |

A: | A majority of our outstanding shares of stock, including shares of Series E and Series G preferred stock entitled to vote as of the record date must be present at the meeting in order for us to hold the meeting and conduct business. This is called a quorum. Your shares will be counted as present at the meeting if you: | |

• are present and entitled to vote at the meeting; | ||

• properly submitted a proxy card or voter instruction card in advance of or at the meeting; or | ||

• do not provide your broker with instructions on how to vote, but the broker submits the proxy nonetheless (a broker non-vote). | ||

If you are present virtually or by proxy at the meeting, but abstain from voting on any or all proposals, your shares are still counted as present and entitled to vote. The proposals listed in this proxy statement identify the votes needed to approve or ratify the proposed actions. | ||

Q: | What proposals will be voted on at the meeting? | |

A: | The proposals to be voted on at the meeting are as follows: | |

1. To elect the seven directors named in the proxy statement to serve until our next annual meeting or until their successors have been elected and qualified; | ||

2. To approve on a non-binding advisory basis our executive compensation; | ||

3. To approve the amended and restated 2019 Omnibus Stock Incentive Plan; and | ||

4. To ratify the appointment of Friedman LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022. | ||

We will also consider any other business that properly comes before the meeting. As of the record date, we are not aware of any other matters to be submitted for consideration at the meeting. If any other matters are properly brought before the meeting, the persons named in the enclosed proxy card or voter instruction card will vote the shares they represent using their best judgment. | ||

Q: | How may I vote my shares personally at the meeting? | |

A: | If your shares are registered directly in your name with our transfer agent, VStock Transfer, LLC, you are considered, with respect to those shares, the stockholder of record. All shares of Series E and Series G preferred stock are held of record by the persons in whose name certificates for such shares have been issued, which current owners are affiliates of Elliott Associates. As the stockholder of record, you have the right to vote during the meeting at www.virtualshareholdermeeting.com/CRMD2022 using your unique control number that was included in your proxy card. If your shares are held in a brokerage account or by another nominee or trustee, you are considered the beneficial owner of shares held in street name. As the beneficial owner, you are also invited to attend the meeting via the Internet. Because a beneficial owner is not the stockholder of record, you may not vote these shares at the meeting unless you obtain a “legal proxy” from your broker, nominee, or trustee that holds your shares, giving you the right to vote the shares at the meeting. |

2

Q: | How can I vote my shares without attending the meeting? | |

A: | Whether you hold shares directly as a registered stockholder of record or beneficially in street name, you may vote without attending the meeting. If your shares are held by a broker, trustee or other nominee, they should send your instructions that you must follow in order to have your shares voted. If you hold shares in your own name, you may vote by proxy in any one of the following ways: • Via the Internet by accessing the proxy materials on the secure website https://www.proxyvote.com and following the voting instructions on that website; • Via telephone by calling toll free 1-800-579-1639 in the United States or outside the United States and following the recorded instructions; or • By requesting that printed copies of the proxy materials be mailed to you pursuant to the instructions provided in the Notice of Internet Availability of Proxy Materials and completing, dating, signing and returning the proxy card that you receive in response to your request. | |

The Internet and telephone voting procedures are designed to authenticate stockholders’ identities by use of a control number to allow stockholders to vote their shares and to confirm that stockholders’ instructions have been properly recorded. Voting via the Internet or telephone must be completed by 11:59 p.m. Eastern Time on October 12, 2022. Of course, you can always attend the meeting virtually and vote your shares. If you submit or return a proxy card without giving specific voting instructions, your shares will be voted as recommended by the Board. | ||

Q: | How can I change my vote after submitting it? | |

A: | If you are a stockholder of record, you can revoke your proxy before your shares are voted at the meeting by: | |

• Filing with our Corporate Secretary at 300 Connell Drive, Suite 4200, Berkeley Heights, New Jersey 07922 a written notice of revocation bearing a later date than the proxy either before the meeting or at the meeting; | ||

• Duly executing a later-dated proxy relating to the same shares and delivering it either before the meeting or live at the meeting and before the taking of the vote, to our Corporate Secretary at 300 Connell Drive, Suite 4200, Berkeley Heights, New Jersey 07922; | ||

• Attending the meeting and voting online during the virtual meeting by visiting www.virtualshareholdermeeting.com/CRMD2022 with your control number (although attendance at the meeting will not in and of itself constitute a revocation of a proxy); or | ||

• If you voted by telephone or via the Internet, voting again by the same means prior to 11:59 PM Eastern Time on October 12, 2022. | ||

If you are a beneficial owner of shares, you may submit new voting instructions by contacting your broker, nominee, trustee or other holder of record. You may also vote at the meeting if you obtain a legal proxy from them as described in the answer to a previous question. | ||

Q: | Where can I find the voting results of the meeting? | |

A: | We will announce the voting results at the annual meeting. We will publish the results in a Form 8-K filed with the SEC within four business days of the annual meeting. |

3

CORMEDIX INC.

300 Connell Drive, Suite 4200

Berkeley Heights, New Jersey 07922

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

OCTOBER 13, 2022

This proxy statement has been prepared by, delivered and solicited on behalf of the management of CorMedix Inc., in connection with the 2022 Annual Meeting of Stockholders to be held virtually at www.virtualshareholdermeeting.com/CRMD2022, on October 13, 2022, at 9:00 a.m. Eastern time. “We”, “our” and the “Company” each refers to CorMedix Inc.

Important Notice Regarding Internet Availability of Proxy Materials for the Annual Meeting to be Held on October 13, 2022:

This proxy statement and our annual report to security holders for the fiscal year ended December 31, 2021 are also available at https://materials.proxyvote.com/21900C.

In accordance with the rules of the SEC, instead of mailing a printed copy of our proxy materials to each stockholder of record, we are furnishing proxy materials, including the notice, this proxy statement, and a proxy card for the meeting, by providing access to them on the Internet to save printing costs and benefit the environment. These materials were first available on the Internet on or about August 30, 2022. We mailed a Notice of Internet Availability of Proxy Materials on or about August 30, 2022 to our stockholders of record and beneficial owners as of August 23, 2022, the record date for the meeting. This proxy statement and the Notice of Internet Availability of Proxy Materials contain instructions for accessing and reviewing our proxy materials on the Internet and for voting by proxy over the Internet. You will need to obtain your own Internet access if you choose to access the proxy materials and/or vote over the Internet. If you prefer to receive printed copies of our proxy materials, the Notice of Internet Availability of Proxy Materials contains instructions on how to request the materials by mail. You will not receive printed copies of the proxy materials unless you request them. If you elect to receive the materials by mail, you may also vote by proxy on the proxy card or voter instruction card that you will receive in response to your request.

GENERAL INFORMATION ABOUT SOLICITATION, VOTING AND ATTENDING

Who Can Vote

You are entitled to attend the meeting and vote your common stock or Series E or G preferred stock if you held shares as of the close of business on August 23, 2022. At the close of business on August 23, 2022, a total of 41,208,210 shares of common stock, 89,623 shares of our Series E preferred stock and 89,999 shares of our Series G preferred stock were outstanding and entitled to vote. Each share of common stock has one vote, each share of Series E preferred stock has approximately 6.20 votes and each share of Series G preferred stock has approximately 23.63 votes. The shares of Series E and G preferred stock vote together with our shares of common stock as a single class on all matters submitted to a vote of the holders of our common stock. The outstanding shares of common stock, shares of Series E preferred stock and shares of Series G preferred stock, represent an aggregate of 41,208,210, 556,045 and 2,126,432 votes, respectively. There is an aggregate total of 43,890,687 votes entitled to be cast at the meeting.

Counting Votes

Consistent with Delaware state law and our bylaws, the presence, in person or by proxy, of at least a majority of the shares entitled to vote at the meeting will constitute a quorum for purposes of voting on a particular matter at the meeting. Once a share is represented for any purpose at the meeting, it is deemed present for quorum purposes for the remainder of the meeting and any adjournment thereof unless a new record date is set for the adjournment. Shares held of record by stockholders or their nominees who do not vote by proxy or attend the meeting in person will not be considered present or represented and will not be counted in determining the presence of a quorum. Signed proxies that withhold authority or reflect abstentions and “broker non-votes” will be counted for purposes of

4

determining whether a quorum is present. “Broker non-votes” are proxies received from banks, brokerage firms or other nominees holding shares on behalf of their clients who have not been given specific voting instructions from their clients with respect to non-routine matters.

Assuming the presence of a quorum at the meeting:

• The election of directors will be determined by a plurality of the votes cast for each director nominee. This means that the seven nominees receiving the highest number of “FOR” votes will be elected as directors. Withheld votes and broker non-votes, if any, are not treated as votes cast, and therefore will have no effect on the proposal to elect directors.

• The advisory vote on our executive compensation requires the affirmative vote of a majority of the votes cast on the proposal. Abstentions and broker non-votes, if any, are not treated as votes cast, and therefore will have no effect on the proposal to approve our executive compensation.

• The amendment to our 2019 Plan requires an affirmative vote of a majority of votes cast on this proposal to approve the amendment. Abstentions will have the effect of a vote against this proposal and broker non-votes, if any, are not treated as votes cast, and therefore will have no effect on the proposal.

• The ratification of the appointment of our independent registered public accounting firm requires the affirmative vote of a majority of the votes cast on the proposal. In this context, abstentions and broker non-votes, if any, are not treated as votes cast, and therefore will have no effect on this proposal.

With respect to “routine” matters, such as the ratification of the selection of our independent registered public accounting firm, a bank, brokerage firm, or other nominee has the authority (but is not required) under the rules governing self-regulatory organizations, or SRO rules, including the Nasdaq Global Market, on which our common stock is listed, to vote its clients’ shares if the clients do not provide instructions. When a bank, brokerage firm or other nominee votes its clients’ shares on routine matters without receiving voting instructions, these shares are counted both for establishing a quorum to conduct business at the meeting and in determining the number of shares voted FOR, AGAINST or ABSTAINING with respect to such routine matters. Broker non-votes are not considered votes cast and, accordingly, will have no effect on any “non-routine” proposal.

With respect to “non-routine” matters, such as the election of directors, the advisory vote to approve the compensation paid by the Company to its executive officers and the advisory vote to approve the frequency of the vote on executive compensation, a bank, brokerage firm, or other nominee is not permitted under the SRO rules to vote its clients’ shares if the clients do not provide instructions. The bank, brokerage firm, or other nominee will so note on the voting instruction form, and this constitutes a “broker non-vote.” Broker non-votes will be counted for purposes of establishing a quorum.

Because the proposal for the advisory vote to approve the compensation paid by the Company to its executive officers requires a majority of votes cast for approval, and broker non-votes are not considered votes cast, a broker non-vote will have no effect on these proposals. While the election of directors is a non-routine matter, directors are elected by a plurality of the votes cast, which means that the seven nominees receiving the highest number of affirmative votes will be elected. As a result, votes withheld and broker non-votes have no effect on the election of directors.

In summary, if you do not vote your proxy, your bank, brokerage firm, or other nominee may either:

• cast a vote on routine matters;

• cast a “broker non-vote” on non-routine matters; or

• leave your shares unvoted altogether.

We strongly encourage you to provide instructions to your bank, brokerage firm, or other nominee by voting your proxy. This action ensures that your shares will be voted in accordance with your wishes at the meeting.

5

Cost of this Proxy Solicitation

We will pay the cost of this proxy solicitation. In addition to soliciting proxies by mail, our directors and employees might solicit proxies personally and by telephone. None of these individuals will receive any additional compensation for this. We plan to retain a proxy solicitor to assist in the solicitation of proxies for a fee. We will, upon request, reimburse banks, brokerage firms and other nominees for their expenses in sending proxy materials to their principals and obtaining their proxies.

Attending the Annual Meeting

To attend the 2022 Annual Meeting, you will need to access www.virtualshareholdermeeting.com/CRMD2022 and enter your control number on your proxy card. If you are a beneficial owner of shares held by a bank or broker, i.e., in “street name”, you may vote them at the Annual Meeting only if you obtain a legal proxy from the bank or broker and deliver such legal proxy to the inspector of election to obtain a control number for access to the 2022 Annual Meeting.

6

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

Our bylaws provide that the number of directors constituting the Board shall be not less than five nor more than nine. The Board may establish the number of directors within this range. There are seven directors presently serving on our Board, following the March 18, 2022 election of Joseph Todisco, who was appointed Chief Executive Officer of the Company, effective May 10, 2022. In March 2015, in connection with a backstop financing agreement, we granted Manchester Securities Corp., a subsidiary of Elliott Associates, L.P., our largest stockholder, the right for as long as it or its affiliates hold any of our common stock or securities convertible into our common stock to appoint, and nominate for election at subsequent stockholder meetings, up to two members of our Board and/or to have up to two observers attend Board meetings in a non-voting capacity. Manchester has exercised its appointment right and appointed Janet Dillione and Myron Kaplan as members of the Board in 2015 and 2016, respectively, and to nominate Ms. Dillione and Mr. Kaplan for election at subsequent stockholder meetings, including the 2022 Annual Meeting.

The Board proposes the seven nominees listed below for election to the Board for a one-year term. The Board has determined that directors Paulo F. Costa, Janet Dillione, Gregory Duncan, Alan W. Dunton, Myron Kaplan, and Steven Lefkowitz are independent as defined in Rule 5605 of the Nasdaq Global Market Listing Rules. In addition to the specific bars to independence set forth in that rule, we also consider whether a director or his or her affiliates have provided any services to, worked for or received any compensation from us or any of our subsidiaries in the past three years in particular. None of the nominees is related by blood, marriage or adoption to any other nominee or any of our executive officers.

Director Nominees with Terms Expiring in 2022

The following table sets forth information concerning our director nominees as of August 23, 2022:

Name | Age | Director Since | Position(s) with CorMedix | |||

Paulo F. Costa | 72 | September 2020 | Director | |||

Janet Dillione | 62 | August 2015 | Director | |||

Gregory Duncan | 57 | November 2020 | Director | |||

Alan W. Dunton | 68 | March 2019 | Director | |||

Myron Kaplan | 77 | April 2016 | Director and Chairman of the Board | |||

Steven Lefkowitz | 66 | June 2017 | Director | |||

Joseph Todisco | 46 | March 2022 | Director |

Paulo F. Costa has been a director of CorMedix since September 2020. Mr. Costa previously served as President and Chief Executive Officer of Novartis U.S. Corporation, from October 2005 to August 2008. Prior to his work at Novartis U.S. Corporation, Mr. Costa was President and Chief Executive Officer of Novartis Pharmaceuticals, U.S. from July 1999 to September 2005. Prior to joining Novartis, Mr. Costa spent 30 years at Johnson & Johnson, including as President of Janssen Pharmaceutica, Inc. from 1992 to 1998. From August 2009 to August 2012, Mr. Costa served as Chairman of the Board of Amylin Pharmaceuticals Inc, a commercial stage biopharma company, until its sale to Bristol-Myers Squibb and AstraZeneca in a $7 billion transaction in 2012. Mr. Costa served as Director from June 2009 to October 2013 and Chairman until May 2022 of MacroGenics, Inc., a public oncology focused biopharma company. Mr. Costa received his undergraduate degree from São Paulo School of Business Administration and earned a master’s degree in business administration from Harvard Business School. Among other experience, qualifications, attributes and skills, Mr. Costa’s significant depth of experience in the pharmaceutical industry, including service as a director and executive of pharmaceutical companies, led to the conclusion of our Board that he should serve as a director of our Company in light of our business and structure.

Janet Dillione has been a director of CorMedix since August 2015. Since November 2020, Ms. Dillione has served as the Chief Executive Officer of Connect America, a nationally recognized leader in comprehensive telehealth and remote patient monitoring solutions. Prior to joining Connect America and starting in May 2014, she served as Chief Executive Officer of Bernoulli Enterprise, Inc., a real-time connected healthcare information technology company. Previously, she was at Nuance Communications, Inc., a leading provider of voice and language solutions for businesses and consumers around the world, having joined Nuance in April 2010 as Executive Vice President and General Manager of the Healthcare Division and serving as an executive officer from March 2010 until May 2014. From June 2000 to March 2010, Ms. Dillione held several senior level management positions at

7

Siemens Medical Solutions, a global leader in medical imaging, laboratory diagnostics, and healthcare information technology, including President and CEO of the global healthcare IT division. Ms. Dillione currently serves as a director of Vizient, Inc., a private health care performance improvement company. Ms. Dillione received her B.A. from Brown University in 1981 and completed the Executive Program at The Wharton School of Business of the University of Pennsylvania in 1998. She has over 25 years of experience leading global teams in the development and delivery of healthcare technology and services. Among other qualifications, attributes and skills, Ms. Dillione’s financial and IT expertise and significant executive management experience with medical device and healthcare companies led to the conclusion of our Board that she should serve as a director of our Company in light of our business and structure.

Gregory Duncan has been a director of CorMedix since November 2020. Mr. Duncan currently serves as the Chairman and CEO of Virios Therapeutics, a clinical-stage biopharmaceutical company developing and commercializing innovative antiviral therapies to treat diseases associated with a viral triggered abnormal immune response, such as fibromyalgia (FM), and has served since April 2020. From 2014 and prior to joining his current company, Mr. Duncan served as President and CEO of Celtaxsys, a privately held biotechnology company focused on cystic fibrosis and other rare, inflammatory diseases. Mr. Duncan has spent the majority of his career in senior leadership roles in commercial stage pharmaceutical companies. From 2007 to 2013, he served as a senior executive at UCB, including as President of its North America business, as well as an executive committee member. Prior to his roles with UCB, Mr. Duncan spent approximately 17 years at Pfizer where he gained significant experience across sales and marketing functions including serving as SVP of US Marketing and later as President of Pfizer’s Latin America business from 2005 to 2007. Mr. Duncan received his undergraduate degree from the State University of New York, Albany, and earned an MBA degree from Emory University. Among other experience, qualifications, attributes and skills, Mr. Duncan’s significant depth of experience in the pharmaceutical industry led to the conclusion of our Board that he should serve as a director of our Company in light of our business and structure.

Alan W. Dunton, M.D. has been a director of CorMedix since March 2019. He is the founder and principal consultant of Danerius, LLC, a biotechnology and pharmaceutical consulting business which he started in 2006. From 1994, he served in senior positions in Research and Development in the Pharmaceutical Division of Johnson and Johnson including President and Managing Director of the Janssen, the major research, development and regulatory arm of the pharmaceuticals division at Johnson & Johnson. From January 2007 through March 2009, Dr. Dunton served as President and Chief Executive Officer of Panacos Pharmaceuticals, Inc. From November 2015 through March 2018, Dr. Dunton was the Head/Senior Vice President of Research, Development and Regulatory Affairs of Purdue Pharma L.P., a private pharmaceutical company. Dr. Dunton received his Bachelor of Science degree in biochemistry, magna cum laude, from State University of New York at Buffalo, and received his M.D. from New York University School of Medicine. In addition to CorMedix, Dr. Dunton currently serves on the boards of three public companies, as a Director at Palatin Technologies, Inc. and Oragenics, Inc. he chairs the Compensation Committees of both companies. He also serves as a member of the Audit Committees of these companies. Additionally, Dr. Dunton is a member of the board of Recce Pharma Ltd., an Australian public biotechnology company focused on developing novel anti-infectives for serious and life threatening diseases. Among other qualifications, Dr. Dunton’s significant depth of experience in the pharmaceutical industry, including service as a director of public pharmaceutical companies, led to the conclusion of our Board that he should serve as a director of our Company in light of our business and structure.

Myron Kaplan became a director of CorMedix in April 2016. He is a founding partner of Kleinberg, Kaplan, Wolff & Cohen, P.C., a New York City general practice law firm, where he has practiced corporate and securities law for more than forty years. In 2012, Mr. Kaplan became a trustee of the Lehman Brothers Plan Holding Trust. Previously, he served as a member of the board of directors of SAirGroup Finance (USA) Inc., a subsidiary of SAirGroup that had publicly issued debt securities, Trans World Airlines, Inc. and Kitty Hawk, Inc. Among his business and civic involvements, Mr. Kaplan currently serves on the boards of directors of a number of private companies and has been active for many years on the boards of trustees and various board committees of The Children’s Museum of Manhattan and JBI International (formerly The Jewish Braille Institute of America). Mr. Kaplan graduated from Columbia College and holds a Juris Doctor from Harvard Law School. Among other experience, qualifications, attributes and skills, Mr. Kaplan’s experience in a broad range of corporate and securities matters and service as a director of public companies led to the conclusion of our Board that he should serve as a director of our Company in light of our business and structure.

8

Steven Lefkowitz was a director of CorMedix from August 2011 to June 2016. He was reappointed to the Board in June 2017. He also served as our acting Chief Financial Officer from August 2013 to July 2014. Mr. Lefkowitz has been the President and Founder of Wade Capital Corporation, a financial advisory services company, since June 1990. Mr. Lefkowitz has been a director of both public and private companies. Mr. Lefkowitz received his A.B. from Dartmouth College in 1977 and his M.B.A. from Columbia University in 1985. Among other experience, qualifications, attributes and skills, Mr. Lefkowitz’s education, experience and financial expertise led to the conclusion of our Board that he should serve as a director of our Company in light of our business and structure.

Joseph Todisco became a director of CorMedix in March 2022. Prior to joining CorMedix as our Chief Executive Officer, he was a senior executive at Amneal Pharmaceuticals, where for the past 11 years he has held various roles, most recently as Executive Vice President, Chief Commercial Officer where he was responsible for Amneal Specialty, a growing branded products business. During his tenure at Amneal, Mr. Todisco held roles overseeing corporate development and international operations, leading commercial teams in several international markets including the UK, Australia and Germany, as well as leading Amneal’s merger integration with Impax Laboratories in 2018. He was previously Co-Founder and managing executive of Gemini Laboratories, a specialty pharmaceutical company focused on the sales and marketing for niche branded products in the US Market. Gemini Laboratories was established as an affiliate of Amneal Pharmaceuticals and was subsequently acquired by Amneal in 2018. Prior to joining Amneal, Mr. Todisco was Vice President, Business Development & Licensing at Ranbaxy, Inc. where he was responsible for developing and executing Ranbaxy’s North American commercial business strategy. Prior to Ranbaxy, he held various roles at Par Pharmaceutical, and in his earlier career held positions at Oppenheimer & Company and Marsh & McLennan Companies. Mr. Todisco obtained his MBA in finance from Fordham Graduate School of Business and his BA in Economics from Georgetown University. Among other qualifications, attributes and skills, Mr. Todisco’s business expertise and significant executive management experience in the pharmaceutical industry led to the conclusion of our Board that he should serve as a director of our Company in light of our business and structure.

Vote Required

Directors are elected by a plurality of the votes cast at the annual meeting. This means that the seven nominees receiving the highest number of affirmative votes will be elected.

Recommendation

The Board recommends that stockholders vote FOR the election of the seven nominees for election to the Board each for a one-year term.

9

PROPOSAL NO. 2 — ADVISORY VOTE ON EXECUTIVE COMPENSATION

As required under Section 14A of the Securities Exchange Act of 1934, or the “Exchange Act”, and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or “Dodd-Frank Act”, the Board is submitting a “say on pay” proposal for stockholder consideration. While the vote on executive compensation is nonbinding and solely advisory in nature, the Board and the Compensation Committee value the opinion of our stockholders and will review and consider the voting results. We currently intend to hold future advisory votes on executive compensation every year, and the next say on pay vote is expected to occur at the annual meeting of our stockholders in 2023.

Our executive officers are compensated based on performance, and in a manner consistent with our strategy, competitive practice, sound corporate governance principles, and our Company’s and our stockholders’ interests. We believe our compensation program is strongly aligned with the long-term interests of our Company and our stockholders. Compensation of our executive officers is designed to enable us to attract and retain talented and experienced senior executives to lead our Company successfully in a competitive environment.

The compensation of the Named Executive Officers is described on pages 34 through 45 of this proxy statement.

We are asking stockholders to vote on the following resolution:

“RESOLVED, that the stockholders of CorMedix Inc. approve, on an advisory basis, the compensation paid to its Named Executive Officers, as disclosed pursuant to the compensation disclosure rules of the SEC, including the Compensation Discussion and Analysis, compensation tables and narrative discussion as disclosed in this proxy statement.”

As indicated above, the stockholder vote on this resolution will not be binding on our Company or the Board and will not be construed as overruling or determining any decision by us or by the Board. The vote will not be construed to create or imply any change to our fiduciary duties or those of the Board, or to create or imply any additional fiduciary duties for our company or the Board.

Vote Required

The affirmative vote of the holders of a majority of the shares of our common stock as of the record date present or represented at the meeting is required to approve the compensation of our Named Executive Officers, as disclosed in this proxy statement.

Recommendation

The Board of Directors unanimously recommends stockholders vote, on an advisory basis, FOR our executive compensation.

10

PROPOSAL NO. 3 — APPROVAL OF AMENDMENT AND RESTATEMENT OF THE 2019 OMNIBUS STOCK INCENTIVE PLAN

On August 23, 2022, our Board adopted an amended and restated CorMedix Inc. 2019 Omnibus Stock Incentive Plan (as amended, the “2022 Plan”), subject to stockholder approval. Pursuant to the 2022 Plan and subject to certain adjustments as described below, on or after the effective date of the 2022 Plan, we may issue up to 4,800,000 additional shares of our common stock as long-term equity incentives to our employees, consultants, and directors. The long-term incentives may be in the form of stock options, stock appreciation rights, restricted stock, restricted stock units, dividend equivalent rights, or other rights or benefits (collectively, “stock rights”) to employees, consultants, and directors of our Company or a related entity (collectively, “participants”). We believe that the effective use of long-term equity incentives is essential to attract, motivate, and retain employees, consultants and directors, to further align participants’ interests with those of our stockholders, and to provide participants incentive compensation opportunities that are competitive with those offered by other companies in the same industry and locations as ours.

In this Proposal No. 3, we are asking our stockholders to approve the 2022 Plan. A full text of the 2022 Plan is attached as Appendix A to this Proxy Statement.

As of August 23, 2022, approximately 30 employees, three consultants and six non-employee directors would have been eligible to participate in the 2022 Plan if the 2022 Plan were in effect on such date, and we expect that the same or similar number of employees, consultants and non-employee directors will be eligible to participate in the 2022 Plan as of the effective date. The closing price of our Company’s common stock on Nasdaq Global Market on August 23, 2022 was $3.91.

As more fully described below under the section titled “Summary of the 2022 Plan,” as of July 31, 2022, 72,302 shares remain available for grant under the 2019 Omnibus Stock Incentive Plan (the “2019 Plan”). If this Proposal No. 3 is approved by our stockholders at the Annual Meeting, the maximum aggregate number of additional shares that may be issued under the 2022 Plan on or after the effective date of the 2022 Plan will be 4,800,000 shares, subject to adjustment as described below. In addition, any shares that remain available for grant under the 2019 Plan as of the effective date of the 2022 Plan, plus any shares subject to outstanding grants under the 2019 Plan and the 2013 Stock Incentive Plan (the “2013 Plan) (collectively, the 2019 Plan and the 2013 Plan are referred to as the “Prior Plans”) that are forfeited, canceled or expire, or are settled in cash after the effective date of the 2022 Plan, shall be available for issuance under the 2022 Plan, subject to adjustment as described below.

Description of Changes

The terms of the 2022 Plan are the same as the 2019 Plan, except that 4,800,000 additional shares will be available for issuance under the 2022 Plan on or after the effective date of the 2022 Plan and the 2022 Plan will expire on October 12, 2032.

Vote Required

Provided there is a quorum for the meeting, approval of the 2022 Plan requires the affirmative vote of a majority of the votes cast on this Proposal No. 3. Broker non-votes, if any, are not treated as votes cast, and therefore will have no effect on this Proposal No. 3 to approve our 2022 Plan. Under applicable Nasdaq Global Market rules and guidance, in the context of stockholder approval of an equity compensation plan, abstentions, if any, are treated as votes cast, and therefore will have the same effect as a vote against this Proposal No. 3.

Recommendation

Our Board unanimously recommends that stockholders vote FOR the 2022 Plan.

Summary of the 2022 Plan

Following is a summary of the principal features of the 2022 Plan. For additional information, please refer to the specific provision of the full text of the 2022 Plan set forth in Appendix A to this proxy statement.

11

Key Provisions

Following are the key provisions of the 2022 Plan:

Provisions of the 2022 Plan | Description | |

Eligible Participants: | Employees, non-employee directors, and consultants of our Company, any related entity, and any successor entity that adopts the 2022 Plan. | |

Share Reserve: | Subject to adjustment as described below, the maximum aggregate number of additional shares of our common stock which may be issued on or after the effective date of the 2022 Plan pursuant to all awards (including incentive stock options) is 4,800,000 shares. In addition, the shares that remain available for grant under the 2019 Plan as of the effective date of the 2022 Plan, plus any shares subject to outstanding grants under the Prior Plans that are forfeited, canceled or expire, or are settled in cash after the effective date of the 2022 Plan, shall be available for issuance under the 2022 Plan. The reserved shares will be reduced by one share for each share granted pursuant to stock rights awarded under the 2022 Plan. | |

No Liberal Share Recycling: | The 2022 Plan does not permit “liberal” share recycling of any awards. Accordingly, any shares tendered or withheld to pay the exercise price or to satisfy tax obligations will be deemed issued and therefore not available for new grants under the 2022 Plan. | |

Award Types: | • Incentive and non-statutory stock options • Stock appreciation rights (referred to as “SARs”) • Restricted stock awards • Restricted stock unit awards (referred to as “RSUs”) • Dividend equivalent rights • Other rights or benefits | |

Vesting: | Determined by our Board or by the Compensation Committee, or another committee if appointed by our Board. | |

No Dividends on Unvested Awards: | Any payment of accumulated dividends or dividend equivalent rights on an outstanding award is contingent on the actual vesting or payment, as applicable, of such award. | |

Repricing: | Other than pursuant to an equitable adjustment as described below, or in connection with a corporate transaction, the plan administrator will not, without the approval of the Company’s stockholders, (a) lower the exercise price of an option or SAR, (b) cancel an option or SAR when the exercise price per share exceeds the fair market value of a share in exchange for cash or another award, or (c) take any other action with respect to an option or SAR that would be treated as a repricing under the rules and regulations of the principal U.S. national securities exchange on which the Shares are listed. | |

2022 Plan Termination Date: | October 12, 2032. |

Determination of Shares to be Available for Issuance

As of July 31, 2022, 72,302 shares remain available for grant under the 2019 Plan. The Board believes that attracting and retaining employees, consultants and directors of high quality has been and will continue to be essential to the Company’s growth and success. Consistent with this view, the Board believes that the number of shares available for issuance under the 2019 Plan is not sufficient for future grants in light of our compensation structure and strategy.

12

If this Proposal No. 3 is approved by our stockholders at the Annual Meeting, the maximum aggregate number of new shares that may be issued under the 2022 Plan on or after the effective date of the 2022 Plan will be 4,800,000 shares, subject to adjustment as described below. In addition, the shares that remain available for grant under the 2019 Plan as of the effective date of the 2022 Plan, plus any shares subject to outstanding grants under the Prior Plans that are forfeited, canceled or expire, or are settled in cash after the effective date of the 2022 Plan, shall be available for issuance under the 2022 Plan. When deciding on the number of shares to be available for awards under the 2022 Plan, the Board considered a number of factors, including the number of shares currently available under the 2022 Plan, the Company’s past share usage (“burn rate”), the number of shares needed for future awards, a dilution analysis, the current and future accounting expenses associated with the Company’s equity award practices, and stockholder perspectives.

Dilution Analysis

The proposed share authorization is a request to amend the 2019 Plan so that 4,800,000 additional shares will be available for awards under the 2022 Plan on or after the effective date of the 2022 Plan.

The table below shows our potential dilution (referred to as “overhang”) levels based on our fully diluted shares of common stock and our request for 4,800,000 new shares to be available for awards under the 2022 Plan. The request for 4,800,000 additional shares to be reserved under the 2022 Plan represents 8.5% of the fully diluted shares of our common stock, as described in the table below. The Board believes that this number of shares of common stock under the 2022 Plan represents a reasonable amount of potential equity dilution, which will allow us to continue awarding stock rights, and that such stock rights are an important component of the Company’s equity compensation program.

Potential Overhang

Stock Options Outstanding as of July 31, 2022(1) |

| 4,568,285 |

| |

Weighted Average Exercise Price of Stock Options Outstanding as of July 31, 2022 | $ | 6.35 |

| |

Weighted Average Remaining Term of Stock Options Outstanding as of July 31, 2022 |

| 7.05 years |

| |

Outstanding Full Value Awards as of July 31, 2022(2) |

| 256,378 |

| |

Total Equity Awards Outstanding as of July 31, 2022(1)(2)(3) |

| 4,824,663 |

| |

Shares Available for Grant under the 2019 Plan as of July 31, 2022(3) |

| 72,302 |

| |

Additional Shares Requested under the 2022 Plan |

| 4,800,000 |

| |

Total Potential Overhang under the 2022 Plan |

| 9,696,965 |

| |

Shares of Common Stock Outstanding as of July 31, 2022 |

| 41,106,777 |

| |

Warrants and Convertible Equity Shares as of July 31, 2022 |

| 5,456,477 |

| |

Fully Diluted Shares of Common Stock |

| 56,266,219 |

| |

Potential Dilution to Stockholders of 4,800,000 Additional Shares Requested under the 2022 Plan as a Percentage of Fully Diluted Shares of Common Stock |

| 8.5 | % |

____________

(1) Represents the number of outstanding stock option awards under the Prior Plans.

(2) The 256,378 Full Value Awards are comprised of time-based restricted stock units granted to employees and non-employee directors under the Prior Plans.

(3) Any shares covered by awards under the Prior Plans that are forfeited, canceled or expire, or are settled in cash, after the effective date of the 2022 Plan will be added to the maximum aggregate number of shares that may be issued under the 2022 Plan.

Based on our current equity award practices, the Board estimates that the authorized shares under the 2022 Plan may be sufficient to provide us with an opportunity to grant stock rights for approximately three to four years. This is only an estimate, and circumstances could cause the share reserve to be used more quickly or more slowly. These circumstances include, but are not limited to, the future price of our common stock, the mix and grant value of cash, options and full value awards provided as long-term incentive compensation, grant amounts provided by our competitors, payout of performance-based awards in excess of target in the event of superior performance, hiring activity, and promotions during the next few years.

13

Share Usage

The table below sets forth the following information regarding the awards granted under the 2019 Plan and the 2013 Plan: (i) the share usage for each of the last three calendar years and (ii) the average share usage rate over the last three calendar years. The share usage for each specified year has been calculated as (i) the sum of (x) all stock options granted in the applicable year, (y) all time-based stock units and stock awards granted in the applicable year, and (z) all performance-based stock units and stock awards granted in the applicable year at target value, divided by (ii) the weighted average number of shares of common stock outstanding for the applicable year.

Dividend equivalents are not included in the share usage calculation because none have been granted.

Share Usage Table

Element | 2021 | 2020 | 2019 | Three-Year | ||||||||

Time-Based Stock Units and Stock Awards Granted | 0 |

| 15,312 |

| 29,863 |

| — |

| ||||

Total Full Value Awards | 0 |

| 15,312 |

| 29,863 |

| — |

| ||||

Stock Options Granted: | 1,664,700 |

| 1,111,984 |

| 496,300 |

| — |

| ||||

Total Full Value Awards and Stock Options Granted | 1,664,700 |

| 1,127,296 |

| 526,163 |

| — |

| ||||

Weighted Average Shares of Common Stock Outstanding at December 31 | 37,666,081 |

| 28,561,963 |

| 24,152,088 |

| — |

| ||||

Share Usage | 4.42 | % | 3.95 | % | 2.18 | % | 3.52 | % | ||||

As noted in the table above, we used an average of 3.52% of the weighted average shares outstanding on an annual basis for awards granted over the past three years under the 2019 Plan and the 2013 Plan.

The Board believes that the Company’s executive compensation program, and particularly the granting of stock rights, allows us to align the interests of employees, consultants and directors who are selected to receive awards with those of our stockholders. The Board believes that awards granted pursuant to the 2022 Plan are a vital component of our compensation program and, accordingly, that it is important that an appropriate number of shares of stock be authorized for issuance under the 2022 Plan.

Administration

The 2022 Plan will be administered by our Board or by the Compensation Committee or another committee appointed by our Board. With respect to awards to our officers or directors, the 2022 Plan will be administered in a manner to satisfy applicable laws and that permits such grants and related transactions to be exempt from Section 16(b) of the Securities Exchange Act of 1934, as amended, or the Exchange Act. The plan administrator has the full authority to select recipients of the grants, determine whether and to what extent grants are awarded, establish additional terms, conditions, rules or procedures to accommodate rules or laws of applicable non-U.S. jurisdictions, adjust awards and take any other action deemed appropriate; however, no action may be taken that is inconsistent with the terms of the 2022 Plan.

Available Shares

Subject to adjustment as described below, the maximum aggregate number of additional shares which may be issued pursuant to awards under the 2022 Plan on or after effective date of the 2022 Plan is 4,800,000 shares of our common stock. In addition, the number of shares available for grant under the 2019 Plan as of the effective date of the 2022 Plan, plus any shares subject to outstanding grants under the Prior Plans that are forfeited, canceled or expire, or are settled in cash after the effective date of the 2022 Plan, shall be available for issuance under the 2022 Plan. The maximum number of shares of common stock that may be issued pursuant to the exercise of incentive stock options (as described below) will not exceed 4,800,000 shares.

In addition, any shares covered by an award that is forfeited, canceled, or expires, or is settled in cash, under the 2022 Plan will be deemed to have not been issued for purposes of determining the maximum aggregate number of shares which may be issued under the 2022 Plan. Any shares covered by a Prior Plan award that is forfeited, canceled or expires, or is settled in cash, after the effective date of the 2022 Plan, will be added to the maximum aggregate number

14

of shares that may be issued under the 2022 Plan. In the event any option or other award granted under the 2022 Plan or a Prior Plan is exercised through the tendering of shares (either actually or through attestation), or in the event tax withholding obligations are satisfied by tendering or withholding shares for any stock right, any shares so tendered or withheld will not again available for awards under the 2022 Plan. With respect to exercise of a stock-settled SAR, the total number of Shares subject to such SAR will be counted against the share reserve, notwithstanding that only the net number of such shares were issued. Shares of common stock we reacquire on the open market or otherwise using cash proceeds from the exercise of options will not be available for awards under the 2022 Plan.

Shares awarded pursuant to awards granted upon the assumption of or in substitution for outstanding awards previously granted by a company that the Company acquires or with which it merges (referred to as “Substitute Awards”) will not reduce the shares authorized for issuance under the 2022 Plan, nor will shares subject to a Substitute Award be added to the shares available for awards under the 2022 Plan. In the event that a company acquired by the Company or a related entity, or of which the Company or related entity combines, has shares available under a pre-existing plan approved by stockholders and not adopted in contemplation of such acquisition or combination, the shares available for grant pursuant to the terms of such pre-existing plan (as adjusted, to the extent appropriate) may be used for awards under the 2022 Plan and will not reduce the shares authorized for issuance under the 2022 Plan. However, awards using such available shares will not be made after the date awards could have been made under the terms of the pre-existing plan, absent the acquisition or combination, and will only be made to individuals who were not employees, consultants, or non-employee directors of the Company prior to such acquisition or combination.

Limit on Non-Employee Director Awards

The maximum number of shares subject to awards granted during a single fiscal year to any non-employee director, taken together with any cash fees paid during the fiscal year to the non-employee director, in respect of the director’s service as a member of the Board during such year, will not exceed $500,000 in total value, calculated based on the grant date fair value of such swards for financial reporting purposes. The independent members of the Board may make exceptions to this limit for a non-executive chair of the Board, provided that any non-employee director receiving such additional compensation may not participate in the decision to award such compensation.

Eligibility and Types of Awards

The 2022 Plan permits us to grant stock awards, including stock options, SARs, restricted stock, RSUs and dividend equivalent rights or other rights or benefits, to our employees, directors, and consultants.

Stock Options

A stock option may be an incentive stock option within the meaning of, and qualifying under, Section 422 of the Internal Revenue Code of 1986, as amended (referred to as the “Code”), or a non-statutory stock option. However, only our employees (or employees of our parent or subsidiaries, if any) may be granted incentive stock options. Incentive and non-statutory stock options are granted pursuant to option agreements adopted by the plan administrator. The plan administrator determines the exercise price for a stock option, within the terms and conditions of the 2022 Plan, provided that the exercise price of a stock option cannot be less than 100% of the fair market value of our common stock on the date of grant except with respect to Substitute Awards. Options granted under the 2022 Plan will become exercisable at the rate specified by the plan administrator.

The plan administrator determines the term of the stock options granted under the 2022 Plan, up to a maximum of 10 years, except in the case of certain incentive stock options, as described below. Unless the terms of an optionholder’s stock option agreement provide otherwise, if an optionholder’s relationship with us, or any of our affiliates, ceases for any reason other than disability or death, the optionholder may exercise any options otherwise exercisable as of the date of termination, but only during the post-termination exercise period designated in the optionholder’s stock option award agreement. The optionholder’s stock option award agreement may provide that upon the termination of the optionholder’s relationship with us for cause, the optionholder’s right to exercise his or her options will terminate concurrently with the termination of the relationship. If an optionholder’s service relationship with us, or any of our affiliates, ceases due to disability or death, or an optionholder dies within a certain period following cessation of service, the optionholder or his or her estate or person who acquired the right to exercise the award by bequest or inheritance may exercise any vested options for a period of 12 months following such date. The option term may be extended in the event that exercise of the option within the applicable time periods is prohibited by applicable securities laws or such longer period as specified in the stock option award agreement but in no event beyond 30 days immediately following the expiration of its term.

15

Acceptable consideration for the purchase of common stock issued upon the exercise of a stock option will be determined by the plan administrator and may include (a) cash or check, (b) a broker-assisted cashless exercise, (c) the tender of common stock previously owned by the optionholder, (d) a net exercise of the option, and (e) any combination of the foregoing methods of payment.

Unless the plan administrator provides otherwise, awards generally are not transferable, except by will or the laws of descent and distribution.

Incentive stock options may be granted only to our employees (or to employees of our parent company and subsidiaries, if any). To the extent that the aggregate fair market value, determined at the time of grant, of shares of our common stock with respect to which incentive stock options are exercisable for the first time by an optionholder during any calendar year under any of our equity plans exceeds $100,000, such options will not qualify as incentive stock options. A stock option granted to any employee who, at the time of the grant, owns or is deemed to own stock representing more than 10% of the voting power of all classes of our stock or stock of any of our affiliates may not be an incentive stock option unless (a) the option exercise price is at least 110% of the fair market value of the stock subject to the option on the date of grant, and (b) the term of the incentive stock option does not exceed five years from the date of grant.

Stock Appreciation Rights

SARs may be granted under the 2022 Plan either concurrently with the grant of an option or at a later time determined by the plan administrator, or alone, without reference to any related stock option. The plan administrator determines both the number of shares of common stock related to each SAR and the exercise price for an SAR, within the terms and conditions of the 2022 Plan, provided that the exercise price of an SAR cannot be less than 100% of the fair market value of the common stock subject thereto on the date of grant. In the case of an SAR granted concurrently with a stock option, the number of shares of common stock to which the SAR relates will be reduced in the same proportion that the holder of the stock option exercises the related option.

The plan administrator will determine whether to deliver cash in lieu of shares of common stock upon the exercise of an SAR. If common stock is issued, the number of shares of common stock that will be issued upon the exercise of an SAR is determined by dividing (a) the number of shares of common stock as to which the SAR is exercised multiplied by the amount of the appreciation in such shares, by (b) the fair market value of a share of common stock on the exercise date.

If the plan administrator elects to pay the holder of the SAR cash in lieu of shares of common stock, the holder of the SAR will receive cash equal to the fair market value on the exercise date of any or all of the shares that would otherwise be issuable.

The exercise of an SAR related to a stock option is permissible only to the extent that the stock option is exercisable under the terms of the 2022 Plan on the date of surrender. Any incentive stock option surrendered will be deemed to have been converted into a non-statutory stock option immediately prior to such surrender.

Restricted Stock

Restricted stock awards are awards of shares of our common stock that are subject to established terms and conditions. The plan administrator sets the terms of the restricted stock awards, including the size of the restricted stock award, the price (if any) to be paid by the recipient and the vesting schedule and criteria (which may include continued service to us for a period of time or the achievement of performance criteria). If a participant’s service terminates before the restricted stock is fully vested, all of the unvested shares generally will be forfeited to, or repurchased by, us.

Restricted Stock Units

An RSU is a right to receive stock, cash equal to the value of a share of stock or other securities or a combination of the three at the end of a set period or the attainment of performance criteria. No stock is issued at the time of grant. The plan administrator sets the terms of the RSU award, including the size of the RSU award, the consideration (if any) to be paid by the recipient, vesting schedule, and criteria and form (stock or cash) in which the award will be settled. If a participant’s service terminates before the RSU is fully vested, the unvested portion of the RSU award generally will be forfeited to us.

16

Dividend Equivalent Rights

Dividend equivalent rights entitle the recipient to compensation measured by ordinary dividends paid with respect to a specified number of shares of common stock. No cash dividends or dividend equivalents will accrue or be paid in respect of any stock options or SARs.

Rights as a Stockholder; No Dividends or Dividend Equivalent Rights on Unvested Awards

Except as otherwise provided in any award agreement, a participant will not have any rights of a stockholder with respect to any of the shares granted under an award of restricted stock (including the right to vote or receive dividends and other distributions paid or made with respect thereto). No dividends or dividend equivalent rights will be paid in respect of any unvested award of restricted stock, unless and until such shares vest.

In the case of awards other than restricted stock, except as otherwise provided in any award agreement, a participant will not have any rights of a stockholder. No dividends or dividend equivalent rights will be paid with respect to any of the shares granted pursuant to such award agreement until the award vests and is paid.

Performance-Based Compensation

The 2022 Plan establishes procedures for our Company to grant performance-based awards, meaning awards structured such that the vesting or other realization of the award will be subject to the achievement of certain performance criteria established by the plan administrator for a specified performance period. The plan administrator will determine the duration of the performance period, the performance criteria on which performance will be measured, and the amount and terms of payment and vesting upon achievement of such criteria.

The business measures that may be used to establish the performance criteria may include, but will not be limited to, one of, or any combination of, the following:

The business measures that may be used to establish the performance criteria may include one of, or combination of, the following:

A. | Net earnings or net income (before or after taxes); | |||

B. | Earnings per share; | |||

C. | Net sales growth; | |||

D. | Net operating profit; | |||

E. | Return measures (including, but not limited to, return on assets, capital, equity, or sales); | |||

F. | Cash flow (including, but not limited to, operating cash flow, free cash flow, and cash flow return on capital); | |||

G. | Cash flow per share; | |||

H. | Earnings before or after taxes, interest, depreciation, and/or amortization; | |||

I. | Gross or operating margins; | |||

J. | Productivity ratios; | |||

K. | Share price (including, but not limited to, growth measures and total stockholder return); | |||

L. | Expense targets or ratios; | |||

M. | Charge-off levels; | |||

N. | Improvement in or attainment of revenue levels; | |||

O. | Margins; | |||

P. | Operating efficiency; |

17

Q. | Operating expenses; | |||

R. | Economic value added; | |||

S. | Improvement in or attainment of expense levels; | |||

T. | Improvement in or attainment of working capital levels; | |||

U. | Debt reduction; | |||

V. | Capital targets; | |||

W. | Regulatory, clinical, or manufacturing milestones; and | |||

X. | Consummation of acquisitions, dispositions, projects or other specific events or transactions. |

Deferrals

The plan administrator may permit participants to defer receipt of the payment of cash or the delivery of shares of common stock that would otherwise be due to the participant in connection with an award under the 2022 Plan. The plan administrator will establish the rules and procedures applicable to any such deferrals.

Adjustments

Subject to any required action by the our stockholders, the number of shares of common stock covered by each outstanding stock right, and the number of shares of common stock which have been authorized for issuance under the 2022 Plan but as to which no stock rights have yet been granted or which have been returned to the Plan, the exercise or purchase price of each such outstanding stock right, as well as any other terms that the plan administrator determines require adjustment will be proportionately adjusted for (i) any increase or decrease in the number of issued and outstanding shares of common stock resulting from a stock split, reverse stock split, stock dividend, extraordinary cash dividend, combination or reclassification of the shares, or similar transaction affecting the shares, (ii) any other increase or decrease in the number of issued and outstanding shares of common stock effected without receipt of consideration by us, or (iii) any other transaction with respect to the our common stock including a corporate merger, consolidation, acquisition of property or stock, separation (including a spin-off or other distribution of stock or property), reorganization, liquidation (whether partial or complete) or any similar transaction; provided, however that conversion of any of our convertible securities will not be deemed to have been “effected without receipt of consideration.” Such adjustment will be made by the plan administrator and its determination will be final, binding and conclusive. Except as the plan administrator determines, no issuance by the Company of shares of stock of any class, or securities convertible into shares of stock of any class, will affect, and no adjustment by reason hereof will be made with respect to, the number or price of shares of common stock subject to a stock right. No adjustments will be made for dividends paid in cash or in property other than our common stock.

Corporate Transactions

Unless otherwise set forth in an award agreement, if a corporate transaction occurs and participants’ awards remain outstanding after the corporate transaction, or are assumed by, or converted to similar awards in the corporate transaction, and the participant incurs an involuntary separation from service other than for cause during a period specified by the plan administrator, (i) all outstanding options and SARs will automatically accelerate and become fully exercisable, (ii) any restrictions and conditions on outstanding restricted stock will immediately lapse, and (iii) awards of RSUs or of other rights or benefits will become payable. Awards that are based on performance goals will vest and be payable as determined by the plan administrator.

Unless otherwise set forth in an award agreement, if a corporate transaction occurs and participants’ awards do not remain outstanding after the corporate transaction, and are not assumed by, or converted to similar awards in the corporate transaction, (i) all outstanding options and SARs will immediately vest and become exercisable, (ii) any restrictions on restricted stock will immediately lapse, and (iii) awards of RSUs or of other rights or benefits will become payable as of the date of the corporate transaction. Awards that are based on performance goals will vest and be payable as determined by the plan administrator.

18

The plan administrator may establish such other terms relating to the effect of a corporate transaction on awards as the plan administrator deems appropriate. In addition to other actions, in the event of a corporate transaction, the plan administrator may take any one or more of the following actions with respect to any or all outstanding awards, without the consent of any participant: (i) the plan administrator may determine that outstanding awards will be assumed by, or replaced with awards that have comparable terms by, the surviving corporation (or a parent or subsidiary of the surviving corporation); (ii) the plan administrator may determine that outstanding options and SARs will automatically accelerate and become fully exercisable, and the restrictions and conditions on outstanding restricted stock will immediately lapse; (iii) the plan administrator may determine that participants will receive a payment in settlement of outstanding awards of RSUs or of other rights or benefits, in such amount and form as may be determined by the plan administrator; (iv) the plan administrator may require that participants surrender their outstanding options and SARs in exchange for a payment by the Company, in cash or shares as determined by the plan administrator, in an amount equal to the amount, if any, by which the then fair market value of the shares subject to the participant’s unexercised options and SARs exceeds the exercise price, and (v) after giving participants an opportunity to exercise all of their outstanding options and SARs, the plan administrator may terminate any or all unexercised options and SARs at such time as the plan administrator deems appropriate. If the per share fair market value of the shares does not exceed the per share exercise price, the Company will not be required to make any payment to the participant upon surrender of the option or SAR.

For purposes of the 2022 Plan, “corporate transaction” means any of the following transactions:

(i) a merger or consolidation in which the Company is not the surviving entity, except for a transaction the principal purpose of which is to change the state in which the Company is incorporated;

(ii) the sale, transfer or other disposition of all or substantially all of the assets of the Company;

(iii) the complete liquidation or dissolution of the Company;

(iv) any reverse merger or series of related transactions culminating in a reverse merger (including, but not limited to, a tender offer followed by a reverse merger) in which the Company is the surviving entity but (A) the shares of common stock outstanding immediately prior to such merger are converted or exchanged by virtue of the merger into other property, whether in the form of securities, cash or otherwise, or (B) in which securities possessing more than 50% of the total combined voting power of the Company’s outstanding securities are transferred to a person or persons different from those who held such securities immediately prior to such merger or the initial transaction culminating in such merger; or

(v) acquisition in a single or series of related transactions by any person or related group of persons (other than the Company or by a Company-sponsored employee benefit plan) of beneficial ownership (within the meaning of Rule 13d-3 of the Exchange Act) of securities possessing more than 50% of the total combined voting power of the Company’s outstanding securities. Any acceleration, surrender, termination, settlement or conversion shall take place as of the date of a corporate transaction or such other date as the plan administrator may specify.

Amendment and Termination; No Repricing

Our Board generally may amend, suspend, or terminate the 2022 Plan. However, it may not amend, suspend, or terminate the 2022 Plan without stockholder approval (obtained within 12 months before or after a related Board resolution) for certain actions, such as an increase in the number of shares reserved under the 2022 Plan (other than pursuant to an equitable adjustment), modifications to the provisions of the 2022 Plan regarding the grant of incentive stock options, modifications to the provisions of the 2022 Plan regarding the exercise prices at which shares may be offered pursuant to options, or extension of the 2022 Plan’s expiration date.